Document

July 23, 2025

Phoenix, Arizona

|

|

|

Knight-Swift Transportation Holdings Inc. Reports Second Quarter 2025 Revenue and Earnings |

Knight-Swift Transportation Holdings Inc. (NYSE: KNX) ("Knight-Swift" or the "Company"), one of the largest and most diversified freight transportation companies, operating the largest full truckload fleet in North America, today reported second quarter 2025 net income attributable to Knight-Swift of $34.2 million and Adjusted Net Income Attributable to Knight-Swift2 of $57.2 million. GAAP earnings per diluted share for the second quarter of 2025 were $0.21, compared to $0.13 for the second quarter of 2024. Adjusted EPS2 was $0.35 for the second quarter of 2025, compared to $0.24 for the second quarter of 2024.

During the second quarter of 2025, consolidated total revenue was $1.9 billion, a 0.8% increase from the second quarter of 2024. Consolidated operating income was $72.6 million, an increase of 14.4% compared to the same quarter last year. The consolidated operating ratio for the quarter was 96.1%, and the Adjusted Operating Ratio2 was 93.8%, reflecting improvements of 50 and 80 basis points, respectively, over the 2024 quarter.

•Truckload — 94.6% Adjusted Operating Ratio, an improvement of 260 basis points year-over-year as continued progress reducing cost per mile outpaced pressure on volumes and pricing. Each truckload brand improved operating margins, led by U.S. Xpress which improved 300 basis points. Adjusted Operating Income2 increased 87.5% year-over-year, while revenue, excluding fuel surcharge and intersegment transactions, decreased 2.7%. Revenue per loaded mile, excluding fuel surcharge and intersegment transactions, was flat year-over-year.

•LTL — Revenue, excluding fuel surcharge, increased 28.4% year-over-year as shipments per day increased 21.7%, and revenue per hundredweight excluding fuel surcharge increased 9.9%. The Adjusted Operating Ratio was 93.1% as Adjusted Operating Income declined by 36.8% due to start-up costs and early-stage operations at recently opened facilities as well as continued costs related to the integration of DHE. We opened three new locations and replaced one more during the second quarter as we continue to invest in our network.

•Logistics — 94.8% Adjusted Operating Ratio with a gross margin of 18.9%. Adjusted Operating Income improved 13.3% year-over-year, driven by operating efficiency gains and a 100 basis point improvement in gross margin %. Revenue per load increased 10.6% year-over-year, largely offsetting an 11.7% decline in load count.

•Intermodal — 104.1% operating ratio, with revenue down 13.8%. Improvements in network balance and cost reductions partially offset a 12.4% year-over-year decrease in load count.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended June 30, 1 |

|

2025 |

|

2024 |

|

Change |

|

(Dollars in thousands, except per share data) |

| Total revenue |

$ |

1,861,940 |

|

|

$ |

1,846,654 |

|

|

0.8 |

% |

| Revenue, excluding truckload and LTL fuel surcharge |

$ |

1,672,201 |

|

|

$ |

1,641,701 |

|

|

1.9 |

% |

| Operating income |

$ |

72,616 |

|

|

$ |

63,460 |

|

|

14.4 |

% |

Adjusted Operating Income 2 |

$ |

103,762 |

|

|

$ |

88,519 |

|

|

17.2 |

% |

| Net income attributable to Knight-Swift |

$ |

34,243 |

|

|

$ |

20,300 |

|

|

68.7 |

% |

Adjusted Net Income Attributable to Knight-Swift 2 |

$ |

57,179 |

|

|

$ |

39,375 |

|

|

45.2 |

% |

| Earnings per diluted share |

$ |

0.21 |

|

|

$ |

0.13 |

|

|

61.5 |

% |

Adjusted EPS 2 |

$ |

0.35 |

|

|

$ |

0.24 |

|

|

45.8 |

% |

|

|

|

|

|

|

1For information regarding comparability of the reported results due to acquisitions, refer to footnote 1 of the Condensed Consolidated Statements of Comprehensive Income in the schedules following this release.

2See GAAP to non-GAAP reconciliation in the schedules following this release.

Our GAAP and non-GAAP results for the quarter include certain items that impact the comparability of year-over-year results. These items include an 8.0 percentage point decrease in the effective tax rate on our GAAP results, and a 3.1 percentage point decrease in the effective tax rate on our non-GAAP results, year-over-year. Further, the prior year second quarter included a $12.5 million accrual for a large claim settlement. Additionally, our GAAP results for the current quarter include severance and impairment charges totaling $11.5 million while the prior year second quarter included severance, legal accrual, and impairment charges totaling $6.5 million, which are excluded from our non-GAAP results.

Adam Miller, CEO of Knight-Swift, commented, "In a quarter of unusual crosscurrents, we leveraged our cost initiatives and the agility of our over-the-road model to overcome a truckload market that lacked the normal seasonal build and which brought mix changes that put more pressure on revenue per mile than anticipated. We are pleased that our Truckload segment sequentially improved its operating income and operating margin despite a sequential decline in revenue per mile. We continue to execute on our revenue and cost initiatives at U.S. Xpress and have made meaningful progress in improving margins and operating profitability in this business unit for the second consecutive quarter. In LTL, we continue to grow our network, customer base, and shipment count while making steady improvement in pricing, all of which is made possible by our commitment to strong service. Customers are responding to our service offering and awarding us strong growth in an industry where volumes remain under pressure. At the same time, our integration of DHE and the organic expansion of our network continues to put cost pressure on the business. We are focused on normalizing our operational fundamentals and regaining efficiencies in our cost performance, and we have multiple initiatives underway to drive improvements in cost and yield, all while maintaining our commitment to service.

"Our customers continue to navigate an uncertain policy landscape and macro environment, which makes projecting demand and contemplating investments more challenging than usual. We are approaching the time of year where planning and discussions around peak season and project activities should take place. Discussions are beginning around a few projects, but it is too early to have a good read on what may materialize as our customers are making real-time adjustments to decisions around inventories and supply chains as information develops around government policy. Hopefully there will be sufficient resolution to allow normal planning and decision-making to resume soon. We have invested significant effort into taking our service, technology-enablement, cost efficiency, and cross-brand collaboration to new levels and are well-positioned to execute on peak season and the opportunities that the next cycle will produce."

Other Income — We recorded $13.2 million of income within "Other income, net" in the second quarter of 2025, compared to $4.9 million of income in the second quarter of 2024.

Income Taxes — The effective tax rate on our GAAP results was 29.2% for the second quarter of 2025, compared to 37.2% for the second quarter of 2024. The effective tax rate on our non-GAAP results was 28.0% for the second quarter of 2025, compared to 31.1% for the second quarter of 2024.

Dividend — On April 30, 2025, our board of directors declared a quarterly cash dividend of $0.18 per share of our common stock. The dividend was payable to the Company's stockholders of record as of June 9, 2025, and was paid on June 23, 2025.

|

|

|

| Segment Financial Performance |

Truckload Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended June 30, |

|

2025 |

|

2024 |

|

Change |

|

(Dollars in thousands) |

| Revenue, excluding fuel surcharge and intersegment transactions |

$ |

1,073,300 |

|

|

$ |

1,102,790 |

|

|

(2.7 |

%) |

| Operating income |

$ |

45,420 |

|

|

$ |

23,483 |

|

|

93.4 |

% |

Adjusted Operating Income 1 |

$ |

58,404 |

|

|

$ |

31,156 |

|

|

87.5 |

% |

| Operating ratio |

96.3 |

% |

|

98.1 |

% |

|

(180 |

bps) |

Adjusted Operating Ratio 1 |

94.6 |

% |

|

97.2 |

% |

|

(260 |

bps) |

|

|

|

|

|

|

1See GAAP to non-GAAP reconciliation in the schedules following this release.

Our diverse Truckload segment consists of our irregular route, dedicated, refrigerated, expedited, flatbed, and cross-border truckload operations across our brands with approximately 15,400 irregular route tractors and nearly 5,900 dedicated tractors.

In a volatile market that was unseasonably soft during the second quarter, our Truckload segment produced revenue that was down modestly year-over-year while growing Adjusted Operating Income 87.5%, largely as a result of reducing our cost per mile. Our Truckload segment revenue, excluding fuel surcharge and intersegment transactions, declined 2.7% year-over-year, driven by a 2.8% decrease in loaded miles. Revenue per loaded mile, excluding fuel surcharge and intersegment transactions, was flat year-over-year but down 1.4% from the first quarter as a result of mix changes and spot market weakness given the lull in import-driven demand during the quarter. The second quarter Adjusted Operating Ratio improved 260 basis points year-over-year to 94.6%, reflecting improvements of 300 basis points for U.S. Xpress and 250 basis points for our legacy trucking businesses. Miles per tractor improved 4.0% year-over-year as a result of our efforts to drive productivity and reduce underutilized assets. Our cost-reduction efforts led to a 2.6% year-over-year reduction in our Adjusted Operating Expenses1 per mile as we continue to make tangible progress improving our cost structure. We are focused on disciplined pricing, cost control, and quality service that we expect will position our business to continue to respond to volatile market conditions.

LTL Segment 1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended June 30, |

|

2025 |

|

2024 |

|

Change |

|

(Dollars in thousands) |

| Revenue, excluding fuel surcharge |

$ |

337,726 |

|

|

$ |

263,095 |

|

|

28.4 |

% |

| Operating income |

$ |

18,333 |

|

|

$ |

33,049 |

|

|

(44.5 |

%) |

Adjusted Operating Income 2 |

$ |

23,353 |

|

|

$ |

36,969 |

|

|

(36.8 |

%) |

| Operating ratio |

95.3 |

% |

|

89.2 |

% |

|

610 |

bps |

Adjusted Operating Ratio 2 |

93.1 |

% |

|

85.9 |

% |

|

720 |

bps |

|

|

|

|

|

|

1For information regarding comparability of the reported results due to acquisitions, refer to footnote 1 of the Condensed Consolidated Statements of Comprehensive Income in the schedules following this release.

2See GAAP to non-GAAP reconciliation in the schedules following this release.

Our LTL segment grew revenue, excluding fuel surcharge, 28.4% as shipments per day increased 21.7% year-over-year, which includes the acquisition of DHE on July 30, 2024. Revenue per hundredweight, excluding fuel surcharge, increased 9.9%, while revenue per shipment, excluding fuel surcharge, increased by 7.1%. Weight per shipment decreased 2.6% year-over-year but was flat with the first quarter. Average length of haul continues to climb, rising 13.8% year-over-year and 4.2% sequentially, as we win new business across our expanding network. This segment produced a 93.1% Adjusted Operating Ratio during the second quarter, which was an improvement of 110 basis points from the first quarter. Adjusted Operating Income decreased 36.8% year-over-year due to the decline in operating margin primarily attributable to early-stage operations at our recently opened facilities as well as continued costs related to the integration of DHE. While the LTL segment continues to post strong growth in customers and freight volumes across the expanding network, we are taking actions to accelerate the realization of cost efficiencies and to better align our resources with shifting volumes and freight flows. We anticipate that progress on these initiatives will partially offset the normal seasonal pattern of operating margin degradation in the back half of the year.

During the second quarter, we opened three new service centers and replaced one more with a larger site, bringing our year-to-date growth in door count to 7.8% and our year-over-year growth in door count to 27.5%. As previously noted, we continue to expect our pace of facility expansion will be lower in 2025 than in 2024 and believe ongoing bid activities will provide further opportunities to grow shipment volume and improve efficiencies. Our focus for 2025 is to drive both revenue and margin expansion in the business. We continue to look for both organic and inorganic opportunities to geographically expand our footprint within the LTL market.

Logistics Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended June 30, |

|

2025 |

|

2024 |

|

Change |

|

(Dollars in thousands) |

| Revenue |

$ |

128,298 |

|

|

$ |

131,700 |

|

|

(2.6 |

%) |

| Operating income |

$ |

5,547 |

|

|

$ |

4,759 |

|

|

16.6 |

% |

Adjusted Operating Income 1 |

$ |

6,711 |

|

|

$ |

5,923 |

|

|

13.3 |

% |

| Operating ratio |

95.7 |

% |

|

96.4 |

% |

|

(70 |

bps) |

Adjusted Operating Ratio 1 |

94.8 |

% |

|

95.5 |

% |

|

(70 |

bps) |

|

|

|

|

|

|

1See GAAP to non-GAAP reconciliation in the schedules following this release.

The Logistics segment Adjusted Operating Ratio improved to 94.8% with a gross margin of 18.9% in the second quarter of 2025. Revenue decreased 2.6% year-over-year, driven by a 11.7% decline in load count, largely offset by a 10.6% increase in revenue per load. We remain disciplined on price and diligent in carrier qualification to provide value to customers while maintaining profitability. We continue to leverage our power-only capabilities to complement our asset business, build a broader and more diversified freight portfolio, and to enhance the returns on our capital assets.

Intermodal Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended June 30, |

|

2025 |

|

2024 |

|

Change |

|

(Dollars in thousands) |

| Revenue |

$ |

84,065 |

|

|

$ |

97,528 |

|

|

(13.8 |

%) |

| Operating loss |

$ |

(3,429) |

|

|

$ |

(1,717) |

|

|

(99.7 |

%) |

|

|

|

|

|

|

| Operating ratio |

104.1 |

% |

|

101.8 |

% |

|

230 |

bps |

|

|

|

|

|

|

|

|

|

|

|

|

The Intermodal segment operating ratio increased 230 basis points year-over-year to 104.1%, driven by a 13.8% decline in revenue, partially offset by reductions in cost and improvements in network balance. The revenue decrease was the result of a 12.4% decrease in load count and a 1.6% decline in revenue per load year-over-year. This segment was the most impacted by the decline in import volumes on the West coast, however, we expect load count to grow sequentially as a result of new customer awards and a return of normalized volumes of existing customers. During the quarter we converted to private chassis in five markets, which we expect will improve the cost structure of this business. We remain focused on creating a balanced network, reducing empty moves, and growing our load count with disciplined pricing.

All Other Segments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended June 30, |

|

2025 |

|

2024 |

|

Change |

|

(Dollars in thousands) |

| Revenue |

$ |

74,446 |

|

|

$ |

68,279 |

|

|

9.0 |

% |

|

|

|

|

|

|

| Operating Income |

$ |

6,745 |

|

|

$ |

3,886 |

|

|

73.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Other Segments include support services provided to our customers, independent contractors, and third-party carriers, including equipment leasing, warehousing, trailer parts manufacturing, insurance, equipment maintenance, and warranty services. All Other Segments also include certain corporate expenses (such as legal settlements and accruals, as well as $11.7 million in quarterly amortization of intangibles related to the 2017 merger between Knight and Swift and certain acquisitions).

Revenue within our All Other Segments for the second quarter increased 9.0%, and operating income increased 73.6% year-over-year, primarily driven by our warehousing and leasing businesses. The operating result also includes a $2.8 million charge ($0.01 negative impact to Adjusted EPS) related to the residual risk from the third-party insurance business that the Company wound down in the first quarter of 2024.

|

|

|

| Consolidated Liquidity, Capital Resources, and Earnings Guidance |

Cash Flow Sources (Uses) 1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Year-to-Date June 30, |

| |

2025 |

|

2024 |

|

Change |

|

(In thousands) |

| Net cash provided by operating activities |

$ |

325,929 |

|

|

$ |

310,700 |

|

|

$ |

15,229 |

|

| Net cash used in investing activities |

(189,617) |

|

|

(258,841) |

|

|

69,224 |

|

| Net cash used in financing activities |

(161,586) |

|

|

(182,288) |

|

|

20,702 |

|

Net decrease in cash, restricted cash, and equivalents 2 |

$ |

(25,274) |

|

|

$ |

(130,429) |

|

|

$ |

105,155 |

|

| Net capital expenditures |

$ |

(172,248) |

|

|

$ |

(258,628) |

|

|

$ |

86,380 |

|

|

|

|

|

|

|

1For information regarding comparability of the reported results due to acquisitions, refer to footnote 1 of the Condensed Consolidated Statements of Comprehensive Income in the schedules following this release.

2"Net decrease in cash, restricted cash, and equivalents" is derived from changes within "Cash and cash equivalents," "Cash and cash equivalents – restricted," and the long-term portion of restricted cash included in "Other long-term assets" in the condensed consolidated balance sheets.

Liquidity and Capitalization — As of June 30, 2025, we had a balance of $1.0 billion of unrestricted cash and available liquidity and $7.1 billion of stockholders' equity. The face value of our debt, net of unrestricted cash ("Net Debt") was $2.6 billion as of June 30, 2025. Free Cash Flow3 for the year-to-date period ended June 30, 2025, was $153.7 million, reflecting $325.9 million in operating cash flows and $172.2 million of cash capital expenditures, net of disposal proceeds. From a financing perspective, we paid down $81.5 million in finance lease liabilities, paid down $75.4 million on operating lease liabilities, and had $45.0 million of net borrowings on our 2021 Revolver and accounts receivable securitization for the year-to-date period ended June 30, 2025.

Equipment and Capital Expenditures — Gain on sale of operating assets was $11.7 million in the second quarter of 2025, compared to $6.0 million in the same quarter of 2024. The average age of the tractor fleet within our Truckload segment was 2.7 years in the second quarter of 2025, compared to 2.7 years in the same quarter of 2024. The average age of the tractor fleet within our LTL segment was 4.5 years in the second quarter of 2025 and 4.2 years in the same quarter of 2024. We expect net cash capital expenditures will be in the range of $525 million - $575 million for full-year 2025, which is a reduction from our original range of $575 million - $625 million. Our expected net cash capital expenditures primarily represent replacements of existing tractors and trailers and investments in our terminal network, driver amenities, and technology, and excludes acquisitions.

________

3See GAAP to non-GAAP reconciliations in the schedules following this release.

Guidance — We expect that Adjusted EPS1 will range from $0.36 to $0.42 for the third quarter of 2025. Because of the significant uncertainty created by the current fluid trade policy situation and its implications for inflation, consumer demand, and demand from our customers, we are providing one quarter of forward guidance. In general, the above guidance for the third quarter assumes current conditions remain fairly stable and we experience limited seasonality. Our expected Adjusted EPS1 range is based on the current truckload, LTL, and general market conditions, recent trends, and the current beliefs, assumptions, and expectations of management, as follows:

Truckload

•Truckload Segment revenue up low single-digit percent sequentially with operating margins slightly improved sequentially,

•Revenue per loaded mile recovers slightly sequentially as freight mix normalizes,

•Tractor count and utilization largely stable sequentially.

LTL

•LTL Segment revenue, excluding fuel surcharge, growth between 20% - 25% year-over-year in third quarter as we lap the DHE acquisition in July,

•Adjusted Operating Ratio improves 100 - 200 basis points sequentially as cost initiatives and operating leverage overcome normal seasonal degradation.

Logistics

•Logistics Segment revenue and Adjusted Operating Ratio fairly stable sequentially.

Intermodal

•Intermodal Segment load count improves high single-digit percent sequentially,

•Operating loss improves sequentially driven by cost initiatives and volume leverage.

All Other

•All Other Segment operating income, before including the $11.7 million quarterly intangible asset amortization, approximately $15 million to $20 million in third quarter, with a fourth quarter sequential step-down similar to prior year trends.

Additional

•Gain on sale to be in the range of $18 million to $23 million in third quarter,

•Net interest expense fairly stable sequentially in third quarter,

•Net cash capital expenditures for the full year 2025 expected range of $525 million - $575 million,

•Expected effective tax rate on adjusted income before taxes of approximately 27% to 28% for third quarter.

The factors described under "Forward-Looking Statements," among others, could cause actual results to materially vary from this guidance. Further, we cannot estimate on a forward-looking basis, the impact of certain income and expense items on our earnings per share, because these items, which could be significant, may be infrequent, are difficult to predict, and may be highly variable. As a result, we do not provide a corresponding GAAP measure for, or reconciliation to, our Adjusted EPS1 guidance.

________

1Our calculation of Adjusted EPS starts with GAAP diluted earnings per share and adds back the after-tax impact of intangible asset amortization (which is expected to be approximately $0.36 for full-year 2025), as well as non-cash impairments and certain other unusual items, if any.

Knight-Swift will host a conference call to discuss the earnings release, the results of operations, and other matters following its earnings press release on Wednesday, July 23, 2025, at 5:30 p.m. EDT. An online, real-time webcast of the quarterly conference call will be available on the Company's website at investor.knight-swift.com. Please note that since the call is expected to begin promptly as scheduled, you will need to join a few minutes before that time. Slides to accompany this call will also be posted on the Company’s website and will be available to download just before the scheduled conference call. To view the slides or listen to the webcast, please visit investor.knight-swift.com, "Knight-Swift Q2 2025 Earnings."

Knight-Swift Transportation Holdings Inc. is one of North America's largest and most diversified freight transportation companies, providing multiple full truckload, LTL, intermodal, and logistics services. Knight-Swift uses a nationwide network of business units and terminals in the United States and Mexico to serve customers throughout North America. In addition to operating one of the country's largest tractor fleets, Knight-Swift also contracts with third-party equipment providers to provide a broad range of transportation services to our customers while creating quality driving jobs for our driving associates and successful business opportunities for independent contractors.

|

|

|

| Investor Relations Contact Information |

Adam Miller, Chief Executive Officer, Andrew Hess, Chief Financial Officer, or Brad Stewart, Treasurer & SVP Investor Relations: (602) 606-6349

|

|

|

| Forward-Looking Statements |

This press release contains statements that may constitute forward-looking statements, usually identified by words such as "anticipates," "believes," "estimates," "plans,'' "projects," "expects," "hopes," "intends," "strategy," "design", ''focus," "outlook," "foresee," "will," "could," "should," "may," "feel", "goal," "continue," or similar expressions. Such statements are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical or current fact, are statements that could be deemed forward-looking statements, including without limitation: any projections of or guidance regarding earnings, earnings per share, Adjusted EPS, revenues, cash flows, dividends, share repurchases, leverage ratio, capital expenditures (including the nature and funding thereof), gain on sale, tax rates, capital structure, capital allocation, liquidity, or other financial items; any statement of plans, strategies, and objectives of management for future operations; any statements concerning proposed acquisition plans, new services, or growth strategies or opportunities; any statements regarding future economic, industry, or Company conditions, environment, or performance, including, without limitation, expectations regarding future trade policy or tariffs, supply or demand, volume, capacity, rates, costs, inflation, or seasonality; future performance or growth of any of our reportable segments, including expected revenues, costs, utilization, or rates within our Truckload segment, expected network, door count, volumes, capacity, revenue, costs, or margin within our LTL segment, expected freight portfolio, pricing, profitability, or return on capital assets within our Logistics segment, and expected pricing, costs, freight portfolio, or volumes within our Intermodal segment; any statements under “Guidance”; and any statements of belief and any statement of assumptions underlying any of the foregoing.

Forward-looking statements are inherently uncertain, and are based upon the current beliefs, assumptions, and expectations of management and current market conditions, which are subject to significant risks and uncertainties as set forth in the Risk Factors section of Knight-Swift's Annual Report on Form 10-K for the year ended December 31, 2024, and various disclosures in our press releases, stockholder reports, and Current Reports on Form 8-K. If the risks or uncertainties ever materialize, or the beliefs, assumptions, or expectations prove incorrect, our business and results of operations may differ materially from those expressed or implied by such forward-looking statements. The forward-looking statements in this press release speak only as of the date hereof, and we disclaim any obligation to update or revise any forward-looking statements to reflect actual results or changes in the factors affecting the forward-looking information.

|

|

|

Condensed Consolidated Statements of Comprehensive Income (Unaudited) 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended June 30, |

|

Year-to-Date June 30, |

| |

2025 |

|

2024 |

|

2025 |

|

2024 |

|

(In thousands, except per share data) |

| Revenue: |

|

|

|

|

|

|

|

| Revenue, excluding truckload and LTL fuel surcharge |

$ |

1,672,201 |

|

|

$ |

1,641,701 |

|

|

$ |

3,305,164 |

|

|

$ |

3,254,515 |

|

Truckload and LTL fuel surcharge |

189,739 |

|

|

204,953 |

|

|

381,138 |

|

|

414,606 |

|

| Total revenue |

1,861,940 |

|

|

1,846,654 |

|

|

3,686,302 |

|

|

3,669,121 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Salaries, wages, and benefits |

754,582 |

|

|

691,878 |

|

|

1,476,241 |

|

|

1,384,785 |

|

| Fuel |

203,566 |

|

|

222,573 |

|

|

410,812 |

|

|

457,162 |

|

| Operations and maintenance |

139,970 |

|

|

138,251 |

|

|

272,342 |

|

|

272,884 |

|

| Insurance and claims |

85,281 |

|

|

105,438 |

|

|

177,506 |

|

|

227,884 |

|

| Operating taxes and licenses |

34,525 |

|

|

30,374 |

|

|

68,891 |

|

|

61,703 |

|

| Communications |

7,381 |

|

|

8,264 |

|

|

14,764 |

|

|

15,797 |

|

| Depreciation and amortization of property and equipment |

176,538 |

|

|

178,850 |

|

|

354,017 |

|

|

360,715 |

|

| Amortization of intangibles |

19,246 |

|

|

18,544 |

|

|

38,492 |

|

|

37,087 |

|

| Rental expense |

43,196 |

|

|

43,930 |

|

|

86,062 |

|

|

86,926 |

|

| Purchased transportation |

265,722 |

|

|

286,768 |

|

|

543,016 |

|

|

564,025 |

|

| Impairments |

10,584 |

|

|

5,877 |

|

|

10,612 |

|

|

9,859 |

|

| Miscellaneous operating expenses |

48,733 |

|

|

52,447 |

|

|

94,268 |

|

|

106,279 |

|

| Total operating expenses |

1,789,324 |

|

|

1,783,194 |

|

|

3,547,023 |

|

|

3,585,106 |

|

| Operating income |

72,616 |

|

|

63,460 |

|

|

139,279 |

|

|

84,015 |

|

| Other income (expenses): |

|

|

|

|

|

|

|

| Interest income |

3,036 |

|

|

3,817 |

|

|

6,070 |

|

|

8,839 |

|

| Interest expense |

(40,878) |

|

|

(40,482) |

|

|

(81,081) |

|

|

(81,718) |

|

| Other income, net |

13,150 |

|

|

4,888 |

|

|

24,188 |

|

|

13,880 |

|

| Total other income (expenses), net |

(24,692) |

|

|

(31,777) |

|

|

(50,823) |

|

|

(58,999) |

|

| Income before income taxes |

47,924 |

|

|

31,683 |

|

|

88,456 |

|

|

25,016 |

|

| Income tax expense |

13,993 |

|

|

11,790 |

|

|

24,296 |

|

|

8,116 |

|

| Net income |

33,931 |

|

|

19,893 |

|

|

64,160 |

|

|

16,900 |

|

| Net loss attributable to noncontrolling interest |

312 |

|

|

407 |

|

|

722 |

|

|

765 |

|

| Net income attributable to Knight-Swift |

$ |

34,243 |

|

|

$ |

20,300 |

|

|

$ |

64,882 |

|

|

$ |

17,665 |

|

| Other comprehensive (loss) income |

(109) |

|

|

41 |

|

|

354 |

|

|

3 |

|

| Comprehensive income |

$ |

34,134 |

|

|

$ |

20,341 |

|

|

$ |

65,236 |

|

|

$ |

17,668 |

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

| Basic |

$ |

0.21 |

|

|

$ |

0.13 |

|

|

$ |

0.40 |

|

|

$ |

0.11 |

|

| Diluted |

$ |

0.21 |

|

|

$ |

0.13 |

|

|

$ |

0.40 |

|

|

$ |

0.11 |

|

|

|

|

|

|

|

|

|

| Dividends declared per share: |

$ |

0.18 |

|

|

$ |

0.16 |

|

|

$ |

0.36 |

|

|

$ |

0.32 |

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

| Basic |

162,131 |

|

|

161,689 |

|

|

162,052 |

|

|

161,598 |

|

| Diluted |

162,541 |

|

|

162,111 |

|

|

162,497 |

|

|

162,089 |

|

_________

1The reported results do not include the results of operations of DHE prior to its acquisition by Knight-Swift on July 30, 2024 in accordance with the accounting treatment applicable to the transaction.

|

|

|

| Condensed Consolidated Balance Sheets (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2025 |

|

December 31, 2024 |

|

(In thousands) |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

216,320 |

|

|

$ |

218,261 |

|

| Cash and cash equivalents – restricted |

123,052 |

|

|

147,684 |

|

|

|

|

|

Trade receivables, net of allowance for doubtful accounts of $38,357 and $37,797, respectively |

848,282 |

|

|

803,696 |

|

| Contract balance – revenue in transit |

11,110 |

|

|

7,238 |

|

| Prepaid expenses |

112,699 |

|

|

123,089 |

|

| Assets held for sale |

70,857 |

|

|

82,993 |

|

| Income tax receivable |

28,016 |

|

|

37,260 |

|

|

|

|

|

| Other current assets |

33,682 |

|

|

28,520 |

|

| Total current assets |

1,444,018 |

|

|

1,448,741 |

|

| Property and equipment, net |

4,616,069 |

|

|

4,703,385 |

|

| Operating lease right-of-use assets |

322,710 |

|

|

372,841 |

|

| Goodwill |

3,962,142 |

|

|

3,962,142 |

|

| Intangible assets, net |

2,018,606 |

|

|

2,057,044 |

|

|

|

|

|

| Other long-term assets |

159,890 |

|

|

154,379 |

|

| Total assets |

$ |

12,523,435 |

|

|

$ |

12,698,532 |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

301,867 |

|

|

$ |

329,697 |

|

| Accrued payroll and purchased transportation |

202,969 |

|

|

194,875 |

|

| Accrued liabilities |

72,865 |

|

|

64,100 |

|

| Claims accruals – current portion |

247,566 |

|

|

249,953 |

|

Finance lease liabilities and long-term debt – current portion |

249,526 |

|

|

288,428 |

|

| Operating lease liabilities – current portion |

111,091 |

|

|

120,715 |

|

| Accounts receivable securitization – current portion |

439,128 |

|

|

458,983 |

|

| Total current liabilities |

1,625,012 |

|

|

1,706,751 |

|

| Revolving line of credit |

297,000 |

|

|

232,000 |

|

Long-term debt – less current portion |

1,392,325 |

|

|

1,445,313 |

|

| Finance lease liabilities – less current portion |

415,895 |

|

|

457,303 |

|

| Operating lease liabilities – less current portion |

230,369 |

|

|

274,549 |

|

|

|

|

|

| Claims accruals – less current portion |

337,359 |

|

|

335,880 |

|

| Deferred tax liabilities |

885,917 |

|

|

919,814 |

|

| Other long-term liabilities |

206,640 |

|

|

210,117 |

|

| Total liabilities |

5,390,517 |

|

|

5,581,727 |

|

| Stockholders’ equity: |

|

|

|

| Common stock |

1,623 |

|

|

1,619 |

|

| Additional paid-in capital |

4,464,204 |

|

|

4,446,726 |

|

| Accumulated other comprehensive loss |

(88) |

|

|

(442) |

|

| Retained earnings |

2,658,937 |

|

|

2,661,064 |

|

| Total Knight-Swift stockholders' equity |

7,124,676 |

|

|

7,108,967 |

|

| Noncontrolling interest |

8,242 |

|

|

7,838 |

|

| Total stockholders’ equity |

7,132,918 |

|

|

7,116,805 |

|

| Total liabilities and stockholders’ equity |

$ |

12,523,435 |

|

|

$ |

12,698,532 |

|

|

|

|

| Segment Operating Statistics (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended June 30, |

|

Year-to-Date June 30, |

|

2025 |

|

2024 |

|

Change |

|

2025 |

|

2024 |

|

Change |

| Truckload |

|

|

|

|

|

|

|

|

|

|

|

Average revenue per tractor |

$ |

50,364 |

|

|

$ |

48,309 |

|

|

4.3 |

% |

|

$ |

98,167 |

|

|

$ |

95,221 |

|

|

3.1 |

% |

| Non-paid empty miles percentage |

13.9 |

% |

|

14.0 |

% |

|

(10 |

bps) |

|

14.0 |

% |

|

14.1 |

% |

|

(10) |

bps |

| Average length of haul (miles) |

369 |

|

|

385 |

|

|

(4.2 |

%) |

|

371 |

|

|

390 |

|

|

(4.9 |

%) |

| Miles per tractor |

21,335 |

|

|

20,518 |

|

|

4.0 |

% |

|

41,366 |

|

|

40,405 |

|

|

2.4 |

% |

| Average tractors |

21,311 |

|

|

22,828 |

|

|

(6.6 |

%) |

|

21,610 |

|

|

23,071 |

|

|

(6.3 |

%) |

Average trailers 1 |

90,085 |

|

|

92,581 |

|

|

(2.7 |

%) |

|

89,826 |

|

|

93,495 |

|

|

(3.9 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

LTL 2 3 |

|

|

|

|

|

|

|

|

|

|

|

| Shipments per day |

24,918 |

|

|

20,482 |

|

|

21.7 |

% |

|

24,140 |

|

|

19,641 |

|

|

22.9 |

% |

| Weight per shipment (pounds) |

982 |

|

|

1,008 |

|

|

(2.6 |

%) |

|

982 |

|

|

1,008 |

|

|

(2.6 |

%) |

| Average length of haul (miles) |

666 |

|

|

585 |

|

|

13.8 |

% |

|

653 |

|

|

579 |

|

|

12.8 |

% |

| Revenue per shipment |

$ |

213.26 |

|

|

$ |

202.46 |

|

|

5.3 |

% |

|

$ |

211.68 |

|

|

$ |

201.20 |

|

|

5.2 |

% |

| Revenue xFSC per shipment |

$ |

185.87 |

|

|

$ |

173.50 |

|

|

7.1 |

% |

|

$ |

183.79 |

|

|

$ |

172.02 |

|

|

6.8 |

% |

| Revenue per hundredweight |

$ |

21.72 |

|

|

$ |

20.09 |

|

|

8.1 |

% |

|

$ |

21.55 |

|

|

$ |

19.97 |

|

|

7.9 |

% |

| Revenue xFSC per hundredweight |

$ |

18.93 |

|

|

$ |

17.22 |

|

|

9.9 |

% |

|

$ |

18.71 |

|

|

$ |

17.07 |

|

|

9.6 |

% |

Average tractors 4 |

4,193 |

|

|

3,429 |

|

|

22.3 |

% |

|

4,108 |

|

|

3,393 |

|

|

21.1 |

% |

Average trailers 5 |

10,962 |

|

|

8,893 |

|

|

23.3 |

% |

|

10,969 |

|

|

8,796 |

|

|

24.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Logistics |

|

|

|

|

|

|

|

|

|

|

|

Revenue per load - Brokerage only 6 |

$ |

2,025 |

|

|

$ |

1,831 |

|

|

10.6 |

% |

|

$ |

1,988 |

|

|

$ |

1,791 |

|

|

11.0 |

% |

| Gross margin - Brokerage only |

18.9 |

% |

|

17.9 |

% |

|

100 |

bps |

|

18.5 |

% |

|

17.3 |

% |

|

120 |

bps |

|

|

|

|

|

|

|

|

|

|

|

|

| Intermodal |

|

|

|

|

|

|

|

|

|

|

|

Average revenue per load |

$ |

2,572 |

|

|

$ |

2,615 |

|

|

(1.6 |

%) |

|

$ |

2,580 |

|

|

$ |

2,615 |

|

|

(1.3 |

%) |

| Load count |

32,682 |

|

|

37,290 |

|

|

(12.4 |

%) |

|

67,893 |

|

|

70,937 |

|

|

(4.3 |

%) |

| Average tractors |

602 |

|

|

613 |

|

|

(1.8 |

%) |

|

612 |

|

|

611 |

|

|

0.2 |

% |

| Average containers |

12,543 |

|

|

12,580 |

|

|

(0.3 |

%) |

|

12,544 |

|

|

12,581 |

|

|

(0.3 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Second quarter 2025 and 2024 includes 9,965 and 8,876 trailers, respectively, related to leasing activities recorded within our All Other Segments. The year-to-date period ending June 30, 2025 and 2024 includes 9,811 and 8,822 trailers, respectively, related to leasing activities recorded within our All Other Segments.

2Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

3Operating statistics within the LTL segment exclude dedicated and other businesses.

4Our LTL tractor fleet includes 660 and 612 tractors from ACT's and MME's dedicated and other businesses for the second quarter of 2025 and 2024, respectively. Our LTL tractor fleet includes 664 and 612 tractors from ACT's and MME's dedicated and other businesses for the year-to-date period ending June 30, 2025 and 2024, respectively.

5Our LTL trailer fleet includes 1,039 and 829 trailers from ACT's and MME's dedicated and other businesses for the second quarter of 2025 and 2024, respectively. Our LTL trailer fleet includes 1,027 and 825 trailers from ACT's and MME's dedicated and other businesses for the year-to-date period ending June 30, 2025 and 2024, respectively.

6Computed with revenue, excluding intersegment transactions.

|

|

|

| Non-GAAP Financial Measures and Reconciliations |

The terms "Adjusted Net Income Attributable to Knight-Swift," "Adjusted Operating Income," "Adjusted Operating Expenses," "Adjusted EPS," "Adjusted Operating Ratio," and "Free Cash Flow," as we define them, are not presented in accordance with GAAP. These financial measures supplement our GAAP results in evaluating certain aspects of our business. We believe that using these measures improves comparability in analyzing our performance because they remove the impact of items from our operating results that, in our opinion, do not reflect our core operating performance. Management and the board of directors focus on Adjusted Net Income Attributable to Knight-Swift, Adjusted EPS, Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio as key measures of our performance, all of which are reconciled to the most comparable GAAP financial measures and further discussed below. Management and the board of directors use Free Cash Flow as a key measure of our liquidity. Free Cash Flow does not represent residual cash flow available for discretionary expenditures. We believe our presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts the same information that we use internally for purposes of assessing our core operating performance.

Adjusted Net Income Attributable to Knight-Swift, Adjusted Operating Income, Adjusted Operating Expenses, Adjusted EPS, Adjusted Operating Ratio, and Free Cash Flow, are not substitutes for their comparable GAAP financial measures, such as net income, cash flows from operating activities, operating margin, or other measures prescribed by GAAP. There are limitations to using non-GAAP financial measures. Although we believe that they improve comparability in analyzing our period to period performance, they could limit comparability to other companies in our industry if those companies define these measures differently. Because of these limitations, our non-GAAP financial measures should not be considered measures of income generated by our business or discretionary cash available to us to invest in the growth of our business. Management compensates for these limitations by primarily relying on GAAP results and using non-GAAP financial measures on a supplemental basis.

|

|

|

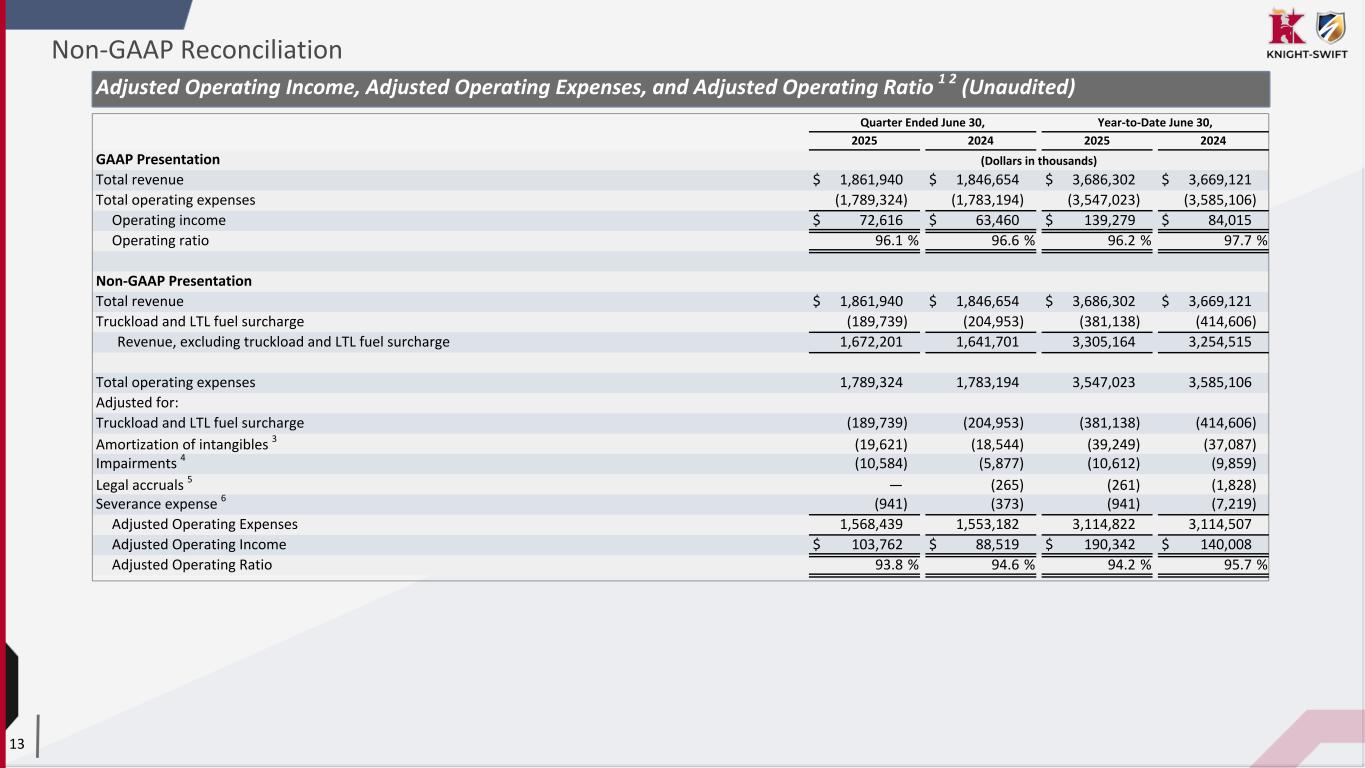

Non-GAAP Reconciliation (Unaudited): |

Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio 1 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended June 30, |

|

Year-to-Date June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP Presentation |

(Dollars in thousands) |

| Total revenue |

$ |

1,861,940 |

|

|

$ |

1,846,654 |

|

|

$ |

3,686,302 |

|

|

$ |

3,669,121 |

|

| Total operating expenses |

(1,789,324) |

|

|

(1,783,194) |

|

|

(3,547,023) |

|

|

(3,585,106) |

|

| Operating income |

$ |

72,616 |

|

|

$ |

63,460 |

|

|

$ |

139,279 |

|

|

$ |

84,015 |

|

| Operating ratio |

96.1 |

% |

|

96.6 |

% |

|

96.2 |

% |

|

97.7 |

% |

|

|

|

|

|

|

|

|

| Non-GAAP Presentation |

|

|

|

|

|

|

|

| Total revenue |

$ |

1,861,940 |

|

|

$ |

1,846,654 |

|

|

$ |

3,686,302 |

|

|

$ |

3,669,121 |

|

| Truckload and LTL fuel surcharge |

(189,739) |

|

|

(204,953) |

|

|

(381,138) |

|

|

(414,606) |

|

| Revenue, excluding truckload and LTL fuel surcharge |

1,672,201 |

|

|

1,641,701 |

|

|

3,305,164 |

|

|

3,254,515 |

|

|

|

|

|

|

|

|

|

| Total operating expenses |

1,789,324 |

|

|

1,783,194 |

|

|

3,547,023 |

|

|

3,585,106 |

|

| Adjusted for: |

|

|

|

|

|

|

|

| Truckload and LTL fuel surcharge |

(189,739) |

|

|

(204,953) |

|

|

(381,138) |

|

|

(414,606) |

|

Amortization of intangibles 3 |

(19,621) |

|

|

(18,544) |

|

|

(39,249) |

|

|

(37,087) |

|

Impairments 4 |

(10,584) |

|

|

(5,877) |

|

|

(10,612) |

|

|

(9,859) |

|

Legal accruals 5 |

— |

|

|

(265) |

|

|

(261) |

|

|

(1,828) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Severance expense 6 |

(941) |

|

|

(373) |

|

|

(941) |

|

|

(7,219) |

|

|

|

|

|

|

|

|

|

| Adjusted Operating Expenses |

1,568,439 |

|

|

1,553,182 |

|

|

3,114,822 |

|

|

3,114,507 |

|

| Adjusted Operating Income |

$ |

103,762 |

|

|

$ |

88,519 |

|

|

$ |

190,342 |

|

|

$ |

140,008 |

|

| Adjusted Operating Ratio |

93.8 |

% |

|

94.6 |

% |

|

94.2 |

% |

|

95.7 |

% |

|

|

|

|

|

|

|

|

1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP operating ratio to consolidated non-GAAP Adjusted Operating Ratio.

2 Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

3 "Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in the 2017

Merger, the ACT acquisition, the U.S. Xpress acquisition, and other acquisitions, as well as the non-cash amortization expense related to the fair value of favorable leases assumed in the DHE acquisition included within "Rental expense" in the condensed consolidated statements of comprehensive income.

4 "Impairments" reflects the non-cash impairment:

•Second quarter 2025 impairments reflects non-cash impairments related to certain real property owned and leased (within the Truckload Segment). First quarter 2025 reflects non-cash impairments related to certain real property leases (within the Truckload segment).

•Second quarter 2024 reflects the non-cash impairments of building improvements, certain revenue equipment held for sale, leases, and other equipment (within the Truckload segment and All Other Segments).

5 "Legal accruals" are included in "Miscellaneous operating expenses" in the condensed consolidated statements of comprehensive income and reflect the following:

•First quarter 2025 legal expense reflects the increased estimated exposures for an accrued legal matter based on a recent settlement agreement.

•First and second quarters 2024 legal expense reflect the increased estimated exposures for an accrued legal matter based on a recent settlement agreement.

6 "Severance expense" is included within "Salaries, wages, and benefits" in the condensed statements of comprehensive income.

|

|

|

Non-GAAP Reconciliation (Unaudited): |

Adjusted Net Income Attributable to Knight-Swift and Adjusted EPS 1 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended June 30, |

|

Year-to-Date June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

(Dollars in thousands, except per share data) |

| GAAP: Net income attributable to Knight-Swift |

$ |

34,243 |

|

|

$ |

20,300 |

|

|

$ |

64,882 |

|

|

$ |

17,665 |

|

| Adjusted for: |

|

|

|

|

|

|

|

| Income tax expense attributable to Knight-Swift |

13,993 |

|

|

11,790 |

|

|

24,296 |

|

|

8,116 |

|

| Income before income taxes attributable to Knight-Swift |

48,236 |

|

|

32,090 |

|

|

89,178 |

|

|

25,781 |

|

Amortization of intangibles 3 |

19,621 |

|

|

18,544 |

|

|

39,249 |

|

|

37,087 |

|

Impairments 4 |

10,584 |

|

|

5,877 |

|

|

10,612 |

|

|

9,859 |

|

Legal accruals 5 |

— |

|

— |

|

265 |

|

|

261 |

|

|

1,828 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Severance expense 6 |

941 |

|

|

373 |

|

|

941 |

|

|

7,219 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted income before income taxes |

79,382 |

|

|

57,149 |

|

|

140,241 |

|

|

81,774 |

|

Provision for income tax expense at effective rate 7 |

(22,203) |

|

|

(17,774) |

|

|

(37,690) |

|

|

(22,625) |

|

| Non-GAAP: Adjusted Net Income Attributable to Knight-Swift |

$ |

57,179 |

|

|

$ |

39,375 |

|

|

$ |

102,551 |

|

|

$ |

59,149 |

|

|

|

|

|

|

|

|

|

Note: Because the numbers reflected in the table below are calculated on a per share basis, they may not foot due to rounding.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended June 30, |

|

Year-to-Date June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP: Earnings per diluted share |

$ |

0.21 |

|

|

$ |

0.13 |

|

|

$ |

0.40 |

|

|

$ |

0.11 |

|

| Adjusted for: |

|

|

|

|

|

|

|

| Income tax expense attributable to Knight-Swift |

0.09 |

|

|

0.07 |

|

|

0.15 |

|

|

0.05 |

|

| Income before income taxes attributable to Knight-Swift |

0.30 |

|

|

0.20 |

|

|

0.55 |

|

|

0.16 |

|

Amortization of intangibles 3 |

0.12 |

|

|

0.11 |

|

|

0.24 |

|

|

0.23 |

|

Impairments 4 |

0.07 |

|

|

0.04 |

|

|

0.07 |

|

|

0.06 |

|

Legal accruals 5 |

— |

|

|

— |

|

|

— |

|

|

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Severance expense 6 |

0.01 |

|

|

— |

|

|

0.01 |

|

|

0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted income before income taxes |

0.49 |

|

|

0.35 |

|

|

0.86 |

|

|

0.50 |

|

Provision for income tax expense at effective rate 7 |

(0.14) |

|

|

(0.11) |

|

|

(0.23) |

|

|

(0.14) |

|

| Non-GAAP: Adjusted EPS |

$ |

0.35 |

|

|

$ |

0.24 |

|

|

$ |

0.63 |

|

|

$ |

0.36 |

|

|

|

|

|

|

|

|

|

1Pursuant to the requirements of Regulation G, these tables reconcile consolidated GAAP net income attributable to Knight-Swift to non-GAAP consolidated Adjusted Net Income Attributable to Knight-Swift and consolidated GAAP diluted earnings per share to non-GAAP consolidated Adjusted EPS.

2Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

3Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 3.

4Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 4.

5Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 5.

6Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 6.

7For the second quarter of 2025, an adjusted effective tax rate of 28.0% was applied in our Adjusted EPS calculation. For the year-to-date period ending June 30, 2025, an adjusted effective tax rate of 26.9% was applied in our Adjusted EPS calculation. For the second quarter of 2024, an adjusted effective tax rate of 31.1% was applied in our Adjusted EPS calculation to exclude certain discrete items. For the year-to-date period ending June 30, 2024, an adjusted effective tax rate of 27.7% was applied in our adjusted EPS calculation to exclude certain discrete items.

|

|

|

Non-GAAP Reconciliation (Unaudited): |

Segment Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended June 30, |

|

Year-to-Date June 30, |

| Truckload Segment |

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP Presentation |

(Dollars in thousands) |

| Total revenue |

$ |

1,214,036 |

|

|

$ |

1,264,237 |

|

|

$ |

2,406,586 |

|

|

$ |

2,527,252 |

|

| Total operating expenses |

(1,168,616) |

|

|

(1,240,754) |

|

|

(2,316,566) |

|

|

(2,480,622) |

|

| Operating income |

$ |

45,420 |

|

|

$ |

23,483 |

|

|

$ |

90,020 |

|

|

$ |

46,630 |

|

| Operating ratio |

96.3 |

% |

|

98.1 |

% |

|

96.3 |

% |

|

98.2 |

% |

| Non-GAAP Presentation |

|

|

|

|

|

|

|

| Total revenue |

$ |

1,214,036 |

|

|

$ |

1,264,237 |

|

|

$ |

2,406,586 |

|

|

$ |

2,527,252 |

|

| Fuel surcharge |

(140,611) |

|

|

(161,570) |

|

|

(284,867) |

|

|

(330,091) |

|

| Intersegment transactions |

(125) |

|

|

123 |

|

|

(336) |

|

|

(320) |

|

| Revenue, excluding fuel surcharge and intersegment transactions |

1,073,300 |

|

|

1,102,790 |

|

|

2,121,383 |

|

|

2,196,841 |

|

|

|

|

|

|

|

|

|

| Total operating expenses |

1,168,616 |

|

|

1,240,754 |

|

|

2,316,566 |

|

|

2,480,622 |

|

| Adjusted for: |

|

|

|

|

|

|

|

| Fuel surcharge |

(140,611) |

|

|

(161,570) |

|

|

(284,867) |

|

|

(330,091) |

|

| Intersegment transactions |

(125) |

|

|

123 |

|

|

(336) |

|

|

(320) |

|

Amortization of intangibles 2 |

(1,775) |

|

|

(1,775) |

|

|

(3,550) |

|

|

(3,550) |

|

Impairments 3 |

(10,584) |

|

|

(5,555) |

|

|

(10,612) |

|

|

(8,654) |

|

Legal accruals 4 |

— |

|

|

30 |

|

|

(82) |

|

|

30 |

|

|

|

|

|

|

|

|

|

Severance 5 |

(625) |

|

|

(373) |

|

|

(625) |

|

|

(1,466) |

|

| Adjusted Operating Expenses |

1,014,896 |

|

|

1,071,634 |

|

|

2,016,494 |

|

|

2,136,571 |

|

| Adjusted Operating Income |

$ |

58,404 |

|

|

$ |

31,156 |

|

|

$ |

104,889 |

|

|

$ |

60,270 |

|

| Adjusted Operating Ratio |

94.6 |

% |

|

97.2 |

% |

|

95.1 |

% |

|

97.3 |

% |

|

|

|

|

|

|

|

|

1 Pursuant to the requirements of Regulation G, this table reconciles GAAP operating ratio to non-GAAP Adjusted Operating Ratio.

2 "Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in historical Knight acquisitions and the U.S. Xpress acquisition.

3Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 4.

4Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 5.

5Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 6.

|

|

|

Non-GAAP Reconciliation (Unaudited): |

Segment Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio 1 — (Continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended June 30, |

|

Year-to-Date June 30, |

LTL Segment 2 |

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP Presentation |

(Dollars in thousands) |

| Total revenue |

$ |

386,854 |

|

|

$ |

306,478 |

|

|

$ |

739,255 |

|

|

$ |

588,600 |

|

| Total operating expenses |

(368,521) |

|

|

(273,429) |

|

|

(708,228) |

|

|

(535,264) |

|

| Operating income |

$ |

18,333 |

|

|

$ |

33,049 |

|

|

$ |

31,027 |

|

|

$ |

53,336 |

|

| Operating ratio |

95.3 |

% |

|

89.2 |

% |

|

95.8 |

% |

|

90.9 |

% |

| Non-GAAP Presentation |

|

|

|

|

|

|

|

| Total revenue |

$ |

386,854 |

|

|

$ |

306,478 |

|

|

$ |

739,255 |

|

|

$ |

588,600 |

|

| Fuel surcharge |

(49,128) |

|

|

(43,383) |

|

|

(96,271) |

|

|

(84,515) |

|

|

|

|

|

|

|

|

|

| Revenue, excluding fuel surcharge |

337,726 |

|

|

263,095 |

|

|

642,984 |

|

|

504,085 |

|

|

|

|

|

|

|

|

|

| Total operating expenses |

368,521 |

|

|

273,429 |

|

|

708,228 |

|

|

535,264 |

|

| Adjusted for: |

|

|

|

|

|

|

|

| Fuel surcharge |

(49,128) |

|

|

(43,383) |

|

|

(96,271) |

|

|

(84,515) |

|

|

|

|

|

|

|

|

|

Amortization of intangibles 3 |

(5,020) |

|

|

(3,920) |

|

|

(10,047) |

|

|

(7,840) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Operating Expenses |

314,373 |

|

|

226,126 |

|

|

601,910 |

|

|

442,909 |

|

| Adjusted Operating Income |

$ |

23,353 |

|

|

$ |

36,969 |

|

|

$ |

41,074 |

|

|

$ |

61,176 |

|

| Adjusted Operating Ratio |

93.1 |

% |

|

85.9 |

% |

|

93.6 |

% |

|

87.9 |

% |

|

|

|

|

|

|

|

|

1Pursuant to the requirements of Regulation G, this table reconciles GAAP operating ratio to non-GAAP Adjusted Operating Ratio.

2Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

3"Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in the ACT, MME, and DHE acquisitions, as well as the non-cash amortization expense related to the fair value of favorable leases assumed in the DHE acquisition.

|

|

|

Non-GAAP Reconciliation (Unaudited): |

Segment Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio 1 — (Continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended June 30, |

|

Year-to-Date June 30, |

| Logistics Segment |

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP Presentation |

(Dollars in thousands) |

| Revenue |

$ |

128,298 |

|

|

$ |

131,700 |

|

|

$ |

269,919 |

|

|

$ |

258,429 |

|

| Total operating expenses |

(122,751) |

|

|

(126,941) |

|

|

(259,229) |

|

|

(251,197) |

|

| Operating income |

$ |

5,547 |

|

|

$ |

4,759 |

|

|

$ |

10,690 |

|

|

$ |

7,232 |

|

| Operating ratio |

95.7 |

% |

|

96.4 |

% |

|

96.0 |

% |

|

97.2 |

% |

| Non-GAAP Presentation |

|

| Revenue |

$ |

128,298 |

|

|

$ |

131,700 |

|

|

$ |

269,919 |

|

|

$ |

258,429 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

122,751 |

|

|

126,941 |

|

|

259,229 |

|

|

251,197 |

|

| Adjusted for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangibles 2 |

(1,164) |

|

|

(1,164) |

|

|

(2,328) |

|

|

(2,328) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Operating Expenses |

121,587 |

|

|

125,777 |

|

|

256,901 |

|

|

248,869 |

|

| Adjusted Operating Income |

$ |

6,711 |

|

|

$ |

5,923 |

|

|

$ |

13,018 |

|

|

$ |

9,560 |

|

| Adjusted Operating Ratio |

94.8 |

% |

|

95.5 |

% |

|

95.2 |

% |

|

96.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended June 30, |

|

Year-to-Date June 30, |

| Intermodal Segment |