Document

ABACUS GLOBAL MANAGEMENT REPORTS THIRD QUARTER 2025 RESULTS

~ Company Delivers 10th Consecutive Quarter of Strong Earnings Growth ~

~ Record Revenue Growth of $63.0 Million, Up 124% Y/Y ~

~ GAAP Net Income of $7.1 Million ~

~ Adjusted Net Income Up 60% Year-over-Year to $23.6 Million ~

~ Adjusted EBITDA Grew 127% Year-over-Year to $37.9 Million ~

~ Increases 2025 Outlook Above Prior Range; Now Expecting Year-over-Year Adjusted Net Income Growth Between 72% & 81% ~

~ Post Quarter End, Company Completes Two Major Milestones with Strategic Acquisition of AccuQuote & $50 Million Securitized Asset-Backed Rated Note to Institutional Investors ~

ORLANDO, Fla. – November 6, 2025 – Abacus Global Management, Inc. (“Abacus” or the “Company”) (NASDAQ: ABL), a leader in the alternative asset management space, today reported results for the third quarter ended September 30, 2025.

“The third quarter represents our tenth consecutive quarter of earnings growth, driven by disciplined execution and robust demand for our longevity-based assets, uncorrelated to traditional markets at a time when investors are increasingly focused on diversification,” said Jay Jackson, Chief Executive Officer of Abacus. “We are once again increasing our full-year 2025 expectations for adjusted earnings, now projecting year-over-year growth of 72 to 81%. Moreover, our acquisition of AccuQuote further expands and strengthens our financial services platform. Most recently, we achieved another key milestone with the sale of $50 million in securitized life insurance assets, structured as an investment-grade rated collateralized note to institutional investors. Together, these achievements reinforce our momentum, scalability, and visibility as we continue building a new asset class and creating long-term value for all Abacus stakeholders.”

Third Quarter 2025 Highlights

•Total revenue for the third quarter grew 124% to $63.0 million, compared to $28.1 million in the prior-year period. The increase was driven by continued growth in Abacus’ Life Solutions and Longevity Funds segments and expanded asset management fees from recent acquisitions.

•Origination capital deployment continued to expand, increasing by 10% for the quarter to $102.4 million, compared to $93.2 million in the prior-year period; number of policies held at quarter end totaled 522, compared to 278 as of September 30, 2024.

•GAAP net income attributable to shareholders was $7.1 million, compared to a net loss of $5.1 million in the prior-year period. The increase was primarily driven primarily driven by higher revenues, partially offset by increased operating costs and interest expense.

•Adjusted net income (a non-GAAP financial measure) increased 60% year-over-year to $23.6 million compared to $14.7 million in the prior year period. Adjusted diluted earnings per share for the third quarter of 2025 was $0.24, compared to $0.20 in the prior-year period.

•Adjusted EBITDA (a non-GAAP financial measure) for the third quarter of 2025 increased 127% to $37.9 million, compared to $16.7 million in the prior-year period. Adjusted EBITDA margin (a non-GAAP financial measure) for the third quarter of 2025 was 60.2%, in line with the prior-year period.

•Annualized return on invested capital (ROIC) (a non-GAAP financial measure) for the third quarter of 2025 was 21%.

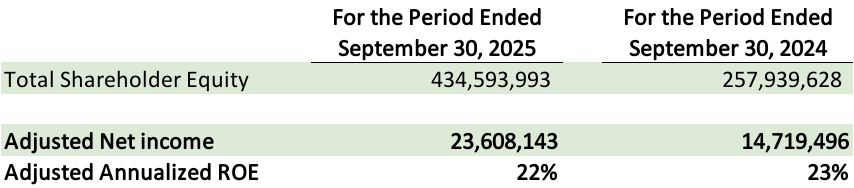

•Annualized Return on equity (ROE) (a non-GAAP financial measure) for the third quarter of 2025 was 22%.

•Annualized Turnover Ratio (a non-GAAP financial measure) for the third quarter of 2025 was 2.0x, in-line with the previously announced long-term target of 1.5x to 2.0x. This compares to the 2.3x Turnover Ratio, a KPI introduced in the second quarter of 2025.

•Average Realized Gain (a non-GAAP financial measure) for the third quarter of 2025 was 37%. This compares to 26.3%, as first reported in the second quarter of 2025.

•Abacus was added to the Russell 2000® and 3000® Indexes, effective September 22, 2025, enhancing visibility and access to institutional investors.

•Subsequent to quarter end, Abacus announced the strategic acquisition of AccuQuote, a premier online life insurance brokerage company. The accretive acquisition adds a new digital origination funnel to the Abacus platform, expanding client lifecycle coverage, and supporting accelerating growth in policy origination and asset acquisition volumes.

•Most recently, Abacus announced a $50 million securitized asset-backed rated note of life insurance assets, structured as an above-investment-grade collateralized note. This milestone transaction marks the beginning of a scalable and recurring funding mechanism.

Liquidity and Capital

As of September 30, 2025, the Company had cash and cash equivalents of $86.4 million and balance sheet policy assets of $424.7 million.

2025 Outlook

The Company is raising its full year 2025 outlook for Adjusted net income to between $80 million and $84 million, compared to its prior outlook of between $74 million and $80 million. The new range implies growth of between 72% to 81% compared to full year 2024 Adjusted net income of $46.5 million.

For a definition of Adjusted net income, see “Non-GAAP Financial Information” below.

Webcast and Conference Call

A webcast and conference call to discuss the Company’s results will be held today, November 6, 2025, beginning at 5:00 p.m. (Eastern Time). A live webcast of the conference call will be available on Abacus’ investor relations website at ir.abacuslife.com. The dial-in number for the conference call is (844) 826-3033 (toll-free) or (412) 317-5185 (international). Please dial the number 10 minutes prior to the scheduled start time.

A webcast replay of the call will be available at ir.abacusgm.com for one year following the call.

Non-GAAP Financial Information

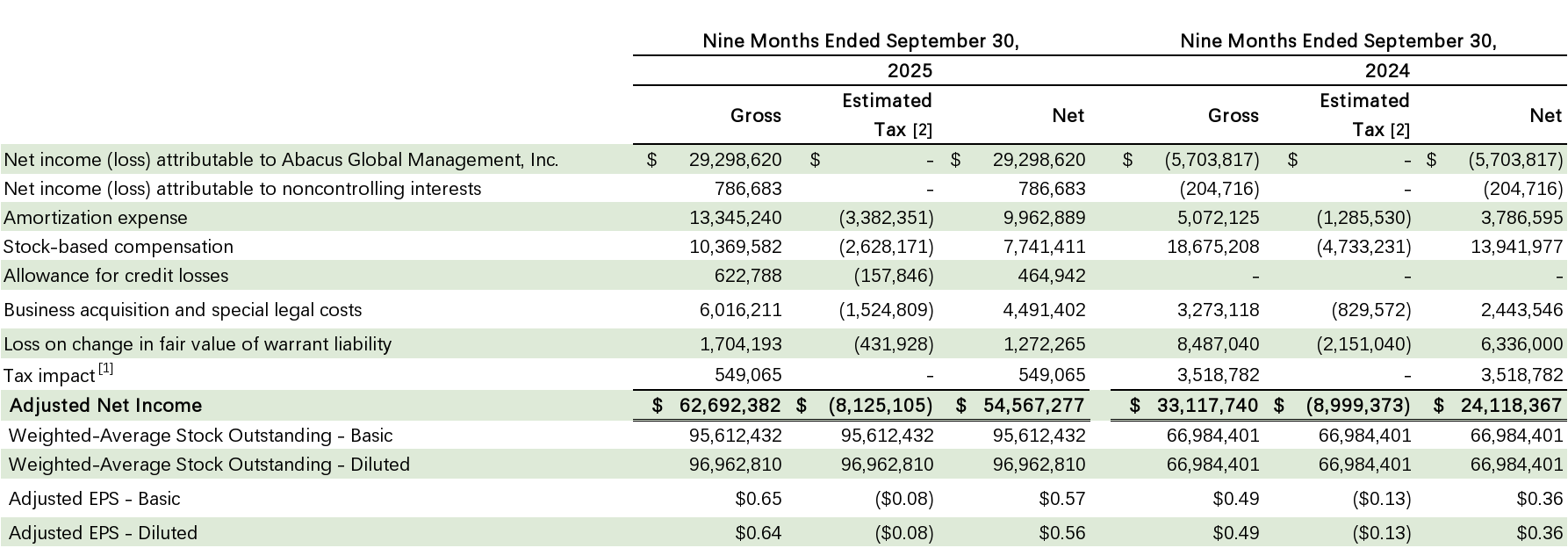

Adjusted Net Income, a non-GAAP financial measure, is defined as net income (loss) attributable to Abacus adjusted for non-controlling interest income, amortization, change in fair value of warrants and non-cash stock-based compensation and the related tax effect of those adjustments. Management believes that Adjusted Net Income is an appropriate measure of operating performance because it eliminates the impact of expenses that do not relate to business performance. A reconciliation of Adjusted Net Income to Net income attributable to Abacus, the most directly comparable GAAP measure, appears below.

The Company is unable to provide a comparable FY 2025 outlook for, or a reconciliation to net income because it cannot provide a meaningful or accurate calculation or estimation of certain reconciling items without unreasonable effort. Its inability to do so is due to the inherent difficulty in forecasting the timing of items that have not yet occurred and quantifying certain amounts that are necessary for such reconciliation, including variations in effective tax rate, expenses to be incurred for acquisition activities, and other one-time or exceptional items.

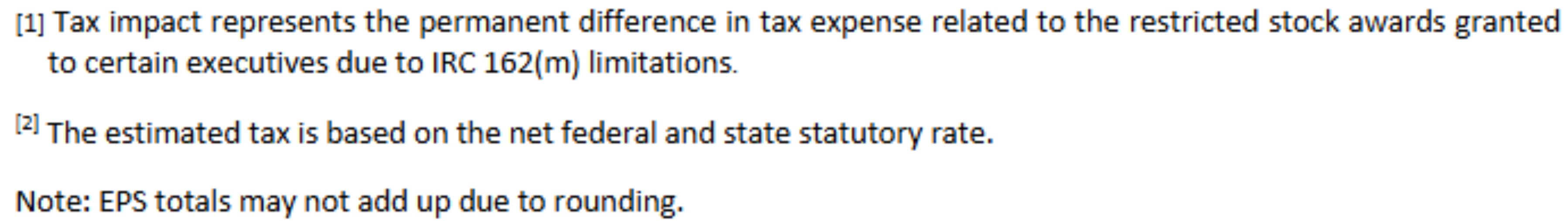

Adjusted EBITDA, a non-GAAP financial measure, is defined as net income (loss) attributable to Abacus adjusted for depreciation expense, amortization, interest expense, income tax and other non-cash and certain non-recurring items that in our judgment significantly impact the period-over-period assessment of performance and operating results that do not directly relate to business performance within Abacus’ control. A reconciliation of Adjusted EBITDA to Net income attributable to Abacus Life, the most directly comparable GAAP measure, appears below.

Adjusted EBITDA margin, a non-GAAP financial measure, is defined as Adjusted EBITDA divided by Total revenues. A reconciliation of Adjusted EBITDA margin to Net income margin, the most directly comparable GAAP measure, appears below.

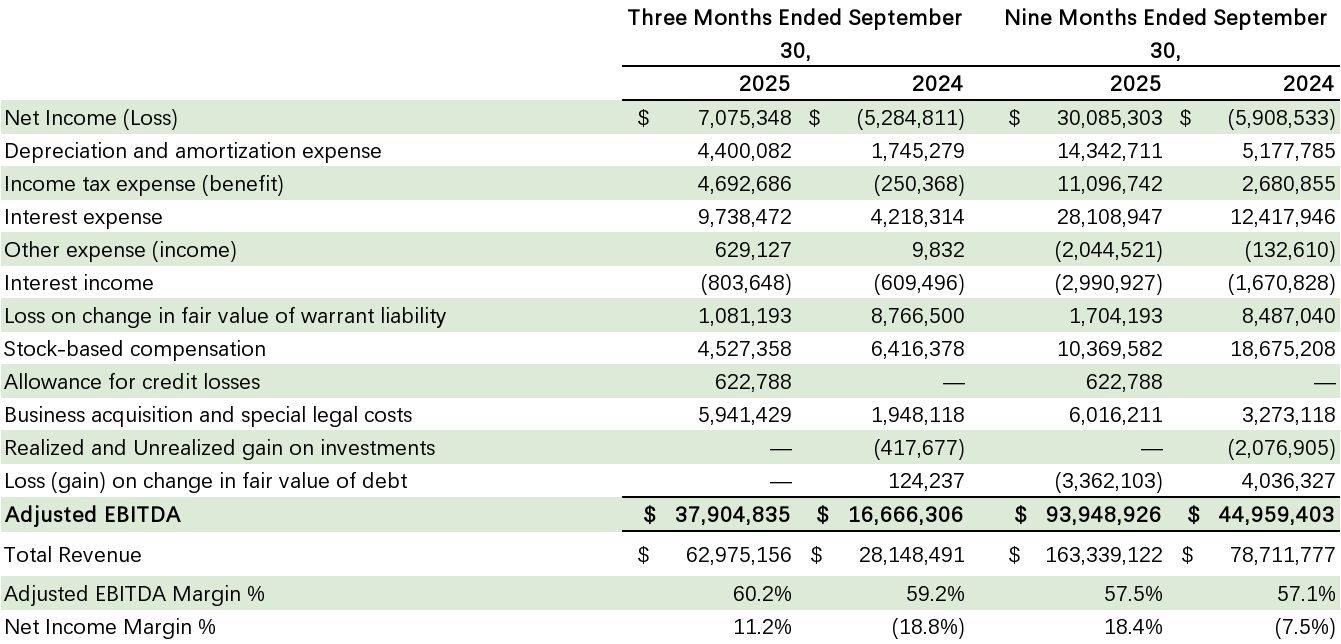

Annualized return on invested capital (ROIC), a non-GAAP financial measure, is defined as Adjusted net income for the quarter divided by the result of Total Assets less Intangible assets, net, Goodwill and Current Liabilities multiplied by four. ROIC is not a measure of financial performance under GAAP. We believe ROIC should be considered in addition to, not as a substitute for, operating income or loss, net income or loss, cash flows provided by or used in operating, investing and financing activities or other income statement or cash flow statement line items reported in accordance with GAAP.

Annualized return on equity (ROE), a non-GAAP financial measure, is defined as Adjusted net income divided by total shareholder equity multiplied by four. ROE is not a measure of financial performance under GAAP. We believe ROE should be considered in addition to, not as a substitute for, operating income or loss, net income or loss, cash flows provided by or used in operating, investing and financing activities or other income statement or cash flow statement line items reported in accordance with GAAP. The below table presents our calculation of ROE.

Forward-Looking Statements

All statements in this press release (and oral statements made regarding the subjects of this press release) other than historical facts are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of uncertainties and factors that could cause actual results to differ materially from such statements, many of which are outside the control of Abacus. Forward-looking information includes but is not limited to statements regarding: Abacus’s financial and operational outlook; Abacus’s operational and financial strategies, including planned growth initiatives and the benefits thereof, Abacus’s ability to successfully effect those strategies, and the expected results therefrom. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “expect,” “intend,” “anticipate,” “goals,” “prospects,” “will,” “would,” “will continue,” “will likely result,” and similar expressions (including the negative versions of such words or expressions).

While Abacus believes that the assumptions concerning future events are reasonable, it cautions that there are inherent difficulties in predicting certain important factors that could impact the future performance or results of its business. The factors that could cause results to differ materially from those indicated by such forward-looking statements include, but are not limited to: the fact that Abacus’s loss reserves are bases on estimates and may be inadequate to cover its actual losses; the failure to properly price Abacus’s insurance policies; the geographic concentration of Abacus’s business; the cyclical nature of Abacus’s industry; the impact of regulation on Abacus’s business; the effects of competition on Abacus’s business; the failure of Abacus’s relationships with independent agencies; the failure to meet Abacus’s investment objectives; the inability to raise capital on favorable terms or at all; the effects of acts of terrorism; and the effectiveness of Abacus’s control environment, including the identification of control deficiencies.

These forward-looking statements are also affected by the risk factors, forward-looking statements and challenges and uncertainties set forth in documents filed by Abacus with the U.S. Securities and Exchange Commission from time to time, including the Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and subsequent periodic reports. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Abacus cautions you not to place undue reliance on the forward-looking statements contained in this press release. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Abacus assumes no obligation and, except as required by law, does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Abacus does not give any assurance that it will achieve its expectations.

About Abacus

Abacus Global Management (NASDAQ: ABL) is a leading financial services company specializing in alternative asset management, data-driven wealth solutions, technology innovations, and institutional services. With a focus on longevity-based assets and personalized financial planning, Abacus leverages proprietary data analytics and decades of industry expertise to deliver innovative solutions that optimize financial outcomes for individuals and institutions worldwide.

Contacts :

Investor Relations

Robert F. Phillips – SVP Investor Relations and Corporate Affairs

rob@abacusgm.com

(321) 290-1198

David Jackson – Managing Director of Investor Relations

david@abacusgm.com

(321) 299-0716

Abacus Global Management Public Relations

press@abacusgm.com

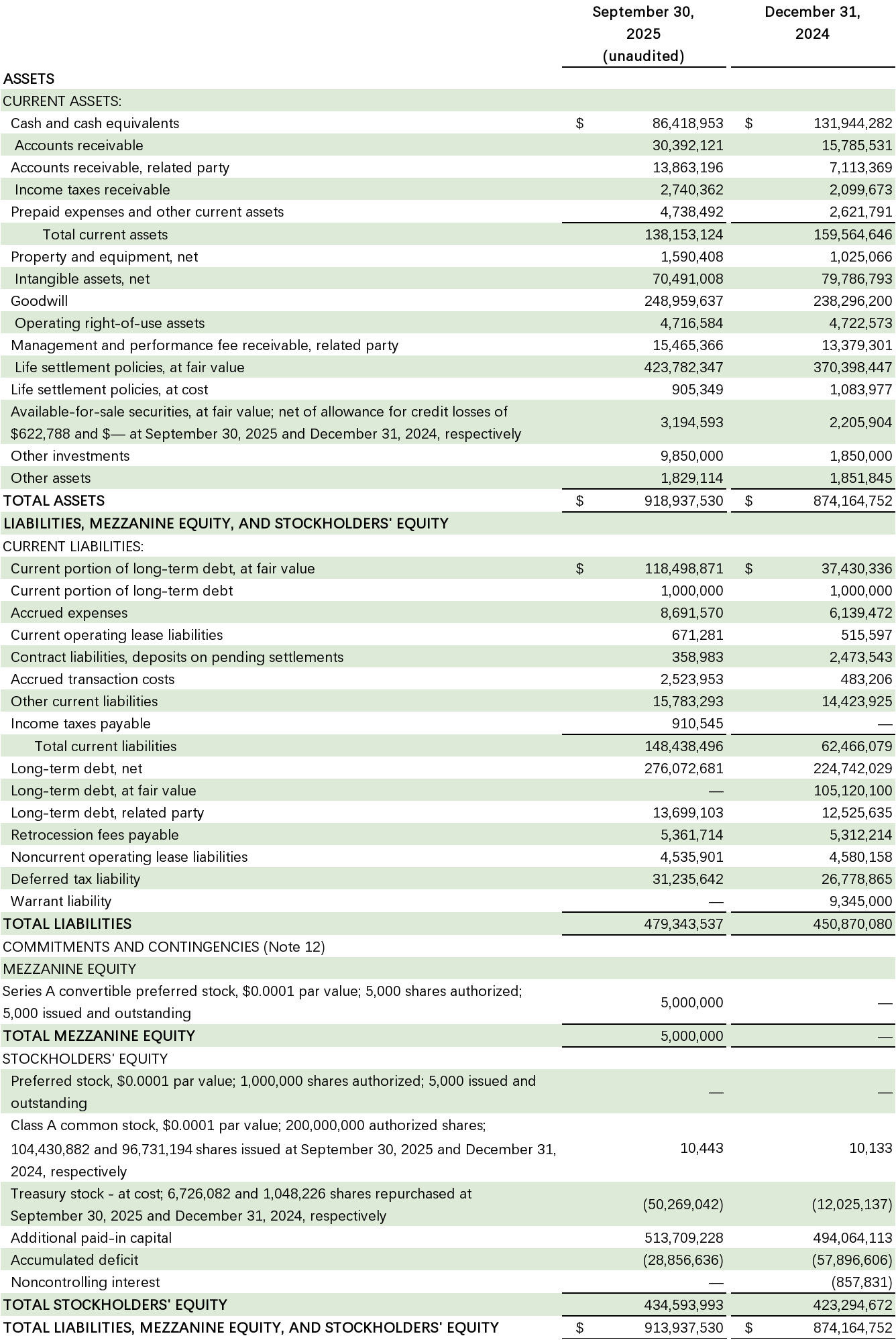

ABACUS GLOBAL MANAGEMENT, INC. CONSOLIDATED BALANCE SHEET

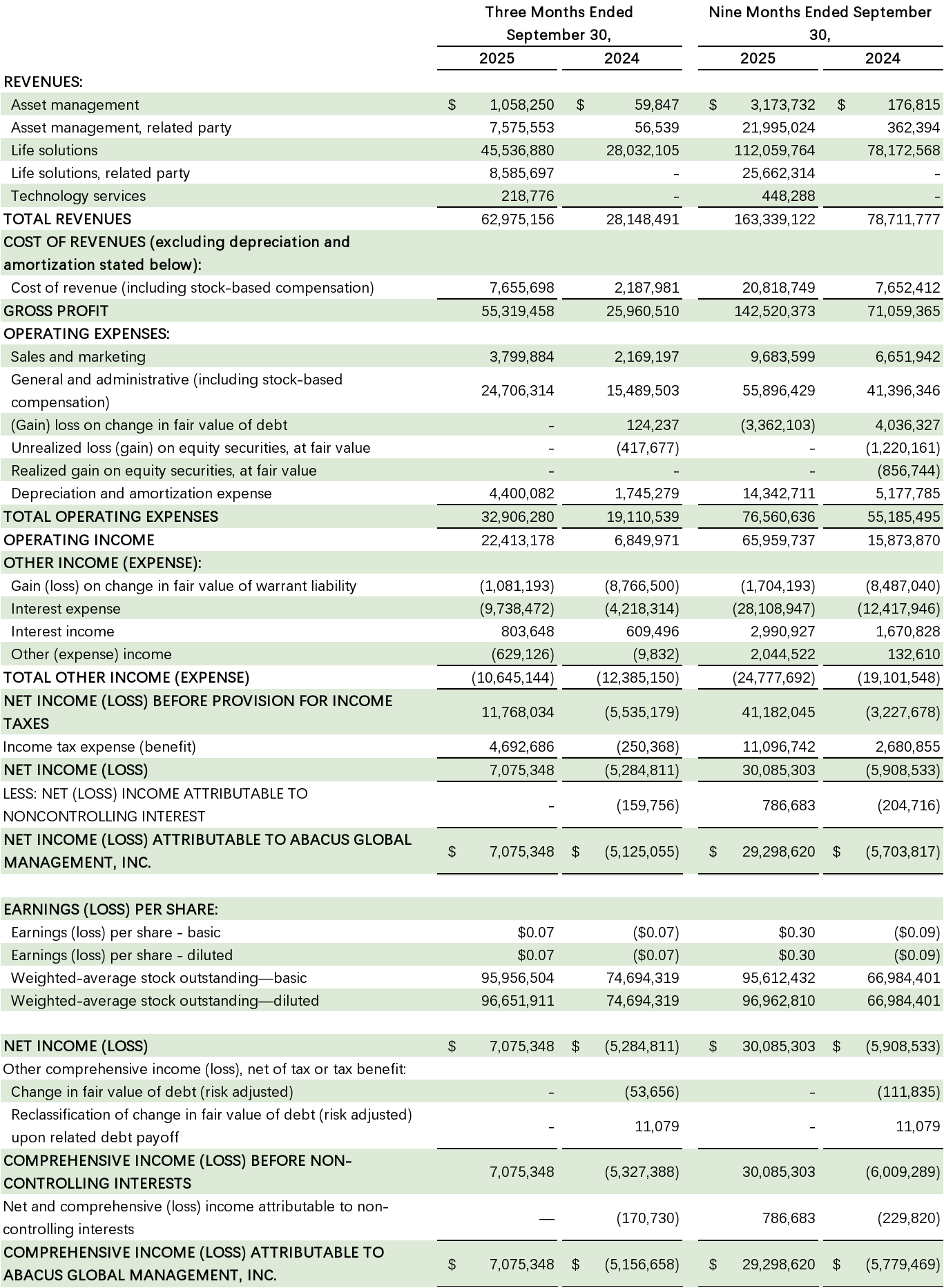

ABACUS GLOBAL MANAGEMENT, INC. UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

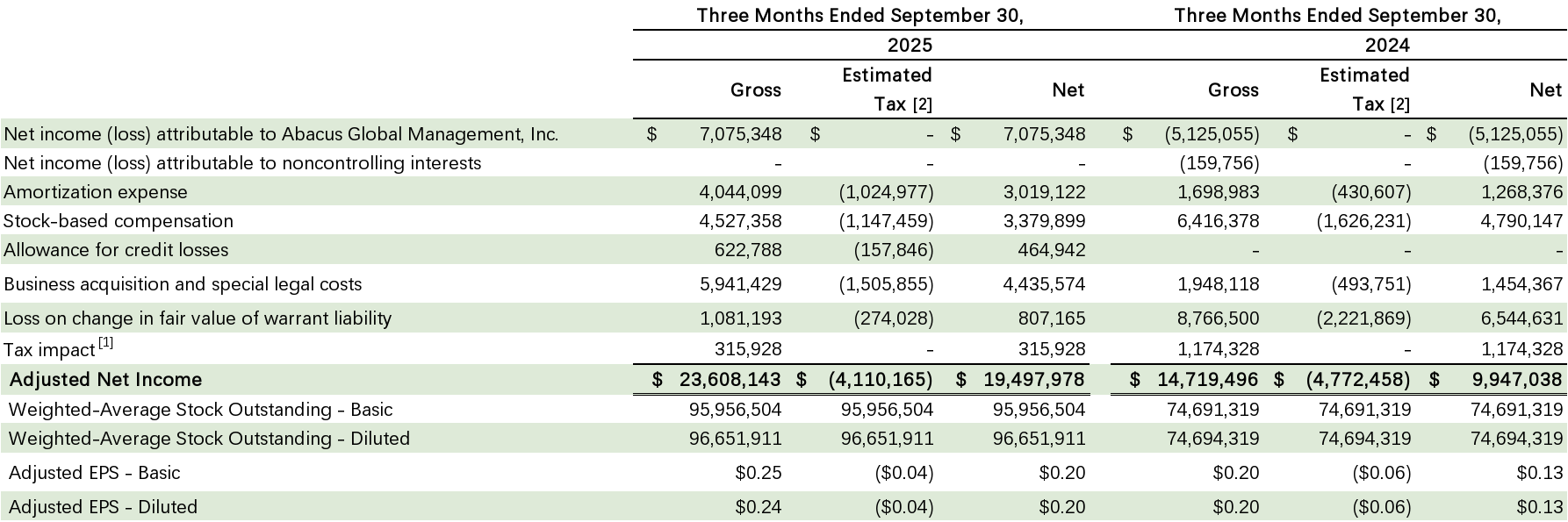

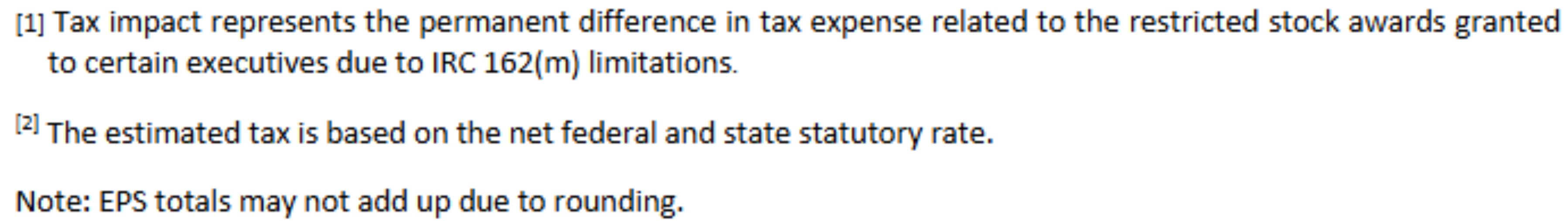

ABACUS GLOBAL MANAGEMENT, INC. ADJUSTED NET INCOME

ABACUS GLOBAL MANAGEMENT, INC. ADJUSTED EBITDA

ABACUS GLOBAL MANAGEMENT, INC. ADJUSTED RETURN ON INVESTED CAPITAL (ROIC)

ABACUS GLOBAL MANAGEMENT, INC. ADJUSTED RETURN ON EQUITY (ROE)