Document

|

|

|

|

|

|

| Press Release |

|

|

|

| Irvine, CA – August 7, 2025 |

Contact: Alan Peterson

Email: investorrelations@ahcreit.com

|

American Healthcare REIT (“AHR”) Announces Second Quarter 2025 Results;

Increases Full Year 2025 Guidance

American Healthcare REIT, Inc. (the “Company,” “we,” “our,” “management,” or “us”) (NYSE: AHR) announced today its second quarter 2025 results and is increasing full year 2025 guidance.

Key Highlights:

•Reported GAAP net income attributable to controlling interest of $9.9 million and GAAP net income attributable to common stockholders of $0.06 per diluted share for the three months ended June 30, 2025.

•Reported Normalized Funds from Operations attributable to common stockholders (“NFFO”) of $0.42 per diluted share for the three months ended June 30, 2025.

•Achieved total portfolio Same-Store Net Operating Income (“NOI”) growth of 13.9% for the three months ended June 30, 2025, compared to the same period in 2024.

•Achieved 23.0% and 18.3% Same-Store NOI growth during the three months ended June 30, 2025, from its senior housing operating properties (“SHOP”) and integrated senior health campuses (“ISHC”), respectively, compared to the same period in 2024.

•During the three months ended June 30, 2025, the Company acquired a new SHOP asset for approximately $65.0 million. Year-to-date 2025, the Company has closed on approximately $255 million of new investments.

•During the three months ended June 30, 2025, the Company issued 5,451,577 shares of common stock through its at-the-market equity offering program ("ATM program") for gross proceeds of approximately $188.6 million. Additionally, the Company entered into a forward sales agreement to sell 3,554,525 shares of common stock through its ATM program, which the Company settled subsequent to quarter end for net proceeds of approximately $126.0 million.

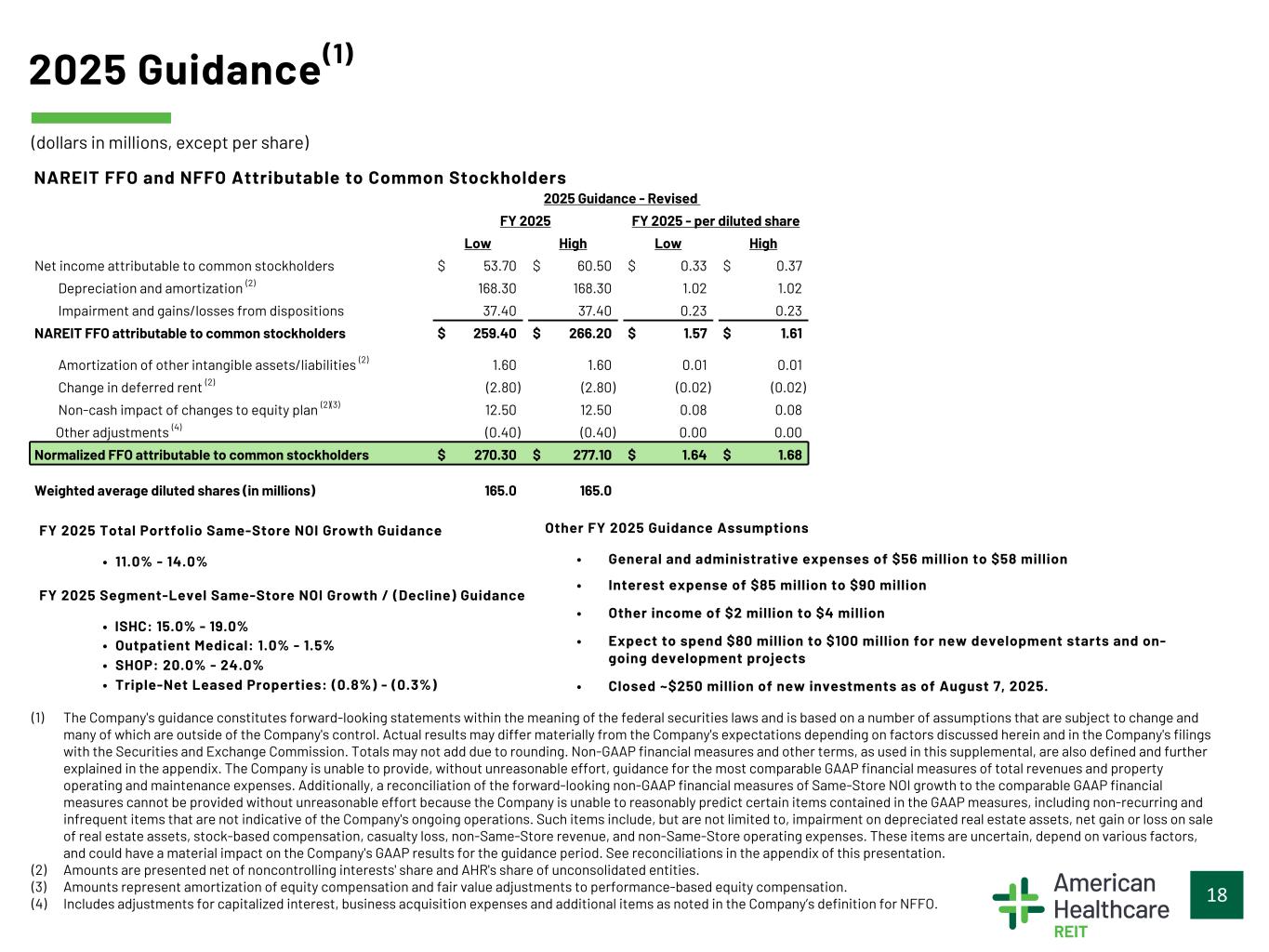

•Increasing total portfolio Same-Store NOI growth guidance for the year ending December 31, 2025, by 150 basis points at the midpoint from a range of 9.0% to 13.0% to a revised range of 11.0% to 14.0%, primarily due to strong operating results in its ISHC and SHOP segments during the three months ended June 30, 2025.

•Increasing NFFO guidance for the year ending December 31, 2025, by $0.05 at the midpoint from a range of $1.58 to $1.64 to a revised range of $1.64 to $1.68, due to increased expectations for full year 2025 NOI growth for its Same-Store portfolio and recent accretive capital allocation activity.

•Reported a 0.8x improvement to Net Debt-to-Annualized Adjusted EBITDA from 4.5x as of March 31, 2025 to 3.7x as of June 30, 2025.

•Awarded the Great Place To Work® Certification™ for 2025, based on direct feedback from employees and an independent analysis conducted by Great Place To Work®, the global authority on workplace culture.

“Fundamentals in the long-term care industry remain solid, as evidenced by our strong growth in the second quarter and year to date. This has prompted an increase in our Same-Store NOI growth and NFFO guidance for the full year 2025,” said Danny Prosky, the Company’s President and Chief Executive Officer. “We are also supplementing our robust organic growth with strategic external investments that we believe will be accretive to our future earnings. We've executed all of this, while still improving our financial position and capacity as highlighted by our Net Debt-to-Annualized Adjusted EBITDA of below 4.0x. As a company, our core mission is providing and facilitating high-quality care and outcomes for residents, and I'm proud that we are advancing that mission by adding more quality assets to our portfolio with best-in-class regional operating partners.”

Second Quarter 2025 and Year-To Date 2025 Results

The Company’s Same-Store NOI growth results for the three and six months ended June 30, 2025 are detailed below. Same-Store NOI growth results from its operating portfolio, comprised of ISHC and SHOP segments, led the Company's growth in the second quarter of 2025, compared to the same period in 2024, supported by proactive expense management, incremental occupancy gains, and mid-single-digit RevPOR growth.

|

|

|

|

|

|

Three Months Ended June 30, 2025 Relative to Three Months Ended June 30, 2024 |

| Segment |

Same-Store NOI Growth |

ISHC |

18.3% |

Outpatient Medical |

1.4% |

SHOP |

23.0% |

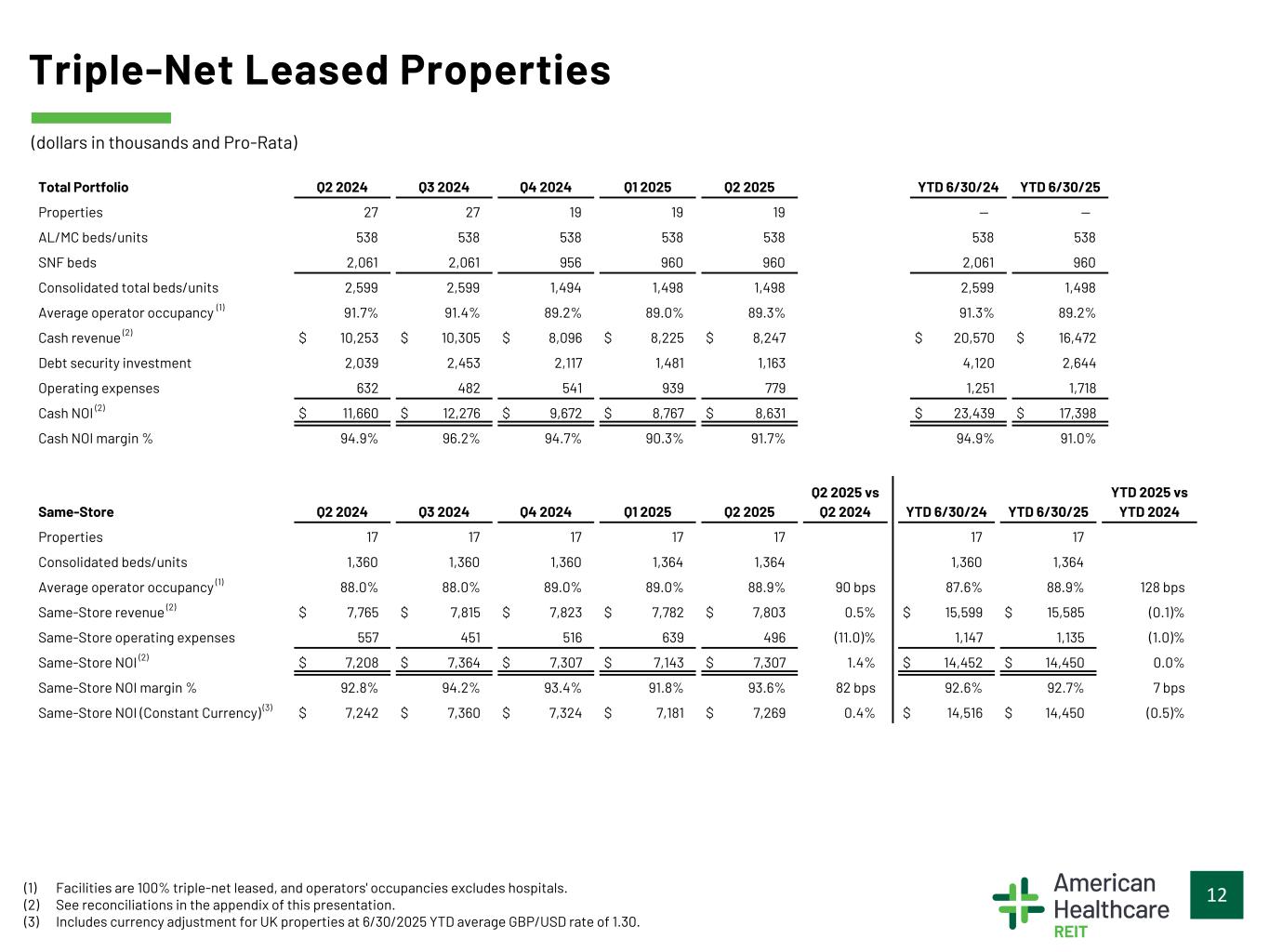

Triple-Net Leased Properties |

1.4% |

Total Portfolio |

13.9% |

|

|

|

|

|

|

Six Months Ended June 30, 2025 Relative to Six Months Ended June 30, 2024 |

| Segment |

Same-Store NOI Growth |

ISHC |

19.0% |

Outpatient Medical |

1.7% |

SHOP |

26.6% |

Triple-Net Leased Properties |

0.0% |

Total Portfolio |

14.5% |

“Demand in the first quarter was primarily driven by the winter and flu season, which increased the need for post-acute care skilled nursing care within our ISHC segment, whereas independent and assisted living units saw more move-out activity in the first quarter," said Gabe Willhite, the Company’s Chief Operating Officer. "As the second quarter progressed, we observed demand become more broad-based for our operating portfolio, as ISHC continued to show steady occupancy gains, with stronger relative demand for independent living and assisted living units. Our SHOP segment saw a similar rise in demand, exhibiting consistent occupancy improvements throughout the quarter driven by the most move-ins we have realized in any quarter since prior to the onset of the pandemic, ultimately leading to spot Same-Store occupancy north of 87.5% by quarter end. Looking ahead, we anticipate higher move-in activity to continue through the busier summer selling season across our operating portfolio, which we believe will further increase occupancy. We believe this occupancy trend, coupled with our hands-on asset management approach and revenue management strategies, will provide for solid results in the second half of the year where we expect to continue achieving strong growth within our operating portfolio.”

Transactional Activity

During the three months ended June 30, 2025, the Company:

•Completed a previously announced acquisition of a SHOP asset for approximately $65.0 million. Operations at the property were transitioned to Heritage Senior Living, one of the Company's existing regional operators in a RIDEA structure.

•Sold four Non-Core Properties for gross proceeds of approximately $33.5 million, including three previously announced dispositions for gross proceeds of $29 million.

Subsequent to quarter end, the Company:

•Purchased its partners' 51% outstanding interests in an unconsolidated joint venture including five pre-stabilized campuses. The recently developed campuses contain 704 beds and will continue to be operated by Trilogy Management Services ("TMS"). Four of the campuses are not yet stabilized and opened within the last year. Total consideration for the acquisition of its partners' 51% interests, including the extinguishment of all partnership level debt, was approximately $118.4 million.

•Completed the acquisition of two new SHOP assets for approximately $33.5 million. One of the properties is managed by one of the Company's existing regional operating partners, Compass Senior Living, which managed the asset for the previous owner. Upon acquisition of the other property, the Company installed Great Lakes Management, to operate the building establishing a new regional operator relationship.

•Acquired four new long-term care assets within the Company's ISHC property segment for approximately $65.3 million. These properties were operated by TMS prior to the Company's acquisition, and will continue to be operated by TMS.

•Completed a lease buyout within its ISHC segment for approximately $7.7 million.

•Sold one Non-Core Property for approximately $1.8 million.

Following the Company's completed transaction activity during the three months ended June 30, 2025, and subsequent to quarter end, the Company has over $300 million of awarded deals within its investments pipeline, which include existing and newly awarded deals since the Company's First Quarter 2025 Earnings Release. The Company expects to close the remaining pipeline by the end of the year, but it cannot guarantee, or provide certainty regarding timing on, the closings. Therefore, the Company is not including any additional transaction activity, including the awarded deals in its investments pipeline, beyond the transactions disclosed as completed in this section within its increased full-year 2025 guidance.

Development Activity

The Company did not start any new development projects during the three months ended June 30, 2025. The Company's total in-process development pipeline is expected to cost approximately $57.8 million, of which $23.8 million has been spent as of June 30, 2025.

Capital Markets and Balance Sheet Activity

As of June 30, 2025, the Company’s total consolidated indebtedness was $1.55 billion, and it had approximately $733.5 million of total liquidity, comprised of cash and undrawn capacity on its line of credit. The Company's Net-Debt-to-Annualized Adjusted EBITDA as of June 30, 2025, was 3.7x.

During the three months ended June 30, 2025, the Company issued 5,451,577 shares of common stock through its ATM program for gross proceeds of approximately $188.6 million, at an average price of $34.60 per share. Additionally, during the three months ended June 30, 2025, the Company entered into a forward sales agreement to sell 3,554,525 shares of common stock through its ATM program. Subsequent to quarter end, the Company settled the entire forward sales agreement by issuing the shares for net cash proceeds of approximately $126.0 million. Also subsequent to quarter end, the Company issued an additional 432,367 shares of common stock for gross proceeds of approximately $15.7 million through its ATM program, at an average price of $36.25 per share.

“I’m pleased with our ability to deliver exceptional NFFO per share growth all while continuing to de-lever the balance sheet - our strong earnings growth and strategic equity issuances utilizing the ATM program have helped us create capacity for future investment activity.” said Brian Peay, the Company’s Chief Financial Officer. “Our strong operating performance achieved by our impressive operating partners is driving an increase in our full-year 2025 total portfolio Same-Store NOI growth and NFFO per share guidance.”

Full Year 2025 Guidance

The Company is increasing guidance for the year ending December 31, 2025 to reflect its improved outlook on operations, capital markets activity and capital allocation activity executed during the second quarter of 2025, as well as activity completed subsequent to quarter end. Guidance does not assume additional transaction or capital markets activity beyond the items previously disclosed or items disclosed in this earnings release. Updated guidance ranges are detailed in the table on the next page:

|

|

|

|

|

|

|

|

|

|

|

|

|

Full Year 2025 Guidance |

| Metric |

Midpoint |

Current FY 2025 Range |

Prior FY 2025 Range |

| Net income per diluted share |

$0.35 |

$0.33 to $0.37 |

$0.29 to $0.35 |

NAREIT FFO per diluted share |

$1.59 |

$1.57 to $1.61 |

$1.49 to $1.55 |

NFFO per diluted share |

$1.66 |

$1.64 to $1.68 |

$1.58 to $1.64 |

| Total Portfolio SS NOI Growth |

12.5% |

11.0% to 14.0% |

9.0% to 13.0% |

| Segment-Level SS NOI Growth / (Decline): |

|

|

|

| ISHC |

17.0% |

15.0% to 19.0% |

12.0% to 16.0% |

| Outpatient Medical |

1.3% |

1.0% to 1.5% |

(1.0%) to 1.0% |

| SHOP |

22.0% |

20.0% to 24.0% |

20.0% to 24.0% |

| Triple-Net Leased Properties |

(0.5%) |

(0.8%) to (0.3%) |

(1.5%) to (0.5%) |

Certain of the assumptions underlying the Company’s 2025 guidance can be found within the Non-GAAP reconciliations in this earnings release and in the appendix of the Company’s Second Quarter 2025 Supplemental Financial Information (“Supplemental”). A reconciliation of net income (loss) calculated in accordance with GAAP to NAREIT FFO and NFFO can be found within the Non-GAAP reconciliations in this earnings release. Non-GAAP financial measures and other terms, as used in this earnings release, are also defined and further explained in the Supplemental. The Company is unable to provide, without unreasonable effort, guidance for the most comparable GAAP financial measures of total revenues and property operating and maintenance expenses. Additionally, a reconciliation of the forward-looking Non-GAAP financial measures of Same-Store NOI growth to the comparable GAAP financial measures cannot be provided without unreasonable effort because the Company is unable to reasonably predict certain items contained in the GAAP measures, including non-recurring and infrequent items that are not indicative of the Company’s ongoing operations. Such items include, but are not limited to, impairment on depreciated real estate assets, net gain or loss on sale of real estate assets, stock-based compensation, casualty loss, non-Same-Store revenue and non-Same-Store operating expenses. These items are uncertain, depend on various factors and could have a material impact on the Company’s GAAP results for the guidance period.

Distributions

As previously announced, the Company’s Board of Directors declared a cash distribution for the quarter ended June 30, 2025 of $0.25 per share of its common stock. The second quarter distribution was paid in cash on or about July 18, 2025, to stockholders of record as of June 30, 2025.

Supplemental Information

The Company has disclosed supplemental information regarding its portfolio, financial position and results of operations as of, and for the three and six months ended June 30, 2025, and certain other information, which is available on the Investor Relations section of the Company's website at https://ir.americanhealthcarereit.com.

Conference Call and Webcast Information

The Company will host a webcast and conference call at 1:00 p.m. Eastern Time on August 8, 2025. During the conference call, Company executives will review second quarter 2025 results, discuss recent events and conduct a question-and-answer period.

To join via webcast, investors may use the following link: https://events.q4inc.com/attendee/185284343.

To join the live telephone conference call, please dial one of the following numbers at least five minutes prior to the start time:

North America - Toll-Free: (800) 715-9871

International Toll: +1 (646) 307-1963

Conference ID: 2930459

A digital replay of the call will be available on the Investor Relations section of the Company’s website at https://ir.americanhealthcarereit.com shortly after the conclusion of the call.

Forward-Looking Statements

Certain statements contained in this press release, including statements relating to the Company's expectations regarding its performance, interest expense savings, balance sheet, net income or loss per diluted share, NAREIT FFO per diluted share, NFFO per diluted share, total portfolio Same-Store NOI growth, segment-level Same-Store NOI growth or decline, occupancy, NOI growth, revenue growth, margin expansion, purchases and sales of assets, development plans, and plans for Trilogy may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in those acts. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as “may,” “will,” “can,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” “possible,” “initiatives,” “focus,” “seek,” “objective,” “goal,” “strategy,” “plan,” “potential,” “potentially,” “preparing,” “projected,” “future,” “long-term,” “once,” “should,” “could,” “would,” “might,” “uncertainty” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Any such forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which the Company operates, and beliefs of, and assumptions made by, the Company's management and involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied therein, including, without limitation, changing macroeconomic conditions, domestic legal and fiscal policies, and geopolitical conditions and other risks disclosed in the Company's Annual Report on Form 10-K for the year ended December 31, 2024, filed on February 28, 2025, and other periodic reports filed with the Securities and Exchange Commission. Except as required by law, the Company does not undertake any obligation to update or revise any forward-looking statements contained in this release.

Non-GAAP Financial Measures

The Company’s reported results are presented in accordance with GAAP. The Company also discloses the following non-GAAP financial measures: EBITDA, Adjusted EBITDA, Net Debt-to-Annualized Adjusted EBITDA, NAREIT FFO, NFFO, NOI and Same-Store NOI. The Company believes these non-GAAP financial measures are useful supplemental measures of its operating performance and used by investors and analysts to compare the operating performance of the Company between periods and to other REITs or companies on a consistent basis without having to account for differences caused by unanticipated and/or incalculable items. Definitions of the non-GAAP financial measures used herein and reconciliations to the most directly comparable financial measure calculated in accordance with GAAP can be found at the end of this earnings release. See below and "Definitions" for further information regarding the Company's non-GAAP financial measures.

EBITDA and Adjusted EBITDA

Management uses earnings before interest, taxes, depreciation and amortization (“EBITDA”) and Adjusted EBITDA to facilitate internal and external comparisons to our historical operating results and in making operating decisions. EBITDA and Adjusted EBITDA are widely used by investors, lenders, credit and equity analysts in the valuation, comparison, and investment recommendations of companies. Additionally, EBITDA and Adjusted EBITDA are utilized by our Board of Directors to evaluate management. Neither EBITDA nor Adjusted EBITDA represents net income (loss) or cash flows provided by operating activities as determined in accordance with GAAP and should not be considered as alternative measures of profitability or liquidity. Finally, the EBITDA and Adjusted EBITDA may not be comparable to similarly entitled items reported by other REITs or other companies. In addition, management uses Net Debt-to-Annualized Adjusted EBITDA as a measure of our ability to service our debt.

NAREIT Funds from Operations (FFO) and Normalized Funds from Operations (NFFO)

We believe that the use of FFO, which excludes the impact of real estate-related depreciation and amortization and impairments, provides a further understanding of our operating performance to investors, industry analysts and our management, and when compared year over year, reflects the impact on our operations from trends in occupancy rates, rental rates, operating costs, general and administrative expenses and interest costs, which may not be immediately apparent from net income (loss) as determined in accordance with GAAP.

However, FFO and NFFO should not be construed to be (i) more relevant or accurate than the current GAAP methodology in calculating net income (loss) as an indicator of our operating performance, (ii) more relevant or accurate than GAAP cash flows from operations as an indicator of our liquidity or (iii) indicative of funds available to fund our cash needs, including our ability to make distributions to our stockholders. The method utilized to evaluate the value and performance of real estate under GAAP should be construed as a more relevant measure of operational performance and considered more prominently than the Non-GAAP FFO and NFFO measures and the adjustments to GAAP in calculating FFO and NFFO. Presentation of this information is intended to provide useful information to investors, industry analysts and management as they compare the operating performance metrics used by the REIT industry, although it should be noted that some REITs may use different methods of calculating funds from operations and normalized funds from operations, so comparisons with such REITs may not be meaningful.

Net Operating Income

We believe that NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI are appropriate supplemental performance measures to reflect the performance of our operating assets because NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI exclude certain items that are not associated with the operations of the properties. We believe that NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI are widely accepted measures of comparative operating performance in the real estate community and are useful to investors in understanding the profitability and operating performance of our property portfolio. However, our use of the terms NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing these amounts.

NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI are not equivalent to our net income (loss) as determined under GAAP and may not be a useful measure in measuring operational income or cash flows. Furthermore, NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI should not be considered as alternatives to net income (loss) as an indication of our operating performance or as an alternative to cash flows from operations as an indication of our liquidity. NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI should not be construed to be more relevant or accurate than the GAAP methodology in calculating net income (loss). NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI should be reviewed in conjunction with other measurements as an indication of our performance.

About American Healthcare REIT, Inc.

American Healthcare REIT, Inc. (NYSE: AHR) is a real estate investment trust that acquires, owns and operates a diversified portfolio of clinical healthcare real estate, focusing primarily on senior housing communities, skilled nursing facilities, and outpatient medical buildings across the United States, and in the United Kingdom and the Isle of Man.

AMERICAN HEALTHCARE REIT, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

As of June 30, 2025 and December 31, 2024

(In thousands, except share and per share amounts) (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

2025 |

|

December 31,

2024 |

| ASSETS |

| Real estate investments, net |

$ |

3,346,121 |

|

|

$ |

3,366,648 |

|

| Debt security investment, net |

91,849 |

|

|

91,264 |

|

| Cash and cash equivalents |

133,494 |

|

|

76,702 |

|

| Restricted cash |

36,497 |

|

|

46,599 |

|

| Accounts and other receivables, net |

224,072 |

|

|

211,104 |

|

|

|

|

|

| Identified intangible assets, net |

155,886 |

|

|

161,473 |

|

| Goodwill |

234,942 |

|

|

234,942 |

|

|

|

|

|

| Operating lease right-of-use assets, net |

147,893 |

|

|

163,987 |

|

| Other assets, net |

135,896 |

|

|

135,338 |

|

| Total assets |

$ |

4,506,650 |

|

|

$ |

4,488,057 |

|

|

|

|

|

| LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND EQUITY |

| Liabilities: |

|

|

|

Mortgage loans payable, net |

$ |

983,510 |

|

|

$ |

982,071 |

|

Lines of credit and term loan, net |

549,632 |

|

|

688,534 |

|

Accounts payable and accrued liabilities |

273,702 |

|

|

258,324 |

|

| Identified intangible liabilities, net |

2,618 |

|

|

3,001 |

|

Financing obligations |

34,364 |

|

|

34,870 |

|

Operating lease liabilities |

148,215 |

|

|

165,239 |

|

Security deposits, prepaid rent and other liabilities |

51,965 |

|

|

51,856 |

|

| Total liabilities |

2,044,006 |

|

|

2,183,895 |

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

Redeemable noncontrolling interests |

— |

|

|

220 |

|

|

|

|

|

| Equity: |

|

|

|

| Stockholders’ equity: |

|

|

|

Preferred stock, $0.01 par value per share; 200,000,000 shares authorized; none issued and outstanding |

— |

|

|

— |

|

Common Stock, $0.01 par value per share; 700,000,000 shares authorized; 164,578,233 and 157,446,697 shares issued and outstanding as of June 30, 2025 and December 31, 2024, respectively |

1,638 |

|

|

1,564 |

|

| Additional paid-in capital |

3,957,653 |

|

|

3,720,268 |

|

| Accumulated deficit |

(1,536,301) |

|

|

(1,458,089) |

|

| Accumulated other comprehensive loss |

(1,993) |

|

|

(2,512) |

|

| Total stockholders’ equity |

2,420,997 |

|

|

2,261,231 |

|

Noncontrolling interests |

41,647 |

|

|

42,711 |

|

| Total equity |

2,462,644 |

|

|

2,303,942 |

|

| Total liabilities, redeemable noncontrolling interests and equity |

$ |

4,506,650 |

|

|

$ |

4,488,057 |

|

AMERICAN HEALTHCARE REIT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

For the Three and Six Months Ended June 30, 2025 and 2024

(In thousands, except share and per share amounts) (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenues: |

|

|

|

|

|

|

|

| Resident fees and services |

$ |

501,285 |

|

|

$ |

458,013 |

|

|

$ |

998,461 |

|

|

$ |

910,131 |

|

| Real estate revenue |

41,218 |

|

|

46,568 |

|

|

84,645 |

|

|

93,983 |

|

| Total revenues |

542,503 |

|

|

504,581 |

|

|

1,083,106 |

|

|

1,004,114 |

|

| Expenses: |

|

|

|

|

|

|

|

| Property operating expenses |

426,285 |

|

|

402,564 |

|

|

858,708 |

|

|

806,193 |

|

| Rental expenses |

12,990 |

|

|

13,323 |

|

|

26,633 |

|

|

27,050 |

|

| General and administrative |

14,943 |

|

|

11,746 |

|

|

28,098 |

|

|

23,574 |

|

| Business acquisition expenses |

(79) |

|

|

15 |

|

|

1,758 |

|

|

2,797 |

|

| Depreciation and amortization |

41,941 |

|

|

45,264 |

|

|

83,055 |

|

|

88,031 |

|

| Total expenses |

496,080 |

|

|

472,912 |

|

|

998,252 |

|

|

947,645 |

|

| Other income (expense): |

|

|

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

|

|

| Interest expense, net |

(22,632) |

|

|

(30,596) |

|

|

(45,577) |

|

|

(67,034) |

|

| (Loss) gain in fair value of derivative financial instruments |

(629) |

|

|

388 |

|

|

(1,379) |

|

|

6,805 |

|

| (Loss) gain on dispositions of real estate investments, net |

(2,676) |

|

|

(2) |

|

|

(3,035) |

|

|

2,261 |

|

| Impairment of real estate investments |

(12,659) |

|

|

— |

|

|

(34,365) |

|

|

— |

|

| Loss from unconsolidated entities |

(1,238) |

|

|

(1,035) |

|

|

(3,086) |

|

|

(2,240) |

|

| Foreign currency gain (loss) |

2,742 |

|

|

82 |

|

|

4,158 |

|

|

(344) |

|

| Other income, net |

1,480 |

|

|

3,106 |

|

|

3,005 |

|

|

4,969 |

|

| Total net other expense |

(35,612) |

|

|

(28,057) |

|

|

(80,279) |

|

|

(55,583) |

|

| Income before income taxes |

10,811 |

|

|

3,612 |

|

|

4,575 |

|

|

886 |

|

| Income tax expense |

(732) |

|

|

(686) |

|

|

(1,336) |

|

|

(964) |

|

| Net income (loss) |

10,079 |

|

|

2,926 |

|

|

3,239 |

|

|

(78) |

|

| Net income attributable to noncontrolling interests |

(171) |

|

|

(947) |

|

|

(135) |

|

|

(1,835) |

|

| Net income (loss) attributable to controlling interest |

$ |

9,908 |

|

|

$ |

1,979 |

|

|

$ |

3,104 |

|

|

$ |

(1,913) |

|

| Net income (loss) per share of Common Stock, Class T common stock and Class I common stock attributable to controlling interest: |

|

|

|

|

|

|

|

| Basic |

$ |

0.06 |

|

|

$ |

0.01 |

|

|

$ |

0.02 |

|

|

$ |

(0.02) |

|

| Diluted |

$ |

0.06 |

|

|

$ |

0.01 |

|

|

$ |

0.02 |

|

|

$ |

(0.02) |

|

| Weighted average number of shares of Common Stock, Class T common stock and Class I common stock outstanding: |

|

|

|

|

|

|

|

| Basic |

160,499,581 |

|

|

130,532,144 |

|

|

158,721,080 |

|

|

117,413,643 |

|

| Diluted |

161,143,556 |

|

|

130,689,889 |

|

|

159,318,503 |

|

|

117,413,643 |

|

|

|

|

|

|

|

|

|

| Net income (loss) |

$ |

10,079 |

|

|

$ |

2,926 |

|

|

$ |

3,239 |

|

|

$ |

(78) |

|

| Other comprehensive income (loss): |

|

|

|

|

|

|

|

| Foreign currency translation adjustments |

343 |

|

|

12 |

|

|

519 |

|

|

(31) |

|

| Total other comprehensive income (loss) |

343 |

|

|

12 |

|

|

519 |

|

|

(31) |

|

| Comprehensive income (loss) |

10,422 |

|

|

2,938 |

|

|

3,758 |

|

|

(109) |

|

| Comprehensive income attributable to noncontrolling interests |

(171) |

|

|

(947) |

|

|

(135) |

|

|

(1,835) |

|

| Comprehensive income (loss) attributable to controlling interest |

$ |

10,251 |

|

|

$ |

1,991 |

|

|

$ |

3,623 |

|

|

$ |

(1,944) |

|

AMERICAN HEALTHCARE REIT, INC.

NAREIT FFO and Normalized FFO Reconciliation

For the Three and Six Months Ended June 30, 2025 and 2024

(In thousands, except share and per share amounts) (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net income (loss) |

$ |

10,079 |

|

|

$ |

2,926 |

|

|

$ |

3,239 |

|

|

$ |

(78) |

|

|

|

|

|

|

|

|

|

| Depreciation and amortization related to real estate — consolidated properties |

41,850 |

|

|

45,226 |

|

|

82,865 |

|

|

87,955 |

|

| Depreciation and amortization related to real estate — unconsolidated entities |

506 |

|

|

186 |

|

|

1,003 |

|

|

372 |

|

| Impairment of real estate investments — consolidated properties |

12,659 |

|

|

— |

|

|

34,365 |

|

|

— |

|

|

|

|

|

|

|

|

|

| Loss (gain) on dispositions of real estate investments, net — consolidated properties |

2,676 |

|

|

2 |

|

|

3,035 |

|

|

(2,261) |

|

|

|

|

|

|

|

|

|

| Net income attributable to noncontrolling interests |

(171) |

|

|

(947) |

|

|

(135) |

|

|

(1,835) |

|

| Depreciation, amortization, impairments and net gain/loss on dispositions — noncontrolling interests |

(803) |

|

|

(5,647) |

|

|

(1,695) |

|

|

(11,109) |

|

| NAREIT FFO attributable to controlling interest |

$ |

66,796 |

|

|

$ |

41,746 |

|

|

$ |

122,677 |

|

|

$ |

73,044 |

|

|

|

|

|

|

|

|

|

| Business acquisition expenses |

$ |

(79) |

|

|

$ |

15 |

|

|

$ |

1,758 |

|

|

$ |

2,797 |

|

| Amortization of above- and below-market leases |

355 |

|

|

419 |

|

|

768 |

|

|

845 |

|

| Amortization of closing costs — debt security investment |

12 |

|

|

80 |

|

|

49 |

|

|

156 |

|

| Change in deferred rent |

(720) |

|

|

(556) |

|

|

(1,392) |

|

|

(1,145) |

|

|

|

|

|

|

|

|

|

| Non-cash impact of changes to equity instruments |

3,190 |

|

|

2,765 |

|

|

5,741 |

|

|

4,700 |

|

| Capitalized interest |

(345) |

|

|

(71) |

|

|

(442) |

|

|

(205) |

|

|

|

|

|

|

|

|

|

| Loss on debt extinguishments |

1,298 |

|

|

— |

|

|

1,806 |

|

|

1,280 |

|

| Loss (gain) in fair value of derivative financial instruments |

629 |

|

|

(388) |

|

|

1,379 |

|

|

(6,805) |

|

| Foreign currency (gain) loss |

(2,742) |

|

|

(82) |

|

|

(4,158) |

|

|

344 |

|

| Adjustments for unconsolidated entities |

5 |

|

|

(138) |

|

|

5 |

|

|

(248) |

|

| Adjustments for noncontrolling interests |

(22) |

|

|

(50) |

|

|

(72) |

|

|

75 |

|

Normalized FFO attributable to controlling interest |

$ |

68,377 |

|

|

$ |

43,740 |

|

|

$ |

128,119 |

|

|

$ |

74,838 |

|

| NAREIT FFO and Normalized FFO weighted average common shares outstanding — diluted |

161,143,556 |

|

|

130,689,889 |

|

|

159,318,503 |

|

|

117,413,643 |

|

| NAREIT FFO per common share attributable to controlling interest — diluted |

$ |

0.41 |

|

|

$ |

0.32 |

|

|

$ |

0.77 |

|

|

$ |

0.62 |

|

| Normalized FFO per common share attributable to controlling interest — diluted |

$ |

0.42 |

|

|

$ |

0.33 |

|

|

$ |

0.80 |

|

|

$ |

0.64 |

|

AMERICAN HEALTHCARE REIT, INC.

Adjusted EBITDA Reconciliation

For the Three Months Ended June 30, 2025

(In thousands) (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

10,079 |

|

|

|

|

|

|

|

| Interest expense, net (including amortization of deferred financing costs, debt discount/premium and loss on debt extinguishments) |

|

22,632 |

|

| Income tax expense |

|

732 |

|

| Depreciation and amortization (including amortization of leased assets and accretion of lease liabilities) |

|

42,387 |

|

|

|

|

| EBITDA |

|

$ |

75,830 |

|

|

|

|

| Loss from unconsolidated entities |

|

1,238 |

|

| Straight line rent and amortization of above/below market leases |

|

(811) |

|

| Non-cash impact of changes to equity instruments |

|

3,190 |

|

| Business acquisition expenses |

|

(79) |

|

| Loss on dispositions of real estate investments, net |

|

2,676 |

|

| Amortization of closing costs — debt security investment |

|

12 |

|

| Foreign currency gain |

|

(2,742) |

|

| Loss in fair value of derivative financial instruments |

|

629 |

|

| Impairment of real estate investments |

|

12,659 |

|

|

|

|

| Non-recurring one-time items |

|

495 |

|

|

|

|

| Adjusted EBITDA |

|

$ |

93,097 |

|

AMERICAN HEALTHCARE REIT, INC.

NOI and Cash NOI Reconciliation

For the Three and Six Months Ended June 30, 2025 and 2024

(In thousands) (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net income (loss) |

$ |

10,079 |

|

|

$ |

2,926 |

|

|

$ |

3,239 |

|

|

$ |

(78) |

|

| General and administrative |

14,943 |

|

|

11,746 |

|

|

28,098 |

|

|

23,574 |

|

| Business acquisition expenses |

(79) |

|

|

15 |

|

|

1,758 |

|

|

2,797 |

|

| Depreciation and amortization |

41,941 |

|

|

45,264 |

|

|

83,055 |

|

|

88,031 |

|

| Interest expense |

22,632 |

|

|

30,596 |

|

|

45,577 |

|

|

67,034 |

|

| Loss (gain) in fair value of derivative financial instruments |

629 |

|

|

(388) |

|

|

1,379 |

|

|

(6,805) |

|

| Loss (gain) on dispositions of real estate investments, net |

2,676 |

|

|

2 |

|

|

3,035 |

|

|

(2,261) |

|

| Impairment of real estate investments |

12,659 |

|

|

— |

|

|

34,365 |

|

|

— |

|

| Loss from unconsolidated entities |

1,238 |

|

|

1,035 |

|

|

3,086 |

|

|

2,240 |

|

|

|

|

|

|

|

|

|

| Foreign currency (gain) loss |

(2,742) |

|

|

(82) |

|

|

(4,158) |

|

|

344 |

|

| Other income, net |

(1,480) |

|

|

(3,106) |

|

|

(3,005) |

|

|

(4,969) |

|

| Income tax expense |

732 |

|

|

686 |

|

|

1,336 |

|

|

964 |

|

| Net operating income |

$ |

103,228 |

|

|

$ |

88,694 |

|

|

$ |

197,765 |

|

|

$ |

170,871 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Straight line rent |

(821) |

|

|

(748) |

|

|

(1,556) |

|

|

(1,880) |

|

| Facility rental expense |

7,278 |

|

|

7,888 |

|

|

14,777 |

|

|

16,728 |

|

| Other non-cash adjustments |

182 |

|

|

315 |

|

|

384 |

|

|

706 |

|

| Cash NOI from dispositions |

(393) |

|

|

— |

|

|

(614) |

|

|

— |

|

Cash NOI attributable to noncontrolling interests (1) |

(261) |

|

|

(247) |

|

|

(517) |

|

|

(477) |

|

| Cash NOI |

$ |

109,213 |

|

|

$ |

95,902 |

|

|

$ |

210,239 |

|

|

$ |

185,948 |

|

____________

(1)All periods are based upon current quarter's ownership percentage.

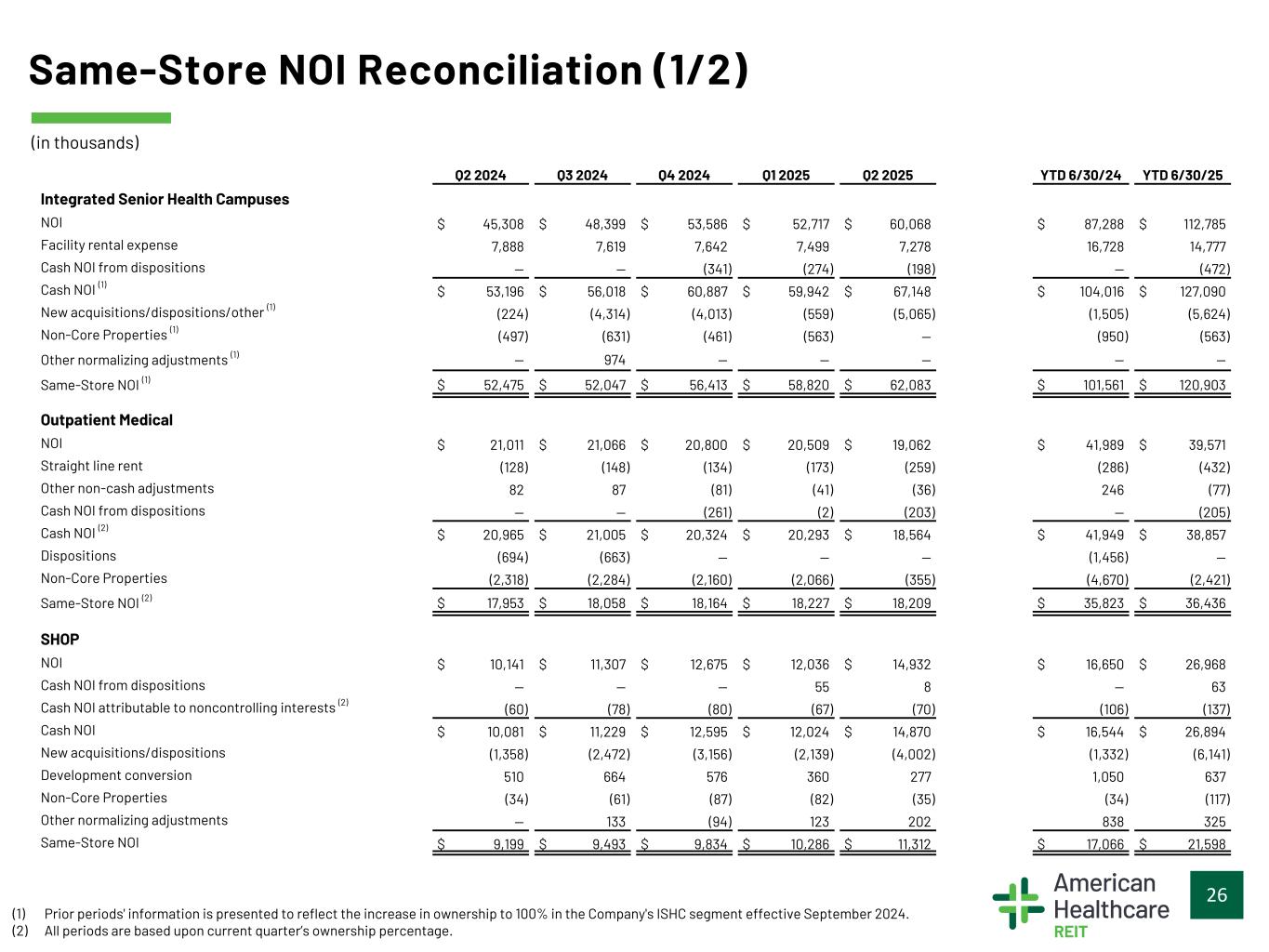

AMERICAN HEALTHCARE REIT, INC.

Same-Store NOI Reconciliation

For the Three and Six Months Ended June 30, 2025 and 2024

(In thousands) (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| ISHC |

|

|

|

|

|

|

|

| NOI |

$ |

60,068 |

|

|

$ |

45,308 |

|

|

$ |

112,785 |

|

|

$ |

87,288 |

|

| Facility rental expense |

7,278 |

|

|

7,888 |

|

|

14,777 |

|

|

16,728 |

|

| Cash NOI from dispositions |

(198) |

|

|

— |

|

|

(472) |

|

|

— |

|

Cash NOI (1) |

$ |

67,148 |

|

|

$ |

53,196 |

|

|

$ |

127,090 |

|

|

$ |

104,016 |

|

New acquisitions/dispositions/other (1) |

(5,065) |

|

|

(224) |

|

|

(5,624) |

|

|

(1,505) |

|

Non-Core Properties (1) |

— |

|

|

(497) |

|

|

(563) |

|

|

(950) |

|

|

|

|

|

|

|

|

|

Same-Store NOI (1) |

$ |

62,083 |

|

|

$ |

52,475 |

|

|

$ |

120,903 |

|

|

$ |

101,561 |

|

|

|

|

|

|

|

|

|

| Outpatient Medical |

|

|

|

|

|

|

|

| NOI |

$ |

19,062 |

|

|

$ |

21,011 |

|

|

$ |

39,571 |

|

|

$ |

41,989 |

|

| Straight line rent |

(259) |

|

|

(128) |

|

|

(432) |

|

|

(286) |

|

| Other non-cash adjustments |

(36) |

|

|

82 |

|

|

(77) |

|

|

246 |

|

| Cash NOI from dispositions |

(203) |

|

|

— |

|

|

(205) |

|

|

— |

|

Cash NOI (2) |

$ |

18,564 |

|

|

$ |

20,965 |

|

|

$ |

38,857 |

|

|

$ |

41,949 |

|

| Dispositions |

— |

|

|

(694) |

|

|

— |

|

|

(1,456) |

|

| Non-Core Properties |

(355) |

|

|

(2,318) |

|

|

(2,421) |

|

|

(4,670) |

|

Same-Store NOI (2) |

$ |

18,209 |

|

|

$ |

17,953 |

|

|

$ |

36,436 |

|

|

$ |

35,823 |

|

|

|

|

|

|

|

|

|

| SHOP |

|

|

|

|

|

|

|

| NOI |

$ |

14,932 |

|

|

$ |

10,141 |

|

|

$ |

26,968 |

|

|

$ |

16,650 |

|

|

|

|

|

|

|

|

|

| Cash NOI from dispositions |

8 |

|

|

— |

|

|

63 |

|

|

— |

|

Cash NOI attributable to noncontrolling interests (2) |

(70) |

|

|

(60) |

|

|

(137) |

|

|

(106) |

|

| Cash NOI |

$ |

14,870 |

|

|

$ |

10,081 |

|

|

$ |

26,894 |

|

|

$ |

16,544 |

|

| New acquisitions/dispositions |

(4,002) |

|

|

(1,358) |

|

|

(6,141) |

|

|

(1,332) |

|

| Development conversion |

277 |

|

|

510 |

|

|

637 |

|

|

1,050 |

|

| Non-Core Properties |

(35) |

|

|

(34) |

|

|

(117) |

|

|

(34) |

|

| Other normalizing adjustments |

202 |

|

|

— |

|

|

325 |

|

|

838 |

|

| Same-Store NOI |

$ |

11,312 |

|

|

$ |

9,199 |

|

|

$ |

21,598 |

|

|

$ |

17,066 |

|

|

|

|

|

|

|

|

|

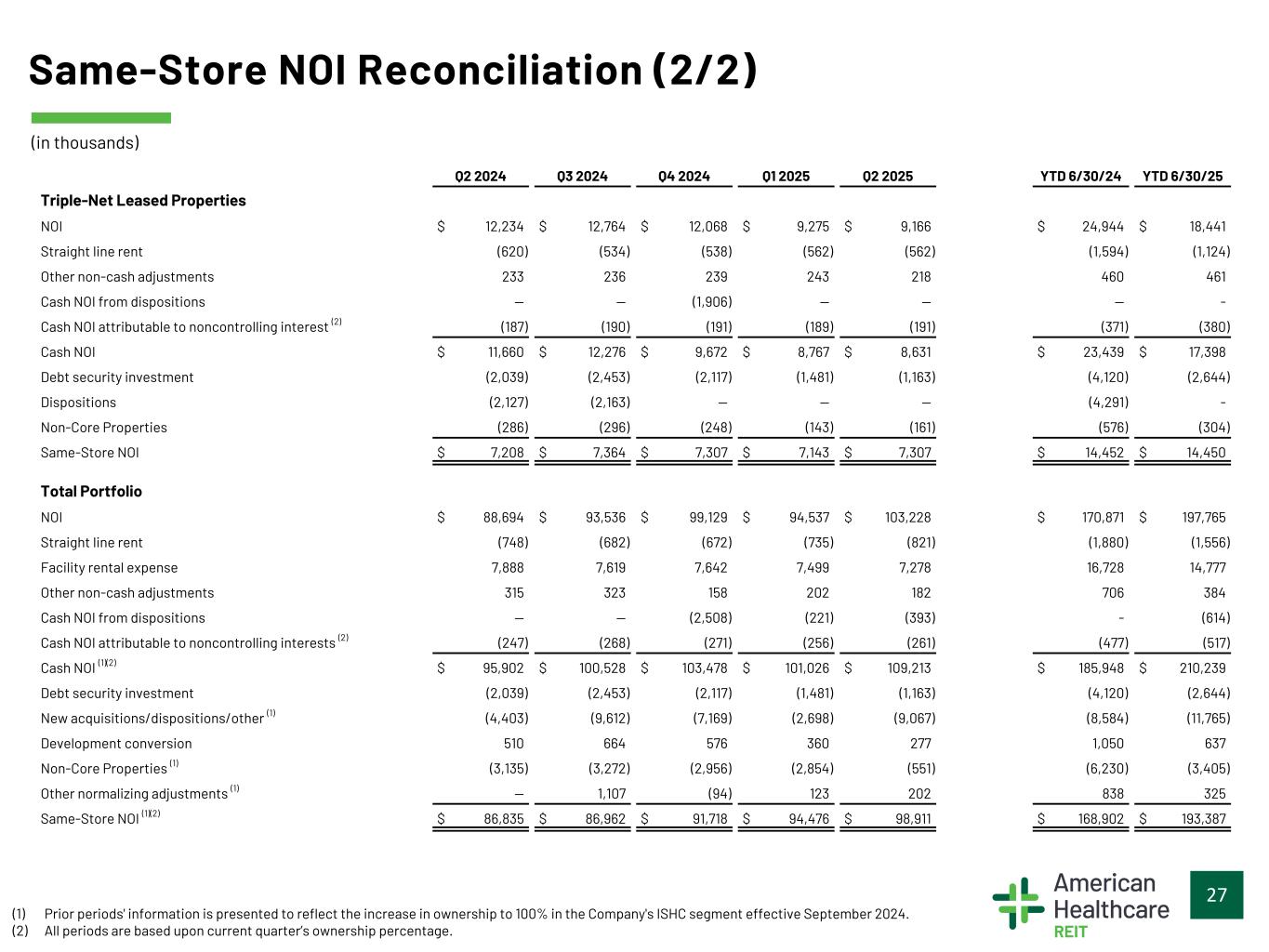

| Triple-Net Leased Properties |

|

|

|

|

|

|

|

| NOI |

$ |

9,166 |

|

|

$ |

12,234 |

|

|

$ |

18,441 |

|

|

$ |

24,944 |

|

| Straight line rent |

(562) |

|

|

(620) |

|

|

(1,124) |

|

|

(1,594) |

|

| Other non-cash adjustments |

218 |

|

|

233 |

|

|

461 |

|

|

460 |

|

|

|

|

|

|

|

|

|

Cash NOI attributable to noncontrolling interest (2) |

(191) |

|

|

(187) |

|

|

(380) |

|

|

(371) |

|

| Cash NOI |

$ |

8,631 |

|

|

$ |

11,660 |

|

|

$ |

17,398 |

|

|

$ |

23,439 |

|

| Debt security investment |

(1,163) |

|

|

(2,039) |

|

|

(2,644) |

|

|

(4,120) |

|

| Dispositions |

— |

|

|

(2,127) |

|

|

— |

|

|

(4,291) |

|

| Non-Core Properties |

(161) |

|

|

(286) |

|

|

(304) |

|

|

(576) |

|

| Same-Store NOI |

$ |

7,307 |

|

|

$ |

7,208 |

|

|

$ |

14,450 |

|

|

$ |

14,452 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMERICAN HEALTHCARE REIT, INC.

Same-Store NOI Reconciliation - (Continued)

For the Three and Six Months Ended June 30, 2025 and 2024

(In thousands) (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

Total Portfolio |

|

|

|

|

|

|

|

| NOI |

$ |

103,228 |

|

|

$ |

88,694 |

|

|

$ |

197,765 |

|

|

$ |

170,871 |

|

| Straight line rent |

(821) |

|

|

(748) |

|

|

(1,556) |

|

|

(1,880) |

|

| Facility rental expense |

7,278 |

|

|

7,888 |

|

|

14,777 |

|

|

16,728 |

|

| Other non-cash adjustments |

182 |

|

|

315 |

|

|

384 |

|

|

706 |

|

| Cash NOI from dispositions |

(393) |

|

|

— |

|

|

(614) |

|

|

— |

|

Cash NOI attributable to noncontrolling interests (2) |

(261) |

|

|

(247) |

|

|

(517) |

|

|

(477) |

|

Cash NOI (1)(2) |

$ |

109,213 |

|

|

$ |

95,902 |

|

|

$ |

210,239 |

|

|

$ |

185,948 |

|

| Debt security investment |

(1,163) |

|

|

(2,039) |

|

|

(2,644) |

|

|

(4,120) |

|

New acquisitions/dispositions/other (1) |

(9,067) |

|

|

(4,403) |

|

|

(11,765) |

|

|

(8,584) |

|

| Development conversion |

277 |

|

|

510 |

|

|

637 |

|

|

1,050 |

|

Non-Core Properties (1) |

(551) |

|

|

(3,135) |

|

|

(3,405) |

|

|

(6,230) |

|

Other normalizing adjustments (1) |

202 |

|

|

— |

|

|

325 |

|

|

838 |

|

Same-Store NOI (1)(2) |

$ |

98,911 |

|

|

$ |

86,835 |

|

|

$ |

193,387 |

|

|

$ |

168,902 |

|

|

|

|

|

|

|

|

|

____________

(1)Prior periods' information is presented to reflect the increase in ownership to 100% in the Company's ISHC segment effective September 2024.

(2)All periods are based upon current quarter's ownership percentage.

AMERICAN HEALTHCARE REIT, INC.

Same-Store Revenue Reconciliation

For the Three and Six Months Ended June 30, 2025 and 2024

(In thousands) (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Ended June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| ISHC |

|

|

|

|

|

|

|

| GAAP revenue |

$ |

423,825 |

|

|

$ |

393,774 |

|

|

$ |

847,189 |

|

|

$ |

786,896 |

|

| Cash revenue from dispositions |

(1,201) |

|

|

— |

|

|

(2,681) |

|

|

— |

|

Cash revenue (1) |

$ |

422,624 |

|

|

$ |

393,774 |

|

|

$ |

844,508 |

|

|

$ |

786,896 |

|

Revenue attributable to new acquisitions/dispositions/other (1) |

(99,681) |

|

|

(98,521) |

|

|

(198,253) |

|

|

(196,469) |

|

Revenue attributable to Non-Core Properties (1) |

— |

|

|

(3,506) |

|

|

(3,855) |

|

|

(6,906) |

|

|

|

|

|

|

|

|

|

Same-Store revenue (1) |

$ |

322,943 |

|

|

$ |

291,747 |

|

|

$ |

642,400 |

|

|

$ |

583,521 |

|

|

|

|

|

|

|

|

|

| Outpatient Medical |

|

|

|

|

|

|

|

| GAAP revenue |

$ |

31,254 |

|

|

$ |

33,682 |

|

|

$ |

64,448 |

|

|

$ |

67,749 |

|

| Straight line rent |

(259) |

|

|

(128) |

|

|

(432) |

|

|

(286) |

|

| Other non-cash adjustments |

(350) |

|

|

(267) |

|

|

(674) |

|

|

(452) |

|

| Cash revenue from dispositions |

(460) |

|

|

— |

|

|

(460) |

|

|

— |

|

Cash revenue (2) |

$ |

30,185 |

|

|

$ |

33,287 |

|

|

$ |

62,882 |

|

|

$ |

67,011 |

|

| Revenue attributable to dispositions |

— |

|

|

(986) |

|

|

— |

|

|

(2,148) |

|

| Revenue attributable to Non-Core Properties |

(1,508) |

|

|

(4,222) |

|

|

(5,399) |

|

|

(8,426) |

|

Same-Store revenue (2) |

$ |

28,677 |

|

|

$ |

28,079 |

|

|

$ |

57,483 |

|

|

$ |

56,437 |

|

|

|

|

|

|

|

|

|

| SHOP |

|

|

|

|

|

|

|

| GAAP revenue |

$ |

77,460 |

|

|

$ |

64,239 |

|

|

$ |

151,272 |

|

|

$ |

123,235 |

|

| Cash revenue from dispositions |

— |

|

|

— |

|

|

(166) |

|

|

— |

|

Cash revenue attributable to noncontrolling interests (2) |

(310) |

|

|

(291) |

|

|

(613) |

|

|

(567) |

|

| Cash revenue |

$ |

77,150 |

|

|

$ |

63,948 |

|

|

$ |

150,493 |

|

|

$ |

122,668 |

|

| Revenue attributable to new acquisitions/dispositions |

(20,765) |

|

|

(12,161) |

|

|

(38,692) |

|

|

(20,482) |

|

| Revenue attributable to development conversion |

(753) |

|

|

(415) |

|

|

(1,391) |

|

|

(685) |

|

| Revenue attributable to Non-Core Properties |

(580) |

|

|

(524) |

|

|

(1,169) |

|

|

(1,006) |

|

| Other normalizing revenue adjustments |

— |

|

|

— |

|

|

— |

|

|

174 |

|

| Same-Store revenue |

$ |

55,052 |

|

|

$ |

50,848 |

|

|

$ |

109,241 |

|

|

$ |

100,669 |

|

|

|

|

|

|

|

|

|

| Triple-Net Leased Properties |

|

|

|

|

|

|

|

| GAAP revenue |

$ |

9,964 |

|

|

$ |

12,886 |

|

|

$ |

20,197 |

|

|

$ |

26,234 |

|

| Straight line rent |

(562) |

|

|

(620) |

|

|

(1,124) |

|

|

(1,594) |

|

| Other non-cash adjustments |

199 |

|

|

212 |

|

|

424 |

|

|

422 |

|

|

|

|

|

|

|

|

|

Cash revenue attributable to noncontrolling interest (2) |

(191) |

|

|

(186) |

|

|

(381) |

|

|

(372) |

|

| Cash revenue |

$ |

9,410 |

|

|

$ |

12,292 |

|

|

$ |

19,116 |

|

|

$ |

24,690 |

|

| Debt security investment |

(1,163) |

|

|

(2,039) |

|

|

(2,644) |

|

|

(4,120) |

|

| Revenue attributable to dispositions |

— |

|

|

(2,169) |

|

|

— |

|

|

(4,338) |

|

| Revenue attributable to Non-Core Properties |

(183) |

|

|

(319) |

|

|

(365) |

|

|

(633) |

|

| Other normalizing revenue adjustments |

(261) |

|

|

— |

|

|

(522) |

|

|

— |

|

| Same-Store revenue |

$ |

7,803 |

|

|

$ |

7,765 |

|

|

$ |

15,585 |

|

|

$ |

15,599 |

|

AMERICAN HEALTHCARE REIT, INC.

Same-Store Revenue Reconciliation - (Continued)

For the Three and Six Months Ended June 30, 2025 and 2024

(In thousands) (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

Total Portfolio |

|

|

|

|

|

|

|

| GAAP revenue |

$ |

542,503 |

|

|

$ |

504,581 |

|

|

$ |

1,083,106 |

|

|

$ |

1,004,114 |

|

| Straight line rent |

(821) |

|

|

(748) |

|

|

(1,556) |

|

|

(1,880) |

|

| Other non-cash adjustments |

(151) |

|

|

(55) |

|

|

(250) |

|

|

(30) |

|

| Cash revenue from dispositions |

(1,661) |

|

|

— |

|

|

(3,307) |

|

|

— |

|

Cash revenue attributable to noncontrolling interests (2) |

(501) |

|

|

(477) |

|

|

(994) |

|

|

(939) |

|

Cash revenue (1) |

$ |

539,369 |

|

|

$ |

503,301 |

|

|

$ |

1,076,999 |

|

|

$ |

1,001,265 |

|

| Debt security investment |

(1,163) |

|

|

(2,039) |

|

|

(2,644) |

|

|

(4,120) |

|

Revenue attributable to new acquisitions/dispositions/other (1) |

(120,446) |

|

|

(113,837) |

|

|

(236,945) |

|

|

(223,437) |

|

| Revenue attributable to development conversion |

(753) |

|

|

(415) |

|

|

(1,391) |

|

|

(685) |

|

Revenue attributable to Non-Core Properties (1) |

(2,271) |

|

|

(8,571) |

|

|

(10,788) |

|

|

(16,971) |

|

Other normalizing revenue adjustments (1) |

(261) |

|

|

— |

|

|

(522) |

|

|

174 |

|

Same-Store revenue (1)(2) |

$ |

414,475 |

|

|

$ |

378,439 |

|

|

$ |

824,709 |

|

|

$ |

756,226 |

|

____________

(1)Prior periods' information is presented to reflect the increase in ownership to 100% in the Company's ISHC segment effective September 2024.

(2)All periods are based upon current quarter's ownership percentage.

AMERICAN HEALTHCARE REIT, INC.

Earnings Guidance Reconciliation

For the Year Ending December 31, 2025

(Dollars and shares in millions, except per share amounts) (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Full Year 2025 Guidance |

|

Prior Full Year 2025 Guidance |

|

Low |

|

High |

|

Low |

|

High |

Net income attributable to common stockholders |

$ |

53.70 |

|

$ |

60.50 |

|

$ |

46.70 |

|

$ |

56.10 |

Depreciation and amortization(1) |

168.30 |

|

168.30 |

|

167.60 |

|

167.60 |

| Impairment and gains/losses from dispositions |

37.40 |

|

37.40 |

|

22.10 |

|

22.10 |

| NAREIT FFO attributable to common stockholders |

$ |

259.40 |

|

$ |

266.20 |

|

$ |

236.40 |

|

$ |

245.80 |

|

|

|

|

|

|

|

|

Amortization of other intangible assets/liabilities(1) |

$ |

1.60 |

|

$ |

1.60 |

|

$ |

1.80 |

|

$ |

1.80 |

Change in deferred rent(1) |

(2.80) |

|

(2.80) |

|

(2.70) |

|

(2.70) |

Non-cash impact of changes to equity plan(1)(2) |

12.50 |

|

12.50 |

|

12.10 |

|

12.10 |

Other adjustments(3) |

(0.40) |

|

(0.40) |

|

3.00 |

|

3.00 |

| Normalized FFO attributable to common stockholders |

$ |

270.30 |

|

$ |

277.10 |

|

$ |

250.60 |

|

$ |

260.00 |

|

|

|

|

|

|

|

|

Net income per common share — diluted |

$ |

0.33 |

|

$ |

0.37 |

|

$ |

0.29 |

|

$ |

0.35 |

|

|

|

|

|

|

|

|

NAREIT FFO per common share — diluted |

$ |

1.57 |

|

$ |

1.61 |

|

$ |

1.49 |

|

$ |

1.55 |

|

|

|

|

|

|

|

|

Normalized FFO per common share — diluted |

$ |

1.64 |

|

$ |

1.68 |

|

$ |

1.58 |

|

$ |

1.64 |

|

|

|

|

|

|

|

|

NAREIT FFO and Normalized FFO weighted average shares — diluted |

165.0 |

|

165.0 |

|

158.5 |

|

158.5 |

|

|

|

|

|

|

|

|

| Total Portfolio Same-Store NOI growth |

11.0 |

% |

|

14.0 |

% |

|

9.0 |

% |

|

13.0 |

% |

|

|

|

|

|

|

|

|

Segment-Level Same-Store NOI growth / (decline): |

|

|

|

|

|

|

|

| ISHC |

15.0 |

% |

|

19.0 |

% |

|

12.0 |

% |

|

16.0 |

% |

Outpatient Medical |

1.0 |

% |

|

1.5 |

% |

|

(1.0 |

%) |

|

1.0 |

% |

| SHOP |

20.0 |

% |

|

24.0 |

% |

|

20.0 |

% |

|

24.0 |

% |

| Triple-Net Leased Properties |

(0.8 |

%) |

|

(0.3 |

%) |

|

(1.5 |

%) |

|

(0.5 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________

(1)Amounts presented net of noncontrolling interests' share and AHR's share of unconsolidated entities.

(2)Amounts represent amortization of equity compensation and fair value adjustments to performance-based equity compensation.

(3)Includes adjustments for capitalized interest, business acquisition expenses and additional items as noted in the Company’s definition of NFFO.

Definitions

Adjusted EBITDA: EBITDA excluding the impact of gain or loss from unconsolidated entities, straight line rent and amortization of above/below market leases, non-cash stock-based compensation expense, business acquisition expenses, gain or loss on sales of real estate investments, unrealized foreign currency gain or loss, change in fair value of derivative financial instruments, impairments of real estate investments, impairments of intangible assets and goodwill, and non-recurring one-time items.

Annualized Adjusted EBITDA: Current period (shown as quarterly) Adjusted EBITDA multiplied by 4.

Cash NOI: NOI excluding the impact of, without duplication, (1) non-cash items such as straight-line rent and the amortization of lease intangibles, (2) third-party facility rent payments and (3) other items set forth in the Cash NOI reconciliation included herein. Both Cash NOI and Same-Store NOI include Pro-Rata ownership and other adjustments.

EBITDA: A Non-GAAP financial measure that is defined as earnings before interest, taxes, depreciation and amortization.

GAAP revenue: Revenue recognized in accordance with Generally Accepted Accounting Principles (“GAAP”), which includes straight line rent and other non-cash adjustments.

ISHC: Integrated senior health campuses include a range of senior care, including independent living, assisted living, memory care, skilled nursing services and certain ancillary businesses. Integrated senior health campuses are operated utilizing a RIDEA structure.

NAREIT FFO or FFO: Funds from operations attributable to controlling interest; a Non-GAAP financial measure, consistent with the standards established by the White Paper on FFO approved by the Board of Governors of NAREIT (the “White Paper”). The White Paper defines FFO as net income (loss) computed in accordance with GAAP, excluding gains or losses from sales of certain real estate assets, gains or losses upon consolidation of a previously held equity interest, and impairment write-downs of certain real estate assets and investments, plus depreciation and amortization related to real estate, after adjustments for unconsolidated partnerships and joint ventures. While impairment charges are excluded from the calculation of FFO as described above, investors are cautioned that impairments are based on estimated future undiscounted cash flows. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect FFO.

Net Debt: Total long-term debt, excluding operating lease liabilities, less cash and cash equivalents and restricted cash related to debt.

NOI: Net operating income; a Non-GAAP financial measure that is defined as net income (loss), computed in accordance with GAAP, generated from properties before general and administrative expenses, business acquisition expenses, depreciation and amortization, interest expense, gain or loss in fair value of derivative financial instruments, gain or loss on dispositions, impairments of real estate investments, impairments of intangible assets and goodwill, income or loss from unconsolidated entities, gain on re-measurement of previously held equity interest, foreign currency gain or loss, other income or expense and income tax benefit or expense.

Non-Core Properties: Assets that have been deemed not essential to generating future economic benefit or value to our day-to-day operations and/or are projected to be sold.

Normalized FFO or NFFO: FFO further adjusted for the following items included in the determination of GAAP net income (loss): expensed acquisition fees and costs, which we refer to as business acquisition expenses; amounts relating to changes in deferred rent and amortization of above and below-market leases (which are adjusted in order to reflect such payments from a GAAP accrual basis); the non-cash impact of changes to our equity instruments; non-cash or non-recurring income or expense; the noncash effect of income tax benefits or expenses; capitalized interest; impairments of intangible assets and goodwill; amortization of closing costs on debt investments; mark-to-market adjustments included in net income (loss); gains or losses included in net income (loss) from the extinguishment or sale of debt, hedges, foreign exchange, derivatives or securities holdings where trading of such holdings is not a fundamental attribute of the business plan; and after adjustments for consolidated and unconsolidated partnerships and joint ventures, with such adjustments calculated to reflect Normalized FFO on the same basis.

Occupancy: With respect to OM, the percentage of total rentable square feet leased and occupied, including month-to-month leases, as of the date reported. With respect to all other property types, occupancy represents average quarterly operating occupancy based on the most recent quarter of available data. The Company uses unaudited, periodic financial information provided solely by tenants to calculate occupancy and has not independently verified the information. Occupancy metrics are reflected at our Pro-Rata share.

Outpatient Medical or OM: Outpatient Medical buildings.

Pro-Rata: For the quarter ended June 30, 2025, we owned and/or operated eight buildings through entities of which we owned between 90.0% and 98.0% of the ownership interests. Because we have a controlling interest in these entities, these entities and the properties these entities own are consolidated in our financial statements in accordance with GAAP. However, while such properties are presented in our financial statements on a consolidated basis, we are only entitled to our Pro-Rata share of the net cash flows generated by such properties. As a result, we have presented certain property information herein based on our Pro-Rata ownership interest in these entities and the properties these entities own, as of the applicable date, and not on a consolidated basis. In such instances, information is noted as being presented on a “Pro-Rata share” basis.

RevPOR: Revenue per occupied room. RevPOR is calculated as total revenue generated by occupied rooms divided by the number of occupied rooms.

RIDEA: Used to describe properties within the portfolio that utilize the RIDEA structure as described in “RIDEA structure”.

RIDEA structure: A structure permitted by the REIT Investment Diversification and Empowerment Act of 2007, pursuant to which we lease certain healthcare real estate properties to a wholly-owned taxable REIT subsidiary (“TRS”), which in turn contracts with an eligible independent contractor (“EIK”) to operate such properties for a fee. Under this structure, the EIK receives management fees, and the TRS receives revenue from the operation of the healthcare real estate properties and retains, as profit, any revenue remaining after payment of expenses (including intercompany rent paid to us and any taxes at the TRS level) necessary to operate the property. Through the RIDEA structure, in addition to receiving rental revenue from the TRS, we retain any after-tax profit from the operation of the healthcare real estate properties and benefit from any improved operational performance while bearing the risk of any decline in operating performance at the properties.

Same-Store or SS: Properties owned or consolidated the full year in both comparison years and that are not otherwise excluded. Properties are excluded from Same-Store if they are: (1) sold, classified as held for sale or properties whose operations were classified as discontinued operations in accordance with GAAP; (2) impacted by materially disruptive events, such as flood or fire for an extensive period of time; or (3) scheduled to undergo or currently undergoing major expansions/renovations or business model transitions or have transitioned business models after the start of the prior comparison period.

Same-Store NOI or SS NOI: Cash NOI for our Same-Store properties. Same-Store NOI is used to evaluate the operating performance of our properties using a consistent population which controls for changes in the composition of our portfolio. Both Cash NOI and Same-Store NOI include ownership and other adjustments.

SHOP: Senior housing operating properties.

Square Feet or Sq. Ft.: Net rentable square feet calculated utilizing Building Owners and Managers Association measurement standards.

Total Debt: The principal balances of the Company’s revolving credit facility, term loan and secured indebtedness as reported in the Company’s consolidated financial statements.

Trilogy: Trilogy Investors, LLC; one of our consolidated subsidiaries, in which we indirectly owned a 100% interest as of June 30, 2025.