| Delaware | 1-8400 | 75-1825172 | ||||||||||||

| Delaware | 1-2691 | 13-1502798 | ||||||||||||

| (State or other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||||||||

| 1 Skyview Drive, | Fort Worth, | Texas | 76155 | ||||||||||||||

| 1 Skyview Drive, | Fort Worth, | Texas | 76155 | ||||||||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered |

||||||||||||

| Common Stock, $0.01 par value per share | AAL | The Nasdaq Global Select Market | ||||||||||||

| Preferred Stock Purchase Rights | — |

(1) |

||||||||||||

| Emerging growth company | ☐ | ||||

| ITEM 2.02. | RESULTS OF OPERATIONS AND FINANCIAL CONDITION. | ||||

| ITEM 7.01. | REGULATION FD DISCLOSURE. | ||||

| ITEM 9.01. | FINANCIAL STATEMENTS AND EXHIBITS. | ||||

| (d) Exhibits. | ||||||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 99.3 | ||||||||

| 104.1 | Cover page interactive data file (embedded within the Inline XBRL document). | |||||||

AMERICAN AIRLINES GROUP INC. |

|||||||||||

| Date: January 23, 2025 | By: | /s/ Devon E. May | |||||||||

| Devon E. May | |||||||||||

| Executive Vice President and Chief Financial Officer |

|||||||||||

AMERICAN AIRLINES, INC. |

|||||||||||

| Date: January 23, 2025 | By: | /s/ Devon E. May | |||||||||

| Devon E. May | |||||||||||

| Executive Vice President and Chief Financial Officer |

|||||||||||

|

Corporate Communications | |||||||

| mediarelations@aa.com | ||||||||

| Investor Relations | ||||||||

| investor.relations@aa.com | ||||||||

| 3 Months Ended December 31, |

Percent Increase (Decrease) |

12 Months Ended December 31, |

Percent Increase (Decrease) |

||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||

| Operating revenues: | |||||||||||||||||||||||||||||||||||

| Passenger | $ | 12,402 | $ | 12,010 | 3.3 | $ | 49,586 | $ | 48,512 | 2.2 | |||||||||||||||||||||||||

| Cargo | 220 | 199 | 10.5 | 804 | 812 | (0.9) | |||||||||||||||||||||||||||||

| Other | 1,038 | 853 | 21.8 | 3,821 | 3,464 | 10.3 | |||||||||||||||||||||||||||||

| Total operating revenues | 13,660 | 13,062 | 4.6 | 54,211 | 52,788 | 2.7 | |||||||||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||||||||||||||

| Aircraft fuel and related taxes | 2,502 | 3,159 | (20.8) | 11,418 | 12,257 | (6.8) | |||||||||||||||||||||||||||||

| Salaries, wages and benefits | 4,104 | 3,689 | 11.2 | 16,021 | 14,580 | 9.9 | |||||||||||||||||||||||||||||

| Regional expenses: | |||||||||||||||||||||||||||||||||||

| Regional operating expenses | 1,228 | 1,101 | 11.5 | 4,723 | 4,325 | 9.2 | |||||||||||||||||||||||||||||

| Regional depreciation and amortization | 81 | 79 | 2.0 | 319 | 318 | 0.3 | |||||||||||||||||||||||||||||

| Maintenance, materials and repairs | 971 | 875 | 10.9 | 3,794 | 3,265 | 16.2 | |||||||||||||||||||||||||||||

| Other rent and landing fees | 789 | 714 | 10.5 | 3,303 | 2,928 | 12.8 | |||||||||||||||||||||||||||||

| Aircraft rent | 297 | 338 | (12.2) | 1,242 | 1,369 | (9.2) | |||||||||||||||||||||||||||||

| Selling expenses | 480 | 443 | 8.7 | 1,812 | 1,799 | 0.7 | |||||||||||||||||||||||||||||

| Depreciation and amortization | 503 | 480 | 4.7 | 1,926 | 1,936 | (0.5) | |||||||||||||||||||||||||||||

| Special items, net | (14) | 9 | nm | (1) |

610 | 971 | (37.2) | ||||||||||||||||||||||||||||

| Other | 1,585 | 1,519 | 4.4 | 6,429 | 6,006 | 7.0 | |||||||||||||||||||||||||||||

| Total operating expenses | 12,526 | 12,406 | 1.0 | 51,597 | 49,754 | 3.7 | |||||||||||||||||||||||||||||

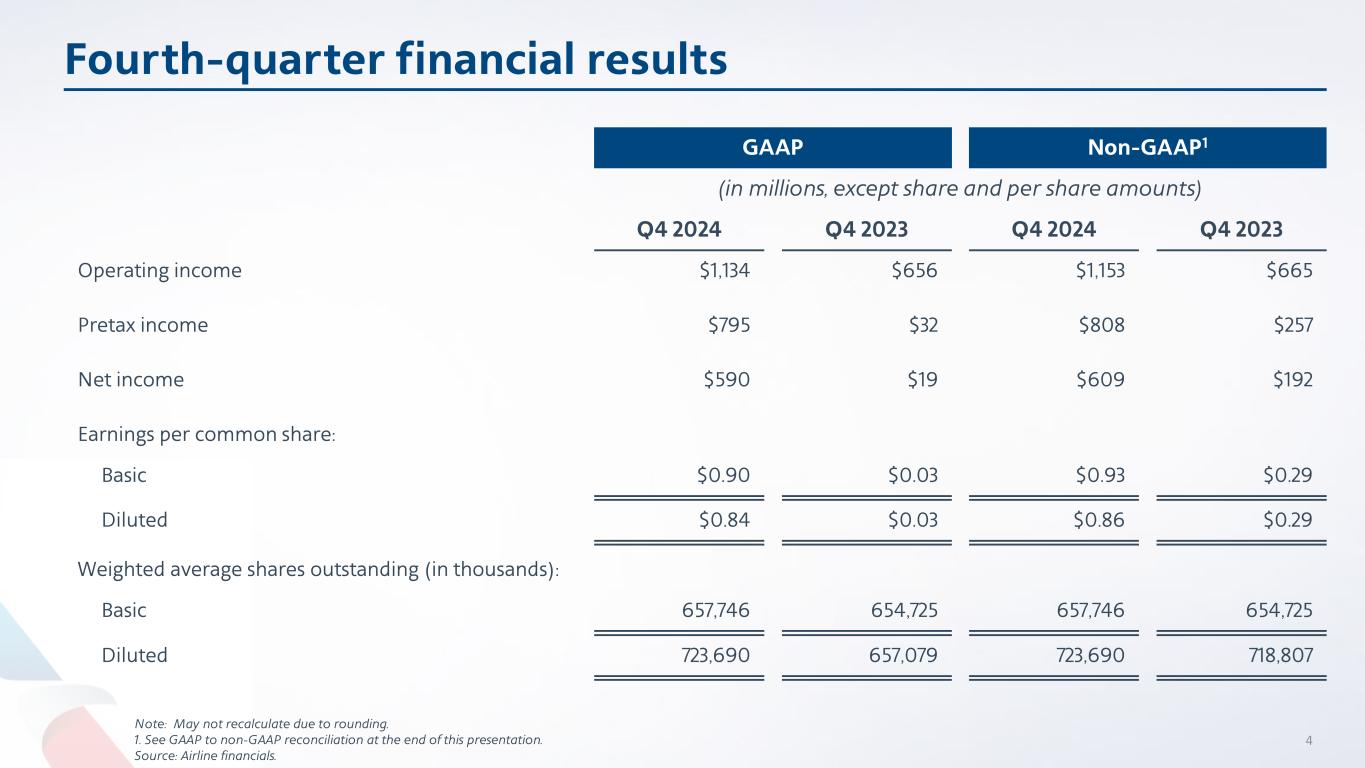

| Operating income | 1,134 | 656 | 72.7 | 2,614 | 3,034 | (13.9) | |||||||||||||||||||||||||||||

| Nonoperating income (expense): | |||||||||||||||||||||||||||||||||||

| Interest income | 106 | 136 | (22.2) | 468 | 591 | (20.8) | |||||||||||||||||||||||||||||

| Interest expense, net | (470) | (519) | (9.5) | (1,934) | (2,145) | (9.9) | |||||||||||||||||||||||||||||

| Other income (expense), net | 25 | (241) | nm | 6 | (359) | nm | |||||||||||||||||||||||||||||

| Total nonoperating expense, net | (339) | (624) | (45.7) | (1,460) | (1,913) | (23.7) | |||||||||||||||||||||||||||||

| Income before income taxes | 795 | 32 | nm | 1,154 | 1,121 | 2.9 | |||||||||||||||||||||||||||||

| Income tax provision | 205 | 13 | nm | 308 | 299 | 2.9 | |||||||||||||||||||||||||||||

| Net income | $ | 590 | $ | 19 | nm | $ | 846 | $ | 822 | 2.9 | |||||||||||||||||||||||||

| Earnings per common share: | |||||||||||||||||||||||||||||||||||

| Basic | $ | 0.90 | $ | 0.03 | $ | 1.29 | $ | 1.26 | |||||||||||||||||||||||||||

| Diluted | $ | 0.84 | $ | 0.03 | $ | 1.24 | $ | 1.21 | |||||||||||||||||||||||||||

| Weighted average shares outstanding (in thousands): | |||||||||||||||||||||||||||||||||||

| Basic | 657,746 | 654,725 | 656,996 | 653,612 | |||||||||||||||||||||||||||||||

| Diluted | 723,690 | 657,079 | 721,300 | 719,669 | |||||||||||||||||||||||||||||||

| 3 Months Ended December 31, |

Increase (Decrease) |

12 Months Ended December 31, |

Increase (Decrease) |

||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||

| Revenue passenger miles (millions) | 60,676 | 58,331 | 4.0 % | 248,795 | 231,926 | 7.3 % | |||||||||||||||||||||||||||||

| Available seat miles (ASM) (millions) | 71,503 | 69,773 | 2.5 % | 292,948 | 277,723 | 5.5 % | |||||||||||||||||||||||||||||

| Passenger load factor (percent) | 84.9 | 83.6 | 1.3 pts | 84.9 | 83.5 | 1.4 pts | |||||||||||||||||||||||||||||

| Yield (cents) | 20.44 | 20.59 | (0.7) % | 19.93 | 20.92 | (4.7) % | |||||||||||||||||||||||||||||

| Passenger revenue per ASM (cents) | 17.34 | 17.21 | 0.8 % | 16.93 | 17.47 | (3.1) % | |||||||||||||||||||||||||||||

| Total revenue per ASM (cents) | 19.10 | 18.72 | 2.0 % | 18.51 | 19.01 | (2.6) % | |||||||||||||||||||||||||||||

| Cargo ton miles (millions) | 526 | 501 | 5.0 % | 2,067 | 1,840 | 12.3 % | |||||||||||||||||||||||||||||

| Cargo yield per ton mile (cents) | 41.85 | 39.74 | 5.3 % | 38.92 | 44.13 | (11.8) % | |||||||||||||||||||||||||||||

| Fuel consumption (gallons in millions) | 1,070 | 1,033 | 3.6 % | 4,391 | 4,140 | 6.1 % | |||||||||||||||||||||||||||||

| Average aircraft fuel price including related taxes (dollars per gallon) | 2.34 | 3.06 | (23.5) % | 2.60 | 2.96 | (12.2) % | |||||||||||||||||||||||||||||

| Operating cost per ASM (cents) | 17.52 | 17.78 | (1.5) % | 17.61 | 17.92 | (1.7) % | |||||||||||||||||||||||||||||

| Operating cost per ASM excluding net special items (cents) | 17.49 | 17.77 | (1.6) % | 17.39 | 17.56 | (1.0) % | |||||||||||||||||||||||||||||

| Operating cost per ASM excluding net special items and fuel (cents) | 13.99 | 13.24 | 5.7 % | 13.50 | 13.15 | 2.6 % | |||||||||||||||||||||||||||||

| Passenger enplanements (thousands) | 55,806 | 53,567 | 4.2 % | 226,405 | 210,692 | 7.5 % | |||||||||||||||||||||||||||||

| Departures (thousands): | |||||||||||||||||||||||||||||||||||

| Mainline | 291 | 285 | 1.9 % | 1,191 | 1,145 | 4.0 % | |||||||||||||||||||||||||||||

| Regional | 256 | 222 | 15.1 % | 972 | 855 | 13.6 % | |||||||||||||||||||||||||||||

| Total | 547 | 507 | 7.7 % | 2,163 | 2,000 | 8.1 % | |||||||||||||||||||||||||||||

| Average stage length (miles): | |||||||||||||||||||||||||||||||||||

| Mainline | 1,147 | 1,157 | (0.9) % | 1,154 | 1,147 | 0.6 % | |||||||||||||||||||||||||||||

| Regional | 461 | 458 | 0.6 % | 459 | 463 | (0.7) % | |||||||||||||||||||||||||||||

| Total | 826 | 851 | (3.0) % | 842 | 855 | (1.5) % | |||||||||||||||||||||||||||||

| Aircraft at end of period: | |||||||||||||||||||||||||||||||||||

| Mainline | 977 | 965 | 1.2 % | 977 | 965 | 1.2 % | |||||||||||||||||||||||||||||

Regional (2) |

585 | 556 | 5.2 % | 585 | 556 | 5.2 % | |||||||||||||||||||||||||||||

| Total | 1,562 | 1,521 | 2.7 % | 1,562 | 1,521 | 2.7 % | |||||||||||||||||||||||||||||

| Full-time equivalent employees at end of period: | |||||||||||||||||||||||||||||||||||

| Mainline | 102,700 | 103,200 | (0.5) % | 102,700 | 103,200 | (0.5) % | |||||||||||||||||||||||||||||

Regional (3) |

30,600 | 28,900 | 5.9 % | 30,600 | 28,900 | 5.9 % | |||||||||||||||||||||||||||||

| Total | 133,300 | 132,100 | 0.9 % | 133,300 | 132,100 | 0.9 % | |||||||||||||||||||||||||||||

| 3 Months Ended December 31, |

Increase (Decrease) |

12 Months Ended December 31, |

Increase (Decrease) |

||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||

Domestic (1) |

|||||||||||||||||||||||||||||||||||

| Revenue passenger miles (millions) | 41,203 | 39,610 | 4.0 % | 166,302 | 155,374 | 7.0 % | |||||||||||||||||||||||||||||

| Available seat miles (ASM) (millions) | 48,495 | 46,805 | 3.6 % | 195,250 | 185,206 | 5.4 % | |||||||||||||||||||||||||||||

| Passenger load factor (percent) | 85.0 | 84.6 | 0.4 pts | 85.2 | 83.9 | 1.3 pts | |||||||||||||||||||||||||||||

| Passenger revenue (dollars in millions) | 9,051 | 8,744 | 3.5 % | 35,336 | 34,592 | 2.1 % | |||||||||||||||||||||||||||||

| Yield (cents) | 21.97 | 22.08 | (0.5) % | 21.25 | 22.26 | (4.6) % | |||||||||||||||||||||||||||||

| Passenger revenue per ASM (cents) | 18.66 | 18.68 | (0.1) % | 18.10 | 18.68 | (3.1) % | |||||||||||||||||||||||||||||

Latin America (2) |

|||||||||||||||||||||||||||||||||||

| Revenue passenger miles (millions) | 8,860 | 8,570 | 3.4 % | 35,438 | 33,337 | 6.3 % | |||||||||||||||||||||||||||||

| Available seat miles (millions) | 10,405 | 9,950 | 4.6 % | 40,889 | 38,531 | 6.1 % | |||||||||||||||||||||||||||||

| Passenger load factor (percent) | 85.2 | 86.1 | (0.9) pts | 86.7 | 86.5 | 0.2 pts | |||||||||||||||||||||||||||||

| Passenger revenue (dollars in millions) | 1,662 | 1,674 | (0.7) % | 6,560 | 6,719 | (2.4) % | |||||||||||||||||||||||||||||

| Yield (cents) | 18.76 | 19.53 | (3.9) % | 18.51 | 20.16 | (8.2) % | |||||||||||||||||||||||||||||

| Passenger revenue per ASM (cents) | 15.98 | 16.82 | (5.0) % | 16.04 | 17.44 | (8.0) % | |||||||||||||||||||||||||||||

| Atlantic | |||||||||||||||||||||||||||||||||||

| Revenue passenger miles (millions) | 8,013 | 8,307 | (3.5) % | 38,407 | 36,581 | 5.0 % | |||||||||||||||||||||||||||||

| Available seat miles (millions) | 9,573 | 10,728 | (10.8) % | 46,574 | 46,056 | 1.1 % | |||||||||||||||||||||||||||||

| Passenger load factor (percent) | 83.7 | 77.4 | 6.3 pts | 82.5 | 79.4 | 3.1 pts | |||||||||||||||||||||||||||||

| Passenger revenue (dollars in millions) | 1,324 | 1,330 | (0.5) % | 6,445 | 6,205 | 3.9 % | |||||||||||||||||||||||||||||

| Yield (cents) | 16.52 | 16.02 | 3.1 % | 16.78 | 16.96 | (1.1) % | |||||||||||||||||||||||||||||

| Passenger revenue per ASM (cents) | 13.82 | 12.40 | 11.5 % | 13.84 | 13.47 | 2.7 % | |||||||||||||||||||||||||||||

| Pacific | |||||||||||||||||||||||||||||||||||

| Revenue passenger miles (millions) | 2,600 | 1,844 | 41.0 % | 8,648 | 6,634 | 30.4 % | |||||||||||||||||||||||||||||

| Available seat miles (millions) | 3,030 | 2,290 | 32.3 % | 10,235 | 7,930 | 29.1 % | |||||||||||||||||||||||||||||

| Passenger load factor (percent) | 85.8 | 80.5 | 5.3 pts | 84.5 | 83.7 | 0.8 pts | |||||||||||||||||||||||||||||

| Passenger revenue (dollars in millions) | 365 | 262 | 39.4 % | 1,245 | 996 | 25.0 % | |||||||||||||||||||||||||||||

| Yield (cents) | 14.03 | 14.19 | (1.1) % | 14.39 | 15.00 | (4.1) % | |||||||||||||||||||||||||||||

| Passenger revenue per ASM (cents) | 12.04 | 11.43 | 5.3 % | 12.16 | 12.55 | (3.1) % | |||||||||||||||||||||||||||||

| Total International | |||||||||||||||||||||||||||||||||||

| Revenue passenger miles (millions) | 19,473 | 18,721 | 4.0 % | 82,493 | 76,552 | 7.8 % | |||||||||||||||||||||||||||||

| Available seat miles (millions) | 23,008 | 22,968 | 0.2 % | 97,698 | 92,517 | 5.6 % | |||||||||||||||||||||||||||||

| Passenger load factor (percent) | 84.6 | 81.5 | 3.1 pts | 84.4 | 82.7 | 1.7 pts | |||||||||||||||||||||||||||||

| Passenger revenue (dollars in millions) | 3,351 | 3,266 | 2.6 % | 14,250 | 13,920 | 2.4 % | |||||||||||||||||||||||||||||

| Yield (cents) | 17.21 | 17.45 | (1.4) % | 17.27 | 18.18 | (5.0) % | |||||||||||||||||||||||||||||

| Passenger revenue per ASM (cents) | 14.56 | 14.22 | 2.4 % | 14.59 | 15.05 | (3.1) % | |||||||||||||||||||||||||||||

| Reconciliation of Operating Income Excluding Net Special Items | 3 Months Ended December 31, |

Percent Increase (Decrease) |

12 Months Ended December 31, |

Percent Increase (Decrease) |

||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||||||

| (in millions) | (in millions) | |||||||||||||||||||||||||||||||||||||

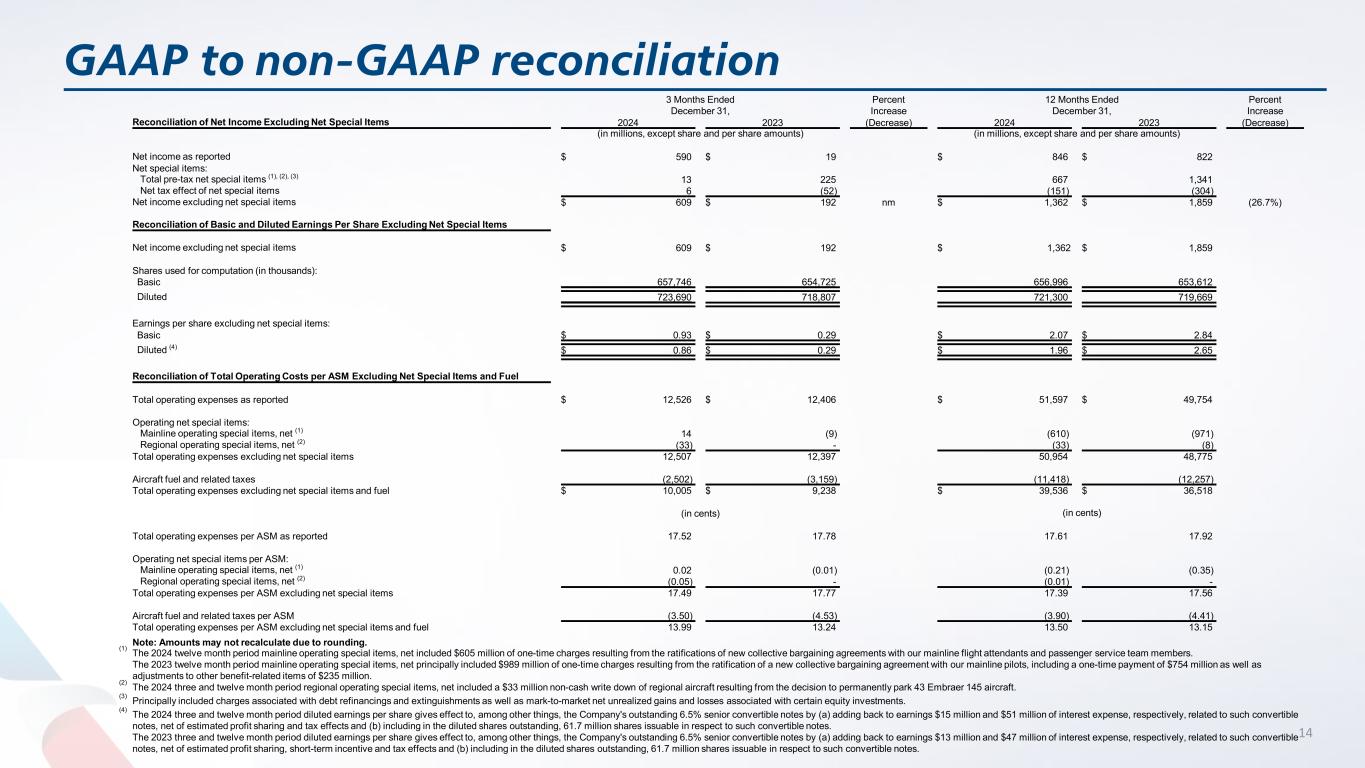

| Operating income as reported | $ | 1,134 | $ | 656 | $ | 2,614 | $ | 3,034 | ||||||||||||||||||||||||||||||

| Operating net special items: | ||||||||||||||||||||||||||||||||||||||

Mainline operating special items, net (1) |

(14) | 9 | 610 | 971 | ||||||||||||||||||||||||||||||||||

Regional operating special items, net (2) |

33 | — | 33 | 8 | ||||||||||||||||||||||||||||||||||

| Operating income excluding net special items | $ | 1,153 | $ | 665 | 73.3% | $ | 3,257 | $ | 4,013 | (18.8%) | ||||||||||||||||||||||||||||

| Calculation of Operating Margin | ||||||||||||||||||||||||||||||||||||||

| Operating income as reported | $ | 1,134 | $ | 656 | $ | 2,614 | $ | 3,034 | ||||||||||||||||||||||||||||||

| Total operating revenues as reported | $ | 13,660 | $ | 13,062 | $ | 54,211 | $ | 52,788 | ||||||||||||||||||||||||||||||

| Operating margin | 8.3 | % | 5.0 | % | 4.8 | % | 5.7 | % | ||||||||||||||||||||||||||||||

| Calculation of Operating Margin Excluding Net Special Items | ||||||||||||||||||||||||||||||||||||||

| Operating income excluding net special items | $ | 1,153 | $ | 665 | $ | 3,257 | $ | 4,013 | ||||||||||||||||||||||||||||||

| Total operating revenues as reported | $ | 13,660 | $ | 13,062 | $ | 54,211 | $ | 52,788 | ||||||||||||||||||||||||||||||

| Operating margin excluding net special items | 8.4 | % | 5.1 | % | 6.0 | % | 7.6 | % | ||||||||||||||||||||||||||||||

| Reconciliation of Pre-Tax Income Excluding Net Special Items | ||||||||||||||||||||||||||||||||||||||

| Pre-tax income as reported | $ | 795 | $ | 32 | $ | 1,154 | $ | 1,121 | ||||||||||||||||||||||||||||||

| Pre-tax net special items: | ||||||||||||||||||||||||||||||||||||||

Mainline operating special items, net (1) |

(14) | 9 | 610 | 971 | ||||||||||||||||||||||||||||||||||

Regional operating special items, net (2) |

33 | — | 33 | 8 | ||||||||||||||||||||||||||||||||||

Nonoperating special items, net (3) |

(6) | 216 | 24 | 362 | ||||||||||||||||||||||||||||||||||

| Total pre-tax net special items | 13 | 225 | 667 | 1,341 | ||||||||||||||||||||||||||||||||||

| Pre-tax income excluding net special items | $ | 808 | $ | 257 | nm | $ | 1,821 | $ | 2,462 | (26.0%) | ||||||||||||||||||||||||||||

| Calculation of Pre-Tax Margin | ||||||||||||||||||||||||||||||||||||||

| Pre-tax income as reported | $ | 795 | $ | 32 | $ | 1,154 | $ | 1,121 | ||||||||||||||||||||||||||||||

| Total operating revenues as reported | $ | 13,660 | $ | 13,062 | $ | 54,211 | $ | 52,788 | ||||||||||||||||||||||||||||||

| Pre-tax margin | 5.8 | % | 0.2 | % | 2.1 | % | 2.1 | % | ||||||||||||||||||||||||||||||

| Calculation of Pre-Tax Margin Excluding Net Special Items | ||||||||||||||||||||||||||||||||||||||

| Pre-tax income excluding net special items | $ | 808 | $ | 257 | $ | 1,821 | $ | 2,462 | ||||||||||||||||||||||||||||||

| Total operating revenues as reported | $ | 13,660 | $ | 13,062 | $ | 54,211 | $ | 52,788 | ||||||||||||||||||||||||||||||

| Pre-tax margin excluding net special items | 5.9 | % | 2.0 | % | 3.4 | % | 4.7 | % | ||||||||||||||||||||||||||||||

| Reconciliation of Net Income Excluding Net Special Items | 3 Months Ended December 31, |

Percent Increase (Decrease) |

12 Months Ended December 31, |

Percent Increase (Decrease) |

||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||||||

| (in millions, except share and per share amounts) | (in millions, except share and per share amounts) | |||||||||||||||||||||||||||||||||||||

| Net income as reported | $ | 590 | $ | 19 | $ | 846 | $ | 822 | ||||||||||||||||||||||||||||||

| Net special items: | ||||||||||||||||||||||||||||||||||||||

Total pre-tax net special items (1), (2), (3) |

13 | 225 | 667 | 1,341 | ||||||||||||||||||||||||||||||||||

| Net tax effect of net special items | 6 | (52) | (151) | (304) | ||||||||||||||||||||||||||||||||||

| Net income excluding net special items | $ | 609 | $ | 192 | nm | $ | 1,362 | $ | 1,859 | (26.7%) | ||||||||||||||||||||||||||||

| Reconciliation of Basic and Diluted Earnings Per Share Excluding Net Special Items | ||||||||||||||||||||||||||||||||||||||

| Net income excluding net special items | $ | 609 | $ | 192 | $ | 1,362 | $ | 1,859 | ||||||||||||||||||||||||||||||

| Shares used for computation (in thousands): | ||||||||||||||||||||||||||||||||||||||

| Basic | 657,746 | 654,725 | 656,996 | 653,612 | ||||||||||||||||||||||||||||||||||

| Diluted | 723,690 | 718,807 | 721,300 | 719,669 | ||||||||||||||||||||||||||||||||||

| Earnings per share excluding net special items: | ||||||||||||||||||||||||||||||||||||||

| Basic | $ | 0.93 | $ | 0.29 | $ | 2.07 | $ | 2.84 | ||||||||||||||||||||||||||||||

Diluted (4) |

$ | 0.86 | $ | 0.29 | $ | 1.96 | $ | 2.65 | ||||||||||||||||||||||||||||||

| Reconciliation of Total Operating Costs per ASM Excluding Net Special Items and Fuel | ||||||||||||||||||||||||||||||||||||||

| Total operating expenses as reported | $ | 12,526 | $ | 12,406 | $ | 51,597 | $ | 49,754 | ||||||||||||||||||||||||||||||

| Operating net special items: | ||||||||||||||||||||||||||||||||||||||

Mainline operating special items, net (1) |

14 | (9) | (610) | (971) | ||||||||||||||||||||||||||||||||||

Regional operating special items, net (2) |

(33) | — | (33) | (8) | ||||||||||||||||||||||||||||||||||

| Total operating expenses excluding net special items | 12,507 | 12,397 | 50,954 | 48,775 | ||||||||||||||||||||||||||||||||||

| Aircraft fuel and related taxes | (2,502) | (3,159) | (11,418) | (12,257) | ||||||||||||||||||||||||||||||||||

| Total operating expenses excluding net special items and fuel | $ | 10,005 | $ | 9,238 | $ | 39,536 | $ | 36,518 | ||||||||||||||||||||||||||||||

| (in cents) | (in cents) | |||||||||||||||||||||||||||||||||||||

| Total operating expenses per ASM as reported | 17.52 | 17.78 | 17.61 | 17.92 | ||||||||||||||||||||||||||||||||||

| Operating net special items per ASM: | ||||||||||||||||||||||||||||||||||||||

Mainline operating special items, net (1) |

0.02 | (0.01) | (0.21) | (0.35) | ||||||||||||||||||||||||||||||||||

Regional operating special items, net (2) |

(0.05) | — | (0.01) | — | ||||||||||||||||||||||||||||||||||

| Total operating expenses per ASM excluding net special items | 17.49 | 17.77 | 17.39 | 17.56 | ||||||||||||||||||||||||||||||||||

| Aircraft fuel and related taxes per ASM | (3.50) | (4.53) | (3.90) | (4.41) | ||||||||||||||||||||||||||||||||||

| Total operating expenses per ASM excluding net special items and fuel | 13.99 | 13.24 | 13.50 | 13.15 | ||||||||||||||||||||||||||||||||||

| Year Ended December 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

| Net cash provided by operating activities | $ | 3,983 | $ | 3,803 | |||||||

| Cash flows from investing activities: | |||||||||||

| Capital expenditures and aircraft purchase deposits | (2,683) | (2,596) | |||||||||

| Proceeds from sale-leaseback transactions and sale of property and equipment | 654 | 230 | |||||||||

| Sales of short-term investments | 8,013 | 8,861 | |||||||||

| Purchases of short-term investments | (7,194) | (7,323) | |||||||||

| Decrease in restricted short-term investments | 177 | 51 | |||||||||

| Other investing activities | 65 | 275 | |||||||||

| Net cash used in investing activities | (968) | (502) | |||||||||

| Cash flows from financing activities: | |||||||||||

| Payments on long-term debt and finance leases | (4,467) | (7,718) | |||||||||

| Proceeds from issuance of long-term debt | 1,670 | 4,822 | |||||||||

| Other financing activities | 3 | (310) | |||||||||

| Net cash used in financing activities | (2,794) | (3,206) | |||||||||

| Net increase in cash and restricted cash | 221 | 95 | |||||||||

| Cash and restricted cash at beginning of year | 681 | 586 | |||||||||

Cash and restricted cash at end of year (1) |

$ | 902 | $ | 681 | |||||||

| Cash | $ | 804 | $ | 578 | |||||||

| Restricted cash included in restricted cash and short-term investments | 98 | 103 | |||||||||

| Total cash and restricted cash | $ | 902 | $ | 681 | |||||||

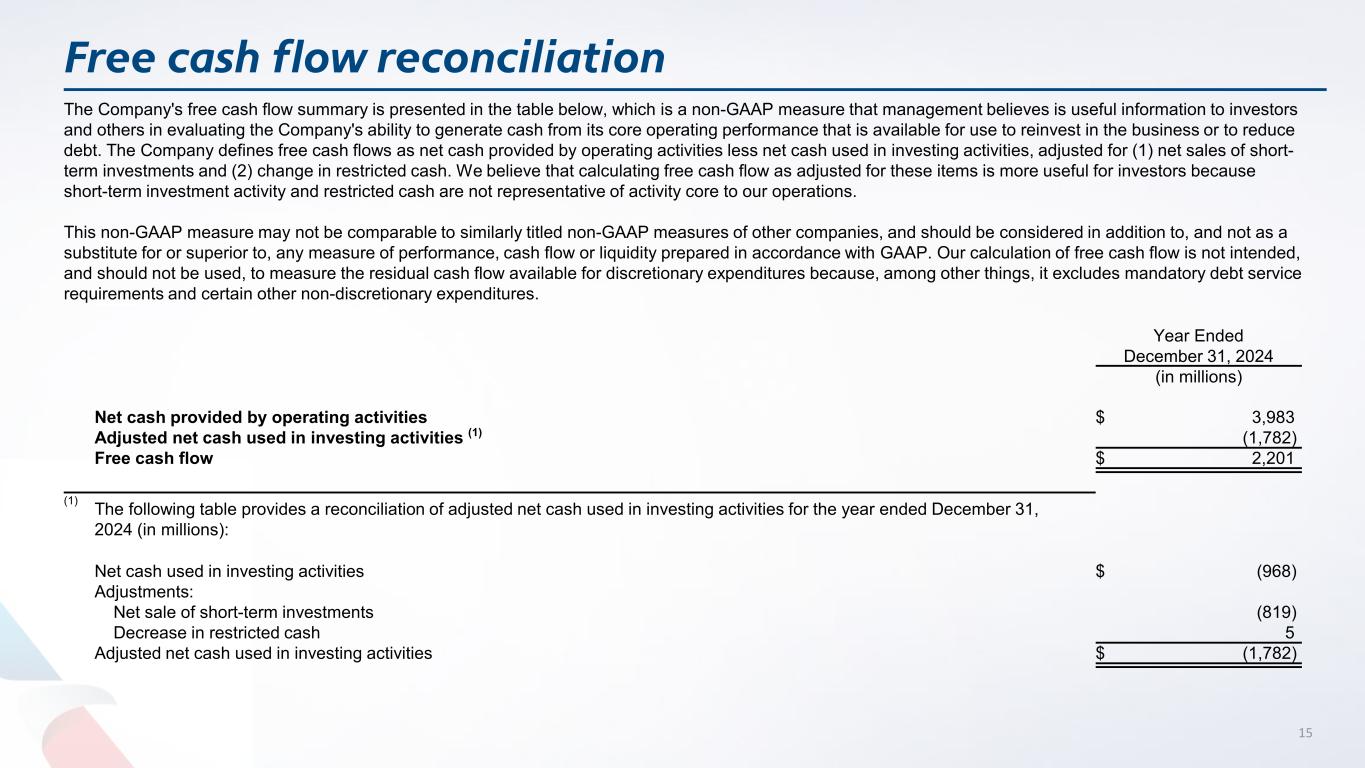

| Year Ended December 31, 2024 |

|||||

| (in millions) | |||||

| Net cash provided by operating activities | $ | 3,983 | |||

Adjusted net cash used in investing activities (1) |

(1,782) | ||||

| Free cash flow | $ | 2,201 | |||

| Net cash used in investing activities | $ | (968) | |||

| Adjustments: | |||||

| Net sales of short-term investments | (819) | ||||

| Decrease in restricted cash | 5 | ||||

| Adjusted net cash used in investing activities | $ | (1,782) | |||

| December 31, 2024 | December 31, 2023 | ||||||||||

| (unaudited) | |||||||||||

| Assets | |||||||||||

| Current assets | |||||||||||

| Cash | $ | 804 | $ | 578 | |||||||

| Short-term investments | 6,180 | 7,000 | |||||||||

| Restricted cash and short-term investments | 732 | 910 | |||||||||

| Accounts receivable, net | 2,006 | 2,026 | |||||||||

| Aircraft fuel, spare parts and supplies, net | 2,638 | 2,400 | |||||||||

| Prepaid expenses and other | 794 | 658 | |||||||||

| Total current assets | 13,154 | 13,572 | |||||||||

| Operating property and equipment | |||||||||||

| Flight equipment | 43,521 | 41,794 | |||||||||

| Ground property and equipment | 10,202 | 10,307 | |||||||||

| Equipment purchase deposits | 1,012 | 760 | |||||||||

| Total property and equipment, at cost | 54,735 | 52,861 | |||||||||

| Less accumulated depreciation and amortization | (23,608) | (22,097) | |||||||||

| Total property and equipment, net | 31,127 | 30,764 | |||||||||

| Operating lease right-of-use assets | 7,333 | 7,939 | |||||||||

| Other assets | |||||||||||

| Goodwill | 4,091 | 4,091 | |||||||||

| Intangibles, net | 2,044 | 2,051 | |||||||||

| Deferred tax asset | 2,485 | 2,888 | |||||||||

| Other assets | 1,549 | 1,753 | |||||||||

| Total other assets | 10,169 | 10,783 | |||||||||

| Total assets | $ | 61,783 | $ | 63,058 | |||||||

| Liabilities and Stockholders’ Equity (Deficit) | |||||||||||

| Current liabilities | |||||||||||

| Current maturities of long-term debt and finance leases | $ | 5,014 | $ | 3,632 | |||||||

| Accounts payable | 2,455 | 2,353 | |||||||||

| Accrued salaries and wages | 2,150 | 2,377 | |||||||||

| Air traffic liability | 6,759 | 6,200 | |||||||||

| Loyalty program liability | 3,556 | 3,453 | |||||||||

| Operating lease liabilities | 1,092 | 1,309 | |||||||||

| Other accrued liabilities | 2,961 | 2,738 | |||||||||

| Total current liabilities | 23,987 | 22,062 | |||||||||

| Noncurrent liabilities | |||||||||||

| Long-term debt and finance leases, net of current maturities | 25,462 | 29,270 | |||||||||

| Pension and postretirement benefits | 2,128 | 3,044 | |||||||||

| Loyalty program liability | 6,498 | 5,874 | |||||||||

| Operating lease liabilities | 5,976 | 6,452 | |||||||||

| Other liabilities | 1,709 | 1,558 | |||||||||

| Total noncurrent liabilities | 41,773 | 46,198 | |||||||||

| Stockholders' equity (deficit) | |||||||||||

Common stock, 657,566,166 shares outstanding at December 31, 2024 |

7 | 7 | |||||||||

| Additional paid-in capital | 7,424 | 7,374 | |||||||||

| Accumulated other comprehensive loss | (4,565) | (4,894) | |||||||||

| Retained deficit | (6,843) | (7,689) | |||||||||

| Total stockholders' deficit | (3,977) | (5,202) | |||||||||

| Total liabilities and stockholders’ equity (deficit) | $ | 61,783 | $ | 63,058 | |||||||

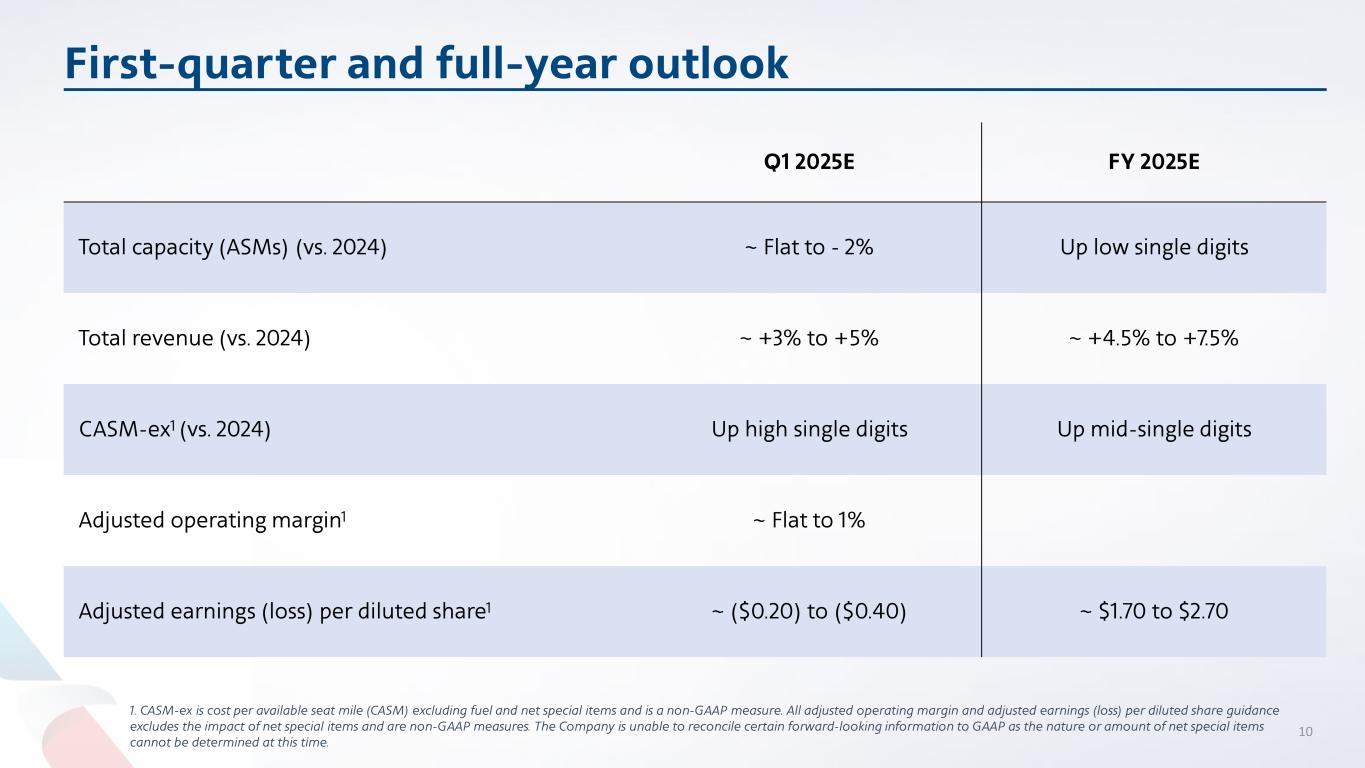

| ● | Capacity - The Company expects its first-quarter capacity to be approximately flat to down 2.0% versus the first quarter of 2024. The Company expects its full-year capacity to be up approximately low single digits year over year. |

||||

| ● | Total Revenue - First-quarter total revenue is expected to be up approximately 3.0% to 5.0% versus the first quarter of 2024. Full-year total revenue is expected to be up approximately 4.5% to 7.5% versus 2024. |

||||

| ● | CASM-ex1 - The Company expects its first-quarter CASM-ex to be up approximately high single digits, driven by the reduction in year over year capacity, the mix of that capacity with regional capacity growing approximately 17% and mainline capacity down 2% to 3%, and the new collective bargaining agreements that were reached in the second half of 2024. The Company currently expects CASM-ex to improve sequentially, exiting the year up low single digits year over year. Full-year CASM-ex is expected to be up approximately mid-single digits year over year, primarily driven by the year over year increase in salaries and benefits. |

||||

| ● | Adjusted operating margin1 - Based on current assumptions, the Company expects its first-quarter adjusted operating margin to be approximately flat to 1.0%. |

||||

| ● | Adjusted nonoperating expense1 - The Company expects its full-year total adjusted nonoperating expense to be approximately $1.35 billion, approximately $90 million lower versus 2024. This forecasted decrease in full-year total adjusted nonoperating expense is primarily driven by a reduction in interest expense due to lower debt balances and lower average cost of debt. |

||||

| ● | Taxes - The Company expects a provision for income taxes at an estimated effective tax rate of approximately 25% for the first quarter and full year, which is expected to be substantially non-cash. |

||||

| ● | Adjusted EPS1 - Based on the assumptions outlined above, the Company expects its first-quarter adjusted loss per diluted share to be between ($0.20) and ($0.40) based on an expected share count of 658.8 million shares. Based on current assumptions, the Company expects its full-year adjusted earnings per diluted share to be between $1.70 and $2.70 using a share count of 726.8 million shares. |

||||

| ● | Free cash flow2 - Based on current assumptions, the Company expects to generate full-year free cash flow of over $2 billion. |

||||

| 1. | CASM-ex is cost per available seat mile (CASM) excluding fuel and net special items and is a non-GAAP measure. All adjusted operating margin, adjusted nonoperating expense and adjusted earnings per diluted share guidance excludes the impact of net special items and are non-GAAP measures. The Company is unable to reconcile certain forward-looking information to GAAP as the nature or amount of net special items cannot be determined at this time. |

||||

| 2. | Free cash flow is a non-GAAP measure. The Company defines free cash flow as net cash provided by operating activities less net cash used in investing activities, adjusted for (1) net purchases of short-term investments and (2) change in restricted cash. |

||||

Q1 20251 |

||||||||||||||||||||

| Available seat miles (ASMs) | ~ Flat to -2.0% (vs. Q1 24) | |||||||||||||||||||

| Total revenue | ~ +3.0% to +5.0% (vs. Q1 24) | |||||||||||||||||||

| CASM excluding fuel and net special items | ~ Up high single digits (vs. Q1 24) | |||||||||||||||||||

Adjusted operating margin |

~ Flat to 1.0% | |||||||||||||||||||

| Adjusted loss per diluted share ($/share) | ~ ($0.20) to ($0.40) | |||||||||||||||||||

| Q1 2025 Shares Forecast | ||||||||||||||||||||

Shares (mil)2 |

||||||||||||||||||||

| Earnings level ($ mil) | Basic | Diluted | Addback ($ mil)3 |

|||||||||||||||||

| Earnings above $147 | 658.8 | 728.0 | $14 | |||||||||||||||||

| Earnings up to $147 | 658.8 | 666.2 | — | |||||||||||||||||

| Net loss | 658.8 | 658.8 | — | |||||||||||||||||

FY 20251 |

||||||||||||||||||||

| Available seat miles (ASMs) | ~ Up low single digits (vs. 2024) | |||||||||||||||||||

| Total revenue | ~ +4.5% to +7.5% (vs. 2024) | |||||||||||||||||||

| CASM excluding fuel and net special items | ~ Up mid-single digits (vs. 2024) | |||||||||||||||||||

| Adjusted earnings per diluted share ($/share) | ~ $1.70 to $2.70 | |||||||||||||||||||

| FY 2025 Shares Forecast | ||||||||||||||||||||

Shares (mil)2 |

||||||||||||||||||||

| Earnings level ($ mil) | Basic | Diluted | Addback ($ mil)3 |

|||||||||||||||||

| Earnings above $527 | 690.8 | 726.8 | $23 | |||||||||||||||||

| Earnings up to $527 | 690.8 | 695.9 | — | |||||||||||||||||

| Net loss | 690.8 | 690.8 | — | |||||||||||||||||

| 1. | Includes guidance on certain non-GAAP measures, which exclude, among other things, net special items. The Company is unable to reconcile certain forward-looking information to GAAP as the nature or amount of net special items cannot be determined at this time. Numbers may not recalculate due to rounding. |

||||

| 2. | Shares outstanding are based upon several estimates and assumptions, including average per share stock price and stock award activity. The number of shares in actual calculations of earnings per share will likely be different from those set forth above. | ||||

| 3. | Interest addback for earnings per diluted share calculation for 6.5% convertible notes, net of estimated profit sharing and tax effects. | ||||