|

Maryland

|

001-39210

|

84-2178264

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange

on which registered

|

||

|

Common Stock, par value $0.01 per share

8.50% Series A Cumulative Redeemable Preferred Stock, par value $0.01 per share

|

NREF

NREF-PRA

|

New York Stock Exchange

New York Stock Exchange

|

|

Exhibit Number

|

Exhibit Description

|

|

|

99.1

|

||

|

99.2

|

||

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

|

NEXPOINT REAL ESTATE FINANCE, INC.

|

||

|

By:

|

/s/ Paul Richards

|

|

|

Name:

Title:

|

Paul Richards

Chief Financial Officer, Executive

VP-Finance, Assistant Secretary and

Treasurer

|

|

|

EXHIBIT 99.1 |

Contact:

Kristen Griffith

Investor Relations

IR@nexpoint.com

Media: pro-nexpoint@prosek.com

NREF Announces Second Quarter 2025 Results, Provides Third Quarter 2025 Guidance

Dallas, TX, Thursday, July 31, 2025 – NexPoint Real Estate Finance, Inc. ("NREF" or the "Company") (NYSE: NREF) today reported its financial results for the quarter ended June 30, 2025.

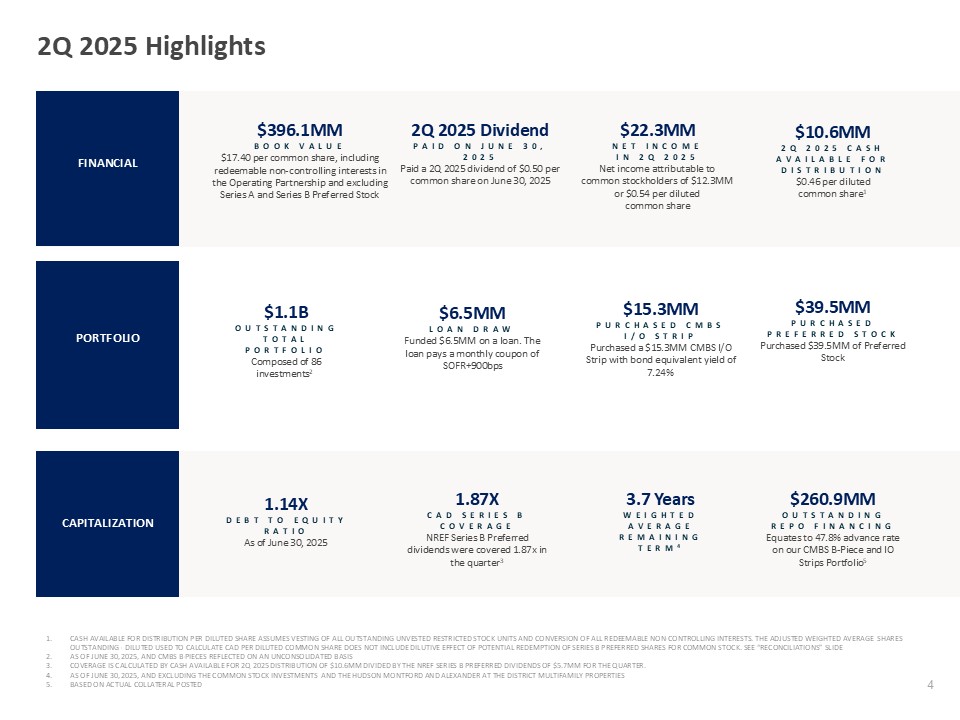

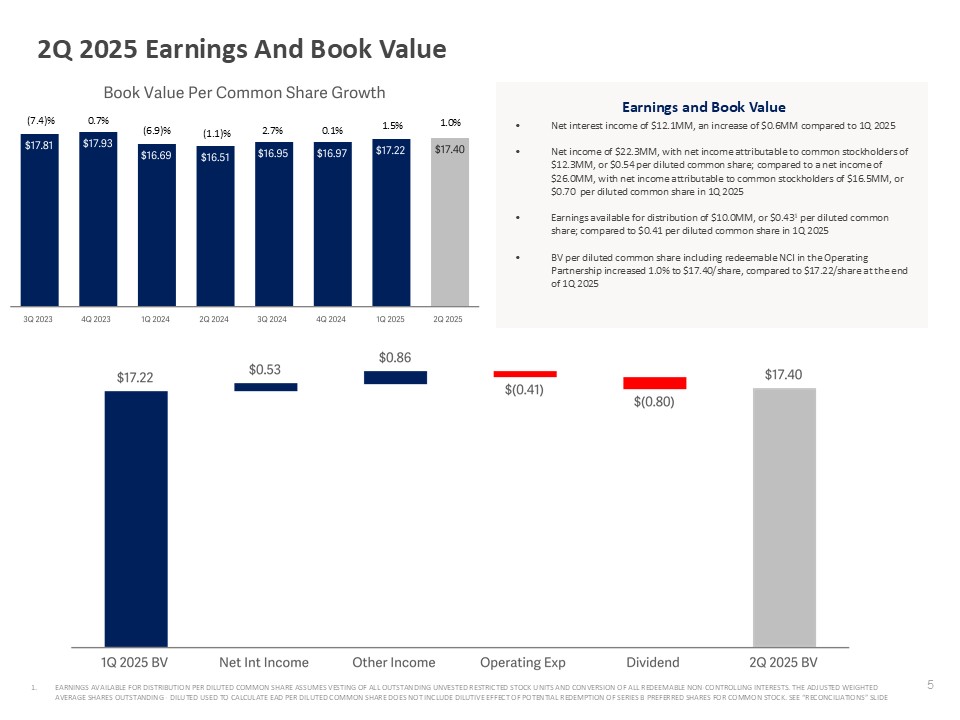

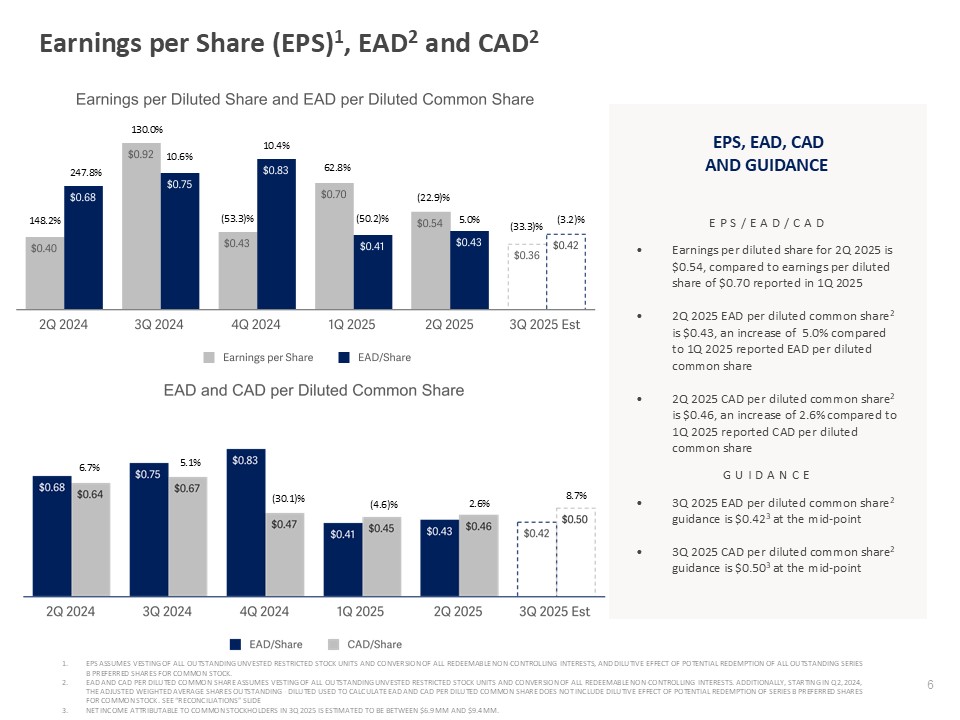

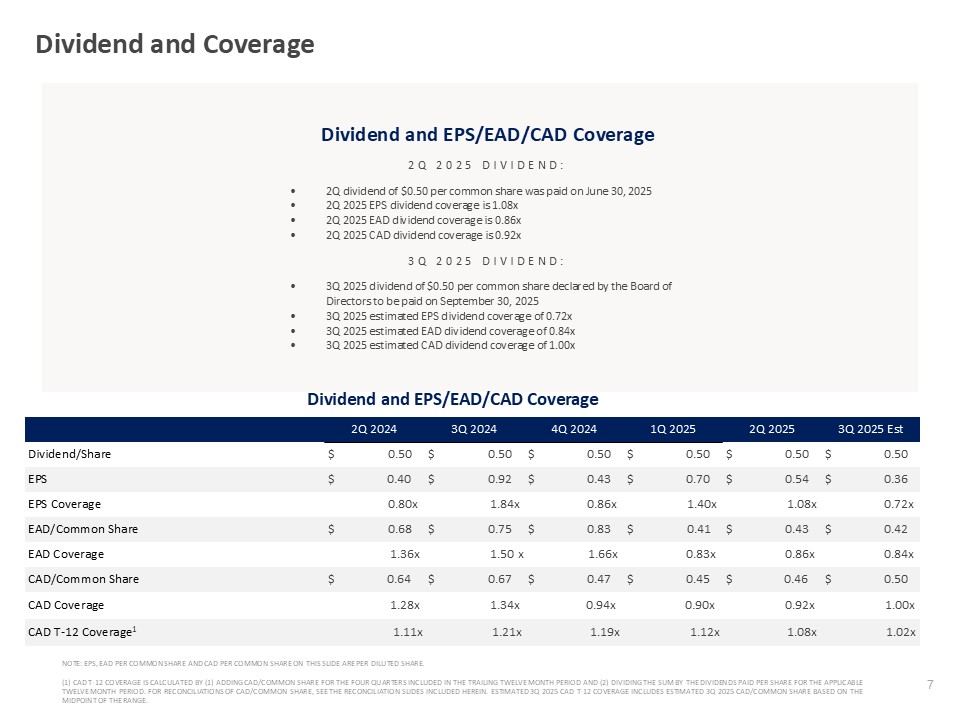

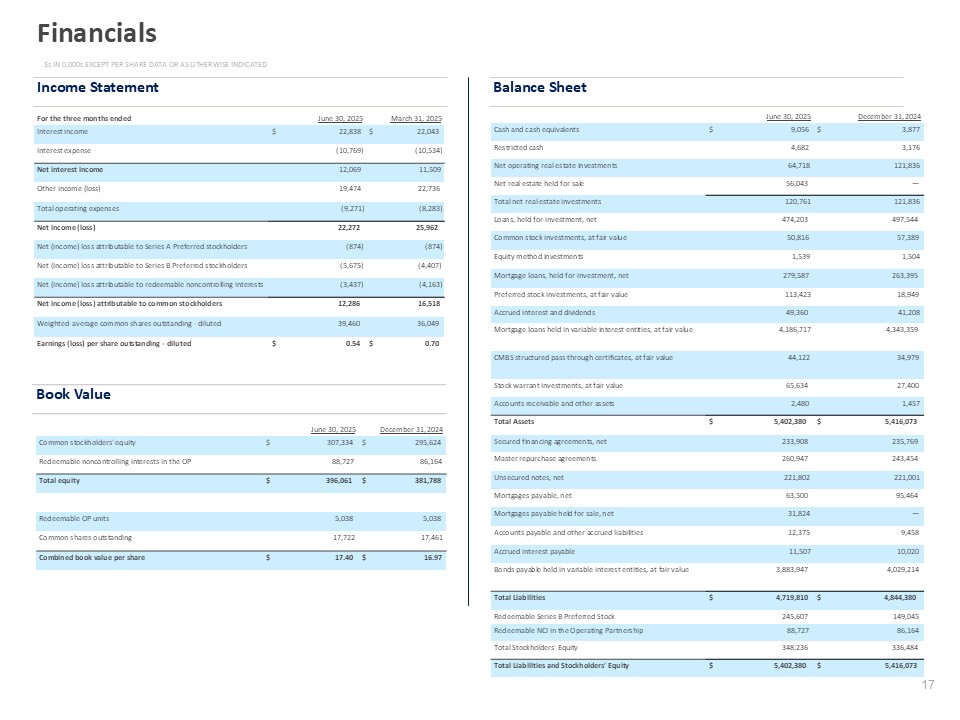

NREF reported net income attributable to common stockholders of $12.3 million, or 0.54 per diluted share1, for the three months ended June 30, 2025.

NREF reported cash available for distribution2 of $10.6 million, or $0.46 per diluted common share2, for the three months ended June 30, 2025.

“NREF is pleased to report another strong quarter, reflecting the consistency and resilience of our earnings across our core property sectors. In a market environment where many banks and traditional lenders are focused on navigating ongoing credit challenges, we remain disciplined, opportunistic, and fully committed to our strategic investment approach. Our ability to deploy capital effectively in today’s complex credit landscape positions us to capture compelling opportunities and generate long-term value for our shareholders,” said Matthew McGraner, Chief Investment Officer.

Second Quarter 2025 Highlights

|

• |

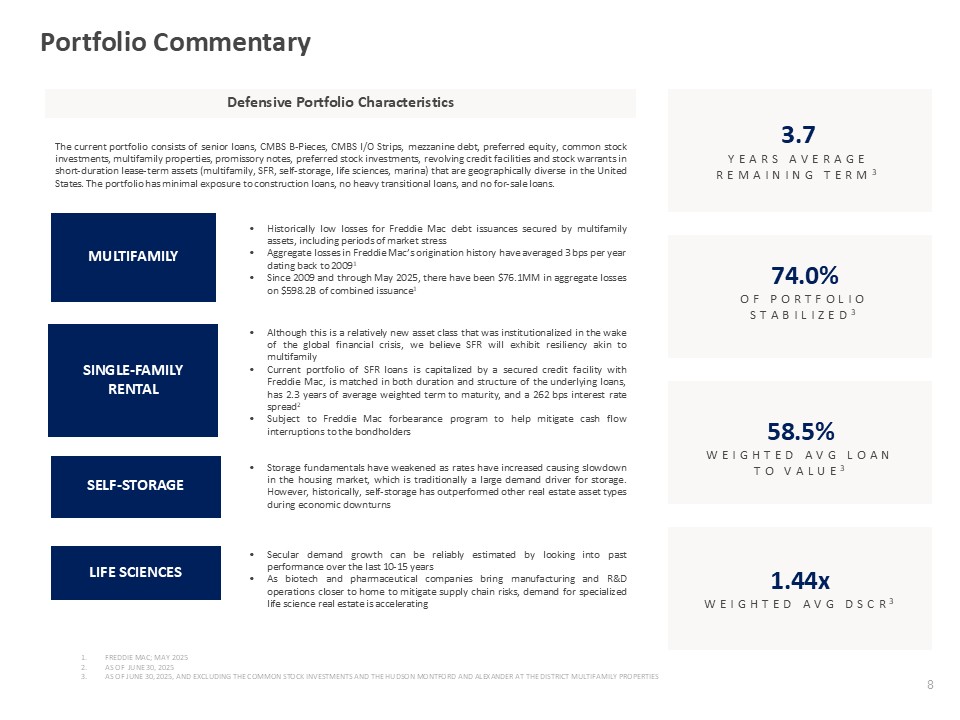

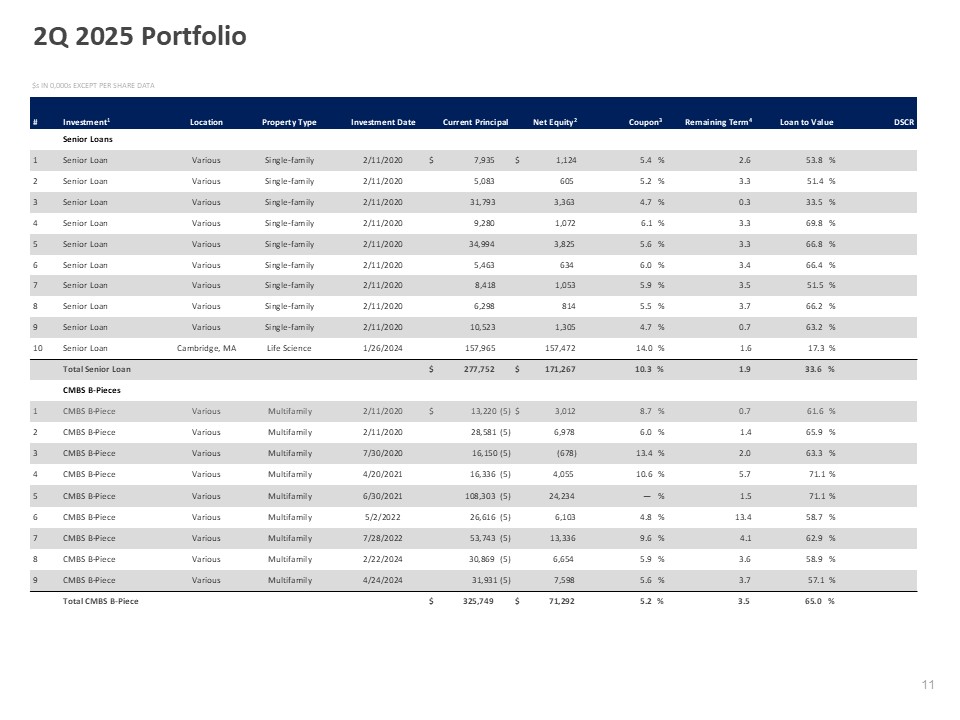

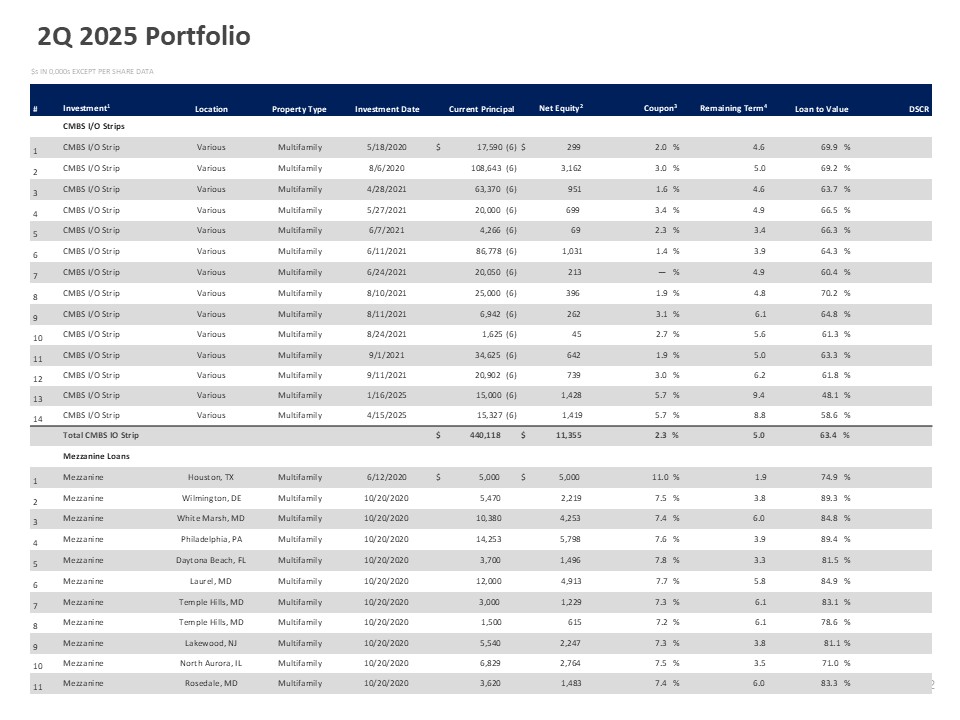

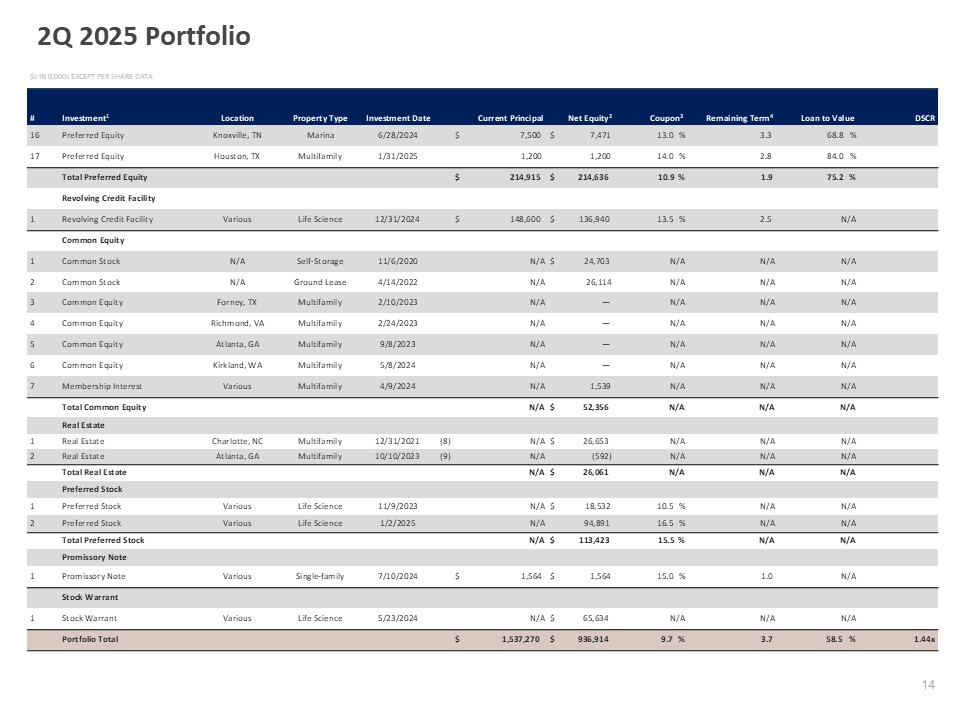

Outstanding total portfolio of $1.1 billion, composed of 86 investments3 |

|

• |

Single-family rental (“SFR”), multifamily, life sciences, specialty manufacturing, self-storage and marinas represent 15.5%, 49.5%, 32.7%, 0.1%, 1.6% and 0.7% of the Company’s investment portfolio, respectively as of June 30, 2025 |

|

• |

Weighted-average loan to value (“LTV”)4 and debt service coverage ratio (“DSCR”) on our senior loans, CMBS, CMBS I/O strips, preferred equity, mezzanine and revolving credit facilities investments are 58.5% and 1.44x3, respectively |

|

• |

During 2Q 2025, NREF purchased $39.5MM of preferred stock |

|

• |

During the quarter, the Company funded $6.5MM on a loan that pays a monthly coupon of SOFR + 900 bps. |

|

• |

During the quarter, the Company purchased a $15.3MM CMBS I/O strip with bond equivalent yield of 7.24%. |

1 Weighted-average shares outstanding - diluted assumes vesting of all outstanding unvested restricted stock units and the conversion of all redeemable non-controlling interests.

2 Earnings available for distribution (“EAD”), cash available for distribution (“CAD”) and adjusted weighted average common shares outstanding - diluted are non-GAAP measures. For a discussion of why we consider these non-GAAP measures useful and reconciliations of these non-GAAP measures, see the “Reconciliations of Non-GAAP Financial Measures” and “Non-GAAP Financial Measures” sections of this release.

3 As of June 30, 2025; and excluding the common stock investments, the Hudson Montford and Alexander at the District multifamily properties. CMBS B-Pieces reflected on an unconsolidated basis.

4 Loan to value is generally based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated or by the current principal amount as of the date of the most recent as-is appraised value. For our CMBS B-Pieces, LTV is based on the weighted-average LTV of the underlying loan pool.

5 Net income attributable to common stockholders in 3Q 2025 is estimated to be between $6.9MM and $9.4MM. See reconciliations below.

|

EXHIBIT 99.1 |

Looking Ahead: Third Quarter 2025 Guidance

Earnings Available for Distribution2

|

● |

3Q 2025 EAD per diluted common share guidance is $0.425 at the midpoint |

|

Low |

Mid |

High |

||||||||||

|

September 30, 2025 |

September 30, 2025 |

September 30, 2025 |

||||||||||

|

Net income |

$ | 14,944 | $ | 16,243 | $ | 17,380 | ||||||

|

Net (income) loss attributable to Series A Preferred stockholders |

(874 | ) | (874 | ) | (874 | ) | ||||||

|

Net (income) loss attributable to Series B Preferred stockholders |

(7,124 | ) | (7,124 | ) | (7,124 | ) | ||||||

|

Net income attributable to common stockholders |

$ | 6,946 | $ | 8,245 | $ | 9,382 | ||||||

|

Adjustments |

||||||||||||

|

Amortization of stock-based compensation |

1,550 | 1,550 | 1,550 | |||||||||

|

EAD |

$ | 8,496 | $ | 9,795 | $ | 10,932 | ||||||

|

Weighted average common shares outstanding – basic |

17,722 | 17,722 | 17,722 | |||||||||

|

Weighted average common shares outstanding – diluted |

43,069 | 43,069 | 43,069 | |||||||||

|

Shares attributable to potential redemption of Series B Preferred |

(20,007 | ) | (20,007 | ) | (20,007 | ) | ||||||

|

Adjusted weighted average common shares outstanding – diluted (1) |

23,062 | 23,062 | 23,062 | |||||||||

|

EPS per Weighted Average Share – diluted |

$ | 0.33 | $ | 0.36 | $ | 0.38 | ||||||

|

EAD per diluted common share |

$ | 0.37 | $ | 0.42 | $ | 0.47 | ||||||

|

EPS Dividend Coverage Ratio |

0.66 | x | 0.72 | x | 0.76 | x | ||||||

|

EAD Dividend Coverage Ratio |

0.74 | x | 0.84 | x | 0.94 | x | ||||||

|

EXHIBIT 99.1 |

Cash Available for Distribution2

|

● |

3Q 2025 CAD per diluted common share guidance is $0.505 at the midpoint |

|

Low |

Mid |

High |

||||||||||

|

September 30, 2025 |

September 30, 2025 |

September 30, 2025 |

||||||||||

|

EAD |

$ | 8,496 | $ | 9,795 | $ | 10,932 | ||||||

|

Adjustments |

||||||||||||

|

Amortization of premiums |

2,394 | 2,394 | 2,394 | |||||||||

|

Accretion of discounts |

(1,171 | ) | (1,171 | ) | (1,171 | ) | ||||||

|

Amortization and depreciation |

584 | 584 | 584 | |||||||||

|

CAD |

$ | 10,303 | $ | 11,602 | $ | 12,739 | ||||||

|

Weighted average common shares outstanding – basic |

17,722 | 17,722 | 17,722 | |||||||||

|

Weighted average common shares outstanding – diluted |

43,069 | 43,069 | 43,069 | |||||||||

|

Shares attributable to potential redemption of Series B Preferred |

(20,007 | ) | (20,007 | ) | (20,007 | ) | ||||||

|

Adjusted weighted average common shares outstanding – diluted (1) |

23,062 | 23,062 | 23,062 | |||||||||

|

EPS per Weighted Average Share – diluted |

$ | 0.33 | $ | 0.36 | $ | 0.38 | ||||||

|

CAD per diluted common share |

$ | 0.45 | $ | 0.50 | $ | 0.55 | ||||||

|

EPS Dividend Coverage Ratio |

0.66 | x | 0.72 | x | 0.76 | x | ||||||

|

CAD Dividend Coverage Ratio |

0.90 | x | 1.00 | x | 1.10 | x | ||||||

|

(1) |

Adjusted weighted average common shares outstanding – diluted does not include the dilutive effect of the potential redemption of Series B Preferred Stock for common shares. |

Conference Call Details

The Company is scheduled to host a conference call on Thursday, July 31, 2025, at 11:00 a.m. ET (10:00 a.m. CT), to discuss second quarter 2025 financial results.

The conference call can be accessed live over the phone by dialing 888-660-4430 or +1 646-960-0537 and entering Conference ID 6891136. A live audio webcast of the call will be available online at the Company's website, https://nref.nexpoint.com (under "Resources"). An online replay will be available shortly after the call on the Company's website and continue to be available for 60 days.

A replay of the conference call will also be available through Thursday, August 14, 2025, by dialing 1 800- 770- 2030 or, for international callers, +1 609-800-9099 and entering passcode 6891136.

For additional commentary and portfolio information, please view NREF’s earning supplement, which was posted on the Company’s website, http://nref.nexpoint.com.

Reconciliations of Non-GAAP Financial Measures

The following table provides a reconciliation of Earnings Available for Distribution and Cash Available for Distribution to GAAP net income attributable to common stockholders and Adjusted Weighted Average Common Shares Outstanding – diluted to Weighted Average Common Shares Outstanding - diluted (in thousands, except per share amounts):

|

For the Three Months Ended June 30, |

||||||||

|

2025 |

2024 |

|||||||

|

Net income (loss) attributable to common stockholders |

$ | 12,286 | 7,488 | |||||

|

Net income (loss) attributable to redeemable noncontrolling interests |

3,437 | 2,275 | ||||||

|

Adjustments |

||||||||

|

Amortization of stock-based compensation |

1,688 | 1,454 | ||||||

|

Provision for (reversal of) credit losses |

5,284 | (2 | ) | |||||

|

Equity in (income) losses of equity method investments |

1,017 | 892 | ||||||

|

Unrealized (gains) or losses (1) |

(13,706 | ) | 3,852 | |||||

|

EAD |

$ | 10,006 | $ | 15,959 | ||||

|

EAD per diluted common share |

$ | 0.43 | $ | 0.68 | ||||

|

Adjustments |

||||||||

|

Amortization of premiums |

$ | 2,558 | 1,682 | |||||

|

Accretion of discounts |

(2,561 | ) | (3,693 | ) | ||||

|

Depreciation and amortization of real estate investments |

614 | 1,082 | ||||||

|

Amortization of deferred financing costs |

12 | 12 | ||||||

|

CAD |

$ | 10,629 | $ | 15,042 | ||||

|

CAD per diluted common share |

$ | 0.46 | $ | 0.64 | ||||

|

Weighted-average common shares outstanding – basic |

17,712 | 17,422 | ||||||

|

Weighted-average common shares outstanding – diluted |

39,460 | 27,788 | ||||||

|

Shares attributable to potential redemption of Series B Preferred |

(16,408 | ) | (4,357 | ) | ||||

|

Adjusted weighted-average common shares outstanding – diluted |

23,052 | 23,431 | ||||||

|

(1) |

Unrealized gains represent the net change in unrealized gains on investments held at fair value. |

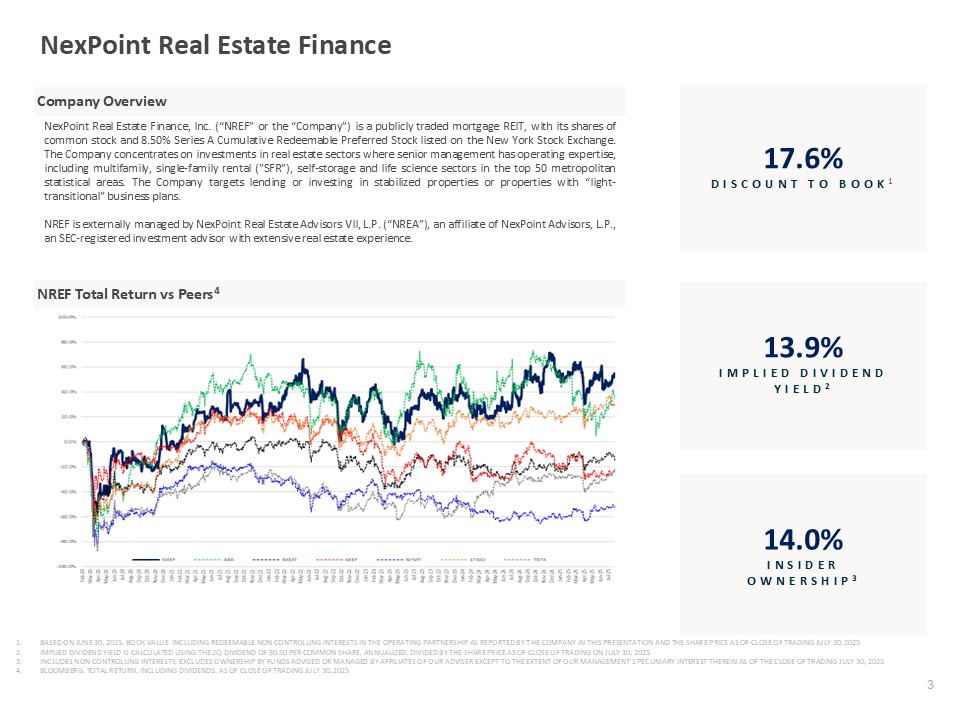

About NexPoint Real Estate Finance, Inc.

NexPoint Real Estate Finance, Inc., is a publicly traded REIT, with its common stock and 8.50% Series A Cumulative Redeemable Preferred Stock listed on the New York Stock Exchange, primarily focused on originating, structuring and investing in first-lien mortgage loans, mezzanine loans, preferred equity, convertible notes, multifamily properties and common equity investments, as well as multifamily and single-family commercial mortgage-backed securities securitizations, promissory notes, revolving credit facilities and stock warrants. More information about the Company is available at http://nref.nexpoint.com.

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on management's current expectations, assumptions and beliefs. Forward-looking statements can often be identified by words such as "anticipate," “believe,” "estimate," "expect," "intend," "may," "should" and similar expressions, and variations or negatives of these words. These forward-looking statements include, but are not limited to, statements regarding the Company’s business, strategy and industry in general, third quarter 2025 guidance, including net income, net income attributable to common stockholders, EAD, CAD, EAD and CAD per diluted common share and related coverage ratios, assumptions and estimates, the Company's intent to not settle Series B Preferred redemptions in shares of common stock when the Company's common stock price is below book value and the Company's ability to deploy capital effectively to capture compelling opportunities and generate long-term value for its shareholders. They are not guarantees of future results and forward-looking statements are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statement, including those described in greater detail in our filings with the Securities and Exchange Commission (the “SEC”), particularly those described in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers should not place undue reliance on any forward-looking statements and are encouraged to review the Company’s Annual Report on Form 10-K and the Company's other filings with the SEC for a more complete discussion of risks and other factors that could affect any forward-looking statement. The statements made herein speak only as of the date of this press release and except as required by law, the Company does not undertake any obligation to publicly update or revise any forward-looking statements.

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures. A “non-GAAP financial measure” is defined as a numerical measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in the statements of income, balance sheets or statements of cash flows of the Company. The non-GAAP financial measures used within this press release are EAD, CAD, EAD and CAD per diluted common share and adjusted weighted average common shares outstanding - diluted.

EAD is defined as net income (loss) attributable to our common stockholders computed in accordance with GAAP, including realized gains and losses not otherwise included in net income (loss), excluding any unrealized gains or losses or other similar non-cash items that are included in net income (loss) for the applicable reporting period, regardless of whether such items are included in other comprehensive income (loss), or in net income (loss) and adding back amortization of stock-based compensation. The Company also adjusts EAD to remove the income/(losses) from equity method investments as they represent changes in the equity value of our investment rather than distributable earnings. The Company will include income from equity method investments to the extent that we receive cash distributions and upon realizing gains and/or losses. Net income (loss) attributable to common stockholders may also be adjusted for the effects of certain GAAP adjustments and transactions that may not be indicative of our current operations. In addition, EAD in this press release includes the dilutive effect of non-controlling interests. We use EAD to evaluate our performance and to assess our long-term ability to pay distributions. We believe providing EAD as a supplement to GAAP net income (loss) to our investors is helpful to their assessment of our performance and our long-term ability to pay distributions. We also use EAD as a component of the management fee paid to our external manager. EAD does not represent net income or cash flows from operating activities and should not be considered as an alternative to GAAP net income, an indication of our GAAP cash flows from operating activities, a measure of our liquidity or an indication of funds available for our cash needs. Our computation of EAD may not be comparable to EAD reported by other REITs.

We calculate CAD by adjusting EAD by adding back amortization of premiums, depreciation and amortization of real estate investment and amortization of deferred financing costs and by removing accretion of discounts. We use CAD to evaluate our performance and our current ability to pay distributions. We also believe that providing CAD as a supplement to GAAP net income (loss) to our investors is helpful to their assessment of our performance and our current ability to pay distributions. CAD does not represent net income or cash flows from operating activities and should not be considered as an alternative to GAAP net income, an indication of our GAAP cash flows from operating activities, a measure of our liquidity or an indication of funds available for our cash needs. Our computation of CAD may not be comparable to CAD reported by other REITs.

EAD per diluted common share and CAD per diluted common share are based on adjusted weighted average common shares outstanding – diluted. Adjusted weighted average common shares outstanding - diluted is calculating by subtracting the dilutive effect of potential redemptions of Series B Preferred shares for shares of our common stock from weighted average common shares outstanding - diluted. We believe providing adjusted weighted average common shares outstanding - diluted to our investors is helpful in their assessment of our performance without the potential dilutive effective of the Series B Preferred shares. We have the right to redeem the Series B Preferred shares for cash or shares of our common stock. Additionally, Series B Preferred redemptions are capped at 2% of the outstanding Series B Preferred shares per month, 5% per quarter and 20% per year. The Company maintains sufficient liquidity to pay cash to cover any redemptions up to the quarterly redemption cap. Further, it is the Company's intent to not settle Series B Preferred redemptions in shares of common stock when the Company's common stock price is below book value.

Adjusted weighted average common shares outstanding – diluted should not be considered as an alternative to the GAAP measure. Our computation of adjusted weighted average common shares outstanding – diluted may not be comparable to adjusted weighted average common shares outstanding - diluted reported by other companies.

Exhibit 99.2