UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 5, 2025

BioSig Technologies, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-38659 | 26-4333375 | ||

| (State or other jurisdiction | (Commission | (IRS Employer | ||

| of incorporation) | File Number) | Identification No.) |

|

12424 Wilshire Blvd, Ste 745 Los Angeles, California |

90025 | |

| (Address of principal executive offices) | (Zip Code) |

(203) 409-5444

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of exchange on which registered | ||

| Common Stock, par value $0.001 per share | BSGM | The NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On May 5, 2025, BioSig Technologies, Inc. (“BioSig” or the “Company”) entered into a Letter of Intent (“LOI”) proposing a merger transaction between the Company and Streamex Exchange Corporation (“Streamex”), a copy of which is attached hereto as Exhibit 99.1 and is incorporated by reference into this Item 8.01 of this Form 8-K.

The LOI summarizes the principal terms relating to a proposed merger or other business combination (the “Merger”), pursuant to which Streamex, a Vancouver, British Columbia, Canada corporation, will undertake a merger with BioSig, a Delaware corporation listed on The Nasdaq Stock Market (“Nasdaq”).

Immediately after the Merger, the current stockholders of Streamex will own approximately 19.9% of the outstanding Common Stock of the Company and a number of shares of Convertible Preferred Stock (“Preferred Stock”), the terms of which are such that after taking into account the conversion of the Preferred Stock, the former stockholders of Streamex will own approximately 75% of the outstanding Common Stock of the Company, with the Company’s current shareholders owning the remaining equity of the Company.

The consummation of the Merger is subject to completion of due diligence to all parties’ satisfaction, and the completion of definitive documentation to close these transactions that is mutually satisfactory to all parties, as well as any required regulatory or listing approval by the Securities and Exchange Commission and Nasdaq.

On May 5, 2025, the Company issued a press release announcing the proposed Merger transaction, a copy of which is attached hereto as Exhibit 99.2 and is incorporated by reference into this Item 8.01 of this Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Letter of Intent, dated May 5, 2025 | |

| 99.2 | Press Release, dated May 5, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BIOSIG TECHNOLOGIES, INC. | ||

| Date: May 5, 2025 | By: | /s/ Anthony Amato |

| Name: | Anthony Amato | |

| Title: | Chief Executive Officer | |

Exhibit 99.1

CONFIDENTIAL

Letter of Intent

May 5, 2025

BioSig Technologies, Inc.

Anthony Amato

Chief Executive Officer

12424 Wilshire Blvd., Ste. 745

Los Angeles, CA 90025

RE: Proposed Merger Transaction between BioSig Technologies, Inc. and Streamex Exchange Corporation

Dear Mr. Amato,

This Letter of Intent (this “LOI”) summarizes the principal terms relating to a proposed merger or other business combination (the “Merger”), pursuant to which Streamex Exchange Corporation, a Vancouver, British Columbia, Canada corporation (“Streamex” or “PrivateCo”), will undertake a merger with BioSig Technologies, Inc., a Delaware corporation listed on The Nasdaq Stock Market (“BSGM,” “PubCo” or the “Company”).

The terms and conditions set forth herein are subject to change and this LOI does not constitute a binding agreement except where otherwise specifically stated. The consummation of the Merger is subject to completion of due diligence to all parties’ satisfaction, and the completion of definitive documentation to close these transactions that is mutually satisfactory to all parties, as well as any required regulatory or listing approval by the Securities and Exchange Commission and Nasdaq.

| PubCo: | The Company’s common stock (“Common Stock”) is publicly traded and listed on The Nasdaq Stock Market LLC (“Nasdaq”) under the ticker symbol “BSGM.” At the time of the consummation of the Merger, PubCo shall (i) be current in filing reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and (ii) be listed for trading on Nasdaq. |

| Proposed Transaction: | Immediately after the Merger, the current stockholders of PrivateCo will own approximately 19.9% of the outstanding Common Stock of the Company and a number of Series X Convertible Preferred Stock, par value $0.0001 per share (“Series X”), on the terms of such Series X as set forth below, such that after taking into account the conversion of the Series X, the former stockholders of PrivateCo will own approximately 75% of the outstanding Common Stock of the Company, with the Company’s current stakeholders owning the remaining equity of the Company. The parties intend for the Merger to be structured as a tax-free reorganization. |

| - |

| Terms of the Series X: | ● | Conversion: Converts at a ratio of 1000 Common Stock for one Series X. |

|

| ● | Dividends: Pro rata with Common Stock. | ||

| ● | Non-Voting: The Series X shall be non-voting. | ||

| ● | Protective Provisions: The affirmative vote of the holders of a 75% of Series X is required to: (i) alter or adversely effect the rights given to Series X; (ii) issue further shares of Series X; or (iii) prior to the stockholder approval regarding issuance of more than 19.9% of the outstanding common stock of the Company pursuant to conversion of the Series X (the “Stockholder Approval”), enter into any change of control or fundamental transactions. | ||

| ● | Liquidation Preference: Same liquidation preference as Common Stock. | ||

| ● | Cash Settlement: If after the Stockholder Approval or six months from the closing of the Merger the Series X is not converted into Common Stock of the Company, the holder of Series X may require the Company to redeem such Series X based on the fair market value of the shares of Common Stock, to be valued at a trailing VWAP. |

| PubCo Liabilities and Working Capital and Cash: | At the time of the consummation of the Merger, PubCo shall have no material liabilities or contingent liabilities, except as mutually agreed upon by the parties and shall provide for specific carve-outs as mutually agreed upon by both parties, which shall include amendment of Anthony Amato’s employment documents to ensure severance shall not exceed $400,000 exclusive of equity-based compensation due Mr. Amato under his current Employment Agreement. |

| Nasdaq Filing: | The Definitive Agreement will require NASDAQ to have approved the issuance of the Merger Consideration. |

| Financing: | As soon as practicable following the execution of the Merger Agreement, the Company will file a registration statement whereby PubCo will use commercially reasonable efforts to raise not less than $5 million USD of equity capital with up to $10 million USD of investor capital committed for investment into the combined company. |

| Definitive Agreement: | Within 30 days or soon as reasonably practicable after the date of this LOI, the parties shall commence negotiation and preparation of the various definitive agreements for the consummation of the Merger and setting forth the legally binding terms therefor (the “Merger Agreement”). The Merger Agreement will include such terms summarized in this LOI and such other representations, warranties, conditions, covenants, and other terms as are customary for transactions of this kind and not inconsistent with this LOI. |

| Voting Agreement: | Certain stockholders of PubCo, owning in the aggregate more than 50% of the outstanding shares of PubCo prior to the Merger (the “VSA Stockholders”), shall enter into irrevocable voting support agreement with PubCo, whereby such VSA Stockholders will agree to vote all of their PubCo’s voting securities in favor of the Stockholder Approval. |

|

Board Composition: |

The board of directors of PubCo immediately following the Merger shall be comprised of six (6) directors, of which four (4) directors shall be designated by PubCo, and (ii) two (2) directors designated by PrivateCo, which shall be Karl Henry McPhie and Morgan Lekstrom (as Chairman). The composition of the Board shall satisfy all NASDAQ and SEC requirements. |

| - |

|

Officer Composition: |

The current officers and management of the Company shall continue their respective roles and capacities of the Company except that Anthony Amato wishes to resign as the CEO of the Company and Karl Henry McPhie shall be his replacement at the time of the Merger. |

|

Governing Law; Jurisdiction; Venue:

|

This LOI and the definitive documentation referred to herein shall be governed by the laws of the State of Delaware without regard to the principles of conflicts of law thereof that might cause the law of another jurisdiction to apply. Any disputes in respect of this LOI and the definitive documentation referred to herein shall be determined in a Federal or State court of competent jurisdiction located in the County of Kent, City of Dover, State of Delaware. |

| Stockholder Meeting | As promptly as practicable, the Company shall give notice of and hold a special meeting for the purposes of considering the approval of: (i) allow issuance of more than 19.9% of the outstanding common stock of the Company pursuant to conversion of the Series X; (ii) approval of the stock incentive plan or similar ESOP if desired by the parties; and (iii) if deemed necessary or appropriate by Parent or as otherwise required by applicable law or contract, to authorize sufficient Parent Common Stock in Parent’s certificate of incorporation for the conversion of the Series X and/or to effectuate a reverse stock split to have sufficient Parent Common Stock. The board of directors of the Company shall recommend to shareholders in the proxy for such meeting that they approve the items described above. |

| Exclusivity: | During the Exclusivity Period (as defined below), neither party nor its representatives shall, directly or indirectly: (i) initiate any contact with; (ii) solicit, encourage or respond to any inquiries or proposals by; (iii) enter into or participate in any discussions or negotiations with; (iv) disclose any information concerning the business, assets, liabilities, income, expenses, or properties of such party to; (v) afford any access to the properties, books or records of such party to; or (vi) enter into any letter, term sheet or agreement, or consummate or close any transaction with, any individual(s) and/or entity(ies) in connection with any possible proposal regarding a Competing Opportunity (as defined below). Notwithstanding the foregoing, nothing shall preclude, prohibit, limit or otherwise restrict the parties from proceeding with the Merger. “Exclusivity Period” shall mean that period beginning on the date hereof until the earlier to occur of: (A) 12:01 a.m. ET on 60th day from the date hereof; or (B) the execution and delivery of a definitive agreement by the parties. The parties acknowledge that the Exclusivity Period may be extended upon mutual consent by both parties, but neither party is under any obligation so to extend. “Competing Opportunity” shall mean (x) the direct or indirect sale or purchase of all or any portion of the existing stock, membership interests or assets of such party; (y) a merger or consolidation involving such party; or (z) any similar transaction; provided, however, a Competing Opportunity shall not include bona fide financings of either party, in each case primarily from existing stockholders (and only so long as any investor therein who is not party to a support agreement enters into one in connection therewith). |

| - |

| Due Diligence and Access: | As soon as reasonably practicable after the date of this LOI, the parties and their representatives shall commence a detailed due diligence investigation of each other. Such due diligence will include, but will not be limited to, a complete review of the legal, financial, tax, environmental, intellectual property, and labor records and agreements of the business, and any other matters that the parties’ legal counsel, accountants, tax or other advisors reasonably deem relevant. The parties acknowledge that they will enter into a confidentiality agreement with respect to the information provided by each party to the other. From and after the date of this LOI, each party shall reasonably respond to the other party’s due diligence inquiries and shall authorize its representatives to provide the other party’s officers, employees, representatives and advisors with full access to its records, key employees, advisers and operations for the purpose of the other’s due diligence. |

| Termination Obligations | Schedule “A” describes all written or oral agreements, arrangements or understandings providing for retention, severance or termination payments, change of control, golden parachute, or any other obligation to, any director, officer, shareholder, employee, consultant or advisor of PubCo or any of its subsidiaries in connection with the termination of their position or their employment (collectively, “Termination Obligations”). There shall not be any other Termination Obligations or any material omissions or misstatements of such Termination Obligations that shall be discovered in the due diligence by either party. |

| Confidentiality: | This LOI is confidential, and none of its provisions or terms shall be disclosed to anyone who is not a party hereto or the Funding Term Sheet, or an officer, director or stockholder of the Company or PrivateCo or Company’s or PrivateCo’s agent, adviser, or legal counsel, unless required by law. |

| Public Announcements: | PubCo and PrivateCo will consult with each other before issuing any press release or otherwise making any public statements with respect to the Merger or this LOI, and/or any financing arrangements described herein and will not issue any such press release or make any disclosure (to any customers or employees of such party, to the public or otherwise) regarding the LOI or Merger and/or any financing arrangements described herein without the prior consent of the other party, which will not be unreasonably withheld, delayed, denied or conditioned; provided, however, that, on the advice of legal counsel, PubCo may comply with any SEC requirements under the Securities Act of 1933, as amended, or the Exchange Act which requires any disclosure. |

| - |

| Effect and Enforceability: | This LOI constitutes merely an outline of the principal intended terms of the proposed transaction to facilitate the negotiation and preparation of the definitive documentation. Neither this LOI nor the negotiations or understandings prior to the execution of the definitive documentation is intended to be or shall constitute binding and legally enforceable agreement of the parties, except the provisions herein titled “Exclusivity”, “Expenses”, “Confidentiality”, and “Public Announcements” shall be binding on the parties. Each party covenants not to institute or participate in any proceeding seeking to establish a contrary interpretation. Each party acknowledges that either party may abandon negotiations toward the definitive documentation at any time for any reason or for no reason, in such party’s sole and absolute discretion. |

| Expenses: | If the parties are unable to enter into a definitive Merger Agreement, the party that refuses to extend the Exclusivity Period shall be required to pay the other party a break-up fee in the amount equal to all liabilities and costs incurred by the party willing to extend the Exclusivity Period, including all expenses, legal, accounting and other third party fees related to this this transaction. |

| Execution of LOI: |

Each party agrees that this LOI may be executed by handwritten or electronic signature of a person authorized to execute this LOI on behalf of each party, respectively, in one or more counterparts each of which will be deemed to be an original and all of which, when taken together, will be deemed to constitute one and the same document. |

| (Signature page follows) |

| - |

If the foregoing accurately reflects our discussions, please execute and return to the undersigned one copy of this LOI to me. We look forward to working with you as expeditiously as possible to complete the proposed transaction.

| BioSig Technologies, Inc. | Streamex Exchange Corporation | |||

| /s/ Anthony Amato | /s/ Karl Henry McPhie | |||

| Name: | Anthony Amato | Name: | Karl Henry McPhie | |

| Title: | Chief Executive Officer | Title: | Chief Executive Officer | |

| /s/ Morgan Lekstrom | ||||

| Name: | Morgan Lekstrom | |||

| Title: | Executive Chairman | |||

| - |

Schedule “A”

Termination Obligations

| 1. | Executive Employment Agreement, dated August 1, 2024 by and between Anthony Amato and BioSig Technologies Inc. |

| - |

Exhibit 99.2

|

|

BioSig Enters into an LOI to Merge with Streamex Exchange Corp. Creating a Publicly Listed Real-World Asset Tokenization Company Led by Seasoned Industry Executives

Los Angeles, CA, May 5, 2025 (GLOBE NEWSWIRE) – BioSig Technologies, Inc. (NASDAQ: BSGM) (“BioSig” or the “Company”), a medical technology company is pleased to announce it has entered into a Letter of Intent (“LOI”) to enter into a proposed merger or other business combination (the “Merger”),with Streamex Exchange Corporation (“Streamex”) in an all-stock transaction, to bring a real-world asset tokenization company public on the Nasdaq.

Proposed Transaction Highlights include:

| ● | Technology Stack – A fully developed and operational primary issuance and decentralized exchange infrastructure for on chain commodity markets. |

| ● | Commodity-focused real-world asset tokenization infrastructure and financing platform. |

| ● | Tokenization and financing infrastructure for streamlining the investment process, increasing capital availability for companies and opportunities for investors. |

| ● | Gain access to real-world assets with the ease and security of crypto. Diversify portfolios with tangible investments in a digital-first world. |

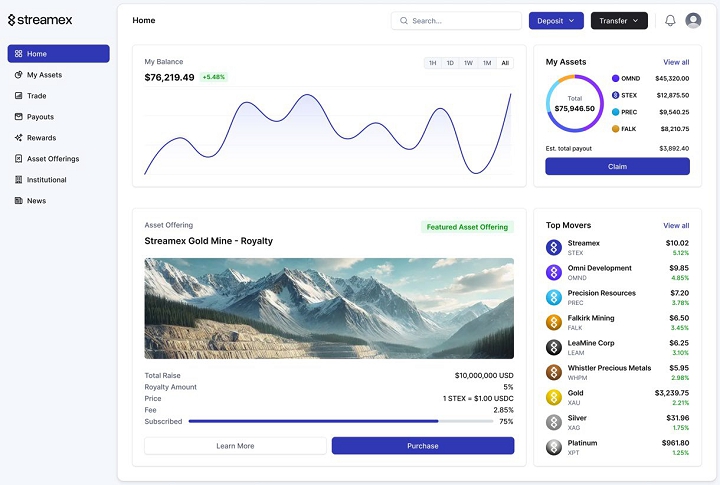

Figure 1: The Streamex Ecosystem Figure 2: The Streamex Platform

About Streamex Exchange Corporation:

Streamex is a real-world asset (RWA) tokenization company focused in the commodities space. With the goal to bring commodity markets on chain, Streamex has developed primary issuance and exchange infrastructure that will revolutionize commodity finance. Streamex is led by a group of highly successful and seasoned executives from financial, commodities and blockchain industries.

Streamex believes the future of finance lies in tokenization, innovative investment strategies, and decentralized markets. By merging advanced financial technologies with blockchain transparency, Streamex has created infrastructure and solutions that enhance liquidity, accessibility, and efficiency. Streamex’s goal is to bridge the gap between traditional finance and the digital economy, unlocking new opportunities for investors and institutions worldwide.

Co-Founders Henry McPhie and Morgan Lekstrom commented, “This is the next evolution of commodity and traditional finance; we are excited to bring to you a product that we believe can transform this legacy industry. In partnership with BioSig Technologies, we are working toward a definitive agreement to list Streamex on the Nasdaq. The world is rapidly moving towards digital and blockchain based financial markets. Billions in assets have already been tokenized and brought on chain by large financial institutions such as BlackRock, Goldman Sachs and HSBC. We at Streamex are excited to be first movers to bring the $2.1 Trillion mining and $142 Trillion global commodities market on chain though a streamlined and efficient platform powered by Solana.”

BioSig’s CEO, Anthony Amato added, “This merger represents a transformative opportunity for both our company and our shareholders. By joining forces with Streamex, we are unlocking significant growth potential while continuing to advance our existing business. This partnership will expand our market reach, enhance our capabilities, and create even greater opportunities for driving substantial returns. I am incredibly excited about the promising future ahead for our shareholders.”

| ● | Board and Management Changes Post Closing of the Proposed Transaction |

| ● | Appointment of a new Chief Executive Officer - Mr. Henry McPhie, Co-Founder and CEO of Streamex will lead the Company as Chief Executive Officer and member of the board of directors (the “Board”) through its next phase of growth. |

| ● | Appointment of a new Chairman - Mr. Morgan Lekstrom, Co-Founder and Chairman of Streamex will also join as Chairman of the Board. |

| ● | Founder of NexGold Mining Corp. (NEXG-TSX) |

| ● | CEO & Director of Premium Resources, which just recapitalized $67.8M (PREM-TSX) |

| ● | Current BioSig CEO and Chairman, Anthony Amato will remain on the Board. |

| ● | Additional Board members to be added post definitive agreement signing. |

| ● | Strategic Advisor Additions Post Closing of the Proposed Transaction |

| ● | Mr. Frank Giustra has agreed to join as a Strategic Investor and Advisor on Commodities. |

| ● | Founder of LionsGate Films (LGF-NYSE, $2B) |

| ● | Founder of Wheaton Precious Metals, (WPM-NYSE, $37B) |

| ● | Founder of GoldCorp, acquired by Newmont (NEM, $57B) |

| ● | Mr. Mathew August has agreed to join as a Strategic Advisor on US Capital Markets. |

| ● | Executive Chairman of Atlas Capital Partners a New York, NY based single family office investment firm and merchant bank |

| ● | Active Venture Capitalist with significant investments within the Defense Tech, FinTech, Aerospace and other diversified industries |

| ● | Mr. Mitchell Williams has agreed to join as a Strategic Advisor on US Capital Markets. |

| ● | Managing Partner of a Private Investment Firm |

| ● | Former Senior Managing Director, Head of Public Markets at Wafra Inc. |

| ● | Former Sole Portfolio Manager of $4+ Billion at Oppenheimer Funds |

Proposed Terms of Merger

By signing the Letter of Intent, this potential transaction marks a distinct shift in a positive direction for existing BioSig shareholders.

| ● | Immediately after the Merger, the current stockholders of Streamex will own approximately 19.9% of the outstanding Common Stock of the Company and a number of Series X Convertible Preferred Stock, par value $0.0001 per share (“Series X”), such that after taking into account the conversion of the Series X, the former stockholders of Streamex will own approximately 75% of the outstanding Common Stock of the Company, with the Company’s current stakeholders owning the remaining equity of the Company. |

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control, and cannot be predicted or quantified and consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. For a discussion of other risks and uncertainties, and other important factors, any of which could cause BioSig’s actual results to differ from those contained in forward-looking statements, see BioSig’s filings with the Securities and Exchange Commission, including the section titled “Risk Factors” in BioSig’s Annual Report on Form 10-K, filed with the SEC on April 15, 2025. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events or otherwise, except as required by law.

Contact:

Todd Adler

BioSig Technologies, Inc.

Investor Relations

12424 Wilshire Blvd Ste 745

Los Angeles, CA 90025

tadler@biosigtech.com

203–409–5444, x104

Anthony Amato

Chief Executive Officer

aamato@biosigtech.com

Henry McPhie

Co-Founder & CEO of Streamex

HenryM@Streamex.com

https://www.streamex.com/

https://x.com/streamex