0002024218false2024FYhttp://fasb.org/srt/2024#NaturalGasLiquidsReservesMemberhttp://fasb.org/srt/2024#NaturalGasLiquidsReservesMember111111http://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrentiso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:puresmlp:claimsmlp:director00020242182024-01-012024-12-3100020242182024-06-300002024218us-gaap:CommonClassAMember2025-03-100002024218us-gaap:CommonClassBMember2025-03-1000020242182024-12-3100020242182023-12-310002024218smlp:DoubleECompanyLLCMember2024-12-310002024218smlp:SubsidiarySeriesAPreferredUnitsMember2023-12-310002024218smlp:SubsidiarySeriesAPreferredUnitsMember2024-12-310002024218us-gaap:SeriesAPreferredStockMember2023-12-310002024218us-gaap:SeriesAPreferredStockMember2024-12-310002024218us-gaap:SeriesAPreferredStockMember2024-12-310002024218us-gaap:CommonStockMember2024-08-010002024218us-gaap:CommonStockMember2024-12-310002024218us-gaap:CommonClassBMember2024-12-310002024218us-gaap:NaturalGasGatheringTransportationMarketingAndProcessingMember2024-01-012024-12-310002024218us-gaap:NaturalGasGatheringTransportationMarketingAndProcessingMember2023-01-012023-12-310002024218us-gaap:OilAndCondensateMember2024-01-012024-12-310002024218us-gaap:OilAndCondensateMember2023-01-012023-12-310002024218us-gaap:ProductAndServiceOtherMember2024-01-012024-12-310002024218us-gaap:ProductAndServiceOtherMember2023-01-012023-12-3100020242182023-01-012023-12-310002024218us-gaap:CommonClassBMember2024-01-012024-12-310002024218us-gaap:CommonClassBMember2023-01-012023-12-310002024218smlp:PartnersCapitalMemberus-gaap:SeriesAPreferredStockMember2022-12-310002024218smlp:PartnersCapitalMember2022-12-310002024218us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2022-12-310002024218us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310002024218us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310002024218us-gaap:AdditionalPaidInCapitalMember2022-12-310002024218us-gaap:RetainedEarningsMember2022-12-310002024218us-gaap:NoncontrollingInterestMember2022-12-3100020242182022-12-310002024218smlp:PartnersCapitalMemberus-gaap:SeriesAPreferredStockMember2023-01-012023-12-310002024218smlp:PartnersCapitalMember2023-01-012023-12-310002024218smlp:PartnersCapitalMemberus-gaap:SeriesAPreferredStockMember2023-12-310002024218smlp:PartnersCapitalMember2023-12-310002024218us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2023-12-310002024218us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310002024218us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-12-310002024218us-gaap:AdditionalPaidInCapitalMember2023-12-310002024218us-gaap:RetainedEarningsMember2023-12-310002024218us-gaap:NoncontrollingInterestMember2023-12-310002024218smlp:PartnersCapitalMemberus-gaap:SeriesAPreferredStockMember2024-01-012024-12-310002024218smlp:PartnersCapitalMember2024-01-012024-12-310002024218us-gaap:PreferredStockMember2024-01-012024-12-310002024218us-gaap:RetainedEarningsMember2024-01-012024-12-310002024218us-gaap:NoncontrollingInterestMember2024-01-012024-12-310002024218us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310002024218us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-12-310002024218smlp:TallOakMemberus-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-01-012024-12-310002024218smlp:TallOakMemberus-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310002024218smlp:TallOakMemberus-gaap:NoncontrollingInterestMember2024-01-012024-12-310002024218smlp:PartnersCapitalMemberus-gaap:SeriesAPreferredStockMember2024-12-310002024218smlp:PartnersCapitalMember2024-12-310002024218us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2024-12-310002024218us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-12-310002024218us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-12-310002024218us-gaap:AdditionalPaidInCapitalMember2024-12-310002024218us-gaap:RetainedEarningsMember2024-12-310002024218us-gaap:NoncontrollingInterestMember2024-12-310002024218smlp:A2026SecuredNotesExcessCashFlowOfferMember2024-01-012024-12-310002024218smlp:A2026SecuredNotesExcessCashFlowOfferMember2023-01-012023-12-310002024218smlp:A2026SecuredNotesAssetSaleOfferMember2024-01-012024-12-310002024218smlp:A2026SecuredNotesAssetSaleOfferMember2023-01-012023-12-310002024218smlp:RepurchaseOf2025SeniorNotesMember2024-01-012024-12-310002024218smlp:RepurchaseOf2025SeniorNotesMember2023-01-012023-12-310002024218smlp:PermianTransmissionTermLoanMember2024-01-012024-12-310002024218smlp:PermianTransmissionTermLoanMember2023-01-012023-12-310002024218smlp:A2025SeniorNotesRedemptionMember2024-01-012024-12-310002024218smlp:A2025SeniorNotesRedemptionMember2023-01-012023-12-310002024218smlp:A2026SecuredNotesRedemptionMember2024-01-012024-12-310002024218smlp:A2026SecuredNotesRedemptionMember2023-01-012023-12-310002024218us-gaap:CommonStockMember2024-08-012024-08-010002024218smlp:SubsidiarySeriesAPreferredUnitsMember2024-08-012024-08-010002024218srt:MinimumMemberus-gaap:GasGatheringAndProcessingEquipmentMember2024-12-310002024218srt:MaximumMemberus-gaap:GasGatheringAndProcessingEquipmentMember2024-12-310002024218srt:MinimumMemberus-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2024-12-310002024218srt:MaximumMemberus-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2024-12-310002024218smlp:FavorableGasGatheringContractMembersrt:MinimumMember2024-12-310002024218smlp:FavorableGasGatheringContractMembersrt:MaximumMember2024-12-310002024218smlp:OtherGasGatheringContractMembersrt:MinimumMember2024-12-310002024218smlp:OtherGasGatheringContractMembersrt:MaximumMember2024-12-310002024218smlp:RightsOfWayMembersrt:MinimumMember2024-12-310002024218smlp:RightsOfWayMembersrt:MaximumMember2024-12-310002024218smlp:TallOakMember2024-12-310002024218smlp:TallOakMembersrt:PartnershipInterestMembersmlp:BusinessContributionAgreementMember2024-12-022024-12-020002024218smlp:TallOakMemberus-gaap:CommonClassBMembersmlp:BusinessContributionAgreementMember2024-12-022024-12-020002024218smlp:TallOakMembersmlp:TallOakParentMembersmlp:BusinessContributionAgreementMember2024-12-022024-12-020002024218smlp:TallOakMember2024-01-012024-12-310002024218smlp:TallOakMember2024-12-022024-12-020002024218smlp:TallOakMember2024-12-020002024218smlp:TallOakMember2024-12-022024-12-310002024218us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersmlp:SummitUticaMember2024-03-220002024218smlp:OhioGatheringCompanyLLCMembersmlp:SummitUticaMember2024-03-220002024218smlp:OCCMembersmlp:SummitUticaMember2024-03-220002024218us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersmlp:SummitUticaMember2024-01-012024-03-310002024218us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersmlp:SummitUticaMember2024-03-310002024218us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2024-01-012024-12-310002024218us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersmlp:MountaineerMidstreamCompanyLLCMember2024-05-010002024218us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersmlp:MountaineerMidstreamCompanyLLCMember2024-04-012024-04-300002024218us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2024-12-3100020242182025-01-01smlp:GatheringServicesandRelatedFeesMember2024-12-3100020242182026-01-01smlp:GatheringServicesandRelatedFeesMember2024-12-3100020242182027-01-01smlp:GatheringServicesandRelatedFeesMember2024-12-3100020242182028-01-01smlp:GatheringServicesandRelatedFeesMember2024-12-3100020242182029-01-01smlp:GatheringServicesandRelatedFeesMember2024-12-3100020242182030-01-01smlp:GatheringServicesandRelatedFeesMember2024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:GatheringServicesandRelatedFeesMembersmlp:RockiesSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NaturalGasNGLAndCondensateSalesMembersmlp:RockiesSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:OtherProductsAndServicesMembersmlp:RockiesSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:RockiesSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:GatheringServicesandRelatedFeesMembersmlp:PermianBasinSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NaturalGasNGLAndCondensateSalesMembersmlp:PermianBasinSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:OtherProductsAndServicesMembersmlp:PermianBasinSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:PermianBasinSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:GatheringServicesandRelatedFeesMembersmlp:PiceanceBasinSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NaturalGasNGLAndCondensateSalesMembersmlp:PiceanceBasinSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:OtherProductsAndServicesMembersmlp:PiceanceBasinSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:PiceanceBasinSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:GatheringServicesandRelatedFeesMembersmlp:MidConBarnettShaleSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NaturalGasNGLAndCondensateSalesMembersmlp:MidConBarnettShaleSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:OtherProductsAndServicesMembersmlp:MidConBarnettShaleSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:MidConBarnettShaleSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:GatheringServicesandRelatedFeesMembersmlp:NortheastSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NaturalGasNGLAndCondensateSalesMembersmlp:NortheastSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:OtherProductsAndServicesMembersmlp:NortheastSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NortheastSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:GatheringServicesandRelatedFeesMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NaturalGasNGLAndCondensateSalesMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:OtherProductsAndServicesMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMember2024-01-012024-12-310002024218smlp:GatheringServicesandRelatedFeesMemberus-gaap:AllOtherSegmentsMember2024-01-012024-12-310002024218smlp:NaturalGasNGLAndCondensateSalesMemberus-gaap:AllOtherSegmentsMember2024-01-012024-12-310002024218smlp:OtherProductsAndServicesMemberus-gaap:AllOtherSegmentsMember2024-01-012024-12-310002024218us-gaap:AllOtherSegmentsMember2024-01-012024-12-310002024218smlp:GatheringServicesandRelatedFeesMember2024-01-012024-12-310002024218smlp:NaturalGasNGLAndCondensateSalesMember2024-01-012024-12-310002024218smlp:OtherProductsAndServicesMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:GatheringServicesandRelatedFeesMembersmlp:RockiesSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NaturalGasNGLAndCondensateSalesMembersmlp:RockiesSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:OtherProductsAndServicesMembersmlp:RockiesSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:RockiesSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:GatheringServicesandRelatedFeesMembersmlp:PermianBasinSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NaturalGasNGLAndCondensateSalesMembersmlp:PermianBasinSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:OtherProductsAndServicesMembersmlp:PermianBasinSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:PermianBasinSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:GatheringServicesandRelatedFeesMembersmlp:PiceanceBasinSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NaturalGasNGLAndCondensateSalesMembersmlp:PiceanceBasinSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:OtherProductsAndServicesMembersmlp:PiceanceBasinSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:PiceanceBasinSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:GatheringServicesandRelatedFeesMembersmlp:MidConBarnettShaleSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NaturalGasNGLAndCondensateSalesMembersmlp:MidConBarnettShaleSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:OtherProductsAndServicesMembersmlp:MidConBarnettShaleSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:MidConBarnettShaleSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:GatheringServicesandRelatedFeesMembersmlp:NortheastSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NaturalGasNGLAndCondensateSalesMembersmlp:NortheastSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:OtherProductsAndServicesMembersmlp:NortheastSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NortheastSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:GatheringServicesandRelatedFeesMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NaturalGasNGLAndCondensateSalesMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:OtherProductsAndServicesMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMember2023-01-012023-12-310002024218smlp:GatheringServicesandRelatedFeesMemberus-gaap:AllOtherSegmentsMember2023-01-012023-12-310002024218smlp:NaturalGasNGLAndCondensateSalesMemberus-gaap:AllOtherSegmentsMember2023-01-012023-12-310002024218smlp:OtherProductsAndServicesMemberus-gaap:AllOtherSegmentsMember2023-01-012023-12-310002024218us-gaap:AllOtherSegmentsMember2023-01-012023-12-310002024218smlp:GatheringServicesandRelatedFeesMember2023-01-012023-12-310002024218smlp:NaturalGasNGLAndCondensateSalesMember2023-01-012023-12-310002024218smlp:OtherProductsAndServicesMember2023-01-012023-12-310002024218us-gaap:GasGatheringAndProcessingEquipmentMember2024-12-310002024218us-gaap:GasGatheringAndProcessingEquipmentMember2023-12-310002024218us-gaap:ConstructionInProgressMember2024-12-310002024218us-gaap:ConstructionInProgressMember2023-12-310002024218smlp:LandandLineFillMember2024-12-310002024218smlp:LandandLineFillMember2023-12-310002024218us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2024-12-310002024218us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2023-12-310002024218smlp:FavorableGasGatheringContractMember2024-12-310002024218smlp:ContractIntangiblesMember2024-12-310002024218smlp:RightsOfWayMember2024-12-310002024218smlp:FavorableGasGatheringContractMember2023-12-310002024218smlp:ContractIntangiblesMember2023-12-310002024218smlp:RightsOfWayMember2023-12-310002024218smlp:FavorableGasGatheringContractMembersmlp:OtherRevenueMember2024-01-012024-12-310002024218smlp:FavorableGasGatheringContractMembersmlp:OtherRevenueMember2023-01-012023-12-310002024218smlp:ContractIntangiblesMembersmlp:CostsAndExpensesMember2024-01-012024-12-310002024218smlp:ContractIntangiblesMembersmlp:CostsAndExpensesMember2023-01-012023-12-310002024218smlp:RightsOfWayMembersmlp:CostsAndExpensesMember2024-01-012024-12-310002024218smlp:RightsOfWayMembersmlp:CostsAndExpensesMember2023-01-012023-12-310002024218smlp:DoubleECompanyLLCMember2023-12-310002024218smlp:OhioGatheringCompanyLLCMember2024-12-310002024218smlp:OhioGatheringCompanyLLCMember2023-12-310002024218smlp:DoubleECompanyLLCMember2024-01-012024-12-310002024218smlp:DoubleECompanyLLCMember2023-01-012023-12-310002024218us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2024-12-310002024218us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-12-310002024218us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2024-01-012024-12-310002024218us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-01-012023-12-310002024218smlp:OhioGatheringCompanyLLCMemberus-gaap:PrincipalOwnerMember2024-12-310002024218smlp:OCCMemberus-gaap:PrincipalOwnerMember2023-12-310002024218smlp:OCCMemberus-gaap:PrincipalOwnerMember2024-12-310002024218smlp:OhioGatheringCompanyLLCMember2024-01-012024-12-310002024218smlp:OhioGatheringCompanyLLCMember2023-01-012023-12-310002024218smlp:AssetBackedLendingFacilityMemberus-gaap:LineOfCreditMember2024-12-310002024218smlp:AssetBackedLendingFacilityMemberus-gaap:LineOfCreditMember2023-12-310002024218smlp:PermianTransmissionTermLoanMemberus-gaap:LineOfCreditMember2024-12-310002024218smlp:PermianTransmissionTermLoanMemberus-gaap:LineOfCreditMember2023-12-310002024218smlp:SeniorSecuredNotesDue2029Memberus-gaap:SecuredDebtMember2024-12-310002024218smlp:SeniorSecuredNotesDue2029Memberus-gaap:SecuredDebtMember2023-12-310002024218smlp:SeniorUnsecuredNotesDue2026Member2024-12-310002024218smlp:SeniorUnsecuredNotesDue2026Memberus-gaap:UnsecuredDebtMember2024-12-310002024218smlp:SeniorUnsecuredNotesDue2026Memberus-gaap:UnsecuredDebtMember2023-12-310002024218smlp:SeniorNotesDueAprilTwentyTwentyFiveMember2024-12-310002024218smlp:SeniorNotesDueAprilTwentyTwentyFiveMemberus-gaap:SeniorNotesMember2024-12-310002024218smlp:SeniorNotesDueAprilTwentyTwentyFiveMemberus-gaap:SeniorNotesMember2023-12-310002024218smlp:SeniorSecuredNotesDue2026Member2024-12-310002024218smlp:SeniorSecuredNotesDue2026Memberus-gaap:SecuredDebtMember2024-12-310002024218smlp:SeniorSecuredNotesDue2026Memberus-gaap:SecuredDebtMember2023-12-310002024218smlp:SeniorSecuredSecondLienNotesDue2029Memberus-gaap:SubsequentEventMember2025-01-100002024218smlp:ABLFacilityMember2024-07-260002024218smlp:ABLFacilityMember2024-12-310002024218smlp:ABLFacilityMembersmlp:SummitHoldingsMember2024-07-262024-07-260002024218smlp:ABLFacilityMembersmlp:SummitHoldingsMember2024-07-260002024218smlp:ABLFacilityMembersmlp:SummitHoldingsMemberus-gaap:BaseRateMembersrt:MinimumMember2024-07-262024-07-260002024218smlp:ABLFacilityMembersmlp:SummitHoldingsMemberus-gaap:BaseRateMembersrt:MaximumMember2024-07-262024-07-260002024218smlp:ABLFacilityMembersmlp:SummitHoldingsMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MinimumMember2024-07-262024-07-260002024218smlp:ABLFacilityMembersmlp:SummitHoldingsMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MaximumMember2024-07-262024-07-260002024218smlp:ABLFacilityMembersmlp:SummitPermianTransmissionLLCMembersrt:MaximumMember2024-07-260002024218smlp:ABLFacilityMembersmlp:SummitPermianTransmissionLLCMembersrt:MaximumMember2024-12-310002024218smlp:ABLFacilityMember2024-01-012024-12-310002024218smlp:ABLFacilityMemberus-gaap:RevolvingCreditFacilityMember2024-12-310002024218smlp:CreditAgreementMember2021-03-080002024218smlp:CreditAgreementMembersmlp:TermLoanCreditFacilityMember2021-03-080002024218smlp:CreditAgreementMembersmlp:WorkingCapitalCreditFacilityMember2021-03-080002024218smlp:CreditAgreementMember2024-01-012024-12-310002024218smlp:CreditAgreementMember2024-12-310002024218smlp:CreditAgreementMemberus-gaap:StandbyLettersOfCreditMember2024-12-310002024218smlp:CreditAgreementMembersmlp:SummitPermianTransmissionLLCMember2024-12-310002024218smlp:CreditAgreementMemberus-gaap:InterestRateContractMembersmlp:SummitPermianTransmissionLLCMember2024-01-012024-12-310002024218smlp:PermianTransmissionTermLoanMember2024-12-310002024218smlp:SeniorSecuredSecondLienNotesDue2029Membersmlp:SummitHoldingsMember2024-07-260002024218smlp:SeniorSecuredSecondLienNotesDue2029Membersmlp:SummitHoldingsMemberus-gaap:SubsequentEventMember2026-07-302026-07-300002024218smlp:SeniorSecuredSecondLienNotesDue2029Membersmlp:SummitHoldingsMemberus-gaap:SubsequentEventMembersrt:ScenarioForecastMember2026-07-302026-07-300002024218smlp:SeniorSecuredSecondLienNotesDue2029Membersmlp:SummitHoldingsMembersmlp:DebtInstrumentsRedemptionPeriodOneMember2024-07-262024-07-260002024218smlp:SeniorSecuredSecondLienNotesDue2029Membersmlp:SummitHoldingsMembersmlp:DebtInstrumentsRedemptionPeriodTwoMember2024-07-262024-07-260002024218smlp:SeniorSecuredSecondLienNotesDue2029Membersmlp:SummitHoldingsMembersmlp:DebtInstrumentRedemptionPeriodAfterTwoMember2024-07-262024-07-260002024218smlp:A2026NotesMember2021-12-310002024218smlp:A2026NotesMember2022-11-300002024218smlp:SecuredNotesIndenture2026Member2024-03-270002024218smlp:SecuredNotesIndenture2026Member2024-04-240002024218smlp:SecuredNotesIndenture2026Member2024-05-070002024218smlp:SecuredNotesIndenture2026Member2024-06-050002024218smlp:SecuredNotesIndenture2026Membersmlp:SummitHoldingsMember2024-07-262024-07-260002024218smlp:SecuredNotesIndenture2026Membersmlp:SummitHoldingsMember2024-07-260002024218smlp:SecuredNotesIndenture2026Member2024-07-260002024218smlp:A2026UnsecuredNotesMember2023-11-300002024218smlp:TwoThousandTwentyFiveSeniorNotesMember2023-11-300002024218smlp:A2026UnsecuredNotesMembersmlp:SummitHoldingsMember2024-06-070002024218smlp:TwoThousandTwentyFiveSeniorNotesMembersmlp:SummitHoldingsAndFinanceCorporationMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMember2017-02-012017-02-280002024218smlp:TwoThousandTwentyFiveSeniorNotesMembersmlp:SummitHoldingsMember2024-07-170002024218smlp:SeniorSecuredSecondLienNotesDue2029Member2024-07-260002024218smlp:TwoThousandTwentyFiveSeniorNotesMembersmlp:SummitHoldingsMember2024-12-310002024218smlp:MeadowlarkMidstreamGatheringSystemMember2022-12-310002024218smlp:MeadowlarkMidstreamGatheringSystemMember2023-01-012023-12-310002024218smlp:MeadowlarkMidstreamGatheringSystemMember2023-12-310002024218smlp:MeadowlarkMidstreamGatheringSystemMember2024-01-012024-12-310002024218smlp:MeadowlarkMidstreamGatheringSystemMember2024-12-310002024218smlp:A2015BlacktailReleaseMember2024-12-310002024218smlp:A2015BlacktailReleaseMember2023-12-310002024218smlp:A2015BlacktailReleaseMembersmlp:NaturalResourceDamagesToFederalAndStateGovernmentsMember2024-01-012024-12-310002024218smlp:A2015BlacktailReleaseMembersmlp:DamagesPayableToFederalGovernmentOverFiveYearsMember2024-01-012024-12-310002024218smlp:A2015BlacktailReleaseMembersmlp:DamagesPayableToStateGovernmentsOverSixYearsMember2024-01-012024-12-310002024218smlp:A2015BlacktailReleaseMembersmlp:DamagesPayableToFederalCriminalOverFiveYearsMember2024-01-012024-12-310002024218smlp:A2015BlacktailReleaseMember2024-01-012024-12-310002024218smlp:SeniorNotesDue2025Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310002024218us-gaap:FairValueInputsLevel2Membersmlp:SeniorNotesDue2025Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310002024218smlp:SeniorNotesDue2025Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310002024218us-gaap:FairValueInputsLevel2Membersmlp:SeniorNotesDue2025Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310002024218smlp:SeniorNotesDueTwentyTwentySixMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310002024218us-gaap:FairValueInputsLevel2Membersmlp:SeniorNotesDueTwentyTwentySixMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310002024218smlp:SeniorNotesDueTwentyTwentySixMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310002024218us-gaap:FairValueInputsLevel2Membersmlp:SeniorNotesDueTwentyTwentySixMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310002024218smlp:SeniorUnsecuredNotesDueTwentyTwentySixMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310002024218us-gaap:FairValueInputsLevel2Membersmlp:SeniorUnsecuredNotesDueTwentyTwentySixMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310002024218smlp:SeniorUnsecuredNotesDueTwentyTwentySixMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310002024218us-gaap:FairValueInputsLevel2Membersmlp:SeniorUnsecuredNotesDueTwentyTwentySixMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310002024218smlp:SeniorSecuredNotesDue2029Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310002024218us-gaap:FairValueInputsLevel2Membersmlp:SeniorSecuredNotesDue2029Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310002024218smlp:SeniorSecuredNotesDue2029Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310002024218us-gaap:FairValueInputsLevel2Membersmlp:SeniorSecuredNotesDue2029Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310002024218us-gaap:FairValueInputsLevel3Member2024-12-310002024218us-gaap:FairValueInputsLevel3Member2023-12-310002024218us-gaap:InterestRateSwapMember2024-12-310002024218us-gaap:InterestRateSwapMember2023-12-310002024218us-gaap:CommonStockMember2024-01-012024-12-310002024218smlp:LimitedPartnerCommonUnitsMember2022-12-310002024218us-gaap:CommonStockMember2022-12-310002024218smlp:LimitedPartnerCommonUnitsMember2023-01-012023-12-310002024218us-gaap:CommonStockMember2023-12-310002024218smlp:LimitedPartnerCommonUnitsMember2023-12-310002024218smlp:LimitedPartnerCommonUnitsMember2024-01-012024-12-310002024218us-gaap:CommonStockMember2024-12-310002024218smlp:LimitedPartnerCommonUnitsMember2024-12-310002024218us-gaap:CommonClassBMember2022-12-310002024218us-gaap:CommonClassBMember2023-12-310002024218smlp:TallOakMemberus-gaap:CommonClassBMember2024-01-012024-12-310002024218us-gaap:SeriesAPreferredStockMember2017-11-012017-11-300002024218us-gaap:SeriesAPreferredStockMember2017-11-300002024218us-gaap:SeriesAPreferredStockMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-10-012023-12-310002024218us-gaap:SeriesAPreferredStockMembersmlp:LondonInterbankOfferRateLIBORMember2023-12-152023-12-150002024218smlp:SeriesAPreferredUnitsMember2022-12-310002024218us-gaap:SeriesAPreferredStockMember2022-12-310002024218smlp:SeriesAPreferredUnitsMember2023-01-012023-12-310002024218us-gaap:SeriesAPreferredStockMember2023-01-012023-12-310002024218smlp:SeriesAPreferredUnitsMember2023-12-310002024218smlp:SeriesAPreferredUnitsMember2024-01-012024-12-310002024218us-gaap:SeriesAPreferredStockMember2024-01-012024-12-310002024218smlp:SeriesAPreferredUnitsMember2024-12-310002024218smlp:TallOakMembersmlp:LimitedPartnerCommonUnitsMemberus-gaap:CommonStockMember2024-01-012024-12-310002024218smlp:LimitedPartnerCommonUnitsMemberus-gaap:CommonStockMember2022-12-310002024218smlp:LimitedPartnerCommonUnitsMemberus-gaap:CommonStockMember2023-12-310002024218smlp:LimitedPartnerCommonUnitsMemberus-gaap:CommonStockMember2024-12-310002024218srt:SubsidiariesMembersmlp:SeriesAPreferredUnitsMember2024-01-012024-12-310002024218srt:SubsidiariesMembersmlp:SeriesAPreferredUnitsMember2023-01-012023-12-310002024218srt:ParentCompanyMembersmlp:SeriesAPreferredUnitsMember2024-01-012024-12-310002024218srt:ParentCompanyMembersmlp:SeriesAPreferredUnitsMember2023-01-012023-12-310002024218smlp:CommonUnitsMember2024-01-012024-12-310002024218smlp:CommonUnitsMember2023-01-012023-12-310002024218us-gaap:RestrictedStockMember2024-01-012024-12-310002024218us-gaap:RestrictedStockMember2023-01-012023-12-310002024218smlp:TallOakMember2023-01-012023-12-310002024218smlp:SeniorNotesDueAprilTwentyTwentyFiveMember2024-01-012024-12-310002024218smlp:SeniorNotesDueAprilTwentyTwentyFiveMember2023-01-012023-12-310002024218smlp:SeriesAPreferredUnitsMember2024-01-012024-12-310002024218smlp:SeriesAPreferredUnitsMember2023-01-012023-12-310002024218smlp:LongTermIncentivePlanMember2024-01-012024-12-310002024218smlp:PhantomShareUnitsAndAssociatedDistributionEquivalentRightsMembersmlp:LongTermIncentivePlanMember2024-01-012024-12-310002024218us-gaap:PerformanceSharesMembersmlp:LongTermIncentivePlanMember2024-01-012024-12-310002024218smlp:CommonUnitsMembersmlp:LongTermIncentivePlanMember2024-01-012024-12-310002024218smlp:CommonUnitsMembersmlp:LongTermIncentivePlanMember2024-05-162024-05-160002024218smlp:SMCLongTermIncentivePlanMember2024-01-012024-12-310002024218us-gaap:RestrictedStockUnitsRSUMembersmlp:SMCLongTermIncentivePlanMember2024-01-012024-12-310002024218us-gaap:RestrictedStockUnitsRSUMembersmlp:SMCLongTermIncentivePlanMember2024-12-310002024218smlp:SMCLongTermIncentivePlanMember2024-12-310002024218us-gaap:RestrictedStockMembersmlp:SMCLongTermIncentivePlanMember2024-12-310002024218us-gaap:PhantomShareUnitsPSUsMembersmlp:LongTermIncentivePlanMember2022-12-310002024218us-gaap:PhantomShareUnitsPSUsMembersmlp:LongTermIncentivePlanMember2023-01-012023-12-310002024218us-gaap:PhantomShareUnitsPSUsMembersmlp:LongTermIncentivePlanMember2023-12-310002024218us-gaap:PhantomShareUnitsPSUsMembersmlp:LongTermIncentivePlanMember2024-01-012024-12-310002024218us-gaap:PhantomShareUnitsPSUsMembersmlp:LongTermIncentivePlanMember2024-12-310002024218us-gaap:RestrictedStockMembersmlp:LongTermIncentivePlanMember2024-12-310002024218smlp:LongTermIncentivePlanMember2024-12-310002024218us-gaap:GeneralAndAdministrativeExpenseMembersmlp:LongTermIncentivePlanMember2023-01-012023-12-3100020242182024-08-012024-08-0100020242182024-08-010002024218srt:MinimumMembersmlp:OfficeSpaceMember2024-12-310002024218srt:MaximumMembersmlp:OfficeSpaceMember2024-12-310002024218srt:MinimumMemberus-gaap:EquipmentMember2024-12-310002024218srt:MaximumMemberus-gaap:EquipmentMember2024-12-310002024218us-gaap:RevolvingCreditFacilityMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasGatheringTransportationMarketingAndProcessingMembersmlp:RockiesSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasGatheringTransportationMarketingAndProcessingMembersmlp:PermianBasinSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasGatheringTransportationMarketingAndProcessingMembersmlp:PiceanceBasinSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasGatheringTransportationMarketingAndProcessingMembersmlp:MidConBarnettShaleSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasGatheringTransportationMarketingAndProcessingMembersmlp:NortheastSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:OilAndCondensateMembersmlp:RockiesSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:OilAndCondensateMembersmlp:PermianBasinSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:OilAndCondensateMembersmlp:PiceanceBasinSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:OilAndCondensateMembersmlp:MidConBarnettShaleSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:OilAndCondensateMembersmlp:NortheastSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMembersmlp:RockiesSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMembersmlp:PermianBasinSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMembersmlp:PiceanceBasinSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMembersmlp:MidConBarnettShaleSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMembersmlp:NortheastSegmentMember2024-01-012024-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasGatheringTransportationMarketingAndProcessingMembersmlp:RockiesSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasGatheringTransportationMarketingAndProcessingMembersmlp:PermianBasinSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasGatheringTransportationMarketingAndProcessingMembersmlp:PiceanceBasinSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasGatheringTransportationMarketingAndProcessingMembersmlp:MidConBarnettShaleSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:NaturalGasGatheringTransportationMarketingAndProcessingMembersmlp:NortheastSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:OilAndCondensateMembersmlp:RockiesSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:OilAndCondensateMembersmlp:PermianBasinSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:OilAndCondensateMembersmlp:PiceanceBasinSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:OilAndCondensateMembersmlp:MidConBarnettShaleSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:OilAndCondensateMembersmlp:NortheastSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMembersmlp:RockiesSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMembersmlp:PermianBasinSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMembersmlp:PiceanceBasinSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMembersmlp:MidConBarnettShaleSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMemberus-gaap:ProductAndServiceOtherMembersmlp:NortheastSegmentMember2023-01-012023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:RockiesSegmentMember2024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:RockiesSegmentMember2023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:PermianBasinSegmentMember2024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:PermianBasinSegmentMember2023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:PiceanceBasinSegmentMember2024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:PiceanceBasinSegmentMember2023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:MidConBarnettShaleSegmentMember2024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:MidConBarnettShaleSegmentMember2023-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NortheastSegmentMember2024-12-310002024218us-gaap:OperatingSegmentsMembersmlp:NortheastSegmentMember2023-12-310002024218us-gaap:OperatingSegmentsMember2024-12-310002024218us-gaap:OperatingSegmentsMember2023-12-310002024218us-gaap:CorporateNonSegmentMember2024-12-310002024218us-gaap:CorporateNonSegmentMember2023-12-310002024218us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembersmlp:PiceanceBasinSegmentMember2023-01-012023-12-310002024218us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembersmlp:RockiesBSegmentMember2024-01-012024-12-310002024218us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembersmlp:RockiesBSegmentMember2023-01-012023-12-310002024218us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembersmlp:RockiesCSegmentMember2024-01-012024-12-310002024218us-gaap:CorporateNonSegmentMember2024-01-012024-12-310002024218us-gaap:CorporateNonSegmentMember2023-01-012023-12-310002024218smlp:TallOakMemberus-gaap:CommonClassBMemberus-gaap:SubsequentEventMember2025-01-012025-01-010002024218smlp:TallOakMemberus-gaap:CommonClassAMemberus-gaap:SubsequentEventMember2025-01-012025-01-010002024218smlp:SeniorSecuredSecondLienNotesDue2029Memberus-gaap:SubsequentEventMember2025-03-070002024218us-gaap:SeriesAPreferredStockMemberus-gaap:SubsequentEventMember2025-02-282025-02-280002024218us-gaap:SeriesAPreferredStockMemberus-gaap:SubsequentEventMember2025-02-280002024218smlp:MoonriseMidstreamLLCMemberus-gaap:SubsequentEventMember2025-03-102025-03-1000020242182024-10-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

|

|

|

|

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

or

|

|

|

|

|

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-42201

Summit Midstream Corporation

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization)

910 Louisiana Street, Suite 4200

Houston, TX

(Address of principal executive offices)

99-3056990

(I.R.S. Employer

Identification No.)

77002

(Zip Code)

(832) 413-4770

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

SMC |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

o |

|

Accelerated filer |

x |

|

|

|

|

|

| Non-accelerated filer |

o |

|

Smaller reporting company |

x |

|

|

|

|

|

| Emerging growth company |

o |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes x No

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2024 was $378,667,239.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

|

|

|

|

|

|

|

|

|

| Class |

|

As of March 10, 2025 |

| Common Stock, par value $0.01 per share |

|

12,120,835 |

Class B Common Stock, par value $0.01 per share |

|

6,524,467 |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its 2025 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission within 120 days of December 31, 2024, are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item 1C. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Investors are cautioned that certain statements contained in this report as well as in periodic press releases and certain oral statements made by our officers and employees during our presentations are “forward-looking” statements. Forward-looking statements include, without limitation, any statement that may project, indicate or imply future results, events, performance or achievements and may contain the words “expect,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “will be,” “will continue,” “will likely result,” and similar expressions, or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” In addition, any statement concerning future financial performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects, and possible actions taken by us or our subsidiaries are also forward-looking statements. These forward-looking statements involve various risks and uncertainties, including, but not limited to, those described in Item 1A. Risk Factors included in this Annual Report on Form 10-K (this “Annual Report”).

Forward-looking statements are based on current expectations and projections about future events and are inherently subject to a variety of risks and uncertainties, many of which are beyond the control of our management team. All forward-looking statements in this report and subsequent written and oral forward-looking statements attributable to us, or to persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements in this paragraph. These risks and uncertainties include, among others:

•our ability to achieve the strategic and other objectives relating to the Tall Oak Acquisition;

•the risk that we are unable to integrate Tall Oak’s operations in a successful manner and in the expected time period;

•our decision whether to pay, or our ability to grow, our cash dividends;

•fluctuations in natural gas, NGLs and crude oil prices, including as a result of political or economic measures taken by various countries or OPEC;

•the extent and success of our customers’ drilling and completion efforts, as well as the quantity of natural gas, crude oil, freshwater deliveries, and produced water volumes produced within proximity of our assets;

•failure or delays by our customers in achieving expected production in their natural gas, crude oil and produced water projects;

•competitive conditions in our industry and their impact on our ability to connect hydrocarbon supplies to our gathering and processing assets or systems;

•actions or inactions taken or nonperformance by third parties, including suppliers, contractors, operators, processors, transporters and customers, including the inability or failure of our shipper customers to meet their financial obligations under our gathering agreements and our ability to enforce the terms and conditions of certain of our gathering agreements in the event of a bankruptcy of one or more of our customers;

•our ability to divest of certain of our assets to third parties on attractive terms, which is subject to a number of factors, including prevailing conditions and outlook in the natural gas, NGL and crude oil industries and markets;

•the ability to attract and retain key management personnel;

•commercial bank and capital market conditions and the potential impact of changes or disruptions in the credit and/or capital markets;

•changes in the availability and cost of capital and the results of our financing efforts, including availability of funds in the credit and/or capital markets;

•restrictions placed on us by the agreements governing our debt and preferred equity instruments;

•the availability, terms and cost of downstream transportation and processing services;

•natural disasters, accidents, weather-related delays, casualty losses and other matters beyond our control;

•the current and potential future impact of pandemics on our business, results of operations, financial position or cash flows;

•operational risks and hazards inherent in the gathering, compression, treating and/or processing of natural gas, crude oil and produced water;

•our ability to comply with the terms of the agreements comprising the Global Settlement;

•weather conditions and terrain in certain areas in which we operate;

•physical and financial risks associated with climate change;

•any other issues that can result in deficiencies in the design, installation or operation of our gathering, compression, treating, processing and freshwater facilities;

•timely receipt of necessary government approvals and permits, our ability to control the costs of construction, including costs of materials, labor and rights-of-way and other factors that may impact our ability to complete projects within budget and on schedule;

•our ability to finance our obligations related to capital expenditures, including through opportunistic asset divestitures or joint ventures and the impact any such divestitures or joint ventures could have on our results;

•the effects of existing and future laws and governmental regulations, including environmental, safety and climate change requirements and federal, state and local restrictions or requirements applicable to oil and/or gas drilling, production or transportation;

•the effects of litigation;

•interest rates;

•changes in general economic conditions; and

•certain factors discussed elsewhere in this report.

Developments in any of these areas could cause actual results to differ materially from those anticipated or projected or cause a significant reduction in the market price of our common stock, Series A Preferred Stock and 2029 Secured Notes.

The foregoing list of risks and uncertainties may not contain all of the risks and uncertainties that could affect us. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this document may not in fact occur. Accordingly, undue reliance should not be placed on these statements. We undertake no obligation to publicly update or revise any forward-looking statements as a result of new information, future events or otherwise, except as otherwise required by law.

Risk Factors Summary

This summary briefly lists the principal risks and uncertainties facing our business, which are only a select portion of those risks. A more complete discussion of those risks and uncertainties is set forth in Part I, Item 1A of this Annual Report. Additional risks not presently known to us or that we currently deem immaterial may also affect us. If any of these risks occur, our business, financial condition or results of operations could be materially and adversely affected.

Our business is subject to the following principal risks and uncertainties:

Risks Related to Our Operations

•We may not have sufficient cash from operations following the establishment of cash reserves and payment of fees and expenses to enable us to pay dividends to holders of our Series A Preferred Stock and common stock.

•We depend on a relatively small number of customers for a significant portion of our revenues. The loss of, or material nonpayment or nonperformance by, or the curtailment of production by, any one or more of our customers could materially adversely affect our revenues, cash flows and results of operations.

•We are exposed to the creditworthiness and performance of our customers, suppliers and contract counterparties and any material nonpayment or nonperformance by one or more of these parties could materially adversely affect our financial and operating results.

•Significant prolonged weakness in natural gas, NGL and crude oil prices could reduce throughput on our systems and materially adversely affect our revenues and results of operations.

•Because of the natural decline in production from our customers' existing wells, our success depends in part on our customers replacing declining production and also on our ability to maintain levels of throughput on our systems. Any decrease in the volumes that we gather and process could materially adversely affect our business and operating results.

•If our customers do not increase the volumes they provide to our gathering systems, our results of operations and financial condition may be materially adversely affected.

•Certain of our gathering and processing agreements contain provisions that can reduce the cash flow stability that the agreements were designed to achieve.

•We have not obtained independent evaluations of all of the reserves connected to our gathering systems; therefore, in the future, customer volumes on our systems could be less than we anticipate.

•Our industry is highly competitive, and increased competitive pressure could materially adversely affect our business and operating results.

•We may not be able to renew or replace expiring contracts at favorable rates or on a long-term basis.

•If third-party pipelines or other midstream facilities interconnected to our gathering systems become partially or fully unavailable, our revenues and cash flows could be materially adversely affected.

•We have had and continue to have discussions with unaffiliated third parties with respect to potential strategic

transactions.

Risks Related to Our Finances

•Limited access to and/or availability of the commercial bank market or debt and equity capital markets could impair our ability to grow or cause us to be unable to meet future capital requirements.

•We have a significant amount of indebtedness. Our leverage and debt service obligations may adversely affect our financial condition, results of operations and business prospects, and may limit our flexibility to obtain financing and to pursue other business opportunities.

•We may not be able to generate sufficient cash to service all of our indebtedness and may be forced to take other actions to satisfy our obligations under our indebtedness or to refinance, which may not be successful.

•The failure to successfully integrate the business and operations of Tall Oak in the expected time frame may adversely affect the Company’s future results.

•Restrictions in the Permian Transmission Credit Facilities, the indenture governing the 2029 Secured Notes and the Amended and Restated ABL Facility could materially adversely affect our business, financial condition, results of operations and ability to make cash dividends.

•An increase in interest rates will cause our debt service obligations to increase.

•A downgrade of our credit rating could impact our liquidity, access to capital and our costs of doing business, and independent third parties determine our credit ratings outside of our control.

Regulatory and Environmental Policy Risks

•We settled a matter that was previously under investigation by federal and state regulatory agencies regarding a pipeline rupture and release of produced water by one of our subsidiaries. The resulting compliance requirements of the settlement may impact our results of operations or cash flows.

•We may, from time to time, be involved in litigation and claims arising out of our operations in the normal course of business. As a result, we may be required to expend significant funds for legal defense or to settle claims. Any such loss, if incurred, could be material.

•A change in laws and regulations applicable to our assets or services, or the interpretation or implementation of existing laws and regulations may cause our revenues to decline or our operation and maintenance expenses to increase.

•Increased regulation of hydraulic fracturing could result in reductions or delays in customer production, which could materially adversely impact our revenues.

•We are subject to FERC jurisdiction, federal anti-market manipulation laws and regulations, potentially other federal regulatory requirements and state and local regulation and could be materially affected by changes in such laws and regulations, or in the way they are interpreted and enforced.

•We are subject to stringent environmental laws and regulations that may expose us to significant costs and liabilities.

Risks Related to the Common Stock and Series A Preferred Stock

•The price of the common stock or Series A Preferred Stock may experience volatility.

•Our Governing Documents contain provisions that may make it difficult for a third party to acquire control of the Company, even if a change in control would result in the purchase of your shares of common stock or Series A Preferred Stock at a premium to the market price or would otherwise be beneficial to you.

•We do not expect to pay dividends on our common stock for the foreseeable future.

•The value of our common stock may be diluted by future equity issuances and shares eligible for future sale may have adverse effects on our share price.

Risks Related to Tax

•The Company is a holding company, and its principal asset is our ownership of Partnership Common Units. Accordingly, we are dependent upon distributions from SMLP to pay dividends, if any, and to pay taxes and other expenses.

•The Tall Oak Acquisition and subsequent changes in stock ownership of the Company (including upon the redemption or exchange of the shares of Class B Common Stock and associated Partnership Common Units for common stock) may trigger a limitation on the utilization of net operating loss carryforwards of the Company.

•If SMLP were to become a publicly traded partnership taxable as a corporation for U.S. federal income tax purposes, the Company and SMLP might be subject to potentially significant tax inefficiencies.

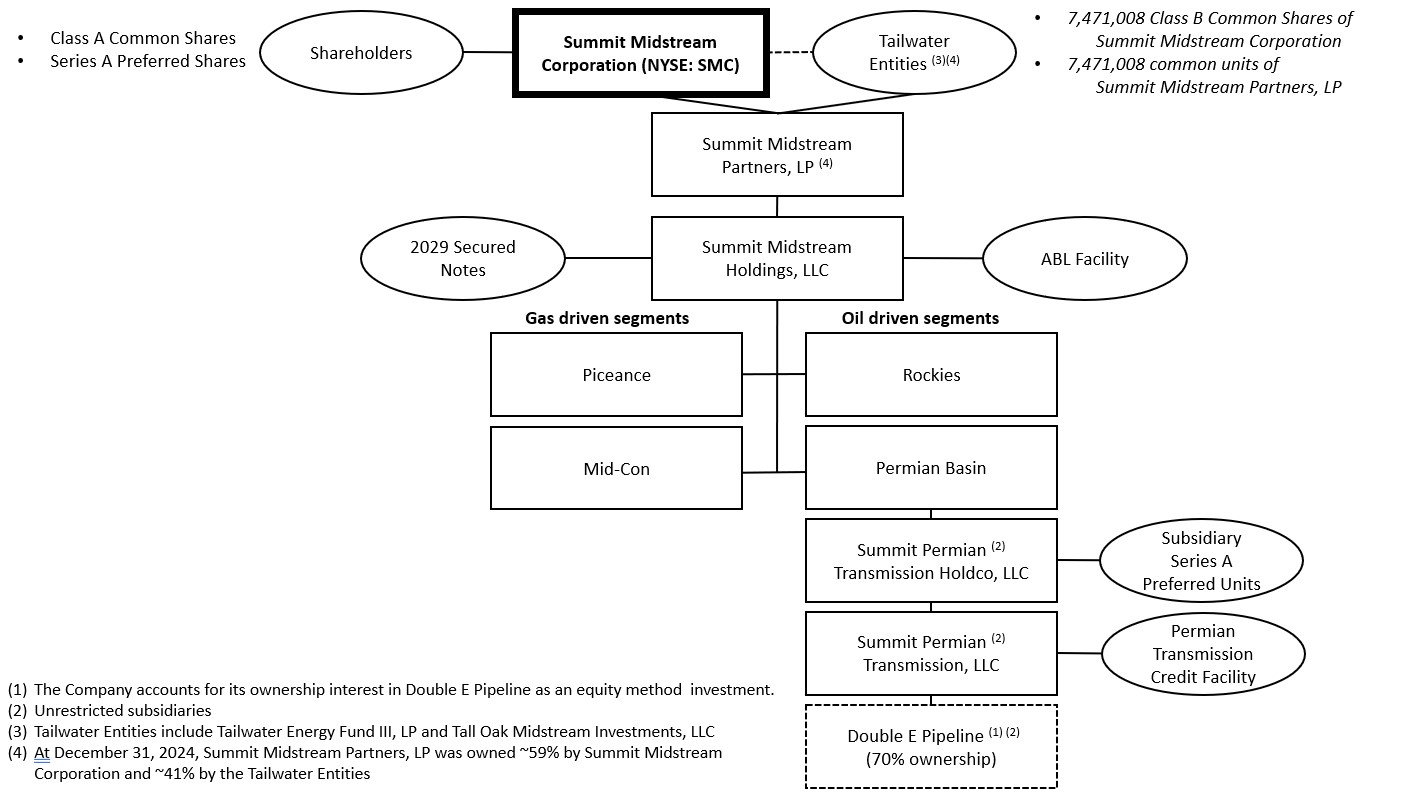

ORGANIZATIONAL CHART

The following chart provides a summarized view of our legal entity structure as of December 31, 2024:

COMMONLY USED OR DEFINED TERMS

|

|

|

|

|

|

| 2015 Blacktail Release |

a 2015 rupture of our four-inch produced water gathering pipeline near Williston, North Dakota

|

|

|

| 2022 DJ Acquisitions |

the acquisition of Outrigger DJ Midstream LLC from Outrigger Energy II LLC, and each of Sterling Energy Investments LLC, Grasslands Energy Marketing LLC and Centennial Water Pipelines LLC from Sterling Investment Holdings LLC

|

2023 Exchange Transactions |

the exchange of new 2026 Unsecured Notes for outstanding 2025 Senior Notes and cash in November 2023 and the subsequent repurchases of outstanding 2025 Senior Notes

|

2024 ECF Offer |

the cash tender offer by Summit Holdings and Finance Corp. to purchase up to $19.3 million

aggregate principal amount of the outstanding 2026 Secured Notes, pursuant to which

$13.6 million aggregate principal amount of the 2026 Secured Notes was tendered and

validly accepted, which settled on April 26, 2024

|

2025 Senior Notes |

Summit Holdings’ and Finance Corp.’s 5.75% senior unsecured notes due April 2025, which

were fully repaid on August 16, 2024

|

| 2026 Secured Notes |

Summit Holdings’ and Finance Corp.’s 8.500% senior secured second lien notes due October 2026, which were fully repaid on October 15, 2024

|

|

|

2026 Unsecured Notes |

Summit Holdings’ and Finance Corp.’s 12.00% senior unsecured notes due October 2026, which were fully repaid on June 24, 2024

|

|

|

|

2026 Secured Notes Asset

Sale Offer

|

the cash tender offer by Summit Holdings and Finance Corp. to purchase up to

$215.0 million aggregate principal amount of the outstanding 2026 Secured Notes, pursuant

to which $6.0 million aggregate principal amount of the 2026 Secured Notes was tendered

and validly accepted, which settled on June 6, 2024

|

|

2026 Secured Notes Tender

Offer

|

the cash tender offer by Summit Holdings and Finance Corp. to purchase any and all of the

outstanding 2026 Secured Notes, pursuant to which $649.8 million aggregate principal

amount of the 2026 Secured Notes was tendered and validly accepted, which settled on July

26, 2024

|

|

2026 Unsecured Notes

Redemption

|

the redemption by Summit Holdings and Finance Corp. of all $209.5 million aggregate

principal amount of the 2026 Unsecured Notes, which settled on June 24, 2024

|

| 2029 Secured Notes |

Summit Holdings’ 8.625% Senior Secured Second Lien Notes due October 2029

|

|

A&R Partnership

Agreement

|

the Sixth Amended and Restated Agreement of Limited Partnership of SMLP, by and among

the Company, the General Partner, and Tall Oak Parent, dated as of December 2, 2024

|

| ABL Agreement |

Loan and Security Agreement, dated as of November 2, 2021, among Summit Holdings, as borrower, SMLP and certain subsidiaries from time to time party thereto, as guarantors, Bank of America, N.A., as agent, ING Capital LLC, Royal Bank of Canada and Regions Bank, as co-syndication agents, and Bank of America, N.A., ING Capital LLC, RBC Capital Markets and Regions Capital Markets, as joint lead arrangers and joint bookrunners

|

| ABL Facility |

the asset-based lending credit facility governed by the ABL Agreement

|

|

|

|

|

|

|

Amended and Restated ABL Agreement |

Amended and Restated Loan and Security Agreement, dated as of July 26, 2024, among Summit Holdings, as borrower, SMLP and certain subsidiaries from time to time party thereto, as guarantors, Bank of America, N.A., as agent, and Bank of America, N.A., Royal Bank of Canada, Regions Capital Markets, TD Securities (USA) LLC, JPMorgan Chase Bank, N.A, Citizens Bank, N.A., and Truist Bank, as joint lead arrangers and joint bookrunners

|

Amended and Restated ABL Facility |

the asset-based lending credit facility governed by the Amended and Restated ABL Agreement

|

|

|

AMI |

area of mutual interest; AMIs require that any production from wells drilled by our customers within the AMI be shipped on and/or processed by our gathering systems

|

associated natural gas |

a form of natural gas which is found with deposits of petroleum, either dissolved in the crude oil or as a free gas cap above the crude oil in the reservoir

|

ASC |

Accounting Standards Codification

|

ASU |

Accounting Standards Update

|

Audit Committee |

the audit committee of the Board of Directors

|

Bbl |

one barrel; used for crude oil and produced water and equivalent to 42 U.S. gallons

|

Bcf |

one billion cubic feet

|

| Bcf/d |

the equivalent of one billion cubic feet per day; generally calculated when liquids are converted into natural gas; determined using a ratio of six thousand cubic feet of natural gas to one barrel of liquids

|

BLM |

Bureau of Land Management

|

Board of Directors |

the board of directors of Summit Midstream Corporation

|

CAA |

Clean Air Act

|

CEA |

Commodity Exchange Act

|

CCPA |

California Consumer Privacy Act, as amended by the California Privacy Rights Act

|

CERCLA |

Comprehensive Environmental Response, Compensation and Liability Act

|

CFTC |

Commodity Futures Trading Commission

|

|

|

Class B Common Stock |

Class B common stock of the Company, par value $0.01 per share

|

common stock |

common stock of the Company, par value $0.01 per share

|

Compensation Committee |

the compensation committee of the Board of Directors

|

condensate |

a natural gas liquid with a low vapor pressure, mainly composed of propane, butane, pentane and heavier hydrocarbon fractions

|

|

|

|

|

|

|

|

|

Corporate Reorganization |

the August 1, 2024 consummation of a transaction that resulted in SMLP becoming a wholly owned subsidiary of a newly formed Delaware corporation, Summit Midstream Corporation (taxed as a C-corporation)

|

Corps |

U.S. Army Corps of Engineers

|

CWA |

Clean Water Act

|

DFW Midstream |

DFW Midstream Services LLC

|

DJ Basin |

Denver-Julesburg Basin

|

Dodd-Frank Act |

Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010

|

DOI |

U.S. Department of the Interior

|

DOJ |

U.S. Department of Justice

|

DOT |

U.S. Department of Transportation

|

Double E |

Double E Pipeline, LLC

|

| Double E Pipeline |

a 135 mile, 1.5 Bcf/d, FERC-regulated interstate natural gas transmission pipeline that commenced operations in November 2021 and provides transportation service from multiple receipt points in the Delaware Basin to various delivery points in and around the Waha hub in Texas

|

|

|

|

|

| Dth/d |

one million British Thermal Units per day

|

|

|

EPA |

Environmental Protection Agency

|

Epping |

Epping Transmission Company, LLC

|

| Epping Pipeline |

an interstate crude oil pipeline in North Dakota, owned and operated by Epping

|

EPS |

earnings or loss per share

|

|

|

ESA |

Endangered Species Act

|

Exchange Act |

Securities Exchange Act of 1934, as amended

|

FASB |

Financial Accounting Standards Board

|

FERC |

Federal Energy Regulatory Commission

|

Finance Corp. |

Summit Midstream Finance Corp.

|

|

|

|

|

FTC |

Federal Trade Commission

|

GAAP |

accounting principles generally accepted in the United States of America

|

| GDPR |

European Union General Data Protection Regulation

|

|

|

|

|

|

|

General Partner |

Summit Midstream GP, LLC

|

GHG |

greenhouse gas(es)

|

|

|

|

|

|

|

Grand River |

Grand River Gathering, LLC

|

|

|

| hub |

geographic location of a storage facility and multiple pipeline interconnections

|

ICA |

Interstate Commerce Act

|

|

|

Initial 2029 Secured Notes |

the $575,000,000 in aggregate principal amount of 2029 Secured Notes issued on July 26,

2024

|

| Intercreditor Agreement |

Intercreditor Agreement, dated as of November 2, 2021, by and among Bank of America, N.A., as first lien representative and collateral agent for the initial first lien claimholders, Regions Bank, as second lien representative for the initial second lien claimholders and as collateral agent for the initial second lien claimholders, acknowledged and agreed to by Summit Holdings and the other grantors referred to therein as reaffirmed and modified by

the Notice of Reaffirmation

|

IRA |

Inflation Reduction Act

|

IRS |

Internal Revenue Service

|

IT |

information technology

|

LIBOR |

London Interbank Offered Rate

|

LNG |

liquefied natural gas

|

MAOP |

Maximum Allowable Operating Pressure

|

Mbbl/d |

one thousand barrels per day

|

|

|

| MDTQ |

maximum daily transportation quantity

|

Meadowlark Midstream |

Meadowlark Midstream Company, LLC

|

| MMBTU |

metric million British thermal units

|

MMcf |

one million cubic feet

|

MMcf/d |

one million cubic feet per day

|

| MMcfe/d |

the equivalent of one million cubic feet per day; determined using a ratio of six thousand cubic feet of natural gas to one barrel of liquids

|

Mountaineer Midstream |

Mountaineer Midstream Company, LLC

|

Mountaineer Transaction |

the sale of the Mountaineer Midstream system to Antero Midstream LLC for a cash sale

price of $70 million, subject to customary post-closing adjustments

|

MVC |

minimum volume commitment

|

|

|

|

|

|

|

NAAQS |

national ambient air quality standard

|

NEPA |

National Environmental Policy Act

|

| NDIC |

North Dakota Industrial Commission

|

NGA |

Natural Gas Act

|

NGLs |

natural gas liquids; the combination of ethane, propane, normal butane, iso-butane and natural gasolines that when removed from unprocessed natural gas streams become liquid under various levels of higher pressure and lower temperature

|

NGPA |

Natural Gas Policy Act of 1978

|

Niobrara G&P |

Niobrara Gathering and Processing system

|

Notice of Reaffirmation |

Notice and Reaffirmation of Intercreditor Agreement, dated as of July 26, 2024, by and

among Bank of America, N.A., as first lien representative and collateral agent for the initial

first lien claimholders, Regions Bank, as second lien representative and collateral agent for

the initial second lien claimholders, acknowledged and agreed to by Summit Holdings and

the other grantors referred to therein

|

NYSE |

New York Stock Exchange

|

|

|

OCC |

Ohio Condensate Company, L.L.C.

|

OGC |

Ohio Gathering Company, L.L.C.

|

Ohio Gathering |

Ohio Gathering Company, L.L.C. and Ohio Condensate Company, L.L.C.

|

OPA |

Oil Pollution Control Act

|

|

|

|

|

OT |

operational technology

|

Partnership Common Units |

common units representing limited partner interests of SMLP

|

PHMSA |

Pipeline and Hazardous Materials Safety Administration

|

play |

a proven geological formation that contains commercial amounts of hydrocarbons

|

|

|

Permian Holdco |

Summit Permian Transmission Holdco, LLC

|

| Permian Term Loan Facility |

the term loan governed by the Credit Agreement, dated as of March 8, 2021, among Summit Permian Transmission, LLC, as borrower, MUFG Bank Ltd., as administrative agent, Mizuho Bank (USA), as collateral agent, ING Capital LLC, Mizuho Bank, Ltd. and MUFG Union Bank, N.A., as L/C issuers, coordinating lead arrangers and joint bookrunners, and the lenders from time to time party thereto

|

Permian Transmission Credit Facilities |

the credit facilities governed by the Credit Agreement, dated as of March 8, 2021, among Summit Permian Transmission, as borrower, MUFG Bank Ltd., as administrative agent, Mizuho Bank (USA), as collateral agent, ING Capital LLC, Mizuho Bank, Ltd. and MUFG Union Bank, N.A., as L/C issuers, coordinating lead arrangers and joint bookrunners, and the lenders from time to time party thereto

|

|

|

|

|

|

|

Polar and Divide |

the Polar and Divide system; collectively Polar Midstream and Epping

|

Polar Midstream |

Polar Midstream, LLC

|

ppb |

parts per billion

|

produced water |

water from underground geologic formations that is a by-product of natural gas and crude oil production

|

PSD |

Prevention of Significant Deterioration

|

RCRA |

Resource Conservation and Recovery Act

|

|

|

|

|

SEC |

U.S. Securities and Exchange Commission

|

Securities Act |

Securities Act of 1933, as amended

|

segment adjusted EBITDA |

total revenues less total costs and expenses; plus (i) other income excluding interest income, (ii) our proportional adjusted EBITDA for equity method investees, (iii) depreciation and amortization, (iv) adjustments related to MVC shortfall payments, (v) adjustments related to capital reimbursement activity, (vi) stock-based and noncash compensation, (vii) impairments and (viii) other noncash expenses or losses, less other noncash income or gains

|

Series A Certificate of Designation |

the Certificate of Designation of Series A Floating Rate Cumulative Redeemable

Perpetual Preferred Stock of the Company

|

| Series A Preferred Stock |

Series A Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Stock issued

by the Company

|

Series A Preferred Units |

Series A Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units issued by SMLP |

shortfall payment |

the payment received from a counterparty when its volume throughput does not meet its MVC for the applicable period

|

| SMC LTIP |

Summit Midstream Corporation 2024 Long-Term Incentive Plan

|

SMLP |

Summit Midstream Partners, LP

|

SMLP LTIP |

SMLP 2022 Long-Term Incentive Plan

|

|

|

|

|

| SOFR |

Secured Overnight Financing Rate

|

SPCC |

Spill Prevention Control and Countermeasure

|

Subsidiary Series A Preferred Units |

Series A Fixed Rate Cumulative Redeemable Preferred Units issued by Permian Holdco

|

Summit Holdings |

Summit Midstream Holdings, LLC

|

Summit Investments |

Summit Midstream Partners, LLC

|

|

|

|

|

|

|

|

|

Summit Permian Transmission |

Summit Permian Transmission, LLC

|

|

|

|

|

|

|

Summit Utica |

Summit Midstream Utica, LLC

|

Tall Oak |

Tall Oak Midstream Operating, LLC

|

Tall Oak Acquisition |

the consummation of the transaction contemplated by the Tall Oak Business Contribution Agreement

|

|

|

|

|

Tall Oak Business Contribution Agreement |

the Business Contribution Agreement, dated as of October 1, 2024, by and among the Company, SMLP, and Tall Oak Parent, pursuant to which Tall Oak Parent contributed all of its equity interests in Tall Oak to SMLP in exchange for total consideration equal to $425.0 million

|

Tall Oak Parent |

Tall Oak Midstream Holdings, LLC

|

Tcfe |

the equivalent of one trillion cubic feet

|

the Company |

Summit Midstream Corporation and its subsidiaries

|

throughput volume |

the volume of natural gas, crude oil or produced water gathered, transported or passing through a pipeline, plant or other facility during a particular period; also referred to as volume throughput

|

|

|

|

|

unconventional resource basin |

a basin where natural gas or crude oil production is developed from unconventional sources that require hydraulic fracturing as part of the completion process, for instance, natural gas produced from shale formations and coalbeds; also referred to as an unconventional resource play

|

Utica Sale |

the sale of Summit Utica to a subsidiary of MPLX LP for a cash sale price of $625.0 million,

subject to customary post-closing adjustments

|

VOC |

volatile organic compound(s)

|

wellhead |

the equipment at the surface of a well, used to control the well’s pressure; also, the point at which the hydrocarbons and water exit the ground

|

PART I

ITEM 1. BUSINESS

Summit Midstream Corporation, a Delaware corporation (including its subsidiaries, collectively, “we”, “our”, “us”, “SMC”, or “the Company”), is a value-driven company focused on developing, owning and operating midstream energy infrastructure assets that are strategically located in the core producing areas of unconventional resource basins, primarily shale formations, in the continental United States. The Company’s business activities are primarily conducted through various operating subsidiaries, each of which is owned or controlled by its subsidiary holding company, Summit Holdings.

The Company was incorporated under the laws of the State of Delaware on May 14, 2024 for the purpose of effecting the Corporate Reorganization of Summit Midstream Partners, LP, a Delaware master limited partnership, in which the Company was incorporated to serve as the new parent holding company of SMLP. The Company’s common stock is listed on the New York Stock Exchange under the ticker symbol “SMC.” SMLP was formed in May 2012, and prior to August 1, 2024, SMLP’s common units were listed on NYSE under the ticker symbol “SMLP.”

The Company’s executive offices are located at 910 Louisiana Street, Suite 4200, Houston, Texas 77002, and can be reached by phone at 832-413-4770. The Company also maintains regional field offices in close proximity to its areas of operation to support the operation and development of the Company’s midstream assets.

Our Business Strategies

We operate a differentiated midstream platform that is built for long-term, sustainable value creation. Our integrated assets are strategically located in production basins, including the Williston Basin, DJ Basin, Barnett Shale, Piceance Basin, Permian Basin and, following the Tall Oak Acquisition, the Arkoma Basin. Our primary business objective is to maximize cash flow and provide cash flow stability for its stakeholders while growing prudently and profitably. We intend to accomplish this objective by executing the following strategies:

•Capital structure optimization. We seek to maximize stakeholder value. Our capital structure currently consists of common equity (including the Company’s common stock and Class B Common Stock and associated Partnership Common Units of SMLP), preferred equity, and indebtedness that is comprised of debt securities and borrowings under our revolving credit facilities, a portion of which is secured by substantially all of our assets. We intend to optimize our capital structure in the future by reducing our indebtedness with free cash flow, and when appropriate, we may pursue opportunistic capital markets transactions, asset acquisitions (such as the Tall Oak Acquisition), or asset divestitures (such as the Utica Sale or the Mountaineer Transaction) with the objective of increasing long-term stakeholder value.

•Portfolio management. We seek to maximize stakeholder value by strategically managing our portfolio of midstream assets and allocating capital based on appropriate risk-informed cash flow assumptions. This may include value enhancing acquisitions (such as the Tall Oak Acquisition) or opportunistic divestitures (such as the Utica Sale or the Mountaineer Transaction), re-allocation of capital to new or existing areas, and development of joint ventures (such as Double E) involving our existing midstream assets or new investment opportunities.

•Maintaining focus on fee-based revenue with minimal direct commodity price exposure. We intend to maintain our focus on providing midstream services under primarily long-term and fee-based contracts. We believe that our focus on fee-based revenues with minimal direct commodity price exposure is essential to maintaining stable cash flows.

•Maintaining strong producer relationships to maximize utilization of all of our midstream assets. We have cultivated strong producer relationships by focusing on customer service and reliable project execution and by operating our assets safely and reliably over time. We believe that our strong producer relationships will create future opportunities to expand our midstream services reach and optimize the utilization of our midstream assets for our customers.

•Continuing to prioritize safe and reliable operations. We believe that providing safe, reliable and efficient operations is a key component of our business strategy. We place a strong emphasis on employee training, operational procedures and enterprise technology, and we intend to continue promoting a high standard with respect to the efficiency of our operations and the safety of all of our constituents.

Recent Developments and Highlights