| Nevada | 001-36555 | 01-0949984 | ||||||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

||||||

| Title of each class: | Trading Symbol(s): | Name of each exchange on which registered: | ||||||||||||

| Common Stock | MARA | NASDAQ Capital Market |

||||||||||||

| Exhibit No. | Description | ||||

| 99.1 | |||||

| 99.2 | |||||

| 104 | Cover page interactive data file (embedded with the inline XBRL document) | ||||

| MARA HOLDINGS, INC. | ||||||||

Date: July 29, 2025 |

By: | /s/ Zabi Nowaid |

||||||

Zabi Nowaid |

||||||||

| General Counsel and Corporate Strategy | ||||||||

Revenues increased

64% to $238.5 million

|

IN Q2 2025 |

from $145.1 million in Q2 2024. |

Net income (loss)

increased 505%

|

TO $808.2 MILLION |

in Q2 2025 from ($199.7) million in Q2 2024. |

Adjusted EBITDA

increased 1093%

|

$1.2 BILLION |

compared to ($125.5) million in Q2 2024. |

Cost/petahash per

day improved by 24%

|

IN Q2 2025 |

from Q2 2024. |

Energized hashrate

("EH/s") increased 82%

|

TO 57.4 EH/S IN Q2 2025 |

from 31.5 EH/s in Q2 2024. |

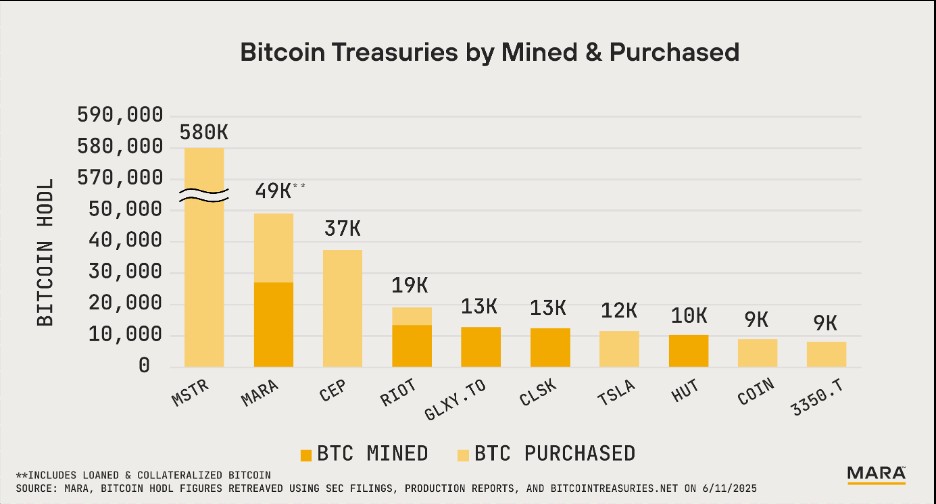

Bitcoin holdings

increased 170%

|

TO 49,951 BTC (C. $5.3B) |

Including 15,550 BTC loaned, actively managed and pledged as

collateral as of June 30, 2025.

|

Total blocks won

increased 52% to 694

|

IN Q2 2025 |

from 457 in Q2 2024. |

Purchased energy cost per

BTC $33,735

|

IN Q2 2025 |

for our owned sites |

Cost per kWh: $0.04 |

FOR Q2 2025 |

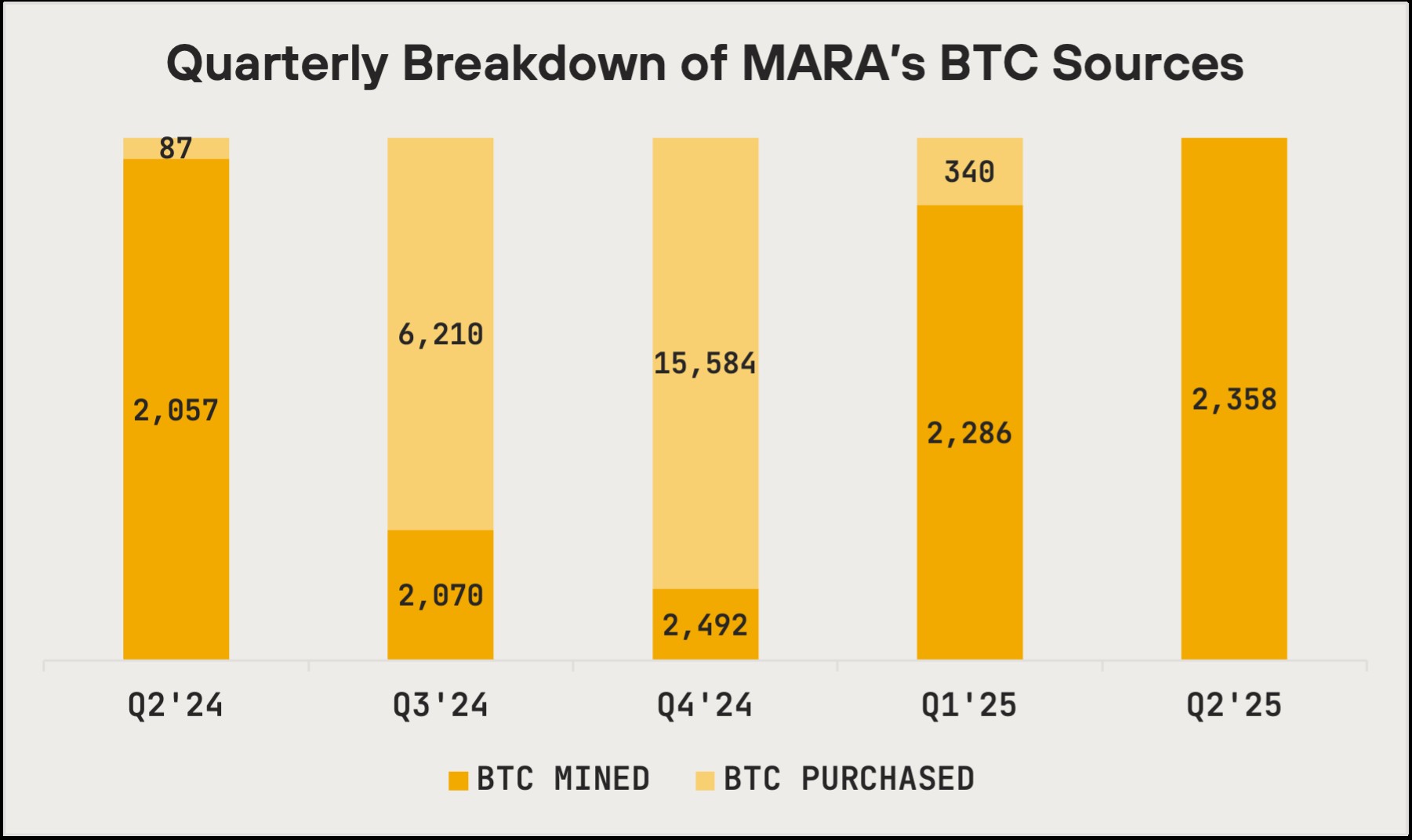

Mined 2,358 BTC |

IN Q2 2025 |

There were no purchases in Q2 2025 |

Prior Quarter Comparison |

|||

Metric |

Q2 2025 |

Q1 2025 |

% Δ |

Number of Blocks Won |

694 |

666 |

4% |

BTC Produced |

2,358 |

2,286 |

3% |

Average BTC Produced per Day |

25.9 |

25.4 |

2% |

Share of Available Miners Rewards (1) |

5.7% |

5.5% |

N/A |

Energized Hashrate (EH/s) (2) |

57.4 |

54.3 |

6% |

MARA's BTC Holdings | |

Quantity |

|

Bitcoin, unrestricted |

34,401 |

Bitcoin Asset Management |

|

Bitcoin - Loaned |

7,877 |

Bitcoin - Actively Managed |

2,004 |

Bitcoin - Pledged as Collateral |

5,669 |

15,550 |

|

Total |

49,951 |

Twitter |

@MARAHoldings |

Linkedin |

MARAHoldings |

Facebook |

MARAHoldings |

Instagram |

@MARAHoldingsinc |

Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||

(in thousands, except share and per share data) |

2025 |

2024 |

2025 |

2024 |

||||

Revenues |

$238,485 |

$145,139 |

$452,369 |

$310,337 |

||||

Costs and operating expenses (income) |

||||||||

Purchased energy costs |

41,730 |

26,113 |

85,211 |

32,201 |

||||

Third-party hosting and other energy costs |

69,029 |

54,020 |

137,212 |

123,586 |

||||

Operating and maintenance costs |

22,362 |

15,595 |

42,156 |

31,409 |

||||

General and administrative |

92,948 |

53,492 |

178,813 |

122,398 |

||||

Depreciation and amortization |

161,741 |

107,508 |

319,638 |

189,110 |

||||

Change in fair value of digital assets |

(846,027) |

147,999 |

(451,865) |

(340,808) |

||||

Change in fair value of derivative instrument |

(20,311) |

(38,251) |

(47,139) |

(22,999) |

||||

Impairment of assets |

26,253 |

— |

26,253 |

— |

||||

Taxes other than on income |

2,437 |

1,555 |

5,532 |

4,065 |

||||

Early termination expenses |

— |

5,660 |

— |

27,757 |

||||

Research and development |

8,546 |

3,845 |

17,844 |

6,311 |

||||

Total costs and operating expenses (income) |

(441,292) |

377,536 |

313,655 |

173,030 |

||||

Operating income (loss) |

679,777 |

(232,397) |

138,714 |

137,307 |

||||

Other income |

||||||||

Change in fair value of digital assets - receivable, net |

346,547 |

— |

230,480 |

— |

||||

Interest income |

9,631 |

2,308 |

21,626 |

4,881 |

||||

Interest expense |

(12,835) |

(1,369) |

(22,776) |

(2,625) |

||||

Equity in net earnings of unconsolidated affiliate |

(902) |

49 |

(915) |

1,308 |

||||

Other |

(5,509) |

93 |

(3,035) |

3,037 |

||||

Total other income |

336,932 |

1,081 |

225,380 |

6,601 |

||||

Income (loss) before income taxes |

1,016,709 |

(231,316) |

364,094 |

143,908 |

||||

Income tax benefit (expense) |

(208,504) |

31,657 |

(89,332) |

(6,394) |

||||

Net income (loss) |

$808,205 |

$(199,659) |

$274,762 |

$137,514 |

||||

Less: net loss attributable to noncontrolling interest |

30 |

— |

274 |

— |

||||

Net income (loss) attributable to common stockholders |

$808,235 |

$(199,659) |

$275,036 |

$137,514 |

||||

Net income (loss) per share of common stock - basic |

$2.29 |

$(0.72) |

$0.79 |

$0.51 |

||||

Weighted average shares of common stock - basic |

352,901,683 |

278,674,506 |

348,524,166 |

268,899,932 |

||||

Net income (loss) per share of common stock - diluted |

$1.84 |

$(0.72) |

$0.64 |

$0.50 |

||||

Weighted average shares of common stock - diluted |

440,912,159 |

278,674,506 |

436,271,805 |

277,959,660 |

||||

Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||

(in thousands, except share and per share data) |

2025 |

2024 |

2025 |

2024 |

||||

Reconciliation to Adjusted EBITDA: |

||||||||

Net income (loss) attributable to common stockholders |

$808,235 |

$(199,659) |

$275,036 |

$137,514 |

||||

Interest expense (income), net |

3,204 |

(939) |

1,150 |

(2,256) |

||||

Income tax expense (benefit) |

208,504 |

(31,657) |

89,332 |

6,394 |

||||

Depreciation and amortization |

164,914 |

111,047 |

325,916 |

195,232 |

||||

EBITDA |

1,184,857 |

(121,208) |

691,434 |

336,884 |

||||

Stock based compensation expense |

54,656 |

28,332 |

103,771 |

80,245 |

||||

Change in fair value of derivative instrument |

(20,311) |

(38,251) |

(47,139) |

(22,999) |

||||

Impairment of assets |

26,253 |

— |

26,253 |

— |

||||

Net gain on investments |

— |

— |

(12,429) |

(5,236) |

||||

Early termination expenses |

— |

5,660 |

— |

27,757 |

||||

Adjusted EBITDA (1) |

$1,245,455 |

$(125,467) |

$761,890 |

$416,651 |

||||

Three Months Ended |

||||||||||

(in thousands, except return on capital employed) |

June 30, 2025 |

March 31,

2025

|

December 31,

2024

|

September

30, 2024

|

June 30, 2024 |

|||||

Reconciliation of last twelve month ("LTM") net income to LTM Adjusted EBITDA (2): | ||||||||||

Net income (loss) attributable to common

stockholders

|

$678,775 |

$(329,119) |

$541,253 |

$164,551 |

$288,950 |

|||||

Interest income, net |

(309) |

(4,452) |

(3,715) |

(4,068) |

(406) |

|||||

Income tax expense (benefit) |

158,433 |

(81,728) |

75,495 |

(26,692) |

22,542 |

|||||

Depreciation and amortization |

572,238 |

518,371 |

441,554 |

372,749 |

321,814 |

|||||

EBITDA |

1,409,137 |

103,072 |

1,054,587 |

506,540 |

632,900 |

|||||

Stock based compensation expense |

181,168 |

154,844 |

157,642 |

122,322 |

104,493 |

|||||

Change in fair value of derivative instrument |

(22,097) |

(40,037) |

2,043 |

35,235 |

(22,999) |

|||||

Impairment of assets |

26,253 |

— |

— |

— |

— |

|||||

Net gain on investments |

(13,121) |

(11,429) |

(4,236) |

(4,236) |

(5,236) |

|||||

Net gain from extinguishment of debt |

(11,429) |

(13,121) |

(13,121) |

— |

(82,600) |

|||||

Early termination expenses |

10,304 |

15,964 |

38,061 |

38,061 |

27,757 |

|||||

Adjusted EBITDA |

$1,580,215 |

$209,293 |

$1,234,976 |

$697,922 |

$654,315 |

|||||

LTM total assets |

$6,136,839 |

$4,985,767 |

$4,113,902 |

$2,911,316 |

$2,362,224 |

|||||

Less: LTM total current liabilities |

241,094 |

155,642 |

81,332 |

65,972 |

60,568 |

|||||

Average capital employed |

$5,895,745 |

$4,830,125 |

$4,032,570 |

$2,845,344 |

$2,301,656 |

|||||

Return on capital employed (1) |

27% |

4% |

31% |

25% |

28% |

|||||