| UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 | |||||

| FORM | 8-K | ||||

| CURRENT REPORT | |||||

| Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934 | |||||

| Date of Report (Date of earliest event reported) | April 25, 2024 | ||||

| Associated Banc-Corp | ||

| (Exact name of registrant as specified in its chapter) | ||

| Wisconsin | 001-31343 | 39-1098068 | ||||||

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

||||||

| 433 Main Street | Green Bay | Wisconsin | 54301 | ||||||||

| (Address of principal executive offices) | (Zip code) | ||||||||||

| Registrant’s telephone number, including area code | 920 | 491-7500 | ||||||

| (Former name or former address, if changed since last report) | |||||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | |||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

||||

| Title of each class | Trading symbol | Name of each exchange on which registered | ||||||

| Common stock, par value $0.01 per share | ASB | New York Stock Exchange | ||||||

| Depositary Shrs, each representing 1/40th intrst in a shr of 5.875% Non-Cum. Perp Pref Stock, Srs E | ASB PrE | New York Stock Exchange | ||||||

| Depositary Shrs, each representing 1/40th intrst in a shr of 5.625% Non-Cum. Perp Pref Stock, Srs F | ASB PrF | New York Stock Exchange | ||||||

| 6.625% Fixed-Rate Reset Subordinated Notes due 2033 | ASBA | New York Stock Exchange | ||||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |||||

☐ |

Emerging growth company |

||||

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

||||

| Item 2.02 Results of Operations and Financial Condition. | ||

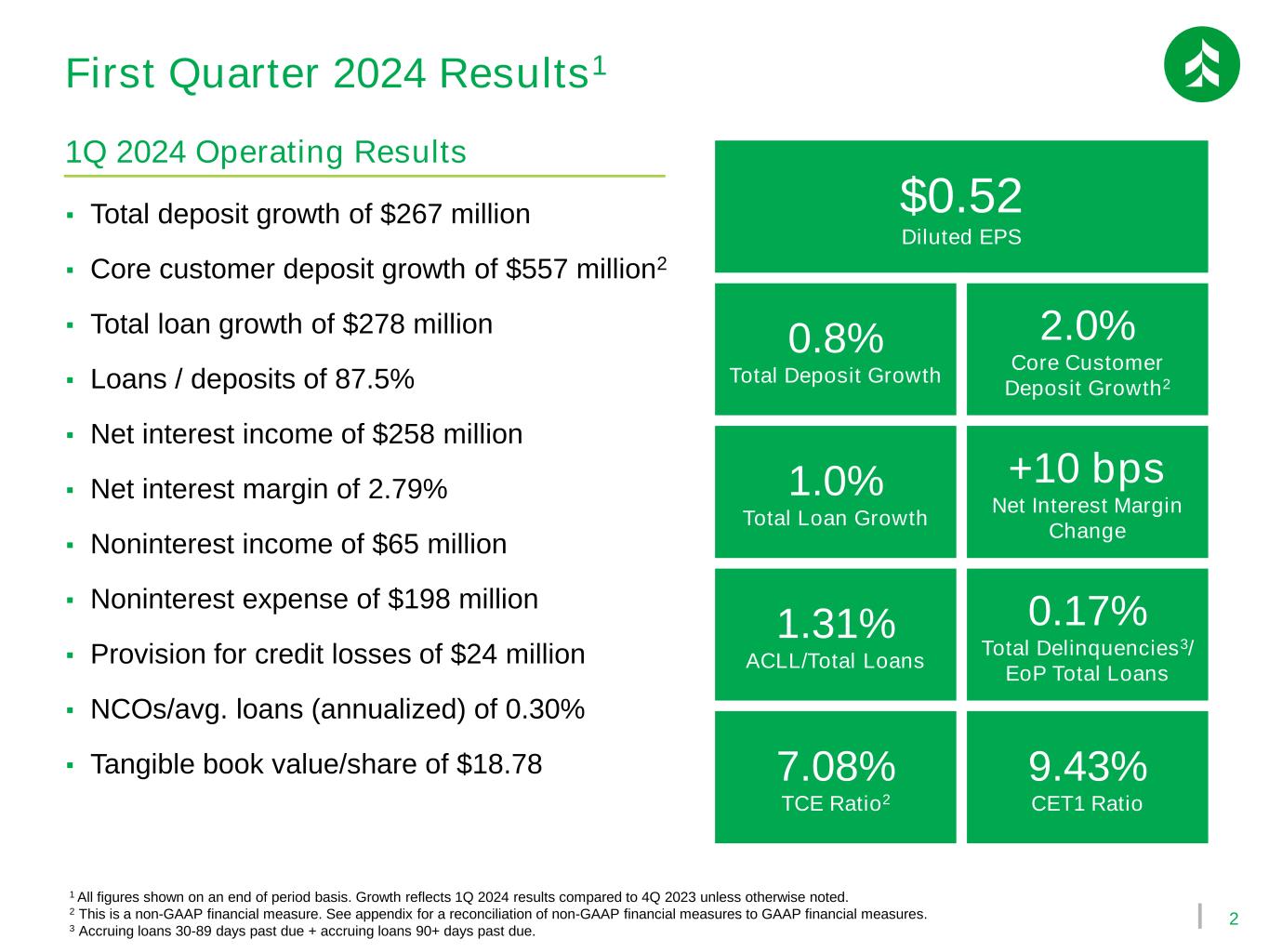

| On April 25, 2024, Associated Banc-Corp announced its earnings for the quarter ended March 31, 2024. A copy of the registrant’s press release containing this information and the slide presentation discussed on the conference call for investors and analysts on April 25, 2024, are being furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Report on Form 8-K and are incorporated herein by reference. | ||

| Item 9.01 Financial Statements and Exhibits. | ||

(d) Exhibits. | ||

The following exhibits are furnished as part of this Report on Form 8-K: | ||

| SIGNATURES | ||||||||

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | ||||||||

| Associated Banc-Corp | ||||||||

| (Registrant) | ||||||||

| Date: April 25, 2024 | By: /s/ Derek S. Meyer | |||||||

| Derek S. Meyer | ||||||||

| Chief Financial Officer | ||||||||

|

NEWS RELEASE

Investor Contact:

Ben McCarville, Vice President, Director of Investor Relations

920-491-7059

Media Contact:

Marilka Vélez, Senior Vice President, Senior Director of Marketing

920-491-7518

|

||||

| Associated Banc-Corp Consolidated Balance Sheets (Unaudited) |

|||||||||||||||||||||||

| ($ in thousands) | March 31, 2024 | December 31, 2023 | Seql Qtr $ Change | September 30, 2023 | June 30, 2023 | March 31, 2023 | Comp Qtr $ Change | ||||||||||||||||

| Assets | |||||||||||||||||||||||

| Cash and due from banks | $ | 429,859 | $ | 484,384 | $ | (54,525) | $ | 388,694 | $ | 407,620 | $ | 311,269 | $ | 118,590 | |||||||||

| Interest-bearing deposits in other financial institutions | 420,114 | 425,089 | (4,975) | 323,130 | 190,881 | 511,116 | (91,002) | ||||||||||||||||

| Federal funds sold and securities purchased under agreements to resell | 1,610 | 14,350 | (12,740) | 965 | 31,160 | 455 | 1,155 | ||||||||||||||||

| Investment securities available for sale, at fair value | 3,724,148 | 3,600,892 | 123,256 | 3,491,679 | 3,504,777 | 3,381,607 | 342,541 | ||||||||||||||||

| Investment securities held to maturity, net, at amortized cost | 3,832,967 | 3,860,160 | (27,193) | 3,900,415 | 3,938,877 | 3,967,058 | (134,091) | ||||||||||||||||

| Equity securities | 19,571 | 41,651 | (22,080) | 35,937 | 30,883 | 30,514 | (10,943) | ||||||||||||||||

| Federal Home Loan Bank and Federal Reserve Bank stocks, at cost | 173,968 | 229,171 | (55,203) | 268,698 | 271,637 | 331,420 | (157,452) | ||||||||||||||||

| Residential loans held for sale | 52,414 | 33,011 | 19,403 | 54,790 | 38,083 | 35,742 | 16,672 | ||||||||||||||||

| Commercial loans held for sale | — | 90,303 | (90,303) | — | 15,000 | 33,490 | (33,490) | ||||||||||||||||

| Loans | 29,494,263 | 29,216,218 | 278,045 | 30,193,187 | 29,848,904 | 29,207,072 | 287,191 | ||||||||||||||||

| Allowance for loan losses | (356,006) | (351,094) | (4,912) | (345,795) | (338,750) | (326,432) | (29,574) | ||||||||||||||||

| Loans, net | 29,138,257 | 28,865,124 | 273,133 | 29,847,392 | 29,510,153 | 28,880,640 | 257,617 | ||||||||||||||||

| Tax credit and other investments | 255,252 | 258,067 | (2,815) | 256,905 | 263,583 | 269,269 | (14,017) | ||||||||||||||||

| Premises and equipment, net | 367,618 | 372,978 | (5,360) | 373,017 | 374,866 | 375,540 | (7,922) | ||||||||||||||||

| Bank and corporate owned life insurance | 685,089 | 682,649 | 2,440 | 679,775 | 678,578 | 677,328 | 7,761 | ||||||||||||||||

| Goodwill | 1,104,992 | 1,104,992 | — | 1,104,992 | 1,104,992 | 1,104,992 | — | ||||||||||||||||

| Other intangible assets, net | 38,268 | 40,471 | (2,203) | 42,674 | 44,877 | 47,079 | (8,811) | ||||||||||||||||

| Mortgage servicing rights, net | 85,226 | 84,390 | 836 | 89,131 | 80,449 | 74,479 | 10,747 | ||||||||||||||||

| Interest receivable | 167,092 | 169,569 | (2,477) | 171,119 | 159,185 | 152,404 | 14,688 | ||||||||||||||||

| Other assets | 640,638 | 658,604 | (17,966) | 608,068 | 573,870 | 518,115 | 122,523 | ||||||||||||||||

| Total assets | $ | 41,137,084 | $ | 41,015,855 | $ | 121,229 | $ | 41,637,381 | $ | 41,219,473 | $ | 40,702,519 | $ | 434,565 | |||||||||

| Liabilities and stockholders’ equity | |||||||||||||||||||||||

| Noninterest-bearing demand deposits | $ | 6,254,135 | $ | 6,119,956 | $ | 134,179 | $ | 6,422,994 | $ | 6,565,666 | $ | 7,328,689 | $ | (1,074,554) | |||||||||

| Interest-bearing deposits | 27,459,023 | 27,326,093 | 132,930 | 25,700,332 | 25,448,743 | 23,003,134 | 4,455,889 | ||||||||||||||||

| Total deposits | 33,713,158 | 33,446,049 | 267,109 | 32,123,326 | 32,014,409 | 30,331,824 | 3,381,334 | ||||||||||||||||

| Short-term funding | 765,671 | 326,780 | 438,891 | 451,644 | 341,253 | 226,608 | 539,063 | ||||||||||||||||

| FHLB advances | 1,333,411 | 1,940,194 | (606,783) | 3,733,041 | 3,630,747 | 4,986,138 | (3,652,727) | ||||||||||||||||

| Other long-term funding | 536,055 | 541,269 | (5,214) | 529,459 | 534,273 | 544,103 | (8,048) | ||||||||||||||||

| Allowance for unfunded commitments | 31,776 | 34,776 | (3,000) | 34,776 | 38,276 | 39,776 | (8,000) | ||||||||||||||||

| Accrued expenses and other liabilities | 588,341 | 552,814 | 35,527 | 637,491 | 537,640 | 448,407 | 139,934 | ||||||||||||||||

| Total liabilities | 36,968,412 | 36,841,882 | 126,530 | 37,509,738 | 37,096,599 | 36,576,856 | 391,556 | ||||||||||||||||

| Stockholders’ equity | |||||||||||||||||||||||

| Preferred equity | 194,112 | 194,112 | — | 194,112 | 194,112 | 194,112 | — | ||||||||||||||||

| Common equity | 3,974,561 | 3,979,861 | (5,300) | 3,933,531 | 3,928,762 | 3,931,551 | 43,010 | ||||||||||||||||

| Total stockholders’ equity | 4,168,673 | 4,173,973 | (5,300) | 4,127,643 | 4,122,874 | 4,125,663 | 43,010 | ||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 41,137,084 | $ | 41,015,855 | $ | 121,229 | $ | 41,637,381 | $ | 41,219,473 | $ | 40,702,519 | $ | 434,565 | |||||||||

| Associated Banc-Corp Consolidated Statements of Income (Unaudited) - Quarterly Trend | |||||||||||||||||||||||||||||

| ($ in thousands, except per share data) | Seql Qtr | Comp Qtr | |||||||||||||||||||||||||||

| 1Q24 | 4Q23 | $ Change | % Change | 3Q23 | 2Q23 | 1Q23 | $ Change | % Change | |||||||||||||||||||||

| Interest income | |||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 454,472 | $ | 457,868 | $ | (3,396) | (1) | % | $ | 447,912 | $ | 423,307 | $ | 391,320 | $ | 63,152 | 16 | % | |||||||||||

| Interest and dividends on investment securities | |||||||||||||||||||||||||||||

| Taxable | 46,548 | 41,809 | 4,739 | 11 | % | 38,210 | 35,845 | 30,142 | 16,406 | 54 | % | ||||||||||||||||||

| Tax-exempt | 14,774 | 15,273 | (499) | (3) | % | 15,941 | 15,994 | 16,025 | (1,251) | (8) | % | ||||||||||||||||||

| Other interest | 7,595 | 10,418 | (2,823) | (27) | % | 6,575 | 6,086 | 5,329 | 2,266 | 43 | % | ||||||||||||||||||

| Total interest income | 523,388 | 525,367 | (1,979) | — | % | 508,637 | 481,231 | 442,817 | 80,571 | 18 | % | ||||||||||||||||||

| Interest expense | |||||||||||||||||||||||||||||

| Interest on deposits | 226,231 | 208,875 | 17,356 | 8 | % | 193,131 | 162,196 | 109,422 | 116,809 | 107 | % | ||||||||||||||||||

| Interest on federal funds purchased and securities sold under agreements to repurchase | 2,863 | 3,734 | (871) | (23) | % | 3,100 | 2,261 | 3,143 | (280) | (9) | % | ||||||||||||||||||

| Interest on other short-term funding | 4,708 | — | 4,708 | N/M | — | — | — | 4,708 | N/M | ||||||||||||||||||||

| Interest on FHLB advances | 21,671 | 49,171 | (27,500) | (56) | % | 48,143 | 49,261 | 49,960 | (28,289) | (57) | % | ||||||||||||||||||

| Interest on long-term funding | 10,058 | 10,185 | (127) | (1) | % | 10,019 | 9,596 | 6,281 | 3,777 | 60 | % | ||||||||||||||||||

| Total interest expense | 265,530 | 271,965 | (6,435) | (2) | % | 254,394 | 223,314 | 168,807 | 96,723 | 57 | % | ||||||||||||||||||

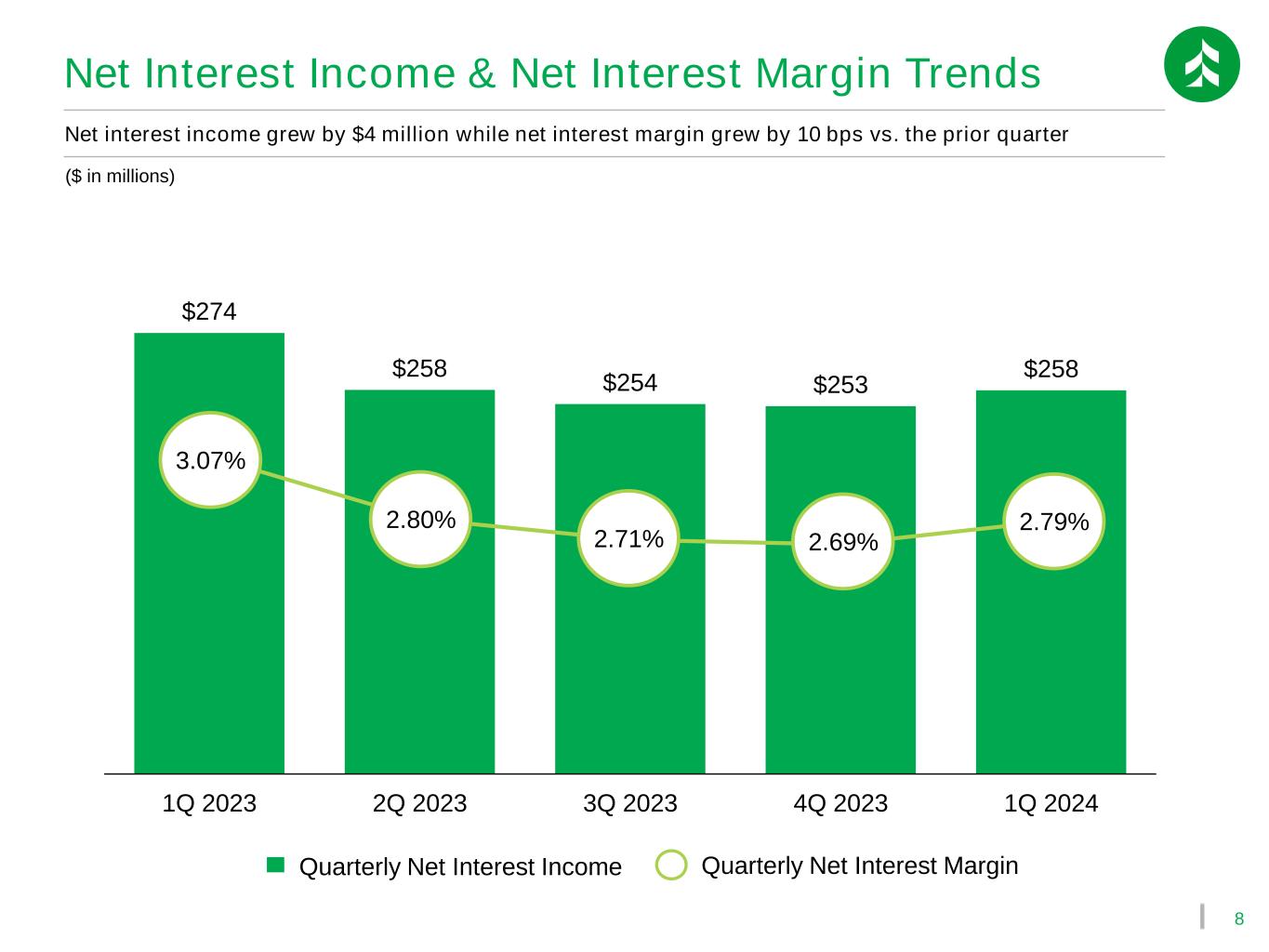

| Net interest income | 257,858 | 253,403 | 4,455 | 2 | % | 254,244 | 257,917 | 274,010 | (16,152) | (6) | % | ||||||||||||||||||

| Provision for credit losses | 24,001 | 21,007 | 2,994 | 14 | % | 21,943 | 22,100 | 17,971 | 6,030 | 34 | % | ||||||||||||||||||

| Net interest income after provision for credit losses | 233,857 | 232,395 | 1,462 | 1 | % | 232,301 | 235,817 | 256,039 | (22,182) | (9) | % | ||||||||||||||||||

| Noninterest income | |||||||||||||||||||||||||||||

| Wealth management fees | 21,694 | 21,003 | 691 | 3 | % | 20,828 | 20,483 | 20,189 | 1,505 | 7 | % | ||||||||||||||||||

| Service charges and deposit account fees | 12,439 | 10,815 | 1,624 | 15 | % | 12,864 | 12,372 | 12,994 | (555) | (4) | % | ||||||||||||||||||

| Card-based fees | 11,267 | 11,528 | (261) | (2) | % | 11,510 | 11,396 | 10,586 | 681 | 6 | % | ||||||||||||||||||

| Other fee-based revenue | 4,402 | 4,019 | 383 | 10 | % | 4,509 | 4,465 | 4,276 | 126 | 3 | % | ||||||||||||||||||

| Capital markets, net | 4,050 | 9,106 | (5,056) | (56) | % | 5,368 | 5,093 | 5,083 | (1,033) | (20) | % | ||||||||||||||||||

| Mortgage banking, net | 2,662 | 1,615 | 1,047 | 65 | % | 6,501 | 7,768 | 3,545 | (883) | (25) | % | ||||||||||||||||||

| Loss on mortgage portfolio sale | — | (136,239) | 136,239 | (100) | % | — | — | — | — | N/M | |||||||||||||||||||

| Bank and corporate owned life insurance | 2,570 | 3,383 | (813) | (24) | % | 2,047 | 2,172 | 2,664 | (94) | (4) | % | ||||||||||||||||||

| Asset gains (losses), net | (306) | (136) | (170) | 125 | % | 625 | (299) | 263 | (569) | N/M | |||||||||||||||||||

| Investment securities gains (losses), net | 3,879 | (58,958) | 62,837 | N/M | (11) | 14 | 51 | 3,828 | N/M | ||||||||||||||||||||

| Other | 2,327 | 2,850 | (523) | (18) | % | 2,339 | 2,080 | 2,422 | (95) | (4) | % | ||||||||||||||||||

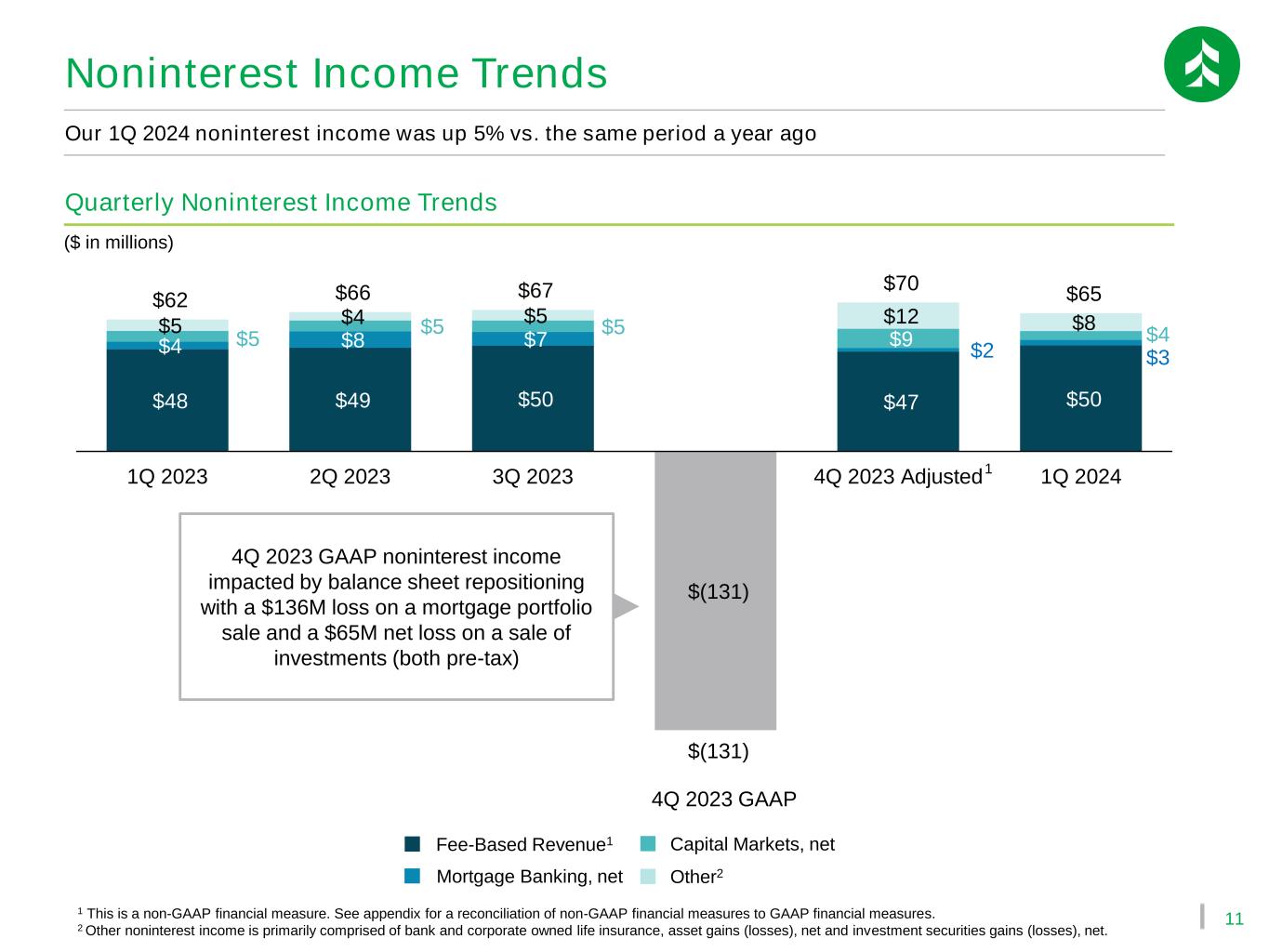

| Total noninterest income (loss) | 64,985 | (131,013) | 195,998 | N/M | 66,579 | 65,543 | 62,073 | 2,912 | 5 | % | |||||||||||||||||||

| Noninterest expense | |||||||||||||||||||||||||||||

| Personnel | 119,395 | 120,686 | (1,291) | (1) | % | 117,159 | 114,089 | 116,420 | 2,975 | 3 | % | ||||||||||||||||||

| Technology | 26,200 | 28,027 | (1,827) | (7) | % | 26,172 | 24,220 | 23,598 | 2,602 | 11 | % | ||||||||||||||||||

| Occupancy | 13,633 | 14,429 | (796) | (6) | % | 14,125 | 13,587 | 15,063 | (1,430) | (9) | % | ||||||||||||||||||

| Business development and advertising | 6,517 | 8,350 | (1,833) | (22) | % | 7,100 | 7,106 | 5,849 | 668 | 11 | % | ||||||||||||||||||

| Equipment | 4,599 | 4,742 | (143) | (3) | % | 5,016 | 4,975 | 4,930 | (331) | (7) | % | ||||||||||||||||||

| Legal and professional | 4,672 | 6,762 | (2,090) | (31) | % | 4,461 | 4,831 | 3,857 | 815 | 21 | % | ||||||||||||||||||

| Loan and foreclosure costs | 1,979 | 585 | 1,394 | N/M | 2,049 | 1,635 | 1,138 | 841 | 74 | % | |||||||||||||||||||

| FDIC assessment | 13,946 | 41,497 | (27,551) | (66) | % | 9,150 | 9,550 | 6,875 | 7,071 | 103 | % | ||||||||||||||||||

| Other intangible amortization | 2,203 | 2,203 | — | — | % | 2,203 | 2,203 | 2,203 | — | — | % | ||||||||||||||||||

| Other | 4,513 | 12,110 | (7,597) | (63) | % | 8,771 | 8,476 | 7,479 | (2,966) | (40) | % | ||||||||||||||||||

| Total noninterest expense | 197,657 | 239,391 | (41,734) | (17) | % | 196,205 | 190,673 | 187,412 | 10,245 | 5 | % | ||||||||||||||||||

| Income (loss) before income taxes | 101,185 | (138,009) | 239,194 | N/M | 102,674 | 110,687 | 130,700 | (29,515) | (23) | % | |||||||||||||||||||

| Income tax expense (benefit) | 20,016 | (47,202) | 67,218 | N/M | 19,426 | 23,533 | 27,340 | (7,324) | (27) | % | |||||||||||||||||||

| Net income (loss) | 81,169 | (90,806) | 171,975 | N/M | 83,248 | 87,154 | 103,360 | (22,191) | (21) | % | |||||||||||||||||||

| Preferred stock dividends | 2,875 | 2,875 | — | — | % | 2,875 | 2,875 | 2,875 | — | — | % | ||||||||||||||||||

| Net income (loss) available to common equity | $ | 78,294 | $ | (93,681) | $ | 171,975 | N/M | $ | 80,373 | $ | 84,279 | $ | 100,485 | $ | (22,191) | (22) | % | ||||||||||||

| Earnings (loss) per common share | |||||||||||||||||||||||||||||

| Basic | $ | 0.52 | $ | (0.63) | $ | 1.15 | N/M | $ | 0.53 | $ | 0.56 | $ | 0.67 | $ | (0.15) | (22) | % | ||||||||||||

| Diluted | $ | 0.52 | $ | (0.62) | $ | 1.14 | N/M | $ | 0.53 | $ | 0.56 | $ | 0.66 | $ | (0.14) | (21) | % | ||||||||||||

| Average common shares outstanding | |||||||||||||||||||||||||||||

| Basic | 149,855 | 150,085 | (230) | — | % | 150,035 | 149,986 | 149,763 | 92 | — | % | ||||||||||||||||||

| Diluted | 151,292 | 151,007 | 285 | — | % | 151,014 | 150,870 | 151,128 | 164 | — | % | ||||||||||||||||||

| Associated Banc-Corp Selected Quarterly Information |

|||||||||||||||||

| ($ in millions except per share data; shares repurchased and outstanding in thousands) | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | ||||||||||||

| Per common share data | |||||||||||||||||

| Dividends | $ | 0.22 | $ | 0.22 | $ | 0.21 | $ | 0.21 | $ | 0.21 | |||||||

| Market value: | |||||||||||||||||

| High | 22.00 | 21.79 | 19.21 | 18.45 | 24.18 | ||||||||||||

| Low | 19.73 | 15.45 | 16.22 | 14.48 | 17.66 | ||||||||||||

| Close | 21.51 | 21.39 | 17.11 | 16.23 | 17.98 | ||||||||||||

| Book value / share | 26.37 | 26.35 | 26.06 | 26.03 | 26.06 | ||||||||||||

| Tangible book value / share | 18.78 | 18.77 | 18.46 | 18.41 | 18.42 | ||||||||||||

| Performance ratios (annualized) | |||||||||||||||||

| Return on average assets | 0.80 | % | (0.87) | % | 0.80 | % | 0.86 | % | 1.06 | % | |||||||

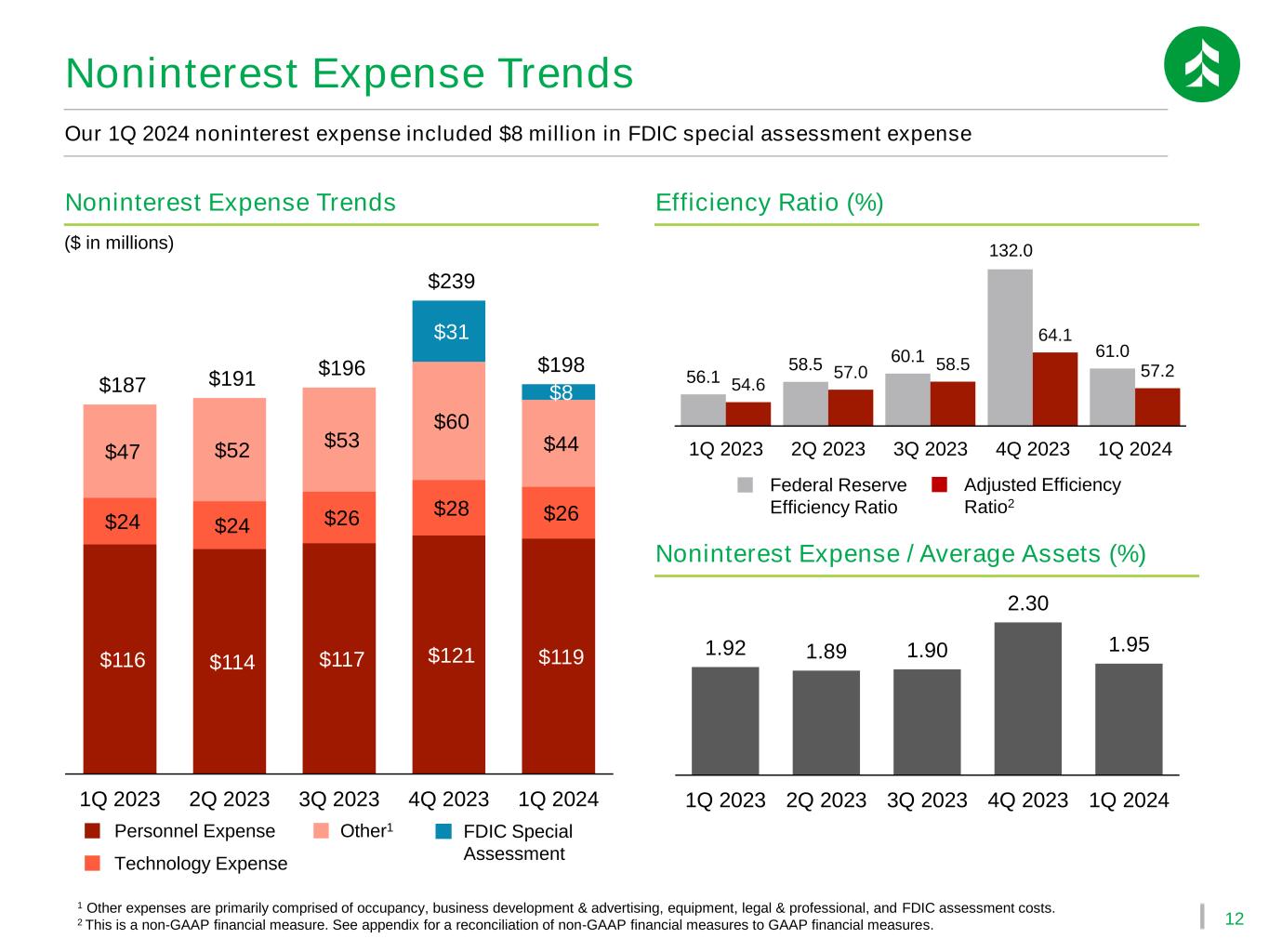

| Noninterest expense / average assets | 1.95 | % | 2.30 | % | 1.90 | % | 1.89 | % | 1.92 | % | |||||||

| Effective tax rate | 19.78 | % | N/M | 18.92 | % | 21.26 | % | 20.92 | % | ||||||||

Dividend payout ratio(a) |

42.31 | % | N/M | 39.62 | % | 37.50 | % | 31.34 | % | ||||||||

| Net interest margin | 2.79 | % | 2.69 | % | 2.71 | % | 2.80 | % | 3.07 | % | |||||||

| Selected trend information | |||||||||||||||||

Average full time equivalent employees(b) |

4,070 | 4,130 | 4,220 | 4,227 | 4,219 | ||||||||||||

| Branch count | 188 | 196 | 202 | 202 | 202 | ||||||||||||

Assets under management, at market value(c) |

$ | 14,171 | $ | 13,545 | $ | 12,543 | $ | 12,995 | $ | 12,412 | |||||||

| Mortgage loans originated for sale during period | $ | 105 | $ | 112 | $ | 115 | $ | 99 | $ | 69 | |||||||

Mortgage loan settlements during period(d) |

$ | 91 | $ | 957 | $ | 103 | $ | 97 | $ | 55 | |||||||

Mortgage portfolio loans transferred to held for sale during period(d) |

$ | — | $ | 969 | $ | — | $ | — | $ | — | |||||||

Mortgage portfolio serviced for others(d) |

$ | 6,349 | $ | 7,364 | $ | 6,452 | $ | 6,525 | $ | 6,612 | |||||||

Mortgage servicing rights, net / mortgage portfolio serviced for others(d) |

1.34 | % | 1.15 | % | 1.38 | % | 1.23 | % | 1.13 | % | |||||||

Shares repurchased during period(e) |

900 | — | — | — | — | ||||||||||||

| Shares outstanding, end of period | 150,739 | 151,037 | 150,951 | 150,919 | 150,886 | ||||||||||||

| Selected quarterly ratios | |||||||||||||||||

| Loans / deposits | 87.49 | % | 87.35 | % | 93.99 | % | 93.24 | % | 96.29 | % | |||||||

| Stockholders’ equity / assets | 10.13 | % | 10.18 | % | 9.91 | % | 10.00 | % | 10.14 | % | |||||||

Risk-based capital(f)(g) |

|||||||||||||||||

| Total risk-weighted assets | $ | 32,753 | $ | 32,733 | $ | 33,497 | $ | 33,144 | $ | 32,646 | |||||||

| Common equity Tier 1 | $ | 3,088 | $ | 3,075 | $ | 3,197 | $ | 3,143 | $ | 3,086 | |||||||

| Common equity Tier 1 capital ratio | 9.43 | % | 9.39 | % | 9.55 | % | 9.48 | % | 9.45 | % | |||||||

| Tier 1 capital ratio | 10.02 | % | 9.99 | % | 10.12 | % | 10.07 | % | 10.05 | % | |||||||

| Total capital ratio | 12.08 | % | 12.21 | % | 12.25 | % | 12.22 | % | 12.22 | % | |||||||

| Tier 1 leverage ratio | 8.21 | % | 8.06 | % | 8.42 | % | 8.40 | % | 8.46 | % | |||||||

| Associated Banc-Corp Selected Asset Quality Information |

|||||||||||||||||||||||

| ($ in thousands) | Mar 31, 2024 | Dec 31, 2023 | Seql Qtr % Change |

Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | Comp Qtr % Change |

||||||||||||||||

| Allowance for loan losses | |||||||||||||||||||||||

| Balance at beginning of period | $ | 351,094 | $ | 345,795 | 2 | % | $ | 338,750 | $ | 326,432 | $ | 312,720 | 12 | % | |||||||||

| Provision for loan losses | 27,000 | 21,000 | 29 | % | 25,500 | 23,500 | 17,000 | 59 | % | ||||||||||||||

| Charge offs | (24,018) | (17,878) | 34 | % | (20,535) | (14,855) | (5,501) | N/M | |||||||||||||||

| Recoveries | 1,930 | 2,177 | (11) | % | 2,079 | 3,674 | 2,212 | (13) | % | ||||||||||||||

| Net (charge offs) recoveries | (22,088) | (15,701) | 41 | % | (18,455) | (11,181) | (3,289) | N/M | |||||||||||||||

| Balance at end of period | $ | 356,006 | $ | 351,094 | 1 | % | $ | 345,795 | $ | 338,750 | $ | 326,432 | 9 | % | |||||||||

| Allowance for unfunded commitments | |||||||||||||||||||||||

| Balance at beginning of period | $ | 34,776 | $ | 34,776 | — | % | $ | 38,276 | $ | 39,776 | $ | 38,776 | (10) | % | |||||||||

| Provision for unfunded commitments | (3,000) | — | N/M | (3,500) | (1,500) | 1,000 | N/M | ||||||||||||||||

| Balance at end of period | $ | 31,776 | $ | 34,776 | (9) | % | $ | 34,776 | $ | 38,276 | $ | 39,776 | (20) | % | |||||||||

| Allowance for credit losses on loans (ACLL) | $ | 387,782 | $ | 385,870 | — | % | $ | 380,571 | $ | 377,027 | $ | 366,208 | 6 | % | |||||||||

| Provision for credit losses on loans | $ | 24,000 | $ | 21,000 | 14 | % | $ | 22,000 | $ | 22,000 | $ | 18,000 | 33 | % | |||||||||

| ($ in thousands) | Mar 31, 2024 | Dec 31, 2023 | Seql Qtr % Change | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | Comp Qtr % Change |

||||||||||||||||

| Net (charge offs) recoveries | |||||||||||||||||||||||

| Commercial and industrial | $ | (18,638) | $ | (13,178) | 41 | % | $ | (16,558) | $ | (11,177) | $ | (1,759) | N/M | ||||||||||

| Commercial real estate—owner occupied | 2 | (22) | N/M | 2 | 3 | 3 | (33) | % | |||||||||||||||

| Commercial and business lending | (18,636) | (13,200) | 41 | % | (16,556) | (11,174) | (1,756) | N/M | |||||||||||||||

| Commercial real estate—investor | — | 216 | (100) | % | 272 | 2,276 | — | N/M | |||||||||||||||

| Real estate construction | 30 | 38 | (21) | % | 18 | (18) | 18 | 67 | % | ||||||||||||||

| Commercial real estate lending | 30 | 253 | (88) | % | 290 | 2,257 | 18 | 67 | % | ||||||||||||||

| Total commercial | (18,606) | (12,947) | 44 | % | (16,266) | (8,917) | (1,738) | N/M | |||||||||||||||

| Residential mortgage | (62) | (53) | 17 | % | (22) | (283) | (53) | 17 | % | ||||||||||||||

| Auto finance | (2,094) | (1,436) | 46 | % | (1,269) | (1,048) | (957) | 119 | % | ||||||||||||||

| Home equity | 211 | 185 | 14 | % | 128 | 183 | 340 | (38) | % | ||||||||||||||

| Other consumer | (1,537) | (1,450) | 6 | % | (1,027) | (1,117) | (881) | 74 | % | ||||||||||||||

| Total consumer | (3,482) | (2,754) | 26 | % | (2,189) | (2,264) | (1,550) | 125 | % | ||||||||||||||

| Total net (charge offs) recoveries | $ | (22,088) | $ | (15,701) | 41 | % | $ | (18,455) | $ | (11,181) | $ | (3,289) | N/M | ||||||||||

| (In basis points) | Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | ||||||||||||||||||

| Net (charge offs) recoveries to average loans (annualized) | |||||||||||||||||||||||

| Commercial and industrial | (77) | (54) | (66) | (46) | (7) | ||||||||||||||||||

| Commercial real estate—owner occupied | — | (1) | — | — | — | ||||||||||||||||||

| Commercial and business lending | (69) | (48) | (60) | (41) | (7) | ||||||||||||||||||

| Commercial real estate—investor | — | 2 | 2 | 18 | — | ||||||||||||||||||

| Real estate construction | 1 | 1 | — | — | — | ||||||||||||||||||

| Commercial real estate lending | — | 1 | 2 | 12 | — | ||||||||||||||||||

| Total commercial | (41) | (28) | (35) | (20) | (4) | ||||||||||||||||||

| Residential mortgage | — | — | — | (1) | — | ||||||||||||||||||

| Auto finance | (35) | (27) | (27) | (25) | (26) | ||||||||||||||||||

| Home equity | 14 | 12 | 8 | 12 | 22 | ||||||||||||||||||

| Other consumer | (232) | (208) | (148) | (163) | (125) | ||||||||||||||||||

| Total consumer | (13) | (9) | (7) | (8) | (6) | ||||||||||||||||||

| Total net (charge offs) recoveries | (30) | (21) | (25) | (15) | (5) | ||||||||||||||||||

| ($ in thousands) | Mar 31, 2024 | Dec 31, 2023 | Seql Qtr % Change |

Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | Comp Qtr % Change |

||||||||||||||||

| Credit quality | |||||||||||||||||||||||

| Nonaccrual loans | $ | 178,346 | $ | 148,997 | 20 | % | $ | 168,558 | $ | 131,278 | $ | 117,569 | 52 | % | |||||||||

| Other real estate owned (OREO) | 8,437 | 10,506 | (20) | % | 8,452 | 7,575 | 15,184 | (44) | % | ||||||||||||||

| Repossessed assets | 1,241 | 919 | 35 | % | 658 | 348 | 92 | N/M | |||||||||||||||

| Total nonperforming assets | $ | 188,025 | $ | 160,421 | 17 | % | $ | 177,668 | $ | 139,201 | $ | 132,845 | 42 | % | |||||||||

| Loans 90 or more days past due and still accruing | $ | 2,417 | $ | 21,689 | (89) | % | $ | 2,156 | $ | 1,726 | $ | 1,703 | 42 | % | |||||||||

| Allowance for credit losses on loans to total loans | 1.31 | % | 1.32 | % | 1.26 | % | 1.26 | % | 1.25 | % | |||||||||||||

| Allowance for credit losses on loans to nonaccrual loans | 217.43 | % | 258.98 | % | 225.78 | % | 287.20 | % | 311.48 | % | |||||||||||||

| Nonaccrual loans to total loans | 0.60 | % | 0.51 | % | 0.56 | % | 0.44 | % | 0.40 | % | |||||||||||||

| Nonperforming assets to total loans plus OREO and repossessed assets | 0.64 | % | 0.55 | % | 0.59 | % | 0.47 | % | 0.45 | % | |||||||||||||

| Nonperforming assets to total assets | 0.46 | % | 0.39 | % | 0.43 | % | 0.34 | % | 0.33 | % | |||||||||||||

| Annualized year-to-date net charge offs (recoveries) to year-to-date average loans | 0.30 | % | 0.16 | % | 0.15 | % | 0.10 | % | 0.05 | % | |||||||||||||

| Associated Banc-Corp Selected Asset Quality Information (continued) |

|||||||||||||||||||||||

| ($ in thousands) | Mar 31, 2024 | Dec 31, 2023 | Seql Qtr % Change |

Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | Comp Qtr % Change |

||||||||||||||||

| Nonaccrual loans | |||||||||||||||||||||||

| Commercial and industrial | $ | 72,243 | $ | 62,022 | 16 | % | $ | 74,812 | $ | 34,907 | $ | 22,735 | N/M | ||||||||||

| Commercial real estate—owner occupied | 2,090 | 1,394 | 50 | % | 3,936 | 1,444 | 1,478 | 41 | % | ||||||||||||||

| Commercial and business lending | 74,333 | 63,416 | 17 | % | 78,748 | 36,352 | 24,213 | N/M | |||||||||||||||

| Commercial real estate—investor | 18,697 | — | N/M | 10,882 | 22,068 | 25,122 | (26) | % | |||||||||||||||

| Real estate construction | 18 | 6 | 200 | % | 103 | 125 | 178 | (90) | % | ||||||||||||||

| Commercial real estate lending | 18,715 | 6 | N/M | 10,985 | 22,193 | 25,300 | (26) | % | |||||||||||||||

| Total commercial | 93,047 | 63,422 | 47 | % | 89,732 | 58,544 | 49,513 | 88 | % | ||||||||||||||

| Residential mortgage | 69,954 | 71,142 | (2) | % | 66,153 | 61,718 | 58,274 | 20 | % | ||||||||||||||

| Auto finance | 7,158 | 5,797 | 23 | % | 4,533 | 3,065 | 2,436 | 194 | % | ||||||||||||||

| Home equity | 8,100 | 8,508 | (5) | % | 7,917 | 7,788 | 7,246 | 12 | % | ||||||||||||||

| Other consumer | 87 | 128 | (32) | % | 222 | 163 | 100 | (13) | % | ||||||||||||||

| Total consumer | 85,299 | 85,574 | — | % | 78,826 | 72,733 | 68,056 | 25 | % | ||||||||||||||

| Total nonaccrual loans | $ | 178,346 | $ | 148,997 | 20 | % | $ | 168,558 | $ | 131,278 | $ | 117,569 | 52 | % | |||||||||

| Mar 31, 2024 | Dec 31, 2023 | Seql Qtr % Change |

Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | Comp Qtr % Change |

|||||||||||||||||

Restructured loans (accruing)(a) |

|||||||||||||||||||||||

| Commercial and industrial | $ | 377 | $ | 306 | 23 | % | $ | 234 | $ | 168 | $ | 47 | N/M | ||||||||||

| Commercial and business lending | 377 | 306 | 23 | % | 234 | 168 | 47 | N/M | |||||||||||||||

| Commercial real estate—investor | — | — | N/M | — | — | — | N/M | ||||||||||||||||

| Real estate construction | — | — | N/M | — | — | — | N/M | ||||||||||||||||

| Commercial real estate lending | — | — | N/M | — | — | — | N/M | ||||||||||||||||

| Total commercial | 377 | 306 | 23 | % | 234 | 168 | 47 | N/M | |||||||||||||||

| Residential mortgage | 345 | 405 | (15) | % | 207 | 126 | 126 | 174 | % | ||||||||||||||

| Auto finance | 66 | 255 | (74) | % | 169 | 80 | 61 | 8 | % | ||||||||||||||

| Home equity | 182 | 305 | (40) | % | 236 | 78 | 31 | N/M | |||||||||||||||

| Other consumer | 1,487 | 1,449 | 3 | % | 1,243 | 988 | 498 | 199 | % | ||||||||||||||

| Total consumer | 2,080 | 2,414 | (14) | % | 1,855 | 1,271 | 716 | 191 | % | ||||||||||||||

| Total restructured loans (accruing) | $ | 2,457 | $ | 2,719 | (10) | % | $ | 2,089 | $ | 1,439 | $ | 763 | N/M | ||||||||||

| Nonaccrual restructured loans (included in nonaccrual loans) | $ | 1,141 | $ | 805 | 42 | % | $ | 961 | $ | 796 | $ | 341 | N/M | ||||||||||

| Mar 31, 2024 | Dec 31, 2023 | Seql Qtr % Change |

Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | Comp Qtr % Change |

|||||||||||||||||

| Accruing loans 30-89 days past due | |||||||||||||||||||||||

| Commercial and industrial | $ | 521 | $ | 5,565 | (91) | % | $ | 1,507 | $ | 12,005 | $ | 4,239 | (88) | % | |||||||||

| Commercial real estate—owner occupied | — | 358 | (100) | % | 1,877 | 1,484 | 2,955 | (100) | % | ||||||||||||||

| Commercial and business lending | 521 | 5,923 | (91) | % | 3,384 | 13,489 | 7,195 | (93) | % | ||||||||||||||

| Commercial real estate—investor | 19,164 | 18,697 | 2 | % | 10,121 | — | — | N/M | |||||||||||||||

| Real estate construction | 1,260 | — | N/M | 10 | 76 | — | N/M | ||||||||||||||||

| Commercial real estate lending | 20,424 | 18,697 | 9 | % | 10,131 | 76 | — | N/M | |||||||||||||||

| Total commercial | 20,945 | 24,619 | (15) | % | 13,515 | 13,565 | 7,195 | 191 | % | ||||||||||||||

| Residential mortgage | 9,903 | 13,446 | (26) | % | 11,652 | 8,961 | 7,626 | 30 | % | ||||||||||||||

| Auto finance | 12,521 | 17,386 | (28) | % | 16,688 | 11,429 | 8,640 | 45 | % | ||||||||||||||

| Home equity | 2,819 | 4,208 | (33) | % | 3,687 | 4,030 | 4,113 | (31) | % | ||||||||||||||

| Other consumer | 2,260 | 2,166 | 4 | % | 1,880 | 2,025 | 1,723 | 31 | % | ||||||||||||||

| Total consumer | 27,503 | 37,205 | (26) | % | 33,908 | 26,444 | 22,102 | 24 | % | ||||||||||||||

| Total accruing loans 30-89 days past due | $ | 48,448 | $ | 61,825 | (22) | % | $ | 47,422 | $ | 40,008 | $ | 29,297 | 65 | % | |||||||||

| Associated Banc-Corp Net Interest Income Analysis - Fully Tax-Equivalent Basis - Sequential and Comparable Quarter |

|||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| March 31, 2024 | December 31, 2023 | March 31, 2023 | |||||||||||||||||||||||||||

| ($ in thousands) | Average Balance |

Interest Income /Expense |

Average Yield /Rate |

Average Balance |

Interest Income /Expense |

Average Yield /Rate |

Average Balance |

Interest Income /Expense |

Average Yield /Rate |

||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||

| Earning assets | |||||||||||||||||||||||||||||

Loans (a) (b) (c) |

|||||||||||||||||||||||||||||

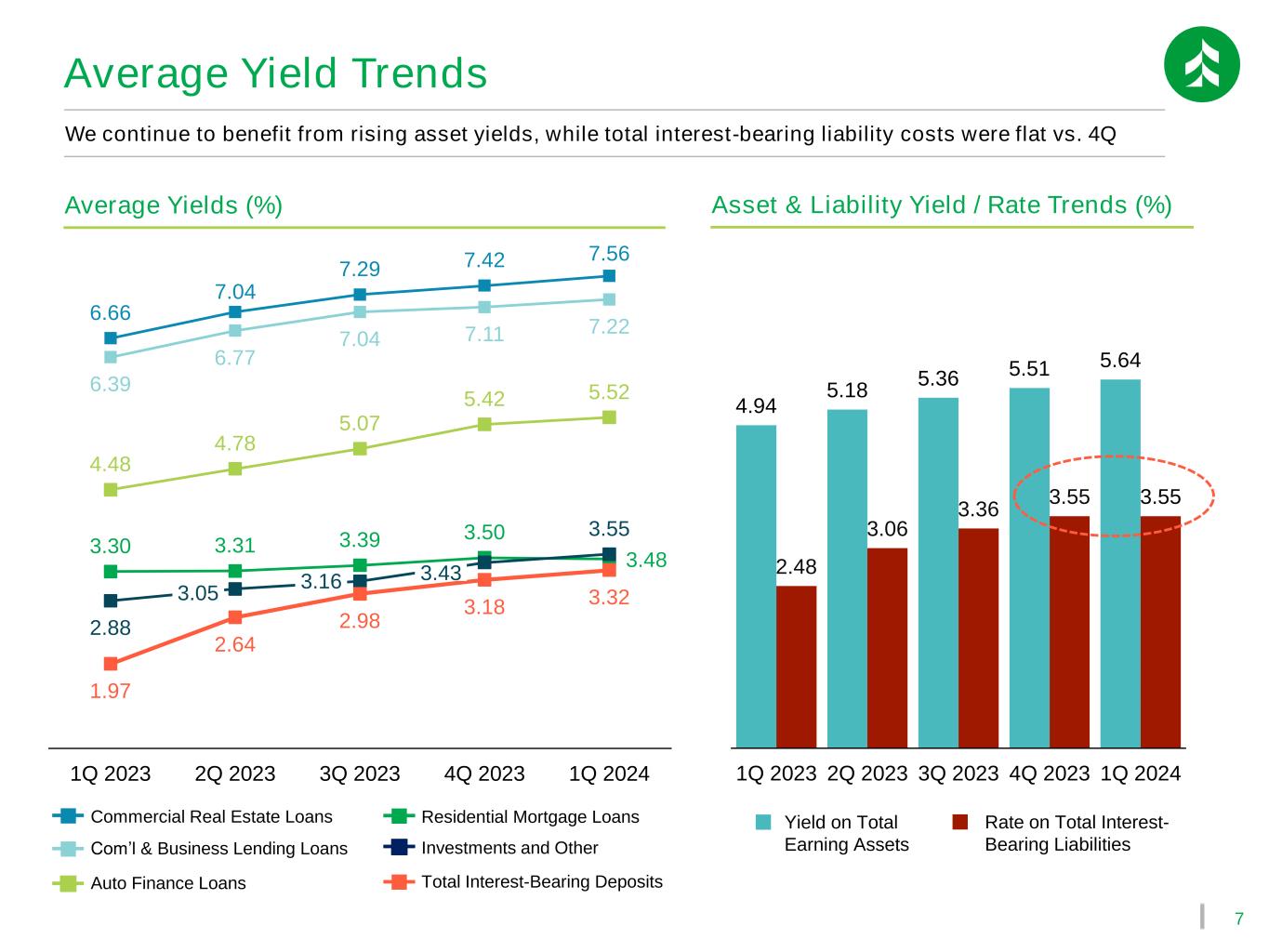

| Commercial and business lending | $ | 10,816,255 | $ | 194,090 | 7.22 | % | $ | 10,820,214 | $ | 193,808 | 7.11 | % | $ | 10,616,026 | $ | 167,174 | 6.39 | % | |||||||||||

| Commercial real estate lending | 7,389,962 | 138,850 | 7.56 | % | 7,397,809 | 138,437 | 7.42 | % | 7,251,193 | 119,087 | 6.66 | % | |||||||||||||||||

| Total commercial | 18,206,217 | 332,940 | 7.35 | % | 18,218,024 | 332,245 | 7.24 | % | 17,867,219 | 286,262 | 6.50 | % | |||||||||||||||||

| Residential mortgage | 7,896,956 | 68,787 | 3.48 | % | 8,691,258 | 76,035 | 3.50 | % | 8,584,528 | 70,711 | 3.30 | % | |||||||||||||||||

| Auto finance | 2,373,720 | 32,603 | 5.52 | % | 2,138,536 | 29,221 | 5.42 | % | 1,490,115 | 16,458 | 4.48 | % | |||||||||||||||||

| Other retail | 892,128 | 20,661 | 9.28 | % | 904,618 | 21,026 | 9.27 | % | 903,956 | 18,494 | 8.23 | % | |||||||||||||||||

| Total loans | 29,369,022 | 454,991 | 6.22 | % | 29,952,435 | 458,527 | 6.08 | % | 28,845,818 | 391,925 | 5.49 | % | |||||||||||||||||

| Investment securities | |||||||||||||||||||||||||||||

| Taxable | 5,517,023 | 46,727 | 3.39 | % | 5,344,578 | 41,809 | 3.13 | % | 4,912,416 | 30,142 | 2.45 | % | |||||||||||||||||

Tax-exempt(a) |

2,133,352 | 18,024 | 3.38 | % | 2,209,662 | 19,244 | 3.48 | % | 2,329,519 | 20,192 | 3.47 | % | |||||||||||||||||

| Other short-term investments | 576,782 | 8,311 | 5.80 | % | 767,256 | 10,418 | 5.39 | % | 493,061 | 5,329 | 4.37 | % | |||||||||||||||||

| Investments and other | 8,227,158 | 73,062 | 3.55 | % | 8,321,495 | 71,471 | 3.43 | % | 7,734,996 | 55,664 | 2.88 | % | |||||||||||||||||

| Total earning assets | 37,596,179 | $ | 528,053 | 5.64 | % | 38,273,931 | $ | 529,998 | 5.51 | % | 36,580,814 | $ | 447,589 | 4.94 | % | ||||||||||||||

| Other assets, net | 3,173,027 | 3,056,772 | 3,026,251 | ||||||||||||||||||||||||||

| Total assets | $ | 40,769,206 | $ | 41,330,703 | $ | 39,607,065 | |||||||||||||||||||||||

| Liabilities and stockholders' equity | |||||||||||||||||||||||||||||

| Interest-bearing liabilities | |||||||||||||||||||||||||||||

| Interest-bearing deposits | |||||||||||||||||||||||||||||

| Savings | $ | 4,928,031 | $ | 21,747 | 1.77 | % | $ | 4,861,913 | $ | 20,334 | 1.66 | % | $ | 4,664,624 | $ | 9,859 | 0.86 | % | |||||||||||

| Interest-bearing demand | 7,490,119 | 49,990 | 2.68 | % | 7,156,151 | 47,277 | 2.62 | % | 6,814,487 | 29,918 | 1.78 | % | |||||||||||||||||

| Money market | 6,116,604 | 47,306 | 3.11 | % | 6,121,105 | 47,110 | 3.05 | % | 7,536,393 | 41,637 | 2.24 | % | |||||||||||||||||

| Network transaction deposits | 1,651,937 | 22,205 | 5.41 | % | 1,616,719 | 22,034 | 5.41 | % | 1,147,089 | 12,825 | 4.53 | % | |||||||||||||||||

| Time deposits | 7,198,315 | 84,983 | 4.75 | % | 6,264,621 | 72,121 | 4.57 | % | 2,362,260 | 15,182 | 2.61 | % | |||||||||||||||||

| Total interest-bearing deposits | 27,385,005 | 226,231 | 3.32 | % | 26,020,510 | 208,875 | 3.18 | % | 22,524,853 | 109,422 | 1.97 | % | |||||||||||||||||

| Federal funds purchased and securities sold under agreements to repurchase | 263,979 | 2,863 | 4.36 | % | 347,204 | 3,734 | 4.27 | % | 429,780 | 3,143 | 2.97 | % | |||||||||||||||||

| Other short-term funding | 449,999 | 5,603 | 5.01 | % | — | — | — | % | 17,339 | — | 0.01 | % | |||||||||||||||||

| FHLB advances | 1,540,247 | 21,671 | 5.66 | % | 3,467,433 | 49,171 | 5.63 | % | 4,254,532 | 49,960 | 4.76 | % | |||||||||||||||||

| Long-term funding | 539,106 | 10,058 | 7.46 | % | 531,155 | 10,185 | 7.67 | % | 408,175 | 6,281 | 6.16 | % | |||||||||||||||||

| Total short and long-term funding | 2,793,331 | 40,194 | 5.78 | % | 4,345,793 | 63,090 | 5.77 | % | 5,109,826 | 59,384 | 4.71 | % | |||||||||||||||||

| Total interest-bearing liabilities | 30,178,337 | $ | 266,425 | 3.55 | % | 30,366,302 | $ | 271,965 | 3.55 | % | 27,634,679 | $ | 168,807 | 2.48 | % | ||||||||||||||

| Noninterest-bearing demand deposits | 5,882,052 | 6,171,240 | 7,340,219 | ||||||||||||||||||||||||||

| Other liabilities | 527,437 | 672,597 | 570,166 | ||||||||||||||||||||||||||

| Stockholders’ equity | 4,181,381 | 4,120,564 | 4,062,001 | ||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 40,769,206 | $ | 41,330,703 | $ | 39,607,065 | |||||||||||||||||||||||

| Interest rate spread | 2.09 | % | 1.96 | % | 2.46 | % | |||||||||||||||||||||||

| Net free funds | 0.70 | % | 0.73 | % | 0.61 | % | |||||||||||||||||||||||

| Fully tax-equivalent net interest income and net interest margin | $ | 261,628 | 2.79 | % | $ | 258,033 | 2.69 | % | $ | 278,782 | 3.07 | % | |||||||||||||||||

| Fully tax-equivalent adjustment | 3,770 | 4,630 | 4,772 | ||||||||||||||||||||||||||

| Net interest income | $ | 257,858 | $ | 253,403 | $ | 274,010 | |||||||||||||||||||||||

| Associated Banc-Corp Loan and Deposit Composition |

|||||||||||||||||||||||

| ($ in thousands) | |||||||||||||||||||||||

| Period end loan composition | Mar 31, 2024 | Dec 31, 2023 | Seql Qtr % Change | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | Comp Qtr % Change | ||||||||||||||||

| Commercial and industrial | $ | 9,858,329 | $ | 9,731,555 | 1 | % | $ | 10,099,068 | $ | 10,055,487 | $ | 9,869,781 | — | % | |||||||||

| Commercial real estate—owner occupied | 1,095,894 | 1,061,700 | 3 | % | 1,054,969 | 1,058,237 | 1,050,236 | 4 | % | ||||||||||||||

| Commercial and business lending | 10,954,223 | 10,793,255 | 1 | % | 11,154,037 | 11,113,724 | 10,920,017 | — | % | ||||||||||||||

| Commercial real estate—investor | 5,035,195 | 5,124,245 | (2) | % | 5,218,980 | 5,312,928 | 5,094,249 | (1) | % | ||||||||||||||

| Real estate construction | 2,287,041 | 2,271,398 | 1 | % | 2,130,719 | 2,009,060 | 2,147,070 | 7 | % | ||||||||||||||

| Commercial real estate lending | 7,322,237 | 7,395,644 | (1) | % | 7,349,699 | 7,321,988 | 7,241,318 | 1 | % | ||||||||||||||

| Total commercial | 18,276,460 | 18,188,898 | — | % | 18,503,736 | 18,435,711 | 18,161,335 | 1 | % | ||||||||||||||

| Residential mortgage | 7,868,180 | 7,864,891 | — | % | 8,782,645 | 8,746,345 | 8,605,164 | (9) | % | ||||||||||||||

| Auto finance | 2,471,257 | 2,256,162 | 10 | % | 2,007,164 | 1,777,974 | 1,551,538 | 59 | % | ||||||||||||||

| Home equity | 619,764 | 628,526 | (1) | % | 623,650 | 615,506 | 609,787 | 2 | % | ||||||||||||||

| Other consumer | 258,603 | 277,740 | (7) | % | 275,993 | 273,367 | 279,248 | (7) | % | ||||||||||||||

| Total consumer | 11,217,802 | 11,027,319 | 2 | % | 11,689,451 | 11,413,193 | 11,045,737 | 2 | % | ||||||||||||||

| Total loans | $ | 29,494,263 | $ | 29,216,218 | 1 | % | $ | 30,193,187 | $ | 29,848,904 | $ | 29,207,072 | 1 | % | |||||||||

| Period end deposit and customer funding composition | Mar 31, 2024 | Dec 31, 2023 | Seql Qtr % Change | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | Comp Qtr % Change | ||||||||||||||||

| Noninterest-bearing demand | $ | 6,254,135 | $ | 6,119,956 | 2 | % | $ | 6,422,994 | $ | 6,565,666 | $ | 7,328,689 | (15) | % | |||||||||

| Savings | 5,124,639 | 4,835,701 | 6 | % | 4,836,735 | 4,777,415 | 4,730,472 | 8 | % | ||||||||||||||

| Interest-bearing demand | 8,747,127 | 8,843,967 | (1) | % | 7,528,154 | 7,037,959 | 6,977,121 | 25 | % | ||||||||||||||

| Money market | 6,721,674 | 6,330,453 | 6 | % | 7,268,506 | 7,521,930 | 8,357,625 | (20) | % | ||||||||||||||

| Brokered CDs | 3,931,230 | 4,447,479 | (12) | % | 3,351,399 | 3,818,325 | 1,185,565 | N/M | |||||||||||||||

| Other time deposits | 2,934,352 | 2,868,494 | 2 | % | 2,715,538 | 2,293,114 | 1,752,351 | 67 | % | ||||||||||||||

| Total deposits | 33,713,158 | 33,446,049 | 1 | % | 32,123,326 | 32,014,409 | 30,331,824 | 11 | % | ||||||||||||||

Other customer funding(a) |

90,536 | 106,620 | (15) | % | 151,644 | 170,873 | 226,258 | (60) | % | ||||||||||||||

| Total deposits and other customer funding | $ | 33,803,694 | $ | 33,552,669 | 1 | % | $ | 32,274,971 | $ | 32,185,282 | $ | 30,558,081 | 11 | % | |||||||||

Network transaction deposits(b) |

$ | 1,792,820 | $ | 1,566,139 | 14 | % | $ | 1,649,389 | $ | 1,600,619 | $ | 1,273,420 | 41 | % | |||||||||

Net deposits and other customer funding(c) |

$ | 28,079,644 | $ | 27,539,051 | 2 | % | $ | 27,274,183 | $ | 26,766,338 | $ | 28,099,096 | — | % | |||||||||

| Quarter average loan composition | Mar 31, 2024 | Dec 31, 2023 | Seql Qtr % Change | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | Comp Qtr % Change | ||||||||||||||||

| Commercial and industrial | $ | 9,729,718 | $ | 9,768,803 | — | % | $ | 9,927,271 | $ | 9,831,956 | $ | 9,600,838 | 1 | % | |||||||||

| Commercial real estate—owner occupied | 1,086,537 | 1,051,412 | 3 | % | 1,058,313 | 1,067,381 | 1,015,187 | 7 | % | ||||||||||||||

| Commercial and business lending | 10,816,255 | 10,820,214 | — | % | 10,985,584 | 10,899,337 | 10,616,026 | 2 | % | ||||||||||||||

| Commercial real estate—investor | 5,041,518 | 5,156,528 | (2) | % | 5,205,626 | 5,206,430 | 5,093,122 | (1) | % | ||||||||||||||

| Real estate construction | 2,348,444 | 2,241,281 | 5 | % | 2,107,018 | 2,088,937 | 2,158,072 | 9 | % | ||||||||||||||

| Commercial real estate lending | 7,389,962 | 7,397,809 | — | % | 7,312,645 | 7,295,367 | 7,251,193 | 2 | % | ||||||||||||||

| Total commercial | 18,206,217 | 18,218,024 | — | % | 18,298,229 | 18,194,703 | 17,867,219 | 2 | % | ||||||||||||||

| Residential mortgage | 7,896,956 | 8,691,258 | (9) | % | 8,807,157 | 8,701,496 | 8,584,528 | (8) | % | ||||||||||||||

| Auto finance | 2,373,720 | 2,138,536 | 11 | % | 1,884,540 | 1,654,523 | 1,490,115 | 59 | % | ||||||||||||||

| Home equity | 625,686 | 627,736 | — | % | 619,423 | 612,045 | 618,724 | 1 | % | ||||||||||||||

| Other consumer | 266,443 | 276,881 | (4) | % | 275,262 | 275,530 | 285,232 | (7) | % | ||||||||||||||

| Total consumer | 11,162,805 | 11,734,412 | (5) | % | 11,586,382 | 11,243,594 | 10,978,599 | 2 | % | ||||||||||||||

Total loans(d) |

$ | 29,369,022 | $ | 29,952,435 | (2) | % | $ | 29,884,611 | $ | 29,438,297 | $ | 28,845,818 | 2 | % | |||||||||

| Quarter average deposit composition | Mar 31, 2024 | Dec 31, 2023 | Seql Qtr % Change | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | Comp Qtr % Change | ||||||||||||||||

| Noninterest-bearing demand | $ | 5,882,052 | $ | 6,171,240 | (5) | % | $ | 6,318,781 | $ | 6,669,787 | $ | 7,340,219 | (20) | % | |||||||||

| Savings | 4,928,031 | 4,861,913 | 1 | % | 4,814,499 | 4,749,808 | 4,664,624 | 6 | % | ||||||||||||||

| Interest-bearing demand | 7,490,119 | 7,156,151 | 5 | % | 6,979,071 | 6,663,775 | 6,814,487 | 10 | % | ||||||||||||||

| Money market | 6,116,604 | 6,121,105 | — | % | 6,294,083 | 6,743,810 | 7,536,393 | (19) | % | ||||||||||||||

| Network transaction deposits | 1,651,937 | 1,616,719 | 2 | % | 1,639,619 | 1,468,006 | 1,147,089 | 44 | % | ||||||||||||||

| Brokered CDs | 4,268,881 | 3,470,516 | 23 | % | 3,428,711 | 3,001,775 | 810,889 | N/M | |||||||||||||||

| Other time deposits | 2,929,434 | 2,794,105 | 5 | % | 2,527,030 | 1,984,174 | 1,551,371 | 89 | % | ||||||||||||||

| Total deposits | 33,267,057 | 32,191,750 | 3 | % | 32,001,794 | 31,281,134 | 29,865,072 | 11 | % | ||||||||||||||

Other customer funding(a) |

101,483 | 127,252 | (20) | % | 164,289 | 196,051 | 245,349 | (59) | % | ||||||||||||||

| Total deposits and other customer funding | $ | 33,368,540 | $ | 32,319,002 | 3 | % | $ | 32,166,082 | $ | 31,477,186 | $ | 30,110,421 | 11 | % | |||||||||

Net deposits and other customer funding(c) |

$ | 27,447,723 | $ | 27,231,767 | 1 | % | $ | 27,097,752 | $ | 27,007,405 | $ | 28,152,443 | (3) | % | |||||||||

| Associated Banc-Corp Non-GAAP Financial Measures Reconciliation |

|||||||||||||||||

| ($ in millions, except per share data) | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | ||||||||||||

Selected equity and performance ratios(a)(b)(c) |

|||||||||||||||||

| Tangible common equity / tangible assets | 7.08 | % | 7.11 | % | 6.88 | % | 6.94 | % | 7.03 | % | |||||||

| Return on average equity | 7.81 | % | (8.74) | % | 7.99 | % | 8.47 | % | 10.32 | % | |||||||

| Return on average tangible common equity | 11.31 | % | (13.13) | % | 11.67 | % | 12.38 | % | 15.26 | % | |||||||

| Return on average common equity Tier 1 | 10.27 | % | (11.85) | % | 10.08 | % | 10.88 | % | 13.38 | % | |||||||

| Return on average tangible assets | 0.84 | % | (0.88) | % | 0.84 | % | 0.90 | % | 1.11 | % | |||||||

| Average stockholders' equity / average assets | 10.26 | % | 9.97 | % | 10.06 | % | 10.18 | % | 10.26 | % | |||||||

Tangible common equity reconciliation(a) |

|||||||||||||||||

| Common equity | $ | 3,975 | $ | 3,980 | $ | 3,934 | $ | 3,929 | $ | 3,932 | |||||||

| Goodwill and other intangible assets, net | (1,143) | (1,145) | (1,148) | (1,150) | (1,152) | ||||||||||||

| Tangible common equity | $ | 2,831 | $ | 2,834 | $ | 2,786 | $ | 2,779 | $ | 2,779 | |||||||

Tangible assets reconciliation(a) |

|||||||||||||||||

| Total assets | $ | 41,137 | $ | 41,016 | $ | 41,637 | $ | 41,219 | $ | 40,703 | |||||||

| Goodwill and other intangible assets, net | (1,143) | (1,145) | (1,148) | (1,150) | (1,152) | ||||||||||||

| Tangible assets | $ | 39,994 | $ | 39,870 | $ | 40,490 | $ | 40,070 | $ | 39,550 | |||||||

Average tangible common equity and average common equity Tier 1 reconciliation(a) |

|||||||||||||||||

| Common equity | $ | 3,987 | $ | 3,926 | $ | 3,938 | $ | 3,935 | $ | 3,868 | |||||||

| Goodwill and other intangible assets, net | (1,145) | (1,147) | (1,149) | (1,151) | (1,153) | ||||||||||||

| Tangible common equity | 2,843 | 2,780 | 2,789 | 2,784 | 2,715 | ||||||||||||

| Modified CECL transitional amount | 22 | 45 | 45 | 45 | 45 | ||||||||||||

| Accumulated other comprehensive loss | 188 | 286 | 302 | 252 | 259 | ||||||||||||

| Deferred tax assets, net | 12 | 27 | 28 | 28 | 28 | ||||||||||||

| Average common equity Tier 1 | $ | 3,065 | $ | 3,138 | $ | 3,164 | $ | 3,108 | $ | 3,047 | |||||||

Average tangible assets reconciliation(a) |

|||||||||||||||||

| Total assets | $ | 40,769 | $ | 41,331 | $ | 41,076 | $ | 40,558 | $ | 39,607 | |||||||

| Goodwill and other intangible assets, net | (1,145) | (1,147) | (1,149) | (1,151) | (1,153) | ||||||||||||

| Tangible assets | $ | 39,625 | $ | 40,184 | $ | 39,927 | $ | 39,407 | $ | 38,454 | |||||||

Adjusted net income reconciliation(b) |

|||||||||||||||||

| Net income | $ | 81 | $ | (91) | $ | 83 | $ | 87 | $ | 103 | |||||||

| Other intangible amortization, net of tax | 2 | 2 | 2 | 2 | 2 | ||||||||||||

| Adjusted net income | $ | 83 | $ | (89) | $ | 85 | $ | 89 | $ | 105 | |||||||

Adjusted net income available to common equity reconciliation(b) |

|||||||||||||||||

| Net income available to common equity | $ | 78 | $ | (94) | $ | 80 | $ | 84 | $ | 100 | |||||||

| Other intangible amortization, net of tax | 2 | 2 | 2 | 2 | 2 | ||||||||||||

| Adjusted net income available to common equity | $ | 80 | $ | (92) | $ | 82 | $ | 86 | $ | 102 | |||||||

Selected trend information(d) |

|||||||||||||||||

| Wealth management fees | $ | 22 | $ | 21 | $ | 21 | $ | 20 | $ | 20 | |||||||

| Service charges and deposit account fees | 12 | 11 | 13 | 12 | 13 | ||||||||||||

| Card-based fees | 11 | 12 | 12 | 11 | 11 | ||||||||||||

| Other fee-based revenue | 4 | 4 | 5 | 4 | 4 | ||||||||||||

| Fee-based revenue | 50 | 47 | 50 | 49 | 48 | ||||||||||||

| Other | 15 | (178) | 17 | 17 | 14 | ||||||||||||

| Total noninterest income | $ | 65 | $ | (131) | $ | 67 | $ | 66 | $ | 62 | |||||||

Pre-tax pre-provision income(e) |

|||||||||||||||||

| Income before income taxes | $ | 101 | $ | (138) | $ | 103 | $ | 111 | $ | 131 | |||||||

| Provision for credit losses | 24 | 21 | 22 | 22 | 18 | ||||||||||||

| Pre-tax pre-provision income | $ | 125 | $ | (117) | $ | 125 | $ | 133 | $ | 149 | |||||||

| End of period core customer deposits reconciliation | |||||||||||||||||

| Total deposits | $ | 33,713 | $ | 33,446 | $ | 32,123 | $ | 32,014 | $ | 30,332 | |||||||

| Network transaction deposits | (1,793) | (1,566) | (1,649) | (1,601) | (1,273) | ||||||||||||

| Brokered CDs | (3,931) | (4,447) | (3,351) | (3,818) | (1,186) | ||||||||||||

| Core customer deposits | $ | 27,989 | $ | 27,432 | $ | 27,123 | $ | 26,595 | $ | 27,873 | |||||||

| Associated Banc-Corp Non-GAAP Financial Measures Reconciliation |

1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | ||||||||||||

Efficiency ratio reconciliation(a) |

|||||||||||||||||

| Federal Reserve efficiency ratio | 61.03 | % | 132.01 | % | 60.06 | % | 58.49 | % | 56.07 | % | |||||||

| Fully tax-equivalent adjustment | (0.71) | % | (3.29) | % | (0.89) | % | (0.85) | % | (0.79) | % | |||||||

| Other intangible amortization | (0.69) | % | (1.21) | % | (0.69) | % | (0.68) | % | (0.66) | % | |||||||

| Fully tax-equivalent efficiency ratio | 59.63 | % | 127.54 | % | 58.50 | % | 56.96 | % | 54.64 | % | |||||||

| FDIC special assessment | (2.38) | % | (9.50) | % | — | % | — | % | — | % | |||||||

| Announced initiatives | — | % | (53.92) | % | — | % | — | % | — | % | |||||||

| Adjusted efficiency ratio | 57.25 | % | 64.12 | % | 58.50 | % | 56.96 | % | 54.64 | % | |||||||

| One Time Item Noninterest Income Reconciliation | YTD | ||||||||||

| ($ in thousands) | 4Q23 | Dec 2023 | |||||||||

| GAAP noninterest income | $ | (131,013) | $ | 63,182 | |||||||

Loss on mortgage portfolio sale(b) |

136,239 | 136,239 | |||||||||

Net loss on sale of investments(b) |

64,940 | 64,940 | |||||||||

| Noninterest income, excluding one time items | $ | 70,166 | $ | 264,361 | |||||||

| One Time Item Noninterest Expense Reconciliation | YTD | ||||||||||

| ($ in thousands) | 1Q24 | 4Q23 | Dec 2023 | ||||||||

| GAAP noninterest expense | $ | 197,657 | $ | 239,391 | $ | 813,682 | |||||

| FDIC special assessment | (7,696) | (30,597) | (30,597) | ||||||||

| Noninterest expense, excluding one time items | $ | 189,961 | $ | 208,795 | $ | 783,085 | |||||