| Delaware | 001-36560 | 51-0483352 | ||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

||||||||||||

| 777 Long Ridge Road | |||||||||||

| Stamford, | Connecticut | 06902 | |||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common stock, par value $0.001 per share | SYF | New York Stock Exchange | ||||||

| Depositary Shares Each Representing a 1/40th Interest in a Share of 5.625% Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series A | SYFPrA | New York Stock Exchange | ||||||

| Depositary Shares Each Representing a 1/40th Interest in a Share of 8.250% Fixed Rate Reset Non-Cumulative Perpetual Preferred Stock, Series B | SYFPrB | New York Stock Exchange | ||||||

| Emerging growth company | ☐ | ||||||||||

| Number | Description | |||||||

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL | |||||||

SYNCHRONY FINANCIAL |

||||||||||||||||||||

| Date: July 22, 2025 | By: |

/s/ Jonathan Mothner |

||||||||||||||||||

Name: |

Jonathan Mothner |

|||||||||||||||||||

Title: |

Executive Vice President, Chief Risk and Legal Officer | |||||||||||||||||||

|

Exhibit 99.1

For Immediate Release

Synchrony Financial (NYSE: SYF)

July 22, 2025

|

||||||||||

3.2% |

13.6% |

$614M |

$99.8B |

|||||||||||||||||

| Return on Assets | CET1 Ratio | Capital Returned | Loan Receivables | |||||||||||||||||

|

|||||||||||

|

|||||||||||

|

|||||||||||

|

|||||||||||

|

|||||||||||

|

|||||||||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FINANCIAL SUMMARY | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, in millions, except per share statistics) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jun 30, 2025 |

Mar 31, 2025 |

Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

2Q'25 vs. 2Q'24 | Jun 30, 2025 |

Jun 30, 2024 |

YTD'25 vs. YTD'24 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| EARNINGS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

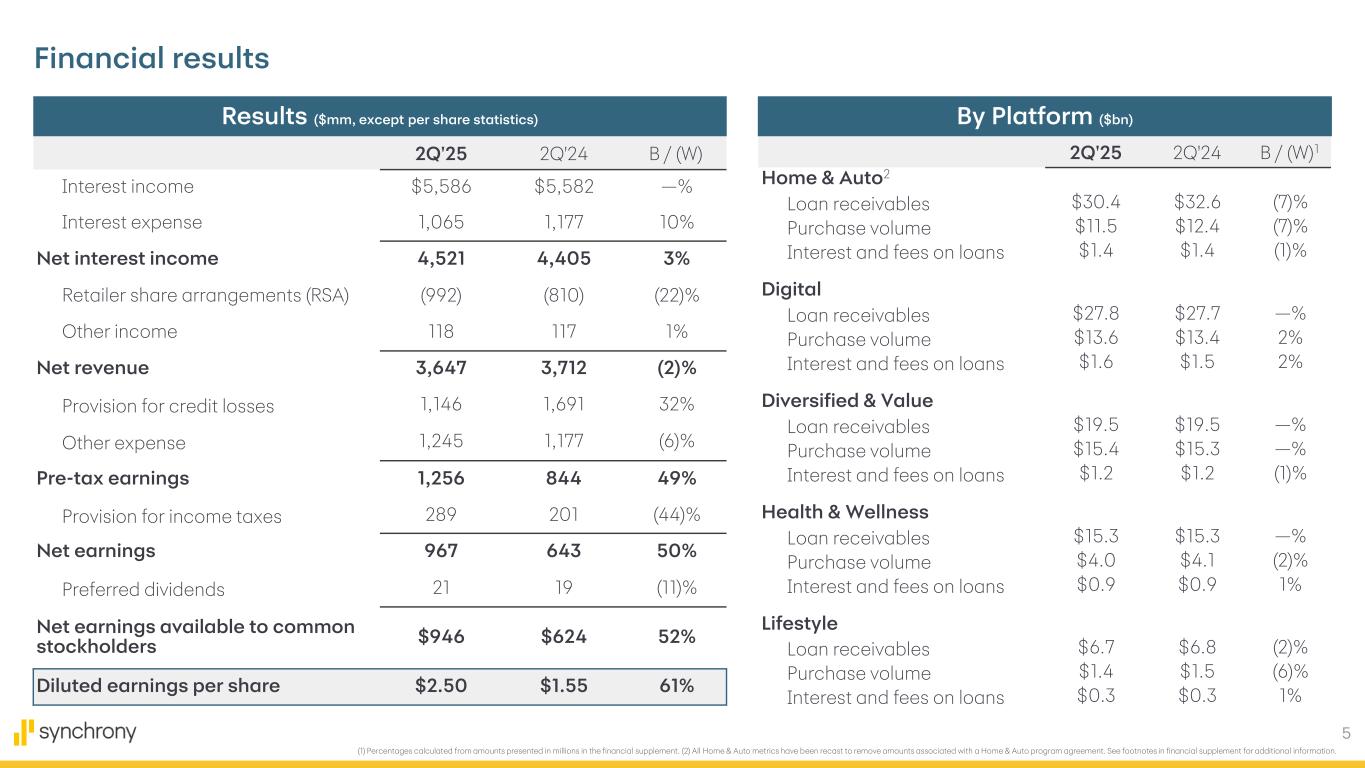

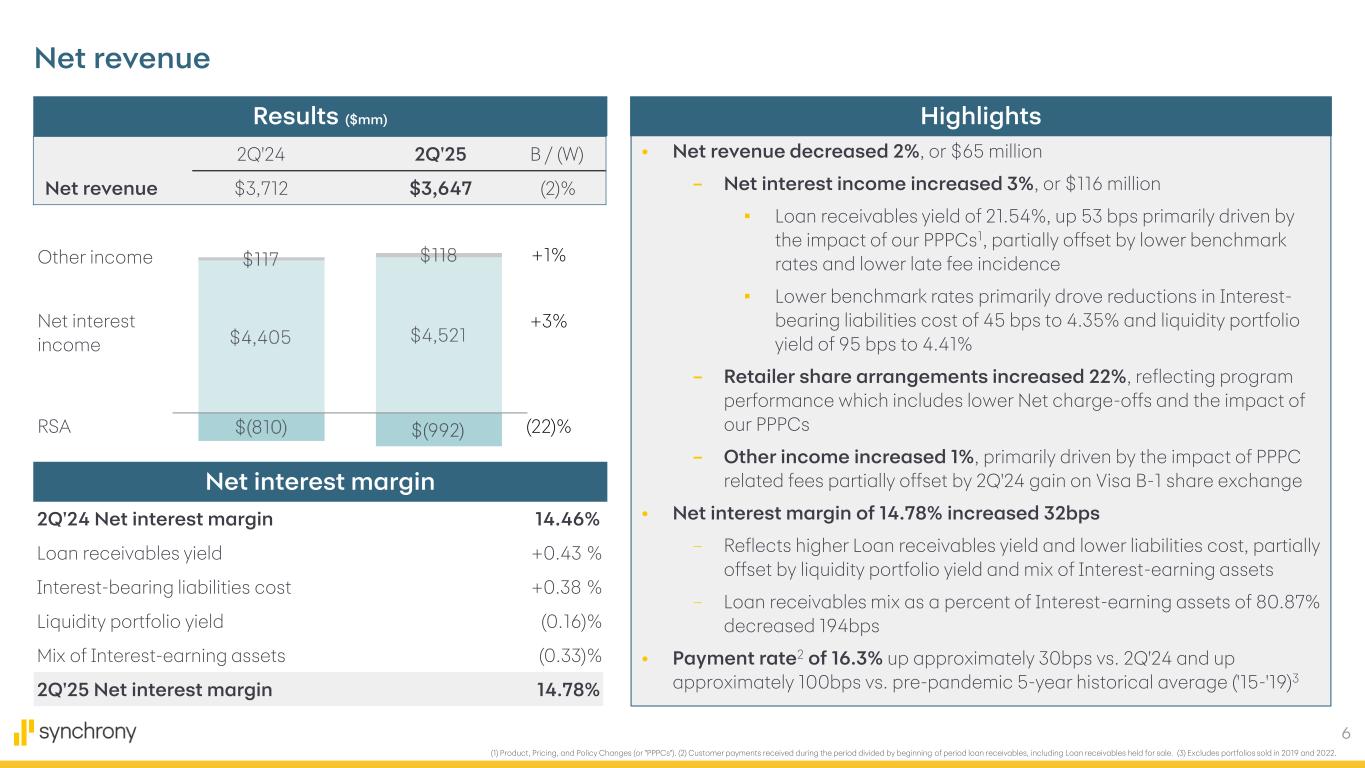

| Net interest income | $ | 4,521 | $ | 4,464 | $ | 4,592 | $ | 4,609 | $ | 4,405 | $ | 116 | 2.6 | % | $ | 8,985 | $ | 8,810 | $ | 175 | 2.0 | % | |||||||||||||||||||||||||||||||||||||

| Retailer share arrangements | (992) | (895) | (919) | (914) | (810) | (182) | 22.5 | % | (1,887) | (1,574) | (313) | 19.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other income | 118 | 149 | 128 | 119 | 117 | 1 | 0.9 | % | 267 | 1,274 | (1,007) | (79.0) | % | ||||||||||||||||||||||||||||||||||||||||||||||

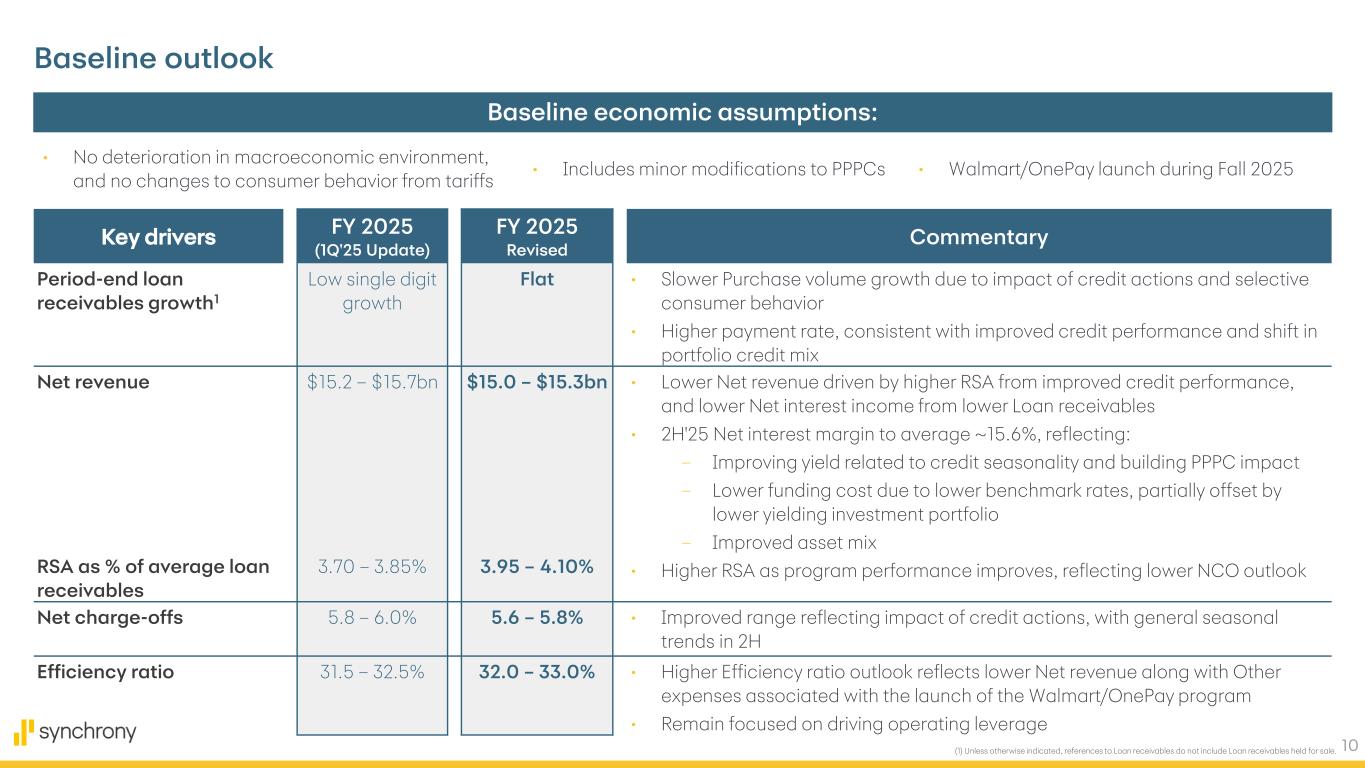

| Net revenue | 3,647 | 3,718 | 3,801 | 3,814 | 3,712 | (65) | (1.8) | % | 7,365 | 8,510 | (1,145) | (13.5) | % | ||||||||||||||||||||||||||||||||||||||||||||||

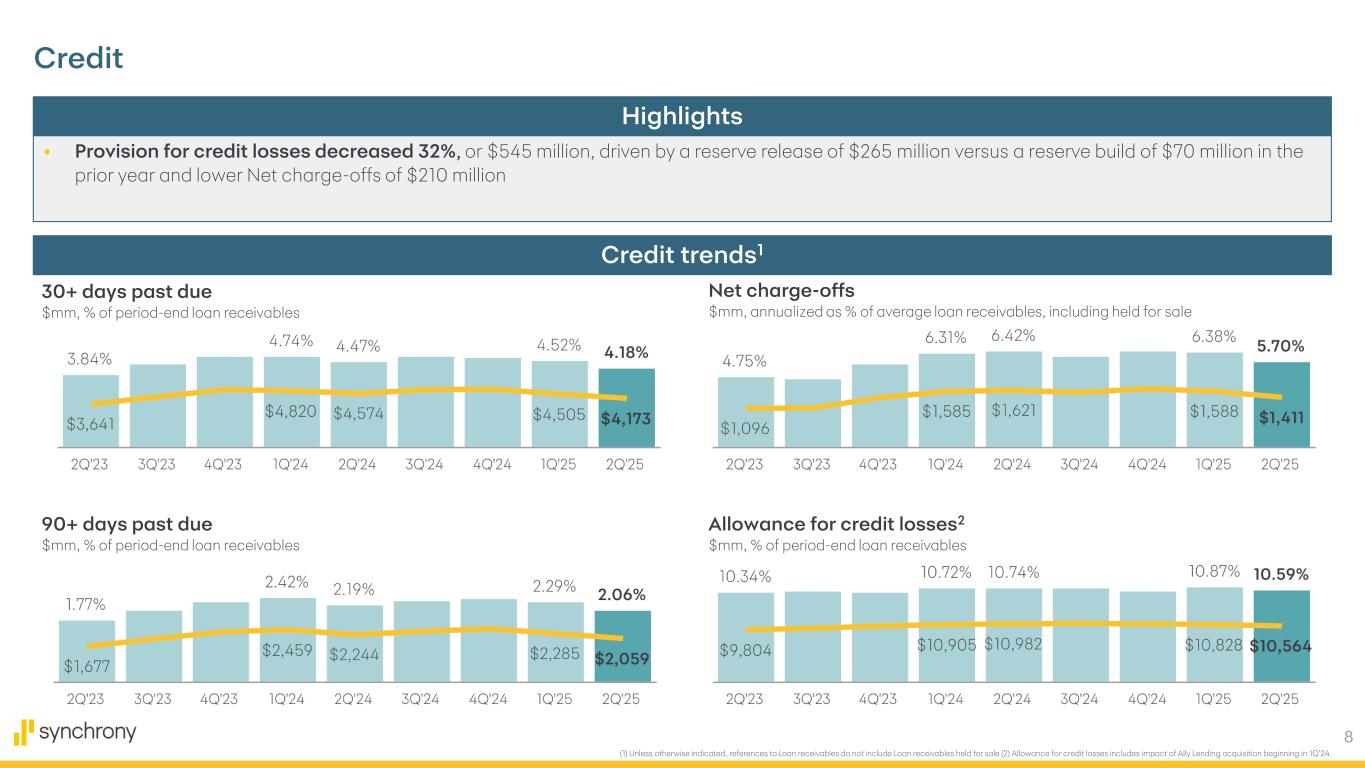

| Provision for credit losses | 1,146 | 1,491 | 1,561 | 1,597 | 1,691 | (545) | (32.2) | % | 2,637 | 3,575 | (938) | (26.2) | % | ||||||||||||||||||||||||||||||||||||||||||||||

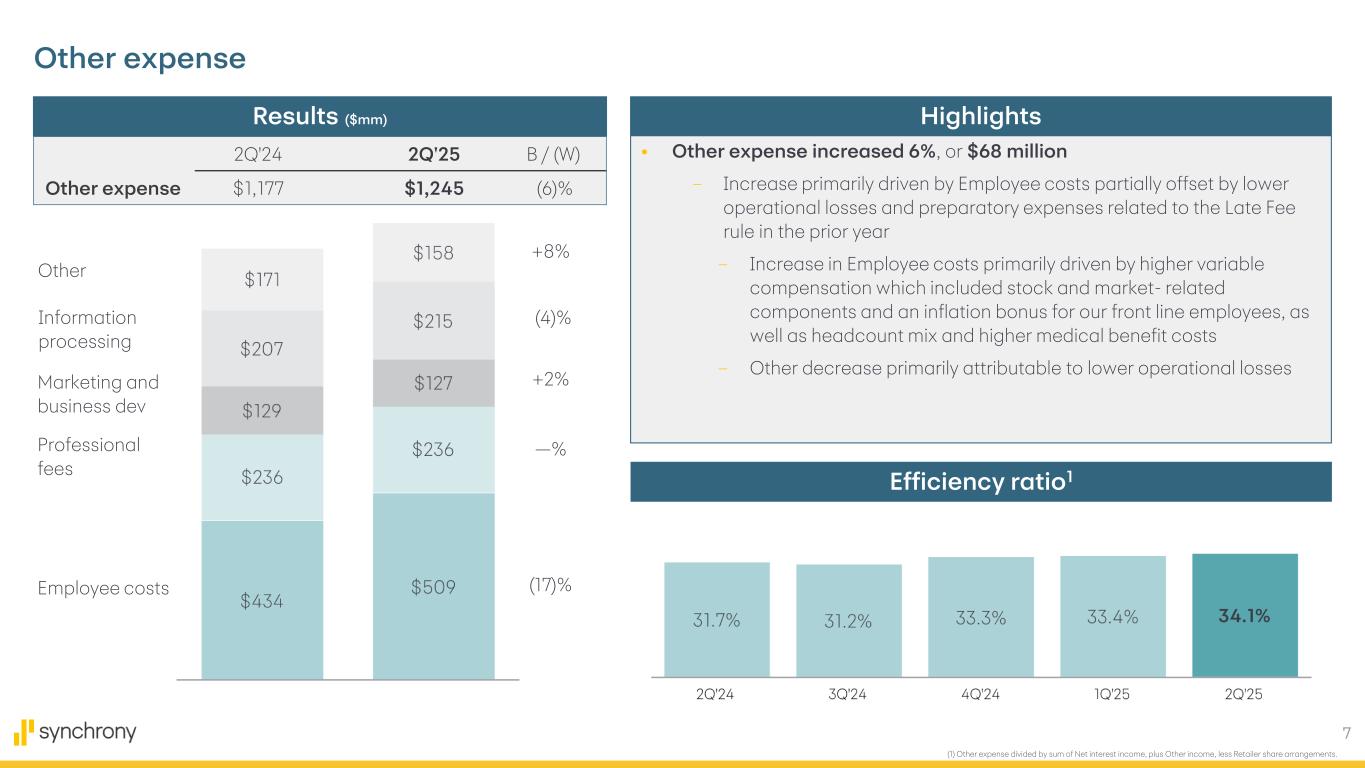

| Other expense | 1,245 | 1,243 | 1,267 | 1,189 | 1,177 | 68 | 5.8 | % | 2,488 | 2,383 | 105 | 4.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Earnings before provision for income taxes | 1,256 | 984 | 973 | 1,028 | 844 | 412 | 48.8 | % | 2,240 | 2,552 | (312) | (12.2) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 289 | 227 | 199 | 239 | 201 | 88 | 43.8 | % | 516 | 616 | (100) | (16.2) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings | $ | 967 | $ | 757 | $ | 774 | $ | 789 | $ | 643 | $ | 324 | 50.4 | % | $ | 1,724 | $ | 1,936 | $ | (212) | (11.0) | % | |||||||||||||||||||||||||||||||||||||

| Net earnings available to common stockholders | $ | 946 | $ | 736 | $ | 753 | $ | 768 | $ | 624 | $ | 322 | 51.6 | % | $ | 1,682 | $ | 1,906 | $ | (224) | (11.8) | % | |||||||||||||||||||||||||||||||||||||

| COMMON SHARE STATISTICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic EPS | $ | 2.51 | $ | 1.91 | $ | 1.93 | $ | 1.96 | $ | 1.56 | $ | 0.95 | 60.9 | % | $ | 4.42 | $ | 4.74 | $ | (0.32) | (6.8) | % | |||||||||||||||||||||||||||||||||||||

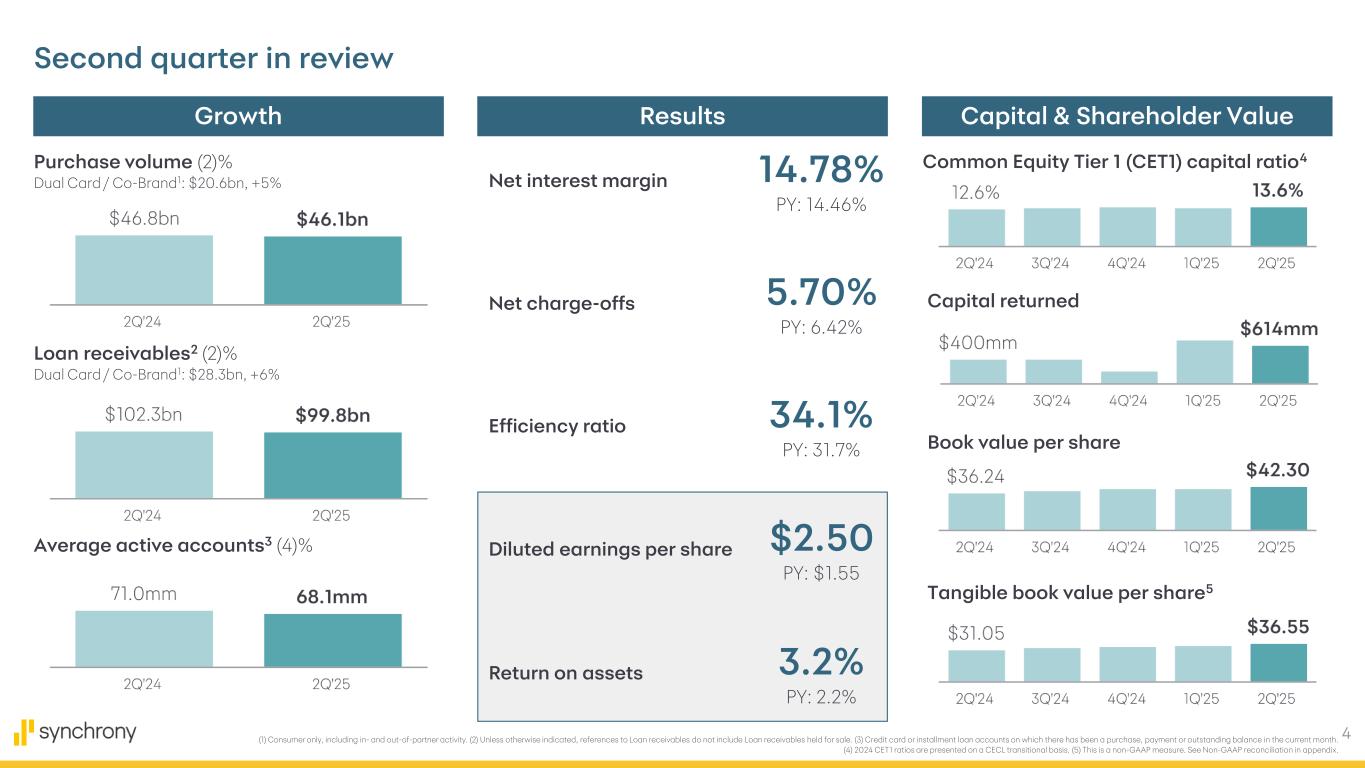

| Diluted EPS | $ | 2.50 | $ | 1.89 | $ | 1.91 | $ | 1.94 | $ | 1.55 | $ | 0.95 | 61.3 | % | $ | 4.38 | $ | 4.70 | $ | (0.32) | (6.8) | % | |||||||||||||||||||||||||||||||||||||

| Dividend declared per share | $ | 0.30 | $ | 0.25 | $ | 0.25 | $ | 0.25 | $ | 0.25 | $ | 0.05 | 20.0 | % | $ | 0.55 | $ | 0.50 | $ | 0.05 | 10.0 | % | |||||||||||||||||||||||||||||||||||||

| Common stock price | $ | 66.74 | $ | 52.94 | $ | 65.00 | $ | 49.88 | $ | 47.19 | $ | 19.55 | 41.4 | % | $ | 66.74 | $ | 47.19 | $ | 19.55 | 41.4 | % | |||||||||||||||||||||||||||||||||||||

| Book value per share | $ | 42.30 | $ | 40.37 | $ | 39.55 | $ | 37.92 | $ | 36.24 | $ | 6.06 | 16.7 | % | $ | 42.30 | $ | 36.24 | $ | 6.06 | 16.7 | % | |||||||||||||||||||||||||||||||||||||

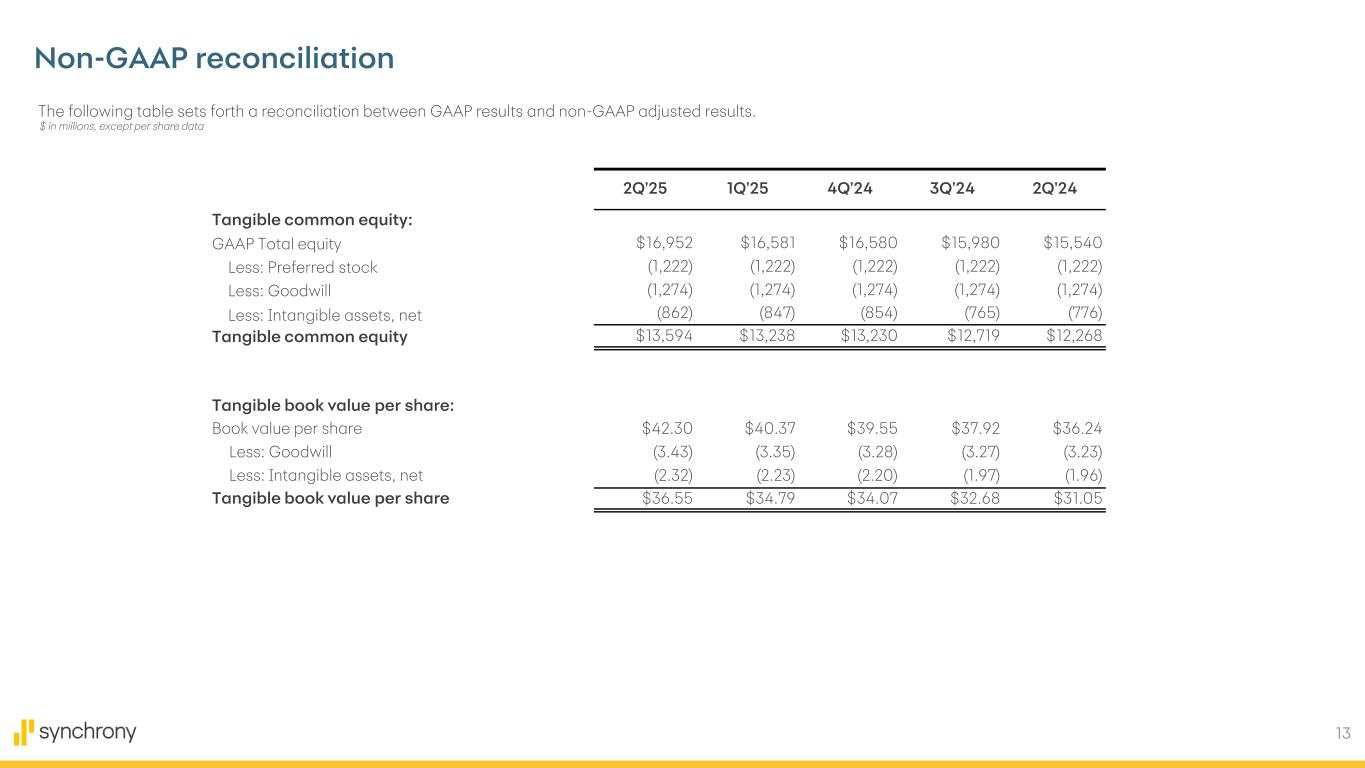

Tangible book value per share(1) |

$ | 36.55 | $ | 34.79 | $ | 34.07 | $ | 32.68 | $ | 31.05 | $ | 5.50 | 17.7 | % | $ | 36.55 | $ | 31.05 | $ | 5.50 | 17.7 | % | |||||||||||||||||||||||||||||||||||||

| Beginning common shares outstanding | 380.5 | 388.3 | 389.2 | 395.1 | 401.4 | (20.9) | (5.2) | % | 388.3 | 406.9 | (18.6) | (4.6) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common shares | — | — | — | — | — | — | NM | — | — | — | NM | ||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | 0.2 | 2.0 | 0.6 | 0.7 | 0.6 | (0.4) | (66.7) | % | 2.2 | 2.6 | (0.4) | (15.4) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Shares repurchased | (8.8) | (9.8) | (1.5) | (6.6) | (6.9) | (1.9) | 27.5 | % | (18.6) | (14.4) | (4.2) | 29.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Ending common shares outstanding | 371.9 | 380.5 | 388.3 | 389.2 | 395.1 | (23.2) | (5.9) | % | 371.9 | 395.1 | (23.2) | (5.9) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Weighted average common shares outstanding | 376.2 | 385.2 | 389.3 | 392.3 | 399.3 | (23.1) | (5.8) | % | 380.7 | 402.0 | (21.3) | (5.3) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Weighted average common shares outstanding (fully diluted) | 379.1 | 389.4 | 394.8 | 396.5 | 402.6 | (23.5) | (5.8) | % | 384.2 | 405.4 | (21.2) | (5.2) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| (1) Tangible book value per share is a non-GAAP measure, calculated based on Tangible common equity divided by common shares outstanding. For corresponding reconciliation of this measure to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SELECTED METRICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jun 30, 2025 |

Mar 31, 2025 |

Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

2Q'25 vs. 2Q'24 | Jun 30, 2025 |

Jun 30, 2024 |

YTD'25 vs. YTD'24 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| PERFORMANCE METRICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Return on assets(1) |

3.2 | % | 2.5 | % | 2.6 | % | 2.6 | % | 2.2 | % | 1.0 | % | 2.9 | % | 3.3 | % | (0.4) | % | |||||||||||||||||||||||||||||||||||||||||

Return on equity(2) |

23.1 | % | 18.4 | % | 18.9 | % | 19.8 | % | 16.7 | % | 6.4 | % | 20.8 | % | 25.8 | % | (5.0) | % | |||||||||||||||||||||||||||||||||||||||||

Return on tangible common equity(3) |

28.3 | % | 22.4 | % | 23.0 | % | 24.3 | % | 20.2 | % | 8.1 | % | 25.3 | % | 31.6 | % | (6.3) | % | |||||||||||||||||||||||||||||||||||||||||

Net interest margin(4) |

14.78 | % | 14.74 | % | 15.01 | % | 15.04 | % | 14.46 | % | 0.32 | % | 14.76 | % | 14.50 | % | 0.26 | % | |||||||||||||||||||||||||||||||||||||||||

| Net revenue as a % of average loan receivables, including held for sale | 14.74 | % | 14.93 | % | 14.76 | % | 14.87 | % | 14.71 | % | 0.03 | % | 14.83 | % | 16.91 | % | (2.08) | % | |||||||||||||||||||||||||||||||||||||||||

Efficiency ratio(5) |

34.1 | % | 33.4 | % | 33.3 | % | 31.2 | % | 31.7 | % | 2.4 | % | 33.8 | % | 28.0 | % | 5.8 | % | |||||||||||||||||||||||||||||||||||||||||

| Other expense as a % of average loan receivables, including held for sale | 5.03 | % | 4.99 | % | 4.92 | % | 4.64 | % | 4.66 | % | 0.37 | % | 5.01 | % | 4.73 | % | 0.28 | % | |||||||||||||||||||||||||||||||||||||||||

| Effective income tax rate | 23.0 | % | 23.1 | % | 20.5 | % | 23.2 | % | 23.8 | % | (0.8) | % | 23.0 | % | 24.1 | % | (1.1) | % | |||||||||||||||||||||||||||||||||||||||||

| CREDIT QUALITY METRICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

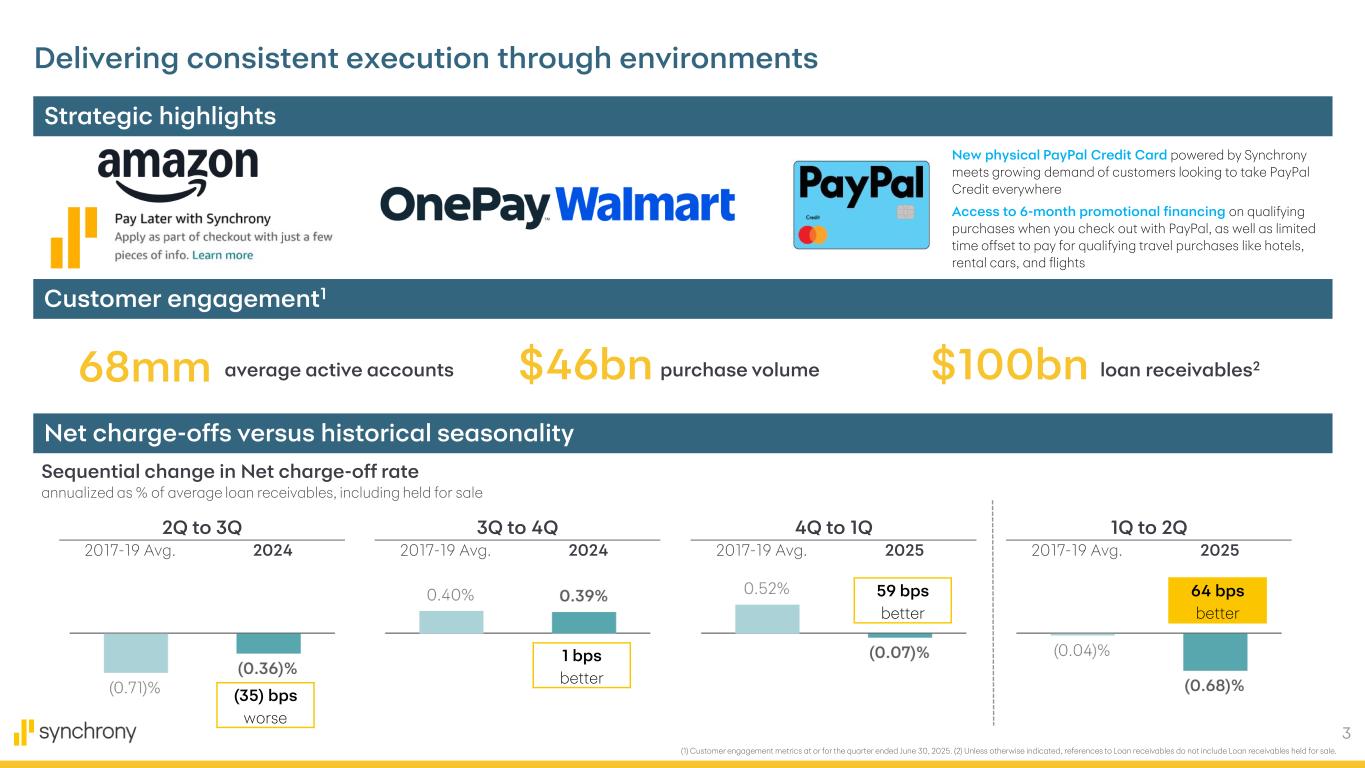

| Net charge-offs as a % of average loan receivables, including held for sale | 5.70 | % | 6.38 | % | 6.45 | % | 6.06 | % | 6.42 | % | (0.72) | % | 6.04 | % | 6.37 | % | (0.33) | % | |||||||||||||||||||||||||||||||||||||||||

30+ days past due as a % of period-end loan receivables(6) |

4.18 | % | 4.52 | % | 4.70 | % | 4.78 | % | 4.47 | % | (0.29) | % | 4.18 | % | 4.47 | % | (0.29) | % | |||||||||||||||||||||||||||||||||||||||||

90+ days past due as a % of period-end loan receivables(6) |

2.06 | % | 2.29 | % | 2.40 | % | 2.33 | % | 2.19 | % | (0.13) | % | 2.06 | % | 2.19 | % | (0.13) | % | |||||||||||||||||||||||||||||||||||||||||

| Net charge-offs | $ | 1,411 | $ | 1,588 | $ | 1,661 | $ | 1,553 | $ | 1,621 | $ | (210) | (13.0) | % | $ | 2,999 | $ | 3,206 | $ | (207) | (6.5) | % | |||||||||||||||||||||||||||||||||||||

Loan receivables delinquent over 30 days(6) |

$ | 4,173 | $ | 4,505 | $ | 4,925 | $ | 4,883 | $ | 4,574 | $ | (401) | (8.8) | % | $ | 4,173 | $ | 4,574 | $ | (401) | (8.8) | % | |||||||||||||||||||||||||||||||||||||

Loan receivables delinquent over 90 days(6) |

$ | 2,059 | $ | 2,285 | $ | 2,512 | $ | 2,382 | $ | 2,244 | $ | (185) | (8.2) | % | $ | 2,059 | $ | 2,244 | $ | (185) | (8.2) | % | |||||||||||||||||||||||||||||||||||||

| Allowance for credit losses (period-end) | $ | 10,564 | $ | 10,828 | $ | 10,929 | $ | 11,029 | $ | 10,982 | $ | (418) | (3.8) | % | $ | 10,564 | $ | 10,982 | $ | (418) | (3.8) | % | |||||||||||||||||||||||||||||||||||||

Allowance coverage ratio(7) |

10.59 | % | 10.87 | % | 10.44 | % | 10.79 | % | 10.74 | % | (0.15) | % | 10.59 | % | 10.74 | % | (0.15) | % | |||||||||||||||||||||||||||||||||||||||||

| BUSINESS METRICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(8) |

$ | 46,084 | $ | 40,720 | $ | 47,955 | $ | 44,985 | $ | 46,846 | $ | (762) | (1.6) | % | $ | 86,804 | $ | 89,233 | $ | (2,429) | (2.7) | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 99,776 | $ | 99,608 | $ | 104,721 | $ | 102,193 | $ | 102,284 | $ | (2,508) | (2.5) | % | $ | 99,776 | $ | 102,284 | $ | (2,508) | (2.5) | % | |||||||||||||||||||||||||||||||||||||

| Credit cards | $ | 92,036 | $ | 91,909 | $ | 96,818 | $ | 94,008 | $ | 94,091 | $ | (2,055) | (2.2) | % | $ | 92,036 | $ | 94,091 | $ | (2,055) | (2.2) | % | |||||||||||||||||||||||||||||||||||||

| Consumer installment loans | $ | 5,669 | $ | 5,736 | $ | 5,971 | $ | 6,125 | $ | 6,072 | $ | (403) | (6.6) | % | $ | 5,669 | $ | 6,072 | $ | (403) | (6.6) | % | |||||||||||||||||||||||||||||||||||||

| Commercial credit products | $ | 1,980 | $ | 1,859 | $ | 1,826 | $ | 1,936 | $ | 2,003 | $ | (23) | (1.1) | % | $ | 1,980 | $ | 2,003 | $ | (23) | (1.1) | % | |||||||||||||||||||||||||||||||||||||

| Other | $ | 91 | $ | 104 | $ | 106 | $ | 124 | $ | 118 | $ | (27) | (22.9) | % | $ | 91 | $ | 118 | $ | (27) | (22.9) | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 99,236 | $ | 101,021 | $ | 102,476 | $ | 102,009 | $ | 101,478 | $ | (2,242) | (2.2) | % | $ | 100,123 | $ | 101,218 | $ | (1,095) | (1.1) | % | |||||||||||||||||||||||||||||||||||||

Period-end active accounts (in thousands)(9) |

68,186 | 67,787 | 71,532 | 69,965 | 70,991 | (2,805) | (4.0) | % | 68,186 | 70,991 | (2,805) | (4.0) | % | ||||||||||||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(9) |

68,050 | 69,315 | 70,299 | 70,424 | 70,974 | (2,924) | (4.1) | % | 68,810 | 71,402 | (2,592) | (3.6) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| LIQUIDITY | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liquid assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and equivalents | $ | 19,457 | $ | 21,629 | $ | 14,711 | $ | 17,934 | $ | 18,632 | $ | 825 | 4.4 | % | $ | 19,457 | $ | 18,632 | $ | 825 | 4.4 | % | |||||||||||||||||||||||||||||||||||||

| Total liquid assets | $ | 21,796 | $ | 23,817 | $ | 17,159 | $ | 19,704 | $ | 20,051 | $ | 1,745 | 8.7 | % | $ | 21,796 | $ | 20,051 | $ | 1,745 | 8.7 | % | |||||||||||||||||||||||||||||||||||||

| Undrawn credit facilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Undrawn credit facilities | $ | 2,625 | $ | 2,625 | $ | 2,625 | $ | 2,700 | $ | 2,950 | $ | (325) | (11.0) | % | $ | 2,625 | $ | 2,950 | $ | (325) | (11.0) | % | |||||||||||||||||||||||||||||||||||||

Total liquid assets and undrawn credit facilities(10) |

$ | 24,421 | $ | 26,442 | $ | 19,784 | $ | 22,404 | $ | 23,001 | $ | 1,420 | 6.2 | % | $ | 24,421 | $ | 23,001 | $ | 1,420 | 6.2 | % | |||||||||||||||||||||||||||||||||||||

| Liquid assets % of total assets | 18.09 | % | 19.52 | % | 14.36 | % | 16.53 | % | 16.64 | % | 1.45 | % | 18.09 | % | 16.64 | % | 1.45 | % | |||||||||||||||||||||||||||||||||||||||||

| Liquid assets including undrawn credit facilities % of total assets | 20.27 | % | 21.67 | % | 16.56 | % | 18.79 | % | 19.09 | % | 1.18 | % | 20.27 | % | 19.09 | % | 1.18 | % | |||||||||||||||||||||||||||||||||||||||||

| (1) Return on assets represents annualized net earnings as a percentage of average total assets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Return on equity represents annualized net earnings as a percentage of average total equity. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) Return on tangible common equity represents annualized net earnings available to common stockholders as a percentage of average tangible common equity. Tangible common equity ("TCE") is a non-GAAP measure. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) Net interest margin represents annualized net interest income divided by average total interest-earning assets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (5) Efficiency ratio represents (i) other expense, divided by (ii) net interest income, plus other income, less retailer share arrangements. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (6) Based on customer statement-end balances extrapolated to the respective period-end date. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (7) Allowance coverage ratio represents allowance for credit losses divided by total period-end loan receivables. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (8) Purchase volume, or net credit sales, represents the aggregate amount of charges incurred on credit cards or other credit product accounts less returns during the period. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (9) Active accounts represent credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (10) Excludes uncommitted credit facilities and available borrowing capacity related to unencumbered assets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STATEMENTS OF EARNINGS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jun 30, 2025 |

Mar 31, 2025 |

Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

2Q'25 vs. 2Q'24 | Jun 30, 2025 |

Jun 30, 2024 |

YTD'25 vs. YTD'24 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 5,328 | $ | 5,312 | $ | 5,480 | $ | 5,522 | $ | 5,301 | $ | 27 | 0.5 | % | $ | 10,640 | $ | 10,594 | $ | 46 | 0.4 | % | |||||||||||||||||||||||||||||||||||||

| Interest on cash and debt securities | 258 | 238 | 230 | 263 | 281 | (23) | (8.2) | % | 496 | 556 | (60) | (10.8) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total interest income | 5,586 | 5,550 | 5,710 | 5,785 | 5,582 | 4 | 0.1 | % | 11,136 | 11,150 | (14) | (0.1) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest on deposits | 855 | 882 | 917 | 968 | 967 | (112) | (11.6) | % | 1,737 | 1,921 | (184) | (9.6) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest on borrowings of consolidated securitization entities | 104 | 104 | 104 | 108 | 110 | (6) | (5.5) | % | 208 | 215 | (7) | (3.3) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest on senior unsecured notes | 106 | 100 | 97 | 100 | 100 | 6 | 6.0 | % | 206 | 204 | 2 | 1.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total interest expense | 1,065 | 1,086 | 1,118 | 1,176 | 1,177 | (112) | (9.5) | % | 2,151 | 2,340 | (189) | (8.1) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 4,521 | 4,464 | 4,592 | 4,609 | 4,405 | 116 | 2.6 | % | 8,985 | 8,810 | 175 | 2.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Retailer share arrangements | (992) | (895) | (919) | (914) | (810) | (182) | 22.5 | % | (1,887) | (1,574) | (313) | 19.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 1,146 | 1,491 | 1,561 | 1,597 | 1,691 | (545) | (32.2) | % | 2,637 | 3,575 | (938) | (26.2) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income, after retailer share arrangements and provision for credit losses | 2,383 | 2,078 | 2,112 | 2,098 | 1,904 | 479 | 25.2 | % | 4,461 | 3,661 | 800 | 21.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interchange revenue | 268 | 238 | 266 | 256 | 263 | 5 | 1.9 | % | 506 | 504 | 2 | 0.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Protection product revenue | 144 | 147 | 151 | 145 | 125 | 19 | 15.2 | % | 291 | 266 | 25 | 9.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Loyalty programs | (360) | (311) | (371) | (346) | (346) | (14) | 4.0 | % | (671) | (665) | (6) | 0.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other | 66 | 75 | 82 | 64 | 75 | (9) | (12.0) | % | 141 | 1,169 | (1,028) | (87.9) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total other income | 118 | 149 | 128 | 119 | 117 | 1 | 0.9 | % | 267 | 1,274 | (1,007) | (79.0) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other expense: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Employee costs | 509 | 506 | 478 | 464 | 434 | 75 | 17.3 | % | 1,015 | 930 | 85 | 9.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Professional fees | 236 | 217 | 249 | 231 | 236 | — | — | % | 453 | 456 | (3) | (0.7) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Marketing and business development | 127 | 116 | 147 | 123 | 129 | (2) | (1.6) | % | 243 | 254 | (11) | (4.3) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Information processing | 215 | 219 | 207 | 203 | 207 | 8 | 3.9 | % | 434 | 393 | 41 | 10.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other | 158 | 185 | 186 | 168 | 171 | (13) | (7.6) | % | 343 | 350 | (7) | (2.0) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total other expense | 1,245 | 1,243 | 1,267 | 1,189 | 1,177 | 68 | 5.8 | % | 2,488 | 2,383 | 105 | 4.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Earnings before provision for income taxes | 1,256 | 984 | 973 | 1,028 | 844 | 412 | 48.8 | % | 2,240 | 2,552 | (312) | (12.2) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 289 | 227 | 199 | 239 | 201 | 88 | 43.8 | % | 516 | 616 | (100) | (16.2) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings | $ | 967 | $ | 757 | $ | 774 | $ | 789 | $ | 643 | $ | 324 | 50.4 | % | $ | 1,724 | $ | 1,936 | $ | (212) | (11.0) | % | |||||||||||||||||||||||||||||||||||||

| Net earnings available to common stockholders | $ | 946 | $ | 736 | $ | 753 | $ | 768 | $ | 624 | $ | 322 | 51.6 | % | $ | 1,682 | $ | 1,906 | $ | (224) | (11.8) | % | |||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | ||||||||||||||||||||||||||||||||||||||

| STATEMENTS OF FINANCIAL POSITION | ||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | ||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||

| Jun 30, 2025 |

Mar 31, 2025 |

Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

June 30, 2025 vs. Jun 30, 2024 |

|||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||

| Cash and equivalents | $ | 19,457 | $ | 21,629 | $ | 14,711 | $ | 17,934 | $ | 18,632 | $ | 825 | 4.4 | % | ||||||||||||||||||||||||

| Debt securities | 2,905 | 2,724 | 3,079 | 2,345 | 2,693 | 212 | 7.9 | % | ||||||||||||||||||||||||||||||

| Loan receivables: | ||||||||||||||||||||||||||||||||||||||

| Unsecuritized loans held for investment | 78,566 | 79,186 | 83,382 | 81,005 | 82,144 | (3,578) | (4.4) | % | ||||||||||||||||||||||||||||||

| Restricted loans of consolidated securitization entities | 21,210 | 20,422 | 21,339 | 21,188 | 20,140 | 1,070 | 5.3 | % | ||||||||||||||||||||||||||||||

| Total loan receivables | 99,776 | 99,608 | 104,721 | 102,193 | 102,284 | (2,508) | (2.5) | % | ||||||||||||||||||||||||||||||

| Less: Allowance for credit losses | (10,564) | (10,828) | (10,929) | (11,029) | (10,982) | 418 | (3.8) | % | ||||||||||||||||||||||||||||||

| Loan receivables, net | 89,212 | 88,780 | 93,792 | 91,164 | 91,302 | (2,090) | (2.3) | % | ||||||||||||||||||||||||||||||

| Loan receivables held for sale | 191 | — | — | — | — | 191 | NM | |||||||||||||||||||||||||||||||

| Goodwill | 1,274 | 1,274 | 1,274 | 1,274 | 1,274 | — | — | % | ||||||||||||||||||||||||||||||

| Intangible assets, net | 862 | 847 | 854 | 765 | 776 | 86 | 11.1 | % | ||||||||||||||||||||||||||||||

| Other assets | 6,604 | 6,772 | 5,753 | 5,747 | 5,812 | 792 | 13.6 | % | ||||||||||||||||||||||||||||||

| Total assets | $ | 120,505 | $ | 122,026 | $ | 119,463 | $ | 119,229 | $ | 120,489 | $ | 16 | — | % | ||||||||||||||||||||||||

| Liabilities and Equity | ||||||||||||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposit accounts | $ | 81,857 | $ | 83,030 | $ | 81,664 | $ | 81,901 | $ | 82,708 | $ | (851) | (1.0) | % | ||||||||||||||||||||||||

| Non-interest-bearing deposit accounts | 405 | 405 | 398 | 383 | 392 | 13 | 3.3 | % | ||||||||||||||||||||||||||||||

| Total deposits | 82,262 | 83,435 | 82,062 | 82,284 | 83,100 | (838) | (1.0) | % | ||||||||||||||||||||||||||||||

| Borrowings: | ||||||||||||||||||||||||||||||||||||||

| Borrowings of consolidated securitization entities | 8,340 | 8,591 | 7,842 | 8,015 | 7,517 | 823 | 10.9 | % | ||||||||||||||||||||||||||||||

| Senior and Subordinated unsecured notes | 7,669 | 8,418 | 7,620 | 7,617 | 8,120 | (451) | (5.6) | % | ||||||||||||||||||||||||||||||

| Total borrowings | 16,009 | 17,009 | 15,462 | 15,632 | 15,637 | 372 | 2.4 | % | ||||||||||||||||||||||||||||||

| Accrued expenses and other liabilities | 5,282 | 5,001 | 5,359 | 5,333 | 6,212 | (930) | (15.0) | % | ||||||||||||||||||||||||||||||

| Total liabilities | 103,553 | 105,445 | 102,883 | 103,249 | 104,949 | (1,396) | (1.3) | % | ||||||||||||||||||||||||||||||

| Equity: | ||||||||||||||||||||||||||||||||||||||

| Preferred stock | 1,222 | 1,222 | 1,222 | 1,222 | 1,222 | — | — | % | ||||||||||||||||||||||||||||||

| Common stock | 1 | 1 | 1 | 1 | 1 | — | — | % | ||||||||||||||||||||||||||||||

| Additional paid-in capital | 9,836 | 9,804 | 9,853 | 9,822 | 9,793 | 43 | 0.4 | % | ||||||||||||||||||||||||||||||

| Retained earnings | 23,036 | 22,209 | 21,635 | 20,975 | 20,310 | 2,726 | 13.4 | % | ||||||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (45) | (53) | (59) | (50) | (73) | 28 | (38.4) | % | ||||||||||||||||||||||||||||||

| Treasury stock | (17,098) | (16,602) | (16,072) | (15,990) | (15,713) | (1,385) | 8.8 | % | ||||||||||||||||||||||||||||||

| Total equity | 16,952 | 16,581 | 16,580 | 15,980 | 15,540 | 1,412 | 9.1 | % | ||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 120,505 | $ | 122,026 | $ | 119,463 | $ | 119,229 | $ | 120,489 | $ | 16 | — | % | ||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE BALANCES, NET INTEREST INCOME AND NET INTEREST MARGIN | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | Sep 30, 2024 | Jun 30, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest | Average | Interest | Average | Interest | Average | Interest | Average | Interest | Average | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average | Income/ | Yield/ | Average | Income/ | Yield/ | Average | Income/ | Yield/ | Average | Income/ | Yield/ | Average | Income/ | Yield/ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance | Expense | Rate(1) |

Balance | Expense | Rate(1) |

Balance | Expense | Rate(1) |

Balance | Expense | Rate(1) |

Balance | Expense | Rate(1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning cash and equivalents | $ | 20,699 | $ | 228 | 4.42 | % | $ | 18,539 | $ | 203 | 4.44 | % | $ | 16,131 | $ | 193 | 4.76 | % | $ | 17,316 | $ | 235 | 5.40 | % | $ | 18,337 | $ | 249 | 5.46 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities available for sale | 2,774 | 30 | 4.34 | % | 3,231 | 35 | 4.39 | % | 3,111 | 37 | 4.73 | % | 2,587 | 28 | 4.31 | % | 2,731 | 32 | 4.71 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan receivables, including held for sale: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit cards | 91,460 | 5,076 | 22.26 | % | 93,241 | 5,055 | 21.99 | % | 94,356 | 5,209 | 21.96 | % | 93,785 | 5,236 | 22.21 | % | 93,267 | 5,013 | 21.62 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer installment loans | 5,692 | 207 | 14.59 | % | 5,833 | 211 | 14.67 | % | 6,041 | 224 | 14.75 | % | 6,107 | 238 | 15.50 | % | 6,085 | 243 | 16.06 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial credit products | 1,981 | 43 | 8.71 | % | 1,842 | 45 | 9.91 | % | 1,953 | 45 | 9.17 | % | 1,992 | 46 | 9.19 | % | 2,001 | 43 | 8.64 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 103 | 2 | 7.79 | % | 105 | 1 | 3.86 | % | 126 | 2 | 6.31 | % | 125 | 2 | 6.37 | % | 125 | 2 | 6.44 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loan receivables, including held for sale | 99,236 | 5,328 | 21.54 | % | 101,021 | 5,312 | 21.33 | % | 102,476 | 5,480 | 21.27 | % | 102,009 | 5,522 | 21.54 | % | 101,478 | 5,301 | 21.01 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 122,709 | 5,586 | 18.26 | % | 122,791 | 5,550 | 18.33 | % | 121,718 | 5,710 | 18.66 | % | 121,912 | 5,785 | 18.88 | % | 122,546 | 5,582 | 18.32 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-earning assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 868 | 868 | 872 | 847 | 887 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | (10,797) | (10,936) | (11,014) | (10,994) | (10,878) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 7,661 | 7,770 | 7,678 | 7,624 | 7,309 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total non-interest-earning assets | (2,268) | (2,298) | (2,464) | (2,523) | (2,682) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 120,441 | $ | 120,493 | $ | 119,254 | $ | 119,389 | $ | 119,864 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposit accounts | $ | 82,014 | $ | 855 | 4.18 | % | $ | 82,370 | $ | 882 | 4.34 | % | $ | 81,635 | $ | 917 | 4.47 | % | $ | 82,100 | $ | 968 | 4.69 | % | $ | 82,749 | $ | 967 | 4.70 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Borrowings of consolidated securitization entities | 7,926 | 104 | 5.26 | % | 8,191 | 104 | 5.15 | % | 7,868 | 104 | 5.26 | % | 7,817 | 108 | 5.50 | % | 7,858 | 110 | 5.63 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Senior and Subordinated unsecured notes | 8,269 | 106 | 5.14 | % | 7,850 | 100 | 5.17 | % | 7,618 | 97 | 5.07 | % | 7,968 | 100 | 4.99 | % | 8,118 | 100 | 4.95 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 98,209 | 1,065 | 4.35 | % | 98,411 | 1,086 | 4.48 | % | 97,121 | 1,118 | 4.58 | % | 97,885 | 1,176 | 4.78 | % | 98,725 | 1,177 | 4.80 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing deposit accounts | 412 | 418 | 379 | 387 | 396 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 5,065 | 4,969 | 5,444 | 5,302 | 5,221 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total non-interest-bearing liabilities | 5,477 | 5,387 | 5,823 | 5,689 | 5,617 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 103,686 | 103,798 | 102,944 | 103,574 | 104,342 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total equity | 16,755 | 16,695 | 16,310 | 15,815 | 15,522 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 120,441 | $ | 120,493 | $ | 119,254 | $ | 119,389 | $ | 119,864 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 4,521 | $ | 4,464 | $ | 4,592 | $ | 4,609 | $ | 4,405 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest rate spread(2) |

13.91 | % | 13.86 | % | 14.08 | % | 14.10 | % | 13.53 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin(3) |

14.78 | % | 14.74 | % | 15.01 | % | 15.04 | % | 14.46 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) Average yields/rates are based on annualized total interest income/expense divided by average balances. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Interest rate spread represents the difference between the yield on total interest-earning assets and the rate on total interest-bearing liabilities. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) Net interest margin represents annualized net interest income divided by average total interest-earning assets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||

| AVERAGE BALANCES, NET INTEREST INCOME AND NET INTEREST MARGIN | |||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||

| Six Months Ended Jun 30, 2025 |

Six Months Ended Jun 30, 2024 |

||||||||||||||||||||||||||||||||||

| Interest | Average | Interest | Average | ||||||||||||||||||||||||||||||||

| Average | Income/ | Yield/ | Average | Income/ | Yield/ | ||||||||||||||||||||||||||||||

| Balance | Expense | Rate(1) |

Balance | Expense | Rate(1) |

||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||

| Interest-earning cash and equivalents | $ | 19,625 | $ | 431 | 4.43 | % | $ | 17,871 | $ | 485 | 5.46 | % | |||||||||||||||||||||||

| Securities available for sale | 3,001 | 65 | 4.37 | % | 3,082 | 71 | 4.63 | % | |||||||||||||||||||||||||||

| Loan receivables, including held for sale: | |||||||||||||||||||||||||||||||||||

| Credit cards | 92,345 | 10,131 | 22.12 | % | 93,743 | 10,109 | 21.69 | % | |||||||||||||||||||||||||||

| Consumer installment loans | 5,762 | 418 | 14.63 | % | 5,409 | 392 | 14.57 | % | |||||||||||||||||||||||||||

| Commercial credit products | 1,912 | 88 | 9.28 | % | 1,939 | 88 | 9.13 | % | |||||||||||||||||||||||||||

| Other | 104 | 3 | 5.82 | % | 127 | 5 | 7.92 | % | |||||||||||||||||||||||||||

| Total loan receivables, including held for sale | 100,123 | 10,640 | 21.43 | % | 101,218 | 10,594 | 21.05 | % | |||||||||||||||||||||||||||

| Total interest-earning assets | 122,749 | 11,136 | 18.29 | % | 122,171 | 11,150 | 18.35 | % | |||||||||||||||||||||||||||

| Non-interest-earning assets: | |||||||||||||||||||||||||||||||||||

| Cash and due from banks | 868 | 915 | |||||||||||||||||||||||||||||||||

| Allowance for credit losses | (10,866) | (10,777) | |||||||||||||||||||||||||||||||||

| Other assets | 7,716 | 7,141 | |||||||||||||||||||||||||||||||||

| Total non-interest-earning assets | (2,282) | (2,721) | |||||||||||||||||||||||||||||||||

| Total assets | $ | 120,467 | $ | 119,450 | |||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||

| Interest-bearing deposit accounts | $ | 82,191 | $ | 1,737 | 4.26 | % | $ | 82,674 | $ | 1,921 | 4.67 | % | |||||||||||||||||||||||

| Borrowings of consolidated securitization entities | 8,058 | 208 | 5.21 | % | 7,620 | 215 | 5.67 | % | |||||||||||||||||||||||||||

| Senior and subordinated unsecured notes | 8,061 | 206 | 5.15 | % | 8,374 | 204 | 4.90 | % | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 98,310 | 2,151 | 4.41 | % | 98,668 | 2,340 | 4.77 | % | |||||||||||||||||||||||||||

| Non-interest-bearing liabilities | |||||||||||||||||||||||||||||||||||

| Non-interest-bearing deposit accounts | 415 | 393 | |||||||||||||||||||||||||||||||||

| Other liabilities | 5,016 | 5,322 | |||||||||||||||||||||||||||||||||

| Total non-interest-bearing liabilities | 5,431 | 5,715 | |||||||||||||||||||||||||||||||||

| Total liabilities | 103,741 | 104,383 | |||||||||||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||||||||

| Total equity | 16,726 | 15,067 | |||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 120,467 | $ | 119,450 | |||||||||||||||||||||||||||||||

| Net interest income | $ | 8,985 | $ | 8,810 | |||||||||||||||||||||||||||||||

Interest rate spread(2) |

13.88 | % | 13.58 | % | |||||||||||||||||||||||||||||||

Net interest margin(3) |

14.76 | % | 14.50 | % | |||||||||||||||||||||||||||||||

| (1) Average yields/rates are based on annualized total interest income/expense divided by average balances. | |||||||||||||||||||||||||||||||||||

| (2) Interest rate spread represents the difference between the yield on total interest-earning assets and the rate on total interest-bearing liabilities. | |||||||||||||||||||||||||||||||||||

| (3) Net interest margin represents annualized net interest income divided by average total interest-earning assets. | |||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | ||||||||||||||||||||||||||||||||||||||

| BALANCE SHEET STATISTICS | ||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions, except per share statistics) | ||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||

| Jun 30, 2025 |

Mar 31, 2025 |

Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

Jun 30, 2025 vs. Jun 30, 2024 |

|||||||||||||||||||||||||||||||||

| BALANCE SHEET STATISTICS | ||||||||||||||||||||||||||||||||||||||

| Total common equity | $ | 15,730 | $ | 15,359 | $ | 15,358 | $ | 14,758 | $ | 14,318 | $ | 1,412 | 9.9 | % | ||||||||||||||||||||||||

| Total common equity as a % of total assets | 13.05 | % | 12.59 | % | 12.86 | % | 12.38 | % | 11.88 | % | 1.17 | % | ||||||||||||||||||||||||||

| Tangible assets | $ | 118,369 | $ | 119,905 | $ | 117,335 | $ | 117,190 | $ | 118,439 | $ | (70) | (0.1) | % | ||||||||||||||||||||||||

Tangible common equity(1) |

$ | 13,594 | $ | 13,238 | $ | 13,230 | $ | 12,719 | $ | 12,268 | $ | 1,326 | 10.8 | % | ||||||||||||||||||||||||

Tangible common equity as a % of tangible assets(1) |

11.48 | % | 11.04 | % | 11.28 | % | 10.85 | % | 10.36 | % | 1.12 | % | ||||||||||||||||||||||||||

Tangible book value per share(2) |

$ | 36.55 | $ | 34.79 | $ | 34.07 | $ | 32.68 | $ | 31.05 | $ | 5.50 | 17.7 | % | ||||||||||||||||||||||||

REGULATORY CAPITAL RATIOS(3)(4) |

||||||||||||||||||||||||||||||||||||||

| Basel III - CECL Transition | ||||||||||||||||||||||||||||||||||||||

Total risk-based capital ratio(5) |

16.9 | % | 16.5 | % | 16.5 | % | 16.4 | % | 15.8 | % | ||||||||||||||||||||||||||||

Tier 1 risk-based capital ratio(6) |

14.8 | % | 14.4 | % | 14.5 | % | 14.3 | % | 13.8 | % | ||||||||||||||||||||||||||||

Tier 1 leverage ratio(7) |

12.7 | % | 12.4 | % | 12.9 | % | 12.5 | % | 12.0 | % | ||||||||||||||||||||||||||||

| Common equity Tier 1 capital ratio | 13.6 | % | 13.2 | % | 13.3 | % | 13.1 | % | 12.6 | % | ||||||||||||||||||||||||||||

| (1) Tangible common equity ("TCE") is a non-GAAP measure. We believe TCE is a more meaningful measure of the net asset value of the Company to investors. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | ||||||||||||||||||||||||||||||||||||||

| (2) Tangible book value per share is a non-GAAP measure, calculated based on Tangible common equity divided by common shares outstanding. For corresponding reconciliation of this measure to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | ||||||||||||||||||||||||||||||||||||||

| (3) Regulatory capital ratios at March 31, 2025 are preliminary and therefore subject to change. | ||||||||||||||||||||||||||||||||||||||

| (4) Capital ratios reflect the phase-in of an estimate of CECL’s effect on regulatory capital over a three-year transitional period beginning in the first quarter of 2022 through 2024. Capital ratios for 2025 and 2024 reflect 100% and 75%, respectively, of the phase-in of CECL effects. | ||||||||||||||||||||||||||||||||||||||

| (5) Total risk-based capital ratio is the ratio of total risk-based capital divided by risk-weighted assets. | ||||||||||||||||||||||||||||||||||||||

| (6) Tier 1 risk-based capital ratio is the ratio of Tier 1 capital divided by risk-weighted assets. | ||||||||||||||||||||||||||||||||||||||

| (7) Tier 1 leverage ratio is the ratio of Tier 1 capital divided by total average assets, after certain adjustments. | ||||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PLATFORM RESULTS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jun 30, 2025 |

Mar 31, 2025 |

Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

2Q'25 vs. 2Q'24 | Jun 30 , 2025 |

Jun 30, 2024 |

YTD'25 vs. YTD'24 | |||||||||||||||||||||||||||||||||||||||||||||||||||

HOME & AUTO(1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(2) |

$ | 11,459 | $ | 9,446 | $ | 10,553 | $ | 11,215 | $ | 12,350 | $ | (891) | (7.2) | % | $ | 20,905 | $ | 22,741 | $ | (1,836) | (8.1) | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 30,374 | $ | 30,254 | $ | 31,816 | $ | 32,321 | $ | 32,611 | $ | (2,237) | (6.9) | % | $ | 30,374 | $ | 32,611 | $ | (2,237) | (6.9) | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 30,137 | $ | 30,810 | $ | 31,903 | $ | 32,403 | $ | 32,385 | $ | (2,248) | (6.9) | % | $ | 30,472 | $ | 32,023 | $ | (1,551) | (4.8) | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(3) |

17,831 | 17,894 | 18,537 | 19,030 | 19,205 | (1,374) | (7.2) | % | 17,899 | 19,039 | (1,140) | (6.0) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 1,395 | $ | 1,402 | $ | 1,476 | $ | 1,479 | $ | 1,409 | $ | (14) | (1.0) | % | $ | 2,797 | $ | 2,781 | $ | 16 | 0.6 | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | 52 | $ | 56 | $ | 62 | $ | 55 | $ | 37 | $ | 15 | 40.5 | % | $ | 108 | $ | 69 | $ | 39 | 56.5 | % | |||||||||||||||||||||||||||||||||||||

| DIGITAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(2) |

$ | 13,647 | $ | 12,479 | $ | 15,317 | $ | 13,352 | $ | 13,403 | $ | 244 | 1.8 | % | $ | 26,126 | $ | 26,031 | $ | 95 | 0.4 | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 27,786 | $ | 27,765 | $ | 29,347 | $ | 27,771 | $ | 27,704 | $ | 82 | 0.3 | % | $ | 27,786 | $ | 27,704 | $ | 82 | 0.3 | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 27,571 | $ | 28,216 | $ | 28,158 | $ | 27,704 | $ | 27,542 | $ | 29 | 0.1 | % | $ | 27,892 | $ | 27,812 | $ | 80 | 0.3 | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(3) |

20,368 | 20,711 | 20,810 | 20,787 | 20,920 | (552) | (2.6) | % | 20,554 | 21,142 | (588) | (2.8) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 1,576 | $ | 1,544 | $ | 1,582 | $ | 1,593 | $ | 1,544 | $ | 32 | 2.1 | % | $ | 3,120 | $ | 3,111 | $ | 9 | 0.3 | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | — | $ | 9 | $ | (6) | $ | 4 | $ | — | $ | — | NM | $ | 9 | $ | 6 | $ | 3 | 50.0 | % | ||||||||||||||||||||||||||||||||||||||

| DIVERSIFIED & VALUE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(2) |

$ | 15,393 | $ | 13,732 | $ | 16,711 | $ | 14,992 | $ | 15,333 | $ | 60 | 0.4 | % | $ | 29,125 | $ | 29,356 | $ | (231) | (0.8) | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 19,510 | $ | 19,436 | $ | 20,867 | $ | 19,466 | $ | 19,516 | $ | (6) | — | % | $ | 19,510 | $ | 19,516 | $ | (6) | — | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 19,338 | $ | 19,670 | $ | 19,793 | $ | 19,413 | $ | 19,360 | $ | (22) | (0.1) | % | $ | 19,504 | $ | 19,477 | $ | 27 | 0.1 | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(3) |

19,471 | 20,114 | 20,253 | 19,960 | 20,253 | (782) | (3.9) | % | 19,858 | 20,691 | (833) | (4.0) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 1,159 | $ | 1,178 | $ | 1,206 | $ | 1,209 | $ | 1,165 | $ | (6) | (0.5) | % | $ | 2,337 | $ | 2,379 | $ | (42) | (1.8) | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | (3) | $ | — | $ | (9) | $ | (11) | $ | (22) | $ | 19 | (86.4) | % | $ | (3) | $ | (39) | $ | 36 | (92.3) | % | |||||||||||||||||||||||||||||||||||||

| HEALTH & WELLNESS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(2) |

$ | 4,007 | $ | 3,774 | $ | 3,742 | $ | 3,867 | $ | 4,089 | $ | (82) | (2.0) | % | $ | 7,781 | $ | 8,069 | $ | (288) | (3.6) | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 15,309 | $ | 15,193 | $ | 15,436 | $ | 15,439 | $ | 15,280 | $ | 29 | 0.2 | % | $ | 15,309 | $ | 15,280 | $ | 29 | 0.2 | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 15,215 | $ | 15,280 | $ | 15,448 | $ | 15,311 | $ | 15,111 | $ | 104 | 0.7 | % | $ | 15,247 | $ | 14,904 | $ | 343 | 2.3 | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(3) |

7,697 | 7,776 | 7,836 | 7,801 | 7,752 | (55) | (0.7) | % | 7,740 | 7,670 | 70 | 0.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 923 | $ | 914 | $ | 935 | $ | 956 | $ | 911 | $ | 12 | 1.3 | % | $ | 1,837 | $ | 1,780 | $ | 57 | 3.2 | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | 66 | $ | 75 | $ | 72 | $ | 68 | $ | 48 | $ | 18 | 37.5 | % | $ | 141 | $ | 114 | $ | 27 | 23.7 | % | |||||||||||||||||||||||||||||||||||||

| LIFESTYLE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(2) |

$ | 1,432 | $ | 1,168 | $ | 1,480 | $ | 1,411 | $ | 1,525 | $ | (93) | (6.1) | % | $ | 2,600 | $ | 2,769 | $ | (169) | (6.1) | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 6,673 | $ | 6,636 | $ | 6,914 | $ | 6,831 | $ | 6,822 | $ | (149) | (2.2) | % | $ | 6,673 | $ | 6,822 | $ | (149) | (2.2) | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 6,646 | $ | 6,716 | $ | 6,818 | $ | 6,823 | $ | 6,723 | $ | (77) | (1.1) | % | $ | 6,681 | $ | 6,677 | $ | 4 | 0.1 | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(3) |

2,531 | 2,651 | 2,688 | 2,677 | 2,662 | (131) | (4.9) | % | 2,598 | 2,665 | (67) | (2.5) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 261 | $ | 261 | $ | 268 | $ | 270 | $ | 258 | $ | 3 | 1.2 | % | $ | 522 | $ | 513 | $ | 9 | 1.8 | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | 9 | $ | 10 | $ | 7 | $ | 9 | $ | 6 | $ | 3 | 50.0 | % | $ | 19 | $ | 14 | $ | 5 | 35.7 | % | |||||||||||||||||||||||||||||||||||||

CORP, OTHER(1) (5) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(2) |

$ | 146 | $ | 121 | $ | 152 | $ | 148 | $ | 146 | $ | — | — | % | $ | 267 | $ | 267 | $ | — | — | % | |||||||||||||||||||||||||||||||||||||

Period-end loan receivables (4) |

$ | 124 | $ | 324 | $ | 341 | $ | 365 | $ | 351 | $ | (227) | (64.7) | % | $ | 124 | $ | 351 | $ | (227) | (64.7) | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 329 | $ | 329 | $ | 356 | $ | 355 | $ | 357 | $ | (28) | (7.8) | % | $ | 327 | $ | 325 | $ | 2 | 0.6 | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(3) |

152 | 169 | 175 | 169 | 182 | (30) | (16.5) | % | 161 | 195 | (34) | (17.4) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 14 | $ | 13 | $ | 13 | $ | 15 | $ | 14 | $ | — | — | % | $ | 27 | $ | 30 | $ | (3) | (10.0) | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | (6) | $ | (1) | $ | 2 | $ | (6) | $ | 48 | $ | (54) | (112.5) | % | $ | (7) | $ | 1,110 | $ | (1,117) | (100.6) | % | |||||||||||||||||||||||||||||||||||||

TOTAL SYF(5) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(2) |

$ | 46,084 | $ | 40,720 | $ | 47,955 | $ | 44,985 | $ | 46,846 | $ | (762) | (1.6) | % | $ | 86,804 | $ | 89,233 | $ | (2,429) | (2.7) | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 99,776 | $ | 99,608 | $ | 104,721 | $ | 102,193 | $ | 102,284 | $ | (2,508) | (2.5) | % | $ | 99,776 | $ | 102,284 | $ | (2,508) | (2.5) | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 99,236 | $ | 101,021 | $ | 102,476 | $ | 102,009 | $ | 101,478 | $ | (2,242) | (2.2) | % | $ | 100,123 | $ | 101,218 | $ | (1,095) | (1.1) | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(3) |

68,050 | 69,315 | 70,299 | 70,424 | 70,974 | (2,924) | (4.1) | % | 68,810 | 71,402 | (2,592) | (3.6) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 5,328 | $ | 5,312 | $ | 5,480 | $ | 5,522 | $ | 5,301 | $ | 27 | 0.5 | % | $ | 10,640 | $ | 10,594 | $ | 46 | 0.4 | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | 118 | $ | 149 | $ | 128 | $ | 119 | $ | 117 | $ | 1 | 0.9 | % | $ | 267 | $ | 1,274 | $ | (1,007) | (79.0) | % | |||||||||||||||||||||||||||||||||||||

| (1) In June 2025, we entered into an agreement to sell $0.2 billion of loan receivables associated with a Home & Auto program agreement. In connection with this agreement, revenue activities for the portfolio are no longer managed within our Home & Auto sales platform. All metrics for the portfolio previously reported within our Home & Auto sales platform are now reported within Corp, Other. We have recast all prior-period reported metrics for our Home & Auto sales platform and Corp, Other to conform to the current-period presentation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Purchase volume, or net credit sales, represents the aggregate amount of charges incurred on credit cards or other credit product accounts less returns during the period. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) Active accounts represent credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) Reflects the reclassification of $0.2 billion to loan receivables held for sale in 2Q 2025. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (5) Includes activity and balances associated with loans receivable held for sale, except for Period-end receivables. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||

RECONCILIATION OF NON-GAAP MEASURES AND CALCULATIONS OF REGULATORY MEASURES(1) |

|||||||||||||||||||||||||||||

| (unaudited, $ in millions, except per share statistics) | |||||||||||||||||||||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||

| Jun 30, 2025 |

Mar 31, 2025 |

Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

|||||||||||||||||||||||||

COMMON EQUITY AND REGULATORY CAPITAL MEASURES(2) |

|||||||||||||||||||||||||||||

| GAAP Total equity | $ | 16,952 | $ | 16,581 | $ | 16,580 | $ | 15,980 | $ | 15,540 | |||||||||||||||||||

| Less: Preferred stock | (1,222) | (1,222) | (1,222) | (1,222) | (1,222) | ||||||||||||||||||||||||

| Less: Goodwill | (1,274) | (1,274) | (1,274) | (1,274) | (1,274) | ||||||||||||||||||||||||

| Less: Intangible assets, net | (862) | (847) | (854) | (765) | (776) | ||||||||||||||||||||||||

| Tangible common equity | $ | 13,594 | $ | 13,238 | $ | 13,230 | $ | 12,719 | $ | 12,268 | |||||||||||||||||||

| Add: CECL transition amount | — | — | 573 | 573 | 573 | ||||||||||||||||||||||||

| Adjustments for certain deferred tax liabilities and certain items in accumulated comprehensive income (loss) | 209 | 208 | 214 | 209 | 227 | ||||||||||||||||||||||||

| Common equity Tier 1 | $ | 13,803 | $ | 13,446 | $ | 14,017 | $ | 13,501 | $ | 13,068 | |||||||||||||||||||

| Preferred stock | 1,222 | 1,222 | 1,222 | 1,222 | 1,222 | ||||||||||||||||||||||||

| Tier 1 capital | $ | 15,025 | $ | 14,668 | $ | 15,239 | $ | 14,723 | $ | 14,290 | |||||||||||||||||||

| Add: Subordinated debt | 742 | 742 | 741 | 741 | 741 | ||||||||||||||||||||||||

| Add: Allowance for credit losses includible in risk-based capital | 1,386 | 1,388 | 1,427 | 1,400 | 1,407 | ||||||||||||||||||||||||

| Total Risk-based capital | $ | 17,153 | $ | 16,798 | $ | 17,407 | $ | 16,864 | $ | 16,438 | |||||||||||||||||||

ASSET MEASURES(2) |

|||||||||||||||||||||||||||||

| Total average assets | $ | 120,441 | $ | 120,493 | $ | 119,254 | $ | 119,389 | $ | 119,864 | |||||||||||||||||||

| Adjustments for: | |||||||||||||||||||||||||||||

| Add: CECL transition amount | — | — | 573 | 573 | 573 | ||||||||||||||||||||||||

| Less: Disallowed goodwill and other disallowed intangible assets (net of related deferred tax liabilities) and other |

(1,913) | (1,895) | (1,904) | (1,808) | (1,805) | ||||||||||||||||||||||||

| Total assets for leverage purposes | $ | 118,528 | $ | 118,598 | $ | 117,923 | $ | 118,154 | $ | 118,632 | |||||||||||||||||||

| Risk-weighted assets | $ | 101,716 | $ | 101,625 | $ | 105,417 | $ | 103,103 | $ | 103,718 | |||||||||||||||||||

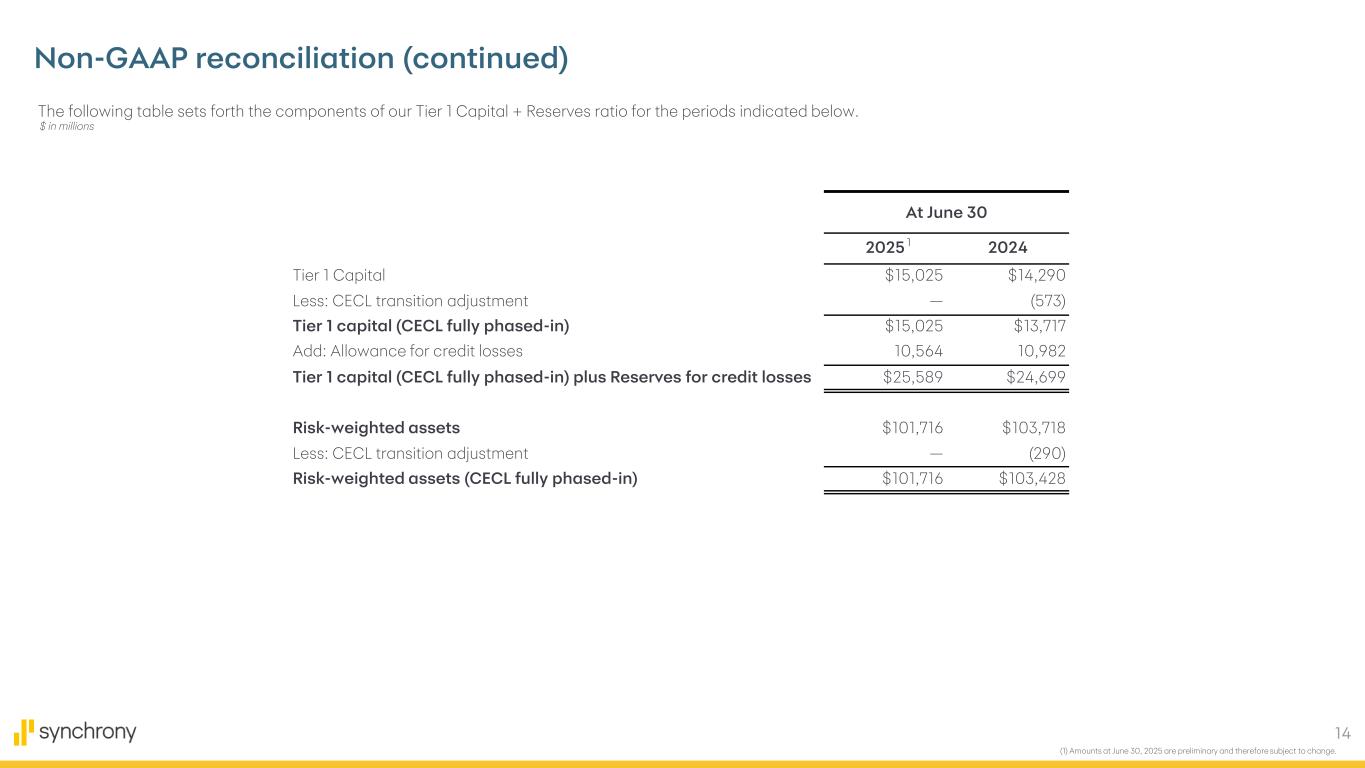

| CECL FULLY PHASED-IN CAPITAL MEASURES | |||||||||||||||||||||||||||||

| Tier 1 capital | $ | 15,025 | $ | 14,668 | $ | 15,239 | $ | 14,723 | $ | 14,290 | |||||||||||||||||||

| Less: CECL transition adjustment | — | — | (573) | (573) | (573) | ||||||||||||||||||||||||

| Tier 1 capital (CECL fully phased-in) | $ | 15,025 | $ | 14,668 | $ | 14,666 | $ | 14,150 | $ | 13,717 | |||||||||||||||||||

| Add: Allowance for credit losses | 10,564 | 10,828 | 10,929 | 11,029 | 10,982 | ||||||||||||||||||||||||

| Tier 1 capital (CECL fully phased-in) + Reserves for credit losses | $ | 25,589 | $ | 25,496 | $ | 25,595 | $ | 25,179 | $ | 24,699 | |||||||||||||||||||

| Risk-weighted assets | $ | 101,716 | $ | 101,625 | $ | 105,417 | $ | 103,103 | $ | 103,718 | |||||||||||||||||||

| Less: CECL transition adjustment | — | — | (290) | (290) | (290) | ||||||||||||||||||||||||

| Risk-weighted assets (CECL fully phased-in) | $ | 101,716 | $ | 101,625 | $ | 105,127 | $ | 102,813 | $ | 103,428 | |||||||||||||||||||

| TANGIBLE BOOK VALUE PER SHARE | |||||||||||||||||||||||||||||

| Book value per share | $ | 42.30 | $ | 40.37 | $ | 39.55 | $ | 37.92 | $ | 36.24 | |||||||||||||||||||

| Less: Goodwill | (3.43) | (3.35) | (3.28) | (3.27) | (3.23) | ||||||||||||||||||||||||

| Less: Intangible assets, net | (2.32) | (2.23) | (2.20) | (1.97) | (1.96) | ||||||||||||||||||||||||

| Tangible book value per share | $ | 36.55 | $ | 34.79 | $ | 34.07 | $ | 32.68 | $ | 31.05 | |||||||||||||||||||

| (1) Regulatory measures at March 31, 2025 are preliminary and therefore subject to change. | |||||||||||||||||||||||||||||

| (2) Capital ratios reflect the phase-in of an estimate of CECL’s effect on regulatory capital over a three-year transitional period beginning in the first quarter of 2022 through 2024. Capital ratios for 2025 and 2024 reflect 100% and 75%, respectively, of the phase-in of CECL effects. | |||||||||||||||||||||||||||||