.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13 a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2025

Perusahaan Perseroan (Persero)

PT Telekomunikasi Indonesia Tbk

(Exact name of Registrant as specified in its charter)

Telecommunications Indonesia

(A state-owned public limited liability Company)

(Translation of registrant’s name into English)

Jl. Japati No. 1 Bandung 40133, Indonesia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F þ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes No þ

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes No þ

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on behalf by the undersigned, thereunto duly authorized.

|

Perusahaan Perseroan (Persero) |

|

PT Telekomunikasi Indonesia Tbk |

|

|

|

|

|

|

|

(Registrant) |

|

|

April 21, 2025 |

By: /s/ Octavius Oky Prakarsa |

(Signature) |

|

|

|

|

Octavius Oky Prakarsa |

|

Vice President Investor Relation |

2

THEME

Reaching New Heights

The transformation journey of PT Telkom Indonesia (Persero) Tbk (Telkom) through the implementation of the Five Bold Moves (5 BM) strategy has created a significant impact for stakeholders and the Indonesian society. In 2024, Telkom successfully accelerated the execution of the 5 BM strategy across its three core business pillars: digital connectivity (FMC and Infraco), digital platforms (Data Center Co and B2B Digital IT Services), and digital services (DigiCo initiatives).

However, much like climbing a mountain towards the summit, this journey requires hard work, dedication, and precise strategies. The theme Reaching New Heights reflects Telkom's relentless spirit in navigating the dynamic industry landscape with a focus on continuous innovation, operational efficiency, and strong collaboration. Each step taken embodies the aspiration to harness technology as a catalyst for broad-based change.

Through these efforts, Telkom is not only surpassing limits but also paving the way for a more inclusive and sustainable future, contributing to the development of a digital ecosystem for all levels of society, and leading Indonesia towards new heights in the digital economy era.

3

DISCLAIMER

PT Telkom Indonesia (Persero) Tbk has published this Report as a form of transparency and accountability to present material data and information for our stakeholders. In general, the contents of this Report are derived from internal analysis as well as credible document sources and trustworthy sources. Some parts of this Report contain data and information that are forward-looking statements such as targets, expectations, forecasts, estimates, prospects, or projections of Telkom's future operational performance and business conditions. Before being presented in this Report, Telkom has carefully considered the data and information.

However, Telkom understands that risks and uncertainties that are caused by several factors, such as changes in the economic, social, and political conditions in Indonesia may affect future operational performance and business conditions. Consequently, Telkom would like to remind readers that Telkom cannot guarantee that the data and information that comprise this Report’s forward-looking statements are true, accurate, and can be fulfilled entirely.

In addition to publishing this Report, Telkom as a company listed on the New York Stock Exchange (NYSE) is also required to submit SEC Form 20-F as Annual Report to the Securities and Exchange Commission (SEC). Therefore, some of the information in the 2024 Annual Report can also be found in the SEC Form 20-F, although the two Reports are not the same.

The terms of “Telkom” and Company in this Report refer to the parent entity, while the terms of “Telkom and Subsidiaries” or “Telkom and Subsidiaries” or “TelkomGroup” refer to the parent company and its subsidiaries and affiliated entities together. However, the use of the term “Telkom” does not exclude subsidiaries and affiliates from the scope of the contents and discussion of the Report. For the convenience of stakeholders, the electronic document of this 2024 Annual Report can be accessed and downloaded through http://www.telkom.co.id or by scanning the following QR code:

IDX Ticker |

: TLKM |

NYSE Ticker |

: TLK |

Telkom stakeholders can submit questions and suggestions to:

Investor Relations Unit

PT Telkom Indonesia (Persero) Tbk

The Telkom Hub, Telkom Landmark Tower 51st Floor

Jl. Jend. Gatot Subroto Kav. 52, Jakarta 12710, Indonesia

Phone |

: (6221) 521 5109 |

Facsimile |

: (6221) 522 0500 |

: investor@telkom.co.id |

|

: TelkomIndonesia |

|

: telkomindonesia |

|

Twitter/X |

: @telkomindonesia |

4

7 |

||

8 |

||

11 |

||

12 |

||

14 |

||

17 |

||

Information Regarding Obligations, Sukuk or Convertible Bonds |

19 |

|

|

|

|

22 |

||

23 |

||

28 |

||

33 |

||

|

|

|

35 |

||

36 |

||

37 |

||

39 |

||

40 |

||

42 |

||

43 |

||

45 |

||

52 |

||

57 |

||

59 |

||

62 |

||

65 |

||

71 |

||

73 |

||

Use of Public Accounting Services and Public Accounting Firms |

75 |

|

Name and Address of Institutions and/or Supporting Capital Market Profession |

77 |

|

|

|

|

79 |

||

80 |

||

85 |

||

97 |

||

110 |

||

124 |

||

Capital Structure and the Management Policies for Capital Structure |

125 |

|

126 |

||

127 |

||

128 |

||

Material Information and Fact After Accountant Reporting Date |

129 |

|

130 |

||

132 |

||

133 |

||

134 |

||

135 |

||

5

136 |

||

137 |

||

138 |

||

|

|

|

140 |

||

141 |

||

148 |

||

149 |

||

150 |

||

162 |

||

183 |

||

183 |

||

197 |

||

210 |

||

223 |

||

236 |

||

259 |

||

262 |

||

267 |

||

271 |

||

291 |

||

292 |

||

294 |

||

Policy Regarding Reporting Share Ownership of Directors and Commissioners |

295 |

|

296 |

||

302 |

||

309 |

||

310 |

||

|

|

|

312 |

||

Brief Summary of Corporate Social Responsibility and Environment |

313 |

|

Implementation Report on the Corporate Social Responsibility and Environment |

314 |

|

|

|

|

327 |

||

Appendix 1: |

328 |

|

Appendix 2: |

336 |

|

Appendix 3: |

Cross Reference to the Circular Letter by the Financial Services Authority No. 16/SEOJK.04/2021 |

341 |

Appendix 4: |

355 |

|

|

|

|

CONSOLIDATED FINANCIAL STATEMENTS |

|

|

Audited Consolidated Financial Statements 2024 and Audited Financial Statements 2024 for Program Pendanaan Usaha Mikro dan Usaha Kecil |

|

|

|

|

|

Annual Report 2024 Feedback Form PT Telkom Indonesia (Persero) Tbk |

|

|

|

|

|

6

7

PROFILE OF TELKOM AND ITS SUBSIDIARIES

PROFILE OF TELKOM

Company Name |

Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk |

|

Abbreviated Name |

PT Telkom Indonesia (Persero) Tbk |

|

Commercial Name |

Telkom |

|

Business Fields, Type of Products, and Services |

The operation and management of telecommunications networks and services, informatics as well as the optimalization of the utilization of the Company’s resources |

|

Corporate Status |

Public Company, State-Owned Enterprise |

|

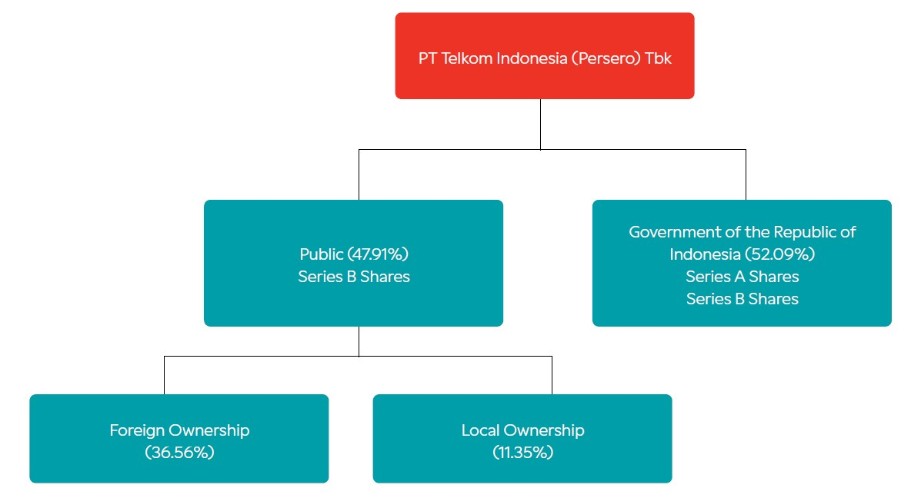

Ownership |

52.09% The Government of the Republic of Indonesia 47.91% Public |

|

Legality |

Tax Identification Number (NPWP) 01.000.013.1-093.000 |

|

|

Trade Business License (SIUP) based on Business Identification Number (NIB) No. 9120304490415 |

|

|

Company Establishment Date |

November 19, 1991 |

|

Legal Basis of Establishment |

Based on Government Regulation No. 25 of 1991, the status of our Company was converted into a State-owned Limited Liability Company ("Persero"), based on the Notarial Deed of Imas Fatimah, S.H. No.128 dated September 24, 1991, as approved by the Ministry of Justice of the Republic of Indonesia by virtue of Decision Letter No. C2-6870.HT.01.01.th.91 dated November 19, 1991 and as announced in the State Gazette of Republic of Indonesia No. 5 dated January 17, 1992, Supplement to the State Gazette No. 210 |

|

Head Office Address and Contact |

Graha Merah Putih Jl. Japati No. 1 Bandung Jawa Barat, Indonesia - 40133 |

|

|

Phone Fax Call Center Website |

: +62-22-4521404 : +62-22-7206757 : +62-21-147 : www.telkom.co.id : corporate_comm@telkom.co.id |

|

|

: investor@telkom.co.id |

|

Social Media |

: TelkomIndonesia |

|

|

: telkomindonesia |

|

|

Twitter/X |

: @telkomindonesia |

|

YouTube |

: TelkomIndonesiaOfficial |

|

: Telkom Indonesia |

|

Stock Listing |

The Company is listed on the Indonesia Stock Exchange (IDX) and New York Stock Exchange (NYSE) since November 14, 1995 |

|

Ticker |

Indonesia Stock Exchange (IDX): TLKM New York Stock Exchange (NYSE): TLK |

|

Stock Type |

Series A Dwiwarna shares and series B shares |

|

Authorized Capital |

1 series A Dwiwarna share 389,999,999,999 series B shares |

|

Issued and Fully Paid Capital |

1 series A Dwiwarna share 99,062,216,599 series B shares |

|

Rating |

International |

: Baa1 (stable) from Moody’s and BBB/stable from Fitch Ratings |

Domestic |

: idAAA by Pefindo for 2024 |

|

8

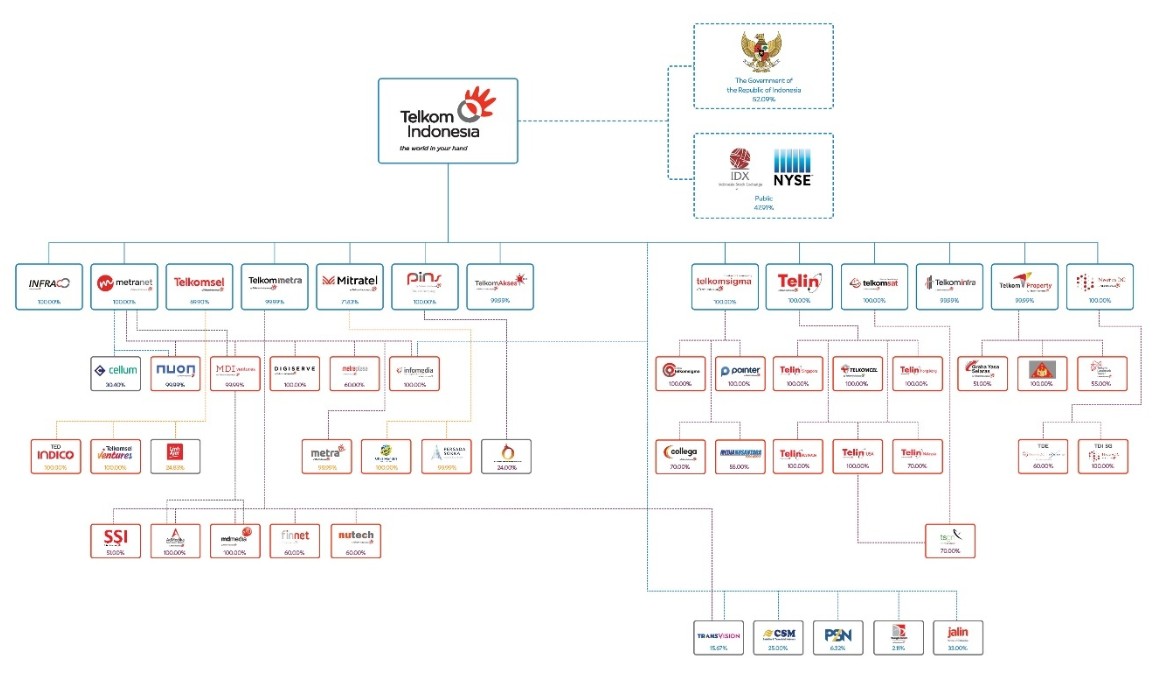

PROFILE OF SUBSIDIARIES

As the largest telecommunications company in Indonesia, Telkom has:

• |

13 subsidiaries with direct ownership |

• |

31 subsidiaries with indirect ownership |

• |

8 affiliated entities |

Subsidiaries with direct ownership and actively operating:

Telkomsel |

PT Telekomunikasi Selular (Telkomsel) is a cellular operator with the widest 4G/LTE network that has reached 97% of Indonesia's population with the core business of cellular telecommunication service, cellular telecommunication network operation, and fixed broadband service. www.telkomsel.com |

Telkomsat |

PT Telkom Satelit Indonesia (Telkomsat) is a company with a satellite business portfolio that provides end-to-end satellite-based digital service focusing on customer needs (customer-oriented). www.telkomsat.co.id |

Telkom Akses |

PT Telkom Akses (Telkom Akses) is a subsidiary of PT Telkom Indonesia (Persero) Tbk which is engaged in providing telecommunication access network in Indonesia, with core businesess including the construction and maintenance of fiber optic network. www.telkomakses.co.id |

TelkomMetra |

PT Multimedia Nusantara (TelkomMetra) is an investment company and sub-holding which has expanded into various basic digital services and ICT industries through acquisition, strategic partnership and the construction of a strong business ecosystem. www.metra.co.id |

PINS |

PT PINS Indonesia (PINS) is a company that provides various technological facilities equipment, device integration, networks, systems, processes, and the Internet of Things (IoT). www.pins.co.id |

Telin |

PT Telekomunikasi Indonesia International (Telin) is a company that provides customized voice, data services and business solutions to wholesale, enterprise, digital and retail customers. Telin operates in several countries, including Indonesia, Singapore, Hong Kong, Australia, Malaysia, Taiwan, the United States, Timor Leste, the United Arab Emirates, and Myanmar, with sales representatives in Canada, the United Kingdom, the Philippines, India, and Vietnam. www.telin.net |

Mitratel |

PT Dayamitra Telekomunikasi (Mitratel) is a company that operates in the telecommunication tower business and its ecosystem, including digital support services for mobile infrastructure and optimizing the utilization of resources owned by the Company. www.mitratel.co.id |

Metranet |

PT Metra Net (Metranet) is an integrated digital media and content provider, with core businesses including online media, digital content, and digital billing. www.metranet.co.id |

Telkom Infra |

PT Infrastruktur Telekomunikasi Indonesia (Telkom Infra) is a provider of domestic and international telecommunication infrastructure management services (services and solution), with core businesses in infrastructure network services, power solution, and submarine cable service. www.telkominfra.co.id |

9

Telkom Property |

PT Graha Sarana Duta (Telkom Property) is a property service provider that prioritizes the utilization of Telkom's idle assets with core businesses of property management, property development, project solutions, fleet management transportation system (TMS), and transport management service. www.telkomproperty.co.id |

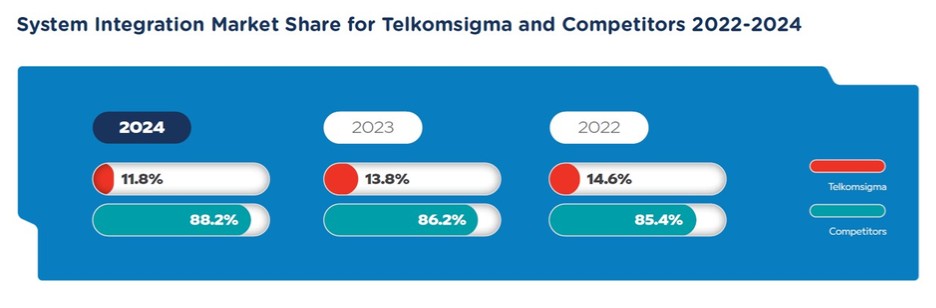

Telkomsigma |

PT Sigma Cipta Caraka (Telkomsigma) is a company that provides Information and Technology (ICT) services in Indonesia, focusing on IT Services, Cloud, and Cyber Security. www.telkomsigma.co.id |

Telkom Infrastruktur Indonesia |

PT Telkom Infrastruktur Indonesia (TIF) is a company that provides telecommunication networks and services through a network-sharing scheme. www.infraco.id |

Telkom Data Ekosistem |

PT Telkom Data Ekosistem (TDE) is a data center ecosystem provider company that provides world-class infrastructure and innovative solution spread across various strategic locations in Indonesia and internationally to support digital transformation in Southeast Asia, including colocation service, cloud solution, managed service, and AI infrastructure, which enables business and government to utilize AI technology to drive innovation and business growth. www.neutradc.com |

Note:

A more complete list of subsidiaries can be seen in the Consolidated Financial Statements.

10

Telkom has a range of products that are divided into five segments, namely:

Product Segment |

|

Description |

|

Number of Customers |

Consumer |

|

Fixed voice, fixed broadband, IP-TV, and digital services. |

|

10.8 IndiHome fixed broadband subscribers |

Mobile |

|

Cellular legacy services (voice and SMS), mobile broadband, as well as mobile digital services including IoT, big data, financial services, VOD, music, gaming, and digital advertisement. |

|

159.4 million cellular subscribers |

151.4 million prepaid subscribers |

||||

8.0 million postpaid subscribers |

||||

Enterprise |

|

ICT service and platform covering connectivity (including Satellite business), Digital IT Services such as information technology (IT) service, cloud, Digital Adjacent Service such as e-health service and ATM management, and Business Process Outsourcing. |

|

513 Groups of SOEs and MOCs customers |

1,790 Private customers |

||||

591,618 SME customers |

||||

717 Government Institution customers |

||||

Wholesale & International Business |

|

Domestic and international wholesale traffic, network, and digital platform and services as well as tower, satellite, data center, and managed infrastructure and network. |

|

6 other licensed operator (OLO) customers |

256 internet service provider customers |

||||

420 satellite service customers |

||||

513 global partner customers |

||||

Others |

|

Digital services such as digital platform, digital content, e-commerce for B2B, and property management in view to fully utilize Telkom's property assets throughout Indonesia. |

|

13.5 million active users of digital music (RBT, music streaming, and Langit Musik) |

22.7 million paying users of digital games |

||||

9.9 million paying users of digital lifestyle (OTT Video) |

11

OPERATIONAL AREAS AND SERVICES

5 |

Telkom Regional Offices |

31 |

Telecommunications areas |

10 |

Global Offices in Indonesia, Singapore, Hong Kong, Australia, Malaysia, Taiwan, United States, Timor Leste, United Arab Emirates, and Myanmar |

5 |

Global Sales Representatives in Canada, United Kingdom, Philippines, India, and Vietnam |

1 |

Global Sales Representative Telkomsel in Saudi Arabia |

486 |

GraPARI in Indonesia (which includes Plasa Telkom outlets that are currently also recognized as GraPARI) |

35 Data Centers | |

• |

5 data centers (overseas) |

• |

26 neuCentrlX in 18 locations (domestic) |

• |

3 data centers enterprise tier 3 and 4 (domestic) |

• |

1 data center hyperscale tier 3 and 4 (domestic) |

Cybersecurity | |

To prevent cyber-attacks on systems and applications, Vulnerability Assessments are routinely conducted on the applications and network elements that we operate. The testing process is carried out using Vulnerability Assessment Tools to ensure the accuracy of the test results. | |

177,443 km Fiber Optic Backbone Network | |

• |

112,743 km domestic fiber optic |

• |

64,700 km international fiber optic |

122 Point of Presence (PoP) | |

• |

64 PoP in the domestic network |

• |

58 PoP in the international network |

3 Satellites | |

• |

Merah Putih-2 Satellite (32.4 Gbps) |

• |

Merah Putih Satellite (5.4 Gbps) |

• |

Telkom 3S (4.4 Gbps) |

271,040 BTS Mobile Network | |

• |

48,775 BTS 2G |

• |

221,290 BTS 4G |

• |

975 BTS 5G |

43,825 Towers | |

• |

4,421Telkomsel towers |

• |

39,404 Mitratel towers |

Fiber Optic Access Network | |

• |

39 million Homes Passed |

• |

16.7 million Optical Ports |

376,212 Wi-Fi Access Point | |

• |

106,836 Managed Access Point |

• |

221,000 Homespot |

• |

48,376 ONT Premium |

12

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Description |

2024 |

2023 |

2022 |

2021 |

2020 |

In billion Rupiah, unless stated otherwise |

|||||

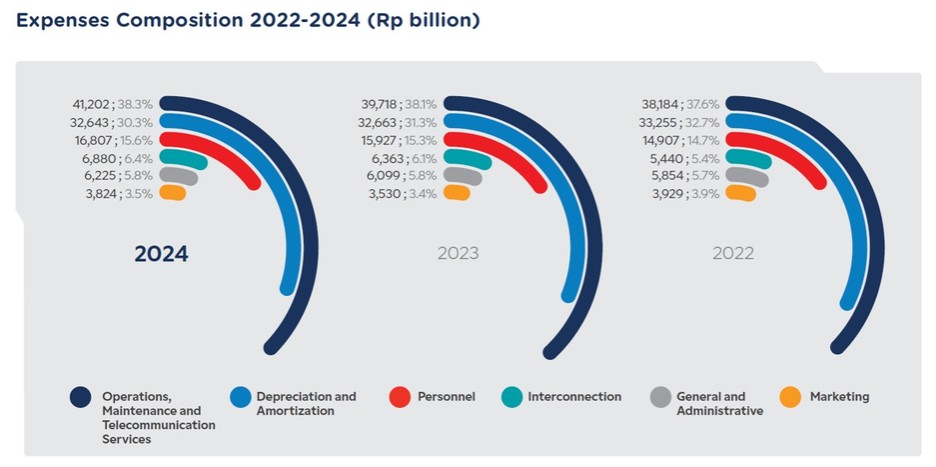

Total revenues |

149,967 |

149,216 |

147,306 |

143,210 |

136,462 |

Total expenses* |

107,581 |

104,300 |

101,569 |

99,303 |

93,274 |

EBITDA |

75,029 |

77,579 |

78,992 |

75,723 |

72,080 |

Operating profit |

42,991 |

44,384 |

39,581 |

47,563 |

43,505 |

Profit for the year |

30,743 |

32,208 |

27,680 |

33,948 |

29,563 |

Profit for the year attributable to: | |||||

Owners of the parent company |

23,649 |

24,560 |

20,753 |

24,760 |

20,804 |

Non-controlling interest |

7,094 |

7,648 |

6,927 |

9,188 |

8,759 |

Total profit for the year |

30,743 |

32,208 |

27,680 |

33,948 |

29,563 |

Total comprehensive profit for the year attributable to: | |||||

Owners of the parent company |

24,434 |

23,083 |

22,468 |

26,767 |

17,595 |

Non-controlling interest |

7,204 |

7,671 |

6,979 |

9,161 |

8,391 |

Total comprehensive income for the year |

31,638 |

30,754 |

29,447 |

35,928 |

25,986 |

Basic earning per share (in full): |

|

|

|

|

|

Net income per share |

238.73 |

247.92 |

209.49 |

249.94 |

210.01 |

Net income per ADS (1 ADS : 100 common stock) |

23,873 |

24,792 |

20,949 |

24,994 |

21,001 |

Remark:

* |

Excluding other expenses. |

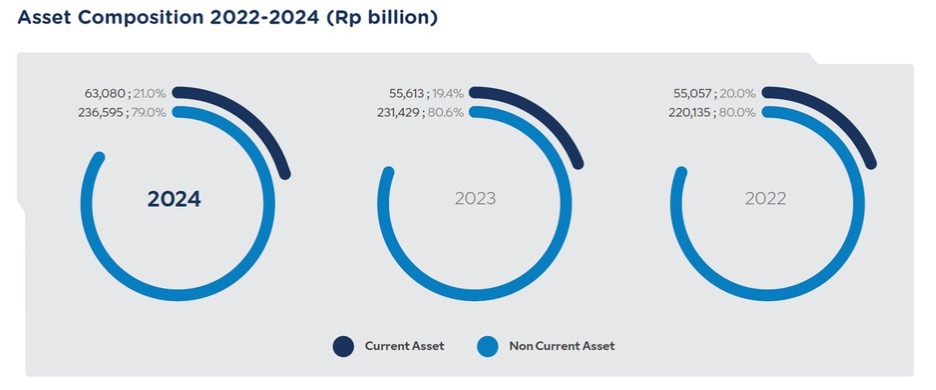

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Description |

2024 |

2023 |

2022 |

2021 |

2020 |

In billion Rupiah, unless stated otherwise |

|||||

Assets |

299,675 |

287,042 |

275,192 |

277,184 |

246,943 |

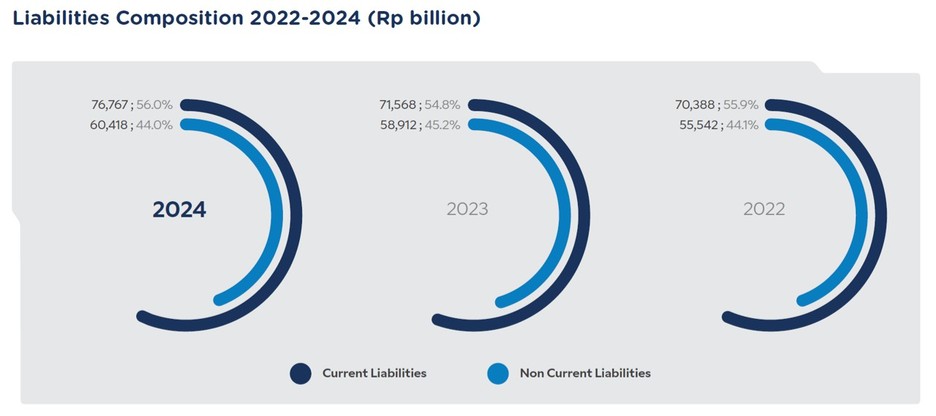

Liabilities |

137,185 |

130,480 |

125,930 |

131,785 |

126,054 |

Equity attributable to owner of the parent company |

142,094 |

135,744 |

129,258 |

121,646 |

102,527 |

Net working capital (current asset - current liabilities) |

(13,687) |

(15,955) |

(15,331) |

(7,854) |

(22,590) |

Long-term investment in associates |

110 |

109 |

123 |

139 |

192 |

CAPITAL EXPENDITURE

Description |

2024 |

2023 |

2022 |

2021 |

2020 |

In billion Rupiah, unless stated otherwise |

|||||

Capital Expenditure |

24,449 |

32,968 |

34,156 |

30,341 |

29,436 |

14

CONSOLIDATED FINANCIAL AND OPERATION RATIOS

Description |

Unit |

2024 |

2023 |

2022 |

2021 |

2020 |

Return on Assets (ROA) (1) |

% |

10.3 |

11.2 |

10.1 |

12.2 |

12.0 |

Return on Equity (ROE) (2) |

18.9 |

20.6 |

18.5 |

23.3 |

24.5 |

|

Operating Profit Margin (3) |

28.7 |

29.7 |

26.9 |

33.2 |

31.9 |

|

Current Ratio (4) |

82.2 |

77.7 |

78.2 |

88.6 |

67.3 |

|

Total Liabilities to Equity (5) |

84.4 |

83.3 |

84.4 |

90.6 |

104.3 |

|

Total Liabilities to Total Assets (6) |

45.8 |

45.5 |

45.8 |

47.5 |

51.0 |

|

Debt to Equity Ratio (7) |

x |

0.5 |

0.4 |

0.4 |

0.5 |

0.5 |

Debt to EBITDA Ratio (8) |

1.0 |

0.9 |

0.8 |

0.9 |

0.9 |

|

EBITDA to Interest Expense (9) |

14.4 |

16.7 |

19.6 |

17.3 |

15.9 |

Remarks:

(1) |

ROA is calculated as profit for the year divided by total assets at year-end December 31. |

(2) |

ROE is calculated as profit for the year divided by total equity at year-end December 31. |

(3) |

Operating profit margin is calculated as operating profit divided by revenues. |

(4) |

Current ratio is calculated as current assets divided by current liabilities at year-end December 31. |

(5) |

Liabilities to equity ratio is calculated as total liabilities divided by total equity at year-end December 31. |

(6) |

Liabilities to total assets ratio is calculated as total liabilities divided by total assets at year-end December 31. |

(7) |

Debt to equity ratio is calculated as debt (included finance lease) divided by total equity. |

(8) |

Debt to EBITDA ratio is calculated as debt (included finance lease) divided by EBITDA. |

(9) |

EBITDA to interest ratio is calculated as EBITDA divided by cost of funds. |

15

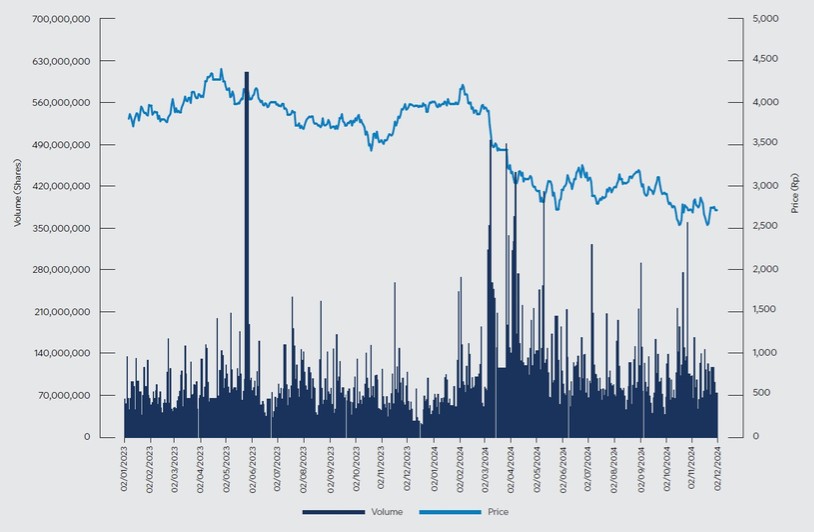

TELKOM’S STOCK INFORMATION AT IDX

Calendar Year |

Price Per Share |

Volume |

Outstanding Shares |

Market Capitalization |

|||

|

Highest (Rp) |

Lowest (Rp) |

Closing (Rp) |

(Shares) |

Excluding Treasury Stock |

(Rp billion) |

||

2023 |

|

4,500 |

3,390 |

3,950 |

21,047,954,600 |

99,062,216,600 |

391,296 |

First quarter |

4,130 |

3,690 |

4,060 |

4,825,397,400 |

99,062,216,600 |

402,193 |

|

Second quarter |

4,500 |

3,930 |

4,000 |

5,570,072,100 |

99,062,216,600 |

396,249 |

|

Third quarter |

4,030 |

3,670 |

3,750 |

5,786,841,600 |

99,062,216,600 |

371,483 |

|

Fourth quarter |

4,000 |

3,390 |

3,950 |

4,865,643,500 |

99,062,216,600 |

391,296 |

|

2024 |

|

4,240 |

2,500 |

2,710 |

29,355,067,200 |

99,062,216,600 |

268,459 |

|

First quarter |

4,240 |

3,430 |

3,470 |

6,088,142,200 |

99,062,216,600 |

343,746 |

|

Second quarter |

3,520 |

2,700 |

3,130 |

9,426,813,700 |

99,062,216,600 |

310,065 |

|

Third quarter |

3,280 |

2,760 |

2,990 |

7,176,112,400 |

99,062,216,600 |

296,196 |

|

Fourth quarter |

3,130 |

2,500 |

2,710 |

6,663,998,900 |

99,062,216,600 |

268,459 |

Telkom's share price on the last trading day of December 30, 2024 on the IDX closed at Rp2,710. With this share price, Telkom's market capitalization reached Rp268.5 trillion or 2.18% of the IDX's total capitalization.

17

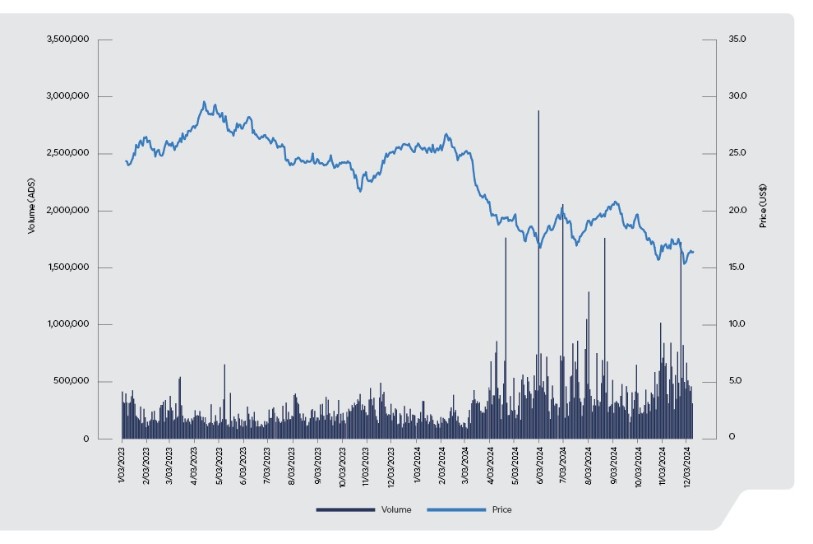

TELKOM’S AMERICAN DEPOSITORY SHARES (ADS) INFORMATION AT NYSE

Calendar Year |

Price Per ADS |

Volume (ADS) |

|||

|---|---|---|---|---|---|

Highest |

Lowest |

Closing |

|||

(US$) |

(US$) |

(US$) |

|||

2023 |

29.58 |

21.67 |

25.76 |

54,900,663 |

|

First quarter |

27.53 |

23.76 |

27.27 |

14,860,295 |

|

Second quarter |

29.58 |

26.16 |

26.67 |

11,001,104 |

|

Third quarter |

26.66 |

23.72 |

24.10 |

13,205,441 |

|

Fourth quarter |

26.01 |

21.67 |

25.76 |

15,833,823 |

|

2024 |

|

26.85 |

15.35 |

16.45 |

100,869,627 |

|

First quarter |

26.85 |

22.04 |

22.26 |

11,576,176 |

|

Second quarter |

22.38 |

16.62 |

18.70 |

29,009,841 |

|

Third quarter |

21.00 |

16.88 |

19.78 |

30,915,534 |

|

Fourth quarter |

20.01 |

15.35 |

16.45 |

29,368,076 |

On December 31, 2024, the closing price for 1 Telkom ADS on the New York Stock Exchange (NYSE) was US$16.45. The following table reports the high, low, closing prices and trading volume of Telkom ADS listed on NYSE for the periods indicated.

CORPORATE ACTION INFORMATION REGARDING STOCKS

Until the end of 2024, both IDX and NYSE, company will not carry out corporate actions such as stock split, reverse stock, stock dividend, bonus share, changes in the nominal value of share, issuance of convertible securities, as well as addition and reduction in capital. Apart from that, there are also no sanctions for temporary termination of suspension and/or delisting. Therefore, this Report does not contain information related to this matter.

18

INFORMATION REGARDING OBLIGATIONS, SUKUK OR CONVERTIBLE BONDS

Bonds |

Principal |

Issuance |

Maturity |

Term |

Interest Rate per Annum (%) |

Underwriter |

Trustee |

Rating (Pefindo) |

Telkom Shelf Registered Bond I 2015 Series B |

2,100,000 |

June 23, 2015 |

June 23, 2025 |

10 |

10.25 |

PT Bahana Sekuritas; PT BRI Danareksa Sekuritas; PT Mandiri Sekuritas; PT Trimegah Sekuritas Indonesia Tbk |

PT Bank Permata Tbk |

idAAA |

Telkom Shelf Registered Bond I 2015 Series C |

1,200,000 |

June 23, 2015 |

June 23, 2030 |

15 |

10.60 |

|||

Telkom Shelf Registered Bond I 2015 Series D |

1,500,000 |

June 23, 2015 |

June 23, 2045 |

30 |

11.00 |

19

KALEIDOSCOPE TELKOM 2024

“TELKOM INDONESIA FOR A SUSTAINABLE FUTURE”

Thank you for the support and trust from all customers, communities, and stakeholders. Throughout the ongoing digital transformation journey, Telkom Indonesia has always taken actual steps to positively impact society and the environment, which is realized through implementing sustainability principles or ESG (Environmental, Social, and Governance). This commitment is reflected through various strategic initiatives that not only support business growth but also encourage environmental conservation, improve social welfare, and implement good corporate governance. Let's create a more sustainable future for Indonesia together.

January | |

• |

Telkom Click 2024: Commitment to continue transforming and providing the best CX |

• |

Assistance with various BNSP standard certifications for 900 selected high school & vocational school students |

• |

Indigo, Nuon, and Ministry of Trade prepare local game Startup to reach global market |

February | |

• |

Successfully overseeing the 2024 Election through national & regional |

• |

Launch of Merah Putih-2 Satellite to strengthen IKN access and equalize connectivity in Indonesia |

March | |

• |

Groundbreaking of Telkom Smart Office in IKN |

• |

NeutraDC completes Telin Singapore data center consolidation |

• |

Safari Ramadan 2024: Ensuring the readiness of telecommunication infrastructure, customer visit, and CSR assistance |

April | |

• |

More than 2,000 homecoming travelers join TelkomGroup's 2024 Mudik Bersama |

• |

SIAGA RAFI 2024 ensures prime infrastructure and services ahead of Eid al-Fitr 1445 H |

• |

Financial Report Q1 - 2024: Operating net profit grows 3.1% YoY |

May | |

• |

MoU with F5 to strengthen Indonesia's cyber security |

• |

Reforestation of 33,800 tree seedlings and restoration of 82.1 ha of critical land |

• |

Telkom AGMS for Fiscal Year 2023 |

• |

Official Telco Partner KTT 10th World Water Forum 2024 Bali |

June | |

• |

Telin and Singtel develop SKKL INSICA |

• |

Together with Google, accelerate national digital transformation |

• |

Distribution of sacrificial animals on Eid al-Adha 1445 H |

July | |

• |

Successful implementation of Digiland 2024 |

• |

More than 10,000 runners enliven Digiland Run 2024 |

• |

Financial Report H1 - 2024: Revenue grows 2.5% YoY |

20

August | |

• |

PT Telkom Infrastruktur Indonesia (TIF) officially operates |

• |

Preparing connectivity access for the 79th Independence Day of the Republic of Indonesia at IKN |

• |

NeutraDC international conference: The Other Side of AI |

• |

Collaboration with Palo Alto improves Indonesia's cyber security resilience |

• |

BATIC 2024 was attended by 1,300 participants from 446 global companies in 40 countries |

September | |

• |

Support the international event HLF MSP & IAF 2024 |

• |

Inauguration of IndigoSpace Aceh |

• |

TelkomGroup makes successful PON XXI Aceh - North Sumatra 2024 |

October | |

• |

Strengthening maritime digitalization through Merah Putih-2 Satellite |

• |

Inauguration of neuCentrIX Pugeran, Yogyakarta |

• |

Successfully supporting the inauguration of the President and Vice President for the 2024-2029 period |

• |

Financial Report Q3 - 2024: Book positive revenue of Rp112.2 T |

November | |

• |

Declaration of Anti-Corruption commitment |

• |

Telkom ESG Program: Earth Restoration Action |

• |

GoZero% launch, Telkom's ESG commitment for a sustainable future |

• |

Innovillage 2024 attended by 2,815 collage students |

December | |

• |

Together with Alibaba Cloud strengthen the digital ecosystem |

• |

President of the Republic of Indonesia inaugurates E-Catalog version 6.0 |

• |

Welcome Christmas and New Year moment by strengthening the telecommunication service infrastructure |

AWARDS AND ACHIEVEMENTS

• |

Forbes World’s Best Employers 2024 |

• |

LinkedIn Top Companies 2024 |

• |

International Public Relations Association 2024 |

• |

GSMA M360 Digital Nations Awards 2024 |

• |

BCOMSS 2024 |

• |

Anugerah Media Humas 2024 (AMH) |

• |

Naker Award 2024 |

21

23 |

|

28 |

|

33 |

22

REPORT OF THE BOARD OF COMMISSIONERS

“Upon on the results of the Board of Commissioners' evaluation of the Company's management, it is our opinion that the Board of Directors performed its duties and responsibilities satisfactorily in 2024. This is reflected in the Company's ability to sustain its performance amid economic uncertainty and increasingly intense competition in the industry.”

Honorable stakeholders,

We extend our gratitude to God Almighty for His blessings and grace, enabling PT Telkom Indonesia (Persero) Tbk (“Telkom” or “the Company”) to navigate through 2024 with solid performance, demonstrating resilience amid evolving challenges and an increasingly complex industry landscape.

As part of our supervisory duties, we hereby present a supervisory report on Telkom’s management for the fiscal year 2024. This report includes an evaluation of the Board of Directors’ performance, oversight of the formulation and execution of business strategies, assessment of the business outlook prepared by the Board of Directors, and our view on the implementation of good corporate governance principles within the Company.

MACROECONOMIC AND INDUSTRY OVERVIEW

The year 2024 marked a pivotal moment in the recovery and growth of the global economy. According to IMF, the global economy grew by 3.2%, signaling increasing stability after navigating challenges such as high inflation, protectionism, geopolitical shifts, and trade tensions. Emerging markets, including Indonesia, played a key role in this recovery, contributing significantly to global economic expansion.

In Indonesia, economic resilience remained strong, with GDP projected to grow by 5.03% in 2024. Driving this growth were several key sectors, including manufacturing, wholesale and retail trade, information and communication, as well as government spending and household consumption. Macroeconomic stability was also reflected in the inflation rate of 1.57% (YoY as of December 2024), supported by the synergy between the government and Bank Indonesia in maintaining price stability and prudent monetary measures. Additionally, Indonesia's Sovereign Credit Rating remained at BBB with a stable outlook, reflecting strong investor confidence in the prospects of the national economy.

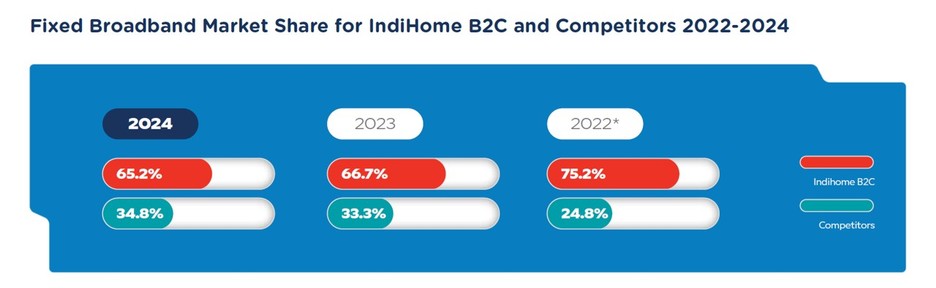

The trend of Fixed Mobile Convergence (FMC) has emerged as a key strategy to deliver a more integrated and seamless user experience across the telecommunications industry. FMC serves as one of Telkom's flagship strategies to gain a competitive edge while unlocking efficiency and optimization opportunities from the convergence of fixed and mobile services. However, intensifying competition, high infrastructure outlays, and challenges from Over-the-Top (OTT) services pose significant hurdles for telecommunications operators.

On the other hand, digital growth prospects continue to expand, with a Gross Merchandise Value (GMV) to reach USD 210-360 billion by 2030, driven by innovations in e-commerce, fintech, and artificial intelligence-based technologies. From a technological standpoint, domestic telecommunications operators are tirelessly developing innovations based on the latest technologies to enable high-quality services, efficient investment, and enhanced solution capabilities.

5G, expected to contribute USD 41 billion to Indonesia's GDP from 2024 to 2030, represents a strategic investment opportunity for telecommunications operators, including TelkomGroup. The key challenge in 5G deployment lies in developing relevant use cases alongside other technological innovations, such as IoT, which can then be applied across sectors like manufacturing, healthcare, logistics and others, so that it provides benefits beyond increased data transmission speed. Telkomsel, as part of TelkomGroup, has taken the lead in 5G implementation by establishing nearly 1,000 5G base stations across 50 cities and is continuously expanding 5G-based enterprise solutions to generate greater value.

23

With a combination of economic resilience, digital infrastructure development, and technological innovation, Indonesia is poised to strengthen its digital transformation, thereby fostering sustainable economic growth. Through the execution of its Five Bold Moves strategy, TelkomGroup remains committed to playing a leading role in realizing this vision and creating added value for the society and its stakeholders.

ASSESSMENT OF THE BOARD OF DIRECTORS’ PERFORMANCE IN COMPANY MANAGEMENT

Each year, the Board of Commissioners conducts a comprehensive evaluation of the Board of Directors’ performance, as reflected in both individual and collective Key Performance Indicators (KPI). The results of this evaluation are subsequently reported to the Shareholders during the General Meeting of Shareholders (GMS). Based on our supervision, the Board of Directors optimally carried out its duties and responsibilities throughout 2024, as evinced by the Company’s solid performance achievements.

Throughout 2024, the Board of Commissioners acknowledged the several strategic initiatives undertaken by the Board of Directors of Telkom Indonesia, including:

b.

|

Maintaining profitability at an industry-comparable level through well-directed and measured efficiency efforts, such as megavendor initiatives, early retirement programs, and risk-based budgeting. |

c.

|

Structuring the business portfolio through subsidiary streamlining initiatives and reinforcing the business and financial fundamentals of subsidiaries to enhance their contribution to TelkomGroup’s overall performance. |

d.

|

Enhancing the quality of human capital by introducing scholarship programs for employees and acquiring highly qualified external talent to strengthen the Company’s competencies, particularly in new digital business segments. |

e.

|

Modernizing the network, optimizing technology selection, refining network topology, improving infrastructure quality and cybersecurity, and strengthening information and technology aspects as fundamental elements for the Company’s business growth. |

BOARD OF COMMISSIONERS’ SUPERVISION IN THE FORMULATION AND IMPLEMENTATION OF CORPORATE STRATEGY BY THE BOARD OF DIRECTORS

As part of its duties as stipulated in the Company’s Articles of Association and applicable regulations, including Minister of SOEs Regulation No. PER-2/MBU/03/2023 on Corporate Governance and Significant Corporate Activities of State-Owned Enterprises, the Board of Commissioners plays a critical role in ensuring that the corporate strategy is effectively formulated and executed. Additionally, the Board ensures that the strategic initiatives undertaken by the Board of Directors fully align with the Company’s vision, mission, and purpose.

The Company's strategic planning process follows a systematic approach, encompassing the Long-Term Corporate Plan (RJPP), the Corporate Strategic Scenario (CSS), and the Corporate Budget and Work Plan (RKAP). The Board of Commissioners is responsible for reviewing proposals submitted by the Board of Directors, providing guidance during the approval process, and overseeing the implementation to ensure proper execution in accordance with the Company’s strategic direction.

Through the Evaluation, Planning and Risk Monitoring Committee (KEMPR), the Board of Commissioners conducts comprehensive oversight of the strategic planning process, particularly in relation to RJPP and CSS. This includes analyzing internal and external factors, identifying and assessing risks, and verifying financial projections. During the RKAP evaluation and approval, the Board reviews the RKAP’s alignment with the strategic plans outlined in RJPP and CSS, assesses its relevance to the aspirations of the Dwiwarna Shareholder, evaluates the underlying assumptions, examines business, financial, and capital expenditure projections, and ensures that the RKAP incorporates a risk-based budgeting approach.

24

Furthermore, to ensure effective implementation of the corporate strategy, the Board of Commissioners establishes priority oversight agendas in collaboration with its supporting Committees at the beginning of the year, based on the risk assessment, conducted during the planning evaluation. Throughout 2024, the Board of Commissioners placed particular emphasis on several strategic aspects, including: Implementation of the Five Bold Moves initiative, strengthening the business fundamentals of subsidiaries, enhancing internal control quality, including risk management and fraud prevention, finalizing the subsidiary streamlining program, and monitoring management’s responsiveness to competitive pressures and technological advancements.

Through this structured and comprehensive oversight approach, the Board of Commissioners strives to ensure that the Company’s strategy implementation delivers optimal impact in supporting sustained growth and the achievement of the Company’s long-term objectives.

MECHANISM FOR ADVISING THE BOARD OF DIRECTORS

As part of its responsibilities, in addition to overseeing and monitoring the Company’s management by the Board of Directors, the Board of Commissioners also plays a role in providing counsel to the Board of Directors. This function is carried out through various mechanisms, including offering guidance during Board of Commissioners meetings, joint meetings with the Board of Directors, and in writing through official letters or Resolutions of the

Board of Commissioners.

Throughout 2024, the Board of Commissioners regularly conducted Internal Meetings, Joint Meetings with the Board of Directors, and committee meetings, to ensure the effectiveness of its oversight and advisory functions. Over the course of the year, the Board convened 24 Internal Meetings of the Board of Commissioners, 12 Joint Meetings with the Board of Directors, 30 Audit Committee Meetings, 28 Evaluation, Planning, and Risk Monitoring Committee Meetings, 24 Nomination and Remuneration Committee Meetings, and 4 Integrated Governance Committee Meetings. Additionally, the Board of Commissioners issued 30 approval letters, 16 advisory letters, and 20 Board of Commissioners Resolutions.

Through these various mechanisms, the Board of Commissioners actively provided insights and recommendations to ensure that every strategic decision made by the Board of Directors was based on comprehensive analysis and a well-rounded and balanced perspective, considering both the potential benefits to the Company and the associated risks to support the Company’s sustainable long-term growth.

ASSESSMENT OF THE PERFORMANCE OF COMMITTEES UNDER THE BOARD OF COMMISSIONERS

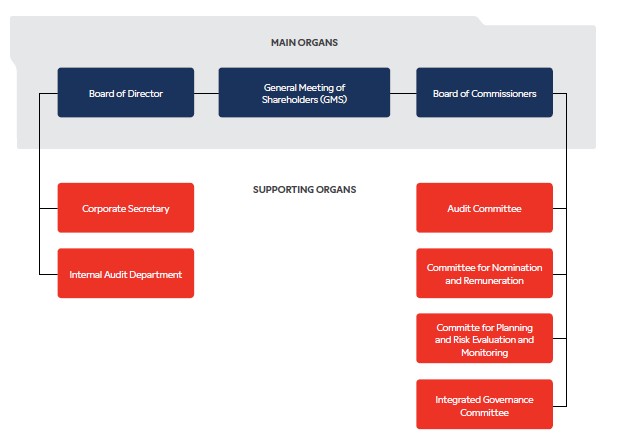

In carrying out its supervisory function, the Board of Commissioners is supported by several committees: the Audit Committee, the Nomination and Remuneration Committee (KNR), and the Evaluation, Planning, and Risk Monitoring Committee (KEMPR). In April 2024, the number of committees increased to four with the establishment of the Integrated Governance Committee, following Telkom’s classification as a Systemic A State-

Owned Enterprise (BUMN Sistemik A). Based on our evaluation, all four committees have optimally fulfilled their roles and responsibilities. Each committee has conducted in-depth assessments and provided recommendations that enhance the effectiveness of the Board of Commissioners’ supervision of the Company’s management.

25

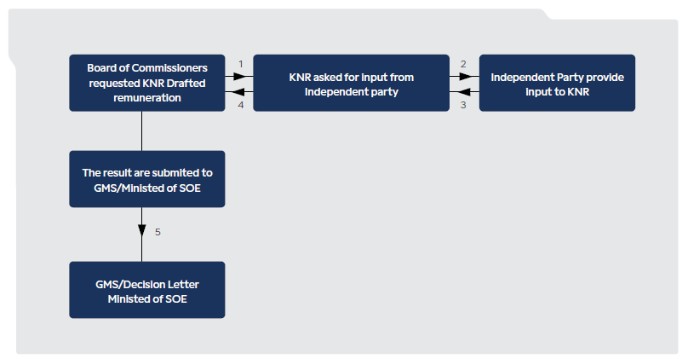

The Evaluation, Planning, and Risk Monitoring Committee provides recommendations to the Board of Commissioners regarding risk management monitoring, implementation of the Company’s strategy, and evaluation of strategic planning proposals submitted by the Board of Directors, including the the Company’s Long-Term Plan (RJPP), Corporate Strategic Scenario (CSS), and the Company Budget and Work Plan (RKAP). The committee also reviews and approves corporate actions within certain thresholds as outlined in the Company’s strategic plan. The Nomination and Remuneration Committee offers recommendations on policies, criteria, and selection processes for strategic positions within TelkomGroup, including policies related to the Board of Directors remuneration. The Audit Committee plays a role in ensuring the integrity of financial information to be published, reviewing the internal control system, and handling reports submitted through the whistleblowing system. Finally, the Integrated Governance Committee is responsible for evaluating the Integrated Governance Policy proposed by the Board of Directors, assessing its implementation, and ensuring alignment between Telkom’s governance framework and that of its subsidiaries.

Contributions of these committees are instrumental in enabling the Board of Commissioners to exercise comprehensive oversight while ensuring sustained growth and strong corporate governance at Telkom Indonesia.

VIEW ON THE IMPLEMENTATION OF GOOD CORPORATE GOVERNANCE

To sustain the Company’s long-term presence and achievements, good corporate governance (GCG) must be upheld at all times and strengthened as one of the Company’s key pillars. Telkom’s commitment to implementing best-in-class governance practices is not only aimed at enhancing stakeholder value but also at reinforcing the Company’s reputation and integrity. The recognition of Telkom’s governance quality is reflected in its ASEAN Corporate Governance Scorecard (ACGS) in 2024 which reached 103.31, marking an increase of 4.81 points from the previous year. While this achievement is commendable, the true significance lies beyond the numbers—it reflects the awareness and concrete actions taken by all elements within TelkomGroup to persistently elevate the quality of its governance.

In the area of risk management, the Board of Directors has demonstrated tangible efforts to enhance corporate governance quality through various strategic initiatives aimed at strengthening internal controls and comprehensive risk management, including:

1.

|

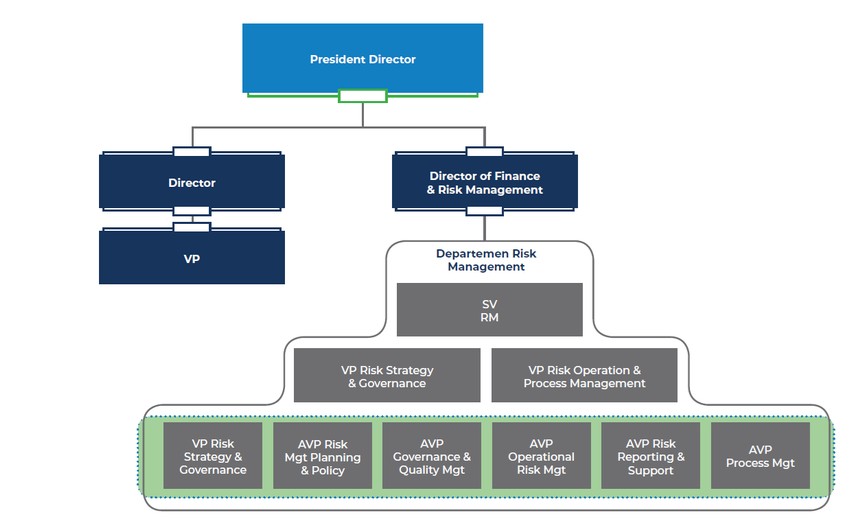

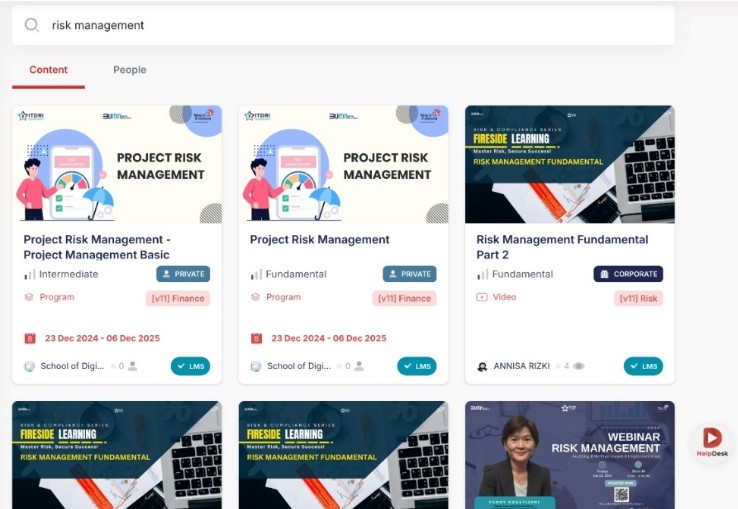

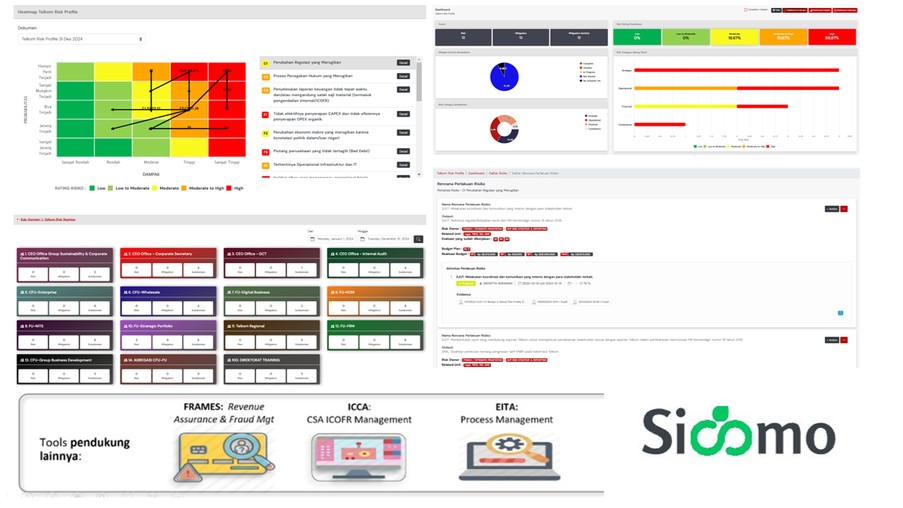

Enhancing the Risk Management Unit, by ensuring an appropriate organizational structure and staffing, issuing policies and procedures related to risk management implementation, developing information technology systems and tools to support risk identification, measurement, monitoring, and evaluation, and designing a role map for the risk management unit so that they can express their opinion in the Company’s strategic decisions. |

2.

|

Measuring the Risk Maturity Index (RMI) and implementing follow-up actions to address areas for improvement. |

3.

|

Strengthening the first line of defense as a critical component of risk management quality enhancement, through training, certification, and dissemination of policies and procedures. |

4.

|

Applying risk assessments for projects undertaken by the Company. |

5.

|

Setting KPI targets in the risk area in the Board of Directors’ KPI. |

6.

|

Providing periodic risk management reports to the Board of Commissioners. |

The consistent and comprehensive implementation of corporate governance is expected to serve as a strategic foundation for Telkom to continue evolving into a resilient, sustainable, and trusted corporation in the eyes of all stakeholders. We extend our appreciation to the entire team, management, and stakeholders for their dedication and contributions in upholding and embedding the principles of good corporate governance.

26

OUTLOOK ON BUSINESS PROSPECTS

In our view, Telkom's business prospects in the coming years remain challenging, accompanied by optimism surrounding the growth of new digital telco businesses and the evolving competitive landscape among players in the telecommunications industry. With a capital expenditure allocation of 22% of total revenue, primarily focused on mobile business development, fixed broadband, data centers & cloud, and infrastructure, the Company is well-positioned to achieve sustainable and positive performance growth. The key focus going forward is to maximize the value of capital investments through more effective investment initiatives, enhanced monetization of production assets via sales optimization, and strengthening the business and financial fundamentals across all entities within TelkomGroup, including improvements in governance and risk management.

Our business outlook will also be shaped by the ascending use of technology by telecommunications operators, particularly in data analytics & artificial intelligence, Internet of Things (IoT), with two main objectives: enhancing operational quality and broadening business opportunities through technology-driven customer solutions. The rapid evolution of technology also notably impacts our infrastructure business, particularly in the satellite and broadband segments.

From a competitive standpoint, the broadband market—both fixed and mobile—is expected to face heightened competition, driven by expanding infrastructure penetration and increased market reach into lower-income segments. Meanwhile, the telecommunications industry may face declining demand from the government segment, following the efficiency measures outlined in the 2025 State Budget. However, rather than seeing this as a setback, this should give us the impetus to further drive innovation and excellence in B2B IT Services & Enterprise Solutions, ensuring that these initiatives can be transformed into a sustainable growth engine for the business.

APPRECIATION TO STAKEHOLDERS AND CLOSING REMARKS

On behalf of the Board of Commissioners, we extend our appreciation to the Board of Directors, management, and all employees of Telkom Indonesia for their dedication, hard work, and commitment in realizing the Company’s goals, vision, and mission. Amid the increasingly complex industry landscape in 2024, strong collaboration, continuous innovation, and a relentless drive for progress have been the key forces enabling. Telkom to maintain its leadership in the telecommunications and digital industries. This spirit of collaboration must continue to be accompanied by a shared awareness among all members of TelkomGroup to uphold sound business practices and ethical standards.

We also extend our sincere appreciation to our loyal customers, shareholders, the Government, business partners, and all stakeholders for their unwavering support and trust in Telkom. This support serves as a crucial foundation for us to continue building an inclusive and sustainable digital ecosystem, while further strengthening Telkom’s role in driving Indonesia’s digital economic growth.

Jakarta, April 21, 2025

On Behalf of the Board of Commissioners

/s/ Bambang Permadi Soemantri Brodjonegoro REPORT OF THE BOARD OF DIRECTORS

Bambang Permadi Soemantri Brodjonegoro

President Commissioner/Independent Commissioner

27

“The year 2024 was a pivotal moment which demonstrated the success of Telkom’s transformation journey through the Five Bold Moves (5BM) initiative. Telkom had been expected to deliver tangible results and a compelling growth story to meet market and investor expectations across both business pillars—B2C (FMC) and B2B—by realizing optimal FMC synergy value and making significant progress in the B2B transformation, particularly in building business capabilities at both the parent company and subsidiary levels.”

To Our Esteemed Shareholders, Members of the Board of Commissioners, and all stakeholders,

We extend our deepest gratitude to God Almighty for His blessings and guidance, with which PT Telkom Indonesia (Persero) Tbk ("Telkom" or “the Company”) concluded 2024 demonstrating sound performance. In a year marked by mounting challenges and increasing industry complexity, the Company succeeded in delivering sustained growth and recording several key milestones.

REVIEW OF ECONOMIC AND INDUSTRY LANDSCAPE

Amid disruption and global uncertainties marked by a slowing macroeconomic environment, heightened industry volatility, and escalating geopolitical tensions, Indonesia’s national GDP recorded cumulative growth of 5.03% by the end of 2024. This achievement was driven by increased investment and manufacturing activities, galvanized by resilient domestic demand and gradually recovering global markets. Meanwhile, inflation was maintained at 1.57% YoY through consistent monetary and fiscal policies and effective coordination between Bank Indonesia and the Government in managing inflation. These developments reflect the resilience and potential of Indonesia’s economy for sustainable growth.

The telecommunications industry continues to play a vital role in supporting inclusive and sustainable economic progress in Indonesia. Telecommunications services not only provide accessibility but also stand as a foundation for innovation, business growth, and social advancement.

To foster a healthy and sustainable telecommunications and information ecosystem, we have continued investing in network development, digital and information technology innovation, and service quality enhancement. It is our endeavor to deliver best-in-class services to improve accessibility for all segments of society across Indonesia.

STRATEGY AND CORPORATE STRATEGIC POLICY

The year 2024 was a pivotal moment which demonstrated the success of Telkom’s transformation journey through the Five Bold Moves (5BM) initiative. Telkom had been expected to deliver tangible results and a compelling growth story to meet market and investor expectations across both business pillars—B2C (FMC) and B2B—by realizing optimal FMC synergy value and making significant progress in the B2B transformation, particularly in building business capabilities at both the parent company and subsidiary levels.

To achieve these objectives, we adopted the corporate theme for 2024:

“Achieve outstanding results in B2C integration and strive for significant improvements in B2B transformation”, supported by three main programs:

1. |

Leverage data-driven approach in addressing customer pain-points and increasing customer lifetime value. Improving Customer Lifetime Value (CLV) is a critical priority, and a comprehensive understanding of customer needs is a key prerequisite for enhancing loyalty. Accordingly, we have adopted a disciplined, data-driven approach to customer management. This has enabled us to respond effectively to customer pain points and deliver the best possible experience. |

28

2. |

Ensure business competitiveness through streamlined portfolio and relentless Five Bold Moves execution while confirming strategic partners. To remain competitively positioned, we have focused on driving business efficiency and optimizing the Group’s assets, while enhancing the business capabilities under development—especially those aligned with the 5BM strategy. Strategic partners play a vital role in building these capabilities, and in 2024 we accelerated strategic partnership initiatives as a key success factor. |

3. |

Execute fit-for-purpose talent fulfillment to enhance business capabilities and productivity. To support sustainable business growth, Telkom has continued to strengthen its business capabilities and productivity through a strategic talent management approach. This approach is grounded in aligning employee competencies with the specific characteristics and needs of the business, ensuring timely and effective execution. |

FORMULATION OF COMPANY STRATEGY AND STRATEGIC POLICIES

In formulating our strategies, we must always align with our vision and mission, while taking into account a thorough analysis of strategic conditions—covering both external and internal factors—and input from stakeholders. This process also incorporates careful consideration of risk factors that may impact the continuity of the Company’s business. The results of the formulation are compiled into a document to be discussed intensively with the Board of Commissioners through a dedicated workshop. The Board of Directors plays a central role in formulating the Company’s strategy and strategic policies. These strategies and policies are structured according to specific timeframes, as follows:

a.

|

Long-Term Corporate Plan (RJPP), a document at the corporate level that contains strategic aspirations from stakeholders, as well as strategic direction and KPIs that are of a high level in nature prepared for periodic planning of 5 (five) years; |

b.

|

Medium-Term Plan, a document at the corporate level that serves as the primary document containing the Company’s strategic scenario in implementing the directives stated in the RJPP, prepared for a planning timeframe of 3 (three) years. The Medium-Term Plan is updated annually so that the strategic scenario can follow the Company’s internal and external dynamics; and |

c.

|

Corporate Work Plan and Budget (RKAP), a document at the strategic execution level containing the plans for the next 1 (one) year, including the targets, work programs, and budgets needed as directed by the long-term and medium-term strategies, accompanied at all times by due consideration of industry dynamics, stakeholder aspirations, and the latest business outlook data. |

IMPLEMENTATION OF CORPORATE STRATEGY

The strategic documents developed by the Company serve as a key reference for the execution of work programs across all business units, support functions, and subsidiaries, ensuring that every part of the organization operates under a unified direction aligned with their respective targets and authorities. To further ensure consistency in actions and decision-making across the organization in the execution of its strategy, the Company issues strategic policies in the form of the Board of Directors Regulations or other relevant regulations that provide more detailed guidance on how the Company operates and behaves effectively and efficiently. These strategic policies cover a broad range of areas, including resource allocation, risk management, product development and customer relations, supplier engagement, environmental sustainability, corporate governance, and other strategic imperatives as needed.

To monitor the execution of work programs, the Board of Directors conducts regular reviews and evaluations of the Company’s performance against a set of financial, operational, and other relevant indicators. The Board of Directors is also accountable for reviewing and updating the effectiveness of the strategies adopted, ensuring the Company remains relevant and competitive in a dynamic market environment.

29

PERFORMANCE ACHIEVEMENT AGAINST TARGET

In 2024, Telkom attained several key milestones in executing its Five Bold Moves (5BM) strategy, which had been designed to strengthen the Company’s strategic positioning within Indonesia’s digital ecosystem. Through the Fixed Mobile Convergence (FMC) initiative, Telkom successfully integrated IndiHome services into Telkomsel, aiming to unleash the synergy between fixed and mobile services, strengthen market leadership, enhance customer experience, and optimize operational and capital expenditure efficiency. This move accelerated customer growth and market penetration, while driving synergy through content optimization, cross-selling, and streamlined customer touchpoints at 486 GraPARI outlets, thereby boosting customer satisfaction and operational efficiency. The launch of a unified billing system (one-billing system), Telkomsel One, is expected to be a new catalyst for future growth. By the end of 2024, IndiHome recorded 10.8 million subscribers and TelkomGroup’s convergence service penetration reached 56%. In addition, Telkomsel’s mobile subscriber base reached 159.4 million with over 50% market share and coverage extending to 97% of Indonesia’s population. These outcomes affirm that the FMC strategy is progressing as planned in support of Telkom’s vision to be the leading convergence operator in Indonesia.

Furthermore, Telkom also activated PT Telkom Infrastruktur Indonesia (TIF) as its InfraCo entity to manage TelkomGroup’s fiber network. Through TIF, Telkom is able to unlock the full value of its fiber assets and accelerate national digital adoption by providing neutral wholesale fiber connectivity services. This model enhances investment efficiency, asset management, operational effectiveness, and creates opportunities for network sharing with other industry players, further sharpening TelkomGroup’s competitive edge in the market.

In the Data Center business, Telkom bolstered its position through the consolidation of NeutraDC, which now operates 35 data centers across Indonesia and abroad, with a business value reaching USD 3 billion. NeutraDC continues to expand its capacity to meet growing cloud storage demands driven by the rapid development of Artificial Intelligence (AI). NeutraDC is also exploring strategic partnerships with global players to augment its capabilities as a digital ecosystem hub, reinforcing Telkom’s positioning in Southeast Asia’s data center market.

Telkom further enhanced its capabilities and business competencies under the B2B IT Services initiative, supported by a notable financial recovery. The Indibiz platform deepened vertical penetration, accelerating business growth. Telkom remains focused on strengthening Cloud services, Digital IT Services, and Cybersecurity through strategic partnerships with global tech companies, targeting the needs of 2,303 corporate clients, 717 government institutions, and 591,618 SMEs currently served by the Company.

In 2024, the DigiCo initiative grew, marked by positive financial contributions and well-received products in the market. This progress has attracted substantial investor interest, contributing to the Company’s overall development.

As a result of these strategic initiatives, Telkom recorded revenue of Rp149.97 trillion by the end of 2024, representing a 0.5% increase from Rp149.22 trillion in 2023. This growth was supported by several positive indicators, including a solid year-on-year payload growth of 13.9%, reflecting strong future growth potential for the Company. Despite this, revenue remained slightly below the 2024 target. In terms of profitability, EBITDA declined by 3.3% from Rp77.58 trillion to Rp75.03 trillion, primarily due to the Company’s investment in an Early Retirement Program, which we expect to enhance efficiency and productivity in the future. Net income decreased to Rp23.65 trillion from Rp24.56 trillion in 2023, factoring in unrealized losses from investments in GOTO. This net income outcome was marginally below the Company’s 2024 target.

30

CHALLENGES AND CONSTRAINTS FACED

We faced a range of challenges in our business operations within the dynamic telecommunications industry, including:

1.

|

Evolving Regulatory Landscape: The Company must proactively address and anticipate regulatory changes that may significantly impact on how we operate. This requires rapid adjustment and adaptation to ensure continued growth while remaining compliant with new rules. One notable example was the implementation of Ministry of Home Affairs Regulation No. 7/2024, whose practical implementation continued to be fraught—particularly due to varying interpretations by regional governments that still apply outdated schemes in determining lease rates for Regional Government Assets (BMD) used for telecommunications infrastructure that may hinder the efficient rollout of infrastructure. |

2.

|

Intensifying Market Competition: The digital telco industry in Indonesia continues to experience increasing competition with the entry of new players—both local and global—alongside a growing range of commoditized products and services, as well as expanded offerings from existing competitors. In response, the Company must consistently innovate across both business and operating models, including forging strategic partnerships that align with our portfolio strategy. This ensures the delivery of up-to-date, efficient services to enhance customer experience and satisfaction. We also monitor competitor consolidation, which we believe will ultimately lead to a healthier industry landscape. |

3.

|

Infrastructure Reach: Despite the Company’s continuous efforts to expand infrastructure, particularly for digital connectivity and platform services, there are still limitations in reaching all regions, especially the 3T areas (Frontier, Outermost, and Disadvantaged). We aim to overcome these barriers with more efficient, cutting-edge technologies and by collaborating with local governments, regional partners, and other stakeholders to increase infrastructure penetration and service coverage. |

4.

|

High Capital Requirements: The development and maintenance of connectivity service infrastructure and platforms requires a significant investment. At the same time, the telecommunications industry is grappling with the growing commoditization of connectivity services. To address this, the Company has begun preparing and developing second-curve services within the digital platform and digital services portfolio such as Data Centers, Cloud Services, and IT Services. |

5.

|

Cybersecurity Threats: Along with the digital lifestyle of today’s society, which implies an increasing dependence on digital technology, the Company also faces greater risks related to cyber security. Threats such as cyberattacks and data breaches pose significant reputational and operational risks. In response, we are relentlessly strengthening our information security systems and promoting cyber risk awareness and understanding across all TelkomGroup employees and partners. |

6.

|

Global Macroeconomic Uncertainty: Global economic uncertainty, influenced by several factors such as geopolitical conflicts, changes in political leadership, and weak economic growth, was one of the main factors behind Indonesia’s stagnant economic expansion in 2024. These conditions have created a challenging business environment for Telkom, influencing market dynamics and requiring strategic recalibration to sustain growth and competitiveness amid global volatility. To navigate this uncertainty, the Company continues to build capacity and capabilities to leverage emerging technologies that can meet the evolving digital needs of society. |

2025 BUSINESS OUTLOOK AND TARGETS

In 2025, the Company is targeting low single-digit revenue growth, with an EBITDA margin in the range of 50%–52%, and a capital expenditure-to-revenue ratio of 15%–20%. To achieve these targets, we will continue executing the Five Bold Moves (5BM) strategy, with a strong focus on accelerating Indonesia’s digitalization and redoubling our investments across core business lines in digital connectivity, digital platforms, and digital services.

We are confident that digitalization presents Indonesia with an exceptional opportunity to leap forward across key sectors such as education, healthcare, finance, and beyond—achieving progress more efficiently and cost-effectively. To this end, the development of robust and extensive digital connectivity infrastructure, advanced digital platforms, and community-relevant digital services are critical components in building a connected society and accelerating the growth of Indonesia’s digital economy.

31

We believe the rollout of Telkomsel One, a unified billing system, will offer a more integrated and seamless digital experience by combining home and mobile internet services into a single ecosystem. This platform is expected to act as a new catalyst, driving future B2C growth.

Telkom will also continue to strengthen its B2B segment by prioritizing high-margin, recurring services such as enterprise solutions that provide a range of integrated solutions such as system integration, IT service management, and Customer Relationship Management (CRM) services. Furthermore, we will accelerate strategic partnerships in the data center business to fuel sustainable B2B growth.

Looking ahead, Indonesia’s economy is expected to improve, supported by government programs already underway, which will provide a positive outlook for the Company’s long-term growth trajectory.

IMPLEMENTATION OF GOOD CORPORATE GOVERNANCE

We remain committed to upholding the principles of Good Corporate Governance (GCG), aligning with the eight principles of company management and governance as stipulated in the OJK’s Guidelines for Public Company Governance. The consistent application of GCG supports the realization of our purpose, vision, and mission while delivering sustainable value for shareholders and all other stakeholders. We firmly believe that sound corporate governance is a critical enabler of the Company’s long-term sustainability.

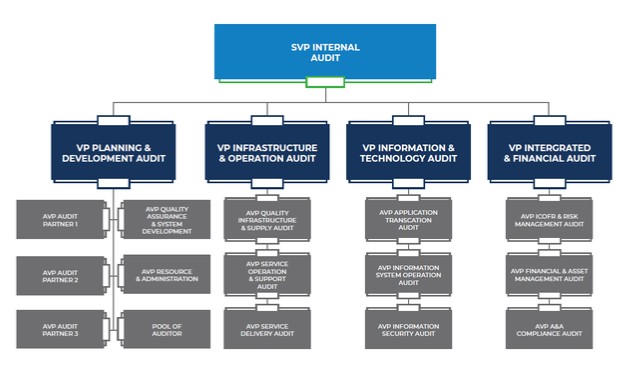

Throughout 2024, we have made significant enhancements across various areas to ensure the effective implementation of good corporate governance, including the strengthening of the Internal Audit organization and its competencies aimed at improving the effectiveness of internal control and oversight, the establishment of a Data Protection Unit to ensure compliance with the Personal Data Protection Law, and the reinforcement of the Company’s risk management function.

CLOSING

To conclude this report, on behalf of the Board of Directors of PT Telkom Indonesia (Persero) Tbk, we would like to extend our highest appreciation to the shareholders, the Board of Commissioners, customers, business partners, media, the public, and all other stakeholders who have supported us throughout 2024. We also extend our gratitude to the entire management team and employees of TelkomGroup, who have played a vital role in implementing strategic initiatives and achieving the Company’s objectives in 2024.

Looking ahead, we believe that Telkom is emboldened to come up with innovation after innovation amid the swift evolution of the digital era. We hope Telkom will continue to grow, deliver added value for stakeholders, and strengthen its position as a leading digital telecommunications company, in line with our commitment to accelerating digital transformation and providing the best services for the people of Indonesia.

Jakarta, April 21, 2025

On behalf of the Board of Directors STATEMENT OF THE MEMBER OF BOARD OF COMMISSIONERS

/s/ Ririek Adriansyah

Ririek Adriansyah

President Director

32

REGARDING WITH RESPONSIBILITY FOR

PT TELKOM INDONESIA (PERSERO) TBK 2024 ANNUAL REPORT

We the undersigned hereby declare that all the information in the PT Telkom Indonesia (Persero) Tbk

2024 Annual Report has been presented in its entirety and that we assume full responsibility

for the accuracy of the content of the Company’s Annual Report.

This statement is made in all truthfulness.

Jakarta, April 21, 2025

Board of Commissioners | |||

|

/s/ Bambang Permadi Soemantri Brodjonegoro | |||

|

Bambang Permadi Soemantri Brodjonegoro President Commissioner/Independent Commissioner | |||

|

/s/ Wawan Iriawan |

/s/ Bono Daru Adji |

||

|

Wawan Iriawan Independent Commissioner |

Bono Daru Adji Independent Commissioner |

||

/s/ Marcelino Rumambo Pandin |

/s/ Ismail |

/s/ Rizal Mallarangeng |

|

|

Marcelino Rumambo Pandin Commissioner |

Ismail Commissioner |

Rizal Mallarangeng Commissioner |

|

/s/ Isa Rachmatarwata |

/s/ Arya Mahendra Sinulingga |

/s/ Silmy Karim |

|

|

Isa Rachmatarwata Commissioner |

Arya Mahendra Sinulingga Commissioner |

Silmy Karim Commissioner |

|

33

STATEMENT OF THE MEMBER OF BOARD OF DIRECTORS

REGARDING WITH RESPONSIBILITY FOR

PT TELKOM INDONESIA (PERSERO) TBK 2024 ANNUAL REPORT

We the undersigned hereby declare that all the information in the PT Telkom Indonesia (Persero) Tbk

2024 Annual Report has been presented in its entirety and that we assume full responsibility

for the accuracy of the content of the Company’s Annual Report.

This statement is made in all truthfulness.

Jakarta, April 21, 2025

Board of Directors | |||

/s/ Ririek Adriansyah | |||

|

Ririek Adriansyah President Director | |||

/s/ Heri Supriadi |

/s/ FM Venusiana R. |

/s/ Herlan Wijanarko |

|

|

Heri Supriadi Director of Finance & Risk Management |

FM Venusiana R. Director of Enterprise & Business Service |

Herlan Wijanarko Director of Network & IT Solution |

|

/s/ Muhamad Fajrin Rasyid |

/s/ Budi Setyawan Wijaya |

/s/ Afriwandi |

|

|

Muhamad Fajrin Rasyid Director of Digital Business |

Budi Setyawan Wijaya Director of Strategic Portfolio |

Afriwandi Director of Human Capital Management |

|

/s/ Bogi Witjaksono |

/s/ Honesti Basyir |

||

|

Bogi Witjaksono Director of Wholesale & International Service |

Honesti Basyir Director of Group Business Development |

||

34

36 |

|

37 |

|

39 |

|

40 |

|

42 |

|

43 |

|

45 |

|

52 |

|

57 |

|

59 |

|

62 |

|

65 |

|

71 |

|

73 |

|

75 |

Use of Public Accounting Services and Public Accounting Firms |

77 |

Name and Address of Institutions and/or Supporting Capital Market Profession |

35

PURPOSE, VISION, MISSION, AND STRATEGY

PURPOSE

To build a more prosperous and competitive nation as well as deliver the best value to our stakeholders.

VISION

To be the most preferred digital telco to empower the society.

MISSION

1. |

Advance rapid buildout of sustainable intelligent digital infrastructure and platforms that is affordable and accessible to all. |

2. |

Nurture best-in-class digital talent that helps develop nation’s digital capabilities and increase digital adoption. |

3. |

Orchestrate digital ecosystem to deliver superior customer experience. |

STRATEGIC FOCUS 2024

In 2024, we will continue the ongoing business transformation and investment and strengthen the Company's fundamental core to drive sustainable growth. This year also proves the Five Bold Moves initiative, focusing on B2C business synergy (FMC) and increasing B2B capabilities. The challenges of global uncertainty, including economic slowdown, industry dynamics, and geopolitical situations, may affect our business. Therefore, we prioritize programs that have a significant impact by adhering to compliance principles and prudence and mitigating potential risks. We have launched a corporate theme for 2024, "Achieve outstanding results in B2C integration and strive for significant improvements in B2B transformation" with three main programs, namely:

1. |

Leverage data-driven approach in addressing customer pain-points and increasing customer lifetime value; |

2. |

Ensure business competitiveness through streamlined portfolio and relentless 5 BM execution while confirming strategic partners; and |

3. |

Execute fit-for-purpose talent fulfillment to enhance business capabilities and productivity. |

36

CORE VALUES AKHLAK

Based on the Circular Letter of the Minister of SOE Number SE-7/MBU/07/2020 dated July 1, 2020, regarding Core Values for Human Resources of State-Owned Enterprises (SOE) strengthened by SK-115/MBU/05/2022 regarding Guidelines for Implementing the Main Value of Human Resources for State-Owned Enterprises (AKHLAK Culture Journey), TelkomGroup as part of a SOE is obliged to implement the main values called AKHLAK.

Amanah/Trustworthy |

Holding on to the trust given |

Kompeten/Competent |

Continue to learn and develop capabilities |

Harmonis/Harmonious |

Caring for each other and respecting differences |

Loyal |

Dedicated and prioritizing the interests of the nation and the state |

Adaptif/Adaptive |

Continue to innovate and be enthusiastic in moving or facing change |

Kolaboratif/Collaborative |

Building a synergistic collaboration |