Document

Exhibit 99.1

News Release

|

|

|

|

|

|

|

|

|

| Contact: |

|

Linsey Wisniewski

Corporate Communications

667-218-7700

Emily Duncan

Investor Relations

833-447-2783

|

CONSTELLATION REPORTS SECOND QUARTER 2025 RESULTS

Earnings Release Highlights

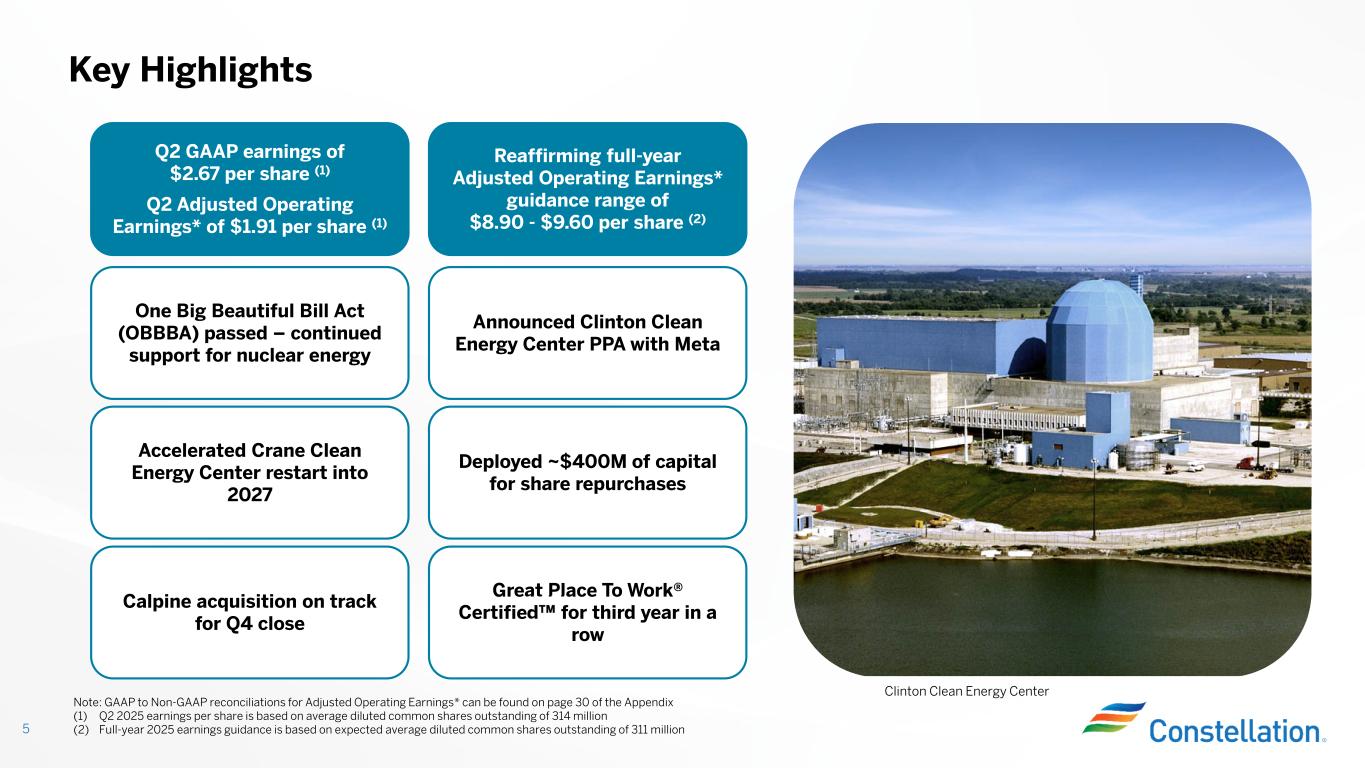

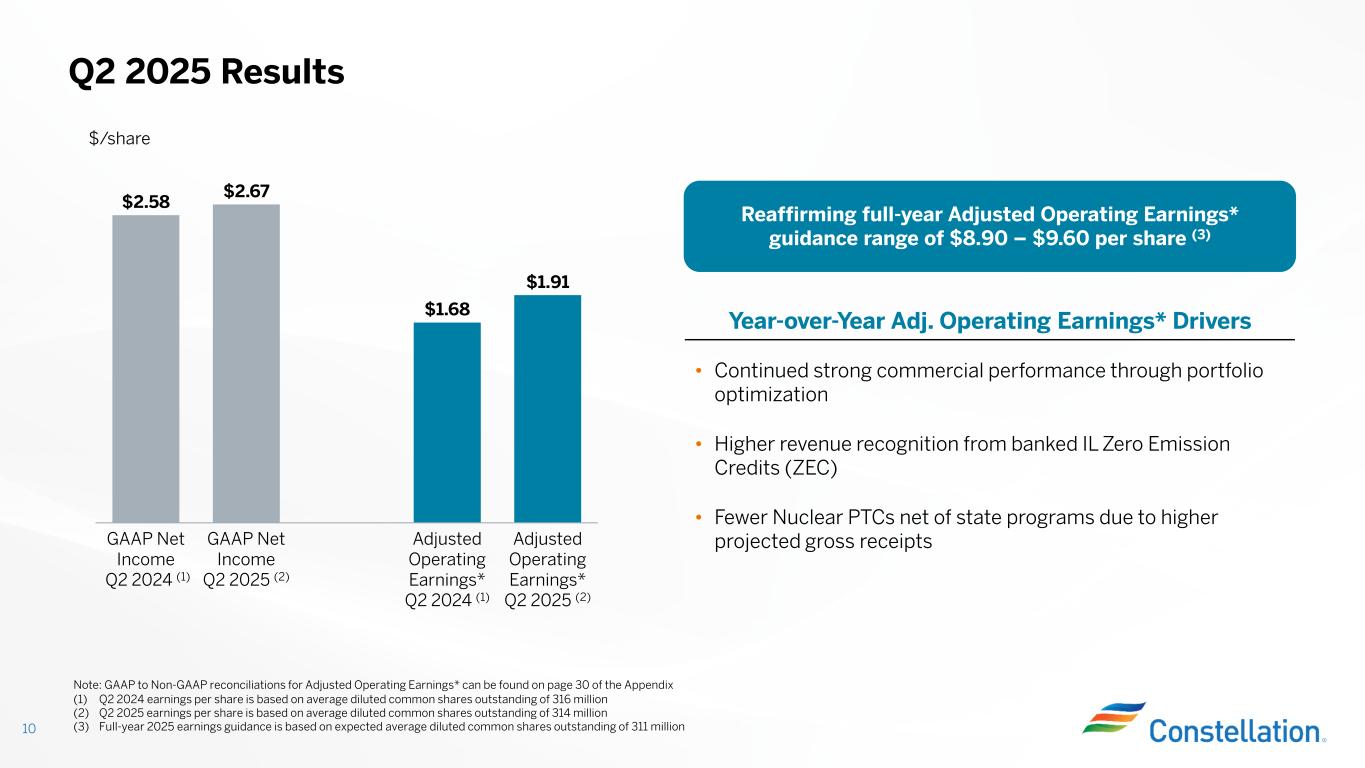

•GAAP Net Income of $2.67 per share and Adjusted (non-GAAP) Operating Earnings of $1.91 per share for the second quarter of 2025

•Signed 20-year deal with Meta for full output of Clinton Clean Energy Center

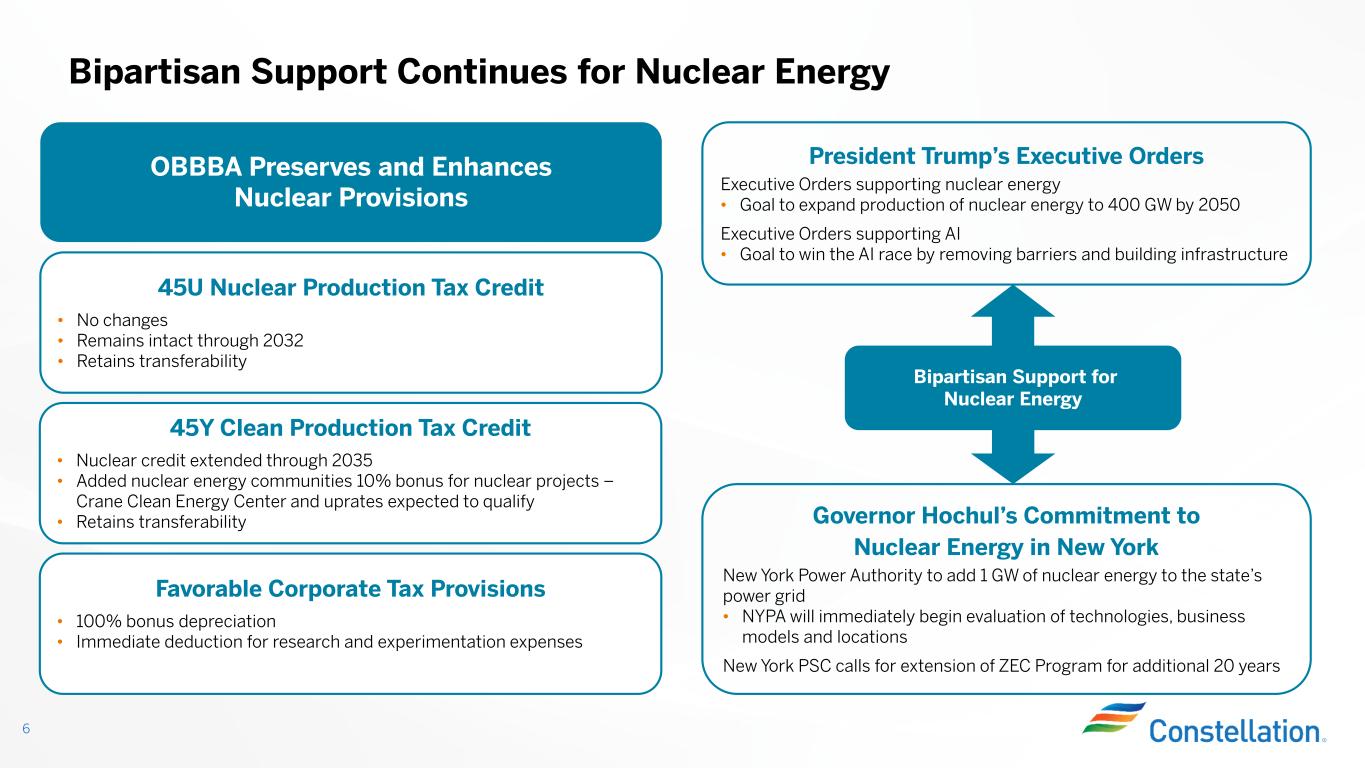

•Continued bipartisan legislative support for nuclear energy

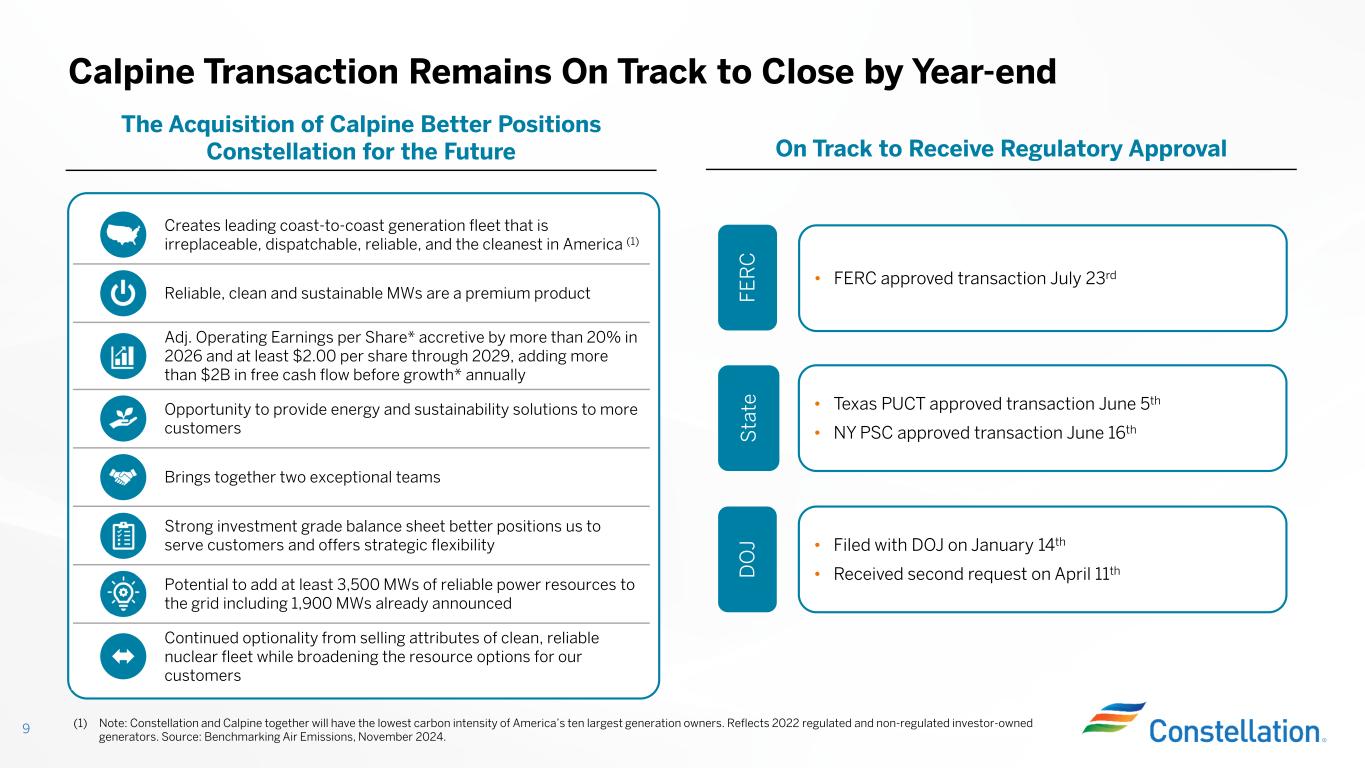

•Calpine acquisition receives FERC and state regulatory approvals

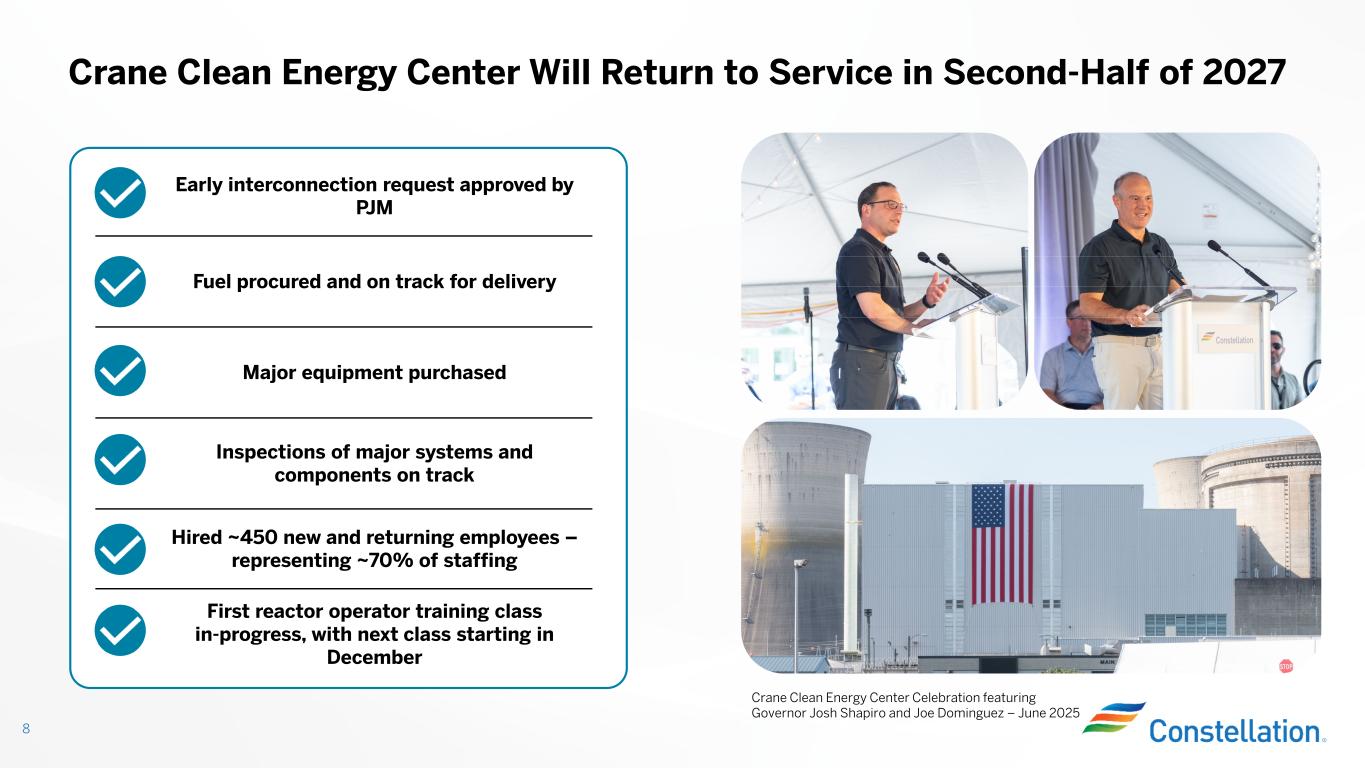

•Crane Clean Energy Center will return to service in 2027

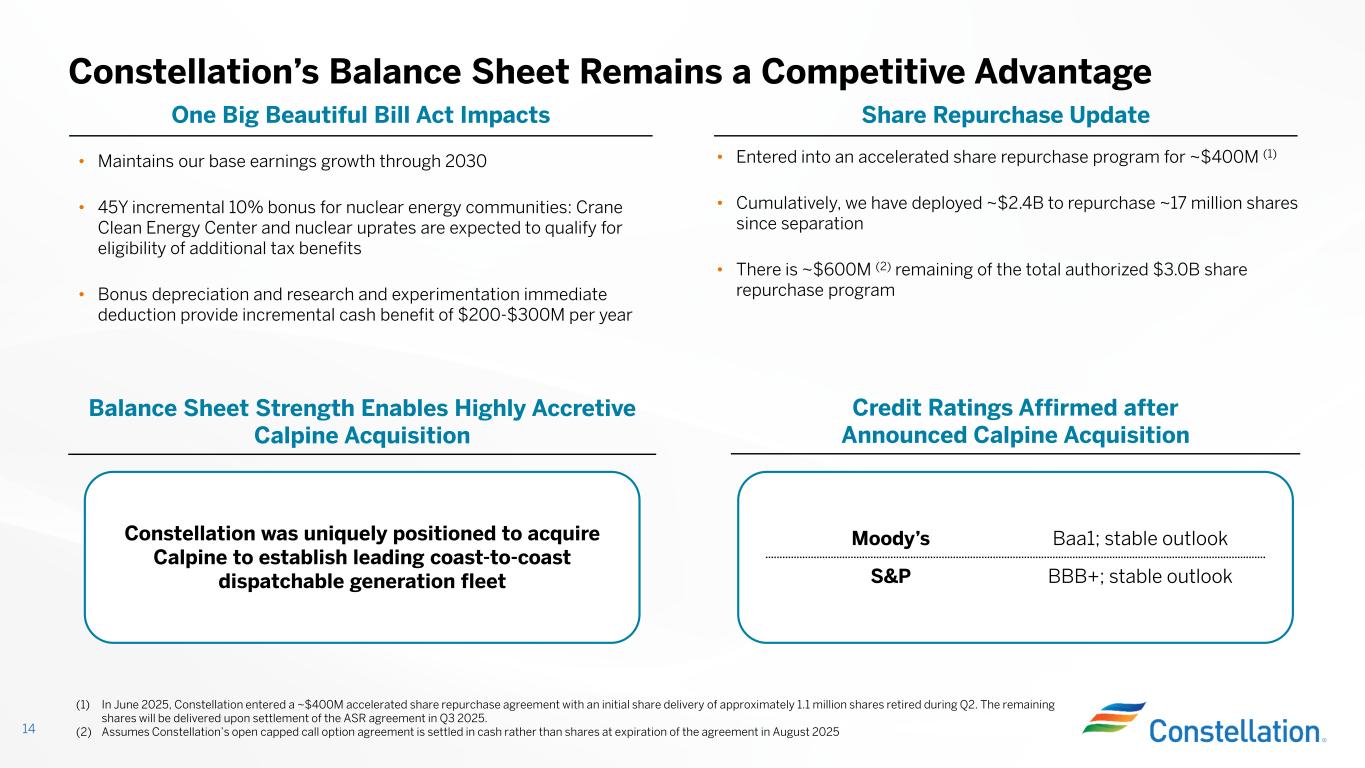

•Repurchased approximately $400 million of our common stock

•Recertified as a Great Place to Work for the third straight year

Baltimore (Aug 7, 2025) — Constellation Energy Corporation (Nasdaq: CEG) today reported its financial results for the second quarter of 2025.

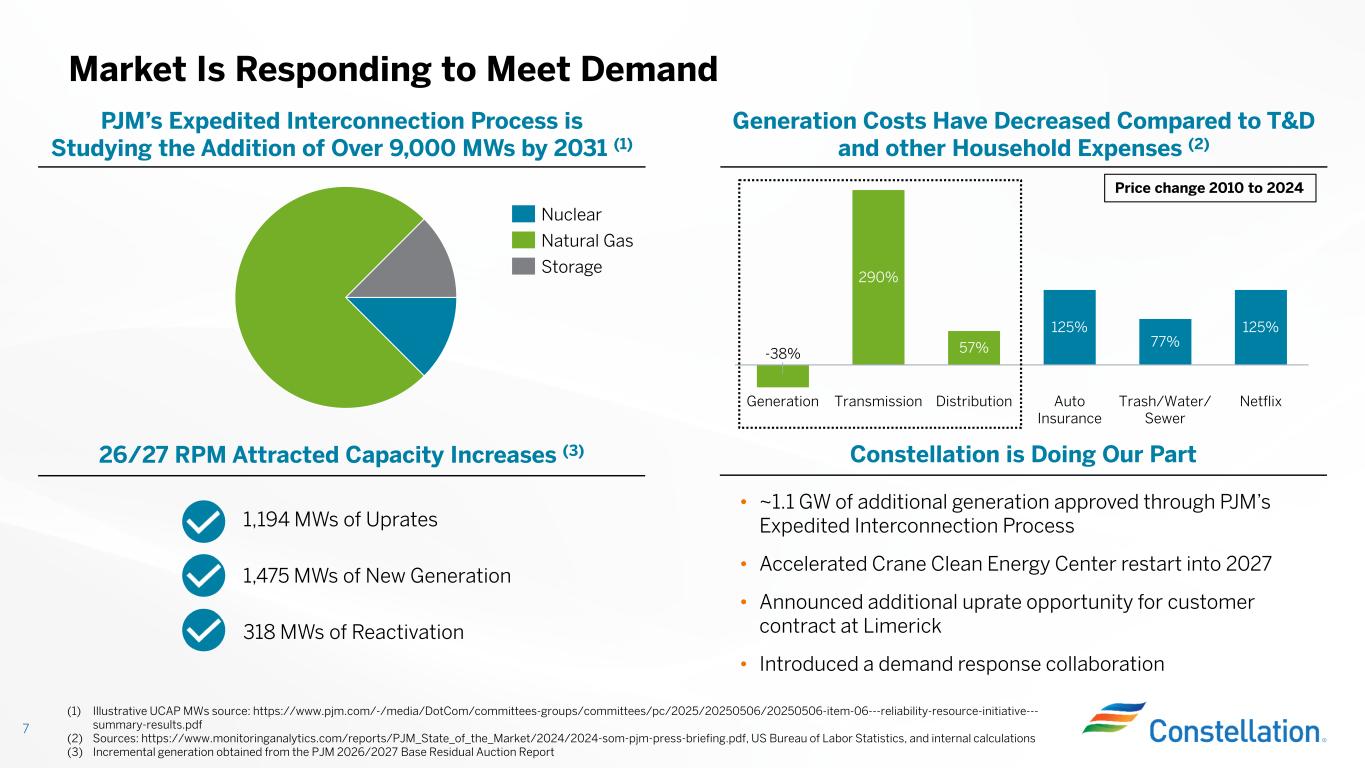

“With increasing demand for electricity to power American families and businesses, AI, electric vehicles and industrial growth, we’re doing our part to ensure reliability and affordability,” said Joe Dominguez, president and CEO of Constellation. “We are adding megawatts to the grid through extending the lives of our existing fleet, expediting the Crane Clean Energy Center restart, expanding nuclear plant capacity through uprates, and launching a new, AI-powered demand response tool that helps businesses reduce energy use during periods of peak demand. These efforts reduce costs for everyone while strengthening grid reliability and reflect the kind of leadership our customers, our communities and our economy need right now.”

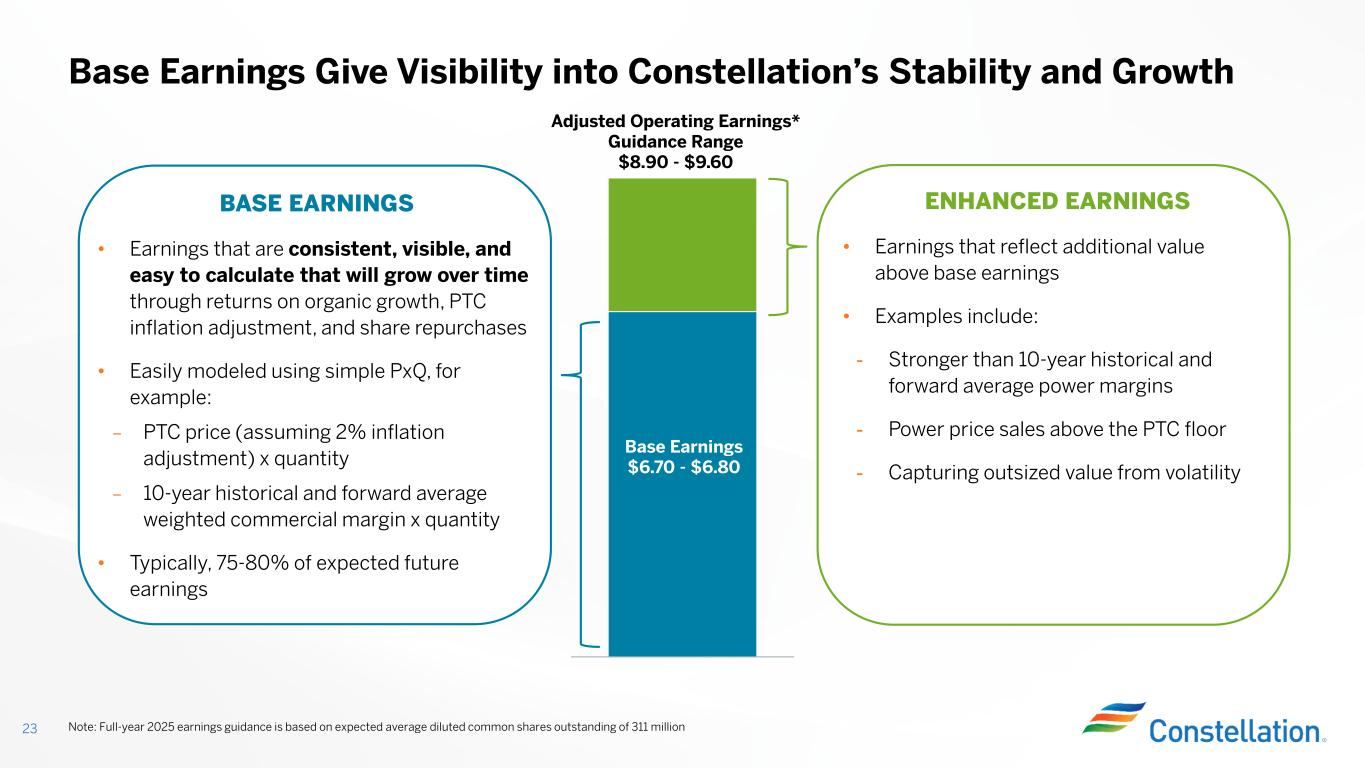

“Backed by continued strong performance from our Generation and Commercial businesses, Constellation delivered adjusted operating earnings of $1.91 per share this quarter, up from $1.68 per share in Q2 last year,” said Dan Eggers, chief financial officer, Constellation. “We’re reaffirming our full-year adjusted operating earnings guidance range of $8.90-$9.60 per share. Following recent approval from FERC, our transaction with Calpine remains on track to close by year-end as we look to combine two leading generation fleets and two exceptional teams to enhance our ability to serve our customers and communities coast-to-coast.”

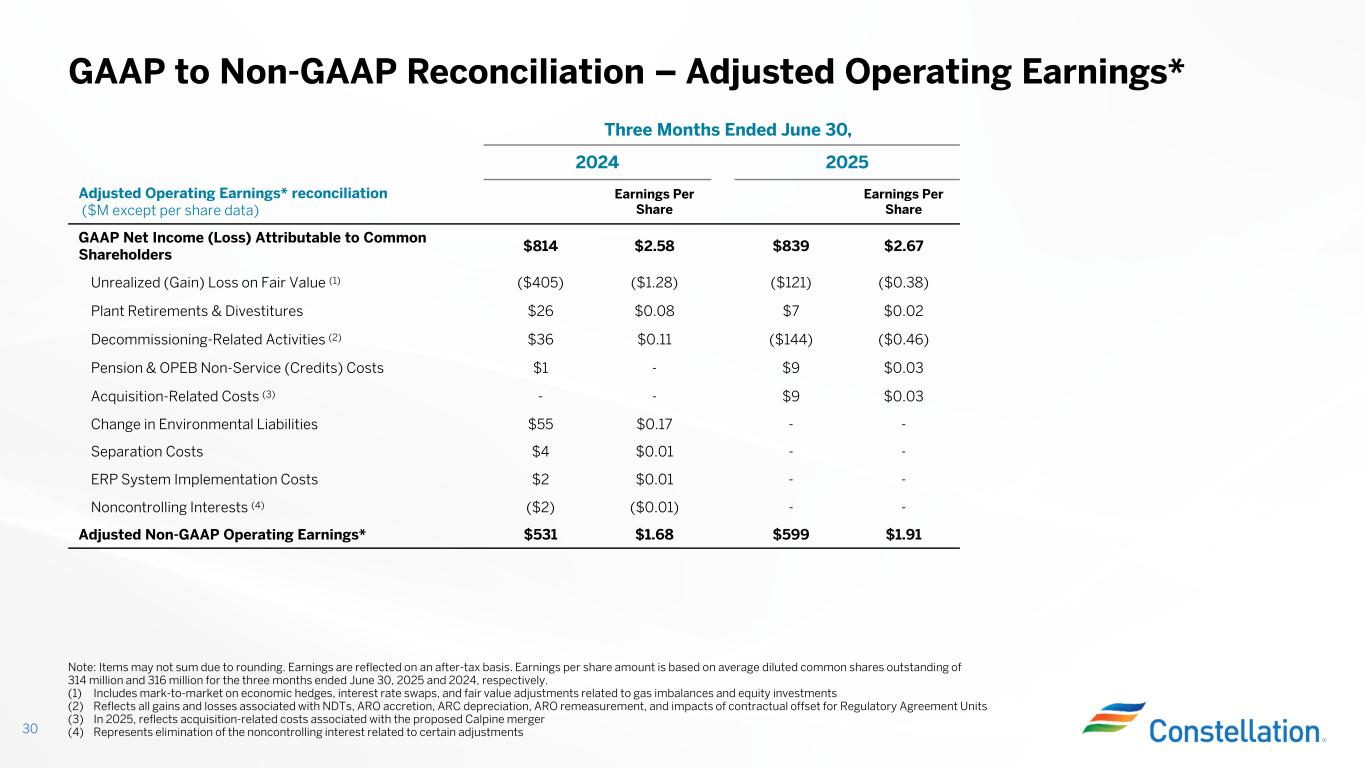

Second Quarter 2025

Our GAAP Net Income for the second quarter of 2025 increased to $2.67 per share from $2.58 per share in the second quarter of 2024. Adjusted (non-GAAP) Operating Earnings for the second quarter of 2025 increased to $1.91 per share from $1.68 per share in the second quarter of 2024. For the reconciliations of GAAP Net Income (Loss) to Adjusted (non-GAAP) Operating Earnings, refer to the GAAP/Adjusted (non-GAAP) Operating Earnings Reconciliation section below.

Adjusted (non-GAAP) Operating Earnings in the second quarter of 2025 primarily reflects:

•Higher IL banked ZEC revenues and favorable market and portfolio conditions, partially offset by lower nuclear PTCs due to higher anticipated gross receipts for the year

Recent Developments and Second Quarter Highlights

•20-Year Deal with Meta for clean, reliable nuclear energy: We have signed a 20-year Power Purchase Agreement with Meta for the full output of the Clinton Clean Energy Center to support their clean energy goals and operations. The agreement, beginning in June of 2027, supports the relicensing and continued operations of the Clinton nuclear facility for another two decades and will allow us to expand Clinton’s clean energy output by 30 megawatts through plant uprates. The Clinton Clean Energy Center will continue to flow power onto the local grid, providing grid reliability and low-cost power to the region for decades to come.

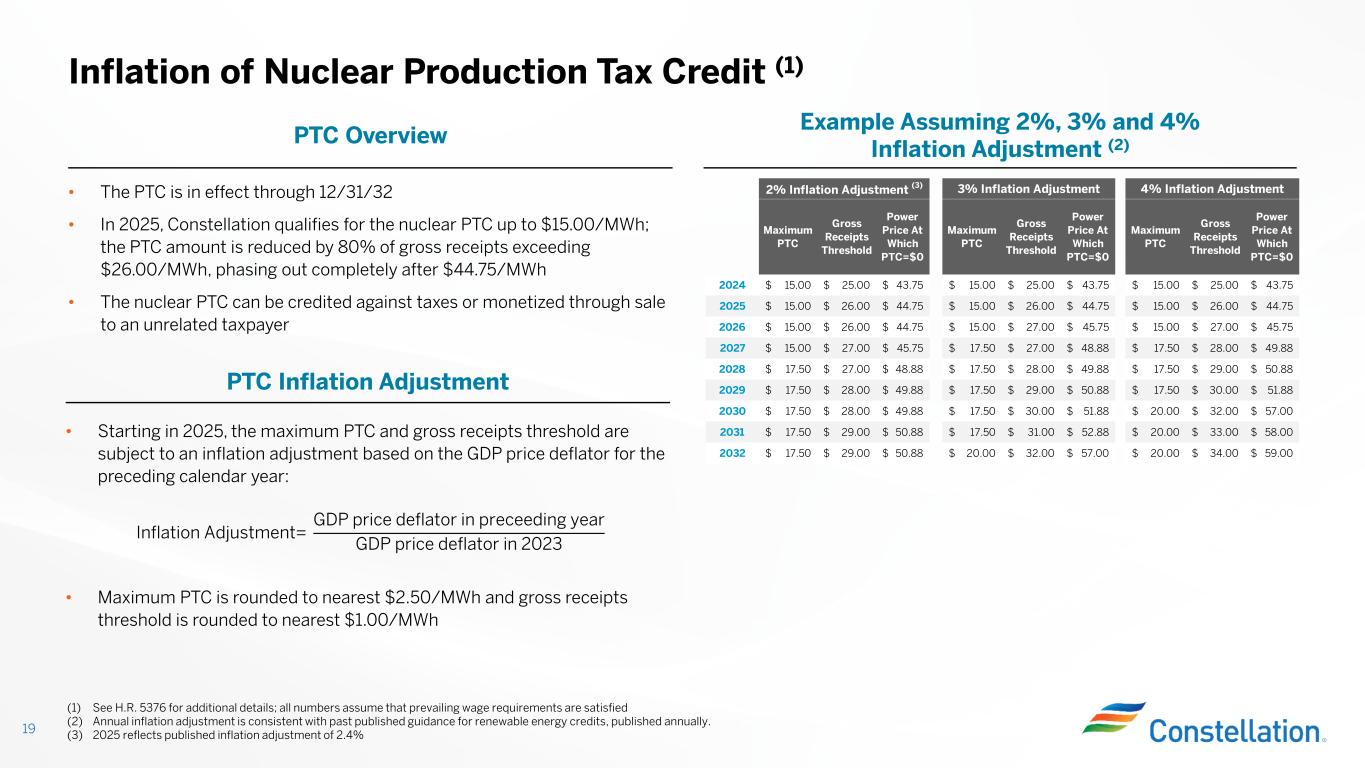

•Legislative support for nuclear energy: Bipartisan support for nuclear energy continues at both the federal and state levels. Passage of the One Big Beautiful Bill Act preserves and expands the nuclear provisions enacted in the Inflation Reduction Act. These are the only tax credits that have received overwhelming support from both the Republican and Democratic congressional delegations. Federal initiatives are also underway to expand the existing fleet with fast-track licensing, increase domestic conversion and enrichment of nuclear fuel, and accelerate deployment of new reactors, all while maintaining the NRC’s track record of being a responsible regulator to what is considered the safest nuclear fleet in the world. At the State level, just last week policymakers in New York called for extension of the ZEC program to ensure that the existing nuclear fleet continues to operate while NY also pursues 1 GW of new nuclear generation in the state. In Maryland and Texas, policymakers are proceeding with implementation to procure and provide financial support for new nuclear reactors in those states.

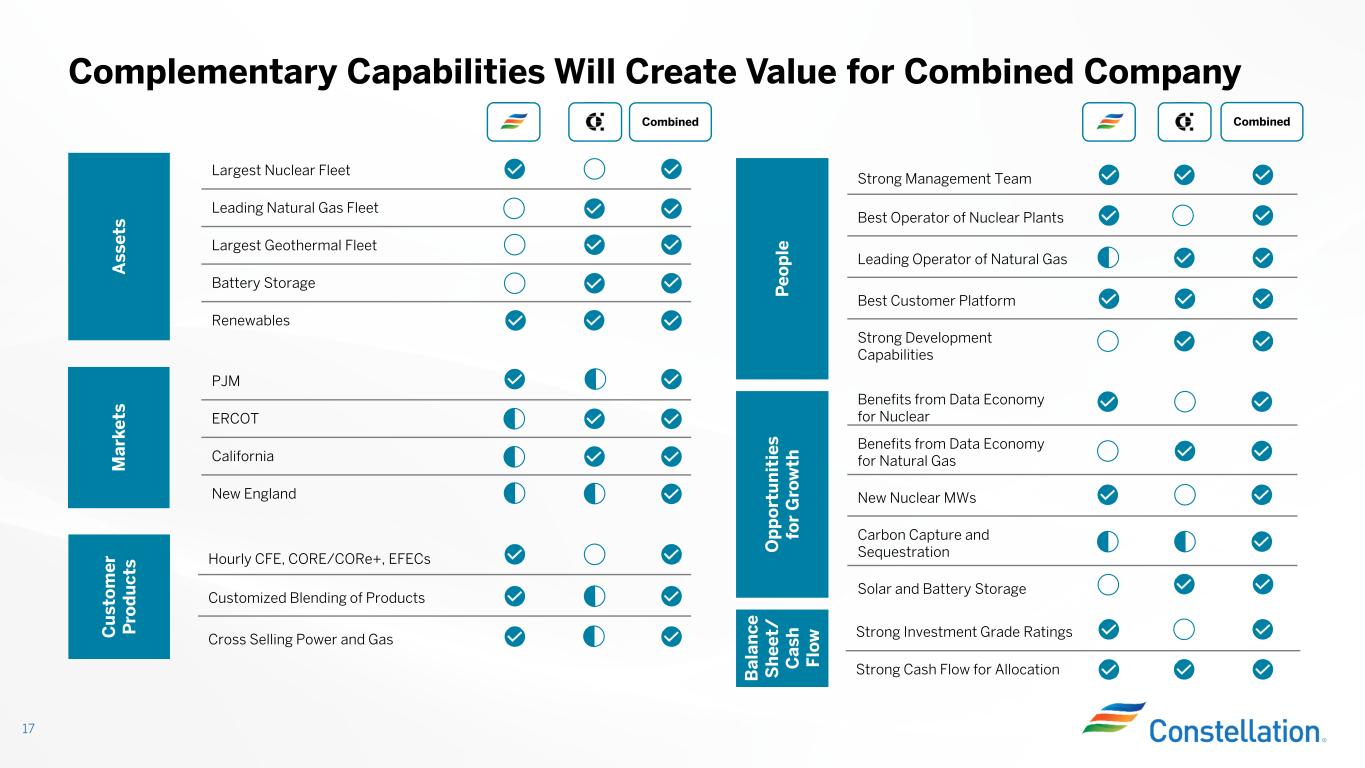

•Calpine Acquisition: We received regulatory approval from the New York State Public Service Commission, the Public Utility Commission of Texas, and the Federal Energy Regulatory Commission for our acquisition of Calpine. We continue to expect this transaction to close in the 4th quarter of this year.

•Crane Clean Energy Center will return to service in 2027: Exceptional project execution will allow the Crane Clean Energy Center to return to service in 2027, ahead of our original schedule. The project was selected by PJM for expedited grid connection as part of its Reliability Resource Initiative and we are ahead of schedule for other long lead time items. Restarting Crane’s Unit 1 reactor will bring new clean, firm, reliable energy to the grid at a time when it is needed to support growing demand.

•Delivering on Our Capital Allocation Promises: In the second quarter we continued our share repurchase program, entering into an Accelerated Share Repurchase agreement with a financial institution to initiate the repurchase of approximately $400 million of our common stock. In addition we continued to deliver on our commitment to increase dividends by 10% in 2025.

•2025 Great Place to Work Certification: For the third year in a row we were Certified™ by Great Place To Work®. The designation is based on how our employees rate their experience working at Constellation. In a survey of about 5,000 of our employees, 86% of those who responded said it is a great place to work – about 29 points higher than the average U.S. company. Great Place To Work® is acknowledged worldwide as a global benchmark for workplace culture, employee experience and the leadership behaviors proven to deliver strong market performance, employee retention and increased innovation.

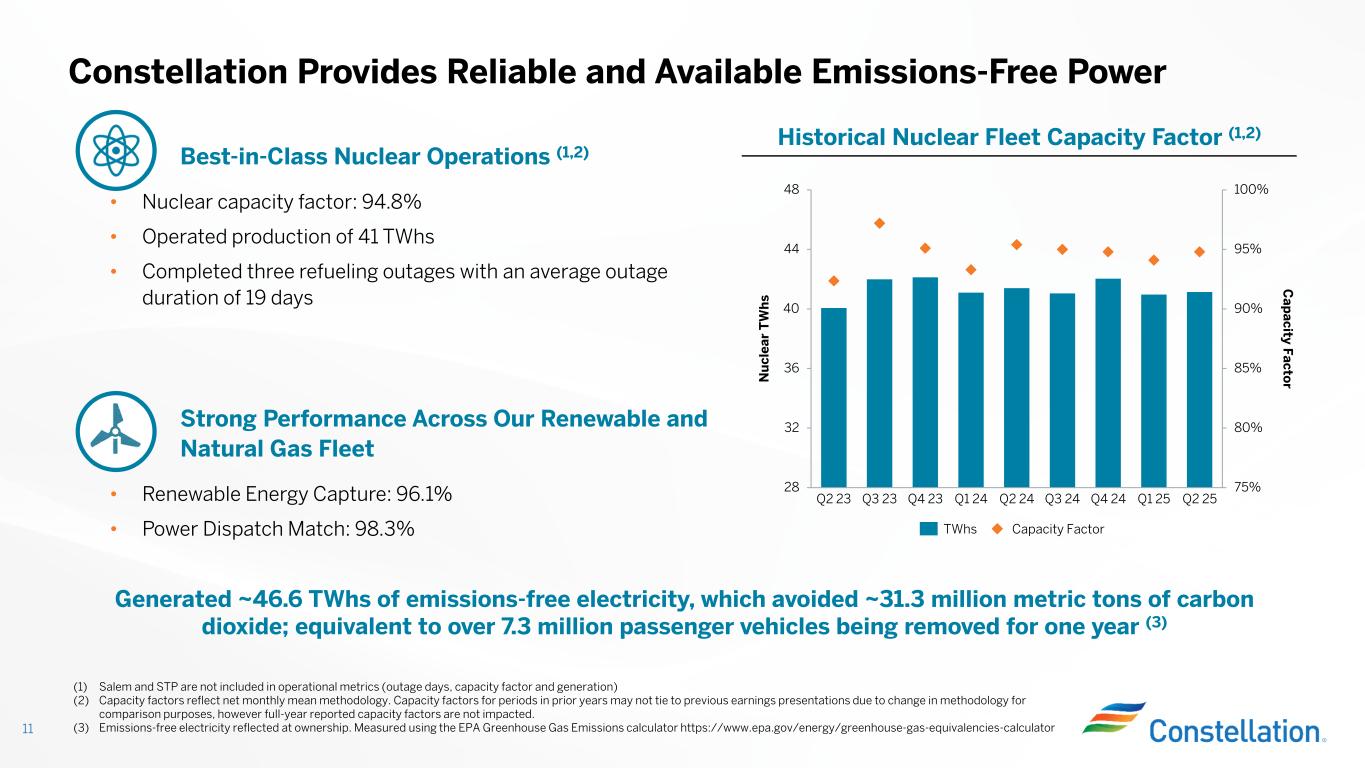

•Nuclear Operations: Our nuclear fleet, including our owned output from the Salem and South Texas Project (STP) Generating Stations, produced 45,170 gigawatt-hours (GWhs) in the second quarter of 2025, compared with 45,314 GWhs in the second quarter of 2024. Excluding Salem and STP, our nuclear plants at ownership achieved a 94.8% capacity factor for the second quarter of 2025, compared with 95.4% for the second quarter of 2024. There were 41 planned refueling outage days in the second quarter of 2025 and 49 in the second quarter of 2024 for sites we operate. There were 22 non-refueling outage days in the second quarter of 2025 and three in the second quarter of 2024 for sites we operate.

•Natural Gas, Oil, and Renewables Operations: The dispatch match rate for our gas and pumped storage fleet was 98.3% in the second quarter of 2025, compared with 98.0% in the second quarter of 2024. Renewable energy capture for our wind, solar and run-of-river hydro fleet was 96.1% in the second quarter of 2025, compared with 96.6% in the second quarter of 2024.

GAAP/Adjusted (non-GAAP) Operating Earnings Reconciliation

The table below provides a reconciliation of GAAP Net Income to Adjusted (non-GAAP) Operating Earnings. Adjusted (non-GAAP) Operating Earnings is not a standardized financial measure and may not be comparable to other companies’ presentations of similarly titled measures.

Unless otherwise noted, the income tax impact of each reconciling adjustment between GAAP Net Income (Loss) Attributable to Common Shareholders and Adjusted (non-GAAP) Operating Earnings is based on the marginal statutory federal and state income tax rates, taking into account whether the income or expense item is taxable or deductible, respectively, in whole or in part. For all adjustments except the NDT fund investment returns, which are included in decommissioning-related activities, the marginal statutory income tax rate was 25.5% and 25.1% for the three months ended June 30, 2025 and 2024, respectively. Under IRS regulations, NDT fund investment returns are taxed at different rates for investments if they are in qualified or non-qualified funds. The effective tax rates for the unrealized and realized gains and losses related to NDT funds were 54.6% and 66.9% for the three months ended June 30, 2025 and 2024, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions, except per share data) |

|

Three Months Ended June 30, 2025 |

|

Earnings Per Share(1) |

| GAAP Net Income (Loss) Attributable to Common Shareholders |

|

$ |

839 |

|

|

$ |

2.67 |

|

Unrealized (Gain) Loss on Fair Value Adjustments (net of taxes of $37) |

|

(121) |

|

|

(0.38) |

|

Plant Retirements and Divestitures (net of taxes of $2) |

|

7 |

|

|

0.02 |

|

Decommissioning-Related Activities (net of taxes of $208) |

|

(144) |

|

|

(0.46) |

|

Pension & OPEB Non-Service (Credits) Costs (net of taxes of $3) |

|

9 |

|

|

0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition-Related Costs (net of taxes of $3) |

|

9 |

|

|

0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted (non-GAAP) Operating Earnings |

|

$ |

599 |

|

|

$ |

1.91 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions, except per share data) |

|

Three Months Ended

June 30, 2024 |

|

Earnings Per Share(1) |

| GAAP Net Income (Loss) Attributable to Common Shareholders |

|

$ |

814 |

|

|

$ |

2.58 |

|

Unrealized (Gain) Loss on Fair Value Adjustments (net of taxes of $136) |

|

(405) |

|

|

(1.28) |

|

Plant Retirements and Divestitures (net of taxes of $9) |

|

26 |

|

|

0.08 |

|

Decommissioning-Related Activities (net of taxes of $3) |

|

36 |

|

|

0.11 |

|

Pension & OPEB Non-Service (Credits) Costs (net of taxes of $—) |

|

1 |

|

|

— |

|

Change in Environmental Liabilities (net of taxes of $18) |

|

55 |

|

|

0.17 |

|

Separation Costs (net of taxes of $1) |

|

4 |

|

|

0.01 |

|

ERP System Implementation Costs (net of taxes of $1) |

|

2 |

|

|

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noncontrolling Interests |

|

(2) |

|

|

(0.01) |

|

Adjusted (non-GAAP) Operating Earnings |

|

$ |

531 |

|

|

$ |

1.68 |

|

_______

(1) Amounts may not sum due to rounding. Earnings per share amount is based on average diluted common shares outstanding of 314 million and 316 million for the three months ended June 30, 2025 and 2024, respectively.

Webcast Information

We will discuss second quarter 2025 earnings in a conference call scheduled for today at 10:00 a.m. Eastern Time. The webcast and associated materials can be accessed at https://investors.constellationenergy.com.

About Constellation

Constellation Energy Corporation (Nasdaq: CEG), a Fortune 200 company headquartered in Baltimore, is the nation’s largest producer of reliable, emissions-free energy and a leading energy supplier to businesses, homes and public sector customers nationwide, including three-fourths of Fortune 100 companies. With annual output that is nearly 90% carbon-free, our hydro, wind and solar facilities paired with the nation’s largest nuclear fleet have the generating capacity to power the equivalent of 16 million homes, providing about 10% of the nation’s clean energy. We are committed to investing in innovative technologies to drive the transition to a reliable, sustainable and secure energy future. Follow Constellation on LinkedIn and X.

Non-GAAP Financial Measures

We utilize Adjusted (non-GAAP) Operating Earnings (and/or its per share equivalent) in our internal analysis, and in communications with investors and analysts, as a consistent measure for comparing our financial performance and discussing the factors and trends affecting our business. The presentation of Adjusted (non-GAAP) Operating Earnings is intended to complement and should not be considered an alternative to, nor more useful than, the presentation of GAAP Net Income.

The tables above provide a reconciliation of GAAP Net Income to Adjusted (non-GAAP) Operating Earnings. Adjusted (non-GAAP) Operating Earnings is not a standardized financial measure and may not be comparable to other companies’ presentations of similarly titled measures.

Due to the forward-looking nature of our Adjusted (non-GAAP) Operating Earnings guidance, we are unable to reconcile this non-GAAP financial measure to GAAP Net Income given the inherent uncertainty required in projecting gains and losses associated with the various fair value adjustments required by GAAP. These adjustments include future changes in fair value impacting the derivative instruments utilized in our current business operations, as well as the debt and equity securities held within our nuclear decommissioning trusts, which may have a material impact on our future GAAP results.

Cautionary Statements Regarding Forward-Looking Information

This press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. Words such as “could,” “may,” “expects,” “anticipates,” “will,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “predicts,” and variations on such words, and similar expressions that reflect our current views with respect to future events and operational, economic, and financial performance, are intended to identify such forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding the proposed transaction between Constellation and Calpine Corporation, the expected closing of the proposed transaction and the timing thereof. This includes statements regarding the financing of the proposed transaction and the pro forma combined company and its operations, strategies and plans, enhancements to investment-grade credit profile, synergies, opportunities and anticipated future performance and capital structure, and expected accretion to earnings per share and free cash flow. Information adjusted for the proposed transaction should not be considered a forecast of future results.

Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause actual results to differ materially from those projected. The factors that could cause actual results to differ materially from the forward-looking statements made by Constellation Energy Corporation and Constellation Energy Generation, LLC, (the Registrants) include those factors discussed herein, as well as the items discussed in (1) the Registrants' 2024 Annual Report on Form 10-K in (a) Part I, ITEM 1A. Risk Factors, (b) Part II, ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and (c) Part II, ITEM 8. Financial Statements and Supplementary Data: Note 18 — Commitments and Contingencies; (2) the Registrants' Second Quarter 2025 Quarterly Report on Form 10-Q (to be filed on August 7, 2025) in (a) Part II, ITEM 1A. Risk Factors, (b) Part I, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and (c) Part I, ITEM 1. Financial Statements: Note 13 — Commitments and Contingencies; and (3) other factors discussed in filings with the SEC by the Registrants.

Investors are cautioned not to place undue reliance on these forward-looking statements, whether written or oral, which apply only as of the date of this press release. Neither Registrant undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this press release.

Earnings Release Attachments

Table of Contents

Constellation Energy Corporation and Subsidiary Companies

Consolidated Statements of Operations

(unaudited)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2025 |

|

Six Months Ended June 30, 2025 |

| Operating revenues |

$ |

6,101 |

|

|

$ |

12,889 |

|

| Operating expenses |

|

|

|

| Purchased power and fuel |

3,132 |

|

|

7,516 |

|

| Operating and maintenance |

1,617 |

|

|

3,162 |

|

| Depreciation and amortization |

254 |

|

|

502 |

|

| Taxes other than income taxes |

147 |

|

|

307 |

|

| Total operating expenses |

5,150 |

|

|

11,487 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

951 |

|

|

1,402 |

|

| Other income and (deductions) |

|

|

|

| Interest expense, net |

(118) |

|

|

(264) |

|

| Other, net |

440 |

|

|

286 |

|

| Total other income and (deductions) |

322 |

|

|

22 |

|

Income (loss) before income taxes |

1,273 |

|

|

1,424 |

|

Income tax (benefit) expense |

440 |

|

|

462 |

|

|

|

|

|

Net income (loss) |

833 |

|

|

962 |

|

Net income (loss) attributable to noncontrolling interests |

(6) |

|

|

5 |

|

Net income (loss) attributable to common shareholders |

$ |

839 |

|

|

$ |

957 |

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2024 |

|

Six Months Ended June 30, 2024 |

| Operating revenues |

$ |

5,475 |

|

|

$ |

11,637 |

|

| Operating expenses |

|

|

|

| Purchased power and fuel |

2,292 |

|

|

5,709 |

|

| Operating and maintenance |

1,645 |

|

|

3,131 |

|

| Depreciation and amortization |

296 |

|

|

602 |

|

| Taxes other than income taxes |

142 |

|

|

282 |

|

| Total operating expenses |

4,375 |

|

|

9,724 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

1,100 |

|

|

1,913 |

|

| Other income and (deductions) |

|

|

|

| Interest expense, net |

(142) |

|

|

(269) |

|

| Other, net |

6 |

|

|

368 |

|

| Total other income and (deductions) |

(136) |

|

|

99 |

|

Income (loss) before income taxes |

964 |

|

|

2,012 |

|

Income tax (benefit) expense |

154 |

|

|

318 |

|

Equity in income (losses) of unconsolidated affiliates |

(1) |

|

|

(2) |

|

Net income (loss) |

809 |

|

|

1,692 |

|

Net income (loss) attributable to noncontrolling interests |

(5) |

|

|

(5) |

|

Net income (loss) attributable to common shareholders |

$ |

814 |

|

|

$ |

1,697 |

|

|

|

|

|

| Change in Net income (loss) attributable to common shareholders from 2024 to 2025 |

$ |

25 |

|

|

$ |

(740) |

|

Constellation Energy Corporation and Subsidiary Companies

Consolidated Balance Sheets

(unaudited)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2025 |

|

December 31, 2024 |

| Assets |

|

|

|

| Current assets |

|

|

|

| Cash and cash equivalents |

$ |

1,974 |

|

|

$ |

3,022 |

|

| Restricted cash and cash equivalents |

88 |

|

|

107 |

|

|

|

|

|

| Accounts receivable |

|

|

|

Customer accounts receivable, net |

2,947 |

|

|

3,116 |

|

Other accounts receivable, net |

571 |

|

|

602 |

|

| Mark-to-market derivative assets |

726 |

|

|

843 |

|

|

|

|

|

| Inventories, net |

|

|

|

| Natural gas, oil, and emission allowances |

200 |

|

|

243 |

|

| Materials and supplies |

1,385 |

|

|

1,357 |

|

| Renewable energy credits |

628 |

|

|

797 |

|

|

|

|

|

| Other |

714 |

|

|

689 |

|

| Total current assets |

9,233 |

|

|

10,776 |

|

| Property, plant, and equipment, net |

21,820 |

|

|

21,235 |

|

| Deferred debits and other assets |

|

|

|

| Nuclear decommissioning trust funds |

18,289 |

|

|

17,305 |

|

| Investments |

398 |

|

|

640 |

|

| Goodwill |

420 |

|

|

420 |

|

| Mark-to-market derivative assets |

527 |

|

|

372 |

|

|

|

|

|

|

|

|

|

| Other |

2,351 |

|

|

2,178 |

|

| Total deferred debits and other assets |

21,985 |

|

|

20,915 |

|

| Total assets |

$ |

53,038 |

|

|

$ |

52,926 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2025 |

|

December 31, 2024 |

| Liabilities and shareholders’ equity |

|

|

|

| Current liabilities |

|

|

|

| Short-term borrowings |

$ |

900 |

|

|

$ |

— |

|

| Long-term debt due within one year |

125 |

|

|

1,028 |

|

Accounts payable and accrued expenses |

3,659 |

|

|

3,943 |

|

|

|

|

|

|

|

|

|

| Mark-to-market derivative liabilities |

407 |

|

|

467 |

|

| Renewable energy credit obligation |

806 |

|

|

1,076 |

|

|

|

|

|

| Other |

359 |

|

|

332 |

|

| Total current liabilities |

6,256 |

|

|

6,846 |

|

| Long-term debt |

7,286 |

|

|

7,384 |

|

|

|

|

|

| Deferred credits and other liabilities |

|

|

|

Deferred income taxes and unamortized ITCs |

3,348 |

|

|

3,331 |

|

| Asset retirement obligations |

12,679 |

|

|

12,449 |

|

Pension and non-pension postretirement benefit obligations |

1,763 |

|

|

1,875 |

|

| Spent nuclear fuel obligation |

1,397 |

|

|

1,366 |

|

|

|

|

|

| Payable related to Regulatory Agreement Units |

4,939 |

|

|

4,518 |

|

| Mark-to-market derivative liabilities |

419 |

|

|

399 |

|

| Other |

1,148 |

|

|

1,219 |

|

| Total deferred credits and other liabilities |

25,693 |

|

|

25,157 |

|

| Total liabilities |

39,235 |

|

|

39,387 |

|

| Commitments and contingencies |

|

|

|

|

|

|

|

| Shareholders’ equity |

|

|

|

|

|

|

|

| Common stock |

10,939 |

|

|

11,402 |

|

| Retained earnings (deficit) |

4,779 |

|

|

4,066 |

|

Accumulated other comprehensive income (loss), net |

(2,272) |

|

|

(2,302) |

|

| Total shareholders’ equity |

13,446 |

|

|

13,166 |

|

| Noncontrolling interests |

357 |

|

|

373 |

|

| Total equity |

13,803 |

|

|

13,539 |

|

| Total liabilities and shareholders’ equity |

$ |

53,038 |

|

|

$ |

52,926 |

|

Constellation Energy Corporation and Subsidiary Companies

Consolidated Statements of Cash Flows

(unaudited)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

| |

|

2025 |

|

2024 |

| Cash flows from operating activities |

|

|

|

|

| Net income (loss) |

|

$ |

962 |

|

|

$ |

1,692 |

|

| Adjustments to reconcile net income (loss) to net cash flows provided by (used in) operating activities |

|

|

|

|

| Depreciation, amortization, and accretion, including nuclear fuel and energy contract amortization |

|

1,300 |

|

|

1,388 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deferred income taxes and amortization of ITCs |

|

14 |

|

|

191 |

|

| Net fair value changes related to derivatives |

|

188 |

|

|

(776) |

|

| Net realized and unrealized (gains) losses on NDT funds |

|

(336) |

|

|

(197) |

|

| Net realized and unrealized (gains) losses on equity investments |

|

275 |

|

|

11 |

|

| Other non-cash operating activities |

|

(21) |

|

|

(65) |

|

| Changes in assets and liabilities: |

|

|

|

|

| Accounts receivable |

|

208 |

|

|

771 |

|

|

|

|

|

|

| Inventories |

|

17 |

|

|

58 |

|

| Accounts payable and accrued expenses |

|

(229) |

|

|

(207) |

|

| Option premiums received (paid), net |

|

18 |

|

|

129 |

|

| Collateral received (posted), net |

|

(242) |

|

|

868 |

|

| Income taxes |

|

209 |

|

|

(86) |

|

| Pension and non-pension postretirement benefit contributions |

|

(181) |

|

|

(188) |

|

| Other assets and liabilities |

|

(598) |

|

|

(4,925) |

|

| Net cash flows provided by (used in) operating activities |

|

1,584 |

|

|

(1,336) |

|

| Cash flows from investing activities |

|

|

|

|

| Capital expenditures |

|

(1,573) |

|

|

(1,284) |

|

| Proceeds from NDT fund sales |

|

3,830 |

|

|

2,890 |

|

| Investment in NDT funds |

|

(3,999) |

|

|

(3,043) |

|

| Collection of DPP, net |

|

— |

|

|

4,096 |

|

|

|

|

|

|

|

|

|

|

|

| Acquisitions of assets and businesses |

|

(10) |

|

|

(15) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other investing activities |

|

(6) |

|

|

6 |

|

| Net cash flows provided by (used in) investing activities |

|

(1,758) |

|

|

2,650 |

|

| Cash flows from financing activities |

|

|

|

|

| Change in short-term borrowings |

|

— |

|

|

(625) |

|

| Proceeds from short-term borrowings with maturities greater than 90 days |

|

900 |

|

|

200 |

|

| Repayments of short-term borrowings with maturities greater than 90 days |

|

— |

|

|

(539) |

|

| Issuance of long-term debt |

|

— |

|

|

900 |

|

| Retirement of long-term debt |

|

(1,008) |

|

|

(65) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends paid on common stock |

|

(244) |

|

|

(222) |

|

| Repurchases of common stock |

|

(400) |

|

|

(999) |

|

| Other financing activities |

|

(141) |

|

|

(35) |

|

| Net cash flows provided by (used in) financing activities |

|

(893) |

|

|

(1,385) |

|

| Increase (decrease) in cash, restricted cash, and cash equivalents |

|

(1,067) |

|

|

(71) |

|

| Cash, restricted cash, and cash equivalents at beginning of period |

|

3,129 |

|

|

454 |

|

| Cash, restricted cash, and cash equivalents at end of period |

|

$ |

2,062 |

|

|

$ |

383 |

|

Constellation Energy Corporation

GAAP Consolidated Statements of Operations and

Adjusted (non-GAAP) Operating Earnings Reconciling Adjustments

(unaudited)

(in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended June 30, 2025 |

|

Three Months Ended June 30, 2024 |

|

GAAP (a) |

|

Non-GAAP Adjustments |

|

|

|

GAAP (a) |

|

Non-GAAP Adjustments |

|

|

| Operating revenues |

$ |

6,101 |

|

|

$ |

(87) |

|

|

(b),(c) |

|

$ |

5,475 |

|

|

$ |

(193) |

|

|

(b),(c) |

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

| Purchased power and fuel |

3,132 |

|

|

77 |

|

|

(b) |

|

2,292 |

|

|

408 |

|

|

(b) |

| Operating and maintenance |

1,617 |

|

|

(76) |

|

|

(c),(j) |

|

1,645 |

|

|

(145) |

|

|

(c),(d),(f),(g),(i) |

| Depreciation and amortization |

254 |

|

|

(32) |

|

|

(c),(g) |

|

296 |

|

|

(61) |

|

|

(c),(g) |

| Taxes other than income taxes |

147 |

|

|

— |

|

|

|

|

142 |

|

|

— |

|

|

|

| Total operating expenses |

5,150 |

|

|

|

|

|

|

4,375 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

951 |

|

|

|

|

|

|

1,100 |

|

|

|

|

|

| Other income and (deductions) |

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

(118) |

|

|

(2) |

|

|

(b) |

|

(142) |

|

|

2 |

|

|

(b) |

| Other, net |

440 |

|

|

(418) |

|

|

(b),(c),(e) |

|

6 |

|

|

8 |

|

|

(b),(c),(e) |

| Total other income and (deductions) |

322 |

|

|

|

|

|

|

(136) |

|

|

|

|

|

| Income (loss) before income taxes |

1,273 |

|

|

|

|

|

|

964 |

|

|

|

|

|

Income tax (benefit) expense |

440 |

|

|

(237) |

|

|

(b),(c),(e),(g),(j) |

|

154 |

|

|

(103) |

|

|

(b),(c),(d),(e),(f),(g),(i) |

| Equity in losses of unconsolidated affiliates |

— |

|

|

— |

|

|

|

|

(1) |

|

|

— |

|

|

|

| Net income (loss) |

833 |

|

|

|

|

|

|

809 |

|

|

|

|

|

Net income (loss) attributable to noncontrolling interests |

(6) |

|

|

1 |

|

|

(h) |

|

(5) |

|

|

1 |

|

|

(h) |

| Net income (loss) attributable to common shareholders |

$ |

839 |

|

|

|

|

|

|

$ |

814 |

|

|

|

|

|

| Effective tax rate |

34.6 |

% |

|

|

|

|

|

16.0 |

% |

|

|

|

|

| Earnings per average common share |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

2.67 |

|

|

|

|

|

|

$ |

2.58 |

|

|

|

|

|

| Diluted |

$ |

2.67 |

|

|

|

|

|

|

$ |

2.58 |

|

|

|

|

|

| Average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

314 |

|

|

|

|

|

|

315 |

|

|

|

|

|

| Diluted |

314 |

|

|

|

|

|

|

316 |

|

|

|

|

|

__________

(a)Results reported in accordance with GAAP.

(b)Adjustment for mark-to-market on economic hedges, interest rate swaps, and fair value adjustments related to gas imbalances and equity investments.

(c)Adjustment for all gains and losses associated with Nuclear Decommissioning Trusts (NDT), Asset Retirement Obligation (ARO) accretion, Asset Retirement Cost (ARC) Depreciation, ARO remeasurement, and any earnings neutral impacts of contractual offset for Regulatory Agreement Units.

(d)In 2024, adjustment for certain incremental costs related to the separation (system-related costs, third-party costs paid to advisors, consultants, lawyers, and other experts assisting in the separation), including a portion of the amounts billed to us pursuant to the transition services agreement (TSA).

(e)Adjustment for Pension and Other Postretirement Employee Benefits (OPEB) Non-Service credits.

(f)In 2024, adjustment for costs related to a multi-year Enterprise Resource Program (ERP) system implemented in the first quarter of 2024.

(g)Adjustments related to plant retirements and divestitures.

(h)Adjustment for elimination of the noncontrolling interest related to certain adjustments.

(i)Adjustment for changes in environmental liabilities.

(j)In 2025, reflects acquisition-related costs associated with the proposed Calpine merger.

Constellation Energy Corporation

GAAP Consolidated Statements of Operations and

Adjusted (non-GAAP) Operating Earnings Reconciling Adjustments

(unaudited)

(in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, 2025 |

|

Six Months Ended June 30, 2024 |

|

GAAP (a) |

|

Non-GAAP Adjustments |

|

|

|

GAAP (a) |

|

Non-GAAP Adjustments |

|

|

| Operating revenues |

$ |

12,889 |

|

|

$ |

199 |

|

|

(b),(c) |

|

$ |

11,637 |

|

|

$ |

(258) |

|

|

(b),(c) |

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

| Purchased power and fuel |

7,516 |

|

|

(7) |

|

|

(b) |

|

5,709 |

|

|

523 |

|

|

(b) |

| Operating and maintenance |

3,162 |

|

|

(154) |

|

|

(c),(i),(k) |

|

3,131 |

|

|

(200) |

|

|

(c),(d),(f),(g),(i) |

| Depreciation and amortization |

502 |

|

|

(69) |

|

|

(c),(g) |

|

602 |

|

|

(125) |

|

|

(c),(g) |

| Taxes other than income taxes |

307 |

|

|

— |

|

|

|

|

282 |

|

|

— |

|

|

|

| Total operating expenses |

11,487 |

|

|

|

|

|

|

9,724 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

1,402 |

|

|

|

|

|

|

1,913 |

|

|

|

|

|

| Other income and (deductions) |

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

(264) |

|

|

32 |

|

|

(b) |

|

(269) |

|

|

— |

|

|

|

| Other, net |

286 |

|

|

(231) |

|

|

(b),(c),(e) |

|

368 |

|

|

(331) |

|

|

(b),(c),(e) |

| Total other income and (deductions) |

22 |

|

|

|

|

|

|

99 |

|

|

|

|

|

| Income (loss) before income taxes |

1,424 |

|

|

|

|

|

|

2,012 |

|

|

|

|

|

Income tax (benefit) expense |

462 |

|

|

(88) |

|

|

(b),(c),(e),(g),(k) |

|

318 |

|

|

(203) |

|

|

(b),(c),(d),(e),(f),(g),(i),(j) |

Equity in income (losses) of unconsolidated affiliates |

— |

|

|

— |

|

|

|

|

(2) |

|

|

— |

|

|

|

| Net income (loss) |

962 |

|

|

|

|

|

|

1,692 |

|

|

|

|

|

Net income (loss) attributable to noncontrolling interests |

5 |

|

|

3 |

|

|

(h) |

|

(5) |

|

|

3 |

|

|

(h) |

| Net income (loss) attributable to common shareholders |

$ |

957 |

|

|

|

|

|

|

$ |

1,697 |

|

|

|

|

|

| Effective tax rate |

32.4 |

% |

|

|

|

|

|

15.8 |

% |

|

|

|

|

| Earnings per average common share |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

3.05 |

|

|

|

|

|

|

$ |

5.37 |

|

|

|

|

|

| Diluted |

$ |

3.05 |

|

|

|

|

|

|

$ |

5.35 |

|

|

|

|

|

| Average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

314 |

|

|

|

|

|

|

316 |

|

|

|

|

|

| Diluted |

314 |

|

|

|

|

|

|

317 |

|

|

|

|

|

__________

(a)Results reported in accordance with GAAP.

(b)Adjustment for mark-to-market on economic hedges interest rate swaps, and fair value adjustments related to gas imbalances and equity investments.

(c)Adjustment for all gains and losses associated with NDTs, ARO accretion, ARC Depreciation, ARO remeasurement, and any earnings neutral impacts of contractual offset for Regulatory Agreement Units.

(d)In 2024, adjustment for certain incremental costs related to the separation (system-related costs, third-party costs paid to advisors, consultants, lawyers, and other experts assisting in the separation), including a portion of the amounts billed to us pursuant to the TSA.

(e)Adjustment for Pension and OPEB Non-Service credits.

(f)In 2024, adjustment for costs related to a multi-year ERP system implemented in the first quarter of 2024.

(g)Adjustments related to plant retirements and divestitures.

(h)Adjustment for elimination of the noncontrolling interest related to certain adjustments.

(i)Adjustment for changes in environmental liabilities.

(j)In 2024, primarily reflects the adjustment to deferred income taxes due to changes in forecasted apportionment.

(k)In 2025, reflects acquisition-related costs associated with the proposed Calpine merger.

Statistics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

(GWhs) |

2025 |

|

2024 |

|

2025 |

|

2024 |

Nuclear Generation(a) |

|

|

|

|

|

|

|

| Mid-Atlantic |

12,263 |

|

|

13,229 |

|

|

25,440 |

|

|

26,419 |

|

| Midwest |

23,760 |

|

|

23,625 |

|

|

47,356 |

|

|

47,546 |

|

| New York |

6,632 |

|

|

6,685 |

|

|

12,913 |

|

|

12,764 |

|

| ERCOT |

2,515 |

|

|

1,775 |

|

|

5,044 |

|

|

3,978 |

|

| Total Nuclear Generation |

45,170 |

|

|

45,314 |

|

|

90,753 |

|

|

90,707 |

|

|

|

|

|

|

|

|

|

| Natural Gas, Oil, and Renewables |

|

|

|

|

|

|

|

| Mid-Atlantic |

810 |

|

|

612 |

|

|

1,442 |

|

|

1,480 |

|

| Midwest |

258 |

|

|

284 |

|

|

643 |

|

|

623 |

|

|

|

|

|

|

|

|

|

ERCOT |

3,206 |

|

|

3,592 |

|

|

6,290 |

|

|

7,107 |

|

Other Power Regions |

1,286 |

|

|

1,617 |

|

|

3,090 |

|

|

5,168 |

|

| Total Natural Gas, Oil, and Renewables |

5,560 |

|

|

6,105 |

|

|

11,465 |

|

|

14,378 |

|

|

|

|

|

|

|

|

|

| Purchased Power |

|

|

|

|

|

|

|

| Mid-Atlantic |

3,750 |

|

|

3,316 |

|

|

8,544 |

|

|

6,685 |

|

| Midwest |

475 |

|

|

225 |

|

|

963 |

|

|

533 |

|

|

|

|

|

|

|

|

|

| ERCOT |

837 |

|

|

1,060 |

|

|

1,495 |

|

|

1,725 |

|

Other Power Regions |

9,849 |

|

|

9,643 |

|

|

20,844 |

|

|

20,042 |

|

| Total Purchased Power |

14,911 |

|

|

14,244 |

|

|

31,846 |

|

|

28,985 |

|

|

|

|

|

|

|

|

|

| Total Supply/Sales by Region |

|

|

|

|

|

|

|

| Mid-Atlantic |

16,823 |

|

|

17,157 |

|

|

35,426 |

|

|

34,584 |

|

| Midwest |

24,493 |

|

|

24,134 |

|

|

48,962 |

|

|

48,702 |

|

| New York |

6,632 |

|

|

6,685 |

|

|

12,913 |

|

|

12,764 |

|

ERCOT |

6,558 |

|

|

6,427 |

|

|

12,829 |

|

|

12,810 |

|

Other Power Regions |

11,135 |

|

|

11,260 |

|

|

23,934 |

|

|

25,210 |

|

| Total Supply/Sales by Region |

65,641 |

|

|

65,663 |

|

|

134,064 |

|

|

134,070 |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2025 |

|

2024 |

|

2025 |

|

2024 |

Outage Days(b) |

|

|

|

|

|

|

|

| Refueling |

41 |

|

|

49 |

|

|

129 |

|

|

127 |

|

| Non-refueling |

22 |

|

|

3 |

|

|

22 |

|

|

13 |

|

| Total Outage Days |

63 |

|

|

52 |

|

|

151 |

|

|

140 |

|

__________

(a)Includes the proportionate share of output where we have an undivided ownership interest in jointly-owned generating plants and the total output for fully owned plants.

(b)Outage days exclude Salem and STP.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

Electricity Reference Prices(a) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Location (Region) |

|

|

|

|

|

|

|

| PJM West (Mid-Atlantic) |

$ |

42.43 |

|

|

$ |

30.80 |

|

|

$ |

48.06 |

|

|

$ |

31.62 |

|

| ComEd (Midwest) |

31.09 |

|

|

22.41 |

|

|

33.20 |

|

|

24.24 |

|

| Central (New York) |

37.40 |

|

|

27.22 |

|

|

56.36 |

|

|

31.05 |

|

| North (ERCOT) |

32.75 |

|

|

30.90 |

|

|

32.07 |

|

|

28.31 |

|

Southeast Massachusetts (Other)(b) |

40.31 |

|

|

29.46 |

|

|

72.53 |

|

|

36.82 |

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

Capacity Reference Prices |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Location (Region) |

|

|

|

|

|

|

|

| Eastern Mid-Atlantic Area Council (Mid-Atlantic) |

$ |

125.71 |

|

|

$ |

50.86 |

|

|

$ |

89.65 |

|

|

$ |

50.18 |

|

| ComEd (Midwest) |

109.25 |

|

|

32.39 |

|

|

69.09 |

|

|

33.26 |

|

| Rest of State (New York) |

132.89 |

|

|

98.33 |

|

|

109.61 |

|

|

102.42 |

|

| Southeast New England (Other) |

662.37 |

|

|

360.97 |

|

|

805.97 |

|

|

213.82 |

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

ZEC Reference Prices(a) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| State (Region) |

|

|

|

|

|

|

|

New Jersey (Mid-Atlantic)(c)(d) |

$ |

10.00 |

|

|

$ |

9.97 |

|

|

$ |

10.00 |

|

|

$ |

9.96 |

|

| Illinois (Midwest) |

6.64 |

|

|

3.33 |

|

|

8.01 |

|

|

1.81 |

|

New York (New York)(c) |

14.76 |

|

|

18.27 |

|

|

16.52 |

|

|

18.27 |

|

__________

(a)Reference prices may not necessarily reflect prices we ultimately realize.

(b)Reflects New England, which comprises the majority of the activity in the Other region.

(c)The NY and NJ state-sponsored programs providing compensation for the emissions-free attributes of generation from certain of our nuclear units include contractual provisions that require us to refund that compensation up to the amount of the nuclear PTC received.

(d)The New Jersey ZEC program ended in May 2025. The ZEC price is expected to be $10.00/MWh for each delivery period and is subject to an annual update once full year generation is known. Following the latest annual update in August 2024, the ZEC price for the delivery period beginning June 2023 through May 2024 was calculated to be $9.95/MWh.