| Maryland | 001-37401 | 46-5212033 | ||||||||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

||||||||||||

| (Address of principal executive offices) (Zip Code) | ||

| Title of each Class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

| Common stock, $0.01 par value per share | CHCT | New York Stock Exchange | ||||||||||||

| Exhibit No. | Description | ||||

| 99.1 |

Press release dated July 29, 2025 |

||||

| 99.2 |

Supplemental Information - Second Quarter 2025 |

||||

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document) | ||||

| COMMUNITY HEALTHCARE TRUST INCORPORATED | ||||||||

| By: | /s/ William G. Monroe IV | |||||||

| William G. Monroe IV | ||||||||

| Executive Vice President and Chief Financial Officer | ||||||||

| July 29, 2025 | ||||||||

| (Unaudited) | |||||||||||

| June 30, 2025 | December 31, 2024 | ||||||||||

ASSETS |

|||||||||||

Real estate properties: |

|||||||||||

Land and land improvements |

$ | 152,887 | $ | 149,501 | |||||||

Buildings, improvements, and lease intangibles |

1,004,616 | 996,104 | |||||||||

Personal property |

809 | 326 | |||||||||

Total real estate properties |

1,158,312 | 1,145,931 | |||||||||

Less accumulated depreciation |

(262,961) | (242,609) | |||||||||

Total real estate properties, net |

895,351 | 903,322 | |||||||||

Cash and cash equivalents |

4,863 | 4,384 | |||||||||

| Assets held for sale | 5,465 | 6,755 | |||||||||

Other assets, net |

60,613 | 78,102 | |||||||||

Total assets |

$ | 966,292 | $ | 992,563 | |||||||

LIABILITIES AND STOCKHOLDERS' EQUITY |

|||||||||||

Liabilities |

|||||||||||

Debt, net |

$ | 500,077 | $ | 485,955 | |||||||

Accounts payable and accrued liabilities |

13,944 | 14,289 | |||||||||

Other liabilities, net |

14,451 | 16,354 | |||||||||

Total liabilities |

528,472 | 516,598 | |||||||||

Commitments and contingencies |

|||||||||||

Stockholders' Equity |

|||||||||||

Preferred stock, $0.01 par value; 50,000 shares authorized; none issued and outstanding |

— | — | |||||||||

Common stock, $0.01 par value; 450,000 shares authorized; 28,368 and 28,242 shares issued and outstanding at June 30, 2025 and December 31, 2024, respectively |

284 | 282 | |||||||||

Additional paid-in capital |

712,498 | 704,524 | |||||||||

Cumulative net income |

74,709 | 85,675 | |||||||||

Accumulated other comprehensive gain |

9,121 | 17,631 | |||||||||

Cumulative dividends |

(358,792) | (332,147) | |||||||||

Total stockholders’ equity |

437,820 | 475,965 | |||||||||

Total liabilities and stockholders' equity |

$ | 966,292 | $ | 992,563 | |||||||

| The Consolidated Balance Sheets do not include all of the information and footnotes required by accounting principles generally accepted in the United States of America for complete financial statements. | ||

| Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| REVENUES | |||||||||||||||||||||||

| Rental income | $ | 30,128 | $ | 27,905 | $ | 59,858 | $ | 56,247 | |||||||||||||||

| Other operating interest | (1,043) | (389) | (695) | 602 | |||||||||||||||||||

| 29,085 | 27,516 | 59,163 | 56,849 | ||||||||||||||||||||

| EXPENSES | |||||||||||||||||||||||

| Property operating | 5,585 | 5,572 | 11,680 | 11,363 | |||||||||||||||||||

General and administrative |

10,559 | 4,760 | 15,659 | 9,314 | |||||||||||||||||||

| Depreciation and amortization | 10,879 | 10,792 | 21,822 | 21,054 | |||||||||||||||||||

| 27,023 | 21,124 | 49,161 | 41,731 | ||||||||||||||||||||

| OTHER (EXPENSE) INCOME | |||||||||||||||||||||||

| Gains on sale, net of impairments of real estate assets | 640 | (140) | 640 | (140) | |||||||||||||||||||

| Interest expense | (6,592) | (5,986) | (12,944) | (11,048) | |||||||||||||||||||

| Credit loss reserve | (8,672) | (11,000) | (8,672) | (11,000) | |||||||||||||||||||

| Interest and other income, net | 5 | 307 | 8 | 308 | |||||||||||||||||||

| (14,619) | (16,819) | (20,968) | (21,880) | ||||||||||||||||||||

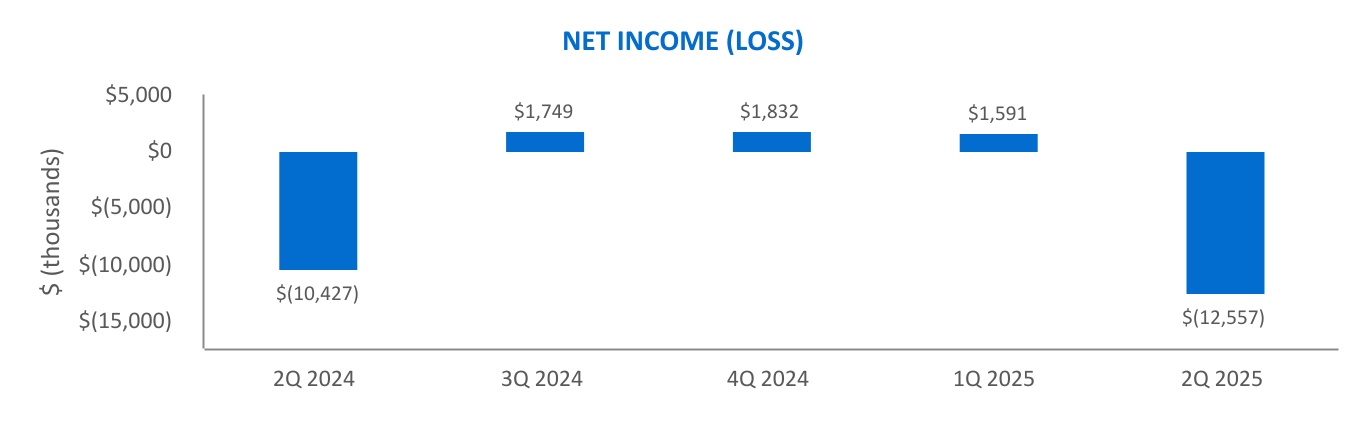

| NET LOSS | $ | (12,557) | $ | (10,427) | $ | (10,966) | $ | (6,762) | |||||||||||||||

| NET LOSS PER COMMON SHARE | |||||||||||||||||||||||

| Net loss per common share - Basic | $ | (0.50) | $ | (0.42) | $ | (0.47) | $ | (0.31) | |||||||||||||||

| Net loss per common share - Diluted | $ | (0.50) | $ | (0.42) | $ | (0.47) | $ | (0.31) | |||||||||||||||

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING-BASIC | 26,803 | 26,479 | 26,768 | 26,388 | |||||||||||||||||||

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING-DILUTED | 26,803 | 26,479 | 26,768 | 26,388 | |||||||||||||||||||

(1) General and administrative expenses for the three and six months ended June 30, 2025, included severance and transition-related expenses totaling $1.3 million related to a termination in the second quarter of 2025, as well as non-cash stock-based compensation expense totaling $7.1 million and $9.8 million, respectively, which includes accelerated amortization of $4.6 million related to a termination in the second quarter of 2025. General and administrative expenses for the three and six months ended June 30, 2024, included non-cash stock-based compensation expense totaling $2.5 million and $4.9 million, respectively. | |||||||||||||||||||||||

| The Consolidated Statements of Operations do not include all of the information and footnotes required by accounting principles generally accepted in the United States of America for complete financial statements. | ||

| Three Months Ended June 30, | |||||||||||

| 2025 | 2024 | ||||||||||

| Net loss | $ | (12,557) | $ | (10,427) | |||||||

| Real estate depreciation and amortization | 10,861 | 10,895 | |||||||||

| Gains on sale, net of impairments of real estate assets | (640) | 140 | |||||||||

Credit loss reserve (3) |

8,672 | 11,000 | |||||||||

| Total adjustments | 18,893 | 22,035 | |||||||||

FFO (1)(2)(3) |

$ | 6,336 | $ | 11,608 | |||||||

| Straight-line rent | (1,184) | 204 | |||||||||

| Stock-based compensation | 2,531 | 2,469 | |||||||||

Accelerated amortization of stock-based compensation (4) |

4,591 | — | |||||||||

Severance and transition related expenses(4) |

1,311 | — | |||||||||

AFFO (1)(2) |

$ | 13,585 | $ | 14,281 | |||||||

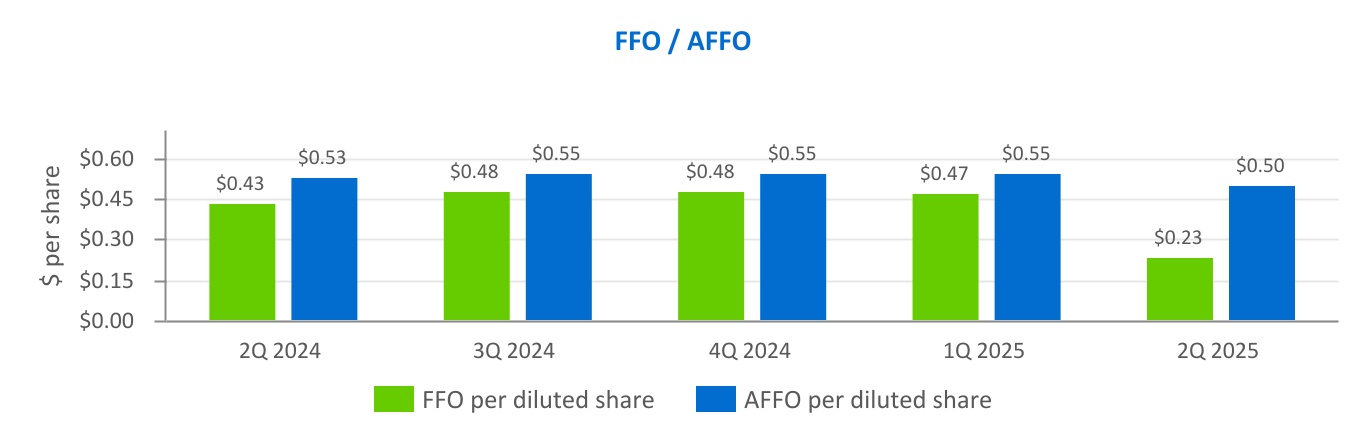

FFO per Common Share-Diluted (1)(2) |

$ | 0.23 | $ | 0.43 | |||||||

AFFO per Common Share-Diluted (1)(2) |

$ | 0.50 | $ | 0.53 | |||||||

Weighted Average Common Shares Outstanding-Diluted (5) |

27,011 | 26,791 | |||||||||

| (1) |

Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. However, since real estate values have historically risen or fallen with market conditions, many industry investors deem presentations of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. For that reason, the Company considers funds from operations ("FFO") and adjusted funds from operations ("AFFO") to be appropriate measures of operating performance of an equity real estate investment trust ("REIT"). In particular, the Company believes that AFFO is useful because it allows investors, analysts and Company management to compare the Company's operating performance to the operating performance of other real estate companies and between periods on a consistent basis without having to account for differences caused by unanticipated items and other events.

The Company uses the National Association of Real Estate Investment Trusts, Inc. ("NAREIT") definition of FFO. FFO is an operating performance measure adopted by NAREIT. NAREIT defines FFO as the most commonly accepted and reported measure of a REIT’s operating performance equal to net income (calculated in accordance with GAAP), excluding gains or losses from the sale of certain real estate assets, gains and losses from change in control, impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity, plus depreciation and amortization related to real estate properties, and after adjustments for unconsolidated partnerships and joint ventures. NAREIT also provides REITs with an option to exclude gains, losses and impairments of assets that are incidental to the main business of the REIT from the calculation of FFO.

In addition to FFO, the Company presents AFFO and AFFO per share. The Company defines AFFO as FFO, excluding certain expenses related to closing costs of properties acquired accounted for as business combinations and mortgages funded, excluding straight-line rent and the amortization of stock-based compensation, and including or excluding other non-cash items from time to time. AFFO presented herein may not be comparable to similar measures presented by other real estate companies due to the fact that not all real estate companies use the same definition.

FFO and AFFO should not be considered as alternatives to net income (determined in accordance with GAAP) as indicators of the Company's financial performance or as alternatives to cash flow from operating activities (determined in accordance with GAAP) as measures of the Company’s liquidity, nor are they necessarily indicative of sufficient cash flow to fund all of the Company’s needs. The Company believes that in order to facilitate a clear understanding of the consolidated historical operating results of the Company, FFO and AFFO should be examined in conjunction with net income as presented elsewhere herein.

|

||||

| (2) | During the three months ended June 30, 2025, the Company reversed interest related to a geriatric behavioral hospital tenant totaling approximately $1.7 million, resulting in a reduction of FFO and AFFO per diluted share of approximately $0.06. During the three months ended June 30, 2024, the Company reversed rent and interest related to this geriatric behavioral hospital tenant totaling approximately $3.2 million, including straight-line rent of approximately $0.9 million, resulting in a reduction of FFO per diluted share of approximately $0.12. AFFO, which adds back straight-line rent, was reduced by approximately $0.09 per diluted share for the three months ending June 30, 2024. |

||||

| (3) | During the three months ended June 30, 2025, the Company recorded a credit loss reserve on its notes related to a geriatric behavioral hospital tenant totaling approximately $8.7 million. During the three months ended June 30, 2024, the Company recorded an $11.0 million credit loss reserve related to its notes receivable with this geriatric behavioral hospital tenant. Because these notes are incidental to the Company's main business, the Company added back these reserves in its calculations of FFO and AFFO. |

||||

| (4) | During the three months ended June 30, 2025, the Company recorded severance and transition-related charges totaling approximately $5.9 million, including non-cash accelerated amortization of stock-based compensation of approximately $4.6 million which reduced FFO per diluted common share by approximately $0.22. | ||||

| (5) |

Diluted weighted average common shares outstanding for FFO and AFFO are calculated based on the treasury method, rather than the 2-class method used to calculate earnings per share. Restricted stock awards and time-based RSUs are included in the calculation of weighted average common shares outstanding to the extent that they are dilutive. Performance-based RSUs are included in the calculation of weighted average common shares outstanding to the extent that they are in-the-money as of the end of the reporting period and are dilutive.

|

||||

|

CHCT | ||||

| LISTED | |||||

| NYSE | |||||

|

SUPPLEMENTAL INFORMATION

Q2 2025

| ||

| Community Healthcare Trust | 2Q 2025 | Supplemental Information | |||||||

| ||

Portfolio Diversification

|

|||||

| Community Healthcare Trust | 2Q 2025 | Supplemental Information | |||||||

| ||

| June 30, 2025 | |||||

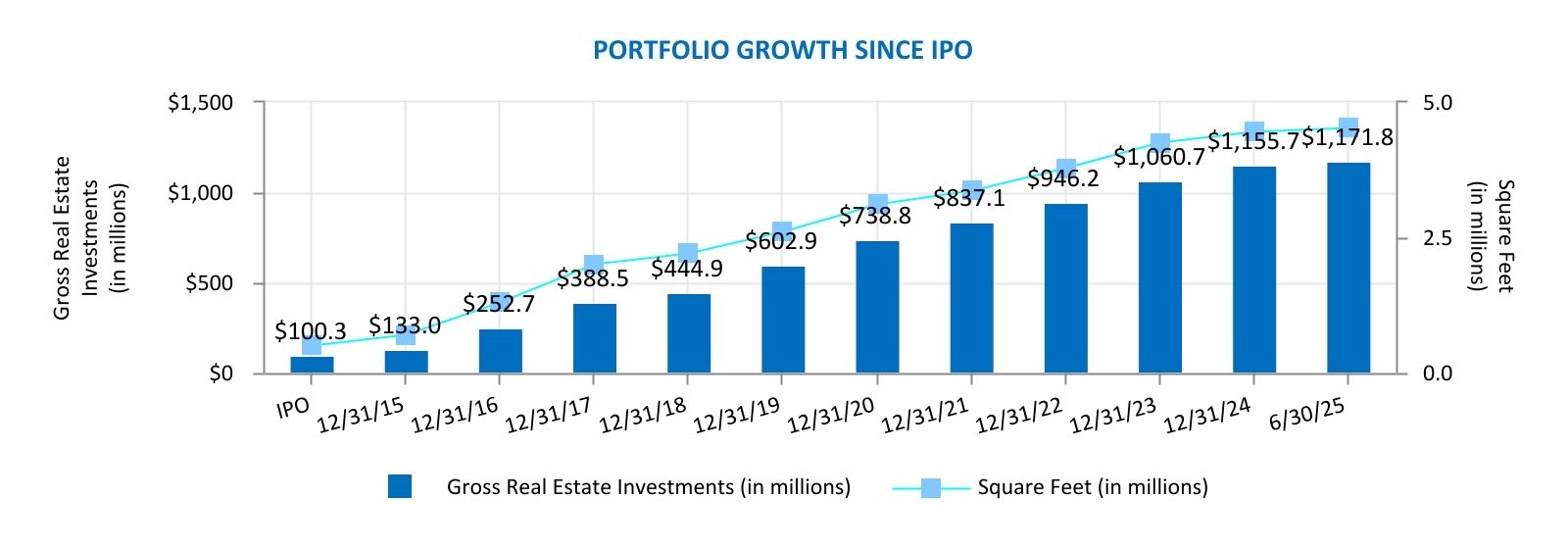

Gross real estate investments (in thousands) (1) |

$1,171,846 | ||||

| Total properties | 200 | ||||

% Leased (2) |

90.7 | % | |||

| Total square feet owned | 4,525,053 | ||||

| Weighted Average remaining lease term (years) | 6.6 | ||||

| Cash and cash equivalents (in thousands) | $4,863 | ||||

| Debt to Total Capitalization | 41.6 | % | |||

Weighted average interest rate per annum on Revolving Line of Credit(3) |

5.3 | % | |||

Weighted average interest rate per annum on Term Loans (4) |

4.7 | % | |||

| Equity market cap (in millions) | $471.8 | ||||

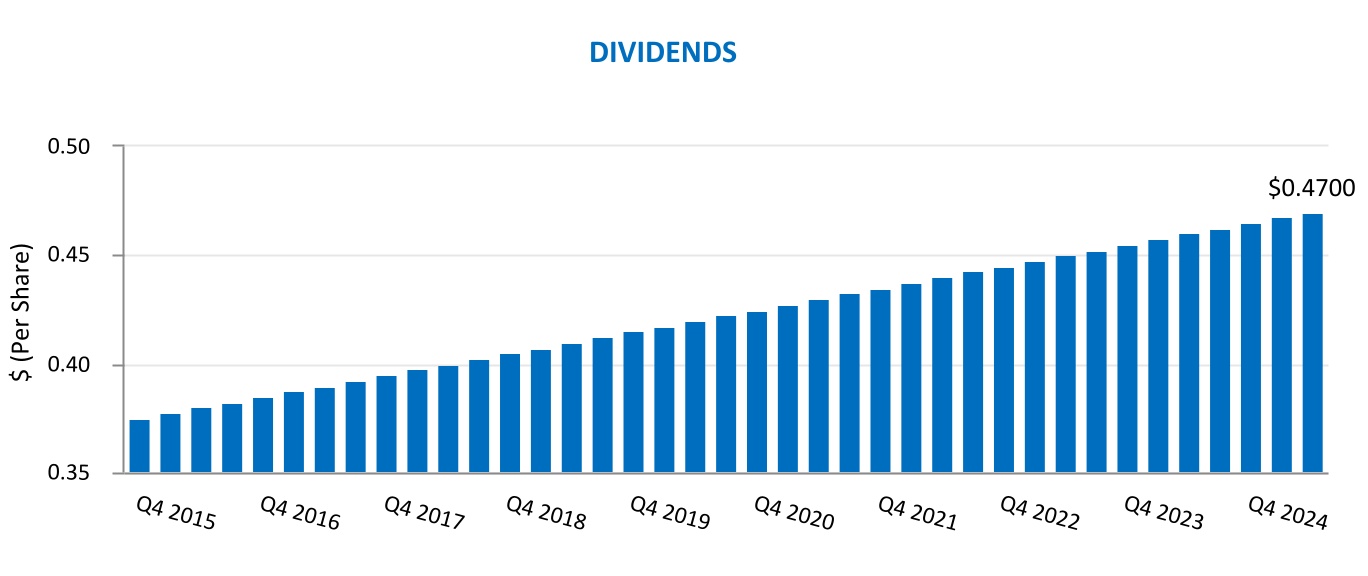

| Quarterly dividend paid in the period (per share) | $0.4700 | ||||

| Quarter end stock price (per share) | $16.63 | ||||

| Dividend yield | 11.30 | % | |||

| Common shares outstanding | 28,368,353 | ||||

| ___________ | |||||

(1) Includes one property with two sales-type leases and one property classified as held for sale. | |||||

(2) Excludes real estate assets held for sale. | |||||

(3) Revolving Line of Credit is partially hedged; this rate represents the weighted average of fixed and floating rates. | |||||

(4) Term Loans are fully hedged; this rate represents the weighted average hedged rates. | |||||

| Community Healthcare Trust | Page | 3 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Community Healthcare Trust Incorporated | |||||||||||||||||

| 3326 Aspen Grove Drive, Suite 150 | |||||||||||||||||

| Franklin, TN 37067 | |||||||||||||||||

| Phone: 615-771-3052 | |||||||||||||||||

| E-mail: Investorrelations@chct.reit | |||||||||||||||||

Website: www.chct.reit | |||||||||||||||||

| BOARD OF DIRECTORS | |||||||||||||||||

| Alan Gardner | Robert Hensley | Claire Gulmi | R. Lawrence Van Horn | Cathrine Cotman | David H. Dupuy | ||||||||||||

| Chairman of the Board |

Audit Committee Chair |

Compensation Committee Chair |

ESG Committee Chair |

Board member |

Board member |

||||||||||||

| EXECUTIVE MANAGEMENT TEAM | ||||||||

| David H. Dupuy | William G. Monroe IV | Leigh Ann Stach | ||||||

| Chief Executive Officer and President |

Executive Vice President Chief Financial Officer |

Executive Vice President Chief Accounting Officer |

||||||

| COVERING ANALYSTS | |||||

| A. Goldfarb - Piper Sandler | R. Stevenson - Janney Capital Markets | ||||

| J. Kammert - Evercore ISI | B. Oxford - Colliers International Securities | ||||

| M. Lewis - Truist Securities | |||||

| PROFESSIONAL SERVICES | |||||

| Independent Registered Public Accounting Firm | Transfer Agent | ||||

| BDO USA, P.C. | Equiniti Trust Company, LLC | ||||

| 501 Commerce Street, Suite 1400 | Operations Center | ||||

| Nashville, TN 37203 | 6201 15th Avenue |

||||

| Brooklyn, NY 11219 | |||||

| 1-800-937-5449 | |||||

| Community Healthcare Trust | Page | 4 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Three Months Ended | ||||||||||||||||||||

| 2Q 2025 | 1Q 2025 | 4Q 2024 | 3Q 2024 | 2Q 2024 | ||||||||||||||||

| (Unaudited and in thousands, except per share data) | ||||||||||||||||||||

STATEMENTS OF OPERATIONS ITEMS (1)(2)(3) |

||||||||||||||||||||

| Revenues | $ | 29,085 | $ | 30,078 | $ | 29,298 | $ | 29,639 | $ | 27,516 | ||||||||||

| Net (loss) income | $ | (12,557) | $ | 1,591 | $ | 1,832 | $ | 1,749 | $ | (10,427) | ||||||||||

| NOI | $ | 23,500 | $ | 23,983 | $ | 23,813 | $ | 23,653 | $ | 21,944 | ||||||||||

EBITDAre |

$ | 4,274 | $ | 18,886 | $ | 19,020 | $ | 18,924 | $ | 6,491 | ||||||||||

Adjusted EBITDAre |

$ | 20,068 | $ | 21,596 | $ | 21,617 | $ | 21,421 | $ | 19,960 | ||||||||||

| FFO | $ | 6,336 | $ | 12,668 | $ | 12,745 | $ | 12,821 | $ | 11,608 | ||||||||||

| AFFO | $ | 13,585 | $ | 14,739 | $ | 14,630 | $ | 14,639 | $ | 14,281 | ||||||||||

Per Diluted Share: (1)(2)(3) |

||||||||||||||||||||

Net (loss) income attributable to common shareholders |

$ | (0.50) | $ | 0.03 | $ | 0.04 | $ | 0.04 | $ | (0.42) | ||||||||||

| FFO | $ | 0.23 | $ | 0.47 | $ | 0.48 | $ | 0.48 | $ | 0.43 | ||||||||||

| AFFO | $ | 0.50 | $ | 0.55 | $ | 0.55 | $ | 0.55 | $ | 0.53 | ||||||||||

| ___________ | ||||||||||||||||||||

(1) Net loss, FFO and AFFO for the second quarter of 2025 included interest receivable reserves totaling approximately $1.7 million, resulting in a reduction of $0.06 per diluted share for net loss, FFO, and AFFO. Net loss and FFO for the second quarter of 2024 included lease and interest receivable reserves totaling approximately $3.2 million, including straight-line rent of approximately $0.9 million, resulting in a reduction of FFO per diluted share of approximately $0.12 per diluted share. AFFO, which adds back straight-line rent, was reduced by approximately $0.09 per diluted share. | ||||||||||||||||||||

(2) Net loss for the second quarter of 2025 included an $8.7 million credit loss reserve related to notes receivable with a geriatric behavioral hospital tenant that are incidental to the Company's main business. Net loss for the second quarter 2024 included an $11.0 million credit loss reserve related to notes receivable with this tenant. | ||||||||||||||||||||

| (3) Net loss and FFO for the second quarter of 2025 included severance and transition-related charges totaling approximately $5.9 million, including approximately $4.6 million of non-cash accelerated amortization of stock-based compensation, which reduced FFO per diluted common share by approximately $0.22. | ||||||||||||||||||||

| Community Healthcare Trust | Page | 5 |

2Q 2025 | Supplemental Information | ||||||

| ||

| As of | ||||||||||||||||||||

| 2Q 2025 | 1Q 2025 | 4Q 2024 | 3Q 2024 | 2Q 2024 | ||||||||||||||||

| (Unaudited and dollars in thousands) | ||||||||||||||||||||

| BALANCE SHEET ITEMS | ||||||||||||||||||||

| ASSETS | ||||||||||||||||||||

| Total real estate properties | $ | 1,158,312 | $ | 1,148,772 | $ | 1,145,931 | $ | 1,135,463 | $ | 1,120,450 | ||||||||||

| Total assets | $ | 966,292 | $ | 985,114 | $ | 992,563 | $ | 981,779 | $ | 983,196 | ||||||||||

| CAPITALIZATION | ||||||||||||||||||||

| Net debt | $ | 500,077 | $ | 496,016 | $ | 485,955 | $ | 473,716 | $ | 457,625 | ||||||||||

| Total capitalization | $ | 1,200,858 | $ | 1,210,874 | $ | 1,204,529 | $ | 1,183,615 | $ | 1,177,230 | ||||||||||

| Net debt/total capitalization | 41.6 | % | 41.0 | % | 40.3 | % | 40.0 | % | 38.9 | % | ||||||||||

| Market valuation | $ | 471,766 | $ | 514,631 | $ | 542,536 | $ | 512,599 | $ | 656,059 | ||||||||||

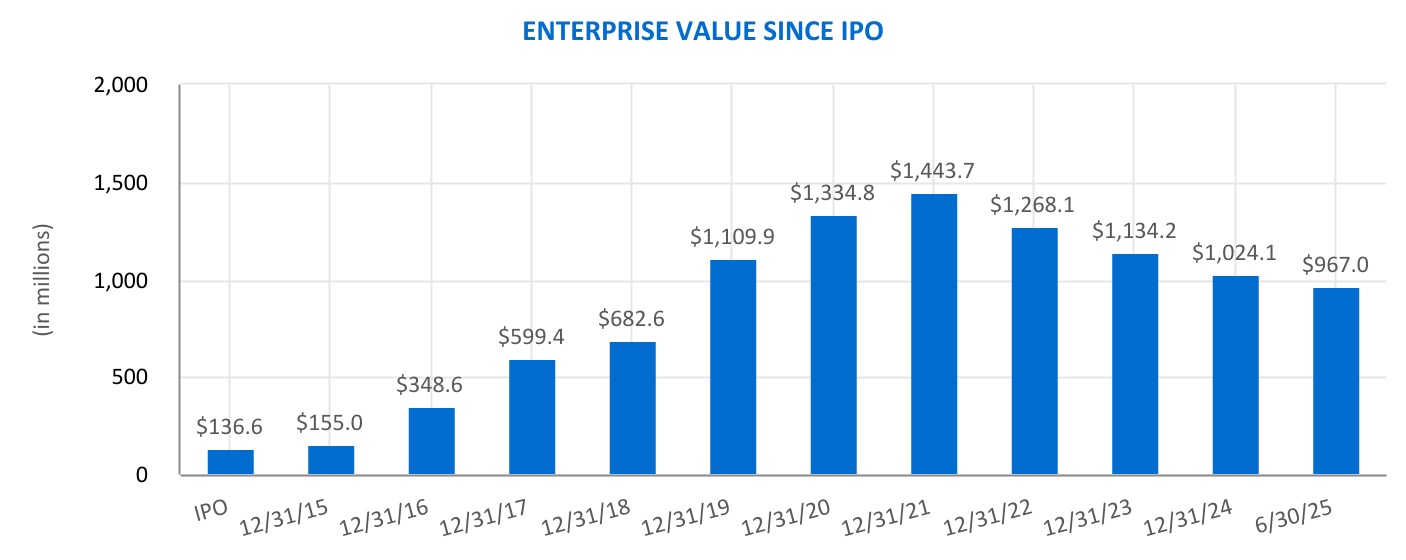

| Enterprise value | $ | 966,980 | $ | 1,008,376 | $ | 1,024,107 | $ | 983,479 | $ | 1,112,950 | ||||||||||

| Community Healthcare Trust | Page | 6 |

2Q 2025 | Supplemental Information | ||||||

| ||

| As of | |||||||||||||||||

| 2Q 2025 | 1Q 2025 | 4Q 2024 | 3Q 2024 | 2Q 2024 | |||||||||||||

ASSETS |

(Unaudited; Dollars and shares in thousands, except per share data) |

||||||||||||||||

Real estate properties |

|||||||||||||||||

Land and land improvements |

$ | 152,887 | $ | 149,506 | $ | 149,501 | $ | 146,118 | $ | 143,717 | |||||||

Buildings, improvements, and lease intangibles |

1,004,616 | 998,933 | 996,104 | 989,019 | 976,415 | ||||||||||||

Personal property |

809 | 333 | 326 | 326 | 318 | ||||||||||||

Total real estate properties |

1,158,312 | 1,148,772 | 1,145,931 | 1,135,463 | 1,120,450 | ||||||||||||

Less accumulated depreciation |

(262,961) | (253,537) | (242,609) | (232,747) | (221,834) | ||||||||||||

Total real estate properties, net |

895,351 | 895,235 | 903,322 | 902,716 | 898,616 | ||||||||||||

Cash and cash equivalents |

4,863 | 2,271 | 4,384 | 2,836 | 734 | ||||||||||||

| Assets held for sale, net | 5,465 | 6,755 | 6,755 | 6,351 | 7,326 | ||||||||||||

Other assets, net |

60,613 | 80,853 | 78,102 | 69,876 | 76,520 | ||||||||||||

Total assets |

$ | 966,292 | $ | 985,114 | $ | 992,563 | $ | 981,779 | $ | 983,196 | |||||||

LIABILITIES AND STOCKHOLDERS' EQUITY |

|||||||||||||||||

Liabilities |

|||||||||||||||||

Debt, net |

$ | 500,077 | $ | 496,016 | $ | 485,955 | $ | 473,716 | $ | 457,625 | |||||||

Accounts payable and accrued liabilities |

13,944 | 12,058 | 14,289 | 14,422 | 12,023 | ||||||||||||

Other liabilities, net |

14,451 | 15,719 | 16,354 | 16,489 | 15,777 | ||||||||||||

Total liabilities |

528,472 | 523,793 | 516,598 | 504,627 | 485,425 | ||||||||||||

Commitments and contingencies |

|||||||||||||||||

Stockholders' Equity |

|||||||||||||||||

Preferred stock, $0.01 par value; 50,000 shares authorized |

— | — | — | — | — | ||||||||||||

Common stock, $0.01 par value; 450,000 shares authorized |

284 | 283 | 282 | 282 | 280 | ||||||||||||

Additional paid-in capital |

712,498 | 706,776 | 704,524 | 702,014 | 699,833 | ||||||||||||

Cumulative net income |

74,709 | 87,266 | 85,675 | 83,843 | 82,094 | ||||||||||||

Accumulated other comprehensive gain |

9,121 | 12,402 | 17,631 | 10,016 | 21,490 | ||||||||||||

Cumulative dividends |

(358,792) | (345,406) | (332,147) | (319,003) | (305,926) | ||||||||||||

Total stockholders’ equity |

437,820 | 461,321 | 475,965 | 477,152 | 497,771 | ||||||||||||

Total liabilities and stockholders' equity |

$ | 966,292 | $ | 985,114 | $ | 992,563 | $ | 981,779 | $ | 983,196 | |||||||

| Community Healthcare Trust | Page | 7 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Three Months Ended | |||||||||||||||||

| 2Q 2025 | 1Q 2025 | 4Q 2024 | 3Q 2024 | 2Q 2024 | |||||||||||||

(Unaudited; Dollars and shares in thousands, except per share data) |

|||||||||||||||||

REVENUES |

|||||||||||||||||

Rental income |

$ | 30,128 | $ | 29,730 | $ | 28,983 | $ | 29,335 | $ | 27,905 | |||||||

Other operating interest |

(1,043) | 348 | 315 | 304 | (389) | ||||||||||||

| 29,085 | 30,078 | 29,298 | 29,639 | 27,516 | |||||||||||||

EXPENSES |

|||||||||||||||||

Property operating |

5,585 | 6,095 | 5,485 | 5,986 | 5,572 | ||||||||||||

General and administrative (1)(2) |

10,559 | 5,100 | 4,809 | 4,935 | 4,760 | ||||||||||||

Depreciation and amortization |

10,879 | 10,943 | 10,797 | 10,927 | 10,792 | ||||||||||||

| 27,023 | 22,138 | 21,091 | 21,848 | 21,124 | |||||||||||||

| OTHER (EXPENSE) INCOME | |||||||||||||||||

| Gains on sale, net of impairments of real estate assets | 640 | — | 14 | 5 | (140) | ||||||||||||

| Interest expense | (6,592) | (6,352) | (6,405) | (6,253) | (5,986) | ||||||||||||

| Credit loss reserve | (8,672) | — | — | — | (11,000) | ||||||||||||

| Interest and other income, net | 5 | 3 | 16 | 206 | 307 | ||||||||||||

| $ | (14,619) | $ | (6,349) | $ | (6,375) | $ | (6,042) | $ | (16,819) | ||||||||

| NET (LOSS) INCOME | $ | (12,557) | $ | 1,591 | $ | 1,832 | $ | 1,749 | $ | (10,427) | |||||||

| NET LOSS (INCOME) PER DILUTED COMMON SHARE | $ | (0.50) | $ | 0.03 | $ | 0.04 | $ | 0.04 | $ | (0.42) | |||||||

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING |

26,803 | 26,733 | 26,682 | 26,660 | 26,479 | ||||||||||||

DIVIDENDS DECLARED, PER COMMON SHARE, IN THE PERIOD |

$ | 0.4700 | $ | 0.4675 | $ | 0.4650 | $ | 0.4625 | $ | 0.4600 | |||||||

(1) GENERAL AND ADMINISTRATIVE EXPENSES: |

|||||||||||||||||

| Non-cash vs. Cash: | |||||||||||||||||

Non-cash (stock-based compensation) |

54.3 | % | 53.1 | % | 54.0 | % | 50.6 | % | 51.9 | % | |||||||

Cash |

45.7 | % | 46.9 | % | 46.0 | % | 49.4 | % | 48.1 | % | |||||||

| As a % of Revenue: | |||||||||||||||||

Non-cash (stock-based compensation) |

8.7 | % | 9.0 | % | 8.8 | % | 8.4 | % | 8.9 | % | |||||||

Cash |

7.3 | % | 7.9 | % | 7.5 | % | 8.2 | % | 8.3 | % | |||||||

| (2) General and administrative expenses for the three months ended June 30, 2025 includes the accelerated amortization of stock-based compensation totaling $4.6 million and severance and transition related expense totaling $1.3 million, recognized upon a termination. These amounts are not included in the calculations above in footnote (1). | |||||||||||||||||

| Community Healthcare Trust | Page | 8 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Three Months Ended | ||||||||||||||||||||

| 2Q 2025 | 1Q 2025 | 4Q 2024 | 3Q 2024 | 2Q 2024 | ||||||||||||||||

(Unaudited; Dollars and shares in thousands, except per share data) |

||||||||||||||||||||

NET (LOSS) INCOME (1)(2)(3) |

$ | (12,557) | $ | 1,591 | $ | 1,832 | $ | 1,749 | $ | (10,427) | ||||||||||

| Real estate depreciation and amortization | 10,861 | 11,077 | 10,927 | 11,077 | 10,895 | |||||||||||||||

| Credit loss reserve | 8,672 | — | — | — | 11,000 | |||||||||||||||

| Gains on sale, net of impairments of real estate assets | (640) | — | (14) | (5) | 140 | |||||||||||||||

FFO(1)(3) |

$ | 6,336 | $ | 12,668 | $ | 12,745 | $ | 12,821 | $ | 11,608 | ||||||||||

| Straight-line rent | (1,184) | (639) | (712) | (679) | 204 | |||||||||||||||

| Stock-based compensation | 2,531 | 2,710 | 2,597 | 2,497 | 2,469 | |||||||||||||||

| Accelerated amortization of stock-based compensation | 4,591 | — | — | — | — | |||||||||||||||

| Severance and transition related expenses | 1,311 | — | — | — | — | |||||||||||||||

AFFO(1)(3) |

$ | 13,585 | $ | 14,739 | $ | 14,630 | $ | 14,639 | $ | 14,281 | ||||||||||

| FFO PER COMMON SHARE | $ | 0.23 | $ | 0.47 | $ | 0.48 | $ | 0.48 | $ | 0.43 | ||||||||||

| AFFO PER COMMON SHARE | $ | 0.50 | $ | 0.55 | $ | 0.55 | $ | 0.55 | $ | 0.53 | ||||||||||

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING (4) |

27,011 | 27,007 | 26,786 | 26,853 | 26,791 | |||||||||||||||

| ________________ | ||||||||||||||||||||

(1) Net loss, FFO and AFFO for the second quarter of 2025 included interest receivable reserves totaling approximately $1.7 million, resulting in a reduction of $0.06 per diluted share for net loss, FFO, and AFFO. Net loss and FFO for the second quarter of 2024 included lease and interest receivable reserves totaling approximately $3.2 million, including straight-line rent of approximately $0.9 million, resulting in a reduction of FFO per diluted share of approximately $0.12 per diluted share. AFFO, which adds back straight-line rent, was reduced by approximately $0.09 per diluted share. | ||||||||||||||||||||

(2) Net loss for the second quarter of 2025 included an $8.7 million credit loss reserve related to notes receivable with a geriatric behavioral hospital tenant that are incidental to the Company's main business. Net loss for the second quarter 2024 included an $11.0 million credit loss reserve related to notes receivable with this tenant. | ||||||||||||||||||||

| (3) Net loss and FFO for the second quarter of 2025 included severance and transition-related charges totaling approximately $5.9 million, including approximately $4.6 million of non-cash accelerated amortization of stock-based compensation, which reduced FFO per diluted common share by approximately $0.22. | ||||||||||||||||||||

| (4) Restricted stock awards and Time-Based RSUs are included in the calculation of weighted average common shares outstanding to the extent that they are dilutive. Performance-based RSUs are included in the calculation of weighted average common shares outstanding to the extent that they are in-the-money as of the end of the reporting period and are dilutive. | ||||||||||||||||||||

AFFO, ADJUSTED FOR ACQUISITIONS (1) |

||||||||||||||||||||

| AFFO | $ | 13,585 | $ | 14,739 | $ | 14,630 | $ | 14,639 | $ | 14,281 | ||||||||||

Revenue on Properties Acquired in the period (2) |

122 | — | 205 | 34 | 98 | |||||||||||||||

Property operating expense adjustment (2) |

— | — | (48) | (2) | (10) | |||||||||||||||

Interest expense adjustment (3) |

— | (41) | (44) | (10) | (28) | |||||||||||||||

| AFFO, ADJUSTED FOR ACQUISITIONS | $ | 13,707 | $ | 14,698 | $ | 14,743 | $ | 14,661 | $ | 14,341 | ||||||||||

| (1) AFFO is adjusted to reflect acquisitions as if they had occurred on the first day of the applicable period. | ||||||||||||||||||||

| (2) Revenue and expense adjustments are calculated based on expected returns and leases in place at acquisition. | ||||||||||||||||||||

| (3) The interest expense adjustment was calculated using the weighted average interest rate on the Company's revolving credit facility. | ||||||||||||||||||||

| AMORTIZATION OF STOCK-BASED COMPENSATION | ||||||||||||||||||||

Amortization Required by GAAP (1)(2) |

$ | 2,531 | $ | 2,710 | $ | 2,597 | $ | 2,498 | $ | 2,153 | ||||||||||

Amortization Based on Legal Vesting Periods (2) |

2,035 | 2,208 | 2,073 | 2,019 | 1,782 | |||||||||||||||

| Acceleration of Amortization | $ | 496 | $ | 502 | $ | 524 | $ | 479 | $ | 371 | ||||||||||

| (1) GAAP requires that deferred compensation be amortized over the earlier of the vesting or retirement eligibility date. | ||||||||||||||||||||

| (2) Amortization amounts for the second quarter of 2025 do not include the accelerated amortization of stock-based compensation totaling $4.6 million recognized upon a termination. | ||||||||||||||||||||

| Community Healthcare Trust | Page | 9 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Three Months Ended | ||||||||||||||||||||

| 2Q 2025 | 1Q 2025 | 4Q 2024 | 3Q 2024 | 2Q 2024 | ||||||||||||||||

(Unaudited; Dollars and shares in thousands, except per share data) |

||||||||||||||||||||

| NET OPERATING INCOME | ||||||||||||||||||||

Net (loss) income (1)(2) |

$ | (12,557) | $ | 1,591 | $ | 1,832 | $ | 1,749 | $ | (10,427) | ||||||||||

General and administrative(3) |

4,657 | 5,100 | 4,809 | 4,935 | 4,760 | |||||||||||||||

| Severance and transition-related compensation | 5,902 | — | — | — | — | |||||||||||||||

| Depreciation and amortization | 10,879 | 10,943 | 10,797 | 10,927 | 10,792 | |||||||||||||||

| Gains on sale, net of impairments of real estate assets | (640) | — | (14) | (5) | 140 | |||||||||||||||

| Credit loss reserve | 8,672 | — | — | — | 11,000 | |||||||||||||||

| Interest expense | 6,592 | 6,352 | 6,405 | 6,253 | 5,986 | |||||||||||||||

| Interest and other income, net | (5) | (3) | (16) | (206) | (307) | |||||||||||||||

| NOI | $ | 23,500 | $ | 23,983 | $ | 23,813 | $ | 23,653 | $ | 21,944 | ||||||||||

EBITDAre and ADJUSTED EBITDAre |

||||||||||||||||||||

EBITDAre |

||||||||||||||||||||

Net (loss) income (1)(2) |

$ | (12,557) | $ | 1,591 | $ | 1,832 | $ | 1,749 | $ | (10,427) | ||||||||||

| Interest expense | 6,592 | 6,352 | 6,405 | 6,253 | 5,986 | |||||||||||||||

| Depreciation and amortization | 10,879 | 10,943 | 10,797 | 10,927 | 10,792 | |||||||||||||||

| Gains on sale, net of impairments of real estate assets | (640) | — | (14) | (5) | 140 | |||||||||||||||

EBITDAre |

$ | 4,274 | $ | 18,886 | $ | 19,020 | $ | 18,924 | $ | 6,491 | ||||||||||

| Non-cash stock-based compensation expense | 2,531 | 2,710 | 2,597 | 2,497 | 2,469 | |||||||||||||||

| Accelerated amortization of stock-based compensation | 4,591 | — | — | — | — | |||||||||||||||

| Credit loss reserve | 8,672 | — | — | — | 11,000 | |||||||||||||||

ADJUSTED EBITDAre |

$ | 20,068 | $ | 21,596 | $ | 21,617 | $ | 21,421 | $ | 19,960 | ||||||||||

ADJUSTED EBITDAre ANNUALIZED (4) |

$ | 80,272 | ||||||||||||||||||

| (1) | During the second quarter of 2025, the Company reversed interest totaling approximately $1.7 million related to a tenant. Net loss for the three months ended June 30, 2024 also included the reversal of rent and interest related to this tenant, totaling approximately $3.2 million, including straight-line rent of approximately $0.9 million. |

||||

| (2) | During the second quarter of 2025 the Company recorded severance and transition-related charges totaling approximately $5.9 million related to the termination of an employee, including approximately $4.6 of million non-cash accelerated amortization of stock-based compensation. | ||||

| (3) | Severance and transition-related compensation, which is included in general and administrative expenses on the income statement, is shown separately in the reconciliation above for the second quarter of 2025. | ||||

| (4) | Adjusted EBITDAre multiplied by 4. This annualized amount may differ significantly from the actual full year results. |

||||

| Community Healthcare Trust | Page | 10 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Three Months Ended | ||||||||||||||||||||

| 2Q 2025 | 1Q 2025 | 4Q 2024 | 3Q 2024 | 2Q 2024 | ||||||||||||||||

(Unaudited; Dollars and shares in thousands, except per share data) |

||||||||||||||||||||

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING (1) | ||||||||||||||||||||

| Weighted average common shares outstanding | 28,364 | 28,324 | 28,242 | 28,168 | 27,879 | |||||||||||||||

Unvested restricted shares |

(1,561) | (1,591) | (1,560) | (1,508) | (1,400) | |||||||||||||||

Weighted average common shares outstanding - EPS |

26,803 | 26,733 | 26,682 | 26,660 | 26,479 | |||||||||||||||

Weighted average common shares outstanding - FFO Basic |

26,803 | 26,733 | 26,682 | 26,660 | 26,479 | |||||||||||||||

| Potential dilutive common shares (from below) | 208 | 274 | 104 | 193 | 312 | |||||||||||||||

| Weighted average common shares outstanding - FFO Diluted | 27,011 | 27,007 | 26,786 | 26,853 | 26,791 | |||||||||||||||

| TREASURY SHARE CALCULATION | ||||||||||||||||||||

| Unrecognized deferred compensation-end of period | $ | 19,919 | $ | 25,420 | $ | 25,220 | $ | 27,575 | $ | 26,764 | ||||||||||

| Unrecognized deferred compensation-beginning of period | $ | 25,420 | $ | 25,668 | $ | 27,575 | $ | 26,168 | $ | 27,752 | ||||||||||

| Average unrecognized deferred compensation | $ | 22,670 | $ | 25,544 | $ | 26,398 | $ | 26,872 | $ | 27,258 | ||||||||||

| Average share price per share | $ | 16.50 | $ | 19.08 | $ | 18.13 | $ | 20.44 | $ | 24.30 | ||||||||||

| Treasury shares | 1,374 | 1,339 | 1,456 | 1,315 | 1,122 | |||||||||||||||

| Unvested restricted shares | (1,561) | (1,591) | (1,560) | (1,508) | (1,400) | |||||||||||||||

| Unvested restricted share units | (21) | (22) | — | — | (34) | |||||||||||||||

| Treasury shares | 1,374 | 1,339 | 1,456 | 1,315 | 1,122 | |||||||||||||||

| Potential dilutive common shares | 208 | 274 | 104 | 193 | 312 | |||||||||||||||

| (1) Restricted stock awards and time-based RSUs are included in the calculation of weighted average common shares outstanding if dilutive. Performance-based RSUs are included in the calculation of weighted average common shares outstanding to the extent that they in-the-money as of the end of the reporting period and are dilutive. | ||||||||||||||||||||

| Community Healthcare Trust | Page | 11 |

2Q 2025 | Supplemental Information | ||||||

| ||

As of June 30, 2025 |

|||||||||||

| Principal Balance |

Stated Rate |

Hedged Rate |

|||||||||

| (in thousands) | |||||||||||

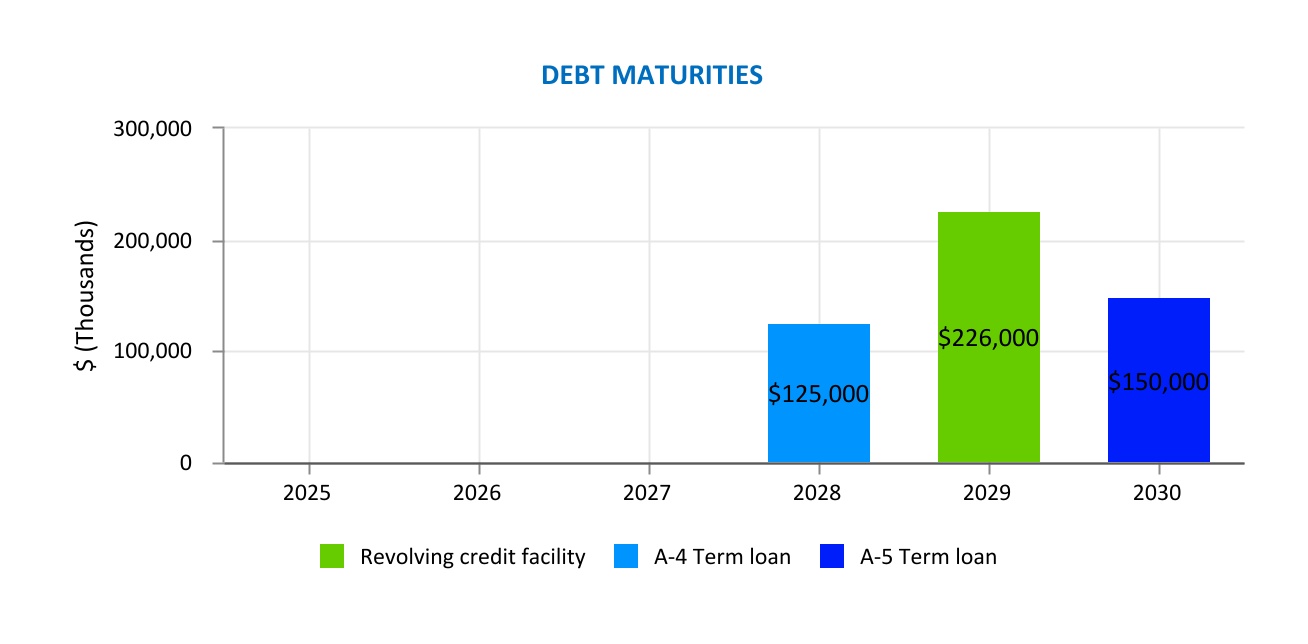

Revolving credit facility (1) |

$ | 226,000 | 5.99% | 3.84% (partial) | |||||||

| Term loan A-4 | 125,000 | 3.60% | |||||||||

| Term loan A-5 | 150,000 | 5.61% | |||||||||

| Debt | 501,000 | ||||||||||

| Deferred Financing Costs, net | (923) | ||||||||||

| Debt, net | $ | 500,077 | |||||||||

| Select Covenants | Required | As of June 30, 2025 |

||||||

| Leverage ratio | ≤ 60.0% | 42.4 | % | |||||

| Fixed charge coverage ratio | ≥ 1.50x | 3.0 | ||||||

| Tangible net worth (in thousands) | ≥ $504,476 | $679,724 | ||||||

| Secured indebtedness | ≤ 30.0% | — | % | |||||

| Minimum debt service coverage ratio | ≥ 2.0 | 3.3 | ||||||

| Community Healthcare Trust | Page | 12 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Property | Market | Property Type |

Date Acquired |

% Leased at Acquisition |

Purchase

Price

(in thousands)

|

Square Feet | ||||||||||||||

| TRT Recovery | Cartersville, GA | BSF | 3/6/2025 (1) |

100.0 | % | $ | 9,504 | 38,339 | ||||||||||||

| 100.0 | % | $ | 9,504 | 38,339 | ||||||||||||||||

| (1) The date acquired for the Cartersville, GA property is the date the Company closed on the transaction with the seller. The lease commenced on 4/4/2025. | ||||||||||||||||||||

| Community Healthcare Trust | Page | 13 |

2Q 2025 | Supplemental Information | ||||||

| ||

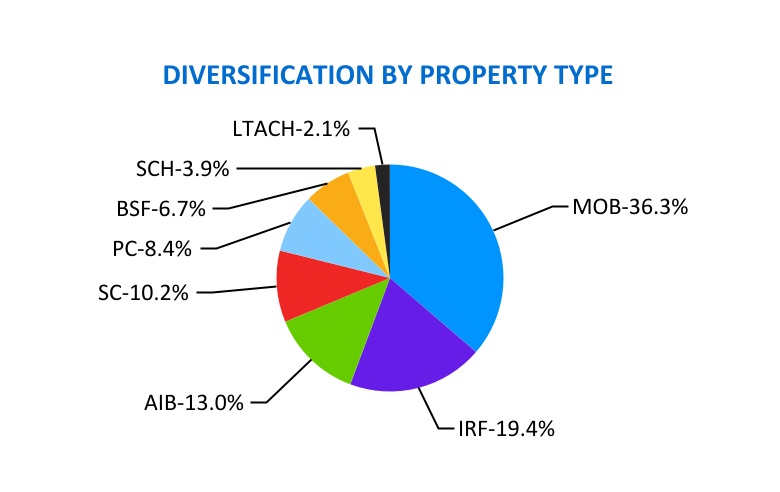

| Property Type | Annualized Rent (%) | ||||

| Medical Office Building (MOB) | 36.3 | % | |||

| Inpatient Rehabilitation Facilities (IRF) | 19.4 | % | |||

| Acute Inpatient Behavioral (AIB) | 13.0 | % | |||

| Specialty Centers (SC) | 10.2 | % | |||

| Physician Clinics (PC) | 8.4 | % | |||

| Behavioral Specialty Facilities (BSF) | 6.7 | % | |||

| Surgical Centers and Hospitals (SCH) | 3.9 | % | |||

| Long-term Acute Care Hospitals (LTACH) | 2.1 | % | |||

| Total | 100.0 | % | |||

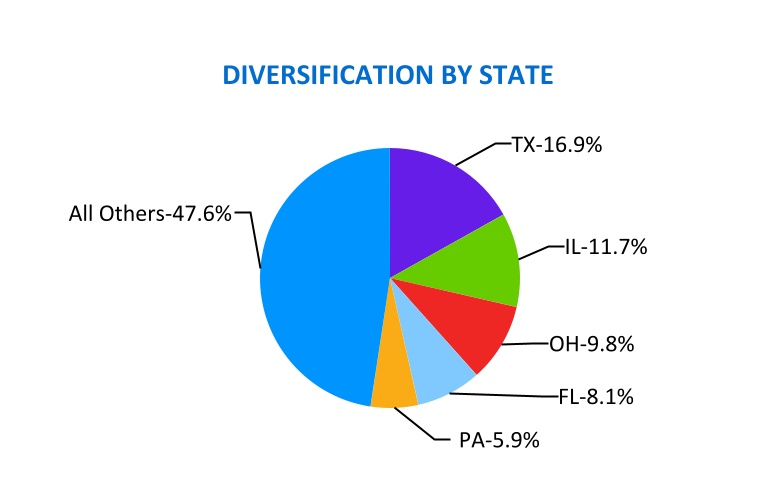

| State | Annualized Rent (%) |

||||

| Texas (TX) | 16.9 | % | |||

| Illinois (IL) | 11.7 | % | |||

| Ohio (OH) | 9.8 | % | |||

| Florida (FL) | 8.1 | % | |||

| Pennsylvania (PA) | 5.9 | % | |||

| All Others | 47.6 | % | |||

| Total | 100.0 | % | |||

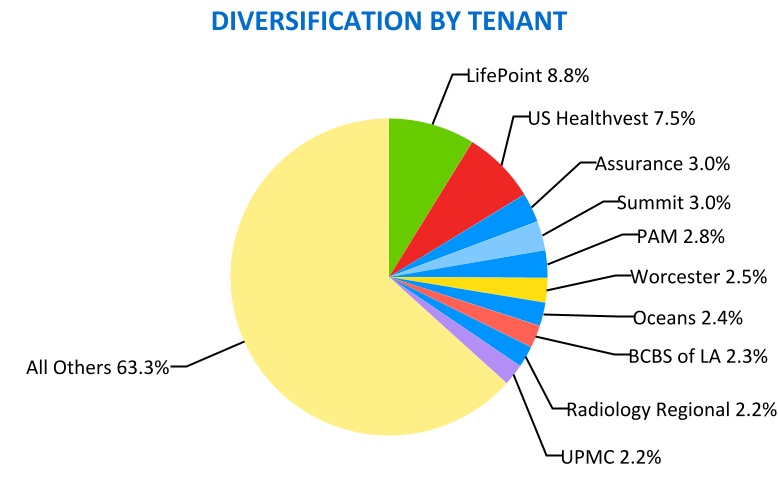

| Tenant | Annualized Rent (%) |

||||

| LifePoint Health (LifePoint) | 8.8 | % | |||

| US Healthvest | 7.5 | % | |||

| Assurance Health (Assurance) | 3.0 | % | |||

| Summit Behavioral Healthcare (Summit) | 3.0 | % | |||

| Post Acute Medical (PAM) | 2.8 | % | |||

| Worcester Behavioral Innovations Hospital (Worcester) | 2.5 | % | |||

| Oceans Behavioral (Oceans) | 2.4 | % | |||

| Blue Cross Blue Shield of Louisiana (BCBS of LA) | 2.3 | % | |||

| Radiology Regional | 2.2 | % | |||

| UPMC - University of Pittsburgh Medical Center (UPMC) | 2.2 | % | |||

| All Others | 63.3 | % | |||

| Total | 100.0 | % | |||

| Community Healthcare Trust | Page | 14 |

2Q 2025 | Supplemental Information | ||||||

| ||

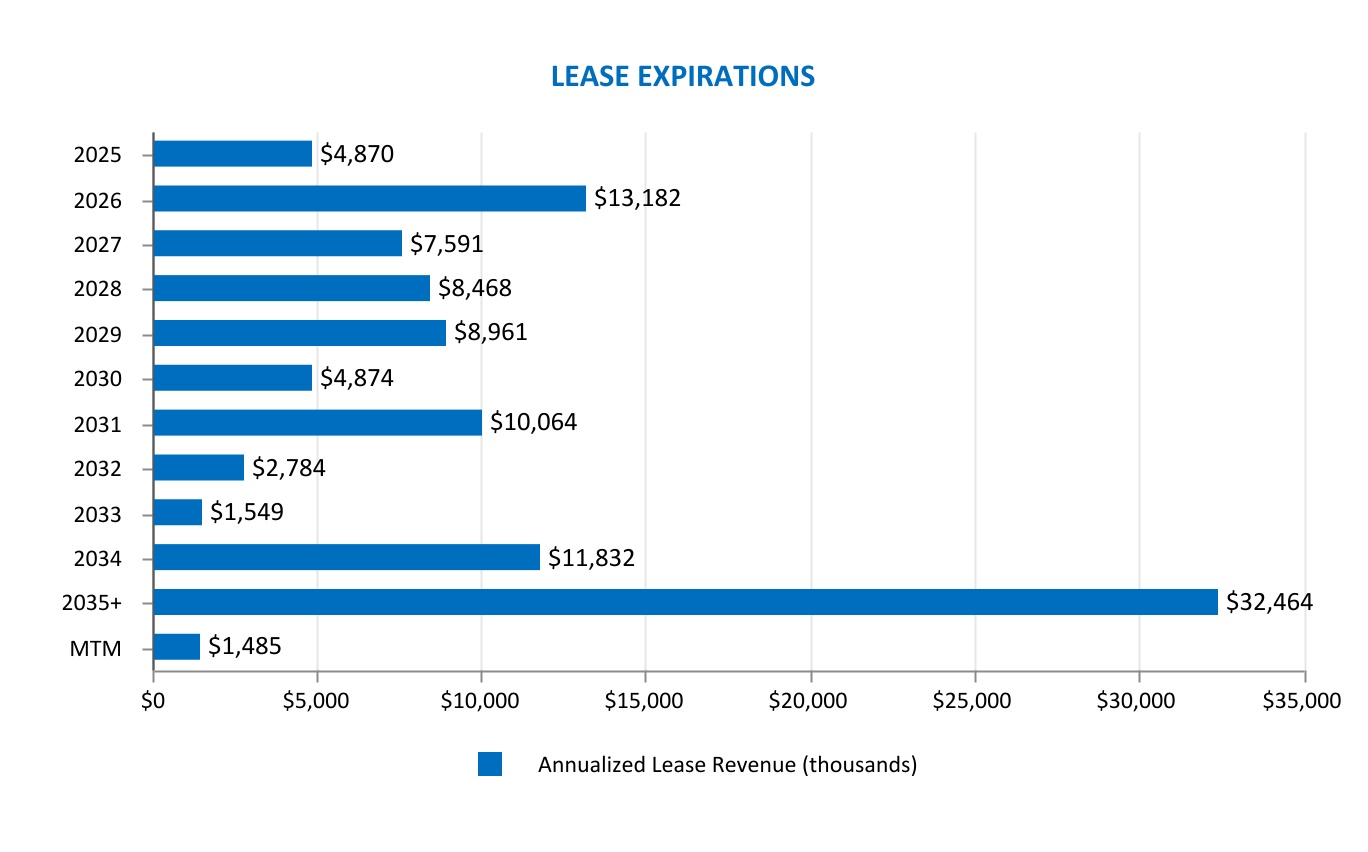

| Total Leased Sq. Ft. | Annualized Rent | |||||||||||||||||||

| Year | Number of Leases Expiring |

Amount

(thousands)

|

Percent (%) |

Amount ($)

(thousands)

|

Percent (%) | |||||||||||||||

| 2025 | 26 | 203 | 5.0 | % | $ | 4,870 | 4.5 | % | ||||||||||||

| 2026 | 82 | 594 | 14.6 | % | 13,182 | 12.2 | % | |||||||||||||

| 2027 | 63 | 363 | 8.9 | % | 7,591 | 7.0 | % | |||||||||||||

| 2028 | 62 | 398 | 9.8 | % | 8,468 | 7.8 | % | |||||||||||||

| 2029 | 42 | 352 | 8.7 | % | 8,961 | 8.3 | % | |||||||||||||

| 2030 | 28 | 199 | 4.9 | % | 4,874 | 4.5 | % | |||||||||||||

| 2031 | 25 | 363 | 8.9 | % | 10,064 | 9.3 | % | |||||||||||||

| 2032 | 18 | 169 | 4.2 | % | 2,784 | 2.6 | % | |||||||||||||

| 2033 | 14 | 80 | 2.0 | % | 1,549 | 1.4 | % | |||||||||||||

| 2034 | 21 | 304 | 7.5 | % | 11,832 | 10.9 | % | |||||||||||||

| Thereafter | 38 | 981 | 24.1 | % | 32,464 | 30.1 | % | |||||||||||||

| Month-to-Month | 18 | 57 | 1.4 | % | 1,485 | 1.4 | % | |||||||||||||

| Totals | 437 | 4,063 | 100.0 | % | $ | 108,124 | 100.0 | % | ||||||||||||

| Community Healthcare Trust | Page | 15 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Property Name | Property Type | Area | % of Square Feet | Annualized Rent ($000's) |

% of Annualized Rent |

Population | MSA/MISA | Rank | ||||||||||||||||||

| Lancaster MOB | MOB | 10,646 | 0.24 | % | $ | 124.8 | 0.12 | % | 12,927,614 | Los Angeles-Long Beach-Anaheim, CA | 2 | |||||||||||||||

| Congress Medical Building 350 | MOB | 17,543 | 0.39 | % | $ | 417.6 | 0.39 | % | 9,408,576 | Chicago-Naperville-Elgin, IL-IN | 3 | |||||||||||||||

| Congress Medical Building 390 | MOB | 30,855 | 0.68 | % | $ | 476.7 | 0.44 | % | 9,408,576 | Chicago-Naperville-Elgin, IL-IN | 3 | |||||||||||||||

| Future Diagnostics Group | SC | 8,876 | 0.20 | % | $ | 314.2 | 0.29 | % | 9,408,576 | Chicago-Naperville-Elgin, IL-IN | 3 | |||||||||||||||

| Gurnee Medical Office Building | MOB | 22,968 | 0.51 | % | $ | 305.2 | 0.28 | % | 9,408,576 | Chicago-Naperville-Elgin, IL-IN | 3 | |||||||||||||||

| New Lenox Medical Clinic | PC | 7,905 | 0.17 | % | $ | 385.0 | 0.36 | % | 9,408,576 | Chicago-Naperville-Elgin, IL-IN | 3 | |||||||||||||||

| Morris Medical Center | MOB | 18,470 | 0.41 | % | $ | 638.7 | 0.59 | % | 9,408,576 | Chicago-Naperville-Elgin, IL-IN | 3 | |||||||||||||||

| Oak Lawn Medical Plaza | MOB | 33,356 | 0.74 | % | $ | 460.7 | 0.43 | % | 9,408,576 | Chicago-Naperville-Elgin, IL-IN | 3 | |||||||||||||||

| Lincolnwood Medical Building | PC | 14,863 | 0.33 | % | $ | 317.0 | 0.29 | % | 9,408,576 | Chicago-Naperville-Elgin, IL-IN | 3 | |||||||||||||||

| Joliet Medical Building | SC | 44,888 | 0.99 | % | $ | 1,474.9 | 1.36 | % | 9,408,576 | Chicago-Naperville-Elgin, IL-IN | 3 | |||||||||||||||

| Endeavor Health | PC | 13,700 | 0.30 | % | $ | 284.3 | 0.26 | % | 9,408,576 | Chicago-Naperville-Elgin, IL-IN | 3 | |||||||||||||||

| Skin MD | PC | 13,565 | 0.30 | % | $ | 526.3 | 0.49 | % | 9,408,576 | Chicago-Naperville-Elgin, IL-IN | 3 | |||||||||||||||

| Chicago Behavioral Hospital | AIB | 85,000 | 1.88 | % | $ | 2,270.7 | 2.10 | % | 9,408,576 | Chicago-Naperville-Elgin, IL-IN | 3 | |||||||||||||||

| US HealthVest - Lake | AIB | 83,658 | 1.85 | % | $ | 3,009.0 | 2.78 | % | 9,408,576 | Chicago-Naperville-Elgin, IL-IN | 3 | |||||||||||||||

| Texas Rehabilitation Hospital of Fort Worth, LLC | IRF | 39,761 | 0.88 | % | $ | 2,068.5 | 1.91 | % | 8,344,032 | Dallas-Fort Worth-Arlington, TX | 4 | |||||||||||||||

| Bayside Medical Center | MOB | 50,593 | 1.12 | % | $ | 1,121.5 | 1.04 | % | 7,796,182 | Houston-Pasadena-The Woodlands, TX | 5 | |||||||||||||||

| Gessner Road MOB | MOB | 14,347 | 0.32 | % | $ | 361.5 | 0.33 | % | 7,796,182 | Houston-Pasadena-The Woodlands, TX | 5 | |||||||||||||||

| Clear Lake Institute for Rehabilitation | IRF | 55,646 | 1.23 | % | $ | 3,060.7 | 2.83 | % | 7,796,182 | Houston-Pasadena-The Woodlands, TX | 5 | |||||||||||||||

| Clinton Towers MOB | MOB | 37,344 | 0.83 | % | $ | 976.8 | 0.90 | % | 6,436,603 | Washington-Arlington-Alexandria, DC-VA-MD-WV | 7 | |||||||||||||||

| 2301 Research Boulevard | MOB | 93,079 | 2.06 | % | $ | 1,916.7 | 1.77 | % | 6,436,489 | Washington-Arlington-Alexandria, DC-VA-MD-WV | 7 | |||||||||||||||

| TRT Recovery Cartersville, LLC | BSF | 38,339 | 0.85 | % | $ | 524.4 | 0.48 | % | 6,411,149 | Atlanta-Sandy Springs-Roswell, GA | 8 | |||||||||||||||

| Haddon Hill Professional Center | MOB | 25,118 | 0.56 | % | $ | 239.2 | 0.22 | % | 6,330,422 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | 9 | |||||||||||||||

| Hopebridge - Westlake | BSF | 15,057 | 0.33 | % | $ | 235.9 | 0.22 | % | 6,330,422 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | 9 | |||||||||||||||

| Continuum Wellness Center | MOB | 8,227 | 0.18 | % | $ | 168.4 | 0.16 | % | 5,186,958 | Phoenix-Mesa-Chandler, AZ | 10 | |||||||||||||||

| Virtuous Health Center | SCH | 11,722 | 0.26 | % | $ | 136.6 | 0.13 | % | 5,186,958 | Phoenix-Mesa-Chandler, AZ | 10 | |||||||||||||||

| Desert Mtn Health Center | BSF | 14,046 | 0.31 | % | $ | 532.8 | 0.49 | % | 5,186,958 | Phoenix-Mesa-Chandler, AZ | 10 | |||||||||||||||

| Associated Surgical Center of Dearborn | SCH | 12,400 | 0.27 | % | $ | 369.5 | 0.34 | % | 4,400,578 | Detroit-Warren-Dearborn, MI | 14 | |||||||||||||||

| Berry Surgical Center | SCH | 27,217 | 0.60 | % | $ | 640.2 | 0.59 | % | 4,400,578 | Detroit-Warren-Dearborn, MI | 14 | |||||||||||||||

| Community Healthcare Trust | Page | 16 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Property Name | Property Type | Area | % of Square Feet | Annualized Rent ($000's) |

% of Annualized Rent |

Population | MSA/MISA | Rank | ||||||||||||||||||

| Smokey Point Behavioral Hospital | AIB | 70,100 | 1.55 | % | $ | 2,814.4 | 2.60 | % | 4,145,494 | Seattle-Tacoma-Bellevue, WA | 15 | |||||||||||||||

| Sanford Health Bemidji 1611 | MOB | 45,800 | 1.01 | % | $ | 1,569.2 | 1.45 | % | 3,757,952 | Minneapolis-St. Paul-Bloomington, MN-WI | 16 | |||||||||||||||

| Sanford Health Bemidji 1705 | MOB | 28,900 | 0.64 | % | $ | 636.8 | 0.59 | % | 3,757,952 | Minneapolis-St. Paul-Bloomington, MN-WI | 16 | |||||||||||||||

| Bay Area Physicians Center | MOB | 17,943 | 0.40 | % | $ | 414.0 | 0.38 | % | 3,424,560 | Tampa-St. Petersburg-Clearwater, FL | 17 | |||||||||||||||

| Sanderling Dialysis Center - 2102 | SC | 11,300 | 0.25 | % | $ | 438.9 | 0.41 | % | 3,298,799 | San Diego-Chula Vista-Carlsbad, CA | 18 | |||||||||||||||

| Liberty Dialysis | SC | 8,450 | 0.19 | % | $ | 262.9 | 0.24 | % | 3,052,498 | Denver-Aurora-Centennial, CO | 19 | |||||||||||||||

| Bassin Center For Plastic-Surgery-Villages | PC | 2,894 | 0.06 | % | $ | 178.5 | 0.17 | % | 2,940,513 | Orlando-Kissimmee-Sanford, FL | 20 | |||||||||||||||

| Bassin Center For Plastic Surgery-Orlando | PC | 2,420 | 0.05 | % | $ | 149.3 | 0.14 | % | 2,940,513 | Orlando-Kissimmee-Sanford, FL | 20 | |||||||||||||||

| Kissimmee Medical Plaza | PC | 4,902 | 0.11 | % | $ | — | — | % | 2,940,513 | Orlando-Kissimmee-Sanford, FL | 20 | |||||||||||||||

| Orthopaedic Associates of Osceola | PC | 15,167 | 0.34 | % | $ | 368.3 | 0.34 | % | 2,940,513 | Orlando-Kissimmee-Sanford, FL | 20 | |||||||||||||||

| Medical Village at Wintergarden | MOB | 21,532 | 0.48 | % | $ | 624.6 | 0.58 | % | 2,940,513 | Orlando-Kissimmee-Sanford, FL | 20 | |||||||||||||||

| Waters Edge Medical | MOB | 23,388 | 0.52 | % | $ | 402.3 | 0.37 | % | 2,859,024 | Baltimore-Columbia-Towson, MD | 22 | |||||||||||||||

| Northbay Professional Pavilion | MOB | 19,656 | 0.43 | % | $ | 487.1 | 0.45 | % | 2,859,024 | Baltimore-Columbia-Towson, MD | 22 | |||||||||||||||

| Righttime Medical Care | SC | 6,236 | 0.14 | % | $ | 359.5 | 0.33 | % | 2,859,024 | Baltimore-Columbia-Towson, MD | 22 | |||||||||||||||

| Belleville Medical Office | PC | 6,487 | 0.14 | % | $ | — | — | % | 2,811,927 | St. Louis, MO-IL | 23 | |||||||||||||||

| Eyecare Partners - 1310 | PC | 5,560 | 0.12 | % | $ | 54.2 | 0.05 | % | 2,811,927 | St. Louis, MO-IL | 23 | |||||||||||||||

| Eyecare Partners - 3990 | SCH | 16,608 | 0.37 | % | $ | 310.6 | 0.29 | % | 2,811,927 | St. Louis, MO-IL | 23 | |||||||||||||||

| Eyecare Partners - 204 | PC | 6,311 | 0.14 | % | $ | 50.7 | 0.05 | % | 2,811,927 | St. Louis, MO-IL | 23 | |||||||||||||||

| Heartland Women's Healthcare of Advantia Shiloh | PC | 16,212 | 0.36 | % | $ | 357.7 | 0.33 | % | 2,811,927 | St. Louis, MO-IL | 23 | |||||||||||||||

| Heartland Women's Healthcare of Advantia Wentzville | PC | 7,900 | 0.17 | % | $ | 137.0 | 0.13 | % | 2,811,927 | St. Louis, MO-IL | 23 | |||||||||||||||

| Baptist Health | PC | 13,500 | 0.30 | % | $ | 376.1 | 0.35 | % | 2,763,006 | San Antonio-New Braunfels, TX | 24 | |||||||||||||||

| San Antonio Head & Neck Surgical Associates | PC | 6,500 | 0.14 | % | $ | 195.5 | 0.18 | % | 2,763,006 | San Antonio-New Braunfels, TX | 24 | |||||||||||||||

| Rehabilitation Institute of South San Antonio | IRF | 38,000 | 0.84 | % | $ | 2,170.6 | 2.01 | % | 2,763,006 | San Antonio-New Braunfels, TX | 24 | |||||||||||||||

| JDH Professional Building | MOB | 12,376 | 0.27 | % | $ | 261.9 | 0.24 | % | 2,763,006 | San Antonio-New Braunfels, TX | 24 | |||||||||||||||

| The Heart & Vascular Center | PC | 15,878 | 0.35 | % | $ | 315.5 | 0.29 | % | 2,429,917 | Pittsburgh, PA | 28 | |||||||||||||||

| Butler Medical Center | MOB | 10,116 | 0.22 | % | $ | 273.3 | 0.25 | % | 2,429,917 | Pittsburgh, PA | 28 | |||||||||||||||

| Forefront Dermatology Building | PC | 15,650 | 0.35 | % | $ | 362.9 | 0.34 | % | 2,429,917 | Pittsburgh, PA | 28 | |||||||||||||||

| Greentree Primary Care | MOB | 34,077 | 0.75 | % | $ | 890.9 | 0.82 | % | 2,429,917 | Pittsburgh, PA | 28 | |||||||||||||||

| Vascular Access Centers of Southern Nevada | SC | 4,800 | 0.11 | % | $ | 127.5 | 0.12 | % | 2,398,871 | Las Vegas-Henderson-North Las Vegas, NV | 29 | |||||||||||||||

| Assurance Health System - 11690 | BSF | 14,381 | 0.32 | % | $ | 588.7 | 0.54 | % | 2,302,815 | Cincinnati, OH-KY-IN | 30 | |||||||||||||||

| Community Healthcare Trust | Page | 17 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Property Name | Property Type | Area | % of Square Feet | Annualized Rent ($000's) |

% of Annualized Rent |

Population | MSA/MISA | Rank | ||||||||||||||||||

| Cavalier Medical & Dialysis Center | MOB | 17,614 | 0.39 | % | $ | 221.7 | 0.21 | % | 2,302,815 | Cincinnati, OH-KY-IN | 30 | |||||||||||||||

| 51 Cavalier Blvd | MOB | 17,935 | 0.40 | % | $ | 180.9 | 0.17 | % | 2,302,815 | Cincinnati, OH-KY-IN | 30 | |||||||||||||||

| Anderson Ferry Plaza | MOB | 43,791 | 0.97 | % | $ | 562.0 | 0.52 | % | 2,302,815 | Cincinnati, OH-KY-IN | 30 | |||||||||||||||

| Liberty Rehabilitation Hospital | IRF | 37,720 | 0.83 | % | $ | 2,518.8 | 2.33 | % | 2,302,815 | Cincinnati, OH-KY-IN | 30 | |||||||||||||||

| Florence Medical Building | MOB | 17,845 | 0.39 | % | $ | 259.4 | 0.24 | % | 2,302,815 | Cincinnati, OH-KY-IN | 30 | |||||||||||||||

| Prairie Star Medical Facility I | MOB | 24,724 | 0.55 | % | $ | 638.2 | 0.59 | % | 2,253,579 | Kansas City, MO-KS | 31 | |||||||||||||||

| Prairie Star Medical Facility II | MOB | 24,840 | 0.55 | % | $ | 153.2 | 0.14 | % | 2,253,579 | Kansas City, MO-KS | 31 | |||||||||||||||

| Ravines Edge | MOB | 16,751 | 0.37 | % | $ | 265.7 | 0.25 | % | 2,225,377 | Columbus, OH | 32 | |||||||||||||||

| Hope Valley Recovery - Circleville | BSF | 7,787 | 0.17 | % | $ | 82.6 | 0.08 | % | 2,225,377 | Columbus, OH | 32 | |||||||||||||||

| Hopebridge - Columbus | BSF | 13,969 | 0.31 | % | $ | 175.2 | 0.16 | % | 2,225,377 | Columbus, OH | 32 | |||||||||||||||

| Sedalia Medical Center | MOB | 19,426 | 0.43 | % | $ | 342.8 | 0.32 | % | 2,225,377 | Columbus, OH | 32 | |||||||||||||||

| Assurance Health, LLC | BSF | 10,200 | 0.23 | % | $ | 383.9 | 0.36 | % | 2,174,833 | Indianapolis-Carmel-Greenwood, IN | 33 | |||||||||||||||

| Assurance Health System - 900 | BSF | 13,722 | 0.30 | % | $ | 523.8 | 0.48 | % | 2,174,833 | Indianapolis-Carmel-Greenwood, IN | 33 | |||||||||||||||

| Kindred Hospital Indianapolis North | LTACH | 37,270 | 0.82 | % | $ | 1,652.4 | 1.53 | % | 2,174,833 | Indianapolis-Carmel-Greenwood, IN | 33 | |||||||||||||||

| Brook Park Medical Building | MOB | 18,444 | 0.41 | % | $ | 291.8 | 0.27 | % | 2,171,877 | Cleveland, OH | 34 | |||||||||||||||

| Smith Road | MOB | 16,802 | 0.37 | % | $ | 326.4 | 0.30 | % | 2,171,877 | Cleveland, OH | 34 | |||||||||||||||

| Assurance - Hudson | BSF | 13,290 | 0.29 | % | $ | 586.6 | 0.54 | % | 2,171,877 | Cleveland, OH | 34 | |||||||||||||||

| Rockside Medical Center | MOB | 55,316 | 1.22 | % | $ | 438.4 | 0.41 | % | 2,171,877 | Cleveland, OH | 34 | |||||||||||||||

| Virginia Orthopaedic & Spine Specialists | PC | 8,445 | 0.19 | % | $ | 159.3 | 0.15 | % | 1,794,278 | Virginia Beach-Chesapeake-Norfolk, VA-NC | 37 | |||||||||||||||

| LTAC Hospital of SE Massachusetts | LTACH | 70,657 | 1.56 | % | $ | 646.4 | 0.60 | % | 1,700,901 | Providence-Warwick, RI-MA | 39 | |||||||||||||||

| Warwick Oncology Center | SC | 10,236 | 0.23 | % | $ | 317.3 | 0.29 | % | 1,700,901 | Providence-Warwick, RI-MA | 39 | |||||||||||||||

| South County Hospital | PC | 13,268 | 0.29 | % | $ | 323.9 | 0.30 | % | 1,700,901 | Providence-Warwick, RI-MA | 39 | |||||||||||||||

| Warwick Medical Office | PC | 7,340 | 0.16 | % | $ | — | — | % | 1,700,901 | Providence-Warwick, RI-MA | 39 | |||||||||||||||

| Mercy Rehabilitation Hospital | IRF | 39,637 | 0.88 | % | $ | 2,068.5 | 1.91 | % | 1,497,821 | Oklahoma City, OK | 42 | |||||||||||||||

| Memphis Center | MOB | 11,669 | 0.26 | % | $ | 241.7 | 0.22 | % | 1,339,345 | Memphis, TN-MS-AR | 45 | |||||||||||||||

| Sanderling Dialysis Center - 7710 | SC | 10,133 | 0.22 | % | $ | 584.8 | 0.54 | % | 1,339,345 | Memphis, TN-MS-AR | 45 | |||||||||||||||

| Gardendale MOB | MOB | 12,956 | 0.29 | % | $ | 325.6 | 0.30 | % | 1,192,583 | Birmingham, AL | 47 | |||||||||||||||

| Glastonbury | MOB | 48,375 | 1.07 | % | $ | 949.2 | 0.88 | % | 1,169,048 | Hartford-West Hartford-East Hartford, CT | 50 | |||||||||||||||

| Sterling Medical Center | MOB | 28,478 | 0.63 | % | $ | 524.5 | 0.49 | % | 1,160,172 | Buffalo-Cheektowaga, NY | 51 | |||||||||||||||

| Los Alamos Professional Plaza | MOB | 43,395 | 0.96 | % | $ | 422.2 | 0.39 | % | 914,820 | McAllen-Edinburg-Mission, TX | 64 | |||||||||||||||

| UMass Memorial Health Cancer Center | SC | 20,046 | 0.44 | % | $ | 844.8 | 0.78 | % | 881,248 | Worcester, MA | 68 | |||||||||||||||

| Worcester Behavioral | AIB | 81,972 | 1.81 | % | $ | 2,772.2 | 2.56 | % | 881,248 | Worcester, MA | 68 | |||||||||||||||

| Community Healthcare Trust | Page | 18 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Property Name | Property Type | Area | % of Square Feet | Annualized Rent ($000's) |

% of Annualized Rent |

Population | MSA/MISA | Rank | ||||||||||||||||||

| El Paso Rehabilitation Hospital | IRF | 38,000 | 0.84 | % | $ | 2,170.6 | 2.01 | % | 879,392 | El Paso, TX | 69 | |||||||||||||||

| Columbia Gastroenterology Surgery Center | PC | 17,016 | 0.38 | % | $ | 349.8 | 0.32 | % | 870,193 | Columbia, SC | 70 | |||||||||||||||

| Genesis Care - Bonita Springs | SC | 4,445 | 0.10 | % | $ | 297.0 | 0.27 | % | 860,959 | Cape Coral-Fort Myers, FL | 72 | |||||||||||||||

| Cape Coral Suite 3 | SC | 12,130 | 0.27 | % | $ | 463.9 | 0.43 | % | 860,959 | Cape Coral-Fort Myers, FL | 72 | |||||||||||||||

| Cape Coral Suite 3A | MOB | 2,023 | 0.04 | % | $ | 40.2 | 0.04 | % | 860,959 | Cape Coral-Fort Myers, FL | 72 | |||||||||||||||

| Cape Coral Suite 5 & 6 | MOB | 6,379 | 0.14 | % | $ | 104.3 | 0.10 | % | 860,959 | Cape Coral-Fort Myers, FL | 72 | |||||||||||||||

| Colonial Blvd Office | SC | 46,356 | 1.02 | % | $ | — | — | % | 860,959 | Cape Coral-Fort Myers, FL | 72 | |||||||||||||||

| Corporate Office 3660 | MOB | 22,104 | 0.49 | % | $ | 639.0 | 0.59 | % | 860,959 | Cape Coral-Fort Myers, FL | 72 | |||||||||||||||

| Corporate Annex Building | MOB | 16,000 | 0.35 | % | $ | 319.4 | 0.30 | % | 860,959 | Cape Coral-Fort Myers, FL | 72 | |||||||||||||||

| Wildwood Hammock RPET Facility | SC | 10,832 | 0.24 | % | $ | 442.0 | 0.41 | % | 860,959 | Cape Coral-Fort Myers, FL | 72 | |||||||||||||||

| Wildwood Hammock - Diagnostic Imaging | SC | 9,376 | 0.21 | % | $ | 417.8 | 0.39 | % | 860,959 | Cape Coral-Fort Myers, FL | 72 | |||||||||||||||

| Wildwood Hammock - Northland | MOB | 1,201 | 0.03 | % | $ | 13.8 | 0.01 | % | 860,959 | Cape Coral-Fort Myers, FL | 72 | |||||||||||||||

| Eye Health of America 4101 | MOB | 43,322 | 0.96 | % | $ | 1,015.6 | 0.94 | % | 860,959 | Cape Coral-Fort Myers, FL | 72 | |||||||||||||||

| Eye Health of America 2665 | MOB | 3,200 | 0.07 | % | $ | 55.6 | 0.05 | % | 860,959 | Cape Coral-Fort Myers, FL | 72 | |||||||||||||||

| Eye Health of America 1320 | MOB | 6,757 | 0.15 | % | $ | 80.9 | 0.07 | % | 860,959 | Cape Coral-Fort Myers, FL | 72 | |||||||||||||||

| Parkway Professional Plaza | MOB | 41,909 | 0.93 | % | $ | 1,000.3 | 0.93 | % | 852,878 | Lakeland-Winter Haven, FL | 73 | |||||||||||||||

| Davita Turner Road | SC | 18,125 | 0.40 | % | $ | 365.4 | 0.34 | % | 821,740 | Dayton-Kettering-Beavercreek, OH | 76 | |||||||||||||||

| Davita Springboro Pike | SC | 10,510 | 0.23 | % | $ | 188.7 | 0.17 | % | 821,740 | Dayton-Kettering-Beavercreek, OH | 76 | |||||||||||||||

| Davita Business Center Court | SC | 12,988 | 0.29 | % | $ | 237.6 | 0.22 | % | 821,740 | Dayton-Kettering-Beavercreek, OH | 76 | |||||||||||||||

| Mercy One Physicians Clinic | PC | 17,318 | 0.38 | % | $ | 406.2 | 0.38 | % | 753,913 | Des Moines-West Des Moines, IA | 82 | |||||||||||||||

| Daytona Medical Office | MOB | 20,193 | 0.45 | % | $ | 378.1 | 0.35 | % | 739,516 | Deltona-Daytona Beach-Ormond Beach, FL | 83 | |||||||||||||||

| Debary Professional Plaza | MOB | 21,874 | 0.48 | % | $ | 298.3 | 0.28 | % | 739,516 | Deltona-Daytona Beach-Ormond Beach, FL | 83 | |||||||||||||||

| UW Health Clinic- Portage | PC | 14,000 | 0.31 | % | $ | 335.6 | 0.31 | % | 707,606 | Madison, WI | 85 | |||||||||||||||

| Novus Clinic | SCH | 14,315 | 0.32 | % | $ | 305.2 | 0.28 | % | 702,209 | Akron, Oh | 87 | |||||||||||||||

| Aurora Health Center | PC | 11,000 | 0.24 | % | $ | — | — | % | 702,209 | Akron, Oh | 87 | |||||||||||||||

| Cypress Medical Center | MOB | 39,746 | 0.88 | % | $ | 238.8 | 0.22 | % | 661,217 | Wichita, KS | 89 | |||||||||||||||

| Family Medicine East | PC | 16,581 | 0.37 | % | $ | 341.6 | 0.32 | % | 661,217 | Wichita, KS | 89 | |||||||||||||||

| Wichita Medical Clinic | PC | 18,681 | 0.41 | % | $ | — | — | % | 661,217 | Wichita, KS | 89 | |||||||||||||||

| Bassin Center For Plastic Surgery-Melbourne | PC | 5,228 | 0.12 | % | $ | 322.5 | 0.30 | % | 658,447 | Palm Bay-Melbourne-Titusville, FL | 90 | |||||||||||||||

| Pennsylvania Gastroenterology | PC | 20,400 | 0.45 | % | $ | 587.4 | 0.54 | % | 615,361 | Harrisburg-Carlisle, PA | 94 | |||||||||||||||

| Penn State Health - Camp Hill | SC | 8,400 | 0.19 | % | $ | 183.6 | 0.17 | % | 615,361 | Harrisburg-Carlisle, PA | 94 | |||||||||||||||

| Penn State Health - Harrisburg | SC | 10,000 | 0.22 | % | $ | 197.9 | 0.18 | % | 615,361 | Harrisburg-Carlisle, PA | 94 | |||||||||||||||

| Community Healthcare Trust | Page | 19 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Property Name | Property Type | Area | % of Square Feet | Annualized Rent ($000's) |

% of Annualized Rent |

Population | MSA/MISA | Rank | ||||||||||||||||||

| Mercy Rehabilitation Hospital - Northwest Arkansas | IRF | 38,817 | 0.86 | % | $ | 2,296.1 | 2.12 | % | 605,615 | Fayetteville-Springdale-Rogers, AR | 96 | |||||||||||||||

| Perrysburg Medical Arts Building | MOB | 26,585 | 0.59 | % | $ | 502.3 | 0.46 | % | 601,396 | Toledo, OH | 98 | |||||||||||||||

| Sunforest Ct Medical Center | MOB | 23,368 | 0.52 | % | $ | 332.8 | 0.31 | % | 601,396 | Toledo, OH | 98 | |||||||||||||||

| Assurance - Toledo | BSF | 13,290 | 0.29 | % | $ | 551.3 | 0.51 | % | 601,396 | Toledo, OH | 98 | |||||||||||||||

| Granite Circle | MOB | 17,164 | 0.38 | % | $ | 241.0 | 0.22 | % | 601,396 | Toledo, OH | 98 | |||||||||||||||

| Cardiology Associates of Greater Waterbury | PC | 16,793 | 0.37 | % | $ | 348.5 | 0.32 | % | 576,718 | New Haven, CT | 100 | |||||||||||||||

| Eynon Surgery Center | SCH | 6,500 | 0.14 | % | $ | — | — | % | 574,009 | Scranton--Wilkes-Barre, PA | 102 | |||||||||||||||

| Riverview Medical Center | MOB | 26,427 | 0.58 | % | $ | 397.4 | 0.37 | % | 574,009 | Scranton--Wilkes-Barre, PA | 102 | |||||||||||||||

| NEI - 200 | MOB | 22,743 | 0.50 | % | $ | 409.4 | 0.38 | % | 574,009 | Scranton--Wilkes-Barre, PA | 102 | |||||||||||||||

| NEI - 204 | MOB | 15,768 | 0.35 | % | $ | 236.4 | 0.22 | % | 574,009 | Scranton--Wilkes-Barre, PA | 102 | |||||||||||||||

| Grandview Plaza | MOB | 20,042 | 0.44 | % | $ | 315.8 | 0.29 | % | 563,293 | Lancaster, PA | 104 | |||||||||||||||

| Pinnacle Health | PC | 10,753 | 0.24 | % | $ | 250.0 | 0.23 | % | 563,293 | Lancaster, PA | 104 | |||||||||||||||

| Manteca Medical Group Building | MOB | 10,519 | 0.23 | % | $ | 323.5 | 0.30 | % | 556,972 | Modesto, CA | 105 | |||||||||||||||

| Treasure Coast Medical Pavilion | MOB | 55,844 | 1.23 | % | $ | 943.2 | 0.87 | % | 556,336 | Port St. Lucie, FL | 106 | |||||||||||||||

| Gulf Coast Cancer Centers-Brewton | SC | 3,971 | 0.09 | % | $ | — | — | % | 542,297 | Huntsville, AL | 107 | |||||||||||||||

| Temple Rehabilitation Hospital | IRF | 38,817 | 0.86 | % | $ | 2,314.5 | 2.14 | % | 509,487 | Killeen-Temple, TX | 110 | |||||||||||||||

| Martin Foot & Ankle Clinic | PC | 27,100 | 0.60 | % | $ | 431.7 | 0.40 | % | 471,240 | York-Hanover, PA | 116 | |||||||||||||||

| UPMC Specialty Care | MOB | 25,982 | 0.57 | % | $ | 453.4 | 0.42 | % | 426,086 | Youngstown-Warren, OH | 131 | |||||||||||||||

| Biltmore Medical Office | SC | 11,099 | 0.25 | % | $ | 222.4 | 0.21 | % | 422,333 | Asheville, NC | 132 | |||||||||||||||

| Genesis Care - Weaverville | SC | 10,696 | 0.24 | % | $ | 469.8 | 0.43 | % | 422,333 | Asheville, NC | 132 | |||||||||||||||

| Lafayette Behavioral | BSF | 31,650 | 0.70 | % | $ | 1,684.9 | 1.56 | % | 419,704 | Lafayette, LA | 133 | |||||||||||||||

| Belden Medical Arts Building | MOB | 47,366 | 1.05 | % | $ | 506.7 | 0.47 | % | 400,551 | Canton-Massillon, OH | 139 | |||||||||||||||

| Hills & Dales Professional Center | MOB | 27,920 | 0.62 | % | $ | 351.6 | 0.33 | % | 400,551 | Canton-Massillon, OH | 139 | |||||||||||||||

| Prattville Town Center Medical Office Bldg | MOB | 13,319 | 0.29 | % | $ | 281.1 | 0.26 | % | 387,885 | Montgomery, AL | 145 | |||||||||||||||

| Wellmont Bristol Urgent Care | SC | 4,548 | 0.10 | % | $ | 78.5 | 0.07 | % | 313,876 | Kingsport-Bristol, TN-VA | 167 | |||||||||||||||

| Steeles Road Medical Building | PC | 10,804 | 0.24 | % | $ | 187.8 | 0.17 | % | 313,876 | Kingsport-Bristol, TN-VA | 167 | |||||||||||||||

| Bluewater Orthopedics Center | MOB | 10,255 | 0.23 | % | $ | 223.8 | 0.21 | % | 310,149 | Crestview-Fort Walton Beach-Destin, FL | 169 | |||||||||||||||

| Londonderry Centre | MOB | 21,115 | 0.47 | % | $ | 377.4 | 0.35 | % | 307,123 | Waco, TX | 171 | |||||||||||||||

| Westlake Medical Office | MOB | 14,100 | 0.31 | % | $ | 238.3 | 0.22 | % | 307,123 | Waco, TX | 171 | |||||||||||||||

| Longview Rehabilitation Hospital | IRF | 38,817 | 0.86 | % | $ | 2,314.5 | 2.14 | % | 295,490 | Longview, TX | 174 | |||||||||||||||

| Gulf Coast Cancer Centers-Foley | SC | 6,146 | 0.14 | % | $ | 174.7 | 0.16 | % | 261,608 | Daphne-Fairhope-Foley, AL | 193 | |||||||||||||||

| Community Healthcare Trust | Page | 20 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Property Name | Property Type | Area | % of Square Feet | Annualized Rent ($000's) |

% of Annualized Rent |

Population | MSA/MISA | Rank | ||||||||||||||||||

| Gulf Shores Building | SC | 6,398 | 0.14 | % | $ | 51.3 | 0.05 | % | 261,608 | Daphne-Fairhope-Foley, AL | 193 | |||||||||||||||

| Monroe Surgical Hospital | SCH | 58,121 | 1.28 | % | $ | 2,473.6 | 2.29 | % | 221,921 | Monroe, LA | 215 | |||||||||||||||

| Ft. Valley Dialysis Center | SC | 4,920 | 0.11 | % | $ | 87.0 | 0.08 | % | 204,110 | Warner Robins, GA | 231 | |||||||||||||||

| Meridian Behavioral Health Systems | AIB | 132,430 | 2.93 | % | $ | 3,199.5 | 2.96 | % | 202,091 | Charleston, WV | 232 | |||||||||||||||

| Tuscola Professional Building | MOB | 25,500 | 0.56 | % | $ | 622.4 | 0.58 | % | 187,714 | Saginaw, MI | 241 | |||||||||||||||

| Kedplasma | SC | 12,870 | 0.28 | % | $ | 272.1 | 0.25 | % | 183,040 | Burlington, NC | 245 | |||||||||||||||

| Redding Oncology Center | SC | 12,206 | 0.27 | % | $ | 623.8 | 0.58 | % | 181,121 | Redding, CA | 250 | |||||||||||||||

| Decatur Morgan Hospital Medical Office Building | MOB | 35,933 | 0.79 | % | $ | 581.3 | 0.54 | % | 159,651 | Decatur, AL | 273 | |||||||||||||||

| Bourbonnais Medical Center | MOB | 54,894 | 1.21 | % | $ | 815.7 | 0.75 | % | 106,410 | Kankakee, IL | 351 | |||||||||||||||

| Parkside Family & Davita Clinics | MOB | 15,637 | 0.35 | % | $ | 220.9 | 0.20 | % | 99,170 | Victoria, TX | 366 | |||||||||||||||

| Cub Lake Square | MOB | 48,993 | 1.08 | % | $ | 808.9 | 0.75 | % | 109,516 | Show Low, AZ | N/A | |||||||||||||||

| Cub Lake Square - Building B | MOB | — | — | % | $ | — | — | % | 109,516 | Show Low, AZ | N/A | |||||||||||||||

| Emory Southern Orthopedics - 1801 | MOB | 2,972 | 0.07 | % | $ | 62.7 | 0.06 | % | 105,326 | LaGrange, GA-AL | N/A | |||||||||||||||

| Emory Healthcare - 1610 | MOB | 5,600 | 0.12 | % | $ | 84.5 | 0.08 | % | 105,326 | LaGrange, GA-AL | N/A | |||||||||||||||

| Nesbitt Place | MOB | 56,003 | 1.24 | % | $ | 1,097.8 | 1.02 | % | 84,233 | Lawrence County, PA | N/A | |||||||||||||||

| Davita Etowah Dialysis Center | SC | 4,720 | 0.10 | % | $ | 70.1 | 0.06 | % | 70,691 | Athens, TN | N/A | |||||||||||||||

| Marion Medical Plaza | MOB | 27,246 | 0.60 | % | $ | 388.3 | 0.36 | % | 64,976 | Marion, OH | N/A | |||||||||||||||

| Corsicana Medical Plaza | MOB | 17,746 | 0.39 | % | $ | 369.2 | 0.34 | % | 56,533 | Corsicana, TX | N/A | |||||||||||||||

| Pahrump Medical Plaza | MOB | 12,545 | 0.28 | % | $ | 499.9 | 0.46 | % | 55,990 | Pahrump, NV | N/A | |||||||||||||||

| Arkansas Valley Surgery Center | MOB | 10,853 | 0.24 | % | $ | 234.6 | 0.22 | % | 50,093 | Cañon City, CO | N/A | |||||||||||||||

| Sanford West Behavioral Facility | BSF | 96,886 | 2.14 | % | $ | 1,383.0 | 1.28 | % | 45,442 | Grand Rapids, MN | N/A | |||||||||||||||

| Fremont Medical Office Building & Surgery Ctr | MOB | 13,050 | 0.29 | % | $ | 337.4 | 0.31 | % | 37,884 | Fremont, NE | N/A | |||||||||||||||

| Baylor Scott & White Clinic | PC | 37,354 | 0.83 | % | $ | 495.6 | 0.46 | % | 37,810 | Brenham, TX | N/A | |||||||||||||||

| Eyecare Partners - 408 | PC | 8,421 | 0.19 | % | $ | 134.3 | 0.12 | % | 36,437 | Centralia, IL | N/A | |||||||||||||||

| Ottumwa Medical Clinic - 1005 | MOB | 68,895 | 1.52 | % | $ | 760.9 | 0.70 | % | 35,681 | Ottumwa, IA | N/A | |||||||||||||||

| Ottumwa Medical Clinic - 1007 | MOB | 6,850 | 0.15 | % | $ | 94.3 | 0.09 | % | 35,681 | Ottumwa, IA | N/A | |||||||||||||||

| Fresenius Gallipolis Dialysis Center | SC | 15,110 | 0.33 | % | $ | 160.2 | 0.15 | % | 28,886 | Gallipolis, OH | N/A | |||||||||||||||

| Sanderling Dialysis Center - 780 | SC | 4,186 | 0.09 | % | $ | 312.4 | 0.29 | % | 27,009 | Crescent City, CA | N/A | |||||||||||||||

| Princeton Cancer Center | SC | 7,236 | 0.16 | % | $ | 204.4 | 0.19 | % | County: 58,758 | Rural - No CBSA | N/A | |||||||||||||||

| Andalusia Medical Plaza | SC | 10,373 | 0.23 | % | $ | 294.4 | 0.27 | % | County: 37,049 | Rural - No CBSA | N/A | |||||||||||||||

| North Mississippi Health Services - 1107 | MOB | 17,629 | 0.39 | % | $ | 99.8 | 0.09 | % | County: 35,252 | Rural - No CBSA | N/A | |||||||||||||||

| Community Healthcare Trust | Page | 21 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Property Name | Property Type | Area | % of Square Feet | Annualized Rent ($000's) |

% of Annualized Rent |

Population | MSA/MISA | Rank | ||||||||||||||||||

| North Mississippi Health Services - 1111 | MOB | 27,743 | 0.61 | % | $ | 157.1 | 0.15 | % | County: 35,252 | Rural - No CBSA | N/A | |||||||||||||||

| North Mississippi Health Services - 1127 | MOB | 18,074 | 0.40 | % | $ | 102.3 | 0.09 | % | County: 35,252 | Rural - No CBSA | N/A | |||||||||||||||

| North Mississippi Health Services - 404 | MOB | 9,890 | 0.22 | % | $ | 56.0 | 0.05 | % | County: 35,252 | Rural - No CBSA | N/A | |||||||||||||||

| North Mississippi Health Services - 305 | MOB | 3,378 | 0.07 | % | $ | 19.1 | 0.02 | % | County: 35,252 | Rural - No CBSA | N/A | |||||||||||||||

| Batesville Regional Medical Center | MOB | 9,263 | 0.20 | % | $ | 52.5 | 0.05 | % | County: 34,192 | Rural - No CBSA | N/A | |||||||||||||||

| Tri Lakes Behavioral | BSF | 58,400 | 1.29 | % | $ | — | — | % | County: 34,192 | Rural - No CBSA | N/A | |||||||||||||||

| Dahlonega Medical Mall | MOB | 22,805 | 0.50 | % | $ | 336.0 | 0.31 | % | County: 33,610 | Rural - No CBSA | N/A | |||||||||||||||

| Russellville Medical Plaza | MOB | 29,129 | 0.64 | % | $ | 168.2 | 0.16 | % | County: 31,362 | Rural - No CBSA | N/A | |||||||||||||||

| Norton Medical Clinic | SC | 4,843 | 0.11 | % | $ | 59.1 | 0.05 | % | County: 3,900 | Rural - No CBSA | N/A | |||||||||||||||

| Norton Medical Plaza | MOB | 32,757 | 0.72 | % | $ | 320.9 | 0.30 | % | County: 3,900 | Rural - No CBSA | N/A | |||||||||||||||

| Wellmont Lebanon Urgent Care | SC | 8,369 | 0.18 | % | $ | 106.7 | 0.10 | % | County: 26,586 | Rural - No CBSA | N/A | |||||||||||||||

| Lexington Carilion Clinic | PC | 15,820 | 0.35 | % | $ | 392.0 | 0.36 | % | County: 22,573 | Rural - No CBSA | N/A | |||||||||||||||

| Sanderling Dialysis Center - 102 | SC | 5,217 | 0.12 | % | $ | 287.1 | 0.27 | % | County: 13,279 | Rural - No CBSA | N/A | |||||||||||||||

| Community Healthcare Trust | Page | 22 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Community Healthcare Trust | Page | 23 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Community Healthcare Trust | Page | 24 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Community Healthcare Trust | Page | 25 |

2Q 2025 | Supplemental Information | ||||||

| ||

| Community Healthcare Trust | Page | 26 |

2Q 2025 | Supplemental Information | ||||||