UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 11, 2025

EPSILON ENERGY LTD.

(Exact name of registrant as specified in charter)

Alberta, Canada |

001-38770 |

98-1476367 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

500 Dallas St., Suite 1250

Houston, Texas 77002

(Address of principal executive offices, including zip code)

(281) 670-0002

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☒ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section 12(b) of the Act:

Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange on which registered: |

Common Shares, no par value |

|

EPSN |

|

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On August 11, 2025, Epsilon Energy Ltd. (the “Company”) and its wholly owned subsidiary, Epsilon Energy USA, Inc. (“Epsilon USA”), entered into a Membership Interest Purchase Agreement (the “Peak E&P Agreement”) with Peak Exploration & Production, LLC (“Peak E&P”), the Sellers party thereto, and Yorktown Energy Partners XI, L.P. (as Sellers’ Representative). Pursuant to the Peak E&P Agreement, the Sellers agreed to sell to Epsilon USA all of the issued and outstanding membership interests in Peak E&P (the “Peak E&P Interests”), with the transfer of certain financial benefits and burdens of Peak E&P’s assets effective as of January 1, 2025 (the “Effective Time”), and the closing to occur on the terms and subject to the conditions set forth in the Peak E&P Agreement.

Also, on August 11, 2025, the Company and Epsilon USA entered into a Membership Interest Purchase Agreement (the “Peak BLM Agreement” and together with the Peak E&P Agreement, the “Purchase Agreements”) with Yorktown Energy Partners XI, L.P. (“Seller”) and Peak BLM Lease LLC (“Peak BLM”). Pursuant to the Peak BLM Agreement, the Seller agreed to sell to Epsilon USA all of the issued and outstanding membership interests in Peak BLM (the “Peak BLM Interests”), with the transfer of certain financial benefits and burdens of Peak BLM’s assets effective as of the Effective Time, and the closing to occur on the terms and subject to the conditions set forth in the Peak BLM Agreement.

Capitalized terms used herein without definition shall have the meaning given to such terms in the respective Purchase Agreement.

Peak E&P Agreement

Purchase Price

The purchase price for the Peak E&P Interests is 5,800,000 of the Company’s common shares (the “Common Shares”), valued based on the volume weighted average price of the Common Shares as reported on the Nasdaq Global Market for the sixty (60) consecutive trading days prior to the Closing Date, subject to adjustment as provided in the Peak E&P Agreement. The Unadjusted Purchase Price is subject to upward and downward adjustments for various items, including, but not limited to, the appraised value of certain real property, title and environmental defect amounts, suspense funds, transaction expenses, unpaid taxes, and other specified items. The Adjusted Purchase Price is determined in accordance with the procedures set forth in the Peak E&P Agreement.

Title and Environmental Review

The Peak E&P Agreement contains detailed provisions regarding title and environmental matters, including procedures for the identification and resolution of title defects, title benefits, and environmental defects, as well as the corresponding adjustments to the unadjusted purchase price. Epsilon USA’s remedies for title and environmental defects are subject to specified thresholds and deductibles, and, except as otherwise provided in the Peak E&P Agreement (including with respect to representations and warranties insurance and certain special warranties), are the sole and exclusive remedies for such matters.

Representations and Warranties; Covenants

The Peak E&P Agreement includes comprehensive and customary representations and warranties, and also contains covenants regarding the conduct of business prior to closing, access to information, employee matters, confidentiality, public announcements, and other customary matters.

Closing and Termination

The closing of the transactions contemplated by the Peak E&P Agreement is subject to customary conditions, including the accuracy of representations and warranties, performance of covenants, absence of legal restraints, the aggregate amount of title and environmental defect and casualty loss adjustments not exceeding 20% of the Unadjusted Purchase Price, receipt of approval of the Company’s shareholders for the issuance of the Common Shares to be issued, approval for listing of the Common Shares to be issued on the Nasdaq Global Market, and the closing of a transactions under the Peak BLM Agreement.

2

The Peak E&P Agreement may be terminated under specified circumstances, including mutual consent, failure to close by a specified outside date, material breach, or failure to obtain required approvals, with Sellers’ right to terminate for the Company’s failure to obtain the consent of its shareholders accompanied by a termination fee of $750,000 as liquidated damages.

Indemnification

The Peak E&P Agreement provides that Epsilon USA’s remedies under a representation and warranty insurance policy to be obtained in connection with the transaction shall be Epsilon USA’s sole and exclusive remedy for breaches of the representations and warranties contained in the Peak E&P Agreement.

A copy of the Peak E&P Agreement is filed as an exhibit to this Current Report on Form 8-K and is incorporated herein by reference. The foregoing description of the Peak E&P Agreement is qualified in its entirety by reference to the full text of the Peak E&P Agreement.

Peak BLM Agreement

Purchase Price

The aggregate purchase price for the Peak BLM Interests consists of (i) 200,000 Common Shares and (ii) up to 2,500,000 additional Common Shares or $6,500,000 in cash, to be issued or paid based on the timing of certain regulatory approvals, each as adjusted in accordance with the Peak BLM Agreement. The Additional Unadjusted Purchase Price is subject to a sliding scale based on the date on which specified drilling permits and rights are obtained, with the number of shares or cash amount decreasing if such approvals are delayed, and with an alternative mechanism for the transfer of certain undeveloped acreage back to Seller if approvals are not obtained by December 31, 2027. The Unadjusted Purchase Price is subject to upward and downward adjustments for various items, including, but not limited to, title and environmental defect amounts, suspense funds, unpaid taxes, and other specified items. The final Adjusted Purchase Price is determined in accordance with the procedures set forth in the Peak BLM Agreement.

Title and Environmental Review

The Peak BLM Agreement contains detailed provisions regarding title and environmental matters, including procedures for the identification and resolution of title defects, title benefits, and environmental defects, as well as the corresponding adjustments to the Unadjusted Purchase Price. Epsilon USA’s remedies for title and environmental defects are subject to specified thresholds and deductibles, and, except as otherwise provided in the Peak BLM Agreement (including with respect to representations and warranties insurance and certain special warranties), are the sole and exclusive remedies for such matters.

Representations and Warranties; Covenants

The Peak BLM Agreement includes comprehensive and customary representations and warranties by Seller, Peak BLM, and Epsilon USA, and also contains covenants regarding the conduct of business prior to closing, access to information, employee matters, confidentiality, public announcements, and other customary matters.

Closing and Termination

The closing of the transactions contemplated by the Peak BLM Agreement is subject to customary conditions, including the accuracy of representations and warranties, performance of covenants, absence of legal restraints, the aggregate amount of title and environmental defect and casualty loss adjustments not exceeding 20% of the Unadjusted Purchase Price, receipt of the consent of the Company’s shareholders for the issuance of the Common Shares to be issued, approval for listing of the Common Shares on the Nasdaq Global Market, and the closing of the transactions under the Peak E&P Agreement. The Peak BLM Agreement may be terminated under specified circumstances, including mutual consent, failure to close by a specified outside date, material breach, or failure to obtain required approvals.

3

Indemnification

The Peak BLM Agreement provides that Epsilon USA’s remedies under a representation and warranty insurance policy to be obtained in connection with the transaction shall be Epsilon USA’s sole and exclusive remedy against the Seller for breaches of the representations and warranties contained in the Peak BLM Agreement.

A copy of the Peak BLM Agreement is filed as an exhibit to this Current Report on Form 8-K and is incorporated herein by reference. The foregoing description of the Peak BLM Agreement is qualified in its entirety by reference to the full text of the Peak BLM Agreement.

Side Letter to Peak BLM Agreement

In connection with the Peak BLM Agreement, the Parties entered into a letter agreement (the “Side Letter”) that modifies certain terms of the Peak BLM Agreement. The Side Letter addresses the treatment of certain oil and gas leases, which have been paid for by the Company but have not yet been issued by the Bureau of Land Management (“BLM”) as of the date of the Side Letter.

Pursuant to the Side Letter, if Peak BLM has not issued any of the Subject Leases by the “Resolution Date”, the Additional Unadjusted Purchase Price payable to Seller will be reduced by the allocated value of each such unissued lease. If Peak BLM has received a refund from the BLM for any unissued subject lease as of such date, the downward adjustment to the purchase price will be offset by the amount of such refund.

If the BLM issues any subject lease after the Resolution Date but on or before December 31, 2027, Epsilon USA will issue to Seller the Common Shares that were previously withheld as a result of the downward adjustment for that lease. If any subject lease remains unissued as of December 31, 2027, Epsilon USA must either (a) issue to Seller the shares previously withheld for such lease, or (b) elect to sell, transfer, and convey the subject lease to Seller (or its designee).

A copy of the Side Letter is filed as an exhibit to this Current Report on Form 8-K and is incorporated herein by reference. The foregoing description of the Side Letter is qualified in its entirety by reference to the full text of the Side Letter.

Lock-Up Agreement

The Peak E&P Agreement provides that certain of the Sellers will be bound by a lock-up agreement pursuant to which they will be restricted from transferring Common Shares for a period of 180 days following the Closing Date, subject to customary exceptions.

Registration Rights Agreement

At Closing, the Company will enter into a registration rights agreement pursuant to which the Company will agree, on the terms set forth therein, to file with the SEC a registration statement registering for resale the Common Shares to be issued pursuant to the Purchase Agreements and to conduct certain underwritten offerings upon the request of holders of Registrable Securities (as defined therein). The Registration Rights Agreement will also provide holders of Registrable Securities with certain customary piggyback registration rights.

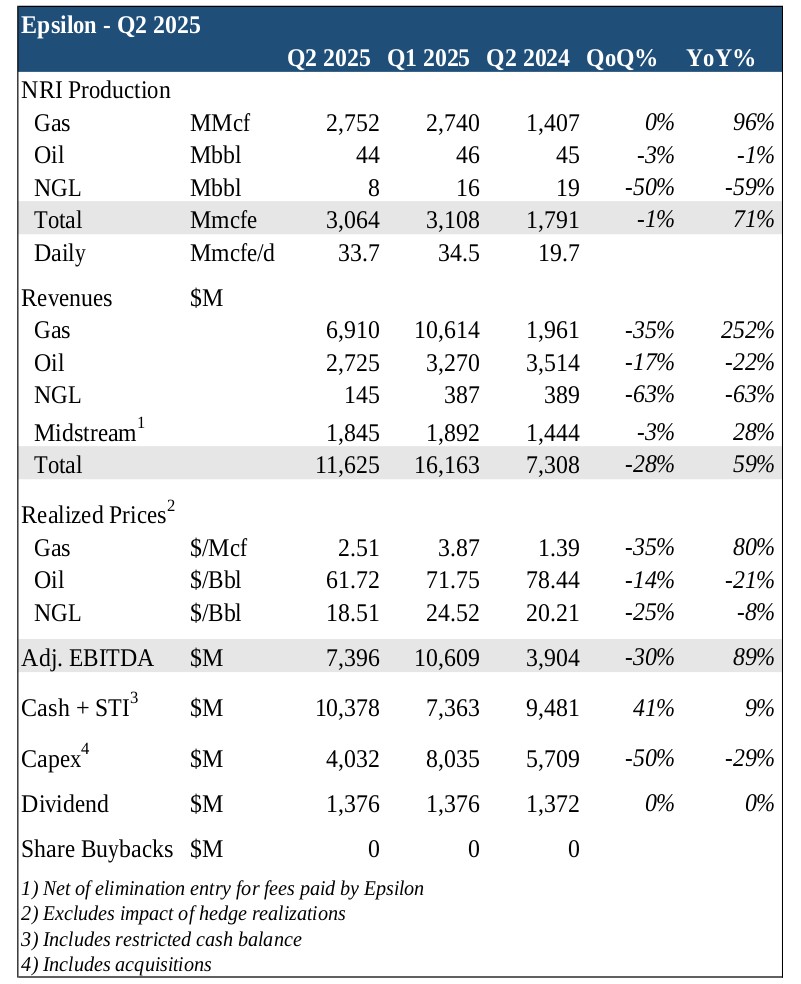

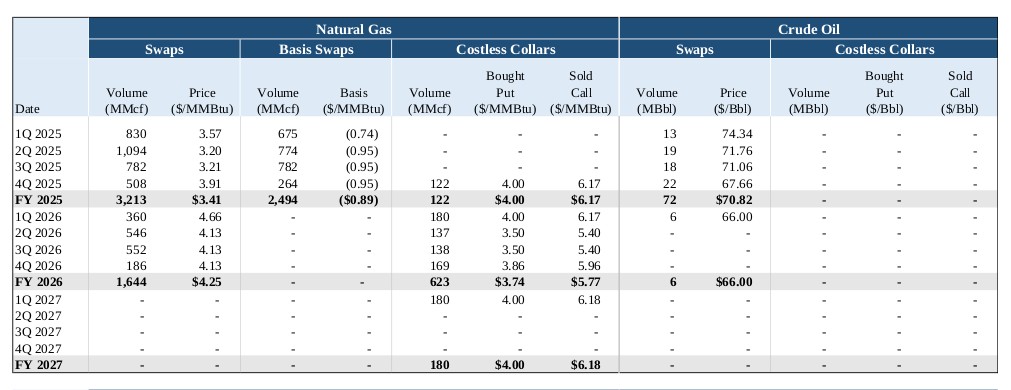

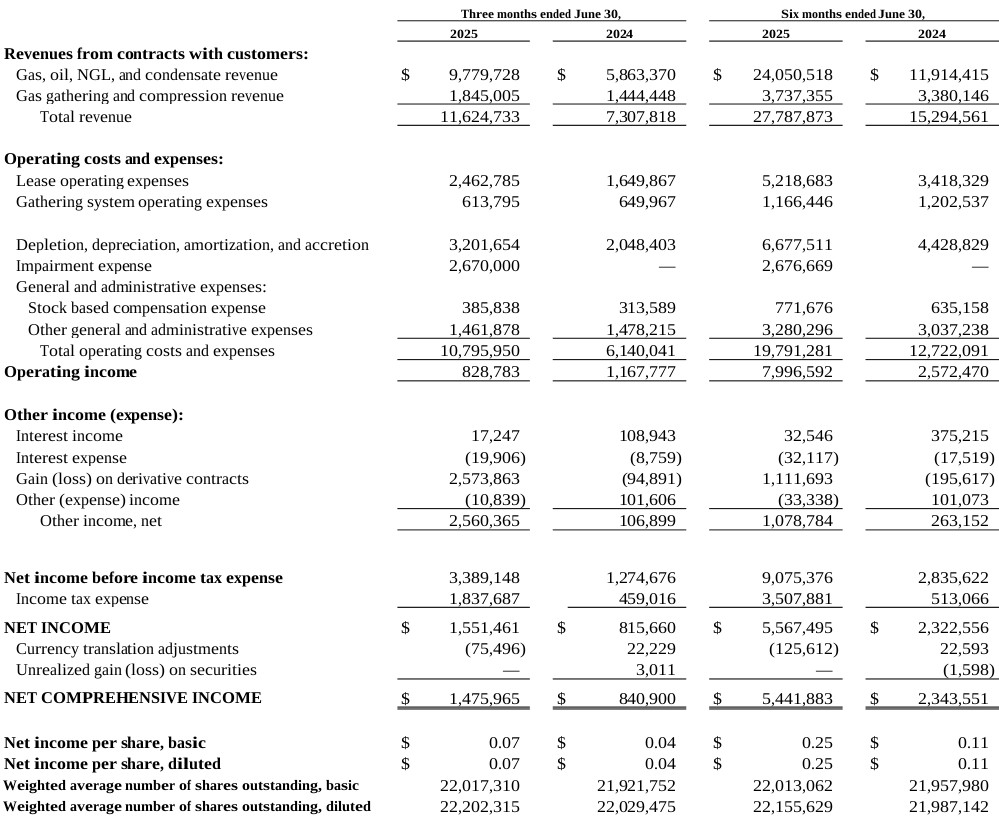

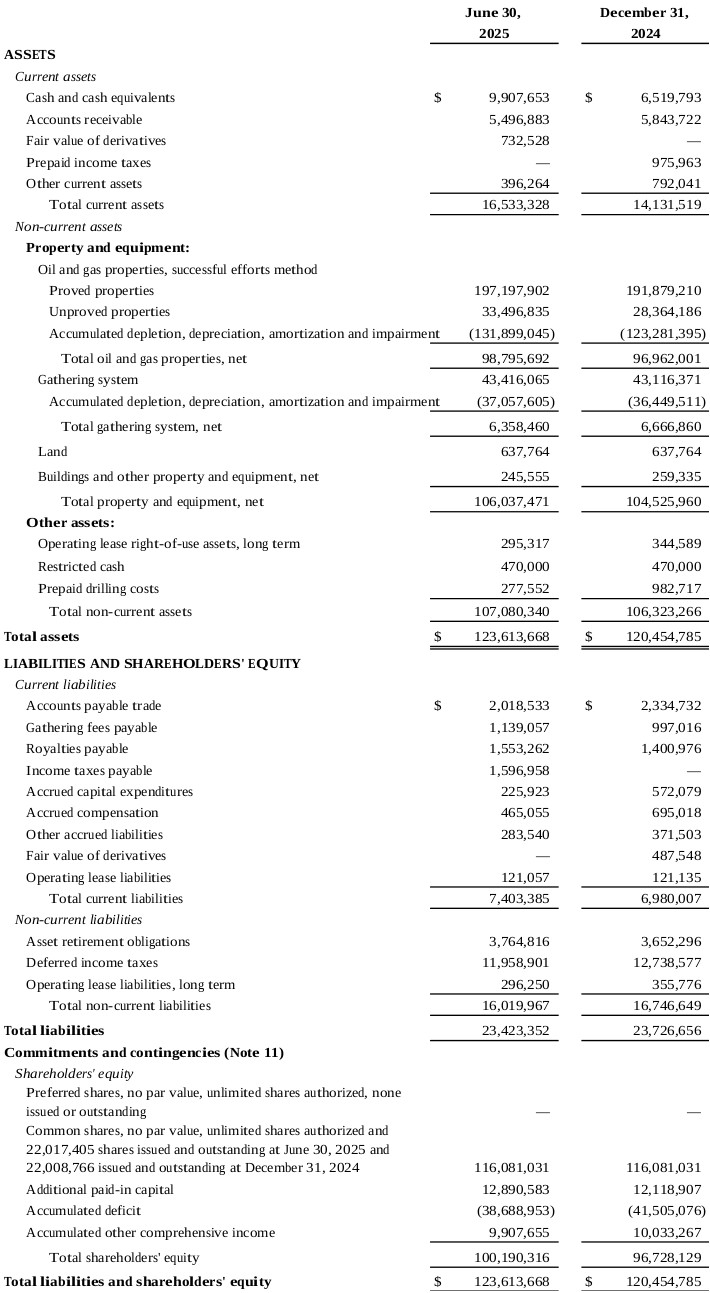

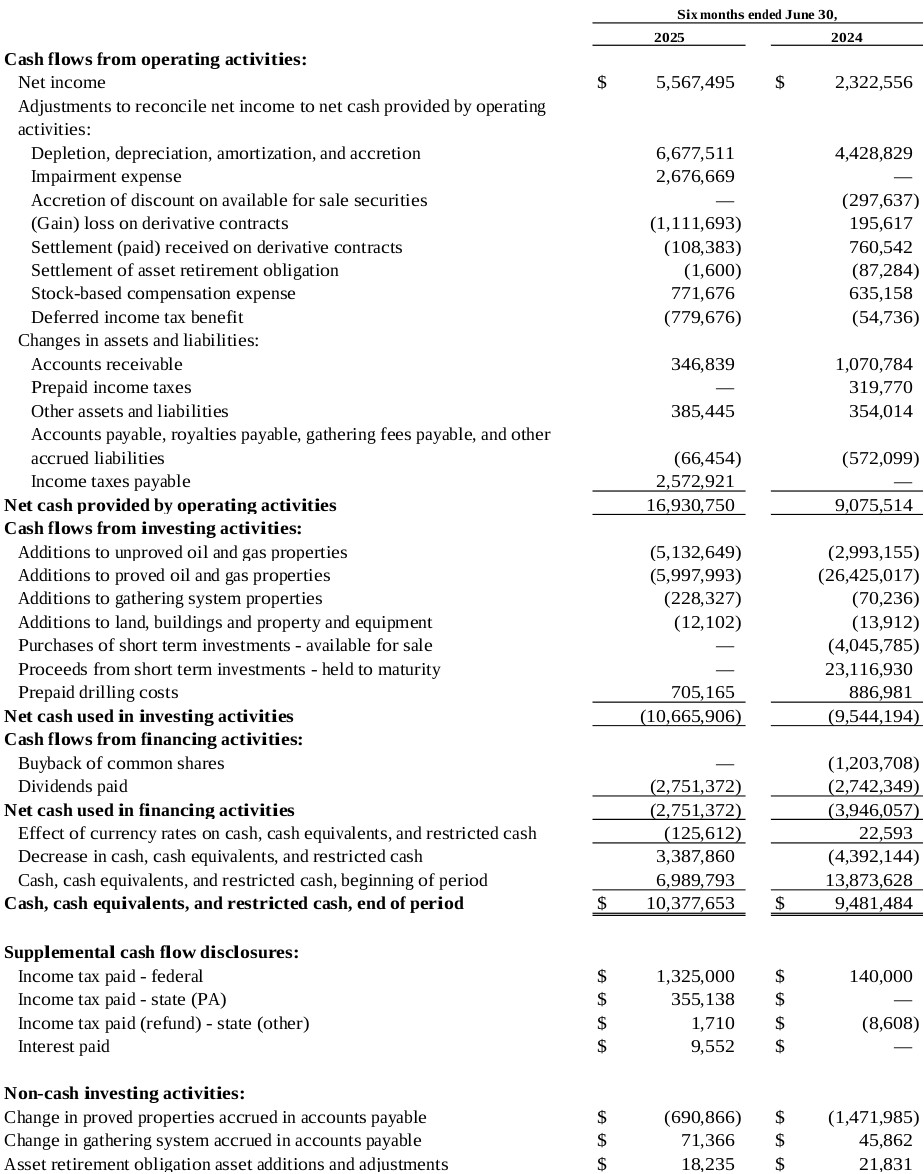

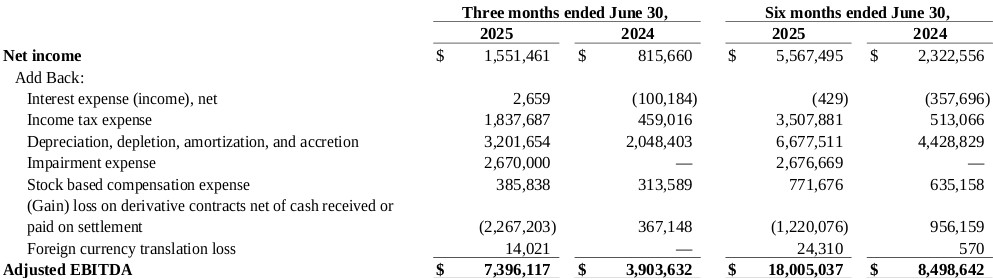

Item 2.02. Results of Operations and Financial Condition.

Attached as Exhibit 99.1 to this Current Report on Form 8-K is a copy of a press release of the Company, dated August 13, 2025 (the “Press Release”), reporting the Company’s 2025 Second Quarter Financial Results. In accordance with General Instruction B.2 of Form 8-K, such information, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

4

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference in response to this Item 3.02. The stock issuance will be completed in reliance upon the exemption from the registration requirements of the Securities Act of 1933, as amended, provided by Section 4(a)(2) thereof as a transaction by an issuer not involving any public offering.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The Peak E&P Purchase Agreement provides that at Closing the Company will cause two nominees of Peak E&P to be appointed to the board of directors of the Company.

Item 7.01. Regulation FD Disclosure.

On August 13, 2025, the Company issued the Press Release announcing the execution of the Purchase Agreements and the entry into the foregoing transactions. A copy of the Press Release is attached hereto as Exhibit 99.1 and incorporated into this Item 7.01 by reference.

On August 13, 2025, the Company provided supplemental information regarding the transactions contemplated by the Purchase Agreements in connection with a presentation to investors. A copy of the investor presentation is attached hereto as Exhibit 99.2 and incorporated into this Item 7.01 by reference.

In accordance with General Instruction B.2 of Form 8-K, the information set forth in this Item 7.01 and the attached Exhibit 99.1 and Exhibit 99.2 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release constitute forward looking statements. The use of any of the words “anticipate”, “continue”, “estimate”, “expect”, ‘may”, “will”, “project”, “should”, ‘believe”, and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated. Forward-looking statements are based on reasonable assumptions, but no assurance can be given that these expectations will prove to be correct and the forward-looking statements included in this news release should not be unduly relied upon.

No Offer or Solicitation

This communication relates to proposed transactions between the Company, Peak E&P and Peak BLM. This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the transactions or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law.

Important Additional Information Regarding the Transactions Will Be Filed With the SEC

In connection with the proposed transactions, the Company will file a proxy statement with the SEC. The definitive proxy statement will be sent to the stockholders of the Company. The Company may also file other documents with the SEC regarding the proposed transactions. INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE ADVISED TO CAREFULLY READ THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS, THE PARTIES TO THE TRANSACTIONS AND THE RISKS ASSOCIATED WITH THE TRANSACTIONS.

5

Investors and security holders may obtain a free copy of the proxy statement (when available) and other relevant documents filed by the Company with the SEC from the SEC’s website at www.sec.gov. Security holders and other interested parties will also be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by (1) directing your written request to: 500 Dallas Street, Suite 1250, Houston, Texas or (2) contacting our Investor Relations department by telephone at 281-670-0002. Copies of the documents filed by the Company with the SEC will be available free of charge on the Company’s website at http://www.epsilonenergyltd.com.

Participants in the Solicitation

The Company and certain of its directors, executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the stockholders of the Company in connection with the transactions, including a description of their respective direct or indirect interests, by security holdings or otherwise, will be included in the proxy statement described above when it is filed with the SEC. Additional information regarding the Company’s directors and executive officers is also included in its 2025 Proxy Statement, which was filed with the SEC on April 22, 2025. These documents are available free of charge as described above.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit Number |

|

Description |

|

|

|

2.1* |

|

|

2.2* |

|

|

2.3* |

|

|

99.1 |

|

|

99.2 |

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* |

All schedules and exhibits to the Membership Interest Purchase Agreements have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished to the SEC upon request. |

6

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

EPSILON ENERGY LTD. |

|

|

|

|

Date: August 13, 2025 |

By: |

/s/ J. Andrew Williamson |

|

|

J. Andrew Williamson |

|

|

Chief Financial Officer |

7

Exhibit 2.1

Execution Version

MEMBERSHIP INTEREST PURCHASE AGREEMENT

BY AND AMONG

THE SELLERS SET FORTH ON ANNEX I HERETO,

PEAK EXPLORATION & PRODUCTION, LLC,

EPSILON ENERGY USA, INC.,

EPSILON ENERGY LTD.

AND

YORKTOWN ENERGY PARTNERS XI, L.P.

(as Sellers’ Representative)

DATED AS OF AUGUST 11, 2025

TABLE OF CONTENTS

ARTICLE 1 DEFINITIONS AND INTERPRETATION |

1 |

|

Section 1.1 |

Defined Terms |

1 |

Section 1.2 |

References and Rules of Construction |

1 |

ARTICLE 2 PURCHASE AND SALE |

2 |

|

Section 2.1 |

Purchase and Sale |

2 |

Section 2.2 |

Effective Time |

2 |

ARTICLE 3 PURCHASE PRICE |

2 |

|

Section 3.1 |

Purchase Price |

2 |

Section 3.2 |

Allocation of Purchase Price |

3 |

Section 3.3 |

Adjustments to Purchase Price |

3 |

Section 3.4 |

Allocated Values |

4 |

ARTICLE 4 TITLE AND ENVIRONMENTAL MATTERS |

5 |

|

Section 4.1 |

Sellers’ and the Company Group’s Title |

5 |

Section 4.2 |

Notice of Title Defects; Title Defect Adjustments |

6 |

Section 4.3 |

Title Benefits |

8 |

Section 4.4 |

Notice of Environmental Defects; Environmental Defect Adjustments |

10 |

Section 4.5 |

Limitations on Applicability |

13 |

Section 4.6 |

Title and Environmental Disputes |

13 |

Section 4.7 |

Casualty or Condemnation Loss |

15 |

ARTICLE 5 REPRESENTATIONS AND WARRANTIES OF SELLERS |

15 |

|

Section 5.1 |

Generally |

15 |

Section 5.2 |

Existence and Qualification |

16 |

Section 5.3 |

Power |

16 |

Section 5.4 |

Authorization and Enforceability |

16 |

Section 5.5 |

No Conflicts |

16 |

Section 5.6 |

Capitalization |

17 |

Section 5.7 |

Liability for Brokers’ Fees |

17 |

Section 5.8 |

Litigation |

17 |

Section 5.9 |

Bankruptcy |

17 |

Section 5.10 |

Credit Support |

17 |

ARTICLE 6 REPRESENTATIONS AND WARRANTIES REGARDING THE COMPANY GROUP AND THE ASSETS |

17 |

|

Section 6.1 |

Generally |

17 |

Section 6.2 |

Existence and Qualification |

18 |

Section 6.3 |

Power |

18 |

Section 6.4 |

Authorization and Enforceability |

18 |

Section 6.5 |

No Conflicts |

18 |

Section 6.6 |

Capitalization |

19 |

Section 6.7 |

Subsidiaries |

20 |

Section 6.8 |

Litigation |

20 |

Section 6.9 |

Taxes and Assessments |

20 |

Section 6.10 |

Capital Commitments |

22 |

Section 6.11 |

Compliance with Laws |

22 |

Section 6.12 |

Material Contracts |

22 |

Section 6.13 |

Payments for Production and Imbalances |

24 |

Section 6.14 |

Consents and Preferential Purchase Rights |

25 |

Section 6.15 |

Non-Consent Operations |

25 |

Section 6.16 |

Plugging and Abandonment |

25 |

Section 6.17 |

Environmental Matters |

25 |

Section 6.18 |

Permits |

27 |

Section 6.19 |

Suspense Funds; Royalties |

27 |

Section 6.20 |

Specified Bank Accounts |

27 |

Section 6.21 |

Bankruptcy |

27 |

Section 6.22 |

Credit Support |

27 |

Section 6.23 |

Bank Accounts |

28 |

Section 6.24 |

Books and Records |

28 |

Section 6.25 |

Special Warranty |

28 |

Section 6.26 |

Undisclosed Liabilities |

28 |

Section 6.27 |

Absence of Changes |

28 |

Section 6.28 |

Employment Matters |

28 |

Section 6.29 |

Employee Benefits Matters |

30 |

Section 6.30 |

Insurance |

31 |

Section 6.31 |

Intellectual Property, IT Systems and Data Privacy |

31 |

Section 6.32 |

Indebtedness |

32 |

Section 6.33 |

Related Party Transactions |

33 |

Section 6.34 |

Condemnation |

33 |

Section 6.35 |

Surface Agreements; Leases |

33 |

Section 6.36 |

Wells |

33 |

Section 6.37 |

Hedges |

33 |

Section 6.38 |

Operations |

34 |

Section 6.39 |

Financial Statements |

34 |

ARTICLE 7 REPRESENTATIONS AND WARRANTIES OF PURCHASER |

34 |

|

Section 7.1 |

Generally |

34 |

Section 7.2 |

Existence and Qualification |

34 |

Section 7.3 |

Power |

35 |

Section 7.4 |

Authorization and Enforceability |

35 |

Section 7.5 |

No Conflicts |

35 |

Section 7.6 |

Liability for Brokers’ Fees |

35 |

Section 7.7 |

Litigation |

36 |

Section 7.8 |

Independent Evaluation |

36 |

Section 7.9 |

Consents, Approvals or Waivers |

37 |

Section 7.10 |

Bankruptcy |

37 |

Section 7.11 |

Sufficiency of Funds |

37 |

Section 7.12 |

Capitalization |

37 |

Section 7.13 |

Internal Controls; Listing Exchange |

38 |

Section 7.14 |

SEC Documents; Financial Statements; No Liabilities |

39 |

Section 7.15 |

Absence of Certain Changes |

39 |

Section 7.16 |

State Takeover Statues |

40 |

Section 7.17 |

Form S-3 |

40 |

ARTICLE 8 COVENANTS OF THE PARTIES |

40 |

|

Section 8.1 |

Access |

40 |

Section 8.2 |

Operation of Business |

42 |

Section 8.3 |

Interim Information |

45 |

Section 8.4 |

Further Assurances |

45 |

Section 8.5 |

Employee Matters |

46 |

Section 8.6 |

R&W Insurance Policy |

46 |

Section 8.7 |

Directors and Officers |

47 |

Section 8.8 |

Certain Disclaimers |

48 |

Section 8.9 |

Affiliate Contracts |

50 |

Section 8.10 |

Hedges |

50 |

Section 8.11 |

Post-Closing Confidentiality |

50 |

Section 8.12 |

Insurance Matters |

51 |

Section 8.13 |

Board Representation at Purchaser Parent |

51 |

Section 8.14 |

Registration Rights; Lock-Up |

52 |

Section 8.15 |

Public Announcements |

52 |

Section 8.16 |

Access to Books and Records |

52 |

Section 8.17 |

Listing Matters |

52 |

Section 8.18 |

Conduct of Purchaser Parent |

52 |

ARTICLE 9 CONDITIONS TO CLOSING |

53 |

|

Section 9.1 |

Sellers’ Conditions to Closing |

53 |

Section 9.2 |

Purchaser’s Conditions to Closing |

55 |

ARTICLE 10 CLOSING |

56 |

|

Section 10.1 |

Time and Place of Closing |

56 |

Section 10.2 |

Obligations of Sellers’ Representative at Closing |

56 |

Section 10.3 |

Obligations of Purchaser at Closing |

57 |

Section 10.4 |

Settlement Statement |

58 |

ARTICLE 11 TERMINATION |

59 |

|

Section 11.1 |

Termination |

59 |

Section 11.2 |

Effect of Termination |

60 |

ARTICLE 12 INDEMNIFICATION |

61 |

|

Section 12.1 |

Indemnification |

61 |

Section 12.2 |

Indemnification Actions |

62 |

Section 12.3 |

Limitations on Actions |

64 |

ARTICLE 13 TAX MATTERS |

67 |

|

Section 13.1 |

Tax Filings |

67 |

Section 13.2 |

Transfer Taxes |

67 |

Section 13.3 |

Cooperation |

67 |

Section 13.4 |

Tax Audits |

68 |

Section 13.5 |

Tax Treatment |

68 |

Section 13.6 |

Tax Withholding |

68 |

Section 13.7 |

Post-Closing Actions |

68 |

ARTICLE 14 MISCELLANEOUS |

69 |

|

Section 14.1 |

Counterparts |

69 |

Section 14.2 |

Notice |

69 |

Section 14.3 |

Expenses and Fees |

70 |

Section 14.4 |

Governing Law; Jurisdiction |

70 |

Section 14.5 |

Waivers |

71 |

Section 14.6 |

Assignment |

71 |

Section 14.7 |

Entire Agreement |

72 |

Section 14.8 |

Amendment |

72 |

Section 14.9 |

No Third Party Beneficiaries |

72 |

Section 14.10 |

Construction |

72 |

Section 14.11 |

Limitation on Damages |

72 |

Section 14.12 |

Conspicuous |

72 |

Section 14.13 |

Time of Essence |

72 |

Section 14.14 |

Delivery of Records |

73 |

Section 14.15 |

Severability |

73 |

Section 14.16 |

Specific Performance |

73 |

Section 14.17 |

Reliance on Own Judgment; Disclaimer of Reliance |

73 |

Section 14.18 |

Limitation on Recourse |

74 |

Section 14.19 |

Schedules |

74 |

Section 14.20 |

Sellers’ Representative |

75 |

APPENDICES

Appendix A – Definitions

ANNEXES

Annex I – Schedule of Sellers

EXHIBITS

Exhibit A-1 – Leases

Exhibit A-2 – Wells

Exhibit A-3 – Surface Interests

Exhibit A-4 – Real Property Interests

Exhibit A-5 – Office Leases

Exhibit A-6 – Permits

Exhibit B – Form of Assignment Agreement

Exhibit C – Form of Lock-Up Agreement

Exhibit D – Form of Registration Rights Agreement

Exhibit E – R&W Insurance Policy

SCHEDULES

Schedule 3.2 – Purchase Price Allocation Schedule

Schedule 3.3(a)(i) – Appraised Value of the Durango Building

Schedule 3.3(b)(vi) – Improvements in Pennsylvania

Schedule 3.4 – Allocated Values

Schedule 5.5 – No Conflicts

Schedule 5.6 – Capitalization

Schedule 5.8 – Litigation

Schedule 5.10 – Credit Support

Schedule 6.1(a) – Knowledge of the Company

Schedule 6.5 – No Conflicts

Schedule 6.6(b) – Outstanding Interests of the Company

Schedule 6.6(c) – Other Interests of the Company

Schedule 6.6(d) – Agreements Affecting Company Interests

Schedule 6.7 – Subsidiaries

Schedule 6.8 – Litigation

Schedule 6.9 – Taxes and Assessments

Schedule 6.10 – Capital Commitments

Schedule 6.12 – Material Contracts

Schedule 6.13 – Payments for Production and Imbalances

Schedule 6.15 – Non-Consent Operations

Schedule 6.16 – Plugging and Abandonment

Schedule 6.17 – Environmental Matters

Schedule 6.18 – Permits

Schedule 6.19 – Suspense Funds; Royalties

Schedule 6.20 – Specified Bank Accounts

Schedule 6.22 – Credit Support

Schedule 6.23 – Bank Accounts

Schedule 6.26 – Undisclosed Liabilities Schedule 6.28(a)(ii) – Contingent Workers

Schedule 6.27 – Absence of Changes

Schedule 6.28(a)(i) – Employees

Schedule 6.29(a) – Benefit Plans

Schedule 6.29(c) – Qualified Benefit Plans

Schedule 6.30 – Insurance

Schedule 6.31(a) – Intellectual Property

Schedule 6.32 – Indebtedness

Schedule 6.33 – Related Party Transactions

Schedule 6.34 – Condemnation

Schedule 6.36 – Wells

Schedule 6.37 – Company Hedges

Schedule 6.38 – Operations

Schedule 6.39 – Financial Statements

Schedule 7.1(a) – Purchaser’s Knowledge

Schedule 7.5 – No Conflicts

Schedule 7.9 – Consents, Approvals or Waivers

Schedule 7.12(c) – Agreements Affecting Purchaser Parent Interests

Schedule 8.2 – Operation of Business

Schedule 10.2(e) – Officers, Managers and Directors to Resign

Schedule 10.2(i) – Acknowledgements

MEMBERSHIP INTEREST PURCHASE AGREEMENT

Schedule 8.18 – Conduct of Purchaser Parent This MEMBERSHIP INTEREST PURCHASE AGREEMENT (this “Agreement”) is dated as of August 11, 2025 (the “Execution Date”), by and among (i) the Sellers set forth on Annex I hereto (each, a “Seller” and collectively, “Sellers”), (ii) PEAK EXPLORATION & PRODUCTION, LLC, a Delaware limited liability company (the “Company”), (iii) EPSILON ENERGY USA, INC., an Ohio corporation (“Purchaser”), (iv) EPSILON ENERGY LTD., a limited liability company organized under the laws of Canada (“Purchaser Parent”), and (v) YORKTOWN ENERGY PARTNERS XI, L.P., a Delaware limited partnership (“Yorktown XI”), as representative of Sellers (in such capacity, “Sellers’ Representative”). Sellers, the Company, Purchaser, Purchaser Parent and Sellers’ Representative are sometimes referred to herein individually as a “Party” and, collectively, as the “Parties.”

RECITALS

WHEREAS, Sellers own 100% of the issued and outstanding Interests of the Company (the “Company Interests”), and the Company Group owns 100% of the Assets; and

WHEREAS, the Parties desire that, at the Closing, Sellers shall sell and transfer to Purchaser, and Purchaser shall purchase and acquire from Sellers, the Company Interests, in the manner and upon the terms and subject to the conditions hereafter set forth.

AGREEMENT

NOW, THEREFORE, in consideration of the premises and of the mutual promises, representations, warranties, covenants, conditions, and agreements contained herein, and for other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound by the terms hereof, agree as follows:

ARTICLE 1

DEFINITIONS AND INTERPRETATION

Section 1.1Defined Terms. In addition to the terms defined in the Preamble and the Recitals of this Agreement, for purposes hereof, the capitalized terms used herein and not otherwise defined shall have the meanings set forth in Appendix A. A defined term has its defined meaning throughout this Agreement regardless of whether such defined term appears before or after the place where such defined term is defined, and its other grammatical forms have corresponding meanings.

Section 1.2References and Rules of Construction. All references in this Agreement to Exhibits, Annexes, Schedules, Appendices, Articles, Sections, subsections, clauses, and other subdivisions refer to the corresponding Exhibits, Annexes, Schedules, Appendices, Articles, Sections, subsections, clauses, and other subdivisions of or to this Agreement unless expressly provided otherwise. Titles appearing at the beginning of any Exhibits, Annexes, Schedules, Appendices, Articles, Sections, subsections, clauses, and other subdivisions of this Agreement are for convenience only, do not constitute any part of this Agreement, and shall be disregarded in construing the language hereof. All references to “$” shall be deemed references to Dollars. Each accounting term not defined herein will have the meaning given to it under GAAP as interpreted as of the Execution Date. Unless expressly provided to the contrary, the word “or,” “either” or “any” is not exclusive. As used herein, the word (a) “day” means calendar day; (b) “extent” in the phrase “to the extent” shall mean the degree to which a subject or other thing extends, and such phrase shall not mean simply “if”; (c) “this Agreement,” “herein,” “hereby,” “hereunder,” and “hereof,” and words of similar import, refer to this Agreement as a whole and not to any particular Article, Section, subsection, clause, or other subdivision unless expressly so limited; (d) “this Article,” “this Section,” “this subsection,” “this clause,” and words of similar import, refer only to the Article, Section, subsection, and clause hereof in which such words occur; and (e) “including” (in its various forms) means including without limiting the foregoing in any respect.

1

Pronouns in masculine, feminine, or neuter genders shall be construed to state and include any other gender, and words, terms, and titles (including terms defined herein) in the singular form shall be construed to include the plural and vice versa, unless the context otherwise requires. Unless expressly provided to the contrary, if a word or phrase is defined, its other grammatical forms have a corresponding meaning. Exhibits, Annexes, Schedules and Appendices referred to herein are attached to this Agreement and by this reference incorporated herein for all purposes. Reference herein to any federal, state, local, or foreign Law shall be deemed to also refer to all rules and regulations promulgated thereunder, unless the context requires otherwise, and shall also be deemed to refer to such Laws as in effect as of the Execution Date or as hereafter amended. Examples are not to be construed to limit, expressly or by implication, the matter they illustrate. References to a specific time shall refer to prevailing Mountain Time, unless otherwise indicated. If any period of days referred to in this Agreement ends on a day that is not a Business Day, then the expiration of such period shall be automatically extended until the end of the first succeeding Business Day. References to a Person are also to its permitted successors and permitted assigns. The phrases “disclosed in writing to Purchaser”, “provided to Purchaser” or “made available to Purchaser” or similar phrases as used in this Agreement shall mean that the subject documents were posted to the Data Room at least two (2) Business Days prior to the Execution Date. Unless expressly provided to the contrary, any agreement, instrument or writing defined or referred to herein means such agreement, instrument, or writing, as from time to time amended, supplemented, or modified.

ARTICLE 2

PURCHASE AND SALE

Section 2.1Purchase and Sale. At the Closing, upon the terms and subject to the conditions of this Agreement, (a) Sellers agree to sell, transfer, and convey the Company Interests to Purchaser, free and clear of any Encumbrances (other than transfer restrictions contained in the Company Organizational Documents, this Agreement, and applicable federal or state securities Laws and subject to Purchaser’s obligations pursuant to Section 10.3(d)) and (b) Purchaser agrees to purchase, accept, and pay for the Company Interests.

Section 2.2Effective Time. Subject to the other terms and conditions of this Agreement, the Company Interests shall be transferred from Sellers to Purchaser at the Closing, but certain financial benefits and burdens of the Assets shall be transferred effective as of 12:01 a.m., Mountain Time, on January 1, 2025 (the “Effective Time”).

ARTICLE 3

PURCHASE PRICE

Section 3.1Purchase Price. On the terms and subject to the conditions of this Agreement, the purchase price for the purchase and sale of the Company Interests shall be Five Million, Eight Hundred Thousand (5,800,000) common shares, no par value, of Purchaser Parent (such Purchaser Parent common shares, the “Purchaser Parent Common Stock”, and as valued in accordance with Section 3.2, the “Unadjusted Purchase Price”), as adjusted and issued, as applicable, pursuant to and in accordance with this Agreement, including Section 3.3 and Section 10.4. Notwithstanding the foregoing, if, at any time on or after the Execution Date and prior to the Closing, (a) Purchaser Parent makes, pays, or effects (or any record date is established with respect thereto) (i) any dividend on the Purchaser Parent Common Stock payable in Purchaser Parent Common Stock, (ii) any subdivision or split of Purchaser Parent Common Stock, (iii) any combination or reclassification of Purchaser Parent Common Stock into a smaller number of shares of Purchaser Parent Common Stock, or (iv) any issuance of any securities by reclassification of Purchaser Parent Common Stock (including any reclassification in connection with a merger, consolidation or business combination in which Purchaser Parent is the surviving person) or (b) any merger, consolidation, combination, or other transaction is consummated pursuant to which Purchaser Parent Common Stock is converted into the right to receive cash or other securities, then the number of shares of Purchaser Parent Common Stock to be issued to Sellers (or their designees) as the Unadjusted Purchase Price pursuant to this Agreement shall be proportionately adjusted, including, for the avoidance of doubt, in the cases of clauses (a)(iv) and (b) to provide for the receipt by Sellers, in lieu of any Purchaser Parent Common Stock, the same number or amount of cash and/or securities as is received in exchange for each share of Purchaser Parent Common Stock in connection with any such transaction described in clauses (a)(iv) and (b) hereof.

2

An adjustment made pursuant to the foregoing sentence shall become effective immediately after the record date in the case of a dividend and shall become effective immediately after the effective date in the case of a subdivision, split, merger, combination, reclassification or other transaction.

Section 3.2Allocation of Purchase Price. The Parties agree that the Adjusted Purchase Price and any other amounts treated as consideration for U.S. federal and applicable state, local, or foreign Tax purposes shall be allocated among the Assets of the Company in accordance with Sections 751 and 1060 of the Code and the methodologies and allocations set forth on Schedule 3.2 (the “Purchase Price Allocation Schedule”). The Parties hereby further agree that, for U.S. federal and applicable state, local, or foreign Tax purposes, the Purchaser Parent Common Stock issued as consideration hereunder shall be valued by the Parties based on the volume weighted average price of Purchaser Parent Common Stock as reported on the Nasdaq Global Market for the sixty (60) consecutive trading days prior to the Closing Date. Within sixty (60) days after the Closing, Purchaser shall deliver to Sellers’ Representative a draft Internal Revenue Service Form 8594 prepared in accordance with the Purchase Price Allocation Schedule. Sellers’ Representative shall, within thirty (30) days after receipt of the draft Purchase Price Allocation Schedule, notify Purchaser if Sellers’ Representative disagrees with such draft Purchase Price Allocation Schedule, and if Sellers’ Representative does not so notify Purchaser within such thirty (30) day period, the draft Purchase Price Allocation Schedule shall be final and binding on the Parties. If Sellers’ Representative disagrees with the draft Purchase Price Allocation Schedule, Purchaser and Sellers’ Representative shall make a good faith effort to resolve the dispute. If Purchaser and Sellers’ Representative have been unable to resolve their differences within thirty (30) days after Purchaser has been notified of Sellers’ Representative’s disagreement with the draft Purchase Price Allocation Schedule, then any remaining disputed issues shall be submitted to the Independent Accountant who shall resolve the disagreement in a final binding manner in accordance with the dispute resolution procedures set forth in Section 10.4, mutatis mutandis. The Parties shall use the Form 8594 and Purchase Price Allocation Schedule, as agreed by the Parties or as determined by the Independent Accountant, in reporting this transaction to the applicable Taxing Authorities, and no Party shall file any Tax Return or otherwise take any position for Tax purposes that is inconsistent with the Form 8594 and Purchase Price Allocation Schedule as finalized hereunder. Each Party shall promptly notify the other in writing upon receipt of notice of any pending or threatened Tax audit or assessment challenging the allocations set forth on Form 8594 or Purchase Price Allocation Schedule, and no Party shall agree to any proposed adjustment to the allocation contained in the Form 8594 or Purchase Price Allocation Schedule by any Taxing Authority unless pursuant to a “determination” within the meaning of Code Section 1313(a).

Section 3.3Adjustments to Purchase Price. All adjustments to the Unadjusted Purchase Price shall be made (a) in accordance with the terms of this Agreement and, to the extent not inconsistent with this Agreement, in accordance with GAAP as consistently applied by Sellers, (b) without duplication (in this Agreement or otherwise), and (c) with respect to matters (i) in the case of Section 3.3(b)(i) and Section 3.3(b)(ii), for which notice is given on or before the Claim Date, and (ii) in all of the other cases set forth in Section 3.3(a) and Section 3.3(b), identified on or before the Closing. Each adjustment to the Unadjusted Purchase Price described in Section 3.3(a) and Section 3.3(b) will be calculated in Dollars and shall be allocated among the Assets in accordance with Section 3.4.

3

Without limiting the foregoing, the adjustments to the Unadjusted Purchase Price shall be translated to an increase or decrease (as the case may be) to the Purchaser Parent Common Stock to be issued by Purchaser by dividing the Dollar amount of such adjustment by the volume weighted average price of Purchaser Parent Common Stock as reported on the Nasdaq Global Market for the sixty (60) consecutive trading days prior to the Closing Date and rounding to the nearest whole number of shares. The result of the adjustments to Unadjusted Purchase Price pursuant to Section 3.3(a) and Section 3.3(b) shall be referred to herein as the “Adjusted Purchase Price”.

(a)The Unadjusted Purchase Price shall be adjusted upward by the following amounts (without duplication):

(i)an amount equal to the appraised value of the Durango Building as per Schedule 3.3 (a)(i); and

(ii)any other amount provided for elsewhere in this Agreement or otherwise agreed upon in writing by the Parties as an upward adjustment to the Unadjusted Purchase Price.

(b)The Unadjusted Purchase Price shall be adjusted downward by the following amounts (without duplication):

(i)any reductions to the Unadjusted Purchase Price to be made in accordance with Section 4.2, reduced by any amounts for Title Benefits determined pursuant to Section 4.3 and Section 4.4;

(ii)any reductions to the Unadjusted Purchase Price to be made in accordance with Section 4.3;

(iii)to the extent not in the Specified Bank Accounts as of Closing, the amount of any Suspense Funds as of Closing, if any;

(iv)any Leakage as of the Closing;

(v)any Company Transaction Expenses in excess of the Fee Cap outstanding as of Closing;

(vi)the appraised value of Purchaser’s non-oil and gas real estate and improvements in Pennsylvania as per Schedule 3.3(b)(vi) attached hereto;

(vii)the unpaid expenses that were incurred in connection with the contemplated initial public offering of securities of Peak Resources LP and Peak Resources GP LLC that (A) Sellers have allocated to the Company and are unpaid as of the Closing and (B) are subject to an obligation of the Company Group to reimburse a Third Party;

(viii)except for the Wyoming Tax Matter, accrued but unpaid Taxes of the Company Group for periods ending on or before the Effective Time, if any; and

(ix)any other amount provided for elsewhere in this Agreement or otherwise agreed upon in writing by the Parties as a downward adjustment to the Unadjusted Purchase Price.

Section 3.4Allocated Values. The “Allocated Values” for the Assets (which are provided for, and allocated among, each of the Leases and Wells are set forth on Schedule 3.4. Each adjustment pursuant to Section 3.3 shall be allocated to the particular Assets to which such adjustment relates to the extent, and in the proportion which, such adjustment relates to such Assets and to the extent that it is, in the commercially reasonable discretion of Purchaser, possible to do so.

4

Any adjustment not allocated to a specific Asset or Assets pursuant to the immediately preceding sentence shall be allocated among each Asset in an amount equal to the Allocated Value of such Asset divided by the total Allocated Value on Schedule 3.4. Sellers have accepted such Allocated Values for purposes of this Agreement and the transactions contemplated hereby, but make no representation or warranty as to the accuracy of such values. For the avoidance of doubt, the Parties agree that the Allocated Values set forth on Schedule 3.4 shall be utilized to determine if the Individual Defect Threshold and Aggregate Defect Deductible are met but all adjustments to the Unadjusted Purchase Price shall be made by utilizing the volume weighted average price of Purchaser Parent Common Stock as reported on the Nasdaq Global Market for the sixty (60) consecutive trading days prior to the Closing Date in accordance with Section 3.3.

ARTICLE 4

TITLE AND ENVIRONMENTAL MATTERS

Section 4.1Sellers’ and the Company Group’s Title.

(a)WITHOUT LIMITING PURCHASER’S REMEDIES UNDER THE R&W INSURANCE POLICY, FOR TITLE DEFECTS SET FORTH IN THIS ARTICLE 4 AND PURCHASER’S RIGHT TO TERMINATE THIS AGREEMENT PRIOR TO CLOSING PURSUANT TO SECTION 11.1(F), (I) SELLERS DO NOT MAKE, SELLERS EXPRESSLY DISCLAIM, AND PURCHASER WAIVES, ANY REPRESENTATION OR WARRANTY, EXPRESS, IMPLIED, STATUTORY, OR OTHERWISE, WITH RESPECT TO THE COMPANY GROUP’S TITLE TO, OR ANY OTHER PERSON’S TITLE TO, OR ANY DEFICIENCY IN TITLE TO, ANY OF THE ASSETS OR THE DESCRIPTIONS THEREOF (INCLUDING ANY LISTINGS OF NET MINERAL ACRES, PERCENTAGE WORKING INTEREST, OR PERCENTAGE NET REVENUE INTEREST FOR ANY ASSET) AND (II) PURCHASER HEREBY ACKNOWLEDGES AND AGREES THAT, SUBJECT TO THE PROVISIONS OF SECTION 4.5, PURCHASER’S SOLE REMEDY FOR ANY DEFECT OF TITLE OR ANY OTHER TITLE MATTER, INCLUDING ANY TITLE DEFECT, WITH RESPECT TO ANY OF THE ASSETS, (i) ON OR BEFORE THE CLAIM DATE, SHALL BE AS SET FORTH IN SECTION 4.2 AND (ii) FROM AND AFTER THE CLAIM DATE (WITHOUT DUPLICATION), SHALL BE PURSUANT TO THE SPECIAL WARRANTY BY SELLERS SET FORTH IN SECTION 6.25. EXCEPT FOR THE SPECIAL WARRANTY BY SELLERS SET FORTH IN SECTION 6.25 AND WITHOUT LIMITING PURCHASER’S REMEDIES UNDER THE R&W INSURANCE POLICY OR FOR TITLE DEFECTS SET FORTH IN THIS ARTICLE 4, PURCHASER HEREBY WAIVES ANY RIGHT TO ASSERT ANY TITLE DEFECT OR OTHER TITLE MATTER, OR TO OTHERWISE RECEIVE ANY ADJUSTMENT TO THE UNADJUSTED PURCHASE PRICE IN RESPECT OF, ANY TITLE DEFECT OR OTHER TITLE MATTER.

(b)NOTWITHSTANDING ANYTHING TO THE CONTRARY IN THIS AGREEMENT, PURCHASER ACKNOWLEDGES AND AGREES THAT PURCHASER SHALL NOT BE ENTITLED TO PROTECTION UNDER (NOR HAVE THE RIGHT TO MAKE A CLAIM AGAINST) THE SPECIAL WARRANTY BY SELLERS SET FORTH IN SECTION 6.25 FOR ANY EXCLUDED DEFECT OR ANY TITLE DEFECT ASSERTED UNDER THIS ARTICLE 4 (OR ANY MATTER RAISED IN ANY TITLE DEFECT NOTICE) PRIOR TO THE CLAIM DATE.

5

Section 4.2Notice of Title Defects; Title Defect Adjustments.

(a)Title Defect Notice. To assert a claim of a Title Defect, Purchaser must deliver a claim notice to Sellers’ Representative (a “Title Defect Notice”) no later than 5:00 p.m., Mountain Time, on the day that is forty-five (45) days following the Execution Date (the “Claim Date”). To give Sellers an opportunity to commence reviewing and curing alleged Title Defects asserted by Purchaser, Purchaser shall use Commercially Reasonable Efforts to give Sellers’ Representative, on or before the end of each calendar week prior to the Claim Date, written notice of all alleged Title Defects discovered by Purchaser or Purchaser’s Representatives during such calendar week, which notice may be preliminary in nature and supplemented prior to the Claim Date; provided that the failure to provide any such preliminary notice shall not affect or otherwise prejudice Purchaser’s right to assert Title Defects at any time prior to the Claim Date and the remedies hereunder therefor. To be effective, each Title Defect Notice shall be in writing and include (i) a detailed description of the alleged Title Defect that is reasonably sufficient for Sellers to determine the basis of the alleged Title Defect, (ii) the Lease or Well adversely affected by the Title Defect (each, a “Title Defect Property”), (iii) the Allocated Value of each Title Defect Property, (iv) all documents upon which Purchaser relies for its assertion of a Title Defect, including, at a minimum, supporting documents reasonably necessary for Sellers (as well as any title attorney or examiner hired by Sellers) to evaluate the existence of the alleged Title Defect (if, and to the extent, such documents are in Purchaser’s or its Representative’s possession or control or if of record or part of the Records, references to the same), and (v) the amount by which Purchaser reasonably believes the Allocated Value of each Title Defect Property is reduced by the alleged Title Defect and the computations and information upon which Purchaser’s belief is based, including any analysis by any title attorney or examiner hired by Purchaser. Notwithstanding anything herein to the contrary (except for the special warranty by Sellers set forth in Section 6.25 and without limiting Purchaser’s remedies under the R&W Insurance Policy and Purchaser’s right to terminate this Agreement prior to Closing pursuant to Section 11.1(f), Purchaser forever waives, and Sellers shall have no liability for, Title Defects or any other matters that may otherwise constitute Title Defects not asserted by a Title Defect Notice meeting, in all material respects, all of the requirements set forth in the preceding sentence by the Claim Date.

(b)Sellers’ Right to Cure.

(i)Sellers shall have the right, but not the obligation, to cause the Company to attempt to cure, at Sellers’ sole cost and expense, on or before the date that is two (2) Business Days before the Closing Date (the “Cure Period”), any Title Defects for which Sellers have received a Title Defect Notice from Purchaser prior to the Claim Date. An election by Sellers to cause the Company to attempt to cure a Title Defect shall be without prejudice to its rights under Section 4.6 and shall not constitute an admission against interest or a waiver of Sellers’ right to dispute the existence, nature or value of, or cost to cure, such Title Defect.

(ii)At the Closing, the Unadjusted Purchase Price shall be adjusted downward by an amount equal to the sum of, subject to and after taking into account the Individual Defect Threshold and Aggregate Defect Deductible:

(A)the aggregate amount of all Title Defect Amounts (as asserted by Purchaser in good faith in accordance with Section 4.2(a)) for all Title Defects that Sellers have elected to cause the Company to attempt to cure at Sellers’ sole cost pursuant to Section 4.2(b) and that have not been cured or that Sellers have elected to dispute pursuant to Section 4.6; plus

6

(B)the aggregate amount of all Title Defect Amounts (as asserted by Purchaser in good faith in accordance with Section 4.2(a)) for all Title Defects that Sellers or the Company attempted to cure prior to the Closing but which Purchaser has elected to dispute such cure pursuant to Section 4.6.

(iii)If (A) before the end of the Cure Period, Sellers’ Representative and Purchaser agree that such Title Defect has been cured, or (B) Sellers’ Representative and Purchaser cannot agree, and it is determined by the Consultant(s) pursuant to Section 4.6 that such Title Defect is fully cured, then there shall be no adjustment to the Unadjusted Purchase Price; provided, however, that, if such Title Defect has only been partially cured (or determined to be partially cured), then the Unadjusted Purchase Price shall be adjusted downward based on the Title Defect Amount for such Title Defect as partially cured, as applicable, and such adjustment and releases shall be reflected in the calculations, and any further reconciliation, if necessary, shall be completed, under Section 10.4(b) or Section 4.6, as applicable.

(iv)If (A) upon the end of the Cure Period, Sellers’ Representative and Purchaser agree that such Title Defect has not been cured, or (B) Sellers’ Representative and Purchaser cannot agree, and it is determined by the Consultant(s) pursuant to Section 4.6 that such Title Defect is not cured, then the Unadjusted Purchase Price shall be adjusted downward by the Title Defect Amount for such Title Defect and such adjustment and releases shall be reflected in the calculations, and any further reconciliation, if necessary, shall be completed, under Section 10.4(b) or Section 4.6, as applicable.

(c)Remedy for Title Defects. Subject to Sellers’ Representative’s continuing right to dispute the existence of a Title Defect or dispute the Title Defect Amount asserted with respect thereto, subject to the right of Purchaser to dispute the adequacy of any cure attempted by Sellers, and subject to the right of each Party to terminate this Agreement prior to Closing pursuant to Section 11.1, in the event that any Title Defect timely and effectively asserted by Purchaser in accordance with Section 4.2(a) is not waived in writing by Purchaser or cured by Sellers prior to the end of the Cure Period, then, subject to the application of the Individual Defect Threshold and the Aggregate Defect Deductible in accordance with Section 4.5, reduce the Unadjusted Purchase Price by the Title Defect Amount determined pursuant to Section 4.2(d) or Section 4.6; provided if such Title Defect is disputed pursuant to Section 4.6, reduce the Unadjusted Purchase Price by the Title Defect Amount determined pursuant to Section 4.6. Without limitation of Purchaser’s rights and remedies under the R&W Insurance Policy and Purchaser’s right to terminate this Agreement prior to Closing pursuant to Section 11.1(f), Purchaser shall be deemed to have assumed responsibility for all of the liability attributable to the applicable Title Defect asserted in the Title Defect Notice.

(d)Title Defect Amount. The amount by which the Allocated Value of a Title Defect Property is reduced as a result of the existence of a Title Defect shall be the “Title Defect Amount” and shall be determined in accordance with the following methodology, terms, and conditions:

(i)if Purchaser and Sellers’ Representative agree on the Title Defect Amount, that amount shall be the Title Defect Amount;

(ii)if the Title Defect is a lien, encumbrance, or other charge that is undisputed and liquidated in amount (other than the Existing Secured Credit Facility), then the Title Defect Amount shall be the amount necessary to be paid to remove the Title Defect from the Company Group’s interest in the affected Title Defect Property;

7

(iii)if the Title Defect reflects a discrepancy (with a proportionate decrease in the Working Interest for the affected Title Defect Property) between (A) the Net Revenue Interest for the affected Title Defect Property and (B) the Net Revenue Interest stated in Exhibit A-2 for such Title Defect Property, then the Title Defect Amount shall be the product of the Allocated Value of such Title Defect Property multiplied by a fraction, the numerator of which is the absolute value of such Net Revenue Interest decrease and the denominator of which is the Net Revenue Interest stated in Exhibit A-2 for such Title Defect Property;

(iv)if the Title Defect reflects a discrepancy (based solely on gross acreage in the lands covered by the affected Lease or the undivided percentage interest in oil, gas, and other minerals covered by the affected Lease) between (A) the Net Mineral Acres for the affected Lease and (B) the Net Mineral Acres stated in Exhibit A-1 for the affected Lease, the Title Defect Amount shall be the product of the Allocated Value of such Title Defect Property multiplied by a fraction, the numerator of which is the absolute value of the Net Mineral Acre decrease for such Title Defect Property and the denominator of which is the Net Mineral Acres of such Title Defect Property stated in Exhibit A-1;

(v)if the Title Defect represents an obligation, encumbrance, burden, or charge upon or other defect in title to the Title Defect Property of a type not described in subsections (ii), (iii) or (iv) above, the Title Defect Amount shall be determined by taking into account the Allocated Value of the Title Defect Property, the portion of the Title Defect Property adversely affected by the Title Defect, the legal effect of the Title Defect, the potential economic effect of the Title Defect over the life of the Title Defect Property, the values placed upon the Title Defect by Purchaser and Sellers’ Representative, and such other factors as are necessary to make a proper evaluation;

(vi)the Title Defect Amount with respect to a Title Defect shall be determined without duplication of any costs or losses included in any other Title Defect Amount hereunder, or for which Purchaser otherwise receives credit in the calculation of the Adjusted Purchase Price; and

(vii)notwithstanding anything to the contrary in this Article 4, except in the case of Title Defect Amounts determined pursuant to Section 4.2(d)(ii), the aggregate Title Defect Amounts attributable to the effects of all Title Defects upon any Title Defect Property shall not exceed the Allocated Value of such Title Defect Property.

Section 4.3Title Benefits.

(a)Sellers’ Representative has the right, but not the obligation, to deliver to Purchaser on or before the Claim Date with respect to each Title Benefit discovered by Sellers a notice (a “Title Benefit Notice”) in writing and including (i) a detailed description of the alleged Title Benefit reasonably sufficient to determine the basis of the alleged Title Benefit, (ii) the Lease or Well affected by such Title Benefit (a “Title Benefit Property”), (iii) the Allocated Value of each Title Benefit Property, (iv) all documents upon which Sellers rely for the assertion of a Title Benefit, including, at a minimum, supporting documents reasonably necessary for Purchaser (as well as any title attorney or examiner hired by Purchaser) to evaluate the existence of the alleged Title Benefit, and (v) the amount by which Sellers reasonably believe the Allocated Value of each Title Benefit Property is increased by such Title Benefit and the computations and information upon which Sellers’ belief is based. Sellers forever waive Title Benefits not asserted by a Title Benefit Notice meeting all the requirements set forth in the preceding sentence by the Claim Date. Purchaser shall, promptly upon discovery, furnish Sellers’ Representative with written notice of any Title Benefit discovered by Purchaser or its Representatives while conducting Purchaser’s due diligence with respect to the Properties prior to the Claim Date.

8

(b)With respect to each Title Benefit Property affected by Title Benefits reported under Section 4.3(a), the downward adjustment to the Unadjusted Purchase Price pursuant to Section 3.3(b)(i) for Title Defects Amounts shall be decreased by an amount (the “Title Benefit Amount”) equal to the increase in the Allocated Value for such Title Benefit Property, as determined pursuant to Section 4.3(c). For the avoidance of doubt, the application of any Title Benefit Amounts to the Unadjusted Purchase Price shall be applicable only as an offset to those Title Defect Amounts that would otherwise result in a downward adjustment to the Unadjusted Purchase Price pursuant to Section 4.2(c) and Section 3.3(b)(i).

(c)The Title Benefit Amount resulting from a Title Benefit shall be the amount by which the Allocated Value of the Title Benefit Property affected by such Title Benefit is increased as a result of the existence of such Title Benefit and shall be determined in accordance with the following methodology, terms, and conditions:

(i)if Purchaser and Sellers’ Representative agree on the Title Benefit Amount, that amount shall be the Title Benefit Amount;

(ii)if the Title Benefit reflects a difference (with a proportional increase in the Working Interest for the affected Title Defect Property) between (A) the Net Revenue Interest for the affected Title Benefit Property and (B) the Net Revenue Interest stated in Exhibit A-2 for such Title Benefit Property, then the Title Benefit Amount shall be the product of the Allocated Value of such Title Benefit Property multiplied by a fraction, the numerator of which is the absolute value of such Net Revenue Interest increase and the denominator of which is the Net Revenue Interest stated in Exhibit A-2 for such Title Benefit Property;

(iii)if the Title Benefit reflects a difference (based solely on gross acreage in the lands covered by the affected Lease or the undivided percentage interest in oil, gas, and other minerals covered by the affected Lease) between (A) the Net Mineral Acres for the affected Lease and (B) the Net Mineral Acres stated in Exhibit A-1 for such Lease, the Title Benefit Amount shall be the product of the Allocated Value of such Title Benefit Property multiplied by a fraction, the numerator of which is the Net Mineral Acres increase for such Title Benefit Property and the denominator of which is the Net Mineral Acres of such Title Benefit Property stated in Exhibit A-1; and

(iv)if the Title Benefit is of a type not described in subsections (ii) or (iii) above, the Title Benefit Amount shall be determined by taking into account the Allocated Value of the Title Benefit Property, the portion of the Title Benefit Property benefitted by the Title Benefit, the legal effect of the Title Benefit, the potential economic effect of the Title Benefit over the life of the Title Benefit Property, the values placed upon the Title Benefit by Purchaser and Sellers, and such other factors as are necessary to make a proper evaluation.

(d)If the Parties cannot reach an agreement on alleged Title Benefits and Title Benefit Amounts prior to Closing, the provisions of Section 4.6 shall apply.

9

Section 4.4Notice of Environmental Defects; Environmental Defect Adjustments.

(a)Environmental Defect Notice. To assert a claim of an Environmental Defect, Purchaser must deliver a claim notice to Sellers’ Representative (an “Environmental Defect Notice”) no later than the Claim Date. To give Sellers an opportunity to commence reviewing and curing alleged Environmental Defects asserted by Purchaser, Purchaser shall use Commercially Reasonable Efforts to give Sellers’ Representative, on or before the end of each calendar week prior to the Claim Date, written notice of all alleged Environmental Defects discovered by Purchaser or Purchaser’s Representatives during such calendar week, which notice may be preliminary in nature and supplemented prior to the Claim Date; provided that the failure to provide any such preliminary notice shall not affect or otherwise prejudice Purchaser’s right to assert Environmental Defects at any time prior to the Claim Date and the remedies hereunder therefor. To be effective, each Environmental Defect Notice shall be in writing and include (i) a reasonably detailed description of the alleged Environmental Defect (including the specific Environmental Law provision(s) forming the basis for the claim) and the Assets adversely affected by such alleged Environmental Defect (each, an “Environmental Defect Property”), (ii) the Allocated Value of the Environmental Defect Property (or portions thereof) affected thereby, (iii) all material documents upon which Purchaser relies for its assertion of such Environmental Defect, including, at a minimum, supporting documents reasonably necessary to determine the existence of the alleged Environmental Defect and the applicable Remediation Amount (if, and to the extent, such documents are in Purchaser’s or its Representatives’ possession or control) and (iv) a reasonably detailed calculation (recognizing any access limitations) of the Remediation Amount that Purchaser asserts is attributable to such alleged Environmental Defect, which shall describe in reasonable detail the Remediation proposed for the alleged Environmental Defect and identify all material assumptions used by Purchaser or its Representatives in calculating the Remediation Amount, including the standards Purchaser or its Representatives assert must be met to comply with applicable Environmental Laws or applicable leases. Purchaser may not assert an Environmental Defect for any matter disclosed with a reasonably detailed description on Schedule 6.17 or Schedule 6.18. Except for the representations and warranties of Sellers in Section 6.17 and Section 6.18 and without limiting Purchaser’s remedies under the R&W Insurance Policy and Purchaser’s right to terminate this Agreement prior to Closing pursuant to Section 11.1(f) and Section 11.1(d) in respect of such representations and warranties of Sellers in Section 6.17 and Section 6.18, Purchaser forever waives, and Sellers shall have no liability under this Agreement, Environmental Law, applicable leases or otherwise, for, Environmental Defects or any other matters that may constitute Environmental Defects that are not asserted by an Environmental Defect Notice meeting, in all material respects, all of the requirements set forth in the preceding sentence by the Claim Date.

(b)Sellers’ Right to Cure.

(i)Sellers shall have the right, but not the obligation, to cause the Company to attempt to cure, at Sellers’ sole cost and expense, before the end of the Cure Period, any Environmental Defects for which Sellers have received an Environmental Defect Notice from Purchaser prior to the Claim Date. An election by Sellers to cause the Company to attempt to cure an Environmental Defect shall be without prejudice to Sellers’ rights under Section 4.6 and shall not constitute an admission against interest or a waiver of Sellers’ right to dispute the existence, nature or value of, or cost to cure or remediate, such Environmental Defect.

(ii)At the Closing, the Unadjusted Purchase Price shall be adjusted downward by an amount equal to the sum of, subject to and after taking into account the Individual Defect Threshold and Aggregate Defect Deductible:

10

(A)the aggregate amount of all Remediation Amounts (as asserted by Purchaser in good faith in accordance with Section 4.4(a)) for all Environmental Defects that Sellers have elected to cause the Company to attempt to cure at Sellers’ sole cost pursuant to Section 4.4(b) and that have not been cured or that Sellers have elected to dispute pursuant to Section 4.6; plus

(B)the aggregate amount of all Remediation Amounts (as asserted by Purchaser in good faith in accordance with Section 4.4(a)) for all Environmental Defects that Sellers or the Company attempted to cure prior to the Closing but which Purchaser has elected to dispute such cure pursuant to Section 4.6.

(iii)If (A) before the end of the Cure Period, Sellers’ Representative and Purchaser agree that such Environmental Defect has been cured, or (B) Sellers’ Representative and Purchaser cannot agree, and it is determined by the Consultant(s) pursuant to Section 4.6 that such Environmental Defect is fully cured, then there shall be no adjustment to the Unadjusted Purchase Price; provided, however, that, if such Environmental Defect has only been partially cured (or determined to be partially cured), then the Unadjusted Purchase Price shall be adjusted downward based on the Remediation Amount for such Environmental Defect as partially cured and such adjustment and releases shall be reflected in the calculations, and any further reconciliation, if necessary, shall be completed, under Section 10.4(b) or Section 4.6, as applicable.

(iv)If (A) upon the end of the Cure Period, Sellers’ Representative and Purchaser agree that such Environmental Defect has not been cured, or (B) Sellers’ Representative and Purchaser cannot agree, and it is determined by the Consultant(s) that such Environmental Defect is not cured, then the Unadjusted Purchase Price shall be adjusted downward by the Remediation Amount for such Environmental Defect and such adjustment and releases shall be reflected in the calculations, and any further reconciliation, if necessary, shall be completed, under Section 10.4(b) or Section 4.6, as applicable.

(c)Remedy for Environmental Defects. Subject to Sellers’ continuing right to dispute the existence of an Environmental Defect or the Remediation Amount asserted with respect thereto, subject to the right of Purchaser to dispute the adequacy of any cure attempted by Sellers, and subject to the right of each Party to terminate this Agreement prior to Closing pursuant to Section 11.1, in the event that any Environmental Defect timely and effectively asserted by Purchaser in accordance with Section 4.4(a) is not waived in writing by Purchaser or cured prior to the end of the Cure Period, Sellers shall, subject to the applicable Individual Defect Threshold and the Aggregate Defect Deductible in accordance with Section 4.5, reduce the Unadjusted Purchase Price by the Remediation Amount relating to such Environmental Defect; provided if such Environmental Defect is disputed pursuant to Section 4.6, reduce the Unadjusted Purchase Price by the Remediation Amount determined pursuant to Section 4.6. Without limitation of Purchaser’s rights and remedies under the R&W Insurance Policy or Purchaser’s right to terminate this Agreement prior to Closing pursuant to Section 11.1(f), Purchaser shall be deemed to have assumed responsibility for all of the liability attributable to the applicable Environmental Defect asserted in the Environmental Defect Notice.

(d)Exclusive Remedy. Except for the representations and warranties of Sellers set forth in Section 6.17 and Section 6.18, Purchaser’s right to terminate this Agreement prior to Closing pursuant to Section 11.1(d) in respect of such representations and warranties, Purchaser’s right to terminate this Agreement prior to Closing pursuant to Section 11.1(f), and Purchaser’s remedies under the R&W Insurance Policy, the provisions set forth in Section 4.2(c) and Section 4.4(c) shall be the sole and exclusive right and remedy of Purchaser with respect to the Company Group’s failure to have Defensible Title to any Asset or any other title matter and with respect to any Environmental Defect affecting any Asset, respectively.

11

(e)Without limiting the disclaimers and acknowledgements set forth in Article 8:

(i)SUBJECT TO, AND WITHOUT LIMITATION OF, SELLERS’ REPRESENTATIONS AND WARRANTIES SET FORTH IN SECTION 6.17 AND SECTION 6.18 (AS RELATED TO PERMITS UNDER ENVIRONMENTAL LAWS) AND PURCHASER’S RIGHTS UNDER THE R&W INSURANCE POLICY RELATED TO SUCH REPRESENTATIONS AND WARRANTIES, PURCHASER (ON BEHALF OF ITSELF AND ITS AFFILIATES, INCLUDING, FROM AND AFTER CLOSING, THE COMPANY GROUP) FROM AND AFTER CLOSING WAIVES AND RELEASES ANY REMEDIES OR CLAIMS (WHETHER KNOWN OR UNKNOWN, FIXED OR CONTINGENT, LIQUIDATED OR UNLIQUIDATED, AND WHETHER ARISING AT LAW OR IN EQUITY) THAT IT MAY HAVE AGAINST SELLERS OR SELLERS’ AFFILIATES UNDER APPLICABLE LAWS WITH RESPECT TO ENVIRONMENTAL DEFECTS (INCLUDING ANY CLAIMS ARISING UNDER CERCLA OR OTHER ENVIRONMENTAL LAWS) OR OTHER ENVIRONMENTAL MATTERS, EXCEPT SOLELY FOR THOSE REMEDIES SET FORTH IN THIS ARTICLE 4.

(ii)SUBJECT TO AND WITHOUT LIMITATION OF PURCHASER’S RIGHTS AND REMEDIES UNDER THIS AGREEMENT AND THE R & W INSURANCE POLICY, PURCHASER ACKNOWLEDGES THAT (A) THE ASSETS HAVE BEEN USED FOR EXPLORATION, DEVELOPMENT, PRODUCTION, GATHERING, AND TRANSPORTATION OF OIL AND GAS AND THERE MAY BE PETROLEUM, PRODUCED WATER, WASTES, SCALE, NORM, HAZARDOUS SUBSTANCES, OR OTHER SUBSTANCES OR MATERIALS LOCATED IN, ON, OR UNDER THE ASSETS OR ASSOCIATED WITH THE ASSETS; (B) EQUIPMENT AND SITES INCLUDED IN THE ASSETS MAY CONTAIN ASBESTOS, NORM, OR OTHER HAZARDOUS SUBSTANCES; (C) NORM MAY AFFIX OR ATTACH ITSELF TO THE INSIDE OF WELLS, PIPELINES, MATERIALS, AND EQUIPMENT AS SCALE, OR IN OTHER FORMS; (D) THE WELLS, MATERIALS, AND EQUIPMENT LOCATED ON THE ASSETS OR INCLUDED IN THE ASSETS MAY CONTAIN NORM AND OTHER WASTES OR HAZARDOUS SUBSTANCES; (E) NORM CONTAINING MATERIAL OR OTHER WASTES OR HAZARDOUS SUBSTANCES MAY HAVE COME IN CONTACT WITH VARIOUS ENVIRONMENTAL MEDIA, INCLUDING WATER, SOILS, OR SEDIMENT; AND (F) SPECIAL PROCEDURES MAY BE REQUIRED FOR THE ASSESSMENT, REMEDIATION, REMOVAL, TRANSPORTATION, OR DISPOSAL OF ENVIRONMENTAL MEDIA, WASTES, ASBESTOS, NORM, AND OTHER HAZARDOUS SUBSTANCES FROM THE ASSETS.

(iii)EXCEPT AS EXPRESSLY SET FORTH IN THIS AGREEMENT OR ANY OTHER AGREEMENT OR INSTRUMENT DELIVERED HEREUNDER, SELLERS DO NOT MAKE, SELLERS EXPRESSLY DISCLAIM, AND PURCHASER (ON BEHALF OF ITSELF AND ITS AFFILIATES, INCLUDING, FROM AND AFTER CLOSING, THE COMPANY GROUP) WAIVES ANY REPRESENTATION, WARRANTY, OR OTHER STATEMENT, EXPRESS OR IMPLIED, ORAL OR WRITTEN, WITH RESPECT TO THE PRESENCE OR ABSENCE OF ASBESTOS, NORM, OR OTHER WASTES OR HAZARDOUS SUBSTANCES IN OR ON THE ASSETS IN QUANTITIES TYPICAL FOR OILFIELD OPERATIONS IN THE AREAS WHERE THE ASSETS ARE LOCATED.

12

Section 4.5Limitations on Applicability.

(a)The right of Purchaser or Sellers’ Representative to assert a Title Defect, Environmental Defect or Title Benefit, respectively, under this Article 4 shall terminate on the Claim Date, except that until the alleged Title Defect, Environmental Defect, Title Benefit, Title Defect Amount, cure, Remediation Amount or Title Benefit Amount, as applicable, is resolved in accordance with this Agreement, there shall be no termination of Purchaser’s or Sellers’ rights under this Article 4 with respect to any alleged Title Defect, Environmental Defect, Title Benefit, Title Defect Amount, cure, Remediation Amount or Title Benefit Amount properly reported in accordance with Section 4.6 on or before the Claim Date. Subject to and without limitation of Purchaser’s rights and remedies under the R&W Insurance Policy, if a matter which would constitute a Title Defect or Environmental Defect under this Article 4 (if a claim for such matter were asserted) results from any matter that could also result in the breach of any representation or warranty of Sellers or the Company as set forth in Article 5 or Article 6, and Purchaser has knowledge of such matter prior to the Claim Date, then Purchaser shall be precluded from also asserting such matter as the basis of a breach of any such representation or warranty for purposes of Section 9.2(a).