Document

Exhibit 99.1

Open Lending Reports Third Quarter 2025 Financial Results

AUSTIN, Texas, November 6, 2025 – Open Lending Corporation (Nasdaq: LPRO) (the “Company” or “Open Lending”), a leading provider of lending enablement and risk analytics solutions for financial institutions, today reported financial results for its third quarter ended September 30, 2025.

“Our results reflect the strategic implementation of enhanced underwriting standards and a more conservative booking approach that we believe will reduce volatility in our profit share unit economics,” said Jessica Buss, Chief Executive Officer of Open Lending. “We believe our value proposition is further enhanced by the launch of ApexOne Auto, an advanced decisioning platform that expands our capabilities to serve the full spectrum of auto borrowers. We have a high degree of confidence in our business model as we head into 2026.”

Three Months Ended September 30, 2025 Highlights

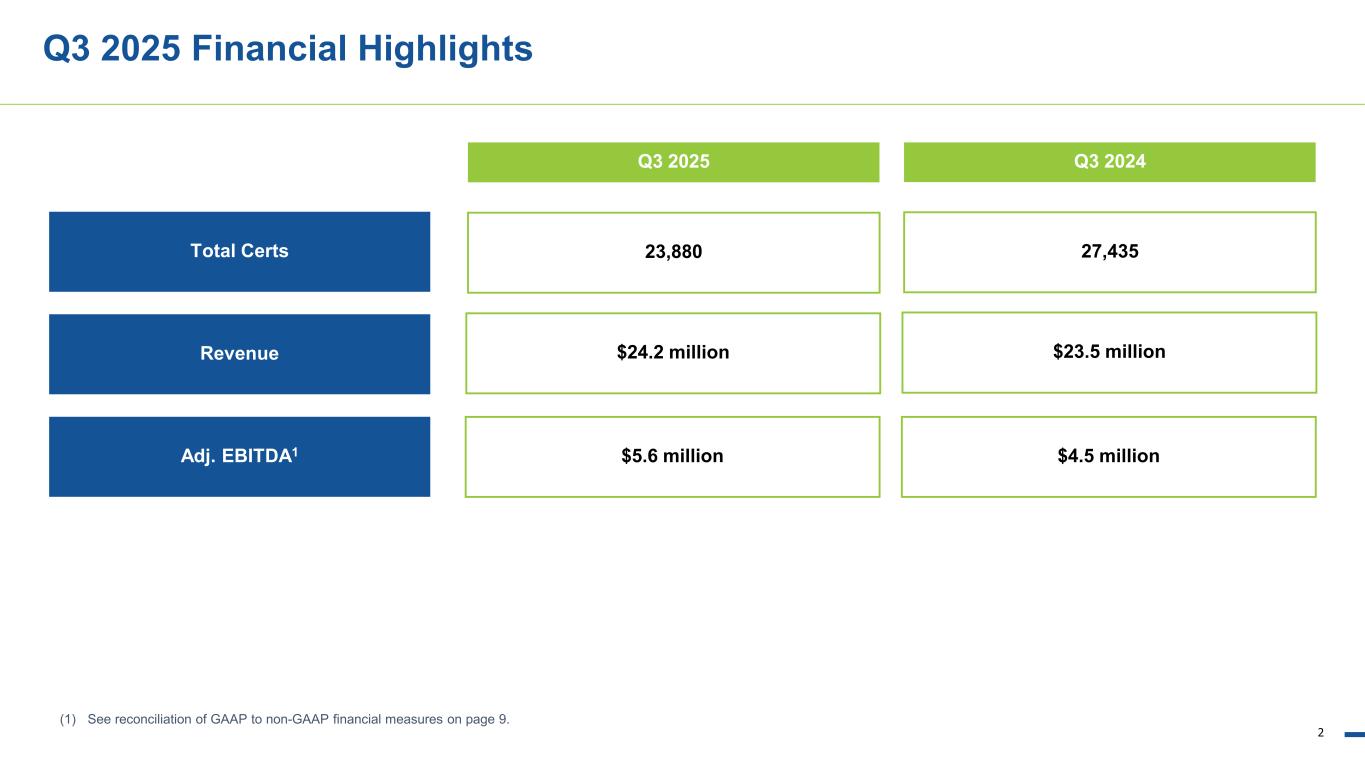

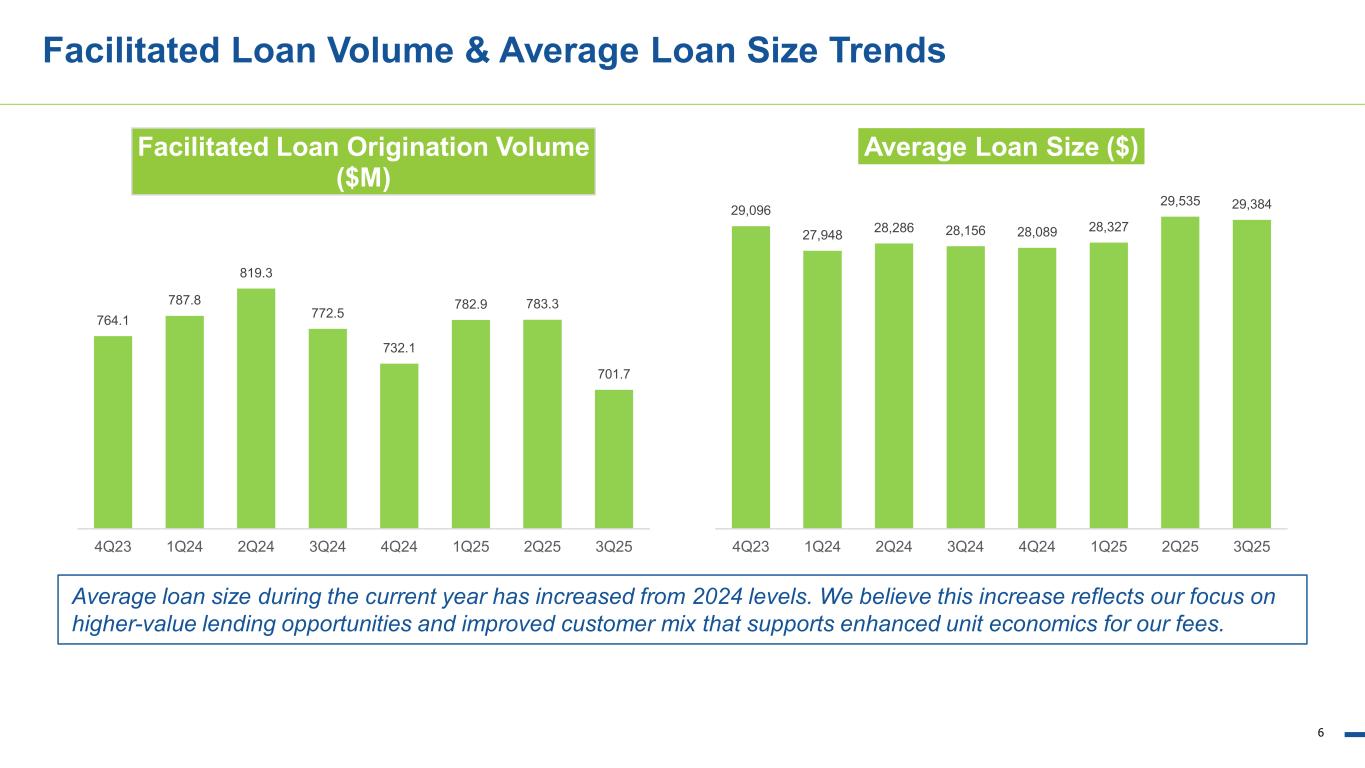

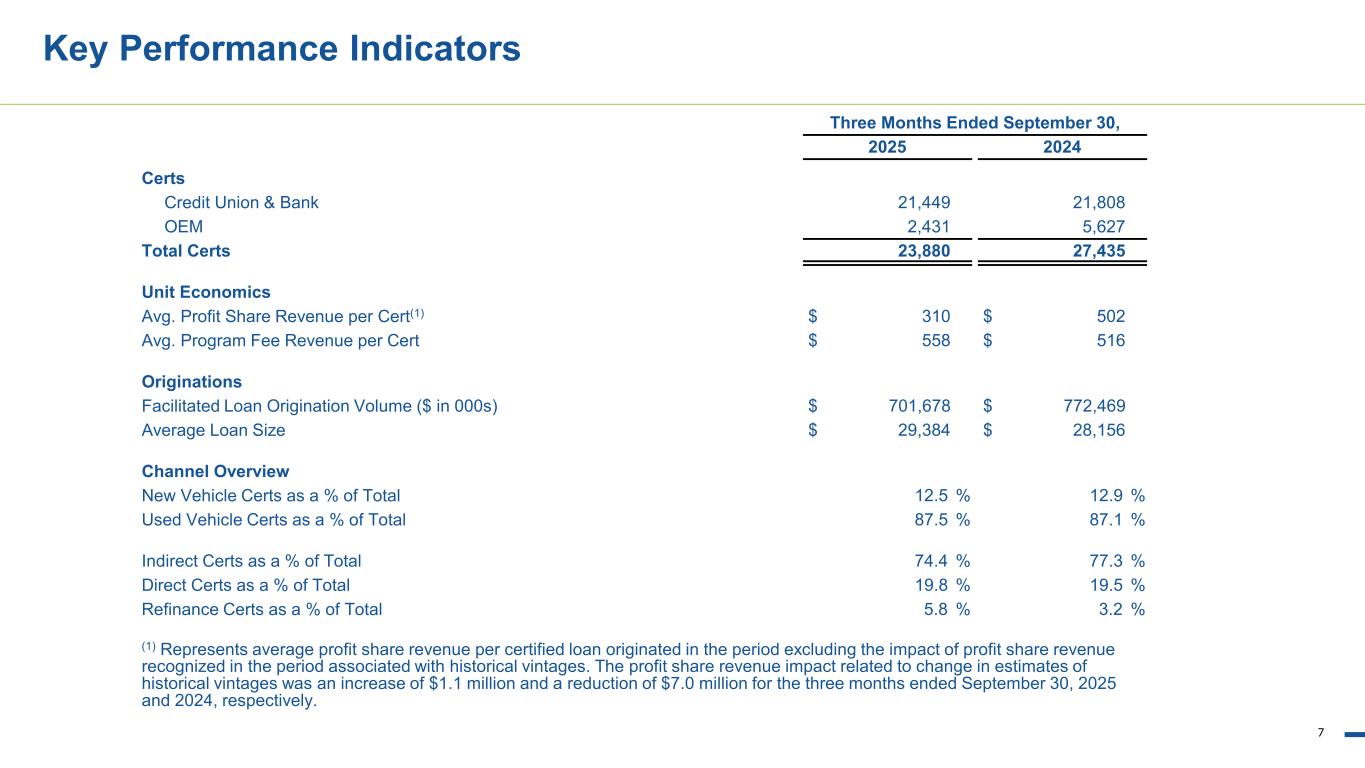

•The Company facilitated 23,880 certified loans during the third quarter of 2025, compared to 27,435 certified loans in the third quarter of 2024.

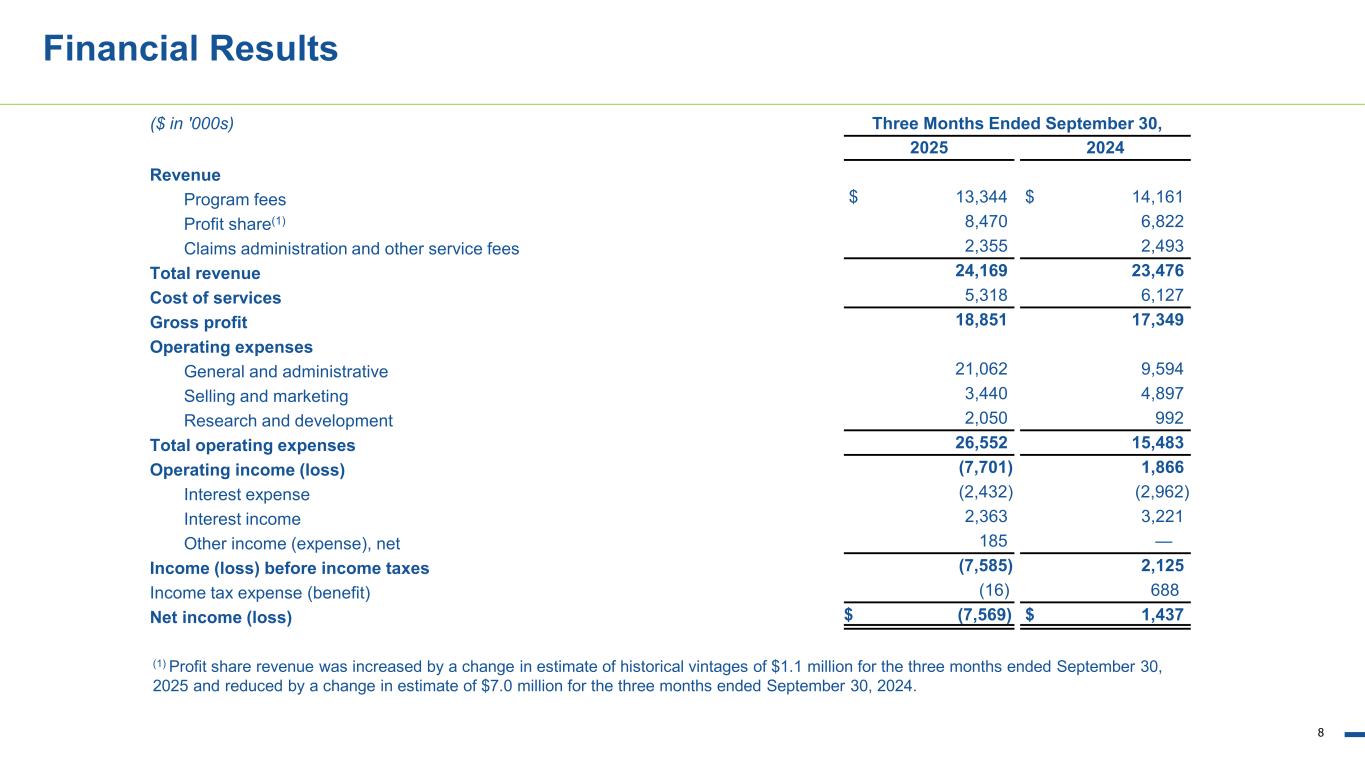

•Total revenue was $24.2 million during the third quarter of 2025, compared to $23.5 million in the third quarter of 2024. The third quarter of 2025 was impacted by an increase of $1.1 million in estimated profit share revenues related to business in historic vintages as compared to a $7.0 million reduction in the third quarter of 2024.

•Gross profit was $18.9 million during the third quarter of 2025, compared to $17.3 million in the third quarter of 2024.

•Net loss was $7.6 million during the third quarter of 2025, compared to net income of $1.4 million in the third quarter of 2024.

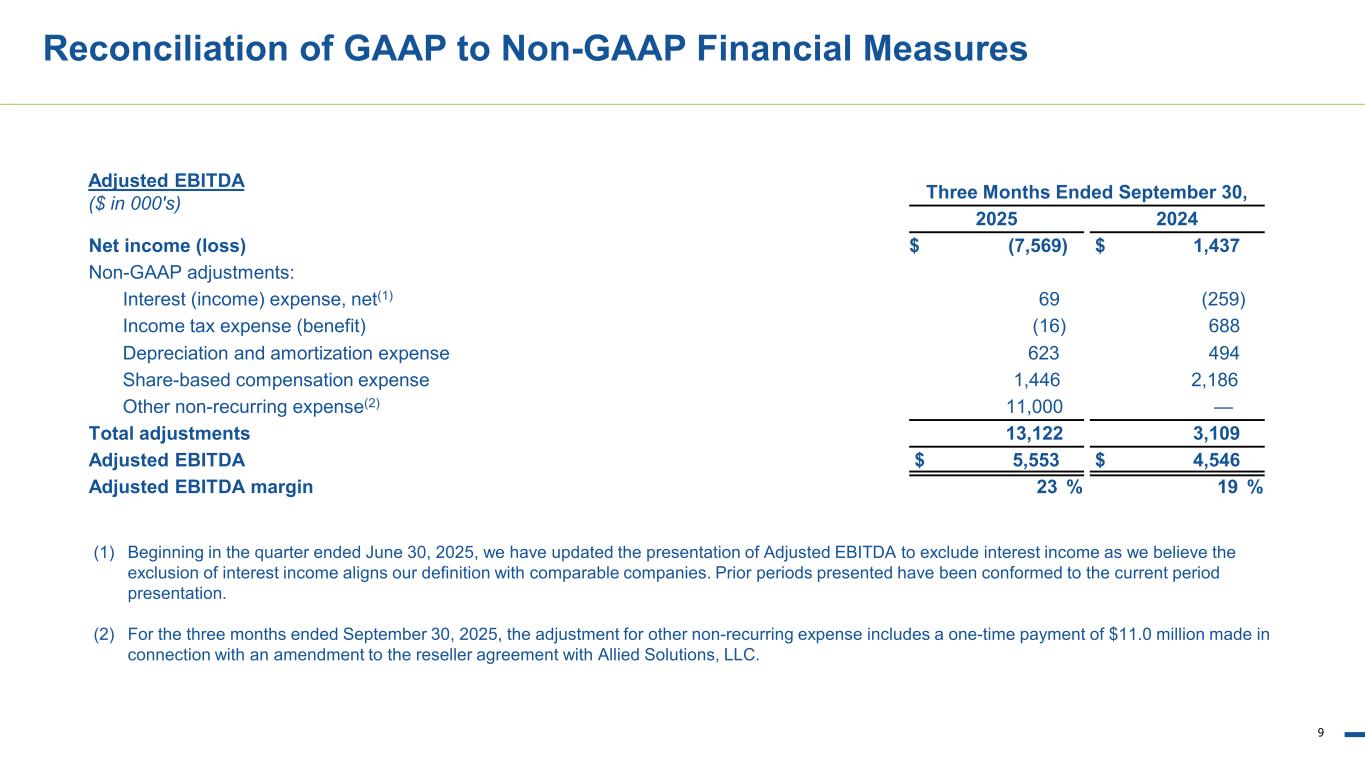

•Adjusted EBITDA was $5.6 million during the third quarter of 2025, compared to $4.5 million in the third quarter of 2024.

Adjusted EBITDA is a non-GAAP financial measure. Beginning in the quarter ended June 30, 2025, we have updated the presentation of Adjusted EBITDA to exclude interest income as we believe the exclusion of interest income aligns our definition with comparable companies. Prior periods presented have been conformed to the current period presentation. In addition, beginning in the quarter ended September 30, 2025, we have updated the presentation of Adjusted EBITDA to exclude certain other non-recurring expenses that do not contribute directly to management’s evaluation of our operating results. A reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure is provided in the financial table included at the end of this press release. An explanation of this measure and how it is calculated is also included under the heading “Non-GAAP Financial Measures.”

Business Highlights

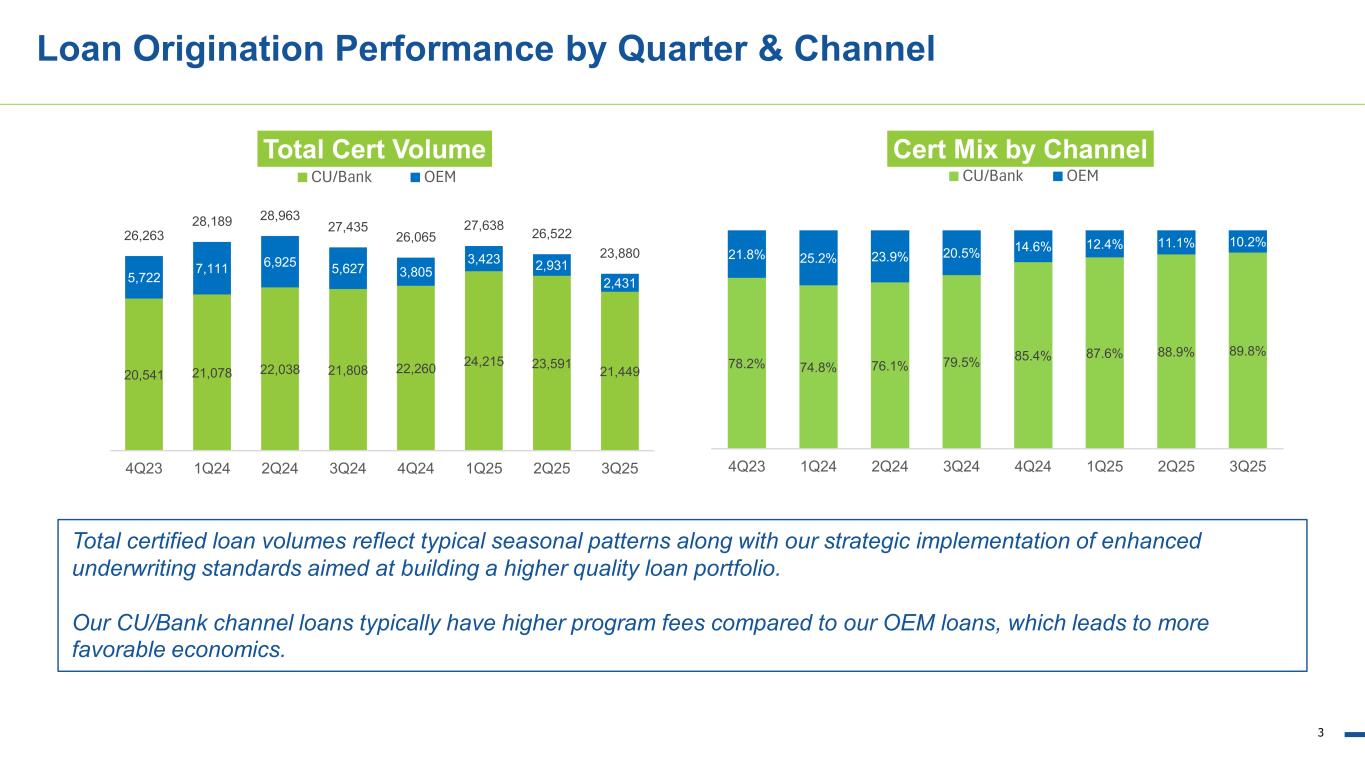

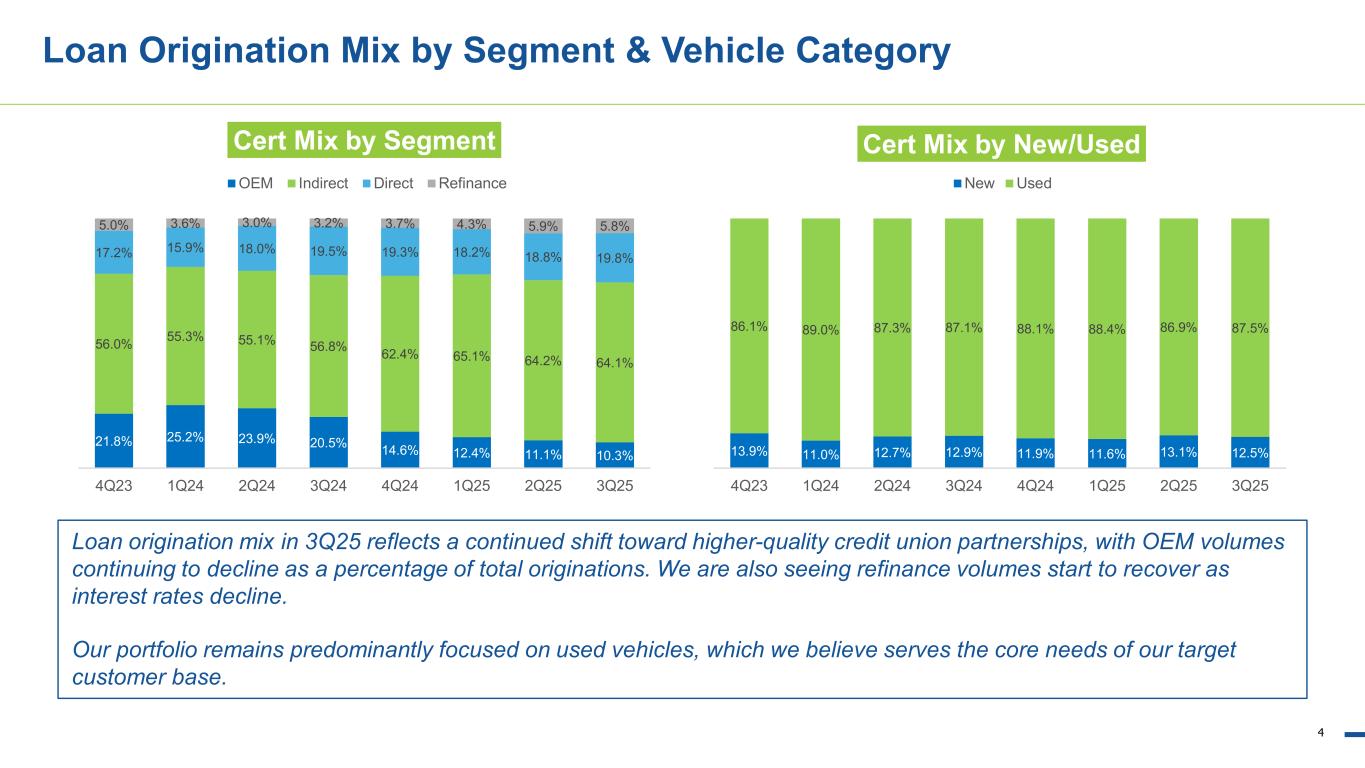

•Credit unions and banks represented 21,449, or 89.8%, of certified loans in the third quarter of 2025, compared to 21,808, or 79.5%, in the third quarter of 2024.

•Average profit share revenue per certified loan was $310 in the third quarter of 2025, compared to $502 in the third quarter of 2024.

•Average program fee revenue per certified loan was $558 in the third quarter of 2025, compared to $516 in the third quarter of 2024.

•On August 13, 2025, the Company and Allied Solutions, LLC (“Allied”) entered into an amendment to their reseller agreement to, among other matters, extend the term of the agreement and to provide for a one-time payment of $11.0 million in exchange for the extinguishment of Allied’s right to certain ongoing compensation and the amendment of the schedule of referral fees payable to Allied.

Fourth Quarter 2025 Outlook

For the fourth quarter of 2025, the Company currently expects total certified loans to be between 21,500 and 23,500.

The guidance provided includes forward-looking statements within the meaning of U.S. securities laws. See “Forward-Looking Statements” below.

Open Lending will host a conference call to discuss the third quarter 2025 financial results on November 6, 2025 at 5:00 pm ET. The conference call will be webcast live from the Company's investor relations website at https://investors.openlending.com/ under the “Events” section. The conference call can also be accessed live over the phone by dialing (800) 343-4849, or for international callers (203) 518-9848, in each case using access code LENDING. An archive of the webcast will be available at the same location on the website shortly after the call has concluded.

About Open Lending

Open Lending (Nasdaq: LPRO) provides loan analytics, risk-based pricing, risk modeling and default insurance to auto lenders throughout the United States. For 25 years, we have been empowering financial institutions to create profitable auto loan portfolios with less risk and more reward. For more information, please visit www.openlending.com.

Forward-Looking Statements

This press release includes certain statements that are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995, including statements related to the Company's new loan measures, lender profitability, volatility, market trends, consumer behavior and demand for automotive loans, as well as future financial performance under the heading "Fourth Quarter 2025 Outlook" above. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “on track,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements are based on various assumptions and on the current expectations of the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the Company’s control. These forward-looking statements are subject to a number of risks and uncertainties, including general economic, market, political and business conditions; applicable taxes, inflation, tariffs, supply chain disruptions including global hostilities and responses thereto, the prolonged U.S. government shutdown, interest rates and the regulatory environment; the outcome of judicial proceedings to which Open Lending may become a party; and other risks discussed in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2024. If the risks materialize or assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that the Company presently does not know or that it currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect the Company’s expectations, plans or forecasts of future events and views as of the date of this press release. Subsequent events and developments may cause the Company's assessments to change, but, the Company specifically disclaims any obligation to update these forward-looking statements. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Non-GAAP Financial Measures

The non-GAAP financial measures included in this press release are financial information that has not been prepared in accordance with GAAP. The Company uses Adjusted EBITDA and Adjusted EBITDA margin internally in analyzing our financial results and believes these measures are useful to investors, as a supplement to GAAP measures, in evaluating our ongoing operational performance. The Company believes that the use of non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing our financial results with other companies in our industry, many of which present similar non-GAAP financial measures to investors.

The Company believes these measures provide useful information to investors and others in understanding and evaluating its operating results in the same manner as its management and board of directors. In addition, these measures provide useful measures for period-to-period comparisons of our business, as they remove the effect of certain non-cash items and certain non-recurring variable charges.

Adjusted EBITDA is defined as GAAP net income (loss) excluding interest expense, interest income, income tax expense, depreciation and amortization expense, share-based compensation expense and certain other non-recurring expenses that do not contribute directly to management’s evaluation of our operating results. Adjusted EBITDA margin is defined as Adjusted EBITDA expressed as a percentage of total revenue.

Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measure provided in the financial statement tables included below in this press release.

Investor Relations Contact:

InvestorRelations@openlending.com

OPEN LENDING CORPORATION

Consolidated Balance Sheets

(Unaudited)

(In thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

September 30,

2025 |

|

December 31,

2024 |

| Assets |

|

|

|

|

| Current assets |

|

|

|

|

| Cash and cash equivalents |

|

$ |

222,134 |

|

|

$ |

243,164 |

|

| Restricted cash |

|

11,595 |

|

|

10,760 |

|

| Accounts receivable, net |

|

4,418 |

|

|

5,055 |

|

| Current contract assets, net |

|

24,015 |

|

|

9,973 |

|

| Income tax receivable |

|

4,015 |

|

|

3,558 |

|

| Other current assets |

|

6,391 |

|

|

3,215 |

|

| Total current assets |

|

272,568 |

|

|

275,725 |

|

| Property and equipment, net |

|

518 |

|

|

729 |

|

| Capitalized software development costs, net |

|

4,645 |

|

|

5,386 |

|

| Operating lease right-of-use assets, net |

|

3,273 |

|

|

3,878 |

|

| Contract assets |

|

3,087 |

|

|

5,094 |

|

|

|

|

|

|

| Other assets |

|

3,560 |

|

|

5,556 |

|

| Total assets |

|

$ |

287,651 |

|

|

$ |

296,368 |

|

| Liabilities and stockholders’ equity |

|

|

|

|

| Current liabilities |

|

|

|

|

| Accounts payable |

|

$ |

1,038 |

|

|

$ |

953 |

|

| Accrued expenses |

|

8,640 |

|

|

5,166 |

|

|

|

|

|

|

| Current portion of debt |

|

7,500 |

|

|

7,500 |

|

| Third-party claims administration liability |

|

11,650 |

|

|

10,797 |

|

| Current portion of excess profit share receipts |

|

17,231 |

|

|

19,346 |

|

| Other current liabilities |

|

2,700 |

|

|

3,490 |

|

| Total current liabilities |

|

48,759 |

|

|

47,252 |

|

| Long-term debt, net of deferred financing costs |

|

126,852 |

|

|

132,217 |

|

| Operating lease liabilities |

|

2,613 |

|

|

3,273 |

|

| Excess profit share receipts |

|

30,001 |

|

|

28,210 |

|

| Other liabilities |

|

6,601 |

|

|

7,329 |

|

| Total liabilities |

|

214,826 |

|

|

218,281 |

|

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

| Preferred stock, $0.01 par value; 10,000,000 shares authorized and none issued and outstanding |

|

— |

|

|

— |

|

Common stock, $0.01 par value; 550,000,000 shares authorized, 128,198,185 shares issued and 118,175,598 shares outstanding as of September 30, 2025 and 128,198,185 shares issued and 119,350,001 shares outstanding as of December 31, 2024 |

|

1,282 |

|

|

1,282 |

|

| Additional paid-in capital |

|

496,827 |

|

|

502,664 |

|

| Accumulated deficit |

|

(334,677) |

|

|

(328,759) |

|

Treasury stock at cost, 10,022,587 shares at September 30, 2025 and 8,848,184 shares at December 31, 2024 |

|

(90,607) |

|

|

(97,100) |

|

| Total stockholders’ equity |

|

72,825 |

|

|

78,087 |

|

| Total liabilities and stockholders’ equity |

|

$ |

287,651 |

|

|

$ |

296,368 |

|

OPEN LENDING CORPORATION

Consolidated Statements of Operations

(Unaudited)

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenue |

|

|

|

|

|

|

|

| Program fees |

$ |

13,344 |

|

|

$ |

14,161 |

|

|

$ |

43,487 |

|

|

$ |

43,306 |

|

| Profit share |

8,470 |

|

|

6,822 |

|

|

23,169 |

|

|

30,037 |

|

| Claims administration and other service fees |

2,355 |

|

|

2,493 |

|

|

7,216 |

|

|

7,605 |

|

| Total revenue |

24,169 |

|

|

23,476 |

|

|

73,872 |

|

|

80,948 |

|

| Cost of services |

5,318 |

|

|

6,127 |

|

|

16,911 |

|

|

17,590 |

|

| Gross profit |

18,851 |

|

|

17,349 |

|

|

56,961 |

|

|

63,358 |

|

| Operating expenses |

|

|

|

|

|

|

|

| General and administrative |

21,062 |

|

|

9,594 |

|

|

43,924 |

|

|

33,318 |

|

| Selling and marketing |

3,440 |

|

|

4,897 |

|

|

11,968 |

|

|

13,260 |

|

| Research and development |

2,050 |

|

|

992 |

|

|

6,832 |

|

|

3,601 |

|

| Total operating expenses |

26,552 |

|

|

15,483 |

|

|

62,724 |

|

|

50,179 |

|

| Operating income (loss) |

(7,701) |

|

|

1,866 |

|

|

(5,763) |

|

|

13,179 |

|

| Interest expense |

(2,432) |

|

|

(2,962) |

|

|

(7,440) |

|

|

(8,468) |

|

| Interest income |

2,363 |

|

|

3,221 |

|

|

7,220 |

|

|

9,278 |

|

| Other income (expense), net |

185 |

|

|

— |

|

|

185 |

|

|

— |

|

| Income (loss) before income taxes |

(7,585) |

|

|

2,125 |

|

|

(5,798) |

|

|

13,989 |

|

| Income tax expense (benefit) |

(16) |

|

|

688 |

|

|

120 |

|

|

4,563 |

|

| Net income (loss) |

$ |

(7,569) |

|

|

$ |

1,437 |

|

|

$ |

(5,918) |

|

|

$ |

9,426 |

|

| Net income (loss) per common share |

|

|

|

|

|

|

|

| Basic |

$ |

(0.06) |

|

|

$ |

0.01 |

|

|

$ |

(0.05) |

|

|

$ |

0.08 |

|

| Diluted |

$ |

(0.06) |

|

|

$ |

0.01 |

|

|

$ |

(0.05) |

|

|

$ |

0.08 |

|

| Weighted average common shares outstanding |

|

|

|

|

|

|

|

| Basic |

118,173 |

|

|

119,253 |

|

|

118,825 |

|

|

119,129 |

|

| Diluted |

118,173 |

|

|

119,481 |

|

|

118,825 |

|

|

119,428 |

|

OPEN LENDING CORPORATION

Consolidated Statements of Cash Flows

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

| Cash flows from operating activities |

|

|

|

Net income (loss) |

$ |

(5,918) |

|

|

$ |

9,426 |

|

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: |

|

|

|

| Share-based compensation |

5,626 |

|

|

6,408 |

|

| Depreciation and amortization |

1,757 |

|

|

1,281 |

|

| Amortization of debt issuance costs |

310 |

|

|

321 |

|

| Non-cash operating lease cost |

605 |

|

|

511 |

|

| Deferred income taxes |

— |

|

|

4,499 |

|

| Other |

149 |

|

|

37 |

|

| Changes in operating assets & liabilities: |

|

|

|

| Accounts receivable, net |

637 |

|

|

50 |

|

| Contract assets, net |

(12,035) |

|

|

(10,594) |

|

| Excess profit share receipts |

(324) |

|

|

— |

|

| Other current and non-current assets |

(3,137) |

|

|

(576) |

|

| Accounts payable |

85 |

|

|

(92) |

|

| Accrued expenses |

3,476 |

|

|

2,164 |

|

| Income tax receivable, net |

1,479 |

|

|

881 |

|

| Operating lease liabilities |

(587) |

|

|

(464) |

|

| Third-party claims administration liability |

853 |

|

|

4,286 |

|

| Other current and non-current liabilities |

(1,620) |

|

|

2,838 |

|

| Net cash provided by (used in) operating activities |

(8,644) |

|

|

20,976 |

|

| Cash flows from investing activities |

|

|

|

| Purchase of property and equipment |

(56) |

|

|

(161) |

|

| Capitalized software development costs |

(855) |

|

|

(2,577) |

|

| Net cash used in investing activities |

(911) |

|

|

(2,738) |

|

| Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

|

|

| Payments on term loans |

(5,625) |

|

|

(2,813) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares repurchased |

(3,952) |

|

|

— |

|

| Shares withheld for taxes related to restricted stock units |

(1,063) |

|

|

(1,147) |

|

| Net cash used in financing activities |

(10,640) |

|

|

(3,960) |

|

| Net change in cash and cash equivalents and restricted cash |

(20,195) |

|

|

14,278 |

|

| Cash and cash equivalents and restricted cash at the beginning of the period |

253,924 |

|

|

246,669 |

|

| Cash and cash equivalents and restricted cash at the end of the period |

$ |

233,729 |

|

|

$ |

260,947 |

|

| Supplemental disclosure of cash flow information: |

|

|

|

| Interest paid |

$ |

7,148 |

|

|

$ |

7,981 |

|

| Income tax paid (refunded), net |

(1,359) |

|

|

(817) |

|

|

|

|

|

|

|

|

|

| Right-of-use assets obtained in exchange for lease obligations |

— |

|

|

592 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPEN LENDING CORPORATION

Reconciliation of GAAP to Non-GAAP Financial Measures

(Unaudited)

(In thousands, except margin data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2025 |

|

2024 |

|

2025 |

|

2024 |

Net income (loss) |

$ |

(7,569) |

|

|

$ |

1,437 |

|

|

$ |

(5,918) |

|

|

$ |

9,426 |

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

| Interest (income) expense, net |

69 |

|

|

(259) |

|

|

220 |

|

|

(810) |

|

| Income tax expense (benefit) |

(16) |

|

|

688 |

|

|

120 |

|

|

4,563 |

|

| Depreciation and amortization expense |

623 |

|

|

494 |

|

|

1,757 |

|

|

1,281 |

|

| Share-based compensation |

1,446 |

|

|

2,186 |

|

|

5,626 |

|

|

6,408 |

|

Other non-recurring expense(1) |

11,000 |

|

|

— |

|

|

11,000 |

|

|

— |

|

| Total adjustments |

13,122 |

|

|

3,109 |

|

|

18,723 |

|

|

11,442 |

|

| Adjusted EBITDA |

$ |

5,553 |

|

|

$ |

4,546 |

|

|

$ |

12,805 |

|

|

$ |

20,868 |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA margin |

23.0 |

% |

|

19.4 |

% |

|

17.3 |

% |

|

25.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) For the three and nine months ended September 30, 2025, the adjustment for other non-recurring expense includes a one-time payment of $11.0 million made pursuant to an amendment to a reseller agreement in exchange for the extinguishment of certain rights to ongoing compensation and the revision of the schedule of referral fees payable. This payment was solely in exchange for such modification of compensation rights and is not conditioned upon, nor related to, any future performance or obligations of either party.