UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-38064

Aeterna Zentaris Inc.

(Translation of registrant’s name into English)

c/o Norton Rose Fulbright Canada, LLP,

222 Bay Street, Suite 3000,

PO Box 53, Toronto ON M5K 1E7, Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Explanatory Note

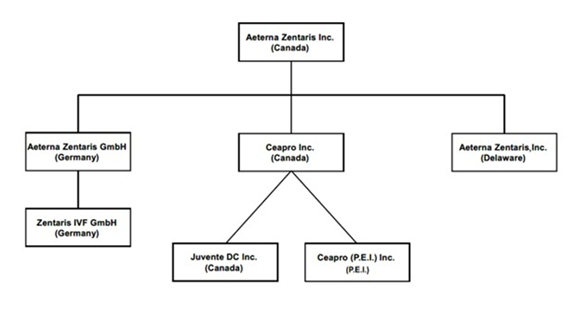

As previously announced, on December 14, 2023 Aeterna Zentaris Inc. (“Aeterna Zentaris”, “we”, “our” or the “Company”) and Ceapro Inc. (“Ceapro”) entered into an Arrangement Agreement (as amended by the Amendment Agreement, dated January 16, 2024, and as may be further amended, supplemented or otherwise modified from time to time, the “Arrangement Agreement”), pursuant to which Aeterna Zentaris and Ceapro undertook a business combination transaction (the “Arrangement”). Pursuant to the Arrangement Agreement, and subject to the terms and conditions therein, Aeterna Zentaris will acquire all of the issued and outstanding common shares in the capital of Ceapro in a company-approved Plan of Arrangement (the “Plan of Arrangement”) under the Canada Business Corporations Act such that Ceapro will become a wholly-owned subsidiary of Aeterna Zentaris and Aeterna Zentaris will continue the operations of Aeterna Zentaris and Ceapro on a combined basis (the “Arrangement”).

On May 14, 2024, we filed Amendment No.2 to our Registration Statement on Form F-1 (File No. 333-277115) (as amended, the “Warrant Registration Statement”) with the U.S. Securities and Exchange Commission (the “SEC”) relating to the offering for no consideration (the “Warrant Offering”) of up to 633,583 common share purchase warrants (“Aeterna Zentaris New Warrants”) to all of the holders (the “Shareholders”) of common shares, no par value per share (“Common Shares”), of Aeterna, and all of the holders (the “Aeterna Warrant Holders”) of our outstanding warrants to purchase Common Shares (“Aeterna Zentaris Adjusted Warrants”).

This Report on Form 6-K (this “Report”) includes certain updated information relating to the Plan of Arrangement, Ceapro and the Combined Company set forth in the prospectus included in the Warrant Registration Statement and is being filed to incorporate by reference the information included in this Report, including the exhibits hereto, into Aeterna Zentaris’ Registration Statements on Forms S-8 (No. 333-224737, No. 333-210561 and No. 333-200834) and Form F-3 (No. 333-254680) (collectively, the “Registration Statements”) and any future Registration Statements or post-effective amendments to Registration Statements that expressly incorporate this Report by reference therein.

This Report on Form 6-K and the Exhibits included with this Report are hereby incorporated by reference into the Registration Statements and shall be deemed to be a part thereof from the date on which this Report is furnished, to the extent not superseded by documents or reports subsequently filed or furnished. The information contained on any websites referenced in this Report or the Exhibits included with this Report are not incorporated by reference or deemed to be a part of this Report or any of the Registration Statements.

The Plan of Arrangement

In addition to the 633,583 Aeterna Zentaris New Warrants being issued to Aeterna Shareholders and Aeterna Warrant Holders in the Plan of Arrangement, we are also issuing (i) up to 1,847,719 Common Shares (the “Aeterna Plan Shares”) to the holders of Ceapro’s outstanding common shares (“Ceapro Shares”), and (ii) replacement options (the “Replacement Options”) exercisable for up to 67,929 Common Shares in exchange for outstanding options (vested and unvested) to purchase Ceapro common shares that Ceapro issued pursuant to its employee plans (“Ceapro Options”), in a transaction exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 3(a)(10) promulgated thereunder.

Each Aeterna Zentaris New Warrant will be exercisable, subject to adjustment, for one (1) Common Share at an exercise price of $0.01 per Common Share, will be exercisable at any time after the date of issuance and will expire three years from the date of issuance. The exercise price is paid on a cashless basis meaning that the number of Common Shares will be reduced by an amount equal to the aggregate exercise price of the Aeterna Zentaris New Warrants being exercised. Each Common Share (including Common Shares underlying the Aeterna Zentaris New Warrants) has associated with it one right to purchase a Common Share under our amended and restated shareholder rights plan dated as of March 26, 2019.

If consummated, on the effective date of the Plan of Arrangement (the “Effective Date”) existing Shareholders and former Ceapro Shareholders would each own approximately 50% of the outstanding Common Shares assuming the exercise of all of the Aeterna Zentaris New Warrants and based on the number of Common Shares and Ceapro Shares issued and outstanding as of market close on December 13, 2023, the day prior to the execution of the Arrangement Agreement, which established the exchange ratio for the Plan of Arrangement. For further information regarding the Combined Company, see section entitled “Information Concerning the Combined Company” below.

Aeterna Zentaris has applied to list all of its Common Shares, including its existing Common Shares and the Common Shares issued to Ceapro’s shareholders and the Common Shares issuable upon the exercise of the Aeterna Zentaris New Warrants in the Plan of Arrangement, on the Toronto Stock Exchange (the “TSX”) and has filed an initial listing application with the NASDAQ Stock Market for the continued listing of its Common Shares on the NASDAQ Capital Market (“NASDAQ”), as the exchange has determined that the Plan of Arrangement constitutes a “change of control” under its rules and regulations, and such approval is a condition to closing of the Plan of Arrangement.

|

|

The Arrangement Agreement contains customary representations and warranties and is subject to customary conditions to closing and other restrictive covenants, including, but not limited to, the following:

| ● | Directors and Officers: Upon the occurrence of the Plan of Arrangement, effective as of the Effective Date, certain directors of Aeterna Zentaris will resign, the number of director seats on the Aeterna Zentaris Board will be increased and nominees of Ceapro will be appointed to fill such vacancies on the Aeterna Zentaris Board, to the extent permitted by law. Furthermore, Aeterna Zentaris will appoint a new Chief Executive Officer as of the Effective Date. | |

| ● | Non-Solicitation: Subject to certain exceptions, neither party will solicit or assist in the initiation of proposals that could result in an Acquisition Proposal by a third-party. | |

| ● | Notification of Proposals: A Party that receives an acquisition solicitation has to notify the other Party within 24 hours of its receipt of such solicitation and must provide certain information and details relating to such acquisition solicitation. | |

| ● | Superior Proposal: Notwithstanding other restrictions contained in the Plan of Arrangement, in the event a Party receives a superior proposal from a third-party, such Party may, subject to compliance with the terms of the Plan of Arrangement, enter into a definitive agreement with a party providing for an Acquisition Proposal so long as such Acquisition Proposal constitutes a Superior Proposal. | |

| ● | Termination of Arrangement Agreement: The parties may terminate the Arrangement Agreement upon the occurrence of certain conditions, and in any event, if the Effective Date has not occurred on or before June 14, 2024. | |

| ● | Termination Fees: Upon the occurrence of certain termination events pursuant to the terms of the Arrangement Agreement, Aeterna Zentaris shall be entitled to a fee of US$500,000 to be paid by Ceapro within the time(s) specified in the Arrangement Agreement in respect to each termination event. |

On March 12, 2024, the shareholders of both Aeterna Zentaris and Ceapro approved the Plan of Arrangement, and on March 28, 2024, the Court of King’s Bench of Alberta issued its final order approving the Plan of Arrangement. No Ceapro Shareholders exercised their Dissent Rights in connection with the Plan of Arrangement.

In order to become effective, the Plan of Arrangement requires, among other things, regulatory approvals, including the Securities and Exchange Commission (the “SEC”) declaring the Warrant Registration Statement effective and receipt of approvals from the TSX Venture Exchange (the “TSXV”), TSX and NASDAQ, as well as the satisfaction of certain closing conditions customary to transactions of this nature.

Share Consolidation

On May 3, 2024, the previously announced 4:1 share consolidation (or reverse stock split) (the “Share Consolidation”) of Aeterna Zentaris’ Common Shares became effective on the basis of one post-Share Consolidation Common Share for every four pre-Share Consolidation Common Shares and the Common Shares commenced trading on a post-Share Consolidation basis on the TSX and NASDAQ at the opening of trading on such date.

|

|

About this Report on Form 6-K

This Report does not constitute an offer to sell, or a solicitation of an offer to buy our securities. We have not done anything that would permit the offer of any securities or possession or distribution of this Report in any jurisdiction where action for that is required other than the United States.

References in this Report to the “Form 20-F” are to our Annual Report on Form 20-F for the year ended December 31, 2023 filed with the SEC on March 27, 2024.

Except as otherwise indicated, the information concerning Ceapro contained in this Report is based solely on information provided to Aeterna Zentaris by Ceapro or is taken from, or is based upon, publicly available information. Information concerning Ceapro should be read together with, and is qualified by, the documents and information related to Ceapro incorporated by reference herein. Although we have no knowledge that would indicate that any of the information provided by Ceapro is untrue or incomplete, neither we nor any of our officers or directors assumes any responsibility for the failure by Ceapro to disclose facts or events which may have occurred or may affect the completeness or accuracy of such information but which are unknown to us. We have no knowledge of any material information concerning Ceapro that has not been generally disclosed.

In this Report, unless otherwise indicated, references to “we”, “us”, “our”, “Aeterna Zentaris” the “Corporation” or the “Company” are to Aeterna Zentaris Inc., a Canadian corporation, and its consolidated subsidiaries, prior to consummation of the Plan of Arrangement, unless it is clear that such terms refer only to Aeterna Zentaris Inc. excluding its subsidiaries.

In this Report, unless otherwise indicated, references to “Ceapro” are to Ceapro Inc., a corporation existing under the federal laws of Canada, and its consolidated subsidiaries, prior to consummation of the Plan of Arrangement, unless it is clear that such terms refer only to Ceapro Inc. excluding its subsidiaries.

In this Report, unless otherwise indicated, references to the “Combined Company” are to Aeterna Zentaris, and its consolidated subsidiaries, after the completion of the Plan of Arrangement, unless it is clear that such terms refer only to Aeterna Zentaris, excluding its subsidiaries, after the completion of the Plan of Arrangement.

The financial statements included in or incorporated by reference into this Report have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”), and thus may not be comparable to financial statements of United States (“U.S.”) companies.

Certain information presented in this Report, including certain documents incorporated by reference herein, may include non-IFRS measures that are used by us as indicators of financial performance. These financial measures do not have standardized meanings prescribed under IFRS and our computation may differ from similarly-named computations as reported by other entities and, accordingly, may not be comparable. These financial measures should not be considered as an alternative to, or more meaningful than, measures of financial performance as determined in accordance with IFRS as an indicator of performance. We believe these measures may be useful supplemental information to assist investors in assessing our operational performance and our ability to generate cash through operations. The non-IFRS measures also provide investors with insight into our decision making as we use these non-IFRS measures to make financial, strategic and operating decisions.

Unless otherwise stated, currency amounts in this Report are stated in United States dollars, or “$” or “US$”. All references to “C$” are to Canadian dollars.

Aeterna Zentaris’ historical financial statements are presented in US dollars and Ceapro’s historical financial statements are presented in Canadian dollars. Unless otherwise indicated, all monetary information included or incorporated by reference in this Report related to Aeterna Zentaris is presented in US dollars and all monetary information in this Report related to Ceapro is presented in Canadian dollars.

The unaudited pro forma condensed consolidated financial information of the Combined Company included in this Report is presented in Canadian dollars. Aeterna Zentaris’ financial statements were translated from US dollars to Canadian dollars in the unaudited pro forma condensed consolidated statement of financial position of the Combined Company as at December 31, 2023 at a spot exchange rate of C$1.3495 = US$1.00. Aeterna Zentaris’ financial statements were translated from US dollars to Canadian dollars in the statement of income (loss) of the Combined Company at the average exchange rate of C$1.3495 = US$1.00 for the year ended December 31, 2023.

It has not yet been determined which currency the Combined Company’s financial statements will be presented if the Plan of Arrangement is consummated.

|

|

Unless otherwise indicated, all references to numbers of our Common Shares, Aeterna Zentaris Adjusted Warrants and all other outstanding convertible securities in this Report have been adjusted to reflect the Share Consolidation.

Unless otherwise indicated, the number of Common Shares to be outstanding after the Plan of Arrangement in this Report is based on 1,213,969 Common Shares outstanding as of December 31, 2023, as adjusted for the Share Consolidation, and excludes:

| ● | 114,405 Common Shares issuable upon the exercise of outstanding Aeterna Zentaris Adjusted Warrants at a weighted average exercise price of $87.04 per share; |

| ● | 13,350 Common Shares issuable upon the exercise of outstanding Aeterna Zentaris employee stock options (vested and unvested) at a weighted average exercise price of $50.05 per share; |

| ● | 218,512 Common Shares reserved for future issuance under our 2018 Long-Term Incentive Plan dated March 27, 2018; |

| ● | 67,929 Common Shares issuable upon the exercise of outstanding Replacement Options (vested and unvested) to be issued to Ceapro’s employees in the Plan of Arrangement in exchange for the Ceapro Options (vested and unvested); and |

| ● | 633,583 Common Shares issuable upon the exercise of Aeterna Zentaris New Warrants to be issued to our Shareholders and the Aeterna Warrant Holders in the Warrant Offering at an exercise price of $0.01 per share. |

Unless otherwise stated, outstanding share information throughout this Report excludes such outstanding securities.

No Offer or Solicitation

This Report on Form 6-K and the exhibit attached hereto and incorporated by reference herein, and the information contained herein and therein are not, and do not, constitute an offer to sell any securities or a solicitation of an offer to buy any securities in the United States or any other state or jurisdiction, nor shall any securities of Aeterna Zentaris or the Combined Company be offered or sold in any jurisdiction in which such an offer, solicitation or sale would be unlawful. Neither the SEC nor any state securities commission has approved or disapproved of the transactions described herein or determined if this communication is truthful or complete. Any representation to the contrary is a criminal offense.

You should not construe the contents of this Report on Form 6-K or the exhibit attached hereto and incorporated herein by reference as legal, tax, accounting or investment advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein.

Forward-Looking Statements

The information in this Report and the exhibits attached hereto and incorporated herein by reference include forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, specifically Section 27A of the Securities Act and Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements involve a number of known and unknown risks, uncertainties and other factors that could result in outcomes to be materially different from historical results or from any future results expressed or implied by such forward-looking statements.

|

|

Forward-looking statements include, but are not limited to, the ability of Aeterna Zentaris and Ceapro to successfully consummate the Plan of Arrangement pursuant to the Arrangement Agreement within the time expected or at all and, if completed, the anticipated benefits and synergies as well as the assets, cost structure, financial position, cash flows and growth prospects of the Combined Company.

Factors that could cause actual results or outcomes to differ materially from expectations include, among others, the following:

| ● | securities exchange approvals from the TSXV, NASDAQ and the TSX; | |

| ● | our ability to raise capital and obtain financing to continue our currently planned operations; | |

| ● | our ability to meet the continued listing requirements of the NASDAQ and maintain listing of our Common Shares on the NASDAQ; | |

| ● | our ability to continue as a going concern, which is dependent, in part, on our ability to transfer cash from AEZS Germany to Aeterna Zentaris and the U.S. subsidiary and to secure additional financing; | |

| ● | our now heavy dependence on the success of Macrilen™ (macimorelin) and related out-licensing arrangements and the continued availability of funds and resources to successfully commercialize the product, including our heavy reliance on the success of the license and assignment agreement with Novo Nordisk A/S; | |

| ● | our ability to enter into out-licensing, development, manufacturing, marketing and distribution agreements with other pharmaceutical companies and keep such agreements in effect; | |

| ● | our reliance on third parties for the manufacturing and commercialization of Macrilen™ (macimorelin); | |

| ● | potential disputes with third parties, leading to delays in or termination of the manufacturing, development, out-licensing or commercialization of our product candidates, or resulting in significant litigation or arbitration; | |

| ● | uncertainties related to the regulatory process; | |

| ● | unforeseen global instability, including the instability due to the global pandemic of the novel coronavirus; | |

| ● | our ability to efficiently commercialize or out-license Macrilen™ (macimorelin); | |

| ● | our reliance on the success of the pediatric clinical trial in the European Union (“E.U.”) and U.S. for Macrilen™ (macimorelin); | |

| ● | the degree of market acceptance of Macrilen™ (macimorelin); | |

| ● | our ability to obtain necessary approvals from the relevant regulatory authorities to enable us to use the desired brand names for our product; | |

| ● | our ability to successfully negotiate pricing and reimbursement in key markets in the E.U. for Macrilen™ (macimorelin); | |

| ● | any evaluation of potential strategic alternatives to maximize potential future growth and shareholder value may not result in any such alternative being pursued, and even if pursued, may not result in the anticipated benefits; | |

| ● | our ability to protect our intellectual property; and | |

| ● | the potential of liability arising from shareholder lawsuits and general changes in economic conditions. |

Additional factors that could cause actual results to differ materially include those risks identified in the section entitled “Risk Factors” as well as in Item 3. “Key Information – Risk Factors” contained in our Form 20-F and our other filings and submissions from time to time with the SEC, which are available on the Company’s website located at www.aeterna.com. Investors should also consult the Company’s other quarterly and annual filings with the Canadian and U.S. securities commissions for additional information on risks and uncertainties.

Many

of these factors are beyond our control. We caution you not to place undue reliance on these forward-looking statements. All written

and oral forward-looking statements attributable to the Company and/or Ceapro, or persons acting on their behalf, are qualified in their

entirety by these cautionary statements. Moreover, unless required by law to update these statements, we will not necessarily update

any of these statements after the date hereof, either to conform them to actual results or to changes in their expectation.

|

|

RISK FACTORS

Investing in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described below in this Report and the information in Item 3. “Key Information – Risk Factors” contained in the Form 20-F and our other subsequent filings and submissions to the SEC from time to time on Form 20-F and Form 6-K, including our other quarterly and annual filings filed with the Canadian securities regulatory authorities.

These risks are not the only risks we face. Additional risks not presently known to us, or that we currently view as immaterial, may also impair our business, if any of the risks described in our SEC filings or any additional risks actually occur, our business, financial condition, results of operations and cash flows could be materially and adversely affected. In that case, the value of our securities could decline substantially and you could lose all or part of your investment.

Risk Factors Relating to the Plan of Arrangement

The Plan of Arrangement remains subject to satisfaction or waiver of several conditions, including receipt of the Stock Exchange Approvals and there can be no certainty that all conditions precedent to the Plan of Arrangement will be satisfied or waived. Failure to complete the Plan of Arrangement could negatively impact the market price of the Common Shares.

Completion of the Plan of Arrangement remains subject to satisfaction or waiver of several conditions, including receipt of the Stock Exchange Approvals. The completion of the Plan of Arrangement is conditional on, among other things, the receipt of the Regulatory Approvals. The completion of the Plan of Arrangement is also subject to the Consideration Shares and the Replacement Options to be issued pursuant to the Plan of Arrangement being exempt from the prospectus and registration requirements of applicable Securities Laws either by virtue of exemptive relief from the securities regulatory authorities of each of the provinces of Canada or by virtue of applicable exemptions under Securities Laws, including pursuant to the Section 3(a)(10) Exemption, and not being subject to resale restrictions, including under the U.S. Securities Act, subject to restrictions applicable to affiliates (as defined in Rule 405 of the U.S. Securities Act) of Aeterna Zentaris at the Effective Date or within 90 days of the Effective Date.

Certain of the conditions to completion of the Plan of Arrangement are outside of the control of Aeterna Zentaris. There can be no certainty, nor can Aeterna Zentaris provide any assurance, that all conditions precedent to the Plan of Arrangement will be satisfied or waived, or, if satisfied or waived, when they will be satisfied or waived and, accordingly, the Plan of Arrangement may not be completed. If, for any reason, the Plan of Arrangement is not completed or its completion is materially delayed and/or the Arrangement Agreement is terminated, the market price of the Common Shares may be materially adversely affected. In such events, Aeterna Zentaris’ business, financial condition or results of operations could also be subject to various material adverse consequences, including that Aeterna Zentaris would remain liable for costs relating to the Plan of Arrangement.

If the Plan of Arrangement is not completed and Aeterna Zentaris decides to seek another transaction, there can be no assurance that it will be able to find another merger on equivalent or more attractive terms than pursuant to the Plan of Arrangement. Furthermore, Ceapro may be entitled to a termination fee from Aeterna Zentaris upon the occurrence of certain events resulting in the termination of the Plan of Arrangement.

Restrictions on the Company’s business during the Interim Period.

The Arrangement Agreement imposes certain restrictions on the conduct of the Company’s business during the Interim Period, being the period between the execution of the Arrangement Agreement and the consummation of the Plan of Arrangement, which may have a negative impact on its performance. As the Plan of Arrangement is dependent upon the satisfaction of certain conditions, its completion is subject to uncertainty, and the Company’s customers and suppliers may delay or defer decisions concerning the Company which could have a negative impact on the Company’s business and operations, regardless of whether the Plan of Arrangement is ultimately completed.

|

|

Completion of the Plan of Arrangement is uncertain. Aeterna Zentaris has dedicated significant resources to pursuing the Plan of Arrangement and is restricted from taking certain specified actions while the Plan of Arrangement is pending and failure to complete the Plan of Arrangement could negatively impact Aeterna Zentaris’ business.

Aeterna Zentaris and Ceapro are subject to certain non-solicitation provisions under the Arrangement Agreement with respect to an Acquisition Proposal. The Arrangement Agreement also restricts Aeterna Zentaris from taking certain specified actions until the Plan of Arrangement is completed, without the consent of Ceapro. These restrictions may prevent Aeterna Zentaris from pursuing attractive business opportunities that may arise prior to the completion of the Plan of Arrangement. As completion of the Plan of Arrangement is dependent upon satisfaction of certain conditions, the completion of the Plan of Arrangement is uncertain. If the Plan of Arrangement is not completed for any reason, the announcement of the Plan of Arrangement, the dedication of Aeterna Zentaris’ resources to the completion thereof and the restrictions that were imposed on Aeterna Zentaris under the Arrangement Agreement may have an adverse effect on the current or future operations, financial condition and prospects of Aeterna Zentaris as a standalone entity.

The Arrangement Agreement may be terminated by Aeterna Zentaris or Ceapro in certain circumstances, which could result in significant costs and could negatively impact the market price of the Common Shares.

In addition to termination rights relating to the failure to satisfy the conditions of closing, each of Aeterna Zentaris and Ceapro has the right, in certain circumstances, to terminate the Arrangement Agreement and the Arrangement. Accordingly, there is no certainty, nor can Aeterna Zentaris provide any assurance, that the Arrangement Agreement will not be terminated by either Aeterna Zentaris or Ceapro before the implementation of the Plan of Arrangement. Failure to complete the Plan of Arrangement could negatively impact the trading price of the Common Shares or otherwise adversely affect Aeterna Zentaris’ business.

Because the market price of the Common Shares and the Ceapro Shares will fluctuate and the Exchange Ratio is fixed, there can be no certainty with respect to the market value of the Consideration Shares that Ceapro Shareholders will receive for their Ceapro Shares under the Plan of Arrangement.

The Exchange Ratio is fixed and will not increase or decrease due to fluctuations in the market price of Common Shares or Ceapro Shares. The market price of the Common Shares or Ceapro Shares could each fluctuate significantly prior to the Effective Date in response to various factors and events, including, without limitation, the differences between Aeterna Zentaris and Ceapro’s actual financial or operating results and those expected by investors and analysts, changes in analysts’ projections or recommendations, changes in general economic or market conditions and broad market fluctuations. The underlying cause of any such change in relative market price may constitute an Aeterna Zentaris Material Adverse Effect or Ceapro Material Adverse Effect, the occurrence of which in respect of a Party could entitle the other Party to terminate the Arrangement Agreement or otherwise entitle either Party to terminate the Arrangement Agreement. As a result of such fluctuations, historical market prices are not indicative of future market prices or the market value of the Consideration Shares that the Ceapro Shareholders may receive on the Effective Date. There can also be no assurance that the trading price of the Common Shares will not decline following the completion of the Plan of Arrangement. Accordingly, the market value represented by the Exchange Ratio will also vary.

The issuance of a significant number of Common Shares and a resulting “market overhang” could adversely affect the market price of the Common Shares following completion of the Plan of Arrangement.

On completion of the Plan of Arrangement, a significant number of additional Common Shares will be issued and available for trading in the public market. The increase in the number of Common Shares may lead to sales of such shares or the perception that such sales may occur (commonly referred to as “market overhang”), either of which may adversely affect the market for, and the market price of, the Common Shares.

|

|

The issuance of the Consideration Shares and the Common Shares upon the exercise of the Aeterna Zentaris New Warrants in connection with the Plan of Arrangement could result in the dilution of ownership and voting interests of current Shareholders.

As of the Record Date, Aeterna Zentaris had 4,855,876 Common Shares issued and outstanding. Following the Share Consolidation and immediately prior to the Plan of Arrangement, it is expected that there will be 1,213,969 Common Shares issued and outstanding. It is anticipated that upon completion of the Plan of Arrangement and the Share Consolidation, there will be 3,695,271 Common Shares, 114,405 existing common share purchase warrants exercisable for 114,405 Common Shares, 13,350 Aeterna Zentaris Options (vested and unvested) exercisable for 13,350 Common Shares, 49,230 Aeterna Zentaris DSUs for 49,230 Common Shares, 633,583 Aeterna Zentaris New Warrants exercisable for 633,583 Common Shares with an exercise price of $0.01 per Common Share, and 67,929 Replacement Options (vested and unvested) exercisable for 67,929 Common Shares issued and outstanding. This increase in the number of issued and outstanding Common Shares post-Arrangement may have a depressive effect on the price of the Common Shares. In addition, as a result of the issuance of such additional Common Shares, the voting power of the existing Shareholders will be substantially diluted. Aeterna Zentaris may, in its sole discretion in accordance with its constituent documents and subject to applicable laws, including the policies of the TSX and NASDAQ, issue additional Common Shares or other securities (equity, debt or otherwise) from time to time, and the interests of the holders of Common Shares may be diluted thereby. Aeterna Zentaris’ constating documents permit the issuance of an unlimited number of Common Shares, and shareholders will have no pre-emptive rights in connection with such further issuances. In addition, when outstanding options are exercised or when Common Shares are issued on the vesting or settlement of outstanding share units, an investor will incur additional dilution. Accordingly, holders of Common Shares may suffer dilution.

The Raymond James Fairness Opinion is based on many factors.

The Company has obtained the Raymond James Fairness Opinion from Raymond James. The Raymond James Fairness Opinion is, of necessity, based on many factors, including an analysis of past results and certain assumptions governing future results. There can be no assurance that the Raymond James Fairness Opinion will prove, in retrospect, to have been accurate.

Aeterna Zentaris and Ceapro may be the targets of legal claims, securities class actions, derivative lawsuits and other claims. Any such claims may delay or prevent the Plan of Arrangement from being completed.

Aeterna Zentaris and Ceapro may be the target of securities class actions and derivative lawsuits which could result in substantial costs and may delay or prevent the Plan of Arrangement from being completed. Securities class action lawsuits and derivative lawsuits are often brought against companies that have entered into an agreement to acquire a public company or to be acquired. Third parties may also attempt to bring claims against Aeterna Zentaris and Ceapro seeking to restrain the Plan of Arrangement or seeking monetary compensation or other remedies. Even if the lawsuits are without merit, defending against these claims can result in substantial costs and divert management time and resources. Additionally, if a plaintiff is successful in obtaining an injunction prohibiting consummation of the Plan of Arrangement, then that injunction may delay or prevent the Plan of Arrangement from being completed.

In addition, political and public attitudes towards the Plan of Arrangement could result in negative press coverage and other adverse public statements affecting Aeterna Zentaris and Ceapro. Adverse press coverage and other adverse statements could lead to investigations by regulators, legislators and law enforcement officials or in legal claims or otherwise negatively impact the ability of Aeterna Zentaris to take advantage of various business and market opportunities. The direct and indirect effects of negative publicity, and the demands of responding to and addressing it, may have a material adverse effect on Aeterna Zentaris’ business, financial condition and results of operations.

Aeterna Zentaris and Ceapro will incur substantial transaction fees and costs in connection with the proposed Arrangement. If the Plan of Arrangement is not completed, the costs may be significant and could have an adverse effect on Aeterna Zentaris.

Aeterna Zentaris and Ceapro have incurred and expect to incur additional material non-recurring expenses in connection with the Plan of Arrangement and completion of the transactions contemplated by the Arrangement Agreement, including costs relating to obtaining the satisfaction of the conditions to closing the Plan of Arrangement provided in the Arrangement Agreement. Additional unanticipated costs may be incurred by Aeterna Zentaris in the course of coordinating the businesses of Aeterna Zentaris and Ceapro after the completion of the Plan of Arrangement. If the Plan of Arrangement is not completed, Aeterna Zentaris will need to pay certain costs relating to the Plan of Arrangement incurred prior to the date the Plan of Arrangement was abandoned, such as legal, accounting, financial advisory and printing fees. Aeterna Zentaris is liable for its own costs incurred in connection with the Plan of Arrangement. Such costs may be significant and could have an adverse effect on Aeterna Zentaris’ future results of operations, cash flows and financial condition.

|

|

Prior to the Effective Date, the Plan of Arrangement may divert the attention of Aeterna Zentaris’ management, and any such diversion could have an adverse effect on the business of Aeterna Zentaris.

The pending Arrangement could cause the attention of Aeterna Zentaris’ management to be diverted from the day-to-day operations of Aeterna Zentaris. These disruptions could be exacerbated by a delay in the completion of the Plan of Arrangement and could result in lost opportunities or negative impacts on performance, which could have a material and adverse effect on the business, financial condition and results of operations or prospects of Aeterna Zentaris if the Plan of Arrangement is not completed, and on the business of Aeterna Zentaris following the Effective Date.

The Aeterna Zentaris Board considered financial projections prepared by Aeterna Zentaris management in connection with the Plan of Arrangement. Actual performance of Aeterna Zentaris and Ceapro may differ materially from these projections.

The Aeterna Zentaris Board considered, among other things, certain projections, prepared by Aeterna Zentaris management, with respect to each of Ceapro (the “Ceapro Projections”) and Aeterna Zentaris (the “Aeterna Zentaris Projections”, together with the Ceapro Projections, the “Projections”). All such projections are based on assumptions and information available at the time the Projections were prepared. Aeterna Zentaris does not know whether the assumptions made will be realized. Such information can be adversely affected by known or unknown risks and uncertainties, many of which are beyond Aeterna Zentaris and Ceapro’s control. Further, financial forecasts of this type are based on estimates and assumptions that are inherently subject to risks and other factors such as counterparty performance, technical estimates, industry performance, legal and regulatory developments, general business, economic, regulatory, market and financial conditions, as well as changes to the business, financial condition or results of operations of Aeterna Zentaris and Ceapro, including the factors described in this “Risk Factors” section and under the section entitled “Forward-Looking Statements”, which factors and changes may impact such forecasts or the underlying assumptions. As a result of these contingencies, there can be no assurance that the Projections will be realized or that actual results will not be significantly higher or lower than projected. In view of these uncertainties, the references to the Projections in this Report should not be regarded as an indication that Aeterna Zentaris, the Aeterna Zentaris Board, or any of its advisors or any other recipient of this information considered, or now considers, it to be an assurance of the achievement of future results.

The Projections were prepared by Aeterna Zentaris management for internal use and to, among other things, assist Aeterna Zentaris in evaluating the Plan of Arrangement. The Projections were not prepared with a view toward public disclosure or toward compliance with IFRS, published guidelines of applicable securities regulatory authorities or the guidelines established by the Chartered Professional Accountants for preparation and presentation of prospective financial information. Neither Aeterna Zentaris’ independent registered public accounting firms, nor any other independent accountants, have compiled, examined, or performed any procedures with respect to the Projections, nor have they expressed any opinion or any other form of assurance on such information or its achievability, and assume no responsibility for, and disclaim any association with, the Projections.

There could be unknown or undisclosed risks or liabilities of Ceapro for which Aeterna Zentaris is not permitted to terminate the Arrangement Agreement.

While Aeterna Zentaris conducted due diligence with respect to Ceapro prior to entering into the Arrangement Agreement, there are risks inherent in any transaction. Specifically, there could be unknown or undisclosed risks or liabilities of Ceapro for which Aeterna Zentaris is not permitted to terminate the Arrangement Agreement. Any such unknown or undisclosed risks or liabilities could materially and adversely affect Aeterna Zentaris’ financial performance and results of operations. Aeterna Zentaris could encounter additional transaction and enforcement-related costs and may fail to realize any or all of the potential benefits from the Arrangement Agreement. Any of the foregoing risks and uncertainties could have a material adverse effect on Aeterna Zentaris’ business, financial condition and results of operations.

|

|

Although Aeterna Zentaris has conducted due diligence on Ceapro, it has not verified the reliability of all of the information regarding Ceapro included in, or which may have been omitted from, this Report.

Unless otherwise indicated, all historical information regarding Ceapro contained in this Report, including all Ceapro financial information and all pro forma financial information of Ceapro reflecting the pro forma effects of the acquisition of Ceapro by Aeterna Zentaris, has been derived from Ceapro’s publicly disclosed information or provided by Ceapro. Although Aeterna Zentaris conducted due diligence on Ceapro to its satisfaction in connection with the Plan of Arrangement and has no reason to doubt the accuracy or completeness of such information, any inaccuracy or material omission in Ceapro’s publicly disclosed information, including the information about or relating to Ceapro contained in this Report, could result in unanticipated liabilities or expenses, increase the cost of integrating the companies or adversely affect Aeterna Zentaris’ operational and development plans and Aeterna Zentaris’ business, financial condition and results of operations.

Uncertainty surrounding the Plan of Arrangement could adversely affect Aeterna Zentaris’ retention of personnel and could negatively impact future business and operations.

The Plan of Arrangement is dependent upon the satisfaction of various conditions, and as a result its completion is subject to uncertainty. In response to this uncertainty, current and prospective employees of Aeterna Zentaris may experience uncertainty about their future roles until such time as Aeterna Zentaris’ plans with respect to such employees are determined and announced. This may adversely affect Aeterna Zentaris’ ability to attract or retain key employees in the period until the Plan of Arrangement is completed or thereafter.

Risk Factors Relating to the Share Consolidation

Reducing the number of issued and outstanding Common Shares through the Share Consolidation is intended, absent other factors, to increase the per share market price of the Common Shares. However, the market price of the Common Shares will also be affected by the Company’s financial and operational results, its financial position, including its liquidity and capital resources, the development of its reserves and resources, industry conditions, the market’s perception of the Company’s business and other factors, which are unrelated to the number of Common Shares outstanding.

Having regard to these other factors, there can be no assurance that the market price of the Common Shares will increase following the implementation of the Share Consolidation to the extent sufficient to ensure compliance with the Bid Price Rule and allow for the continued listing of the Common Shares on the NASDAQ following the completion of the Plan of Arrangement, or that the market price of the Common Shares will not decrease in the future and result in noncompliance with the continuous listing Bid Price Rule. There can also be no assurance that the implementation of the Share Consolidation will, in and of itself, guarantee the continued listing of the Common Shares on the NASDAQ or that the Common Shares will not be delisted from the NASDAQ because the Company fails to meet other NASDAQ listing requirements.

The market price of the Common Shares immediately following the implementation of the Share Consolidation was expected to be approximately equal to the market price of the Common Shares prior to the implementation of the Share Consolidation multiplied by the Share Consolidation Ratio but there is no assurance that the anticipated market price following the implementation of the Share Consolidation will be realized or, if realized, will be sustained or will increase. There is a risk that the total market capitalization of the Common Shares (the market price of the Common Shares multiplied by the number of Common Shares outstanding) after the implementation of the Share Consolidation may be lower than the total market capitalization of the Common Shares prior to the implementation of the Share Consolidation.

Although the Company believes that establishing a higher market price for the Common Shares could increase investment interest for the Common Shares in equity capital markets by potentially broadening the pool of investors that may consider investing in the Company, including investors whose internal investment policies prohibit or discourage them from purchasing stocks trading below a certain minimum price, there is no assurance that implementing the Share Consolidation will achieve this result.

|

|

If, following the Share Consolidation, the market price of the Common Shares (adjusted to reflect the Share Consolidation Ratio) declines, the percentage decline as an absolute number and as a percentage of the Company’s overall market capitalization may be greater than would have occurred if the Share Consolidation had not been implemented. Both the total market capitalization of a company and the adjusted market price of such company’s shares following a consolidation or reverse split may be lower than they were before the consolidation or reverse split took effect. The reduced number of Common Shares outstanding after the Share Consolidation could adversely affect the liquidity of the Common Shares.

The Share Consolidation may result in some Shareholders owning “odd lots” of fewer than 100 Common Shares on a post- Share Consolidation basis. Odd lot Common Shares may be more difficult to sell, or may attract greater transaction costs per Share to sell, and brokerage commissions and other costs of transactions in odd lots may be higher than the costs of transactions in “round lots” of even multiples of 100 Common Shares.

Risk Factors Relating to the Combined Company

In addition to the risk factors set forth under this “Risk Factors” section, those in Item 3. “Key Information – Risk Factors” in the Form 20-F and those included under the heading entitled “Information Concerning Ceapro – Risk Factors” below, the following risk factors relate to Aeterna Zentaris (including Ceapro as its wholly-owned subsidiary) following the completion of the Plan of Arrangement:

Significant demands will be placed on the Combined Company and Aeterna Zentaris and Ceapro cannot provide any assurance that their systems, procedures and controls will be adequate to support the expansion of operations and associated increased costs and complexity following and resulting from the Plan of Arrangement.

As a result of the pursuit and completion of the Plan of Arrangement, significant demands will be placed on the managerial, operational and financial personnel and systems of Aeterna Zentaris and Ceapro. Aeterna Zentaris cannot provide any assurance that their systems, procedures and controls will be adequate to support the expansion of operations and associated increased costs and complexity following and resulting from the Plan of Arrangement. The future operating results of the Combined Company will be affected by the ability of its officers and key employees to manage changing business conditions, to integrate the acquisition of Ceapro, to implement a new business strategy and to improve its operational and financial controls and reporting systems.

The failure to achieve the desired synergies and benefits of the Plan of Arrangement could have a material adverse effect on the market price of the Common Shares following completion of the Plan of Arrangement.

The Plan of Arrangement has been agreed to with the expectation that its completion will result in an increase in sustained profitability, cost savings and enhanced growth opportunities for the Combined Company. These anticipated benefits will depend in part on whether Aeterna Zentaris and Ceapro’s operations can be integrated in an efficient and effective manner. The extent to which synergies are realized and the timing of such cannot be assured.

Aeterna Zentaris and Ceapro may be unable to successfully integrate their businesses and realize the anticipated benefits of the Plan of Arrangement. The failure to successfully integrate the businesses of Aeterna Zentaris and Ceapro could have a material adverse effect on the market price of the Common Shares following completion of the Plan of Arrangement.

The integration requires the dedication of substantial effort, time and resources on the part of management which may divert management’s focus and resources from other strategic opportunities and from operational matters during this process. In addition, the integration process could result in disruption of existing relationships with suppliers, employees, customers and other constituencies of each Party. There can be no assurance that management will be able to integrate the operations of each of the businesses successfully or achieve any of the synergies or other benefits that are anticipated as a result of the Plan of Arrangement. Most operational and strategic decisions and certain staffing decisions with respect to integration have not yet been made. These decisions and the integration of the two parties will present challenges to management, including the integration of systems and personnel of the two parties which may be geographically separated, unanticipated liabilities and unanticipated costs. It is possible that the integration process could result in the loss of key employees, the disruption of the respective ongoing businesses or inconsistencies in standards, controls, procedures and policies that adversely affect the ability of management to maintain relationships with operators or employees or to achieve the anticipated benefits of the Plan of Arrangement. The performance of the Combined Company’s operations after completion of the Plan of Arrangement could be adversely affected if the Combined Company cannot retain key employees to assist in the integration and operation of Aeterna Zentaris and Ceapro.

|

|

The consummation of the Plan of Arrangement may pose special risks, including one-time write-offs, restructuring charges and unanticipated costs. Although Ceapro, Aeterna Zentaris and their respective advisors have conducted due diligence on the various operations, there can be no guarantee that Aeterna Zentaris will be aware of any and all liabilities of Ceapro or the Plan of Arrangement. As a result of these factors, it is possible that certain benefits expected from the Plan of Arrangement may not be realized. Any inability of management to successfully integrate the operations could have an adverse effect on the business, financial condition and results of operations of the Combined Company.

The unaudited pro forma consolidated financial statements contained herein are presented for illustrative purposes only and may not be indicative of the results of operations or financial condition of the Combined Company’s financial condition or results of operations following completion of the Plan of Arrangement and the Share Consolidation.

The unaudited pro forma consolidated financial statements included in this Report are presented for illustrative purposes only to show the effect of the Plan of Arrangement and the Share Consolidation, and should not be considered to be an indication of the financial condition or results of operations of the Combined Company following completion of the foregoing. For example, the pro forma consolidated financial statements have been prepared using the consolidated historical financial statements of Aeterna Zentaris and Ceapro and do not represent a financial forecast or projection. In addition, the pro forma consolidated financial statements included in this Report is based in part on certain assumptions regarding the Plan of Arrangement and the Share Consolidation. These assumptions may not prove to be accurate, and other factors may affect the Combined Company’s results of operations or financial condition following completion of the foregoing. Accordingly, the historical and pro forma consolidated financial statements included in this Report do not necessarily represent the Combined Company’s results of operations and financial condition had Aeterna Zentaris and Ceapro as a combined entity during the periods presented, or of the Combined Company’s results of operations and financial condition following the Plan of Arrangement.

In preparing the pro forma consolidated financial statements contained in this Report, Aeterna Zentaris has given effect to, among other items, the Plan of Arrangement, including the issuance of the Consideration Shares and the Aeterna Zentaris New Warrants, and the Share Consolidation. The unaudited pro forma consolidated financial statements do not reflect all of the costs that are expected to be incurred by the Combined Company in connection with the Plan of Arrangement and the Share Consolidation. For example, the impact of any incremental costs incurred in integrating Aeterna Zentaris and Ceapro is not reflected in the pro forma consolidated financial statements. See also the notes to the unaudited pro forma consolidated financial statements included in the section entitled “Unaudited Pro Forma Combined Consolidated Financial Information” included in this Report.

Failure by Aeterna Zentaris and/or Ceapro to comply with applicable Laws prior to the Plan of Arrangement could subject the Combined Company to penalties and other adverse consequences following completion of the Plan of Arrangement.

Aeterna Zentaris is subject to the United States Foreign Corrupt Practices Act and Aeterna Zentaris and Ceapro are subject to the Corruption of Foreign Public Officials Act (Canada). The foregoing Laws prohibit companies and their intermediaries from making improper payments to officials for the purpose of obtaining or retaining business. In addition, such Laws require the maintenance of records relating to transactions and an adequate system of internal controls over financial reporting. There can be no assurance that either party’s internal control policies and procedures, compliance mechanisms or monitoring programs will protect it from recklessness, fraudulent behavior, dishonesty or other inappropriate acts or adequately prevent or detect possible violations under applicable anti-bribery and anti-corruption legislation. A failure by Aeterna Zentaris or Ceapro to comply with anti-bribery and anti-corruption legislation could result in severe criminal or civil sanctions, and may subject the Combined Company to other liabilities, including fines, prosecution, potential debarment from public procurement and reputational damage, all of which could have a material adverse effect on the business, consolidated results of operations and consolidated financial condition of the Combined Company. Investigations by governmental authorities could have a material adverse effect on the business, consolidated results of operations and consolidated financial condition of the Combined Company.

|

|

Aeterna Zentaris and Ceapro are also subject to a wide variety of Laws relating to the environment, health and safety, intellectual property, taxes, employment, labor standards, money laundering, terrorist financing and other matters in the jurisdictions in which they operate. A failure by either of Aeterna Zentaris or Ceapro to comply with any such legislation prior to the Plan of Arrangement could result in severe criminal or civil sanctions, and may subject the Combined Company to other liabilities, including fines, prosecution and reputational damage, all of which could have a material adverse effect on the business, consolidated results of operations and consolidated financial condition of the Combined Company. The compliance mechanisms and monitoring programs adopted and implemented by either of Aeterna Zentaris or Ceapro prior to the Plan of Arrangement may not adequately prevent or detect possible violations of such applicable laws. Investigations by governmental authorities could also have a material adverse effect on the business, consolidated results of operations and consolidated financial condition of the Combined Company.

Following the Plan of Arrangement, the trading price of the Common Shares cannot be guaranteed, may be volatile and could be less than, on an adjusted basis, the current trading prices of Aeterna Zentaris and Ceapro due to various market-related and other factors.

Securities markets have a high level of price and volume volatility, and the market price of securities of many companies have experienced wide fluctuations in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. Securities of companies in biotechnology, biopharmaceutical and related industries have experienced substantial volatility in the past, often based on factors unrelated to the financial performance or prospects of the companies involved. There can be no assurance that continuing fluctuations in price will not occur. The market price per Common Share is also likely to be affected by changes in the Combined Company’s financial condition or results of operations. Other factors unrelated to the performance of the Combined Company that may have an effect on the price of Common Shares include the following: (a) current events affecting the economic situation in Canada, United States and internationally; (b) changes in the market price of the commodities that Aeterna Zentaris and Ceapro sell and purchase; (c) trends in the biotechnology and biopharmaceutical industries; (d) regulatory and/or government actions, rulings or policies; (e) changes in financial estimates and recommendations by securities analysts or rating agencies; (f) acquisitions and financings; (g) the economics of current and future projects and operations of Aeterna Zentaris and Ceapro; (h) quarterly variations in operating results; (i) the operating and share price performance of other companies, including those that investors may deem comparable; (j) the issuance of additional equity securities by Aeterna Zentaris or Ceapro, as applicable, or the perception that such issuance may occur; and (k) purchases or sales of blocks of Common Shares or Ceapro Shares, as applicable.

There are no assurances with respect to the resale of Common Shares, including the Consideration Shares and Common Shares issuable upon the exercise of the Aeterna Zentaris New Warrants issued under the Plan of Arrangement.

There can be no assurance that the publicly-traded market price of the Common Shares will be high enough to create a positive return for the existing investors. Further, there can be no assurance that the Common Shares will be sufficiently liquid so as to permit investors to sell their position in the Combined Company without adversely affecting the stock price. In such event, the probability of resale of the Common Shares would be diminished.

In the event that Aeterna Zentaris fails to satisfy any of the listing requirements of NASDAQ, including the Bid Price Rule, NASDAQ may reject Aeterna Zentaris’ application for the continued listing of the Common Shares on NASDAQ.

The Common Shares are currently listed on both the NASDAQ and the TSX under the symbol “AEZS”, however, under applicable NASDAQ rules and regulations, the Plan of Arrangement is considered to be change of control requiring a new listing and, in such a circumstance, Aeterna Zentaris is required to make a new application for the continued listing of the Common Shares on NASDAQ following the completion of the Plan of Arrangement. To meet the continued listing requirements on the NASDAQ, the NASDAQ requires, among other things, that listed securities have a minimum bid price of US$4.00 per share or a minimum closing price of US$2.00 to US$3.00 per share, with the specific requisite price based on the satisfaction of certain financial and liquidity requirements set forth in NASDAQ Listing Rules 5505(a) and (b) in accordance with the Bid Price Rule.

|

|

In addition to the Bid Price Rule, because the Plan of Arrangement is treated as a change of control requiring an application for the continued listing of the Common Shares on NASDAQ, Aeterna Zentaris is required to have either: (i) stockholders’ equity of at least US$5 million, a market value of unrestricted publicly held shares of US$15 million, an operating history of 2 years, at least 1 million unrestricted publicly held shares outstanding, at least 300 unrestricted round lot shareholders, and at least 3 market makers; (ii) stockholders’ equity of at least US$4 million, a market value of unrestricted publicly held shares of US$15 million, a market value of listed securities of at least US$50 million, at least 1 million unrestricted publicly held shares outstanding, at least 300 unrestricted round lot shareholders, and at least 3 market makers; or (iii) stockholders’ equity of at least US$4 million, a market value of unrestricted publicly held shares of US$5 million, net income from continuing operations (in the latest fiscal year or in two of the last three fiscal years) of at least US$750,000, at least 1 million unrestricted publicly held shares outstanding, at least 300 unrestricted round lot shareholders, and at least 3 market makers, in each case in addition to the NASDAQ’s corporate governance requirements.

It is possible that we may be a passive foreign investment company.

Adverse U.S. federal income tax rules apply to U.S. Holders who directly or indirectly hold stock of a PFIC. We would be classified as a PFIC for U.S. federal income tax purposes for a taxable year if (i) at least 75% of our gross income is “passive income” or (ii) at least 50% quarterly of the average value of our assets, including goodwill (based on annual quarterly average), is attributable to assets which produce passive income or are held for the production of passive income.

The determination of whether we are, or will be, a PFIC for a taxable year depends, in part, on the application of complex U.S. federal income tax rules, which are subject to various interpretations. Although the matter is not free from doubt, we believe that we were not a PFIC during our 2023 taxable year and it does not expect to be a PFIC for our 2024 taxable year. Because PFIC status is based on our income, assets and activities for the entire taxable year, and our market capitalization, it is not possible to determine whether we will be characterized as a PFIC for the 2024 taxable year until after the close of the taxable year. The tests for determining PFIC status are subject to a number of uncertainties. These tests are applied annually, and it is difficult to accurately predict future income, assets and activities relevant to this determination. In addition, because the market price of our Common Shares is likely to fluctuate, the market price may affect the determination of whether we will be considered a PFIC. Accordingly, there can be no assurance that we have not been, or will not be, a PFIC for any taxable year (including our 2024 taxable year).

If we were or are classified as a PFIC for U.S. federal income tax purposes, U.S. investors that hold Common Shares may be subject to potentially significant adverse U.S. federal income tax consequences.

If we were to constitute a PFIC for any year during a U.S. Holder’s holding period for Common Shares, then certain potentially adverse rules will affect the U.S. federal income tax consequences to such U.S. Holder, including resulting from the ownership and disposition of Common Shares. For a more detailed discussion of the PFIC rules, including the consequences and availability of certain elections, see Item 10.E. “Taxation – Material U.S. Federal Income Tax Considerations – Tax Consequences if we are a Passive Foreign Investment Company (“PFIC”)” in the Form 20-F.

Investments in biopharmaceutical companies are generally considered to be speculative in nature.

The prospects for companies operating in the biopharmaceutical industry are uncertain, given the very nature of the industry, in which companies often experience lengthy development time, extensive capital requirements, rapid technological developments and a high degree of competition based primarily on scientific and technological factors. These factors include the availability to obtain patent and other protection for technology and products, the ability to commercialize technological developments and the ability to obtain government approval for testing, manufacturing and marketing. Accordingly, investments in biopharmaceutical companies should be considered to be speculative assets.

|

|

The Combined Company may not achieve our projected development goals in the time-frames we announce and expect.

The Combined Company may set goals and make public statements regarding the timing of the accomplishment of objectives material to our success, such as the commencement, enrollment and anticipated completion of clinical trials, anticipated regulatory submission and approval dates and time of product launch. The actual timing of these events can vary dramatically due to factors such as delays or failures in any clinical trials, the uncertainties inherent in the regulatory approval process and delays in achieving manufacturing or marketing arrangements sufficient to commercialize any of our products or product candidates. There can be no assurance that the Combined Company will make regulatory submissions or receive regulatory approvals as planned. If the Combined Company fails to achieve one or more of its planned milestones, the share price of the Common Shares may decline.

Competition in our targeted markets is intense, and development by other companies could render any of our current or future products, non-competitive.

The biopharmaceutical field is highly competitive. New products developed by other companies in the industry could render any of the Combined Company’s future products uncompetitive or significantly less competitive. Competitors are developing and testing products and technologies that would compete with the Combined Company’s products. Some of these competitive products may be more effective or have an entirely different approach or means of accomplishing the desired effect. The Combined Company expects competition from pharmaceutical and biopharmaceutical companies and academic research institutions to continue to increase over time. Many competitors and potential competitors have substantially greater product development capabilities and financial, scientific, marketing and human resources than the Combined Company.

The Combined Company may infringe the intellectual property rights of others.

The Combined Company’s commercial success depends significantly on its ability to operate without infringing the patents and other intellectual property rights of third parties. There could be issued patents of which the Combined Company is not aware that the Combined Company’s products or methods may be found to infringe, or patents of which the Combined Company may become aware and believes that it does not infringe, but which it may ultimately be found to infringe. Moreover, patent applications and their underlying discoveries are in some cases maintained in secrecy until patents are issued. Because patents can take many years to issue, there may be currently pending applications of which the Combined Company is unaware that may later result in issued patents that the Combined Company’s products or technologies are found to infringe. Moreover, there may be published pending applications that do not currently include a claim covering our products or technologies, but, which nonetheless, provide support for a later drafted claim that, if issued, our products or technologies could be found to infringe.

If the Combined Company infringes or is alleged to infringe intellectual property rights of third parties, it will adversely affect its business. Third parties may own or control these patents or patent applications in the U.S. and abroad. These third parties could bring claims against the Combined Company or its collaborators that would cause us to incur substantial expenses and, if successful against the Combined Company, could cause us to pay substantial damages. Further, if a patent infringement suit were brought against the Combined Company or its collaborators, the Combined Company could be forced to stop or delay research, development, manufacturing or sales of the product or product candidate that is the subject of the suit.

The biopharmaceutical industry has produced a proliferation of patents, and it is not always clear to industry participants which patents cover various types of products. The coverage of patents is subject to interpretation by the courts, and the interpretation is not always uniform. In the event of infringement or violation of another party’s patent or other intellectual property rights, the Combined Company may not be able to enter into licensing arrangements or make other arrangements at a reasonable cost. Any inability to secure licenses or alternative technology could result in delays in the introduction of the Combined Company’s products or lead to prohibition of the manufacture or sale of products by the Combined Company or its partners and collaborators.

|

|

Patent litigation is costly and time consuming and may subject us to liabilities.

If the Combined Company becomes involved in any patent litigation, interference, opposition, re-examination or other administrative proceedings, we will likely incur substantial expenses in connection therewith, and the efforts of our technical and management personnel will be significantly diverted. In addition, an adverse determination in litigation could subject the Combined Company to significant liabilities.

In carrying out operations, the Combined Company is expected to be dependent on a stable and consistent supply of ingredients and raw materials.

There can be no assurance that the Combined Company, its contract manufacturers or its licensees, will be able, in the future, to continue to purchase products from our current suppliers or any other supplier on terms that are favorable or similar to current terms or at all. An interruption in the availability of certain raw materials or ingredients, or significant increases in the prices we pay for them, could have a material adverse effect on the Combined Company’s business, financial condition, liquidity and operating results.

We are subject to intense competition for our skilled personnel, and the loss of key personnel or the inability to attract additional personnel could impair our ability to conduct our operations.

The Combined Company will be highly dependent on management and clinical, regulatory and scientific staff, the loss of whose services might adversely impact our ability to achieve the Combined Company’s objectives. Recruiting and retaining qualified management and clinical, scientific and regulatory personnel is critical to the Combined Company’s success. The competition for qualified personnel in the biopharmaceutical field is intense, and if the Combined Company is not able to retain qualified personnel and/or maintain positive relationships with outside consultants, the Combined Company may not be able to achieve its strategic and operational objectives.

The Combined Company may be subject to litigation in the future.

The Combined Company may, from time to time, be a party to litigation in the normal course of business. Monitoring and defending against legal actions, whether meritorious, is time-consuming for our management and detracts from the Combined Company’s ability to fully focus our internal resources on our business activities. In addition, legal fees and costs incurred in connection with such activities may be significant and the Combined Company could, in the future, be subject to judgments or enter into settlements of claims for significant monetary damages. A decision adverse to the Combined Company’s interests could result in the payment of substantial damages and could have a material adverse effect on the Combined Company’s cash flow, results of operations and financial position.

With respect to any litigation, the Combined Company’s insurance may not reimburse it, or may not be sufficient to reimburse, for the expenses or losses it may suffer in contesting and concluding such lawsuit. Substantial litigation costs, including the substantial self-insured retention that the Combined Company is required to satisfy before any insurance applies to a claim, unreimbursed legal fees or an adverse result in any litigation may adversely impact the Combined Company’s business, operating results or financial condition.

The Combined Company will be subject to the risk of product liability claims, for which it may not have or may not be able to obtain adequate insurance coverage.

The sale and use of the Combined Company’s products will involve the risk of product liability claims and associated adverse publicity. Product liability claims might be made against the Combined Company directly by patients, healthcare providers or pharmaceutical companies, or others selling, buying or using our products. The Combined Company plans to maintain insurance covering its liability for preclinical and clinical studies as well as products liability insurance. However, the Combined Company may not have or be able to obtain or maintain sufficient and affordable insurance coverage, including coverage for potentially very significant legal expenses, and without sufficient coverage any claim brought against the Combined Company could have a materially adverse effect on our business, financial condition or results of operations.

|

|

It may be difficult for U.S. investors to obtain and enforce judgments against the Combined Company because of its Canadian incorporation and German presence.

The Combined Company will be a company existing under the laws of Canada. Substantially all of the directors and officers of the Combined Company are residents of Canada or otherwise reside outside the U.S., and all or a substantial portion of their assets, and a substantial portion of our assets, are located outside the U.S. Consequently, although the Combined Company will have appointed an agent for service of process in the U.S., it may be difficult for investors in the U.S. to bring an action against such directors or officers or to enforce against those persons or us a judgment obtained in a U.S. court predicated upon the civil liability provisions of federal securities laws or other laws of the U.S. investors should not assume that foreign courts (i) would enforce judgments of U.S. courts obtained in actions against us or such directors, officers or experts predicated upon the civil liability provisions of the U.S. federal securities laws or the securities or “blue sky” laws of any state within the U.S. or (ii) would enforce, in original actions, liabilities against us or such directors, officers or experts predicated upon the U.S. federal securities laws or any such state securities or “blue sky” laws.

The Combined Company is subject to various internal control reporting requirements under applicable Canadian securities laws and the Sarbanes-Oxley Act in the U.S. The Combined Company can provide no assurance that it will, at all times in the future, be able to report that our internal controls over financial reporting are effective.

As a public company, the Combined Company is required to comply with Section 404 of the U.S. Sarbanes-Oxley Act of 2002 and National Instrument 52-109 – Certification of Disclosure in Issuers’ Annual and Interim Filings of the Canadian securities administrators. The Combined Company cannot be certain as to the time of completion of its internal control evaluation, testing and remediation actions or of their impact on the Combined Company’s operations. Upon completion of this process, the Combined Company may identify control deficiencies of varying degrees of severity under applicable SEC and Public Company Accounting Oversight Board (U.S.) rules and regulations. As a public company, the Combined Company is required to report, among other things, control deficiencies that constitute material weaknesses or changes in internal controls that, or that are reasonably likely to, materially affect internal controls over financial reporting. A “material weakness” is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim consolidated financial statements will not be prevented or detected on a timely basis. If the Combined Company fails to comply with the requirements of Section 404 of the U.S. Sarbanes-Oxley Act of 2002 or similar Canadian requirements, or if the Combined Company reports a material weakness, the Combined Company might be subject to regulatory sanction and investors may lose confidence in our consolidated financial statements, which may be inaccurate if the Combined Company fails to remedy such material weakness.