UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 20, 2024

ORGENESIS INC.

(Exact name of registrant as specified in its charter)

| Nevada | 001-38416 | 98-0583166 | ||

| (State or other jurisdiction | (Commission File | (IRS Employer | ||

| of incorporation | Number) | Identification No.) |

20271 Goldenrod Lane, Germantown, MD 20876

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (480) 659-6404

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock | ORGS | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b -2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modification to Rights of Security Holders.

The Board of Directors of Orgenesis Inc., a Nevada corporation (the “Company”), approved a reverse stock split of the Company’s authorized, issued and outstanding shares of common stock, par value $0.0001 per share (the “Common Stock”), at a ratio of 1-for-10 (the “Reverse Stock Split”). The Company expects that the effective time of the Reverse Stock Split will be on or about 5:00 pm New York time on Tuesday, September 24, 2024 (the “Effective Date”), with the Common Stock trading on the Nasdaq Capital Market (“Nasdaq”) on a reverse split-adjusted basis under the Company’s existing trading symbol, “ORGS,” at the market open on Wednesday, September 25, 2024.

Reasons for the Reverse Stock Split

The Company is effectuating the Reverse Stock Split to raise the per share bid price of the Company’s Common Stock above $1.00 per share and bring the Company back into compliance with Nasdaq Listing Rule 5550(a)(2). The Company will have regained compliance once the Company’s Common Stock trades at or above $1.00 for a minimum of 10 consecutive trading days, at which time Nasdaq will provide the Company with notice that it has regained compliance.

Effects of the Reverse Stock Split

Effective Date; Symbol; CUSIP Number. The Reverse Stock Split becomes effective with Nasdaq and the Common Stock will begin trading on a split-adjusted basis at the open of business on September 25, 2024. In connection with the Reverse Stock Split, the CUSIP number for the Common Stock will change to 68619K303.

Split Adjustment; Treatment of Fractional Shares. On the Effective Date, the total number of shares of Common Stock held by each stockholder of the Company will be converted automatically into the number of shares of Common Stock equal to: (i) the number of issued and outstanding shares of Common Stock held by each such stockholder immediately prior to the Reverse Stock Split divided by (ii) 10. Any fractional share of Common Stock that would otherwise result from the Reverse Stock Split will be rounded down to the nearest whole share and the Company shall pay to any person otherwise entitled to become a holder of a fraction of a share an amount in cash based on a per share value, with such cash payment being calculated by multiplying such fractional interest by the closing trading price of the Common Stock on the trading day immediately preceding the Effective Date. As a result, no fractional shares will be issued in connection with the Reverse Stock Split. The Company intends to treat stockholders holding shares of Common Stock in “street name” (that is, held through a bank, broker or other nominee) in the same manner as stockholders of record whose shares of Common Stock are registered in their names. Banks, brokers or other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding shares of our Common Stock in “street name;” however, these banks, brokers or other nominees may apply their own specific procedures for processing the Reverse Stock Split.

Also on the Effective Date, all options, warrants and convertible debt of the Company outstanding immediately prior to the Reverse Stock Split will be adjusted by dividing the number of shares of Common Stock into which the options, warrants and convertible debt are exercisable or convertible by 10 and multiplying the exercise or conversion price thereof by 10, all in accordance with the terms of the plans, agreements or arrangements governing such options, warrants and convertible debt and subject to rounding to the nearest whole share.

Certificated and Non-Certificated Shares. Stockholders who hold their shares in electronic form at brokerage firms do not need to take any action, as the effect of the Reverse Stock Split will automatically be reflected in their brokerage accounts.

Stockholders holding paper certificate(s) must send the certificate(s) to Securities Transfer Corporation, at the following address:

| By Mail: | By Overnight Delivery | For Assistance Please Call: | ||

|

Securities Transfer Corporation, Reorganization Department P.O. Box 701629 Dallas, TX 75370-1629 |

Securities Transfer Corporation, Reorganization Department 2901 N. Dallas Parkway, Suite 380 Plano, TX 75093 |

1-800-780-1920 |

Securities Transfer Corporation will issue the new shares in book entry reflecting the Reverse Stock Split to each requesting stockholder.

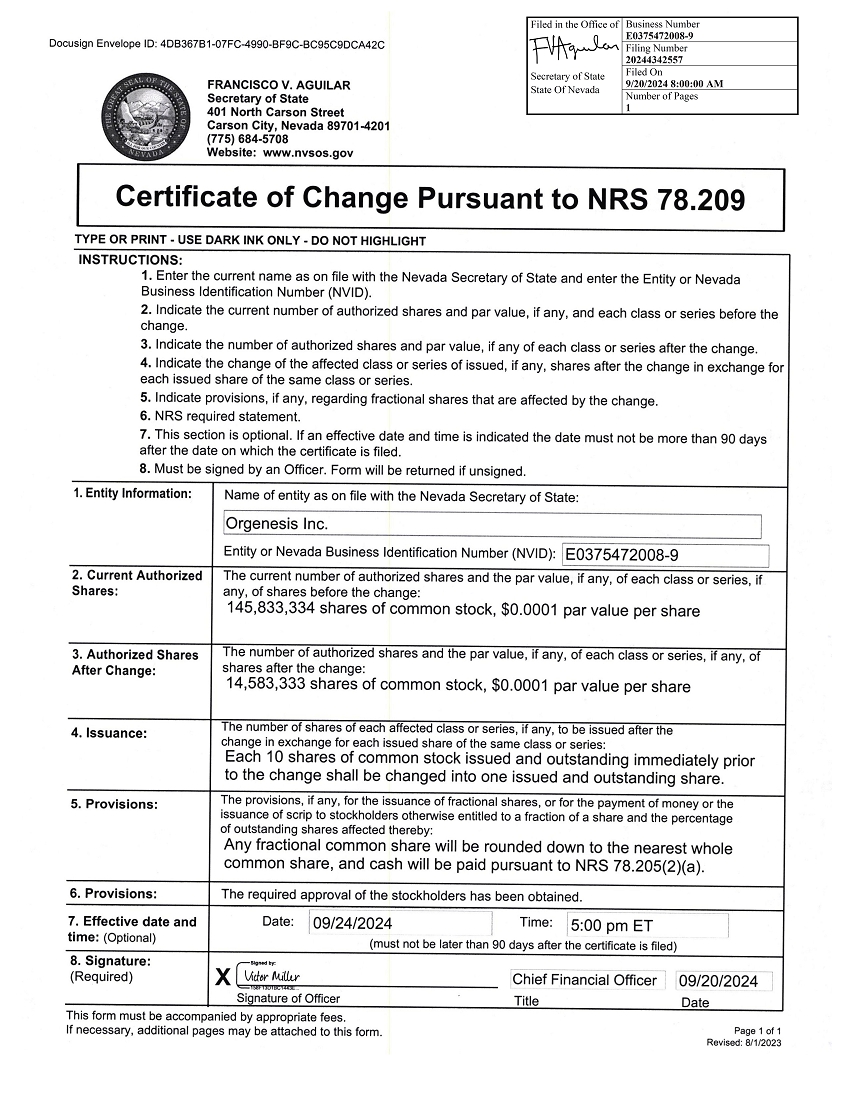

Certificate of Change. The Company effected the Reverse Stock Split pursuant to the Company’s filing of a Certificate of Change (the “Certificate”) with the Nevada Secretary of State on September 20, 2024, in accordance with Nevada Revised Statutes (“NRS”) 78.209. The Certificate is expected to become effective at or about 5:00 pm New York time on or about September 24, 2024. A copy of the Certificate is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

No Stockholder Approval Required. The Reverse Stock Split was approved by the Board of Directors of the Company and given effect pursuant to and in accordance with NRS 78.207 and, as such, no stockholder approval of the Reverse Stock Split is required.

Capitalization. Prior to the Reverse Stock Split, the Company was authorized to issue 145,833,334 shares of Common Stock. As a result of the Reverse Stock Split, the Company will be authorized to issue 14,583,333 shares of Common Stock. As of September 20, 2024, there were 47,707,849 shares of Common Stock outstanding. As a result of the Reverse Stock Split, there will be approximately 4,770,785 shares of Common Stock outstanding (subject to adjustment due to the effect of rounding fractional shares into whole shares).

Immediately after the Reverse Stock Split, each stockholder’s relative ownership interest in the Company and proportional voting power will remain virtually unchanged except for minor changes and adjustments that will result from rounding fractional shares into whole shares.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. Forward-looking statements may include, but are not limited to, statements related to the Reverse Stock Split, the effectiveness of the Certificate of Change, and the Company’s ability to regain compliance with Nasdaq’s minimum bid price requirement, as well as statements, other than historical facts, that address activities, events or developments that the company intends, expects, projects, believes or anticipates will or may occur in the future. These statements are often characterized by terminology such as “believes,” “hopes,” “may,” “anticipates,” “should,” “intends,” “plans,” “will,” “expects,” “estimates,” “projects,” “positioned,” “strategy” and similar expressions and are based on assumptions and assessments made in light of management’s experience and perception of historical trends, current conditions, expected future developments and other factors believed to be appropriate. Forward-looking statements in this Current Report on Form 8-K are made as of the date of this Current Report on Form 8-K, and the Company undertakes no duty to update or revise any such statements, whether as a result of new information, future events or otherwise. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, many of which are outside of the Company’s control. Important factors that could cause actual results, developments and business decisions to differ materially from forward-looking statements are described in the sections titled “Risk Factors” in the Company’s filings with the Securities and Exchange Commission, including its most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, as well as reports on Form 8-K, and include whether the Company will be successful in maintaining the listing of its Common Stock on Nasdaq and the effects of the Reverse Stock Split.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

The information set forth in Item 3.03 is hereby incorporated by reference into this Item 5.03.

Item 7.01 Regulation FD Disclosure.

On September 23, 2024, the Company issued a press release announcing the Reverse Stock Split. A copy of the press release is being filed as Exhibit 99.1 hereto and is incorporated by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| 3.1 | Certificate of Change of Orgenesis Inc. dated September 20, 2024 |

| 99.1 | Press Release, dated September 23, 2024 |

| 104 | Cover Page Interactive Data File (embedded with the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ORGENESIS INC. | ||

| Date: September 23, 2024 | By: | /s/ Victor Miller |

| Victor Miller | ||

| Chief Financial Officer, Treasurer and Secretary | ||

Exhibit 3.1

Exhibit 99.1

Orgenesis Announces Reverse Stock Split

GERMANTOWN, MD, September 23, 2024 – Orgenesis Inc. (Nasdaq:ORGS) (“Orgenesis” or the “Company”) today announced that its Board of Directors has approved a 1-for-10 reverse stock split of the Company’s common stock, par value $0.0001, which will be effective at 5:00 pm Eastern Time on September 24, 2024. The Company’s common stock will continue to be traded on The Nasdaq Capital Market on a split-adjusted basis beginning on September 25, 2024, under the Company’s existing trading symbol “ORGS”.

The reverse stock split is intended to regain compliance with the minimum bid price requirement of $1.00 per share of the Company’s common stock for continued listing on The Nasdaq Capital Market. The new CUSIP number following the reverse stock split will be 68619K303. The Company filed a Certificate of Change with the Nevada Secretary of State on September 20, 2024 to effect the reverse split.

The reverse stock split will affect all stockholders uniformly and will not alter the stockholder’s percentage ownership interest in the Company, except to the extent that the reverse stock split results in any of the Company’s stockholders owning a fractional share as described in more detail below. The reverse stock split will reduce the number of shares of common stock issued and outstanding from 47,707,849 to approximately 4,770,785. The total authorized number of shares of common stock will be proportionally reduced from 145,833,334 to 14,583,333 shares of common stock. No fractional shares will be issued in connection with the reverse stock split. Each stockholder who would otherwise be entitled to receive a fraction of a share of the Company’s common stock will be entitled to receive a cash payment based on the closing price per share of the Company’s common stock as quoted on the Nasdaq Capital Market on September 24, 2024.

As of the effective date of the reverse stock split, the number of shares of common stock available for issuance under the Company’s equity incentive plans and issuable upon the exercise of stock options, warrants and convertible notes outstanding immediately prior to the reverse stock split will be proportionately affected by the reverse stock split. The exercise prices of the Company’s outstanding options and warrants (and conversion prices of the Company’s outstanding convertible notes) will be adjusted in accordance with their respective terms.

Securities Transfer Corporation (“STC”), the Company’s transfer agent, will act as the exchange agent for the reverse stock split. STC will provide instructions to any stockholders with physical certificates regarding the process for exchanging their certificates for split-adjusted shares into “book-entry form”. Those stockholders with common stock in “street name” will receive instructions from their brokers.

About Orgenesis:

Orgenesis is a global biotech company that has been committed to unlocking the potential of cell and gene therapies (CGTs) since 2012 as well as a paradigm-shifting decentralized approach to processing since 2020. This new model allows Orgenesis to bring academia, hospitals, and industry together to make these essential therapies a reality sooner rather than later. Orgenesis is focusing on advancing its CGTs toward eventual commercialization, while partnering with key industry stakeholders to provide a rapid, globally harmonized pathway for these therapies to reach and treat a larger numbers of patients more cost effectively and with better outcomes through great science and decentralized production. Additional information about the Company is available at: www.orgenesis.com.

Forward-Looking Statements:

This press release contains forward-looking statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements in this press release that are not purely historical are forward-looking statements. Such forward-looking statements include, among other things, statements relating to the timing, consummation, and impact of the reverse stock split, the Company’s ability to regain compliance with Nasdaq’s minimum bid price requirement, and the actions of third parties, including STC, with respect to the reverse stock split. Actual results could differ from those projected in any forward-looking statement due to numerous factors. Such factors include, among others, our ability to maintain compliance with Nasdaq’s continued listing standard, our ability to secure additional capital, our reliance on, and our ability to grow our point-of-care cell therapy platform, our ability to achieve and maintain overall profitability, our ability to manage our research and development programs that are based on novel technologies, our ability to control key elements relating to the development and commercialization of therapeutic product candidates with third parties, the timing of completion of clinical trials and studies, the availability of additional data, outcomes of clinical trials of our product candidates, the potential uses and benefits of our product candidates, the sufficiency of working capital to realize our business plans and our ability to raise additional capital, the development of our POCare strategy, our trans differentiation technology as therapeutic treatment for diabetes, the technology behind our in-licensed ATMPs not functioning as expected, our ability to further our CGT development projects, either directly or through our JV partner agreements, and to fulfill our obligations under such agreements, our license agreements with other institutions, our ability to retain key employees, our competitors developing better or cheaper alternatives to our products, risks relating to legal proceedings against us and the risks and uncertainties discussed under the heading “RISK FACTORS” in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and in our other filings with the Securities and Exchange Commission. We undertake no obligation to revise or update any forward-looking statement for any reason.

Investor relations contact for Orgenesis:

Crescendo Communications, LLC

Tel: 212-671-1021

Orgs@crescendo-ir.com

Communications contact for Orgenesis:

IB Communications Neil Hunter / Michelle Boxall