Document

Exhibit 99.1

Q1

2025

EARNINGS RESULTS

Conference Call

Thursday April 24, 2025

9:00 a.m. (Mexico City Time)

11:00 a.m. (Eastern Time)

To participate in the conference call please connect via webcast or by dialing:

International Toll-Free: +1 (888) 350-3870

International Toll: +1 (646) 960-0308

International Numbers: https://events.q4irportal.com/custom/access/2324/

Participant Code: 1849111

Webcast: https://events.q4inc.com/attendee/563716832

The replay will be available two hours after the call had ended and can be accessed from Vesta's IR website.

Juan Sottil

CFO

+52 55 5950-0070 ext. 133

jsottil@vesta.com.mx

Fernanda Bettinger

IRO

+52 55 5950-0070 ext. 163

mfbettinger@vesta.com.mx

investor.relations@vesta.com.mx

Barbara Cano

InspIR Group

+1 (646) 452-2334

barbara@inspirgroup.com

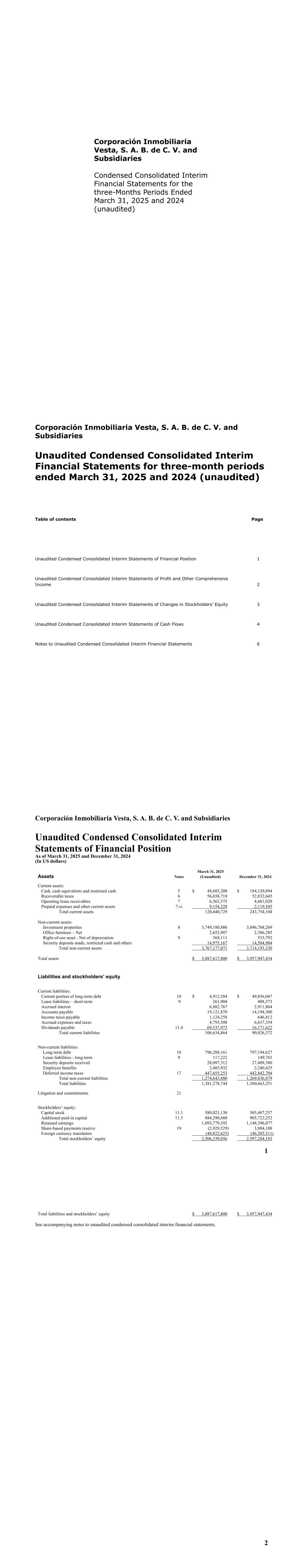

Mexico City, April 23, 2025 – Corporación Inmobiliaria Vesta S.A.B. de C.V., (“Vesta”, or the “Company”) (BMV: VESTA; NYSE: VTMX), a leading industrial real estate company in Mexico, today announced results for the first quarter ended March 31, 2025. All figures included herein were prepared in accordance with International Financial Reporting Standards (IFRS), which differs in certain significant respects from U.S. GAAP. This information should be read in conjunction with, and is qualified in its entirety by reference to, our consolidated financial statements, including the notes thereto. Vesta’s financial results are stated in US dollars unless otherwise noted.

Q1 2025 Highlights

•Vesta delivered strong financial results for the first quarter 2025: total income was US$ 67.1 million; a 10.7% year over year increase, while total income excluding energy reached US$ 64.9 million; an 8.6% increase compared to US$ 59.7 million in the first quarter 2024. First quarter 2025 Adjusted NOI1 margin and Adjusted EBITDA2 margin reached 95.7% and 85.2%, respectively. Vesta FFO reached US$ 45.0 million for the first quarter 2025; an 11.4% increase compared to US$ 40.4 million in first quarter 2024.

•Based on first quarter performance and the Company's current outlook, Vesta reaffirms its full year 2025 guidance as was provided within its fourth quarter 2024 earnings results press release: Vesta expects 2025 revenues to increase between 10.0-11.0% with a 94.5% Adjusted NOI margin and an 83.5% Adjusted EBITDA margin, while maintaining the Company´s solid performance across key operational metrics.

•First quarter 2025 leasing activity reached 1.4 million sf: 139 thousand sf in new contracts, with three new Vesta tenants, and 1.3 million sf in lease renewals. Vesta’s first quarter 2025 total portfolio occupancy therefore reached 92.8%, while stabilized and same-store occupancy reached 95.3% and 97.4%, respectively.

•First quarter 2025 renewals and re-leasing reached 1.4 million sf with a trailing twelve-month weighted average spread of 11.5%. Same-store NOI increased by 4.3% year over year.

•During the first quarter, the Company acquired 18.7 acres of land in Mexico City representing 367 thousand sf in GLA. In April 2025, subsequent to the quarter´s end, Vesta acquired 20.2 acres of land in Monterrey representing 449 thousand sf in buildable area for future construction. Both land acquisitions represent highly desirable urban infill locations which address critical last-mile logistics and e-commerce demand. These acquisitions represent another important milestone for the Company, further expanding its strategic land bank, aligned with Vesta's Route 2030 plan.

•Vesta ended the first quarter 2025 with 1.9 million sf in current construction in progress; an estimated investment of approximately US$ 142.6 million with a projected yield on cost of 10.6%, in markets including Mexico City, Querétaro and Monterrey.

•At Vesta's General Shareholders' Meeting on March 19, 2025, Vesta shareholders approved a share buyback plan in the amount of US$ 150 million. Vesta´s share repurchase program reached US$ 36.4 million, or 15.5 million shares, for the first quarter 2025. All shares acquired as part of the Company's buyback program will be subsequently canceled, aligned with Vesta's focus on consistently allocating capital to ensure the most significant shareholder return.

•Also at its March 19, 2025 General Shareholders' Meeting, Vesta shareholders approved a US$ 69.5 million dividend for 2025, representing a 7.5% year over year dividend increase. Vesta therefore paid US$ 17.4 million in dividends, equivalent to PS$ 0.4137 per ordinary share, on April 15, 2025 for the first quarter 2025.

•Subsequent to quarter's end, in April 2025, Vesta drew down US$ 100 million of the US$ 345 million syndicated loan the Company had closed in December 2024.

1 Adjusted NOI and Adjusted NOI Margin calculations have been modified, please refer to Notes and Disclaimers.

2Adjusted EBITDA and Adjusted EBITDA Margin calculations have been modified, please refer to Notes and Disclaimers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

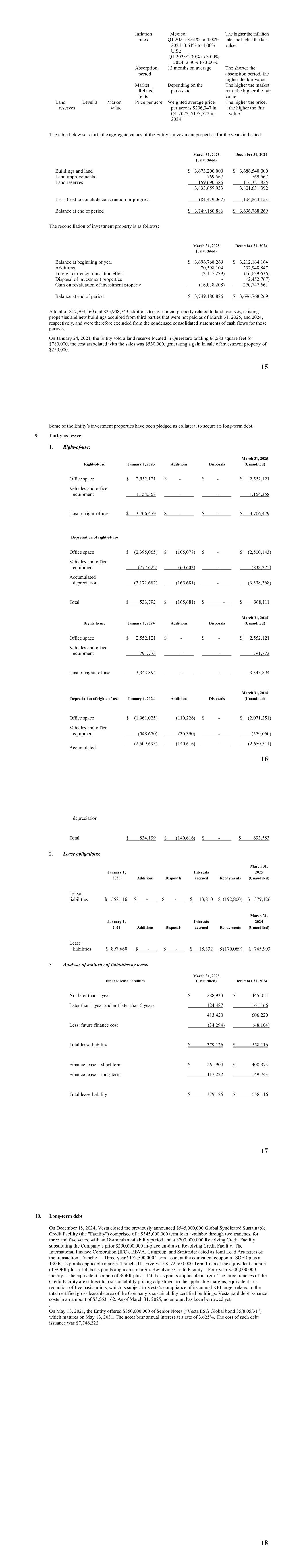

| Financial Indicators (million) |

Q1 2025 |

Q1 2024 |

Chg. % |

|

|

|

| Total Rental Income |

67.1 |

60.6 |

10.7 |

|

|

|

| Total Revenues (-) Energy |

64.9 |

59.7 |

8.6 |

|

|

|

| Adjusted NOI |

62.1 |

57.2 |

8.5 |

|

|

|

| Adjusted NOI Margin % |

95.7% |

95.8% |

|

|

|

|

| Adjusted EBITDA |

55.3 |

50.6 |

9.3 |

|

|

|

| Adjusted EBITDA Margin % |

85.2% |

84.7% |

|

|

|

|

| EBITDA Per Share |

0.0637 |

0.0572 |

11.4 |

|

|

|

| Total Comprehensive Income |

12.3 |

124.0 |

(90.1) |

|

|

|

| Vesta FFO |

45.0 |

40.4 |

11.4 |

|

|

|

| Vesta FFO Per Share |

0.0518 |

0.0456 |

1359.0 |

|

|

|

| Vesta FFO (-) Tax Expense |

36.1 |

33.4 |

8.2 |

|

|

|

| Vesta FFO (-) Tax Expense Per Share |

0.0416 |

0.0377 |

10.3 |

|

|

|

| Diluted EPS |

0.0142 |

0.1402 |

(89.9) |

|

|

|

| Shares (average) |

867.9 |

884.8 |

(1.9) |

|

|

|

•First quarter 2025 total revenue reached US$ 67.1 million; a 10.7% year on year increase from US$ 60.6 million in the first quarter 2024. Total revenues excluding energy increased to US$ 64.9 million; a 8.6% year on year increase from US$ 59.7 million in 2024 due to US$ 5.2 million in new revenue-generating contracts and a US$ 2.1 million inflationary benefit on first quarter 2025 results.

•First quarter 2025 Adjusted Net Operating Income (Adjusted NOI) increased 8.5% to US$ 62.1 million, compared to US$ 57.2 million in the first quarter 2024. The first quarter 2025 Adjusted NOI margin was 95.7%; a 10-basis-point year on year decrease due to increased costs related to rental income generating properties.

•Adjusted EBITDA for the quarter increased 9.3% to US$ 55.3 million, as compared to US$ 50.6 million in the first quarter 2024. The Adjusted EBITDA margin was 85.2%; a 50-basis-point increase primarily due to a decrease in the proportion of administrative expenses relative to total revenues for the quarter.

•First quarter 2025 Vesta funds from operations after tax (Vesta FFO (-) Tax Expense) increased to a US$ 36.1 million gain, from US$ 33.4 million for the same period in 2024. Vesta FFO after tax per share was US$ 0.0416 for the first quarter 2025 compared with US$ 0.0377 for the same period in 2024, a 9.2% increase. This increase is due to higher income for the first quarter 2025. First quarter 2025 Vesta FFO excluding current tax was US$ 45.0 million compared to US$ 40.4 million in the first quarter 2024, due to higher 2025 profit relative to the same period in 2024.

•First quarter 2025 total comprehensive income was US$ 12.3 million, versus a US$ 124.0 million gain in the first quarter 2024, primarily due to lower other expenses during the first quarter 2024.

•The total value of Vesta’s investment property portfolio was US$ 3.7 billion as of March 31, 2025; a 1.4% increase compared to US$ 3.7 billion at the end of December 31, 2024.

Letter from the CEO

PRUDENCE, DISCIPLINE AND LEADERSHIP THROUGH TIMES OF UNCERTAINTY

A judicious and measured approach is essential during uncertain times. Vesta has maintained our focus through the ever-evolving global trade scenario, having successfully navigated volatility throughout our history. While Trump's sweeping new tariffs introduced complexity, to say the least, Mexico received what some describe as preferential treatment, with a reduced 12% tariff applied only to non-USMCA compliant exports. This underscores not only our countries' close partnership but Mexico's important strategic role in North American trade.

Trump’s new tariff regime leaves in place Mexico’s status as a prime destination for companies seeking to move production and supplies closer to the U.S. This privileged position may unlock new opportunities for our country, further driving manufacturing's shift from Asia while accelerating global supply chain nearshoring. Both El Financiero and The Wall Street Journal note this trend could even exceed earlier trade shifts and manufacturing relocation. While Vesta is ever-vigilant of risks, sector-specific tensions and uncertainty- also surrounding the upcoming USMCA renegotiation- it's clear our two economies are deeply integrated. And Vesta remains manufacturers' partner of choice for future investment and profitable long-term growth.

As can be expected: uncertainty prevails, which has been the overarching theme over the last three months. Across industries and markets, companies are simply not making decisions- particularly on long-term investments. Leasing activity and market-wide absorption has slowed in Mexico, as it has in the U.S. and Europe. However, Vesta’s tenants are staying- and are expanding - within our portfolio, also with new tenants and healthy rent increases on renewals during the first quarter. We delivered 1.4 million square feet in total leasing activity: 138,735 square feet of new contracts with three new tenants and 1.3 million sf in lease renewals. And Vesta's value creation proposition was again evidenced, with mark to market rent increases on re-leasing as well as renewals resulting in an 11.5% trailing twelve-month weighted average spread for the quarter. Same-store NOI increased by 4.3% year over year.

Current construction in progress reached 1.9 million sf by quarter's end, representing an estimated investment of approximately US$ 143 million and a 10.6% yield on cost, mainly across Mexico City, Querétaro and Monterrey.

Two of Vesta's important competitive advantages are our strong balance sheet and our ability to nimbly adapt to capture opportunities. During the first quarter we acquired 18.7 acres of in Mexico City, with a buildable area of 367 thousand sf. Shortly after the close of the quarter, in April, we acquired 20.2 acres of land in Monterrey, providing 449 thousand sf for future development. Both properties are strategically located urban-infill and are optimally positioned to meet last-mile logistics and e-commerce needs, aligned with our Route 2030 strategic plan. This ensures our flexible platform remains agile and ready to capture demand once the dust settles, with land and infrastructure poised to support future development.

Vesta delivered solid financial results in the first quarter 2025: total income reached US$ 67.1 million, a 10.7% year on year increase. Adjusted NOI margin stood at 95.7%, and adjusted EBITDA margin at 85.2%. FFO reached US$ 45.0 million; an 11.4% increase compared to US$ 40.4 million in the first quarter 2024.

In light of the current environment, we’re making high-conviction decisions to put our capital to work in the best way possible to drive value for Vesta’s shareholders. In March, we executed a substantial share buyback, taking advantage of a significant discount between our share price and the intrinsic value of our assets. These repurchases were made at an attractive entry point from a replacement cost, yield multiple, and NAV perspective. Further, at our March Annual Shareholders Meeting, Vesta shareholders approved a US$ 150 million share buyback program, enabling us to opportunistically repurchase our shares at a considerable discount, returning value our shareholders without adversely effecting trading liquidity. Importantly, I’d like to underscore that all shares Vesta has and will be acquiring will be cancelled.

Our focus therefore remains on disciplined capital allocation, opportunistically buying back shares to capture what we believe to be a disconnect in the market's valuation of Vesta’s current static portfolio, which today is at 95% stabilized occupancy with rents indexed to inflation, and the sustained growth, recurring income and long-term maturity profile of Vesta’s current portfolio represents. We'll also continue to prudently direct capital to secure land for future growth to drive our long-term vision, which remains firmly intact.

In April 2025, Vesta drew down US$ 100 million from the US$ 345 million syndicated loan we secured in December 2024, ensuring sound liquidity. With our loan-to-value ratio at an historic low during the first

quarter at of 20.6%, we maintain ample capacity to finance future opportunities and are well positioned to respond as market conditions improve.

Therefore, while we're proceeding with caution in response to current headwinds, we remain confident in the strength of Vesta's future. Our Route 2030 strategic plan was designed with a long-term perspective while taking current and potential disruptions into account.

Vesta has demonstrated our resilience in the past: we adapt, we react, we lead. We're leveraging our competitive advantages to achieve our vision as we seize opportunities to build for the future.

Thank you for your continued support.

Lorenzo D. Berho

CEO

First Quarter Financial Summary

Consolidated Statutory Accounts

The accompanying consolidated condensed interim financial statements have been prepared based on International Accounting Standards (IFRS), which differs in certain significant respects from U.S. GAAP. This information should be read in conjunction with, and is qualified in its entirety by reference to, our financial consolidated statements, including the notes thereto and are stated in US dollars unless otherwise noted.

All consolidated financial statements have been prepared using an historical cost basis, excluding investment properties and financial instruments at the end of each reporting period. Historical cost is largely based on the fair value of the consideration given in exchange for assets. First quarter 2025 results are presented in comparison to the same period of the prior year and on an adjusted basis based on the same accounting rules.

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Interim and Annual Statements of Profit and Other Comprehensive Income (million) |

Q1 2025 |

Q1 2024 |

Chg. % |

|

|

|

| Revenues |

|

|

|

|

|

|

| Rental income |

60.6 |

55.8 |

8.5 |

|

|

|

| Reimbursable building services |

4.3 |

3.5 |

21.8 |

|

|

|

| Energy Income |

2.2 |

0.8 |

157.1 |

|

|

|

| Management Fees |

0.0 |

0.4 |

0.0 |

|

|

|

| Total Revenues |

67.1 |

60.6 |

10.7 |

|

|

|

| Total Operating Property Costs |

(5.2) |

(4.5) |

15.6 |

|

|

|

| Related to properties that generate rental income |

(4.4) |

(3.9) |

13.5 |

|

|

|

| Costs related to properties |

(2.8) |

(2.5) |

11.3 |

|

|

|

| Costs related to energy |

(1.7) |

(1.4) |

17.3 |

|

|

|

| Related to properties that did not generate rental income |

(0.8) |

(0.6) |

29.3 |

|

|

|

| Adjusted Net Operating Income |

62.1 |

57.2 |

8.5 |

|

|

|

Vesta’s first quarter 2025 total revenues increased 10.7% to US$ 67.1 million, from US$ 60.6 million in the first quarter 2024. The US$ 6.5 million rental revenue increase was primarily due to: [i] a US$ 5.2 million, or 8.6%, increase from space rented in the first quarter of 2025 which had previously been vacant in the first quarter of 2024; [ii] a US$ 2.1 million, or 3.5%, increase related to inflationary adjustments on rented property in the first quarter of 2025; [iii] a US$ 0.8 million increase in other income reflecting reimbursements for expenses paid by Vesta on behalf of clients that are not recorded as rental revenue; and [iv] US$ 1.3 million increase in energy income.

These results were partially offset by: [i] a US$ 1.2 million, or 2.0%, decrease related to lease agreements which expired and were not renewed during the first quarter 2025; [ii] a US$ 1.1 million, or 1.9%, decrease in rental income due to the conversion of peso-denominated rental income into US dollars; [iii] US$ 0.2 million, or 0.3%%, decrease related to lease agreements which were renewed during the first quarter 2025 at a lower rental rate in order to extend certain clients short term renewal option to a longer term lease agreement; and [iv] US$ 0.4 million decrease related to a management fee collected during 2024 but not in 2025.

89.7% of Vesta’s first quarter 2025 rental revenues were US dollar denominated and indexed to the US Consumer Price Index (CPI), an increase from 87.8% in the first quarter 2024. Contracts denominated in pesos are adjusted annually based on the equivalent Mexican Consumer Price Index, the “Indice Nacional de Precios al Consumidor” (INPC).

Property Operating Costs

Vesta’s first quarter 2025 total operating costs reached US$ 5.2 million, compared to US$ 4.5 million in the first quarter 2024; a US$ 2.6 million, or 15.6%, increase due to increased costs related to both rental income generating properties and non generating income properties.

During the first quarter 2025, costs related to investment properties generating rental revenues amounted to US$ 4.4 million, compared to US$ 3.9 million for the same period in 2024. This was primarily attributable to an increase in costs related to real estate taxes, insurance costs, maintenance and other property related expenses, as well as higher energy-related costs, which increased to US$ 1.7 million in first quarter 2025, from US$ 1.4 million in first quarter 2024.

Costs from investment properties which did not generate rental revenues during the first quarter 2025 increased by US$ 0.2 million to US$ 0.8 million. This was primarily due to an increase in Vesta Parks' vacancy rate compared to last year.

Adjusted Net Operating Income (Adjusted NOI) 3

First quarter Adjusted Net Operating Income increased 8.5% to US$ 62.1 million year on year with an 10-basis-point NOI margin decrease, to 95.7%. This decrease was due to higher costs related to rental income generating properties resulting in a lower margin.

General and Administrative Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Interim and Annual Statements of Profit and Other Comprehensive Income (million) |

Q1 2025 |

Q1 2024 |

Chg. % |

|

|

|

| General and Administrative Expenses |

(8.3) |

(8.2) |

0.7 |

|

|

|

| Stock- based Compensation Expenses |

2.2 |

2.1 |

2.3 |

|

|

|

| Depreciation |

(0.6) |

(0.3) |

94.3 |

|

|

|

| Adjusted EBITDA |

55.3 |

50.6 |

9.3 |

|

|

|

First quarter 2025 administrative expenses totaled US$ 8.3 million, compared to US$ 8.2 million in the first quarter of 2024; a 0.7% increase. The increase is primarily due to an increase in the Company's long term compensation plan and other administrative expenses.

Expenses related to the share-based payment of Vesta’s compensation plan amounted to US$ 2.2 million for the first quarter of 2025. For detailed information on Vesta’s expenses, please see Note 18 within the Company’s Financial Statements.

Depreciation

First quarter 2025 depreciation was US$ 0.6 million, compared to US$ 0.3 million in the first quarter of 2024. This amount reflects office space and equipment depreciation as well as the amortization of Vesta´s operating systems.

___________________________________

1.NOI and NOI Margin calculations have been modified, please refer to Notes and Disclaimers

Adjusted EBITDA 4

First quarter 2025 Adjusted EBITDA increased 9.3% to US$ 55.3 million, from US$ 50.6 million in the first quarter 2024, and the EBITDA margin increased 50-basis-points to 85.2%, as compared to 84.7% for the same period in 2024. This margin increase was due to lower expenses relative to total income during the first quarter 2025.

Other Income and Expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Interim and Annual Statements of Profit and Other Comprehensive Income (million) |

Q1 2025 |

Q1 2024 |

Chg. % |

|

|

|

| Other Income and Expenses |

|

|

|

|

|

|

| Interest income |

1.0 |

5.1 |

(79.8) |

|

|

|

| Other (expenses) income |

1.6 |

0.9 |

74.5 |

|

|

|

| Other net income energy |

(0.5) |

(1.1) |

(53.3) |

|

|

|

| Transaction cost on debt issuance |

0.0 |

0.0 |

na |

|

|

|

| Interest expense |

(10.3) |

(10.2) |

0.7 |

|

|

|

| Exchange gain (loss) |

(0.1) |

0.9 |

(111.3) |

|

|

|

| Gain from properties sold |

0.0 |

0.3 |

(100.0) |

|

|

|

| Gain on revaluation of investment properties |

(16.0) |

107.3 |

(114.9) |

|

|

|

| Total other income (expenses) |

(24.3) |

103.1 |

(123.6) |

|

|

|

Total first quarter 2025 other expense reached US$ 24.3 million, compared to US$ 103.1 million in other income at the end of the first quarter 2024, a decrease primarily due to a decreased gain on revaluation of investment properties and lower interest income.

First quarter 2025 interest income decreased to US$ 1.0 million year on year, from US$ 5.1 million in the first quarter 2024, due to a lower cash position during the first quarter 2025 as compared to the same quarter last year.

First quarter 2025 other income resulted in a US$ 1.6 million gain due to the net result of the Company’s other accounting expenses.

First quarter 2025 other net expense related to energy resulted in a US$ 0.5 million expense, which reflects energy sold to companies which are not Vesta´s clients.

First quarter 2025 interest expense increase to US$ 10.3 million, from US$ 10.2 million for the same quarter in 2024, reflecting the 2018 private placement prepayment fee.

Vesta’s first quarter 2025 foreign exchange loss was US$ 0.1 million, compared to a US$ 0.9 million gain in first quarter 2024. This loss relates primarily to a sequential currency movement in Vesta’s dollar-denominated debt balance during first quarter 2025 within WTN, the Company’s only subsidiary that uses the Mexican peso as its functional currency.

First quarter 2025 valuation of investment properties resulted in a US$ 16.0 million loss, compared to a US$ 107.3 million gain in the first quarter of 2024. This year-on-year decrease was due to the appraiser's assessment of lower occupancy across Mexico´s regions and forecast that rents will stabilize.

___________________________________

2.EBITDA and EBITDA Margin calculations have been modified, please refer to Notes and Disclaimers

Profit Before Income Taxes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Interim and Annual Statements of Profit and Other Comprehensive Income (million) |

Q1 2025 |

Q1 2024 |

Chg. % |

|

|

|

| Profit Before Income Taxes |

28.6 |

150.6 |

(81.0) |

|

|

|

| Income Tax Expense |

(13.7) |

(25.7) |

(46.9) |

|

|

|

| Current Tax |

(8.9) |

(7.0) |

26.7 |

|

|

|

| Deferred Tax |

(4.8) |

(18.7) |

(74.3) |

|

|

|

| Profit for the Period |

14.9 |

124.9 |

(88.1) |

|

|

|

| Valuation of derivative financial instruments |

0.0 |

0.0 |

na |

|

|

|

| Exchange differences on translating other functional currency operations |

(2.6) |

(0.9) |

204.3 |

|

|

|

| Total Comprehensive Income for the period |

12.3 |

124.0 |

(90.1) |

|

|

|

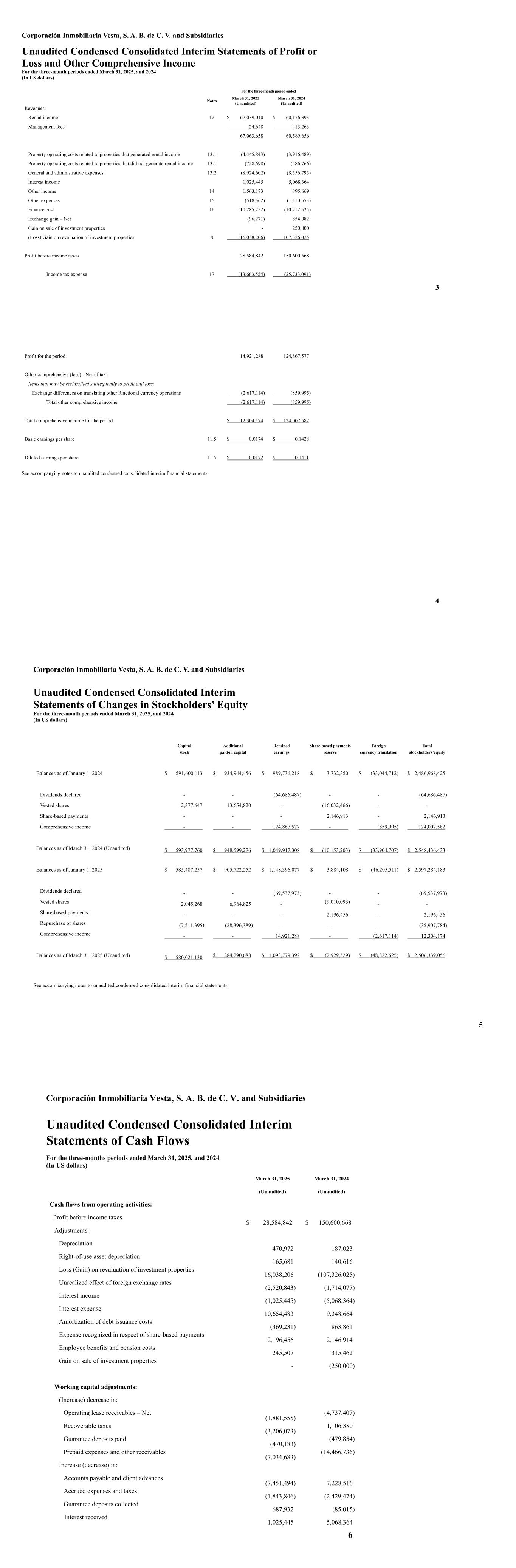

Due to the above factors, first quarter 2025 profit before income tax reached US$ 28.6 million, compared to US$ 150.6 million for the same quarter last year.

Income Tax Expense

Vesta reported a US$ 13.7 million income tax expense in the first quarter 2025, compared to a US$ 25.7 million expense in first quarter 2024.

To calculate the income tax expense for each quarter of the year the Company estimated 2025 ETR, considering stable balances, the statutory rate, the effects of expected exchange rates on tax balances and the expected effects of inflation.

First Quarter 2025 Profit

Due to the above, the Company’s first quarter 2025 profit was US$ 14.9 million, compared to US$ 124.9 million profit in the first quarter 2024.

Total Comprehensive Income (Loss) for the Period

Vesta closed the first quarter 2025 with US$ 12.3 million in total comprehensive income, compared to a US$ 124.0 million gain at the end of the first quarter of 2024, due to the above factors. This comprehensive income was partially offset by a US$ 2.6 million loss in exchange differences when translating other functional currency operations.

Funds from Operations (FFO)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FFO Reconciliation (million) |

Q1 2025 |

Q1 2024 |

Chg. % |

|

|

|

| Profit for the year |

14.9 |

124.9 |

(88.1) |

|

|

|

| Gain on revaluation of investment properties |

16.0 |

(107.3) |

(114.9) |

|

|

|

| Gain in properties sold |

0.0 |

(0.3) |

na |

|

|

|

| FFO |

31.0 |

17.3 |

79.0 |

|

|

|

| Stock- based Compensation Expenses |

2.2 |

2.1 |

2.3 |

|

|

|

| Exchange Gain (Loss) |

0.1 |

(0.9) |

(111.3) |

|

|

|

| Depreciation |

0.6 |

0.3 |

94.3 |

|

|

|

| Other income |

(1.6) |

(0.9) |

74.5 |

|

|

|

| Other income energy |

0.5 |

1.1 |

(53.3) |

|

|

|

| Energy |

(0.5) |

0.6 |

(188.7) |

|

|

|

| Interest income |

(1.0) |

(5.1) |

(79.8) |

|

|

|

| Income Tax Expense |

13.7 |

25.7 |

(46.9) |

|

|

|

| Vesta FFO |

45.0 |

40.4 |

11.4 |

|

|

|

| Vesta FFO per share |

0.0518 |

0.0456 |

12.4 |

|

|

|

| Current Tax |

(8.9) |

(7.0) |

26.7 |

|

|

|

| Vesta FFO (-) Tax Expense |

36.1 |

33.4 |

8.2 |

|

|

|

| Vesta FFO (-) Tax Expense per share |

0.0416 |

0.0377 |

9.2 |

|

|

|

First quarter 2025 Vesta Funds from Operations (Vesta FFO (-) Tax Expense) after tax expense resulted in a US$ 36.1 million, or US$ 0.0416 per share, gain compared with a US$ 33.4 million, or US$ 0.0377 per share, gain for first quarter 2024.

Vesta FFO for the first quarter 2025 reached US$ 45.0 million; a 11.4% increase compared with US$ 40.4 million in first quarter 2024.

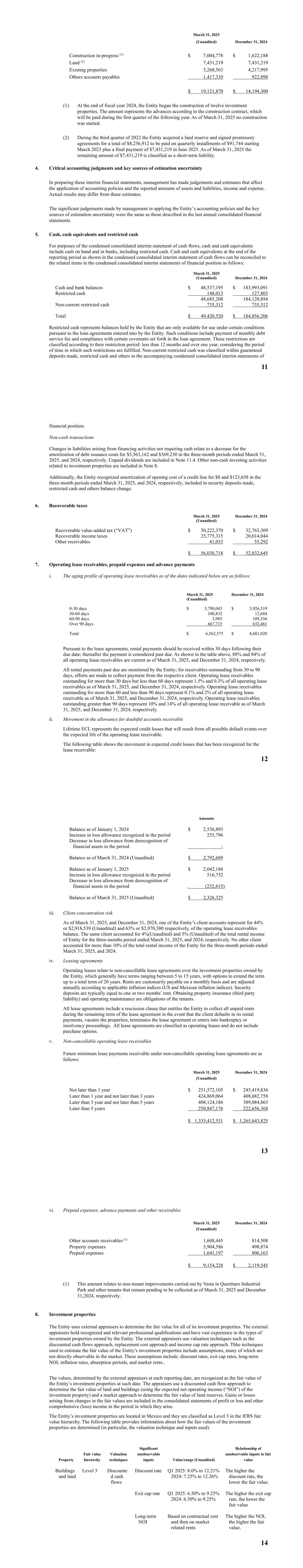

Capex

Investing activities during the first quarter of 2025 were primarily related to payments for works in progress in the construction of new buildings in the Northern, Bajio and Central regions, reflected in a US$ 58.2 million total expense.

Debt

As of March 31, 2025, the Company´s overall balance of debt was US$ 801.2 million, of which US$ 4.9 million is related to short-term liabilities and US$ 796.3 million is related to long-term liabilities. The secured portion of the debt is approximately 36.8% of total debt and is guaranteed by some of the Company’s investment properties, as well as by the related income derived from these properties. As of first quarter 2025, 100% of Vesta’s debt was denominated in US dollars and 100% of its interest rate was fixed.

Stabilized Portfolio

Vesta currently reports stabilized portfolio occupancy and same store occupancy as management believes these metrics are useful indicators of the performance of the Company’s operating portfolio. The additional metrics are intended to reflect market best practices and better enable the comparison of Vesta’s performance with the performance of its publicly traded industrial real estate peers.

The 'operating portfolio' calculation includes properties which have reached 80% occupancy or have been completed for more than one year, whichever occurs first.

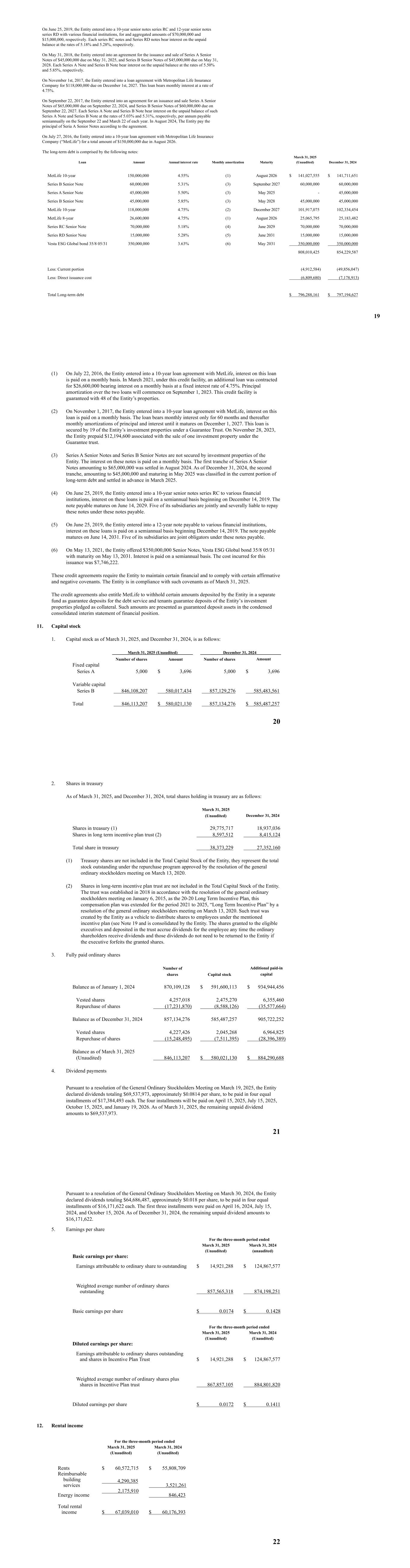

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 2024 |

|

Q1 2025 |

| Region |

Stabilized Portfolio |

Growth SF |

Stabilized Portfolio |

| SF |

% |

SF |

SF |

% |

| Central Mexico |

7,256,310 |

20.1% |

850,047 |

8,106,357 |

20.3% |

| Bajio |

17,731,773 |

49.1% |

1,083,860 |

18,815,632 |

47.1% |

| North |

11,094,136 |

30.7% |

1,943,228 |

13,037,364 |

32.6% |

| Total |

36,082,218 |

100% |

3,877,135 |

39,959,353 |

100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 2024 |

Q1 2025 |

|

Occupancy SF |

% Total |

Occupancy SF |

% Total |

| Central Mexico |

7,194,137 |

99.1% |

8,106,357 |

100.0% |

| Bajio |

16,858,355 |

95.1% |

18,004,555 |

95.7% |

| North |

10,993,123 |

99.1% |

11,966,256 |

91.8% |

| Total |

35,045,615 |

97.1% |

38,077,168 |

95.3% |

Same-Store Portfolio

Based on the updated calculation, this metric will only include properties within the Company’s portfolio which have been stabilized for the entirety of current and comparable periods. This amended definition is intended to reflect market best practices and aid in the comparison of Vesta’s performance with the performance of its publicly traded industrial real estate peers. Vesta has provided below a reconciliation of the updated definition versus the prior definition.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 2024 |

|

Q1 2025 |

| Region |

Same Store Portfolio |

Growth SF |

Same Store Portfolio |

| SF |

% |

SF |

SF |

% |

| Central Mexico |

7,179,938 |

21.8% |

76,371 |

7,256,309 |

19.8% |

| Bajio |

15,778,261 |

47.8% |

2,248,381 |

18,026,641 |

49.3% |

| North |

10,046,335 |

30.4% |

1,258,599 |

11,304,934 |

30.9% |

| Total |

33,004,534 |

100% |

3,583,350 |

36,587,884 |

100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 2024 |

Q1 2025 |

|

Occupancy SF |

% Total |

Occupancy SF |

% Total |

| Central Mexico |

7,117,765 |

99.1% |

7,256,309 |

100.0% |

| Bajio |

15,074,827 |

95.5% |

17,377,324 |

96.4% |

| North |

9,945,322 |

99.0% |

10,987,328 |

97.2% |

| Total |

32,137,914 |

97.4% |

35,620,961 |

97.4% |

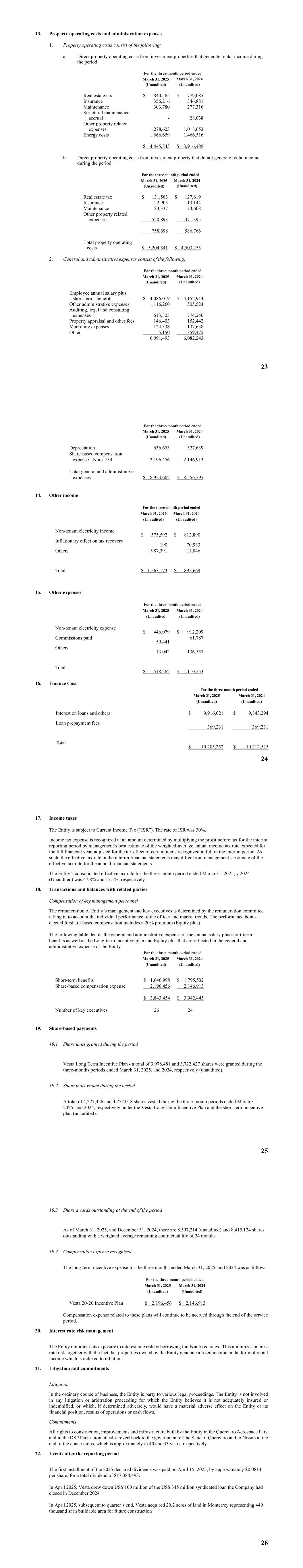

Total Portfolio

As of March 31, 2025, the Company’s portfolio was comprised of 228 high-quality industrial assets, with a total gross leased area (“GLA”) of 41.2 million sf (3.7 million square meters “m2”) and with 89.7% of the Company’s income denominated in US dollars. The majority of Vesta’s properties are located in markets representing the most significant economic growth in the country, such as the Northern, Central and Bajio regions. Vesta’s tenants are predominantly multinational companies, and the Company has balanced industry exposure to sectors such as e-commerce/online retail, food and beverage, automotive, aerospace and logistics, among others.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q4 2024 |

Q1 2025 |

| Region |

Total Portfolio |

Growth SF |

Total Portfolio |

| SF |

% |

SF |

SF |

% |

| Central Mexico |

8,319,422 |

20.6% |

86,133 |

8,405,555 |

20.4% |

| Bajio |

19,193,885 |

47.6% |

339,156 |

19,533,041 |

47.4% |

| North |

12,786,657 |

31.7% |

476,964 |

13,263,621 |

32.2% |

| Total |

40,299,964 |

100% |

902,253 |

41,202,217 |

100% |

Total Vacancy

Vesta’s property portfolio had a 7.2% vacancy rate as of March 31, 2025.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q4 2024 |

Q1 2025 |

|

Vacant SF |

% Total |

Vacant SF |

% Total |

| Central Mexico |

213,065 |

2.6% |

299,198 |

3.6% |

| Bajio |

1,255,577 |

6.5% |

1,377,640 |

|

7.1% |

| North |

1,190,291 |

9.3% |

1,297,365 |

|

9.8% |

| Total |

2,658,933 |

6.6% |

2,974,203 |

|

7.2% |

Projects Under Construction

Vesta is currently developing 1,874,461 sf (174,143 m2) in inventory and BTS buildings.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Projects under Construction |

| Project |

GLA (SF) |

GLA (m2) |

Investment (1) (thousand USD) |

Type |

Expected Termination Date |

City |

Region |

| Apodaca 6 |

209,383 |

19,452 |

15.8 |

Inventory |

Apr-25 |

Monterrey |

North Region |

| Apodaca 7 |

202,179 |

18,783 |

17.1 |

Inventory |

Apr-25 |

Monterrey |

North Region |

| Apodaca 8 |

730,762 |

67,890 |

57.2 |

Inventory |

Aug-25 |

Monterrey |

North Region |

| PIQ-13 |

186,983 |

17,371 |

12.3 |

Inventory |

Aug-25 |

Querétaro |

Bajio Region |

| Querétaro 8 |

218,194 |

20,271 |

12.2 |

Inventory |

Aug-25 |

Querétaro |

Bajio Region |

| Querétaro 9 |

155,674 |

14,463 |

9.3 |

Inventory |

Aug-25 |

Querétaro |

Bajio Region |

| Punta Norte 2 |

171,286 |

15,913 |

18.7 |

Inventory |

Apr-25 |

Valle de México |

Central Region |

| Total |

1,874,461 |

174,143 |

142.6 |

|

|

|

|

(1)Investment includes proportional cost of land and infrastructure.

*Adjusted based on final leasing terms.

Land Reserves

The Company had 33.7 million sf in land reserves as of March 31, 2025.

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

March 31, 2025 |

|

| Region |

Gross Land Area (SF) |

Gross Land Area (SF) |

% Chg. |

| Tijuana |

3,847,171 |

3,847,171 |

—% |

| Monterrey |

0 |

0 |

na |

| Juárez |

0 |

4,237,626 |

na |

| San Luis Potosí |

2,555,692 |

2,555,692 |

0.0% |

| Querétaro |

3,561,966 |

3,561,966 |

0.0% |

| Guanajuato |

3,404,979 |

3,404,979 |

0.0% |

| Aguascalientes |

10,281,833 |

10,281,833 |

—% |

| SMA |

3,597,220 |

3,597,220 |

0.0% |

| Guadalajara |

1,408,555 |

1,408,555 |

—% |

| Puebla |

0 |

0 |

na |

| Mexico City |

0 |

815,780 |

na |

| Total |

28,657,415 |

33,710,821 |

17.6% |

Summary of 12-Month 2025 Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 months |

| Consolidated Interim and Annual Statements of Profit and Other Comprehensive Income (million) |

Q1 2025 |

Q1 2024 |

Chg. % |

2024 |

2023 |

Chg. % |

| Revenues |

|

|

|

|

|

|

| Rental income |

60.6 |

55.8 |

8.5 |

231.2 |

200.3 |

15.5 |

| Reimbursable building services |

4.3 |

3.5 |

21.8 |

13.2 |

11.2 |

17.0 |

| Energy Income |

2.2 |

0.8 |

157.1 |

7.6 |

1.9 |

290.2 |

| Management Fees |

0.0 |

0.4 |

— |

0.4 |

1.0 |

(63.1) |

| Total Revenues |

67.1 |

60.6 |

10.7 |

252.3 |

214.5 |

17.7 |

| Total Operating Property Costs |

(5.2) |

(4.5) |

15.6 |

(24.6) |

(18.2) |

34.8 |

| Related to properties that generate rental income |

(4.4) |

(3.9) |

13.5 |

(21.2) |

(13.5) |

57.6 |

| Costs related to properties |

(2.8) |

(2.5) |

11.3 |

(13.2) |

(11.4) |

16.4 |

| Costs related to energy |

(1.7) |

(1.4) |

17.3 |

(8.0) |

(2.1) |

280.8 |

| Related to properties that did not generate rental income |

(0.80) |

(0.60) |

29.3 |

(3.3) |

(4.8) |

(29.7) |

| Adjusted Net Operating Income |

62.1 |

57.2 |

8.5 |

231.5 |

201.2 |

15.1 |

| General and Administrative Expenses |

(8.3) |

(8.2) |

0.7 |

(32.8) |

(30.1) |

8.7 |

| Stock- based Compensation Expenses |

2.2 |

2.1 |

2.3 |

9.0 |

8.0 |

12.3 |

| Depreciation |

(0.6) |

(0.3) |

94.3 |

(1.4) |

(1.6) |

(10.3) |

| Adjusted EBITDA |

55.3 |

50.6 |

9.3 |

204.4 |

174.2 |

17.3 |

| Other Income and Expenses |

|

|

|

|

|

|

| Interest income |

1.0 |

5.1 |

(79.8) |

15.2 |

9.4 |

0.6 |

| Other (expenses) income |

1.6 |

0.9 |

74.5 |

4.3 |

5.1 |

(0.2) |

| Other net income energy |

(0.5) |

(1.1) |

(53.3) |

(5.2) |

(3.0) |

0.7 |

| Transaction cost on debt issuance |

0.0 |

0.0 |

na |

0.0 |

0.0 |

na |

| Interest expense |

(10.3) |

(10.2) |

0.7 |

(44.3) |

(46.3) |

— |

| Exchange gain (loss) |

(0.1) |

0.9 |

(111.3) |

(10.8) |

8.9 |

(2.2) |

| Gain from properties sold |

0.0 |

0.3 |

(100.0) |

2.6 |

(0.5) |

(6.7) |

| Gain on revaluation of investment properties |

(16.0) |

107.3 |

(114.9) |

270.7 |

243.5 |

0.1 |

| Total other income (expenses) |

(24.3) |

103.1 |

(123.6) |

232.6 |

217.1 |

0.1 |

| Profit Before Income Taxes |

28.6 |

150.6 |

(81.0) |

426.2 |

381.6 |

11.7 |

| Income Tax Expense |

(13.7) |

(25.7) |

(46.9) |

(202.8) |

(65.0) |

na |

| Current Tax |

(8.9) |

(7.0) |

26.7 |

(31.9) |

(92.0) |

na |

| Deferred Tax |

(4.8) |

(18.7) |

(74.3) |

(170.9) |

27.0 |

na |

| Profit for the Period |

14.9 |

124.9 |

(88.1) |

223.3 |

316.6 |

(29.5) |

| Valuation of derivative financial instruments |

0.0 |

0.0 |

na |

0.0 |

0.0 |

na |

| Exchange differences on translating other functional currency operations |

(2.6) |

(0.9) |

204.3 |

(13.2) |

7.9 |

(2.7) |

| Total Comprehensive Income for the period |

12.3 |

124.0 |

(90.1) |

210.2 |

324.5 |

(0.4) |

| Shares (average) |

867.9 |

884.8 |

(1.9) |

883.3 |

768.8 |

14.9 |

| Diluted EPS |

0.0142 |

0.1402 |

|

0.2380 |

0.4221 |

|

Revenues increased 17.7% to US$ 252.3 million for the accumulated twelve months of 2025, compared to US$ 214.5 million in 2024, while operating costs increased to US$ 24.6 million, or 34.8% compared to US$ 18.2 million in 2024, primarily due to the increase in properties that generate income. Adjusted Net operating income for the twelve months 2025 was US$ 231.5 million compared to US$ 201.2 million in the same period of 2024.

At the close of March 31, 2025, administrative expenses increased by 8.7% to US$ 32.8 million in 2025, from US$ 30.1 million in 2024, primarily due to an increase in employee annual salaries, marketing expenses, other expenses and to Vesta´s stock-based compensation.

Total other income for the twelve months of 2025 was US$ 232.6 million, compared to US$ 217.1 million in the prior year. The result reflects an increase in interest income, lower interest expense and higher gain on the revaluation of investment properties.

The Company’s profit before tax therefore amounted to US$ 426.2 million for the first twelve months of 2025.

Income tax for the twelve months ending March 31, 2025 resulted in a US$ 202.8 million expense, compared to US$ 65.0 million expense for the twelve months ended March 31, 2024. This year-on-year increase was primarily due to an increase in deferred taxes.

Profit for the twelve months of 2025 was US$ 223.3 million, compared to US$ 316.6 million in the same period of 2024, due to factors described above.

Vesta ended the twelve-month period ending March 31, 2025 with US$ 210.2 million in total comprehensive income, compared to US$ 324.5 million at the end of the twelve-months of 2024 period, due to the factors previously described. This gain was partially decreased by a US$ 13.2 million loss in functional currency operations.

Capex for the twelve-months of 2025 reached US$ 58.2 million and was related to the investment property development.

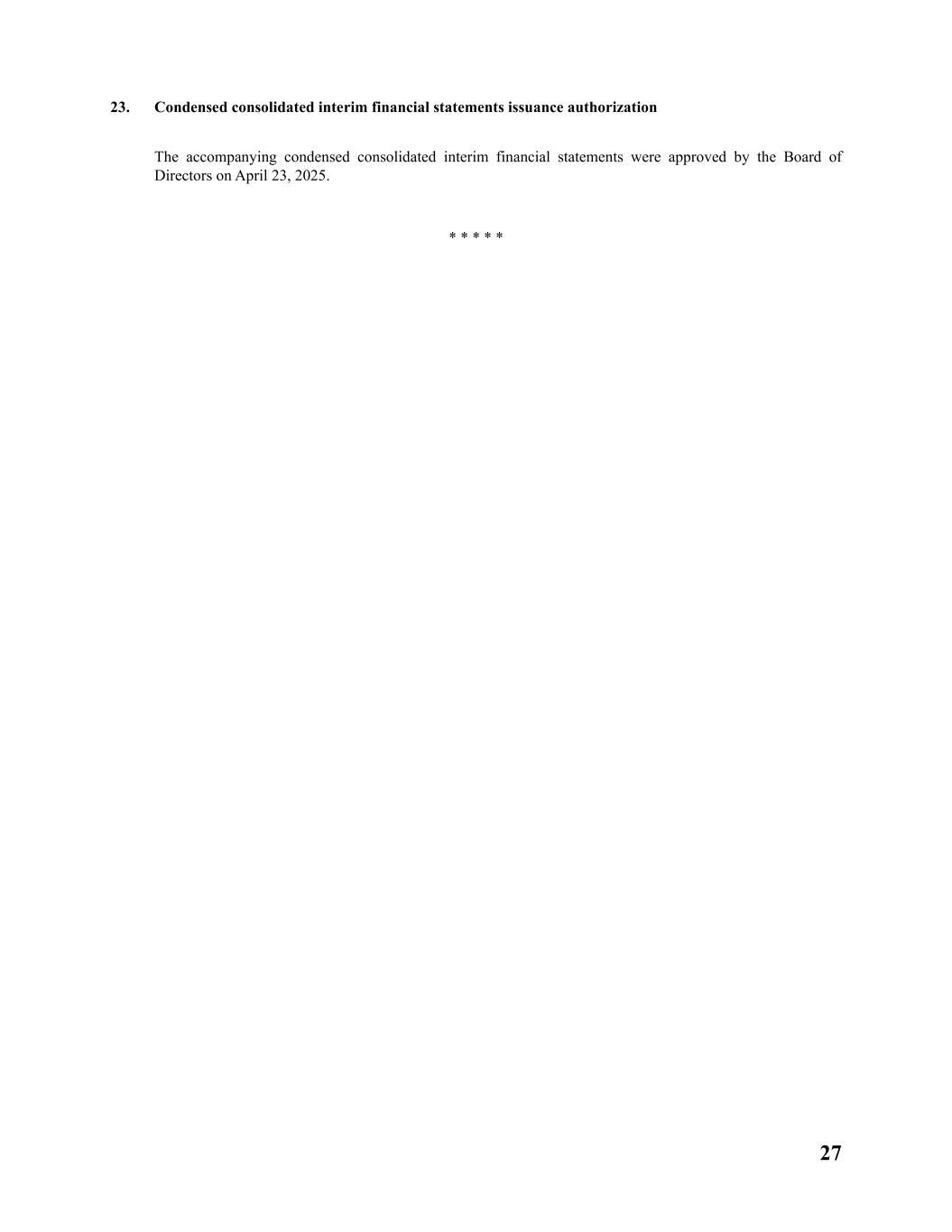

Subsequent Events

Dividends:

Vesta shareholders approved a US$ 69.5 million-dollar dividend at its Annual General Shareholders Meeting held on March 19, 2025, to be paid in quarterly installments at the closing exchange rate of the day prior to payment. The quarterly dividend per share will be determined based on the outstanding number of shares on the distribution date.

|

|

|

|

|

|

|

|

|

|

|

|

| Dividend Payout (millions) |

2024 |

|

2025 |

|

|

|

|

| Plus (Loss)/ Minus (Profit) |

381.6 |

|

426.2 |

| Depreciation |

1.6 |

|

1.4 |

| Foreign Exchange Loss (Profit) |

-8.9 |

|

10.8 |

| Non cash share compensation plan 2015 |

8.0 |

|

9.0 |

| Gain (Loss) on revaluation of investment properties |

-243.5 |

|

-270.7 |

| Gain in sell properties |

0.5 |

|

-2.6 |

| Total Non cash adjustments |

-242.3 |

|

-252.1 |

| Available cash |

139.3 |

|

174.0 |

| Principal Payment |

-4.6 |

|

-4.9 |

| Taxes Paid in Cash |

-38.8 |

|

-0.6 |

| Maintenance Reserve |

-3.5 |

|

-9.5 |

| Total Cash Adjustment |

-46.9 |

|

-15.0 |

| Distributable Cash |

92.4 |

|

159.0 |

| Dividend Recommentation |

64.7 |

|

69.5 |

| Dividend Ratio |

70.0% |

|

43.7% |

Vesta paid a cash dividend for the first quarter 2025 equivalent to PS$ 0.4137 per ordinary share on April 15, 2025. The dividend was paid through the S.D. Indeval S.A. de C.V. Institución para el Depósito de Valores (INDEVAL). This amount was provisioned within the Company’s financial statements at the end of the first quarter 2025 as dividends payable.

|

|

|

|

|

|

|

Dividends per share |

| Q1 2025 |

0.4137 |

|

|

|

|

|

|

Appendix: Financial Tables

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Interim and Annual Statements of Profit and Other Comprehensive Income (million) |

Q1 2025 |

Q1 2024 |

Chg. % |

|

|

|

| Revenues |

|

|

|

|

|

|

| Rental income |

60.6 |

55.8 |

8.5 |

|

|

|

| Reimbursable building services |

4.3 |

3.5 |

21.8 |

|

|

|

| Energy Income |

2.2 |

0.8 |

157.1 |

|

|

|

| Management Fees |

0.0 |

0.4 |

— |

|

|

|

| Total Revenues |

67.1 |

60.6 |

10.7 |

|

|

|

| Total Operating Property Costs |

(5.2) |

(4.5) |

15.6 |

|

|

|

| Related to properties that generate rental income |

(4.4) |

(3.9) |

13.5 |

|

|

|

| Costs related to properties |

(2.8) |

(2.5) |

11.3 |

|

|

|

| Costs related to energy |

(1.7) |

(1.4) |

17.3 |

|

|

|

| Related to properties that did not generate rental income |

(0.80) |

(0.60) |

29.3 |

|

|

|

| Adjusted Net Operating Income |

62.1 |

57.2 |

8.5 |

|

|

|

| General and Administrative Expenses |

(8.3) |

(8.2) |

0.7 |

|

|

|

| Stock- based Compensation Expenses |

2.2 |

2.1 |

2.3 |

|

|

|

| Depreciation |

(0.6) |

(0.3) |

94.3 |

|

|

|

| Adjusted EBITDA |

55.3 |

50.6 |

9.3 |

|

|

|

| Other Income and Expenses |

|

|

|

|

|

|

| Interest income |

1.0 |

5.1 |

(79.8) |

|

|

|

| Other (expenses) income |

1.6 |

0.9 |

74.5 |

|

|

|

| Other net income energy |

(0.5) |

(1.1) |

(53.3) |

|

|

|

| Transaction cost on debt issuance |

0.0 |

0.0 |

na |

|

|

|

| Interest expense |

(10.3) |

(10.2) |

0.7 |

|

|

|

| Exchange gain (loss) |

(0.1) |

0.9 |

(111.3) |

|

|

|

| Gain from properties sold |

0.0 |

0.3 |

(100.0) |

|

|

|

| Gain on revaluation of investment properties |

(16.0) |

107.3 |

(114.9) |

|

|

|

| Total other income (expenses) |

(24.3) |

103.1 |

(123.6) |

|

|

|

| Profit Before Income Taxes |

28.6 |

150.6 |

(81.0) |

|

|

|

| Income Tax Expense |

(13.7) |

(25.7) |

(46.9) |

|

|

|

| Current Tax |

(8.9) |

(7.0) |

26.7 |

|

|

|

| Deferred Tax |

(4.8) |

(18.7) |

(74.3) |

|

|

|

| Profit for the Period |

14.9 |

124.9 |

(88.1) |

|

|

|

| Valuation of derivative financial instruments |

0.0 |

0.0 |

na |

|

|

|

| Exchange differences on translating other functional currency operations |

(2.6) |

(0.9) |

204.3 |

|

|

|

| Total Comprehensive Income for the period |

12.3 |

124.0 |

(90.1) |

|

|

|

| Shares (average) |

867.9 |

884.8 |

(1.9) |

|

|

|

| Diluted EPS |

0.0142 |

0.1402 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Statements of Financial Position (million) |

March 31, 2025 |

December 31, 2024 |

| ASSETS |

|

|

| CURRENT |

|

|

| Cash and cash equivalents |

48.7 |

184.1 |

| Financial assets held for trading |

0.0 |

0.0 |

| Accounts receivable- net |

56.0 |

52.8 |

| Operating lease receivable |

6.6 |

4.7 |

| Due from related parties |

0.0 |

0.0 |

| Prepaid expenses |

9.2 |

2.1 |

| Guarantee deposits made |

0.0 |

0.0 |

| Total current assets |

120.4 |

243.8 |

| NON-CURRENT |

|

|

| Investment properties |

3,749.2 |

3,696.8 |

| Leasing Terms |

0.4 |

0.5 |

| Office equipment - net |

2.7 |

2.4 |

| Derivative financial instruments |

0.0 |

0.0 |

| Guarantee Deposits made |

15.0 |

14.5 |

| Total non-current assets |

3,767.2 |

3,714.2 |

|

|

|

| TOTAL ASSETS |

3,887.6 |

3,957.9 |

|

|

|

| LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

| CURRENT LIABILITIES |

|

|

| Current portion of long-term debt |

4.9 |

49.9 |

| Financial leases payable-short term |

0.3 |

0.4 |

| Accrued interest |

6.9 |

2.9 |

| Accounts payable |

19.1 |

14.2 |

| Income tax payable |

1.1 |

0.6 |

| Dividends payable |

69.5 |

16.2 |

| Accrued expenses |

4.8 |

6.6 |

| Total current liabilities |

106.6 |

90.8 |

| NON-CURRENT |

|

|

| Long-term debt |

796.3 |

797.2 |

| Financial leases payable-long term |

0.1 |

0.1 |

| Derivative financial instruments |

0.0 |

0.0 |

| Guarantee deposits received |

28.1 |

27.4 |

| Long-term accounts payable |

0.0 |

0.0 |

| Employees benefits |

2.5 |

2.2 |

| Deferred income taxes |

447.7 |

442.8 |

| Total non-current liabilities |

1,274.6 |

1,269.8 |

|

|

|

| TOTAL LIABILITIES |

1,381.3 |

1,360.7 |

|

|

|

| STOCKHOLDERS' EQUITY |

|

|

| Capital stock |

580.0 |

585.5 |

| Additional paid-in capital |

884.3 |

905.7 |

| Retained earnings |

1,093.8 |

1,148.4 |

| Share-base payments reserve |

(2.9) |

3.9 |

| Foreign currency translation |

(48.8) |

(46.2) |

| Valuation of derivative financial instruments |

0.0 |

0.0 |

| Total shareholders' equity |

2,506.3 |

2,597.3 |

|

|

|

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

3,887.6 |

3,957.9 |

|

|

|

|

|

|

|

|

|

| Consolidated Statements of Cash Flows (million) |

March 31, 2025 |

March 31, 2024 |

| Cash flow from operating activities: |

|

|

| Profit before income taxes |

28.6 |

150.6 |

| Adjustments: |

|

|

| Depreciation |

0.5 |

0.2 |

| Depreciation of right of use assets |

0.2 |

0.1 |

| Gain on revaluation of investment properties |

16.0 |

(107.3) |

| Effect of foreign exchange rates |

(2.5) |

(1.7) |

| Interest income |

(1.0) |

(5.1) |

| Interest expense |

10.7 |

9.3 |

| Amortization debt issuance-related expenses |

(0.4) |

0.9 |

| Expense recognized related to share-based payments |

2.2 |

2.1 |

| Employee benefits |

0.2 |

0.3 |

| Gain in sale of investment property |

0.0 |

(0.3) |

| Income tax benefit from equity issuance costs |

0.0 |

0.0 |

| Working capital adjustments |

|

|

| (Increase) decrease in: |

|

|

| Operating leases receivables- net |

(1.9) |

(4.7) |

| Recoverable taxes |

(3.2) |

1.1 |

| Guarantee Deposits made |

(0.5) |

(0.5) |

| Prepaid expenses |

(7.0) |

(14.5) |

| (Increase) decrease in: |

|

|

| Accounts payable |

(7.5) |

7.2 |

| Accrued expenses |

(1.8) |

(2.4) |

| Guarantee Deposits received |

0.7 |

(0.1) |

| Interest received |

1.0 |

5.1 |

| Income Tax Paid |

(8.4) |

(40.4) |

| Net cash generated by operating activities |

25.90 |

0.0 |

|

|

|

| Cash flow from investing activities |

|

|

| Purchases of investment property |

(58.2) |

(33.3) |

| Non-tenant reimbursements |

0.0 |

0.0 |

| Sale of investment property |

0.0 |

0.8 |

| Acquisition of office furniture |

(0.7) |

0.0 |

| Net cash used in investing activities |

(59.0) |

(32.5) |

|

|

|

| Cash flow from financing activities |

|

|

| Interest paid |

(6.7) |

(6.4) |

| Loans obtained |

0.0 |

0.0 |

| Loans paid |

(45.5) |

(1.1) |

| Cost of debt issuance |

0.0 |

0.0 |

| Dividends paid |

(16.2) |

(15.2) |

| Repurchase of treasury shares |

0.0 |

0.0 |

| Equity issuance |

0.0 |

0.0 |

| Costs of equity issuance |

(35.9) |

0.0 |

| Payment of lease liabilities |

(0.2) |

(0.2) |

| Net cash (used in) generated by financing activities |

(104.4) |

(22.9) |

|

|

|

| Effects of exchange rates changes on cash |

2.1 |

(0.8) |

| Net Increase in cash and cash equivalents |

(135.4) |

(56.1) |

| Cash, restricted cash and cash equivalents at the beginning of period |

184.9 |

501.9 |

| Cash, restricted cash and cash equivalents at the end of period |

49.4 |

445.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Statements of Changes in Stockholders’ Equity (million) |

Capital Stock |

Additional Paid-in Capital |

Retained Earnings |

Share-based payment reserve |

Foreign Currency Translation |

Total Stockholders´ Equity |

|

|

|

|

|

|

|

| Balances as of January 1, 2024 |

591.6 |

934.9 |

989.7 |

3.7 |

(33.0) |

2,487.0 |

| Equity Issuance |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

| Vested shares |

0.0 |

0.0 |

(64.7) |

0.0 |

0.0 |

(64.7) |

| Share-based payments |

2.4 |

13.7 |

0.0 |

(16.0) |

0.0 |

0.0 |

| Dividends declared |

0.0 |

0.0 |

0.0 |

2.1 |

0.0 |

2.1 |

| Comprehensive income (loss) |

0.0 |

0.0 |

124.9 |

0.0 |

(0.9) |

124.0 |

| Balances as of March 31, 2024 |

594.0 |

948.6 |

1,049.9 |

(10.2) |

(33.9) |

2,548.4 |

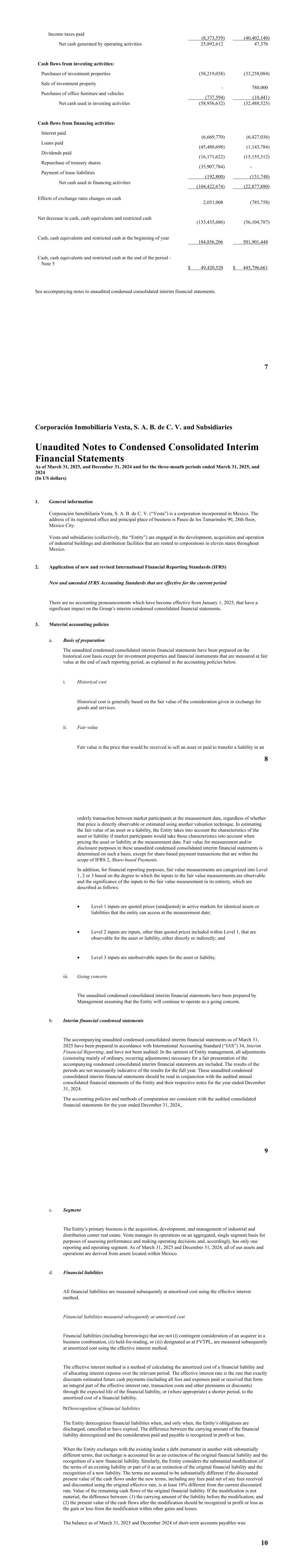

Balances as of January 1, 2025 |

585.5 |

905.7 |

1148.4 |

3.9 |

(46.2) |

2597.3 |

| Dividends declared |

0.0 |

0.0 |

(69.5) |

0.0 |

0.0 |

(69.5) |

| Vested shares |

2.0 |

7.0 |

0.0 |

(9.0) |

0.0 |

0.0 |

| Share-based payments |

0.0 |

0.0 |

0.0 |

2.2 |

0.0 |

2.2 |

| Repurchase of shares |

(7.5) |

(28.4) |

0.0 |

0.0 |

0.0 |

(35.9) |

| Comprehensive income (loss) |

0.0 |

0.0 |

14.9 |

0.0 |

(2.6) |

12.3 |

| Balances as of December 30, 2024 |

580.0 |

884.3 |

1,093.8 |

(2.9) |

(48.8) |

2,506.3 |

Notes and Disclaimers

Interim Consolidated Condensed Financial Statements: The figures presented within this release for the three-month periods ending March 31, 2025 and 2024 have not been audited.

Exchange Rate: The exchange rates used for the figures expressed in US dollars (US$) were:

|

|

|

|

|

|

| Date |

Exchange Rate |

| Balance Sheet |

| March 31, 2024 |

16.678 |

| March 31, 2025 |

20.318 |

| Income Statement |

| Q1 2024 (average) |

16.995 |

| Q1 2025 (average) |

20.422 |

|

|

|

|

“Adjusted EBITDA” as the sum of profit for the year adjusted by (a) total income tax expense (b) interest income, (c) other income, (d) other expense (e) finance costs, (f) exchange gain (loss) – net, (g) gain on sale of investment property, (h) gain on revaluation of investment property, (i) depreciation, (j) stock-based compensation expense (k) energy income and (l) energy costs during the relevant period

“Adjusted EBITDA margin” means Adjusted EBITDA divided by total revenues minus energy income.

“NOI” means the sum of Adjusted EBITDA plus general and administrative expenses, reversing the discrete depreciation expense impact in Adjusted EBITDA minus and stock-based compensation expense during the relevant period.

“Adjusted NOI” means the sum of NOI plus property operating costs related to properties that did not generate rental income during the relevant period minus energy costs.

“Adjusted NOI margin” means Adjusted NOI divided by total revenues minus energy income.

“FFO” means profit for the period, excluding: (i) gain on sale of investment property and (ii) gain on revaluation of investment property.

“Vesta FFO” means the sum of FFO, as adjusted for the impact of exchange gain (loss) - net, other income – net, other energy income net, interest income, total income tax expense, depreciation and stock-based compensation expense and equity plus.

Prior period: Unless otherwise stated, the comparison of operating and financial figures compares the same prior year period.

Percentages may not sum to total due to rounding.

Build to Suit (BTS): a building which is custom-made in design and construction in order to meet client-specific needs.

Inventory buildings: buildings constructed in accordance with standard industry specifications, for those clients that do not require a BTS Building.

Analyst Coverage

In compliance with the internal regulation of the BMV, article 4.033.01 Frac. VIII, Vesta is covered by analysts at the following brokers:

•Barclays Bank Mexico, S.A.

•Bank of America

•BBVA Bancomer S.A.

•Bradesco BBI Research

•BTG Pactual US Capital LLC

•Casa de Bolsa Credit Suisse S.A. de C.V.

•Casa de Bolsa Santander S.A. de C.V.

•Citigroup Global Markets Inc.

•GBM Grupo Bursátil Mexicano S.A. de C.V.

•Grupo Financiero Interacciones S.A. de C.V.

•Grupo Signum, S.A. de C.V.

•Goldman Sachs

•Itaú Corretora de Valores S.A

•J.P. Morgan Casa de Bolsa, S.A. de C.V.

•Morgan Stanley

•Scotia Inverlat Casa de Bolsa S.A. de C.V.

Vesta is a real estate owner, developer and asset manager of industrial buildings and distribution centers in Mexico. As of March 31, 2025, Vesta owned 228 properties located in modern industrial parks in 16 states of Mexico totaling a GLA of 41.2 million sf (3.7 million m2). Vesta has several world-class clients participating in a variety of industries such as automotive, aerospace, retail, high-tech, pharmaceuticals, electronics, food and beverage and packaging. For additional information visit: www.vesta.com.mx.

Note on Forward-Looking Statements

This report may contain certain forward-looking statements and information relating to the Company and its expected future performance that reflects the current views and/or expectations of the Company and its management with respect to its performance, business and future events. Forward looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain words like “believe,” “anticipate,” “expect,” “envisages,” “will likely result,” or any other words or phrases of similar meaning. Such statements are subject to a number of risks, uncertainties and assumptions. Some of the factors that may affect outcomes and results include, but are not limited to: (i) national, regional and local economic and political climates; (ii) changes in global financial markets, interest rates and foreign currency exchange rates; (iii) increased or unanticipated competition for our properties; (iv) risks associated with acquisitions, dispositions and development of properties; (v) tax structuring and changes in income tax laws and rates; (vi) availability of financing and capital, the levels of debt that we maintain; (vii) environmental uncertainties, including risks of natural disasters; (viii) risks related to any potential health crisis and the measures that governments, agencies, law enforcement and/or health authorities implement to address such crisis; and (ix) those additional factors discussed in reports filed with the Bolsa Mexicana de Valores and in the U.S. Securities and Exchange Commission. We caution you that these important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in this presentation and in oral statements made by authorized officers of the Company. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. The Company undertakes no obligation to update or revise any forward-looking statements, including any financial guidance, whether as a result of new information, future events or otherwise except as may be required by law.

Definitions / Discussion of Non-GAAP Financial Measures:

Change in Adjusted EBITDA, NOI, Adjusted NOI and Vesta FFO calculation methodology

During the year ended December 31, 2023, our business began to experience different effects associated with our tenants growing their operations in Mexico that among other impacts resulted in increased energy consumption which we recognize as an energy income and energy cost during the period. Our management considered these income and costs represent a business activity not actively managed by us and does not relate directly to our business operation and strategy; therefore, we updated our policy to further adjust our Adjusted EBITDA, NOI, Adjusted NOI and Vesta FFO to exclude energy income and energy costs.

We have applied the change in calculation methodology retroactively. This change had an impact on Adjusted EBITDA, NOI, Adjusted NOI and Vesta FFO of $0.3 million, ($0.4) million and $0.0 million as of December 31, 2023, 2022 and 2021.

Reconciliation of Adjusted EBITDA, NOI and Adjusted NOI

The table below sets forth a reconciliation of Adjusted EBITDA, NOI and Adjusted NOI to profit for the year, the most directly comparable IFRS financial measure, for each of the periods indicated, as reported in the Company’s financial statements. We calculate Adjusted EBITDA as the sum of profit for the year adjusted by (a) total income tax expense (b) interest income, (c) other income, (d) other expense (e) finance costs, (f) exchange gain (loss) – net, (g) gain on sale of investment property, (h) gain on revaluation of investment property, (i) depreciation, (j) stock-based compensation expense (k) energy income and (l) energy costs during the relevant period. We calculate NOI as the sum of Adjusted EBITDA plus general and administrative expenses, reversing the discrete depreciation expense impact in Adjusted EBITDA minus and stock-based compensation expense during the relevant period. We calculate Adjusted NOI as the sum of NOI plus property operating costs related to properties that did not generate rental income during the relevant period.

Adjusted EBITDA is not a financial measure recognized under IFRS and does not purport to be an alternative to profit or total comprehensive income for the period as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. Additionally, Adjusted EBITDA is not intended to be a measure of free cash flow available for management’s discretionary use, as it does not consider certain cash requirements such as interest payments and tax payments. Our presentation of Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under IFRS. Management uses Adjusted EBITDA to measure and evaluate the operating performance of our principal business (which consists of developing, leasing and managing industrial properties) before our cost of capital and income tax expense. Adjusted EBITDA is a measure commonly used in our industry, and we present Adjusted EBITDA to supplement investor understanding of our operating performance. We believe that Adjusted EBITDA provides investors and analysts with a measure of operating results unaffected by differences in tenant’s operation, capital structures, capital investment cycles and fair value adjustments of related assets among otherwise comparable companies.

NOI or Adjusted NOI are not financial measures recognized under IFRS and do not purport to be alternatives to profit for the period or total comprehensive income as measures of operating performance. NOI and Adjusted NOI are supplemental industry reporting measures used to evaluate the performance of our investments in real estate assets and our operating results. In addition, Adjusted NOI is a leading indicator of the trends related to NOI as we typically have a strong development portfolio of “speculative buildings.” Under IAS 40, we have adopted the fair value model to measure our investment property and, for that reason, our financial statements do not reflect depreciation nor amortization of our investment properties, and therefore such items are not part of the calculations of NOI or Adjusted NOI. We believe that NOI is useful to investors as a performance measure and that it provides useful information regarding our results of operations and financial condition because, when compared across periods, it reflects the impact on operations from trends in occupancy rates, rental rates, operating costs and acquisition and development activity on an unleveraged basis, providing perspective not immediately apparent from profit for the year. For example, interest expense is not necessarily linked to the operating performance of a real estate asset and is often incurred at the corporate level as opposed to the property level. Similarly, interest expense may be incurred at the property level even though the financing proceeds may be used at the corporate level (e.g., used for other investment activity). As so defined, NOI and Adjusted NOI may not be comparable to net operating income or similar measures reported by other real estate companies that define NOI or Adjusted NOI differently.

Adjusted EBITDA margin, NOI margin and Adjusted NOI margin

The table below also includes a reconciliation of Adjusted EBITDA margin, NOI margin and Adjusted NOI margin to profit for the year, the most directly comparable IFRS financial measure, for each of the periods indicated, as reported in the Company’s financial statements. We present margin ratios to rental income plus management fees minus electricity income to compliment the understanding of our operating performance; measuring our profitability compared to the revenues directly related to our business activities.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three-Month |

|

|

|

Period Ended March 31, |

|

|

|

2025 |

2024 |

|

|

|

|

|

|

|

|

|

|

(millions of US$) |

| Profit for the period |

14.9 |

124.9 |

|

|

|

| (+) Total income tax expense |

13.7 |

25.7 |

|

|

|

| (-) Interest income |

(1.0) |

(5.1) |

|

|

|

| (-) Other income – net(1) |

(1.6) |

(0.9) |

|

|

|

| (-) Other income energy |

0.5 |

1.1 |

|

|

|

| (+) Finance costs |

10.3 |

10.2 |

|

|

|

| (-) Exchange gain (loss) - net |

0.1 |

(0.9) |

|

|

|

| (-) Gain on sale of investment property |

0.0 |

(0.3) |

|

|

|

| (-) Gain on revaluation of investment property |

16.0 |

(107.3) |

|

|

|

| (+) Depreciation |

0.6 |

0.3 |

|

|

|

| (+) Long-term incentive plan and Equity plus |

2.2 |

2.1 |

|

|

|

| (+) Energy net |

(0.5) |

0.6 |

|

|

|

| Adjusted EBITDA |

55.3 |

50.6 |

|

|

|

| (+) General and administrative expenses |

8.3 |

8.2 |

|

|

|

| (-) Long-term incentive plan and Equity plus |

(2.2) |

(2.1) |

|

|

|

| NOI |

61.3 |

56.7 |

|

|

|

| (+) Property operating costs related to properties that did not generate rental income |

0.8 |

0.7 |

|

|

|

| Adjusted NOI |

62.1 |

57.4 |

|

|

|

(1)Includes other income and expenses unrelated to our operations, such as reimbursements from insurance proceeds, and sales of office equipment. For more information, see note 15 to our audited consolidated financial statements.

Reconciliation of FFO and Vesta FFO

The table below sets forth a reconciliation of FFO and Vesta FFO to profit for the period, the most directly comparable IFRS financial measure, for each of the periods indicated, as reported in the Company’s financial statements. FFO is calculated as profit for the period, excluding: (i) gain on sale of investment property and (ii) gain on revaluation of investment property. We calculate Vesta FFO as the sum of FFO, as adjusted for the impact of exchange gain (loss) - net, other income – net, interest income, total income tax expense, depreciation and long-term incentive plan and equity plus.

The Company believes that Vesta FFO is useful to investors as a supplemental performance measure because it excludes the effects of certain items which can create significant earnings volatility, but which do not directly relate to our business operations. We believe Vesta FFO can facilitate comparisons of operating performance between periods, while also providing a more meaningful predictor of future earnings potential. Additionally, since Vesta FFO does not capture the level of capital expenditures per maintenance and improvements to maintain the operating performance of properties, which has a material economic impact on operating results, we believe Vesta FFO’s usefulness as a measure of performance may be limited.

Our computation of FFO and Vesta FFO may not be comparable to FFO measures reported by other REITs or real estate companies that define or interpret the FFO definition differently. FFO and Vesta FFO should not be considered as a substitute for net profit for the period attributable to our common shareholders.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three-Month |

|

|

|

Period Ended March 31, |

|

|

|

2025 |

2024 |

|

|

|

|

|

|

|

|

|

|

(millions of US$) |

| Profit for the period |

14.9 |

124.9 |

|

|

|

| (-) Gain on sale of investment property |

0.0 |

(0.3) |

|

|

|

| (-) Gain on revaluation of investment property |

16.0 |

(107.3) |

|

|

|

| FFO |

31.0 |

17.3 |

|

|

|

| (-) Exchange gain (loss) – net |

0.1 |

(0.9) |

|

|

|

| (-) Other income – net(1) |

(1.6) |

(0.9) |

|

|

|

| (-) Other income energy |

0.5 |

1.1 |

|

|

|

| (-) Interest income |

(1.0) |

(5.1) |

|

|

|

| (+) Total income tax expense |

13.7 |

25.7 |

|

|

|

| (+) Depreciation |

0.6 |

0.3 |

|

|

|

| (+) Long-term incentive plan and Equity plus |

2.2 |

2.1 |

|

|

|

| (+) Energy net |

(0.5) |

0.6 |

|

|

|

| Vesta FFO |

45.0 |

40.4 |

|

|

|

(1)Includes other income and expenses unrelated to our operations, such as reimbursements from insurance proceeds, and sales of office equipment. For more information, see note 15 to Vesta’s consolidated financial statements.