| Maryland | 001-36105 | 37-1645259 | ||||||||||||

| (State or other Jurisdiction of Incorporation) |

(Commission

File Number)

|

(I.R.S. Employer Identification No.) |

||||||||||||

| Delaware | 001-36106 | 45-4685158 | ||||||||||||

| (State or other Jurisdiction of Incorporation) |

(Commission

File Number)

|

(I.R.S. Employer Identification No.) |

||||||||||||

|

111 West 33rd Street,

|

12th Floor | |||||||

| New York, | New York | 10120 | ||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class |

Trading

Symbol(s)

|

Name of each exchange

on which registered

|

||||||||||||

| Empire State Realty Trust, Inc. | ||||||||||||||

| Class A Common Stock, par value $0.01 per share | ESRT | The New York Stock Exchange | ||||||||||||

| Empire State Realty OP, L.P. | ||||||||||||||

| Series ES Operating Partnership Units | ESBA | NYSE Arca, Inc. | ||||||||||||

| Series 60 Operating Partnership Units | OGCP | NYSE Arca, Inc. | ||||||||||||

| Series 250 Operating Partnership Units | FISK | NYSE Arca, Inc. | ||||||||||||

| Item 2.02. | Results of Operations and Financial Condition. | ||||

| Item 7.01. | Regulation FD Disclosure | ||||

| Exhibit No. | Description | ||||

| 104 | Cover Page Interactive File (the cover page tags are embedded within the Inline XBRL document). | ||||

|

Date: October 29, 2025

|

EMPIRE STATE REALTY TRUST, INC. (Registrant)

By: /s/ Stephen V. Horn

Name: Stephen V. Horn

Title: Executive Vice President, Chief Financial Officer & Chief Accounting Officer

|

||||

|

Date: October 29, 2025

|

EMPIRE STATE REALTY OP, L.P.

(Registrant)

By: Empire State Realty Trust, Inc., as general partner

By: /s/ Stephen V. Horn

Name: Stephen V. Horn

Title: Executive Vice President, Chief Financial Officer & Chief Accounting Officer

|

||||

September 30, 20251 |

June 30, 20251 |

September 30, 20241 |

||||||||||||

Percent occupied: |

||||||||||||||

Total commercial portfolio |

90.0%2 |

89.2%2 |

89.1% | |||||||||||

Total office |

89.7% | 88.9% | 88.9% | |||||||||||

Manhattan office |

90.3% | 89.5% | 89.6% | |||||||||||

| Total retail | 92.8%2 |

91.7%2 |

91.1% | |||||||||||

Percent leased (includes signed leases not commenced): | ||||||||||||||

Total commercial portfolio |

92.6%2 |

93.1%2 |

93.4% | |||||||||||

Total office |

92.4% | 93.1% | 93.3% | |||||||||||

Manhattan office |

93.1% | 93.8% | 94.1% | |||||||||||

| Total retail | 94.7%2 |

92.4%2 |

94.0% | |||||||||||

Total multifamily portfolio |

98.6% | 98.6% | 96.8% | |||||||||||

Total Portfolio |

Leases executed |

Square

footage executed

|

Average cash rent psf – leases executed |

% of new cash rent over / under previously escalated rents |

||||||||||

Office |

14 | 71,859 | 69.97 | 3.9 | % | |||||||||

Retail |

2 | 16,021 | 128.33 | (11.8) | % | |||||||||

Total Overall |

16 | 87,880 | 80.61 | (1.2) | % | |||||||||

Manhattan Office Portfolio |

Leases executed |

Square

footage executed

|

Average cash rent psf – leases executed |

% of new cash rent over / under previously escalated rents |

||||||||||

New Office |

6 | 26,430 | 68.56 | 1.3 | % | |||||||||

Renewal Office |

8 | 45,429 | 70.80 | 5.5 | % | |||||||||

Total Office |

14 | 71,859 | 69.97 | 3.9 | % | |||||||||

Key Assumptions |

2025 Current Guidance (October 2025) | 2025 Prior Guidance (July 2025) | Comments |

||||||||

Earnings |

|||||||||||

Core FFO Per Fully Diluted Share |

$0.83 to $0.86 |

$0.83 to $0.86 |

•2025 includes ~$0.05 from multifamily assets |

||||||||

Commercial Property Drivers |

|||||||||||

Commercial Occupancy at year-end |

89% to 91% |

89% to 91% |

|||||||||

|

SS Property Cash NOI

(excluding lease termination fees)

|

–2.0% to +1.5% |

–2.0% to +1.5% |

•Assumes positive revenue y/y growth

•Assumes a ~2.0 to 4.0% y/y increase in operating expenses and real estate taxes

•2025 SS NOI y/y growth is expected to range from ~0.5 to 4.0% relative to 2024 excluding one-time items

|

||||||||

Observatory Drivers |

|||||||||||

Observatory NOI |

$90M to $94M |

$90M to $94M |

•Reflects average quarterly expenses of ~$9 to 10M |

||||||||

Low |

High |

|||||||

| Net Income (Loss) Attributable to Common Stockholders and the Operating Partnership | $0.22 | $0.25 | ||||||

Add: |

||||||||

Impairment Charge |

0.00 | 0.00 | ||||||

Real Estate Depreciation & Amortization |

0.65 | 0.65 | ||||||

Less: |

||||||||

Private Perpetual Distributions |

0.02 | 0.02 | ||||||

Gain on Disposal of Real Estate, net |

0.05 | 0.05 | ||||||

FFO Attributable to Common Stockholders and the Operating Partnership |

$0.80 | $0.83 | ||||||

Add: |

||||||||

Amortization of Below Market Ground Lease |

0.03 | 0.03 | ||||||

Core FFO Attributable to Common Stockholders and the Operating Partnership |

$0.83 | $0.86 | ||||||

Empire State Realty Trust, Inc. | |||||||||||

Condensed Consolidated Statements of Operations | |||||||||||

|

(unaudited and amounts in thousands, except per share data)

| |||||||||||

| Three Months Ended September 30, | |||||||||||

| 2025 | 2024 | ||||||||||

Revenues |

|||||||||||

Rental revenue |

$ | 158,410 | $ | 153,117 | |||||||

Observatory revenue |

36,037 | 39,382 | |||||||||

Lease termination fees |

— | 4,771 | |||||||||

Third-party management and other fees |

404 | 271 | |||||||||

Other revenue and fees |

2,879 | 2,058 | |||||||||

Total revenues |

197,730 | 199,599 | |||||||||

Operating expenses |

|||||||||||

Property operating expenses |

46,957 | 45,954 | |||||||||

Ground rent expenses |

2,331 | 2,331 | |||||||||

General and administrative expenses |

18,743 | 18,372 | |||||||||

Observatory expenses |

9,510 | 9,715 | |||||||||

Real estate taxes |

33,241 | 31,982 | |||||||||

Depreciation and amortization |

47,615 | 45,899 | |||||||||

Total operating expenses |

158,397 | 154,253 | |||||||||

Total operating income |

39,333 | 45,346 | |||||||||

Other income (expense): |

|||||||||||

Interest income |

1,146 | 6,960 | |||||||||

Interest expense |

(25,189) | (27,408) | |||||||||

Interest expense associated with property in receivership |

— | (1,922) | |||||||||

Gain on disposition of property |

— | 1,262 | |||||||||

Income before income taxes |

15,290 | 24,238 | |||||||||

Income tax expense |

(1,645) | (1,442) | |||||||||

Net income |

13,645 | 22,796 | |||||||||

Net income attributable to non-controlling interests: |

|||||||||||

Non-controlling interest in the Operating Partnership |

(4,610) | (8,205) | |||||||||

Preferred unit distributions |

(1,050) | (1,050) | |||||||||

Net income attributable to common stockholders |

$ | 7,985 | $ | 13,541 | |||||||

Total weighted average shares |

|||||||||||

Basic |

169,250 | 164,880 | |||||||||

Diluted |

270,357 | 269,613 | |||||||||

Earnings per share attributable to common stockholders |

|||||||||||

Basic |

$ | 0.05 | $ | 0.08 | |||||||

Diluted |

$ | 0.05 | $ | 0.08 | |||||||

Empire State Realty Trust, Inc. | |||||||||||

Condensed Consolidated Statements of Operations | |||||||||||

|

(unaudited and amounts in thousands, except per share data)

| |||||||||||

| Nine Months Ended September 30, | |||||||||||

| 2025 | 2024 | ||||||||||

Revenues |

|||||||||||

Rental revenue |

$ | 466,492 | $ | 459,469 | |||||||

Observatory revenue |

93,097 | 98,102 | |||||||||

Lease termination fees |

464 | 4,771 | |||||||||

Third-party management and other fees |

1,243 | 912 | |||||||||

Other revenue and fees |

7,750 | 7,067 | |||||||||

Total revenues |

569,046 | 570,321 | |||||||||

Operating expenses |

|||||||||||

Property operating expenses |

136,897 | 132,530 | |||||||||

Ground rent expenses |

6,994 | 6,994 | |||||||||

General and administrative expenses |

54,368 | 52,364 | |||||||||

Observatory expenses |

27,450 | 27,104 | |||||||||

Real estate taxes |

98,898 | 96,106 | |||||||||

Depreciation and amortization |

144,196 | 139,453 | |||||||||

Total operating expenses |

468,803 | 454,551 | |||||||||

Total operating income |

100,243 | 115,770 | |||||||||

Other income (expense): |

|||||||||||

Interest income |

6,799 | 16,230 | |||||||||

Interest expense |

(77,253) | (77,859) | |||||||||

Interest expense associated with property in receivership |

(647) | (2,550) | |||||||||

Loss on early extinguishment of debt |

— | (553) | |||||||||

Gain on disposition of property |

13,170 | 12,065 | |||||||||

Income before income taxes |

42,312 | 63,103 | |||||||||

Income tax expense |

(1,504) | (1,537) | |||||||||

Net income |

40,808 | 61,566 | |||||||||

Net income attributable to non-controlling interests: |

|||||||||||

Non-controlling interest in the Operating Partnership |

(13,933) | (22,138) | |||||||||

Non-controlling interests in other partnerships |

— | (4) | |||||||||

Preferred unit distributions |

(3,151) | (3,151) | |||||||||

Net income attributable to common stockholders |

$ | 23,724 | $ | 36,273 | |||||||

Total weighted average shares |

|||||||||||

Basic |

168,103 | 164,453 | |||||||||

Diluted |

269,945 | 268,608 | |||||||||

Earnings per share attributable to common stockholders |

|||||||||||

Basic |

$ | 0.14 | $ | 0.22 | |||||||

Diluted |

$ | 0.14 | $ | 0.22 | |||||||

Empire State Realty Trust, Inc. | |||||||||||

Reconciliation of Net Income to Funds From Operations (“FFO”), | |||||||||||

Modified Funds From Operations (“Modified FFO”) and Core Funds From Operations (“Core FFO”) | |||||||||||

(unaudited and amounts in thousands, except per share data) | |||||||||||

| Three Months Ended September 30, | |||||||||||

| 2025 | 2024 | ||||||||||

Net income |

$ | 13,645 | $ | 22,796 | |||||||

Preferred unit distributions |

(1,050) | (1,050) | |||||||||

Real estate depreciation and amortization |

46,741 | 44,871 | |||||||||

Gain on disposition of property |

— | (1,262) | |||||||||

FFO attributable to common stockholders and Operating Partnership units |

59,336 | 65,355 | |||||||||

Amortization of below-market ground leases |

1,957 | 1,958 | |||||||||

Modified FFO attributable to common stockholders and Operating Partnership units |

61,293 | 67,313 | |||||||||

Interest expense associated with property in receivership |

— | 1,922 | |||||||||

Core FFO attributable to common stockholders and Operating Partnership units |

$ | 61,293 | $ | 69,235 | |||||||

Total weighted average shares and Operating Partnership units |

|||||||||||

Basic |

266,963 | 264,787 | |||||||||

Diluted |

270,357 | 269,613 | |||||||||

FFO per share |

|||||||||||

Basic |

$ | 0.22 | $ | 0.25 | |||||||

Diluted |

$ | 0.22 | $ | 0.24 | |||||||

Modified FFO per share |

|||||||||||

Basic |

$ | 0.23 | $ | 0.25 | |||||||

Diluted |

$ | 0.23 | $ | 0.25 | |||||||

Core FFO per share |

|||||||||||

Basic |

$ | 0.23 | $ | 0.26 | |||||||

Diluted |

$ | 0.23 | $ | 0.26 | |||||||

Empire State Realty Trust, Inc. | |||||||||||

Reconciliation of Net Income to Funds From Operations (“FFO”), | |||||||||||

Modified Funds From Operations (“Modified FFO”) and Core Funds From Operations (“Core FFO”) | |||||||||||

(unaudited and amounts in thousands, except per share data) | |||||||||||

| Nine Months Ended September 30, | |||||||||||

| 2025 | 2024 | ||||||||||

Net income |

$ | 40,808 | $ | 61,566 | |||||||

Non-controlling interests in other partnerships |

— | (4) | |||||||||

Preferred unit distributions |

(3,151) | (3,151) | |||||||||

Real estate depreciation and amortization |

141,533 | 136,126 | |||||||||

Gain on disposition of property |

(13,170) | (12,065) | |||||||||

FFO attributable to common stockholders and Operating Partnership units |

166,020 | 182,472 | |||||||||

Amortization of below-market ground leases |

5,873 | 5,874 | |||||||||

Modified FFO attributable to common stockholders and Operating Partnership units |

171,893 | 188,346 | |||||||||

Interest expense associated with property in receivership |

647 | 2,550 | |||||||||

| Loss on early extinguishment of debt | — | 553 | |||||||||

Core FFO attributable to common stockholders and Operating Partnership units |

$ | 172,540 | $ | 191,449 | |||||||

Total weighted average shares and Operating Partnership units |

|||||||||||

Basic |

266,978 | 264,675 | |||||||||

Diluted |

269,945 | 268,608 | |||||||||

FFO per share |

|||||||||||

Basic |

$ | 0.62 | $ | 0.69 | |||||||

Diluted |

$ | 0.62 | $ | 0.68 | |||||||

Modified FFO per share |

|||||||||||

Basic |

$ | 0.64 | $ | 0.71 | |||||||

Diluted |

$ | 0.64 | $ | 0.70 | |||||||

Core FFO per share |

|||||||||||

Basic |

$ | 0.65 | $ | 0.72 | |||||||

Diluted |

$ | 0.64 | $ | 0.71 | |||||||

Empire State Realty Trust, Inc. | |||||||||||

Condensed Consolidated Balance Sheets | |||||||||||

(unaudited and amounts in thousands) | |||||||||||

| September 30, 2025 | December 31, 2024 | ||||||||||

Assets |

|||||||||||

Commercial real estate properties, at cost |

$ | 3,940,755 | $ | 3,786,653 | |||||||

Less: accumulated depreciation |

(1,381,726) | (1,274,193) | |||||||||

Commercial real estate properties, net |

2,559,029 | 2,512,460 | |||||||||

Contract asset3 |

— | 170,419 | |||||||||

Cash and cash equivalents |

154,113 | 385,465 | |||||||||

Restricted cash |

43,642 | 43,837 | |||||||||

Tenant and other receivables |

27,416 | 31,427 | |||||||||

Deferred rent receivables |

259,070 | 247,754 | |||||||||

Prepaid expenses and other assets |

58,679 | 101,852 | |||||||||

Deferred costs, net |

177,307 | 183,987 | |||||||||

Acquired below market ground leases, net |

307,537 | 313,410 | |||||||||

Right of use assets |

28,007 | 28,197 | |||||||||

Goodwill |

491,479 | 491,479 | |||||||||

Total assets |

$ | 4,106,279 | $ | 4,510,287 | |||||||

Liabilities and equity |

|||||||||||

Mortgage notes payable, net |

$ | 691,046 | $ | 692,176 | |||||||

Senior unsecured notes, net |

1,097,498 | 1,197,061 | |||||||||

Unsecured term loan facility, net |

268,959 | 268,731 | |||||||||

Unsecured revolving credit facility |

— | 120,000 | |||||||||

Debt associated with property in receivership |

— | 177,667 | |||||||||

Accrued interest associated with property in receivership |

— | 5,433 | |||||||||

Accounts payable and accrued expenses |

111,732 | 132,016 | |||||||||

Acquired below market leases, net |

15,875 | 19,497 | |||||||||

Ground lease liabilities |

28,007 | 28,197 | |||||||||

Deferred revenue and other liabilities |

64,191 | 62,639 | |||||||||

Tenants’ security deposits |

30,751 | 24,908 | |||||||||

Total liabilities |

2,308,059 | 2,728,325 | |||||||||

Total equity |

1,798,220 | 1,781,962 | |||||||||

Total liabilities and equity |

$ | 4,106,279 | $ | 4,510,287 | |||||||

|

|||||

Third Quarter 2025 | |||||

| Table of Content | Page | ||||

| Summary | |||||

| Supplemental Definitions | |||||

| Company Profile | |||||

| Condensed Consolidated Balance Sheets | |||||

| Condensed Consolidated Statements of Operations | |||||

| FFO, Modified FFO, Core FFO, FAD and EBITDA | |||||

| Highlights | |||||

| Selected Property Data | |||||

| Property Summary Net Operating Income | |||||

| Same Store Net Operating Income | |||||

| Leasing Activity | |||||

| Commercial Property Detail | |||||

| Portfolio Expirations and Vacates Summary | |||||

| Tenant Lease Expirations | |||||

| Largest Tenants and Portfolio Tenant Diversification by Industry | |||||

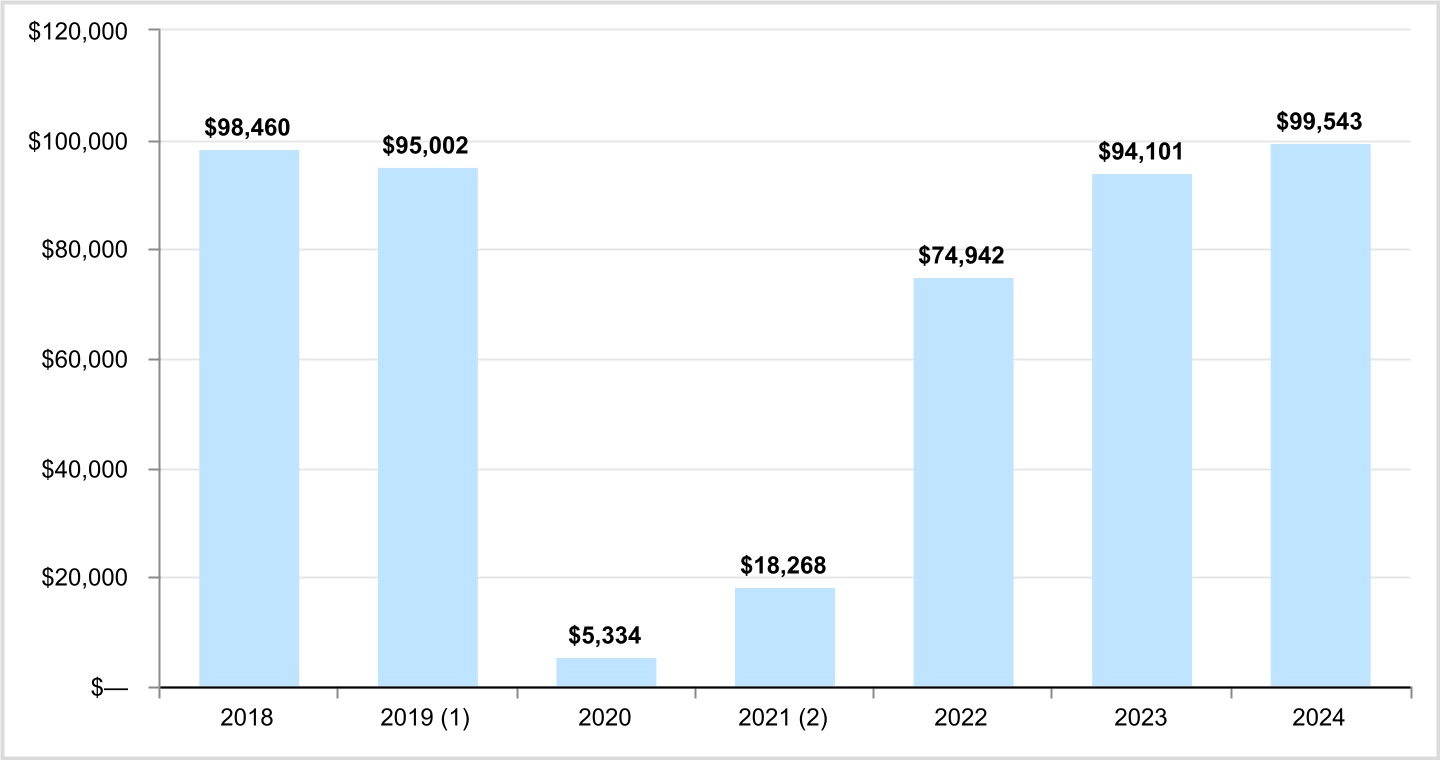

| Initial Cash Rent Contributing to Cash NOI, Capital Expenditures and Redevelopment Program | |||||

| Observatory Summary | |||||

| Financial information | |||||

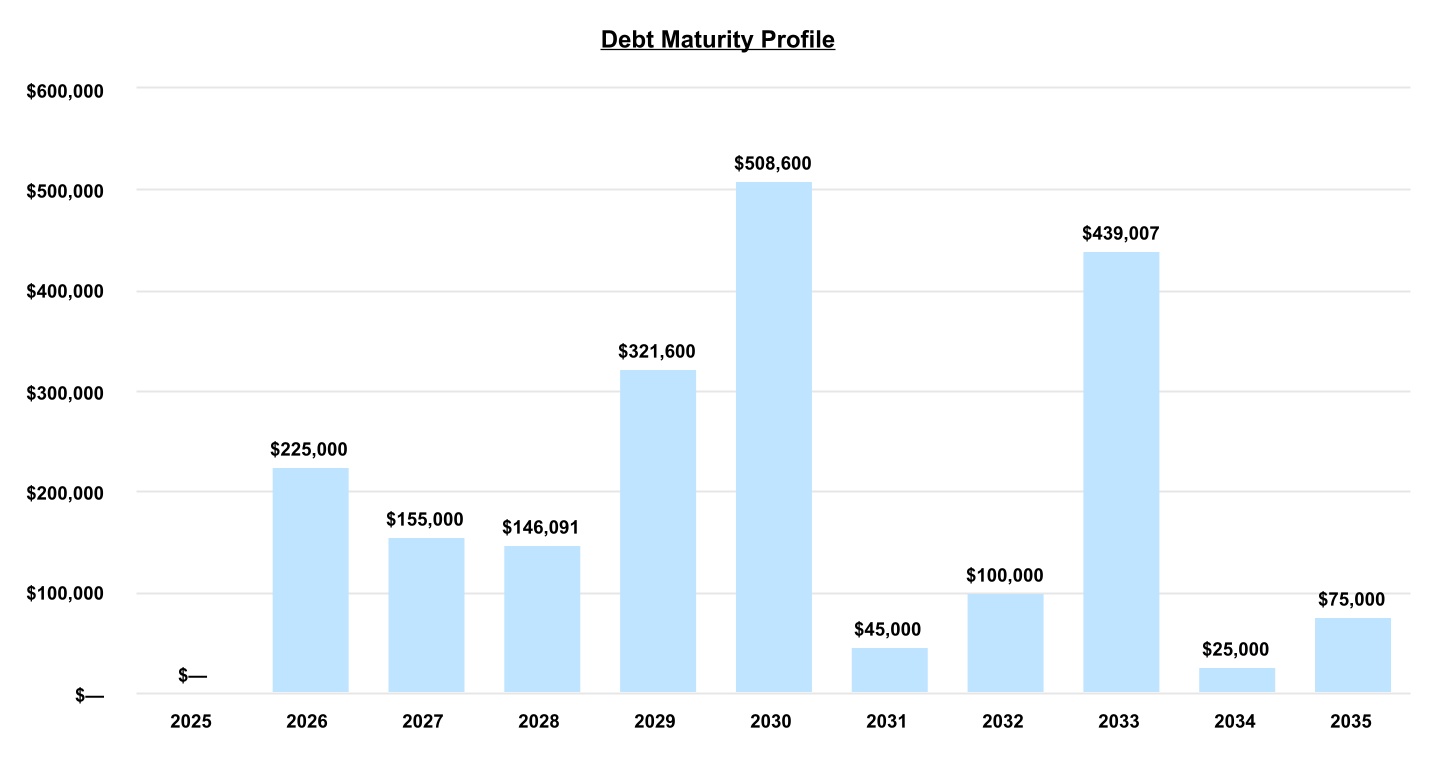

| Consolidated Debt Analysis | |||||

| Debt Summary | |||||

| Debt Detail | |||||

| Debt Maturities | |||||

| Ground Leases | |||||

|

|||||

Third Quarter 2025 | |||||

| Supplemental Definitions | |||||

|

|||||

Third Quarter 2025 | |||||

| Supplemental Definitions | |||||

|

|||||

Third Quarter 2025 | |||||

| COMPANY PROFILE | ||||||||

| BROAD OF DIRECTORS | |||||

| Anthony E. Malkin | Chairman and Chief Executive Officer | ||||

| Steven J. Gilbert | Director, Lead Independent Director, Chair of the Compensation Committee | ||||

| S. Michael Giliberto | Director, Chair of the Audit Committee | ||||

| Patricia S. Han | Director | ||||

| Grant H. Hill | Director | ||||

| R. Paige Hood | Director, Chair of the Finance Committee | ||||

| George L. W. Malkin | Director | ||||

| James D. Robinson IV | Director, Chair of the Nominating and Corporate Governance Committee | ||||

| Christina Van Tassell | Director | ||||

| Hannah Yang | Director | ||||

| EXECUTIVE MANAGEMENT | |||||

| Anthony E. Malkin | Chairman and Chief Executive Officer | ||||

| Christina Chiu | President | ||||

| Thomas P. Durels | Executive Vice President, Real Estate | ||||

| Steve Horn | Executive Vice President, Chief Financial Officer & Chief Accounting Officer | ||||

| COMPANY INFORMATION | ||||||||

| Corporate Headquarters | Investor Relations | New York Stock Exchange | ||||||

| 111 West 33rd Street, 12th Floor | IR@esrtreit.com | Trading Symbol: ESRT |

||||||

| New York, NY 10120 | ||||||||

| www.esrtreit.com | ||||||||

| (212) 687-8700 | ||||||||

| RESEARCH COVERAGE | |||||||||||

| BMO Capital Markets Corp. | John Kim | (212) 885-4115 | jp.kim@bmo.com | ||||||||

| BTIG | Thomas Catherwood | (212) 738-6140 | tcatherwood@btig.com | ||||||||

| Citi | Seth Bergey | (212) 816-2066 | seth.bergey@citi.com | ||||||||

| Evercore ISI | Steve Sakwa | (212) 446-9462 | steve.sakwa@evercoreisi.com | ||||||||

| Green Street Advisors | Dylan Burzinski | (949) 640-8780 | dburzinski@greenstreetadvisors.com | ||||||||

| Wells Fargo Securities, LLC | Blaine Heck | (443) 263-6529 | blaine.heck@wellsfargo.com | ||||||||

| Wolfe Research | Ally Yaseen | (646) 582-9253 | ayaseen@wolferesearch.com | ||||||||

|

Third Quarter 2025 |

||||

| Condensed Consolidated Balance Sheet | |||||

| (unaudited and dollars in thousands) | |||||

| Assets | September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

||||||||||||||||||||||||

| Commercial real estate properties, at cost | $ | 3,940,755 | $ | 3,903,950 | $ | 3,825,422 | $ | 3,786,653 | $ | 3,667,687 | |||||||||||||||||||

| Less: accumulated depreciation | (1,381,726) | (1,341,144) | (1,306,924) | (1,274,193) | (1,241,454) | ||||||||||||||||||||||||

| Commercial real estate properties, net | 2,559,029 | 2,562,806 | 2,518,498 | 2,512,460 | 2,426,233 | ||||||||||||||||||||||||

Contract asset(1) |

— | — | — | 170,419 | 168,687 | ||||||||||||||||||||||||

| Cash and cash equivalents | 154,113 | 94,643 | 187,823 | 385,465 | 421,896 | ||||||||||||||||||||||||

| Restricted cash | 43,642 | 42,084 | 49,589 | 43,837 | 48,023 | ||||||||||||||||||||||||

| Tenant and other receivables | 27,416 | 28,124 | 29,071 | 31,427 | 34,068 | ||||||||||||||||||||||||

| Deferred rent receivables | 259,070 | 255,272 | 252,299 | 247,754 | 244,448 | ||||||||||||||||||||||||

| Prepaid expenses and other assets | 58,679 | 85,083 | 64,233 | 101,852 | 81,758 | ||||||||||||||||||||||||

| Deferred costs, net | 177,307 | 181,694 | 181,802 | 183,987 | 176,720 | ||||||||||||||||||||||||

| Acquired below-market ground leases, net | 307,537 | 309,495 | 311,452 | 313,410 | 315,368 | ||||||||||||||||||||||||

| Right of use assets | 28,007 | 28,070 | 28,134 | 28,197 | 28,257 | ||||||||||||||||||||||||

| Goodwill | 491,479 | 491,479 | 491,479 | 491,479 | 491,479 | ||||||||||||||||||||||||

| Total assets | $ | 4,106,279 | $ | 4,078,750 | $ | 4,114,380 | $ | 4,510,287 | $ | 4,436,937 | |||||||||||||||||||

| Liabilities and Equity | |||||||||||||||||||||||||||||

| Mortgage notes payable, net | $ | 691,046 | $ | 691,440 | $ | 691,816 | $ | 692,176 | $ | 692,989 | |||||||||||||||||||

| Senior unsecured notes, net | 1,097,498 | 1,097,355 | 1,097,212 | 1,197,061 | 1,196,911 | ||||||||||||||||||||||||

| Unsecured term loan facility, net | 268,959 | 268,883 | 268,807 | 268,731 | 268,655 | ||||||||||||||||||||||||

| Unsecured revolving credit facility | — | — | — | 120,000 | 120,000 | ||||||||||||||||||||||||

| Debt associated with property in receivership | — | — | — | 177,667 | 177,667 | ||||||||||||||||||||||||

| Accrued interest associated with property in receivership | — | — | — | 5,433 | 3,511 | ||||||||||||||||||||||||

| Accounts payable and accrued expenses | 111,732 | 104,315 | 135,298 | 132,016 | 81,443 | ||||||||||||||||||||||||

| Acquired below-market leases, net | 15,875 | 17,081 | 18,306 | 19,497 | 14,702 | ||||||||||||||||||||||||

| Ground lease liabilities | 28,007 | 28,070 | 28,134 | 28,197 | 28,257 | ||||||||||||||||||||||||

| Deferred revenue and other liabilities | 64,191 | 55,343 | 61,888 | 62,639 | 70,766 | ||||||||||||||||||||||||

| Tenants' security deposits | 30,751 | 27,015 | 27,044 | 24,908 | 24,715 | ||||||||||||||||||||||||

| Total liabilities | 2,308,059 | 2,289,502 | 2,328,505 | 2,728,325 | 2,679,616 | ||||||||||||||||||||||||

| Total equity | 1,798,220 | 1,789,248 | 1,785,875 | 1,781,962 | 1,757,321 | ||||||||||||||||||||||||

| Total liabilities and equity | $ | 4,106,279 | $ | 4,078,750 | $ | 4,114,380 | $ | 4,510,287 | $ | 4,436,937 | |||||||||||||||||||

|

Third Quarter 2025 |

||||

| Condensed Consolidated Statements of Operations | |||||

| (unaudited and in thousands, except per share amounts) | |||||

| Three Months Ended | |||||||||||||||||||||||||||||

| September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

|||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||

Rental revenue (1) |

$ | 158,410 | $ | 153,540 | $ | 154,542 | $ | 155,127 | $ | 153,117 | |||||||||||||||||||

| Observatory revenue | 36,037 | 33,899 | 23,161 | 38,275 | 39,382 | ||||||||||||||||||||||||

| Lease termination fees | — | 464 | — | — | 4,771 | ||||||||||||||||||||||||

| Third-party management and other fees | 404 | 408 | 431 | 258 | 271 | ||||||||||||||||||||||||

| Other revenue and fees | 2,879 | 2,939 | 1,932 | 3,942 | 2,058 | ||||||||||||||||||||||||

| Total revenues | 197,730 | 191,250 | 180,066 | 197,602 | 199,599 | ||||||||||||||||||||||||

| Operating expenses | |||||||||||||||||||||||||||||

| Property operating expenses | 46,957 | 44,880 | 45,060 | 46,645 | 45,954 | ||||||||||||||||||||||||

| Ground rent expenses | 2,331 | 2,332 | 2,331 | 2,332 | 2,331 | ||||||||||||||||||||||||

| General and administrative expenses | 18,743 | 18,685 | 16,940 | 17,870 | 18,372 | ||||||||||||||||||||||||

| Observatory expenses | 9,510 | 9,822 | 8,118 | 9,730 | 9,715 | ||||||||||||||||||||||||

| Real estate taxes | 33,241 | 32,607 | 33,050 | 32,720 | 31,982 | ||||||||||||||||||||||||

| Depreciation and amortization | 47,615 | 47,802 | 48,779 | 45,365 | 45,899 | ||||||||||||||||||||||||

| Total operating expenses | 158,397 | 156,128 | 154,278 | 154,662 | 154,253 | ||||||||||||||||||||||||

| Total operating income | 39,333 | 35,122 | 25,788 | 42,940 | 45,346 | ||||||||||||||||||||||||

| Other income (expense) | |||||||||||||||||||||||||||||

| Interest income | 1,146 | 1,867 | 3,786 | 5,068 | 6,960 | ||||||||||||||||||||||||

| Interest expense | (25,189) | (25,126) | (26,938) | (27,380) | (27,408) | ||||||||||||||||||||||||

| Interest expense associated with property in receivership | — | — | (647) | (1,921) | (1,922) | ||||||||||||||||||||||||

| Gain on disposition of property | — | — | 13,170 | 1,237 | 1,262 | ||||||||||||||||||||||||

| Income before income taxes | 15,290 | 11,863 | 15,159 | 19,944 | 24,238 | ||||||||||||||||||||||||

| Income tax (expense) benefit | (1,645) | (478) | 619 | (1,151) | (1,442) | ||||||||||||||||||||||||

| Net income | 13,645 | 11,385 | 15,778 | 18,793 | 22,796 | ||||||||||||||||||||||||

| Net income attributable to noncontrolling interests: | |||||||||||||||||||||||||||||

| Non-controlling interests in the Operating Partnership | (4,610) | (3,815) | (5,508) | (6,575) | (8,205) | ||||||||||||||||||||||||

| Private perpetual preferred unit distributions | (1,050) | (1,051) | (1,050) | (1,050) | (1,050) | ||||||||||||||||||||||||

| Net income attributable to common stockholders | $ | 7,985 | $ | 6,519 | $ | 9,220 | $ | 11,168 | $ | 13,541 | |||||||||||||||||||

| Weighted average common shares outstanding | |||||||||||||||||||||||||||||

| Basic | 169,250 | 168,368 | 167,181 | 166,671 | 164,880 | ||||||||||||||||||||||||

| Diluted | 270,357 | 269,951 | 269,529 | 270,251 | 269,613 | ||||||||||||||||||||||||

| Earnings per share attributable to common stockholders | |||||||||||||||||||||||||||||

| Basic | $ | 0.05 | $ | 0.04 | $ | 0.06 | $ | 0.07 | $ | 0.08 | |||||||||||||||||||

| Diluted | $ | 0.05 | $ | 0.04 | $ | 0.05 | $ | 0.07 | $ | 0.08 | |||||||||||||||||||

| Dividends per share | $ | 0.035 | $ | 0.035 | $ | 0.035 | $ | 0.035 | $ | 0.035 | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Rental Revenue | September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

||||||||||||||||||||||||

| Base rent | $ | 136,371 | $ | 133,987 | $ | 136,096 | $ | 135,629 | $ | 132,492 | |||||||||||||||||||

| Billed tenant expense reimbursement | 22,039 | 19,553 | 18,446 | 19,498 | 20,625 | ||||||||||||||||||||||||

| Total rental revenue | $ | 158,410 | $ | 153,540 | $ | 154,542 | $ | 155,127 | $ | 153,117 | |||||||||||||||||||

|

Third Quarter 2025 |

||||

| FFO, Modified FFO, Core FFO, Core FAD and EBITDA | |||||

| (unaudited and in thousands, except per share amounts) | |||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Reconciliation of Net Income to FFO, Modified FFO, and Core FFO | September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

||||||||||||||||||||||||

| Net Income | $ | 13,645 | $ | 11,385 | $ | 15,778 | $ | 18,793 | $ | 22,796 | |||||||||||||||||||

| Preferred unit distributions | (1,050) | (1,051) | (1,050) | (1,050) | (1,050) | ||||||||||||||||||||||||

| Real estate depreciation and amortization | 46,741 | 46,921 | 47,871 | 44,386 | 44,871 | ||||||||||||||||||||||||

| Gain on disposition of property | — | — | (13,170) | (1,237) | (1,262) | ||||||||||||||||||||||||

| FFO attributable to common stockholders and the Operating Partnership | 59,336 | 57,255 | 49,429 | 60,892 | 65,355 | ||||||||||||||||||||||||

| Amortization of below-market ground lease | 1,957 | 1,958 | 1,958 | 1,958 | 1,958 | ||||||||||||||||||||||||

| Modified FFO attributable to common stockholders and the Operating Partnership | 61,293 | 59,213 | 51,387 | 62,850 | 67,313 | ||||||||||||||||||||||||

| Interest expense associated with property in receivership | — | — | 647 | 1,921 | 1,922 | ||||||||||||||||||||||||

| Core FFO attributable to common stockholders and the Operating Partnership | $ | 61,293 | $ | 59,213 | $ | 52,034 | $ | 64,771 | $ | 69,235 | |||||||||||||||||||

| Total weighted average shares and Operating Partnership units | |||||||||||||||||||||||||||||

| Basic | 266,963 | 266,899 | 267,073 | 264,798 | 264,787 | ||||||||||||||||||||||||

| Diluted | 270,357 | 269,951 | 269,529 | 270,251 | 269,613 | ||||||||||||||||||||||||

| FFO attributable to common stockholders and the Operating Partnership per share and unit | |||||||||||||||||||||||||||||

| Basic | $ | 0.22 | $ | 0.21 | $ | 0.19 | $ | 0.23 | $ | 0.25 | |||||||||||||||||||

| Diluted | $ | 0.22 | $ | 0.21 | $ | 0.18 | $ | 0.23 | $ | 0.24 | |||||||||||||||||||

| Modified FFO attributable to common stockholders and the Operating Partnership per share and unit | |||||||||||||||||||||||||||||

| Basic | $ | 0.23 | $ | 0.22 | $ | 0.19 | $ | 0.24 | $ | 0.25 | |||||||||||||||||||

| Diluted | $ | 0.23 | $ | 0.22 | $ | 0.19 | $ | 0.23 | $ | 0.25 | |||||||||||||||||||

| Core FFO attributable to common stockholders and the Operating Partnership per share and unit | |||||||||||||||||||||||||||||

| Basic | $ | 0.23 | $ | 0.22 | $ | 0.19 | $ | 0.24 | $ | 0.26 | |||||||||||||||||||

| Diluted | $ | 0.23 | $ | 0.22 | $ | 0.19 | $ | 0.24 | $ | 0.26 | |||||||||||||||||||

| Reconciliation of Core FFO to Core FAD | |||||||||||||||||||||||||||||

| Core FFO | $ | 61,293 | $ | 59,213 | $ | 52,034 | $ | 64,771 | $ | 69,235 | |||||||||||||||||||

| Add: | |||||||||||||||||||||||||||||

| Amortization of deferred financing costs | 1,082 | 1,080 | 1,094 | 1,099 | 1,110 | ||||||||||||||||||||||||

| Non-real estate depreciation and amortization | 874 | 880 | 908 | 979 | 1,029 | ||||||||||||||||||||||||

| Amortization of non-cash compensation expense | 6,484 | 6,900 | 4,980 | 6,107 | 5,752 | ||||||||||||||||||||||||

| Amortization of loss on interest rate derivative | 1,385 | 1,386 | 1,386 | 1,386 | 1,386 | ||||||||||||||||||||||||

| Deduct: | |||||||||||||||||||||||||||||

| Straight-line rental revenues, above/below market rent, and other non-cash adjustments | (5,832) | (4,913) | (6,407) | (5,044) | (3,082) | ||||||||||||||||||||||||

| Corporate capital expenditures | (218) | (234) | (83) | (226) | (121) | ||||||||||||||||||||||||

| Tenant improvements - second generation | (15,979) | (36,890) | (39,304) | (45,969) | (17,149) | ||||||||||||||||||||||||

| Building improvements - second generation | (5,571) | (7,868) | (5,770) | (9,377) | (7,838) | ||||||||||||||||||||||||

| Leasing commissions - second generation | (3,144) | (7,605) | (7,629) | (10,769) | (3,753) | ||||||||||||||||||||||||

| Core FAD | $ | 40,374 | $ | 11,949 | $ | 1,209 | $ | 2,957 | $ | 46,569 | |||||||||||||||||||

| Reconciliation of Net Income to EBITDA and Adjusted EBITDA | |||||||||||||||||||||||||||||

| Net income | $ | 13,645 | $ | 11,385 | $ | 15,778 | $ | 18,793 | $ | 22,796 | |||||||||||||||||||

| Interest expense | 25,189 | 25,126 | 26,938 | 27,380 | 27,408 | ||||||||||||||||||||||||

| Interest expense associated with property in receivership | — | — | 647 | 1,921 | 1,922 | ||||||||||||||||||||||||

| Income tax expense (benefit) | 1,645 | 478 | (619) | 1,151 | 1,442 | ||||||||||||||||||||||||

| Depreciation and amortization | 47,615 | 47,802 | 48,779 | 45,365 | 45,899 | ||||||||||||||||||||||||

| EBITDA | 88,094 | 84,791 | 91,523 | 94,610 | 99,467 | ||||||||||||||||||||||||

| Gain on disposition of property | — | — | (13,170) | (1,237) | (1,262) | ||||||||||||||||||||||||

| Adjusted EBITDA | $ | 88,094 | $ | 84,791 | $ | 78,353 | $ | 93,373 | $ | 98,205 | |||||||||||||||||||

|

Third Quarter 2025 |

||||

| Highlights | |||||

| (unaudited and dollars and shares in thousands, except per share amounts) | |||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Office and Retail Metrics: | September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

||||||||||||||||||||||||

Total rentable square footage(1) |

8,603,750 | 8,611,559 | 8,617,292 | 8,616,284 | 8,592,481 | ||||||||||||||||||||||||

Percent occupied (1)(2) |

90.0 | % | 89.2 | % | 87.9 | % | 88.6 | % | 89.1 | % | |||||||||||||||||||

Percent leased (1)(3) |

92.6 | % | 93.1 | % | 92.5 | % | 93.5 | % | 93.4 | % | |||||||||||||||||||

| Same Store Property Cash Net Operating Income (NOI) - excluding lease termination fees: | |||||||||||||||||||||||||||||

| Manhattan office portfolio | $ | 64,715 | $ | 63,589 | $ | 61,548 | $ | 64,110 | $ | 65,069 | |||||||||||||||||||

| Greater New York office portfolio | 1,244 | 1,393 | 1,584 | 1,769 | 1,651 | ||||||||||||||||||||||||

| Retail portfolio | 2,171 | 2,298 | 2,433 | 2,472 | 2,431 | ||||||||||||||||||||||||

| Total Same Store Property Cash NOI | $ | 68,130 | $ | 67,280 | $ | 65,565 | $ | 68,351 | $ | 69,151 | |||||||||||||||||||

| Multifamily Metrics: | |||||||||||||||||||||||||||||

| Multifamily Cash NOI | $ | 5,284 | $ | 5,173 | $ | 4,643 | $ | 4,168 | $ | 4,506 | |||||||||||||||||||

| Total number of units | 743 | 743 | 732 | 732 | 732 | ||||||||||||||||||||||||

| Percent occupied | 98.6 | % | 98.6 | % | 99.0 | % | 98.5 | % | 96.8 | % | |||||||||||||||||||

| Observatory Metrics: | |||||||||||||||||||||||||||||

| Observatory NOI | $ | 26,527 | $ | 24,077 | $ | 15,043 | $ | 28,545 | $ | 29,667 | |||||||||||||||||||

Number of visitors (4) |

648,000 | 629,000 | 428,000 | 718,000 | 727,000 | ||||||||||||||||||||||||

| Change in visitors year-over-year | (10.9) | % | (2.9) | % | (11.8) | % | 1.0 | % | (2.2) | % | |||||||||||||||||||

| Ratios: | |||||||||||||||||||||||||||||

Debt to Total Market Capitalization (5) |

48.2 | % | 46.9 | % | 47.8 | % | 44.0 | % | 42.3 | % | |||||||||||||||||||

Net Debt to Total Market Capitalization (5) |

46.3 | % | 45.8 | % | 45.4 | % | 39.5 | % | 37.5 | % | |||||||||||||||||||

|

Debt and Perpetual Preferred Units to

Total Market Capitalization (5)

|

50.3 | % | 49.0 | % | 49.8 | % | 45.7 | % | 44.0 | % | |||||||||||||||||||

|

Net Debt and Perpetual Preferred Units to

Total Market Capitalization (5)

|

48.5 | % | 47.8 | % | 47.5 | % | 41.4 | % | 39.3 | % | |||||||||||||||||||

Debt to Adjusted EBITDA (6) |

6.0x | 5.8x | 5.8x | 6.4x | 6.4x | ||||||||||||||||||||||||

Net Debt to Adjusted EBITDA (6) |

5.6x | 5.6x | 5.2x | 5.3x | 5.2x | ||||||||||||||||||||||||

Core FFO Payout Ratio (7) |

16 | % | 16 | % | 19 | % | 15 | % | 14 | % | |||||||||||||||||||

| Core FAD Payout Ratio | 24 | % | 82 | % | 805 | % | 324 | % | 21 | % | |||||||||||||||||||

| Core FFO per share - diluted | $ | 0.23 | $ | 0.22 | $ | 0.19 | $ | 0.24 | $ | 0.26 | |||||||||||||||||||

| Diluted weighted average shares | 270,357 | 269,951 | 269,529 | 270,251 | 269,613 | ||||||||||||||||||||||||

| Class A common stock price at quarter end | $ | 7.66 | $ | 8.09 | $ | 7.82 | $ | 10.32 | $ | 11.08 | |||||||||||||||||||

| Dividends declared and paid per share | $ | 0.035 | $ | 0.035 | $ | 0.035 | $ | 0.035 | $ | 0.035 | |||||||||||||||||||

| Dividends per share - annualized | $ | 0.14 | $ | 0.14 | $ | 0.14 | $ | 0.14 | $ | 0.14 | |||||||||||||||||||

Dividend yield (8) |

1.8 | % | 1.7 | % | 1.8 | % | 1.4 | % | 1.3 | % | |||||||||||||||||||

| Series 2014 Private Perpetual Preferred Units outstanding ($16.62 liquidation value) |

1,560 | 1,560 | 1,560 | 1,560 | 1,560 | ||||||||||||||||||||||||

| Series 2019 Private Perpetual Preferred Units outstanding ($13.52 liquidation value) |

4,664 | 4,664 | 4,664 | 4,664 | 4,664 | ||||||||||||||||||||||||

| Class A common stock | 168,970 | 168,301 | 167,094 | 166,405 | 165,507 | ||||||||||||||||||||||||

Class B common stock (9) |

972 | 975 | 976 | 978 | 981 | ||||||||||||||||||||||||

| Operating partnership units | 108,674 | 109,308 | 110,662 | 106,768 | 107,664 | ||||||||||||||||||||||||

|

Total common stock and operating partnership units

outstanding (10)

|

278,616 | 278,584 | 278,732 | 274,151 | 274,152 | ||||||||||||||||||||||||

|

Third Quarter 2025 |

||||

| Property Summary - Same Store NOI | |||||

| (unaudited and dollars in thousands) | |||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||

| September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

September 30, 2025 |

September 30, 2024 |

|||||||||||||||||||||||||||||||||||

Same Store Portfolio(1) |

|||||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 148,211 | $ | 143,776 | $ | 143,916 | $ | 146,969 | $ | 145,501 | $ | 435,903 | $ | 426,411 | |||||||||||||||||||||||||||

| Operating expenses | (77,041) | (74,612) | (74,891) | (76,317) | (75,596) | (226,544) | (215,844) | ||||||||||||||||||||||||||||||||||

| Same store property NOI | 71,170 | 69,164 | 69,025 | 70,652 | 69,905 | 209,359 | 210,567 | ||||||||||||||||||||||||||||||||||

| Straight-line rent | (4,387) | (3,213) | (4,831) | (3,782) | (2,184) | (12,431) | (7,289) | ||||||||||||||||||||||||||||||||||

| Above/below-market rent revenue amortization | (610) | (629) | (587) | (477) | (528) | (1,826) | (1,658) | ||||||||||||||||||||||||||||||||||

| Below-market ground lease amortization | 1,957 | 1,958 | 1,958 | 1,958 | 1,958 | 5,873 | 5,874 | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI - excluding lease termination fees | $ | 68,130 | $ | 67,280 | $ | 65,565 | $ | 68,351 | $ | 69,151 | $ | 200,975 | $ | 207,494 | |||||||||||||||||||||||||||

| Percent change over prior year | (1.5) | % | (5.9) | % | (1.9) | % | (2.9) | % | 5.2 | % | (3.1) | % | 4.6 | % | |||||||||||||||||||||||||||

| Total same store property cash NOI - excluding lease termination fees | $ | 68,130 | $ | 67,280 | $ | 65,565 | $ | 68,351 | $ | 69,151 | $ | 200,975 | $ | 207,494 | |||||||||||||||||||||||||||

| Lease termination fees | — | 464 | — | — | 4,771 | 464 | 4,771 | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI | $ | 68,130 | $ | 67,744 | $ | 65,565 | $ | 68,351 | $ | 73,922 | $ | 201,439 | $ | 212,265 | |||||||||||||||||||||||||||

Same Store Manhattan Office(1),(2) |

|||||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 140,613 | $ | 136,543 | $ | 136,408 | $ | 139,380 | $ | 138,060 | $ | 413,564 | $ | 405,159 | |||||||||||||||||||||||||||

| Operating expenses | (73,102) | (71,336) | (71,598) | (73,062) | (72,287) | (216,036) | (205,933) | ||||||||||||||||||||||||||||||||||

| Same store property NOI | 67,511 | 65,207 | 64,810 | 66,318 | 65,773 | 197,528 | 199,226 | ||||||||||||||||||||||||||||||||||

| Straight-line rent | (4,143) | (2,947) | (4,633) | (3,689) | (2,134) | (11,723) | (7,297) | ||||||||||||||||||||||||||||||||||

| Above/below-market rent revenue amortization | (610) | (629) | (587) | (477) | (528) | (1,826) | (1,658) | ||||||||||||||||||||||||||||||||||

| Below-market ground lease amortization | 1,957 | 1,958 | 1,958 | 1,958 | 1,958 | 5,873 | 5,874 | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI - excluding lease termination fees | 64,715 | 63,589 | 61,548 | 64,110 | 65,069 | 189,852 | 196,145 | ||||||||||||||||||||||||||||||||||

| Lease termination fees | — | 464 | — | — | 4,771 | 464 | 4,771 | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI | $ | 64,715 | $ | 64,053 | $ | 61,548 | $ | 64,110 | $ | 69,840 | $ | 190,316 | $ | 200,916 | |||||||||||||||||||||||||||

Same Store Greater New York Metropolitan Area Office(1) |

|||||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 3,516 | $ | 2,985 | $ | 3,154 | $ | 3,213 | $ | 3,060 | $ | 9,655 | $ | 9,223 | |||||||||||||||||||||||||||

| Operating expenses | (2,214) | (1,551) | (1,606) | (1,572) | (1,612) | (5,371) | (4,862) | ||||||||||||||||||||||||||||||||||

| Same store property NOI | 1,302 | 1,434 | 1,548 | 1,641 | 1,448 | 4,284 | 4,361 | ||||||||||||||||||||||||||||||||||

| Straight-line rent | (58) | (41) | 36 | 128 | 203 | (63) | 498 | ||||||||||||||||||||||||||||||||||

| Above/below-market rent revenue amortization | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Below-market ground lease amortization | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI - excluding lease termination fees | 1,244 | 1,393 | 1,584 | 1,769 | 1,651 | 4,221 | 4,859 | ||||||||||||||||||||||||||||||||||

| Lease termination fees | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI | $ | 1,244 | $ | 1,393 | $ | 1,584 | $ | 1,769 | $ | 1,651 | $ | 4,221 | $ | 4,859 | |||||||||||||||||||||||||||

Same Store Retail(1) |

|||||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 4,082 | $ | 4,248 | $ | 4,354 | $ | 4,376 | $ | 4,381 | $ | 12,684 | $ | 12,029 | |||||||||||||||||||||||||||

| Operating expenses | (1,725) | (1,725) | (1,687) | (1,683) | (1,697) | (5,137) | (5,049) | ||||||||||||||||||||||||||||||||||

| Same store property NOI | 2,357 | 2,523 | 2,667 | 2,693 | 2,684 | 7,547 | 6,980 | ||||||||||||||||||||||||||||||||||

| Straight-line rent | (186) | (225) | (234) | (221) | (253) | (645) | (490) | ||||||||||||||||||||||||||||||||||

| Above/below-market rent revenue amortization | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Below-market ground lease amortization | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI - excluding lease termination fees | 2,171 | 2,298 | 2,433 | 2,472 | 2,431 | 6,902 | 6,490 | ||||||||||||||||||||||||||||||||||

| Lease termination fees | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total same store property cash NOI | $ | 2,171 | $ | 2,298 | $ | 2,433 | $ | 2,472 | $ | 2,431 | $ | 6,902 | $ | 6,490 | |||||||||||||||||||||||||||

|

Third Quarter 2025 |

||||

| Same Store NOI | |||||

| (unaudited and dollars in thousands) | |||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||

| Reconciliation of Net Income to Cash NOI and Same Store Cash NOI | September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

September 30, 2025 |

September 30, 2024 |

||||||||||||||||||||||||||||||||||

| Net income | $ | 13,645 | $ | 11,385 | $ | 15,778 | $ | 18,793 | $ | 22,796 | $ | 40,808 | $ | 61,566 | |||||||||||||||||||||||||||

| Add: | |||||||||||||||||||||||||||||||||||||||||

| General and administrative expenses | 18,743 | 18,685 | 16,940 | 17,870 | 18,372 | 54,368 | 52,364 | ||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 47,615 | 47,802 | 48,779 | 45,365 | 45,899 | 144,196 | 139,453 | ||||||||||||||||||||||||||||||||||

| Interest expense | 25,189 | 25,126 | 26,938 | 27,380 | 27,408 | 77,253 | 77,859 | ||||||||||||||||||||||||||||||||||

| Interest expense associated with property in receivership | — | — | 647 | 1,921 | 1,922 | 647 | 2,550 | ||||||||||||||||||||||||||||||||||

| Loss on early extinguishment of debt | — | — | — | — | — | — | 553 | ||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 1,645 | 478 | (619) | 1,151 | 1,442 | 1,504 | 1,537 | ||||||||||||||||||||||||||||||||||

| Less: | |||||||||||||||||||||||||||||||||||||||||

| Gain on disposition of property | — | — | (13,170) | (1,237) | (1,262) | (13,170) | (12,065) | ||||||||||||||||||||||||||||||||||

| Third-party management and other fees | (404) | (408) | (431) | (258) | (271) | (1,243) | (912) | ||||||||||||||||||||||||||||||||||

| Interest income | (1,146) | (1,867) | (3,786) | (5,068) | (6,960) | (6,799) | (16,230) | ||||||||||||||||||||||||||||||||||

| Net operating income | 105,287 | 101,201 | 91,076 | 105,917 | 109,346 | 297,564 | 306,675 | ||||||||||||||||||||||||||||||||||

| Straight-line rent | (4,688) | (3,748) | (5,283) | (4,045) | (2,277) | (13,719) | (7,238) | ||||||||||||||||||||||||||||||||||

| Above/below-market rent revenue amortization | (821) | (840) | (798) | (674) | (476) | (2,459) | (1,503) | ||||||||||||||||||||||||||||||||||

| Below-market ground lease amortization | 1,957 | 1,958 | 1,958 | 1,958 | 1,958 | 5,873 | 5,874 | ||||||||||||||||||||||||||||||||||

| Total cash NOI - including Observatory and lease termination fees | 101,735 | 98,571 | 86,953 | 103,156 | 108,551 | 287,259 | 303,808 | ||||||||||||||||||||||||||||||||||

| Less: Observatory NOI | (26,527) | (24,077) | (15,043) | (28,545) | (29,667) | (65,647) | (70,998) | ||||||||||||||||||||||||||||||||||

| Less: cash NOI from non-Same Store properties | (7,078) | (6,750) | (6,345) | (6,260) | (4,962) | (20,173) | (20,545) | ||||||||||||||||||||||||||||||||||

| Total Same Store property cash NOI - including lease termination fees | 68,130 | 67,744 | 65,565 | 68,351 | 73,922 | 201,439 | 212,265 | ||||||||||||||||||||||||||||||||||

| Less: Lease termination fees | — | (464) | — | — | (4,771) | (464) | (4,771) | ||||||||||||||||||||||||||||||||||

| Total Same Store property cash NOI - excluding Observatory and lease termination fees | $ | 68,130 | $ | 67,280 | $ | 65,565 | $ | 68,351 | $ | 69,151 | $ | 200,975 | $ | 207,494 | |||||||||||||||||||||||||||

| Multifamily NOI | |||||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 10,080 | $ | 9,846 | $ | 9,646 | $ | 9,322 | $ | 9,140 | $ | 29,572 | $ | 26,773 | |||||||||||||||||||||||||||

| Operating expenses | (4,786) | (4,665) | (4,993) | (5,145) | (4,623) | (14,444) | (13,410) | ||||||||||||||||||||||||||||||||||

| NOI | 5,294 | 5,181 | 4,653 | 4,177 | 4,517 | 15,128 | 13,363 | ||||||||||||||||||||||||||||||||||

| Straight-line rent | (68) | (67) | (67) | (67) | (69) | (202) | (280) | ||||||||||||||||||||||||||||||||||

| Above/below-market rent revenue amortization | 58 | 59 | 57 | 58 | 58 | 174 | 173 | ||||||||||||||||||||||||||||||||||

| Cash NOI | $ | 5,284 | $ | 5,173 | $ | 4,643 | $ | 4,168 | $ | 4,506 | $ | 15,100 | $ | 13,256 | |||||||||||||||||||||||||||

|

Third Quarter 2025 |

||||

| Property Summary - Leasing Activity by Quarter | |||||

| (unaudited) | |||||

| Three Months Ended | |||||||||||||||||||||||||||||

| September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

|||||||||||||||||||||||||

Total Office and Retail Portfolio(1) |

|||||||||||||||||||||||||||||

| Total leases executed | 16 | 22 | 20 | 20 | 31 | ||||||||||||||||||||||||

| Weighted average lease term | 8.1 years | 9.9 years | 8.4 years | 8.0 years | 7.0 years | ||||||||||||||||||||||||

| Average free rent period | 6.0 months | 7.6 months | 7.8 months | 5.7 months | 5.2 months | ||||||||||||||||||||||||

| Office | |||||||||||||||||||||||||||||

| Total square footage executed | 71,859 | 221,776 | 229,367 | 378,913 | 291,418 | ||||||||||||||||||||||||

| Average starting cash rent psf - leases executed | $ | 69.97 | $ | 71.21 | $ | 66.43 | $ | 78.40 | $ | 70.11 | |||||||||||||||||||

| Previously escalated cash rents psf | $ | 67.33 | $ | 63.50 | $ | 60.63 | $ | 71.03 | $ | 68.34 | |||||||||||||||||||

| Percentage of new cash rent over previously escalated rents | 3.9 | % | 12.1 | % | 9.6 | % | 10.4 | % | 2.6 | % | |||||||||||||||||||

| Retail | |||||||||||||||||||||||||||||

| Total square footage executed | 16,021 | 10,332 | 1,181 | — | 12,792 | ||||||||||||||||||||||||

| Average starting cash rent psf - leases executed | $ | 128.33 | $ | 268.92 | $ | 193.00 | $ | — | $ | 203.88 | |||||||||||||||||||

| Previously escalated cash rents psf | $ | 145.48 | $ | 316.28 | $ | 183.74 | $ | — | $ | 332.35 | |||||||||||||||||||

| Percentage of new cash rent over previously escalated rents | (11.8) | % | (15.0) | % | 5.0 | % | — | (38.7) | % | ||||||||||||||||||||

| Total Office and Retail Portfolio | |||||||||||||||||||||||||||||

| Total square footage executed | 87,880 | 232,108 | 230,548 | 378,913 | 304,210 | ||||||||||||||||||||||||

| Average starting cash rent psf - leases executed | $ | 80.61 | $ | 80.01 | $ | 67.08 | $ | 78.40 | $ | 75.74 | |||||||||||||||||||

| Previously escalated cash rents psf | $ | 81.57 | $ | 74.75 | $ | 61.27 | $ | 71.03 | $ | 79.44 | |||||||||||||||||||

| Percentage of new cash rent over previously escalated rents | (1.2) | % | 7.0 | % | 9.5 | % | 10.4 | % | (4.7) | % | |||||||||||||||||||

| Leasing commission costs per square foot | $ | 33.24 | $ | 31.62 | $ | 22.39 | $ | 21.73 | $ | 19.67 | |||||||||||||||||||

| Tenant improvement costs per square foot | 59.60 | 86.85 | 47.92 | 49.46 | 42.90 | ||||||||||||||||||||||||

Total LC and TI per square foot(2) |

$ | 92.84 | $ | 118.47 | $ | 70.31 | $ | 71.19 | $ | 62.57 | |||||||||||||||||||

| Total LC and TI per square foot per year of weighted average lease term | $ | 11.48 | $ | 11.93 | $ | 8.34 | $ | 8.89 | $ | 8.94 | |||||||||||||||||||

Occupancy(3),(4) |

90.0 | % | 89.2 | % | 87.9 | % | 88.6 | % | 89.1 | % | |||||||||||||||||||

| Manhattan Office Portfolio | |||||||||||||||||||||||||||||

| Total leases executed | 14 | 18 | 18 | 18 | 25 | ||||||||||||||||||||||||

| Office - New Leases | |||||||||||||||||||||||||||||

| Total square footage executed | 26,430 | 202,499 | 43,184 | 184,258 | 130,688 | ||||||||||||||||||||||||

| Average starting cash rent psf - leases executed | $ | 68.56 | $ | 72.28 | $ | 69.13 | $ | 71.07 | $ | 66.07 | |||||||||||||||||||

| Previously escalated cash rents psf | $ | 67.69 | $ | 63.11 | $ | 66.77 | $ | 59.54 | $ | 63.21 | |||||||||||||||||||

| Percentage of new cash rent over previously escalated rents | 1.3 | % | 14.5 | % | 3.5 | % | 19.4 | % | 4.5 | % | |||||||||||||||||||

Office - Renewal Leases(1) |

|||||||||||||||||||||||||||||

| Current Renewals | 30,907 | 19,277 | 177,328 | 10,178 | 53,622 | ||||||||||||||||||||||||

| Early Renewals | 14,522 | — | — | 172,286 | 105,019 | ||||||||||||||||||||||||

| Total square footage executed | 45,429 | 19,277 | 177,328 | 182,464 | 158,641 | ||||||||||||||||||||||||

| Average starting cash rent psf - leases executed | $ | 70.80 | $ | 59.97 | $ | 66.62 | $ | 86.98 | $ | 73.11 | |||||||||||||||||||

| Previously escalated cash rents psf | $ | 67.11 | $ | 67.51 | $ | 59.35 | $ | 83.14 | $ | 72.24 | |||||||||||||||||||

| Percentage of new cash rent over previously escalated rents | 5.5 | % | (11.2) | % | 12.3 | % | 4.6 | % | 1.2 | % | |||||||||||||||||||

| Total Manhattan Office Portfolio | |||||||||||||||||||||||||||||

| Total square footage executed | 71,859 | 221,776 | 220,512 | 366,722 | 289,329 | ||||||||||||||||||||||||

| Average starting cash rent psf - leases executed | $ | 69.97 | $ | 71.21 | $ | 67.11 | $ | 78.99 | $ | 69.93 | |||||||||||||||||||

| Previously escalated cash rents psf | $ | 67.33 | $ | 63.50 | $ | 60.80 | $ | 71.28 | $ | 68.16 | |||||||||||||||||||

| Percentage of new cash rent over previously escalated rents | 3.9 | % | 12.1 | % | 10.4 | % | 10.8 | % | 2.6 | % | |||||||||||||||||||

| Leasing commission costs per square foot | $ | 20.16 | $ | 28.97 | $ | 22.47 | $ | 21.85 | $ | 17.40 | |||||||||||||||||||

| Tenant improvement costs per square foot | 47.79 | 89.60 | 49.50 | 47.96 | 42.82 | ||||||||||||||||||||||||

Total LC and TI per square foot(2) |

$ | 67.95 | $ | 118.57 | $ | 71.97 | $ | 69.81 | $ | 60.22 | |||||||||||||||||||

| Total LC and TI per square foot per year of weighted average lease term | $ | 10.76 | $ | 11.79 | $ | 8.41 | $ | 8.66 | $ | 8.67 | |||||||||||||||||||

Occupancy(3) |

90.3 | % | 89.5 | % | 88.1 | % | 89.0 | % | 89.6 | % | |||||||||||||||||||

|

Third Quarter 2025 |

||||

| Property Summary - Leasing Activity by Quarter - (Continued) | |||||

| (unaudited) | |||||

| Three Months Ended | |||||||||||||||||||||||||||||

| September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

|||||||||||||||||||||||||

| Retail Portfolio | |||||||||||||||||||||||||||||

| Total leases executed | 2 | 4 | 1 | — | 5 | ||||||||||||||||||||||||

| Total square footage executed | 16,021 | 10,332 | 1,181 | — | 12,792 | ||||||||||||||||||||||||

| Average starting cash rent psf - leases executed | $ | 128.33 | $ | 268.92 | $ | 193.00 | $ | — | $ | 203.88 | |||||||||||||||||||

| Previously escalated cash rents psf | $ | 145.48 | $ | 316.28 | $ | 183.74 | $ | — | $ | 332.35 | |||||||||||||||||||

| Percentage of new cash rent over previously escalated rents | (11.8) | % | (15.0) | % | 5.0 | % | — | (38.7) | % | ||||||||||||||||||||

| Leasing commission costs per square foot | $ | 91.92 | $ | 88.59 | $ | 63.04 | $ | — | $ | 74.25 | |||||||||||||||||||

| Tenant improvement costs per square foot | 112.59 | 27.88 | — | — | 51.72 | ||||||||||||||||||||||||

Total LC and TI per square foot(2) |

$ | 204.51 | $ | 116.47 | $ | 63.04 | $ | — | $ | 125.97 | |||||||||||||||||||

| Total LC and TI per square foot per year of weighted average lease term | $ | 12.74 | $ | 16.15 | $ | 6.25 | $ | — | $ | 14.73 | |||||||||||||||||||

Occupancy(3),(4) |

92.8 | % | 91.7 | % | 91.2 | % | 90.4 | % | 91.1 | % | |||||||||||||||||||

| Multifamily Portfolio | |||||||||||||||||||||||||||||

| Percent occupied | 98.6 | % | 98.6 | % | 99.0 | % | 98.5 | % | 96.8 | % | |||||||||||||||||||

| Total number of units | 743 | 743 | 732 | 732 | 732 | ||||||||||||||||||||||||

|

Third Quarter 2025 |

||||

| Commercial Property Detail | |||||

| (unaudited) | |||||

| Property Name | Location or Sub-Market | Rentable Square Feet (1) |

Percent Occupied (2),(3) |

Percent Leased (3),(4) |

Annualized Rent (5) |

Annualized Rent per Occupied Square Foot (6) |

Number of Leases (7) |

||||||||||||||||||||||||||||||||||

| Office - Manhattan | |||||||||||||||||||||||||||||||||||||||||

| The Empire State Building | Penn Station -Times Sq. South | 2,711,335 | 91.3 | % | 95.9 | % | $ | 169,632,539 | $ | 69.15 | 144 | ||||||||||||||||||||||||||||||

| One Grand Central Place | Grand Central | 1,224,687 | 87.2 | % | 93.7 | % | 68,290,259 | 64.18 | 124 | ||||||||||||||||||||||||||||||||

1400 Broadway (8) |

Penn Station -Times Sq. South | 917,281 | 94.5 | % | 94.5 | % | 54,992,292 | 63.50 | 18 | ||||||||||||||||||||||||||||||||

111 West 33rd Street (9) |

Penn Station -Times Sq. South | 639,595 | 94.3 | % | 94.3 | % | 42,729,471 | 70.87 | 22 | ||||||||||||||||||||||||||||||||

| 250 West 57th Street | Columbus Circle - West Side | 476,831 | 82.9 | % | 82.9 | % | 28,114,437 | 71.24 | 29 | ||||||||||||||||||||||||||||||||

| 1359 Broadway | Penn Station -Times Sq. South | 456,634 | 86.0 | % | 86.0 | % | 23,469,839 | 59.79 | 28 | ||||||||||||||||||||||||||||||||

| 501 Seventh Avenue | Penn Station -Times Sq. South | 455,432 | 89.2 | % | 89.2 | % | 22,538,410 | 55.52 | 15 | ||||||||||||||||||||||||||||||||

1350 Broadway (10) |

Penn Station -Times Sq. South | 384,128 | 93.6 | % | 95.4 | % | 22,757,995 | 63.53 | 48 | ||||||||||||||||||||||||||||||||

| 1333 Broadway | Penn Station -Times Sq. South | 297,126 | 89.8 | % | 89.8 | % | 15,462,025 | 57.97 | 11 | ||||||||||||||||||||||||||||||||

| Office - Manhattan | 7,563,049 | 90.3 | % | 93.1 | % | 447,987,267 | 65.84 | 439 | |||||||||||||||||||||||||||||||||

| Office - Greater New York Metropolitan Area | |||||||||||||||||||||||||||||||||||||||||

| Metro Center | Stamford, CT | 282,176 | 72.3 | % | 72.3 | % | 11,903,524 | 58.36 | 20 | ||||||||||||||||||||||||||||||||

| Office - Greater New York Metropolitan Area | 282,176 | 72.3 | % | 72.3 | % | 11,903,524 | 58.36 | 20 | |||||||||||||||||||||||||||||||||

| Total/Weighted Average Office Properties | 7,845,225 | 89.7 | % | 92.4 | % | 459,890,791 | 65.62 | 459 | |||||||||||||||||||||||||||||||||

| Retail Properties | |||||||||||||||||||||||||||||||||||||||||

112 West 34th Street (9) |

Penn Station -Times Sq. South | 93,057 | 100.0 | % | 100.0 | % | 25,256,270 | 271.41 | 4 | ||||||||||||||||||||||||||||||||

| The Empire State Building | Penn Station -Times Sq. South | 88,143 | 79.0 | % | 79.0 | % | 8,064,475 | 115.80 | 12 | ||||||||||||||||||||||||||||||||

North Sixth Street Collection (11) |

Williamsburg - Brooklyn | 87,355 | 91.2 | % | 91.2 | % | 11,300,830 | 141.82 | 16 | ||||||||||||||||||||||||||||||||

| One Grand Central Place | Grand Central | 70,810 | 79.6 | % | 100.0 | % | 6,916,328 | 122.67 | 11 | ||||||||||||||||||||||||||||||||

| 1333 Broadway | Penn Station -Times Sq. South | 67,001 | 100.0 | % | 100.0 | % | 10,305,521 | 153.81 | 4 | ||||||||||||||||||||||||||||||||

| 250 West 57th Street | Columbus Circle - West Side | 63,443 | 93.2 | % | 93.2 | % | 8,608,308 | 145.65 | 6 | ||||||||||||||||||||||||||||||||

| 1542 Third Avenue | Upper East Side | 58,161 | 100.0 | % | 100.0 | % | 3,093,298 | 53.19 | 4 | ||||||||||||||||||||||||||||||||

| 10 Union Square | Union Square | 58,049 | 88.2 | % | 88.2 | % | 7,962,960 | 155.51 | 8 | ||||||||||||||||||||||||||||||||

| 1359 Broadway | Penn Station -Times Sq. South | 29,247 | 99.4 | % | 99.4 | % | 2,250,533 | 77.39 | 5 | ||||||||||||||||||||||||||||||||

| 1010 Third Avenue | Upper East Side | 28,243 | 100.0 | % | 100.0 | % | 3,077,783 | 108.98 | 1 | ||||||||||||||||||||||||||||||||

| 501 Seventh Avenue | Penn Station -Times Sq. South | 27,213 | 89.4 | % | 89.4 | % | 1,592,710 | 65.48 | 8 | ||||||||||||||||||||||||||||||||

| 77 West 55th Street | Midtown | 25,388 | 100.0 | % | 100.0 | % | 2,112,538 | 83.21 | 3 | ||||||||||||||||||||||||||||||||

1350 Broadway (10) |

Penn Station -Times Sq. South | 19,511 | 100.0 | % | 100.0 | % | 4,140,068 | 212.19 | 6 | ||||||||||||||||||||||||||||||||

1400 Broadway (8) |

Penn Station -Times Sq. South | 17,017 | 100.0 | % | 100.0 | % | 2,078,326 | 122.13 | 7 | ||||||||||||||||||||||||||||||||

| 561 10th Avenue | Hudson Yards | 11,822 | 100.0 | % | 100.0 | % | 1,626,620 | 137.59 | 2 | ||||||||||||||||||||||||||||||||

| 298 Mulberry Street | NoHo | 10,365 | 100.0 | % | 100.0 | % | 1,986,316 | 191.64 | 1 | ||||||||||||||||||||||||||||||||

| 345 East 94th Street | Upper East Side | 3,700 | 100.0 | % | 100.0 | % | 261,359 | 70.64 | 1 | ||||||||||||||||||||||||||||||||

| Total/Weighted Average Retail Properties | 758,525 | 92.8 | % | 94.7 | % | 100,634,243 | 143.01 | 99 | |||||||||||||||||||||||||||||||||

| Portfolio Total | 8,603,750 | 90.0 | % | 92.6 | % | $ | 560,525,034 | $ | 72.68 | 558 | |||||||||||||||||||||||||||||||

|

Third Quarter 2025 |

||||

| Total Portfolio Expirations and Vacates Summary | |||||

| (unaudited and in square feet) | |||||

| Actual | Forecast (1) |

Forecast (1) |

|||||||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||

Total Office and Retail Portfolio (2) |

September 30, 2025 |

December 31, 2025 |

March 31, 2026 |

June 30, 2026 |

September 30, 2026 |

December 31, 2026 |

Full Year 2026 | ||||||||||||||||||||||||||||||||||

| Total expirations | 59,360 | 186,516 | 143,591 | 32,122 | 109,224 | 227,041 | 511,978 | ||||||||||||||||||||||||||||||||||

| Less: broadcasting | (511) | (906) | — | — | (511) | — | (511) | ||||||||||||||||||||||||||||||||||

| Office and retail expirations | 58,849 | 185,610 | 143,591 | 32,122 | 108,713 | 227,041 | 511,467 | ||||||||||||||||||||||||||||||||||

Renewals & relocations (3) |

15,615 | 13,046 | 50,806 | 3,859 | 42,024 | 12,539 | 109,228 | ||||||||||||||||||||||||||||||||||

New leases (4) |

— | 133,458 | 11,455 | — | — | 16,321 | 27,776 | ||||||||||||||||||||||||||||||||||

Vacates (5) |

43,234 | 38,753 | 73,588 | 28,263 | 52,868 | 133,066 | 287,785 | ||||||||||||||||||||||||||||||||||

Unknown (6) |

— | 353 | 7,742 | — | 13,821 | 65,115 | 86,678 | ||||||||||||||||||||||||||||||||||

| Total Office and Retail Portfolio expirations and vacates | 58,849 | 185,610 | 143,591 | 32,122 | 108,713 | 227,041 | 511,467 | ||||||||||||||||||||||||||||||||||

| Manhattan Office Portfolio | |||||||||||||||||||||||||||||||||||||||||

| Total expirations | 54,281 | 185,049 | 138,153 | 32,122 | 74,305 | 176,993 | 421,573 | ||||||||||||||||||||||||||||||||||

| Less: broadcasting | (511) | (906) | — | — | (511) | — | (511) | ||||||||||||||||||||||||||||||||||

| Office and retail expirations | 53,770 | 184,143 | 138,153 | 32,122 | 73,794 | 176,993 | 421,062 | ||||||||||||||||||||||||||||||||||

Renewals & relocations (3) |

15,615 | 13,046 | 50,806 | 3,859 | 41,533 | 10,868 | 107,066 | ||||||||||||||||||||||||||||||||||

New leases (4) |

— | 133,458 | 11,455 | — | — | 16,321 | 27,776 | ||||||||||||||||||||||||||||||||||

Vacates (5) |

38,155 | 37,639 | 68,150 | 28,263 | 18,440 | 133,066 | 247,919 | ||||||||||||||||||||||||||||||||||

Unknown (6) |

— | — | 7,742 | — | 13,821 | 16,738 | 38,301 | ||||||||||||||||||||||||||||||||||

| Total expirations and vacates | 53,770 | 184,143 | 138,153 | 32,122 | 73,794 | 176,993 | 421,062 | ||||||||||||||||||||||||||||||||||

| Greater New York Metropolitan Area Office Portfolio | |||||||||||||||||||||||||||||||||||||||||

| Office expirations | 5,079 | — | — | — | 23,268 | — | 23,268 | ||||||||||||||||||||||||||||||||||

Renewals & relocations (3) |

— | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

New leases (4) |

— | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

Vacates (5) |

5,079 | — | — | — | 23,268 | — | 23,268 | ||||||||||||||||||||||||||||||||||

Unknown (6) |

— | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total expirations and vacates | 5,079 | — | — | — | 23,268 | — | 23,268 | ||||||||||||||||||||||||||||||||||

| Retail Portfolio | |||||||||||||||||||||||||||||||||||||||||

| Office expirations | — | 1,467 | 5,438 | — | 11,651 | 50,048 | 67,137 | ||||||||||||||||||||||||||||||||||

Renewals & relocations (3) |

— | — | — | — | 491 | 1,671 | 2,162 | ||||||||||||||||||||||||||||||||||

New leases (4) |

— | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

Vacates (5) |

— | 1,114 | 5,438 | — | 11,160 | — | 16,598 | ||||||||||||||||||||||||||||||||||

Unknown (6) |

— | 353 | — | — | — | 48,377 | 48,377 | ||||||||||||||||||||||||||||||||||

| Total expirations and vacates | — | 1,467 | 5,438 | — | 11,651 | 50,048 | 67,137 | ||||||||||||||||||||||||||||||||||

|

Third Quarter 2025 |

||||

| Tenant Lease Expirations | |||||

| (unaudited) | |||||

| Total Office and Retail Lease Expirations | Number of Leases Expiring(1) |

Rentable Square Feet Expiring(2) |

Percent of Portfolio Rentable Square Feet Expiring | Annualized Rent(3) |

Percent of Annualized Rent | Annualized Rent Per Rentable Square Foot | |||||||||||||||||||||||||||||

| Available | — | 670,147 | 7.8 | % | $ | — | — | % | $ | — | |||||||||||||||||||||||||

| Signed leases not commenced | 15 | 221,593 | 2.6 | % | — | — | % | — | |||||||||||||||||||||||||||

3Q 2025(4) |

5 | 19,423 | 0.2 | % | 1,239,070 | 0.2 | % | 63.79 | |||||||||||||||||||||||||||

| 4Q 2025 | 15 | 185,590 | 2.2 | % | 12,120,435 | 2.2 | % | 65.31 | |||||||||||||||||||||||||||

| Total 2025 | 20 | 205,013 | 2.4 | % | 13,359,505 | 2.4 | % | 65.16 | |||||||||||||||||||||||||||

| 1Q 2026 | 14 | 143,591 | 1.7 | % | 8,918,368 | 1.6 | % | 62.11 | |||||||||||||||||||||||||||

| 2Q 2026 | 7 | 32,122 | 0.4 | % | 1,993,327 | 0.4 | % | 62.05 | |||||||||||||||||||||||||||

| 3Q 2026 | 19 | 109,224 | 1.3 | % | 6,805,024 | 1.2 | % | 62.30 | |||||||||||||||||||||||||||

| 4Q 2026 | 21 | 227,041 | 2.6 | % | 12,175,916 | 2.2 | % | 53.63 | |||||||||||||||||||||||||||

| Total 2026 | 61 | 511,978 | 6.0 | % | 29,892,635 | 5.4 | % | 58.39 | |||||||||||||||||||||||||||

| 2027 | 87 | 707,766 | 8.2 | % | 47,950,004 | 8.6 | % | 67.75 | |||||||||||||||||||||||||||

| 2028 | 62 | 868,524 | 10.1 | % | 52,901,567 | 9.4 | % | 60.91 | |||||||||||||||||||||||||||

| 2029 | 67 | 790,106 | 9.2 | % | 68,389,913 | 12.2 | % | 86.56 | |||||||||||||||||||||||||||

| 2030 | 61 | 786,711 | 9.1 | % | 59,638,049 | 10.6 | % | 75.81 | |||||||||||||||||||||||||||

| 2031 | 38 | 250,288 | 2.9 | % | 27,699,144 | 4.9 | % | 110.67 | |||||||||||||||||||||||||||

| 2032 | 31 | 388,724 | 4.5 | % | 29,373,989 | 5.2 | % | 75.57 | |||||||||||||||||||||||||||

| 2033 | 37 | 326,415 | 3.8 | % | 24,682,056 | 4.4 | % | 75.62 | |||||||||||||||||||||||||||

| 2034 | 23 | 370,764 | 4.3 | % | 27,764,941 | 5.0 | % | 74.89 | |||||||||||||||||||||||||||

| 2035 | 25 | 473,508 | 5.5 | % | 32,929,648 | 5.9 | % | 69.54 | |||||||||||||||||||||||||||

| Thereafter | 46 | 2,032,213 | 23.6 | % | 145,943,583 | 26.0 | % | 71.82 | |||||||||||||||||||||||||||

| Total | 573 | 8,603,750 | 100.0 | % | $ | 560,525,034 | 100.0 | % | $ | 72.68 | |||||||||||||||||||||||||

Manhattan Office Properties(5) |

|||||||||||||||||||||||||||||||||||

| Available | — | 551,507 | 7.3 | % | $ | — | — | % | $ | — | |||||||||||||||||||||||||

| Signed leases not commenced | 14 | 207,163 | 2.7 | % | — | — | % | — | |||||||||||||||||||||||||||

3Q 2025(4) |

5 | 19,423 | 0.3 | % | 1,239,070 | 0.3 | % | 63.79 | |||||||||||||||||||||||||||

| 4Q 2025 | 13 | 184,123 | 2.4 | % | 12,005,811 | 2.7 | % | 65.21 | |||||||||||||||||||||||||||

| Total 2025 | 18 | 203,546 | 2.7 | % | 13,244,881 | 3.0 | % | 65.07 | |||||||||||||||||||||||||||

| 1Q 2026 | 13 | 138,153 | 1.8 | % | 8,518,368 | 1.9 | % | 61.66 | |||||||||||||||||||||||||||

| 2Q 2026 | 7 | 32,122 | 0.4 | % | 1,993,327 | 0.4 | % | 62.05 | |||||||||||||||||||||||||||

| 3Q 2026 | 15 | 74,305 | 1.0 | % | 4,539,380 | 1.0 | % | 61.09 | |||||||||||||||||||||||||||

| 4Q 2026 | 19 | 176,993 | 2.3 | % | 10,988,835 | 2.5 | % | 62.09 | |||||||||||||||||||||||||||

| Total 2026 | 54 | 421,573 | 5.5 | % | 26,039,910 | 5.8 | % | 61.77 | |||||||||||||||||||||||||||

| 2027 | 77 | 626,215 | 8.3 | % | 38,508,279 | 8.6 | % | 61.49 | |||||||||||||||||||||||||||

| 2028 | 56 | 845,634 | 11.2 | % | 50,422,065 | 11.3 | % | 59.63 | |||||||||||||||||||||||||||

| 2029 | 53 | 653,047 | 8.6 | % | 43,151,129 | 9.6 | % | 66.08 | |||||||||||||||||||||||||||

| 2030 | 44 | 666,742 | 8.8 | % | 45,163,387 | 10.1 | % | 67.74 | |||||||||||||||||||||||||||

| 2031 | 26 | 160,544 | 2.1 | % | 11,716,975 | 2.6 | % | 72.98 | |||||||||||||||||||||||||||

| 2032 | 23 | 344,120 | 4.6 | % | 25,219,550 | 5.6 | % | 73.29 | |||||||||||||||||||||||||||

| 2033 | 22 | 218,722 | 2.9 | % | 14,083,014 | 3.1 | % | 64.39 | |||||||||||||||||||||||||||

| 2034 | 16 | 343,694 | 4.5 | % | 24,196,728 | 5.4 | % | 70.40 | |||||||||||||||||||||||||||

| 2035 | 20 | 458,489 | 6.1 | % | 31,420,015 | 7.0 | % | 68.53 | |||||||||||||||||||||||||||

| Thereafter | 30 | 1,862,053 | 24.7 | % | 124,821,334 | 27.9 | % | 67.03 | |||||||||||||||||||||||||||

| Total Manhattan office properties | 453 | 7,563,049 | 100.0 | % | $ | 447,987,267 | 100.0 | % | $ | 65.84 | |||||||||||||||||||||||||

|

Third Quarter 2025 |

||||

| Tenant Lease Expirations | |||||

| (unaudited) | |||||

|

Greater New York Metropolitan

Area Office Portfolio

|

Number of Leases Expiring(1) |

Rentable Square Feet Expiring(2) |

Percent of Portfolio Rentable Square Feet Expiring | Annualized Rent(3) |

Percent of Annualized Rent | Annualized Rent Per Rentable Square Foot | |||||||||||||||||||||||||||||

| Available | — | 78,226 | 27.7 | % | $ | — | — | % | $ | — | |||||||||||||||||||||||||

| Signed leases not commenced | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

3Q 2025(4) |

— | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| 4Q 2025 | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| Total 2025 | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| 1Q 2026 | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| 2Q 2026 | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| 3Q 2026 | 1 | 23,268 | 8.2 | % | 1,471,503 | 12.4 | % | 63.24 | |||||||||||||||||||||||||||

| 4Q 2026 | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| Total 2026 | 1 | 23,268 | 8.2 | % | 1,471,503 | 12.4 | % | 63.24 | |||||||||||||||||||||||||||

| 2027 | 4 | 21,546 | 7.6 | % | 1,264,659 | 10.6 | % | 58.70 | |||||||||||||||||||||||||||

| 2028 | 2 | 11,480 | 4.1 | % | 662,232 | 5.6 | % | 57.69 | |||||||||||||||||||||||||||

| 2029 | 3 | 12,208 | 4.3 | % | 731,372 | 6.1 | % | 59.91 | |||||||||||||||||||||||||||

| 2030 | 5 | 42,827 | 15.2 | % | 2,525,635 | 21.2 | % | 58.97 | |||||||||||||||||||||||||||

| 2031 | 1 | 15,030 | 5.3 | % | 879,672 | 7.4 | % | 58.53 | |||||||||||||||||||||||||||

2032(6) |

2 | 7,281 | 2.6 | % | 381,961 | 3.2 | % | 52.46 | |||||||||||||||||||||||||||

| 2033 | 1 | 63,173 | 22.4 | % | 3,618,934 | 30.4 | % | 57.29 | |||||||||||||||||||||||||||

| 2034 | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| 2035 | 1 | 7,137 | 2.6 | % | 367,556 | 3.1 | % | 51.50 | |||||||||||||||||||||||||||

| Thereafter | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| Total greater New York metropolitan area office portfolio | 20 | 282,176 | 100.0 | % | $ | 11,903,524 | 100.0 | % | $ | 58.36 | |||||||||||||||||||||||||

| Retail Properties | |||||||||||||||||||||||||||||||||||

| Available | — | 40,414 | 5.3 | % | $ | — | — | % | $ | — | |||||||||||||||||||||||||

| Signed leases not commenced | 1 | 14,430 | 1.9 | % | — | — | % | — | |||||||||||||||||||||||||||

3Q 2025(4) |

— | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| 4Q 2025 | 2 | 1,467 | 0.2 | % | 114,624 | 0.1 | % | 78.13 | |||||||||||||||||||||||||||

| Total 2025 | 2 | 1,467 | 0.2 | % | 114,624 | 0.1 | % | 78.13 | |||||||||||||||||||||||||||

| 1Q 2026 | 1 | 5,438 | 0.7 | % | 400,000 | 0.4 | % | 73.56 | |||||||||||||||||||||||||||

| 2Q 2026 | — | — | — | % | — | — | % | — | |||||||||||||||||||||||||||

| 3Q 2026 | 3 | 11,651 | 1.5 | % | 794,141 | 0.8 | % | 68.16 | |||||||||||||||||||||||||||

| 4Q 2026 | 2 | 50,048 | 6.6 | % | 1,187,081 | 1.2 | % | 23.72 | |||||||||||||||||||||||||||

| Total 2026 | 6 | 67,137 | 8.8 | % | 2,381,222 | 2.4 | % | 35.47 | |||||||||||||||||||||||||||

| 2027 | 6 | 60,005 | 7.9 | % | 8,177,066 | 8.1 | % | 136.27 | |||||||||||||||||||||||||||

| 2028 | 4 | 11,410 | 1.5 | % | 1,817,270 | 1.8 | % | 159.27 | |||||||||||||||||||||||||||

| 2029 | 11 | 124,851 | 16.5 | % | 24,507,412 | 24.4 | % | 196.29 | |||||||||||||||||||||||||||

| 2030 | 12 | 77,142 | 10.2 | % | 11,949,027 | 11.9 | % | 154.90 | |||||||||||||||||||||||||||

| 2031 | 11 | 74,714 | 9.8 | % | 15,102,497 | 15.0 | % | 202.14 | |||||||||||||||||||||||||||

| 2032 | 6 | 37,323 | 4.9 | % | 3,772,478 | 3.7 | % | 101.08 | |||||||||||||||||||||||||||

| 2033 | 14 | 44,520 | 5.9 | % | 6,980,108 | 6.9 | % | 156.79 | |||||||||||||||||||||||||||

| 2034 | 7 | 27,070 | 3.6 | % | 3,568,213 | 3.5 | % | 131.81 | |||||||||||||||||||||||||||

| 2035 | 4 | 7,882 | 1.0 | % | 1,142,077 | 1.1 | % | 144.90 | |||||||||||||||||||||||||||

| Thereafter | 16 | 170,160 | 22.5 | % | 21,122,249 | 21.1 | % | 124.13 | |||||||||||||||||||||||||||

| Total retail properties | 100 | 758,525 | 100.0 | % | $ | 100,634,243 | 100.0 | % | $ | 143.01 | |||||||||||||||||||||||||

|

Third Quarter 2025 |

||||

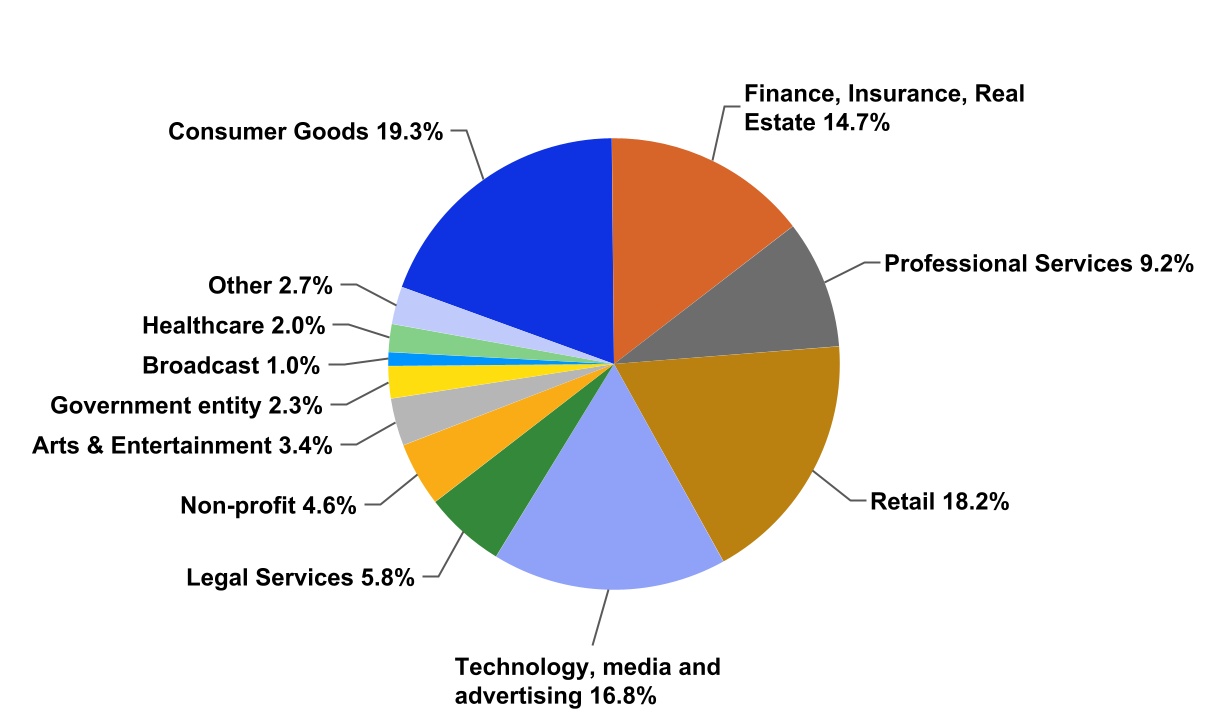

| 20 Largest Tenants and Portfolio Tenant Diversification by Industry | |||||

| (unaudited) | |||||

| 20 Largest Tenants | Property | Lease Expiration(1) |

Weighted Average Remaining Lease Term(2) |

Total Occupied Square Feet(3) |

Percent of Portfolio Rentable Square Feet(4) |

Annualized Rent(5) |

Percent of Portfolio Annualized Rent(6) |

|||||||||||||||||||||||||||||||||||||

| 1. | LinkedIn(7) |

Empire State Building | Feb. 2026 - Aug. 2036 | 10.1 years | 423,544 | 5.00 | % | $ | 31,179,290 | 5.56 | % | |||||||||||||||||||||||||||||||||

| 2. | Flagstar Bank | 1400 Broadway | Aug. 2039 | 13.9 years | 313,109 | 3.70 | % | 19,636,148 | 3.50 | % | ||||||||||||||||||||||||||||||||||

| 3. | Centric Brands Inc. | Empire State Building | Oct. 2028 | 3.1 years | 252,929 | 3.00 | % | 14,255,159 | 2.54 | % | ||||||||||||||||||||||||||||||||||

| 4. | PVH Corp.(8) |

501 Seventh Avenue | Jan. 2026 - Oct. 2028 | 2.4 years | 237,281 | 2.80 | % | 13,455,701 | 2.40 | % | ||||||||||||||||||||||||||||||||||

| 5. | Institutional Capital Network, Inc.(9) |

One Grand Central Place | Nov. 2027 - Dec. 2041 | 15.3 years | 154,050 | 1.80 | % | 11,004,747 | 1.96 | % | ||||||||||||||||||||||||||||||||||

| 6. | Burlington Merchandising Corporation | 1400 Broadway | Dec. 2041 | 16.3 years | 170,763 | 2.00 | % | 10,754,111 | 1.92 | % | ||||||||||||||||||||||||||||||||||

| 7. | Sephora USA, Inc. | 112 West 34th Street | Jan. 2029 | 3.3 years | 11,334 | 0.10 | % | 10,575,900 | 1.89 | % | ||||||||||||||||||||||||||||||||||

| 8. | Target Corporation | 112 West 34th St., 10 Union Sq. | Jan. 2038 | 12.3 years | 81,340 | 1.00 | % | 9,578,241 | 1.71 | % | ||||||||||||||||||||||||||||||||||

| 9. | Macy's | 111 West 33rd Street | May 2030 | 4.7 years | 131,117 | 1.50 | % | 9,520,794 | 1.70 | % | ||||||||||||||||||||||||||||||||||

| 10. | Coty Inc. | Empire State Building | Jan. 2030 | 4.3 years | 157,892 | 1.90 | % | 9,422,377 | 1.68 | % | ||||||||||||||||||||||||||||||||||

| 11. | URBAN OUTFITTERS | 1333 Broadway | Sep. 2029 | 4.0 years | 56,730 | 0.70 | % | 8,287,997 | 1.48 | % | ||||||||||||||||||||||||||||||||||

| 12. | Li & Fung(10) |

1359 Broadway, ESB | Oct. 2027 - Oct. 2028 | 2.8 years | 149,061 | 1.80 | % | 8,230,130 | 1.47 | % | ||||||||||||||||||||||||||||||||||

| 13. | Foot Locker, Inc. | 112 West 34th Street | Sep. 2031 | 6.0 years | 34,192 | 0.40 | % | 7,873,484 | 1.40 | % | ||||||||||||||||||||||||||||||||||

| 14. | FDIC(11) |

Empire State Building | Dec. 2025 | 0.3 years | 119,226 | 1.40 | % | 7,823,959 | 1.40 | % | ||||||||||||||||||||||||||||||||||

| 15. | Shutterstock, Inc. | Empire State Building | Apr. 2029 | 3.6 years | 108,937 | 1.30 | % | 7,617,570 | 1.36 | % | ||||||||||||||||||||||||||||||||||

| 16. | Fragomen | 1400 Broadway | Feb. 2035 | 9.4 years | 107,680 | 1.30 | % | 7,118,080 | 1.27 | % | ||||||||||||||||||||||||||||||||||

| 17. | The Michael J. Fox Foundation | 111 West 33rd Street | Nov. 2029 | 4.2 years | 86,492 | 1.00 | % | 6,549,061 | 1.17 | % | ||||||||||||||||||||||||||||||||||

| 18. | ASCAP | 250 West 57th Street | Aug. 2034 | 8.9 years | 87,943 | 1.00 | % | 6,476,281 | 1.16 | % | ||||||||||||||||||||||||||||||||||