Financial Supplement Third Quarter 2025 Exhibit 99.2

Disclaimers 02 This supplement contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not historical statements of fact and statements regarding the following: future financial and financing plans; strategies related to the Company's business and its portfolio, including acquisition opportunities and disposition plans; growth prospects, operating and financial performance, expectations regarding the making of distributions, payment of dividends, and the performance of our operators and their respective properties. Words such as “anticipate,” “believe,” “could,” "expect,” “estimate,” “intend,” “may,” “plan,” “seek,” “should,” “will,” “would,” and similar expressions, or the negative of these terms, are intended to identify such forward- looking statements, though not all forward-looking statements contain these identifying words. Our forward- looking statements are based on our current expectations and beliefs, and are subject to a number of risks and uncertainties that could lead to actual results differing materially from those projected, forecasted or expected. Although we believe that the assumptions underlying these forward-looking statements are reasonable, they are not guarantees and we can give no assurance that our expectations will be attained. Factors which could have a material adverse effect on our operations and future prospects or which could cause actual results to differ materially from expectations include, but are not limited to: (i) the ability and willingness of our tenants and borrowers to meet and/or perform their obligations under the agreements we have entered into with them, including without limitation, their respective obligations to indemnify, defend and hold us harmless from and against various claims, litigation and liabilities; (ii) the risk that we may have to incur additional impairment charges related to our assets held for sale if we are unable to sell such assets at the prices we expect; (iii) the impact of healthcare reform legislation, including potential minimum staffing level requirements, on the operating results and financial conditions of our tenants and borrowers; (iv) the ability of our tenants and borrowers to comply with applicable laws, rules and regulations in the operation of the properties we lease to them or finance; (v) the intended benefits of our acquisition of Care REIT plc (“Care REIT”) may not be realized, and we will be subject to additional risks from our investment in Care REIT and any other international investments; (vi) the ability and willingness of our tenants to renew their leases with us upon their expiration, and the ability to reposition our properties on the same or better terms in the event of nonrenewal or in the event we replace an existing tenant, as well as any obligations, including indemnification obligations, we may incur in connection with the replacement of an existing tenant; (vii) the availability of and the ability to identify (a) tenants who meet our credit and operating standards, and (b) suitable acquisition opportunities and the ability to acquire and lease the respective properties to such tenants on favorable terms; (viii) the ability to generate sufficient cash flows to service our outstanding indebtedness; (ix) access to debt and equity capital markets; (x) fluctuating interest and currency rates; (xi) the impact of public health crises, including significant COVID-19 outbreaks as well as other pandemics or epidemics; (xii) the ability to retain our key management personnel; (xiii) the ability to maintain our status as a real estate investment trust (“REIT”); (xiv) changes in the U.S. and U.K. tax law and other state, federal or local laws, whether or not specific to REITs; (xv) other risks inherent in the real estate business, including potential liability relating to environmental matters and illiquidity of real estate investments; and (xvi) any additional factors included under Item 1A “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024, and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, including in the sections entitled “Risk Factors” in Item 1A of such reports, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the Securities and Exchange Commission (the "SEC"). This supplement contains certain non-GAAP financial information relating to CareTrust REIT including EBITDA, Normalized EBITDA, FFO, Normalized FFO, FAD, Normalized FAD, and certain related ratios. Explanatory footnotes and a glossary explaining this non-GAAP information are included in this supplement. Reconciliations of these non-GAAP measures are also included in this supplement or on our website. See “Financials and Filings – Quarterly Results” on the Investors section of our website at investor.caretrustreit.com. Non-GAAP financial information does not represent financial performance under GAAP and should not be considered in isolation, as a measure of liquidity, as an alternative to net income, or as an indicator of any other performance measure determined in accordance with GAAP. You should not rely on non-GAAP financial information as a substitute for GAAP financial information, and should recognize that non-GAAP information presented herein may not compare to similarly-termed non-GAAP information of other companies (i.e., because they do not use the same definitions for determining any such non-GAAP information). This supplement also includes certain information regarding operators of our properties (such as EBITDARM Coverage, EBITDAR Coverage, and Occupancy), most of which are not subject to audit or SEC reporting requirements. The operator information provided in this supplement has been provided by the operators. We have not independently verified this information, but have no reason to believe that such information is inaccurate in any material respect. We are providing this information for informational purposes only. The Ensign Group, Inc. ("Ensign"), The Pennant Group, Inc. ("Pennant") and PACS Group, Inc. ("PACS") are subject to the registration and reporting requirements of the SEC and are required to file with the SEC annual reports containing audited financial information and quarterly reports containing unaudited financial information. Ensign’s, Pennant's and PACS' financial statements, as filed with the SEC, can be found at the SEC's website at www.sec.gov. This supplement provides information about our financial results as of and for the quarter ended September 30, 2025 and is provided as of the date hereof, unless specifically stated otherwise. We expressly disclaim any obligation to update or revise any information in this supplement (including forward-looking statements), whether to reflect any change in our expectations, any change in events, conditions or circumstances, or otherwise. As used in this supplement, unless the context requires otherwise, references to “CTRE,” “CareTrust,” “CareTrust REIT” or the “Company” refer to CareTrust REIT, Inc. and its consolidated subsidiaries. GAAP refers to generally accepted accounting principles in the United States of America.

Table of Contents CONTACT INFORMATION 03 CareTrust REIT, Inc. 905 Calle Amanecer, Suite 300 San Clemente, CA 92673 (949) 542-3130 ir@caretrustreit.com www.CareTrustReit.com Transfer Agent Broadridge Corporate Issuer Solutions P.O. Box 1342 Brentwood, NY 11717 (800) 733-1121 shareholder@broadridge.com Bayshire Carlsbad (Carlsbad, CA) COMPANY PROFILE 04 COMPANY SNAPSHOT 05 INVESTMENTS 06 PORTFOLIO OVERVIEW 07-14 Net-Leased Rent Coverage Portfolio Performance Rent Diversification by Tenant Total Revenue Diversification by Geography Lease Maturities Net-Leased Purchase Options Other Real Estate Investments FINANCIAL OVERVIEW 15-25 Consolidated Income Statements Reconciliation of EBITDA, FFO and FAD Consolidated Balance Sheets Key Debt Metrics Debt Summary Debt Covenants 2025 Guidance Equity Capital Transactions Other Financial Highlights GLOSSARY 26-27

Company Profile MANAGEMENT Dave Sedgwick – Chief Executive Officer Bill Wagner - Chief Financial Officer James Callister - Chief Investment Officer CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of skilled nursing, senior housing and other healthcare-related properties located in the United States and the United Kingdom. Since its debut as a standalone public company on June 1, 2014, and as of September 30, 2025, CareTrust REIT has expanded its tenant roster to 38 operators, and has grown its real estate portfolio to 390 net-leased healthcare properties across 31 states and the United Kingdom, consisting of 35,687 operating beds/units. As of September 30, 2025, CareTrust REIT also had 23 other real estate related investments related to 143 healthcare properties across 17 states and the United Kingdom, consisting of 14,082 operating beds/units and one financing receivable related to 46 properties in one state consisting of 3,820 operating beds/ units. BOARD OF DIRECTORS Diana Laing - Chair Anne Olson Spencer Plumb Dave Sedgwick Careina Williams EQUITY ANALYST COVERAGE* Baird - Wes Golladay | (216) 737-7510 Bank of America - Farrell Granath | (646) 855-1351 BMO Capital Markets - Juan Sanabria | (312) 845-4074 Cantor Fitzgerald & Co. - Richard Anderson | (929) 441-6927 Deutsche Bank - Omotayo Okusanya | (212) 250-9284 Green Street - John Pawlowski | (949) 640-8780 Jefferies - Joe Dickstein | (212) 778-8771 KeyBanc Capital Markets - Austin Wurschmidt | (917) 368-2311 Raymond James - Jonathan Hughes | (727) 567-2438 RBC Capital Markets - Michael Carroll | (440) 715-2649 Wells Fargo - John Kilichowski | (212) 214-5311 * This information is provided as of November 5, 2025. This list may be incomplete and is subject to change as firms initiate or discontinue coverage of CareTrust. Please note that any opinions, estimates, or forecasts regarding our historical or predicted performance made by these analysts are theirs alone and do not represent opinions, estimates, or forecasts of CareTrust or our management. CareTrust does not by our reference or distribution of the information above imply our endorsement of or concurrence with any opinions, estimates, or forecasts of these analysts. Interested persons may obtain copies of analysts’ reports on their own as we do not distribute these reports. Several of these firms may, from time to time, own our stock and/or hold other long or short positions in our stock and may provide compensated services to us. See “Glossary” for additional information.04

CARETRUST REIT, INC. NYSE: CTRE Market Data (as of September 30, 2025) ◦ Closing Price: $34.68 ◦ 52 Week Range: $35.18 – $24.79 ◦ Market Cap: $7.7B ◦ Enterprise Value: $7.9B ◦ Outstanding Shares: 223.3M Credit Ratings ◦ Corporate Rating: BB+ (stable) ◦ Senior Unsecured Notes: BBB- ◦ Corporate Rating: BBB- (stable) ◦ Senior Unsecured Notes: BBB- FitchS&P ◦ Corporate Rating: Ba1 (positive) ◦ Senior Unsecured Notes: Ba1 Moody’s $4,812M INVESTMENTS 579 PROPERTIES 53,589 OPERATING BEDS/UNITS 45 OPERATORS 33 STATES + UK Note: Portfolio amounts presented above are as of September 30, 2025 and include properties securing our financing receivable and other real estate related investments. General Note: Totals may not add due to rounding. Throughout this presentation, the terms "operators" and "tenants" are used interchangeably to reflect the healthcare providers who lease and operate our properties. See “Glossary” for additional information. Snapshot 05

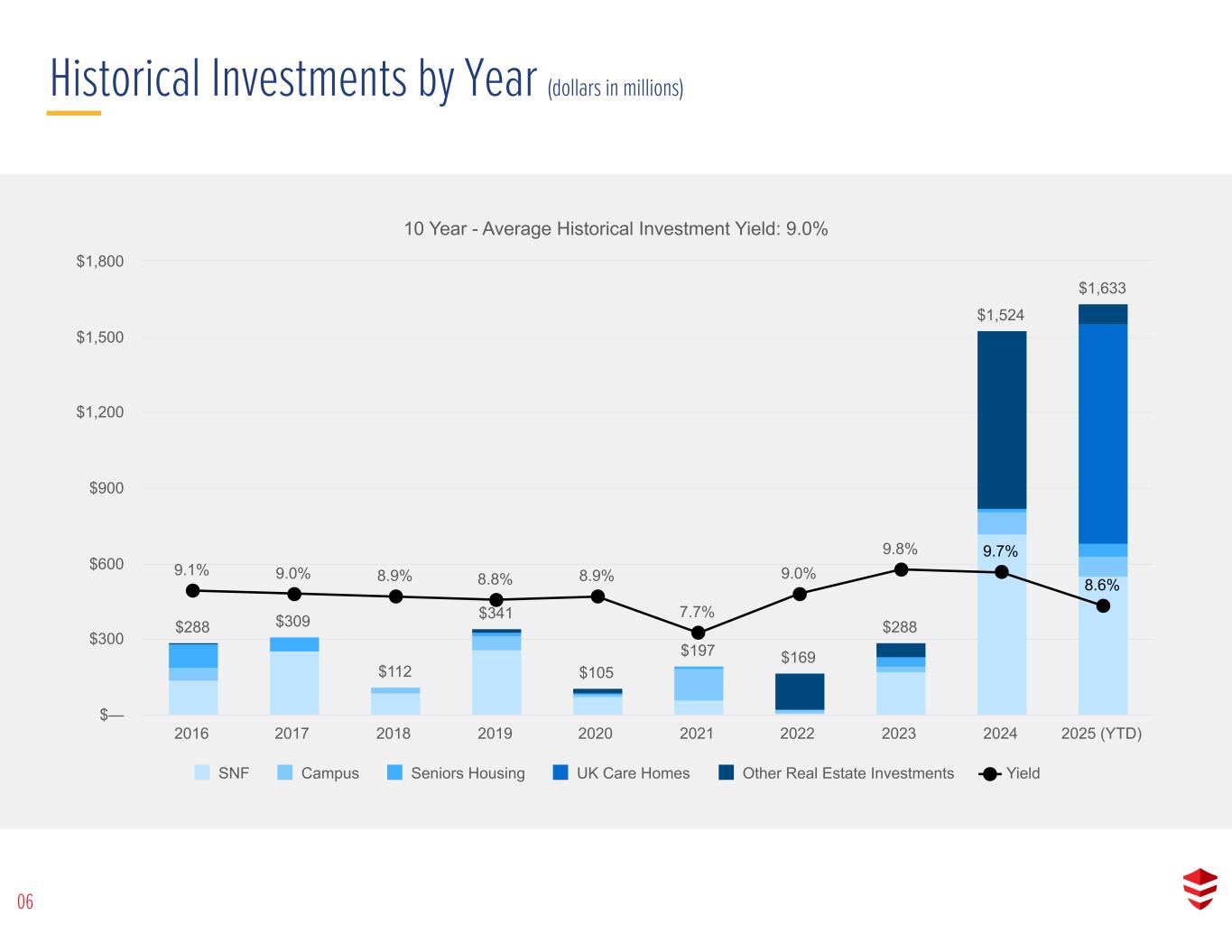

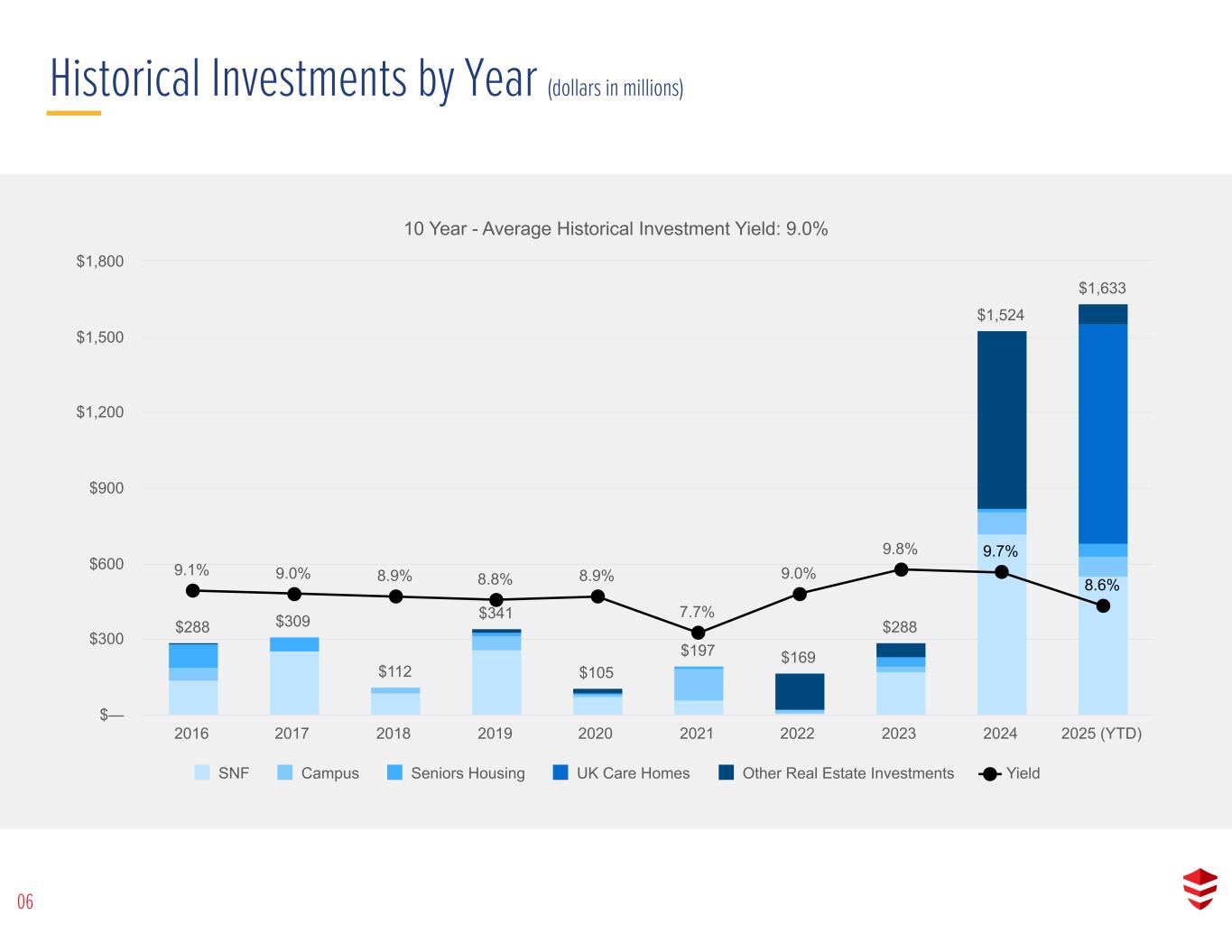

Historical Investments by Year (dollars in millions) 06 10 Year - Average Historical Investment Yield: 9.3% $288 $309 $112 $341 $105 $197 $169 $288 $1,524 $1,201 9.1% 9.0% 8.9% 8.8% 8.9% 7.7% 9.0% 9.8% 9.7% 7.8% SNF Campus Seniors housing UK care homes Other real estate investments Yield 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (YTD) $— $500 $1,000 $1,500 $2,000 10 Year - Average Historical Investment Yield: 9.0% $288 $309 $112 $341 $105 $197 $169 $288 $1,524 $1,633 9.1% 9.0% 8.9% 8.8% 8.9% 7.7% 9.0% 9.8% 9.7% 8.6% SNF Campus Seniors Housing UK Care Homes Other Real Estate Investments Yield 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (YTD) $— $300 $600 $900 $1,200 $1,500 $1,800

Notes: [1] EBITDAR Coverage and EBITDARM Coverage are based on financial information provided by our operators. We have not independently verified this information, but have no reason to believe that such information is inaccurate in any material respect. Coverage metrics are based on contractual cash rents in place during the period presented unless a lease has been entered into or amended since the end of the period, in which case the current contractual rent is used. EBITDAR Coverage and EBITDARM Coverage are provided only for Stabilized properties. See "Glossary" for additional information. Net-Leased Rent Coverage[1] 07 Trailing Twelve Months EBITDARM Rent Coverage Distribution as a % of Rent by Operator As of June 30, 2025 Operators Properties SNF SH UK CH Multi Q2'25 Q1'25 Q4'24 Q3'24 Q2'24 <1.00x 0 0 — % — % — % — % — % — % — % — % — % 1.00-1.39x 3 19 — % 3 % 2 % — % 5 % 10 % 10 % 9 % 8 % 1.40-1.79x 7 97 17 % — % 13 % 2 % 32 % 28 % 26 % 27 % 28 % 1.80-2.19x 4 12 5 % — % 1 % — % 6 % 7 % 11 % 9 % 8 % 2.20-2.59x 4 11 3 % 3 % — % — % 7 % 4 % 1 % 1 % — % 2.60-2.99x 3 25 5 % — % 2 % — % 8 % 11 % 17 % 26 % 28 % >=3.00x 5 125 35 % 2 % 6 % — % 42 % 40 % 35 % 28 % 28 % Rent Coverage 26 289 3.16x 2.16x 2.08x 1.61x 2.77x 2.72x 2.68x 2.67x 2.67x Trailing Twelve Months EBITDAR Rent Coverage Distribution as a % of Rent by Operator As of June 30, 2025 Operators Properties SNF SH UK CH Multi Q2'25 Q1'25 Q4'24 Q3'24 Q2'24 <1.00x 2 16 3 % — % 2 % — % 4 % 6 % 10 % 9 % 7 % 1.00-1.39x 6 42 1 % 3 % 6 % 2 % 13 % 34 % 32 % 30 % 34 % 1.40-1.79x 7 75 18 % 3 % 9 % — % 29 % 4 % 5 % 6 % 3 % 1.80-2.19x 3 6 3 % — % — % — % 4 % 4 % 2 % 8 % 8 % 2.20-2.59x 3 25 5 % — % 2 % — % 8 % 24 % 23 % 20 % 20 % 2.60-2.99x 3 29 6 % 2 % 6 % — % 14 % 2 % — % — % — % >=3.00x 2 96 28 % — % — % — % 28 % 26 % 27 % 27 % 28 % Rent Coverage 26 289 2.51x 1.72x 1.69x 1.28x 2.21x 2.15x 2.12x 2.11x 2.11x

Portfolio Performance 08 [1] All amounts exclude 8 properties classified as held for sale as of September 30, 2025. [2] The financing receivable arrangement provides for multiple purchase option windows. The first option window opened December 1, 2024 for 3 properties, the second option window opens December 1, 2026 for 4 properties, the third option window opens December 1, 2027 for 35 properties and the fourth option window opens December 1, 2028 for 4 properties. Each option window will remain open until the expiration of the lease. [3] All amounts exclude 6 properties classified as held for sale as of June 30, 2025. [4] All amounts exclude 8 properties classified as held for sale as of September 30, 2024, and one property which was in the process of being repurposed. See “Glossary” for additional information. (dollars in thousands) As of September 30, 2025 Asset Type Properties Operating Beds/Units Investment % of Total Investment Rent / Interest % of Total Rent / Interest Current Yield Investment in Real Estate Properties Skilled Nursing 200 21,465 $ 2,255,078 46.9 % $ 238,567 51.2 % 10.6 % UK Care Homes 131 7,307 930,768 19.3 % 68,489 14.7 % 7.4 % Multi-Service Campus 30 4,381 503,626 10.5 % 48,893 10.5 % 9.7 % Seniors Housing 29 2,534 164,027 3.4 % 16,124 3.5 % 9.8 % Total Net-Leased Assets[1] 390 35,687 $ 3,853,499 80.1 % $ 372,073 79.8 % 9.7 % Financing Receivable[2] 46 3,820 $ 97,082 2.0 % $ 11,787 2.5 % 12.1 % Other Real Estate Related Investments 143 14,082 $ 861,463 17.9 % $ 82,148 17.6 % 9.5 % Total Investments 579 53,589 $ 4,812,044 100.0 % $ 466,008 100.0 % 9.7 % As of June 30, 2025 Asset Type Properties Operating Beds/Units Investment % of Total Investment Rent / Interest % of Total Rent / Interest Current Yield Investment in Real Estate Properties Skilled Nursing 200 21,387 $ 2,252,120 47.3 % $ 234,715 51.2 % 10.4 % UK Care Homes 133 7,456 901,593 18.9 % 67,500 14.7 % 7.5 % Multi-Service Campus 29 4,280 494,236 10.4 % 47,776 10.4 % 9.7 % Seniors Housing 31 2,596 178,997 3.8 % 17,010 3.7 % 9.5 % Total Net-Leased Assets[3] 393 35,719 $ 3,826,946 80.4 % $ 367,001 80.0 % 9.6 % Financing Receivable[2] 46 3,820 $ 97,082 2.0 % $ 11,729 2.6 % 12.1 % Other Real Estate Related Investments 142 13,944 $ 835,657 17.6 % $ 79,951 17.4 % 9.6 % Total Investments 581 53,483 $ 4,759,685 100.0 % $ 458,681 100.0 % 9.6 % As of September 30, 2024 Asset Type Properties Operating Beds/Units Investment % of Total Investment Rent / Interest % of Total Rent / Interest Current Yield Skilled Nursing 159 17,300 $ 1,587,521 53.7 % $ 164,809 55.9 % 10.4 % Multi-Service Campus 29 4,164 466,715 15.8 % 41,712 14.2 % 8.9 % Seniors Housing 29 2,427 156,539 5.3 % 17,328 5.9 % 11.1 % Total Net-Leased Assets[4] 217 23,891 $ 2,210,775 74.8 % $ 223,849 76.0 % 10.1 % Other Real Estate Related Investments 109 11,515 $ 745,818 25.2 % $ 70,784 24.0 % 9.5 % Total Investments 326 35,406 $ 2,956,593 100.0 % $ 294,633 100.0 % 10.0 %

Rent Diversification by Tenant for Net-Leased Assets 09 Notes: [1] All amounts exclude 8 properties classified as held for sale as of September 30, 2025. [2] Cascadia operates the subject facilities under a long-term sublease agreement. See “Glossary” for additional information. (dollars in thousands) As of September 30, 2025[1] Net-Leased Assets Operating Beds/Units Rent % of Total Rent 1 The Ensign Group 113 12,216 $ 92,102 24.8 % 2 PACS Group 25 3,011 39,894 10.7 % 3 Priority Management Group 15 2,144 31,894 8.6 % 4 Minster Care Management 49 2,466 23,106 6.2 % 5 Links Healthcare 12 1,296 20,264 5.4 % Total Top 5 Tenants 214 21,133 $ 207,260 55.7 % 6 Kalesta 12 1,261 18,885 5.1 % 7 Bayshire Senior Communities 9 1,263 16,350 4.4 % 8 Welford 17 1,066 14,118 3.8 % 9 Cascadia[2] 12 987 13,438 3.6 % 10 Holmes 21 1,102 9,918 2.7 % Total Top 10 Tenants 285 26,812 $ 279,969 75.2 % All Other Tenants 105 8,875 $ 92,104 24.8 % Total 390 35,687 $ 372,073 100.0 %

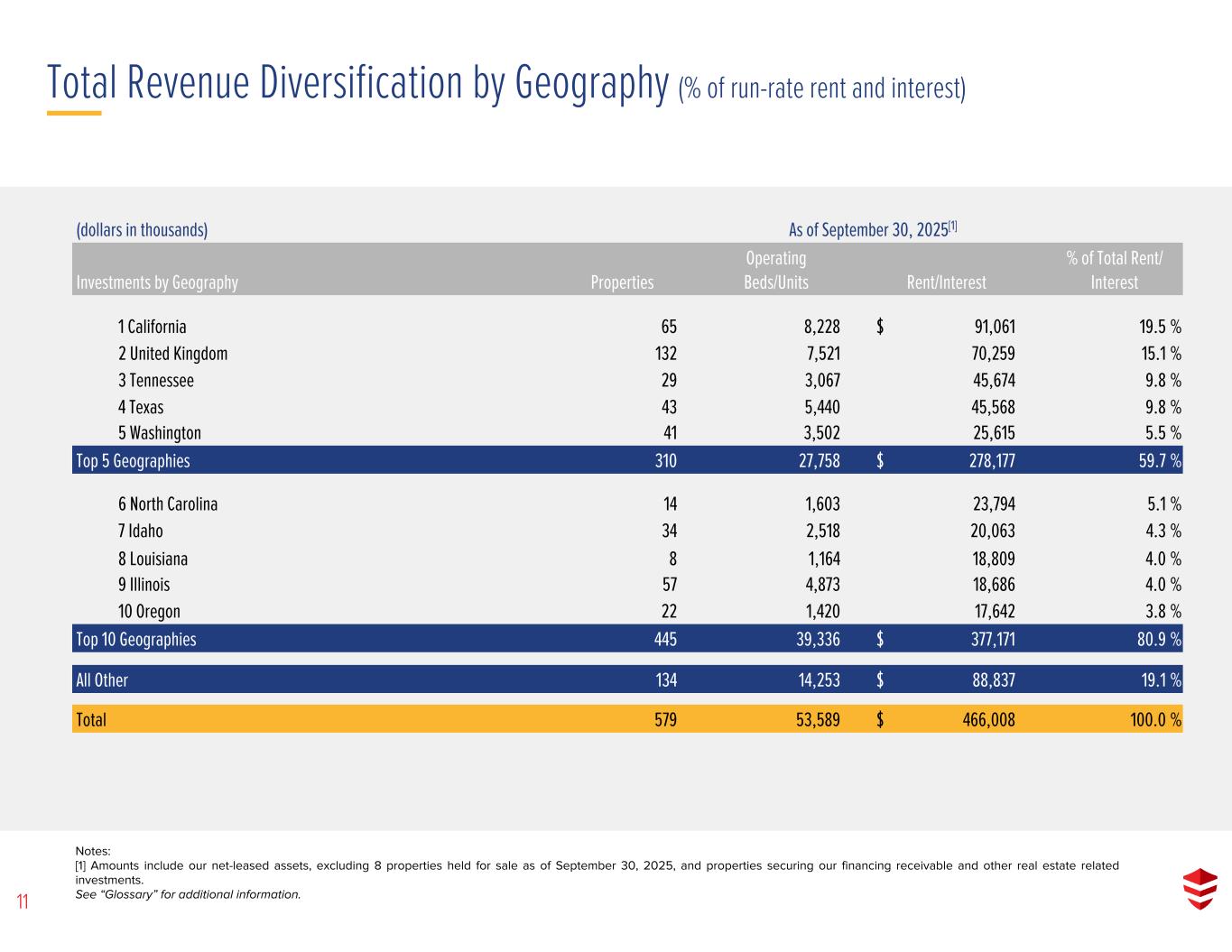

Total Revenue Diversification by Geography (% of run-rate rent and interest) 10 Note: Numbers are as of September 30, 2025 and include our net-leased assets and properties securing our financing receivable and other real estate related investments. Numbers exclude 8 properties held for sale as of September 30, 2025. See “Glossary” for additional information. 7% * 19% 10% 4% 3% 2% 4%2% 2% 1% 1% 1% 1% 1% 1% 1% * 5% * * * *4% * 10% 1%* *

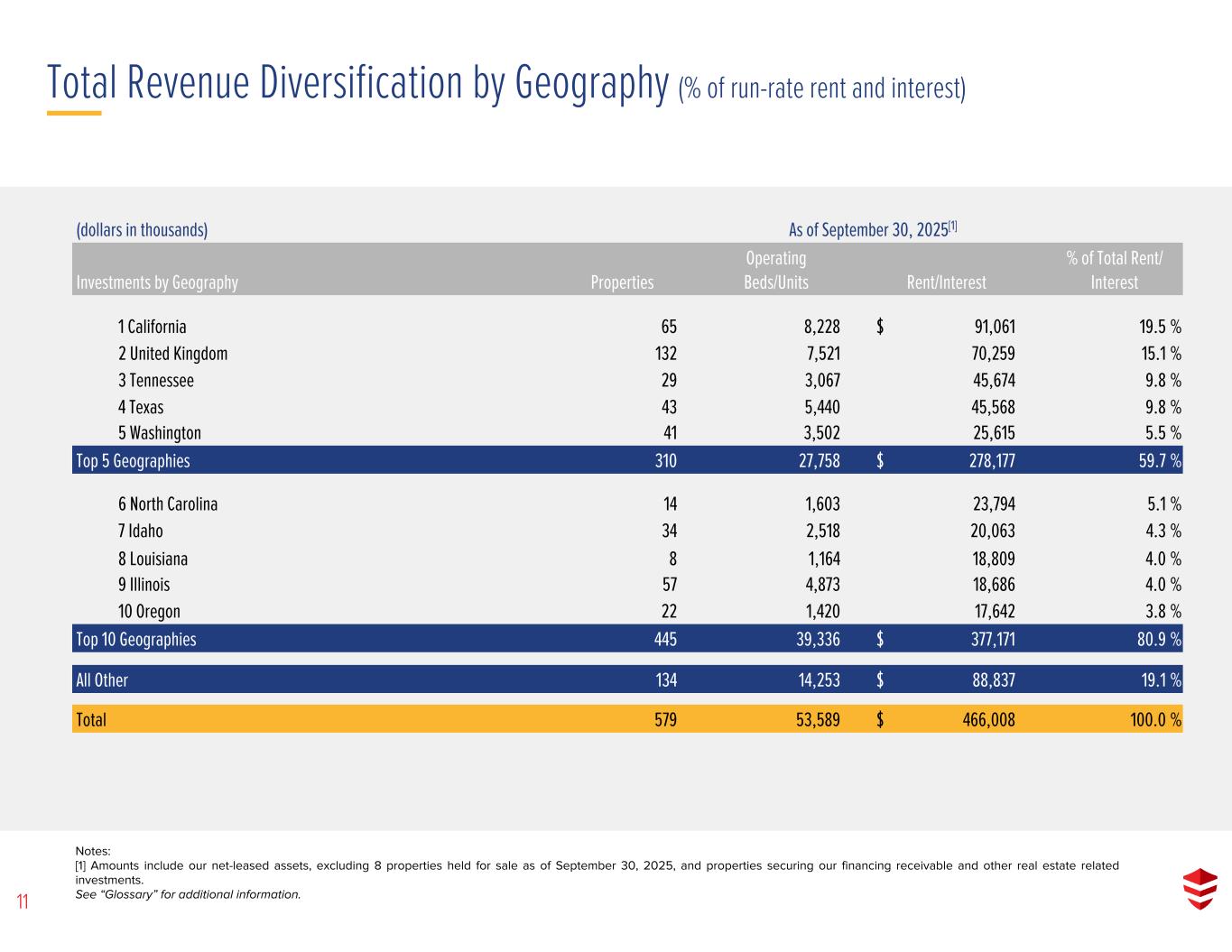

11 Notes: [1] Amounts include our net-leased assets, excluding 8 properties held for sale as of September 30, 2025, and properties securing our financing receivable and other real estate related investments. See “Glossary” for additional information. (dollars in thousands) As of September 30, 2025[1] Investments by Geography Properties Operating Beds/Units Rent/Interest % of Total Rent/ Interest 1 California 65 8,228 $ 91,061 19.5 % 2 United Kingdom 132 7,521 70,259 15.1 % 3 Tennessee 29 3,067 45,674 9.8 % 4 Texas 43 5,440 45,568 9.8 % 5 Washington 41 3,502 25,615 5.5 % Top 5 Geographies 310 27,758 $ 278,177 59.7 % 6 North Carolina 14 1,603 23,794 5.1 % 7 Idaho 34 2,518 20,063 4.3 % 8 Louisiana 8 1,164 18,809 4.0 % 9 Illinois 57 4,873 18,686 4.0 % 10 Oregon 22 1,420 17,642 3.8 % Top 10 Geographies 445 39,336 $ 377,171 80.9 % All Other 134 14,253 $ 88,837 19.1 % Total 579 53,589 $ 466,008 100.0 % Total Revenue Diversification by Geography (% of run-rate rent and interest)

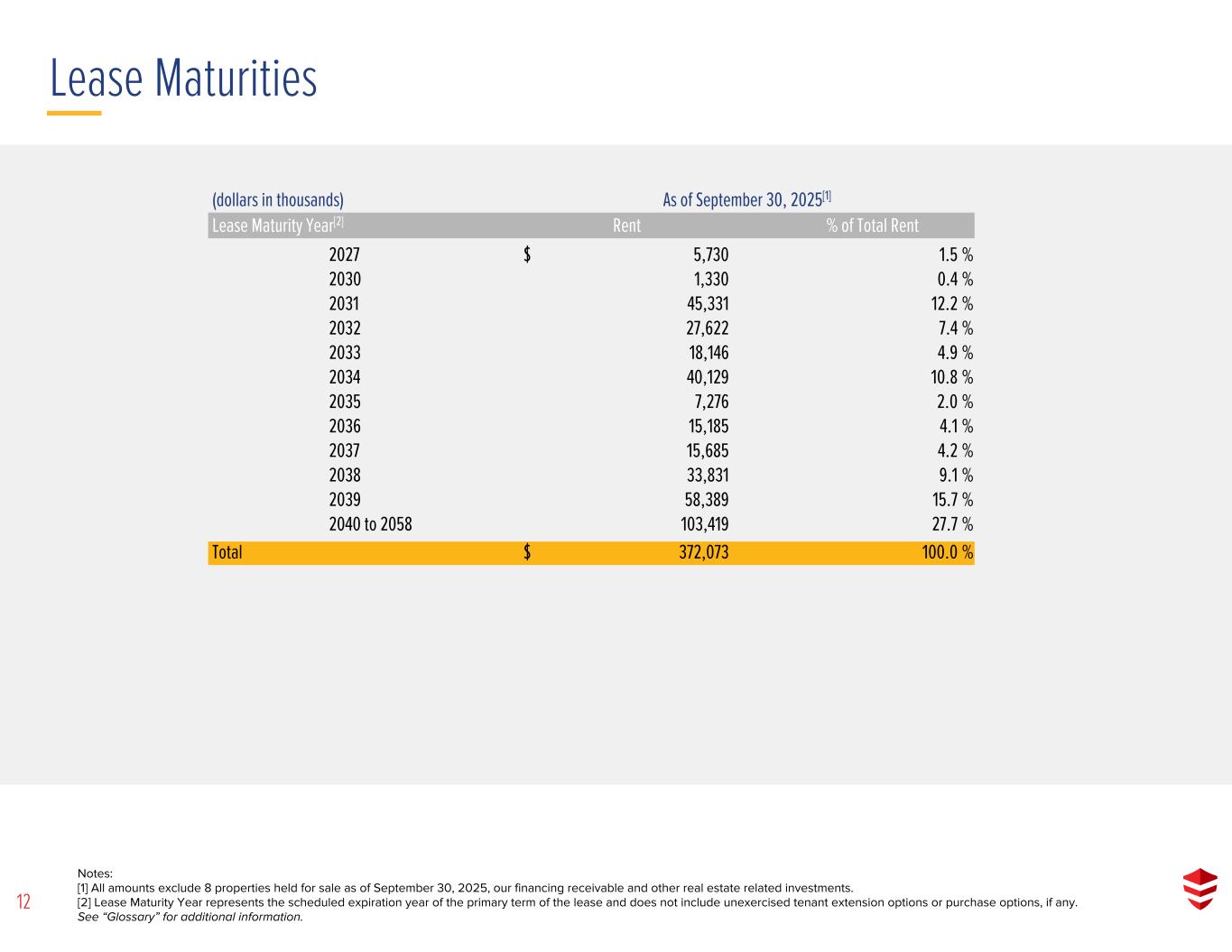

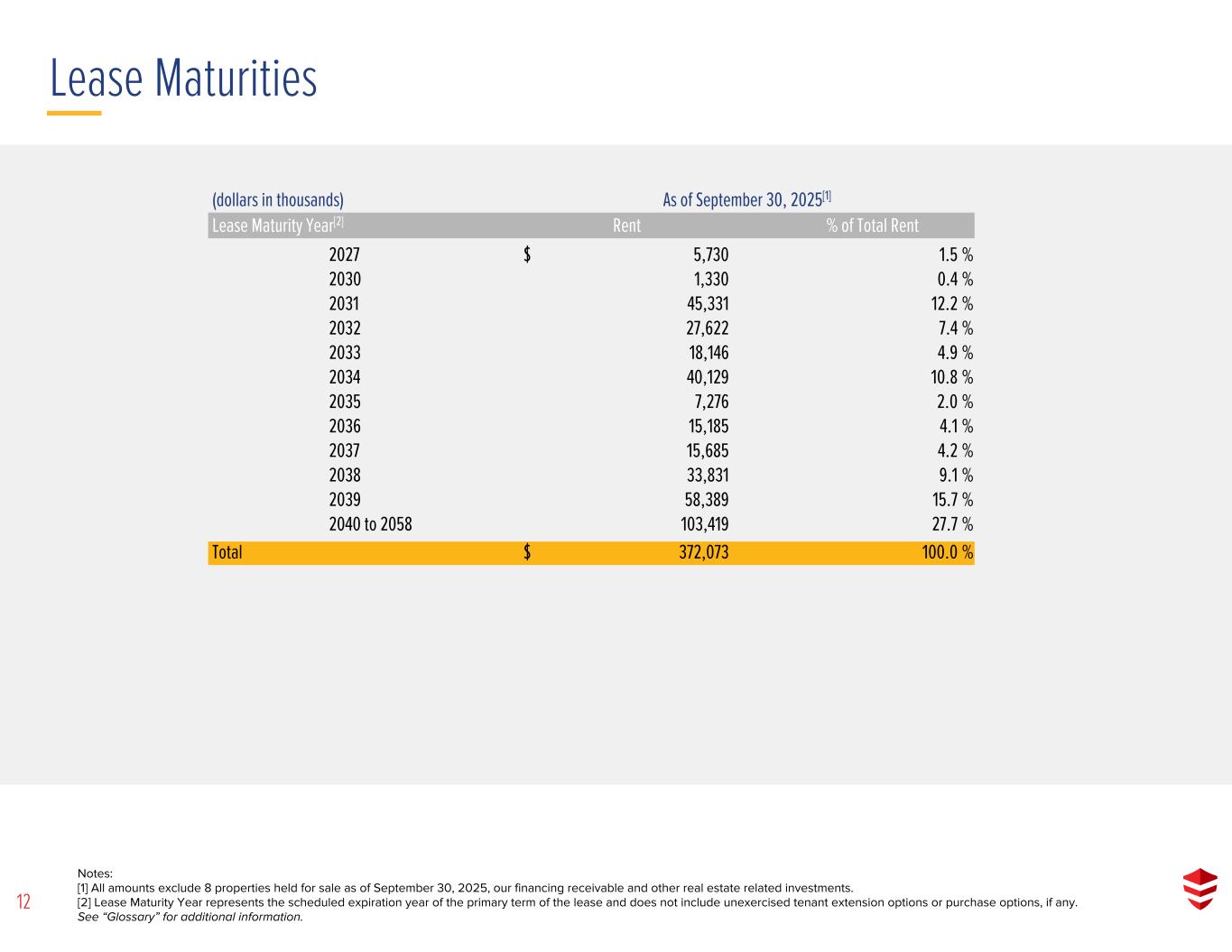

Lease Maturities 12 Notes: [1] All amounts exclude 8 properties held for sale as of September 30, 2025, our financing receivable and other real estate related investments. [2] Lease Maturity Year represents the scheduled expiration year of the primary term of the lease and does not include unexercised tenant extension options or purchase options, if any. See “Glossary” for additional information. Lease Maturity Year % o f T ot al R en t (dollars in thousands) As of September 30, 2025[1] Lease Maturity Year[2] Rent % of Total Rent 2027 $ 5,730 1.5 % 2030 1,330 0.4 % 2031 45,331 12.2 % 2032 27,622 7.4 % 2033 18,146 4.9 % 2034 40,129 10.8 % 2035 7,276 2.0 % 2036 15,185 4.1 % 2037 15,685 4.2 % 2038 33,831 9.1 % 2039 58,389 15.7 % 2040 to 2058 103,419 27.7 % Total $ 372,073 100.0 % —% 0.3% 2.0% —% 3.1% —% 19.0% 9.9% 6.4% 16.6% —% 5.3% —% 11.6% 20.8% 2.4% 2.6% 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 2044

Purchase Options on Net-Leased Assets (dollars in thousands) 13 Notes: [1] Option type includes: A - Fixed base price. B - Fixed capitalization rate on lease revenue. [2] Based on annualized cash revenue for contracts in place as of September 30, 2025. [3] Option window is open until the expiration of the lease term. [4] Option window is open for six months from the option period open date. [5] Option window is open for nine months from the option period open date. [6] Lease agreement provides for the purchase of one to two properties in each window over four option windows, for a total of six properties. Each purchase option window opens at the beginning of each of lease years four, five, six, and seven beginning December 1, 2027 and is open for one year. [7] Option window is open for 24 months from the option period open date. [8] Option provides for purchase of any two of the three properties. The current cash rent shown is an average of the range of $3.2 million to $3.5 million. [9] Option provides for purchase of any one of five properties in the first option window and another one of five properties in the second option window beginning June 1, 2027. The current cash rent shown is an average of the range of $2.7 million to $3.5 million. Provided the operator exercises its option to extend the term of the master lease, beginning on June 1, 2035 and ending nine months thereafter, the operator shall have a purchase option for all properties then remaining in the master lease. See “Glossary” for additional information. Tenant Purchase Options As of September 30, 2025 Asset Type Properties Lease Expiration Option Period Open Date Option Type[1] Current Cash Rent[2] % of Total Rent SNF 1 January 2030 2/1/2026 [3] A 1,200 0.32 % SNF / Campus 2 October 2032 3/5/2027 [4] B 3,367 [8] 0.90 % SNF / Campus 2 May 2034 6/1/2026 [5] B 3,064 [9] 0.82 % SNF 1 November 2034 12/1/2027 [3] A 1,100 0.30 % SNF 6 November 2039 12/1/2027 [6] B 10,160 2.73 % SNF 1 August 2040 9/1/2028 [7] B 741 0.20 % 13 $ 19,632 5.27 %

Other Real Estate Investments 14 Notes: [1] Maturity Year represents the scheduled maturity date of the loan agreement and does not include extension options, purchase options or prepayment options, if any. [2] Rate is net of subservicing fee. [3] For pre-Stabilized properties, the DSCR is not presented. As such, the DSCR may only represent a portion of the total investment amount. See “Glossary” for additional information. (dollars in thousands) As of September 30, 2025 Mortgage Loans Maturity Year[1] Property Type Location Investment Wtd Avg Contractual Interest Rate Interest TTM DSCR[3] 2025 SNF GA $ 29,600 9.1 % [2] $ 2,701 2.00x 2026 SH / SNF / UK Care Home CA, UK 30,705 9.2 % 2,835 1.43x 2027 SNF / Campus Mid-Atlantic 75,000 8.5 % [2] 6,368 1.44x 2028 SNF FL 15,727 9.1 % 1,435 — 2029 SNF / Campus / SH Various 434,000 8.8 % [2] 38,285 2.30x 2031 SNF TN 26,675 9.2 % 2,461 — 2033 SNF Campus / SH CA 25,993 9.1 % 2,372 1.66x 2034 SNF CO, WA 21,050 8.6 % 1,814 — 2035 SNF WA 11,065 8.6 % 954 — 2039 SNF MD 19,190 9.4 % 1,794 — Total Mortgage Loans $ 689,005 8.9 % $ 61,019 Mezzanine Loans Maturity Year[1] Property Type Location Investment Wtd Avg Contractual Interest Rate Interest TTM DSCR[3] 2027 SNF / Campus / SH MO, VA $ 44,800 14.2 % [2] $ 6,359 2.33x 2029 SNF CA 7,365 11.7 % 859 2.13x 2032 SNF / Campus Mid-Atlantic 25,000 11.2 % 2,788 1.44x 2034 SNF / Campus MD 11,511 13.2 % 1,517 — Total Mezzanine Loans $ 88,676 13.0 % $ 11,523 Preferred Equity Investments Property Type Location Investment Return Rate Return TTM DSCR[3] SNF CA $ 1,782 15.0 % $ 271 1.32x SNF / Campus NC 9,000 11.0 % 1,004 2.14x SNF / Campus / SH Various 43,000 11.0 % 4,730 — SNF / SH Various 30,000 12.0 % 3,600 — Total Preferred Equity Investments $ 83,782 11.5 % $ 9,605 Total $ 861,463 $ 82,148

Consolidated Income Statements 15 (amounts in thousands, except per share data) For the Three Months Ended September 30, For the Nine Months Ended September 30, 2025 2024 2025 2024 Revenues: Rental income $ 104,265 $ 57,153 $ 261,944 $ 166,062 Interest income from financing receivable 2,908 — 8,601 — Interest income from other real estate related investments and other income 25,271 20,228 70,989 43,280 Total revenues 132,444 77,381 341,534 209,342 Expenses: Depreciation and amortization 26,693 14,009 65,749 41,317 Interest expense 12,622 8,281 32,329 25,188 Property taxes and insurance 2,326 2,115 6,508 5,892 Impairment of real estate investments 452 8,417 452 36,872 Transaction costs 560 — 1,509 — Property operating expenses 279 3,477 1,322 4,392 General and administrative 15,420 6,663 36,992 19,637 Total expenses 58,352 42,962 144,861 133,298 Other income (loss): Loss on extinguishment of debt (390) (657) (390) (657) (Loss) gain on sale of real estate, net — (2,286) 3,876 (2,254) Unrealized gain (loss) on other real estate related investments, net 3,603 1,800 6,858 (689) (Loss) gain on foreign currency transactions (298) — 4,115 — Total other income (loss) 2,915 (1,143) 14,459 (3,600) Income before income tax expense 77,007 33,276 211,132 72,444 Income tax expense (2,077) — (3,107) — Net income 74,930 33,276 208,025 72,444 Net income (loss) attributable to noncontrolling interests 29 (165) (1,223) (501) Net income attributable to CareTrust REIT, Inc. $ 74,901 $ 33,441 $ 209,248 $ 72,945 Earnings available to CareTrust REIT, Inc. per common share: Basic $ 0.35 $ 0.21 $ 1.06 $ 0.50 Diluted $ 0.35 $ 0.21 $ 1.06 $ 0.50 Weighted-average number of common shares: Basic 211,746 159,459 197,204 145,780 Diluted 212,271 159,850 197,603 146,153 Dividends declared per common share $ 0.335 $ 0.29 $ 1.005 $ 0.87

See "Glossary" for additional information. Reconciliation of EBITDA, FFO and FAD 16 (amounts in thousands) Quarter Ended September 30, 2024 Quarter Ended December 31, 2024 Quarter Ended March 31, 2025 Quarter Ended June 30, 2025 Quarter Ended September 30, 2025 Net income attributable to CareTrust REIT, Inc. $ 33,441 $ 52,135 $ 65,802 $ 68,545 $ 74,901 Depreciation and amortization 14,009 15,514 17,841 21,215 24,309 Noncontrolling interests' share of real estate related depreciation and amortization — (837) (2,223) (2,513) (2,796) Interest expense 7,807 4,768 6,669 13,038 12,622 Income tax expense — — — 1,030 2,077 Amortization of stock-based compensation 1,143 1,461 3,093 1,945 1,700 Amortization of stock-based compensation related to extraordinary incentive plan — — 816 1,081 793 EBITDA attributable to CareTrust REIT, Inc. 56,400 73,041 91,998 104,341 113,606 Write-off of deferred financing costs — 354 — — — Impairment of real estate investments 8,417 5,353 — — 452 (Gain) loss on foreign currency transactions — — — (4,413) 298 Provision for loan losses — 4,900 — — — Property operating expenses (recovery) 3,893 1,665 (105) 1,090 402 Loss (gain) on sale of real estate, net 2,286 (46) (3,876) — — Loss on extinguishment of debt 657 — — — 390 Non-routine transaction costs — 1,326 888 61 560 Accelerated amortization of lease intangibles, net of noncontrolling interests' share — — — — (1,023) Extraordinary incentive plan payment — 2,313 — — — Unrealized gain on other real estate related investments, net (1,800) (9,734) (1,287) (1,968) (3,603) Normalized EBITDA attributable to CareTrust REIT, Inc. $ 69,853 $ 79,172 $ 87,618 $ 99,111 $ 111,082

See "Glossary" for additional information. Reconciliation of EBITDA, FFO and FAD (continued) 17 (amounts in thousands) Quarter Ended September 30, 2024 Quarter Ended December 31, 2024 Quarter Ended March 31, 2025 Quarter Ended June 30, 2025 Quarter Ended September 30, 2025 Net income attributable to CareTrust REIT, Inc. $ 33,441 $ 52,135 $ 65,802 $ 68,545 $ 74,901 Real estate related depreciation and amortization 14,002 15,507 17,833 21,208 24,303 Noncontrolling interests' share of real estate related depreciation and amortization — (837) (2,223) (2,513) (2,796) Impairment of real estate investments 8,417 5,353 — — 452 Loss (gain) on sale of real estate, net 2,286 (46) (3,876) — — Funds from Operations (FFO) attributable to CareTrust REIT, Inc. 58,146 72,112 77,536 87,240 96,860 Write-off of deferred financing costs — 354 — — — (Gain) loss on foreign currency transactions — — — (4,413) 298 Accelerated amortization of lease intangibles, net of noncontrolling interests' share — — — — (1,023) Provision for loan losses — 4,900 — — — Property operating expenses (recovery) 3,893 1,665 (105) 1,090 402 Non-routine transaction costs — 1,326 888 61 560 Loss on extinguishment of debt 657 — — — 390 Amortization of stock-based compensation related to extraordinary incentive plan — — 816 1,081 793 Extraordinary incentive plan payment — 2,313 — — — Unrealized gain on other real estate related investments, net (1,800) (9,734) (1,287) (1,968) (3,603) Normalized FFO attributable to CareTrust REIT, Inc. $ 60,896 $ 72,936 $ 77,848 $ 83,091 $ 94,677

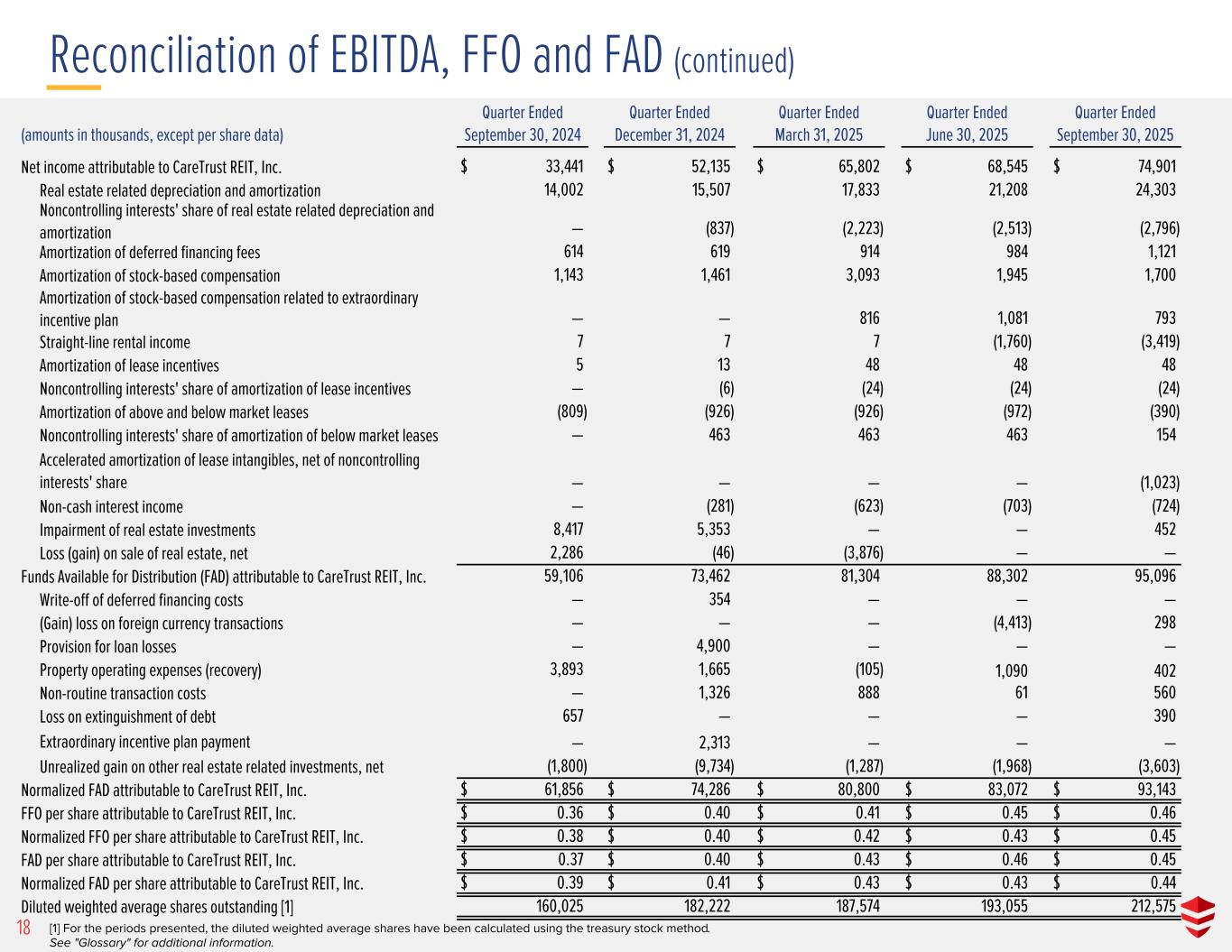

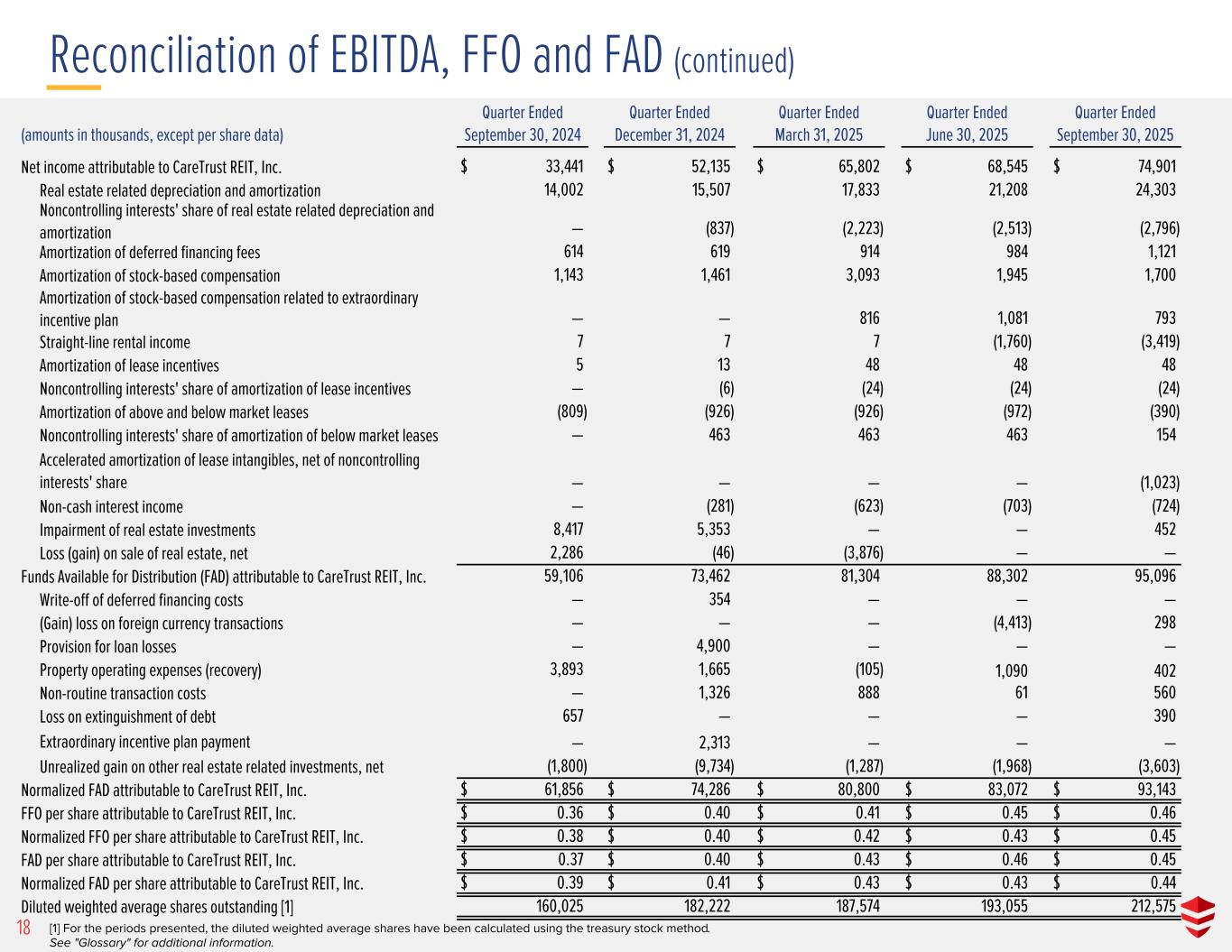

(amounts in thousands, except per share data) Quarter Ended September 30, 2024 Quarter Ended December 31, 2024 Quarter Ended March 31, 2025 Quarter Ended June 30, 2025 Quarter Ended September 30, 2025 Net income attributable to CareTrust REIT, Inc. $ 33,441 $ 52,135 $ 65,802 $ 68,545 $ 74,901 Real estate related depreciation and amortization 14,002 15,507 17,833 21,208 24,303 Noncontrolling interests' share of real estate related depreciation and amortization — (837) (2,223) (2,513) (2,796) Amortization of deferred financing fees 614 619 914 984 1,121 Amortization of stock-based compensation 1,143 1,461 3,093 1,945 1,700 Amortization of stock-based compensation related to extraordinary incentive plan — — 816 1,081 793 Straight-line rental income 7 7 7 (1,760) (3,419) Amortization of lease incentives 5 13 48 48 48 Noncontrolling interests' share of amortization of lease incentives — (6) (24) (24) (24) Amortization of above and below market leases (809) (926) (926) (972) (390) Noncontrolling interests' share of amortization of below market leases — 463 463 463 154 Accelerated amortization of lease intangibles, net of noncontrolling interests' share — — — — (1,023) Non-cash interest income — (281) (623) (703) (724) Impairment of real estate investments 8,417 5,353 — — 452 Loss (gain) on sale of real estate, net 2,286 (46) (3,876) — — Funds Available for Distribution (FAD) attributable to CareTrust REIT, Inc. 59,106 73,462 81,304 88,302 95,096 Write-off of deferred financing costs — 354 — — — (Gain) loss on foreign currency transactions — — — (4,413) 298 Provision for loan losses — 4,900 — — — Property operating expenses (recovery) 3,893 1,665 (105) 1,090 402 Non-routine transaction costs — 1,326 888 61 560 Loss on extinguishment of debt 657 — — — 390 Extraordinary incentive plan payment — 2,313 — — — Unrealized gain on other real estate related investments, net (1,800) (9,734) (1,287) (1,968) (3,603) Normalized FAD attributable to CareTrust REIT, Inc. $ 61,856 $ 74,286 $ 80,800 $ 83,072 $ 93,143 FFO per share attributable to CareTrust REIT, Inc. $ 0.36 $ 0.40 $ 0.41 $ 0.45 $ 0.46 Normalized FFO per share attributable to CareTrust REIT, Inc. $ 0.38 $ 0.40 $ 0.42 $ 0.43 $ 0.45 FAD per share attributable to CareTrust REIT, Inc. $ 0.37 $ 0.40 $ 0.43 $ 0.46 $ 0.45 Normalized FAD per share attributable to CareTrust REIT, Inc. $ 0.39 $ 0.41 $ 0.43 $ 0.43 $ 0.44 Diluted weighted average shares outstanding [1] 160,025 182,222 187,574 193,055 212,575 [1] For the periods presented, the diluted weighted average shares have been calculated using the treasury stock method. See "Glossary" for additional information. Reconciliation of EBITDA, FFO and FAD (continued) 18

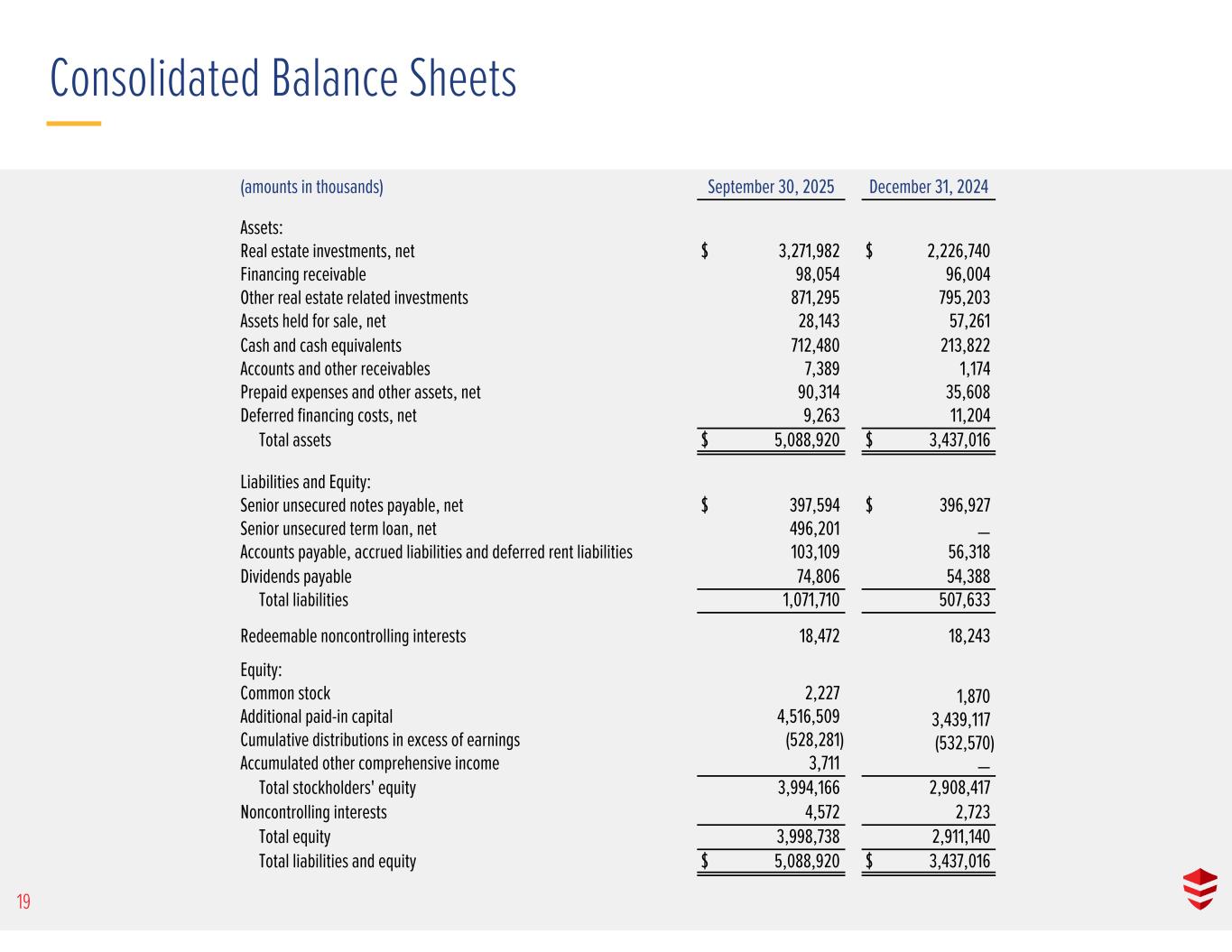

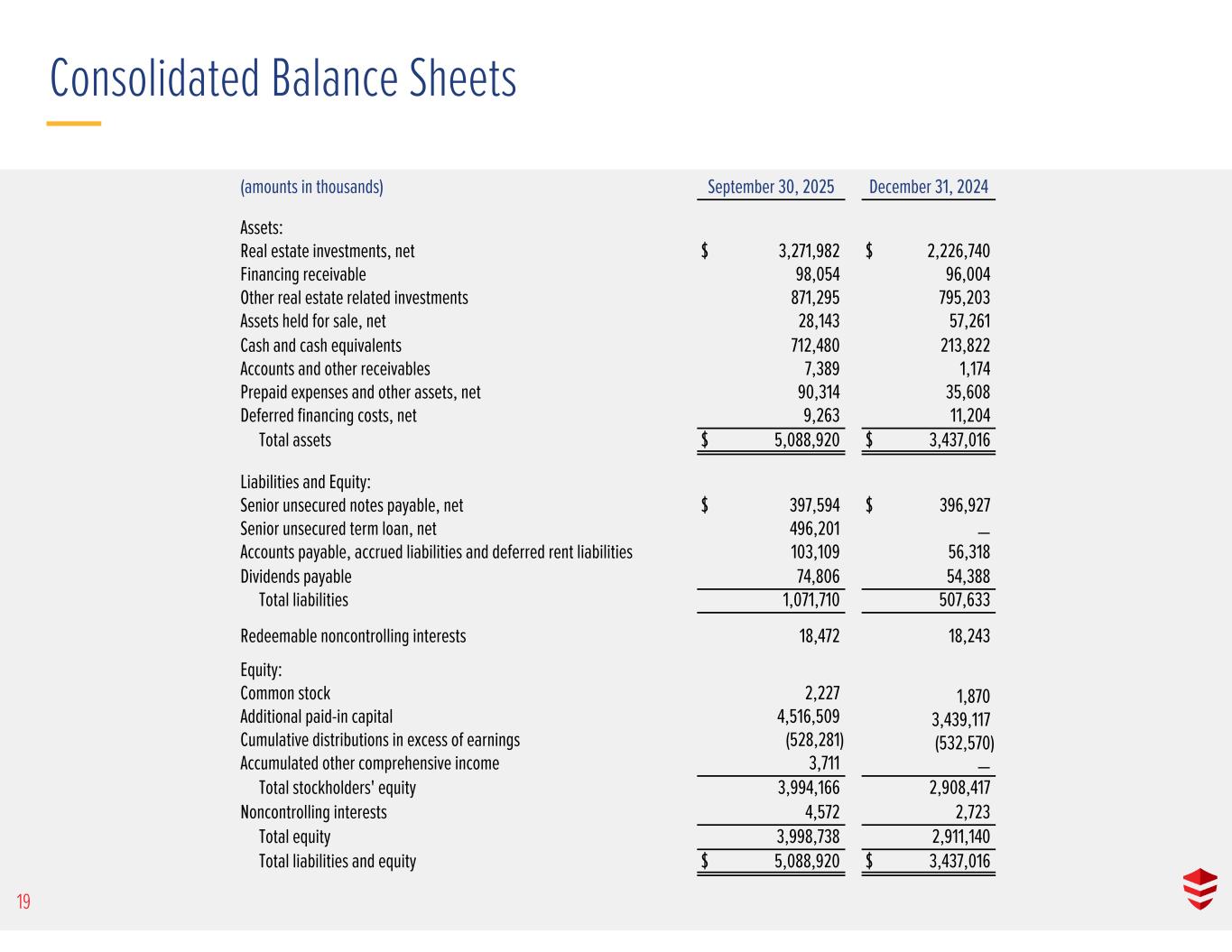

Consolidated Balance Sheets 19 (amounts in thousands) September 30, 2025 December 31, 2024 Assets: Real estate investments, net $ 3,271,982 $ 2,226,740 Financing receivable 98,054 96,004 Other real estate related investments 871,295 795,203 Assets held for sale, net 28,143 57,261 Cash and cash equivalents 712,480 213,822 Accounts and other receivables 7,389 1,174 Prepaid expenses and other assets, net 90,314 35,608 Deferred financing costs, net 9,263 11,204 Total assets $ 5,088,920 $ 3,437,016 Liabilities and Equity: Senior unsecured notes payable, net $ 397,594 $ 396,927 Senior unsecured term loan, net 496,201 — Accounts payable, accrued liabilities and deferred rent liabilities 103,109 56,318 Dividends payable 74,806 54,388 Total liabilities 1,071,710 507,633 Redeemable noncontrolling interests 18,472 18,243 Equity: Common stock 2,227 1,870 Additional paid-in capital 4,516,509 3,439,117 Cumulative distributions in excess of earnings (528,281) (532,570) Accumulated other comprehensive income 3,711 — Total stockholders' equity 3,994,166 2,908,417 Noncontrolling interests 4,572 2,723 Total equity 3,998,738 2,911,140 Total liabilities and equity $ 5,088,920 $ 3,437,016

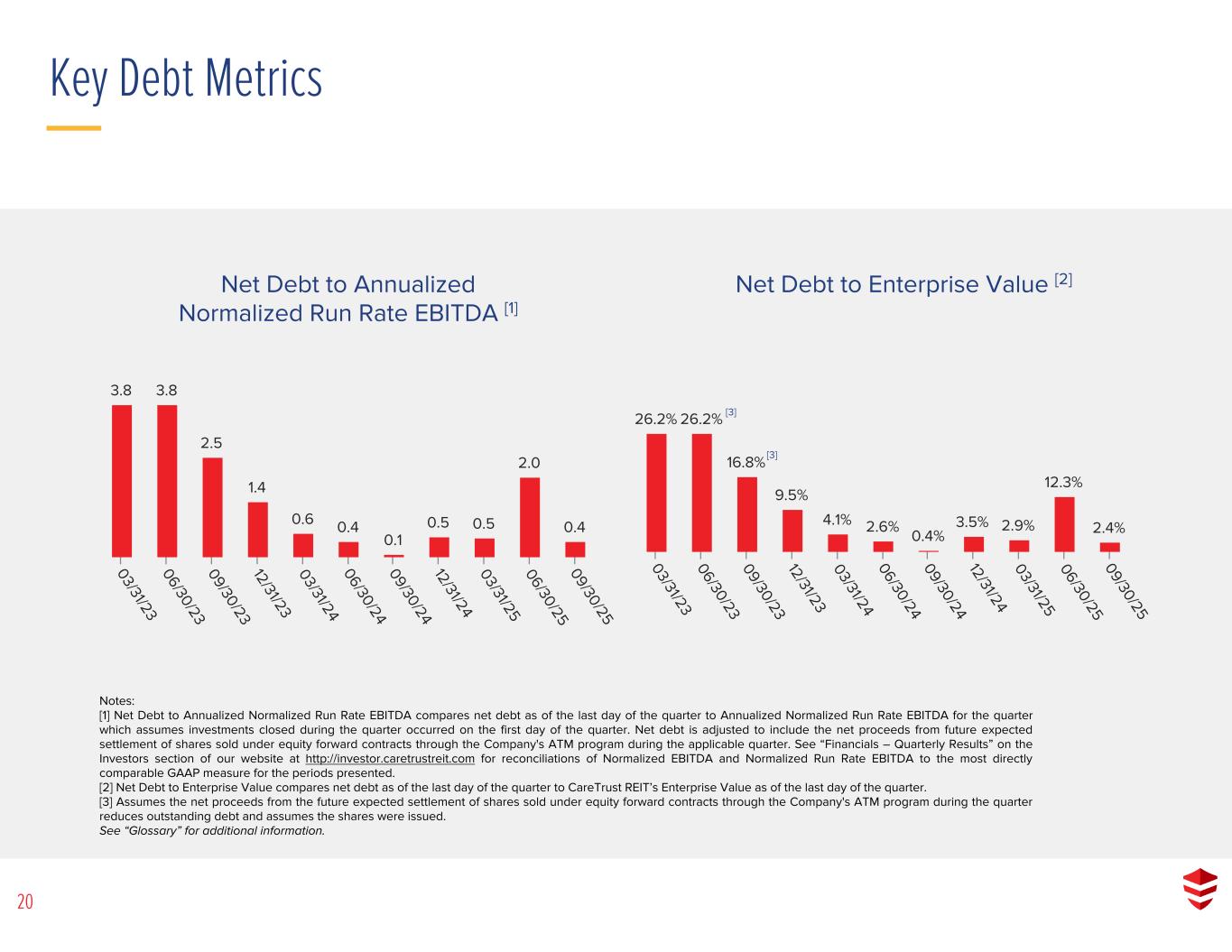

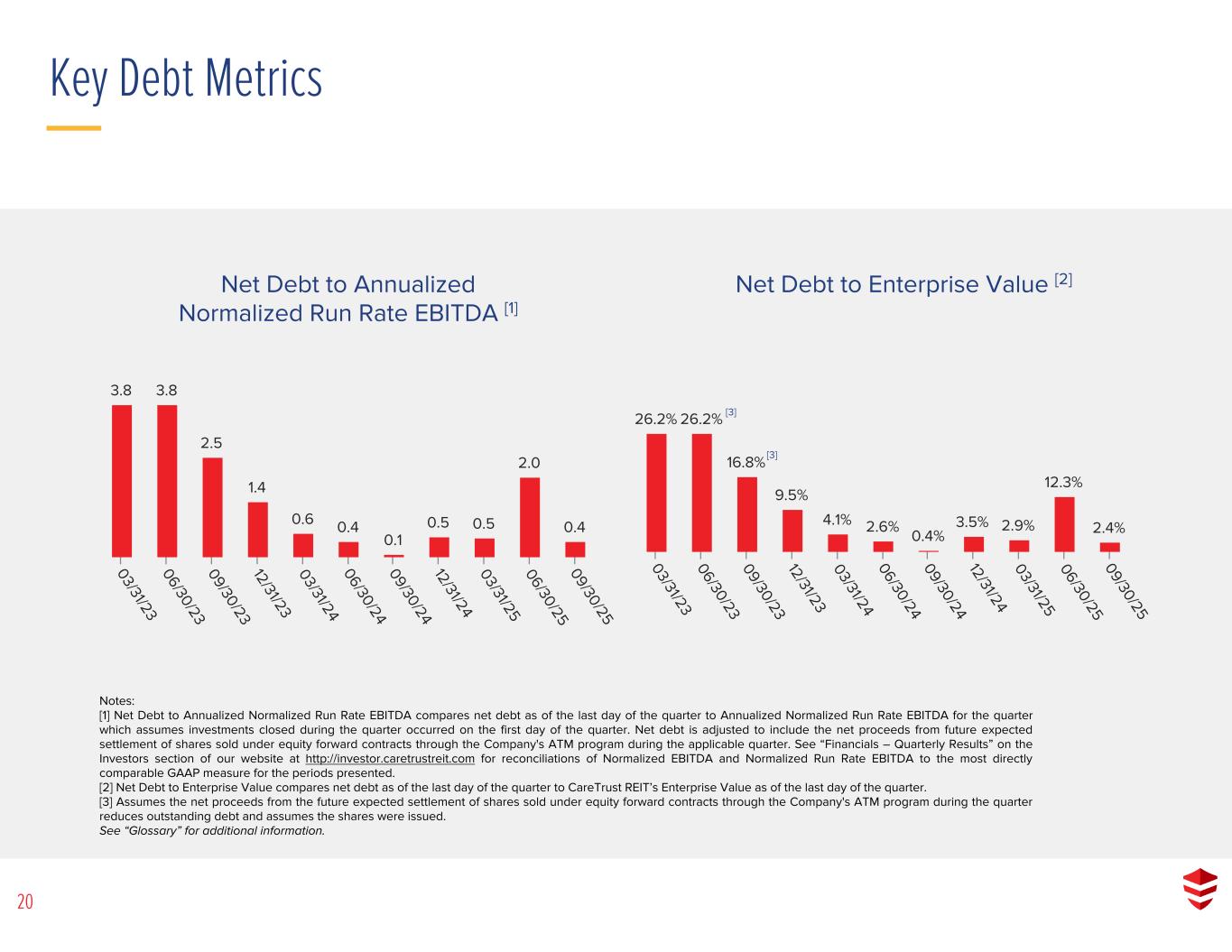

Notes: [1] Net Debt to Annualized Normalized Run Rate EBITDA compares net debt as of the last day of the quarter to Annualized Normalized Run Rate EBITDA for the quarter which assumes investments closed during the quarter occurred on the first day of the quarter. Net debt is adjusted to include the net proceeds from future expected settlement of shares sold under equity forward contracts through the Company's ATM program during the applicable quarter. See “Financials – Quarterly Results” on the Investors section of our website at http://investor.caretrustreit.com for reconciliations of Normalized EBITDA and Normalized Run Rate EBITDA to the most directly comparable GAAP measure for the periods presented. [2] Net Debt to Enterprise Value compares net debt as of the last day of the quarter to CareTrust REIT’s Enterprise Value as of the last day of the quarter. [3] Assumes the net proceeds from the future expected settlement of shares sold under equity forward contracts through the Company's ATM program during the quarter reduces outstanding debt and assumes the shares were issued. See “Glossary” for additional information. Net Debt to Enterprise Value [2]Net Debt to Annualized Normalized Run Rate EBITDA [1] Key Debt Metrics 20 3.8 3.8 2.5 1.4 0.6 0.4 0.1 0.5 0.5 2.0 0.4 03/31/23 06/30/23 09/30/23 12/31/23 03/31/24 06/30/24 09/30/24 12/31/24 03/31/25 06/30/25 09/30/25 26.2% 26.2% 16.8% 9.5% 4.1% 2.6% 0.4% 3.5% 2.9% 12.3% 2.4% 03/31/23 06/30/23 09/30/23 12/31/23 03/31/24 06/30/24 09/30/24 12/31/24 03/31/25 06/30/25 09/30/25 [3] [3]

Notes: [1] Funds can be borrowed at applicable SOFR plus 1.10% to 1.80% or at the Base Rate (as defined) plus 0.10% to 0.80%. The Company entered into interest rate swaps to hedge the interest expense of the $500.0 million variable rate term loan by fixing SOFR at 3.5%. [2] Funds can be borrowed at applicable SOFR plus 1.05% to 1.55% or at the Base Rate (as defined) plus 0.05% to 0.55%. [3] Maturity date does not assume exercise of two, 6-month extension options. [4] Represents the unsecured revolving credit facility if drawn in full and outstanding at maturity. Debt Maturity Schedule Debt Summary 21 $— $— $— $400,000 $1,200,000 $500,000 2025 2026 2027 2028 2029 2030 Debt Maturity Year Pri nci pa l (dollars in thousands) September 30, 2025 Debt Interest Rate Maturity Date Principal % of Principal Fixed Rate Debt Senior unsecured notes payable 3.875 % 2028 $ 400,000 44.4 % Senior unsecured term loan 4.630 % [1] 2030 500,000 55.6 % 4.294 % $ 900,000 100.0 % Floating Rate Debt Unsecured revolving credit facility — % [2] 2029 [3] $ — — % — % $ — — % Total Debt 4.294 % $ 900,000 100.0 % [4]

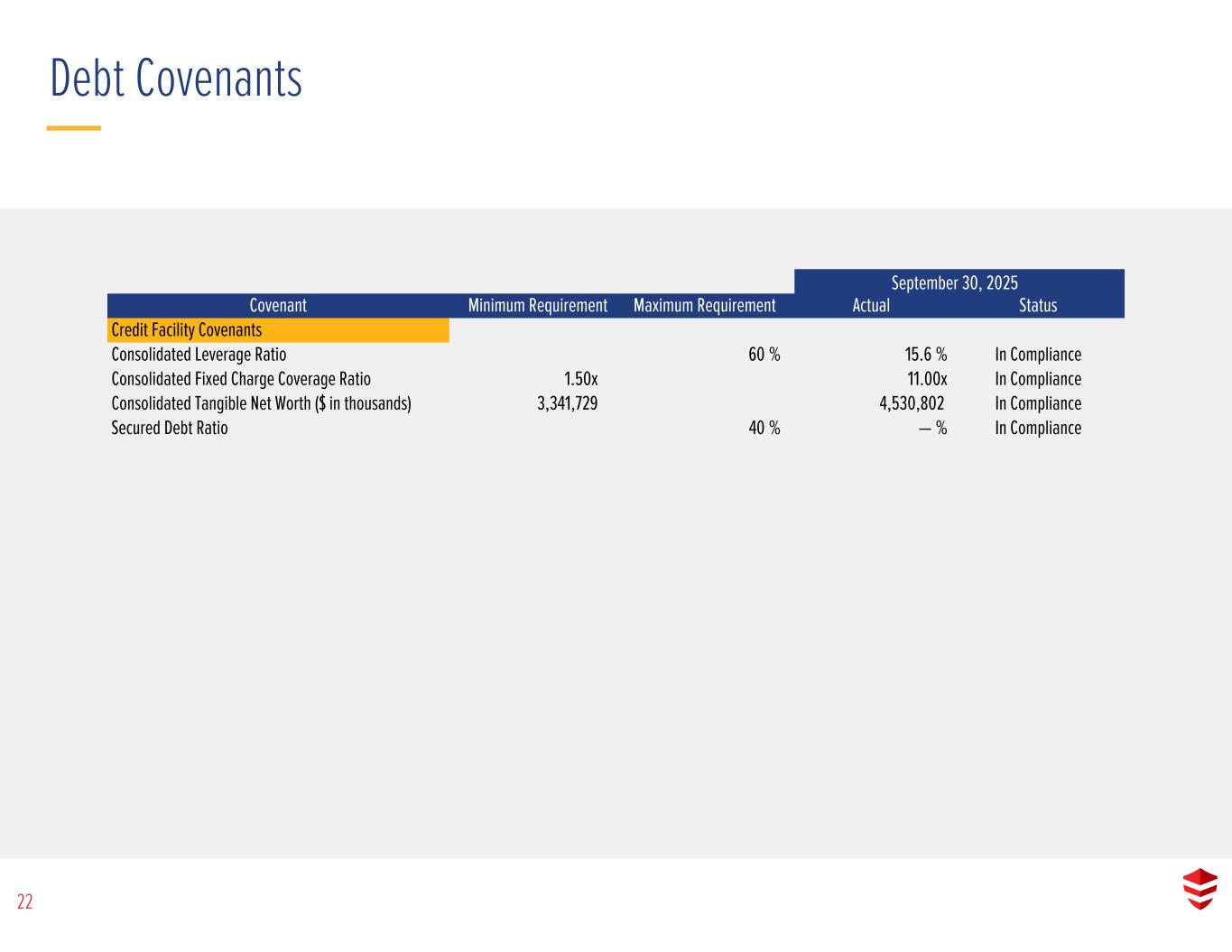

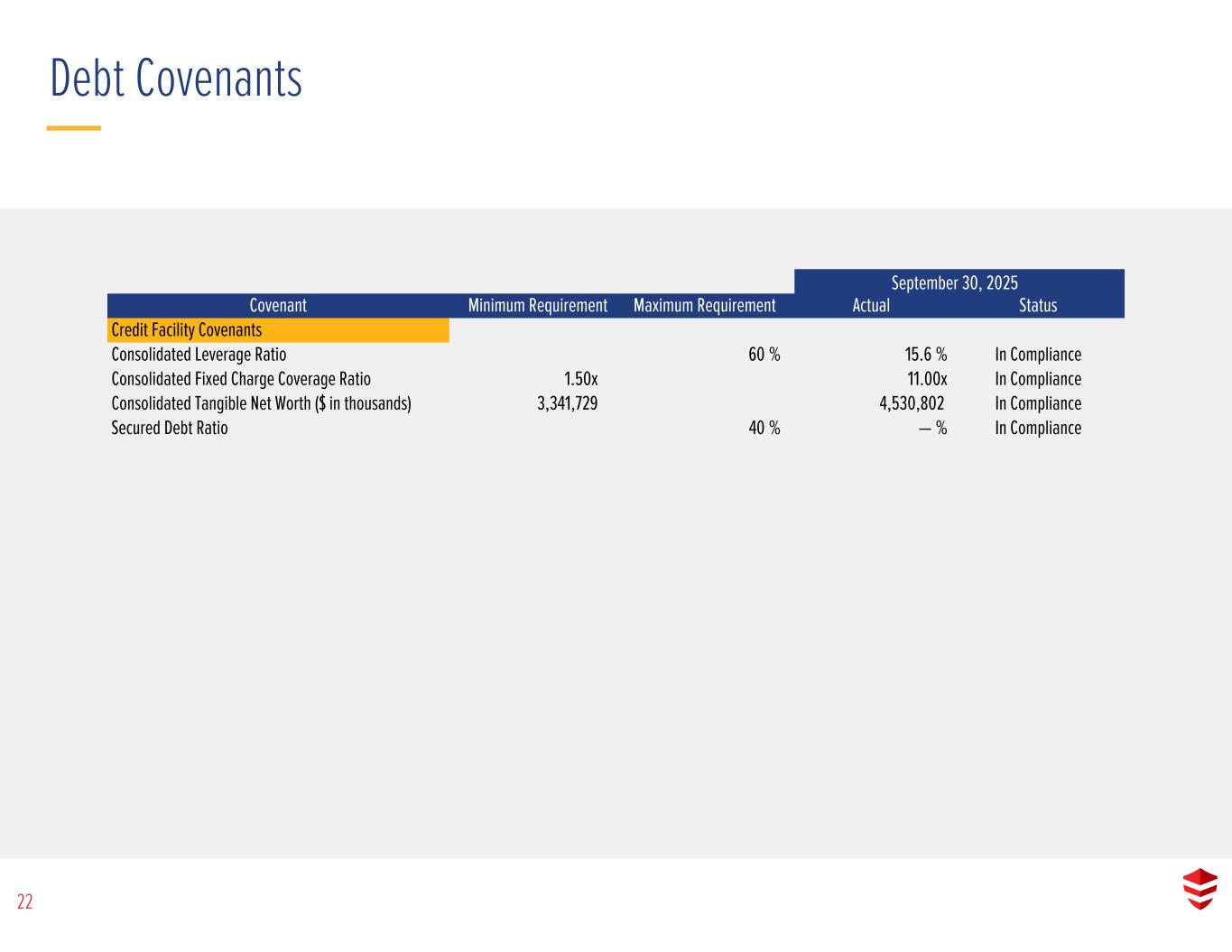

Debt Covenants 22 September 30, 2025 Covenant Minimum Requirement Maximum Requirement Actual Status Credit Facility Covenants Consolidated Leverage Ratio 60 % 15.6 % In Compliance Consolidated Fixed Charge Coverage Ratio 1.50x 11.00x In Compliance Consolidated Tangible Net Worth ($ in thousands) 3,341,729 4,530,802 In Compliance Secured Debt Ratio 40 % — % In Compliance

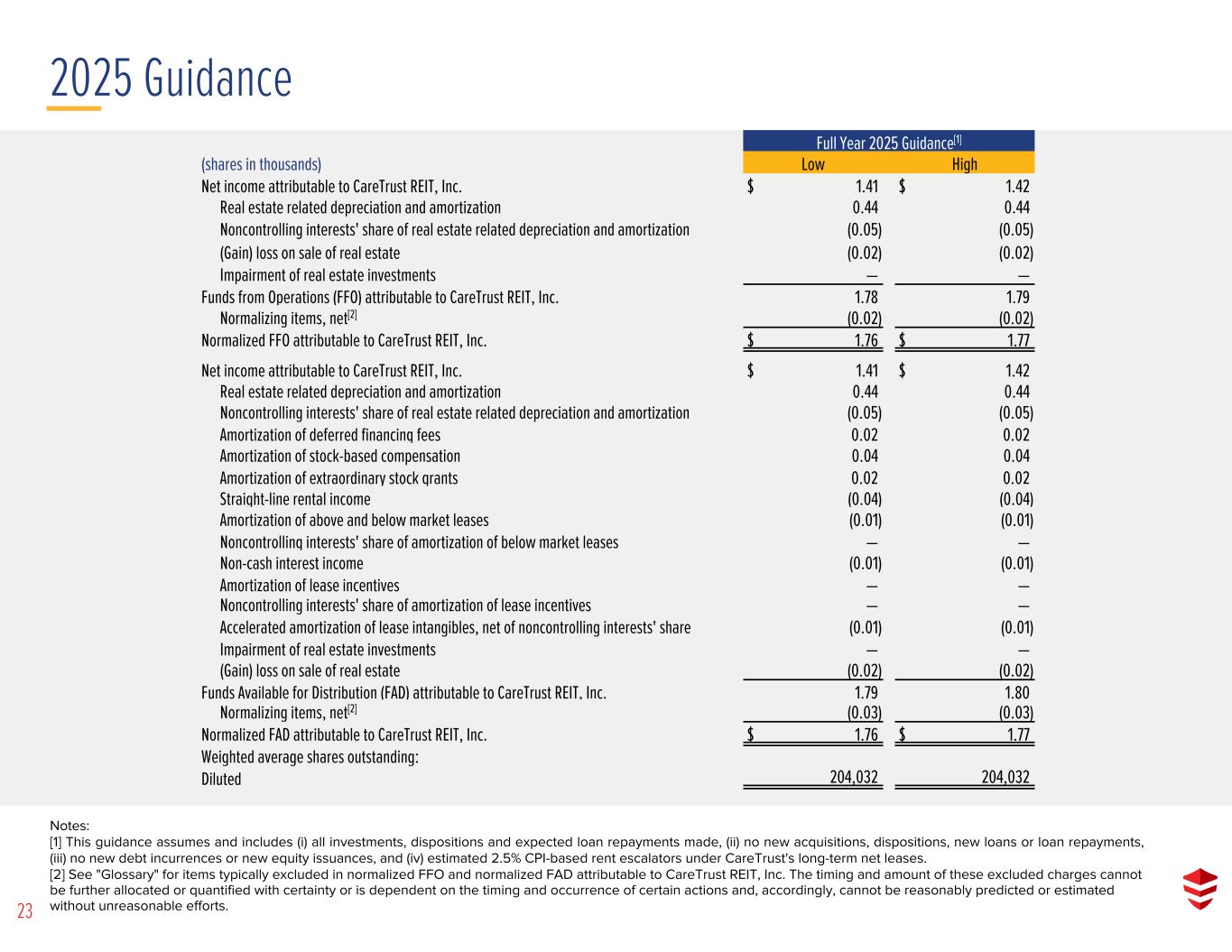

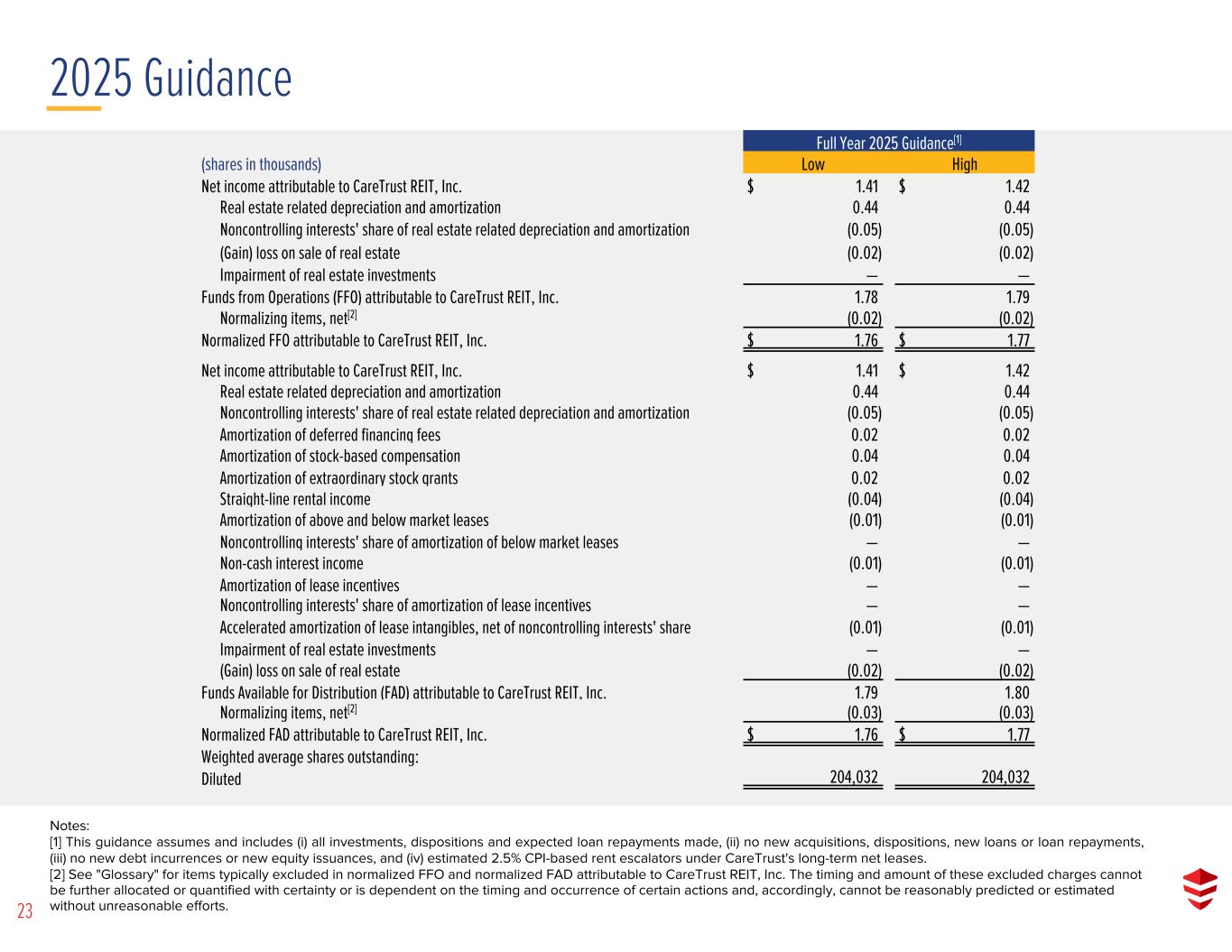

Notes: [1] This guidance assumes and includes (i) all investments, dispositions and expected loan repayments made, (ii) no new acquisitions, dispositions, new loans or loan repayments, (iii) no new debt incurrences or new equity issuances, and (iv) estimated 2.5% CPI-based rent escalators under CareTrust's long-term net leases. [2] See "Glossary" for items typically excluded in normalized FFO and normalized FAD attributable to CareTrust REIT, Inc. The timing and amount of these excluded charges cannot be further allocated or quantified with certainty or is dependent on the timing and occurrence of certain actions and, accordingly, cannot be reasonably predicted or estimated without unreasonable efforts. 2025 Guidance 23 Full Year 2025 Guidance[1] (shares in thousands) Low High Net income attributable to CareTrust REIT, Inc. $ 1.41 $ 1.42 Real estate related depreciation and amortization 0.44 0.44 Noncontrolling interests' share of real estate related depreciation and amortization (0.05) (0.05) (Gain) loss on sale of real estate (0.02) (0.02) Impairment of real estate investments — — Funds from Operations (FFO) attributable to CareTrust REIT, Inc. 1.78 1.79 Normalizing items, net[2] (0.02) (0.02) Normalized FFO attributable to CareTrust REIT, Inc. $ 1.76 $ 1.77 Net income attributable to CareTrust REIT, Inc. $ 1.41 $ 1.42 Real estate related depreciation and amortization 0.44 0.44 Noncontrolling interests' share of real estate related depreciation and amortization (0.05) (0.05) Amortization of deferred financing fees 0.02 0.02 Amortization of stock-based compensation 0.04 0.04 Amortization of extraordinary stock grants 0.02 0.02 Straight-line rental income (0.04) (0.04) Amortization of above and below market leases (0.01) (0.01) Noncontrolling interests' share of amortization of below market leases — — Non-cash interest income (0.01) (0.01) Amortization of lease incentives — — Noncontrolling interests' share of amortization of lease incentives — — Accelerated amortization of lease intangibles, net of noncontrolling interests' share (0.01) (0.01) Impairment of real estate investments — — (Gain) loss on sale of real estate (0.02) (0.02) Funds Available for Distribution (FAD) attributable to CareTrust REIT, Inc. 1.79 1.80 Normalizing items, net[2] (0.03) (0.03) Normalized FAD attributable to CareTrust REIT, Inc. $ 1.76 $ 1.77 Weighted average shares outstanding: Diluted 204,032 204,032

Notes: [1] Represents average offering price per share for follow-on equity offerings. [2] As of September 30, 2025, CareTrust REIT had $380.1 million available for future issuances under the ATM Program. Follow-On Equity Offering Activity At-the-Market Offering Activity Equity Capital Transactions 24 2015 2016 2019 2024 2025 Number of Shares (000s) 16,330 16,100 6,641 15,870 23,000 Public Offering Price per Share $ 10.50 $ 12.14 [1] $ 23.35 $ 32.00 $ 32.00 Gross Proceeds (000s) $ 171,465 $ 195,385 $ 155,073 $ 507,840 $ 736,000 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025[2] Q1 Q2 Q3 Total Number of Shares (000s) 924 10,574 10,265 2,459 — 990 2,405 30,869 40,986 553 12,055 — 12,608 Average Price per Share $ 15.31 $ 16.43 $ 17.76 $ 19.48 $ — $ 23.74 $ 20.00 $ 20.86 $ 26.35 $ 28.87 $ 29.36 $ — $ 29.34 Gross Proceeds (000s) $ 14,147 $ 173,760 $ 182,321 $ 47,893 $ — $ 23,505 $ 48,100 $ 643,802 $ 1,079,852 $ 15,964 $ 353,907 $ — $ 369,871

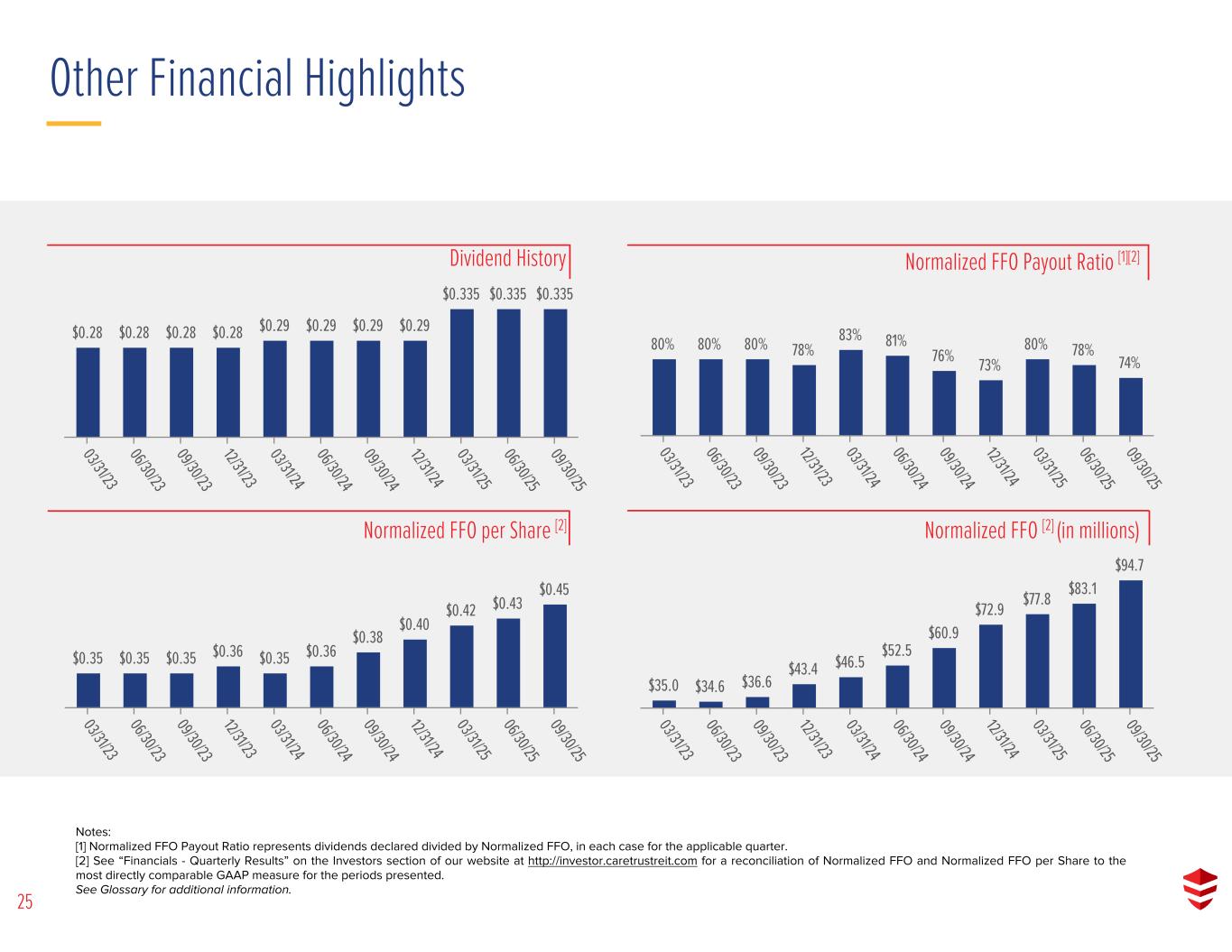

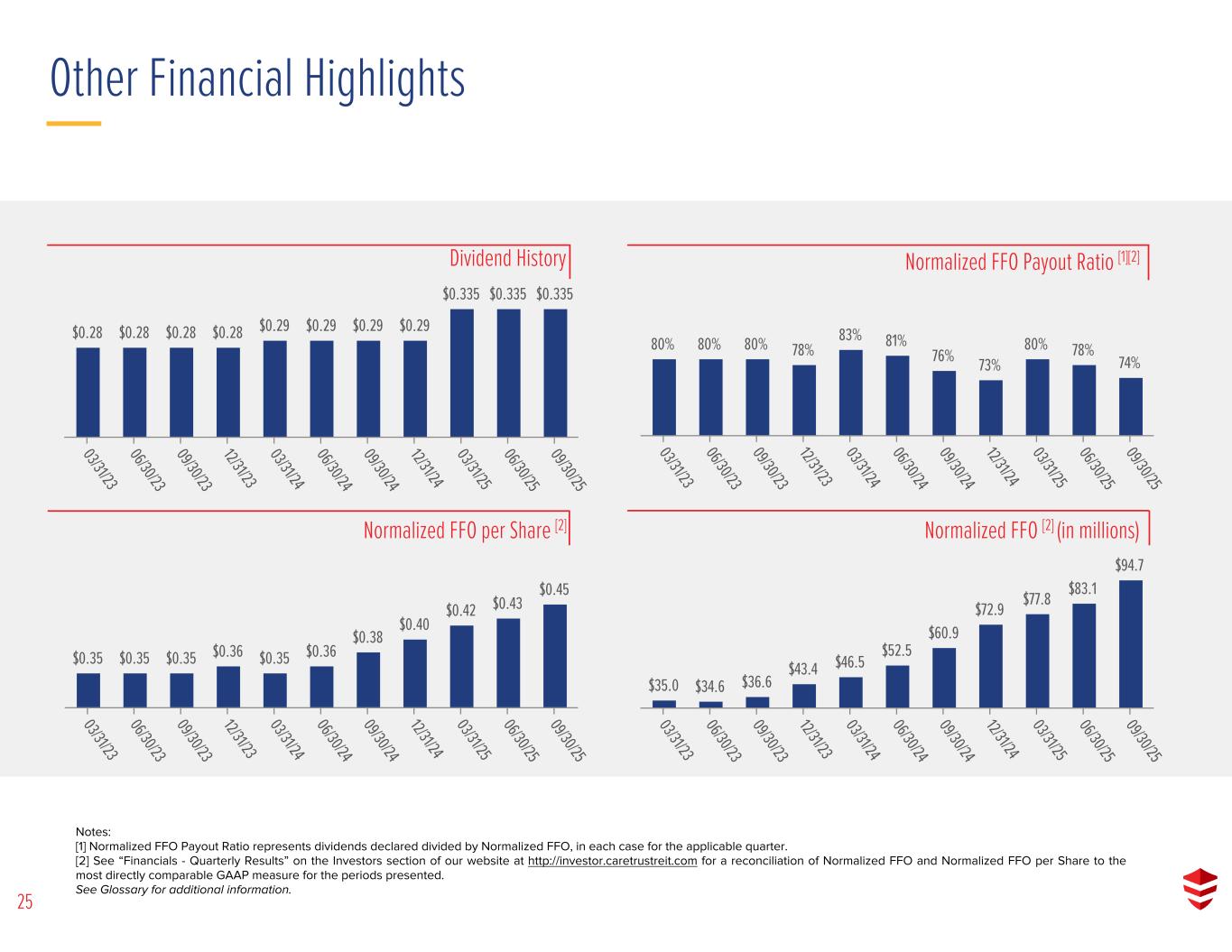

Notes: [1] Normalized FFO Payout Ratio represents dividends declared divided by Normalized FFO, in each case for the applicable quarter. [2] See “Financials - Quarterly Results” on the Investors section of our website at http://investor.caretrustreit.com for a reconciliation of Normalized FFO and Normalized FFO per Share to the most directly comparable GAAP measure for the periods presented. See Glossary for additional information. Dividend History Normalized FFO Payout Ratio [1][2] Normalized FFO per Share [2] Normalized FFO [2] (in millions) Other Financial Highlights 25 $0.28 $0.28 $0.28 $0.28 $0.29 $0.29 $0.29 $0.29 $0.335 $0.335 $0.335 03/31/23 06/30/23 09/30/23 12/31/23 03/31/24 06/30/24 09/30/24 12/31/24 03/31/25 06/30/25 09/30/25 80% 80% 80% 78% 83% 81% 76% 73% 80% 78% 74% 03/31/23 06/30/23 09/30/23 12/31/23 03/31/24 06/30/24 09/30/24 12/31/24 03/31/25 06/30/25 09/30/25 $0.35 $0.35 $0.35 $0.36 $0.35 $0.36 $0.38 $0.40 $0.42 $0.43 $0.45 03/31/23 06/30/23 09/30/23 12/31/23 03/31/24 06/30/24 09/30/24 12/31/24 03/31/25 06/30/25 09/30/25 $35.0 $34.6 $36.6 $43.4 $46.5 $52.5 $60.9 $72.9 $77.8 $83.1 $94.7 03/31/23 06/30/23 09/30/23 12/31/23 03/31/24 06/30/24 09/30/24 12/31/24 03/31/25 06/30/25 09/30/25

Initial Investment Initial Investment for properties acquired in connection with the Company becoming public represents Ensign's and Pennant's gross book value. Initial Investment for properties acquired since inception as a public company represents CareTrust REIT’s purchase price and transaction costs and includes commitments for capital expenditures that are not rent producing and impairment charges (on all portfolio slides except the Investments slide). Multi-Service Campus Facilities that include a combination of Skilled Nursing beds and Seniors Housing units, including Continuing Care Retirement Communities. Normalized EBITDA EBITDA attributable to CareTrust REIT, Inc, adjusted for certain income and expense items the Company does not believe are indicative of its ongoing results, such as write- off of deferred financing costs, real estate impairment charges, provision for loan losses, provision for doubtful accounts and lease restructuring, recovery of previously reversed rent, lease termination revenue, property operating expenses, non-routine transaction costs, loss on extinguishment of debt, unrealized gains or losses on other real estate related investments, gains or losses from dispositions of real estate or other real estate, accelerated amortization of lease intangibles, net of noncontrolling interests' share, extraordinary incentive plan payment and gains or losses on foreign currency transactions.[1] Normalized FAD FAD attributable to CareTrust REIT, Inc, adjusted for certain income and expense items the Company does not believe are indicative of its ongoing results, such as provision for loan losses, provision for doubtful accounts and lease restructuring, recovery of previously reversed rent, lease termination revenue, non-routine transaction costs, write-off of deferred financing fees, loss on extinguishment of debt, extraordinary incentive plan payment, unrealized gains or losses on other real estate related investments, gains or losses on foreign currency transactions and property operating expenses.[2] Care Homes ("UK Care Homes") In the United Kingdom ("UK"), a care home is a residential setting that provides accommodation and personal care services for individuals who need assistance with daily living activities and are unable to manage independently in their own homes. Care homes generally fall into two main categories: residential care homes and care homes with nursing (also called nursing homes). Residential care homes provide personal care and support for daily living activities like washing, dressing, and medication management, while care homes with nursing also offer 24/7 on-site nursing care for individuals with more complex medical needs. Debt Service Coverage Ratio ("DSCR") Aggregate EBITDARM produced by all properties under a loan agreement for the trailing twelve-months ending on the period presented divided by the total interest payable by borrower for the same period. EBITDA Net income attributable to CareTrust REIT, Inc. before interest expense, income tax, depreciation and amortization and amortization of stock-based compensation.[1] EBITDAR Net income before interest expense, income tax, depreciation, amortization and cash rent, after applying a standardized management fee (5% of facility operating revenues). EBITDAR Coverage Aggregate EBITDAR produced by all properties under a master lease (or other grouping) for the trailing twelve-months ending on the period presented divided by the base rent payable to CareTrust REIT under such master lease (or other grouping) for the same period; provided that if the master lease has been amended to change the base rent during or since such period, then the aggregate EBITDAR for such period is divided by the annualized monthly base rent currently in effect. "Rent" refers to the total monthly rent due under the Company's lease agreements. EBITDAR reflects the application of a standard 5% management fee. EBITDARM Earnings before interest expense, income tax, depreciation, amortization, cash rent, and a standardized management fee (5% of facility operating revenues). EBITDARM Coverage Aggregate EBITDARM produced by all properties under a master lease (or other grouping) for the trailing twelve- months ending on the period presented divided by the base rent payable to CareTrust REIT under such master lease (or other grouping) for the same period; provided that if the master lease has been amended to change the base rent during or since such period, then the aggregate EBITDARM for such period is divided by the annualized monthly base rent currently in effect. Enterprise Value Share price multiplied by the number of outstanding shares, including assumed shares issued from the ATM program, plus total outstanding debt minus cash and assumed net proceeds from the ATM program, each as of a specified date. Property Counts Property counts exclude land under development, properties classified as held for sale or non-operational. As of September 30, 2025, the Company had eight properties classified as held for sale. Funds Available for Distribution (“FAD”) FFO attributable to CareTrust REIT, Inc, excluding straight- line rental income adjustments, amortization of deferred financing fees, lease incentives, above and below market lease intangibles, stock-based compensation expense, non-cash interest income and adjustments for joint ventures. Adjustments for joint ventures are calculated to reflect our pro rata share of our consolidated joint ventures. [2] Funds from Operations (“FFO”) Net income attributable to CareTrust REIT, Inc, excluding gains and losses from dispositions of real estate or other real estate, before real estate depreciation, amortization and real estate impairment charges and adjustments for joint ventures. Adjustments for joint ventures are calculated to reflect our pro rata share of our consolidated joint ventures. CareTrust REIT calculates and reports FFO attributable to CareTrust REIT, Inc in accordance with the definition and interpretive guidelines issued by the National Association of Real Estate Investment Trusts.[2] Employee Retention Tax Credit The Employee Retention Credit ("ERTC") is a fully refundable tax credit for employers equal to 50 percent of qualified wages (including allocable qualified health plan expenses) that eligible employers pay their employees. Glossary 26

Normalized FFO FFO attributable to CareTrust REIT, Inc, adjusted for certain income and expense items the Company does not believe are indicative of its ongoing results, such as write-off of deferred financing costs, accelerated amortization of lease intangibles, net of noncontrolling interests' share, provision for loan losses, provision for doubtful accounts and lease restructuring, recovery of previously reversed rent, lease termination revenue, amortization of stock-based compensation related to extraordinary incentive plan, extraordinary incentive plan payment, non-routine transaction costs, loss on extinguishment of debt, unrealized gains or losses on other real estate related investments, gains or losses on foreign currency transactions and property operating expenses.[2] Rent / Interest Rent represents the respective period's contractual cash rent, annualized, and presented at 100% share for consolidated entities, and excludes ground lease income and the impact of any rent abatement for recent acquisitions, if applicable. Rent denominated in GBP is translated to USD using the spot rate at the balance sheet date. Interest income includes annualized interest from other real estate related loans and preferred equity investments. Additionally, if a lease or loan agreement was entered into, amended or restructured subsequent to the period, but prior to our filing date for the respective period the initial or amended contractual cash rent or interest is used. Seniors Housing ("SH") Includes licensed healthcare facilities that provide personal care services, support and housing for those who need help with daily living activities, such as bathing, eating and dressing, yet require limited medical care. The programs and services may include transportation, social activities, exercise and fitness programs, beauty or barber shop access, hobby and craft activities, community excursions, meals in a dining room setting and other activities sought by residents. These facilities are often in apartment-like buildings with private residences ranging from single rooms to large apartments. Certain seniors housing properties may offer higher levels of personal assistance for residents requiring memory care as a result of Alzheimer’s disease or other forms of dementia. Levels of personal assistance are based in part on local regulations. Seniors Housing also includes retirement communities or senior apartments, which are not healthcare facilities. These communities typically consist of entirely self- contained apartments, complete with their own kitchens, baths and individual living spaces, as well as parking for tenant vehicles. They are most often rented unfurnished, and generally can be personalized by the tenants, typically an individual or a couple over the age of 55. These facilities offer various services and amenities such as laundry, housekeeping, dining options/meal plans, exercise and wellness programs, transportation, social, cultural and recreational activities, and on-site security. Skilled Nursing or Skilled Nursing Facilities (“SNFs”) Licensed healthcare facilities that provide restorative, rehabilitative and nursing care for people not requiring the more extensive and sophisticated treatment available at an acute care hospital or long-term acute care hospital. Treatment programs include physical, occupational, speech, respiratory, ventilator, and wound therapy. Stabilized A property is considered stabilized unless it (i) is held for sale or disposed of during the reporting period, (ii) temporarily on Special Focus Facility status, (iii) slated to be transitioned to a new operator, or (iv) has recently undergone significant renovations or was recently repositioned or transitioned to a new operator and has not achieved underwritten stabilization within 12 months following its stabilization target date. Notes: [1] EBITDA attributable to CareTrust REIT, Inc and Normalized EBITDA attributable to CareTrust REIT, Inc do not represent cash flows from operations or net income as defined by GAAP and should not be considered an alternative to those measures in evaluating the Company’s liquidity or operating performance. EBITDA attributable to CareTrust REIT, Inc and Normalized EBITDA attributable to CareTrust REIT, Inc do not purport to be indicative of cash available to fund future cash requirements, including the Company’s ability to fund capital expenditures or make payments on its indebtedness. Further, the Company’s computation of EBITDA attributable to CareTrust REIT, Inc and Normalized EBITDA attributable to CareTrust REIT, Inc may not be comparable to EBITDA and Normalized EBITDA reported by other REITs. [2] CareTrust REIT believes FAD attributable to CareTrust REIT, Inc, FFO attributable to CareTrust REIT, Inc, Normalized FAD attributable to CareTrust REIT, Inc, and Normalized FFO attributable to CareTrust REIT, Inc (and their related per-share amounts) are important non-GAAP supplemental measures of its operating performance. Because the historical cost accounting convention used for real estate assets requires straight-line depreciation (except on land), such accounting presentation implies that the value of real estate assets diminishes predictably over time, even though real estate values have historically risen or fallen with market and other conditions. Moreover, by excluding items not indicative of ongoing results, Normalized FAD attributable to CareTrust REIT, Inc and Normalized FFO attributable to CareTrust REIT, Inc can facilitate meaningful comparisons of operating performance between periods and between other companies. However, FAD attributable to CareTrust REIT, Inc, FFO attributable to CareTrust REIT, Inc, Normalized FAD attributable to CareTrust REIT, Inc, and Normalized FFO attributable to CareTrust REIT, Inc (and their related per- share amounts) do not represent cash flows from operations or net income attributable to shareholders as defined by GAAP and should not be considered an alternative to those measures in evaluating the Company’s liquidity or operating performance. Glossary 27