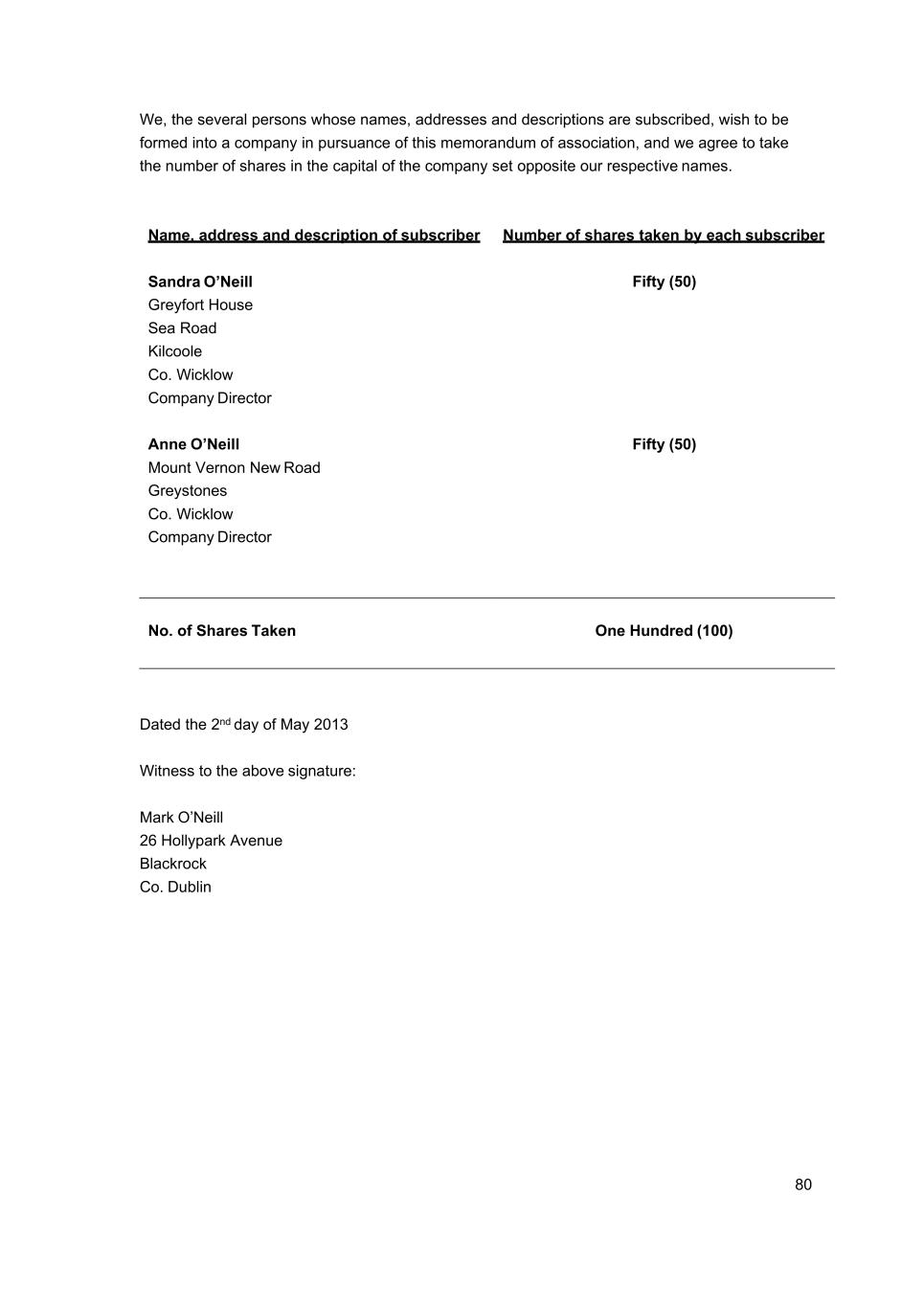

PERRIGO COMPANY PLC RESTRICTED STOCK UNIT AWARD AGREEMENT (SERVICE-BASED) (Under the Perrigo Company plc 2019 Long-Term Incentive Plan) TO: Participant Name RE: Notice of Restricted Stock Unit Award (Service-Based) This is to notify you that Perrigo Company plc (the “Company”) has granted you an Award under the Perrigo Company plc 2019 Long-Term Incentive Plan (the “Plan”), effective as of Grant Date (the “Grant Date”). This Award consists of service-based restricted stock units. The terms and conditions of this incentive are set forth in the remainder of this agreement (including any special terms and conditions set forth in any appendix for your country (“Appendix”) (collectively, the “Agreement”). The capitalized terms that are not otherwise defined in this Agreement shall have the meanings ascribed to such terms under the Plan. SECTION 1 Restricted Stock Units – Service-Based Vesting 1.1 Grant. As of the Grant Date, and subject to the terms and conditions of this Agreement and the Plan, the Company grants you Number of Awards Granted (“Restricted Stock Units” or “RSUs”). Each RSU shall entitle you to one ordinary share of the Company, nominal value €0.001 per share (“Ordinary Share”) on the applicable RSU Vesting Date, provided the vesting conditions described in Section 1.2 are satisfied. 1.2 Vesting. Except as provided in Section 1.3, the RSUs awarded in Section 1.1 shall vest as follows following the Grant Date (“RSU Vesting Date(s)”): Vesting Schedule (Dates & Quantities); provided, however, that you continue in the service of the Company from the Grant Date through the applicable RSU Vesting Date. Except as provided in Section 1.3, if your Termination Date occurs prior to the RSU Vesting Date, any RSUs awarded under Section 1.1 that have not previously vested as of such Termination Date shall be permanently forfeited on your Termination Date. 1.3 Special Vesting Rules. Notwithstanding Section 1.2 above: (a) If your Termination Date occurs by reason of death, Disability or Retirement with the Company’s consent, any RSUs awarded under Section 1.1 that have not vested prior to such Termination Date shall become fully vested. (b) If your Termination Date occurs by reason of an Involuntary Termination for Economic Reasons, any RSUs awarded under Section 1.1 that would otherwise be scheduled to vest under Section 1.2 in the 24-month period following such Termination Date shall continue to vest during such 24-month period according to the vesting schedule in effect prior to such Termination Date; provided, however, that if your Termination Date occurs for a reason that is 2 both described in this subsection (b) and in subsection (c) below, the special vesting rules described in subsection (c) shall apply in lieu of the vesting rules described in this subsection (b). Any RSUs that are not scheduled to vest during such 24-month period will be permanently forfeited on the Termination Date. (c) If your Termination Date occurs by reason of a Termination without Cause or a Separation for Good Reason on or after a Change in Control (as defined in the Plan and as such definition may be amended hereafter) and prior to the two (2) year anniversary of the Change in Control, all RSUs awarded under Section 1.1 that have not vested or been forfeited prior to such Termination Date shall become fully vested. (d) As used in this Section 1.3, the following terms shall have the meanings set forth below: (1) “Separation for Good Reason” means your voluntary resignation from the Company and the existence of one or more of the following conditions that arose without your consent: (i) a material change in the geographic location at which you are required to perform services, such that your commute between home and your primary job site increases by more than 30 miles, or (ii) a material diminution in your authority, duties or responsibilities or a material diminution in your base compensation or incentive compensation opportunities; provided, however, that a voluntary resignation from the Company shall not be considered a Separation for Good Reason unless you provide the Company with notice, in writing, of your voluntary resignation and the existence of the condition(s) giving rise to the separation within 90 days of its initial existence. The Company will then have 30 days to remedy the condition, in which case you will not be deemed to have incurred a Separation for Good Reason. In the event the Company fails to cure the condition within the 30 day period, your Termination Date shall occur on the 31st day following the Company’s receipt of such written notice. (2) “Termination without Cause” means the involuntary termination of your employment or contractual relationship by the Company without Cause, including, but not limited to, (i) a termination effective when you exhaust a leave of absence during, or at the end of, a notice period under the Worker Adjustment and Retraining Notification Act (“WARN”), and (ii) a situation where you are on an approved leave of absence during which your position is protected under applicable law (e.g., a leave under the Family Medical Leave Act), you return from such leave, and you cannot be placed in employment or other form of contractual relationship with the Company. 1.4 Settlement of RSUs. As soon as practicable after the RSU Vesting Date, the Company shall transfer to you one Ordinary Share for each RSUs becoming vested on such date (the date of any such transfer shall be the “settlement date” for purposes of this Agreement); provided, however, the Company may withhold shares otherwise transferable to you to the extent necessary to satisfy withholding taxes due by reason of the vesting of the RSUs, in accordance with Section 2.6. You shall have no rights as a stockholder with respect to the RSUs awarded hereunder prior to the date of issuance to you of a certificate or certificates for such shares. Notwithstanding the foregoing, the Committee, in its sole discretion, may elect to settle RSUs in cash based on the fair market value of the Ordinary Shares on the RSU Vesting Date. 3 1.5 Dividend Equivalents. The RSUs awarded under Section 1.1 shall be eligible to receive dividend equivalents in accordance with the following: (a) An “Account” will be established in your name. Such Account shall be for recordkeeping purposes only, and no assets or other amounts shall be set aside from the Company’s general assets with respect to such Account. (b) On each date that a cash dividend is paid with respect to Ordinary Shares, the Company shall credit your Account with the dollar amount of dividends you would have received if each RSU held by you on the record date for such dividend payment had been an Ordinary Share. No interest or other earnings shall accrue on such Account. (c) As of each RSU Vesting Date, you shall receive a payment equal to the amount of dividends that would have been paid on the RSUs vesting on such date had they been Ordinary Shares during the period beginning on the Grant Date and ending on the RSU Vesting Date, and the Account shall be debited appropriately. If you forfeit RSUs, any amounts in the Account attributable to such RSUs shall also be forfeited. (d) If dividends are paid in the form of Ordinary Shares rather than cash, then you will be credited with one additional RSU for each Ordinary Share that would have been received as a dividend had your outstanding RSUs been Ordinary Shares. Such additional RSUs shall vest or be forfeited at the same time as the RSU to which they relate. SECTION 2 General Terms and Conditions 2.1 Nontransferability. The Award under this Agreement shall not be transferable other than by will or by the laws of descent and distribution. 2.2 No Rights as a Stockholder. You shall not have any rights as a stockholder with respect to any Ordinary Shares subject to the RSU awarded under this Agreement prior to the date of issuance to you of a certificate or certificates for such shares. 2.3 Cause Termination. If your Termination Date occurs for reasons of Cause, all of your rights under this Agreement, whether or not vested, shall terminate immediately. 2.4 Award Subject to Plan. The granting of the Award under this Agreement is being made pursuant to the Plan and the Award shall be payable only in accordance with the applicable terms of the Plan. The Plan contains certain definitions, restrictions, limitations and other terms and conditions all of which shall be applicable to this Agreement. ALL THE PROVISIONS OF THE PLAN ARE INCORPORATED HEREIN BY REFERENCE AND ARE MADE A PART OF THIS AGREEMENT IN THE SAME MANNER AS IF EACH AND EVERY SUCH PROVISION WERE FULLY WRITTEN INTO THIS AGREEMENT. Should the Plan become void or unenforceable by operation of law or judicial decision, this Agreement shall have no force or effect. Nothing set forth in this Agreement is intended, nor shall any of its provisions be construed, to limit or exclude any definition, restriction, limitation or other term or condition of the Plan as is relevant to this Agreement and as may be specifically applied to it by 4 the Committee. In the event of a conflict in the provisions of this Agreement and the Plan, as a rule of construction the terms of the Plan shall be deemed superior and apply. 2.5 Adjustments in Event of Change in Ordinary Shares. In the event of a stock split, stock dividend, recapitalization, reclassification or combination of shares, merger, sale of assets or similar event, the number and kind of shares subject to Award under this Agreement will be appropriately adjusted in an equitable manner to prevent dilution or enlargement of the rights granted to or available for you. 2.6 Acknowledgement. The Company and you agree that the RSUs are granted under and governed by the Notice of Grant, this Agreement (including the Appendix, if applicable) and by the provisions of the Plan (incorporated herein by reference). You: (i) acknowledge receipt of a copy of each of the foregoing documents, (ii) represent that you have carefully read and are familiar with their provisions, and (iii) hereby accept the RSUs subject to all of the terms and conditions set forth herein and those set forth in the Plan and the Notice of Grant. 2.7 Taxes and Withholding. (a) Withholding (Only Applicable to Individuals Subject to U.S. Tax Laws). This Award is subject to the withholding of all applicable taxes. The Company may withhold, or permit you to remit to the Company, any Federal, state or local taxes applicable to the grant, vesting or other event giving rise to tax liability with respect to this Award. If you have not remitted the full amount of applicable withholding taxes to the Company by the date the Company is required to pay such withholding to the appropriate taxing authority (or such earlier date that the Company may specify to assist it in timely meeting its withholding obligations), the Company shall have the unilateral right to withhold Ordinary Shares relating to this Award in the amount it determines is sufficient to satisfy the tax withholding required by law. State taxes will be withheld at the appropriate rate set by the state in which you are employed or were last employed by the Company. In no event may the number of shares withheld exceed the number necessary to satisfy the maximum Federal, state and local income and employment tax withholding requirements. You may elect to surrender previously acquired Ordinary Shares or to have the Company withhold Ordinary Shares relating to this Award in an amount sufficient to satisfy all or a portion of the tax withholding required by law. (b) Responsibility for Taxes (Only Applicable to Individuals Subject to Tax Laws Outside the U.S.) Regardless of any action the Company or, if different, the Affiliate employing or retaining you takes with respect to any or all income tax, social insurance, payroll tax, payment on account or other tax-related items related to your participation in the Plan and legally applicable to you (“Tax-Related Items”), you acknowledge that the ultimate liability for all Tax-Related Items is and remains your responsibility and may exceed the amount actually withheld by the Company or the Affiliate employing or retaining you. You further acknowledge that the Company and/or the Affiliate employing or retaining you (1) make no representations or undertakings regarding the treatment of any Tax-Related Items in connection with any aspect of the RSUs, including, but not limited to, the grant, vesting or settlement of the RSUs, the subsequent sale of Ordinary Shares acquired pursuant to such settlement and the receipt of any dividends; and (2) do not commit to and are under no obligation to structure the terms of the grant or any aspect of the RSUs to reduce or eliminate your liability for Tax-Related Items or

5 achieve any particular tax result. Further, if you have become subject to tax in more than one jurisdiction between the RSU Grant Date and the date of any relevant taxable event, as applicable, you acknowledge that the Company and/or the Affiliate employing or retaining you (or formerly employing or retaining you, as applicable) may be required to withhold or account for Tax-Related Items in more than one jurisdiction. (1) Prior to any relevant taxable or tax withholding event, as applicable, you will pay or make adequate arrangements satisfactory to the Company and/or the Affiliate employing or retaining you to satisfy all Tax-Related Items. In this regard, you authorize the Company and/or the Affiliate employing or retaining you, or their respective agents, at their discretion, to satisfy the obligations with regard to all Tax-Related Items by one or a combination of the following: (A) withholding from your wages or other cash compensation paid to you by the Company and/or the Affiliate employing or retaining you; or (B) withholding from proceeds of the sale of Ordinary Shares acquired upon settlement of the RSUs either through a voluntary sale or through a mandatory sale arranged by the Company (on your behalf pursuant to this authorization); or (C) withholding in Ordinary Shares to be issued upon settlement of the RSUs. (2) To avoid negative accounting treatment, the Company may withhold or account for Tax-Related Items by considering applicable statutory withholding amounts or other applicable withholding rates. If the obligation for Tax-Related Items is satisfied by withholding in Ordinary Shares, for tax purposes, you are deemed to have been issued the full number of Ordinary Shares subject to the vested RSUs, notwithstanding that a number of the Ordinary Shares are held back solely for the purpose of paying the Tax-Related Items. (3) Finally, you shall pay to the Company or the Affiliate employing or retaining you any amount of Tax-Related Items that the Company or the Affiliate employing or retaining you may be required to withhold or account for as a result of your participation in the Plan that cannot be satisfied by the means previously described. The Company may refuse to issue or deliver the Ordinary Shares or the proceeds of the sale of Ordinary Shares, if you fail to comply with your obligations in connection with the Tax-Related Items. 2.8 Compliance with Applicable Law. The issuance of Ordinary Shares will be subject to and conditioned upon compliance by the Company and you, including any written representations, warranties and agreements as the Administrator may request of you for compliance with all (i) applicable U.S. state and federal laws and regulations, (ii) applicable laws of the country where you reside pertaining to the issuance or sale of Ordinary Shares, and (iii) applicable requirements of any stock exchange or automated quotation system on which the Company’s Ordinary Shares may be listed or quoted at the time of such issuance or transfer. Notwithstanding any other provision of this Agreement, the Company shall have no obligation to 6 issue any Ordinary Shares under this Agreement if such issuance would violate any applicable law or any applicable regulation or requirement of any securities exchange or similar entity. 2.9 Code Section 409A (Only Applicable to Individuals Subject to U.S. Federal Tax Laws) (a) RSUs other than RSUs that continue to vest by reason of your Involuntary Termination for Economic Reasons and dividend equivalents payable under this Agreement are intended to be exempt from Code Section 409A under the exemption for short-term deferrals. Accordingly, RSUs (other than RSUs that continue to vest by reason of your Involuntary Termination for Economic Reasons) will be settled and dividend equivalents will be paid no later than the 15th day of the third month following the later of (i) the end of your taxable year in which the RSU Vesting Date occurs, or (ii) the end of the fiscal year of the Company in which the RSU Vesting Date occurs. (b) RSUs that continue to vest by reason of your Involuntary Termination for Economic Reasons are subject to the provisions of this subsection (b). Any distribution in settlement of such RSUs will occur provided your Involuntary Termination for Economic Reasons constitutes a “separation from service” as defined in Treasury Regulation §1.409A-1(h). If the Company determines that you are a “specified employee” as defined in Code Section 409A (i.e., an officer with annual compensation above $130,000 (as adjusted for inflation), a five- percent owner of the Company or a one-percent owner with annual compensation in excess of $150,000), distribution in settlement of any such RSUs that would be payable within six months of your separation from service shall be delayed to the first business day following the six-month anniversary of your separation from service. Any distribution in settlement of such RSUs that would be made more than six months after your separation from service (without application of the six-month delay) shall not be subject to the six-month delay described in this subsection. 2.10 Data Privacy. (a) U.S. Data Privacy Rules (Only Applicable if this Award is Subject to U.S. Data Privacy Laws). By entering into this Agreement and accepting this Award, you (a) explicitly and unambiguously consent to the collection, use and transfer, in electronic or other form, of any of your personal data that is necessary to facilitate the implementation, administration and management of the Award and the Plan, (b) understand that the Company may, for the purpose of implementing, administering and managing the Plan, hold certain personal information about you, including, but not limited to, your name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job title, and details of all awards or entitlements to Shares granted to you under the Plan or otherwise (“Personal Data”), (c) understand that Personal Data may be transferred to any third parties assisting in the implementation, administration and management of the Plan, including any broker with whom the Shares issued upon vesting of the Award may be deposited, and that these recipients may be located in your country or elsewhere, and that the recipient’s country may have different data privacy laws and protections than your country, (d) waive any data privacy rights you may have with respect to the data, and (e) authorize the Company, its Affiliates and its agents, to store and transmit such information in electronic form. 7 (b) Non-U.S. Data Privacy Rules (Only Applicable if this Award is Subject to Data Privacy Laws Outside of the U.S.) (1) By entering into this Agreement and accepting this Award, you hereby explicitly and unambiguously consent to the collection, use and transfer, in electronic or other form, of your personal data as described in this Agreement and any other RSU grant materials by and among, as applicable, the Affiliate employing or retaining you, the Company and its Affiliates for the exclusive purpose of implementing, administering and managing your participation in the Plan. (2) You understand that the Company and the Affiliate employing or retaining you may hold certain personal information about you, including, but not limited to, your name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job title, any Ordinary Shares or directorships held in the Company, details of all RSUs or any other entitlement to Ordinary Shares awarded, canceled, exercised, vested, unvested or outstanding in your favor, for the exclusive purpose of implementing, administering and managing the Plan (“Data”). (3) You understand that Data will be transferred to legal counsel or a broker or such other stock plan service provider as may be selected by the Company in the future, which is assisting the Company with the implementation, administration and management of the Plan. You understand that the recipients of the Data may be located in the United States or elsewhere, and that the recipients’ country (e.g., the United States) may have different data privacy laws and protections than your country of residence. You understand that if you reside outside the United States, you may request a list with the names and addresses of any potential recipients of the Data by contacting your local or Company human resources representative. You authorize the Company and any other possible recipients which may assist the Company (presently or in the future) with implementing, administering and managing the Plan to receive, possess, use, retain and transfer the Data, in electronic or other form, for the sole purpose of implementing, administering and managing your participation in the Plan. You understand that Data will be held only as long as is necessary to implement, administer and manage your participation in the Plan. You understand that if you reside outside the United States, you may, at any time, view Data, request additional information about the storage and processing of Data, require any necessary amendments to Data or refuse or withdraw the consents herein, in any case without cost, by contacting in writing your local or Company human resources representative. You understand, however, that refusing or withdrawing your consent may affect your ability to participate in the Plan. For more information on the consequences of your refusal to consent or withdrawal of consent, you understand that you may contact your local or Company human resources representative. 2.11 Successors and Assigns. This Agreement shall be binding upon any or all successors and assigns of the Company. 2.12 Applicable Law. This Agreement shall be governed by and construed and enforced in accordance with the applicable Code provisions to the maximum extent possible and otherwise by the laws of the State of Michigan without regard to principals of conflict of laws, provided that if you are a foreign national or employed outside the United States, this Agreement 8 shall be governed by and construed and enforced in accordance with applicable foreign law to the extent that such law differs from the Code and Michigan law. Any proceeding related to or arising out of this Agreement shall be commenced, prosecuted or continued in the Circuit Court in Kent County, Michigan located in Grand Rapids, Michigan or in the United Stated District Court for the Western District of Michigan, and in any appellate court thereof. 2.13 Forfeiture of RSUs. If the Company, as a result of misconduct, is required to prepare an accounting restatement due to material noncompliance with any financial reporting requirement under the securities laws, then (a) if your incentive or equity-based compensation is subject to automatic forfeiture due to such misconduct and restatement under Section 304 of the Sarbanes-Oxley Act of 2002, or (b) the Committee determines you either knowingly engaged in or failed to prevent the misconduct, or your actions or inactions with respect to the misconduct and restatement constituted gross negligence, you shall (i) be required to reimburse the Company the amount of any payment (including dividend equivalents) relating to any RSUs earned or accrued during the twelve month period following the first public issuance or filing with the SEC (whichever first occurred) of the financial document embodying such financial reporting requirement, and (ii) all outstanding RSUs (including related dividend equivalents) that have not yet been settled shall be immediately forfeited. In addition, Ordinary Shares acquired under this Agreement, and any gains or profits on the sale of such Ordinary Shares, shall be subject to any “clawback” or recoupment policy later adopted by the Company. 2.14 Special Rules for Non-U.S. Grantees (Only Applicable if You Reside Outside of the U.S.) (a) Nature of Grant. In accepting the grant, you acknowledge, understand and agree that: (1) the Plan is established voluntarily by the Company, it is discretionary in nature and it may be modified, amended, suspended or terminated by the Company at any time, except as otherwise provided in the Plan; (2) the grant of the RSUs is voluntary and occasional and does not create any contractual or other right to receive future grants of RSUs, or benefits in lieu of RSUs, even if RSUs have been granted repeatedly in the past; (3) all decisions with respect to future RSU grants, if any, will be at the sole discretion of the Company; (4) you are voluntarily participating in the Plan; (5) the RSUs and the Ordinary Shares subject to the RSUs are an extraordinary item and which is outside the scope of your employment or service contract, if any; (6) the RSUs and the Ordinary Shares subject to the RSUs are not intended to replace any pension rights or compensation; (7) the RSUs and the Ordinary Shares subject to the RSUs are not part of normal or expected compensation for purposes of calculating any severance, resignation,

9 termination, redundancy, dismissal, end of service payments, bonuses, long-service awards, pension or retirement or welfare benefits or similar payments and in no event should be considered as compensation for, or relating in any way to, past services for the Company, the Affiliate employing or retaining you or any other Affiliate; (8) the grant and your participation in the Plan will not be interpreted to form an employment or service contract with the Company or any Affiliate; (9) the future value of the underlying Ordinary Shares is unknown, indeterminable and cannot be predicted with certainty; (10) no claim or entitlement to compensation or damages shall arise from forfeiture of the RSUs resulting from your Termination Date (for any reason whatsoever, whether or not later found to be invalid and whether or not in breach of employment laws in the jurisdiction where you are employed or rendering services, or the terms of your employment agreement, if any), and in consideration of the grant of the RSUs to which you are otherwise not entitled, you irrevocably agree never to institute any claim against the Company or the Affiliate employing or retaining you, waive your ability, if any, to bring any such claim, and release the Company and the Affiliate employing or retaining you from any such claim; if, notwithstanding the foregoing, any such claim is allowed by a court of competent jurisdiction, then, by participating in the Plan, you shall be deemed irrevocably to have agreed not to pursue such claim and agree to execute any and all documents necessary to request dismissal or withdrawal of such claim; and (11) you acknowledge and agree that neither the Company, the Affiliate employing or retaining you nor any other Affiliate shall be liable for any foreign exchange rate fluctuation between the currency of the country in which you reside and the United States Dollar that may affect the value of the RSUs or of any amounts due to you pursuant to the settlement of the RSUs or the subsequent sale of any Ordinary Shares acquired upon settlement. (b) Appendix. Notwithstanding any provisions in this Agreement, the RSU grant shall be subject to any special terms and conditions set forth in any Appendix to this Agreement for your country. Moreover, if you relocate to one of the countries included in the Appendix, the special terms and conditions for such country will apply to you, to the extent the Company determines that the application of such provisions is necessary or advisable in order to comply with laws of the country where you reside or to facilitate the administration of the Plan. If you relocate to the United States, the special terms and conditions in the Appendix will apply, or cease to apply, to you, to the extent the Company determines that the application or otherwise of such provisions is necessary or advisable in order to facilitate the administration of the Plan. The Appendix constitutes part of this Agreement. (c) Imposition of Other Requirements. The Company reserves the right to impose other requirements on your participation in the Plan, on the RSUs and on any Ordinary Shares acquired under the Plan, to the extent the Company determines it is necessary or advisable in order to comply with laws of the country where you reside or to facilitate the administration of the Plan, and to require you to sign any additional agreements or undertakings that may be necessary to accomplish the foregoing. 10 2.15 Noncompetition and Nonsolicitation. (a) Noncompetition. During your employment with the Company and its Affiliates and for a twelve (12) month period following your Termination Date (the “Restricted Period”), you shall not (i) directly or indirectly, without the prior written consent of the Company, engage in or invest a material or controlling interest in as an owner, partner, stockholder, licensor, director, officer, agent or consultant for any Person that conducts a business that is in competition with a business conducted by the Company or any of its Affiliates anywhere in the country or countries in which you regularly work or provide services; or (ii) accept employment or an engagement for the provision of services in any capacity, including as an employee, director, consultant or advisor, directly or indirectly, with any Person that conducts a business that is in competition with a business conducted by the Company or any of its Affiliates anywhere in the country or countries in which you regularly work or provide services except where prohibited by local law. For purposes hereof, conducting a business that is in competition with a business conducted by the Company or any of its Affiliates shall include the sale, manufacture, distribution or research and development of any product or service that is similar to a product or service sold, distributed, marketed or being researched or developed (including through a joint venture or investment in another entity) by the Company or any of its Affiliates, including store brand and value brand OTC drug or nutritional products, extended topical generic prescription pharmaceutical products, infant nutrition products, oral care products, and any other product or products that the Company or an Affiliate is marketing or actively planning to market during your employment with the Company and during the oneyear period following your Termination Date. If there is a completed sale, transfer or other disposition of the Perrigo Prescription Pharmaceutical business during the Restricted Period, this Section 2.15(a) will not apply to the Perrigo Prescription Pharmaceutical business. Notwithstanding the foregoing, nothing in this provision shall prevent you from passively owning two percent (2%) or less of the outstanding securities of any class of any company listed on a national securities exchange or quoted on an automated quotation system. You may make a written request in writing to the CHRO of the Company for an exception to this Section 2.15(a) and such exception will not be unreasonably withheld, particularly where you are seeking employment with a business that does not compete with the segment of the Company where you worked or provided services during the last two years of your employment with the Company. (b) Nonsolicitation of Service Providers. During your employment with the Company and its Affiliates and for the duration of the Restricted Period, you shall not, directly or indirectly, without the prior written consent of the Company, (i) actively solicit, recruit or hire any Person who is at such time, or who at any time during the 12-month period prior to such solicitation or hiring had been, an employee or consultant of the Company or any of its Affiliates, (ii) solicit or encourage any employee of the Company or any of its Affiliates to leave the employment of the Company or any of its Affiliates or (iii) interfere with the relationship of the Company or any of its Affiliates with any Person or entity who or that is employed by or otherwise engaged to perform services for the Company or any of its Affiliates except where prohibited by local law. (c) Nonsolicitation of Clients. During your employment with the Company and its Affiliates and for the duration of the Restricted Period, you shall not, directly or indirectly, alone or in association with any other Person, without the prior written consent of the 11 Company, (i) induce or attempt to induce any client, customer (whether former or current), supplier, licensee, franchisee, joint venture partner or other business relation of the Company or any of its Affiliates (collectively, “Clients”) to cease doing business with the Company or any such Affiliate, (ii) divert all or any portion of a Client’s business with the Company to any competitor of the Company or any such Affiliate, or (iii) in any way interfere with the relationship between any Client, on the one hand, and the Company or any such Affiliate, on the other hand except where prohibited by local law. (d) Remedies and Injunctive Relief. You acknowledge that a violation by you of any of the covenants contained in this Section 2.15 would cause irreparable damage to the Company and its Affiliates in an amount that would be material but not readily ascertainable, and that any remedy at law (including the payment of damages) would be inadequate. Accordingly, you agree that, notwithstanding any provision of this Agreement to the contrary, in addition to any other damages it is able to show, the Company and its Affiliates shall be entitled (without the necessity of showing economic loss or other actual damage) to injunctive relief (including temporary restraining orders, preliminary injunctions and permanent injunctions), without posting a bond, in any court of competent jurisdiction for any actual or threatened breach of any of the covenants set forth in this Section 2.15 in addition to any other legal or equitable remedies it may have. In addition, in the event of your Willful Restrictive Covenant Breach (as defined in this Section 2.15), (i) all of your rights under this Agreement, whether or not vested, shall terminate immediately, and (ii) any Shares, cash or other property paid or delivered to you pursuant to this Agreement shall be forfeited and you shall be required to repay such Shares, cash or other property to the Company, no later than thirty (30) calendar days after the Company makes demand to you for repayment. For purposes of this Agreement, “Willful Restrictive Covenant Breach” means your material breach of any of the covenants set forth in this Section 2.15 which you knew, or with due inquiry, should have known, would constitute such a material breach. The preceding sentences of this Section 2.15 shall not be construed as a waiver of the rights that the Company and its Affiliates may have for damages under this Agreement or otherwise, and all such rights shall be unrestricted. The Restricted Period shall be tolled during (and shall be deemed automatically extended by) any period during which you are in violation of the provisions of Section 2.15(a), (b) or (c), as applicable. In the event that a court of competent jurisdiction determines that any provision of this Section 2.15 is invalid or more restrictive than permitted under the governing law of such jurisdiction, then, only as to enforcement of this Section 2.15 within the jurisdiction of such court, such provision shall be interpreted and enforced as if it provided for the maximum restriction permitted under such governing law. (e) Acknowledgments. (1) You acknowledge that the Company and its Affiliates have expended and will continue to expend substantial amounts of time, money and effort to develop business strategies, employee, customer and other relationships and goodwill to build an effective organization. You acknowledge that the Company and its Affiliates have a legitimate business interest in and right to protect its goodwill and employee, customer and other relationships, and that the Company and its Affiliates could be seriously damaged by the loss or deterioration of its employee, customer and other relationships. You further acknowledge that the Company and its Affiliates are entitled to protect and preserve the going concern value of the Company and its Affiliates to the extent permitted by law. 12 (2) In light of the foregoing acknowledgments, you agree that the covenants contained in this Agreement are reasonable and properly required for the adequate protection of the businesses and goodwill of the Company and its Affiliates. You further acknowledge that, although your compliance with the covenants contained in this Agreement may prevent you from earning a livelihood in a business similar to the business of the Company and its Affiliates, your experience and capabilities are such that you have other opportunities to earn a livelihood and adequate means of support for you and your dependents. (3) In light of the acknowledgements contained in this Section 2.15, you agree not to challenge or contest the reasonableness, validity or enforceability of any limitations on, and obligations of, you contained in this Section 2.15. **** We look forward to your continuing contribution to the growth of the Company. Please acknowledge your receipt of the Plan and this Award. Very truly yours, /s/ Patrick Lockwood-Taylor Patrick Lockwood-Taylor Chief Executive Officer and President

13 PERRIGO COMPANY PLC ACCORD RELATIF À L’ATTRIBUTION D’UNITÉS D’ACTION AVEC RESTRICTIONS (RÉMUNÉRATION FONDÉE SUR LES SERVICES) (Dans le cadre du Plan d’incitation à long terme 2019 de Perrigo Company plc) À : Participant Name OBJET : Avis d’attribution d’unités d’action avec restrictions (rémunération fondée sur les services) Les présentes visent à vous informer que Perrigo Company plc (la « Société ») vous a octroyé une Prime dans le cadre du Plan d’incitation à long terme 2019 de Perrigo Company plc (le « Plan »), avec prise d’effet à la Grant Date (la « Date d’octroi »). Cette Prime est constituée d’unités d’action avec restrictions sur la base des services. Les conditions de cette incitation sont exposées dans le reste du présent accord, dénommé collectivement l’« Accord » (y compris toutes les conditions particulières stipulées dans les appendices applicables à votre pays [l’« Appendice »]). Les termes commençant par une lettre majuscule utilisés dans le présent Accord et qui n’y sont pas définis ont le sens qui leur est attribué en vertu du Plan. SECTION 1 Unités d’action avec restrictions — Dévolution sur la base des services 1.1 Octroi. À compter de la Date d’octroi et sous réserve des conditions du présent Accord et du Plan, la Société vous octroie Number of Awards Granted (« Unités d’action avec restrictions » ou « UAR »). Chaque UAR vous donne droit à une action ordinaire de la Société d’une valeur nominale de 0,001 € par action (« Action ordinaire ») à la Date de dévolution des UAR applicable pour autant qu’il soit satisfait aux conditions décrites à la section 1.2. 1.2 Dévolution. Sous réserve des cas prévus à la section 1.3, les UAR attribuées à la section 1.1 sont dévolues comme suit après la Date d’octroi (« Date(s) de dévolution des UAR ») : Vesting Schedule (Dates & Quantities); pour autant, toutefois, que vous restiez au service de la Société de la Date d’octroi jusqu’à la Date de dévolution applicable. Sauf dans les cas prévus à la section 1.3, si votre Date de cessation d’emploi survient avant la Date de dévolution des UAR, toutes les UAR attribuées en vertu de la section 1.1 n’ayant pas encore été dévolues à ladite Date de cessation d’emploi sont déchues définitivement à cette date. 1.3 Règles de dévolution particulières. Nonobstant les dispositions de la section 1.2 : (a) Si votre Date de cessation d’emploi survient à la suite d’un décès, d’un Handicap ou d’un Départ à la retraite avec l’accord de la Société, toutes les UAR attribuées en vertu de la section 1.1 n’ayant pas été dévolues avant la Date de cessation d’emploi le deviennent alors intégralement. 14 (b) Si votre Date de cessation d’emploi survient à la suite d’un Licenciement involontaire pour motifs économiques, toutes les UAR attribuées en vertu de la section 1.1 qui auraient, en d’autres circonstances, été dévolues en vertu de la section 1.2 au cours de la période de 24 mois suivant ladite Date de cessation d’emploi continuent d’être dévolues durant cette période de 24 mois, conformément au programme de dévolution en vigueur avant cette date ; toutefois, si votre Date de cessation d’emploi survient pour un motif décrit aussi bien dans la présente sous-section (b) et dans la sous-section (c), les règles de dévolution particulières décrites dans la sous-section (c) s’appliquent au lieu de celles décrites dans la présente sous- section (b). Toutes les UAR dont la dévolution n’est pas planifiée durant la période de 24 mois en question sont déchues définitivement à la Date de cessation d’emploi. (c) Si votre Date de cessation d’emploi survient en raison d’un Licenciement sans motif valable ou d’un Départ pour motifs justifiés au moment ou à la suite d’un Changement de contrôle (défini dans le Plan, cette définition pouvant être modifiée par la suite) et avant le deuxième (2e) anniversaire du Changement de contrôle, toutes les UAR attribuées en vertu de la section 1.1 n’ayant pas été dévolues ou déchues avant la Date de cessation d’emploi sont dévolues intégralement. (d) Tels qu’ils sont utilisés dans la présente section 1.3, les termes suivants ont le sens qui leur est attribué ci-après : (1) Par « Départ pour motifs justifiés », on entend votre démission volontaire de la Société et l’existence d’une ou de plusieurs des conditions suivantes, survenues sans votre consentement : (i) une modification importante de l’emplacement géographique où vous êtes tenu de fournir les services, de sorte que le trajet entre votre domicile et votre lieu de travail principal est allongé de plus de 50 km ou (ii) une réduction importante de votre autorité, de vos fonctions ou de vos responsabilités ou une baisse considérable de votre rémunération de base ou de vos possibilités de rémunération incitatives, étant toutefois entendu qu’une démission volontaire de la Société n’est pas considérée comme un Départ pour motifs justifiés tant que vous ne signifiez pas à la Société, par écrit, ladite démission et l’existence de la ou des conditions donnant lieu à la cessation d’emploi dans un délai de 90 jours après le moment où elles surviennent pour la première fois. La Société dispose ensuite de 30 jours pour remédier à la situation, auquel cas il ne sera pas considéré que vous avez subi un Départ pour motifs justifiés. Si la Société n’est pas en mesure de remédier à la situation dans ce délai de 30 jours, votre Date de cessation d’emploi intervient le 31e jour suivant la réception de votre avis écrit par la Société. (2) Par « Licenciement sans motif valable », on entend la cessation involontaire et sans motif de votre emploi ou de la relation contractuelle qui vous lie à la Société, notamment, de manière non limitative, (i) un licenciement intervenant lorsque vous épuisez un congé durant ou au terme d’une période de préavis en vertu du Worker Adjustment and Retraining Notification Act (« WARN ») et (ii) une situation dans laquelle vous bénéficiez d’un congé autorisé durant lequel votre poste est protégé en vertu de la loi applicable (par exemple le Family Medical Leave Act) et, à votre retour de congé, vous ne pouvez pas être employé ou conclure une autre forme de relation contractuelle avec la Société. 1.4 Règlement des UAR. Le plus tôt possible après la Date de dévolution des UAR, la Société vous cède une Action ordinaire pour chaque UAR dévolue à cette date (la date 15 de cession étant dénommée la « date de règlement » aux fins du présent Accord), étant toutefois entendu que la Société peut retenir des actions qui devraient vous être cédées pour satisfaire à des retenues d’impôt dues en conséquence de la dévolution des UAR, conformément à la section 2.6. Vous ne détenez aucun droit en tant qu’actionnaire relatif aux UAR attribuées en vertu des présentes avant la date d’émission, à votre bénéfice, d’un ou de plusieurs certificats concernant les actions en question. Nonobstant ce qui précède, le Comité peut, à sa seule discrétion, choisir de régler les UAR en espèces sur la base de la juste valeur de marché des Actions ordinaires à la Date de dévolution des UAR. 1.5 Équivalents de dividendes. Les UAR attribuées en vertu de la section 1.1 sont admissibles au versement d’équivalents de dividendes conformément à ce qui suit : (a) Un « Compte » est établi à votre nom. Ce Compte est uniquement utilisé à des fins de tenue des dossiers et aucun actif ou autre montant ne sera prélevé des actifs généraux de la Société pour y être déposé. (b) À chaque date à laquelle un dividende en espèces est versé relativement aux Actions ordinaires, la Société crédite votre Compte du montant, en dollars, des dividendes que vous auriez reçus si chaque UAR que vous détenez à la date d’enregistrement du paiement des dividendes avait été une Action ordinaire. Aucun intérêt ou autre revenu ne sera accumulé sur ce Compte. (c) À chaque Date de dévolution des UAR, vous recevez un paiement équivalant au montant des dividendes qui vous auraient été versés sur les UAR dévolues à cette date s’il s’était agi d’Actions ordinaires au cours de la période débutant à la Date d’octroi et se terminant à la Date de dévolution des UAR, et le compte est débité en conséquence. Si des UAR sont déchues, tous les montants du Compte imputables à ces UAR sont déchus également. (d) Si des dividendes sont versés sous la forme d’Actions ordinaires plutôt que d’espèces, vous êtes crédité d’une UAR supplémentaire pour chaque Action ordinaire qui aurait été perçue sous forme de dividende si vos UAR en suspend avaient été des Actions ordinaires. Ces UAR supplémentaires sont dévolues ou déchues au même moment que les UAR auxquelles elles se rapportent. SECTION 2 Conditions générales 2.1 Incessibilité. La Prime qui fait l’objet du présent Accord ne peut être cédée par d’autres voies que par testament ou en vertu du droit successoral. 2.2 Absence de droits d’actionnaire. Vous ne détenez aucun droit en tant qu’actionnaire relatif aux Actions ordinaires soumises aux UAR attribuées en vertu du présent Accord avant la date d’émission, à votre bénéfice, d’un ou de plusieurs certificats concernant les actions en question. 16 2.3 Licenciement justifié. Si votre Date de cessation d’emploi survient pour des motifs justifiés, l’ensemble de vos droits découlant du présent Accord, acquis ou non, prennent fin immédiatement. 2.4 Soumission de la Prime au Plan. L’octroi de la Prime en vertu du présent Accord est organisé conformément au Plan et la Prime est payable uniquement conformément aux conditions de celui-ci qui sont en vigueur. Le Plan comporte certaines définitions, restrictions, limitations et d’autres conditions qui s’appliquent toutes au présent Accord. L’ENSEMBLE DES DISPOSITIONS DU PLAN SONT INTÉGRÉES AUX PRÉSENTES PAR RENVOI ET FONT PARTIE INTÉGRANTE DU PRÉSENT ACCORD COMME SI CHACUNE D’ENTRE ELLES Y FIGURAIT EXPLICITEMENT. Si le Plan devient nul ou inexécutoire en vertu d’une loi ou d’une décision judiciaire, le présent Accord devient nul et sans effet. Rien de ce qui est énoncé dans le présent Accord ne vise à restreindre ou à exclure toute définition, restriction, limitation ou autre condition du Plan susceptible d’être pertinente à l’égard du présent Accord et spécifiquement appliquée à ce dernier par le Comité, et aucune de ses dispositions ne saurait être interprétée en ce sens. En cas de conflit entre les dispositions du présent Accord et le Plan, la règle d’interprétation considère que les conditions du Plan priment et, partant, s’appliquent. 2.5 Ajustements en cas de Changement relatif aux Actions ordinaires. En cas de fractionnement des actions, de dividendes en actions, de recapitalisation, de reclassement ou de regroupement d’actions, de fusion, de vente d’actifs ou d’événements similaires, le nombre et le type d’actions qui constituent la Prime en vertu du présent Accord seront ajustés de manière appropriée et équitable pour éviter la dilution ou la majoration des droits qui vous sont octroyés ou reconnus. 2.6 Accusé de réception. La Société et vous-même convenez que les UAR sont attribuées et régies par l’Avis d’octroi, le présent Accord (y compris son éventuel Appendice) et les dispositions du Plan (intégrées aux présentes par renvoi). Vous (i) accusez réception d’un exemplaire de chacun des documents susmentionnés, (ii) déclarez les avoir lus attentivement et en comprendre les dispositions et (iii) acceptez par les présentes les UAR soumises à l’ensemble des conditions énoncées dans les présentes et à celles stipulées dans le Plan et l’Avis d’octroi. 2.7 Impôts et retenues. (a) Retenues (applicable uniquement aux individus soumis à la législation fiscale des États-Unis). La présente Prime est soumise à la retenue de l’ensemble des impôts applicables. La Société est en droit de retenir ou de vous autoriser à lui verser tous impôts de l’État fédéral, des États fédérés ou des autorités locales applicables à la prime, à sa dévolution ou à tout autre événement entraînant une obligation fiscale relativement à la présente Prime. Si vous n’avez pas versé l’intégralité du montant correspondant aux retenues d’impôt applicables à la Société à la date où cette dernière est tenue de s’en acquitter auprès des autorités fiscales concernées (ou à une date antérieure spécifiée par la Société en vue de lui permettre de respecter ses obligations à temps), la Société est en droit, unilatéralement, de retenir de la présente Prime le nombre d’Actions ordinaires qu’elle estime suffisant pour respecter les retenues fiscales imposées par la loi. Les impôts des États fédérés font l’objet d’une retenue au taux applicable fixé par l’État dans lequel vous êtes employé par la Société ou dans lequel vous avez travaillé

17 pour cette dernière en dernier lieu. En aucun cas le nombre d’actions retenues ne peut être supérieur au nombre nécessaire au respect des exigences relatives aux retenues d’impôts sur le revenu et sur le travail de l’État fédéral, des États fédérés ou des autorités locales. Vous pouvez décider de céder des Actions ordinaires acquises par le passé ou de demander à la Société de retenir des Actions ordinaires relatives à la présente Prime dans un montant suffisant à respecter tout ou partie des retenues fiscales imposées par la loi. (b) Responsabilité fiscale (applicable uniquement aux individus soumis aux législations fiscales hors États-Unis) Indépendamment de toute action entreprise par la Société ou la Filiale qui vous emploie ou a recours à vos services concernant l’impôt sur le revenu, la sécurité sociale, l’impôt sur les salaires, les acomptes versés ou tout autre élément fiscal relatif à votre participation au Plan qui s’appliquent à vous en vertu de la loi (les « Éléments fiscaux »), vous acceptez qu’en définitive, les obligations se rapportant aux Éléments fiscaux sont et demeurent votre responsabilité et peuvent être supérieures au montant réellement retenu par la Société ou la Filiale qui vous emploie ou a recours à vos services. Vous reconnaissez en outre que la Société ou la Filiale qui vous emploie ou a recours à vos services (1) ne fait aucune déclaration et ne prend aucun engagement concernant le traitement de tous Éléments fiscaux relatifs à un quelconque aspect des UAR, notamment, de manière non limitative, l’octroi, la dévolution ou le règlement des UAR, la vente ultérieure d’Actions ordinaires acquises en vertu du règlement en question et la réception de tous dividendes et (2) ne s’engage pas à structurer les conditions de l’octroi ou tout aspect des UAR de manière à réduire ou à éliminer votre obligation relative aux Éléments fiscaux ou d’obtenir un quelconque résultat fiscal particulier, et n’est pas dans l’obligation de le faire. Par ailleurs, si vous êtes devenu assujetti à l’impôt dans plus d’une juridiction entre la Date de dévolution des UAR et celle de tout événement fiscal applicable, le cas échéant, vous acceptez que la Société ou la Filiale qui vous emploie ou a recours à vos services (ou le faisait par le passé, le cas échéant) soit tenue de retenir ou de justifier des Éléments fiscaux dans plus d’une juridiction. (1) Avant tout événement imposable ou donnant lieu à une retenue fiscale, le cas échéant, vous vous acquittez de toutes vos obligations ou prenez des dispositions satisfaisant la Société ou la Filiale qui vous emploie ou a recours à vos services en vue de respecter l’ensemble des Éléments fiscaux. À cet égard, vous autorisez la Société ou la Filiale qui vous emploie ou a recours à vos services (ou ses représentants, à sa discrétion) à respecter les obligations relatives à l’ensemble des Éléments fiscaux au travers d’une des démarches suivantes ou d’une combinaison de celles-ci : (A) retenue sur vos salaires ou toute autre rémunération en espèces versée par la Société ou la Filiale qui vous emploie ou a recours à vos services ; (B) retenue sur les produits de la vente d’Actions ordinaires acquises par le règlement des UAR, soit par une vente volontaire, soit par une vente obligatoire organisée par la Société (en votre nom, en vertu de la présente autorisation) ; (C) retenue sur des Actions ordinaires à émettre lors du règlement des UAR. 18 (2) Pour éviter un traitement comptable négatif, la Société peut retenir ou justifier des Éléments fiscaux en prenant en considération les montants prévus par la loi ou d’autres taux de retenue applicables. Si l’obligation relative aux Éléments fiscaux est remplie à travers la retenue d’Actions ordinaires, à des fins fiscales, il est considéré que l’intégralité des Actions ordinaires soumises aux UAR dévolues ont été émises à votre intention, même si un certain nombre d’Actions ordinaires sont retenues exclusivement aux fins du paiement des Éléments fiscaux. (3) Enfin, vous vous engagez à verser à la Société ou à la Filiale qui vous emploie ou a recours à vos services tout montant des Éléments fiscaux que celle-ci peut être tenue de retenir ou de justifier en conséquence de votre participation au Plan et qui ne peut être acquitté par les moyens décrits ci-avant. La Société peut refuser d’émettre ou de remettre les Actions ordinaires ou le produit de la vente de celles-ci si vous ne respectez pas vos obligations relatives aux Éléments fiscaux. 2.8 Respect de la loi applicable. L’émission d’Actions ordinaires est soumise et conditionnée au respect, par la Société et vous-même, y compris toutes déclarations, garanties et accords écrits que l’Administrateur est susceptible d’exiger, de toutes les (i) lois et réglementations américaines, tant au niveau de l’État fédéral que des États fédérés, (ii) lois applicables de votre pays de résidence en matière d’émission ou de vente d’Actions ordinaires et (iii) réglementations applicables de toute bourse ou tout système automatisé de cotation où sont inscrites ou cotées les Actions ordinaires de la Société au moment de l’émission ou de la cession. Nonobstant les autres dispositions du présent Accord, la Société n’est tenue à aucune obligation d’émission d’Actions ordinaires en vertu du présent Accord si ladite émission enfreint toute loi, réglementation ou exigence applicable d’une entité boursière ou similaire. 2.9 Section 409A de l’Internal Revenue Code (applicable uniquement aux individus soumis à la législation fiscale fédérale des États-Unis). (a) Les UAR autres que celles qui continuent d’être dévolues en conséquence de votre Licenciement involontaire pour motifs économiques et les équivalents de dividendes payables en vertu du présent Accord ont vocation à être exemptées de la section 409A de l’Internal Revenue Code en vertu de l’exemption des reports à court terme. Par conséquent, les UAR (autres que celles qui continuent d’être dévolues en conséquence de votre Licenciement involontaire pour motifs économiques) sont réglées et les équivalents de dividendes versés au plus tard le 15e jour du troisième mois qui suit la dernière des dates ci-après : (i) la fin de votre année d’imposition durant laquelle intervient la Date de dévolution des UAR ou (ii) la fin de l’exercice de la Société durant lequel intervient la Date de dévolution des UAR. (b) Les UAR qui continuent d’être dévolues en conséquence de votre Licenciement involontaire pour motifs économiques sont soumises aux dispositions de la présente sous-section (b). Toute distribution à titre de règlement de ces UAR intervient pour autant que votre Licenciement involontaire pour motifs économiques constitue une « cessation de service » au sens du règlement du Trésor § 1.409A-1(h). Si la Société établit que vous êtes un « employé déterminé » au sens de la section 409A de l’Internal Revenue Code (c’est-à-dire un responsable dont la rémunération annuelle est supérieure à 130 000 $ [ajusté en fonction de l’inflation], un détenteur de cinq pour cent des parts de la Société ou un détenteur d’un pour cent 19 des parts dont la rémunération annuelle est supérieure à 150 000 $), la distribution à titre de règlement de toutes les UAR qui seraient payables dans les six mois suivant votre cessation de service sera différée au premier jour ouvrable suivant la date marquant les six mois de votre cessation de service. Toute distribution à titre de règlement de ces UAR qui serait effectuée plus de six mois après votre cessation de service (sans application du délai de six mois) ne sera pas soumise au délai de six mois décrit dans la présente sous-section. 2.10 Confidentialité des données. (a) Réglementations concernant la confidentialité des données aux États-Unis (uniquement applicables si la Prime est soumise aux lois des États-Unis sur la confidentialité des données). À travers la conclusion du présent Accord et l’acception de la présente Prime, vous (a) consentez explicitement et sans équivoque à la collecte, à l’utilisation et au transfert, par voie électronique ou autre, de toutes vos données personnelles nécessaires pour faciliter la mise en œuvre, l’administration et la gestion de la Prime et du Plan, (b) comprenez que la Société peut, aux fins de la mise en œuvre, de l’administration et de la gestion du Plan, détenir certaines informations vous concernant, notamment, de manière non limitative, vos nom, adresse personnelle, numéro de téléphone, date de naissance, numéro de sécurité sociale ou autre numéro d’identification, salaire, nationalité, poste et les détails de l’ensemble des primes ou droits à Actions qui vous ont été octroyés dans le cadre du Plan ou d’une autre manière (les « Données personnelles »), (c) comprenez que des Données personnelles puissent être transférées à des tiers contribuant à la mise en œuvre, à l’administration et à la gestion du Plan, notamment tout courtier auquel la garde des Actions a été confiée lors de la dévolution de la Prime, que ces destinataires peuvent être établis dans votre pays ou ailleurs et que leur pays d’établissement peut disposer de lois et de protections différentes du vôtre en matière de confidentialité des données, (d) renoncez à tous les droits de confidentialité dont vous disposez relativement aux données et (e) autorisez la Société, ses Filiales et leurs représentants à stocker et transmettre lesdites informations par voie électronique. (b) Réglementations concernant la confidentialité des données hors États-Unis (uniquement applicables si la Prime est soumise à des lois sur la confidentialité des données en dehors des États-Unis). (1) À travers la conclusion du présent Accord et l’acception de la présente Prime, vous consentez explicitement et sans équivoque à la collecte, à l’utilisation et au transfert, par voie électronique ou autre, de vos données personnelles, comme décrit dans le présent Accord ainsi que dans tous autres documents relatifs à l’octroi des UAR, le cas échéant, par la Filiale qui vous emploie ou a recours à vos services ainsi que la Société et ses Filiales, aux fins exclusives de la mise en œuvre, de l’administration et de la gestion de votre participation du Plan. (2) Vous comprenez que la Société et la Filiale qui vous emploie ou a recours à vos services peut détenir certaines informations vous concernant, notamment, de manière non limitative, vos nom, adresse personnelle, numéro de téléphone, date de naissance, numéro de sécurité sociale ou autre numéro d’identification, salaire, nationalité, poste, toutes Actions ordinaires ou tous mandats d’administrateur dans la Société, les détails de l’ensemble des UAR et autres droits à Actions ordinaires octroyés, annulés, exercés, acquis, non acquis ou 20 en suspens en votre faveur, aux fins exclusives de la mise en œuvre, de l’administration et de la gestion du Plan (les « Données »). (3) Vous comprenez que les Données seront transférées à un conseiller juridique, un courtier ou tout autre prestataire de services de plan d’action choisi par la Société à l’avenir pour assister cette dernière dans la mise en œuvre, l’administration et la gestion du Plan. Vous comprenez que les destinataires des Données peuvent être établis aux États-Unis ou ailleurs et que leur pays d’établissement (p. ex. les États-Unis) peut disposer de lois et de protections différentes du vôtre en matière de confidentialité des données. Vous comprenez que si vous résidez en dehors des États-Unis, vous pouvez demander une liste reprenant le nom et l’adresse de tous les destinataires potentiels des Données en contactant votre représentant local des ressources humaines ou celui de la Société. Vous autorisez la Société ainsi que tous autres destinataires éventuels chargés d’assister la Société (actuellement ou à l’avenir) dans la mise en œuvre, l’administration et la gestion du Plan à recevoir, détenir, utiliser, conserver et transférer les Données, par voie électronique ou autre, aux fins exclusives de la mise en œuvre, de l’administration et de la gestion de votre participation au Plan. Vous comprenez que les Données seront détenues aussi longtemps que le requièrent la mise en œuvre, l’administration et la gestion de votre participation au Plan. Vous comprenez que si vous résidez en dehors des États-Unis, vous pouvez, à tout moment, consulter les Données, demander des informations complémentaires sur leur stockage et leur traitement, demander toutes les modifications nécessaires aux Données, refuser votre consentement ou le retirer, dans tous les cas sans frais, en contactant par écrit votre représentant local des ressources humaines ou celui de la Société. Vous comprenez toutefois que le refus ou le retrait de votre consentement peut avoir une incidence sur votre capacité à participer au Plan. Pour de plus amples informations sur les conséquences du refus de consentement ou du retrait de celui-ci, vous comprenez que vous pouvez contacter votre représentant local des ressources humaines ou celui de la Société. 2.11 Successeurs et ayants droit. Le présent Accord lie tous les successeurs et ayants droit de la Société. 2.12 Droit applicable. Le présent Accord est régi, interprété et exécuté dans toute la mesure du possible conformément aux dispositions applicables du Code et, autrement, conformément au droit de l’État du Michigan, sans égard aux principes relatifs aux conflits de droit, étant entendu que si vous êtes un ressortissant étranger ou êtes employé en dehors des États-Unis, le présent Accord sera régi, interprété et exécuté en vertu du droit étranger applicable dans la mesure où ledit droit diffère du Code et du droit de l’État du Michigan. Toute procédure liée au présent Accord ou en découlant sera engagée, exercée ou poursuivie dans le tribunal d’arrondissement du comté de Kent, dans le Michigan, situé à Grand Rapids, dans le Michigan, ou dans l’United States District Court for the Western District of Michigan et dans la cour d’appel correspondante. 2.13 Déchéance des UAR. Si la Société, à la suite d’une faute, est tenue de préparer un retraitement comptable en raison d’un cas grave de non-respect des exigences relatives à la présentation des informations financières en vertu des lois sur les valeurs mobilières, alors (a) si votre incitation ou votre rémunération fondée sur des actions est soumise à la déchéance automatique en raison de ladite faute et du retraitement, en vertu de la section 304 du Sarbanes- Oxley Act de 2002 ou (b) si le Comité établit que vous avez sciemment pris part à la faute, que