Document

|

|

|

|

|

|

|

|

|

|

|

|

REPORT TO SHAREHOLDERS |

|

|

| Second Quarter 2025 |

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

|

|

|

|

|

|

|

|

| Table of Contents |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basis of Presentation

The following Management's Discussion and Analysis ("MD&A") of the financial and operating results of Pembina Pipeline Corporation ("Pembina" or the "Company") is dated August 7, 2025, and is supplementary to, and should be read in conjunction with, Pembina's unaudited condensed consolidated interim financial statements for the three and six months ended June 30, 2025 ("Interim Financial Statements") as well as Pembina's audited consolidated annual financial statements ("Consolidated Financial Statements") and MD&A for the year ended December 31, 2024. All financial information provided in this MD&A has been prepared in accordance with International Accounting Standard ("IAS") 34 Interim Financial Reporting and is expressed in Canadian dollars, unless otherwise noted. A description of Pembina's operating segments and additional information about Pembina is filed with Canadian and U.S. securities commissions, including quarterly and annual reports, annual information forms (which are filed with the U.S. Securities and Exchange Commission under Form 40-F) and management information circulars, which can be found online at www.sedarplus.ca, www.sec.gov and through Pembina's website at www.pembina.com. Information contained in or otherwise accessible through Pembina's website does not form part of this MD&A and is not incorporated into this document by reference.

Abbreviations

For a list of abbreviations that may be used in this MD&A, refer to the "Abbreviations" section of this MD&A.

Non-GAAP and Other Financial Measures

Pembina has disclosed certain financial measures and ratios within this MD&A that management believes provide meaningful information in assessing Pembina's underlying performance, but which are not specified, defined or determined in accordance with the Canadian generally accepted accounting principles ("GAAP") and which are not disclosed in Pembina's Interim Financial Statements or Consolidated Financial Statements. Such non-GAAP financial measures and non-GAAP ratios do not have any standardized meaning prescribed by IFRS and may not be comparable to similar financial measures or ratios disclosed by other issuers. Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A for additional information regarding these non-GAAP financial measures and non-GAAP ratios.

Risk Factors and Forward-Looking Information

Management has identified the primary risk factors that could have a material impact on the financial results and operations of Pembina. Such risk factors are presented in the "Risk Factors" sections of Pembina's MD&A and Annual Information Form ("AIF"), each for the year ended December 31, 2024. The Company's financial and operational performance is potentially affected by a number of factors, including, but not limited to, the factors described within the "Forward-Looking Statements & Information" section of this MD&A. This MD&A contains forward-looking statements based on Pembina's current expectations, estimates, projections and assumptions. This information is provided to assist readers in understanding the Company's future plans and expectations and may not be appropriate for other purposes.

Pembina Pipeline Corporation Second Quarter 2025 1

1. ABOUT PEMBINA

Pembina Pipeline Corporation is a leading energy transportation and midstream service provider that has served North America's energy industry for more than 70 years. Pembina owns an extensive network of strategically-located assets, including hydrocarbon liquids and natural gas pipelines, gas gathering and processing facilities, oil and natural gas liquids infrastructure and logistics services, and an export terminals business. Through our integrated value chain, we seek to provide safe and reliable energy solutions that connect producers and consumers across the world, support a more sustainable future and benefit our customers, investors, employees and communities. For more information, please visit www.pembina.com.

Pembina's Purpose and Strategy

We deliver extraordinary energy solutions so the world can thrive.

Pembina will build on its strengths by continuing to invest in and grow the core businesses that provide critical transportation and midstream services to help ensure reliable and secure energy supply. Pembina will capitalize on exciting opportunities to leverage its assets and expertise into new service offerings that enable the transition to a lower-carbon economy. In continuing to meet global energy demand and its customers' needs, while ensuring Pembina's long-term success and resilience, the Company has established four strategic priorities:

1.To be resilient, we will sustain, decarbonize, and enhance our businesses. This priority is focused on strengthening and growing our existing franchise and demonstrating environmental leadership.

2.To thrive, we will invest in the energy transition to improve the basins in which we operate. We will prioritize lighter commodities as we continue to invest in new infrastructure and expand our portfolio to include new businesses associated with lower-carbon commodities.

3.To meet global demand, we will transform and export our products. We will continue our focus on supporting the transformation of Western Canadian Sedimentary Basin commodities into higher margin products and enabling more coastal egress.

4.To set ourselves apart, we will create a differentiated experience for our stakeholders. We remain committed to delivering excellence for our four key stakeholder groups meaning that:

a.Employees say we are the 'employer of choice' and value our safe, respectful, collaborative, and inclusive work culture.

b.Communities welcome us and recognize the net positive impact of our social and environmental commitment.

c.Customers choose us first for reliable and value-added services.

d.Investors receive sustainable industry-leading total returns.

2 Pembina Pipeline Corporation Second Quarter 2025

2. FINANCIAL & OPERATING OVERVIEW

Consolidated Financial Overview for the Three Months Ended June 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, except where noted) |

2025 |

2024 |

Change |

|

| Revenue |

1,792 |

|

1,855 |

|

(63) |

|

|

Net revenue(1) |

1,184 |

|

1,222 |

|

(38) |

|

|

| Operating expenses |

235 |

|

240 |

|

(5) |

|

|

Gross profit |

780 |

|

815 |

|

(35) |

|

|

Adjusted EBITDA(1) |

1,013 |

|

1,091 |

|

(78) |

|

|

|

|

|

|

|

Earnings |

417 |

|

479 |

|

(62) |

|

|

Earnings per common share – basic and diluted (dollars) |

0.65 |

|

0.75 |

|

(0.10) |

|

|

|

|

|

|

|

| Cash flow from operating activities |

790 |

|

954 |

|

(164) |

|

|

Cash flow from operating activities per common share – basic (dollars) |

1.36 |

|

1.64 |

|

(0.28) |

|

|

Adjusted cash flow from operating activities(1) |

698 |

|

837 |

|

(139) |

|

|

Adjusted cash flow from operating activities per common share – basic (dollars)(1) |

1.20 |

|

1.44 |

|

(0.24) |

|

|

| Capital expenditures |

197 |

|

265 |

|

(68) |

|

|

|

|

|

|

|

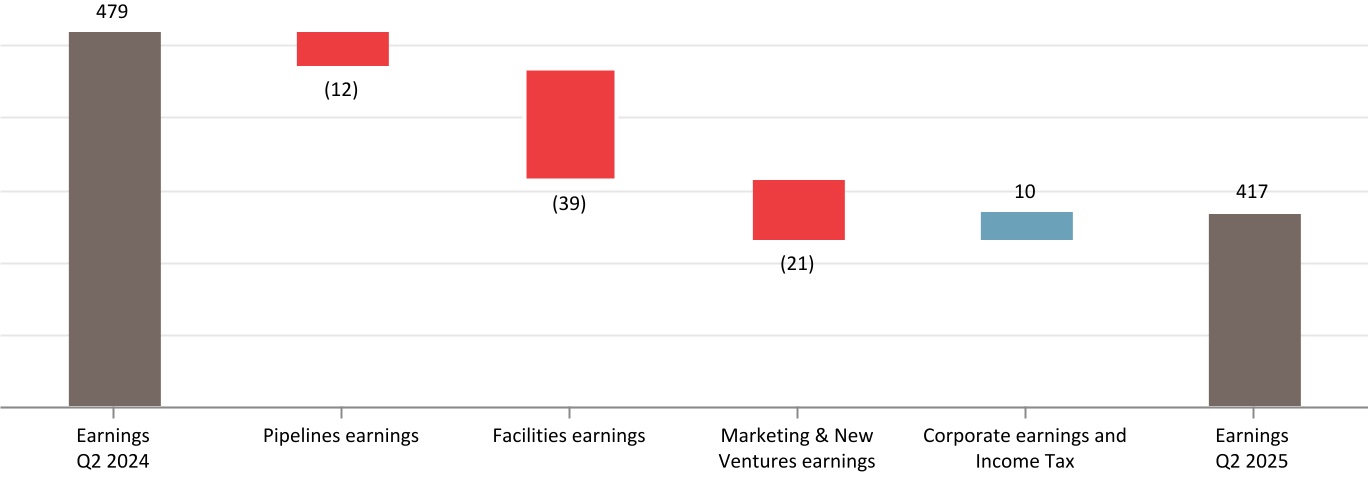

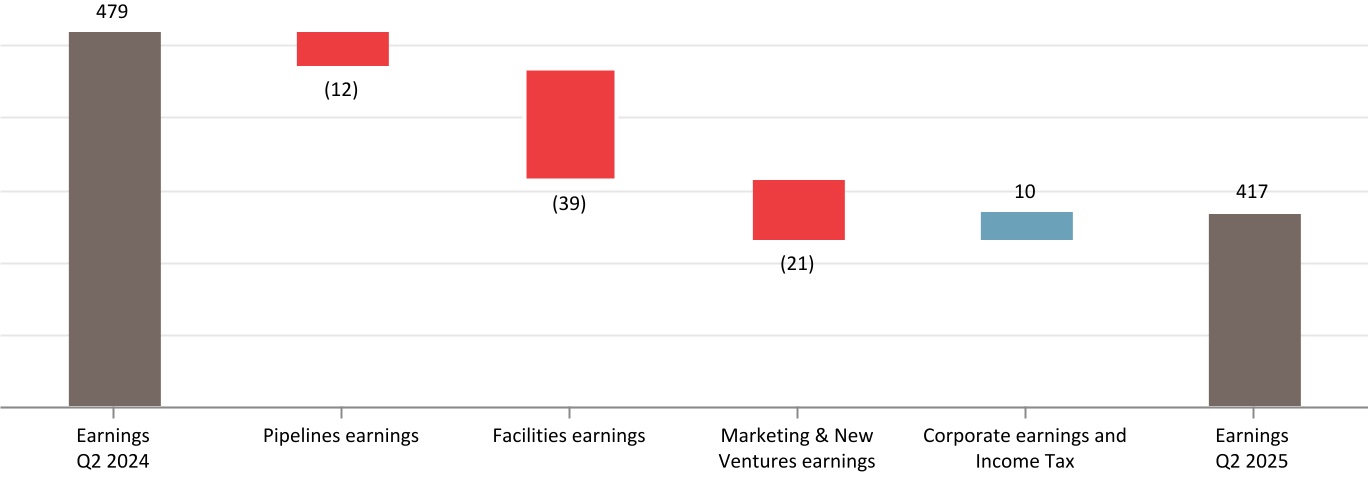

Change in Earnings ($ millions)

Results Overview

Earnings in the second quarter of 2025 decreased by $62 million compared to the prior period. Significant factors impacting the quarter by segment include:

•Pipelines: Decrease largely due to lower tolls on new contracts on the Cochin Pipeline and lower revenue at the Edmonton Terminals, partially offset by higher demand on seasonal contracts on the Alliance Pipeline, as well as higher revenue on the Peace Pipeline system due to increased volumes and higher tolls mainly related to contractual inflation adjustments.

•Facilities: Decrease largely due to lower share of profit from PGI and a planned outage during the period for an asset upgrade, which resulted in higher costs driven by the associated retirement at the Redwater Complex.

•Marketing & New Ventures: Lower net revenue due to a decrease in NGL margins and volumes, combined with lower other income due to no similar gain to that recognized in the second quarter of 2024 related to Pembina's financial assurances assumed by Cedar LNG upon positive final investment decision. This was partially offset by higher revenue from risk management and physical derivatives, as well as an increase in share of profit from Cedar LNG.

•Corporate and Income Tax: Higher primarily due to lower acquisition and integration costs, combined with lower general and administrative expense. This was partially offset by no similar net gain on acquisition to that recognized in the second quarter of 2024.

Further details and additional factors impacting the segments are discussed in the table below and in the "Segment Results" section of this MD&A.

Pembina Pipeline Corporation Second Quarter 2025 3

|

|

|

|

|

|

|

Changes in Results for the Three Months Ended June 30 |

Net revenue(1) |

|

$38 million decrease, lower net revenue in the Marketing & New Ventures Division due to lower gains on crude oil-based derivatives, as well as lower NGL margins as a result of lower butane and propane prices, combined with lower volumes because of a planned outage in the Facilities Division related to an asset upgrade, as well as higher input natural gas prices at Aux Sable. Additionally, lower net revenue on the Cochin Pipeline ($33 million) primarily due to lower tolls on new contracts, which replaced long-term contracts that expired in mid-July 2024, and lower revenue at the Edmonton Terminals largely related to the decommissioning of the Edmonton South Rail Terminal in the second quarter of 2024.

These results were partially offset by lower losses on renewable power purchase agreements, gains on NGL-based derivatives in the second quarter of 2025 compared to losses in the second quarter of 2024, and higher demand on seasonal contracts on the Alliance Pipeline. Additionally, higher net revenue on the Peace Pipeline system from fewer outages in the second quarter of 2025 compared to the same period in 2024 which was impacted by planned outages for the Phase VIII Peace Pipeline Expansion, higher contracted volumes, and higher tolls primarily due to contractual inflation adjustments, contributed to the offsetting decrease in net revenue.

|

|

|

|

| Operating expenses |

|

Consistent with prior period. Minor decreases in operating expenses were offset by higher integrity spending. |

|

|

|

|

|

|

|

|

|

| Cash flow from operating activities |

|

$164 million decrease, primarily driven by a decrease in earnings adjusted for items not involving cash, change in non-cash working capital, and higher net interest paid. This was partially offset by lower taxes paid and higher distributions from equity accounted investees primarily from PGI. |

Adjusted cash flow from operating activities(1) |

|

$139 million decrease, largely due to the same items impact cash flow from operating activities, discussed above, combined with higher current income tax expense, partially offset by lower accrued share-based payment expense. |

Adjusted cash flow from operating activities per common share – basic (dollars)(1) |

|

$0.24 decrease, primarily due to the factors impacting adjusted cash flow from operating activities, discussed above, while outstanding common shares remained consistent with prior period. |

Adjusted EBITDA(1) |

|

$78 million decrease, largely due to lower NGL margins as a result of lower butane and propane prices, combined with lower volumes because of a planned outage in the Facilities Division related to an asset upgrade, as well as higher input natural gas prices at Aux Sable. In addition, lower realized gains on crude oil-based derivatives, lower tolls on new contracts on the Cochin Pipeline, and lower revenue at the Edmonton Terminals contributed to the decrease in adjusted EBITDA.

These results were partially offset by lower realized losses on NGL-based derivatives, combined with higher net revenue on the Alliance Pipeline and Peace Pipeline system.

|

|

|

|

(1) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

4 Pembina Pipeline Corporation Second Quarter 2025

Consolidated Financial Overview for the Six Months Ended June 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, except where noted) |

2025 |

2024 |

Change |

|

| Revenue |

4,074 |

|

3,395 |

|

679 |

|

|

Net revenue(1) |

2,527 |

|

2,134 |

|

393 |

|

|

| Operating expenses |

461 |

|

429 |

|

32 |

|

|

Gross profit |

1,708 |

|

1,545 |

|

163 |

|

|

Adjusted EBITDA(1) |

2,180 |

|

2,135 |

|

45 |

|

|

|

|

|

|

|

Earnings |

919 |

|

917 |

|

2 |

|

|

Earnings per common share – basic (dollars) |

1.45 |

|

1.49 |

|

(0.04) |

|

|

Earnings per common share – diluted (dollars) |

1.45 |

|

1.48 |

|

(0.03) |

|

|

| Cash flow from operating activities |

1,630 |

|

1,390 |

|

240 |

|

|

Cash flow from operating activities per common share – basic (dollars) |

2.81 |

|

2.46 |

|

0.35 |

|

|

Adjusted cash flow from operating activities(1) |

1,475 |

|

1,619 |

|

(144) |

|

|

Adjusted cash flow from operating activities per common share – basic (dollars)(1) |

2.54 |

|

2.87 |

|

(0.33) |

|

|

| Capital expenditures |

371 |

|

451 |

|

(80) |

|

|

|

|

|

|

|

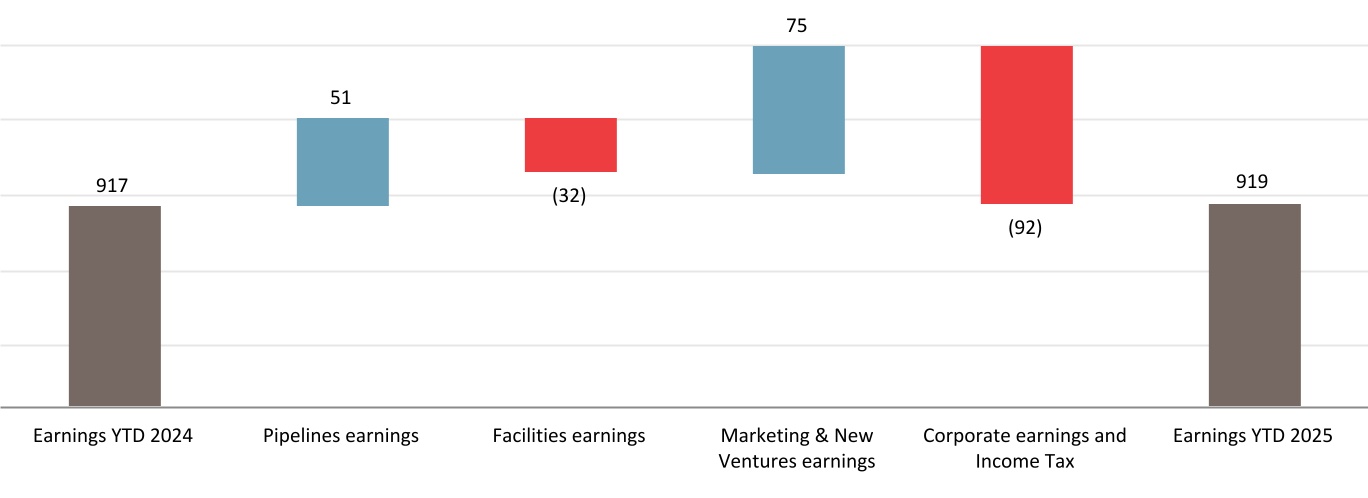

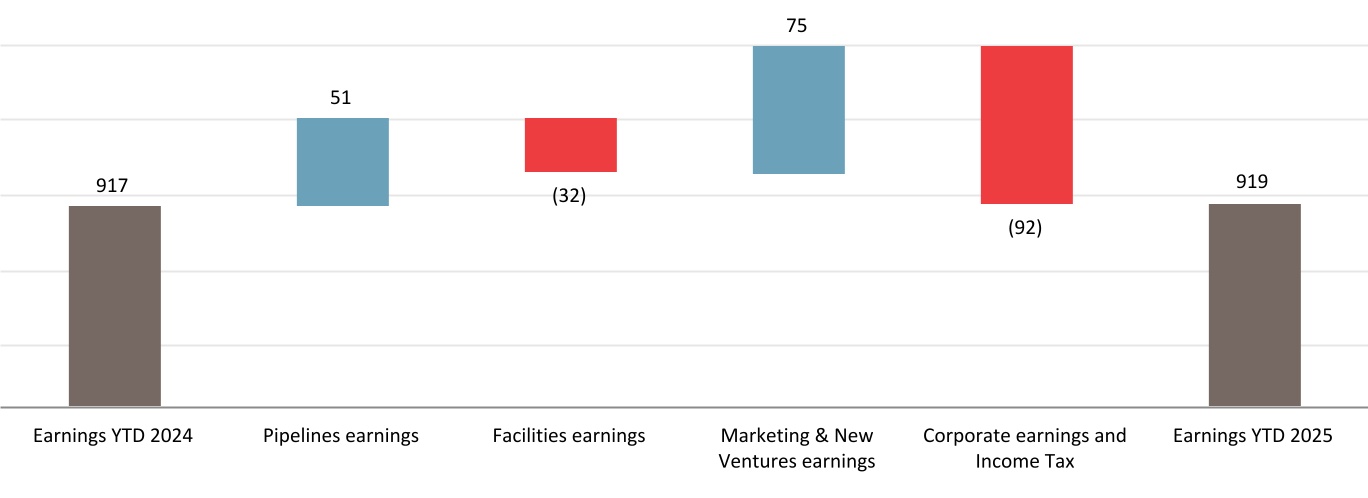

Change in Earnings ($ millions)

Results Overview

Earnings during the first six months of 2025 increased by $2 million compared to the prior period. Significant factors impacting the period by segment include:

•Pipelines: Positive impacts from Pembina acquiring a controlling ownership interest in Alliance on April 1, 2024, combined with higher seasonal revenue on the Alliance Pipeline. Additionally, higher revenue on the Peace Pipeline system due to increased volumes and higher tolls mainly related to contractual inflation adjustments, as well as higher contracted volumes on the Nipisi Pipeline. These impacts were partially offset by lower tolls on new contracts on the Cochin Pipeline and lower revenue at the Edmonton Terminals.

•Facilities: Decrease largely due to lower share of profit from PGI, partially offset by the positive impacts of Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024.

•Marketing & New Ventures: Positive impacts from Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024, combined with higher revenue from risk management and physical derivative contracts, as well as higher WCSB NGL margins resulting from higher marketed NGL volumes. This was partially offset by a share of loss from Cedar LNG, lower NGL margins from Aux Sable, and lower other income.

•Corporate and Income Tax: Lower largely due to higher net finance costs, higher income tax expense, and no similar net gain on acquisition to that recognized in the second quarter of 2024. This was partially offset by lower acquisition and integration costs.

Further details and additional factors impacting the segments are discussed in the table below and in the "Segment Results" section of this MD&A.

Pembina Pipeline Corporation Second Quarter 2025 5

|

|

|

|

|

|

|

Changes in Results for the Six Months Ended June 30 |

Net revenue(1) |

|

$393 million increase, largely due to Pembina acquiring a controlling ownership interest in Alliance and Aux Sable on April 1, 2024. The Marketing & New Ventures Division had increased net revenue largely due to higher WCSB NGL margins resulting from higher marketed NGL volumes, lower unrealized losses on renewable power purchase agreements and crude oil-based derivatives, and unrealized gains on NGL-based derivatives in the 2025 period compared to losses in the 2024 period. Additionally, higher demand on seasonal contracts on the Alliance Pipeline, higher net revenue on the Peace Pipeline system due to fewer outages in the 2025 period compared to the same period in 2024 which was impacted by planned outages for the Phase VIII Peace Pipeline Expansion, and increased contracted volumes on the Peace Pipeline system and Nipisi Pipeline, along with higher tolls on the Peace Pipeline system primarily due to contractual inflation adjustments, contributed to the higher net revenue.

These results were partially offset by lower net revenue on the Cochin Pipeline primarily due to lower tolls on new contracts, which replaced long-term contracts that expired in mid-July 2024. Also contributing to a decrease in net revenue were lower realized gains on crude oil-based derivatives, lower NGL margins from Aux Sable due to higher input natural gas prices, lower revenue at the Edmonton Terminals largely related to the decommissioning of the Edmonton South Rail Terminal in the second quarter of 2024, and lower recoverable power costs.

|

|

|

|

| Operating expenses |

|

$32 million increase, primarily due to operating expenses from Alliance and Aux Sable now being fully consolidated as of April 1, 2024, as well as higher environmental costs in the current period, as the 2024 period included a recovery related to the Northern Pipeline system outage. These increases were partially offset by lower recoverable power costs resulting from the lower power pool price during the 2025 period. |

|

|

|

| Cash flow from operating activities |

|

$240 million increase, primarily driven by an increase in earnings adjusted for items not involving cash, lower taxes paid, and the change in non-cash working capital. This was partially offset by lower distributions from equity accounted investees and higher net interest paid, both largely the result of Pembina acquiring a controlling ownership interest in Alliance and Aux Sable on April 1, 2024, as well as a decrease in payments collected through contract liabilities. |

Adjusted cash flow from operating activities(1) |

|

$144 million decrease, primarily due to the same items impacting cash flow from operating activities, discussed above, excluding the change in non-cash working capital and taxes paid, which leads to a decrease when adjusted, combined with higher current income tax expense. |

Adjusted cash flow from operating activities per common share – basic (dollars)(1) |

|

$0.33 decrease, primarily due to the factors impacting adjusted cash flow from operating activities, discussed above, as well as an increase in outstanding common shares following the conversion of subscription receipts into common shares, concurrent with the closing of Pembina's acquisition of a controlling ownership interest in Alliance and Aux Sable on April 1, 2024. |

Adjusted EBITDA(1) |

|

$45 million increase, largely due to Pembina acquiring a controlling ownership interest in Alliance and Aux Sable on April 1, 2024, and higher revenue on the Alliance Pipeline due to higher demand on seasonal contracts. Higher WSCB NGL margins resulting from higher marketed NGL volumes, combined with higher revenue on the Peace Pipeline system and Nipisi Pipeline, further contributed to the increase in adjusted EBITDA.

These results were partially offset by lower tolls on new contracts on the Cochin Pipeline, lower realized gains on commodity-related derivatives, lower NGL margins from Aux Sable due to higher input natural gas prices, and lower revenue at the Edmonton Terminals.

|

|

|

|

(1) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

6 Pembina Pipeline Corporation Second Quarter 2025

3. SEGMENT RESULTS

Business Overview

The Pipelines Division provides customers with pipeline transportation, terminalling, and storage in key market hubs in Canada and the United States for crude oil, condensate, natural gas liquids and natural gas. The Pipelines Division manages pipeline transportation capacity of 3.0 mmboe/d(1) and above ground storage capacity of approximately 10 mmbbls(1) within its conventional, oil sands and heavy oil, and transmission assets. The conventional assets include strategically located pipelines and terminalling hubs that gather and transport light and medium crude oil, condensate and natural gas liquids from western Alberta and northeast British Columbia to downstream pipelines and processing facilities in the Edmonton, Alberta area. The oil sands and heavy oil assets transport heavy and synthetic crude oil produced within Alberta to the Edmonton, Alberta area and offer associated storage and terminalling. The transmission assets transport natural gas, ethane and condensate throughout Canada and the United States on long haul pipelines linking various key market hubs. In addition, the Pipelines Division assets provide linkages to Pembina's Facilities Division assets across North America, enhancing flexibility and optionality in our customer service offerings. Together, these assets supply products from hydrocarbon producing regions to refineries, fractionators and market hubs in Alberta, British Columbia, and Illinois, as well as other regions throughout North America.

The Facilities Division includes infrastructure that provides Pembina's customers with natural gas, condensate and NGL services. Through its wholly-owned assets and its interest in PGI, Pembina's natural gas gathering and processing facilities are strategically positioned in active, liquids-rich areas of the WCSB and Williston Basin and may be serviced by the Company's other businesses. Pembina provides sweet and sour gas gathering, compression, condensate stabilization, and both shallow cut and deep cut gas processing services with a total capacity of approximately 6.7 bcf/d(1) for its customers. Condensate and NGL extracted at virtually all Canadian-based facilities have access to transportation on Pembina's pipelines. In addition, all NGL transported along the Alliance Pipeline are extracted through the Channahon Facility at the terminus. The Facilities Division includes approximately 430 mbpd(1) of NGL fractionation capacity, 21 mmbbls(1) of cavern storage capacity, various oil batteries, associated pipeline and rail terminalling facilities and a liquefied propane export facility on Canada's West Coast. These facilities are accessible to Pembina's other strategically-located assets and pipeline systems, providing customers with flexibility and optionality to access a comprehensive suite of services to enhance the value of their hydrocarbons. In addition, Pembina owns a bulk marine import/export terminal in Vancouver, British Columbia.

The Marketing & New Ventures Division leverages Pembina's integrated value chain and existing network of pipelines, facilities, and energy infrastructure assets to maximize the value of hydrocarbon liquids and natural gas originating in the basins where the Company operates. Pembina pursues the creation of new markets, and further enhances existing markets, to support both the Company's and its customers' business interests. In particular, Pembina seeks to identify opportunities to connect hydrocarbon production to new demand locations through the development of infrastructure.

Within the Marketing & New Ventures Division, Pembina undertakes value-added commodity marketing activities, including buying and selling products (natural gas, ethane, propane, butane, condensate, crude oil, electricity, and carbon credits), commodity arbitrage, and optimizing storage opportunities. The marketing business enters into contracts for capacity on both Pembina's and third-party infrastructure, handles proprietary and customer volumes and aggregates production for onward sale. Through this infrastructure capacity, including Pembina's Prince Rupert Terminal, as well as utilizing the Company's expansive rail fleet and logistics capabilities, Pembina's marketing business adds incremental value to the commodities by accessing high value markets across North America and globally.

The Marketing & New Ventures Division is also responsible for the development of new large-scale, or value chain extending projects, including those that seek to provide enhanced access to global markets and to support a transition to a lower-carbon economy. The Marketing & New Ventures Division includes Pembina's interest in the Cedar LNG project, a liquified natural gas ("LNG") export facility currently under construction (the "Cedar LNG Project"). Additionally, Pembina is pursuing opportunities associated with low-carbon commodities and large-scale greenhouse gas ("GHG") emissions reductions.

(1)Net capacity.

Pembina Pipeline Corporation Second Quarter 2025 7

Financial and Operational Overview by Division

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended June 30 |

|

2025 |

2024 |

($ millions, except where noted) |

Volumes(1) |

Earnings (Loss) |

|

|

Adjusted EBITDA(2) |

Volumes(1) |

Earnings (Loss) |

|

|

Adjusted EBITDA(2) |

| Pipelines |

2,768 |

|

473 |

|

|

|

646 |

|

2,716 |

|

485 |

|

|

|

655 |

|

| Facilities |

826 |

|

142 |

|

|

|

331 |

|

855 |

|

181 |

|

|

|

340 |

|

Marketing & New Ventures |

302 |

|

114 |

|

|

|

74 |

|

319 |

|

135 |

|

|

|

143 |

|

| Corporate |

— |

|

(196) |

|

|

|

(38) |

|

— |

|

(828) |

|

|

|

(47) |

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax (recovery) expense |

— |

|

(116) |

|

|

|

— |

|

— |

|

506 |

|

|

|

— |

|

| Total |

|

417 |

|

|

|

1,013 |

|

|

479 |

|

|

|

1,091 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 Months Ended June 30 |

|

2025 |

2024 |

($ millions, except where noted) |

Volumes(1) |

Earnings (Loss) |

|

|

Adjusted EBITDA(2) |

Volumes(1) |

Earnings (Loss) |

|

|

Adjusted EBITDA(2) |

| Pipelines |

2,789 |

|

991 |

|

|

|

1,323 |

|

2,657 |

|

940 |

|

|

|

1,254 |

|

| Facilities |

861 |

|

326 |

|

|

|

676 |

|

830 |

|

358 |

|

|

|

650 |

|

Marketing & New Ventures |

335 |

|

274 |

|

|

|

284 |

|

307 |

|

199 |

|

|

|

331 |

|

| Corporate |

— |

|

(419) |

|

|

|

(103) |

|

— |

|

(995) |

|

|

|

(100) |

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax (recovery) expense |

— |

|

(253) |

|

|

|

— |

|

— |

|

415 |

|

|

|

— |

|

| Total |

|

919 |

|

|

|

2,180 |

|

|

917 |

|

|

|

2,135 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition. Volumes for Pipelines and Facilities divisions are revenue volumes, which are physical volumes plus volumes recognized from take-or-pay commitments. Volumes for Marketing & New Ventures are marketed crude oil and NGL volumes.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

8 Pembina Pipeline Corporation Second Quarter 2025

Equity Accounted Investees Overview by Division

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended June 30 |

|

|

|

|

|

|

2025 |

2024 |

| ($ millions, except where noted) |

Share of profit |

Adjusted EBITDA(4) |

Contributions |

Distributions |

Volumes(5) |

Share of profit (loss) |

Adjusted EBITDA(4) |

Contributions |

Distributions |

Volumes(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pipelines(1) |

— |

|

1 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Facilities(2) |

46 |

|

173 |

|

82 |

|

136 |

|

344 |

|

63 |

|

174 |

|

— |

|

123 |

|

354 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing &

New Ventures(3)

|

28 |

|

— |

|

44 |

|

— |

|

— |

|

(2) |

|

— |

|

144 |

|

— |

|

— |

|

| Total |

74 |

|

174 |

|

126 |

|

136 |

|

344 |

|

61 |

|

174 |

|

144 |

|

123 |

|

354 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 Months Ended June 30 |

|

|

|

|

|

|

2025 |

2024 |

| ($ millions, except where noted) |

Share of profit (loss) |

Adjusted EBITDA(4) |

Contributions |

Distributions |

Volumes(5) |

Share of profit |

Adjusted EBITDA(4) |

Contributions |

Distributions |

Volumes(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pipelines(1) |

1 |

|

3 |

|

— |

|

— |

|

— |

|

43 |

|

87 |

|

5 |

|

80 |

|

74 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Facilities(2) |

111 |

|

350 |

|

124 |

|

268 |

|

355 |

|

138 |

|

349 |

|

— |

|

251 |

|

357 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing &

New Ventures(3)

|

(8) |

|

(2) |

|

52 |

|

— |

|

— |

|

31 |

|

40 |

|

242 |

|

31 |

|

18 |

|

| Total |

104 |

|

351 |

|

176 |

|

268 |

|

355 |

|

212 |

|

476 |

|

247 |

|

362 |

|

449 |

|

(1) Pipelines includes Grand Valley in both the three and six month periods ended June 30, 2025 and 2024. In addition, Alliance is included in the three month results for 2024, reflecting its contribution during the period. Pembina owned a 50 percent interest in Alliance up to the closing of the acquisition on April 1, 2024. The results of Alliance following closing of the acquisition are fully consolidated and incorporated into Pembina's financial results. See Note 3 to the Interim Financial Statements.

(2) Facilities includes PGI and Fort Corp.

(3) Marketing and New Ventures includes Greenlight in 2025, Cedar LNG and ACG in both the three and six month periods ended June 30, 2025 and 2024, and Aux Sable in the three month results for 2024, reflecting its contribution during the period. Pembina owned approximately a 42.7 percent interest in Aux Sable's U.S operations and a 50 percent interest in Aux Sable's Canadian operations up to the closing of the acquisition on April 1, 2024. The results of Aux Sable following closing of the acquisition are fully consolidated and incorporated into Pembina's financial results. See Note 3 to the Interim Financial Statements.

(4) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(5) Volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

Refer to the "Segment Results – Changes in Results" sections of this MD&A under each of the divisions for additional information.

For the three and six months ended June 30, 2025, contributions in the Facilities Division were made to PGI to partially fund growth capital projects. Contributions in Marketing & New Ventures in both 2025 and 2024 were made to Cedar LNG to fund the Cedar LNG Project. Refer to the "Segment Results – Marketing & New Ventures Division – Projects & New Developments" sections of this MD&A for additional information.

Pembina Pipeline Corporation Second Quarter 2025 9

Pipelines

Financial Overview for the Three Months Ended June 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, except where noted) |

2025 |

2024 |

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pipelines revenue(1) |

874 |

|

890 |

|

(16) |

|

|

Cost of goods sold(1) |

14 |

|

15 |

|

(1) |

|

|

Net revenue(1)(2) |

860 |

|

875 |

|

(15) |

|

|

Operating expenses(1) |

198 |

|

203 |

|

(5) |

|

|

| Depreciation and amortization included in gross profit |

165 |

|

164 |

|

1 |

|

|

|

|

|

|

|

| Gross profit |

497 |

|

508 |

|

(11) |

|

|

| Earnings |

473 |

|

485 |

|

(12) |

|

|

Adjusted EBITDA(2) |

646 |

|

655 |

|

(9) |

|

|

Volumes(3) |

2,768 |

|

2,716 |

|

52 |

|

|

|

|

|

|

|

|

|

| Change in Results |

|

|

|

|

|

|

|

|

|

|

|

Net revenue(1)(2) |

|

Decrease largely due to lower tolls on new contracts on the Cochin Pipeline, which replaced long-term contracts that expired in mid-July 2024 ($33 million), lower revenue at the Edmonton Terminals largely related to the decommissioning of the Edmonton South Rail Terminal in the second quarter of 2024, as well as lower volumes and tolls on the Vantage Pipeline. These decreases were partially offset by higher demand on seasonal contracts on the Alliance Pipeline, combined with higher revenue on the Peace Pipeline system due to fewer outages in the second quarter of 2025 compared to the same period in 2024 which was impacted by planned outages for the Phase VIII Peace Pipeline Expansion, as well as higher contracted volumes. Additionally, higher contracted volumes on the Nipisi Pipeline, and increased tolls on the Peace Pipeline system primarily due to contractual inflation adjustments, contributed to higher net revenue. |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings |

|

Decrease largely due to lower net revenue impacted by the same factors discussed above. |

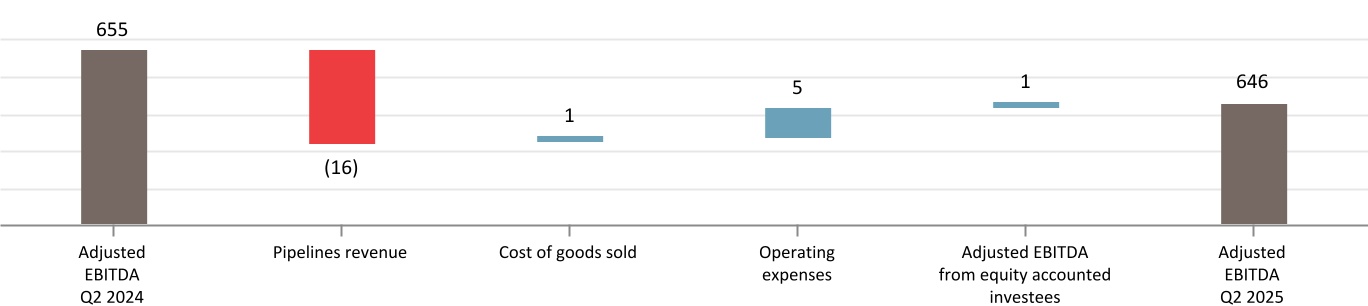

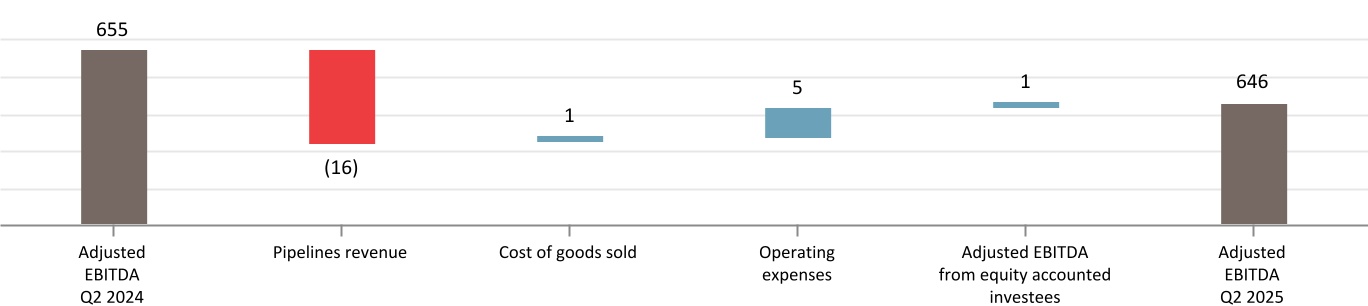

Adjusted EBITDA(2) |

|

Decrease largely due to lower net revenue impacted by the same factors discussed above. |

Volumes(3) |

|

Higher largely due to increased contracted volumes on the Peace Pipeline system and Nipisi Pipeline, fewer outages on the Peace Pipeline system in the second quarter of 2025 compared to the same period in 2024 which was impacted by planned outages for the Phase VIII Peace Pipeline Expansion, combined with higher demand on seasonal contracts on the Alliance Pipeline, which was partially offset by third-party restrictions and planned outages at the Channahon Facility. Additionally, lower volumes on AEGS due to restrictions from third-party outages in the second quarter of 2025, and lower interruptible volumes on the Vantage Pipeline contributed to a decrease in total Pipeline volumes. |

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Interim Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

10 Pembina Pipeline Corporation Second Quarter 2025

Financial Overview for the Six Months Ended June 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, except where noted) |

2025 |

2024 |

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pipelines revenue(1) |

1,768 |

|

1,578 |

|

190 |

|

|

Cost of goods sold(1) |

27 |

|

26 |

|

1 |

|

|

Net revenue(1)(2) |

1,741 |

|

1,552 |

|

189 |

|

|

Operating expenses(1) |

383 |

|

357 |

|

26 |

|

|

| Depreciation and amortization included in gross profit |

316 |

|

259 |

|

57 |

|

|

| Share of profit from equity accounted investees |

1 |

|

43 |

|

(42) |

|

|

| Gross profit |

1,043 |

|

979 |

|

64 |

|

|

| Earnings |

991 |

|

940 |

|

51 |

|

|

Adjusted EBITDA(2) |

1,323 |

|

1,254 |

|

69 |

|

|

Volumes(3) |

2,789 |

|

2,657 |

|

132 |

|

|

|

|

|

|

|

|

|

| Change in Results |

|

|

|

|

|

|

|

|

|

|

|

Net revenue(1)(2) |

|

Higher largely due to Pembina acquiring a controlling ownership interest in Alliance on April 1, 2024, and higher demand on seasonal contracts on the Alliance Pipeline. Also contributing to the increase were higher volumes on the Peace Pipeline system due to fewer outages in the 2025 period compared to the 2024 period which was impacted by planned outages for the Phase VIII Peace Pipeline Expansion, higher contracted volumes on the Peace Pipeline system and Nipisi Pipeline, higher tolls on the Peace Pipeline system mainly related to contractual inflation adjustments, and favourable U.S. dollar foreign exchange rate impacts on certain assets. These increases were partially offset by lower net revenue on the Cochin Pipeline ($70 million) due to lower tolls on new contracts, which replaced long-term contracts that expired in mid-July 2024. In addition, lower volumes and tolls on the Vantage Pipeline, lower revenue at the Edmonton Terminals largely related to the decommissioning of the Edmonton South Rail Terminal in the second quarter of 2024, and lower recoverable power costs, contributed to the offsetting decrease to net revenue. |

|

|

|

Operating expenses(1) |

|

Increase largely due to Pembina acquiring a controlling ownership interest in Alliance on April 1, 2024, as well as higher environmental costs in the current period, as the 2024 period included a recovery related to the Northern Pipeline system outage. These increases were partially offset by lower recoverable power costs resulting from a lower power pool price during the 2025 period. |

Depreciation and amortization included in gross profit |

|

Higher largely due to Pembina acquiring a controlling ownership interest in Alliance on April 1, 2024, combined with new assets placed into service in the second and fourth quarters of 2024. |

Share of profit from equity accounted investees |

|

Following Pembina acquiring a controlling ownership interest in Alliance on April 1, 2024, the results from Alliance are no longer accounted for in share of profit and are fully consolidated. |

| Earnings |

|

Higher largely due to the net impacts of Pembina acquiring a controlling ownership interest in Alliance on April 1, 2024 and higher seasonal revenue on the Alliance Pipeline, combined with higher revenue on the Peace Pipeline system and Nipisi Pipeline, and favourable foreign exchange rate impacts on certain assets. These factors were partially offset by lower tolls on new contracts on the Cochin Pipeline, and lower revenue on the Vantage Pipeline and at the Edmonton South Terminal. |

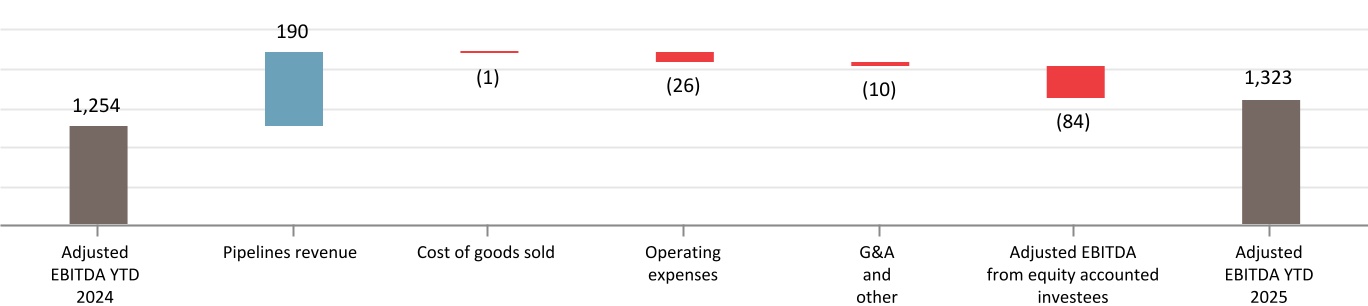

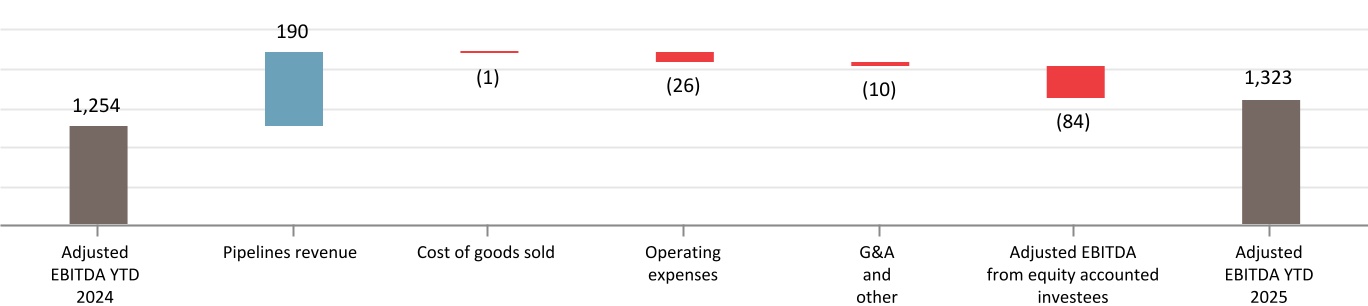

Adjusted EBITDA(2) |

|

Increase largely due to the same factors impacting earnings, discussed above. |

Volumes(3) |

|

Higher largely due to Pembina acquiring a controlling ownership interest in Alliance on April 1, 2024, and higher demand on seasonal contracts on the Alliance Pipeline, which was partially offset by third-party restrictions and planned outages at the Channahon Facility. Additionally, higher contracted volumes on the Peace Pipeline system and the Nipisi Pipeline, and fewer outages on the Peace Pipeline system in the second quarter of 2025 compared to the same period in 2024 which was impacted by planned outages for the Phase VIII Peace Pipeline Expansion, contributed to the increase in volumes. |

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Interim Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

Pembina Pipeline Corporation Second Quarter 2025 11

Financial and Operational Overview

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended June 30 |

6 Months Ended June 30 |

|

|

|

|

2025 |

2024 |

2025 |

2024 |

| ($ millions, except where noted) |

Volumes(1) |

Earnings |

Adjusted

EBITDA(2)

|

Volumes(1) |

Earnings |

Adjusted

EBITDA(2)

|

Volumes(1) |

Earnings |

Adjusted

EBITDA(2)

|

Volumes(1) |

Earnings |

Adjusted

EBITDA(2)

|

Pipelines(3) |

|

|

|

|

|

|

|

|

|

|

|

|

| Conventional |

1,006 |

|

298 |

|

358 |

|

969 |

|

269 |

|

338 |

|

1,020 |

|

598 |

|

709 |

|

988 |

|

564 |

|

679 |

|

| Transmission |

722 |

|

143 |

|

223 |

|

726 |

|

177 |

|

244 |

|

731 |

|

326 |

|

484 |

|

657 |

|

296 |

|

433 |

|

Oil Sands &

Heavy Oil |

1,040 |

|

32 |

|

65 |

|

1,021 |

|

39 |

|

73 |

|

1,038 |

|

67 |

|

130 |

|

1,012 |

|

80 |

|

142 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

2,768 |

|

473 |

|

646 |

|

2,716 |

|

485 |

|

655 |

|

2,789 |

|

991 |

|

1,323 |

|

2,657 |

|

940 |

|

1,254 |

|

(1) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Includes values attributed to Pembina's conventional, transmission and oil sands and heavy oil assets within the Pipelines Division. Refer to Pembina's AIF for the year ended December 31, 2024.

Projects & New Developments(1)

The following outlines the projects and new developments that have recently come into service within Pipelines:

|

|

|

|

|

|

| Significant Projects |

In-service Date |

Phase VIII Peace Pipeline Expansion |

May 2024 |

| NEBC MPS Expansion |

November 2024 |

|

(1) For further details on Pembina's significant assets, including definitions for capitalized terms used herein that are not otherwise defined, refer to Pembina's AIF for the year ended December 31, 2024 filed at www.sedarplus.ca (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com.

Pembina is advancing more than $1.0 billion of conventional NGL and condensate pipeline expansions to reliably and cost-effectively meet rising transportation demand from growing production in the WCSB. Pembina's outlook for volume growth is secured by long-term contracts underpinned by take-or-pay agreements, areas of dedication across the Montney and Duvernay formations, and other long-term agreements that ensure a strong base of committed volumes. The potential expansions under development include:

•Taylor-to-Gordondale Project - a new approximately 89 kilometer, 16-inch pipeline proposed by Pouce Coupé Pipe Line Ltd. (a subsidiary of Pembina) connecting mostly condensate volumes from Taylor, British Columbia to the Gordondale, Alberta area. Engineering activities are continuing and subject to regulatory and board approval, Pembina expects to move forward with this expansion. A final investment decision is anticipated in the first quarter of 2026.

•Fox Creek-to-Namao Expansion - an expansion of the Peace Pipeline system that, through the addition of new pump stations, would add approximately 70,000 bpd of propane-plus capacity to the market delivery pipelines from Fox Creek, Alberta to Namao, Alberta. Engineering and regulatory activities are progressing and subject to regulatory and board approval, Pembina expects to move forward with this expansion. A final investment decision is expected by the end of 2025.

•Pembina is also evaluating and engineering further expansions to support volume growth in northeast British Columbia, including new pipelines and terminal upgrades.

12 Pembina Pipeline Corporation Second Quarter 2025

Facilities

Financial Overview for the Three Months Ended June 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, except where noted) |

2025 |

2024 |

Change |

|

|

|

|

|

|

|

|

|

|

|

Facilities revenue(1) |

295 |

|

294 |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses(1) |

133 |

|

123 |

|

10 |

|

|

Depreciation and amortization included in gross profit |

59 |

|

45 |

|

14 |

|

|

Share of profit from equity accounted investees |

46 |

|

63 |

|

(17) |

|

|

| Gross profit |

149 |

|

189 |

|

(40) |

|

|

| Earnings |

142 |

|

181 |

|

(39) |

|

|

Adjusted EBITDA(2) |

331 |

|

340 |

|

(9) |

|

|

Volumes(3) |

826 |

|

855 |

|

(29) |

|

|

|

|

|

|

|

|

|

| Changes in Results |

|

|

|

|

|

|

|

|

Revenue(1) |

|

Consistent with prior period. The Redwater Complex had higher operating recoveries at the fractionation facilities in the second quarter of 2025, which were largely offset by the impact of a planned outage related to an asset upgrade. |

Operating expenses(1) |

|

Increase largely due to higher integrity spending at the Redwater Complex. |

| Depreciation and amortization included in gross profit |

|

Increase primarily due to an asset upgrade and associated retirement at the Redwater Complex in the second quarter of 2025, resulting in a planned outage during the same period. |

Share of profit from equity accounted investees |

|

Decrease due to lower earnings from PGI as a result of higher depreciation expense resulting from a larger asset base following the recent transactions with Whitecap Resources Inc. ("Whitecap") combined with asset upgrades and associated retirements, unrealized losses on commodity-related derivatives compared to gains in the second quarter in 2024, and lower volumes due to planned outages at certain PGI assets in the second quarter of 2025 and on-going third-party restrictions impacting the Dawson Assets. These factors were partially offset by gains recognized by PGI on interest rate derivative financial instruments compared to losses in the second quarter of 2024, and higher revenue from PGI assets related to the transactions with Whitecap. |

| Earnings |

|

Decrease largely due to lower share of profit from PGI and an asset upgrade and associated retirement at the Redwater Complex. |

Adjusted EBITDA(2) |

|

Consistent with prior period. Lower volumes due to planned outages at certain PGI assets in the second quarter of 2025 and on-going third-party restrictions impacting the Dawson Assets, were largely offset by higher revenue from PGI assets related to the transactions discussed above. Included in adjusted EBITDA is $171 million (2024: $172 million) related to PGI. |

|

|

|

Volumes(3) |

|

Decrease is primarily attributed to third-party restrictions and planned outages at the Channahon Facility, planned outages at certain PGI assets, combined with higher outage days at the Redwater Complex compared to the second quarter of 2024 due to an asset upgrade, and third-party restrictions impacting the Dawson Assets. Volumes include 344 mboe/d (2024: 354 mboe/d) related to PGI. |

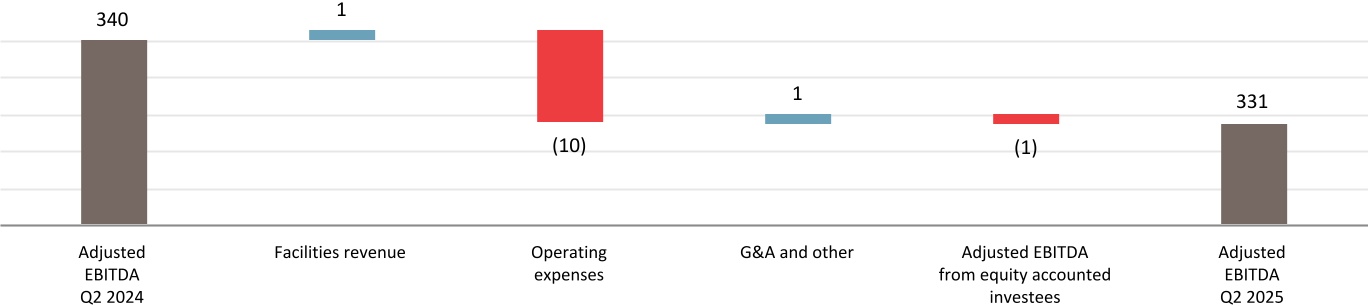

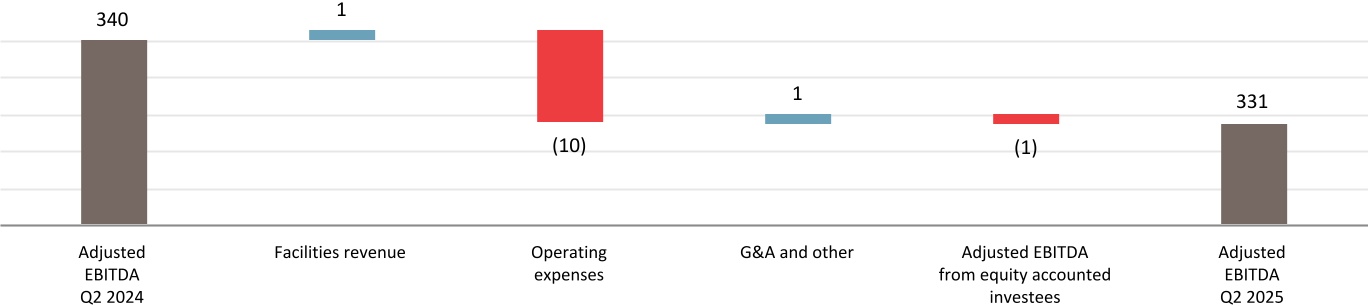

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Interim Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

Pembina Pipeline Corporation Second Quarter 2025 13

Financial Overview for the Six Months Ended June 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

($ millions, except where noted) |

2025 |

2024 |

Change |

|

|

|

|

|

|

|

|

|

|

|

Facilities revenue(1) |

602 |

|

525 |

|

77 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses(1) |

266 |

|

213 |

|

53 |

|

|

Depreciation and amortization included in gross profit |

104 |

|

78 |

|

26 |

|

|

Share of profit from equity accounted investees |

111 |

|

138 |

|

(27) |

|

|

| Gross profit |

343 |

|

372 |

|

(29) |

|

|

| Earnings |

326 |

|

358 |

|

(32) |

|

|

Adjusted EBITDA(2) |

676 |

|

650 |

|

26 |

|

|

Volumes(3) |

861 |

|

830 |

|

31 |

|

|

|

|

|

|

|

|

|

| Changes in Results |

|

|

|

|

|

|

|

|

Revenue(1) |

|

Increase largely due to Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024, combined with higher operating recoveries at the fractionation facilities within the Redwater Complex in the 2025 period, partially offset by the impact of a planned outage at the Redwater Complex related to an asset upgrade. |

Operating expenses(1) |

|

Increase largely due to Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024, combined with higher integrity spending at the Redwater Complex. |

| Depreciation and amortization included in gross profit |

|

Higher largely due to Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024, combined with an asset upgrade and associated retirement at the Redwater Complex in the second quarter of 2025, resulting in a planned outage during the same period. |

|

|

|

|

|

|

Share of profit from equity accounted investees |

|

Decrease due to lower earnings from PGI as a result of higher depreciation expense resulting from a larger asset asset base following the transactions with Whitecap combined with asset upgrades and associated retirements, unrealized losses on interest rate derivative financial instruments recognized in the 2025 period compared to gains in the 2024 period, as well as lower volumes as a result of planned outages at certain PGI assets in the second quarter of 2025 and on-going third-party restrictions impacting the Dawson Assets. These factors were partially offset by higher contributions from PGI assets related to the transactions with Whitecap. |

| Earnings |

|

Decrease primarily due to lower share of profit from PGI, higher depreciation expense, and lower revenue at the Redwater Complex due to a planned outage, discussed above. This was partially offset by the net impacts of Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024. |

Adjusted EBITDA(2) |

|

Increase primarily due to the net impacts of Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024, partially offset by lower revenue at the Redwater Complex due to a planned outage, discussed above. Included in adjusted EBITDA is $346 million (2024: $346 million) related to PGI with higher contributions as a result of the transactions with Whitecap, largely offset by planned outages at certain PGI assets in the second quarter of 2025 and on-going third-party restrictions impacting the Dawson Assets. |

Volumes(3) |

|

Higher largely due to Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024. This is partially offset by third-party restrictions and planned outages at the Channahon Facility, planned outages at certain PGI assets, higher outage days at the Redwater Complex compared to 2024 due to an asset upgrade, and on-going third-party restrictions impacting the Dawson Assets. Volumes include 355 mboe/d (2024: 357 mboe/d) related to PGI. |

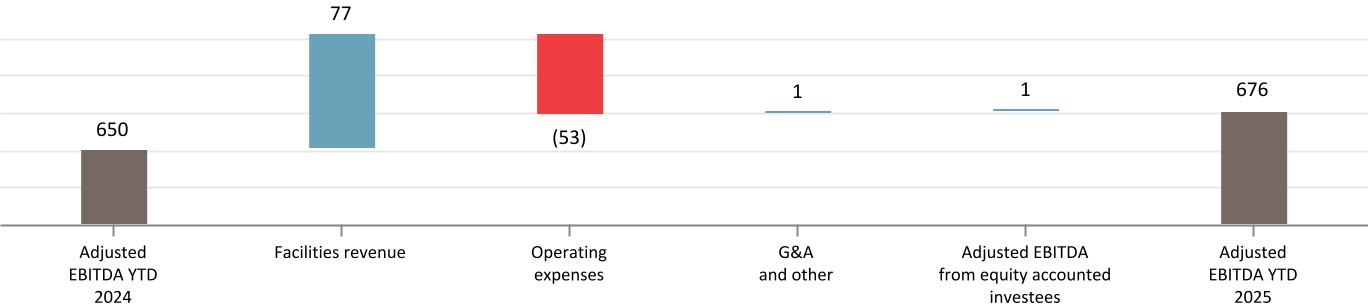

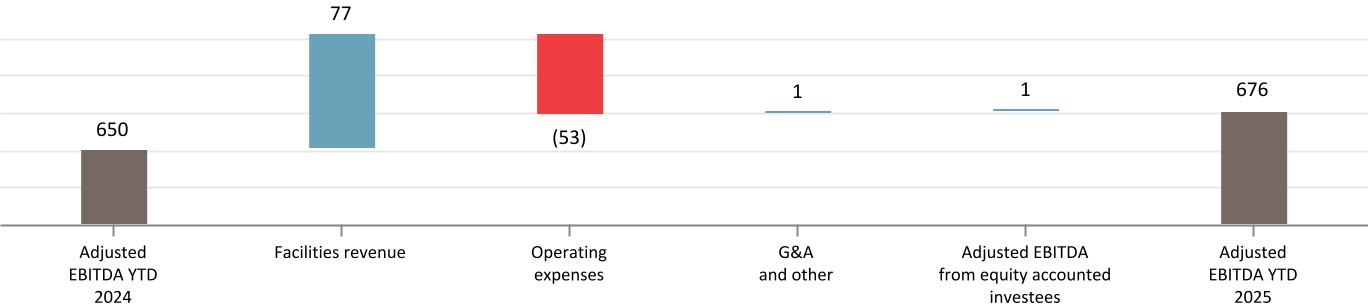

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Interim Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

14 Pembina Pipeline Corporation Second Quarter 2025

Financial and Operational Overview

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months Ended June 30 |

6 Months Ended June 30 |

|

2025 |

2024 |

2025 |

2024 |

| ($ millions, except where noted) |

Volumes(1) |

Earnings |

Adjusted

EBITDA(2)

|

Volumes(1) |

Earnings |

Adjusted

EBITDA(2)

|

Volumes(1) |

Earnings |

Adjusted

EBITDA(2)

|

Volumes(1) |

Earnings |

Adjusted

EBITDA(2)

|

Facilities(3) |

|

|

|

|

|

|

|

|

|

|

|

|

| Gas Services |

590 |

|

67 |

|

201 |

|

599 |

|

83 |

|

200 |

|

604 |

|

151 |

|

404 |

|

606 |

|

175 |

|

401 |

|

| NGL Services |

236 |

|

75 |

|

130 |

|

256 |

|

98 |

|

140 |

|

257 |

|

175 |

|

272 |

|

224 |

|

183 |

|

249 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

826 |

|

142 |

|

331 |

|

855 |

|

181 |

|

340 |

|

861 |

|

326 |

|

676 |

|

830 |

|

358 |

|

650 |

|

(1) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Includes values attributed to Pembina's gas services and NGL services assets within the Facilities operating segment. For a description of Pembina's gas and NGL assets, refer to Pembina's AIF for the year ended December 31, 2024.

Projects & New Developments(1)

Facilities continues to grow its natural gas and NGL processing and fractionation assets to service customer demand. The following outlines the projects and new developments within Facilities:

|

|

|

|

|

|

|

|

|

| RFS IV |

|

|

Capital Budget: $525 million |

|

|

Revised Capital Cost: $500 million |

In-service Date(2): First half of 2026 |

Status: On time, trending under budget |

RFS IV is a 55,000 bpd propane-plus fractionator at the existing Redwater fractionation and storage complex (the "Redwater Complex"). The project includes additional rail loading capacity and will leverage the design, engineering, and operating best practices of the existing facilities at the Redwater Complex. With the addition of RFS IV, the fractionation capacity at the Redwater Complex will total 256,000 bpd. Pembina has entered into a lump-sum engineering, procurement and construction agreement in respect of the project, for more than 70 percent of the project cost. Engineering, procurement, and fabrication is substantially complete, while field construction has progressed to approximately 50 percent complete. |

|

|

|

|

|

|

|

|

|

| Wapiti Expansion |

|

|

Capital Budget: $140 million (net to Pembina) |

In-service Date(2): First half of 2026 |

Status: On time, on budget |

PGI is developing an expansion that will increase natural gas processing capacity at the Wapiti Plant by 115 mmcf/d (gross to PGI). The expansion opportunity is driven by strong customer demand supported by growing Montney production and is fully underpinned by long-term, take-or-pay contracts. The project includes a new sales gas pipeline and other related infrastructure. During the second quarter of 2025, construction activities, including tie-ins, progressed. |

|

|

|

|

|

|

|

|

|

| K3 Cogeneration Facility |

|

|

Capital Budget: $70 million (net to Pembina) |

In-service Date(2): First half of 2026 |

Status: On time, on budget |

PGI is developing a 28 MW cogeneration facility at its K3 Plant, which is expected to reduce overall operating costs by providing power and heat to the gas processing facility, while reducing customers' exposure to power prices. The K3 Cogeneration Facility is expected to fully supply the K3 Plant's power requirements, with excess power sold to the grid at market rates. Further, through the utilization of the cogeneration waste heat and the low-emission power generated, the project is expected to contribute to a reduction in annual emissions compliance costs at the K3 Plant. During the second quarter of 2025, engineering work was completed and construction activities progressed. |

(1) For further details on Pembina's significant assets, including definitions for capitalized terms used herein that are not otherwise defined, refer to Pembina's AIF for the year ended December 31, 2024 filed at www.sedarplus.ca (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com.

(2) Subject to environmental and regulatory approvals. See the "Forward-Looking Statements & Information" section of this MD&A.

Pembina Pipeline Corporation Second Quarter 2025 15

Pursuant to an agreement with Whitecap, PGI has committed to support infrastructure development in the Lator area, including a new battery and gathering laterals (the "Lator Infrastructure"), which PGI will own. PGI anticipates funding up to $400 million ($240 million net to Pembina) for the battery and gathering laterals within the first phase of the Lator Infrastructure development, with all gas volumes flowing to PGI's Musreau facility upon startup, which is expected in late 2026/early 2027, supporting long-term plant utilization. During the first half of 2025, detailed engineering advanced and long-lead equipment was ordered.

Pursuant to an agreement with Whitecap, PGI has committed to fund capital up to $300 million ($180 million net to Pembina) for battery and gathering infrastructure in the Gold Creek and Karr areas. During the first half of 2025, construction for the pipeline progressed, detailed engineering advanced and long-lead equipment was ordered related to the battery.

PGI has entered into an agreement with a Montney producer to fund and acquire an under-construction battery and additional infrastructure (the "North Gold Creek Battery") in the Wapiti/North Gold Creek Montney area for a capital commitment up to $150 million ($90 million net to Pembina). The North Gold Creek Battery will be operated by the producer and highly contracted under a long-term, take-or-pay agreement. The expected in-service date of the North Gold Creek Battery is the second quarter of 2026.

16 Pembina Pipeline Corporation Second Quarter 2025

Marketing & New Ventures

Financial Overview for the Three Months Ended June 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, except where noted) |

2025 |

2024 |

Change |

|

Marketing revenue(1) |

883 |

|

925 |

|

(42) |

|

|

Cost of goods sold(1) |

761 |

|

796 |

|

(35) |

|

|

Net revenue(1)(2) |

122 |

|

129 |

|

(7) |

|

|

Operating expenses(1) |

9 |

|

4 |

|

5 |

|

|

| Depreciation and amortization included in gross profit |

17 |

|

17 |

|

— |

|

|

| Share of profit (loss) from equity accounted investees |

28 |

|

(2) |

|

30 |

|

|

| Gross profit |

124 |

|

106 |

|

18 |

|

|

| Earnings |

114 |

|

135 |

|

(21) |

|

|

Adjusted EBITDA(2) |

74 |

|

143 |

|

(69) |

|

|

Crude oil sales volumes(3) |

95 |

|

100 |

|

(5) |

|

|

NGL sales volumes(3) |

207 |

|

219 |

|

(12) |

|

|

|

|

|

|

|

|

|

| Change in Results |

|

|

|

|

|

|

|

|

Net revenue(1)(2) |

|

Lower net revenue from contracts with customers was largely due to a decrease in NGL margins as a result of lower butane and propane prices, coupled with lower volumes resulting from third-party restrictions and planned outages, as discussed below, as well as higher input natural gas prices at Aux Sable.

Higher revenue from risk management and physical derivative contracts, resulting from lower unrealized losses on renewable power purchase agreements, unrealized gains on NGL-based derivatives compared to losses in the second quarter of 2024, and lower realized losses on NGL-based derivatives. These results were partially offset by lower unrealized and realized gains on crude oil-based derivatives. The second quarter of 2025 includes unrealized gains on commodity-related derivatives of $31 million (2024: $45 million loss) and realized gains on commodity-related derivatives of $38 million (2024: $74 million gain).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share of profit (loss) from equity accounted investees |

|

The share of profit in the second quarter of 2025 primarily relates to unrealized foreign exchange gains recognized by Cedar LNG on U.S. dollar denominated debt. |

| Earnings |

|

Decrease primarily due to lower NGL margins and volumes, as well as no similar gain to that recognized in the second quarter of 2024 associated with the derecognition of the provision related to financial assurances provided by Pembina which were assumed by Cedar LNG following the positive final investment decision in June 2024. These decreases were partially offset by higher revenue from risk management and physical derivative contracts as well as higher share of profit from Cedar LNG, discussed above. |

Adjusted EBITDA(2) |

|

Decrease largely due to lower NGL margins and volumes, lower realized gains on crude-oil based derivatives, partially offset by lower realized losses on NGL-based derivatives. |

|

|

|

NGL sales volumes(3) |

|

Decrease primarily driven by lower supply volumes from the Channahon Facility and Redwater Complex, resulting from third-party restrictions at the Channahon Facility and outages at both facilities detailed in the "Segment Results - Facilities - Changes in Results" section of this MD&A. |

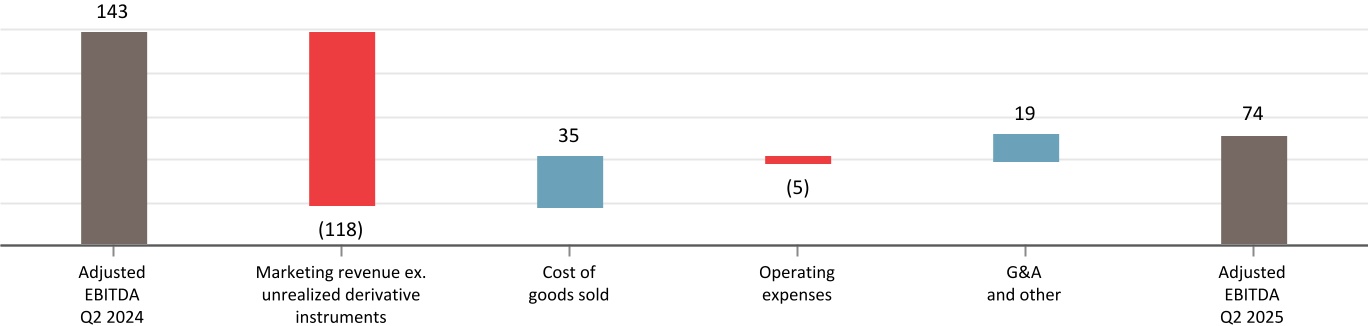

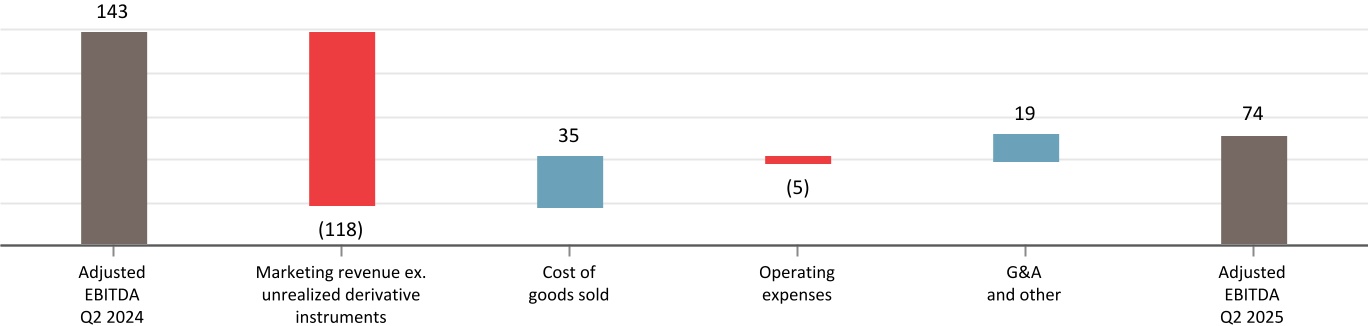

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Interim Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Marketed crude oil and NGL volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

Pembina Pipeline Corporation Second Quarter 2025 17

Financial Overview for the Six Months Ended June 30

Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ millions, except where noted) |

2025 |

2024 |

Change |

|

Marketing revenue(1) |

2,219 |

|

1,725 |

|

494 |

|

|

Cost of goods sold(1) |

1,858 |

|

1,547 |

|

311 |

|

|

Net revenue(1)(2) |

361 |

|

178 |

|

183 |

|

|

Operating expenses(1) |

17 |

|

8 |

|

9 |

|

|

| Depreciation and amortization included in gross profit |

37 |

|

32 |

|

5 |

|

|

| Share of (loss) profit from equity accounted investees |

(8) |

|

31 |

|

(39) |

|

|

| Gross profit |

299 |

|

169 |

|

130 |

|

|

| Earnings |

274 |

|

199 |

|

75 |

|

|

Adjusted EBITDA(2) |

284 |

|

331 |

|

(47) |

|

|

Crude oil sales volumes(3) |

91 |

|

90 |

|

1 |

|

|

NGL sales volumes(3) |

244 |

|

217 |

|

27 |

|

|

|

|

|

|

|

|

|

| Change in Results |

|

|

|

|

|

|

|

|

Net revenue(1)(2) |

|

Higher net revenue from contracts with customers was largely due to Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024, combined with higher WCSB NGL margins resulting from higher marketed NGL volumes. This is partially offset by a decrease in NGL margins from Aux Sable primarily due to higher input natural gas prices and lower volumes resulting from third-party restrictions and planned outages, as discussed below.

Higher revenue from risk management and physical derivative contracts was primarily due to lower unrealized losses on renewable power purchase agreements largely due to improved forward power prices, unrealized gains on NGL-based derivative compared to losses in 2024, and lower unrealized losses on crude oil-based derivatives. These increases were partially offset by lower realized gains on crude oil-based derivatives. The 2025 period includes unrealized gains on commodity-related derivatives of $40 million (2024: $147 million loss) and realized gains on commodity-related derivatives of $59 million (2024: $119 million gain).

|

|

|

|

|

|

|

|

|

|

| Share of (loss) profit from equity accounted investees |

|

The share of loss in the 2025 period primarily relates to unrealized losses on interest rate derivative financial instruments recognized by Cedar LNG in the current period, which were entered into in the third quarter of 2024, largely offset by unrealized foreign exchange gains on U.S. dollar denominated debt. The share of profit in the 2024 period relates to the results from Aux Sable. Following Pembina acquiring a controlling ownership interest in Aux Sable on April 1, 2024, the results from Aux Sable are no longer accounted for in share of profit and are now being fully consolidated. |

|

|

|

| Earnings |

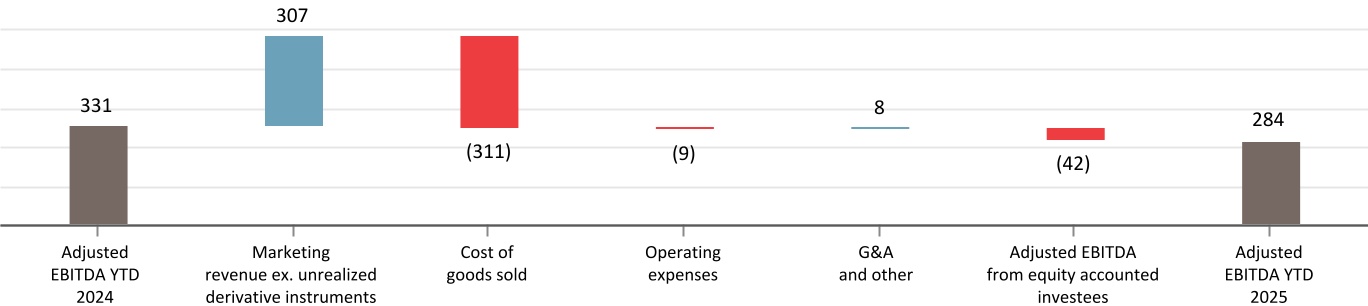

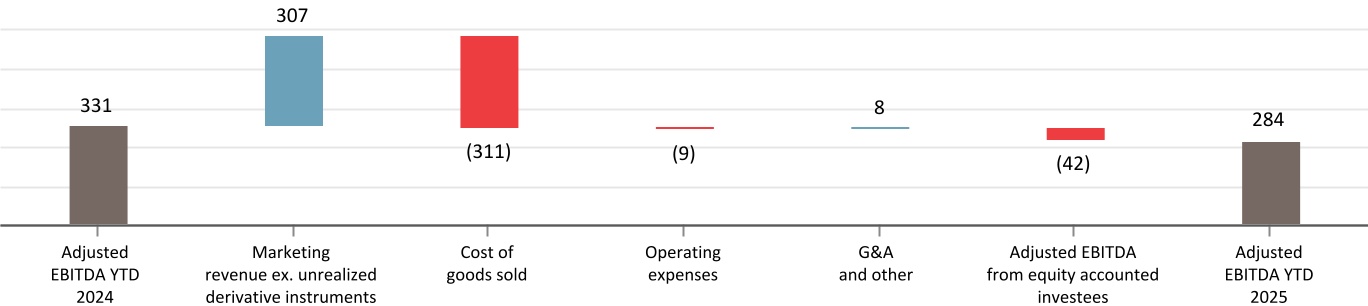

|