First Fiscal Quarter 2026

We delivered another set of stellar results to get fiscal 2026 started, in both growth and profitability rubrics. Fellow Affirm Shareholders, 2 Affirm FQ1’26 Shareholder Letter 1 Information about Affirm's use of non-GAAP financial measures is provided under “Key Operating Metrics, Non-GAAP Financial Measures and Supplemental Performance Indicators” and “Use of Non-GAAP Financial Measures” below, and reconciliations of GAAP results to non-GAAP results are provided in the tables at the end of this letter. Network effects of data Affirm is a payment network, a multi-sided one: we connect consumers, merchants, payment processors, capital partners, etc. Although we are primarily thought of as a payments provider, a better mental model is a message router: we are shuttling packets of information, which happen to encode in some detail who paid whom, for what, and the risk-based prices of credit for such transactions. The network effects of the payment industry are well understood, but the incremental value gained with each new connection varies. Because most legacy payment methods route data-light messages devoid of, for example, purchasing or credit details, their value curves flatten with scale. Each additional seller or buyer does not enhance the underlying network’s product, only its revenue base. Setting another highest-ever GMV record in a quarter with relatively few shopping holidays showcases the consistency of Team Affirm, once again executing to beat the band. Results like these are never an accidental success, and the last several quarters really felt like the team has accelerated from strength to strength. The quote attributed to the American cycling great Greg LeMond – “it doesn’t get any easier, you just get faster” – finds its way into a fair number of internal communications here at Affirm, both as a rallying cry and a reminder to never rest on our successes. However, given the nature of our business, I propose that some aspects should, in fact, become easier with scale. $455M Revenue Less Transaction Costs (“RLTC”)1 +60% $933M Revenue +34% $10.8B Gross Merchandise Volume (“GMV”) +42% Net Income +$181M 28% Adjusted Operating Income1 As a percent of Revenue +10 pp 7% Operating Income As a percent of Revenue +26 pp $81M All comparisons on a year-over-year basis unless otherwise indicated

3 Affirm FQ1’26 Shareholder Letter We are different. From day one, Affirm was designed to build towards network effects of data. Routing information-rich messages allows us to rapidly improve the products we offer, ensuring the value curve keeps rising and creating a moat around our business. The rich data we gather during each transaction’s lifetime improves our many models: credit and fraud, AdaptAI (personalized incentives to maximize sales conversion), BoostAI (program selection for merchants), etc. As we refine these models using data other lenders can’t access, we improve credit approvals and consumer take-up at the point of sale, which improves merchant value, as well as credit outcomes. Better approvals bring more new consumers into our network, strengthening the case for Affirm as a required payment mark at more merchants, which naturally increases overall network frequency, and therefore, the rate of data acquisition. The growth of the data asset we’re able to put to work is accelerating. So perhaps the most interesting question one can ask is neither ‘when will this get easier?’ nor ‘how fast can we go?’ (answer to that, by the way, is governed by our unwavering attention to our credit metrics and unit economics) but ‘what other kinds of messages might we route on Network Affirm?’ The trust asset Credit comes to us from credere, Latin for trust. Last quarter we made approximately 40 million data-informed decisions to trust consumers to repay us as we funded their purchases. That’s only one half of it. A myriad of decisions to trust Affirm take place every day. Consumers trust us to secure the information they share with us in the underwriting process, to debit their connected bank account for repayment, and to honor our upfront pricing and never charge hidden fees (an unrepentant betrayal of trust so common elsewhere in our industry). Our merchant partners trust us to maximize the value we deliver to them in exchange for the margin and signal-rich data they share with us: more sales, higher conversion, a buyer experience that more than stands up to their own standards. Our capital partners trust us to be accurate and timely with our reporting, and to deliver consistent credit outcomes. While we firmly believe that the depth of our network’s moat is proportional to the petabytes of data we collect (fun fact: since inception, we’ve processed about 6 billion live model decisions over nearly 15 years, with a data footprint of about 6 petabytes), our most important asset is trust.

We don’t take that lightly. We keep earning it by doing the fundamentally honest thing by all our partners, customers, consumers, and indeed, shareholders, with integrity and transparency. Staying with the cycling metaphor, if building Affirm is a grand tour, we are still racing its earliest stages; but we are getting more efficient and intelligent as a team. My continued gratitude to all Affirmers – here’s to more top podium steps in fiscal 2026. Onward, 44 Affirm FQ1’26 Shareholder Letter ● Earlier this week, we extended our US agreement with Amazon for an additional five years through January 2031, and we look forward to continuing to serve these customers going forward. Notable achievements ● More than 7 million consumers began a transaction on Affirm owned-and-operated surfaces over the past twelve months. ● The Card continued to shine this quarter. Card GMV was up 135% year over year, and active cardholders grew another 500 thousand from last quarter to reach 2.8 million. ● While still experimental, we are very excited to see first successful efforts in cash flow underwriting specific to Affirm Card. ● Affirm and Shopify have expanded our global partnership with the UK launch of Shop Pay Instalments. The Affirm App is also now available in the UK. ● Announced partnerships with ServiceTitan, Vagaro, and launched Ace Hardware in-store, as we continue to bring honest financial products to new merchants, platforms, and categories. ● Signed Worldpay for Platforms, enabling us to serve their more than one thousand ISVs. ● Launched Affirm Connected Accounts (which we designed to power Shop Pay Installments) at key enterprise partners, enabling a much faster and more intuitive checkout. ● Credit outcomes remained steady and well within our targets, but does not change the fact that credit is always job #1 at Affirm.

Gross Merchandise Volume (GMV) grew 42% to $10.8 billion with about half of growth coming from direct merchant point-of-sale integrations, a third from the direct-to-consumer business led by Affirm Card, and the remainder from wallet partnerships. From a product perspective, GMV from 0% APR products inclusive of Pay in X grew 64% and significantly outpaced our overall growth rate. GMV from our top five merchants and platform partners collectively grew 33%, and the concentration of GMV derived from top five partners declined slightly to 44% compared to 47% during the same period in the prior year.2 GMV from 0% APR monthly installment loans grew 74% as the number of merchants funding 0% APR offers more than tripled to over 40 thousand merchants. These merchants showed strong willingness to pay for such offers, with approximately 95% of GMV from 0% APR monthly installments at integrated merchants being funded by the merchant. We also increased the prominence and availability of 0% APR offers on Affirm Card, which led to 0% APR GMV on Card growing 158%. All categories except sporting goods and outdoors grew during the quarter, with notable strength in services and travel and ticketing. The fashion and beauty category also accelerated to its highest growth rate in three years. FQ1’26 Operating Highlights 5 Affirm FQ1’26 Shareholder Letter Direct-to-Consumer GMV (D2C GMV) grew 53% to $3.2 billion and Affirm Card GMV within this grew 135% to $1.4 billion. GMV derived from in-store usage of Card grew 170%, and the mix of in-store GMV on Card continues to be more than an order of magnitude higher than in-store spend on Affirm non-Card surfaces. Active cardholders again more than doubled year over year to 2.8 million as card attach rate increased to approximately 12%, up about two points sequentially versus the prior quarter.3 Active consumers increased 24% to 24.1 million as of September 30, 2025, marking the seventh consecutive quarter that the year-over-year growth rate of active consumers accelerated. Active merchant count increased 30% to 419 thousand as of September 30, 2025 with the year-over-year growth rate accelerating 6 percentage points from the prior quarter. The increase in merchant count was driven by two wallet partnerships, as well as the launch of several independent software vendor (ISV) partnerships. 2 All growth rate references are on a year-over-year basis unless otherwise indicated. 3 Card attach rate defined as active cardholders divided by total active consumers during a given period.

Within the PSP channel, ISVs have become essential partners to serve long-tail merchants, particularly those with in-store use cases. These ISV partners serve a variety of end industries – from auto repair shops, to elective medical, and professional services such as legal advice – that historically have been underserved by legacy payment methods. Given the diversity of end markets and use cases, ISVs particularly value the range and simplicity of financial products that we offer: from 14 days to 60 months, and $35 to $30,000, with no late fees or gimmicks ever. During FQ1’26, GMV from ISVs grew 68% year over year. ISVs accounted for approximately 27 thousand active merchants, with Affirm being presented as a default payment option and chosen by consumers at more than half of these merchants. Capitalizing on distribution partnerships Wallets and payment service providers (PSPs) have become important channels for consumers to transact with Affirm. These partners allow us to address long-tail merchants, simplify merchant onboarding, and deliver a consistent user experience across channels. Wallets play an important role because they allow us to serve both integrated and non-integrated merchants. Today we are partnered with four of the top wallets. For the twelve month period ending September 30, 2025, these wallets collectively accounted for more than $7 billion of GMV, and grew nearly 70% year over year in FQ1’26. Payment Service Provider U.S. TPV $1 E-comm status In-store status Default payment status Partner A $2.6T Partner B $2T Partner C $1.9T Partner D $600B Partner E $300B 1 Source: TSG eReport 2025 = Live = Currently being built or on commercial roadmap = In discussions Logos indicate ISV partners that are either live with Affirm or have signed and are in the process of being integrated 6 Affirm FQ1’26 Shareholder Letter PSPs are also a crucial distribution channel. In 2024, our top five PSP partners processed an immense $7 trillion in volume. More directly, they contributed over $4 billion to our GMV across more than 50 thousand merchants in the twelve months ending September 30, 2025. Our current focus is enhancing these integrations: we are already a default payment option with a top PSP, transacting at approximately 20 thousand merchants through this motion in FQ1’26, and are in discussions to become a default payment option at four of our top five PSPs. We are also expanding into physical retail by supporting in-store transactions with three of these partners already, with more to follow. Independent software vendors (ISVs)

Total revenue grew 34% to $933 million. Revenue as a percentage of GMV was 8.7%, a decrease of 52 basis points compared to FQ1’25. The following factors contributed to revenue growth and the year-over-year change in revenue as a percentage of GMV: ● Network revenue grew 38%, or slightly below overall GMV growth in part due to a mix shift towards direct-to-consumer (D2C) GMV, which comes with lower network revenue as a percentage of GMV relative to integrated POS volume. As a percent of GMV, network revenue declined 7 basis points due to the aforementioned growth in DTC GMV and an approximately 6% decline in the average term length of 0% APR monthly installment loans on a year-over-year basis. On average, network revenue as a percent of GMV for 0% APR products scales directly with the duration of the underlying loan, and shorter-duration 0% APR products have a lower network revenue as a percent of GMV than longer-duration products. ● Interest income grew 20%, driven primarily by a 19% increase in average loans held for investment. As a percent of GMV, interest income declined 74 basis points as we sold more loans as a percent of GMV and therefore retained less loans on the balance sheet. Additionally, the mix of 0% APR loans, including Pay in X loans, increased from 25% in FQ1’25 to 28% in FQ1’26, leading to a lower average interest yield on loans than if the product mix had remained constant. ● Gain on sales of loans grew 87% and increased by 27 basis points as a percent of GMV. This increase was driven primarily by an increase in loans sold, which grew approximately 76%. The mix of loans sold as a percent of GMV continued to be higher compared to some prior periods due to the ramping of the Sixth Street and other forward flow partnerships. Additionally, we saw an increase in loan sale pricing, with gain on sale as a percentage of loans sold increasing by 14 basis points. ● Servicing income grew 53% and increased by 3 basis points as a percent of GMV. Servicing income is primarily driven by the size of the off-balance sheet platform portfolio, which grew by approximately 60% as we sold more loans in recent quarters. Servicing income remained stable at approximately 2% of the average off-balance sheet platform portfolio on an annualized basis. FQ1’26 Financial Highlights 7 Affirm FQ1’26 Shareholder Letter Total Revenue Adj. Operating Income as a % of Revenue 27% +4 pp Total Revenue as a % of GMV 8.7% RLTC as a % of GMV 4.2% +48 bps Operating Income as a % of Revenue 7% +26 pp All comparisons on a year-over-year basis (52) bps j i I f 8 10 pp Year-over-Year Change in Revenue as a % of GMV

8 Affirm FQ1’26 Shareholder Letter Mix-stabilized network revenue as a % of 0% APR Monthly Installment GMV Loan Product Mix We continued to observe strong uptake of 0% APR offers, with GMV from 0% APR monthly installment products increasing 74% while Pay-in-X volume increased 55%. Network revenue as a percentage of GMV for 0% APR monthly installment loans remained stable after adjusting for variations in loan duration. *Other transaction costs include changes in processing and servicing expense and loss on loan purchase commitment Year-over-year Change in RLTC as a % of GMV RLTC grew 60% to $455 million. RLTC as a percentage of GMV increased 48 basis points to 4.2% and exceeded our 3 to 4% long-term target range. The approximate 48 basis point increase was primarily attributable to a 59 basis point improvement in provision for credit losses and 35 basis point improvement in funding costs, partially offset by a 52 basis point decline in revenue. Average Funding Costs Funding costs were a tailwind to RLTC as a percent of GMV with average funding costs declining approximately 98 basis points year over year and 7 basis points sequentially to 6.7%. Average funding costs declined as we continue to execute well in the ABS market and benefit from the repricing of both ABS and warehouse facilities. 15% Pay in X (Short-term 0% APR) 72% Interest- bearing 13% 0% APR monthly 15% Pay in X (Short-term 0% APR) 72% Interest- bearing 13% 0% APR monthly 68% YoY growth 35% YoY growth 55% YoY growth 55% YoY growth 35% YoY growth 74% YoY growth

Adjusted Operating Income Adjusted Operating Income was $264 million, a $134 million improvement and 104% increase from the $130 million of Adjusted Operating Income in FQ1’25. Adjusted Operating Income as a percentage of Revenue, or Adjusted Operating Margin, was 28% during the period compared to 19% during FQ1’25. Adjusted Operating Income excludes the impact of enterprise warrant and share-based expenses, stock-based compensation expense, depreciation and amortization, and other items. The $134 million increase in Adjusted Operating Income consisted of a $170 million increase in RLTC, which was partially offset by a $36 million increase, or 23% increase, in operating expenses excluding transaction costs. Within these operating expenses: ● Technology and data analytics increased $16 million, or 25%, driven by an $11 million, or 34%, increase in infrastructure expenses which primarily increased due to the 52% growth in transactions. ● Sales and marketing increased $6 million, or 36%, with the majority of the increase attributable to increases in comarketing and profit share expenses. ● General and administrative increased $14 million, or 18%, primarily driven by payroll, professional services related to consulting and legal fees, and software and subscription expenses. 9 Affirm FQ1’26 Shareholder Letter Operating Income Operating Income was $64 million, a $196 million improvement compared to the ($133) million loss in FQ1’25. Operating Income as a percentage of revenue, or Operating Margin, was approximately 7% in the period, compared to (19%) during FQ1’25. The $64 million of Operating Income is inclusive of $49 million in enterprise warrant and share-based expenses associated with warrants granted to two enterprise partners. The $196 million improvement in Operating Income was driven by a $170 million increase in RLTC and $26 million decrease, or 6% decline, in operating expenses excluding transaction costs. Within these operating expenses: ● Technology and data analytics increased $34 million, or 25%, as transaction count increased 52% and led to higher infrastructure expenses. Additionally, we continued to invest in products such as Card, wallet partnerships, and international expansion, including investments made into incremental headcount associated with these projects. ● Sales and marketing declined $67 million, or 46%, due to a $72 million decline in enterprise warrant expense. Certain tranches of enterprise warrants completed their amortization period during FQ2’25 and therefore no longer contributed to sales and marketing expenses in subsequent periods. Excluding enterprise warrant expense, sales and marketing expense increased $6 million, or 24%, due to increases in comarketing and profit share expenses. ● General and administrative increased $6 million, or 5%, with the increase split primarily between professional services related to consulting and legal fees and software and subscription expenses.

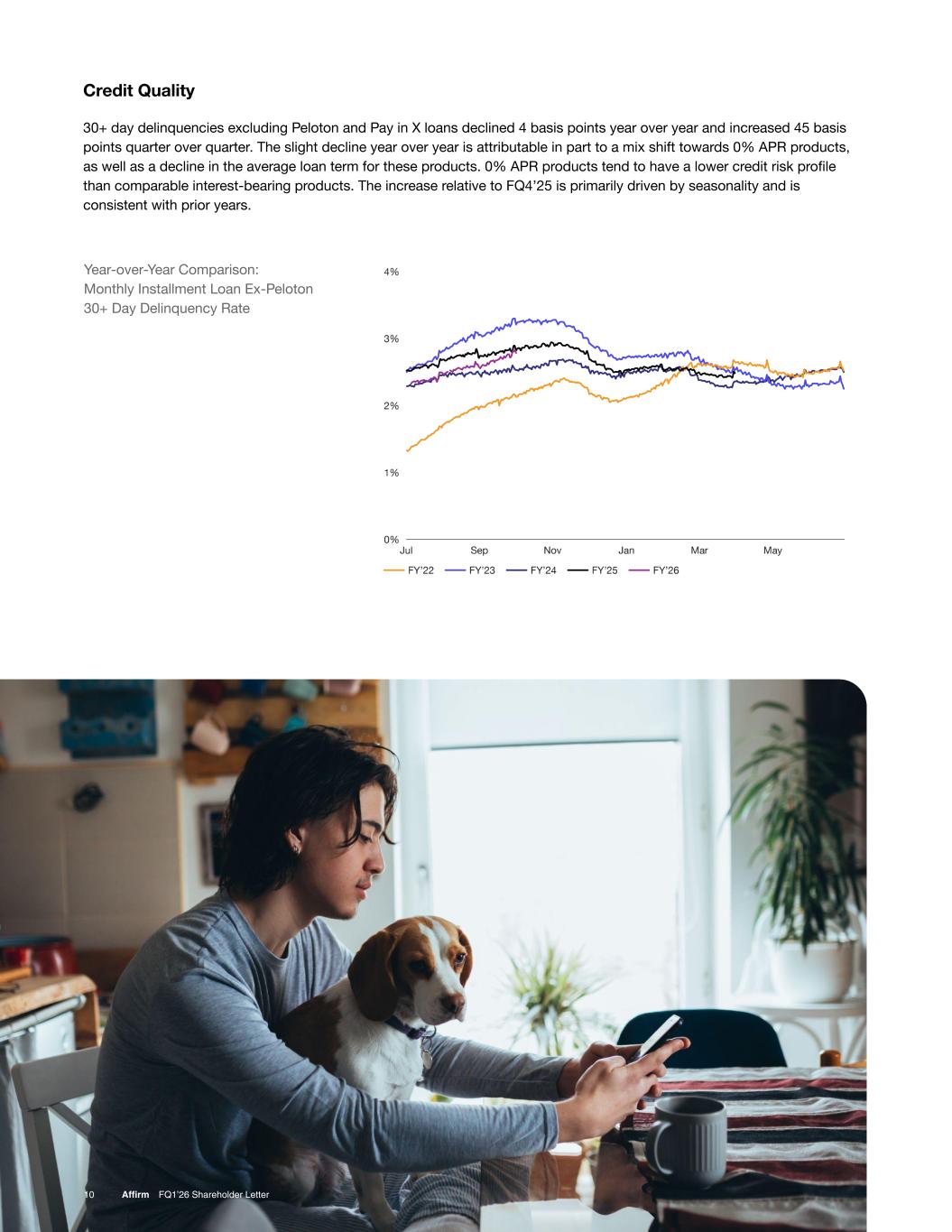

Year-over-Year Comparison: Monthly Installment Loan Ex-Peloton 30+ Day Delinquency Rate 10 Affirm FQ1’26 Shareholder Letter Credit Quality 30+ day delinquencies excluding Peloton and Pay in X loans declined 4 basis points year over year and increased 45 basis points quarter over quarter. The slight decline year over year is attributable in part to a mix shift towards 0% APR products, as well as a decline in the average loan term for these products. 0% APR products tend to have a lower credit risk profile than comparable interest-bearing products. The increase relative to FQ4’25 is primarily driven by seasonality and is consistent with prior years.

Cumulative Net Charge-offs by Origination Vintage: Monthly Installment Loans U.S. Monthly Installment Loans from FQ3’22 through FQ3’25 Recent cohorts of monthly installment loans are tracking towards approximately 3.5% ultimate net charge-offs as a percent of cohort GMV, which is consistent with the performance of historic loan cohorts. 11 Affirm FQ1’26 Shareholder Letter Cumulative Net Charge-offs by Origination Vintage: Pay in 4 Loans U.S. loans only All recent vintages of Pay in 4 loans are continuing to track to loss rates of less than 1% of GMV. Net Charge-off Performance

12 Affirm FQ1’26 Shareholder Letter Capital and Funding Update Funding Capacity increased to up to $26.6 billion at the end of FQ1’26, from $26.1 billion at the end of FQ4’25. We believe this capacity can support more than $60 billion in annual GMV based upon our weighted-average loan duration of 5 months at the end of FQ1’26. The main highlights across the funding channels were: ● ABS: in September we closed AFFRM 2025-3, which was the third issuance out of our Master Trust. The transaction was our largest ABS issuance to date at $1.1 billion and had the lowest weighted-average yield since FY’22. It was also our first ABS issuance with a three year revolving period, which provides greater stability through market cycles by reducing refinancing pressure and increasing total available ABS debt funding. Offsetting this issuance was the ongoing amortization of previously-issued static ABS deals. ● Forward flow: we added approximately $500 million in capacity compared to FQ4’25 as we expanded our partnerships with several large insurers and onboarded a new asset management partner. ● Warehouse and other funding debt: we added $300 million in funding capacity in the US as we upsized our agreement with two existing bank partners. Efficiency also improved as we benefited from a higher advance rate in one of those facilities resulting from favorable and predictable credit performance across a multi-year relationship with the bank partner. In Canada, we also improved efficiency through the addition of a mezzanine note to one of our facilities. Capital Allocation and Liquidity At the end of September, we had approximately $2.2 billion in total liquidity split between cash and equivalents plus securities available for sale, against which we had approximately $1.1 billion in convertible debt. Our net cash position of $1.1 billion increased by $196 million year over year as cash and securities available for sale increased by $121 million, while convertible debt outstanding decreased by $75 million. Quarter over quarter, net cash increased by $41 million as cash and securities available for sale increased by $15 million, while convertible debt outstanding decreased by $25 million. The Affirm board of directors has authorized the repurchase of up to $200 million in aggregate principal amount of our outstanding 2026 convertible notes during the period from July 1, 2025 through December 31, 2025. As of September 30, $174 million of this authorization remains available.

1313 Affirm FQ1’26 Shareholder Letter Product mix On a year-over-year basis, the mix of 0% APR GMV inclusive of Pay-in-X products is expected to increase. 0% APR products generally have a lower RLTC as a percentage of GMV than equivalent interest-bearing products. Enterprise partnerships An enterprise merchant that has previously expressed an intent to switch its Pay Later volumes to its own wallet solution substantially completed this transition during FQ1’26. Enterprise warrant expense Enterprise warrant expense in FQ2’26 is expected to decrease approximately 25% compared to FQ2’25, and FY’26 enterprise warrant expense is expected to decrease at least 30% from FY’25. Assumptions Embedded Within the Outlook Interest rate environment Based upon the forward curve embedded within the outlook, short-term benchmark interest rates are expected to decline modestly during FY’26. Funding Equity Capital Required (“ECR”) as a percent of Total Platform Portfolio (“ECR Ratio”) is expected to remain below 5%. Product and go-to-market initiatives Our outlook includes the expected financial impact of our expansion outside of North America, which is not expected to be a material growth contributor during FY’26. Fiscal Q2 2026 Fiscal 2026 GMV $13.00 - 13.30 billion More than $47.5 billion Revenue $1,030 - 1,060 million ~8.4% of GMV Revenue Less Transaction Costs $510 - 525 million ~4% of GMV Operating Margin 6.5 - 8.5% More than 7.5% Adjusted Operating Margin4 28 - 30% More than 27.1% Weighted Avg. Basic Shares Outstanding 335 million 336 million Weighted Avg. Diluted Shares Outstanding 354 million 353 million Financial Outlook 4 A reconciliation of adjusted operating margin to the comparable GAAP measure is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses that may be incurred in the future.

14 Affirm FQ1’26 Shareholder Letter About Affirm Affirm’s mission is to deliver honest financial products that improve lives. By building a new kind of payment network – one based on trust, transparency and putting people first – we empower millions of consumers to spend and save responsibly, and give thousands of businesses the tools to fuel growth. Unlike most credit cards and other pay-over-time options, we show consumers exactly what they will pay up front, and never charge any late or hidden fees. Contacts Investor Relations: ir@affirm.com Media: press@affirm.com Conference Call Affirm will host a conference call and webcast to discuss first fiscal quarter 2026 financial results on November 6, 2025, at 2:00 pm PT. Hosting the call will be Max Levchin, Founder and Chief Executive Officer, Michael Linford, Chief Operating Officer, and Rob O’Hare, Chief Financial Officer. The conference call will be webcast live from the Company’s investor relations website at https://investors.affirm.com/. A replay will be available on the investor relations website following the call. UBS Global Technology and AI Conference December 2, 2025 Scottsdale, AZ Upcoming Investment Conferences Affirm will be attending the following upcoming investment conference: never harge any late or hidden f es.

Three Months Ended September 30, 2025 2024 (in millions, except GMV and percent data) (unaudited) GMV (in billions) $ 10.8 $ 7.6 Total Transactions (count) 41.4 27.2 Total Revenue, net $ 933.3 $ 698.5 Total Revenue as a % of GMV 8.7 % 9.2 % Transaction Costs (Non-GAAP) $ 478.1 $ 413.4 Transaction Costs as a % of GMV 4.4 % 5.4 % Revenue Less Transaction Costs (Non-GAAP) $ 455.2 $ 285.1 Revenue Less Transaction Costs as a % of GMV (Non-GAAP) 4.2 % 3.8 % Operating Income (Loss) $ 63.7 $ (132.6) Operating Margin 6.8 % (19.0) % Adjusted Operating Income (Non-GAAP) $ 263.9 $ 129.6 Adjusted Operating Margin (Non-GAAP) 28.3 % 18.6 % Net Income (Loss) $ 80.7 $ (100.2) Key Operating Metrics, Non-GAAP Financial Measures and Supplemental Performance Indicators September 30, 2025 June 30, 2025 September 30, 2024 (unaudited) Active Consumers (in millions) 24.1 23.0 19.5 Transactions per Active Consumer 6.1 5.8 5.1 Active Merchants (in thousands) 418.9 376.8 323.0 Total Platform Portfolio (Non-GAAP) (in billions) $ 16.1 $ 15.1 $ 11.8 Equity Capital Required (Non-GAAP) (in millions) $ 626.5 $ 568.9 $ 581.3 Equity Capital Required as a % of Total Platform Portfolio (Non-GAAP) 3.9 % 3.8 % 4.9 % Allowance for Credit Losses as a % of Loans Held for Investment 5.9 % 5.6 % 5.6 % 15 Affirm FQ1’26 Shareholder Letter

Key Operating Metrics Gross Merchandise Volume (“GMV”) - The Company defines GMV as the total dollar amount of all transactions on the Affirm platform during the applicable period, net of refunds. GMV does not represent revenue earned by the Company. However, the Company believes that GMV is a useful operating metric to both the Company and investors in assessing the volume of transactions that take place on the Company's platform, which is an indicator of the success of the Company's merchants and the strength of that platform. Active Consumers - The Company defines an active consumer as a consumer who completes at least one transaction on its platform during the twelve months prior to the measurement date. The Company believes that active consumers is a useful operating metric to both the Company and investors in assessing consumer adoption and engagement and measuring the size of the Company's network. Transactions per Active Consumer - Transactions per active consumer is defined as the average number of transactions that an active consumer has conducted on its platform during the twelve months prior to the measurement date. The Company believes that transactions per active consumer is a useful operating metric to both the Company and investors in assessing consumer engagement and repeat usage, which is an indicator of the value of the Company's network. Non-GAAP Financial Measures Transaction Costs - The Company defines transaction costs as the sum of loss on loan purchase commitment, provision for credit losses, funding costs, and processing and servicing expense. The Company believes that transaction costs is a useful financial measure to both the Company and investors of those costs, which vary with the volume of transactions processed on the Company's platform. Transaction Costs as a Percentage of GMV - The Company defines transaction costs as a Percentage of GMV as transaction costs, as defined above, as a percentage of GMV, as defined above. The Company believes that transaction costs as a percentage of GMV is a useful financial measure to both the Company and investors as it approximates the variable cost efficiency of transactions processed on the Company's platform. Revenue Less Transaction Costs (“RLTC”) - The Company defines revenue less transaction costs as GAAP total revenue less transaction costs, as defined above. The Company believes that revenue less transaction costs is a useful financial measure to both the Company and investors of the economic value generated by transactions processed on the Company's platform. Revenue Less Transaction Costs as a Percentage of GMV - The Company defines revenue less transaction costs as a percentage of GMV as revenue less transaction costs, as defined above, as a percentage of GMV, as defined above. The Company believes that revenue less transaction costs as a percentage of GMV is a useful financial measure to both the Company and investors of the unit economics of transactions processed on the Company's platform. Adjusted Operating Income - The Company defines adjusted operating income as its GAAP operating loss, excluding: (a) depreciation and amortization; (b) stock-based compensation included in GAAP operating loss; (c) the expense related to warrants and share-based payments granted to enterprise partners; (d) restructuring costs included in GAAP operating loss; and (e) certain other costs as set forth in the reconciliation of adjusted operating income (loss) to GAAP operating loss included in the tables at the end of this letter. Adjusted operating income is presented because the Company believes that it is a useful financial measure to both the Company and investors for evaluating its operating performance and that it facilitates period to period comparisons of the Company's results of operations as the items excluded generally are not a function of the Company's operating performance. 16 Affirm FQ1’26 Shareholder Letter

Adjusted Operating Margin - The Company defines adjusted operating margin as its adjusted operating income (loss), as defined above, as a percentage of its GAAP total revenue. Similar to adjusted operating income (loss), the Company believes that adjusted operating margin is a useful financial measure to both the Company and investors for evaluating its operating performance and that it facilitates period to period comparisons of the Company's results of operations as the items excluded generally are not a function of the Company's operating performance. Total Platform Portfolio - The Company defines total platform portfolio as the unpaid principal balance outstanding of all loans facilitated through its platform as of the balance sheet date, including loans held for investment, loans held for sale, and loans owned by third-parties. The Company believes that total platform portfolio is a useful financial measure to both the Company and investors in assessing the scale of funding requirements for the Company's network. Equity Capital Required (“ECR”) - The Company defines equity capital required as the sum of the balance of loans held for investment and loans held for sale, less the balance of funding debt and notes issued by securitization trusts as of the balance sheet date. The Company believes that equity capital required is a useful financial measure to both the Company and investors in assessing the amount of the Company's total platform portfolio that the Company funds with its own equity capital. Equity Capital Required as a Percentage of Total Platform Portfolio (“ECR Ratio”) - The Company defines equity capital required as a percentage of total platform portfolio as equity capital required, as defined above, as a percentage of total platform portfolio, as defined above. The Company believes that equity capital required as a percentage of total platform portfolio is a useful financial measure to both the Company and investors in assessing the proportion of outstanding loans on the Company's platform that are funded by the Company's own equity capital. Non-GAAP Sales and Marketing Expense - The Company defines non-GAAP sales and marketing expense as GAAP sales and marketing expense, excluding: (a) depreciation and amortization; (b) stock-based compensation included in GAAP operating loss; (c) the expense related to warrants and share-based payments granted to enterprise partners; and (d) certain other costs as set forth in the reconciliation of adjusted operating income (loss) to GAAP operating loss included in the tables at the end of this letter. Non-GAAP sales and marketing expense is presented because the Company believes that it is a useful financial measure to both the Company and investors of its sales and marketing activities and that it facilitates period to period comparisons of the Company's sales and marketing as the items excluded generally are not a function of the Company's operating performance. Non-GAAP Technology and Data Analytics Expense - The Company defines non-GAAP technology and data analytics expense as GAAP technology and data analytics expense, excluding: (a) depreciation and amortization; (b) stock-based compensation included in GAAP operating loss; and (c) certain other costs as set forth in the reconciliation of adjusted operating income (loss) to GAAP operating loss included in the tables at the end of this letter. Non-GAAP technology and data analytics expense is presented because the Company believes that it is a useful financial measure to both the Company and investors of its technology and data analytics activities and that it facilitates period to period comparisons of the Company's technology and data analytics as the items excluded generally are not a function of the Company's operating performance. Non-GAAP General and Administrative Expense - The Company defines non-GAAP general and administrative expense as GAAP general and administrative expense, excluding: (a) depreciation and amortization; (b) stock-based compensation included in GAAP operating loss; and (c) certain other costs as set forth in the reconciliation of adjusted operating income (loss) to GAAP operating loss included in the tables at the end of this letter. Non-GAAP general and administrative expense is presented because the Company believes that it is a useful financial measure to both the Company and investors as it facilitates period to period comparisons of the Company's general and administrative costs as the items excluded generally are not a function of the Company's operating performance. Non-GAAP Other Operating Expenses - The Company defines non-GAAP operating expenses as the aggregate of non-GAAP sales and marketing expense, non-GAAP technology and data analytics expense, and non-GAAP general and administrative expense. Each of these components is calculated as the corresponding GAAP expense category, excluding: (a) depreciation and amortization; (b) stock-based compensation included in GAAP operating loss; (c) the expense related to warrants and share-based payments granted to enterprise partners; and (d) certain other costs as set forth in the reconciliation of adjusted operating income (loss) to GAAP operating loss included in the tables at the end of this letter. Non-GAAP operating expenses are presented because the Company believes that they are useful financial measures to both the Company and investors, facilitating period-to-period comparisons of the Company’s core operating expenses, as the items excluded generally do not reflect the underlying performance of the Company's ongoing operations. 17 Affirm FQ1’26 Shareholder Letter

Supplemental Performance Indicators Active Merchants - The Company defines an active merchant as a merchant which has a contractual point-of-sale relationship with Affirm or a platform partner, and engages in at least one Affirm transaction during the twelve months prior to the measurement date. The Company believes that active merchants is a useful performance indicator to both the Company and investors because it measures the reach of the Company's network. Total Transactions - The Company defines total transactions as the total number of unique transactions on the Affirm platform during the applicable period. The Company believes that total transactions is a useful performance indicator to both the Company and investors because it measures the frequency of consumer engagement, as demonstrated by the total number of unique transactions. Total Revenue as a Percentage of GMV - The Company defines total revenue as a percentage of GMV as GAAP total revenue as a percentage of GMV, as defined above. The Company believes that total revenue as a percentage of GMV is a useful performance indicator to both the Company and investors of the revenue generated on a transaction processed on the Company's platform. Allowance for Credit Losses as a Percentage of Loans Held for Investment - The Company defines allowance for credit losses as a percentage of loans held for investment as GAAP allowance for credit losses as a percentage of GAAP loans held for investment. The Company believes that allowance for credit losses as a percentage of loans held for investment is a useful performance indicator to both the Company and investors of the future estimated credit losses on the Company's outstanding loans held for investment. Funding Capacity - The Company defines funding capacity as the total amount of committed funding provided by warehouse credit facilities, securitizations, and forward flow loan sale agreements available for the purchase or financing of loans. For certain committed forward flow loan sale agreements, the stated funding capacity reflects the maximum outstanding unpaid principal balance at a point in time for loans sold under the agreement, subject to meeting certain conditions which may not have yet been satisfied as of the measurement date. Funding capacity also includes the utilized portion of uncommitted forward flow loan sale agreements as of the measurement date. The Company believes that funding capacity is a useful performance indicator to both the Company and investors of its ability to fund loan transactions on the Affirm platform. Delinquencies - The Company defines delinquency as when a payment on a loan becomes more than 4 days past due. The Company generally views delinquency in groupings of more than 30 days past due, more than 60 days past due, and more than 90 days past due. A loan is charged off after a payment on a loan becomes 120 days past due. The Company believes that delinquencies are a useful performance indicator to both the Company and investors of the credit quality and performance of the loan portfolio. Repeat Consumer - The Company defines repeat consumer as a consumer who has transacted with Affirm at least twice. The Company believes that repeat consumer rates on a cohortized basis are a useful indicator of consumer retention and engagement. Average Annualized Cost of Funds - The Company defines average annualized cost of funds as annualized funding costs divided by the average of funding debt and notes issued by securitization trusts during the period. The Company believes that this is a useful indicator of the average cost of third-party financing of loans held for investment. Cumulative Net Charge-Offs - The Company defines cumulative net charge-offs as the total dollar amount of loans charged off over time from a specific cohort of transaction, less any recoveries. The Company believes that cumulative net charge-offs is a useful performance indicator to both the Company and Investors of the credit quality and performance of the loan portfolio. Net Cash - The Company defines net cash as cash and cash equivalents plus securities available for sale, minus convertible senior notes. The Company believes that net cash is a useful performance indicator to both the Company and investors as it provides an alternative perspective of the Company's liquidity. 18 Affirm FQ1’26 Shareholder Letter

Card Attach Rate - The Company defines card attach rate as active cardholders divided by total active consumers at the end of a given period. The Company believes card attach rate is a useful performance indicator to both the Company and investors because it reflects the rate of our card product adoption among our active consumer base. Use of Non-GAAP Financial Measures To supplement the Company's condensed consolidated financial statements, which are prepared and presented in accordance with generally accepted accounting principles in the United States ("GAAP"), the Company presents the following non-GAAP financial measures: transaction costs, transaction costs as a percentage of GMV, revenue less transaction costs, revenue less transaction costs as a percentage of GMV, non-GAAP sales and marketing expense, non-GAAP general and administrative expense, adjusted operating income (loss), adjusted operating margin, total platform portfolio, equity capital required, and equity capital required as a percentage of total platform portfolio. Definitions of these non-GAAP financial measures are included under "Key Operating Metrics, Non-GAAP Financial Measures and Supplemental Performance Indicators" above, and reconciliations of these non-GAAP financial measures with the most directly comparable GAAP financial measures are included in the tables below. Summaries of the reasons why the Company believes that the presentation of each of these non-GAAP financial measures provides useful information to the Company and investors are included under "Key Operating Metrics, Non-GAAP Financial Measures and Supplemental Performance Indicators" above. In addition, the Company uses these non-GAAP financial measures in conjunction with financial measures prepared in accordance with GAAP for planning purposes, including the preparation of its annual operating budget, and for evaluating the effectiveness of its business strategy. However, these non-GAAP financial measures are presented for supplemental informational purposes only, and these non-GAAP financial measures have limitations as analytical tools. Some of these limitations are as follows: ● Revenue less transaction costs and revenue less transaction costs as a percentage of GMV are not intended to be measures of operating profit or loss as they exclude key operating expenses such as technology and data analytics, sales and marketing, and general and administrative expenses; ● Adjusted operating income (loss) and adjusted operating margin exclude certain recurring, non-cash charges such as depreciation and amortization, the expense related to warrants and share-based payments granted to enterprise partners, and share-based compensation expense, which have been, and will continue to be for the foreseeable future, significant recurring expenses; and ● Other companies, including companies in the same industry, may calculate these non-GAAP financial measures differently from how the Company calculates them or not at all, which reduces its usefulness as a comparative measure. Accordingly, investors should not consider these non-GAAP financial measures in isolation or as substitutes for analysis of the Company's financial results as reported under GAAP, and these non-GAAP measures should be considered along with other operating and financial performance measures presented in accordance with GAAP. Investors are encouraged to review the related GAAP financial measures and the reconciliations of these non-GAAP financial measures to their most directly comparable GAAP financial measures and not rely on any single financial measure to evaluate the business. 19 Affirm FQ1’26 Shareholder Letter

Cautionary Note About Forward-Looking Statements This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended, that involve risks and uncertainties. All statements other than statements of historical fact are forward-looking statements, including statements regarding: the Company’s strategy and future operations, including the Company's partnerships with certain key merchant partners and commerce platforms as well as its engagement with existing and prospective originating bank partners and card issuing bank partners; the development, innovation, introduction and performance of, and demand for, the Company’s products, including Affirm Card; the Company’s use and provision of AI-powered solutions; the Company’s ability to execute on its initiatives; the Company’s ability to maintain funding sources to support its business; acquisition and retention of merchant partners, commerce platforms and consumers; the Company’s future growth, investments, network expansion, product mix, brand awareness, financial position, gross merchandise volume, revenue, transaction costs, operating income, provision for credit losses, and cash flows; and general economic trends and trends in the Company’s industry and markets. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Risks, uncertainties and assumptions include factors relating to: the Company’s need to attract additional merchants partners, commerce platforms and consumers and retain and grow its relationships with existing merchants partners, commerce platforms and consumers; the highly competitive and evolving nature of its industry; its need to maintain a consistently high level of consumer satisfaction and trust in its brand; the concentration of a large percentage of its revenue and GMV with a small number of merchant partners and commerce platforms; its ability to sustain its revenue growth rate or the growth rate of its related key operating metrics; its ability to successfully maintain its relationship with existing originating bank partners and card issuing bank partners and engage additional originating bank partners and card issuing bank partners; its ability to maintain, renew or replace its existing funding arrangements and build and grow new funding relationships; the impact of any of its existing funding sources becoming unwilling or unable to provide funding to it on terms acceptable to it, or at all; its ability to effectively underwrite loans facilitated through its platform and accurately price credit risk; the performance of loans facilitated through its platform; its ability to effectively use and provide AI-powered solutions; the impact of elevated market interest rates and corresponding higher negotiated interest rate spreads on its business; the terms of its securitizations, warehouse credit facilities and forward flow agreements; the impact on its business of general economic conditions, including the impact of inflation, ongoing recessionary concerns, uncertainty relating to the magnitude, duration and impact of tariffs on global trade, the potential for more instability of financial institutions, the financial performance of its merchant partners and commerce platforms, and fluctuations in the U.S. consumer credit market; its ability to achieve sustained profitability in the future; its ability to grow effectively through acquisitions or other strategic investments or alliances; its ability to successfully expand into new international geographies; seasonal or other fluctuations in its revenue and GMV as a result of consumer spending patterns; pending and future litigation, regulatory actions and/or compliance issues; developments in its regulatory environment; its ability to continue to attract and retain highly skilled employees; and other risks that are described in its most recent Annual Report on Form 10-K and in its other filings with the U.S. Securities and Exchange Commission. These forward-looking statements reflect the Company’s views with respect to future events as of the date hereof and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, investors should not place undue reliance on these forward-looking statements. The forward-looking statements are made as of the date hereof, and the Company assumes no obligation and does not intend to update these forward-looking statements. 20 Affirm FQ1’26 Shareholder Letter

September 30, 2025 June 30, 2025 Assets Cash and cash equivalents $ 1,428,848 $ 1,354,455 Restricted cash 668,762 401,968 Securities available for sale at fair value 812,442 871,425 Loans held for sale 12 — Loans held for investment 7,235,177 7,025,534 Allowance for credit losses (425,801) (396,929) Loans held for investment, net 6,809,376 6,628,606 Accounts receivable, net 283,726 426,177 Property, equipment and software, net 613,938 572,637 Goodwill 529,910 534,156 Intangible assets 12,685 12,935 Commercial agreement assets 49,154 57,210 Other assets 269,713 295,360 Total assets $ 11,478,567 $ 11,154,929 Liabilities and stockholders’ equity Liabilities: Accounts payable $ 58,019 $ 82,820 Payable to third-party loan owners 193,790 211,700 Accrued interest payable 25,649 24,465 Accrued expenses and other liabilities 165,830 157,272 Convertible senior notes, net 1,127,668 1,153,000 Notes issued by securitization trusts 4,830,819 4,833,855 Funding debt 1,777,906 1,622,808 Total liabilities 8,179,682 8,085,919 Stockholders’ equity: Class A common stock, par value $0.00001 per share: 3,030,000,000 shares authorized, 289,324,958 shares issued and outstanding as of September 30, 2025; 3,030,000,000 shares authorized, 284,378,565 shares issued and outstanding as of June 30, 2025 2 2 Class B common stock, par value $0.00001 per share: 140,000,000 shares authorized, 40,723,546 shares issued and outstanding as of September 30, 2025; 140,000,000 shares authorized, 40,734,234 shares issued and outstanding as of June 30, 2025 1 1 Additional paid in capital 6,299,395 6,140,893 Accumulated deficit (2,976,124) (3,056,818) Accumulated other comprehensive loss (24,389) (15,069) Total stockholders’ equity 3,298,885 3,069,009 Total liabilities and stockholders’ equity $ 11,478,567 $ 11,154,929 AFFIRM HOLDINGS, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) (in thousands, except share and per share amounts) 1 Within the table presented certain columns may not sum due to the use of rounded numbers 21 Affirm FQ1’26 Shareholder Letter

AFFIRM HOLDINGS, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) (Unaudited) (in thousands, except share and per share amounts) Three Months Ended September 30, 2025 2024 Revenue Merchant network revenue $ 251,147 $ 184,339 Card network revenue 69,330 47,480 Total network revenue 320,477 231,819 Interest income 454,122 377,064 Gain on sales of loans 119,049 63,613 Servicing income 39,689 25,983 Total revenue, net 933,337 698,479 Operating expenses Loss on loan purchase commitment 71,552 54,237 Provision for credit losses 162,752 159,824 Funding costs 110,027 104,145 Processing and servicing 133,807 95,146 Technology and data analytics 168,106 134,290 Sales and marketing 78,491 145,233 General and administrative 144,941 138,482 Restructuring and other — (255) Total operating expenses 869,676 831,102 Operating income (loss) $ 63,661 $ (132,623) Other income, net 19,358 34,303 Income (loss) before income taxes $ 83,019 $ (98,320) Income tax expense 2,326 1,902 Net income (loss) $ 80,694 $ (100,222) Other comprehensive income (loss) Foreign currency translation adjustments $ (10,003) $ 8,346 Loss on cash flow hedges (129) (1,492) Unrealized gain on securities available for sale, net 812 5,589 Net other comprehensive income (loss) (9,320) 12,443 Comprehensive income (loss) $ 71,373 $ (87,779) Per share data: Net income (loss) per share attributable to common stockholders for Class A and Class B Basic $ 0.24 $ (0.31) Diluted $ 0.23 $ (0.31) Weighted average common shares outstanding Basic 330,238,205 318,234,555 Diluted 348,278,403 318,234,555 Three Months Ended September 30, 2025 2024 General and administrative $ 55,773 $ 62,804 Technology and data analytics 24,764 25,972 Sales and marketing 5,076 5,195 Processing and servicing 240 262 Total stock-based compensation in operating expenses $ 85,853 $ 94,233 The following table presents the components and classification of stock-based compensation (in thousands): 1 Within the table presented certain columns may not sum due to the use of rounded numbers 22 Affirm FQ1’26 Shareholder Letter

AFFIRM HOLDINGS, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) (in thousands) Three Months Ended September 30, 2025 2024 Cash flows from operating activities Net income (loss) $ 80,694 $ (100,222) Adjustments to reconcile net income (loss) to net cash used in operating activities: Provision for losses 162,752 159,824 Amortization of premiums and discounts on loans (65,072) (52,064) Gain on sales of loans (119,049) (63,613) Gain on extinguishment of debt (1,495) (19,624) Changes in fair value of assets and liabilities (110) 1,668 Amortization of commercial agreement assets 8,056 14,256 Amortization of debt issuance costs 6,828 6,083 Accrued interest on securities available for sale (9,959) (15,797) Commercial agreement warrant expense 40,977 107,263 Stock-based compensation 85,853 94,233 Depreciation and amortization 65,329 46,720 Other (4,930) (2,209) Change in operating assets and liabilities: Purchases and origination of loans held for sale (749,202) (1,219,022) Proceeds from the sale of loans held for sale 748,761 1,219,061 Accounts receivable, net 138,862 41,117 Other assets 30,955 (6,833) Accounts payable (24,801) 16,543 Payable to third-party loan buyers (17,910) (7,608) Accrued interest payable 1,621 846 Accrued expenses and other liabilities (3,586) (23,755) Net cash provided by operating activities 374,572 196,867 Cash flows from investing activities Purchases and origination of loans held for investment (9,797,362) (6,388,350) Proceeds from the sale of loans held for investment 4,282,839 1,630,671 Principal repayments and other loan servicing activity 5,359,253 4,132,682 Additions to property, equipment and software (54,365) (44,152) Purchases of securities available for sale (146,462) (136,727) Proceeds from maturities and repayments of securities available for sale 216,425 215,680 Other investing inflows 61 36,197 Other investing outflows — (21,000) Net cash used in investing activities (139,611) (574,999) Cash flows from financing activities Proceeds from the issuance of funding debt 7,980,435 3,188,998 Proceeds from issuance of notes and certificates by securitization trust 1,100,000 750,000 Principal repayments of funding debt (7,818,589) (3,289,384) Principal repayments of notes issued by securitization trust (1,100,000) — Payment of debt issuance costs (9,466) (4,321) Extinguishment of convertible debt (24,814) (120,056) Proceeds from exercise of common stock options and warrants and contributions to ESPP 94,828 3,596 Taxes paid related to net share settlement of equity awards (112,307) (63,208) Net cash provided by financing activities 110,086 465,625 Effect of exchange rate changes on cash, cash equivalents and restricted cash (3,861) 1,730 Net increase in cash, cash equivalents and restricted cash 341,187 89,223 Cash, cash equivalents and restricted cash, beginning of period 1,756,423 1,295,399 Cash, cash equivalents and restricted cash, end of period $ 2,097,610 $ 1,384,622 1 Within the table presented certain columns may not sum due to the use of rounded numbers 23 Affirm FQ1’26 Shareholder Letter

AFFIRM HOLDINGS, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS, CONT. (Unaudited) (in thousands) Three Months Ended September 30, 2025 2024 Supplemental disclosures of cash flow information Cash payments for interest expense $ 103,252 $ 99,506 Cash paid for operating leases 4,253 4,159 Cash paid for income taxes 1,749 454 Supplemental disclosures of non-cash investing and financing activities Stock-based compensation included in capitalized internal-use software 52,885 49,478 Three Months Ended September 30, 2025 2024 Reconciliation to amounts on consolidated balance sheets (as of period end) Cash and cash equivalents $ 1,428,848 $ 1,046,160 Restricted cash 668,762 338,462 Total cash, cash equivalents and restricted cash $ 2,097,610 $ 1,384,622 24 Affirm FQ1’26 Shareholder Letter

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES The following tables present a reconciliation of transaction costs, revenue less transaction costs, adjusted operating income, adjusted operating margin, non-GAAP general and administrative expense, non-GAAP technology and data analytics expense, non-GAAP sales and marketing expense, and equity capital required to their most directly comparable financial measures prepared in accordance with GAAP for each of the periods indicated. Three Months Ended September 30, 2025 2024 (in thousands, except percent data) Operating expenses Loss on loan purchase commitment $ 71,552 $ 54,237 Provision for credit losses 162,752 159,824 Funding costs 110,027 104,145 Processing and servicing 133,807 95,146 Transaction costs (Non-GAAP) $ 478,138 $ 413,352 Technology and data analytics 168,106 134,290 Sales and marketing 78,491 145,233 General and administrative 144,941 138,482 Restructuring and other — (255) Total operating expenses $ 869,676 $ 831,102 Total revenue $ 933,337 $ 698,479 Less: Transaction costs (Non-GAAP) (478,138) (413,352) Revenue less transaction costs (Non-GAAP) $ 455,199 $ 285,127 Operating income (loss) $ 63,661 $ (132,623) Add: Depreciation and amortization 65,328 46,715 Add: Stock-based compensation included in operating expenses 85,853 94,233 Add: Enterprise warrant and share-based expense 49,033 121,519 Add: Restructuring and other 1 — (255) Adjusted operating income (Non-GAAP) $ 263,875 $ 129,589 Divided by: Total revenue, net $ 933,337 $ 698,479 Adjusted operating margin (Non-GAAP) 28.3 % 18.6 % General and administrative expense $ 144,941 $ 138,482 Less: Depreciation and amortization included in general and administrative expense (550) (605) Less: Stock-based compensation included in general and administrative expense (55,773) (62,804) Non-GAAP General and administrative expense $ 88,618 $ 75,073 Technology and data analytics expense $ 168,106 $ 134,290 Less: Depreciation and amortization included in technology and data analytics expense (64,631) (45,392) Less: Stock-based compensation included in technology and data analytics expense (24,764) (25,972) Non-GAAP Technology and data analytics expense $ 78,711 $ 62,926 Sales and marketing expense $ 78,491 $ 145,233 Less: Depreciation and amortization included in sales and marketing expense (117) (686) Less: Stock-based compensation included in sales and marketing expense (5,076) (5,195) Less: Enterprise warrant and share-based included in sales and marketing expense (49,033) (121,519) Non-GAAP Sales and marketing expense $ 24,265 $ 17,833 September 30, 2025 June 30, 2025 September 30, 2024 (in thousands) Loans held for investment $ 7,235,177 $ 7,025,534 $ 6,310,834 Add: Loans held for sale 12 — — Less: Funding debt (1,777,906) (1,622,808) (1,744,040) Less: Notes issued by securitization trusts (4,830,819) (4,833,855) (3,985,484) Equity capital required (Non-GAAP) $ 626,464 $ 568,871 $ 581,310 1 Restructuring and other costs includes expenses incurred in the period associated with the Company's restructurings and other exit and disposal activities. 2 Within the table presented certain columns may not sum due to the use of rounded numbers 25 Affirm FQ1’26 Shareholder Letter

SUPPLEMENTAL DELINQUENCY INFORMATION Three Months Ending September 30 December 31 March 31 June 30 30+ Day Delinquencies FY 2020 2.5% 2.1% 1.9% 1.1% FY 2021 0.8% 0.8% 0.7% 0.9% FY 2022 1.5% 1.6% 2.1% 2.1% FY 2023 2.7% 2.4% 2.3% 2.1% FY 2024 2.4% 2.4% 2.3% 2.4% FY 2025 2.8% 2.5% 2.4% 2.3% FY 2026 2.8% 60+ Day Delinquencies FY 2020 1.4% 1.2% 1.1% 0.8% FY 2021 0.5% 0.4% 0.4% 0.5% FY 2022 0.9% 0.9% 1.2% 1.2% FY 2023 1.6% 1.5% 1.4% 1.2% FY 2024 1.4% 1.4% 1.4% 1.5% FY 2025 1.7% 1.5% 1.5% 1.4% FY 2026 1.6% 90+ Day Delinquencies FY 2020 0.6% 0.6% 0.5% 0.4% FY 2021 0.2% 0.2% 0.2% 0.2% FY 2022 0.4% 0.4% 0.5% 0.5% FY 2023 0.7% 0.7% 0.6% 0.5% FY 2024 0.7% 0.7% 0.6% 0.6% FY 2025 0.8% 0.7% 0.6% 0.6% FY 2026 0.7% Three Months Ending September 30 December 31 March 31 June 30 30+ Day Delinquencies FY 2020 3.2% 2.9% 2.8% 1.8% FY 2021 1.4% 1.3% 1.2% 1.3% FY 2022 2.1% 2.1% 2.7% 2.5% FY 2023 3.2% 2.7% 2.5% 2.3% FY 2024 2.5% 2.5% 2.4% 2.5% FY 2025 2.8% 2.5% 2.5% 2.3% FY 2026 2.8% 60+ Day Delinquencies FY 2020 1.8% 1.7% 1.6% 1.3% FY 2021 0.8% 0.7% 0.7% 0.7% FY 2022 1.2% 1.2% 1.6% 1.4% FY 2023 1.9% 1.6% 1.5% 1.3% FY 2024 1.5% 1.5% 1.4% 1.5% FY 2025 1.7% 1.5% 1.5% 1.4% FY 2026 1.6% 90+ Day Delinquencies FY 2020 0.8% 0.8% 0.7% 0.6% FY 2021 0.4% 0.3% 0.3% 0.3% FY 2022 0.6% 0.6% 0.6% 0.6% FY 2023 0.9% 0.8% 0.7% 0.6% FY 2024 0.7% 0.7% 0.7% 0.6% FY 2025 0.8% 0.7% 0.7% 0.6% FY 2026 0.7% Monthly Installment Loan (ex-Peloton) Monthly Installment Loan 26 Affirm FQ1’26 Shareholder Letter