Shareholder Letter Q2 2024 JO B Y A V IA T IO N A U G U S T 7 , 20 24 JO B YA V IA T IO N .C O M

AT A GLANCE Production Ramp-Up Our third production prototype aircraft rolled off our pilot assembly line and our second began flying. We expect to have four aircraft in active flight test during the next quarter. Certification Progress The fourth stage of type certification is now more than one-third complete on the Joby side, with numerous test plans submitted and accepted during the quarter. International Expansion We applied for certification in Australia and signed an agreement with Mukamalah, a wholly owned subsidiary of Saudi Aramco and operator of the world’s largest fleet of corporate aircraft, to introduce Joby’s aircraft to the Kingdom of Saudi Arabia via direct sales. Future Technologies We flew a first-of-its-kind, hydrogen-electric air taxi demonstrator 561 miles and acquired the autonomy division of Xwing, an industry leader in the development of autonomous technology for aviation. STRONG FINANCIAL FOUNDATION At the end of the second quarter of 2024, we maintained a strong balance sheet with $825 million in cash and short-term investments. Our use of cash in the quarter reflected spending to progress aircraft certification and manufacturing operations. NET LOSS Net loss of $123 million reflected a loss from operations of $144 million, partly offset by interest and other income of $21 million. Operating expenses primarily reflected costs to support certification and manufacturing of prototype aircraft, parts and test articles. ADJUSTED EBITDA Adjusted EBITDA loss of $107 million largely reflected our operating expenses excluding depreciation, amortization and stock-based compensation. Q2 2024 Highlights Joby AviationQ2 2024 Shareholder Letter August 7, 2024 2

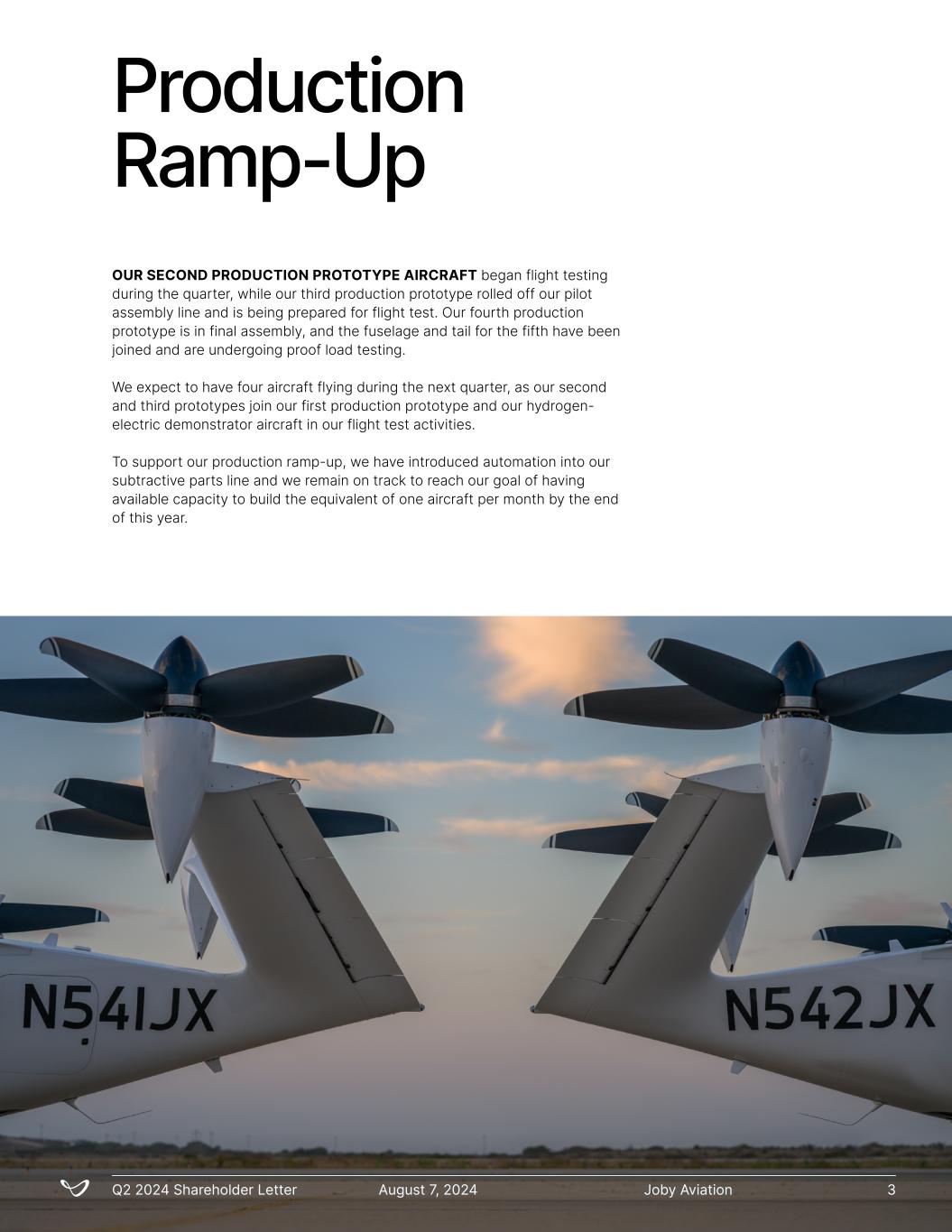

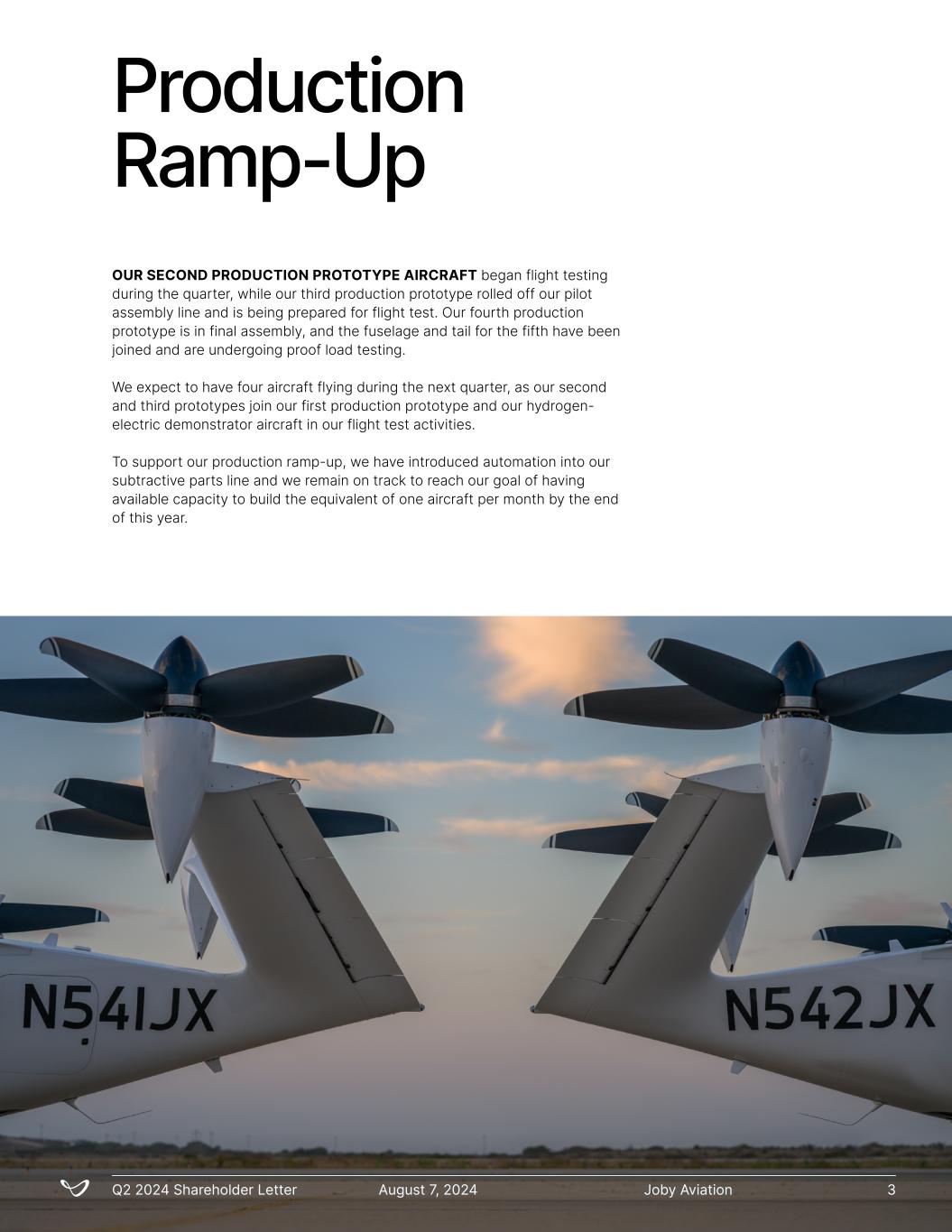

Production Ramp-Up Joby AviationQ2 2024 Shareholder Letter August 7, 2024 3 OUR SECOND PRODUCTION PROTOTYPE AIRCRAFT began flight testing during the quarter, while our third production prototype rolled off our pilot assembly line and is being prepared for flight test. Our fourth production prototype is in final assembly, and the fuselage and tail for the fifth have been joined and are undergoing proof load testing. We expect to have four aircraft flying during the next quarter, as our second and third prototypes join our first production prototype and our hydrogen- electric demonstrator aircraft in our flight test activities. To support our production ramp-up, we have introduced automation into our subtractive parts line and we remain on track to reach our goal of having available capacity to build the equivalent of one aircraft per month by the end of this year.

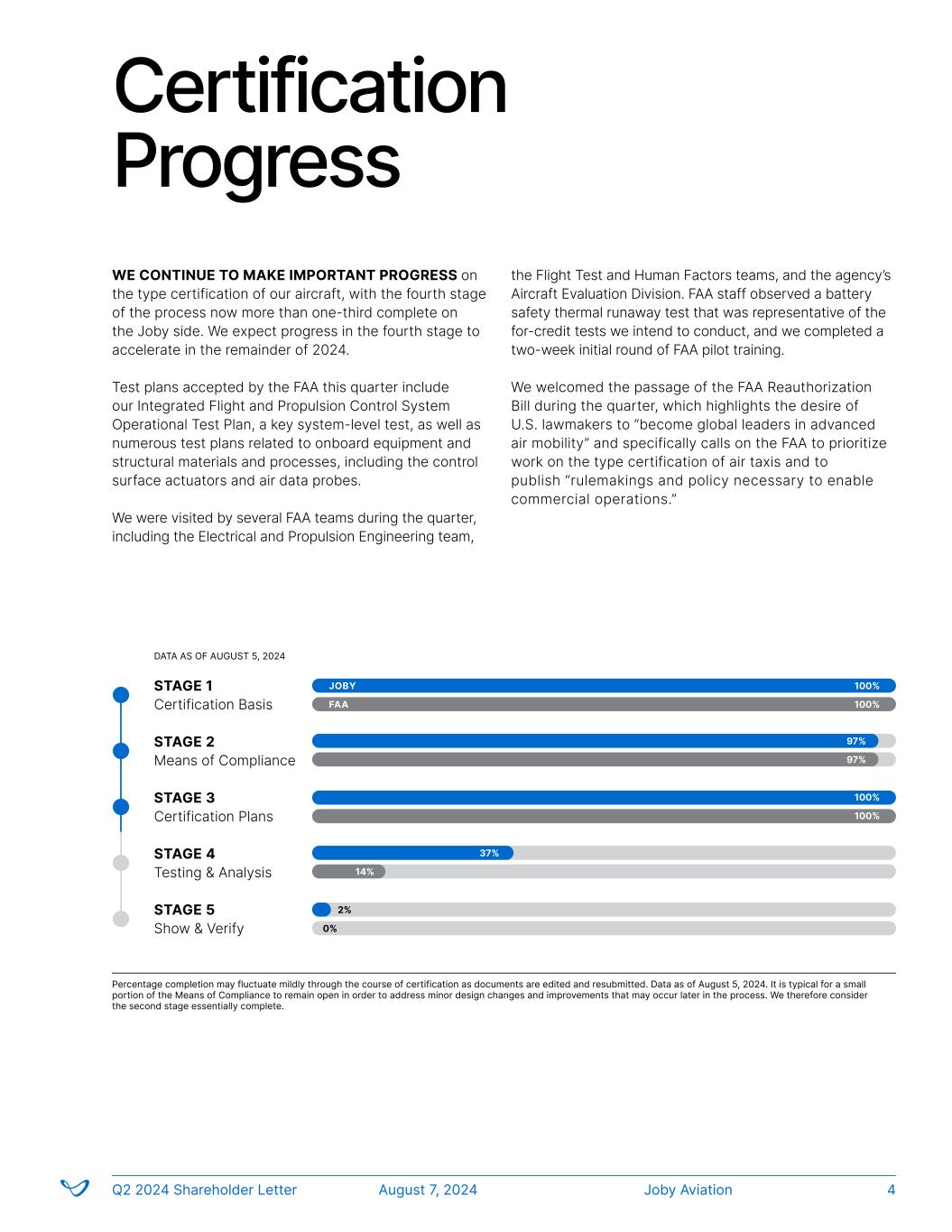

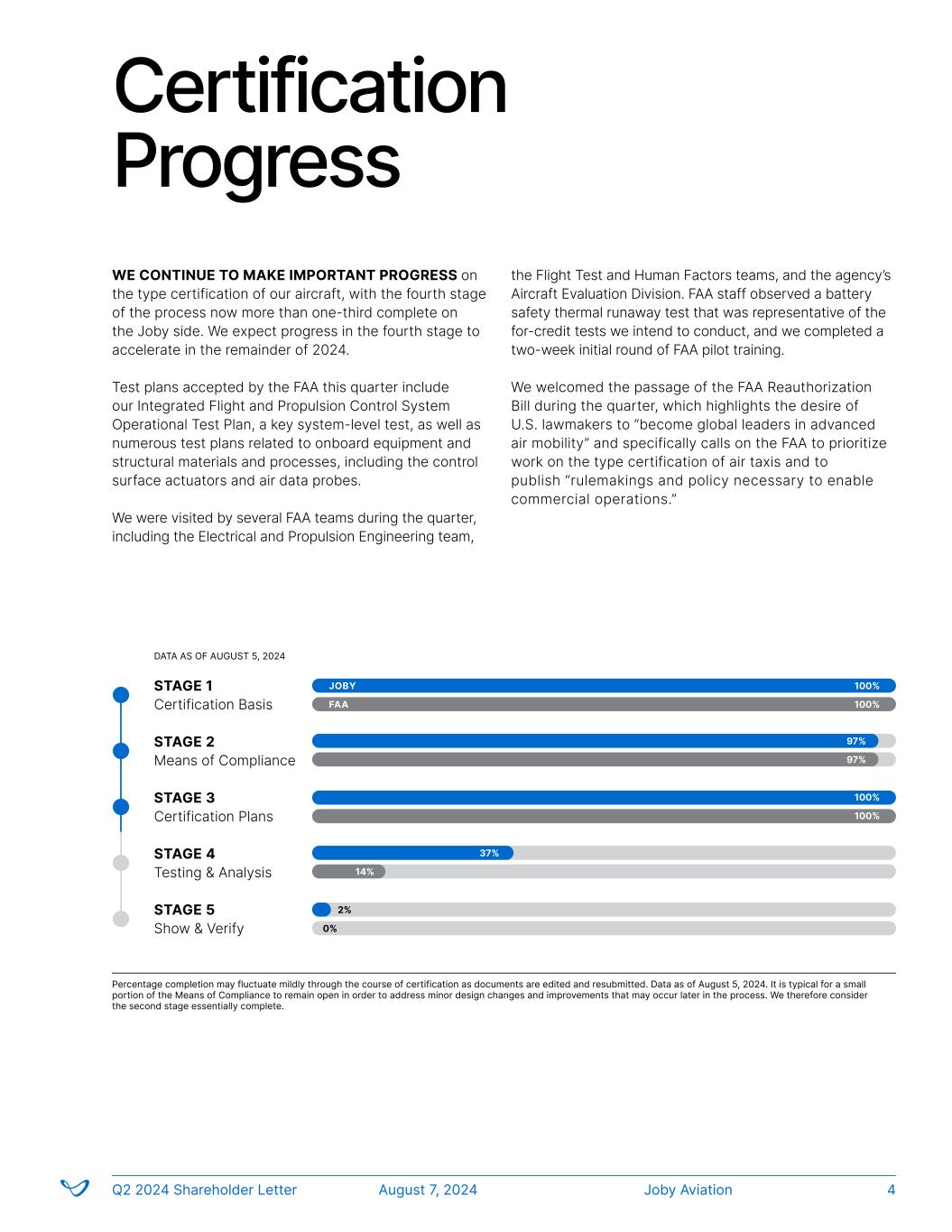

Certification Progress WE CONTINUE TO MAKE IMPORTANT PROGRESS on the type certification of our aircraft, with the fourth stage of the process now more than one-third complete on the Joby side. We expect progress in the fourth stage to accelerate in the remainder of 2024. Test plans accepted by the FAA this quarter include our Integrated Flight and Propulsion Control System Operational Test Plan, a key system-level test, as well as numerous test plans related to onboard equipment and structural materials and processes, including the control surface actuators and air data probes. We were visited by several FAA teams during the quarter, including the Electrical and Propulsion Engineering team, the Flight Test and Human Factors teams, and the agency’s Aircraft Evaluation Division. FAA staff observed a battery safety thermal runaway test that was representative of the for-credit tests we intend to conduct, and we completed a two-week initial round of FAA pilot training. We welcomed the passage of the FAA Reauthorization Bill during the quarter, which highlights the desire of U.S. lawmakers to “become global leaders in advanced air mobility” and specifically calls on the FAA to prioritize work on the type certification of air taxis and to publish “rulemakings and policy necessary to enable commercial operations.” Percentage completion may fluctuate mildly through the course of certification as documents are edited and resubmitted. Data as of August 5, 2024. It is typical for a small portion of the Means of Compliance to remain open in order to address minor design changes and improvements that may occur later in the process. We therefore consider the second stage essentially complete. Joby’s Progress to Type Certification STAGE 1 Certification Basis STAGE 2 Means of Compliance STAGE 3 Certification Plans STAGE 4 Testing & Analysis STAGE 5 Show & Verify JOBY 100% 97% 37% 2% FAA 100% 97% 14% 0% DATA AS OF AUGUST 5, 2024 Joby AviationQ2 2024 Shareholder Letter August 7, 2024 4 100% 100%

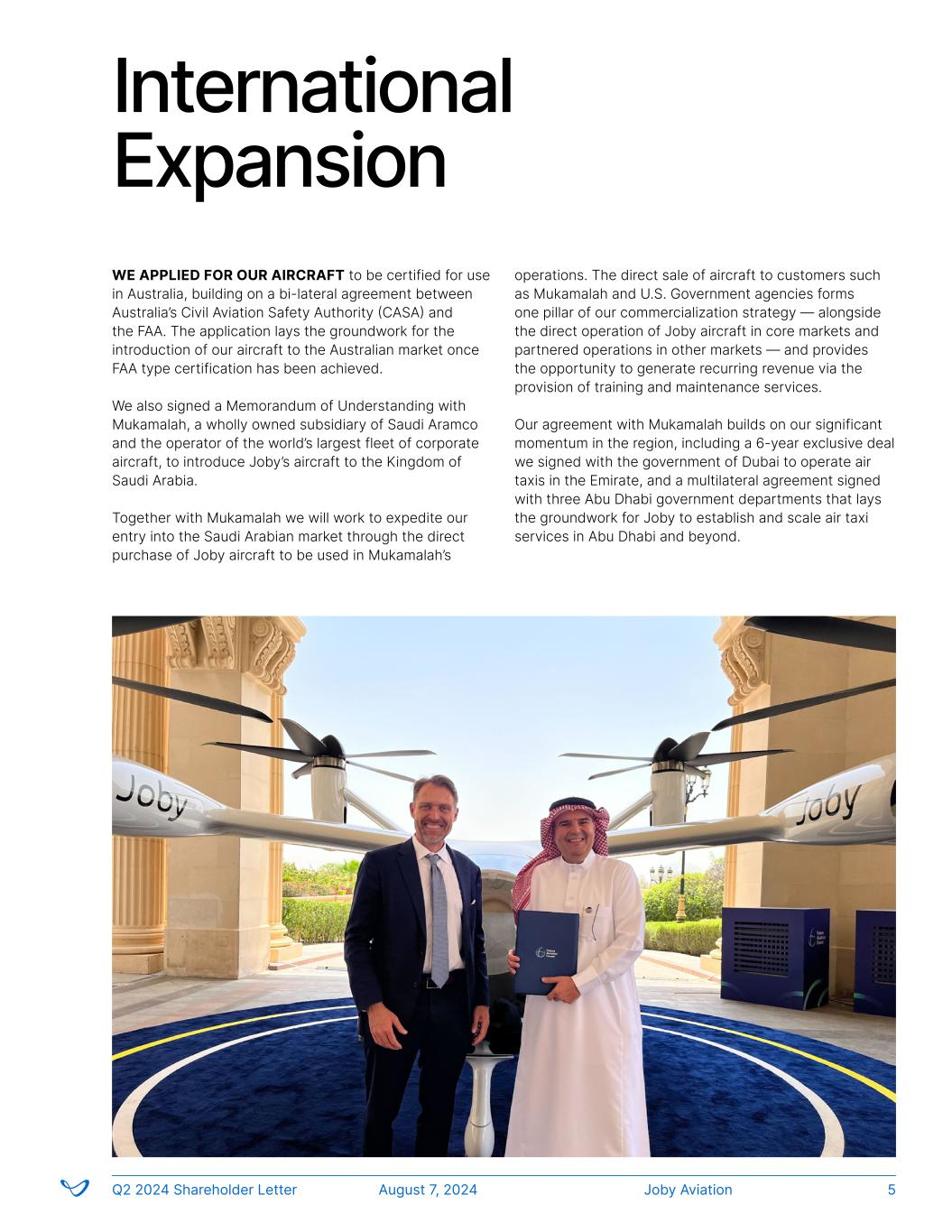

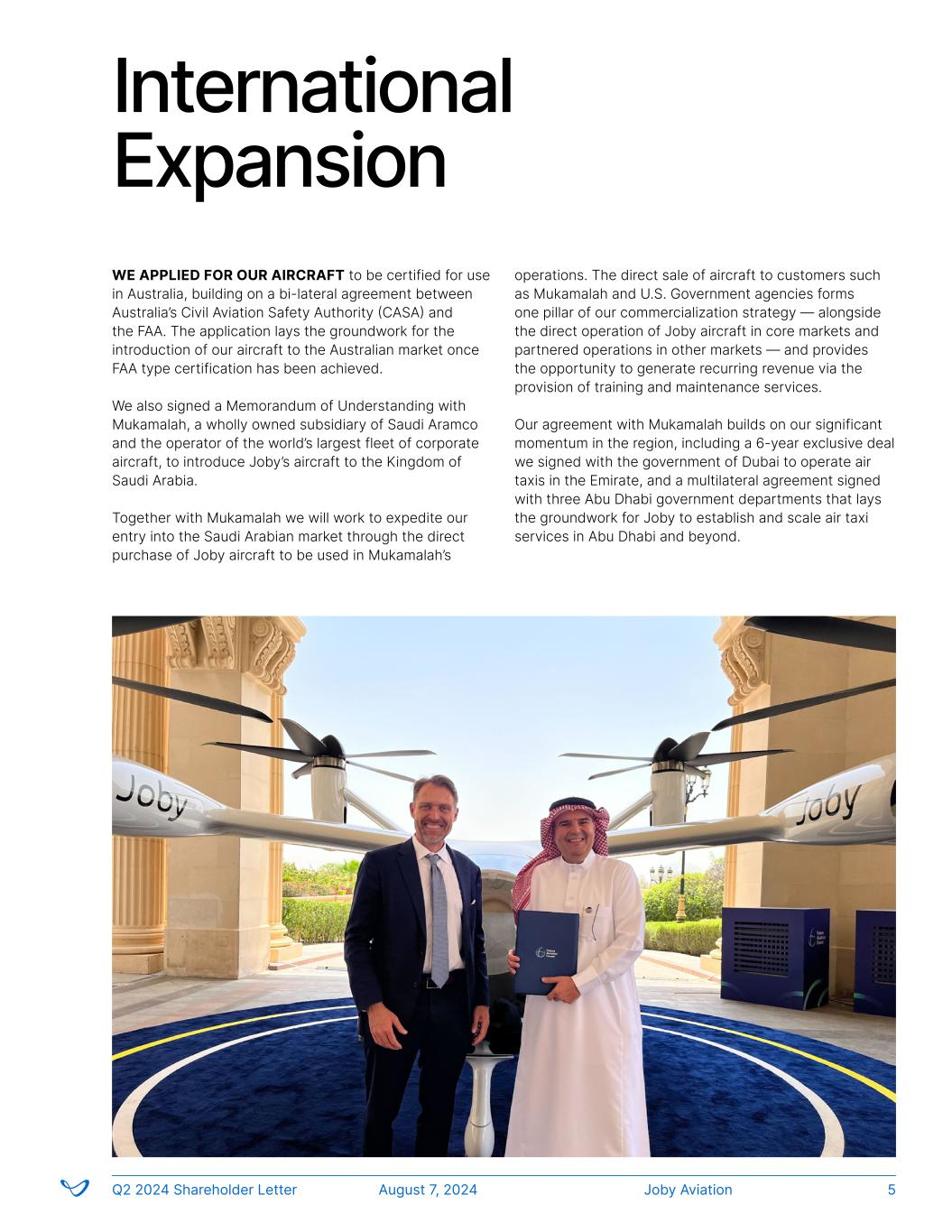

International Expansion WE APPLIED FOR OUR AIRCRAFT to be certified for use in Australia, building on a bi-lateral agreement between Australia’s Civil Aviation Safety Authority (CASA) and the FAA. The application lays the groundwork for the introduction of our aircraft to the Australian market once FAA type certification has been achieved. We also signed a Memorandum of Understanding with Mukamalah, a wholly owned subsidiary of Saudi Aramco and the operator of the world’s largest fleet of corporate aircraft, to introduce Joby’s aircraft to the Kingdom of Saudi Arabia. Together with Mukamalah we will work to expedite our entry into the Saudi Arabian market through the direct purchase of Joby aircraft to be used in Mukamalah’s operations. The direct sale of aircraft to customers such as Mukamalah and U.S. Government agencies forms one pillar of our commercialization strategy — alongside the direct operation of Joby aircraft in core markets and partnered operations in other markets — and provides the opportunity to generate recurring revenue via the provision of training and maintenance services. Our agreement with Mukamalah builds on our significant momentum in the region, including a 6-year exclusive deal we signed with the government of Dubai to operate air taxis in the Emirate, and a multilateral agreement signed with three Abu Dhabi government departments that lays the groundwork for Joby to establish and scale air taxi services in Abu Dhabi and beyond. Joby AviationQ2 2024 Shareholder Letter August 7, 2024 5

JOBY’S VERTICALLY-INTEGRATED APPROACH empowers us to instill high standards for quality, safety, sustainability and social impact across all aspects of our business, and during the quarter we published our second annual Impact Report, covering 2023. In addition to establishing our first global Scope 1 and 2 greenhouse gas (GHG) inventory, the report provides insight into our performance across safety, environment, people, and community, including, for example, Joby’s apprenticeship program. Joby hired 63 apprentices across 12 manufacturing specialties, with 71% of our 2023 apprentices coming from underrepresented groups. The majority of our GHG footprint comes from our electricity consumption, and our report highlights efforts we are making to reduce our impact. We consumed 100% renewable electricity at our primary facilities in 2023. During the year, we recycled almost 60,000 pounds of manufacturing waste, including 1,000 pounds of lithium batteries in partnership with Redwood Materials. We believe that transparently reporting Joby’s impact on the planet and our communities is a core part of our journey to build a next-generation aviation company. 2023 Impact Report Reflecting on our 2023 Impact As we scale our manufacturing and commercial operations, we aim to do so in a manner that: • Recognizes safety as foundational to how our team members work and our aircraft operates • Minimizes our operational environmental impact • Has a positive impact on our team members’ lives and our larger communities • Operates in an ethical and responsible manner We are at the beginning of our journey. What we do today will set the tone for how our company, and potentially the broader electric air taxi industry, will manufacture and operate at scale. It is important we seize this opportunity to make a positive impact on the future of our industry. We recognize that the disclosure landscape is rapidly evolving in response to growing stakeholder expectations and the realities of concurrent global challenges: the climate crisis, inflation and ongoing macroeconomic shifts. These challenges underscore the importance of transparent and comprehensive reporting, to which we are continually committed and stress the urgency of evaluating our company’s impact. Being a catalyst for change starts with transparency and accountability. Highlights of how we’ve started that journey are shown to the right. Safety programs accepted by two rigorous standard-setting governance organizations 4,000 hours of team member training on key Occupational Safety and Health Administration (OSHA) principles Completed our first global Scope 1 and 2 greenhouse gas inventory 81% of global electricity consumed from renewable sources as we work towards our Commitment to the Planet 300+ team members added in 2023 63 apprentices hired across 12 manufacturing specialties with 71% from underrepresented racial/ethnic groups 1,800 students inspired on the next generation of technology careers Letter from our CEO 2023 Highlights 2023 Impact Report | 7 Contents AppendixSafety Environment People and Community Corporate Governance Stationary Combustion Propane Natural Gas Diesel Vehicles Aviation Gasoline Gasoline Diesel Building Electricity Heating Energy Consumption: 12,546 MWh 57% from renewable sources Total Energy Consumption (MWh) Renewable Electricity We have committed to source 100% renewable electricity for primary facilities where feasible as part of our greenhouse gas reduction strategy. • Globally, 81% of our electricity consumed in 2023 was sourced from renewable sources. • In California, where 74% of our team members are, 96% of our electricity consumed in 2023 was sourced from renewable sources.7 100% of our primary facilities were on 100% renewable electricity rate plans by the end of 2023. • For 2023, non-renewable electricity was our biggest source of greenhouse gas emissions globally identifying that there is still work to be done. WHERE DOES OUR RENEWABLE ELECTRICITY COME FROM? In 2023, 60% of the electricity consumed at our Santa Cruz headquarters was generated by onsite solar panels. For the remaining demand along with our additional Santa Cruz and Marina facilities, 100% renewable electricity is procured through the local Community Choice Aggregation company, Central Coast Community Energy (CCCE).8 CCCE sources renewable electricity for its customers from locations in the Central Coast of California. Recent online projects include Slate Solar & Storage in Kings County, CA, Mountain View Wind in Riverside County, CA, and Rabbitbrush Solar & Storage in Kern County, CA. For our San Carlos facility, 100% renewable electricity is procured through an agreement with Commercial Energy through our landlord.9 7 Sources of electricity for our California sites are noted in the power content labels on the CEC website. Where eligible, facilities are upgraded to the 100% renewable electricity rate plan through an energy provider as they come online. There can occasionally be a billing cycle delay. During this period and for facilities not on renewable electricity plans, renewable electricity data excludes any renewable electricity that is part of the grid by default, in alignment with reporting frameworks. Notably, we operate in a number of grids that rely significantly on renewable sources. 8 CCCE’s 100% renewable electricity plan, 3CE Prime, sources electricity from 50% solar and 50% wind sources, as noted in the 2022 Power Content Label. 9 Commercial Energy’s 100% renewable electricity plan, Commercial Energy of California Renewable, sources 100% solar electricity, as noted in the 2022 Power Content Label. Total Renewable Energy Electricity Consumption: 8,802 MWh 81% from renewable sources globally 100% of primary California facilities used renewable electricity by the end of 2023 Self-Generated Renewable Electricity: 518 MWh 2,046 542 445 25 8,802 422 91 172 Safety Environment 2023 Impact Report | 17 2023 HighlightsLetter from our CEOContents AppendixPeople and Community Corporate Governance Joby AviationQ2 2024 Shareholder Letter August 7, 2024 6

Joby AviationQ2 2024 Shareholder Letter August 7, 2024 7 Record-breaking Hydrogen Flight BUILDING ON THE SUCCESS of our battery-electric air taxi development program, we began flying a first-of-its-kind hydrogen-electric air taxi demonstrator aircraft, completing several flights over 500 miles, including one of 561 miles, with water as the only by-product. The flights demonstrate the potential for hydrogen to unlock emissions-free, regional journeys that don’t require a runway and were completed using a converted Joby pre-production aircraft fitted with a liquid hydrogen fuel tank and fuel cell system. The fuel cell system was designed and built by H2FLY, Joby’s wholly- owned subsidiary based in Stuttgart, Germany. “The vast majority of the design, testing and certification work we’ve completed on our battery-electric aircraft carries over to commercializing hydrogen-electric flight. In service, we also expect to be able to use the same landing pads, the same operations team, and Joby’s ElevateOS software that will support the commercial operations of our battery-electric aircraft.” JoeBen Bevirt, Founder and CEO

Xwing Acquisition Joby AviationQ2 2024 Shareholder Letter August 7, 2024 8 THE ACQUISITION of the autonomy division of Xwing, Inc., an industry leader in the development of autonomous technology for aviation, brings Joby to the forefront of this technology and complements our 2021 acquisition of Inras GmbH, a company developing lightweight, high-performance radar sensor technology. Founded in 2016, Xwing has been flying autonomous aircraft since 2020, using the Superpilot software it developed in-house. Superpilot enables safe, uncrewed operations, supervised from the ground, and is the world’s first fully autonomous gate-to-gate flight technology. With 250 fully autonomous flights and more than 500 auto-landings completed, Xwing became the first company to receive an official project designation for the certification of a large unmanned aerial system (UAS) from the FAA and the first to receive an Air Force Military Flight Release in 2024. Joby expects the technology to play an important role in accelerating the execution of existing contract deliverables with the U.S. Department of Defense and expanding the potential for future contracts.

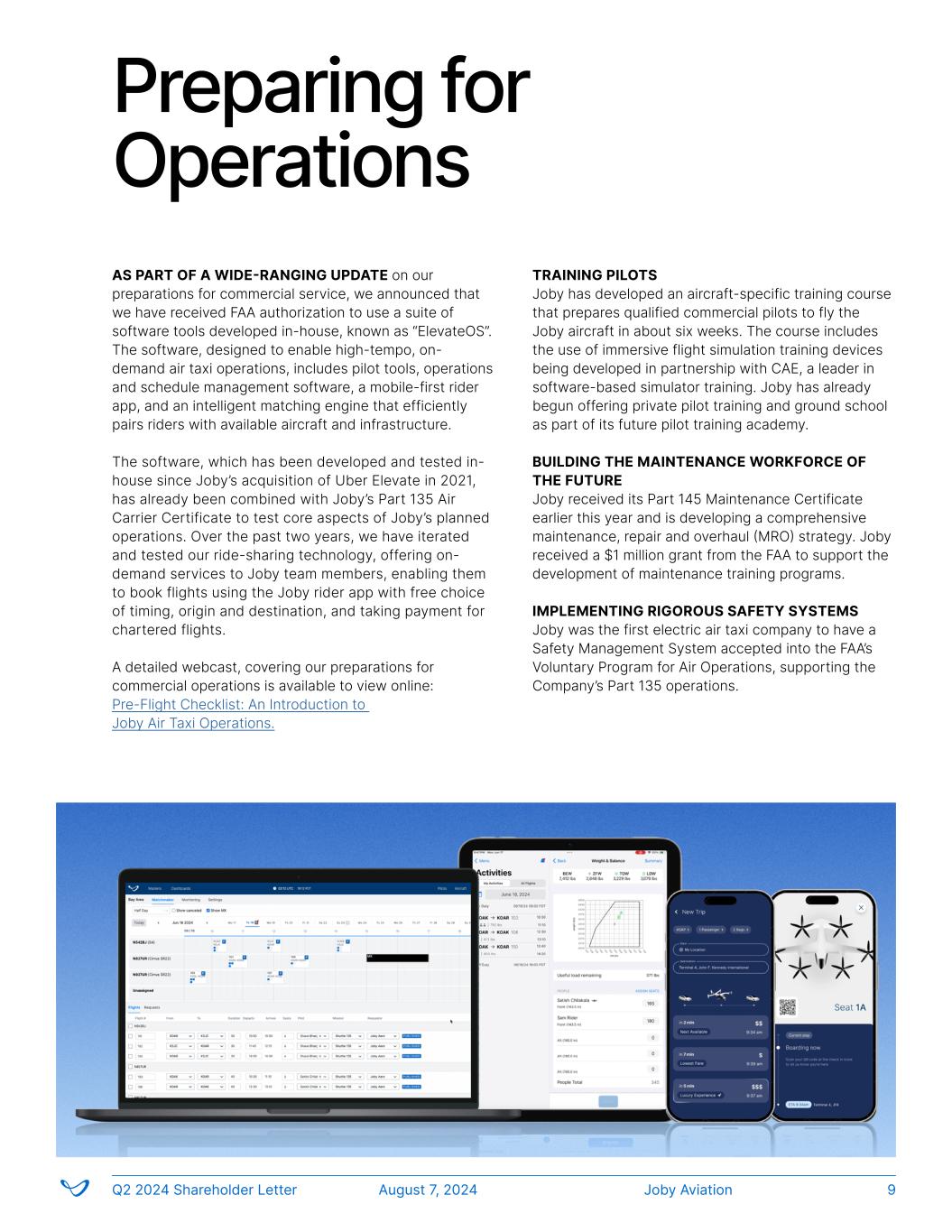

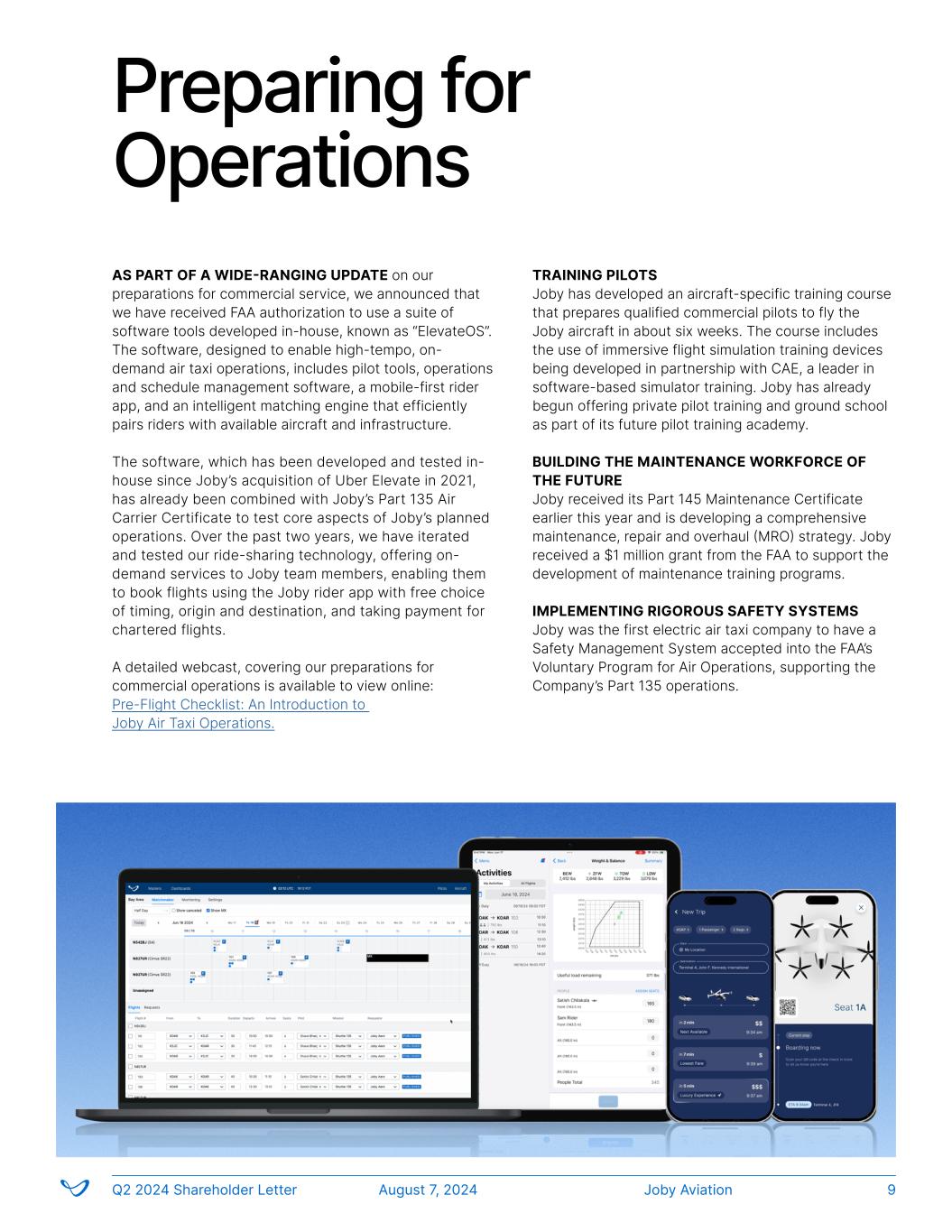

AS PART OF A WIDE-RANGING UPDATE on our preparations for commercial service, we announced that we have received FAA authorization to use a suite of software tools developed in-house, known as “ElevateOS”. The software, designed to enable high-tempo, on- demand air taxi operations, includes pilot tools, operations and schedule management software, a mobile-first rider app, and an intelligent matching engine that efficiently pairs riders with available aircraft and infrastructure. The software, which has been developed and tested in- house since Joby’s acquisition of Uber Elevate in 2021, has already been combined with Joby’s Part 135 Air Carrier Certificate to test core aspects of Joby’s planned operations. Over the past two years, we have iterated and tested our ride-sharing technology, offering on- demand services to Joby team members, enabling them to book flights using the Joby rider app with free choice of timing, origin and destination, and taking payment for chartered flights. A detailed webcast, covering our preparations for commercial operations is available to view online: Pre-Flight Checklist: An Introduction to Joby Air Taxi Operations. Preparing for Operations Joby AviationQ2 2024 Shareholder Letter August 7, 2024 9 TRAINING PILOTS Joby has developed an aircraft-specific training course that prepares qualified commercial pilots to fly the Joby aircraft in about six weeks. The course includes the use of immersive flight simulation training devices being developed in partnership with CAE, a leader in software-based simulator training. Joby has already begun offering private pilot training and ground school as part of its future pilot training academy. BUILDING THE MAINTENANCE WORKFORCE OF THE FUTURE Joby received its Part 145 Maintenance Certificate earlier this year and is developing a comprehensive maintenance, repair and overhaul (MRO) strategy. Joby received a $1 million grant from the FAA to support the development of maintenance training programs. IMPLEMENTING RIGOROUS SAFETY SYSTEMS Joby was the first electric air taxi company to have a Safety Management System accepted into the FAA’s Voluntary Program for Air Operations, supporting the Company’s Part 135 operations.

An event for policymakers in Washington, D.C., held alongside the FAA- EASA International Aviation Safety Conference. Our Founder and CEO JoeBen Bevirt receiving the Bay Area Entrepreneur of the Year award from Ernst & Young. Gathering in San Jose for a screening of IMAX documentary ‘Cities of the Future’ which features Joby.A group of NASA Aeronautics personnel visit our team at Edwards Air Force Base. Joby hosted the Bay Area Women in Space and Aerospace (BAWISA) organization at our facility in San Carlos. Joby AviationQ2 2024 Shareholder Letter August 7, 2024 10 Our mobile simulator trailer at EAA AirVenture in Oshkosh, WI.

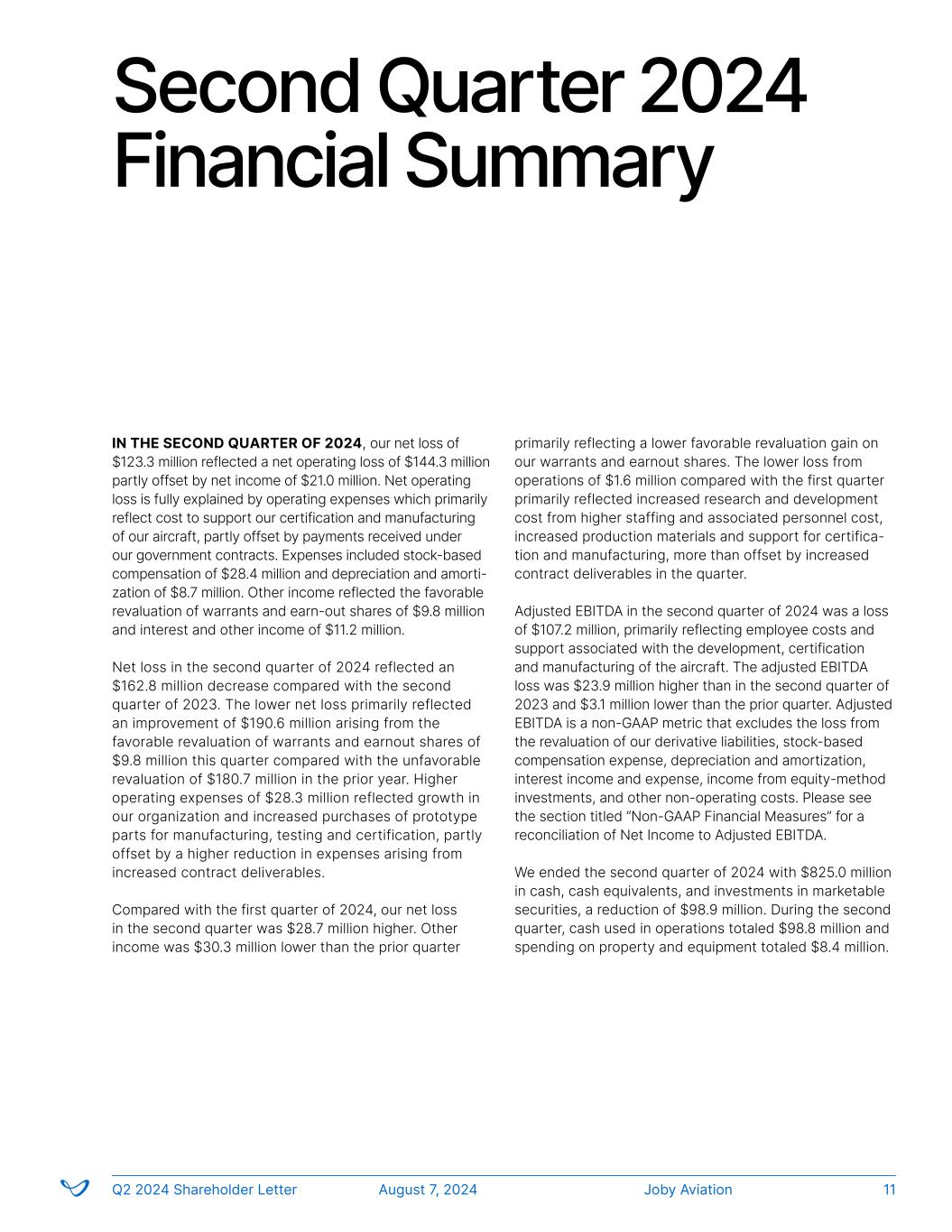

Second Quarter 2024 Financial Summary IN THE SECOND QUARTER OF 2024, our net loss of $123.3 million reflected a net operating loss of $144.3 million partly offset by net income of $21.0 million. Net operating loss is fully explained by operating expenses which primarily reflect cost to support our certification and manufacturing of our aircraft, partly offset by payments received under our government contracts. Expenses included stock-based compensation of $28.4 million and depreciation and amorti- zation of $8.7 million. Other income reflected the favorable revaluation of warrants and earn-out shares of $9.8 million and interest and other income of $11.2 million. Net loss in the second quarter of 2024 reflected an $162.8 million decrease compared with the second quarter of 2023. The lower net loss primarily reflected an improvement of $190.6 million arising from the favorable revaluation of warrants and earnout shares of $9.8 million this quarter compared with the unfavorable revaluation of $180.7 million in the prior year. Higher operating expenses of $28.3 million reflected growth in our organization and increased purchases of prototype parts for manufacturing, testing and certification, partly offset by a higher reduction in expenses arising from increased contract deliverables. Compared with the first quarter of 2024, our net loss in the second quarter was $28.7 million higher. Other income was $30.3 million lower than the prior quarter primarily reflecting a lower favorable revaluation gain on our warrants and earnout shares. The lower loss from operations of $1.6 million compared with the first quarter primarily reflected increased research and development cost from higher staffing and associated personnel cost, increased production materials and support for certifica- tion and manufacturing, more than offset by increased contract deliverables in the quarter. Adjusted EBITDA in the second quarter of 2024 was a loss of $107.2 million, primarily reflecting employee costs and support associated with the development, certification and manufacturing of the aircraft. The adjusted EBITDA loss was $23.9 million higher than in the second quarter of 2023 and $3.1 million lower than the prior quarter. Adjusted EBITDA is a non-GAAP metric that excludes the loss from the revaluation of our derivative liabilities, stock-based compensation expense, depreciation and amortization, interest income and expense, income from equity-method investments, and other non-operating costs. Please see the section titled “Non-GAAP Financial Measures” for a reconciliation of Net Income to Adjusted EBITDA. We ended the second quarter of 2024 with $825.0 million in cash, cash equivalents, and investments in marketable securities, a reduction of $98.9 million. During the second quarter, cash used in operations totaled $98.8 million and spending on property and equipment totaled $8.4 million. Joby AviationQ2 2024 Shareholder Letter August 7, 2024 11

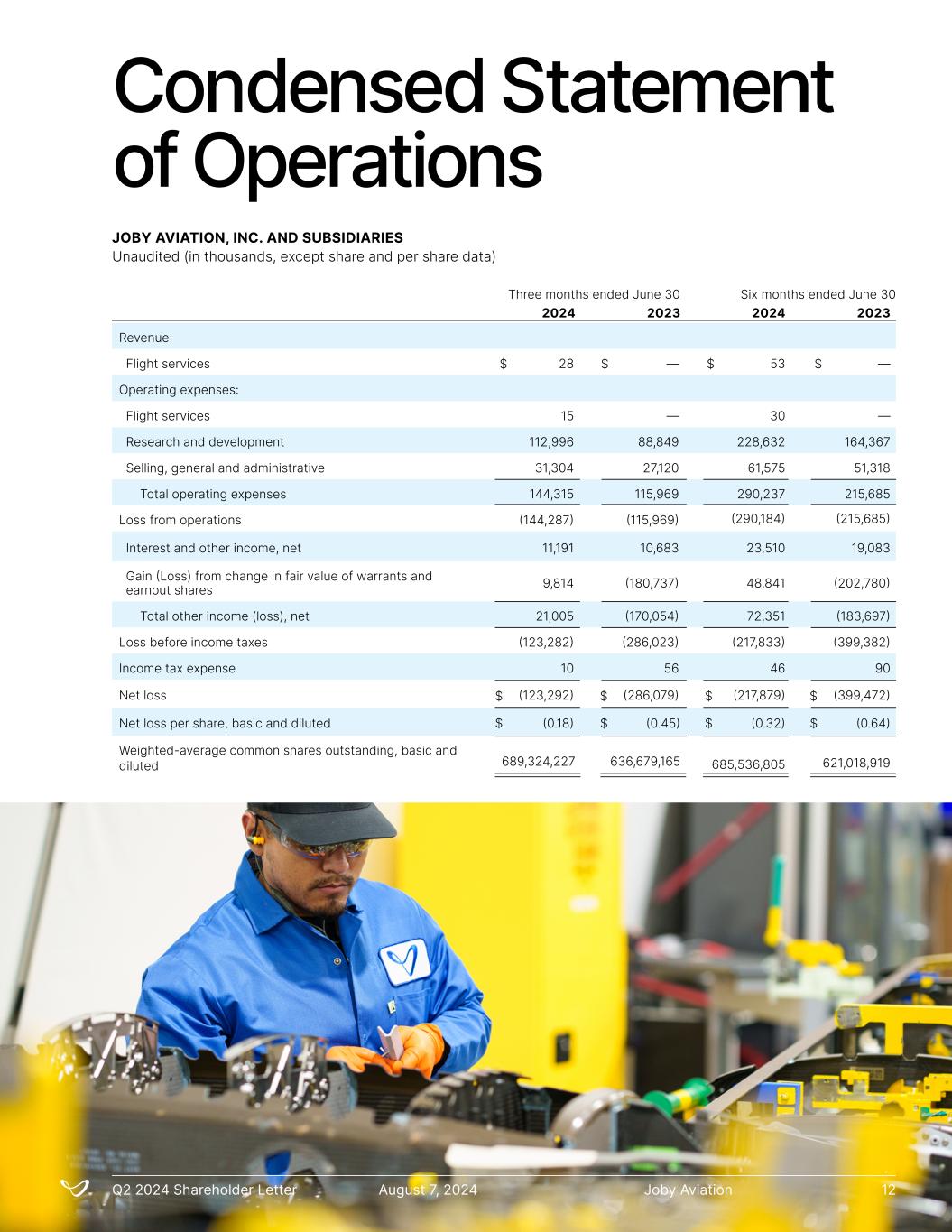

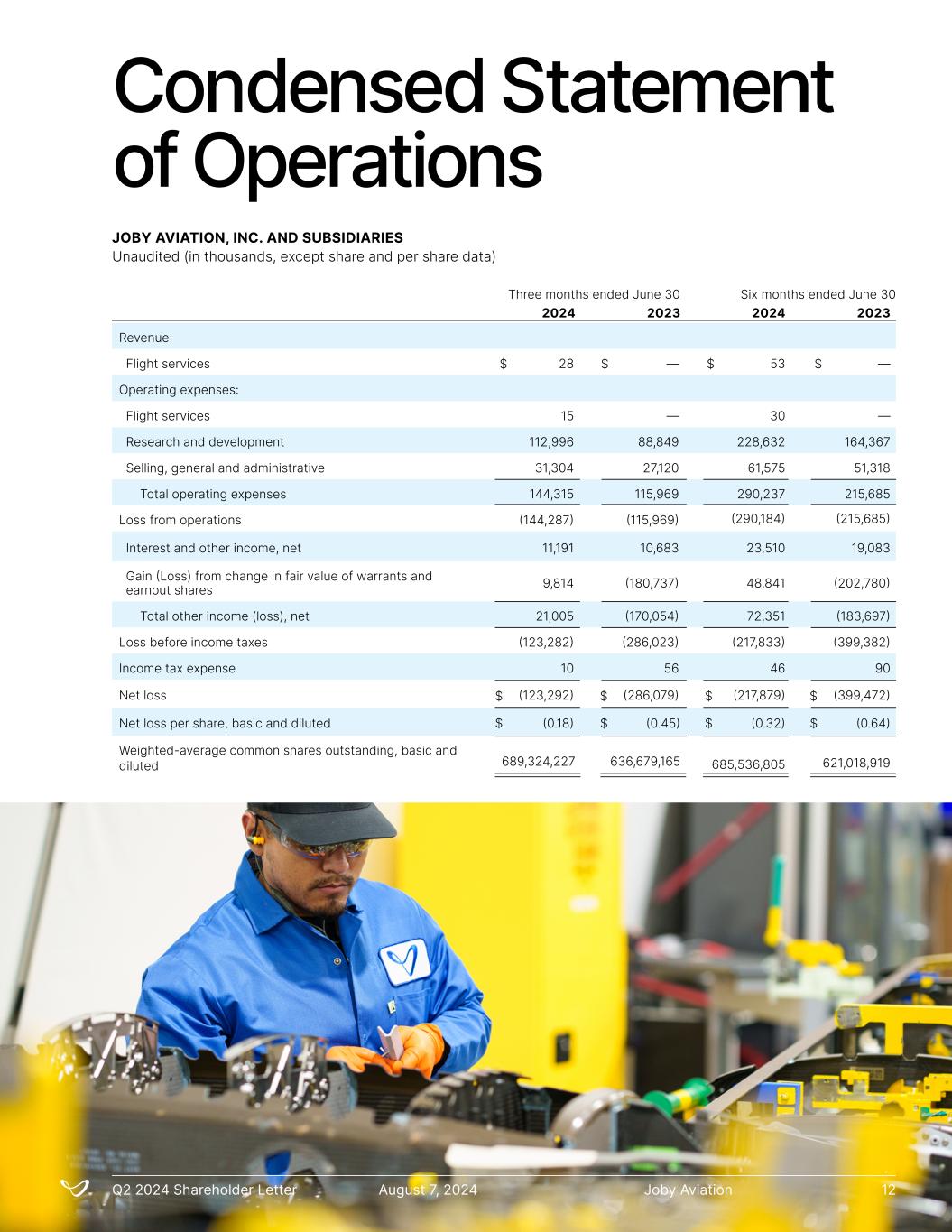

Condensed Statement of Operations JOBY AVIATION, INC. AND SUBSIDIARIES Unaudited (in thousands, except share and per share data) 2024 2023 2024 2023 Revenue Flight services 28 — 53 — Operating expenses: Flight services 15 — 30 — Research and development 112,996 88,849 228,632 164,367 Selling, general and administrative 31,304 27,120 61,575 51,318 Total operating expenses 144,315 115,969 290,237 215,685 Loss from operations (144,287) (115,969) (290,184) (215,685) Interest and other income, net 11,191 10,683 23,510 19,083 Gain (Loss) from change in fair value of warrants and earnout shares 9,814 (180,737) 48,841 (202,780) Total other income (loss), net 21,005 (170,054) 72,351 (183,697) Loss before income taxes (123,282) (286,023) (217,833) (399,382) Income tax expense 10 56 46 90 Net loss (123,292) (286,079) (217,879) (399,472) Net loss per share, basic and diluted (0.18) (0.45) (0.32) (0.64) Weighted-average common shares outstanding, basic and diluted 689,324,227 636,679,165 685,536,805 621,018,919 Three months ended June 30 Six months ended June 30 $ $ $ $ Joby AviationQ2 2024 Shareholder Letter August 7, 2024 12 $ $ $ $ $ $ $ $

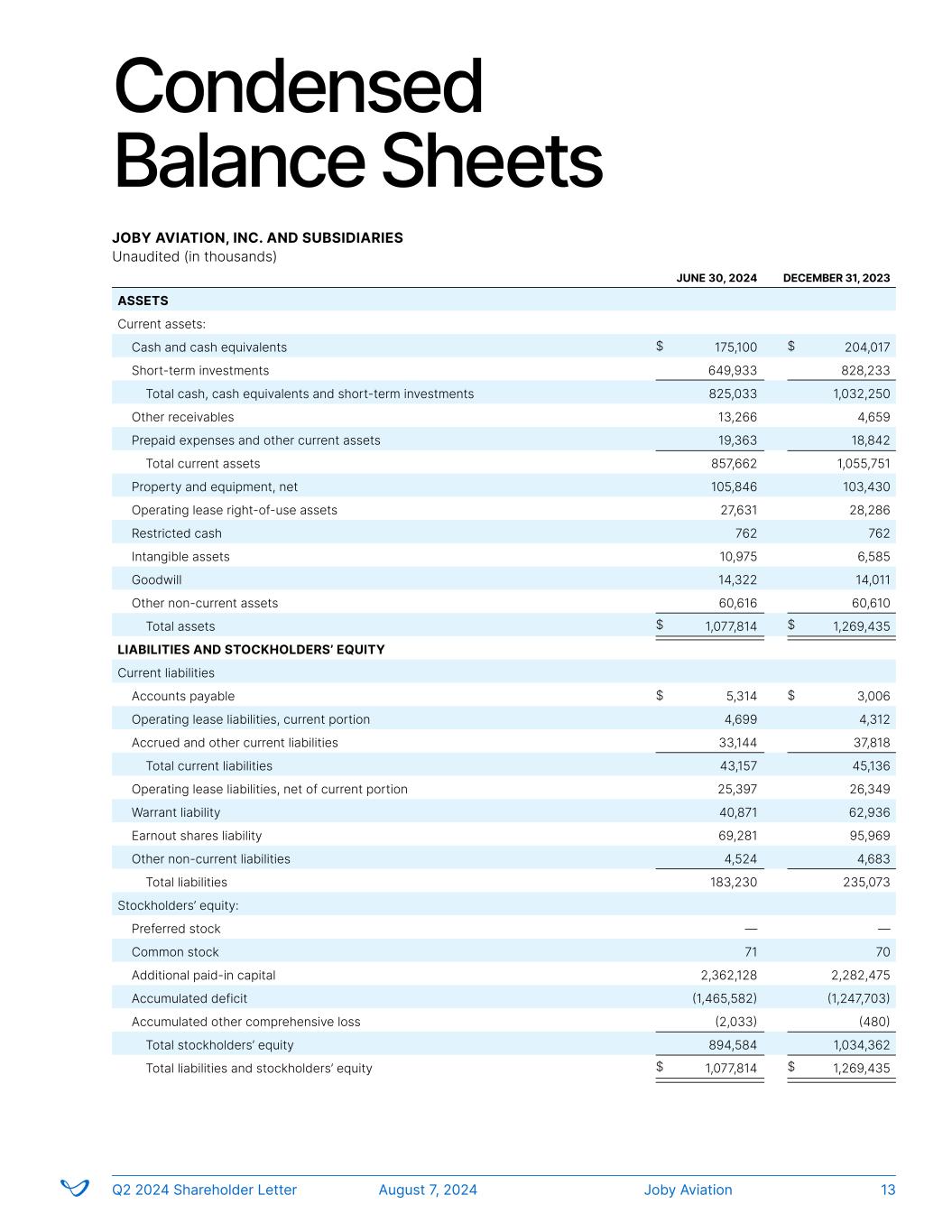

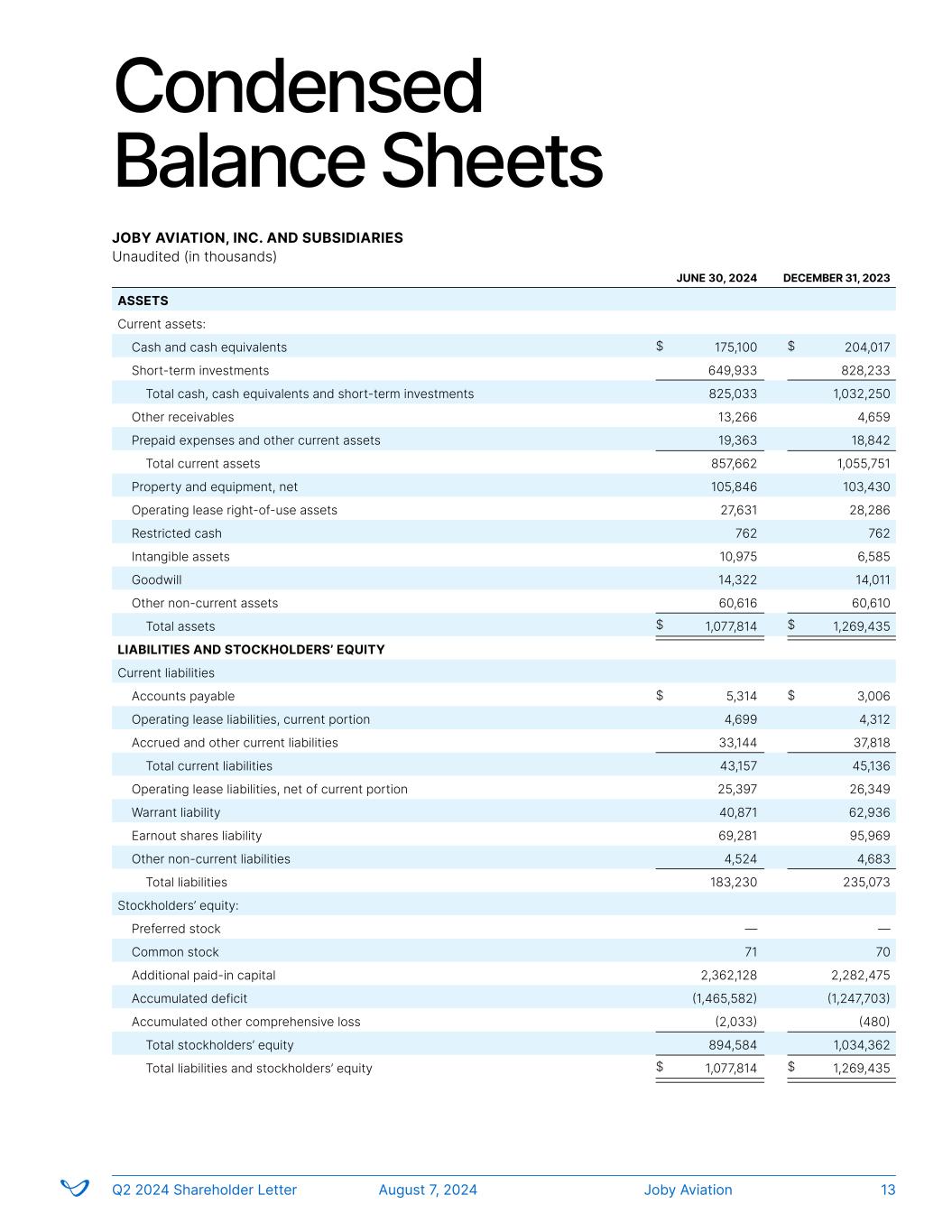

Condensed Balance Sheets JOBY AVIATION, INC. AND SUBSIDIARIES Unaudited (in thousands) JUNE 30, 2024 DECEMBER 31, 2023 ASSETS Current assets: Cash and cash equivalents 175,100 204,017 Short-term investments 649,933 828,233 Total cash, cash equivalents and short-term investments 825,033 1,032,250 Other receivables 13,266 4,659 Prepaid expenses and other current assets 19,363 18,842 Total current assets 857,662 1,055,751 Property and equipment, net 105,846 103,430 Operating lease right-of-use assets 27,631 28,286 Restricted cash 762 762 Intangible assets 10,975 6,585 Goodwill 14,322 14,011 Other non-current assets 60,616 60,610 Total assets 1,077,814 1,269,435 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities Accounts payable 5,314 3,006 Operating lease liabilities, current portion 4,699 4,312 Accrued and other current liabilities 33,144 37,818 Total current liabilities 43,157 45,136 Operating lease liabilities, net of current portion 25,397 26,349 Warrant liability 40,871 62,936 Earnout shares liability 69,281 95,969 Other non-current liabilities 4,524 4,683 Total liabilities 183,230 235,073 Stockholders’ equity: Preferred stock — — Common stock 71 70 Additional paid-in capital 2,362,128 2,282,475 Accumulated deficit (1,465,582) (1,247,703) Accumulated other comprehensive loss (2,033) (480) Total stockholders’ equity 894,584 1,034,362 Total liabilities and stockholders’ equity 1,077,814 1,269,435 $ $ $ $ $ $ $ $ Joby AviationQ2 2024 Shareholder Letter August 7, 2024 13

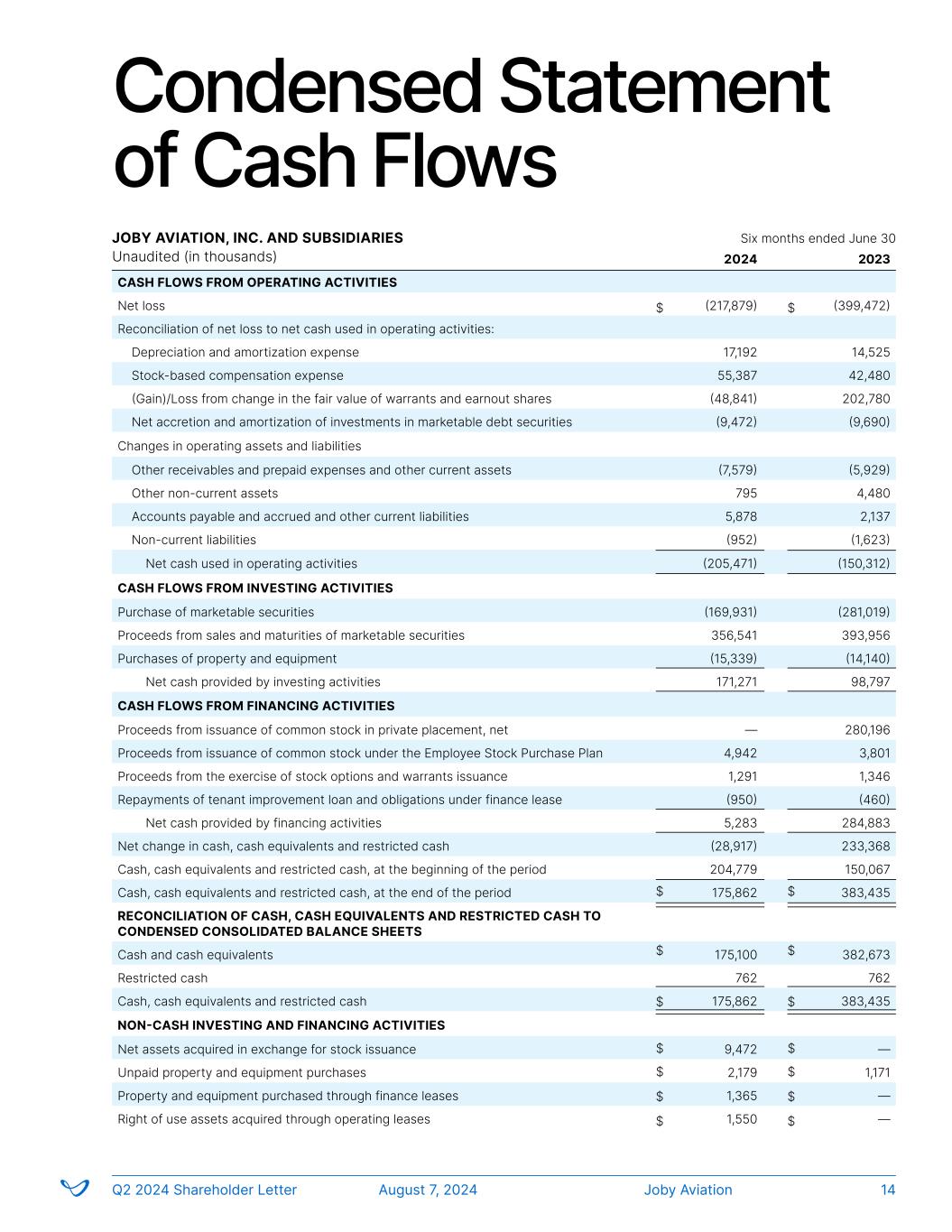

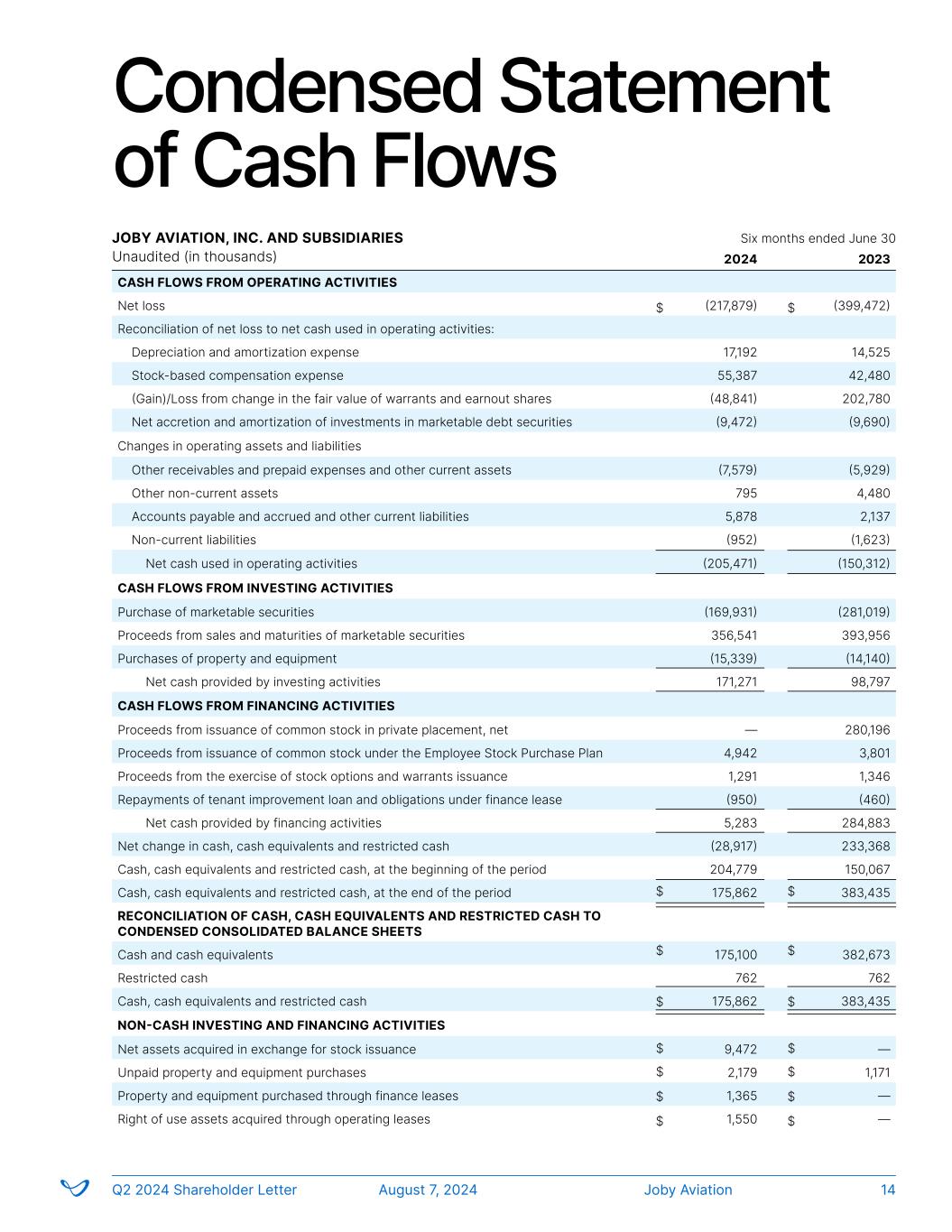

Condensed Statement of Cash Flows JOBY AVIATION, INC. AND SUBSIDIARIES Unaudited (in thousands) 2024 2023 CASH FLOWS FROM OPERATING ACTIVITIES Net loss (217,879) (399,472) Reconciliation of net loss to net cash used in operating activities: Depreciation and amortization expense 17,192 14,525 Stock-based compensation expense 55,387 42,480 (Gain)/Loss from change in the fair value of warrants and earnout shares (48,841) 202,780 Net accretion and amortization of investments in marketable debt securities (9,472) (9,690) Changes in operating assets and liabilities Other receivables and prepaid expenses and other current assets (7,579) (5,929) Other non-current assets 795 4,480 Accounts payable and accrued and other current liabilities 5,878 2,137 Non-current liabilities (952) (1,623) Net cash used in operating activities (205,471) (150,312) CASH FLOWS FROM INVESTING ACTIVITIES Purchase of marketable securities (169,931) (281,019) Proceeds from sales and maturities of marketable securities 356,541 393,956 Purchases of property and equipment (15,339) (14,140) Net cash provided by investing activities 171,271 98,797 CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from issuance of common stock in private placement, net — 280,196 Proceeds from issuance of common stock under the Employee Stock Purchase Plan 4,942 3,801 Proceeds from the exercise of stock options and warrants issuance 1,291 1,346 Repayments of tenant improvement loan and obligations under finance lease (950) (460) Net cash provided by financing activities 5,283 284,883 Net change in cash, cash equivalents and restricted cash (28,917) 233,368 Cash, cash equivalents and restricted cash, at the beginning of the period 204,779 150,067 Cash, cash equivalents and restricted cash, at the end of the period 175,862 383,435 RECONCILIATION OF CASH, CASH EQUIVALENTS AND RESTRICTED CASH TO CONDENSED CONSOLIDATED BALANCE SHEETS Cash and cash equivalents 175,100 382,673 Restricted cash 762 762 Cash, cash equivalents and restricted cash 175,862 383,435 NON-CASH INVESTING AND FINANCING ACTIVITIES Net assets acquired in exchange for stock issuance 9,472 — Unpaid property and equipment purchases 2,179 1,171 Property and equipment purchased through finance leases 1,365 — Right of use assets acquired through operating leases 1,550 — $ $ $ $ $ $ $ $ $ $ Six months ended June 30 Joby AviationQ2 2024 Shareholder Letter August 7, 2024 14 $ $ $ $ $ $

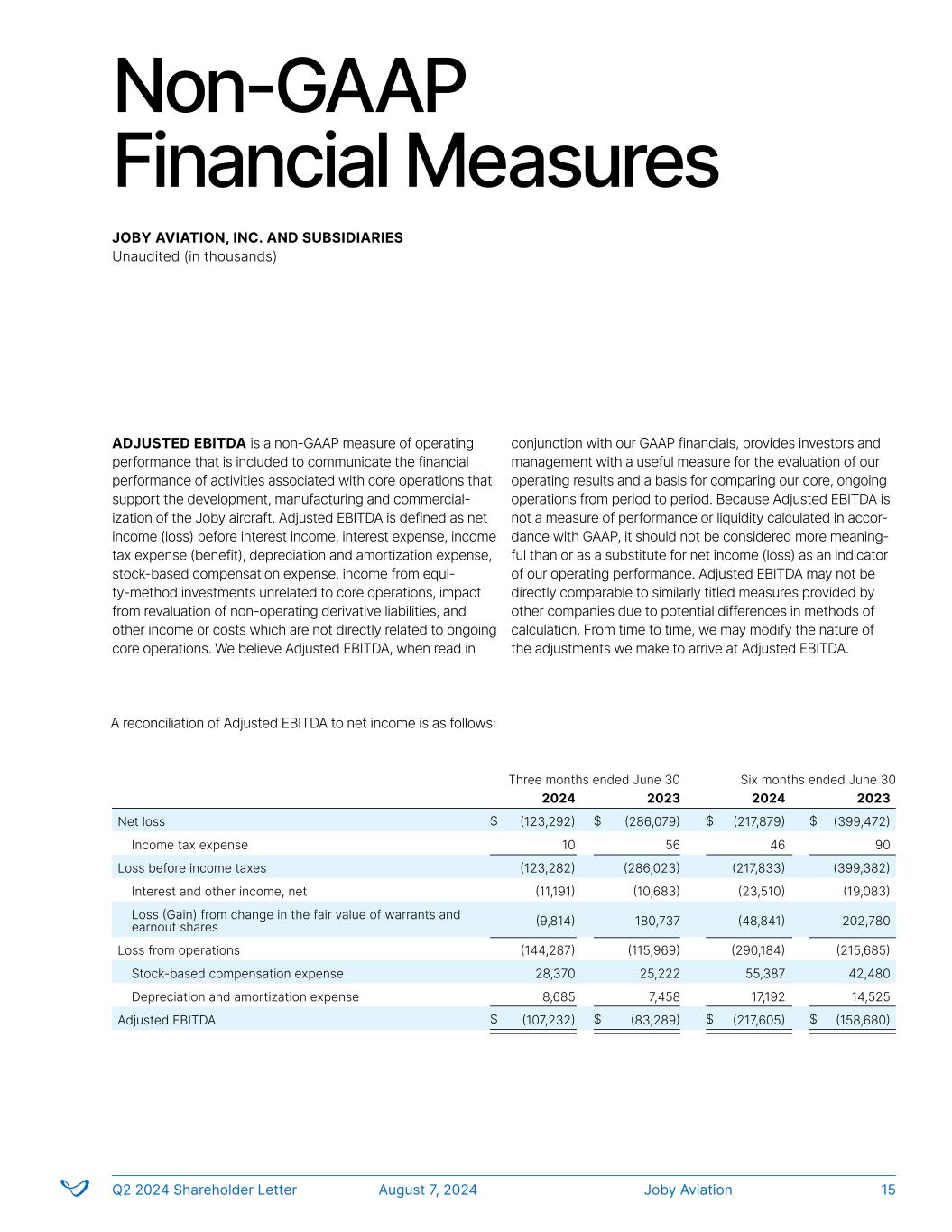

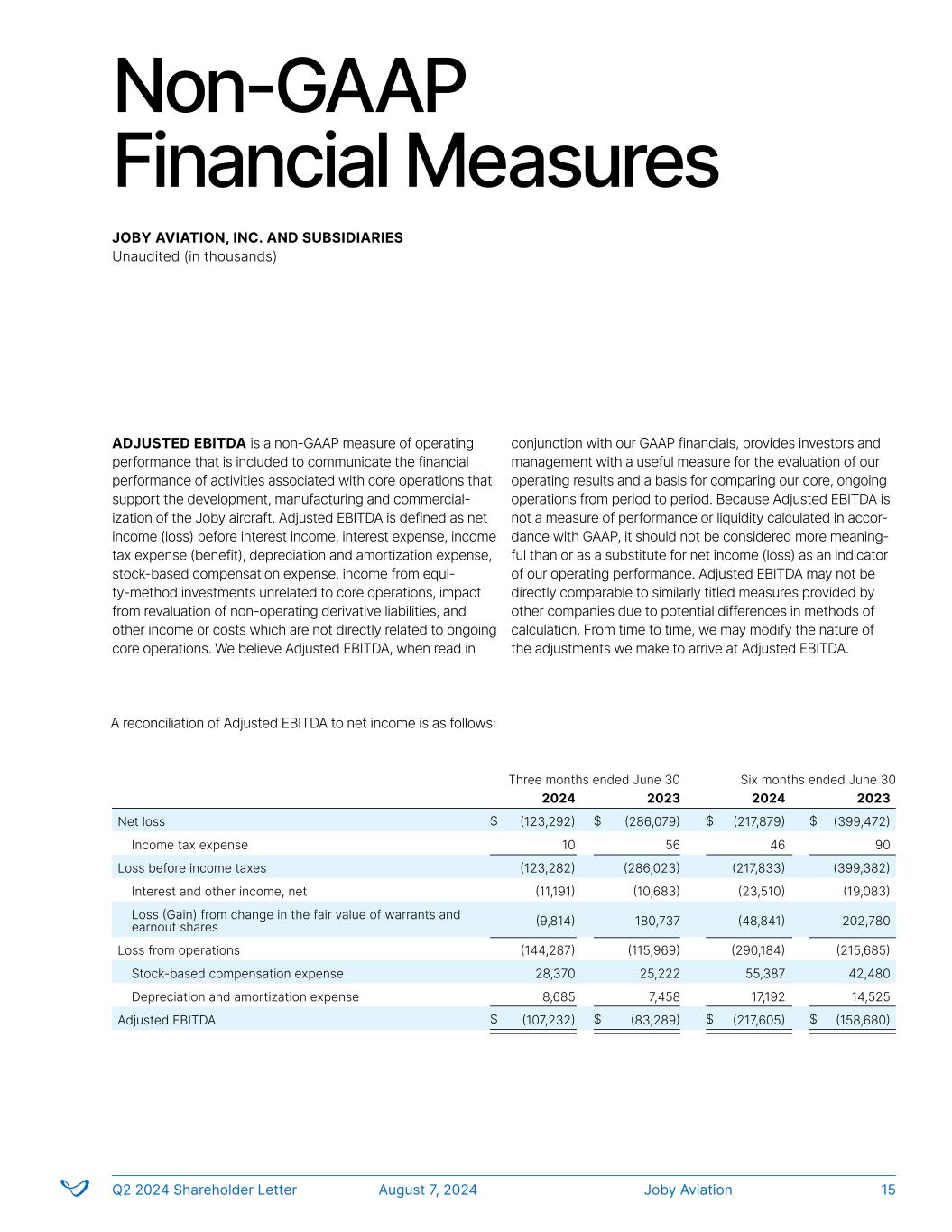

Non-GAAP Financial Measures ADJUSTED EBITDA is a non-GAAP measure of operating performance that is included to communicate the financial performance of activities associated with core operations that support the development, manufacturing and commercial- ization of the Joby aircraft. Adjusted EBITDA is defined as net income (loss) before interest income, interest expense, income tax expense (benefit), depreciation and amortization expense, stock-based compensation expense, income from equi- ty-method investments unrelated to core operations, impact from revaluation of non-operating derivative liabilities, and other income or costs which are not directly related to ongoing core operations. We believe Adjusted EBITDA, when read in conjunction with our GAAP financials, provides investors and management with a useful measure for the evaluation of our operating results and a basis for comparing our core, ongoing operations from period to period. Because Adjusted EBITDA is not a measure of performance or liquidity calculated in accor- dance with GAAP, it should not be considered more meaning- ful than or as a substitute for net income (loss) as an indicator of our operating performance. Adjusted EBITDA may not be directly comparable to similarly titled measures provided by other companies due to potential differences in methods of calculation. From time to time, we may modify the nature of the adjustments we make to arrive at Adjusted EBITDA. A reconciliation of Adjusted EBITDA to net income is as follows: JOBY AVIATION, INC. AND SUBSIDIARIES Unaudited (in thousands) 2024 2023 2024 2023 Net loss (123,292) (286,079) (217,879) (399,472) Income tax expense 10 56 46 90 Loss before income taxes (123,282) (286,023) (217,833) (399,382) Interest and other income, net (11,191) (10,683) (23,510) (19,083) Loss (Gain) from change in the fair value of warrants and earnout shares (9,814) 180,737 (48,841) 202,780 Loss from operations (144,287) (115,969) (290,184) (215,685) Stock-based compensation expense 28,370 25,222 55,387 42,480 Depreciation and amortization expense 8,685 7,458 17,192 14,525 Adjusted EBITDA (107,232) (83,289) (217,605) (158,680) Three months ended June 30 Six months ended June 30 $ $$ $ $ $$ $ Joby AviationQ2 2024 Shareholder Letter August 7, 2024 15

Upcoming Events Today’s Webcast Details Q2 2024 FINANCIAL RESULTS WEBCAST The Company will host a webcast and conference call at 5:00pm ET (2:00pm PT) on Wednesday, August 7, 2024. The webcast will be publicly available in the Financial Results section of the company’s investor website: ir.jobyaviation.com. CANACCORD GENUITY 44TH ANNUAL GROWTH CONFERENCE MORGAN STANLEY 12TH ANNUAL LAGUNA CONFERENCE Joby AviationQ2 2024 Shareholder Letter August 7, 2024 16

Forward-Looking Statements THIS SHAREHOLDER LETTER CONTAINS “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, includ- ing but not limited to, statements regarding the development and performance of our aircraft, the growth of our manufac- turing capabilities, our regulatory outlook, progress and timing, including our expectation to start commercial passenger ser- vice in 2025, expected certification progress, manufacturing and flight test capabilities and timing; our planned operations with the Department of Defense, including the timing and location of delivery of aircraft, timing of execution of existing contract deliverables, and potential for expansion of future contracts and plans to sell aircraft to U.S. government agen- cies; our plans to sell aircraft into the Saudi Arabian market; plans related to certification and operation of our aircraft in the United Arab Emirates; potential revenue associated with aircraft sales; potential markets for hydrogen-electric aircraft and potential benefits of our investments in autonomous technology; potential routes and markets for our services; our business plan, objectives, goals and market opportunity; plans for, and potential benefits of, our strategic partnerships; and our current expectations relating to our business, financial condition, results of operations, prospects, capital needs and growth of our operations, including the expected benefits of our vertically-integrated business model. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate”, “estimate”, “expect”, “project”, “plan”, “intend”, “believe”, “may”, “will”, “should”, “can have”, “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. All forward looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including: our ability to launch our air taxi service and the growth of the urban air mobility market generally; our ability to produce aircraft that meet our performance expec- tations in the volumes and on the timelines that we project; complexities related to obtaining certification and operating in foreign markets, including the need to negotiate additional definitive agreements related to such operations; unknown demand, performance characteristics and certification requirements for hydrogen-electric aircraft and autonomous technology; the competitive environment in which we operate; our future capital needs; our ability to adequately protect and enforce our intellectual property rights; our ability to effective- ly respond to evolving regulations and standards relating to our aircraft; our reliance on third-party suppliers and service partners; uncertainties related to our estimates of the size of the market for our service and future revenue opportunities; and other important factors discussed in the section titled “Risk Factors” in our Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on February 27, 2024, and in future filings and other reports we file with or furnish to the SEC. Any such forward-looking statements represent management’s estimates and beliefs as of the date of this shareholder letter. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. CONTACT DETAILS Investors: investors@jobyaviation.com Media: press@jobyaviation.com Joby AviationQ2 2024 Shareholder Letter August 7, 2024 17