Delaware |

001-07882 |

94-1692300 |

||||||||||||

|

(State of

Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification Number)

|

||||||||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

||||

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||||||

Common Stock, $0.01 par value |

AMD |

The Nasdaq Global Select Market |

||||||

| EXHIBIT INDEX | ||||||||

Exhibit No. |

Description |

|||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Inline XBRL for the cover page of this Current Report on Form 8-K | |||||||

| Date: May 2, 2023 | ADVANCED MICRO DEVICES, INC. |

||||||||||

By: |

/s/ Jean Hu |

||||||||||

Name: |

Jean Hu |

||||||||||

Title: |

Executive Vice President, Chief Financial Officer & Treasurer |

||||||||||

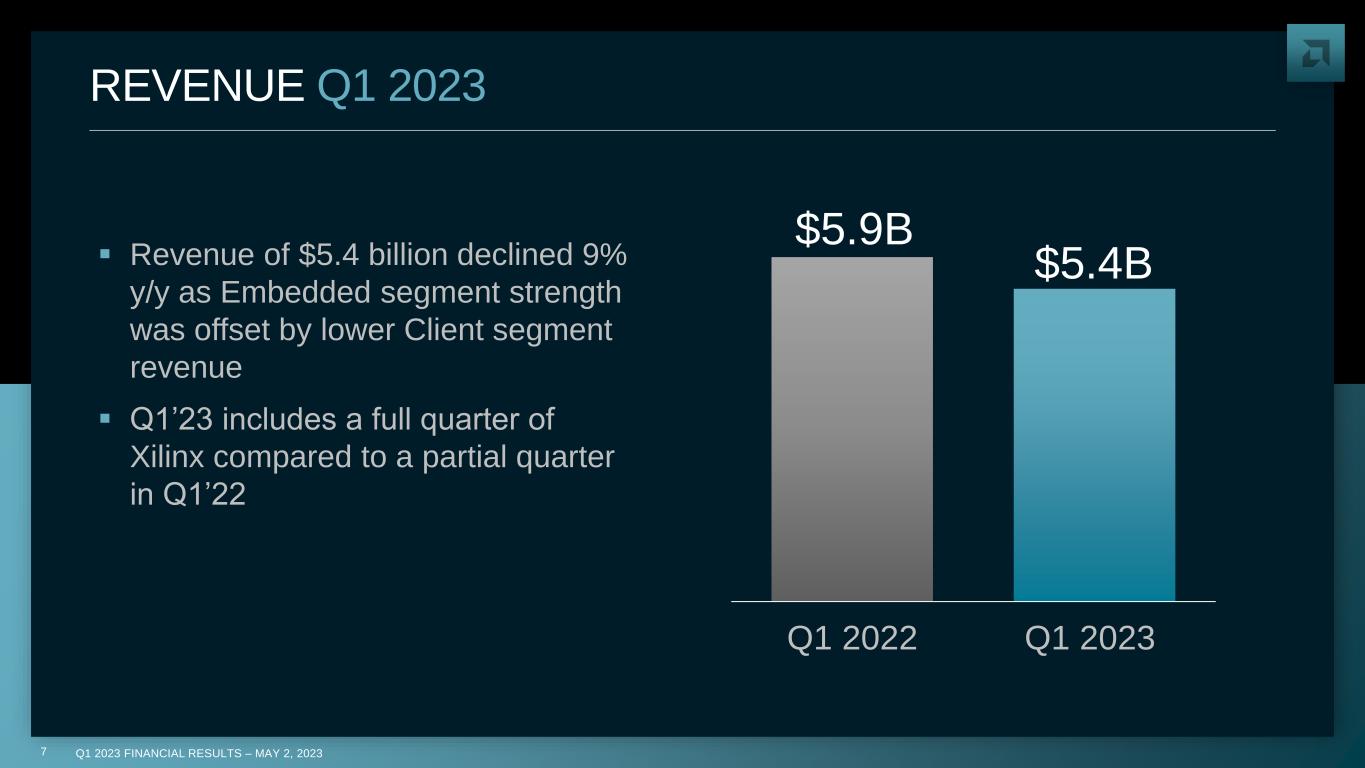

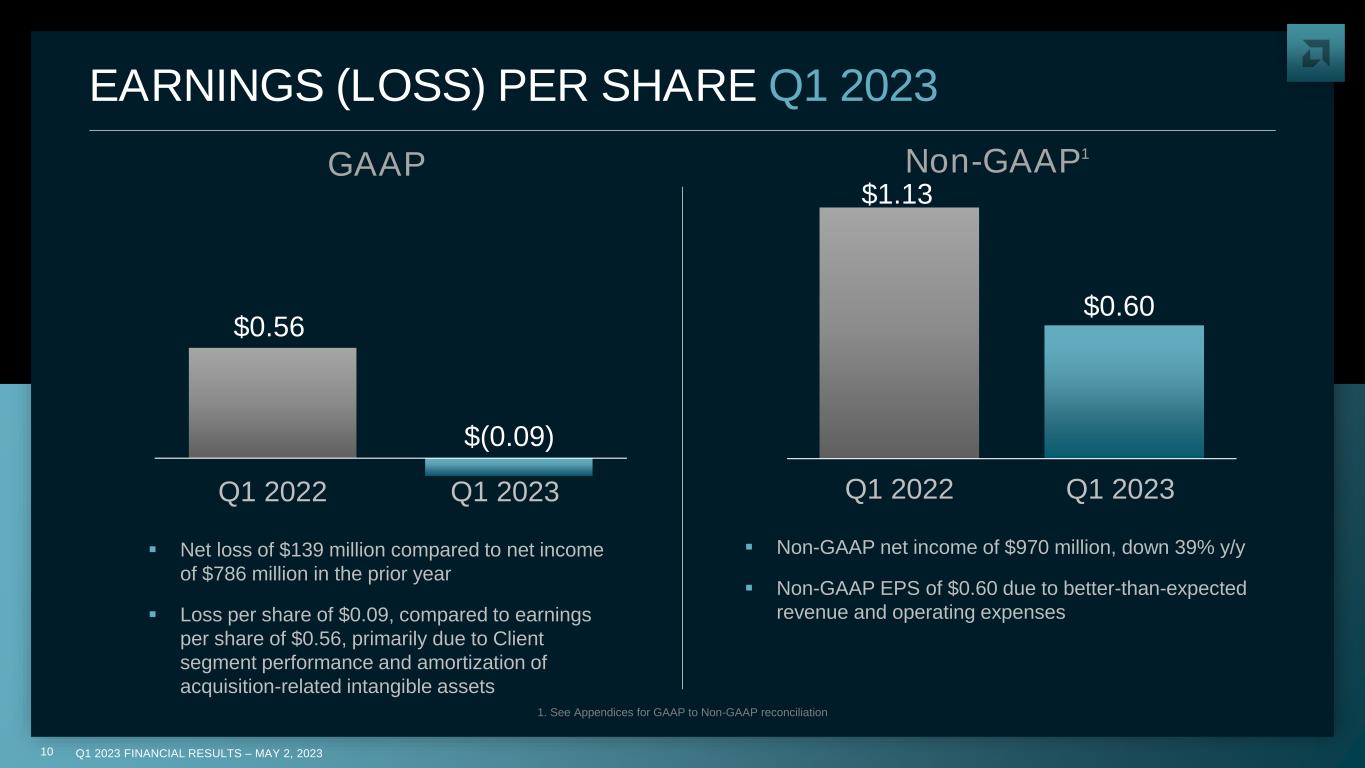

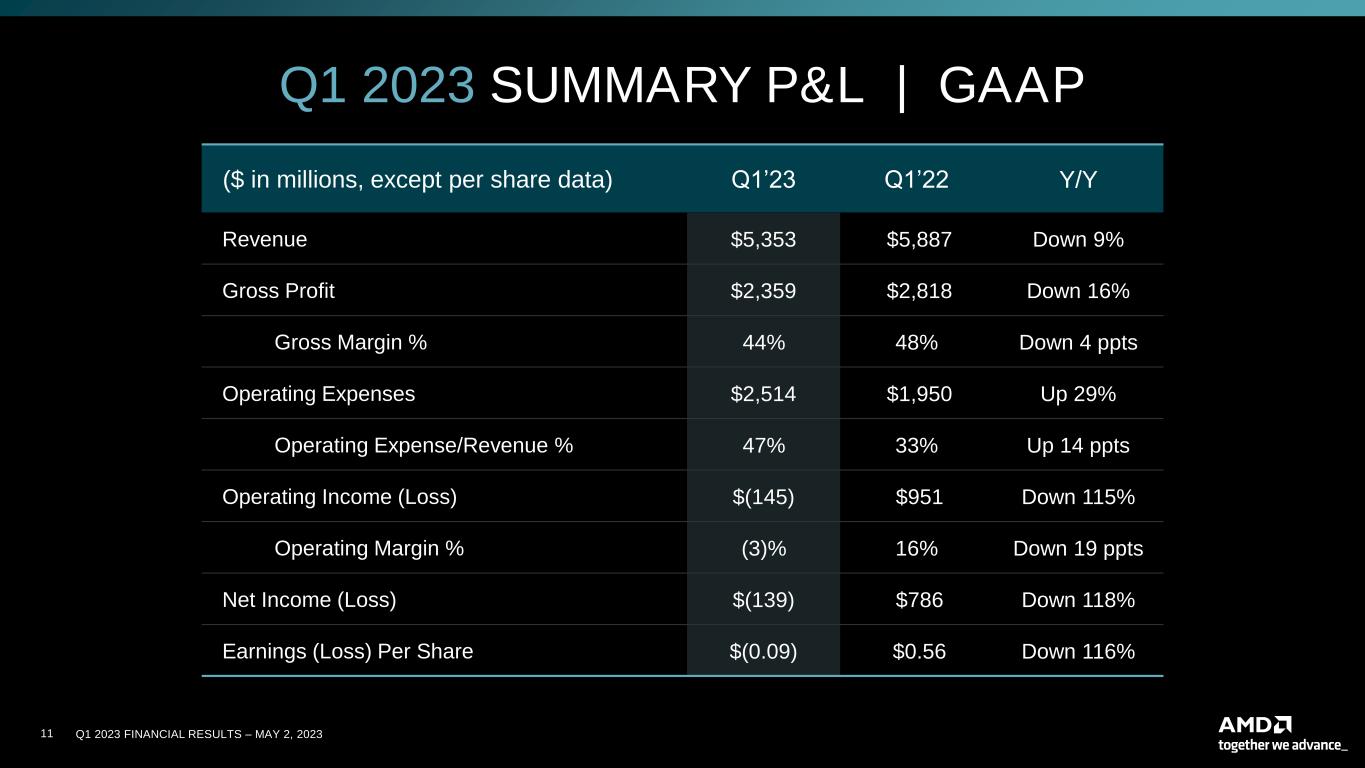

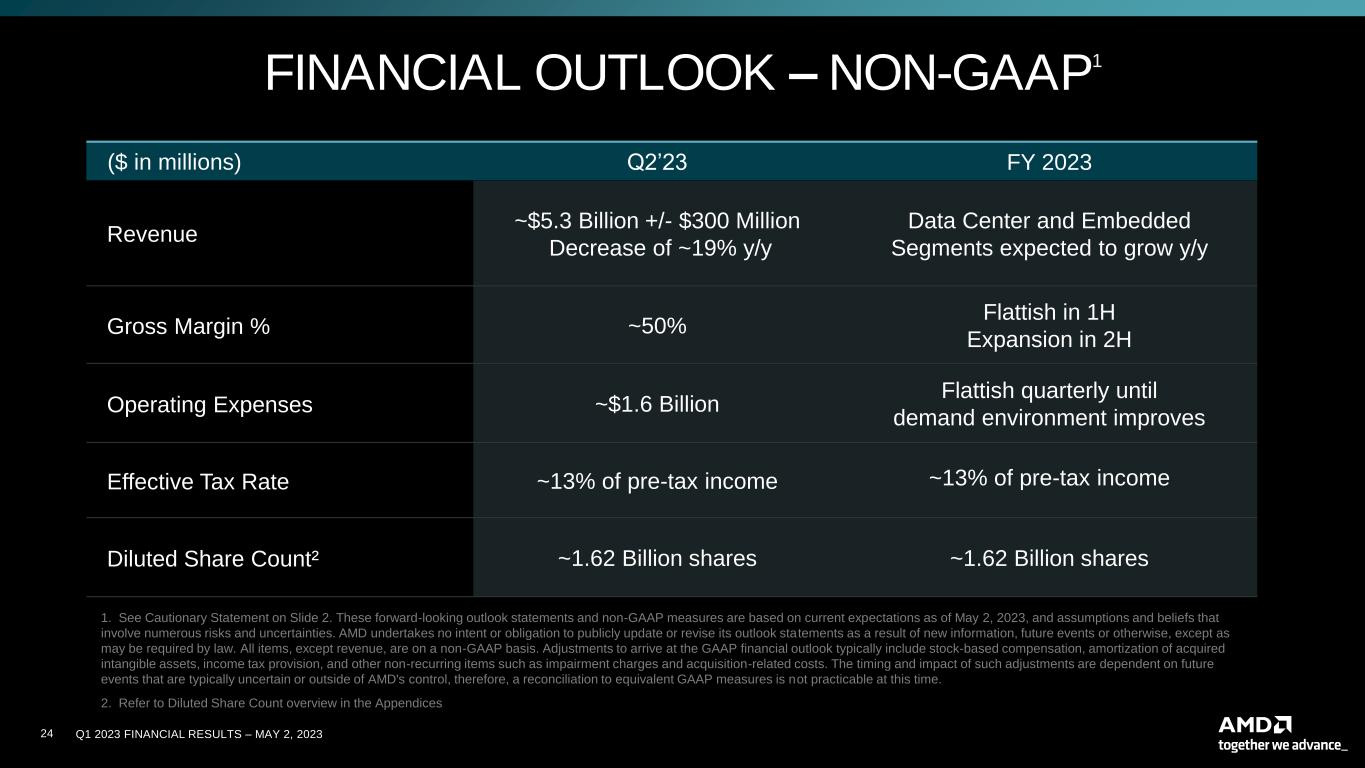

| Q1 2023 | Q1 2022 | Y/Y | |||||||||

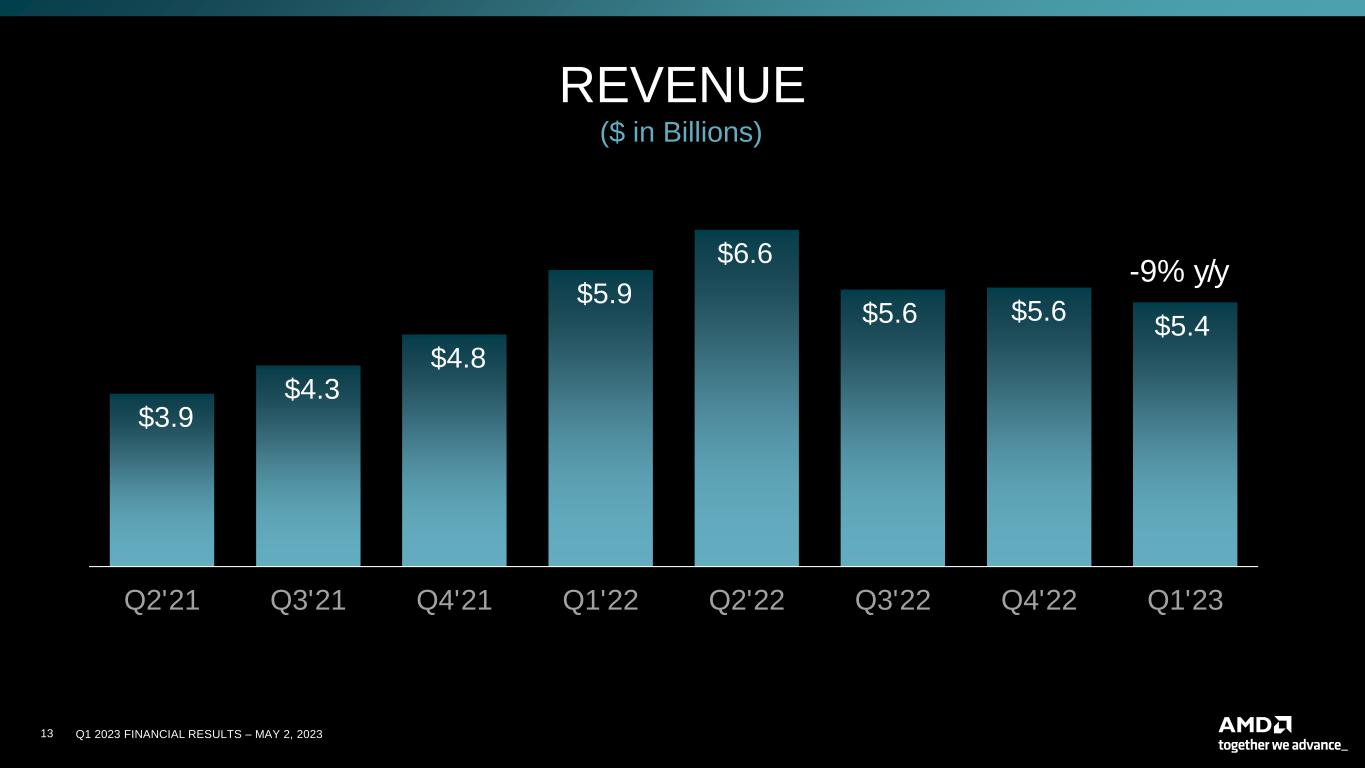

| Revenue ($M) | $5,353 | $5,887 | Down 9% | ||||||||

| Gross profit ($M) | $2,359 | $2,818 | Down 16% | ||||||||

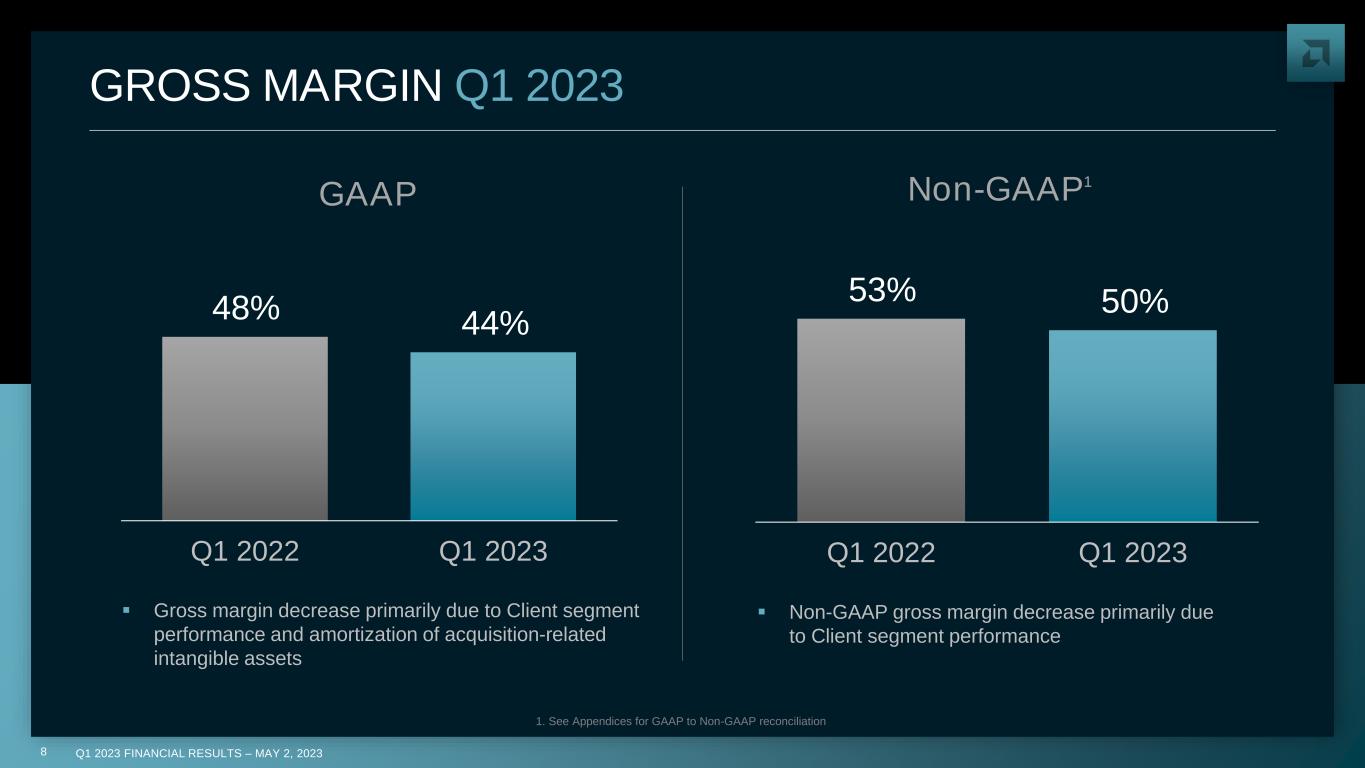

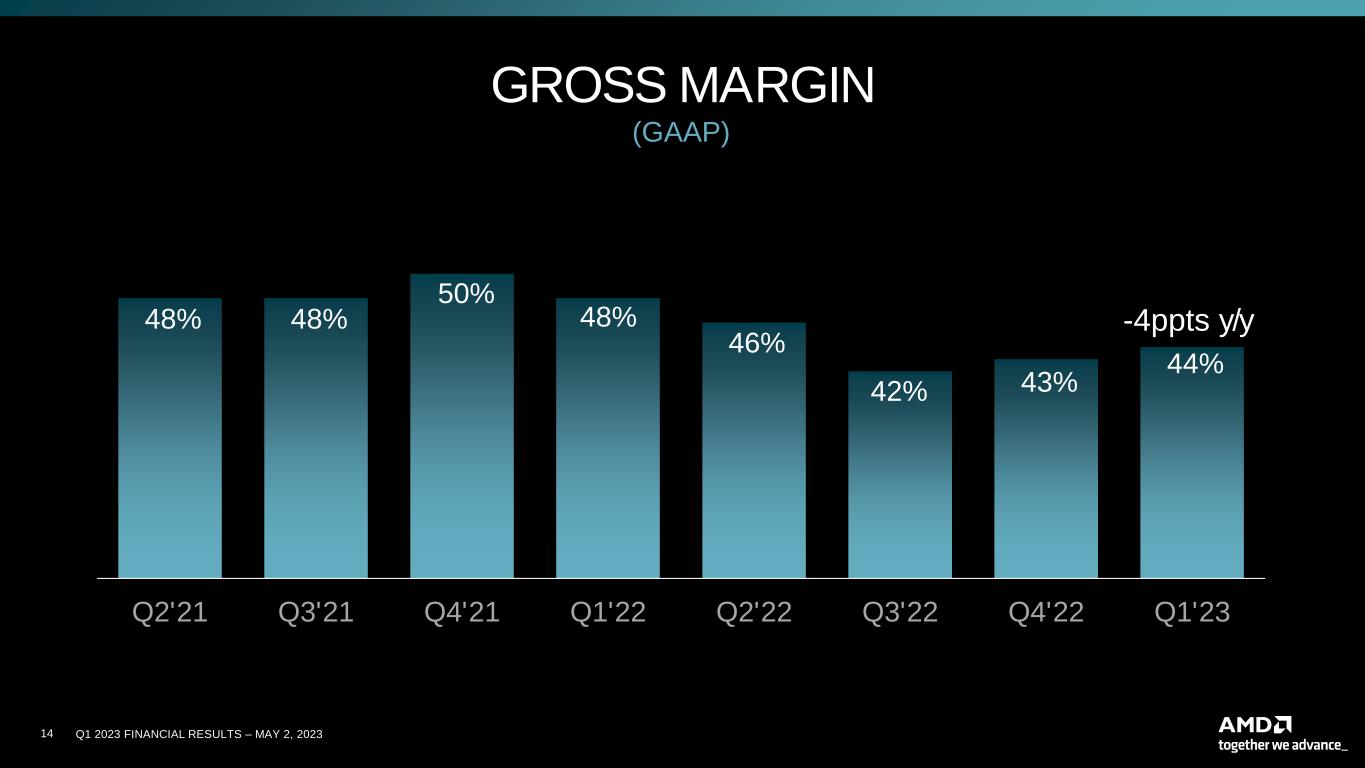

| Gross margin % | 44% | 48% | Down 4 ppts | ||||||||

| Operating expenses ($M) | $2,514 | $1,950 | Up 29% | ||||||||

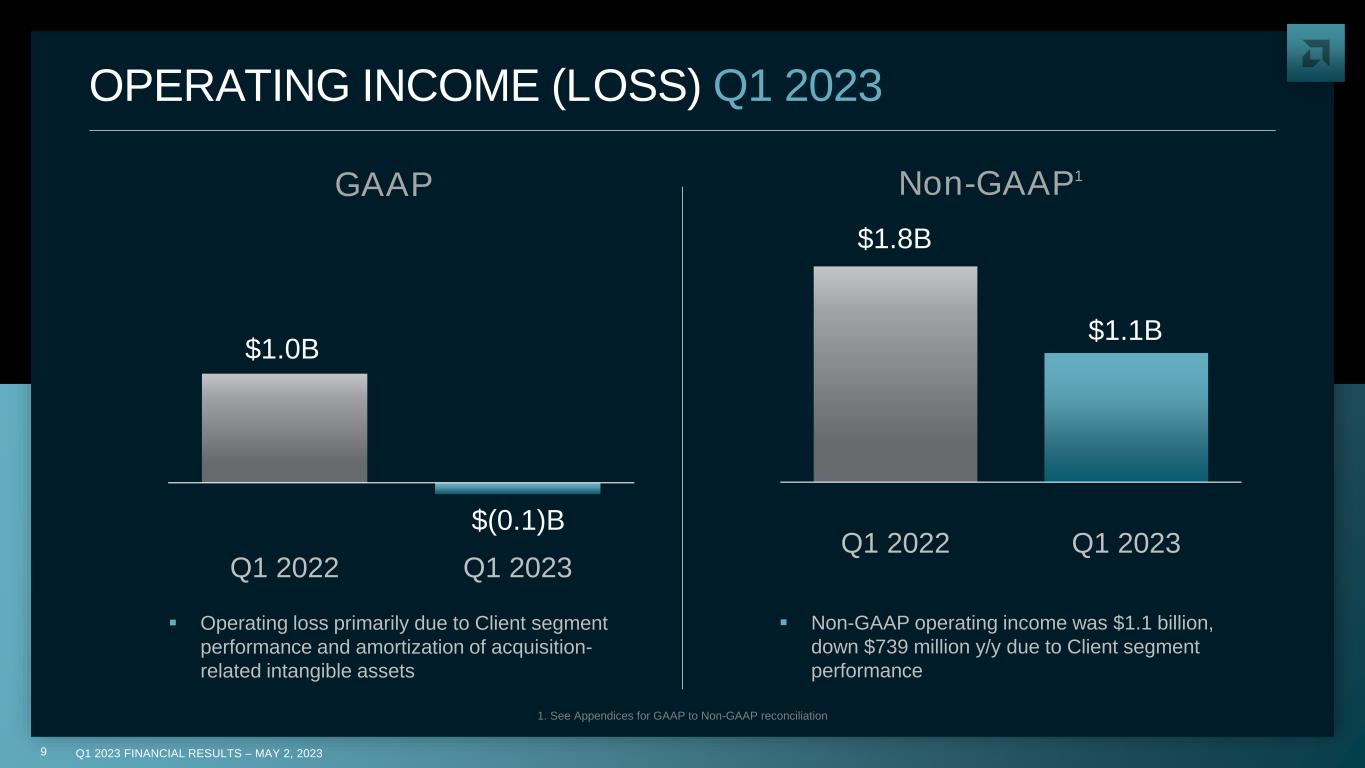

| Operating income (loss) ($M) | $(145) | $951 | Down 115% | ||||||||

| Operating margin % | (3)% | 16% | Down 19 ppts | ||||||||

| Net income (loss) ($M) | $(139) | $786 | Down 118% | ||||||||

| Earnings (loss) per share | $(0.09) | $0.56 | Down 116% | ||||||||

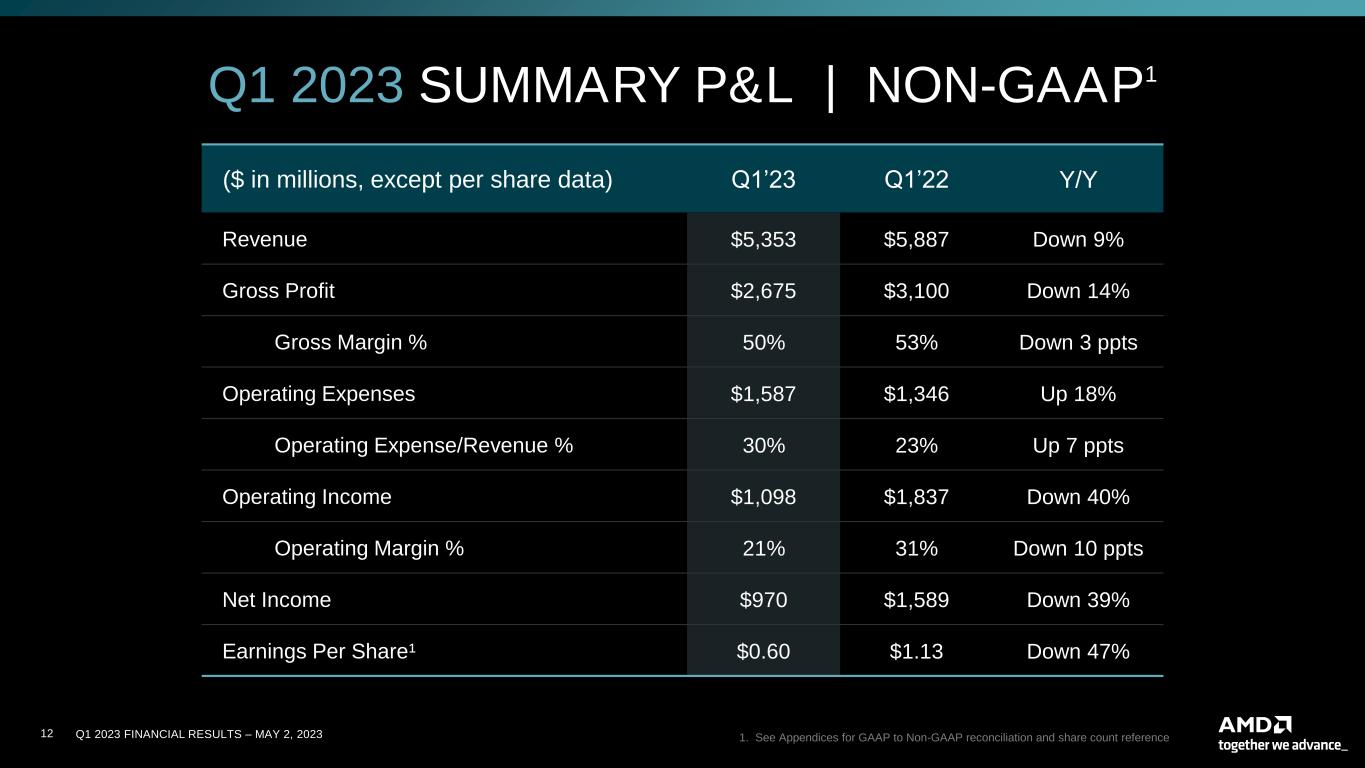

| Q1 2023 | Q1 2022 | Y/Y | |||||||||

| Revenue ($M) | $5,353 | $5,887 | Down 9% | ||||||||

| Gross profit ($M) | $2,675 | $3,100 | Down 14% | ||||||||

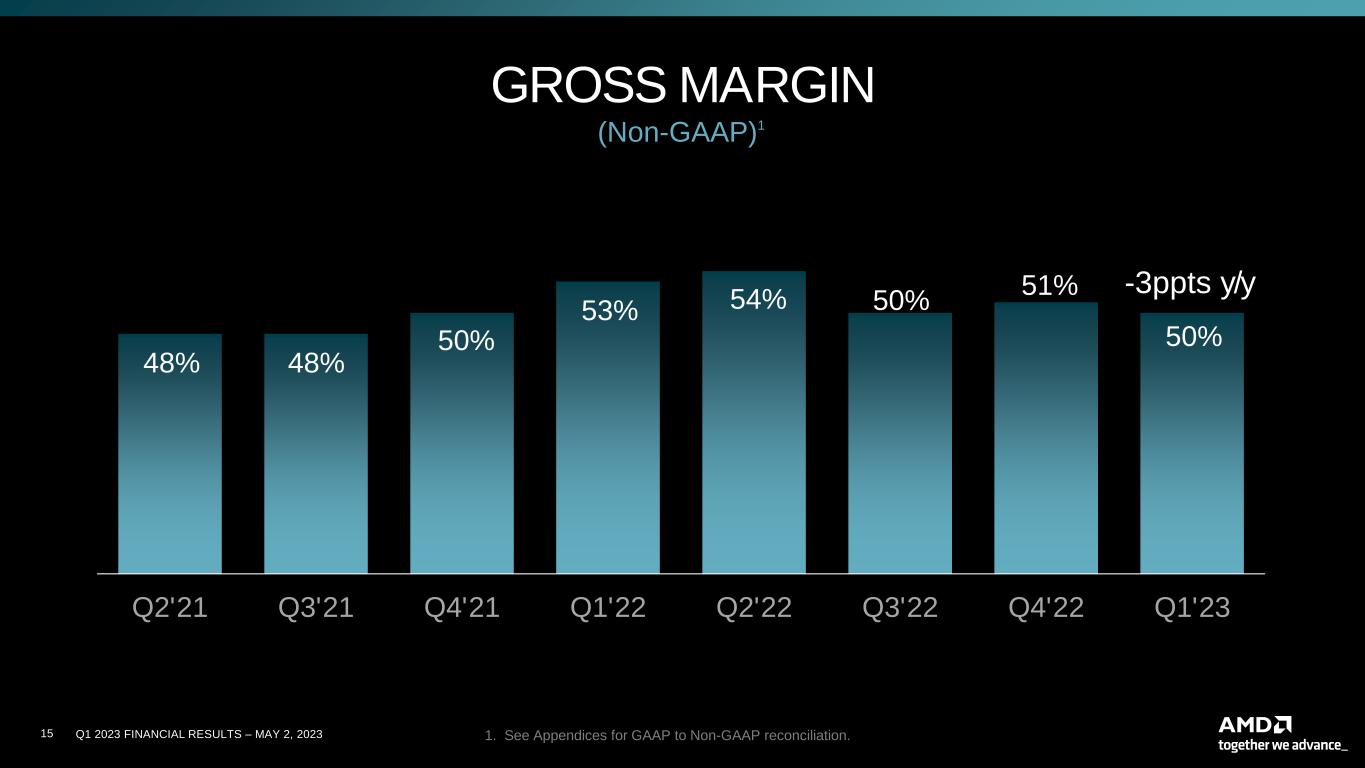

| Gross margin % | 50% | 53% | Down 3 ppts | ||||||||

| Operating expenses ($M) | $1,587 | $1,346 | Up 18% | ||||||||

| Operating income ($M) | $1,098 | $1,837 | Down 40% | ||||||||

| Operating margin % | 21% | 31% | Down 10 ppts | ||||||||

| Net income ($M) | $970 | $1,589 | Down 39% | ||||||||

| Earnings per share | $0.60 | $1.13 | Down 47% | ||||||||

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES | |||||||||||||||||

(in millions, except per share data) (Unaudited) |

|||||||||||||||||

| Three Months Ended | |||||||||||||||||

| April 1, 2023 |

March 26, 2022 |

||||||||||||||||

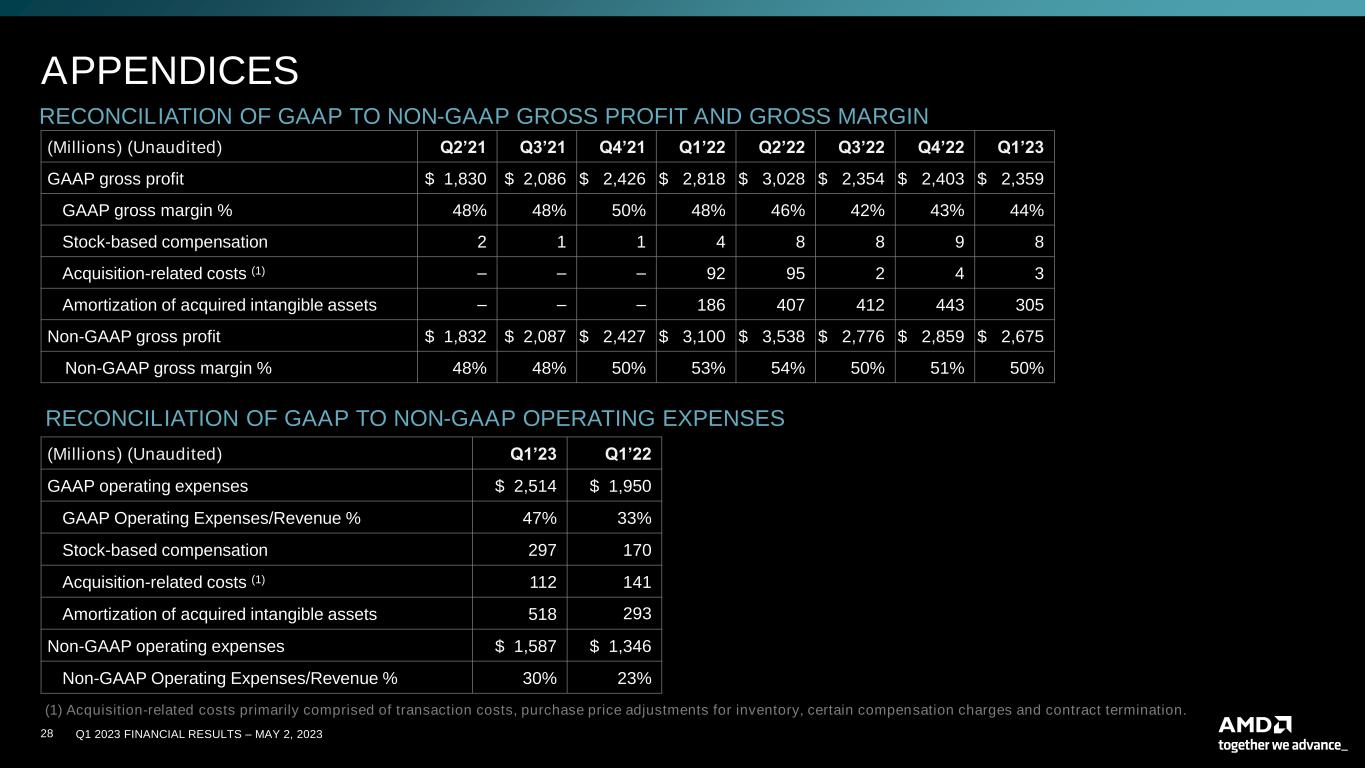

| GAAP gross profit | $ | 2,359 | $ | 2,818 | |||||||||||||

| GAAP gross margin % | 44 | % | 48 | % | |||||||||||||

| Stock-based compensation | 8 | 4 | |||||||||||||||

Acquisition-related costs (1) |

3 | 92 | |||||||||||||||

| Amortization of acquired intangible assets | 305 | 186 | |||||||||||||||

| Non-GAAP gross profit | $ | 2,675 | $ | 3,100 | |||||||||||||

| Non-GAAP gross margin % | 50 | % | 53 | % | |||||||||||||

| GAAP operating expenses | $ | 2,514 | $ | 1,950 | |||||||||||||

| GAAP operating expenses/revenue % | 47 | % | 33 | % | |||||||||||||

| Stock-based compensation | 297 | 170 | |||||||||||||||

Acquisition-related costs (1) |

112 | 141 | |||||||||||||||

| Amortization of acquired intangible assets | 518 | 293 | |||||||||||||||

| Non-GAAP operating expenses | $ | 1,587 | $ | 1,346 | |||||||||||||

| Non-GAAP operating expenses/revenue % | 30 | % | 23 | % | |||||||||||||

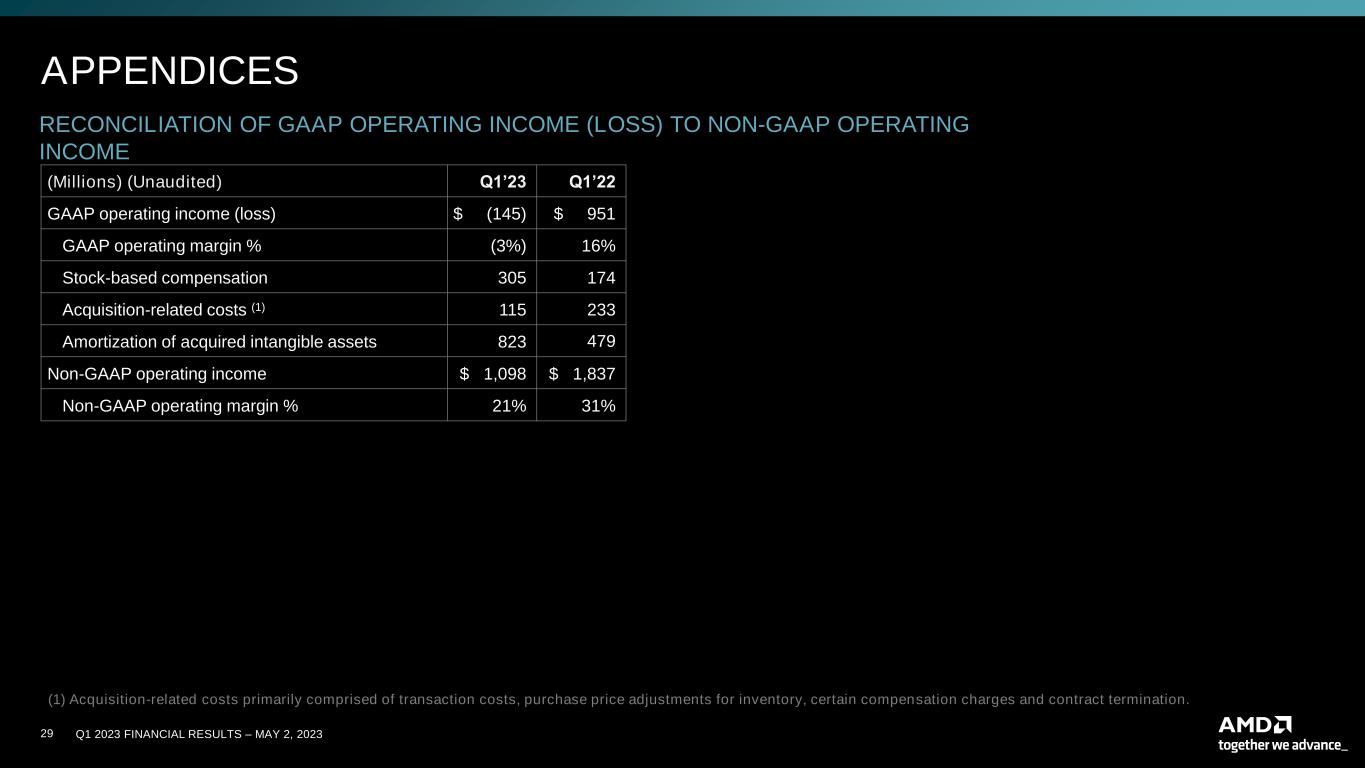

| GAAP operating income (loss) | $ | (145) | $ | 951 | |||||||||||||

| GAAP operating margin % | (3) | % | 16 | % | |||||||||||||

| Stock-based compensation | 305 | 174 | |||||||||||||||

Acquisition-related costs (1) |

115 | 233 | |||||||||||||||

| Amortization of acquired intangible assets | 823 | 479 | |||||||||||||||

| Non-GAAP operating income | $ | 1,098 | $ | 1,837 | |||||||||||||

| Non-GAAP operating margin % | 21 | % | 31 | % | |||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| April 1, 2023 |

March 26, 2022 |

||||||||||||||||||||||||||||

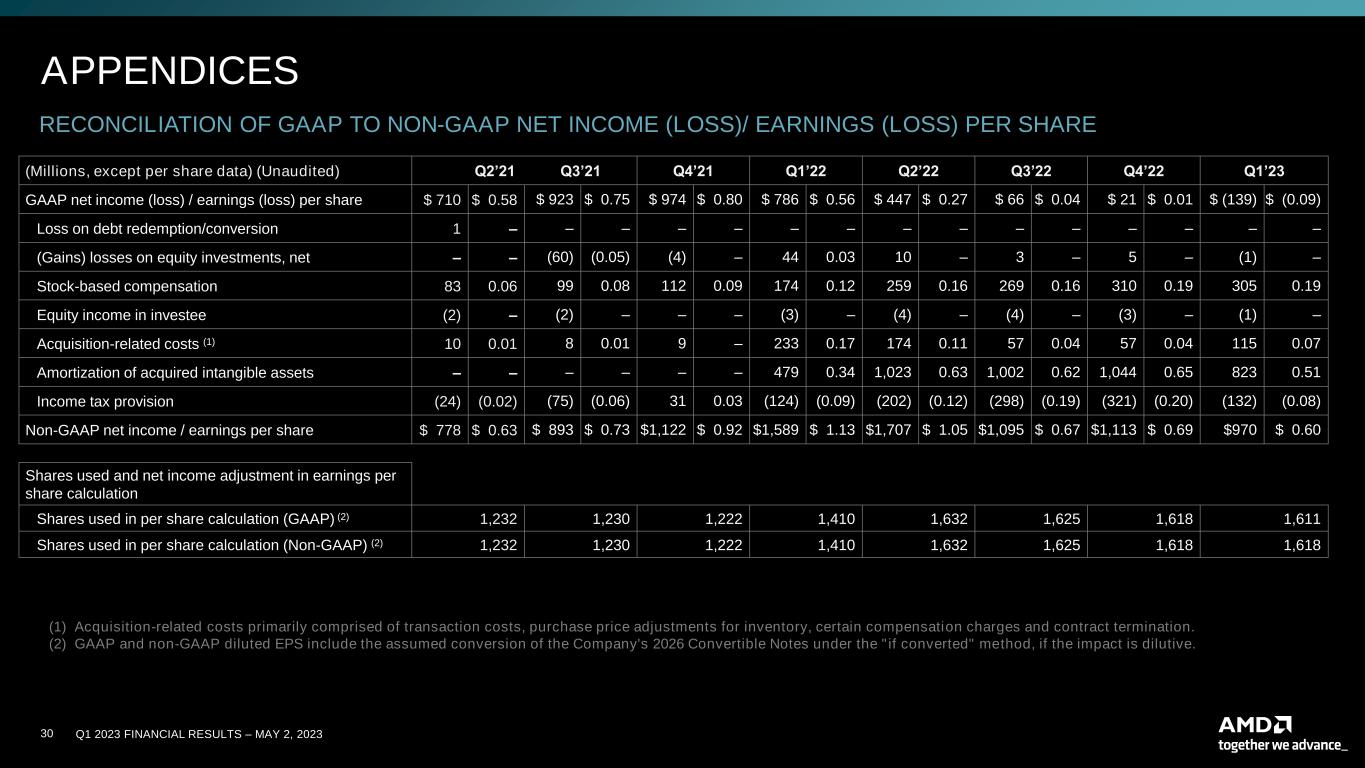

| GAAP net income (loss) / earnings (loss) per share | $ | (139) | $ | (0.09) | $ | 786 | $ | 0.56 | |||||||||||||||||||||

| (Gains) losses on equity investments, net | (1) | — | 44 | 0.03 | |||||||||||||||||||||||||

| Stock-based compensation | 305 | 0.19 | 174 | 0.12 | |||||||||||||||||||||||||

| Equity income in investee | (1) | — | (3) | — | |||||||||||||||||||||||||

Acquisition-related costs (1) |

115 | 0.07 | 233 | 0.17 | |||||||||||||||||||||||||

| Amortization of acquired intangible assets | 823 | 0.51 | 479 | 0.34 | |||||||||||||||||||||||||

| Income tax provision | (132) | (0.08) | (124) | (0.09) | |||||||||||||||||||||||||

| Non-GAAP net income / earnings per share | 970 | 0.60 | 1,589 | 1.13 | |||||||||||||||||||||||||

| (1) | Acquisition-related costs primarily comprised of transaction costs, purchase price adjustments for inventory, certain compensation charges and contract termination. | ||||||||||||||||||||||||||||||||||||||||

| (*) | In this earnings press release, in addition to GAAP financial results, AMD has provided non-GAAP financial measures including non-GAAP gross profit, non-GAAP operating expenses, non-GAAP operating income, non-GAAP net income, non-GAAP diluted earnings per share. AMD uses a normalized tax rate in its computation of the non-GAAP income tax provision to provide better consistency across the reporting periods. For fiscal 2023, AMD uses a projected non-GAAP tax rate of 13%, which excludes the tax impact of pre-tax non-GAAP adjustments, reflecting currently available information. AMD also provided adjusted EBITDA and free cash flow as supplemental non-GAAP measures of its performance. These items are defined in the footnotes to the selected corporate data tables provided at the end of this earnings press release. AMD is providing these financial measures because it believes this non-GAAP presentation makes it easier for investors to compare its operating results for current and historical periods and also because AMD believes it assists investors in comparing AMD’s performance across reporting periods on a consistent basis by excluding items that it does not believe are indicative of its core operating performance and for the other reasons described in the footnotes to the selected data tables. The non-GAAP financial measures disclosed in this earnings press release should be viewed in addition to and not as a substitute for or superior to AMD’s reported results prepared in accordance with GAAP and should be read only in conjunction with AMD’s Consolidated Financial Statements prepared in accordance with GAAP. These non GAAP financial measures referenced are reconciled to their most directly comparable GAAP financial measures in the data tables in this earnings press release. This earnings press release also contains forward-looking non-GAAP gross margin concerning AMD’s financial outlook, which is based on current expectations as of May 2, 2023 and assumptions and beliefs that involve numerous risks and uncertainties. Adjustments to arrive at the GAAP gross margin outlook typically include stock-based compensation, amortization of acquired intangible assets and acquisition-related costs. The timing and impact of such adjustments are dependent on future events that are typically uncertain or outside of AMD's control, therefore, a reconciliation to equivalent GAAP measures is not practicable at this time. AMD undertakes no intent or obligation to publicly update or revise its outlook statements as a result of new information, future events or otherwise, except as may be required by law. |

|||||||

| Three Months Ended | |||||||||||||||||

| April 1, 2023 |

March 26, 2022 |

||||||||||||||||

| Net revenue | $ | 5,353 | $ | 5,887 | |||||||||||||

| Cost of sales | 2,689 | 2,883 | |||||||||||||||

| Amortization of acquisition-related intangibles | 305 | 186 | |||||||||||||||

| Total cost of sales | 2,994 | 3,069 | |||||||||||||||

| Gross profit | 2,359 | 2,818 | |||||||||||||||

| Gross margin % | 44 | % | 48 | % | |||||||||||||

| Research and development | 1,411 | 1,060 | |||||||||||||||

| Marketing, general and administrative | 585 | 597 | |||||||||||||||

| Amortization of acquisition-related intangibles | 518 | 293 | |||||||||||||||

| Licensing gain | (10) | (83) | |||||||||||||||

| Operating income (loss) | (145) | 951 | |||||||||||||||

| Interest expense | (25) | (13) | |||||||||||||||

| Other income (expense), net | 43 | (42) | |||||||||||||||

| Income (loss) before income taxes and equity income | (127) | 896 | |||||||||||||||

| Income tax provision | 13 | 113 | |||||||||||||||

| Equity income in investee | 1 | 3 | |||||||||||||||

| Net income (loss) | $ | (139) | $ | 786 | |||||||||||||

| Earnings (loss) per share | |||||||||||||||||

| Basic | $ | (0.09) | $ | 0.56 | |||||||||||||

| Diluted | $ | (0.09) | $ | 0.56 | |||||||||||||

| Shares used in per share calculation | |||||||||||||||||

| Basic | 1,611 | 1,393 | |||||||||||||||

| Diluted | 1,611 | 1,410 | |||||||||||||||

| April 1, 2023 |

December 31, 2022 |

|||||||||||||

| (Unaudited) | ||||||||||||||

| ASSETS | ||||||||||||||

| Current assets: | ||||||||||||||

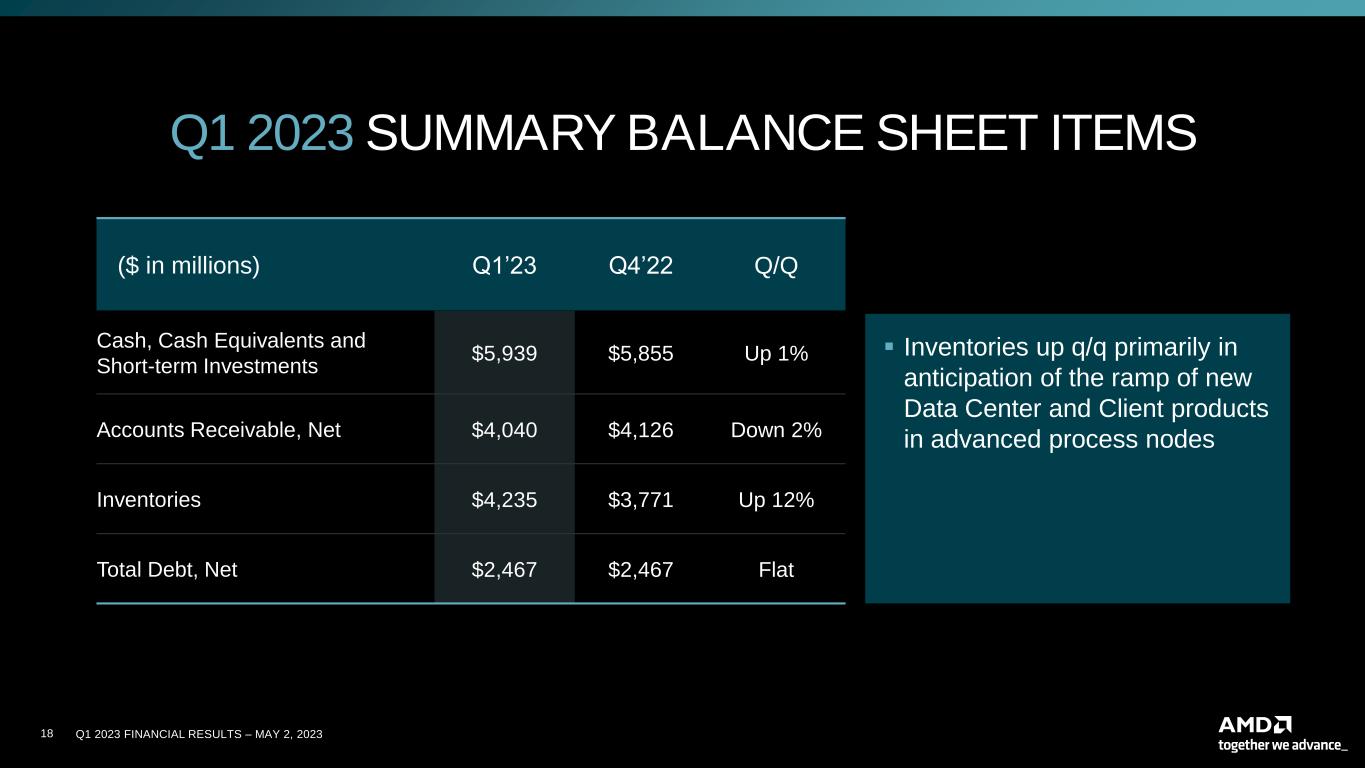

| Cash and cash equivalents | $ | 3,825 | $ | 4,835 | ||||||||||

| Short-term investments | 2,114 | 1,020 | ||||||||||||

| Accounts receivable, net | 4,040 | 4,126 | ||||||||||||

| Inventories | 4,235 | 3,771 | ||||||||||||

| Receivables from related parties | 2 | 2 | ||||||||||||

| Prepaid expenses and other current assets | 1,442 | 1,265 | ||||||||||||

| Total current assets | 15,658 | 15,019 | ||||||||||||

| Property and equipment, net | 1,500 | 1,513 | ||||||||||||

| Operating lease right-of use assets | 447 | 460 | ||||||||||||

| Goodwill | 24,177 | 24,177 | ||||||||||||

| Acquisition-related intangibles, net | 23,291 | 24,118 | ||||||||||||

| Investment: equity method | 84 | 83 | ||||||||||||

| Deferred tax assets | 67 | 58 | ||||||||||||

| Other non-current assets | 2,410 | 2,152 | ||||||||||||

| Total Assets | $ | 67,634 | $ | 67,580 | ||||||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Accounts payable | $ | 2,518 | $ | 2,493 | ||||||||||

| Payables to related parties | 353 | 463 | ||||||||||||

| Accrued liabilities | 3,167 | 3,077 | ||||||||||||

| Other current liabilities | 539 | 336 | ||||||||||||

| Total current liabilities | 6,577 | 6,369 | ||||||||||||

| Long-term debt | 2,467 | 2,467 | ||||||||||||

| Long-term operating lease liabilities | 381 | 396 | ||||||||||||

| Deferred tax liabilities | 1,641 | 1,934 | ||||||||||||

| Other long-term liabilities | 1,874 | 1,664 | ||||||||||||

| Stockholders' equity: | ||||||||||||||

| Capital stock: | ||||||||||||||

| Common stock, par value | 16 | 16 | ||||||||||||

| Additional paid-in capital | 58,331 | 58,005 | ||||||||||||

| Treasury stock, at cost | (3,362) | (3,099) | ||||||||||||

| Accumulated deficit | (270) | (131) | ||||||||||||

| Accumulated other comprehensive loss | (21) | (41) | ||||||||||||

| Total stockholders' equity | $ | 54,694 | $ | 54,750 | ||||||||||

| Total Liabilities and Stockholders' Equity | $ | 67,634 | $ | 67,580 | ||||||||||

| Three Months Ended | ||||||||||||||||||||

| April 1, 2023 |

March 26, 2022 |

|||||||||||||||||||

| Net cash provided by (used in) | ||||||||||||||||||||

| Operating activities | $ | 486 | $ | 995 | ||||||||||||||||

| Investing activities | $ | (1,237) | $ | 3,158 | ||||||||||||||||

| Financing activities | $ | (259) | $ | (1,948) | ||||||||||||||||

| Three Months Ended | |||||||||||||||||

| April 1, 2023 |

March 26, 2022 | ||||||||||||||||

Segment and Category Information(1) |

|||||||||||||||||

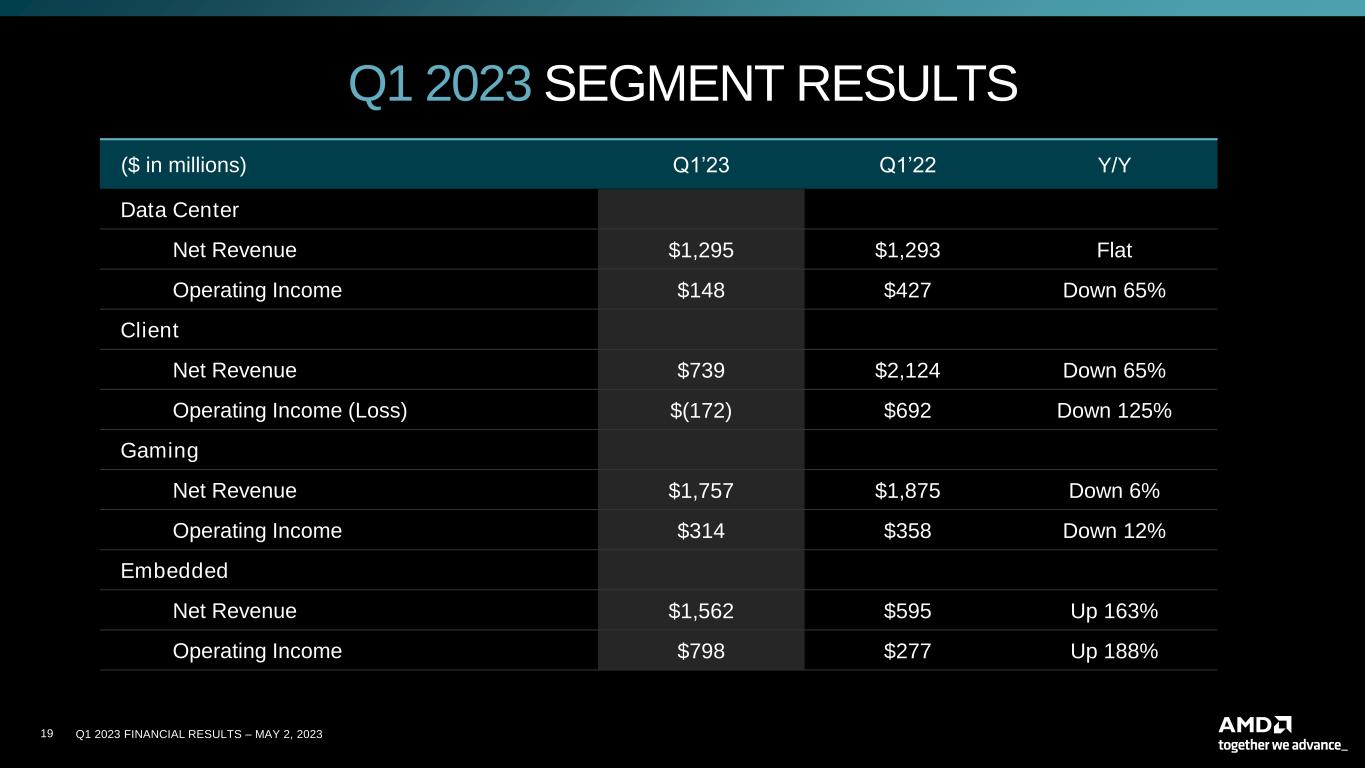

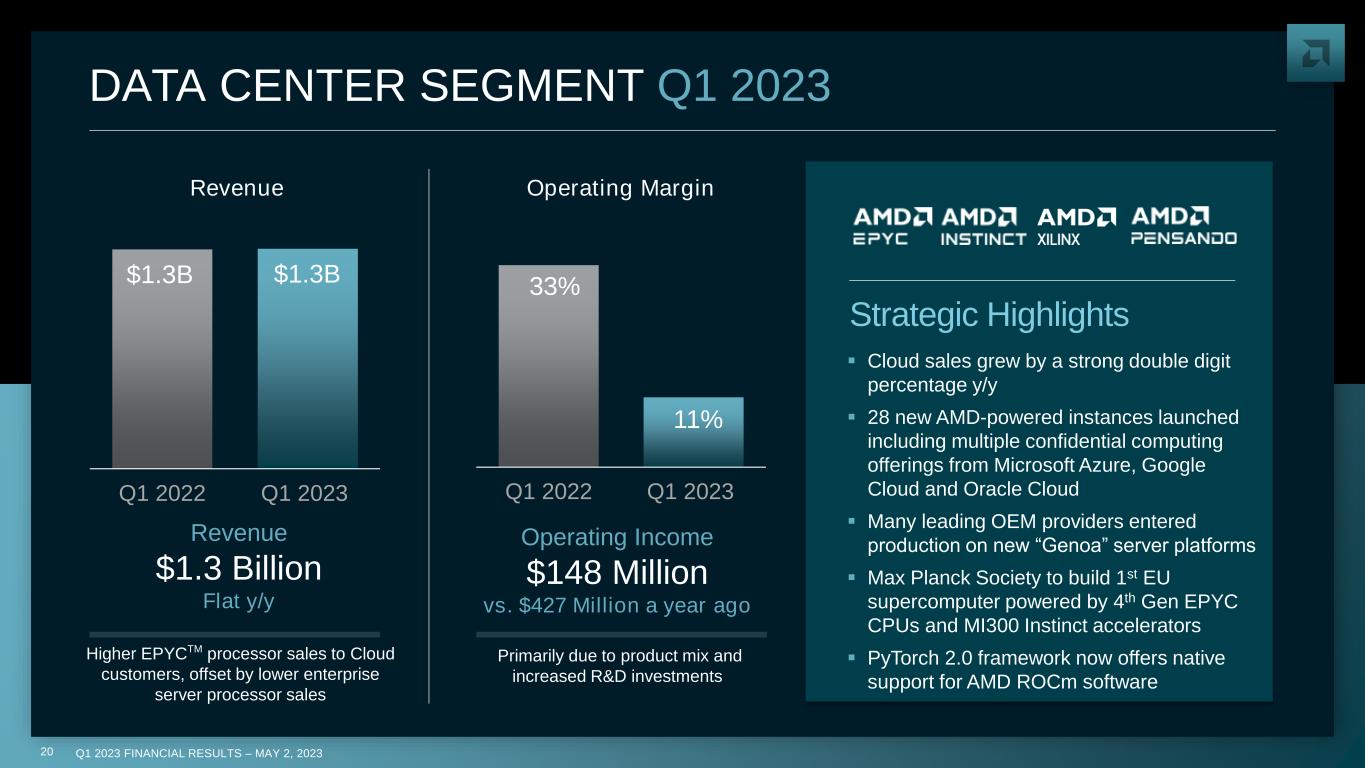

| Data Center | |||||||||||||||||

| Net revenue | $ | 1,295 | $ | 1,293 | |||||||||||||

| Operating income | $ | 148 | $ | 427 | |||||||||||||

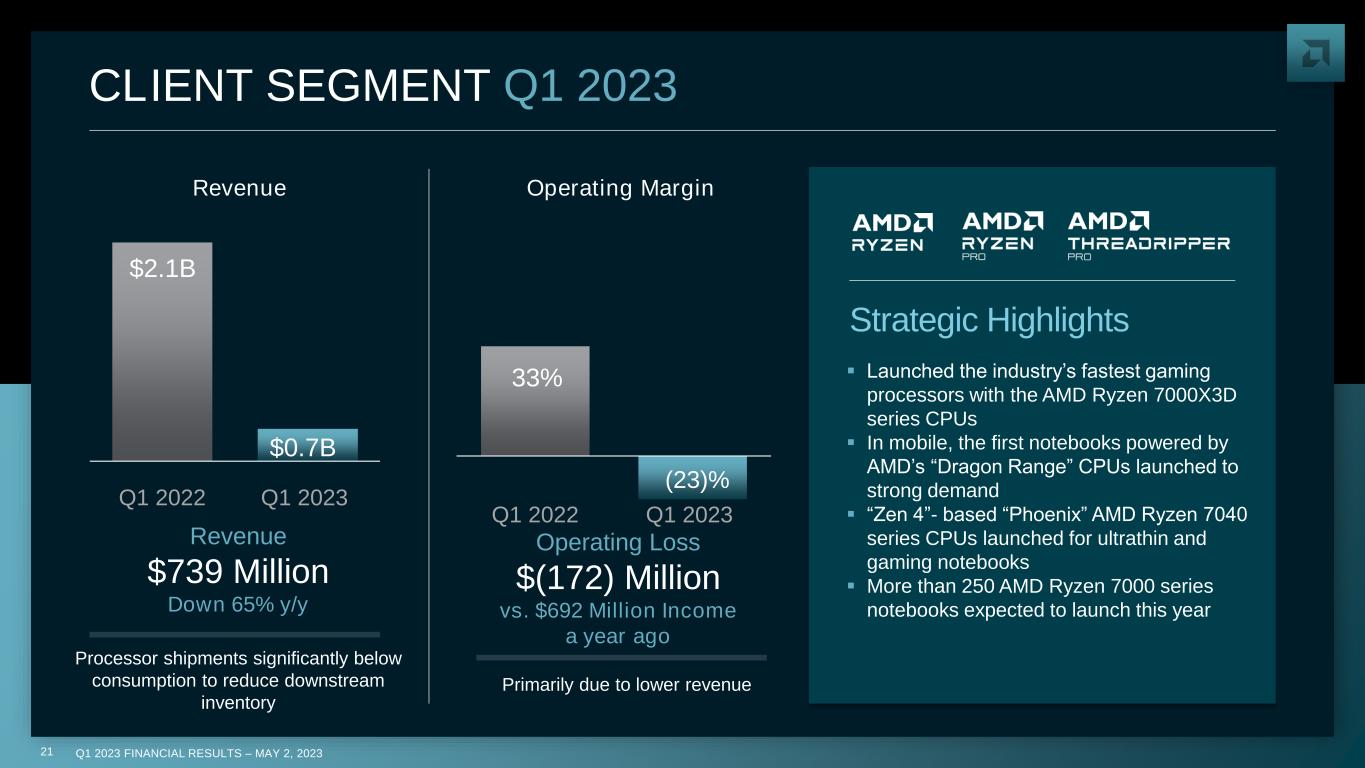

| Client | |||||||||||||||||

| Net revenue | $ | 739 | $ | 2,124 | |||||||||||||

| Operating income (loss) | $ | (172) | $ | 692 | |||||||||||||

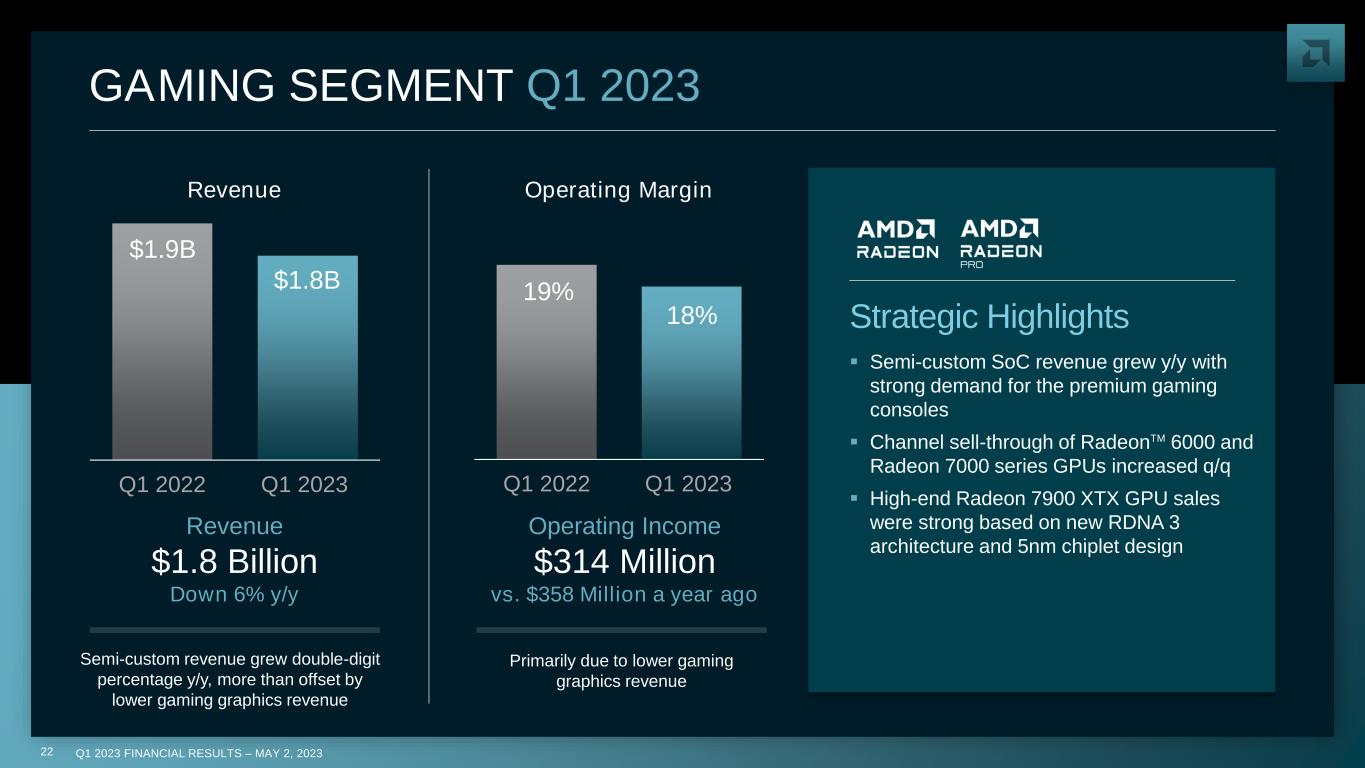

| Gaming | |||||||||||||||||

| Net revenue | $ | 1,757 | $ | 1,875 | |||||||||||||

| Operating income | $ | 314 | $ | 358 | |||||||||||||

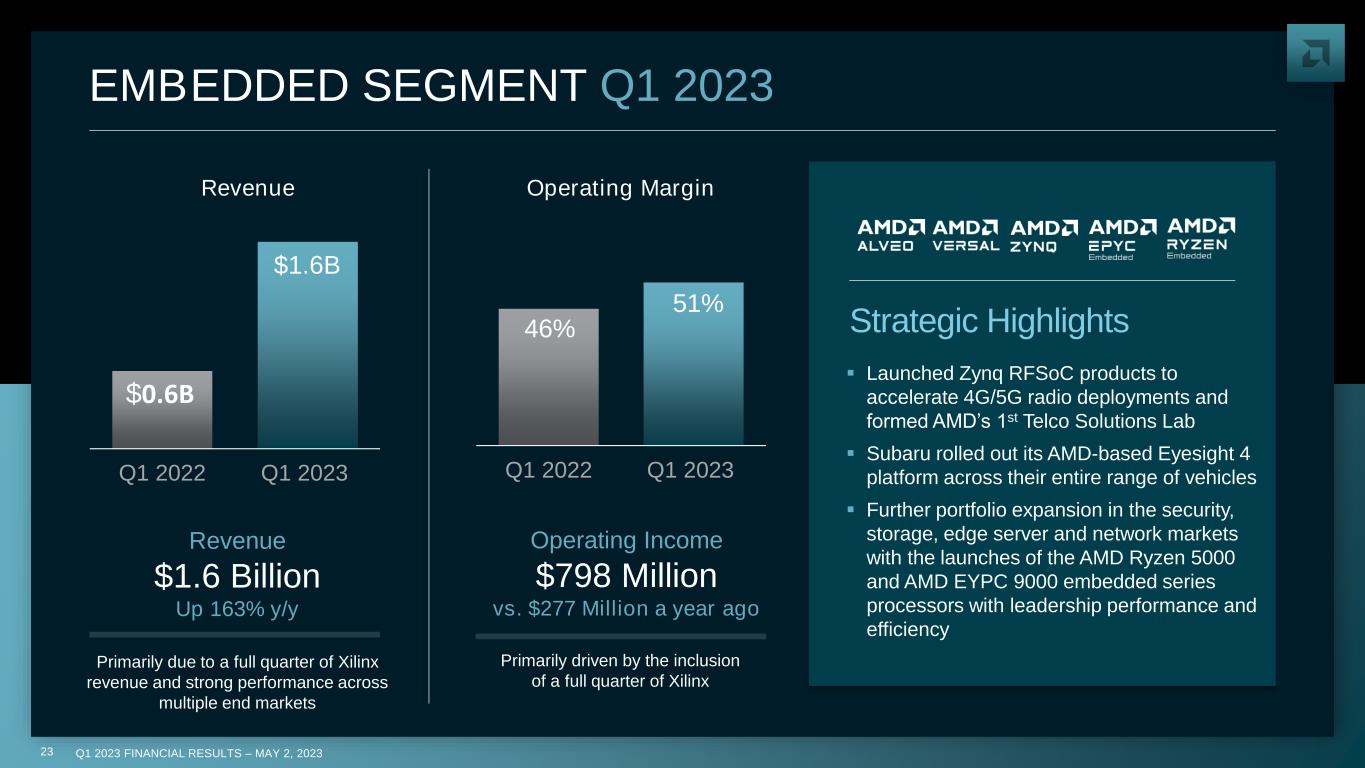

| Embedded | |||||||||||||||||

| Net revenue | $ | 1,562 | $ | 595 | |||||||||||||

| Operating income | $ | 798 | $ | 277 | |||||||||||||

| All Other | |||||||||||||||||

| Net revenue | $ | — | $ | — | |||||||||||||

| Operating loss | $ | (1,233) | $ | (803) | |||||||||||||

| Total | |||||||||||||||||

| Net revenue | $ | 5,353 | $ | 5,887 | |||||||||||||

| Operating income (loss) | $ | (145) | $ | 951 | |||||||||||||

| (Blank) | |||||||||||||||||

| Other Data | |||||||||||||||||

| Capital expenditures | $ | 158 | $ | 71 | |||||||||||||

Adjusted EBITDA (2) |

$ | 1,257 | $ | 1,967 | |||||||||||||

| Cash, cash equivalents and short-term investments | $ | 5,939 | $ | 6,532 | |||||||||||||

Free cash flow (3) |

$ | 328 | $ | 924 | |||||||||||||

| Total assets | $ | 67,634 | $ | 66,915 | |||||||||||||

| Total debt | $ | 2,467 | $ | 1,787 | |||||||||||||

| (1) | The Data Center segment primarily includes server microprocessors (CPUs) and graphics processing units (GPUs), data processing units (DPUs), Field Programmable Gate Arrays (FPGAs) and Adaptive System-on-Chip (SoC) products for data centers. | |||||||||||||||||||||||||

| The Client segment primarily includes CPUs, accelerated processing units that integrate microprocessors and GPUs (APUs), and chipsets for desktop and notebook personal computers. | ||||||||||||||||||||||||||

| The Gaming segment primarily includes discrete GPUs, semi-custom SoC products and development services. | ||||||||||||||||||||||||||

| The Embedded segment primarily includes embedded CPUs and GPUs, FPGAs, and Adaptive SoC products. | ||||||||||||||||||||||||||

| From time to time, the Company may also sell or license portions of its IP portfolio. | ||||||||||||||||||||||||||

| All Other category primarily includes certain expenses and credits that are not allocated to any of the operating segments, such as amortization of acquisition-related intangible asset, employee stock-based compensation expense, acquisition-related costs and licensing gain. | ||||||||||||||||||||||||||

| (2) | Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA | |||||||

| Three Months Ended | |||||||||||||||||

| April 1, 2023 |

March 26, 2022 |

||||||||||||||||

| GAAP net income (loss) | $ | (139) | $ | 786 | |||||||||||||

| Interest expense | 25 | 13 | |||||||||||||||

| Other (income) expense, net | (43) | 42 | |||||||||||||||

| Income tax provision | 13 | 113 | |||||||||||||||

| Equity income in investee | (1) | (3) | |||||||||||||||

| Stock-based compensation | 305 | 174 | |||||||||||||||

| Depreciation and amortization | 159 | 130 | |||||||||||||||

| Amortization of acquired intangible assets | 823 | 479 | |||||||||||||||

| Acquisition-related costs | 115 | 233 | |||||||||||||||

| Adjusted EBITDA | $ | 1,257 | $ | 1,967 | |||||||||||||

| The Company presents “Adjusted EBITDA” as a supplemental measure of its performance. Adjusted EBITDA for the Company is determined by adjusting GAAP net income (loss) for interest expense, other income (expense), net, income tax provision, equity income in investee, stock-based compensation, depreciation and amortization expense (including amortization of acquired intangible assets) and acquisition-related costs. The Company calculates and presents Adjusted EBITDA because management believes it is of importance to investors and lenders in relation to its overall capital structure and its ability to borrow additional funds. In addition, the Company presents Adjusted EBITDA because it believes this measure assists investors in comparing its performance across reporting periods on a consistent basis by excluding items that the Company does not believe are indicative of its core operating performance. The Company’s calculation of Adjusted EBITDA may or may not be consistent with the calculation of this measure by other companies in the same industry. Investors should not view Adjusted EBITDA as an alternative to the GAAP operating measure of income or GAAP liquidity measures of cash flows from operating, investing and financing activities. In addition, Adjusted EBITDA does not take into account changes in certain assets and liabilities that can affect cash flows. | ||||||||||||||||||||

| (3) | Reconciliation of GAAP Net Cash Provided by Operating Activities to Free Cash Flow | |||||||

| Three Months Ended | |||||||||||||||||

| April 1, 2023 |

March 26, 2022 | ||||||||||||||||

| GAAP net cash provided by operating activities | $ | 486 | $ | 995 | |||||||||||||

| Operating cash flow margin % | 9 | % | 17 | % | |||||||||||||

| Purchases of property and equipment | $ | (158) | $ | (71) | |||||||||||||

| Free cash flow | $ | 328 | $ | 924 | |||||||||||||

| Free cash flow margin % | 6 | % | 16 | % | |||||||||||||

| The Company also presents free cash flow as a supplemental Non-GAAP measure of its performance. Free cash flow is determined by adjusting GAAP net cash provided by operating activities for capital expenditures, and free cash flow margin % is free cash flow expressed as a percentage of the Company's net revenue. The Company calculates and communicates free cash flow in the financial earnings press release because management believes it is of importance to investors to understand the nature of these cash flows. The Company’s calculation of free cash flow may or may not be consistent with the calculation of this measure by other companies in the same industry. Investors should not view free cash flow as an alternative to GAAP liquidity measures of cash flows from operating activities. | ||||||||||||||||||||