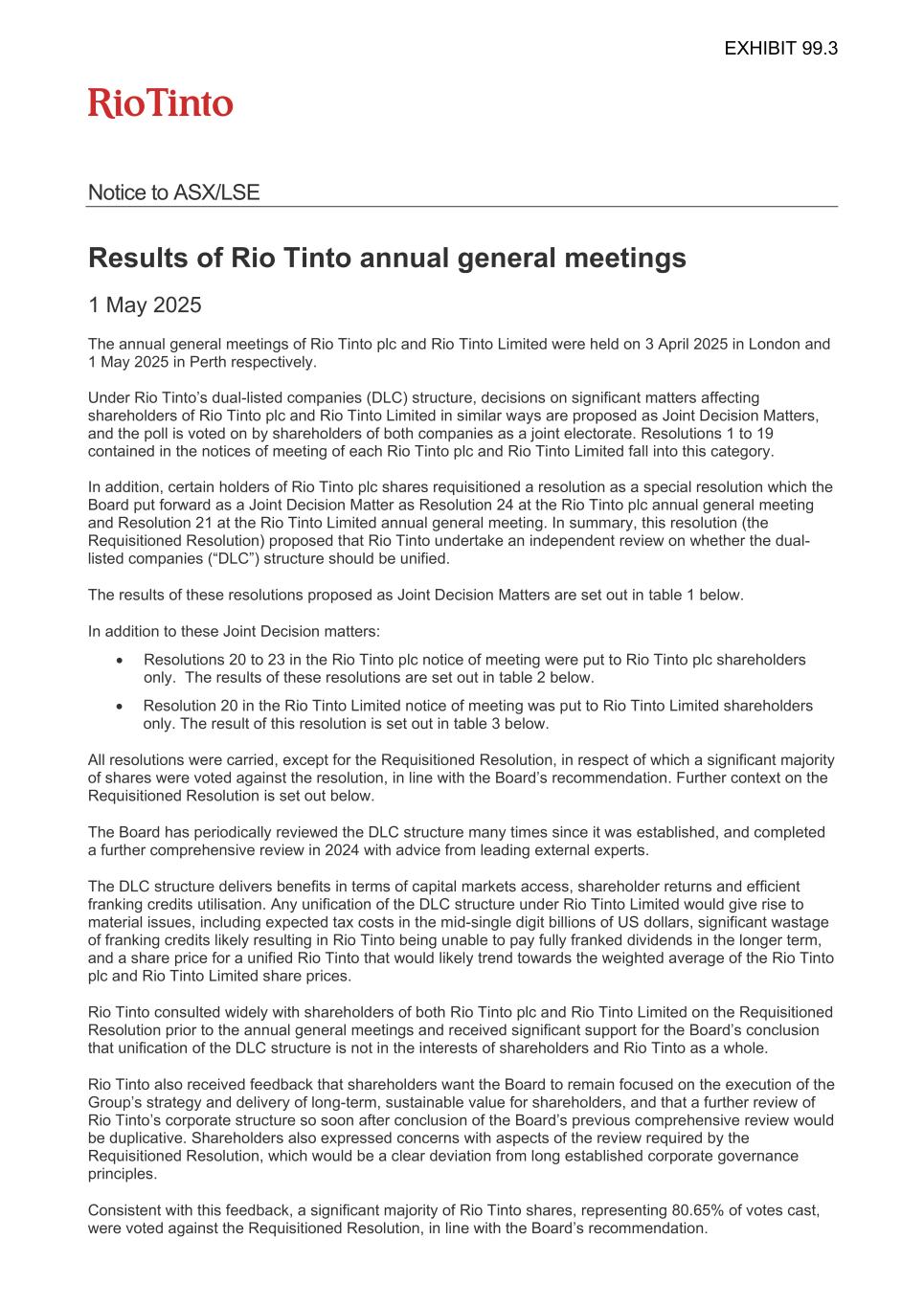

Notice to ASX/LSE Results of Rio Tinto annual general meetings 1 May 2025 The annual general meetings of Rio Tinto plc and Rio Tinto Limited were held on 3 April 2025 in London and 1 May 2025 in Perth respectively. Under Rio Tinto’s dual-listed companies (DLC) structure, decisions on significant matters affecting shareholders of Rio Tinto plc and Rio Tinto Limited in similar ways are proposed as Joint Decision Matters, and the poll is voted on by shareholders of both companies as a joint electorate. Resolutions 1 to 19 contained in the notices of meeting of each Rio Tinto plc and Rio Tinto Limited fall into this category. In addition, certain holders of Rio Tinto plc shares requisitioned a resolution as a special resolution which the Board put forward as a Joint Decision Matter as Resolution 24 at the Rio Tinto plc annual general meeting and Resolution 21 at the Rio Tinto Limited annual general meeting. In summary, this resolution (the Requisitioned Resolution) proposed that Rio Tinto undertake an independent review on whether the dual- listed companies (“DLC”) structure should be unified. The results of these resolutions proposed as Joint Decision Matters are set out in table 1 below. In addition to these Joint Decision matters: • Resolutions 20 to 23 in the Rio Tinto plc notice of meeting were put to Rio Tinto plc shareholders only. The results of these resolutions are set out in table 2 below. • Resolution 20 in the Rio Tinto Limited notice of meeting was put to Rio Tinto Limited shareholders only. The result of this resolution is set out in table 3 below. All resolutions were carried, except for the Requisitioned Resolution, in respect of which a significant majority of shares were voted against the resolution, in line with the Board’s recommendation. Further context on the Requisitioned Resolution is set out below. The Board has periodically reviewed the DLC structure many times since it was established, and completed a further comprehensive review in 2024 with advice from leading external experts. The DLC structure delivers benefits in terms of capital markets access, shareholder returns and efficient franking credits utilisation. Any unification of the DLC structure under Rio Tinto Limited would give rise to material issues, including expected tax costs in the mid-single digit billions of US dollars, significant wastage of franking credits likely resulting in Rio Tinto being unable to pay fully franked dividends in the longer term, and a share price for a unified Rio Tinto that would likely trend towards the weighted average of the Rio Tinto plc and Rio Tinto Limited share prices. Rio Tinto consulted widely with shareholders of both Rio Tinto plc and Rio Tinto Limited on the Requisitioned Resolution prior to the annual general meetings and received significant support for the Board’s conclusion that unification of the DLC structure is not in the interests of shareholders and Rio Tinto as a whole. Rio Tinto also received feedback that shareholders want the Board to remain focused on the execution of the Group’s strategy and delivery of long-term, sustainable value for shareholders, and that a further review of Rio Tinto’s corporate structure so soon after conclusion of the Board’s previous comprehensive review would be duplicative. Shareholders also expressed concerns with aspects of the review required by the Requisitioned Resolution, which would be a clear deviation from long established corporate governance principles. Consistent with this feedback, a significant majority of Rio Tinto shares, representing 80.65% of votes cast, were voted against the Requisitioned Resolution, in line with the Board’s recommendation. EXHIBIT 99.3

Notice to ASX/LSE Rio Tinto recognises that shareholders representing 19.35% of votes cast chose to support the Requisitioned Resolution. Rio Tinto will continue to engage with our shareholders and will carefully consider the feedback provided. Table 1 The following Joint Decision Matter resolutions were put to the Rio Tinto plc and Rio Tinto Limited shareholders by polls at the respective annual general meetings. All resolutions save for the Requisitioned Resolution (listed as Resolution 21/24) were duly carried. The results of the polls were as follows: Resolution Total Votes Cast For Against Withheld/ Abstained ¹ Number % Number % 1. Receipt of the 2024 Annual Report 1,115,893,747 1,113,867,379 99.82 2,026,368 0.18 10,081,351 2. Approval of the Directors’ Remuneration Report: Implementation Report 1,099,347,399 1,074,116,989 97.70 25,230,410 2.30 26,622,923 3. Approval of the Directors’ Remuneration Report 1,099,713,996 1,071,056,748 97.39 28,657,248 2.61 26,246,816 4. To elect Sharon Thorne as a Director 1,122,530,759 1,115,790,068 99.40 6,740,691 0.60 3,442,000 5. To re-elect Dominic Barton BBM as a Director 1,121,184,547 1,075,101,867 95.89 46,082,680 4.11 4,790,942 6. To re-elect Peter Cunningham as a Director 1,119,200,039 1,106,579,234 98.87 12,620,805 1.13 6,775,592 7. To re-elect Dean Dalla Valle as a Director 1,121,205,084 1,070,534,038 95.48 50,671,046 4.52 4,770,697 8. To re-elect Simon Henry as a Director 1,122,663,812 1,098,042,067 97.81 24,621,745 2.19 3,338,957 9. To re-elect Susan Lloyd-Hurwitz as a Director 1,122,709,122 1,110,944,549 98.95 11,764,573 1.05 3,293,661 10. To re-elect Martina Merz as a Director 1,122,400,241 1,110,941,738 98.98 11,458,503 1.02 3,602,542 11. To re-elect Jennifer Nason as a Director 1,122,680,124 1,107,122,486 98.61 15,557,638 1.39 3,321,174 12. To re-elect Joc O’Rourke as a Director 1,122,660,828 1,111,450,890 99.00 11,209,938 1.00 3,341,437 13. To re-elect Jakob Stausholm as a Director 1,122,773,830 1,106,906,054 98.59 15,867,776 1.41 3,228,953 14. To re-elect Ngaire Woods CBE as a Director 1,122,528,749 1,097,200,003 97.74 25,328,746 2.26 3,474,035 15. To re-elect Ben Wyatt as a Director 1,118,933,309 1,098,349,394 98.16 20,583,915 1.84 7,069,223 16. Re-appointment of auditors 1,121,487,633 1,114,057,282 99.34 7,430,351 0.66 4,513,371 17. Remuneration of auditors 1,122,813,436 1,120,896,143 99.83 1,917,293 0.17 3,187,550 18. Authority to make political donations 1,116,257,914 1,103,324,510 98.84 12,933,404 1.16 9,726,612

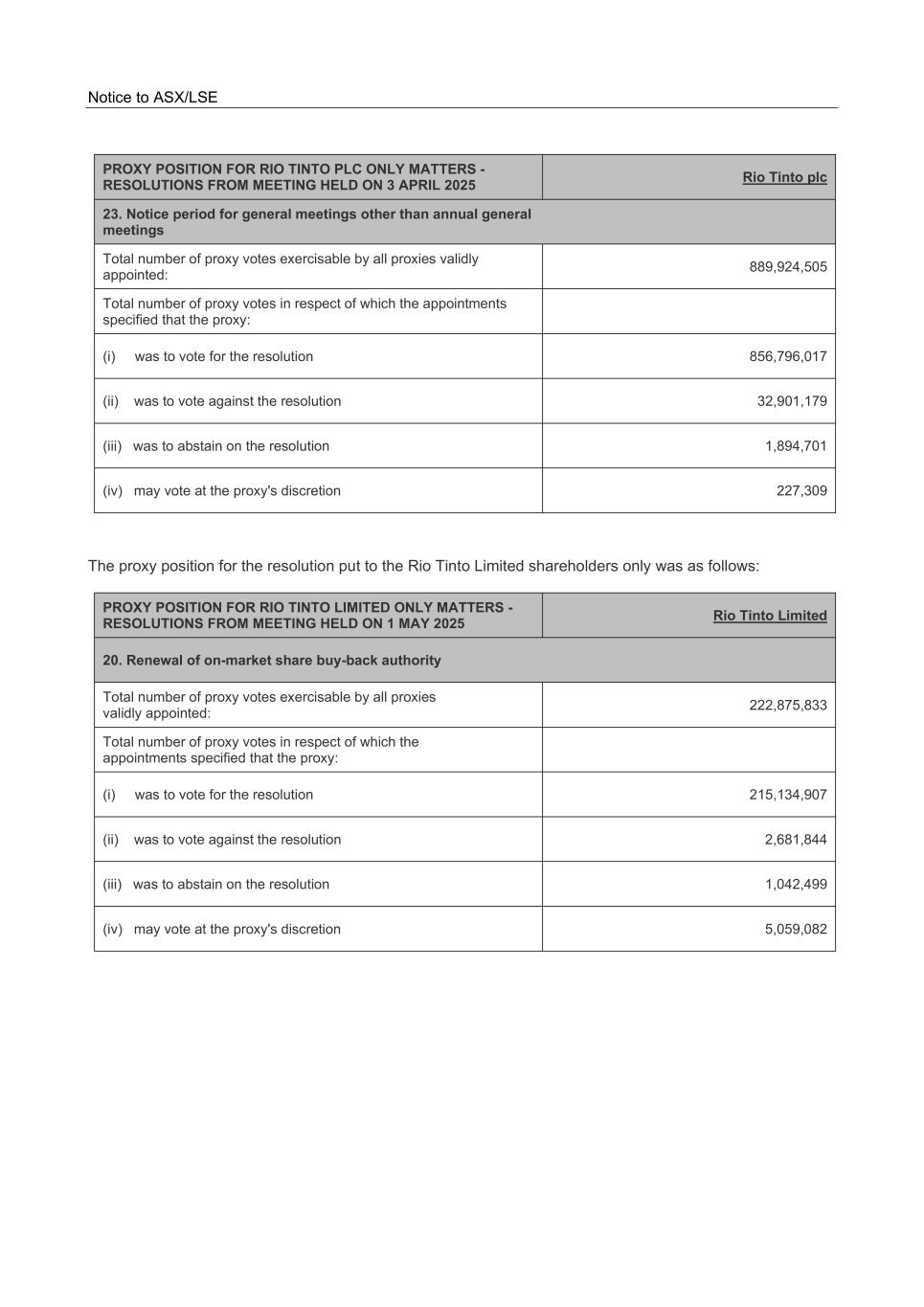

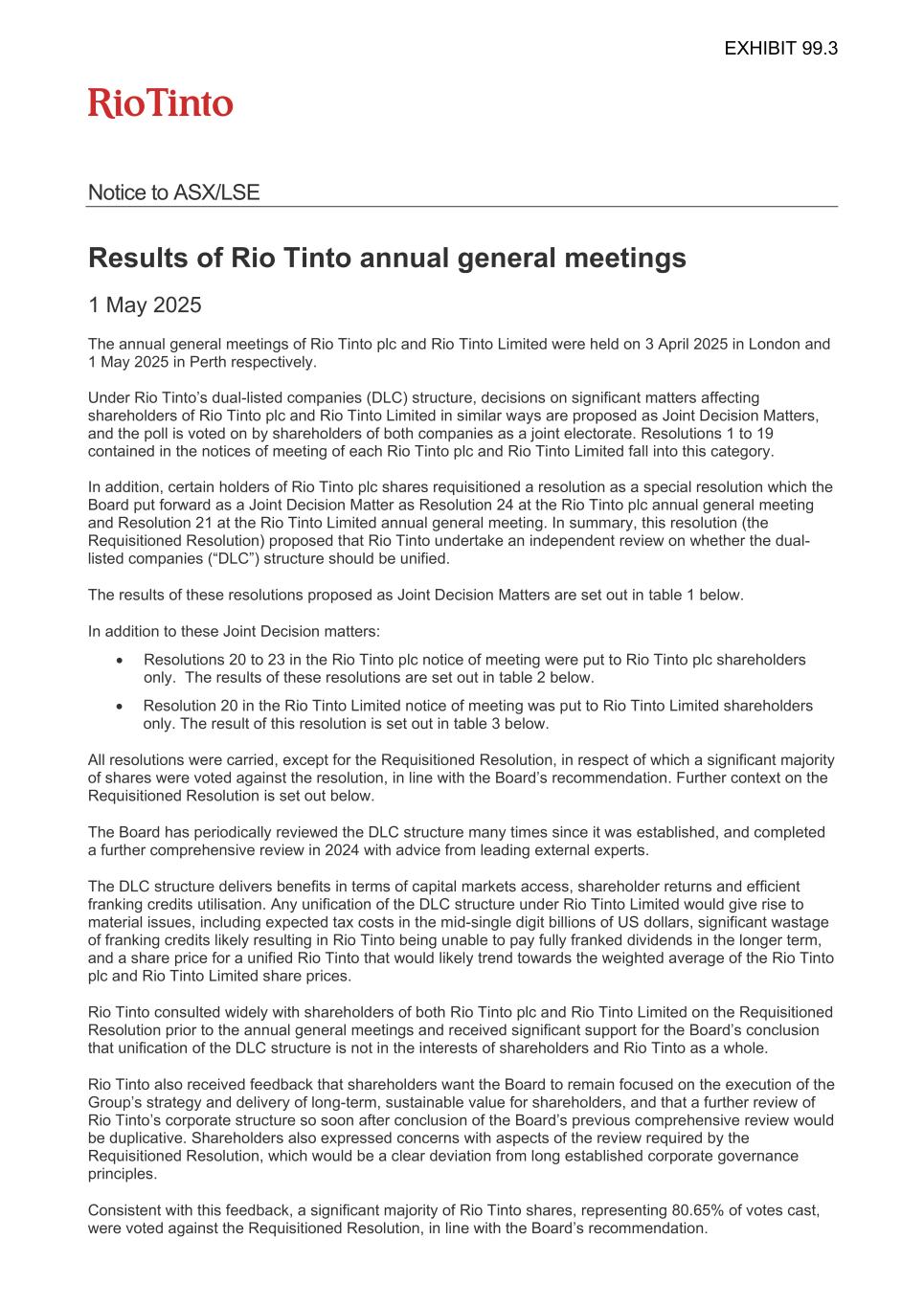

Notice to ASX/LSE Resolution Total Votes Cast For Against Withheld/ Abstained ¹ Number % Number % 19. 2025 Climate Action Plan 1,023,895,914 955,082,547 93.28 68,813,367 6.72 102,102,363 21/242 Shareholder requisitioned resolution 1,115,660,973 215,922,209 19.35 899,738,764 80.65 10,339,170 ¹ In calculating the results of the respective polls under the joint electoral procedure, “withheld” votes at Rio Tinto plc’s meeting are aggregated with “abstained” votes at Rio Tinto Limited’s meeting. For all relevant purposes “withheld” votes and “abstained” votes have the same meaning. They are not included in the calculation of the proportion of votes for and against each resolution. 2 Resolution 21 in the Rio Tinto Limited notice of meeting is the corresponding resolution of Resolution 24 in the Rio Tinto plc notice of meeting. Table 2 The following resolutions were put to Rio Tinto plc shareholders only and carried at the Rio Tinto plc meeting held on 3 April 2025. Resolution 20 was carried as an ordinary resolution and Resolutions 21 to 23 as special resolutions. In accordance with the UK Listing Authority’s Listing Rule 9.6.2, copies of all the resolutions passed by Rio Tinto plc shareholders, other than ordinary business, have been submitted to the National Storage Mechanism and are available for inspection at http://www.morningstar.co.uk/uk/NSM. The results of the polls were as follows: Resolution Total Votes Cast For Against Withheld/ Abstained Number % Number % 20. General authority to allot shares 899,962,813 874,962,881 97.22 24,999,932 2.78 2,046,157 21. Disapplication of pre-emption rights 898,993,354 894,753,496 99.53 4,239,858 0.47 3,014,919 22. Authority to purchase Rio Tinto plc shares 900,115,072 711,804,446 79.08 188,310,626 20.92 1,894,892 23. Notice period for general meetings other than annual general meetings 900,114,767 867,091,016 96.33 33,023,751 3.67 1,895,195 Resolution 22 ‘Authority to purchase Rio Tinto plc shares’ was passed with less than 80% of votes in favour. As previously announced, Shining Prospect (a subsidiary of the Aluminium Corporation of China “Chinalco”) voted against Resolution 22. Chinalco has not sold any of its shares in Rio Tinto plc and now has a holding of over 14% given its non-participation in the Company’s significant share buyback programmes. This places Chinalco close to the 14.99% holding threshold agreed with the Australian Government at the time of its original investment in Rio Tinto. Table 3 Resolution 20 below was put to Rio Tinto Limited shareholders only. Resolution 20 was carried as an ordinary resolution. The results of the poll were as follows: Resolution Total Votes Cast For Against Withheld / Abstained Number % Number % 20. Renewal of on-market share buy- back authority 222,947,287 220,263,631 98.80 2,683,656 1.20 1,044,956 The results of the Rio Tinto plc polls were certified by the scrutineer, Computershare Investor Services PLC, and the results of the Rio Tinto Limited polls were as reported by the duly appointed returning officer, a representative of Computershare Investor Services Pty Limited. Information on the final proxy positions for each meeting is detailed in Appendix 1, and the votes cast on each resolution as a percentage of the issued capital of each company is set out on our website at riotinto.com/agm.

Notice to ASX/LSE Contacts Please direct all enquiries to media.enquiries@riotinto.com Media Relations, United Kingdom Matthew Klar M +44 7796 630 637 David Outhwaite M +44 7787 597 493 Media Relations, Australia Matt Chambers M +61 433 525 739 Michelle Lee M +61 458 609 322 Rachel Pupazzoni M +61 438 875 469 Media Relations, Canada Simon Letendre M +1 514 796 4973 Malika Cherry M +1 418 592 7293 Vanessa Damha M +1 514 715 2152 Media Relations, US Jesse Riseborough M +1 202 394 9480 Investor Relations, United Kingdom Rachel Arellano M +44 7584 609 644 David Ovington M +44 7920 010 978 Laura Brooks M +44 7826 942 797 Weiwei Hu M +44 7825 907 230 Investor Relations, Australia Tom Gallop M +61 439 353 948 Amar Jambaa M +61 472 865 948 Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 Rio Tinto Limited Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 This announcement is authorised for release to the market by Andy Hodges, Rio Tinto’s Group Company Secretary. riotinto.com

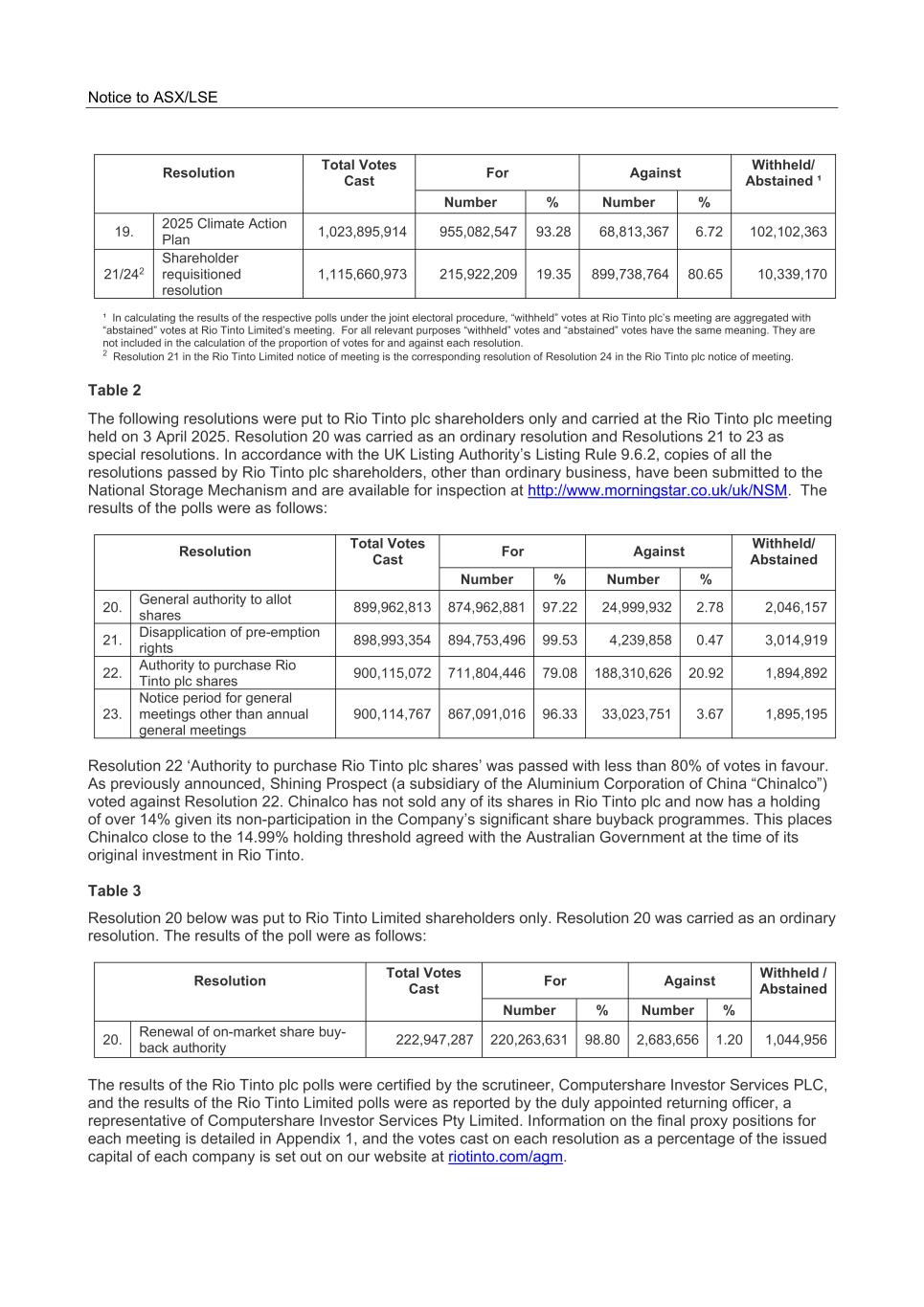

Notice to ASX/LSE Appendix 1 FINAL PROXY POSITION Shareholders are encouraged to look at the voting figures provided in the main part of this announcement, as proxy figures may not be an accurate indication of the voting at the annual general meetings; a proxy is an authority or direction to the proxy holder to vote and not a vote itself. As such, the proxy figures do not reflect the votes cast by shareholders who attend the meeting in person, or through an attorney or corporate representative. References in this appendix in respect of resolutions 1-19 and 24 to an appointment specifying that a proxy abstain on a resolution should, when referring to voting at Rio Tinto plc’s annual general meeting, be taken as references to the appointment specifying that the proxy withhold from voting on a resolution. The proxy positions for each company (excluding the proxy votes carried from one meeting to the other meeting by the Special Voting Shares in accordance with the DLC structure) for the resolutions put to both Rio Tinto plc and Rio Tinto Limited shareholders under the joint electoral procedure were as follows: PROXY POSITION FOR RIO TINTO PLC AND RIO TINTO LIMITED ON JOINT DECISIONS Rio Tinto plc Rio Tinto Limited 1. Receipt of the 2024 Annual Report Total number of proxy votes exercisable by all proxies validly appointed: 884,657,385 220,974,390 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 882,978,106 215,453,828 (ii) was to vote against the resolution 1,450,211 576,132 (iii) was to abstain on the resolution 7,134,169 2,944,487 (iv) may vote at the proxy's discretion 229,068 4,944,430 2. Approval of the Directors’ Remuneration Report: Implementation Report Total number of proxy votes exercisable by all proxies validly appointed: 867,580,785 221,576,023 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 848,584,639 210,708,353 (ii) was to vote against the resolution 18,785,950 5,943,119 (iii) was to abstain on the resolution 24,211,453 2,339,779 (iv) may vote at the proxy's discretion 210,196 4,924,551

Notice to ASX/LSE PROXY POSITION FOR RIO TINTO PLC AND RIO TINTO LIMITED ON JOINT DECISIONS Rio Tinto plc Rio Tinto Limited 3. Approval of the Directors’ Remuneration Report Total number of proxy votes exercisable by all proxies validly appointed: 867,612,084 221,911,821 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 845,496,024 210,682,802 (ii) was to vote against the resolution 21,893,390 6,265,043 (iii) was to abstain on the resolution 24,180,154 1,994,471 (iv) may vote at the proxy's discretion 222,670 4,963,976 4. To elect Sharon Thorne as a Director Total number of proxy votes exercisable by all proxies validly appointed: 889,728,511 222,539,925 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 884,005,938 216,468,557 (ii) was to vote against the resolution 5,502,473 1,063,180 (iii) was to abstain on the resolution 2,062,855 1,376,827 (iv) may vote at the proxy's discretion 220,100 5,008,188 5. To re-elect Dominic Barton BBM as a Director Total number of proxy votes exercisable by all proxies validly appointed: 888,374,335 222,547,887 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 845,705,829 214,106,054 (ii) was to vote against the resolution 42,448,648 3,413,920 (iii) was to abstain on the resolution 3,417,608 1,370,992 (iv) may vote at the proxy's discretion 219,858 5,027,913

Notice to ASX/LSE PROXY POSITION FOR RIO TINTO PLC AND RIO TINTO LIMITED ON JOINT DECISIONS Rio Tinto plc Rio Tinto Limited 6. To re-elect Peter Cunningham as a Director Total number of proxy votes exercisable by all proxies validly appointed: 887,146,292 221,796,905 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 876,946,761 214,306,081 (ii) was to vote against the resolution 9,980,242 2,450,946 (iii) was to abstain on the resolution 4,645,795 2,121,972 (iv) may vote at the proxy's discretion 219,289 5,039,878 7. To re-elect Dean Dalla Valle as a Director Total number of proxy votes exercisable by all proxies validly appointed: 888,402,548 222,545,694 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 844,989,766 210,115,234 (ii) was to vote against the resolution 43,183,224 7,300,599 (iii) was to abstain on the resolution 3,389,689 1,373,183 (iv) may vote at the proxy's discretion 229,558 5,129,861 8. To re-elect Simon Henry as a Director Total number of proxy votes exercisable by all proxies validly appointed: 889,764,797 222,642,473 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 868,248,028 214,990,455 (ii) was to vote against the resolution 21,297,802 2,630,939 (iii) was to abstain on the resolution 2,054,427 1,276,405 (iv) may vote at the proxy's discretion 218,967 5,021,079

Notice to ASX/LSE PROXY POSITION FOR RIO TINTO PLC AND RIO TINTO LIMITED ON JOINT DECISIONS Rio Tinto plc Rio Tinto Limited 9. To re-elect Susan Lloyd-Hurwitz as a Director Total number of proxy votes exercisable by all proxies validly appointed: 889,803,909 222,648,371 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 879,443,168 216,172,495 (ii) was to vote against the resolution 10,136,333 1,454,145 (iii) was to abstain on the resolution 2,015,330 1,270,506 (iv) may vote at the proxy's discretion 224,408 5,021,731 10. To re-elect Martina Merz as a Director Total number of proxy votes exercisable by all proxies validly appointed: 889,791,815 222,351,584 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 879,880,095 215,705,750 (ii) was to vote against the resolution 9,692,842 1,591,563 (iii) was to abstain on the resolution 2,027,424 1,567,293 (iv) may vote at the proxy's discretion 218,878 5,054,271 11. To re-elect Jennifer Nason as a Director Total number of proxy votes exercisable by all proxies validly appointed: 889,801,791 222,622,318 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 877,000,641 215,261,582 (ii) was to vote against the resolution 12,584,256 2,287,130 (iii) was to abstain on the resolution 2,015,962 1,296,560 (iv) may vote at the proxy's discretion 216,894 5,073,606

Notice to ASX/LSE PROXY POSITION FOR RIO TINTO PLC AND RIO TINTO LIMITED ON JOINT DECISIONS Rio Tinto plc Rio Tinto Limited 12. To re-elect Joc O’Rourke as a Director Total number of proxy votes exercisable by all proxies validly appointed: 889,793,498 222,610,488 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 879,885,038 216,165,658 (ii) was to vote against the resolution 9,677,868 1,360,559 (iii) was to abstain on the resolution 2,025,742 1,307,870 (iv) may vote at the proxy's discretion 230,592 5,084,271 13. To re-elect Jakob Stausholm as a Director Total number of proxy votes exercisable by all proxies validly appointed: 889,806,413 222,710,875 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 877,280,341 214,254,082 (ii) was to vote against the resolution 12,307,420 3,387,117 (iii) was to abstain on the resolution 2,012,826 1,208,002 (iv) may vote at the proxy's discretion 218,652 5,069,676 14. To re-elect Ngaire Woods CBE as a Director Total number of proxy votes exercisable by all proxies validly appointed: 889,641,874 222,630,033 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 867,795,572 214,569,280 (ii) was to vote against the resolution 21,626,455 3,009,209 (iii) was to abstain on the resolution 2,177,365 1,288,845 (iv) may vote at the proxy's discretion 219,847 5,051,544

Notice to ASX/LSE PROXY POSITION FOR RIO TINTO PLC AND RIO TINTO LIMITED ON JOINT DECISIONS Rio Tinto plc Rio Tinto Limited 15. To re-elect Ben Wyatt as a Director Total number of proxy votes exercisable by all proxies validly appointed: 887,141,152 221,535,315 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 869,961,620 213,576,798 (ii) was to vote against the resolution 16,961,102 2,927,462 (iii) was to abstain on the resolution 4,677,937 2,383,511 (iv) may vote at the proxy's discretion 218,430 5,031,055 16. Re-appointment of auditors Total number of proxy votes exercisable by all proxies validly appointed: 888,582,995 222,647,880 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 881,472,131 217,084,502 (ii) was to vote against the resolution 6,897,719 528,530 (iii) was to abstain on the resolution 3,234,833 1,270,629 (iv) may vote at the proxy's discretion 213,145 5,034,848 17. Remuneration of auditors Total number of proxy votes exercisable by all proxies validly appointed: 889,873,419 222,677,772 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 888,590,854 216,808,709 (ii) was to vote against the resolution 1,065,399 842,993 (iii) was to abstain on the resolution 1,944,829 1,240,299 (iv) may vote at the proxy's discretion 217,166 5,026,070

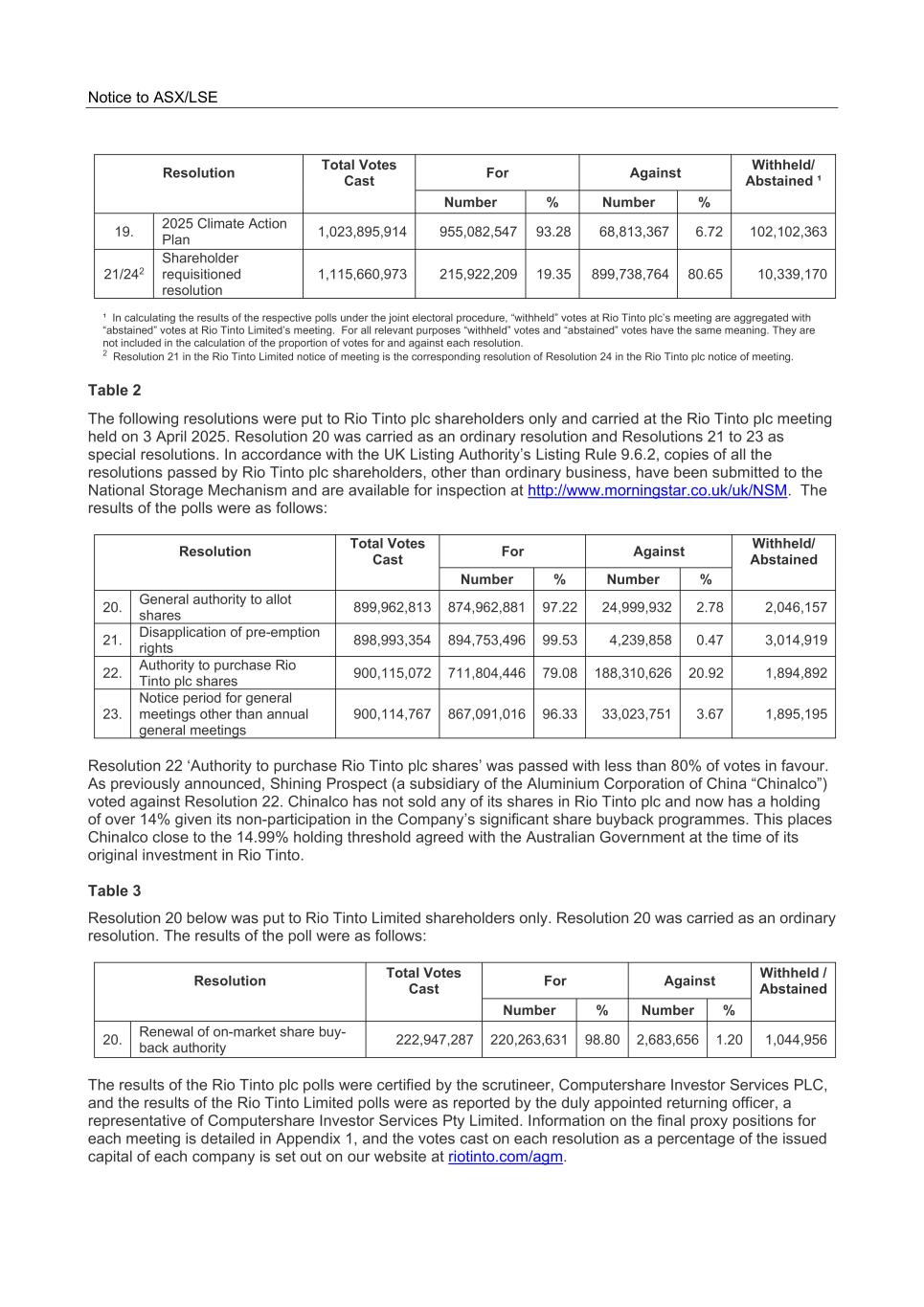

Notice to ASX/LSE PROXY POSITION FOR RIO TINTO PLC AND RIO TINTO LIMITED ON JOINT DECISIONS Rio Tinto plc Rio Tinto Limited 18. Authority to make political donations Total number of proxy votes exercisable by all proxies validly appointed: 883,224,511 222,789,080 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 875,575,346 212,362,864 (ii) was to vote against the resolution 7,438,970 5,448,652 (iii) was to abstain on the resolution 8,586,470 1,119,798 (iv) may vote at the proxy's discretion 210,195 4,977,564 19. 2025 Climate Action Plan Total number of proxy votes exercisable by all proxies validly appointed: 818,067,714 195,568,297 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 765,321,653 174,554,348 (ii) was to vote against the resolution 52,523,568 16,049,262 (iii) was to abstain on the resolution 73,747,019 28,350,580 (iv) may vote at the proxy's discretion 222,493 4,964,687 21/24. Shareholder requisitioned resolution1 Total number of proxy votes exercisable by all proxies validly appointed: 883,139,080 222,271,129 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 184,299,258 30,577,313 (ii) was to vote against the resolution 698,568,141 188,834,971 (iii) was to abstain on the resolution 8,679,257 1,647,747 (iv) may vote at the proxy's discretion 271,681 2,858,845 1 Resolution 21 in the Rio Tinto Limited notice of meeting is the corresponding resolution of Resolution 24 in the Rio Tinto plc notice of meeting.

Notice to ASX/LSE The proxy positions for the resolutions put to the Rio Tinto plc shareholders only were as follows: PROXY POSITION FOR RIO TINTO PLC ONLY MATTERS - RESOLUTIONS FROM MEETING HELD ON 3 APRIL 2025 Rio Tinto plc 20. General authority to allot shares Total number of proxy votes exercisable by all proxies validly appointed: 889,772,551 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 864,979,498 (ii) was to vote against the resolution 24,574,161 (iii) was to abstain on the resolution 2,045,663 (iv) may vote at the proxy's discretion 218,892 21. Disapplication of pre-emption rights Total number of proxy votes exercisable by all proxies validly appointed: 888,803,742 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 884,353,201 (ii) was to vote against the resolution 4,238,456 (iii) was to abstain on the resolution 3,013,775 (iv) may vote at the proxy's discretion 212,085 22. Authority to purchase Rio Tinto plc shares Total number of proxy votes exercisable by all proxies validly appointed: 889,924,810 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 883,950,944 (ii) was to vote against the resolution 5,760,319 (iii) was to abstain on the resolution 1,894,398 (iv) may vote at the proxy's discretion 213,547

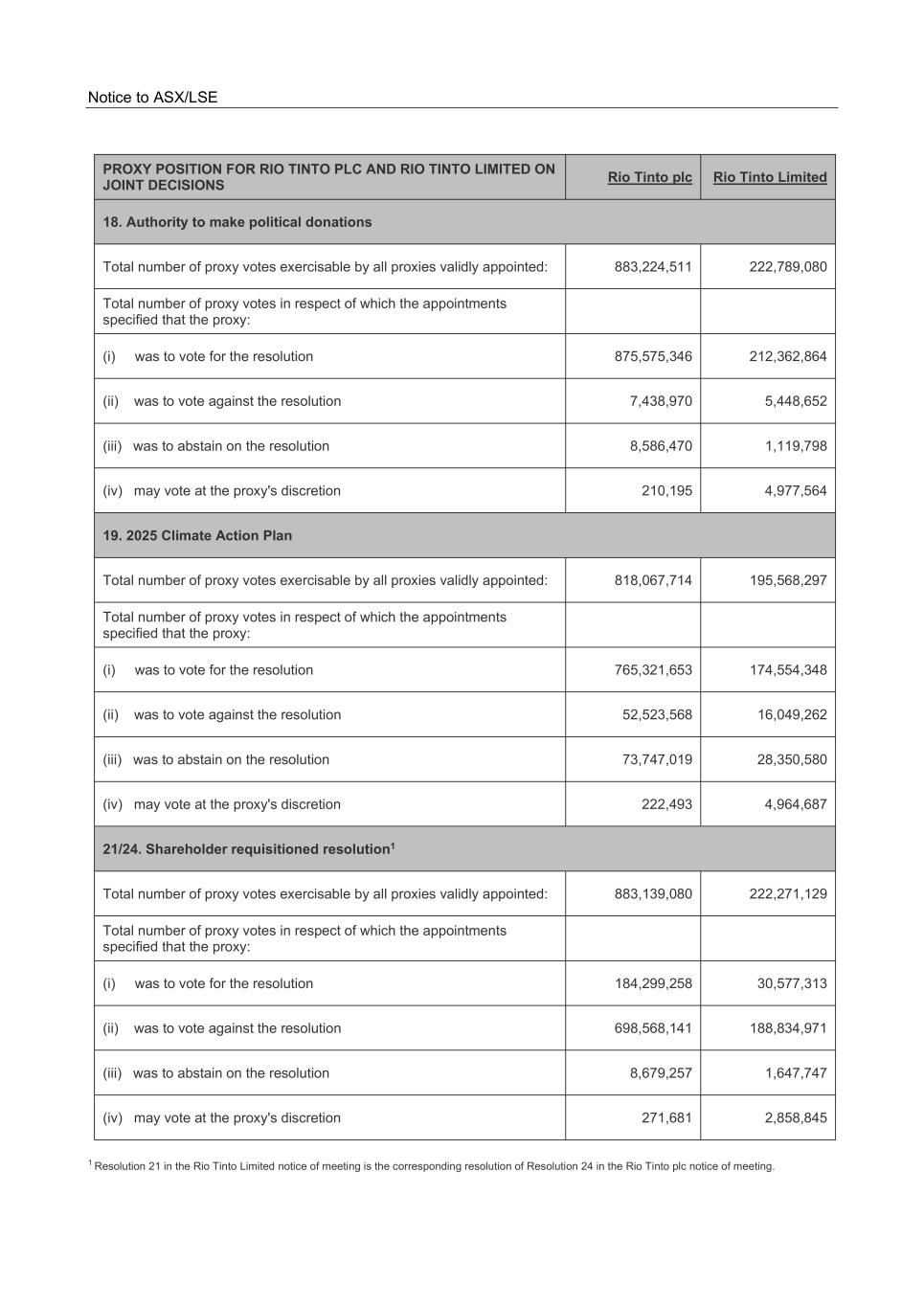

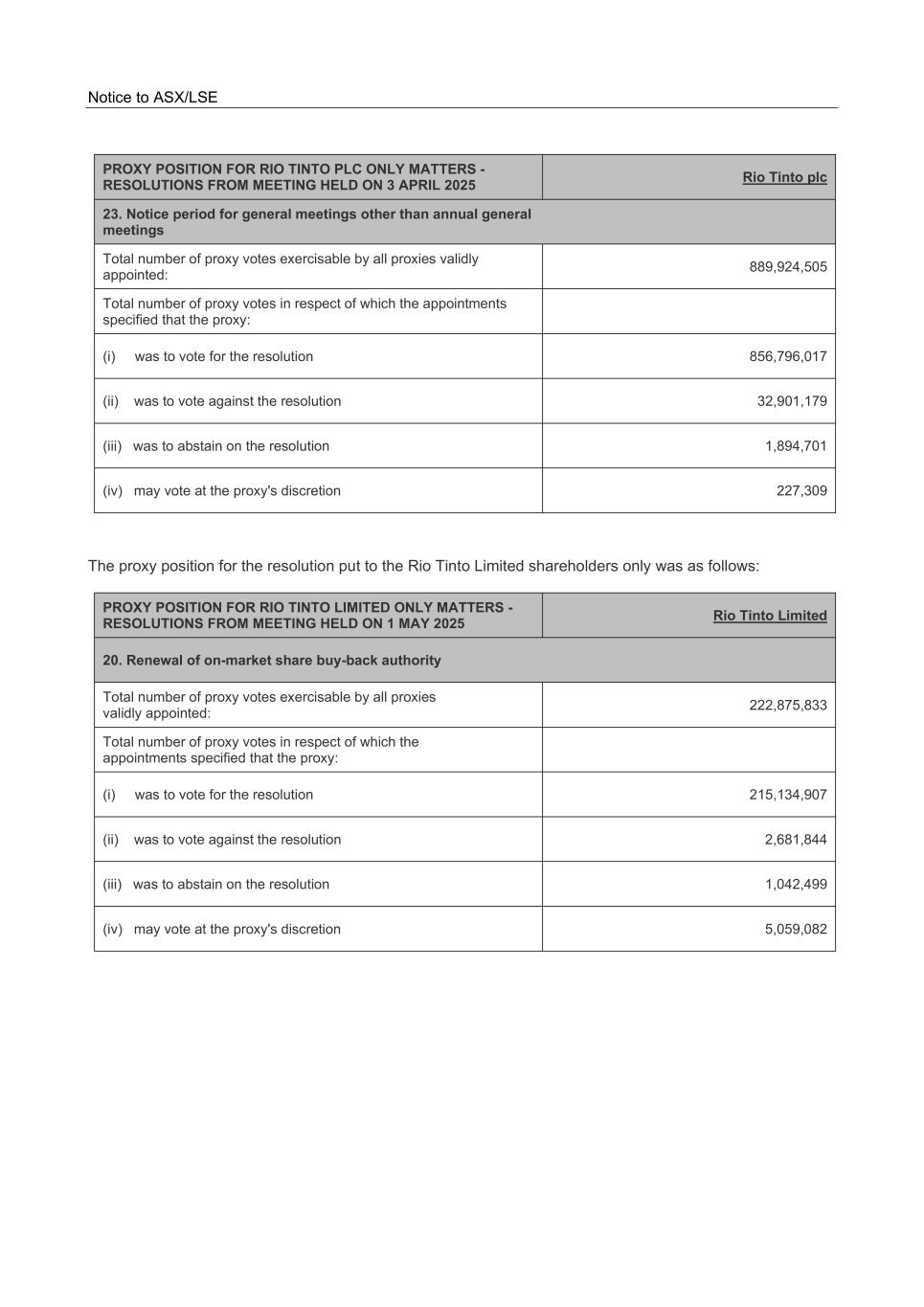

Notice to ASX/LSE PROXY POSITION FOR RIO TINTO PLC ONLY MATTERS - RESOLUTIONS FROM MEETING HELD ON 3 APRIL 2025 Rio Tinto plc 23. Notice period for general meetings other than annual general meetings Total number of proxy votes exercisable by all proxies validly appointed: 889,924,505 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 856,796,017 (ii) was to vote against the resolution 32,901,179 (iii) was to abstain on the resolution 1,894,701 (iv) may vote at the proxy's discretion 227,309 The proxy position for the resolution put to the Rio Tinto Limited shareholders only was as follows: PROXY POSITION FOR RIO TINTO LIMITED ONLY MATTERS - RESOLUTIONS FROM MEETING HELD ON 1 MAY 2025 Rio Tinto Limited 20. Renewal of on-market share buy-back authority Total number of proxy votes exercisable by all proxies validly appointed: 222,875,833 Total number of proxy votes in respect of which the appointments specified that the proxy: (i) was to vote for the resolution 215,134,907 (ii) was to vote against the resolution 2,681,844 (iii) was to abstain on the resolution 1,042,499 (iv) may vote at the proxy's discretion 5,059,082