false00015812802025FYhttp://fasb.org/us-gaap/2025#AccountingStandardsUpdate201613Memberiso4217:USDxbrli:sharesiso4217:USDxbrli:sharestwst:segmentxbrli:puretwst:investmenttwst:voteutr:sqfttwst:sqft00015812802024-10-012025-09-3000015812802025-03-3100015812802025-11-1300015812802025-09-3000015812802024-09-300001581280us-gaap:RelatedPartyMember2025-09-300001581280us-gaap:RelatedPartyMember2024-09-3000015812802023-10-012024-09-3000015812802022-10-012023-09-300001581280us-gaap:RelatedPartyMember2024-10-012025-09-300001581280us-gaap:RelatedPartyMember2023-10-012024-09-300001581280us-gaap:RelatedPartyMember2022-10-012023-09-300001581280us-gaap:CommonStockMember2022-09-300001581280us-gaap:AdditionalPaidInCapitalMember2022-09-300001581280us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001581280us-gaap:RetainedEarningsMember2022-09-3000015812802022-09-300001581280us-gaap:CommonStockMember2022-10-012023-09-300001581280us-gaap:AdditionalPaidInCapitalMember2022-10-012023-09-300001581280us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-012023-09-300001581280us-gaap:RetainedEarningsMember2022-10-012023-09-300001581280us-gaap:CommonStockMember2023-09-300001581280us-gaap:AdditionalPaidInCapitalMember2023-09-300001581280us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001581280us-gaap:RetainedEarningsMember2023-09-3000015812802023-09-300001581280srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2023-09-300001581280srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2023-09-300001581280us-gaap:CommonStockMember2023-10-012024-09-300001581280us-gaap:AdditionalPaidInCapitalMember2023-10-012024-09-300001581280us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-012024-09-300001581280us-gaap:RetainedEarningsMember2023-10-012024-09-300001581280us-gaap:CommonStockMember2024-09-300001581280us-gaap:AdditionalPaidInCapitalMember2024-09-300001581280us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001581280us-gaap:RetainedEarningsMember2024-09-300001581280us-gaap:CommonStockMember2024-10-012025-09-300001581280us-gaap:AdditionalPaidInCapitalMember2024-10-012025-09-300001581280us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-10-012025-09-300001581280us-gaap:RetainedEarningsMember2024-10-012025-09-300001581280us-gaap:CommonStockMember2025-09-300001581280us-gaap:AdditionalPaidInCapitalMember2025-09-300001581280us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-09-300001581280us-gaap:RetainedEarningsMember2025-09-300001581280us-gaap:EquityMethodInvestmentsMember2024-09-300001581280twst:LaboratoryEquipmentMember2025-09-300001581280us-gaap:FurnitureAndFixturesMember2025-09-300001581280us-gaap:ComputerEquipmentMember2025-09-300001581280us-gaap:VehiclesMember2025-09-300001581280us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2025-09-300001581280srt:AmericasMember2024-10-012025-09-300001581280srt:AmericasMember2023-10-012024-09-300001581280srt:AmericasMember2022-10-012023-09-300001581280us-gaap:EMEAMember2024-10-012025-09-300001581280us-gaap:EMEAMember2023-10-012024-09-300001581280us-gaap:EMEAMember2022-10-012023-09-300001581280srt:AsiaPacificMember2024-10-012025-09-300001581280srt:AsiaPacificMember2023-10-012024-09-300001581280srt:AsiaPacificMember2022-10-012023-09-300001581280twst:SyntheticGenesMember2024-10-012025-09-300001581280twst:SyntheticGenesMember2023-10-012024-09-300001581280twst:SyntheticGenesMember2022-10-012023-09-300001581280twst:OligoPoolsMember2024-10-012025-09-300001581280twst:OligoPoolsMember2023-10-012024-09-300001581280twst:OligoPoolsMember2022-10-012023-09-300001581280twst:DnaAndBiopharmaLibrariesMember2024-10-012025-09-300001581280twst:DnaAndBiopharmaLibrariesMember2023-10-012024-09-300001581280twst:DnaAndBiopharmaLibrariesMember2022-10-012023-09-300001581280twst:AntibodyDiscoveryMember2024-10-012025-09-300001581280twst:AntibodyDiscoveryMember2023-10-012024-09-300001581280twst:AntibodyDiscoveryMember2022-10-012023-09-300001581280twst:NgsToolsMember2024-10-012025-09-300001581280twst:NgsToolsMember2023-10-012024-09-300001581280twst:NgsToolsMember2022-10-012023-09-300001581280twst:IndustrialChemicalsMember2024-10-012025-09-300001581280twst:IndustrialChemicalsMember2023-10-012024-09-300001581280twst:IndustrialChemicalsMember2022-10-012023-09-300001581280twst:AcademicResearchMember2024-10-012025-09-300001581280twst:AcademicResearchMember2023-10-012024-09-300001581280twst:AcademicResearchMember2022-10-012023-09-300001581280us-gaap:HealthCareMember2024-10-012025-09-300001581280us-gaap:HealthCareMember2023-10-012024-09-300001581280us-gaap:HealthCareMember2022-10-012023-09-300001581280twst:FoodOrAgricultureMember2024-10-012025-09-300001581280twst:FoodOrAgricultureMember2023-10-012024-09-300001581280twst:FoodOrAgricultureMember2022-10-012023-09-300001581280country:USus-gaap:GeographicConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2024-10-012025-09-300001581280country:USus-gaap:GeographicConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2023-10-012024-09-300001581280country:USus-gaap:GeographicConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-10-012023-09-300001581280twst:CustomerOneMember2024-10-012025-09-300001581280twst:CustomerOneMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2024-10-012025-09-300001581280us-gaap:CashMember2025-09-300001581280us-gaap:MoneyMarketFundsMember2025-09-300001581280us-gaap:USTreasuryBillSecuritiesMember2025-09-300001581280us-gaap:CashMember2024-09-300001581280us-gaap:MoneyMarketFundsMember2024-09-300001581280us-gaap:USTreasuryBillSecuritiesMember2024-09-300001581280us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2025-09-300001581280us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Member2025-09-300001581280us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2025-09-300001581280us-gaap:USTreasuryBillSecuritiesMemberus-gaap:FairValueInputsLevel1Member2025-09-300001581280us-gaap:USTreasuryBillSecuritiesMemberus-gaap:FairValueInputsLevel2Member2025-09-300001581280us-gaap:USTreasuryBillSecuritiesMemberus-gaap:FairValueInputsLevel3Member2025-09-300001581280us-gaap:FairValueInputsLevel1Member2025-09-300001581280us-gaap:FairValueInputsLevel2Member2025-09-300001581280us-gaap:FairValueInputsLevel3Member2025-09-300001581280us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2024-09-300001581280us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Member2024-09-300001581280us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2024-09-300001581280us-gaap:USTreasuryBillSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-09-300001581280us-gaap:USTreasuryBillSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-09-300001581280us-gaap:USTreasuryBillSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-09-300001581280us-gaap:FairValueInputsLevel1Member2024-09-300001581280us-gaap:FairValueInputsLevel2Member2024-09-300001581280us-gaap:FairValueInputsLevel3Member2024-09-300001581280us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembertwst:DNADigitalDataStorageMembertwst:AtlasDataStorageIncMember2025-05-022025-05-020001581280us-gaap:MeasurementInputDiscountForLackOfMarketabilityMember2025-05-020001581280us-gaap:MeasurementInputRiskFreeInterestRateMember2025-05-020001581280twst:MeasurementInputTimeOfExitMember2025-05-020001581280us-gaap:MeasurementInputPriceVolatilityMember2025-05-0200015812802025-05-022025-05-020001581280us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembertwst:DNADigitalDataStorageMember2024-10-012025-09-300001581280us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembertwst:DNADigitalDataStorageMember2025-09-300001581280us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembertwst:DNADigitalDataStorageMembertwst:AtlasDataStorageIncMember2024-10-012025-09-300001581280us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembertwst:DNADigitalDataStorageMembertwst:AtlasDataStorageIncMember2025-05-020001581280twst:LaboratoryEquipmentMember2024-09-300001581280us-gaap:FurnitureAndFixturesMember2024-09-300001581280us-gaap:VehiclesMember2024-09-300001581280us-gaap:ComputerEquipmentMember2024-09-300001581280us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-09-300001581280us-gaap:LeaseholdsAndLeaseholdImprovementsMember2025-09-300001581280us-gaap:LeaseholdsAndLeaseholdImprovementsMember2024-09-300001581280us-gaap:ConstructionInProgressMember2025-09-300001581280us-gaap:ConstructionInProgressMember2024-09-300001581280country:US2025-09-300001581280country:US2024-09-300001581280us-gaap:NonUsMember2025-09-300001581280us-gaap:NonUsMember2024-09-300001581280us-gaap:DevelopedTechnologyRightsMember2025-09-300001581280us-gaap:DevelopedTechnologyRightsMember2024-10-012025-09-300001581280us-gaap:DevelopedTechnologyRightsMember2024-09-300001581280us-gaap:DevelopedTechnologyRightsMember2023-10-012024-09-300001581280us-gaap:CustomerRelationshipsMember2024-09-300001581280us-gaap:CustomerRelationshipsMember2023-10-012024-09-300001581280us-gaap:TrademarksAndTradeNamesMember2024-09-300001581280us-gaap:TrademarksAndTradeNamesMember2023-10-012024-09-300001581280us-gaap:RelatedPartyMember2023-09-300001581280twst:AtlasDataStorageIncMemberus-gaap:RelatedPartyMember2024-10-012025-09-300001581280us-gaap:StateAndLocalJurisdictionMember2025-09-300001581280us-gaap:DomesticCountryMember2025-09-300001581280us-gaap:StateAndLocalJurisdictionMember2024-09-300001581280us-gaap:DomesticCountryMember2024-09-300001581280us-gaap:DomesticCountryMembertwst:NeverExpireMember2025-09-300001581280us-gaap:DomesticCountryMembertwst:YearTwoThousandThirtyTwoThroughTwoThousandThirtyEightMember2025-09-300001581280us-gaap:StateAndLocalJurisdictionMembertwst:YearTwentyTwentyFiveMember2025-09-300001581280us-gaap:StateAndLocalJurisdictionMembertwst:YearTwentyTwentyFiveAndBeyondMember2025-09-300001581280us-gaap:DomesticCountryMemberus-gaap:ResearchMember2025-09-300001581280us-gaap:StateAndLocalJurisdictionMemberus-gaap:ResearchMember2025-09-3000015812802025-02-280001581280twst:TwoThousandAndEighteenEquityIncentivePlanMember2025-02-012025-02-280001581280twst:TwoThousandAndEighteenEquityIncentivePlanMember2018-09-260001581280twst:InducementPlanMember2025-02-012025-02-280001581280twst:InducementPlanMember2023-08-220001581280twst:TwoThousandAndEighteenEquityIncentivePlanMember2025-09-300001581280us-gaap:CostOfSalesMember2024-10-012025-09-300001581280us-gaap:CostOfSalesMember2023-10-012024-09-300001581280us-gaap:CostOfSalesMember2022-10-012023-09-300001581280us-gaap:ResearchAndDevelopmentExpenseMember2024-10-012025-09-300001581280us-gaap:ResearchAndDevelopmentExpenseMember2023-10-012024-09-300001581280us-gaap:ResearchAndDevelopmentExpenseMember2022-10-012023-09-300001581280us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-10-012025-09-300001581280us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-10-012024-09-300001581280us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-10-012023-09-300001581280us-gaap:StockCompensationPlanMember2025-09-300001581280us-gaap:StockCompensationPlanMember2024-09-300001581280us-gaap:RestrictedStockUnitsRSUMember2024-10-012025-09-300001581280srt:DirectorMemberus-gaap:RestrictedStockUnitsRSUMember2024-10-012025-09-300001581280us-gaap:RestrictedStockUnitsRSUMember2024-09-300001581280us-gaap:RestrictedStockUnitsRSUMember2025-09-300001581280us-gaap:RestrictedStockUnitsRSUMember2023-10-012024-09-300001581280us-gaap:RestrictedStockUnitsRSUMember2022-10-012023-09-300001581280twst:PerformanceStockUnitMembersrt:MinimumMembertwst:EmployeeMember2025-07-012025-09-300001581280twst:PerformanceStockUnitMembersrt:MaximumMembertwst:EmployeeMember2024-10-012025-09-300001581280srt:MinimumMembertwst:PerformanceStockUnitMember2024-10-012025-09-300001581280srt:MaximumMembertwst:PerformanceStockUnitMember2024-10-012025-09-300001581280twst:PerformanceStockUnitMember2024-09-300001581280twst:PerformanceStockUnitMember2024-10-012025-09-300001581280twst:PerformanceStockUnitMember2025-09-300001581280twst:PerformanceStockUnitMember2023-10-012024-09-300001581280twst:PerformanceStockUnitMember2022-10-012023-09-300001581280us-gaap:EmployeeStockOptionMember2024-10-012025-09-300001581280us-gaap:EmployeeStockOptionMember2025-09-300001581280us-gaap:EmployeeStockOptionMember2023-10-012024-09-300001581280us-gaap:EmployeeStockOptionMember2022-10-012023-09-300001581280twst:TwoThousandAndEighteenEmployeeStockPurchasePlanMember2018-09-260001581280twst:TwoThousandAndEighteenEmployeeStockPurchasePlanMember2018-09-262018-09-260001581280twst:TwoThousandAndEighteenEmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2024-10-012025-09-300001581280twst:TwoThousandAndEighteenEmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2023-10-012024-09-300001581280twst:TwoThousandAndEighteenEmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2022-10-012023-09-300001581280us-gaap:EmployeeStockMember2024-10-012025-09-300001581280us-gaap:EmployeeStockMember2023-10-012024-09-300001581280us-gaap:EmployeeStockMember2022-10-012023-09-300001581280twst:RestrictedStockUnitsAndPerformanceStockUnitsMember2024-10-012025-09-300001581280twst:RestrictedStockUnitsAndPerformanceStockUnitsMember2023-10-012024-09-300001581280twst:RestrictedStockUnitsAndPerformanceStockUnitsMember2022-10-012023-09-300001581280twst:SharesSubjectToEmployeeStockPurchasePlanMember2024-10-012025-09-300001581280twst:SharesSubjectToEmployeeStockPurchasePlanMember2023-10-012024-09-300001581280twst:SharesSubjectToEmployeeStockPurchasePlanMember2022-10-012023-09-300001581280twst:ReportableSegmentMember2024-10-012025-09-300001581280twst:ReportableSegmentMember2023-10-012024-09-300001581280twst:ReportableSegmentMember2022-10-012023-09-3000015812802024-10-210001581280twst:SouthSanFranciscoCaliforniaMemberus-gaap:SubsequentEventMember2025-11-130001581280twst:SouthSanFranciscoCaliforniaMemberus-gaap:SubsequentEventMember2025-11-132025-11-1300015812802025-07-012025-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

|

|

|

|

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2025

OR

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38720

Twist Bioscience Corporation

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

| Delaware |

46-2058888 |

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

681 Gateway Blvd, South San Francisco, CA 94080

(Address of principal executive offices and zip code)

(800) 719-0671

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class Trading Symbol(s) Name of each exchange on which registered

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Stock |

|

TWST |

|

The Nasdaq Global Select Market |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

|

Small reporting company |

☐ |

| |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

As of March 31, 2025, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of shares of common stock held by non-affiliates of the registrant was approximately $2.32 billion based upon the closing sale price on the Nasdaq Global Select Market reported for such date.

The number of shares of the Registrant’s common stock outstanding as of November 13, 2025, was 61,148,026.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement to be filed in connection with its 2025 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

TWIST BIOSCIENCE CORPORATION

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2025

TABLE OF CONTENTS

Forward-looking statements

This Annual Report on Form 10-K for the fiscal year ended September 30, 2025 (this "Form 10-K"), contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These statements relate to, among other matters, plans for product development and licensing to third parties, expectations regarding market penetration, anticipated customer conversions to our products, plans to expand in the international markets, and identification and development of potential antibody candidates. Forward-looking statements are also identified by the words “believe,” “will,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “could,” “potentially” and variations of such words and similar expressions. You should not rely upon forward-looking statements as predictions of future events. Such statements are based on management’s expectations as of the date of this filing and involve many risks and uncertainties that could cause our actual results, events or circumstances to differ materially from those expressed or implied in our forward-looking statements. Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to, statements about:

•our ability to increase our revenue and our revenue growth rate;

•our ability to accurately estimate capital requirements and our needs for additional financing;

•our estimates of the size of our market opportunities;

•our ability to increase DNA production, reduce turnaround times and drive cost reductions for our customers;

•our ability to effectively manage our growth and maintain and improve operational efficiency, cost control, and gross margin as we scale;

•our ability to successfully enter new markets and manage our international expansion;

•our ability to comply with evolving international regulatory requirements, including those in the European Union and other key markets;

•our ability to develop and commercialize additional products in the synthetic biology, biologic drug industries, including our portfolio of Express products;

•our ability to leverage our investment in our manufacturing facility in Wilsonville, Oregon;

•our ability to protect our intellectual property, including our proprietary DNA synthesis platform;

•costs associated with defending intellectual property infringement and other claims;

•the effects of increased competition in our business;

•our ability to keep pace with rapid changes in technology and evolving competitive dynamics;

•our ability to integrate and leverage artificial intelligence and machine learning technologies to improve operational efficiency, product development, and customer solutions;

•our ability to successfully identify, evaluate and manage any future acquisitions of businesses, solutions or technologies;

•the success of our marketing efforts;

•a significant disruption in, or breach in security of our information technology systems and resultant interruptions in service and any related impact on our reputation;

•our ability to attract and retain qualified employees and key personnel;

•the effects of natural or man-made catastrophic events or public health emergencies;

•the effectiveness of our internal controls;

•changes in government regulation affecting our business;

•uncertainty as to economic and market conditions and the impact of adverse economic conditions; and

•other risk factors included under the section titled “Risk Factors"

You should not rely upon forward-looking statements as predictions of future events. Such statements are based on management’s expectations as of the date of this filing and involve many risks and uncertainties that could cause our actual results, events or circumstances to differ materially from those expressed or implied in our forward-looking statements.

Readers are urged to carefully review and consider all of the information in this Form 10-K and in other documents we file from time to time with the Securities and Exchange Commission (the "SEC"). We undertake no obligation to update any forward-looking statements made in this Form 10-K to reflect events or circumstances after the date of this filing or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

When we use the terms “Twist,” “Twist Bioscience,” the “Company,” “we,” “us” or “our” in this report, we are referring to Twist Bioscience Corporation and its consolidated subsidiaries unless the context requires otherwise. Sequence space and the Twist logo are trademarks of Twist Bioscience Corporation. All other company and product names may be trademarks of the respective companies with which they are associated.

* * * * *

PART I

Item 1.Business

At Twist Bioscience Corporation, we work in service of our customers who are changing the world for the better. In fields such as health care, food/agriculture, industrial chemicals/materials and academic research, by using our products, our customers are developing ways to better lives and improve the sustainability of the planet. We believe Twist Bioscience is uniquely positioned to help accelerate their efforts and the faster our customers succeed, the better for all of us.

We have developed a disruptive DNA synthesis platform to industrialize the engineering of biology. The core of our platform is a proprietary technology that pioneers a new method of manufacturing synthetic DNA by “writing” DNA on a silicon chip. We have miniaturized traditional chemical DNA synthesis reactions to write over 1,000,000 pieces of DNA (oligonucleotides) up to 500 bases through direct synthesis on each silicon chip, approximately the size of a large mobile phone, reducing by 99.8% the amount of chemicals we estimate would be used per gene as compared to plate-based synthesis. We have combined our silicon-based DNA writing technology with proprietary software, scalable commercial infrastructure and an e-commerce platform to create an integrated technology platform that enables us to achieve high levels of quality, precision, automation, and manufacturing throughput at a significantly lower cost and quicker than our competitors.

Building from this platform, we deliver products and services for a wide range of uses and markets. We have applied our unique technology to manufacture a broad range of products, including synthetic genes, tools for next generation sequencing ("NGS"), sample preparation, and both products and services for drug discovery and development, all designed to enable our customers to conduct research more efficiently and effectively. We sell our products and services to a global customer base of more than 3,800, customers across a broad range of industries.

We believe our products and services enable a broad range of applications that may ultimately improve health and the sustainability of the planet across multiple industries, including:

•healthcare for the identification, prevention, diagnosis and treatment of disease (antibody discovery and optimization technology);

•chemicals/materials for cost-effective and sustainable production of new and existing specialty chemicals and materials, such as spider silk, nylon, rubber, fragrances, food flavors and food additives;

•food/agriculture for more effective and sustainable crop production; and

•academic research for a broad range of education and discovery applications.

Background

We currently generate revenue through our synthetic biology and NGS tools product lines as well as biopharma services for antibody discovery, optimization and development. In addition, we are leveraging our platform to expand our portfolio to include other products and services to address additional market opportunities.

In fiscal year 2025, we served more than 3,800 customers and reported $376.6 million in revenue, including $215.1 million in revenue from the healthcare sector, $93.2 million in revenue from the chemicals/materials sector, $65.9 million in revenue from the academic research sector and $2.4 million in revenue from the food/agriculture sector.

Our Markets

Synthetic Biology

Our synthetic biology products serve life sciences researchers across a variety of healthcare applications including drug discovery, disease detection, enzyme engineering, gene editing and basic academic research. In addition, our synthetic biology products are used for chemical and materials applications including development of synthetic spider silk, nylon, rubber, fragrances, flavors and food additives; for food and agricultural applications including improving crop traits such as adding vitamins or improving drought tolerance, and engineering bacteria to deliver nitrogen at the root of plants. While synthetic DNA has been produced for more than 40 years, the complexities of biology and the production constraints inherent in legacy processes have historically limited the applications and market opportunities for DNA synthesis.

Synthetic DNA is the fundamental building block that allows researchers to engineer biology. Synthetic DNA is a foundational product enabling the entire bioeconomy, with synthetic biology alone expected to have a $2-4 trillion global impact by 2030-2040. The National Security Commission on Emerging Biotechnology recognized synthetic DNA as a critical choke point in many supply chains, making broad access important for many industries. In addition to synthetic DNA, we offer RNA products and proteins to fuel discoveries through the design-build-test-learn cycle.

Next-Generation Sequencing

Our NGS tools play an integral role in the way our customers prepare their patient samples to be sequenced. NGS has transformed many markets in recent years by changing the landscape of diagnosing disease and disorders and offers a path to prevent or treat disease. Some of the markets impacted by NGS include cancer diagnosis and care, reproductive health, food/agriculture, consumer genomics, infectious disease research and drug discovery. As NGS technology improves and the cost of sequencing declines, new emerging markets that were once considered impractical, such as therapy selection, population-scale sequencing, liquid biopsy (a test that detects multiple types of cancer from a single blood sample), minimal residual disease ("MRD") testing and single cell sequencing, have become major areas of interest and investment.

Historically, a significant constraint in many NGS applications has been the high cost and long turnaround time of oligonucleotide production. Highly accurate and reproducible oligonucleotide production is required to produce high quality target enrichment data. Traditionally, the lack of options for oligonucleotide production forced researchers to choose between using less precise methods or reducing the number of samples in their study. Twist’s silicon-based platform synthesizes millions of oligonucleotides simultaneously with high uniformity and accuracy. Using highly uniform oligonucleotides ensures that the amount of oversampling needed to represent a dataset is kept to a minimum, meaning researchers can screen with confidence while reducing the down-stream sequencing costs.

The ability of the Twist DNA synthesis platform to precisely manufacture target enrichment probes at large scale has dramatically increased the types of projects that can now be addressed using NGS technologies. In addition to target enrichment, we offer innovative and application-specific library preparation with Twist-developed enzymes, buffers, beads, unique dual indexes ("UDIs"), unique molecular identifiers ("UMIs"), adapters and more. Our platform has unlocked new applications, improved data quality, and dramatically expanded the types of scientific questions that can be answered using NGS. In addition, the speed of our DNA synthesis platform enables customers to quickly deploy NGS technologies to applications where the time to answer is critical.

Our Platform

We developed the Twist Bioscience DNA synthesis platform to address the limitations of throughput, scalability, and cost inherent in legacy DNA synthesis methods. Our platform stems from extensive analyses and improvements to the existing gene synthesis and assembly workflows. Our core technologies combine expertise in silicon, software, fluidics, chemistry, and motion and vision control to miniaturize thousands of parallel chemical reactions on silicon and write thousands of strands of DNA in parallel.

Our Products

We have developed multiple products derived from synthetic DNA and our versatile DNA synthesis technology. Our current offering consists of two primary product lines, synthetic biology tools and NGS tools, that address different needs of our customers across a variety of applications as well as a biopharma service offering. As we have moved further up the value chain from fragments to genes to preps to proteins and beyond, the strategic connection between our synbio and biopharma groups tightens. More customers now leverage both products and services to accelerate discovery and identify breakthrough therapeutics. This growing convergence highlights the power of our integrated platform and reinforces Twist’s unique position to serve the full spectrum of innovation in discovery.

Synthetic Biology Products

Synthetic Genes and Gene Fragments

Synthetic genes are manufactured strands of DNA. Customers (biotech, pharma, industrial chemical, agricultural companies as well as academic labs) order our synthetic genes to conduct a wide range of research, including product development for therapeutics, diagnostics, chemicals/materials, food/agriculture as well as a multitude of emerging applications within academic research. Virtually all research and development of this type requires trial and error, and our customers require many variations of genes to find the DNA sequence that achieves their objectives.

We offer two primary categories of synthetic genes: clonal genes of perfect quality delivered to the customer in a vehicle called a vector; and genes that customers can place in their own vector, non-clonal genes or fragments. Within these two categories, customers can order different lengths of DNA depending on their required final gene construct. Customers can order longer genes or shorter genes and can stitch genes together to create longer or shorter constructs if desired.

Currently, we manufacture genes of up to 5,000 base pairs in length, yielding a clonally perfect piece of DNA that our customers can immediately use for their research. We offer non-clonal genes of up to 5,000 base pairs in length, which we believe addresses the vast majority of demand for non-clonal genes. We also offer larger quantities of DNA for customers who require it for their development efforts. Our error rate for gene fragments is 1:7500 nucleotides.

In November 2023, we introduced Express Genes, a product line that offers customers the same perfect-quality clonal genes at a turnaround time of 5 business days. We charge a premium for this fast turnaround time. We make all genes and gene fragments on our Express timeline.

In fiscal year 2024, we expanded our Express product portfolio to include many other products including Multiplexed Gene Fragments and IgG proteins on a fast turnaround timeline. Our ability to provide this rapid turnaround for products at scale differentiates us from our competitors.

Oligonucleotide, or Oligo Pools

Oligo pools, or high diversity collections of oligonucleotides, are utilized in many applications, including targeted NGS, CRISPR gene editing, mutagenesis experiments, DNA origami (the nanoscale folding of DNA to create two- and three-dimensional shapes at the nanoscale), among others. Our oligo pools are also used for high-throughput reporter assays to study cell signaling pathways, gene regulation and the structure of cell regulatory elements. For these applications, we provide customers with accurate and uniform synthetic oligos to precisely match their required designs.

We sell a diverse, customizable set of oligo pools, ranging from a few hundred oligos to over one million, and offer oligonucleotides of up to 500 nucleotides in length, with an error rate of 1:3000 nucleotides. In fiscal year 2024, we added an offering of cloned oligo pools to further enable researchers.

IgG Proteins

Pairing the automation in our synthetic biology platform along with our expertise in antibody discovery, we introduced an immunoglobulin G ("IgG") protein offering for our customers focused on the pursuit of drug discovery and development. In the process of antibody discovery, antibody fragments (Fab, small chain fragment variable (scFv) or VHH) must be reformatted to full IgGs. Leveraging our silicon-based synthesis platform, we provide customers with a high throughput IgG capability, removing this bottleneck from the antibody discovery process.

We offer standard and Express turnaround times in both CHO and HEK293 cell lines as well as a wide variety of antibody characterization assays.

NGS Tools

Building from our DNA synthesis platform, we have developed products to enable NGS. Our products work on multiple sequencing platforms as we are sequencer agnostic. In particular, we are focused on addressing the demand for better sample preparation products that improve sequencing workflow, increase sequencing accuracy, and reduce downstream sequencing costs. Using our silicon-based DNA synthesis platform, we are able to synthesize exact sequences of interest. In the target enrichment process, our synthetic DNA probes bind to the sequence of interest within the sample, acting like a magnet to isolate and physically extract the targeted segment of DNA.

Our NGS products are primarily used within diagnostic tests for various indications including rare disease, SARS-CoV-2 and cancer through liquid biopsy and MRD. In addition, customers use our NGS tools for therapy selection, population genetics research and biomarker discovery, translational research, microbiology and applied markets research. Our customers are primarily diagnostic companies and hospitals, research institutions, agricultural biotechnology companies, and consumer genetics companies conducting diagnostic tests for a wide range of applications.

We offer a wide variety of NGS tools for our customers including library preparation kits, human exome kits, fixed and custom panels as well as Alliance panels. Alliance panels are customer-curated content sold through Twist. In addition, we offer specific workflow solutions including a methylation detection kit for cancer, rare and inherited disease study, as well as a fast hybridization solution (FastHyb), which allows researchers to go from sample to sequencer in a single day. In addition to NGS tools for DNA workflows, we offer full RNA sequencing workflows.

Synthetic Controls

Leveraging our DNA synthesis platform, we offer positive synthetic controls that provide quality control measures for a wide range of applications from assay development to routine testing of samples with both NGS and reverse transcription polymerase chain reaction (RT-PCR) assays.

Drug and Target Discovery Services and Solutions

Biopharma Services

Modern therapeutic targets are increasing in complexity and traditional, single modality platforms are no longer sufficient on their own. Our biopharma services group offers the “discovery trifecta” – in vivo, in vitro and in silico antibody discovery all under one roof. We provide comprehensive discovery services for our partners including library generation, screening, developability assays and antibody expression and characterization that result in ultra fast lead selection and engineering, which can mean a faster path in the race to the clinic.

Partnerships with Leading Companies

We have several avenues available to monetize our antibody discovery programs. Partnerships for our antibody development platforms require us to provide rapid, high quality, fit for purpose antibodies based on one or more targets and functional criterion provided to us by the customer.

We provide end-to-end services, whereby customers can choose to design and/or purchase libraries, or select various discovery platforms for Twist to characterize antibody candidates that bind to the customer's target(s) of interest. Customers pursuing artificial intelligence (“AI”) enabled antibody discovery platforms may use Twist to generate not only the antibodies of interest but also comprehensive high quality characterization data that is critical for use in the development and refinement of algorithms and subsequently used for the identification of therapeutic antibody candidates with appropriate developability properties. These partnerships generate revenue through licensing fees, fee-for service, as well as, in some cases, the inclusion of success-based milestones for clinical, regulatory and commercial achievements.

To date, we have generated antibody leads to multiple biological targets and these antibody leads are in various stages of early discovery and development.

As of September 30, 2025, we had signed 442 revenue-generating partnerships. Through these partnerships, we had 1182 completed programs and 84 active programs with 82 of the programs including milestones and/or royalties as of September 30, 2025. Some of our partners include Bayer, Boehringer Ingelheim GmbH, Takeda Pharmaceutical Company Limited, Adicet Bio, Ono Pharmaceutical Ltd., Kyowa Kirin, Invetx, Inc., Astellas Pharma Inc. and Neogene Therapeutics, Inc.

In October 2024, we entered into an agreement with XOMA Royalty under which they paid Twist $15 million cash in exchange for 50% of future milestone and royalty payments from our existing collaborations as of the date of signing. We retain all upfront, service and other revenue earned under antibody discovery and biopharma solutions agreements as well as half of future milestones and royalties.

Our Growth Strategy

Our objective is to be the leading provider of synthetic DNA and related solution worldwide, including RNA and proteins, and to leverage our platform to build a leadership position in other life sciences markets in which we have a competitive advantage. We intend to accomplish this objective by executing on the following:

•maintain and expand our position as the provider of choice for high-quality, affordable synthetic DNA, RNA and proteins to customers across multiple industries;

•expand antibody and protein production as well as expand array of characterization assays to support customers conducting therapeutics discovery projects;

•become a leading supplier of NGS sample preparation products for a wide range of applications including liquid biopsy tests, MRD, agricultural genomics and population genomics;

•conduct biopharma services for our current customers and future partners; and

•expand our global presence.

Beyond these opportunities, we are working with industry partners to create new markets for our products by leveraging our platform.

Sales and Marketing

We have built a versatile and scalable commercial platform that enables us to reach a diverse customer base that we estimate consists of over 100,000 synthetic DNA users, potential customers of our NGS tools products and partners who may use our services for antibody discovery. In order to address this diverse customer base, we employ a multi-channel strategy comprised of a direct sales force targeting synthetic DNA customers, a direct sales force focusing on the NGS market and an e-commerce platform that serves both commercial channels. We employ business development and sales representatives for our biopharma solutions as well. Our sales force is focused on customer acquisition, support, and management across industries, and is highly trained on both the technical aspects of our platform and how our product and services can be used in a wide range of industries. Our easy-to-use e-commerce platform allows customers to design, validate, and place on-demand orders of customized DNA online, and enables them to receive real-time customized quotes for their products and track their order status through the manufacturing and delivery process. This is a critical part of our strategy to address our large markets and diverse customer base, as well as drive commercial productivity, enhance the customer experience, and promote loyalty.

We sell our products through a worldwide commercial organization that includes direct sales personnel, commercial consultants in Europe and Asia, an e-commerce platform and distributors. As of September 30, 2025, we employed 278 employees and 5 dedicated commercial consultants in sales, marketing and customer support.

Research and Development

We are engaged in ongoing research and development efforts focused on enhancements to existing products and the development of new products. Currently, we are pursuing research and development projects with respect to the following:

•process development for highest quality oligos;

•develop proprietary enzymes to optimize SynBio and NGS products and workflows;

•evaluate and implement AI applications to potentially optimize services for our customers;

•expansion of our product offerings for oligo, gene, synthetic controls, NGS library preparation and target enrichment, and DNA Libraries products;

•continuous process improvements across the business to facilitate speed, efficiency and automation;

•develop new products including mRNA and proteins; and

•expand capabilities for antibody and protein production to support multiple formats and provide a wide array of characterization assays.

Research and development activities are conducted in collaboration with manufacturing activities to help expedite new products from the development phase to manufacturing and to more quickly implement new process technologies. From time to time, our research and development efforts have included participation in technology collaborations with universities and research institutions.

As of September 30, 2025, we employed 91 people in our research and development team.

Patents and Other Intellectual Property Rights

Worldwide, we own or exclusively in-license over 200 issued or allowed patents and more than 250 pending patent applications as of September 30, 2025. In addition to these owned and exclusively licensed patents and pending patent applications, we also license patents on a non-exclusive and/or territory restricted basis. Our intellectual property portfolio includes important patents and patent applications directed to DNA synthesis, NGS and antibody libraries. Our policy is to file patent applications to protect technology, inventions and add improvements that are important to our business. Individual patent terms extend for varying periods of time, depending upon the date of filing of the patent application, the date of patent issuance, and the legal term of patents in the countries in which they are obtained.

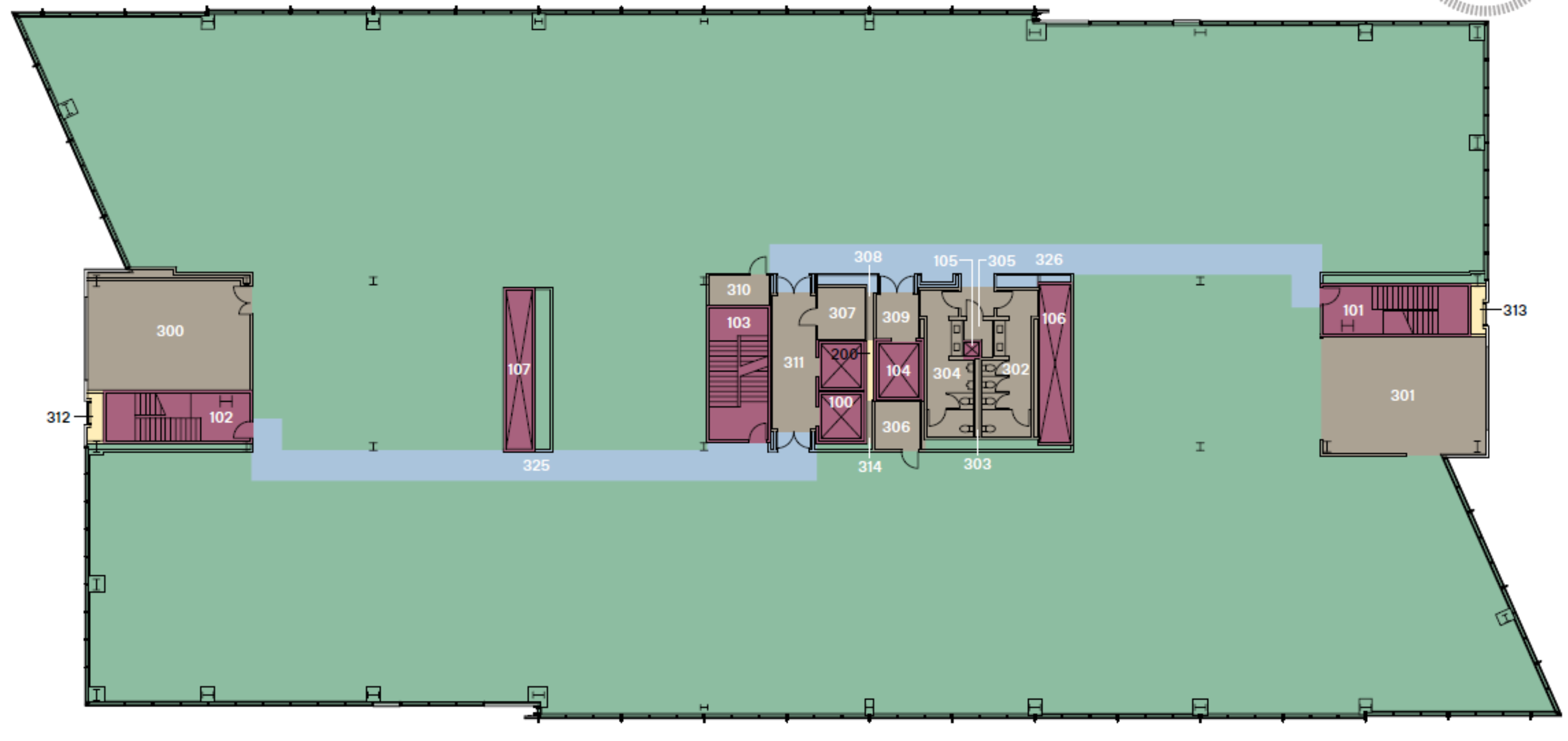

Manufacturing and Facilities

The production of our products is a highly complex and precise process. We currently manufacture all of our products and multiple sub-assemblies at our manufacturing facilities in South San Francisco, California and Wilsonville, Oregon. We consider our long-lived assets to be ready for their intended use when they are first capable of producing a unit of product that is saleable at which point depreciation of the asset commences. We also outsource some of our sub-assemblies to third party manufacturers. All of our products originate from synthetic DNA obtained from nanostructured clusters fabricated on our proprietary silicon technology platform. Due to its on-demand nature, the gene synthesis business requires manufacturing operations to be in operation 24 hours a day, seven days a week, 365 days per year. For synthetic genes, we have built a highly scalable gene production process with what we believe is industry-leading capacity to address the growing demand of scalable, high-quality, affordable synthetic genes. As of September 30, 2025, we employed 412 people in our manufacturing and operations team.

In addition to synthetic genes, we manufacture oligo pools. The pooling process has been fully automated through a mixture of custom proprietary and over-the-counter liquid handling equipment. We have the capacity to make many millions of high-quality oligos per day that can be used to make genes and gene fragments of various lengths, multiplex gene fragments, oligo pools of various sizes, DNA libraries and NGS tools products. We intend to increase our shipments to leverage our production capacity through our e-commerce platform, and express offerings, which we believe will expand both our market opportunity and our customer base.

The manufacturing process for our NGS tools is highly flexible given the efficiency of our production capability. We have automated the entire workflow using proprietary and over-the-counter laboratory equipment. We have built dedicated production capabilities for our NGS products.

ISO certification

Medical device manufacturers implement a Quality Management System ("QMS") for medical devices to ensure that their products consistently meet regulatory requirements and customer expectations. Implementing a QMS for medical devices is crucial for ensuring patient safety, regulatory compliance, and the overall effectiveness and reliability of medical devices in the market. The international standard International Organization for Standardization (“ISO”) 13485 is widely recognized and provides a framework for developing and maintaining a QMS specific to the medical device industry. We certified our QMS to ISO 13485:2016 standard (Medical devices—Quality management systems—Requirements for regulatory purposes).

ISO is a global network of national standards with over 21,000 standards for nearly every aspect of technology and business. ISO has standard bodies in 163 countries. ISO surveillance audits are carried out annually by the registrar (certification body) to ensure we maintain our system in compliance with ISO standards and to demonstrate the continuous improvement of our QMS. Recertification is required every three years, and we have been successfully recertified since obtaining our original ISO certification. Our latest successful surveillance audit took place in September 2025.

In 2020, our QMS for manufacturing NGS Target Enrichment Panels at our South San Francisco facility was certified to ISO 13485:2016, followed by certification of our Wilsonville manufacturing facility in 2023.

Supply Chain

We have historically purchased many of the components and raw materials used in our products from numerous suppliers worldwide. For reasons of quality assurance, sole source availability or cost effectiveness, certain components and raw materials used in the manufacture of our products are available only from one supplier. We have worked closely with our suppliers to develop contingency plans to assure continuity of supply while maintaining high quality and reliability, and in some cases, we have established long-term supply contracts with our suppliers. We qualify additional suppliers for key materials in an effort to ensure continuity of supply for our operations.

Competition

The synthetic biology industry is intensely competitive and is characterized by price competition, technological change, international competition, product turnaround time and manufacturing yield problems. The competitive factors in the market for our products include:

•price;

•product quality, reliability and accuracy;

•product offerings & complexity;

•turnaround time;

•breadth of product line;

•design and introduction of new products;

•market acceptance of our products and those of our customers;

•throughput and scale; and

•technical support and service.

We face competition from a broad range of providers of core synthetic biology products such as GenScript Biotech Corporation, GENEWIZ (owned by Azenta Life Sciences), Integrated DNA Technologies, Inc. (owned by Danaher Corporation), DNA 2.0 Inc. d/b/a/ ATUM, GeneArt (owned by Thermo Fisher Scientific Inc.), Eurofins Genomics LLC, OriGene Technologies, Inc., Eurofins Genomics Blue Heron, Elegen Corporation, Ansa Biotechnologies, Inc., Telesis Bio, Inc. and others. Additionally, we compete with both large and emerging providers in the life sciences tools and diagnostics industries focused on sample preparation for NGS such as Thermo Fisher Scientific Inc., Illumina, Inc., Integrated DNA Technologies, Inc., Roche Holding AG, New England Bioloabs, Inc., Watchmaker Genomics, Inc. and Agilent Technologies, Inc. In the antibody discovery market, we compete with contract research organizations including Curia Global, Inc., GenScript Biotech Corporation, and Genovac (formerly part of Aldevron, LLC), and antibody discovery biotechnology companies, such as FairJourney Biologics S.A/IONTAS Limited, Adimab, LLC, Distributed Bio (owned by Charles River Laboratories International, Inc.), Ablexis, LLC, Specifica Inc., OmniAb, Inc., Alloy Therapeutics, Inc. and AbCellera Biologics Inc.

Corporate Responsibility

We are at the forefront of the bioeconomy revolution, and our products are increasingly being used to empower our customers, which consist of diagnostic, therapeutic and healthcare companies, agricultural biotech companies, chemical companies, academic institutions and government entities, around the world to address large societal challenges. All of our work supports our mission to provide synthetic DNA and DNA products to improve health and sustainability.

Full results from our Corporate Responsibility efforts, including our 2025 Corporate Responsibility Report can be found here: https://www.twistbioscience.com/company/corporate-responsibility. The information on our website, including, without limitation, in the 2025 Corporate Responsibility Report, should not be deemed incorporated by reference into this annual report or otherwise “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section.

Human Capital

Our employees are a key factor in our ability to serve our customers. The ability to hire and retain highly skilled professionals remains key to our success in the marketplace. To attract, develop and motivate our employees, we offer a challenging work environment, ongoing skills development initiatives, attractive career advancement, opportunities and a culture that rewards entrepreneurial initiative and exceptional execution.

Our guiding principles of grit, impact, service and trust serve as the foundation of our culture. Our guiding principles set the tone for how we work together, provide a framework for giving feedback and increase the power of our brand. Service is at the core of our business and our interactions with one another. We relentlessly focus on exceeding internal and external customer needs.

Employee Population

As of September 30, 2025, we had 979 employees. Of these employees, 91 were primarily engaged in research and development activities; 278 were primarily engaged in marketing, sales and customer support; 198 were primarily engaged in general and administrative activities; and 412 were primarily engaged in operations and manufacturing, dedicated to manufacturing our synthetic genes, oligo pools, NGS tools, antibody proteins and DNA libraries. None of our employees is represented by a labor union, and we consider our employee relations to be good.

Recruiting, Development and Retention

Recruiting

We believe that our employees are our most important asset. Beginning with the pre-recruitment process, we provide internship opportunities in both scientific and non-scientific fields for students interested in biotechnology and the science, technology, engineering and mathematics (STEM) careers. We engage with local communities to provide expert speakers sharing nontraditional career pathways for the biotechnology field. We partner with community colleges to build our brand as a source of high-quality candidates for every role with the goal of identifying the best possible candidate to fill open positions within the Company.

Growth and Development

We invest significant financial and support resources to develop the talent we need to remain at the cutting edge of innovation to ensure Twist Bioscience is an employer of choice. Our performance management system is aimed at supporting our culture, maintaining consistency with our guiding principles and to focusing on continuous learning and development. Our success in the market depends on employees understanding and embracing how their job contributes to the Company’s overall strategy. We encourage cross team communication as well as integrated departmental communication. We believe this broadens our employee’s skill set and provides opportunity for growth and advancement. We invest in our next generation of leaders through a six-month leadership program and individualized coaching for mid-level managers. In addition, we offer tuition reimbursement aimed at growth and career development.

Compensation and Benefits, Health and Wellness

We strive to provide pay, comprehensive benefits and services that help meet the varying needs of our employees. Our total rewards package includes above-market pay; fully covered healthcare benefits for employees, with family member healthcare benefits covered at 90%; onsite services; and other benefits.

Employee Health and Safety

We remain steadfast in our commitment to promote the health and safety of our employees and have implemented a robust Injury and Illness Prevention Program (IIPP). We require annual workplace safety training to reinforce workplace safety procedures that may be useful in the event of emergency situations and to assist our employees in helping to prevent workplace accidents. Our Employee Safety Committee, which is comprised of numerous cross-departmental members, meets on a regular basis (at least quarterly) to review workplace safety and adherence to safety policies. As part of our efforts, all employees and managers complete workplace harassment and sexual harassment training that includes details on how to report any violation of these policies.

Employee Communications and Engagement

We employ a variety of tools to facilitate open and direct communication including open forums with executives, employee surveys and engagement through focus groups, forums and committees. We endeavor to further refine our employee programs through our employee engagement survey as well as follow up quarterly pulse surveys. Our most recent survey was conducted in September 2025 where 90% of our employees responded.

We hold All Employee meetings twice per month as well as a monthly managers meeting for all people managers.

Community Engagement, Social and Relationship Capital

We are endeavoring to develop relationships, give back to our communities and engage in corporate social responsibility and sustainability initiatives. We provide all employees with eight fully paid hours each year to give back to the community at an organization of their choice. We are working to engage with the local community organizations to provide volunteer opportunities for our employees.

Government Regulation

Twist Bioscience is a leading provider of synthetic DNA products, serving customers across research, development and commercial applications. We offer a wide range of products intended for "Research Use Only" ("RUO") as well as a limited catalog of NGS tools that have been CE-marked pursuant to, and regulated by, the In Vitro Diagnostic Device Regulation (EU) 2017/746 (the "IVDR"), and sold as in-vitro diagnostic medical devices ("IVDs") in the European market. Our RUO products are sold and promoted for non-diagnostic and non-clinical purposes to academic institutions, life sciences and research laboratories, and biopharmaceutical and biotechnology companies who then integrate our products into their workflows for further commercialization. These products serve as vital research tools, enabling our customers to develop a diverse spectrum of commercial products. However, if we expand our portfolio of IVDs , we may be subject to a variety of specialized regulatory requirements, including those set forth by the U.S. Food and Drug Administration (the "FDA") in the United States and the IVDR in the European Union ("EU").

Aside from certain labeling requirements, we believe that most of our products, as currently marketed, are largely unregulated by governmental bodies, including the FDA. Even so, we recognize that the applications of synthetic biology are rapidly evolving and we are actively involved in supporting our customers who are developing regulated products, including through contract manufacturing and specialized packaging solutions. As such, we may be subject to certain regulatory requirements, directly or indirectly, and maintain a robust QMS to ensure compliance. Furthermore, if we expand our own portfolio of IVDs, we anticipate further engagement with regulatory bodies such as the FDA. We are committed to navigating this evolving landscape and ensuring that our products and services meet the highest quality and regulatory standards. For example, we have been recently evaluated by an external third party who has determined that we have processes in place to support compliance with current Good Manufacturing Practices and to support the required regulatory requirements as future regulations are updated by the FDA. Currently, our QMS adheres to ISO 13485:2016 to ensure the quality and reliability of our products.

RUO is a term applicable to our target enrichment products for the NGS market and is applied to kits sold to this market segment. It is intended to restrict use of the kits to non-in vitro diagnostic purposes. Our NGS target enrichment and library preparation products are used in a more comprehensive workflow for NGS for research purposes only. In the future, we may develop this larger workflow as an in vitro diagnostic, for which we will obtain prior authorization from FDA or other applicable regulatory authorities before commercialization. For example, we launched a limited line of IVDs that are CE-marked and IVDR compliant to support our European customers who are in the in vitro diagnostic medical device market.

FDA

Pursuant to its authority under the Federal Food, Drug, and Cosmetic Act (the "FDC Act"), the FDA has jurisdiction over medical devices. The FDA regulates, among other things, the research, testing, manufacturing, safety, labeling, storage, recordkeeping, premarket clearance or approval, marketing and promotion and sales and distribution of medical devices in the United States to ensure that medical products distributed domestically are not adulterated and are safe and effective for their intended uses. In addition, the FDA regulates the import and export of medical devices.

Medical Device Regulation in General

IVDs are a category of medical devices that include reagents, instruments, and systems intended for use in diagnosis of disease or other conditions, including a determination of the state of health, in order to cure, mitigate, treat, or prevent disease or its sequelae. IVDs are intended for use in the collection, preparation, and examination of specimens taken from the human body. An RUO IVD product is an IVD product that is in the laboratory research phase of development or is intended for use in the conduct of nonclinical laboratory research and not intended to produce results for clinical use. As such, an RUO IVD is not intended for use in clinical investigations or in clinical practice. Such RUO products do not require premarket clearance or approval from the FDA, provided that they be labeled “For Research Use Only. Not For Use In Diagnostic Procedures” pursuant to FDA regulations or they may be considered to be adulterated and misbranded.

As noted above, although our products are currently intended for research purposes only, the regulatory requirements related to marketing, selling, and supporting such products could be uncertain and depend on the totality of circumstances. This uncertainty exists even if a use by our customers occurs without our consent. If the FDA or other regulatory authorities assert that any of our RUO products are subject to regulatory clearance or approval, our business, financial condition, or results of operations could be adversely affected.

According to the FDA, including the RUO labeling statement will not necessarily render the device exempt from FDA premarket clearance, approval, or other regulatory requirements if the totality of circumstances surrounding the distribution of the product indicate that the manufacturer intended its RUO products for diagnostic use. Such circumstances may include, but are not limited to, the product’s advertising, labeling, or promotion, or the manufacturer’s assistance of a clinical laboratory in validating or verifying a test that incorporates products labeled RUO. This uncertainty exists even if such use by our customers occurs without our consent. If the FDA or other regulatory authorities assert that any of our RUO products are subject to regulatory clearance or approval, our business, financial condition, or results of operations could be adversely affected.

Some of our customers may use our products in their own laboratory-developed tests ("LDTs"). The FDA has historically taken the position that LDTs are considered to be IVDs but has generally exercised enforcement discretion. However, the FDA recently attempted to regulate virtually all LDTs as medical devices by publishing a final rule that would have phased out the policy of enforcement discretion it historically applied to LDTs (the “LDT Final Rule”). On August 6, 2025, the FDA rescinded the LDT Final Rule after it was vacated in its entirety on March 31, 2025 by the United States District Court for the Eastern District of Texas.

EU Regulation

In the EU, the new IVDR imposes stricter requirements for the marketing and sale of applicable medical devices, including in the area of clinical evaluation requirements, quality systems and post-market surveillance. Some of the IVDR requirements such as general safety and performance requirements became effective in May 2022 while the complete enforcement of the entirety of IVDR will not happen until May 2028. We likely will be impacted by this new regulation, either directly as a manufacturer of IVDs, or indirectly as a supplier to customers who are placing IVDs in the EU market for clinical or diagnostic use. In February 2024, we introduced IVDR-compliant Precision Dx products for whole exome sequencing to meet the needs of our European customers and demonstrate our commitment to providing compliant solutions for clinical and diagnostic use in the EU.

Federal Select Agent Program

The Centers for Disease Control and Prevention (the "CDC") and the Animal and Plant Health Inspection Service (the "APHIS") administer requirements of the Federal Select Agent Program ("FSAP"). FSAP requirements govern possession, use, and transfer of select agents and toxins consisting of biological materials that have the potential to pose a severe threat to public, animal or plant health or to animal or plant products.

The FSAP currently lists approximately 63 select agents and toxins. The registered entities primarily consist of academic, federal and non-federal government, commercial, and private facilities that conduct research studies or diagnostic activities. We are not a registered entity under the FSAP and it is our policy generally not to produce or otherwise work with any biological material that is subject to the FSAP license requirements. To the extent that we may possess, use, or transfer any material considered a select agent or toxin under the FSAP prospectively, we would seek to register with the FSAP and obtain all necessary permits for possession, transfer, importation, or any other regulated activity.

Export Controls

Some sequences and synthetic controls we produce may be subject to licensing requirements for export outside of the United States under the U.S. Export Administration Regulations. Given the evolving nature of our industry, legislative bodies or regulatory authorities may adopt additional regulation or expand existing regulation to include our products. Changes to the current regulatory framework, including the imposition of additional or new regulations, could arise at any time, and we may be unable to obtain or maintain comparable regulatory approval or clearance of our products, if required. For example, the U.S. government is expected to promulgate a new export control regarding DNA writers, which may require additional compliance considerations with respect to hiring. These regulations and restrictions may materially and adversely affect our business, financial condition, and results of operations.

OSTP Framework for Nucleic Acid Synthesis Screening

The Office of Science and Technology Policy in 2024 published the Framework for Nucleic Acid Synthesis Screening. The Framework requires that U.S.-funded researchers and institutions limit the purchase of synthetic nucleic acids only to companies that publicly attest to adherence to the screening requirements of the Framework. Twist's biosecurity practices satisfy or exceed the requirements of the Framework and, as such, Twist has publicly attested to our adherence. We have also agreed, as required by the Framework, to amend our attestation within 72 hours should the status of our adherence to the Framework change.

Available Information

Our corporate website address is www.twistbioscience.com. We use the investor relations page of our website for purposes of compliance with Regulation FD and as a routine channel for distribution of important information, including news releases, analyst presentations, financial information and corporate governance practices. Our filings with the SEC are posted on our website and available free of charge as soon as reasonably practical after they are electronically filed with, or furnished to, the SEC. The SEC’s website, www.sec.gov, contains reports, proxy statements and other information regarding issuers that file electronically with the SEC. The content on any website referred to in this Form 10-K is not incorporated by reference in this Form 10-K unless expressly noted. Further, the Company’s references to website URLs are intended to be inactive textual references only.

Item 1A.Risk Factors

Risk Factor Summary

Investing in our common stock involves a high degree of risk. You should carefully consider all information in this Form 10-K and in subsequent reports we file with SEC prior to investing in our common stock. These risks are discussed more fully in the section titled “Risk Factors.” These risks and uncertainties include, but are not limited to, the following:

•We have incurred net losses in every period to date, and we expect to continue to incur significant losses as we develop our business and may never achieve profitability;

•If we are unable to maintain adequate revenue growth or do not successfully manage such growth, our business and growth prospects will be harmed;

•The continued success of our business relies heavily on our disruptive technologies and products and our position in the market as a leading provider or synthetic DNA using a silicon chip;

•We are substantially dependent on the success of our synthetic DNA products;

•We operate in a highly competitive industry and if we are not able to compete effectively, our business and operating results will likely be harmed;

•If we are unable to attract new customers and retain and grow sales from our existing customers, our business will be materially and adversely affected;

•Our revenue, results of operations, cash flows and reputation in the marketplace may suffer upon the loss of a limited number of large customers;

•If we, or our partners or suppliers, experience a significant disruption in, or breach in security of, information technology systems or other cybersecurity incidents, our business could be adversely affected;

•As we continue to grow our business, we will need to implement new systems and software successfully, otherwise our business and our financial condition and results of operations could be adversely affected;

•Rapidly changing technology and extensive competition in synthetic biology could make the products we are developing and producing obsolete or non-competitive unless we continue to develop and manufacture new and improved products and pursue new market opportunities;

•We depend on one single-source supplier for a critical component for our DNA synthesis process. Although we have a reserve of supplies and alternative suppliers exist, the loss of this supplier or its failure to supply us with the necessary component on a timely basis could cause delays in the future capacity of our DNA synthesis process and adversely affect our business;

•We depend on the continuing efforts of our senior management team and other key personnel, including our scientific and engineering personnel. If we lose members of our senior management team or other key personnel or are unable to successfully retain, recruit and train qualified researchers, engineering and other personnel, our ability to develop our products could be harmed, and we may be unable to achieve our goals;

•We may engage in strategic transactions, including acquisitions and divestitures that could disrupt our business, cause dilution to our stockholders, reduce our financial resources, or prove not to be successful;

•We may require additional financing to achieve our goals, and such additional financing may not be available acceptable terms, or at all, which could have an adverse effect on our business;

•If we fail to maintain proper and effective internal controls, our ability to produce accurate financial statements on a timely basis could be impaired, which would adversely affect our business;

•Our ability to protect our intellectual property and proprietary technology through patents and other means is uncertain; and

•If we are unable to obtain, maintain and enforce intellectual property protection, others may be able to make, use, or sell products and technologies substantially the same as ours, which could adversely affect our ability to compete in the market.

Risk Factors

The following discussion of risk factors contains forward-looking statements. These risk factors may be important to understanding other statements in this Form 10-K. The following information should be read in conjunction with Part II, Item 7, “Management’s discussion and analysis of financial condition and results of operations” and the consolidated financial statements and related notes in Part II, Item 8, “Consolidated financial statements and supplementary data” of this Form 10-K. The risks and uncertainties described below are not the only ones we face. Additional risk and uncertainties not presently known to us or that we presently deem less significant may also impair our business operations. If any of the events or circumstances described in the following risk factors actually occur, our business, operating results, financial condition, cash flows, and prospects could be materially and adversely affected. In that event, the market price of our common stock could decline, and you could lose part or all of your investment.

Our business, financial condition and operating results can be affected by a number of factors, whether currently known or unknown, including but not limited to those described below, any one or more of which could, directly or indirectly, cause our actual financial condition and operating results to vary materially from past, or from anticipated future, financial condition and operating results. Any of these factors, in whole or in part, could materially and adversely affect our business, financial condition, operating results and stock price.

Because of the following factors, as well as other factors affecting our financial condition and operating results, past financial performance should not be considered to be a reliable indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods.

Risks Related to Our Business

We have incurred net losses in every period to date, and we may continue to experience losses as we develop our business and may never achieve profitability.

We have incurred net losses each year since inception and have generated limited revenue from product sales to date. We expect to incur increasing costs as we grow our business. We cannot be certain if or when we will produce sufficient revenue from our operations to support our costs. Our ability to generate product revenue sufficient to achieve profitability will depend heavily on the success of our existing products and the development and commercialization of additional products in the synthetic biology and biologic drug industries as well as leveraging our investment in our manufacturing facility in Wilsonville, Oregon, and investing in technology to support our growth. Even if profitability is achieved, we may not be able to sustain profitability. We incurred net losses of $77.7 million, $208.7 million and $204.6 million for the years ended September 30, 2025, 2024 and 2023, respectively. As of September 30, 2025, we had an accumulated deficit of $1,319.6 million. We may continue to experience losses in the future as we continue to devote a substantial portion of our resources to market acceptance of our products, future product development, and our market penetration and margins as well as the other risks described in this Form 10-K, many of which are beyond our control. In addition, inflationary pressure could adversely impact our financial results by increasing operating costs. We may not fully offset these cost increases by raising prices for our products and services, which could result in downward pressure on our margins. Further, our clients may choose to reduce their business with us if we increase our pricing.

If we are unable to maintain adequate revenue growth or do not successfully manage such growth, our business and growth prospects will be harmed.