UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant To Rule 13a-16 Or 15d-16 of the

Securities Exchange Act of 1934

For the month of August 2025

Commission File Number: 333-251238

|

|

COSAN S.A.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

|

|

Av. Brigadeiro Faria Lima, 4100, – 16th floor

São Paulo, SP 04538-132 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40‑F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

CONTENTS

To the Board of Directors and Stockholders

Cosan S.A.

Introduction

We have reviewed the accompanying interim statement of financial position of Cosan S.A. ("Company") as at June 30, 2025 and the related statements of profit or loss and other comprehensive income for the quarter and six-month period then ended, and the statements of changes in equity and cash flows for the six-month period then ended, as well as the accompanying consolidated interim statement of financial position of the Company and its subsidiaries ("Consolidated") as at June 30, 2025 and the related consolidated statements of profit or loss and other comprehensive income for the quarter and six-month period then ended, and the consolidated statements of changes in equity and cash flows for the six-month period then ended, and explanatory notes.

Management is responsible for the preparation and presentation of these parent company and consolidated condensed interim financial statements in accordance with the accounting standard CPC 21, Interim Financial Reporting, of the Brazilian Accounting Pronouncements Committee (CPC), and International Accounting Standard (IAS) 34 - Interim Financial Reporting, of the International Accounting Standards Board (IASB). Our responsibility is to express a conclusion on these condensed interim financial statements based on our review.

Scope of review

We conducted our review in accordance with Brazilian and International Standards on Reviews of Interim Financial Information (NBC TR 2410 - Review of Interim Financial Information Performed by the Independent Auditor of the Entity, and ISRE 2410 - Review of Interim Financial Information Performed by the Independent Auditor of the Entity, respectively). A review of interim financial information consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with Brazilian and International Standards on Auditing and consequently did not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the accompanying parent company and consolidated condensed interim financial statements referred to above are not prepared, in all material respects, in accordance with CPC 21 and IAS 34.

| PricewaterhouseCoopers Auditores Independentes Ltda. | |

| Avenida Brigadeiro Faria Lima, 3732, Edifício B32, 16o, | |

| São Paulo, SP, Brasil, 04538-132 | |

| www.pwc.com.br | T: +55 (11) 4004-8000 |

Statements of value added

The interim condensed financial statements referred to above include the parent company and consolidated statements of value added for the six-month period ended June 30, 2025. These statements are the responsibility of the Company's management and are presented as supplementary information under IAS 34. These statements have been subjected to review procedures performed together with the review of the condensed interim financial statements for the purpose of concluding whether they are reconciled with the condensed interim financial statements and accounting records, as applicable, and if their form and content are in accordance with the criteria defined in the accounting standard CPC 09 - "Statement of Value Added". Based on our review, nothing has come to our attention that causes us to believe that these statements of value added have not been properly prepared, in all material respects, in accordance with the criteria established in this accounting standard, and consistent with the parent company and consolidated condensed interim financial statements taken as a whole.

Audit and review of previous year's figures

The condensed interim financial statements referred to in the first paragraph include accounting information corresponding to the statements of profit or loss and other comprehensive income for the for the quarter and six-month period ended June 30, 2024, and the statements of changes in equity, cash flows and value added for the six-month period ended June 30, 2024, obtained from the condensed interim financial statements for that period, and the statement of financial position as of December 31, 2024, obtained from the financial statements ended December 31, 2024, presented for comparison purposes. The review of the condensed interim financial statements for the period ended June 30, 2024 and the audit of the financial statements for the year ended December 31, 2024 were conducted under the responsibility of other independent auditors, who issued review and audit reports dated August 14, 2024, and March 10, 2025, respectively, without qualifications.

São Paulo, August 14, 2025

PricewaterhouseCoopers

Auditores Independentes Ltda.

CRC 2SP000160/O-5

Alessandro Marchesino de Oliveira

Contador CRC 1SP265450/O-8

(In thousands of Brazilian reais - R$)

|

Parent Company |

Consolidated |

||||||||

|

Note |

June 30, 2025 |

December 31, 2024 |

June 30, 2025 |

December 31, 2024 |

|||||

|

Assets |

|||||||||

|

Cash and cash equivalents |

5.1 |

2,931,314 |

2,201,267 |

13,527,889 |

16,903,542 |

||||

|

Restricted cash |

— |

— |

27,915 |

28,006 |

|||||

|

Marketable securities |

485,179 |

805,335 |

2,723,105 |

3,272,941 |

|||||

|

Trade receivables |

— |

— |

3,951,961 |

3,730,364 |

|||||

|

Derivative financial instruments |

5.3 |

— |

18,402 |

161,993 |

905,341 |

||||

|

Inventories |

— |

— |

2,104,814 |

2,072,905 |

|||||

|

Receivables from related parties |

5.4 |

152,874 |

114,099 |

184,061 |

197,063 |

||||

|

Income tax receivable |

657,871 |

453,308 |

972,638 |

793,721 |

|||||

|

Other current tax receivable |

5,373 |

5,364 |

902,796 |

886,136 |

|||||

|

Dividend receivable |

11,848 |

19,377 |

32,669 |

153,548 |

|||||

|

Reduction of capital receivable |

— |

1,013,714 |

— |

— |

|||||

|

Sectorial financial assets |

— |

— |

258,142 |

221,947 |

|||||

|

Other financial assets |

— |

— |

91 |

675 |

|||||

|

Other current assets |

91,740 |

50,896 |

1,054,926 |

629,426 |

|||||

|

Current assets |

4,336,199 |

4,681,762 |

25,903,000 |

29,795,615 |

|||||

|

Current assets held for sale |

795,828 |

796,211 |

979,697 |

978,788 |

|||||

|

5,132,027 |

5,477,973 |

26,882,697 |

30,774,403 |

||||||

|

Trade receivables |

— |

— |

166,429 |

265,370 |

|||||

|

Marketable securities |

224,748 |

— |

325,481 |

113,360 |

|||||

|

Restricted cash |

188 |

— |

192,778 |

146,297 |

|||||

|

Deferred tax assets |

9 |

1,158,637 |

1,758,410 |

3,488,404 |

4,495,296 |

||||

|

Receivables from related parties |

5.4 |

95,250 |

292,882 |

26,319 |

202,826 |

||||

|

Income tax receivable |

— |

— |

140,012 |

264,308 |

|||||

|

Other non-current tax receivable |

36,083 |

35,177 |

1,599,348 |

1,334,553 |

|||||

|

Judicial deposits |

10 |

390,067 |

416,969 |

1,054,531 |

1,056,690 |

||||

|

Derivative financial instruments |

5.3 |

120,468 |

1,547,093 |

1,998,415 |

2,893,987 |

||||

|

Sectorial financial assets |

— |

— |

530,602 |

509,695 |

|||||

|

Other non-current assets |

137,906 |

140,594 |

834,681 |

739,386 |

|||||

|

Other financial assets |

— |

— |

4,472 |

3,820 |

|||||

|

Investment in subsidiaries and associates |

6.1 |

22,482,118 |

31,308,696 |

1,638,515 |

10,678,566 |

||||

|

Investment in joint ventures |

7 |

1,013,743 |

1,193,072 |

8,960,090 |

10,545,044 |

||||

|

Property, plant and equipment |

8.1 |

39,042 |

39,038 |

24,367,923 |

23,019,016 |

||||

|

Intangible assets and goodwill |

8.2 |

11,441 |

9,873 |

26,477,844 |

26,330,785 |

||||

|

Contract assets |

— |

— |

1,031,451 |

1,114,830 |

|||||

|

Right-of-use assets |

8.3 |

|

16,102 |

17,557 |

9,583,592 |

9,958,751 |

|||

|

Investment property |

— |

— |

16,732,690 |

16,818,919 |

|||||

|

Non-current assets |

25,725,793 |

36,759,361 |

99,153,577 |

110,491,499 |

|||||

|

|

|||||||||

|

Total assets |

30,857,820 |

42,237,334 |

126,036,274 |

141,265,902 |

|||||

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of the condensed interim individual and consolidated financial statements.Condensed statement of financial position

Interim statement of financial position

(In thousands of Brazilian reais - R$)

|

Parent Company |

Consolidated |

||||||||

|

Note |

June 30, 2025 |

December 31, 2024 |

June 30, 2025 |

December 31, 2024 |

|||||

|

Liabilities |

|||||||||

|

Loans, borrowings and debentures |

5.2 |

480,944 |

347,032 |

3,873,610 |

4,403,148 |

||||

|

Leases |

9,987 |

9,227 |

1,016,530 |

1,007,533 |

|||||

|

Derivative financial instruments |

5.3 |

252,037 |

1,074,991 |

2,027,992 |

2,504,117 |

||||

|

Trade payables |

5.5 |

1,366 |

2,900 |

4,059,315 |

5,168,593 |

||||

|

Employee benefits payables |

26,489 |

43,356 |

582,617 |

794,906 |

|||||

|

Income tax payables |

13,837 |

18,514 |

142,713 |

414,823 |

|||||

|

Other taxes payable |

80,992 |

78,197 |

605,900 |

637,842 |

|||||

|

Dividends payable |

11 |

39 |

3,495 |

135,875 |

96,722 |

||||

|

Reduction of capital payable |

— |

— |

— |

486,285 |

|||||

|

Concessions payable |

— |

— |

178,611 |

166,273 |

|||||

|

Related party payables |

5.4 |

146,329 |

210,620 |

377,952 |

416,410 |

||||

|

Sectorial financial liabilities |

— |

— |

78,067 |

64,718 |

|||||

|

Other financial liabilities |

5 |

— |

— |

695,027 |

770,103 |

||||

|

Other current liabilities |

308,389 |

298,534 |

855,658 |

895,223 |

|||||

|

Current liabilities |

1,320,409 |

2,086,866 |

14,629,867 |

17,826,696 |

|||||

|

Liabilities related to assets held for sale |

— |

— |

86,145 |

86,138 |

|||||

|

1,320,409 |

2,086,866 |

14,716,012 |

17,912,834 |

||||||

|

Loans, borrowings and debentures |

5.2 |

15,659,544 |

21,003,523 |

56,526,653 |

62,052,278 |

||||

|

Leases |

12,482 |

15,232 |

5,359,142 |

5,502,220 |

|||||

|

Derivative financial instruments |

5.3 |

159,973 |

29,883 |

618,691 |

966,087 |

||||

|

Trade payables |

5.5 |

— |

— |

19,763 |

19,256 |

||||

|

Employee benefits payables |

— |

— |

31,294 |

19,101 |

|||||

|

Other taxes payable |

135,436 |

216,203 |

163,811 |

255,245 |

|||||

|

Income tax payables |

52,928 |

— |

124,485 |

— |

|||||

|

Provision for legal proceedings |

10 |

266,965 |

308,607 |

2,044,858 |

2,044,633 |

||||

|

Concessions payable |

— |

— |

3,793,992 |

3,554,917 |

|||||

|

Investments with unsecured liabilities |

6.1 |

349,663 |

263,722 |

— |

— |

||||

|

Related party payables |

5.4 |

5,359,068 |

7,052,404 |

1,078 |

1,078 |

||||

|

Post-employment benefits |

389 |

279 |

566,971 |

526,620 |

|||||

|

Deferred tax liabilities |

9 |

— |

— |

6,003,008 |

5,973,506 |

||||

|

Sectorial financial liabilities |

— |

— |

2,068,665 |

1,975,521 |

|||||

|

Deferred income |

— |

— |

15,336 |

16,589 |

|||||

|

Other financial liabilities |

5 |

— |

— |

158,475 |

297,736 |

||||

|

Other non-current liabilities |

349,903 |

356,851 |

719,624 |

749,919 |

|||||

|

Non-current liabilities |

22,346,351 |

29,246,704 |

78,215,846 |

83,954,706 |

|||||

|

Total liabilities |

23,666,760 |

31,333,570 |

92,931,858 |

101,867,540 |

|||||

|

Shareholders’ equity |

11 |

||||||||

|

Share capital |

8,182,738 |

8,832,544 |

8,182,738 |

8,832,544 |

|||||

|

Treasury shares |

(84,162) |

(50,708) |

(84,162) |

(50,708) |

|||||

|

Additional paid-in capital |

1,171,058 |

2,205,878 |

1,171,058 |

2,205,878 |

|||||

|

Accumulated other comprehensive income |

655,361 |

565,855 |

655,361 |

565,855 |

|||||

|

Profit reserve |

— |

8,773,990 |

— |

8,773,990 |

|||||

|

Retained losses |

(2,733,935) |

(9,423,795) |

(2,733,935) |

(9,423,795) |

|||||

|

Equity attributable to owners of the Company |

7,191,060 |

10,903,764 |

7,191,060 |

10,903,764 |

|||||

|

Non-controlling interests |

6.2 |

— |

— |

25,913,356 |

28,494,598 |

||||

|

Total shareholders' equity |

7,191,060 |

10,903,764 |

33,104,416 |

39,398,362 |

|||||

|

Total liabilities and shareholders' equity |

|

|

30,857,820 |

|

42,237,334 |

|

126,036,274 |

|

141,265,902 |

The accompanying notes are an integral part of the condensed interim individual and consolidated financial statements.

(In thousands of Brazilian reais - R$, except earnings (loss) per share)

|

Parent Company |

Consolidated |

||||||||||||||||

|

|

|

|

Period of three months ended June 30, |

Period of six months ended June 30, |

Period of three months ended June 30, |

Period of six months ended June 30, |

|||||||||||

|

Note |

2025 |

2024 |

2025 |

2024 |

2025 |

2024 |

2025 |

2024 |

|||||||||

|

Net sales |

13 |

— |

— |

— |

— |

10,477,652 |

10,694,008 |

20,140,253 |

20,536,064 |

||||||||

|

Cost of sales |

14 |

— |

— |

— |

— |

(6,881,505) |

(7,137,604) |

(13,673,411) |

(14,066,041) |

||||||||

|

Gross profit |

— |

— |

— |

— |

3,596,147 |

3,556,404 |

6,466,842 |

6,470,023 |

|||||||||

|

Selling expenses |

14 |

— |

— |

— |

— |

(457,529) |

(376,497) |

(897,585) |

(737,901) |

||||||||

|

General and administrative expenses |

14 |

(77,614) |

(111,518) |

(135,551) |

(215,201) |

(643,624) |

(611,413) |

(1,178,656) |

(1,194,668) |

||||||||

|

Other operating income (expenses), net |

15 |

(7,925) |

28,634 |

166,001 |

14,395 |

488,794 |

165,774 |

1,012,924 |

166,535 |

||||||||

|

Impairment |

15 |

— |

— |

— |

— |

(397,531) |

(2,574,817) |

(683,139) |

(2,574,817) |

||||||||

|

Operating (expenses) income |

(85,539) |

(82,884) |

30,450 |

(200,806) |

(1,009,890) |

(3,396,953) |

(1,746,456) |

(4,340,851) |

|||||||||

|

Loss (profit) before equity in earnings of investees, finance results and income taxes |

(85,539) |

(82,884) |

30,450 |

(200,806) |

2,586,257 |

159,451 |

4,720,386 |

2,129,172 |

|||||||||

|

Interest in earnings (losses) of subsidiaries and associates |

6.1 |

46,008 |

753,820 |

(447,229) |

1,577,990 |

79,604 |

833,371 |

98,652 |

1,294,795 |

||||||||

|

Interest in (losses) earnings of joint ventures |

7 |

(92,880) |

50,927 |

(221,073) |

5,052 |

(828,449) |

450,974 |

(1,967,495) |

47,066 |

||||||||

|

Equity in earnings (losses) of investees |

(46,872) |

804,747 |

(668,302) |

1,583,042 |

(748,845) |

1,284,345 |

(1,868,843) |

1,341,861 |

|||||||||

|

Finance expense |

(623,490) |

(625,774) |

(1,387,451) |

(1,155,309) |

(2,060,943) |

(2,130,752) |

(4,774,585) |

(3,995,308) |

|||||||||

|

Finance income |

111,488 |

42,188 |

336,030 |

100,371 |

716,707 |

726,385 |

1,754,607 |

1,341,486 |

|||||||||

|

Foreign exchange, net |

421,118 |

(1,514,581) |

1,500,402 |

(1,852,577) |

794,492 |

(2,442,818) |

2,588,455 |

(2,974,036) |

|||||||||

|

Net effect of derivatives |

(562,976) |

652,311 |

(1,726,075) |

138,950 |

(1,253,143) |

1,325,382 |

(3,274,360) |

1,326,726 |

|||||||||

|

Finance results, net |

16 |

(653,860) |

(1,445,856) |

(1,277,094) |

(2,768,565) |

(1,802,887) |

(2,521,803) |

(3,705,883) |

(4,301,132) |

||||||||

|

Profit (loss) before income taxes |

(786,271) |

(723,993) |

(1,914,946) |

(1,386,329) |

34,525 |

(1,078,007) |

(854,340) |

(830,099) |

|||||||||

|

Income taxes |

9 |

||||||||||||||||

|

Current |

— |

— |

— |

(3,849) |

(371,559) |

(543,520) |

(674,721) |

(827,916) |

|||||||||

|

Deferred |

(159,771) |

496,885 |

(818,990) |

970,896 |

(231,063) |

652,042 |

(974,436) |

952,076 |

|||||||||

|

(159,771) |

496,885 |

(818,990) |

967,047 |

(602,622) |

108,522 |

(1,649,157) |

124,160 |

||||||||||

|

Loss for the period |

(946,042) |

(227,108) |

(2,733,936) |

(419,282) |

(568,097) |

(969,485) |

(2,503,497) |

(705,939) |

|||||||||

|

Profit (loss) attributable to: |

|||||||||||||||||

|

Owners of the Company |

(946,042) |

(227,108) |

(2,733,936) |

(419,282) |

(946,042) |

(227,108) |

(2,733,936) |

(419,282) |

|||||||||

|

Non-controlling interests |

— |

— |

— |

— |

377,945 |

(742,377) |

230,439 |

(286,657) |

|||||||||

|

(946,042) |

(227,108) |

(2,733,936) |

(419,282) |

(568,097) |

(969,485) |

(2,503,497) |

(705,939) |

||||||||||

|

Earnings (loss) per share |

12 |

||||||||||||||||

|

Basic |

R$ (0.51) |

R$ (0.12) |

R$ (1.47) |

R$ (0.22) |

|||||||||||||

|

Diluted |

R$ (0.51) |

R$ (0.12) |

R$ (1.47) |

R$ (0.22) |

|||||||||||||

The accompanying notes are an integral part of the condensed interim individual and consolidated financial statements.

Interim statement of other comprehensive income

(In thousands of Brazilian reais - R$, except earnings (loss) per share)

|

Parent Company |

Consolidated |

||||||||||||||

|

Period of three months ended June 30, |

Period of six months ended June 30, |

Period of three months ended June 30, |

Period of six months ended June 30, |

||||||||||||

|

2025 |

2024 |

2025 |

2024 |

2025 |

2024 |

2025 |

2024 |

||||||||

|

Loss for the period |

(946,042) |

(227,108) |

(2,733,936) |

(419,282) |

(568,097) |

(969,485) |

(2,503,497) |

(705,939) |

|||||||

|

Other comprehensive income: |

|||||||||||||||

|

Items that are or may be reclassified subsequently to profit or loss: |

|||||||||||||||

|

Foreign currency translation differences |

221,491 |

101,317 |

(69,205) |

164,203 |

244,609 |

131,448 |

(45,589) |

194,502 |

|||||||

|

Gain (loss) on cash flow hedge |

9,810 |

(127,372) |

172,697 |

(159,756) |

25,815 |

(229,812) |

219,360 |

(291,759) |

|||||||

|

Deferred taxes |

— |

— |

— |

— |

(19,548) |

62,666 |

(47,573) |

82,049 |

|||||||

|

231,301 |

(26,055) |

103,492 |

4,447 |

250,876 |

(35,698) |

126,198 |

(15,208) |

||||||||

|

Items that will not be reclassified to profit or loss: |

|||||||||||||||

|

Actuarial gains (losses) with defined benefit plan |

13 |

892 |

(22,484) |

16,968 |

(7,230) |

(14,138) |

(37,619) |

10,148 |

|||||||

|

Deferred taxes |

(1) |

— |

8,498 |

(1,668) |

7,022 |

14,981 |

24,024 |

6,724 |

|||||||

|

12 |

892 |

(13,986) |

15,300 |

(208) |

843 |

(13,595) |

16,872 |

||||||||

|

Total comprehensive loss for the period |

(714,729) |

(252,271) |

(2,644,430) |

(399,535) |

(317,429) |

(1,004,340) |

(2,390,894) |

(704,275) |

|||||||

|

Comprehensive income (loss) attributable to: |

|||||||||||||||

|

Owners of the Company |

(714,729) |

(252,271) |

(2,644,430) |

(399,535) |

(714,729) |

(252,271) |

(2,644,430) |

(399,535) |

|||||||

|

Non-controlling interests |

— |

— |

— |

— |

397,300 |

(752,069) |

253,536 |

(304,740) |

|||||||

|

(714,729) |

(252,271) |

(2,644,430) |

(399,535) |

(317,429) |

(1,004,340) |

(2,390,894) |

(704,275) |

||||||||

The accompanying notes are an integral part of the condensed interim individual and consolidated financial statements.

(In thousands of Brazilian reais - R$)

|

Capital reserve |

Profit reserve |

Shareholders’ equity attributable to |

||||||||||||||||||||

|

Share capital |

Treasury shares |

Corporate transactions - Law 6,404/76 |

Additional paid-in capital |

Accumulated other comprehensive income |

Legal |

Statutory reserve |

Retained losses |

Controlling shareholders |

Non-controlling shareholders |

Total equity |

||||||||||||

|

Balance as at January 1, 2025 |

8,832,544 |

(50,708) |

737 |

2,205,141 |

565,855 |

58,802 |

8,715,188 |

(9,423,795) |

10,903,764 |

28,494,598 |

39,398,362 |

|||||||||||

|

Profit (loss) for the period |

— |

— |

— |

— |

— |

— |

— |

(2,733,936) |

(2,733,936) |

230,439 |

(2,503,497) |

|||||||||||

|

Other comprehensive income |

||||||||||||||||||||||

|

Gain (loss) from cash flow hedge |

— |

— |

— |

— |

172,697 |

— |

— |

— |

172,697 |

(910) |

171,787 |

|||||||||||

|

Foreign currency translation differences |

— |

— |

— |

— |

(69,205) |

— |

— |

— |

(69,205) |

23,616 |

(45,589) |

|||||||||||

|

Actuarial gains (losses) on defined benefit plans, net of tax |

— |

— |

— |

— |

(13,986) |

— |

— |

— |

(13,986) |

391 |

(13,595) |

|||||||||||

|

Total comprehensive income (loss) for the period |

— |

— |

— |

— |

89,506 |

— |

— |

(2,733,936) |

(2,644,430) |

253,536 |

(2,390,894) |

|||||||||||

|

Transactions with owners of the Company contributions and distributions: |

||||||||||||||||||||||

|

Effect arising from capital increase in subsidiary |

— |

— |

— |

(89,084) |

— |

— |

— |

— |

(89,084) |

89,084 |

— |

|||||||||||

|

Own shares acquired (note 11 (a)) |

— |

(34,022) |

— |

— |

— |

— |

— |

— |

(34,022) |

— |

(34,022) |

|||||||||||

|

Share-based payments |

— |

568 |

538 |

— |

— |

— |

— |

1,106 |

11,955 |

13,061 |

||||||||||||

|

Absorption of accumulated losses (note 11 (c)) |

(649,806) |

— |

— |

— |

— |

(58,802) |

(8,715,188) |

9,423,796 |

— |

— |

— |

|||||||||||

|

Dividends |

— |

— |

— |

— |

— |

— |

— |

— |

— |

(1,745,209) |

(1,745,209) |

|||||||||||

|

Employee share schemes - value of employee services |

— |

— |

— |

29,289 |

— |

— |

— |

— |

29,289 |

3,133 |

32,422 |

|||||||||||

|

Total contributions and distributions |

(649,806) |

(33,454) |

— |

(59,257) |

— |

(58,802) |

(8,715,188) |

9,423,796 |

(92,711) |

(1,641,037) |

(1,733,748) |

|||||||||||

|

Transactions with owners of the Company: |

||||||||||||||||||||||

|

Change of shareholding interest in subsidiary (note 6.1) |

— |

— |

— |

(975,563) |

— |

— |

— |

— |

(975,563) |

(1,193,741) |

(2,169,304) |

|||||||||||

|

Total transactions with owners of the Company |

— |

— |

— |

(975,563) |

— |

— |

— |

— |

(975,563) |

(1,193,741) |

(2,169,304) |

|||||||||||

|

Total transactions with owners of the Company contributions and distributions |

(649,806) |

(33,454) |

— |

(1,034,820) |

— |

(58,802) |

(8,715,188) |

9,423,796 |

(1,068,274) |

(2,834,778) |

(3,903,052) |

|||||||||||

|

Balance as at June 30, 2025 |

8,182,738 |

|

(84,162) |

737 |

1,170,321 |

655,361 |

— |

— |

(2,733,935) |

7,191,060 |

25,913,356 |

33,104,416 |

||||||||||

The accompanying notes are an integral part of the condensed interim individual and consolidated financial statements.

Condensed statement of changes in equity

Interim statement of changes in equity

(In thousands of Brazilian reais - R$)

|

Capital reserve |

Profit reserve |

Shareholders’ equity attributable to |

||||||||||||||||||||||

|

Share capital |

Treasury shares |

Corporate transactions - Law 6,404/76 |

Additional paid-in capital |

Accumulated other comprehensive income |

Legal |

Statutory reserve |

Profit retention |

Retained losses |

Controlling shareholders |

Non-controlling shareholders |

Total equity |

|||||||||||||

|

Balance as at January 1, 2024 |

8,682,544 |

(93,917) |

737 |

2,561,227 |

314,325 |

58,802 |

8,610,796 |

820,793 |

— |

20,955,307 |

30,025,873 |

50,981,180 |

||||||||||||

|

Loss for the period |

— |

— |

— |

— |

— |

— |

— |

— |

(419,282) |

(419,282) |

(286,657) |

(705,939) |

||||||||||||

|

Other comprehensive income |

|

|||||||||||||||||||||||

|

Gain (loss) from cash flow hedge |

— |

— |

— |

— |

(159,756) |

— |

— |

— |

— |

(159,756) |

(49,954) |

(209,710) |

||||||||||||

|

Foreign currency translation differences |

— |

— |

— |

— |

164,203 |

— |

— |

— |

— |

164,203 |

30,299 |

194,502 |

||||||||||||

|

Actuarial gains with defined benefit plan, net of tax |

— |

— |

— |

— |

15,300 |

— |

— |

— |

— |

15,300 |

1,572 |

16,872 |

||||||||||||

|

Total comprehensive income (loss) for the period |

— |

— |

— |

— |

19,747 |

— |

— |

— |

(419,282) |

(399,535) |

(304,740) |

(704,275) |

||||||||||||

|

Transactions with owners of the Company contributions and distributions: |

||||||||||||||||||||||||

|

Capital increase |

150,000 |

— |

— |

— |

— |

— |

(150,000) |

— |

— |

— |

— |

— |

||||||||||||

|

Capital reduction in subsidiary |

— |

— |

— |

— |

— |

— |

— |

— |

— |

— |

(20,629) |

(20,629) |

||||||||||||

|

Share-based payment |

— |

43,678 |

— |

(132,064) |

— |

— |

— |

— |

— |

(88,386) |

9,700 |

(78,686) |

||||||||||||

|

Loss in dividend distribution to non-controlling shareholders |

— |

— |

— |

(420) |

— |

— |

— |

— |

— |

(420) |

549 |

129 |

||||||||||||

|

Dividends |

— |

— |

— |

— |

— |

— |

(566,401) |

— |

— |

(566,401) |

(1,249,678) |

(1,816,079) |

||||||||||||

|

Own shares acquired |

— |

(162,174) |

— |

— |

— |

— |

— |

— |

— |

(162,174) |

— |

(162,174) |

||||||||||||

|

Employee share schemes - value of employee services |

— |

— |

— |

47,775 |

— |

— |

— |

— |

— |

47,775 |

10,521 |

58,296 |

||||||||||||

|

Total contributions and distributions |

150,000 |

(118,496) |

— |

(84,709) |

— |

— |

(716,401) |

— |

— |

(769,606) |

(1,249,537) |

(2,019,143) |

||||||||||||

|

Transactions with owners of the Company: |

||||||||||||||||||||||||

|

Change of shareholding interest in subsidiary |

— |

— |

— |

(1,852) |

— |

— |

— |

— |

— |

(1,852) |

— |

(1,852) |

||||||||||||

|

Total transactions with owners of the Company |

— |

— |

— |

(1,852) |

— |

— |

— |

— |

— |

(1,852) |

— |

(1,852) |

||||||||||||

|

Total transactions with owners of the Company contributions and distributions |

150,000 |

(118,496) |

— |

(86,561) |

— |

— |

(716,401) |

— |

— |

(771,458) |

(1,249,537) |

(2,020,995) |

||||||||||||

|

Balance as at June 30, 2024 |

8,832,544 |

(212,413) |

737 |

2,474,666 |

334,072 |

58,802 |

7,894,395 |

820,793 |

|

(419,282) |

|

19,784,314 |

|

28,471,596 |

|

48,255,910 |

||||||||

The accompanying notes are an integral part of the condensed interim individual and consolidated financial statements.

(In thousands of Brazilian reais - R$)

Condensed statement of cash flows

|

|

|

|

Parent Company |

|

Consolidated |

||||

|

|

|

Period of six months ended June 30, |

|||||||

|

Note |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

|

Profit (loss) before income taxes |

|

|

(1,914,946) |

|

(1,386,329) |

|

(854,340) |

|

(830,099) |

|

Adjustments for: |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

14 |

|

9,792 |

|

7,780 |

|

1,960,208 |

|

1,833,725 |

|

Impairment |

15 |

|

— |

|

— |

|

683,139 |

|

2,574,817 |

|

Interest in earnings (losses) of subsidiaries and associates |

6.1 |

|

447,229 |

|

(1,577,990) |

|

(98,652) |

|

(1,294,795) |

|

Interest in earnings (losses) of joint ventures |

7 |

|

221,073 |

|

(5,052) |

|

1,967,495 |

|

(47,066) |

|

Loss (gain) on disposed assets |

15 |

|

— |

|

7 |

|

35,612 |

|

40,261 |

|

Share-based payment |

17 |

|

12,440 |

|

32,836 |

|

44,618 |

|

81,258 |

|

Provision for legal proceedings |

15 |

|

53,921 |

|

3,877 |

|

143,507 |

|

149,301 |

|

Interest, derivatives, monetary and foreign exchange, net |

|

|

1,506,757 |

|

2,786,747 |

|

4,629,865 |

|

4,994,791 |

|

Sectorial financial assets and liabilities, net |

|

|

— |

|

— |

|

(1,418) |

|

28,016 |

|

Provisions for employee benefits |

|

|

24,674 |

|

19,459 |

|

212,337 |

|

190,575 |

|

Allowance for expected credit losses |

|

|

— |

|

— |

|

31,220 |

|

23,670 |

|

Profit on sale of investment |

15 |

|

— |

|

— |

|

— |

|

383,205 |

|

Insurance claims |

2.1 |

|

— |

|

— |

|

(491,427) |

|

— |

|

Income from finance investments |

|

|

(9,143) |

|

— |

|

(9,143) |

|

(63,966) |

|

Previously recognized gain in other comprehensive income reclassified to profit or loss upon disposal of investment |

15 |

|

(206,388) |

|

— |

|

(206,388) |

|

— |

|

Other |

|

|

110 |

|

611 |

|

52,672 |

|

(103,303) |

|

|

|

|

145,519 |

|

(118,054) |

|

8,099,305 |

|

7,960,390 |

|

Variation in: |

|

|

|

|

|

|

|

|

|

|

Trade receivable |

|

|

— |

|

— |

|

(8,966) |

|

(654,468) |

|

Inventories |

|

|

— |

|

— |

|

(261,788) |

|

(82,238) |

|

Other taxes, net |

|

|

(2,950) |

|

(7,974) |

|

(313,916) |

|

33,447 |

|

Income tax |

|

|

(18,501) |

|

69,003 |

|

(136,735) |

|

(198,354) |

|

Income taxes paid |

— | — | (594,738) | (498,998) | |||||

|

Related parties, net |

|

|

(16,373) |

|

384 |

|

(41,568) |

|

109,994 |

|

Trade payables |

|

|

(1,396) |

|

1,001 |

|

(18,112) |

|

122,132 |

|

Employee benefits |

|

|

(46,255) |

|

(58,180) |

|

(417,779) |

|

(347,607) |

|

Provision for legal proceedings |

|

|

2,124 |

|

1,678 |

|

(108,443) |

|

(157,302) |

|

Derivative financial instruments |

|

|

— |

|

— |

|

(31,761) |

|

(18,095) |

|

Other financial liabilities |

|

|

— |

|

— |

|

(243,766) |

|

(31,671) |

|

Judicial deposits |

|

|

(7,576) |

|

(3,026) |

|

(22,392) |

|

(127,925) |

|

Post-employment benefit obligation |

|

|

— |

|

— |

|

(20,193) |

|

(17,659) |

|

Other assets and liabilities, net |

|

|

(34,980) |

|

(19,255) |

|

(220,565) |

|

22,213 |

|

|

|

|

(125,907) |

|

(16,369) |

|

(2,440,722) |

|

(1,846,531) |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash generated from (used in) operating activities |

|

|

19,612 |

|

(134,423) |

|

5,658,583 |

|

6,113,859 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

|

Capital contribution to associates |

|

|

(333,892) |

|

(4,173,198) |

|

— |

|

— |

|

Capital contribution in joint ventures |

|

|

— |

|

(8,337) |

|

— |

|

(8,337) |

|

Sale (purchase) of marketable securities, net |

|

|

349,576 |

|

123,223 |

|

665,309 |

|

(242,724) |

|

Restricted cash |

|

|

(188) |

|

43,048 |

|

(50,078) |

|

40,779 |

|

Dividends received from subsidiaries and associates |

|

|

592,906 |

|

1,787,186 |

|

49,544 |

|

644,631 |

Interim statement of cash flows

(In thousands of Brazilian reais - R$)

|

|

|

|

Parent Company |

|

Consolidated |

||||

|

|

|

Period of six months ended June 30, |

|||||||

|

Note |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

Dividends received from joint venture |

|

|

5,184 |

|

228,342 |

|

45,640 |

|

293,912 |

|

Dividends received from finance investment |

|

|

87,608 |

|

— |

|

87,608 |

|

— |

|

Other financial assets |

|

|

(148) |

|

— |

|

45 |

|

(354) |

|

Cash in the incorporation operation |

|

|

10,089 |

|

— |

|

— |

|

— |

|

Capital reduction in subsidiaries |

|

|

1,013,760 |

|

5,227 |

|

11,000 |

|

— |

|

Acquisition of property, plant and equipment, intangible and contract assets |

|

|

(8,035) |

|

(2,489) |

|

(4,210,158) |

|

(3,207,373) |

|

Proceeds from the sale of investments |

2.1 |

|

8,911,587 |

|

16,847 |

|

8,911,587 |

|

2,096,475 |

|

Related parties |

|

|

25,592 |

|

— |

|

25,592 |

|

— |

|

Operation discontinued |

|

|

— |

|

— |

|

7,425 |

|

— |

|

Acquisition of subsidiary |

6.3 |

|

— |

|

— |

|

(213,086) |

|

(17,047) |

|

Receipt of derivative financial instruments, except debt |

|

|

1,021 |

|

— |

|

1,021 |

|

132 |

|

Payment of derivative financial instruments, except debt |

|

|

(1,006,973) |

|

(70,503) |

|

(1,006,973) |

|

(70,689) |

|

Cash received on the sale of fixed assets and intangible assets |

|

|

— |

|

— |

|

4,250 |

|

— |

|

Net cash generated (used in) from investing activities |

|

|

9,648,087 |

|

(2,050,654) |

|

4,328,726 |

|

(470,595) |

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

|

Proceeds from loans, borrowings and debentures |

5.2 |

|

2,427,312 |

|

4,421,447 |

|

7,914,651 |

|

10,799,808 |

|

Principal repayment of loans, borrowings and debentures |

5.2 |

|

(7,148,782) |

|

— |

|

(13,410,998) |

|

(7,772,439) |

|

Payment of interest on loans, borrowings and debentures |

5.2 |

|

(765,076) |

|

(680,726) |

|

(2,360,197) |

|

(2,252,731) |

|

Payment of derivatives financial instruments |

|

|

(317,314) |

|

(355,848) |

|

(1,397,516) |

|

(2,111,172) |

|

Proceeds from derivative financial instruments |

|

|

351,562 |

|

14,199 |

|

996,647 |

|

959,656 |

|

Costs of banking operations with derivatives |

|

|

— |

|

— |

|

— |

|

(29,828) |

|

Principal repayment of leases |

|

|

(3,832) |

|

(3,169) |

|

(297,476) |

|

(248,175) |

|

Payment of interest on leases |

|

|

(1,335) |

|

(1,604) |

|

(183,557) |

|

(177,171) |

|

Capital reduction |

|

|

— |

|

— |

|

(486,240) |

|

(20,520) |

|

Related parties |

|

|

(1,293,363) |

|

(249,499) |

|

— |

|

— |

|

Payments to redeem entity’s shares and acquisition of treasury shares |

11 |

|

(34,022) |

|

(164,685) |

|

(34,022) |

|

(164,685) |

|

Acquisition of non-controlling shareholders’ shares |

2.1 |

|

(2,169,000) |

|

— |

|

(2,169,000) |

|

— |

|

Dividends paid |

11 |

|

— |

|

(782,081) |

|

(1,331,630) |

|

(1,537,377) |

|

Dividends paid for preferred shares |

11 |

|

— |

|

— |

|

(371,000) |

|

(668,022) |

|

Gain on banking operations with derivatives |

|

|

22,100 |

|

— |

|

22,100 |

|

— |

|

Net cash (used in) generated from financing activities |

|

|

(8,931,750) |

|

2,198,034 |

|

(13,108,238) |

|

(3,222,656) |

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents |

|

|

735,949 |

|

12,957 |

|

(3,120,929) |

|

2,420,608 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the beginning of the period |

|

|

2,201,267 |

|

1,769,976 |

|

16,903,542 |

|

14,658,481 |

|

Effect of the foreign exchange rate changes |

|

|

(5,902) |

|

17,436 |

|

(254,724) |

|

150,972 |

|

Cash and cash equivalents at the end of the period |

|

|

2,931,314 |

|

1,800,369 |

|

13,527,889 |

|

17,230,061 |

The accompanying notes are an integral part of the condensed interim individual and consolidated financial statements.

Interim statement of cash flows

(In thousands of Brazilian reais - R$)

Non-cash transactions:

The Company presents its individual and consolidated statements of cash flow using the indirect method. During the period ended June 30, 2025, the Company carried out the following transactions that did not involve cash and, therefore, are not reflected in the parent company and consolidated statement of cash flows:

| (i) | Recognition of right-of-use as a counterpart to the lease liability in the amount of R$348,662 (R$784,084 on June 30, 2024), resulting from the application of inflation indexes and new contracts classified under the leasing rule. (Note 8.3). | |

| (ii) | Acquisition of property, plant and equipment and intangible assets with payment in installments of R$610,127 (R$759,766 on June 30, 2024). |

Disclosure of interest and dividends:

Dividends and interest on equity capital received are classified as cash flow from investing activities by the Company. Dividends and interest received or paid are classified as cash flow from financing activities.

(In thousands of Brazilian reais - R$)

|

Parent Company |

Consolidated |

||||||

|

Period of six months ended June 30, |

|||||||

|

2025 |

2024 |

2025 |

2024 |

||||

|

Revenue |

|||||||

|

Net sales |

— |

— |

22,723,913 |

23,650,222 |

|||

|

Other income (expenses), net |

225,787 |

15,758 |

776,109 |

721,780 |

|||

|

Impairment gain (loss) on trade receivables |

— |

— |

(31,220) |

205 |

|||

|

225,787 |

15,758 |

23,468,802 |

24,372,207 |

||||

|

Inputs purchased from third parties |

|||||||

|

Cost of goods sold and services rendered |

— |

— |

11,867,355 |

13,016,297 |

|||

|

Materials, energy, third-party services and other |

62,311 |

66,448 |

565,292 |

1,107,676 |

|||

|

Impairment |

— |

— |

683,139 |

2,574,817 |

|||

|

62,311 |

66,448 |

13,115,786 |

16,698,790 |

||||

|

Gross value added |

163,476 |

(50,690) |

10,353,016 |

7,673,417 |

|||

|

Retention |

|||||||

|

Depreciation and amortization |

9,792 |

7,780 |

1,960,208 |

1,833,725 |

|||

|

Net value added |

153,684 |

(58,470) |

8,392,808 |

5,839,692 |

|||

|

Value added transferred in |

|||||||

|

Interest in earnings (losses) of subsidiaries and associates |

(447,229) |

1,577,990 |

98,652 |

1,294,795 |

|||

|

Interest in losses of joint ventures |

(221,073) |

5,052 |

(1,967,495) |

47,066 |

|||

|

Finance income |

1,836,432 |

100,371 |

4,343,062 |

1,341,486 |

|||

|

1,168,130 |

1,683,413 |

2,474,219 |

2,683,347 |

||||

|

Value added to be distributed |

1,321,814 |

1,624,943 |

10,867,027 |

8,523,039 |

|||

|

Distribution of value added |

|||||||

|

Personnel and payroll charges |

99,625 |

111,018 |

1,371,093 |

1,289,541 |

|||

|

Direct remuneration |

86,863 |

90,869 |

1,131,805 |

1,019,285 |

|||

|

Benefits |

8,642 |

6,207 |

183,998 |

204,900 |

|||

|

FGTS and other |

4,120 |

13,942 |

55,290 |

65,356 |

|||

|

Taxes, fees and contributions |

842,601 |

(935,727) |

3,992,894 |

2,231,848 |

|||

|

Federal |

835,340 |

(951,722) |

2,444,576 |

696,163 |

|||

|

State |

1 |

1 |

1,447,482 |

1,438,565 |

|||

|

Municipal |

7,260 |

15,994 |

100,836 |

97,120 |

|||

|

Financial expenses and rents |

3,113,524 |

2,868,934 |

8,006,537 |

5,707,589 |

|||

|

Interest and foreign exchange variation |

2,995,987 |

2,853,384 |

7,545,982 |

5,488,129 |

|||

|

Rents |

— |

— |

51,006 |

72,019 |

|||

|

Other |

117,537 |

15,550 |

409,549 |

147,441 |

|||

|

Equity remuneration |

(2,733,936) |

(419,282) |

(2,503,497) |

(705,939) |

|||

|

Non-controlling interests |

— |

— |

230,439 |

(286,657) |

|||

|

Retained losses |

(2,733,936) |

|

(419,282) |

|

(2,733,936) |

|

(419,282) |

The accompanying notes are an integral part of the condensed interim individual and consolidated financial statements.

Notes to the condensed interim financial statements

(In thousands of Brazilian reais - R$, except when otherwise indicated)

1 Operational context

Cosan S.A. (“Cosan” or “the Company”) is a publicly traded company at B3 S.A. - Brasil, Bolsa, Balcão (“B3”) in the special New Market (Novo Mercado) segment under the ticker “CSAN3”. The Company's American Depositary Shares (“ADSs”) are listed on the New York Stock Exchange, or “NYSE”, and are traded under the ticker “CSAN”. Cosan is a corporation (sociedade anônima) of indefinite term incorporated under the laws of Brazil, with its registered office in the city of São Paulo, state of São Paulo (SP). Mr. Rubens Ometto Silveira Mello is the ultimate controlling shareholder of Cosan.

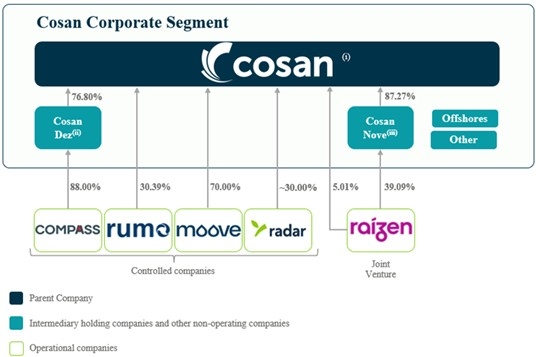

As of June 30, 2025, Cosan Corporate (Cosan’s Corporate segment) is formed by the following entities:

| (i) | Parent company with direct or indirect equity interest in subsidiaries and joint ventures. The main effects on its profit or loss are general and administrative expenses, contingencies, equity income and financial results attributed to loans. |

| (ii) | Bradesco BBI S.A. (“Bradesco”) holds preferred shares corresponding to a 23.20% stake in Cosan Dez Participações S.A. (“Cosan Dez”), which has a direct 88% stake in Compass. |

| (iii) | Itaú Unibanco S.A. (“Itaú”) holds preferred shares corresponding to a 12.73% stake in Cosan Nove Participações S.A. (“Cosan Nove”), which has a direct 39.09% stake in Raízen S.A. (“Raízen”). |

Notes to the condensed interim financial statements

(In thousands of Brazilian reais - R$, except when otherwise indicated)

2 Relevant events of the period

Acquisition of DIPI Holdings Ltda. by Moove

On September 29, 2024, Cosan Lubrificantes e Especialidades S.A. (“CLE”) entered into a purchase and sale agreement to acquire 100% of the shares of DIPI Holdings Ltda, for the price of R$329,006. The transaction was concluded on January 2, 2025, after all the conditions precedent had been met. The Company made the preliminary recognition of the price allocation, as detailed in Note 6.3.

Incorporation of Cosan Oito S.A.

On January 8, 2025, the Company successfully finalized the merger with Cosan Oito S.A. ("Cosan Oito"), after securing the requisite regulatory approvals. Consequently, all assets, liabilities, and shareholders' equity of Cosan Oito were comprehensively transferred to the Company. See Note 6.1.

Partial disposal of investment in Vale S.A.

On January 16, 2025, the Company sold 173,073,795 Vale S.A. (“Vale”) common shares, representing 4.05% of Vale's share capital, for a net commission of R$8,892,802 (see Note 6.1(b)). After this transaction, the Company kept 4,268,720 Vale common shares, corresponding to 0.10% of the share capital, in the amount of R$242,036.

Discontinuation of the operation of the Costa Pinto second-generation ethanol (“E2G”) pilot plant.

On January 17, 2025, Raízen, jointly controlled by the Company, announced the discontinuation of the recurring operation of Costa Pinto's Second-Generation Ethanol (E2G) pilot plant (Plant 1), located in Piracicaba, São Paulo. The plant, inaugurated in 2015, will operate as a unit dedicated to the testing and future development of biofuel from the harvest starting on April 1, 2025.

The commercial commitments previously linked to Plant 1 will be met by the Bonfim Plant (Plant 2), which is already in operation, and by the Univalem (Plant 3) and Barra (Plant 4) plants, which are in the commissioning phase and will begin operations after obtaining the necessary regulatory authorizations.

Fire at Moove lubricants factory

On February 8, 2025, a fire broke out at Moove's Ilha do Governador Complex ("CIG"), located in Rio de Janeiro. The incident primarily affected the manufacturing and bottling areas for finished lubricant products, which were inoperative at the time of the incident, representing 10% of the complex's total area.

Moove promptly activated all emergency and risk management protocols to control the incident. The containment measures, implemented through Moove's contingency plan, were effective in minimizing damage to the structure, the local community, and the environment. There were no casualties or injuries, and no environmental or social impacts were identified.

Moove immediately initiated and is currently operating its continuity plan to restore mixing and filling operations.

Notes to the condensed interim financial statements

(In thousands of Brazilian reais - R$, except when otherwise indicated)

• Financial assessment of the fire

a) Operational interruption:

The fire was confined to the finished lubricant product manufacturing area. The cleanup and clearance plan for the area is already well underway. The industrial complex's other operations (bulk lubricant and base oil operations, tank terminals, maritime operations, and pier operations) continued uninterrupted. These operations represent between 30% and 35% of total nominal production.

To mitigate the impacts in the affected areas, Moove has implemented the following measures:

(i) Relocation of mixing and filling to other production plants, including approved third-party partners.

(ii) Use of the strategic alliance to ensure product availability and supply chain continuity.

(iii) Use of safety stock distributed in the distribution center network.

b) Write-off of assets:

Moove engaged a specialized third-party company with expertise in its operations to conduct a physical inventory of the damaged and unaffected assets in the CIG (Individual Property and Equipment Inventory). This inventory aimed to more accurately determine the true extent of the loss, identify and catalog the affected assets, and measure impairment losses (cost less accumulated depreciation) in accordance with CPC 01/IAS 36 – Impairment of Assets. In addition to the work performed by the specialized third-party company, Moove conducted internal due diligence and field inspections in the directly impacted area, as well as secondary areas exposed to intense heat or chemicals from firefighting. Following the work, Moove recognized the total amount of damaged fixed assets to be written off as of June 30, 2025, at R$43,793, which was recorded in other income and expenses in the company's income statement.

c) Inventory reduction

After the incident, an inventory loss survey was conducted to identify lost products located directly in the impacted area and also in the vicinity of the fire site (which underwent qualitative changes). As of June 30, 2025, the total inventory loss is R$41,879, and the tax credit reversal related to the loss is R$13,480, totaling R$55,359 in losses, impacting the cost of goods sold item.

d) Compensation receivable

Moove has a current insurance policy that covers material damage to damaged assets and lost profits. Technical analyses and independent reports were conducted by the appropriate agencies, and the Company's insurers issued a confirmation letter confirming the existence and entitlement to insurance coverage. As a result, Moove is now entitled to receive compensation for property damage and lost profits, since Moove has concluded that it is virtually certain that it will receive compensation, and that this is reasonably estimable based on technical reports, internal expertise, and the contractual conditions of the policy.

To measure the recognized compensation, independent companies of technical experts specialized in insurance calculations for large-scale claims were hired.

On June 30, 2025, the amount of insurance compensation receivable recognized in assets for material damages and compensable loss of profits is R$491,427, offset against other revenues and expenses and costs of products sold.

Potential corporate reorganization proposal of Rumo Malha Norte

On February 19, 2025, Rumo S.A. (“Rumo”) and Rumo Malha Norte S.A. (“Rumo Malha Norte”) informed their shareholders and the market in general of the approval, by their respective Boards of Directors, of a potential corporate reorganization proposal. The proposal will be submitted for approval by the shareholders of the companies involved at their respective general meetings.

Notes to the condensed interim financial statements

(In thousands of Brazilian reais - R$, except when otherwise indicated)

To conduct the negotiation of the exchange ratio in the potential corporate reorganization, special independent committees were set up and their members elected.

If approved, the corporate reorganization will optimize the corporate structure by incorporating the shares of the minority shareholders (0.26% of the share capital) of Rumo Malha Norte into Rumo, converting Rumo Malha Norte into a wholly owned subsidiary of Rumo. The minority shareholders of Rumo Malha Norte who retain their shares until the date of approval of the corporate reorganization by the general meetings of the companies involved will receive common shares in Rumo, in proportion to their holdings in the share capital of Rumo Malha Norte.

Cosan Dez capital reduction

On February 27, 2025, the Company received the amount of R$1,013,760 related to the capital reduction of Cosan Dez, approved at the Extraordinary General Meeting on June 26, 2024.

Redemption of Cosan Nove preferred shares

On March 31, 2025, the Company redeemed 1,087,179,567 preferred shares of Cosan Nove, previously held by Banco Itaú, for the amount of R$2,169,000. After the transaction, the preferred shares were converted into common shares. As a result, the Company's stake in Cosan Nove increased to 87.27% (see Note 6.1).

Sale of the Leme Plant

On May 12, 2025, the jointly-owned subsidiary Raízen S.A. announced the sale of the Leme Plant, located in Piracicaba, São Paulo, with an installed capacity of 1.8 million tons per harvest. The sale price is R$425,000, to be received in cash upon closing.

Termination of the Share Purchase Agreement for Terminal XXXIX

On June 5, 2025, Rumo announced the termination of the agreement for the sale of shares in Terminal XXXIX de Santos SA (“Terminal XXXIX”) due to non-compliance with conditions precedent set forth in the agreement. The termination exempts the parties from any liens, fines, or compensation obligations, while maintaining their 50% equity interest in Terminal XXXIX.

As a result of the termination, the asset was reclassified from "asset held for sale" to "investments." The equity method was recognized for the current and retroactive periods during which the asset was classified as held for sale, totaling R$50,877.

Early redemptions of debentures

On January 22, 2025, the Company requested the optional early redemption of the 1st Series of the 3rd Issue of Simple Debentures, non-convertible into shares, unsecured, with original maturity in 2028, in the total amount of R$750,000 to be increased by the remuneration calculated pro rata temporis from the date of the last payment until the date of the actual payment and the premium.

Early call (Bond 2027)

On January 29, 2025, the Company informed the market that it had exercised the early redemption clause of the 2027 Bond, maturing in January 2027. The full redemption, in the amount of U.S.$392,000 thousand, equivalent to R$2,250,825, was carried out on March 14, 2025, at the face value of the bonds.

Tender offers - Bonds 2029, 2030 and 2031 and debentures

During the first quarter of 2025, the Company made partial repurchases of the 5th and 6th issue of Debentures and securities issued by Cosan Luxembourg S.A. (“Cosan Lux”), specifically Bonds 2029, 2030 and 2031, as detailed in the table below:

|

Notes |

Added value of the principal |

Added value paid on repurchase |

Interest paid |

Prize |

Gain/Loss |

|

5.50% Senior notes – 2029 |

1,347,741 |

1,228,072 |

(30,487) |

(67,135) |

52,534 |

|

7.50% Senior notes – 2030 |

1,600,016 |

1,572,518 |

(17,055) |

(80,379) |

(52,881) |

|

7.25% Senior notes – 2031 |

1,637,819 |

1,588,054 |

(18,008) |

(82,112) |

(32,347) |

|

5th and 6th Debentures |

1,152,469 |

1,152,469 |

(52,384) |

(17,714) |

(17,714) |

Notes to the condensed interim financial statements

(In thousands of Brazilian reais - R$, except when otherwise indicated)

Early redemption

On February 12 and 13, 2025, respectively, the Company settled in advance Loan 4.131 in the amount of U.S.$600,000 thousand, equivalent to R$3,462,660, and Debenture in the amount of U.S.$300,000 thousand, equivalent to R$1,733,640, acquired in February 2024 and December 2023, respectively.

With the early settlement of these debts, the Total Return Swap (“TRS”) and Time Deposit operations were also settled, which had been used to internalize debts.

New debts

|

Segment/Modalities |

Date |

Incidence of interest |

Index |

Objective |

Funding costs |

Value |

Maturity |

|

Cosan Corporate |

|||||||

|

Debentures |

03/12/2025 |

Yearly |

CDI + 0.60% p. a. |

Ordinary capital management |

(46,633) |

1,500,000 |

01/27/2029 |

|

Debentures |

03/12/2025 |

Yearly |

CDI + 0.70% p. a. |

Ordinary capital management |

(13,797) |

500,000 |

03/27/2030 |

|

Debentures |

03/12/2025 |

Yearly |

CDI + 1.00% p. a. |

Ordinary capital management |

(13,721) |

500,000 |

03/27/2032 |

| Compass | |||||||

|

Debentures |

01/10/2025 |

Yearly |

DI + spread 0.50% p.a. |

Ordinary capital management |

— |

410,000 |

01/07/2027 |

|

Debentures |

02/18/2025 |

Six-monthly |

IPCA + 7.44% p. a. |

Ordinary capital management |

(18,546) |

800,000 |

01/15/2033 |

|

Loan 4.131 |

03/20/2025 |

Yearly |

CDI + 0.78% p. a. |

Investment |

(859) |

350,000 |

03/20/2026 |

|

Debentures |

05/19/2025 |

Six-monthly |

CDI + 0.45% p. a. |

Investment |

(2,414) |

1,500,000 |

05/15/2028 |

| Rumo | |||||||

|

Debentures |

03/28/2025 |

Yearly |

IPCA + 7.47% p. a. |

Ordinary capital management |

(17,020) |

434,949 |

03/28/2037 |

|

Debentures |

03/28/2025 |

Yearly |

IPCA + 7.53% p. a. |

Ordinary capital management |

(63,990) |

1,365,051 |

03/28/2040 |

| Moove | |||||||

|

Loan 4.131 |

01/16/2025 |

Yearly |

CDI + 0.45% p. a. |

Ordinary capital management |

— |

500,000 |

01/18/2028 |

The condensed interim individual and consolidated financial statements, contained in the Quarterly Information Return (ITR), have been prepared and are being presented in accordance with Technical Pronouncement CPC 21 (R1) - Interim Financial Statements, International Accounting Standard (IAS 34) - Interim Financial Reporting as issued by the International Accounting Standards Board (“IASB”), the Brazilian Corporation Law and the rules of the Brazilian Securities Commission (“CVM”) applicable to the preparation of Quarterly Information (“ITR”).

These condensed interim financial statements should be read in conjunction with the Company's annual consolidated financial statements for the fiscal year ended December 31, 2024 (“annual financial statements”). They do not include all the information required for a complete set of financial statements prepared in accordance with accounting practices adopted in Brazil and the International Financial Reporting Standards (“IFRS”). However, selected explanatory notes have been included to clarify events and transactions relevant to an understanding of the changes in the Company's financial position and performance since the last annual financial statements.

Notes to the condensed interim financial statements

(In thousands of Brazilian reais - R$, except when otherwise indicated)

The presentation of the Interim Statement of Value-Added (“VAS”), both individual and consolidated, is required by Brazilian corporate law and by the accounting practices adopted in Brazil applicable to publicly traded companies. The VAS was prepared in accordance with the criteria established in Technical Pronouncement CPC 09 - Statement of Value Added. The IFRS do not require the presentation of this statement; therefore, it is presented as supplementary information to the individual and consolidated interim financial statements.

These individual and consolidated condensed interim financial statements were prepared using the same basis of preparation and accounting policies adopted in the preparation of the financial statements as of December 31, 2024. All balances have been rounded to the nearest thousand, unless otherwise indicated.

The relevant information specific to the condensed interim financial statements, and only this information, is disclosed and corresponds to the information used by management in the management of the Company.

These condensed interim financial statements were authorized for issue by the Board of Directors on August 14, 2025.

The Company's senior management (the Chief Operating Decision Maker) uses segment information to evaluate the performance of operating segments and make resource allocation decisions. This information is prepared on a basis consistent with the accounting policies used in the preparation of the financial statements.

Earnings before interest, taxes, depreciation, and amortization ("EBITDA") are used by the Company to evaluate the performance of its operating segments.

Reported segments:

| 1) | Raízen: operates in the (i) production, commercialization, origination and trading of ethanol, (ii) production and commercialization of bioenergy, (iii) resale and trading of electricity, (iv) production and commercialization of other renewable products (solar energy and biogas), (v) production, commercialization, origination and trading of sugar and (vi) trading and commercialization of fossil fuels, renewable fuels and lubricants through a franchised network of service stations under the Shell brand throughout the country and in Latin America, operating in Argentina and Paraguay. |

| 2) | Compass: its main activities are: (i) distribution of piped natural gas in the South, Southeast and Central West regions for customers in the industrial, residential, commercial, automotive and cogeneration segments; (ii) marketing of natural gas; and (iii) development of infrastructure projects in a regasification terminal. |

| 3) | Moove: operates in the production, formulation and distribution of high-performance lubricants, base oils and specialties with headquarters in Brazil and operates in 11 countries in South America, North America, and Europe. It blends, distributes, and sells products under Mobil and proprietary brands for different end-markets including industrial, commercial and passenger/cargo vehicles. |

| 4) | Rumo: logistics services for rail transport, port storage and loading of goods, primarily grains and sugar, leasing of locomotives, wagons, and other railroad equipment, as well as operation of containers. |

| 5) | Radar: A reference in agricultural property management, Radar invests in a diversified portfolio with high potential for appreciation, through participation in the companies Radar, Tellus and Janus. |

Reconciliation:

| 1) | Cosan Corporate: represents the reconciliation of Cosan's corporate structure, which is composed of: (i) senior management and corporate teams, which incur general and administrative expenses and other operating expenses (income), including pre-operating investments; (ii) equity income from investments; and (iii) financial income attributable to cash and debts of the parent company, intermediate holding companies (Cosan Nove and Cosan Dez), offshore financial companies and investment in the Climate Tech Fund, a fund managed by Fifth Wall, specializing in technological innovation. |

Although Raízen S.A. is a joint venture registered under the equity method and is not proportionally consolidated, Management continues to review the information by segment. The reconciliation of these segments is presented in the column “Deconsolidation of Joint Ventures”.

Notes to the condensed interim financial statements

(In thousands of Brazilian reais - R$, except when otherwise indicated)

|

Period of six months ended June 30, 2025 |

|||||||||||||||||

|

Reported segments |

Reconciliation |

||||||||||||||||

|

Raízen |

Compass |

Moove |

Rumo |

Radar |

Cosan Corporate |

Deconsolidation of Joint Ventures |

Elimination between segments |

Consolidated |

|||||||||

|

Statement of profit or loss |

|||||||||||||||||

|

Net sales |

111,819,950 |

8,544,938 |

4,587,853 |

6,678,143 |

336,414 |

1,455 |

(111,819,950) |

(8,550) |

20,140,253 |

||||||||

|

Cost of sales |

(107,858,882) |

(6,675,630) |

(3,405,069) |

(3,569,422) |

(31,840) |

— |

107,858,882 |

8,550 |

(13,673,411) |

||||||||

|

Gross profit |

3,961,068 |

1,869,308 |

1,182,784 |

3,108,721 |

304,574 |

1,455 |

(3,961,068) |

— |

6,466,842 |

||||||||

|

Selling expenses |

(3,183,326) |

(109,603) |

(758,036) |

(29,946) |

— |

— |

3,183,326 |

— |

(897,585) |

||||||||

|

General and administrative expenses |

(1,164,668) |

(392,108) |

(287,545) |

(315,859) |

(45,803) |

(137,341) |

1,164,668 |

— |

(1,178,656) |

||||||||

|

Other operation income (expenses), net |

223,628 |

467,500 |

402,261 |

(17,451) |

(5,377) |

165,991 |

(223,628) |

— |

1,012,924 |

||||||||

|

Impairment |

— |

— |

— |

(683,139) |

— |

— |

— |

— |

(683,139) |

||||||||

|

Interest in earnings (losses) of subsidiaries and associates |

(53,823) |

52,408 |

— |

42,312 |

21,329 |

(939,332) |

53,823 |

(1,045,560) |