UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| For the fiscal year ended June 30, 2025 | Commission File Number: 001-41976 |

POWERBANK CORPORATION

(Exact name of Registrant as specified in its charter)

| Ontario, Canada | 221114 | N/A | ||

|

(Province or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code) |

(I.R.S. Employer Identification No.) |

505 Consumers Rd., Suite 803

Toronto, Ontario, M2J 4Z2

Canada

(416) 494-9559

(Address and telephone number of Registrant’s principal executive offices)

Cogency Global Inc.

122 E. 42 Street, 18 Floor

New York, New York 10168

(800) 221-0102

(Name, address (including zip code) and telephone number (including

area code) of agent for service in the United States)

Securities registered or to be registered pursuant to section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered: | |

| Common Shares | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this Form:

| ☒ Annual Information Form | ☒ Audited Annual Financial Statements |

Indicate the number of outstanding shares of each of the Registrant’s classes of capital or common stock as of the close of the period covered by the annual report: 35,433,947

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Yes | ☒ | No | ☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

| Yes | ☒ | No | ☐ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financials statements of the registrant included in the filing reflect correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

INTRODUCTORY INFORMATION

PowerBank Corporation (formerly known as Solarbank Corporation) (the “Company” or “PowerBank”) is a “foreign private issuer” as defined in Rule 3b-4 under Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is a Canadian issuer eligible to file its annual report (“Annual Report”) pursuant to Section 13 of the Exchange Act on Form 40-F pursuant to the multi-jurisdictional disclosure system (the “MJDS”) adopted by the United States Securities and Exchange Commission (the “SEC”). The Company’s common shares are listed on the Cboe Canada Exchange under the trading symbol “SUNN” and the Nasdaq Global Market (“Nasdaq”) under the trading symbol “SUUN”.

In this annual report, references to “we”, “our”, “us”, the “Company” or “PowerBank”, mean PowerBank Corporation and its subsidiaries, unless the context suggests otherwise.

Unless otherwise indicated, all amounts in this annual report are in Canadian dollars and all references to “$” mean Canadian dollars and references to “U.S. dollars” or “US$” are to United States dollars.

PRINCIPAL DOCUMENTS

The following principal documents are filed as exhibits to, and incorporated by reference into this Annual Report:

FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report on Form 40-F are forward-looking statements within the meaning of Section 21E of the Exchange Act and Section 27A of the Securities Act of 1933, as amended. Please see “Cautionary Note Regarding Forward-Looking Information” and “Risk Factors” in the AIF for a discussion of risks, uncertainties, and assumptions that could cause actual results to vary from those forward-looking statements.

NOTE TO UNITED STATES READERS REGARDING DIFFERENCES

BETWEEN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Company is permitted to prepare this Annual Report in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company prepares its consolidated financial statements in accordance with IFRS Accounting Standards (“IFRS “), as issued by the International Accounting Standards Board (the “IASB”), which differ in certain respects from United States generally accepted accounting principles (“US GAAP “) and from practices prescribed by the SEC. Therefore, the Company’s financial statements incorporated by reference in this Annual Report may not be comparable to financial statements prepared in accordance with U.S. GAAP.

CURRENCY

Unless otherwise indicated, all dollar amounts in this Annual Report are in Canadian dollars. The exchange rate of Canadian dollars into United States dollars, on June 30, 2025 was U.S.$1.00 = Cdn.$1.3643 and on October 1, 2025 was U.S.$1.00 = 1.3940, in each case based upon the daily average exchange rate as published by the Bank of Canada .

TAX MATTERS

Purchasing, holding, or disposing of the Company’s securities may have tax consequences under the laws of the United States and Canada that are not described in this Annual Report.

CONTROLS AND PROCEDURES

A. Certifications

The required disclosure is included in Exhibits 99.1, 99.2, and 99.3 of this Annual Report on Form 40-F.

B. Disclosure Controls and Procedures.

See Exhibit 99.5, under the heading “Disclosure Controls and Procedures (“DC&P”)”.

C. Management’s Annual Report on Internal Control over Financial Reporting.

See Exhibit 99.5, under the heading “Management’s Annual Report on Internal Control over Financial Reporting (“ICFR”)”.

D. Attestation Report of the Registered Public Accounting Firm

Under Section 3 of the Exchange Act, as a result of enactment of the Jumpstart Our Business Startups Act (the “JOBS Act”), “emerging growth companies” are exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002, which generally requires that a public company’s registered public accounting firm provide an attestation report relating to management’s assessment of internal control over financial reporting. PowerBank qualifies as an “emerging growth company” and therefore has not included in, or incorporated by reference into, this Annual Report such an attestation report as of the end of the period covered by this Annual Report.

E. Changes in Internal Control over Financial Reporting.

See Exhibit 99.5, under the heading “Changes in Internal Control Over Financial Reporting”.

AUDIT COMMITTEE

Our Board has established an Audit Committee in accordance with section 3(a)(58)(A) of the Exchange Act and Rule 5605(c) of the Nasdaq Marketplace Rules for the purpose of overseeing our accounting and financial reporting processes and the audits of our annual financial statements (the “Audit Committee”).

The Audit Committee is comprised of Paul Pasalic, Paul Sparkes and Chelsea Nickles. Our Board has determined that the Audit Committee meets the composition requirements set forth by Section 5605(c)(2) of the Nasdaq Marketplace Rules, and that each of the members of the Audit Committee is independent as determined under Rule 10A-3 of the Exchange Act and Rule 5605(a)(2) of the Nasdaq Marketplace Rules. All three members of the Audit Committee are financially literate, meaning they are able to read and understand the Company’s financial statements and to understand the breadth and level of complexity of the issues that can reasonably be expected to be raised by the Company’s financial statements.

The Board of Directors of the Company has determined that the Chair of the Audit Committee, Paul Pasalic, is an “audit committee financial expert,” as defined in General Instruction B(8)(b) of Form 40-F and is “independent”, under the applicable listing rules of NASDAQ. The SEC has indicated that the designation of the foregoing as audit committee financial experts does not make them an “expert” for any purpose, impose any duties, obligations or liability on them that are greater than those imposed on members of the audit committee and board of directors who do not carry this designation or affect the duties, obligations or liability of any other member of the audit committee. See the section entitled “Audit Committee” in the Company’s AIF, which is filed as Exhibit 99.6 to this Annual Report, for additional details on Mr. Pasalic’s experience relevant to his designation as an “audit committee financial expert.”

PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES PROVIDED BY

INDEPENDENT AUDITOR

The Audit Committee Charter sets out responsibilities regarding the provision of non-audit services by the Company’s external auditors and requires the Audit Committee to pre-approve all permitted non-audit services to be provided by the Company’s external auditors, in accordance with applicable law. Between scheduled Audit Committee meetings, the Audit Committee Chair, on behalf of the Audit Committee, is authorized to pre-approve any audit or non-audit services and engagement fees and terms up to Cdn$50,000. At the next Audit Committee meeting, the Audit Committee Chair shall report to the Audit Committee any such pre-approval given.

PRINCIPAL ACCOUNTING FEES AND SERVICES

Deloitte LLP (Toronto, Canada, PCAOB ID No. 1208) acted as the Company’s Independent Registered Public Accounting Firm for the fiscal year ended June 30, 2025.

See the section entitled “Audit Committee - External Auditor Service Fees” in the Company’s AIF, which is filed as Exhibit 99.6 to this Annual Report, for the total amount billed to the Company by Deloitte LLP for services performed in the current fiscal year, and by ZH CPA, LLC for services performed in the last fiscal year, by category of service (for audit fees, audit-related fees, tax fees and all other fees).

OFF-BALANCE SHEET ARRANGEMENTS

The Company has not entered into any “off-balance sheet arrangements”, as defined in General Instruction B(11) to Form 40-F, that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues, expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

CONTRACTUAL OBLIGATIONS

Information regarding our contractual and other obligations is included in the MD&A incorporated herein by reference to Exhibit 99.5, under the heading “Contractual obligations and commitments”.

CODE OF ETHICS

We have adopted a Code of Business Conduct and Ethics (the “Code”) that applies to our officers (including without limitation, the CEO, CFO), employees and directors of the Company and its subsidiaries and promotes, among other things, honest and ethical conduct. The Code meets the requirements for a “code of ethics” within the meaning of that term in Form 40-F.

The Code is available on the Company’s corporate website at www.powerbankcorp.com and under the Company’s SEDAR profile on www.SEDAR.com, and is filed as Exhibit 99.4 to the Company’s registration statement on Form 40-F/A, filed with the SEC on March 28, 2024. If there is an amendment to the Code, or if a waiver of the Code is granted to any of the Company’s principal executive officer, principal financial officer, principal accounting officer or controller, the Company intends to disclose any such amendment or waiver by posting such information on the Company’s website within five business days of the amendment or waiver and such information will remain available for a twelve-month period. Unless and to the extent specifically referred to herein, the information on the Company’s website shall not be deemed to be incorporated by reference in this annual report.

No waivers of the Code were granted to any principal officer of the Company or any person performing similar functions during the fiscal year ended June 30, 2025.

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104 of Regulation BTR that the Company sent during the year ended June 30, 2025 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

NASDAQ CORPORATE GOVERNANCE

The Company complies with corporate governance requirements of both the CBOE Canada and Nasdaq. As a foreign private issuer, the Company is not required to comply with all of the corporate governance requirements of Nasdaq; however, the Company adopts best practices consistent with domestic Nasdaq listed companies when appropriate to its circumstances.

As required by Nasdaq Rule 5615(a)(3), the Company discloses on its website, www.powerbankcorp.com/investors, each requirement of the Nasdaq Rules that it does not follow and describes the home country practice followed in lieu of such requirements.

MINE SAFETY DISCLOSURE

Not applicable.

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

Undertaking

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

Consent to Service of Process

The Company has previously filed with the SEC a written consent to service of process on Form F-X. Any change to the name or address of the Company’s agent for service shall be communicated promptly to the SEC by amendment to the Form F-X referencing the file number of the Company.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Company certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: October 2, 2025 | PowerBank Corporation. | |

| By: | /s/ Richard Lu | |

| Dr. Richard Lu | ||

|

Director, Chief Executive Officer and President |

||

EXHIBIT INDEX

Exhibit 97

| POWERBANK CORPORATION | CLAWBACK POLICY |

POWERBANK CORPORATION

CLAWBACK POLICY

February 26, 2024

| POWERBANK CORPORATION | CLAWBACK POLICY |

CLAWBACK POLICY

The Board of Directors (the “Board”) of PowerBank Corporation (the “Company”) believes that it is in the best interests of the Company and its shareholders to create and maintain a culture that emphasizes integrity and accountability and that reinforces the Company’s pay-for-performance compensation philosophy. The Board has therefore adopted this policy which provides for the recoupment of certain executive compensation in the event of an accounting restatement resulting from material noncompliance with financial reporting requirements under the federal securities laws (the “Policy”). This Policy is designed to comply with Section 10D of the Securities Exchange Act of 1934 (the “Exchange Act”) and Nasdaq Listing Rule 5608 (the “Clawback Listing Standards”).

This Policy shall be administered by the Board or, if so designated by the Board, the Compensation, Corporate Governance and Nominating Committee or any successor or other committee of the Board responsible for executive compensation matters (the “Compensation Committee”), in which case references herein to the Board shall be deemed to be references to the Compensation Committee. Any determinations made by the Board shall be final and binding on all affected individuals.

This Policy applies to the Company’s current and former executive officers, as determined by the Board in accordance with the definition in Section 10D of the Exchange Act and the Clawback Listing Standards, and such other senior executives who may from time to time be deemed subject to the Policy by the Board (“Covered Executives”).

In the event the Company is required to prepare an accounting restatement of its financial statements due to the Company’s material noncompliance with any financial reporting requirement under the securities laws, including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period, the Board will require reimbursement or forfeiture of any excess Incentive Compensation received by any Covered Executive during the three completed fiscal years immediately preceding the date on which the Company is required to prepare an accounting restatement.

For purposes of this Policy, “Incentive Compensation” means any of the following, provided that, such compensation is granted, earned, or vested based wholly or in part on the attainment of a financial reporting measure:

| ● | Annual bonuses and other short- and long-term cash incentives. |

| ● | Stock options. |

| ● | Stock appreciation rights. |

|

|

| POWERBANK CORPORATION | CLAWBACK POLICY |

| ● | Restricted shares. |

| ● | Restricted share units. |

| ● | Performance shares. |

| ● | Performance share units. |

Financial reporting measures include:

| ● | Company stock price. |

| ● | Total shareholder return. |

| ● | Revenues. |

| ● | Net income. |

| ● | Earnings before interest, taxes, depreciation, and amortization (EBITDA). |

| ● | Funds from operations. |

| ● | Liquidity measures such as working capital or operating cash flow. |

| ● | Return measures such as return on invested capital or return on assets. |

| ● | Earnings measures such as earnings per share. |

The amount to be recovered will be the excess of the Incentive Compensation paid to the Covered Executive based on the erroneous data over the Incentive Compensation that would have been paid to the Covered Executive had it been based on the restated results, as determined by the Board, without regard to any taxes paid by the Covered Executive in respect of the Incentive Compensation paid based on the erroneous data.

If the Board cannot determine the amount of excess Incentive Compensation received by the Covered Executive directly from the information in the accounting restatement, then it will make its determination based on a reasonable estimate of the effect of the accounting restatement.

The Board will determine, in its sole discretion, the method for recouping Incentive Compensation hereunder which may include, without limitation:

| (a) | requiring reimbursement of cash Incentive Compensation previously paid; |

| (b) | seeking recovery of any gain realized on the vesting, exercise, settlement, sale, transfer, or other disposition of any equity-based awards; |

| (c) | offsetting the recouped amount from any compensation otherwise owed by the Company to the Covered Executive; |

| (d) | cancelling outstanding vested or unvested equity awards; and/or |

| (e) | taking any other remedial and recovery action permitted by law, as determined by the Board. |

|

|

| POWERBANK CORPORATION | CLAWBACK POLICY |

The Company shall not indemnify any Covered Executives against the loss of any incorrectly awarded Incentive Compensation.

The Board is authorized to interpret and construe this Policy and to make all determinations necessary, appropriate, or advisable for the administration of this Policy. It is intended that this Policy be interpreted in a manner that is consistent with the requirements of Section 10D of the Exchange Act, any applicable rules or standards adopted by the Securities and Exchange Commission, and the Clawback Listing Standards.

This Policy shall be effective as of the date it is adopted by the Board (the “Effective Date”) and shall apply to Incentive Compensation that is received by Covered Executives on or after the Effective Date, even if such Incentive Compensation was approved, awarded, or granted to Covered Executives prior to the Effective Date.

The Board may amend this Policy from time to time in its discretion and shall amend this Policy as it deems necessary to reflect final regulations adopted by the Securities and Exchange Commission under Section 10D of the Exchange Act and to comply with the Clawback Listing Standards and any other rules or standards adopted by a national securities exchange on which the Company’s securities are listed. The Board may terminate this Policy at any time.

Any right of recoupment under this Policy is in addition to, and not in lieu of, any other remedies or rights of recoupment that may be available to the Company pursuant to the terms of any similar policy in any employment agreement, equity award agreement, or similar agreement and any other legal remedies available to the Company.

The Board intends that this Policy will be applied to the fullest extent of the law. The Board may require that any employment agreement, equity award agreement, or similar agreement entered into on or after the Effective Date shall, as a condition to the grant of any benefit thereunder, require a Covered Executive to agree to abide by the terms of this Policy. In the event of any inconsistency between the terms of the Policy and the terms of any employment agreement, equity award agreement, or similar agreement under which Incentive Compensation has been granted, awarded, earned or paid to a Covered Executive, whether or not deferred, the terms of the Policy shall govern.

Each Covered Executive shall sign an acknowledgment form in which such Covered Executive acknowledges having read and understood the terms of this Policy and agree to be bound by this Policy.

The Board shall recover any excess Incentive Compensation in accordance with this Policy unless such recovery would be impracticable, as determined by the Board in accordance with Rule 10D-1 of the Exchange Act and the listing standards of the national securities exchange on which the Company’s securities are listed.

This Policy shall be binding and enforceable against all Covered Executives and their beneficiaries, heirs, executors, administrators or other legal representatives.

Approved by the Board February 26, 2024.

|

|

Exhibit 99.1

CERTIFICATION

I, Richard Lu, certify that:

| 1. | I have reviewed this annual report on Form 40-F of PowerBank Corporation; | |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; | |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the issuer as of, and for, the periods presented in this report; | |

| 4. | The issuer’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the issuer and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the issuer, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; | |

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; | |

| (c) | Evaluated the effectiveness of the issuer’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and | |

| (d) | Disclosed in this report any change in the issuer’s internal control over financial reporting that occurred during the period covered by the annual report that has materially affected, or is reasonably likely to materially affect, the issuer’s internal control over financial reporting; and |

| 5. | The issuer’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the issuer’s auditors and the audit committee of the issuer’s board of directors (or persons performing the equivalent functions): |

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the issuer’s ability to record, process, summarize and report financial information; and | |

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the issuer’s internal control over financial reporting. |

Date: October 2, 2025

| /s/ Richard Lu | |

| Richard Lu | |

| President and Chief Executive Officer | |

| (Principal Executive Officer) |

Exhibit 99.2

CERTIFICATION

I, Sam Sun, certify that:

| 1. | I have reviewed this annual report on Form 40-F of PowerBank Corporation; | |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; | |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the issuer as of, and for, the periods presented in this report; | |

| 4. | The issuer’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the issuer and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the issuer, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; | |

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; | |

| (c) | Evaluated the effectiveness of the issuer’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and | |

| (d) | Disclosed in this report any change in the issuer’s internal control over financial reporting that occurred during the period covered by the annual report that has materially affected, or is reasonably likely to materially affect, the issuer’s internal control over financial reporting; and |

| 5. | The issuer’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the issuer’s auditors and the audit committee of the issuer’s board of directors (or persons performing the equivalent functions): |

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the issuer’s ability to record, process, summarize and report financial information; and | |

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the issuer’s internal control over financial reporting. |

Date: October 2, 2025

| /s/ Sam Sun | |

| Sam Sun | |

| Chief Financial Officer | |

| (Principal Financial Officer) |

Exhibit 99.3

CERTIFICATION PURSUANT TO

18 U.S.C. s.1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Annual Report of PowerBank Corporation (the “Company”) on Form 40-F for the period ended June 30, 2025, as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Richard Lu, President and Chief Executive Officer of the Company, certify, pursuant to 18 U.S.C. §1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

| (1) | The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and | |

| (2) | The information contained in this Report fairly presents, in all material respects, the financial condition and results of operations of the Company. |

October 2, 2025

| By: | /s/ Richard Lu | |

| Richard Lu | ||

| Chief Executive Officer | ||

| (Principal Executive Officer) |

A signed original of this written statement required by Section 906 has been provided to PowerBank Corporation and will be retained by PowerBank Corporation and furnished to the Securities and Exchange Commission or its staff upon request.

CERTIFICATION PURSUANT TO

18 U.S.C. s.1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Annual Report of PowerBank Corporation (the “Company”) on Form 40-F for the period ended June 30, 2025, as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Sam Sun, Chief Financial Officer of the Company, certify, pursuant to 18 U.S.C. §1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

| (1) | The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and |

| (2) | The information contained in this Report fairly presents, in all material respects, the financial condition and results of operations of the Company. |

October 2, 2025

| By: | /s/ Sam Sun | |

| Sam Sun | ||

| Chief Financial Officer | ||

| (Principal Financial Officer) |

A signed original of this written statement required by Section 906 has been provided to PowerBank Corporation and will be retained by PowerBank Corporation and furnished to the Securities and Exchange Commission or its staff upon request.

Exhibit 99.4

POWERBANK CORPORATION

(Formerly SolarBank Corporation)

Consolidated Financial Statements

(Expressed in thousands of Canadian Dollars)

For the years ended June 30, 2025 and 2024

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the shareholders and the Board of Directors of PowerBank Corporation

Opinion on the Financial Statements

We have audited the accompanying consolidated statements of financial position of PowerBank Corporation (formerly ‘SolarBank Corporation’) and subsidiaries (the “Company”) as at June 30, 2025, the related consolidated statements of comprehensive income (loss), changes in shareholders’ equity, and cash flows, for the year ended June 30, 2025, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as at June 30, 2025, and its financial performance and its cash flows for the year ended June 30, 2025, in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board (IASB).

The financial statements of the Company for the year ended June 30, 2024, before the effects of the retrospective adjustments to the disclosures for a change in the composition of reportable segments discussed in Note 27 to the financial statements, were audited by predecessor auditors whose report, dated September 30, 2024, expressed an unqualified opinion on those financial statements. We also have audited the adjustments to the 2024 financial statements to retrospectively adjust the disclosures for a change in the composition of reportable segments in 2025, as discussed in Note 27 to the financial statements. Our procedures included (1) comparing the adjustment amounts of segment revenues, cost of goods sold, operating expenses, and total assets, liabilities and property plant, and equipment to the Company’s underlying analysis and (2) testing the mathematical accuracy of the reconciliation of segment amounts to the financial statements. In our opinion, such retrospective adjustments are appropriate and have been properly applied. However, we were not engaged to audit, review, or apply any procedures to the 2024 consolidated financial statements of the Company other than with respect to the retrospective adjustments, and accordingly, we do not express an opinion or any other form of assurance on the 2024 financial statements taken as a whole.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/s/ Deloitte LLP

Chartered Professional Accountants

Licensed Public Accountants

Toronto, Canada

October 2, 2025

We have served as the Company’s auditor since Fiscal 2025.

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the shareholders and Board of Directors of Solarbank Corporation

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated statements of financial position of Solarbank Corporation and its subsidiaries (the “Company”) as of June 30, 2024, and the related consolidated statements of income (loss) and comprehensive income (loss), changes in shareholders’ equity, and cash flows for the year ended June 30, 2024, and the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of June 30, 2024, and the results of its consolidated operations and its consolidated cash flows for the year ended June 30, 2024, in conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audit provides a reasonable basis for our opinion.

/s/ ZH CPA, LLC

We have served as the Company’s auditor since 2024.

Denver, Colorado

September, 30, 2024

999 18th Street, Suite 3000, Denver, CO, 80202 USA Phone: 1.303.386.7224 Fax: 1.303.386.7101 Email: admin@zhcpa.us

|

|

POWERBANK CORPORATION

(FORMERLY SOLARBANK CORPORATION)

Consolidated Statements of Financial Position

(Expressed in thousands of Canadian dollars)

As at June 30, 2025 and 2024

| Note | 2025 | 2024 | ||||||||||

| Assets | ||||||||||||

| Current assets: | ||||||||||||

| Cash | $ | 7,624 | $ | 5,270 | ||||||||

| Restricted cash | 32 | 2,095 | - | |||||||||

| Short-term investments | 4 | 1,106 | 920 | |||||||||

| Trade and other receivables | 5 | 11,287 | 1,115 | |||||||||

| Prepaid expenses and deposits | 6 | 9,558 | 3,127 | |||||||||

| Unbilled revenue | 8 | 651 | 667 | |||||||||

| Inventories | 9 | 9,001 | 6,531 | |||||||||

| Total current assets | 41,322 | 17,630 | ||||||||||

| Non-current assets: | ||||||||||||

| Restricted cash | 32 | 4,119 | - | |||||||||

| Prepaid expenses and deposits | 6 | 735 | - | |||||||||

| Property, plant and equipment | 7 | 34,507 | 3,455 | |||||||||

| Construction in progress | 10 | 31,622 | 8,909 | |||||||||

| Right-of-use assets | 13 | 8,588 | 1,085 | |||||||||

| Intangible assets | 14 | 14,038 | 2,001 | |||||||||

| Tax equity assets | 17 | 311 | 401 | |||||||||

| Goodwill | 25 | 2,766 | 439 | |||||||||

| Investments | - | 5,152 | ||||||||||

| Derivative financial instruments | 20(a) | 343 | 153 | |||||||||

| Total non-current assets | 97,029 | 21,595 | ||||||||||

| Total assets | $ | 138,351 | $ | 39,225 | ||||||||

| Liabilities and Shareholders’ equity | ||||||||||||

| Current liabilities: | ||||||||||||

| Trade and other payables | 11 | $ | 21,786 | $ | 4,690 | |||||||

| Unearned revenue | 12 | 5,698 | 4,600 | |||||||||

| Lease liabilities | 13 | 991 | 149 | |||||||||

| Short-term loans | 15 | 4,734 | 1,310 | |||||||||

| Long-term debt | 16 | 9,170 | 448 | |||||||||

| Current tax liabilities | 654 | 2,113 | ||||||||||

| Tax equity liabilities | 17 | 77 | 78 | |||||||||

| Total current liabilities | 43,110 | 13,388 | ||||||||||

| Non-current liabilities: | ||||||||||||

| Lease liabilities | 13 | 6,690 | 993 | |||||||||

| Long-term debt | 16 | 53,790 | 4,379 | |||||||||

| Tax equity liabilities | 17 | 215 | 300 | |||||||||

| Provisions | 18 | 2,401 | - | |||||||||

| Other long-term liabilities | 33 | 5,150 | 366 | |||||||||

| Deferred tax liabilities | 28 | 5,835 | 1,074 | |||||||||

| Warrant liabilities | 31 | 1,400 | - | |||||||||

| Total non-current liabilities | 75,481 | 7,112 | ||||||||||

| Total liabilities | 118,591 | 20,500 | ||||||||||

| Shareholders’ equity: | ||||||||||||

| Share capital | 21 | 45,285 | 9,026 | |||||||||

| Contributed surplus | 1,951 | 4,059 | ||||||||||

| Accumulated other comprehensive income (loss) | (242 | ) | 100 | |||||||||

| Retained earnings (Deficit) | (27,753 | ) | 3,179 | |||||||||

| Equity attributable to common shareholders | 19,241 | 16,364 | ||||||||||

| Non-controlling interests | 23 | 519 | 2,361 | |||||||||

| Total equity | 19,760 | 18,725 | ||||||||||

| Total liabilities and shareholders’ equity | $ | 138,351 | $ | 39,225 | ||||||||

The accompanying notes are integral part of these consolidated financial statements.

Approved and authorized for issuance on behalf of the Board of Directors:

| Richard Lu, CEO, and Director _______________ | Sam Sun, CFO_______________ |

|

|

POWERBANK CORPORATION

(FORMERLY SOLARBANK CORPORATION)

Consolidated Statements of Comprehensive Income (loss)

(Expressed in thousands of Canadian dollars, except per share amounts)

For the years ended June 30, 2025 and 2024

| Note | 2025 | 2024 | ||||||||||

| Revenue from development fees | $ | 7,687 | $ | 2,012 | ||||||||

| Revenue from EPC services | 23,261 | 54,066 | ||||||||||

| Revenue from IPP production | 9,297 | 578 | ||||||||||

| Revenue from O&M and other services | 1,286 | 1,721 | ||||||||||

| Total Revenue | 41,531 | 58,377 | ||||||||||

| Cost of goods sold | 31,020 | 46,698 | ||||||||||

| Gross profit | 10,511 | 11,679 | ||||||||||

| Operating expense: | ||||||||||||

| Advertising and promotion | 1,111 | 4,088 | ||||||||||

| Professional fees | 8,035 | 1,861 | ||||||||||

| Consulting fees | 5,040 | 1,541 | ||||||||||

| Depreciation and amortization | 7,13 | 100 | 79 | |||||||||

| Salary and wages | 1,713 | 1,280 | ||||||||||

| Share-based compensation | 22 | 177 | 860 | |||||||||

| Insurance | 879 | 416 | ||||||||||

| Listing fees | 166 | 724 | ||||||||||

| Travel and events | 495 | 362 | ||||||||||

| Repairs and maintenance | 131 | 140 | ||||||||||

| Other operating expense | 1,366 | 646 | ||||||||||

| Impairment loss | 25 | 30,374 | 4,100 | |||||||||

| Total operating expenses | 49,587 | 16,097 | ||||||||||

| Other income (expense) | ||||||||||||

| Interest income | 607 | 321 | ||||||||||

| Interest expense | (3,263 | ) | (285 | ) | ||||||||

| Fair value change of derivatives | 16 | (1,340 | ) | (137 | ) | |||||||

| Fair value change of warrant liabilities | 31 | 3,575 | - | |||||||||

| Fair value change of CVR | 19 | 7,195 | ||||||||||

| Loss on investments | 19 | (3,385 | ) | (1,125 | ) | |||||||

| Other income | 5 | 351 | 5,013 | |||||||||

| Net loss before income taxes | (35,336 | ) | (631 | ) | ||||||||

| Current tax expense | 28 | 953 | 2,962 | |||||||||

| Deferred tax recovery | 28 | (5,173 | ) | (16 | ) | |||||||

| Net loss for the year | $ | (31,116 | ) | $ | (3,577 | ) | ||||||

| Other comprehensive income (loss) | $ | $ | ||||||||||

| Foreign currency translation gain (loss) | (342 | ) | 225 | |||||||||

| Total comprehensive loss | $ | (31,458 | ) | $ | (3,352 | ) | ||||||

| Loss attributable to: | ||||||||||||

| Shareholders of the Company | (31,040 | ) | (3,474 | ) | ||||||||

| Non-controlling interest | 23 | (76 | ) | (103 | ) | |||||||

| Net loss for the year | $ | (31,116 | ) | $ | (3,577 | ) | ||||||

| Total comprehensive loss attributable to: | ||||||||||||

| Shareholders of the Company | (31,382 | ) | (3,257 | ) | ||||||||

| Non-controlling interest | 23 | (76 | ) | (95 | ) | |||||||

| Total comprehensive loss | $ | (31,458 | ) | $ | (3,352 | ) | ||||||

| Loss per share | ||||||||||||

| Basic | 29 | $ | (0.97 | ) | $ | (0.13 | ) | |||||

| Diluted | 29 | $ | (0.97 | ) | $ | (0.13 | ) | |||||

The accompanying notes are an integral part of these consolidated financial statements.

|

|

POWERBANK CORPORATION

(FORMERLY SOLARBANK CORPORATION)

Consolidated Statements of Changes in Shareholders’ Equity

(Expressed in thousands of Canadian dollars, except number of common shares)

For the years ended June 30, 2025 and 2024

| Note | Number of shares |

Share Capital |

Contributed Surplus |

Retained Earnings (Deficit) |

Accumulated other comprehensive income (loss) |

Equity attributable to common shareholders | Non- Controlling Interest |

Total Equity | ||||||||||||||||||||||||||

| Balance as at June 30, 2023 | 26,800,000 | $ | 6,855 | $ | 3,002 | $ | 6,653 | $ | (117 | ) | $ | 16,393 | $ | 238 | $ | 16,631 | ||||||||||||||||||

| Net loss for the year | - | - | - | (3,474 | ) | - | (3,474 | ) | (103 | ) | (3,577 | ) | ||||||||||||||||||||||

| Other comprehensive income | - | - | - | - | 217 | 217 | 8 | 225 | ||||||||||||||||||||||||||

| Total comprehensive income (loss) | - | - | - | (3,474 | ) | 217 | (3,257 | ) | (95 | ) | (3,352 | ) | ||||||||||||||||||||||

| Common shares issued, net of costs | 2,200 | 22 | - | - | - | 22 | - | 22 | ||||||||||||||||||||||||||

| Equity warrant exercised | 21(c) | 110,000 | 83 | - | - | - | 83 | - | 83 | |||||||||||||||||||||||||

| RSU granted | - | - | 65 | - | - | 65 | - | 65 | ||||||||||||||||||||||||||

| Share-based compensation | - | - | 795 | - | - | 795 | - | 795 | ||||||||||||||||||||||||||

| Acquisition of OFIT GM and OFIT RT | 19 | 278,875 | 2,066 | - | - | - | 2,066 | 2,509 | 4,575 | |||||||||||||||||||||||||

| Acquisition of NCI of Solar Alliance | 23 | - | - | 197 | - | - | 197 | (291 | ) | (94 | ) | |||||||||||||||||||||||

| Balance as at June 30, 2024 | 27,191,075 | $ | 9,026 | $ | 4,059 | $ | 3,179 | $ | 100 | $ | 16,364 | $ | 2,361 | $ | 18,725 | |||||||||||||||||||

| Net loss for the year | - | - | - | (31,040 | ) | - | (31,040 | ) | (76 | ) | (31,116 | ) | ||||||||||||||||||||||

| Other comprehensive loss | - | - | - | - | (342 | ) | (342 | ) | - | (342 | ) | |||||||||||||||||||||||

| Total comprehensive loss | - | - | - | (31,040 | ) | (342 | ) | (31,382 | ) | (76 | ) | (31,458 | ) | |||||||||||||||||||||

| Common shares issued, net of costs | 21(b) | 990,726 | 3,550 | - | - | - | 3,550 | - | 3,550 | |||||||||||||||||||||||||

| Equity warrant exercised | 21(c) | 235,000 | 176 | - | - | - | 176 | - | 176 | |||||||||||||||||||||||||

| RSU granted | 22(b) | - | - | 1,612 | - | - | 1,612 | - | 1,612 | |||||||||||||||||||||||||

| RSU exercised | 22(b) | 508,381 | 1,874 | (1,874 | ) | - | - | - | - | - | ||||||||||||||||||||||||

| Share-based compensation | 22(a) | 81,551 | 384 | 207 | - | - | 591 | - | 591 | |||||||||||||||||||||||||

| Share option exercised | 22(a) | 457,215 | 2,919 | (2,857 | ) | - | - | 62 | - | 62 | ||||||||||||||||||||||||

| Equity warrant granted | 21(c) | - | 791 | - | - | - | 791 | - | 791 | |||||||||||||||||||||||||

| Shelf prospectus shares issued | 21(c) | 2,394,367 | 6,615 | - | - | - | 6,615 | - | 6,615 | |||||||||||||||||||||||||

| Reclassification of NCI to financial liability | 23 | - | - | 804 | - | - | 804 | (1,535 | ) | (731 | ) | |||||||||||||||||||||||

| Acquisition of Solar Flow-Through Funds | 19 | 3,575,632 | 19,950 | - | - | - | 19,950 | - | 19,950 | |||||||||||||||||||||||||

| Acquisition of non-controlling interests | 23 | - | - | - | 108 | - | 108 | (231 | ) | (123 | ) | |||||||||||||||||||||||

| Balance as at June 30, 2025 | 35,433,947 | $ | 45,285 | $ | 1,951 | $ | (27,753 | ) | $ | (242 | ) | $ | 19,241 | $ | 519 | $ | 19,760 | |||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

|

|

POWERBANK CORPORATION

(FORMERLY SOLARBANK CORPORATION)

Consolidated Statements of Cash Flows

(Expressed in thousands of Canadian dollars)

For the years ended June 30, 2025 and June 30, 2024

| Note | 2025 | 2024 | ||||||||||

| Operating activities: | ||||||||||||

| Net loss for the year | $ | (31,116 | ) | $ | (3,577 | ) | ||||||

| Items not affecting cash: | ||||||||||||

| Depreciation and amortization | 7,13,14 | 5,067 | 410 | |||||||||

| Fair value change on derivatives | 16 | 1,340 | 137 | |||||||||

| Fair value change of warrant liabilities | 31 | (3,575 | ) | - | ||||||||

| Fair value change of CVR | 19 | (7,195 | ) | - | ||||||||

| Loss on investments | 19 | 3,385 | 1,125 | |||||||||

| Impairment loss | 25 | 30,374 | 4,100 | |||||||||

| Other income related to tax equity | 17 | - | (33 | ) | ||||||||

| Recovery of receivable through shares settlement | 4 | - | (3,089 | ) | ||||||||

| Recognition of receivable credit loss | 4 | 26 | 174 | |||||||||

| Interest expense | 13,15,16,18 | 3,724 | 92 | |||||||||

| Income tax expense | 28 | 953 | 2,962 | |||||||||

| Deferred fees on long-term debt | (534 | ) | - | |||||||||

| Deferred income tax recovery | 28 | (5,173 | ) | (16 | ) | |||||||

| Loss on property, plant and equipment disposal | 7 | 93 | - | |||||||||

| Lease modifications | 13 | (5 | ) | - | ||||||||

| Provisions | 13,18 | 65 | - | |||||||||

| Share-based compensation | 22 | 2,203 | 860 | |||||||||

| Other liabilities due to non-controlling interest holders | 23 | (731 |

) | - | ||||||||

| Changes in non-cash operating assets and liabilities | 30 | (10,625 | ) | 7,148 | ||||||||

| Interest paid | (2,904 | ) | - | |||||||||

| Income tax paid | (2,632 | ) | (1,808 | ) | ||||||||

| Net cash flows from (used in) operating activities | (17,260 | ) | 8,485 | |||||||||

| Investing activities: | ||||||||||||

| Purchase of property, plant and equipment | - | (43 | ) | |||||||||

| Purchase of construction in progress | (8,255 | ) | (7,689 | ) | ||||||||

| Purchase of short-term investments | (4,076 | ) | (2,500 | ) | ||||||||

| Proceeds of short-term investments | 4,530 | 8,130 | ||||||||||

| Decreases in restricted cash | 32 | (6,214 | ) | - |

||||||||

| Investment in SFF shares | - | (2,465 | ) | |||||||||

| Cash and restricted cash acquired on acquisition of SFF | 19 | 9,887 | - | |||||||||

| Acquisition of Solar Alliance DevCo NCI | - | (94 | ) | |||||||||

| Net cash flows from (used in) investing activities | (4,128 | ) | (4,661 | ) | ||||||||

| Financing activities: | ||||||||||||

| Proceeds from long-term debt | 10,091 | - | ||||||||||

| Proceeds from issuance of shelf prospectus shares | 21(b) | 6,615 | - | |||||||||

| Proceeds from short-term loans | 6,189 | 1,252 | ||||||||||

| Proceeds from issuance of warrants | 4,975 | - | ||||||||||

| Proceeds from issuance of common shares, net transaction costs | 21(b) | 3,550 | 104 | |||||||||

| Proceeds from exercise of share options | 62 | - | ||||||||||

| Proceeds from broker warrants exercised | 176 | - | ||||||||||

| Proceeds from broker warrants grants | 791 | - | ||||||||||

| Repayment of long-term debt | (4,354 | ) | (479 | ) | ||||||||

| Repayment of short-term loans | (3,062 | ) | - | |||||||||

| Repayment of lease obligation | 13 | (981 | ) | (149 | ) | |||||||

| Acquisition of non-controlling interests | 23 | (123 | ) | - | ||||||||

| Net cash flows from (used in) in financing activities | 23,929 | 728 | ||||||||||

| Net increase/(decrease) in cash | 2,541 | 4,552 | ||||||||||

| Effect of changes in exchange rates on cash | (187 | ) | (31 | ) | ||||||||

| Cash, beginning of year | 5,270 | 749 | ||||||||||

| Cash, end of year | $ | 7,624 | $ | 5,270 | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

|

|

POWERBANK CORPORATION

(FORMERLY SOLARBANK CORPORATION)

Notes to Consolidated Financial Statements

(Expressed in thousands of Canadian dollars, except per share amounts and as otherwise indicated)

For the years ended June 30, 2025 and 2024

1. Nature of operations:

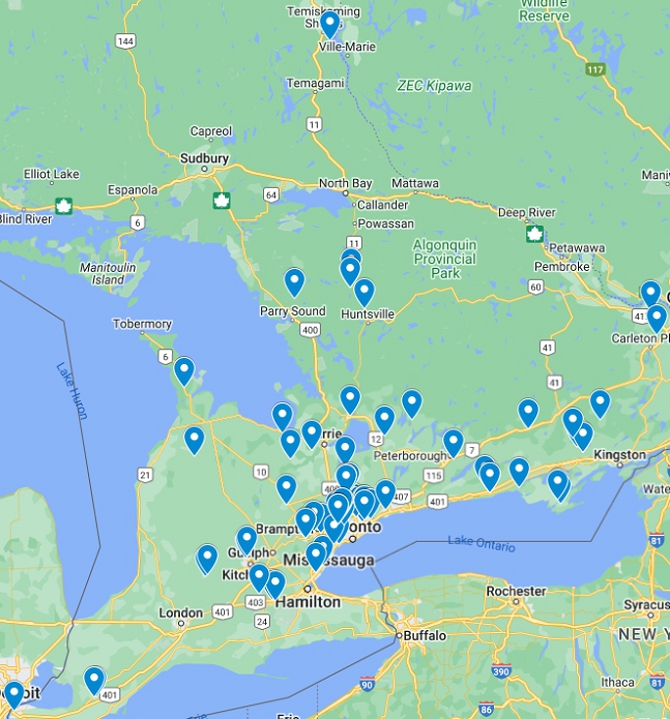

PowerBank Corporation (the “Company”) operates as an independent renewable and clean energy project developer, power producer, and asset operator in Canada and the United States. It focuses on solar photovoltaic power generation projects, battery energy storage systems, and EV-charging projects. The Company changed its name from Abundant Solar Energy Inc. to SolarBank Corporation on October 17, 2022 and subsequently to PowerBank Corporation on July 23, 2025. The address of the Company and the principal place of the business is 505 Consumers Rd, Suite 803, Toronto, ON, M2J 4V8.

On March 1, 2023, the Company closed its initial public offering (the “Offering”) of common shares. With completion of the Offering, the Company commenced trading its common shares on the Canadian Securities Exchange (the “CSE”) under the symbol “SUNN” on March 2, 2023. On February 14, 2024, the Company migrated its listing to the Cboe Canada Exchange Inc. under the existing trading symbol “SUNN”. On April 8, 2024, the Company’s common shares commenced trading on the Nasdaq Global market under the symbol “SUUN”.

2. Basis of presentation:

| (a) | Statement of compliance: |

These consolidated financial statements have been prepared in accordance with IFRS® Accounting Standards as issued by the International Accounting Standards Board (“IASB”).

These consolidated financial statements for the year ended June 30, 2025 were authorized for issuance by the Board of Directors on October 2, 2025.

| (b) | Basis of measurement: |

These consolidated financial statements were prepared on a going concern basis and historical cost basis with the exception of certain financial instruments as disclosed in note 3.

| (c) | Basis of consolidation: |

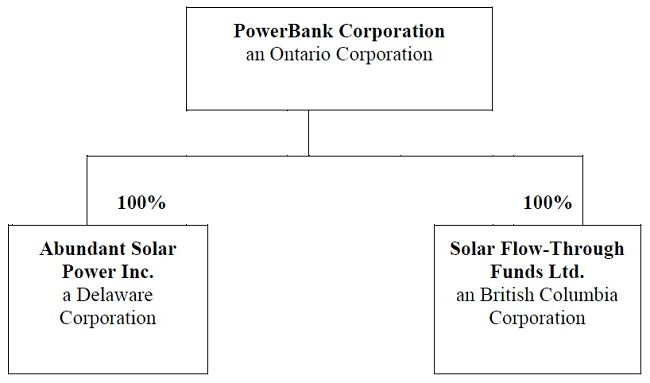

These consolidated financial statements include the accounts of the Company and its wholly or partially owned subsidiaries.

Subsidiaries are consolidated from the date on which the Company obtains control up to the date of the disposition of control. Control is achieved when the Company has power over the subsidiary, is exposed or has rights to variable returns from its involvement with the subsidiary and has the ability to use its power to affect its returns. For non-wholly owned subsidiaries over which the Company has control, the net assets attributable to outside equity shareholders are presented as “non-controlling interests” in the equity section of the consolidated statements of financial position. Net income or loss for the period that is attributable to the non-controlling interests is calculated based on the ownership of the non-controlling interest shareholders in the subsidiary.

Balance, transactions, income and expenses between the Company and its subsidiaries are eliminated on consolidation.

|

|

POWERBANK CORPORATION

(FORMERLY SOLARBANK CORPORATION)

Notes to Consolidated Financial Statements

(Expressed in thousands of Canadian dollars, except per share amounts and as otherwise indicated)

For the years ended June 30, 2025 and 2024

Details of the Company’s subsidiaries which are consolidated are as follows:

2. Basis of presentation (continued):

Schedule of significant subsidiaries

| Country of | Ownership interest | |||||||||

| Name | Incorporation | June 30, 2025 | June 30, 2024 | |||||||

| Abundant Solar Power Inc. | USA | 100 | % | 100 | % | |||||

| Abundant Construction Inc. | Canada | 100 | % | 100 | % | |||||

| Abundant Solar Power (US1) LLC | USA | 100 | % | 100 | % | |||||

| Abundant Solar Power (New York) LLC | USA | 100 | % | 100 | % | |||||

| Abundant Solar Power (Maryland) LLC | USA | 100 | % | 100 | % | |||||

| Abundant Solar Power (RP) LLC | USA | 100 | % | 100 | % | |||||

| Abundant Solar Power (CNY) LLC | USA | 100 | % | 100 | % | |||||

| Abundant Solar Power (TZ1) LLC | USA | 100 | % | 100 | % | |||||

| Abundant Solar Power (J1) LLC | USA | 100 | % | 100 | % | |||||

| Abundant Solar Power (Steuben) LLC | USA | 100 | % | 100 | % | |||||

| Abundant Solar Power (USNY- MARKHAM HOLLOW RD-001) LLC | USA | 100 | % | 100 | % | |||||

| Abundant Solar Power (LCP) LLC | USA | 100 | % | 100 | % | |||||

| Solar Alliance Energy DevCo LLC | USA | 100 | % | 100 | % | |||||

| Solar Alliance TE HoldCo 1, LLC | USA | 100 | % | 100 | % | |||||

| Solar Alliance VC1 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1001 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1003 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1004 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1005 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1006 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1007 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1008 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1010 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1012 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1013 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1014 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1015 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1016 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1017 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1018 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1019 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1020 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1021 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1022 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 1023 LLC | USA | 100 | % | 100 | % | |||||

| SUNN 2001 LLC | USA | 100 | % | - | ||||||

| SUNN 2002 LLC | USA | 100 | % | - | ||||||

| SUNN 2003 LLC | USA | 100 | % | - | ||||||

| SUNN 2004 LLC | USA | 100 | % | - | ||||||

| SUNN 2005 LLC | USA | 100 | % | - | ||||||

| 2467264 Ontario Inc. | Canada | 49.90 | % | 49.90 | % | |||||

| OFIT GM Inc. | Canada | 49.90 | % | 49.90 | % | |||||

| OFIT RT Inc. | Canada | 49.90 | % | 49.90 | % | |||||

| Solar Flow-Through Funds Ltd. | Canada | 100 | % | - | ||||||

| Solar High Yield Project #1 Ltd. | Canada | 100 | % | - | ||||||

| 2344215 Ontario Inc. | Canada | 100 | % | - | ||||||

| SHY 1 2012 FIT 2 Ltd. | Canada | 100 | % | - | ||||||

| 2343461 Ontario Inc. | Canada | 100 | % | - | ||||||

| Solar Flow-Through Projects #1 (2013) Ltd. | Canada | 100 | % | - | ||||||

| Solar Flow-Through (2014) Ltd. | Canada | 100 | % | - | ||||||

| Solar Flow-Through Projects (2014 Subco F2) Ltd. | Canada | 100 | % | - | ||||||

| Solar Flow-Through (2015) Ltd. | Canada | 100 | % | - | ||||||

| SFF Solar (2015) Ltd. | Canada | 100 | % | - | ||||||

|

|

POWERBANK CORPORATION

(FORMERLY SOLARBANK CORPORATION)

Notes to Consolidated Financial Statements

(Expressed in thousands of Canadian dollars, except per share amounts and as otherwise indicated)

For the years ended June 30, 2025 and 2024

2. Basis of presentation (continued):

| Country of | Ownership interest | |||||||||

| Name | Incorporation | June 30, 2025 | June 30, 2024 | |||||||

| Solar Flow-Through (2016) Ltd. | Canada | 100 | % | - | ||||||

| Solar Flow-Through (2017-I) Ltd. | Canada | 100 | % | - | ||||||

| Solar Flow-Through (2017-A) Ltd. | Canada | 100 | % | - | ||||||

| Solar Flow-Through (2018-I) Ltd. | Canada | 100 | % | - | ||||||

| Solar Flow-Through (2018-A) Ltd. | Canada | 100 | % | - | ||||||

| Solar Power Network 004 Inc. | Canada | 100 | % | - | ||||||

| 15155355 Canada Inc. | Canada | 100 | % | - | ||||||

| Sustainable Energies Corporation | USA | 100 | % | - | ||||||

| Sustainable Energies OR LLC | USA | 100 | % | - | ||||||

| Sustainable Energies VA LLC | USA | 100 | % | - | ||||||

| Abundant Construction Alberta Corp. | Canada | 100 | % | - | ||||||

| Icarus Whitesand Solar Limited Partnership | Canada | 85.00 | % | - | ||||||

| 1000234763 Ontario Inc. | Canada | 50.00 | % | - | ||||||

| 1000234813 Ontario Inc. | Canada | 50.00 | % | - | ||||||

| 2387280 Ontario Inc. | Canada | 49.90 | % | - | ||||||

| 2405402 Ontario Inc. | Canada | 49.90 | % | - | ||||||

| 2405514 Ontario Inc. | Canada | 49.90 | % | - | ||||||

| 2467260 Ontario Inc. | Canada | 49.90 | % | - | ||||||

| 2405372 Ontario Inc. | Canada | 49.90 | % | - | ||||||

| 2469780 Ontario Inc. | Canada | 49.90 | % | - | ||||||

| 2405799 Ontario Inc. | Canada | 49.90 | % | - | ||||||

| 2503072 Ontario Inc. | Canada | 49.90 | % | - | ||||||

| 2503225 Ontario Inc. | Canada | 49.90 | % | - | ||||||

| 2503903 Ontario Inc. | Canada | 49.90 | % | - | ||||||

| Northern Development Solar 2016 Inc. | Canada | 49.90 | % | - | ||||||

| Sunshine Solar Ontario 2016 Inc. | Canada | 49.90 | % | - | ||||||

| 2387276 Ontario Inc. | Canada | 49.90 | % | - | ||||||

| 2387281 Ontario Inc. | Canada | 49.90 | % | - | ||||||

| 2387282 Ontario Inc. | Canada | 49.90 | % | - | ||||||

| 2391395 Ontario Inc. | Canada | 49.90 | % | - | ||||||

| SPN LP 7 | Canada | 49.99 | % | - | ||||||

| (d) | Functional and presentation currency: |

The Company’s consolidated financial statements are presented in Canadian dollars. The functional currency of the Canadian parent company and its Canadian subsidiaries is the Canadian dollar. The functional currency of its subsidiaries in the United States is the US dollar.

Unless otherwise indicated, all amounts in these consolidated financial statements are expressed in thousands of Canadian dollar.

|

|

POWERBANK CORPORATION

(FORMERLY SOLARBANK CORPORATION)

Notes to Consolidated Financial Statements

(Expressed in thousands of Canadian dollars, except per share amounts and as otherwise indicated)

For the years ended June 30, 2025 and 2024

3. Material accounting policies:

(a) Revenue recognition:

The Company recognizes revenue for project development services, engineering, procurement, and construction (“EPC”) services, independent power producer (“IPP”) facilities, operation and maintenance (“O&M”) services and other services.

The Company applies the five-step model to contracts when it is probable that the Company will collect the consideration that it is entitled to in exchange for the services transferred to the customer.

At contract inception, the Company assesses services promised within each contract that falls under the scope of IFRS 15, Revenue from Contracts with Customers, to identify distinct performance obligations.

Project development services

Each project development service contract with customers includes a single performance obligation: to deliver a fully permitted solar project that is ready for construction. The performance obligation is satisfied at a point in time, specifically when the development phase is considered complete, and all necessary permits are obtained.

Revenue from development contracts is recognized when control of the fully permitted project is transferred to the customer, which occurs when the project is ready for construction. This reflects the point in time when the customer has the ability to direct the use of, and obtain substantially all the remaining benefits from, the solar project.

EPC services

Each EPC contract has a single performance obligation because the services provided are highly interrelated and include a significant service of integrating goods and services into a combined output — namely, the construction of solar sites. The performance obligation is satisfied over time, as the customer simultaneously receives and benefits from the services as they are provided.

Revenue is recognized using the input method, based on the proportion of costs incurred to date relative to the total estimated costs of the project. This method best reflects the transfer of control of the services and the customer’s continuous receipt of benefits as the project progresses. The total estimated costs are regularly reviewed, and any changes are reflected in the percentage of completion and revenue recognized.

IPP production

Each Company-owned IPP has a single performance obligation, which is to generate and deliver electricity to the grid. The performance obligation is satisfied over time, as the customer simultaneously receives and consumes the benefits of electricity as it is delivered. Revenue is recognized as electricity is dispatched and delivered to the grid, measured based on the quantity of electricity (kWh) provided.

O&M services

Each O&M service contract with customers contains a single performance obligation, which is to provide maintenance services as needed for the solar sites. The performance obligation is satisfied over time, as the services are provided, and the customer receives and benefits from the services in real time.

Revenue is recognized monthly, in line with the completion of the services. The amount of revenue recognized is based on the actual hours of service provided during the period, multiplied by the pre-determined hourly rate specified in the contract. This method reflects the continuous transfer of services and the customer’s immediate benefit from maintenance activities performed.

|

|

POWERBANK CORPORATION

(FORMERLY SOLARBANK CORPORATION)

Notes to Consolidated Financial Statements

(Expressed in thousands of Canadian dollars, except per share amounts and as otherwise indicated)

For the years ended June 30, 2025 and 2024

3. Material accounting policies (continued):

Other services

Each other services contract with customers includes a single performance obligation: to complete the specified service or milestone outlined in the contract. The performance obligation is satisfied at a point in time, specifically when the service is fully performed or the milestone is achieved.

Revenue is recognized at the point when control of the completed service or milestone passes to the customer, which occurs when the service is fully completed or the milestone is satisfied, in accordance with the terms of the contract.

(b) Inventories:

Inventories are stated at the lower of cost and net realizable value. Cost includes interconnection fees, direct development costs, and other overheads incurred for the development of prospective solar projects. Net realizable value is the estimated selling price in the ordinary course of business at the reporting date, less the estimated costs of completion and the estimated costs necessary to make the sale.

The Company’s inventory mainly consists of costs incurred on solar projects. Once a project is determined to be cancelled, the net realizable value of the related inventory items becomes nil and the costs are expensed.

(c) Unbilled revenue and unearned revenue:

Unbilled revenue and unearned revenue are a result of timing difference between when revenue is recognized and when billing is issued or collected. EPC services recognize revenue based on percentage of completion. Invoicing to customers typically follows milestones or predetermined schedules, which may not reflect the percentage of completion exactly.

(d) Foreign currency translation:

The functional currency of the Company is the Canadian dollar. Functional currencies of the Company’s subsidiaries are the currency of the primary economic environment in which the subsidiary operates.

Monetary assets and liabilities denominated in foreign currencies are translated to the appropriate functional currency at foreign exchange rates as at the balance sheet date. Foreign exchange differences arising on translation are recognized in the consolidated statements of comprehensive income (loss). Non-monetary assets that are measured in a foreign currency at historical cost are translated using the exchange rate at the date of the transaction.

In preparing the Company’s consolidated financial statements, the financial statements of each entity are translated into Canadian dollars. The assets and liabilities of foreign operations are translated into Canadian dollars at exchange rates prevailing at the balance sheet date. Revenues and expenses are translated at average exchange rates for the year. Foreign exchange differences are recognized in other comprehensive income.

|

|

POWERBANK CORPORATION

(FORMERLY SOLARBANK CORPORATION)

Notes to Consolidated Financial Statements

(Expressed in thousands of Canadian dollars, except per share amounts and as otherwise indicated)

For the years ended June 30, 2025 and 2024

3. Material accounting policies (continued):

(e) Short-term investments:

Short-term investments consist of investments with market values closely approximating book values and original maturities between three and twelve months at the time of purchase.

(f) Business combination:

The Company applies the acquisition method in accounting for business combinations. The consideration transferred by the Company to obtain control of a subsidiary is calculated as the sum of the acquisition-date fair values of assets transferred, liabilities incurred and the equity interests issued by the Company, which includes the fair value of any asset or liability arising from a contingent consideration arrangement. Acquisition costs are expensed as incurred. If the Company acquires a controlling interest in a business in which it previously held an equity interest, that equity interest is remeasured to fair value at the acquisition date with any resulting gain or loss recognised in profit or loss or other comprehensive income, as appropriate. Consideration transferred as part of a business combination may include the amounts related to the settlement of pre-existing relationships. The gain or loss on the settlement of any pre-existing relationship is recognised in profit or loss.

(g) Financial instruments:

The Company recognizes a financial asset or a financial liability in its consolidated statements of financial position when it becomes party to the contractual provisions of the instrument. At initial recognition, the Company measures a financial asset or a financial liability at its fair value plus or minus, in the case of a financial asset or a financial liability not at fair value through profit or loss, transaction costs that are directly attributable to the acquisition or issue of the financial asset or the financial liability.

(i) Financial assets:

The Company will classify financial assets as subsequently measured at amortized cost, fair value through other comprehensive income, or fair value through profit or loss based on its business model for managing the financial asset and the financial asset’s contractual cash flow characteristics. The three categories are defined as follows:

| A. | Financial assets at amortized cost: |

A financial asset is measured at amortized cost if both of the following conditions are met:

| ● | the asset is held within a business model whose objective is to hold assets in order to collect contractual cash flows; and | |

| ● | the contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding. |

The Company’s cash, restricted cash, trade and other receivables, unbilled revenue, tax equity assets and short-term investments are measured at amortized cost.

| B. | Financial assets at fair value through other comprehensive income (loss): |

Financial assets are classified and measured at fair value through other comprehensive income (loss) if they are held in a business model whose objective is achieved by both collecting contractual cash flows and selling financial assets. The Company does not have any financial assets classified as fair value through other comprehensive income (loss).

|

|

POWERBANK CORPORATION

(FORMERLY SOLARBANK CORPORATION)

Notes to Consolidated Financial Statements

(Expressed in thousands of Canadian dollars, except per share amounts and as otherwise indicated)

For the years ended June 30, 2025 and 2024

3. Material accounting policies (continued):

| C. | Financial assets at fair value through profit or loss: |

Any financial assets that are not held in one of the two business models mentioned are measured at fair value through profit or loss. The Company’s derivative financial instruments and investments are classified as fair value through profit or loss.

(ii) Financial liabilities:

The Company’s financial liabilities include trade and other payables, short-term loans, long-term debt, lease liability, other long-term liabilities and tax equity liabilities. The Company classifies its financial liabilities into one of two categories, depending on the purpose for which the asset was acquired. The Company’s accounting policy for each category is as follows:

| A. | Financial liabilities at fair value through profit or loss: |

Financial liabilities are classified at fair value through profit or loss if they are held for trading or are derivative liabilities. The Company classified derivatives, warrant liabilities, other liabilities due to non-controlling interest holders, and contingent value right (“CVR”) liabilities are classified at fair value through profit or loss. These instruments are remeasured at fair value at each reporting period end, with changes in fair value recognized in profit or loss.

| B. | Financial liabilities at amortized cost: |

Financial liabilities classified at amortized cost are those that are not classified as financial liabilities at fair value through profit or loss. Subsequent to initial recognition, they are carried at amortized cost using the effective interest rate (“EIR”) method. The Company’s trade and other payables, short-term loans, lease liabilities, long-term debt and tax equity liabilities are classified at amortized cost.

(h) Expected credit losses:

In accordance with IFRS 9, Financial Instruments, the Company recognizes loss allowances for expected credit losses (“ECLs”) on financial assets measured at amortized cost or at FVOCI are recognized. ECLs are updated at each reporting date on the basis of available information. The Company applies the simplified approach described in IFRS 9 to trade receivables, whereby the amount of the impairment allowance of a receivable is measured subsequent to initial recognition on the basis of lifetime expected credit losses.

|

|

POWERBANK CORPORATION

(FORMERLY SOLARBANK CORPORATION)

Notes to Consolidated Financial Statements