Document

Exhibit 99.1 Press Release dated October 27, 2025

Simpson Manufacturing Co., Inc. Announces 2025 Third Quarter Financial Results and Updates 2025 Guidance

|

|

|

|

|

|

|

l

|

Net sales of $623.5 million increased 6.2% year-over-year |

|

|

|

l

|

Income from operations of $140.7 million increased 12.7% year-over-year including one-time gain on sale |

|

l

|

Net income per diluted share of $2.58 increased 16.7% year-over-year |

|

l

|

Repurchased $30.0 million of common stock during the quarter; increased 2025 share repurchase authorization program to $120.0 million |

|

l

|

Announced 2026 share repurchases up to $150.0 million of the Company's common stock |

|

|

|

l

|

Declared a $0.29 per share dividend |

|

|

|

|

Pleasanton, CA - October 27, 2025: Simpson Manufacturing Co., Inc. (the “Company”) (NYSE: SSD), an industry leader in engineered structural connectors and building solutions, today announced its financial results for the third quarter of 2025. All comparisons below (which are generally indicated by words such as “increased,” “decreased,” “remained,” or “compared to”), unless otherwise noted, are comparing the quarter ended September 30, 2025 with the quarter ended September 30, 2024. In the first quarter of 2025, the Company reclassified certain engineering costs related to the Company's digital efforts from research and development and engineering expense as well as selling expense to general and administrative expense. The financial results of prior three and nine month periods ending on September 30, 2024, were revised to reflect these changes, with $3.1 million and $8.5 million, respectively, of costs being reclassified from research and development expenses and $1.6 million and $4.3 million, respectively, from selling expense to general and administrative expense. While this reclassification impacts the comparability of the results for prior periods, the reclassification did not have any impact on the total operating expenses.

Consolidated 2025 Third Quarter Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Year-Over- |

|

Nine Months Ended |

|

Year-Over- |

|

September 30, |

|

Year |

|

September 30, |

|

Year |

|

2025 |

|

2024 |

|

Change |

|

2025 |

|

2024 |

|

Change |

|

(In thousands, except per share data and percentages) |

| Net sales |

$ |

623,513 |

|

|

$ |

587,153 |

|

|

6.2 |

% |

|

$ |

1,793,463 |

|

|

$ |

1,714,710 |

|

|

4.6 |

% |

| Gross profit |

289,262 |

|

|

275,057 |

|

|

5.2 |

% |

|

835,752 |

|

|

798,159 |

|

|

4.7 |

% |

| Gross profit margin |

46.4 |

% |

|

46.8 |

% |

|

|

|

46.6 |

% |

|

46.5 |

% |

|

|

| Total operating expenses |

162,291 |

|

|

148,872 |

|

|

9.0 |

% |

|

466,358 |

|

|

440,491 |

|

|

5.9 |

% |

| Income from operations |

140,743 |

|

|

124,854 |

|

|

12.7 |

% |

|

383,306 |

|

|

353,136 |

|

|

8.5 |

% |

| Operating income margin |

22.6 |

% |

|

21.3 |

% |

|

|

|

21.4 |

% |

|

20.6 |

% |

|

|

| Net income |

$ |

107,444 |

|

|

$ |

93,519 |

|

|

14.9 |

% |

|

$ |

288,869 |

|

|

$ |

266,778 |

|

|

8.3 |

% |

| Net income per diluted common share |

$ |

2.58 |

|

|

$ |

2.21 |

|

|

16.7 |

% |

|

$ |

6.89 |

|

|

$ |

6.28 |

|

|

9.7 |

% |

| Adjusted EBITDA1 |

$ |

155,254 |

|

|

$ |

148,614 |

|

|

4.5 |

% |

|

$ |

437,184 |

|

|

$ |

419,295 |

|

|

4.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total U.S. Housing starts - September 30, 2025 data not available2 |

|

|

|

|

|

|

1 Adjusted EBITDA is a non-GAAP financial measure and is defined in the Non-GAAP Financial Measures section of this press release. For a reconciliation of Adjusted EBITDA to U.S. GAAP (as defined below) net income, see the schedule titled “Reconciliation of Non-GAAP Financial Measures.”

2 The housing starts data was unavailable at the time of the press release due to the government shutdown.

Management Commentary

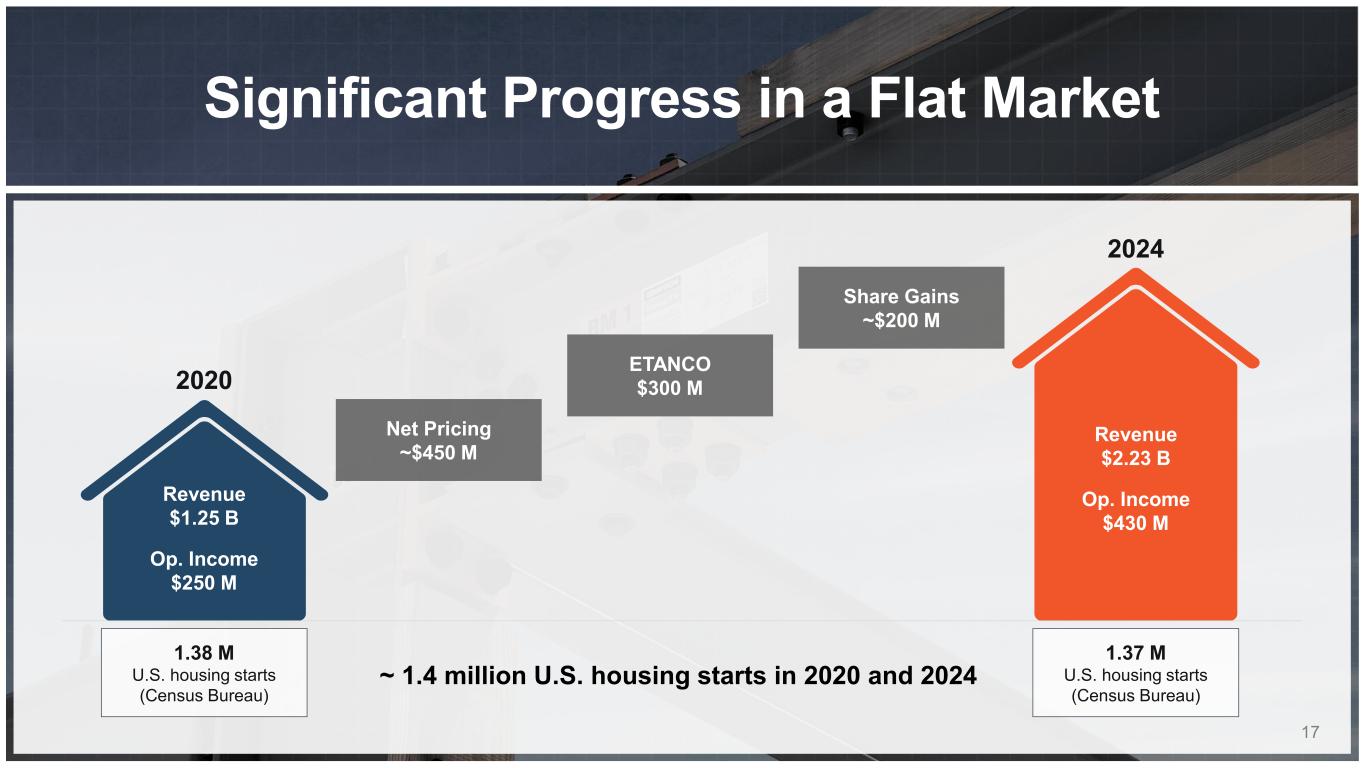

“We delivered solid third quarter results despite ongoing softness in residential housing markets across the U.S. and Europe,” said Mike Olosky, President and Chief Executive Officer of Simpson Manufacturing Co., Inc. “Our pricing actions, particularly in response to tariff pressures and a positive impact from foreign exchange, drove net sales growth of over 6%. I am proud of how our teams navigated a complex macroeconomic backdrop, especially in the Southern and Western regions of the U.S., where we typically have higher content per unit and housing starts remain under pressure. In Europe, we were also pleased to see sales growth in local currency, primarily driven by higher volumes. We remain focused on driving above market growth.”

Mr. Olosky continued, “As we look ahead, we are undertaking proactive strategic cost savings initiatives to align our operations with evolving market demand and position the Company for long-term success. We expect these initiatives to generate at least $30 million in annualized cost savings. While these decisions are never easy, we remain committed to supporting our people and maintaining our strong focus on innovation, customer service, and operational excellence. Our proven ability to outperform the market, maintain strong margins, and consistently grow EPS ahead of net sales, gives us confidence in delivering sustained shareholder value, even in a challenging environment.”

North America Segment 2025 Third Quarter Financial Highlights

•Net sales of $483.6 million increased 4.8% from $461.4 million primarily due to price increases that took effect in June 2025 and incremental sales from the Company's 2024 acquisitions, partially offset by decreased sales volumes.

•Gross margin declined to 49.0% from 49.5% due to higher factory and overhead as well as warehouse costs, as a percentage of net sales.

•Income from operations of $125.2 million increased 1.6% from $123.3 million. The increase was due to higher gross profit, partially offset by higher variable incentive compensation, personnel costs, severance costs related to strategic cost savings initiatives, and software related costs.

Europe Segment 2025 Third Quarter Financial Highlights

•Net sales of $134.4 million increased 10.9% from $121.2 million due to increased sales volume as well as the positive effect of approximately $8.1 million in foreign currency translation.

•Gross margin increased to 37.9% from 36.6%, primarily due to lower material costs, as a percentage of net sales.

•Income from operations of $16.1 million increased 27.6% from $12.6 million primarily due to an increase in gross profit, partially offset by increases in operating expenses due to the negative effect of approximately $2.1 million in foreign currency translation.

Administrative and All Other 2025 Third Quarter Financial Highlights

•Loss from operations of $1.1 million decreased from $11.3 million due to net gain on disposal of assets of $12.9 million related to the sale of the existing Gallatin, Tennessee facility.

Refer to the “Segment and Product Group Information” table below for additional segment information (including information about the Company’s Asia/Pacific and Administrative and All Other segments).

Corporate Developments

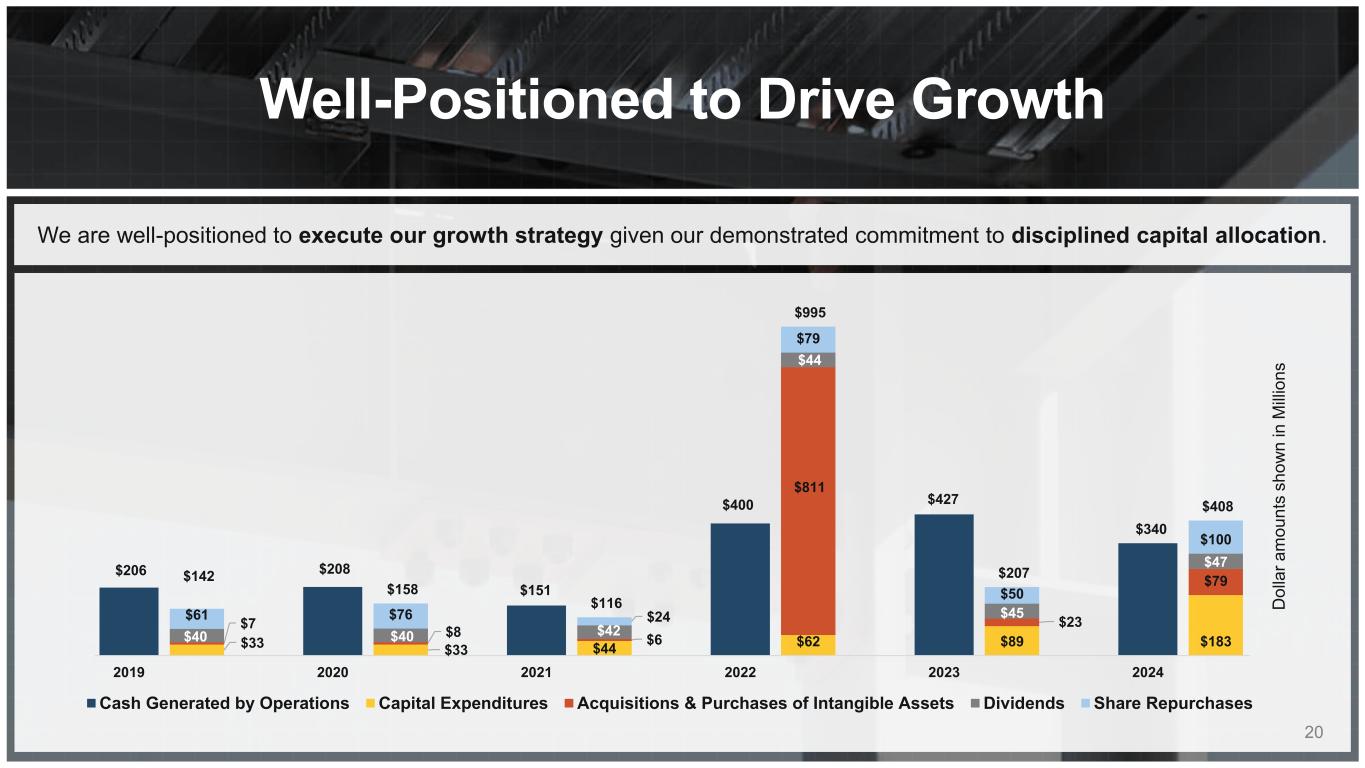

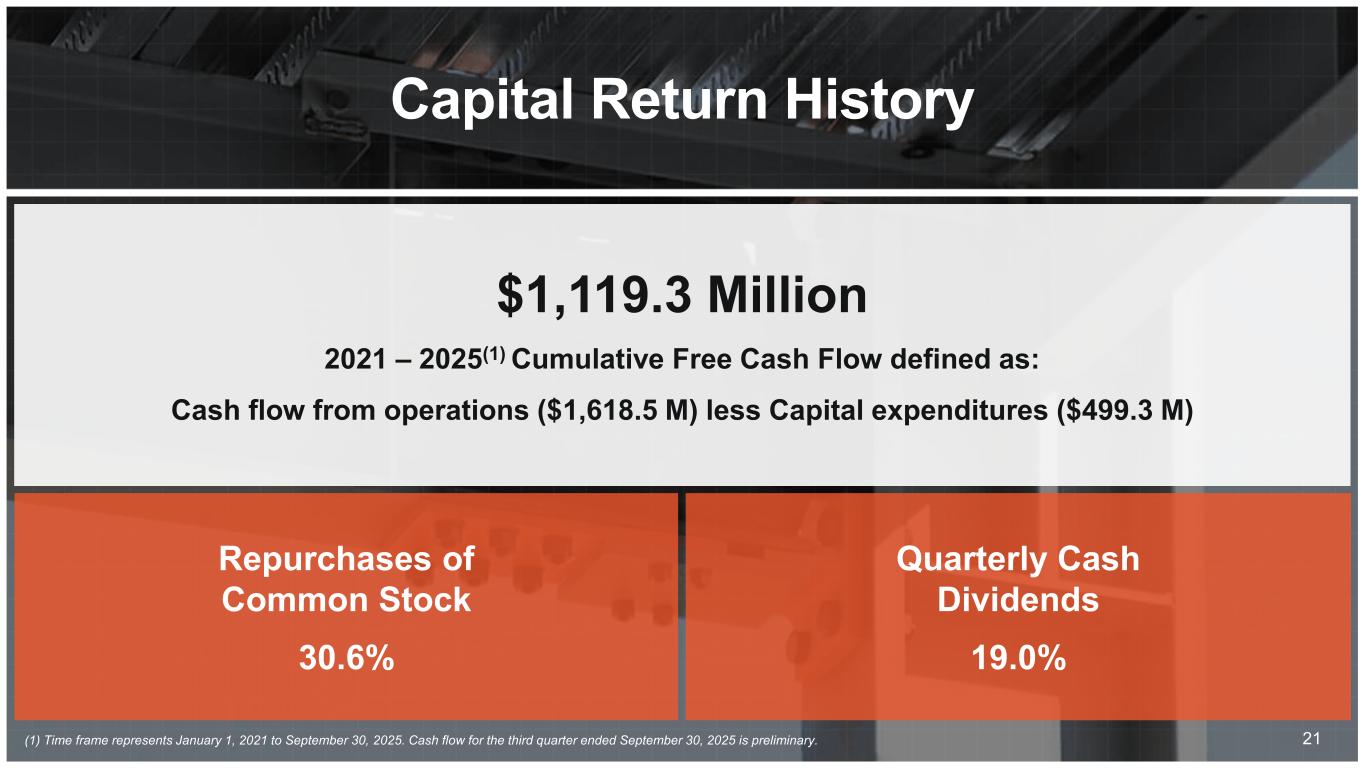

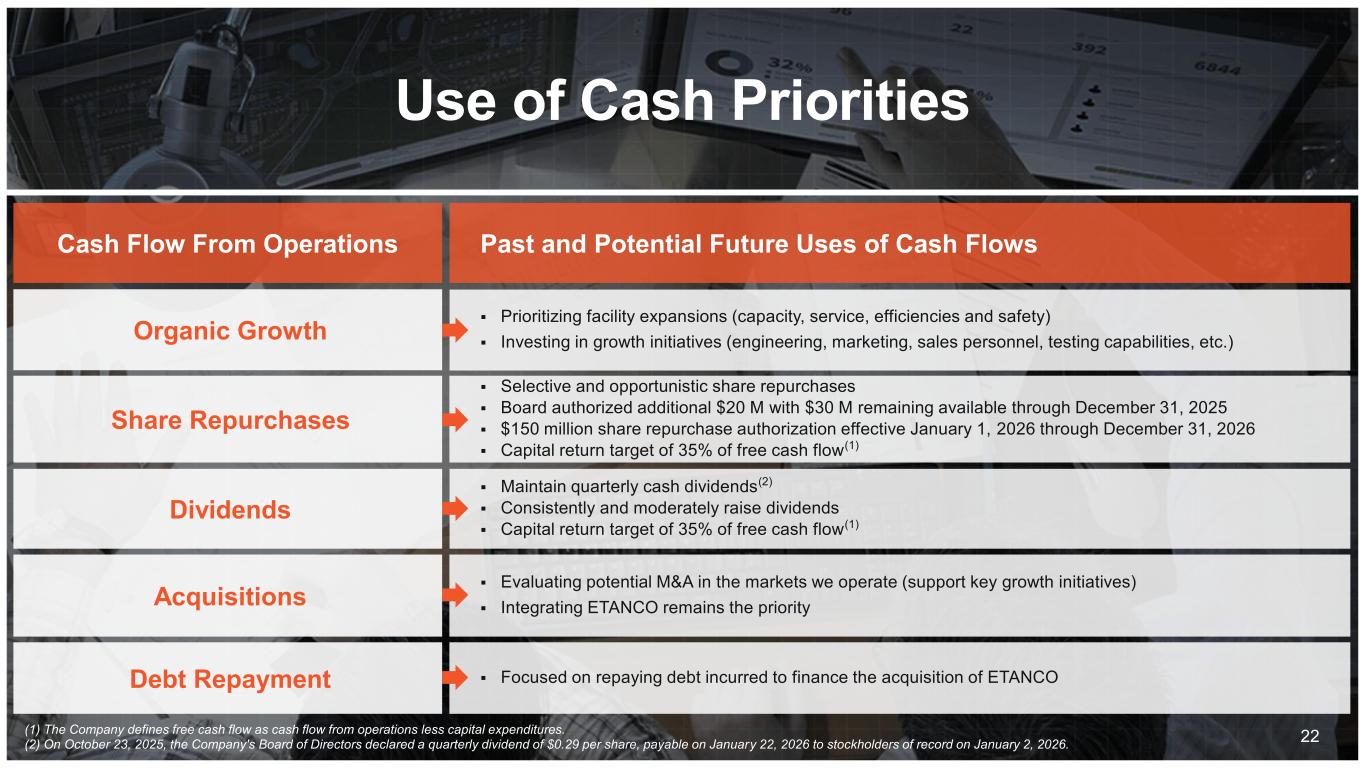

•For the quarter ended September 30, 2025, the Company repurchased 158,865 shares of common stock in the open market at an average price of $188.84 per share, for a total of $30.0 million. For the nine month period ended September 30, 2025, the Company repurchased 522,150 shares of common stock in the open market at an average price of $172.36 per share, for a total of $90.0 million.

•On October 23, 2025, the Company's Board of Directors (the “Board”) increased the 2025 share repurchase authorization by an additional $20.0 million, with an aggregate $30.0 million now available for repurchases of the Company's common stock through December 31, 2025.

•On October 23, 2025, the Board authorized the Company to repurchase up to $150.0 million of the Company's common stock, effective January 1, 2026 through December 31, 2026.

•On October 23, 2025, the Board declared a quarterly cash dividend of $0.29 per share, estimated to be $12.0 million in aggregate. The dividend will be payable on January 22, 2026, to the Company's stockholders of record on January 2, 2026.

•The Company implemented strategic cost savings initiatives during Q3 2025 aimed at enhancing operational efficiencies and reducing costs to better align its operations with current and expected market conditions. These actions are part of a broader effort to maintain margin stability during a sustained period of housing market weakness. The Company expects to generate annualized cost savings of approximately $30 million, with one-time charges of approximately $9.0 to $12.0 million in fiscal year 2025. Management emphasizes that these actions are proactive and strategic, reinforcing the Company’s continued commitment to operational discipline, in alignment with its key financial ambitions, and long-term value creation.

Balance Sheet & 2025 Third Quarter Cash Flow Highlights

•As of September 30, 2025, cash and cash equivalents totaled $297.3 million with total debt outstanding of $371.3 million under the Company's $450.0 million term credit facility.

•Cash flow provided by operating activities of $169.5 million increased by $67.1 million from $102.4 million, primarily due to changes in working capital.

•Cash flow used in investing activities of $15.7 million decreased by $90.8 million from $106.4 million primarily due to decreases in asset acquisitions and capital expenditures as well as increased proceeds on sale of assets.

Business Outlook

The Company is updating its prior 2025 financial outlook. As of today, October 27, 2025, the Company's outlook for the full fiscal year ending December 31, 2025 is as follows:

•Consolidated operating margin is estimated to be in the range of 19.0% to 20.0%, reflecting current market conditions and recent strategic initiatives. The outlook reflects the previously announced price increases that went into effect on June 2, 2025 and October 15, 2025 and it includes a benefit of $12.9 million from the sale of the existing Gallatin, Tennessee facility as well as non-recurring severance costs of approximately $9.0 to $12.0 million.

•The effective tax rate is estimated to be in the range of 25.5% to 26.5%, including both federal and state income tax rates as well as international income tax rates, and assumes minimal impact from recently passed tax legislation.

•Capital expenditures are now estimated to be in the range of $150.0 million to $160.0 million, which includes approximately $75.0 million to $80.0 million remaining for both the Columbus, Ohio facility expansion and the new Gallatin, Tennessee facility construction.

Conference Call Details

Investors, analysts and other interested parties are invited to join the Company’s third quarter 2025 financial results conference call on Monday, October 27, 2025, at 5:00 pm Eastern Time (2:00 pm Pacific Time). To participate, callers may dial (877) 407-0792 (U.S. and Canada) or (201) 689-8263 (International) approximately 10 minutes prior to the start time. The call will be webcast simultaneously and can be accessed through https://viavid.webcasts.com/starthere.jsp?ei=1735146&tp_key=4ec4ebc4d2 or a link on the Company’s website at https://ir.simpsonmfg.com. For those unable to participate during the live broadcast, a replay of the call will also be available beginning that same day at 8:00 p.m. Eastern Time until 11:59 p.m. Eastern Time on Monday, November 10, 2025 by dialing (844) 512–2921 (U.S. and Canada) or (412) 317–6671 (International) and entering the conference ID: 13755920. The webcast will remain posted on the Investor Relations section of Simpson's website at ir.simpsonmfg.com for 90 days.

A copy of this earnings release will be available prior to the call, accessible through the Investor Relations section of the Company's website at ir.simpsonmfg.com.

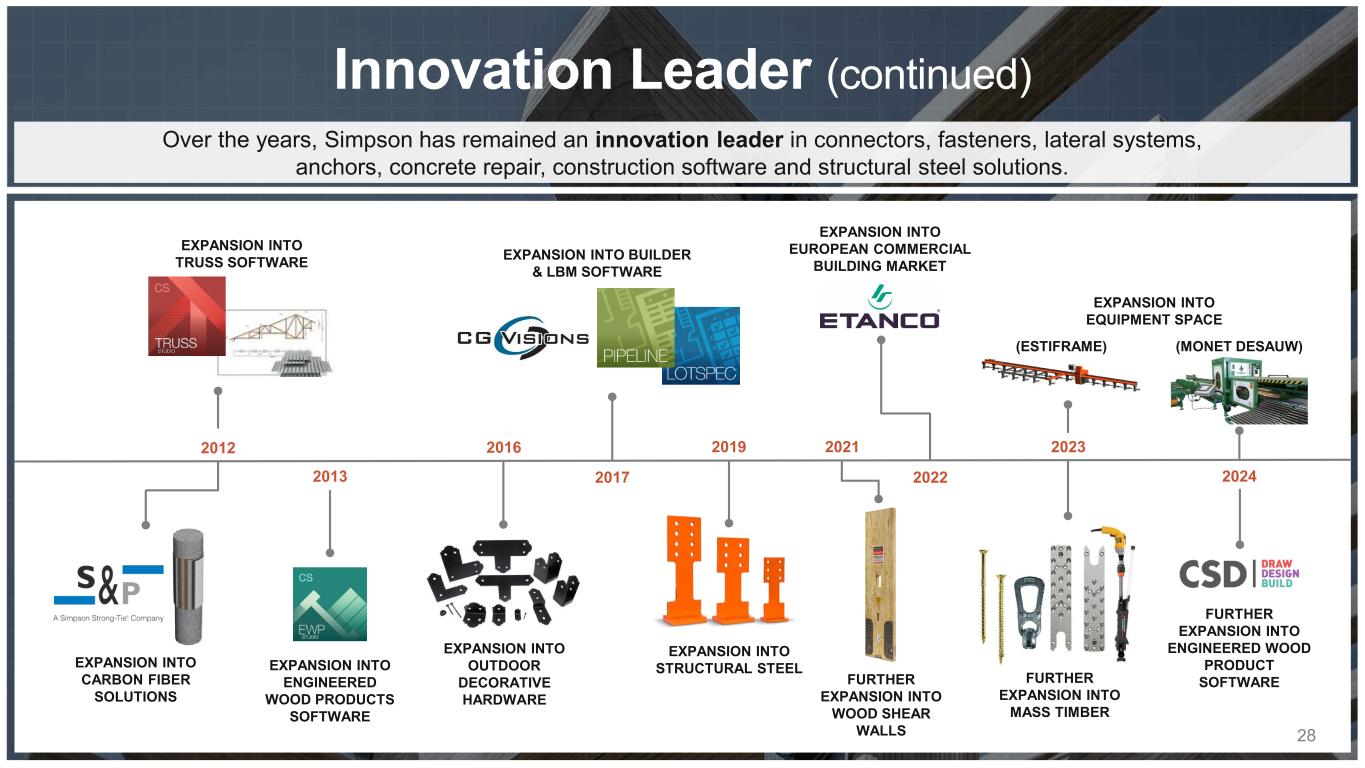

About Simpson Manufacturing Co., Inc.

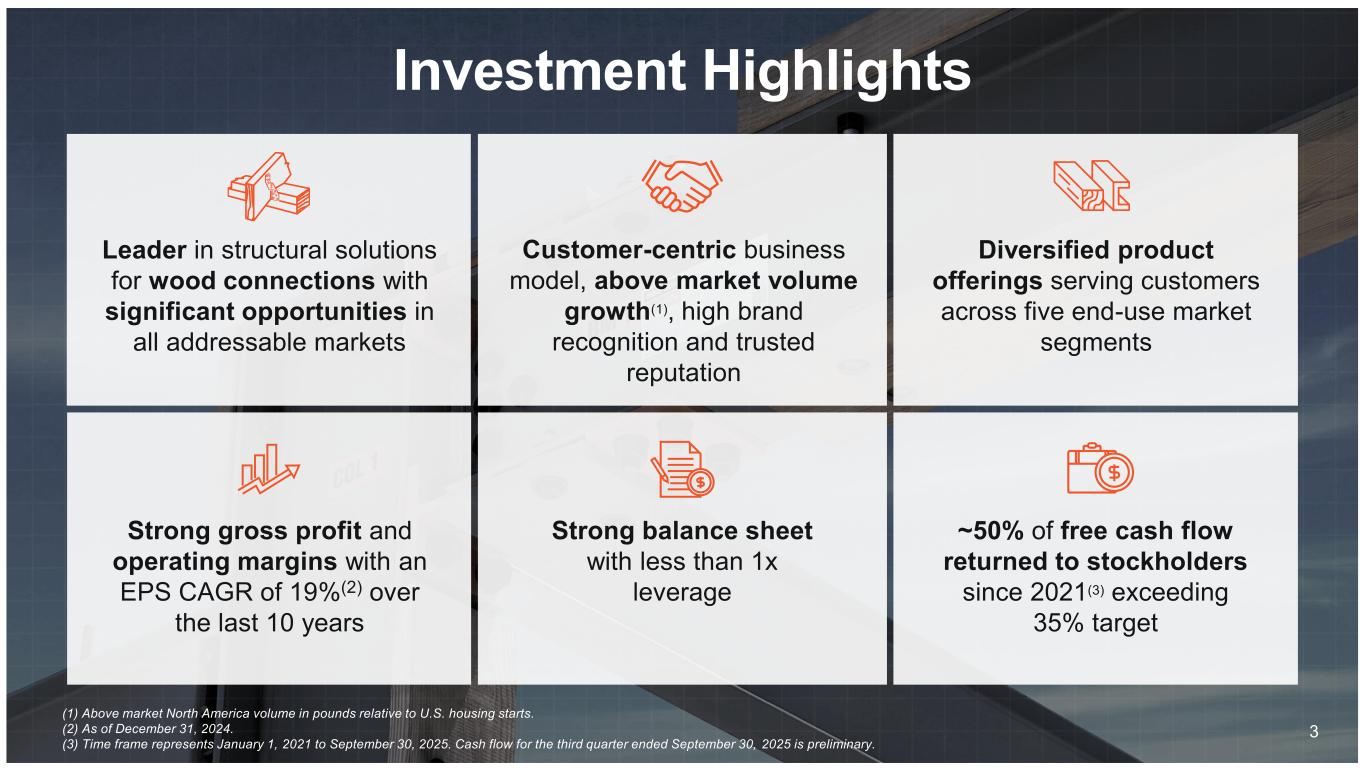

Simpson Manufacturing Co., Inc., headquartered in Pleasanton, California, through its subsidiary, Simpson Strong-Tie Company Inc., designs, engineers and is a leading manufacturer of wood construction products, including connectors, truss plates, fastening systems, fasteners and shearwalls, and concrete construction products, including adhesives, specialty chemicals, mechanical anchors, powder actuated tools and reinforcing carbon & glass fiber materials. The Company primarily supplies its building product solutions to both the residential and commercial markets in North America and Europe. The Company's common stock trades on the New York Stock Exchange under the symbol “SSD.”

Copies of Simpson Manufacturing's Annual Report to Stockholders and its proxy statements and other SEC filings, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, are made available free of charge on the company's website on the same day they are filed with the SEC. To view these filings, visit the Investor Relations section of the Company's website.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally can be identified by words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “outlook,” “target,” “continue,” “predict,” “project,” “change,” “result,” “future,” “will,” “could,” “can,” “may,” “likely,” “potentially,” or similar expressions. Forward-looking statements are all statements other than those of historical fact and include, but are not limited to, statements about future financial and operating results, our plans, objectives, business outlook, priorities, expectations and intentions, expectations for sales and market growth, comparable sales, earnings and performance, stockholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for services, share repurchases, strategic initiatives, including the impact of these initiatives on our strategic and operational plans and financial results, and any statement of an assumption underlying any of the foregoing.

Forward-looking statements are subject to inherent uncertainties, risks and other factors that are difficult to predict and could cause our actual results to vary in material respects from what we have expressed or implied by these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those expressed in or implied by our forward-looking statements include the effect of tariffs and international trade policies on our business operations, the effects of inflation and labor and supply shortages on our operations and the operations of our customers, suppliers and business partners, the effect of a global pandemic such as the COVID-19 pandemic or other widespread public health crisis and their effects on the global economy as well as those discussed in the “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” sections of our most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and other reports we file with the SEC.

We caution that you should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Readers are urged to carefully review and consider the various disclosures made in our reports filed with the SEC that advise of the risks and factors that may affect our business, results of operations and financial condition.

Non-GAAP Financial Measures

This press release includes certain financial information not prepared in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”). Since not all companies calculate non-GAAP financial information identically (or at all), the presentations herein may not be comparable to other similarly titled measures used by other companies. Further, these measures should not be considered substitutes for the performance measures derived in accordance with GAAP. The Company uses Adjusted EBITDA as an additional financial measure in evaluating the ongoing operating performance of its business. The Company believes Adjusted EBITDA allows it to readily view operating trends, perform analytical comparisons, and identify strategies to improve operating performance. Adjusted EBITDA should not be considered in isolation or as a substitute for GAAP financial measures such as net income or any other performance measures derived in accordance with GAAP. See the Reconciliation of Non-GAAP Financial Measures below.

The Company defines Adjusted EBITDA as net income (loss) before income taxes, adjusted to exclude depreciation and amortization, integration, acquisition and restructuring costs, non-qualified compensation adjustments, goodwill impairment, gain on bargain purchase, lease termination costs, severance costs, net loss or gain on disposal of assets, interest income or expense, and foreign exchange and other expense (income).

Simpson Manufacturing Co., Inc. and Subsidiaries

UNAUDITED Condensed Consolidated Statements of Operations

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net sales |

$ |

623,513 |

|

|

$ |

587,153 |

|

|

$ |

1,793,463 |

|

|

$ |

1,714,710 |

|

| Cost of sales |

334,251 |

|

|

312,096 |

|

|

957,711 |

|

|

916,551 |

|

| Gross profit |

289,262 |

|

|

275,057 |

|

|

835,752 |

|

|

798,159 |

|

| Research and development and engineering expense |

20,793 |

|

|

20,546 |

|

|

61,399 |

|

|

59,759 |

|

| Selling expense |

56,123 |

|

|

52,997 |

|

|

166,730 |

|

|

160,755 |

|

| General and administrative expense |

85,375 |

|

|

75,329 |

|

|

238,229 |

|

|

219,977 |

|

| Total operating expense |

162,291 |

|

|

148,872 |

|

|

466,358 |

|

|

440,491 |

|

| Acquisition and integration related costs |

309 |

|

|

1,356 |

|

|

449 |

|

|

4,992 |

|

| Net gain on disposal of assets |

(14,081) |

|

|

(25) |

|

|

(14,361) |

|

|

(460) |

|

| Income from operations |

140,743 |

|

|

124,854 |

|

|

383,306 |

|

|

353,136 |

|

| Interest income, net and other finance costs |

2,317 |

|

|

1,668 |

|

|

4,315 |

|

|

4,111 |

|

| Other & foreign exchange gain (loss), net |

777 |

|

|

(29) |

|

|

151 |

|

|

352 |

|

| Income before taxes |

143,837 |

|

|

126,493 |

|

|

387,772 |

|

|

357,599 |

|

| Provision for income taxes |

36,393 |

|

|

32,974 |

|

|

98,903 |

|

|

90,821 |

|

| Net income |

$ |

107,444 |

|

|

$ |

93,519 |

|

|

$ |

288,869 |

|

|

$ |

266,778 |

|

| Earnings per common share: |

|

|

|

|

|

|

|

| Basic |

$ |

2.59 |

|

|

$ |

2.22 |

|

|

$ |

6.92 |

|

|

$ |

6.31 |

|

| Diluted |

$ |

2.58 |

|

|

$ |

2.21 |

|

|

$ |

6.89 |

|

|

$ |

6.28 |

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

| Basic |

41,520 |

|

|

42,151 |

|

|

41,737 |

|

|

42,254 |

|

| Diluted |

41,704 |

|

|

42,335 |

|

|

41,903 |

|

|

42,464 |

|

| Cash dividends declared per common share |

$ |

0.29 |

|

|

$ |

0.28 |

|

|

$ |

0.86 |

|

|

$ |

0.83 |

|

| Other data: |

|

|

|

|

|

|

|

| Depreciation and amortization |

$ |

22,999 |

|

|

$ |

21,276 |

|

|

$ |

63,516 |

|

|

$ |

59,835 |

|

| Pre-tax equity-based compensation expense |

$ |

5,829 |

|

|

$ |

4,662 |

|

|

$ |

18,734 |

|

|

$ |

15,089 |

|

Simpson Manufacturing Co., Inc. and Subsidiaries

UNAUDITED Condensed Consolidated Balance Sheets

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

2025 |

|

2024 |

|

2024 |

| Cash and cash equivalents |

|

$ |

297,304 |

|

|

$ |

339,427 |

|

|

$ |

239,371 |

|

| Trade accounts receivable, net |

|

395,353 |

|

|

360,350 |

|

|

284,392 |

|

| Inventories |

|

591,877 |

|

|

583,380 |

|

|

593,175 |

|

| Other current assets |

|

64,834 |

|

|

51,609 |

|

|

59,383 |

|

| Total current assets |

|

1,349,368 |

|

|

1,334,766 |

|

|

1,176,321 |

|

| Property, plant and equipment, net |

|

613,896 |

|

|

495,822 |

|

|

531,655 |

|

| Operating lease right-of-use assets |

|

94,363 |

|

|

87,097 |

|

|

93,933 |

|

| Goodwill |

|

557,836 |

|

|

550,946 |

|

|

512,383 |

|

| Intangible assets, net |

|

392,517 |

|

|

395,517 |

|

|

375,051 |

|

| Other noncurrent assets |

|

37,443 |

|

|

33,311 |

|

|

46,825 |

|

| Total assets |

|

$ |

3,045,423 |

|

|

$ |

2,897,459 |

|

|

$ |

2,736,168 |

|

| Trade accounts payable |

|

$ |

103,593 |

|

|

$ |

110,321 |

|

|

$ |

100,972 |

|

| Long-term debt, current portion |

|

22,500 |

|

|

22,500 |

|

|

22,500 |

|

| Accrued liabilities and other current liabilities |

|

277,204 |

|

|

245,130 |

|

|

242,876 |

|

| Total current liabilities |

|

403,297 |

|

|

377,951 |

|

|

366,348 |

|

| Operating lease liabilities, net of current portion |

|

76,599 |

|

|

70,496 |

|

|

76,184 |

|

| Long-term debt, net of current portion and issuance costs |

|

346,709 |

|

|

442,885 |

|

|

362,563 |

|

| Deferred income tax |

|

94,088 |

|

|

89,226 |

|

|

90,303 |

|

| Other long-term liabilities |

|

111,437 |

|

|

53,457 |

|

|

27,636 |

|

| Non-qualified deferred compensation plan awards |

|

6,653 |

|

|

6,473 |

|

|

7,786 |

|

| Stockholders’ equity |

|

2,006,640 |

|

|

1,856,971 |

|

|

1,805,348 |

|

| Total liabilities, mezzanine equity, and stockholders’ equity |

|

$ |

3,045,423 |

|

|

$ |

2,897,459 |

|

|

$ |

2,736,168 |

|

Simpson Manufacturing Co., Inc. and Subsidiaries

UNAUDITED Segment and Product Group Information

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

Nine Months Ended |

|

|

|

|

September 30, |

|

% |

|

September 30, |

|

% |

|

2025 |

|

2024 |

|

change* |

|

2025 |

|

2024 |

|

change* |

| Net Sales by Reporting Segment |

|

|

|

|

|

|

|

|

|

|

|

|

North America |

$ |

483,607 |

|

$ |

461,356 |

|

4.8% |

|

$ |

1,396,993 |

|

$ |

1,331,126 |

|

4.9% |

|

Percentage of total net sales |

77.6 |

% |

|

78.6 |

% |

|

|

|

77.9 |

% |

|

77.6 |

% |

|

|

|

Europe |

134,430 |

|

121,170 |

|

10.9% |

|

381,688 |

|

370,985 |

|

2.9% |

|

Percentage of total net sales |

21.6 |

% |

|

20.6 |

% |

|

|

|

21.3 |

% |

|

21.6 |

% |

|

|

|

Asia/Pacific |

5,476 |

|

4,627 |

|

18.3% |

|

14,782 |

|

12,599 |

|

17.3% |

|

|

$ |

623,513 |

|

$ |

587,153 |

|

6.2% |

|

$ |

1,793,463 |

|

$ |

1,714,710 |

|

4.6% |

| Net Sales by Product Group** |

|

|

|

|

|

|

|

|

|

|

|

|

Wood Construction |

$ |

524,439 |

|

$ |

499,546 |

|

5.0% |

|

$ |

1,520,283 |

|

$ |

1,461,413 |

|

4.0% |

|

Percentage of total net sales |

84.1 |

% |

|

85.1 |

% |

|

|

|

84.8 |

% |

|

85.2 |

% |

|

|

|

Concrete Construction |

97,798 |

|

86,715 |

|

12.8% |

|

269,885 |

|

251,892 |

|

7.1% |

|

Percentage of total net sales |

15.7 |

% |

|

14.8 |

% |

|

|

|

15.0 |

% |

|

14.7 |

% |

|

|

|

Other |

1,276 |

|

892 |

|

N/M |

|

3,295 |

|

1,405 |

|

N/M |

|

|

$ |

623,513 |

|

$ |

587,153 |

|

6.2% |

|

$ |

1,793,463 |

|

$ |

1,714,710 |

|

4.6% |

| Gross Profit (Loss) by Reporting Segment |

|

|

|

|

|

|

|

|

|

|

|

|

North America |

$ |

237,181 |

|

$ |

228,169 |

|

3.9% |

|

$ |

693,527 |

|

$ |

660,287 |

|

5.0% |

|

North America gross margin |

49.0 |

% |

|

49.5 |

% |

|

|

|

49.6 |

% |

|

49.6 |

% |

|

|

|

Europe |

51,014 |

|

44,327 |

|

15.1% |

|

139,311 |

|

134,088 |

|

3.9% |

|

Europe gross margin |

37.9 |

% |

|

36.6 |

% |

|

|

|

36.5 |

% |

|

36.1 |

% |

|

|

|

Asia/Pacific |

2,077 |

|

1,619 |

|

N/M |

|

5,337 |

|

3,781 |

|

N/M |

|

Administrative and all other |

(1,010) |

|

942 |

|

N/M |

|

(2,423) |

|

3 |

|

N/M |

|

|

$ |

289,262 |

|

$ |

275,057 |

|

5.2% |

|

$ |

835,752 |

|

$ |

798,159 |

|

4.7% |

| Income (Loss) from Operations |

|

|

|

|

|

|

|

|

|

|

|

|

North America |

$ |

125,179 |

|

$ |

123,251 |

|

1.6% |

|

$ |

366,516 |

|

$ |

354,212 |

|

3.5% |

|

North America operating margin |

25.9 |

% |

|

26.7 |

% |

|

|

|

26.2 |

% |

|

26.6 |

% |

|

|

|

Europe |

16,119 |

|

12,635 |

|

27.6% |

|

41,097 |

|

33,037 |

|

24.4% |

|

Europe operating margin |

12.0 |

% |

|

10.4 |

% |

|

|

|

10.8 |

% |

|

8.9 |

% |

|

|

|

Asia/Pacific |

555 |

|

260 |

|

N/M |

|

828 |

|

(617) |

|

N/M |

|

Administrative and all other |

(1,110) |

|

(11,292) |

|

N/M |

|

(25,135) |

|

(33,496) |

|

N/M |

|

|

$ |

140,743 |

|

$ |

124,854 |

|

12.7% |

|

$ |

383,306 |

|

$ |

353,136 |

|

8.5% |

|

|

|

|

|

|

|

|

|

|

* |

Unfavorable percentage changes are presented in parentheses, if any. |

|

** |

The Company manages its business by geographic segment but presents sales by product group as additional information. |

|

N/M |

Statistic is not material or not meaningful. |

Simpson Manufacturing Co., Inc. and Subsidiaries

Reconciliation of Non-GAAP Financial Measures

(In thousands) (Unaudited)

A reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP measure, is set forth below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net Income |

$ |

107,444 |

|

|

$ |

93,519 |

|

|

$ |

288,869 |

|

|

$ |

266,778 |

|

| Provision for income taxes |

36,393 |

|

|

32,974 |

|

|

98,903 |

|

|

90,821 |

|

| Interest income, net and other financing costs |

(2,317) |

|

|

(1,668) |

|

|

(4,315) |

|

|

$ |

(4,111) |

|

| Depreciation and amortization |

22,999 |

|

|

21,276 |

|

|

63,516 |

|

|

59,835 |

|

| Other* |

(9,265) |

|

|

2,513 |

|

|

(9,789) |

|

|

5,972 |

|

| Adjusted EBITDA |

$ |

155,254 |

|

|

$ |

148,614 |

|

|

$ |

437,184 |

|

|

$ |

419,295 |

|

*Other: Includes acquisition integration and restructuring related expenses, non-qualified deferred compensation adjustments, lease termination, severance costs, other & foreign exchange loss net, and net loss or gain on disposal of assets.

CONTACT:

Addo Investor Relations

investor.relations@strongtie.com

(310) 829-5400