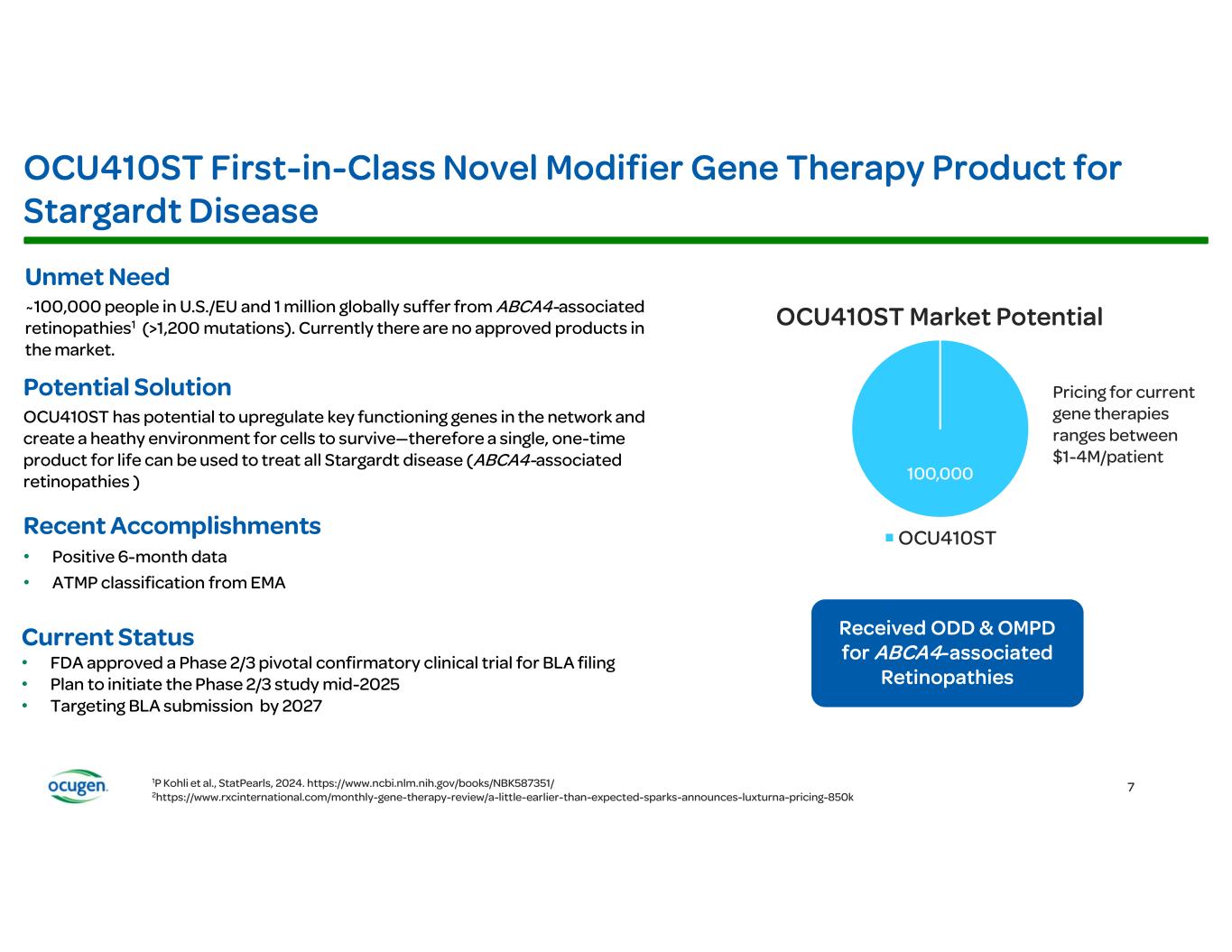

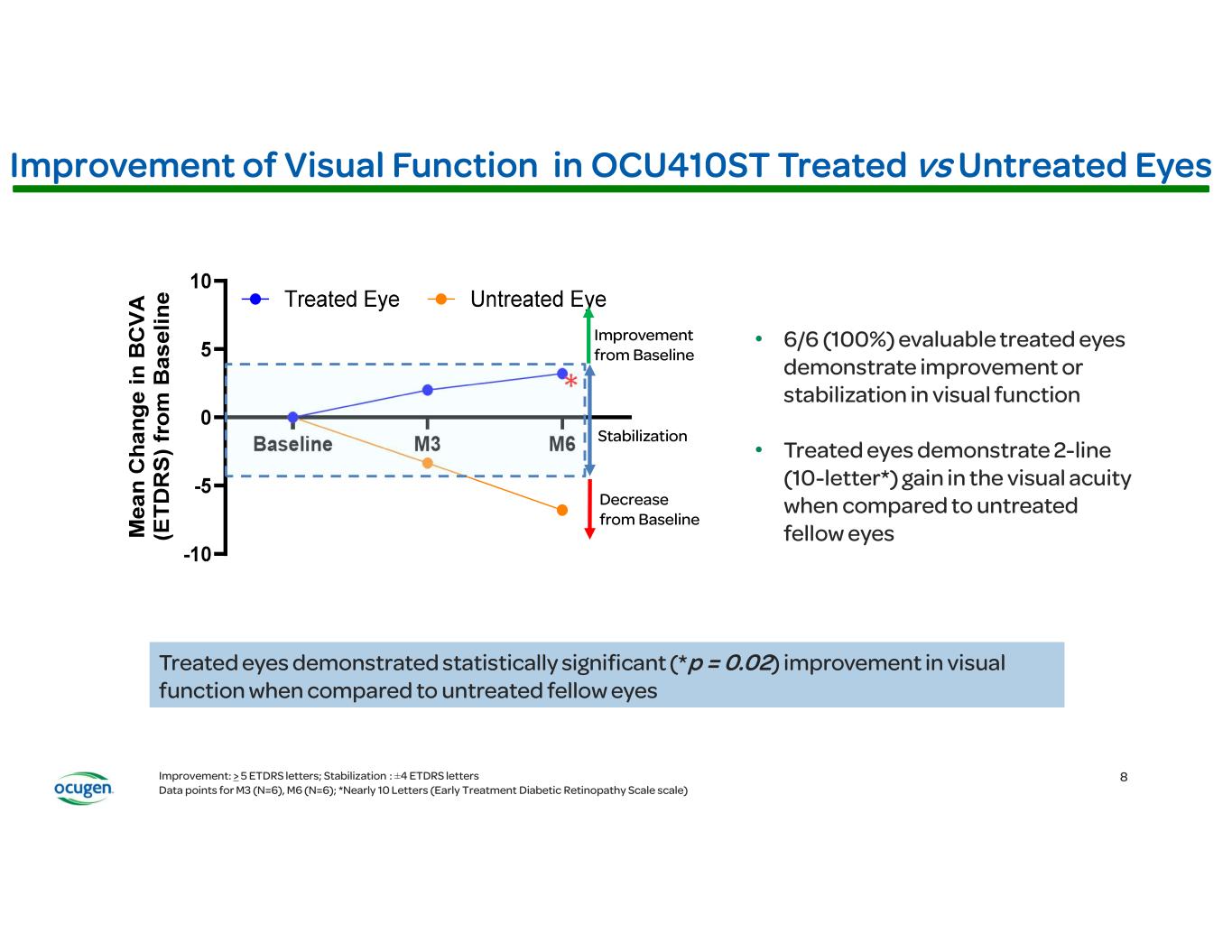

Ocugen Provides Business Update with First Quarter 2025 Financial Results Conference Call and Webcast Today at 8:30 a.m. ET • OCU400 Phase 3 clinical trial for retinitis pigmentosa (RP) is progressing well and on target for potential BLA/MAA filings by mid-2026 • Anticipate initiating OCU410ST Phase 2/3 pivotal confirmatory clinical trial for Stargardt disease mid- 2025 MALVERN, Pa., May 9, 2025 GLOBE NEWSWIRE) – Ocugen, Inc. (Ocugen or the Company) (NASDAQ: OCGN), a pioneering biotechnology leader in gene therapies for blindness diseases, today reported first quarter 2025 financial results along with a general business update. “All three of our novel modifier gene therapies are advancing through the clinic and we are on track to meet our goal of three Biologics License Application (BLA)/Marketing Authorization Application (MAA) filings in the next three years,” said Dr. Shankar Musunuri, Chairman, Chief Executive Officer, and Co-Founder of Ocugen. “We remain steadfast in our mission to provide a one-time therapy for life to address considerable unmet medical needs that exist for millions of patients facing the terrifying prospect of losing their vison.” In January, the Company announced positive two-year long-term safety and efficacy data from the Phase 1/2 clinical trial of OCU400 for RP that demonstrated a durable, clinically meaningful, and statistically significant (p=0.005) improvement in visual function (LLVA) in all evaluable treated subjects at two years when compared to untreated eyes. Additionally, 100% (10/10) of treated evaluable subjects demonstrated improvement or preservation in visual function compared to untreated eyes. This data further supports the gene-agnostic mechanism of action of OCU400, a broad RP treatment not restricted to specific mutations, with durability. The OCU400 Phase 3 liMeliGhT clinical trial is open to all eligible RP patients—early to advanced stage RP including pediatric subjects age 5+—regardless of gene mutation (syndromic and non-syndromic forms of RP). OCU400 has the potential to treat all 300,000 RP patients in the U.S. and EU. Alignment was reached with the FDA to move forward with a Phase 2/3 pivotal confirmatory trial for OCU410ST for Stargardt disease, which includes an adaptive design with a masked interim analysis at 8 months. Stargardt disease affects 100,000 people in the U.S. and EU. The Phase 2/3 clinical trial will randomize 51 subjects, 34 of whom will receive a single, subretinal, injection of OCU410ST (200 μL at a concentration of 1.5 × 10¹¹ vector genomes/mL) in the eye with worse visual acuity, and 17 of whom will serve as untreated controls. The primary endpoint in the clinical trial is change in atrophic lesion size. Key secondary endpoints include visual acuity as measured by best corrected visual acuity (BCVA) and LLVA compared to untreated controls. One-year data will be utilized for the BLA filing. The latest data from the OCU410ST Phase 1 clinical trial demonstrates atrophic lesions grew slower by 54% at six months in evaluable treated eyes when compared to untreated eyes. In BCVA, treated eyes demonstrated statistically significant (p=0.02) improvement in visual function when compared to untreated fellow eyes. Ocugen plans to initiate the Phase 2/3 study by mid-year with a target BLA filing in 2027. In February, dosing was complete in the Phase 2 portion of the OCU410 Phase 1/2 ArMaDa clinical trial for geographic atrophy (GA), an advanced stage of dry age-related macular degeneration (dAMD). In evaluable subjects, OCU410 12-month data demonstrates a 4-line (23-letter) gain in visual acuity and 41% slower GA lesion growth in treated eyes versus untreated fellow eyes after a single injection. The unique mechanism of action of OCU410 targets multiple pathways associated with dAMD pathogenesis, in contrast to products currently approved or under development that treat only one cause of GA, require multiple injections per year, and have safety considerations. Approximately 2-3 million patients in the U.S. & EU and 8 million globally suffer from GA.

All of Ocugen’s modifier gene therapies—OCU400 for RP, OCU410ST for Stargardt disease, and OCU410 for GA were granted Advanced Therapy Medicinal Product (ATMP) classification from the European Medicines Agency’s (EMA) Committee for Advanced Therapies. ATMP classification is granted to medicines that can offer groundbreaking opportunities for the treatment of disease and accelerates the regulatory review timeline of this potential one-time gene therapy for life. Additionally, this classification allows the Company to interact with the EMA more frequently for scientific advice and protocol assistance. Relevant to Ocugen’s recent ATMP classifications, Dr. Musunuri participated in a panel addressing the journey of successfully commercializing ATMPs, which focused on the challenges and strategies in achieving commercial success while also ensuring access for the patients who need them, during the 2025 Cell & Gene Meeting on the Mediterranean, hosted by the Alliance for Regenerative Medicine. The Meeting on the Med provided an excellent forum to reach a wide audience about the importance of changing the treatment paradigm by bringing potentially transformative modifier gene therapies to market. Also in the first quarter of 2025, the first patient was dosed in the Phase 1 clinical trial for OCU200, the Company’s biologic product candidate for diabetic macular edema. Currently, patients are being dosed in the second cohort and Ocugen is planning to complete the Phase 1 clinical trial in the second half of this year. The Company intends to initiate the Phase 3 trial for NeoCart® contingent on adequate availability of funding and/or based on the potential of a future partnership. Finally, the Investigational New Drug application is in effect for OCU500, and the National Institute of Allergy and Infectious Diseases intends to initiate a Phase 1 clinical trial in the second quarter of 2025. Ocugen is continuing discussions with relevant government agencies as well as strategic partners regarding developmental funding for its vaccines technology for flu. “We have had a strong start to 2025 and are approaching considerable milestones in the next few months,” said Dr. Musunuri. “I am enthusiastic about where we are as a Company, with a clear and precise business strategy to operate efficiently in service of our patients and shareholders.” Modifier Gene Therapy Platform—a Novel First-in-Class Platform • OCU400 for RP – The EMA provided a positive opinion for ATMP classification for OCU400 and granted eligibility to submit the OCU400 MAA via the centralized procedure as an ATMP based on the current study design and statistical analysis plan. Actively recruiting patients in the U.S. and Canada in the Phase 3 liMeliGhT clinical trial and on track to meet BLA/MAA filing targets in mid-2026. • OCU410ST for Stargardt Disease – Received FDA alignment to move forward with Phase 2/3 pivotal confirmatory clinical trial, which can be the basis of a BLA submission. ATMP classification granted by the EMA. • OCU410 for GA – Announced that dosing was complete, ahead of schedule, in the Phase 2 portion of the Phase 1/2 ArMaDa clinical trial for OCU410. Received ATMP classification from the EMA. First Quarter 2025 Financial Results • The Company’s cash and restricted cash totaled $38.1 million as of March 31, 2025, compared to $58.8 million as of December 31, 2024. The Company had 292.0 million shares of common stock outstanding as of March 31, 2025. The Company expects its cash and restricted cash runway into the first quarter of 2026. • Total operating expenses for the three months ended March 31, 2025 were $16.0 million and included research and development expenses of $9.5 million and general and administrative expenses of

$6.5 million. This compares to total operating expenses for the three months ended March 31, 2024 of $13.2 million that included research and development expenses of $6.8 million and general and administrative expenses of $6.4 million. • Ocugen reported a $0.05 net loss per common share for the three months ended March 31, 2025 compared to a $0.05 net loss per common share for the three months ended March 31, 2024. Conference Call and Webcast Details Ocugen has scheduled a conference call and webcast for 8:30 a.m. ET today to discuss the financial results and recent business highlights. Ocugen’s senior management team will host the call, which will be open to all listeners. There will also be a question-and-answer session following the prepared remarks. Attendees are invited to participate on the call or webcast using the following details: Dial-in Numbers: (800) 715-9871 for U.S. callers and (646) 307-1963 for international callers Conference ID: 1773288 Webcast: Available on the events section of the Ocugen investor site A replay of the call and archived webcast will be available for approximately 45 days following the event on the Ocugen investor site. About Ocugen, Inc. Ocugen, Inc. is a pioneering biotechnology leader in gene therapies for blindness diseases. Our breakthrough modifier gene therapy platform has the potential to address significant unmet medical need for large patient populations through our gene-agnostic approach. Unlike traditional gene therapies and gene editing, Ocugen’s modifier gene therapies address the entire disease—complex diseases that are potentially caused by imbalances in multiple gene networks. Currently we have programs in development for inherited retinal diseases and blindness diseases affecting millions across the globe, including retinitis pigmentosa, Stargardt disease, and geographic atrophy—late stage dry age-related macular degeneration. Discover more at www.ocugen.com and follow us X and LinkedIn. Cautionary Note on Forward-Looking Statements This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995, including, but not limited to, strategy, business plans and objectives for Ocugen’s clinical programs, plans and timelines for the preclinical and clinical development of Ocugen’s product candidates, including the therapeutic potential, clinical benefits and safety thereof, expectations regarding timing, success and data announcements of current ongoing preclinical and clinical trials, the ability to initiate new clinical programs; Ocugen’s expected cash runway, statements regarding qualitative assessments of available data, potential benefits, expectations for ongoing clinical trials, anticipated regulatory filings and anticipated development timelines, which are subject to risks and uncertainties. We may, in some cases, use terms such as “predicts,” “believes,” “potential,” “proposed,” “continue,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Such statements are subject to numerous important factors, risks, and uncertainties that may cause actual events or results to differ materially from our current expectations, including, but not limited to, the risks that preliminary, interim and top-line clinical trial results may not be indicative of, and may differ from, final clinical data; that unfavorable new clinical trial data may emerge in ongoing clinical trials or through further analyses of existing clinical trial data; that earlier non-clinical and clinical data and testing of may not be predictive of the results or success of later clinical trials; and that that clinical trial data are subject to differing interpretations and assessments, including by regulatory authorities. These and other risks and

uncertainties are more fully described in our annual and periodic filings with the Securities and Exchange Commission (SEC), including the risk factors described in the section entitled “Risk Factors” in the quarterly and annual reports that we file with the SEC. Any forward-looking statements that we make in this press release speak only as of the date of this press release. Except as required by law, we assume no obligation to update forward- looking statements contained in this press release whether as a result of new information, future events, or otherwise, after the date of this press release. Contact: Tiffany Hamilton Head of Communications IR@ocugen.com (Tables to follow)

OCUGEN, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) (Unaudited) March 31, 2025 December 31, 2024 Assets Current assets Cash $ 37,800 $ 58,514 Prepaid expenses and other current assets 6,164 3,168 Total current assets 43,964 61,682 Property and equipment, net 15,989 16,554 Restricted cash 309 307 Other assets 4,198 3,899 Total assets $ 64,460 $ 82,442 Liabilities and stockholders' equity Current liabilities Accounts payable $ 3,224 $ 4,243 Accrued expenses and other current liabilities 12,926 15,500 Operating lease obligations 736 519 Current portion of long-term debt — 1,326 Total current liabilities 16,886 21,588 Non-current liabilities Operating lease obligations, less current portion 3,418 3,313 Long term debt, net 27,669 27,345 Other non-current liabilities 573 564 Total non-current liabilities 31,660 31,222 Total liabilities 48,546 52,810 Stockholders' equity Common stock 2,922 2,915 Treasury stock (48) (48) Additional paid-in capital 368,571 366,938 Accumulated other comprehensive income 40 48 Accumulated deficit (355,571) (340,221) Total stockholders' equity 15,914 29,632 Total liabilities and stockholders' equity $ 64,460 $ 82,442

OCUGEN, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (in thousands, except share and per share amounts) (Unaudited) Three months ended March 31, 2025 2024 Collaborative arrangement revenue $ 1,481 $ 1,014 Total revenue 1,481 1,014 Operating expenses Research and development 9,529 6,826 General and administrative 6,453 6,404 Total operating expenses 15,982 13,230 Loss from operations (14,501) (12,216) Interest (expense) income, net (914) 302 Other income (expense), net 65 (10) Net loss $ (15,350) $ (11,924) Other comprehensive income (loss) Foreign currency translation adjustment (8) 5 Comprehensive loss $ (15,358) $ (11,919) Net loss attributable to common shareholders— basic and diluted (15,350) (11,899) Weighted shares used in calculating net loss per common share — basic and diluted 291,996,562 257,232,636 Net loss per share attributable to common shareholders — basic and diluted $ (0.05) $ (0.05) Net loss attributable to Series B Convertible Preferred shareholders — basic and diluted — (25) Weighted shares used in calculating net loss per Series B Convertible Preferred Stock — basic and diluted — 54,745 Net loss per share attributable to Series B Convertible Preferred shareholders — basic and diluted $ — $ (0.46)

株探プレミアムに申し込む(初回無料体験付き)

プレミアム会員の方はこちらからログイン

株探プレミアムに申し込む(初回無料体験付き)

プレミアム会員の方はこちらからログイン