Document

loanDepot announces first quarter 2025 financial results

Q1 was a quarter of positive momentum for the company.

Higher volume, margins and ongoing cost discipline drive improved Q1 results.

Company Founder and Executive Chairman Anthony Hsieh also returned to the company’s day-to-day operations in Q1; Hsieh will focus on expanding originations and driving innovation through tech enablement.

Current CEO Frank Martell set to transition to a board advisory role in June; Hsieh will assume interim CEO role at that time.

Highlights:

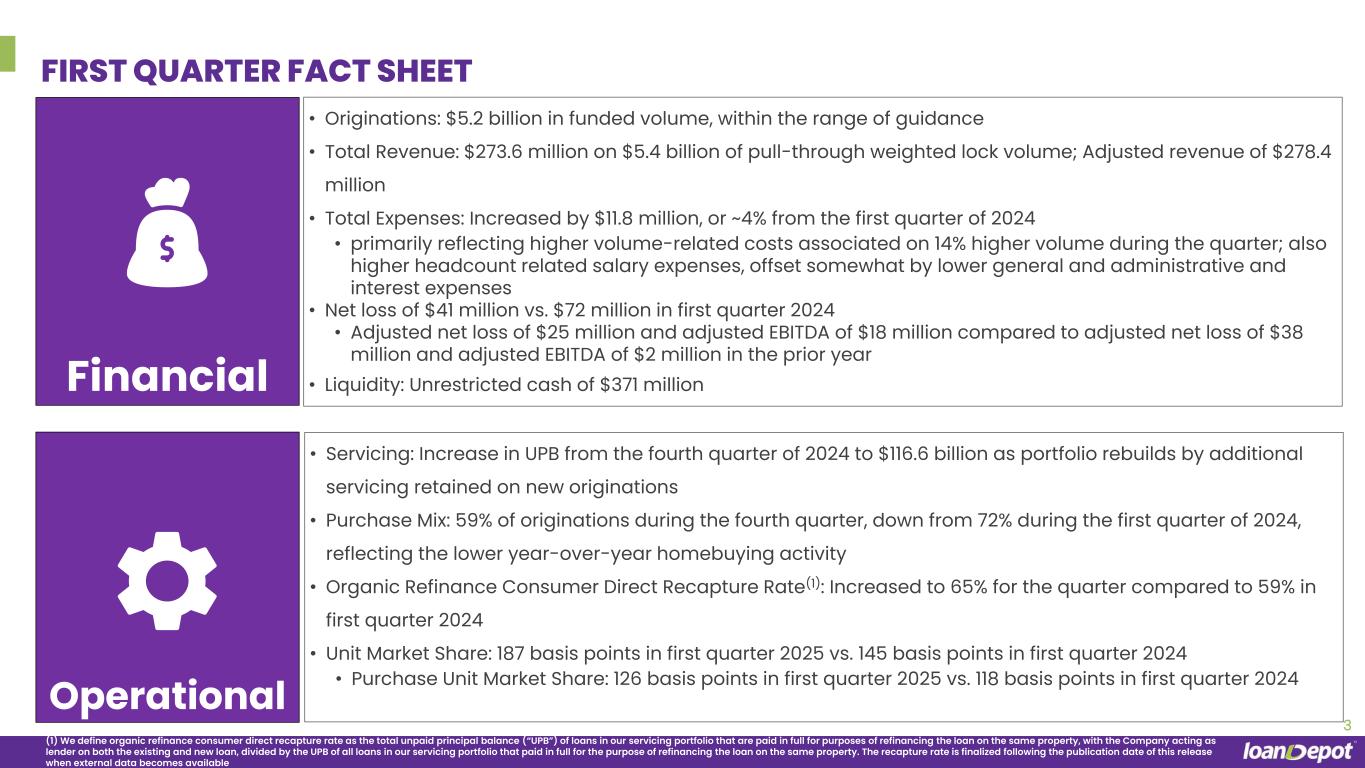

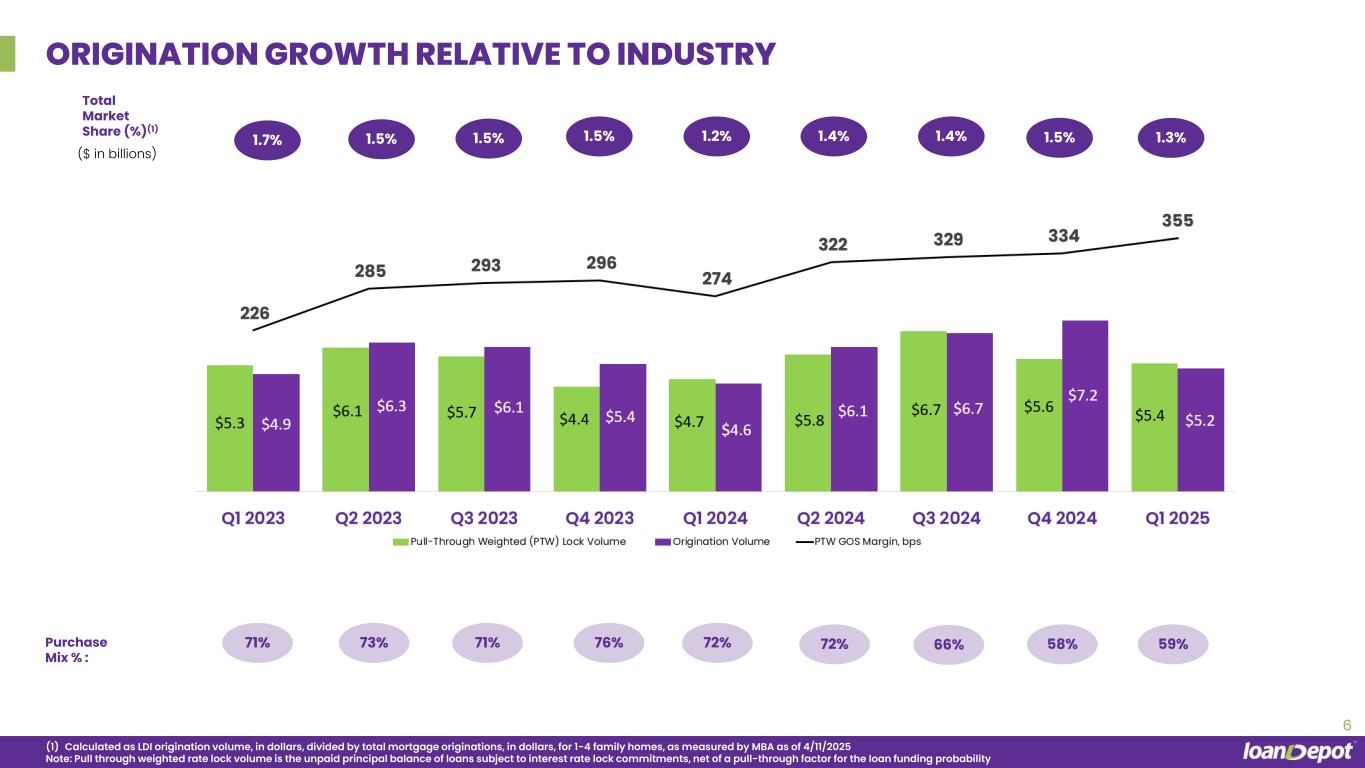

•Revenue increased 23% to $274 million and adjusted revenue increased 21% to $278 million compared to the prior year on higher volume and pull-through weighted gain on sale margin.

•Strong mortgage revenue growth more than overcame loss of $20 million of servicing revenue resulting from 2024 MSR bulk sales.

•Pull-through weighted gain on sale margin grew 81 basis points to 355 basis points.

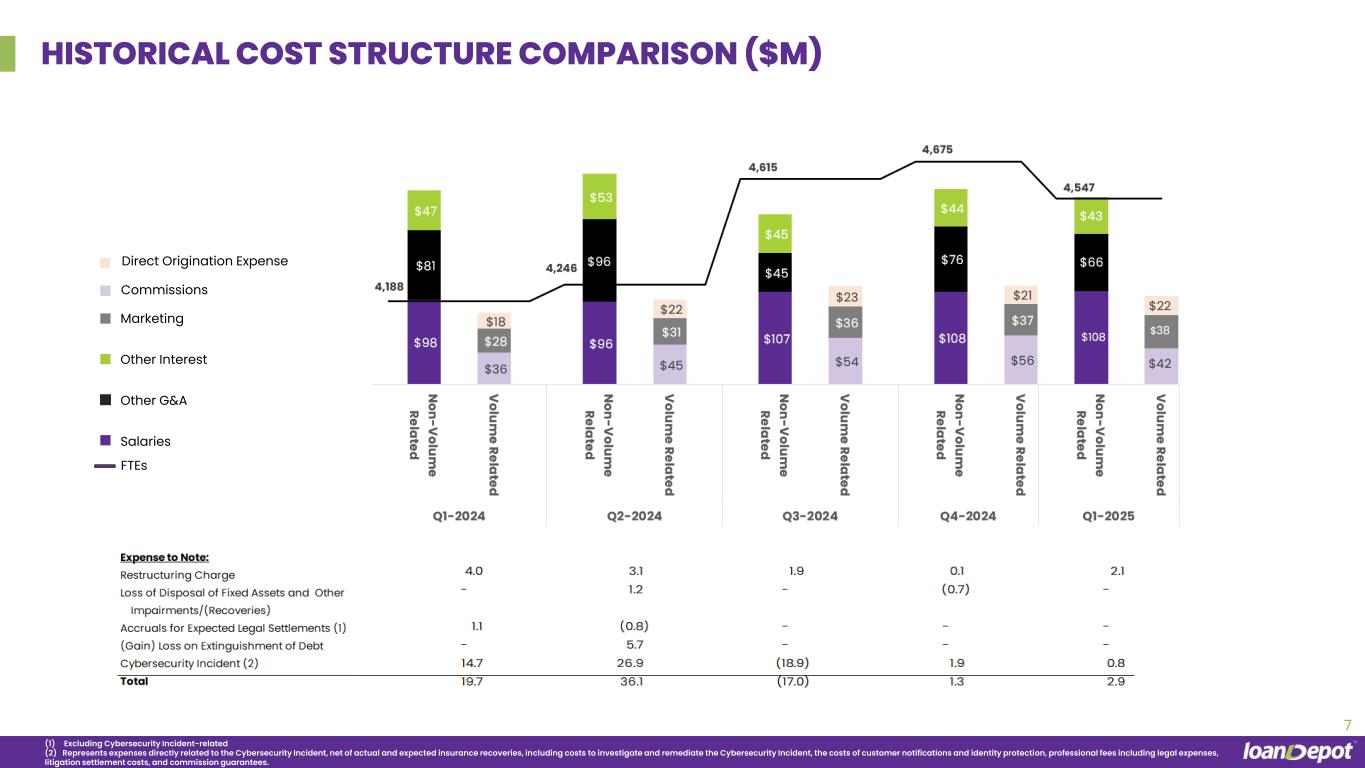

•Expenses increased 4% to $320 million, driven primarily by increased volume-related costs; non-volume related expenses decreased 3% to $218 million.

•Net loss of $41 million was down 43%, compared with net loss of $72 million in the prior year.

•Adjusted net loss of $25 million was down 34%, compared with the prior year adjusted net loss of $38 million, primarily reflecting higher adjusted revenue.

•Adjusted EBITDA increased $16 million to $18 million compared to $2 million in the prior year.

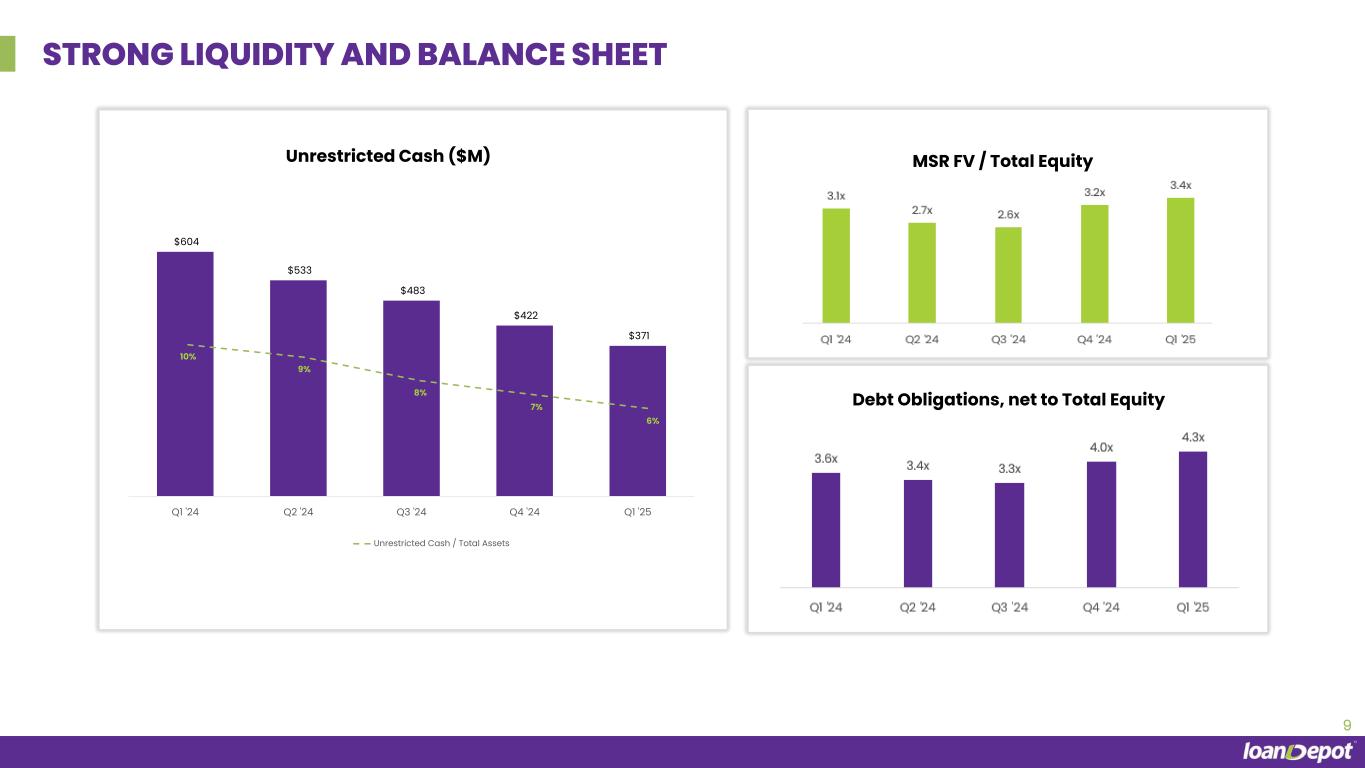

•Strong liquidity profile with cash balance of $371 million.

•Founder and noted transformative leader Anthony Hsieh, an innovator in tech-forward consumer direct lending, has returned to the company’s day-to-day operations and is expected to focus on expanding originations and driving growth.

IRVINE, Calif., May 06, 2025 - loanDepot, Inc. (NYSE: LDI), (together with its subsidiaries, “loanDepot” or the “Company”), a leading provider of products and services that power the homeownership journey, today announced results for the first quarter ended March 31, 2025.

“I would like to thank Team loanDepot for their dedication and support over these past three years,” said President and Chief Executive Officer Frank Martell. “Together as a team, we addressed the realities of the market while investing in critical systems, products, and processes; these investments will allow loanDepot to take advantage of our marketplace differentiators in this and upcoming cycles, as well as to continue to deliver a best-in-class customer experience. I am proud to have been a part of loanDepot and look forward with confidence to the company’s future success.”

“On behalf of the entire board of directors, I would like to thank Frank for his leadership over the past three years,” said Founder and Executive Chairman of the Board Anthony Hsieh. “Frank is a man of honor and a servant leader – his care for Team loanDepot and the customers we serve is evident.”

“As we go forward,” continued Hsieh, “the team and I will focus on capitalizing upon the things that already make loanDepot great. Our multi-channel sales model, proprietary mello tech stack, wide product array, powerful brand muscle and our servicing business are foundational places in which loanDepot can win. By leveraging this unique constellation of assets, plus adding to our arsenal with new and emerging technologies and platform refinements, I believe we are well positioned to regain profitable market share and scale our business.”

“We deeply appreciate all that Frank Martell brought to our company, and are energized by Anthony’s return,” said Chief Financial Officer David Hayes. “Under Frank’s guidance, the first quarter reflected the benefits of our investment in growth generating initiatives, despite the adverse impact of lower servicing revenue stemming from our 2024 MSR bulk sales. Our home equity-linked products supported strong margin and volume increases, growing revenue by 23%. On the cost side, aligned with our enduring discipline in expense management, our non-volume expenses decreased 3% year-over-year.”

“As Anthony and I work together moving forward,” continued Hayes, “we remain focused on our commitment to profitability and disciplined approach to growing revenue and market share while maintaining ample cash and a strong balance sheet.”

First Quarter Highlights:

Financial Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

($ in thousands except per share data)

(Unaudited) |

Mar 31,

2025 |

|

Dec 31,

2024 |

|

Mar 31,

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rate lock volume |

$ |

7,637,987 |

|

|

$ |

7,648,829 |

|

|

$ |

6,802,330 |

|

|

|

|

|

Pull-through weighted lock volume(1) |

5,418,685 |

|

|

5,592,527 |

|

|

4,731,836 |

|

|

|

|

|

| Loan origination volume |

5,173,928 |

|

|

7,188,186 |

|

|

4,558,351 |

|

|

|

|

|

Gain on sale margin(2) |

3.72 |

% |

|

2.60 |

% |

|

2.84 |

% |

|

|

|

|

Pull-through weighted gain on sale margin(3) |

3.55 |

% |

|

3.34 |

% |

|

2.74 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Results |

|

|

|

|

|

|

|

|

|

| Total revenue |

$ |

273,620 |

|

|

$ |

257,464 |

|

|

$ |

222,785 |

|

|

|

|

|

| Total expense |

319,723 |

|

|

341,588 |

|

|

307,950 |

|

|

|

|

|

Net loss |

(40,696) |

|

|

(67,466) |

|

|

(71,505) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted loss per share |

$ |

(0.11) |

|

|

$ |

(0.17) |

|

|

$ |

(0.19) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted total revenue |

$ |

278,443 |

|

|

$ |

266,594 |

|

|

$ |

230,816 |

|

|

|

|

|

Adjusted net loss |

(25,335) |

|

|

(47,017) |

|

|

(38,144) |

|

|

|

|

|

Adjusted EBITDA (LBITDA) |

18,298 |

|

|

(15,071) |

|

|

2,340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Pull-through weighted rate lock volume is the principal balance of loans subject to interest rate lock commitments, net of a pull-through factor for the loan funding probability.

(2)Gain on sale margin represents the total of (i) gain on origination and sale of loans, net, and (ii) origination income, net, divided by loan origination volume during period.

(3)Pull-through weighted gain on sale margin represents the total of (i) gain on origination and sale of loans, net, and (ii) origination income, net, divided by the pull-through weighted rate lock volume.

(4)See “Non-GAAP Financial Measures” for a discussion of Non-GAAP Financial Measures and a reconciliation of these metrics to their closest GAAP measure.

Year-over-Year Operational Highlights

•Non-volume1 related expenses decreased $7.4 million from the first quarter of 2024, primarily due to lower general and administrative and other interest expenses.

•Accrued $0.8 million expense associated with the first quarter 2024 cybersecurity incident (the “Cybersecurity Incident”) compared to $14.7 million in the first quarter of 2024.

•Pull-through weighted lock volume of $5.4 billion for the first quarter of 2025, an increase of $0.7 billion or 15% from the first quarter of 2024.

•Loan origination volume for the first quarter of 2025 was $5.2 billion, an increase of $0.6 billion or 14% from the first quarter of 2024.

•Purchase volume totaled 59% of total loans originated during the first quarter, down from 72% during the first quarter of 2024.

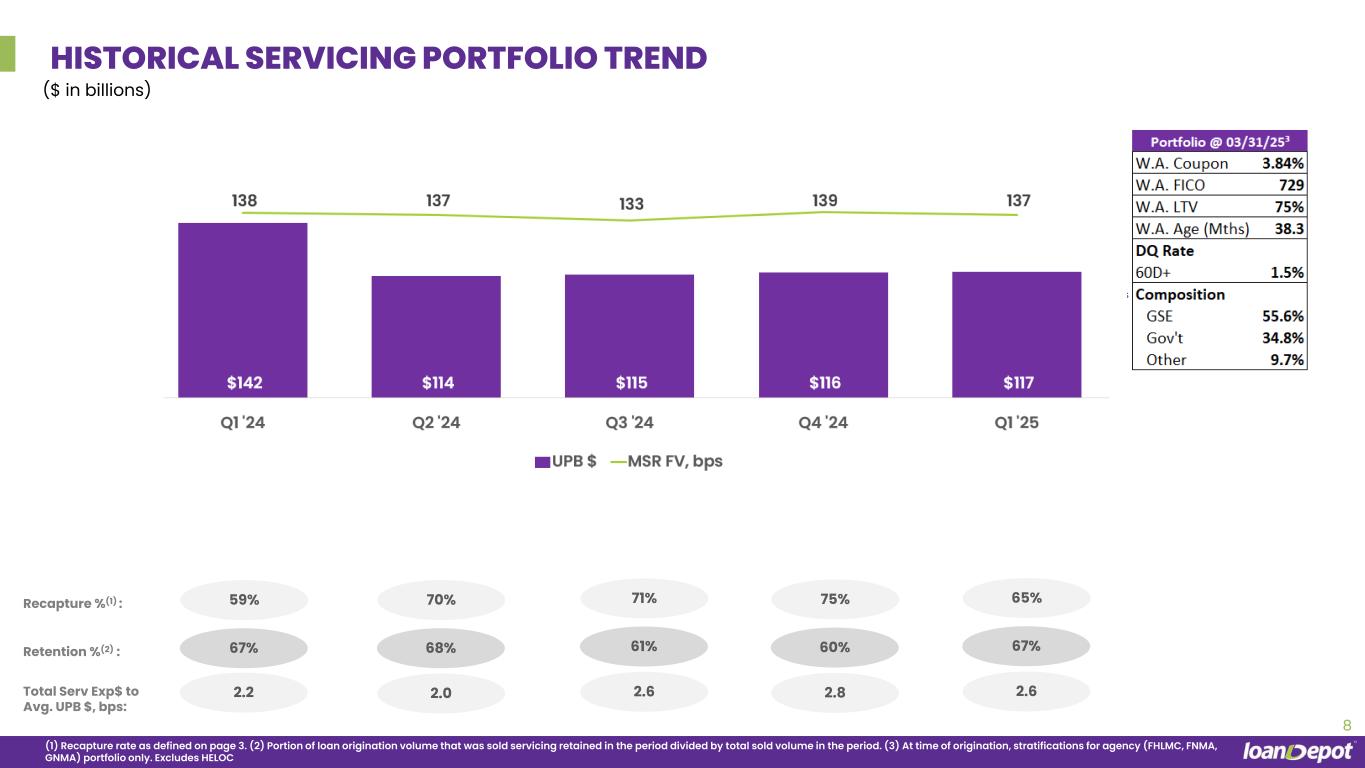

•Our preliminary organic refinance consumer direct recapture rate2 increased to 65% from the first quarter 2024’s recapture rate of 59%.

•Net loss for the first quarter of 2025 of $40.7 million as compared to net loss of $71.5 million in the first quarter of 2024. Net loss narrowed primarily due to higher volume and margins, offset somewhat by lower servicing revenue and increased expenses.

•Adjusted net loss for the first quarter of 2025 was $25.3 million as compared to adjusted net loss of $38.1 million for the first quarter of 2024.

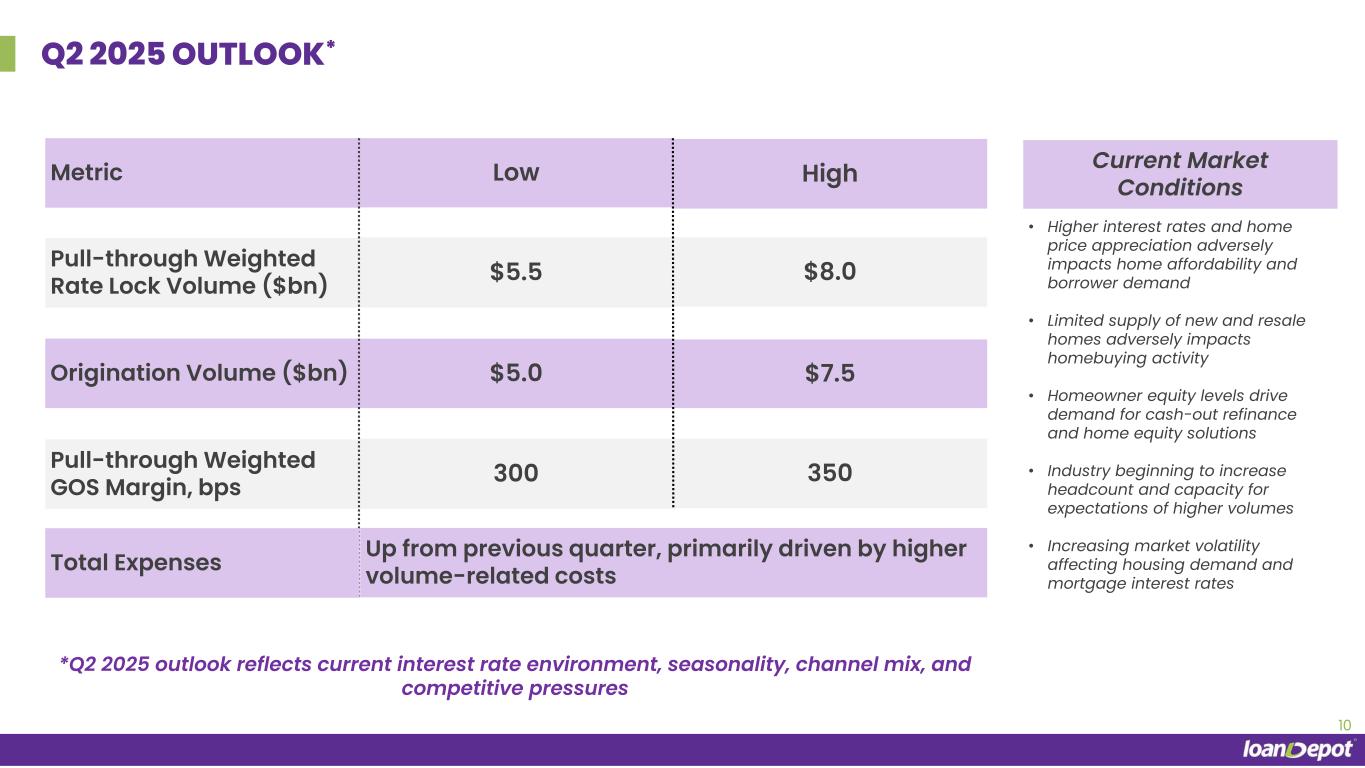

Outlook for the second quarter of 2025

•Origination volume of between $5.0 billion and $7.5 billion.

•Pull-through weighted rate lock volume of between $5.5 billion and $8.0 billion.

•Pull-through weighted gain on sale margin of between 300 basis points and 350 basis points.

1 Volume related expenses include commissions, marketing and advertising expense, and direct origination expense. All remaining expenses are considered non-volume related.

2 We define organic refinance consumer direct recapture rate as the total unpaid principal balance (“UPB”) of loans in our servicing portfolio that are paid in full for purposes of refinancing the loan on the same property, with the Company acting as lender on both the existing and new loan, divided by the UPB of all loans in our servicing portfolio that paid in full for the purpose of refinancing the loan on the same property. The recapture rate is finalized following the publication date of this release when external data becomes available.

Servicing

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

Servicing Revenue Data:

($ in thousands)

(Unaudited)

|

|

Mar 31,

2025 |

|

Dec 31,

2024 |

|

Mar 31,

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Due to collection/realization of cash flows |

|

$ |

(36,176) |

|

|

$ |

(43,227) |

|

|

$ |

(35,999) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Due to changes in valuation inputs or assumptions |

|

(23,689) |

|

|

68,228 |

|

|

28,244 |

|

|

|

|

|

| Realized gains (losses) on sale of servicing rights |

|

62 |

|

|

(56) |

|

|

44 |

|

|

|

|

|

Net gain (loss) from derivatives hedging servicing rights |

|

18,804 |

|

|

(77,302) |

|

|

(36,319) |

|

|

|

|

|

Changes in fair value of servicing rights, net of hedging gains and losses |

|

(4,823) |

|

|

(9,130) |

|

|

(8,031) |

|

|

|

|

|

Other realized losses on sales of servicing rights (1) |

|

(104) |

|

|

(162) |

|

|

(1,240) |

|

|

|

|

|

| Changes in fair value of servicing rights, net |

|

$ |

(41,103) |

|

|

$ |

(52,519) |

|

|

$ |

(45,270) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Servicing fee income |

|

$ |

104,278 |

|

|

$ |

108,426 |

|

|

$ |

124,059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Includes the provision for sold MSRs and broker fees.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

Servicing Rights, at Fair Value:

($ in thousands)

(Unaudited)

|

|

Mar 31,

2025 |

|

Dec 31,

2024 |

|

Mar 31,

2024 |

|

|

|

|

| Balance at beginning of period |

|

$ |

1,615,510 |

|

|

$ |

1,526,013 |

|

|

$ |

1,985,718 |

|

|

|

|

|

| Additions |

|

52,686 |

|

|

75,547 |

|

|

48,375 |

|

|

|

|

|

| Sales proceeds |

|

(5,362) |

|

|

(10,995) |

|

|

(56,113) |

|

|

|

|

|

| Changes in fair value: |

|

|

|

|

|

|

|

|

|

|

| Due to changes in valuation inputs or assumptions |

|

(23,689) |

|

|

68,228 |

|

|

28,244 |

|

|

|

|

|

| Due to collection/realization of cash flows |

|

(36,176) |

|

|

(43,227) |

|

|

(35,999) |

|

|

|

|

|

| Realized gains (losses) on sales of servicing rights |

|

62 |

|

|

(56) |

|

|

(61) |

|

|

|

|

|

| Total changes in fair value |

|

(59,803) |

|

|

24,945 |

|

|

(7,816) |

|

|

|

|

|

Balance at end of period (1) |

|

$ |

1,603,031 |

|

|

$ |

1,615,510 |

|

|

$ |

1,970,164 |

|

|

|

|

|

(1)Balances are net of $18.5 million, $18.2 million, and $15.8 million of servicing rights liability as of March 31, 2025, December 31, 2024, and March 31, 2024, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Change |

|

Servicing Portfolio Data:

($ in thousands)

(Unaudited)

|

Mar 31,

2025 |

|

Dec 31,

2024 |

|

Mar 31,

2024 |

|

Mar-25

vs

Dec-24 |

|

Mar-25

vs

Mar-24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

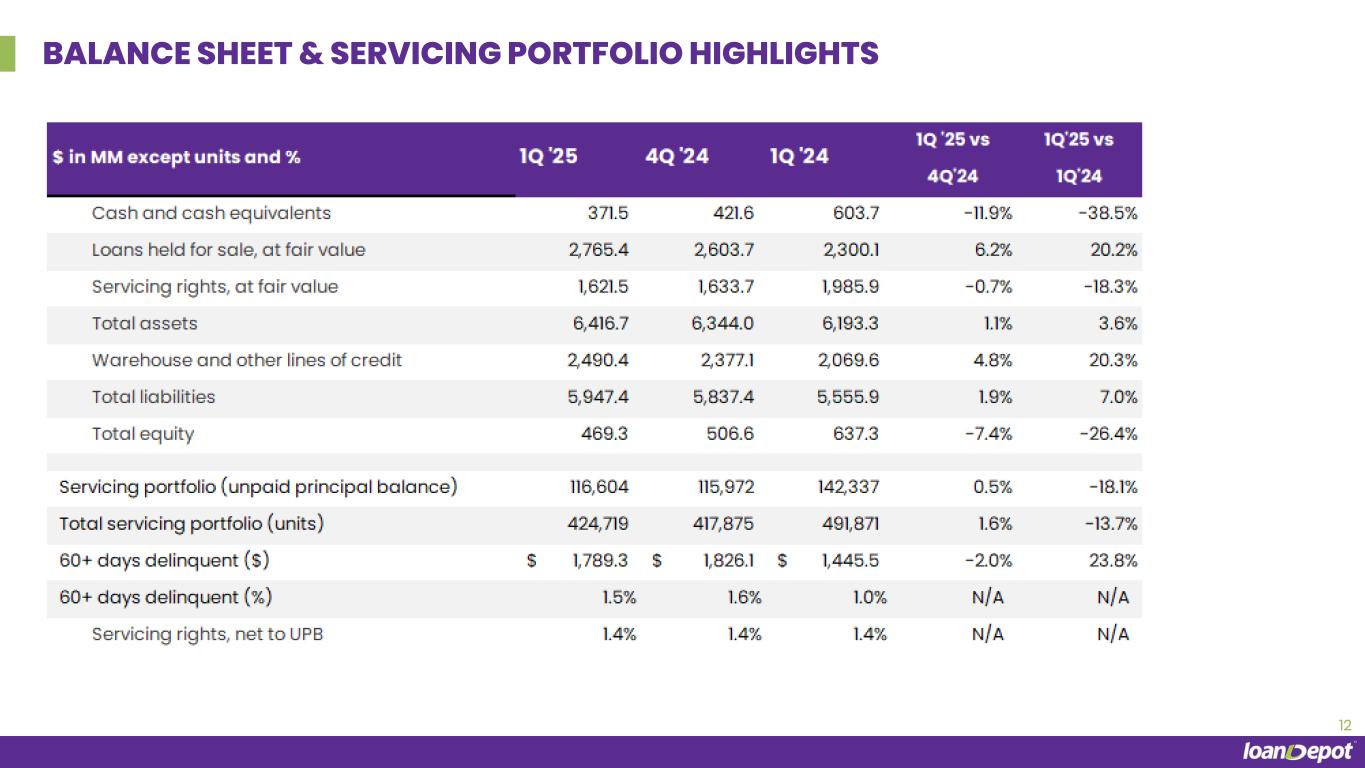

| Servicing portfolio (unpaid principal balance) |

$ |

116,604,153 |

|

|

$ |

115,971,984 |

|

|

$ |

142,337,251 |

|

|

0.5 |

% |

|

(18.1) |

% |

|

|

|

|

|

|

|

|

|

|

| Total servicing portfolio (units) |

424,719 |

|

|

417,875 |

|

|

491,871 |

|

|

1.6 |

|

|

(13.7) |

|

|

|

|

|

|

|

|

|

|

|

| 60+ days delinquent ($) |

$ |

1,789,276 |

|

|

$ |

1,826,105 |

|

|

$ |

1,445,489 |

|

|

(2.0) |

|

|

23.8 |

|

| 60+ days delinquent (%) |

1.5 |

% |

|

1.6 |

% |

|

1.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Servicing rights, net to UPB |

1.4 |

% |

|

1.4 |

% |

|

1.4 |

% |

|

|

|

|

Balance Sheet Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Change |

|

($ in thousands)

(Unaudited)

|

Mar 31,

2025 |

|

Dec 31,

2024 |

|

Mar 31,

2024 |

|

Mar-25

vs

Dec-24 |

|

Mar-25

vs

Mar-24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

371,480 |

|

|

$ |

421,576 |

|

|

$ |

603,663 |

|

|

(11.9) |

% |

|

(38.5) |

% |

| Loans held for sale, at fair value |

2,765,417 |

|

|

2,603,735 |

|

|

2,300,058 |

|

|

6.2 |

|

|

20.2 |

|

| Loans held for investment, at fair value |

114,447 |

|

|

116,627 |

|

|

— |

|

|

(1.9) |

|

|

NM |

| Servicing rights, at fair value |

1,621,494 |

|

|

1,633,661 |

|

|

1,985,948 |

|

|

(0.7) |

|

|

(18.4) |

|

| Total assets |

6,416,714 |

|

|

6,344,028 |

|

|

6,193,270 |

|

|

1.1 |

|

|

3.6 |

|

| Warehouse and other lines of credit |

2,490,447 |

|

|

2,377,127 |

|

|

2,069,619 |

|

|

4.8 |

|

|

20.3 |

|

| Total liabilities |

5,947,416 |

|

|

5,837,417 |

|

|

5,555,928 |

|

|

1.9 |

|

|

7.0 |

|

| Total equity |

469,298 |

|

|

506,611 |

|

|

637,342 |

|

|

(7.4) |

|

|

(26.4) |

|

An increase in loans held for sale at March 31, 2025, resulted in a corresponding increase in the balance on our warehouse lines of credit. Total funding capacity with our lending partners was $3.7 billion at March 31, 2025, and $3.1 billion at March 31, 2024. Available borrowing capacity was $1.2 billion at March 31, 2025.

Consolidated Statements of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in thousands except per share data) |

Three Months Ended |

|

|

|

Mar 31,

2025 |

|

Dec 31,

2024 |

|

Mar 31,

2024 |

|

|

|

|

|

(Unaudited) |

|

|

|

|

| REVENUES: |

|

|

|

|

|

|

|

|

|

| Interest income |

$ |

35,070 |

|

|

$ |

41,835 |

|

|

$ |

30,925 |

|

|

|

|

|

| Interest expense |

(31,762) |

|

|

(40,491) |

|

|

(31,666) |

|

|

|

|

|

Net interest income (expense) |

3,308 |

|

|

1,344 |

|

|

(741) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on origination and sale of loans, net |

166,376 |

|

|

161,071 |

|

|

116,060 |

|

|

|

|

|

| Origination income, net |

25,858 |

|

|

25,515 |

|

|

13,606 |

|

|

|

|

|

| Servicing fee income |

104,278 |

|

|

108,426 |

|

|

124,059 |

|

|

|

|

|

| Change in fair value of servicing rights, net |

(41,103) |

|

|

(52,519) |

|

|

(45,270) |

|

|

|

|

|

| Other income |

14,903 |

|

|

13,627 |

|

|

15,071 |

|

|

|

|

|

| Total net revenues |

273,620 |

|

|

257,464 |

|

|

222,785 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EXPENSES: |

|

|

|

|

|

|

|

|

|

| Personnel expense |

150,161 |

|

|

163,800 |

|

|

134,318 |

|

|

|

|

|

| Marketing and advertising expense |

38,250 |

|

|

36,860 |

|

|

28,354 |

|

|

|

|

|

| Direct origination expense |

21,954 |

|

|

21,392 |

|

|

18,171 |

|

|

|

|

|

| General and administrative expense |

44,132 |

|

|

50,344 |

|

|

57,746 |

|

|

|

|

|

| Occupancy expense |

4,295 |

|

|

4,321 |

|

|

5,110 |

|

|

|

|

|

| Depreciation and amortization |

7,666 |

|

|

8,779 |

|

|

9,443 |

|

|

|

|

|

| Servicing expense |

10,000 |

|

|

12,218 |

|

|

8,261 |

|

|

|

|

|

| Other interest expense |

43,265 |

|

|

43,874 |

|

|

46,547 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total expenses |

319,723 |

|

|

341,588 |

|

|

307,950 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes |

(46,103) |

|

|

(84,124) |

|

|

(85,165) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax benefit |

(5,407) |

|

|

(16,658) |

|

|

(13,660) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

(40,696) |

|

|

(67,466) |

|

|

(71,505) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to noncontrolling interests |

(18,800) |

|

|

(34,232) |

|

|

(37,250) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to loanDepot, Inc. |

$ |

(21,896) |

|

|

$ |

(33,234) |

|

|

$ |

(34,255) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic loss per share |

$ |

(0.11) |

|

|

$ |

(0.17) |

|

|

$ |

(0.19) |

|

|

|

|

|

Diluted loss per share |

$ |

(0.11) |

|

|

$ |

(0.17) |

|

|

$ |

(0.19) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

| Basic |

200,792,570 |

|

|

193,413,971 |

|

|

181,407,353 |

|

|

|

|

|

| Diluted |

200,792,570 |

|

|

193,413,971 |

|

|

324,679,090 |

|

|

|

|

|

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in thousands) |

Mar 31,

2025 |

|

Dec 31,

2024 |

|

|

|

(Unaudited) |

|

|

| ASSETS |

|

|

|

|

|

| Cash and cash equivalents |

$ |

371,480 |

|

|

$ |

421,576 |

|

|

|

| Restricted cash |

74,247 |

|

|

105,645 |

|

|

|

| Loans held for sale, at fair value |

2,765,417 |

|

|

2,603,735 |

|

|

|

| Loans held for investment, at fair value |

114,447 |

|

|

116,627 |

|

|

|

| Derivative assets, at fair value |

49,762 |

|

|

44,389 |

|

|

|

| Servicing rights, at fair value |

1,621,494 |

|

|

1,633,661 |

|

|

|

| Trading securities, at fair value |

87,355 |

|

|

87,466 |

|

|

|

| Property and equipment, net |

60,192 |

|

|

61,079 |

|

|

|

| Operating lease right-of-use asset |

22,682 |

|

|

20,432 |

|

|

|

| Loans eligible for repurchase |

1,022,924 |

|

|

995,398 |

|

|

|

| Investments in joint ventures |

18,214 |

|

|

18,113 |

|

|

|

| Other assets |

208,500 |

|

|

235,907 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

$ |

6,416,714 |

|

|

$ |

6,344,028 |

|

|

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

| LIABILITIES: |

|

|

|

|

|

| Warehouse and other lines of credit |

$ |

2,490,447 |

|

|

$ |

2,377,127 |

|

|

|

| Accounts payable and accrued expenses |

368,276 |

|

|

379,439 |

|

|

|

| Derivative liabilities, at fair value |

13,453 |

|

|

25,060 |

|

|

|

| Liability for loans eligible for repurchase |

1,022,924 |

|

|

995,398 |

|

|

|

| Operating lease liability |

34,821 |

|

|

33,190 |

|

|

|

| Debt obligations, net |

2,017,495 |

|

|

2,027,203 |

|

|

|

| Total liabilities |

5,947,416 |

|

|

5,837,417 |

|

|

|

| EQUITY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity |

469,298 |

|

|

506,611 |

|

|

|

| Total liabilities and equity |

$ |

6,416,714 |

|

|

$ |

6,344,028 |

|

|

|

Loan Origination and Sales Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in thousands)

(Unaudited) |

|

Three Months Ended |

|

|

|

Mar 31,

2025 |

|

Dec 31,

2024 |

|

Mar 31,

2024 |

|

|

|

|

|

|

|

| Loan origination volume by type: |

|

|

|

|

|

|

|

|

|

|

| Conventional conforming |

|

$2,118,866 |

|

$3,331,526 |

|

$2,545,203 |

|

|

|

|

| FHA/VA/USDA |

|

2,121,208 |

|

2,938,168 |

|

1,654,025 |

|

|

|

|

| Jumbo |

|

319,390 |

|

368,518 |

|

75,794 |

|

|

|

|

| Other |

|

614,464 |

|

549,974 |

|

283,329 |

|

|

|

|

| Total |

|

$5,173,928 |

|

$7,188,186 |

|

$4,558,351 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loan origination volume by purpose: |

|

|

|

|

|

|

|

|

|

|

| Purchase |

|

$3,063,914 |

|

$4,139,542 |

|

$3,296,273 |

|

|

|

|

| Refinance - cash out |

|

1,847,176 |

|

2,424,749 |

|

1,143,682 |

|

|

|

|

| Refinance - rate/term |

|

262,838 |

|

623,895 |

|

118,396 |

|

|

|

|

| Total |

|

$5,173,928 |

|

$7,188,186 |

|

$4,558,351 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans sold: |

|

|

|

|

|

|

|

|

|

|

| Servicing retained |

|

$3,453,710 |

|

$4,421,935 |

|

$2,986,541 |

|

|

|

|

| Servicing released |

|

1,713,963 |

|

2,937,984 |

|

1,452,812 |

|

|

|

|

| Total |

|

$5,167,673 |

|

$7,359,919 |

|

$4,439,353 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter Earnings Call

Management will host a conference call and live webcast today at 5:00 p.m. ET to discuss the Company’s financial and operational highlights followed by a question-and-answer session.

The conference call can be accessed by registering online at https://registrations.events/direct/Q4I41447641 at which time registrants will receive dial-in information as well as a conference ID. At the time of the call, participants will dial in using the participant number and conference ID provided upon registration.

A live audio webcast of the conference call will also be available via the Company's website, investors.loandepot.com, under Events & Presentation tab. A replay of the webcast will be made available on the Investor Relations website following the conclusion of the event.

For more information about loanDepot, please visit the company’s Investor Relations website: investors.loandepot.com.

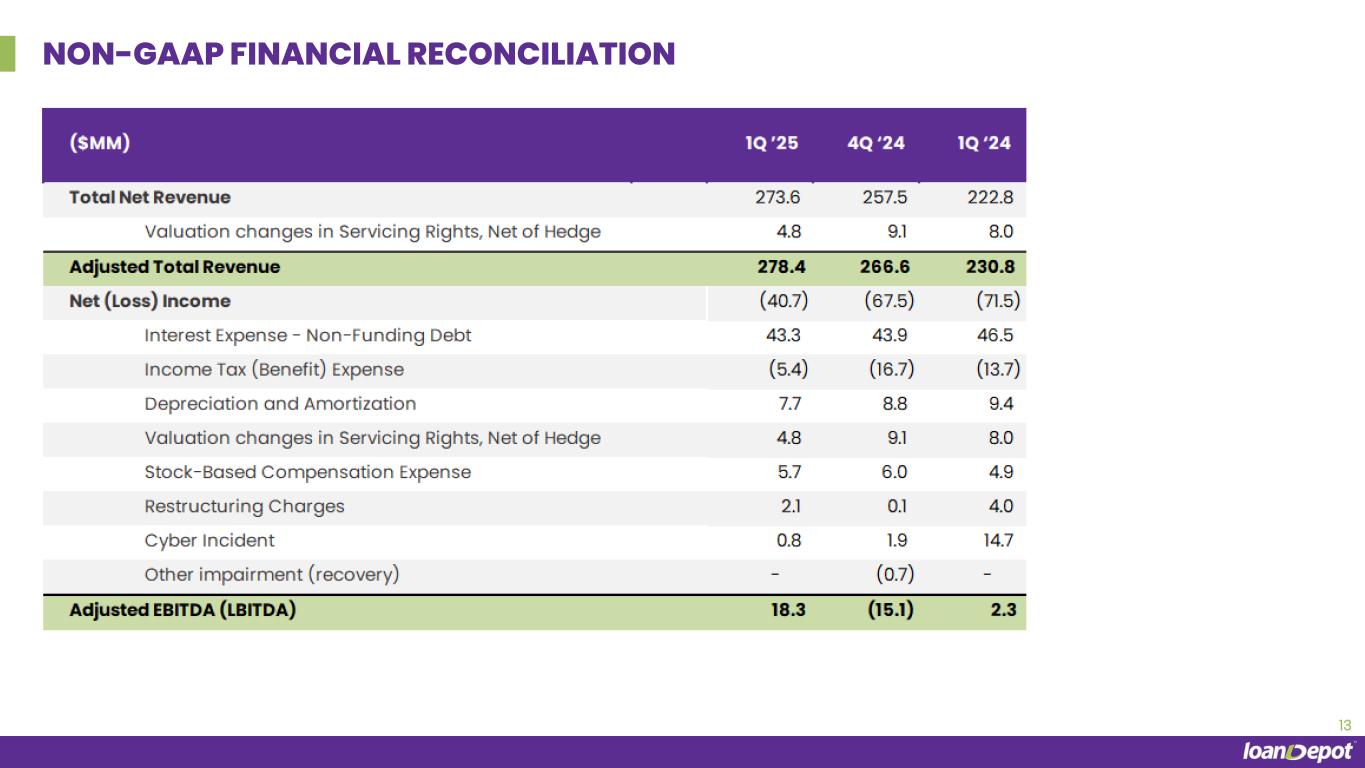

Non-GAAP Financial Measures

To provide investors with information in addition to our results as determined by GAAP, we disclose certain non-GAAP measures to assist investors in evaluating our financial results. We believe these non-GAAP measures provide useful information to investors regarding our results of operations because each measure assists both investors and management in analyzing and benchmarking the performance and value of our business. They facilitate company-to-company operating performance comparisons by backing out potential differences caused by variations in hedging strategies, changes in valuations, capital structures (affecting interest expense on non-funding debt), taxation, the age and book depreciation of facilities (affecting relative depreciation expense), and other cost or benefit items which may vary for different companies for reasons unrelated to operating performance. These non-GAAP measures include our Adjusted Total Revenue, Adjusted Net Income (Loss), Adjusted Diluted Weighted Average Shares Outstanding, and Adjusted EBITDA (LBITDA). We exclude from these non-GAAP financial measures the change in fair value of MSRs, gains (losses) from the sale of MSRs and related hedging gains and losses that represent realized and unrealized adjustments resulting from changes in valuation, mostly due to changes in market interest rates, and are not indicative of the Company’s operating performance or results of operation. Beginning in the second quarter of 2024, we began to include the gains (losses) from the sale of MSRs in valuation changes in servicing rights, net of hedging gains and losses to appropriately capture all valuation changes in MSRs up to and including the sales date. Prior periods have been revised to conform with this new presentation. We have excluded expenses directly related to the Cybersecurity Incident, net of insurance recoveries during fiscal 2024, such as costs to investigate and remediate the Cybersecurity Incident, the costs of customer notifications and identity protection, and professional fees, including legal expenses, litigation settlement costs, and commission guarantees. We also exclude stock-based compensation expense, which is a non-cash expense, gains or losses on extinguishment of debt and disposal of fixed assets, non-cash goodwill impairment, and other impairment charges to intangible assets and operating lease right-of-use assets, as well as certain costs associated with our restructuring efforts, as management does not consider these costs to be indicative of our performance or results of operations. Adjusted EBITDA (LBITDA) includes interest expense on funding facilities, which are recorded as a component of “net interest income (expense),” as these expenses are a direct operating expense driven by loan origination volume. By contrast, interest expense on our non-funding debt is a function of our capital structure and is therefore excluded from Adjusted EBITDA (LBITDA). Adjustments for income taxes are made to reflect historical results of operations on the basis that it was taxed as a corporation under the Internal Revenue Code, and therefore subject to U.S. federal, state and local income taxes. Adjustments to Diluted Weighted Average Shares Outstanding assumes the pro forma conversion of weighted average Class C common stock to Class A common stock. These non-GAAP measures have limitations as analytical tools and should not be considered in isolation or as a substitute for revenue, net income, or any other operating performance measure calculated in accordance with GAAP, and may not be comparable to a similarly titled measure reported by other companies. Some of these limitations are:

•They do not reflect every cash expenditure, future requirements for capital expenditures or contractual commitments;

•Adjusted EBITDA (LBITDA) does not reflect the significant interest expense or the cash requirements necessary to service interest or principal payment on our debt;

•Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced or require improvements in the future, and Adjusted Total Revenue, Adjusted Net Income (Loss), and Adjusted EBITDA (LBITDA) do not reflect any cash requirement for such replacements or improvements; and

•They are not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows.

Because of these limitations, Adjusted Total Revenue, Adjusted Net Income (Loss), Adjusted Diluted Weighted Average Shares Outstanding, and Adjusted EBITDA (LBITDA) are not intended as alternatives to total revenue, net income (loss), net income (loss) attributable to the Company, or Diluted Earnings (Loss) Per Share or as an indicator of our operating performance and should not be considered as measures of discretionary cash available to us to invest in the growth of our business or as measures of cash that will be available to us to meet our obligations.

We compensate for these limitations by using Adjusted Total Revenue, Adjusted Net Income (Loss), Adjusted Diluted Weighted Average Shares Outstanding, and Adjusted EBITDA (LBITDA) along with other comparative tools, together with U.S. GAAP measurements, to assist in the evaluation of operating performance. See below for a reconciliation of these non-GAAP measures to their most comparable U.S. GAAP measures.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Total Revenue to Adjusted Total Revenue

($ in thousands)

(Unaudited)

|

|

Three Months Ended |

|

|

|

Mar 31,

2025 |

|

Dec 31,

2024 |

|

Mar 31,

2024 |

|

|

|

|

| Total net revenue |

|

$ |

273,620 |

|

|

$ |

257,464 |

|

|

$ |

222,785 |

|

|

|

|

|

Valuation changes in servicing rights, net of hedging gains and losses(1) |

|

4,823 |

|

|

9,130 |

|

|

8,031 |

|

|

|

|

|

| Adjusted total revenue |

|

$ |

278,443 |

|

|

$ |

266,594 |

|

|

$ |

230,816 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Represents the change in the fair value of servicing rights due to changes in valuation inputs or assumptions, net of gains or losses from derivatives hedging servicing rights. Beginning in the second quarter of 2024, we began to include the gains (losses) from the sale of MSRs in valuation changes in servicing rights, net of hedging gains and losses to appropriately capture all valuation changes in MSRs up to and including the sales date. Prior periods have been revised to conform with this new presentation.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

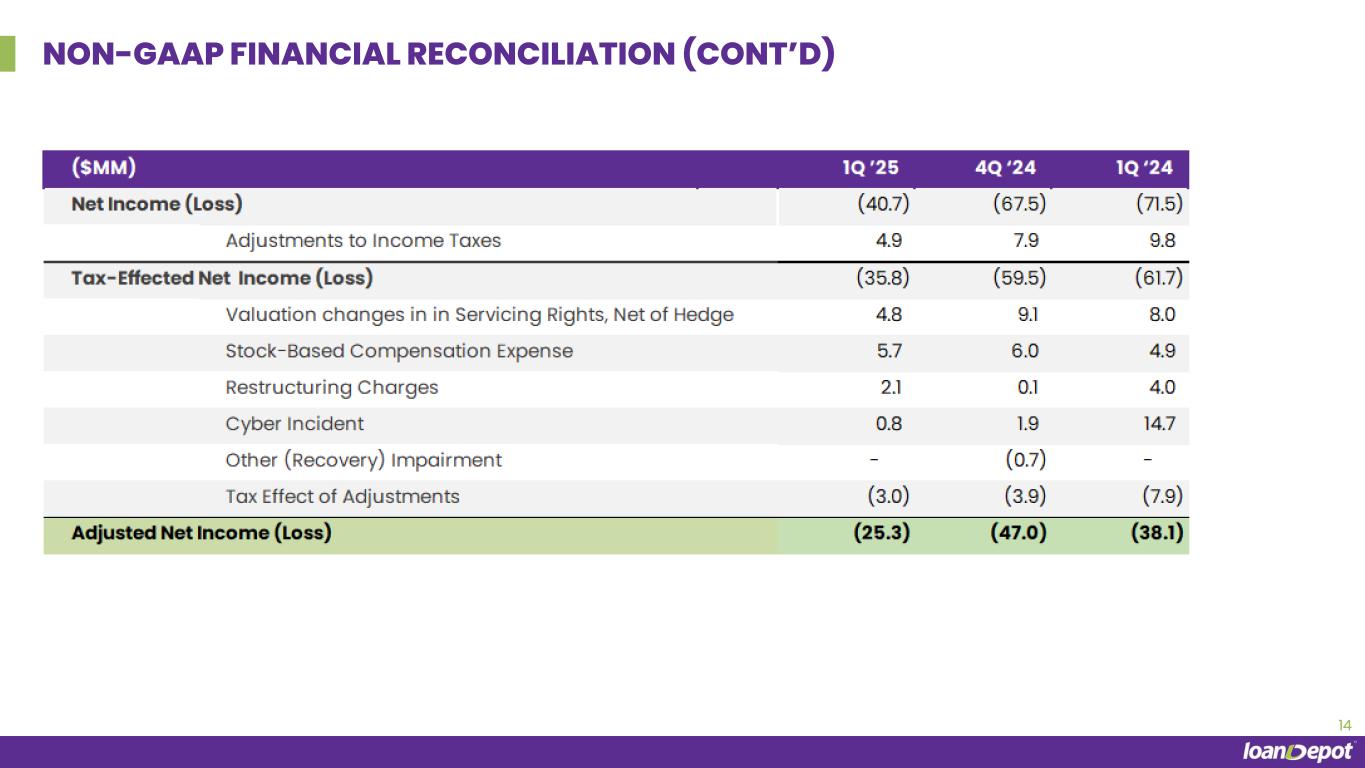

Reconciliation of Net Loss to Adjusted Net Loss

($ in thousands)

(Unaudited)

|

|

Three Months Ended |

|

|

|

Mar 31,

2025 |

|

Dec 31,

2024 |

|

Mar 31,

2024 |

|

|

|

|

Net loss attributable to loanDepot, Inc. |

|

$ |

(21,896) |

|

|

$ |

(33,234) |

|

|

$ |

(34,255) |

|

|

|

|

|

Net loss from the pro forma conversion of Class C common stock to Class A common stock (1) |

|

(18,800) |

|

|

(34,232) |

|

|

(37,250) |

|

|

|

|

|

Net loss |

|

(40,696) |

|

|

(67,466) |

|

|

(71,505) |

|

|

|

|

|

Adjustments to the benefit for income taxes(2) |

|

4,901 |

|

|

7,928 |

|

|

9,774 |

|

|

|

|

|

Tax-effected net loss |

|

(35,795) |

|

|

(59,538) |

|

|

(61,731) |

|

|

|

|

|

Valuation changes in servicing rights, net of hedging gains and losses(3) |

|

4,823 |

|

|

9,130 |

|

|

8,031 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation expense |

|

5,716 |

|

|

5,966 |

|

|

4,855 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charges(4) |

|

2,121 |

|

|

93 |

|

|

3,961 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cybersecurity incident(5) |

|

788 |

|

|

1,868 |

|

|

14,698 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss (gain) on disposal of fixed assets |

|

17 |

|

|

33 |

|

|

(29) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other impairment (recovery)(6) |

|

5 |

|

|

(690) |

|

|

(1) |

|

|

|

|

|

Tax effect of adjustments(7) |

|

(3,010) |

|

|

(3,879) |

|

|

(7,928) |

|

|

|

|

|

Adjusted net loss |

|

$ |

(25,335) |

|

|

$ |

(47,017) |

|

|

$ |

(38,144) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Reflects net loss to Class A common stock and Class D common stock from the pro forma exchange of Class C common stock.

(2)loanDepot, Inc. is subject to federal, state and local income taxes. Adjustments to the benefit for income taxes reflect the income tax rates below, and the pro forma assumption that loanDepot, Inc. owns 100% of LD Holdings.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

Mar 31,

2025 |

|

Dec 31,

2024 |

|

Mar 31,

2024 |

|

|

|

|

| Statutory U.S. federal income tax rate |

|

21.00 |

% |

|

21.00 |

% |

|

21.00 |

% |

|

|

|

|

| State and local income taxes (net of federal benefit) |

|

5.07 |

|

|

2.16 |

|

|

5.24 |

|

|

|

|

|

| Effective income tax rate |

|

26.07 |

% |

|

23.16 |

% |

|

26.24 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3)Represents the change in the fair value of servicing rights due to changes in valuation inputs or assumptions, net of gains or losses from derivatives hedging servicing rights, and gains (losses) from the sale of MSRs. Beginning in the second quarter of 2024, we began to include the gains (losses) from the sale of MSRs in valuation changes in servicing rights, net of hedging gains and losses to appropriately capture all valuation changes in MSRs up to and including the sales date. Prior periods have been revised to conform with this new presentation.

(4)Reflects employee severance expense and professional services associated with restructuring efforts.

(5)Represents expenses directly related to the Cybersecurity Incident, net of insurance recoveries during fiscal 2024, including costs to investigate and remediate the Cybersecurity Incident, the costs of customer notifications and identity protection, professional fees including legal expenses, litigation settlement costs, and commission guarantees.

(6)Represents lease impairment on corporate and retail locations.

(7)Amounts represent the income tax effect using the aforementioned effective income tax rates, excluding certain discrete tax items.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Diluted Weighted Average Shares Outstanding to Adjusted Diluted Weighted Average Shares Outstanding

(Unaudited)

|

|

Three Months Ended |

|

|

|

Mar 31,

2025 |

|

Dec 31,

2024 |

|

Mar 31,

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share Data: |

|

|

|

|

|

|

|

|

|

|

Diluted weighted average shares of Class A common stock and Class D common stock outstanding |

|

200,792,570 |

|

|

193,413,971 |

|

|

324,679,090 |

|

|

|

|

|

Assumed pro forma conversion of weighted average Class C common stock to Class A common stock (1) |

|

127,290,603 |

|

|

133,595,797 |

|

|

— |

|

|

|

|

|

| Adjusted diluted weighted average shares outstanding |

|

328,083,173 |

|

327,009,768 |

|

324,679,090 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Reflects the assumed pro forma exchange and conversion of Class C common stock.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Net Loss to Adjusted EBITDA (LBITDA)

($ in thousands)

(Unaudited)

|

|

Three Months Ended |

|

|

|

Mar 31,

2025 |

|

Dec 31,

2024 |

|

Mar 31,

2024 |

|

|

|

|

Net loss |

|

$ |

(40,696) |

|

|

$ |

(67,466) |

|

|

$ |

(71,505) |

|

|

|

|

|

Interest expense - non-funding debt (1) |

|

43,265 |

|

|

43,874 |

|

|

46,547 |

|

|

|

|

|

Income tax benefit |

|

(5,407) |

|

|

(16,658) |

|

|

(13,660) |

|

|

|

|

|

| Depreciation and amortization |

|

7,666 |

|

|

8,779 |

|

|

9,443 |

|

|

|

|

|

|

Valuation changes in servicing rights, net of

hedging gains and losses(2)

|

|

4,823 |

|

|

9,130 |

|

|

8,031 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation expense |

|

5,716 |

|

|

5,966 |

|

|

4,855 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charges(3) |

|

2,121 |

|

|

93 |

|

|

3,961 |

|

|

|

|

|

Cybersecurity incident(4) |

|

788 |

|

|

1,868 |

|

|

14,698 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss (gain) on disposal of fixed assets |

|

17 |

|

|

33 |

|

|

(29) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other impairment (recovery)(5) |

|

5 |

|

|

(690) |

|

|

(1) |

|

|

|

|

|

Adjusted EBITDA (LBITDA) |

|

$ |

18,298 |

|

|

$ |

(15,071) |

|

|

$ |

2,340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Represents other interest expense, which includes gain or loss on extinguishment of debt and amortization of debt issuance costs and debt discount, in the Company’s consolidated statements of operations.

(2)Represents the change in the fair value of servicing rights due to changes in valuation inputs or assumptions, net of gains or losses from derivatives hedging servicing rights, and gains (losses) from the sale of MSRs. Beginning in the second quarter of 2024, we began to include the gains (losses) from the sale of MSRs in valuation changes in servicing rights, net of hedging gains and losses to appropriately capture all valuation changes in MSRs up to and including the sales date. Prior periods have been revised to conform with this new presentation.

(3)Reflects employee severance expense and professional services associated with restructuring efforts.

(4)Represents expenses directly related to the Cybersecurity Incident, net of insurance recoveries during fiscal 2024, including costs to investigate and remediate the Cybersecurity Incident, the costs of customer notifications and identity protection, professional fees including legal expenses, litigation settlement costs, and commission guarantees.

(5)Represents lease impairment on corporate and retail locations.

Forward-Looking Statements

This press release and related management commentary contain, and responses to investor questions may contain, forward-looking statements that can be identified by the fact that they do not relate strictly to historical or current facts and may contain the words “believe,” “anticipate,” “expect,” “intend,” “plan,” “predict,” “estimate,” “project,” “will be,” “will continue,” “will likely result,” or other similar words and phrases or future or conditional verbs such as “will,” “may,” “might,” “should,” “would,” or “could” and the negatives of those terms. Examples of forward-looking statements include, but are not limited to, statements about future operations, performance, financial condition, competitive advantages, prospects, plans and strategies, sustainable profitability, market share revenue and growth opportunities, and expense management.

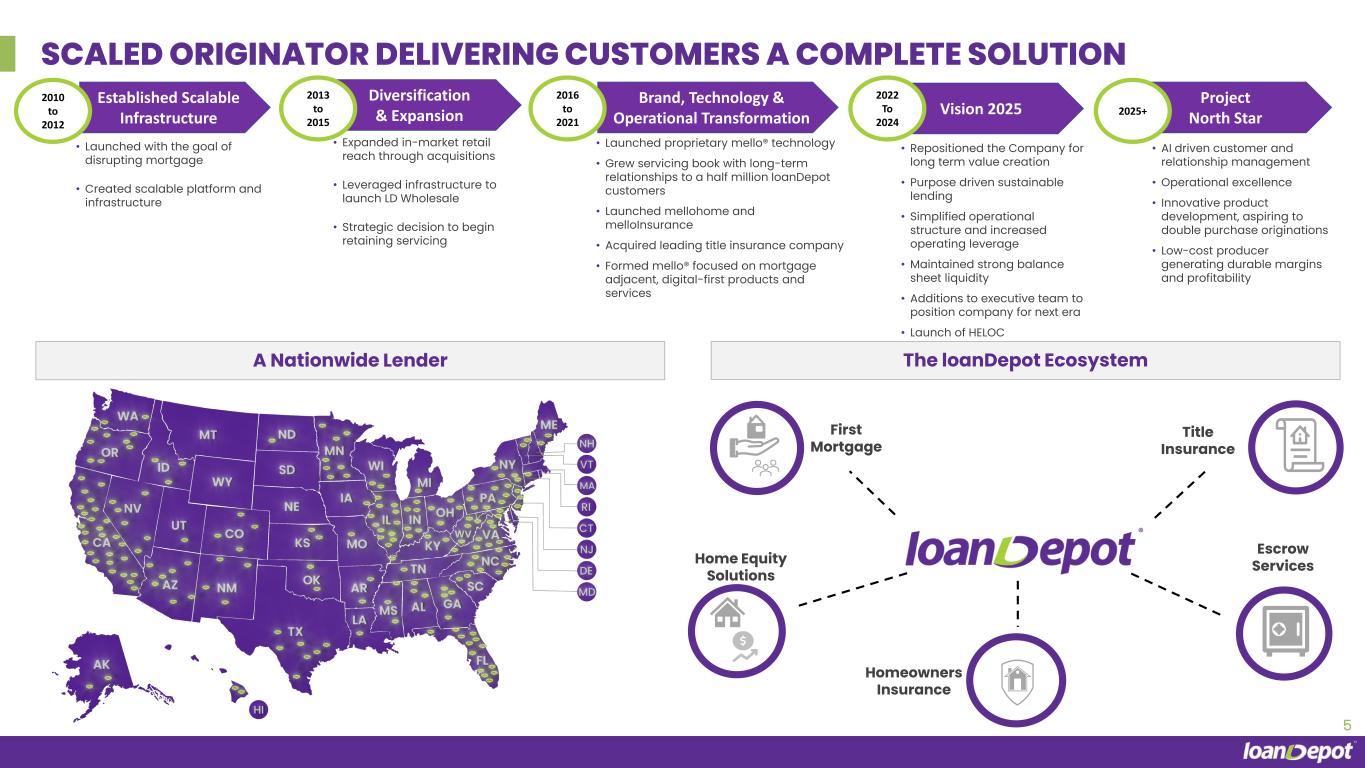

These forward-looking statements are based on current available operating, financial, economic and other information, and are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict, including but not limited to, the following: our ability to achieve the expected benefits of Project North Star and the success of other business initiatives; our ability to achieve profitability; our loan production volume; our ability to maintain an operating platform and management system sufficient to conduct our business; our ability to maintain warehouse lines of credit and other sources of capital and liquidity; impacts of cybersecurity incidents, cyberattacks, information or security breaches and technology disruptions or failures, of ours or of our third party vendors; the outcome of legal proceedings to which we are a party; our ability to reach a definitive settlement agreement related to the Cybersecurity Incident; adverse changes in macroeconomic and U.S residential real estate and mortgage market conditions, including changes in interest rates and changes in global trade policy and tariffs; changing federal, state and local laws, as well as changing regulatory enforcement policies and priorities; and other risks detailed in the "Risk Factors" section of loanDepot, Inc.'s Annual Report on Form 10-K for the year ended December 31, 2024, as well as any subsequent filings with the Securities and Exchange Commission. Therefore, current plans, anticipated actions, and financial results, as well as the anticipated development of the industry, may differ materially from what is expressed or forecasted in any forward-looking statement. loanDepot does not undertake any obligation to publicly update or revise any forward-looking statement to reflect future events or circumstances, except as required by applicable law.

About loanDepot

At loanDepot (NYSE: LDI), we know home means everything. That’s why we are on a mission to support homeowners with a suite of products and services that fuel the American Dream. Our portfolio of digital-first home purchase, home refinance and home equity lending products make homeownership more accessible, achievable, and rewarding, especially for the increasingly diverse communities of first-time homebuyers we serve. Headquartered in Southern California with local market offices nationwide, loanDepot and its sister real estate and home services company, mellohome, are dedicated to helping customers put down roots and bring dreams to life – all while building stronger communities and a better tomorrow.

Investor Relations Contact:

Gerhard Erdelji

Senior Vice President, Investor Relations

(949) 822-4074

gerdelji@loandepot.com

Media Contact:

Rebecca Anderson

Senior Vice President, Communications & Public Relations

(949) 822-4024

rebeccaanderson@loandepot.com

LDI-IR