false000182818500-000000000018281852025-05-012025-05-010001828185brns:AmericanDepositarySharesMember2025-05-012025-05-010001828185us-gaap:CommonStockMember2025-05-012025-05-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 1, 2025

BARINTHUS BIOTHERAPEUTICS PLC

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| England and Wales |

001-40367 |

Not Applicable |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

Barinthus Biotherapeutics plc

Unit 6-10, Zeus Building Rutherford Avenue,

Harwell, Didcot, OX11 0DF

United Kingdom

(Address of principal executive offices, including zip code)

+44 (0) 1865 818 808

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

| o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

|

|

|

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

|

|

|

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

|

|

|

| o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trade Symbol(s) |

Name of each exchange on which

registered

|

| American Depositary Shares |

BRNS |

The Nasdaq Global Market |

| Ordinary shares, nominal value £0.000025 per share* |

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

*American Depositary Shares may be evidenced by American Depositary Receipts. Each American Depositary Share represents one (1) ordinary share. Not for trading, but only in connection with the listing of the American Depositary Shares on The Nasdaq Global Market. The American Depositary Shares represent the right to receive ordinary shares and are being registered under the Securities Act of 1933, as amended, pursuant to a separate Registration Statement on Form F-6. Accordingly, the American Depositary Shares are exempt from the operation of Section 12(a) of the Securities Exchange Act of 1934, as amended, pursuant to Rule 12a-8.

Item 2.02. Results of Operations and Financial Condition.

On May 7, 2025, Barinthus Biotherapeutics plc (the “Company”) provided an overview of the Company’s progress and announced its financial results for the three months ended March 31, 2025. The full text of the press release issued in connection with the update is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 2.02 of this Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective as of April 30, 2025, the Company terminated the employment of Gemma Brown as Chief Financial Officer in connection with its restructuring plan that was announced in 2025. Ms. Brown will transition to a consultant role and continue to provide support to the Company. In connection with this change, effective as of May 1, 2025, the board of directors of the Company appointed William Enright, the Company’s Chief Executive Officer, as principal financial officer, and Ms. Brown as principal accounting officer, in each case until a successor is appointed.

Information regarding Mr. Enright and Ms. Brown that is responsive to Items 401(b), (d), (e) and Item 404(a) of Regulation S-K is incorporated by reference herein from the Company’s definitive proxy statement on Schedule 14A filed with the Securities and Exchange Commission (the “SEC”) on April 25, 2025.

Item 7.01 Regulation FD Disclosure.

On May 7, 2025, the Company updated its corporate presentation for use in meetings with investors, analysts and others. A copy of this presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K. The Company undertakes no obligation to update, supplement or amend the presentation.

The information in Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.2) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing by the Company under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

On May 7, 2025, the Company announced preliminary analysis data from the IM-PROVE II and HBV003 trial presented at the European Association for the Study of the Liver (“EASL”) Congress 2025, taking place May 7-10, 2025, in Amsterdam, the Netherlands.

HBV003 data: VTP-300 and Low-dose Nivolumab

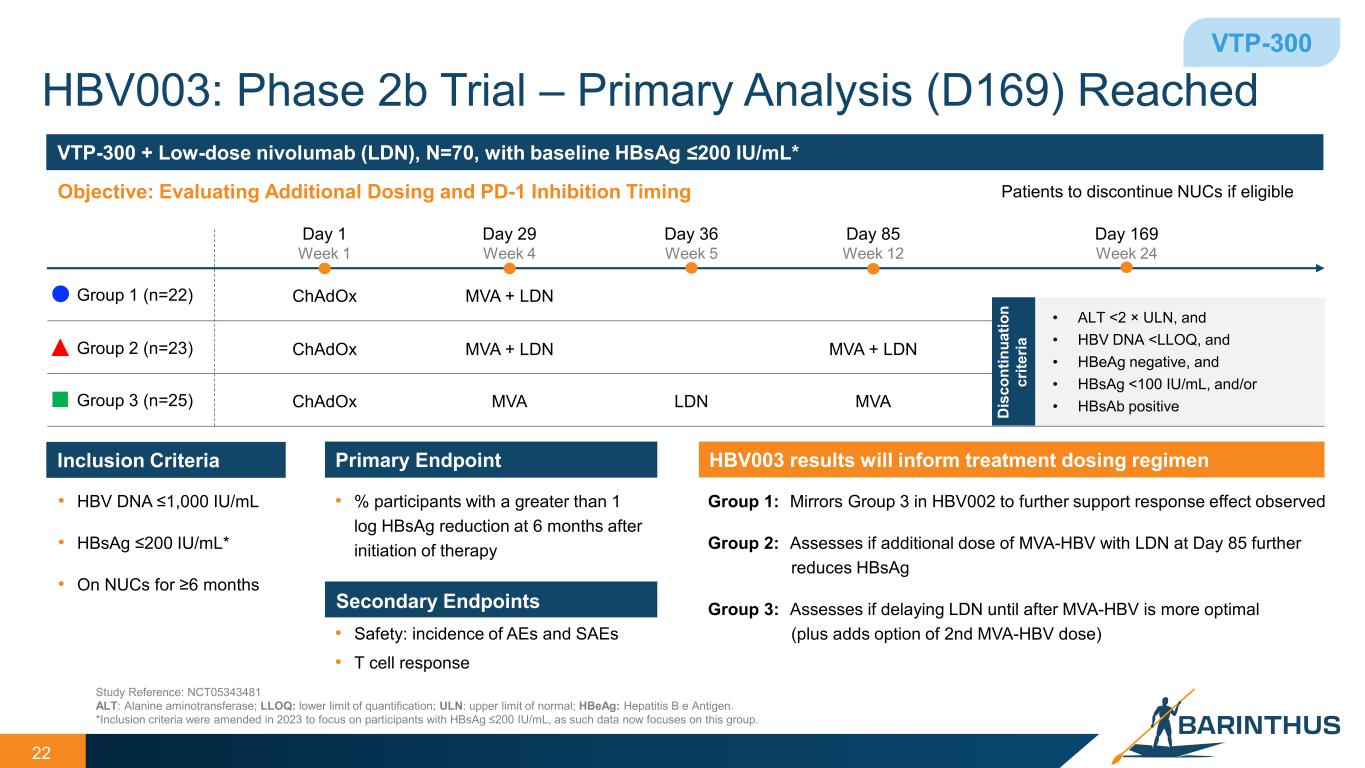

The HBV003 study is evaluating the safety, immunogenicity and disease modifying activity of three different dosing regimens of VTP-300 in combination with low-dose nivolumab (“LDN”), an anti-PD-1 monoclonal antibody. The preliminary analysis showed:

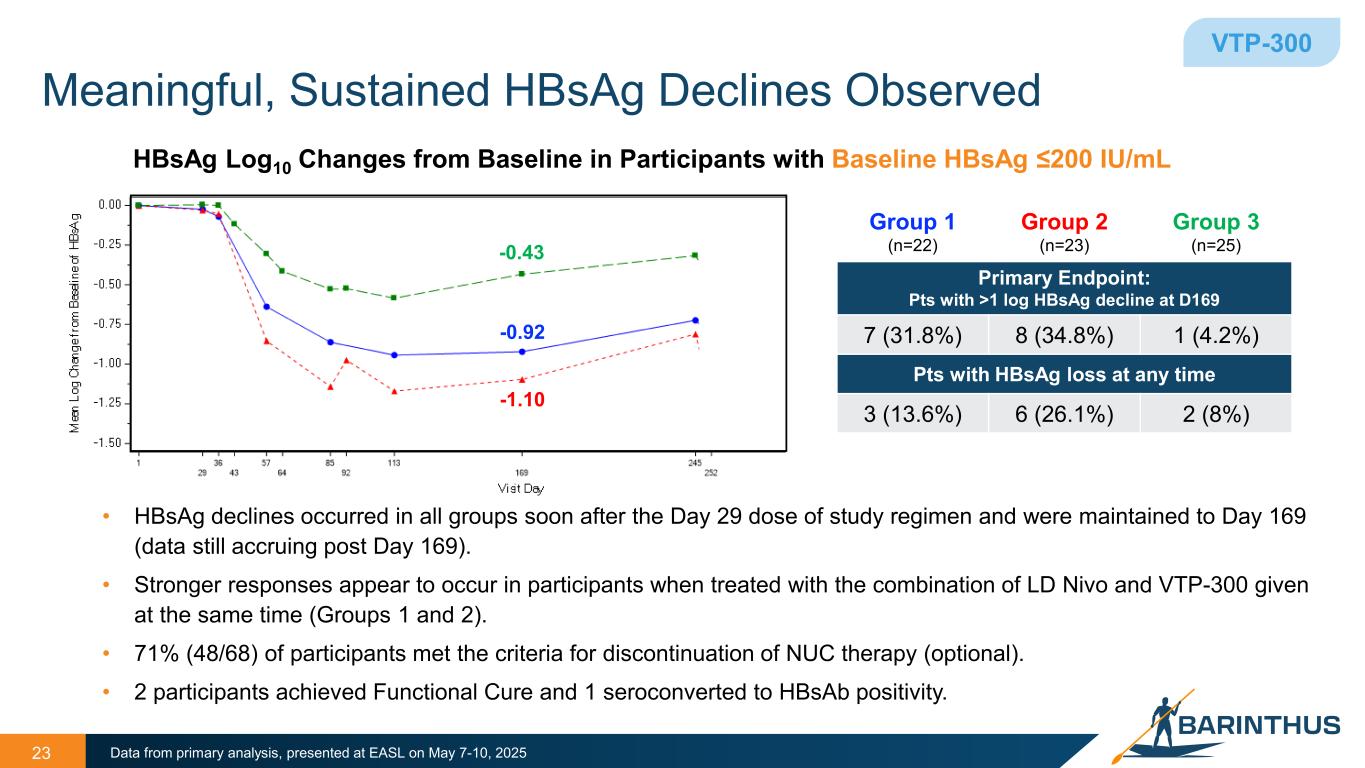

•In chronic hepatitis B participants with hepatitis B surface antigen (“HBsAg”) levels of <200 IU/mL, meaningful reductions in HBsAg (>1 log decline) occurred soon after dosing on Day 29 in all treatment groups and were maintained to Day 169.

•In the two best treatment arms HBsAg declines of ≥1 log at Day 169 were observed in 33% (15/45) of participants with HBsAg ≤200 IU/mL at baseline, and 22% (10/45) of participants achieved HBsAg loss at any timepoint.

•71% (48/68) of participants met the criteria for discontinuation of NUC therapy.

•NUC discontinuation was optional; two participants achieved functional cure and one seroconverted to HBsAb positivity.

•Treatment with VTP-300 in combination with LDN was generally well-tolerated, with no related serious adverse events reported.

The primary analysis confirms observations from previous interim data, which indicated that stronger responses occurred in participants treated with the combination of VTP-300 and LDN (Groups 1 and 2).

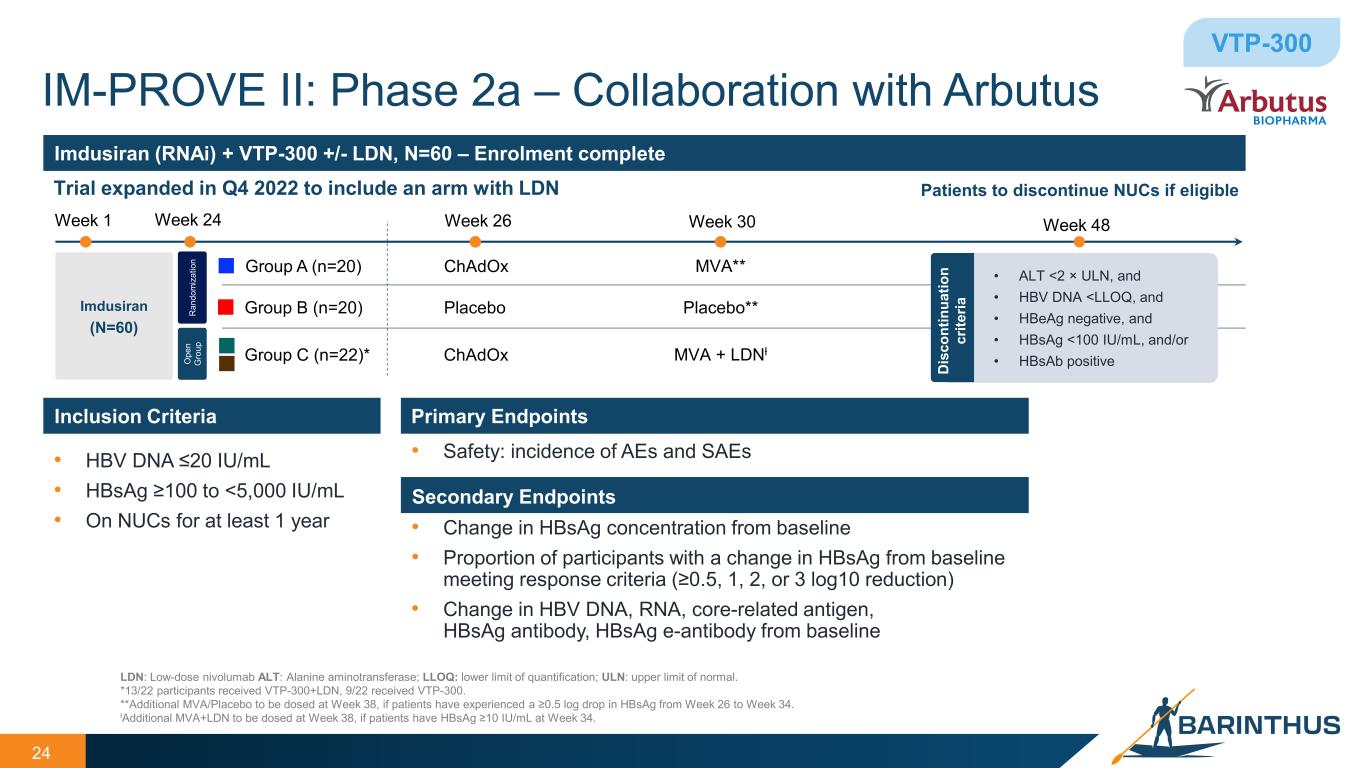

IM-PROVE II data: imdusiran and VTP-300

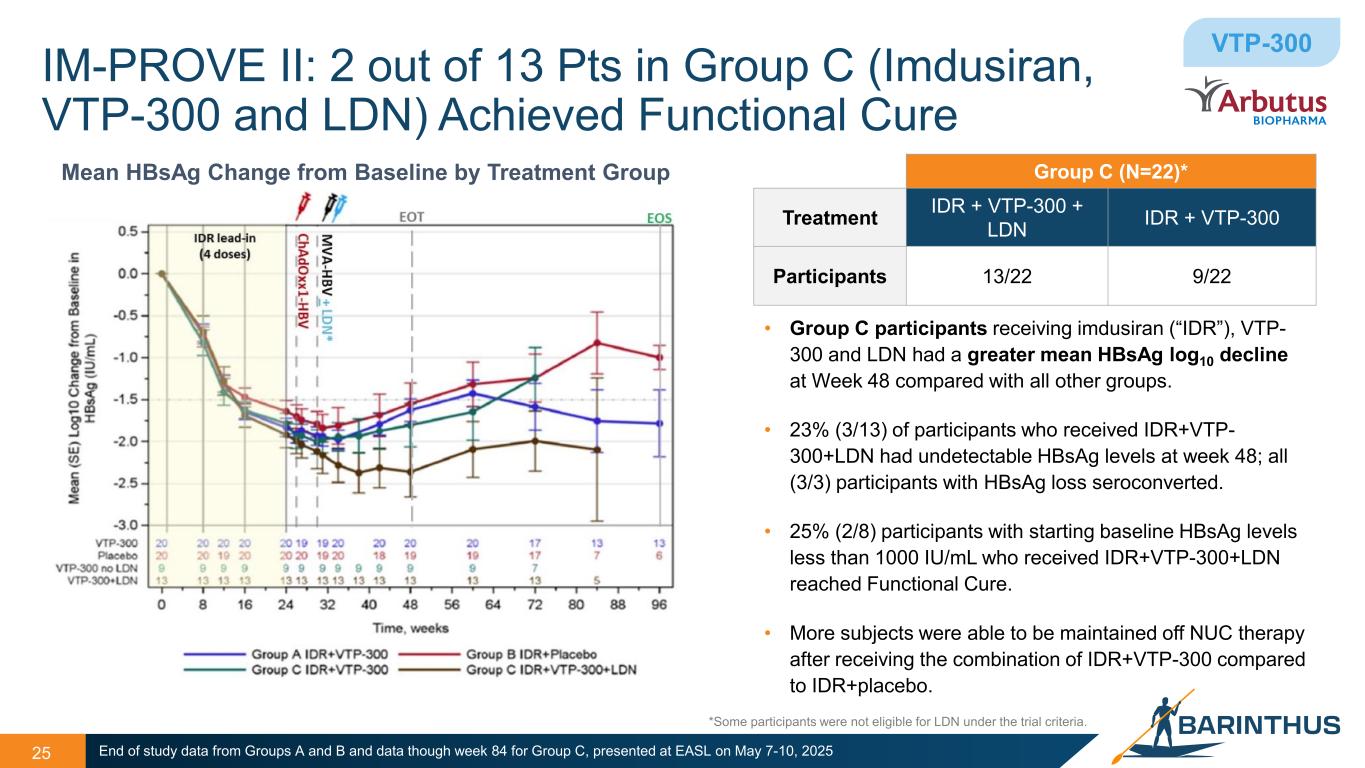

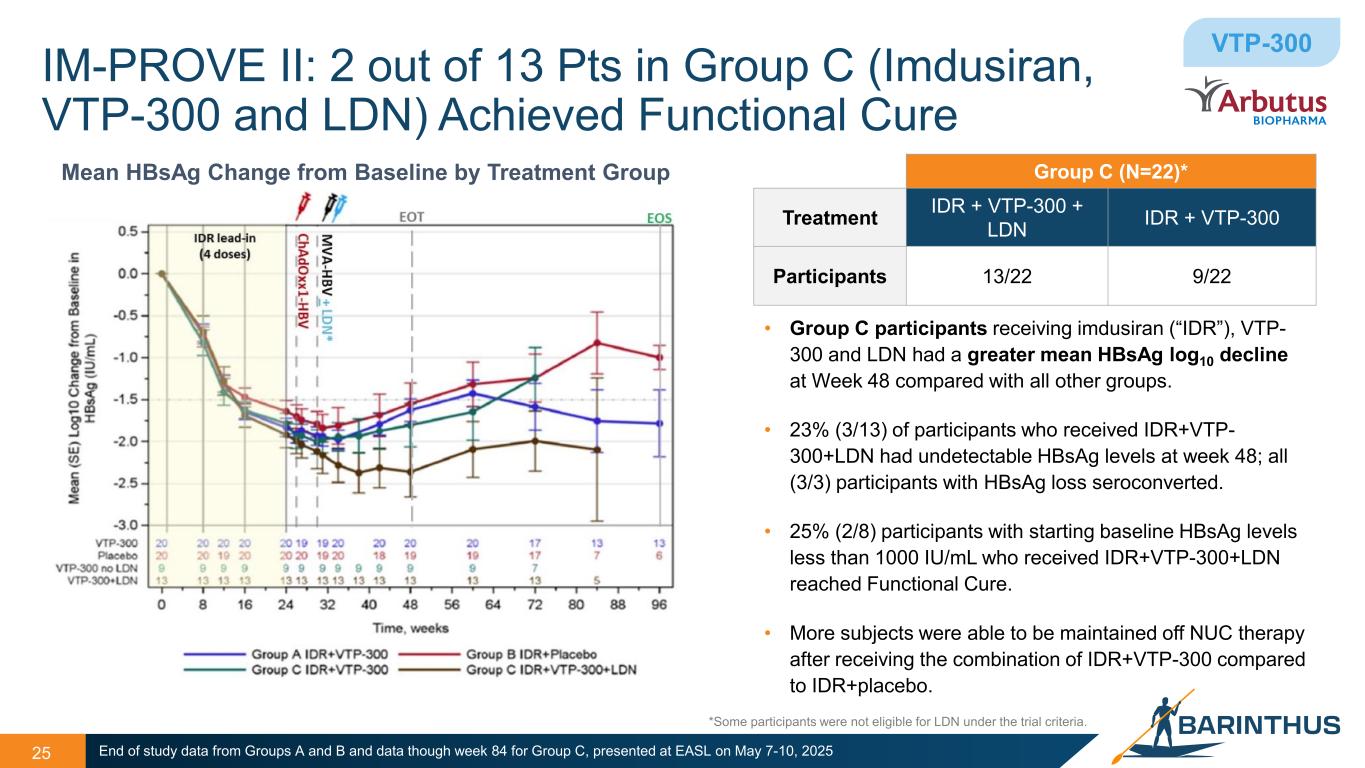

The IM-PROVE II study is evaluating the combination of imdusiran (“IDR”), Arbutus’ RNAi therapeutic, followed by Barinthus Bio's T-cell stimulating immunotherapeutic, VTP-300, with or without LDN. The end of study data showed:

•25% (2/8) of participants with starting baseline HBsAg levels less than 1000 IU/mL that received the combination of IDR, VTP-300 and LDN reached functional cure;

•3 of 13 participants (23%) receiving IDR+VTP-300+LDN had undetectable HBsAg levels at week 48; all (3/3) of participants with HBsAg loss seroconverted;

•Treatment with IDR and VTP-300 was generally well-tolerated, with no serious adverse events or treatment discontinuations reported.

The data indicate that more participants treated with IDR followed by VTP-300 and LDN were able to be maintained off NUC therapy after receiving the combination compared to IDR and placebo.

Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements regarding Barinthus Bio within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, which can generally be identified as such by use of the words “may,” “will,” “plan,” “forward,” “encouraging,” “believe,” “potential,” and similar expressions, although not all forward-looking statements contain these identifying words. These forward-looking statements include, without limitation, express or implied statements regarding our product development activities and clinical trials, including the transition of our former Chief Financial Officer to a consulting role and the tolerability or potential benefits of VTP-300 or IDR, including the combination with LDN. Any forward-looking statements in this Current Report on Form 8-K are based on our management’s current expectations and beliefs and are subject to numerous risks, uncertainties and important factors that may cause actual events or results to differ materially from those expressed or implied by any forward-looking statements contained in this Current Report on Form 8-K, including, without limitation, risks and uncertainties related to the success, cost and timing of our pipeline development activities and planned and ongoing clinical trials, including the risk that the timing for preliminary, interim or final data or initiation of our clinical trials may be delayed, the risk that interim or topline data may not reflect final data or results, our ability to execute on our strategy, regulatory developments, the risk that we may not achieve the anticipated benefits of our pipeline prioritization and corporate restructuring, our ability to fund our operations and access capital, our cash runway, including the risk that our estimate of our cash runway may be incorrect, global economic uncertainty, including disruptions in the banking industry, the conflict in Ukraine, the conflict in Israel and Gaza, tariffs imposed by the U.S. and other countries, and other risks identified in our filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2024 and subsequent filings we may make with the SEC. We caution you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. We expressly disclaim any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

|

|

|

|

|

|

|

|

|

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

Barinthus Biotherapeutics plc |

|

|

|

Date: May 7, 2025 |

By: |

/s/ William Enright |

|

|

William Enright |

|

|

Chief Executive Officer |

EX-99.1

2

brns-20250331xexx991.htm

EX-99.1

Document

Barinthus Bio Reports First Quarter 2025 Financial Results and Updates on Corporate Developments

•Highly differentiated immunotherapy for celiac disease (VTP-1000) in the clinic, with Phase 1 single ascending dose readout from AVALON expected in the third quarter of 2025;

•Initiation of VTP-1000 multiple ascending dose expected in the second half of 2025;

•Encouraging results from HBV003 and IM-PROVE II presented at EASL, supporting ongoing partnering efforts;

•Available resources expected to provide a cash runway into 2027.

OXFORD, United Kingdom and GERMANTOWN, Maryland, May 7, 2025 (GLOBE NEWSWIRE) – Barinthus Biotherapeutics plc (NASDAQ: BRNS) (“Barinthus Bio,” or the “Company”), an immunology and inflammation (“I&I”) company focused on developing therapies that promote immune tolerance with curative potential, today announced its financial results for the quarter ended March 31, 2025 and provided an overview of the Company’s corporate developments.

“2025 has started with a strategic focus on immunological and inflammatory diseases, which includes directing our resources to our highly differentiated lead asset,VTP-1000, using the SNAP-TI platform, being tested in patients with celiac disease. Looking ahead, we remain on track to announce Phase 1 single ascending dose data for the celiac program using VTP-1000 in the third quarter of 2025, and will be initiating the multiple ascending dose part of the Phase 1 clinical trial in the second half of 2025, where we are incorporating a gluten challenge as part of our initial clinical evaluation of efficacy” said Bill Enright, Chief Executive Officer of Barinthus Bio. “Today, we announced multiple data milestones from our viral vector pipeline, including encouraging primary endpoint analyses from the two Phase 2 trials in chronic hepatitis B ("CHB") which we believe strengthen VTP-300’s market positioning as a component of a potential functional cure for CHB.”

First Quarter 2025 and Recent Corporate Developments

Clinical Developments

Data from two Phase 2 clinical trials of VTP-300 will be showcased in poster presentations at the European Association for the Study of the Liver (“EASL”) Congress 2025, taking place May 7-10, 2025, in Amsterdam, the Netherlands. The presentations include the six-month primary analysis of the Phase 2b clinical trial (HBV003), as well as end-of-study data from the Phase 2a clinical trial (IM-PROVE II, AB-729-202) in partnership with Arbutus Biopharma, both in people with CHB receiving ongoing standard of care nucleos(t)ide analogue (“NUC”) therapy.

HBV003 data: VTP-300 and Low-dose Nivolumab

The HBV003 study is evaluating the safety, immunogenicity and disease modifying activity of three different dosing regimens of VTP-300 in combination with low-dose nivolumab (“LDN”), an anti-PD-1 monoclonal antibody. The primary analysis showed;

•In CHB participants with hepatitis B surface antigen (“HBsAg”) levels of <200 IU/mL, meaningful reductions in HBsAg (>1 log decline) occurred soon after dosing on Day 29 in all treatment groups and were maintained to Day 169.

•In the two best treatment arms HBsAg declines of ≥1 log at Day 169 were observed in 33% (15/45) of participants with HBsAg ≤200 IU/mL at baseline, and 22% (10/45) of participants achieved HBsAg loss at any timepoint.

•71% (48/68) of participants met the criteria for discontinuation of NUC therapy at day 169; and although NUC discontinuation was optional; two participants who did discontinue NUCs achieved functional cure and one seroconverted to HBsAb positivity.

•Treatment with VTP-300 in combination with LDN was generally well-tolerated, with no serious adverse events reported.

The primary analysis confirms observations from previous interim data, which indicated that stronger responses occurred in participants treated with the combination of VTP-300 and LDN (Groups 1 and 2).

IM-PROVE II data: imdusiran and VTP-300

The IM-PROVE II study is evaluating the combination of imdusiran (“IDR”), Arbutus’ RNAi therapeutic, followed by Barinthus Bio's T-cell stimulating immunotherapeutic, VTP-300, with or without LDN. The end of study data showed:

•25% (2/8) of participants with starting baseline HBsAg levels less than 1000 IU/mL receiving the combination of IDR, VTP-300 and LDN achieved functional cure.

•3 of 13 participants (23%) receiving IDR+VTP-300+LDN had undetectable HBsAg levels at week 48; all (3/3) of participants with HBsAg loss seroconverted.

•Treatment with IDR and VTP-300 was generally well-tolerated, with no serious adverse events or treatment discontinuations reported.

Corporate Updates

•In January 2025, Barinthus Bio announced a strategic business refocus and restructuring to prioritize immunology and inflammation indications, including antigen-specific immune tolerance. Barinthus Bio will not invest in VTP-300 for chronic hepatitis B beyond the completion of the ongoing Phase 2b HBV003 clinical trial and will seek potential partners to be able to take advantage of its differentiated ability to achieve sustained HBsAg loss and functional cure in patients with low levels of HBsAg. Partners are also being sought for the other assets that are based upon the viral vector platforms.

Upcoming Milestones

Celiac Disease (VTP-1000):

•Single ascending dose data from the Phase 1 AVALON clinical trial evaluating the safety, tolerability, pharmacokinetics and pharmacodynamics of VTP-1000 in adults with celiac disease expected in the third quarter of 2025.

•Initiation of the multiple ascending dose portion of the Phase 1 AVALON clinical trial is expected in the second half of 2025.

Prostate Cancer (VTP-850):

•Topline results from the Phase 1 PCA001 clinical trial evaluating safety and efficacy of VTP-850 in men with rising prostate-specific antigen after definitive local therapy for prostate cancer were received and analysis is ongoing. Data will be used to support partnering efforts for VTP-850.

First Quarter 2025 Financial Highlights

•Cash: As of March 31, 2025, cash, cash equivalents and restricted cash was $100.6 million, compared to $112.4 million as of December 31, 2024. The $11.8 million decrease is a result of the net cash used in operating activities of $14.9 million for the development of our pipeline and ongoing clinical trials, offset by a $3.1 million gain on foreign exchange on cash, cash equivalents and restricted cash. Based on current research and development plans, the Company expects its available resources to fund its operating expenses and capital expenditure requirements into 2027.

•Research and Development Expenses: Research and development expenses were $8.3 million for the three months ended March 31, 2025 compared to $11.1 million for the three months ended March 31, 2024, with the decrease attributable to the stage of clinical development of the pipeline assets, a reduction in preclinical activity and a reduction in workforce when compared to the prior year. The year-on-year research and development expenses per program are outlined in the following table. It is anticipated that research and development expenses related to the legacy programs in infectious disease and oncology will reduce going forward, as the ongoing clinical trials complete, and that research and development expenses related to autoimmune programs will continue or increase, as the clinical development continues.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31, 2025 |

|

Three months ended March 31, 2024 |

|

Change |

|

|

|

$000 |

|

$000 |

|

$000 |

|

| Direct research and development expenses by program: |

|

|

|

|

|

|

|

| VTP-1000 Celiac |

|

$ |

982 |

|

|

$ |

1,374 |

|

|

$ |

(392) |

|

|

| VTP-300 HBV |

|

1,350 |

|

|

1,913 |

|

|

(563) |

|

|

Other clinical programs1 |

|

741 |

|

|

1,767 |

|

|

(1,026) |

|

|

| Other pre-clinical programs |

|

419 |

|

|

784 |

|

|

(365) |

|

|

| Total direct research and development expenses |

|

3,492 |

|

|

5,838 |

|

|

(2,346) |

|

|

| Indirect research and development expenses: |

|

|

|

|

|

|

|

Personnel-related (including share-based compensation)2 |

|

3,944 |

|

|

4,335 |

|

|

(391) |

|

|

| Facility related |

|

335 |

|

|

390 |

|

|

(55) |

|

|

| Other indirect costs |

|

519 |

|

|

562 |

|

|

(43) |

|

|

| Total indirect research and development expenses |

|

4,798 |

|

|

5,287 |

|

|

(489) |

|

|

| Total research and development expense |

|

$ |

8,290 |

|

|

$ |

11,125 |

|

|

$ |

(2,835) |

|

|

1 This includes expenses relating to the infectious disease and oncology programs; VTP-850 Prostate cancer, VTP-200 HPV, VTP-600 NSCLC (the Phase 1/2a trial is sponsored by Cancer Research UK) and VTP-500 MERS (funded pursuant to an agreement with the Coalition for Epidemic Preparedness Innovations (“CEPI”). Expenses relating to these programs were previously presented separately, but are now aggregated for the prior period comparative.

2 This includes $0.07 million and $0.14 million for the three months ended March 31, 2025 and 2024, respectively, of personnel-related indirect expenses relating to time spent progressing the VTP-500 MERS program, which is funded by CEPI.

•General and Administrative Expenses: General and administrative expenses were $12.6 million in the first quarter of 2025, compared to $6.0 million in 2024. The increase of $6.6 million relates primarily to a loss of $4.4 million on foreign exchange in 2025, compared to a gain of $1.2 million in 2024 due to fluctuations between the pound sterling and the US dollar during the year. The remaining increase is attributable to an increase in depreciation of U.K. assets as a result of the expected closure of the U.K. site, and an increase in personnel costs as a result of the workforce reduction.

•Net Loss: For the first quarter of 2025, the Company generated a net loss attributable to its shareholders of $19.6 million, or $(0.49) per share on both basic and fully diluted bases, compared to a net loss attributable to its shareholders of $15.5 million, or $(0.40) per share on both basic and fully diluted bases for the first quarter of 2024.

About Barinthus Bio

Barinthus Biotherapeutics (NASDAQ: BRNS) is a clinical-stage biopharmaceutical company focused on developing novel immunotherapeutic candidates for treating autoimmune and inflammatory diseases. Our guiding principle at the heart of Barinthus Bio is to help patients and their families by developing truly transformational and highly disease-specific immunotherapies that are potentially curative. Barinthus Bio's pipeline for I&I indications is enabled by our proprietary and highly differentiated platform for promoting immune tolerance, SNAP-TI, that is designed to guide a patient's T cells to a specific location to reduce inflammation and restore the natural state of immune non-responsiveness to healthy tissue. Our lead candidate, VTP-1000, is designed to restore immune non-responsiveness to gluten in patients with celiac disease and is currently in a Phase 1 clinical trial. Barinthus Bio’s differentiated technology platform and therapeutic approach, coupled with deep scientific expertise and focus on clinical development, uniquely positions the company to navigate towards delivering treatments that improve the lives of people with autoimmune and inflammatory diseases. For more information, visit www.barinthusbio.com.

Forward Looking Statements

This press release contains forward-looking statements regarding Barinthus Bio within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, which can generally be identified as such by use of the words “may,” “will,” “plan,” “forward,” “encouraging,” “believe,” “potential,” “expect,” and similar expressions, although not all forward-looking statements contain these identifying words. These forward-looking statements include, without limitation, express or implied statements regarding our future expectations, plans and prospects, including our product development activities and clinical trials, including timing for readouts of any preliminary, interim or final data for any of our programs, the timing for initiation of any clinical trials, our anticipated regulatory filings and approvals, our cash runway and cash burn, our ability to develop and advance our current and future product candidates and programs, our ability to establish and maintain collaborations or strategic relationships and the terms and timing of the restructuring and related activities. Any forward-looking statements in this press release are based on our management’s current expectations and beliefs and are subject to numerous risks, uncertainties and important factors that may cause actual events or results to differ materially from those expressed or implied by any forward-looking statements contained in this press release, including, without limitation, risks and uncertainties related to the success, cost and timing of our pipeline development activities and planned and ongoing clinical trials, including the risk that the timing for preliminary, interim or final data or initiation of our clinical trials may be delayed, the risk that interim or topline data may not reflect final data or results, our ability to execute on our strategy, regulatory developments, the risk that we may not achieve the anticipated benefits of our pipeline prioritization and corporate restructuring, our ability to fund our operations and access capital, our cash runway, including the risk that our estimate of our cash runway may be incorrect, global economic uncertainty, including disruptions in the banking industry, the conflicts in Ukraine, Israel and Gaza, tariffs imposed by the U.S. and other countries and other risks identified in our filings with the Securities and Exchange Commission (the “SEC”), including our most recent annual report on Form 10-K and subsequent filings we may make with the SEC. We caution you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. We expressly disclaim any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements.

BARINTHUS BIOTHERAPEUTICS PLC

CONSOLIDATED BALANCE SHEETS

(IN THOUSANDS, EXCEPT NUMBER OF SHARES AND PER SHARE AMOUNTS)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

2025 |

|

December 31,

2024 |

|

| ASSETS |

|

|

|

|

| Cash and cash equivalents |

$ |

99,118 |

|

|

$ |

110,662 |

|

|

| Restricted cash |

1,461 |

|

|

1,738 |

|

|

| Research and development incentives receivable |

2,997 |

|

|

7,139 |

|

|

| Prepaid expenses and other current assets |

6,306 |

|

|

6,203 |

|

|

| Total current assets |

109,882 |

|

|

125,742 |

|

|

| Property and equipment, net |

6,201 |

|

|

7,373 |

|

|

| Intangible assets, net |

21,156 |

|

|

21,947 |

|

|

| Right of use assets, net |

3,855 |

|

|

4,384 |

|

|

| Other assets |

902 |

|

|

881 |

|

|

| Total assets |

$ |

141,996 |

|

|

$ |

160,327 |

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

| Current liabilities: |

|

|

|

|

| Accounts payable |

1,357 |

|

|

2,474 |

|

|

| Accrued expenses and other current liabilities |

7,198 |

|

|

9,525 |

|

|

| Deferred income |

1,461 |

|

|

1,738 |

|

|

| Operating lease liability - current |

1,960 |

|

|

1,920 |

|

|

|

|

|

|

|

| Total current liabilities |

11,976 |

|

|

15,657 |

|

|

| Non-current liabilities: |

|

|

|

|

| Operating lease liability - non-current |

9,959 |

|

|

10,087 |

|

|

| Contingent consideration |

2,652 |

|

|

2,650 |

|

|

| Other non-current liabilities |

1,400 |

|

|

1,360 |

|

|

| Deferred tax liability, net |

416 |

|

|

438 |

|

|

| Total liabilities |

$ |

26,403 |

|

|

$ |

30,192 |

|

|

| Commitments and contingencies (Note 15) |

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

Ordinary shares, £0.000025 nominal value; 40,339,395 shares authorized, issued and outstanding (December 31, 2024: authorized, issued and outstanding: 40,234,663) |

1 |

|

|

1 |

|

|

Deferred A shares, £1 nominal value; 63,443 shares authorized, issued and outstanding (December 31, 2024: authorized, issued and outstanding: 63,443) |

86 |

|

|

86 |

|

|

| Additional paid-in capital |

393,944 |

|

|

393,474 |

|

|

| Accumulated deficit |

(257,312) |

|

|

(237,664) |

|

|

| Accumulated other comprehensive loss – foreign currency translation adjustments |

(21,225) |

|

|

(25,868) |

|

|

| Total stockholders’ equity attributable to Barinthus Biotherapeutics plc shareholders |

115,494 |

|

|

130,029 |

|

|

| Noncontrolling interest |

99 |

|

|

106 |

|

|

| Total stockholders’ equity |

$ |

115,593 |

|

|

$ |

130,135 |

|

|

| Total liabilities and stockholders’ equity |

$ |

141,996 |

|

|

$ |

160,327 |

|

|

|

|

|

|

|

BARINTHUS BIOTHERAPEUTICS PLC

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(IN THOUSANDS, EXCEPT NUMBER OF SHARES AND PER SHARE AMOUNTS)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

|

|

March 31, 2025 |

|

March 31, 2024 |

| Operating expenses |

|

|

|

|

|

|

|

| Research and development |

|

|

|

|

$ |

8,290 |

|

|

$ |

11,125 |

|

| General and administrative |

|

|

|

|

12,639 |

|

|

5,994 |

|

| Total operating expenses |

|

|

|

|

20,929 |

|

|

17,119 |

|

| Other operating income |

|

|

|

|

329 |

|

|

205 |

|

| Loss from operations |

|

|

|

|

(20,600) |

|

|

(16,914) |

|

| Other income/(expense): |

|

|

|

|

|

|

|

| Interest income |

|

|

|

|

556 |

|

|

775 |

|

| Interest expense |

|

|

|

|

(13) |

|

|

(12) |

|

| Research and development incentives |

|

|

|

|

302 |

|

|

594 |

|

| Other income |

|

|

|

|

75 |

|

|

— |

|

| Total other income, net |

|

|

|

|

920 |

|

|

1,357 |

|

| Loss before income tax |

|

|

|

|

(19,680) |

|

|

(15,557) |

|

| Tax benefit |

|

|

|

|

22 |

|

|

37 |

|

| Net loss |

|

|

|

|

(19,658) |

|

|

(15,520) |

|

| Net loss attributable to noncontrolling interest |

|

|

|

|

10 |

|

|

31 |

|

| Net loss attributable to Barinthus Biotherapeutics plc shareholders |

|

|

|

|

(19,648) |

|

|

(15,489) |

|

|

|

|

|

|

|

|

|

| Weighted-average ordinary shares outstanding, basic |

|

|

|

|

40,265,216 |

|

38,773,482 |

| Weighted-average ordinary shares outstanding, diluted |

|

|

|

|

40,265,216 |

|

38,773,482 |

| Net loss per share attributable to ordinary shareholders, basic |

|

|

|

|

$ |

(0.49) |

|

|

$ |

(0.40) |

|

| Net loss per share attributable to ordinary shareholders, diluted |

|

|

|

|

$ |

(0.49) |

|

|

$ |

(0.40) |

|

|

|

|

|

|

|

|

|

| Net loss |

|

|

|

|

$ |

(19,658) |

|

|

$ |

(15,520) |

|

| Other comprehensive gain/(loss) – foreign currency translation adjustments |

|

|

|

|

4,646 |

|

|

(1,577) |

|

| Comprehensive loss |

|

|

|

|

(15,012) |

|

|

(17,097) |

|

| Comprehensive loss attributable to noncontrolling interest |

|

|

|

|

7 |

|

|

28 |

|

| Comprehensive loss attributable to Barinthus Biotherapeutics plc shareholders |

|

|

|

|

$ |

(15,005) |

|

|

$ |

(17,069) |

|

IR contact:

Kevin Gardner

Managing Director

LifeSci Advisors

+1 617-283-2856

kgardner@lifesciadvisors.com

Media contacts:

Alexis Feinberg

Vice President

ICR Healthcare

Alexis.feinberg@icrhealthcare.com

Jonathan Edwards

Associate Partner

ICR Healthcare

Barinthus@icrinc.com

Company contact:

ir@barinthusbio.com

EX-99.2

3

brns-20250507xexx992.htm

EX-99.2

brns-20250507xexx992

Barinthus Biotherapeutics Corporate Presentation Guiding the Immune System to Cure Disease May 2025 Nasdaq: BRNS

Disclosure 2 This presentation includes express and implied “forward-looking statements,” including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward looking statements include all statements that are not historical facts, and in some cases, can be identified by terms such as “may,” “will,” “could,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “potential,” “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. Forward- looking statements contained in this presentation include, but are not limited to, statements regarding: our product development activities and clinical trials, including timing for readouts of any interim data for any of our programs and initiation of clinical trials, our regulatory filings and approvals, our estimated cash runway and cash burn, our ability to develop and advance our current and future product candidates and programs, our ability to establish and maintain collaborations or strategic relationships or obtain additional funding, the rate and degree of market acceptance and clinical utility of our product candidates, and the ability and willingness of our third-party collaborators to continue research and development activities relating to our product candidates. By their nature, these statements are subject to numerous risks and uncertainties, including factors beyond our control, that could cause actual results, performance or achievement to differ materially and adversely from those anticipated or implied in the statements. Such risks and uncertainties, include, without limitation, risks and uncertainties related to: preclinical and clinical studies, the success, cost and timing of our product development activities and planned and ongoing preclinical studies and clinical trials, including the risks of the timing for preliminary, interim or final data or initiation of our clinical trials may be delayed, the risk that interim or topline data may not reflect final data or results, our ability to execute on our strategy, regulatory developments, the risk that we may not achieve the anticipated benefits of our pipeline prioritization and corporate restructuring, our ability to fund our operations, and access capital, our cash runway, including the risk that our estimate of our cash runway may be incorrect, global economic uncertainty, including disruptions in the banking industry, the conflict in Ukraine, the conflict in Israel and Gaza, tariffs imposed by the U.S. and other countries and other risks, uncertainties and other factors identified in our filings with the Securities and Exchange Commission (the “SEC”), including our Annual Report on Form 10-K for the year ended December 31, 2024 and subsequent filings we may make with the SEC. You should not rely upon forward-looking statements as predictions of future events. Although our management believes that the expectations reflected in our statements are reasonable, we cannot guarantee that the future results, performance or events and circumstances described in the forward-looking statements will be achieved or occur and actual results may vary. Recipients are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date such statements are made and should not be construed as statements of fact. Except as required by law, we do not assume any intent to update any forward-looking statements after the date on which the statement is made, whether as a result of new information, future events or circumstances or otherwise. Certain information contained in this presentation and statements made orally during this presentation relate to or are based on studies, publications, surveys and other data obtained from third-party sources and our own internal estimates and research. While we believe these third-party studies, publications, surveys and other data to be reliable as of the date of this presentation, it has not independently verified, and makes no representations as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, no independent source has evaluated the reasonableness or accuracy of our internal estimates or research and no reliance should be made on any information or statements made in this presentation relating to or based on such internal estimates and research.

Our Mission To advance the next generation of immunotherapies for autoimmunity and inflammatory diseases.

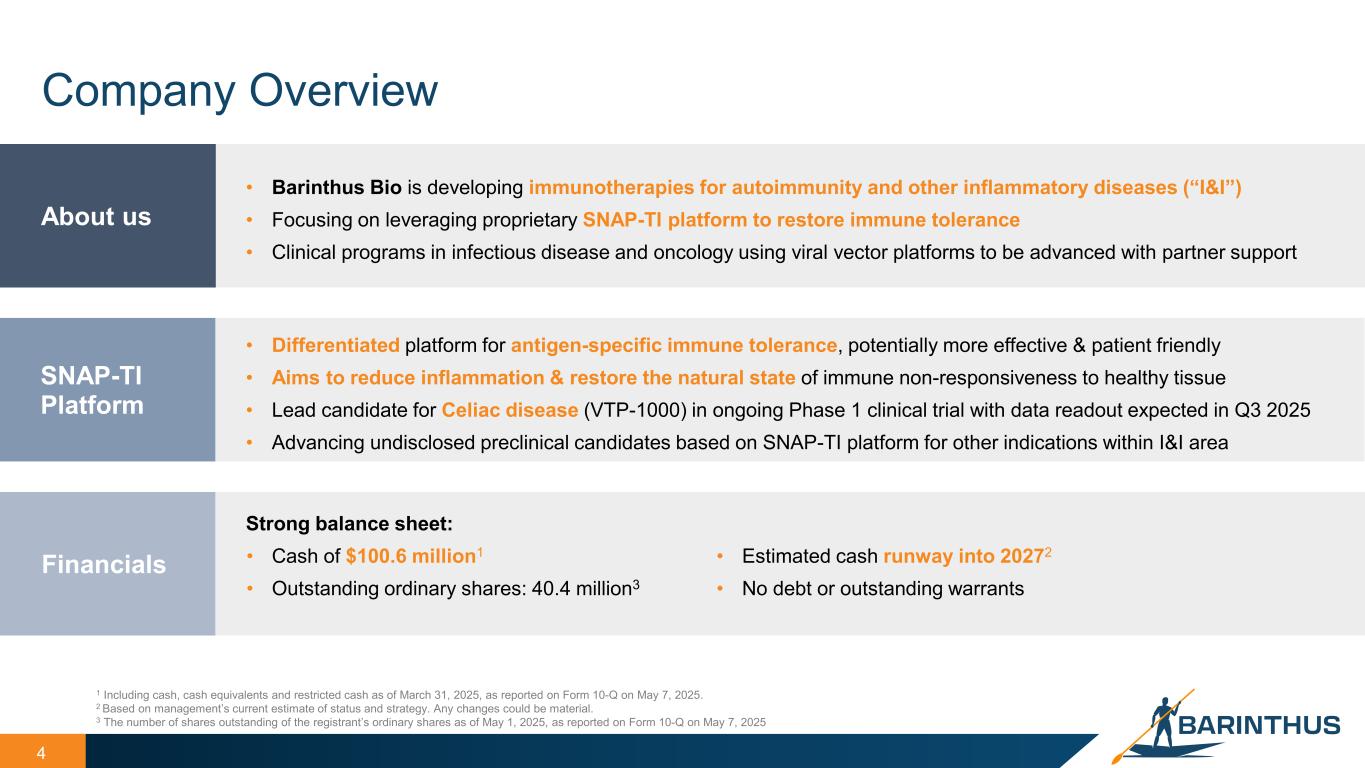

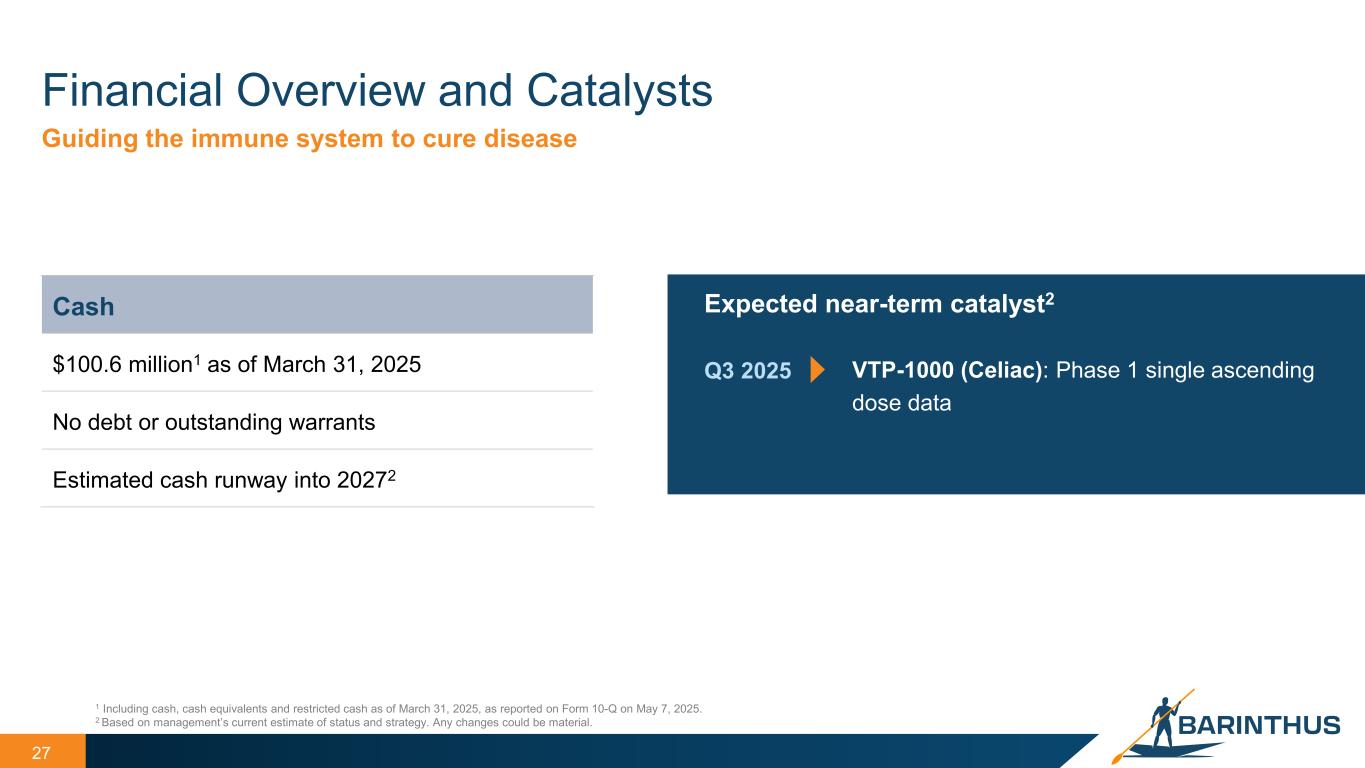

Company Overview 4 About us • Barinthus Bio is developing immunotherapies for autoimmunity and other inflammatory diseases (“I&I”) • Focusing on leveraging proprietary SNAP-TI platform to restore immune tolerance • Clinical programs in infectious disease and oncology using viral vector platforms to be advanced with partner support SNAP-TI Platform • Differentiated platform for antigen-specific immune tolerance, potentially more effective & patient friendly • Aims to reduce inflammation & restore the natural state of immune non-responsiveness to healthy tissue • Lead candidate for Celiac disease (VTP-1000) in ongoing Phase 1 clinical trial with data readout expected in Q3 2025 • Advancing undisclosed preclinical candidates based on SNAP-TI platform for other indications within I&I area Strong balance sheet: • Cash of $100.6 million1 • Outstanding ordinary shares: 40.4 million3 • Estimated cash runway into 20272 • No debt or outstanding warrants Financials 1 Including cash, cash equivalents and restricted cash as of March 31, 2025, as reported on Form 10-Q on May 7, 2025. 2 Based on management’s current estimate of status and strategy. Any changes could be material. 3 The number of shares outstanding of the registrant’s ordinary shares as of May 1, 2025, as reported on Form 10-Q on May 7, 2025

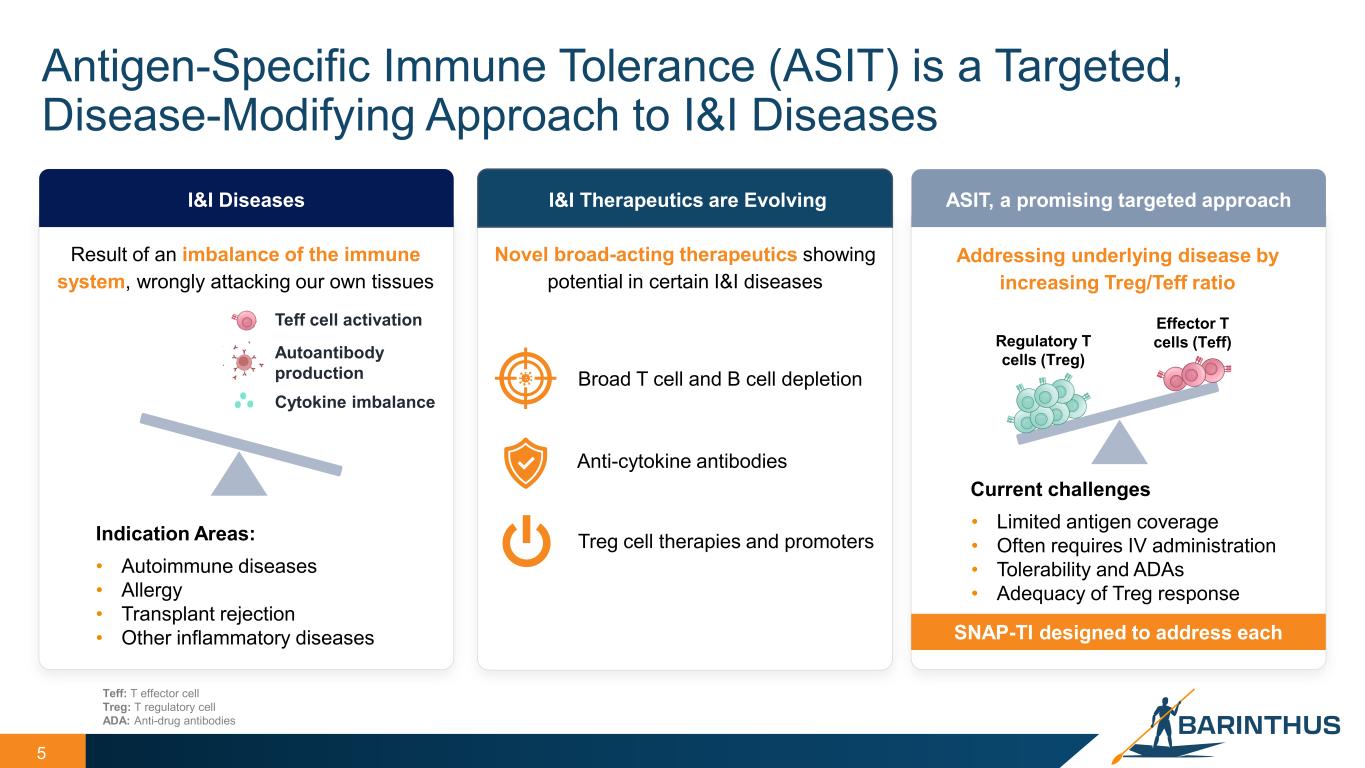

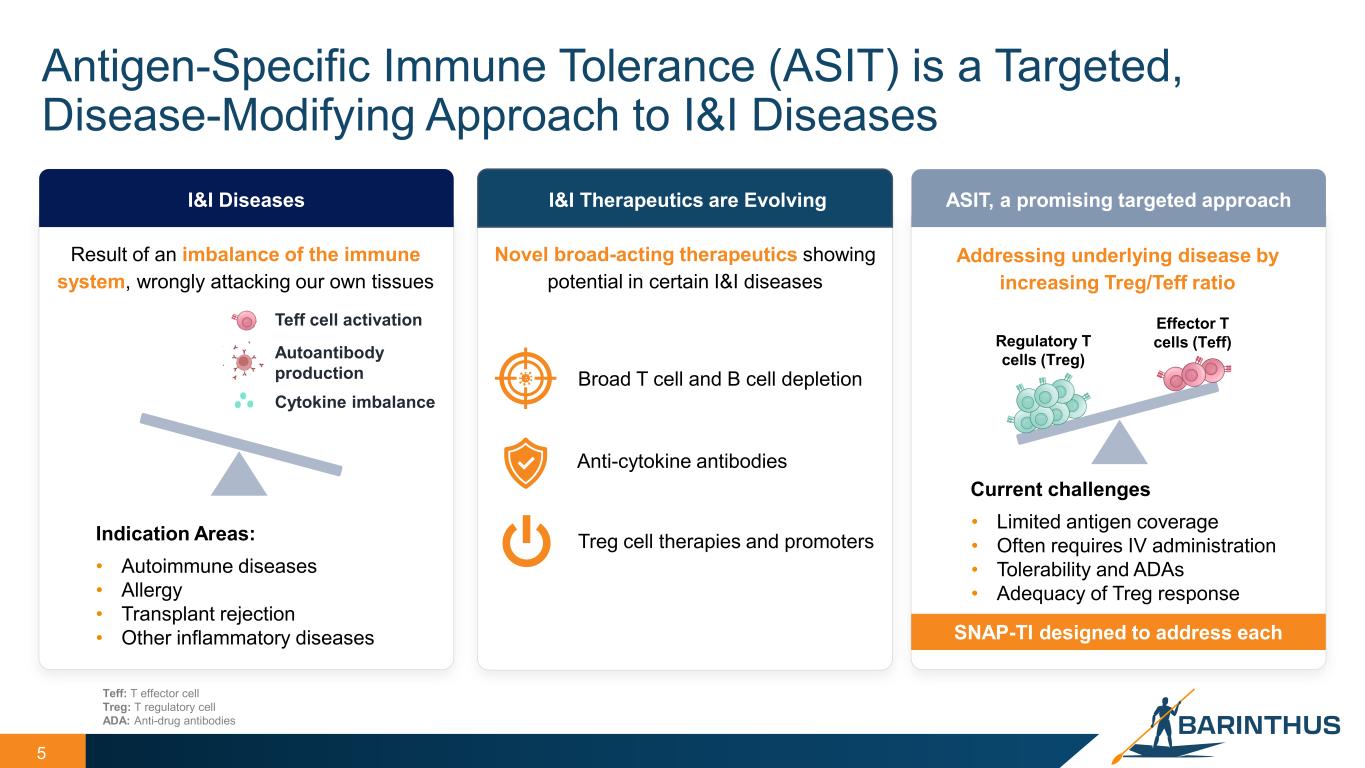

Antigen-Specific Immune Tolerance (ASIT) is a Targeted, Disease-Modifying Approach to I&I Diseases 5 I&I Diseases Indication Areas: • Autoimmune diseases • Allergy • Transplant rejection • Other inflammatory diseases I&I Therapeutics are Evolving ASIT, a promising targeted approach Current challenges • Limited antigen coverage • Often requires IV administration • Tolerability and ADAs • Adequacy of Treg response Treg cell therapies and promoters Broad T cell and B cell depletion Anti-cytokine antibodies SNAP-TI designed to address each Teff cell activation Autoantibody production Cytokine imbalance Result of an imbalance of the immune system, wrongly attacking our own tissues Novel broad-acting therapeutics showing potential in certain I&I diseases Addressing underlying disease by increasing Treg/Teff ratio Teff: T effector cell Treg: T regulatory cell ADA: Anti-drug antibodies Effector T cells (Teff)Regulatory T cells (Treg)

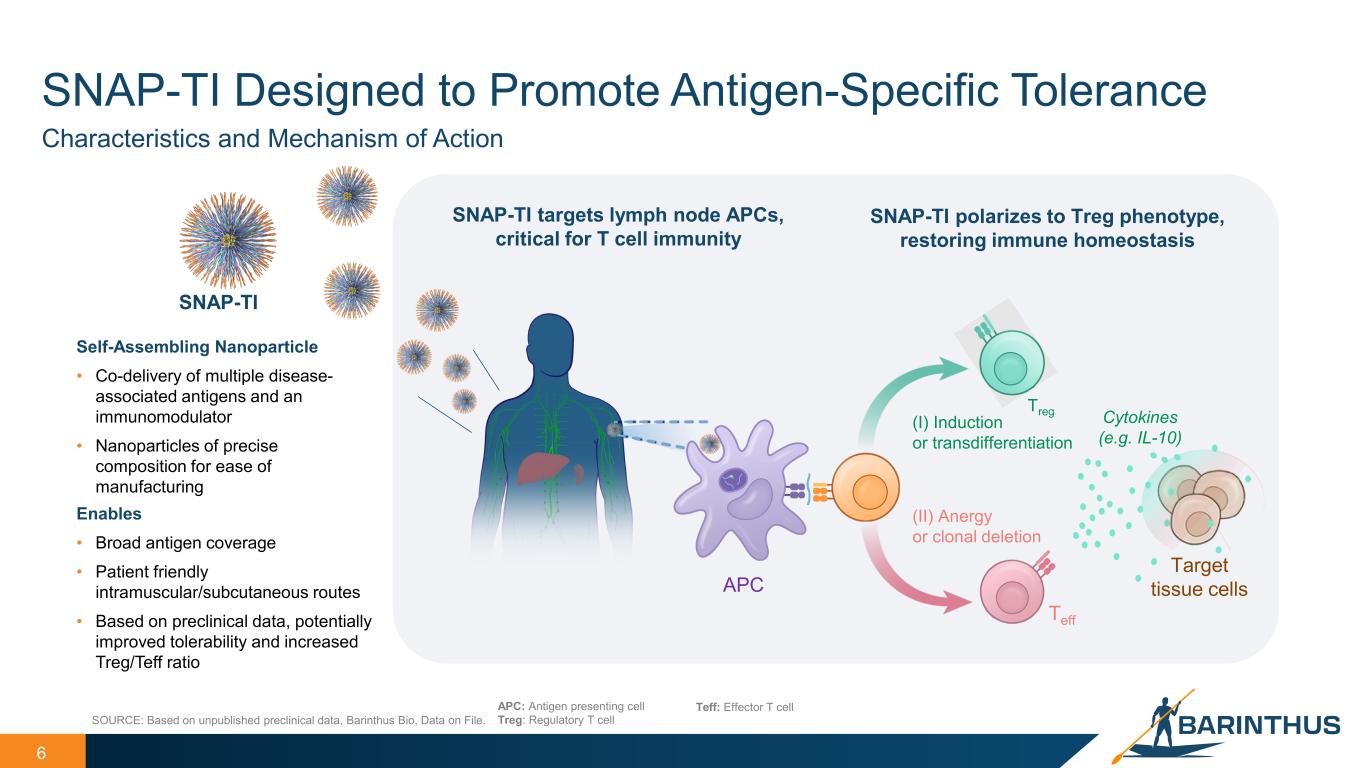

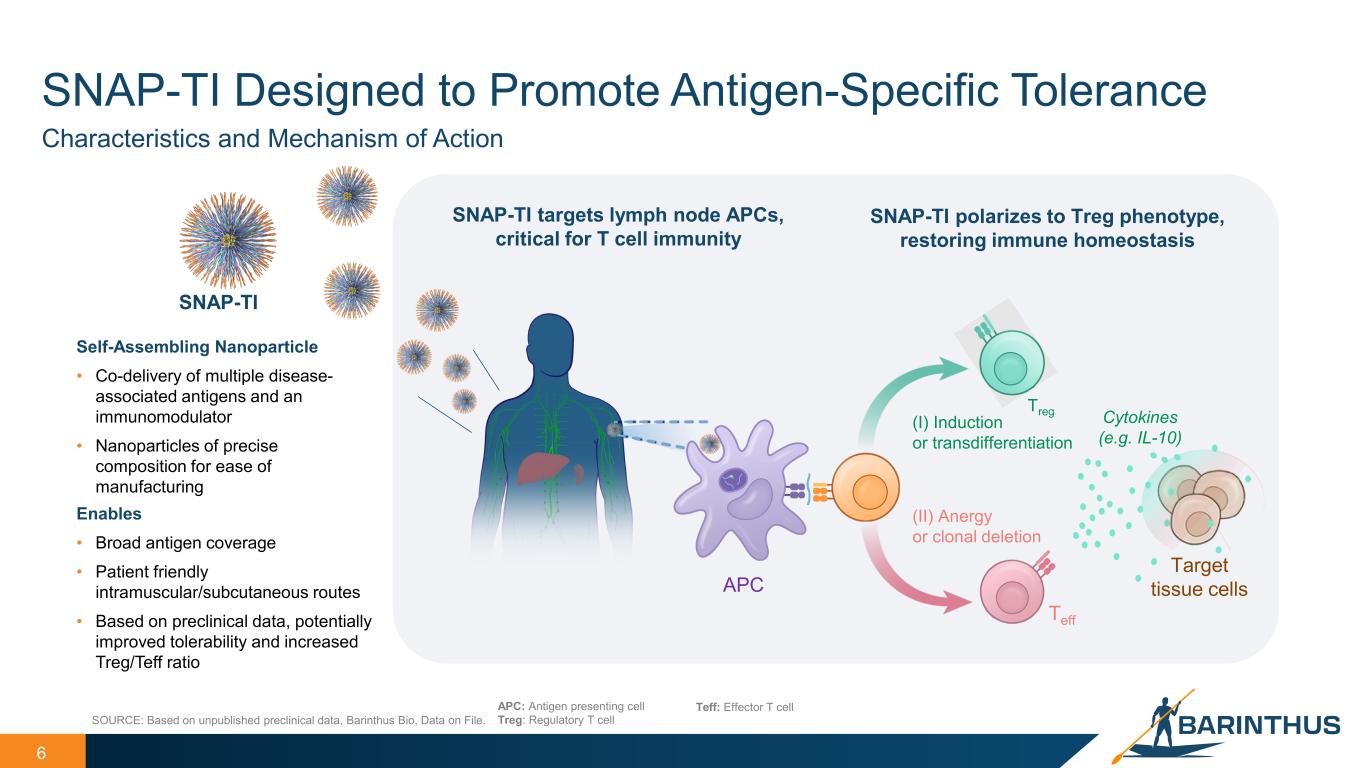

Teff 6 Enables • Broad antigen coverage • Patient friendly intramuscular/subcutaneous routes • Based on preclinical data, potentially improved tolerability and increased Treg/Teff ratio SOURCE: Based on unpublished preclinical data, Barinthus Bio, Data on File. APC: Antigen presenting cell Treg: Regulatory T cell Teff: Effector T cell Characteristics and Mechanism of Action Self-Assembling Nanoparticle • Co-delivery of multiple disease- associated antigens and an immunomodulator • Nanoparticles of precise composition for ease of manufacturing (II) Anergy or clonal deletion (I) Induction or transdifferentiation SNAP-TI targets lymph node APCs, critical for T cell immunity Treg SNAP-TI polarizes to Treg phenotype, restoring immune homeostasis SNAP-TI Cytokines (e.g. IL-10) APC Target tissue cells SNAP-TI Designed to Promote Antigen-Specific Tolerance

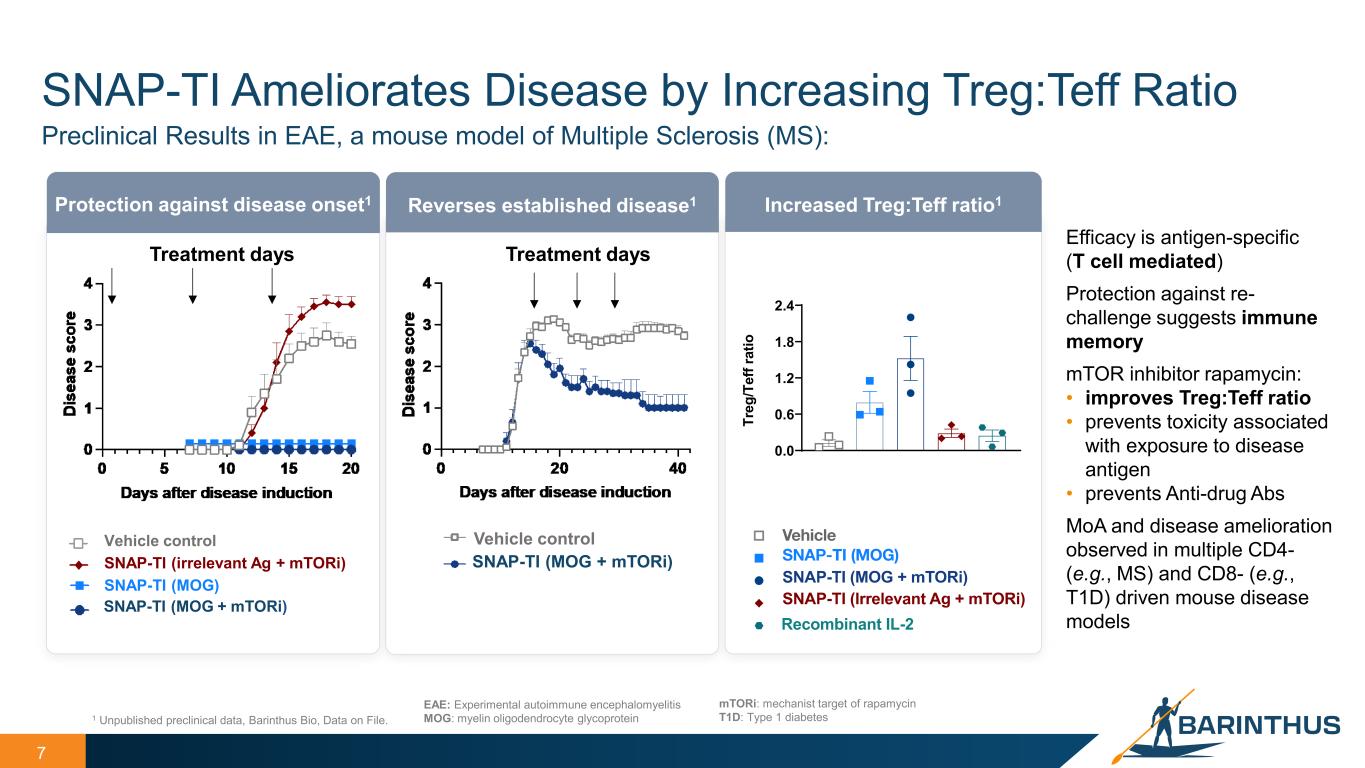

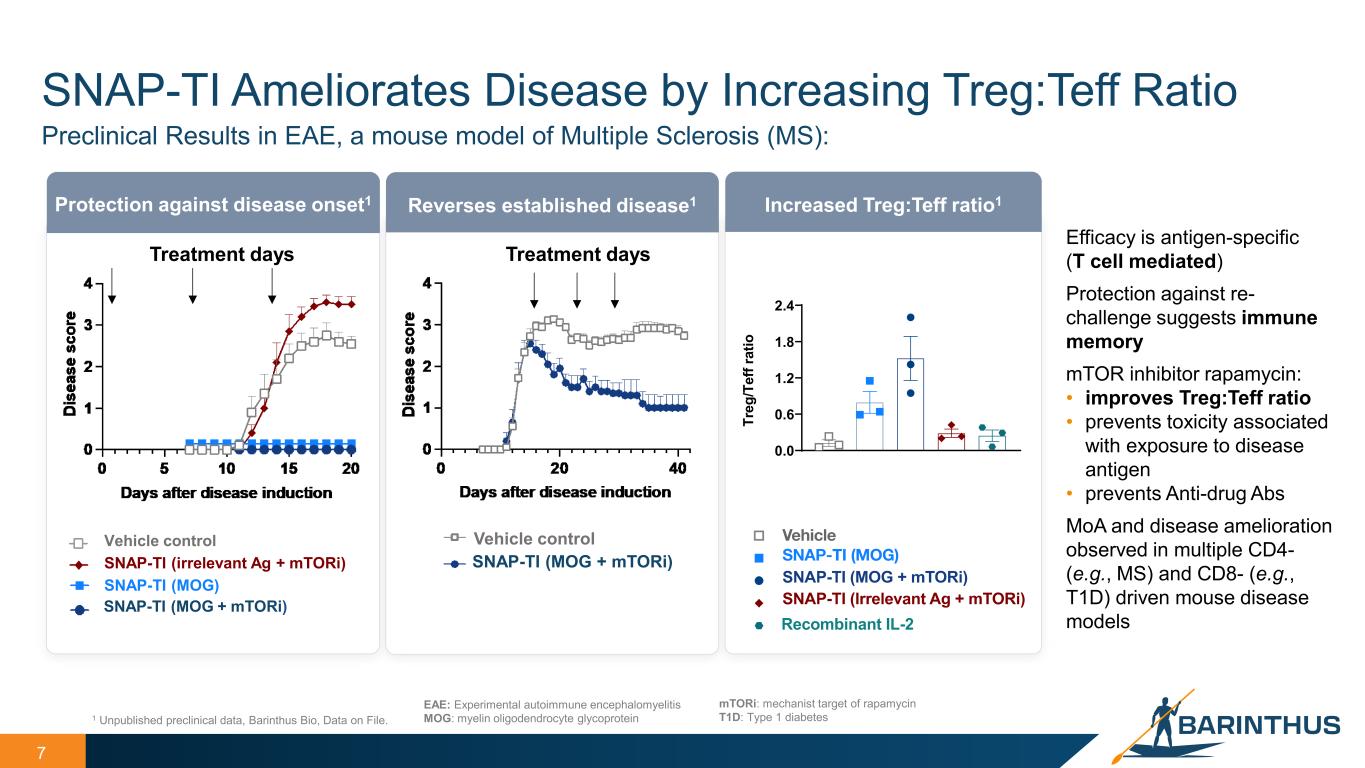

7 SNAP-TI Ameliorates Disease by Increasing Treg:Teff Ratio 1 Unpublished preclinical data, Barinthus Bio, Data on File. EAE: Experimental autoimmune encephalomyelitis MOG: myelin oligodendrocyte glycoprotein Preclinical Results in EAE, a mouse model of Multiple Sclerosis (MS): Efficacy is antigen-specific (T cell mediated) Protection against re- challenge suggests immune memory mTOR inhibitor rapamycin: • improves Treg:Teff ratio • prevents toxicity associated with exposure to disease antigen • prevents Anti-drug Abs MoA and disease amelioration observed in multiple CD4- (e.g., MS) and CD8- (e.g., T1D) driven mouse disease models mTORi: mechanist target of rapamycin T1D: Type 1 diabetes Protection against disease onset1 Reverses established disease1 Treatment days Treatment days Vehicle control SNAP-TI (MOG + mTORi) Increased Treg:Teff ratio1 Vehicle control SNAP-TI (MOG + mTORi) SNAP-TI (MOG) SNAP-TI (irrelevant Ag + mTORi) 0.0 0.6 1.2 1.8 2.4 Tr eg /T ef f r at io

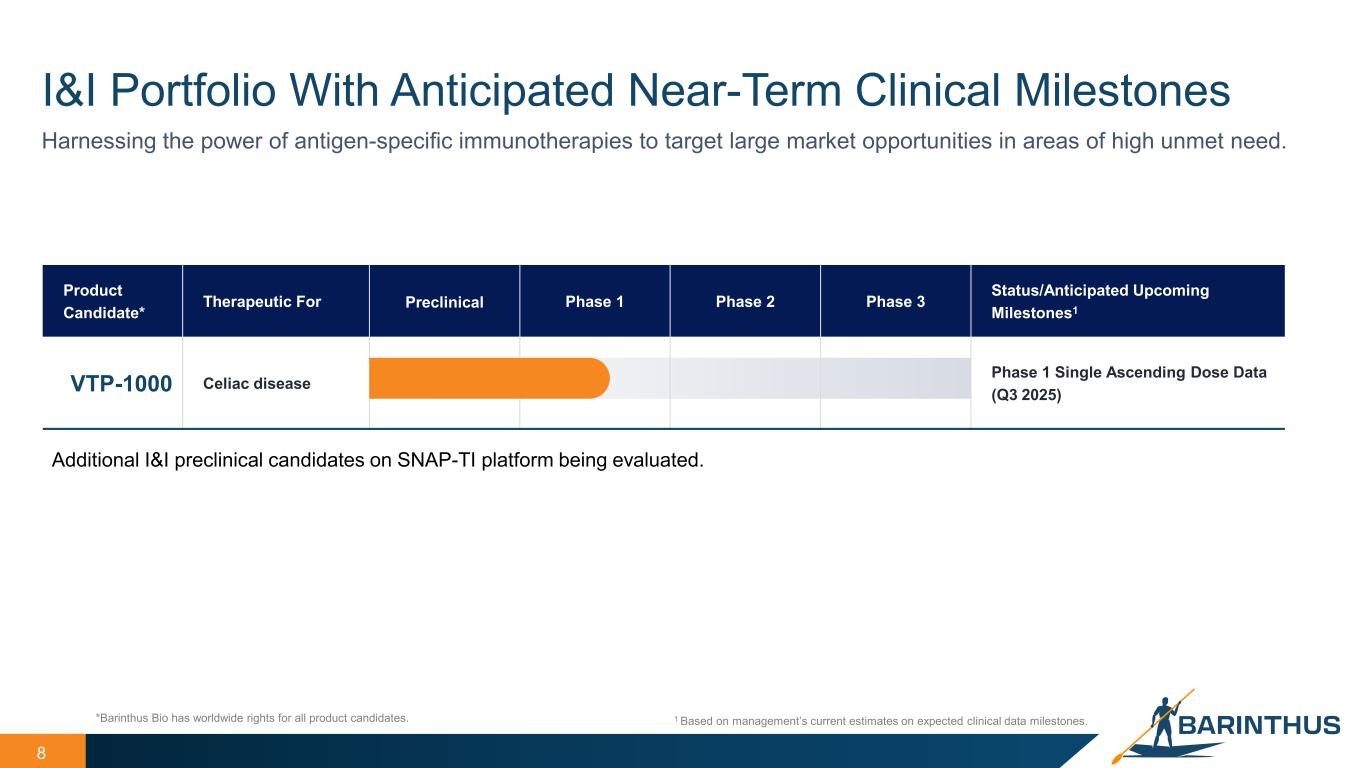

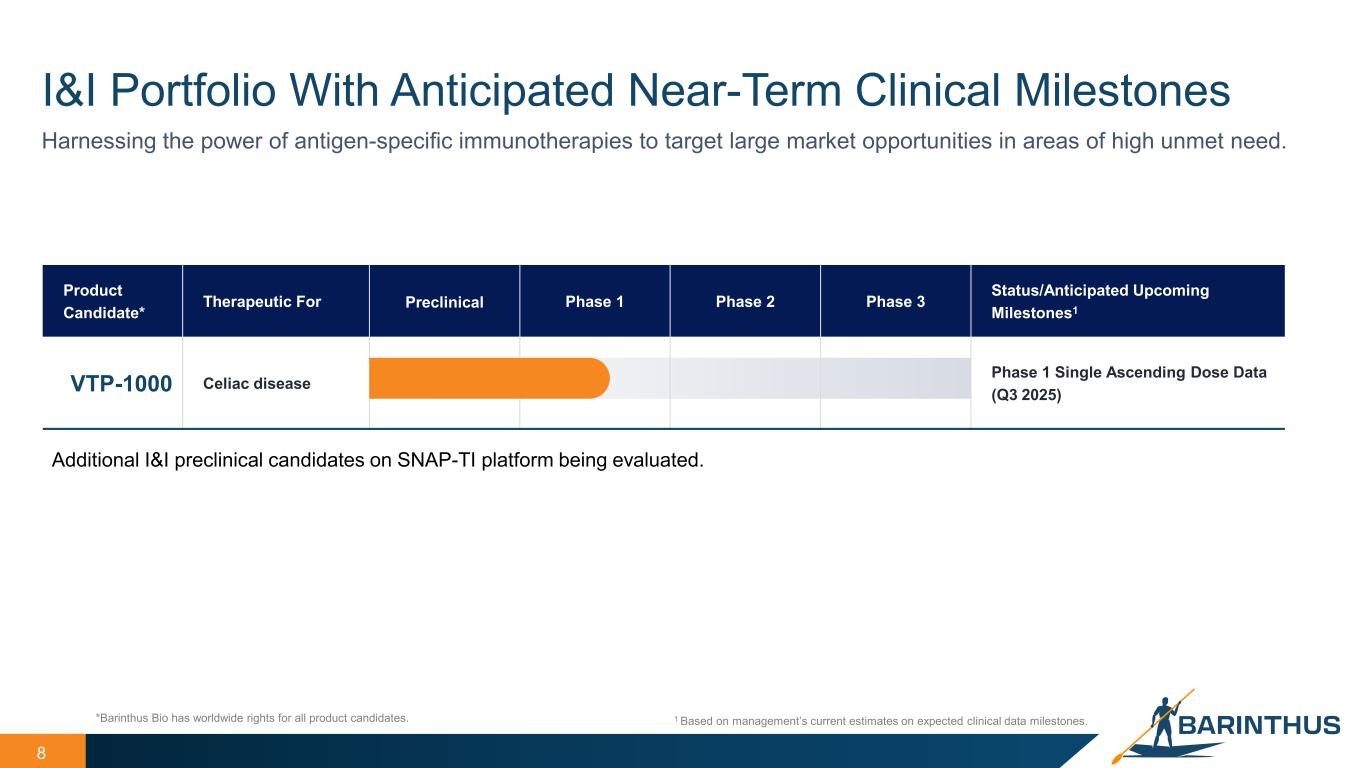

8 I&I Portfolio With Anticipated Near-Term Clinical Milestones *Barinthus Bio has worldwide rights for all product candidates. Harnessing the power of antigen-specific immunotherapies to target large market opportunities in areas of high unmet need. Product Candidate* Therapeutic For Preclinical Phase 1 Phase 2 Phase 3 Status/Anticipated Upcoming Milestones1 VTP-1000 Celiac disease Phase 1 Single Ascending Dose Data (Q3 2025) 1 Based on management’s current estimates on expected clinical data milestones. Additional I&I preclinical candidates on SNAP-TI platform being evaluated.

VTP-1000 Celiac Disease Immunotherapeutic Guiding the immune system to cure disease

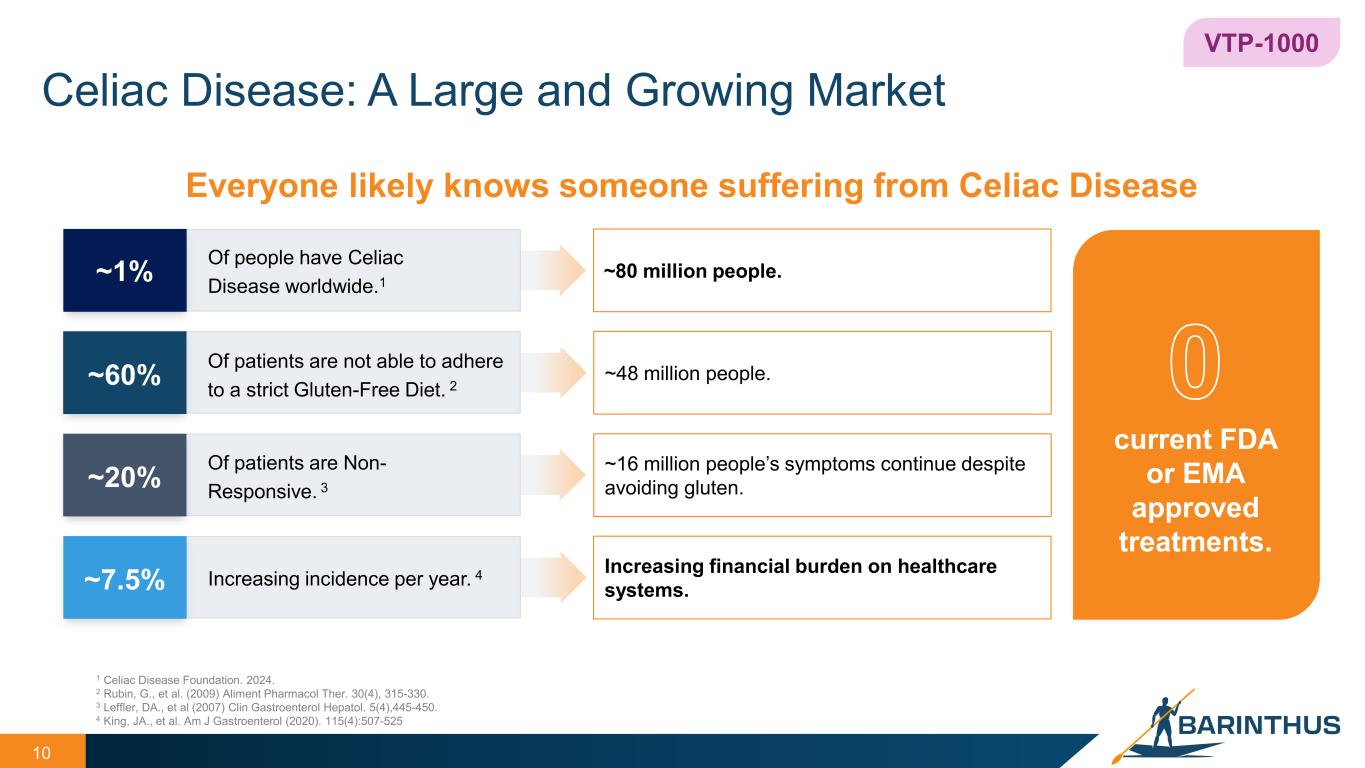

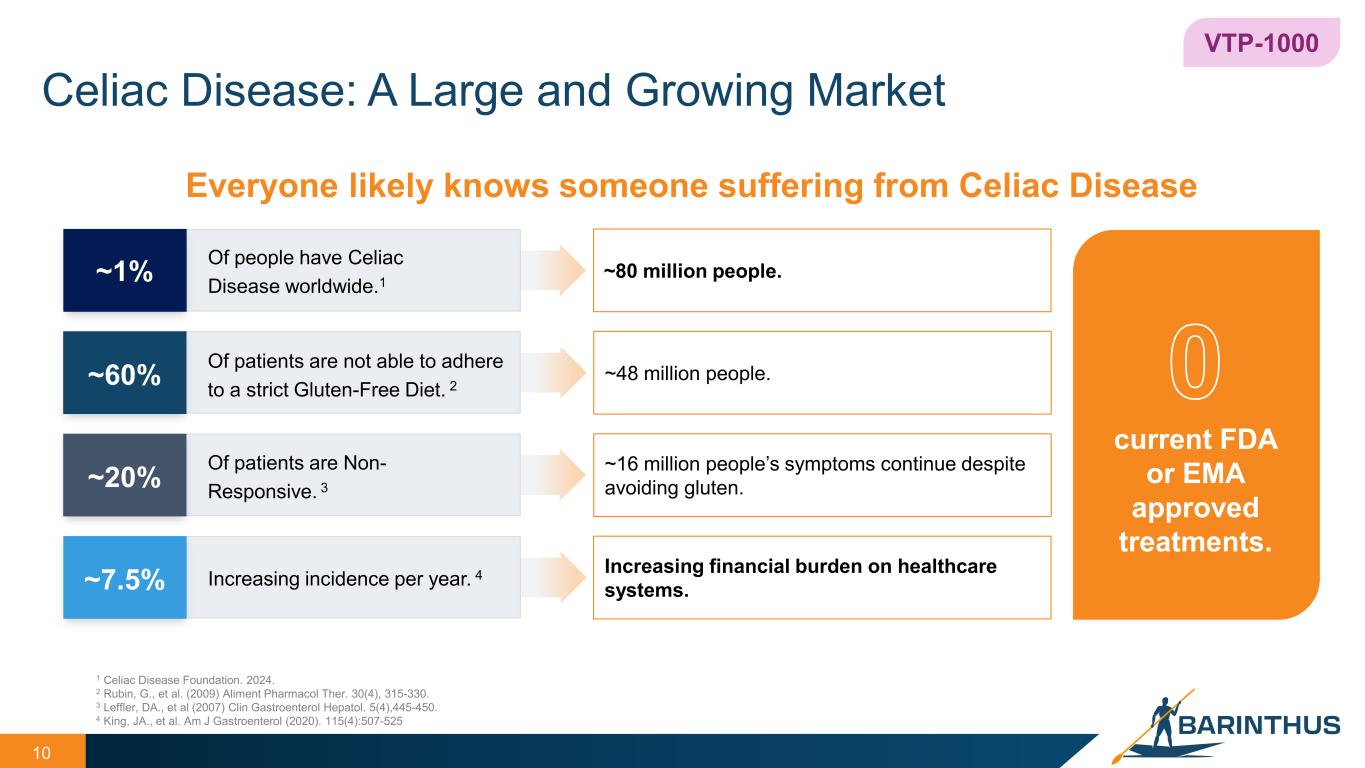

Celiac Disease: A Large and Growing Market 10 VTP-1000 current FDA or EMA approved treatments. Everyone likely knows someone suffering from Celiac Disease 1 Celiac Disease Foundation. 2024. 2 Rubin, G., et al. (2009) Aliment Pharmacol Ther. 30(4), 315-330. 3 Leffler, DA., et al (2007) Clin Gastroenterol Hepatol. 5(4),445-450. 4 King, JA., et al. Am J Gastroenterol (2020). 115(4):507-525 Of people have Celiac Disease worldwide.1~1% ~80 million people. Of patients are not able to adhere to a strict Gluten-Free Diet. 2~60% ~48 million people. Of patients are Non- Responsive. 3~20% ~16 million people’s symptoms continue despite avoiding gluten. Increasing incidence per year. 4~7.5% Increasing financial burden on healthcare systems.

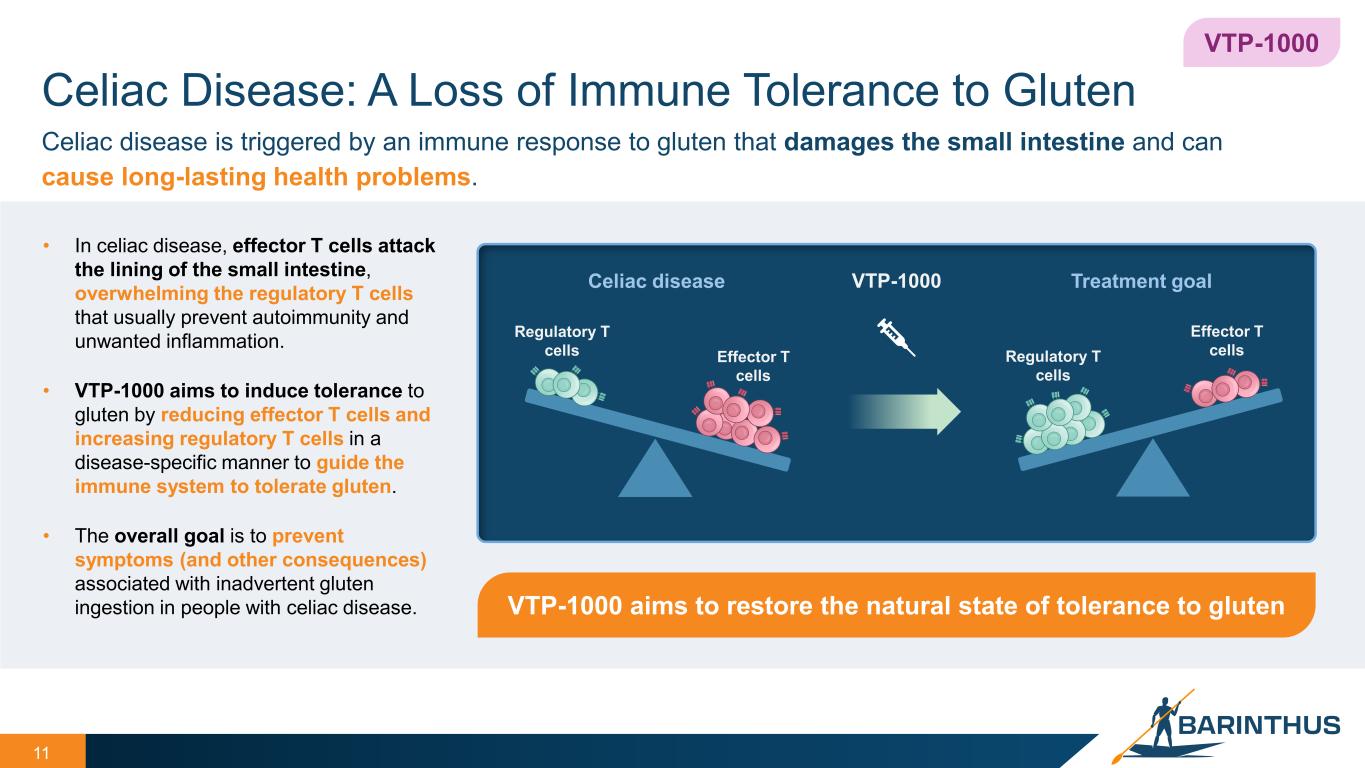

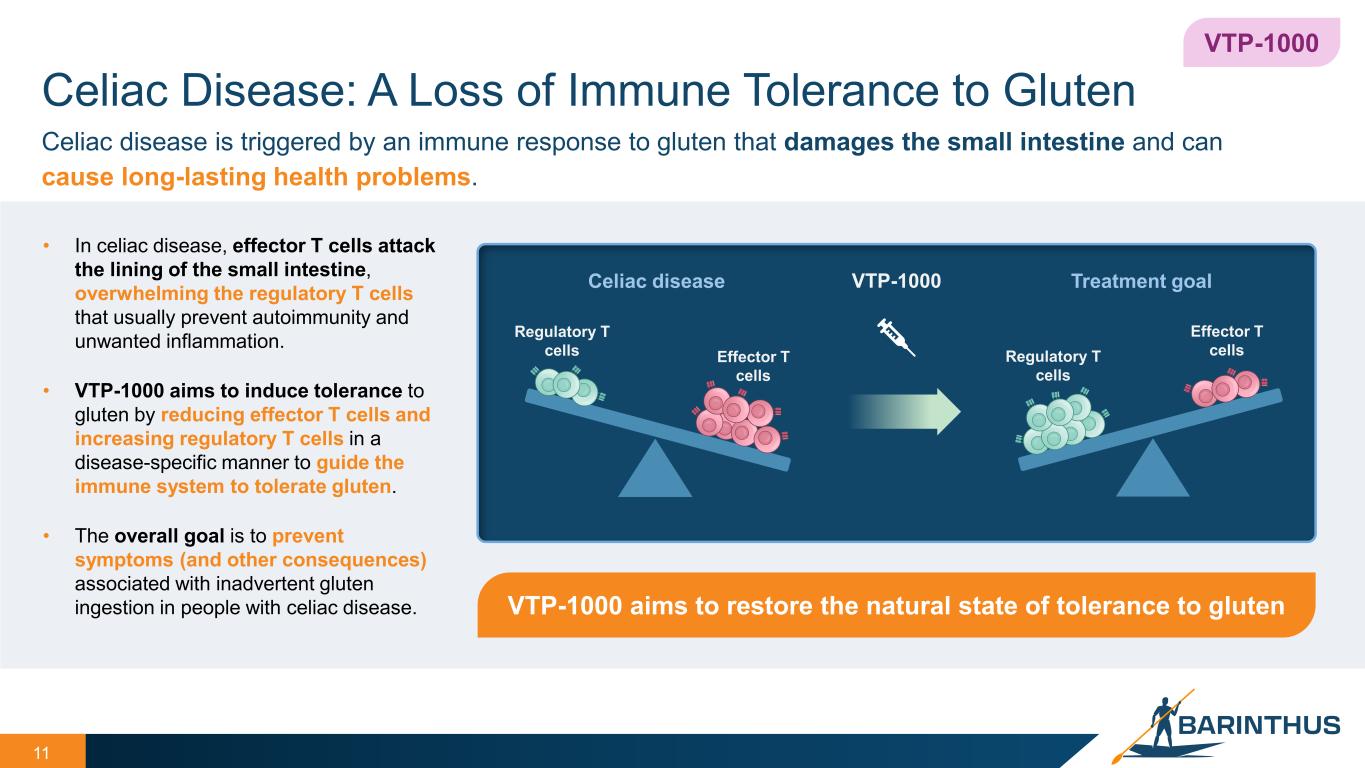

Celiac Disease: A Loss of Immune Tolerance to Gluten 11 VTP-1000 • In celiac disease, effector T cells attack the lining of the small intestine, overwhelming the regulatory T cells that usually prevent autoimmunity and unwanted inflammation. • VTP-1000 aims to induce tolerance to gluten by reducing effector T cells and increasing regulatory T cells in a disease-specific manner to guide the immune system to tolerate gluten. • The overall goal is to prevent symptoms (and other consequences) associated with inadvertent gluten ingestion in people with celiac disease. VTP-1000 aims to restore the natural state of tolerance to gluten Celiac disease is triggered by an immune response to gluten that damages the small intestine and can cause long-lasting health problems. Celiac disease Treatment goal Regulatory T cells Effector T cells VTP-1000 Regulatory T cells Effector T cells

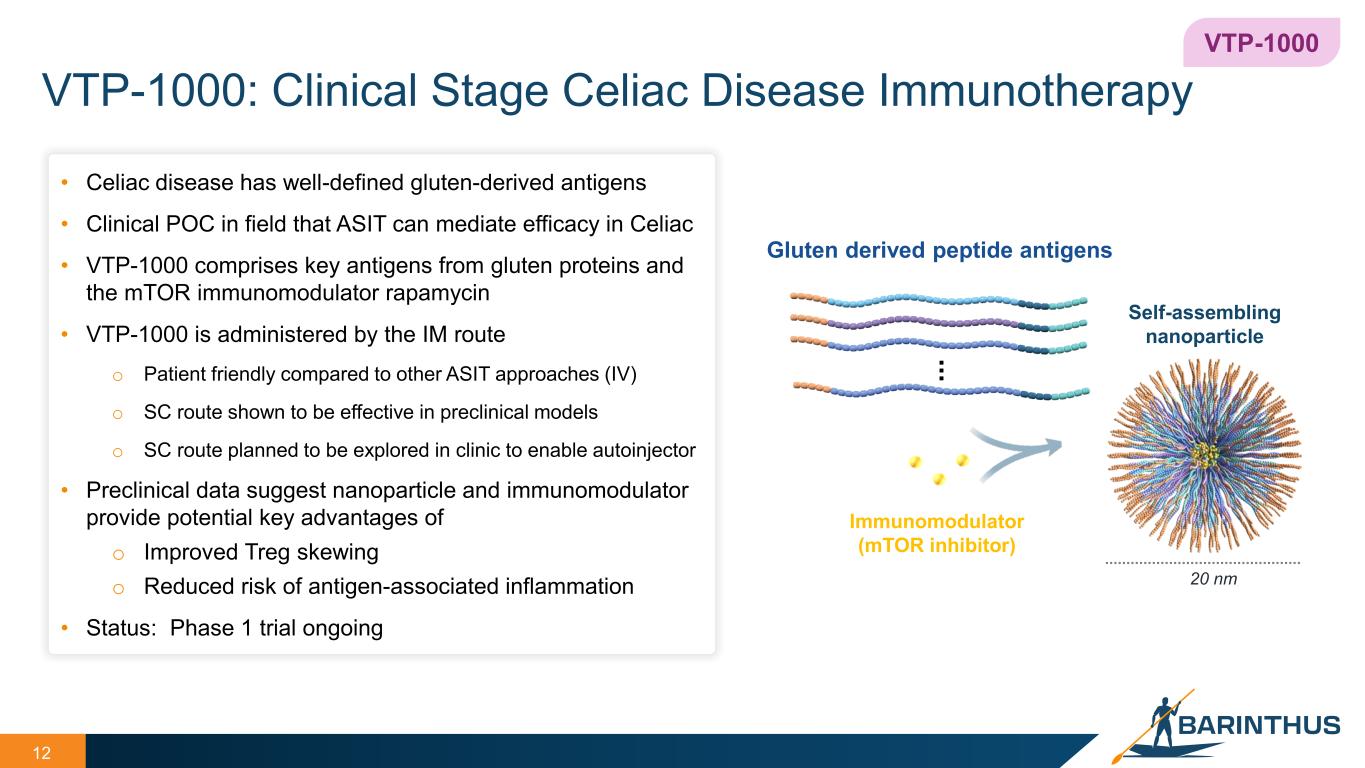

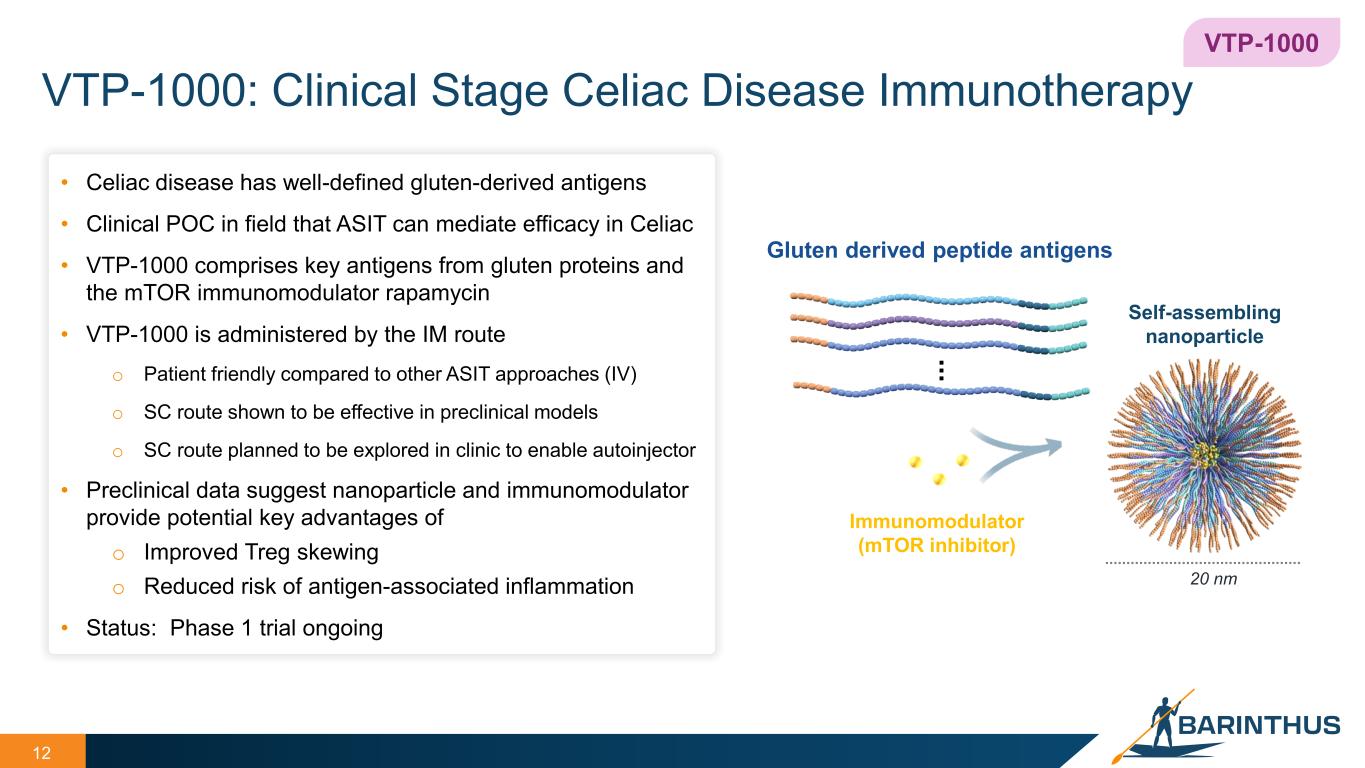

VTP-1000: Clinical Stage Celiac Disease Immunotherapy 12 • Celiac disease has well-defined gluten-derived antigens • Clinical POC in field that ASIT can mediate efficacy in Celiac • VTP-1000 comprises key antigens from gluten proteins and the mTOR immunomodulator rapamycin • VTP-1000 is administered by the IM route o Patient friendly compared to other ASIT approaches (IV) o SC route shown to be effective in preclinical models o SC route planned to be explored in clinic to enable autoinjector • Preclinical data suggest nanoparticle and immunomodulator provide potential key advantages of o Improved Treg skewing o Reduced risk of antigen-associated inflammation • Status: Phase 1 trial ongoing 20 nm Gluten derived peptide antigens Immunomodulator (mTOR inhibitor) ... Self-assembling nanoparticle VTP-1000

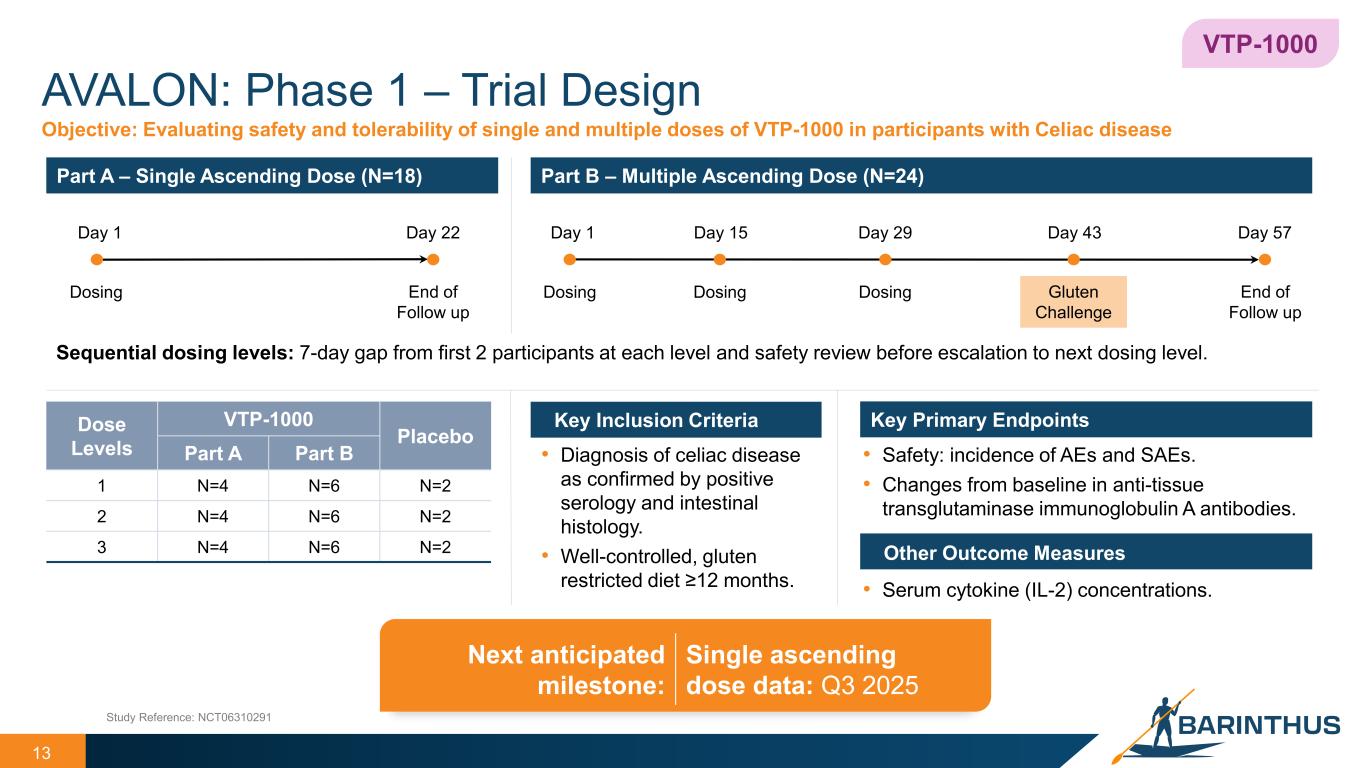

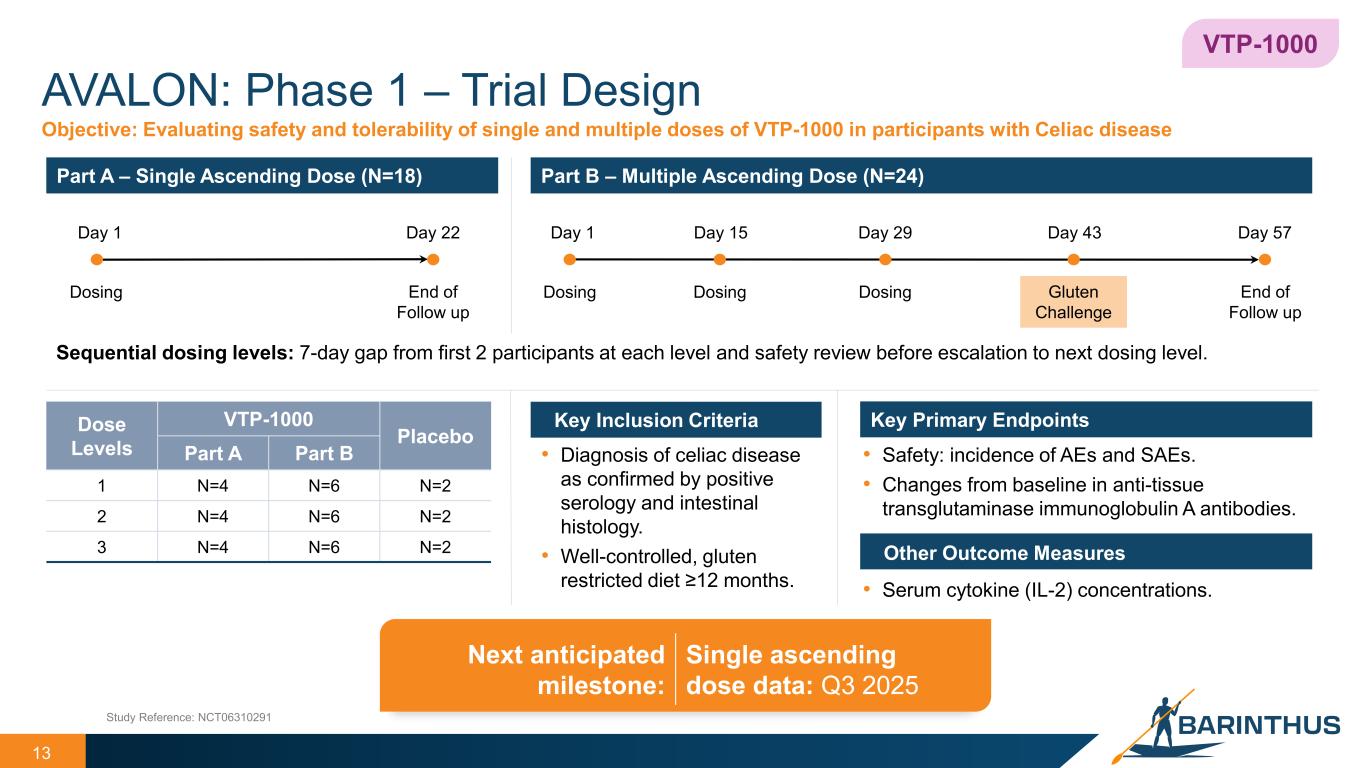

AVALON: Phase 1 – Trial Design 13 Key Inclusion Criteria Part A – Single Ascending Dose (N=18) Part B – Multiple Ascending Dose (N=24) Key Primary Endpoints VTP-1000 Dose Levels VTP-1000 Placebo Part A Part B 1 N=4 N=6 N=2 2 N=4 N=6 N=2 3 N=4 N=6 N=2 Objective: Evaluating safety and tolerability of single and multiple doses of VTP-1000 in participants with Celiac disease • Safety: incidence of AEs and SAEs. • Changes from baseline in anti-tissue transglutaminase immunoglobulin A antibodies. Other Outcome Measures • Serum cytokine (IL-2) concentrations. • Diagnosis of celiac disease as confirmed by positive serology and intestinal histology. • Well-controlled, gluten restricted diet ≥12 months. Study Reference: NCT06310291 Dosing End of Follow up Day 1 Day 22 Day 1 Day 57Day 15 Day 29 Day 43 Dosing Dosing Dosing End of Follow up Gluten Challenge Sequential dosing levels: 7-day gap from first 2 participants at each level and safety review before escalation to next dosing level. Next anticipated milestone: Single ascending dose data: Q3 2025

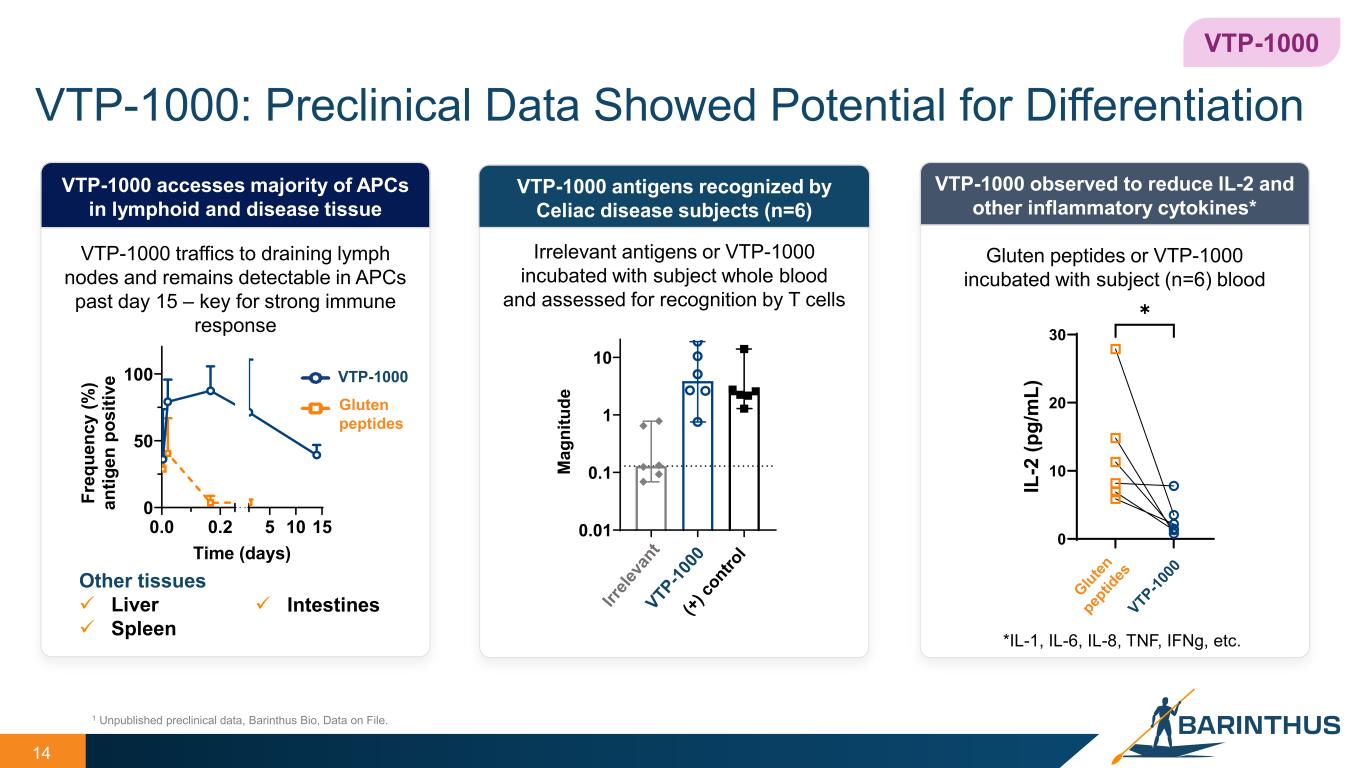

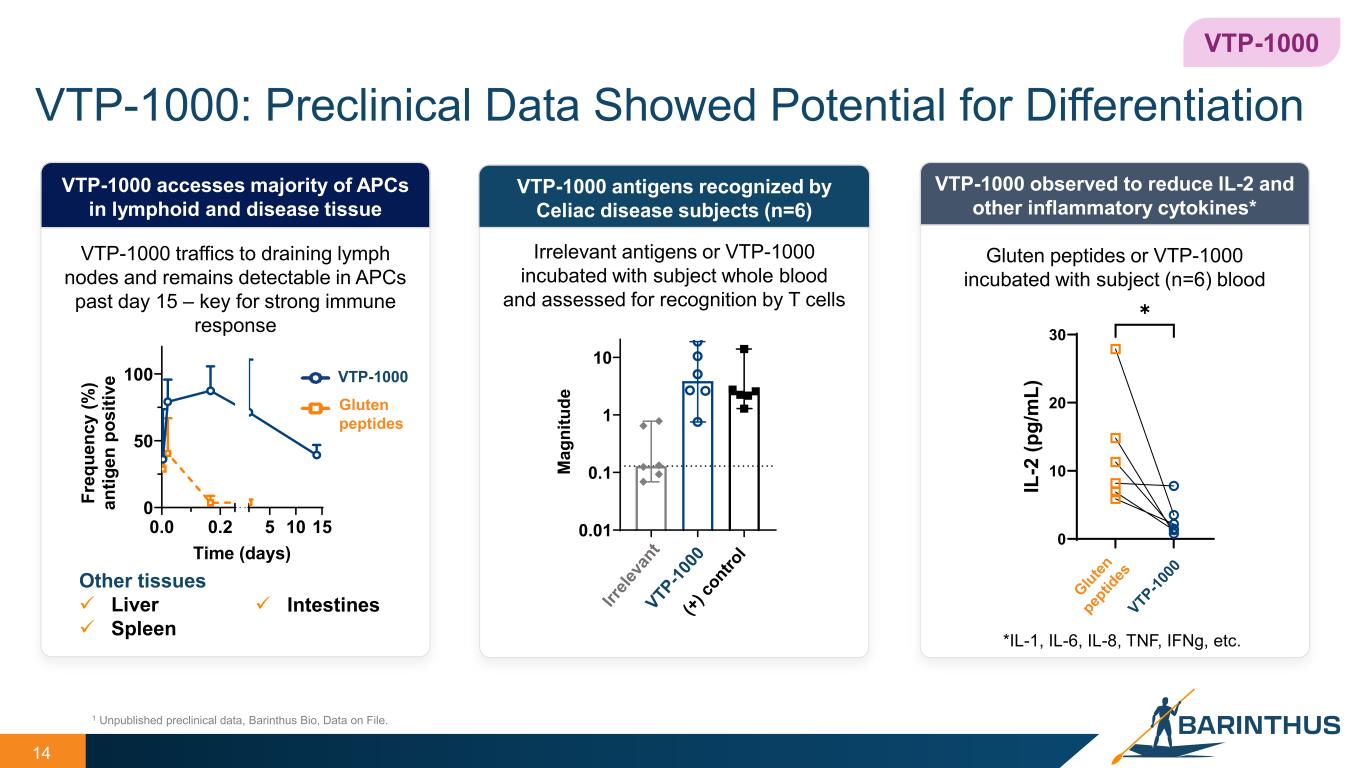

14 VTP-1000: Preclinical Data Showed Potential for Differentiation VTP-1000 antigens recognized by Celiac disease subjects (n=6) VTP-1000 observed to reduce IL-2 and other inflammatory cytokines* *IL-1, IL-6, IL-8, TNF, IFNg, etc. VTP-1000 1 Unpublished preclinical data, Barinthus Bio, Data on File. Irrelevant antigens or VTP-1000 incubated with subject whole blood and assessed for recognition by T cells VTP-1000 accesses majority of APCs in lymphoid and disease tissue Other tissues Liver Spleen VTP-1000 Gluten peptides Gluten peptides or VTP-1000 incubated with subject (n=6) blood VTP-1000 traffics to draining lymph nodes and remains detectable in APCs past day 15 – key for strong immune response 0.0 0.2 5 10 15 0 50 100 Time (days) Fr eq ue nc y (% ) an tig en p os iti ve 0.01 0.1 1 10 M ag ni tu de 0 10 20 30 IL -2 (p g/ m L) ✱ Intestines

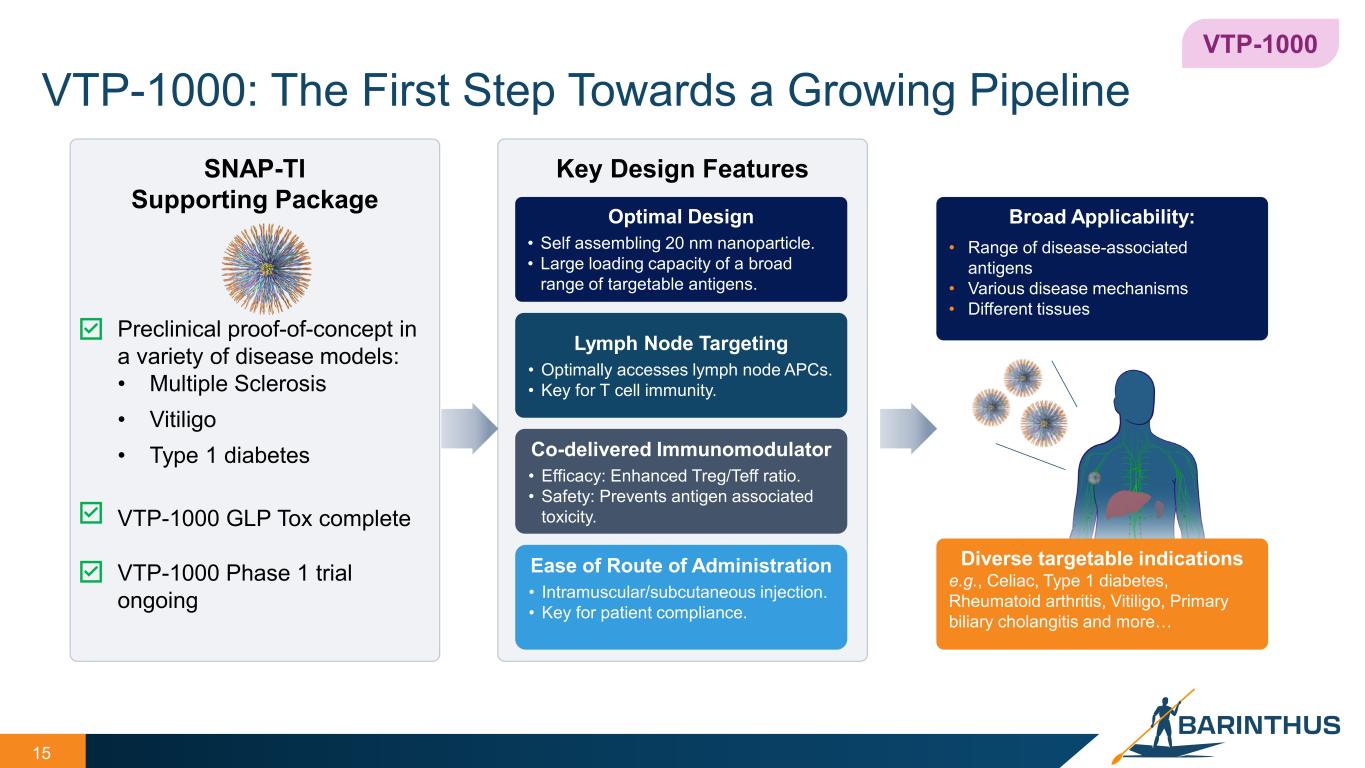

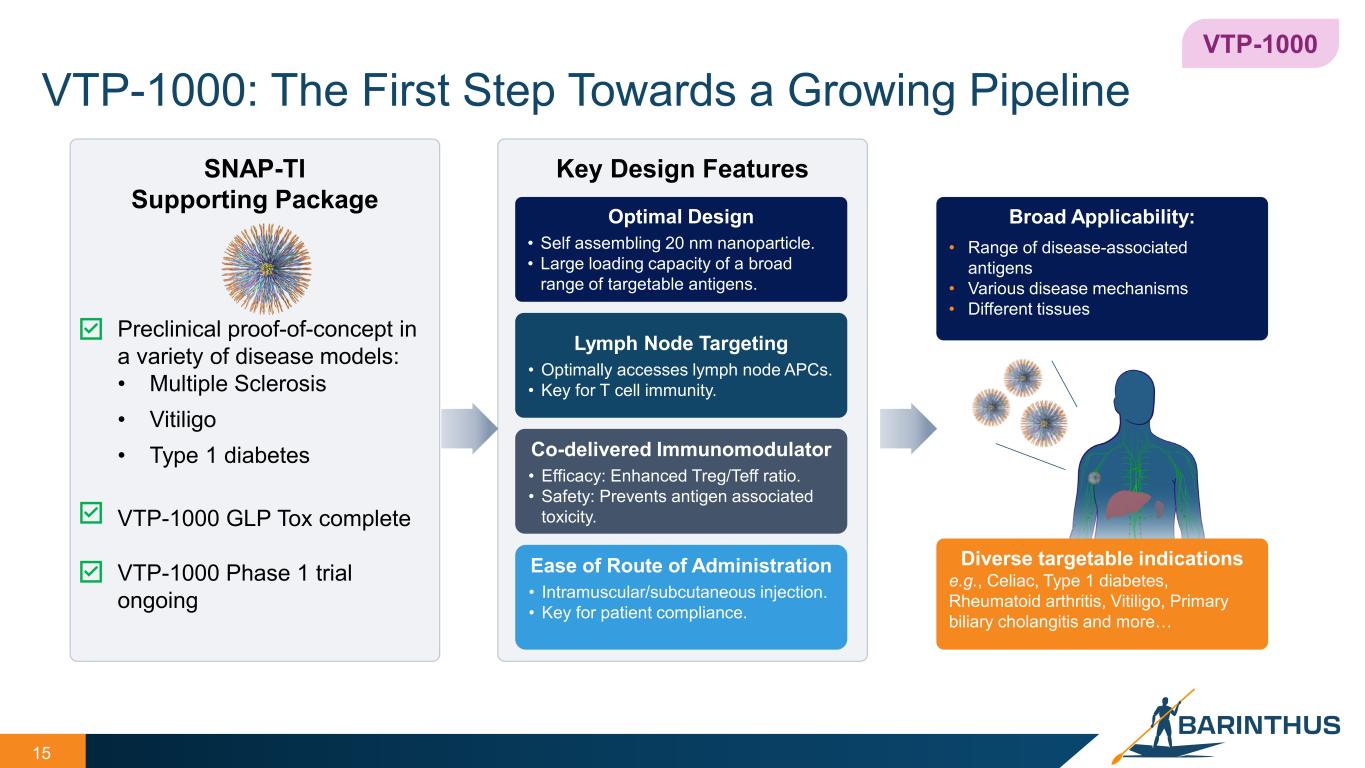

VTP-1000: The First Step Towards a Growing Pipeline 15 15 Key Design Features Optimal Design • Self assembling 20 nm nanoparticle. • Large loading capacity of a broad range of targetable antigens. Lymph Node Targeting • Optimally accesses lymph node APCs. • Key for T cell immunity. Co-delivered Immunomodulator • Efficacy: Enhanced Treg/Teff ratio. • Safety: Prevents antigen associated toxicity. Ease of Route of Administration • Intramuscular/subcutaneous injection. • Key for patient compliance. SNAP-TI Supporting Package Preclinical proof-of-concept in a variety of disease models: • Multiple Sclerosis • Vitiligo • Type 1 diabetes VTP-1000 GLP Tox complete VTP-1000 Phase 1 trial ongoing VTP-1000 Diverse targetable indications e.g., Celiac, Type 1 diabetes, Rheumatoid arthritis, Vitiligo, Primary biliary cholangitis and more… Broad Applicability: • Range of disease-associated antigens • Various disease mechanisms • Different tissues

Viral Vector Platform Programs Programs Looking for Partners to Advance Guiding the immune system to cure disease

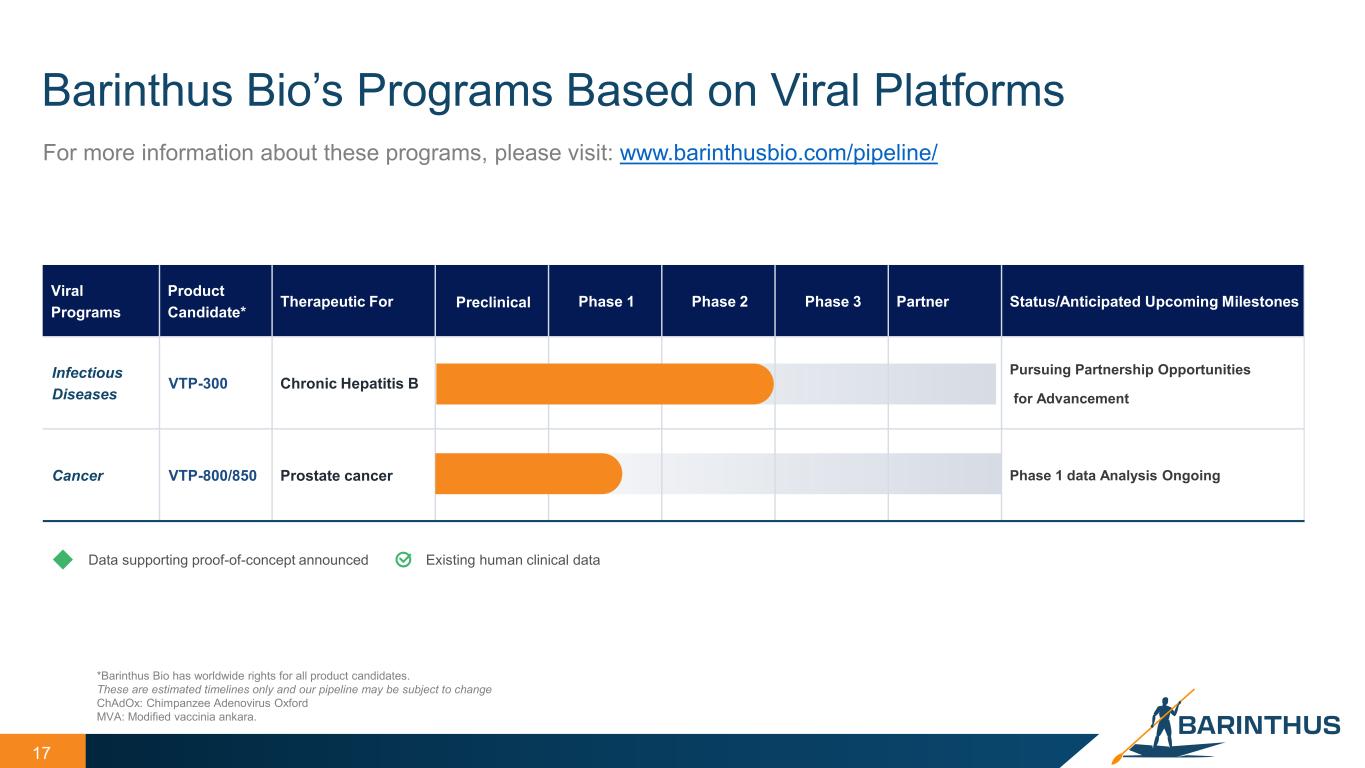

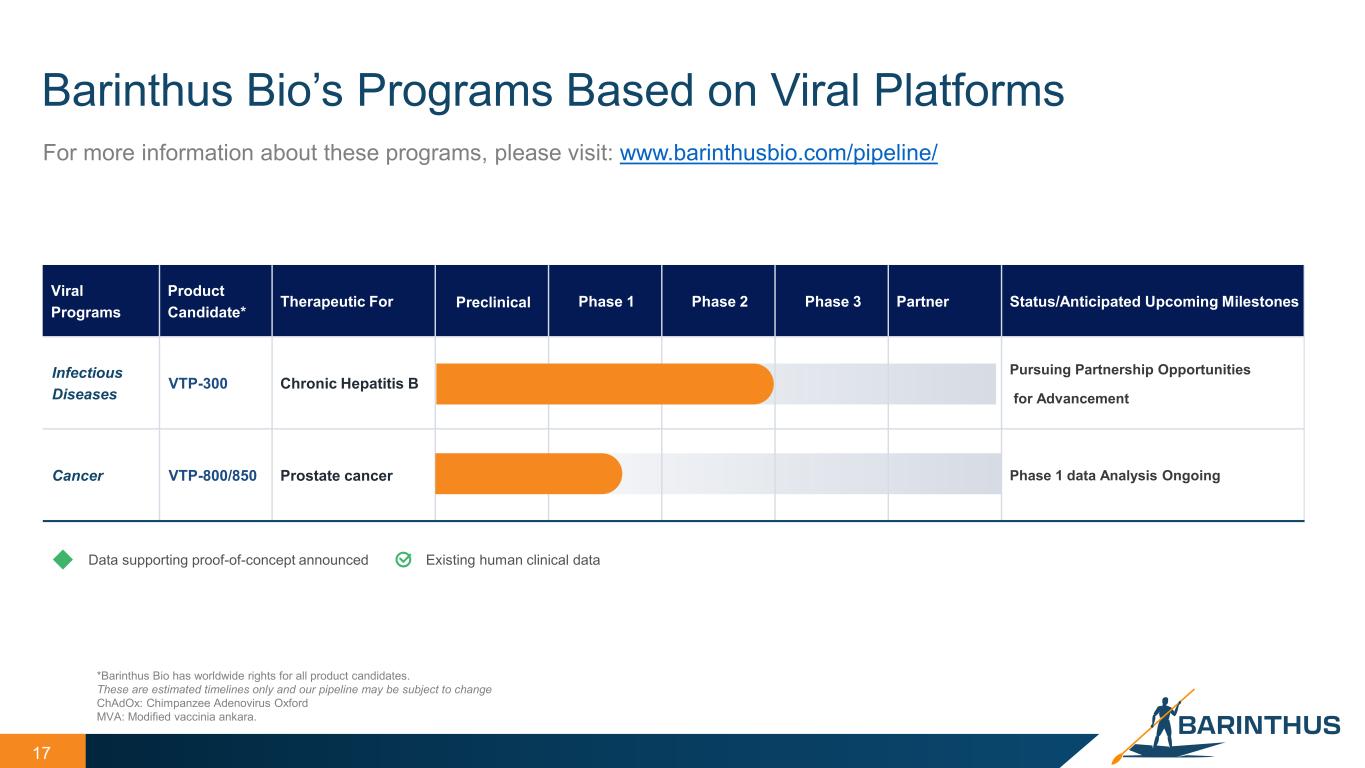

17 Barinthus Bio’s Programs Based on Viral Platforms *Barinthus Bio has worldwide rights for all product candidates. These are estimated timelines only and our pipeline may be subject to change ChAdOx: Chimpanzee Adenovirus Oxford MVA: Modified vaccinia ankara. For more information about these programs, please visit: www.barinthusbio.com/pipeline/ Viral Programs Product Candidate* Therapeutic For Preclinical Phase 1 Phase 2 Phase 3 Partner Status/Anticipated Upcoming Milestones Infectious Diseases VTP-300 Chronic Hepatitis B Pursuing Partnership Opportunities for Advancement Cancer VTP-800/850 Prostate cancer Phase 1 data Analysis Ongoing Existing human clinical dataData supporting proof-of-concept announced

VTP-300 Hepatitis B Virus (HBV) Therapeutic Guiding the immune system to cure disease

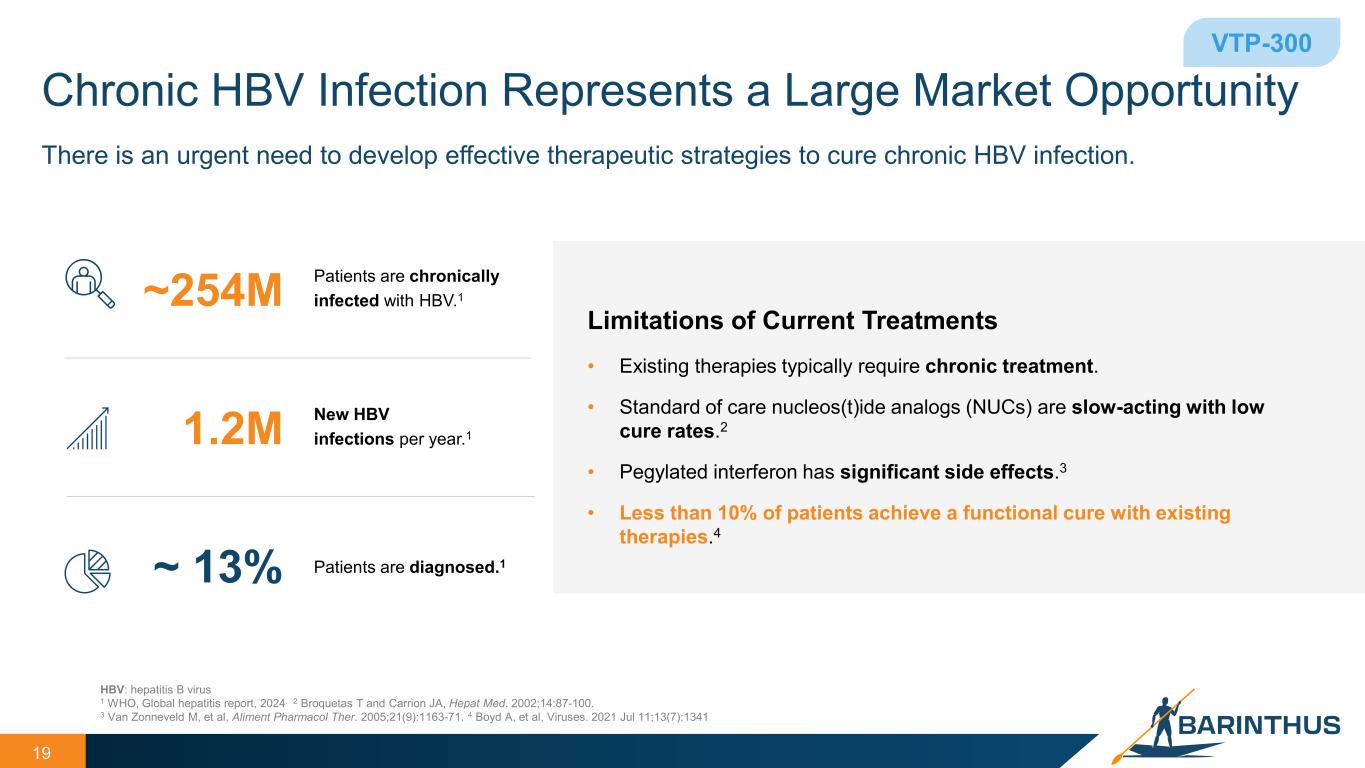

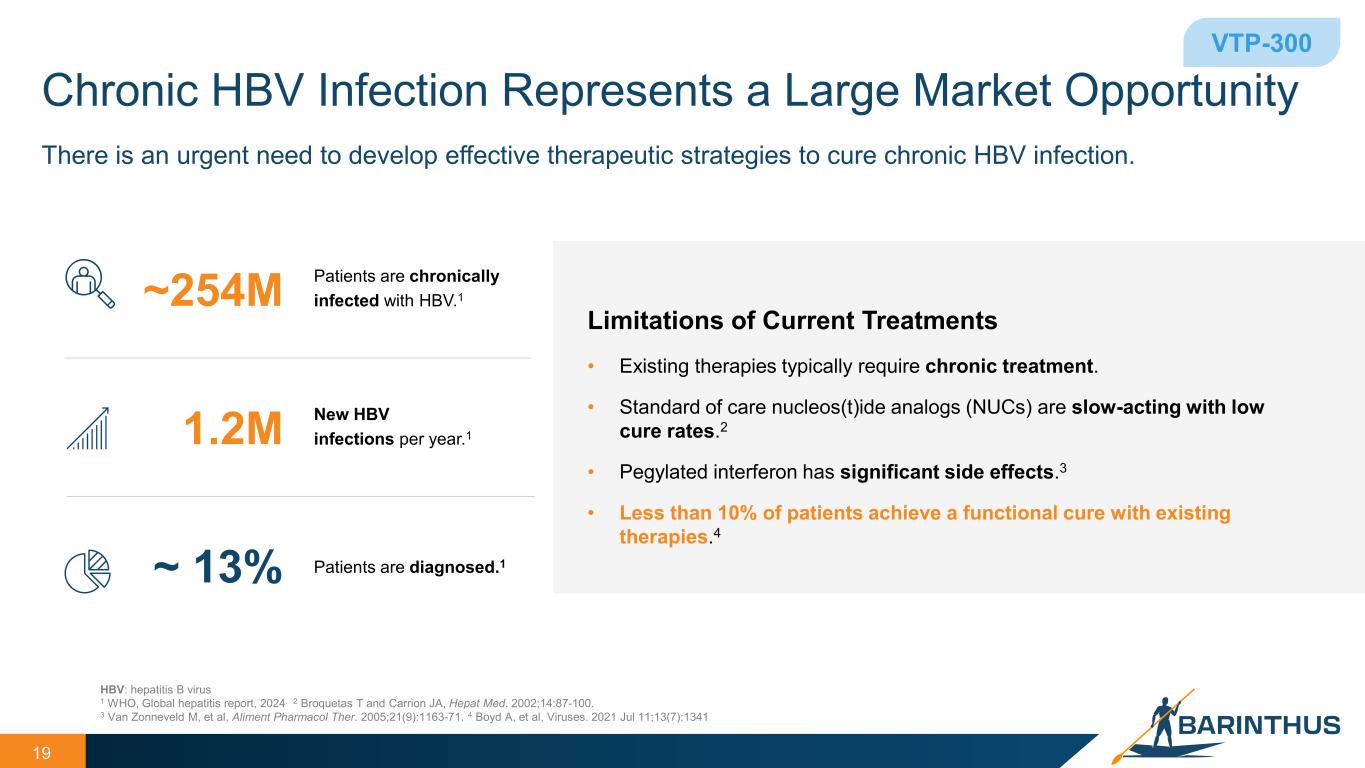

Chronic HBV Infection Represents a Large Market Opportunity 19 HBV: hepatitis B virus 1 WHO, Global hepatitis report, 2024. 2 Broquetas T and Carrion JA, Hepat Med. 2002;14:87-100. 3 Van Zonneveld M, et al, Aliment Pharmacol Ther. 2005;21(9):1163-71. 4 Boyd A, et al, Viruses. 2021 Jul 11;13(7):1341 • Existing therapies typically require chronic treatment. • Standard of care nucleos(t)ide analogs (NUCs) are slow-acting with low cure rates.2 • Pegylated interferon has significant side effects.3 • Less than 10% of patients achieve a functional cure with existing therapies.4 Limitations of Current Treatments Patients are chronically infected with HBV.1~254M New HBV infections per year.11.2M Patients are diagnosed.1~ 13% VTP-300 There is an urgent need to develop effective therapeutic strategies to cure chronic HBV infection.

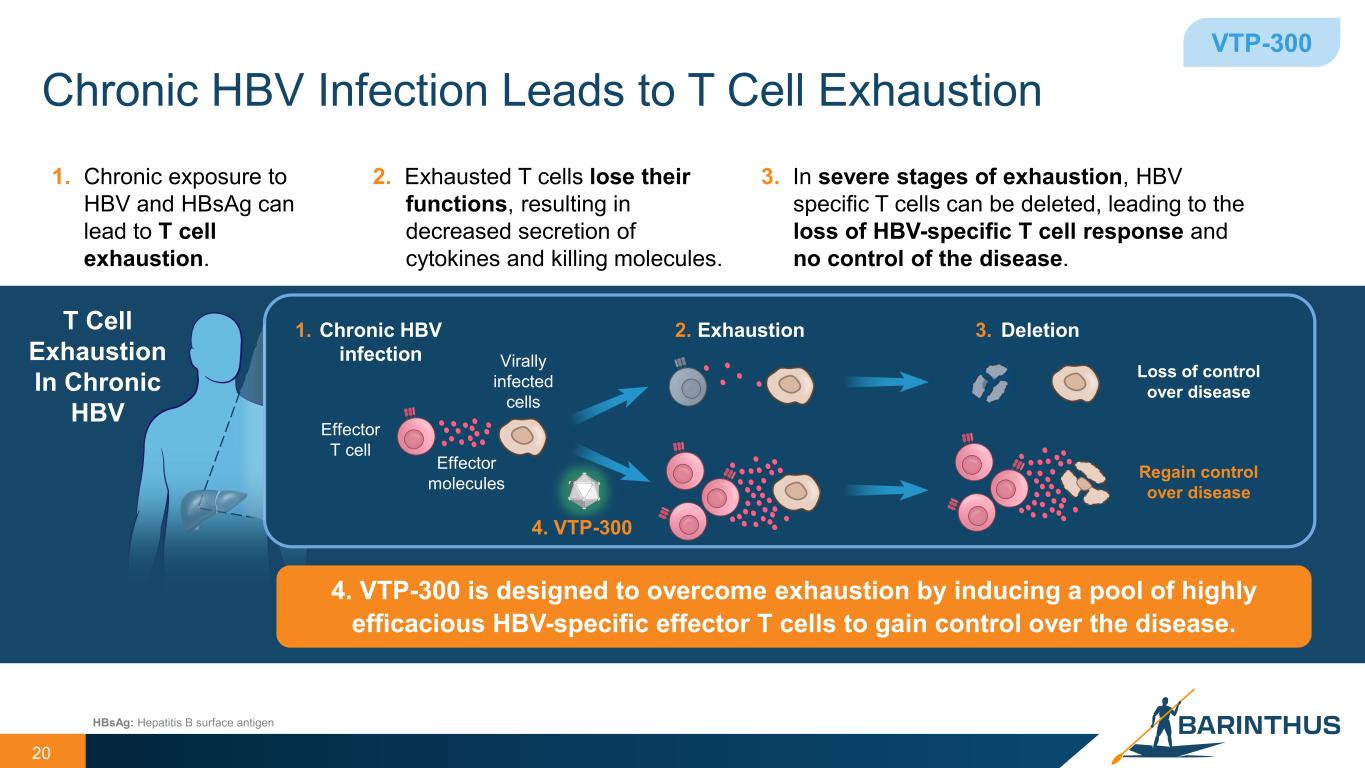

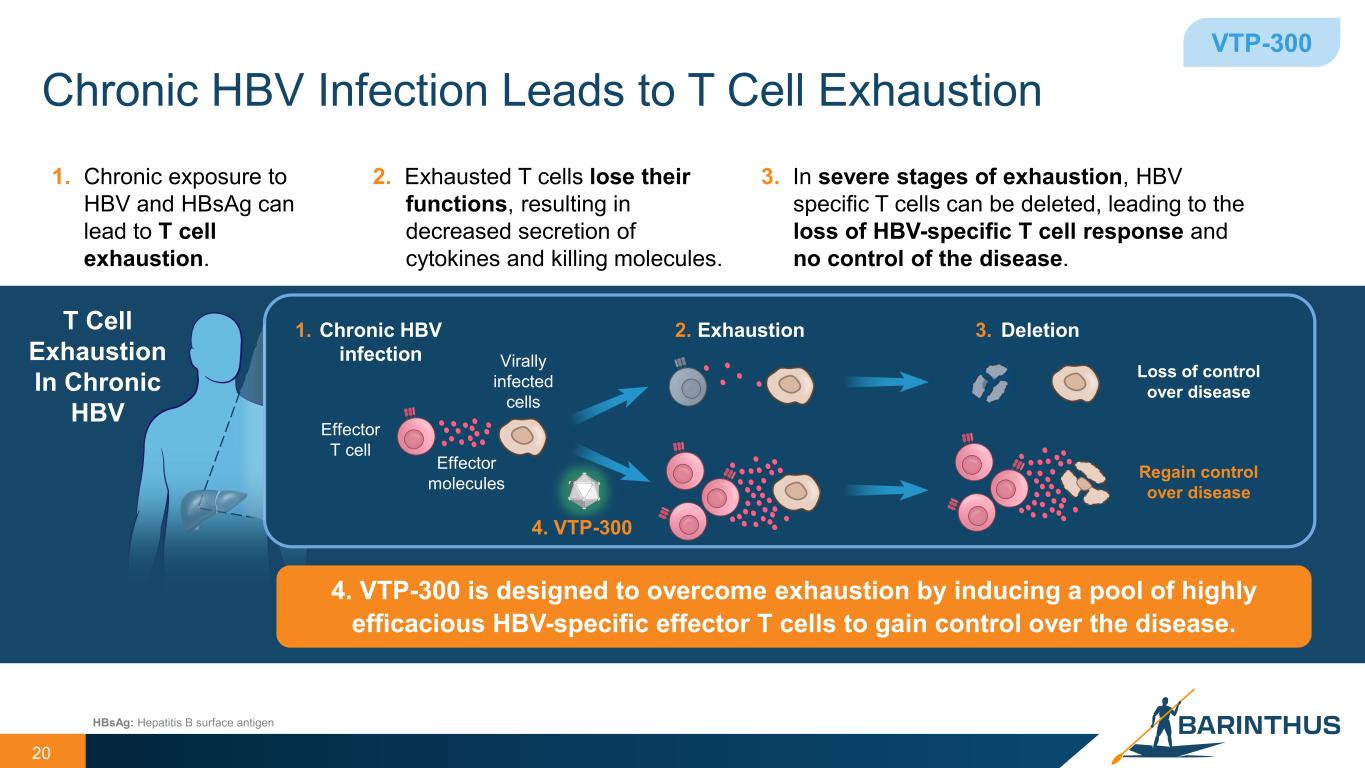

Chronic HBV Infection Leads to T Cell Exhaustion 20 VTP-300 Exhaustion DeletionChronic HBV infection HBsAg: Hepatitis B surface antigen 1. 2. 3.T Cell Exhaustion In Chronic HBV Virally infected cells Effector T cell 4. VTP-300 Loss of control over disease Regain control over disease Effector molecules 3. In severe stages of exhaustion, HBV specific T cells can be deleted, leading to the loss of HBV-specific T cell response and no control of the disease. 1. Chronic exposure to HBV and HBsAg can lead to T cell exhaustion. 2. Exhausted T cells lose their functions, resulting in decreased secretion of cytokines and killing molecules. 4. VTP-300 is designed to overcome exhaustion by inducing a pool of highly efficacious HBV-specific effector T cells to gain control over the disease.

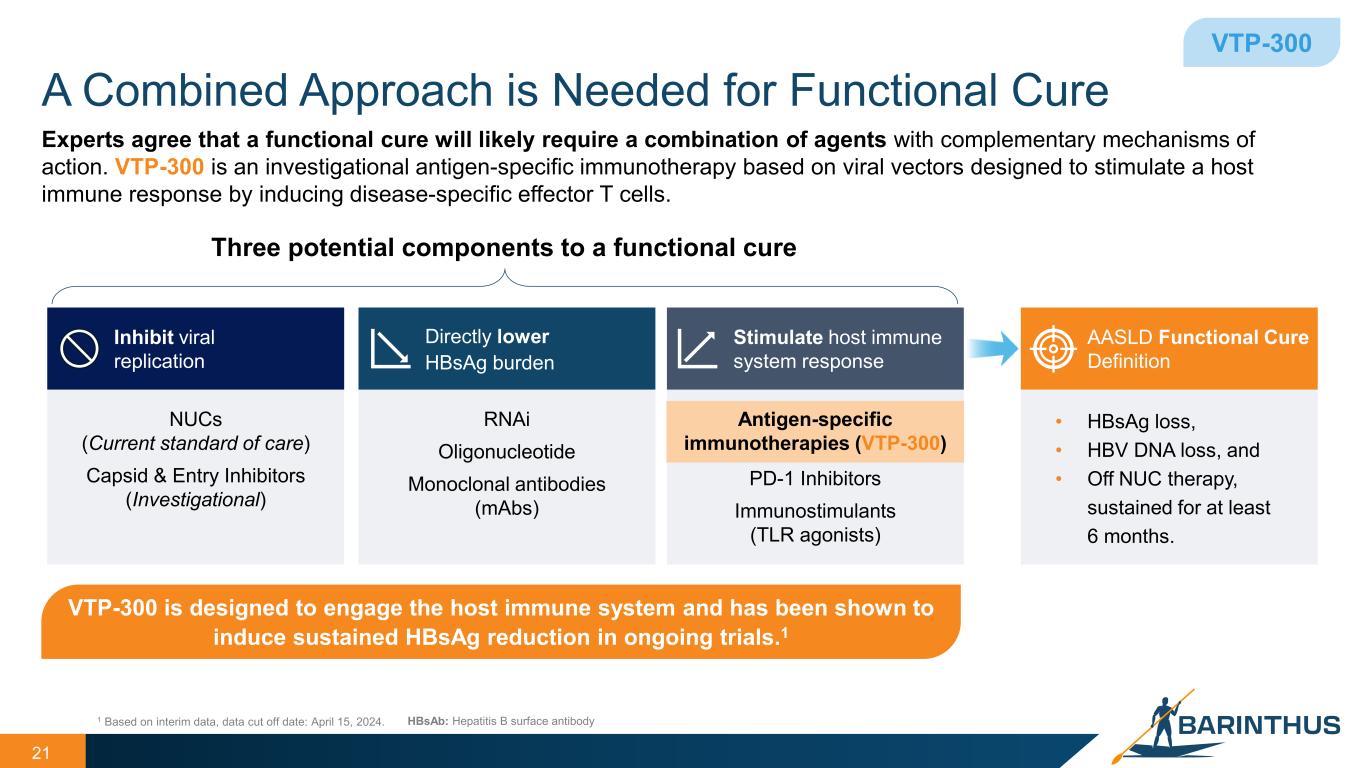

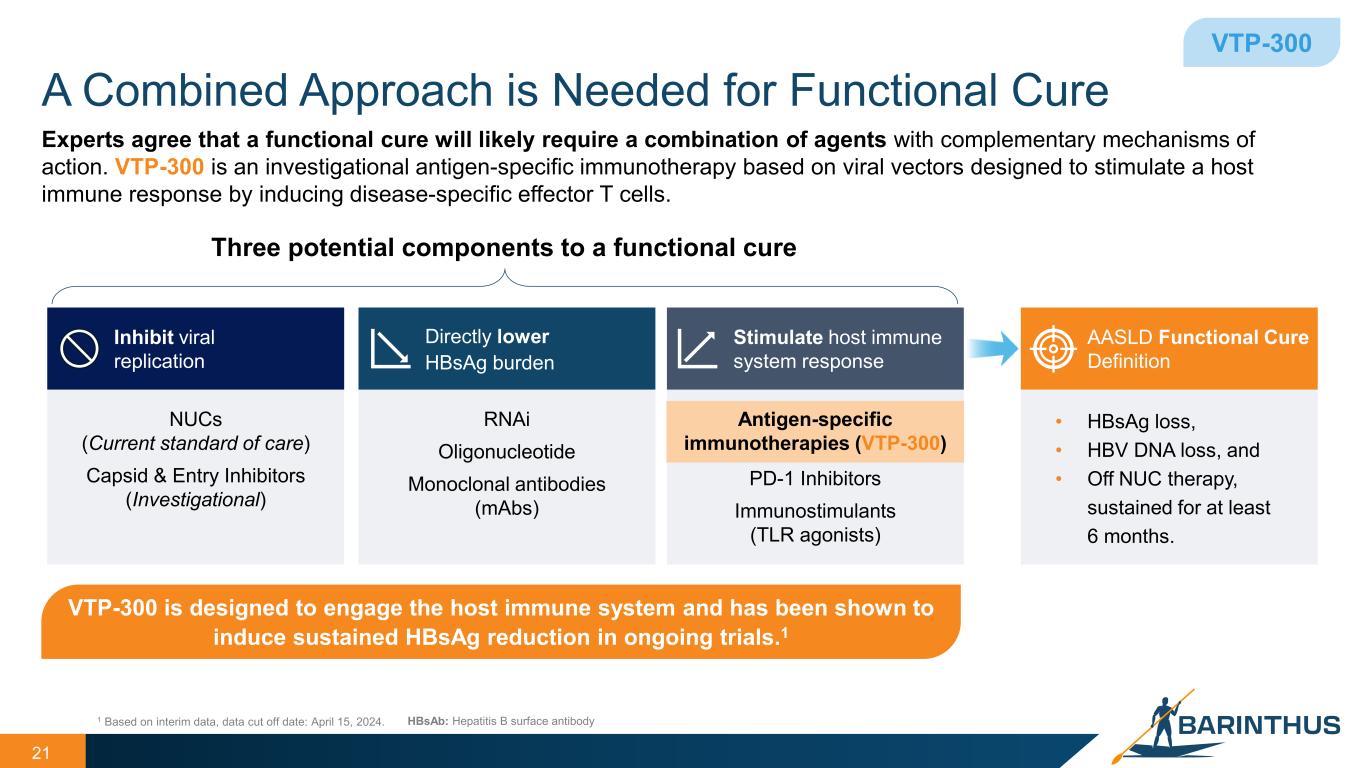

A Combined Approach is Needed for Functional Cure 21 VTP-300 Experts agree that a functional cure will likely require a combination of agents with complementary mechanisms of action. VTP-300 is an investigational antigen-specific immunotherapy based on viral vectors designed to stimulate a host immune response by inducing disease-specific effector T cells. Three potential components to a functional cure 1 Based on interim data, data cut off date: April 15, 2024. Inhibit viral replication NUCs (Current standard of care) Capsid & Entry Inhibitors (Investigational) Directly lower HBsAg burden RNAi Oligonucleotide Monoclonal antibodies (mAbs) Stimulate host immune system response Antigen-specific immunotherapies (VTP-300) PD-1 Inhibitors Immunostimulants (TLR agonists) HBsAb: Hepatitis B surface antibody VTP-300 is designed to engage the host immune system and has been shown to induce sustained HBsAg reduction in ongoing trials.1 AASLD Functional Cure Definition • HBsAg loss, • HBV DNA loss, and • Off NUC therapy, sustained for at least 6 months.

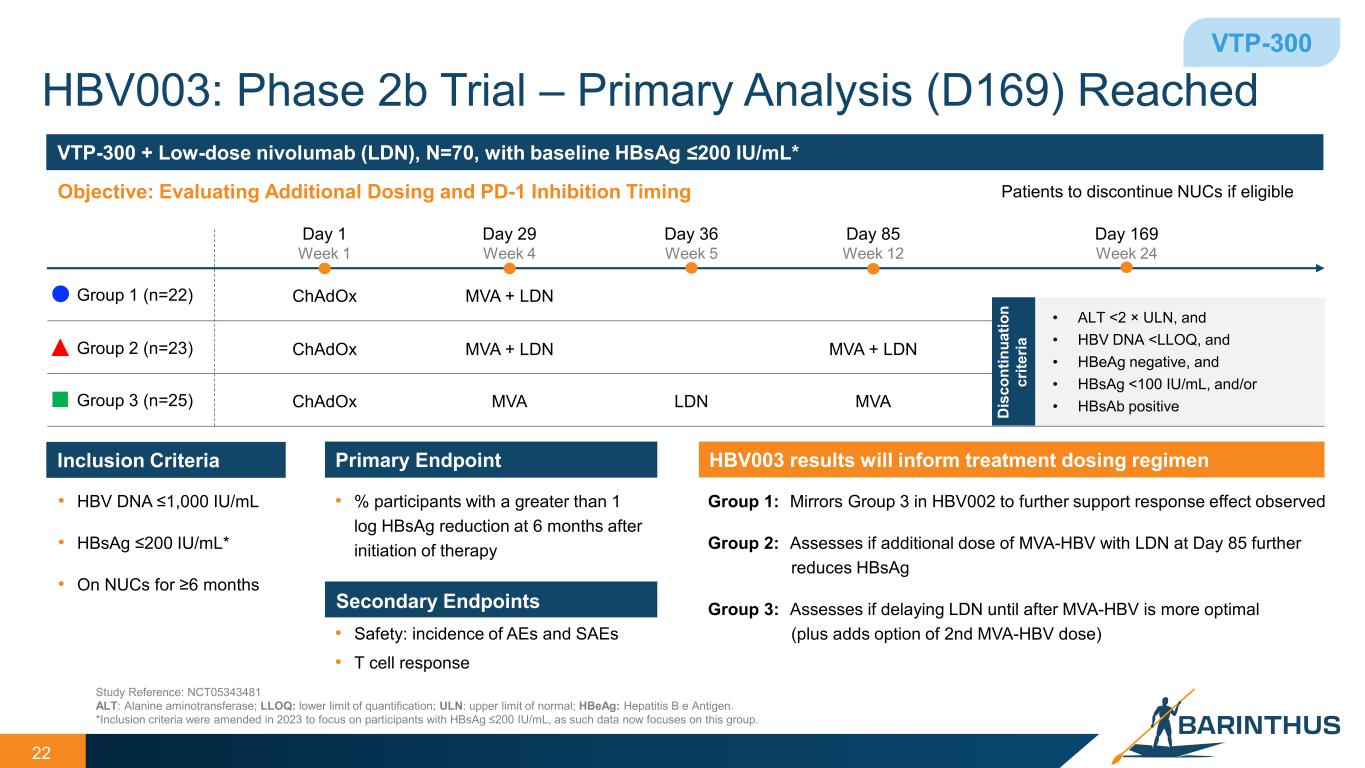

HBV003: Phase 2b Trial – Primary Analysis (D169) Reached 22 Study Reference: NCT05343481 ALT: Alanine aminotransferase; LLOQ: lower limit of quantification; ULN: upper limit of normal; HBeAg: Hepatitis B e Antigen. *Inclusion criteria were amended in 2023 to focus on participants with HBsAg ≤200 IU/mL, as such data now focuses on this group. VTP-300 Inclusion Criteria • HBV DNA ≤1,000 IU/mL • HBsAg ≤200 IU/mL* • On NUCs for ≥6 months Primary Endpoint • % participants with a greater than 1 log HBsAg reduction at 6 months after initiation of therapy Secondary Endpoints • Safety: incidence of AEs and SAEs • T cell response HBV003 results will inform treatment dosing regimen Group 1: Mirrors Group 3 in HBV002 to further support response effect observed Group 2: Assesses if additional dose of MVA-HBV with LDN at Day 85 further reduces HBsAg Group 3: Assesses if delaying LDN until after MVA-HBV is more optimal (plus adds option of 2nd MVA-HBV dose) VTP-300 + Low-dose nivolumab (LDN), N=70, with baseline HBsAg ≤200 IU/mL* Objective: Evaluating Additional Dosing and PD-1 Inhibition Timing Group 1 (n=22) Group 2 (n=23) Group 3 (n=25) Day 169 Week 24 Patients to discontinue NUCs if eligible Day 1 Week 1 ChAdOx ChAdOx ChAdOx MVA + LDN Day 29 Week 4 MVA + LDN MVA Day 36 Week 5 LDN Day 85 Week 12 MVA + LDN MVA • ALT <2 × ULN, and • HBV DNA <LLOQ, and • HBeAg negative, and • HBsAg <100 IU/mL, and/or • HBsAb positiveD is co nt in ua tio n cr ite ria

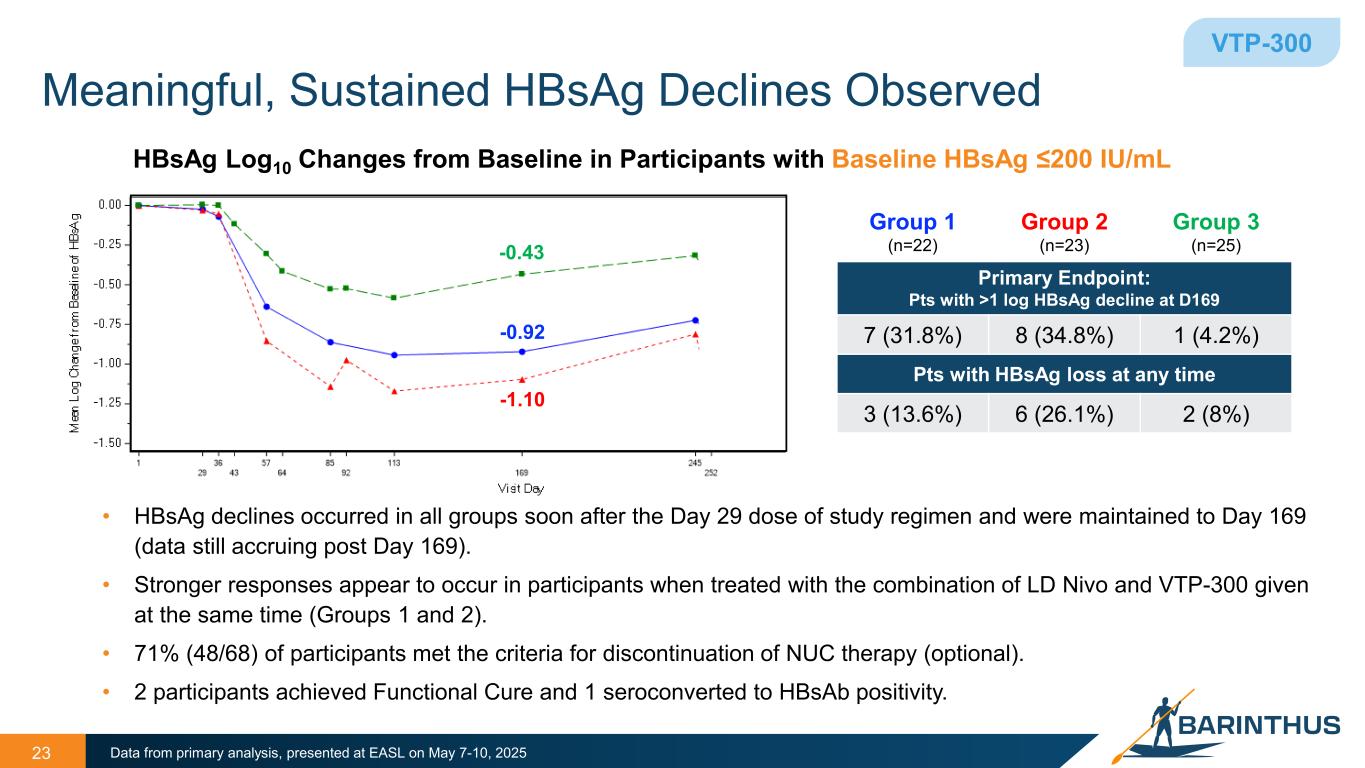

Meaningful, Sustained HBsAg Declines Observed • HBsAg declines occurred in all groups soon after the Day 29 dose of study regimen and were maintained to Day 169 (data still accruing post Day 169). • Stronger responses appear to occur in participants when treated with the combination of LD Nivo and VTP-300 given at the same time (Groups 1 and 2). • 71% (48/68) of participants met the criteria for discontinuation of NUC therapy (optional). • 2 participants achieved Functional Cure and 1 seroconverted to HBsAb positivity. 23 HBsAg Log10 Changes from Baseline in Participants with Baseline HBsAg ≤200 IU/mL Data from primary analysis, presented at EASL on May 7-10, 2025 Group 1 (n=22) Group 2 (n=23) Group 3 (n=25) Primary Endpoint: Pts with >1 log HBsAg decline at D169 7 (31.8%) 8 (34.8%) 1 (4.2%) Pts with HBsAg loss at any time 3 (13.6%) 6 (26.1%) 2 (8%) VTP-300 -0.43 -0.92 -1.10

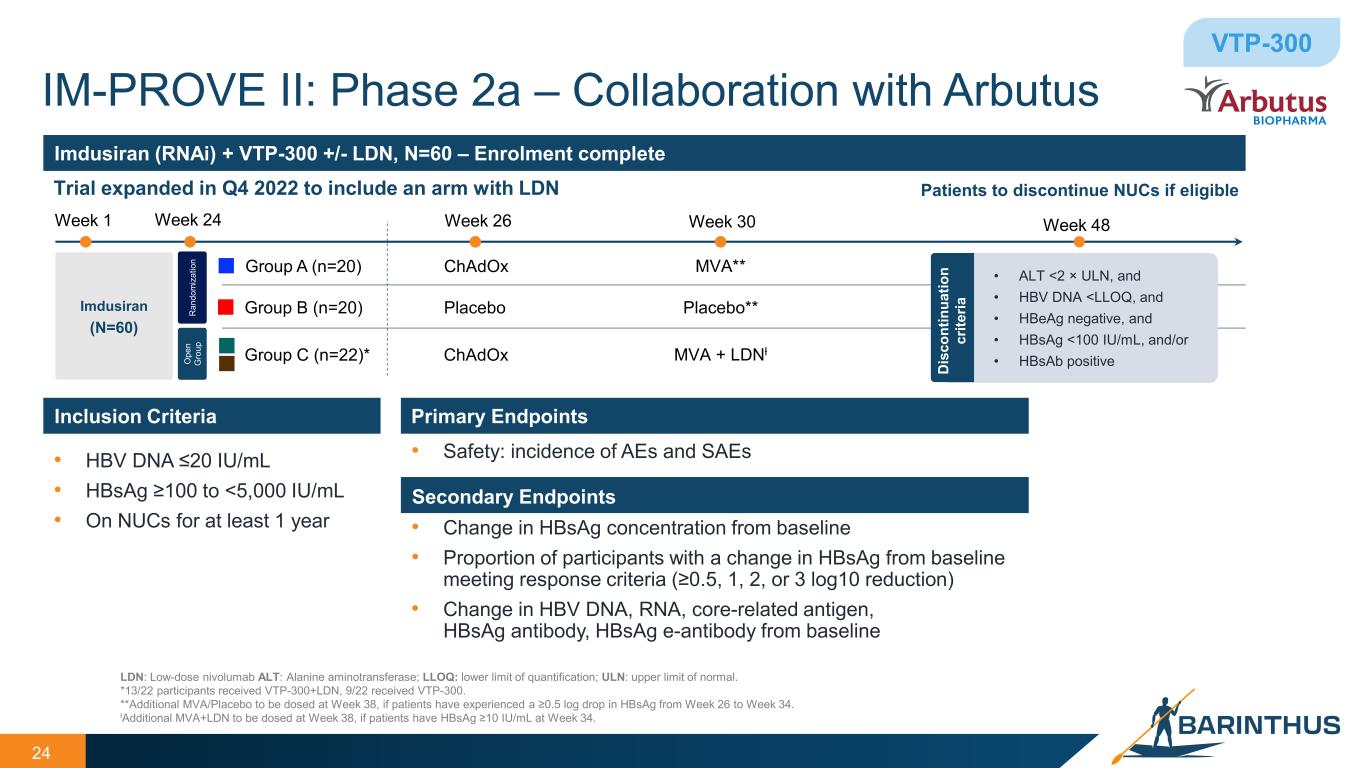

• HBV DNA ≤20 IU/mL • HBsAg ≥100 to <5,000 IU/mL • On NUCs for at least 1 year Inclusion Criteria Primary Endpoints Secondary Endpoints • Safety: incidence of AEs and SAEs • Change in HBsAg concentration from baseline • Proportion of participants with a change in HBsAg from baseline meeting response criteria (≥0.5, 1, 2, or 3 log10 reduction) • Change in HBV DNA, RNA, core-related antigen, HBsAg antibody, HBsAg e-antibody from baseline Imdusiran (RNAi) + VTP-300 +/- LDN, N=60 – Enrolment complete Trial expanded in Q4 2022 to include an arm with LDN 24 LDN: Low-dose nivolumab ALT: Alanine aminotransferase; LLOQ: lower limit of quantification; ULN: upper limit of normal. *13/22 participants received VTP-300+LDN, 9/22 received VTP-300. **Additional MVA/Placebo to be dosed at Week 38, if patients have experienced a ≥0.5 log drop in HBsAg from Week 26 to Week 34. ƚAdditional MVA+LDN to be dosed at Week 38, if patients have HBsAg ≥10 IU/mL at Week 34. Imdusiran (N=60) R an do m iz at io n O pe n G ro up IM-PROVE II: Phase 2a – Collaboration with Arbutus VTP-300 Week 1 Group A (n=20) Group B (n=20) Week 24 Week 26 Week 48 ChAdOx Placebo Group C (n=22)* ChAdOx Week 30 MVA + LDNƚ MVA** Placebo** Patients to discontinue NUCs if eligible • ALT <2 × ULN, and • HBV DNA <LLOQ, and • HBeAg negative, and • HBsAg <100 IU/mL, and/or • HBsAb positiveD is co nt in ua tio n cr ite ria

IM-PROVE II: 2 out of 13 Pts in Group C (Imdusiran, VTP-300 and LDN) Achieved Functional Cure 25 Mean HBsAg Change from Baseline by Treatment Group • Group C participants receiving imdusiran (“IDR”), VTP- 300 and LDN had a greater mean HBsAg log10 decline at Week 48 compared with all other groups. • 23% (3/13) of participants who received IDR+VTP- 300+LDN had undetectable HBsAg levels at week 48; all (3/3) participants with HBsAg loss seroconverted. • 25% (2/8) participants with starting baseline HBsAg levels less than 1000 IU/mL who received IDR+VTP-300+LDN reached Functional Cure. • More subjects were able to be maintained off NUC therapy after receiving the combination of IDR+VTP-300 compared to IDR+placebo. End of study data from Groups A and B and data though week 84 for Group C, presented at EASL on May 7-10, 2025 Group C (N=22)* Treatment IDR + VTP-300 + LDN IDR + VTP-300 Participants 13/22 9/22 VTP-300 *Some participants were not eligible for LDN under the trial criteria.

Company Highlights Guiding the immune system to cure disease

Financial Overview and Catalysts 27 Guiding the immune system to cure disease Cash $100.6 million1 as of March 31, 2025 No debt or outstanding warrants Estimated cash runway into 20272 Expected near-term catalyst2 Q3 2025 VTP-1000 (Celiac): Phase 1 single ascending dose data 1 Including cash, cash equivalents and restricted cash as of March 31, 2025, as reported on Form 10-Q on May 7, 2025. 2 Based on management’s current estimate of status and strategy. Any changes could be material.

Guiding the Immune System to Cure Disease Thank You