Document

Funko Reports Third Quarter 2025 Financial Results

--Net Sales In Line with Expectations;

Gross Margin, Net Income and Adjusted EBITDA Higher Than Expected;

Provides Comments on Outlook--

EVERETT, Wash. November 6, 2025 -- Funko, Inc. (Nasdaq: FNKO), a leading pop culture lifestyle brand, today reported its consolidated financial results for the third quarter ended September 30, 2025.

Third Quarter Financial Results Summary: 2025 vs 2024

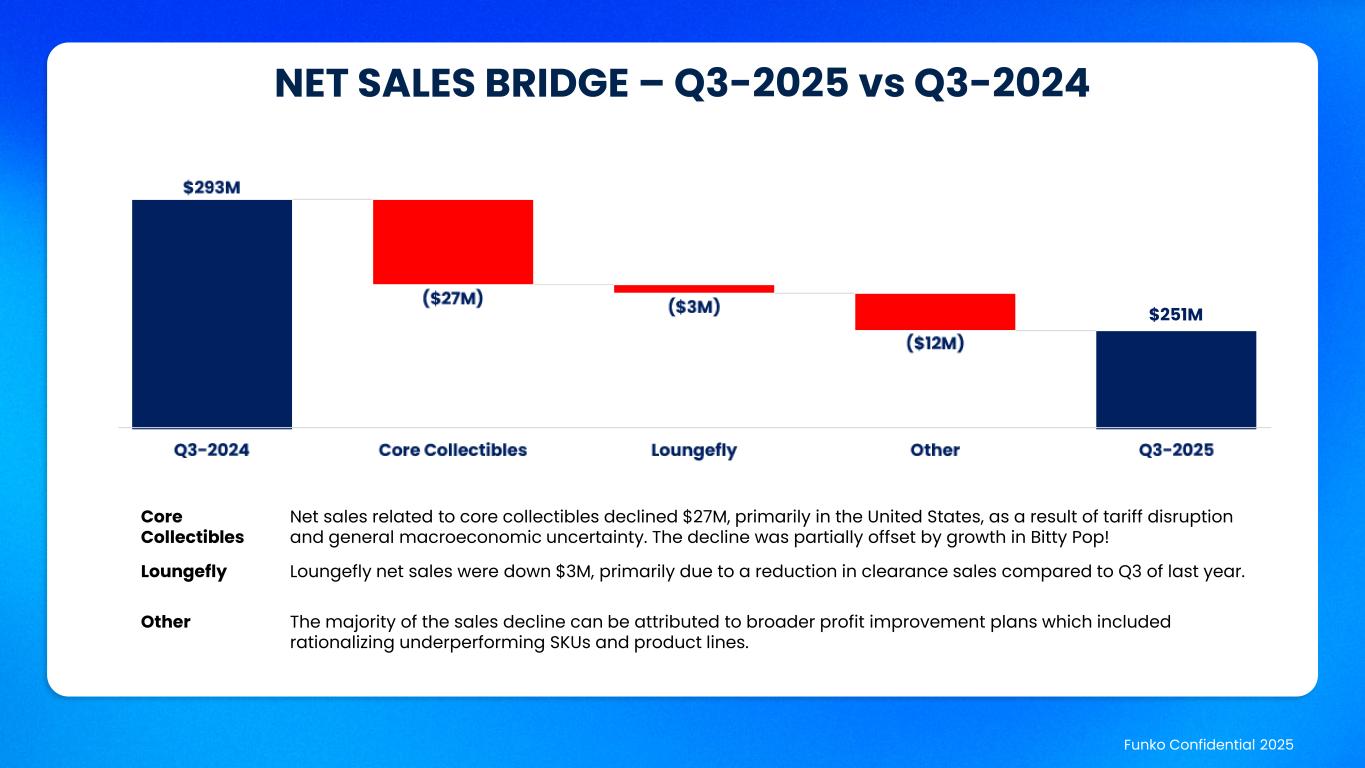

•Net sales were $250.9 million compared with $292.8 million

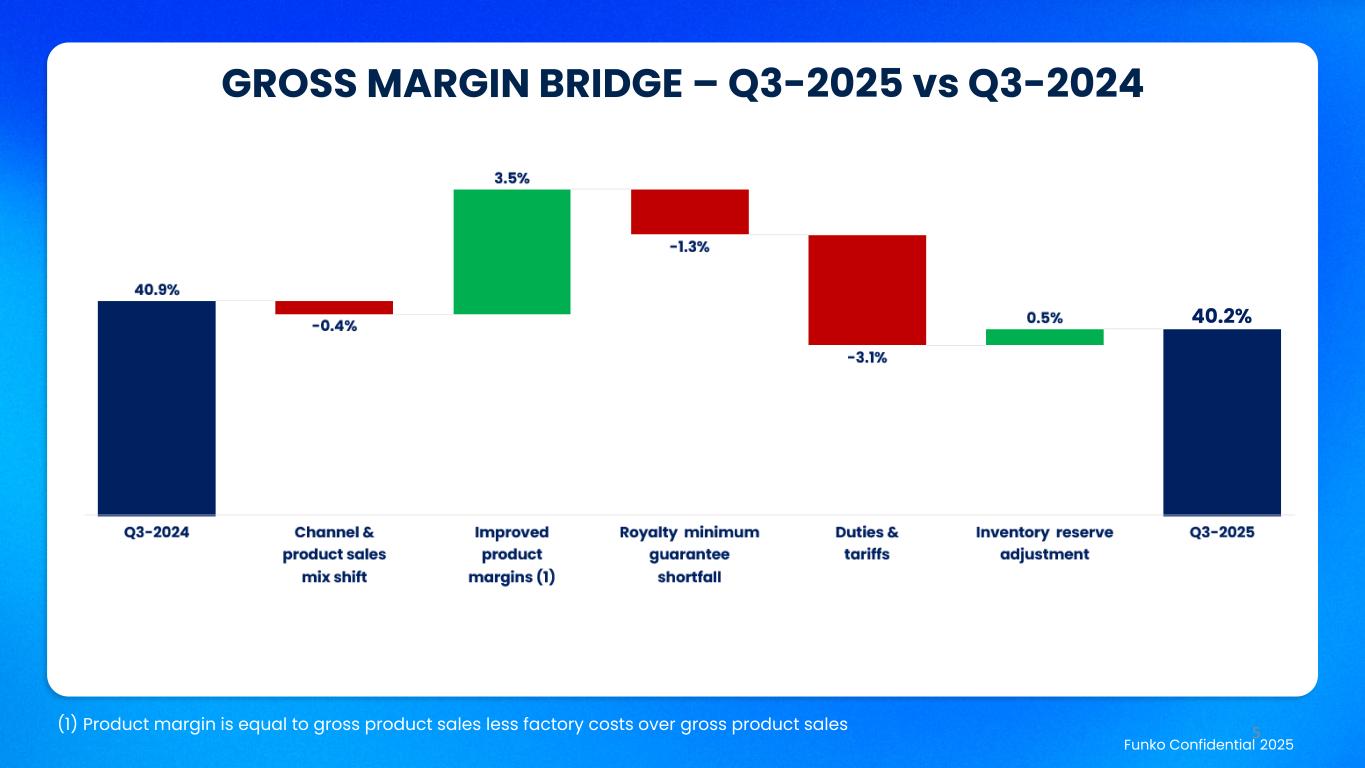

•Gross profit was $100.8 million, equal to gross margin of 40.2%, compared with $119.8 million, equal to gross margin of 40.9%

•SG&A expenses were $79.8 million, which included a non-recurring charge of $1.0 million, compared with $92.7 million, which included non-recurring charges of $0.4 million. Details related to the non-recurring charges can be found in footnotes 3 and 4 of the attached reconciliation tables

•Net income was $0.9 million, or $0.02 per diluted share, compared with $4.6 million, or $0.08 per diluted share

•Adjusted net income* was $3.2 million, or $0.06 per diluted share*, compared with $8.0 million, or $0.14 per diluted share*

•Adjusted EBITDA* was $24.4 million compared with $31.0 million

"We delivered a solid 2025 third quarter performance, with net sales in line with internal expectations and gross margin and bottom-line profitability well ahead of expectations,” said Josh Simon, Chief Executive Officer of Funko. “Sales of our Bitty Pop! line, which made Walmart's 2025 Top Toy List, was a key contributor, and our strong gross margin benefited from the swift implementation earlier this year of our tariff mitigation plans.

“I’m only 60 days into the role, but it’s already clear how powerful the Funko brand is and how much growth opportunity lies ahead. Our Make Culture POP! strategy is all about being at the center of the moments everyone is talking about. Beginning with lightning-fast launches like KPop Demon Hunters—where we’ll be one of the only licensees on shelves this holiday season—we’re moving fast to turn pop culture into products, expanding into new fandoms, delivering bold retail experiences, and celebrating the creativity that makes Funko unique.”

Third Quarter 2025 Net Sales by Category and Geography

The tables below show the breakdown of net sales on a brand category and geographical basis (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Period Over Period Change |

|

2025 |

|

2024 |

|

Dollar |

|

Percentage |

| Net sales by brand category: |

|

|

|

|

|

|

|

| Core Collectible |

$ |

200,414 |

|

|

$ |

227,845 |

|

|

$ |

(27,431) |

|

|

(12.0) |

% |

| Loungefly |

44,685 |

|

|

47,310 |

|

|

(2,625) |

|

|

(5.5) |

% |

| Other |

5,806 |

|

|

17,610 |

|

|

(11,804) |

|

|

(67.0) |

% |

| Total net sales |

$ |

250,905 |

|

|

$ |

292,765 |

|

|

$ |

(41,860) |

|

|

(14.3) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Period Over Period Change |

|

2025 |

|

2024 |

|

Dollar |

|

Percentage |

| Net sales by geography: |

|

|

|

|

|

|

|

| United States |

$ |

155,415 |

|

|

$ |

194,416 |

|

|

$ |

(39,001) |

|

|

(20.1) |

% |

| Europe |

74,196 |

|

|

74,473 |

|

|

(277) |

|

|

(0.4) |

% |

| Other International |

21,294 |

|

|

23,876 |

|

|

(2,582) |

|

|

(10.8) |

% |

| Total net sales |

$ |

250,905 |

|

|

$ |

292,765 |

|

|

$ |

(41,860) |

|

|

(14.3) |

% |

Balance Sheet Highlights - At September 30, 2025 vs December 31, 2024

•Total cash and cash equivalents were $39.2 million at September 30, 2025 compared with $34.7 million at December 31, 2024

•Inventories were $99.8 million at September 30, 2025 up from $92.6 million at December 31, 2024

•Total debt was $241.0 million at September 30, 2025 versus $182.8 million at December 31, 2024. Total debt includes the amount outstanding under the company's term loan facility, net of unamortized discounts, revolving line of credit and equipment finance loan.

Outlook for 2025

The Company provided the following comments regarding its outlook for the fourth quarter of 2025, as follows:

•Net sales to increase modestly from Q3 2025;

•Gross margin of approximately 40%;

•Adjusted EBITDA margin* to be in the mid– to high single-digits range.

*Adjusted net income (loss), adjusted net income (loss) per diluted share, adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures. For a reconciliation of historical adjusted net income (loss), adjusted income (loss) per diluted share, and adjusted EBITDA, to the most directly comparable U.S. GAAP financial measures, please refer to the “Non-GAAP Financial Measures” section of this press release. A reconciliation of adjusted EBITDA margin outlook to the corresponding GAAP measure on a forward-looking basis cannot be provided without unreasonable efforts, as we are unable to provide reconciling information with respect to certain items. However, for the fourth quarter of 2025 the company expects equity-based compensation of approximately $4 million, depreciation and amortization of approximately $15 million and interest expense of approximately $6 million. See "Use of Non-GAAP Financial Measures" and the attached reconciliations for more information.

Conference Call and Webcast

The company will host a conference call at 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time) today, November 6, 2025, to further discuss its third quarter results and business update. A live webcast and a replay of the event will be available on the Investor Relations section on the company’s website at investor.funko.com. The replay of the webcast will be available for one year.

Use of Non-GAAP Financial Measures

This release contains references to non-GAAP financial measures, including adjusted net (loss) income, including per share amounts, adjusted EBITDA, adjusted EBITDA margin and adjusted net (loss) income margin, which are financial measures that are not prepared in conformity with United States generally accepted accounting principles (U.S. GAAP). Management uses these measures internally for evaluating its operating performance, for planning purposes, including the preparation of our annual operating budget and financials projections, to assess incentive compensation for our employees, and to evaluate our capacity to expand our business. The company's management believes that the presentation of non-GAAP financial measures provides useful supplementary information regarding operational performance because it enhances an investor's overall understanding of the financial results for the company's core business. Additionally, it provides a basis for the comparison of the financial results for the company's core business between current, past and future periods as they remove the impact of items not directly resulting from our core operations. The company also believes that including adjusted EBITDA and the other non-GAAP financial measures presented in this release is appropriate to provide additional information to investors and help to compare against other companies in our industry. Non-GAAP financial measures have limitations as analytical tools and should be considered only as a supplement to, and not as a substitute for or as a superior measure to, financial measures prepared in accordance with U.S. GAAP. We caution investors that amounts presented in accordance with our definitions of adjusted net (loss) income, including per share amounts, adjusted EBITDA and adjusted EBITDA margin may not be comparable to similar measures disclosed by our competitors, because not all companies and analysts calculate these measures in the same manner.

Detailed reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the financial tables following this release.

About Funko

Funko is a leading global pop culture lifestyle brand, with a diverse collection of brands, including Funko, Loungefly, and Mondo, and an industry-leading portfolio of licenses. Funko delivers industry-defining products that span vinyl figures, micro-collectibles, fashion accessories, apparel, plush, action toys, high-end art, and music collectibles, many of which are at the forefront of the growing Kidult economy. Through these products, which include the iconic original Pop! line, Bitty Pop!, and Pop! Yourself, Funko inspires fans across the globe to express their passions, build community, and have fun. Founded in 1998 and headquartered in Washington state, Funko has offices, retail locations, operations, and licensed partnerships in major consumer geographies across the globe. Learn more at Funko.com, Loungefly.com, MondoShop.com, and follow us on TikTok, X, and Instagram.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including statements regarding our product offerings, our strategic plan and speed to market, anticipated financial results, including without limitation, equity-based compensation and financial position, the impact of and anticipated trends in the macroeconomic environment, including tariffs, on the company’s business, and actions to address the current macroeconomic environment. These forward-looking statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: our ability to execute our business strategy; our ability to manage our inventories and growth; risks relating to our indebtedness, including our ability to comply with financial and negative covenants under our Credit Agreement, as amended, and our ability to continue as a going concern; our ability to maintain and realize the full value of our license agreements; impacts from economic downturns; changes in the retail industry and markets for our consumer products; our ability to maintain our relationships with retail customers and distributors; our ability to compete effectively; fluctuations in our gross margin and seasonal impacts; our dependence on content development and creation by third parties; the ongoing level of popularity of our products with consumers; our ability to develop and introduce products in a timely and cost-effective manner; our ability to obtain, maintain and protect our intellectual property rights or those of our licensors; potential violations of the intellectual property rights of others; risks associated with counterfeit versions of our products; our ability to attract and retain qualified employees and maintain our corporate culture; our use of third-party manufacturing; risks associated with climate change; increased attention to sustainability and environmental, social and governance initiatives; geographic concentration of our operations; risks associated with our international operations, including risks related to tariffs and trade restrictions; changes in effective tax rates or tax law; our dependence on vendors and outsourcers; risks relating to government regulation; risks relating to litigation, including products liability claims and securities class action litigation; any failure to successfully integrate or realize the anticipated benefits of acquisitions or investments; future development and acceptance of blockchain networks; risks associated with receiving payments in digital assets; risk resulting from our e-commerce business and social media presence; our ability to successfully operate our information systems and implement new technology; our ability to secure additional financing on favorable terms or at all; the potential for our or our third-party providers’ electronic data or the electronic data of our customers to be compromised; the influence of our significant stockholder, TCG, and the possibility that TCG’s interests may conflict with the interests of our other stockholders; risks relating to our organizational structure; including the Tax Receivable Agreement ("TRA") which confers certain benefits upon the parties to the TRA ("TRA Parties") that will not benefit Class A common stockholders to the same extent as it will benefit the TRA Parties; volatility in the price of our Class A common stock; and risks associated with our internal control over financial reporting. These and other important factors discussed under the caption “Risk Factors” in our quarterly report on Form 10-Q for the quarter ended September 30, 2025 and our other filings with the Securities and Exchange Commission could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

Investor Relations:

investorrelations@funko.com

Media:

pr@funko.com

Funko, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

(In thousands, except per share data) |

| Net sales |

$ |

250,905 |

|

|

$ |

292,765 |

|

|

$ |

635,113 |

|

|

$ |

756,121 |

|

| Cost of sales (exclusive of depreciation and amortization) |

150,154 |

|

|

172,956 |

|

|

395,451 |

|

|

445,992 |

|

| Selling, general, and administrative expenses |

79,794 |

|

|

92,662 |

|

|

246,860 |

|

|

256,154 |

|

| Depreciation and amortization |

14,529 |

|

|

15,411 |

|

|

44,319 |

|

|

46,409 |

|

| Total operating expenses |

244,477 |

|

|

281,029 |

|

|

686,630 |

|

|

748,555 |

|

| Income (loss) from operations |

6,428 |

|

|

11,736 |

|

|

(51,517) |

|

|

7,566 |

|

| Interest expense, net |

5,611 |

|

|

4,971 |

|

|

13,982 |

|

|

16,363 |

|

|

|

|

|

|

|

|

|

| Other (income) expense, net |

(1,359) |

|

|

998 |

|

|

(304) |

|

|

1,994 |

|

| Income (loss) before income taxes |

2,176 |

|

|

5,767 |

|

|

(65,195) |

|

|

(10,791) |

|

| Income tax expense |

1,228 |

|

|

1,170 |

|

|

2,920 |

|

|

2,859 |

|

| Net income (loss) |

948 |

|

|

4,597 |

|

|

(68,115) |

|

|

(13,650) |

|

Less: net income (loss) attributable to non-controlling interests |

47 |

|

|

267 |

|

|

(938) |

|

|

(432) |

|

| Net income (loss) attributable to Funko, Inc. |

$ |

901 |

|

|

$ |

4,330 |

|

|

$ |

(67,177) |

|

|

$ |

(13,218) |

|

|

|

|

|

|

|

|

|

| Earnings (loss) per share of Class A common stock: |

|

|

|

|

|

|

|

| Basic |

$ |

0.02 |

|

|

$ |

0.08 |

|

|

$ |

(1.24) |

|

|

$ |

(0.26) |

|

| Diluted |

$ |

0.02 |

|

|

$ |

0.08 |

|

|

$ |

(1.24) |

|

|

$ |

(0.26) |

|

| Weighted average shares of Class A common stock outstanding: |

|

|

|

|

|

|

|

| Basic |

54,649 |

|

|

52,523 |

|

|

54,184 |

|

|

51,781 |

|

| Diluted |

54,707 |

|

|

53,428 |

|

|

54,184 |

|

|

51,781 |

|

Funko, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2025 |

|

December 31,

2024 |

|

(In thousands, except per share data) |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

39,177 |

|

|

$ |

34,655 |

|

| Accounts receivable, net |

128,434 |

|

|

119,882 |

|

| Inventories |

99,805 |

|

|

92,580 |

|

| Prepaid expenses and other current assets |

32,527 |

|

|

39,942 |

|

| Total current assets |

299,943 |

|

|

287,059 |

|

| Property and equipment, net |

70,631 |

|

|

78,357 |

|

| Operating lease right-of-use assets, net |

48,766 |

|

|

52,846 |

|

| Goodwill |

133,920 |

|

|

133,652 |

|

| Intangible assets, net |

139,789 |

|

|

151,547 |

|

|

|

|

|

| Other assets |

6,222 |

|

|

3,793 |

|

| Total assets |

$ |

699,271 |

|

|

$ |

707,254 |

|

| Liabilities and Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

| Line of credit |

$ |

135,000 |

|

|

$ |

60,000 |

|

| Current portion of long-term debt |

104,579 |

|

|

22,512 |

|

| Current portion of operating lease liabilities |

18,720 |

|

|

17,102 |

|

| Accounts payable |

63,952 |

|

|

63,130 |

|

|

|

|

|

| Accrued royalties |

57,795 |

|

|

61,362 |

|

| Accrued expenses and other current liabilities |

77,363 |

|

|

81,688 |

|

|

|

|

|

| Total current liabilities |

457,409 |

|

|

305,794 |

|

| Long-term debt |

1,388 |

|

|

100,303 |

|

| Operating lease liabilities |

52,548 |

|

|

60,390 |

|

|

|

|

|

|

|

|

|

| Other long-term liabilities |

4,313 |

|

|

4,414 |

|

|

|

|

|

| Commitments and Contingencies |

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

Class A common stock, par value $0.0001 per share, 200,000 shares authorized; 54,740 and 52,967 shares issued and outstanding as of September 30, 2025 and December 31, 2024, respectively |

5 |

|

|

5 |

|

Class B common stock, par value $0.0001 per share, 50,000 shares authorized; 648 and 1,430 shares issued and outstanding as of September 30, 2025 and December 31, 2024, respectively |

— |

|

|

— |

|

| Additional paid-in-capital |

354,094 |

|

|

343,472 |

|

| Accumulated other comprehensive income (loss) |

4,544 |

|

|

(1,676) |

|

| Accumulated deficit |

(175,959) |

|

|

(108,782) |

|

| Total stockholders’ equity attributable to Funko, Inc. |

182,684 |

|

|

233,019 |

|

| Non-controlling interests |

929 |

|

|

3,334 |

|

| Total stockholders’ equity |

183,613 |

|

|

236,353 |

|

| Total liabilities and stockholders’ equity |

$ |

699,271 |

|

|

$ |

707,254 |

|

Funko, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

(In thousands) |

| Operating Activities |

|

|

|

| Net loss |

$ |

(68,115) |

|

|

$ |

(13,650) |

|

| Adjustments to reconcile net loss to net cash (used in) provided by operating activities: |

|

|

|

| Depreciation and amortization |

44,319 |

|

|

46,409 |

|

| Equity-based compensation |

8,906 |

|

|

10,530 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other, net |

(2,298) |

|

|

(271) |

|

| Changes in operating assets and liabilities: |

|

|

|

| Accounts receivable, net |

(5,617) |

|

|

(38,547) |

|

| Inventories |

(4,755) |

|

|

3,306 |

|

| Prepaid expenses and other assets |

13,847 |

|

|

26,608 |

|

| Accounts payable |

(153) |

|

|

23,851 |

|

|

|

|

|

| Accrued royalties |

(3,567) |

|

|

6,838 |

|

| Accrued expenses and other liabilities |

(15,773) |

|

|

(1,332) |

|

| Net cash (used in) provided by operating activities |

(33,206) |

|

|

63,742 |

|

|

|

|

|

| Investing Activities |

|

|

|

| Purchases of property and equipment |

(24,064) |

|

|

(20,796) |

|

|

|

|

|

| Sale of Funko Games inventory and certain intellectual property |

— |

|

|

6,754 |

|

| Other, net |

1,042 |

|

|

655 |

|

| Net cash used in investing activities |

(23,022) |

|

|

(13,387) |

|

|

|

|

|

| Financing Activities |

|

|

|

| Borrowings on line of credit |

85,000 |

|

|

25,000 |

|

| Payments on line of credit |

(10,000) |

|

|

(50,500) |

|

|

|

|

|

| Payments of long-term debt |

(17,323) |

|

|

(25,365) |

|

|

|

|

|

|

|

|

|

| Payments under tax receivable agreement |

— |

|

|

(8,960) |

|

|

|

|

|

| Other, net |

171 |

|

|

1,250 |

|

| Net cash provided by (used in) financing activities |

57,848 |

|

|

(58,575) |

|

|

|

|

|

| Effect of exchange rates on cash and cash equivalents |

2,902 |

|

|

313 |

|

|

|

|

|

| Net change in cash and cash equivalents |

4,522 |

|

|

(7,907) |

|

| Cash and cash equivalents at beginning of period |

34,655 |

|

|

36,453 |

|

| Cash and cash equivalents at end of period |

$ |

39,177 |

|

|

$ |

28,546 |

|

The following tables reconcile the Non-GAAP Financial Measures to the most directly comparable U.S. GAAP financial performance measure, which is net income (loss), for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

(In thousands, except per share data) |

| Net income (loss) attributable to Funko, Inc. |

$ |

901 |

|

|

$ |

4,330 |

|

|

$ |

(67,177) |

|

|

$ |

(13,218) |

|

Reallocation of net income (loss) attributable to non-controlling interests from the assumed exchange of common units of FAH, LLC for Class A common stock (1) |

47 |

|

|

267 |

|

|

(938) |

|

|

(432) |

|

Equity-based compensation (2) |

2,529 |

|

|

3,430 |

|

|

8,906 |

|

|

10,530 |

|

|

|

|

|

|

|

|

|

Acquisition costs and other expenses (3) |

1,029 |

|

|

287 |

|

|

1,029 |

|

|

1,866 |

|

|

|

|

|

|

|

|

|

Certain severance, relocation and related costs (4) |

— |

|

|

114 |

|

|

— |

|

|

2,081 |

|

Foreign currency transaction (gain) loss (5) |

(1,442) |

|

|

1,005 |

|

|

197 |

|

|

2,018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense (benefit) (6) |

155 |

|

|

(1,481) |

|

|

16,686 |

|

|

1,433 |

|

| Adjusted net income (loss) |

$ |

3,219 |

|

|

$ |

7,952 |

|

|

$ |

(41,297) |

|

|

$ |

4,278 |

|

Adjusted net income (loss) margin (7) |

1.3 |

% |

|

2.7 |

% |

|

(6.5) |

% |

|

0.6 |

% |

| Weighted-average shares of Class A common stock outstanding - basic |

54,649 |

|

|

52,523 |

|

|

54,184 |

|

|

51,781 |

|

| Equity-based compensation awards and common units of FAH, LLC that are convertible into Class A common stock |

808 |

|

|

2,755 |

|

|

854 |

|

|

2,182 |

|

| Adjusted weighted-average shares of Class A stock outstanding - diluted |

55,457 |

|

|

55,278 |

|

|

55,038 |

|

|

53,963 |

|

| Adjusted earnings (loss) per diluted share |

$ |

0.06 |

|

|

$ |

0.14 |

|

|

$ |

(0.75) |

|

|

$ |

0.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

(amounts in thousands) |

| Net income (loss) |

$ |

948 |

|

|

$ |

4,597 |

|

|

$ |

(68,115) |

|

|

$ |

(13,650) |

|

| Interest expense, net |

5,611 |

|

|

4,971 |

|

|

13,982 |

|

|

16,363 |

|

| Income tax expense |

1,228 |

|

|

1,170 |

|

|

2,920 |

|

|

2,859 |

|

| Depreciation and amortization |

14,529 |

|

|

15,411 |

|

|

44,319 |

|

|

46,409 |

|

| EBITDA |

$ |

22,316 |

|

|

$ |

26,149 |

|

|

$ |

(6,894) |

|

|

$ |

51,981 |

|

Adjustments: |

|

|

|

|

|

|

|

Equity-based compensation (2) |

2,529 |

|

|

3,430 |

|

|

8,906 |

|

|

10,530 |

|

|

|

|

|

|

|

|

|

Acquisition costs and other expenses (3) |

1,029 |

|

|

287 |

|

|

1,029 |

|

|

1,866 |

|

|

|

|

|

|

|

|

|

Certain severance, relocation and related costs (4) |

— |

|

|

114 |

|

|

— |

|

|

2,081 |

|

Foreign currency transaction (gain) loss (5) |

(1,442) |

|

|

1,005 |

|

|

197 |

|

|

2,018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

24,432 |

|

|

$ |

30,985 |

|

|

$ |

3,238 |

|

|

$ |

68,476 |

|

Adjusted EBITDA margin (8) |

9.7 |

% |

|

10.6 |

% |

|

0.5 |

% |

|

9.1 |

% |

|

|

|

|

|

|

|

|

| (1) |

Represents the reallocation of net income attributable to non-controlling interests from the assumed exchange of common units of FAH, LLC for Class A common stock in periods in which income was attributable to non-controlling interests. |

| (2) |

Represents non-cash charges related to equity-based compensation programs, which vary from period to period depending on the timing of awards. |

| (3) |

For the three and nine months ended September 30, 2025, includes charges related to fair market value adjustments for certain assets held for sale. For the three months ended September 30, 2024, includes charges related to contract settlement agreements for warehouse leased space. For the nine months ended September 30, 2024, includes a net one-time legal settlement gain of $1.4 million related to a previously disclosed Loungefly customs-related matter offset by $3.2 million related to contract settlement agreements and related services for assets held for sale (including fair market value adjustments of $135,000) related to a potential business initiative and the sale of certain assets under Funko Games. |

| (4) |

For the three and nine months ended September 30, 2024, includes charges related to severance and benefit costs related to certain management departures. |

| (5) |

Represents both unrealized and realized foreign currency gains and losses on transactions denominated other than in U.S. dollars, including derivative gains and losses on foreign currency forward exchange contracts. |

| (6) |

Represents the income tax expense (benefit) effect of the above adjustments including net (loss) income. This adjustment uses an effective tax rate of 25% for all periods presented. |

| (7) |

Adjusted net income (loss) margin is calculated as adjusted net loss as a percentage of net sales. |

| (8) |

Adjusted EBITDA margin is calculated as adjusted EBITDA as a percentage of net sales. |