May 2, 2023 2Q 2023 Fixed Income Investor Presentation Associated Banc-Corp Exhibit 99.1

1 Forward-Looking Statements Important note regarding forward-looking statements: Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “will,” “intend,” "target,“ “outlook,” “project,” “guidance,” or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include those identified in the Company’s most recent Form 10-K and subsequent Form 10-Qs and other SEC filings, and such factors are incorporated herein by reference. Trademarks: All trademarks, service marks, and trade names referenced in this material are official trademarks and the property of their respective owners. Presentation: Within the charts and tables presented, certain segments, columns and rows may not sum to totals shown due to rounding. Non-GAAP Measures: This presentation includes certain non-GAAP financial measures. These non-GAAP measures are provided in addition to, and not as substitutes for, measures of our financial performance determined in accordance with GAAP. Our calculation of these non-GAAP measures may not be comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related GAAP measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found at the end of this presentation.

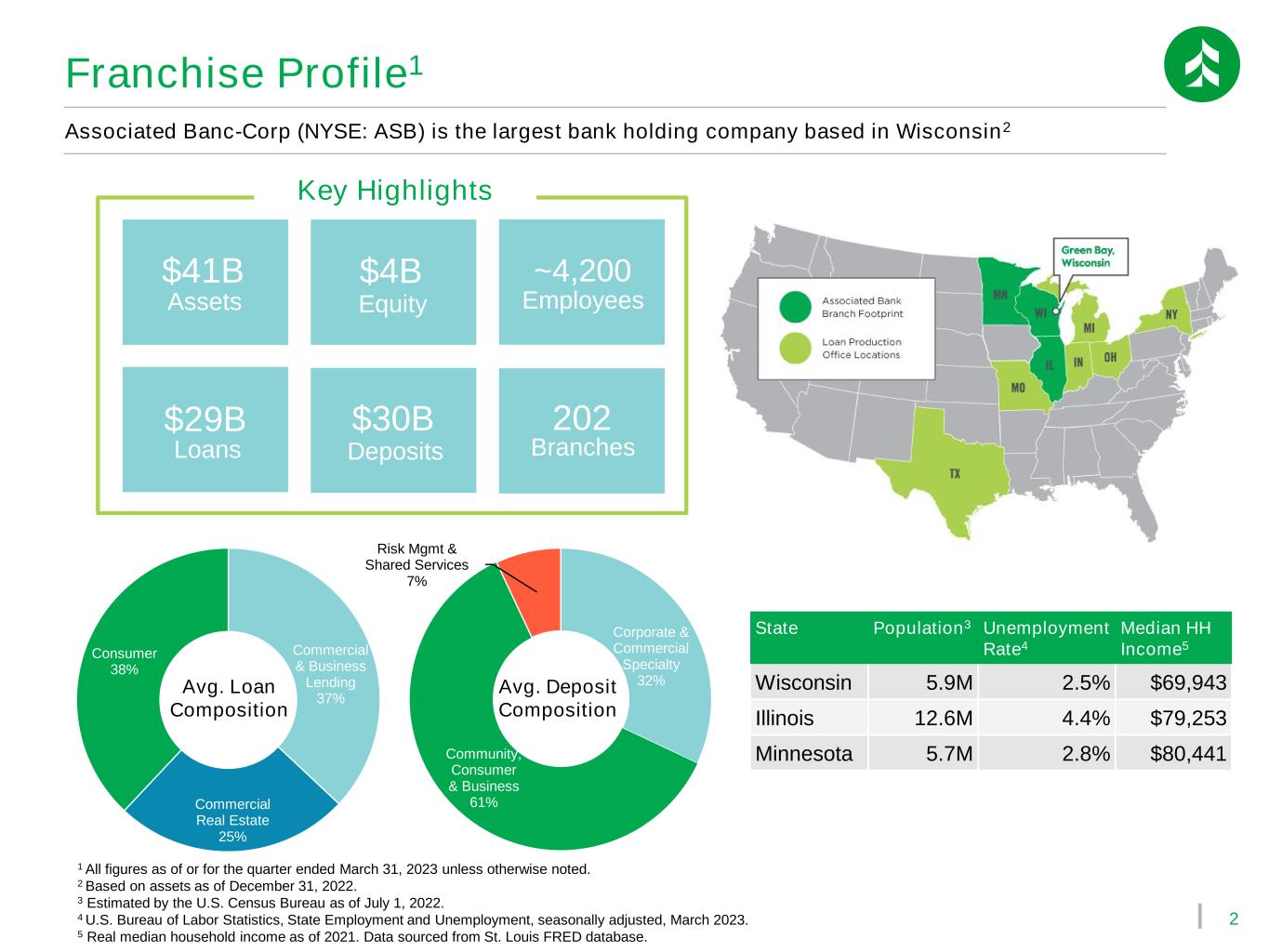

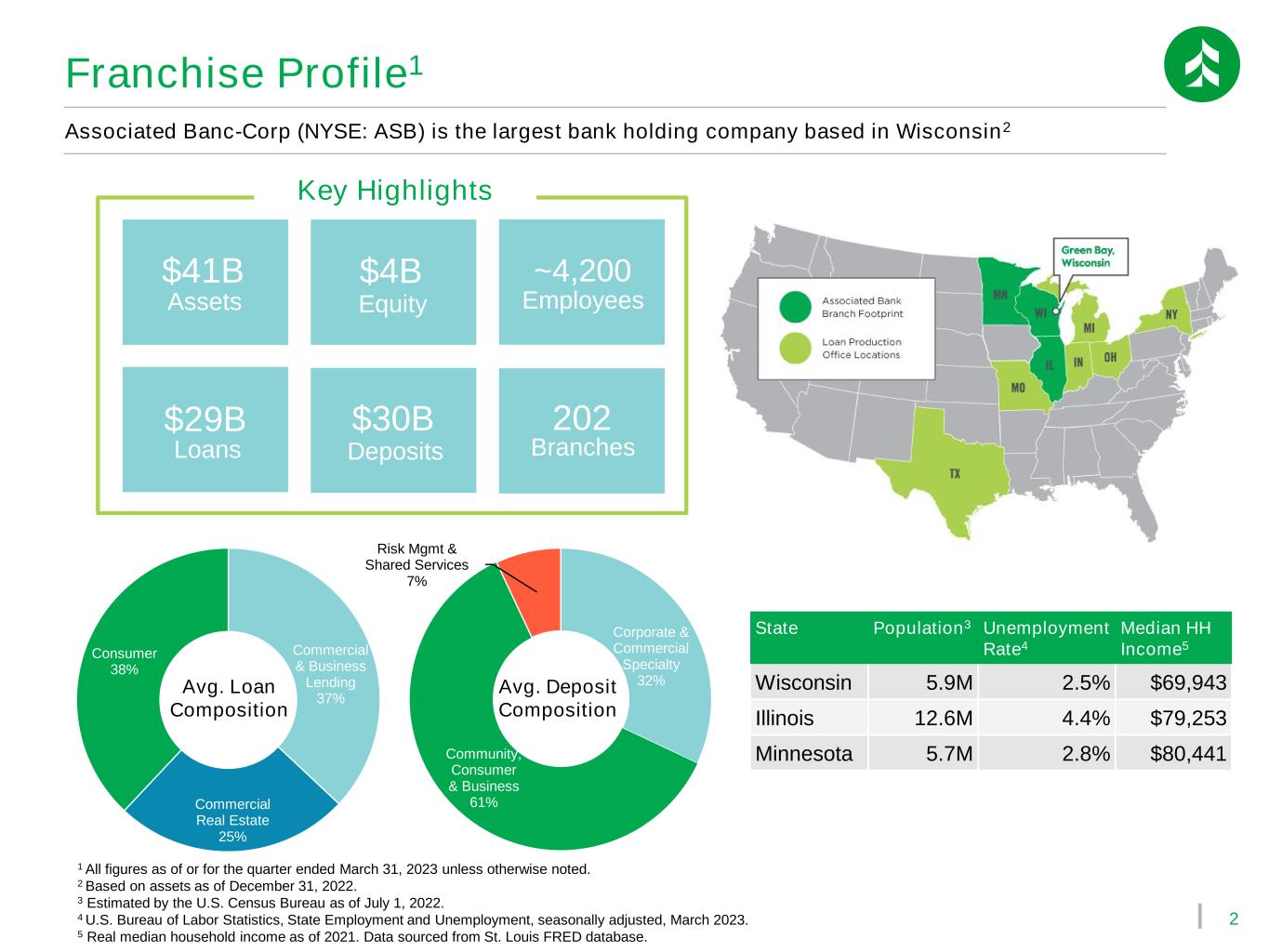

2 Corporate & Commercial Specialty 32% Community, Consumer & Business 61% Risk Mgmt & Shared Services 7% Commercial & Business Lending 37% Commercial Real Estate 25% Consumer 38% Associated Banc-Corp (NYSE: ASB) is the largest bank holding company based in Wisconsin2 Franchise Profile1 Key Highlights $41B $29B $4B $30B ~4,200 202 Assets Loans Equity Deposits Employees Branches Avg. Loan Composition Avg. Deposit Composition 1 All figures as of or for the quarter ended March 31, 2023 unless otherwise noted. 2 Based on assets as of December 31, 2022. 3 Estimated by the U.S. Census Bureau as of July 1, 2022. 4 U.S. Bureau of Labor Statistics, State Employment and Unemployment, seasonally adjusted, March 2023. 5 Real median household income as of 2021. Data sourced from St. Louis FRED database. State Population3 Unemployment Rate4 Median HH Income5 Wisconsin 5.9M 2.5% $69,943 Illinois 12.6M 4.4% $79,253 Minnesota 5.7M 2.8% $80,441

3 Deep Roots in Strong Communities Building on our Strong Foundation Our growth focused, digital forward plan has already added to the bottom line and is proving to be sustainable 1 Strong Foundation 1 2 3 4 5 Diversified & De-Risked Balance Sheet Enhanced Core Funding Profile Well-Positioned in a Changing Interest Rate Environment Robust Capital Position Investing in Digital Transformation Low-Cost Core Deposit Franchise Disciplined Expense Management Effective Risk Management

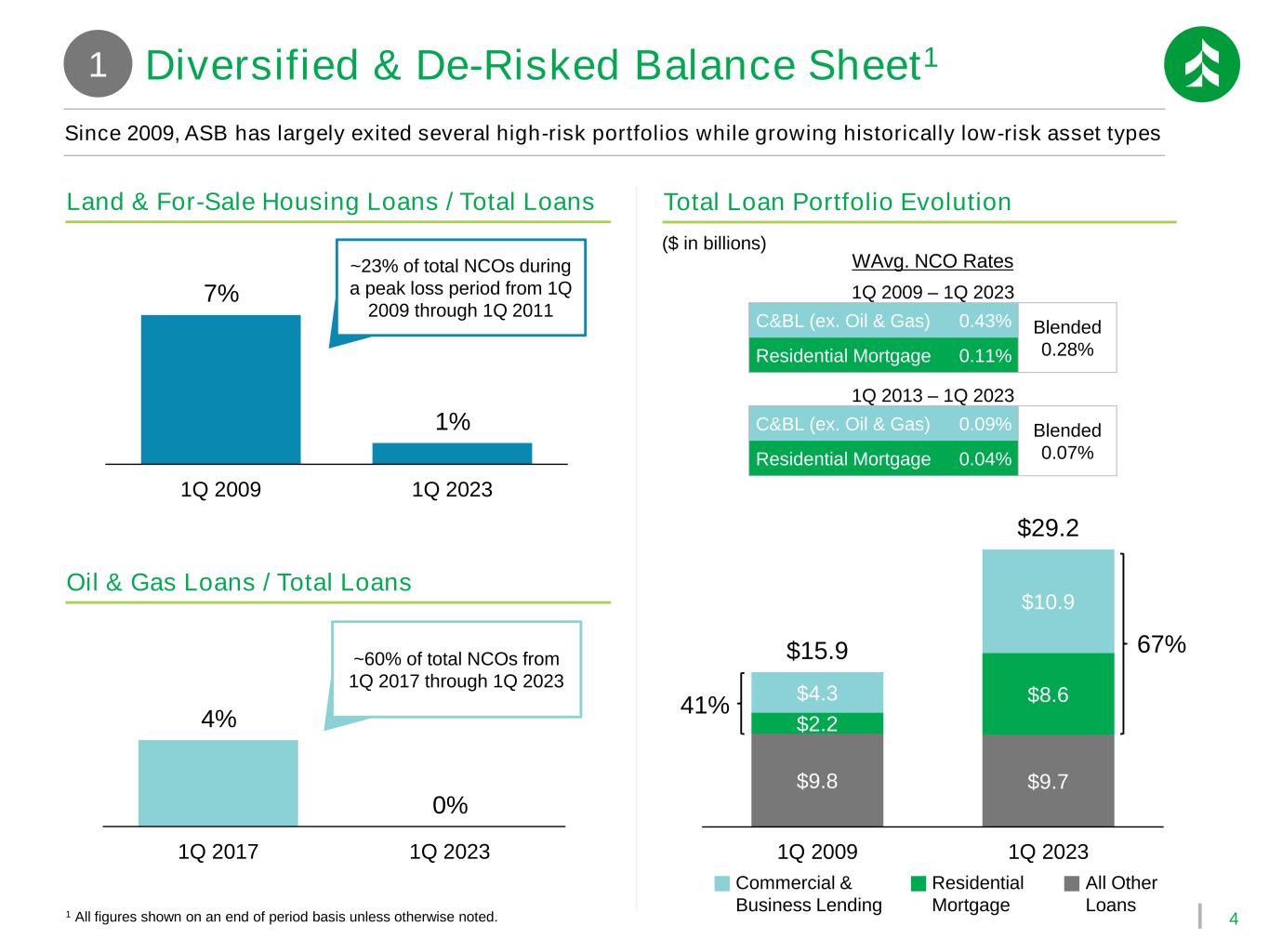

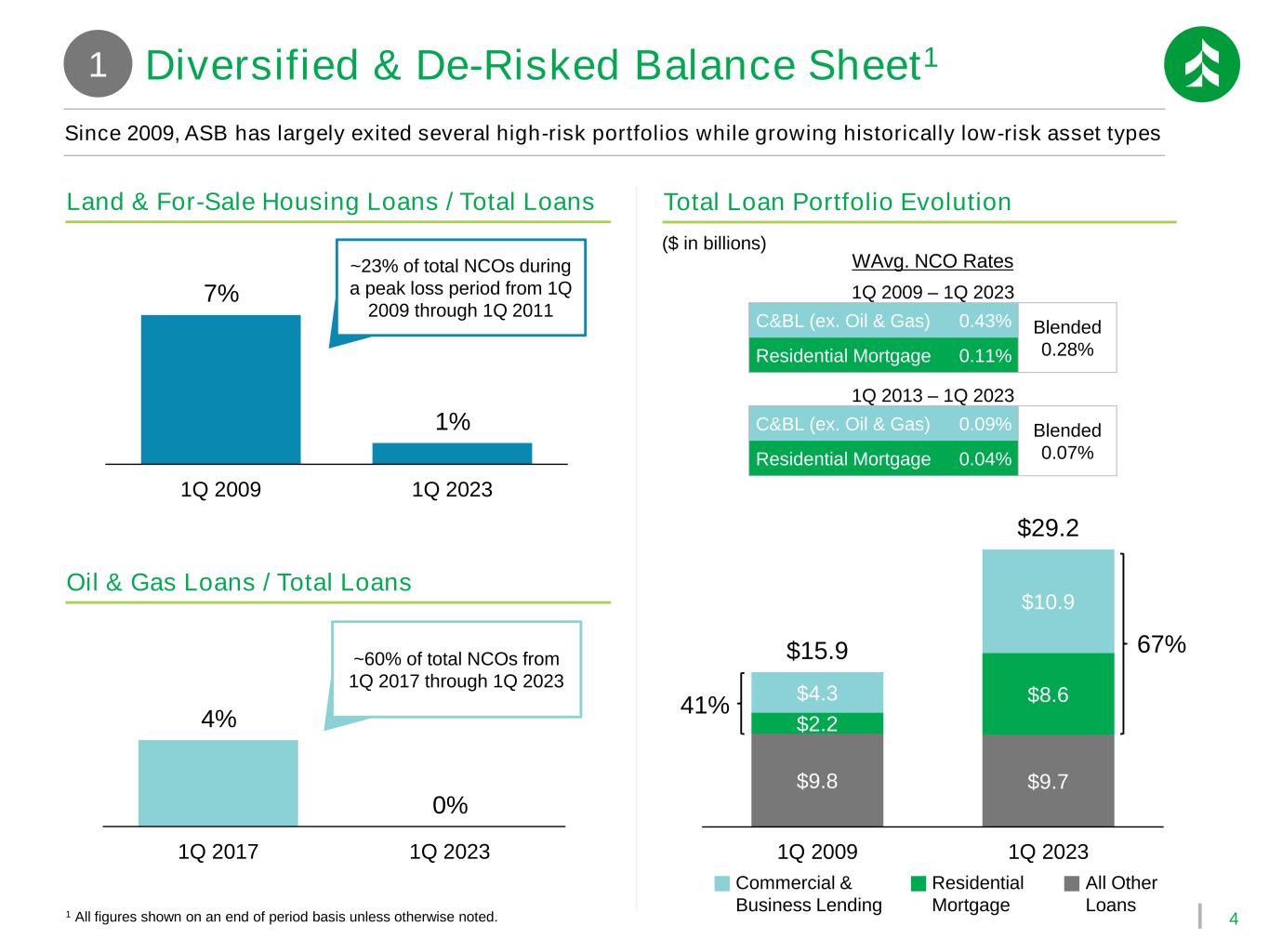

4 4% 0% 1Q 2017 1Q 2023 7% 1% 1Q 2009 1Q 2023 Diversified & De-Risked Balance Sheet1 Since 2009, ASB has largely exited several high-risk portfolios while growing historically low-risk asset types 1 $9.8 $9.7 $2.2 $8.6$4.3 $10.9 $15.9 $29.2 1Q 2009 1Q 2023 Land & For-Sale Housing Loans / Total Loans Oil & Gas Loans / Total Loans Total Loan Portfolio Evolution ($ in billions) Commercial & Business Lending Residential Mortgage All Other Loans 1 All figures shown on an end of period basis unless otherwise noted. 41% 67% 1Q 2013 – 1Q 2023 C&BL (ex. Oil & Gas) 0.09% Blended 0.07%Residential Mortgage 0.04% ~23% of total NCOs during a peak loss period from 1Q 2009 through 1Q 2011 ~60% of total NCOs from 1Q 2017 through 1Q 2023 1Q 2009 – 1Q 2023 C&BL (ex. Oil & Gas) 0.43% Blended 0.28%Residential Mortgage 0.11% WAvg. NCO Rates

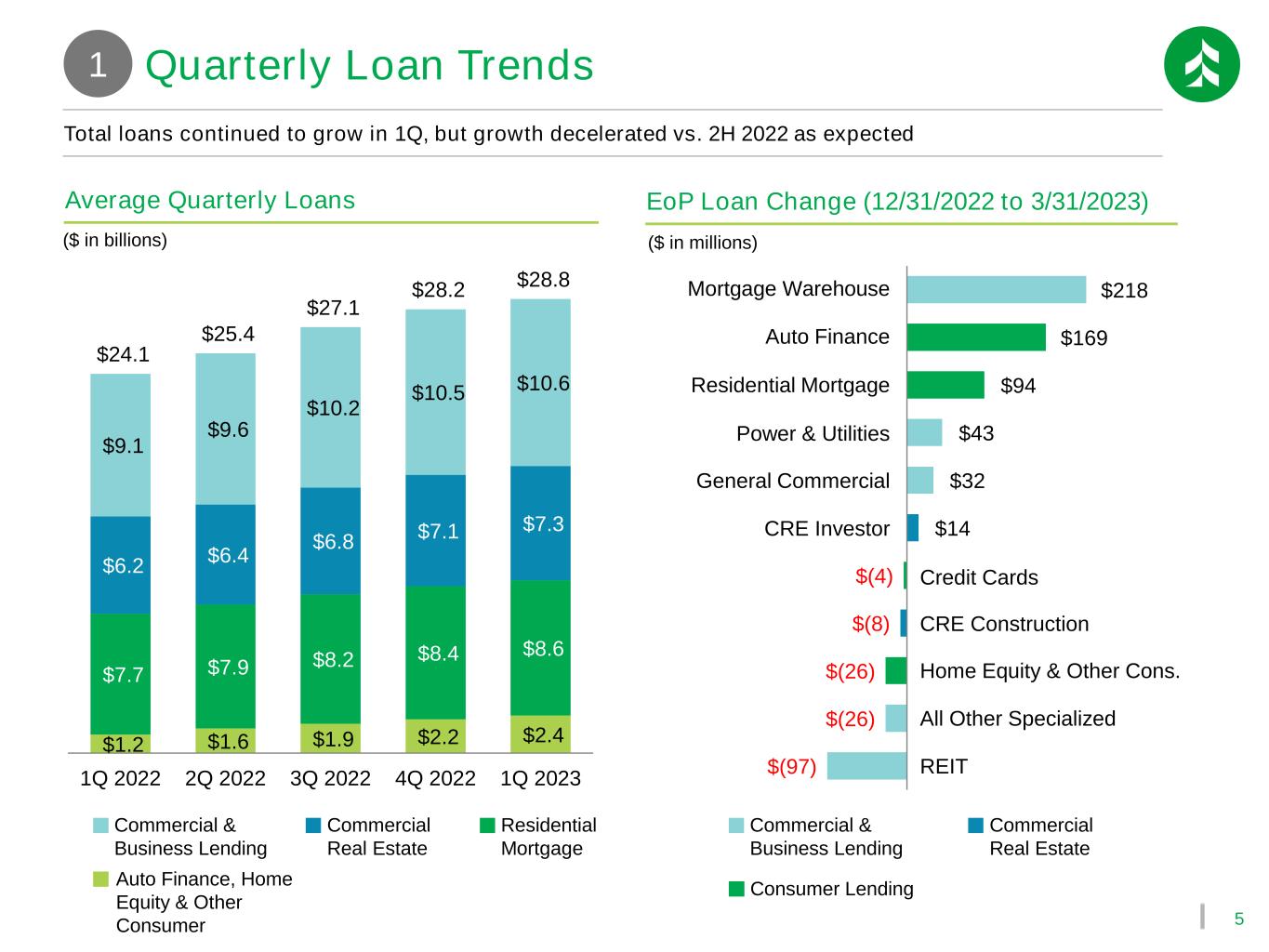

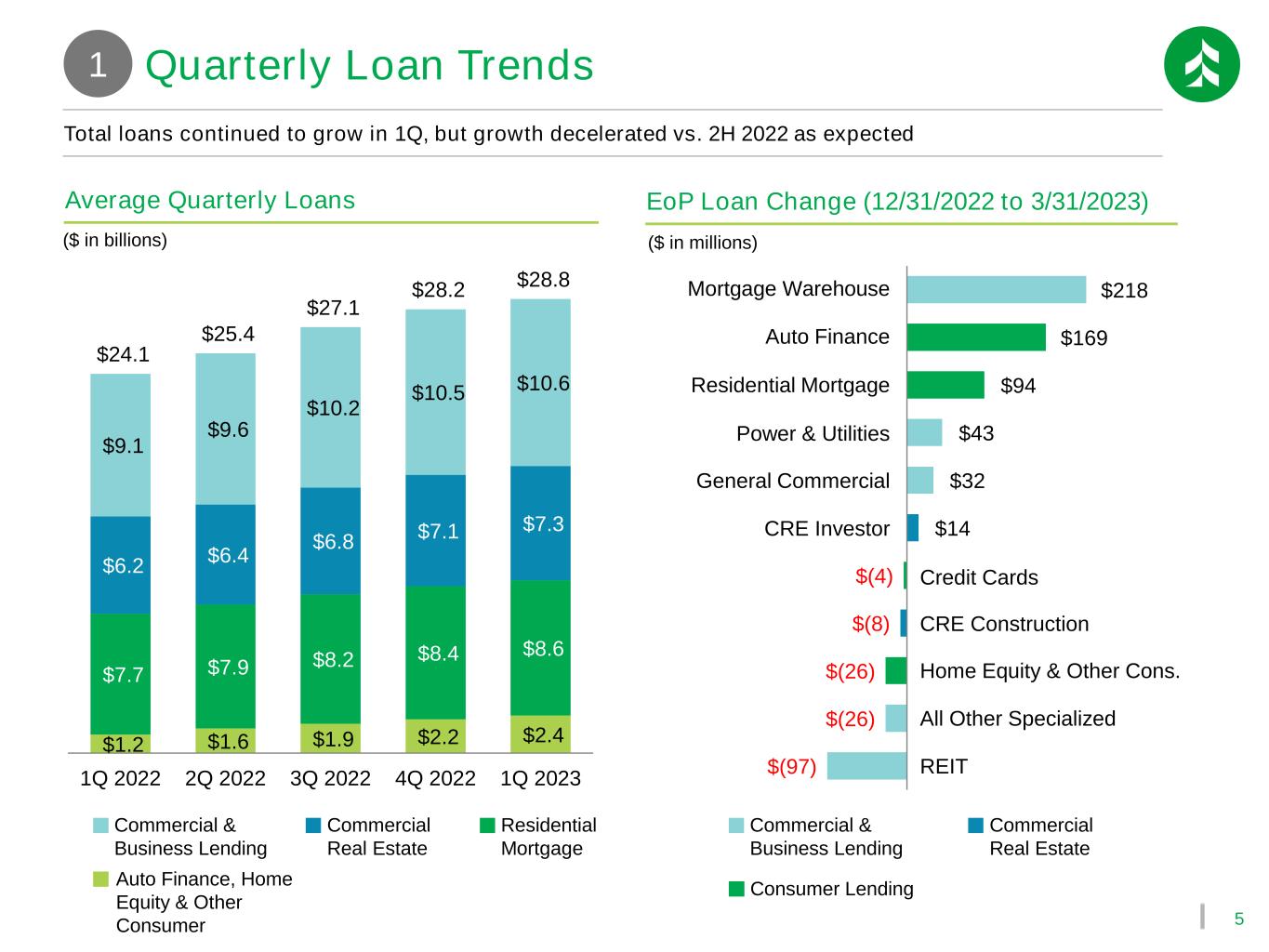

5 Total loans continued to grow in 1Q, but growth decelerated vs. 2H 2022 as expected Commercial & Business Lending Commercial Real Estate Consumer Lending $1.2 $1.6 $1.9 $2.2 $2.4 $7.7 $7.9 $8.2 $8.4 $8.6 $6.2 $6.4 $6.8 $7.1 $7.3 $9.1 $9.6 $10.2 $10.5 $10.6 $24.1 $25.4 $27.1 $28.2 $28.8 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 ($ in billions) Commercial & Business Lending Commercial Real Estate Residential Mortgage Auto Finance, Home Equity & Other Consumer Average Quarterly Loans ($ in millions) $(97) $(26) $(26) $(8) $(4) $14 $32 $43 $94 $169 $218 REIT Residential Mortgage CRE Investor Power & Utilities Mortgage Warehouse Auto Finance EoP Loan Change (12/31/2022 to 3/31/2023) All Other Specialized Home Equity & Other Cons. CRE Construction Credit Cards General Commercial Quarterly Loan Trends1

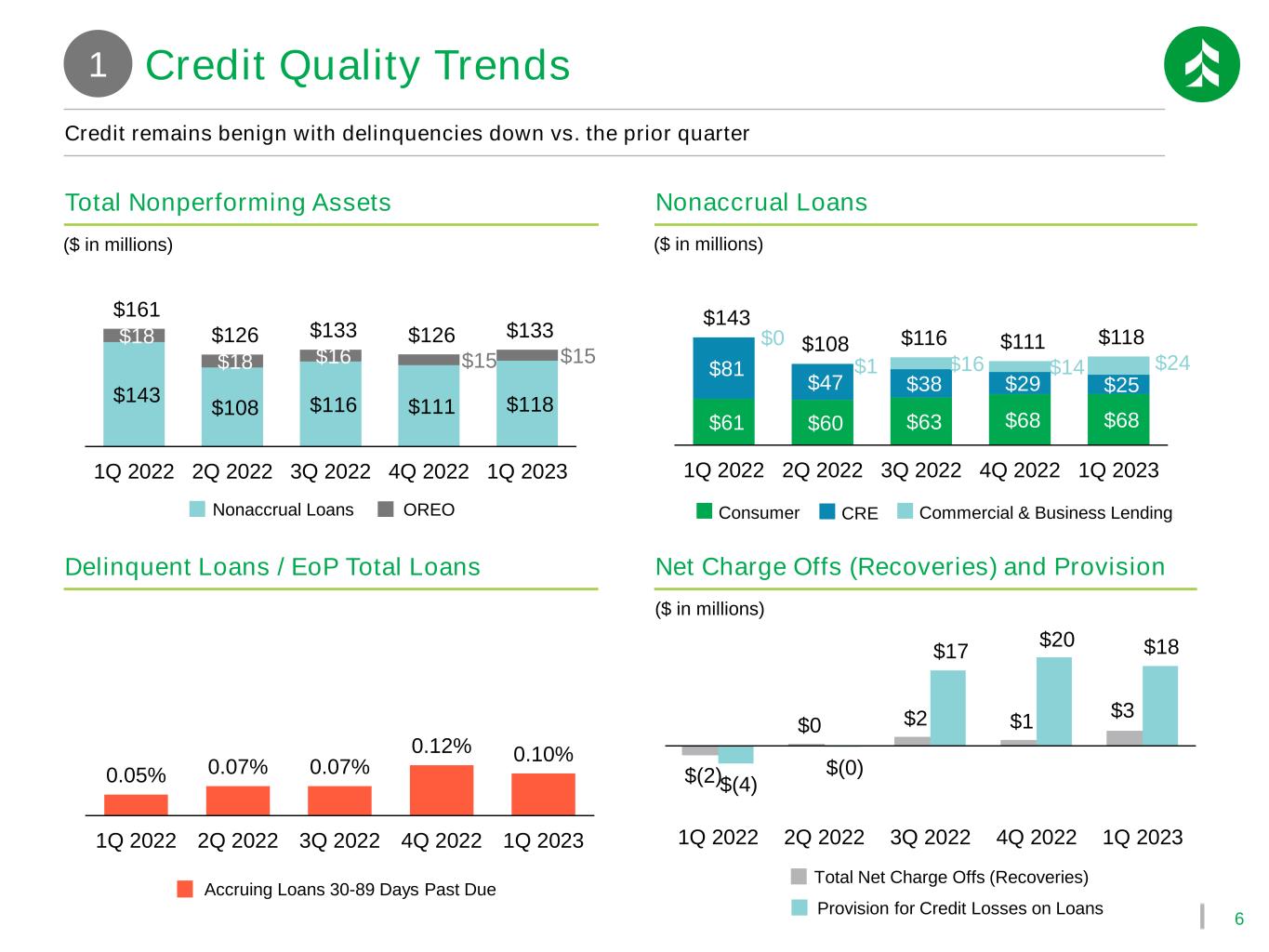

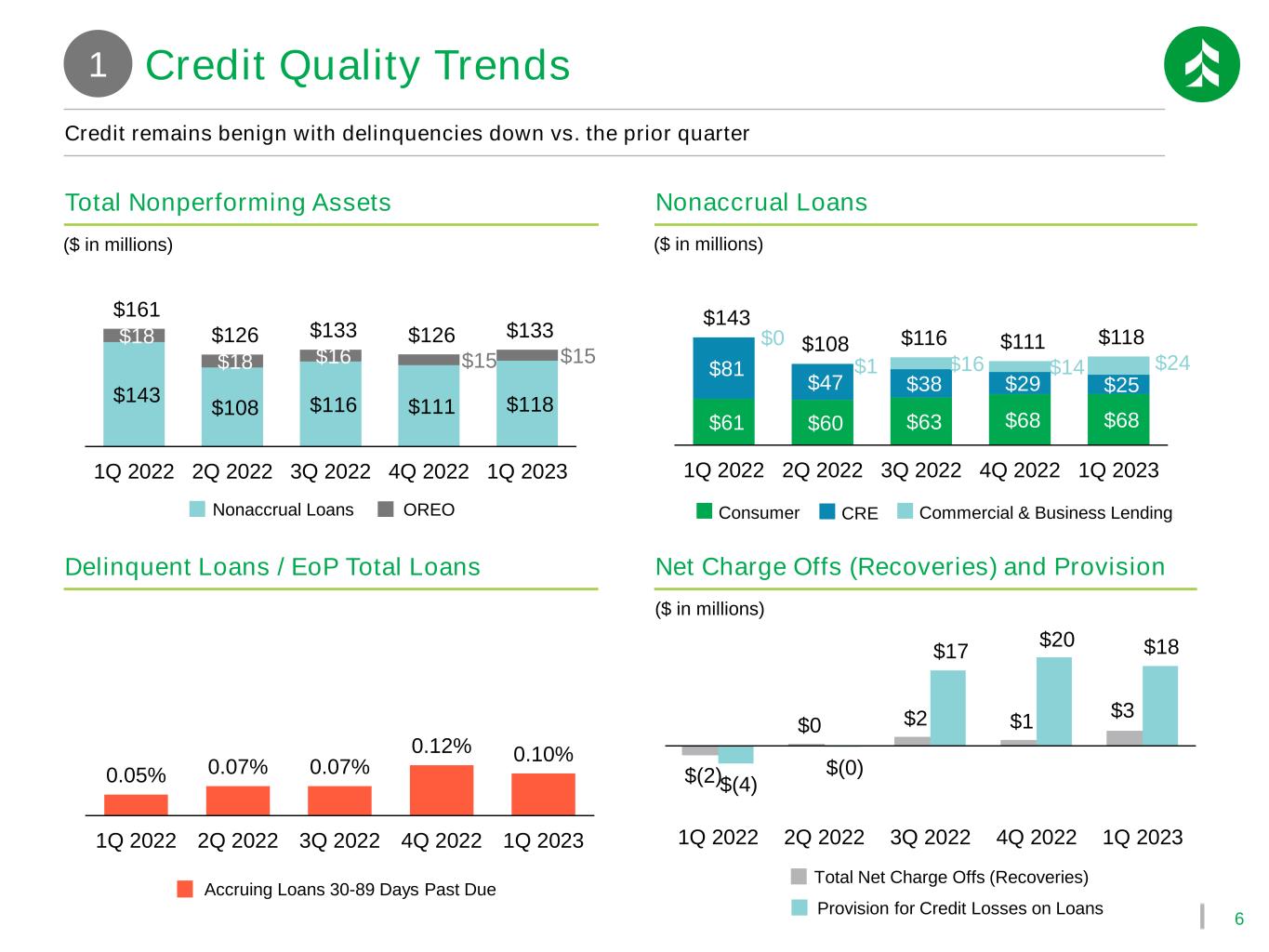

6 Net Charge Offs (Recoveries) and ProvisionDelinquent Loans / EoP Total Loans Nonaccrual LoansTotal Nonperforming Assets $61 $60 $63 $68 $68 $81 $47 $38 $29 $25 $0 $1 $16 $14 $24 $143 $108 $116 $111 $118 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 0.05% 0.07% 0.07% 0.12% 0.10% 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Credit remains benign with delinquencies down vs. the prior quarter ($ in millions) ($ in millions) Accruing Loans 30-89 Days Past Due CREConsumer $143 $108 $116 $111 $118 $18 $18 $16 $15 $15 $161 $126 $133 $126 $133 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 ($ in millions) $(2) $0 $2 $1 $3 $(4) $(0) $17 $20 $18 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Total Net Charge Offs (Recoveries) Provision for Credit Losses on Loans Commercial & Business LendingNonaccrual Loans OREO Credit Quality Trends1

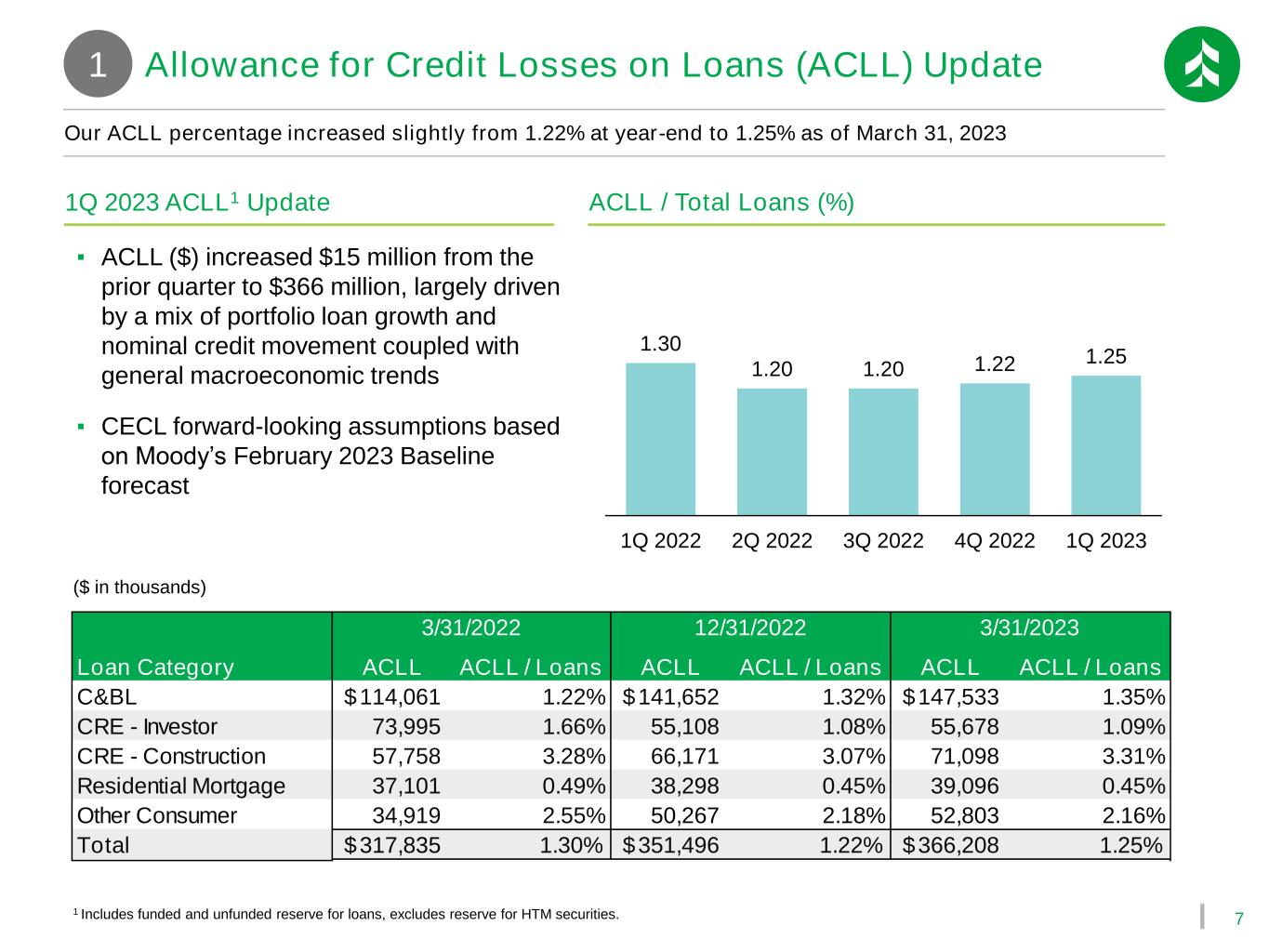

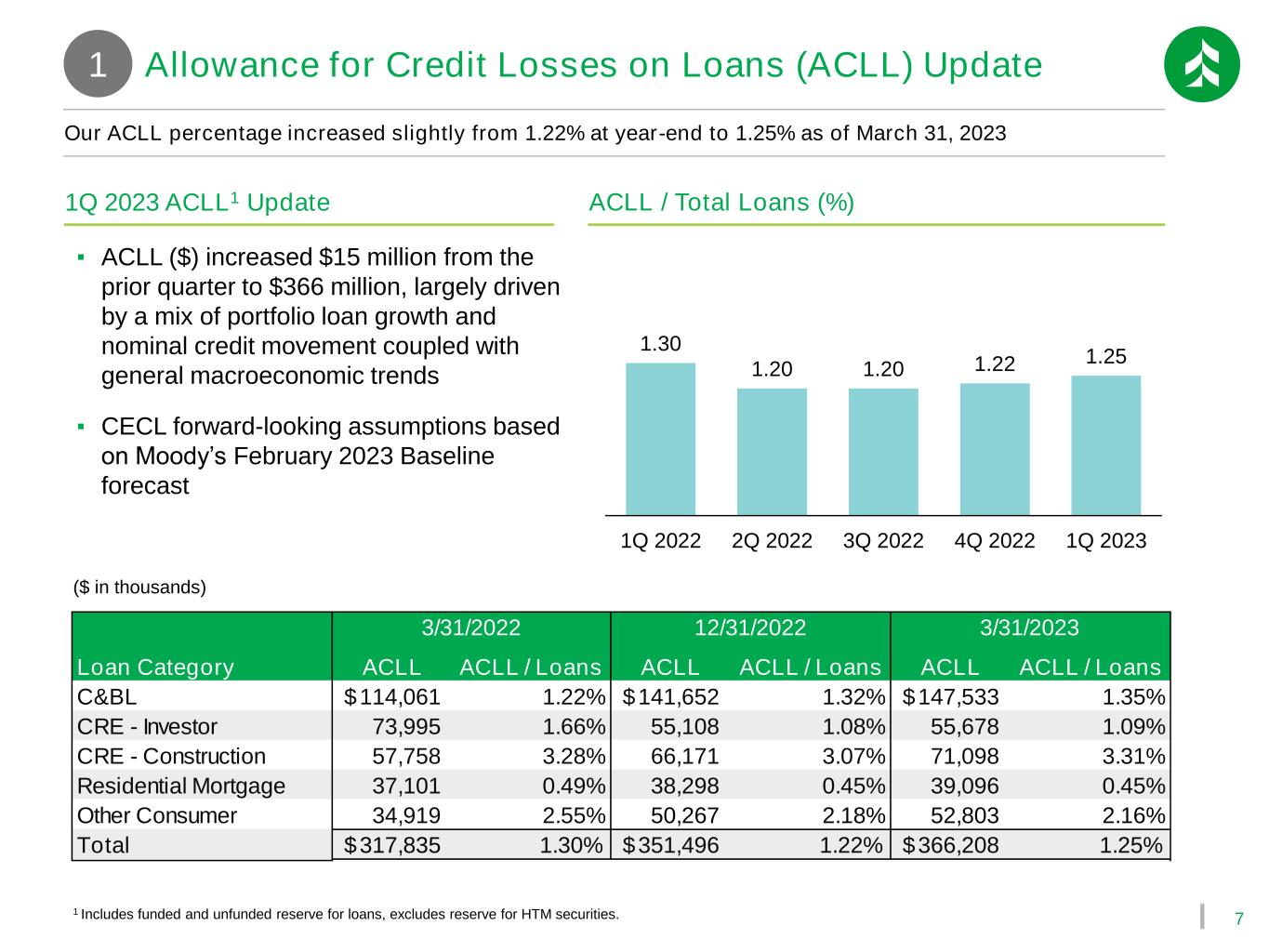

7 ACLL / Total Loans (%)1Q 2023 ACLL1 Update ▪ ACLL ($) increased $15 million from the prior quarter to $366 million, largely driven by a mix of portfolio loan growth and nominal credit movement coupled with general macroeconomic trends ▪ CECL forward-looking assumptions based on Moody’s February 2023 Baseline forecast 1 Includes funded and unfunded reserve for loans, excludes reserve for HTM securities. ($ in thousands) Our ACLL percentage increased slightly from 1.22% at year-end to 1.25% as of March 31, 2023 1.30 1.20 1.20 1.22 1.25 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Loan Category ACLL ACLL / Loans ACLL ACLL / Loans ACLL ACLL / Loans C&BL 114,061$ 1.22% 141,652$ 1.32% 147,533$ 1.35% CRE - Investor 73,995 1.66% 55,108 1.08% 55,678 1.09% CRE - Construction 57,758 3.28% 66,171 3.07% 71,098 3.31% Residential Mortgage 37,101 0.49% 38,298 0.45% 39,096 0.45% Other Consumer 34,919 2.55% 50,267 2.18% 52,803 2.16% Total 317,835$ 1.30% 351,496$ 1.22% 366,208$ 1.25% 3/31/202312/31/20223/31/2022 Allowance for Credit Losses on Loans (ACLL) Update1

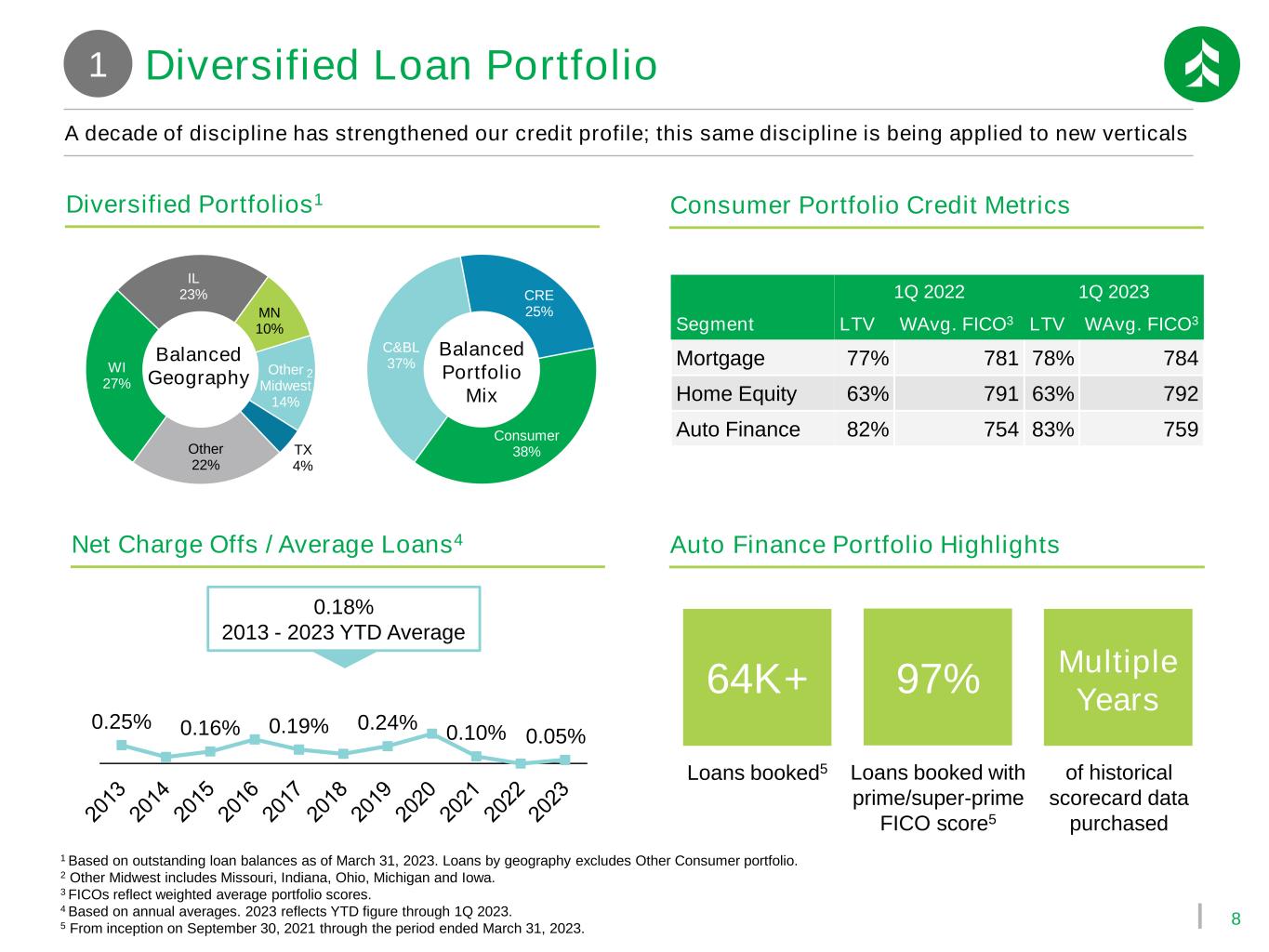

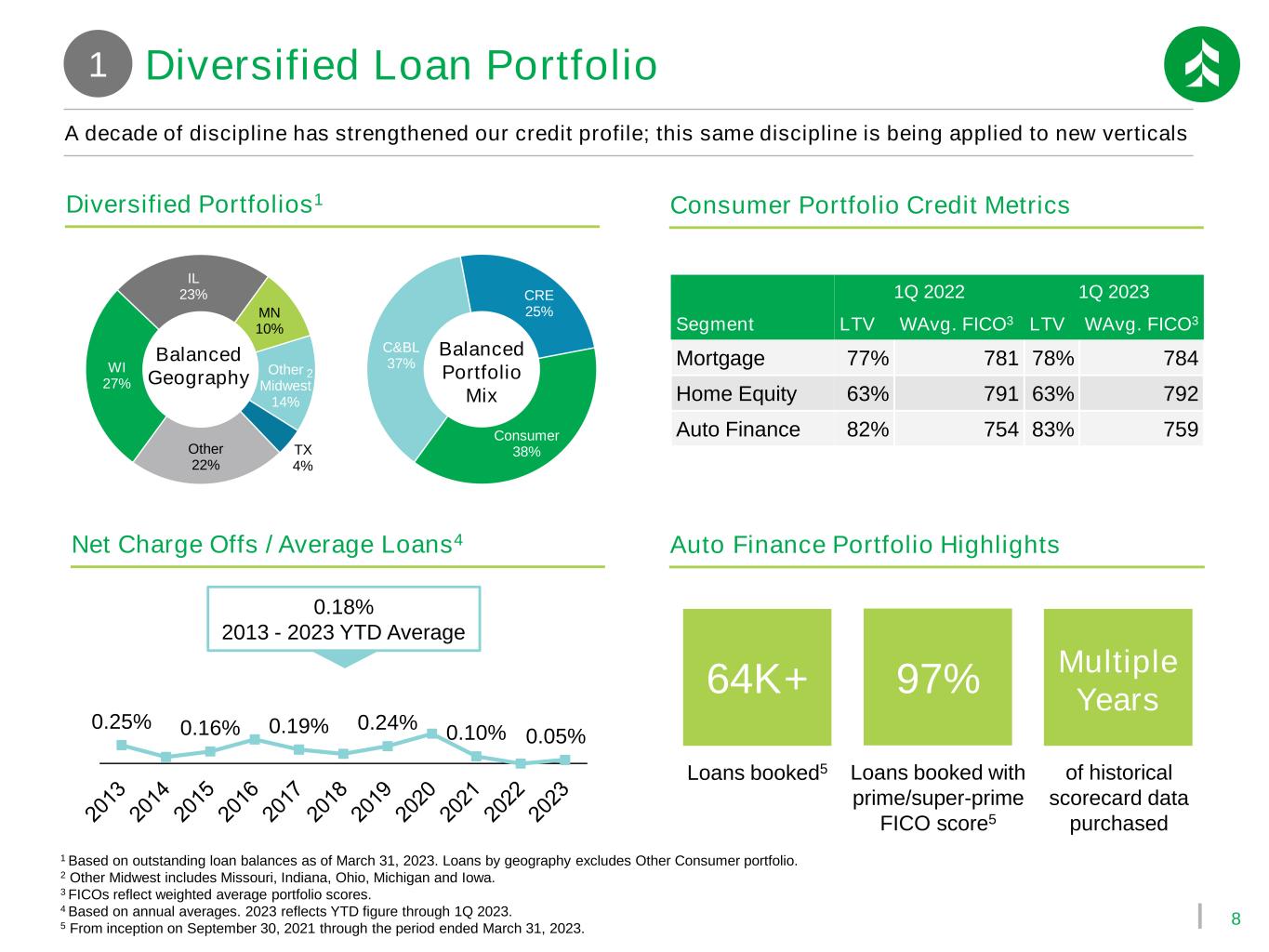

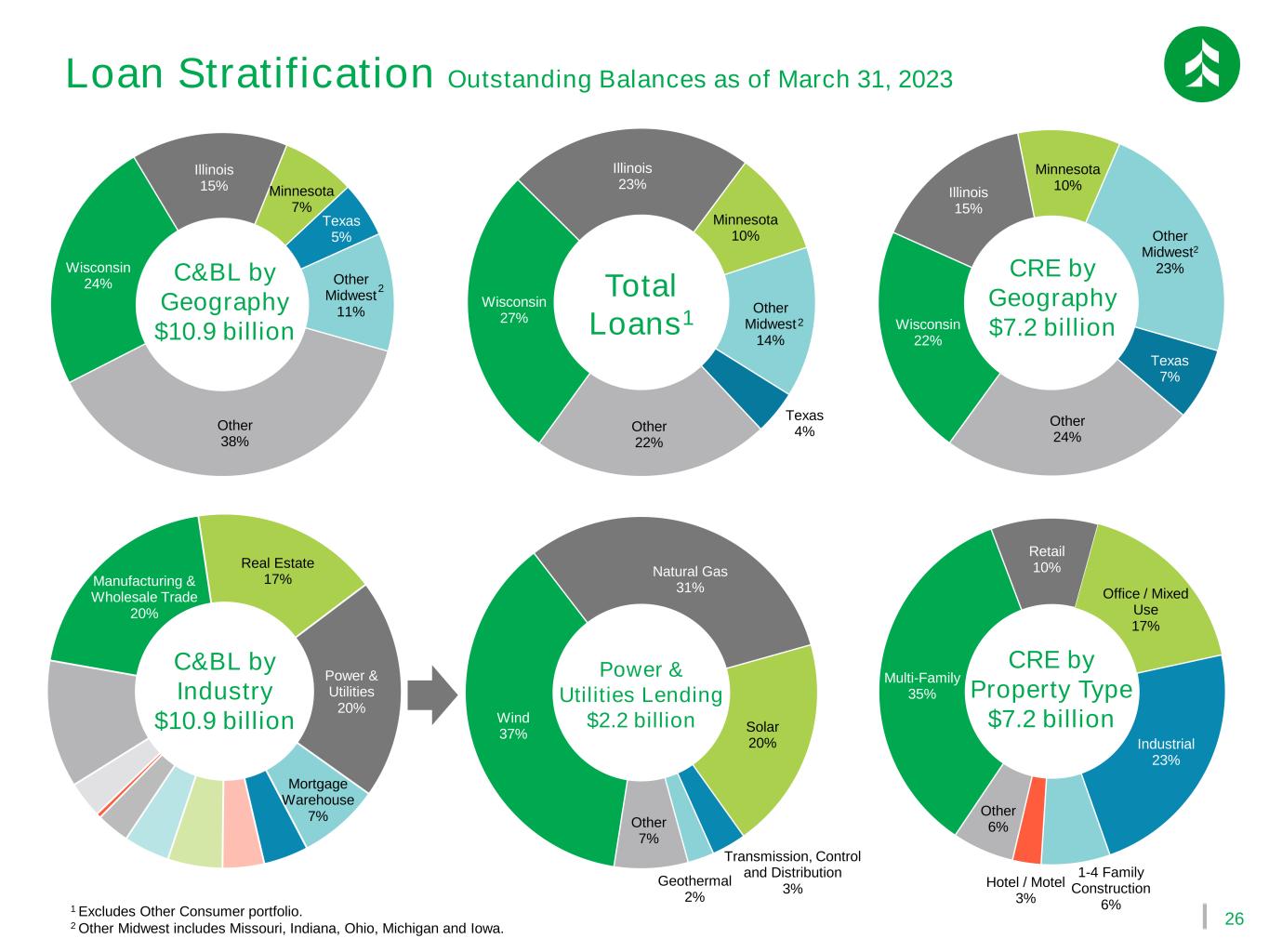

8 1 Based on outstanding loan balances as of March 31, 2023. Loans by geography excludes Other Consumer portfolio. 2 Other Midwest includes Missouri, Indiana, Ohio, Michigan and Iowa. 3 FICOs reflect weighted average portfolio scores. 4 Based on annual averages. 2023 reflects YTD figure through 1Q 2023. 5 From inception on September 30, 2021 through the period ended March 31, 2023. WI 27% IL 23% MN 10% Other Midwest 14% TX 4% Other 22% Balanced Geography C&BL 37% CRE 25% Consumer 38% Balanced Portfolio Mix 2 A decade of discipline has strengthened our credit profile; this same discipline is being applied to new verticals 0.25% 0.16% 0.19% 0.24% 0.10% 0.05% 1Q 2022 1Q 2023 Segment LTV WAvg. FICO3 LTV WAvg. FICO3 Mortgage 77% 781 78% 784 Home Equity 63% 791 63% 792 Auto Finance 82% 754 83% 759 Consumer Portfolio Credit MetricsDiversified Portfolios1 Net Charge Offs / Average Loans4 Diversified Loan Portfolio1 0.18% 2013 - 2023 YTD Average Auto Finance Portfolio Highlights 97% Multiple Years Loans booked with prime/super-prime FICO score5 of historical scorecard data purchased 64K+ Loans booked5

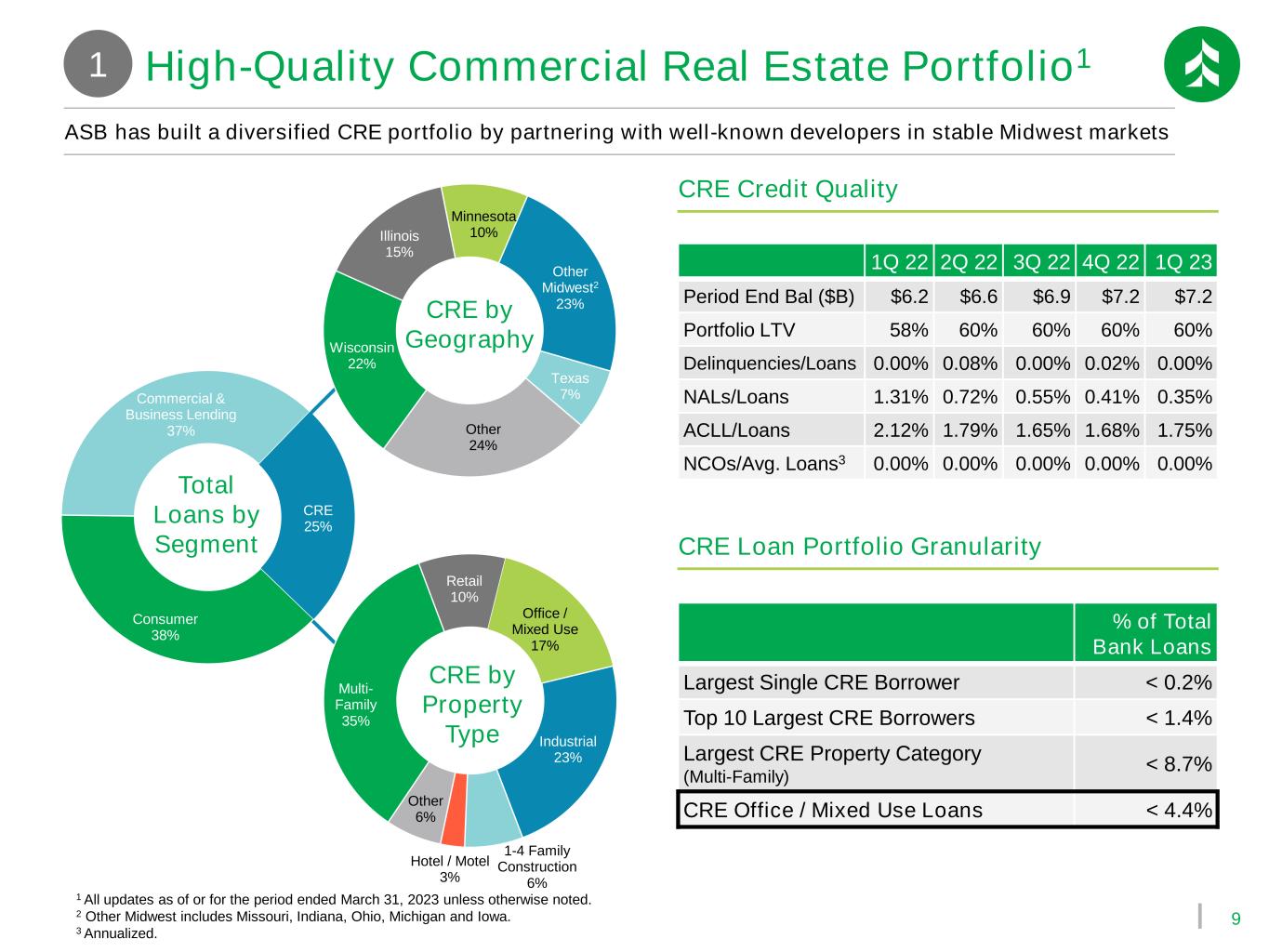

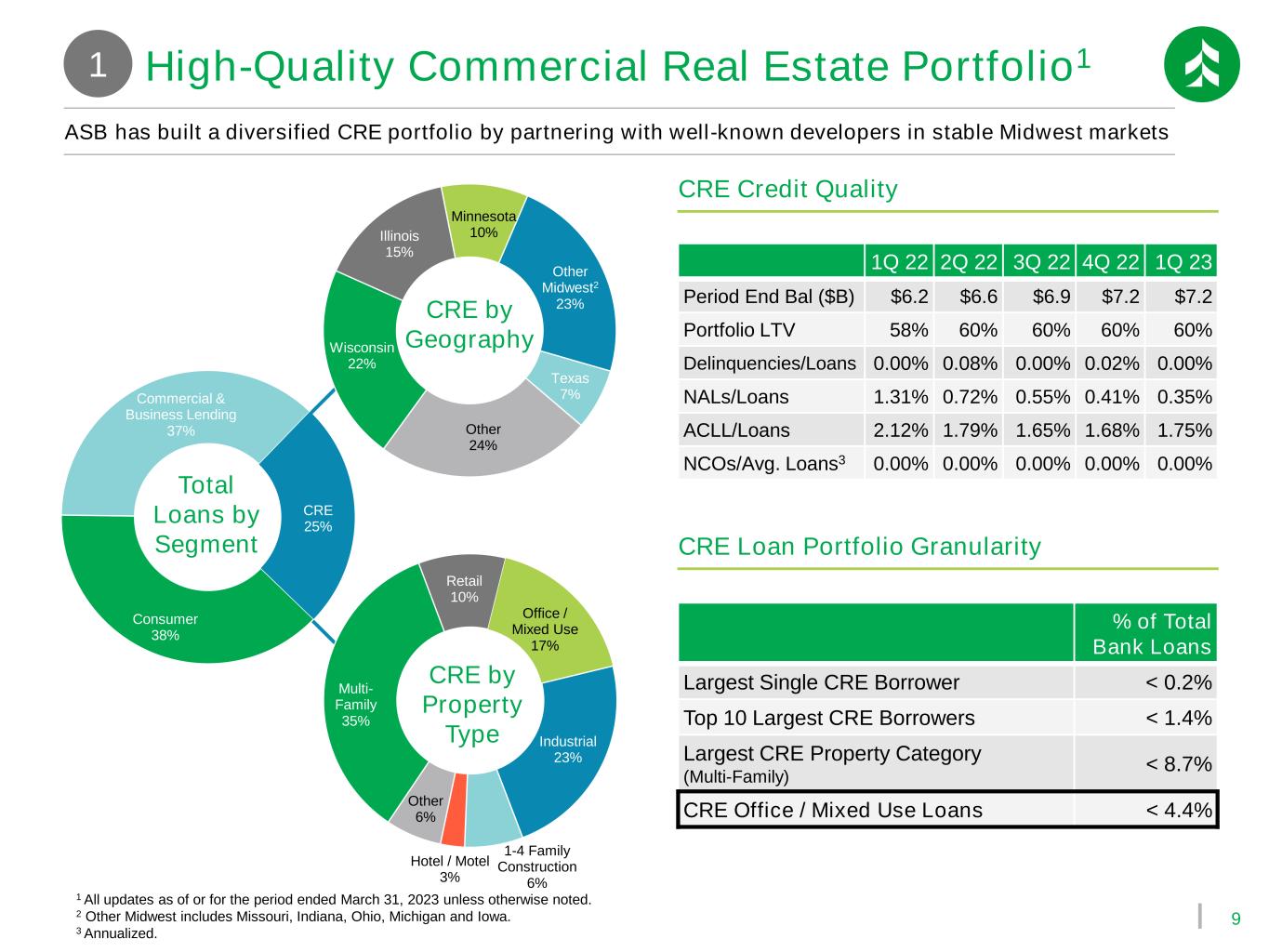

9 Wisconsin 22% Illinois 15% Minnesota 10% Other Midwest2 23% Texas 7% Other 24% Multi- Family 35% Retail 10% Office / Mixed Use 17% Industrial 23% 1-4 Family Construction 6% Hotel / Motel 3% Other 6% Consumer 38% Commercial & Business Lending 37% CRE 25% 1 All updates as of or for the period ended March 31, 2023 unless otherwise noted. 2 Other Midwest includes Missouri, Indiana, Ohio, Michigan and Iowa. 3 Annualized. High-Quality Commercial Real Estate Portfolio1 ASB has built a diversified CRE portfolio by partnering with well-known developers in stable Midwest markets 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 Period End Bal ($B) $6.2 $6.6 $6.9 $7.2 $7.2 Portfolio LTV 58% 60% 60% 60% 60% Delinquencies/Loans 0.00% 0.08% 0.00% 0.02% 0.00% NALs/Loans 1.31% 0.72% 0.55% 0.41% 0.35% ACLL/Loans 2.12% 1.79% 1.65% 1.68% 1.75% NCOs/Avg. Loans3 0.00% 0.00% 0.00% 0.00% 0.00% CRE Credit Quality CRE Loan Portfolio Granularity % of Total Bank Loans Largest Single CRE Borrower < 0.2% Top 10 Largest CRE Borrowers < 1.4% Largest CRE Property Category (Multi-Family) < 8.7% CRE Office / Mixed Use Loans < 4.4% CRE by Geography CRE by Property Type Total Loans by Segment 1

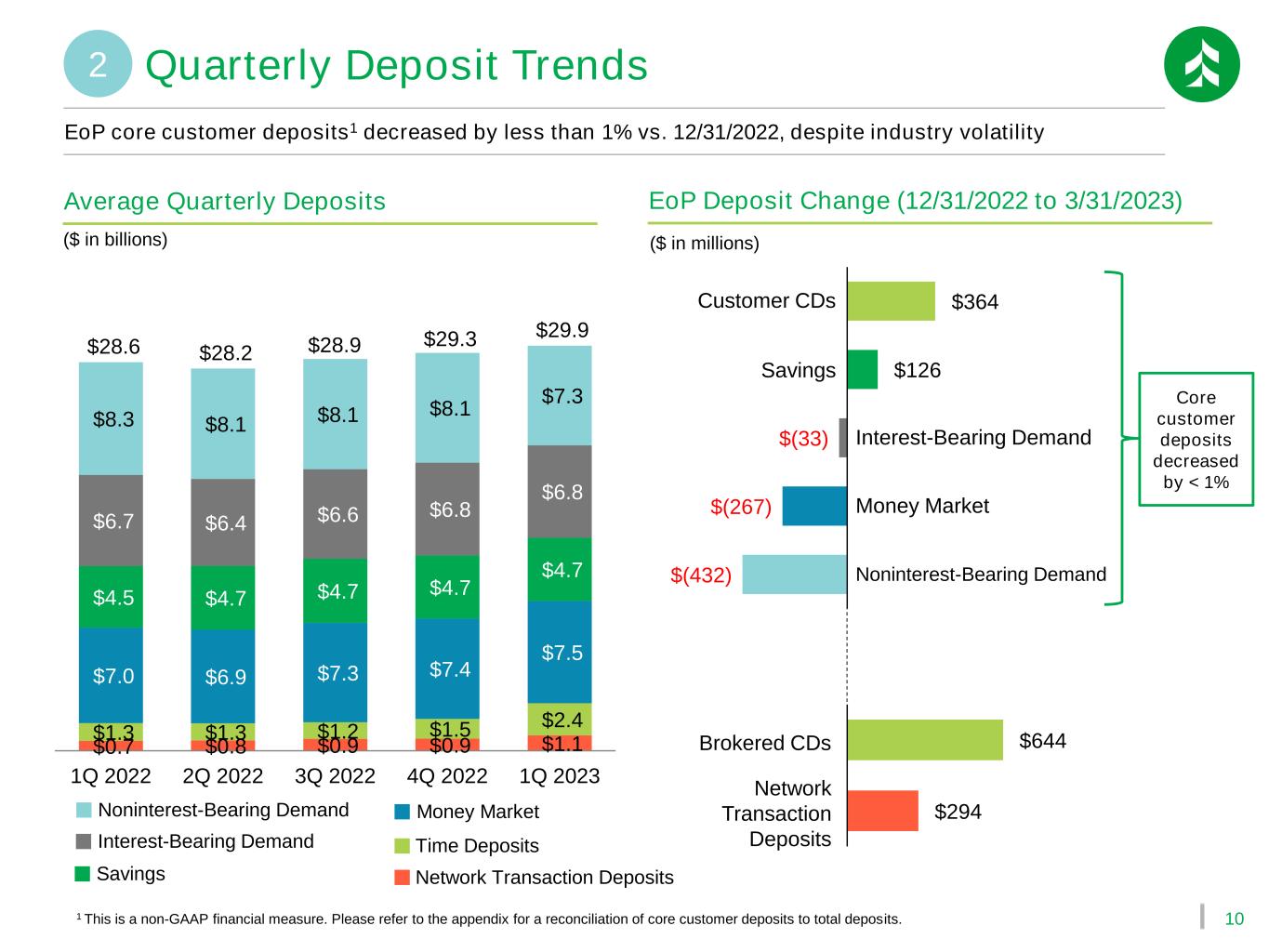

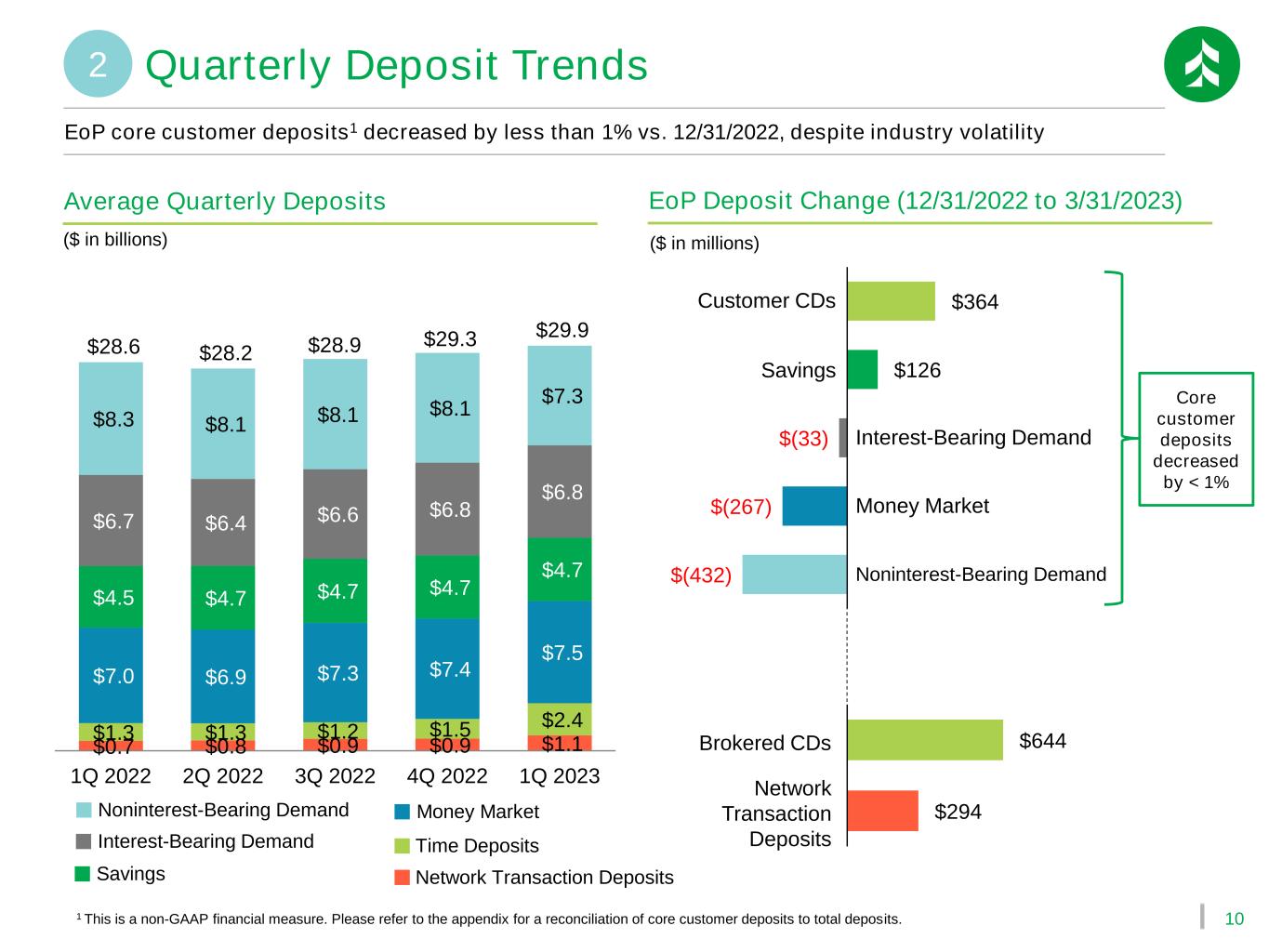

10 Average Quarterly Deposits $0.7 $0.8 $0.9 $0.9 $1.1 $1.3 $1.3 $1.2 $1.5 $2.4 $7.0 $6.9 $7.3 $7.4 $7.5 $4.5 $4.7 $4.7 $4.7 $4.7 $6.7 $6.4 $6.6 $6.8 $6.8 $8.3 $8.1 $8.1 $8.1 $7.3 $28.6 $28.2 $28.9 $29.3 $29.9 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 EoP core customer deposits1 decreased by less than 1% vs. 12/31/2022, despite industry volatility ($ in billions) $(432) $(267) $(33) $126 $364 Customer CDs Money Market EoP Deposit Change (12/31/2022 to 3/31/2023) ($ in millions) 1 This is a non-GAAP financial measure. Please refer to the appendix for a reconciliation of core customer deposits to total deposits. Time Deposits Savings Money Market Network Transaction Deposits Noninterest-Bearing Demand Interest-Bearing Demand Savings Noninterest-Bearing Demand Interest-Bearing Demand $294 $644 Network Transaction Deposits Brokered CDs Core customer deposits decreased by < 1% Quarterly Deposit Trends2

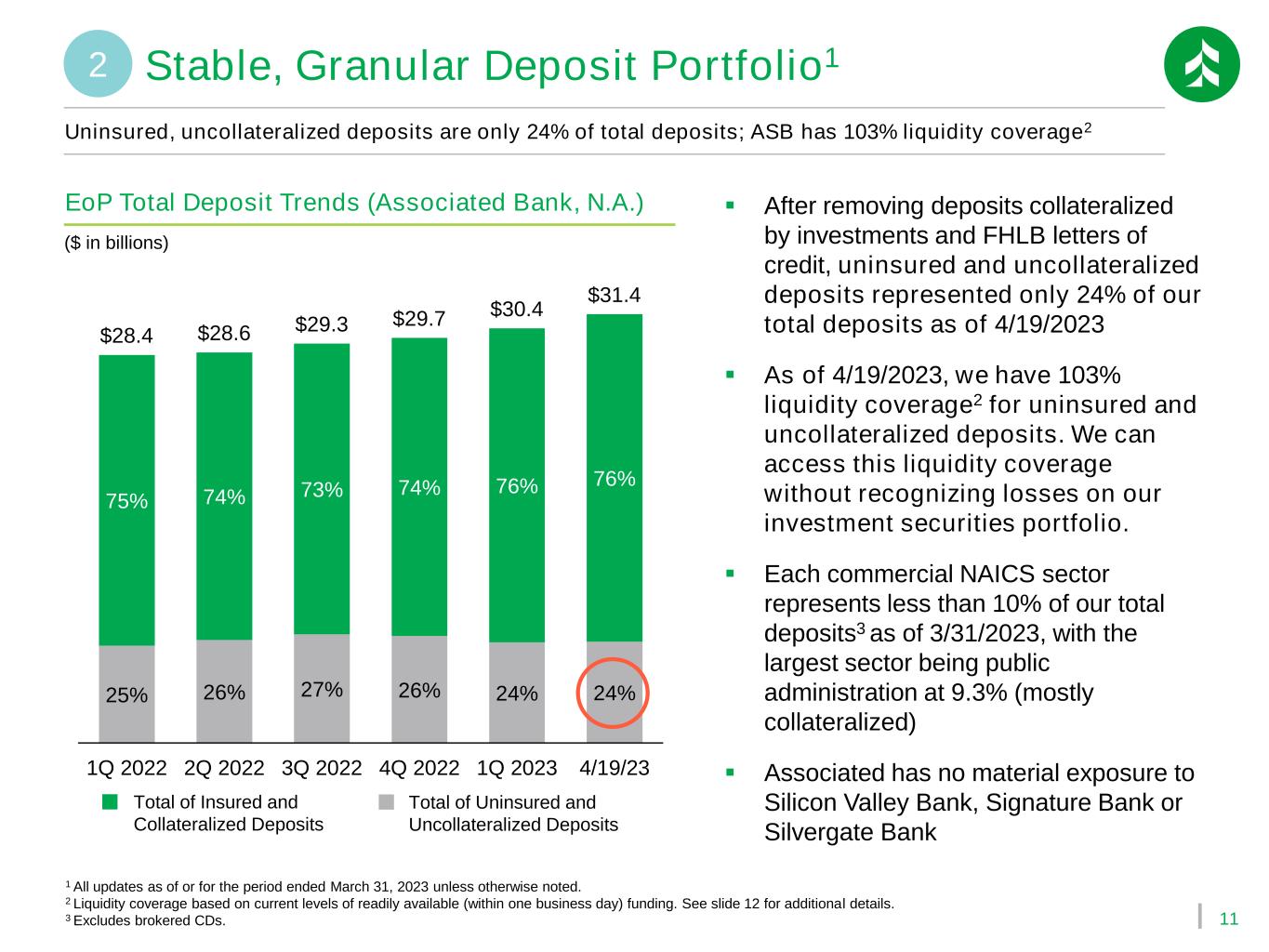

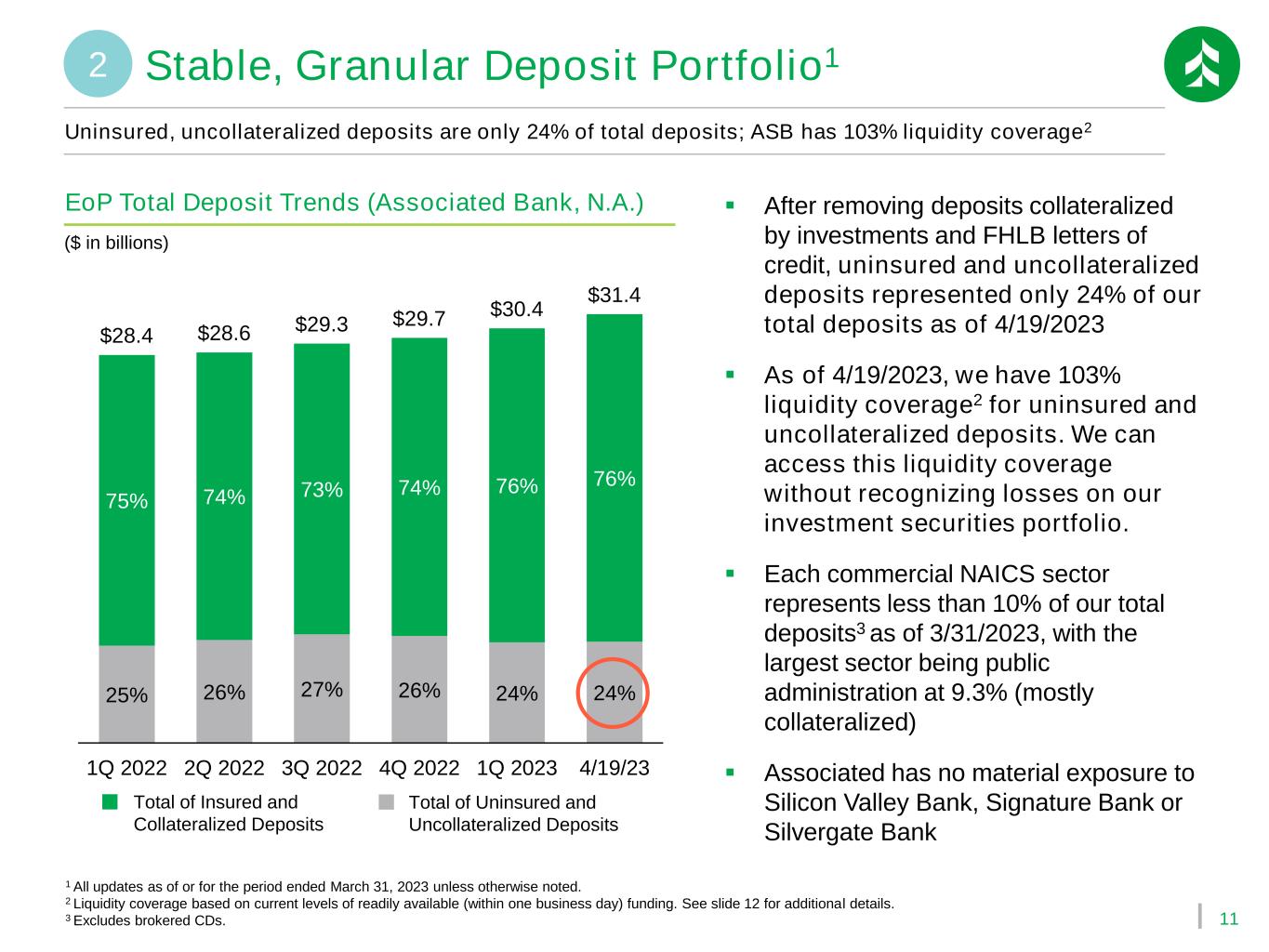

11 Stable, Granular Deposit Portfolio1 Uninsured, uncollateralized deposits are only 24% of total deposits; ASB has 103% liquidity coverage2 ▪ After removing deposits collateralized by investments and FHLB letters of credit, uninsured and uncollateralized deposits represented only 24% of our total deposits as of 4/19/2023 ▪ As of 4/19/2023, we have 103% liquidity coverage2 for uninsured and uncollateralized deposits. We can access this liquidity coverage without recognizing losses on our investment securities portfolio. ▪ Each commercial NAICS sector represents less than 10% of our total deposits3 as of 3/31/2023, with the largest sector being public administration at 9.3% (mostly collateralized) ▪ Associated has no material exposure to Silicon Valley Bank, Signature Bank or Silvergate Bank 1 All updates as of or for the period ended March 31, 2023 unless otherwise noted. 2 Liquidity coverage based on current levels of readily available (within one business day) funding. See slide 12 for additional details. 3 Excludes brokered CDs. 25% 26% 27% 26% 24% 24% 75% 74% 73% 74% 76% 76% $28.4 $28.6 $29.3 $29.7 $30.4 $31.4 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 4/19/23 EoP Total Deposit Trends (Associated Bank, N.A.) ($ in billions) Total of Insured and Collateralized Deposits Total of Uninsured and Uncollateralized Deposits 2

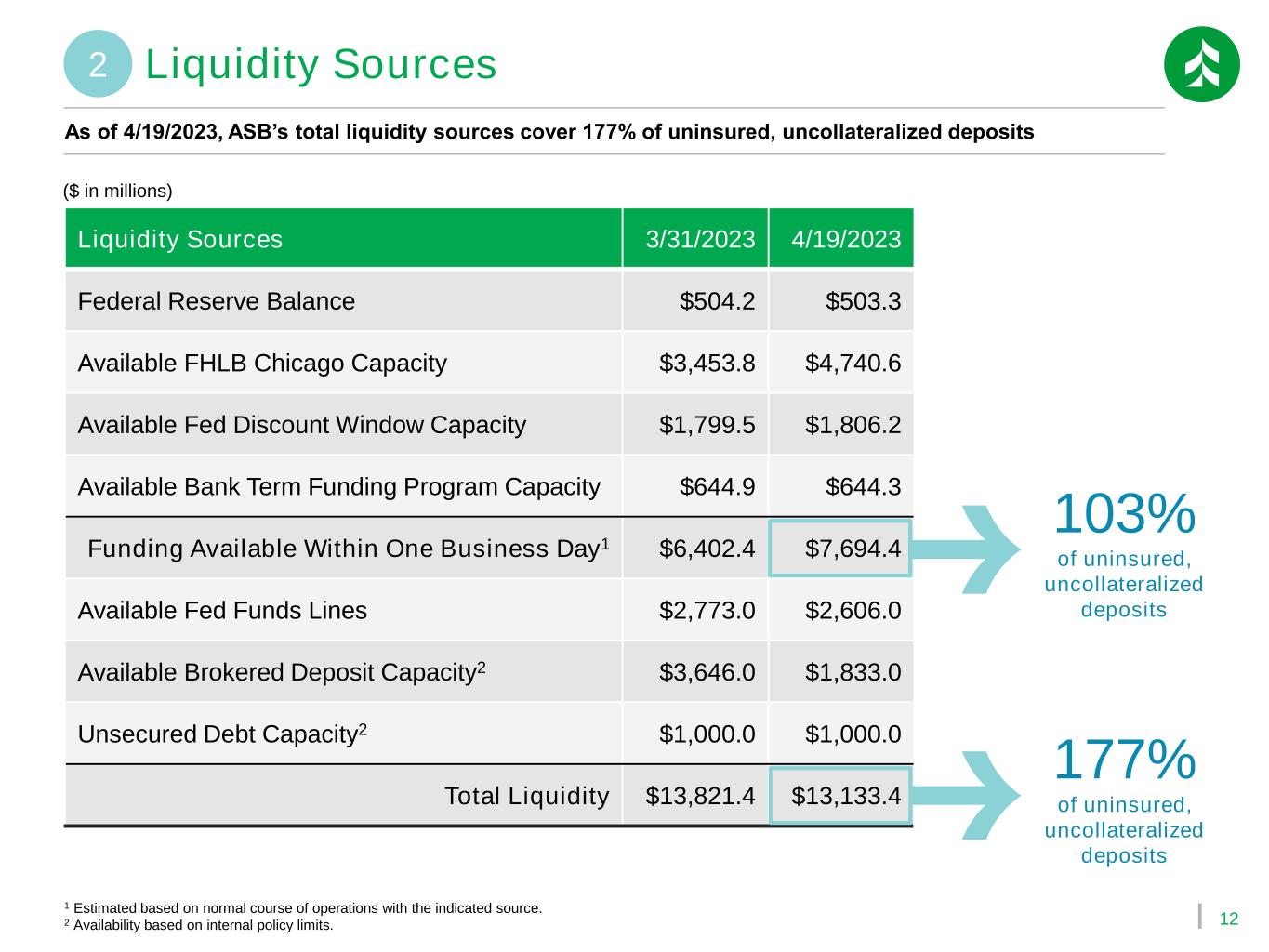

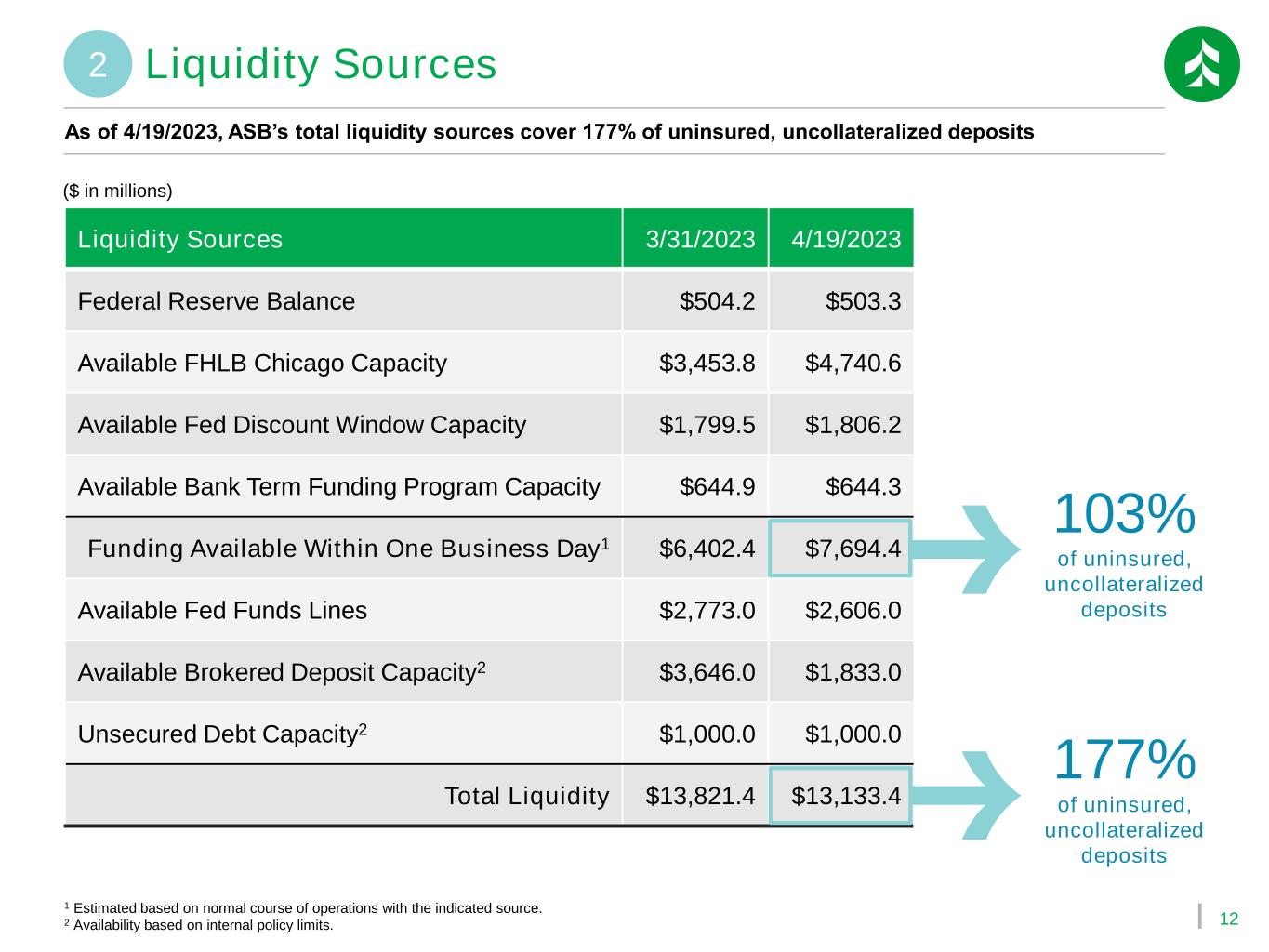

12 Liquidity Sources As of 4/19/2023, ASB’s total liquidity sources cover 177% of uninsured, uncollateralized deposits Liquidity Sources 3/31/2023 4/19/2023 Federal Reserve Balance $504.2 $503.3 Available FHLB Chicago Capacity $3,453.8 $4,740.6 Available Fed Discount Window Capacity $1,799.5 $1,806.2 Available Bank Term Funding Program Capacity $644.9 $644.3 Funding Available Within One Business Day1 $6,402.4 $7,694.4 Available Fed Funds Lines $2,773.0 $2,606.0 Available Brokered Deposit Capacity2 $3,646.0 $1,833.0 Unsecured Debt Capacity2 $1,000.0 $1,000.0 Total Liquidity $13,821.4 $13,133.4 ($ in millions) 103% of uninsured, uncollateralized deposits 177% of uninsured, uncollateralized deposits 1 Estimated based on normal course of operations with the indicated source. 2 Availability based on internal policy limits. 2

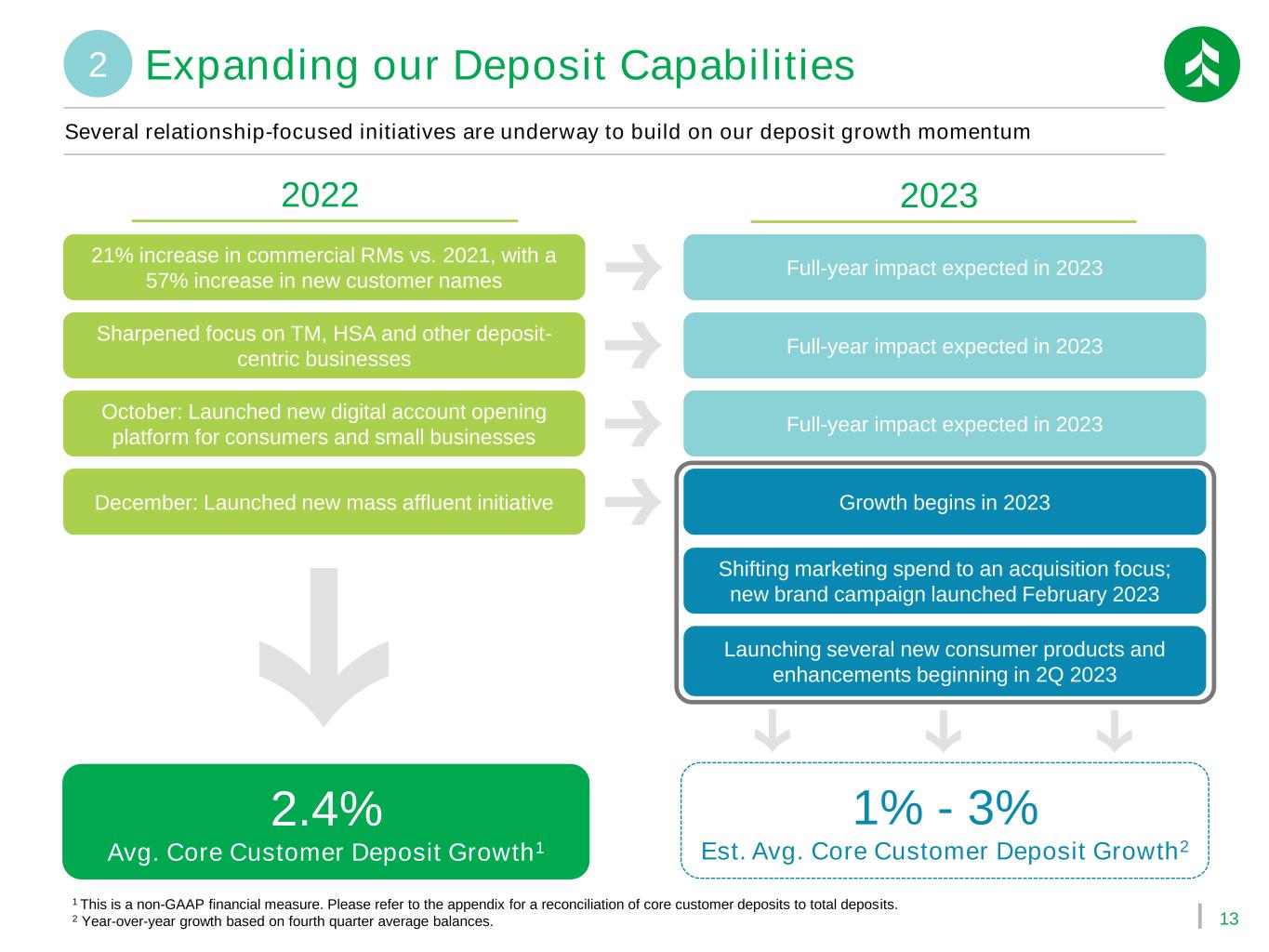

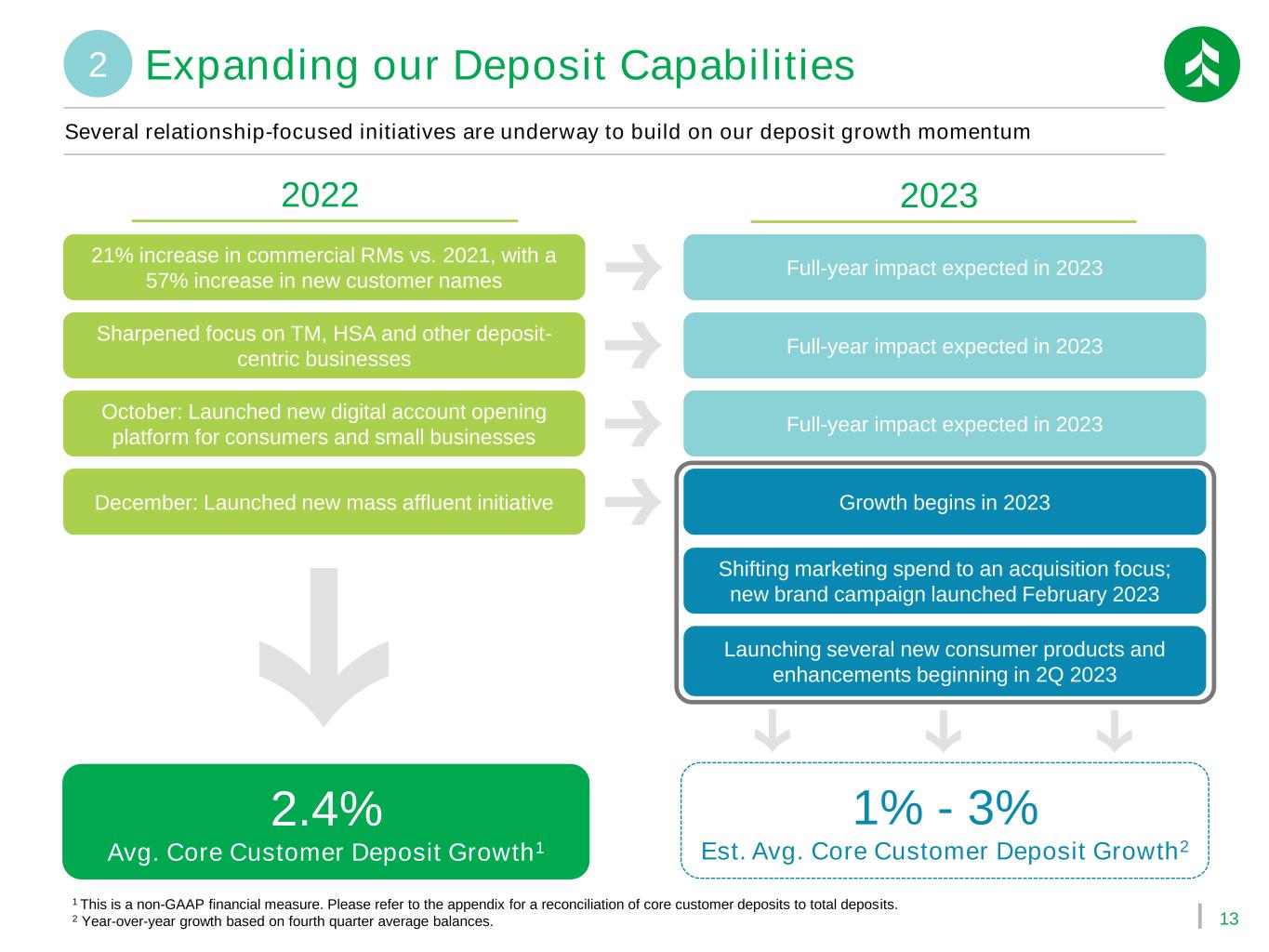

13 Full-year impact expected in 2023 Several relationship-focused initiatives are underway to build on our deposit growth momentum 21% increase in commercial RMs vs. 2021, with a 57% increase in new customer names Sharpened focus on TM, HSA and other deposit- centric businesses October: Launched new digital account opening platform for consumers and small businesses December: Launched new mass affluent initiative Full-year impact expected in 2023 Full-year impact expected in 2023 Growth begins in 2023 Launching several new consumer products and enhancements beginning in 2Q 2023 Shifting marketing spend to an acquisition focus; new brand campaign launched February 2023 20232022 1 This is a non-GAAP financial measure. Please refer to the appendix for a reconciliation of core customer deposits to total deposits. 2 Year-over-year growth based on fourth quarter average balances. 2.4% Avg. Core Customer Deposit Growth1 1% - 3% Est. Avg. Core Customer Deposit Growth2 Expanding our Deposit Capabilities2

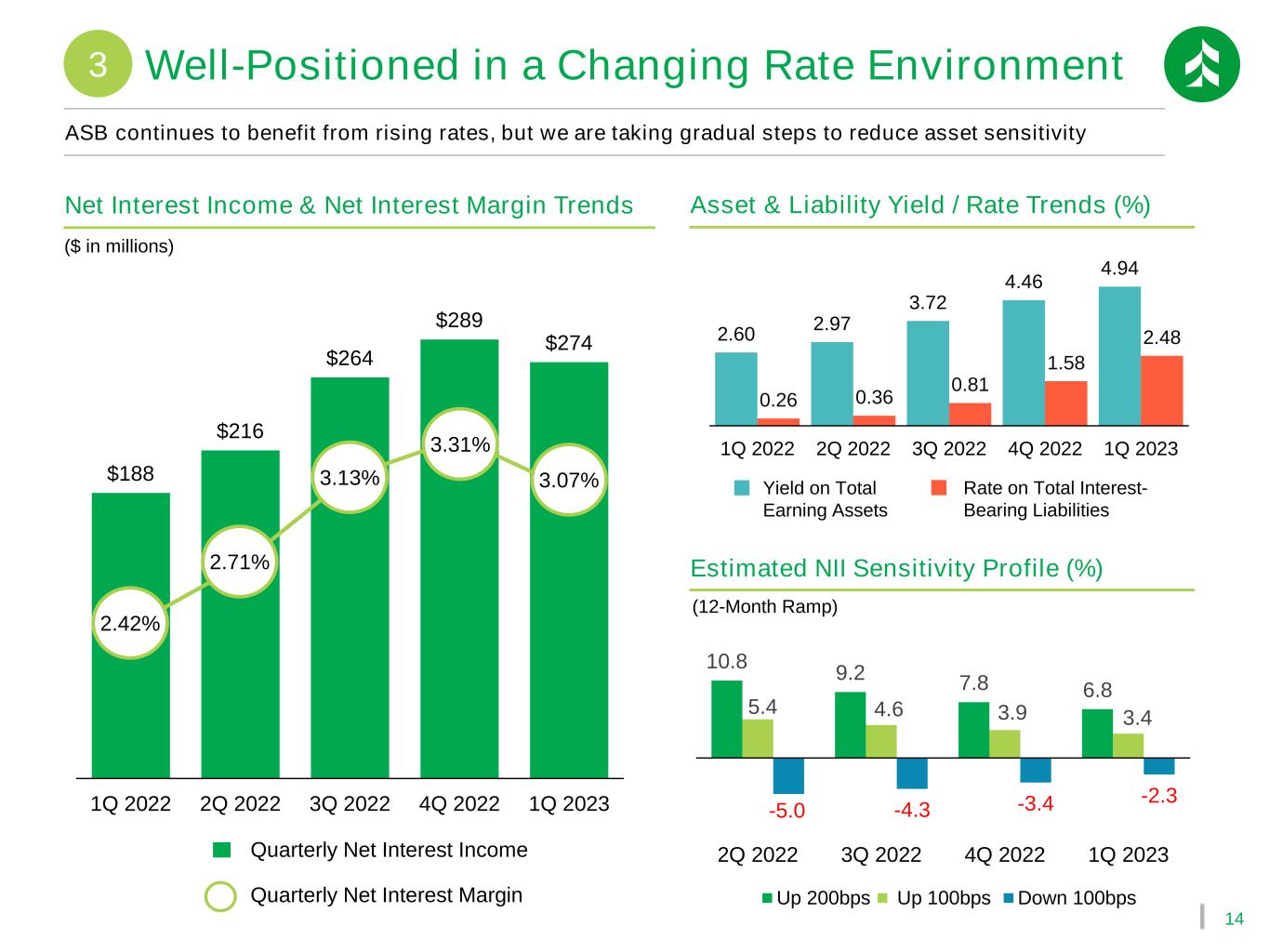

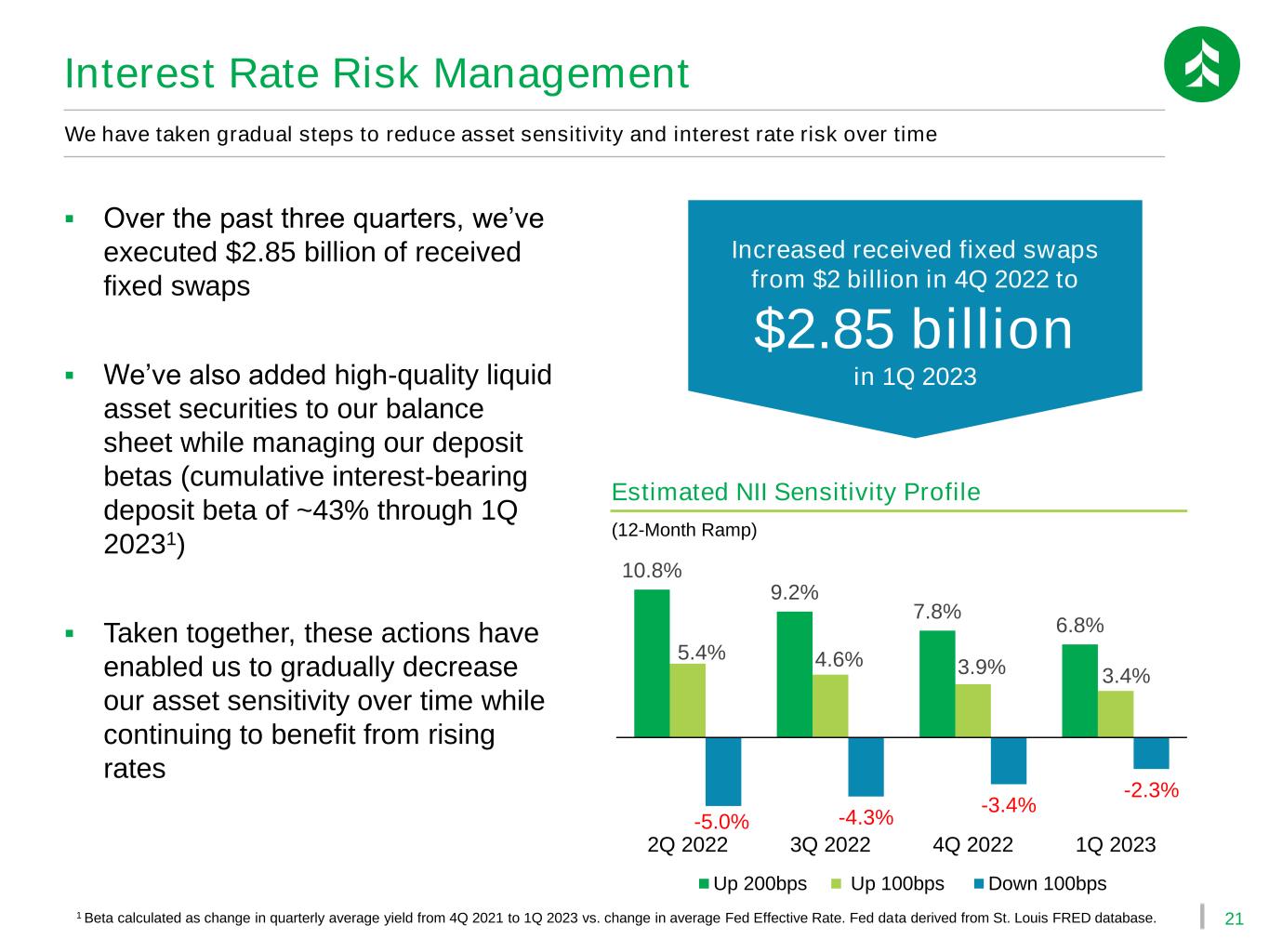

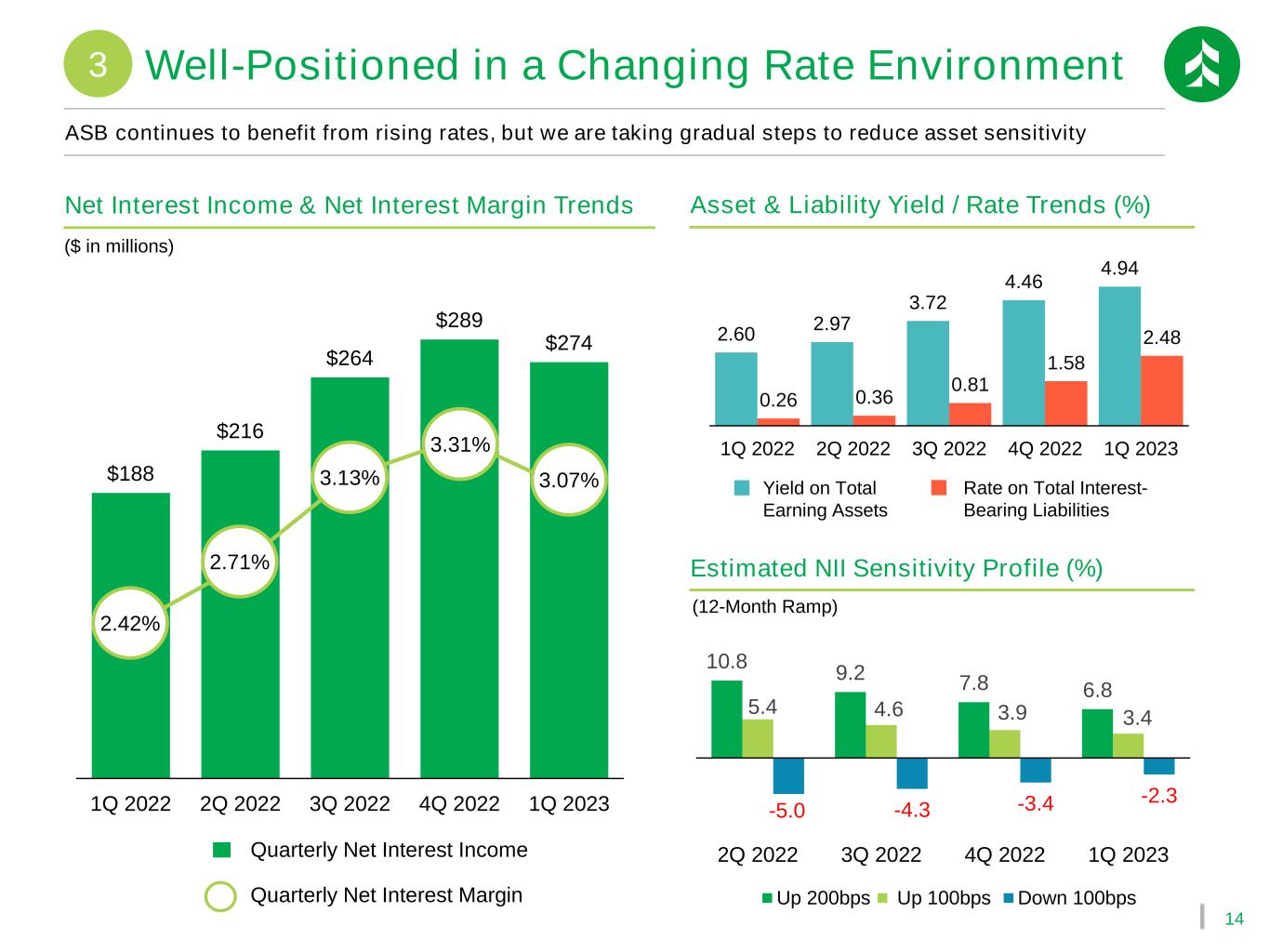

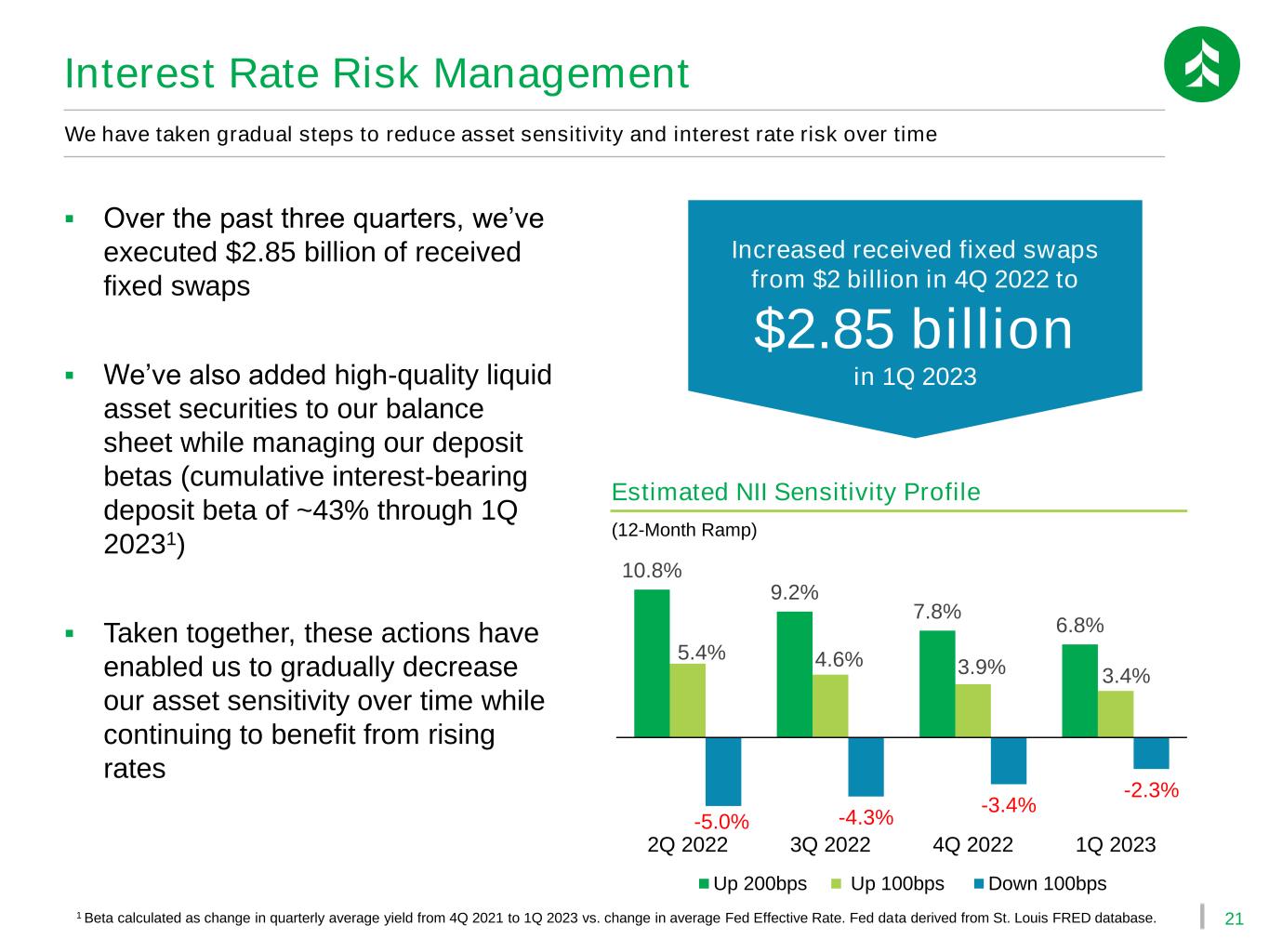

14 Net Interest Income & Net Interest Margin Trends ASB continues to benefit from rising rates, but we are taking gradual steps to reduce asset sensitivity Asset & Liability Yield / Rate Trends (%) 3 Well-Positioned in a Changing Rate Environment $188 $216 $264 $289 $274 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 3.07% 3.31% 3.13% 2.71% 2.42% Quarterly Net Interest Income Quarterly Net Interest Margin Rate on Total Interest- Bearing Liabilities Yield on Total Earning Assets 2.60 2.97 3.72 4.46 4.94 0.26 0.36 0.81 1.58 2.48 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Estimated NII Sensitivity Profile (%) 10.8 9.2 7.8 6.8 5.4 4.6 3.9 3.4 -5.0 -4.3 -3.4 -2.3 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Up 200bps Up 100bps Down 100bps (12-Month Ramp) ($ in millions)

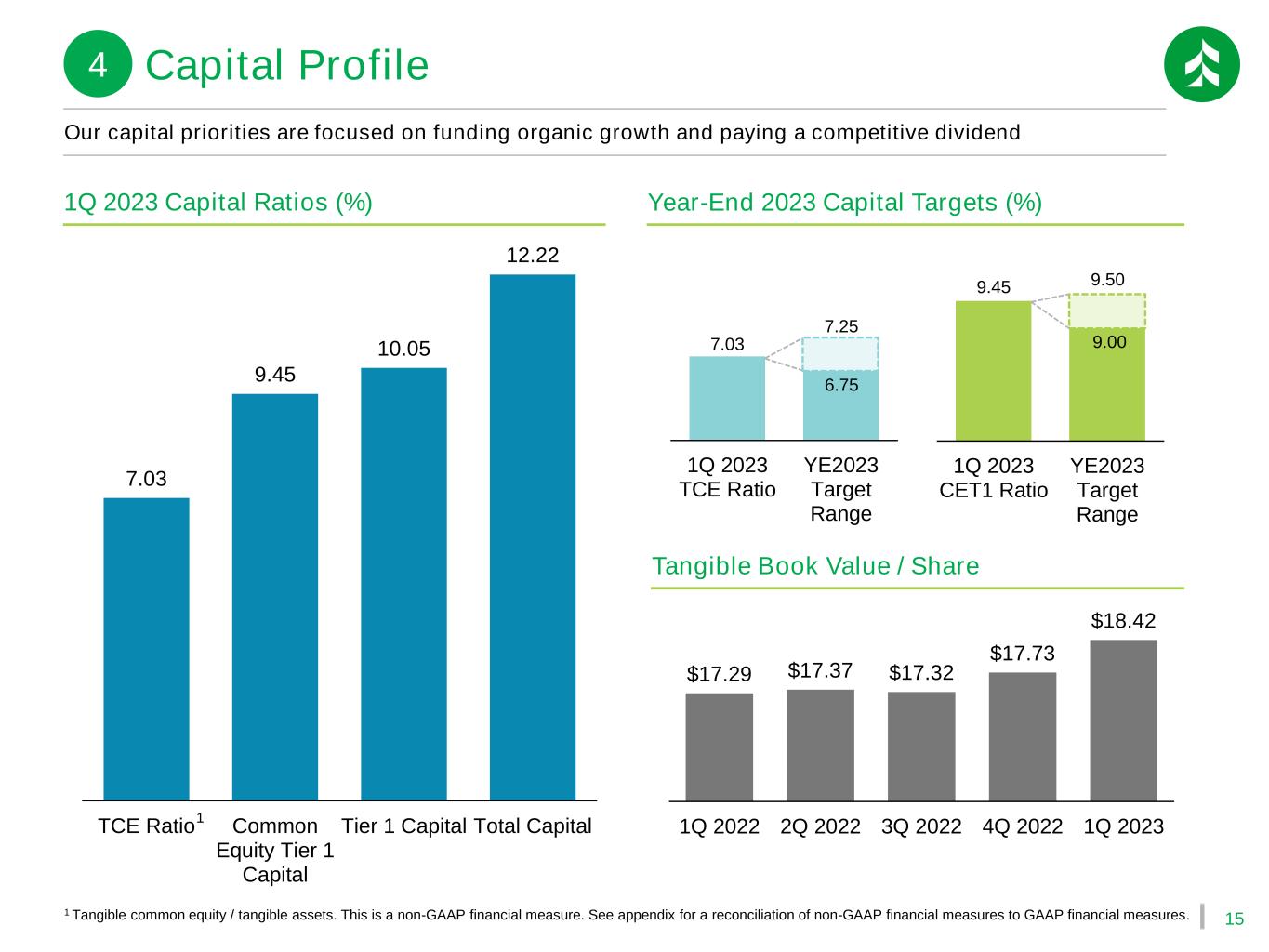

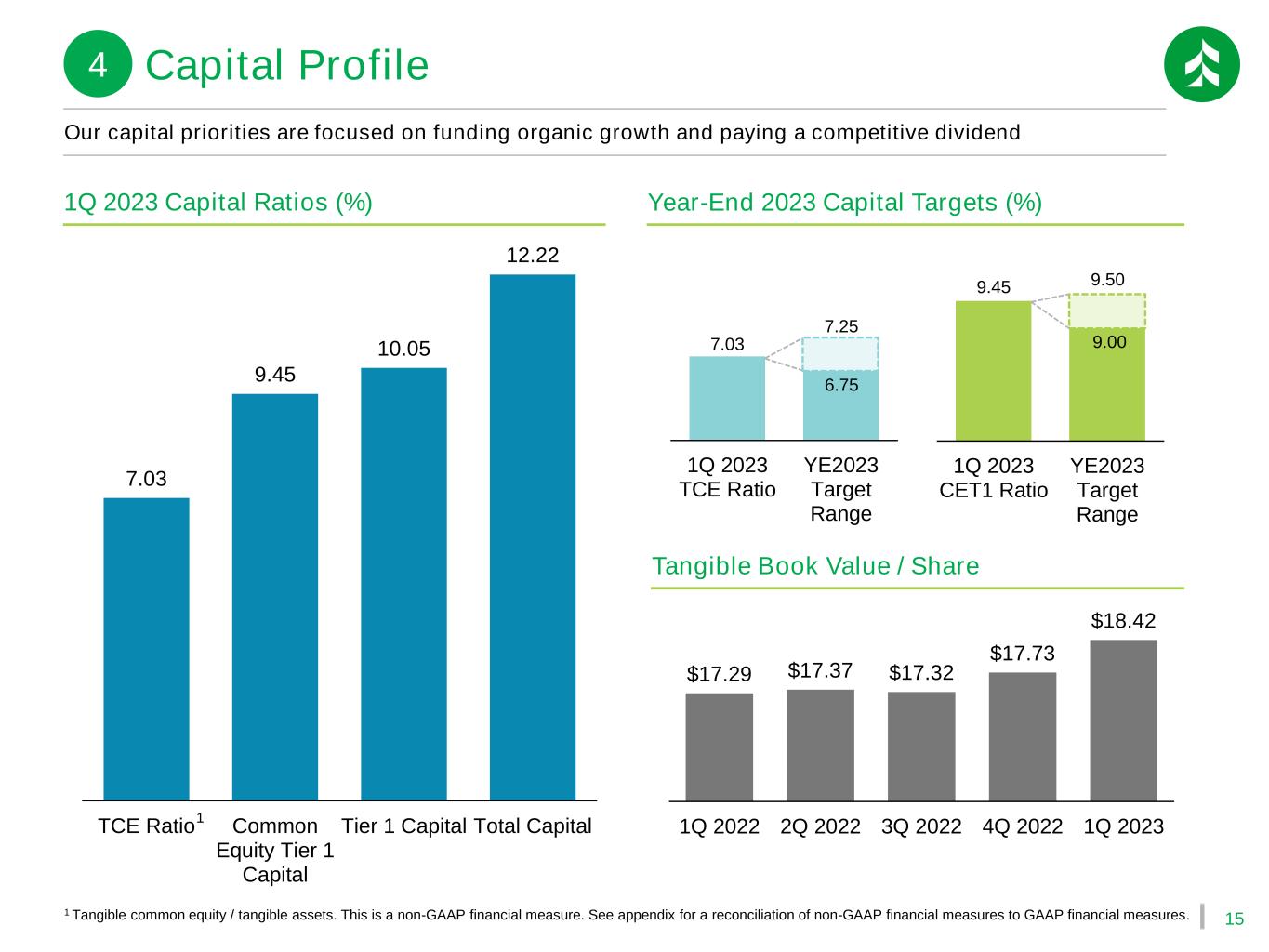

15 1Q 2023 Capital Ratios (%) 7.03 9.45 10.05 12.22 TCE Ratio Common Equity Tier 1 Capital Tier 1 Capital Total Capital 1 Tangible common equity / tangible assets. This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. Our capital priorities are focused on funding organic growth and paying a competitive dividend 1 Year-End 2023 Capital Targets (%) $17.29 $17.37 $17.32 $17.73 $18.42 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Tangible Book Value / Share 7.03 1Q 2023 TCE Ratio YE2023 Target Range 9.45 1Q 2023 CET1 Ratio YE2023 Target Range 7.25 9.50 6.75 9.00 Capital Profile4

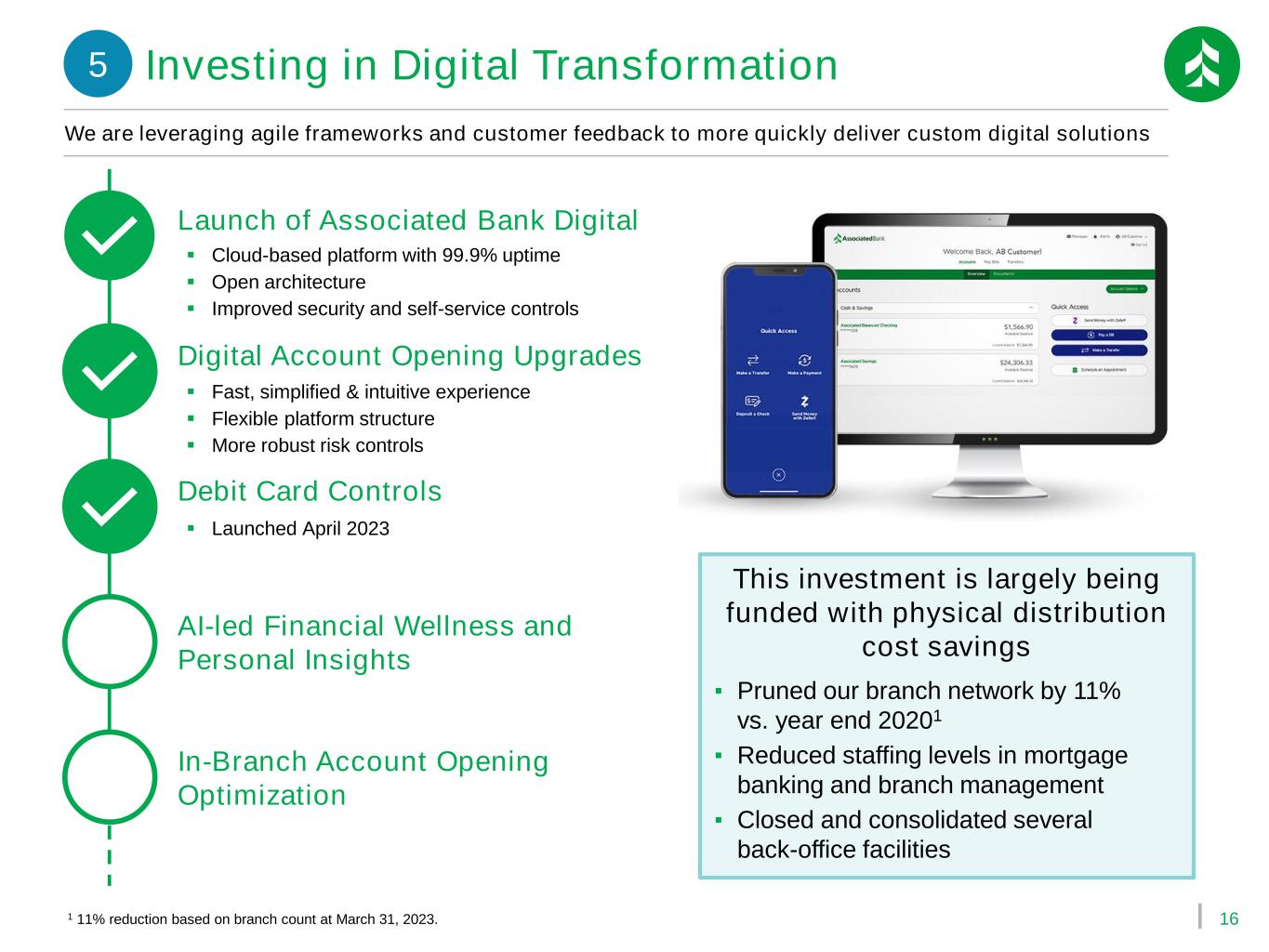

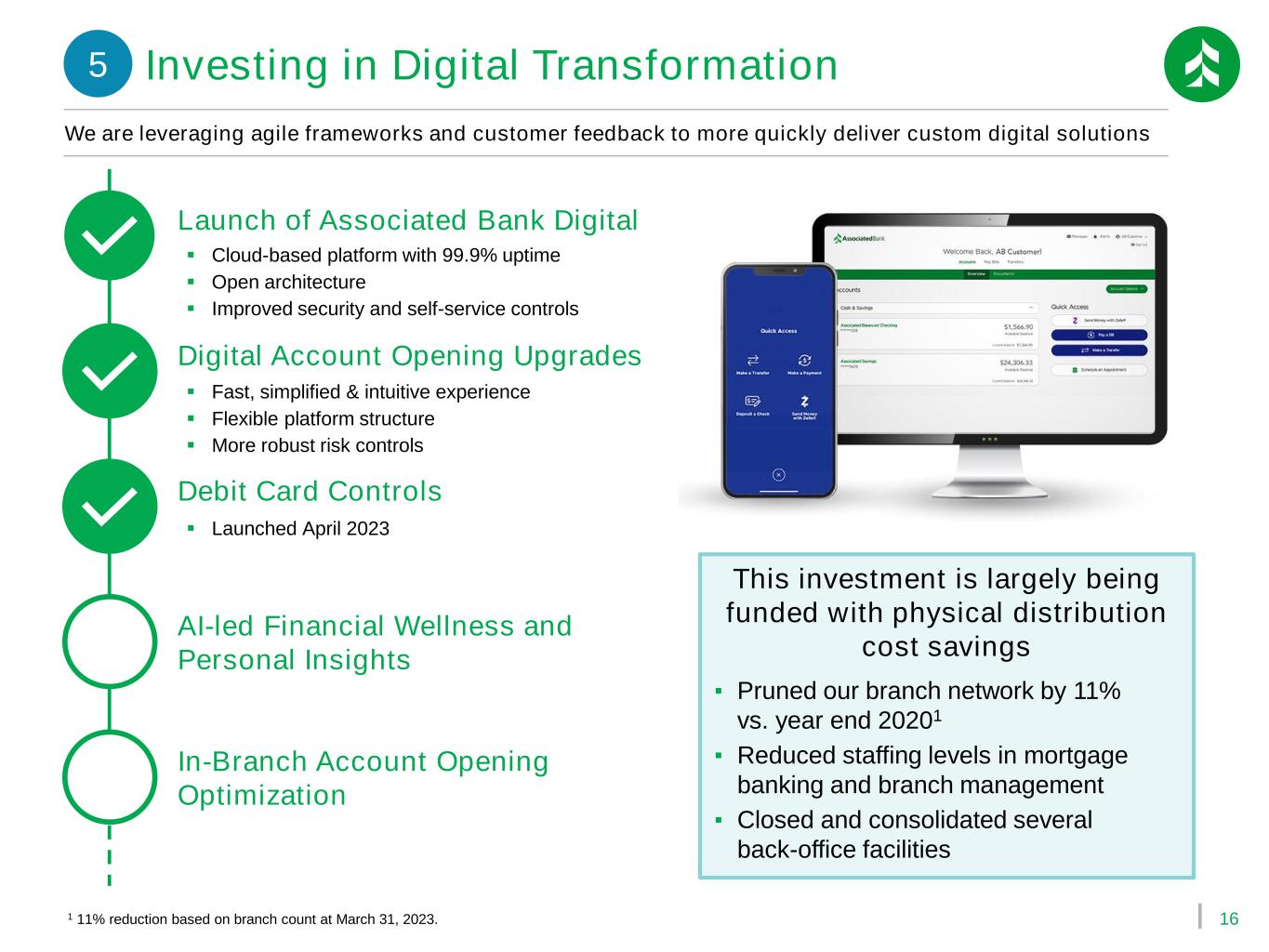

16 We are leveraging agile frameworks and customer feedback to more quickly deliver custom digital solutions Investing in Digital Transformation5 Launch of Associated Bank Digital Debit Card Controls AI-led Financial Wellness and Personal Insights Digital Account Opening Upgrades ▪ Cloud-based platform with 99.9% uptime ▪ Open architecture ▪ Improved security and self-service controls This investment is largely being funded with physical distribution cost savings ▪ Pruned our branch network by 11% vs. year end 20201 ▪ Reduced staffing levels in mortgage banking and branch management ▪ Closed and consolidated several back-office facilities 1 11% reduction based on branch count at March 31, 2023. ▪ Fast, simplified & intuitive experience ▪ Flexible platform structure ▪ More robust risk controls In-Branch Account Opening Optimization ▪ Launched April 2023

Appendix

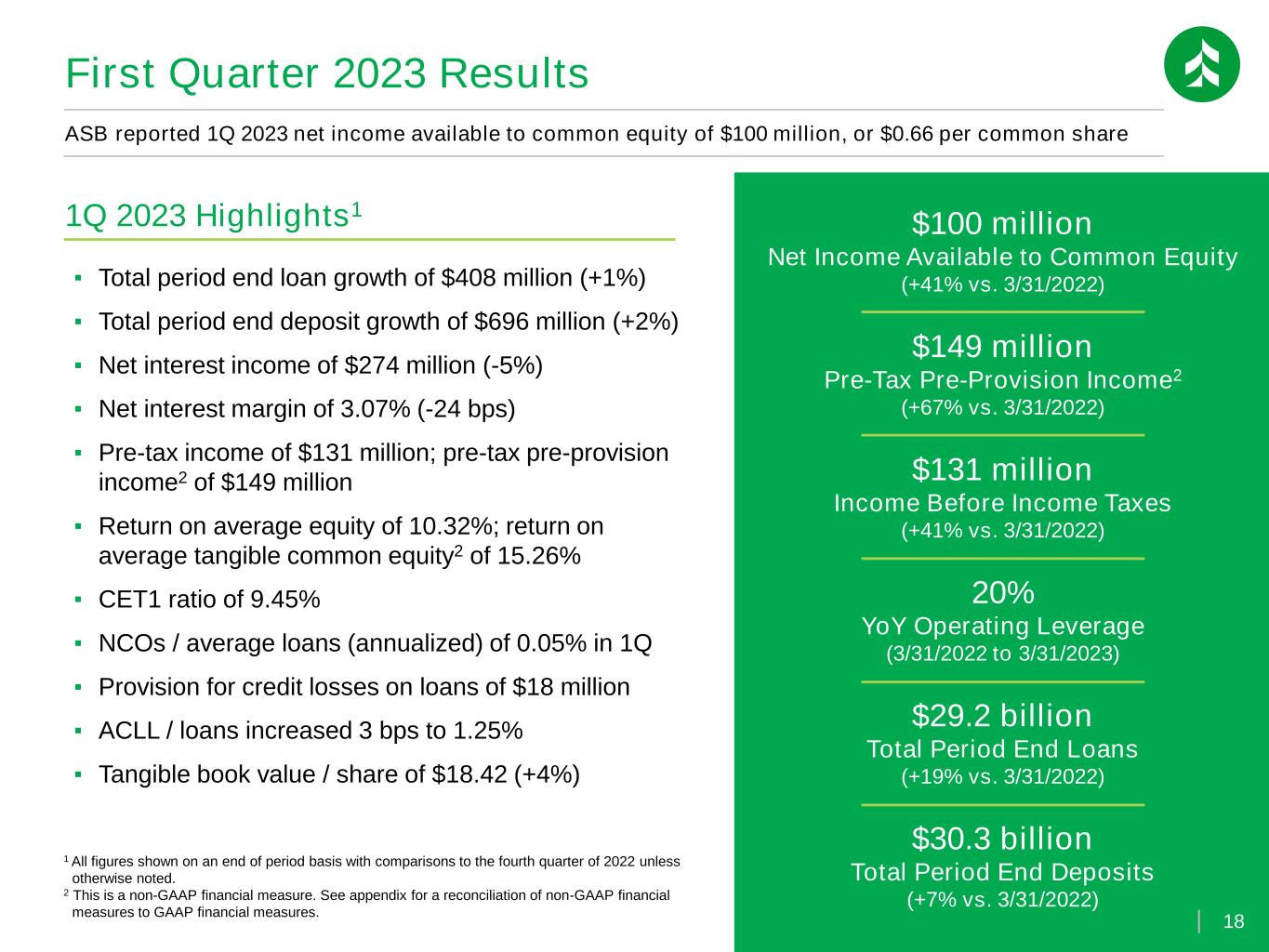

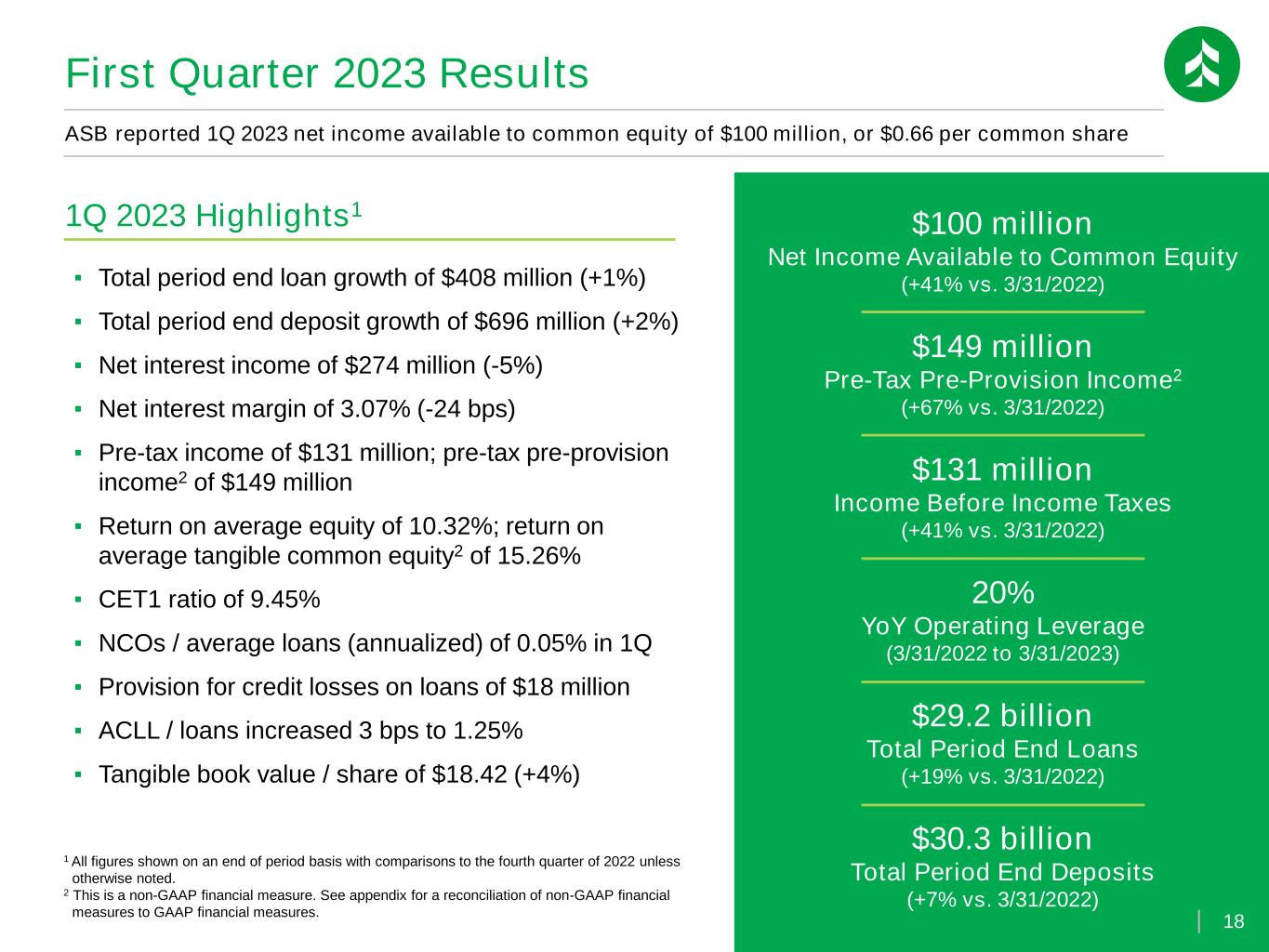

18 $131 million Income Before Income Taxes (+41% vs. 3/31/2022) $29.2 billion Total Period End Loans (+19% vs. 3/31/2022) $30.3 billion Total Period End Deposits (+7% vs. 3/31/2022) 20% YoY Operating Leverage (3/31/2022 to 3/31/2023) $100 million Net Income Available to Common Equity (+41% vs. 3/31/2022) $149 million Pre-Tax Pre-Provision Income2 (+67% vs. 3/31/2022) First Quarter 2023 Results 1 All figures shown on an end of period basis with comparisons to the fourth quarter of 2022 unless otherwise noted. 2 This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. ▪ Total period end loan growth of $408 million (+1%) ▪ Total period end deposit growth of $696 million (+2%) ▪ Net interest income of $274 million (-5%) ▪ Net interest margin of 3.07% (-24 bps) ▪ Pre-tax income of $131 million; pre-tax pre-provision income2 of $149 million ▪ Return on average equity of 10.32%; return on average tangible common equity2 of 15.26% ▪ CET1 ratio of 9.45% ▪ NCOs / average loans (annualized) of 0.05% in 1Q ▪ Provision for credit losses on loans of $18 million ▪ ACLL / loans increased 3 bps to 1.25% ▪ Tangible book value / share of $18.42 (+4%) 1Q 2023 Highlights1 ASB reported 1Q 2023 net income available to common equity of $100 million, or $0.66 per common share | 18

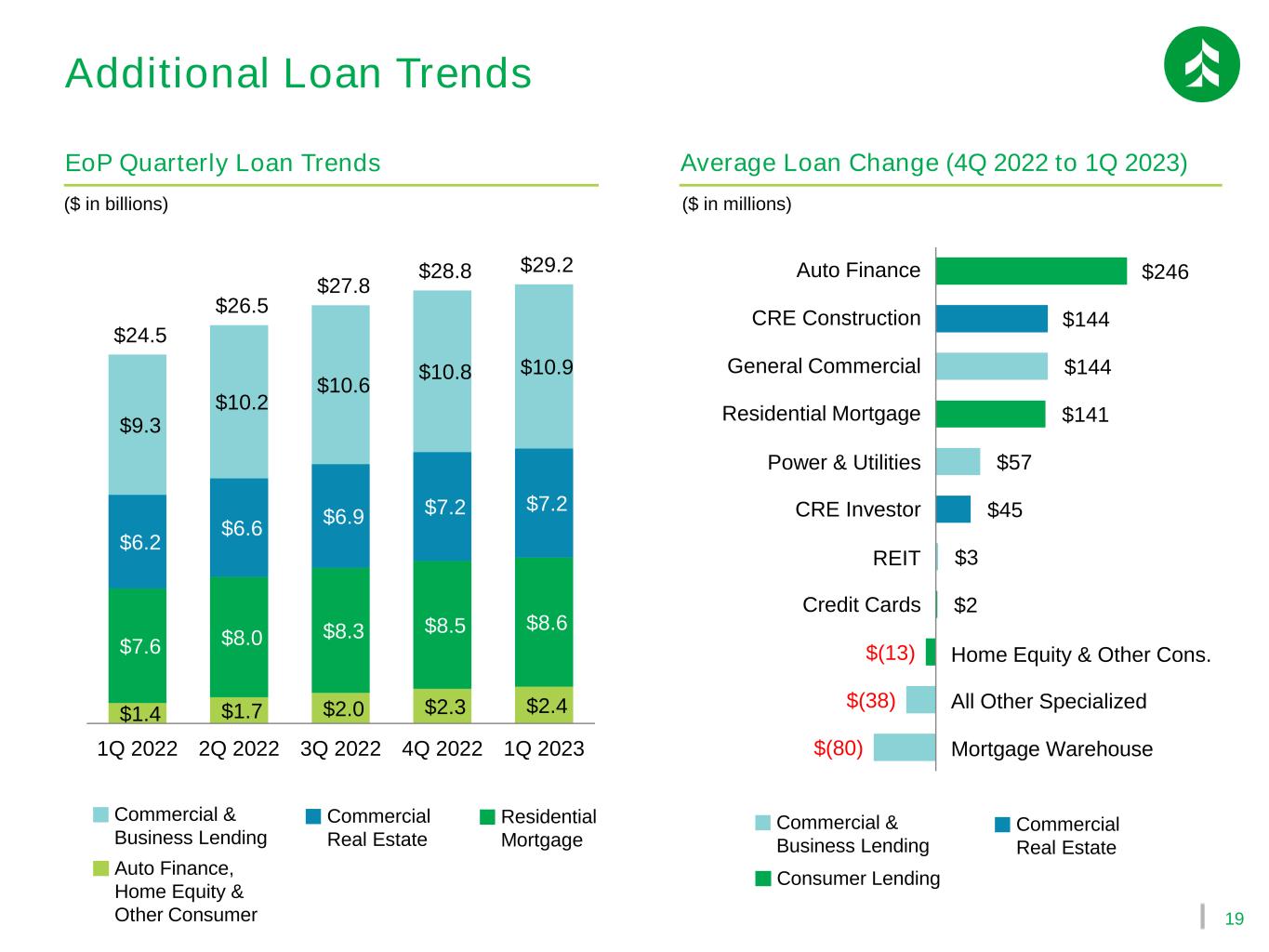

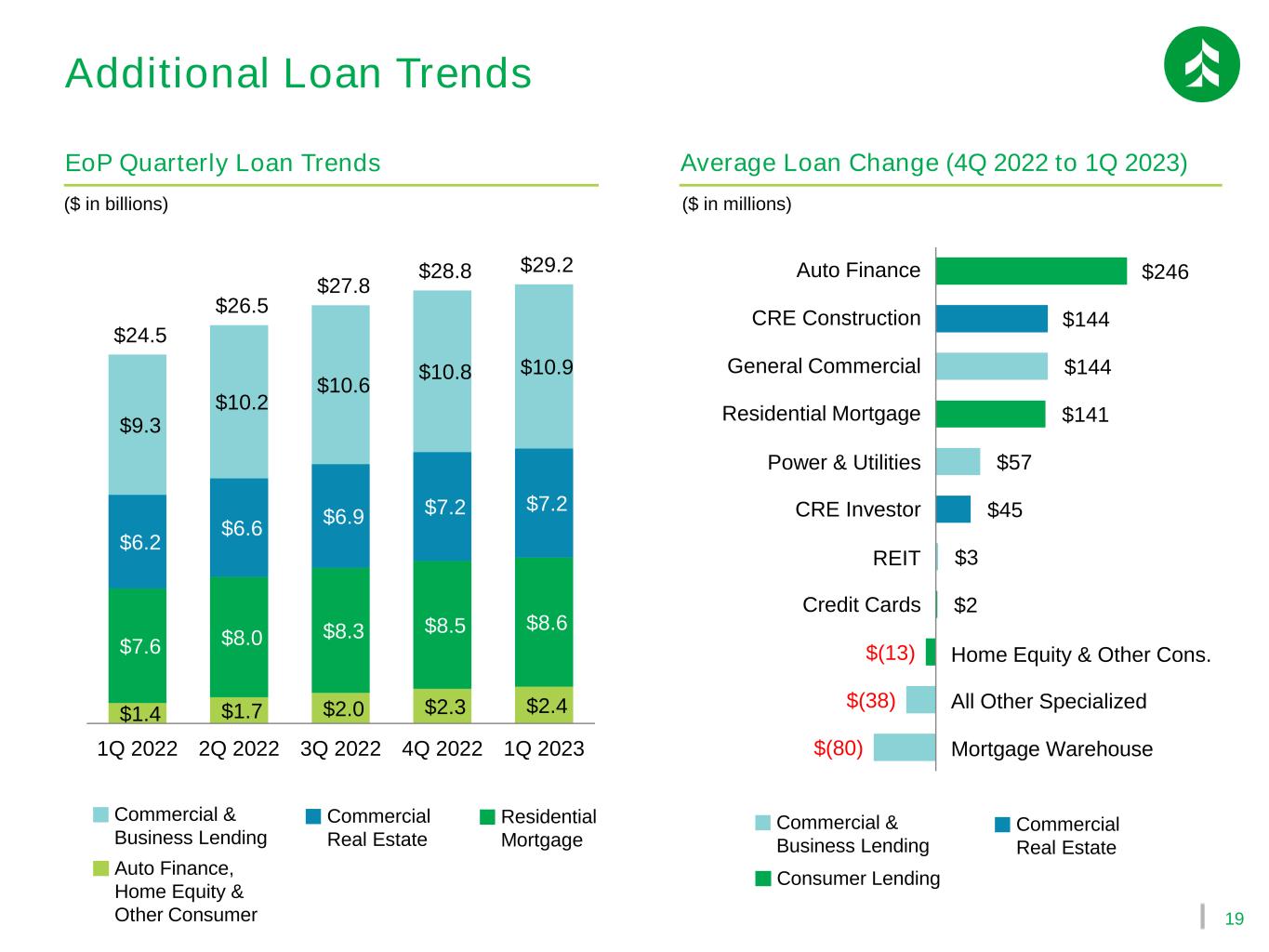

19 Additional Loan Trends ($ in billions) Commercial & Business Lending Commercial Real Estate Residential Mortgage Auto Finance, Home Equity & Other Consumer ($ in millions) Commercial & Business Lending Commercial Real Estate Consumer Lending Average Loan Change (4Q 2022 to 1Q 2023)EoP Quarterly Loan Trends $1.4 $1.7 $2.0 $2.3 $2.4 $7.6 $8.0 $8.3 $8.5 $8.6 $6.2 $6.6 $6.9 $7.2 $7.2 $9.3 $10.2 $10.6 $10.8 $10.9 $24.5 $26.5 $27.8 $28.8 $29.2 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 $(80) $(38) $(13) $2 $3 $45 $57 $141 $144 $144 $246 Mortgage Warehouse Residential Mortgage REIT General Commercial Power & Utilities Auto Finance CRE Investor Credit Cards CRE Construction All Other Specialized Home Equity & Other Cons.

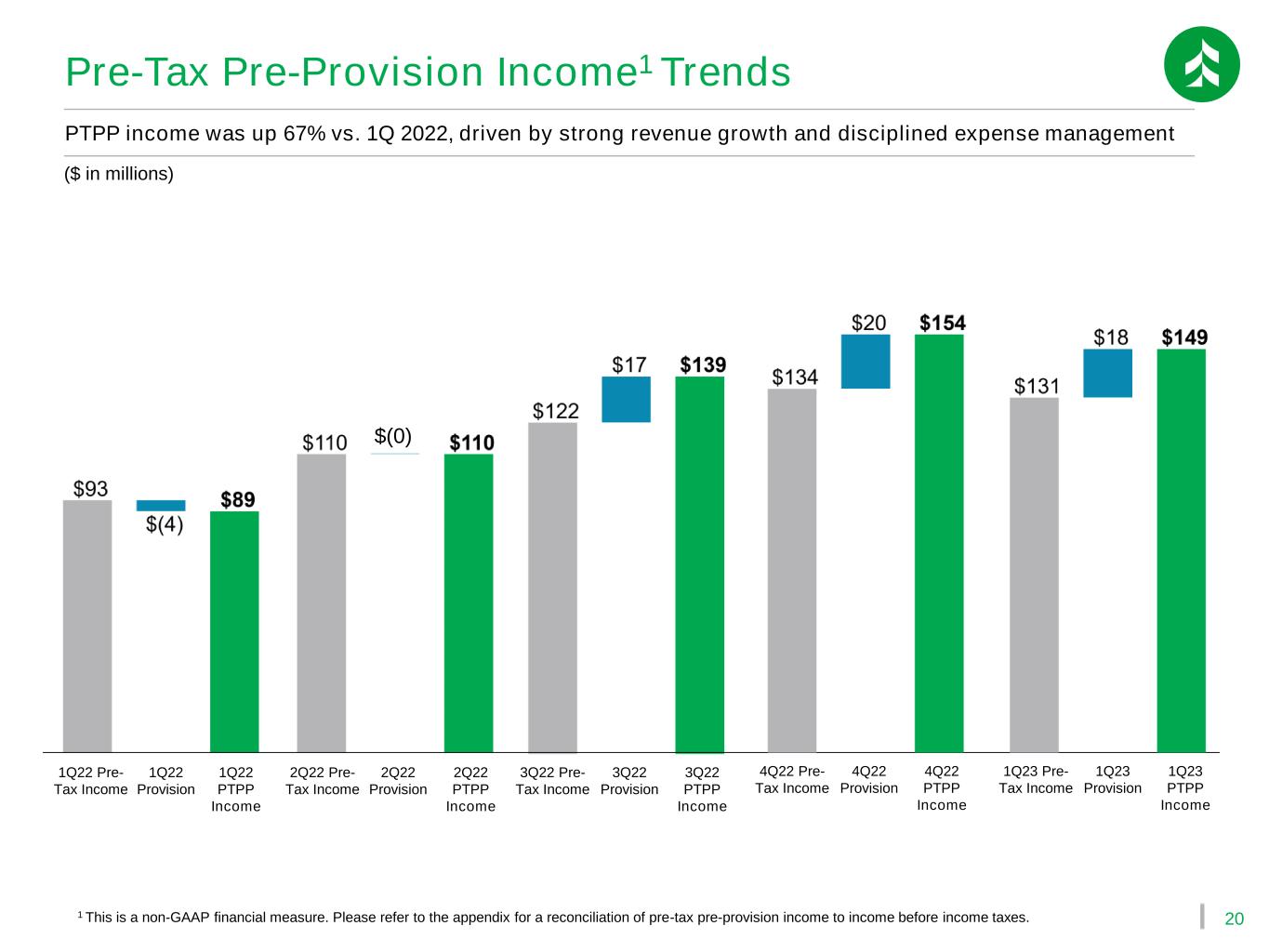

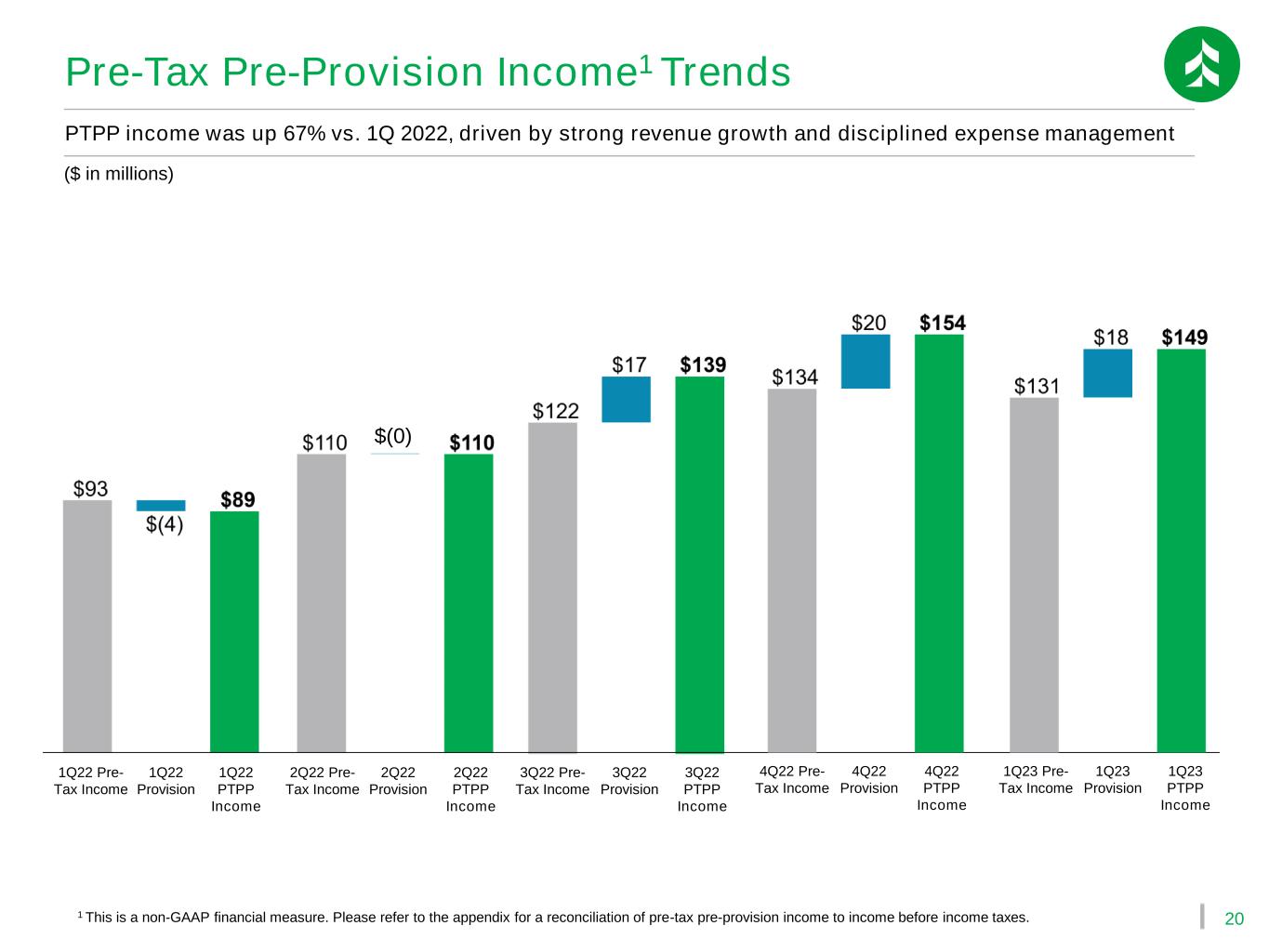

20 Pre-Tax Pre-Provision Income1 Trends PTPP income was up 67% vs. 1Q 2022, driven by strong revenue growth and disciplined expense management ($ in millions) 1 This is a non-GAAP financial measure. Please refer to the appendix for a reconciliation of pre-tax pre-provision income to income before income taxes. 1Q22 Pre- Tax Income 1Q22 Provision 1Q22 PTPP Income 2Q22 Pre- Tax Income 2Q22 Provision 2Q22 PTPP Income 3Q22 Pre- Tax Income 3Q22 Provision 3Q22 PTPP Income $(0) 4Q22 Pre- Tax Income 4Q22 Provision 4Q22 PTPP Income 1Q23 Pre- Tax Income 1Q23 Provision 1Q23 PTPP Income

21 ▪ Over the past three quarters, we’ve executed $2.85 billion of received fixed swaps ▪ We’ve also added high-quality liquid asset securities to our balance sheet while managing our deposit betas (cumulative interest-bearing deposit beta of ~43% through 1Q 20231) ▪ Taken together, these actions have enabled us to gradually decrease our asset sensitivity over time while continuing to benefit from rising rates Interest Rate Risk Management We have taken gradual steps to reduce asset sensitivity and interest rate risk over time Estimated NII Sensitivity Profile 1 Beta calculated as change in quarterly average yield from 4Q 2021 to 1Q 2023 vs. change in average Fed Effective Rate. Fed data derived from St. Louis FRED database. 10.8% 9.2% 7.8% 6.8% 5.4% 4.6% 3.9% 3.4% -5.0% -4.3% -3.4% -2.3% 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Up 200bps Up 100bps Down 100bps (12-Month Ramp) Increased received fixed swaps from $2 billion in 4Q 2022 to $2.85 billion in 1Q 2023

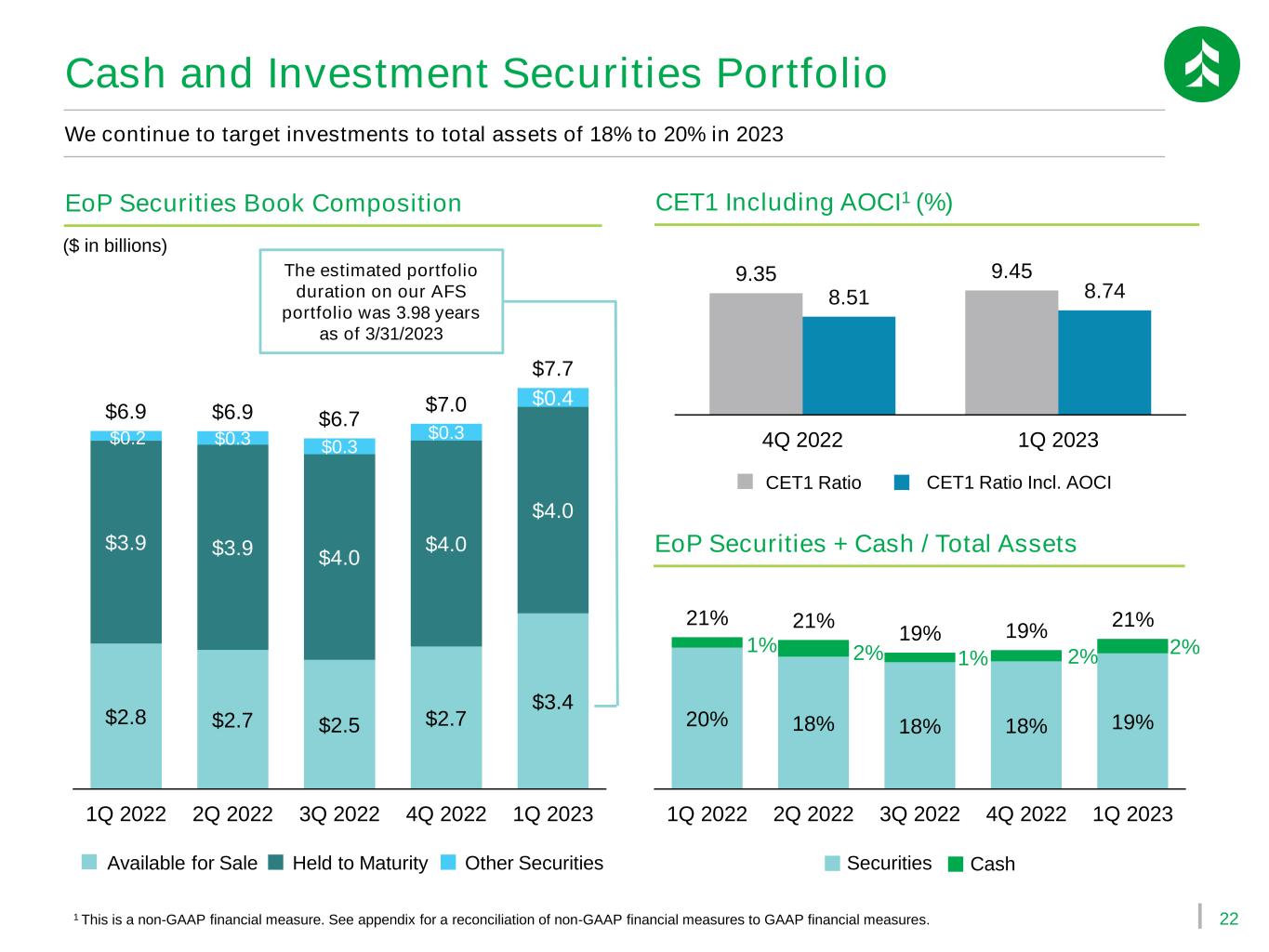

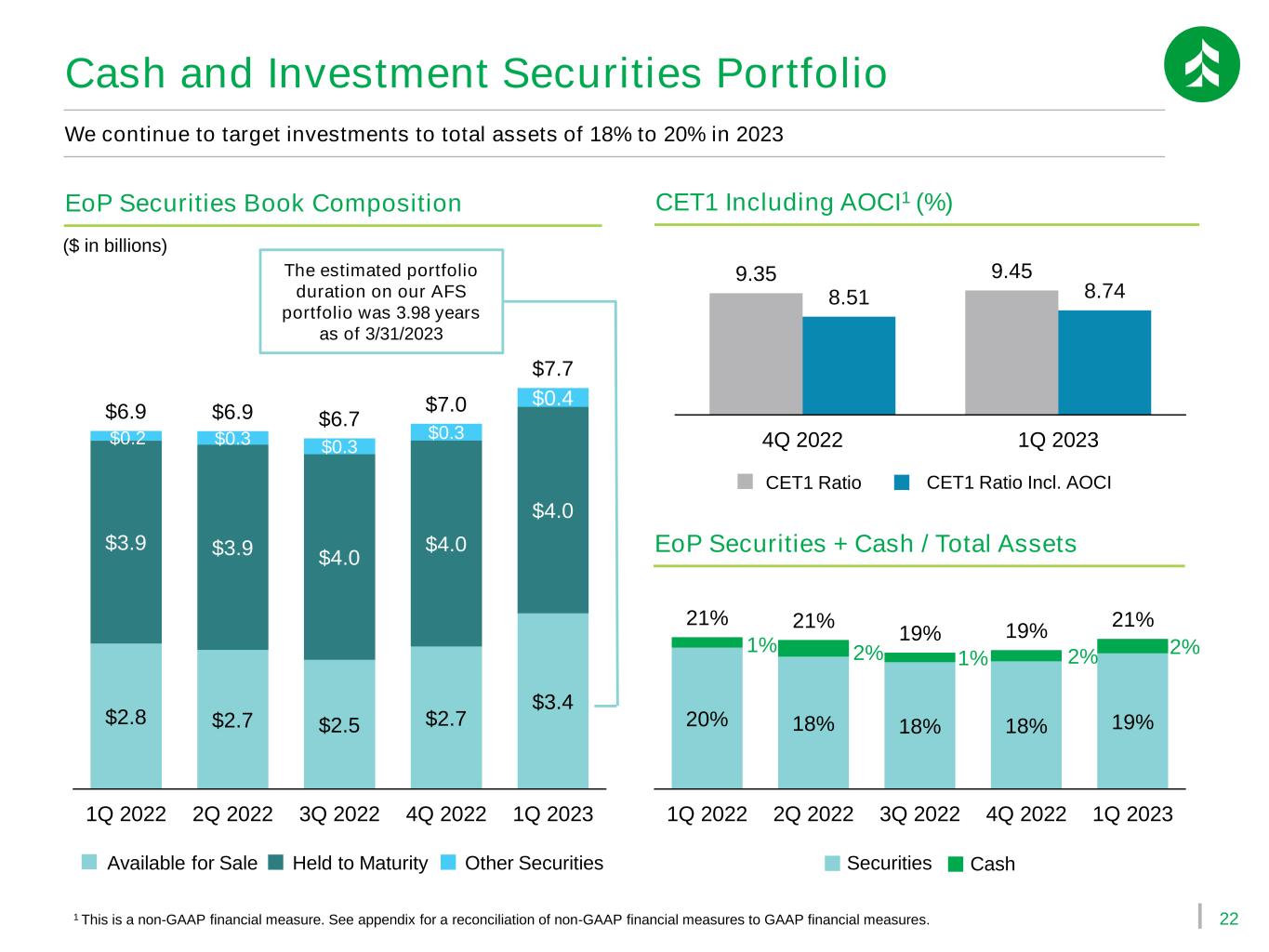

22 Cash and Investment Securities Portfolio We continue to target investments to total assets of 18% to 20% in 2023 20% 18% 18% 18% 19% 1% 2% 1% 2% 2% 21% 21% 19% 19% 21% 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Securities EoP Securities + Cash / Total Assets Cash $2.8 $2.7 $2.5 $2.7 $3.4 $3.9 $3.9 $4.0 $4.0 $4.0 $0.2 $0.3 $0.3 $0.3 $0.4 $6.9 $6.9 $6.7 $7.0 $7.7 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Held to MaturityAvailable for Sale ($ in billions) EoP Securities Book Composition Other Securities CET1 Including AOCI1 (%) CET1 Ratio Incl. AOCICET1 Ratio 9.35 9.45 8.51 8.74 4Q 2022 1Q 2023 1 This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. The estimated portfolio duration on our AFS portfolio was 3.98 years as of 3/31/2023

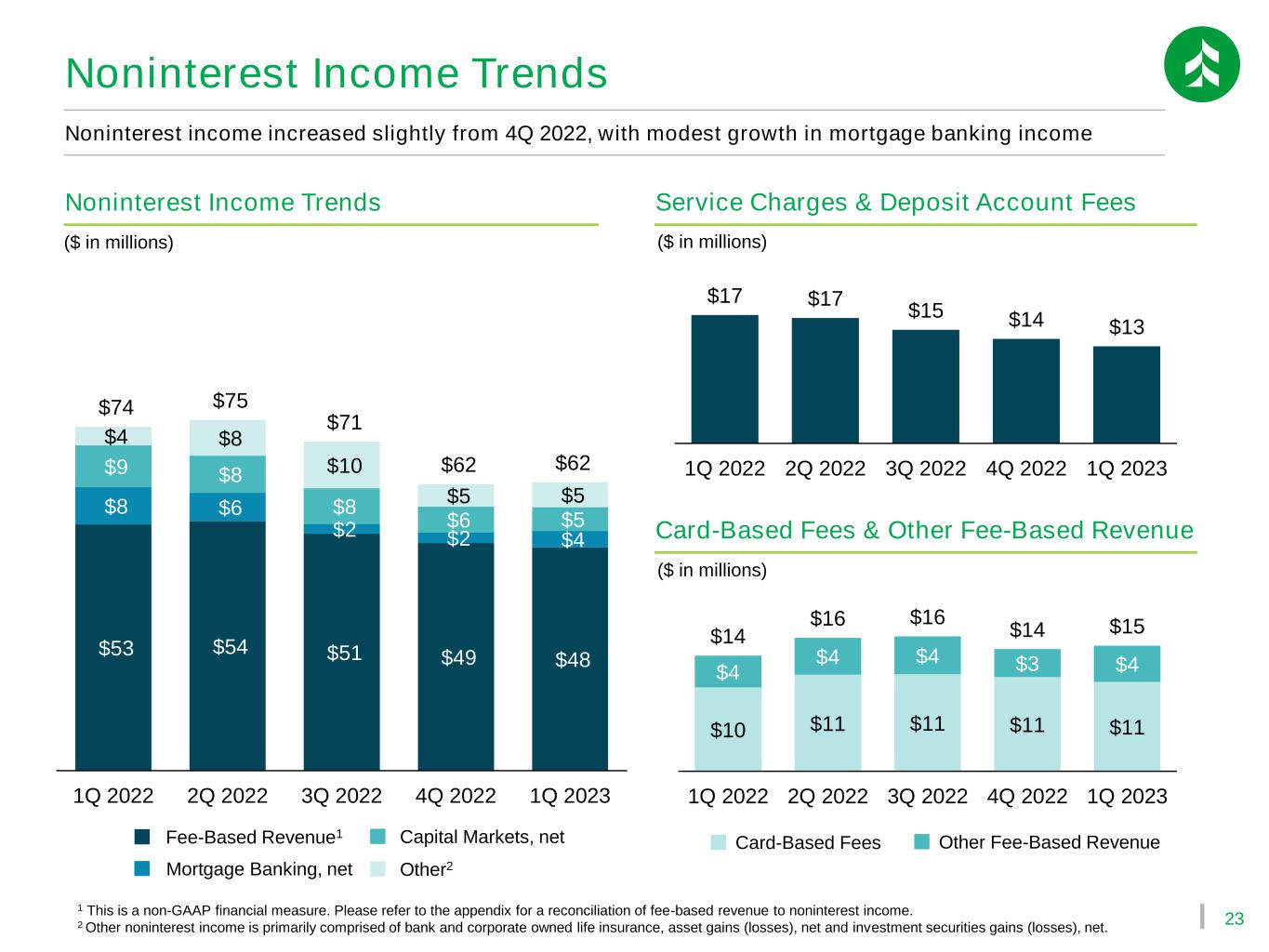

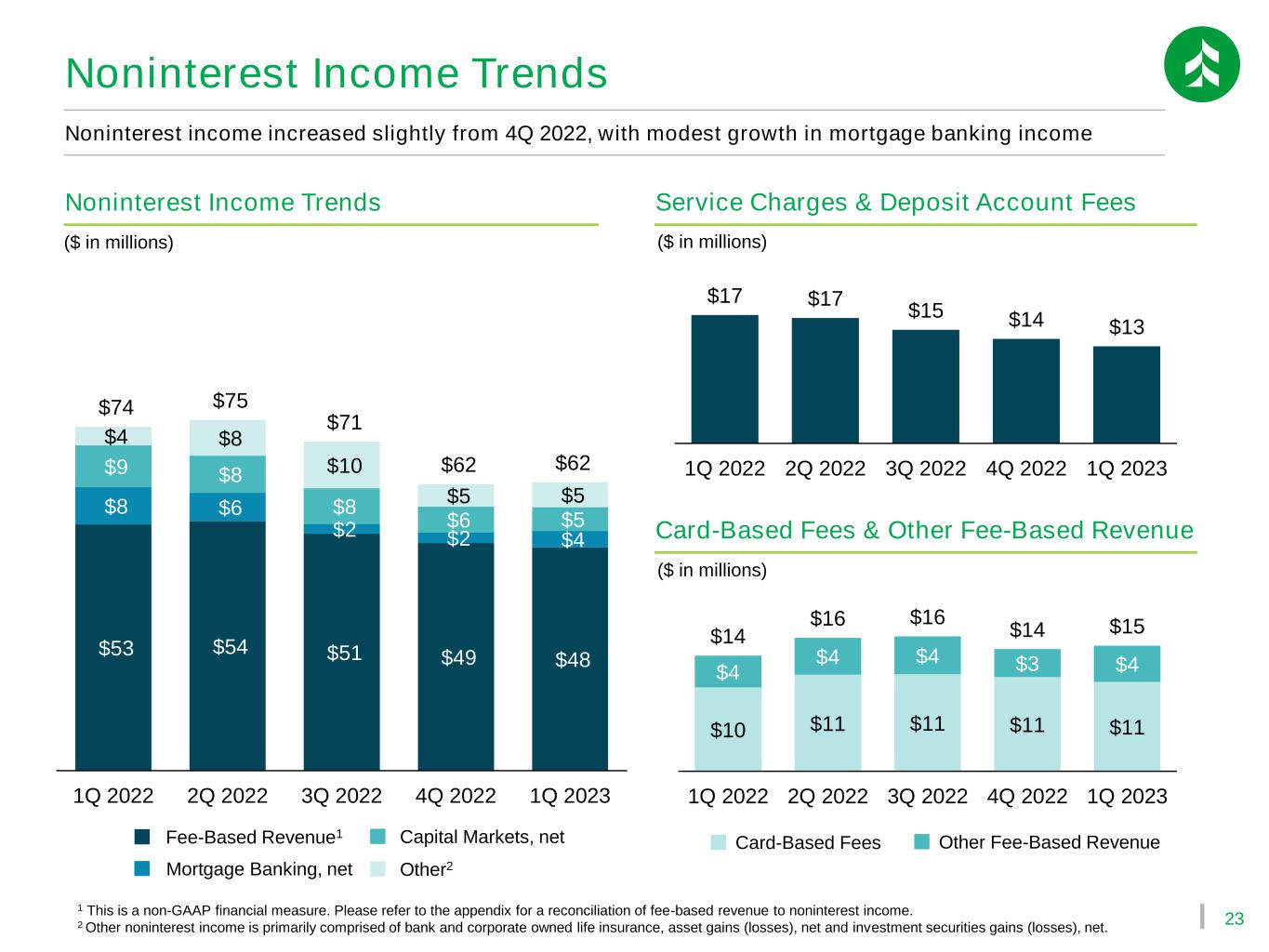

23 Noninterest Income Trends ($ in millions) ($ in millions) Noninterest income increased slightly from 4Q 2022, with modest growth in mortgage banking income 1 This is a non-GAAP financial measure. Please refer to the appendix for a reconciliation of fee-based revenue to noninterest income. 2 Other noninterest income is primarily comprised of bank and corporate owned life insurance, asset gains (losses), net and investment securities gains (losses), net. Service Charges & Deposit Account FeesNoninterest Income Trends Card-Based Fees & Other Fee-Based Revenue ($ in millions) $10 $11 $11 $11 $11 $4 $4 $4 $3 $4 $14 $16 $16 $14 $15 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Other Fee-Based RevenueCard-Based Fees $17 $17 $15 $14 $13 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 $53 $54 $51 $49 $48 $8 $6 $2 $2 $4 $9 $8 $8 $6 $5 $4 $8 $10 $5 $5 $74 $75 $71 $62 $62 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Fee-Based Revenue1 Capital Markets, net Mortgage Banking, net Other2

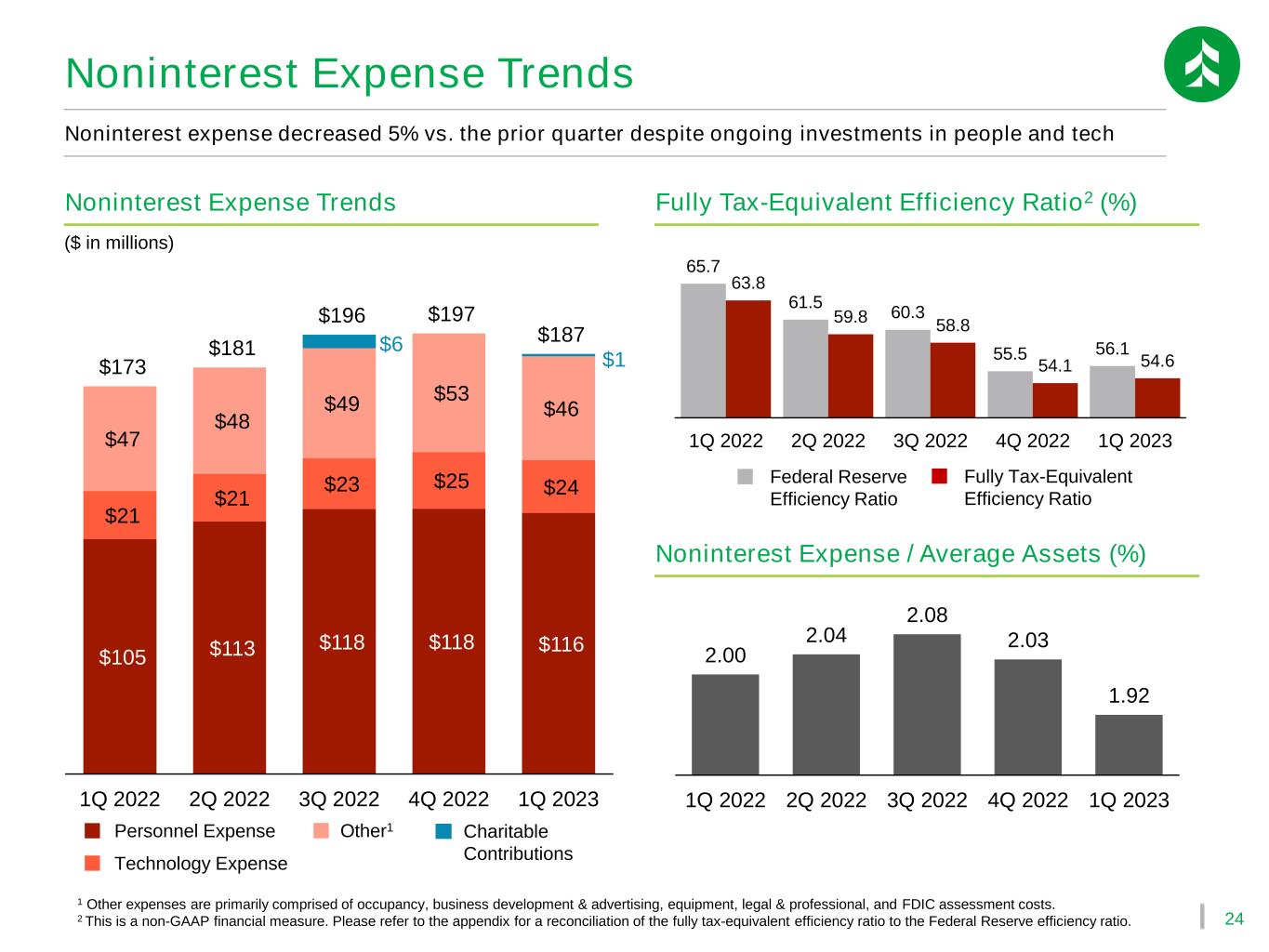

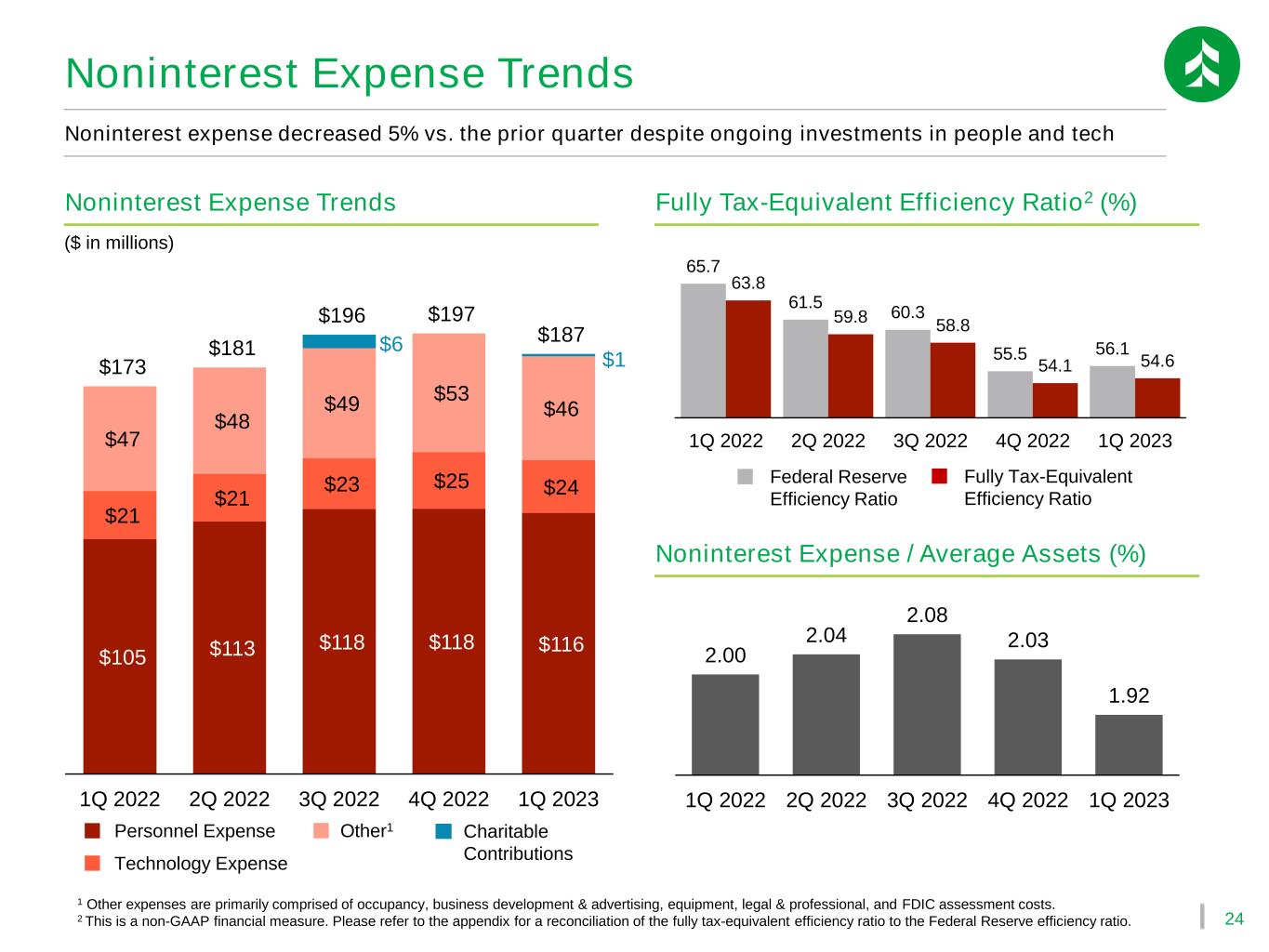

24 $105 $113 $118 $118 $116 $21 $21 $23 $25 $24 $47 $48 $49 $53 $46 $6 $1 $173 $181 $196 $197 $187 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Noninterest Expense / Average Assets (%) Fully Tax-Equivalent Efficiency Ratio2 (%)Noninterest Expense Trends Noninterest Expense Trends 1 Other expenses are primarily comprised of occupancy, business development & advertising, equipment, legal & professional, and FDIC assessment costs. 2 This is a non-GAAP financial measure. Please refer to the appendix for a reconciliation of the fully tax-equivalent efficiency ratio to the Federal Reserve efficiency ratio. ($ in millions) Noninterest expense decreased 5% vs. the prior quarter despite ongoing investments in people and tech 2.00 2.04 2.08 2.03 1.92 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Fully Tax-Equivalent Efficiency Ratio Federal Reserve Efficiency Ratio 65.7 61.5 60.3 55.5 56.1 63.8 59.8 58.8 54.1 54.6 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Personnel Expense Other1 Technology Expense Charitable Contributions

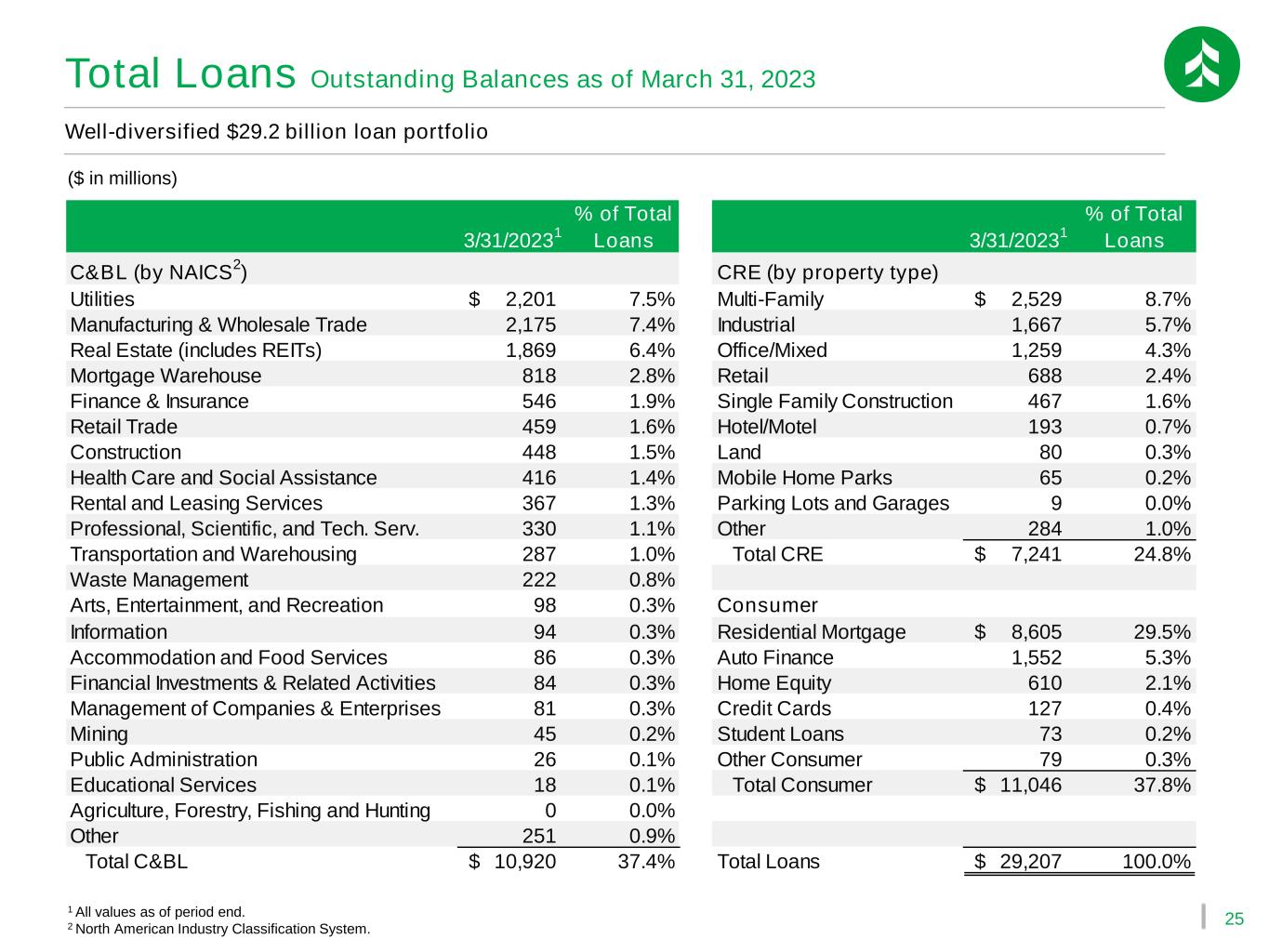

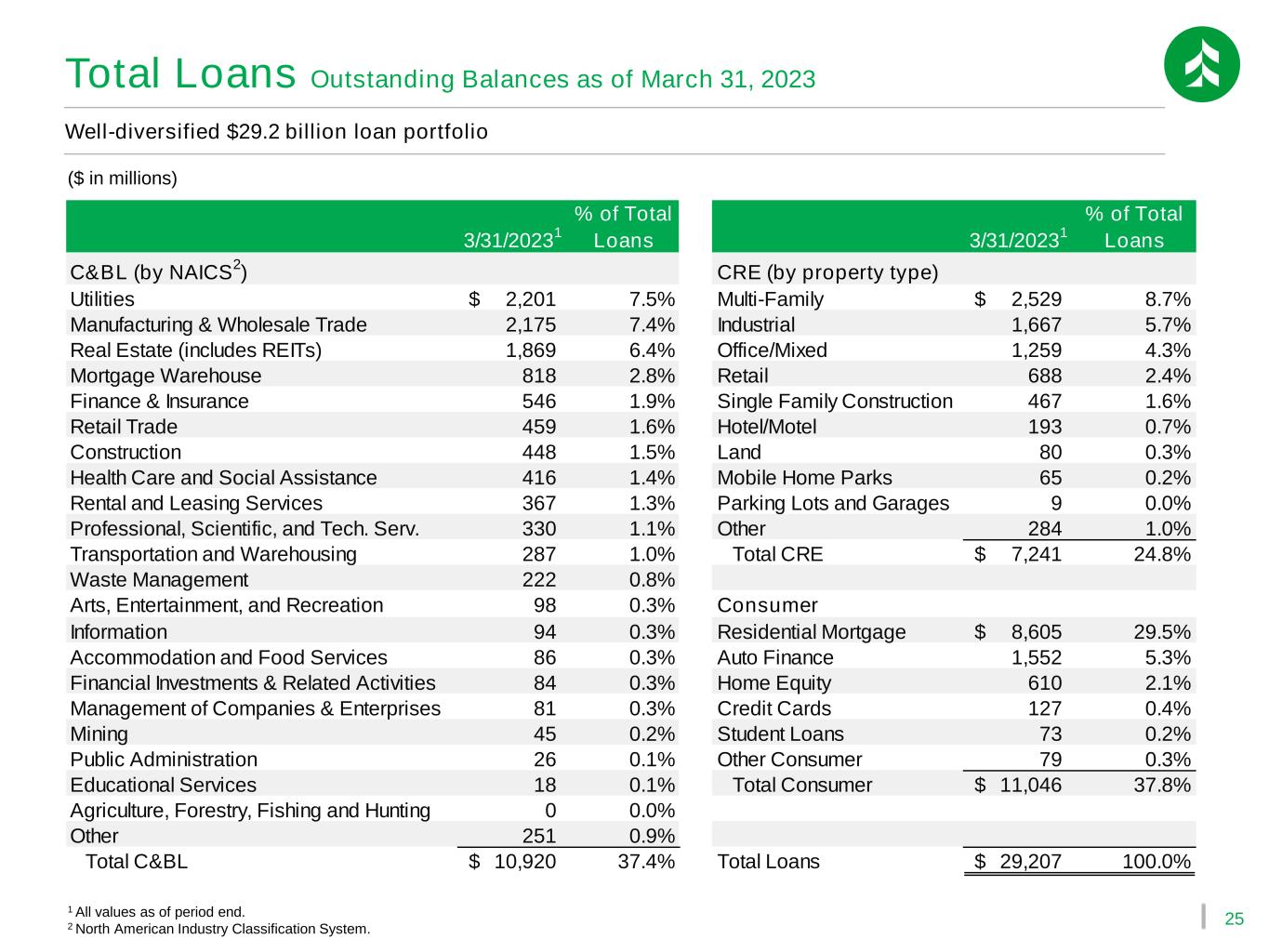

25 Total Loans Outstanding Balances as of March 31, 2023 Well-diversified $29.2 billion loan portfolio ($ in millions) 1 All values as of period end. 2 North American Industry Classification System. 3/31/2023 1 % of Total Loans 3/31/2023 1 % of Total Loans C&BL (by NAICS 2 ) CRE (by property type) Utilities 2,201$ 7.5% Multi-Family 2,529$ 8.7% Manufacturing & Wholesale Trade 2,175 7.4% Industrial 1,667 5.7% Real Estate (includes REITs) 1,869 6.4% Office/Mixed 1,259 4.3% Mortgage Warehouse 818 2.8% Retail 688 2.4% Finance & Insurance 546 1.9% Single Family Construction 467 1.6% Retail Trade 459 1.6% Hotel/Motel 193 0.7% Construction 448 1.5% Land 80 0.3% Health Care and Social Assistance 416 1.4% Mobile Home Parks 65 0.2% Rental and Leasing Services 367 1.3% Parking Lots and Garages 9 0.0% Professional, Scientific, and Tech. Serv. 330 1.1% Other 284 1.0% Transportation and Warehousing 287 1.0% Total CRE 7,241$ 24.8% Waste Management 222 0.8% Arts, Entertainment, and Recreation 98 0.3% Consumer Information 94 0.3% Residential Mortgage 8,605$ 29.5% Accommodation and Food Services 86 0.3% Auto Finance 1,552 5.3% Financial Investments & Related Activities 84 0.3% Home Equity 610 2.1% Management of Companies & Enterprises 81 0.3% Credit Cards 127 0.4% Mining 45 0.2% Student Loans 73 0.2% Public Administration 26 0.1% Other Consumer 79 0.3% Educational Services 18 0.1% Total Consumer 11,046$ 37.8% Agriculture, Forestry, Fishing and Hunting 0 0.0% Other 251 0.9% Total C&BL 10,920$ 37.4% Total Loans 29,207$ 100.0%

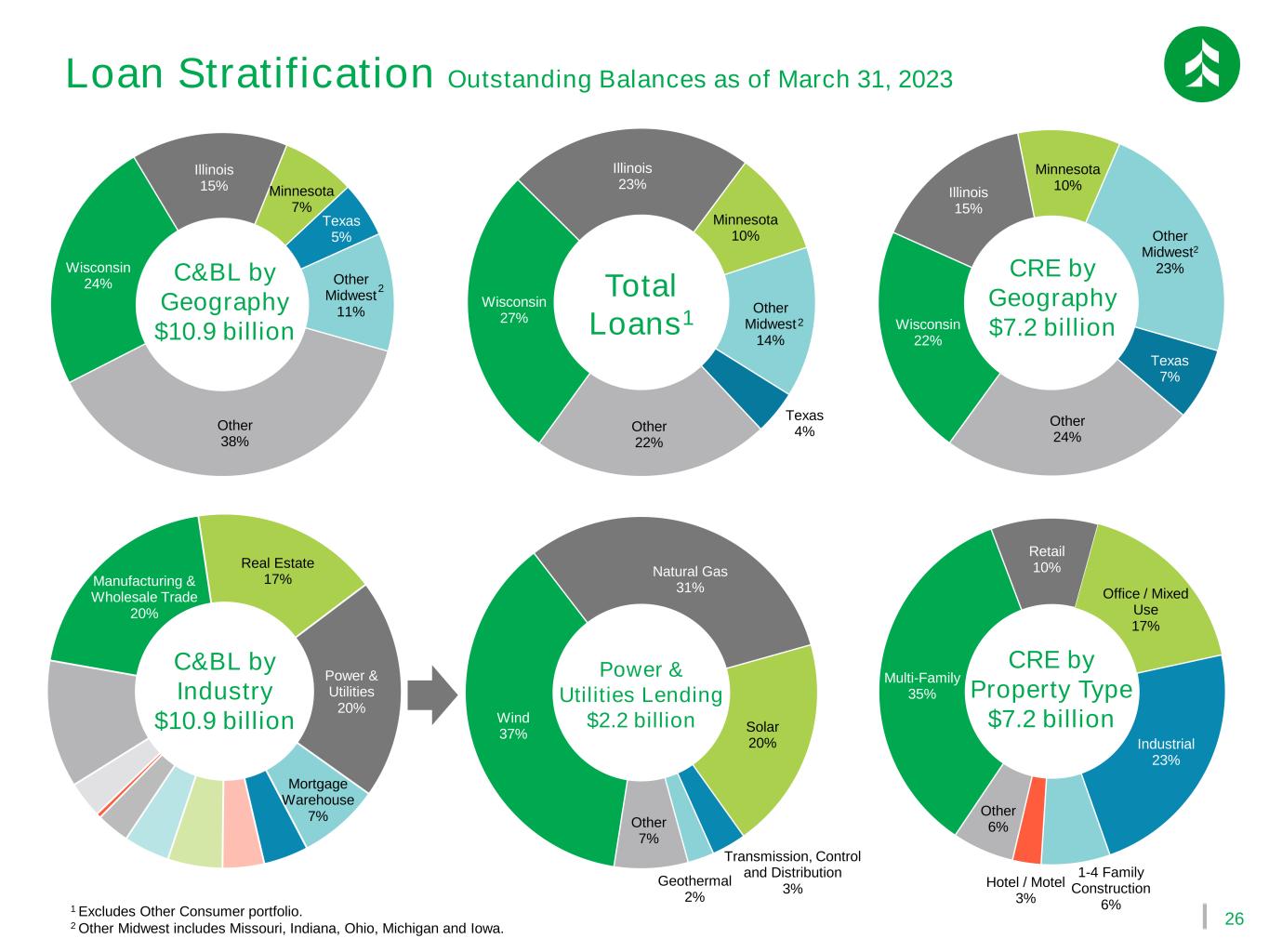

26 Multi-Family 35% Retail 10% Office / Mixed Use 17% Industrial 23% 1-4 Family Construction 6% Hotel / Motel 3% Other 6% Wisconsin 27% Illinois 23% Minnesota 10% Other Midwest 14% Texas 4%Other 22% Manufacturing & Wholesale Trade 20% Real Estate 17% Power & Utilities 20% Mortgage Warehouse 7% 1 Excludes Other Consumer portfolio. 2 Other Midwest includes Missouri, Indiana, Ohio, Michigan and Iowa. Wind 37% Natural Gas 31% Solar 20% Transmission, Control and Distribution 3% Geothermal 2% Other 7% Wisconsin 24% Illinois 15% Minnesota 7% Texas 5% Other Midwest 11% Other 38% Wisconsin 22% Illinois 15% Minnesota 10% Other Midwest2 23% Texas 7% Other 24% 2 2 Loan Stratification Outstanding Balances as of March 31, 2023 C&BL by Geography $10.9 billion Power & Utilities Lending $2.2 billion C&BL by Industry $10.9 billion Total Loans1 CRE by Geography $7.2 billion CRE by Property Type $7.2 billion

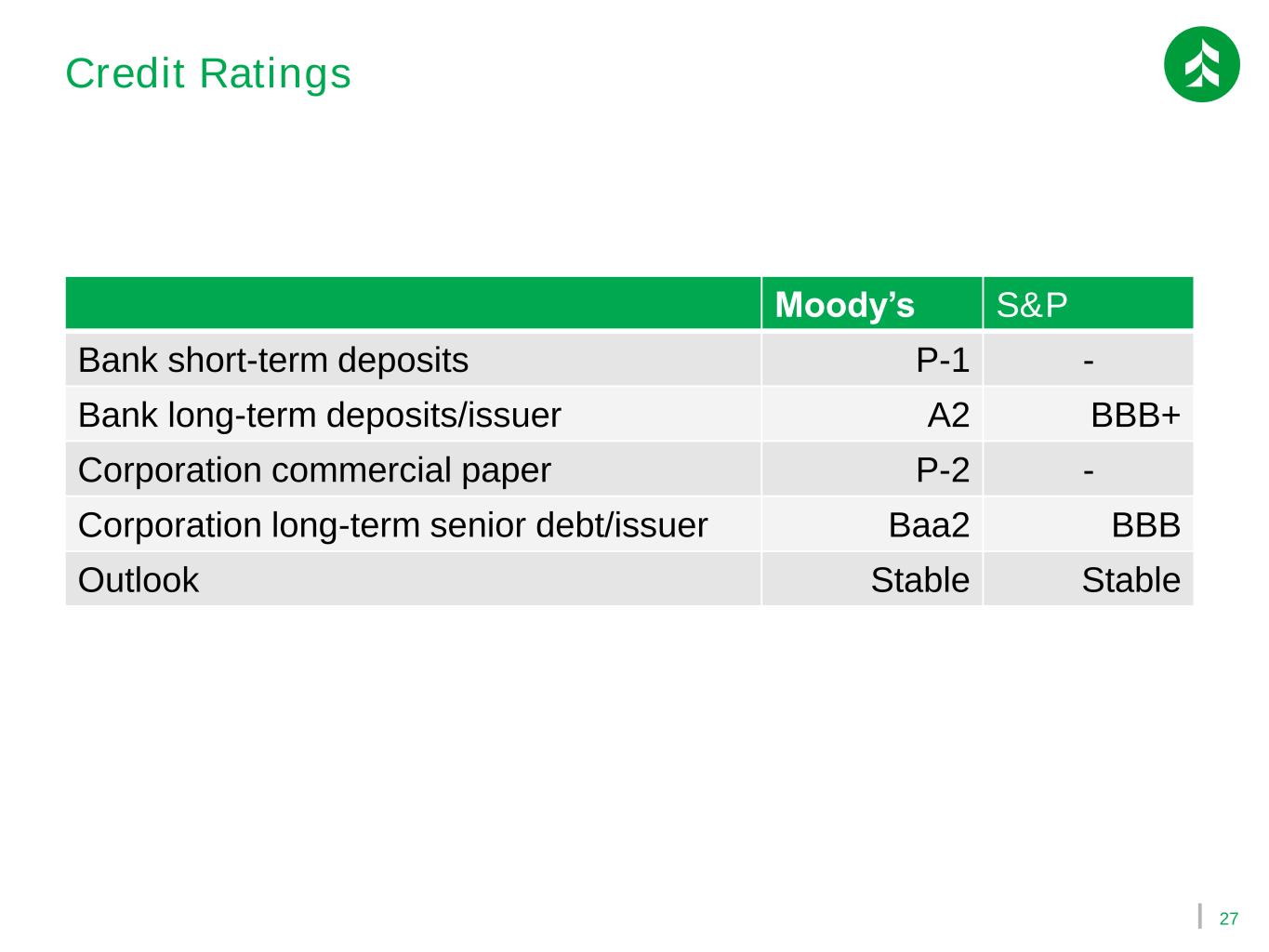

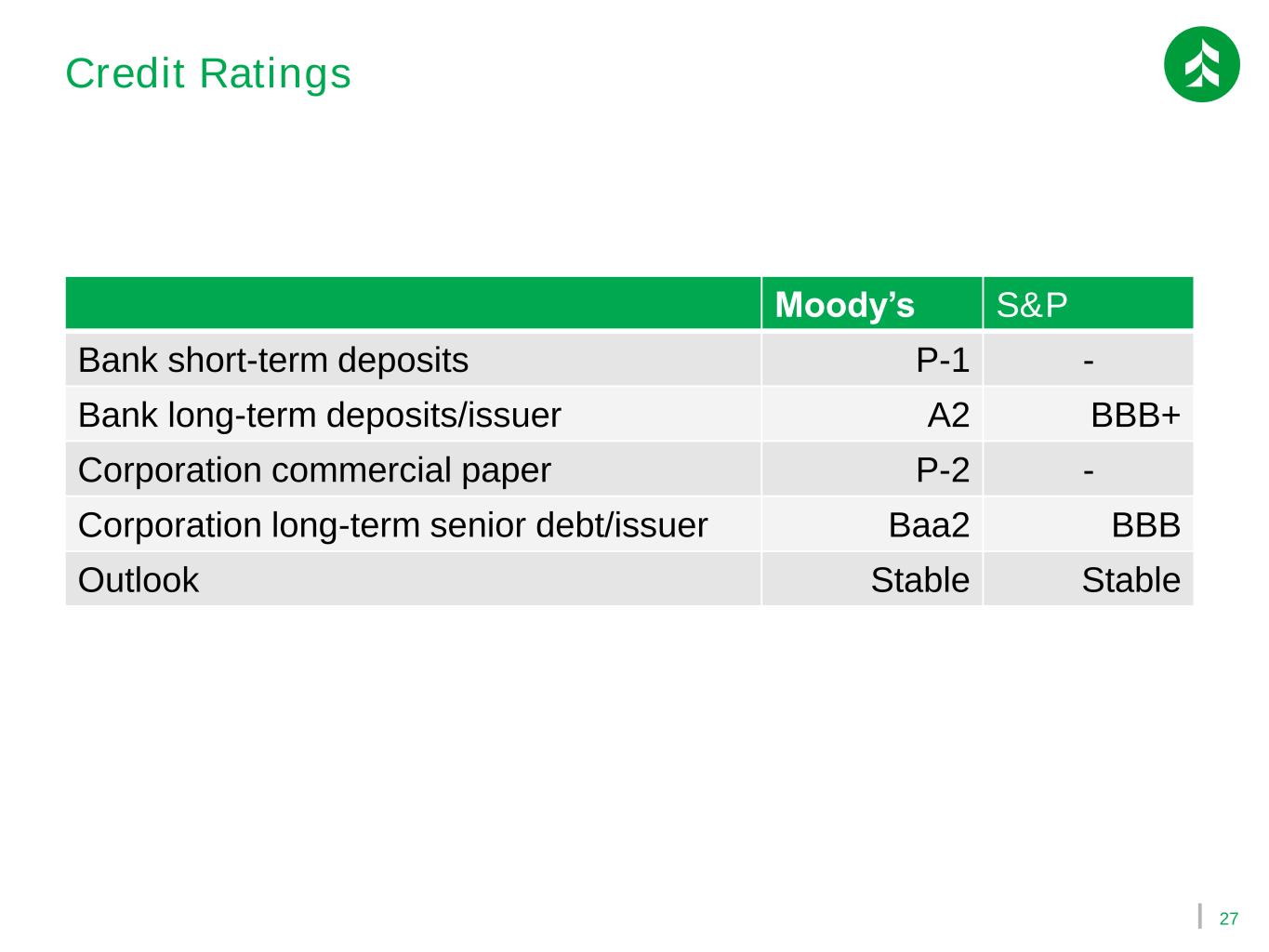

27 Credit Ratings Moody’s S&P Bank short-term deposits P-1 - Bank long-term deposits/issuer A2 BBB+ Corporation commercial paper P-2 - Corporation long-term senior debt/issuer Baa2 BBB Outlook Stable Stable

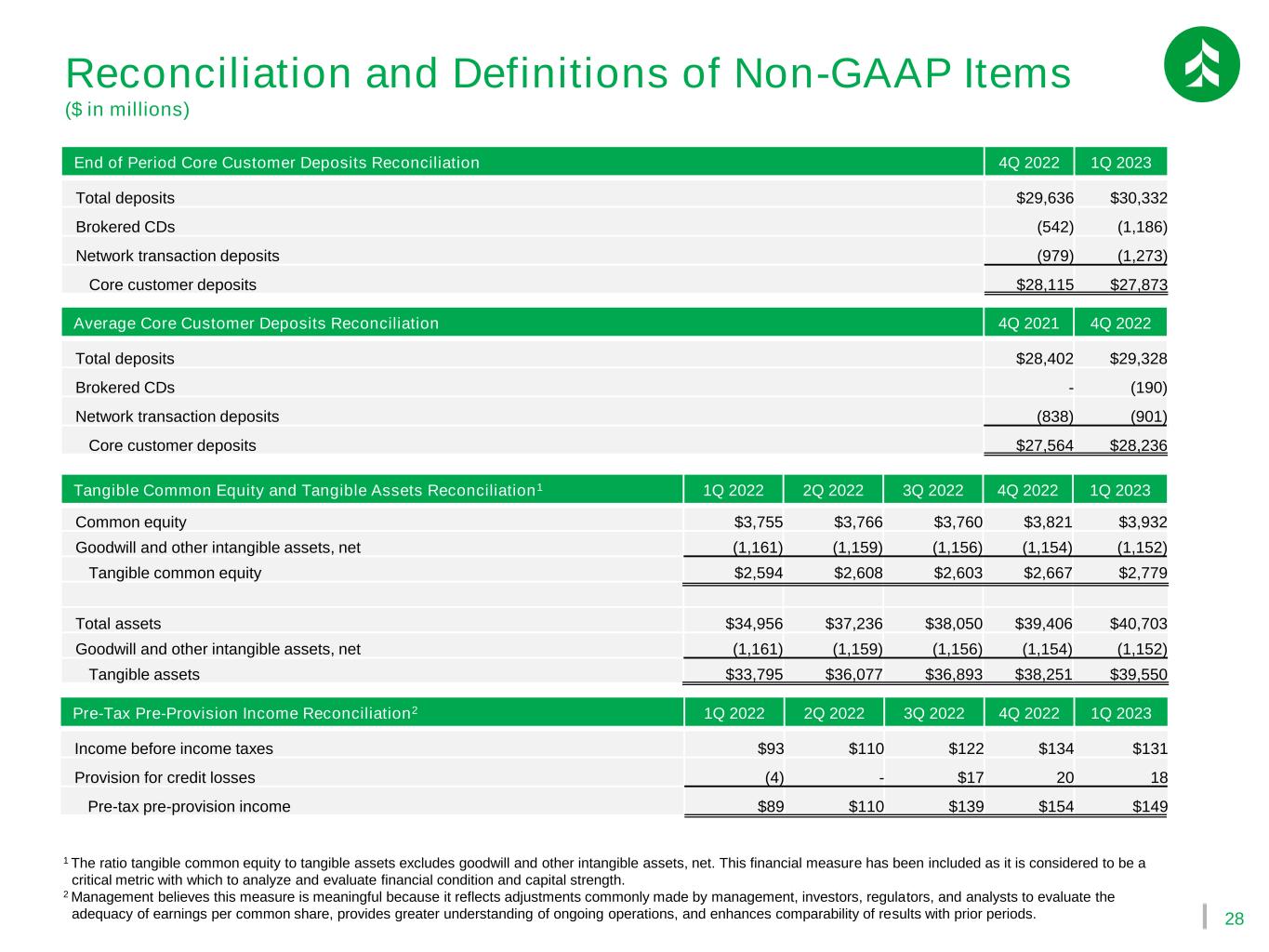

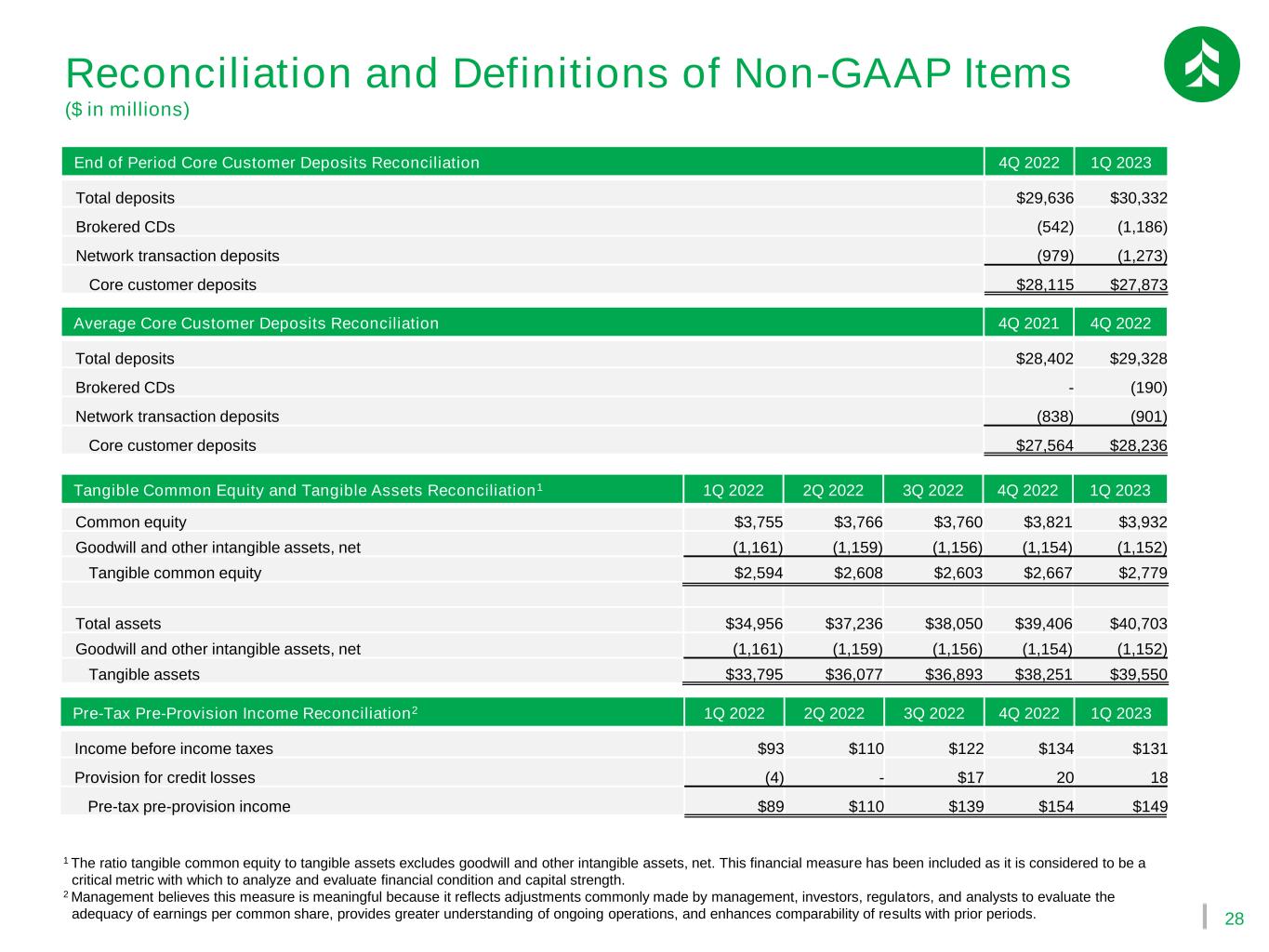

28 Reconciliation and Definitions of Non-GAAP Items ($ in millions) 1 The ratio tangible common equity to tangible assets excludes goodwill and other intangible assets, net. This financial measure has been included as it is considered to be a critical metric with which to analyze and evaluate financial condition and capital strength. 2 Management believes this measure is meaningful because it reflects adjustments commonly made by management, investors, regulators, and analysts to evaluate the adequacy of earnings per common share, provides greater understanding of ongoing operations, and enhances comparability of results with prior periods. Pre-Tax Pre-Provision Income Reconciliation2 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Income before income taxes $93 $110 $122 $134 $131 Provision for credit losses (4) - $17 20 18 Pre-tax pre-provision income $89 $110 $139 $154 $149 End of Period Core Customer Deposits Reconciliation 4Q 2022 1Q 2023 Total deposits $29,636 $30,332 Brokered CDs (542) (1,186) Network transaction deposits (979) (1,273) Core customer deposits $28,115 $27,873 Tangible Common Equity and Tangible Assets Reconciliation1 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Common equity $3,755 $3,766 $3,760 $3,821 $3,932 Goodwill and other intangible assets, net (1,161) (1,159) (1,156) (1,154) (1,152) Tangible common equity $2,594 $2,608 $2,603 $2,667 $2,779 Total assets $34,956 $37,236 $38,050 $39,406 $40,703 Goodwill and other intangible assets, net (1,161) (1,159) (1,156) (1,154) (1,152) Tangible assets $33,795 $36,077 $36,893 $38,251 $39,550 Average Core Customer Deposits Reconciliation 4Q 2021 4Q 2022 Total deposits $28,402 $29,328 Brokered CDs - (190) Network transaction deposits (838) (901) Core customer deposits $27,564 $28,236

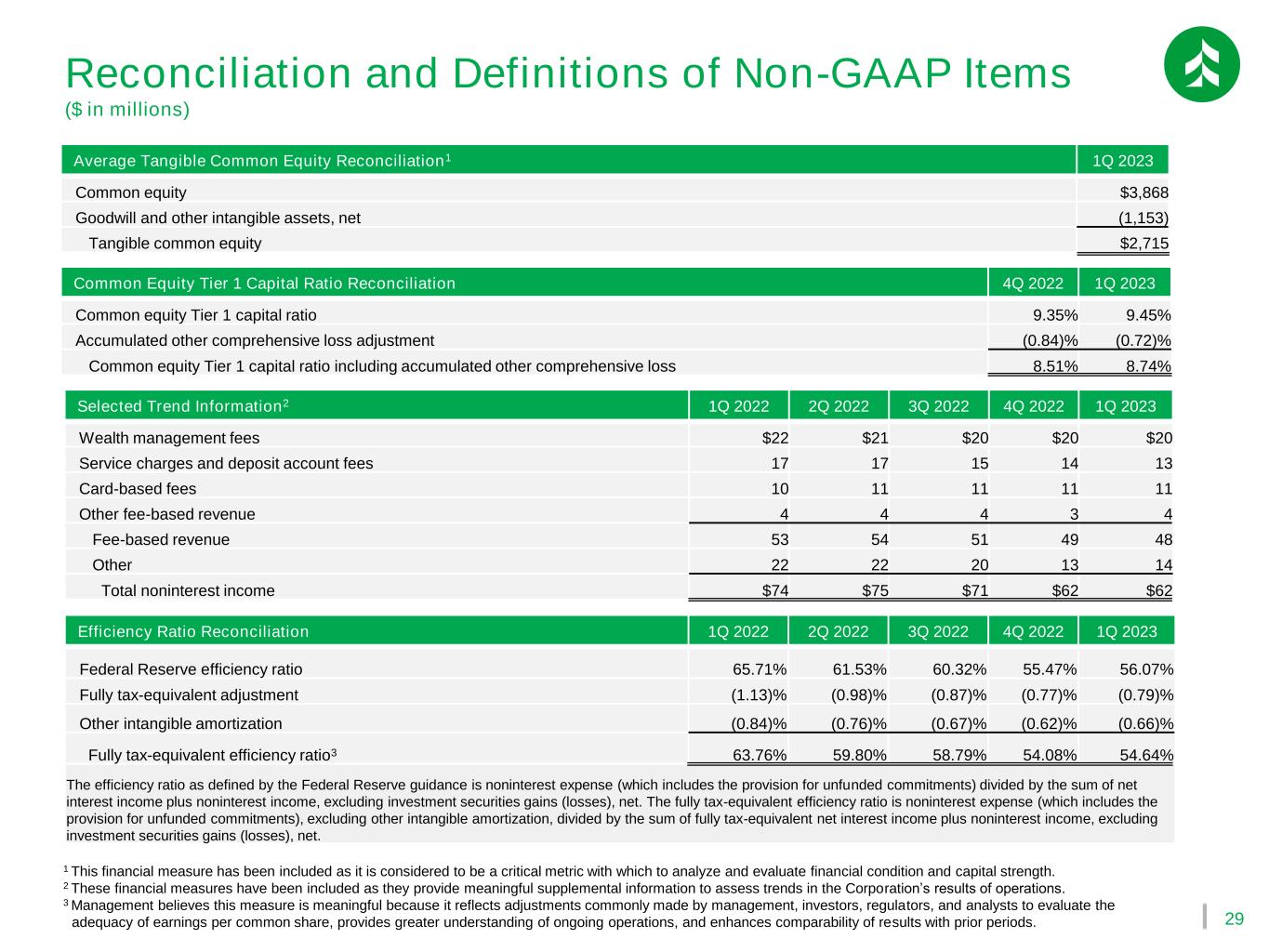

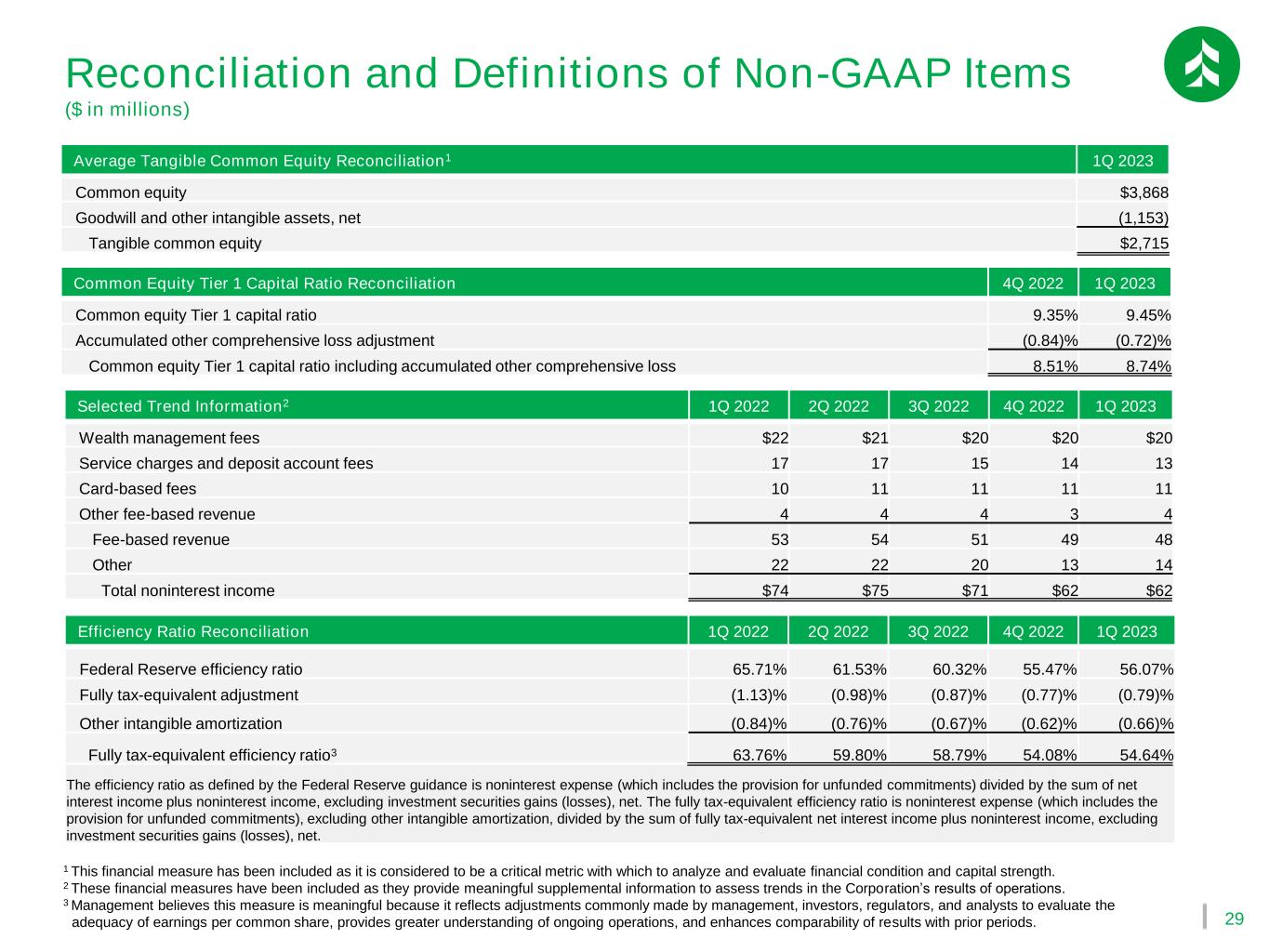

29 Reconciliation and Definitions of Non-GAAP Items ($ in millions) 1 This financial measure has been included as it is considered to be a critical metric with which to analyze and evaluate financial condition and capital strength. 2 These financial measures have been included as they provide meaningful supplemental information to assess trends in the Corporation’s results of operations. 3 Management believes this measure is meaningful because it reflects adjustments commonly made by management, investors, regulators, and analysts to evaluate the adequacy of earnings per common share, provides greater understanding of ongoing operations, and enhances comparability of results with prior periods. Efficiency Ratio Reconciliation 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Federal Reserve efficiency ratio 65.71% 61.53% 60.32% 55.47% 56.07% Fully tax-equivalent adjustment (1.13)% (0.98)% (0.87)% (0.77)% (0.79)% Other intangible amortization (0.84)% (0.76)% (0.67)% (0.62)% (0.66)% Fully tax-equivalent efficiency ratio3 63.76% 59.80% 58.79% 54.08% 54.64% The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the sum of net interest income plus noninterest income, excluding investment securities gains (losses), net. The fully tax-equivalent efficiency ratio is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains (losses), net. Selected Trend Information2 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Wealth management fees $22 $21 $20 $20 $20 Service charges and deposit account fees 17 17 15 14 13 Card-based fees 10 11 11 11 11 Other fee-based revenue 4 4 4 3 4 Fee-based revenue 53 54 51 49 48 Other 22 22 20 13 14 Total noninterest income $74 $75 $71 $62 $62 Common Equity Tier 1 Capital Ratio Reconciliation 4Q 2022 1Q 2023 Common equity Tier 1 capital ratio 9.35% 9.45% Accumulated other comprehensive loss adjustment (0.84)% (0.72)% Common equity Tier 1 capital ratio including accumulated other comprehensive loss 8.51% 8.74% Average Tangible Common Equity Reconciliation1 1Q 2023 Common equity $3,868 Goodwill and other intangible assets, net (1,153) Tangible common equity $2,715