Document

First Internet Bancorp Reports Fourth Quarter and Full Year 2024 Results

Fishers, Indiana, January 22, 2025 – First Internet Bancorp (the “Company”) (Nasdaq: INBK), the parent company of First Internet Bank (the “Bank”), announced today financial and operational results for the fourth quarter and full year ended December 31, 2024.

Fourth Quarter 2024 Financial Highlights

▪Net income of $7.3 million, an increase of 4.9% from the third quarter of 2024

▪Diluted earnings per share of $0.83, an increase of 3.8% from the third quarter of 2024

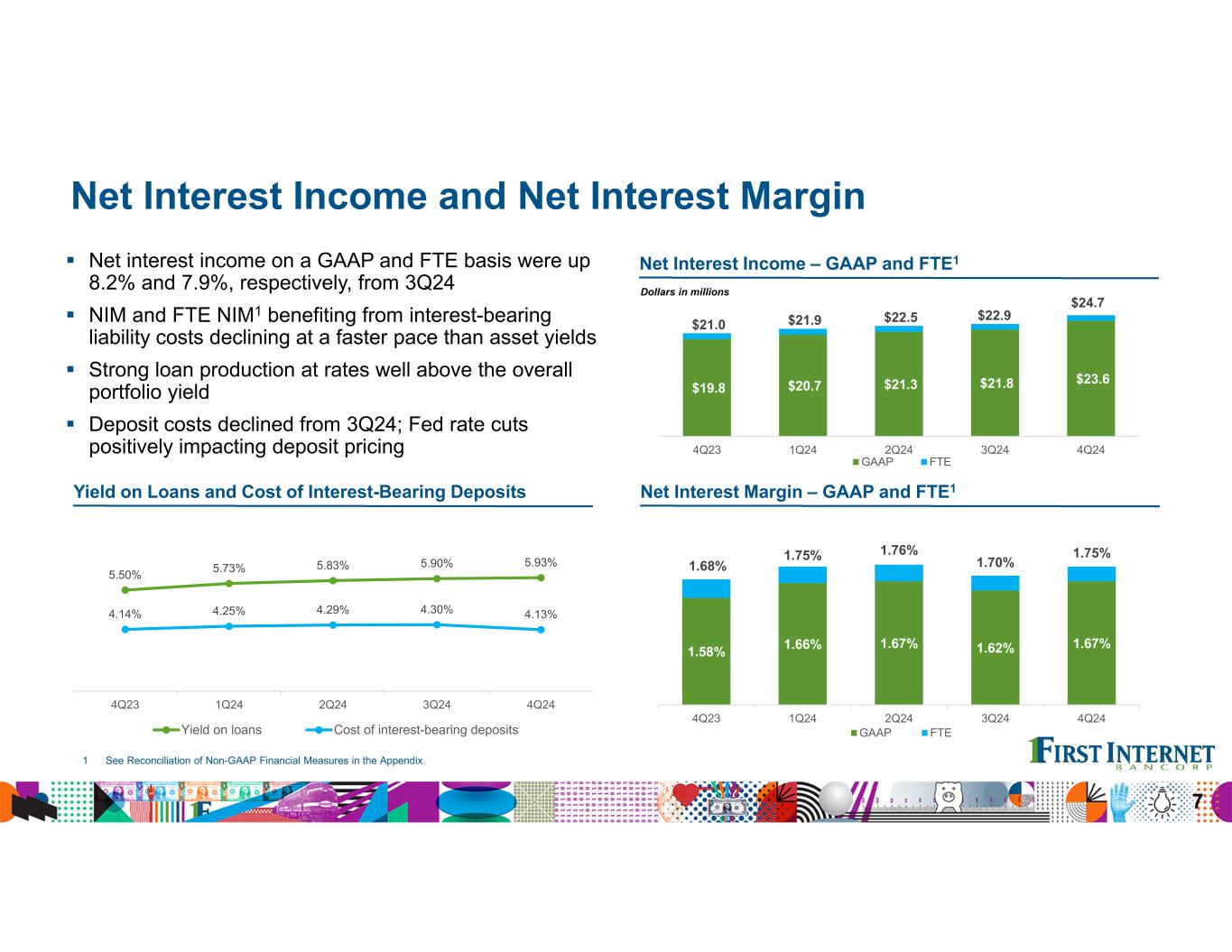

▪Net interest income of $23.6 million and fully taxable equivalent net interest income of $24.7 million1, increases of 8.2% and 7.9%, respectively, from the third quarter of 2024

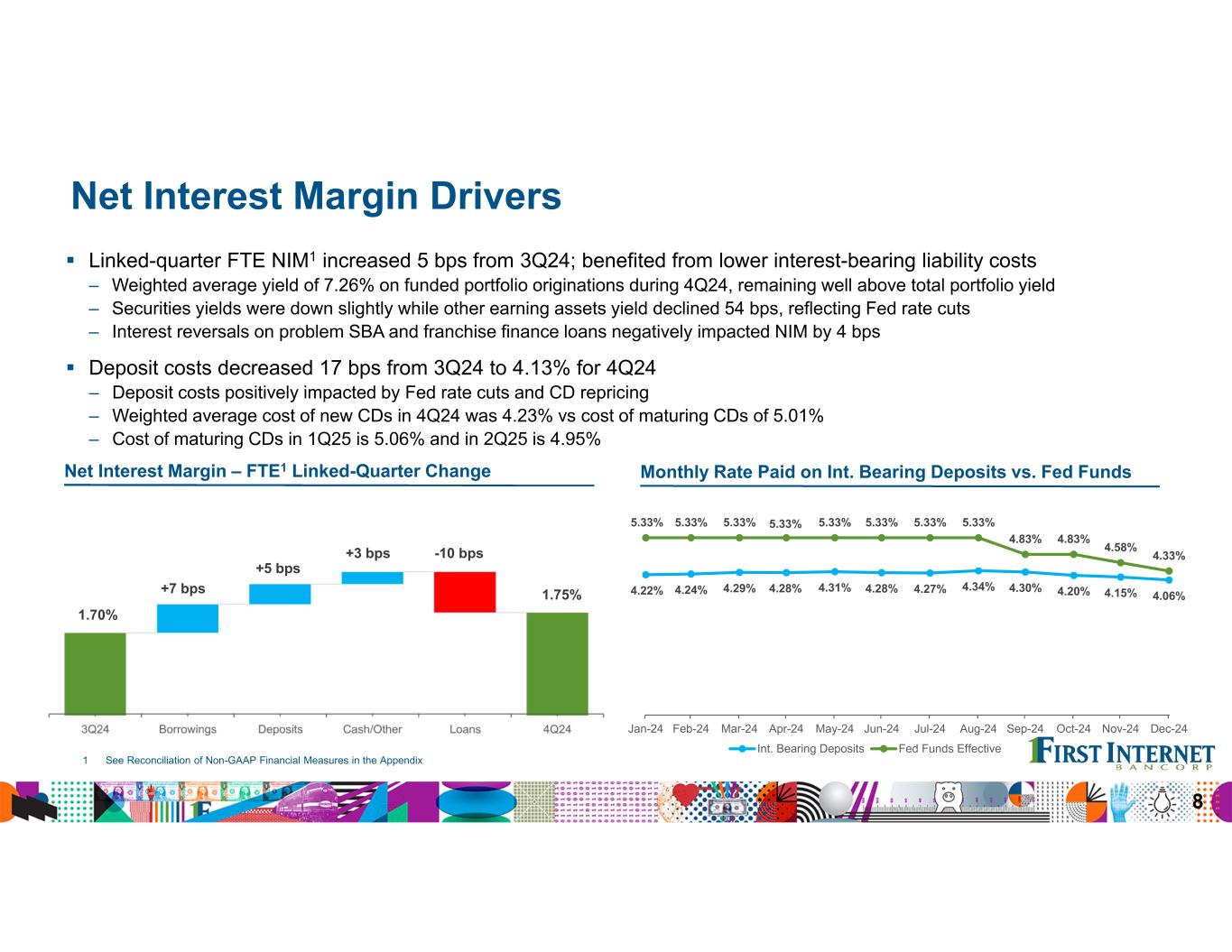

▪Net interest margin of 1.67% and fully taxable equivalent net interest margin of 1.75%1, both increasing 5 basis points (“bps”) from the third quarter of 2024

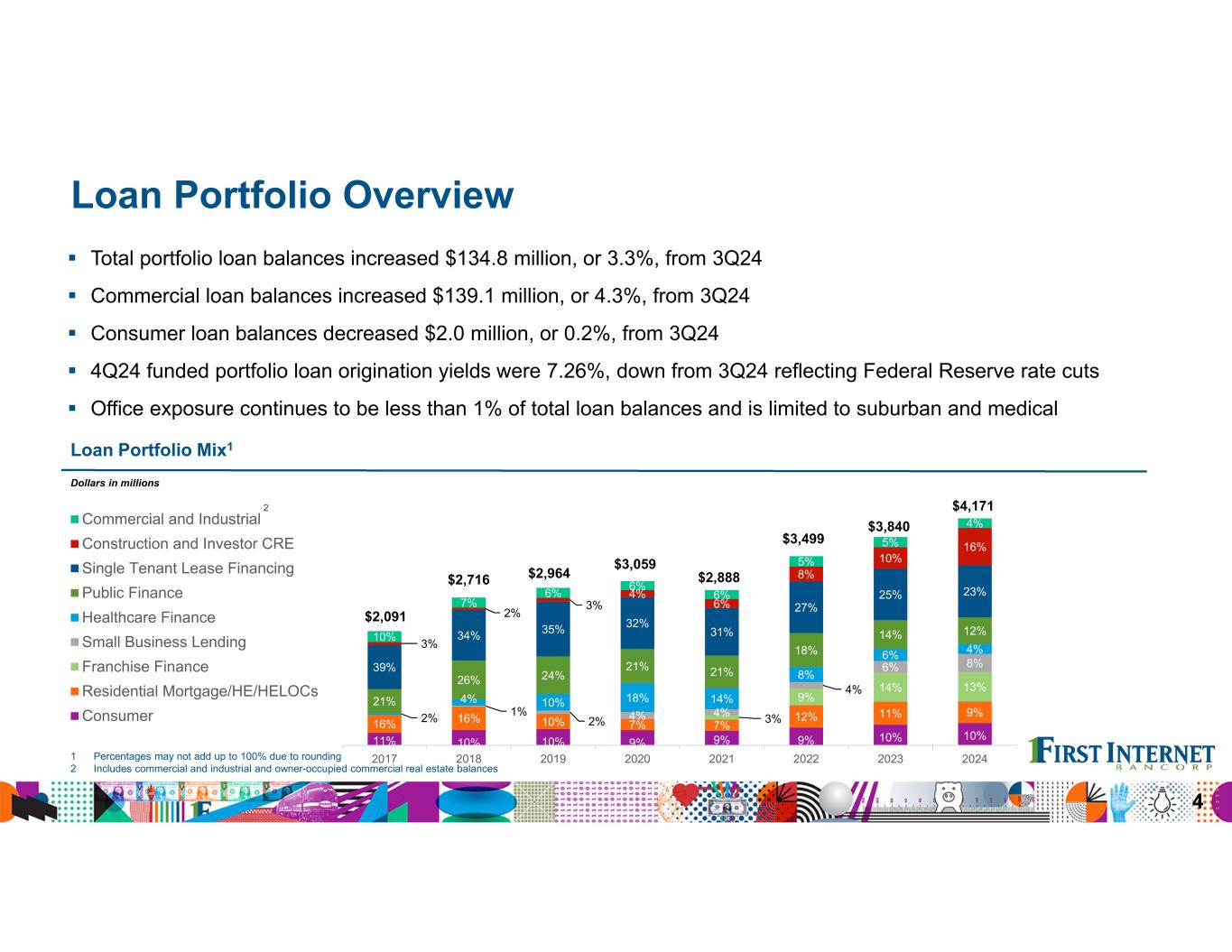

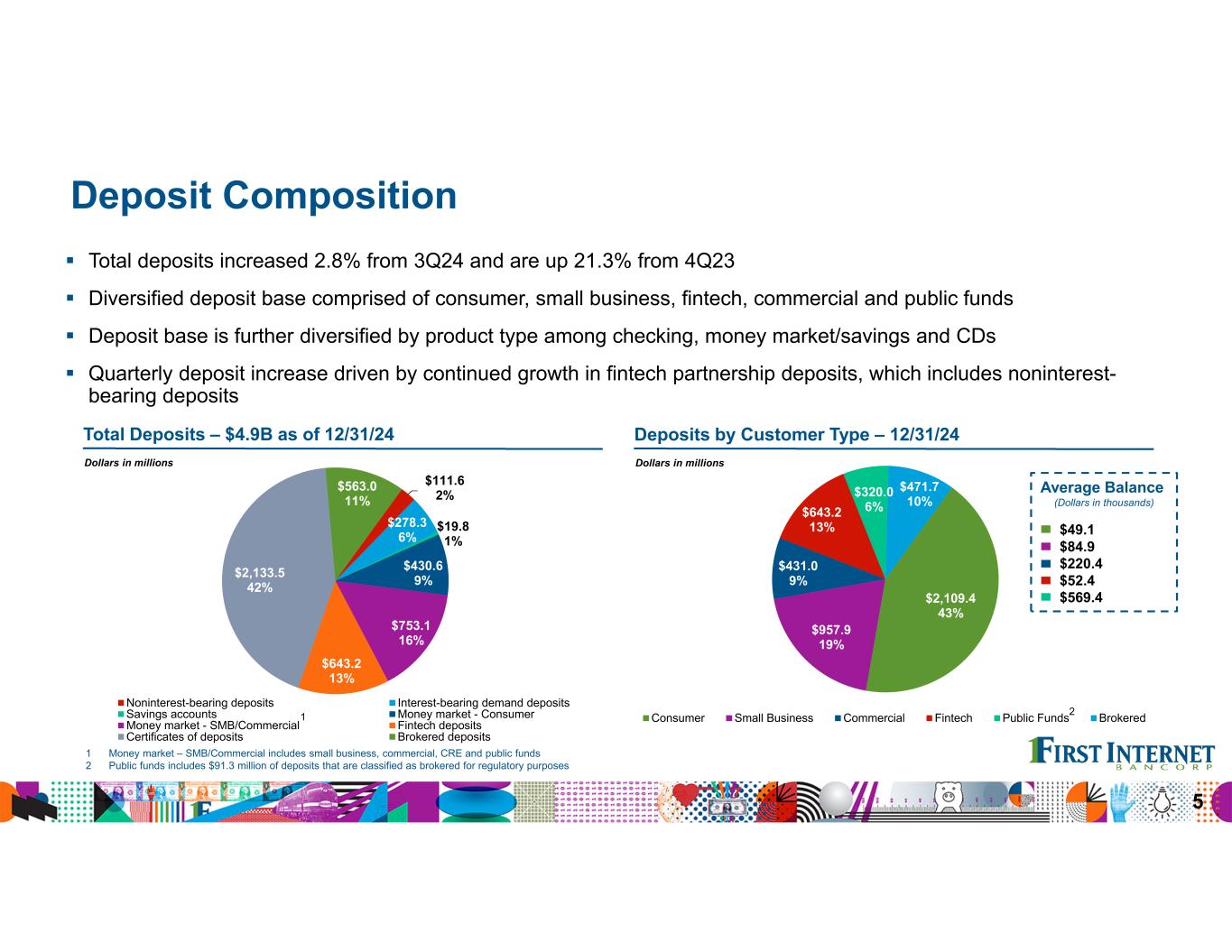

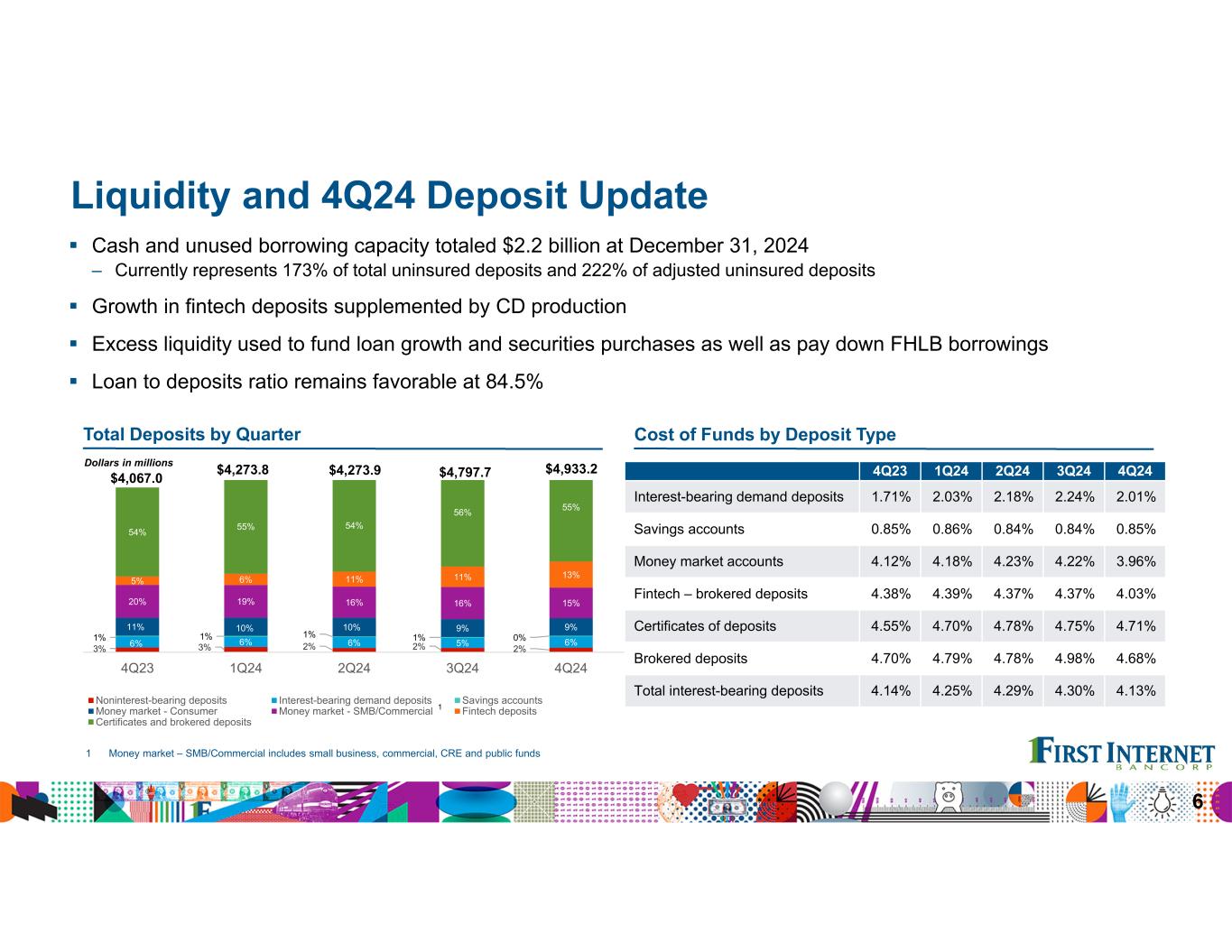

▪Loan growth of $134.8 million, a 3.3% increase from the third quarter of 2024; deposit growth of $135.5 million, a 2.8% increase from the third quarter of 2024; loans to deposits ratio of 84.5%

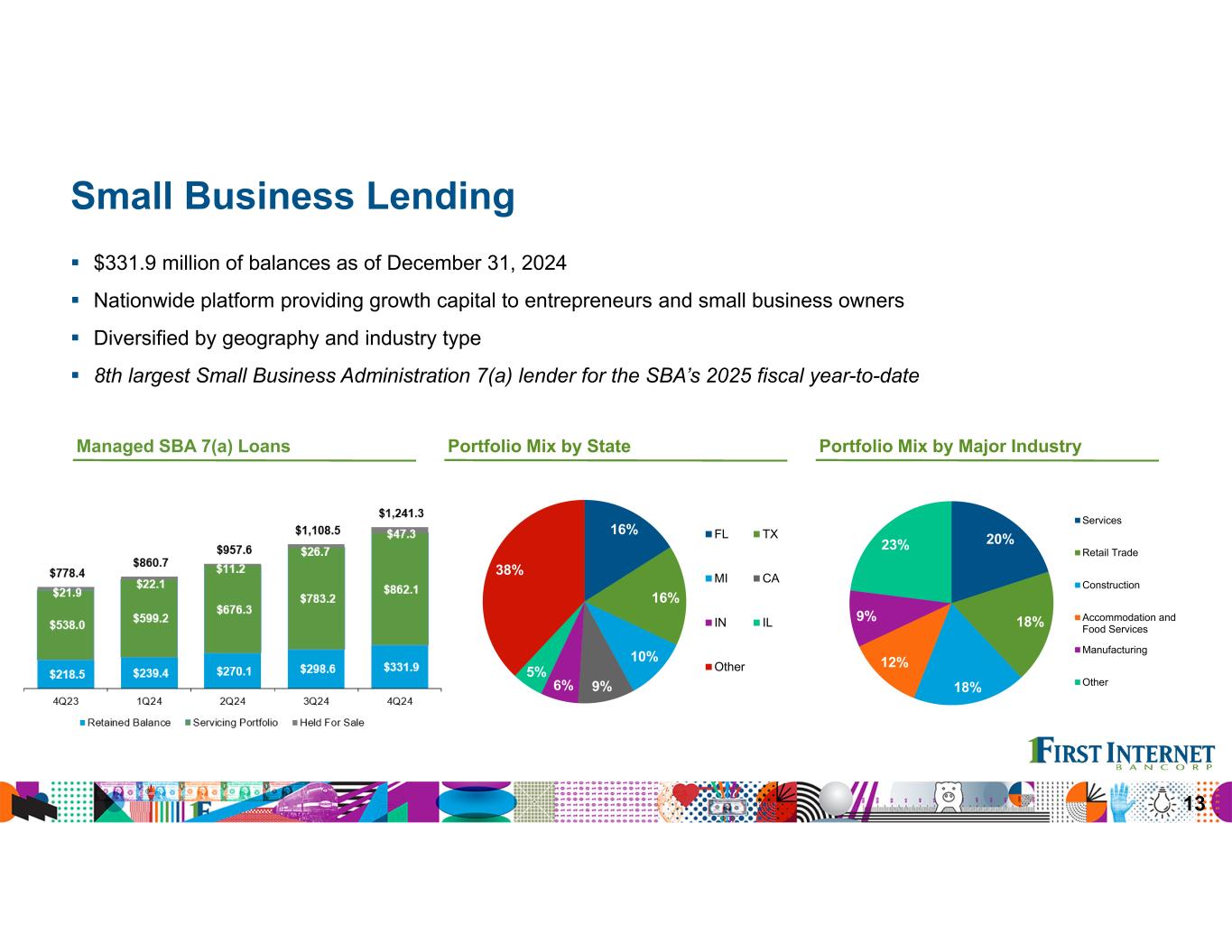

•Closed $63.1 million in SBA Loans in December; guaranteed portion to be sold to the secondary market in the first quarter of 2025

▪Nonperforming loans to total loans of 0.68%; net charge-offs to average loans of 0.91%; allowance for credit losses to total loans of 1.07%

▪Tangible common equity to tangible assets of 6.62%1, and 7.40% ex-AOCI and adjusted for normalized cash balances1; CET1 ratio of 9.30%; tangible book value per share of $43.771

Full Year 2024 Financial Highlights

▪Net income of $25.3 million, an increase of 200.3% from 2023

▪Diluted earnings per share of $2.88, an increase of 203.2% from 2023

▪Net interest income of $87.4 million and fully taxable equivalent net interest income of $92.0 million1, increases of 16.7% and 14.8%, respectively, from 2023

▪Net interest margin of 1.65% and fully taxable equivalent net interest margin of 1.74%1, increases of 9 bps and 7 bps, respectively, from 2023

▪Loan growth of $330.4 million, an 8.6% increase from 2023 and deposit growth of $866.2 million, a 21.3% increase from 2023

1 This information represents a non-GAAP financial measure. For a discussion of non-GAAP financial measures, see the section below entitled "Non-GAAP Financial Measures."

▪Annual tangible book value per share growth of 5.7%1

“Our performance throughout 2024 reflects a year of remarkable growth and significantly improved performance,” said David Becker, Chairman and Chief Executive Officer. “Full year net income and earnings per share increased substantially from 2023, driven by growth in net interest income and greater gain on sale revenue from our small business lending business. Strong commercial loan growth, particularly in construction, investor commercial real estate and small business lending, enhanced our interest rate risk profile and drove loan yields higher. As a result, total revenue growth for the year far outpaced expense growth, driving significant operating leverage.

“Several of these key operating trends continued through the fourth quarter, providing a high level of momentum as we enter the new year. Our liquidity and capital positions are solid, and measures of asset quality remain sound. We anticipate continued net interest margin expansion. We are excited about the outlook for 2025 as the combination of our core businesses, a more favorable interest rate environment, and emerging opportunities leave us well-positioned to deliver continued earnings growth and increased profitability.”

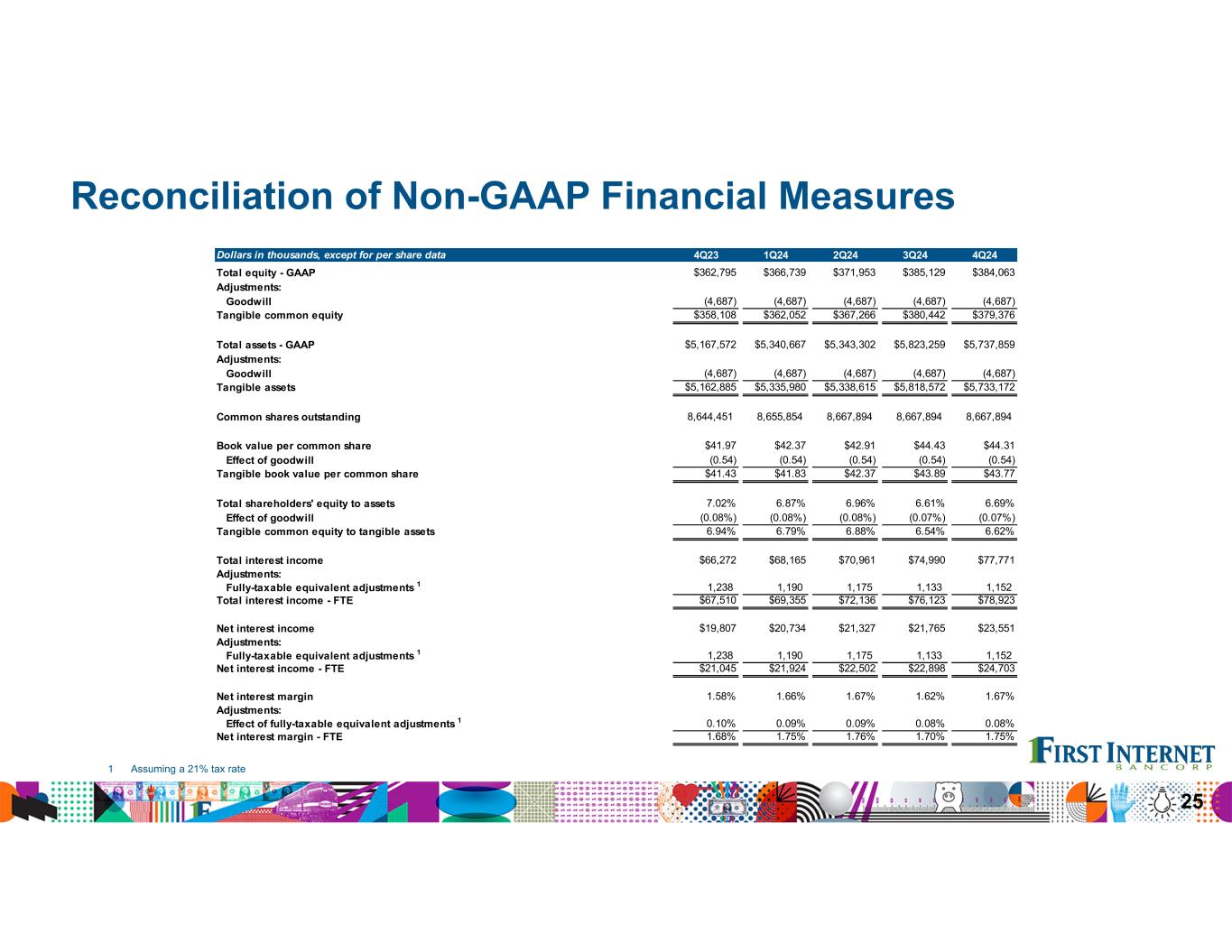

Net Interest Income and Net Interest Margin

Net interest income for the fourth quarter of 2024 was $23.6 million, compared to $21.8 million for the third quarter of 2024, and $19.8 million for the fourth quarter of 2023. On a fully taxable equivalent basis, net interest income for the fourth quarter of 2024 was $24.7 million, compared to $22.9 million for the third quarter of 2024, and $21.0 million for the fourth quarter of 2023.

Total interest income for the fourth quarter of 2024 was $77.8 million, an increase of 3.7% compared to the third quarter of 2024, and an increase of 17.4% compared to the fourth quarter of 2023. On a fully taxable equivalent basis, total interest income for the fourth quarter of 2024 was $78.9 million, an increase of 3.7% compared to the third quarter of 2024, and an increase of 16.9% compared to the fourth quarter of 2023. The yield on average interest-earning assets for the fourth quarter of 2024 decreased to 5.52% from 5.58% for the third quarter of 2024 due to a 54 basis point (“bp”) decrease in the yield earned on other earning assets and a 3 bp decrease in the yield earned on securities, partially offset by a 3 bp increase in the yield earned on loans. Compared to the linked quarter, average loan balances, including loans held-for-sale, increased $99.8 million, or 2.5%, the average balance of securities increased $49.3 million, or 6.2%, and the average balance of other earning assets increased $110.0 million, or 20.9%.

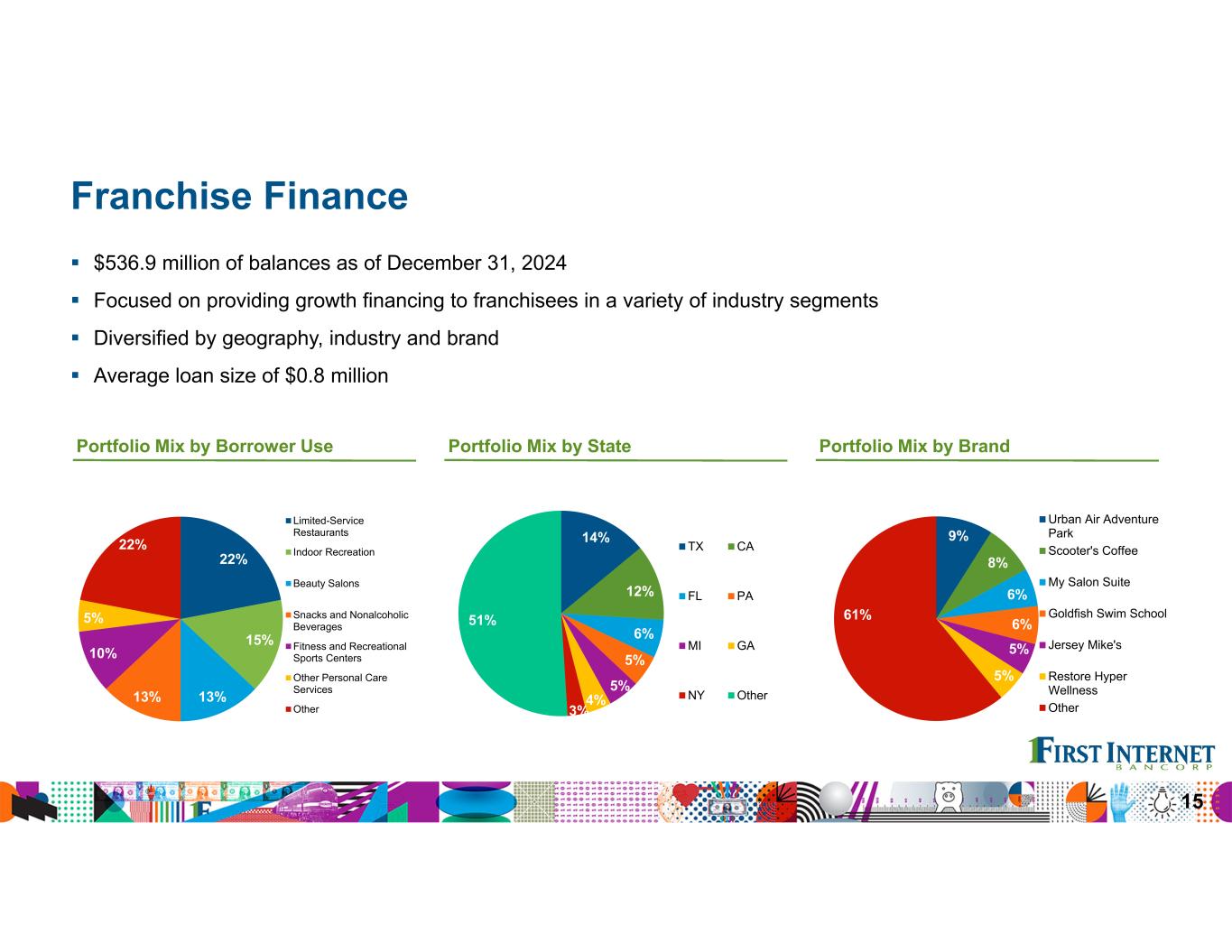

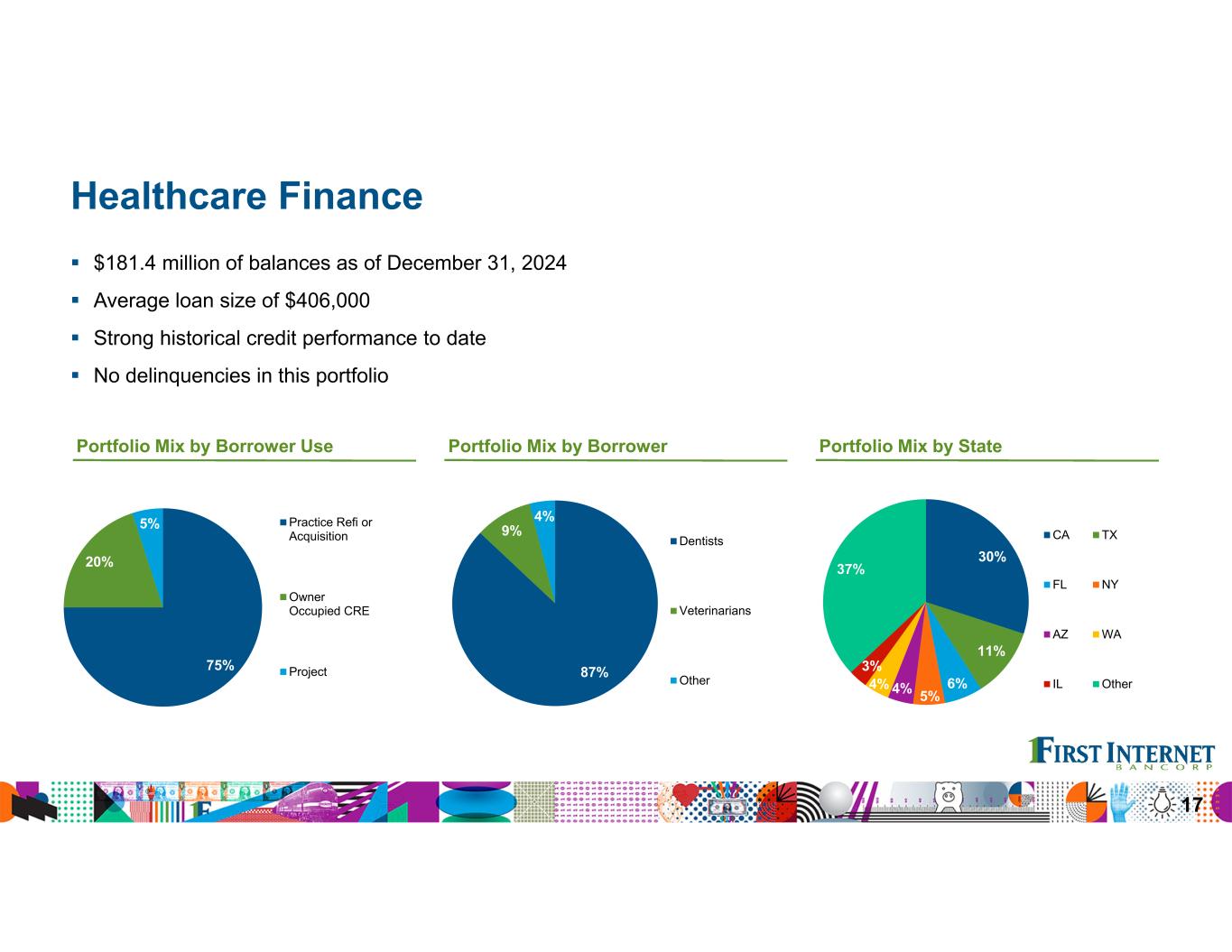

Interest income earned on commercial loans was higher due primarily to increased average balances within the investor commercial real estate, construction and small business lending portfolios. This was partially offset by lower average balances in the healthcare and franchise finance portfolios. The continued shift in the loan mix reflects the Company’s focus on higher-yielding variable rate and shorter-duration products, in part, to help improve the interest rate risk profile of the balance sheet.

In the consumer loan portfolio, interest income was up due to the combination of higher average balances and continued strong new origination yields in the trailers and RV portfolios, partially offset by lower average balances in the residential mortgage and home equity portfolios.

The yield on funded portfolio loan originations was 7.26% in the fourth quarter of 2024, down from 8.85% in the third quarter of 2024, reflecting 100 bps of Fed rate cuts since late in the third quarter of 2024, as well as the larger volume of originations in fixed-rate portfolios which are priced at lower spreads over US treasuries, but are still significantly higher than historical yields in these portfolios.

1 This information represents a non-GAAP financial measure. For a discussion of non-GAAP financial measures, see the section below entitled "Non-GAAP Financial Measures."

Interest income earned on securities during the fourth quarter of 2024 increased $0.4 million, or 5.2%, compared to the third quarter of 2024 due to the increase in average balances, partially offset by a slight decrease in the yield earned on the portfolio. The yield on the securities portfolio decreased 3 bps to 3.98%, driven primarily by variable rate securities repricing lower following the Fed rate cuts and the maturity of an interest rate swap tied to the securities portfolio. Interest earned on other earning asset balances increased $0.6 million, or 8.8%, in the fourth quarter of 2024 compared to the linked quarter, due primarily to higher average cash balances, partially offset by the decrease in yields earned on those balances due to the Fed rate cuts.

Total interest expense for the fourth quarter of 2024 was $54.2 million, an increase of $1.0 million, or 1.9%, compared to the linked quarter, due to a 7.8% increase in average interest-bearing deposit balances throughout the quarter, partially offset by lower costs on those deposits and a decline in the average balance of FHLB advances. Interest expense related to interest-bearing deposits increased $1.7 million, or 3.6%, driven primarily by higher average balances, partially offset by a decline of 17 bps in the cost of funds to 4.13%.

The increase in interest expense was driven primarily by CDs as average balances increased $185.9 million, or 9.7%, compared to the linked quarter, driven by strong consumer demand, partially offset by a 4 bp decrease in the cost of funds. The decrease in the cost of funds for CDs is the second consecutive quarter of declining costs, reflecting the favorable repricing gap between new production and maturities. The weighted-average cost of new CDs during the fourth quarter of 2024 was 4.23%, or 78 bps lower than the cost of maturing CDs. Although medium-to-longer term treasury rates increased during the fourth quarter of 2024, the Company held CD pricing constant through most of the quarter and further lowered CD rates in December following the Fed’s rate cut that month. Additionally, the average balance of fintech – brokered deposits increased $55.5 million, or 36.3%, due to higher payments volume, partially offset by a 34 bp decrease in the cost of funds. Furthermore, the average balance of interest-bearing demand deposits increased $63.1 million, or 12.3%, which was almost completely offset by a decline of 23 bps in the cost of funds. During the fourth quarter of 2024, the Bank submitted a notice of reliance on the primary purpose exemption with the Federal Deposit Insurance Corporation related to fintech deposits that had been classified as brokered, and as of December 31, 2024, reclassified these deposits to interest-bearing demand deposits.

These increases were partially offset by a decline in interest expense related to money market accounts and brokered deposits. While the average balance of money market accounts increased slightly, the cost of funds decreased 26 bps. Similarly, the average balance of brokered deposits increased during the fourth quarter, which was more than offset by a decline of 30 bps in the cost of funds. The decline in the cost of money market accounts and brokered deposits was driven primarily by the Fed rate cuts in the third and fourth quarters of 2024. Additionally, the Company paid down higher- cost brokered CD issuances during the fourth quarter of 2024.

Interest expense also benefitted from a lower average balance of FHLB advances as the Company deployed liquidity to pay down $220.0 million of advances during the fourth quarter of 2024.

Net interest margin (“NIM”) was 1.67% for the fourth quarter of 2024, up from 1.62% for the third quarter of 2024, and up from 1.58% for the fourth quarter of 2023. Fully taxable equivalent NIM (“FTE NIM”) was 1.75% for the fourth quarter of 2024, up from 1.70% for the third quarter of 2024, and up from 1.68% for the fourth quarter of 2023. The increases in NIM and FTE NIM compared to the linked quarter were due to the decline in the cost of interest-bearing liabilities outpacing the decrease in the yield on interest-earning assets following the Fed rate cuts that began in late September of 2024.

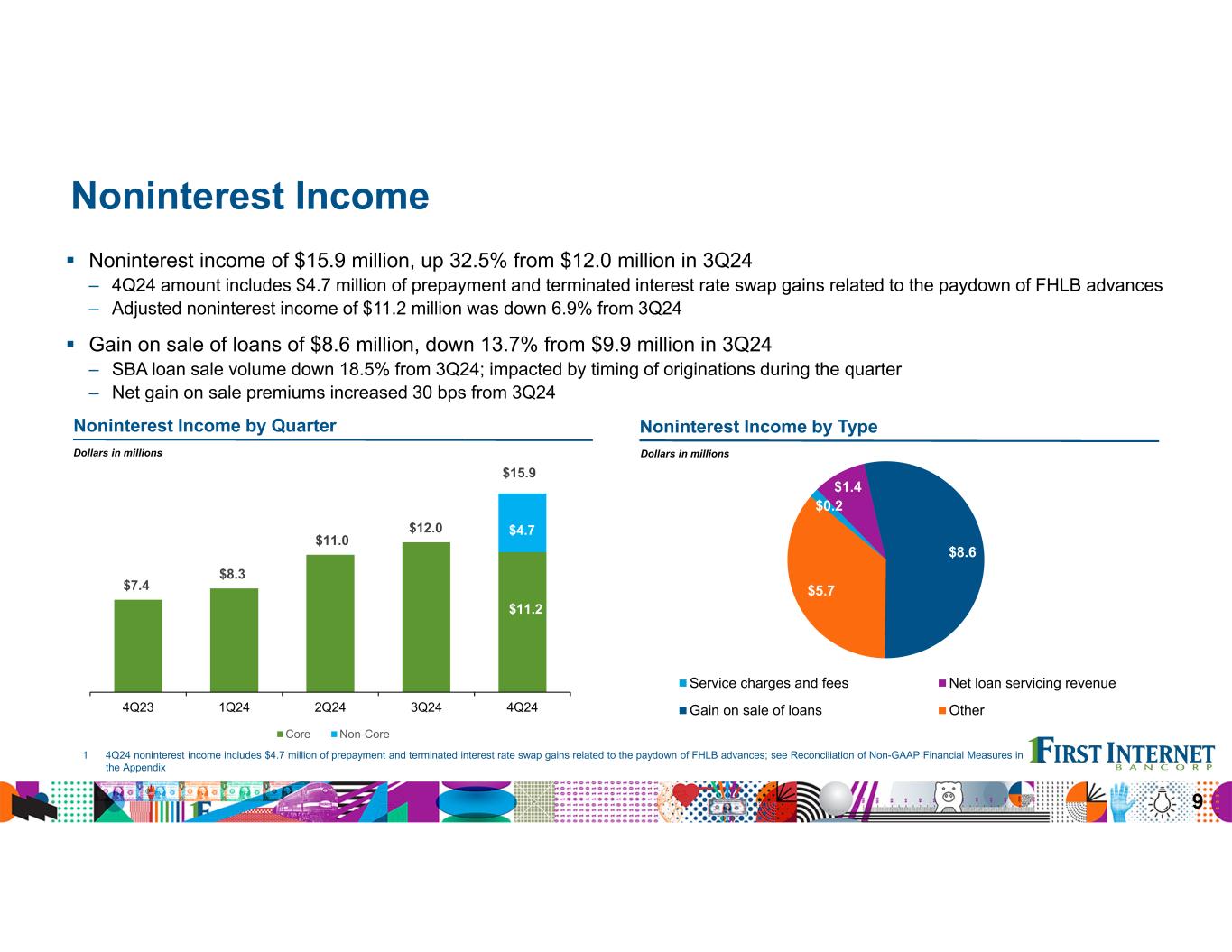

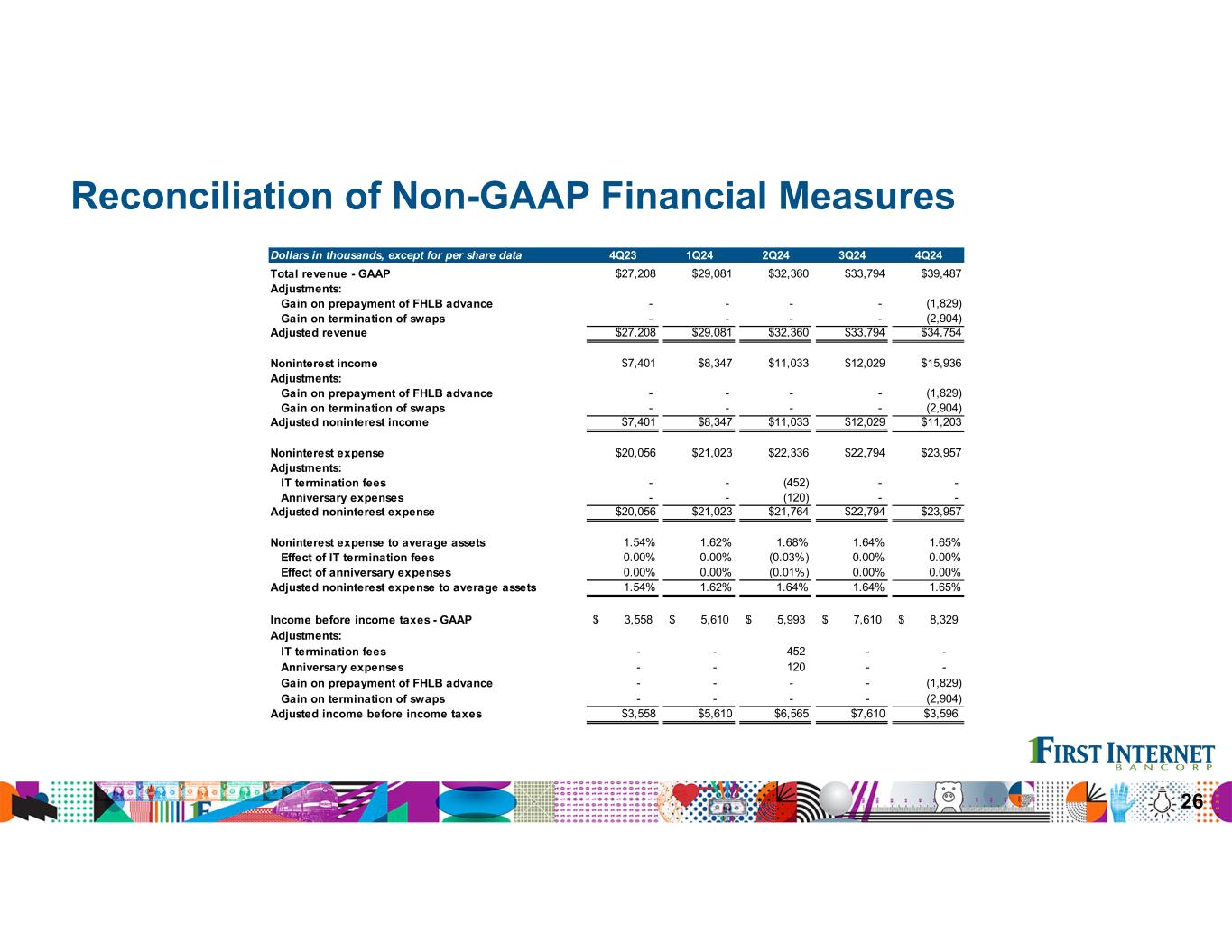

Noninterest Income

Noninterest income for the fourth quarter of 2024 was $15.9 million, up from $12.0 million in the third quarter of 2024, and up from $7.4 million in the fourth quarter of 2023. During the fourth quarter of 2024, the Company recognized $4.7 million of prepayment and terminated interest rate swap gains related to the paydown of FHLB advances. Excluding these gains, adjusted noninterest income for the quarter was $11.2 million, down 6.9% from the third quarter of 2024. Gain on sale of loans totaled $8.6 million for the fourth quarter of 2024, down $1.4 million, or 13.7%, from the linked quarter. Gain on sale revenue consisted almost entirely of sales of U.S. Small Business Administration (“SBA”) 7(a) guaranteed loans during the fourth quarter of 2024. SBA loan sale volume during the fourth quarter of 2024 was down 18.5% compared to the third quarter of 2024, while net premiums increased 30 bps. The decline in loan sale volume was due mainly to a timing issue as a significant portion of originations during the quarter closed late in December and will not be sold in the secondary market until January of 2025. The decline in gain-on-sale revenue was partially offset by higher net loan servicing revenue, which increased $0.7 million, due primarily to growth in the servicing portfolio and a lower fair value adjustment to the loan servicing asset.

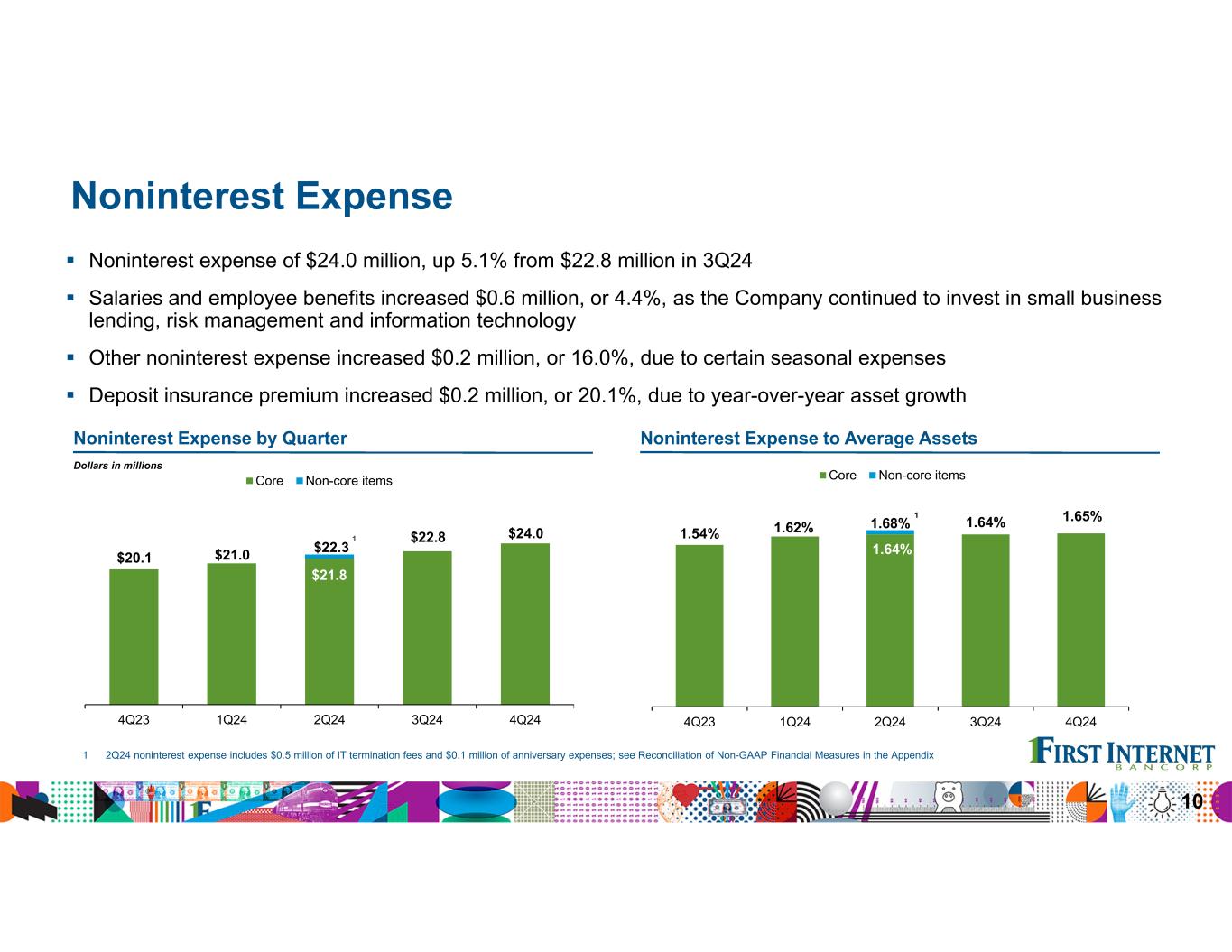

Noninterest Expense

Noninterest expense totaled $24.0 million for the fourth quarter of 2024, compared to $22.8 million for the third quarter of 2024, and $20.1 million for the fourth quarter of 2023, representing increases of 5.1% and 19.5%, respectively. The increase of $1.2 million compared to the linked quarter was due primarily to higher salaries and employee benefits, other noninterest expense and deposit insurance premium. The increase in salaries and employee benefits was driven by staff additions in small business lending, risk management and information technology as the Company continues to invest in key areas. The increase in other noninterest expense was due to seasonal expenses while the increase in deposit insurance premium was due mainly to year-over-year asset growth.

Income Taxes

The Company recorded income tax expense of $1.0 million and an effective tax rate of 12.0% for the fourth quarter of 2024, compared to income tax expense of $0.6 million and an effective tax rate of 8.1% for the third quarter of 2024, and an income tax benefit of $0.6 million for the fourth quarter of 2023. The increase in the effective tax rate for the fourth quarter of 2024 reflects higher pre-tax income compared to prior quarters.

Loans and Credit Quality

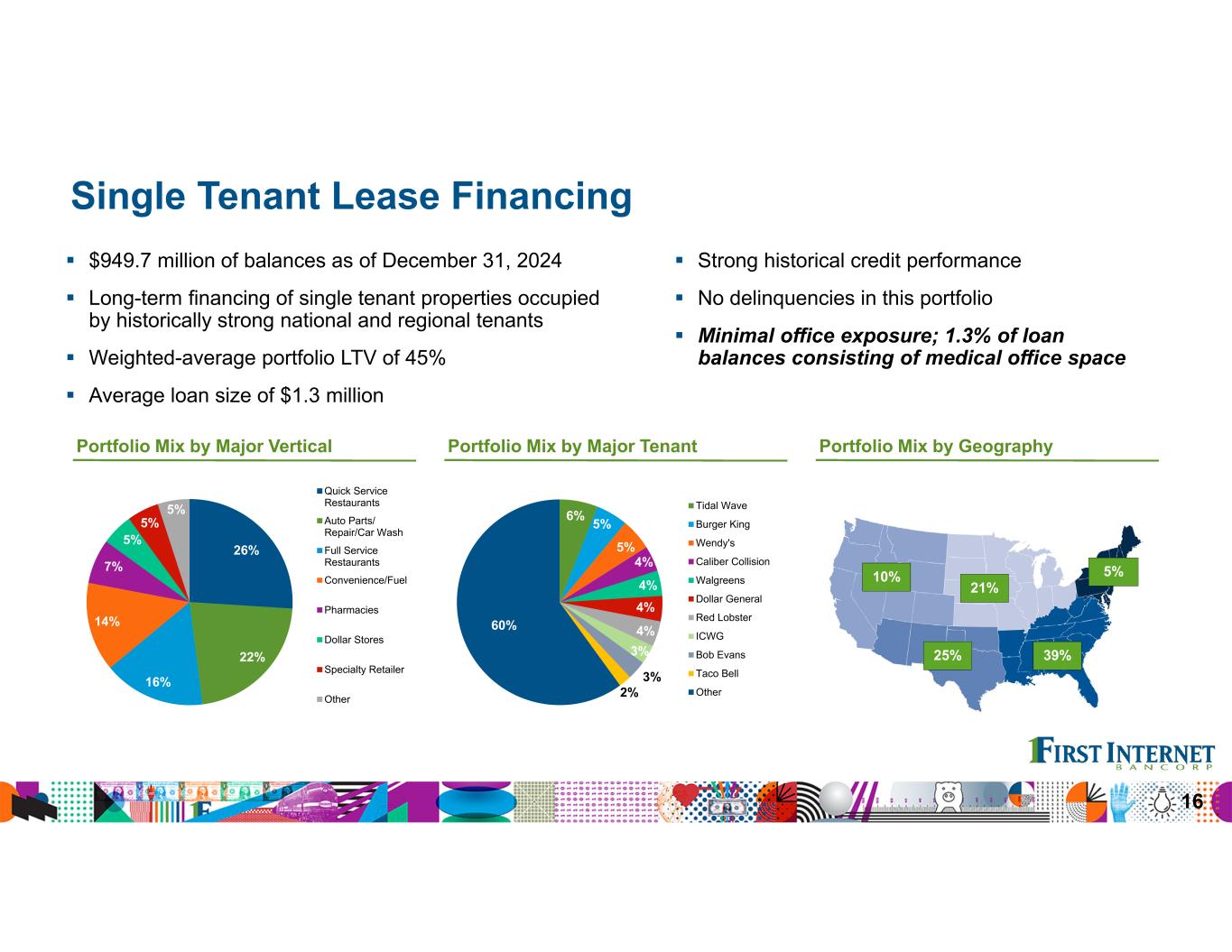

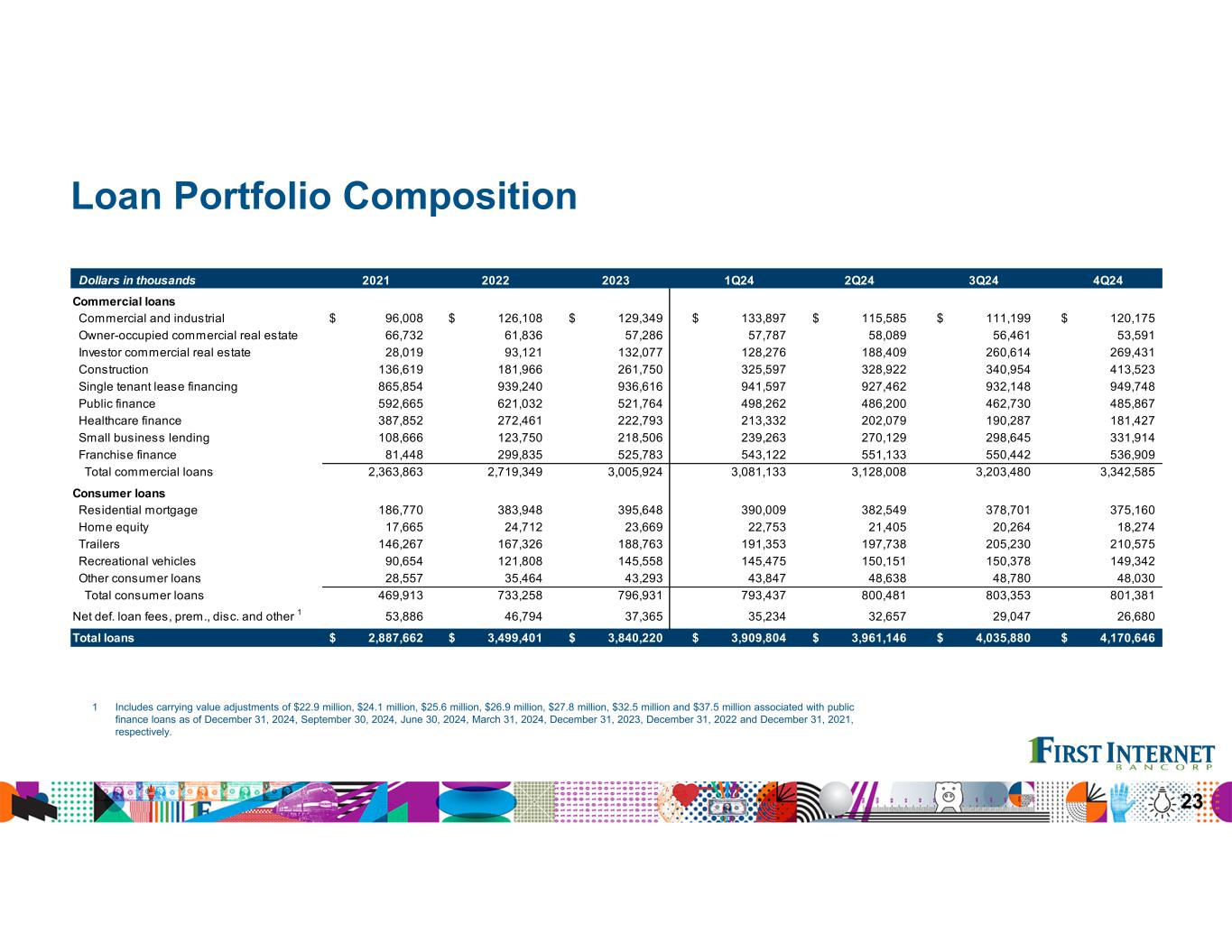

Total loans as of December 31, 2024, were $4.2 billion, an increase of $134.8 million, or 3.3%, compared to September 30, 2024, and an increase of $330.4 million, or 8.6%, compared to December 31, 2023. Total commercial loan balances were $3.3 billion as of December 31, 2024, an increase of $139.1 million, or 4.3%, compared to September 30, 2024, and an increase of $336.7 million, or 11.2%, compared to December 31, 2023. During the fourth quarter of 2024, the Company experienced strong growth across most of its commercial lines of business with notable contributions from construction, small business lending, public finance and single tenant lease financing.

Total consumer loan balances were $801.4 million as of December 31, 2024, a decrease of $2.0 million, or 0.2%, compared to September 30, 2024, and an increase of $4.5 million, or 0.6%, compared to December 31, 2023. The decrease compared to the linked quarter was due primarily to lower balances in the residential mortgage and home equity portfolios, partially offset by a higher balance in the trailers portfolio.

Total delinquencies 30 days or more past due, excluding nonperforming loans, were 0.63% of total performing loans as of December 31, 2024, compared to 0.36% at September 30, 2024 and 0.11% as of December 31, 2023. The increase compared to the linked quarter was due primarily to an increase in delinquencies in the small business lending and franchise finance portfolios, some of which was due to the timing of principal and interest payments.

Subsequent to quarter end, payments were received from certain borrowers and as of the date of this release, delinquencies 30 days or more past due declined to 0.44% of total performing loans.

Nonperforming loans were 0.68% of total loans as of December 31, 2024, compared to 0.56% as of September 30, 2024, and 0.26% as of December 31, 2023. Nonperforming loans totaled $28.4 million at December 31, 2024, up from $22.5 million at September 30, 2024, and up from $10.0 million at December 31, 2023. The increase in nonperforming loans during the fourth quarter of 2024 was due primarily to franchise finance and small business lending loans that were placed on nonaccrual during the quarter. At quarter end, there were $8.2 million of specific reserves held against the balance of nonperforming loans.

The allowance for credit losses (“ACL”) as a percentage of total loans was 1.07% as of December 31, 2024, compared to 1.13% as of September 30, 2024, and 1.01% as of December 31, 2023. The decrease in the ACL compared to the linked quarter reflects the decline in specific reserves and the elevated net charge-off activity discussed below, partially offset by qualitative adjustments to the small business lending ACL and overall loan growth.

Net charge-offs of $9.4 million were recognized during the fourth quarter of 2024, resulting in net charge-offs to average loans of 0.91%, compared to $1.5 million, or 0.15%, for the third quarter of 2024 and $1.2 million, or 0.12%, for the fourth quarter of 2023. Net charge-offs in the fourth quarter of 2024 were elevated as the Company took action to resolve problem small business lending loans and de-risk the portfolio. Approximately $3.4 million of net charge-offs recognized during the quarter were related to small business lending loans with existing specific reserves.

The provision for credit losses in the fourth quarter of 2024 was $7.2 million, compared to $3.4 million for the third quarter of 2024, and $3.6 million for the fourth quarter of 2023. The provision for the fourth quarter of 2024 was driven primarily by the elevated net charge-offs, qualitative adjustments to the small business lending ACL and overall loan growth, partially offset by the decline in specific reserves and adjustments to qualitative factors on other portfolios.

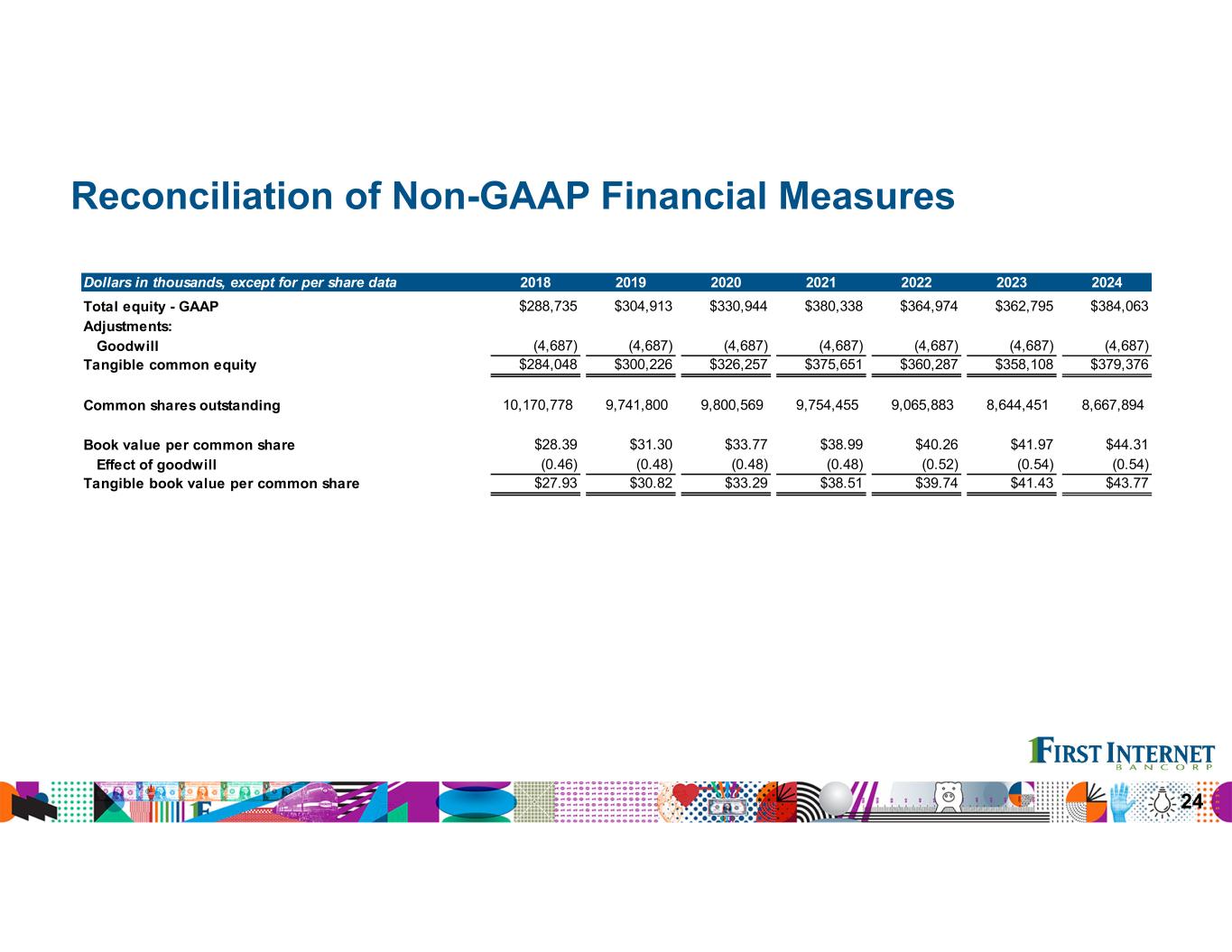

Capital

As of December 31, 2024, total shareholders’ equity was $384.1 million, a decrease of $1.1 million, or 0.3%, compared to September 30, 2024, and an increase of $21.3 million, or 5.9%, compared to December 31, 2023. The modest decrease in shareholders’ equity during the fourth quarter of 2024 compared to the linked quarter was due primarily to an increase in accumulated other comprehensive loss driven by higher intermediate and long-term interest rates at quarter end, partially offset by the net income earned during the quarter. Book value per common share was $44.31 as of December 31, 2024, down from $44.43 as of September 30, 2024, and up from $41.97 as of December 31, 2023. Tangible book value per share was $43.77, down from $43.89 as of September 30, 2024, and up from $41.43 as of December 31, 2023.

The following table presents the Company’s and the Bank’s regulatory and other capital ratios as of December 31, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2024 |

|

|

Company |

|

Bank |

|

|

|

|

|

| Total shareholders' equity to assets |

|

6.69 |

% |

|

8.01 |

% |

Tangible common equity to tangible assets 1 |

|

6.62 |

% |

|

7.93 |

% |

Tier 1 leverage ratio 2 |

|

6.91 |

% |

|

8.22 |

% |

Common equity tier 1 capital ratio 2 |

|

9.30 |

% |

|

11.06 |

% |

Tier 1 capital ratio 2 |

|

9.30 |

% |

|

11.06 |

% |

Total risk-based capital ratio 2 |

|

12.61 |

% |

|

12.11 |

% |

|

|

|

|

|

1 This information represents a non-GAAP financial measure. For a discussion of non-GAAP financial measures, see the section below entitled "Non-GAAP Financial Measures." |

2 Regulatory capital ratios are preliminary pending filing of the Company's and the Bank's regulatory reports. |

Conference Call and Webcast

The Company will host a conference call and webcast at 2:00 p.m. Eastern Time on Thursday, January 23, 2025 to discuss its quarterly financial results. The call can be accessed via telephone at (800) 549-8228; access code: 28199. A recorded replay can be accessed through January 30, 2025 by dialing (888) 660-6264; access code: 28199 #.

Additionally, interested parties can listen to a live webcast of the call on the Company's website at www.firstinternetbancorp.com. An archived version of the webcast will be available in the same location shortly after the live call has ended.

About First Internet Bancorp

First Internet Bancorp is a bank holding company with assets of $5.7 billion as of December 31, 2024. The Company’s subsidiary, First Internet Bank, opened for business in 1999 as an industry pioneer in the branchless delivery of banking services. First Internet Bank provides consumer and small business deposit, SBA financing, franchise finance, consumer loans, and specialty finance services nationally as well as commercial real estate loans, construction loans, commercial and industrial loans, and treasury management services on a regional basis. First Internet Bancorp’s common stock trades on the Nasdaq Global Select Market under the symbol “INBK” and is a component of the Russell 2000® Index. Additional information about the Company is available at www.firstinternetbancorp.com and additional information about First Internet Bank, including its products and services, is available at www.firstib.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements with respect to the financial condition, results of operations, trends in lending policies and loan programs, plans and prospective business partnerships, objectives, future performance and business of the Company. Forward-looking statements are generally identifiable by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “growth,” “help,” "improve,” “may,” “ongoing,” “opportunities,” “pending,” “plan,” “position,” “preliminary,” “remain,” “should,” “thereafter,” “well-positioned,” “will,” or other similar expressions. Forward-looking statements are not a guarantee of future performance or results, are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from the information in the forward-looking statements. Such statements are subject to certain risks and uncertainties including: our business and operations and the business and operations of our vendors and customers: general economic conditions, whether national or regional, and conditions in the lending markets in which we participate that may have an adverse effect on the demand for our loans and other products; our credit quality and related levels of nonperforming assets and loan losses, and the value and salability of the real estate that is the collateral for our loans. Other factors that may cause such differences include: failures or breaches of or interruptions in the communications and information systems on which we rely to conduct our business; failure of our plans to grow our commercial and industrial, construction and SBA loan portfolios; competition with national, regional and community financial institutions; the loss of any key members of senior management; the anticipated impacts of inflation and rising interest rates on the general economy; risks relating to the regulation of financial institutions; and other factors identified in reports we file with the U.S. Securities and Exchange Commission. All statements in this press release, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events.

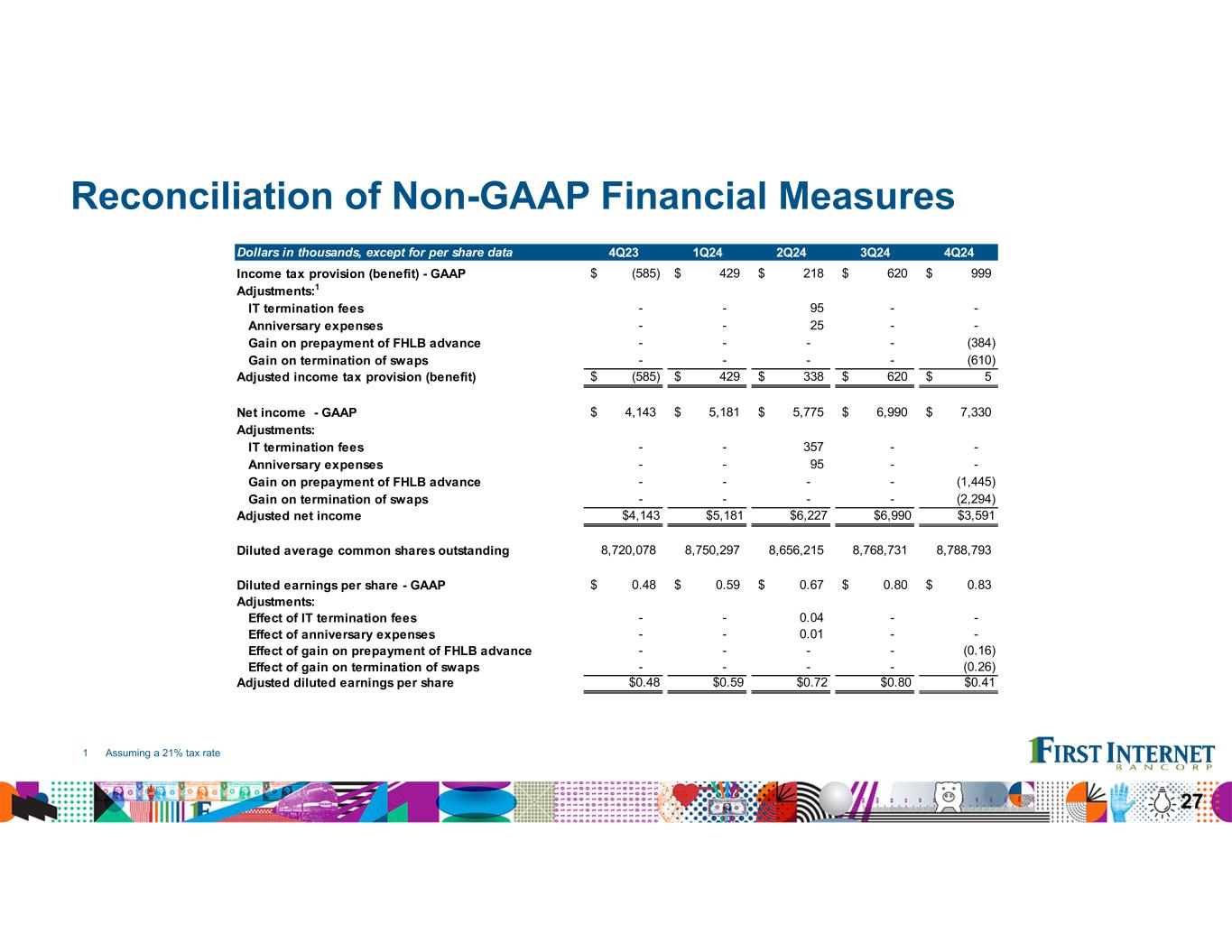

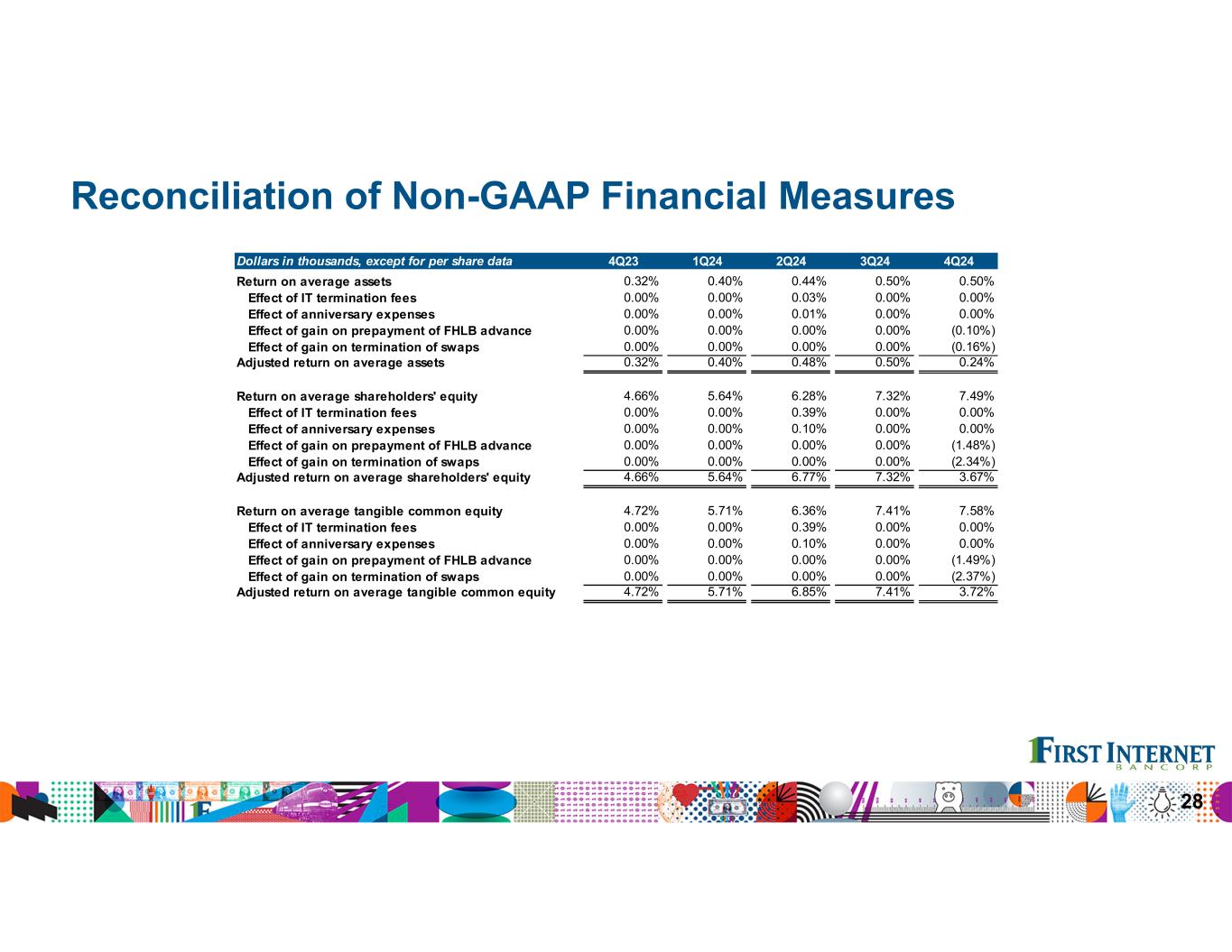

Non-GAAP Financial Measures

This press release contains financial information determined by methods other than in accordance with U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial measures, specifically tangible common equity, tangible assets, tangible book value per common share, tangible common equity to tangible assets, average tangible common equity, return on average tangible common equity, total interest income – FTE, net interest income – FTE, net interest margin – FTE, adjusted total revenue, adjusted noninterest income, adjusted noninterest expense, adjusted income before income taxes, adjusted income tax provision (benefit), adjusted net income, adjusted diluted earnings per share, adjusted return on average assets, adjusted return on average shareholders’ equity and adjusted return on average tangible common equity are used by the Company’s management to measure the strength of its capital and analyze profitability, including its ability to generate earnings on tangible capital invested by its shareholders. Although management believes these non-GAAP measures are useful to investors by providing a greater understanding of its business, they should not be considered a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the table at the end of this release under the caption “Reconciliation of Non-GAAP Financial Measures.”

|

|

|

|

|

|

|

|

|

|

|

|

| Contact Information: |

|

|

|

| Investors/Analysts |

|

Media |

|

| Paula Deemer |

|

Panblast |

|

| Director of Corporate Administration |

|

Zach Weismiller |

| (317) 428-4628 |

|

firstib@panblastpr.com |

|

| investors@firstib.com |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First Internet Bancorp |

|

|

|

|

|

|

|

| Summary Financial Information (unaudited) |

|

|

|

|

|

|

| Dollar amounts in thousands, except per share data |

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

December 31,

2024 |

|

September 30,

2024 |

|

December 31,

2023 |

|

December 31,

2024 |

|

December 31,

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

7,330 |

|

|

$ |

6,990 |

|

|

$ |

4,143 |

|

|

$ |

25,276 |

|

|

$ |

8,417 |

|

|

|

|

|

|

|

|

|

|

|

|

| Per share and share information |

|

|

|

|

|

|

|

|

|

|

| Earnings per share - basic |

|

$ |

0.84 |

|

|

$ |

0.80 |

|

|

$ |

0.48 |

|

|

$ |

2.91 |

|

|

$ |

0.95 |

|

| Earnings per share - diluted |

|

0.83 |

|

|

0.80 |

|

|

0.48 |

|

|

2.88 |

|

|

0.95 |

|

| Dividends declared per share |

|

0.06 |

|

|

0.06 |

|

|

0.06 |

|

|

0.24 |

|

|

0.24 |

|

| Book value per common share |

|

44.31 |

|

|

44.43 |

|

|

41.97 |

|

|

44.31 |

|

|

41.97 |

|

Tangible book value per common share 1 |

|

43.77 |

|

|

43.89 |

|

|

41.43 |

|

|

43.77 |

|

|

41.43 |

|

| Common shares outstanding |

|

8,667,894 |

|

|

8,667,894 |

|

|

8,644,451 |

|

|

8,667,894 |

|

|

8,644,451 |

|

| Average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

| Basic |

|

8,696,704 |

|

|

8,696,634 |

|

|

8,683,331 |

|

|

8,690,416 |

|

|

8,837,558 |

|

| Diluted |

|

8,788,793 |

|

|

8,768,731 |

|

|

8,720,078 |

|

|

8,765,725 |

|

|

8,858,890 |

|

| Performance ratios |

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

0.50 |

% |

|

0.50 |

% |

|

0.32 |

% |

|

0.46 |

% |

|

0.17 |

% |

| Return on average shareholders' equity |

|

7.49 |

% |

|

7.32 |

% |

|

4.66 |

% |

|

6.70 |

% |

|

2.35 |

% |

Return on average tangible common equity 1 |

|

7.58 |

% |

|

7.41 |

% |

|

4.72 |

% |

|

6.78 |

% |

|

2.38 |

% |

| Net interest margin |

|

1.67 |

% |

|

1.62 |

% |

|

1.58 |

% |

|

1.65 |

% |

|

1.56 |

% |

Net interest margin - FTE 1,2 |

|

1.75 |

% |

|

1.70 |

% |

|

1.68 |

% |

|

1.74 |

% |

|

1.67 |

% |

Capital ratios 3 |

|

|

|

|

|

|

|

|

|

|

| Total shareholders' equity to assets |

|

6.69 |

% |

|

6.61 |

% |

|

7.02 |

% |

|

6.69 |

% |

|

7.02 |

% |

Tangible common equity to tangible assets 1 |

|

6.62 |

% |

|

6.54 |

% |

|

6.94 |

% |

|

6.62 |

% |

|

6.94 |

% |

| Tier 1 leverage ratio |

|

6.91 |

% |

|

7.13 |

% |

|

7.33 |

% |

|

6.91 |

% |

|

7.33 |

% |

| Common equity tier 1 capital ratio |

|

9.30 |

% |

|

9.37 |

% |

|

9.60 |

% |

|

9.30 |

% |

|

9.60 |

% |

| Tier 1 capital ratio |

|

9.30 |

% |

|

9.37 |

% |

|

9.60 |

% |

|

9.30 |

% |

|

9.60 |

% |

| Total risk-based capital ratio |

|

12.61 |

% |

|

12.79 |

% |

|

13.23 |

% |

|

12.61 |

% |

|

13.23 |

% |

| Asset quality |

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans |

|

$ |

28,421 |

|

|

$ |

22,478 |

|

|

$ |

9,962 |

|

|

$ |

28,421 |

|

|

$ |

9,962 |

|

| Nonperforming assets |

|

28,905 |

|

|

22,944 |

|

|

10,354 |

|

|

28,905 |

|

|

10,354 |

|

| Nonperforming loans to loans |

|

0.68 |

% |

|

0.56 |

% |

|

0.26 |

% |

|

0.68 |

% |

|

0.26 |

% |

| Nonperforming assets to total assets |

|

0.50 |

% |

|

0.39 |

% |

|

0.20 |

% |

|

0.50 |

% |

|

0.20 |

% |

| Allowance for credit losses - loans to: |

|

|

|

|

|

|

|

|

|

|

| Loans |

|

1.07 |

% |

|

1.13 |

% |

|

1.01 |

% |

|

1.07 |

% |

|

1.01 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans |

|

157.5 |

% |

|

203.4 |

% |

|

389.2 |

% |

|

157.5 |

% |

|

389.2 |

% |

| Net charge-offs to average loans |

|

0.91 |

% |

|

0.15 |

% |

|

0.12 |

% |

|

0.32 |

% |

|

0.31 |

% |

| Average balance sheet information |

|

|

|

|

|

|

|

|

|

|

| Loans |

|

$ |

4,123,510 |

|

|

$ |

4,022,196 |

|

|

$ |

3,799,211 |

|

|

$ |

3,992,031 |

|

|

$ |

3,682,490 |

|

| Total securities |

|

841,700 |

|

|

792,409 |

|

|

683,468 |

|

|

770,793 |

|

|

624,050 |

|

| Other earning assets |

|

636,377 |

|

|

526,384 |

|

|

500,733 |

|

|

516,836 |

|

|

500,061 |

|

| Total interest-earning assets |

|

5,607,195 |

|

|

5,348,153 |

|

|

4,984,133 |

|

|

5,285,026 |

|

|

4,809,840 |

|

| Total assets |

|

5,782,116 |

|

|

5,523,910 |

|

|

5,154,285 |

|

|

5,462,730 |

|

|

4,968,514 |

|

| Noninterest-bearing deposits |

|

114,311 |

|

|

113,009 |

|

|

123,351 |

|

|

114,396 |

|

|

125,816 |

|

| Interest-bearing deposits |

|

4,726,449 |

|

|

4,384,078 |

|

|

3,935,519 |

|

|

4,318,926 |

|

|

3,744,964 |

|

| Total deposits |

|

4,840,760 |

|

|

4,497,087 |

|

|

4,058,870 |

|

|

4,433,322 |

|

|

3,870,780 |

|

| Shareholders' equity |

|

389,435 |

|

|

380,061 |

|

|

353,037 |

|

|

377,215 |

|

|

357,800 |

|

1 Refer to "Non-GAAP Financial Measures" section above and "Reconciliation of Non-GAAP Financial Measures" below

2 On a fully-taxable equivalent ("FTE") basis assuming a 21% tax rate

3 Regulatory capital ratios are preliminary pending filing of the Company's regulatory reports

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First Internet Bancorp |

|

|

|

|

|

|

| Condensed Consolidated Balance Sheets (unaudited, except for December 31, 2023) |

|

|

| Dollar amounts in thousands |

|

|

|

|

|

|

|

|

December 31,

2024 |

|

September 30,

2024 |

|

December 31,

2023 |

| Assets |

|

|

|

|

|

|

| Cash and due from banks |

|

$ |

9,249 |

|

|

$ |

6,539 |

|

|

$ |

8,269 |

|

| Interest-bearing deposits |

|

457,161 |

|

|

705,940 |

|

|

397,629 |

|

| Securities available-for-sale, at fair value |

|

587,355 |

|

|

575,257 |

|

|

474,855 |

|

| Securities held-to-maturity, at amortized cost, net of allowance for credit losses |

|

249,796 |

|

|

263,320 |

|

|

227,153 |

|

| Loans held-for-sale |

|

54,695 |

|

|

32,996 |

|

|

22,052 |

|

| Loans |

|

4,170,646 |

|

|

4,035,880 |

|

|

3,840,220 |

|

| Allowance for credit losses - loans |

|

(44,769) |

|

|

(45,721) |

|

|

(38,774) |

|

| Net loans |

|

4,125,877 |

|

|

3,990,159 |

|

|

3,801,446 |

|

| Accrued interest receivable |

|

28,180 |

|

|

27,750 |

|

|

26,746 |

|

| Federal Home Loan Bank of Indianapolis stock |

|

28,350 |

|

|

28,350 |

|

|

28,350 |

|

| Cash surrender value of bank-owned life insurance |

|

41,394 |

|

|

41,111 |

|

|

40,882 |

|

| Premises and equipment, net |

|

71,453 |

|

|

72,150 |

|

|

73,463 |

|

| Goodwill |

|

4,687 |

|

|

4,687 |

|

|

4,687 |

|

| Servicing asset |

|

16,389 |

|

|

14,662 |

|

|

10,567 |

|

| Other real estate owned |

|

272 |

|

|

251 |

|

|

375 |

|

| Accrued income and other assets |

|

63,001 |

|

|

60,087 |

|

|

51,098 |

|

| Total assets |

|

$ |

5,737,859 |

|

|

$ |

5,823,259 |

|

|

$ |

5,167,572 |

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

| Noninterest-bearing deposits |

|

$ |

136,451 |

|

|

$ |

111,591 |

|

|

$ |

123,464 |

|

| Interest-bearing deposits |

|

4,796,755 |

|

|

4,686,119 |

|

|

3,943,509 |

|

| Total deposits |

|

4,933,206 |

|

|

4,797,710 |

|

|

4,066,973 |

|

| Advances from Federal Home Loan Bank |

|

295,000 |

|

|

515,000 |

|

|

614,934 |

|

| Subordinated debt |

|

105,150 |

|

|

105,071 |

|

|

104,838 |

|

| Accrued interest payable |

|

2,495 |

|

|

2,808 |

|

|

3,848 |

|

| Accrued expenses and other liabilities |

|

17,945 |

|

|

17,541 |

|

|

14,184 |

|

| Total liabilities |

|

5,353,796 |

|

|

5,438,130 |

|

|

4,804,777 |

|

| Shareholders' equity |

|

|

|

|

|

|

| Voting common stock |

|

186,094 |

|

|

185,631 |

|

|

184,700 |

|

| Retained earnings |

|

230,622 |

|

|

223,824 |

|

|

207,470 |

|

| Accumulated other comprehensive loss |

|

(32,653) |

|

|

(24,326) |

|

|

(29,375) |

|

| Total shareholders' equity |

|

384,063 |

|

|

385,129 |

|

|

362,795 |

|

| Total liabilities and shareholders' equity |

|

$ |

5,737,859 |

|

|

$ |

5,823,259 |

|

|

$ |

5,167,572 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First Internet Bancorp |

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Income (unaudited, except for the twelve months ended December 31, 2023) |

| Dollar amounts in thousands, except per share data |

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

December 31,

2024 |

|

September 30,

2024 |

|

December 31,

2023 |

|

December 31,

2024 |

|

December 31,

2023 |

| Interest income |

|

|

|

|

|

|

|

|

|

| Loans |

$ |

61,523 |

|

|

$ |

59,792 |

|

|

$ |

52,690 |

|

|

$ |

233,844 |

|

|

$ |

192,337 |

|

| Securities - taxable |

7,619 |

|

|

6,953 |

|

|

5,447 |

|

|

26,742 |

|

|

17,189 |

|

| Securities - non-taxable |

794 |

|

|

1,042 |

|

|

962 |

|

|

3,775 |

|

|

3,532 |

|

| Other earning assets |

7,835 |

|

|

7,203 |

|

|

7,173 |

|

|

27,526 |

|

|

26,384 |

|

| Total interest income |

77,771 |

|

|

74,990 |

|

|

66,272 |

|

|

291,887 |

|

|

239,442 |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

| Deposits |

49,111 |

|

|

47,415 |

|

|

41,078 |

|

|

183,150 |

|

|

143,363 |

|

| Other borrowed funds |

5,109 |

|

|

5,810 |

|

|

5,387 |

|

|

21,360 |

|

|

21,175 |

|

| Total interest expense |

54,220 |

|

|

53,225 |

|

|

46,465 |

|

|

204,510 |

|

|

164,538 |

|

| Net interest income |

23,551 |

|

|

21,765 |

|

|

19,807 |

|

|

87,377 |

|

|

74,904 |

|

| Provision for credit losses |

7,201 |

|

|

3,390 |

|

|

3,594 |

|

|

17,070 |

|

|

16,653 |

|

| Net interest income after provision for credit losses |

16,350 |

|

|

18,375 |

|

|

16,213 |

|

|

70,307 |

|

|

58,251 |

|

| Noninterest income |

|

|

|

|

|

|

|

|

|

| Service charges and fees |

248 |

|

|

245 |

|

|

216 |

|

|

959 |

|

|

851 |

|

| Loan servicing revenue |

1,825 |

|

|

1,570 |

|

|

1,134 |

|

|

6,188 |

|

|

3,833 |

|

| Loan servicing asset revaluation |

(428) |

|

|

(846) |

|

|

(793) |

|

|

(2,537) |

|

|

(1,463) |

|

| Mortgage banking activities |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

76 |

|

|

|

|

|

|

|

|

|

|

|

| Gain on sale of loans |

8,568 |

|

|

9,933 |

|

|

6,028 |

|

|

33,329 |

|

|

20,526 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

5,723 |

|

|

1,127 |

|

|

816 |

|

|

9,406 |

|

|

2,302 |

|

| Total noninterest income |

15,936 |

|

|

12,029 |

|

|

7,401 |

|

|

47,345 |

|

|

26,125 |

|

| Noninterest expense |

|

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

14,042 |

|

|

13,456 |

|

|

11,055 |

|

|

51,756 |

|

|

45,322 |

|

| Marketing, advertising and promotion |

696 |

|

|

548 |

|

|

518 |

|

|

2,589 |

|

|

2,567 |

|

| Consulting and professional fees |

967 |

|

|

902 |

|

|

893 |

|

|

3,744 |

|

|

3,082 |

|

| Data processing |

603 |

|

|

675 |

|

|

493 |

|

|

2,448 |

|

|

2,373 |

|

| Loan expenses |

1,381 |

|

|

1,524 |

|

|

1,371 |

|

|

5,947 |

|

|

5,756 |

|

| Premises and equipment |

3,004 |

|

|

2,918 |

|

|

2,846 |

|

|

11,902 |

|

|

10,599 |

|

| Deposit insurance premium |

1,464 |

|

|

1,219 |

|

|

1,334 |

|

|

5,000 |

|

|

3,880 |

|

|

|

|

|

|

|

|

|

|

|

| Other |

1,800 |

|

|

1,552 |

|

|

1,546 |

|

|

6,724 |

|

|

5,857 |

|

| Total noninterest expense |

23,957 |

|

|

22,794 |

|

|

20,056 |

|

|

90,110 |

|

|

79,436 |

|

| Income before income taxes |

8,329 |

|

|

7,610 |

|

|

3,558 |

|

|

27,542 |

|

|

4,940 |

|

| Income tax provision (benefit) |

999 |

|

|

620 |

|

|

(585) |

|

|

2,266 |

|

|

(3,477) |

|

| Net income |

$ |

7,330 |

|

|

$ |

6,990 |

|

|

$ |

4,143 |

|

|

$ |

25,276 |

|

|

$ |

8,417 |

|

|

|

|

|

|

|

|

|

|

|

| Per common share data |

|

|

|

|

|

|

|

|

|

| Earnings per share - basic |

$ |

0.84 |

|

|

$ |

0.80 |

|

|

$ |

0.48 |

|

|

$ |

2.91 |

|

|

$ |

0.95 |

|

| Earnings per share - diluted |

$ |

0.83 |

|

|

$ |

0.80 |

|

|

$ |

0.48 |

|

|

$ |

2.88 |

|

|

$ |

0.95 |

|

| Dividends declared per share |

$ |

0.06 |

|

|

$ |

0.06 |

|

|

$ |

0.06 |

|

|

$ |

0.24 |

|

|

$ |

0.24 |

|

All periods presented have been reclassified to conform to the current period classification

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First Internet Bancorp |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Balances and Rates (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dollar amounts in thousands |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

|

Average Balance |

|

Interest / Dividends |

|

Yield / Cost |

|

Average Balance |

|

Interest / Dividends |

|

Yield / Cost |

|

Average Balance |

|

Interest / Dividends |

|

Yield/ Cost |

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, including loans held-for-sale 1 |

$ |

4,129,118 |

|

|

$ |

61,523 |

|

|

5.93 |

% |

|

$ |

4,029,360 |

|

|

$ |

59,792 |

|

|

5.90 |

% |

|

$ |

3,799,932 |

|

|

$ |

52,690 |

|

|

5.50 |

% |

| Securities - taxable |

758,560 |

|

|

7,619 |

|

|

4.00 |

% |

|

713,992 |

|

|

6,953 |

|

|

3.87 |

% |

|

611,664 |

|

|

5,447 |

|

|

3.53 |

% |

| Securities - non-taxable |

83,140 |

|

|

794 |

|

|

3.80 |

% |

|

78,417 |

|

|

1,042 |

|

|

5.29 |

% |

|

71,804 |

|

|

962 |

|

|

5.32 |

% |

| Other earning assets |

636,377 |

|

|

7,835 |

|

|

4.90 |

% |

|

526,384 |

|

|

7,203 |

|

|

5.44 |

% |

|

500,733 |

|

|

7,173 |

|

|

5.68 |

% |

| Total interest-earning assets |

5,607,195 |

|

|

77,771 |

|

|

5.52 |

% |

|

5,348,153 |

|

|

74,990 |

|

|

5.58 |

% |

|

4,984,133 |

|

|

66,272 |

|

|

5.28 |

% |

| Allowance for credit losses - loans |

(46,427) |

|

|

|

|

|

|

(44,572) |

|

|

|

|

|

|

(36,792) |

|

|

|

|

|

| Noninterest-earning assets |

221,348 |

|

|

|

|

|

|

220,329 |

|

|

|

|

|

|

206,944 |

|

|

|

|

|

| Total assets |

$ |

5,782,116 |

|

|

|

|

|

|

$ |

5,523,910 |

|

|

|

|

|

|

$ |

5,154,285 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing demand deposits |

$ |

574,577 |

|

|

$ |

2,910 |

|

|

2.01 |

% |

|

$ |

511,446 |

|

|

$ |

2,880 |

|

|

2.24 |

% |

|

$ |

382,427 |

|

|

$ |

1,646 |

|

|

1.71 |

% |

| Savings accounts |

21,072 |

|

|

45 |

|

|

0.85 |

% |

|

22,774 |

|

|

48 |

|

|

0.84 |

% |

|

22,394 |

|

|

48 |

|

|

0.85 |

% |

| Money market accounts |

1,236,116 |

|

|

12,309 |

|

|

3.96 |

% |

|

1,224,680 |

|

|

12,980 |

|

|

4.22 |

% |

|

1,225,781 |

|

|

12,739 |

|

|

4.12 |

% |

| Fintech - brokered deposits |

208,545 |

|

|

2,111 |

|

|

4.03 |

% |

|

153,012 |

|

|

1,682 |

|

|

4.37 |

% |

|

62,098 |

|

|

685 |

|

|

4.38 |

% |

| Certificates and brokered deposits |

2,686,139 |

|

|

31,736 |

|

|

4.70 |

% |

|

2,472,166 |

|

|

29,825 |

|

|

4.80 |

% |

|

2,242,819 |

|

|

25,960 |

|

|

4.59 |

% |

| Total interest-bearing deposits |

4,726,449 |

|

|

49,111 |

|

|

4.13 |

% |

|

4,384,078 |

|

|

47,415 |

|

|

4.30 |

% |

|

3,935,519 |

|

|

41,078 |

|

|

4.14 |

% |

| Other borrowed funds |

528,806 |

|

|

5,109 |

|

|

3.84 |

% |

|

620,032 |

|

|

5,810 |

|

|

3.73 |

% |

|

719,733 |

|

|

5,387 |

|

|

2.97 |

% |

| Total interest-bearing liabilities |

5,255,255 |

|

|

54,220 |

|

|

4.10 |

% |

|

5,004,110 |

|

|

53,225 |

|

|

4.23 |

% |

|

4,655,252 |

|

|

46,465 |

|

|

3.96 |

% |

| Noninterest-bearing deposits |

114,311 |

|

|

|

|

|

|

113,009 |

|

|

|

|

|

|

123,351 |

|

|

|

|

|

| Other noninterest-bearing liabilities |

23,115 |

|

|

|

|

|

|

26,730 |

|

|

|

|

|

|

22,645 |

|

|

|

|

|

| Total liabilities |

5,392,681 |

|

|

|

|

|

|

5,143,849 |

|

|

|

|

|

|

4,801,248 |

|

|

|

|

|

| Shareholders' equity |

389,435 |

|

|

|

|

|

|

380,061 |

|

|

|

|

|

|

353,037 |

|

|

|

|

|

| Total liabilities and shareholders' equity |

$ |

5,782,116 |

|

|

|

|

|

|

$ |

5,523,910 |

|

|

|

|

|

|

$ |

5,154,285 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

$ |

23,551 |

|

|

|

|

|

|

$ |

21,765 |

|

|

|

|

|

|

$ |

19,807 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest rate spread |

|

|

|

|

1.42 |

% |

|

|

|

|

|

1.35 |

% |

|

|

|

|

|

1.32 |

% |

| Net interest margin |

|

|

|

|

1.67 |

% |

|

|

|

|

|

1.62 |

% |

|

|

|

|

|

1.58 |

% |

Net interest margin - FTE 2,3 |

|

|

|

|

1.75 |

% |

|

|

|

|

|

1.70 |

% |

|

|

|

|

|

1.68 |

% |

1 Includes nonaccrual loans

2 On a fully-taxable equivalent ("FTE") basis assuming a 21% tax rate

3 Refer to "Non-GAAP Financial Measures" section above and "Reconciliation of Non-GAAP Financial Measures" below

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First Internet Bancorp |

|

|

|

|

|

|

|

|

|

|

|

| Average Balances and Rates (unaudited) |

|

|

|

|

|

|

|

|

|

|

| Dollar amounts in thousands |

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended |

|

December 31, 2024 |

|

December 31, 2023 |

|

Average Balance |

|

Interest / Dividends |

|

Yield/Cost |

|

Average Balance |

|

Interest / Dividends |

|

Yield / Cost |

| Assets |

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

Loans, including loans held-for-sale 1 |

$ |

3,997,397 |

|

|

$ |

233,844 |

|

|

5.85 |

% |

|

$ |

3,685,729 |

|

|

$ |

192,337 |

|

|

5.22 |

% |

| Securities - taxable |

692,806 |

|

|

26,742 |

|

|

3.86 |

% |

|

551,479 |

|

|

17,189 |

|

|

3.12 |

% |

| Securities - non-taxable |

77,987 |

|

|

3,775 |

|

|

4.84 |

% |

|

72,571 |

|

|

3,532 |

|

|

4.87 |

% |

| Other earning assets |

516,836 |

|

|

27,526 |

|

|

5.33 |

% |

|

500,061 |

|

|

26,384 |

|

|

5.28 |

% |

| Total interest-earning assets |

5,285,026 |

|

|

291,887 |

|

|

5.52 |

% |

|

4,809,840 |

|

|

239,442 |

|

|

4.98 |

% |

| Allowance for credit losses - loans |

(42,758) |

|

|

|

|

|

|

(36,038) |

|

|

|

|

|

| Noninterest-earning assets |

220,462 |

|

|

|

|

|

|

194,712 |

|

|

|

|

|

| Total assets |

$ |

5,462,730 |

|

|

|

|

|

|

$ |

4,968,514 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing demand deposits |

$ |

494,082 |

|

|

$ |

10,448 |

|

|

2.11 |

% |

|

$ |

366,082 |

|

|

$ |

6,186 |

|

|

1.69 |

% |

| Savings accounts |

22,336 |

|

|

189 |

|

|

0.85 |

% |

|

29,200 |

|

|

249 |

|

|

0.85 |

% |

| Money market accounts |

1,230,443 |

|

|

51,036 |

|

|

4.15 |

% |

|

1,276,602 |

|

|

49,890 |

|

|

3.91 |

% |

| Fintech - brokered deposits |

141,860 |

|

|

6,023 |

|

|

4.25 |

% |

|

33,039 |

|

|

1,402 |

|

|

4.24 |

% |

| Certificates and brokered deposits |

2,430,205 |

|

|

115,454 |

|

|

4.75 |

% |

|

2,040,041 |

|

|

85,636 |

|

|

4.20 |

% |

| Total interest-bearing deposits |

4,318,926 |

|

|

183,150 |

|

|

4.24 |

% |

|

3,744,964 |

|

|

143,363 |

|

|

3.83 |

% |

| Other borrowed funds |

629,137 |

|

|

21,360 |

|

|

3.40 |

% |

|

719,617 |

|

|

21,175 |

|

|

2.94 |

% |

| Total interest-bearing liabilities |

4,948,063 |

|

|

204,510 |

|

|

4.13 |

% |

|

4,464,581 |

|

|

164,538 |

|

|

3.69 |

% |

| Noninterest-bearing deposits |

114,396 |

|

|

|

|

|

|

125,816 |

|

|

|

|

|

| Other noninterest-bearing liabilities |

23,056 |

|

|

|

|

|

|

20,317 |

|

|

|

|

|

| Total liabilities |

5,085,515 |

|

|

|

|

|

|

4,610,714 |

|

|

|

|

|

| Shareholders' equity |

377,215 |

|

|

|

|

|

|

357,800 |

|

|

|

|

|

| Total liabilities and shareholders' equity |

$ |

5,462,730 |

|

|

|

|

|

|

$ |

4,968,514 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

$ |

87,377 |

|

|

|

|

|

|

$ |

74,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest rate spread |

|

|

|

|

1.39 |

% |

|

|

|

|

|

1.29 |

% |

| Net interest margin |

|

|

|

|

1.65 |

% |

|

|

|

|

|

1.56 |

% |

Net interest margin - FTE 2,3 |

|

|

|

|

1.74 |

% |

|

|

|

|

|

1.67 |

% |

1 Includes nonaccrual loans

2 On a fully-taxable equivalent ("FTE") basis assuming a 21% tax rate

3 Refer to "Non-GAAP Financial Measures" section above and "Reconciliation of Non-GAAP Financial Measures" below

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First Internet Bancorp |

|

|

|

|

|

|

|

|

|

|

|

|

| Loans and Deposits (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| Dollar amounts in thousands |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

|

|

Amount |

|

Percent |

|

Amount |

|

Percent |

|

Amount |

|

Percent |

| Commercial loans |

|

|

|

|

|

|

|

|

|

|

|

|

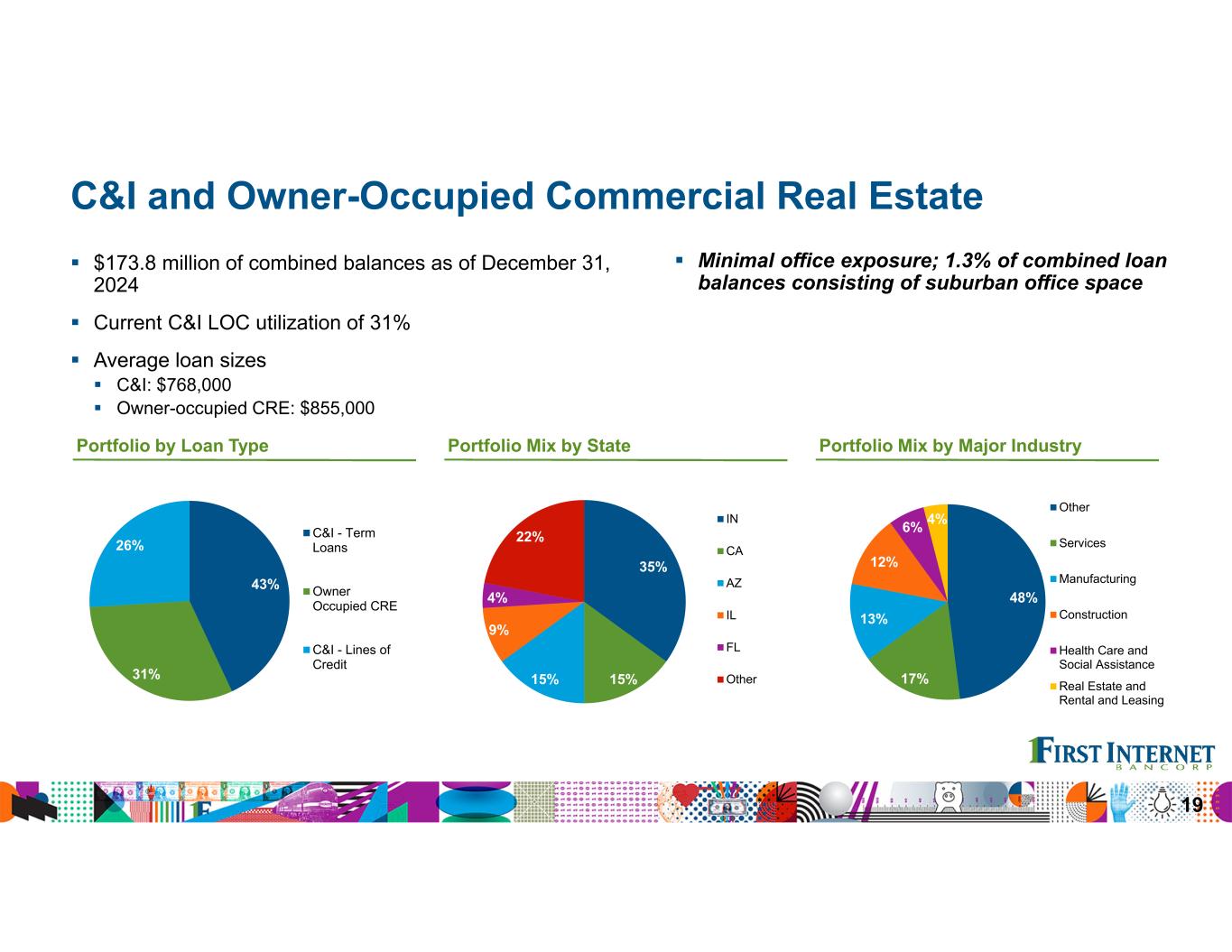

| Commercial and industrial |

|

$ |

120,175 |

|

|

2.9 |

% |

|

$ |

111,199 |

|

|

2.8 |

% |

|

$ |

129,349 |

|

|

3.4 |

% |

| Owner-occupied commercial real estate |

|

53,591 |

|

|

1.3 |

% |

|

56,461 |

|

|

1.4 |

% |

|

57,286 |

|

|

1.5 |

% |

| Investor commercial real estate |

|

269,431 |

|

|

6.5 |

% |

|

260,614 |

|

|

6.5 |

% |

|

132,077 |

|

|

3.4 |

% |

| Construction |

|

413,523 |

|

|

9.9 |

% |

|

340,954 |

|

|

8.4 |

% |

|

261,750 |

|

|

6.8 |

% |

| Single tenant lease financing |

|

949,748 |

|

|

22.7 |

% |

|

932,148 |

|

|

23.1 |

% |

|

936,616 |

|

|

24.4 |

% |

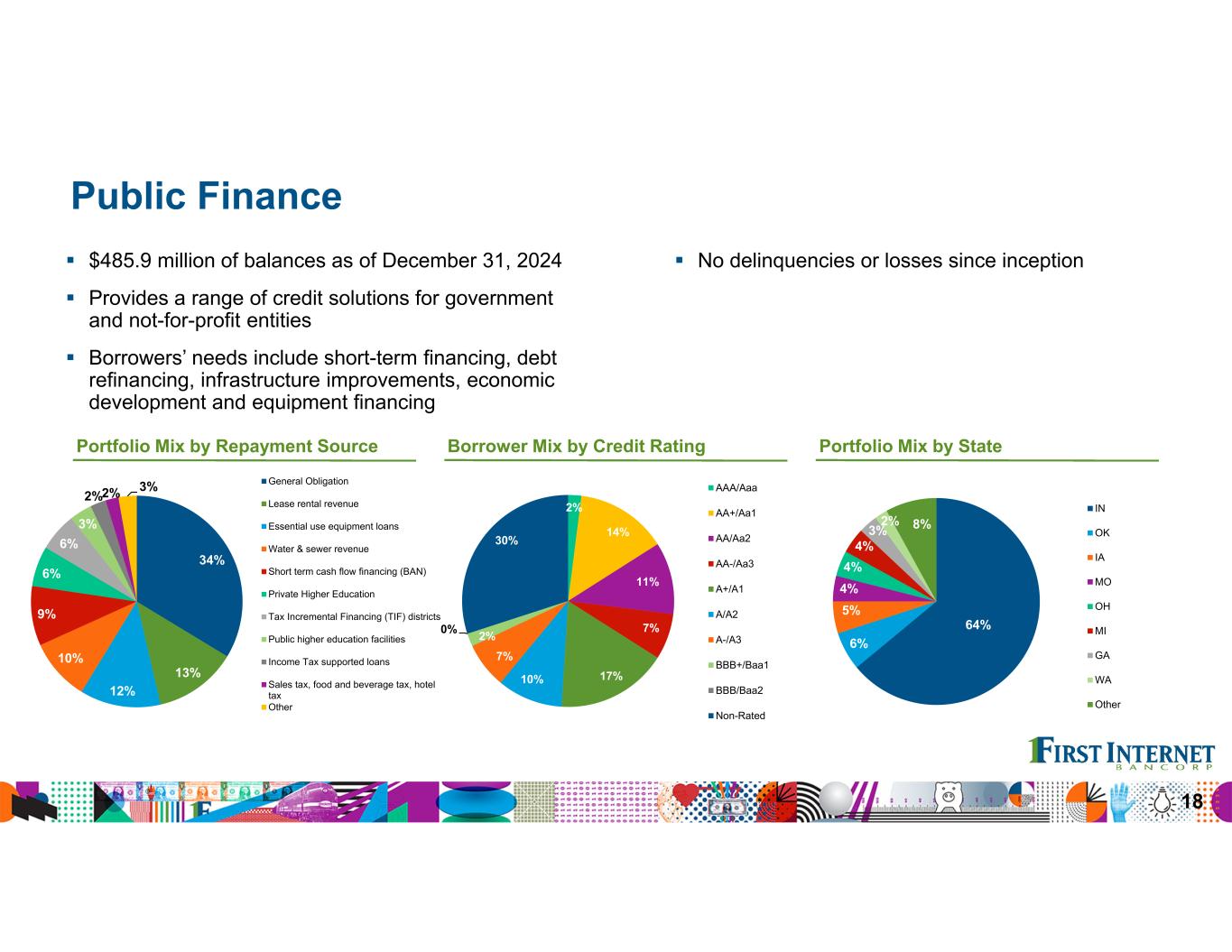

| Public finance |

|

485,867 |

|

|

11.6 |

% |

|

462,730 |

|

|

11.5 |

% |

|

521,764 |

|

|

13.6 |

% |

| Healthcare finance |

|

181,427 |

|

|

4.4 |

% |

|

190,287 |

|

|

4.7 |

% |

|

222,793 |

|

|

5.8 |

% |

| Small business lending |

|

331,914 |

|

|

8.0 |

% |

|

298,645 |

|

|

7.4 |

% |

|

218,506 |

|

|

5.7 |

% |

| Franchise finance |

|

536,909 |

|

|

12.9 |

% |

|

550,442 |

|

|

13.6 |

% |

|

525,783 |

|

|

13.7 |

% |

| Total commercial loans |

|

3,342,585 |

|

|

80.2 |

% |

|

3,203,480 |

|

|

79.4 |

% |

|

3,005,924 |

|

|

78.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consumer loans |

|

|

|

|

|

|

|

|

|

|

|

|

| Residential mortgage |

|

375,160 |

|

|

9.0 |

% |

|

378,701 |

|

|

9.4 |

% |

|

395,648 |

|

|

10.3 |

% |

| Home equity |

|

18,274 |

|

|

0.4 |

% |

|

20,264 |

|

|

0.5 |

% |

|

23,669 |

|

|

0.6 |

% |

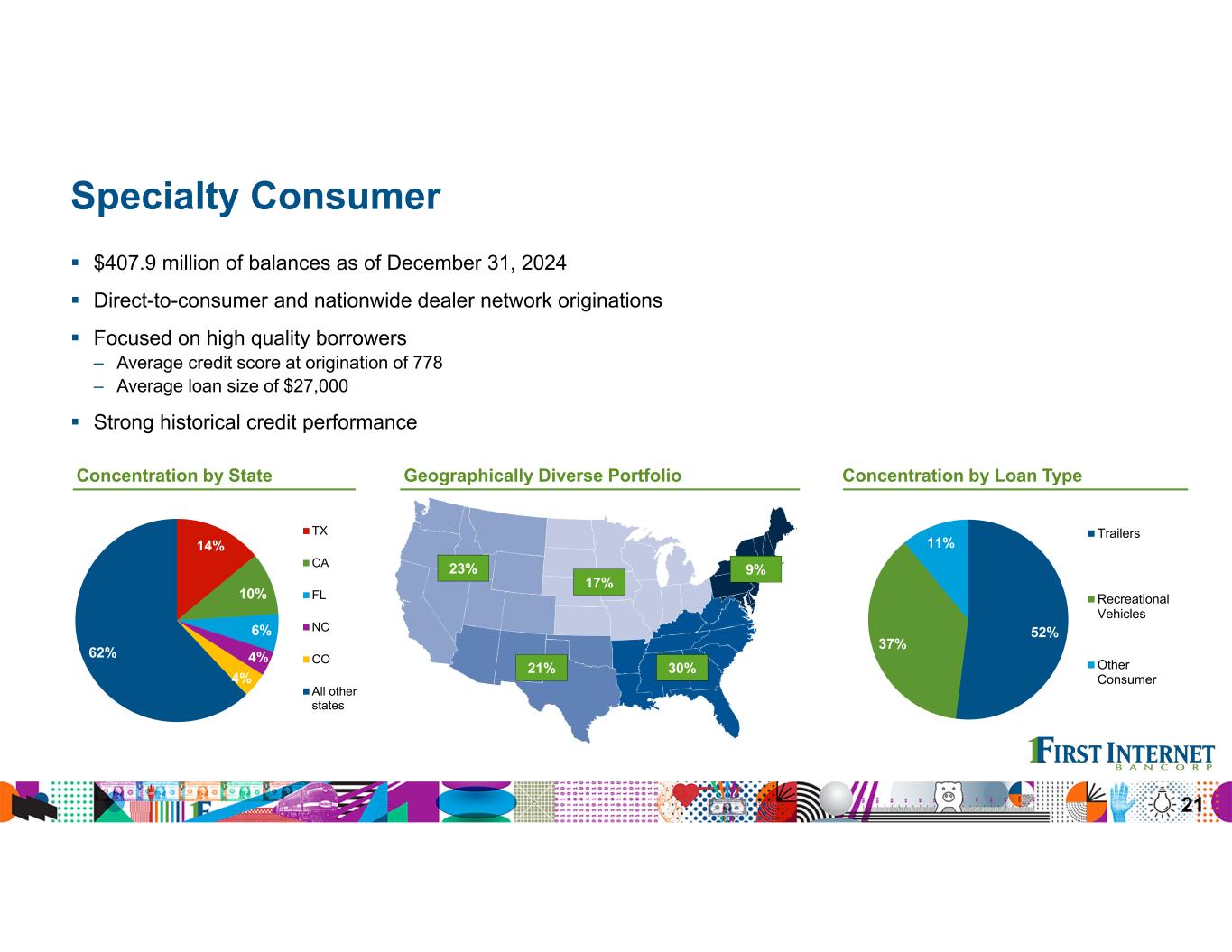

| Trailers |

|

210,575 |

|

|

5.0 |

% |

|

205,230 |

|

|

5.1 |

% |

|

188,763 |

|

|

4.9 |

% |

| Recreational vehicles |

|

149,342 |

|

|

3.6 |

% |

|

150,378 |

|

|

3.7 |

% |

|

145,558 |

|

|

3.8 |

% |

| Other consumer loans |

|

48,030 |

|

|

1.2 |

% |

|

48,780 |

|

|

1.2 |

% |

|

43,293 |

|

|

1.1 |

% |

| Total consumer loans |

|

801,381 |

|

|

19.2 |

% |

|

803,353 |

|

|

19.9 |

% |

|

796,931 |

|

|

20.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net deferred loan fees, premiums, discounts and other 1 |

|

26,680 |

|

|

0.6 |

% |

|

29,047 |

|

|

0.7 |

% |

|

37,365 |

|

|

1.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total loans |

|

$ |

4,170,646 |

|

|

100.0 |

% |

|

$ |

4,035,880 |

|

|

100.0 |

% |

|

$ |

3,840,220 |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

|

|

Amount |

|

Percent |

|

Amount |

|

Percent |

|

Amount |

|

Percent |

| Deposits |

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing deposits |

|

$ |

136,451 |

|

|

2.8 |

% |

|

$ |

111,591 |

|

|

2.3 |

% |

|

$ |

123,464 |

|

|

3.0 |

% |

| Interest-bearing demand deposits |

|

896,661 |

|

|

18.2 |

% |

|

538,484 |

|

|

11.2 |

% |

|

402,976 |

|

|

9.9 |

% |

| Savings accounts |

|

19,823 |

|

|

0.4 |

% |

|

21,712 |

|

|

0.5 |

% |

|

21,364 |

|

|

0.5 |

% |

| Money market accounts |

|

1,183,789 |

|

|

24.0 |

% |

|

1,230,707 |

|

|

25.7 |

% |

|

1,248,319 |

|

|

30.8 |

% |

| Fintech - brokered deposits |

|

— |

|

|

0.0 |

% |

|

211,814 |

|

|

4.4 |

% |

|

74,401 |

|

|

1.8 |

% |

| Certificates of deposits |

|

2,133,455 |

|

|

43.2 |

% |

|

2,110,618 |

|

|

44.0 |

% |

|

1,605,156 |

|

|

39.5 |

% |

| Brokered deposits |

|

563,027 |

|

|

11.4 |

% |

|

572,784 |

|

|

11.9 |

% |

|

591,293 |

|

|

14.5 |

% |

| Total deposits |

|

$ |

4,933,206 |

|

|

100.0 |

% |

|

$ |

4,797,710 |

|

|

100.0 |

% |

|

$ |

4,066,973 |

|

|

100.0 |

% |

1 Includes carrying value adjustments of $22.9 million, $24.1 million and $27.8 million related to terminated interest rate swaps associated with public finance loans as of December 31, 2024, September 30, 2024 and December 31, 2023, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First Internet Bancorp |

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Non-GAAP Financial Measures |

|

|

|

|

|

|

| Dollar amounts in thousands, except per share data |

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

December 31,

2024 |

|

September 30,

2024 |

|

December 31,

2023 |

|

December 31,

2024 |

|

December 31,

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Total equity - GAAP |

|

$ |

384,063 |

|

|

$ |

385,129 |

|

|

$ |

362,795 |

|

|

$ |

384,063 |

|

|

$ |

362,795 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

| Goodwill |

|

(4,687) |

|

|

(4,687) |

|

|

(4,687) |

|

|

(4,687) |

|

|

(4,687) |

|

| Tangible common equity |

|

$ |

379,376 |

|

|

$ |

380,442 |

|

|

$ |

358,108 |

|

|

$ |

379,376 |

|

|

$ |

358,108 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets - GAAP |

|

$ |

5,737,859 |

|

|

$ |

5,823,259 |

|

|

$ |

5,167,572 |

|

|

$ |

5,737,859 |

|

|

$ |

5,167,572 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

| Goodwill |

|

(4,687) |

|

|

(4,687) |

|

|

(4,687) |

|

|

(4,687) |

|

|

(4,687) |

|

| Tangible assets |

|

$ |

5,733,172 |

|

|

$ |

5,818,572 |

|

|

$ |

5,162,885 |

|

|

$ |

5,733,172 |

|

|

$ |

5,162,885 |

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares outstanding |

|

8,667,894 |

|

|

8,667,894 |

|

|

8,644,451 |

|

|

8,667,894 |

|

|

8,644,451 |

|

|

|

|

|

|

|

|

|

|

|

|

| Book value per common share |

|

$ |

44.31 |

|

|

$ |

44.43 |

|

|

$ |

41.97 |

|

|

$ |

44.31 |

|

|

$ |

41.97 |

|

| Effect of goodwill |

|

(0.54) |

|

|

(0.54) |

|

|

(0.54) |

|

|

(0.54) |

|

|

(0.54) |

|

| Tangible book value per common share |

|

$ |

43.77 |

|

|

$ |

43.89 |

|

|

$ |

41.43 |

|

|

$ |

43.77 |

|

|

$ |

41.43 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total shareholders' equity to assets |

|

6.69 |

% |

|

6.61 |

% |

|

7.02 |

% |

|