1 Q3 Le!er to Shareholders DATE ISSUED November 10, 2025

2 Q3 Financial Highlights Gal Krubiner | Co-founder and CEO Our results demonstrate another quarter of prudent underwriting and consistent execution across our network as we raise full- year guidance for the third consecutive quarter. Our pipeline has never been stronger, as lenders across asset classes recognize the unique and powerful value proposition the Pagaya network provides. With our partners, we are commi!ed to bridging Main Street and Wall Street for the long run.” “ $2.8B Record network volume of $2.8 billion compared to our outlook of $2.75 - $2.95 billion and grew 19% year-over-year, with a focus on prudent growth. $350M Record total revenue & other income of $350 million compared to our outlook of $330 - $350 million and grew 36% year-over-year, driven by 36% growth in revenue from fees. $139M Record revenue from fees less production costs (“FRLPC”) of $139 million increased 39% year-over-year, outpacing network revenue growth. FRLPC as a percentage of network volume (“FRLPC %”) improved 70bps year-over-year to 5.0%. $107M Record adjusted EBITDA of $107 million compared to our outlook of $90 - $100 million and grew 91% year-over-year, well ahead of revenue and FRLPC growth, demonstrating continued strong operating leverage. Adjusted EBITDA margin rose nearly 9 points to 31%. GAAP operating income was $80 million. $23M Record GAAP net income a!ributable to Pagaya shareholders of $23 million, a 6% margin, compared to our outlook of $10 - $20 million, up $90 million year-over-year and $6 million quarter-over-quarter, driven by fee revenue growth and operating leverage. $93M Adjusted net income of $93 million excludes the impact of non-cash items such as share-based compensation expense and fair value adjustments.

3 Network volume growth demonstrates further diversification Volumes grew 19% year-over-year to $2.8 billion in the third quarter. Point-of-sale (POS) and Auto segment volumes reached an annualized run-rate of $1.4 billion and $2.2 billion, respectively. Collectively, POS and Auto represented 32% of total volumes versus 9% in the year-ago quarter and 30% in the previous quarter. Increased 2025 total revenue, adjusted EBITDA and GAAP net income guidance reflects strong demand and continued execution to drive profitable growth For the third straight quarter, we increased our FY25 guidance to reflect continued momentum across the business as we grow our top-line through disciplined underwriting and operational e"ciencies. Continued funding momentum and diversification In the third quarter we issued $1.8 billion in our ABS program across 4 transactions, marketed to our network of more than 150 institutional funding partners. Additionally, in early October, we closed a $400 million RPM auto ABS transaction, which included the sale of the residual certificates. In November, we closed our inaugural $500 million Auto Forward Flow with Castlelake and closed our second $300 million POSH ABS transaction. Public bond o!ering & revolver - step function improvement in balance sheet e"ciency We raised $500 million in corporate debt, rated by all three major credit rating agencies, a major external validation of our strategy and step function change in our funding costs. This was followed by an expansion of our corporate revolver on October 1st, with four new major banks and a 400bps decline in funding cost. Together, these further strengthen Pagaya’s balance sheet and access to liquidity, support continued growth, and be!er position the Company to operate through all market cycles. Two new partners added to our onboarding pipeline to further support future growth We now have a record number of partners in our onboarding pipeline across all asset classes, as lenders look to grow their businesses through Pagaya’s network, further validating our product market fit and value proposition. Q3 Business Highlights

4 Gal Krubiner Co-founder and CEO Dear Fellow Shareholders, In Q3, we continued to push forward with strong execution against our long-term operational and financial goals. As we approach the end of the year, we have raised our guidance again, reflecting an annual run rate of over $120M of GAAP Income in the 4th quarter. Our results demonstrate the momentum & strength of our platform and the continued stability of our unit economics, with our deliberate approach to scaling in a complex environment. As we are ge!ing closer to the end of a full year of profitability, we continue to shi# our focus from quarterly execution to longer term planning, and while the quarterly results are important, they should reinforce our progress toward our longer-term goals. Over the last 18 months, we focused relentlessly on improving our unit economics and capital structure, laying the groundwork to support future profitable growth. Over the next 18 months, our strategy is focused on our product-led growth, perfecting our products and solutions to ensure we solve fundamental challenges for lenders and consumers alike. We help lenders serve more customers, increasing our value proposition (and scale) with partners. This is leading more partners to choose Pagaya as they realize the increasing value that can be derived from our o$ering. And as they do, they accelerate our journey to become a necessary utility for every lender in the US, as they look to serve more customers with an improved experience. Our unique approach to designing these products is rooted in our vast data network, mastering and injecting strong modeling capabilities into di$erent parts of the lending process. From underwriting, verification and up until optimization on a"liate channels, we are focused on continuing to embed data & machine learning as a backbone. This ultimate tool, combined with data, creates unparalleled optimization for lenders and investors. It is not a coincidence that we have the greatest number of partners in onboarding in our history, spanning all three asset classes. It is a direct outcome of the investment we made in improving our product, doubling down on B2B product thinking and initiatives. In fact, we recently added an additional 2 new partners to our onboarding queue. We will provide more color on our product strategy, which is being further refined by listening to the needs of our partners. In the course of regular ongoing meetings, this quarter Sanjiv and I met with many of our partners and prospects to dive deeper into their needs, see how they see their businesses are growing, and how our product initiatives fit. The set of opportunities that lie ahead will help us reimagine how consumer credit works. We are building a platform that connects lenders with be!er data, more automation and smarter decisions. By bringing new products to partners on day one, we are validating our product market fit even faster, while staying disciplined on credit. The result is the same

5 hallmark of Pagaya’s success: generating assets that meet the needs of both our lenders and investors. This balanced approach is the foundation of our profitability and long-term resilience. Our current focus and phase is marked by greater discipline, internal structure, and collaboration across our entire organization. We now feel we are a significantly more mature and sophisticated company, one that is constantly moving the needle through creativity and rigorous execution. This operating rhythm has allowed us to look further ahead while continuing to deliver consistent results. This is very apparent in the velocity of our initiatives and the adoption of these products by our partners. Demand for our assets remains consistent and robust. On the funding side, we continue to mature our network, diversifying programs through our first Auto forward flow, strategic funding on residual certificates, and second $300 million POS revolving ABS transaction. On the corporate funding side, we were rated by all three major credit rating agencies and raised $500 million in corporate debt. We expanded our corporate revolver with four new major banks, enabling Pagaya to be more capital e"cient and providing robust liquidity, flexibility and enhanced profitibility for the future. Together, we continue to diversify our sources of capital while improving e"ciency across our funding and corporate capital structures. While we have become consistently profitable, we are still in the early days of the extended platform strategy. Pagaya’s diversified growth continues to be driven by disciplined expansion with a diverse and high quality set of existing partners (expansion across products and access to more applications from newer partners, supported by responsible underwriting, leveraging our unique vast set of data and machine learning capabilities) as well as through the addition of new high-potential partners to the platform. We see our network e$ects compound. Solving for partner needs strengthens our product ecosystem, and solving for product e$ectiveness enhances every partner relationship in return. This flywheel e$ect will continue to define Pagaya’s next chapter. We envision a future where Pagaya fills the credit capabilities for organizations wherever they see fit, the full-spectrum lending partner supporting their core asset classes as well as their new ventures. We aim to serve as the plug-and-play solution for lenders’ gaps in credit, spanning risk tiers and asset types, all delivered in a seamless white label solution powering the next generation of lending. We’re extremely proud of how far we’ve come, delivering against the goals we have defined throughout our history, and are even more energized about what lies ahead. We are building an enduring company. One that combines data, discipline, and partnership to transform access to credit for years to come.

Pagaya’s growth continues to be driven by disciplined expansion with existing partners (expansion across products and access to more applications), as well as through the addition of new high-potential partners to the platform. We are continuing to strengthen our business by expanding and institutionalizing our relationships with lending partners - in line with enterprise B2B best practices, while ensuring responsible underwriting and risk management on the consumer side. New Partners We are currently seeing the highest number of partners in our onboarding pipeline in Pagaya’s history. This is testament to the work we have done through the year to build a solid value proposition which presents a significant growth opportunity for the lenders across the ecosystem. This value proposition enabled by Pagaya’s products accompanied by a clear growth plan incentivizes our lending partners to invest time and e$ort in the integration with Pagaya. It is important to note that Pagaya’s new partner onboarding includes pre-built integration for all of the products and features that Pagaya o$ers. This helps to significantly accelerate new partner scaling and unlock far more value for partners in the onboarding process. The composition of the partners who are currently onboarding span a mix of asset classes (personal loan, auto and POS) amongst lenders including both leading banks and Fintechs. Sanjiv Das Co-founder and President 6 Update on our Operating Business For the banks, the focus continues to shi# toward growth against the backdrop of a more favorable regulatory environment. As they do, they are increasingly focused on building and scaling personal loan and POS franchises. They are looking for help not only supporting and scaling existing businesses, but also enabling the launch of new asset classes. Existing Partners Our relevance among our existing lending partners remains high. Banks are increasingly focused on driving non-interest income, enabling customer retention, and maximizing customer lifetime value. Fintech operators are striving to maximize return on their acquisition spend. Pagaya continues to solve for what it is that lenders care most about. We successfully grew 5 accounts to $1B+ relationships driven by product and feature adoption, as well as expanded access to their application flow. For existing bank and non-bank partners, growth is a key theme in 2026 and beyond, and they are increasingly leveraging Pagaya’s capabilities to drive volume, revenue and customer growth. It is important to understand that our existing lending partners are at varying stages of maturity with Pagaya, based on where they are in their own lifecycle. We define the level of partner maturity with Pagaya based on a lender’s booked volume across our platform, which is largely driven by the number of Pagaya products that they have adopted.

Pagaya platform adoption curve for lending partners Illustrative Stages of lending partner lifecycle with PGY % of total volume potential captured for an average PGY partner in a given tier 1 Onboarding Integration with PGY 2 Ramp Recently onboarded, still ramping up 3 Scale Partners at scale with Decline Monetization program 4 Product Expansion At scale, fully leveraging PGY platform 15-20% 60-70% 100% Decline Monetization A"liate Optimizer Engine Direct Marketing Engine Dynamic Verification Most advanced partners are actively expanding into PGY products PGY Standard o!ering (“The Pagaya package”) PL FastPass Dual Look AUTO Dual Look POS Zooming in, we can split each lending partner’s lifecycle with Pagaya into 4 unique phases, in line with how enterprise technology companies broadly contemplate the client lifecycle. The phases on Pagaya’s lending partner lifecycle include Onboarding, Ramp, Scale, and Product Expansion. The following exhibit illustrates those stages of the lifecycle for a particular lending partner. It shows how the partner’s volumes with Pagaya ramp through the earlier stages of the relationship, leveraging our decline monetization product, and expand over time as they continue to adopt our products. Note that even at scale, growth continues without expanding risk tolerance, as many of our partners continue to ramp their own marketing expenditures to drive top-of-funnel volumes and Pagaya continues to expand across new channels, lead sources and asset classes in which our partners participate. Importantly, the exhibit depicts the power of added products and features to further expand the potential of the relationship we have with each of our lending partners. Taking a step back, as we look across the spectrum of lending partners, we can segment each based on their respective level of maturity with Pagaya: • Newer partners - This group includes partners which are just starting to ramp up their volume with Pagaya, where we have only captured a small portion of the total potential volume. These are typically partners that we have onboarded in the last 12 months. • Partners at Scale with Decline Monetization product - This group includes partners which have achieved scale in our decline monetization program. It is important to note that Pagaya-enabled o$ers are currently present at scale across all lead sources. 7

• Multiproduct Partners - This group includes partners which are already tapping into our various products (including A"liate Optimizer Engine and Direct Marketing Engine) and features. We define features as add-ons to our products. The mix of products and features that drives growth is di$erent for Personal Loans, Auto Loans, and Point-of-Sale financing as it takes into account the unique nature of each of these asset classes. Product and feature expansion allows these partners to significantly grow volume, revenue, incremental customers and long-term value from existing customers. A number of our Personal Loan and Auto partners are currently expanding into Pagaya’s products and features. Products and Features above and beyond Decline Monetization are already contributing significantly to our volume and revenue. These newer Products and Features include Direct Marketing Engine, A"liate Optimizer Engine, FastPass, and Dual Look where we get to assess applications concurrently with our partners. In fact, approximately 50% of our current volumes already come from these newer products and features. This number includes volume booked through a"liate channels, including Credit Karma, Lending Tree and others. Pagaya has been originating loans through a"liate channels for many years now, and last year we productized and commercialized this o$ering given its proven success in driving growth for our lending partners. Our product expansion approach to growing existing partner relationships is a proven strategy, which we are currently rolling out across partners that are at scale with our Decline Monetization product. In fact, while multiproduct partners represent only ~30% of Pagaya’s partners by number, their contribution to our volume is more than two-thirds. Becoming Multiproduct presents a significant growth opportunity for other partners who are currently only leveraging a Decline Monetization program. For instance, one of our partners recently grew their volume with Pagaya by 80% by leveraging our newer Products and Features. The following exhibit underscores the power of growing existing partner relationships. The more products partners have with Pagaya, the more volume, revenue, new customers, and lifetime value they get from the partnership. This underscores the notable organic growth opportunity ahead of Pagaya for years to come. Multiproduct lending partners book more volume with Pagaya Illustrative, sizes of circles represent # of Pagaya partners in a given group N um b er o f P ro d uc ts w ith P ag ay a 1 2 3 1 Onboarding 2 Ramp 3 Scale 4 Product Expansion Partner’s Issued Volume & Revenue with Pagaya Volume & Fees Newer Partners (went live in the last 12-18 months) Partners at Scale with Decline Monetization (most of them are currently exploring other PGY products) Multiproduct Partners (e.g. Decline Monetization and A"liate Optimizer engine at scale) Partners in Onboarding 8

9 Similar to our partners’ lifecycles, all products are at varying levels of maturity with respect to their Network Volume contributions. For example, our A"liate Optimizer Engine currently resides on the more mature side, while our Prescreen o$ering is still at the earlier stages of maturity, therefore it has significant volume upside across existing partners. We have a well defined roadmap for newer products and features that we are planning to roll out across partners by 2026. In addition, we are increasingly institutionalizing our relationships with our lending partners. In so doing, we have worked to solidify sustainable growth for both parties to mitigate cyclical changes in credit appetite as well as shi#s in the rate environment. Specifically, we are working on implementing long- term agreements with several key lending partners to establish stability for our partners and commitments around flow size, quality and controls to maximize mutual benefit through the cycle. Our loan categories I’d like to take a moment to briefly review each of our loan categories and their performance during the quarter and going forward. As discussed above, our value proposition across our three core asset classes - Personal Loan, Auto and Point-of-Sale - remains strong and continues maturing. In Personal loans, we continue penetrating deeper into our existing partner base as they adopt our products (Direct Marketing Engine and A"liate Optimizer Engine), while simultaneously ramping volumes with newer partners, which we have announced in the last 18-24 months. Point-of-Sale (“POS”) continues to make notable progress on both sides of the network. While still a relatively newer business, we have been able to quickly grow annualized POS volumes to $1.4 billion, up from $1.2 billion last quarter. On the funding side, we closed our second AAA rated POSH ABS o$ering in November, underscoring the demand and performance of our POS ABS shelf. Annualized Auto volumes grew to $2.2 billion, up from $2 billion last quarter. It is important to recognize that the ability to achieve this success in auto lending is driven in large part by our tremendous progress in maturing and evolving our funding capabilities. This is a!ributable to both our capital markets capabilities as well as the a!ractiveness of our auto assets. This quarter’s announcements underscore several examples of the strength and performance of our Auto franchise, including the sale of the residual certificates to One William Street in our latest RPM deal and our inaugural Auto Forward Flow agreement with Castlelake that we announced last week. Before closing, I will touch on the macro economy, credit and our risk appetite. It is simple - not much has changed for Pagaya. As we expand upon below, macro and credit performance remain robust. We continue to build a through-the-cycle business to withstand normal fluctuations in the macro, consumer behavior, funding markets, and lending partner strategies. We didn’t build Pagaya to optimize its potential in 2025 or even 2026, we built it to optimize its potential for the very long term. We entered the year poised for conservative growth given macro uncertainty and su"ce to say - nothing has changed in Pagaya’s near, or long-term outlook. In summary, we are continuing to expand our enterprise relationships across our lending and funding partners that will support growth for years to come. With disciplined growth, we remain fully commi"ed to our mission to help bridge Wall Street to Main Street for the long term.

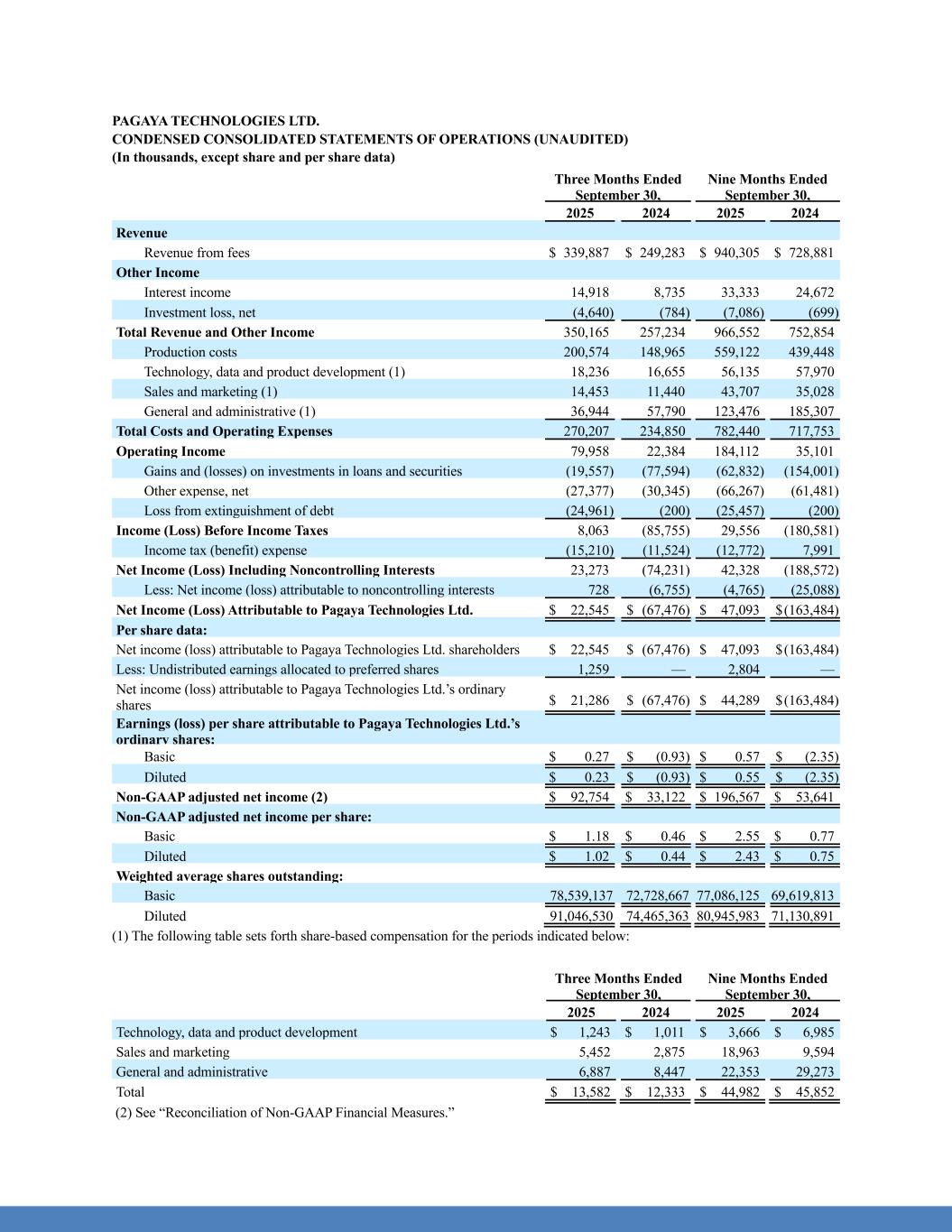

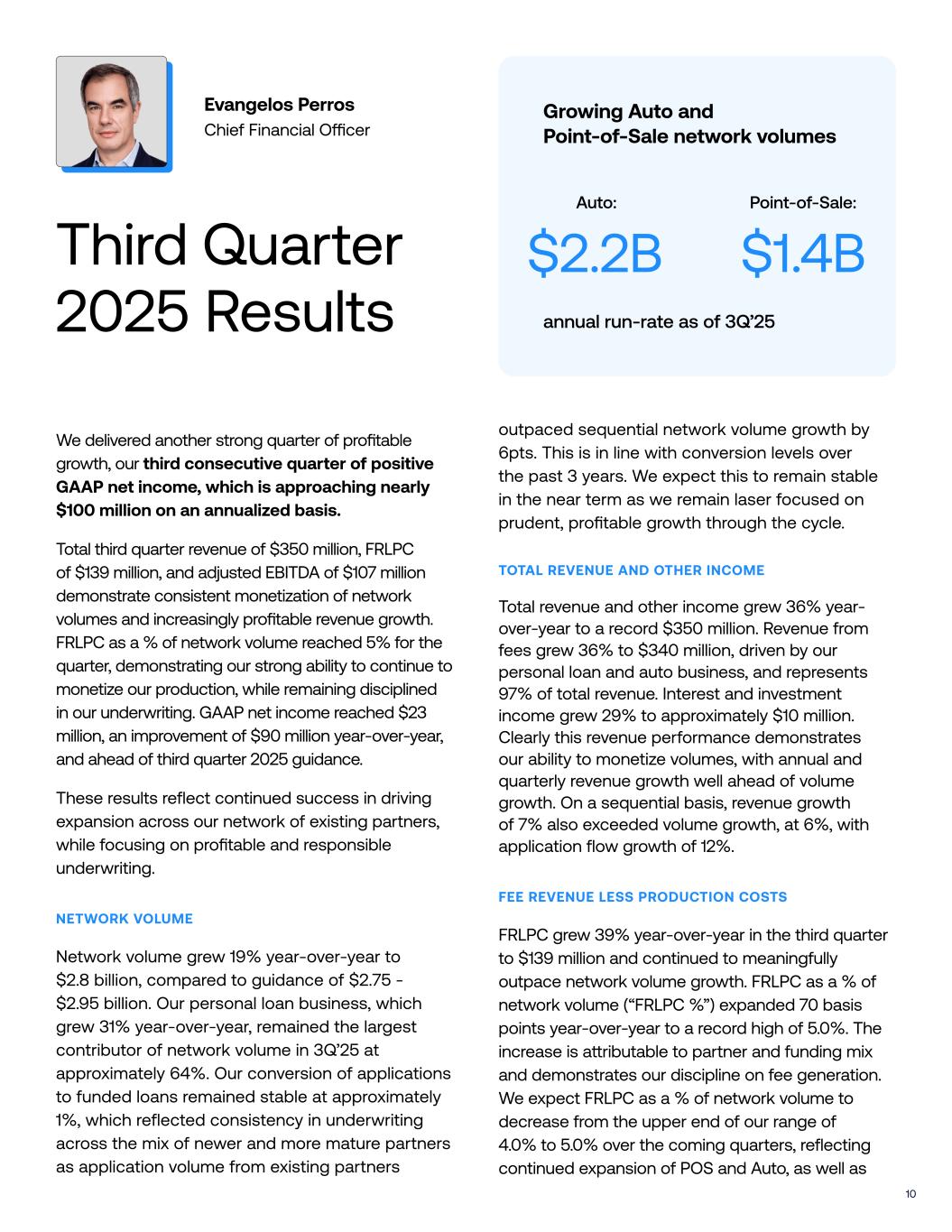

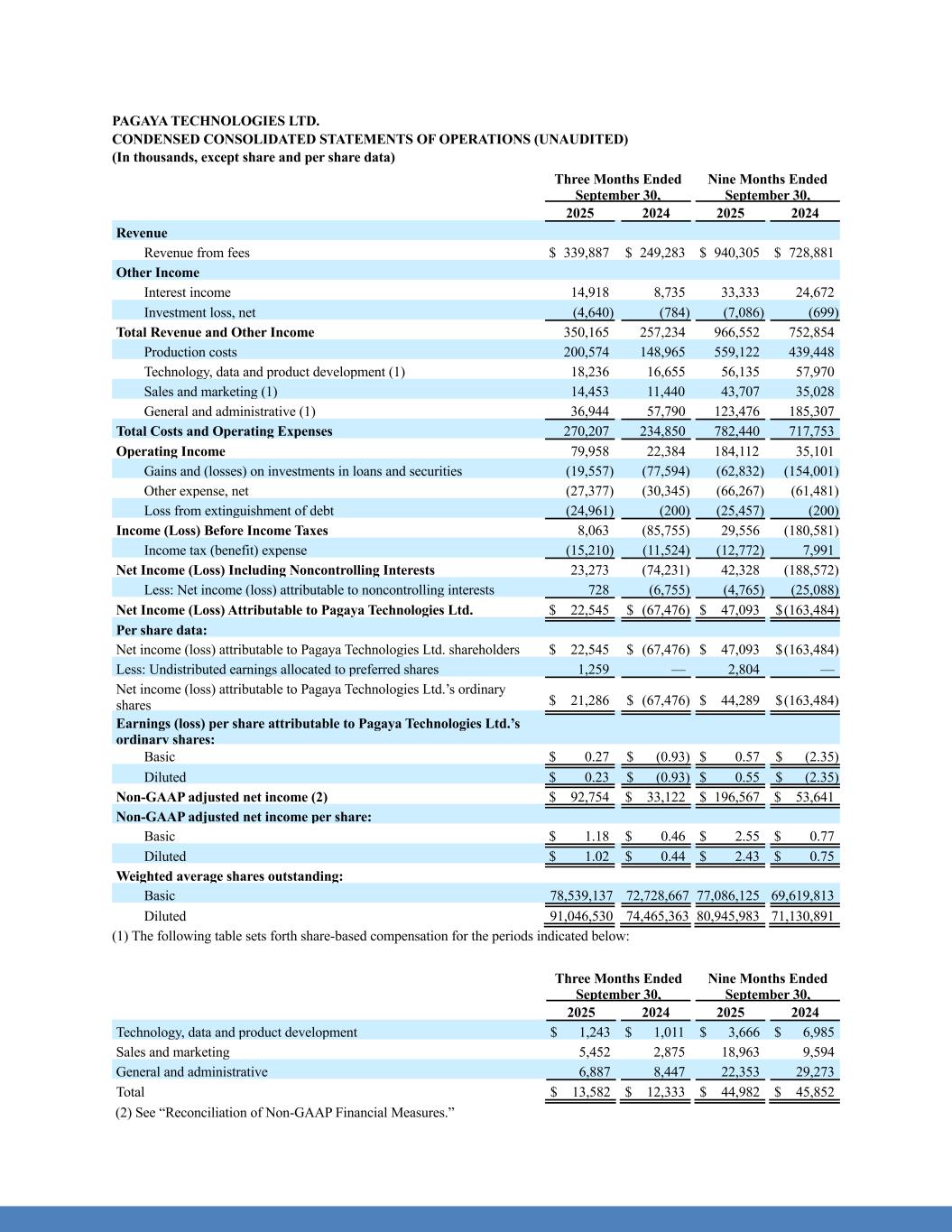

Evangelos Perros Chief Financial O"cer Third Quarter 2025 Results We delivered another strong quarter of profitable growth, our third consecutive quarter of positive GAAP net income, which is approaching nearly $100 million on an annualized basis. Total third quarter revenue of $350 million, FRLPC of $139 million, and adjusted EBITDA of $107 million demonstrate consistent monetization of network volumes and increasingly profitable revenue growth. FRLPC as a % of network volume reached 5% for the quarter, demonstrating our strong ability to continue to monetize our production, while remaining disciplined in our underwriting. GAAP net income reached $23 million, an improvement of $90 million year-over-year, and ahead of third quarter 2025 guidance. These results reflect continued success in driving expansion across our network of existing partners, while focusing on profitable and responsible underwriting. NETWORK VOLUME Network volume grew 19% year-over-year to $2.8 billion, compared to guidance of $2.75 - $2.95 billion. Our personal loan business, which grew 31% year-over-year, remained the largest contributor of network volume in 3Q’25 at approximately 64%. Our conversion of applications to funded loans remained stable at approximately 1%, which reflected consistency in underwriting across the mix of newer and more mature partners as application volume from existing partners outpaced sequential network volume growth by 6pts. This is in line with conversion levels over the past 3 years. We expect this to remain stable in the near term as we remain laser focused on prudent, profitable growth through the cycle. TOTAL REVENUE AND OTHER INCOME Total revenue and other income grew 36% year- over-year to a record $350 million. Revenue from fees grew 36% to $340 million, driven by our personal loan and auto business, and represents 97% of total revenue. Interest and investment income grew 29% to approximately $10 million. Clearly this revenue performance demonstrates our ability to monetize volumes, with annual and quarterly revenue growth well ahead of volume growth. On a sequential basis, revenue growth of 7% also exceeded volume growth, at 6%, with application flow growth of 12%. FEE REVENUE LESS PRODUCTION COSTS FRLPC grew 39% year-over-year in the third quarter to $139 million and continued to meaningfully outpace network volume growth. FRLPC as a % of network volume (“FRLPC %”) expanded 70 basis points year-over-year to a record high of 5.0%. The increase is a!ributable to partner and funding mix and demonstrates our discipline on fee generation. We expect FRLPC as a % of network volume to decrease from the upper end of our range of 4.0% to 5.0% over the coming quarters, reflecting continued expansion of POS and Auto, as well as 10 Point-of-Sale: Growing Auto and Point-of-Sale network volumes annual run-rate as of 3Q’25 $2.2B $1.4B Auto:

11 our diversified funding mix. As we look forward, our focus is on continuing to grow our total FRLPC in dollar terms in a consistent and sustainable way inline with our product strategy. Lending product fees made up 78% of our total FRLPC in the quarter, compared to 71% in 3Q’24. Investor fees made up 22% of our total FRLPC, compared to 29% in 3Q’24. ADJUSTED EBITDA Adjusted EBITDA increased by 91%, or by $51 million year-over-year to a record $107 million. This represented an adjusted EBITDA margin of 30.6%, up nearly 9 points year-over-year, an annualized equivalent of $428 million. Core operating expenses as a percentage of FRLPC are at their lowest since going public, at 34%, a 19 point improvement year-over-year. Operating leverage is enhancing flow-through of higher fees to our bo!om-line, as our growth comes with li!le to no incremental expense. Third quarter incremental adjusted EBITDA margin of more than 100% of year-over-year FRLPC growth in the third quarter. Operating income was $80 million in the s Historical FRLPC Growth and Contribution Mix 1Q’24 $92M 2Q’24 2Q’24 3Q’24 4Q’24 1Q’25 2Q’25 3Q’25 $97M $100M $117M $116M $126M $139M $34 $30 $30 $34 $27 $24 $30 $58 $67 $71 $84 $89 $102 $109 Total FRLPC YoY +$42M +$32M +$28M +$42M +$23M +$29M +$39M Fees from Lending Partners Fees from Funding Partners quarter, up 257% year-over-year, while operating cash flow of $67 million was a historical high and exceeded investing cash flow. NET INCOME This was our third consecutive quarter of positive GAAP net income. GAAP net income a!ributable to Pagaya was $23 million in the quarter, compared to a net loss of ($67) million in 3Q’24, driven primarily by 36% revenue growth with lower operating expenses and impairments. This equated to a 6% margin, compared to 5% last quarter and negative 26% in the year-ago quarter. Reported GAAP net income included ~$10mm in net one-time costs related to our recent notes issuance and refinancing, warrant liability, partially o$set by tax benefits. Starting this quarter, to enhance disclosure and clarity, we are breaking out losses on investments in loans and securities from other expense, net. The new reporting line is “Gains and (losses) on investments in loans and securities”. Credit related fair value adjustments, reported in Gains and (losses) on investments in loans and securities, amounted to a loss of $20 million vs.

Auto CNLs vs comparable 2022 period Personal Loan CNLs vs 4Q’21 peak 1Q’24 2Q’24 3Q’24 4Q’24 1Q’24 2Q’24 3Q’24 4Q’24 (54%) (63%) (66%) (62%) (36%) (35%) (38%) (35%) MOB 18 15 12 9 MOB 17 14 11 8 12 $14 million in the prior quarter and $78 million in the prior year quarter. Interest expense of $22 million declined $1 million from last quarter. Third quarter GAAP Net Income was impacted by several non-operating and non-recurring items. As noted in the prior quarter, we recorded costs due to the extinguishment of our corporate term loan and other secured borrowings which were refinanced during 3Q’25 as part of the bond issuance. This amounted to $25 million in the quarter. We are on track to achieve the $12 million savings in annualized interest expense relative to 2Q’25 and $40 million in cash generation as a result of this refinancing. In addition, we had a non-cash warrant expense of $5 million due to the increase in the market value of the underlying warrants, which were issued at IPO. Partially o$se!ing this impact, we recorded a one-time benefit of $20 million from the resolution of certain tax-related ma!ers. Share-based compensation expense of $14 million was up $1 million year-over-year and down $5 million from last quarter. Adjusted net income was $93 million, which excludes share-based compensation and other non-cash items such as fair value adjustments. CREDIT PERFORMANCE Credit performance remains in line with expectations across Auto, Personal Loan and POS, and well within our disciplined risk tolerance. Following 2024 performance, which was driven by a focus on achieving consistent through-the- cycle GAAP earnings power, 2025 onward is more representative of our normalized production, particularly given the lower cost of capital. As a reminder, while macro and credit performance are robust, we are underwriting with a cushion against potential shi#s. Since the beginning of the year, we have been managing the business and positioning our portfolio accordingly and we have reflected potential future losses in our guidance as shown in our earnings supplement. For personal loans, quarterly 2024 vintage cumulative net losses (“CNLs”) are trending approximately 35% - 40% lower than peak levels in the fourth quarter of 2021 at month-on-book (“MOB”) 8 - 17. For auto loans, CNLs across quarterly 2024 vintages are trending approximately 50% - 65% lower than levels during comparable to 2022 periods at MOB 9 - 18. For POS as well, credit trends remain stable and in line with expectations.

13 Funding and Balance Sheet E"ciency Funding We continue to improve the mix of our funding sources and lower the cost of capital. During the third quarter, we issued $1.8 billion in our ABS program across 4 transactions, marketed to our network of more than 150 institutional funding partners. We continue to rapidly evolve and diversify our funding sources, meeting buyers where they are and supporting further balanced growth for our lending partners. Just last week we closed our second AAA-rated $300 million POSH ABS transaction, as well as a forward flow agreement with Castlelake to purchase up to $500 million in auto loans. This marks a debut in auto forward flow agreements for Pagaya and Castlelake, as institutional investor demand for Pagaya’s auto assets remains strong. Additionally, in early October a#er the quarter, we closed a $400 million RPM auto ABS transaction, which included the sale of the residual certificates to strategic funding partner, One William Street Capital Management. This underscores the a!ractiveness of Pagaya’s auto assets as we grow our auto product o$ering. Balance sheet As of September 30, 2025, our balance sheet primarily consisted of $265 million in cash and cash equivalents and $888 million of Investments in Loans and Securities (primarily regulatory and discretionary risk retention assets from our sponsored ABS transactions). We successfully completed a $500 million senior unsecured notes o$ering that reduced our cost of capital ~2 full percentage points to 9% and is expected to improve cash flow by ~$40 million annualized. As part of the refinancing of higher-cost facilities, we also released over $100 million in highly liquid collateral, which further bolsters our corporate liquidity. We expect to see the full impact of these savings in 4Q’25. The quality and mix of our assets on our balance sheet has improved materially over the last twelve months, providing us access to embedded liquidity and flexibility. A#er the quarter in October we announced an expansion of our existing revolving credit facility with the addition of four new bank partners; Citizens, TD Bank, Wells Fargo and Texas Capital Bank, as well as expanded commitments from our prior four existing lenders. This lowered the facility’s interest rate by nearly 35% from SOFR+750 to SOFR+350. As a result, the cost of substantially all of Pagaya’s corporate borrowings are now at or below the Company’s high-yield bond coupon of 8.875%. This expansion further strengthens Pagaya’s access to liquidity, supports continued growth, and be!er positions the Company to operate through all market cycles. In the third quarter, the fair value of the overall investment portfolio and allowances, net of non- controlling interest and prior to any new additions, was adjusted downward by $32 million vs. $20 million last quarter. We also added $38 million of new investments in loans & securities, net of paydowns from prior investments, the majority of which is required risk retention related to ABS securitizations. As provided in our supplemental filing this morning, we maintain our “Scenario A” illustrative assumption of $100 - $150 million in rolling 12-month forward credit-related impairments and reflect that in our guidance. And while trends can be lumpy, we do assume we will consistently approach those implied levels.

14 Our full-year 2025 outlook reflects the momentum and resilience in our business to-date and our unique operating leverage, while maintaining our cautious stance given the protracted volatility. The Company will continue to focus on driving profitable prudent growth, while monitoring the market environment closely. Key drivers include consistent levels of Personal Loan production and continued growth in Auto and POS products. Given our focus on overall company profitability, we continue to expect total FRLPC to grow steadily and range between 4.0% and 5.0% as a % of network volume in the 4th quarter vs staying at the levels of 3Q’25. Profitability trends will reflect continued scale and operating leverage. Our guidance continues to reflect potential scenarios related to future credit-related impairments, if any, as laid out in our Earnings Supplement. Interest expense is projected to trend lower as a result of the recent refinancing notes transaction. 2025 Financial Outlook FY25E Network Volume $10.5B to $10.75B Total Revenue & Other Income $1,300M to $1,325M Adjusted EBITDA $372M to $382M GAAP Net Income $72M to $82M Implied 4Q’25 $2.65B to $2.9B $333M to $358M $99M to $109M $25M to $35M

15 Conference Call and Webcast Information The Company will hold a webcast and conference call today, November 10, 2025, at 8:30 a.m. Eastern Time. A live webcast of the call will be available via the Investor Relations section of the Company’s website at investor.pagaya.com. To listen to the live webcast, please go to the site at least five minutes prior to the scheduled start time in order to register, download and install any necessary audio so#ware. Shortly before the call, the accompanying materials will be made available on the Company’s website. Shortly a#er the call, a replay of the webcast will be available for 90 days on the Company’s website. The conference call can also be accessed by dialing 1-877-407-9208 or 1-201-493-6784 and providing conference ID PAGAYA. The telephone replay can be accessed by dialing 1-844-512-2921 or 1-412-317-6671 and providing the conference ID# 13756335. The telephone replay will be available starting shortly a#er the call until Monday, November 24, 2025. A replay will also be available on the Investor Relations website following the call. About Pagaya Technologies Pagaya (NASDAQ: PGY) is a global technology company making life-changing financial products and services available to more people nationwide, as it reshapes the financial services ecosystem. By using machine learning, a vast data network and an AI-driven approach, Pagaya provides comprehensive consumer credit and residential real estate solutions for its partners, their customers, and investors. Its proprietary API and capital solutions integrate into its network of partners to deliver seamless user experiences and greater access to the mainstream economy. Pagaya has o"ces in New York and Tel Aviv. For more information, visit pagaya.com. INVESTORS & ANALYSTS Josh Fagen, CFA Head of Investor Relations & COO of Finance ir@pagaya.com MEDIA & PRESS Emily Passer Head of PR & External Communications press@pagaya.com

16 This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve risks and uncertainties. These forward-looking statements generally are identified by the words “anticipate,” “believe,” “continue,” “can,” “could,” “estimate,” “expect,” “intend,” “may,” “opportunity,” “future,” “strategy,” “might,” “outlook,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. All statements other than statements of historical fact are forward-looking statements, including statements regarding: The Company’s strategy and future operations, including the Company’s expectations regarding sustainable revenue growth and the Company’s ability to deliver consistent results for its lending partners and investors; the Company’s ability to continue to drive sustainable gains in profitability; the Company’s ability to achieve continued momentum in its business; the Company’s ability to achieve positive net cash flow in 2025; the Company’s ability to continue to achieve GAAP net income profitability in 2025; the Company’s financial outlook for Network Volume, Total Revenue and Other Income, GAAP net income and Adjusted EBITDA for the third quarter of 2025 and the Company’s financial outlook for Network Volume, Total Revenue and Other Income, Adjusted EBITDA and GAAP net income for the full year 2025. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause the Company’s actual results, performance or achievements to be materially di$erent from any future results, performance or achievements expressed or implied by the forward-looking statements. Risks, uncertainties and assumptions include factors relating to: the Company’s ability to a!ract new partners and to retain and grow its relationships with existing partners to support the underlying investment needs for its securitizations and funds products; the need to maintain a consistently high level of trust in its brand; the concentration of a large percentage of its investment revenue with a small number of partners and platforms; its ability to sustain its revenue growth rate or the growth rate of its related key operating metrics; its ability to improve, operate and implement its technology, its existing funding arrangements for the Company and its a"liates that may not be renewed or replaced or its existing funding sources that may be unwilling or unable to provide funding to it on terms acceptable to it, or at all; the performance of loans facilitated through its model; changes in market interest rates; its securitizations, warehouse credit facility agreements; the impact on its business of general economic conditions, including, but not limited to rising interest rates, inflation, supply chain disruptions, exchange rate fluctuations and labor shortages; its ability to realize the potential benefits of past or future acquisitions; changes in the political, legal and regulatory framework for AI technology, machine learning, financial institutions and consumer protection; the ability to maintain the listing of our securities on Nasdaq; the financial performance of its partners, and fluctuations in the U.S. consumer credit and housing market; its ability to grow e$ectively through strategic alliances; seasonal fluctuations in our revenue as a result of consumer spending and saving pa!erns; pending and future litigation, regulatory actions and/or compliance issues and other risks that are described in and the Company’s Form 10-K filed on March 12, 2025 and subsequent filings with the U.S. Securities and Exchange Commission. These forward-looking statements reflect the Company’s views with respect to future events as of the date hereof and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, investors should not place undue reliance on these forward-looking statements. The forward-looking statements are made as of the date hereof, reflect the Company’s current beliefs and are based on information currently available as of the date they are made, and the Company assumes no obligation and does not intend to update these forward-looking statements. Financial Information; Non-GAAP Financial Measures Some of the unaudited financial information and data contained in this shareholder le!er, our earnings press release and Form 8-K, such as Fee Revenue Less Production Costs (“FRLPC”), FRLPC as a % of volume, Adjusted EBITDA, Adjusted Net Income (Loss), core operating expenses, Net Income Margin, net cash provided by operating activities less payments for the purchase of property and equipment and net cash provided by operating activities less payments for the purchase of property and equipment as a percentage of FRLPC, have not been prepared in accordance with United States generally accepted accounting principles (“U.S. GAAP”). To supplement the unaudited consolidated financial statements prepared and presented in accordance with U.S. GAAP, management uses the non-GAAP financial measures FRLPC, FRLPC as a % of volume, Adjusted EBITDA, Adjusted Net Income (Loss), core operating expenses, Net Income Margin, net cash provided by operating activities less payments for the purchase of property and equipment Cautionary Note About Forward-Looking Statements

17 and net cash provided by operating activities less payments for the purchase of property and equipment as a percentage of FRLPC to provide investors with additional information about our financial performance and to enhance the overall understanding of the results of operations by highlighting the results from ongoing operations and the underlying profitability of our business. Management believes these non-GAAP measures provide an additional tool for investors to use in comparing our core financial performance over multiple periods. However, non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by U.S. GAAP and are not prepared under any comprehensive set of accounting rules or principles. In addition, non-GAAP financial measures may be calculated di$erently from, and therefore may not be directly comparable to, similarly titled measures used by other companies. As a result, non-GAAP financial measures should be viewed as supplementing, and not as an alternative or substitute for, our unaudited consolidated financial statements prepared and presented in accordance with U.S. GAAP. To address these limitations, management provides a reconciliation of Adjusted Net Income (Loss), Adjusted EBITDA to net income (loss) a!ributable to Pagaya’s shareholders, a reconciliation of FRLPC to Operating Income and a reconciliation of core operating expenses to Operating expenses, and a calculation of FRLPC as a % of volume, Net Income Margin, net cash provided by operating activities less payments for the purchase of property and equipment and net cash provided by operating activities less payments for the purchase of property and equipment as a percentage of FRLPC. Management encourages investors and others to review our financial information in its entirety, not to rely on any single financial measure and to view Adjusted Net Income (Loss) and Adjusted EBITDA in conjunction with its respective related GAAP financial measures. Non-GAAP financial measures include the following items: Fee Revenue Less Production Costs (“FRLPC”) is defined as revenue from fees less production costs. FRLPC as a % of volume is defined as FRLPC divided by Network Volume. Adjusted Net Income (Loss) is defined as net income (loss) a!ributable to Pagaya Technologies Ltd.’s shareholders excluding share-based compensation expense, change in fair value of warrant liability, change in fair value of contingent liability, impairment, including credit-related charges, restructuring expenses, transaction-related expenses, and non-recurring expenses associated with mergers and acquisitions. Adjusted EBITDA is defined as net income (loss) a!ributable to Pagaya Technologies Ltd.’s shareholders excluding share-based compensation expense, change in fair value of warrant liability, change in fair value of contingent liability, impairment, including credit-related charges, restructuring expenses, transaction-related expenses, non-recurring expenses associated with mergers and acquisitions, interest expense, depreciation expense, and income tax expense (benefit). Core operating expenses is defined as operating expenses less share-based compensation, depreciation and amortization, whole loan allowance for losses, write-o$ of capitalized so#ware, transaction-related expenses, restructuring expenses and non- recurring expenses. The foregoing items are excluded from our Adjusted Net Income (Loss), Adjusted EBITDA and core operating expenses measures because they are noncash in nature, or because the amount and timing of these items is unpredictable, is not driven by core results of operations and renders comparisons with prior periods and competitors less meaningful. We believe FRLPC, FRLPC as a % of volume, Adjusted Net Income (Loss), Adjusted EBITDA, core operating expenses, Net IncomeMargin, net cash provided by operating activities less payments for the purchase of property and equipment and net cash provided by operating activities less payments for the purchase of property and equipment as a percentage of FRLPC provide useful information to investors and others in understanding and evaluating our results of operations, as well as providing a useful measure for period-to-period comparisons of our business performance. Moreover, we have included FRLPC, FRLPC as a % of volume, Adjusted Net Income (Loss), Adjusted EBITDA, core operating expenses, Net Income Margin, net cash provided by operating activities less payments for the purchase of property and equipment and net cash provided by operating activities less payments for the purchase of property and equipment as a percentage of FRLPC because these are key measurements used by our management internally to make operating decisions, including those related to operating expenses, evaluate performance, and perform strategic planning and annual budgeting. However, this non-GAAP financial information is presented for supplemental informational purposes only, should not be considered a substitute for or superior to financial information presented in accordance with U.S. GAAP and may be di$erent from similarly titled non-GAAP financial measures used by other companies. The tables below provide reconciliations of this non-GAAP financial information to its most directly comparable U.S. GAAP metric. In addition, Pagaya provides an outlook for the fourth quarter and full year 2025 on a non-GAAP basis. The Company cannot reconcile its expected Adjusted EBITDA to expected Net Income A!ributable to Pagaya under “2025 Financial Outlook” without unreasonable e$ort because certain items that impact net income (loss) and other reconciling items are out of the Company’s control and/or cannot be reasonably predicted at this time, which unavailable information could have a significant impact on the Company’s U.S. GAAP financial results.

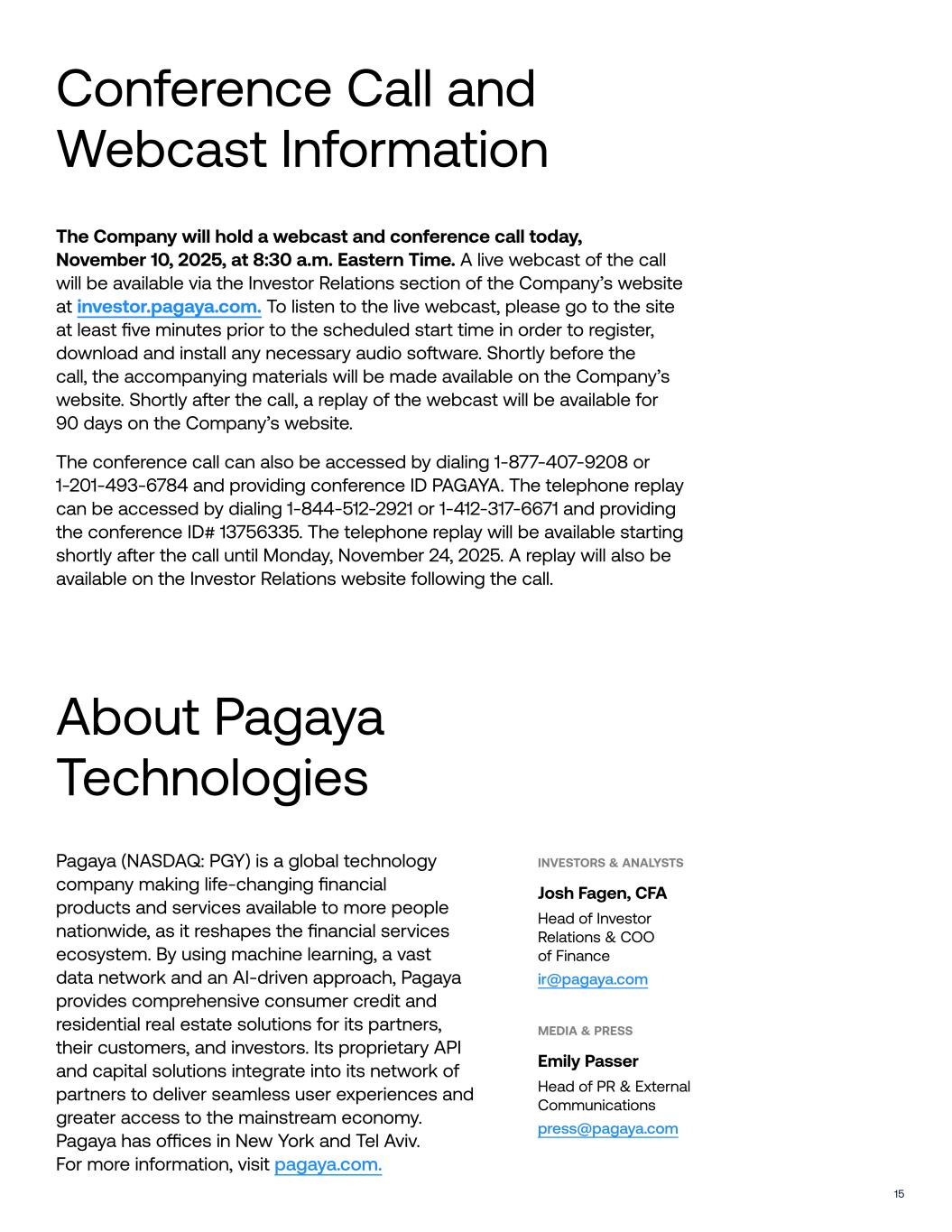

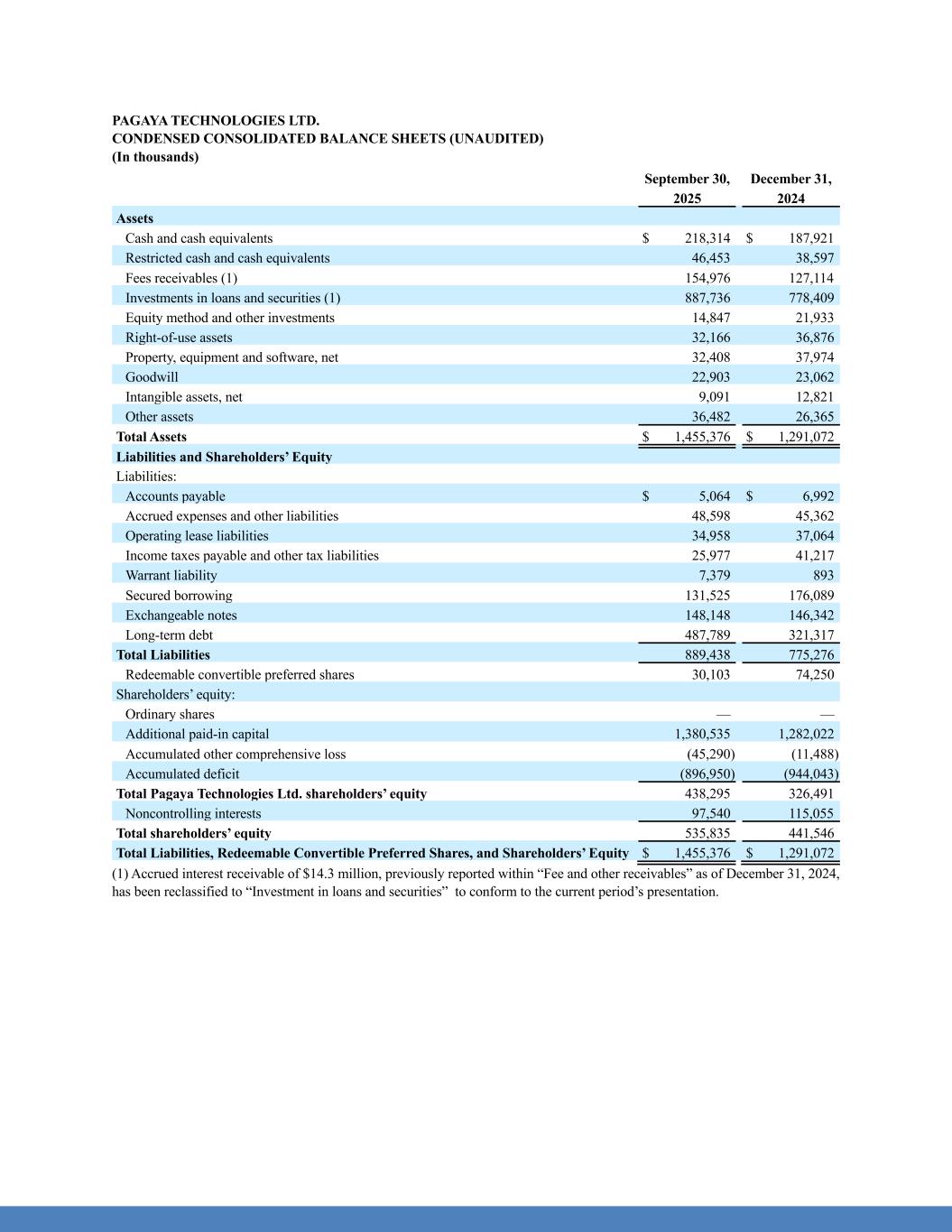

PAGAYA TECHNOLOGIES LTD. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) (In thousands, except share and per share data) Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Revenue Revenue from fees $ 339,887 $ 249,283 $ 940,305 $ 728,881 Other Income Interest income 14,918 8,735 33,333 24,672 Investment loss, net (4,640) (784) (7,086) (699) Total Revenue and Other Income 350,165 257,234 966,552 752,854 Production costs 200,574 148,965 559,122 439,448 Technology, data and product development (1) 18,236 16,655 56,135 57,970 Sales and marketing (1) 14,453 11,440 43,707 35,028 General and administrative (1) 36,944 57,790 123,476 185,307 Total Costs and Operating Expenses 270,207 234,850 782,440 717,753 Operating Income 79,958 22,384 184,112 35,101 Gains and (losses) on investments in loans and securities (19,557) (77,594) (62,832) (154,001) Other expense, net (27,377) (30,345) (66,267) (61,481) Loss from extinguishment of debt (24,961) (200) (25,457) (200) Income (Loss) Before Income Taxes 8,063 (85,755) 29,556 (180,581) Income tax (benefit) expense (15,210) (11,524) (12,772) 7,991 Net Income (Loss) Including Noncontrolling Interests 23,273 (74,231) 42,328 (188,572) Less: Net income (loss) attributable to noncontrolling interests 728 (6,755) (4,765) (25,088) Net Income (Loss) Attributable to Pagaya Technologies Ltd. $ 22,545 $ (67,476) $ 47,093 $ (163,484) Per share data: Net income (loss) attributable to Pagaya Technologies Ltd. shareholders $ 22,545 $ (67,476) $ 47,093 $ (163,484) Less: Undistributed earnings allocated to preferred shares 1,259 — 2,804 — Net income (loss) attributable to Pagaya Technologies Ltd.’s ordinary shares $ 21,286 $ (67,476) $ 44,289 $ (163,484) Earnings (loss) per share attributable to Pagaya Technologies Ltd.’s ordinary shares: Basic $ 0.27 $ (0.93) $ 0.57 $ (2.35) Diluted $ 0.23 $ (0.93) $ 0.55 $ (2.35) Non-GAAP adjusted net income (2) $ 92,754 $ 33,122 $ 196,567 $ 53,641 Non-GAAP adjusted net income per share: Basic $ 1.18 $ 0.46 $ 2.55 $ 0.77 Diluted $ 1.02 $ 0.44 $ 2.43 $ 0.75 Weighted average shares outstanding: Basic 78,539,137 72,728,667 77,086,125 69,619,813 Diluted 91,046,530 74,465,363 80,945,983 71,130,891 (1) The following table sets forth share-based compensation for the periods indicated below: Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Technology, data and product development $ 1,243 $ 1,011 $ 3,666 $ 6,985 Sales and marketing 5,452 2,875 18,963 9,594 General and administrative 6,887 8,447 22,353 29,273 Total $ 13,582 $ 12,333 $ 44,982 $ 45,852 (2) See “Reconciliation of Non-GAAP Financial Measures.”

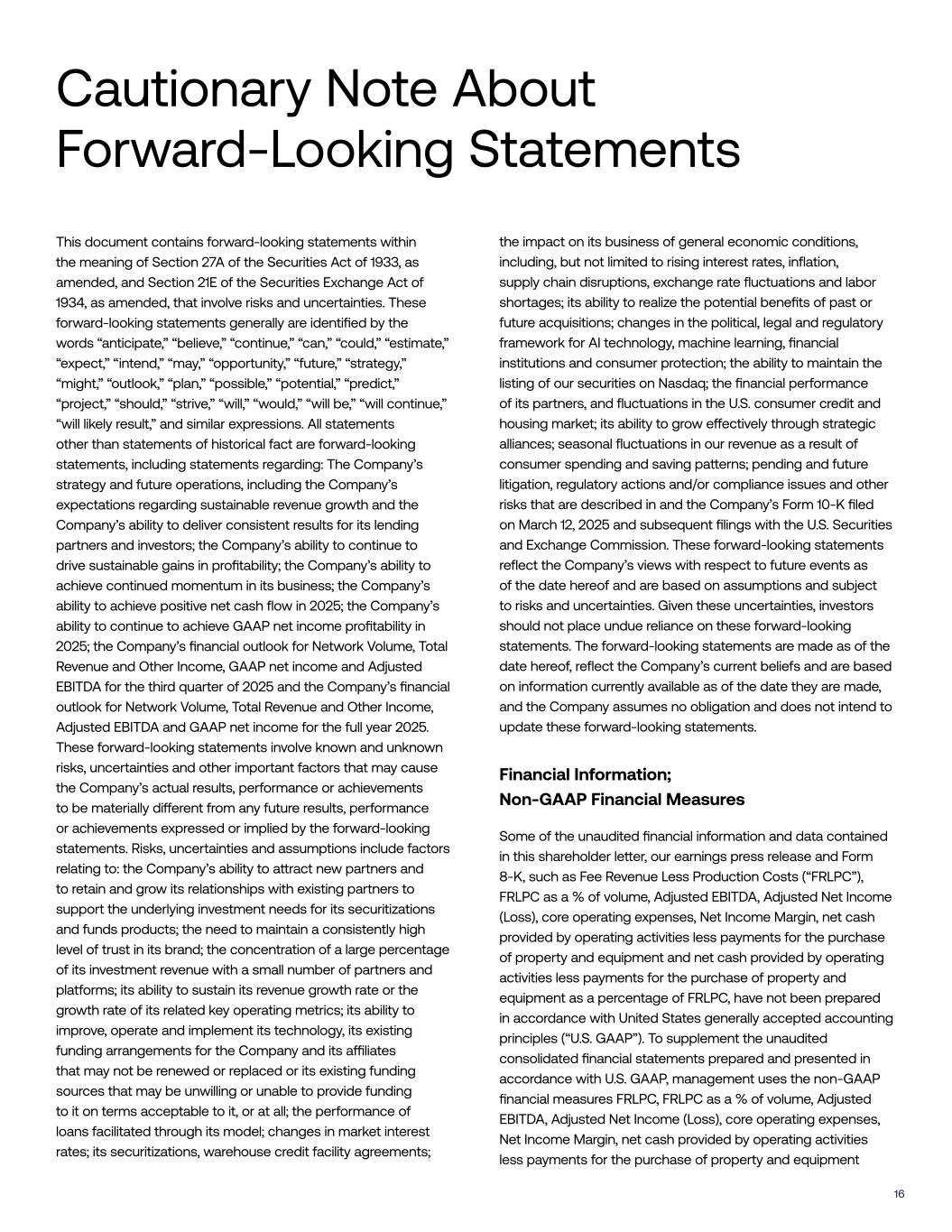

PAGAYA TECHNOLOGIES LTD. CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (In thousands) September 30, December 31, 2025 2024 Assets Cash and cash equivalents $ 218,314 $ 187,921 Restricted cash and cash equivalents 46,453 38,597 Fees receivables (1) 154,976 127,114 Investments in loans and securities (1) 887,736 778,409 Equity method and other investments 14,847 21,933 Right-of-use assets 32,166 36,876 Property, equipment and software, net 32,408 37,974 Goodwill 22,903 23,062 Intangible assets, net 9,091 12,821 Other assets 36,482 26,365 Total Assets $ 1,455,376 $ 1,291,072 Liabilities and Shareholders’ Equity Liabilities: Accounts payable $ 5,064 $ 6,992 Accrued expenses and other liabilities 48,598 45,362 Operating lease liabilities 34,958 37,064 Income taxes payable and other tax liabilities 25,977 41,217 Warrant liability 7,379 893 Secured borrowing 131,525 176,089 Exchangeable notes 148,148 146,342 Long-term debt 487,789 321,317 Total Liabilities 889,438 775,276 Redeemable convertible preferred shares 30,103 74,250 Shareholders’ equity: Ordinary shares — — Additional paid-in capital 1,380,535 1,282,022 Accumulated other comprehensive loss (45,290) (11,488) Accumulated deficit (896,950) (944,043) Total Pagaya Technologies Ltd. shareholders’ equity 438,295 326,491 Noncontrolling interests 97,540 115,055 Total shareholders’ equity 535,835 441,546 Total Liabilities, Redeemable Convertible Preferred Shares, and Shareholders’ Equity $ 1,455,376 $ 1,291,072 (1) Accrued interest receivable of $14.3 million, previously reported within “Fee and other receivables” as of December 31, 2024, has been reclassified to “Investment in loans and securities” to conform to the current period’s presentation.

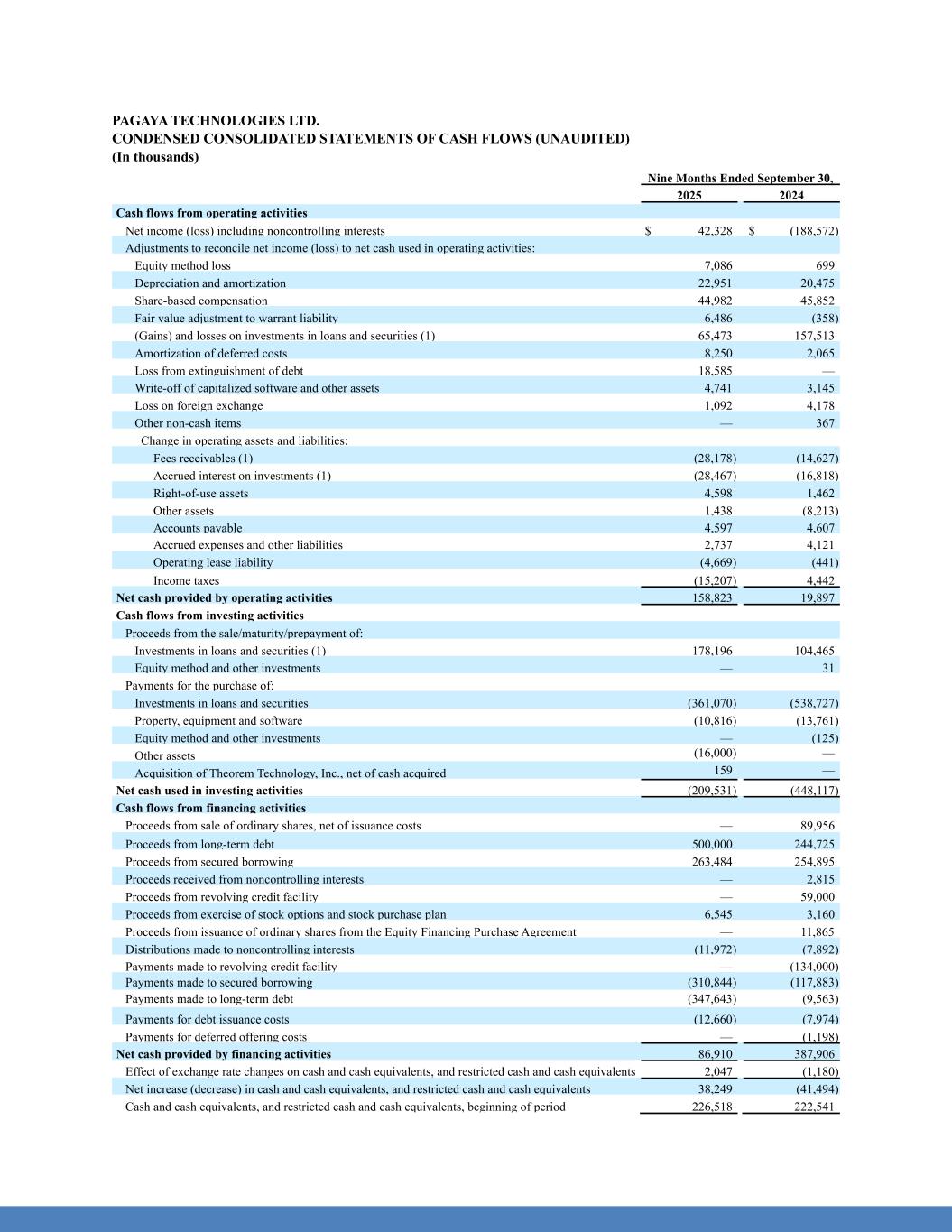

PAGAYA TECHNOLOGIES LTD. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) (In thousands) Nine Months Ended September 30, 2025 2024 Cash flows from operating activities Net income (loss) including noncontrolling interests $ 42,328 $ (188,572) Adjustments to reconcile net income (loss) to net cash used in operating activities: Equity method loss 7,086 699 Depreciation and amortization 22,951 20,475 Share-based compensation 44,982 45,852 Fair value adjustment to warrant liability 6,486 (358) (Gains) and losses on investments in loans and securities (1) 65,473 157,513 Amortization of deferred costs 8,250 2,065 Loss from extinguishment of debt 18,585 — Write-off of capitalized software and other assets 4,741 3,145 Loss on foreign exchange 1,092 4,178 Other non-cash items — 367 Change in operating assets and liabilities: Fees receivables (1) (28,178) (14,627) Accrued interest on investments (1) (28,467) (16,818) Right-of-use assets 4,598 1,462 Other assets 1,438 (8,213) Accounts payable 4,597 4,607 Accrued expenses and other liabilities 2,737 4,121 Operating lease liability (4,669) (441) Income taxes (15,207) 4,442 Net cash provided by operating activities 158,823 19,897 Cash flows from investing activities Proceeds from the sale/maturity/prepayment of: Investments in loans and securities (1) 178,196 104,465 Equity method and other investments — 31 Payments for the purchase of: Investments in loans and securities (361,070) (538,727) Property, equipment and software (10,816) (13,761) Equity method and other investments — (125) Other assets (16,000) — Acquisition of Theorem Technology, Inc., net of cash acquired 159 — Net cash used in investing activities (209,531) (448,117) Cash flows from financing activities Proceeds from sale of ordinary shares, net of issuance costs — 89,956 Proceeds from long-term debt 500,000 244,725 Proceeds from secured borrowing 263,484 254,895 Proceeds received from noncontrolling interests — 2,815 Proceeds from revolving credit facility — 59,000 Proceeds from exercise of stock options and stock purchase plan 6,545 3,160 Proceeds from issuance of ordinary shares from the Equity Financing Purchase Agreement — 11,865 Distributions made to noncontrolling interests (11,972) (7,892) Payments made to revolving credit facility — (134,000) Payments made to secured borrowing (310,844) (117,883) Payments made to long-term debt (347,643) (9,563) Payments for debt issuance costs (12,660) (7,974) Payments for deferred offering costs — (1,198) Net cash provided by financing activities 86,910 387,906 Effect of exchange rate changes on cash and cash equivalents, and restricted cash and cash equivalents 2,047 (1,180) Net increase (decrease) in cash and cash equivalents, and restricted cash and cash equivalents 38,249 (41,494) Cash and cash equivalents, and restricted cash and cash equivalents, beginning of period 226,518 222,541

Cash and cash equivalents, and restricted cash and cash equivalents, end of period $ 264,767 $ 181,047 (1) Accrued interest receivable previously reported within “Fee and other receivables” in the prior period has been reclassified to “Investment in loans and securities” to conform to the current period’s presentation.

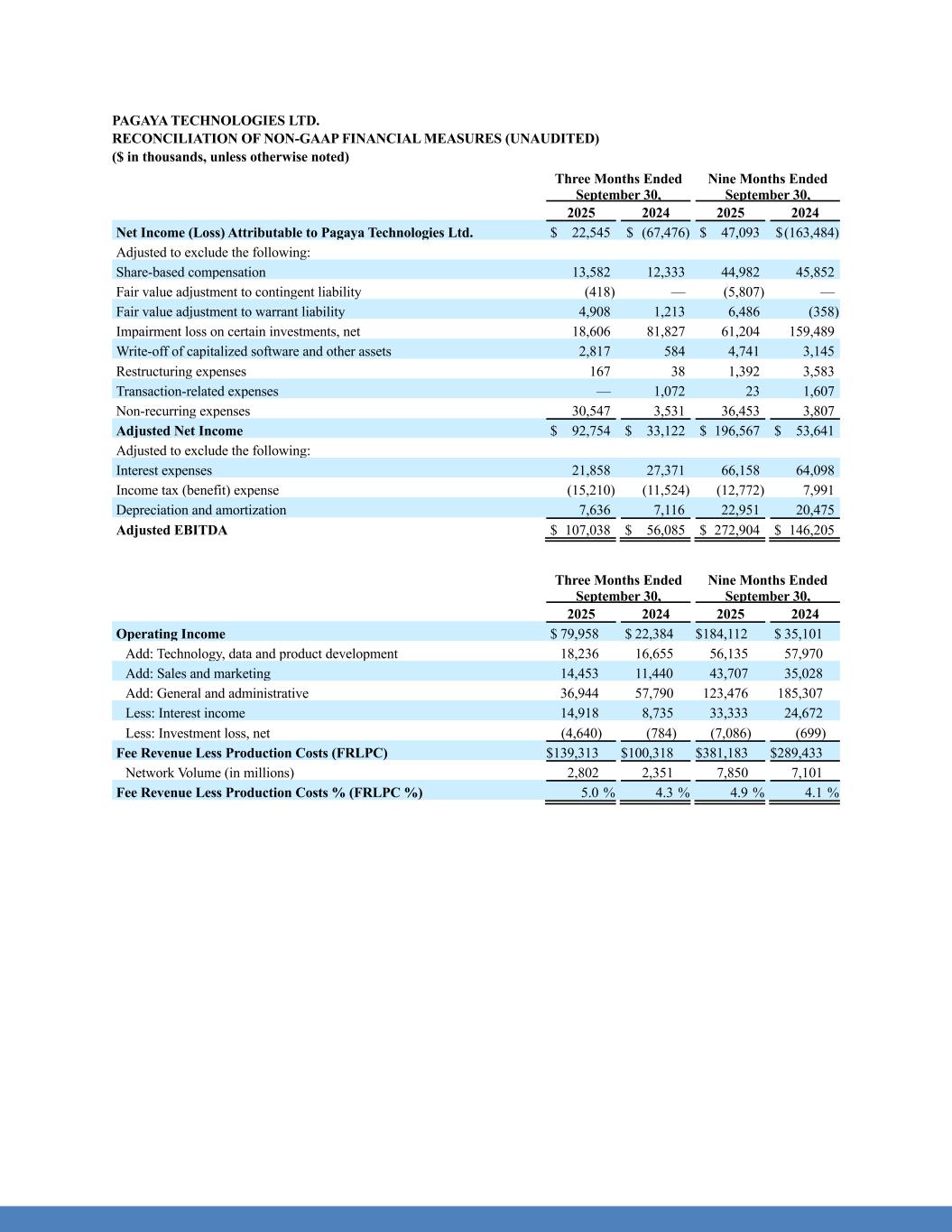

PAGAYA TECHNOLOGIES LTD. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (UNAUDITED) ($ in thousands, unless otherwise noted) Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Net Income (Loss) Attributable to Pagaya Technologies Ltd. $ 22,545 $ (67,476) $ 47,093 $ (163,484) Adjusted to exclude the following: Share-based compensation 13,582 12,333 44,982 45,852 Fair value adjustment to contingent liability (418) — (5,807) — Fair value adjustment to warrant liability 4,908 1,213 6,486 (358) Impairment loss on certain investments, net 18,606 81,827 61,204 159,489 Write-off of capitalized software and other assets 2,817 584 4,741 3,145 Restructuring expenses 167 38 1,392 3,583 Transaction-related expenses — 1,072 23 1,607 Non-recurring expenses 30,547 3,531 36,453 3,807 Adjusted Net Income $ 92,754 $ 33,122 $ 196,567 $ 53,641 Adjusted to exclude the following: Interest expenses 21,858 27,371 66,158 64,098 Income tax (benefit) expense (15,210) (11,524) (12,772) 7,991 Depreciation and amortization 7,636 7,116 22,951 20,475 Adjusted EBITDA $ 107,038 $ 56,085 $ 272,904 $ 146,205 Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Operating Income $ 79,958 $ 22,384 $ 184,112 $ 35,101 Add: Technology, data and product development 18,236 16,655 56,135 57,970 Add: Sales and marketing 14,453 11,440 43,707 35,028 Add: General and administrative 36,944 57,790 123,476 185,307 Less: Interest income 14,918 8,735 33,333 24,672 Less: Investment loss, net (4,640) (784) (7,086) (699) Fee Revenue Less Production Costs (FRLPC) $ 139,313 $ 100,318 $ 381,183 $ 289,433 Network Volume (in millions) 2,802 2,351 7,850 7,101 Fee Revenue Less Production Costs % (FRLPC %) 5.0 % 4.3 % 4.9 % 4.1 % Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Operating expenses $ 69,633 $ 85,885 $ 223,318 $ 278,305 Adjusted to exclude the following: Share-based compensation 13,582 12,333 44,982 45,852 Depreciation and amortization 7,636 7,116 22,951 20,475 Whole loan allowance for losses — 12,087 8,030 34,738 Write-off of capitalized software — 584 — 3,145 Transaction-related expenses — 1,072 23 1,607 Restructuring expenses 167 38 1,392 3,583 Non-recurring expenses 1,171 35 6,129 311 Core operating expenses $ 47,077 $ 52,620 $ 139,811 $ 168,594 Core operating expenses as a % of FRLPC 34 % 52 % 37 % 58 %