Feeling good in your body & mind transforms how you show up in life. That’s why we’re on a mission to help the world feel great through the power of better health. 2 Hims & Hers Q3 2025

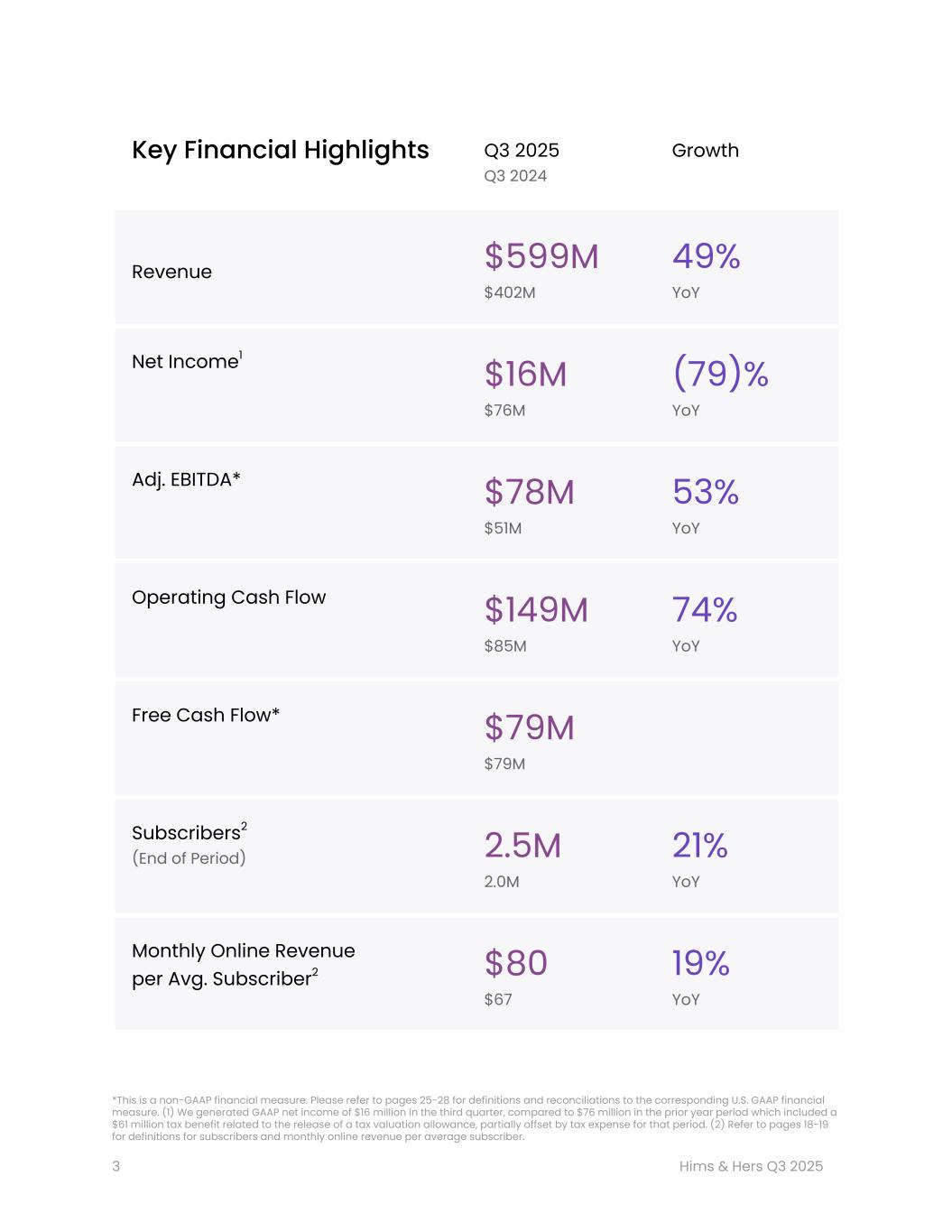

Key Financial Highlights Q3 2025 Q3 2024 Growth Revenue $599M $402M 49% YoY Net Income1 $16M $76M (79)% YoY Adj. EBITDA* $78M $51M 53% YoY Operating Cash Flow $149M $85M 74% YoY Free Cash Flow* $79M $79M Subscribers2 (End of Period) 2.5M 2.0M 21% YoY Monthly Online Revenue per Avg. Subscriber2 $80 $67 19% YoY *This is a non-GAAP financial measure. Please refer to pages 25-28 for definitions and reconciliations to the corresponding U.S. GAAP financial measure. (1) We generated GAAP net income of $16 million in the third quarter, compared to $76 million in the prior year period which included a $61 million tax benefit related to the release of a tax valuation allowance, partially offset by tax expense for that period. (2) Refer to pages 18-19 for definitions for subscribers and monthly online revenue per average subscriber. 3 Hims & Hers Q3 2025

Q3 2025 Letter to Our Shareholders Hims & Hers is one of the few — if not the only — healthcare platforms where each customer experience drives the continuous improvement of the platform. Scaling our platform allows us to create opportunities for better experiences, stronger customer relationships, and greater efficiency, which is why we’re excited about the progress we’ve made in unlocking access to a new standard of healthcare for millions of customers. Our third quarter results demonstrate continued momentum in this transformation. Revenue grew 49% year-over-year, driven by a 21% year-over-year increase in subscribers and a 19% year-over-year increase in monthly online revenue per average subscriber, reflecting both expanding reach and deepening engagement. Core to this progress is the growing adoption of personalized solutions, as well as the increasing frequency with which customers rely on our platform to address multiple needs. Subscribers using a personalized treatment plan increased 50% year-over-year, while subscribers utilizing treatment plans to target multiple conditions increased more than 80% year-over-year, now representing over 20% of total subscribers on the platform. This momentum fueled our ability to drive subscriber growth in the quarter of more than 40% year-over-year, excluding the impact of the ongoing transition within on-demand sexual health. Hims & Hers is actively transforming into a trusted health and wellness partner to millions of customers, becoming a platform that can not only support people in addressing existing conditions, but proactively help them in their journey to stay healthy. We’ve never been more excited about where we are heading. When we first shared our 2030 goals of at least $6.5 billion in revenue and $1.3 billion in adjusted EBITDA, it was with this clear vision in mind: to redefine what modern healthcare can look like for consumers everywhere. Today, we’re delivering on that vision in a real way. The opportunities to accelerate our trajectory are materializing quicker than expected, and we’re leaning in. 4 Hims & Hers Q3 2025

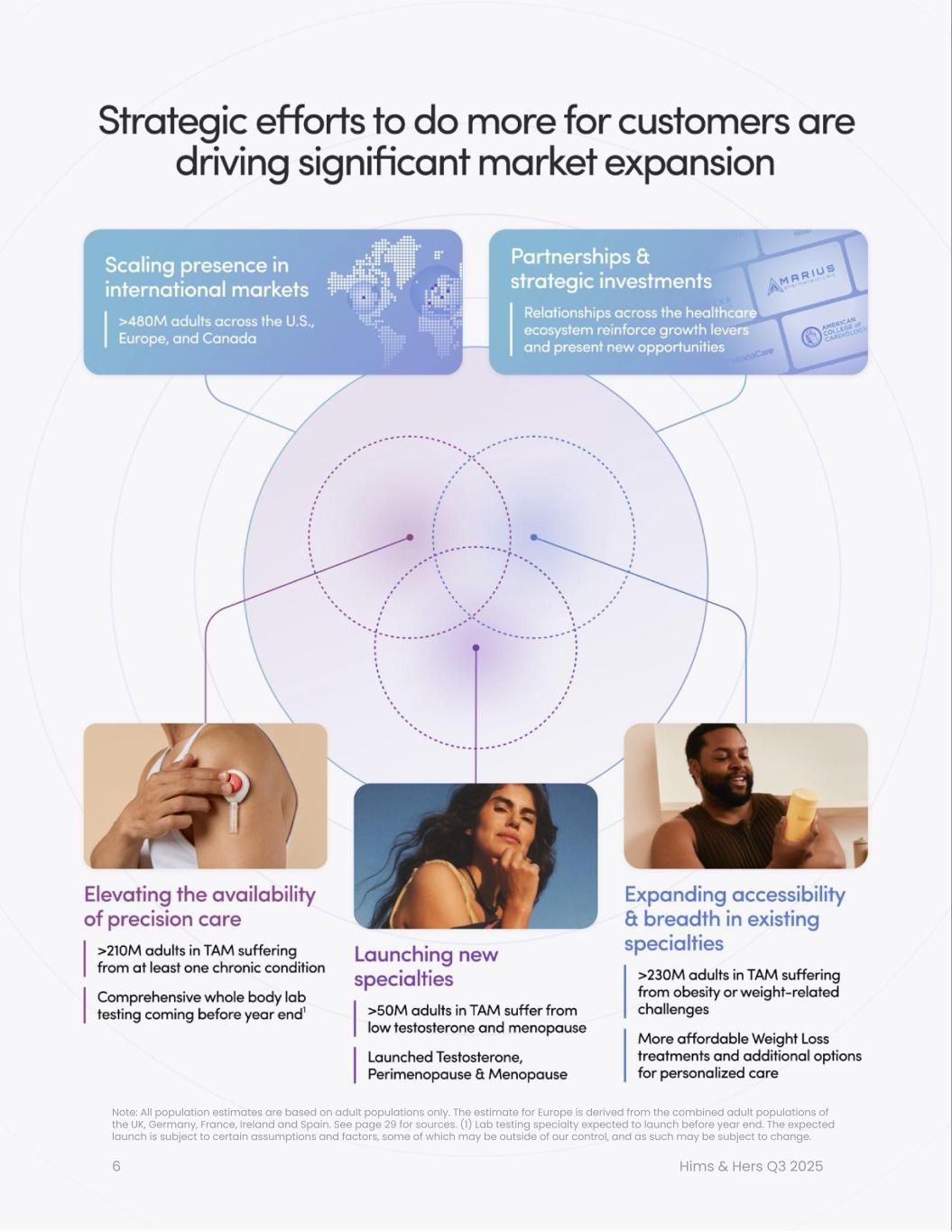

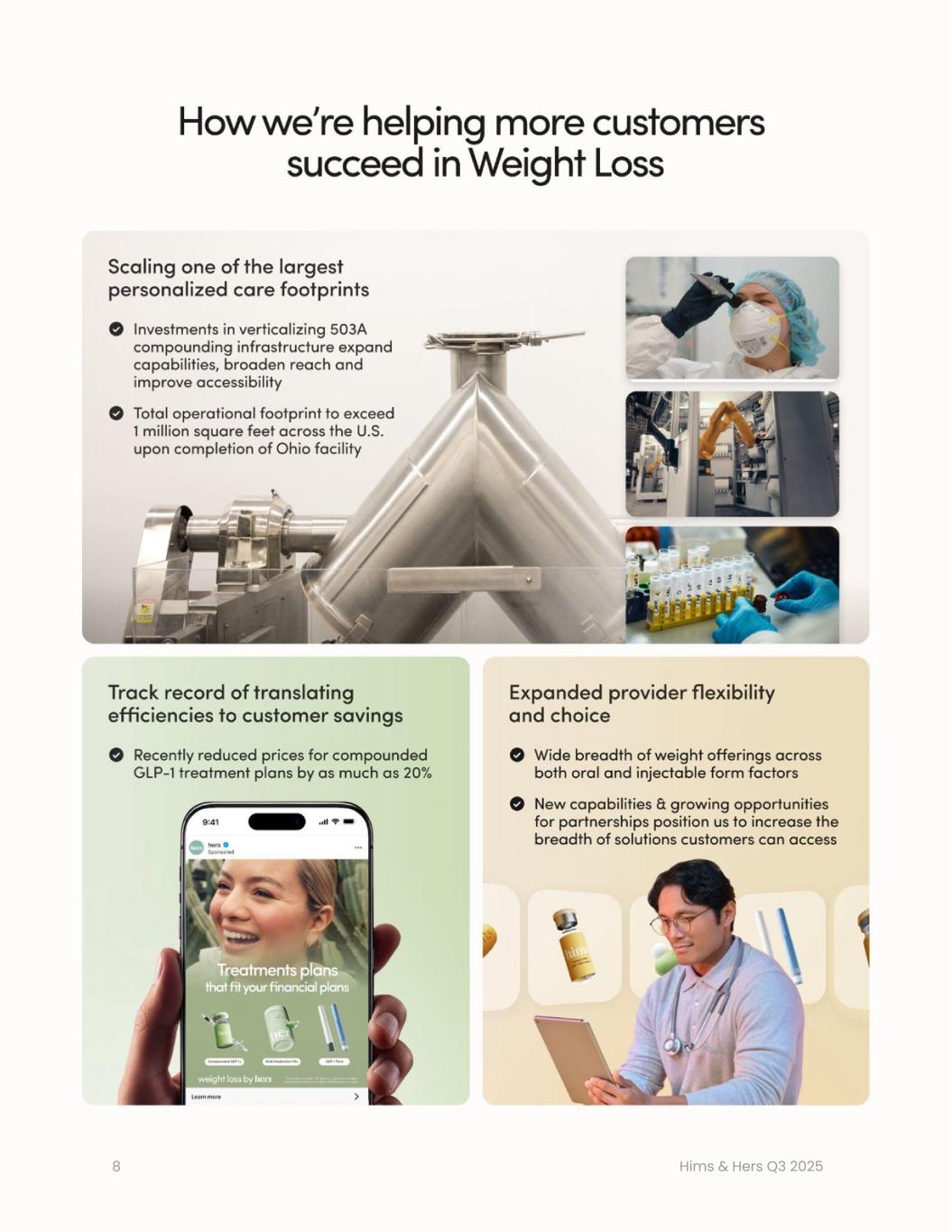

Looking ahead, we’re focused on increasing the ways we serve our customers and expanding the addressable market for our platform. We are making significant progress across the key priorities we outlined at the start of the year, which we expect will enable us to serve tens of millions of subscribers: ● Expanding accessibility & breadth in existing specialties: We recently reduced prices across personalized GLP-1 treatment plans by up to 20%, expanding access to more customers seeking effective weight-management care. We believe ongoing efforts to verticalize our 503A operations will further solidify the new gold standard we're establishing in compounding infrastructure, while also enabling us to lead the industry in broadening accessibility. ● Launching new specialties that resonate with both new and existing customers: We expect new offerings in testosterone and menopause care to unlock significant long-term growth opportunities. These specialties extend the reach of our platform to tens of millions of prospective subscribers while increasing opportunities to deepen relationships with existing customers. ● Allowing subscribers to proactively manage their health with plans to broaden diagnostic capabilities and preventive solutions: We plan to launch comprehensive lab testing capabilities in the near future, which will pave the way for the launch of our longevity specialty planned for 2026. We believe both will expand our addressable market meaningfully, enabling us to meet customers earlier in their healthcare journey, before conditions arise. Our recent investment in GRAIL reflects this interest in innovations that can shape the future of early detection and screening. ● Forging relationships across the healthcare ecosystem to become a curator of best-in-class solutions & services: We expect to continue exploring opportunities to collaborate with partners who see Hims & Hers as a trusted and efficient platform to reach more customers. The curation of leading next generation therapies, advancements in early diagnostics, and even personalization based on whole-genome sequencing is of top focus for potential partnerships. As noted in our earnings release, we are in active discussions with Novo Nordisk to make Wegovy injections and Novo’s oral Wegovy (when FDA approved) available through the Hims & Hers platform, advancing consumer options.1 ● Scaling our presence in international markets: We see international markets as a powerful long-term growth lever, representing more than $1 billion in annual revenue potential. Through continued investment and strategic M&A, we believe Hims & Hers can quickly emerge as the world’s most trusted consumer health platform, providing direct-to-consumer access to personalized care to more customers than any company on the planet. (1) Hims & Hers notes that discussions are ongoing, no definitive agreement has been executed with Novo Nordisk, and there is a possibility that no definitive agreement may ever be executed with Novo Nordisk. In addition, to the extent that a definitive agreement is executed, those terms may differ from what is currently anticipated. While Hims & Hers may voluntarily disclose the terms of any definitive agreement if and when it is executed, depending on the contours of such agreement, Hims & Hers may be under no legal obligation to do so. 5 Hims & Hers Q3 2025

Note: All population estimates are based on adult populations only. The estimate for Europe is derived from the combined adult populations of the UK, Germany, France, Ireland and Spain. See page 29 for sources. (1) Lab testing specialty expected to launch before year end. The expected launch is subject to certain assumptions and factors, some of which may be outside of our control, and as such may be subject to change. 6 Hims & Hers Q3 2025

Setting a new gold standard in compounding infrastructure to make personalized weight-loss care more affordable and accessible Investment in verticalization efforts and expanding capabilities throughout our facilities is allowing us to reach consumers with a broader spectrum of affordable solutions. Our U.S. operational footprint now spans more than 700,000 square feet, with an additional 350,000 square feet expected to come online when our new Ohio facility is completed. We believe these investments are further establishing a gold standard for compounding infrastructure broadly, positioning us to accelerate growth and gain margin expansion while maintaining the high standards of safety, quality, and affordability our customers are accustomed to. By building a more connected and transparent supply chain, we’re able to maintain strong oversight to help ensure consistency and reliability in our processes. This means all active pharmaceutical ingredients (APIs) in compounded treatments are sourced from FDA-registered facilities and, in the case of APIs such as semaglutide for which the FDA has recently established a Green List for GLP-1 API suppliers, are sourced solely from suppliers on the Green List. As we scale our operations, we have demonstrated a consistent track record of translating this growth into greater efficiency. By the end of 2026, we plan to be in position to fulfil the majority of compounded GLP-1 orders through our own internal facilities–an important milestone that we believe will accelerate our ability to lower pricing, and unlock access for more customers seeking support in their weight loss journey. Recently, our progress on this front put us in a position to strategically reduce prices across compounded GLP-1 treatment plans by as much as 20%. We are confident that with continued execution, we can lead industry efforts to provide broader access to these life-changing medications. In the coming quarters, we expect to continue expanding the breadth of offerings available through our platform. We believe our growing reach and the expanding customer insights made possible by our integrated technology and infrastructure, position Hims & Hers as the market leader in providing access to high-touch, patient-centric care. This vertically integrated platform enables greater personalization through individualized dosages and ongoing treatment adjustments which now include micro-dosing options for compounded semaglutide treatments. These ongoing advancements give us confidence that by helping customers find the right treatment, supporting them throughout their journey, and supporting providers in evolving their care as their needs change, we can continue to extend that leadership position. Together, these initiatives underscore the strength and potential of our platform and the power of our model: leveraging scale, data, and customer insights to continuously improve accessibility and customer experience, all without sacrificing quality. 7 Hims & Hers Q3 2025

8 Hims & Hers Q3 2025

Our new offerings supporting low testosterone and menopause unlock significant long-term growth opportunities as we deepen relationships with existing subscribers and expand access to care for millions more Millions of people continue to face barriers to care in areas like low testosterone and menopause. By expanding into these underserved categories, we’re showing how the Hims & Hers platform can break down longstanding barriers by making care more accessible to all of our customers. Millions of men experience symptoms of low testosterone, yet struggle to understand what effective and affordable solutions are available. Our offering simplifies access to personalized care with at-home lab testing and provider-guided treatment plans. While still early, the response to this launch has already indicated an immediate product-market fit. We’ve seen a strong response from existing customers, with more than 60% of new testosterone customers in the quarter already subscribed to another Hims offering. We’re actively optimizing both the experience and the operational engine behind this offering to meet the strong demand, and believe it will serve as a meaningful growth driver for years to come. In 2026, we look forward to expanding upon our oral testosterone offering with the addition of a branded, FDA-approved oral testosterone therapy through our partnership with Marius Pharmaceuticals. Through our perimenopause and menopause offering, we’re addressing one of the largest gaps in women’s health today. Nearly 1.3 million women in the United States enter menopause each year, yet only ~30% of OB/GYN residency programs provide formal menopause training. We expect our new offering to help close the gap by providing access to solutions and support designed specifically for women navigating this challenging stage in life. We believe that the menopause specialty will represent an important new growth engine for the Hers brand: not only can it expand our reach to millions of women with care designed specifically for their needs, but we expect it can serve as a meaningful contributor to the Hers brand scaling toward $1 billion in annual revenue in 2026. Together, these launches expand our reach into deeply personal conditions that require tailored treatment and stronger relationships with customers. To support that work, we’re building the capabilities that will enable customers to take a more proactive, data-driven approach to their health. 9 Hims & Hers Q3 2025

We plan to meaningfully expand our role in supporting proactive care through our upcoming lab, diagnostic, and longevity offerings Historically, our subscribers have come to us seeking care for conditions they are already suffering from, and relied on our provider network to help them find solutions. With our upcoming launch of comprehensive lab testing and diagnostics, we expect to do even more. We envision these capabilities will eventually empower consumers to proactively identify health concerns that may not yet show obvious signs, such as vitamin deficiencies, unoptimized hormonal levels, and genetic risk markers, while also identifying early indicators of more serious health conditions like cancer and cardiovascular disease. We expect our platform will be unique in its ability to support customers in understanding their health concerns, while also providing them with access to personalized treatment plans and continuous tracking to measure progress over time, all within a single integrated experience. While we plan to build certain diagnostic capabilities in-house, we also recognize an opportunity to develop relationships with innovative companies that share our mission to help people around the world in their pursuit of healthier and longer lives. We intend to continue engaging with those driving progress in this area. For instance, our recent strategic investment in GRAIL reflects our belief in the importance of making access to pre-cancer diagnostic testing, which has historically been accessible only to a small, affluent subset of the population, available to many more people. We believe diagnostic capabilities will set the foundation for new innovative personalized treatments backed by immense data sets, as well as deeper expansion into new specialties, such as longevity — a specialty we are on track to launch in 2026. By leveraging our existing capabilities, including our California-based peptide manufacturing facility, which is actively onshoring R&D for core peptide applications, we expect this specialty to feature a broad range of therapies, in addition to our new testing options. Over time, these are expected to include peptides, coenzymes, and GLP/GIP treatments designed to improve performance, recovery, and cardiometabolic longevity markers. (1) Lab testing specialty expected to launch before year end. The expected launch is subject to certain assumptions and factors, some of which may be outside of our control, and as such may be subject to change. 10 Hims & Hers Q3 2025

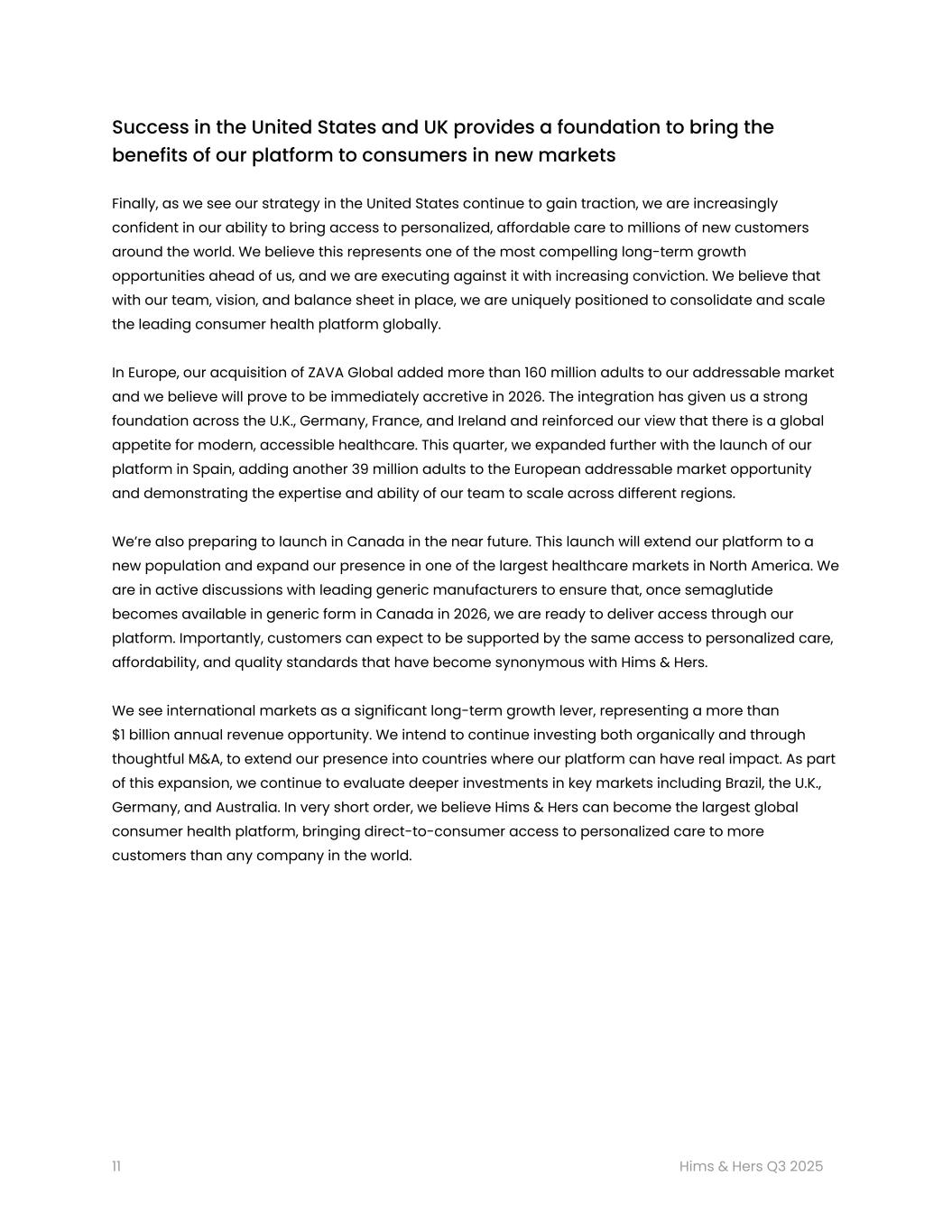

Success in the United States and UK provides a foundation to bring the benefits of our platform to consumers in new markets Finally, as we see our strategy in the United States continue to gain traction, we are increasingly confident in our ability to bring access to personalized, affordable care to millions of new customers around the world. We believe this represents one of the most compelling long-term growth opportunities ahead of us, and we are executing against it with increasing conviction. We believe that with our team, vision, and balance sheet in place, we are uniquely positioned to consolidate and scale the leading consumer health platform globally. In Europe, our acquisition of ZAVA Global added more than 160 million adults to our addressable market and we believe will prove to be immediately accretive in 2026. The integration has given us a strong foundation across the U.K., Germany, France, and Ireland and reinforced our view that there is a global appetite for modern, accessible healthcare. This quarter, we expanded further with the launch of our platform in Spain, adding another 39 million adults to the European addressable market opportunity and demonstrating the expertise and ability of our team to scale across different regions. We’re also preparing to launch in Canada in the near future. This launch will extend our platform to a new population and expand our presence in one of the largest healthcare markets in North America. We are in active discussions with leading generic manufacturers to ensure that, once semaglutide becomes available in generic form in Canada in 2026, we are ready to deliver access through our platform. Importantly, customers can expect to be supported by the same access to personalized care, affordability, and quality standards that have become synonymous with Hims & Hers. We see international markets as a significant long-term growth lever, representing a more than $1 billion annual revenue opportunity. We intend to continue investing both organically and through thoughtful M&A, to extend our presence into countries where our platform can have real impact. As part of this expansion, we continue to evaluate deeper investments in key markets including Brazil, the U.K., Germany, and Australia. In very short order, we believe Hims & Hers can become the largest global consumer health platform, bringing direct-to-consumer access to personalized care to more customers than any company in the world. 11 Hims & Hers Q3 2025

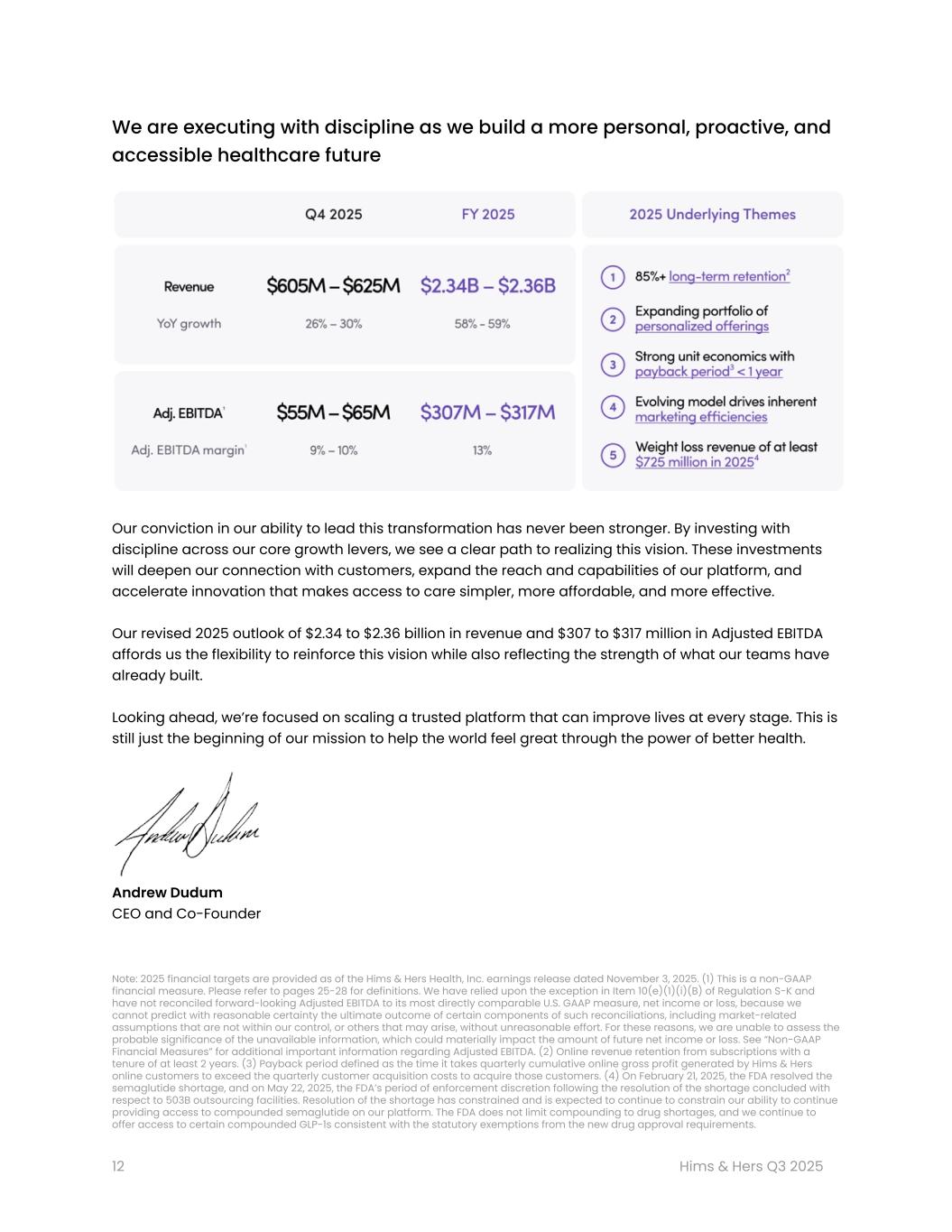

We are executing with discipline as we build a more personal, proactive, and accessible healthcare future Our conviction in our ability to lead this transformation has never been stronger. By investing with discipline across our core growth levers, we see a clear path to realizing this vision. These investments will deepen our connection with customers, expand the reach and capabilities of our platform, and accelerate innovation that makes access to care simpler, more affordable, and more effective. Our revised 2025 outlook of $2.34 to $2.36 billion in revenue and $307 to $317 million in Adjusted EBITDA affords us the flexibility to reinforce this vision while also reflecting the strength of what our teams have already built. Looking ahead, we’re focused on scaling a trusted platform that can improve lives at every stage. This is still just the beginning of our mission to help the world feel great through the power of better health. Andrew Dudum CEO and Co-Founder Note: 2025 financial targets are provided as of the Hims & Hers Health, Inc. earnings release dated November 3, 2025. (1) This is a non-GAAP financial measure. Please refer to pages 25-28 for definitions. We have relied upon the exception in Item 10(e)(1)(i)(B) of Regulation S-K and have not reconciled forward-looking Adjusted EBITDA to its most directly comparable U.S. GAAP measure, net income or loss, because we cannot predict with reasonable certainty the ultimate outcome of certain components of such reconciliations, including market-related assumptions that are not within our control, or others that may arise, without unreasonable effort. For these reasons, we are unable to assess the probable significance of the unavailable information, which could materially impact the amount of future net income or loss. See “Non-GAAP Financial Measures” for additional important information regarding Adjusted EBITDA. (2) Online revenue retention from subscriptions with a tenure of at least 2 years. (3) Payback period defined as the time it takes quarterly cumulative online gross profit generated by Hims & Hers online customers to exceed the quarterly customer acquisition costs to acquire those customers. (4) On February 21, 2025, the FDA resolved the semaglutide shortage, and on May 22, 2025, the FDA’s period of enforcement discretion following the resolution of the shortage concluded with respect to 503B outsourcing facilities. Resolution of the shortage has constrained and is expected to continue to constrain our ability to continue providing access to compounded semaglutide on our platform. The FDA does not limit compounding to drug shortages, and we continue to offer access to certain compounded GLP-1s consistent with the statutory exemptions from the new drug approval requirements. 12 Hims & Hers Q3 2025

13 Hims & Hers Q3 2025

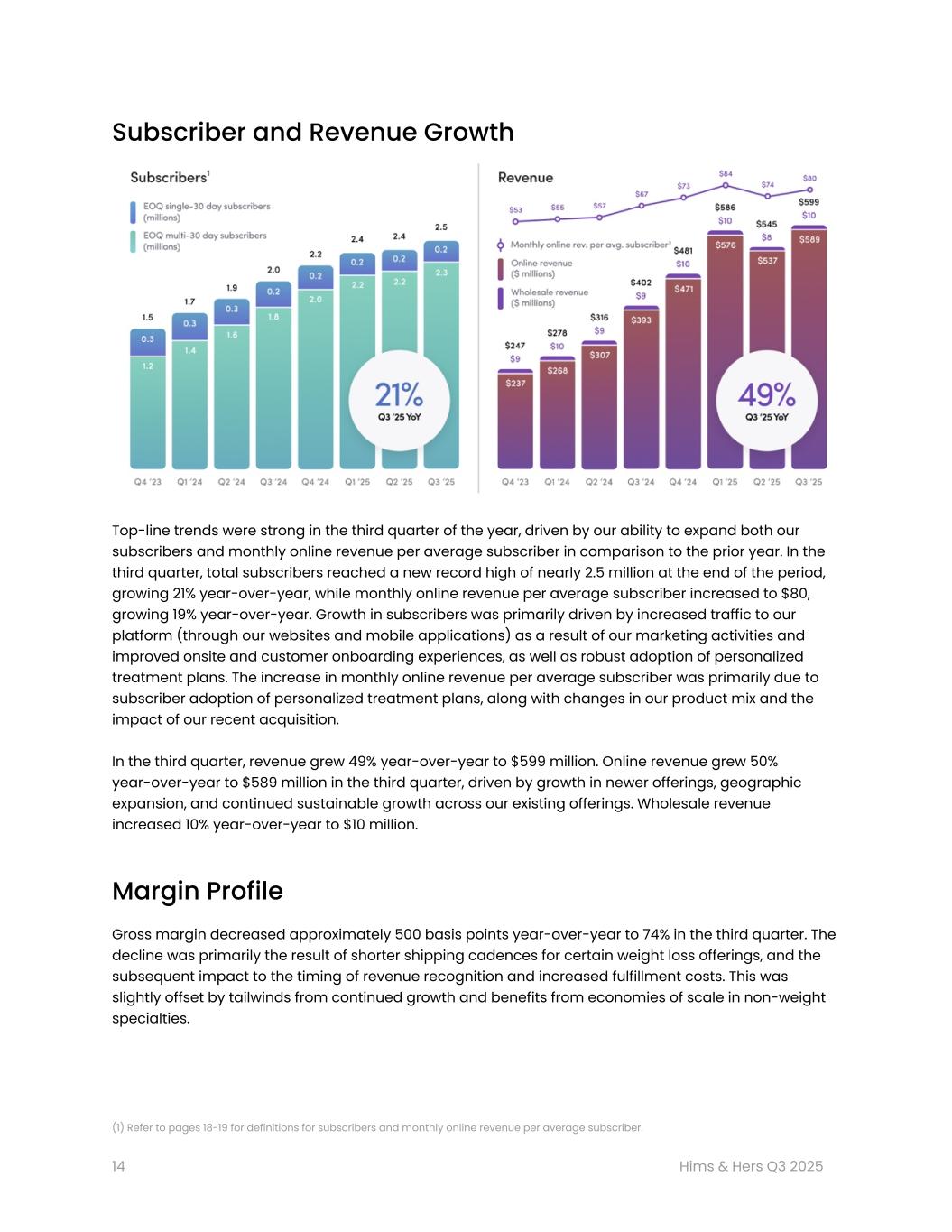

Subscriber and Revenue Growth Top-line trends were strong in the third quarter of the year, driven by our ability to expand both our subscribers and monthly online revenue per average subscriber in comparison to the prior year. In the third quarter, total subscribers reached a new record high of nearly 2.5 million at the end of the period, growing 21% year-over-year, while monthly online revenue per average subscriber increased to $80, growing 19% year-over-year. Growth in subscribers was primarily driven by increased traffic to our platform (through our websites and mobile applications) as a result of our marketing activities and improved onsite and customer onboarding experiences, as well as robust adoption of personalized treatment plans. The increase in monthly online revenue per average subscriber was primarily due to subscriber adoption of personalized treatment plans, along with changes in our product mix and the impact of our recent acquisition. In the third quarter, revenue grew 49% year-over-year to $599 million. Online revenue grew 50% year-over-year to $589 million in the third quarter, driven by growth in newer offerings, geographic expansion, and continued sustainable growth across our existing offerings. Wholesale revenue increased 10% year-over-year to $10 million. Margin Profile Gross margin decreased approximately 500 basis points year-over-year to 74% in the third quarter. The decline was primarily the result of shorter shipping cadences for certain weight loss offerings, and the subsequent impact to the timing of revenue recognition and increased fulfillment costs. This was slightly offset by tailwinds from continued growth and benefits from economies of scale in non-weight specialties. (1) Refer to pages 18-19 for definitions for subscribers and monthly online revenue per average subscriber. 14 Hims & Hers Q3 2025

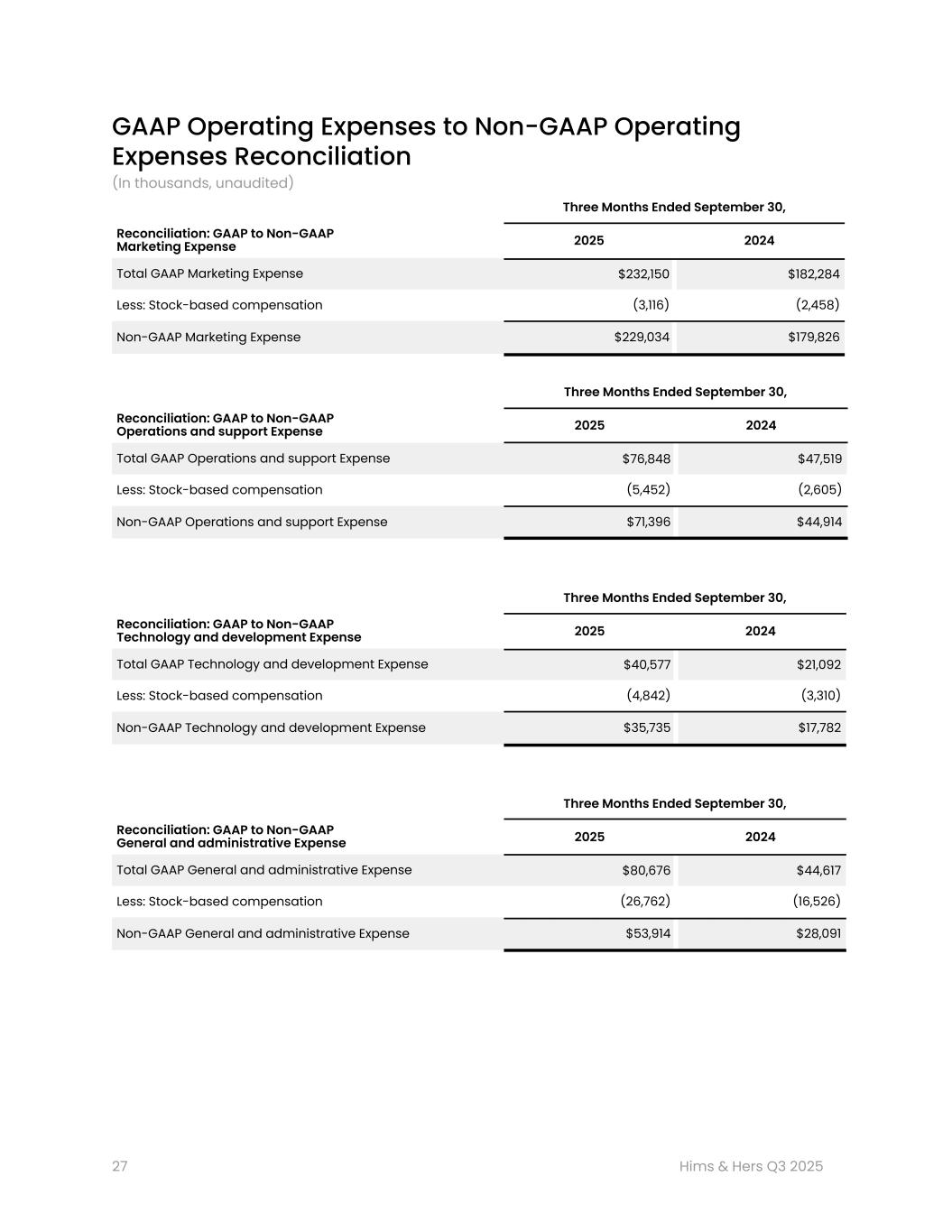

We report four categories of operating expenses: Marketing, Operations and support, Technology and development, and General and administrative. Non-GAAP operating expenses represent GAAP expenses adjusted for stock-based compensation. During the third quarter of 2025, we achieved notable year-over-year Marketing leverage on both a GAAP and non-GAAP basis, as we benefited from efficiencies related to new product launches and improving organic customer acquisition trends. On a GAAP basis, Marketing expenses decreased from 45% to 39% of revenue during the third quarter. On a non-GAAP basis, Marketing expenses decreased from 45% to 38% of revenue. Operations and support in the third quarter of 2025 increased modestly as we continue investing across staffing, fulfillment, and processing, largely in order to accommodate higher volume fulfilled through our pharmacies. GAAP Operations and support expenses increased modestly from 12% to 13% of revenue in the third quarter. On a non-GAAP basis, Operations and support expenses increased from 11% to 12% of revenue. Technology and development expenses during the third quarter of 2025 increased as a percentage of revenue relative to the prior year period, reflecting ongoing investment in engineering and product talent across the organization. GAAP Technology and development expenses increased from 5% to 7% of revenue in the third quarter. On a non-GAAP basis, Technology and development expenses increased from 4% to 6% of revenue. (1) This is a non-GAAP financial measure. Please refer to pages 25-28 for definitions and reconciliations to the corresponding U.S. GAAP financial measure. 15 Hims & Hers Q3 2025

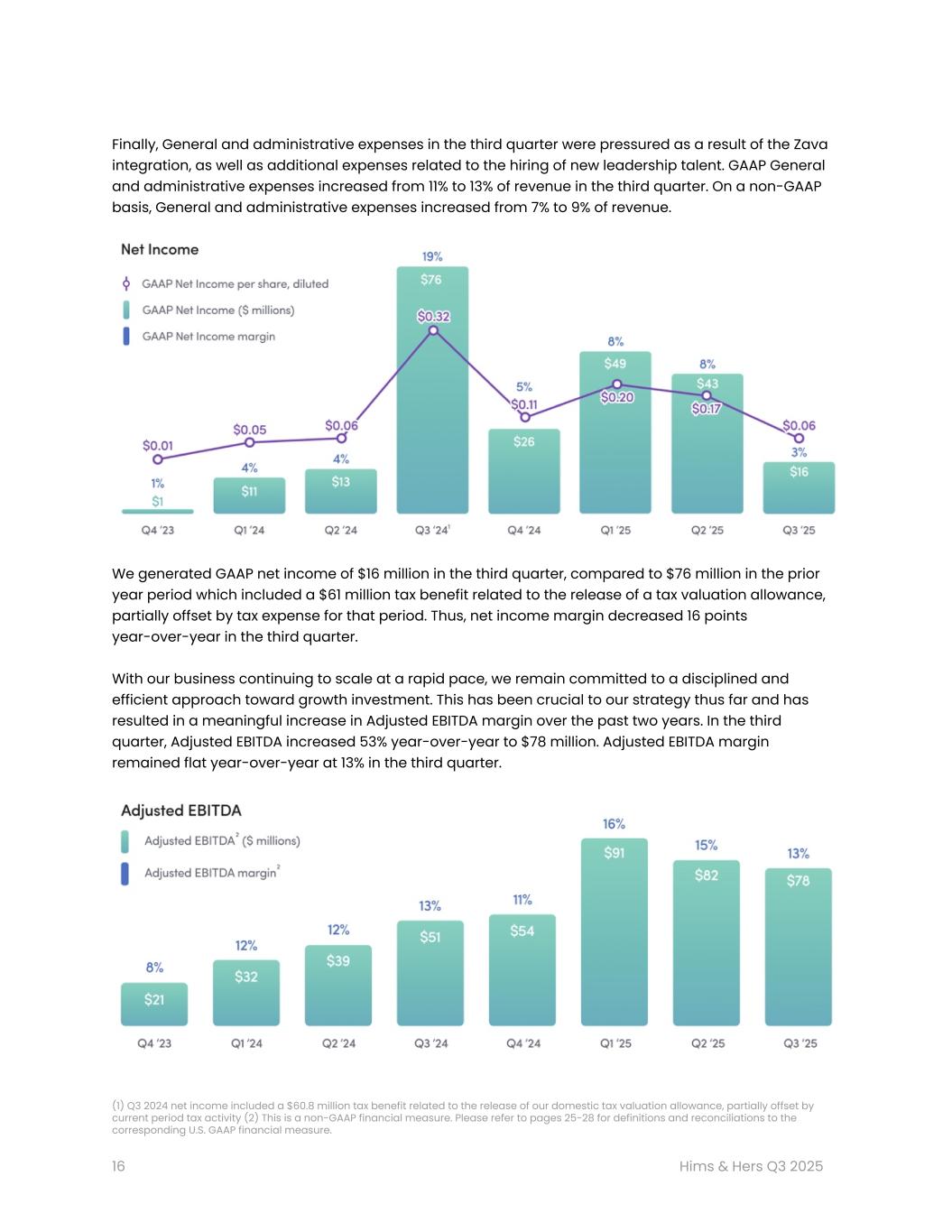

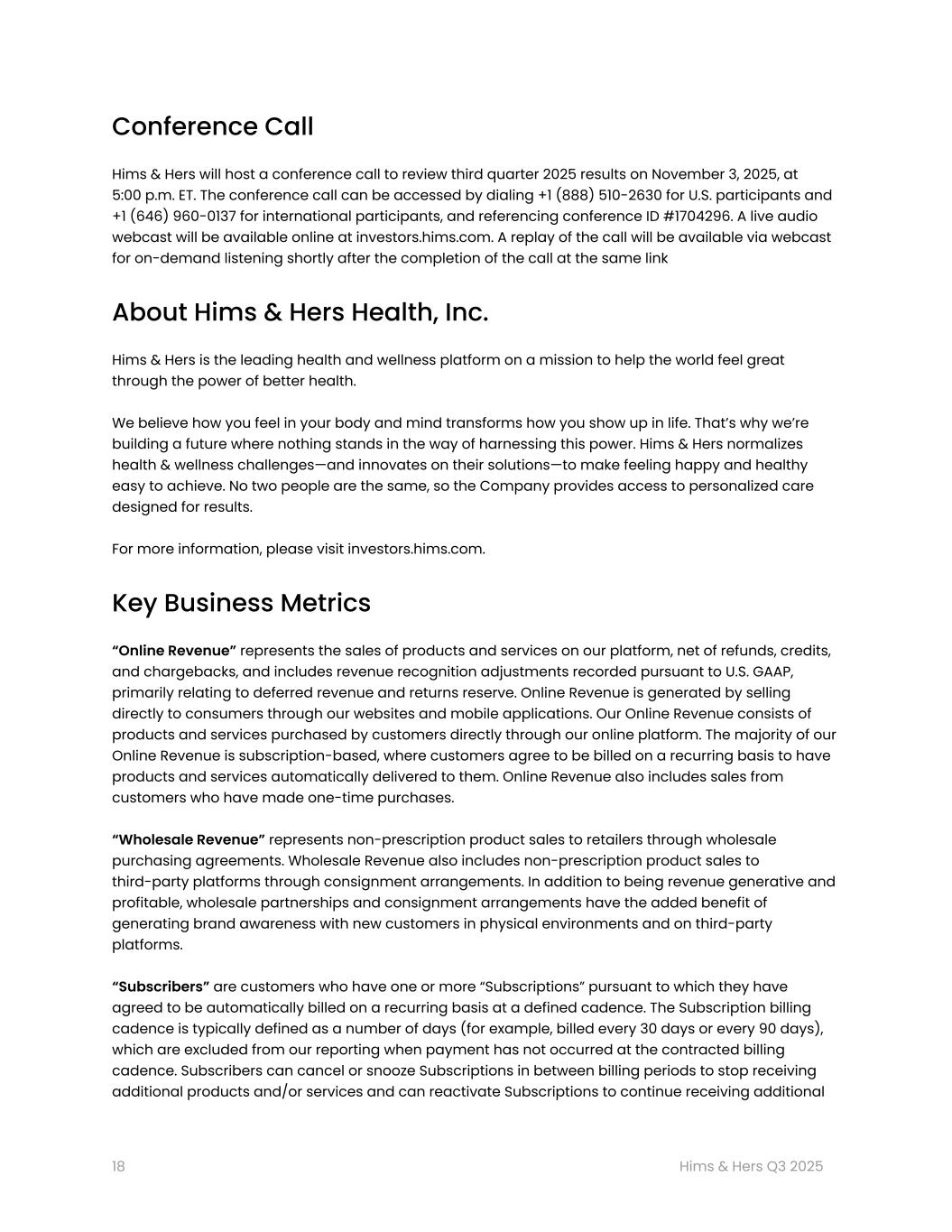

Finally, General and administrative expenses in the third quarter were pressured as a result of the Zava integration, as well as additional expenses related to the hiring of new leadership talent. GAAP General and administrative expenses increased from 11% to 13% of revenue in the third quarter. On a non-GAAP basis, General and administrative expenses increased from 7% to 9% of revenue. We generated GAAP net income of $16 million in the third quarter, compared to $76 million in the prior year period which included a $61 million tax benefit related to the release of a tax valuation allowance, partially offset by tax expense for that period. Thus, net income margin decreased 16 points year-over-year in the third quarter. With our business continuing to scale at a rapid pace, we remain committed to a disciplined and efficient approach toward growth investment. This has been crucial to our strategy thus far and has resulted in a meaningful increase in Adjusted EBITDA margin over the past two years. In the third quarter, Adjusted EBITDA increased 53% year-over-year to $78 million. Adjusted EBITDA margin remained flat year-over-year at 13% in the third quarter. (1) Q3 2024 net income included a $60.8 million tax benefit related to the release of our domestic tax valuation allowance, partially offset by current period tax activity (2) This is a non-GAAP financial measure. Please refer to pages 25-28 for definitions and reconciliations to the corresponding U.S. GAAP financial measure. 16 Hims & Hers Q3 2025

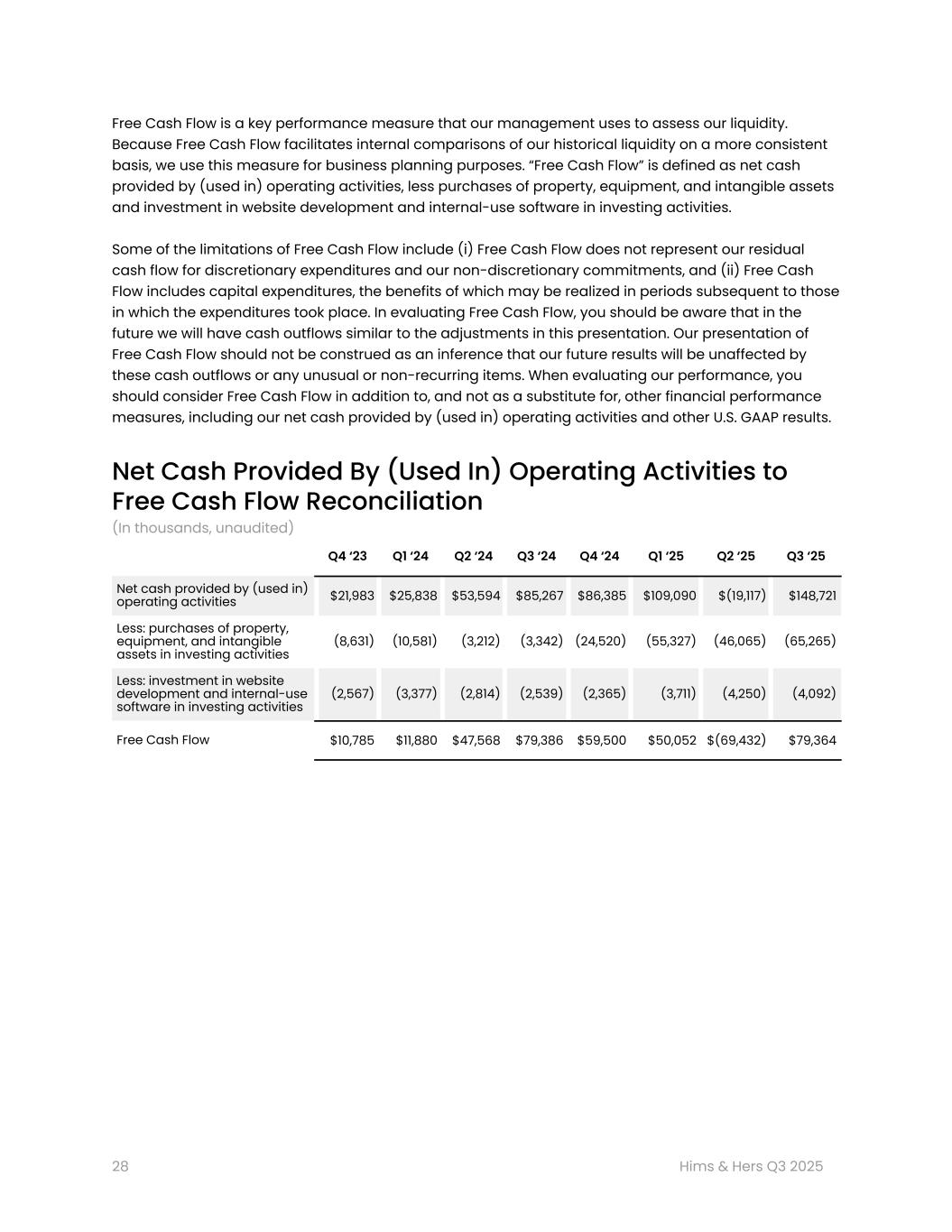

Cash Flow and Balance Sheet In the third quarter, net cash provided by operating activities was $149 million, an increase of 74% year-over-year. Free cash flow in the third quarter was flat at $79 million, as the improvements in operating cash flow were largely offset by an increase in capital expenditures as we continue to invest in the level of automation and broader capabilities of our underlying pharmacy infrastructure. At the end of the third quarter, our principal sources of liquidity totaled $1.1 billion, consisting of approximately $630 million of cash, cash equivalents, and short-term investments, and $438 million of long-term investments. Cash generated during the quarter was partially offset by initial cash consideration of approximately $170 million related to the purchase of Zava. At the end of the quarter, we had approximately $1 billion of debt on our balance sheet, primarily driven by our May convertible note offering. In July 2024, we announced a share repurchase authorization of up to $100 million of our Class A common stock, which can be utilized through August 31, 2027. During the third quarter, we capitalized on periods of volatility in our stock price to repurchase approximately $10 million of Class A common stock and have $55 million remaining on the authorization at quarter end. We expect this program will give us the ongoing ability to capitalize on moments of disconnect between the market value of our Class A common stock and what we believe is the intrinsic value, while also allowing us to offset ongoing dilution as a result of stock-based compensation. (1) This is a non-GAAP financial measure. Please refer to pages 25-28 for definitions and reconciliations to the corresponding U.S. GAAP financial measure. 17 Hims & Hers Q3 2025

Conference Call Hims & Hers will host a conference call to review third quarter 2025 results on November 3, 2025, at 5:00 p.m. ET. The conference call can be accessed by dialing +1 (888) 510-2630 for U.S. participants and +1 (646) 960-0137 for international participants, and referencing conference ID #1704296. A live audio webcast will be available online at investors.hims.com. A replay of the call will be available via webcast for on-demand listening shortly after the completion of the call at the same link About Hims & Hers Health, Inc. Hims & Hers is the leading health and wellness platform on a mission to help the world feel great through the power of better health. We believe how you feel in your body and mind transforms how you show up in life. That’s why we’re building a future where nothing stands in the way of harnessing this power. Hims & Hers normalizes health & wellness challenges—and innovates on their solutions—to make feeling happy and healthy easy to achieve. No two people are the same, so the Company provides access to personalized care designed for results. For more information, please visit investors.hims.com. Key Business Metrics “Online Revenue” represents the sales of products and services on our platform, net of refunds, credits, and chargebacks, and includes revenue recognition adjustments recorded pursuant to U.S. GAAP, primarily relating to deferred revenue and returns reserve. Online Revenue is generated by selling directly to consumers through our websites and mobile applications. Our Online Revenue consists of products and services purchased by customers directly through our online platform. The majority of our Online Revenue is subscription-based, where customers agree to be billed on a recurring basis to have products and services automatically delivered to them. Online Revenue also includes sales from customers who have made one-time purchases. “Wholesale Revenue” represents non-prescription product sales to retailers through wholesale purchasing agreements. Wholesale Revenue also includes non-prescription product sales to third-party platforms through consignment arrangements. In addition to being revenue generative and profitable, wholesale partnerships and consignment arrangements have the added benefit of generating brand awareness with new customers in physical environments and on third-party platforms. “Subscribers” are customers who have one or more “Subscriptions” pursuant to which they have agreed to be automatically billed on a recurring basis at a defined cadence. The Subscription billing cadence is typically defined as a number of days (for example, billed every 30 days or every 90 days), which are excluded from our reporting when payment has not occurred at the contracted billing cadence. Subscribers can cancel or snooze Subscriptions in between billing periods to stop receiving additional products and/or services and can reactivate Subscriptions to continue receiving additional 18 Hims & Hers Q3 2025

products and/or services. Customers who have made one-time purchases are not considered Subscribers. “Monthly Online Revenue per Average Subscriber” is defined as Online Revenue divided by “Average Subscribers”, which amount is then further divided by the number of months in a period. “Average Subscribers” are calculated as the sum of the Subscribers at the beginning and end of a given period divided by 2. Forward-Looking Statements This shareholder letter includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes,” “estimates,” “anticipates,” “expects,” “intends,” “plans,” “assume,” “may,” “will,” “likely,” “potential,” “projects,” “predicts,” “continue,” “goal,” “strategy,” “future,” “forecast,” “target,” “outlook,” “opportunity,” “project,” “confidence,” “foundation,” “groundwork,” or “should,” or, in each case, their negative or other variations or comparable terminology. There can be no assurance that actual results will not materially differ from expectations. Such statements include, but are not limited to, any statements relating to our financial outlook and guidance, including our mission to drive top-line revenue growth and profitability and our ability to attain our 2025, 2026, and long-term financial and operational targets; our expected future financial and business performance, including with respect to the Hims & Hers platform, our marketing campaigns, investments in innovation, the solutions accessible on our platform, the markets accessible on our platform, and our infrastructure, and the underlying assumptions with respect to the foregoing; potential strategic investments, partnerships, or collaborations, and the expected timing or outcome of any such investments, partnerships, or collaborations; statements relating to events and trends relevant to us, including with respect to our regulatory environment, financial condition, results of operations, short- and long-term business operations, objectives, strategy, and financial needs; expectations regarding our mobile applications, market acceptance, user experience, customer retention, brand development, our ability to invest and generate a return on any such investment, customer acquisition costs, operating efficiencies and leverage (including our fulfillment capabilities), the effect of any pricing decisions; changes in our product or offering mix, and the timing and market acceptance of any new products or offerings; the timing and anticipated effect of any acquisitions; the success and utility of our business model; our market opportunity; our ability to scale our business or expand internationally; the growth of certain of our specialties; our ability to innovate on and expand the scope of our offerings and experiences, including through the use of diagnostics, data analytics and artificial intelligence; our ability to reinvest into the customer experience; and our ability to comply with the extensive, complex and evolving legal and regulatory requirements applicable to our business, including without limitation state and federal healthcare, privacy and consumer protection laws and regulations, and the effect or outcome of litigation or governmental actions in relation to any such legal and regulatory requirements. These statements are based on management’s current expectations, but actual results may differ materially due to various factors. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, the forward-looking statements contained in this letter are based on our current expectations, assumptions and beliefs concerning future developments and their potential effects on us. Future 19 Hims & Hers Q3 2025

developments affecting us may not be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) and other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the Risk Factors and other sections of our most recently filed Quarterly Report on Form 10-Q, our most recently filed Annual Report on Form 10-K, and other current and periodic reports we file from time to time with the Securities and Exchange Commission (the “Commission”). Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. The forward-looking statements contained in this letter are made only as of November 3, 2025. We undertake no obligation (and expressly disclaim any obligation) to update or revise any forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and developments in the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in reports we have filed or will file with the Commission, including our most recently filed Quarterly Report on Form 10-Q, our most recently filed Annual Report on Form 10-K, and other current and periodic reports we file from time to time. In addition, even if our results of operations, financial condition and liquidity, and developments in the industry in which we operate are consistent with the forward-looking statements contained in such reports, those results or developments may not be indicative of results or developments in subsequent periods. We include statements and information in this letter concerning our industry and the markets in which we operate, including our market opportunity, which are based on information from independent industry organizations and other third-party sources (including industry publications, surveys and forecasts). While we believe these third-party sources to be reliable as of the date of this letter, we have not independently verified any third-party information and such information is inherently imprecise. 20 Hims & Hers Q3 2025

Condensed Consolidated Balance Sheets (In thousands, except share and per share data, unaudited) September 30, 2025 December 31, 2024 Assets Current assets: Cash and cash equivalents $345,778 $220,584 Short-term investments 283,966 79,667 Inventory 105,989 64,427 Prepaid expenses and other current assets 109,527 31,153 Total current assets 845,260 395,831 Restricted cash - 856 Long-term investments 438,340 - Goodwill 259,236 112,728 Property, equipment, and software, net 267,438 82,083 Intangible assets, net 194,931 43,410 Operating lease right-of-use assets 139,297 10,881 Deferred tax assets, net 84,925 61,603 Other long-term assets 3,877 147 Total assets $2,233,304 $707,539 Liabilities and stockholders’ equity Current liabilities: Accounts payable $198,413 $91,180 Accrued liabilities 80,131 53,013 Deferred revenue 118,458 75,285 Earn-out liabilities 50,361 - Operating lease liabilities 3,422 1,889 Total current liabilities 450,785 221,367 Convertible senior notes, net 971,023 - Operating lease liabilities 143,578 9,456 Earn-out liabilities 49,623 - Deferred tax liabilities, net 31,208 - Other long-term liabilities 6,105 - Total liabilities 1,652,322 230,823 Commitments and contingencies Stockholders’ equity: Common stock – Class A shares, par value $0.0001, 2,750,000,000 shares authorized and 219,121,219 and 212,459,586 shares issued and outstanding as of September 30, 2025 and December 31, 2024, respectively; Class V shares, par value $0.0001, 10,000,000 shares authorized and 8,377,623 shares issued and outstanding as of September 30, 2025 and December 31, 2024 23 22 Additional paid-in capital 714,411 719,155 Accumulated other comprehensive income (loss) 921 (324) Accumulated deficit (134,373) (242,137) Total stockholders’ equity 580,982 476,716 Total liabilities and stockholders’ equity $2,233,304 $707,539 21 Hims & Hers Q3 2025

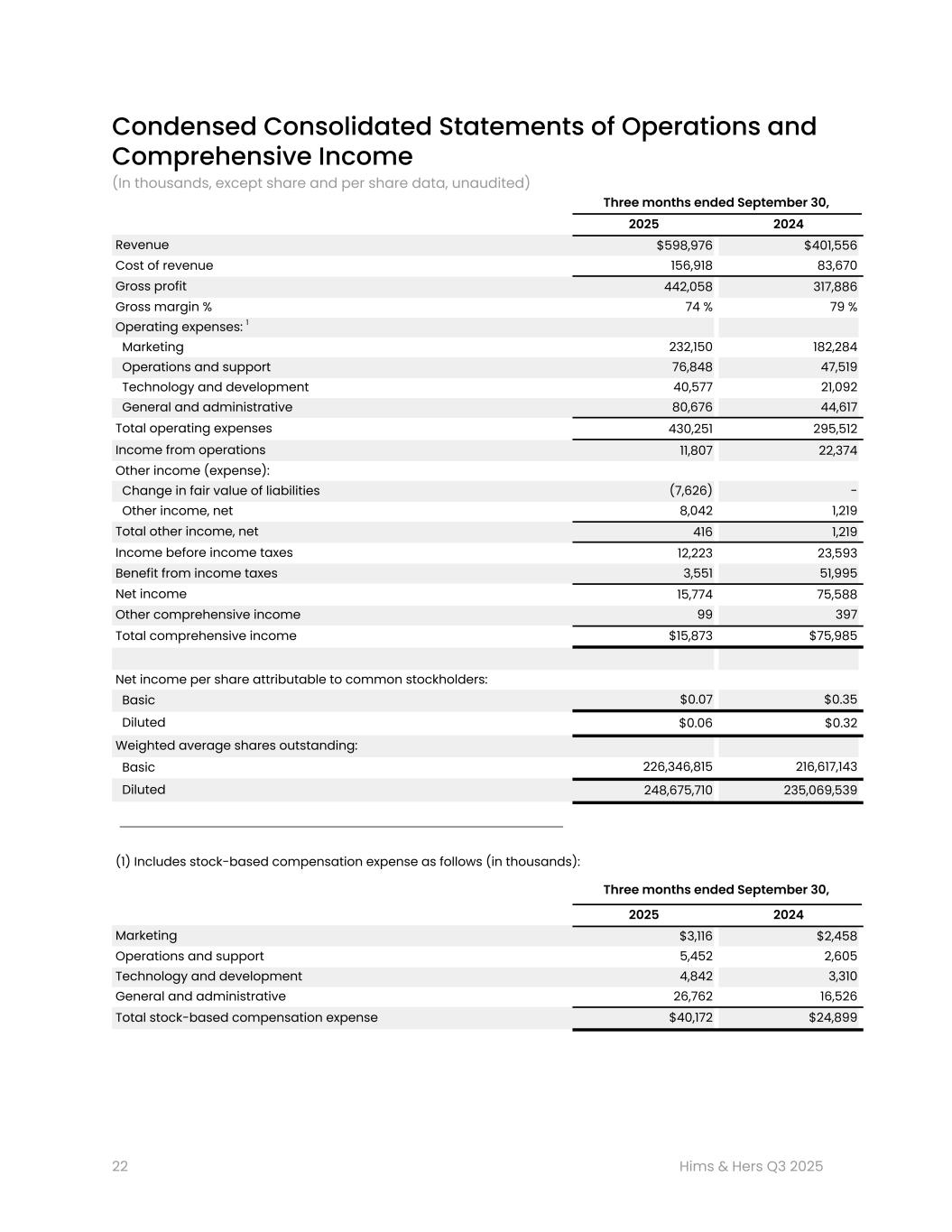

Condensed Consolidated Statements of Operations and Comprehensive Income (In thousands, except share and per share data, unaudited) Three months ended September 30, 2025 2024 Revenue $598,976 $401,556 Cost of revenue 156,918 83,670 Gross profit 442,058 317,886 Gross margin % 74 % 79 % Operating expenses: 1 Marketing 232,150 182,284 Operations and support 76,848 47,519 Technology and development 40,577 21,092 General and administrative 80,676 44,617 Total operating expenses 430,251 295,512 Income from operations 11,807 22,374 Other income (expense): Change in fair value of liabilities (7,626) - Other income, net 8,042 1,219 Total other income, net 416 1,219 Income before income taxes 12,223 23,593 Benefit from income taxes 3,551 51,995 Net income 15,774 75,588 Other comprehensive income 99 397 Total comprehensive income $15,873 $75,985 Net income per share attributable to common stockholders: Basic $0.07 $0.35 Diluted $0.06 $0.32 Weighted average shares outstanding: Basic 226,346,815 216,617,143 Diluted 248,675,710 235,069,539 (1) Includes stock-based compensation expense as follows (in thousands): Three months ended September 30, 2025 2024 Marketing $3,116 $2,458 Operations and support 5,452 2,605 Technology and development 4,842 3,310 General and administrative 26,762 16,526 Total stock-based compensation expense $40,172 $24,899 22 Hims & Hers Q3 2025

Condensed Consolidated Statements of Cash Flows (In thousands, unaudited) Nine months ended September 30, 2025 2024 Operating activities Net income $107,764 $100,013 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 36,410 11,027 Stock-based compensation 100,756 67,973 Change in fair value of liabilities 7,626 - Net accretion on securities (1,313) (3,440) Benefit from deferred taxes (9,484) (54,340) Impairment of long-lived assets 531 114 Amortization of debt discount and issuance costs 2,790 - Non-cash operating lease cost 7,905 1,875 Non-cash acquisition-related costs 4,961 - Non-cash other (2,129) 435 Changes in operating assets and liabilities: Inventory (40,103) (26,295) Prepaid expenses and other current assets (54,382) (1,535) Other long-term assets (5) (47) Accounts payable 76,098 35,052 Accrued liabilities (41,146) 14,002 Deferred revenue 43,079 24,451 Operating lease liabilities (664) (1,761) Earn-out payable - (2,825) Net cash provided by operating activities 238,694 164,699 Investing activities Purchases of investments (713,556) (150,595) Maturities of investments 72,757 189,292 Proceeds from sales of investments - 725 Investment in website development and internal-use software (12,053) (8,730) Purchases of property, equipment, and intangible assets (166,657) (17,135) Acquisition of businesses, net of cash acquired (121,773) (15,399) Net cash used in investing activities (941,282) (1,842) Financing activities Proceeds from issuance of convertible senior notes, net of debt discount 970,000 - Purchases of capped calls related to convertible senior notes (47,800) - Proceeds from exercise of vested stock options 9,796 18,505 Payments for taxes related to net share settlement of equity rewards (94,955) (33,096) Proceeds from employee stock purchase plan 2,970 1,622 Payments for debt issuance costs (3,390) - Repurchases of common stock (9,479) (78,034) Payments for acquisition-related earn-out consideration - (3,190) Net cash provided by (used in) financing activities 827,142 (94,193) Foreign currency effect on cash and cash equivalents (216) 191 Increase in cash, cash equivalents, and restricted cash 124,338 68,855 Cash, cash equivalents, and restricted cash at beginning of period 221,440 97,519 Cash, cash equivalents, and restricted cash at end of period $345,778 $166,374 Reconciliation of cash, cash equivalents, and restricted cash Cash and cash equivalents $345,778 $165,518 Restricted cash - 856 Total cash, cash equivalents, and restricted cash $345,778 $166,374 Supplemental disclosures of cash flow information Cash paid for taxes $23,430 $3,872 Non-cash investing and financing activities Purchases of property and equipment included in accounts payable and accrued liabilities $36,841 $704 Right-of-use asset obtained in exchange for lease liability 132,837 2,174 Issuance of common stock in connection with asset acquisition 12,760 - Common stock to be issued for asset acquisition indemnification holdback 6,380 - Common stock issued, contingent consideration, additional consideration payable, and liabilities assumed in connection with acquisition of businesses 193,890 16,000 Issuance of common stock for acquisition-related earn-out consideration - 1,396 23 Hims & Hers Q3 2025

24 Hims & Hers Q3 2025

Non-GAAP Financial Measures In addition to our financial results determined in accordance with U.S. GAAP, we present Adjusted EBITDA (which is a non-GAAP financial measure), Adjusted EBITDA margin (which is a non-GAAP ratio), and Free Cash Flow (which is a non-GAAP financial measure) each as defined below. We use Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash Flow to evaluate our ongoing operations and for internal planning and forecasting purposes. We also present Non-GAAP Marketing, Non-GAAP Operations and support, Non-GAAP Technology and development, and Non-GAAP General and administrative expenses. In each case, the non-GAAP operating expenses represent GAAP expenses adjusted for stock-based compensation. We believe that Adjusted EBITDA, Adjusted EBITDA margin, non-GAAP operating expenses, and Free Cash Flow, when taken together with the corresponding U.S. GAAP financial measures, provide meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. We consider Adjusted EBITDA, Adjusted EBITDA margin, non-GAAP operating expenses, and Free Cash Flow to be important measures because they help illustrate underlying trends in our business and our historical operating performance on a more consistent basis. We believe that the use of Adjusted EBITDA, Adjusted EBITDA margin, non-GAAP operating expenses, and Free Cash Flow is helpful to our investors as they are used by management in assessing the health of our business, our operating performance, and our liquidity. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with U.S. GAAP. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP financial measures or ratios differently or may use other financial measures or ratios to evaluate their performance, all of which could reduce the usefulness of Adjusted EBITDA, Adjusted EBITDA margin, non-GAAP operating expenses, and Free Cash Flow as tools for comparison. Reconciliations are provided below to the most directly comparable financial measures stated in accordance with U.S. GAAP. Investors are encouraged to review our U.S. GAAP financial measures and not to rely on any single financial measure to evaluate our business. Adjusted EBITDA is a key performance measure that our management uses to assess our operating performance. Because Adjusted EBITDA facilitates internal comparisons of our historical operating performance on a more consistent basis, we use this measure for business planning purposes. “Adjusted EBITDA” is defined as net income before stock-based compensation, depreciation and amortization, change in fair value of liabilities, acquisition and transaction-related costs (which includes (i) consideration paid for employee compensation with vesting requirements incurred directly as a result of acquisitions, inclusive of revaluation of earn-out consideration recorded in general and administrative expenses prior to 2024, and (ii) transaction professional services), payroll tax expense related to stock-based compensation, impairment of long-lived assets, legal settlement expenses that are considered non-recurring, income taxes, and interest income and expense, net. “Adjusted EBITDA margin” is defined as Adjusted EBITDA divided by revenue. In the second quarter of 2025, we revised our definition of Adjusted EBITDA to include payroll tax expense related to stock-based compensation, which comprises employer taxes incurred upon vesting of restricted stock units and upon exercise of nonqualified stock options. As a result of recent trends in our stock price, this amount was not considered significant for prior periods and, accordingly, prior period disclosures were not recast to conform to the current presentation. Some of the limitations of Adjusted EBITDA include (i) Adjusted EBITDA does not properly reflect capital commitments to be paid in the future, and (ii) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and Adjusted EBITDA does not reflect these capital expenditures. In evaluating Adjusted EBITDA, you should be aware that in the future we will incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-recurring items. We compensate for these limitations by providing specific information regarding the U.S. GAAP items excluded from Adjusted EBITDA. When evaluating our performance, you should consider Adjusted EBITDA in addition to, and not as a substitute for, other financial performance measures, including our net income (loss) and other U.S. GAAP results. 25 Hims & Hers Q3 2025

Net Income to Adjusted EBITDA Reconciliation (In thousands, unaudited) Q4 ‘23 Q1 ‘24 Q2 ‘24 Q3 ‘24 Q4 ‘24 Q1 ‘25 Q2 ‘25 Q3 ‘25 Revenue $246,619 $278,171 $315,648 $401,556 $481,139 $586,010 $544,833 $598,976 Net income 1,245 11,128 13,297 75,588 26,025 49,485 42,505 15,774 Stock-based compensation 17,791 19,032 24,042 24,899 24,349 24,858 35,726 40,172 Depreciation and amortization 2,658 3,001 3,643 4,383 6,061 8,276 10,465 17,669 Change in fair value of liabilities 19 – – – – – – 7,626 Acquisition and transaction-related costs 507 376 590 858 2,155 24 6,231 5,838 Payroll tax expense related to stock-based compensation – – – – – – 3,078 2,314 Impairment of long-lived assets – 75 39 – – – – 531 Legal settlement – – – – 2,008 – – – (Benefit from) provision for income taxes 951 1,275 127 (51,995) (3,734) 11,010 (9,652) (3,551) Interest income and expense, net (2,601) (2,540) (2,431) (2,637) (2,741) (2,596) (6,117) (8,008) Adjusted EBITDA $20,570 $32,347 $39,307 $51,096 $54,123 $91,057 $82,236 $78,365 Net income as a % of revenue 1 % 4 % 4 % 19 % 5 % 8 % 8 % 3 % Adjusted EBITDA margin 8 % 12 % 12 % 13 % 11 % 16 % 15 % 13 % 26 Hims & Hers Q3 2025

GAAP Operating Expenses to Non-GAAP Operating Expenses Reconciliation (In thousands, unaudited) Three Months Ended September 30, Reconciliation: GAAP to Non-GAAP Marketing Expense 2025 2024 Total GAAP Marketing Expense $232,150 $182,284 Less: Stock-based compensation (3,116) (2,458) Non-GAAP Marketing Expense $229,034 $179,826 Three Months Ended September 30, Reconciliation: GAAP to Non-GAAP Operations and support Expense 2025 2024 Total GAAP Operations and support Expense $76,848 $47,519 Less: Stock-based compensation (5,452) (2,605) Non-GAAP Operations and support Expense $71,396 $44,914 Three Months Ended September 30, Reconciliation: GAAP to Non-GAAP Technology and development Expense 2025 2024 Total GAAP Technology and development Expense $40,577 $21,092 Less: Stock-based compensation (4,842) (3,310) Non-GAAP Technology and development Expense $35,735 $17,782 Three Months Ended September 30, Reconciliation: GAAP to Non-GAAP General and administrative Expense 2025 2024 Total GAAP General and administrative Expense $80,676 $44,617 Less: Stock-based compensation (26,762) (16,526) Non-GAAP General and administrative Expense $53,914 $28,091 27 Hims & Hers Q3 2025

Free Cash Flow is a key performance measure that our management uses to assess our liquidity. Because Free Cash Flow facilitates internal comparisons of our historical liquidity on a more consistent basis, we use this measure for business planning purposes. “Free Cash Flow” is defined as net cash provided by (used in) operating activities, less purchases of property, equipment, and intangible assets and investment in website development and internal-use software in investing activities. Some of the limitations of Free Cash Flow include (i) Free Cash Flow does not represent our residual cash flow for discretionary expenditures and our non-discretionary commitments, and (ii) Free Cash Flow includes capital expenditures, the benefits of which may be realized in periods subsequent to those in which the expenditures took place. In evaluating Free Cash Flow, you should be aware that in the future we will have cash outflows similar to the adjustments in this presentation. Our presentation of Free Cash Flow should not be construed as an inference that our future results will be unaffected by these cash outflows or any unusual or non-recurring items. When evaluating our performance, you should consider Free Cash Flow in addition to, and not as a substitute for, other financial performance measures, including our net cash provided by (used in) operating activities and other U.S. GAAP results. Net Cash Provided By (Used In) Operating Activities to Free Cash Flow Reconciliation (In thousands, unaudited) Q4 ‘23 Q1 ‘24 Q2 ‘24 Q3 ‘24 Q4 ‘24 Q1 ‘25 Q2 ‘25 Q3 ‘25 Net cash provided by (used in) operating activities $21,983 $25,838 $53,594 $85,267 $86,385 $109,090 $(19,117) $148,721 Less: purchases of property, equipment, and intangible assets in investing activities (8,631) (10,581) (3,212) (3,342) (24,520) (55,327) (46,065) (65,265) Less: investment in website development and internal-use software in investing activities (2,567) (3,377) (2,814) (2,539) (2,365) (3,711) (4,250) (4,092) Free Cash Flow $10,785 $11,880 $47,568 $79,386 $59,500 $50,052 $(69,432) $79,364 28 Hims & Hers Q3 2025

Sources In order of appearance: Mulligan T, Frick MF, Zuraw QC, Stemhagen A, McWhirter C. Prevalence of hypogonadism in males aged at least 45 years: the HIM study. 2006 Jul;60(7):762-9. doi: 10.1111/j.1742-1241.2006.00992.x. PMID: 16846397; PMCID: PMC1569444. Iyer TK, Manson JE. Recent Trends in Menopausal Hormone Therapy Use in the US: Insights, Disparities, and Implications for Practice. JAMA Health Forum. 2024;5(9):e243135. doi:10.1001/jamahealthforum.2024.3135. Ogunwole, S., Rabe, M., Roberts, A., & Caplan, Z. (2021, August 12). U.S. Adult Population Grew Faster Than Nation’s Total Population From 2010 to 2020. The United States Census Bureau. Estimates of the population for the UK, England and Wales, Scotland and Northern Ireland - Office for National Statistics. (2024, October 8). Office for National Statistics. France. (2023). World Health Organization. Population by age groups. (2024, June 14). Federal Statistical Office of Germany. Population of the Republic of Ireland in 2024, by age group. (2024). Statista. Instituto Nacional de Estadística. (2024). Población por sexo, edad y año (Tabla 68536) [Data set]. INEbase. Population estimates on July 1st, by age and gender. (2024, September 25). Statistics Canada. European Commission. (2024). Self-perceived health statistics. Eurostat Statistics Explained. Benavidez, G. A., Zahnd, W. E., Hung, P., & Eberth, J. M. (2024). Chronic disease prevalence in the US: Sociodemographic and geographic variations by zip code tabulation area. Preventing Chronic Disease, 21, E14. Statistics Canada. (2023, November 29). A glimpse at the health of Canadians. Government of Canada. European Commission. (2024, July). Overweight and obesity – BMI statistics. Eurostat Statistics Explained. Office for Health Improvement & Disparities. (2024, May 8). Obesity Profile: Short statistical commentary May 2024. GOV.UK. Schienkiewitz, A., Kuhnert, R., Blume, M., & Mensink, G. B. M. (2022). Overweight and obesity among adults in Germany – Results from GEDA 2019/2020-EHIS. Journal of Health Monitoring, 7(3), 21-28. Public Health Agency of Canada. (2024, September). Obesity statistics in Canada (Cat. No. HP35-188/2024E-PDF). Government of Canada. Menopause. (n.d.). Society for Women’s Health Research. Allen, J., Laks, S., Zahler-Miller, C., Bunja Rungruang, Braun, K., Goldstein, S. R., & Schnatz, P. F. (2023). Needs assessment of menopause education in United States obstetrics and gynecology residency training programs. Menopause, 30(10), 1002–1005. 29 Hims & Hers Q3 2025

Contacts: Investor Relations Bill Newby Investors@forhims.com Media Relations Abby Reisinger-Moley Press@forhims.com 30 Hims & Hers Q3 2025