00015853642024FYFALSEhttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#LongTermDebtCurrenthttp://fasb.org/us-gaap/2024#LongTermDebtCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#LongTermDebtNoncurrenthttp://fasb.org/us-gaap/2024#LongTermDebtNoncurrenthttp://fasb.org/us-gaap/2024#AssetImpairmentChargeshttp://fasb.org/us-gaap/2024#CostOfGoodsAndServicesSold http://fasb.org/us-gaap/2024#InterestIncomeExpenseNonoperatingNet http://fasb.org/us-gaap/2024#OtherNonoperatingIncomeExpense http://fasb.org/us-gaap/2024#RevenueFromContractWithCustomerExcludingAssessedTaxiso4217:USDxbrli:sharesiso4217:USDxbrli:sharesiso4217:EURxbrli:sharesprgo:reporting_unitxbrli:pureprgo:productprgo:transactioniso4217:EURprgo:derivativeprgo:yearprgo:classprgo:stateprgo:manufacturerprgo:employeeprgo:hospitalprgo:plaintiffprgo:individualprgo:claimiso4217:ILSiso4217:USDiso4217:ILSprgo:policy_period00015853642024-01-012024-12-310001585364prgo:OrdinaryShares0001ParValueMember2024-01-012024-12-310001585364prgo:A4.900SeniorNotesDue2030Member2024-01-012024-12-310001585364prgo:A6.125SeniorNotesDue2032Member2024-01-012024-12-310001585364prgo:A5.375SeniorNotesDue2032Member2024-01-012024-12-310001585364prgo:A5.300SeniorNotesDue2043Member2024-01-012024-12-310001585364prgo:A4.900SeniorNotesDue2044Member2024-01-012024-12-3100015853642024-06-2800015853642025-02-2100015853642023-01-012023-12-3100015853642022-01-012022-12-3100015853642024-12-3100015853642023-12-3100015853642022-12-3100015853642021-12-310001585364us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-12-310001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001585364us-gaap:RetainedEarningsMember2021-12-310001585364us-gaap:RetainedEarningsMember2022-01-012022-12-310001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001585364us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-01-012022-12-310001585364us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-12-310001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001585364us-gaap:RetainedEarningsMember2022-12-310001585364us-gaap:RetainedEarningsMember2023-01-012023-12-310001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001585364us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-01-012023-12-310001585364us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-12-310001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001585364us-gaap:RetainedEarningsMember2023-12-310001585364us-gaap:RetainedEarningsMember2024-01-012024-12-310001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310001585364us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-01-012024-12-310001585364us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-12-310001585364us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001585364us-gaap:RetainedEarningsMember2024-12-310001585364us-gaap:ForeignExchangeForwardMember2024-01-012024-12-310001585364prgo:ConsumerSelfCareInternationalMember2024-01-012024-12-310001585364country:US2024-01-012024-12-310001585364country:US2023-01-012023-12-310001585364country:US2022-01-012022-12-310001585364srt:EuropeMember2024-01-012024-12-310001585364srt:EuropeMember2023-01-012023-12-310001585364srt:EuropeMember2022-01-012022-12-310001585364prgo:OtherGeographicalAreasMember2024-01-012024-12-310001585364prgo:OtherGeographicalAreasMember2023-01-012023-12-310001585364prgo:OtherGeographicalAreasMember2022-01-012022-12-310001585364country:IE2024-01-012024-12-310001585364country:IE2023-01-012023-12-310001585364country:IE2022-01-012022-12-310001585364prgo:UpperRespiratoryMemberprgo:ConsumerSelfCareAmericasMember2024-01-012024-12-310001585364prgo:UpperRespiratoryMemberprgo:ConsumerSelfCareAmericasMember2023-01-012023-12-310001585364prgo:UpperRespiratoryMemberprgo:ConsumerSelfCareAmericasMember2022-01-012022-12-310001585364prgo:DigestiveHealthMemberprgo:ConsumerSelfCareAmericasMember2024-01-012024-12-310001585364prgo:DigestiveHealthMemberprgo:ConsumerSelfCareAmericasMember2023-01-012023-12-310001585364prgo:DigestiveHealthMemberprgo:ConsumerSelfCareAmericasMember2022-01-012022-12-310001585364prgo:NutritionMemberprgo:ConsumerSelfCareAmericasMember2024-01-012024-12-310001585364prgo:NutritionMemberprgo:ConsumerSelfCareAmericasMember2023-01-012023-12-310001585364prgo:NutritionMemberprgo:ConsumerSelfCareAmericasMember2022-01-012022-12-310001585364prgo:PainAndSleepAidsMemberprgo:ConsumerSelfCareAmericasMember2024-01-012024-12-310001585364prgo:PainAndSleepAidsMemberprgo:ConsumerSelfCareAmericasMember2023-01-012023-12-310001585364prgo:PainAndSleepAidsMemberprgo:ConsumerSelfCareAmericasMember2022-01-012022-12-310001585364prgo:HealthyLifestyleMemberprgo:ConsumerSelfCareAmericasMember2024-01-012024-12-310001585364prgo:HealthyLifestyleMemberprgo:ConsumerSelfCareAmericasMember2023-01-012023-12-310001585364prgo:HealthyLifestyleMemberprgo:ConsumerSelfCareAmericasMember2022-01-012022-12-310001585364prgo:OralCareMemberprgo:ConsumerSelfCareAmericasMember2024-01-012024-12-310001585364prgo:OralCareMemberprgo:ConsumerSelfCareAmericasMember2023-01-012023-12-310001585364prgo:OralCareMemberprgo:ConsumerSelfCareAmericasMember2022-01-012022-12-310001585364prgo:SkincareAndPersonalHygieneMemberprgo:ConsumerSelfCareAmericasMember2024-01-012024-12-310001585364prgo:SkincareAndPersonalHygieneMemberprgo:ConsumerSelfCareAmericasMember2023-01-012023-12-310001585364prgo:SkincareAndPersonalHygieneMemberprgo:ConsumerSelfCareAmericasMember2022-01-012022-12-310001585364prgo:WomensHealthMemberprgo:ConsumerSelfCareAmericasMember2024-01-012024-12-310001585364prgo:WomensHealthMemberprgo:ConsumerSelfCareAmericasMember2023-01-012023-12-310001585364prgo:WomensHealthMemberprgo:ConsumerSelfCareAmericasMember2022-01-012022-12-310001585364prgo:VitaminsMineralsAndSupplementsMemberprgo:ConsumerSelfCareAmericasMember2024-01-012024-12-310001585364prgo:VitaminsMineralsAndSupplementsMemberprgo:ConsumerSelfCareAmericasMember2023-01-012023-12-310001585364prgo:VitaminsMineralsAndSupplementsMemberprgo:ConsumerSelfCareAmericasMember2022-01-012022-12-310001585364prgo:OtherCSCAMemberprgo:ConsumerSelfCareAmericasMember2024-01-012024-12-310001585364prgo:OtherCSCAMemberprgo:ConsumerSelfCareAmericasMember2023-01-012023-12-310001585364prgo:OtherCSCAMemberprgo:ConsumerSelfCareAmericasMember2022-01-012022-12-310001585364prgo:ConsumerSelfCareAmericasMember2024-01-012024-12-310001585364prgo:ConsumerSelfCareAmericasMember2023-01-012023-12-310001585364prgo:ConsumerSelfCareAmericasMember2022-01-012022-12-310001585364prgo:SkincareAndPersonalHygieneMemberprgo:ConsumerSelfCareInternationalMember2024-01-012024-12-310001585364prgo:SkincareAndPersonalHygieneMemberprgo:ConsumerSelfCareInternationalMember2023-01-012023-12-310001585364prgo:SkincareAndPersonalHygieneMemberprgo:ConsumerSelfCareInternationalMember2022-01-012022-12-310001585364prgo:UpperRespiratoryMemberprgo:ConsumerSelfCareInternationalMember2024-01-012024-12-310001585364prgo:UpperRespiratoryMemberprgo:ConsumerSelfCareInternationalMember2023-01-012023-12-310001585364prgo:UpperRespiratoryMemberprgo:ConsumerSelfCareInternationalMember2022-01-012022-12-310001585364prgo:HealthyLifestyleMemberprgo:ConsumerSelfCareInternationalMember2024-01-012024-12-310001585364prgo:HealthyLifestyleMemberprgo:ConsumerSelfCareInternationalMember2023-01-012023-12-310001585364prgo:HealthyLifestyleMemberprgo:ConsumerSelfCareInternationalMember2022-01-012022-12-310001585364prgo:PainAndSleepAidsMemberprgo:ConsumerSelfCareInternationalMember2024-01-012024-12-310001585364prgo:PainAndSleepAidsMemberprgo:ConsumerSelfCareInternationalMember2023-01-012023-12-310001585364prgo:PainAndSleepAidsMemberprgo:ConsumerSelfCareInternationalMember2022-01-012022-12-310001585364prgo:VitaminsMineralsAndSupplementsMemberprgo:ConsumerSelfCareInternationalMember2024-01-012024-12-310001585364prgo:VitaminsMineralsAndSupplementsMemberprgo:ConsumerSelfCareInternationalMember2023-01-012023-12-310001585364prgo:VitaminsMineralsAndSupplementsMemberprgo:ConsumerSelfCareInternationalMember2022-01-012022-12-310001585364prgo:WomensHealthMemberprgo:ConsumerSelfCareInternationalMember2024-01-012024-12-310001585364prgo:WomensHealthMemberprgo:ConsumerSelfCareInternationalMember2023-01-012023-12-310001585364prgo:WomensHealthMemberprgo:ConsumerSelfCareInternationalMember2022-01-012022-12-310001585364prgo:OralCareMemberprgo:ConsumerSelfCareInternationalMember2024-01-012024-12-310001585364prgo:OralCareMemberprgo:ConsumerSelfCareInternationalMember2023-01-012023-12-310001585364prgo:OralCareMemberprgo:ConsumerSelfCareInternationalMember2022-01-012022-12-310001585364prgo:DigestiveHealthMemberprgo:ConsumerSelfCareInternationalMember2024-01-012024-12-310001585364prgo:DigestiveHealthMemberprgo:ConsumerSelfCareInternationalMember2023-01-012023-12-310001585364prgo:DigestiveHealthMemberprgo:ConsumerSelfCareInternationalMember2022-01-012022-12-310001585364prgo:OtherCSCIMemberprgo:ConsumerSelfCareInternationalMember2024-01-012024-12-310001585364prgo:OtherCSCIMemberprgo:ConsumerSelfCareInternationalMember2023-01-012023-12-310001585364prgo:OtherCSCIMemberprgo:ConsumerSelfCareInternationalMember2022-01-012022-12-310001585364prgo:ConsumerSelfCareInternationalMember2023-01-012023-12-310001585364prgo:ConsumerSelfCareInternationalMember2022-01-012022-12-310001585364prgo:ContractManufacturingMember2024-01-012024-12-310001585364prgo:ContractManufacturingMember2023-01-012023-12-310001585364prgo:ContractManufacturingMember2022-01-012022-12-310001585364prgo:RareDiseasesBusinessMember2024-07-100001585364prgo:RareDiseasesBusinessMember2024-07-102024-07-100001585364prgo:RareDiseasesBusinessMember2024-06-292024-06-290001585364prgo:BrandedProductsMember2024-01-012024-12-310001585364prgo:BrandedProductsMember2024-12-310001585364prgo:HospitalSpecialtyBusinessMember2024-11-010001585364prgo:HospitalSpecialtyBusinessMember2024-11-012024-11-010001585364prgo:HospitalSpecialtyBusinessMember2024-09-282024-09-280001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:AdventInternationalMember2022-03-090001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:AdventInternationalMember2022-03-092022-03-090001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2022-03-090001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:LatinAmericaBusinessMember2022-03-092022-03-090001585364prgo:ScarAwayMemberprgo:ConsumerSelfCareInternationalMember2022-03-242022-03-240001585364prgo:HRAPharmaMember2022-04-290001585364prgo:HRAPharmaMember2022-04-292022-04-290001585364prgo:HRAPharmaMember2022-04-292022-12-310001585364prgo:HRAPharmaMember2022-01-012022-12-310001585364prgo:HRAPharmaMemberus-gaap:TrademarksAndTradeNamesMember2022-04-290001585364prgo:HRAPharmaMemberus-gaap:DevelopedTechnologyRightsMember2022-04-290001585364prgo:HRAPharmaMemberprgo:DistributionNetworksMember2022-04-290001585364prgo:HRAPharmaMemberus-gaap:InProcessResearchAndDevelopmentMember2022-04-290001585364prgo:ConsumerSelfCareAmericasMember2022-04-292022-04-290001585364prgo:ConsumerSelfCareInternationalMember2022-04-292022-04-290001585364prgo:HRAPharmaMemberus-gaap:TrademarksAndTradeNamesMember2022-04-292022-04-290001585364prgo:HRAPharmaMemberus-gaap:DevelopedTechnologyRightsMembersrt:MinimumMember2022-04-292022-04-290001585364prgo:HRAPharmaMemberus-gaap:DevelopedTechnologyRightsMembersrt:MaximumMember2022-04-292022-04-290001585364prgo:HRAPharmaMemberprgo:DistributionNetworksMembersrt:MinimumMember2022-04-292022-04-290001585364prgo:HRAPharmaMemberprgo:DistributionNetworksMembersrt:MaximumMember2022-04-292022-04-290001585364prgo:NestlesGatewayInfantFormulaPlantAndGoodStartInfantFormulaMember2022-11-012022-11-010001585364prgo:NestlesGatewayInfantFormulaPlantAndGoodStartInfantFormulaMember2022-01-012022-12-310001585364prgo:NestlesGatewayInfantFormulaPlantAndGoodStartInfantFormulaMember2022-11-012022-12-310001585364prgo:NestlesGatewayInfantFormulaPlantAndGoodStartInfantFormulaMember2022-11-010001585364prgo:NestlesGatewayInfantFormulaPlantAndGoodStartInfantFormulaMemberprgo:DistributionAndLicenceAgreementsAndSupplyAgreementsMember2022-11-010001585364prgo:NestlesGatewayInfantFormulaPlantAndGoodStartInfantFormulaMemberprgo:CustomerRelationshipsAndDistributionNetworksMember2022-11-010001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:RXPharmaceuticalsMember2021-07-060001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:RXPharmaceuticalsMember2021-07-062021-07-060001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:RXPharmaceuticalsMember2024-01-012024-12-310001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:RXPharmaceuticalsMember2023-01-012023-12-310001585364us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberprgo:RXPharmaceuticalsMember2022-01-012022-12-310001585364us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-12-310001585364us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310001585364us-gaap:OtherNoncurrentAssetsMember2024-12-310001585364us-gaap:OtherNoncurrentAssetsMember2023-12-310001585364us-gaap:LandMember2024-12-310001585364us-gaap:LandMember2023-12-310001585364srt:MinimumMemberus-gaap:BuildingMember2024-12-310001585364srt:MaximumMemberus-gaap:BuildingMember2024-12-310001585364us-gaap:BuildingMember2024-12-310001585364us-gaap:BuildingMember2023-12-310001585364srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2024-12-310001585364srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2024-12-310001585364us-gaap:MachineryAndEquipmentMember2024-12-310001585364us-gaap:MachineryAndEquipmentMember2023-12-310001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareAmericasMember2024-12-310001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareAmericasMember2023-12-310001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareInternationalMember2024-12-310001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareInternationalMember2023-12-310001585364us-gaap:MaterialReconcilingItemsMember2024-12-310001585364us-gaap:MaterialReconcilingItemsMember2023-12-310001585364prgo:ConsumerSelfCareAmericasMember2022-12-310001585364prgo:ConsumerSelfCareInternationalMember2022-12-310001585364prgo:ConsumerSelfCareAmericasMember2023-12-310001585364prgo:ConsumerSelfCareInternationalMember2023-12-310001585364prgo:ConsumerSelfCareAmericasMember2024-12-310001585364prgo:ConsumerSelfCareInternationalMember2024-12-310001585364us-gaap:OperatingSegmentsMemberprgo:RareDiseasesReportingUnitMemberprgo:ConsumerSelfCareInternationalMember2024-03-312024-06-290001585364us-gaap:OperatingSegmentsMemberprgo:RareDiseasesReportingUnitMemberprgo:ConsumerSelfCareInternationalMember2023-10-012023-12-310001585364us-gaap:OperatingSegmentsMemberprgo:HospitalAndSpecialtyBusinessReportingUnitMemberprgo:ConsumerSelfCareInternationalMember2024-01-012024-12-310001585364prgo:TrademarksTradeNamesAndBrandsMember2024-12-310001585364prgo:TrademarksTradeNamesAndBrandsMember2023-12-310001585364us-gaap:InProcessResearchAndDevelopmentMember2024-12-310001585364us-gaap:InProcessResearchAndDevelopmentMember2023-12-310001585364us-gaap:LicensingAgreementsMember2024-12-310001585364us-gaap:LicensingAgreementsMember2023-12-310001585364us-gaap:DevelopedTechnologyRightsMember2024-12-310001585364us-gaap:DevelopedTechnologyRightsMember2023-12-310001585364us-gaap:CustomerRelationshipsMember2024-12-310001585364us-gaap:CustomerRelationshipsMember2023-12-310001585364prgo:TrademarksTradeNamesAndBrandsMember2024-12-310001585364prgo:TrademarksTradeNamesAndBrandsMember2023-12-310001585364us-gaap:NoncompeteAgreementsMember2024-12-310001585364us-gaap:NoncompeteAgreementsMember2023-12-310001585364prgo:HospitalSpecialtyBusinessMember2024-01-012024-12-310001585364prgo:RareDiseasesBusinessMember2024-01-012024-12-3100015853642024-09-292024-12-310001585364us-gaap:LicensingAgreementsMember2024-01-012024-12-310001585364us-gaap:DevelopedTechnologyRightsMember2024-01-012024-12-310001585364us-gaap:CustomerRelationshipsMember2024-01-012024-12-310001585364prgo:TrademarksTradeNamesAndBrandsMember2024-01-012024-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeForwardMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeForwardMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeForwardMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeForwardMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:CurrencySwapMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:CurrencySwapMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:CurrencySwapMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:CurrencySwapMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:CurrencySwapMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:CurrencySwapMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMember2024-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2024-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2024-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001585364prgo:RareDiseasesReportingUnitMember2022-12-310001585364prgo:RareDiseasesReportingUnitMember2023-12-310001585364us-gaap:FairValueInputsLevel1Memberprgo:PublicBondsAndPrivatePlacementMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310001585364us-gaap:FairValueInputsLevel2Memberprgo:PublicBondsAndPrivatePlacementMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310001585364us-gaap:FairValueInputsLevel1Memberprgo:PublicBondsAndPrivatePlacementMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001585364us-gaap:FairValueInputsLevel2Memberprgo:PublicBondsAndPrivatePlacementMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001585364us-gaap:FairValueInputsLevel1Memberprgo:PublicBondsAndPrivatePlacementMember2024-12-310001585364us-gaap:FairValueInputsLevel2Memberprgo:PublicBondsAndPrivatePlacementMember2024-12-310001585364us-gaap:FairValueInputsLevel1Memberprgo:PublicBondsAndPrivatePlacementMember2023-12-310001585364us-gaap:FairValueInputsLevel2Memberprgo:PublicBondsAndPrivatePlacementMember2023-12-310001585364us-gaap:ForeignExchangeOptionMember2021-09-300001585364us-gaap:ForeignExchangeOptionMemberus-gaap:NondesignatedMember2021-09-300001585364us-gaap:ForeignExchangeOptionMember2022-04-300001585364us-gaap:ForeignExchangeOptionMember2022-04-012022-04-300001585364us-gaap:ForeignExchangeOptionMemberus-gaap:NondesignatedMember2022-01-012022-12-310001585364us-gaap:ForeignExchangeOptionMemberus-gaap:NondesignatedMember2021-01-012021-12-310001585364us-gaap:ForeignExchangeOptionMemberus-gaap:NondesignatedMember2024-01-012024-12-310001585364us-gaap:ForeignExchangeOptionMemberus-gaap:NondesignatedMember2023-01-012023-12-310001585364prgo:April142022ThroughApril202024Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2022-04-300001585364prgo:April272022ThroughMarch152026Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2022-04-300001585364prgo:April222022ThroughJune152030Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2022-04-300001585364us-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2022-10-252022-10-250001585364prgo:October252022ThroughDecember152024Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2022-10-250001585364prgo:October252022ThroughMarch152026Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2022-10-250001585364prgo:October252022ThroughJune152030Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2022-10-250001585364prgo:November212023ThroughApril202027Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2023-11-210001585364us-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-05-072024-05-070001585364prgo:May072024ThroughApril202027Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-05-070001585364us-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-08-020001585364prgo:September172024ThroughSeptember302028Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-09-170001585364prgo:September172024ThroughJune152030Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-09-170001585364prgo:September172024ThroughSeptember302032Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-09-170001585364prgo:November212023ThroughApril202027Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-11-262024-11-260001585364prgo:May072024ThroughApril202027Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-11-262024-11-260001585364prgo:September172024ThroughSeptember302028Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-11-262024-11-260001585364prgo:October252022ThroughMarch152026Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-11-262024-11-260001585364us-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-11-262024-11-260001585364prgo:September172024ThroughMarch302033Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-11-260001585364prgo:September172024ThroughDecember152030Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-11-260001585364prgo:October252022ThroughDecember152030Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-11-260001585364prgo:November272024ThroughApril202027Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-11-300001585364prgo:November272024ThroughSeptember302028Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-11-300001585364us-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-12-310001585364prgo:EffectiveThroughMarch2026Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-12-310001585364prgo:EffectiveThroughApril2027Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-12-310001585364prgo:EffectiveThroughSeptember2028Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-12-310001585364prgo:EffectiveThroughDecember2030Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-12-310001585364prgo:EffectiveThroughMarch2033Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2024-12-310001585364us-gaap:InterestRateSwapMember2022-04-012022-04-300001585364prgo:TermLoanBFacilityMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2022-04-012022-04-300001585364us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberprgo:TermLoanBMembersrt:MaximumMember2022-04-300001585364us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberprgo:TermLoanBMembersrt:MinimumMember2022-04-300001585364prgo:TermLoanAFacilityMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2022-04-012022-04-300001585364us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberprgo:TermLoanAMembersrt:MaximumMember2022-04-300001585364us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberprgo:TermLoanAMembersrt:MinimumMember2022-04-300001585364us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2023-11-300001585364us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2023-11-012023-11-300001585364us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2024-09-012024-09-300001585364prgo:DeDesignatedInterestRateSwapMember2024-09-012024-09-300001585364us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2024-12-310001585364us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2024-05-012024-05-310001585364us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2024-06-290001585364prgo:SeniorNotesDue2032Member2024-09-170001585364us-gaap:ForeignExchangeForwardMembersrt:MinimumMember2024-01-012024-12-310001585364us-gaap:ForeignExchangeForwardMembersrt:MaximumMember2024-01-012024-12-310001585364currency:EURus-gaap:ForeignExchangeForwardMember2024-12-310001585364currency:EURus-gaap:ForeignExchangeForwardMember2023-12-310001585364currency:GBPus-gaap:ForeignExchangeForwardMember2024-12-310001585364currency:GBPus-gaap:ForeignExchangeForwardMember2023-12-310001585364currency:SEKus-gaap:ForeignExchangeForwardMember2024-12-310001585364currency:SEKus-gaap:ForeignExchangeForwardMember2023-12-310001585364currency:USDus-gaap:ForeignExchangeForwardMember2024-12-310001585364currency:USDus-gaap:ForeignExchangeForwardMember2023-12-310001585364currency:CNYus-gaap:ForeignExchangeForwardMember2024-12-310001585364currency:CNYus-gaap:ForeignExchangeForwardMember2023-12-310001585364currency:CADus-gaap:ForeignExchangeForwardMember2024-12-310001585364currency:CADus-gaap:ForeignExchangeForwardMember2023-12-310001585364currency:DKKus-gaap:ForeignExchangeForwardMember2024-12-310001585364currency:DKKus-gaap:ForeignExchangeForwardMember2023-12-310001585364currency:NOKus-gaap:ForeignExchangeForwardMember2024-12-310001585364currency:NOKus-gaap:ForeignExchangeForwardMember2023-12-310001585364currency:HUFus-gaap:ForeignExchangeForwardMember2024-12-310001585364currency:HUFus-gaap:ForeignExchangeForwardMember2023-12-310001585364currency:PLNus-gaap:ForeignExchangeForwardMember2024-12-310001585364currency:PLNus-gaap:ForeignExchangeForwardMember2023-12-310001585364currency:XXXus-gaap:ForeignExchangeForwardMember2024-12-310001585364currency:XXXus-gaap:ForeignExchangeForwardMember2023-12-310001585364us-gaap:ForeignExchangeForwardMember2024-12-310001585364us-gaap:ForeignExchangeForwardMember2023-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310001585364us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2024-12-310001585364us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2023-12-310001585364us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2024-12-310001585364us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2023-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2024-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2023-12-310001585364us-gaap:DesignatedAsHedgingInstrumentMember2024-12-310001585364us-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310001585364us-gaap:NondesignatedMember2024-12-310001585364us-gaap:NondesignatedMember2023-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherLiabilitiesMember2024-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherLiabilitiesMember2023-12-310001585364us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherLiabilitiesMember2024-12-310001585364us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherLiabilitiesMember2023-12-310001585364us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2024-12-310001585364us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-12-310001585364us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2024-12-310001585364us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:OtherLiabilitiesMember2024-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:OtherLiabilitiesMember2023-12-310001585364us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMemberus-gaap:OtherNoncurrentLiabilitiesMember2024-12-310001585364us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2024-01-012024-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2023-01-012023-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2022-01-012022-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:InterestExpenseMember2024-01-012024-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:InterestExpenseMember2023-01-012023-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:InterestExpenseMember2022-01-012022-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2024-01-012024-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2023-01-012023-12-310001585364us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2022-01-012022-12-310001585364us-gaap:InterestRateSwapMember2024-01-012024-12-310001585364us-gaap:SalesMemberus-gaap:ForeignExchangeForwardMember2024-01-012024-12-310001585364us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeForwardMember2024-01-012024-12-310001585364us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeForwardMember2024-01-012024-12-310001585364us-gaap:CurrencySwapMember2024-01-012024-12-310001585364prgo:A5.375SeniorNotesDue2032Member2024-01-012024-12-310001585364us-gaap:TreasuryLockMember2023-01-012023-12-310001585364us-gaap:InterestRateSwapMember2023-01-012023-12-310001585364us-gaap:ForeignExchangeForwardMember2023-01-012023-12-310001585364us-gaap:SalesMemberus-gaap:ForeignExchangeForwardMember2023-01-012023-12-310001585364us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeForwardMember2023-01-012023-12-310001585364us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeForwardMember2023-01-012023-12-310001585364us-gaap:CurrencySwapMember2023-01-012023-12-310001585364us-gaap:TreasuryLockMember2022-01-012022-12-310001585364us-gaap:InterestRateSwapMember2022-01-012022-12-310001585364us-gaap:ForeignExchangeForwardMember2022-01-012022-12-310001585364us-gaap:SalesMemberus-gaap:ForeignExchangeForwardMember2022-01-012022-12-310001585364us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeForwardMember2022-01-012022-12-310001585364us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeForwardMember2022-01-012022-12-310001585364us-gaap:CurrencySwapMember2022-01-012022-12-310001585364us-gaap:InterestExpenseMemberus-gaap:ForeignExchangeForwardMember2024-01-012024-12-310001585364us-gaap:SalesMemberus-gaap:InterestRateSwapMember2024-01-012024-12-310001585364us-gaap:CostOfSalesMemberus-gaap:InterestRateSwapMember2024-01-012024-12-310001585364us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:InterestRateSwapMember2024-01-012024-12-310001585364us-gaap:InterestExpenseMemberus-gaap:ForeignExchangeForwardMember2023-01-012023-12-310001585364us-gaap:SalesMemberus-gaap:TreasuryLockMember2023-01-012023-12-310001585364us-gaap:CostOfSalesMemberus-gaap:TreasuryLockMember2023-01-012023-12-310001585364us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:TreasuryLockMember2023-01-012023-12-310001585364us-gaap:SalesMemberus-gaap:InterestRateSwapMember2023-01-012023-12-310001585364us-gaap:CostOfSalesMemberus-gaap:InterestRateSwapMember2023-01-012023-12-310001585364us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:InterestRateSwapMember2023-01-012023-12-310001585364us-gaap:InterestExpenseMemberus-gaap:ForeignExchangeForwardMember2022-01-012022-12-310001585364us-gaap:SalesMemberus-gaap:TreasuryLockMember2022-01-012022-12-310001585364us-gaap:CostOfSalesMemberus-gaap:TreasuryLockMember2022-01-012022-12-310001585364us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:TreasuryLockMember2022-01-012022-12-310001585364us-gaap:SalesMemberus-gaap:InterestRateSwapMember2022-01-012022-12-310001585364us-gaap:CostOfSalesMemberus-gaap:InterestRateSwapMember2022-01-012022-12-310001585364us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:InterestRateSwapMember2022-01-012022-12-310001585364prgo:TermALoansJune12022ThroughApril12027Member2024-12-310001585364prgo:TermALoansJune12022ThroughApril12027Member2023-12-310001585364prgo:TermBLoansJune12022ThroughApril12029Member2024-12-310001585364prgo:TermBLoansJune12022ThroughApril12029Member2023-12-310001585364prgo:A3.900SeniorNoteDue2024Member2024-12-310001585364prgo:A3.900SeniorNoteDue2024Member2023-12-310001585364prgo:A4.375SeniorNoteDueMarch152026Member2024-12-310001585364prgo:A4.375SeniorNoteDueMarch152026Member2023-12-310001585364prgo:SeniorNotesDueJune152030Member2024-12-310001585364prgo:SeniorNotesDueJune152030Member2023-12-310001585364prgo:A5.375SeniorNotesDue2032Member2024-12-310001585364prgo:A5.375SeniorNotesDue2032Member2023-12-310001585364prgo:A6.125SeniorNotesDue2032Member2024-12-310001585364prgo:A6.125SeniorNotesDue2032Member2023-12-310001585364prgo:A5.300SeniorNotesDue2043Member2024-12-310001585364prgo:A5.300SeniorNotesDue2043Member2023-12-310001585364prgo:A4.900SeniorNotesDue2044Member2024-12-310001585364prgo:A4.900SeniorNotesDue2044Member2023-12-310001585364prgo:SeniorNotesDueJune152030Member2024-06-150001585364prgo:SeniorNotesDueJune152030Member2024-06-160001585364us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001585364us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310001585364prgo:A2022RevolverMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-04-200001585364prgo:A2022RevolverMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-04-202022-04-200001585364prgo:TermLoanAFacilityMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-04-200001585364prgo:TermLoanAFacilityMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-04-202022-04-200001585364prgo:TermLoanBFacilityMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-04-200001585364prgo:TermLoanBFacilityMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-04-202022-04-200001585364prgo:TermLoanBFacilityMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2023-12-150001585364prgo:SeniorNotesDue2024Memberus-gaap:SeniorNotesMember2023-11-100001585364prgo:SeniorNotesDue2024Memberus-gaap:SeniorNotesMember2023-12-152023-12-150001585364us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-04-300001585364prgo:TermLoanAFacilityMember2023-01-012023-12-310001585364prgo:TermLoanBFacilityMember2023-01-012023-12-310001585364prgo:TermLoanBFacilityMember2024-09-192024-09-190001585364prgo:TermLoanBFacilityMember2024-06-302024-09-280001585364prgo:TermLoanBFacilityMemberus-gaap:SecuredDebtMember2024-12-152024-12-150001585364us-gaap:DomesticLineOfCreditMember2024-12-310001585364us-gaap:DomesticLineOfCreditMember2024-01-012024-12-310001585364prgo:A3.900SeniorNoteDue2024Memberus-gaap:SeniorNotesMember2014-12-020001585364prgo:A4.900SeniorNotesDue2044Memberus-gaap:SeniorNotesMember2014-12-020001585364prgo:SeniorNotes2014Memberus-gaap:SeniorNotesMember2014-12-022014-12-020001585364prgo:A4.900SeniorNotesDue2044Memberus-gaap:SeniorNotesMember2017-01-012017-12-310001585364prgo:A4.900SeniorNotesDue2044Memberus-gaap:SeniorNotesMember2017-12-310001585364prgo:A3.900SeniorNoteDue2024Memberus-gaap:SeniorNotesMember2023-12-150001585364prgo:A3.900SeniorNoteDue2024Memberus-gaap:SeniorNotesMember2023-12-152023-12-150001585364prgo:A3.900SeniorNoteDue2024Memberus-gaap:SeniorNotesMember2024-12-122024-12-120001585364prgo:A4.375SeniorNoteDueMarch152026Memberus-gaap:SeniorNotesMember2016-03-070001585364prgo:A4.375SeniorNoteDueMarch152026Memberus-gaap:SeniorNotesMember2016-03-072016-03-070001585364prgo:A4.375SeniorNoteDueMarch152026Memberus-gaap:SeniorNotesMember2024-09-292024-12-310001585364prgo:A3.150SeniorNotesDueJune152030Memberus-gaap:SeniorNotesMember2020-06-190001585364prgo:A3.150SeniorNotesDueJune152030Memberus-gaap:SeniorNotesMember2020-06-192020-06-190001585364prgo:A3.900SeniorNotesDueJune152030Memberus-gaap:SeniorNotesMember2021-12-150001585364prgo:A4.400SeniorNotesDueJune152030Memberus-gaap:SeniorNotesMember2022-06-150001585364prgo:A4650SeniorNotesDueJune152030Memberus-gaap:SeniorNotesMember2023-06-150001585364prgo:A4.900SeniorNotesDue2044Memberus-gaap:SeniorNotesMember2024-06-150001585364prgo:A6.125SeniorNotesDue2032Memberus-gaap:SeniorNotesMember2024-09-170001585364prgo:A5.375SeniorNotesDue2032Memberus-gaap:SeniorNotesMember2024-09-170001585364prgo:A6.125And5.375SeniorNotesDue2032Memberus-gaap:SeniorNotesMember2024-09-170001585364prgo:A4.375SeniorNoteDueMarch152026Memberus-gaap:SeniorNotesMember2024-10-022024-10-020001585364prgo:A4.375SeniorNoteDueMarch152026Memberus-gaap:SeniorNotesMember2024-10-020001585364prgo:A5.300SeniorNotesDue2043Memberus-gaap:SeniorNotesMember2013-11-080001585364prgo:A5.300SeniorNotesDue2043Memberus-gaap:SeniorNotesMember2017-01-012017-12-310001585364country:US2024-01-012024-12-310001585364country:IE2024-01-012024-12-310001585364us-gaap:DefinedBenefitPostretirementHealthCoverageMember2024-01-012024-12-310001585364us-gaap:PensionPlansDefinedBenefitMember2023-12-310001585364us-gaap:PensionPlansDefinedBenefitMember2022-12-310001585364us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001585364us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001585364us-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310001585364us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310001585364us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-01-012024-12-310001585364us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310001585364us-gaap:PensionPlansDefinedBenefitMember2024-12-310001585364us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-12-310001585364us-gaap:OtherNoncurrentAssetsMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310001585364us-gaap:OtherNoncurrentAssetsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001585364us-gaap:OtherNoncurrentAssetsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-12-310001585364us-gaap:OtherNoncurrentAssetsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001585364us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310001585364us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001585364us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-12-310001585364us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001585364us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310001585364us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-12-310001585364us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquitySecuritiesMember2024-01-012024-12-310001585364us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DebtSecuritiesMember2024-01-012024-12-310001585364us-gaap:PensionPlansDefinedBenefitMemberprgo:AbsoluteReturnFundMember2024-01-012024-12-310001585364us-gaap:PensionPlansDefinedBenefitMemberus-gaap:InsuranceContractRightsAndObligationsFairValueOptionMember2024-01-012024-12-310001585364us-gaap:PensionPlansDefinedBenefitMemberprgo:OtherMember2024-01-012024-12-310001585364srt:MinimumMemberus-gaap:EquitySecuritiesMember2024-12-310001585364srt:MaximumMemberus-gaap:EquitySecuritiesMember2024-12-310001585364srt:MinimumMemberus-gaap:DebtSecuritiesMember2024-12-310001585364srt:MaximumMemberus-gaap:DebtSecuritiesMember2024-12-310001585364srt:MinimumMemberprgo:AbsoluteReturnFundMember2024-12-310001585364srt:MaximumMemberprgo:AbsoluteReturnFundMember2024-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2024-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2024-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2024-12-310001585364us-gaap:EquitySecuritiesMember2024-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2023-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2023-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2023-12-310001585364us-gaap:EquitySecuritiesMember2023-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:DebtSecuritiesMember2024-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:DebtSecuritiesMember2024-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:DebtSecuritiesMember2024-12-310001585364us-gaap:DebtSecuritiesMember2024-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:DebtSecuritiesMember2023-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:DebtSecuritiesMember2023-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:DebtSecuritiesMember2023-12-310001585364us-gaap:DebtSecuritiesMember2023-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:InsuranceContractRightsAndObligationsFairValueOptionMember2024-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:InsuranceContractRightsAndObligationsFairValueOptionMember2024-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:InsuranceContractRightsAndObligationsFairValueOptionMember2024-12-310001585364us-gaap:InsuranceContractRightsAndObligationsFairValueOptionMember2024-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:InsuranceContractRightsAndObligationsFairValueOptionMember2023-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:InsuranceContractRightsAndObligationsFairValueOptionMember2023-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:InsuranceContractRightsAndObligationsFairValueOptionMember2023-12-310001585364us-gaap:InsuranceContractRightsAndObligationsFairValueOptionMember2023-12-310001585364us-gaap:FairValueInputsLevel1Memberprgo:AbsoluteReturnFundMember2024-12-310001585364us-gaap:FairValueInputsLevel2Memberprgo:AbsoluteReturnFundMember2024-12-310001585364us-gaap:FairValueInputsLevel3Memberprgo:AbsoluteReturnFundMember2024-12-310001585364prgo:AbsoluteReturnFundMember2024-12-310001585364us-gaap:FairValueInputsLevel1Memberprgo:AbsoluteReturnFundMember2023-12-310001585364us-gaap:FairValueInputsLevel2Memberprgo:AbsoluteReturnFundMember2023-12-310001585364us-gaap:FairValueInputsLevel3Memberprgo:AbsoluteReturnFundMember2023-12-310001585364prgo:AbsoluteReturnFundMember2023-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2024-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2024-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMember2024-12-310001585364us-gaap:CashAndCashEquivalentsMember2024-12-310001585364us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2023-12-310001585364us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2023-12-310001585364us-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMember2023-12-310001585364us-gaap:CashAndCashEquivalentsMember2023-12-310001585364us-gaap:FairValueInputsLevel1Member2024-12-310001585364us-gaap:FairValueInputsLevel2Member2024-12-310001585364us-gaap:FairValueInputsLevel3Member2024-12-310001585364us-gaap:FairValueInputsLevel1Member2023-12-310001585364us-gaap:FairValueInputsLevel2Member2023-12-310001585364us-gaap:FairValueInputsLevel3Member2023-12-310001585364us-gaap:FairValueInputsLevel3Member2022-12-310001585364us-gaap:FairValueInputsLevel3Member2024-01-012024-12-310001585364us-gaap:FairValueInputsLevel3Member2023-01-012023-12-310001585364us-gaap:DeferredCompensationArrangementWithIndividualByTypeOfCompensationPensionAndOtherPostretirementBenefitsMember2024-12-310001585364us-gaap:DeferredCompensationArrangementWithIndividualByTypeOfCompensationPensionAndOtherPostretirementBenefitsMember2023-12-3100015853642018-10-310001585364srt:MinimumMember2024-01-012024-12-310001585364srt:MaximumMember2024-01-012024-12-310001585364prgo:ServiceBasedRestrictedShareUnitsMember2022-12-310001585364prgo:ServiceBasedRestrictedShareUnitsMember2022-01-012022-12-310001585364prgo:ServiceBasedRestrictedShareUnitsMember2023-01-012023-12-310001585364prgo:ServiceBasedRestrictedShareUnitsMember2023-12-310001585364prgo:ServiceBasedRestrictedShareUnitsMember2024-01-012024-12-310001585364prgo:ServiceBasedRestrictedShareUnitsMember2024-12-310001585364prgo:PerformanceBasedRestrictedShareUnitsMember2022-12-310001585364prgo:PerformanceBasedRestrictedShareUnitsMember2022-01-012022-12-310001585364prgo:PerformanceBasedRestrictedShareUnitsMember2023-01-012023-12-310001585364prgo:PerformanceBasedRestrictedShareUnitsMember2023-12-310001585364prgo:PerformanceBasedRestrictedShareUnitsMember2024-01-012024-12-310001585364prgo:PerformanceBasedRestrictedShareUnitsMember2024-12-310001585364prgo:RelativeTotalShareholderReturnPerformanceShareUnitsMember2024-01-012024-12-310001585364prgo:RelativeTotalShareholderReturnPerformanceShareUnitsMember2023-01-012023-12-310001585364prgo:RelativeTotalShareholderReturnPerformanceShareUnitsMember2022-01-012022-12-310001585364prgo:RelativeTotalShareholderReturnPerformanceShareUnitsMember2022-12-310001585364prgo:RelativeTotalShareholderReturnPerformanceShareUnitsMember2023-12-310001585364prgo:RelativeTotalShareholderReturnPerformanceShareUnitsMember2024-12-310001585364us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001585364us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001585364us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001585364us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310001585364us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310001585364us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310001585364us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310001585364us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001585364us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001585364us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-12-310001585364us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-12-310001585364us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-12-310001585364us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-12-310001585364us-gaap:AccumulatedTranslationAdjustmentMember2024-12-310001585364us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-12-310001585364prgo:SupplyChainReinventionMember2023-12-310001585364prgo:HRAPharmaIntegrationMember2023-12-310001585364prgo:ProjectEnergizeMember2023-12-310001585364us-gaap:OtherRestructuringMember2023-12-310001585364prgo:SupplyChainReinventionMember2024-01-012024-12-310001585364prgo:HRAPharmaIntegrationMember2024-01-012024-12-310001585364prgo:ProjectEnergizeMember2024-01-012024-12-310001585364us-gaap:OtherRestructuringMember2024-01-012024-12-310001585364prgo:SupplyChainReinventionMember2024-12-310001585364prgo:HRAPharmaIntegrationMember2024-12-310001585364prgo:ProjectEnergizeMember2024-12-310001585364us-gaap:OtherRestructuringMember2024-12-310001585364prgo:SupplyChainReinventionMember2022-12-310001585364prgo:HRAPharmaIntegrationMember2022-12-310001585364prgo:ProjectEnergizeMember2022-12-310001585364us-gaap:OtherRestructuringMember2022-12-310001585364prgo:SupplyChainReinventionMember2023-01-012023-12-310001585364prgo:HRAPharmaIntegrationMember2023-01-012023-12-310001585364prgo:ProjectEnergizeMember2023-01-012023-12-310001585364us-gaap:OtherRestructuringMember2023-01-012023-12-310001585364prgo:SupplyChainReinventionMember2021-12-310001585364prgo:HRAPharmaIntegrationAndOtherRestructuringMember2021-12-310001585364prgo:SupplyChainReinventionMember2022-01-012022-12-310001585364prgo:HRAPharmaIntegrationAndOtherRestructuringMember2022-01-012022-12-310001585364prgo:HRAPharmaIntegrationAndOtherRestructuringMember2022-12-310001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareInternationalMember2024-01-012024-12-310001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareAmericasMember2024-01-012024-12-310001585364us-gaap:MaterialReconcilingItemsMember2024-01-012024-12-310001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareInternationalMember2023-01-012023-12-310001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareAmericasMember2023-01-012023-12-310001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareInternationalMember2022-01-012022-12-310001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareAmericasMember2022-01-012022-12-3100015853642009-01-012009-12-3100015853642010-01-012010-12-3100015853642011-01-012011-12-3100015853642012-01-012012-12-3100015853642017-08-152017-08-1500015853642021-01-132021-01-130001585364srt:MinimumMember2021-01-132021-01-130001585364srt:MaximumMember2021-01-132021-01-1300015853642021-01-130001585364prgo:GenericPricingMultidistrictLitigationMember2024-12-310001585364prgo:StateAttorneyGeneralComplaintMember2020-06-100001585364prgo:CanadianClassActionComplaintMember2020-06-300001585364prgo:HospitalComplaintMember2023-06-300001585364prgo:SelfInsuredEmployerComplaintMember2024-04-042024-04-040001585364prgo:SelfInsuredEmployerComplaintMember2024-04-0400015853642017-06-210001585364prgo:SecuritiesLitigationInTheUnitedStatesMember2017-06-210001585364prgo:SecuritiesLitigationInTheUnitedStatesMember2019-11-140001585364prgo:SecuritiesLitigationInTheUnitedStatesMember2024-04-052024-04-050001585364prgo:SecuritiesLitigationInTheUnitedStatesMember2024-01-012024-03-300001585364prgo:SecuritiesLitigationInTheUnitedStatesMember2024-05-012024-05-310001585364prgo:SecuritiesLitigationInTheUnitedStatesMember2024-01-012024-12-310001585364prgo:SecuritiesLitigationInTheUnitedStatesMember2020-06-012020-06-300001585364prgo:SecuritiesLitigationInTheUnitedStatesMemberus-gaap:SubsequentEventMember2025-01-012025-01-310001585364prgo:IsraelElec.Corp.EmployeesEduc.Fundv.PerrigoCompanyplcetal.Member2017-06-280001585364prgo:IsraelElec.Corp.EmployeesEduc.Fundv.PerrigoCompanyplcetal.Member2017-06-282017-06-280001585364prgo:TalcumPowderLitigationMemberus-gaap:SubsequentEventMember2025-02-280001585364prgo:RanitidineLitigationMember2024-12-310001585364prgo:InsuranceCoverageLitigationMember2021-05-310001585364us-gaap:MaterialReconcilingItemsMember2023-01-012023-12-310001585364us-gaap:MaterialReconcilingItemsMember2022-01-012022-12-310001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareAmericasMember2022-12-310001585364us-gaap:OperatingSegmentsMemberprgo:ConsumerSelfCareInternationalMember2022-12-310001585364us-gaap:MaterialReconcilingItemsMember2022-12-310001585364country:US2024-12-310001585364country:US2023-12-310001585364srt:EuropeMember2024-12-310001585364srt:EuropeMember2023-12-310001585364prgo:AllOtherCountriesMember2024-12-310001585364prgo:AllOtherCountriesMember2023-12-310001585364country:IE2024-12-310001585364country:IE2023-12-310001585364prgo:WalmartMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310001585364prgo:WalmartMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001585364prgo:WalmartMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 001-36353

Perrigo Company plc

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Ireland |

|

N/A |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

The Sharp Building, Hogan Place, Dublin 2, Ireland D02 TY74

+353 1 7094000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

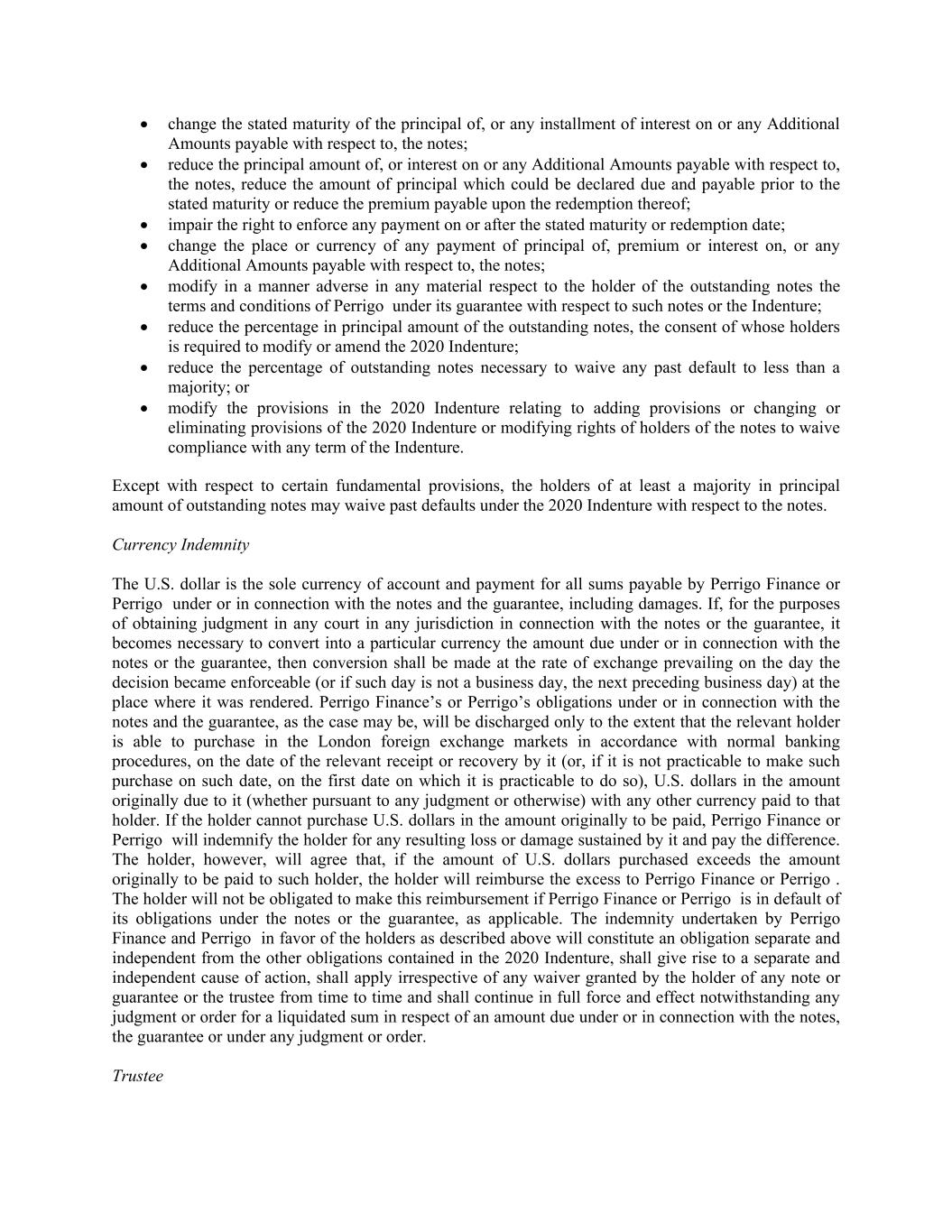

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Ordinary shares, €0.001 par value |

PRGO |

New York Stock Exchange |

4.900% Notes due 2030 |

PRGO30 |

New York Stock Exchange |

| 6.125% Notes due 2032 |

PRGO32A |

New York Stock Exchange |

| 5.375% Notes due 2032 |

PRGO32B |

New York Stock Exchange |

| 5.300% Notes due 2043 |

PRGO43 |

New York Stock Exchange |

| 4.900% Notes due 2044 |

PRGO44 |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

(Title of Class)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

|

Yes |

☒ |

No |

☐ |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act. |

|

Yes |

☐ |

No |

☒ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

|

Yes |

☒ |

No |

☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). |

|

Yes |

☒ |

No |

☐ |

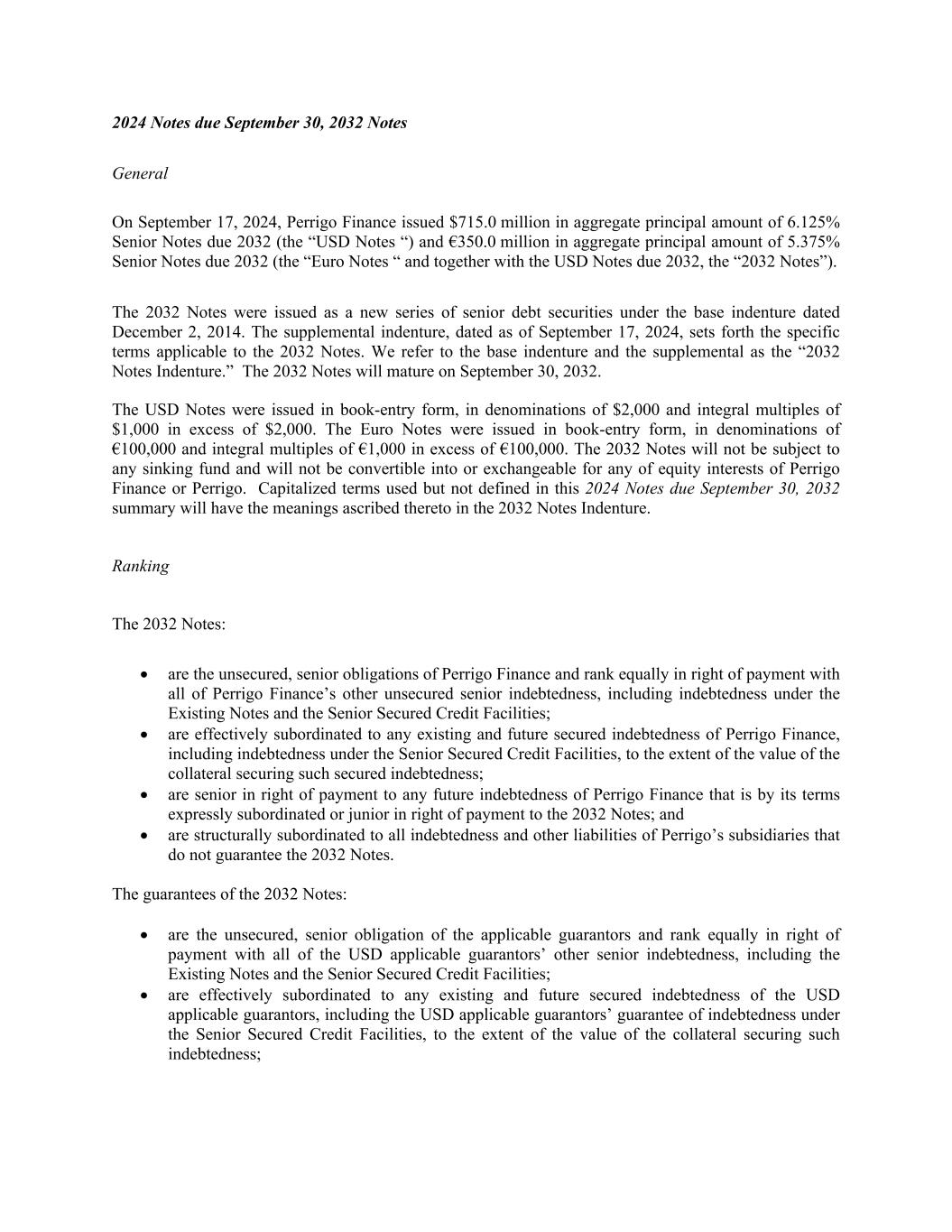

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Exchange Act. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

|

|

|

|

|

|

Emerging growth company |

☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

☐ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. |

☒ |

| If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. |

☐ |

| Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). |

☐ |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). |

|

Yes |

☐ |

No |

☒ |

The aggregate market value of the voting stock held by non-affiliates of the registrant, based upon the closing sale price of our ordinary shares on June 28, 2024 as reported on the New York Stock Exchange, was $3,502,398,592. Ordinary shares held by each director or executive officer have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 21, 2025, the registrant had 136,458,620 outstanding ordinary shares.

Documents incorporated by reference:

The information called for by Part III will be incorporated by reference from the Registrant's definitive Proxy Statement for its Annual Meeting of Shareholders to be filed pursuant to Regulation 14A or will be included in an amendment to this Form 10-K.

PERRIGO COMPANY PLC

FORM 10-K

YEAR ENDED DECEMBER 31, 2024

TABLE OF CONTENTS

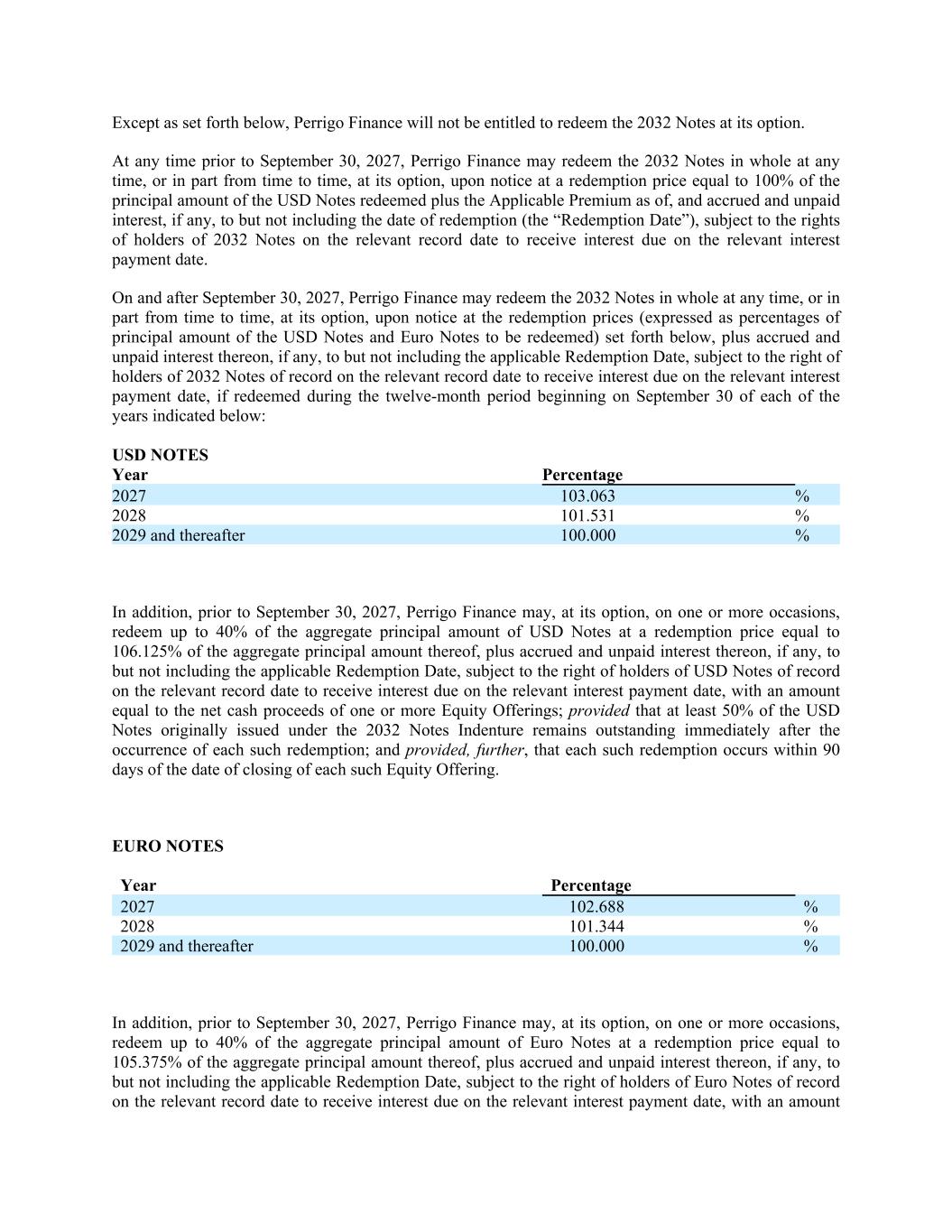

|

|

|

|

|

|

|

|

|

|

|

Page No. |

|

|

|

|

|

| Part I. |

|

|

| Item 1. |

|

|

| Item 1A. |

|

|

| Item 1B. |

|

|

| Item 1C. |

|

|

| Item 2. |

|

|

| Item 3. |

|

|

| Item 4. |

|

|

| Additional Item. |

|

|

|

|

|

| Part II. |

|

|

| Item 5. |

|

|

| Item 6. |

|

|

| Item 7. |

|

|

| Item 7A. |

|

|

| Item 8. |

|

|

| Item 9. |

|

|

| Item 9A. |

|

|

| Item 9B. |

|

|

| Item 9C. |

|

|

|

|

|

| Part III. |

|

|

| Item 10. |

|

|

| Item 11. |

|

|

| Item 12. |

|

|

| Item 13. |

|

|

| Item 14. |

|

|

|

|

|

| Part IV. |

|

|

| Item 15. |

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this report are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created thereby. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our, or our industry’s actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by any forward-looking statements. In particular, statements about our expectations, beliefs, plans, objectives, assumptions, future events or future performance contained in this report, including certain statements contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” "forecast," “predict,” “potential” or the negative of those terms or other comparable terminology.

The Company has based these forward-looking statements on its current expectations, assumptions, estimates and projections. While the Company believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond the Company’s control, including: supply chain impacts on the Company’s business, including those caused or exacerbated by armed conflict, trade and other economic sanctions and/or disease; general economic, credit, and market conditions; the impact of the war in Ukraine and any escalation thereof, including the effects of economic and political sanctions imposed by the United States, United Kingdom, European Union, and other countries related thereto; the outbreak or escalation of conflict in other regions where we do business, including the Middle East; current and future impairment charges, including those related to the sale of the Héra SAS ("HRA Pharma") Rare Diseases Business, if we determine that the carrying amount of specific assets may not be recoverable from the expected future cash flows of such assets; customer acceptance of new products; competition from other industry participants, some of whom have greater marketing resources or larger market shares in certain product categories than the Company does; pricing pressures from customers and consumers; resolution of uncertain tax positions and any litigation relating thereto, ongoing or future government investigations and regulatory initiatives; uncertainty regarding the Company's ability to obtain and maintain its regulatory approvals; potential costs and reputational impact of product recalls or sales halts; potential adverse changes to U.S. and foreign tax, healthcare and other government policy; the effect of epidemic or pandemic disease; the timing, amount and cost of any share repurchases (or the absence thereof) and/or any refinancing of outstanding debt at or prior to maturity; fluctuations in currency exchange rates and interest rates; the Company’s ability to achieve benefits expected from its sale of the HRA Rare Diseases Business, including potential earnout payments, and the sale of its Hospital and Specialty Business and the risk that potential costs or liabilities incurred or retained in connection with those transactions may exceed the Company's estimates or adversely affect the Company's business or operations; the risk that potential costs or liabilities incurred or retained in connection with the sale of the Company's Rx business may exceed the Company’s estimates or adversely affect the Company’s business or operations; the Company's ability to achieve the benefits expected from the acquisitions of HRA Pharma and Nestlé’s Gateway infant formula plant along with the U.S. and Canadian rights to the GoodStart® infant formula brand and other related formula brands ("Gateway") and/or the risks that the Company’s synergy estimates are inaccurate or that the Company faces higher than anticipated integration or other costs in connection with the acquisitions; risks associated with the integration of HRA Pharma and Gateway, including the risk that growth rates are adversely affected by any delay in the integration of sales and distribution networks; the consummation and success of other announced and unannounced acquisitions or dispositions, and the Company’s ability to realize the desired benefits thereof; and the Company’s ability to execute and achieve the desired benefits of announced cost-reduction efforts and other strategic initiatives and investments, including the Company's ability to achieve the expected benefits from its ongoing restructuring programs described herein. Adverse results with respect to pending litigation could have a material adverse impact on the Company's operating results, cash flows and liquidity, and could ultimately require the use of corporate assets to pay damages, reducing assets that would otherwise be available for other corporate purposes. These and other important factors, including those discussed in this report under “Risk Factors” and in any subsequent filings with the United States Securities and Exchange Commission, may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements in this report are made only as of the date hereof, and unless otherwise required by applicable securities laws, we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This report contains trademarks, trade names and service marks that are the property of Perrigo Company plc, as well as, for informational purposes, trademarks, trade names, and service marks that are the property of other organizations. Solely for convenience, certain trademarks, trade names, and service marks referred to in this report appear without the ®, ™ and SM symbols, but those references are not intended to indicate that we or the applicable owner, as the case may be, will not assert, to the fullest extent under applicable law, our or their rights to such trademarks, trade names, and service marks.

Perrigo Company plc - Item 1

Business

PART I.

ITEM 1. BUSINESS

Perrigo Company plc was incorporated under the laws of Ireland on June 28, 2013 and became the successor registrant of Perrigo Company, a Michigan corporation, on December 18, 2013 in connection with the acquisition of Elan Corporation, plc ("Elan"). Unless the context requires otherwise, the terms "Perrigo," the "Company," "we," "our," "us," and similar pronouns used herein refer to Perrigo Company plc, its subsidiaries, and all predecessors of Perrigo Company plc and its subsidiaries.

WHO WE ARE

Perrigo is a leading pure-play self-care company with more than a century of providing high-quality health and wellness solutions to meet the evolving needs of consumers. As one of the originators of the over-the-counter ("OTC") self-care market, Perrigo is led by its vision "To Provide The Best Self-Care For Everyone" and its purpose to "Make Lives Better Through Trusted Health and Wellness Solutions, Accessible To All".

Perrigo provides access to trusted self-care solutions that can be used without the need to visit a health practitioner for a prescription. Guided by our vision and purpose, our strategic goal is to create sustainable and value accretive growth by 1) delivering consumer preferred brands and innovation, 2) driving category growth with our customers, 3) powering our business with our world-class, quality assured supply chain, including a focus on sustainability with meaningful goals to reduce greenhouse gas emissions, water, and waste, in addition to increasing the recyclability of our packaging, and 4) evolving our global organization to one cohesive operating model. Our unique competency is to deliver health and wellness solutions across multiple price and value tiers that improve access and choice for consumers.

Perrigo's broad offerings are well diversified across several major product categories as well as across geographies, primarily in North America and Europe, with no one product representing more than 5% of total revenue. In North America, Perrigo is the leading store brand private label provider of self-care products in many categories, including upper respiratory, nutrition and women's health, along with brands including Opill® and Mederma®. In Europe, our portfolio consists primarily of brands, including Compeed®, EllaOne®, Solpadeine®, and ACO®.

Two key initiatives are fundamental to advancing our self-care strategy — our Supply Chain Reinvention Program, a global supply chain efficiency program, and Project Energize, a global investment and efficiency program. In addition, we continue to invest in other initiatives, including innovation, information systems and tools, and our people to drive consistent and sustainable results.

Perrigo’s unique complementary businesses enables each individually to play a specific reinforcing role, where 1) store brands and infant formula generate cash for investments into the Company’s key higher margin, higher growth or ‘High-Grow’ brands, 2) branding and innovation capabilities that deliver brand and store brand demand generation leading to stronger customer partnerships, 3) consumer-led innovation that is scaled across brands, store brands and geographies, and 4) the Company’s global supply chain scale and reach with 100-plus molecules, at 100% consumer price point coverage, serves the most consumers.

The Company’s plan to drive cash flow and total shareholder return is anchored behind its ‘Three-S’ plan – ‘Stabilizing’ Consumer Self-Care Americas store brand and infant formula businesses; ‘Streamlining’ the global portfolio, enterprise operating model and Consumer Self-Care International business; and ‘Strengthening’ what is working by prioritizing and increasing investments behind key ‘High-Grow’ brands. Further 2024 highlights can be found in

Item 7. Management Discussion and Analysis - Executive Overview.

Strategy & Competitive Advantage

Our objective is to grow our business by responsibly leveraging our global infrastructure to deliver high quality self-care solutions to customers and consumers through our expansive product offerings, providing new innovative products, brands, and product line extensions to existing consumers and servicing new consumers through entering new adjacent products and categories, new geographies and new channels of distribution organically and inorganically.

Perrigo Company plc - Item 1

Business

Among other things, we believe the following factors give us a competitive advantage and provide value to our customers and consumers:

•A diverse product portfolio, leadership in first-to-market product development, and product life cycle management;

•Experienced research and development ("R&D"), innovation and regulatory capabilities to develop and launch high-quality solutions, differentiated product features and benefits, product reformulations, new brands and brand line extensions, and differentiated products;

•Deep understanding of consumer needs and customer strategies with market, category and product specific promotional and e-commerce capabilities;

•Expansive pan-European commercial infrastructure, brand-building capabilities, and an extensive and diverse product portfolio;

•Supply chain breadth, and utilizing economies of scale to manage supply chain complexity across multiple dosage forms, formulations, and stock-keeping units; and

•Quality and cost effectiveness throughout the supply chain and operational systems across all products creating a sustainable, lower-cost network across our manufacturing and distribution networks.

SEGMENTS

Our reporting and operating segments reflect the way our chief operating decision maker, who is our CEO, makes operating decisions, allocates resources and manages the growth and profitability of the Company. Our reporting and operating segments are:

•Consumer Self-Care Americas ("CSCA") comprises our consumer self-care business in the U.S. and Canada.

•Consumer Self-Care International ("CSCI") comprises our consumer self-care business outside of the U.S. and Canada, primarily in Europe and Australia.

We previously had an Rx segment comprised of our generic prescription pharmaceuticals business in the U.S. and other pharmaceuticals and diagnostic businesses in Israel, which have been divested. The Rx segment was reported as Discontinued Operations in 2021, and is presented as such for all periods in this report. See

Item 8. Note 4 for more information. Financial information related to our business segments can be found in

Item 8. Note 20.

CONSUMER SELF-CARE AMERICAS

The CSCA segment develops, manufactures and markets our leading self-care consumer solutions in the U.S. and Canada. We primarily provide our customers self-care products that are sold and marketed under the customer's own brands and/or exclusive brands ("store brands"). We additionally have a select lineup of branded self-care products. Customers include major global, national, and regional retail drug, supermarket, mass merchandise chains, e-commerce retailers, and major wholesalers.

Our store brand products are comparable in quality and effectiveness to national brands. Store brand products must meet the same stringent U.S. Food and Drug Administration ("FDA") requirements as national brands within the U.S. and the requirements of comparable regulatory bodies outside the U.S. In most instances, our product packaging, marketing, advertising, and e-commerce focus are designed to invite and reinforce comparison to national brand products, while conveying a superior value for consumers. The cost of store brand products to retailers is significantly lower than that of comparable nationally advertised brand name products. The retailer, therefore, can price a store brand product below the competing national brand product and realize a greater percentage and dollar profit, while consumers benefit from receiving a high-quality product at a price below the comparable national brand product. Consumer awareness and knowledge of the quality, value and efficacy of our products are achieved from marketing efforts made by us, our retailer customers and wholesalers.

Certain branded products are developed, manufactured and distributed within the CSCA segment. Our primary branded products sold under brand names include Compeed®, Dr. Fresh®, Firefly®, Good Sense®, Good Start®, Mederma®, Nasonex®, Plackers®, Prevacid®24HR, REACH®, Rembrandt®, Steripod®. In March 2024, we launched Opill®, the first ever FDA approved birth control pill for OTC use without age restriction. On September 26, 2024, we announced a new brand partnership with Dr. Brown's™ Baby to provide infant formula solutions for babies with tolerance concerns. The new Good Start® | Dr. Brown's™ portfolio will offer the same trusted infant formula products as the existing SoothePro™ and GentlePro™, continue to feature probiotics, advanced protein hydrolysis, and 100% whey protein; but now with a refreshed label to celebrate the new partnership.

CONSUMER SELF-CARE INTERNATIONAL

The CSCI segment comprises our consumer self-care product categories outside the U.S. and Canada, including our branded products in Europe and Australia and our store brand products in the United Kingdom and parts of Europe and Asia.

Perrigo Company plc - Item 1

Business

We leverage our broad marketing, sales, regulatory, manufacturing and distribution infrastructure to drive market share, innovate new products and brands, in-license and expand product lines, and sell and distribute third-party brands. The CSCI segment products are sold primarily through an established pharmacy sales force to an extensive network of customers including pharmacies, wholesalers, drug and grocery store retailers, e-commerce retailers, and para-pharmacies in more than 31 countries, predominantly in Europe. Products in the CSCI segment are marketed using traditional and digital advertising as well as point-of-sale promotional spending to enhance brand equity.

While we have hundreds of brands, we focus our resources on growth brands, including Solpadeine®, Coldrex®, Physiomer®, NiQuitin®, ACO®, Compeed®, and ellaOne®. Many of these brands have leading positions in the markets in which they compete. Additional resources, including R&D investments, are allocated to these brands to strengthen their market position while leveraging the same R&D efforts under smaller local brands. Our new product pipeline is supported by internal R&D, new product development, acquisitions and partnerships, both in terms of brand extensions and product improvements.

PRODUCTS

We offer products in the following categories:

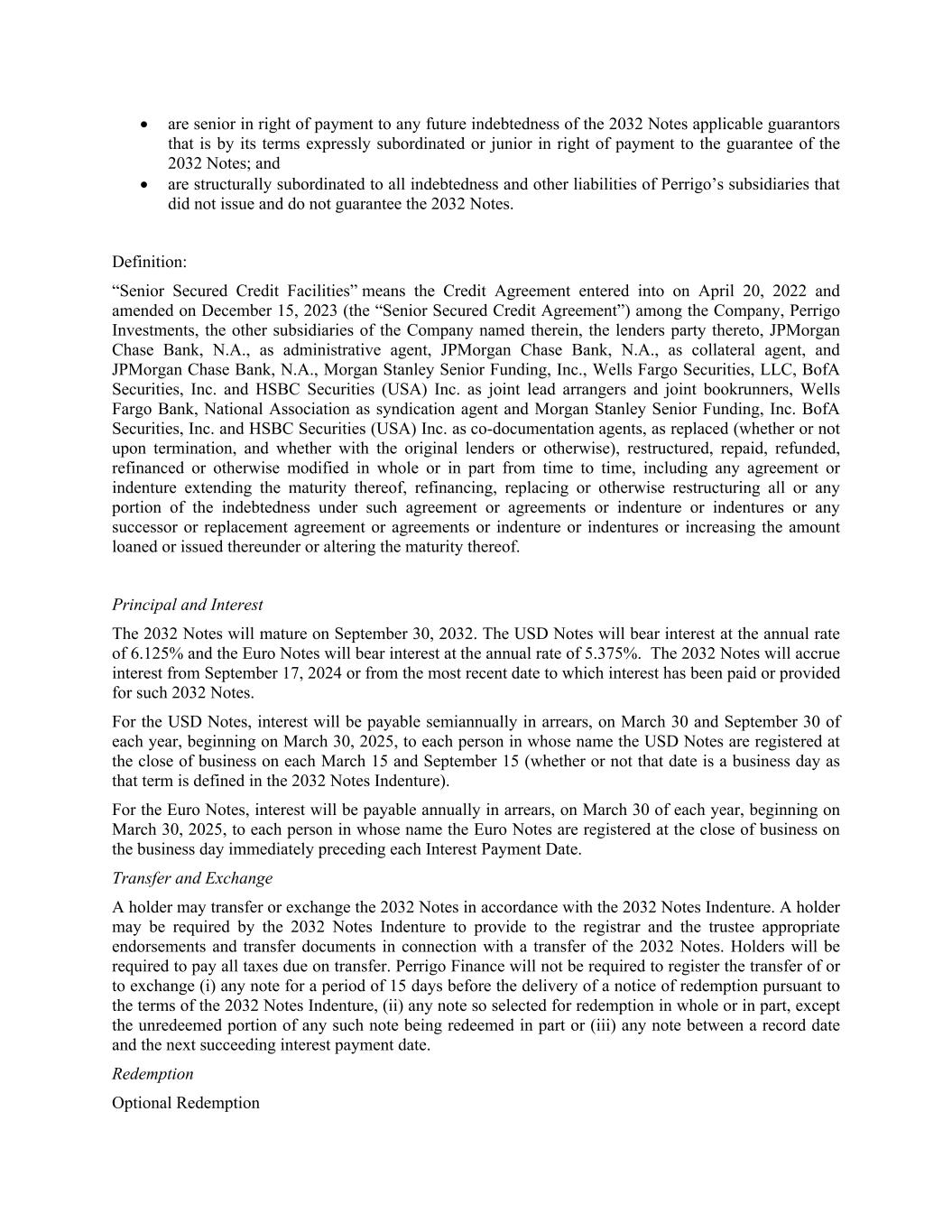

|

|

|

|

|

|

|

|

|

| Product Category |

|

Description |

| Upper Respiratory |

|