UNUM GROUP | ||||||||||||||

| (Exact name of registrant as specified in its charter) | ||||||||||||||

Delaware |

001-11294 |

62-1598430 |

||||||||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common stock, $0.10 par value | UNM | New York Stock Exchange | ||||||||||||

| 6.250% Junior Subordinated Notes due 2058 | UNMA | New York Stock Exchange | ||||||||||||

(d) Exhibits. |

||||||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 99.3 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |||||||

| Unum Group | |||||||||||

| (Registrant) | |||||||||||

Date: February 5, 2026 |

By: | /s/ J. Paul Jullienne | |||||||||

| Name: | J. Paul Jullienne | ||||||||||

| Title: | Vice President, Managing Counsel, and | ||||||||||

| Corporate Secretary | |||||||||||

| Exhibit 99.1 | ||||||||||||||

|

1 Fountain Square Chattanooga, TN 37402 www.unum.com |

|||||||||||||

| FOR IMMEDIATE RELEASE | ||||||||||||||

| Contacts | ||||||||||||||

|

MEDIA |

Emily Downing

edowning@unum.com

|

||||||||||||

| INVESTORS |

Matt Royal

investorrelations@unum.com

|

|||||||||||||

|

||||||||

2 |

||||||||

|

||||||||

3 |

||||||||

|

||||||||

4 |

||||||||

|

||||||||

5 |

||||||||

|

||||||||

6 |

||||||||

|

||||||||

7 |

||||||||

|

||||||||

| ($ in millions, except share data) | |||||||||||||||||||||||

| Three Months Ended December 31 | Year Ended December 31 | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Revenue | |||||||||||||||||||||||

| Premium Income | $ | 2,692.1 | $ | 2,631.1 | $ | 10,831.0 | $ | 10,497.4 | |||||||||||||||

| Net Investment Income | 482.0 | 543.6 | 2,032.7 | 2,130.0 | |||||||||||||||||||

| Net Investment Loss | (10.1) | (10.1) | (106.6) | (34.6) | |||||||||||||||||||

| Other Income | 80.1 | 72.0 | 318.4 | 294.5 | |||||||||||||||||||

| Total Revenue | 3,244.1 | 3,236.6 | 13,075.5 | 12,887.3 | |||||||||||||||||||

| Benefits and Expenses | |||||||||||||||||||||||

Policy Benefits Including Remeasurement Loss or Gain |

1,892.9 | 1,861.2 | 8,065.3 | 6,917.9 | |||||||||||||||||||

| Commissions | 333.4 | 310.8 | 1,355.3 | 1,258.6 | |||||||||||||||||||

| Interest and Debt Expense | 52.6 | 52.5 | 208.8 | 201.1 | |||||||||||||||||||

| Deferral of Acquisition Costs | (176.1) | (156.2) | (697.1) | (651.5) | |||||||||||||||||||

| Amortization of Deferred Acquisition Costs | 137.2 | 133.1 | 527.1 | 521.0 | |||||||||||||||||||

| Other Expenses | 785.7 | 589.7 | 2,682.6 | 2,388.9 | |||||||||||||||||||

| Total Benefits and Expenses | 3,025.7 | 2,791.1 | 12,142.0 | 10,636.0 | |||||||||||||||||||

| Income Before Income Tax | 218.4 | 445.5 | 933.5 | 2,251.3 | |||||||||||||||||||

Income Tax Expense |

44.3 | 96.8 | 195.0 | 472.2 | |||||||||||||||||||

| Net Income | $ | 174.1 | $ | 348.7 | $ | 738.5 | $ | 1,779.1 | |||||||||||||||

| PER SHARE INFORMATION | |||||||||||||||||||||||

| Net Income Per Common Share | |||||||||||||||||||||||

| Basic | $ | 1.04 | $ | 1.93 | $ | 4.28 | $ | 9.49 | |||||||||||||||

| Assuming Dilution | $ | 1.04 | $ | 1.92 | $ | 4.27 | $ | 9.46 | |||||||||||||||

| Weighted Average Common Shares - Basic (000s) | 167,650.8 | 180,985.5 | 172,511.5 | 187,497.7 | |||||||||||||||||||

| Weighted Average Common Shares - Assuming Dilution (000s) | 168,038.3 | 181,637.7 | 172,921.6 | 188,069.2 | |||||||||||||||||||

| Outstanding Shares - (000s) | 165,694.4 | 178,589.0 | |||||||||||||||||||||

8 |

||||||||

|

||||||||

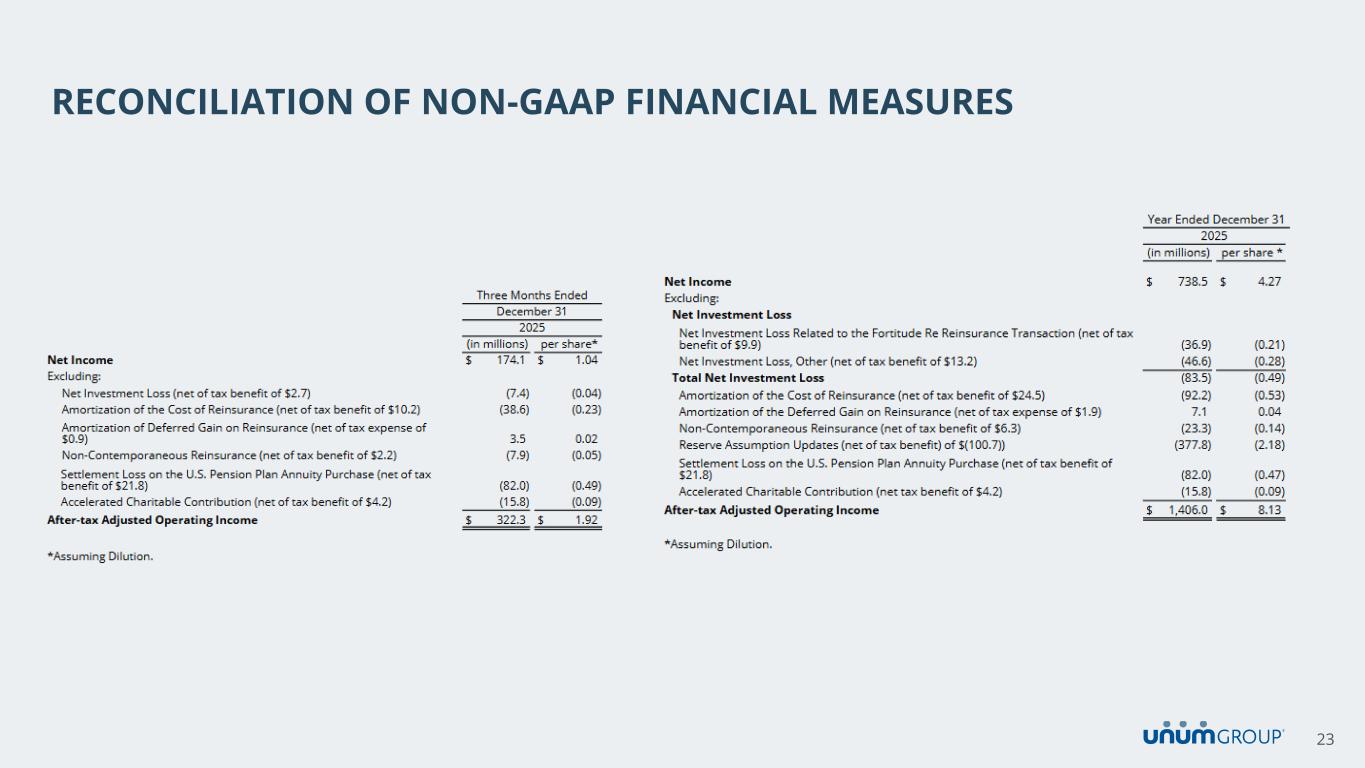

| Three Months Ended December 31 | |||||||||||||||||||||||

| 2025 | 2024 | ||||||||||||||||||||||

| (in millions) | per share * | (in millions) | per share * | ||||||||||||||||||||

| Net Income | $ | 174.1 | $ | 1.04 | $ | 348.7 | $ | 1.92 | |||||||||||||||

| Excluding: | |||||||||||||||||||||||

Net Investment Loss (net of tax benefit of $2.7; $1.9) |

(7.4) | (0.04) | (8.2) | (0.04) | |||||||||||||||||||

Amortization of the Cost of Reinsurance (net of tax benefit of $10.2; $2.2) |

(38.6) | (0.23) | (8.1) | (0.04) | |||||||||||||||||||

Amortization of the Deferred Gain on Reinsurance (net of tax expense of $0.9; $—) |

3.5 | 0.02 | — | — | |||||||||||||||||||

Non-Contemporaneous Reinsurance (net of tax benefit of $2.2; $1.0) |

(7.9) | (0.05) | (3.9) | (0.03) | |||||||||||||||||||

Settlement Loss on the U.S. Pension Plan Annuity Purchase (net of tax benefit of $21.8;$—) |

(82.0) | (0.49) | — | — | |||||||||||||||||||

Accelerated Charitable Contribution (net of tax benefit of $4.2;$—) |

(15.8) | (0.09) | — | — | |||||||||||||||||||

| After-tax Adjusted Operating Income | $ | 322.3 | $ | 1.92 | $ | 368.9 | $ | 2.03 | |||||||||||||||

| Year Ended December 31 | |||||||||||||||||||||||

| 2025 | 2024 | ||||||||||||||||||||||

| (in millions) | per share * | (in millions) | per share * | ||||||||||||||||||||

| Net Income | $ | 738.5 | $ | 4.27 | $ | 1,779.1 | $ | 9.46 | |||||||||||||||

| Excluding: | |||||||||||||||||||||||

Net Investment Loss |

|||||||||||||||||||||||

Net Investment Loss Related to the Fortitude Re Reinsurance Transaction (net of tax benefit of $9.9; $—) |

(36.9) | (0.21) | — | — | |||||||||||||||||||

Net Investment Loss, Other (net of tax benefit of $13.2; $7.6) |

(46.6) | (0.28) | (27.0) | (0.14) | |||||||||||||||||||

Total Net Investment Loss |

(83.5) | (0.49) | (27.0) | (0.14) | |||||||||||||||||||

Amortization of the Cost of Reinsurance (net of tax benefit of $24.5; $8.7) |

(92.2) | (0.53) | (32.7) | (0.17) | |||||||||||||||||||

Amortization of the Deferred Gain on Reinsurance (net of tax expense of $1.9;$—) |

7.1 | 0.04 | — | — | |||||||||||||||||||

Non-Contemporaneous Reinsurance (net of tax benefit of $6.3; $5.2) |

(23.3) | (0.14) | (19.9) | (0.11) | |||||||||||||||||||

Reserve Assumption Updates (net of tax expense (benefit) of $(100.7); $74.8) |

(377.8) | (2.18) | 282.6 | 1.50 | |||||||||||||||||||

Settlement Loss on the U.S. Pension Annuity Purchase (net of tax benefit of $21.8;$—) |

(82.0) | (0.47) | — | — | |||||||||||||||||||

Accelerated Charitable Contribution (net of tax benefit of $4.2;$—) |

(15.8) | (0.09) | — | — | |||||||||||||||||||

Loss on Legal Settlement (net of tax benefit of $—; $3.2) |

— | — | (12.1) | (0.06) | |||||||||||||||||||

| After-tax Adjusted Operating Income | $ | 1,406.0 | $ | 8.13 | $ | 1,588.2 | $ | 8.44 | |||||||||||||||

| * Assuming Dilution | |||||||||||||||||||||||

9 |

||||||||

|

||||||||

| December 31 | |||||||||||||||||||||||

| 2025 | 2024 | ||||||||||||||||||||||

| (in millions) | per share | (in millions) | per share | ||||||||||||||||||||

| Total Stockholders' Equity (Book Value) | $ | 11,119.1 | $ | 67.11 | $ | 10,961.1 | $ | 61.38 | |||||||||||||||

| Excluding: | |||||||||||||||||||||||

| Net Unrealized Loss on Securities | (2,003.1) | (12.09) | (2,755.2) | (15.43) | |||||||||||||||||||

Effect of Change in Discount Rate Assumptions on the Liability for Future Policy Benefits |

929.9 | 5.61 | 1,185.4 | 6.64 | |||||||||||||||||||

| Net Loss on Derivatives | (278.8) | (1.68) | (270.7) | (1.51) | |||||||||||||||||||

| Subtotal | 12,471.1 | 75.27 | 12,801.6 | 71.68 | |||||||||||||||||||

| Excluding: | |||||||||||||||||||||||

| Foreign Currency Translation Adjustment | (245.6) | (1.48) | (343.0) | (1.93) | |||||||||||||||||||

| Subtotal | 12,716.7 | 76.75 | 13,144.6 | 73.61 | |||||||||||||||||||

| Excluding: | |||||||||||||||||||||||

| Unrecognized Pension and Postretirement Benefit Costs | (210.9) | (1.27) | (340.2) | (1.90) | |||||||||||||||||||

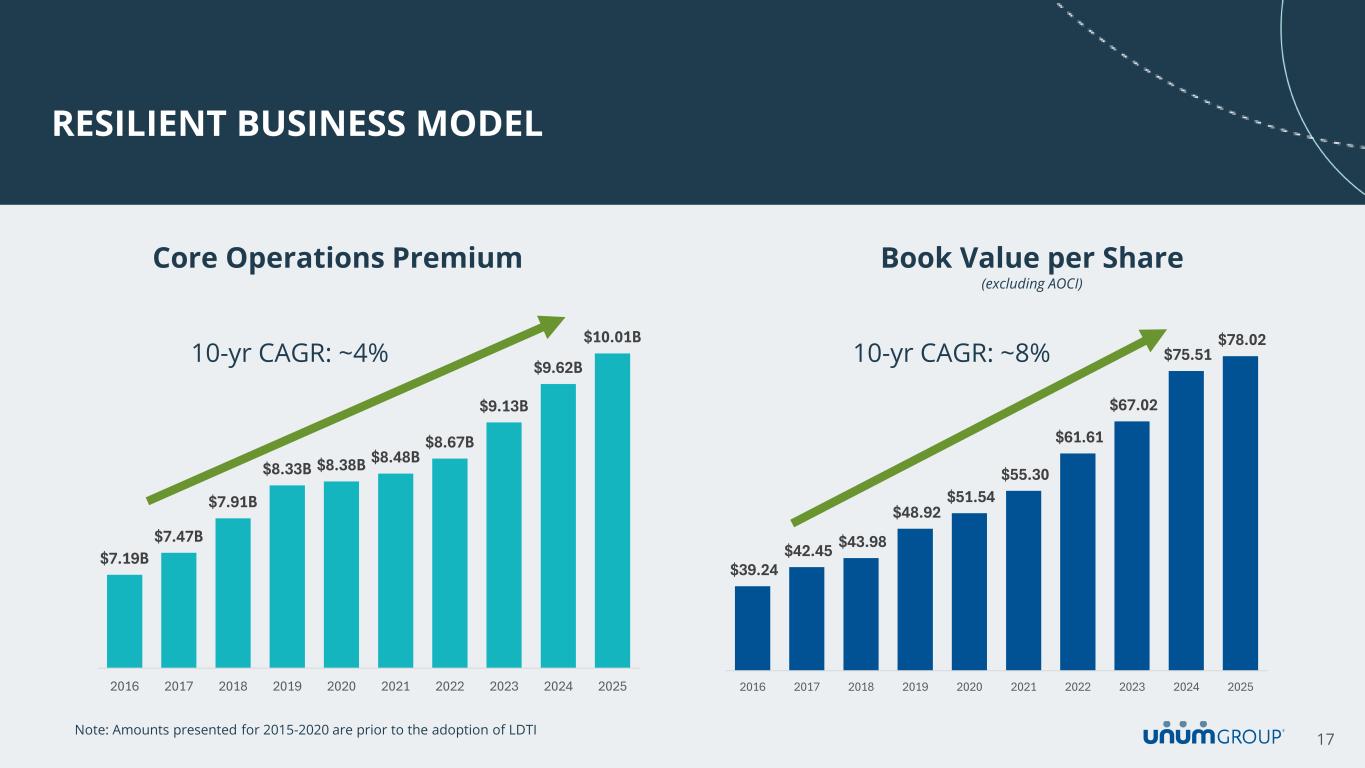

Total Stockholders' Equity, Excluding Accumulated Other Comprehensive Loss |

$ | 12,927.6 | $ | 78.02 | $ | 13,484.8 | $ | 75.51 | |||||||||||||||

Year Ended |

||||||||||||||||||||||||||

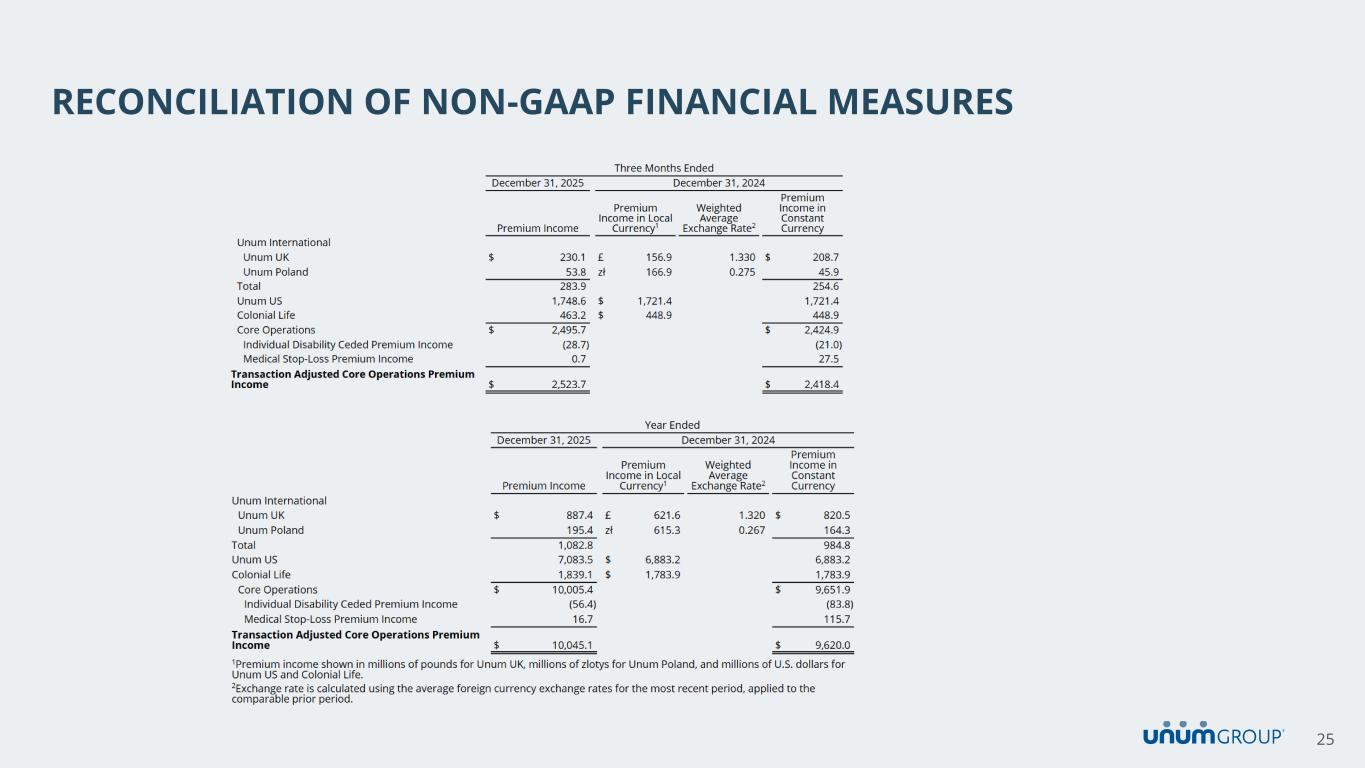

| December 31, 2025 | December 31, 2024 | |||||||||||||||||||||||||

| Premium Income | Premium Income, Local Currency1 |

Weighted Average Exchange Rate2 |

Premium Income in Constant Currency | |||||||||||||||||||||||

| Unum International | ||||||||||||||||||||||||||

| Unum UK | $ | 887.4 | £ | 621.6 | 1.320 | $ | 820.5 | |||||||||||||||||||

| Unum Poland | 195.4 | zł | 615.3 | 0.267 | 164.3 | |||||||||||||||||||||

| Total | 1,082.8 | 984.8 | ||||||||||||||||||||||||

| Unum US | 7,083.5 | $ | 6,883.2 | 6,883.2 | ||||||||||||||||||||||

| Colonial Life | 1,839.1 | $ | 1,783.9 | 1,783.9 | ||||||||||||||||||||||

| Core Operations | $ | 10,005.4 | $ | 9,651.9 | ||||||||||||||||||||||

10 |

||||||||

|

||||||||

| After-Tax Adjusted Operating Income (Loss) | Average Allocated Equity1 |

Annualized Adjusted Operating Return on Equity | ||||||||||||||||||

Year Ended December 31, 2025 |

||||||||||||||||||||

Unum US |

$ | 1,005.2 | $ | 4,441.2 | 22.6 | % | ||||||||||||||

Unum International |

118.5 | 799.0 | 14.8 | % | ||||||||||||||||

Colonial Life |

365.8 | 2,011.0 | 18.2 | % | ||||||||||||||||

Core Operating Segments |

1,489.5 | 7,251.2 | 20.5 | % | ||||||||||||||||

Closed Block |

40.7 | 4,830.0 | ||||||||||||||||||

Corporate |

(124.2) | 555.2 | ||||||||||||||||||

| Total | $ | 1,406.0 | $ | 12,636.4 | 11.1 | % | ||||||||||||||

| 12/31/2025 | 12/31/2024 | |||||||||||||

Total Stockholders' Equity |

$ | 11,119.1 | $ | 10,961.1 | ||||||||||

Excluding: |

||||||||||||||

Net Unrealized Loss on Securities |

(2,003.1) | (2,755.2) | ||||||||||||

Effect of Change in Discount Rate Assumptions on the Liability for Future Policy Benefits |

929.9 | 1,185.4 | ||||||||||||

Net Loss on Derivatives |

(278.8) | (270.7) | ||||||||||||

Total Adjusted Stockholders' Equity |

$ | 12,471.1 | $ | 12,801.6 | ||||||||||

| Year Ended | ||||||||||||||

| 12/31/2025 | ||||||||||||||

Average Adjusted Stockholders' Equity |

$ | 12,636.4 | ||||||||||||

11 |

||||||||

|

||||||||

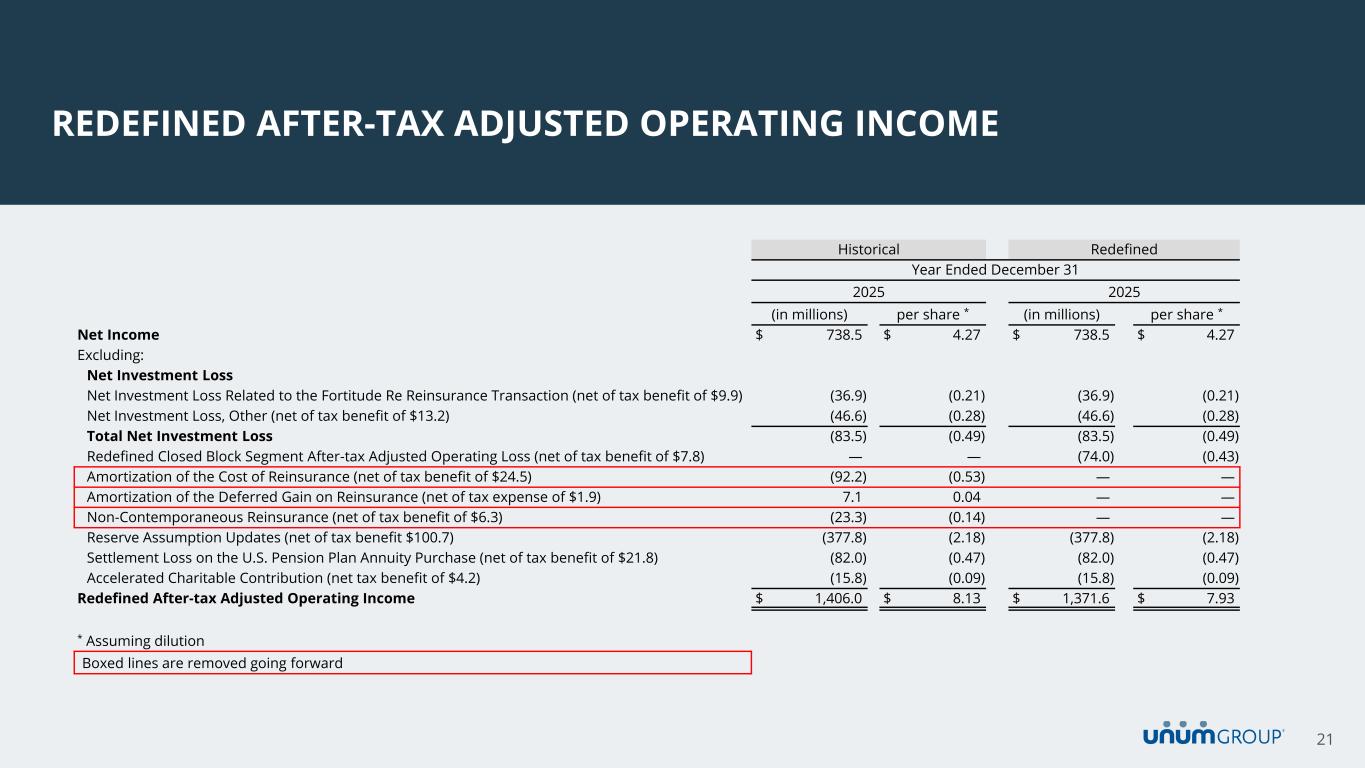

Redefined After-tax Adjusted Operating Income |

||||||||||||||

| Year Ended December 31 | ||||||||||||||

| 2025 | ||||||||||||||

| (in millions) | per share * | |||||||||||||

| Net Income | $ | 738.5 | $ | 4.27 | ||||||||||

| Excluding: | ||||||||||||||

| Net Investment Loss | ||||||||||||||

Net Investment Loss Related to Fortitude Re Reinsurance Transaction (net of tax benefit of $9.9) |

(36.9) | (0.21) | ||||||||||||

Net Investment Loss, Other (net of tax benefit of $13.2) |

(46.6) | (0.28) | ||||||||||||

| Total Net Investment Loss | (83.5) | (0.5) | ||||||||||||

Redefined Closed Block Segment after-tax adjusted operating loss (net of tax benefit of $7.8) |

(74.0) | (0.43) | ||||||||||||

Reserve Assumption Updates (net of tax benefit of $100.7) |

(377.8) | (2.18) | ||||||||||||

Settlement Loss on U.S. Pension Plan Annuity Purchase (net of tax benefit of $21.8) |

(82.0) | (0.47) | ||||||||||||

Accelerated Charitable Contribution (net of tax benefit of $4.2) |

(15.8) | (0.09) | ||||||||||||

Redefined After-tax Adjusted Operating Income |

$ | 1,371.6 | $ | 7.93 | ||||||||||

| * Assuming Dilution | ||||||||||||||

12 |

||||||||

| Page | |||||||||||

See "Appendix to Statistical Supplement" on page 15 for a summary of significant items and page 15.2 for a reconciliation of our non-GAAP financial measures. |

|||||||||||

| N.M. = not a meaningful percentage | |||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 | 12/31/2025 | 12/31/2024 | 12/31/2023 | |||||||||||||||||||||||||

| Consolidated U.S. GAAP Results¹ | |||||||||||||||||||||||||||||

| Premium Income | $ | 2,692.1 | $ | 2,631.1 | $ | 10,831.0 | $ | 10,497.4 | $ | 10,046.0 | |||||||||||||||||||

| Adjusted Operating Revenue | $ | 3,249.8 | $ | 3,246.7 | $ | 13,173.1 | $ | 12,921.9 | $ | 12,421.9 | |||||||||||||||||||

| Net Investment Loss | (10.1) | (10.1) | (106.6) | (34.6) | (36.0) | ||||||||||||||||||||||||

| Amortization of the Deferred Gain on Reinsurance | 4.4 | — | 9.0 | — | — | ||||||||||||||||||||||||

Total Revenue |

$ | 3,244.1 | $ | 3,236.6 | $ | 13,075.5 | $ | 12,887.3 | $ | 12,385.9 | |||||||||||||||||||

| Net Income | $ | 174.1 | $ | 348.7 | $ | 738.5 | $ | 1,779.1 | $ | 1,283.8 | |||||||||||||||||||

| Net Income Per Common Share: | |||||||||||||||||||||||||||||

| Basic | $ | 1.04 | $ | 1.93 | $ | 4.28 | $ | 9.49 | $ | 6.53 | |||||||||||||||||||

| Assuming Dilution | $ | 1.04 | $ | 1.92 | $ | 4.27 | $ | 9.46 | $ | 6.50 | |||||||||||||||||||

| Assets | $ | 63,519.4 | $ | 61,959.3 | $ | 63,255.2 | |||||||||||||||||||||||

Liabilities |

$ | 52,400.3 | $ | 50,998.2 | $ | 53,603.8 | |||||||||||||||||||||||

| Stockholders' Equity | $ | 11,119.1 | $ | 10,961.1 | $ | 9,651.4 | |||||||||||||||||||||||

Adjusted Stockholders' Equity |

$ | 12,471.1 | $ | 12,801.6 | $ | 12,292.6 | |||||||||||||||||||||||

| Adjusted Operating Return on Equity | |||||||||||||||||||||||||||||

| Unum US | 21.1 | % | 23.0 | % | 22.6 | % | 25.2 | % | 23.1 | % | |||||||||||||||||||

| Unum International | 12.3 | % | 14.6 | % | 14.8 | % | 15.6 | % | 16.5 | % | |||||||||||||||||||

| Colonial Life | 17.5 | % | 20.2 | % | 18.2 | % | 19.7 | % | 18.1 | % | |||||||||||||||||||

| Core Operating Segments | 19.1 | % | 21.4 | % | 20.5 | % | 22.7 | % | 21.2 | % | |||||||||||||||||||

| Consolidated | 10.3 | % | 11.4 | % | 11.1 | % | 12.7 | % | 12.7 | % | |||||||||||||||||||

Traditional U.S. Life Insurance Companies' Statutory Results2 |

|||||||||||||||||||||||||||||

| Net Gain from Operations, After Tax | $ | 215.9 | $ | 304.8 | $ | 652.5 | $ | 1,337.0 | $ | 1,351.5 | |||||||||||||||||||

| Net Realized Capital Loss, After Tax | (2.0) | (13.7) | (18.5) | (14.6) | (21.6) | ||||||||||||||||||||||||

| Net Income | $ | 213.9 | $ | 291.1 | $ | 634.0 | $ | 1,322.4 | $ | 1,329.9 | |||||||||||||||||||

| Capital and Surplus | $ | 3,770.6 | $ | 3,909.7 | $ | 3,751.3 | |||||||||||||||||||||||

| Weighted Average Risk-based Capital Ratio | ~ 440% | ~ 430% | ~ 415% | ||||||||||||||||||||||||||

1 Generally Accepted Accounting Principles | |||||||||||||||||||||||||||||

2 Our traditional U.S. life insurance companies are Provident Life and Accident Insurance Company, Unum Life Insurance Company of America, First Unum Life Insurance Company, Colonial Life & Accident Insurance Company, The Paul Revere Life Insurance Company, Unum Insurance Company, Provident Life and Casualty Insurance Company, and Starmount Life Insurance Company. | |||||||||||||||||||||||||||||

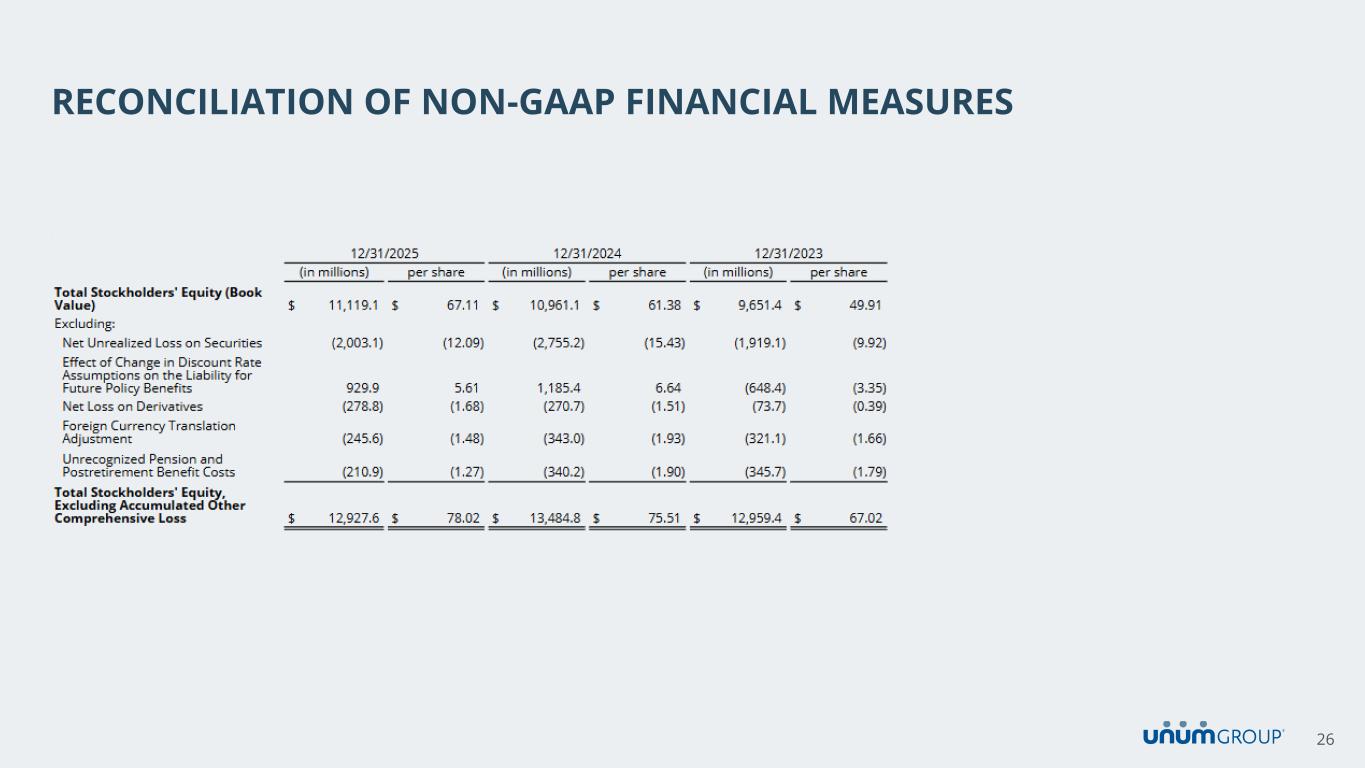

| 12/31/2025 | 12/31/2024 | 12/31/2023 | |||||||||||||||||||||||||||||||||

| (in millions) | per share | (in millions) | per share | (in millions) | per share | ||||||||||||||||||||||||||||||

| Total Stockholders' Equity (Book Value) | $ | 11,119.1 | $ | 67.11 | $ | 10,961.1 | $ | 61.38 | $ | 9,651.4 | $ | 49.91 | |||||||||||||||||||||||

| Excluding: | |||||||||||||||||||||||||||||||||||

| Net Unrealized Loss on Securities | (2,003.1) | (12.09) | (2,755.2) | (15.43) | (1,919.1) | (9.92) | |||||||||||||||||||||||||||||

| Effect of Change in Discount Rate Assumptions on the Liability for Future Policy Benefits | 929.9 | 5.61 | 1,185.4 | 6.64 | (648.4) | (3.35) | |||||||||||||||||||||||||||||

| Net Loss on Derivatives | (278.8) | (1.68) | (270.7) | (1.51) | (73.7) | (0.39) | |||||||||||||||||||||||||||||

| Subtotal | 12,471.1 | 75.27 | 12,801.6 | 71.68 | 12,292.6 | 63.57 | |||||||||||||||||||||||||||||

| Excluding: | |||||||||||||||||||||||||||||||||||

| Foreign Currency Translation Adjustment | (245.6) | (1.48) | (343.0) | (1.93) | (321.1) | (1.66) | |||||||||||||||||||||||||||||

| Subtotal | 12,716.7 | 76.75 | 13,144.6 | 73.61 | 12,613.7 | 65.23 | |||||||||||||||||||||||||||||

| Excluding: | |||||||||||||||||||||||||||||||||||

| Unrecognized Pension and Postretirement Benefit Costs | (210.9) | (1.27) | (340.2) | (1.90) | (345.7) | (1.79) | |||||||||||||||||||||||||||||

| Total Stockholders' Equity, Excluding Accumulated Other Comprehensive Loss | $ | 12,927.6 | $ | 78.02 | $ | 13,484.8 | $ | 75.51 | $ | 12,959.4 | $ | 67.02 | |||||||||||||||||||||||

| Dividends Paid | $ | 307.2 | $ | 1.76 | $ | 296.6 | $ | 1.57 | $ | 277.1 | $ | 1.39 | |||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 | 12/31/2025 | 12/31/2024 | 12/31/2023 | |||||||||||||||||||||||||

Shares Repurchased (millions)1 |

3.3 | 6.0 | 13.6 | 15.7 | 5.7 | ||||||||||||||||||||||||

Cost of Shares Repurchased (millions)2 |

$ | 252.5 | $ | 474.5 | $ | 1,011.7 | $ | 979.3 | $ | 252.0 | |||||||||||||||||||

| Price (UNM closing price on last trading day of period) | $ | 77.50 | $ | 73.03 | $ | 45.22 | |||||||||||||||||||||||

Leverage Ratio |

23.6 | % | 22.9 | % | 22.1 | % | |||||||||||||||||||||||

Holding Company Liquidity (millions) |

$ | 2,344 | $ | 1,987 | $ | 1,650 | |||||||||||||||||||||||

|

1For the year ended December 31, 2025, includes 0.7 million shares related to the settlement of the November 2024 accelerated share repurchase agreement (ASR) which occurred in February 2025.

| |||||||||||||||||||||||||||||

2Includes commissions of $0.1 million for the three months ended December 31, 2025, a de minimis amount for the three months ended December 31, 2024, $1.9 million for the year ended December 31, 2025, a de minimis amount for the year ended December 31, 2024, and $0.1 million for the year ended December 31, 2023. There was excise tax of $2.4 million and $9.8 million for the three months and year ended December 31, 2025, respectively, $3.5 million, and $8.3 million for the three months and year ended December 31, 2024, respectively, and $1.9 million for the year ended December 31, 2023. Also included for the year ended December 31, 2024 is $80.3 million related to shares which settled in February 2025 in connection with the November 2024 ASR agreement. | |||||||||||||||||||||||||||||

| AM Best | Fitch | Moody's | S&P | ||||||||||||||||||||

| Outlook | Stable | Stable | Stable | Stable | |||||||||||||||||||

Senior Unsecured Debt Ratings |

bbb+ | BBB |

Baa2 |

BBB |

|||||||||||||||||||

| Financial Strength Ratings | |||||||||||||||||||||||

| Provident Life and Accident Insurance Company | A | A | A2 | A | |||||||||||||||||||

| Unum Life Insurance Company of America | A | A | A2 | A | |||||||||||||||||||

| First Unum Life Insurance Company | A | A | A2 | A | |||||||||||||||||||

| Colonial Life & Accident Insurance Company | A | A | A2 | A | |||||||||||||||||||

| The Paul Revere Life Insurance Company | A | A | A2 | A | |||||||||||||||||||

| Unum Insurance Company | A | A | A2 | NR | |||||||||||||||||||

| Provident Life and Casualty Insurance Company | A | A | NR | NR | |||||||||||||||||||

| Starmount Life Insurance Company | A | NR | NR | NR | |||||||||||||||||||

| Unum Limited | NR | NR | NR | A- | |||||||||||||||||||

| NR = not rated | |||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 | 12/31/2025 | 12/31/2024 | 12/31/2023 | |||||||||||||||||||||||||

| Revenue | |||||||||||||||||||||||||||||

| Premium Income | $ | 2,692.1 | $ | 2,631.1 | $ | 10,831.0 | $ | 10,497.4 | $ | 10,046.0 | |||||||||||||||||||

| Net Investment Income | 482.0 | 543.6 | 2,032.7 | 2,130.0 | 2,096.7 | ||||||||||||||||||||||||

| Net Investment Loss | (10.1) | (10.1) | (106.6) | (34.6) | (36.0) | ||||||||||||||||||||||||

| Other Income | 80.1 | 72.0 | 318.4 | 294.5 | 279.2 | ||||||||||||||||||||||||

| Total Revenue | 3,244.1 | 3,236.6 | 13,075.5 | 12,887.3 | 12,385.9 | ||||||||||||||||||||||||

| Benefits and Expenses | |||||||||||||||||||||||||||||

| Policy Benefits Including Remeasurement Loss or Gain | 1,892.9 | 1,861.2 | 8,065.3 | 6,917.9 | 7,257.1 | ||||||||||||||||||||||||

| Commissions | 333.4 | 310.8 | 1,355.3 | 1,258.6 | 1,170.1 | ||||||||||||||||||||||||

Interest and Debt Expense |

52.6 | 52.5 | 208.8 | 201.1 | 194.8 | ||||||||||||||||||||||||

| Deferral of Acquisition Costs | (176.1) | (156.2) | (697.1) | (651.5) | (632.2) | ||||||||||||||||||||||||

| Amortization of Deferred Acquisition Costs | 137.2 | 133.1 | 527.1 | 521.0 | 481.4 | ||||||||||||||||||||||||

| Other Expenses | 785.7 | 589.7 | 2,682.6 | 2,388.9 | 2,274.6 | ||||||||||||||||||||||||

| Total Benefits and Expenses | 3,025.7 | 2,791.1 | 12,142.0 | 10,636.0 | 10,745.8 | ||||||||||||||||||||||||

| Income Before Income Tax | 218.4 | 445.5 | 933.5 | 2,251.3 | 1,640.1 | ||||||||||||||||||||||||

| Income Tax Expense | 44.3 | 96.8 | 195.0 | 472.2 | 356.3 | ||||||||||||||||||||||||

| Net Income | $ | 174.1 | $ | 348.7 | $ | 738.5 | $ | 1,779.1 | $ | 1,283.8 | |||||||||||||||||||

| Weighted Average Shares Outstanding | |||||||||||||||||||||||||||||

| Basic | 167.7 | 181.0 | 172.5 | 187.5 | 196.7 | ||||||||||||||||||||||||

| Assuming Dilution | 168.0 | 181.6 | 172.9 | 188.1 | 197.6 | ||||||||||||||||||||||||

| Actual Number of Shares Outstanding | 165.7 | 178.6 | 193.4 | ||||||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 | % Change | 12/31/2025 | 12/31/2024 | 12/31/2023 | ||||||||||||||||||||||||||||||

| Sales by Product | |||||||||||||||||||||||||||||||||||

| Group Disability and Group Life and AD&D | |||||||||||||||||||||||||||||||||||

| Group Long-term Disability | $ | 127.2 | $ | 154.5 | (17.7) | % | $ | 243.8 | $ | 298.3 | $ | 292.7 | |||||||||||||||||||||||

| Group Short-term Disability | 177.9 | 122.4 | 45.3 | 274.0 | 216.5 | 229.5 | |||||||||||||||||||||||||||||

| Group Life and AD&D | 206.8 | 210.3 | (1.7) | 361.5 | 361.5 | 305.4 | |||||||||||||||||||||||||||||

| Subtotal | 511.9 | 487.2 | 5.1 | 879.3 | 876.3 | 827.6 | |||||||||||||||||||||||||||||

| Supplemental and Voluntary | |||||||||||||||||||||||||||||||||||

| Voluntary Benefits | 57.9 | 60.7 | (4.6) | 289.6 | 293.7 | 263.2 | |||||||||||||||||||||||||||||

| Individual Disability | 24.2 | 25.6 | (5.5) | 105.6 | 101.7 | 108.9 | |||||||||||||||||||||||||||||

| Dental and Vision | 45.9 | 51.9 | (11.6) | 84.4 | 95.3 | 84.1 | |||||||||||||||||||||||||||||

| Subtotal | 128.0 | 138.2 | (7.4) | 479.6 | 490.7 | 456.2 | |||||||||||||||||||||||||||||

| Total Sales | $ | 639.9 | $ | 625.4 | 2.3 | $ | 1,358.9 | $ | 1,367.0 | $ | 1,283.8 | ||||||||||||||||||||||||

| Sales by Market Sector | |||||||||||||||||||||||||||||||||||

| Group Disability and Group Life and AD&D | |||||||||||||||||||||||||||||||||||

| Core Market (< 2,000 employees) | $ | 309.4 | $ | 265.5 | 16.5 | % | $ | 527.8 | $ | 512.6 | $ | 521.3 | |||||||||||||||||||||||

| Large Case Market | 202.5 | 221.7 | (8.7) | 351.5 | 363.7 | 306.3 | |||||||||||||||||||||||||||||

| Subtotal | 511.9 | 487.2 | 5.1 | 879.3 | 876.3 | 827.6 | |||||||||||||||||||||||||||||

| Supplemental and Voluntary | 128.0 | 138.2 | (7.4) | 479.6 | 490.7 | 456.2 | |||||||||||||||||||||||||||||

| Total Sales | $ | 639.9 | $ | 625.4 | 2.3 | $ | 1,358.9 | $ | 1,367.0 | $ | 1,283.8 | ||||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||||||||

| (in millions of dollars) | 12/31/2025 | 12/31/2024 | % Change | 12/31/2025 | 12/31/2024 | 12/31/2023 | |||||||||||||||||||||||||||||

| Sales by Product | |||||||||||||||||||||||||||||||||||

| Unum UK | |||||||||||||||||||||||||||||||||||

| Group Long-term Disability | $ | 8.3 | $ | 7.0 | 18.6 | % | $ | 48.6 | $ | 47.3 | $ | 48.3 | |||||||||||||||||||||||

| Group Life | 17.7 | 15.2 | 16.4 | 69.6 | 68.3 | 61.4 | |||||||||||||||||||||||||||||

| Supplemental | 7.8 | 4.8 | 62.5 | 32.8 | 34.9 | 28.0 | |||||||||||||||||||||||||||||

| Unum Poland | 11.8 | 11.8 | — | 46.2 | 36.4 | 33.2 | |||||||||||||||||||||||||||||

| Total Sales | $ | 45.6 | $ | 38.8 | 17.5 | $ | 197.2 | $ | 186.9 | $ | 170.9 | ||||||||||||||||||||||||

| Sales by Market Sector | |||||||||||||||||||||||||||||||||||

| Unum UK | |||||||||||||||||||||||||||||||||||

| Group Long-term Disability and Group Life | |||||||||||||||||||||||||||||||||||

| Core Market (< 500 employees) | $ | 12.5 | $ | 11.1 | 12.6 | % | $ | 48.2 | $ | 41.8 | $ | 51.2 | |||||||||||||||||||||||

| Large Case Market | 13.5 | 11.1 | 21.6 | 70.0 | 73.8 | 58.5 | |||||||||||||||||||||||||||||

| Subtotal | 26.0 | 22.2 | 17.1 | 118.2 | 115.6 | 109.7 | |||||||||||||||||||||||||||||

| Supplemental | 7.8 | 4.8 | 62.5 | 32.8 | 34.9 | 28.0 | |||||||||||||||||||||||||||||

| Unum Poland | 11.8 | 11.8 | — | 46.2 | 36.4 | 33.2 | |||||||||||||||||||||||||||||

| Total Sales | $ | 45.6 | $ | 38.8 | 17.5 | $ | 197.2 | $ | 186.9 | $ | 170.9 | ||||||||||||||||||||||||

| (in millions of pounds) | |||||||||||||||||||||||||||||||||||

| Unum UK Sales by Product | |||||||||||||||||||||||||||||||||||

| Group Long-term Disability | £ | 6.3 | £ | 5.5 | 14.5 | % | £ | 36.7 | £ | 37.2 | £ | 38.8 | |||||||||||||||||||||||

| Group Life | 13.2 | 11.9 | 10.9 | 52.7 | 53.4 | 49.4 | |||||||||||||||||||||||||||||

| Supplemental | 5.9 | 3.7 | 59.5 | 25.0 | 27.5 | 22.6 | |||||||||||||||||||||||||||||

| Total Sales | £ | 25.4 | £ | 21.1 | 20.4 | £ | 114.4 | £ | 118.1 | £ | 110.8 | ||||||||||||||||||||||||

| Unum UK Sales by Market Sector | |||||||||||||||||||||||||||||||||||

| Group Long-term Disability and Group Life | |||||||||||||||||||||||||||||||||||

| Core Market (< 500 employees) | £ | 9.4 | £ | 8.7 | 8.0 | % | £ | 36.6 | £ | 32.8 | £ | 41.2 | |||||||||||||||||||||||

| Large Case Market | 10.1 | 8.7 | 16.1 | 52.8 | 57.8 | 47.0 | |||||||||||||||||||||||||||||

| Subtotal | 19.5 | 17.4 | 12.1 | 89.4 | 90.6 | 88.2 | |||||||||||||||||||||||||||||

| Supplemental | 5.9 | 3.7 | 59.5 | 25.0 | 27.5 | 22.6 | |||||||||||||||||||||||||||||

| Total Sales | £ | 25.4 | £ | 21.1 | 20.4 | £ | 114.4 | £ | 118.1 | £ | 110.8 | ||||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 | % Change | 12/31/2025 | 12/31/2024 | 12/31/2023 | ||||||||||||||||||||||||||||||

| Sales by Product | |||||||||||||||||||||||||||||||||||

| Accident, Sickness, and Disability | $ | 117.2 | $ | 111.2 | 5.4 | % | $ | 336.7 | $ | 326.3 | $ | 329.5 | |||||||||||||||||||||||

| Life | 54.7 | 44.8 | 22.1 | 142.0 | 127.9 | 132.1 | |||||||||||||||||||||||||||||

| Cancer and Critical Illness | 32.0 | 29.4 | 8.8 | 81.6 | 78.0 | 78.0 | |||||||||||||||||||||||||||||

| Total Sales | $ | 203.9 | $ | 185.4 | 10.0 | $ | 560.3 | $ | 532.2 | $ | 539.6 | ||||||||||||||||||||||||

| Sales by Market Sector | |||||||||||||||||||||||||||||||||||

| Commercial | |||||||||||||||||||||||||||||||||||

| Core Market (< 1,000 employees) | $ | 118.0 | $ | 111.5 | 5.8 | % | $ | 343.5 | $ | 331.9 | $ | 347.4 | |||||||||||||||||||||||

| Large Case Market | 33.6 | 27.8 | 20.9 | 71.8 | 65.1 | 62.3 | |||||||||||||||||||||||||||||

| Subtotal | 151.6 | 139.3 | 8.8 | 415.3 | 397.0 | 409.7 | |||||||||||||||||||||||||||||

| Public Sector | 52.3 | 46.1 | 13.4 | 145.0 | 135.2 | 129.9 | |||||||||||||||||||||||||||||

| Total Sales | $ | 203.9 | $ | 185.4 | 10.0 | $ | 560.3 | $ | 532.2 | $ | 539.6 | ||||||||||||||||||||||||

| December 31 | |||||||||||

| 2025 | 2024 | ||||||||||

| Assets | |||||||||||

| Investments | |||||||||||

| Fixed Maturity Securities - at fair value | $ | 33,056.6 | $ | 35,629.9 | |||||||

| Mortgage Loans | 2,109.5 | 2,224.5 | |||||||||

| Policy Loans | 3,668.1 | 3,617.2 | |||||||||

| Other Long-term Investments | 1,670.4 | 1,694.4 | |||||||||

| Short-term Investments | 3,016.2 | 2,540.3 | |||||||||

| Total Investments | 43,520.8 | 45,706.3 | |||||||||

| Other Assets | |||||||||||

| Cash and Bank Deposits | 158.2 | 162.8 | |||||||||

| Accounts and Premiums Receivable | 1,429.8 | 1,459.0 | |||||||||

| Reinsurance Recoverable | 11,574.6 | 8,296.4 | |||||||||

| Accrued Investment Income | 596.0 | 649.8 | |||||||||

| Deferred Acquisition Costs | 2,920.3 | 2,842.8 | |||||||||

| Goodwill | 353.9 | 349.1 | |||||||||

| Property and Equipment | 503.7 | 487.6 | |||||||||

| Deferred Income Tax | 79.5 | 369.7 | |||||||||

| Other Assets | 2,382.6 | 1,635.8 | |||||||||

| Total Assets | $ | 63,519.4 | $ | 61,959.3 | |||||||

| December 31 | |||||||||||

| 2025 | 2024 | ||||||||||

| Liabilities and Stockholders' Equity | |||||||||||

| Liabilities | |||||||||||

Future Policy Benefits |

$ | 38,017.0 | $ | 36,806.4 | |||||||

Policyholders' Account Balances |

5,636.4 | 5,633.7 | |||||||||

| Unearned Premiums | 412.8 | 384.0 | |||||||||

| Other Policyholders’ Funds | 1,479.7 | 1,526.7 | |||||||||

| Income Tax Payable | 52.2 | 226.5 | |||||||||

| Deferred Income Tax | 38.8 | 31.0 | |||||||||

| Short-term Debt | — | 274.6 | |||||||||

| Long-term Debt | 3,767.6 | 3,465.2 | |||||||||

| Other Liabilities | 2,995.8 | 2,650.1 | |||||||||

| Total Liabilities | 52,400.3 | 50,998.2 | |||||||||

| Stockholders’ Equity | |||||||||||

| Common Stock | 19.6 | 19.5 | |||||||||

| Additional Paid-in Capital | 1,593.0 | 1,489.6 | |||||||||

| Accumulated Other Comprehensive Loss | (1,808.5) | (2,523.7) | |||||||||

| Retained Earnings | 13,345.3 | 12,914.0 | |||||||||

| Treasury Stock - at cost | (2,030.3) | (938.3) | |||||||||

| Total Stockholders’ Equity | 11,119.1 | 10,961.1 | |||||||||

| Total Liabilities and Stockholders’ Equity | $ | 63,519.4 | $ | 61,959.3 | |||||||

| Unum US | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Group Disability | Group Life and Accidental Death & Dismemberment | Supplemental and Voluntary | Total Unum US | Unum International | Colonial Life | Closed Block | Corporate | Consolidated | |||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investments | $ | 5,685.7 | $ | 1,827.5 | $ | 4,314.6 | $ | 11,827.8 | $ | 3,183.2 | $ | 3,420.8 | $ | 21,459.4 | $ | 3,629.6 | $ | 43,520.8 | |||||||||||||||||||||||||||||||||||

| Deferred Acquisition Costs | 63.6 | 57.6 | 1,087.5 | 1,208.7 | 72.1 | 1,639.5 | — | — | 2,920.3 | ||||||||||||||||||||||||||||||||||||||||||||

| Goodwill | 10.1 | — | 271.1 | 281.2 | 45.0 | 27.7 | — | — | 353.9 | ||||||||||||||||||||||||||||||||||||||||||||

Reinsurance Recoverable |

26.2 | 7.6 | 410.1 | 443.9 | 93.3 | 4.6 | 11,032.8 | — | 11,574.6 | ||||||||||||||||||||||||||||||||||||||||||||

| All Other | 386.5 | 326.9 | 160.3 | 873.7 | 254.4 | 197.3 | 1,395.6 | 2,428.8 | 5,149.8 | ||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | $ | 6,172.1 | $ | 2,219.6 | $ | 6,243.6 | $ | 14,635.3 | $ | 3,648.0 | $ | 5,289.9 | $ | 33,887.8 | $ | 6,058.4 | $ | 63,519.4 | |||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Future Policy Benefits |

$ | 4,591.6 | $ | 802.4 | $ | 3,099.4 | $ | 8,493.4 | $ | 2,404.3 | $ | 2,032.0 | $ | 25,087.3 | $ | — | $ | 38,017.0 | |||||||||||||||||||||||||||||||||||

Policyholders' Account Balances |

— | — | 665.7 | 665.7 | — | 858.9 | 4,111.8 | — | 5,636.4 | ||||||||||||||||||||||||||||||||||||||||||||

Unearned Premiums |

1.3 | 5.7 | 41.7 | 48.7 | 201.5 | 46.9 | 115.7 | — | 412.8 | ||||||||||||||||||||||||||||||||||||||||||||

Other Policyholders' Funds |

26.1 | 769.6 | 33.0 | 828.7 | 78.3 | 8.8 | 563.9 | — | 1,479.7 | ||||||||||||||||||||||||||||||||||||||||||||

| Debt | — | — | — | — | — | — | — | 3,767.6 | 3,767.6 | ||||||||||||||||||||||||||||||||||||||||||||

| All Other | 36.3 | 27.2 | 209.2 | 272.7 | 125.6 | 71.1 | 594.4 | 2,023.0 | 3,086.8 | ||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities | 4,655.3 | 1,604.9 | 4,049.0 | 10,309.2 | 2,809.7 | 3,017.7 | 30,473.1 | 5,790.6 | 52,400.3 | ||||||||||||||||||||||||||||||||||||||||||||

| Allocated Stockholders' Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Allocated Stockholders' Equity | 1,473.7 | 666.6 | 2,165.0 | 4,305.3 | 822.4 | 2,083.1 | 4,495.2 | 765.1 | 12,471.1 | ||||||||||||||||||||||||||||||||||||||||||||

Net Unrealized Loss on Securities and Net Loss on Derivatives |

(106.3) | (67.0) | (141.6) | (314.9) | (115.0) | (72.1) | (1,282.6) | (497.3) | (2,281.9) | ||||||||||||||||||||||||||||||||||||||||||||

Effect of Change in Discount Rate Assumptions on the Liability for Future Policy Benefits |

149.4 | 15.1 | 171.2 | 335.7 | 130.9 | 261.2 | 202.1 | — | 929.9 | ||||||||||||||||||||||||||||||||||||||||||||

| Total Allocated Stockholders' Equity | 1,516.8 | 614.7 | 2,194.6 | 4,326.1 | 838.3 | 2,272.2 | 3,414.7 | 267.8 | 11,119.1 | ||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities and Allocated Stockholders' Equity | $ | 6,172.1 | $ | 2,219.6 | $ | 6,243.6 | $ | 14,635.3 | $ | 3,648.0 | $ | 5,289.9 | $ | 33,887.8 | $ | 6,058.4 | $ | 63,519.4 | |||||||||||||||||||||||||||||||||||

| Unum US | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Group Disability | Group Life and Accidental Death & Dismemberment | Supplemental and Voluntary | Total Unum US | Unum International | Colonial Life | Closed Block | Corporate | Consolidated | |||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investments | $ | 6,016.7 | $ | 1,924.5 | $ | 4,557.3 | $ | 12,498.5 | $ | 2,968.7 | $ | 3,249.7 | $ | 23,862.5 | $ | 3,126.9 | $ | 45,706.3 | |||||||||||||||||||||||||||||||||||

| Deferred Acquisition Costs | 61.1 | 51.1 | 1,148.4 | 1,260.6 | 53.0 | 1,529.2 | — | — | 2,842.8 | ||||||||||||||||||||||||||||||||||||||||||||

| Goodwill | 8.9 | — | 271.1 | 280.0 | 41.4 | 27.7 | — | — | 349.1 | ||||||||||||||||||||||||||||||||||||||||||||

Reinsurance Recoverable |

31.7 | 5.7 | 166.4 | 203.8 | 99.0 | 4.3 | 7,989.3 | — | 8,296.4 | ||||||||||||||||||||||||||||||||||||||||||||

| All Other | 351.2 | 202.4 | 185.1 | 738.7 | 129.2 | 153.3 | 1,524.2 | 2,219.3 | 4,764.7 | ||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | $ | 6,469.6 | $ | 2,183.7 | $ | 6,328.3 | $ | 14,981.6 | $ | 3,291.3 | $ | 4,964.2 | $ | 33,376.0 | $ | 5,346.2 | $ | 61,959.3 | |||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Future Policy Benefits |

$ | 4,773.9 | $ | 836.0 | $ | 3,059.8 | $ | 8,669.7 | $ | 2,163.0 | $ | 1,904.2 | $ | 24,069.5 | $ | — | $ | 36,806.4 | |||||||||||||||||||||||||||||||||||

Policyholders' Account Balances |

— | — | 675.7 | 675.7 | — | 862.5 | 4,095.5 | — | 5,633.7 | ||||||||||||||||||||||||||||||||||||||||||||

Unearned Premiums |

1.6 | 6.1 | 44.0 | 51.7 | 165.5 | 45.4 | 121.4 | — | 384.0 | ||||||||||||||||||||||||||||||||||||||||||||

Other Policyholders' Funds |

37.7 | 775.9 | 32.7 | 846.3 | 60.1 | 8.3 | 612.0 | — | 1,526.7 | ||||||||||||||||||||||||||||||||||||||||||||

| Debt | — | — | — | — | — | — | — | 3,739.8 | 3,739.8 | ||||||||||||||||||||||||||||||||||||||||||||

| All Other | 34.2 | 25.8 | 149.3 | 209.3 | 119.0 | 63.9 | 598.2 | 1,917.2 | 2,907.6 | ||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities | 4,847.4 | 1,643.8 | 3,961.5 | 10,452.7 | 2,507.6 | 2,884.3 | 29,496.6 | 5,657.0 | 50,998.2 | ||||||||||||||||||||||||||||||||||||||||||||

| Allocated Stockholders' Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Allocated Stockholders' Equity | 1,584.2 | 626.8 | 2,366.2 | 4,577.2 | 775.6 | 1,938.8 | 5,164.7 | 345.3 | 12,801.6 | ||||||||||||||||||||||||||||||||||||||||||||

Net Unrealized Loss on Securities and Net Loss on Derivatives |

(192.6) | (111.0) | (211.1) | (514.7) | (134.9) | (138.8) | (1,581.4) | (656.1) | (3,025.9) | ||||||||||||||||||||||||||||||||||||||||||||

Effect of Change in Discount Rate Assumptions on the Liability for Future Policy Benefits |

230.6 | 24.1 | 211.7 | 466.4 | 143.0 | 279.9 | 296.1 | — | 1,185.4 | ||||||||||||||||||||||||||||||||||||||||||||

| Total Allocated Stockholders' Equity | 1,622.2 | 539.9 | 2,366.8 | 4,528.9 | 783.7 | 2,079.9 | 3,879.4 | (310.8) | 10,961.1 | ||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities and Allocated Stockholders' Equity | $ | 6,469.6 | $ | 2,183.7 | $ | 6,328.3 | $ | 14,981.6 | $ | 3,291.3 | $ | 4,964.2 | $ | 33,376.0 | $ | 5,346.2 | $ | 61,959.3 | |||||||||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 | % Change | 12/31/2025 | 12/31/2024 | % Change | ||||||||||||||||||||||||||||||

| Premium Income | |||||||||||||||||||||||||||||||||||

| Unum US | $ | 1,748.6 | $ | 1,721.4 | 1.6 | % | $ | 7,083.5 | $ | 6,883.2 | 2.9 | % | |||||||||||||||||||||||

| Unum International | 283.9 | 242.4 | 17.1 | 1,082.8 | 949.5 | 14.0 | |||||||||||||||||||||||||||||

| Colonial Life | 463.2 | 448.9 | 3.2 | 1,839.1 | 1,783.9 | 3.1 | |||||||||||||||||||||||||||||

| Closed Block | 196.4 | 218.4 | (10.1) | 825.6 | 880.8 | (6.3) | |||||||||||||||||||||||||||||

| 2,692.1 | 2,631.1 | 2.3 | 10,831.0 | 10,497.4 | 3.2 | ||||||||||||||||||||||||||||||

| Net Investment Income | |||||||||||||||||||||||||||||||||||

| Unum US | 148.3 | 156.1 | (5.0) | 604.2 | 632.2 | (4.4) | |||||||||||||||||||||||||||||

| Unum International | 34.7 | 34.3 | 1.2 | 145.6 | 128.8 | 13.0 | |||||||||||||||||||||||||||||

| Colonial Life | 43.5 | 42.1 | 3.3 | 172.6 | 161.5 | 6.9 | |||||||||||||||||||||||||||||

| Closed Block | 237.6 | 297.3 | (20.1) | 1,016.5 | 1,148.9 | (11.5) | |||||||||||||||||||||||||||||

| Corporate | 17.9 | 13.8 | 29.7 | 93.8 | 58.6 | 60.1 | |||||||||||||||||||||||||||||

| 482.0 | 543.6 | (11.3) | 2,032.7 | 2,130.0 | (4.6) | ||||||||||||||||||||||||||||||

| Other Income | |||||||||||||||||||||||||||||||||||

| Unum US | 63.4 | 57.0 | 11.2 | 258.8 | 235.9 | 9.7 | |||||||||||||||||||||||||||||

| Unum International | 4.4 | 0.4 | N.M. | 7.7 | 1.6 | N.M. | |||||||||||||||||||||||||||||

| Colonial Life | 0.3 | 0.4 | (25.0) | 1.6 | 4.0 | (60.0) | |||||||||||||||||||||||||||||

| Closed Block | 11.6 | 14.0 | (17.1) | 49.9 | 51.7 | (3.5) | |||||||||||||||||||||||||||||

| Corporate | 0.4 | 0.2 | N.M. | 0.4 | 1.3 | (69.2) | |||||||||||||||||||||||||||||

| 80.1 | 72.0 | 11.3 | 318.4 | 294.5 | 8.1 | ||||||||||||||||||||||||||||||

Total Operating Revenue |

|||||||||||||||||||||||||||||||||||

| Unum US | 1,960.3 | 1,934.5 | 1.3 | 7,946.5 | 7,751.3 | 2.5 | |||||||||||||||||||||||||||||

| Unum International | 323.0 | 277.1 | 16.6 | 1,236.1 | 1,079.9 | 14.5 | |||||||||||||||||||||||||||||

| Colonial Life | 507.0 | 491.4 | 3.2 | 2,013.3 | 1,949.4 | 3.3 | |||||||||||||||||||||||||||||

| Closed Block | 445.6 | 529.7 | (15.9) | 1,892.0 | 2,081.4 | (9.1) | |||||||||||||||||||||||||||||

| Corporate | 18.3 | 14.0 | 30.7 | 94.2 | 59.9 | 57.3 | |||||||||||||||||||||||||||||

| $ | 3,254.2 | $ | 3,246.7 | 0.2 | $ | 13,182.1 | $ | 12,921.9 | 2.0 | ||||||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 | % Change | 12/31/2025 | 12/31/2024 | % Change | ||||||||||||||||||||||||||||||

| Benefits and Expenses | |||||||||||||||||||||||||||||||||||

| Unum US | $ | 1,666.8 | $ | 1,601.3 | 4.1 | % | $ | 6,518.9 | $ | 6,168.5 | 5.7 | % | |||||||||||||||||||||||

| Unum International | 289.8 | 239.5 | 21.0 | 1,078.4 | 929.6 | 16.0 | |||||||||||||||||||||||||||||

| Colonial Life | 393.1 | 368.7 | 6.6 | 1,540.8 | 1,436.7 | 7.2 | |||||||||||||||||||||||||||||

| Closed Block | 482.8 | 517.2 | (6.7) | 2,614.3 | 1,834.8 | 42.5 | |||||||||||||||||||||||||||||

| Corporate | 193.2 | 64.4 | 200.0 | 389.6 | 266.4 | 46.2 | |||||||||||||||||||||||||||||

| 3,025.7 | 2,791.1 | 8.4 | 12,142.0 | 10,636.0 | 14.2 | ||||||||||||||||||||||||||||||

| Income (Loss) Before Income Tax and Net Investment Loss | |||||||||||||||||||||||||||||||||||

| Unum US | 293.5 | 333.2 | (11.9) | 1,427.6 | 1,582.8 | (9.8) | |||||||||||||||||||||||||||||

| Unum International | 33.2 | 37.6 | (11.7) | 157.7 | 150.3 | 4.9 | |||||||||||||||||||||||||||||

| Colonial Life | 113.9 | 122.7 | (7.2) | 472.5 | 512.7 | (7.8) | |||||||||||||||||||||||||||||

| Closed Block | (37.2) | 12.5 | N.M. | (722.3) | 246.6 | N.M. | |||||||||||||||||||||||||||||

| Corporate | (174.9) | (50.4) | N.M. | (295.4) | (206.5) | 43.1 | |||||||||||||||||||||||||||||

| 228.5 | 455.6 | (49.8) | 1,040.1 | 2,285.9 | (54.5) | ||||||||||||||||||||||||||||||

Income Tax Expense Before Net Investment Loss |

47.0 | 98.7 | (52.4) | 218.1 | 479.8 | (54.5) | |||||||||||||||||||||||||||||

| Income Before Net Investment Loss | 181.5 | 356.9 | (49.1) | 822.0 | 1,806.1 | (54.5) | |||||||||||||||||||||||||||||

Net Investment Loss (net of tax benefit of $2.7; $1.9; $23.1; $7.6) |

(7.4) | (8.2) | (9.8) | (83.5) | (27.0) | N.M. | |||||||||||||||||||||||||||||

| Net Income | $ | 174.1 | $ | 348.7 | (50.1) | $ | 738.5 | $ | 1,779.1 | (58.5) | |||||||||||||||||||||||||

| 12/31/2025 | 9/30/2025 | 6/30/2025 | 3/31/2025 | 12/31/2024 | 9/30/2024 | 6/30/2024 | 3/31/2024 | ||||||||||||||||||||||||||||||||||||||||

| Premium Income | |||||||||||||||||||||||||||||||||||||||||||||||

| Unum US | $ | 1,748.6 | $ | 1,755.4 | $ | 1,798.6 | $ | 1,780.9 | $ | 1,721.4 | $ | 1,723.5 | $ | 1,730.9 | $ | 1,707.4 | |||||||||||||||||||||||||||||||

| Unum International | 283.9 | 281.1 | 271.1 | 246.7 | 242.4 | 246.6 | 228.8 | 231.7 | |||||||||||||||||||||||||||||||||||||||

| Colonial Life | 463.2 | 456.5 | 462.1 | 457.3 | 448.9 | 441.9 | 446.2 | 446.9 | |||||||||||||||||||||||||||||||||||||||

| Closed Block | 196.4 | 195.0 | 216.2 | 218.0 | 218.4 | 216.8 | 221.3 | 224.3 | |||||||||||||||||||||||||||||||||||||||

| 2,692.1 | 2,688.0 | 2,748.0 | 2,702.9 | 2,631.1 | 2,628.8 | 2,627.2 | 2,610.3 | ||||||||||||||||||||||||||||||||||||||||

| Net Investment Income | |||||||||||||||||||||||||||||||||||||||||||||||

| Unum US | 148.3 | 151.9 | 155.1 | 148.9 | 156.1 | 161.0 | 158.1 | 157.0 | |||||||||||||||||||||||||||||||||||||||

| Unum International | 34.7 | 36.2 | 46.2 | 28.5 | 34.3 | 30.4 | 38.0 | 26.1 | |||||||||||||||||||||||||||||||||||||||

| Colonial Life | 43.5 | 44.3 | 42.6 | 42.2 | 42.1 | 39.6 | 40.5 | 39.3 | |||||||||||||||||||||||||||||||||||||||

| Closed Block | 237.6 | 224.7 | 284.5 | 269.7 | 297.3 | 284.3 | 294.2 | 273.1 | |||||||||||||||||||||||||||||||||||||||

| Corporate | 17.9 | 19.7 | 32.3 | 23.9 | 13.8 | 12.5 | 14.3 | 18.0 | |||||||||||||||||||||||||||||||||||||||

| 482.0 | 476.8 | 560.7 | 513.2 | 543.6 | 527.8 | 545.1 | 513.5 | ||||||||||||||||||||||||||||||||||||||||

| Other Income | |||||||||||||||||||||||||||||||||||||||||||||||

| Unum US | 63.4 | 65.5 | 58.0 | 71.9 | 57.0 | 60.1 | 58.2 | 60.6 | |||||||||||||||||||||||||||||||||||||||

| Unum International | 4.4 | 2.9 | 0.3 | 0.1 | 0.4 | 0.4 | 0.5 | 0.3 | |||||||||||||||||||||||||||||||||||||||

| Colonial Life | 0.3 | 0.6 | 0.3 | 0.4 | 0.4 | 0.4 | 0.2 | 3.0 | |||||||||||||||||||||||||||||||||||||||

| Closed Block | 11.6 | 16.3 | 12.1 | 9.9 | 14.0 | 12.4 | 12.2 | 13.1 | |||||||||||||||||||||||||||||||||||||||

| Corporate | 0.4 | 0.3 | (0.3) | — | 0.2 | — | 0.4 | 0.7 | |||||||||||||||||||||||||||||||||||||||

| 80.1 | 85.6 | 70.4 | 82.3 | 72.0 | 73.3 | 71.5 | 77.7 | ||||||||||||||||||||||||||||||||||||||||

Total Operating Revenue |

|||||||||||||||||||||||||||||||||||||||||||||||

| Unum US | 1,960.3 | 1,972.8 | 2,011.7 | 2,001.7 | 1,934.5 | 1,944.6 | 1,947.2 | 1,925.0 | |||||||||||||||||||||||||||||||||||||||

| Unum International | 323.0 | 320.2 | 317.6 | 275.3 | 277.1 | 277.4 | 267.3 | 258.1 | |||||||||||||||||||||||||||||||||||||||

| Colonial Life | 507.0 | 501.4 | 505.0 | 499.9 | 491.4 | 481.9 | 486.9 | 489.2 | |||||||||||||||||||||||||||||||||||||||

| Closed Block | 445.6 | 436.0 | 512.8 | 497.6 | 529.7 | 513.5 | 527.7 | 510.5 | |||||||||||||||||||||||||||||||||||||||

| Corporate | 18.3 | 20.0 | 32.0 | 23.9 | 14.0 | 12.5 | 14.7 | 18.7 | |||||||||||||||||||||||||||||||||||||||

| $ | 3,254.2 | $ | 3,250.4 | $ | 3,379.1 | $ | 3,298.4 | $ | 3,246.7 | $ | 3,229.9 | $ | 3,243.8 | $ | 3,201.5 | ||||||||||||||||||||||||||||||||

| 12/31/2025 | 9/30/2025 | 6/30/2025 | 3/31/2025 | 12/31/2024 | 9/30/2024 | 6/30/2024 | 3/31/2024 | ||||||||||||||||||||||||||||||||||||||||

| Benefits and Expenses | |||||||||||||||||||||||||||||||||||||||||||||||

| Unum US | $ | 1,666.8 | $ | 1,486.0 | $ | 1,693.5 | $ | 1,672.6 | $ | 1,601.3 | $ | 1,437.7 | $ | 1,589.7 | $ | 1,539.8 | |||||||||||||||||||||||||||||||

| Unum International | 289.8 | 276.0 | 276.0 | 236.6 | 239.5 | 244.6 | 224.8 | 220.7 | |||||||||||||||||||||||||||||||||||||||

| Colonial Life | 393.1 | 375.9 | 387.6 | 384.2 | 368.7 | 322.5 | 370.0 | 375.5 | |||||||||||||||||||||||||||||||||||||||

| Closed Block | 482.8 | 1,118.3 | 523.6 | 489.6 | 517.2 | 320.4 | 493.4 | 503.8 | |||||||||||||||||||||||||||||||||||||||

| Corporate | 193.2 | 67.7 | 63.7 | 65.0 | 64.4 | 77.2 | 60.0 | 64.8 | |||||||||||||||||||||||||||||||||||||||

| 3,025.7 | 3,323.9 | 2,944.4 | 2,848.0 | 2,791.1 | 2,402.4 | 2,737.9 | 2,704.6 | ||||||||||||||||||||||||||||||||||||||||

| Income (Loss) Before Income Tax Expense (Benefit) and Net Investment Gain (Loss) | |||||||||||||||||||||||||||||||||||||||||||||||

| Unum US | 293.5 | 486.8 | 318.2 | 329.1 | 333.2 | 506.9 | 357.5 | 385.2 | |||||||||||||||||||||||||||||||||||||||

| Unum International | 33.2 | 44.2 | 41.6 | 38.7 | 37.6 | 32.8 | 42.5 | 37.4 | |||||||||||||||||||||||||||||||||||||||

| Colonial Life | 113.9 | 125.5 | 117.4 | 115.7 | 122.7 | 159.4 | 116.9 | 113.7 | |||||||||||||||||||||||||||||||||||||||

| Closed Block | (37.2) | (682.3) | (10.8) | 8.0 | 12.5 | 193.1 | 34.3 | 6.7 | |||||||||||||||||||||||||||||||||||||||

| Corporate | (174.9) | (47.7) | (31.7) | (41.1) | (50.4) | (64.7) | (45.3) | (46.1) | |||||||||||||||||||||||||||||||||||||||

| 228.5 | (73.5) | 434.7 | 450.4 | 455.6 | 827.5 | 505.9 | 496.9 | ||||||||||||||||||||||||||||||||||||||||

| Income Tax Expense (Benefit) Before Net Investment Gain (Loss) | 47.0 | (12.0) | 85.2 | 97.9 | 98.7 | 172.0 | 108.2 | 100.9 | |||||||||||||||||||||||||||||||||||||||

| Income (Loss) Before Net Investment Gain (Loss) | 181.5 | (61.5) | 349.5 | 352.5 | 356.9 | 655.5 | 397.7 | 396.0 | |||||||||||||||||||||||||||||||||||||||

| Net Investment Gain (Loss) | (10.1) | 128.0 | (17.7) | (206.8) | (10.1) | (12.9) | (10.4) | (1.2) | |||||||||||||||||||||||||||||||||||||||

| Tax Expense (Benefit) on Net Investment Gain (Loss) | (2.7) | 26.8 | (3.8) | (43.4) | (1.9) | (3.1) | (2.2) | (0.4) | |||||||||||||||||||||||||||||||||||||||

| Net Income | $ | 174.1 | $ | 39.7 | $ | 335.6 | $ | 189.1 | $ | 348.7 | $ | 645.7 | $ | 389.5 | $ | 395.2 | |||||||||||||||||||||||||||||||

| Net Income Per Common Share - Assuming Dilution | $ | 1.04 | $ | 0.23 | $ | 1.92 | $ | 1.06 | $ | 1.92 | $ | 3.46 | $ | 2.05 | $ | 2.04 | |||||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 | 12/31/2025 | 12/31/2024 | 12/31/2023 | |||||||||||||||||||||||||

| Operating Revenue | |||||||||||||||||||||||||||||

| Premium Income | $ | 1,748.6 | $ | 1,721.4 | $ | 7,083.5 | $ | 6,883.2 | $ | 6,579.2 | |||||||||||||||||||

| Net Investment Income | 148.3 | 156.1 | 604.2 | 632.2 | 639.9 | ||||||||||||||||||||||||

| Other Income | 63.4 | 57.0 | 258.8 | 235.9 | 220.5 | ||||||||||||||||||||||||

| Total | 1,960.3 | 1,934.5 | 7,946.5 | 7,751.3 | 7,439.6 | ||||||||||||||||||||||||

| Benefits and Expenses | |||||||||||||||||||||||||||||

| Policy Benefits Including Remeasurement Loss or Gain | 1,068.8 | 1,024.7 | 4,120.4 | 3,864.7 | 3,808.5 | ||||||||||||||||||||||||

| Commissions | 189.7 | 177.4 | 794.9 | 729.3 | 664.4 | ||||||||||||||||||||||||

| Deferral of Acquisition Costs | (78.0) | (73.5) | (331.7) | (320.9) | (314.7) | ||||||||||||||||||||||||

| Amortization of Deferred Acquisition Costs | 75.1 | 75.8 | 283.3 | 292.5 | 267.6 | ||||||||||||||||||||||||

| Other Expenses | 411.2 | 396.9 | 1,652.0 | 1,602.9 | 1,529.5 | ||||||||||||||||||||||||

| Total | 1,666.8 | 1,601.3 | 6,518.9 | 6,168.5 | 5,955.3 | ||||||||||||||||||||||||

| Income Before Income Tax and Net Investment Gains and Losses | 293.5 | 333.2 | 1,427.6 | 1,582.8 | 1,484.3 | ||||||||||||||||||||||||

| Amortization of the Deferred Gain on Reinsurance | (4.4) | — | (9.0) | — | — | ||||||||||||||||||||||||

Non-Contemporaneous Reinsurance |

0.6 | — | 1.0 | — | — | ||||||||||||||||||||||||

| Reserve Assumption Updates | — | — | (147.7) | (143.6) | (128.8) | ||||||||||||||||||||||||

| Adjusted Operating Income | $ | 289.7 | $ | 333.2 | $ | 1,271.9 | $ | 1,439.2 | $ | 1,355.5 | |||||||||||||||||||

| Operating Ratios (% of Premium Income): | |||||||||||||||||||||||||||||

Benefit Ratio1 |

61.1 | % | 59.5 | % | 60.2 | % | 58.2 | % | 59.8 | % | |||||||||||||||||||

Other Expense Ratio2 |

22.8 | % | 22.3 | % | 22.6 | % | 22.5 | % | 22.5 | % | |||||||||||||||||||

| Income Ratio | 16.8 | % | 20.2 | % | 23.0 | % | 22.6 | % | |||||||||||||||||||||

| Adjusted Operating Income Ratio | 16.6 | % | 19.4 | % | 18.0 | % | 20.9 | % | 20.6 | % | |||||||||||||||||||

1Excludes the reserve assumption updates that occurred during the third quarters of 2025, 2024, and 2023. Also excludes the impact of non-contemporaneous reinsurance. | |||||||||||||||||||||||||||||

2Ratio of Other Expenses to Premium Income plus Unum US Group Disability Other Income, which is primarily related to fee-based services. | |||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 | 12/31/2025 | 12/31/2024 | 12/31/2023 | |||||||||||||||||||||||||

| Operating Revenue | |||||||||||||||||||||||||||||

| Premium Income | |||||||||||||||||||||||||||||

| Group Long-term Disability | $ | 499.6 | $ | 525.8 | $ | 2,011.1 | $ | 2,086.1 | $ | 2,057.2 | |||||||||||||||||||

| Group Short-term Disability | 284.8 | 273.3 | 1,138.4 | 1,084.0 | 1,012.3 | ||||||||||||||||||||||||

| Total Premium Income | 784.4 | 799.1 | 3,149.5 | 3,170.1 | 3,069.5 | ||||||||||||||||||||||||

| Net Investment Income | 72.2 | 76.4 | 296.0 | 311.2 | 324.8 | ||||||||||||||||||||||||

| Other Income | 57.2 | 57.3 | 228.6 | 232.1 | 211.6 | ||||||||||||||||||||||||

| Total | 913.8 | 932.8 | 3,674.1 | 3,713.4 | 3,605.9 | ||||||||||||||||||||||||

| Benefits and Expenses | |||||||||||||||||||||||||||||

| Policy Benefits Including Remeasurement Loss or Gain | 503.4 | 482.5 | 1,858.5 | 1,781.8 | 1,693.2 | ||||||||||||||||||||||||

| Commissions | 59.3 | 60.3 | 250.1 | 244.4 | 230.5 | ||||||||||||||||||||||||

| Deferral of Acquisition Costs | (14.2) | (14.1) | (60.7) | (62.2) | (60.2) | ||||||||||||||||||||||||

| Amortization of Deferred Acquisition Costs | 16.7 | 17.9 | 58.2 | 64.7 | 57.6 | ||||||||||||||||||||||||

| Other Expenses | 246.3 | 239.7 | 982.4 | 973.5 | 936.1 | ||||||||||||||||||||||||

| Total | 811.5 | 786.3 | 3,088.5 | 3,002.2 | 2,857.2 | ||||||||||||||||||||||||

| Income Before Income Tax and Net Investment Gains and Losses | 102.3 | 146.5 | 585.6 | 711.2 | 748.7 | ||||||||||||||||||||||||

Reserve Assumption Updates |

— | — | (105.8) | (90.0) | (121.0) | ||||||||||||||||||||||||

| Adjusted Operating Income | $ | 102.3 | $ | 146.5 | $ | 479.8 | $ | 621.2 | $ | 627.7 | |||||||||||||||||||

| Operating Ratios (% of Premium Income): | |||||||||||||||||||||||||||||

Benefit Ratio1 |

64.2 | % | 60.4 | % | 62.4 | % | 59.0 | % | 59.1 | % | |||||||||||||||||||

Other Expense Ratio2 |

29.3 | % | 28.0 | % | 29.1 | % | 28.6 | % | 28.5 | % | |||||||||||||||||||

| Income Ratio | 18.6 | % | 22.4 | % | 24.4 | % | |||||||||||||||||||||||

| Adjusted Operating Income Ratio | 13.0 | % | 18.3 | % | 15.2 | % | 19.6 | % | 20.4 | % | |||||||||||||||||||

| Persistency: | |||||||||||||||||||||||||||||

| Group Long-term Disability | 91.1 | % | 93.3 | % | 90.8 | % | |||||||||||||||||||||||

| Group Short-term Disability | 88.9 | % | 91.7 | % | 88.9 | % | |||||||||||||||||||||||

1Excludes the reserve assumption updates that occurred during the third quarters of 2025, 2024, and 2023. | |||||||||||||||||||||||||||||

2Ratio of Other Expenses to Premium Income plus Other Income, which is primarily related to fee-based services. | |||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 | 12/31/2025 | 12/31/2024 | 12/31/2023 | |||||||||||||||||||||||||

| Operating Revenue | |||||||||||||||||||||||||||||

| Premium Income | |||||||||||||||||||||||||||||

| Group Life | $ | 466.6 | $ | 446.8 | $ | 1,871.1 | $ | 1,784.7 | $ | 1,679.0 | |||||||||||||||||||

| Accidental Death & Dismemberment | 49.3 | 46.8 | 195.6 | 186.1 | 175.5 | ||||||||||||||||||||||||

| Total Premium Income | 515.9 | 493.6 | 2,066.7 | 1,970.8 | 1,854.5 | ||||||||||||||||||||||||

| Net Investment Income | 21.1 | 21.7 | 81.6 | 88.3 | 90.1 | ||||||||||||||||||||||||

| Other Income | 0.2 | 0.1 | 1.2 | 1.5 | 1.0 | ||||||||||||||||||||||||

| Total | 537.2 | 515.4 | 2,149.5 | 2,060.6 | 1,945.6 | ||||||||||||||||||||||||

| Benefits and Expenses | |||||||||||||||||||||||||||||

| Policy Benefits Including Remeasurement Loss or Gain | 334.5 | 329.1 | 1,391.8 | 1,294.2 | 1,347.7 | ||||||||||||||||||||||||

| Commissions | 45.3 | 41.5 | 186.3 | 168.0 | 155.9 | ||||||||||||||||||||||||

| Deferral of Acquisition Costs | (10.8) | (9.6) | (45.5) | (40.6) | (38.6) | ||||||||||||||||||||||||

| Amortization of Deferred Acquisition Costs | 12.6 | 11.7 | 39.0 | 38.4 | 39.0 | ||||||||||||||||||||||||

| Other Expenses | 63.7 | 60.0 | 255.4 | 243.0 | 229.9 | ||||||||||||||||||||||||

| Total | 445.3 | 432.7 | 1,827.0 | 1,703.0 | 1,733.9 | ||||||||||||||||||||||||

| Income before Income Tax and Net Investment Gains and Losses | 91.9 | 82.7 | 322.5 | 357.6 | 211.7 | ||||||||||||||||||||||||

| Reserve Assumption Update | — | — | (3.1) | (13.0) | — | ||||||||||||||||||||||||

| Adjusted Operating Income | $ | 91.9 | $ | 82.7 | $ | 319.4 | $ | 344.6 | $ | 211.7 | |||||||||||||||||||

| Operating Ratios (% of Premium Income): | |||||||||||||||||||||||||||||

Benefit Ratio1 |

64.8 | % | 66.7 | % | 67.5 | % | 66.3 | % | 72.7 | % | |||||||||||||||||||

| Other Expense Ratio | 12.3 | % | 12.2 | % | 12.4 | % | 12.3 | % | 12.4 | % | |||||||||||||||||||

| Income Ratio | 15.6 | % | 18.1 | % | |||||||||||||||||||||||||

Adjusted Operating Income Ratio |

17.8 | % | 16.8 | % | 15.5 | % | 17.5 | % | 11.4 | % | |||||||||||||||||||

| Persistency: | |||||||||||||||||||||||||||||

| Group Life | 90.2 | % | 92.0 | % | 89.6 | % | |||||||||||||||||||||||

| Accidental Death & Dismemberment | 89.1 | % | 91.2 | % | 88.7 | % | |||||||||||||||||||||||

1Excludes the reserve assumption update that occurred during the third quarters of 2025 and 2024. | |||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 | 12/31/2025 | 12/31/2024 | 12/31/2023 | |||||||||||||||||||||||||

| Operating Revenue | |||||||||||||||||||||||||||||

| Premium Income | |||||||||||||||||||||||||||||

| Voluntary Benefits | $ | 227.2 | $ | 214.1 | $ | 927.4 | $ | 879.2 | $ | 850.1 | |||||||||||||||||||

| Individual Disability | 139.7 | 141.4 | 615.1 | 566.0 | 527.0 | ||||||||||||||||||||||||

| Dental and Vision | 81.4 | 73.2 | 324.8 | 297.1 | 278.1 | ||||||||||||||||||||||||

| Total Premium Income | 448.3 | 428.7 | 1,867.3 | 1,742.3 | 1,655.2 | ||||||||||||||||||||||||

| Net Investment Income | 55.0 | 58.0 | 226.6 | 232.7 | 225.0 | ||||||||||||||||||||||||

| Other Income | 6.0 | (0.4) | 29.0 | 2.3 | 7.9 | ||||||||||||||||||||||||

| Total | 509.3 | 486.3 | 2,122.9 | 1,977.3 | 1,888.1 | ||||||||||||||||||||||||

| Benefits and Expenses | |||||||||||||||||||||||||||||

| Policy Benefits Including Remeasurement Loss or Gain | 230.9 | 213.1 | 870.1 | 788.7 | 767.6 | ||||||||||||||||||||||||

| Commissions | 85.1 | 75.6 | 358.5 | 316.9 | 278.0 | ||||||||||||||||||||||||

| Deferral of Acquisition Costs | (53.0) | (49.8) | (225.5) | (218.1) | (215.9) | ||||||||||||||||||||||||

| Amortization of Deferred Acquisition Costs | 45.8 | 46.2 | 186.1 | 189.4 | 171.0 | ||||||||||||||||||||||||

| Other Expenses | 101.2 | 97.2 | 414.2 | 386.4 | 363.5 | ||||||||||||||||||||||||

| Total | 410.0 | 382.3 | 1,603.4 | 1,463.3 | 1,364.2 | ||||||||||||||||||||||||

| Income Before Income Tax and Net Investment Gains and Losses | 99.3 | 104.0 | 519.5 | 514.0 | 523.9 | ||||||||||||||||||||||||

Amortization of the Deferred Gain on Reinsurance |

(4.4) | — | (9.0) | — | — | ||||||||||||||||||||||||

Non-Contemporaneous Reinsurance |

0.6 | — | 1.0 | — | — | ||||||||||||||||||||||||

| Reserve Assumption Updates - Voluntary Benefits | — | — | (11.1) | 12.2 | (10.4) | ||||||||||||||||||||||||

| Reserve Assumption Updates - Individual Disability | — | — | (27.7) | (52.8) | 2.6 | ||||||||||||||||||||||||

| Adjusted Operating Income | $ | 95.5 | $ | 104.0 | $ | 472.7 | $ | 473.4 | $ | 516.1 | |||||||||||||||||||

| Operating Ratios (% of Premium Income): | |||||||||||||||||||||||||||||

| Benefit Ratios: | |||||||||||||||||||||||||||||

Voluntary Benefits1 |

48.5 | % | 47.3 | % | 45.7 | % | 43.0 | % | 39.8 | % | |||||||||||||||||||

Individual Disability1,2 |

42.7 | % | 41.0 | % | 38.8 | % | 41.0 | % | 44.3 | % | |||||||||||||||||||

| Dental and Vision | 74.3 | % | 73.5 | % | 75.6 | % | 73.9 | % | 73.1 | % | |||||||||||||||||||

| Other Expense Ratio | 22.6 | % | 22.7 | % | 22.2 | % | 22.2 | % | 22.0 | % | |||||||||||||||||||

| Income Ratio | 22.2 | % | 27.8 | % | 29.5 | % | 31.7 | % | |||||||||||||||||||||

| Adjusted Operating Income Ratio | 21.3 | % | 24.3 | % | 25.3 | % | 27.2 | % | 31.2 | % | |||||||||||||||||||

| Persistency: | |||||||||||||||||||||||||||||

| Voluntary Benefits | 76.5 | % | 76.0 | % | 75.5 | % | |||||||||||||||||||||||

| Individual Disability | 87.7 | % | 89.0 | % | 89.0 | % | |||||||||||||||||||||||

| Dental and Vision | 83.3 | % | 81.4 | % | 77.1 | % | |||||||||||||||||||||||

1Excludes the reserve assumption updates that occurred during the third quarters of 2025, 2024, and 2023. | |||||||||||||||||||||||||||||

2Excludes the impact of non-contemporaneous reinsurance. | |||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 | 12/31/2025 | 12/31/2024 | 12/31/2023 | |||||||||||||||||||||||||

| Operating Revenue | |||||||||||||||||||||||||||||

| Premium Income | |||||||||||||||||||||||||||||

| Unum UK | |||||||||||||||||||||||||||||

| Group Long-term Disability | $ | 108.1 | $ | 105.6 | $ | 427.5 | $ | 418.0 | $ | 396.1 | |||||||||||||||||||

| Group Life | 74.1 | 55.0 | 275.7 | 211.3 | 169.3 | ||||||||||||||||||||||||

| Supplemental | 47.9 | 40.5 | 184.2 | 165.6 | 141.5 | ||||||||||||||||||||||||

| Unum Poland | 53.8 | 41.3 | 195.4 | 154.6 | 118.3 | ||||||||||||||||||||||||

| Total Premium Income | 283.9 | 242.4 | 1,082.8 | 949.5 | 825.2 | ||||||||||||||||||||||||

| Net Investment Income | 34.7 | 34.3 | 145.6 | 128.8 | 137.2 | ||||||||||||||||||||||||

| Other Income | 4.4 | 0.4 | 7.7 | 1.6 | 1.6 | ||||||||||||||||||||||||

| Total | 323.0 | 277.1 | 1,236.1 | 1,079.9 | 964.0 | ||||||||||||||||||||||||

| Benefits and Expenses | |||||||||||||||||||||||||||||

| Policy Benefits Including Remeasurement Loss or Gain | 211.9 | 169.3 | 767.4 | 656.7 | 579.8 | ||||||||||||||||||||||||

| Commissions | 22.1 | 20.8 | 95.7 | 82.5 | 72.5 | ||||||||||||||||||||||||

| Deferral of Acquisition Costs | (5.6) | (4.6) | (22.0) | (17.8) | (14.6) | ||||||||||||||||||||||||

| Amortization of Deferred Acquisition Costs | 2.9 | 2.2 | 10.7 | 9.5 | 8.4 | ||||||||||||||||||||||||

| Other Expenses | 58.5 | 51.8 | 226.6 | 198.7 | 177.7 | ||||||||||||||||||||||||

| Total | 289.8 | 239.5 | 1,078.4 | 929.6 | 823.8 | ||||||||||||||||||||||||

| Income Before Income Tax and Net Investment Gains and Losses | 33.2 | 37.6 | 157.7 | 150.3 | 140.2 | ||||||||||||||||||||||||

Reserve Assumption Updates |

— | — | (5.4) | 7.5 | 17.9 | ||||||||||||||||||||||||

| Adjusted Operating Income | $ | 33.2 | $ | 37.6 | $ | 152.3 | $ | 157.8 | $ | 158.1 | |||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||

| (in millions of pounds, except exchange rate) | 12/31/2025 | 12/31/2024 | 12/31/2025 | 12/31/2024 | 12/31/2023 | ||||||||||||||||||||||||

| Operating Revenue | |||||||||||||||||||||||||||||

| Premium Income | |||||||||||||||||||||||||||||

| Group Long-term Disability | £ | 81.3 | £ | 82.4 | £ | 324.0 | £ | 327.0 | £ | 318.5 | |||||||||||||||||||

| Group Life | 55.7 | 42.9 | 208.8 | 165.1 | 136.1 | ||||||||||||||||||||||||

| Supplemental | 36.0 | 31.6 | 139.6 | 129.5 | 113.7 | ||||||||||||||||||||||||

| Total Premium Income | 173.0 | 156.9 | 672.4 | 621.6 | 568.3 | ||||||||||||||||||||||||

| Net Investment Income | 23.3 | 24.4 | 99.4 | 91.9 | 102.4 | ||||||||||||||||||||||||

| Other Income (Loss) | 3.1 | (0.1) | 5.3 | 0.1 | 0.2 | ||||||||||||||||||||||||

| Total | 199.4 | 181.2 | 777.1 | 713.6 | 670.9 | ||||||||||||||||||||||||

| Benefits and Expenses | |||||||||||||||||||||||||||||

| Policy Benefits Including Remeasurement Loss or Gain | 134.7 | 113.1 | 493.8 | 440.2 | 408.5 | ||||||||||||||||||||||||

| Commissions | 8.5 | 9.2 | 40.6 | 38.2 | 37.4 | ||||||||||||||||||||||||

| Deferral of Acquisition Costs | (1.0) | (1.0) | (3.9) | (3.8) | (3.9) | ||||||||||||||||||||||||

| Amortization of Deferred Acquisition Costs | 1.2 | 1.2 | 4.9 | 5.2 | 5.2 | ||||||||||||||||||||||||

| Other Expenses | 33.7 | 31.1 | 133.5 | 122.4 | 115.4 | ||||||||||||||||||||||||

| Total | 177.1 | 153.6 | 668.9 | 602.2 | 562.6 | ||||||||||||||||||||||||

| Income Before Income Tax and Net Investment Gains and Losses | 22.3 | 27.6 | 108.2 | 111.4 | 108.3 | ||||||||||||||||||||||||

| Reserve Assumption Updates | — | — | (0.7) | 6.4 | 16.3 | ||||||||||||||||||||||||

| Adjusted Operating Income | £ | 22.3 | £ | 27.6 | £ | 107.5 | £ | 117.8 | £ | 124.6 | |||||||||||||||||||

| Weighted Average Pound/Dollar Exchange Rate | 1.332 | 1.279 | 1.318 | 1.278 | 1.243 | ||||||||||||||||||||||||

| Operating Ratios (% of Premium Income): | |||||||||||||||||||||||||||||

Benefit Ratio1 |

77.9 | % | 72.1 | % | 73.5 | % | 69.8 | % | 69.0 | % | |||||||||||||||||||

| Other Expense Ratio | 19.5 | % | 19.8 | % | 19.9 | % | 19.7 | % | 20.3 | % | |||||||||||||||||||

| Income Ratio | 16.1 | % | 17.9 | % | 19.1 | % | |||||||||||||||||||||||

| Adjusted Operating Income Ratio | 12.9 | % | 17.6 | % | 16.0 | % | 19.0 | % | 21.9 | % | |||||||||||||||||||

| Persistency: | |||||||||||||||||||||||||||||

| Group Long-term Disability | 92.3 | % | 92.0 | % | 92.5 | % | |||||||||||||||||||||||

| Group Life | 90.1 | % | 89.1 | % | 83.0 | % | |||||||||||||||||||||||

| Supplemental | 93.3 | % | 90.4 | % | 91.7 | % | |||||||||||||||||||||||

1Excludes the reserve assumption updates that occurred during the third quarters of 2025, 2024, and 2023. | |||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 | 12/31/2025 | 12/31/2024 | 12/31/2023 | |||||||||||||||||||||||||

| Operating Revenue | |||||||||||||||||||||||||||||

| Premium Income | |||||||||||||||||||||||||||||

| Accident, Sickness, and Disability | $ | 249.8 | $ | 244.0 | $ | 993.5 | $ | 969.5 | $ | 946.1 | |||||||||||||||||||

| Life | 122.9 | 115.4 | 483.6 | 458.0 | 426.5 | ||||||||||||||||||||||||

| Cancer and Critical Illness | 90.5 | 89.5 | 362.0 | 356.4 | 353.5 | ||||||||||||||||||||||||

| Total Premium Income | 463.2 | 448.9 | 1,839.1 | 1,783.9 | 1,726.1 | ||||||||||||||||||||||||

| Net Investment Income | 43.5 | 42.1 | 172.6 | 161.5 | 153.5 | ||||||||||||||||||||||||

| Other Income | 0.3 | 0.4 | 1.6 | 4.0 | 1.2 | ||||||||||||||||||||||||

| Total | 507.0 | 491.4 | 2,013.3 | 1,949.4 | 1,880.8 | ||||||||||||||||||||||||

| Benefits and Expenses | |||||||||||||||||||||||||||||

| Policy Benefits Including Remeasurement Loss or Gain | 223.6 | 210.0 | 876.2 | 804.7 | 798.1 | ||||||||||||||||||||||||

| Commissions | 106.0 | 96.2 | 398.6 | 378.4 | 359.4 | ||||||||||||||||||||||||

| Deferral of Acquisition Costs | (92.5) | (78.1) | (343.4) | (312.8) | (302.9) | ||||||||||||||||||||||||

| Amortization of Deferred Acquisition Costs | 59.2 | 55.1 | 233.1 | 219.0 | 205.4 | ||||||||||||||||||||||||

| Other Expenses | 96.8 | 85.5 | 376.3 | 347.4 | 340.0 | ||||||||||||||||||||||||

| Total | 393.1 | 368.7 | 1,540.8 | 1,436.7 | 1,400.0 | ||||||||||||||||||||||||

| Income Before Income Tax and Net Investment Gains and Losses | 113.9 | 122.7 | 472.5 | 512.7 | 480.8 | ||||||||||||||||||||||||

Reserve Assumption Updates |

— | — | (8.9) | (46.0) | (80.7) | ||||||||||||||||||||||||

| Adjusted Operating Income | $ | 113.9 | $ | 122.7 | $ | 463.6 | $ | 466.7 | $ | 400.1 | |||||||||||||||||||

| Operating Ratios (% of Premium Income): | |||||||||||||||||||||||||||||

Benefit Ratio1 |

48.3 | % | 46.8 | % | 48.1 | % | 47.7 | % | 50.9 | % | |||||||||||||||||||

| Other Expense Ratio | 20.9 | % | 19.0 | % | 20.5 | % | 19.5 | % | 19.7 | % | |||||||||||||||||||

| Income Ratio | 25.7 | % | 28.7 | % | 27.9 | % | |||||||||||||||||||||||

| Adjusted Operating Income Ratio | 24.6 | % | 27.3 | % | 25.2 | % | 26.2 | % | 23.2 | % | |||||||||||||||||||

| Persistency: | |||||||||||||||||||||||||||||

| Accident, Sickness, and Disability | 74.1 | % | 73.7 | % | 73.6 | % | |||||||||||||||||||||||

| Life | 84.2 | % | 84.4 | % | 85.1 | % | |||||||||||||||||||||||

| Cancer and Critical Illness | 82.1 | % | 82.2 | % | 82.4 | % | |||||||||||||||||||||||

1Excludes the reserve assumption updates that occurred during the third quarters of 2025, 2024, and 2023. | |||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 | 12/31/2025 | 12/31/2024 | 12/31/2023 | |||||||||||||||||||||||||

| Operating Revenue | |||||||||||||||||||||||||||||

| Premium Income | |||||||||||||||||||||||||||||

| Long-term Care | $ | 160.1 | $ | 174.6 | $ | 670.8 | $ | 696.1 | $ | 696.0 | |||||||||||||||||||

| All Other | 36.3 | 43.8 | 154.8 | 184.7 | 219.5 | ||||||||||||||||||||||||

| Total Premium Income | 196.4 | 218.4 | 825.6 | 880.8 | 915.5 | ||||||||||||||||||||||||

| Net Investment Income | 237.6 | 297.3 | 1,016.5 | 1,148.9 | 1,066.3 | ||||||||||||||||||||||||

| Other Income | 11.6 | 14.0 | 49.9 | 51.7 | 52.6 | ||||||||||||||||||||||||

| Total | 445.6 | 529.7 | 1,892.0 | 2,081.4 | 2,034.4 | ||||||||||||||||||||||||

| Benefits and Expenses | |||||||||||||||||||||||||||||

| Policy Benefits Including Remeasurement Loss or Gain | 388.6 | 457.2 | 2,301.3 | 1,591.8 | 2,070.7 | ||||||||||||||||||||||||

| Commissions | 15.6 | 16.4 | 66.1 | 68.4 | 73.8 | ||||||||||||||||||||||||

| Other Expenses | 78.6 | 43.6 | 246.9 | 174.6 | 172.7 | ||||||||||||||||||||||||

| Total | 482.8 | 517.2 | 2,614.3 | 1,834.8 | 2,317.2 | ||||||||||||||||||||||||

| Income (Loss) Before Income Tax and Net Investment Gains and Losses | (37.2) | 12.5 | (722.3) | 246.6 | (282.8) | ||||||||||||||||||||||||

| Amortization of the Cost of Reinsurance | 48.8 | 10.3 | 116.7 | 41.4 | 44.1 | ||||||||||||||||||||||||

| Non-Contemporaneous Reinsurance | 9.5 | 4.9 | 28.6 | 25.1 | 34.8 | ||||||||||||||||||||||||

| Reserve Assumption Updates - Long-term Care | — | — | 643.1 | (174.1) | 368.1 | ||||||||||||||||||||||||

| Reserve Assumption Updates - All Other | — | — | (2.6) | (1.2) | 0.7 | ||||||||||||||||||||||||

| Adjusted Operating Income | $ | 21.1 | $ | 27.7 | $ | 63.5 | $ | 137.8 | $ | 164.9 | |||||||||||||||||||

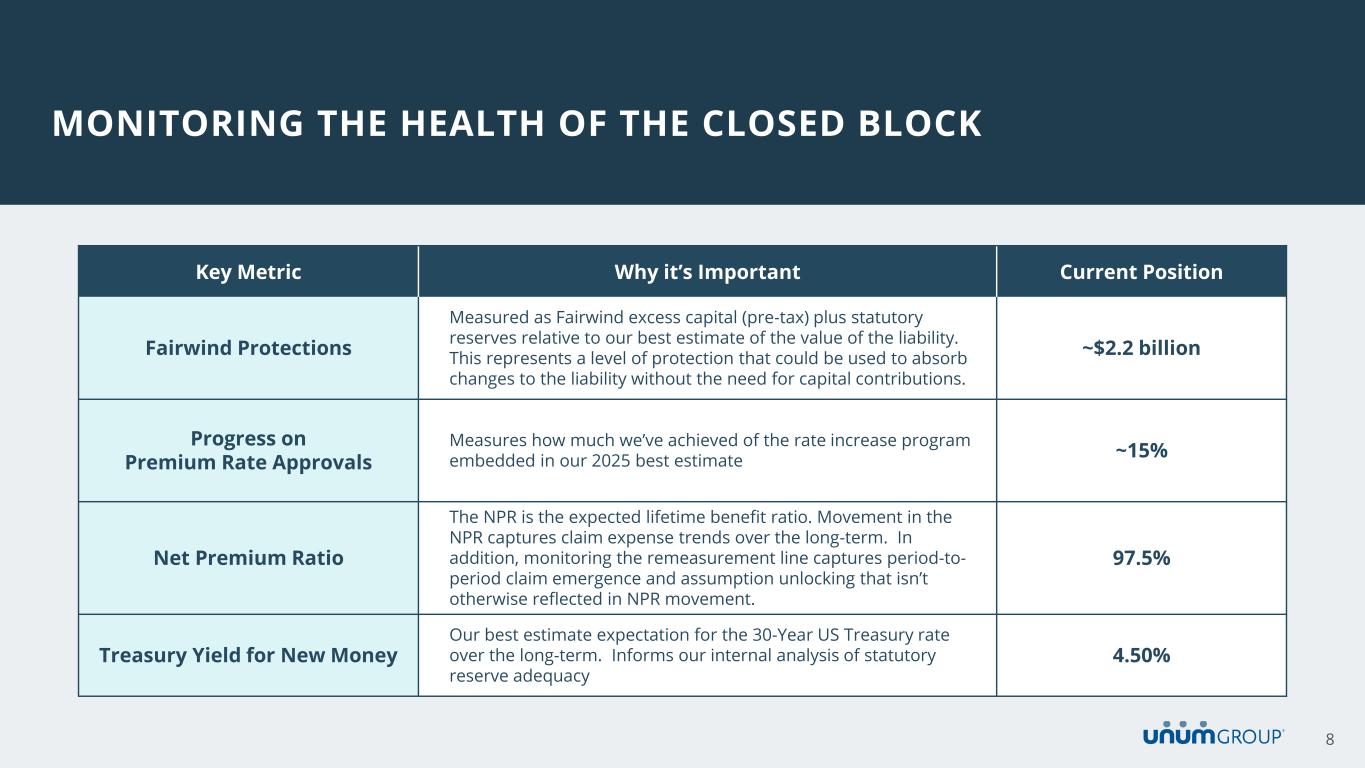

Long-term Care Net Premium Ratio1 |

97.5 | % | 94.6 | % | 93.5 | % | |||||||||||||||||||||||

| Operating Ratios (% of Premium Income): | |||||||||||||||||||||||||||||

Other Expense Ratio2 |

15.2 | % | 15.2 | % | 15.8 | % | 15.1 | % | 14.0 | % | |||||||||||||||||||

| Income (Loss) Ratio | (18.9) | % | 5.7 | % | (87.5) | % | 28.0 | % | (30.9) | % | |||||||||||||||||||

| Adjusted Operating Income Ratio | 10.7 | % | 12.7 | % | 7.7 | % | 15.6 | % | 18.0 | % | |||||||||||||||||||

| Long-term Care Persistency | 95.8 | % | 95.8 | % | 95.6 | % | |||||||||||||||||||||||

1Gross of reinsurance. | |||||||||||||||||||||||||||||

2Excludes amortization of the cost of reinsurance. | |||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 | 12/31/2025 | 12/31/2024 | 12/31/2023 | |||||||||||||||||||||||||

| Operating Revenue | |||||||||||||||||||||||||||||

| Net Investment Income | $ | 17.9 | $ | 13.8 | $ | 93.8 | $ | 58.6 | $ | 99.8 | |||||||||||||||||||

| Other Income | 0.4 | 0.2 | 0.4 | 1.3 | 3.3 | ||||||||||||||||||||||||

| Total | 18.3 | 14.0 | 94.2 | 59.9 | 103.1 | ||||||||||||||||||||||||

| Interest, Debt, and Other Expenses | 193.2 | 64.4 | 389.6 | 266.4 | 249.5 | ||||||||||||||||||||||||

| Loss Before Income Tax and Net Investment Gains and Losses | (174.9) | (50.4) | (295.4) | (206.5) | (146.4) | ||||||||||||||||||||||||

Settlement Loss on the U.S. Pension Plan Annuity Purchase |

103.8 | — | 103.8 | — | — | ||||||||||||||||||||||||

Accelerated Charitable Contribution |

20.0 | — | 20.0 | — | — | ||||||||||||||||||||||||

| Loss on Legal Settlement | — | — | — | 15.3 | — | ||||||||||||||||||||||||

| Adjusted Operating Loss | $ | (51.1) | $ | (50.4) | $ | (171.6) | $ | (191.2) | $ | (146.4) | |||||||||||||||||||

| 12/31/2025 | 12/31/2025 | 12/31/2024 | ||||||||||||||||||||||||||||||

| Fixed Maturity Securities (Fair Value) | Selected Statistics | |||||||||||||||||||||||||||||||

| Public | $ | 20,360.0 | 61.6 | % | Earned Book Yield | 4.35 | % | 4.44 | % | |||||||||||||||||||||||

Mortgage-Backed/Asset-Backed Securities1 |

1,179.3 | 3.6 | Average Duration (in years) | 8.42 | 8.28 | |||||||||||||||||||||||||||

| Private Placements | 5,827.4 | 17.6 | ||||||||||||||||||||||||||||||

| High Yield | 1,208.6 | 3.6 | ||||||||||||||||||||||||||||||

| Government Securities | 1,415.3 | 4.3 | ||||||||||||||||||||||||||||||

| Municipal Securities | 3,058.1 | 9.3 | ||||||||||||||||||||||||||||||

| Redeemable Preferred Stocks | 7.9 | — | ||||||||||||||||||||||||||||||

| Total | $ | 33,056.6 | 100.0 | % | ||||||||||||||||||||||||||||

| Amortized Cost | Fair Value | Private Equity Partnerships | 12/31/2025 | 12/31/2024 | ||||||||||||||||||||||||||||

| Quality Ratings of Fixed Maturity Securities | Private Credit Partnerships | $ | 255.8 | $ | 289.2 | |||||||||||||||||||||||||||

| Aaa | 3.6 | % | 3.6 | % | Private Equity Partnerships | 651.4 | 640.2 | |||||||||||||||||||||||||

| Aa | 16.5 | 15.8 | Real Asset Partnerships | 549.1 | 521.2 | |||||||||||||||||||||||||||

| A | 32.6 | 33.1 | Total | $ | 1,456.3 | $ | 1,450.6 | |||||||||||||||||||||||||

| Baa | 43.7 | 43.9 | ||||||||||||||||||||||||||||||

| Below Baa | 3.6 | 3.6 | ||||||||||||||||||||||||||||||

| Total | 100.0 | % | 100.0 | % | Non-Current Investments | $ | — | $ | 13.0 | |||||||||||||||||||||||

| Fixed Maturity Securities - By Industry Classification - Unrealized Gain (Loss) | ||||||||||||||||||||||||||||||||||||||

| Classification | Fair Value | Net Unrealized Gain (Loss) | Fair Value with Gross Unrealized Loss | Gross Unrealized Loss | Fair Value with Gross Unrealized Gain | Gross Unrealized Gain | ||||||||||||||||||||||||||||||||

| Basic Industry | $ | 2,189.1 | $ | (76.4) | $ | 1,099.9 | $ | 121.5 | $ | 1,089.2 | $ | 45.1 | ||||||||||||||||||||||||||

| Capital Goods | 2,854.6 | (78.8) | 1,512.6 | 153.5 | 1,342.0 | 74.7 | ||||||||||||||||||||||||||||||||

| Communications | 1,994.6 | (49.4) | 915.0 | 136.9 | 1,079.6 | 87.5 | ||||||||||||||||||||||||||||||||

| Consumer Cyclical | 1,204.6 | (72.9) | 837.2 | 95.2 | 367.4 | 22.3 | ||||||||||||||||||||||||||||||||

| Consumer Non-Cyclical | 5,594.0 | (384.9) | 3,744.5 | 502.5 | 1,849.5 | 117.6 | ||||||||||||||||||||||||||||||||

| Energy | 2,170.6 | 42.0 | 652.7 | 63.6 | 1,517.9 | 105.6 | ||||||||||||||||||||||||||||||||

| Financial Institutions | 3,642.5 | (219.3) | 2,520.6 | 254.7 | 1,121.9 | 35.4 | ||||||||||||||||||||||||||||||||

Mortgage/Asset-Backed1 |

1,179.3 | (8.0) | 481.9 | 17.3 | 697.4 | 9.3 | ||||||||||||||||||||||||||||||||

| Sovereigns | 870.3 | (138.5) | 582.8 | 157.3 | 287.5 | 18.8 | ||||||||||||||||||||||||||||||||

| Technology | 1,346.1 | (100.2) | 952.1 | 115.2 | 394.0 | 15.0 | ||||||||||||||||||||||||||||||||

| Transportation | 1,473.9 | (92.2) | 917.2 | 116.5 | 556.7 | 24.3 | ||||||||||||||||||||||||||||||||

| U.S. Government Agencies and Municipalities | 3,603.1 | (391.4) | 2,317.8 | 482.4 | 1,285.3 | 91.0 | ||||||||||||||||||||||||||||||||

| Public Utilities | 4,933.9 | (114.7) | 2,352.4 | 290.1 | 2,581.5 | 175.4 | ||||||||||||||||||||||||||||||||

| Total | $ | 33,056.6 | $ | (1,684.7) | $ | 18,886.7 | $ | 2,506.7 | $ | 14,169.9 | $ | 822.0 | ||||||||||||||||||||||||||

| Gross Unrealized Loss on Fixed Maturity Securities by Length of Time in Unrealized Loss Position | ||||||||||||||||||||||||||||||||||||||

| Investment-Grade | Below-Investment-Grade | |||||||||||||||||||||||||||||||||||||

| Category | Fair Value | Gross Unrealized Loss | Fair Value | Gross Unrealized Loss | ||||||||||||||||||||||||||||||||||

| Less than 91 days | $ | 2,786.5 | $ | (39.3) | $ | 59.4 | $ | (0.5) | ||||||||||||||||||||||||||||||

| 91 through 180 days | 219.8 | (12.8) | 5.4 | (0.3) | ||||||||||||||||||||||||||||||||||

| 181 through 270 days | 53.4 | (3.0) | 0.0 | — | ||||||||||||||||||||||||||||||||||

| 271 days to 1 year | 201.0 | (12.5) | 7.8 | (1.5) | ||||||||||||||||||||||||||||||||||

| Greater than 1 year | 15,261.2 | (2,390.4) | 292.2 | (46.4) | ||||||||||||||||||||||||||||||||||

| Total | $ | 18,521.9 | $ | (2,458.0) | $ | 364.8 | $ | (48.7) | ||||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||

| 12/31/2025 | 12/31/2024 |

12/31/2025 | 12/31/2024 | 12/31/2023 | ||||||||||||||||||||||||||||

| Total Revenue | $ | 3,244.1 | $ | 3,236.6 | $ | 13,075.5 | $ | 12,887.3 | $ | 12,385.9 | ||||||||||||||||||||||

| Excluding: | ||||||||||||||||||||||||||||||||

Net Investment Loss |

(10.1) | (10.1) | (106.6) | (34.6) | (36.0) | |||||||||||||||||||||||||||

Amortization of the Deferred Gain on Reinsurance |

4.4 | — | 9.0 | — | — | |||||||||||||||||||||||||||

| Adjusted Operating Revenue | $ | 3,249.8 | $ | 3,246.7 | $ | 13,173.1 | $ | 12,921.9 | $ | 12,421.9 | ||||||||||||||||||||||

| After-Tax Adjusted Operating Income (Loss) | Average Allocated Equity1 |

Adjusted Operating Return on Equity | ||||||||||||||||||

| Year Ended December 31, 2025 | ||||||||||||||||||||

| Unum US | $ | 1,005.2 | $ | 4,441.2 | 22.6 | % | ||||||||||||||

| Unum International | 118.5 | 799.0 | 14.8 | % | ||||||||||||||||

| Colonial Life | 365.8 | 2,011.0 | 18.2 | % | ||||||||||||||||

| Core Operating Segments | 1,489.5 | 7,251.2 | 20.5 | % | ||||||||||||||||

| Closed Block | 40.7 | 4,830.0 | ||||||||||||||||||

| Corporate | (124.2) | 555.2 | ||||||||||||||||||

| Total | $ | 1,406.0 | $ | 12,636.4 | 11.1 | % | ||||||||||||||

| Year Ended December 31, 2024 | ||||||||||||||||||||

| Unum US | $ | 1,137.6 | $ | 4,523.2 | 25.2 | % | ||||||||||||||