| Georgia | 001-07434 | 58-1167100 | ||||||||||||

| (State or other jurisdiction | (Commission | (IRS Employer | ||||||||||||

| of incorporation) | File Number) | Identification No.) | ||||||||||||

| 1932 Wynnton Road | Columbus | Georgia | 31999 | |||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |||||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, $.10 Par Value | AFL | New York Stock Exchange | ||||||||||||

| Exhibit Number | Exhibit Title or Description | |||||||||||||

Press release of Aflac Incorporated dated February 5, 2025 |

||||||||||||||

Financial Supplement for Fourth Quarter 2024 |

||||||||||||||

| Transcript of comments in video presentation by Max Brodén, Senior Executive Vice President and Chief Financial Officer of Aflac Incorporated. | ||||||||||||||

| Slides referenced in video presentation by Max Brodén, Senior Executive Vice President and Chief Financial Officer of Aflac Incorporated. | ||||||||||||||

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) | |||||||||||||

| Aflac Incorporated | ||||||||||||||

| February 5, 2025 | /s/ Robin L. Blackmon | |||||||||||||

| (Robin L. Blackmon) | ||||||||||||||

| Senior Vice President, Financial Services | ||||||||||||||

| Chief Accounting Officer | ||||||||||||||

| AFLAC INCORPORATED AND SUBSIDIARIES CONDENSED INCOME STATEMENT | ||||||||||||||||||||

| (UNAUDITED – IN MILLIONS, EXCEPT FOR SHARE AND PER-SHARE AMOUNTS) | ||||||||||||||||||||

| THREE MONTHS ENDED DECEMBER 31, | 2024 | 2023 | % Change | |||||||||||||||||

| Total revenues | $ | 5,403 | $ | 3,777 | 43.1 | % | ||||||||||||||

| Benefits and claims, net | 1,923 | 2,103 | (8.6) | |||||||||||||||||

| Total acquisition and operating expenses | 1,345 | 1,385 | (2.9) | |||||||||||||||||

| Earnings before income taxes | 2,135 | 289 | 638.8 | |||||||||||||||||

| Income taxes | 233 | 21 | ||||||||||||||||||

| Net earnings | $ | 1,902 | $ | 268 | 609.7 | % | ||||||||||||||

| Net earnings per share – basic | $ | 3.44 | $ | 0.46 | 647.8 | % | ||||||||||||||

| Net earnings per share – diluted | 3.42 | 0.46 | 643.5 | |||||||||||||||||

| Shares used to compute earnings per share (000): | ||||||||||||||||||||

| Basic | 552,767 | 581,876 | (5.0) | % | ||||||||||||||||

| Diluted | 555,483 | 584,881 | (5.0) | |||||||||||||||||

| Dividends paid per share | $ | 0.50 | $ | 0.42 | 19.0 | % | ||||||||||||||

| AFLAC INCORPORATED AND SUBSIDIARIES CONDENSED INCOME STATEMENT | ||||||||||||||||||||

| (UNAUDITED – IN MILLIONS, EXCEPT FOR SHARE AND PER-SHARE AMOUNTS) | ||||||||||||||||||||

| TWELVE MONTHS ENDED DECEMBER 31, | 2024 | 2023 | % Change | |||||||||||||||||

| Total revenues | $ | 18,927 | $ | 18,701 | 1.2 | % | ||||||||||||||

| Benefits and claims, net | 7,450 | 8,211 | (9.3) | |||||||||||||||||

| Total acquisition and operating expenses | 5,060 | 5,228 | (3.2) | |||||||||||||||||

| Earnings before income taxes | 6,417 | 5,262 | 21.9 | |||||||||||||||||

| Income taxes | 974 | 603 | ||||||||||||||||||

| Net earnings | $ | 5,443 | $ | 4,659 | 16.8 | % | ||||||||||||||

| Net earnings per share – basic | $ | 9.68 | $ | 7.81 | 23.9 | % | ||||||||||||||

| Net earnings per share – diluted | 9.63 | 7.78 | 23.8 | |||||||||||||||||

| Shares used to compute earnings per share (000): | ||||||||||||||||||||

| Basic | 562,492 | 596,173 | (5.6) | % | ||||||||||||||||

| Diluted | 565,015 | 598,745 | (5.6) | |||||||||||||||||

| Dividends paid per share | $ | 2.00 | $ | 1.68 | 19.0 | % | ||||||||||||||

| AFLAC INCORPORATED AND SUBSIDIARIES CONDENSED BALANCE SHEET | ||||||||||||||||||||

| (UNAUDITED – IN MILLIONS, EXCEPT FOR SHARE AMOUNTS) | ||||||||||||||||||||

| DECEMBER 31, | 2024 | 2023 | % Change | |||||||||||||||||

| Assets: | ||||||||||||||||||||

| Total investments and cash | $ | 105,087 | $ | 113,560 | (7.5) | % | ||||||||||||||

| Deferred policy acquisition costs | 8,758 | 9,132 | (4.1) | |||||||||||||||||

| Other assets | 3,721 | 4,032 | (7.7) | |||||||||||||||||

| Total assets | $ | 117,566 | $ | 126,724 | (7.2) | % | ||||||||||||||

| Liabilities and shareholders’ equity: | ||||||||||||||||||||

| Policy liabilities | $ | 77,508 | $ | 91,599 | (15.4) | % | ||||||||||||||

| Notes payable and lease obligations | 7,498 | 7,364 | 1.8 | |||||||||||||||||

| Other liabilities | 6,462 | 5,776 | 11.9 | |||||||||||||||||

| Shareholders’ equity | 26,098 | 21,985 | 18.7 | |||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 117,566 | $ | 126,724 | (7.2) | % | ||||||||||||||

| Shares outstanding at end of period (000) | 549,964 | 578,479 | (4.9) | % | ||||||||||||||||

| RECONCILIATION OF NET EARNINGS TO ADJUSTED EARNINGS | ||||||||||||||||||||

| (UNAUDITED – IN MILLIONS, EXCEPT FOR PER-SHARE AMOUNTS) | ||||||||||||||||||||

| THREE MONTHS ENDED DECEMBER 31, | 2024 | 2023 | % Change | |||||||||||||||||

| Net earnings | $ | 1,902 | $ | 268 | 609.7 | % | ||||||||||||||

| Items impacting net earnings: | ||||||||||||||||||||

| Adjusted net investment (gains) losses | (1,084) | 450 | ||||||||||||||||||

Other and non-recurring (income) loss |

22 | — | ||||||||||||||||||

| Income tax (benefit) expense on items excluded from adjusted earnings |

25 | 14 | ||||||||||||||||||

| Adjusted earnings | 865 | 732 | 18.2 | % | ||||||||||||||||

Current period foreign currency impact 1 |

6 | N/A | ||||||||||||||||||

Adjusted earnings excluding current period foreign currency impact 2 |

$ | 871 | $ | 732 | 19.0 | % | ||||||||||||||

| Net earnings per diluted share | $ | 3.42 | $ | 0.46 | 643.5 | % | ||||||||||||||

| Items impacting net earnings: | ||||||||||||||||||||

| Adjusted net investment (gains) losses | (1.95) | 0.77 | ||||||||||||||||||

Other and non-recurring (income) loss |

0.04 | — | ||||||||||||||||||

| Income tax (benefit) expense on items excluded from adjusted earnings |

0.05 | 0.02 | ||||||||||||||||||

| Adjusted earnings per diluted share | 1.56 | 1.25 | 24.8 | % | ||||||||||||||||

Current period foreign currency impact 1 |

0.01 | N/A | ||||||||||||||||||

Adjusted earnings per diluted share excluding current period foreign currency impact 2 |

$ | 1.57 | $ | 1.25 | 25.6 | % | ||||||||||||||

| RECONCILIATION OF NET EARNINGS TO ADJUSTED EARNINGS | ||||||||||||||||||||

| (UNAUDITED – IN MILLIONS, EXCEPT FOR PER-SHARE AMOUNTS) | ||||||||||||||||||||

| TWELVE MONTHS ENDED DECEMBER 31, | 2024 | 2023 | % Change | |||||||||||||||||

| Net earnings | $ | 5,443 | $ | 4,659 | 16.8 | % | ||||||||||||||

| Items impacting net earnings: | ||||||||||||||||||||

| Adjusted net investment (gains) losses | (1,495) | (914) | ||||||||||||||||||

Other and non-recurring (income) loss |

23 | (39) | ||||||||||||||||||

| Income tax (benefit) expense on items excluded from adjusted earnings |

101 | 26 | ||||||||||||||||||

| Adjusted earnings | 4,072 | 3,733 | 9.1 | % | ||||||||||||||||

Current period foreign currency impact 1 |

103 | N/A | ||||||||||||||||||

Adjusted earnings excluding current period foreign currency impact 2 |

$ | 4,175 | $ | 3,733 | 11.8 | % | ||||||||||||||

| Net earnings per diluted share | $ | 9.63 | $ | 7.78 | 23.8 | % | ||||||||||||||

| Items impacting net earnings: | ||||||||||||||||||||

| Adjusted net investment (gains) losses | (2.65) | (1.53) | ||||||||||||||||||

Other and non-recurring (income) loss |

0.04 | (0.07) | ||||||||||||||||||

| Income tax (benefit) expense on items excluded from adjusted earnings |

0.18 | 0.04 | ||||||||||||||||||

| Adjusted earnings per diluted share | 7.21 | 6.23 | 15.7 | % | ||||||||||||||||

Current period foreign currency impact 1 |

0.18 | N/A | ||||||||||||||||||

Adjusted earnings excluding current period foreign currency impact 2 |

$ | 7.39 | $ | 6.23 | 18.6 | % | ||||||||||||||

| RECONCILIATION OF NET INVESTMENT (GAINS) LOSSES TO ADJUSTED NET INVESTMENT (GAINS) LOSSES | ||||||||||||||||||||

| (UNAUDITED – IN MILLIONS) | ||||||||||||||||||||

| THREE MONTHS ENDED DECEMBER 31, | 2024 | 2023 | % Change | |||||||||||||||||

| Net investment (gains) losses | $ | (1,032) | $ | 511 | (302.0) | % | ||||||||||||||

| Items impacting net investment (gains) losses: | ||||||||||||||||||||

| Amortized hedge costs | (7) | (9) | ||||||||||||||||||

| Amortized hedge income | 26 | 29 | ||||||||||||||||||

|

Net interest income (expense) from derivatives associated

with certain investment strategies

|

(73) | (90) | ||||||||||||||||||

|

Impact of interest from derivatives associated with

notes payable1

|

2 | 8 | ||||||||||||||||||

| Adjusted net investment (gains) losses | $ | (1,084) | $ | 450 | (340.9) | % | ||||||||||||||

| RECONCILIATION OF NET INVESTMENT INCOME TO ADJUSTED NET INVESTMENT INCOME | ||||||||||||||||||||

| (UNAUDITED – IN MILLIONS) | ||||||||||||||||||||

| THREE MONTHS ENDED DECEMBER 31, | 2024 | 2023 | % Change | |||||||||||||||||

| Net investment income | $ | 1,016 | $ | 865 | 17.5 | % | ||||||||||||||

| Items impacting net investment income: | ||||||||||||||||||||

| Amortized hedge costs | (7) | (9) | ||||||||||||||||||

| Amortized hedge income | 26 | 29 | ||||||||||||||||||

|

Net interest income (expense) from derivatives associated

with certain investment strategies

|

(73) | (90) | ||||||||||||||||||

| Adjusted net investment income | $ | 962 | $ | 795 | 21.0 | % | ||||||||||||||

| RECONCILIATION OF NET INVESTMENT (GAINS) LOSSES TO ADJUSTED NET INVESTMENT (GAINS) LOSSES | ||||||||||||||||||||

| (UNAUDITED – IN MILLIONS) | ||||||||||||||||||||

| TWELVE MONTHS ENDED DECEMBER 31, | 2024 | 2023 | % Change | |||||||||||||||||

| Net investment (gains) losses | $ | (1,271) | $ | (590) | 115.4 | % | ||||||||||||||

| Items impacting net investment (gains) losses: | ||||||||||||||||||||

| Amortized hedge costs | (26) | (157) | ||||||||||||||||||

| Amortized hedge income | 113 | 121 | ||||||||||||||||||

|

Net interest income (expense) from derivatives associated

with certain investment strategies

|

(338) | (328) | ||||||||||||||||||

|

Impact of interest from derivatives associated with

notes payable1

|

27 | 41 | ||||||||||||||||||

| Adjusted net investment (gains) losses | $ | (1,495) | $ | (914) | 63.6 | % | ||||||||||||||

| RECONCILIATION OF NET INVESTMENT INCOME TO ADJUSTED NET INVESTMENT INCOME | ||||||||||||||||||||

| (UNAUDITED – IN MILLIONS) | ||||||||||||||||||||

| TWELVE MONTHS ENDED DECEMBER 31, | 2024 | 2023 | % Change | |||||||||||||||||

| Net investment income | $ | 4,116 | $ | 3,811 | 8.0 | % | ||||||||||||||

| Items impacting net investment income: | ||||||||||||||||||||

| Amortized hedge costs | (26) | (157) | ||||||||||||||||||

| Amortized hedge income | 113 | 121 | ||||||||||||||||||

|

Net interest income (expense) from derivatives associated

with certain investment strategies

|

(338) | (328) | ||||||||||||||||||

| Adjusted net investment income | $ | 3,865 | $ | 3,447 | 12.1 | % | ||||||||||||||

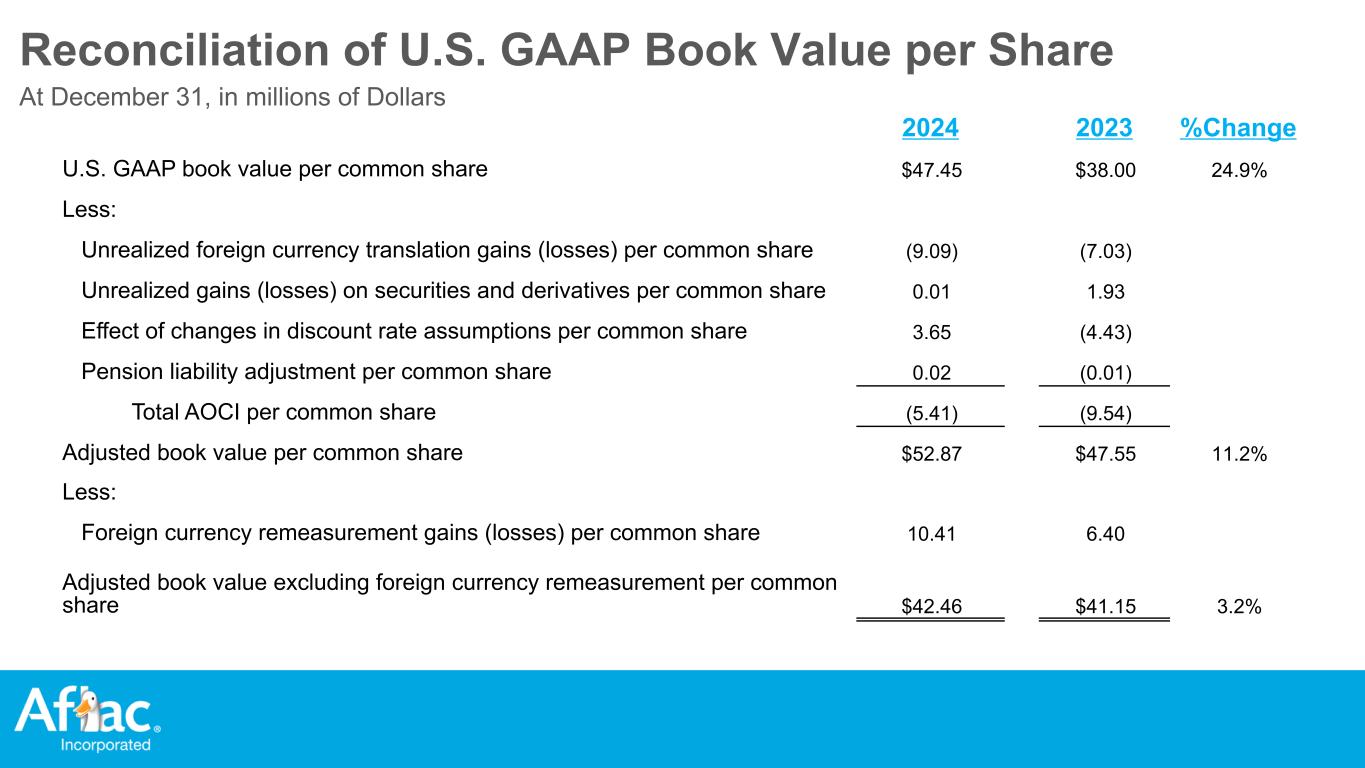

RECONCILIATION OF U.S. GAAP BOOK VALUE TO ADJUSTED BOOK VALUE | ||||||||||||||||||||

| (EXCLUDING FOREIGN CURRENCY REMEASUREMENT) | ||||||||||||||||||||

| (UNAUDITED - IN MILLIONS, EXCEPT FOR SHARE AND PER-SHARE AMOUNTS) | ||||||||||||||||||||

| DECEMBER 31, | 2024 | 2023 | % Change | |||||||||||||||||

| U.S. GAAP book value | $ | 26,098 | $ | 21,985 | ||||||||||||||||

| Less: | ||||||||||||||||||||

Unrealized foreign currency translation gains (losses) |

(4,998) | (4,069) | ||||||||||||||||||

Unrealized gains (losses) on securities and derivatives |

4 | 1,117 | ||||||||||||||||||

| Effect of changes in discount rate assumptions | 2,006 | (2,560) | ||||||||||||||||||

Pension liability adjustment |

10 | (8) | ||||||||||||||||||

Total AOCI |

(2,978) | (5,520) | ||||||||||||||||||

| Adjusted book value | $ | 29,076 | $ | 27,505 | ||||||||||||||||

| Less: | ||||||||||||||||||||

| Foreign currency remeasurement gains (losses) | 5,725 | 3,700 | ||||||||||||||||||

| Adjusted book value excluding foreign currency remeasurement | $ | 23,351 | $ | 23,805 | ||||||||||||||||

| Number of outstanding shares at end of period (000) | 549,964 | 578,479 | ||||||||||||||||||

| U.S. GAAP book value per common share | $ | 47.45 | $ | 38.00 | 24.9 | % | ||||||||||||||

| Less: | ||||||||||||||||||||

Unrealized foreign currency translation gains (losses) per common share |

(9.09) | (7.03) | ||||||||||||||||||

Unrealized gains (losses) on securities and derivatives per common share |

0.01 | 1.93 | ||||||||||||||||||

| Effect of changes in discount rate assumptions per common share |

3.65 | (4.43) | ||||||||||||||||||

Pension liability adjustment per common share |

0.02 | (0.01) | ||||||||||||||||||

Total AOCI per common share |

(5.41) | (9.54) | ||||||||||||||||||

| Adjusted book value per common share | $ | 52.87 | $ | 47.55 | 11.2 | % | ||||||||||||||

| Less: | ||||||||||||||||||||

| Foreign currency remeasurement gains (losses) per common share | 10.41 | 6.40 | ||||||||||||||||||

| Adjusted book value excluding foreign currency remeasurement per common share | $ | 42.46 | $ | 41.15 | 3.2 | % | ||||||||||||||

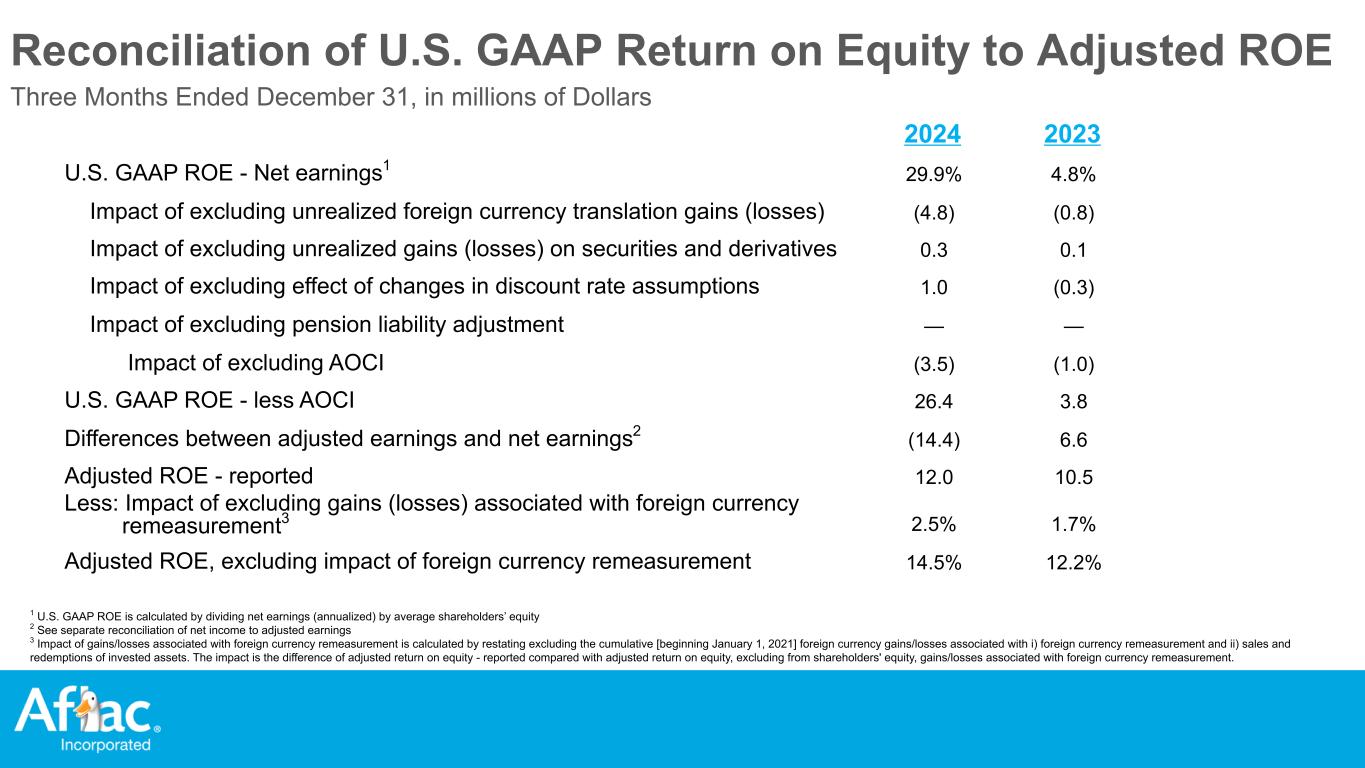

RECONCILIATION OF U.S. GAAP RETURN ON EQUITY (ROE) TO ADJUSTED ROE | ||||||||||||||

| (EXCLUDING IMPACT OF FOREIGN CURRENCY) | ||||||||||||||

| THREE MONTHS ENDED DECEMBER 31, | 2024 | 2023 | ||||||||||||

U.S. GAAP ROE - Net earnings1 |

29.9 | % | 4.8 | % | ||||||||||

Impact of excluding unrealized foreign currency translation gains (losses) |

(4.8) | (0.8) | ||||||||||||

Impact of excluding unrealized gains (losses) on securities and derivatives |

0.3 | 0.1 | ||||||||||||

| Impact of excluding effect of changes in discount rate assumptions | 1.0 | (0.3) | ||||||||||||

Impact of excluding pension liability adjustment |

— | — | ||||||||||||

Impact of excluding AOCI |

(3.5) | (1.0) | ||||||||||||

| U.S. GAAP ROE - less AOCI | 26.4 | 3.8 | ||||||||||||

Differences between adjusted earnings and net earnings2 |

(14.4) | 6.6 | ||||||||||||

| Adjusted ROE - reported | 12.0 | 10.5 | ||||||||||||

Less: Impact of excluding gains (losses) associated with foreign currency remeasurement3 |

2.5 | 1.7 | ||||||||||||

| Adjusted ROE, excluding foreign currency remeasurement | 14.5 | 12.2 | ||||||||||||

RECONCILIATION OF U.S. GAAP RETURN ON EQUITY (ROE) TO ADJUSTED ROE | ||||||||||||||

| (EXCLUDING IMPACT OF FOREIGN CURRENCY) | ||||||||||||||

| TWELVE MONTHS ENDED DECEMBER 31, | 2024 | 2023 | ||||||||||||

U.S. GAAP ROE - Net earnings1 |

22.6 | % | 22.1 | % | ||||||||||

Impact of excluding unrealized foreign currency translation gains (losses) |

(3.6) | (3.1) | ||||||||||||

Impact of excluding unrealized gains (losses) on securities and derivatives |

0.4 | 0.2 | ||||||||||||

| Impact of excluding effect of changes in discount rate assumptions | (0.2) | (1.9) | ||||||||||||

Impact of excluding pension liability adjustment |

— | — | ||||||||||||

Impact of excluding AOCI |

(3.4) | (4.9) | ||||||||||||

| U.S. GAAP ROE - less AOCI | 19.2 | 17.2 | ||||||||||||

Differences between adjusted earnings and net earnings2 |

(4.8) | (3.4) | ||||||||||||

| Adjusted ROE - reported | 14.4 | 13.8 | ||||||||||||

Less: Impact of excluding gains (losses) associated with foreign currency remeasurement3 |

2.9 | 1.8 | ||||||||||||

| Adjusted ROE, excluding foreign currency remeasurement | 17.3 | 15.6 | ||||||||||||

EFFECT OF FOREIGN CURRENCY ON ADJUSTED RESULTS1 | ||||||||||||||

| (SELECTED PERCENTAGE CHANGES, UNAUDITED) | ||||||||||||||

| THREE MONTHS ENDED DECEMBER 31, 2024 | Including Currency Changes |

Excluding

Currency

Changes2

|

||||||||||||

Net earned premiums3 |

(1.6) | % | 0.2 | % | ||||||||||

Adjusted net investment income4 |

21.0 | 21.5 | ||||||||||||

| Total benefits and expenses | (6.8) | (5.1) | ||||||||||||

| Adjusted earnings | 18.2 | 19.0 | ||||||||||||

| Adjusted earnings per diluted share | 24.8 | 25.6 | ||||||||||||

EFFECT OF FOREIGN CURRENCY ON ADJUSTED RESULTS1 | ||||||||||||||

| (SELECTED PERCENTAGE CHANGES, UNAUDITED) | ||||||||||||||

| TWELVE MONTHS ENDED DECEMBER 31, 2024 | Including Currency Changes |

Excluding

Currency

Changes2

|

||||||||||||

Net earned premiums3 |

(4.8) | % | (0.6) | % | ||||||||||

Adjusted net investment income4 |

12.1 | 14.1 | ||||||||||||

| Total benefits and expenses | (7.3) | (3.3) | ||||||||||||

| Adjusted earnings | 9.1 | 11.8 | ||||||||||||

| Adjusted earnings per diluted share | 15.7 | 18.6 | ||||||||||||

| Aflac Incorporated | Page | |||||||||||||||||||

| Aflac U.S. | ||||||||||||||||||||

| Aflac Japan | ||||||||||||||||||||

| Corporate and Other | ||||||||||||||||||||

| Non-U.S. GAAP Financial Measures | ||||||||||||||||||||

| Aflac Incorporated and Subsidiaries | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share Data | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In Thousands) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Beginning | Shares Issued | Shares Purchased | Ending | QTD Weighted Avg. Shares | YTD Weighted Avg. Shares | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Stk. Bon. | Stk. Opt. | Treas. | Misc. | Shares | Avg. | Dilutive | Avg. | Avg. | Dilutive | Avg. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Period | Outstanding | & DRP | & Misc. | Shares | Purch.(1) |

Outstanding | Shares | Shares | Diluted | Shares | Shares | Diluted | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 1 | 652,132 | 259 | 1,308 | 8,007 | 343 | 645,349 | 649,753 | 3,074 | 652,827 | 649,753 | 3,074 | 652,827 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 645,349 | 269 | 101 | 11,185 | 8 | 634,526 | 640,707 | 2,536 | 643,243 | 645,205 | 2,805 | 648,010 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 634,526 | 258 | 144 | 11,057 | 3 | 623,868 | 629,350 | 2,597 | 631,946 | 639,862 | 2,735 | 642,597 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 623,868 | 222 | 120 | 8,938 | 16 | 615,256 | 619,845 | 3,149 | 622,994 | 634,816 | 2,839 | 637,655 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 | 1 | 615,256 | 239 | 1,152 | 10,348 | 347 | 605,952 | 611,205 | 2,745 | 613,950 | 611,205 | 2,745 | 613,950 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 605,952 | 259 | 225 | 10,461 | 6 | 595,969 | 600,742 | 2,187 | 602,929 | 605,945 | 2,466 | 608,411 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 595,969 | 210 | 115 | 9,390 | 7 | 586,897 | 591,246 | 2,350 | 593,596 | 600,991 | 2,427 | 603,419 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 586,897 | 191 | 94 | 8,698 | 5 | 578,479 | 581,876 | 3,005 | 584,881 | 596,173 | 2,572 | 598,745 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 1 | 578,479 | 212 | 1,320 | 9,276 | 457 | 570,278 | 574,886 | 2,596 | 577,482 | 574,886 | 2,596 | 577,482 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 570,278 | 217 | 186 | 9,288 | 24 | 561,369 | 564,573 | 2,265 | 566,838 | 569,730 | 2,430 | 572,160 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 561,369 | 165 | 75 | 4,882 | 10 | 556,717 | 557,899 | 2,515 | 560,414 | 565,757 | 2,459 | 568,216 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 556,717 | 156 | 77 | 6,982 | 4 | 549,964 | 552,767 | 2,716 | 555,483 | 562,492 | 2,523 | 565,015 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aflac Incorporated and Subsidiaries | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Summary of Adjusted Results by Business Segment | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In Millions, except per-share data and where noted) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Years Ended December 31, | 3 Months Ended December 31, | 12 Months Ended December 31, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 | 2024 | Change | 2023 | 2024 | Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aflac Japan | $ | 3,261 | $ | 3,263 | $ | 3,755 | $ | 3,281 | $ | 3,234 | $ | 755 | $ | 747 | (1.1) | $ | 3,234 | $ | 3,494 | 8.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aflac U.S. | 1,272 | 1,268 | 1,356 | 1,359 | 1,501 | 302 | 330 | 9.3 | 1,501 | 1,419 | (5.5) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Corporate and other (1) |

(72) | (115) | (293) | (218) | (425) | (318) | (4) | (425) | 32 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pretax adjusted earnings | 4,461 | 4,416 | 4,819 | 4,422 | 4,310 | 739 | 1,073 | 45.2 | 4,310 | 4,945 | 14.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Income taxes (1) |

1,147 | 864 | 893 | 808 | 577 | 7 | 208 | 2,871.4 | 577 | 873 | 51.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted earnings (2) |

3,314 | 3,552 | 3,925 | 3,614 | 3,733 | 732 | 865 | 18.2 | 3,733 | 4,072 | 9.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reconciling items: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted net investment gains (losses) | (15) | (229) | 462 | 447 | 914 | (450) | 1,084 | 914 | 1,495 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other and non-recurring income (loss) (3) |

(1) | (28) | (73) | 1 | 39 | — | (22) | 39 | (23) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Income tax benefit (expense) on items excluded from adjusted earnings (4) |

3 | 72 | (83) | 357 | (26) | (14) | (25) | (26) | (101) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tax reform adjustment (5) |

4 | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tax valuation allowance release (6) |

— | 1,411 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings | $ | 3,304 | $ | 4,778 | $ | 4,231 | $ | 4,418 | $ | 4,659 | $ | 268 | $ | 1,902 | 609.7 | $ | 4,659 | $ | 5,443 | 16.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Effective Tax rate | 25.7 | % | (14.9) | % | 18.7 | % | 9.3 | % | 11.5 | % | 7.4 | % | 10.9 | % | 11.5 | % | 15.2 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Earnings per share of common stock: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings (basic) | $ | 4.45 | $ | 6.69 | $ | 6.28 | $ | 6.96 | $ | 7.81 | $ | 0.46 | $ | 3.44 | 647.8 | $ | 7.81 | $ | 9.68 | 23.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings (diluted) | 4.43 | 6.67 | 6.25 | 6.93 | 7.78 | 0.46 | 3.42 | 643.5 | 7.78 | 9.63 | 23.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted earnings (basic) (2) |

$ | 4.46 | $ | 4.98 | $ | 5.83 | $ | 5.69 | $ | 6.26 | $ | 1.26 | $ | 1.56 | 23.8 | $ | 6.26 | $ | 7.24 | 15.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted earnings (diluted) (2) |

4.44 | 4.96 | 5.80 | 5.67 | 6.23 | 1.25 | 1.56 | 24.8 | 6.23 | 7.21 | 15.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) The change in value of federal historic rehabilitation and solar investments in partnerships of $46 and $174 for the three-month periods and $165 and $343 for the twelve-month periods ended December 31, 2024, and 2023, respectively, is included as a reduction to net investment income. Tax credits on these investments of $22 and $163 for the three-month periods and $164 and $334 for the twelve-month periods ended December 31, 2024, and 2023, respectively, have been recorded as an income tax benefit in the consolidated statement of earnings. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) See non-U.S. GAAP financial measures for definition of adjusted earnings. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Foreign currency gains and losses for all periods have been reclassified from Other and non-recurring income (loss) to Net investment gains and losses. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(4) Primarily reflects release of $452 in deferred taxes in 2022 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(5) The impact of Tax Reform was adjusted in 2018 for return-to-provision adjustments, various amended returns filed by the Company, and final true-ups of deferred tax liabilities. Further impacts were recorded in 2019 as a result of additional guidance released by the IRS. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(6) Tax benefit recognized in 2020 represents the release of valuation allowances on deferred tax benefits related to foreign tax credits. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aflac Incorporated and Subsidiaries | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Statements of Earnings - U.S. GAAP | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In Millions, except per-share data) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Years Ended December 31, | 3 Months Ended December 31, | 12 Months Ended December 31, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 | 2024 | Change | 2023 | 2024 | Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net earned premiums | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross premiums | $ | 19,122 | $ | 18,955 | $ | 17,305 | $ | 15,025 | $ | 14,318 | $ | 3,433 | $ | 3,369 | $ | 14,318 | $ | 13,562 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assumed (ceded) | (342) | (333) | (210) | (124) | (195) | (48) | (38) | (195) | (122) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total net earned premiums (1) |

18,780 | 18,622 | 17,095 | 14,901 | 14,123 | 3,385 | 3,331 | (1.6) | 14,123 | 13,440 | (4.8) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net investment income | 3,578 | 3,638 | 3,818 | 3,656 | 3,811 | 865 | 1,016 | 17.5 | 3,811 | 4,116 | 8.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net investment gains (losses) (2) |

(135) | (270) | 468 | 363 | 590 | (511) | 1,032 | 590 | 1,271 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other income (2) |

84 | 157 | 173 | 220 | 177 | 38 | 24 | 177 | 100 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenues | 22,307 | 22,147 | 21,554 | 19,140 | 18,701 | 3,777 | 5,403 | 43.1 | 18,701 | 18,927 | 1.2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Benefits and Claims: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Benefits and claims, net | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Incurred claims -direct | 9,279 | 9,364 | 8,949 | 8,271 | 8,005 | 1,959 | 2,033 | 8,005 | 8,281 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Incurred claims -assumed (ceded) | (372) | (296) | (147) | (108) | (177) | (51) | (38) | (177) | (95) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Increase in FPB (3)-direct |

2,952 | 2,707 | 1,819 | 888 | 594 | 96 | (37) | 594 | (184) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Increase in FPB (3)-assumed (ceded) |

83 | 21 | 3 | 51 | 172 | 171 | 7 | 172 | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total net benefits and claims, excluding reserve remeasurement |

N/A | N/A | 10,623 | 9,102 | 8,594 | 2,174 | 1,966 | 8,594 | 8,008 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reserve remeasurement (gain) loss | N/A | N/A | (147) | (215) | (383) | (71) | (43) | (383) | (558) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total net benefits and claims | 11,942 | 11,796 | 10,476 | 8,887 | 8,211 | 2,103 | 1,923 | (8.6) | 8,211 | 7,450 | (9.3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Acquisition and operating expenses: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Amortization of DAC (4) |

1,282 | 1,214 | 835 | 792 | 816 | 208 | 213 | 816 | 851 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Insurance commissions | 1,321 | 1,316 | 1,256 | 1,117 | 1,052 | 255 | 247 | 1,052 | 998 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Insurance expenses | 3,089 | 3,420 | 3,541 | 3,249 | 3,165 | 876 | 835 | 3,165 | 3,014 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense | 228 | 242 | 238 | 226 | 195 | 46 | 50 | 195 | 197 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total acquisition and operating expenses | 5,920 | 6,192 | 5,870 | 5,384 | 5,228 | 1,385 | 1,345 | (2.9) | 5,228 | 5,060 | (3.2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total benefits and expenses | 17,862 | 17,988 | 16,346 | 14,271 | 13,439 | 3,488 | 3,268 | (6.3) | 13,439 | 12,510 | (6.9) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pretax earnings | 4,445 | 4,159 | 5,208 | 4,869 | 5,262 | 289 | 2,135 | 5,262 | 6,417 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Income tax expense (benefit) (5) |

1,141 | (619) | 977 | 451 | 603 | 21 | 233 | 603 | 974 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings | $ | 3,304 | $ | 4,778 | $ | 4,231 | $ | 4,418 | $ | 4,659 | $ | 268 | $ | 1,902 | 609.7 | $ | 4,659 | $ | 5,443 | 16.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) Includes a gain (loss) of $(1) and $(2) for the three-month periods and $(81) and $20 for the twelve-month periods ended December 31, 2024 and 2023, respectively, related to remeasurement of the deferred profit liability for limited-payment contracts. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Foreign currency gains and losses for all periods have been reclassified from Other income to Net investment gains and losses for consistency with current period presentation. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Future policy benefits |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(4) Deferred acquisition costs |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(5) Primarily reflects release of $452 in deferred taxes in 2022 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aflac Incorporated and Subsidiaries | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Analysis of Net Earnings and Net Earnings Per Diluted Share | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In Millions, except for per-share data) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other and | Foreign | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net | Other and Non- | Foreign | Net | Net | Non-Recurring | Currency | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net | Investment | Recurring | Currency | Earnings | Investment | Items | Impact | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Period | Earnings | Gains (Losses) (1) |

Items (1)(3)(4) |

Impact (2) |

Per Share | Gains (Losses) (1) |

Per Share (1)(3)(4) |

Per Share (2) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2019 | 3,304 | (13) | 3 | 15 | 4.43 | (.02) | .01 | .02 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | 4,778 | (181) | 1,407 | 31 | 6.67 | (.25) | 1.96 | .04 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 4,231 | 365 | (59) | (42) | 6.25 | .54 | (.09) | (.06) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 4,418 | 803 | 1 | (262) | 6.93 | 1.26 | — | (.41) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 | 4,659 | 896 | 31 | (113) | 7.78 | 1.50 | .05 | (.19) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 5,443 | 1,389 | (18) | (103) | 9.63 | 2.46 | (.03) | (.18) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 1 | 1,047 | 106 | (1) | (35) | 1.60 | .16 | — | (.05) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 1,394 | 448 | — | (59) | 2.17 | .70 | — | (.09) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 1,781 | 871 | 1 | (97) | 2.82 | 1.38 | — | (.15) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 196 | (621) | — | (70) | .31 | (1.00) | — | (.11) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 | 1 | 1,188 | 235 | — | (41) | 1.94 | .38 | — | (.07) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 1,634 | 653 | 28 | (25) | 2.71 | 1.08 | .05 | (.04) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 1,569 | 472 | 2 | (33) | 2.64 | .80 | — | (.06) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 268 | (464) | — | (14) | .46 | (.79) | — | (.02) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 1 | 1,879 | 920 | (2) | (44) | 3.25 | 1.59 | — | (.08) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 1,755 | 720 | — | (37) | 3.10 | 1.27 | — | (.07) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | (93) | (1,304) | — | (16) | (.17) | (2.33) | — | (.03) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 1,902 | 1,054 | (17) | (6) | 3.42 | 1.90 | (.03) | (.01) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) Items are presented net of tax. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) See non-U.S. GAAP financial measures for definition of adjusted earnings excluding current period foreign currency impact |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Foreign currency gains and losses and amortized hedge costs/income for all periods have been reclassified from Other income to Net investment gains and losses for consistency with current period presentation. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(4 )Tax benefit recognized in the third quarter of 2020 represents the release of valuation allowances on deferred tax benefits related to foreign tax credits. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aflac Incorporated and Subsidiaries | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Balance Sheets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In Millions, except per-share data) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets: | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investments and cash: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities available for sale: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed maturity securities available for sale, at fair value | $ | 86,950 | $ | 101,286 | $ | 94,206 | $ | 71,936 | $ | 69,578 | $ | 61,841 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed maturity securities available for sale - consolidated variable interest entities, at fair value | 4,312 | 4,596 | 4,490 | 3,805 | 3,712 | 3,428 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed maturity securities held to maturity, at amortized cost, net of allowance for credit losses | 30,085 | 24,464 | 22,000 | 19,056 | 17,819 | 15,966 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity securities, at fair value | 802 | 1,283 | 1,603 | 1,091 | 1,088 | 796 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial mortgage and other loans, net of allowance for credit losses | 9,569 | 10,554 | 11,786 | 13,496 | 12,527 | 10,869 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other investments | 1,477 | 2,429 | 3,842 | 4,070 | 4,530 | 5,958 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | 4,896 | 5,141 | 5,051 | 3,943 | 4,306 | 6,229 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total investments and cash | 138,091 | 149,753 | 142,978 | 117,397 | 113,560 | 105,087 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Receivables, net of allowance for credit losses (1) |

816 | 778 | 672 | 647 | 848 | 779 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accrued investment income | 772 | 780 | 737 | 745 | 731 | 710 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deferred policy acquisition costs | 10,128 | 10,441 | 9,848 | 9,239 | 9,132 | 8,758 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Property and equipment, net | 581 | 601 | 538 | 530 | 445 | 387 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other assets, net of allowance for credit losses (1)(2) |

2,380 | 2,733 | 3,377 | 3,180 | 2,008 | 1,845 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 152,768 | $ | 165,086 | $ | 158,150 | $ | 131,738 | $ | 126,724 | $ | 117,566 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and Shareholders' Equity: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total policy liabilities | $ | 106,554 | $ | 114,391 | $ | 126,331 | $ | 96,910 | $ | 91,599 | $ | 77,508 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Notes payable | 6,569 | 7,899 | 7,956 | 7,442 | 7,364 | 7,498 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income taxes, primarily deferred | 5,370 | 4,661 | 30 | 698 | 154 | 573 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 5,316 | 4,576 | 6,802 | 6,548 | 5,622 | 5,889 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 123,809 | 131,527 | 141,119 | 111,598 | 104,739 | 91,468 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders' equity: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock | 135 | 135 | 135 | 135 | 136 | 136 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Additional paid-in capital | 2,313 | 2,410 | 2,529 | 2,641 | 2,771 | 2,894 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retained earnings | 34,291 | 37,984 | 40,963 | 44,367 | 47,993 | 52,277 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss): | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unrealized foreign currency translation gains (losses) | (1,623) | (1,109) | (1,985) | (3,564) | (4,069) | (4,998) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unrealized gains (losses) on fixed maturity securities | 8,548 | 10,361 | 9,602 | (702) | 1,139 | 24 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unrealized gains (losses) on derivatives | (33) | (34) | (30) | (27) | (22) | (20) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Effect of change in discount rate assumption(s) | N/A | N/A | (15,832) | (2,100) | (2,560) | 2,006 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pension liability adjustment | (277) | (284) | (166) | (36) | (8) | 10 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Treasury stock | (14,395) | (15,904) | (18,185) | (20,574) | (23,395) | (26,231) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total shareholders' equity | 28,959 | 33,559 | 17,031 | 20,140 | 21,985 | 26,098 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities & shareholders' equity | $ | 152,768 | $ | 165,086 | $ | 158,150 | $ | 131,738 | $ | 126,724 | $ | 117,566 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aflac Incorporated and Subsidiaries | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarterly Financial Results | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars In Millions, except per-share data) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net | Net | Benefits | Acquisitions | Total | Net EPS | Adj. EPS (1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Earned | Inv. | Total | & | & | Pretax | Net | Adjusted | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Period | Premiums | Income | Revenues | Claims, Net | Adj. Exp. | Earn. | Earn. | Earn. (1) |

Basic | Dil. | Basic | Dil. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2019 | 18,780 | 3,578 | 22,307 | 11,942 | 5,920 | 4,445 | 3,304 | 3,314 | 4.45 | 4.43 | 4.46 | 4.44 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | 18,622 | 3,638 | 22,147 | 11,796 | 6,192 | 4,159 | 4,778 | 3,552 | 6.69 | 6.67 | 4.98 | 4.96 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 17,095 | 3,818 | 21,554 | 10,476 | 5,870 | 5,208 | 4,231 | 3,925 | 6.28 | 6.25 | 5.83 | 5.80 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 14,901 | 3,656 | 19,140 | 8,887 | 5,384 | 4,869 | 4,418 | 3,614 | 6.96 | 6.93 | 5.69 | 5.67 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 | 14,123 | 3,811 | 18,701 | 8,211 | 5,228 | 5,262 | 4,659 | 3,733 | 7.81 | 7.78 | 6.26 | 6.23 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 13,440 | 4,116 | 18,927 | 7,450 | 5,060 | 6,417 | 5,443 | 4,072 | 9.68 | 9.63 | 7.24 | 7.21 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 1 | 4,079 | 903 | 5,173 | 2,483 | 1,396 | 1,294 | 1,047 | 942 | 1.61 | 1.60 | 1.45 | 1.44 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 3,764 | 937 | 5,315 | 2,274 | 1,333 | 1,708 | 1,394 | 945 | 2.18 | 2.17 | 1.47 | 1.47 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 3,535 | 920 | 4,704 | 2,076 | 1,299 | 1,329 | 1,781 | 910 | 2.83 | 2.82 | 1.45 | 1.44 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 3,523 | 896 | 3,948 | 2,054 | 1,356 | 538 | 196 | 817 | .32 | .31 | 1.32 | 1.31 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 | 1 | 3,688 | 943 | 4,800 | 2,150 | 1,308 | 1,342 | 1,188 | 953 | 1.94 | 1.94 | 1.56 | 1.55 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 3,573 | 999 | 5,172 | 2,098 | 1,249 | 1,825 | 1,634 | 954 | 2.72 | 2.71 | 1.59 | 1.58 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 3,476 | 1,004 | 4,950 | 1,860 | 1,285 | 1,805 | 1,569 | 1,095 | 2.65 | 2.64 | 1.85 | 1.84 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 3,385 | 865 | 3,777 | 2,103 | 1,385 | 289 | 268 | 732 | .46 | .46 | 1.26 | 1.25 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 1 | 3,456 | 1,000 | 5,436 | 2,010 | 1,256 | 2,170 | 1,879 | 961 | 3.27 | 3.25 | 1.67 | 1.66 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 3,325 | 1,095 | 5,138 | 1,921 | 1,198 | 2,019 | 1,755 | 1,035 | 3.11 | 3.10 | 1.83 | 1.83 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 3,328 | 1,006 | 2,949 | 1,595 | 1,262 | 92 | (93) | 1,211 | (0.17) | (0.17) | 2.17 | 2.16 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 3,331 | 1,016 | 5,403 | 1,923 | 1,345 | 2,135 | 1,902 | 865 | 3.44 | 3.42 | 1.56 | 1.56 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarterly Book Value Per Share | ||||||||||||||||||||||||||||||||||||||

| (Dollars In Millions, except per-share data) | ||||||||||||||||||||||||||||||||||||||

| Equity | AOCI | Adjusted BV | ||||||||||||||||||||||||||||||||||||

| BV Per | BV Per | Adjusted BV | Per Share | |||||||||||||||||||||||||||||||||||

| Period | Share | Share | Per Share (1) |

% Change | ||||||||||||||||||||||||||||||||||

| 2019 | 39.84 | 9.10 | 30.74 | 8.9% | ||||||||||||||||||||||||||||||||||

| 2020 | 48.46 | 12.90 | 35.56 | 15.7% | ||||||||||||||||||||||||||||||||||

| 2021 | 26.12 | (12.90) | 39.01 | 9.7% | ||||||||||||||||||||||||||||||||||

| 2022 | 32.73 | (10.45) | 43.18 | 10.7% | ||||||||||||||||||||||||||||||||||

| 2023 | 38.00 | (9.54) | 47.55 | 10.1% | ||||||||||||||||||||||||||||||||||

| 2024 | 47.45 | (5.41) | 52.87 | 11.2% | ||||||||||||||||||||||||||||||||||

| 2022 | 1 | 27.21 | (13.09) | 40.31 | 10.1% | |||||||||||||||||||||||||||||||||

| 2 | 30.82 | (11.00) | 41.82 | 11.3% | ||||||||||||||||||||||||||||||||||

| 3 | 31.97 | (12.03) | 44.00 | 14.6% | ||||||||||||||||||||||||||||||||||

| 4 | 32.73 | (10.45) | 43.18 | 10.7% | ||||||||||||||||||||||||||||||||||

| 2023 | 1 | 32.65 | (12.01) | 44.66 | 10.8% | |||||||||||||||||||||||||||||||||

| 2 | 34.30 | (12.31) | 46.61 | 11.5% | ||||||||||||||||||||||||||||||||||

| 3 | 38.63 | (9.81) | 48.44 | 10.1% | ||||||||||||||||||||||||||||||||||

| 4 | 38.00 | (9.54) | 47.55 | 10.1% | ||||||||||||||||||||||||||||||||||

| 2024 | 1 | 41.27 | (8.95) | 50.22 | 12.4% | |||||||||||||||||||||||||||||||||

| 2 | 46.40 | (5.86) | 52.26 | 12.1% | ||||||||||||||||||||||||||||||||||

| 3 | 44.60 | (6.60) | 51.21 | 5.7% | ||||||||||||||||||||||||||||||||||

| 4 | 47.45 | (5.41) | 52.87 | 11.2% | ||||||||||||||||||||||||||||||||||

| Aflac Incorporated and Subsidiaries | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended December 31, | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 2019 | 2020 | 2021 (4) |

2022 |

2023 | 2024 | |||||||||||||||||||||||||||||||||||||||||||||

U.S. GAAP ROE (1) - Net earnings |

12.6 | % | 15.3 | % | 26.7 | % | 23.8 | % | 22.1 | % | 22.6 | % | ||||||||||||||||||||||||||||||||||||||

| Impact of excluding unrealized foreign currency translation gains (losses) | (1.0) | (0.9) | (1.7) | (2.5) | (3.1) | (3.6) | ||||||||||||||||||||||||||||||||||||||||||||

| Impact of excluding unrealized gains (losses) on securities and derivatives | 3.6 | 6.2 | 10.7 | 4.1 | 0.2 | 0.4 | ||||||||||||||||||||||||||||||||||||||||||||

| Impact of excluding effect on change in discount rate assumptions | N/A | N/A | (18.5) | (8.2) | (1.9) | (0.2) | ||||||||||||||||||||||||||||||||||||||||||||

| Impact of excluding pension liability adjustment | (0.1) | (0.2) | (0.2) | (0.1) | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Impact of excluding AOCI | 2.5 | 5.1 | (9.7) | (6.8) | (4.9) | (3.4) | ||||||||||||||||||||||||||||||||||||||||||||

| U.S. GAAP ROE - less AOCI | 15.1 | 20.3 | 17.0 | 17.0 | 17.2 | 19.2 | ||||||||||||||||||||||||||||||||||||||||||||

Differences between adjusted earnings and net earnings (2) |

— | (5.2) | (1.2) | (3.1) | (3.4) | (4.8) | ||||||||||||||||||||||||||||||||||||||||||||

Adjusted ROE - reported (3) |

15.2 | 15.1 | 15.8 | 13.9 | 13.8 | 14.4 | ||||||||||||||||||||||||||||||||||||||||||||

Less: Impact of excluding gains (losses) associated with foreign currency remeasurement (5) |

N/A | N/A | 0.1 | 1.0 | 1.8 | 2.9 | ||||||||||||||||||||||||||||||||||||||||||||

Adjusted ROE, excluding foreign currency remeasurement (5) |

N/A | N/A | 15.9 | 14.9 | 15.6 | 17.3 | ||||||||||||||||||||||||||||||||||||||||||||

| (1) | U.S. GAAP ROE is calculated by dividing net earnings (annualized) by average shareholders' equity. | |||||||||||||||||||||||||||||||||||||||||||||||||

| (2) | See separate reconciliation of net income to adjusted earnings. | |||||||||||||||||||||||||||||||||||||||||||||||||

| (3) | See non-U.S. GAAP financial measures for definition of adjusted return on equity | |||||||||||||||||||||||||||||||||||||||||||||||||

| (4) | Return on equity calculations for 2021 use beginning retained earnings and accumulated other comprehensive income adjusted for the adoption of LDTI. | |||||||||||||||||||||||||||||||||||||||||||||||||

| (5) | Impact of gains/losses associated with foreign currency remeasurement is calculated by excluding the cumulative [beginning January 1, 2021] foreign currency gains/losses associated with i) foreign currency remeasurement and ii) sales and redemptions of invested assets. The impact is the difference of adjusted return on equity - reported compared with adjusted return on equity, excluding from shareholders' equity, gains/losses associated with foreign currency remeasurement | |||||||||||||||||||||||||||||||||||||||||||||||||

| Aflac Incorporated and Subsidiaries | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted Earnings Per Share Excluding Current Period Foreign Currency Impact (1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Diluted Basis) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| QTD | YTD | Excluding | Excluding | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign | Foreign | Foreign | Foreign | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted | Currency | Currency | Currency | Currency | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Period | EPS(1) |

Growth | Impact(1) |

Impact(1) |

Impact(1) |

Impact | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2019 | $ | 4.44 | 6.7 | % | N/A | .02 | $ | 4.42 | 6.3 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | $ | 4.96 | 11.7 | % | N/A | .04 | $ | 4.92 | 10.8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | $ | 5.80 | 16.9 | % | N/A | (.06) | $ | 5.86 | 18.1 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | $ | 5.67 | (2.2) | % | N/A | (.41) | $ | 6.08 | 4.8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 | $ | 6.23 | 9.9 | % | N/A | (.19) | $ | 6.43 | 13.4 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | $ | 7.21 | 15.7 | % | N/A | (.18) | $ | 7.39 | 18.6 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 1 | $ | 1.44 | .7 | % | (.05) | (.05) | $ | 1.50 | 4.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 1.47 | — | (.09) | (.15) | 1.56 | 6.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 1.44 | (8.3) | (.15) | (.30) | 1.59 | 1.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 1.31 | (.8) | (.11) | (.41) | 1.43 | 8.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 5.67 | (2.2) | % | $ | 6.08 | 4.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 | 1 | $ | 1.55 | 7.6 | % | (.07) | (.07) | $ | 1.62 | 12.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 1.58 | 7.5 | (.04) | (.11) | 1.62 | 10.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 1.84 | 27.8 | (.06) | (.17) | 1.90 | 31.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 1.25 | (4.6) | (.02) | (.19) | 1.28 | (2.3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 6.23 | 9.9 | % | $ | 6.43 | 13.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 1 | $ | 1.66 | 7.1 | % | (.08) | (.08) | $ | 1.74 | 12.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 1.83 | 15.8 | (.07) | (.14) | 1.89 | 19.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 2.16 | 17.4 | (.03) | (.17) | 2.19 | 19.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 1.56 | 24.8 | (.01) | (.18) | 1.57 | 25.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 7.21 | 15.7 | % | $ | 7.39 | 18.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) See non-U.S.GAAP financial measures for definition of adjusted earnings and adjusted earnings excluding current period foreign currency impact |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aflac Incorporated and Subsidiaries | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Composition of Invested Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In Millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fixed Maturity Securities(1) |

$ | 109,456 | $ | 116,056 | $ | 107,369 | $ | 94,525 | $ | 88,508 | $ | 80,055 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Commercial mortgage and other loans, net of allowance for credit losses (1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Transitional Real Estate (floating rate) | 5,450 | 5,231 | 5,246 | 6,455 | 5,998 | 4,703 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Middle Market Loans (floating rate) | 2,412 | 3,635 | 4,601 | 5,028 | 4,531 | 4,283 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial Mortgage Loans | 1,707 | 1,688 | 1,854 | 1,775 | 1,697 | 1,523 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Loans | — | — | 20 | 238 | 301 | 360 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Commercial mortgage and other loans, net of allowance for credit losses(1) |

9,569 | 10,554 | 11,721 | 13,496 | 12,527 | 10,869 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity Securities, at FV through net earnings | 802 | 1,283 | 1,603 | 1,091 | 1,088 | 796 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Alternatives(2) |

551 | 919 | 1,703 | 2,107 | 2,619 | 3,167 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Portfolio | $ | 120,378 | $ | 128,812 | $ | 122,396 | $ | 111,219 | $ | 104,742 | $ | 94,887 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unrealized Gains (Losses) on Invested Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In Millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed Maturity Securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Available For Sale - Gross Gains |

$ | 12,266 | $ | 14,771 | $ | 13,566 | $ | 4,800 | $ | 6,050 | $ | 5,308 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Available For Sale - Gross Losses |

(375) | (481) | (239) | (4,528) | (3,449) | (4,128) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Available For Sale | 11,891 | 14,290 | 13,327 | 272 | 2,601 | 1,180 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Held to Maturity - Gross Gains |

7,519 | 5,935 | 4,869 | 2,154 | 1,838 | 815 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Held to Maturity - Gross Losses |

(10) | — | — | — | — | (9) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Held to Maturity | $ | 7,509 | $ | 5,935 | $ | 4,869 | $ | 2,154 | $ | 1,838 | $ | 806 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit Ratings on Fixed Maturities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (At Amortized Cost) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit Rating | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AAA | 1.1 | % | 1.0 | % | 1.0 | % | 1.6 | % | 1.6 | % | 1.5 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AA | 4.3 | 4.5 | 5.1 | 5.2 | 5.7 | 6.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A | 68.6 | 69.3 | 68.9 | 68.0 | 68.1 | 68.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BBB | 23.1 | 21.9 | 22.5 | 23.0 | 22.9 | 22.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BB or Lower | 2.9 | 3.3 | 2.5 | 2.2 | 1.7 | 1.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(1) Presented at amortized cost, net of reserves beginning in 2020

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Presented at carrying value; includes asset classes such as private equity and real estate funds managed by Global Investments; excludes Corporate driven activity, policy loans, short-term investments, real estate owned assets and FHLB equity balances |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aflac Incorporated and Subsidiaries | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Supplemental Investment Data by Segment | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, | December 31, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2023 | 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aflac Japan: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Invested assets (in millions)(1) |

¥ | 11,784,586 | ¥ | 11,936,087 | ¥ | 12,405,531 | ¥ | 12,617,181 | ¥ | 12,127,531 | ¥ | 11,881,515 | ¥ | 12,127,531 | ¥ | 11,881,515 | |||||||||||||||||||||||||||||||||||||||||||

Return on average invested assets(2) |

2.33 | % | 2.38 | % | 2.72 | % | 2.78 | % | 2.90 | % | 3.33 | % | 3.12 | % | 3.35 | % | |||||||||||||||||||||||||||||||||||||||||||

Portfolio book yield at end of period(3) |

2.64 | % | 2.59 | % | 2.60 | % | 3.06 | % | 3.18 | % | 3.22 | % | 3.18 | % | 3.22 | % | |||||||||||||||||||||||||||||||||||||||||||

Total purchases for period (in millions)(3) |

¥ | 1,003,885 | ¥ | 714,124 | ¥ | 952,038 | ¥ | 716,964 | ¥ | 378,541 | ¥ | 735,141 | ¥ | 61,185 | ¥ | 88,037 | |||||||||||||||||||||||||||||||||||||||||||

New money yield(3)(4) |

3.83 | % | 3.75 | % | 3.50 | % | 4.48 | % | 5.18 | % | 6.11 | % | 6.73 | % | 8.01 | % | |||||||||||||||||||||||||||||||||||||||||||

| Aflac U.S.: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Invested assets (in millions)(1) |

$ | 14,036 | $ | 14,848 | $ | 15,841 | $ | 16,772 | $ | 17,075 | $ | 17.341 | $ | 17,075 | $ | 17.341 | |||||||||||||||||||||||||||||||||||||||||||

Return on average invested assets(2) |

5.70 | % | 4.90 | % | 4.87 | % | 4.72 | % | 4.88 | % | 5.00 | % | 5.04 | % | 5.01 | % | |||||||||||||||||||||||||||||||||||||||||||

Portfolio book yield at end of period(3) |

5.40 | % | 5.18 | % | 4.94 | % | 5.39 | % | 5.53 | % | 5.58 | % | 5.53 | % | 5.58 | % | |||||||||||||||||||||||||||||||||||||||||||

Total purchases for period (in millions)(3) |

$ | 1,835 | $ | 1,050 | $ | 2,130 | $ | 1,701 | $ | 907 | $ | 934 | $ | 159 | $ | 48 | |||||||||||||||||||||||||||||||||||||||||||

New money yield(3)(4) |

4.51 | % | 3.04 | % | 3.41 | % | 5.16 | % | 7.56 | % | 6.90 | % | 7.45 | % | 9.41 | % | |||||||||||||||||||||||||||||||||||||||||||

Hedge Costs/Income Metrics (5)(6) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, | December 31, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2023 | 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aflac Japan: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FX hedged notional at end of period (in billions) - forwards (7) |

$ | 8.8 | $ | 6.0 | $ | 6.4 | $ | 4.1 | $ | — | $ | — | $ | — | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| FX hedged notional at end of period (in billions) - put options | 9.2 | 13.1 | 11.6 | 13.5 | 24.7 | 24.2 | 24.7 | 24.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortized hedge costs for period (in millions) | (257) | (206) | (76) | (112) | (157) | (26) | (9) | (7) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate and Other (Parent Company): | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FX hedged notional at end of period (in billions) - forwards (7) |

$ | 4.9 | $ | 5.0 | $ | 5.0 | $ | 5.0 | $ | 2.6 | $ | 1.8 | $ | 2.6 | $ | 1.8 | |||||||||||||||||||||||||||||||||||||||||||

| FX hedged notional at end of period (in billions) - put options | 2.0 | 2.0 | 1.9 | 2.6 | 0.5 | — | 0.5 | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortized hedge income (costs) for period (in millions) | 89 | 97 | 57 | 68 | 122 | 113 | 30 | 25 | |||||||||||||||||||||||||||||||||||||||||||||||||||

(1) Invested assets, including cash and short term investments, are stated at amortized cost; except for equities, which are at fair value. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Net of investment expenses and amortized hedge costs, year-to-date number reflected on a quarterly average basis |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Includes fixed maturity securities, commercial mortgage and other loans, equity securities, and excludes alternative investments in limited partnerships, and any impacts from hedging activities |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(4) Reported on a gross yield basis; excludes investment expenses, external management fees, and amortized hedge costs |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(5) See non-U.S. GAAP financial measures for definition of amortized hedge costs/income. Further, the metrics in this table are split to show the hedging of the market value of a portion of the USD investments in Japan Segment’s "USD Program" in the "Japan Segment Portfolio Allocation by Currency" table on page 13 of this supplement as well as the corporate hedging activities at Aflac Incorporated |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(6) Aflac Japan and the Parent Company utilize foreign currency forwards and options to hedge foreign currency exchange rate risk. The hedge cost/income on the table above reflects our FX forward protection of the hedged USD portfolio, and hedge costs on one sided options used as caps, and on tail-risk put options. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(7) Notional is reported net of any offsetting positions within Aflac Japan or the Parent Company, respectively. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aflac Incorporated and Subsidiaries | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Japan Segment Portfolio Allocation by Currency (1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars In Millions, U.S. GAAP Basis) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2023 | December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Amortized Cost (3) |

Fair Value |

Amortized Cost (3) |

Fair Value |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JGB | $ | 39,151 | $ | 40,222 | $ | 31,951 | $ | 32,844 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 19,517 | 20,285 | 16,867 | 17,145 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total yen denominated | 58,668 | 60,507 | 48,818 | 49,989 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD Program | 23,384 | 25,254 | 21,303 | 23,501 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 2,081 | 2,902 | 1,645 | 2,406 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US dollar denominated | 25,465 | 28,156 | 22,948 | 25,907 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 84,133 | $ | 88,663 | $ | 71,766 | $ | 75,896 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Distribution of Consolidated Fixed Maturities by Sector (2) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions) | Amortized Cost (3) |

% of Total |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Government and agencies | $ | 34,926 | 43.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Municipalities | 2,271 | 2.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage- and asset-backed securities | 3,314 | 4.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Public utilities | 6,716 | 8.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Electric | 5,354 | 6.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Natural Gas | 820 | 1.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 542 | .7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sovereign and supranational | 761 | 1.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Banks/financial institutions | 8,647 | 10.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Banking | 5,112 | 6.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Insurance | 1,780 | 2.2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 1,755 | 2.2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other corporate | 23,420 | 29.2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic Industry | 2,017 | 2.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital Goods | 2,612 | 3.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Communications | 2,521 | 3.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer Cyclical | 1,862 | 2.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer Non-Cyclical | 5,500 | 6.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Energy | 2,058 | 2.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 1,068 | 1.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Technology | 3,029 | 3.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Transportation | 2,753 | 3.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total fixed maturity securities | $ | 80,055 | 100.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) The entire U.S. segment investment portfolio is U.S. dollar denominated. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(2)In the first quarter of 2023, the Utility/Energy subsector was combined with the Natural Gas subsector to better reflect the risk characteristics of those issuers and align more closely with industry

benchmarks.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Net of reserves |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aflac Incorporated and Subsidiaries | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-Term Debt Data | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted Leverage Ratios | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In Millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Notes payable | $ | 6,569 | $ | 7,899 | $ | 7,956 | $ | 7,442 | $ | 7,364 | $ | 7,498 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 50% of subordinated debentures and perpetual bonds | (408) | (432) | (389) | (337) | (315) | (282) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-funding of debt maturities | (348) | — | — | — | (211) | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted debt (1) |

5,814 | 7,467 | 7,568 | 7,105 | 6,839 | 7,216 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Shareholders' Equity | 28,959 | 33,559 | 17,031 | 20,140 | 21,985 | 26,098 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive (income) loss: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unrealized foreign currency translation (gains) losses | 1,623 | 1,109 | 1,985 | 3,564 | 4,069 | 4,998 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unrealized (gains) losses on fixed maturity securities | (8,548) | (10,361) | (9,602) | 702 | (1,139) | (24) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unrealized (gains) losses on derivatives | 33 | 34 | 30 | 27 | 22 | 20 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Effect on change in discount rate assumptions | N/A | N/A | 15,832 | 2,100 | 2,560 | (2,006) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pension liability adjustment | 277 | 284 | 166 | 36 | 8 | (10) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted book value (1) |

22,344 | 24,625 | 25,442 | 26,569 | 27,505 | 29,076 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted capitalization ex-AOCI(1)(2) |

$ | 28,565 | $ | 32,524 | $ | 33,398 | $ | 34,011 | $ | 34,658 | $ | 36,574 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||