Investor Day 2025 November 17, 2025

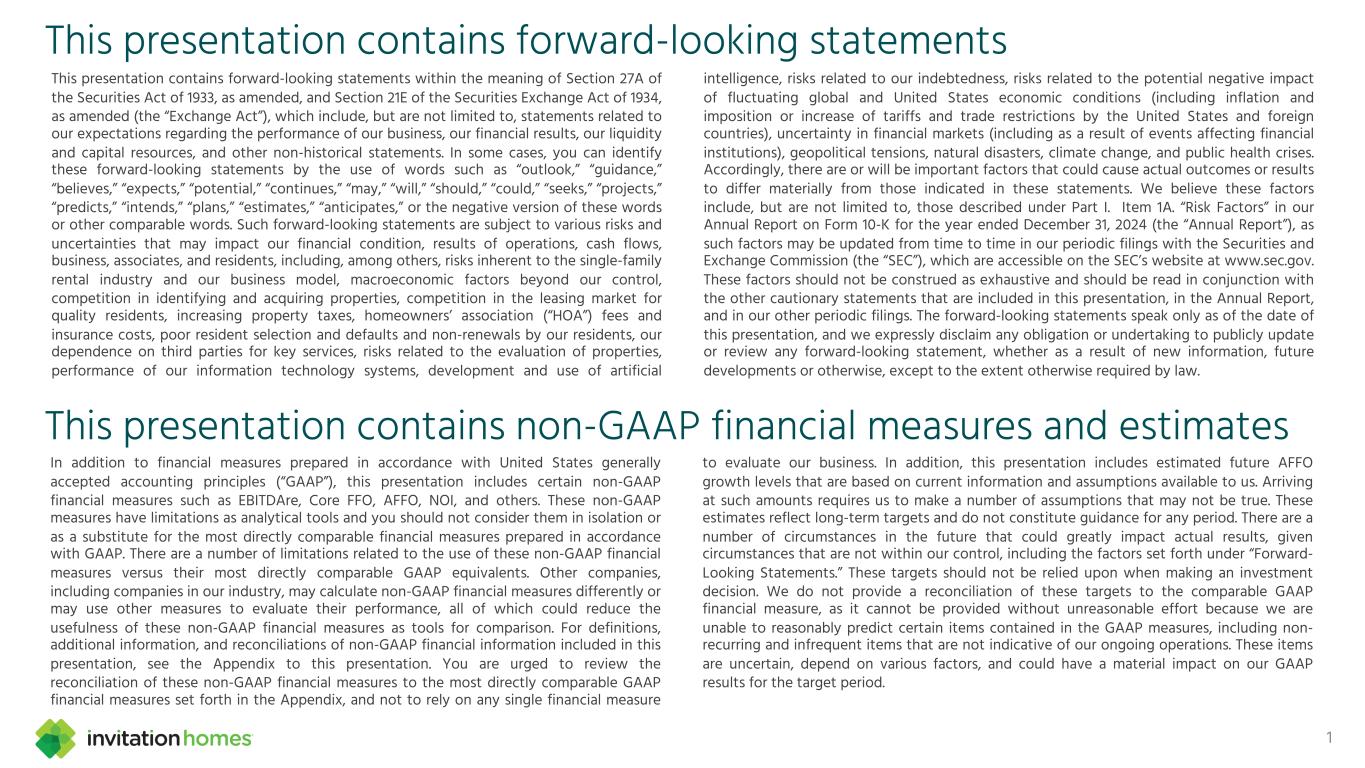

This presentation contains forward-looking statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which include, but are not limited to, statements related to our expectations regarding the performance of our business, our financial results, our liquidity and capital resources, and other non-historical statements. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “guidance,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties that may impact our financial condition, results of operations, cash flows, business, associates, and residents, including, among others, risks inherent to the single-family rental industry and our business model, macroeconomic factors beyond our control, competition in identifying and acquiring properties, competition in the leasing market for quality residents, increasing property taxes, homeowners’ association (“HOA”) fees and insurance costs, poor resident selection and defaults and non-renewals by our residents, our dependence on third parties for key services, risks related to the evaluation of properties, performance of our information technology systems, development and use of artificial intelligence, risks related to our indebtedness, risks related to the potential negative impact of fluctuating global and United States economic conditions (including inflation and imposition or increase of tariffs and trade restrictions by the United States and foreign countries), uncertainty in financial markets (including as a result of events affecting financial institutions), geopolitical tensions, natural disasters, climate change, and public health crises. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include, but are not limited to, those described under Part I. Item 1A. “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024 (the “Annual Report”), as such factors may be updated from time to time in our periodic filings with the Securities and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation, in the Annual Report, and in our other periodic filings. The forward-looking statements speak only as of the date of this presentation, and we expressly disclaim any obligation or undertaking to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except to the extent otherwise required by law. 1 This presentation contains non-GAAP financial measures and estimates In addition to financial measures prepared in accordance with United States generally accepted accounting principles (“GAAP”), this presentation includes certain non-GAAP financial measures such as EBITDAre, Core FFO, AFFO, NOI, and others. These non-GAAP measures have limitations as analytical tools and you should not consider them in isolation or as a substitute for the most directly comparable financial measures prepared in accordance with GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus their most directly comparable GAAP equivalents. Other companies, including companies in our industry, may calculate non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of these non-GAAP financial measures as tools for comparison. For definitions, additional information, and reconciliations of non-GAAP financial information included in this presentation, see the Appendix to this presentation. You are urged to review the reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures set forth in the Appendix, and not to rely on any single financial measure to evaluate our business. In addition, this presentation includes estimated future AFFO growth levels that are based on current information and assumptions available to us. Arriving at such amounts requires us to make a number of assumptions that may not be true. These estimates reflect long-term targets and do not constitute guidance for any period. There are a number of circumstances in the future that could greatly impact actual results, given circumstances that are not within our control, including the factors set forth under “Forward- Looking Statements.” These targets should not be relied upon when making an investment decision. We do not provide a reconciliation of these targets to the comparable GAAP financial measure, as it cannot be provided without unreasonable effort because we are unable to reasonably predict certain items contained in the GAAP measures, including non- recurring and infrequent items that are not indicative of our ongoing operations. These items are uncertain, depend on various factors, and could have a material impact on our GAAP results for the target period.

2 We Unlock the Power of Home by providing high-quality living solutions and Genuine CARE™, which together offer stability, comfort, and the freedom for residents and communities to thrive.

Today’s Agenda: A Guided Tour Through Our Business Welcome First Q&A Session The Front Porch President & CEO, Dallas Tanner U N L O C K W H A T ’ S N E X T The Living Room President & CEO, Dallas Tanner U N L O C K T H E P O W E R W I T H I N Break Second Q&A Session The Kitchen COO, Tim Lobner U N L O C K T H E R E S I D E N T E X P E R I E N C E The Garage CIO, Scott Eisen U N L O C K E X T E R N A L G R O W T H The Den CIDO, Virginia Suliman U N L O C K T H E F U T U R E O F H O M E The Home Office CFO, Jon Olsen U N L O C K S H A R E H O L D E R V A L U E 3

S E E I T L I V E VIDEO 4

Living Room Unlock the Power Within T H E 5

6 Today’s three strategic themes: Innovation, Growth, and Possibility 1 I N N O V A T I O N G R O W T H P O S S I B I L I T Y We’ve built the premier SFR platform, and we’re committed to staying best in class We’re unlocking value through disciplined external growth We’re thinking strategically about tomorrow and exploring long-term opportunities Our three strategic themes Unlock the Power of Home for long-term performance

Three distinct phases of growth since our founding 7 0 20,000 40,000 60,000 80,000 100,000 120,000 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Beyond 1st Asset accumulation 2nd Consolidation 3rd Opening the aperture We’re still in the early days of our third phase of growth Number of Homes Owned / Managed

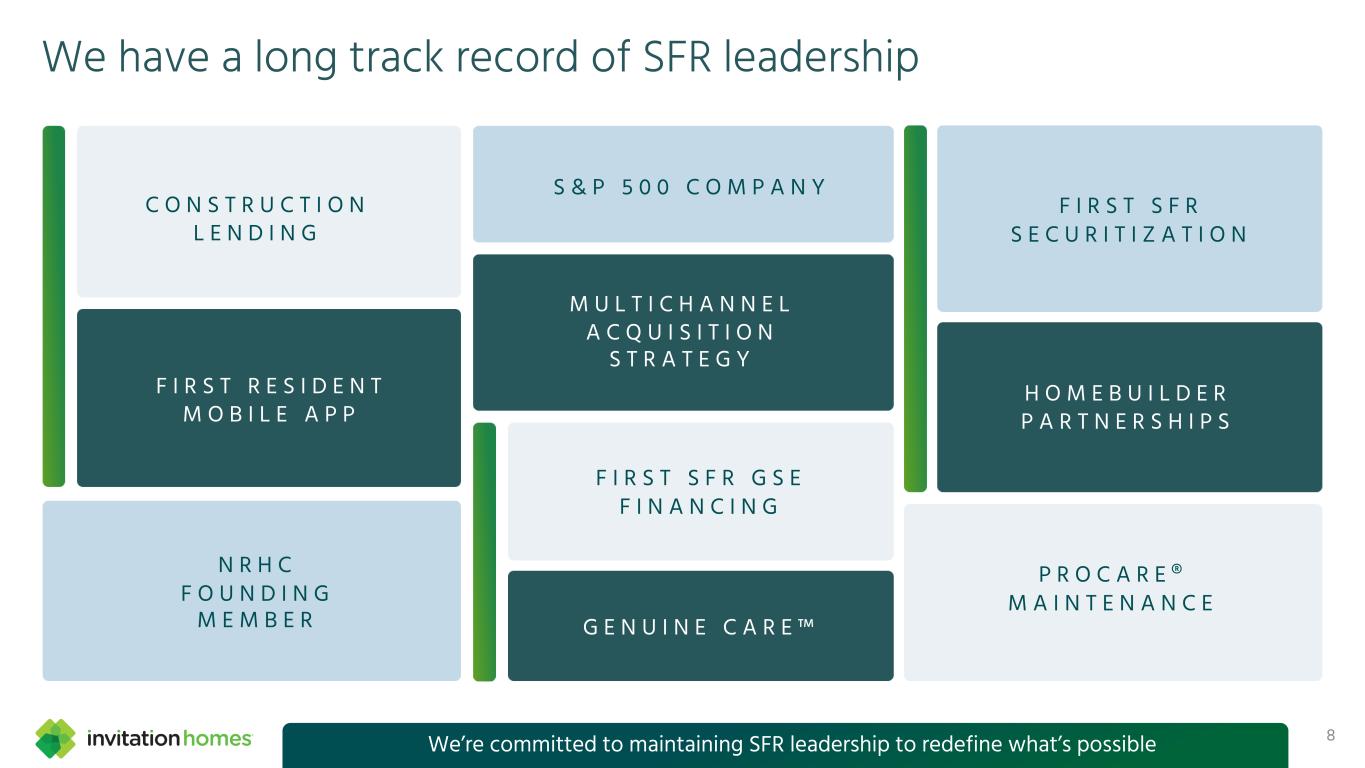

8 We have a long track record of SFR leadership We’re committed to maintaining SFR leadership to redefine what’s possible P R O C A R E ® M A I N T E N A N C E G E N U I N E C A R E ™ M U L T I C H A N N E L A C Q U I S I T I O N S T R A T E G Y F I R S T S F R S E C U R I T I Z A T I O N F I R S T S F R G S E F I N A N C I N G H O M E B U I L D E R P A R T N E R S H I P S S & P 5 0 0 C O M P A N Y C O N S T R U C T I O N L E N D I N G F I R S T R E S I D E N T M O B I L E A P P N R H C F O U N D I N G M E M B E R

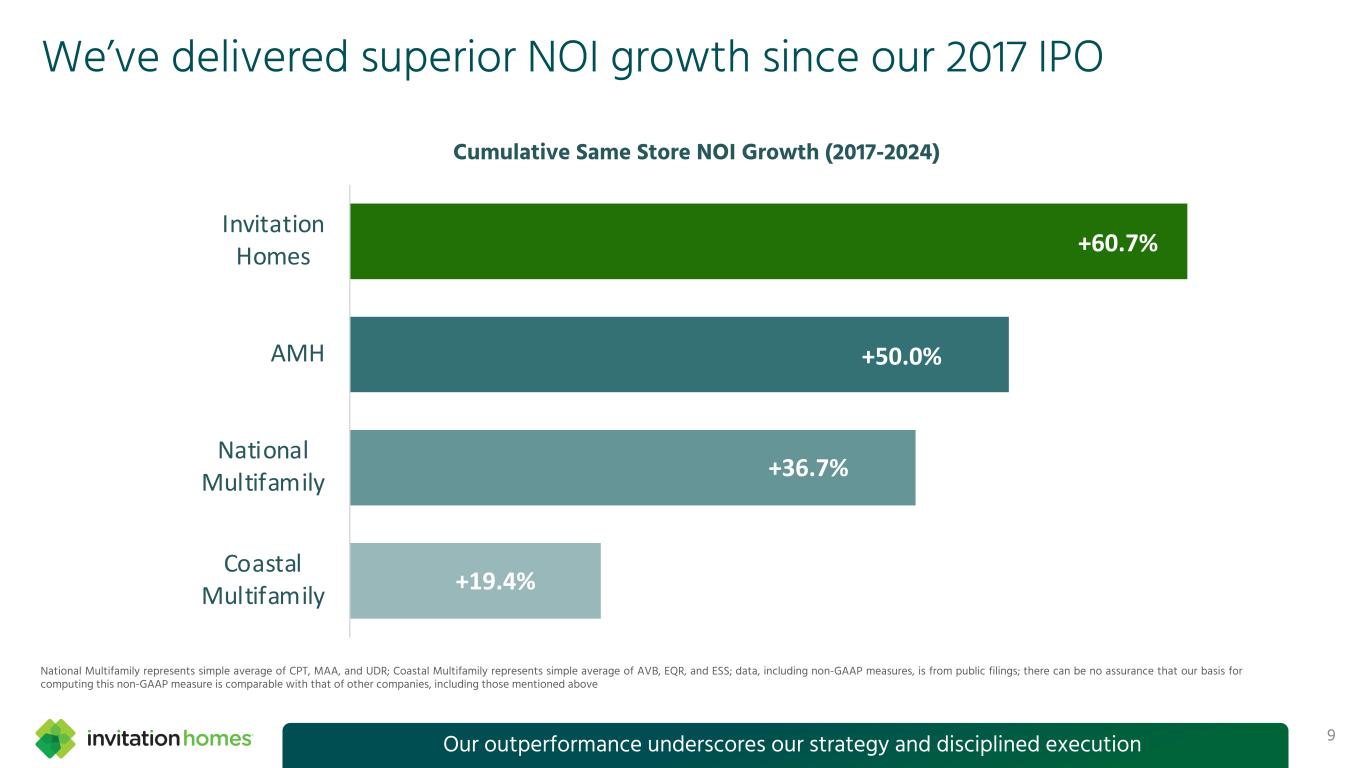

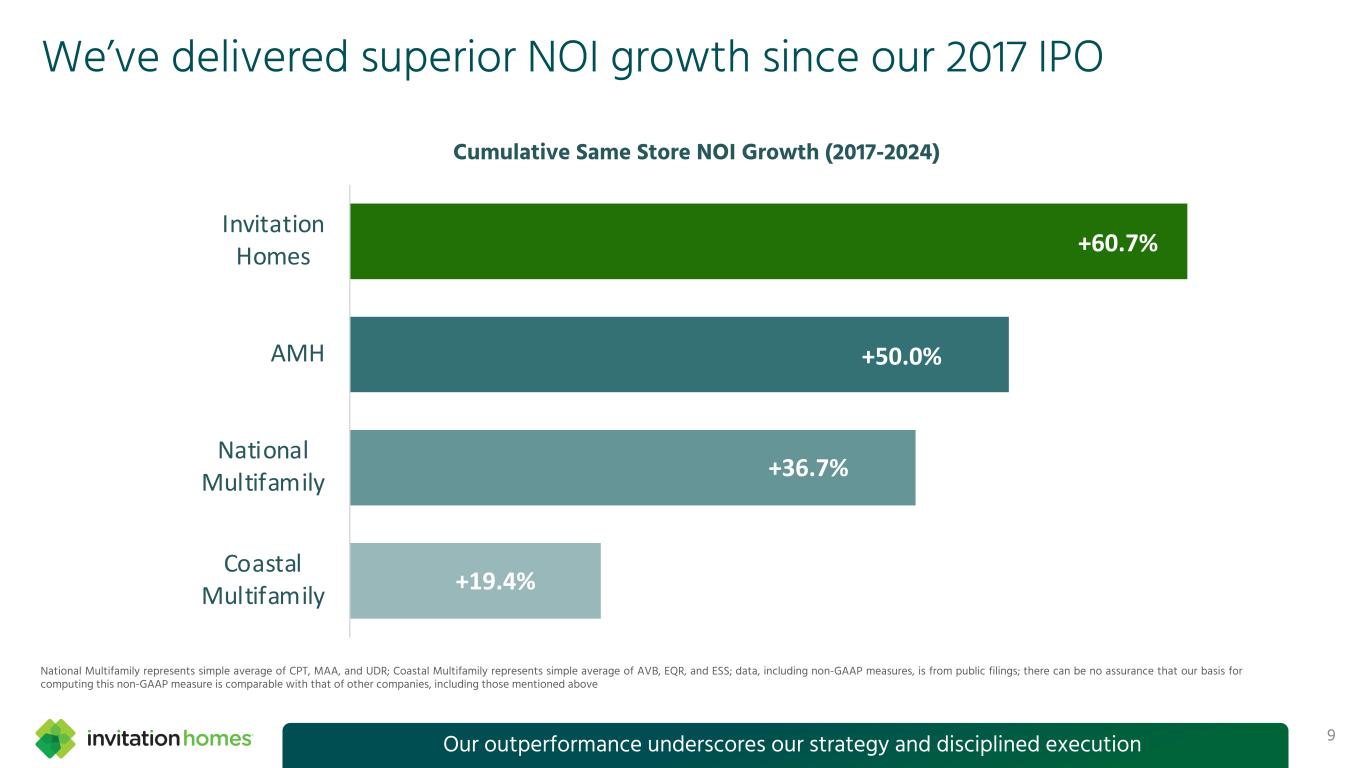

We’ve delivered superior NOI growth since our 2017 IPO 9 +60.7% +50.0% +36.7% +19.4% Invitation Homes AMH National Multifamily Coastal Multifamily Cumulative Same Store NOI Growth (2017-2024) National Multifamily represents simple average of CPT, MAA, and UDR; Coastal Multifamily represents simple average of AVB, EQR, and ESS; data, including non-GAAP measures, is from public filings; there can be no assurance that our basis for computing this non-GAAP measure is comparable with that of other companies, including those mentioned above Our outperformance underscores our strategy and disciplined execution

High-growth locations Percent of 3Q25 revenue Seattle 6% Minn. 1% Denver 4% Dallas 4% Phoenix 9% Atlanta 13% Tampa 11% Southern California 11% Las Vegas 4% South Florida 12% Northern California 5% Carolinas 6% Jax. 2% Orlando 8%Hou. 2% Chicago 2% 10Primarily infill locations in high-growth markets for long-term performance

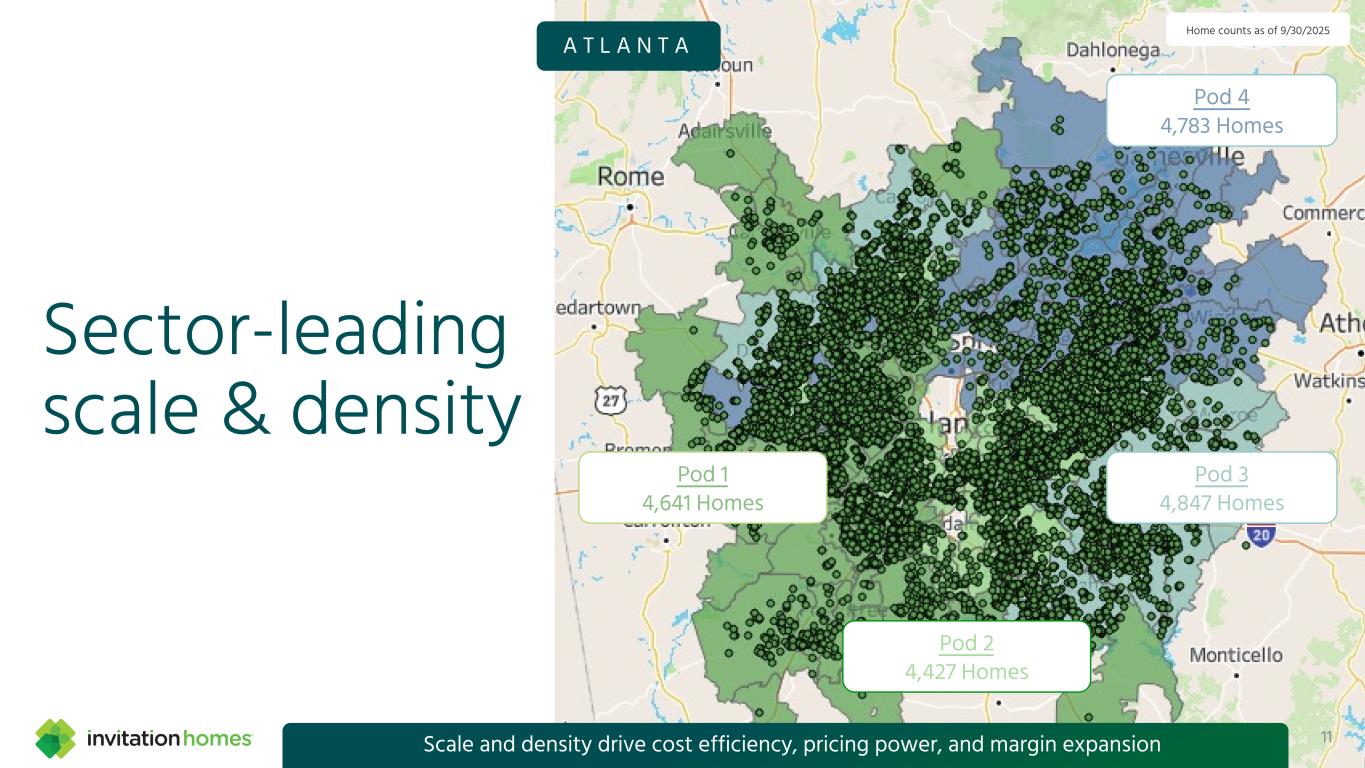

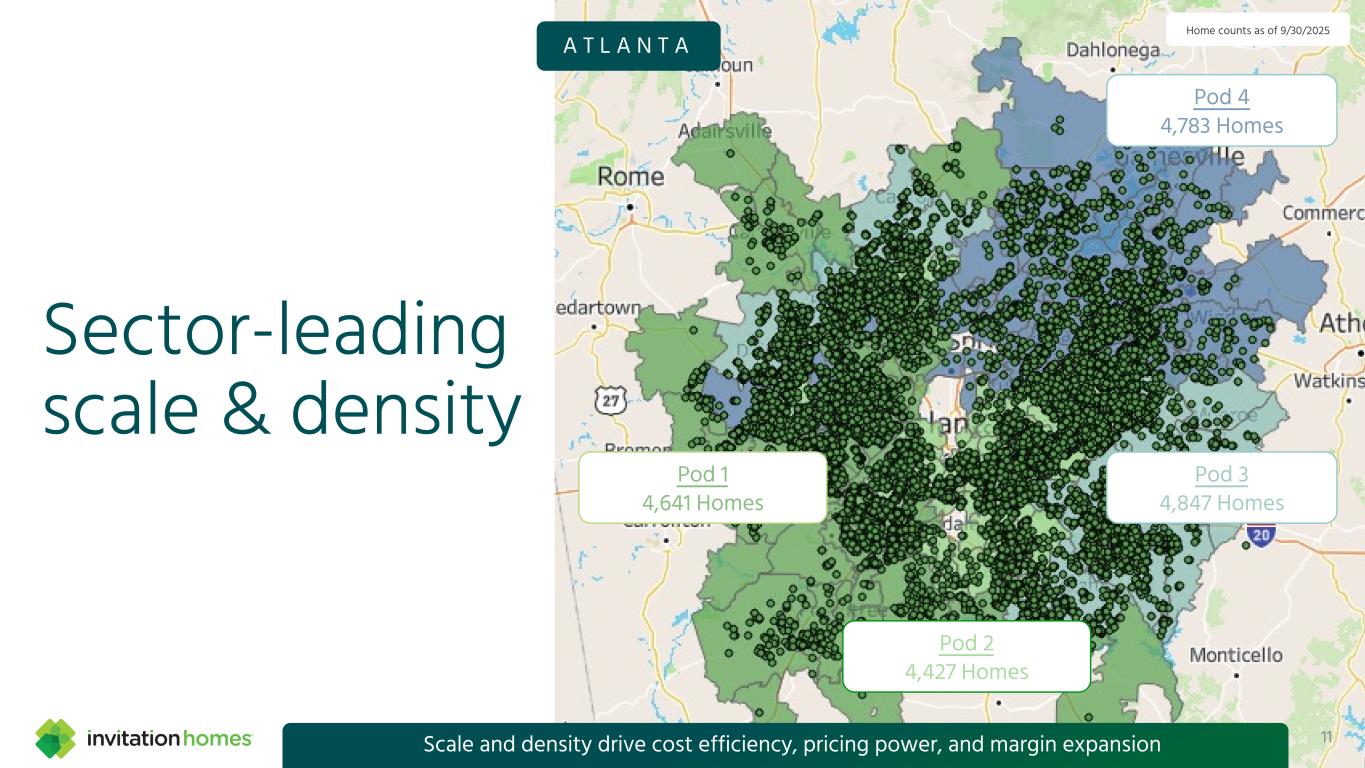

11 Sector-leading scale & density Pod 1 4,641 Homes Pod 2 4,427 Homes Pod 3 4,847 Homes Pod 4 4,783 Homes Home counts as of 9/30/2025 Scale and density drive cost efficiency, pricing power, and margin expansion A T L A N T A 11

The best awards are earned from our customers 12 Atlanta Resident satisfaction drives renewals, lowers turnover, and strengthens returns 4.09 / 5.0 Cumulative all-time Google / Yelp rating 4.74 / 5.0 Average stars on post- maintenance surveys ~40 MONTHS YTD Same Store avg resident tenure 97.0% YTD Same Store avg occupancy rate >78% YTD Same Store avg renewal rate A W A R D S & A C C O L A D E S R E S I D E N T S A T I S F A C T I O N Figures as of 9/30/2025

S E E I T L I V E VIDEO 13

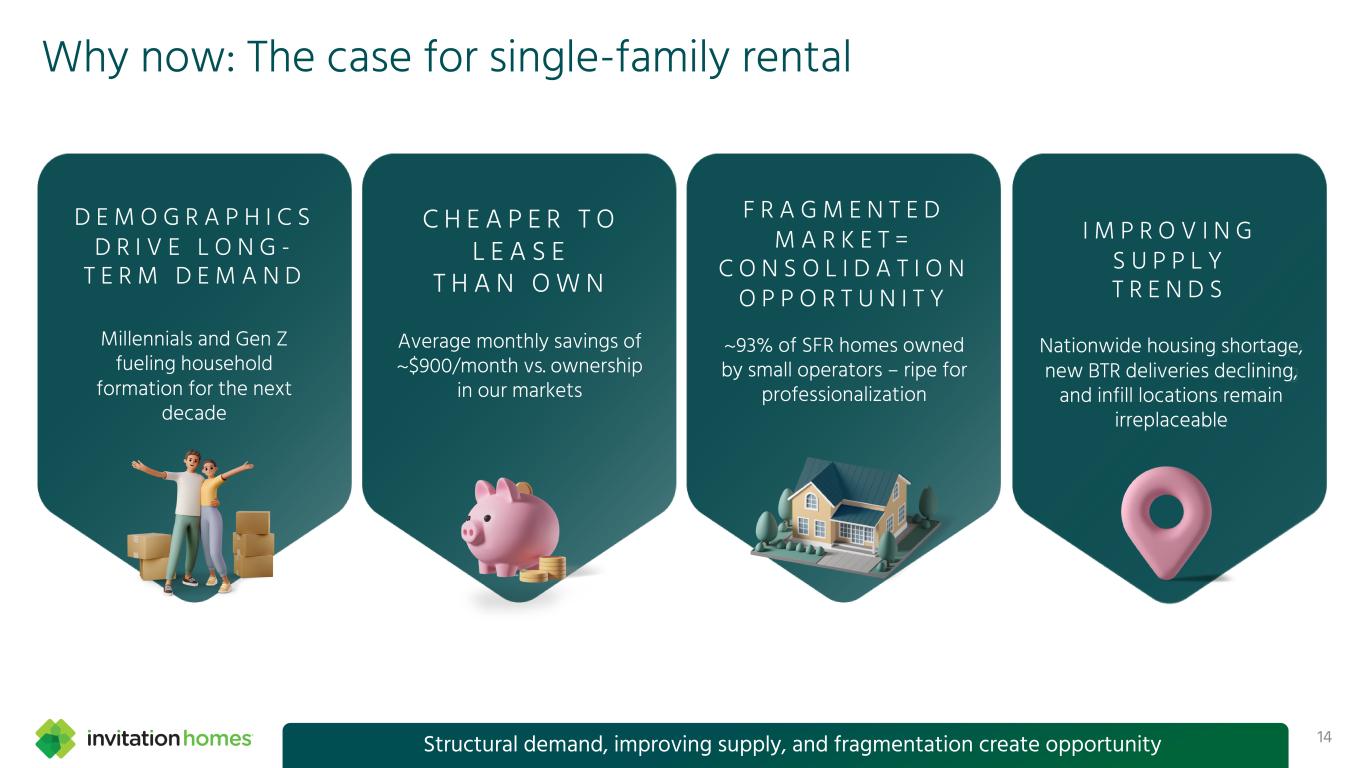

Why now: The case for single-family rental 14Structural demand, improving supply, and fragmentation create opportunity C H E A P E R T O L E A S E T H A N O W N Average monthly savings of ~$900/month vs. ownership in our markets D E M O G R A P H I C S D R I V E L O N G - T E R M D E M A N D Millennials and Gen Z fueling household formation for the next decade F R A G M E N T E D M A R K E T = C O N S O L I D A T I O N O P P O R T U N I T Y ~93% of SFR homes owned by small operators – ripe for professionalization I M P R O V I N G S U P P L Y T R E N D S Nationwide housing shortage New BTR deliveries declining Infill locations remain irreplaceable i s rtage, n li ries declining, and infill locations remain

Millennials & Gen Z fuel long-term demand for single-family rentals 15Over 13k people expected to turn age 35 every day over the next 10 years -3M -2M -1M 0M 1M 2M 3M 4M Age 0–4 Age 5–9 Age 10–14 Age 15–19 Age 20–24 Age 25–29 Age 30–34 Age 35–39 Age 40–44 Age 45–49 Age 50–54 Age 55–59 Age 60–64 Age 65–69 U.S. 10-Year Net Population Change by Age Group (2025-2034) I N V H S W E E T S P O T Average age of new resident: 39 years Source: John Burns Research & Consulting, tabulations of U.S. Census Bureau Population Estimates and the Congressional Budget Office Projections, published September 2025

Net migration trends in our markets remain resilient 16Jobs, quality of life, and affordability remain powerful draws for our markets Source: John Burns Research & Consulting; data as of September 2025

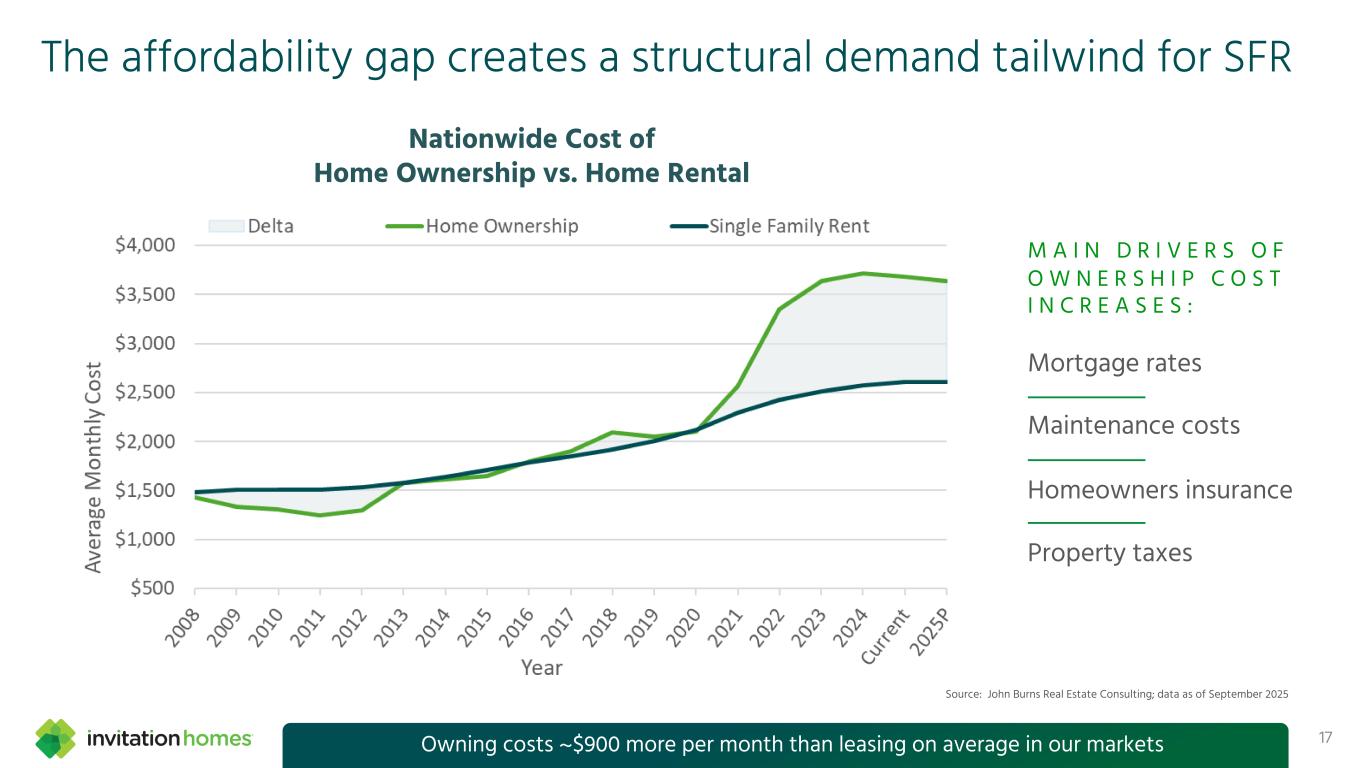

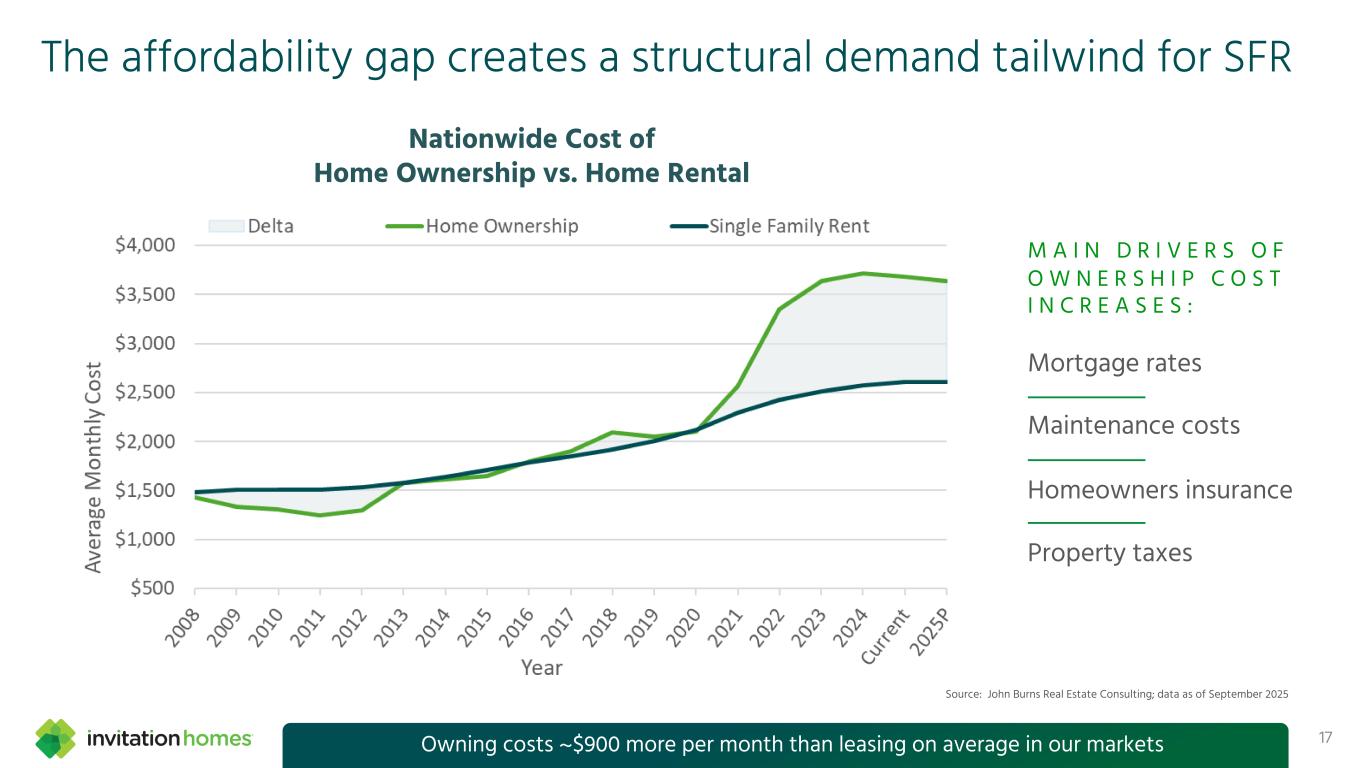

The affordability gap creates a structural demand tailwind for SFR 17 Nationwide Cost of Home Ownership vs. Home Rental Source: John Burns Real Estate Consulting; data as of September 2025 M A I N D R I V E R S O F O W N E R S H I P C O S T I N C R E A S E S : Mortgage rates Maintenance costs Homeowners insurance Property taxes Owning costs ~$900 more per month than leasing on average in our markets

This creates a long runway of opportunity for growth Source: John Burns Research & Consulting, Single-Family Rental Analysis and Forecast, published September 2025 3.30% 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% Ownership Own 1,000+ homes Own 100-999 homes Own 10-99 homes Own 1-9 homes 4 6 M I L L I O N R E N T A L H O U S E H O L D S Single- Family: 30% (14M units) Owned: 65% (88M units) Rented: 35% (46M units) 1 3 4 M I L L I O N H O U S E H O L D S Vacant: 9% (14M units) 1 4 8 M I L L I O N H O U S I N G U N I T S “Mom & Pop” Owners 76.8% 1 4 M I L L I O N S F R H O M E S “Mom & Pop” owners dominate SFR; professionals own just 3% Mobile Homes, Boats, Etc.: 4% (2M units) Households: 91% (134M units) Apartments: 66% (31M units) 18

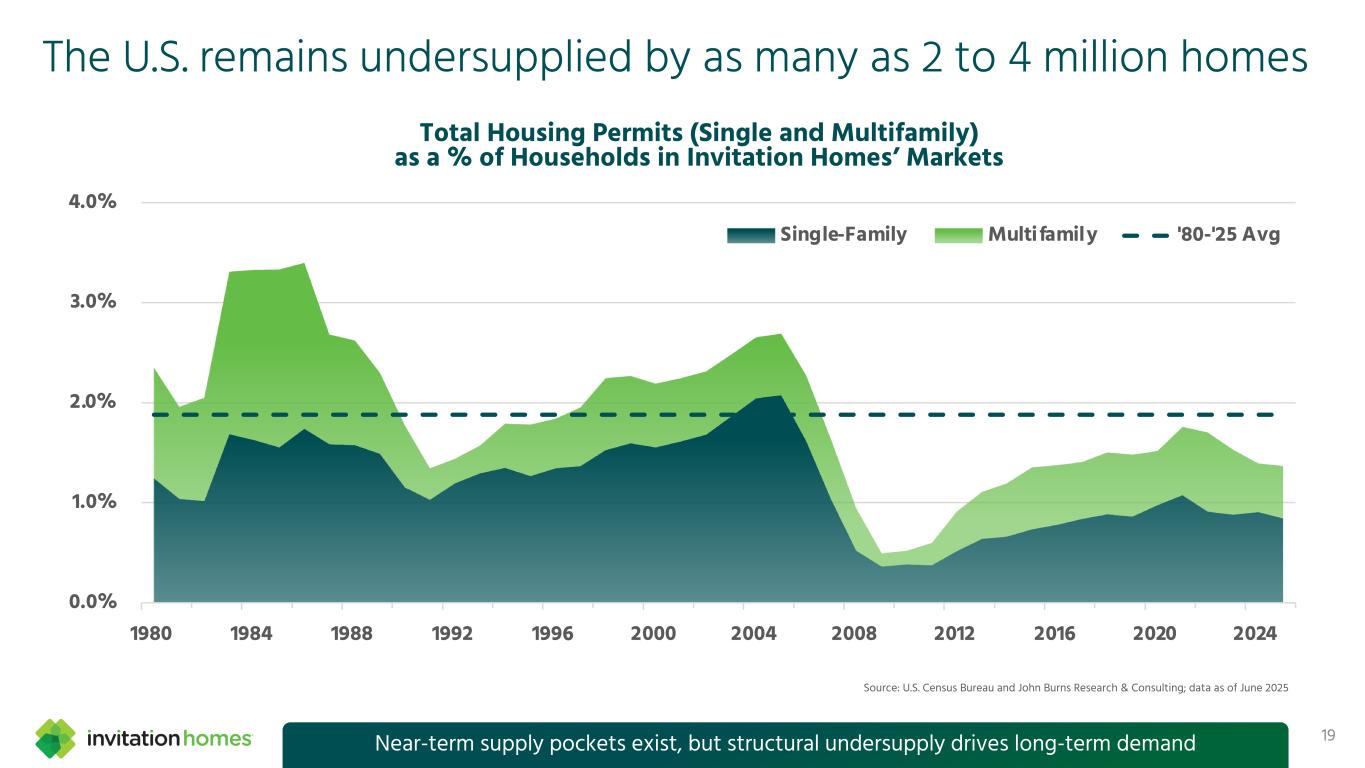

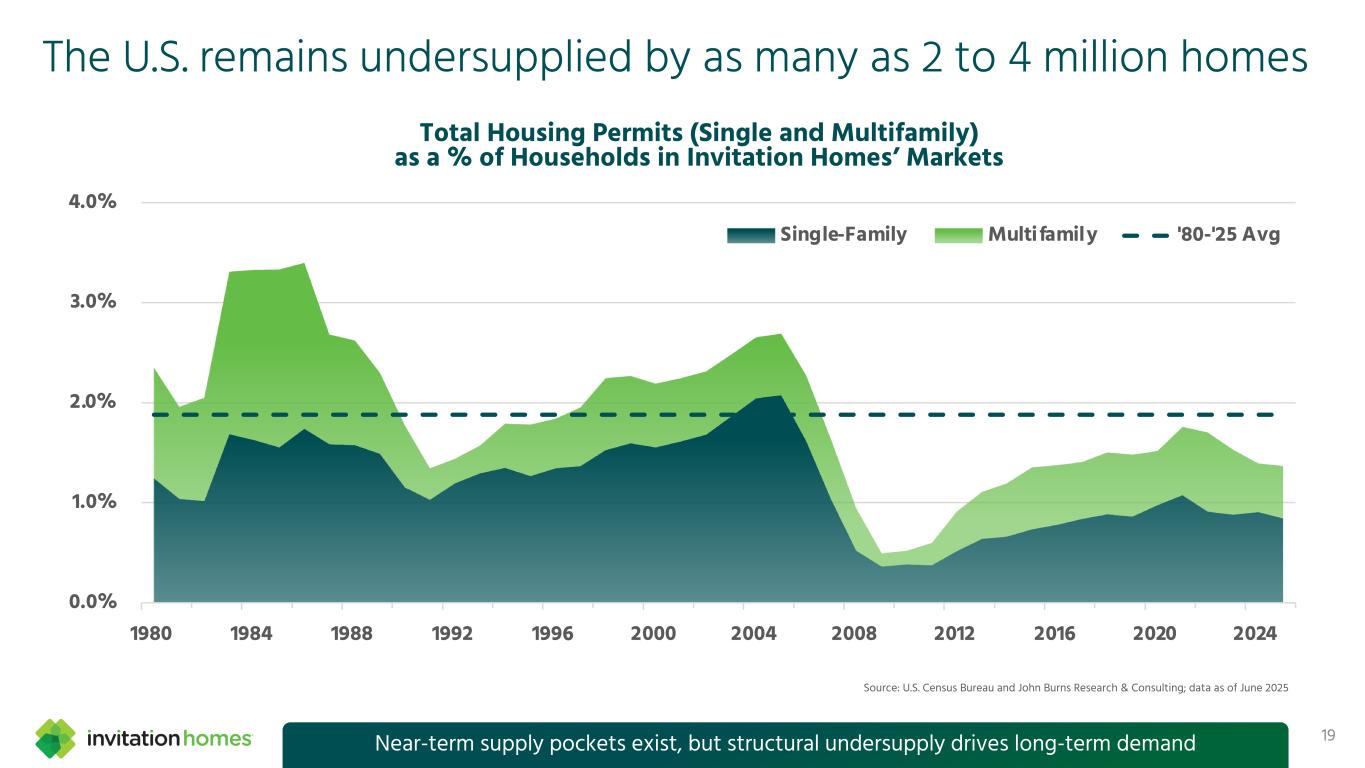

The U.S. remains undersupplied by as many as 2 to 4 million homes Total Housing Permits (Single and Multifamily) as a % of Households in Invitation Homes’ Markets 0.0% 1.0% 2.0% 3.0% 4.0% 1980 1984 1988 1992 1996 2000 2004 2008 2012 2016 2020 2024 Single-Family Multifamily '80-'25 Avg Source: U.S. Census Bureau and John Burns Research & Consulting; data as of June 2025 19Near-term supply pockets exist, but structural undersupply drives long-term demand

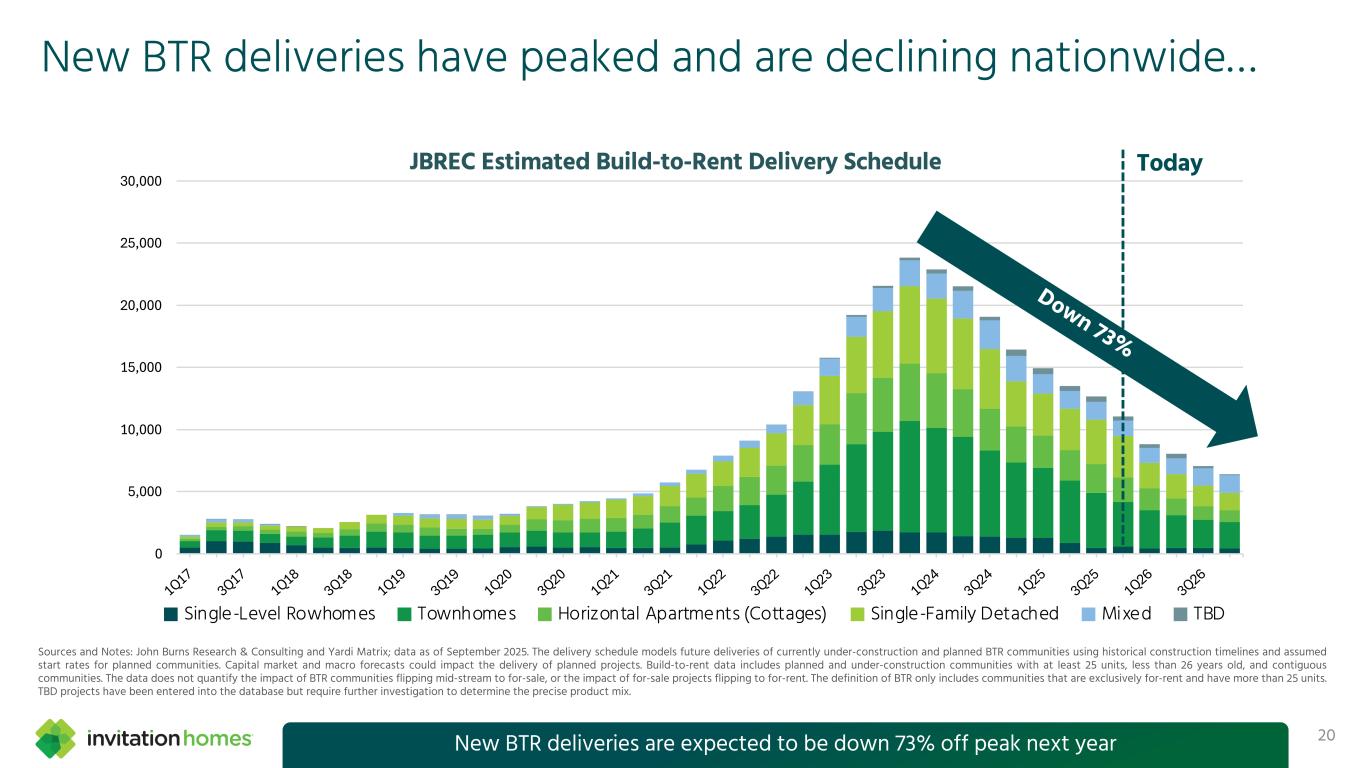

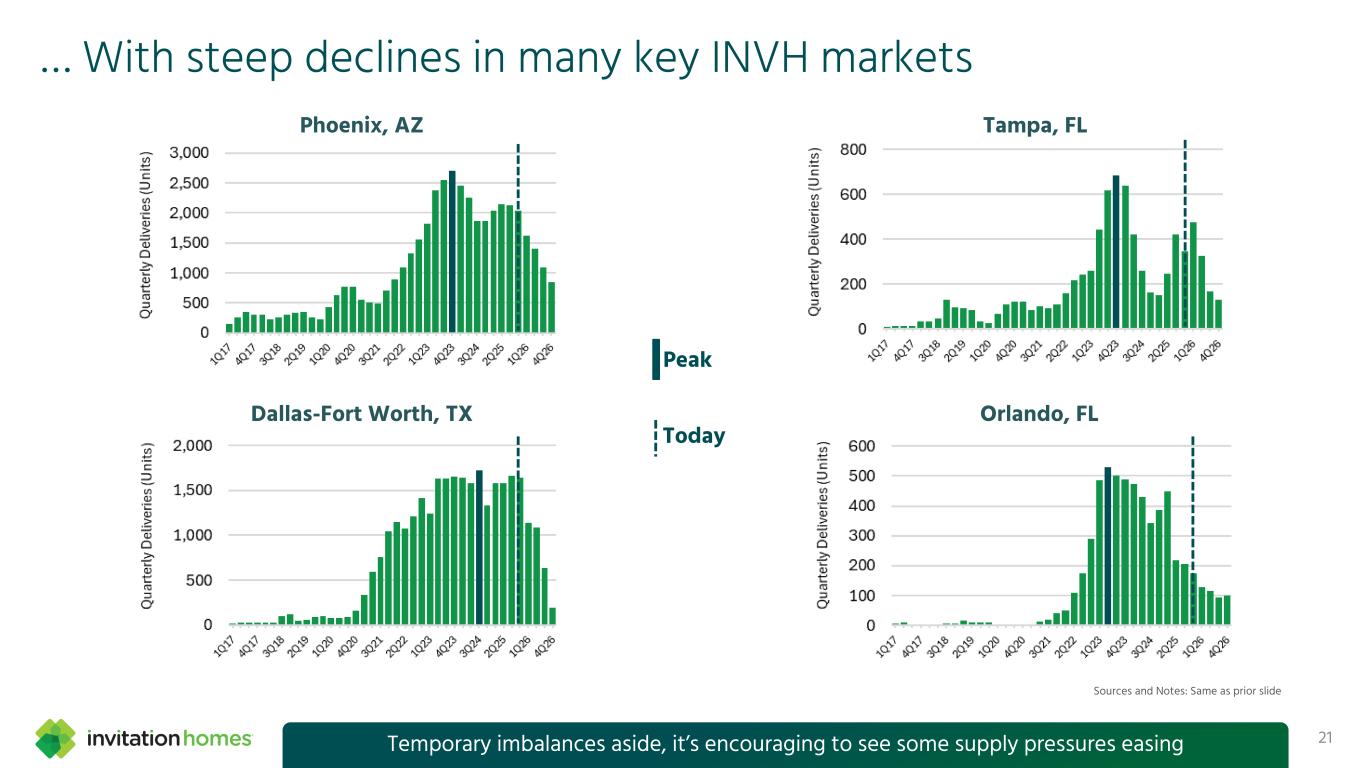

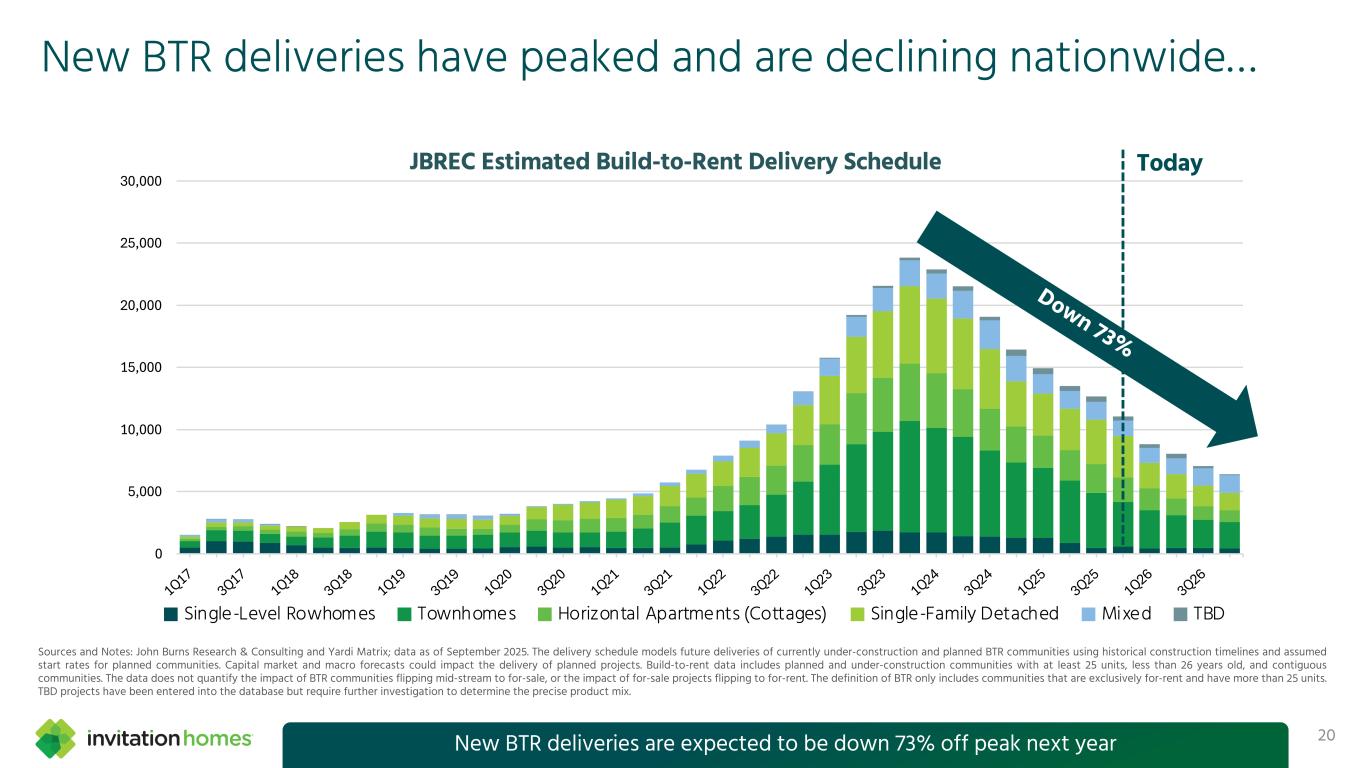

New BTR deliveries have peaked and are declining nationwide… 20 0 5,000 10,000 15,000 20,000 25,000 30,000 1Q 17 3Q 17 1Q 18 3Q 18 1Q 19 3Q 19 1Q 20 3Q 20 1Q 21 3Q 21 1Q 22 3Q 22 1Q 23 3Q 23 1Q 24 3Q 24 1Q 25 3Q 25 1Q 26 3Q 26 JBREC Estimated Build-to-Rent Delivery Schedule Single-Level Rowhomes Townhomes Horizontal Apartments (Cottages) Single-Family Detached Mixed TBD Today Down 73% New BTR deliveries are expected to be down 73% off peak next year Sources and Notes: John Burns Research & Consulting and Yardi Matrix; data as of September 2025. The delivery schedule models future deliveries of currently under-construction and planned BTR communities using historical construction timelines and assumed start rates for planned communities. Capital market and macro forecasts could impact the delivery of planned projects. Build-to-rent data includes planned and under-construction communities with at least 25 units, less than 26 years old, and contiguous communities. The data does not quantify the impact of BTR communities flipping mid-stream to for-sale, or the impact of for-sale projects flipping to for-rent. The definition of BTR only includes communities that are exclusively for-rent and have more than 25 units. TBD projects have been entered into the database but require further investigation to determine the precise product mix.

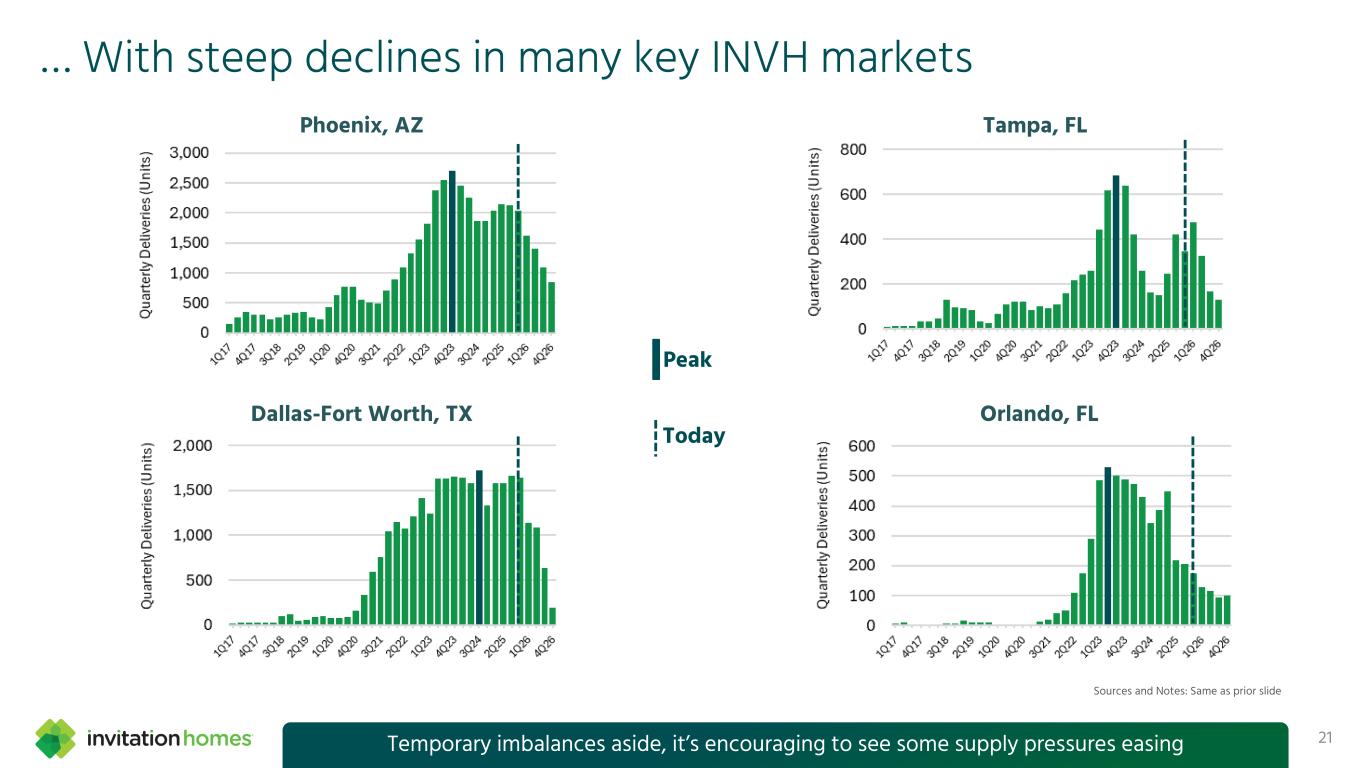

… With steep declines in many key INVH markets 21 Sources and Notes: Same as prior slide Today Peak Phoenix, AZ Tampa, FL Dallas-Fort Worth, TX Orlando, FL Temporary imbalances aside, it’s encouraging to see some supply pressures easing

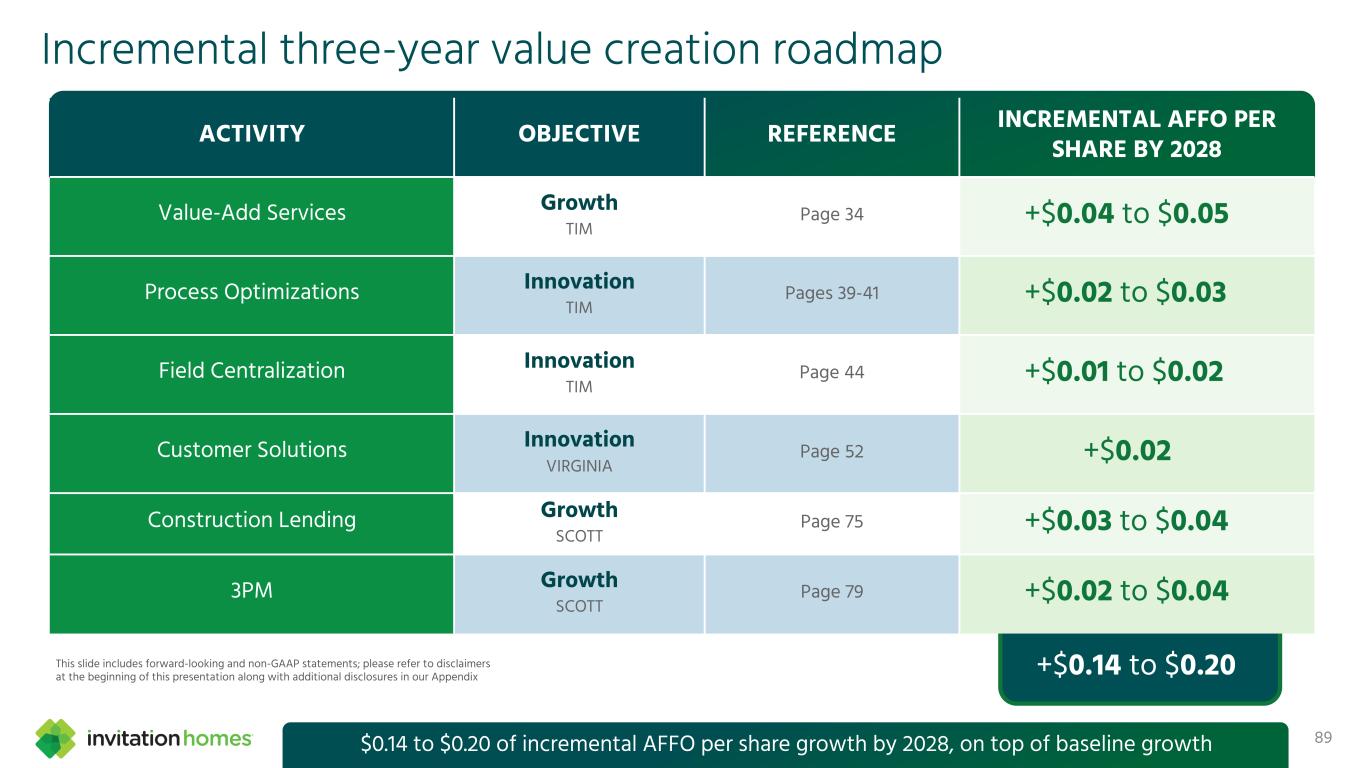

Why invest in INVH? 22We expect our plans today to deliver $0.14 to $0.20 per share of incremental AFFO growth by 2028 Resident satisfaction Customer centricity Value-add services Genuine CARETM P R E M I E R C U S T O M E R E X P E R I E N C E P O W E R O F O U R P L A T F O R M Unmatched scale & density Proprietary technology Optimization Centralization D I V E R S I T Y O F O U R G R O W T H C H A N N E L S Accretive acquisitions Strategic partnerships Construction lending Third party management I N N O V A T I O N + G R O W T H + P O S S I B I L I T Y = V A L U E C R E A T I O N

Today you will hear from our experienced executive team Dallas Tanner President & Chief Executive Officer, Co-Founder, Director „ 13 years at Invitation Homes „ Treehouse Group founder, including SF, MF, MH, and property management „ Roots Management board member Tim Lobner EVP, Chief Operating Officer „ 13 years at Invitation Homes „ Trammel Crow Company § Industrial, office, and retail opportunities „ United States Navy § Nuclear submarine officer Virginia Suliman EVP, Chief Information & Digital Officer „ 6 years at Invitation Homes „ Hilton Worldwide § Senior Vice President of Software Engineering „ AMR § Various positions Scott Eisen EVP, Chief Investment Officer „ 2 years at Invitation Homes „ Citigroup § Head of North American Real Estate Investment Banking „ Merrill Lynch & Co. § Director of Real Estate Banking Jon Olsen EVP, Chief Financial Officer „ 13 years at Invitation Homes „ Goldman Sachs „ BAML „ Jefferies 23

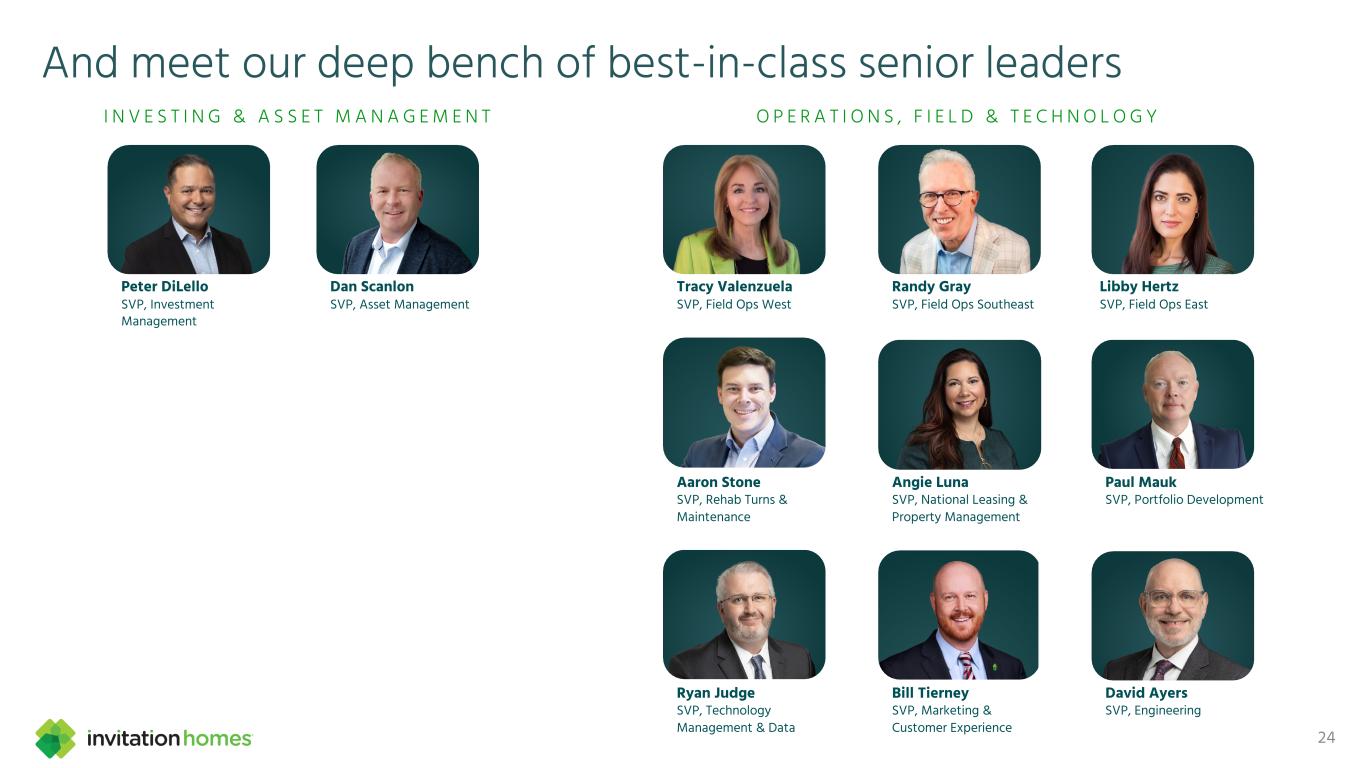

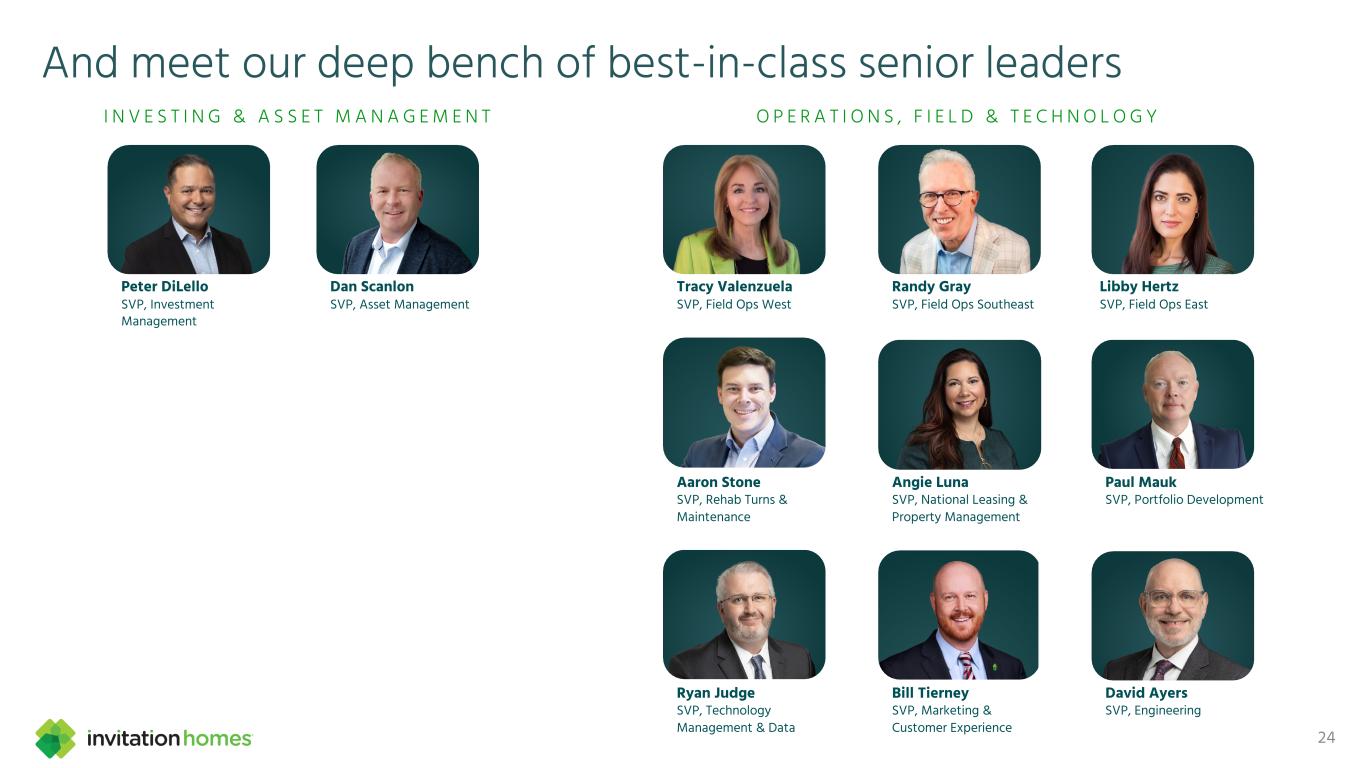

And meet our deep bench of best-in-class senior leaders 24 I N V E S T I N G & A S S E T M A N A G E M E N T O P E R A T I O N S , F I E L D & T E C H N O L O G Y Peter DiLello SVP, Investment Management Dan Scanlon SVP, Asset Management Bill Tierney SVP, Marketing & Customer Experience Paul Mauk SVP, Portfolio Development Ryan Judge SVP, Technology Management & Data Angie Luna SVP, National Leasing & Property Management Randy Gray SVP, Field Ops Southeast David Ayers SVP, Engineering Libby Hertz SVP, Field Ops East Aaron Stone SVP, Rehab Turns & Maintenance Tracy Valenzuela SVP, Field Ops West

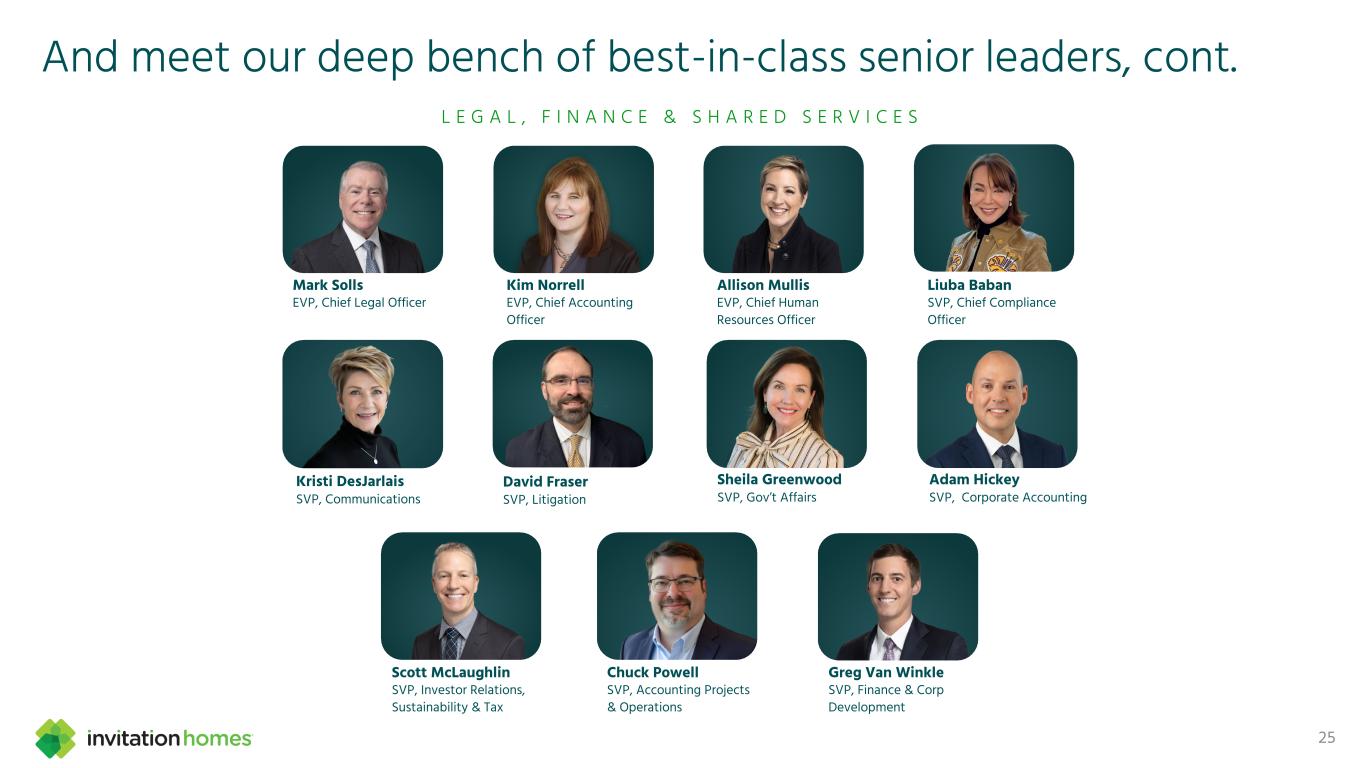

And meet our deep bench of best-in-class senior leaders, cont. 25 L E G A L , F I N A N C E & S H A R E D S E R V I C E S Kim Norrell EVP, Chief Accounting Officer Allison Mullis EVP, Chief Human Resources Officer Sheila Greenwood SVP, Gov’t Affairs Kristi DesJarlais SVP, Communications Mark Solls EVP, Chief Legal Officer Greg Van Winkle SVP, Finance & Corp Development David Fraser SVP, Litigation Liuba Baban SVP, Chief Compliance Officer Scott McLaughlin SVP, Investor Relations, Sustainability & Tax Chuck Powell SVP, Accounting Projects & Operations Adam Hickey SVP, Corporate Accounting

Kitchen Unlock the Resident Experience T H E 26

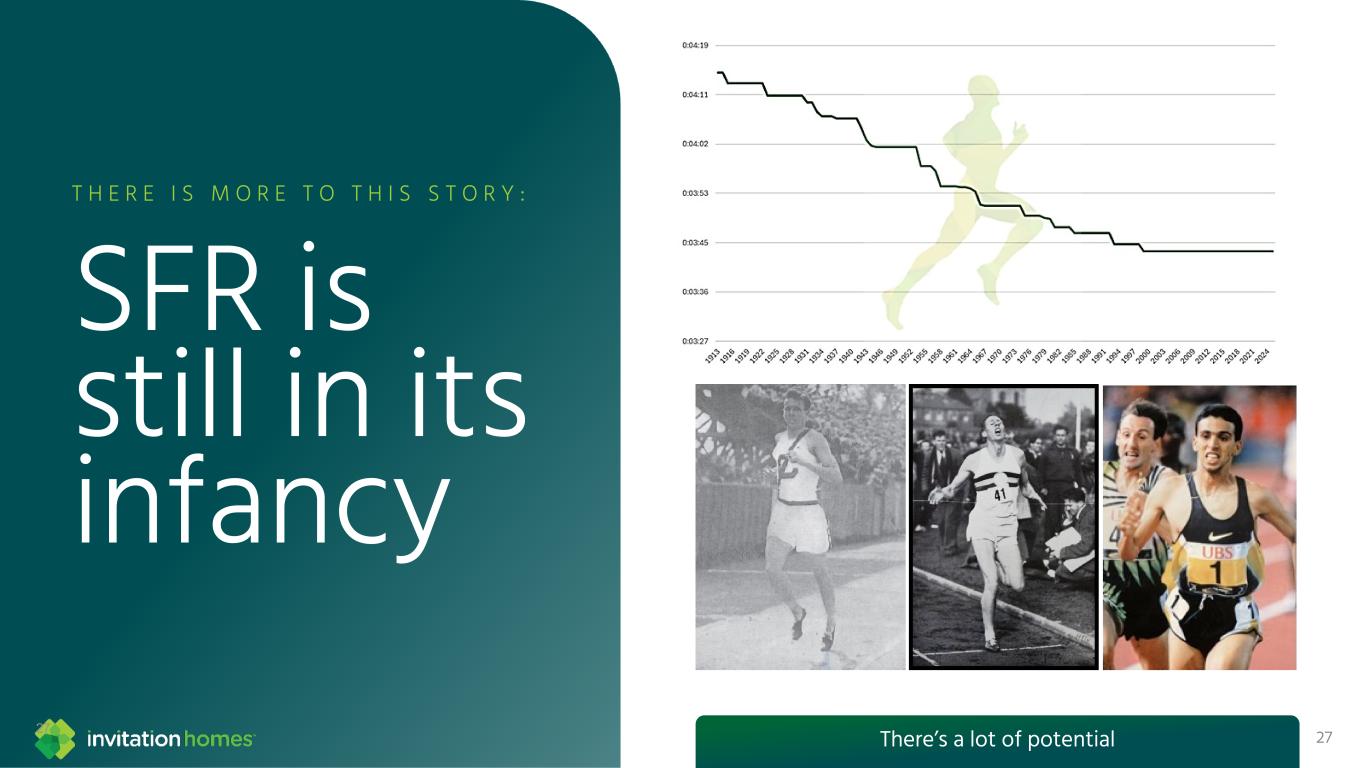

T H E R E I S M O R E T O T H I S S T O R Y : SFR is still in its infancy There’s a lot of potential27 27

28 Where we are & what makes us different

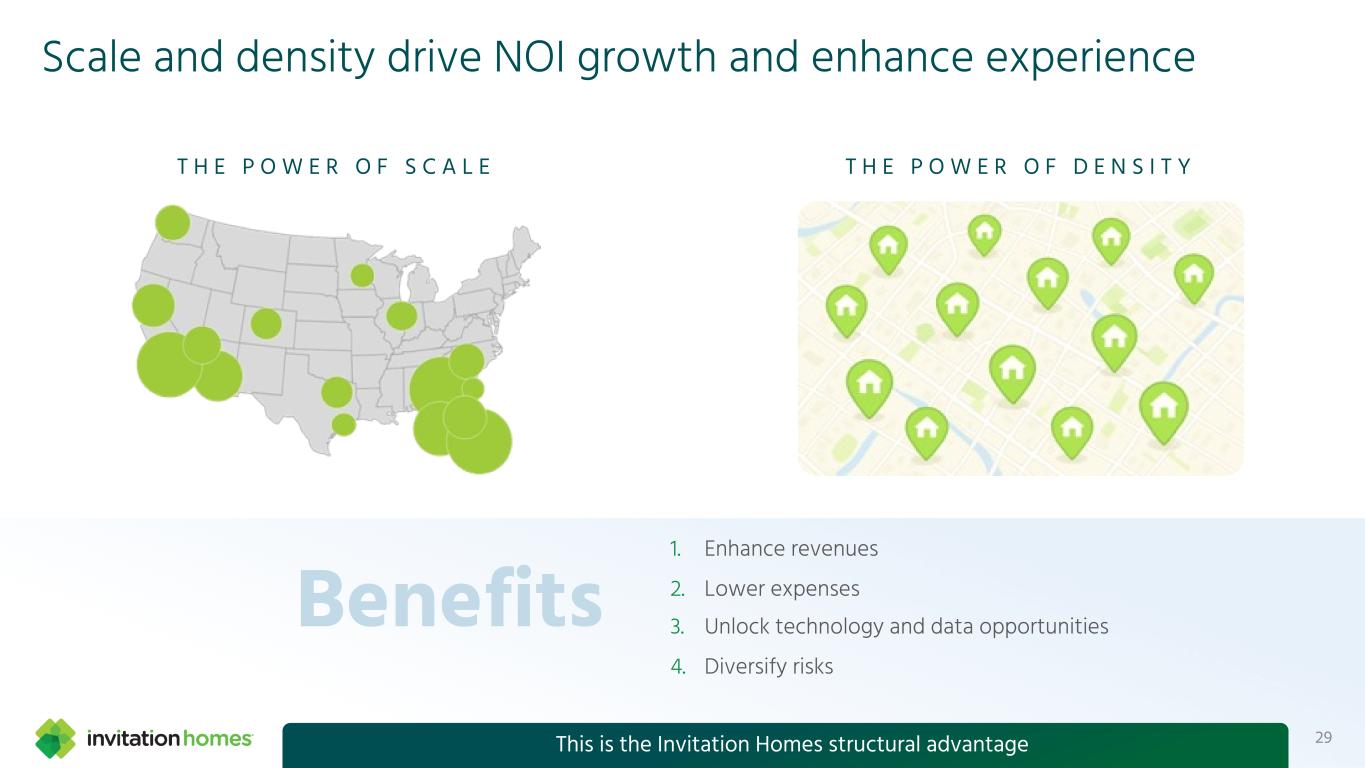

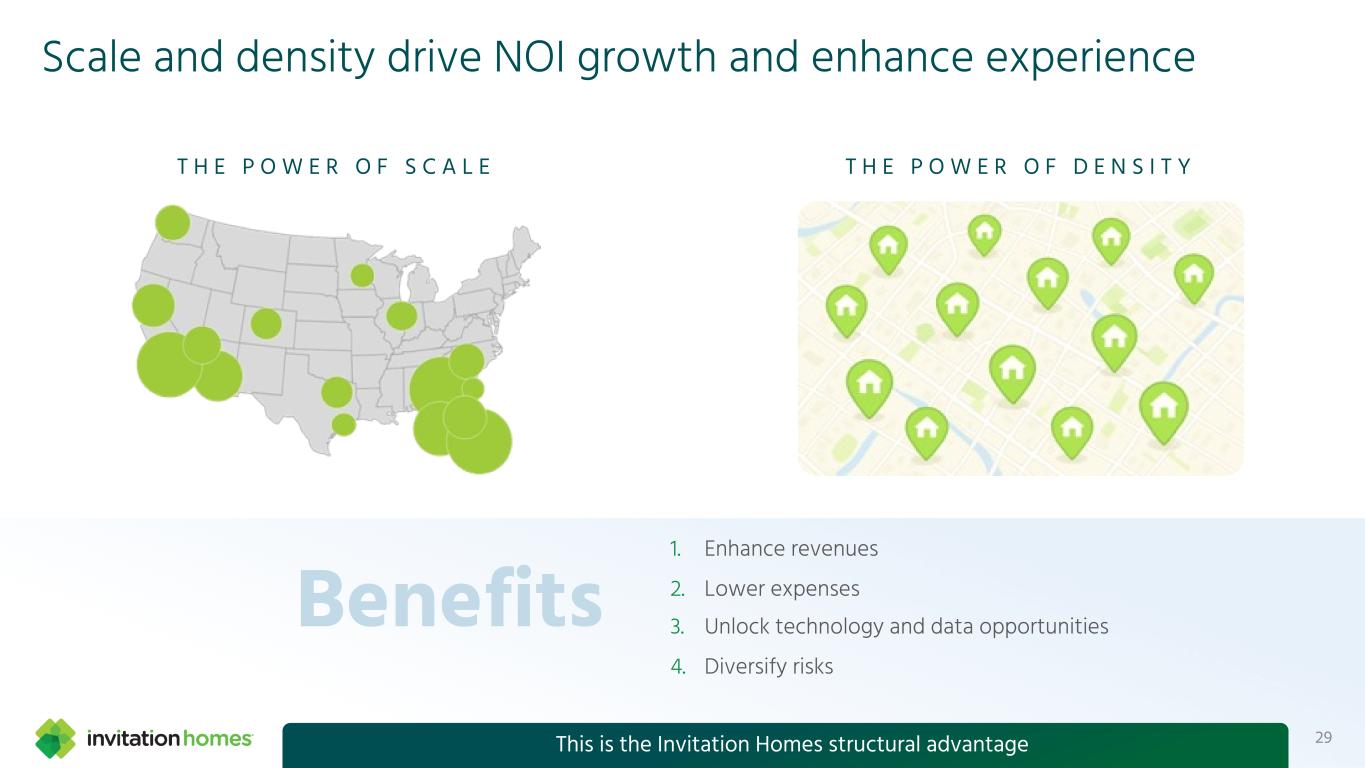

T H E P O W E R O F D E N S I T Y Scale and density drive NOI growth and enhance experience 29 T H E P O W E R O F S C A L E This is the Invitation Homes structural advantage 1. Enhance revenues 2. Lower expenses 3. Unlock technology and data opportunities 4. Diversify risks Benefits

Phoenix illustrates the power of scale 30 Team and home counts as of 9/30 for each respective year 2022 and 2025; 2022 payroll figures have been adjusted for inflation to reflect 2025 dollars for comparability P H O E N I X Phoenix Home Count 2022 2025 Increase Wholly-owned 8,906 9,208 +3.4% JV and 3PM 822 3,268 +297.6% Total homes 9,728 12,476 +28.2% Phoenix Associate Count 2022 2025 Increase Directors and above 7 7 0.0% Managers and below 108 123 13.9% Total associates 115 130 13.0% Homes per associate 84.6 96.0 13.4% 28.2% more homes since 2022 while payroll per home has declined by 13.5% Total payroll $ per home $ 1,022 $ 884 -13.5% 3

We provide a differentiated maintenance experience We offer a unique package of value-add services 31 Attract Convert Move outRetain Renew Customer explores & finds their perfect home Customer chooses their home & applies Customer leaves home Customer enjoys their home and the easy “Leasing Lifestyle” Customer decides whether to stay An overview of the customer journey — and what makes our approach great for customers and investors We price intelligently We offer lease term flexibility

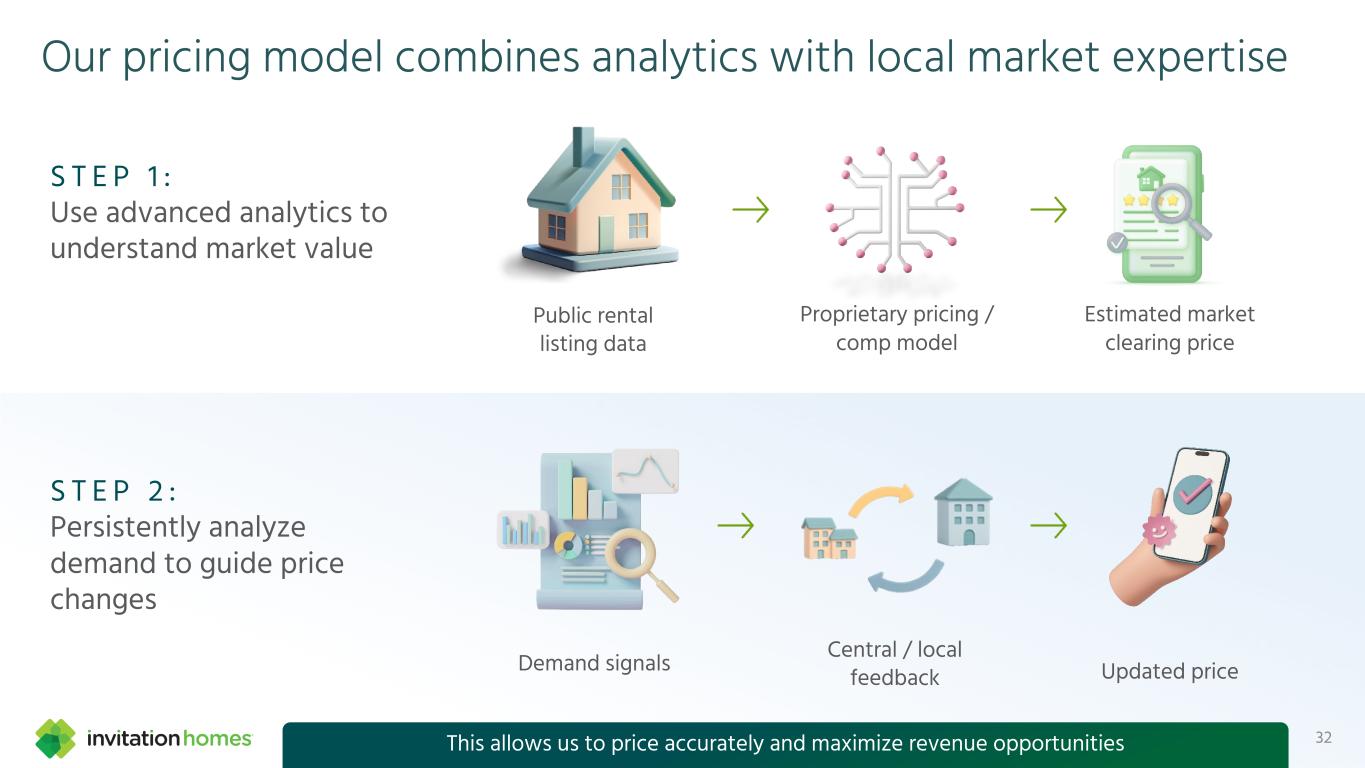

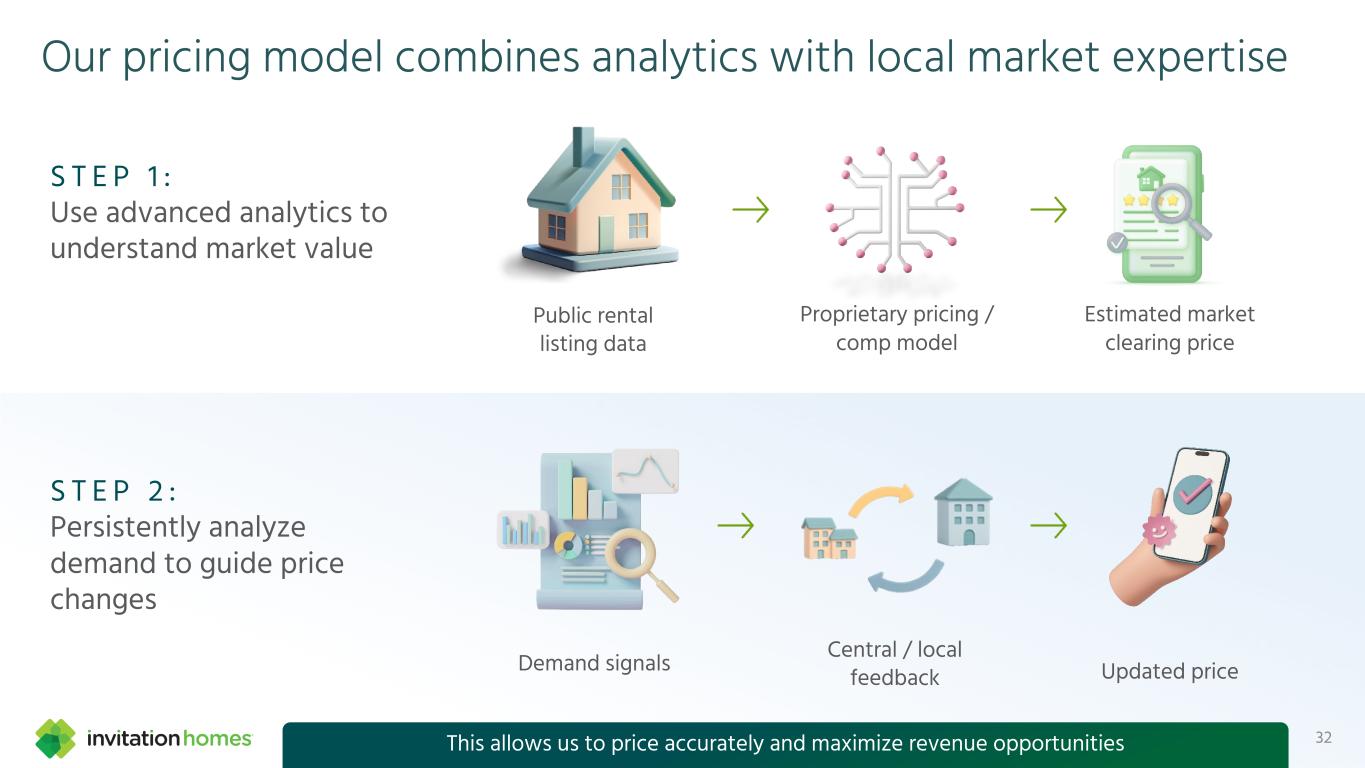

Public rental listing data Proprietary pricing / comp model Our pricing model combines analytics with local market expertise S T E P 1 : Use advanced analytics to understand market value Estimated market clearing price S T E P 2 : Persistently analyze demand to guide price changes Demand signals Central / local feedback Updated price 32This allows us to price accurately and maximize revenue opportunities

33Reduces operational strain and enhances customer experience Dynamic lease terms can shape the expiration curve and offer more flexibility and transparency for residents 0% 5% 10% 15% 20% 25% 30% 1Q 2Q 3Q 4Q L E A S E E X P I R A T I O N S 2024 2025 Ideal

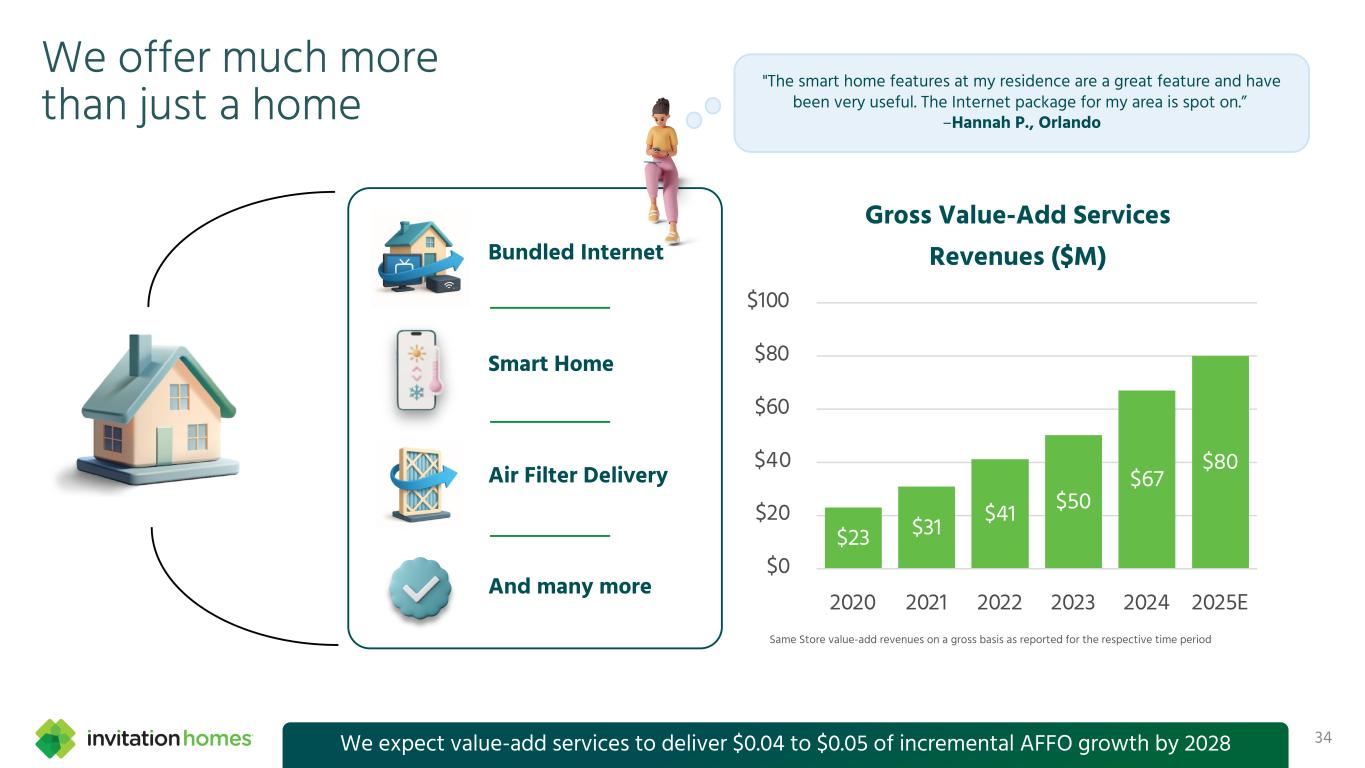

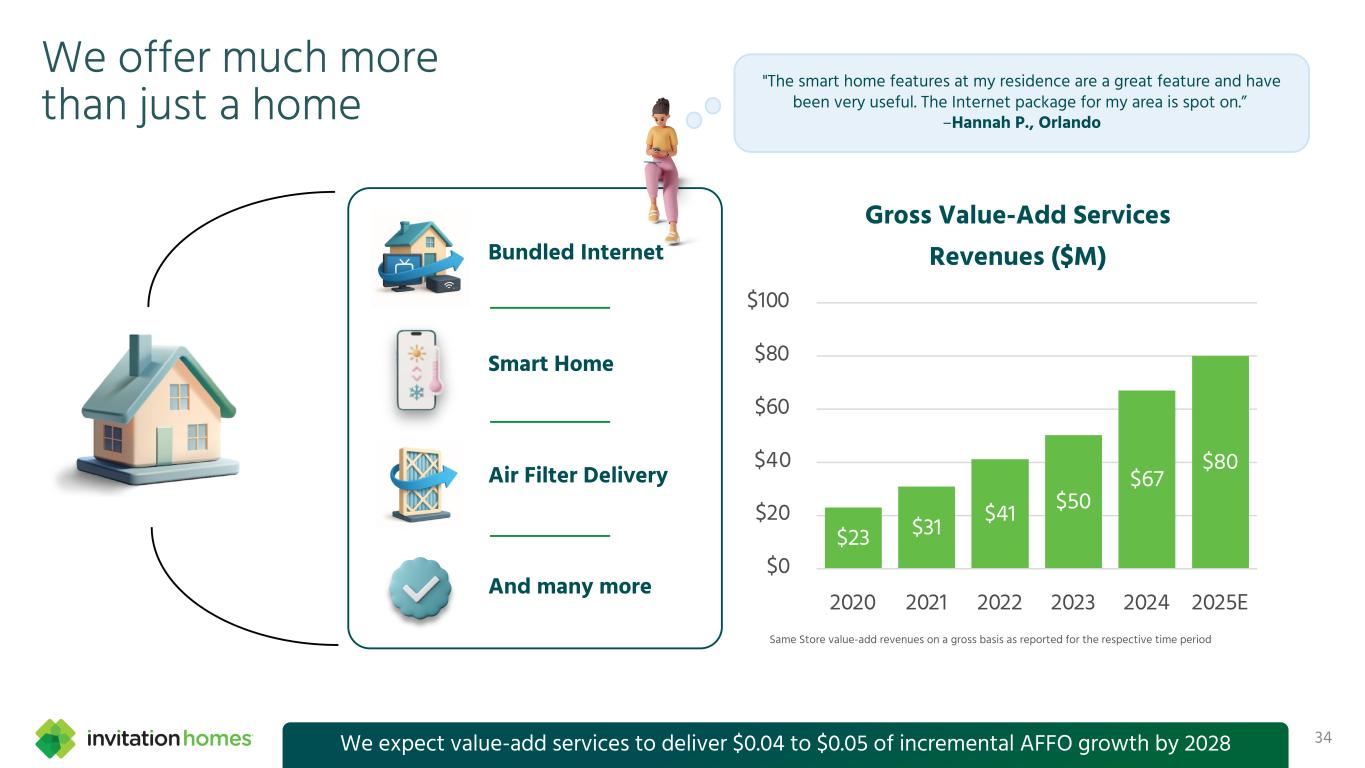

Bundled Internet Smart Home Air Filter Delivery And many more 34We expect value-add services to deliver $0.04 to $0.05 of incremental AFFO growth by 2028 We offer much more than just a home $23 $31 $41 $50 $67 $80 $0 $20 $40 $60 $80 $100 2020 2021 2022 2023 2024 2025E Gross Value-Add Services Revenues ($M) Same Store value-add revenues on a gross basis as reported for the respective time period "The smart home features at my residence are a great feature and have been very useful. The Internet package for my area is spot on.” –Hannah P., Orlando

35We leverage our scale to provide an enhanced leasing experience Maintenance isn’t just a service – it’s a loyalty strategy 24/7 self-service Institutional customer experience Multilingual & accessible Intelligent work order management Scalable Data-driven

36 Where we’re going & why you should care

We are embarking on a journey to revolutionize our business through technology enablement & centralization 37

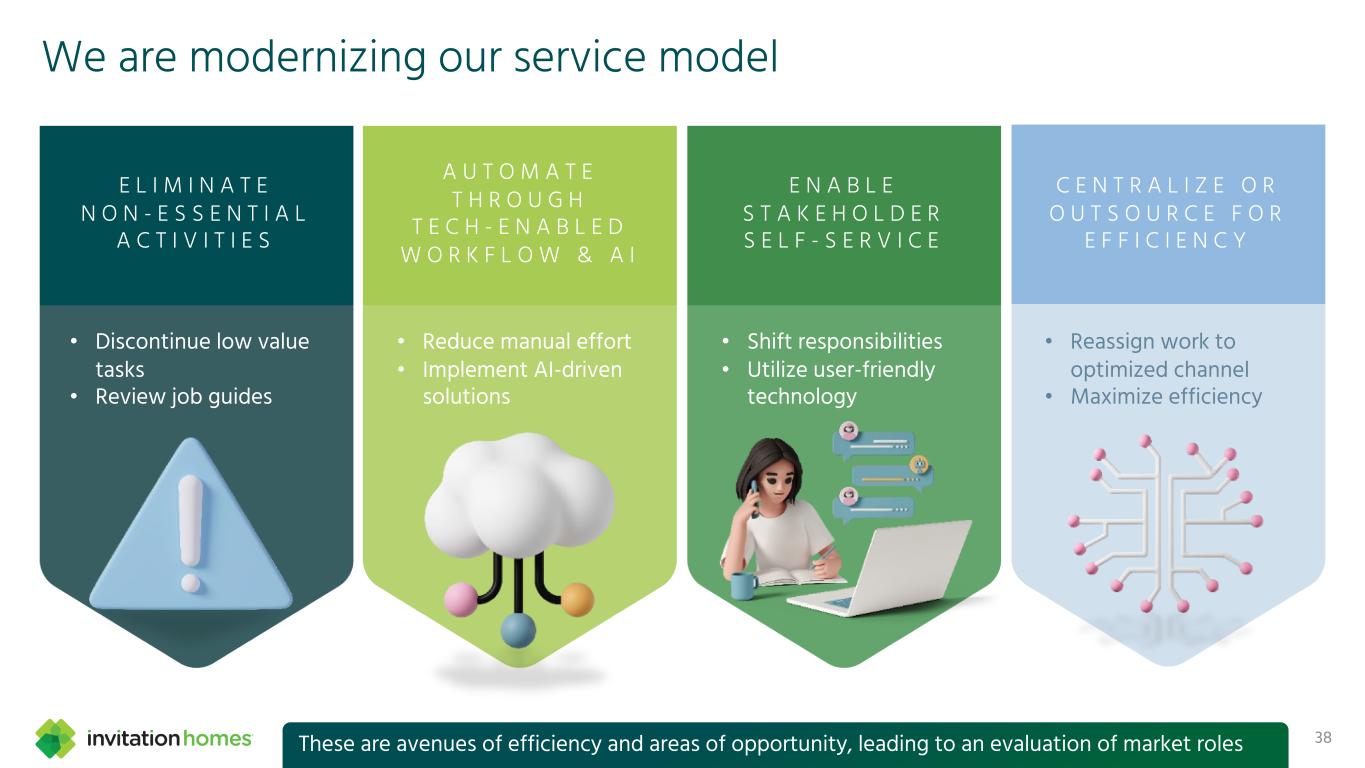

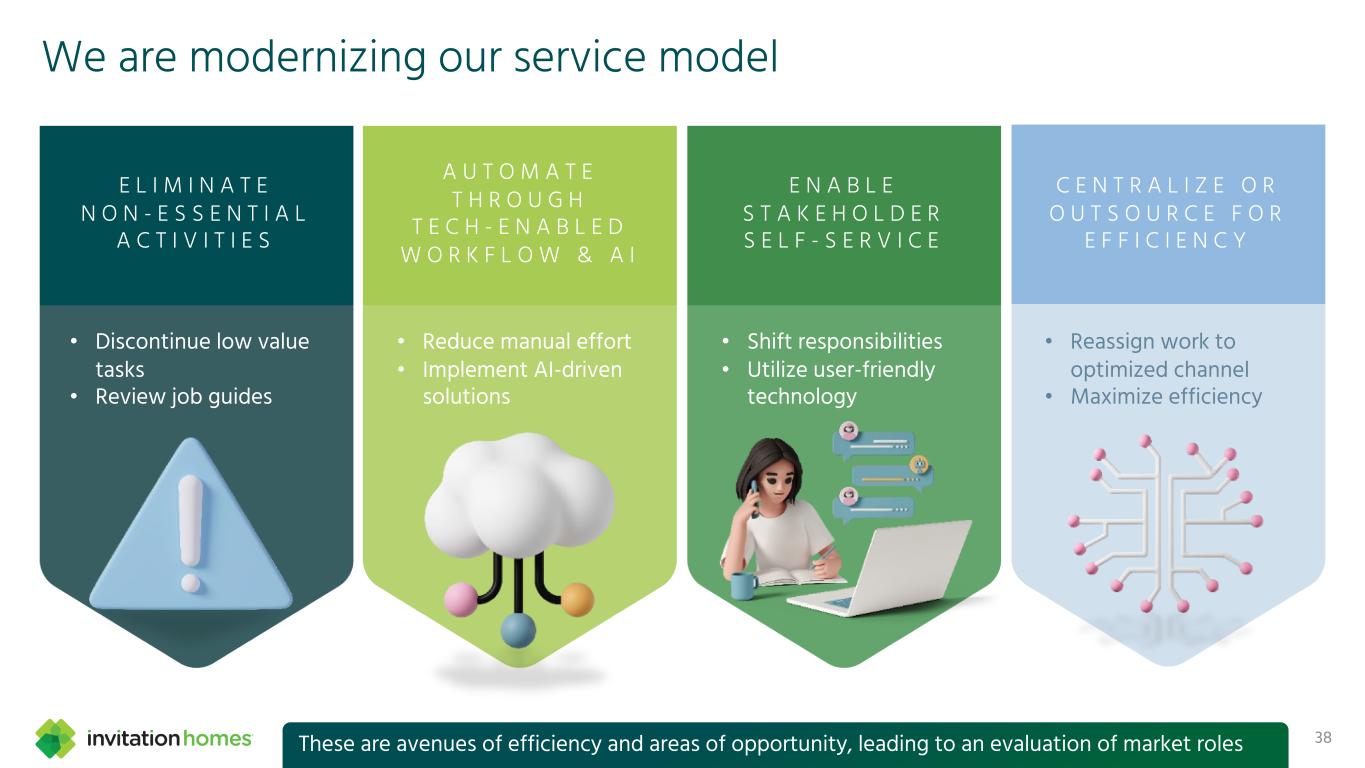

We are modernizing our service model 38These are avenues of efficiency and areas of opportunity, leading to an evaluation of market roles E L I M I N A T E N O N - E S S E N T I A L A C T I V I T I E S A U T O M A T E T H R O U G H T E C H - E N A B L E D W O R K F L O W & A I E N A B L E S T A K E H O L D E R S E L F - S E R V I C E C E N T R A L I Z E O R O U T S O U R C E F O R E F F I C I E N C Y • Discontinue low value tasks • Review job guides • Reduce manual effort • Implement AI-driven solutions • Shift responsibilities • Utilize user-friendly technology • Reassign work to optimized channel • Maximize efficiency

39Fewer calls, faster services, and $1M in savings (so far) Process optimization case study #1: Call center consolidation 100,000 105,000 110,000 115,000 2024 2025 2026 Home Count 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 2024 2025 2026 Answer Rate $0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 2024 2025 2026 Costs - 500,000 1,000,000 1,500,000 2024 2025 2026 Call Volume F R O M 2 0 2 4 T O 2 0 2 5 : Home count increased by 4.7% Call volume decreased by 22.3% Answer rate improved by 11.5% Costs improved by ~$1M F R O M 2 0 2 4 T O 2 0 2 5 :

40 Process optimization case study #2: Digital home care hub C U R R E N T S T A T E F U T U R E S T A T E Potential Implications „ 20,000 – 25,000 move ins per year „ Intelligent, digital asset observation with improved data collection „ Can provide proactive maintenance identification and reduction in HOA violations „ More self-troubleshooting: 30% of residents forgo work orders after watching video tips Reduces operational strain and enhances customer experience

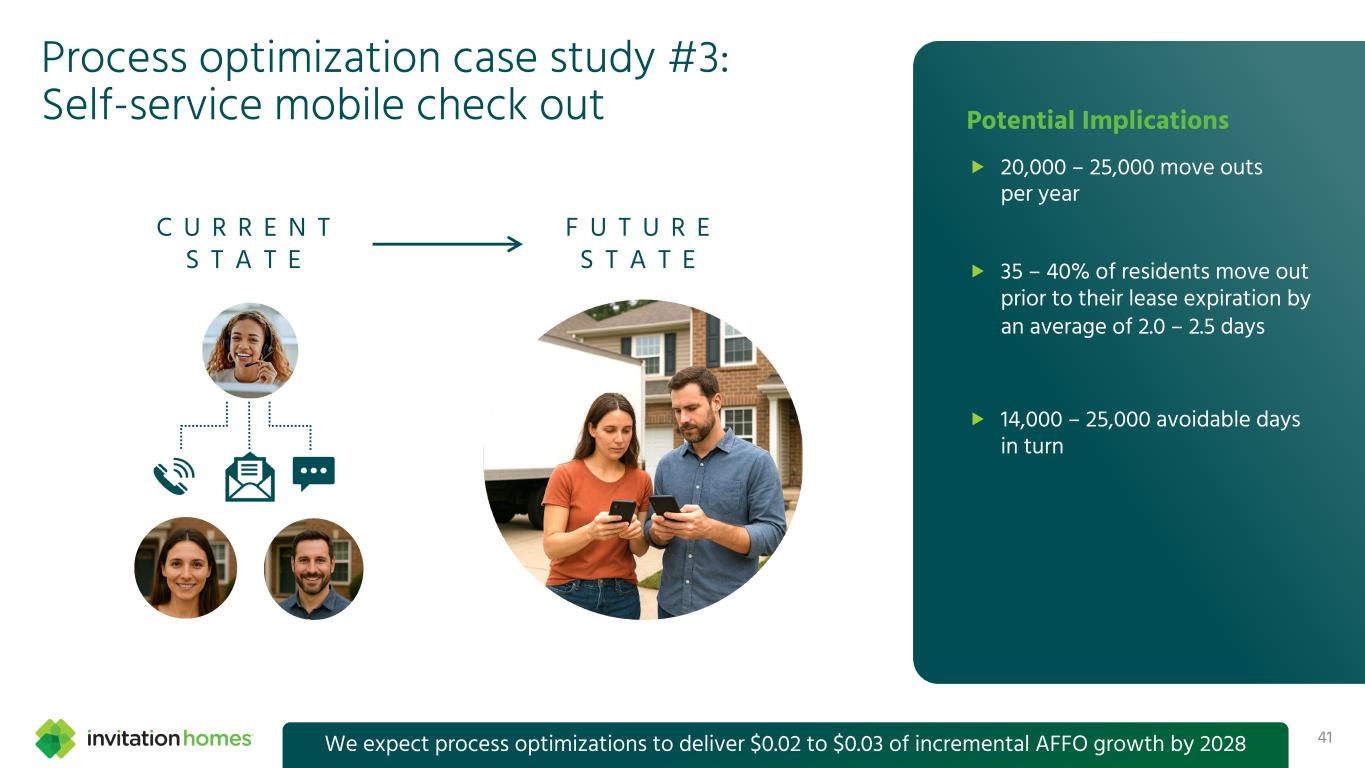

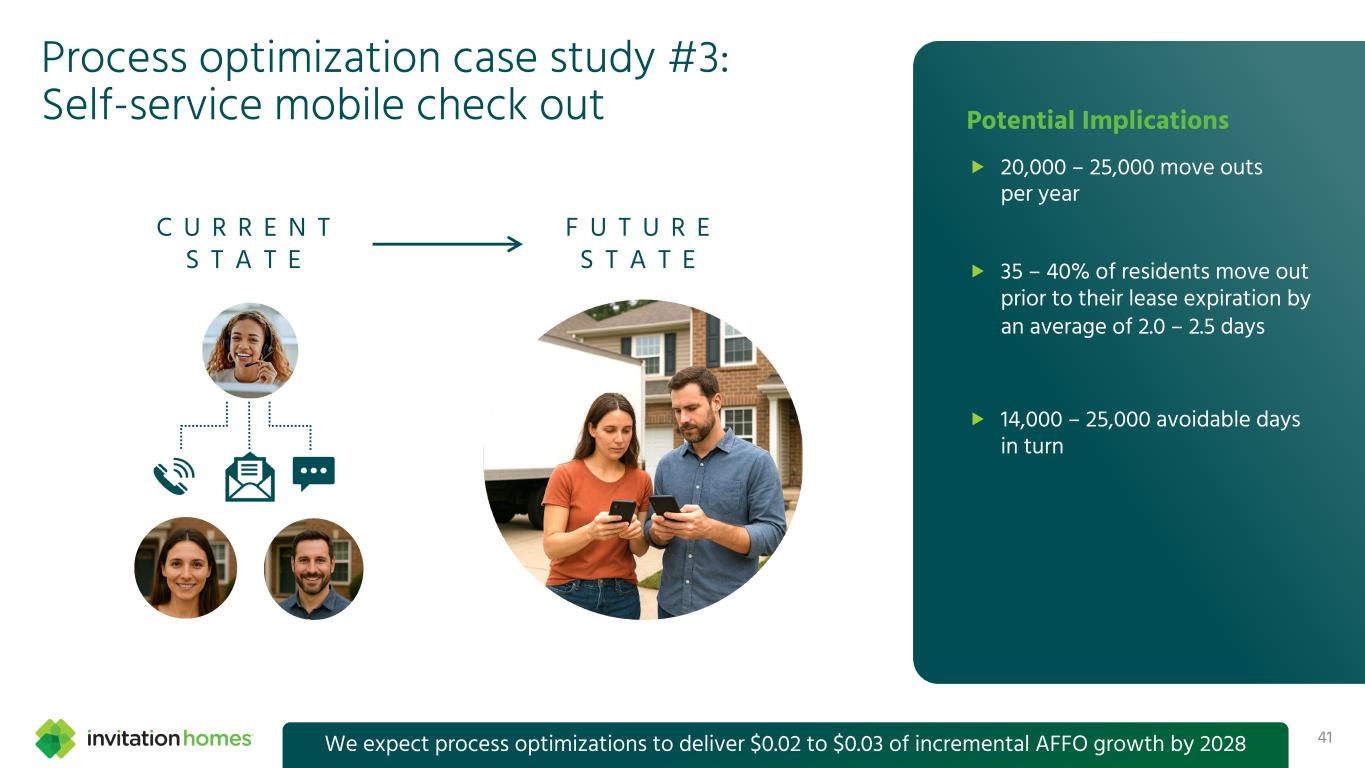

41 Process optimization case study #3: Self-service mobile check out C U R R E N T S T A T E Potential Implications „ 20,000 – 25,000 move outs per year „ 35 – 40% of residents move out prior to their lease expiration by an average of 2.0 – 2.5 days „ 14,000 – 25,000 avoidable days in turn F U T U R E S T A T E We expect process optimizations to deliver $0.02 to $0.03 of incremental AFFO growth by 2028

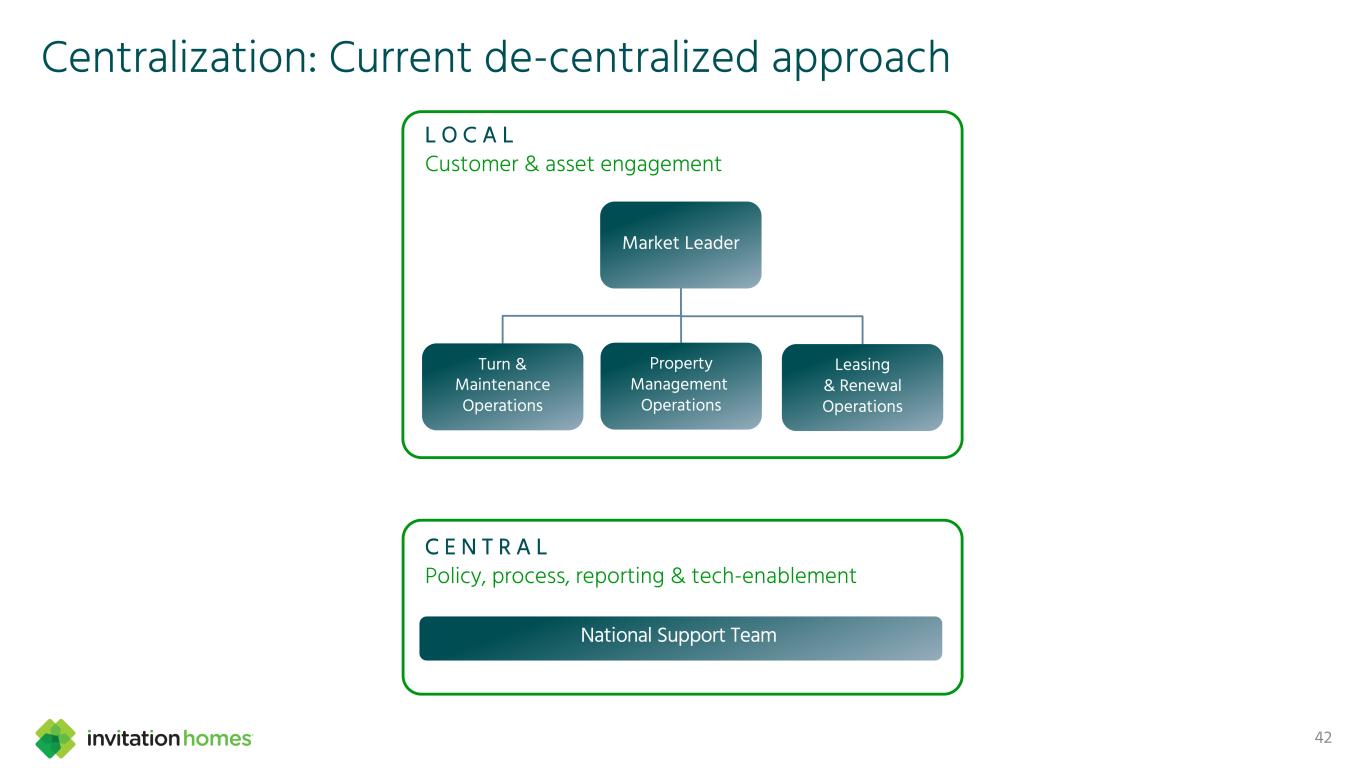

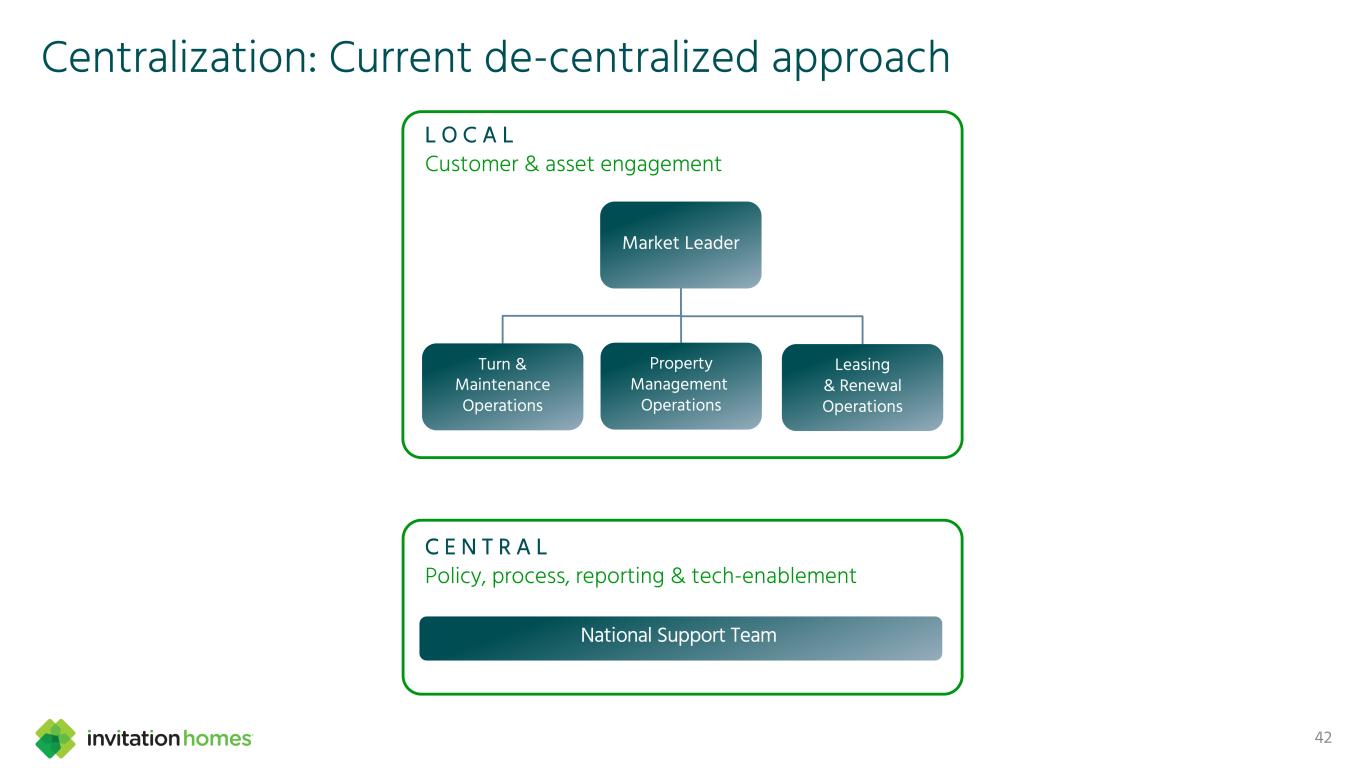

Centralization: Current de-centralized approach 42 Market Leader Turn & Maintenance Operations Property Management Operations Leasing & Renewal Operations National Support Team L O C A L Customer & asset engagement C E N T R A L Policy, process, reporting & tech-enablement

Centralization: Current de-centralized approach 43 • Routine, repeatable processes • High-volume administrative tasks • Market specific knowledge not required • Support focused activities Market Leader Turn & Maintenance Operations Property Management Operations Leasing & Renewal Operations National Support Team L O C A L Customer & asset engagement C E N T R A L Policy, process, reporting & tech-enablement

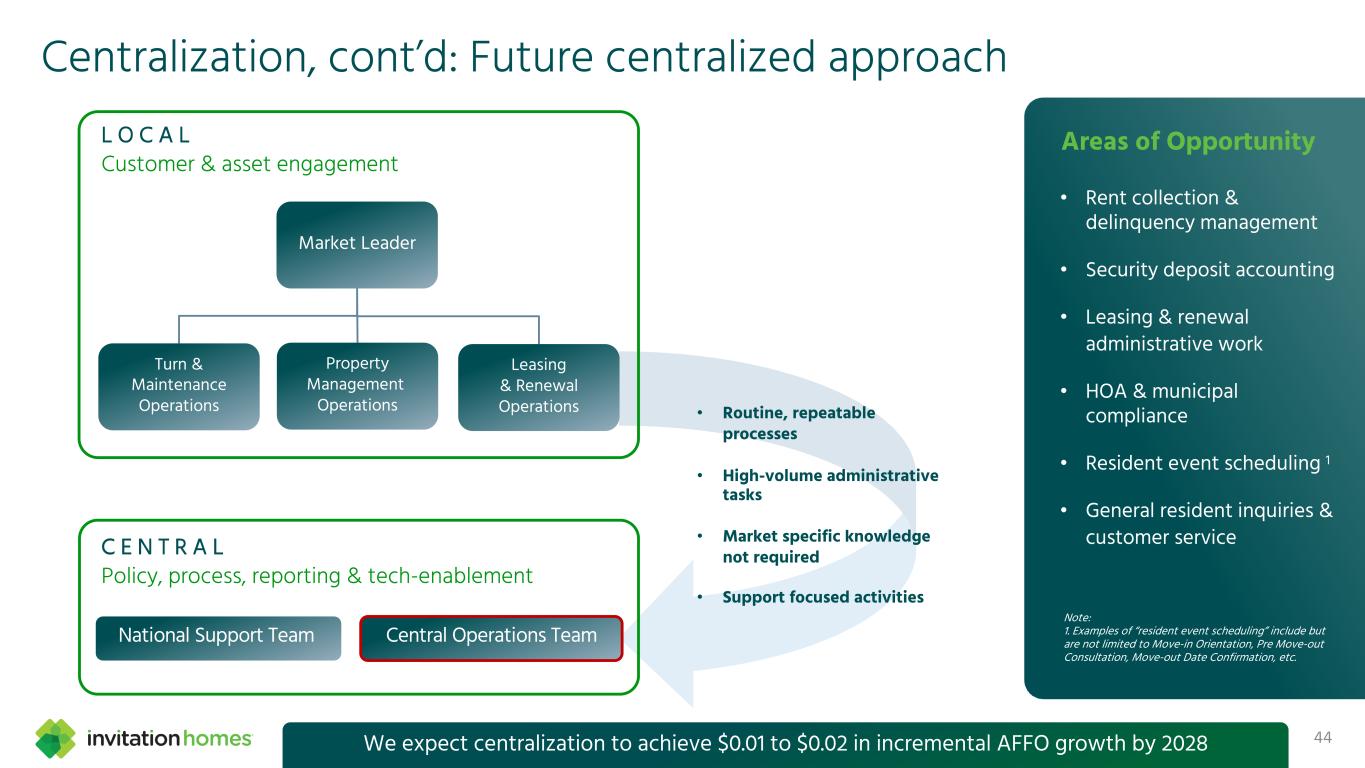

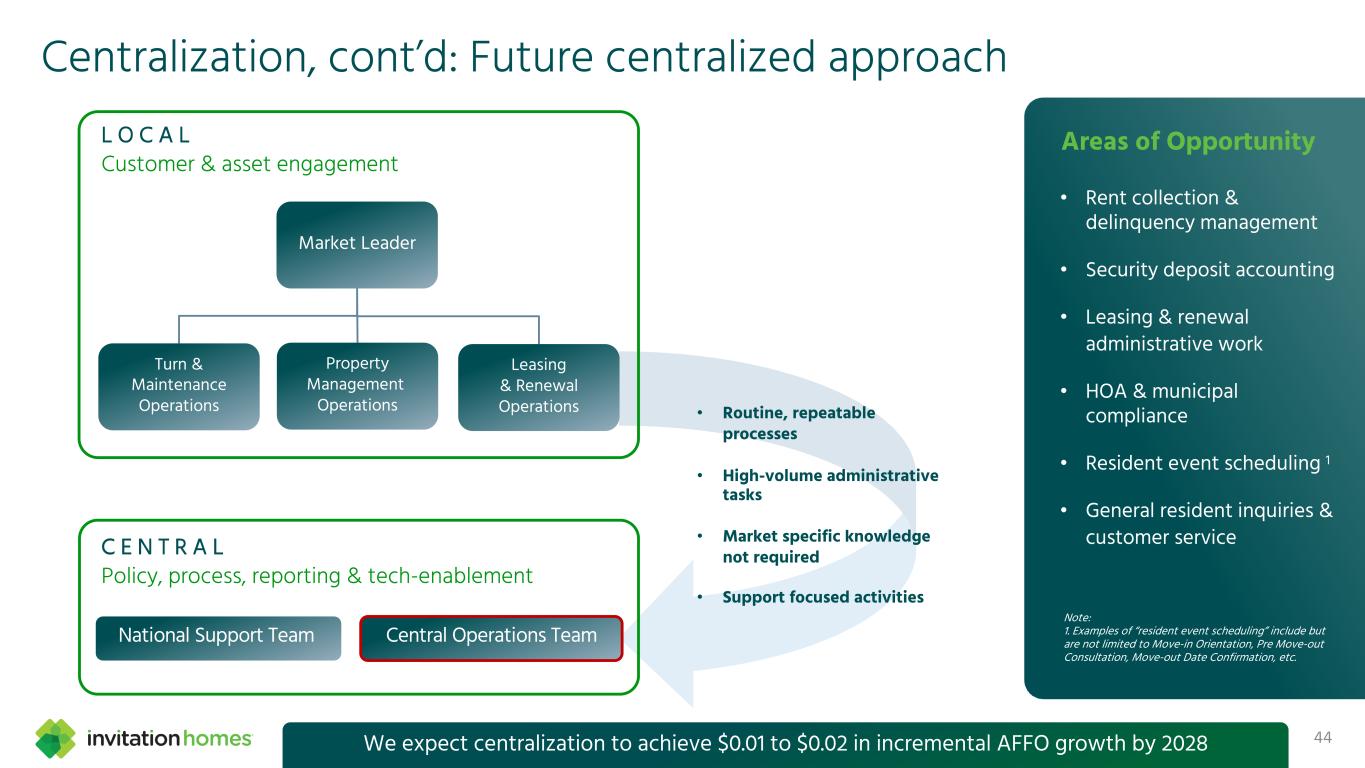

Centralization, cont’d: Future centralized approach 44We expect centralization to achieve $0.01 to $0.02 in incremental AFFO growth by 2028 • Rent collection & delinquency management • Security deposit accounting • Leasing & renewal administrative work • HOA & municipal compliance • Resident event scheduling 1 • General resident inquiries & customer service Note: 1. Examples of “resident event scheduling” include but are not limited to Move-in Orientation, Pre Move-out Consultation, Move-out Date Confirmation, etc. Areas of Opportunity • Routine, repeatable processes • High-volume administrative tasks • Market specific knowledge not required • Support focused activities Central Operations Team Market Leader Turn & Maintenance Operations Property Management Operations Leasing & Renewal Operations National Support Team L O C A L Customer & asset engagement C E N T R A L Policy, process, reporting & tech-enablement

Key takeaways Diversified revenue opportunities as we enhance the customer experience journey Future operational efficiencies through process optimization & centralization Lots of opportunity still ahead Scale & density core to our success We expect our operational initiatives to achieve $0.07 to $0.10 in incremental AFFO growth by 2028 Simple approach scaled with precision 45

Tampa Den Unlock the Future of Home T H E 46

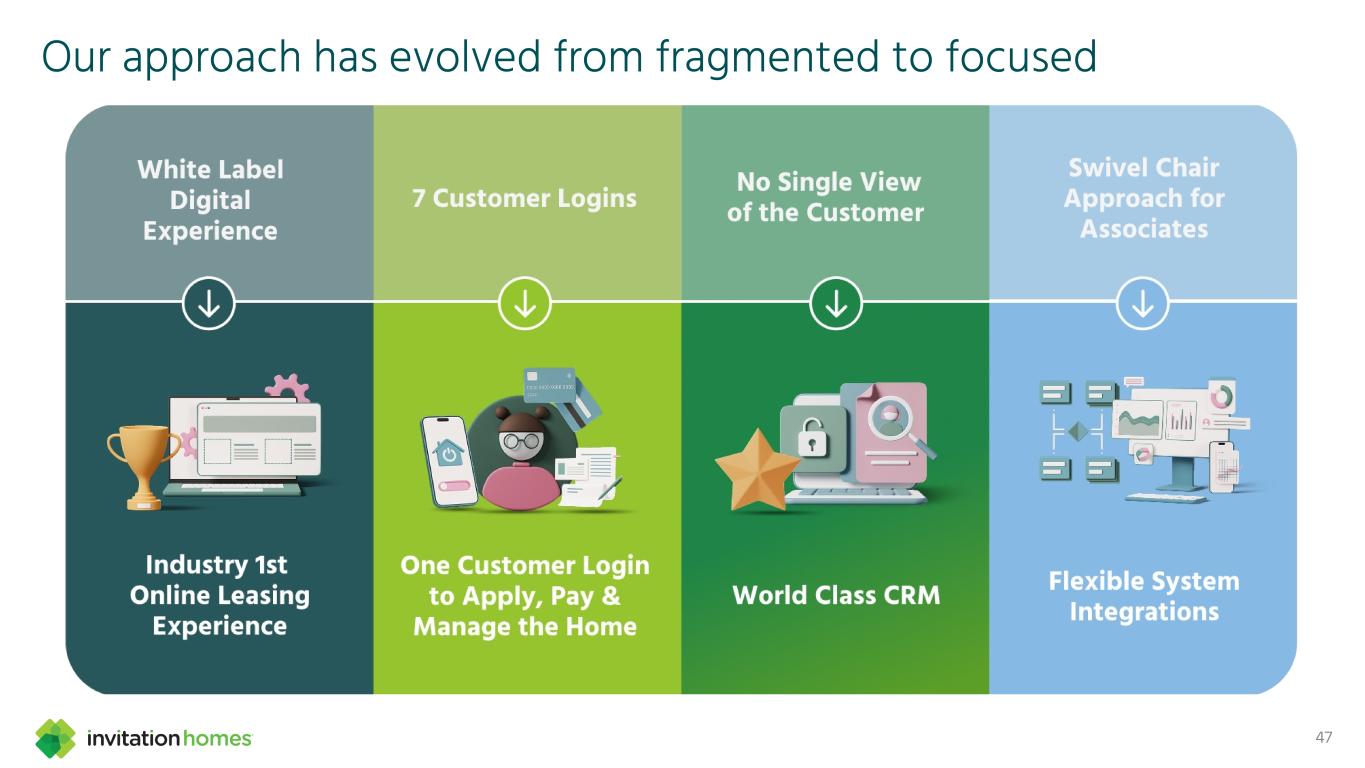

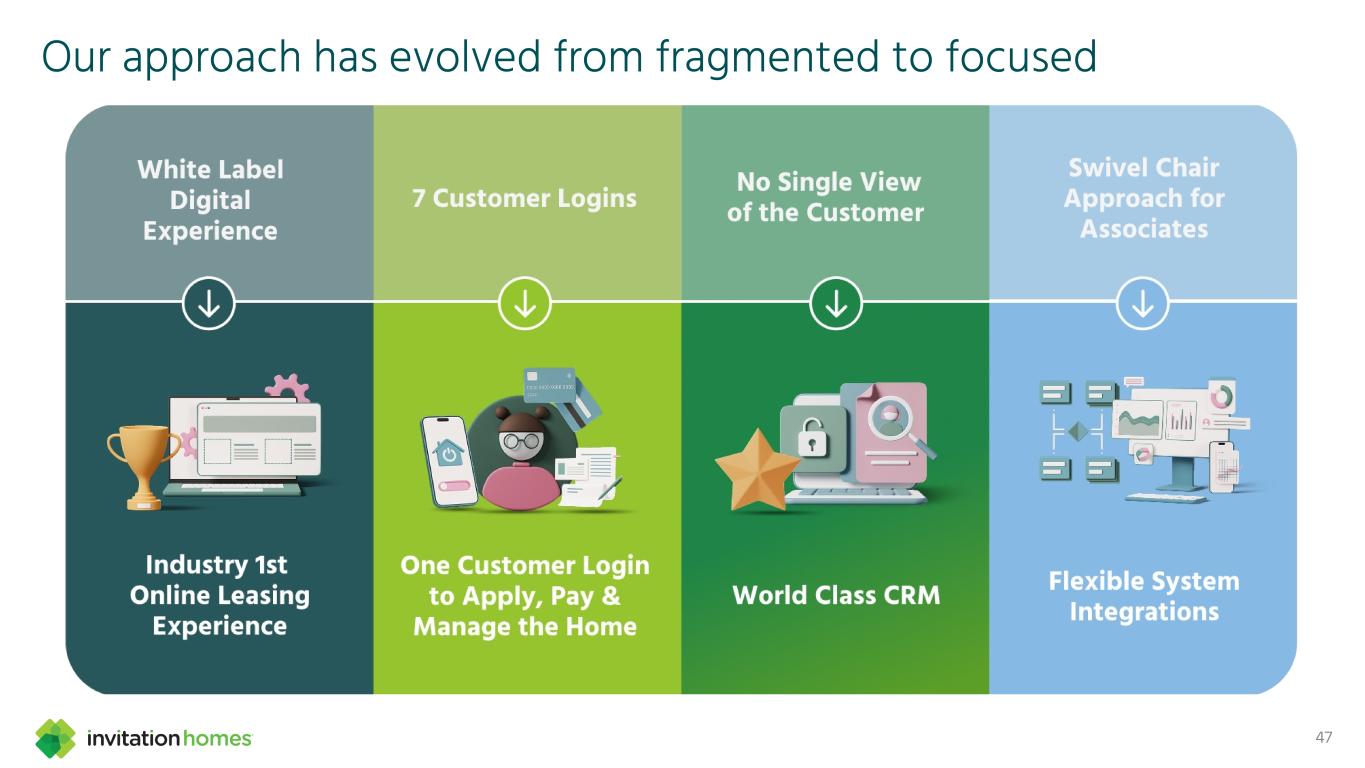

Our approach has evolved from fragmented to focused 47

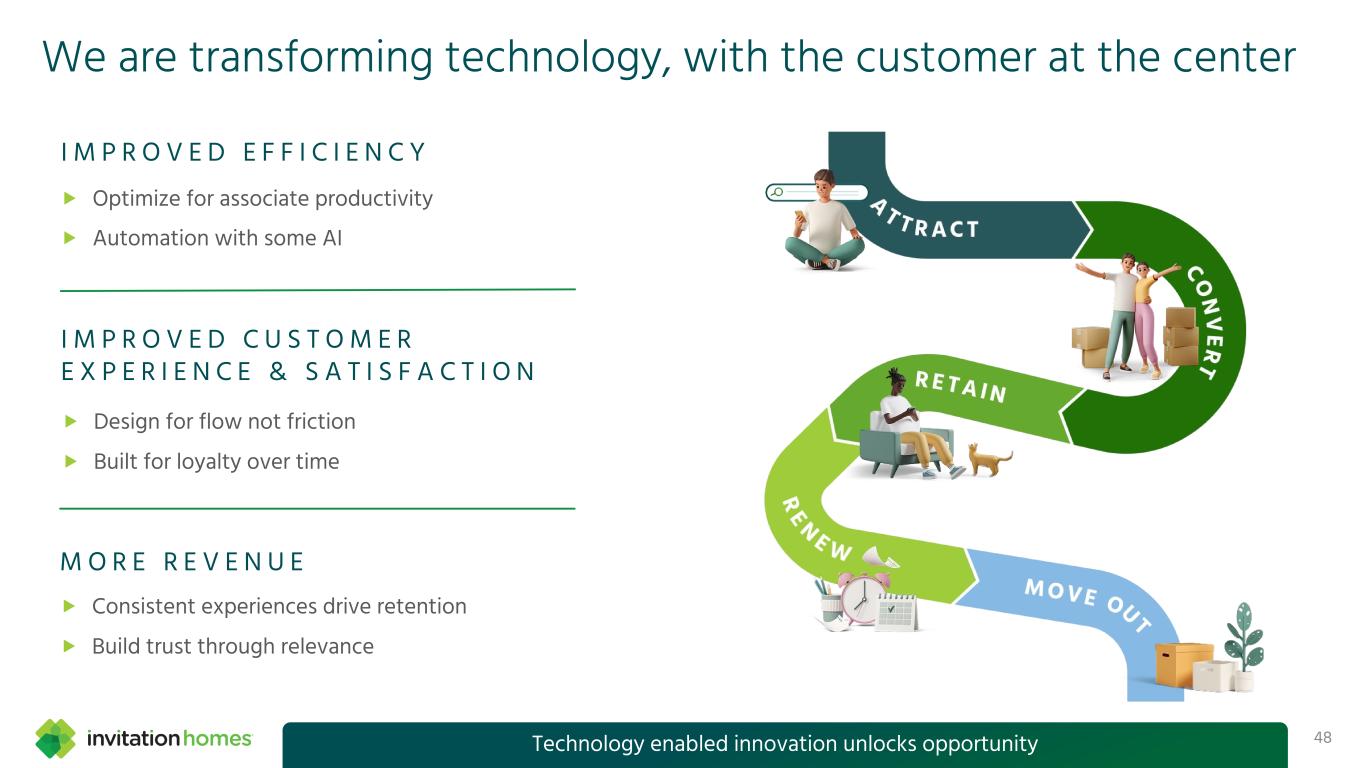

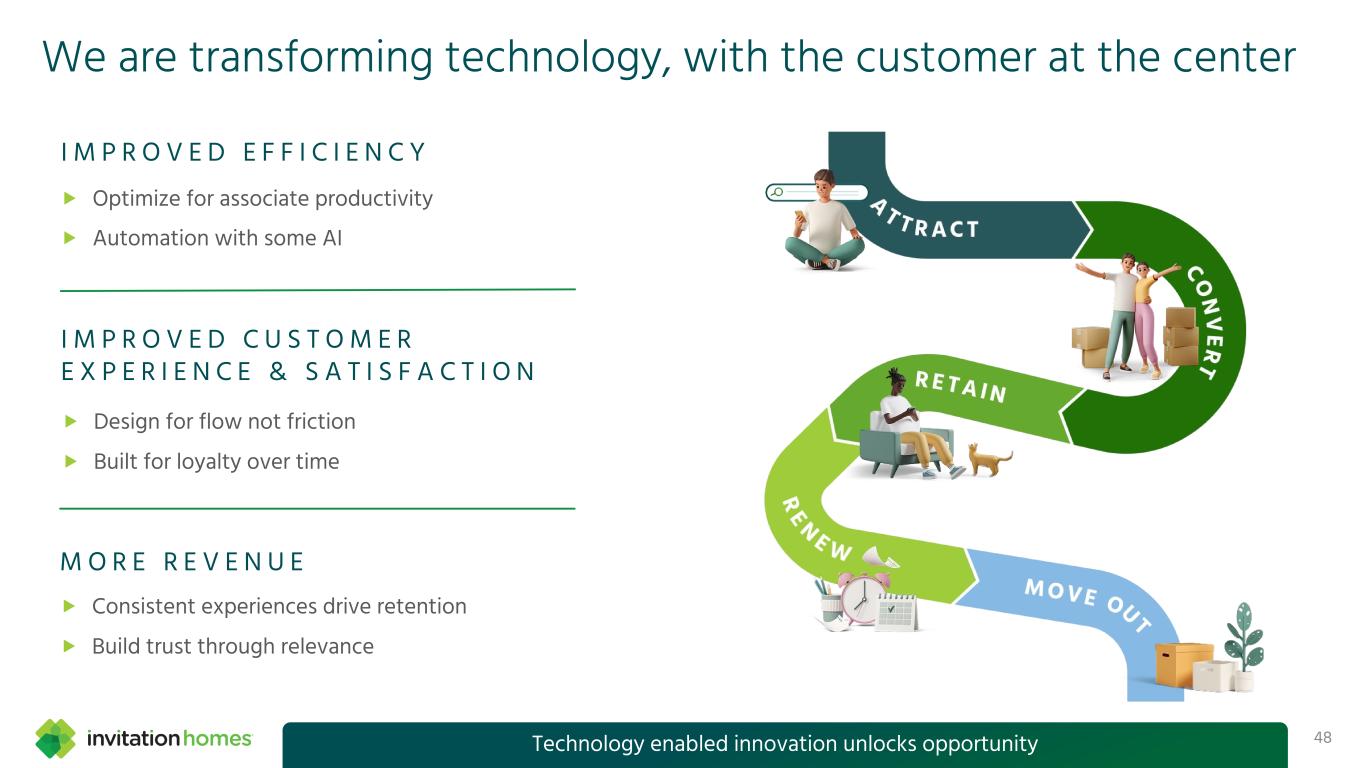

We are transforming technology, with the customer at the center 48 „ Optimize for associate productivity „ Automation with some AI I M P R O V E D E F F I C I E N C Y I M P R O V E D C U S T O M E R E X P E R I E N C E & S A T I S F A C T I O N „ Design for flow not friction „ Built for loyalty over time „ Consistent experiences drive retention „ Build trust through relevance M O R E R E V E N U E Technology enabled innovation unlocks opportunity

We are connecting the dots of attraction through improved communication and technology 49 We meet customers where and when they want 24/7 79% of our applications are submitted without human intervention 46% of our chatbot interactions happen outside of office hours A great home + right location & price + elevated digital shopping experience = customer win/win

The customer’s control is at their fingertips 50 A N I N D U S T R Y F I R S T , A I - L E D L E A S I N G E N G I N E D A T A - D R I V E N C O N V E R S I O N O P T I M I Z A T I O N M O D E R N P A Y M E N T E X P E R I E N C E Time to decision has been reduced by 35% Allowing for features like waitlisting, decreased fraud, and pre-qualification

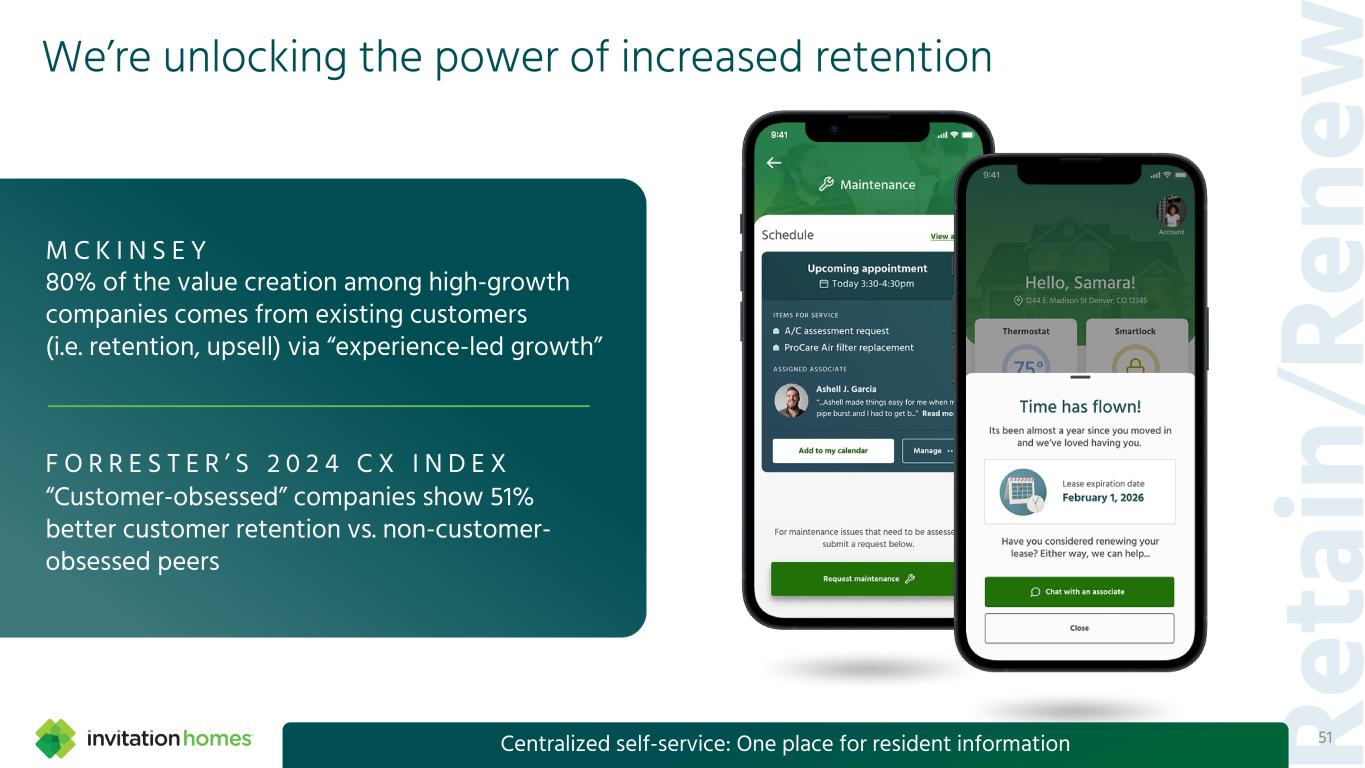

We’re unlocking the power of increased retention 80% of the value creation among high-growth companies comes from existing customers (i.e. retention, upsell) via “experience-led growth” M C K I N S E Y “Customer-obsessed” companies show 51% better customer retention vs. non-customer- obsessed peers F O R R E S T E R ’ S 2 0 2 4 C X I N D E X 51Centralized self-service: One place for resident information

Our vision is unified, intelligent, and seamless 52We expect customer-centric solutions to achieve ~$0.02 in incremental AFFO growth by 2028

Protecting our house – secure by design 53We protect residents and data while enabling digital growth, customer trust, and long-term value

S E E I T L I V E VIDEO 54

Q&A Session 1 55

56 Break

Tampa Garage Unlock External Growth T H E 57

58 Strategic growth summary T H I R D P A R T Y M A N A G E M E N T „ Engine for capital light growth „ 3PM provides opportunity to enter new growth markets P O R T F O L I O O P T I M I Z A T I O N „ Disciplined, data driven investment framework „ Scaled platform creates information flywheel „ Ability to attractively recycle capital through home sales to the end-user market E X T E R N A L G R O W T H „ Growth through multiple acquisition channels „ Current market is attractive to purchase new construction homes „ INVH operating model can be scaled for both SFR and BTR management „ Construction lending can grow cash flow and create predictable acquisition pipeline „ Positioned to move up the value chain to generate higher returns from development

59 Portfolio optimization

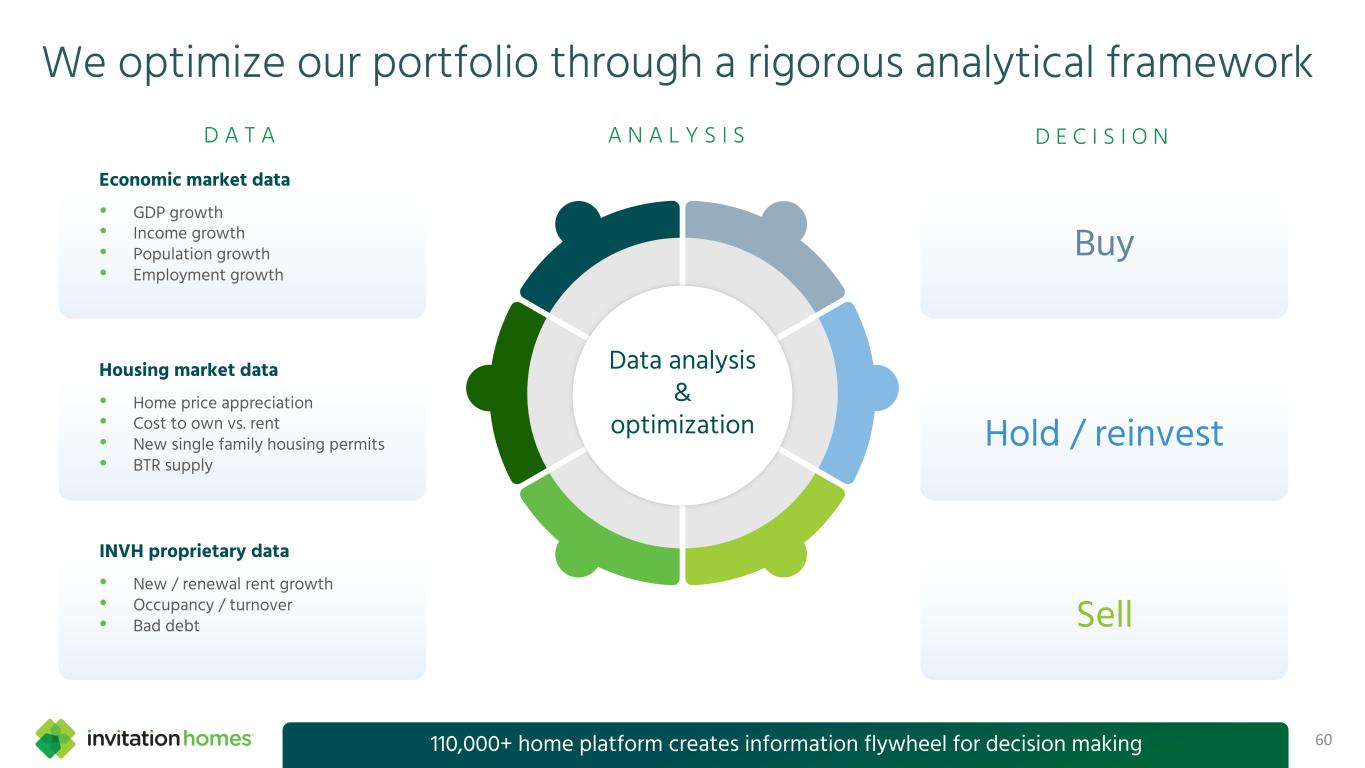

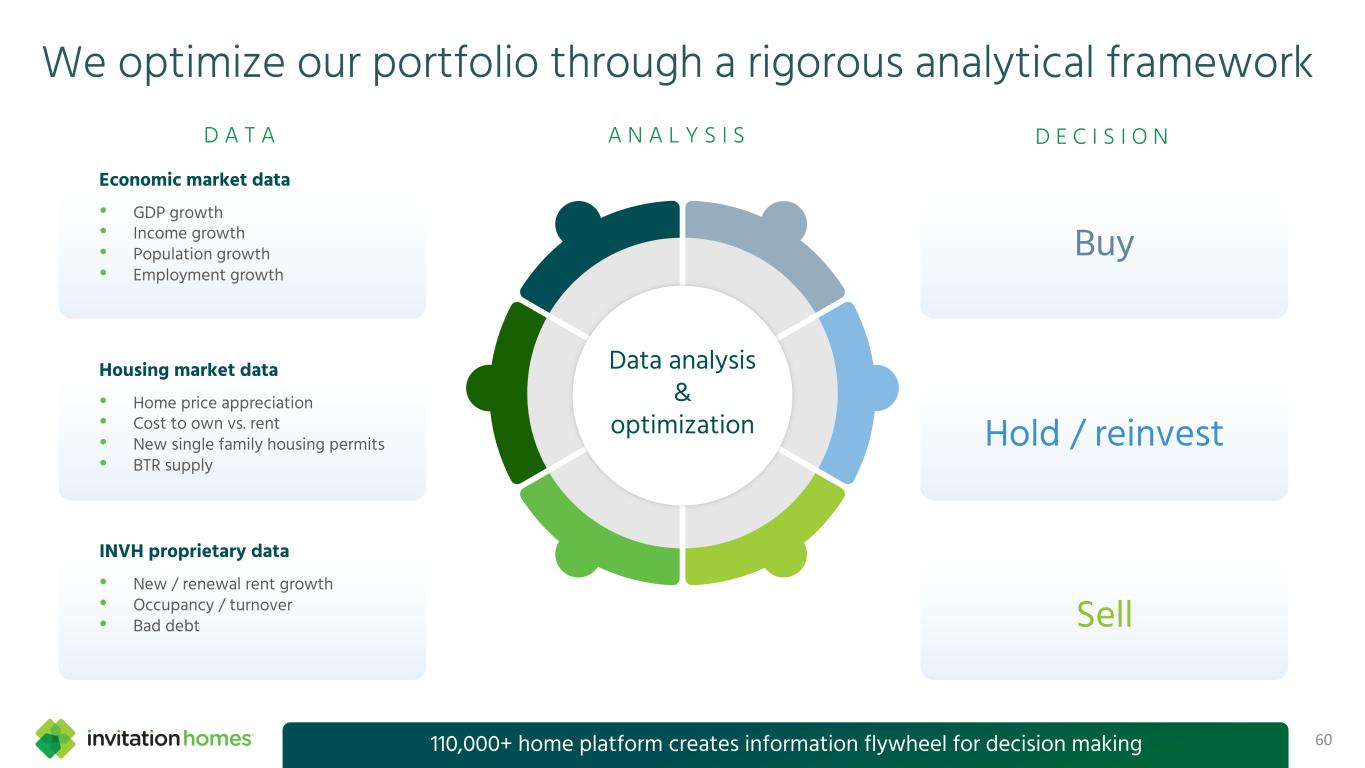

60 We optimize our portfolio through a rigorous analytical framework D A T A A N A L Y S I S D E C I S I O N Economic market data • GDP growth • Income growth • Population growth • Employment growth Housing market data • Home price appreciation • Cost to own vs. rent • New single family housing permits • BTR supply INVH proprietary data • New / renewal rent growth • Occupancy / turnover • Bad debt Buy Hold / reinvest Sell Data analysis & optimization 110,000+ home platform creates information flywheel for decision making

61 We have a disciplined investment framework Organized to drive strategic, accretive growth through disciplined underwriting Source Underwrite Diligence Acquire Rehab Lease We have bought or sold nearly 130,000 homes since inception

We are allocating capital to long-term, high-growth markets Core established markets New growth markets Core growth markets 62

We continue to reinvest in our portfolio through our RevEx Program 63 ~$7,500 re-investment per home 6,000 homes in FY 2025 $43M total capital spend in FY 2025 10 – 15% average ROI 2023 2024 2025 5,300 4,600 6,000# of Homes

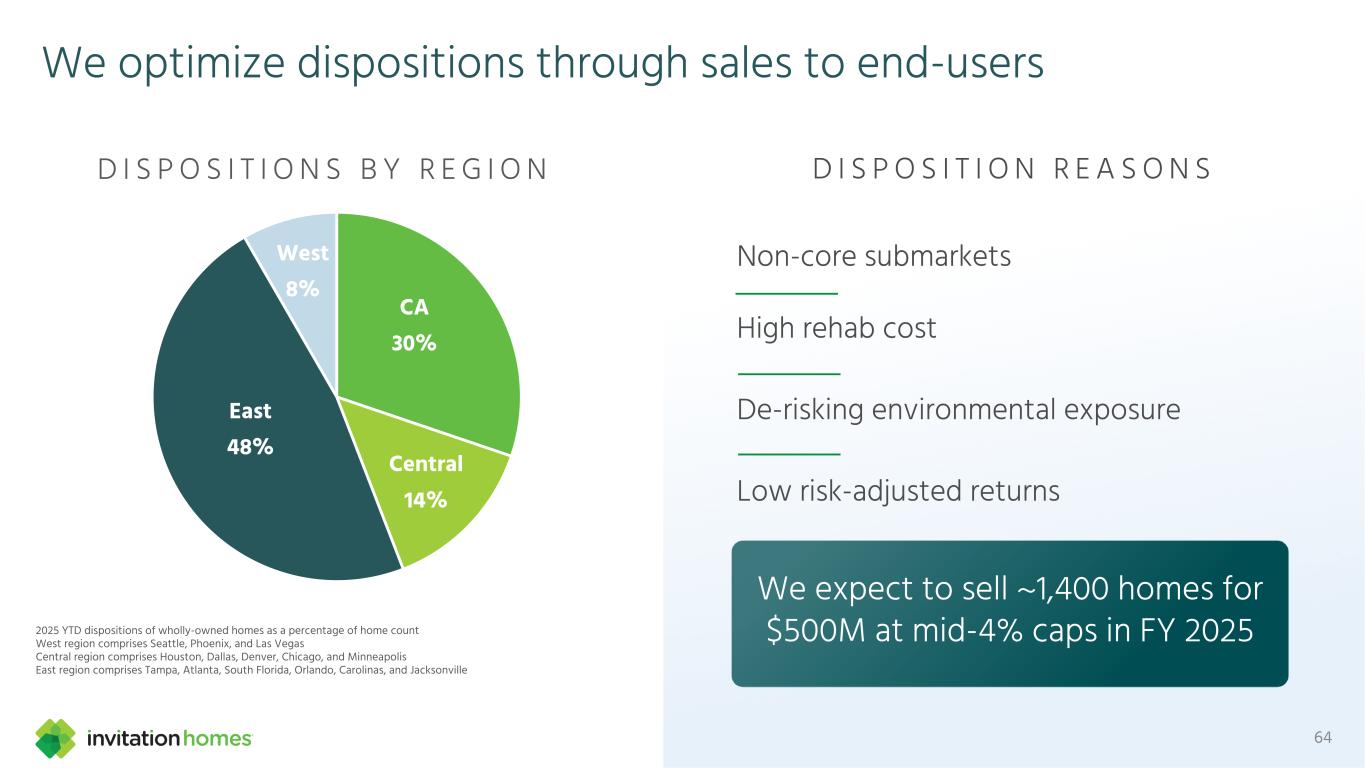

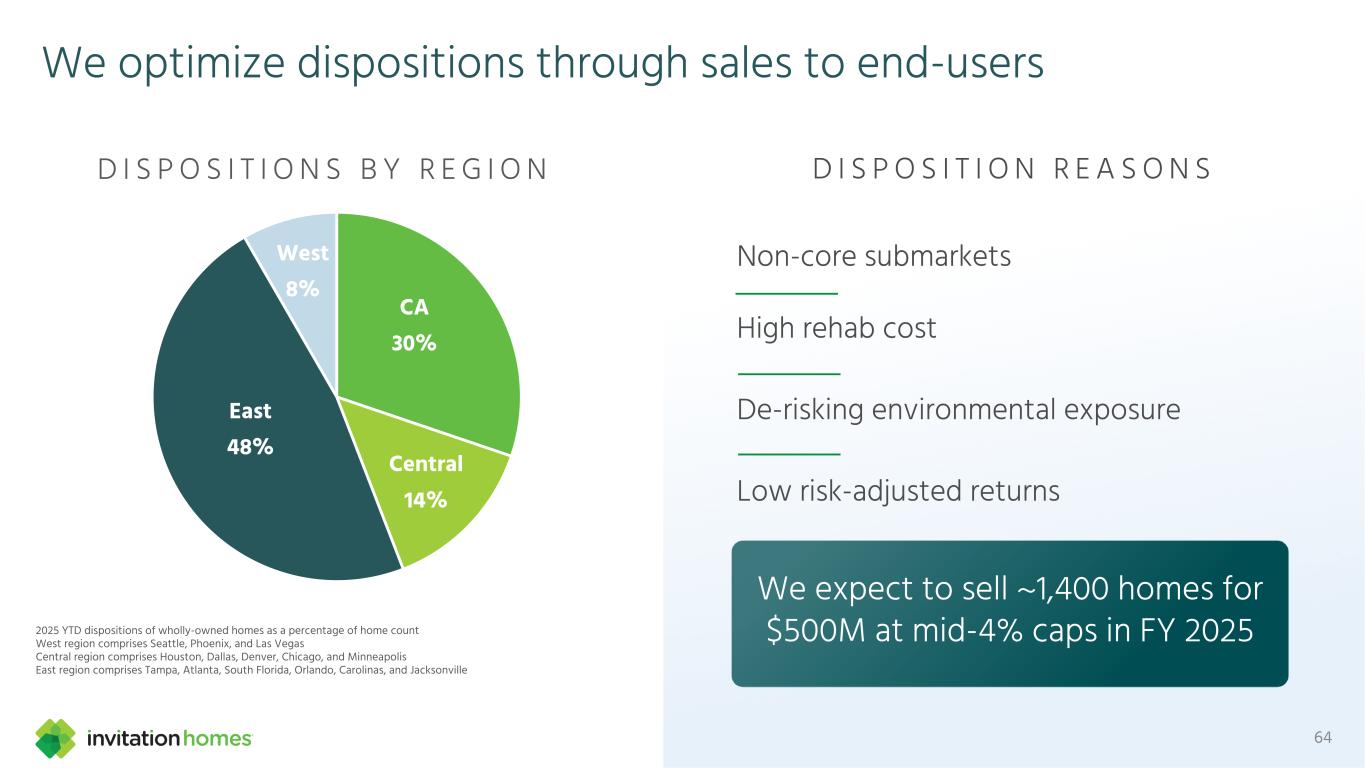

We optimize dispositions through sales to end-users 64 CA 30% Central 14% East 48% West 8% D I S P O S I T I O N S B Y R E G I O N 2025 YTD dispositions of wholly-owned homes as a percentage of home count West region comprises Seattle, Phoenix, and Las Vegas Central region comprises Houston, Dallas, Denver, Chicago, and Minneapolis East region comprises Tampa, Atlanta, South Florida, Orlando, Carolinas, and Jacksonville Non-core submarkets High rehab cost De-risking environmental exposure Low risk-adjusted returns D I S P O S I T I O N R E A S O N S We expect to sell ~1,400 homes for $500M at mid-4% caps in FY 2025

65 External growth

Our external growth strategies Acquisition of scattered-site new construction from builders Homebuilder partnerships and BTR-community forward purchases Construction lending for BTR developers 66 Future development opportunities 1 2 3 4

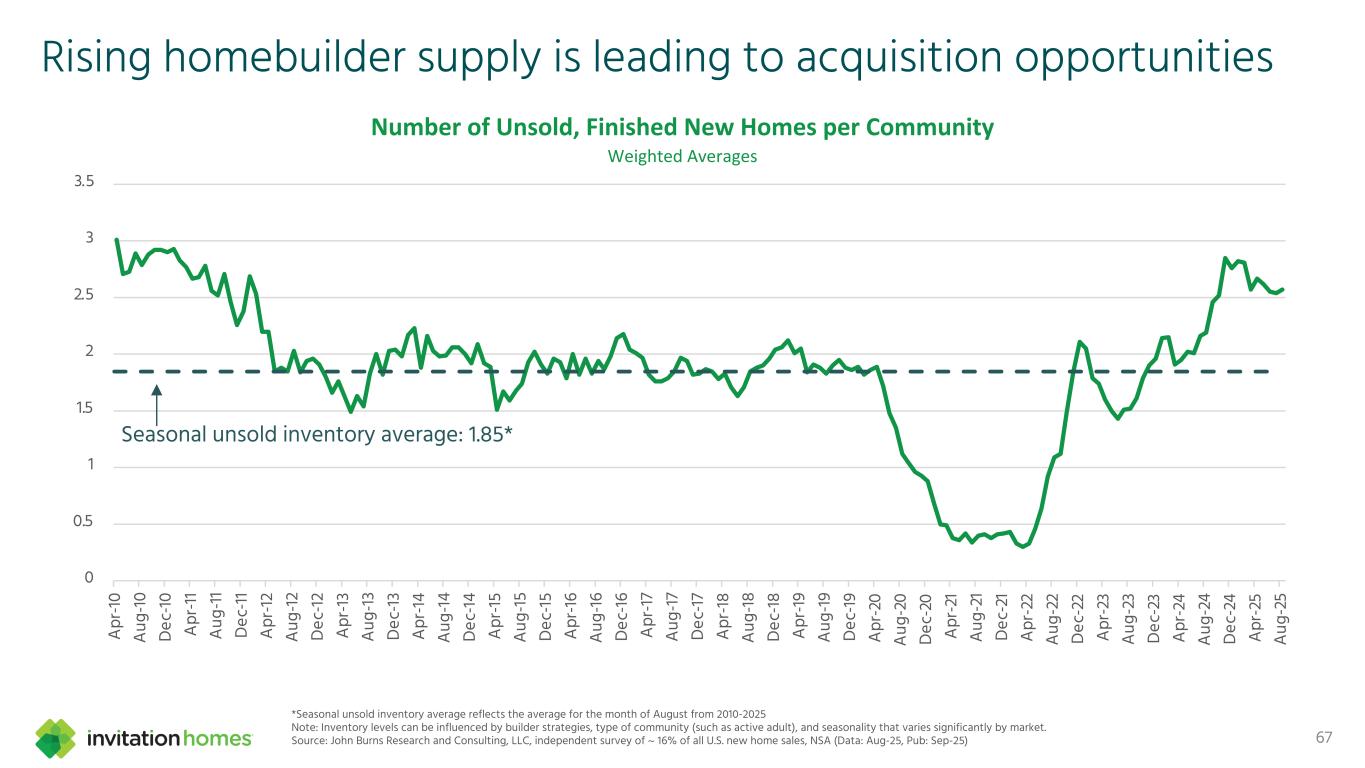

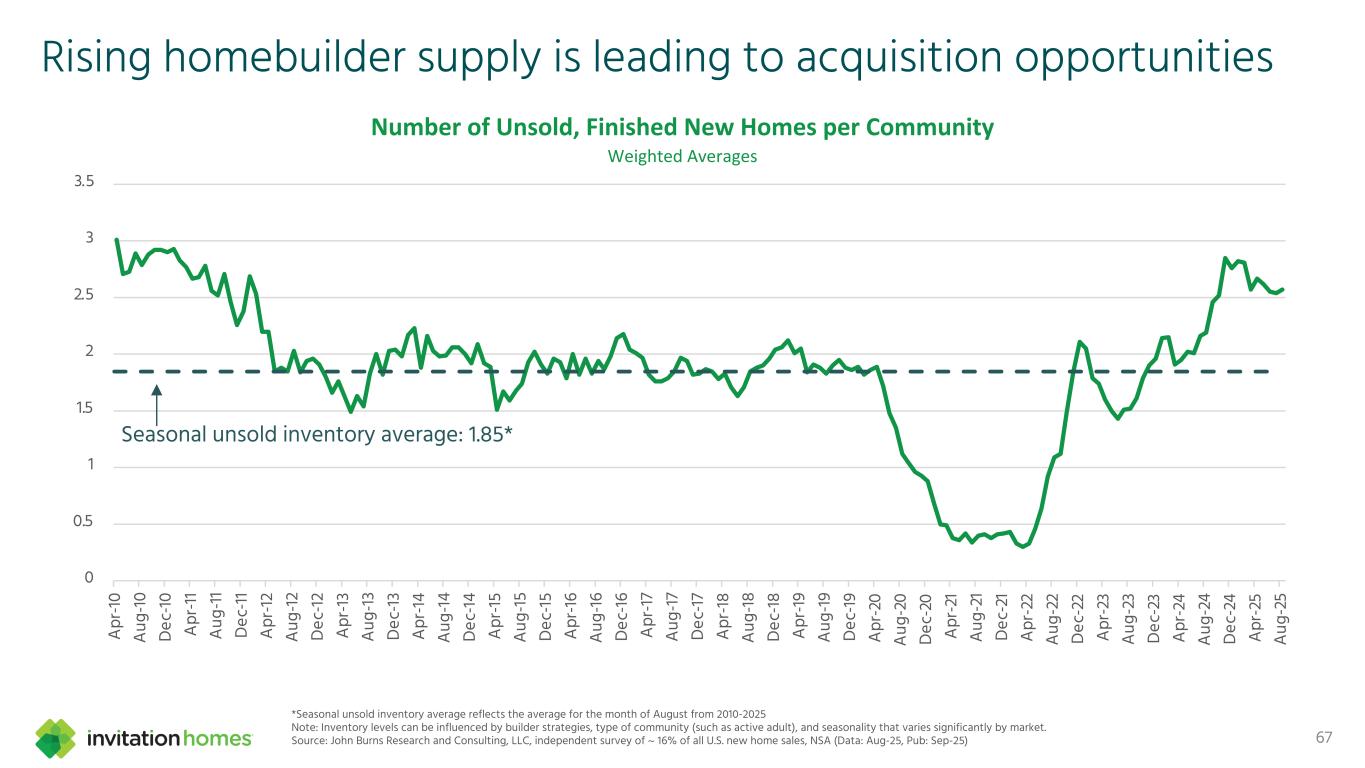

Rising homebuilder supply is leading to acquisition opportunities 67 0 0.5 1 1.5 2 2.5 3 3.5 Ap r-1 0 Au g- 10 De c- 10 Ap r-1 1 Au g- 11 De c- 11 Ap r-1 2 Au g- 12 De c- 12 Ap r-1 3 Au g- 13 De c- 13 Ap r-1 4 Au g- 14 De c- 14 Ap r-1 5 Au g- 15 De c- 15 Ap r-1 6 Au g- 16 De c- 16 Ap r-1 7 Au g- 17 De c- 17 Ap r-1 8 Au g- 18 De c- 18 Ap r-1 9 Au g- 19 De c- 19 Ap r-2 0 Au g- 20 De c- 20 Ap r-2 1 Au g- 21 De c- 21 Ap r-2 2 Au g- 22 De c- 22 Ap r-2 3 Au g- 23 De c- 23 Ap r-2 4 Au g- 24 De c- 24 Ap r-2 5 Au g- 25 Number of Unsold, Finished New Homes per Community Weighted Averages Seasonal unsold inventory average: 1.85* *Seasonal unsold inventory average reflects the average for the month of August from 2010-2025 Note: Inventory levels can be influenced by builder strategies, type of community (such as active adult), and seasonality that varies significantly by market. Source: John Burns Research and Consulting, LLC, independent survey of ~ 16% of all U.S. new home sales, NSA (Data: Aug-25, Pub: Sep-25)

-5.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 20 24 20 25 New Home Price Premium vs. Resale (12-month average) Aug-25 = -0.2% 68 Auction purchases MLS purchases New home pricing more attractive Construction lending Homebuilder forward purchasing Resale home pricing more attractive Homebuilder Inventory We have multiple acquisition channels to pivot with the cycles *Historical average: Jan-68 through Aug-25 Note: Data between January 2020 and March 2024 have been re-calculated to include additional data and revisions due to new price groupings from Census. Sources: NAR; U.S. Census Bureau John Burns Research and Consulting, LLC (Data: May-25, Pub: Sep-25) Historical average: 16.1%*

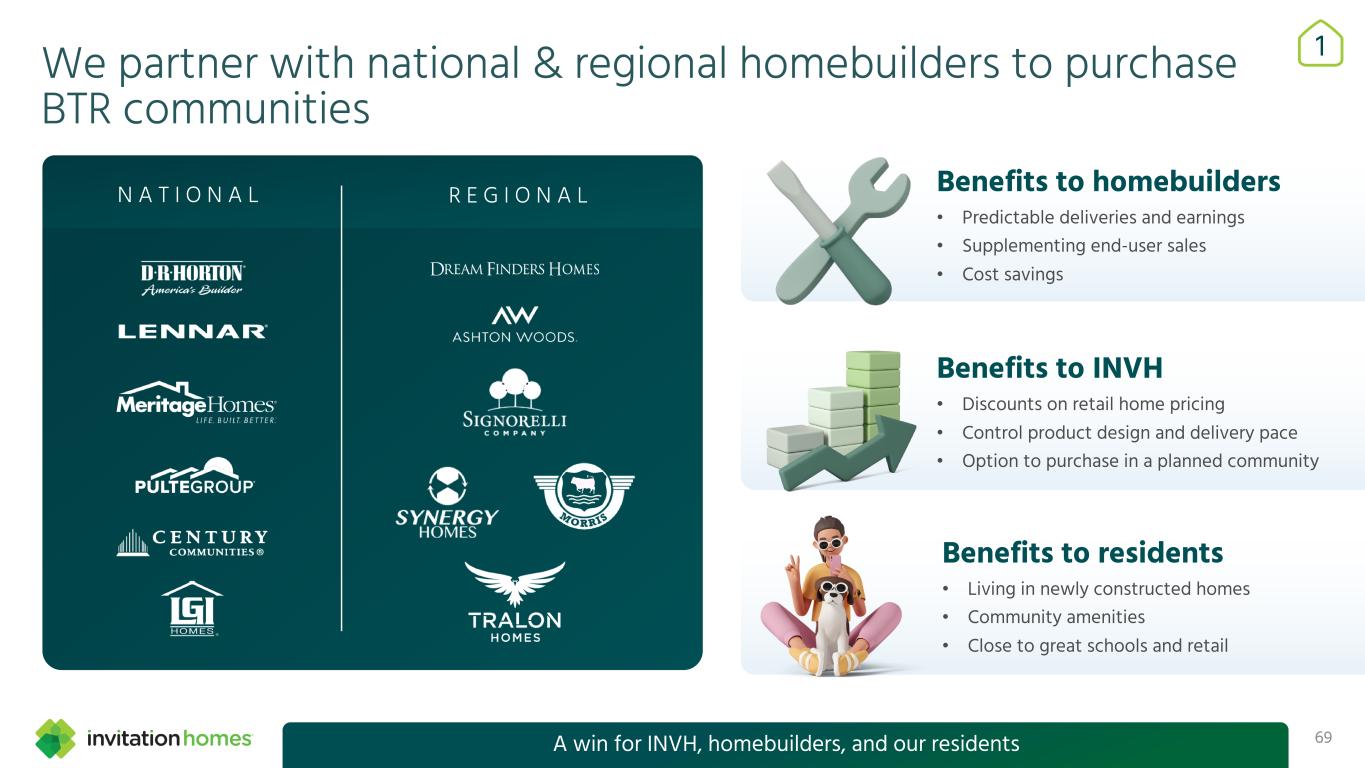

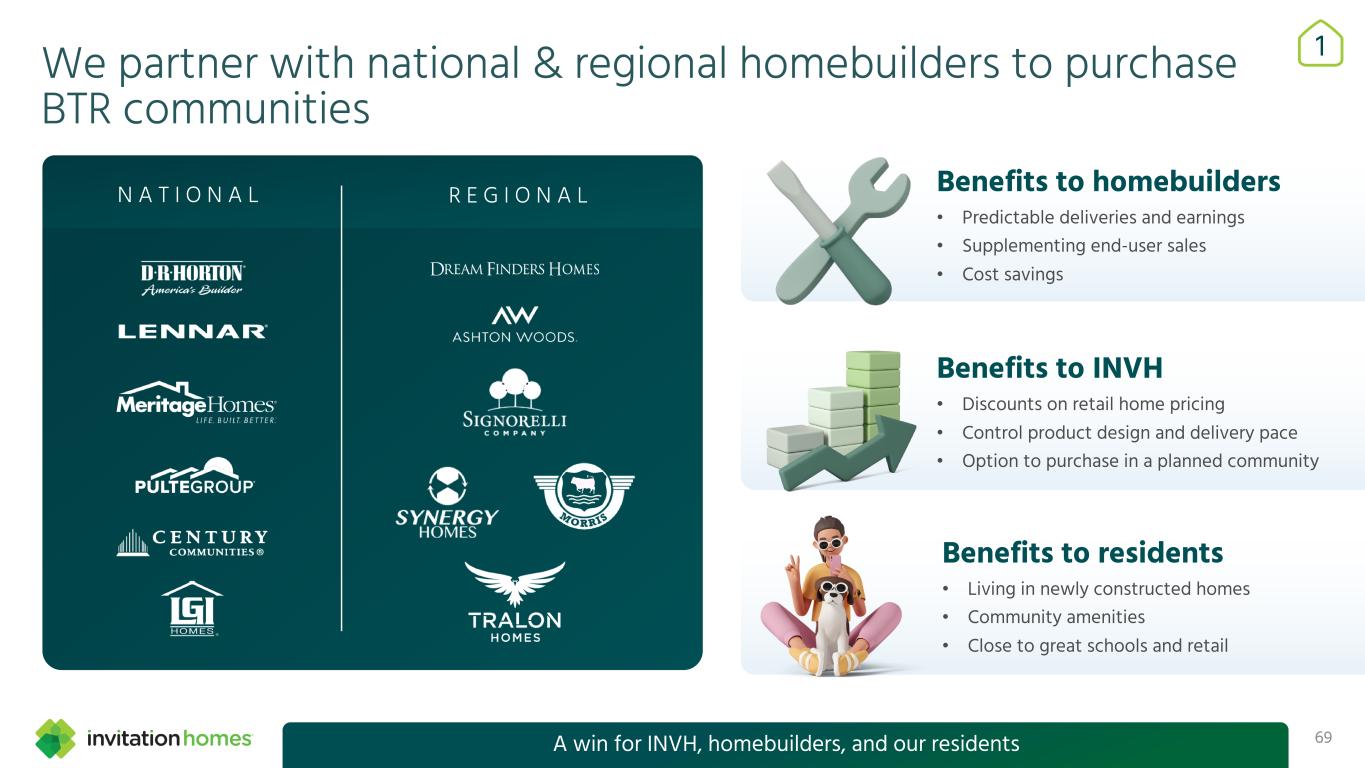

1We partner with national & regional homebuilders to purchase BTR communities 69 R E G I O N A LN A T I O N A L A win for INVH, homebuilders, and our residents Benefits to homebuilders • Predictable deliveries and earnings • Supplementing end-user sales • Cost savings Benefits to INVH • Discounts on retail home pricing • Control product design and delivery pace • Option to purchase in a planned community Benefits to residents • Living in newly constructed homes • Community amenities • Close to great schools and retail

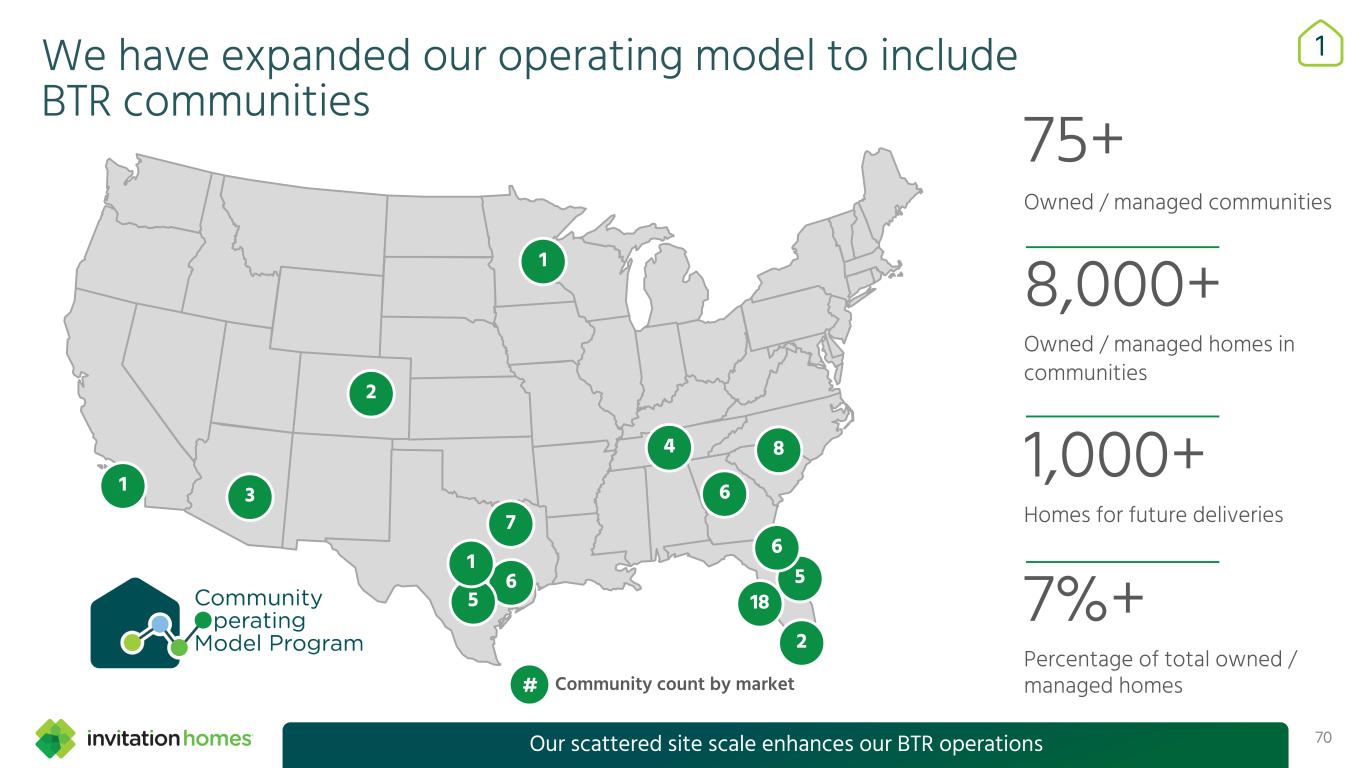

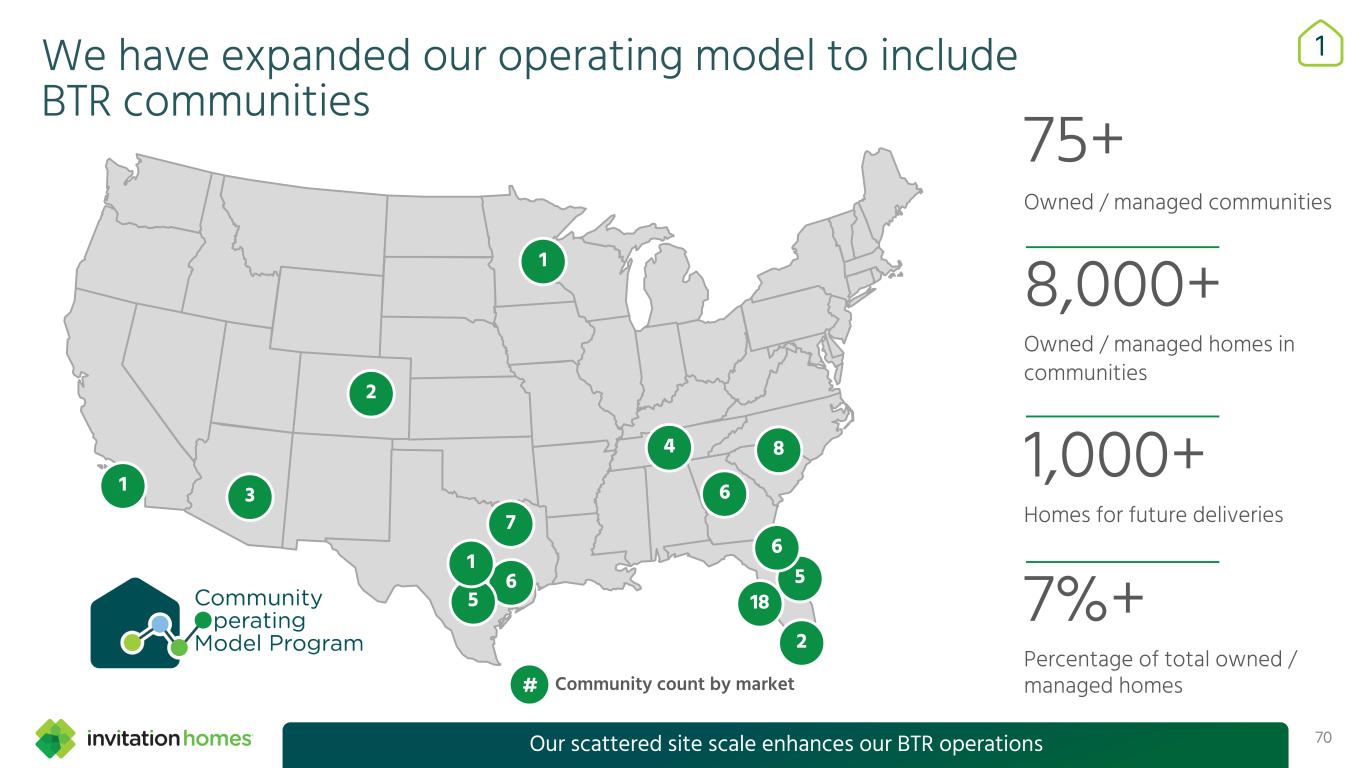

75+ Owned / managed communities 8,000+ Owned / managed homes in communities 1,000+ Homes for future deliveries 7%+ Percentage of total owned / managed homes 70 Community count by market# Our scattered site scale enhances our BTR operations 1 2 3 1 7 6 5 1 6 84 5 6 2 18 1We have expanded our operating model to include BTR communities

71Flexibility to operate non-traditional types of BTR communities C F U L L S T A N D A L O N E C O M M U N I T Y A S C A T T E R E D S I T E B P O D S O F H O M E S 1Our "Power of Scale" enables us to have a differentiated operating model for BTR communities

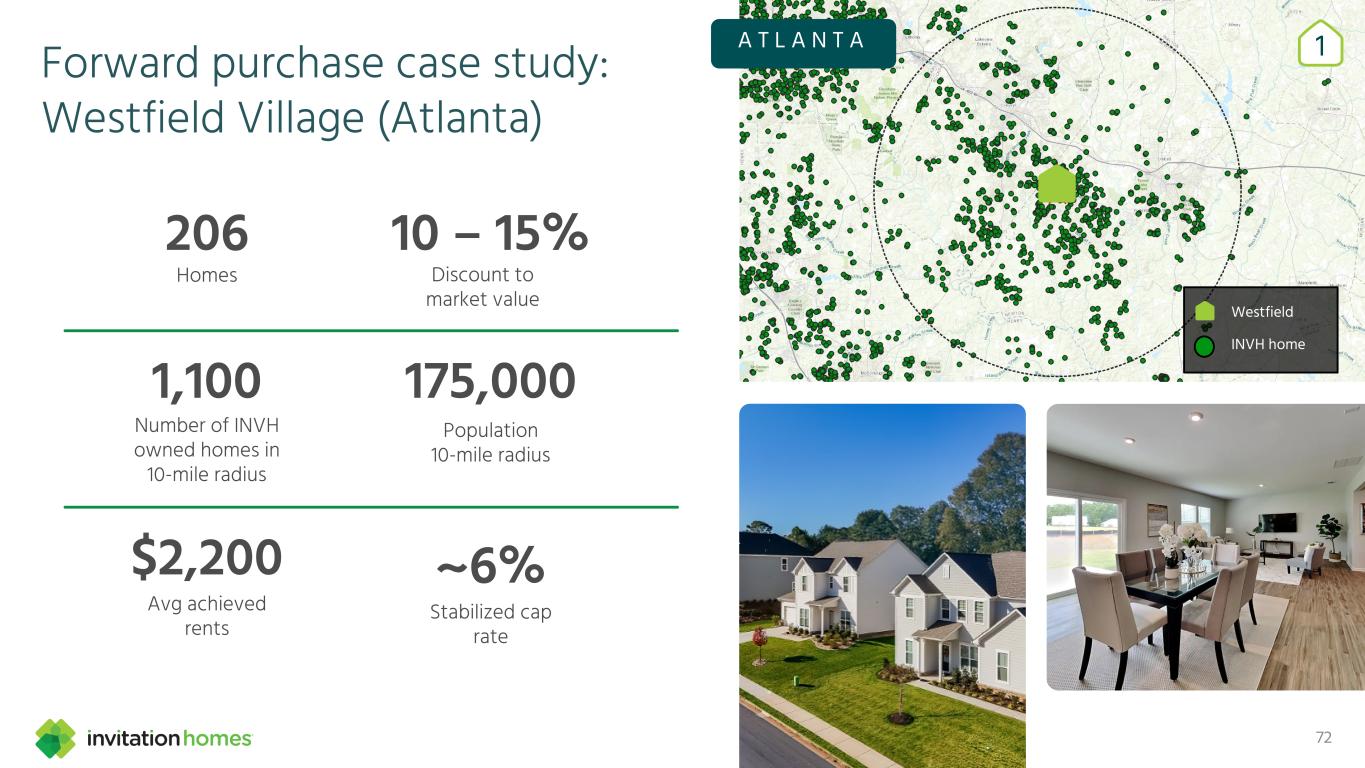

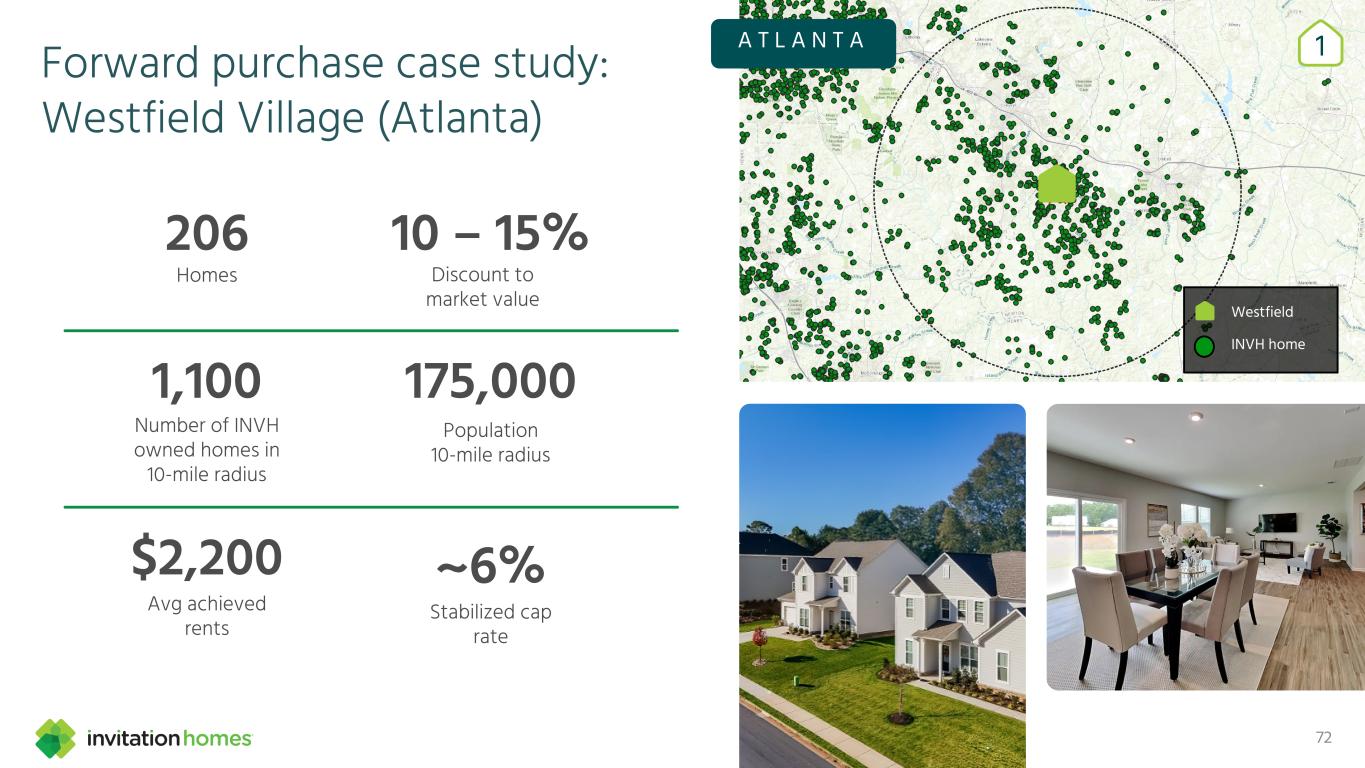

Forward purchase case study: Westfield Village (Atlanta) 72 Westfield INVH home 10 – 15%206 Homes ~6% Stabilized cap rate 175,000 Population 10-mile radius Discount to market value 1,100 Number of INVH owned homes in 10-mile radius A T L A N T A $2,200 Avg achieved rents 1

S E E I T L I V E VIDEO 73

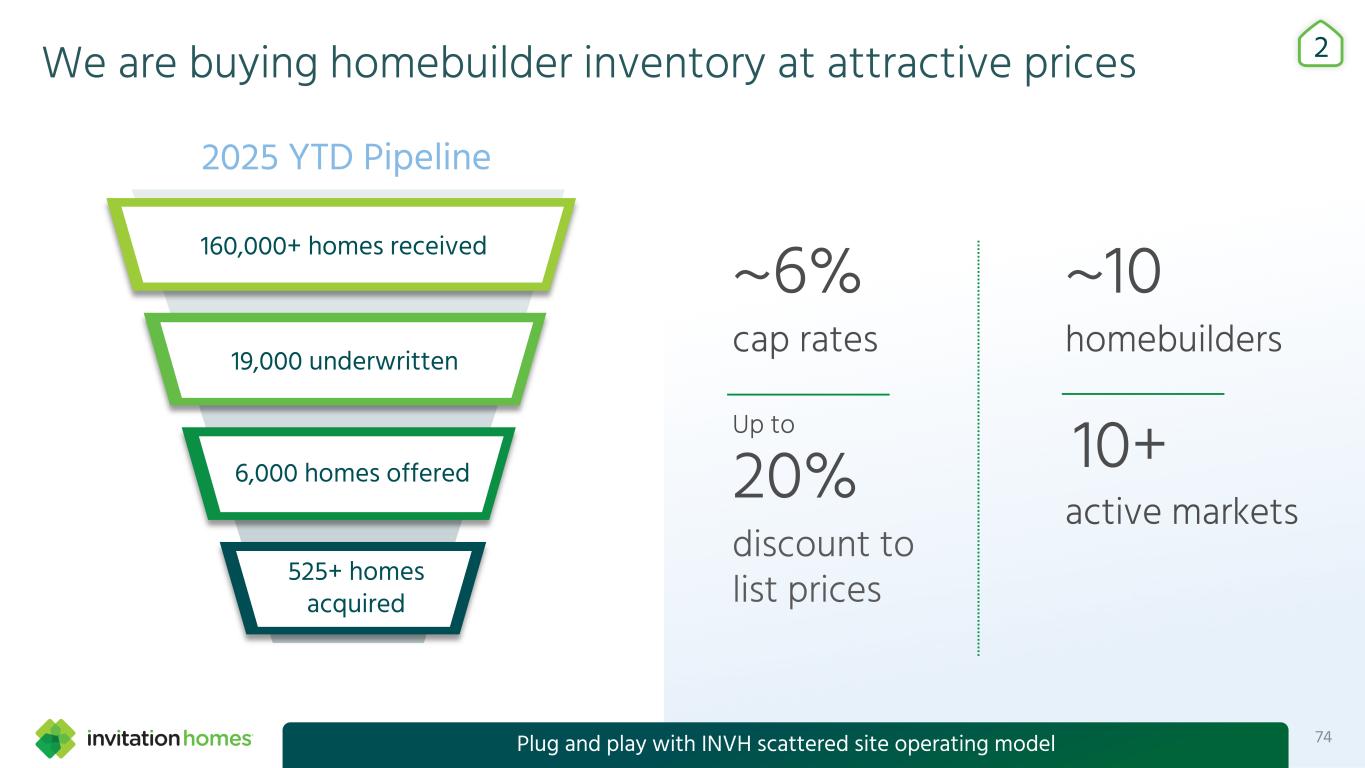

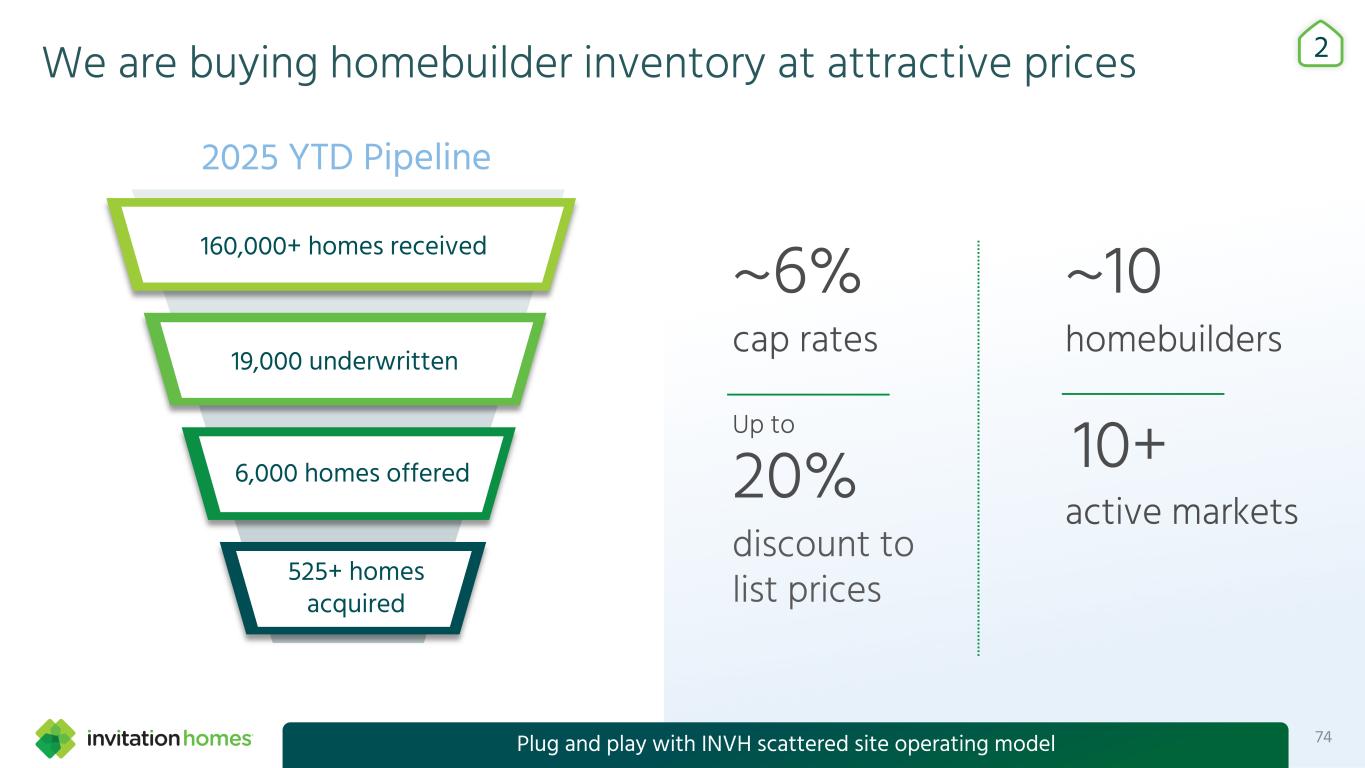

2We are buying homebuilder inventory at attractive prices ~10 homebuilders 10+ active markets 19,000 underwritten 6,000 homes offered 160,000+ homes received 525+ homes acquired 2025 YTD Pipeline ~6% cap rates Up to 20% discount to list prices Plug and play with INVH scattered site operating model 74

„ Support new housing supply „ Strengthen developer relationships „ Gain influence over design, location, and delivery „ Strategic inventory access „ Build pipeline of high-quality, purpose-built homes „ Step in where traditional lenders are retreating „ Attractive risk-adjusted returns „ Higher single-digit yield on cost „ Scalable opportunity with disciplined capital deployment Strategic rationale Business advantage Financial impact 75 3 We expect to grow our loan book to $1B, with $0.03 to $0.04 in incremental AFFO growth by 2028 Construction lending builds new partnerships and a future pipeline

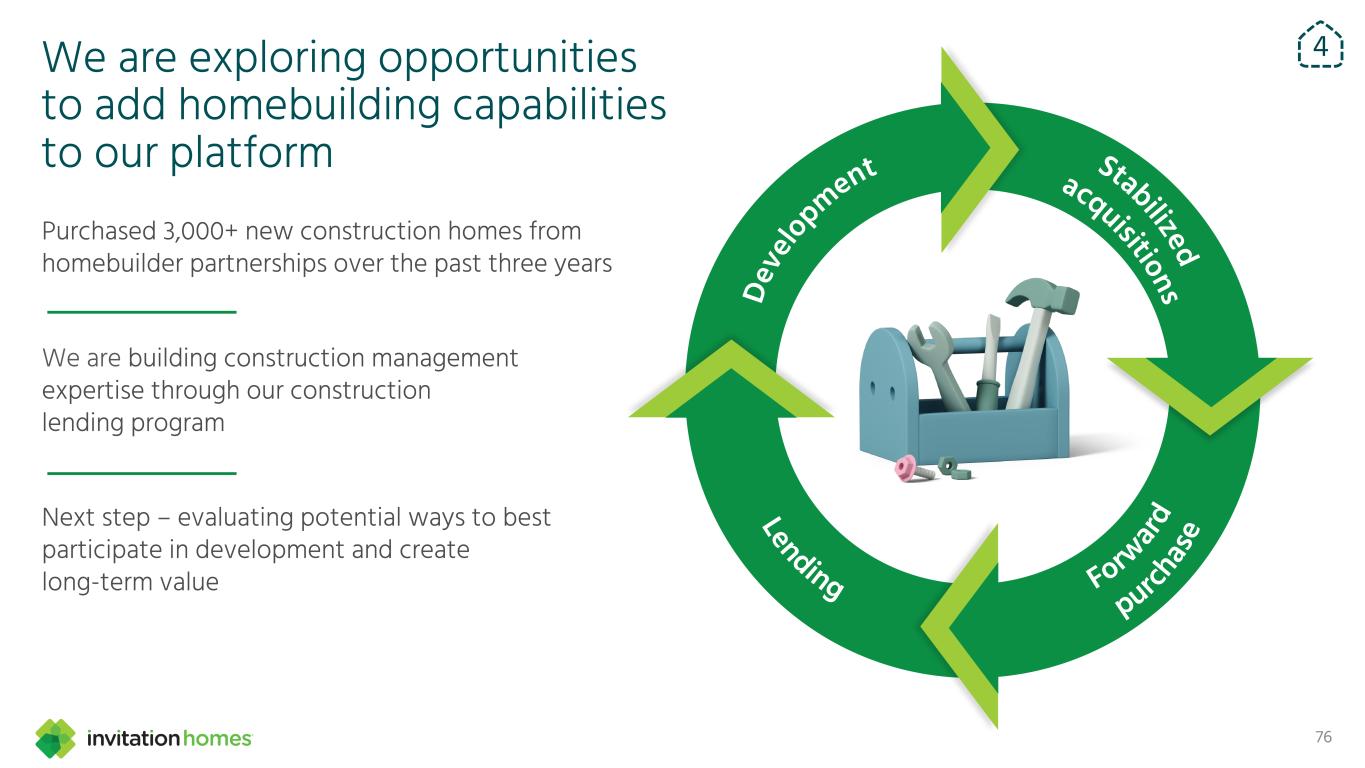

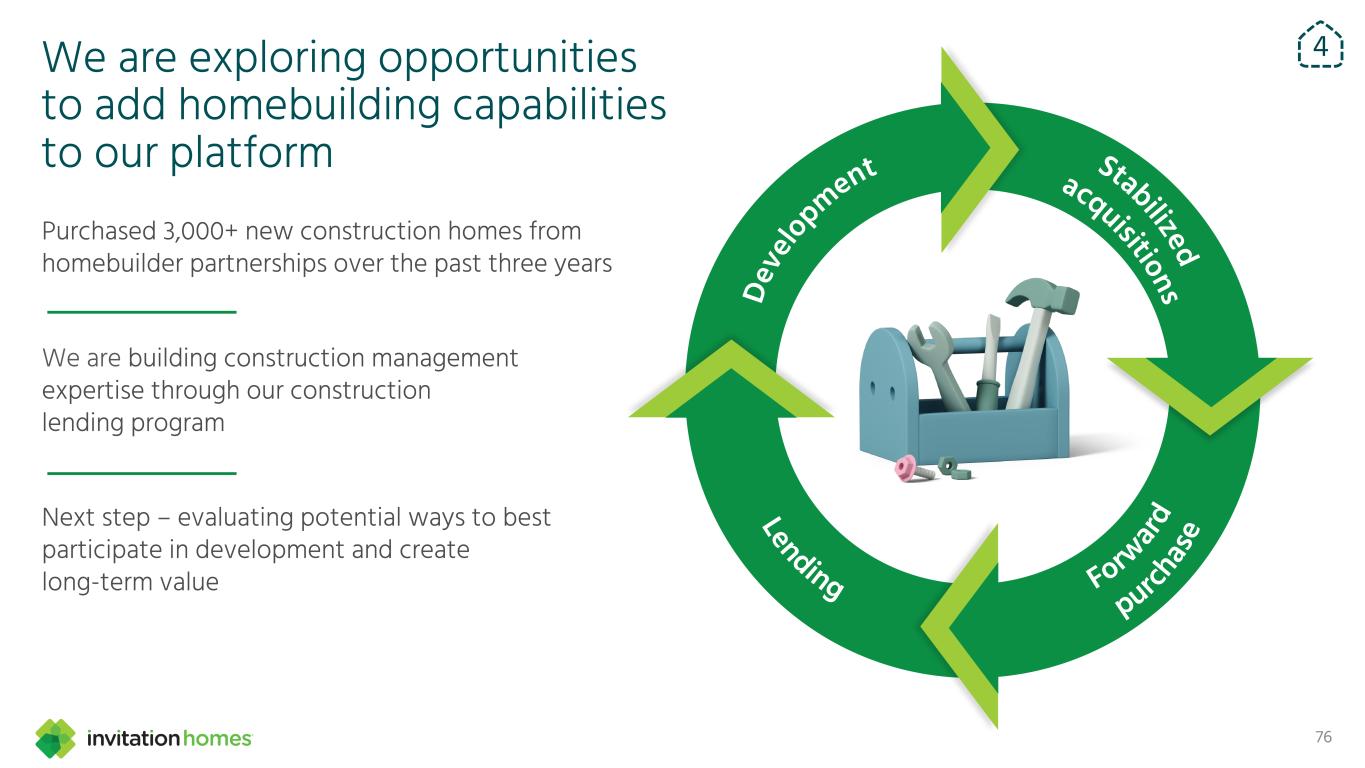

We are exploring opportunities to add homebuilding capabilities to our platform Purchased 3,000+ new construction homes from homebuilder partnerships over the past three years We are building construction management expertise through our construction lending program Next step – evaluating potential ways to best participate in development and create long-term value 4 76

77 Third party management

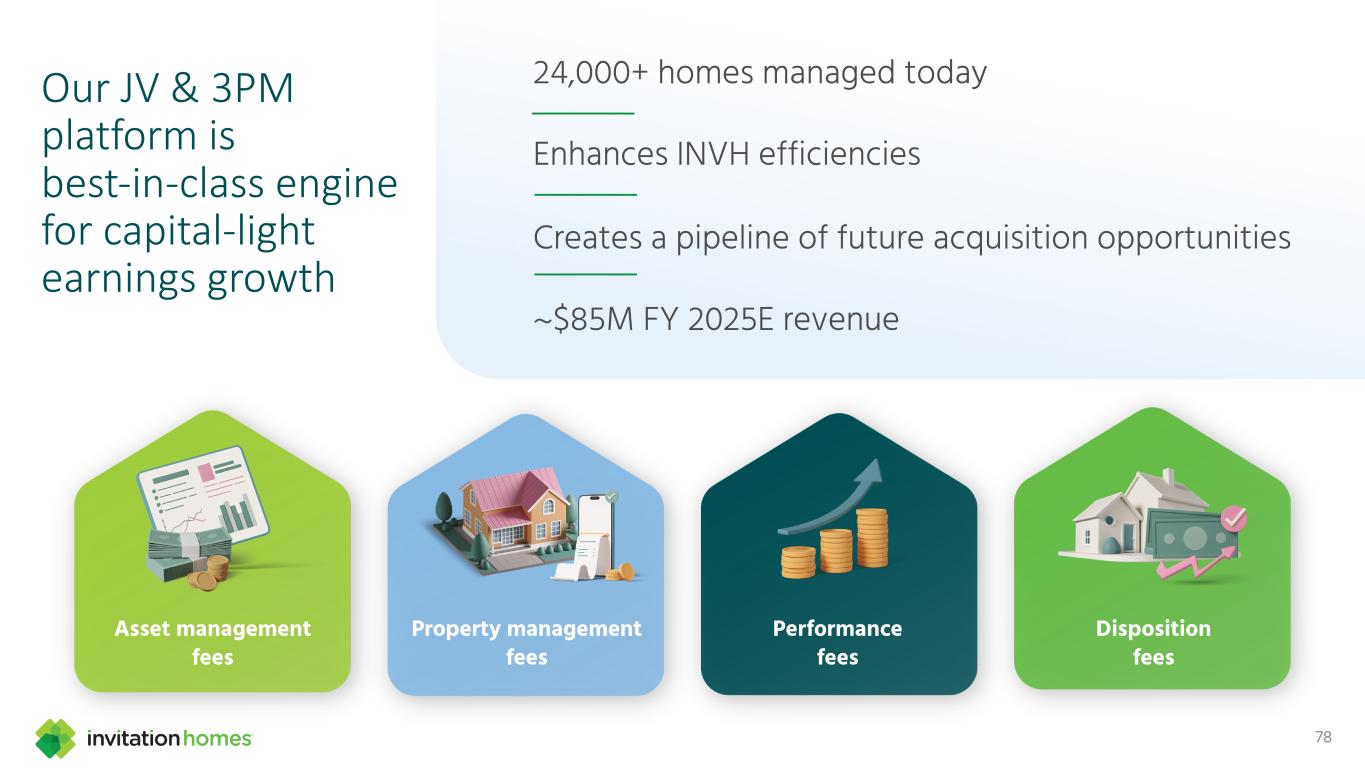

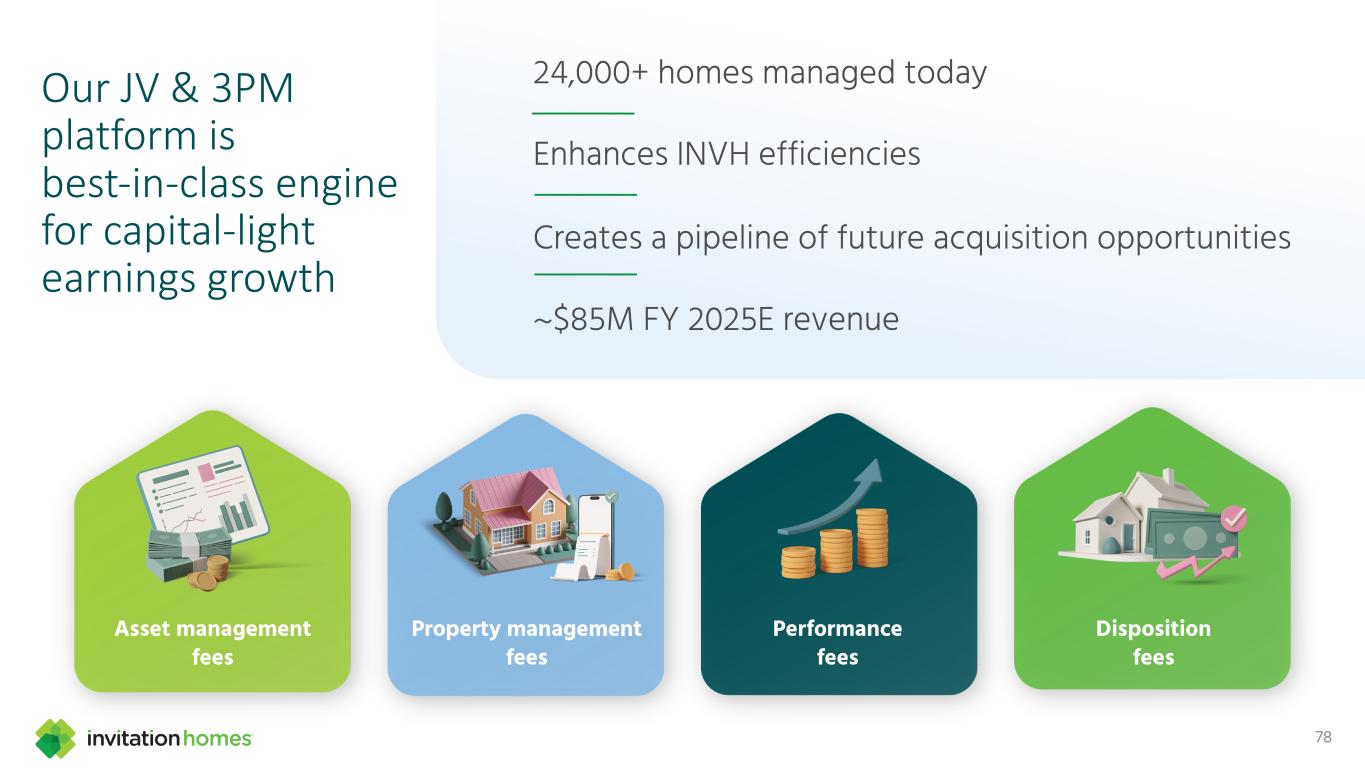

24,000+ homes managed today Enhances INVH efficiencies Creates a pipeline of future acquisition opportunities ~$85M FY 2025E revenue Our JV & 3PM platform is best-in-class engine for capital-light earnings growth Asset management fees Disposition fees Property management fees Performance fees 78

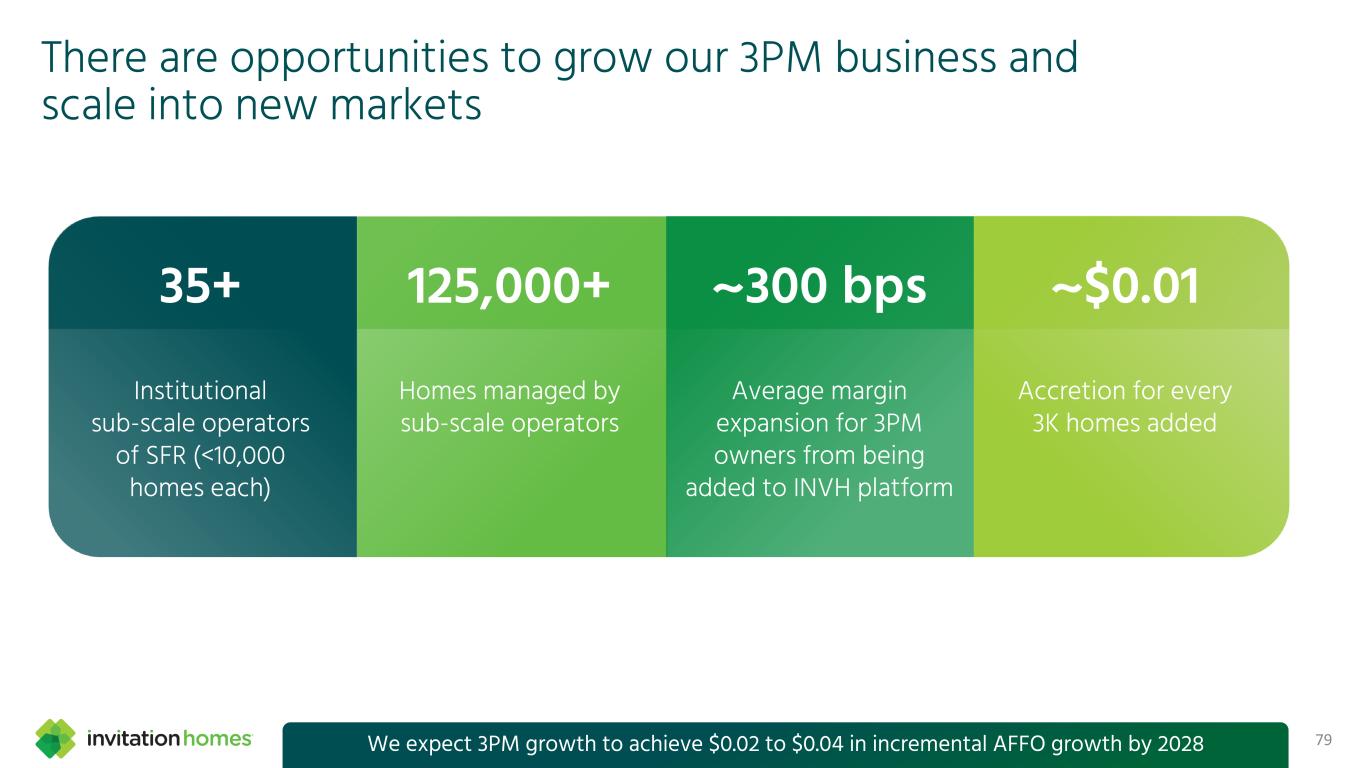

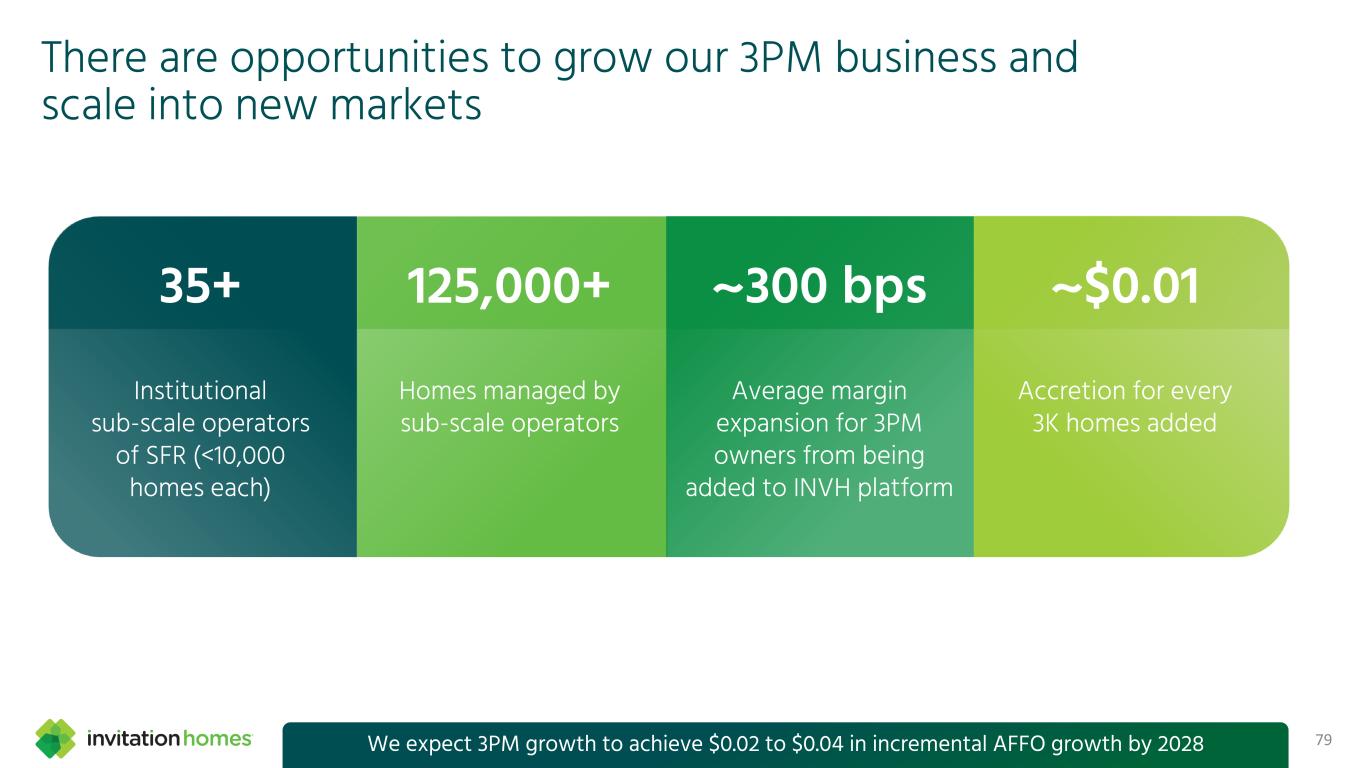

79 ~300 bps Average margin expansion for 3PM owners from being added to INVH platform 35+ Institutional sub-scale operators of SFR (<10,000 homes each) 125,000+ Homes managed by sub-scale operators ~$0.01 Accretion for every 3K homes added There are opportunities to grow our 3PM business and scale into new markets We expect 3PM growth to achieve $0.02 to $0.04 in incremental AFFO growth by 2028

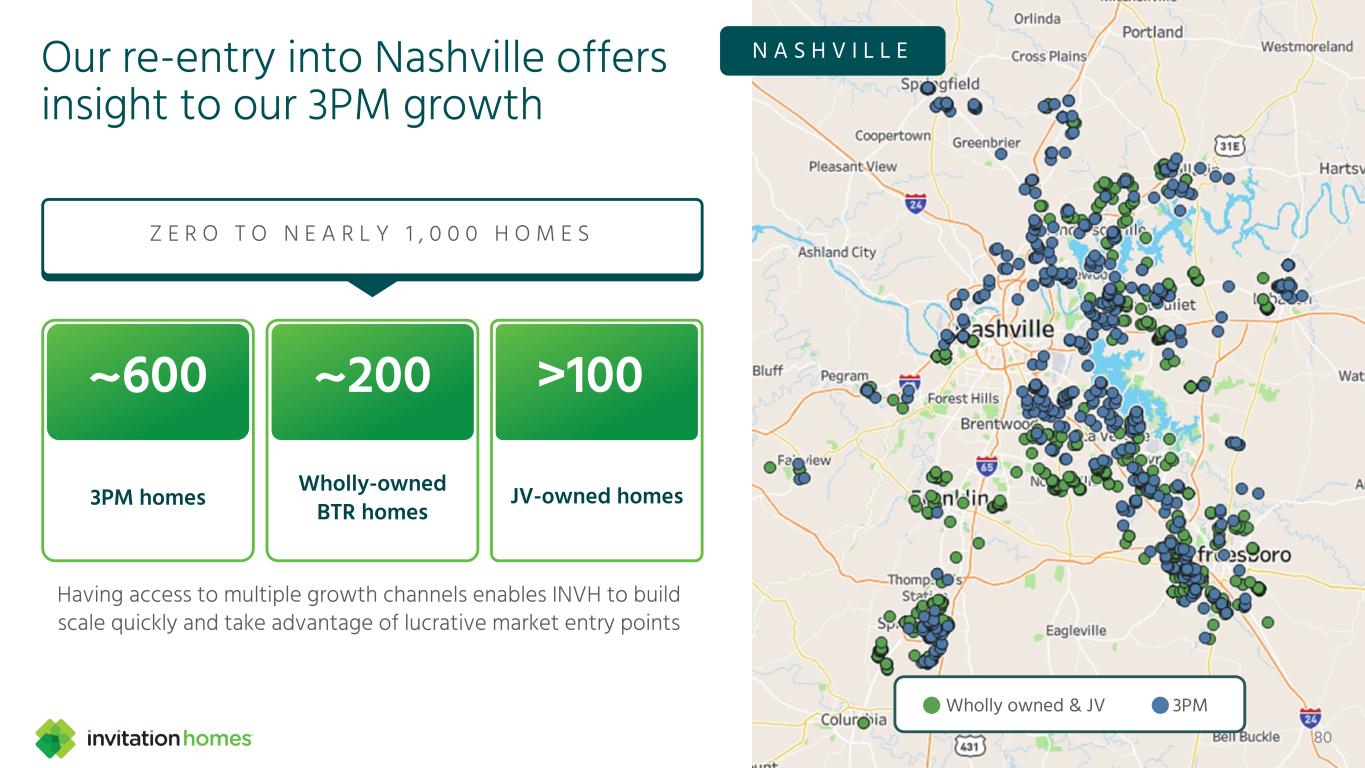

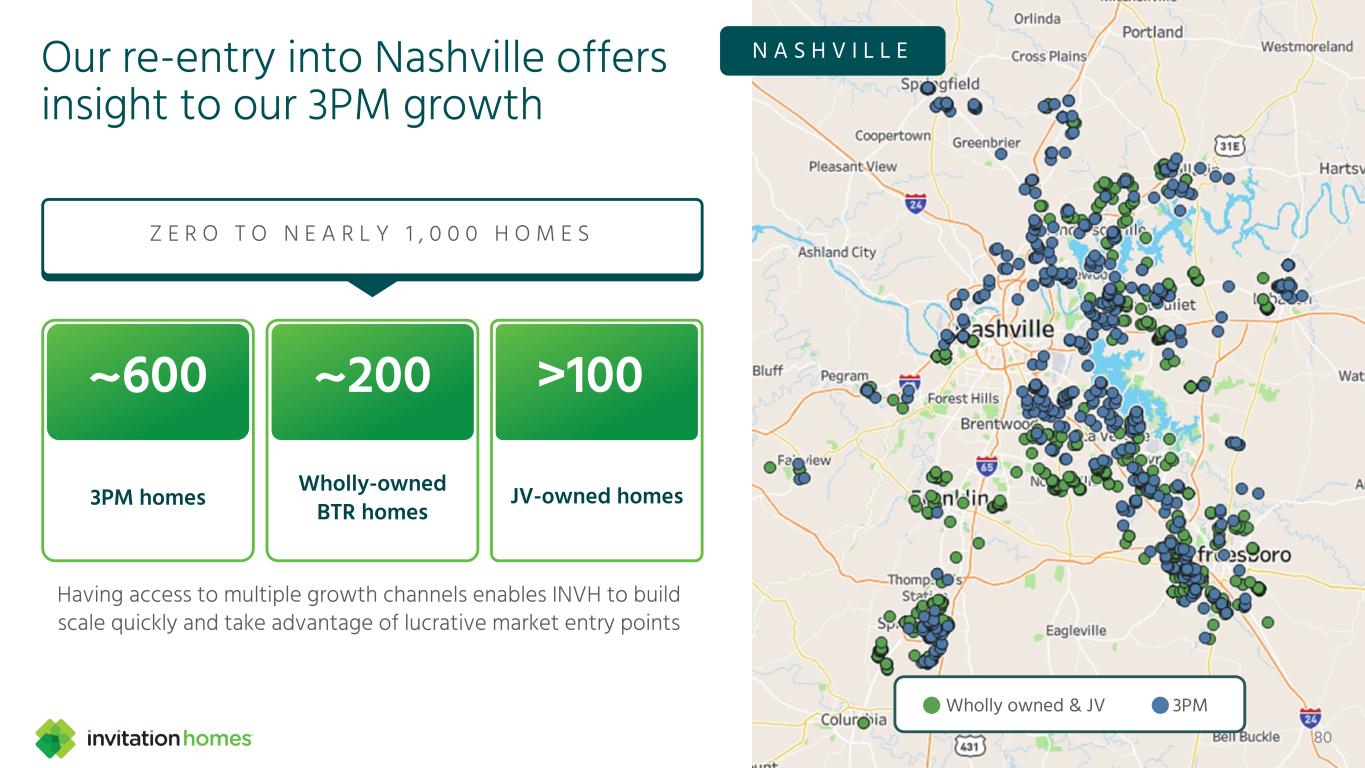

80 Having access to multiple growth channels enables INVH to build scale quickly and take advantage of lucrative market entry points Z E R O T O N E A R L Y 1 , 0 0 0 H O M E S Wholly owned & JV 3PM 3PM homes Wholly-owned BTR homes JV-owned homes ~600 ~200 >100 Our re-entry into Nashville offers insight to our 3PM growth N A S H V I L L E

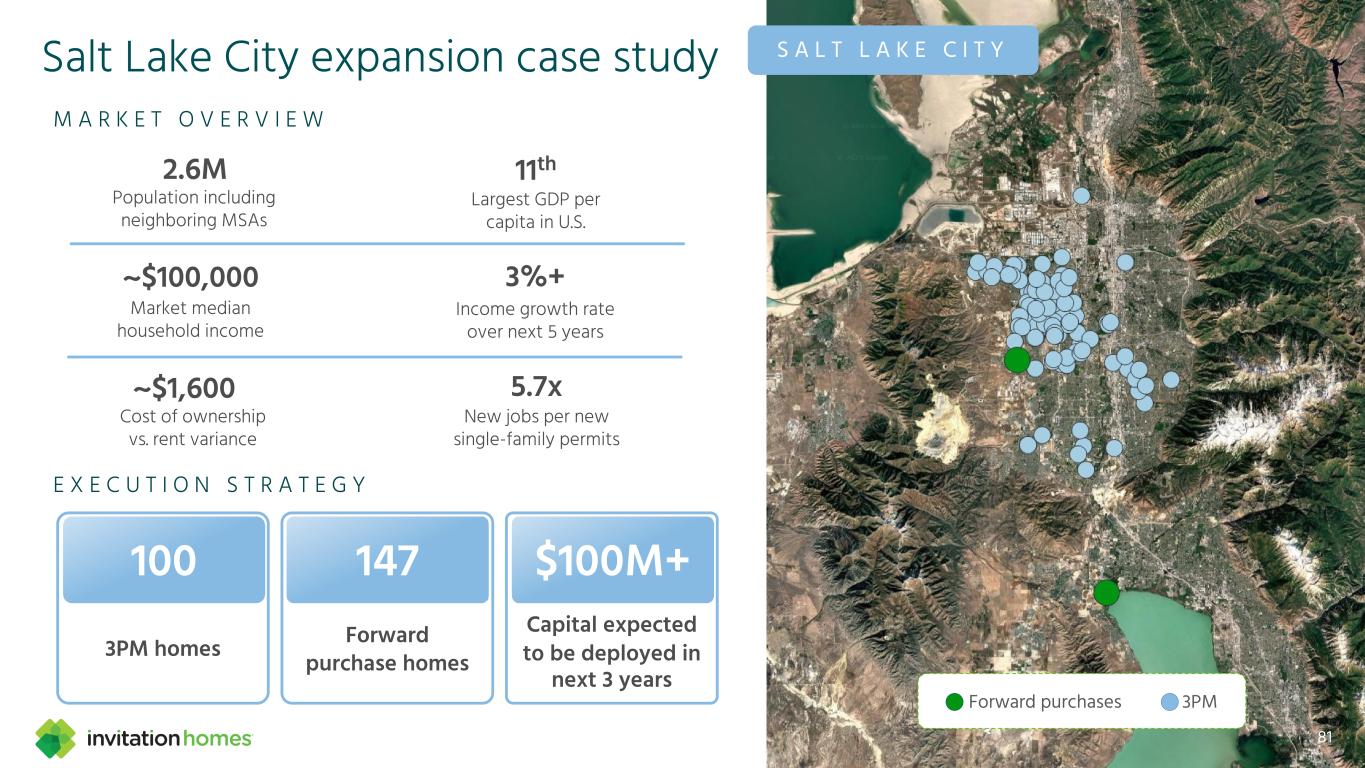

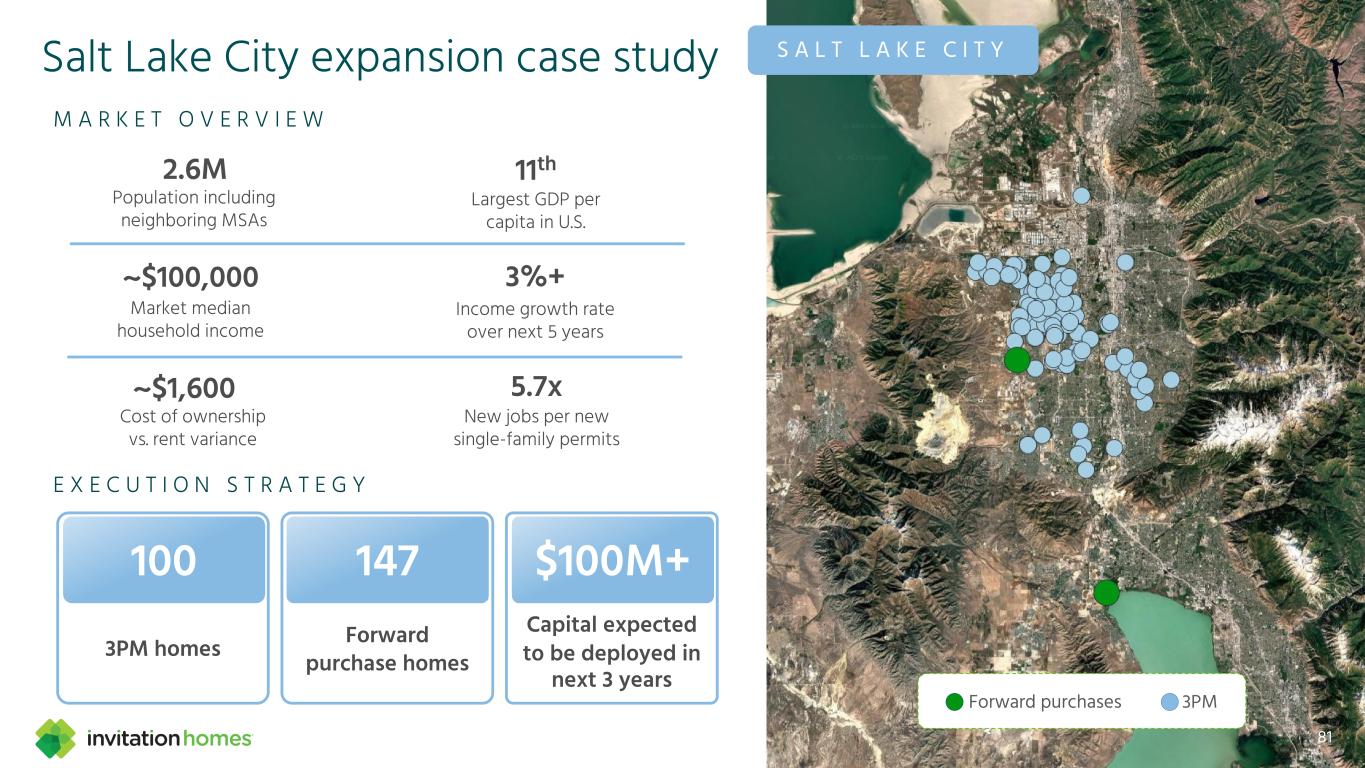

S A L T L A K E C I T YSalt Lake City expansion case study 81 M A R K E T O V E R V I E W E X E C U T I O N S T R A T E G Y Forward purchases 3PM 11th 3%+ 5.7x 2.6M Population including neighboring MSAs New jobs per new single-family permits Income growth rate over next 5 years Largest GDP per capita in U.S. ~$100,000 ~$1,600 Cost of ownership vs. rent variance Market median household income 3PM homes Forward purchase homes Capital expected to be deployed in next 3 years 100 147 $100M+ 1

82 Strategic growth summary T H I R D P A R T Y M A N A G E M E N T „ Engine for capital light growth „ 3PM provides opportunity to enter new growth markets P O R T F O L I O O P T I M I Z A T I O N „ Disciplined, data driven investment framework „ Scaled platform creates information flywheel „ Ability to attractively recycle capital through home sales to the end-user market E X T E R N A L G R O W T H „ Growth through multiple acquisition channels „ Current market is attractive to purchase new construction homes „ INVH operating model can be scaled for both SFR and BTR management „ Construction lending can grow cash flow and create predictable acquisition pipeline „ Positioned to move up the value chain to generate higher returns from development We expect construction lending and 3PM to deliver $0.05 to $0.08 of incremental AFFO growth by 2028

Tampa Home Office Unlock Shareholder Value T H E 83

The financial five: Today’s topics Ample sources of capital to fund growth opportunities Our balance sheet is well-positioned to support growth 2025 property tax growth up 5.0%, the lowest rate since 2021 84 NOI benefit of revenue management strategy 1 2 3 4 Value creation roadmap with incremental AFFO per share growth in 20285 We believe our flexibility and optionality will help unlock shareholder value

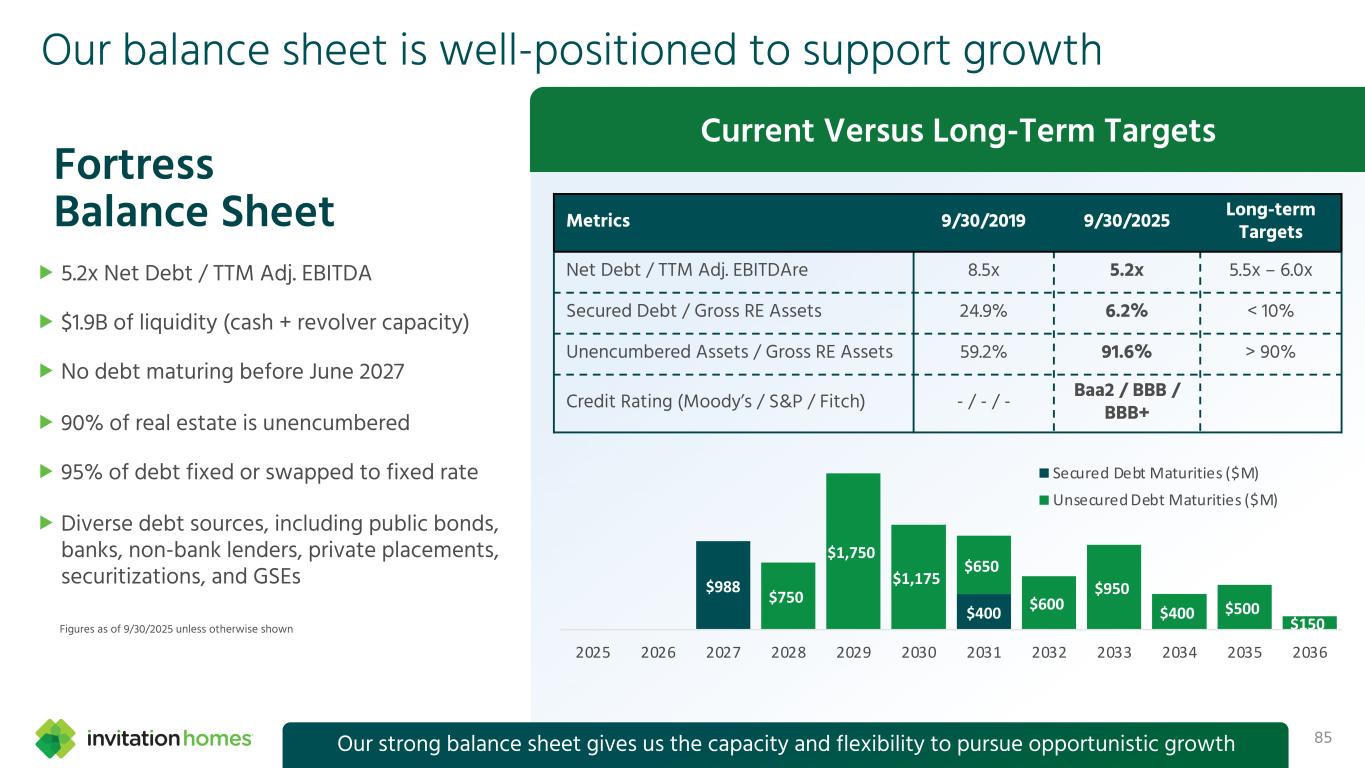

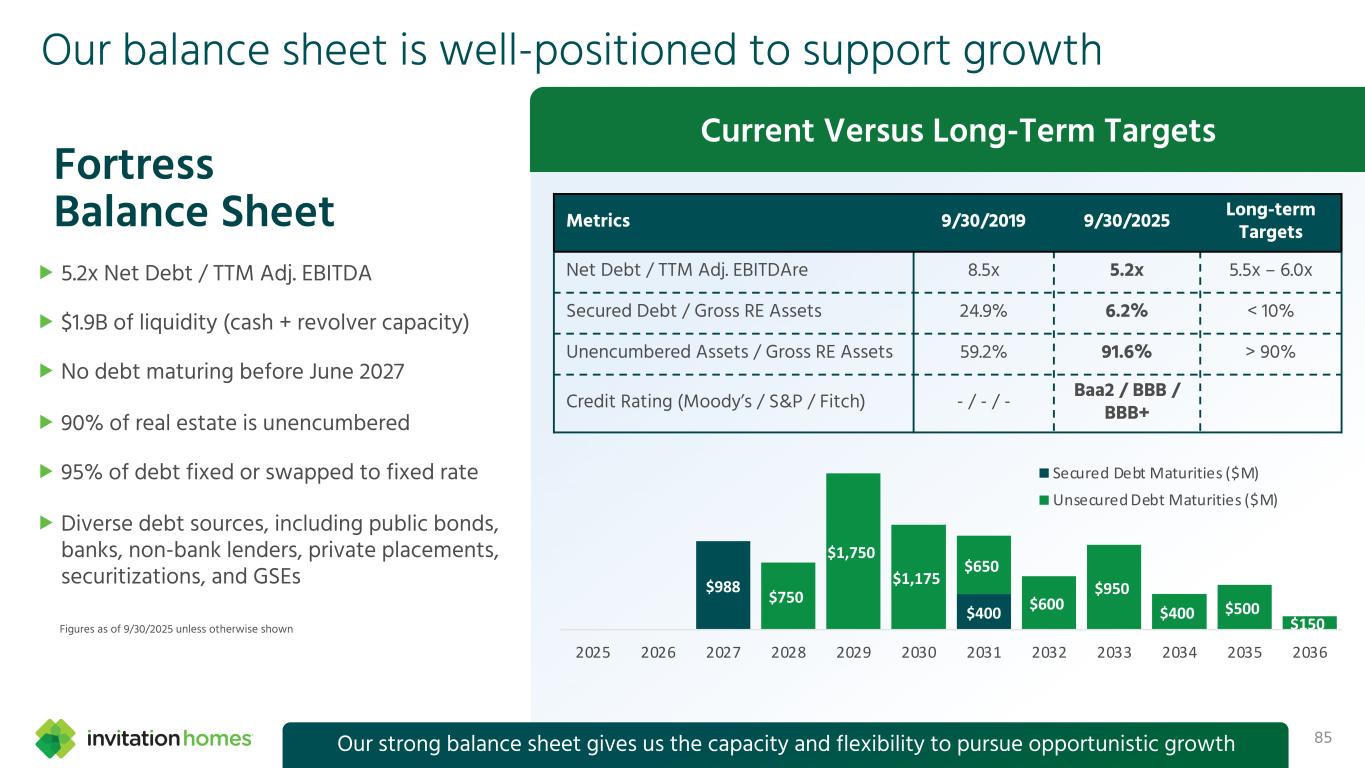

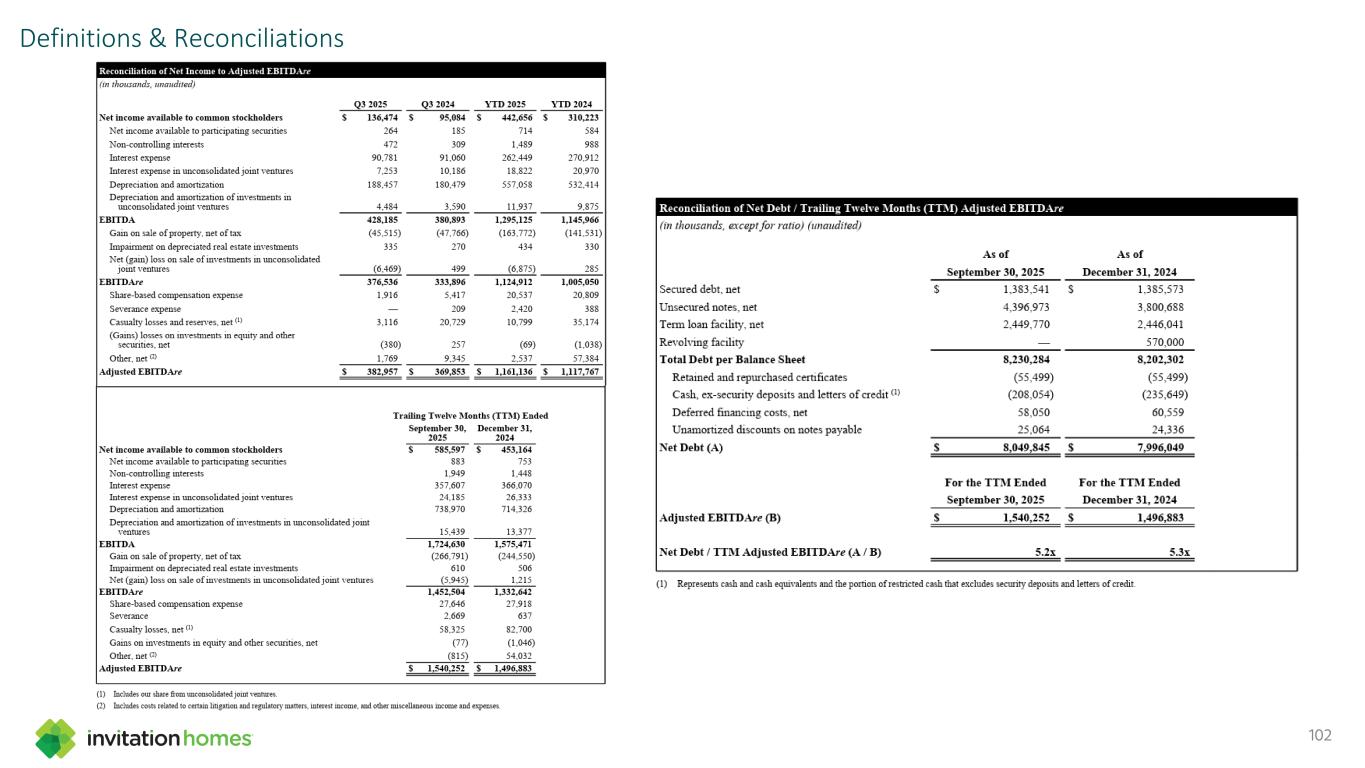

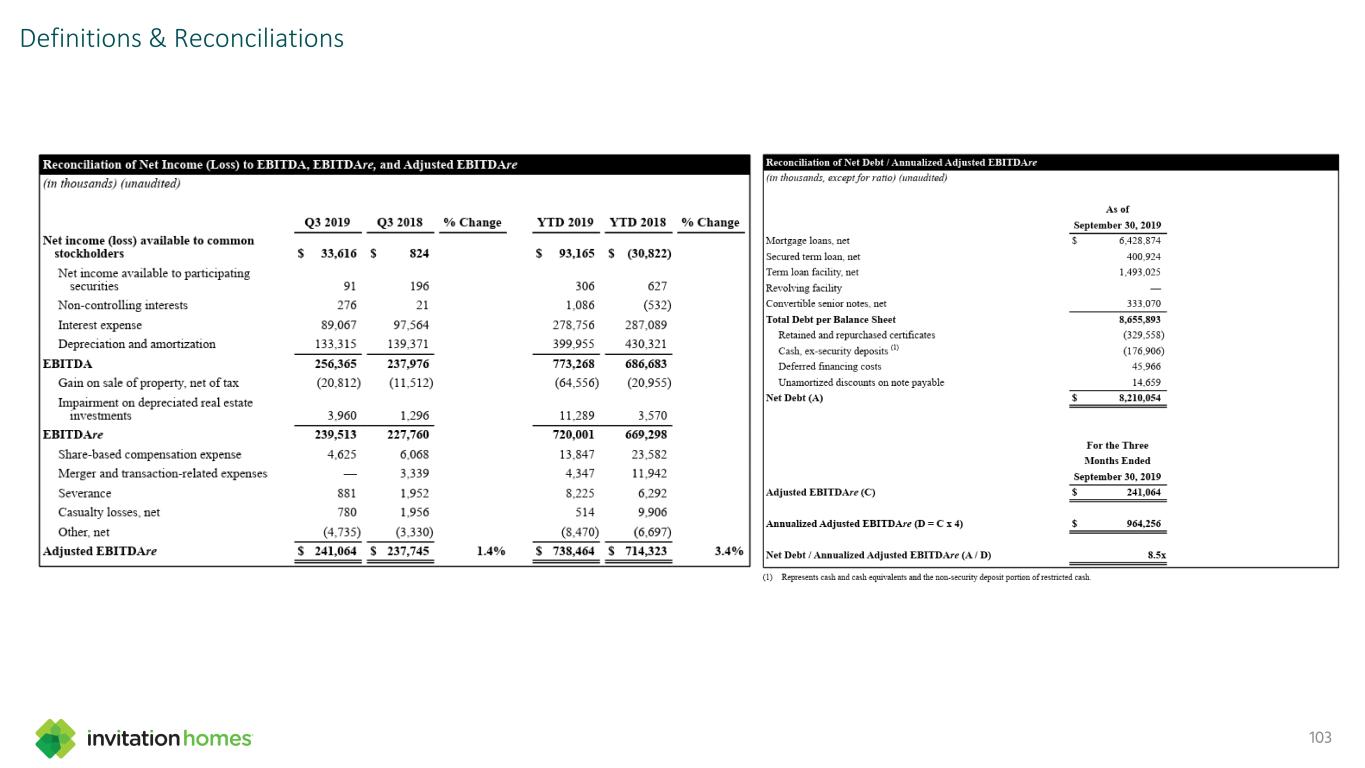

Our balance sheet is well-positioned to support growth „ 5.2x Net Debt / TTM Adj. EBITDA „ $1.9B of liquidity (cash + revolver capacity) „ No debt maturing before June 2027 „ 90% of real estate is unencumbered „ 95% of debt fixed or swapped to fixed rate „ Diverse debt sources, including public bonds, banks, non-bank lenders, private placements, securitizations, and GSEs Fortress Balance Sheet Metrics 9/30/2019 9/30/2025 Long-term Targets Net Debt / TTM Adj. EBITDAre 8.5x 5.2x 5.5x – 6.0x Secured Debt / Gross RE Assets 24.9% 6.2% < 10% Unencumbered Assets / Gross RE Assets 59.2% 91.6% > 90% Credit Rating (Moody’s / S&P / Fitch) - / - / - Baa2 / BBB / BBB+ $988 $400 $750 $1,750 $1,175 $650 $600 $950 $400 $500 $150 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 Secured Debt Maturities ($M) Unsecured Debt Maturities ($M) Figures as of 9/30/2025 unless otherwise shown 85Our strong balance sheet gives us the capacity and flexibility to pursue opportunistic growth Current Versus Long-Term Targets

$400 – 600M Ample sources of capital to fund growth opportunities 86Figures as of 9/30/2025 >$1B Joint venture deployment capacity ~$2B Capacity to add incremental debt for growth without exceeding long-term leverage target $1.75B Untapped revolver capacity >$250M Annual free cash flow after the dividend Potential annual pool of disposition candidates creating accretive capital recycling opportunities

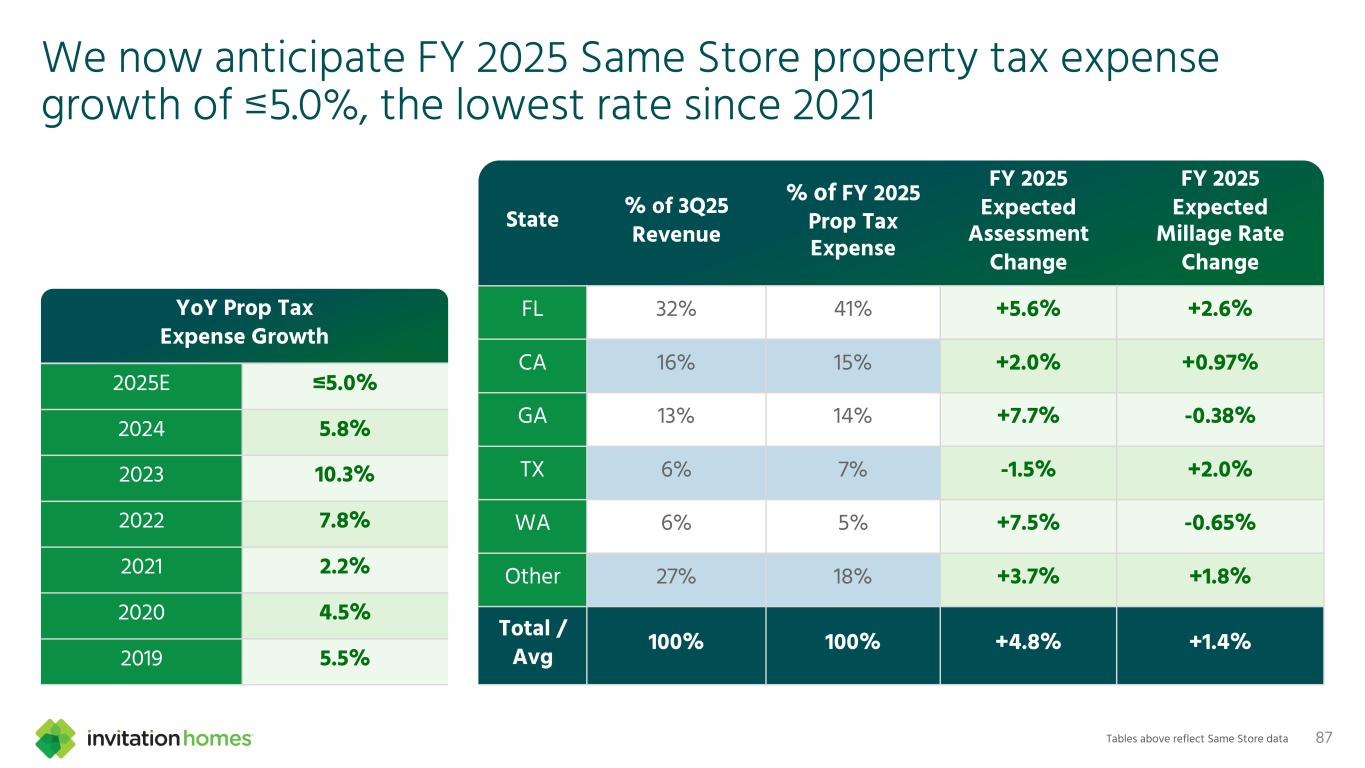

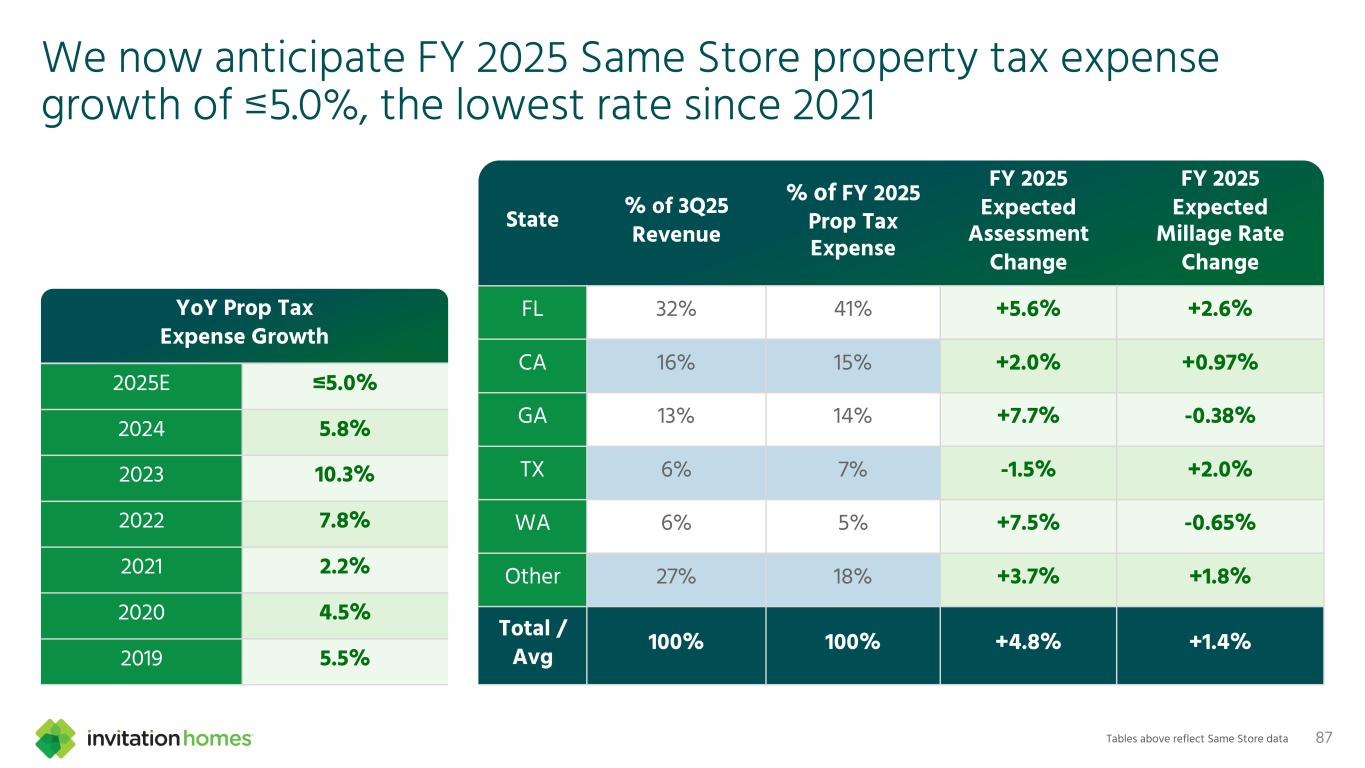

87 YoY Prop Tax Expense Growth 2025E ≤5.0% 2024 5.8% 2023 10.3% 2022 7.8% 2021 2.2% 2020 4.5% 2019 5.5% We now anticipate FY 2025 Same Store property tax expense growth of ≤5.0%, the lowest rate since 2021 State % of 3Q25 Revenue % of FY 2025 Prop Tax Expense FY 2025 Expected Assessment Change FY 2025 Expected Millage Rate Change FL 32% 41% +5.6% +2.6% CA 16% 15% +2.0% +0.97% GA 13% 14% +7.7% -0.38% TX 6% 7% -1.5% +2.0% WA 6% 5% +7.5% -0.65% Other 27% 18% +3.7% +1.8% Total / Avg 100% 100% +4.8% +1.4% Tables above reflect Same Store data

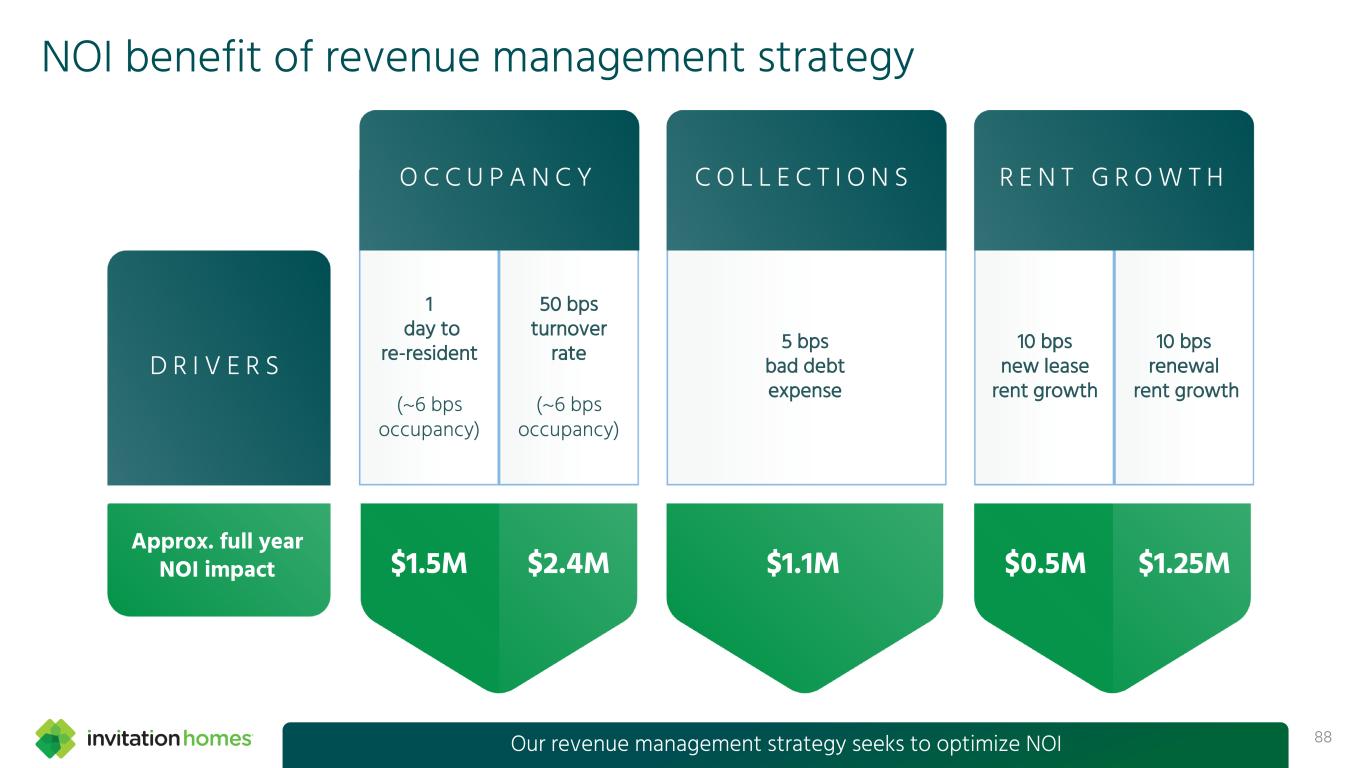

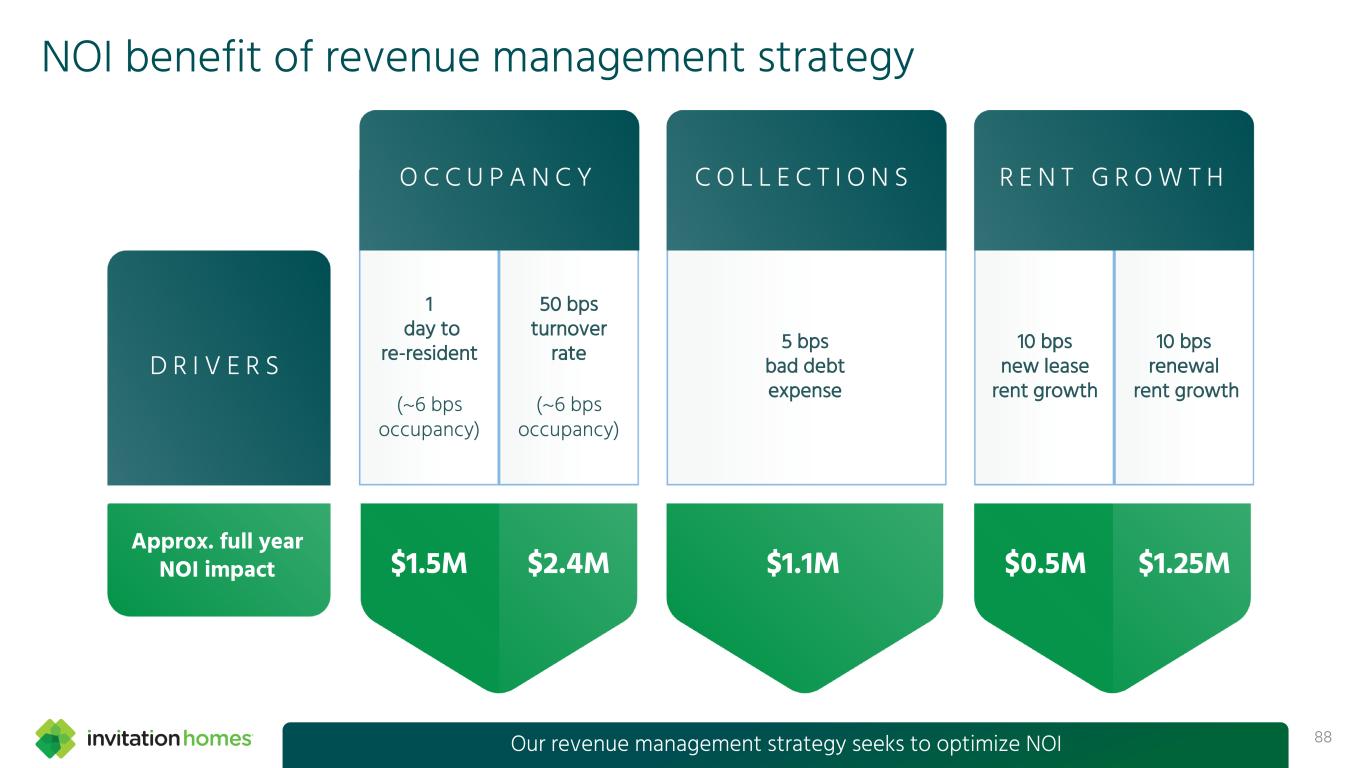

NOI benefit of revenue management strategy 88Our revenue management strategy seeks to optimize NOI O C C U P A N C Y 50 bps turnover rate (~6 bps occupancy) 1 day to re-resident (~6 bps occupancy) 10 bps renewal rent growth 10 bps new lease rent growth 5 bps bad debt expense Approx. full year NOI impact $1.5M $1.1M $0.5M $1.25M$2.4M C O L L E C T I O N S R E N T G R O W T H D R I V E R S

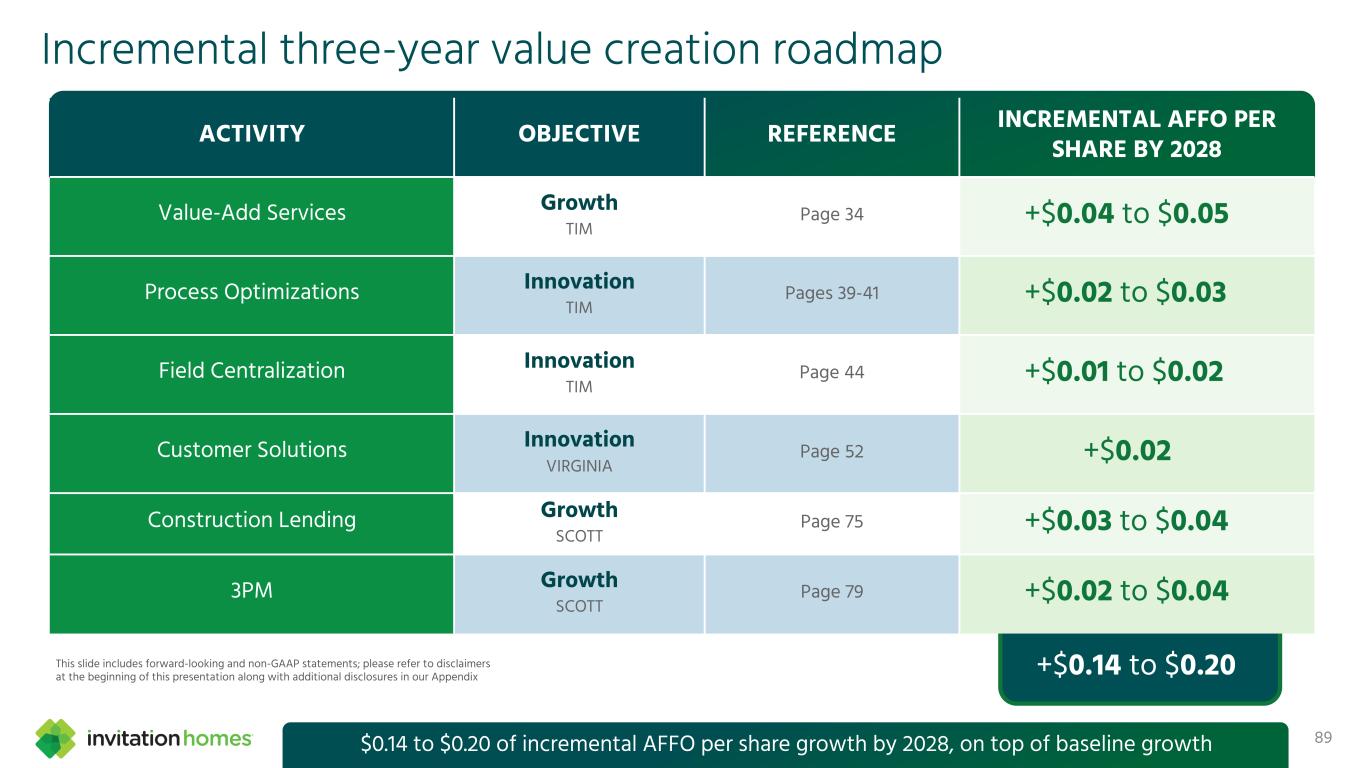

Incremental three-year value creation roadmap 89 ACTIVITY OBJECTIVE REFERENCE INCREMENTAL AFFO PER SHARE BY 2028 Value-Add Services Growth TIM Page 34 +$0.04 to $0.05 Process Optimizations Innovation TIM Pages 39-41 +$0.02 to $0.03 Field Centralization Innovation TIM Page 44 +$0.01 to $0.02 Customer Solutions Innovation VIRGINIA Page 52 +$0.02 Construction Lending Growth SCOTT Page 75 +$0.03 to $0.04 3PM Growth SCOTT Page 79 +$0.02 to $0.04 +$0.14 to $0.20 $0.14 to $0.20 of incremental AFFO per share growth by 2028, on top of baseline growth This slide includes forward-looking and non-GAAP statements; please refer to disclaimers at the beginning of this presentation along with additional disclosures in our Appendix

Tampa Front Porch Unlock What’s Next T H E 9090

91 Today’s three strategic themes: Innovation, Growth, and Possibility 1 I N N O V A T I O N G R O W T H P O S S I B I L I T Y We’ve built the premier SFR platform, and we’re committed to staying best in class We’re unlocking value through disciplined external growth We’re thinking strategically about tomorrow and exploring long-term opportunities Our three strategic themes Unlock the Power of Home for long-term performance

RA I S E T H E R O O F We pursue excellence by continuously improving, innovating, and creating value EM B R A C E T H E J O U R N E Y We encourage curiosity and varied perspectives to shape our community and drive us forward A I M T R U E We act with integrity, take responsibility, and focus on doing what's right in every decision CO N N E C T T H E D O T S We foster open and transparent communication to provide context, ensure clarity, and build trust Unlocking confidence through our trademarked Genuine CARE™ 92

S E E I T L I V E VIDEO 93

Q&A Session 2 94

95 Appendix

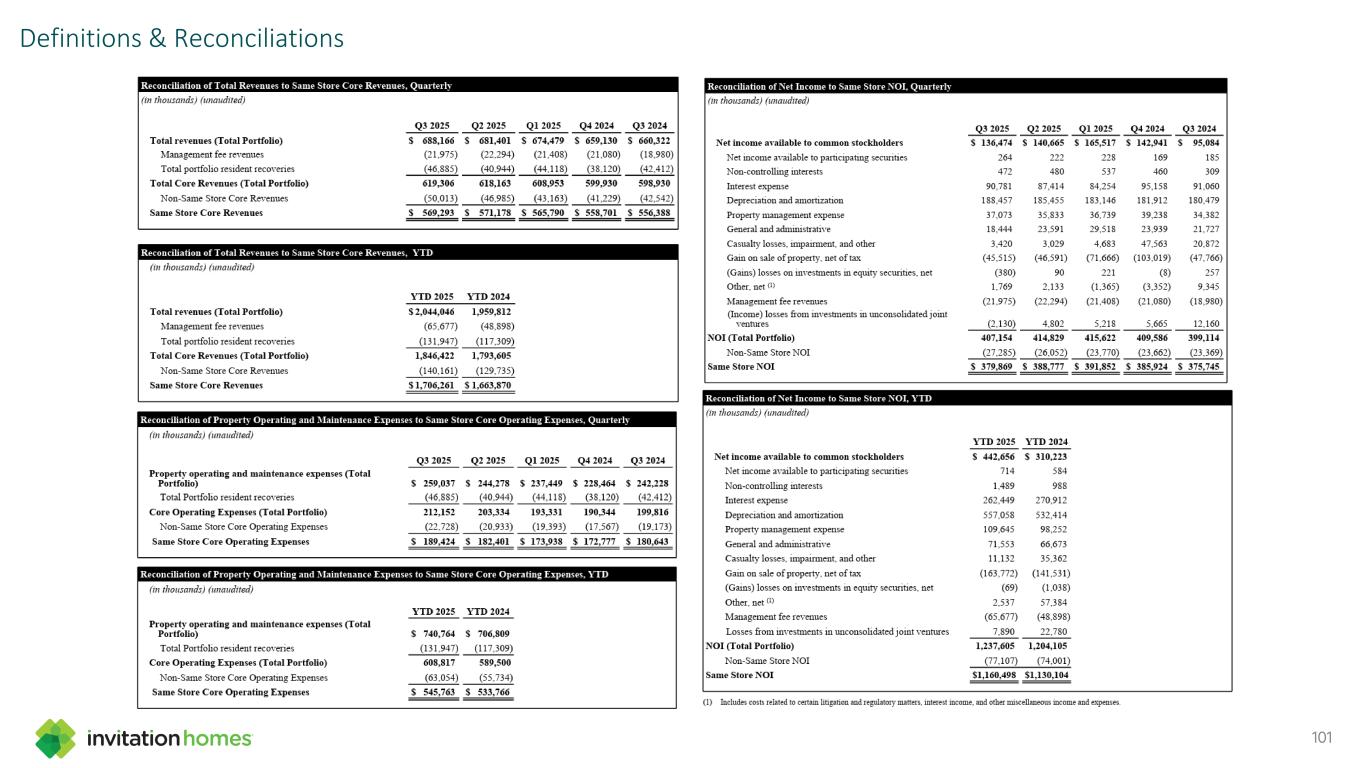

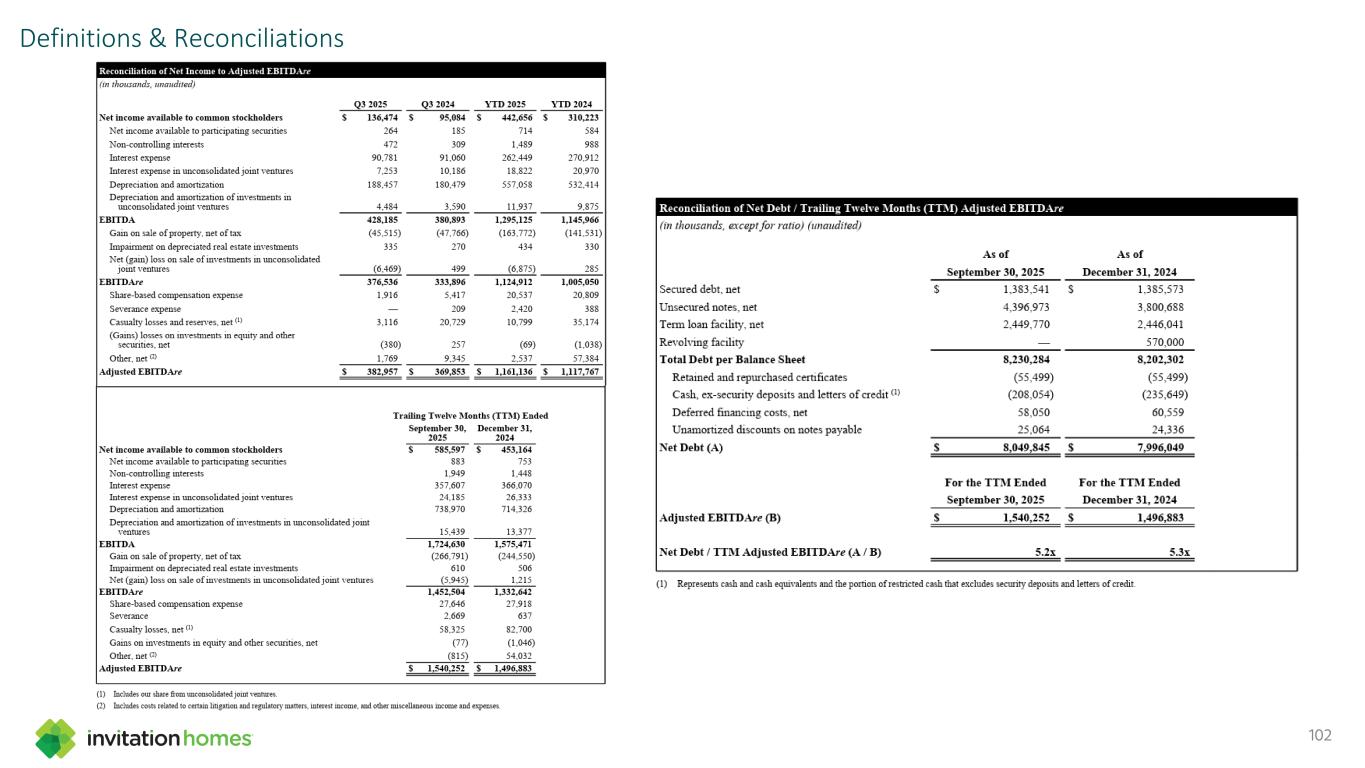

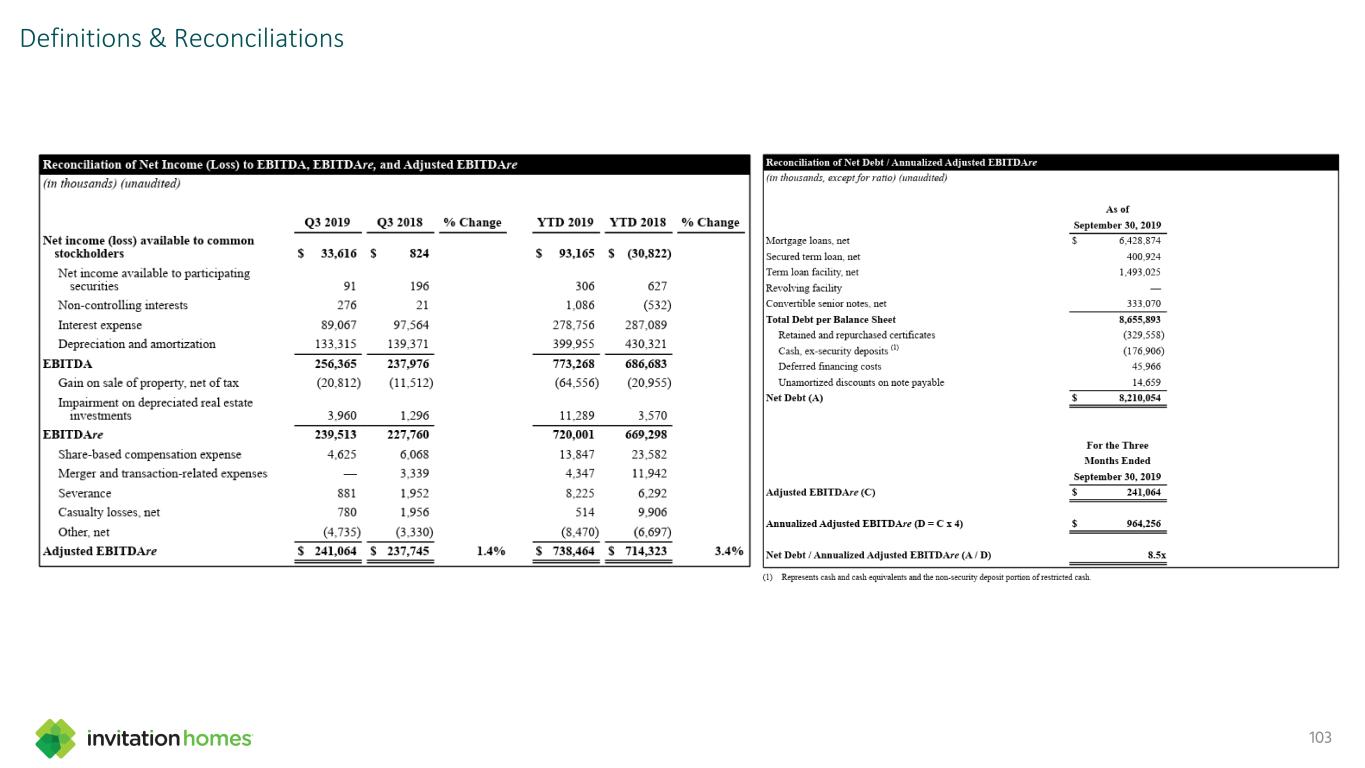

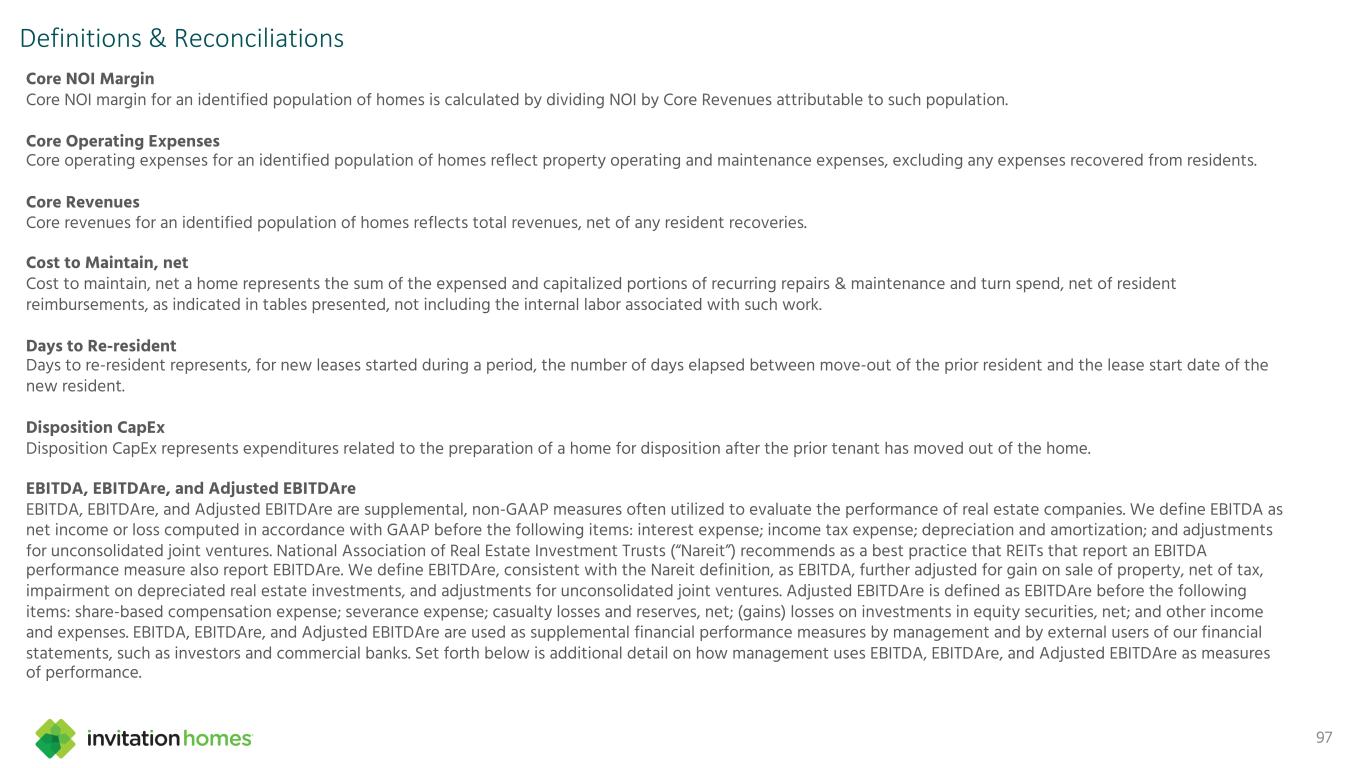

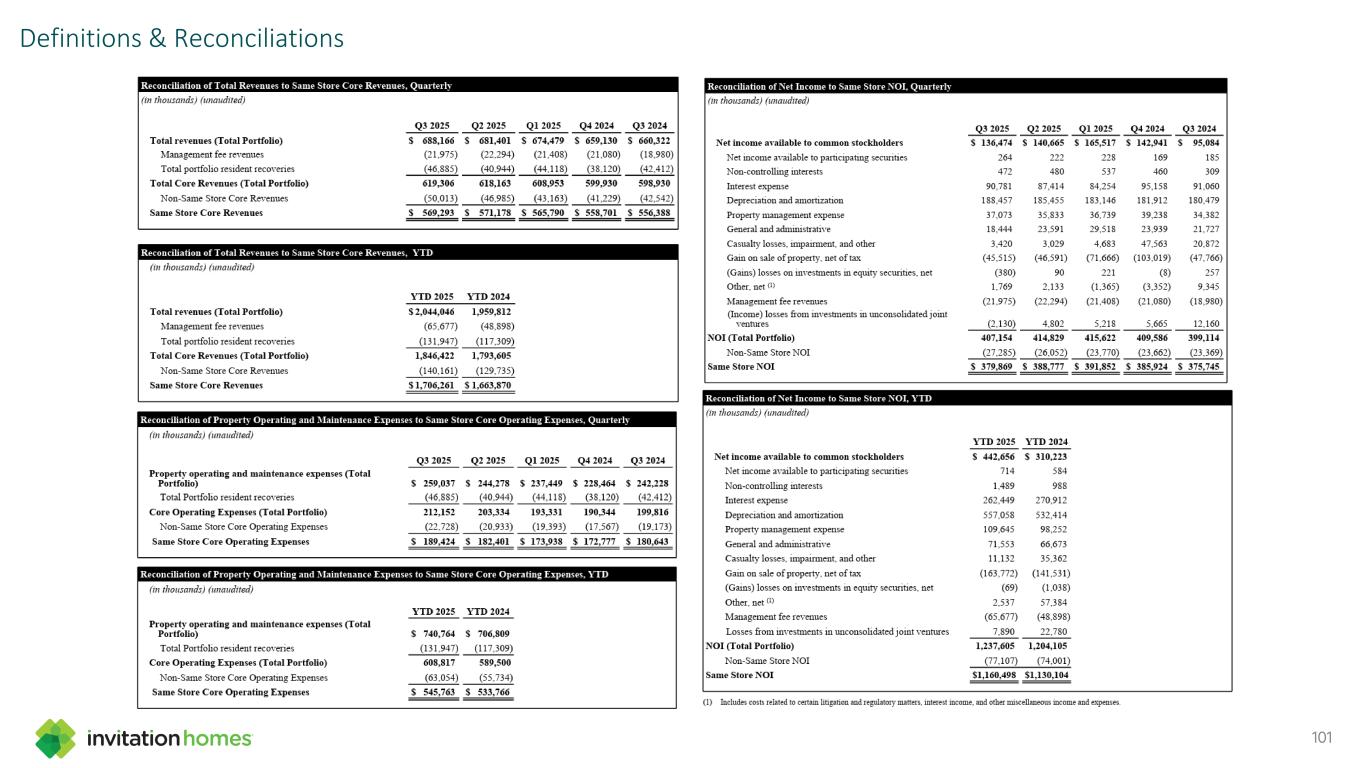

Definitions & Reconciliations 96 Financial and operating measures found in this presentation include certain non-GAAP financial measures. These non-GAAP financial measures are defined herein and, as applicable, reconciled to the most directly comparable GAAP financial measures. In accordance with SEC rules, we do not provide guidance for the most comparable GAAP financial measures of net income (loss), total revenues, and property operating and maintenance expense. Additionally, a reconciliation of the forward-looking non-GAAP financial measures of Core FFO per share, AFFO per share, Same Store Core Revenues growth, Same Store Core Operating Expenses growth, and Same Store NOI growth to the comparable GAAP financial measures cannot be provided without unreasonable effort because we are unable to reasonably predict certain items contained in the GAAP measures, including non-recurring and infrequent items that are not indicative of our ongoing operations. Such items include, but are not limited to, impairment on depreciated real estate assets, net (gain)/loss on sale of previously depreciated real estate assets, share-based compensation, net casualty losses and reserves, non-Same Store revenues, and non-Same Store operating expenses. These items are uncertain, depend on various factors, and could have a material impact on our GAAP results for the guidance period. Average Estimated Cost Basis Average estimated cost basis on acquisition represents the sum of purchase price, any closing adjustments, and estimated initial renovation expenditure for an acquired home or population of homes. Average Monthly Rent Average monthly rent represents average monthly rental income per home for occupied properties in an identified population of homes over the measurement period and reflects the impact of non-service rental concessions and contractual rent increases amortized over the life of the lease. Average Occupancy Average occupancy for an identified population of homes represents (i) the total number of days that the homes in such population were occupied during the measurement period, divided by (ii) the total number of days that the homes in such population were owned during the measurement period. Bad Debt Bad debt represents our reserves for residents’ accounts receivables balances that are aged greater than 30 days, under the rationale that a resident’s security deposit should cover approximately the first 30 days of receivables. For all resident receivables balances aged greater than 30 days, the amount reserved as bad debt is 100% of outstanding receivables from the resident, less the amount of the resident’s security deposit on hand. For the purpose of determining age of receivables, charges are considered to be due based on the terms of the original lease, not based on a payment plan if one is in place. All rental revenues and other property income, in both Total Portfolio and Same Store Portfolio presentations, are reflected net of bad debt.

Definitions & Reconciliations 97 Core NOI Margin Core NOI margin for an identified population of homes is calculated by dividing NOI by Core Revenues attributable to such population. Core Operating Expenses Core operating expenses for an identified population of homes reflect property operating and maintenance expenses, excluding any expenses recovered from residents. Core Revenues Core revenues for an identified population of homes reflects total revenues, net of any resident recoveries. Cost to Maintain, net Cost to maintain, net a home represents the sum of the expensed and capitalized portions of recurring repairs & maintenance and turn spend, net of resident reimbursements, as indicated in tables presented, not including the internal labor associated with such work. Days to Re-resident Days to re-resident represents, for new leases started during a period, the number of days elapsed between move-out of the prior resident and the lease start date of the new resident. Disposition CapEx Disposition CapEx represents expenditures related to the preparation of a home for disposition after the prior tenant has moved out of the home. EBITDA, EBITDAre, and Adjusted EBITDAre EBITDA, EBITDAre, and Adjusted EBITDAre are supplemental, non-GAAP measures often utilized to evaluate the performance of real estate companies. We define EBITDA as net income or loss computed in accordance with GAAP before the following items: interest expense; income tax expense; depreciation and amortization; and adjustments for unconsolidated joint ventures. National Association of Real Estate Investment Trusts (“Nareit”) recommends as a best practice that REITs that report an EBITDA performance measure also report EBITDAre. We define EBITDAre, consistent with the Nareit definition, as EBITDA, further adjusted for gain on sale of property, net of tax, impairment on depreciated real estate investments, and adjustments for unconsolidated joint ventures. Adjusted EBITDAre is defined as EBITDAre before the following items: share-based compensation expense; severance expense; casualty losses and reserves, net; (gains) losses on investments in equity securities, net; and other income and expenses. EBITDA, EBITDAre, and Adjusted EBITDAre are used as supplemental financial performance measures by management and by external users of our financial statements, such as investors and commercial banks. Set forth below is additional detail on how management uses EBITDA, EBITDAre, and Adjusted EBITDAre as measures of performance.

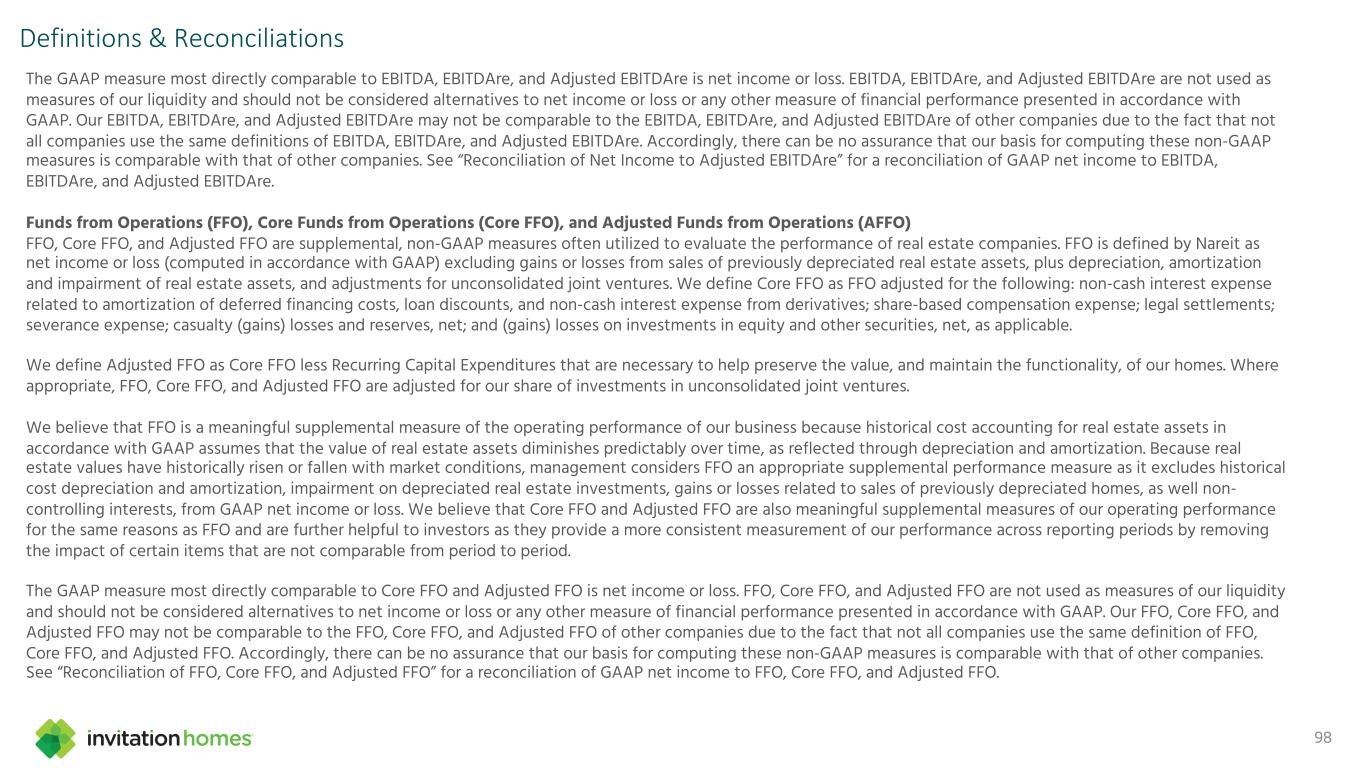

Definitions & Reconciliations 98 The GAAP measure most directly comparable to EBITDA, EBITDAre, and Adjusted EBITDAre is net income or loss. EBITDA, EBITDAre, and Adjusted EBITDAre are not used as measures of our liquidity and should not be considered alternatives to net income or loss or any other measure of financial performance presented in accordance with GAAP. Our EBITDA, EBITDAre, and Adjusted EBITDAre may not be comparable to the EBITDA, EBITDAre, and Adjusted EBITDAre of other companies due to the fact that not all companies use the same definitions of EBITDA, EBITDAre, and Adjusted EBITDAre. Accordingly, there can be no assurance that our basis for computing these non-GAAP measures is comparable with that of other companies. See “Reconciliation of Net Income to Adjusted EBITDAre” for a reconciliation of GAAP net income to EBITDA, EBITDAre, and Adjusted EBITDAre. Funds from Operations (FFO), Core Funds from Operations (Core FFO), and Adjusted Funds from Operations (AFFO) FFO, Core FFO, and Adjusted FFO are supplemental, non-GAAP measures often utilized to evaluate the performance of real estate companies. FFO is defined by Nareit as net income or loss (computed in accordance with GAAP) excluding gains or losses from sales of previously depreciated real estate assets, plus depreciation, amortization and impairment of real estate assets, and adjustments for unconsolidated joint ventures. We define Core FFO as FFO adjusted for the following: non-cash interest expense related to amortization of deferred financing costs, loan discounts, and non-cash interest expense from derivatives; share-based compensation expense; legal settlements; severance expense; casualty (gains) losses and reserves, net; and (gains) losses on investments in equity and other securities, net, as applicable. We define Adjusted FFO as Core FFO less Recurring Capital Expenditures that are necessary to help preserve the value, and maintain the functionality, of our homes. Where appropriate, FFO, Core FFO, and Adjusted FFO are adjusted for our share of investments in unconsolidated joint ventures. We believe that FFO is a meaningful supplemental measure of the operating performance of our business because historical cost accounting for real estate assets in accordance with GAAP assumes that the value of real estate assets diminishes predictably over time, as reflected through depreciation and amortization. Because real estate values have historically risen or fallen with market conditions, management considers FFO an appropriate supplemental performance measure as it excludes historical cost depreciation and amortization, impairment on depreciated real estate investments, gains or losses related to sales of previously depreciated homes, as well non- controlling interests, from GAAP net income or loss. We believe that Core FFO and Adjusted FFO are also meaningful supplemental measures of our operating performance for the same reasons as FFO and are further helpful to investors as they provide a more consistent measurement of our performance across reporting periods by removing the impact of certain items that are not comparable from period to period. The GAAP measure most directly comparable to Core FFO and Adjusted FFO is net income or loss. FFO, Core FFO, and Adjusted FFO are not used as measures of our liquidity and should not be considered alternatives to net income or loss or any other measure of financial performance presented in accordance with GAAP. Our FFO, Core FFO, and Adjusted FFO may not be comparable to the FFO, Core FFO, and Adjusted FFO of other companies due to the fact that not all companies use the same definition of FFO, Core FFO, and Adjusted FFO. Accordingly, there can be no assurance that our basis for computing these non-GAAP measures is comparable with that of other companies. See “Reconciliation of FFO, Core FFO, and Adjusted FFO” for a reconciliation of GAAP net income to FFO, Core FFO, and Adjusted FFO.

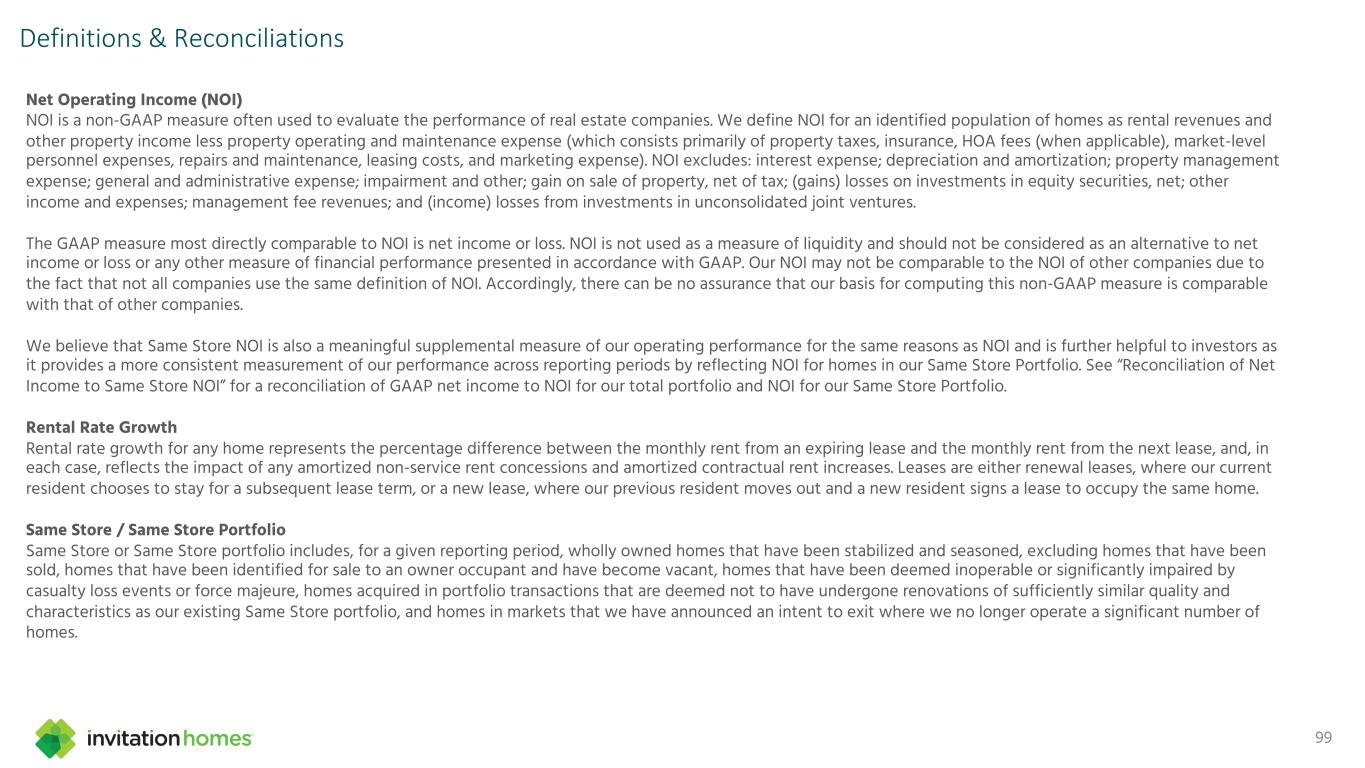

Definitions & Reconciliations 99 Net Operating Income (NOI) NOI is a non-GAAP measure often used to evaluate the performance of real estate companies. We define NOI for an identified population of homes as rental revenues and other property income less property operating and maintenance expense (which consists primarily of property taxes, insurance, HOA fees (when applicable), market-level personnel expenses, repairs and maintenance, leasing costs, and marketing expense). NOI excludes: interest expense; depreciation and amortization; property management expense; general and administrative expense; impairment and other; gain on sale of property, net of tax; (gains) losses on investments in equity securities, net; other income and expenses; management fee revenues; and (income) losses from investments in unconsolidated joint ventures. The GAAP measure most directly comparable to NOI is net income or loss. NOI is not used as a measure of liquidity and should not be considered as an alternative to net income or loss or any other measure of financial performance presented in accordance with GAAP. Our NOI may not be comparable to the NOI of other companies due to the fact that not all companies use the same definition of NOI. Accordingly, there can be no assurance that our basis for computing this non-GAAP measure is comparable with that of other companies. We believe that Same Store NOI is also a meaningful supplemental measure of our operating performance for the same reasons as NOI and is further helpful to investors as it provides a more consistent measurement of our performance across reporting periods by reflecting NOI for homes in our Same Store Portfolio. See “Reconciliation of Net Income to Same Store NOI” for a reconciliation of GAAP net income to NOI for our total portfolio and NOI for our Same Store Portfolio. Rental Rate Growth Rental rate growth for any home represents the percentage difference between the monthly rent from an expiring lease and the monthly rent from the next lease, and, in each case, reflects the impact of any amortized non-service rent concessions and amortized contractual rent increases. Leases are either renewal leases, where our current resident chooses to stay for a subsequent lease term, or a new lease, where our previous resident moves out and a new resident signs a lease to occupy the same home. Same Store / Same Store Portfolio Same Store or Same Store portfolio includes, for a given reporting period, wholly owned homes that have been stabilized and seasoned, excluding homes that have been sold, homes that have been identified for sale to an owner occupant and have become vacant, homes that have been deemed inoperable or significantly impaired by casualty loss events or force majeure, homes acquired in portfolio transactions that are deemed not to have undergone renovations of sufficiently similar quality and characteristics as our existing Same Store portfolio, and homes in markets that we have announced an intent to exit where we no longer operate a significant number of homes.

Definitions & Reconciliations 100 Homes are considered stabilized if they have (i) completed an initial renovation and (ii) entered into at least one post-initial renovation lease. An acquired portfolio that is both leased and deemed to be of sufficiently similar quality and characteristics as our existing Same Store portfolio may be considered stabilized at the time of acquisition. Homes are considered to be seasoned once they have been stabilized for at least 15 months prior to January 1st of the year in which the Same Store portfolio was established. We believe presenting information about the portion of our portfolio that has been fully operational for the entirety of a given reporting period and our prior year comparison period provides investors with meaningful information about the performance of our comparable homes across periods and about trends in our organic business. Total Homes / Total Portfolio Total homes or total portfolio refers to the total number of homes owned, whether or not stabilized, and excludes any properties previously acquired in purchases that have been subsequently rescinded or vacated. Unless otherwise indicated, total homes or total portfolio refers to the wholly owned homes and excludes homes owned in joint ventures. Turnover Rate Turnover rate represents the number of instances that homes in an identified population become unoccupied in a given period, divided by the number of homes in such population. Value Enhancing CapEx Value enhancing CapEx represents re-investment in stabilized homes, above and beyond general replacements to preserve and maintain the value and functionality of a home, for the purpose of enhancing expected risk-adjusted returns.

Definitions & Reconciliations 101

Definitions & Reconciliations 102

Definitions & Reconciliations 103