UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report …………………………..

Commission file number: 001-34175

ECOPETROL S.A.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

REPUBLIC OF COLOMBIA

(Jurisdiction of incorporation or organization)

Carrera 13 No. 36 – 24

Bogotá – Colombia

Tel. (57) 310 315 8600

(Address of principal executive offices)

Lina Maria Contreras Mora

Investor Relations Officer

investors@ecopetrol.com.co

Tel. (57) 310 315 8600

Carrera 13 No.36 - 24

Bogotá, Colombia

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

American Depository Shares (as evidenced by American Depository Receipts), each representing 20 common shares par value COP 609 per share |

EC |

|

New York Stock Exchange |

|

Ecopetrol common shares par value COP 609 per share |

|

|

New York Stock Exchange (for listing purposes only) |

|

8.625% Notes due 2029 |

|

EC29 |

|

New York Stock Exchange |

6.875% Notes due 2030 |

|

EC30 |

|

New York Stock Exchange |

4.625% Notes due 2031 |

|

EC31 |

|

New York Stock Exchange |

7.750% Notes due 2032 |

|

EC32 |

|

New York Stock Exchange |

8.875% Notes due 2033 |

|

EC33 |

|

New York Stock Exchange |

8.375% Notes due 2036 |

|

EC36 |

|

New York Stock Exchange |

7.375% Notes due 2043 |

|

EC43 |

|

New York Stock Exchange |

5.875% Notes due 2045 |

EC45 |

|

New York Stock Exchange |

|

5.875% Bonds due 2051 |

|

EC51 |

|

New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

41,116,694,690 Ecopetrol common shares, par value COP 609 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

⌧ Yes ◻ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

◻ Yes ⌧ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

⌧ Yes ◻ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

⌧ Yes ◻ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ⌧ |

Accelerated filer ◻ |

Non-accelerated filer ◻ |

Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ◻

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

◻ U.S. GAAP |

⌧ International Financial Reporting Standards as issued by the International Accounting Standards Board |

◻ Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

◻ Item 17 ◻ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ⌧ No

Table of Contents

|

Page |

1 |

|

1 |

|

2 |

|

3 |

|

3 |

|

4 |

|

4 |

|

5 |

|

6 |

|

6 |

|

7 |

|

7 |

|

8 |

|

8 |

|

9 |

|

11 |

|

12 |

|

12 |

|

13 |

|

14 |

|

16 |

|

17 |

|

18 |

|

3.5.2.1.1 Ecopetrol S.A.’s Production Activities in Colombia |

18 |

3.5.2.1.2 Ecopetrol S.A.’s Affiliates and Subsidiaries’ Production Activities in Colombia |

25 |

28 |

|

30 |

|

31 |

|

33 |

|

42 |

|

45 |

|

45 |

|

48 |

|

52 |

|

52 |

|

53 |

|

53 |

|

53 |

|

54 |

|

55 |

|

56 |

|

56 |

|

56 |

|

56 |

|

56 |

|

57 |

|

57 |

|

58 |

|

3.8.2.2 Electricity Transmission Activities Outside Colombia |

58 |

59 |

|

59 |

|

60 |

|

61 |

|

61 |

|

61 |

|

67 |

|

70 |

|

71 |

ii

iii

179 |

|

182 |

|

182 |

|

5.3.1 Integrated Risk Management System and Internal Control System |

182 |

184 |

|

185 |

|

186 |

|

188 |

|

199 |

|

199 |

|

199 |

|

201 |

|

201 |

|

202 |

|

203 |

|

203 |

|

210 |

|

213 |

|

214 |

|

214 |

|

215 |

|

216 |

|

220 |

|

224 |

|

224 |

|

231 |

|

233 |

|

235 |

|

236 |

|

241 |

|

242 |

|

242 |

|

F-1 |

|

245 |

|

246 |

|

249 |

iv

1. |

Introduction |

1.1 |

About This Annual Report |

We file our Annual Report on Form 20-F and other information with the U.S. Securities and Exchange Commission.

We file reports, including annual reports on Form 20-F, and other information with the SEC pursuant to the rules and regulations of the SEC that apply to foreign private issuers. The materials included in this annual report on Form 20-F may be downloaded at the SEC’s website: http://www.sec.gov. Any filings we make are also available to the public over the Internet at the SEC’s website at www.sec.gov and at our website at www.ecopetrol.com.co. These URLs are intended to be inactive textual references only. They are not intended to be active hyperlinks to such websites. The information on our website, which might be accessible through a hyperlink resulting from such URL, is not and shall not be deemed to be incorporated into this annual report.

Unless the context otherwise requires, the terms “Ecopetrol”, “we”, “us”, “our”, “Ecopetrol Group”, “Group” or the “Company” are used in this annual report to refer to Ecopetrol S.A. and its subsidiaries on a consolidated basis.

For purposes of the section Business Overview—Exploration and Production, “we” refers to Ecopetrol S.A., its subsidiaries and the partnerships in which Ecopetrol has an interest.

References to the “Nation” or “Colombia” in this annual report relate to the Republic of Colombia, our controlling shareholder. References made to the Colombian Government or the “Government” correspond to the executive branch including the President of Colombia, the ministries, and other government agencies responsible for regulating our business.

Our consolidated financial statements for the years ended December 31, 2022, 2023, and 2024 were prepared in accordance with IFRS accounting standards as issued by IASB. References in this annual report to IFRS mean IFRS as issued by the IASB.

IFRS differs in certain significant aspects from the current reporting standards as in effect in Colombia (“Colombian IFRS”), which is the accounting standard we use for local reporting purposes. As a result, our financial information presented under IFRS is not directly comparable to our financial information presented under Colombian IFRS. For a description of the differences between Colombian IFRS and IFRS, see section Financial Review—Summary of Differences between Internal Reporting Policies (Colombian IFRS) and IFRS.

Our consolidated financial statements were consolidated line by line and all transactions and balances among subsidiaries have been eliminated. These financial statements include the financial results of all subsidiary companies controlled, directly or indirectly, by Ecopetrol S.A. See Exhibit 1 – Consolidated subsidiaries, associates, and joint ventures, to our consolidated financial statements included in this annual report.

In this annual report, references to “USD” or “U.S. dollars” are to United States dollars and references to “COP” “Colombian Peso” or “Colombian Pesos” are to Colombian Pesos, the Ecopetrol Group’s functional and presentation currency under which we prepare our consolidated financial statements. This annual report translates certain Colombian Peso amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise indicated, such Colombian Peso amounts have been translated at the rate of COP 4,073.75 per USD 1.00, which corresponds to the average Tasa Representativa del Mercado (TRM), or Representative Market Exchange Rate, for 2024. Such conversion should not be construed as a representation that the Colombian Peso amounts correspond to, or have been or could be converted into, U.S. dollars at that rate or any other rate. On March 31, 2025, the Representative Market Exchange Rate was COP 4,192.57 per USD 1.00. Certain figures shown in this annual report have been subject to rounding adjustments, and, accordingly, certain totals may therefore not precisely equal the sum of the numbers presented. In this annual report, a billion is equal to one with nine zeros.

In this annual report, we use unit measures like: “bpd” (barrels per day), “boepd” (barrels of oil equivalent per day), “mbd” (thousand barrels day), “mboed” (thousand barrels of oil equivalent day), “mboe” (thousand barrels of oil equivalent), “mmboe” (million barrels of oil equivalent), “mmbd” (million barrels per day) and “mmb” (million barrels).

1

1.2 |

Forward-looking Statements |

This annual report on Form 20-F contains forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements are not based on historical facts and reflect our expectations for future events and results. Most facts are uncertain because of their nature. Words such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “should”, “plan”, “potential”, “predict”, “prognosticate”, “project”, “target”, “achieve” and “intend”, among other similar expressions, are understood as forward-looking statements. We have made forward-looking statements that address, among other things:

| ● | changes in international crude oil and natural gas prices; |

| ● | our exploration and production activities, including drilling; and import and export activities; |

| ● | our liquidity, cash flow, and sources of funding; |

| ● | the results of our electric power transmission and toll roads activities through our subsidiary, Interconexión Eléctrica S.A. (“ISA”); |

| ● | our projected and targeted capital expenditures and other cost commitments and revenues; and |

| ● | dates by which certain areas will be developed or will come on-stream. |

Our forward-looking statements and sensitivity analysis are not guarantees of future performance and are subject to assumptions that may prove incorrect and to risks and uncertainties that are difficult to predict. Actual results could differ materially from those expressed or forecasted in any forward-looking statements as a result of a variety of factors. These factors may include, but are not limited to, the following:

| ● | future growth and development of the energy industry and its transition into lower carbon sources of energy; |

| ● | general economic and business conditions, including increased and prolonged inflation in Colombia and worldwide, volatility in crude oil and other commodity prices, refining margins and prevailing exchange rates; |

| ● | competition; |

| ● | our ability to obtain financing; |

| ● | our ability to find, acquire or gain access to additional reserves and our ability to develop existing reserves; |

| ● | uncertainties inherent in making estimates of our reserves; |

| ● | the modification, adjustment or reduction of the tariffs, rates or fees charged by the electricity transmission and transport businesses in the countries where they operate; |

| ● | significant political, economic and social developments in Colombia and other countries where we do business; |

| ● | the impact of tariffs, trade barriers and other restrictions imposed on global trade; |

| ● | natural disasters, pandemics and other public health events; |

| ● | the continuing Russian invasion of Ukraine and Israel - Hamas conflict; |

| ● | other military operations, terrorist acts, wars or embargoes; |

| ● | regulatory developments, including regulations related to climate change and cybersecurity; |

2

| ● | receipt and maintenance of government approvals and licenses; |

| ● | technical difficulties; and |

| ● | other factors discussed in section Risk Review—Risk Factors of this document as “Risk Factors.” |

All forward-looking statements attributed to us are qualified in their entirety by this cautionary statement. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason. Accordingly, readers should not place undue reliance on forward-looking statements.

1.3 |

Selected Operating Data |

The following table sets forth, for the periods and at the dates indicated, certain key operating data.

Table 1 – Selected Operating Data

Operating Information |

|

2024 |

|

2023 |

|

2022 |

|

2021 |

|

2020 |

|

Oil and gas production (mboed) |

|

745.8 |

|

736.6 |

|

709.5 |

|

679.0 |

|

697.0 |

|

Proved oil and gas reserves (mmboe)(1) |

|

1,893 |

|

1,883 |

|

2,011 |

|

2,002 |

|

1,770 |

|

Exploratory wells(2)(3) |

|

16 |

|

26 |

|

29 |

|

16 |

|

18 |

|

Refinery throughput (bpd)(4) |

|

416,879 |

|

422,623 |

|

360,451 |

|

355,895 |

|

322,038 |

|

1P Reserves replacement ratio |

|

104 |

% |

48 |

% |

104 |

% |

200 |

% |

48 |

% |

Transmission Lines (km) |

|

49,677 |

|

49,426 |

|

48,766 |

|

48,330 |

|

47,358 |

|

(1) |

Include natural gas royalties and exclude crude oil royalties. |

(2) |

Gross exploratory wells. |

(3) |

The table does not include stratigraphic wells, although they are considered exploratory. These wells do not come into production, and are subsequently plugged and abandoned after the relevant study is completed. The table also includes wells drilled by partners at sole risk. |

(4) |

Includes the Barrancabermeja, Cartagena, Apiay and Orito refineries. |

2. |

Strategy and Market Overview |

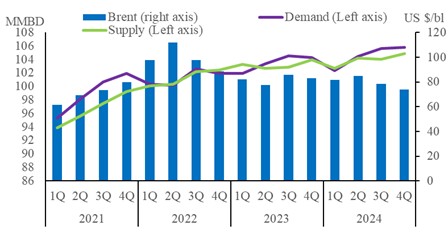

Our consolidated financial results for 2024 reflect the cumulative impact of a crude oil price that exceeded our initial expectations. In our investment plan for 2024, we forecasted a Brent Crude oil price of USD 75 per barrel for the year, while the actual average price stood at USD 79.84 per barrel, a decrease of USD 2.33 per barrel compared to 2023. This higher-than-expected price was due to (i) a volatile global crude market, shaped by the steady growth in supply from non-OPEC+ countries and subdued demand, and (ii) to weaker-than-anticipated consumption in China and the influence of geopolitical factors. Despite the overall increase in 2024, Brent oil prices averaged lower than in 2023, reflecting a market shift towards supply-side dominance.

On the demand front, global oil consumption grew by one million barrels per day (“mmbd”) in 2024, below the trend rate of 1.2 mmbd over five years preceding the pandemic (2015-2019). Notably, while the U.S. economy exceeded expectations for a second consecutive year, with robust growth, China’s oil demand slowed significantly in 2024. Given that China accounted for nearly 50% of global oil demand growth over the past two decades, this slowdown weighed heavily on the worldwide demand balance. However, strong demand growth in emerging markets, particularly in Asia-Pacific, partially offset this weakness. Meanwhile, demand in OECD countries showed minimal growth, reflecting a manufacturing sector that remained in contraction throughout the year.

On the supply side, OPEC and its allies (OPEC+), including Russia, maintained their production quotas throughout the year, prioritizing price stability through disciplined output cuts. By year-end, OPEC+ supply was 0.7 mmbd lower than in 2023, reflecting improved compliance among member countries. These cuts helped counterbalance the increasing supply from non-OPEC+ countries (excluding Russia), which decreased by 1.4 mmbd over the year. As a result, global crude inventories remained essentially unchanged compared to the beginning of 2024. The expansion of non-OPEC+ supply was primarily driven by the U.S. production of 0.3 mmbd. However, non-OPEC+ supply growth fell short of market expectations made at the beginning of the year, highlighting a more constrained expansion than anticipated (1.4 mmbd versus the 2.5 mmbd forecast in January). Overall, the market achieved better balance by the end of 2024, driven by a combination of disciplined output reductions by OPEC+ and the moderated growth of non-OPEC+ supply. The graph below sets forth the oil demand and supply balance compared against the evolution of the Brent price as of the periods indicated.

3

Graph 1 – Supply/Demand Balance vs ICE Brent Price Evolution

Source: S&P Global Commodity Insights, Bloomberg

In the latter part of 2024, with the U.S. economy stabilizing, inflation moderating in developed markets, and major economies initiating interest rate cuts, signs of demand recovery emerged. Additionally, China’s economy rebounded, boosting market sentiment. These developments prompted the International Monetary Fund (IMF) to maintain the forecast global economic growth of 3.2% for 2024, with advanced economies growing at 1.8% and emerging market and developing economies at 4.2%.

Although international oil prices and global demand and supply dynamics are significant factors affecting our business and financial condition, Colombia’s local economic factors have also influenced, and will continue to affect our performance, given that we conduct most of our business in Colombia.

The Colombian economy, as measured by real GDP, grew at a rate of 1.7% in 2024, one of the lowest in the region, but exhibiting a much faster economy as compared to the 0.6% growth rate in 2023. In 2024, GDP growth rate was mainly driven by (i) a small increase in private consumption, which expanded at a rate of 1.6%, and (ii) a decrease in the unemployment rate to 9.1%, which was 0.89 percentage points lower compared to 2023 and positively impacted by a growth of investment into the country. Investment spending also contributed favorable to GDP, with an increase in gross capital formation in annual terms of 3.0% in 2024. In contrast, the external sector contributed negatively to GDP growth, with imports increasing by 4.2% and exports growing by 2.0%, resulting in an increase in the current account deficit.

Under current Colombian regulations, depending on the price of fuels in the international markets, participants in the Colombian fuel market either contribute to or receive payments from the Fuel Price Stabilization Fund (“FEPC” for its acronym in Spanish), a fund managed by the MHCP to attenuate, in the domestic market, the impact of fluctuations of fuel prices in international markets. Moreover, the decrease in the difference between gasoline and diesel parity prices with those of domestic prices due to factors such as Brent price, gasoline and diesel cracks and the exchange rate, has resulted in a decrease in the amounts owed by FEPC to Ecopetrol. See “Regulation Concerning Production and Prices—Fuel Price Stabilization Fund (FEPC)”. On March 22, 2024, the Annual Shareholders’ Meeting announced a dividend per share of COP 312. The dividend amount declared by the Company for the Government of Colombia (the “Government”) as majority shareholder was COP 11.35 trillion. This dividend was offset against the 2024 FEPC receivables from the Government. As of December 31, 2024, the cumulative balance of the FEPC account receivable was COP 7.6 trillion, accrued in 2024, to be paid in 2025.

2.1 |

Our Corporate Strategy |

2.1.1 |

2040 Strategy: Energy That Transforms |

On February 8, 2022, the Ecopetrol Group published its long-term strategy (the “2040 Strategy”), also referred to as “Energy That Transforms”, being the first company in the oil and gas industry in Latin America to disclose a roadmap for the next 20 years. The strategy aims to address comprehensively current environmental, social, and governance priorities, while maintaining our focus on generating sustainable value for all our stakeholders. The objective of this long-term strategy is to consolidate an agile and dynamic organization that promptly adapts to the changes faced by the energy industry.

4

“Energy That Transforms” is designed to position the Ecopetrol Group as an integrated energy group, leader in Latin America in energy diversification, that participates in all segments of the hydrocarbon chain (upstream, midstream, downstream and commercialization) as well as energy infrastructure, with the ambition to diversify into low-emission businesses that allow us to continue reducing our carbon footprint and achieve a 55% reduction in methane emissions by 2030, a net-zero carbon emissions (scopes 1 and 2) and a 50% reduction in total emissions (scopes 1, 2 and 3) by 2050. This strategy comprises four strategic pillars: (i) Grow with the Energy Transition, (ii) Generate Value through Technology, Environmental, Social and Governance (“TESG”), (iii) Cutting-edge Knowledge, and (iv) Competitive Returns. The strategy is based on a short-term Brent price of USD 75/Bl and a long-term oil price of USD 55/Bl.

In addition, on September 11, 2023, Ecopetrol announced certain adjustments to its 2040 Strategy initially presented in February 2022. Such adjustments were approved by the Board of Directors of the Company and pertain to the following aspects of the strategy: (1) the new strategic focus of the Caribbean offshore lever is to maximize gas potential in the Colombian Caribbean; (2) unconventional hydrocarbon exploration activities will not be pursued in Colombia; and (3) the previously defined strategic objective of “energy efficiency” has been replaced by optimization of the internal consumption of energy by 25 petajoules (“PJ”) for the period 2018-2030.

The replacement of the strategic objective of “energy efficiency” has impacted the “Generate Value through TESG” and “Grow with the Energy Transition” pillars of the Company. All other elements of the 2040 Strategy which were announced to the market in February 2022 remain unchanged. The long-term strategy reaffirms our commitment to a just and equitable energy transition, emphasizing portfolio diversification while preserving the integrity and value of our traditional business. Additionally, our focus remains on strict capital discipline to ensure profitable and sustainable growth in our business lines and the creation of value for all our stakeholders.

Although the Company has not yet updated its operating and financial reporting model to the 2040 Strategy, some progress made in relation to the 2040 Strategy includes (i) changes in the management structure of the upstream subsegment, which belongs to the exploration and production segment (see Ecopetrol S.A.’s Production Activities in Colombia), (ii) statutory reforms to include guiding principles of the 2040 Strategy, (iii) new business line committees and a strategic committee aligned to the 2040 Strategy (see – Section 7 – Corporate Governance).

2.1.1.1 |

Grow with the Energy Transition |

The first pillar seeks to maximize the life and value of the hydrocarbon portfolio, while advancing in the decarbonization and diversification strategy of low-emission businesses. This pillar aims to maintain Ecopetrol Group’s competitiveness in the integrated hydrocarbon value chain and increasing gas supply, offshore exploration, and enhanced recovery, thereby strengthening our traditional businesses with the latest technology and innovations to have more sustainable processes and maximize the value of reserves and future barrels.

On average, we expect to invest between COP 20 and COP 30 trillion annually by 2040. In production, investment is expected to be focused on enhanced recovery technologies, Caribbean offshore gas developments, and protecting the base production curve by improving the natural decline of production fields. In line with international best practices, the valuation for these projects includes greenhouse gas emissions cost under the CO2 shadow price methodology, with a price curve that begins at 40 USD/tCO2e today and reaches 50 USD/tCO2e by 2030.

In the upstream segment, we expect to maintain our production between 700 and 750 thousand barrels of oil equivalent per day (“mboed”) through 2040. For gas, production is expected to increase, along with new commercialization options, with the long-term expectation of business to grow its stake in relative EBITDA generation.

In the midstream segment, the long-term objectives include capturing over 90% share of the Colombian hydrocarbon transport market, among others.

The downstream segment seeks to: (i) increase the margin of existing refineries’ assets; (ii) maximize the polypropylene margin, and (iii) assess options for diversifying into petrochemicals and on green fuels.

Additionally, the value of the various products is expected to be strengthened through commercial strategies which seek to diversify heavy crude destinations, leverage the advantage in quality and reliability of supply and integrate customer-based logistics and recipes.

5

The diversification towards low-emission businesses in the long term contemplates a gradual incursion into emerging businesses that seek to mitigate the effects of climate change, such as the production of low-carbon hydrogen as an energy carrier, Carbon Capture, Utilization, and Storage (“CCUS”), and Natural Climate Solutions (NCS). The value proposition includes diversifying into low-emission businesses, for which more than USD 183 million are expected to be invested over the next three years, in green hydrogen projects, CCUS and in renewables incorporation.

ISA, a leader in the electric power transmission business, responds competitively to the challenges of decarbonization and diversification, meeting new demands in the context of the energy transition.

In the electric power transmission and road concessions segment, the aim is to continue the growth trajectory in both new and existing geographies, leveraging ISA’s strategic leadership position in the power transmission business in Latin America.

On March 13, 2025, ISA launched its 2040 Strategy “Energy that brings life to the transition” intending to establish itself as a leading energy transmission company on the continent, with investments in new electric energy businesses. In this new strategic cycle, the goal is to maintain the relevance of the transmission business and seize opportunities in new businesses derived from the energy transition, complementing the core business.

For this new strategic cycle, the focus will be on: consolidating the core business, and accelerating new energy businesses (i.e. energy solutions, and storage). Additionally, the strategy includes expanding into new locations, making a positive contribution to communities and nature, and growing selectively and strategically in the roads business. By 2040, ISA intends to have invested between USD 28 billion and USD 33 billion across the continent, focusing on: (i) consolidating electric energy transmission in Latin America (67%), (ii) deploying/accelerating new electric energy businesses (23%), (iii) growing selectively/strategically in the toll roads business (10%), (iv) expanding into new geographies, (v) doubling 2024 EBITDA COP 0.7 trillion, (vi) actively managing its portfolio of toll roads and concessions transmission lines, and (vii) positively contributing to the development of talent, communities, and nature.

2.1.1.2 |

Generate Value through TESG |

This pillar seeks to strengthen transparent and ethical relations with our stakeholders, applying high standards of corporate governance to achieve environmentally responsible, safe, and efficient operations in which innovation and technology act as catalysts to accelerate solutions for future challenges. To achieve this, the Ecopetrol Group has identified five strategic lines: (i) build and generate value through an efficient, clean and safe production, (ii) accelerate and prioritize decarbonization and energy efficiency, (iii) ensure circular water management, (iv) support local development in the places where we operate, and (v) generate trust in the social context through proactive dialogue and by improving the quality of life of people looking for mutual benefits, with a focus on inclusion, and on reactivating and diversifying local economies.

Environmentally, the long-term TESG targets include the achievement of: (i) 45% and 55% reduction in methane emissions by 2025 and 2030 in the upstream business, respectively (however, Ecopetrol intends to reach zero methane emissions under the Oil and Gas Climate Initiative (OGCI), (ii) net-zero emissions of CO2 equivalent by 2050 (scopes 1 and 2) in all our operations, (iii) zero routine gas flaring by 2030 in the upstream business, (iv) zero treated produced and wastewater discharges by 2045 along with an expected reduction of 58% to 66% in the intake of fresh water for operations, (v) the addition of a portfolio of Natural Climate Solutions (NCS) that help reduce 2-4 metric tons of carbon dioxide equivalent (MtCO2e) by 2030.

The Company has set specific targets towards achieving its energy matrix decarbonization and enabling the incorporation of low-emission businesses within its portfolio. Additionally, by 2025, the Company aims to accelerate the incorporation of approximately 900 MW of non-conventional renewable energy into its generation. The Company maintains its long-term target of incorporating more than 1,000 MW of non-conventional renewable energy by 2030.

On the social front, the long-term TESG targets focus on promoting the generation of approximately 230 thousand new non-oil related jobs by 2040 and contributing to the education of two million young Colombians.

2.1.1.3 |

Cutting-edge Knowledge |

This pillar seeks to develop the required skills and capacities to face the challenges towards growth and TESG, through a comprehensive science, technology, and innovation strategy, as well as improving the competitiveness and resilience of current assets, contributing to diversification, increasing clean energy, decarbonizing operations and strengthening of talent through transformative practices by means of training programs to optimize performance (upskilling) or fill new positions (reskilling).

6

Thus, the expected long-term goals are, among others: (i) having approximately 70% of workers complete reskilling programs by 2030, and (ii) achieving automation of 100% of human talent processes by 2030.

2.1.1.4 |

Competitive Returns |

The fourth pillar ensures continuity of our strict capital discipline, the efficient use of resources, and the protection of cash, all of which have been leveraging the Ecopetrol Group’s strategy since 2015. The long-term aspiration includes, among others, maintaining the ordinary dividend policy at between 40% and 60%, in line with operating results. The long-term strategy will allow transfers to the Nation between COP 13-20 trillion annually on average, through royalties, taxes, and dividends and is expected to enable a sustainable capital structure with a gross debt to EBITDA ratio below 2.5 times.

2.1.2 |

2025 Investment Plan |

On November 29, 2024, we announced that the Board of Directors approved the 2025 investment plan (the “2025 Investment Plan”) which contemplates a budget of between COP 24 trillion pesos (USD 5.9 billion) and COP 28 trillion pesos (USD 6.9 billion). The 2025 Investment Plan is aligned with the group’s commitment to energy security and the country’s energy transition. The 2025 Investment Plan assumes, among others, a USD 73 /Bl Brent price, an exchange rate of COP 4,100 per USD 1.00 and assumes the collection of the accounts receivable from the FEPC for 2024. The 2025 Investment Plan increases investment levels compared to 2024, under capital discipline criteria and is expected to have the following implications:

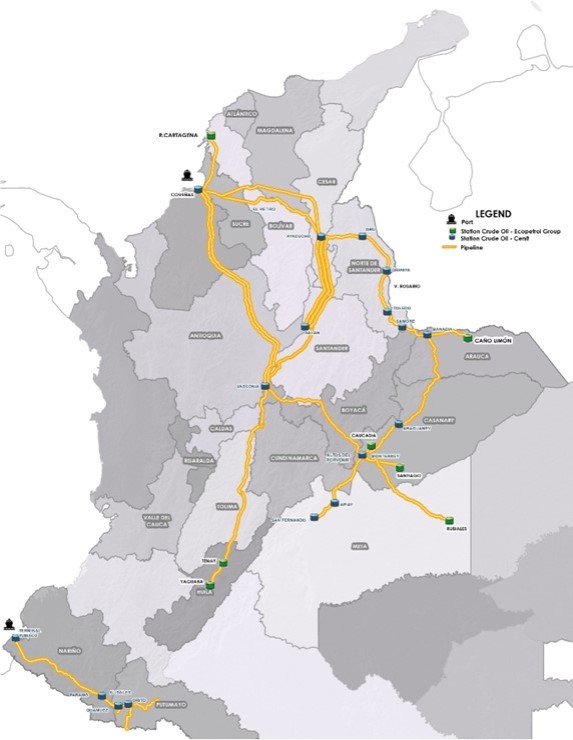

The upstream business is expected to invest approximately COP 17.2 trillion pesos (approximately USD 4.0 billion) (equivalent to 52% of the 2025 Investment Plan for crude oil-related investments and 12% for gas-related investments). The upper range of the target is adjusted to 740,000 and 750,000 barrels of oil equivalent per day for 2025 (78% crude, 17% gas, and 5% white products), seeking to implement recovery technologies that optimize the use of available resources and maintain production levels. Crude oil production in Colombia is expected to grow, compensating the natural decline of gas fields. In 2025, the Company plans to drill between 455 and 465 development wells, of which 79% are expected to be executed in Colombia and the remaining 21% in the United States. In terms of exploration, the Company expects to drill 10 wells mainly in the Llanos area and Caribbean offshore of Colombia. Gas investments are estimated between COP 3.1 and COP 3.3 trillion pesos (approximately 750 and 800 million dollars), mainly in the Piedemonte Llanero and Offshore, to develop the gas of the Caribbean offshore, contributing to a production of approximately 123,000 barrels of oil equivalent per day (which represents approximately 700 million cubic feet of natural gas), of which 85% are forecasted to be part of the gas supply for the country.

Investments in the transportation segment are expected to reach approximately COP 1.5 trillion pesos (approximately USD 350 million), corresponding to 5% of the 2025 Investment Plan, mainly focused on integrity and reliability projects concerning the infrastructure developed by Cenit Transporte y Logística de Hidrocarburos S.A.S., Oleoducto Central S.A., Oleoducto de Colombia S.A., and Oleoducto de los Llanos S.A. Transported volumes are expected to reach between 1,130,000 and 1,170,000 barrels per day, in line with the country’s production expectations and refined products demand. Investments in the refining segment are expected to reach approximately COP 1.6 trillion pesos (approximately USD 400 million), corresponding to 6% of the total investment budget for 2025, and are expected to be focused on ensuring the reliability, availability, and sustainability of the operation of the Barrancabermeja and Cartagena refineries, as well as developing programs that would reduce product imports, improve quality of fuels, and advancing sustainable fuel (SAF) projects. The joint load of both refineries is expected to be between 415,000 and 420,000 barrels per day.

Interconexión Eléctrica S.A E.S.P. (ISA), a subsidiary of Ecopetrol S.A., is expected to invest between COP 5.7 and COP 6.5 trillion pesos (approximately 1.4 and 1.6 billion dollars) in 2025 (equivalent to approximately 21% of the 2025 Investment Plan), of which approximately 90% is expected to be allocated to the electric transmission business. These investments seek to increase the electric power grid to achieve approximately 50,400 km in operation by 2025, maintaining the Company as the energy transmission leader in the region.

In order to advance in the energy transition goals while simultaneously decarbonizing the hydrocarbon operations, the 2025 Investment Plan intends to allocate an amount between COP 9.4 trillion pesos (approximately USD 2.3 billion) and COP 11.4 trillion pesos (approximately USD 2.8 billion), which include investments in electric power transmission and roads, gas investments, and renewable energy projects, among others. We continue to review growth opportunities in all business lines and depending on the results of this process, the Company may allocate additional investment resources towards energy transition in 2025.

7

Moreover, in 2025, the Company expects to achieve an additional energy optimization of 2.6 Peta Joules (PJ) reaching an accumulated energy saving of around 21 PJ between 2018 and 2025, accelerating the completion of the goal of 25 PJ optimization by 2030. Additionally, the goal of 900 MW by 2025 is projected to be accomplished in line with the corporate strategy. As part of the Company’s energy transition efforts, the 2025 Investment Plan forecasts an additional reduction of about 300,000 tons of CO2 equivalent emissions by 2025, contributing to the achievement of the total emissions reduction target by 2030.

In line with our goal of generating value through TESG, the 2025 Investment Plan allocates COP 2.3 trillion pesos (USD 555 million) towards this objective. The financial plan for 2025 aims to ensure competitive returns in a scenario of Brent prices averaging USD 73/barrel, generating an EBITDA margin at levels close to 39%.

The plan incorporates efficiency targets for 2025, exceeding 4 trillion pesos, aiming to capture savings in operational management and investment projects, to achieve improvements on indicators such as lifting cost, total refining cost, and cost per barrel transported. We expect our Return on Average Capital Employed (ROACE) to remain at competitive levels. Considering the above, the financing of the 2025 Investment Plan for Ecopetrol S.A. is expected to be carried out with operational resources and forecasts transfers to the Nation (including dividends, royalties, and taxes) of approximately 35 trillion pesos (approximately USD 8.4 billion). The table below sets forth the details of the investment plan per business segment:

Table 2 – 2025 Investment Plan

Business Segment |

|

% Percentage(1) |

|

Exploration |

|

6 |

% |

Production |

|

59 |

% |

Downstream |

|

6 |

% |

Midstream |

|

5 |

% |

Electric Power Transmission and Toll Roads |

|

21 |

% |

Other |

|

3 |

% |

TOTAL |

|

100 |

% |

(1) |

Percentage over the upper range. |

3. |

Business Overview |

3.1 |

Our History |

We were formed in 1951 by the Colombian Government as Empresa Colombiana de Petróleos and began operating the crude oil fields at La Cira-Infantas, the first oil field in Colombia, where production started in 1918, and the pipeline that connected that field with the Barrancabermeja refinery and the port of Cartagena. In 1961, we assumed the direct operation of the Barrancabermeja refinery and continued its transformation into an industrial complex. In 1974, we acquired the Cartagena Refinery (as defined below), which had been in operation since 1957. Pursuant to Decree 0062 of 1970, we were transformed into a governmental, industrial, and commercial company.

In 2003, pursuant to Decree Law 1760, the National Hydrocarbons Agency (Agencia Nacional de Hidrocarburos or “ANH” for its acronym in Spanish) was created and Ecopetrol’s public role as administrator and regulator of the national hydrocarbons resources was transferred to the ANH. Ecopetrol modified its organic structure and became Ecopetrol S.A., a publicly held corporation, one hundred percent state-owned, and continued the development of exploration and production activities on a competitive basis with autonomy over business decisions. Since 2006, according to Law 1118, we evolved from a wholly state-owned entity to a mixed-economy company with private capital. This process has resulted in a substantial change in the legal framework to which we are subject, and in the nature of our relationship with the Nation, as our controlling shareholder.

We carried out our initial public offering in August 2007, when our common shares were listed on the Colombian Stock Exchange. Our American Depositary Shares (ADSs) were listed on the New York Stock Exchange in September 2008. We carried out a follow-on public offering in Colombia in August 2011.

In June 2012, Cenit was incorporated as a subsidiary specialized in logistics and transportation of hydrocarbons in Colombia, whose main objective was to enhance the strategic and logistical framework of the Colombian oil industry, given the boost in hydrocarbon production and looking to increase sales of crude oil and refined products in Colombia and in the international markets.

8

In 2016, 34 units of the Cartagena Refinery came into operation and upgrades were made to the Barrancabermeja refinery.

In 2017, we entered for the first time into the Mexican market, where we were awarded (together with Petronas and Pemex) two blocks to explore and produce hydrocarbons in shallow waters in the southeastern basin.

In 2018, we made progress in the internationalization of offshore exploration by entering the Brazilian pre-salt oil region, one of the areas with the greatest potential for oil reserves in the world, working together with top-tier companies such as British Petroleum, China National Petroleum, China National Offshore Oil Corporation (“CNOOC”), Shell and Chevron. Additionally, we reached a milestone in our plan to transition into renewable energies with the award of a contract for the construction of the first solar farm in Meta, with an installed capacity of more than 20 MW to supply part of the energy demanded by the Castilla field.

In 2019, we began operations in the Permian Basin through a strategic alliance with Occidental Petroleum. We believe this project contributed to strengthen our position in knowledge and technology in unconventional reservoirs.

On July 1, 2021, we incorporated Ecopetrol Singapore Pte Ltd., a wholly owned subsidiary which owns 100% of the capital stock of Ecopetrol Trading Asia Pte Ltd. The latter’s main purpose is the international commercialization of crude oil and refined products of the Ecopetrol Group and of third parties throughout Asia.

On August 20, 2021, we acquired 51.4% of the outstanding shares of ISA from the Ministry of the Treasury and Public Credit (Ministerio de Hacienda y Crédito Público or “MHCP” for its acronym in Spanish), through which we expect to reposition ourselves along the energy value chain by offering services such as electricity transmission and aligning ourselves with the market trends towards decarbonization and electrification.

On November 16, 2022, we incorporated Ecopetrol US Trading LLC, a wholly owned indirect subsidiary of the Company owned through its subsidiary Ecopetrol USA Inc. Ecopetrol US Trading LLC’s main purpose is the international marketing of refined, petrochemical and industrial products as well as crude oil and natural gas from the Ecopetrol Group and third parties.

On March 17, 2023, we incorporated Econova Technology & Innovation, S.L.U. (“Econova”), a wholly owned subsidiary in Spain. Econova’s main purpose is the development of technology, innovation and science activities.

On October 1, 2024, the Company concluded the liquidation process of Ecopetrol Energía S.A.S. E.S.P.

3.2 |

Our Corporate Structure |

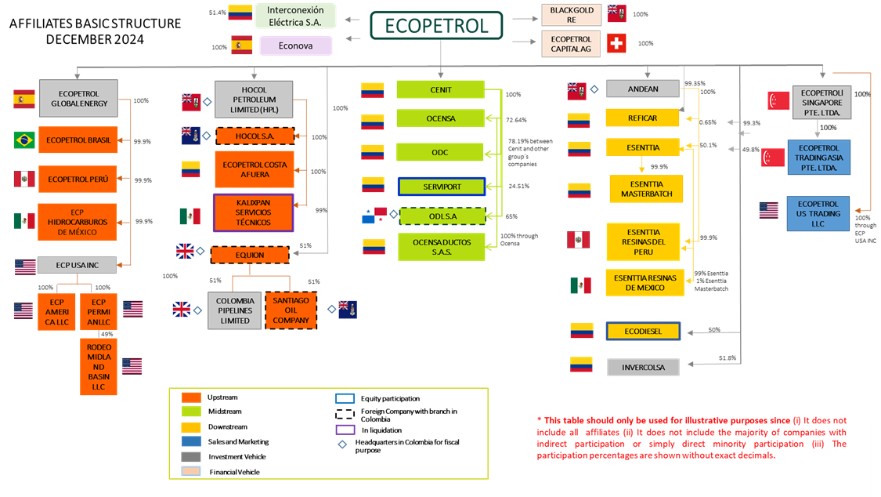

We are currently organized into three corporate business lines: (A) hydrocarbons, which includes four operational divisions: (i) exploration and production, (ii) transportation and logistics, (iii) refining, petrochemicals and biofuels, and (iv) sales and marketing; (B) energies for the transition; and (C) energy transmission and toll roads. This organization seeks to maintain the competitiveness of the Hydrocarbons business, the development and scaling of the businesses in the Energies for the Transition portfolio, and the growth of the Transmission and Toll Roads line. However, as discussed above in Our Corporate Strategy—2025 Investment Plan, given the transformation of our Company with the ISA acquisition and in line with our 2040 Strategy, in 2022, we started a process to align our current segments more closely to the vision of the 2040 Strategy for the Ecopetrol Group and such process is expected to continue throughout 2025.

For purposes of this annual report, the financial information included in this annual report is organized by the following segments: (i) exploration and production, (ii) transportation and logistics, (iii) refining and petrochemicals, and (iv) energy transmission and roads, which is consistent with previous Company annual reports. The Company’s management is currently reviewing different options to update the operating and financial reporting model of the Company to be better aligned with the 2040 Strategy.

Our subsidiaries, Refinería de Cartagena S.A.S. (“Reficar” or “Cartagena Refinery”), Cenit, ISA, Ecopetrol Trading Asia Pte Ltd. (“Ecopetrol Trading Asia”), Ecopetrol US Trading LLC, Esenttia S.A., Ecopetrol Permian LLC (“Permian”), and Ocensa are significant subsidiaries, as such term is defined under SEC Regulation S-X.

We have several directly and indirectly held subsidiaries both in Colombia and abroad. As of December 31, 2024, we have 12 directly owned and 76 indirectly owned subsidiaries.

9

In 2024, the Ecopetrol Group’s corporate structure changed as follows:

| ● | The Shareholders’ Meeting of Ecopetrol Energia S.A.S E.S.P., with the favorable and affirmative vote of 100% of its subscribed shares, authorized its liquidator, Mr. Christian Schneider Jaramillo, to carry out all the necessary steps for the due liquidation of this company whose purpose was the commercialization of energy, which culminated with the cancellation of its commercial registration the first days of October 2024. The liquidation of this entity was because Ecopetrol S.A. is currently the parent company of an electric power transmission company, and current regulations restrict the same group from simultaneously carrying out commercialization and transmission activities. |

| ● | On July 22, 2024, a share purchase agreement was executed among Oleoducto Central S.A. (“Ocensa”), as purchaser, and Talisman Colombia Holdco Limited, as seller, by means of which Ocensa acquired 100% of the shares of C.I. Repsol Ductos Colombia S.A.S., which is now known as Ocensa Ductos S.A.S. (“Ocensa Ductos”). Ocensa Ductos holds a 7.14% equity interest in Oleoducto de Colombia S.A. (“ODC”), a subsidiary of Ecopetrol. Following the closing of the transaction, Ocensa Ductos became a fully-owned subsidiary of Ocensa. |

| ● | On December 16, 2024, the respective General Shareholders’ Meetings of both Ocensa and Ocensa Ductos approved the merger of Ocensa Ductos S.A.S. and Ocensa, with Ocensa resulting the surviving entity. The completion of this merger is subject to the authorization of the Superintendence of Companies (Superintendencia de Sociedades). Once the merger is completed, Ocensa will become a direct shareholder of ODC, holding a 7.14% equity interest in the company. |

The table below sets forth our corporate structure as of December 31, 2024:

Graph 2 – Ecopetrol’s Corporate Structure

The stock ownership percentage listed next to each entity refers to Ecopetrol S.A.’s direct and indirect participation therein as of December 31, 2024. Such data presents a summary of Ecopetrol S.A.’s corporate structure and does not include information about every entity directly or indirectly owned by the Company, and participation information has been rounded to the nearest integer; as such, it should not be relied upon and should be used solely for information purposes.

Exhibit 8.1 to this annual report identifies our principal operating subsidiaries, their respective countries of incorporation, and our percentage ownership in each (both directly and indirectly through other subsidiaries).

10

3.3 |

Recent Developments |

Refineria of Cartagena

On January 16, 2025, Refinería de Cartagena S.A.S. was notified of the decision issued by the Court of the Southern District of New York, by which it denied the request presented by Chicago Bridge & Iron Company N.V., CB&I UK Limited to vacate the arbitration award dated June 2, 2023 in relation to the EPC Contract (Engineering, Procurement, and Construction Contract) executed between Reficar and CB&I for the expansion and modernization of the refinery located in the city of Cartagena, accordingly resolving the disputes between Reficar and Chicago Bridge & Iron Company N.V., CB&I UK Limited and CBI Colombiana S.A. (collectively “CB&I”). Consequently, the arbitration award in question was confirmed in its entirety. For more information, see section Risk Review—Legal Proceedings and Related Matters—Reficar Investigations.

Management

On January 15, 2025, we announced the following senior management changes:

1. |

Walter Fabián Canova, who had served as Vice President of Refining and Industrial Processes, performed his duties until January 15, 2025 and terminated his employment contract by mutual agreement after working at the Company for more than seven years. |

2. |

Felipe Trujillo López, current Vice President of Commercial and Marketing, serves as Vice President of Refining and Industrial Processes until a permanent appointment is made. |

3. |

Julio César Herrera serves as Vice President of Commercial and Marketing in charge and until a permanent appointment is made. |

On January 31, 2025, we announced the following senior management changes:

1. |

María Cristina Toro Restrepo was confirmed as Corporate Legal Vice President and General Secretary. This Vice Presidency reports directly to the President. |

2. |

Rafael Ernesto Guzmán Ayala was appointed Executive Vice President of Hydrocarbons. He will continue to report directly to the President. |

On April 23, 2025, we announced the following senior management changes:

1. |

Diana Marcela Jimenez Rodriguez was confirmed as Director of Institutional Relations and Communication. |

2. |

Julian Fernando Lemos Valero was confirmed as Corporate Vice President of Strategy and Business Development. |

3. |

Julio Herrera was confirmed as Vice President of Commercial and Marketing. |

See Corporate Governance – Management.

Temporal reduction in the conversion cost of Ecopetrol´s ADR

On January 15, 2025, Ecopetrol reached an agreement with JPMorgan Chase Bank N.A., the depositary bank of its American Depositary Receipts (ADR) program, to reduce 50% of the conversion cost for the purchase and sale of ADRs in the United States. The measure is temporary and is expected to be effective until July 10, 2025.

Ecopetrol & Occidental Petroleum Corp. Joint Venture extension agreement

On February 3, 2025, Ecopetrol Permian LLC and Occidental Petroleum Corp (“Oxy”) reached an agreement to extend the development plan of Rodeo Midland Basin LLC, located in the Permian Basin in Texas, under the joint-venture established in July 2019.

11

Ecopetrol & Repsol transaction completion to acquire 45% of its participation in Block CPO-09

Ecopetrol S.A. successfully completed the transaction with Repsol Colombia Oil & Gas Limited to acquire the remaining 45% of its participation in the CPO-09 Block, making it the holder of 100% of the participation interest in the block, a strategic asset in the Piedemonte Llanero.

Agreement for Launching the Market Maker program for its Shares on the Colombian Stock Exchange

On March 3, 2025, Ecopetrol S.A. announced it implemented a market maker program for Ecopetrol’s shares listed on the Colombian Stock Exchange, for a 12-month period with Valores Bancolombia S.A. Comisionista de Bolsa and Andes Investment Group Inc., a subsidiary of the Chilean group Larraín Vial and an affiliate of the local Larraín Vial broker-dealer, each entity operating under applicable regulation and in compliance with Colombian markets’ regulation. On March 14, 2025, Ecopetrol S.A. announced it had completed the necessary procedures for the implementation of market maker program for its common stock, with Andes Investment Group Inc., and Valores Bancolombia S.A. Comisionista de Bolsa. The market maker program began on March 3, 2025, through Andes Investment Group Inc., while through Valores Bancolombia S.A. Comisionista de Bolsa, the program began on Friday, March 14, with the authorization from the Colombian Stock Exchange.

Election of the statutory auditor for the 2025–2029 period

On March 28, 2025, Ecopetrol S.A. shareholders approved to appoint the firm Deloitte & Touche S.A.S., as the statutory auditor of Ecopetrol S.A. for fiscal years 2025-2028. The agreement with Deloitte & Touche S.A.S. was executed in April 2025, while the statutory audit and external audit agreement executed with the firm ERNST & YOUNG AUDIT S.A.S., ending on May 27, 2025.

Ecopetrol signed an agreement to build the Jemeiwaa Ka’I wind cluster in La Guajira

On April 14, 2025, Ecopetrol S.A. signed an investment framework agreement with AES Colombia & CIA SCA E.S.P. to build 49% of the Jemeiwaa Ka’I wind cluster located in La Guajira, subject to the fulfillment of condition precedents and other legal requirements. Jemeiwaa Ka’I comprises a portfolio of wind projects located in the upper and middle Guajira, in the municipality of Uribia, with an approximate capacity of 1,087 MW, along with a 35 km transmission line.

3.4 |

Our Business |

We are the largest company in Colombia and one of the main integrated energy companies in the American continent. We are responsible for more than 60% of the hydrocarbon production, of most transportation, logistics, and hydrocarbon refining systems, and hold leading positions in the petrochemicals and gas distribution segments. With the acquisition of 51.4% of ISA’s shares, the Company participates in energy transmission, the management of real-time systems (XM), and the Barranquilla - Cartagena coastal highway concession. At the international level, Ecopetrol has a stake in strategic basins in the American continent, with drilling and exploration operations in the United States (Permian basin and the Gulf of Mexico (aka Gulf of America)), Brazil, and Mexico, and, through ISA and its subsidiaries, Ecopetrol holds leading positions in the power transmission business in Brazil, Chile, Peru, and Bolivia, road concessions in Chile, and the telecommunications sector. The Nation currently owns 88.49% of our voting capital stock. We are among the world’s largest public companies, ranking 316 on the Forbes 2024 Global 2000 Ranking, and the largest Colombian company in this ranking.

3.5Exploration and Production

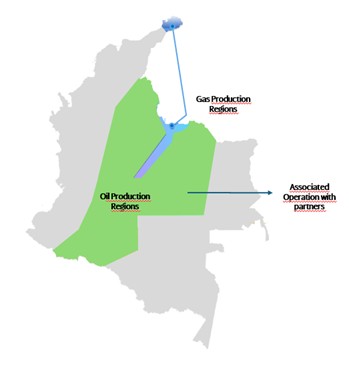

Our exploration and production business segment includes exploration, development, and production activities in Colombia and abroad. We began local exploration in 1955 and international exploration in 2006. Exploration and production activities are conducted directly by Ecopetrol S.A., and through some of our subsidiaries, as well as through joint ventures with third parties. As of December 31, 2024, we were the largest operator and producer of crude oil and natural gas in Colombia, maintaining the largest exploration acreage position in Colombia.

Unless otherwise stated, all figures are given before deducting royalties.

12

3.5.1 |

Exploration Activities |

In 2024, our exploration strategy was focused on three working fronts: Colombian onshore, Colombian Caribbean offshore, and overseas. By year-end, the Ecopetrol Group was a party to 86 contracts for exploratory activities, with 49 of those contracts being for Colombia, and 37 of those contracts for outside of Colombia, distributed as follows:

| ● | Exploratory Activities in Colombia: |

| o | Ecopetrol is a party to (i) 22 E&P contracts in exploratory stage, (ii) three E&P Agreement in exploratory stage, (iii) three technical evaluation agreements (TEAs), (iv) one risk sharing agreement, (v) two association contracts. |

| o | Hocol S.A. (“Hocol”), is a party to (i) 16 E&P contracts in exploratory stage, and (ii) two E&P Agreements in exploratory stage. |

| ● | Exploratory Activities outside of Colombia: |

| o | One production sharing contract (PSC) in Mexico; |

| o | 24 royalty tax agreements for Ecopetrol America LLC, and |

| o | One production sharing (PSC) and 11 concessions (four in 2024 (S-M-1717, S-M-1707, S-M-1719, and S-M-1715) for Ecopetrol Óleo e Gás do Brasil Ltda. |

Our Business Plan aims at incorporating resources in high reward projects concentrated in: (i) onshore basins in Colombia (both foothills and foreland in Llanos basin, Middle and Upper Magdalena Valley, Putumayo and gas in Guajira, Sinú-San Jacinto and Lower Magdalena Valley), (ii) offshore Colombia (appraise and evaluate existing gas discoveries as well as identify new hydrocarbons accumulations), and (iii) international areas such as Gulf of Mexico (aka Gulf of America) and offshore Brazil in pre-salt and post-salt Santos and Campos basins.

Graph 3 – Sedimentary Basins where Ecopetrol Executes Exploration Activities

13

3.5.1.1 |

Exploration Activities in Colombia |

In 2024, Ecopetrol S.A. and its subsidiaries drilled 15 exploration and appraisal wells in Colombia, out of which ten were exploratory (A3/A2) and five were appraisal (A1) wells. As of December 31, 2024, six wells were successful, six were dry, and three remained under technical evaluation. This drilling activity was concentrated in basins of interest around Colombia, including the Caribbean offshore, Llanos, the Lower, Middle and Upper Magdalena Valley.

The six successful wells drilled by Ecopetrol S.A. and its partners in Colombia during 2024 were located in the following regions: Toritos Norte-1,Toritos-2, Toritos Sur-1, Bisbita Este-1 and Guamal Profundo-1 in Llanos basin, and Sirius-2 in the Caribe Offshore.

In 2024, Ecopetrol and other partners executed the following agreements for exploration activities:

| ● | In April, a business collaboration agreement (BCA) was signed with Parex Resources (Colombia) AG (“Parex”) with the objective to develop exploratory activities in the Siriri region of the Piedemonte basin. |

| ● | In June, Ecopetrol and Parex signed an amendment to LLA-121, LLA 16-1 and LLA 4-1 E&P agreements to make exploratory gas activities in Piedemonte, with a 50% participation by Ecopetrol and 50% participation by Parex in each agreement. |

| ● | In July, Río Magdalena E&P agreement for an exploratory stage in Medium Magdalena Valley basin was executed. Ecopetrol holds 100% of the participation in this agreement. |

| ● | In September, the Magangué E&P agreement for an exploratory stage in the Lower Magdalena Valley basin was assigned from Ecopetrol to Hocol. |

| ● | In November, an agreement with Parex was executed to develop exploratory activities in the Farallones region of the Llano’s basin, which is in process of formalization with the ANH. |

On February 5, 2025, Ecopetrol S.A. successfully completed the transaction with Repsol Colombia Oil & Gas Limited to acquire the remaining 45% of its participation in the CPO-09 Block, making it the holder of 100% of the participation interest in the block, a strategic asset in the Piedemonte Llanero.

The following table sets forth, for the periods indicated, the number of gross and net productive, dry, and under evaluation exploratory wells drilled by Ecopetrol S.A., Hocol and by our joint venture partners, and the exploratory wells drilled by third parties pursuant to sole risk contracts with us.

14

Table 3 – Exploratory Drilling in Colombia

|

|

For the year ended December 31, |

||||

|

|

2024 |

|

2023 |

|

2022 |

|

|

(Number of wells) |

||||

COLOMBIA |

|

|

|

|

|

|

Ecopetrol S.A. |

|

|

|

|

|

|

Gross exploratory wells |

|

|

|

|

|

|

Owned and operated by Ecopetrol |

|

|

|

|

|

|

Productive |

|

— |

|

— |

|

1.00 |

Dry(1) |

|

— |

|

3.00 |

|

1.00 |

Under Evaluation(2) |

|

— |

|

2.00 |

|

1.00 |

Total |

|

— |

|

5.00 |

|

3.00 |

Operated by a partner in Joint Venture |

|

|

|

|

|

|

Productive |

|

1.00 |

|

1.00 |

|

3.00 |

Dry(1) |

|

2.00 |

|

— |

|

2.00 |

Under Evaluation(2)(4) |

|

1.00 |

|

2.00 |

|

1.00 |

Total |

|

4.00 |

|

3.00 |

|

6.00 |

Operated by Ecopetrol in Joint Venture |

|

|

|

|

|

|

Productive |

|

1.00 |

|

2.00 |

|

1.00 |

Dry(1) |

|

1.00 |

|

1.00 |

|

— |

Under Evaluation(2) |

|

— |

|

1.00 |

|

1.00 |

Total |

|

2.00 |

|

4.00 |

|

2.00 |

Net Exploratory Wells(3) |

|

|

|

|

|

|

Productive |

|

1.11 |

|

1.60 |

|

3.10 |

Dry(1) |

|

1.21 |

|

3.48 |

|

2.00 |

Under Evaluation(2)(4) |

|

0.65 |

|

3.55 |

|

1.75 |

Total |

|

2.97 |

|

8.63 |

|

6.85 |

Sole Risk |

|

|

|

|

|

|

Productive |

|

— |

|

— |

|

1.00 |

Dry(1) |

|

— |

|

2.00 |

|

3.00 |

Under Evaluation(2) |

|

— |

|

1.00 |

|

2.00 |

Total |

|

— |

|

3.00 |

|

6.00 |

Hocol |

|

|

|

|

|

|

Gross Exploratory Wells |

|

|

|

|

|

|

Productive |

|

4.00 |

|

5.00 |

|

2.00 |

Dry(1) |

|

3.00 |

|

3.00 |

|

6.00 |

Under Evaluation(2) |

|

2.00 |

|

3.00 |

|

3.00 |

Total |

|

9.00 |

|

11.00 |

|

11.00 |

Net Exploratory Wells(3) |

|

|

|

|

|

|

Productive |

|

2.00 |

|

2.50 |

|

2.00 |

Dry(1) |

|

2.50 |

|

1.50 |

|

5.50 |

Under Evaluation(2) |

|

1.00 |

|

2.00 |

|

2.50 |

Total |

|

5.50 |

|

6.00 |

|

10.00 |

(1) |

A dry well or hole is an exploratory well found to be incapable of producing either crude oil or natural gas in sufficient quantities to justify completion as a crude oil or natural gas well. |

(2) |

An “under evaluation” well is an exploratory well where there is not yet enough information to determine its result as successful or dry. This classification is maintained until additional well-testing operations are carried out to determine the hydrocarbon production capacity or some petrophysical parameter of the rocks or fluids in the reservoir. |

(3) |

Net exploratory wells were calculated according to our percentage of ownership in these wells. |

(4) |

Caripeto-1 well was classified as “under evaluation”. However, as of January 2025, it has been declared successful well drilling, confirming hydrocarbon presence. |

15

Seismic

In Colombia, during 2024, Ecopetrol acquired 193.4 km2 of seismic information through the Yacopí 3D program, and the completion of 2.7 km2 through the Cesar 3D program, while Hocol acquired 352.9 km2 3D of seismic information in Llanos 86, 281 km2 in Llanos 104, and 84,53 km2 in COR 9. Additionally, Ecopetrol purchased 108.65 km of 2D seismic and 333.99 km2 of 3D seismic of the Middle Magdalena Valley; while Hocol purchased 98.9 km of 2D seismic of the Lower and Upper Magdalena Valley.

Moreover, 23,969 km2 of 3D seismic and 3,858 km of 2D seismic were reprocessed by Ecopetrol in the Middle (VMM) and Lower (VIM) Magdalena Valley, Putumayo Llanos, Piedemonte and in the Colombian Caribbean. In non-seismic methods, 18,413 km of aerogradiometry (iFTG) data were acquired and reprocessed and seismic characterization has been done through quantitative interpretation – IQ of 7,256 km2 of 3D projects and 83 km in 2D in the Middle (VMM) and Lower (VIM) Magdalena Valley, Llanos and in the Colombian Caribbean.

3.5.1.2 |

Exploration Activities Outside Colombia |

Our international exploration strategy is focused on basins with high materiality, aiming at mitigating our risk exposure and ultimately increasing our reserves. This strategy is supported by an efficient, business-oriented portfolio management, which involves the participation in competitive bidding rounds to secure high-potential exploration blocks in the focus areas. Within this context, a key element is the formation of strong joint-ventures with international and regional oil companies which can contribute with operational expertise and leading-edge technology.

In the Santos Basin, the partnership among BP plc (“BP”), CNOOC, Ecopetrol Óleo e Gás do Brasil Ltda., in which the aforementioned partners have, respectively, a 50%, 30% and 20% ownership stake, pursued the exploration and drilling of the Pau Brasil-1 well. The Pau Brasil-1 well resulted dry with hydrocarbon shows.

Regarding the Gato do Mato project in Brazil, operated by Shell and associated with Total Energies, the project has made steady progress. In 2025 Ecopetrol Óleo e Gás do Brasil Ltda, a subsidiary of the Ecopetrol Group S.A., has already approved the Final Investment Decision (FID). The project completed the basic engineering “Front End Engineering Design” (FEED) for the subsea and floating production facilities, with the expectation of incorporating the first volumes of 1P reserves during 2025.

16

The following table sets forth information on our international exploratory drilling for the periods indicated.

Table 4 – Exploratory Drilling Outside Colombia

|

|

For the year ended December 31, |

||||

|

|

2024 |

|

2023 |

|

2022 |

|

|

(Number of wells) |

||||

UNITED STATES |

|

|

|

|

|

|

Ecopetrol America LLC |

|

|

|

|

|

|

Gross Exploratory Wells |

|

|

|

|

|

|

Productive |

|

— |

|

— |

|

— |

Dry(1) |

|

— |

|

— |

|

1.00 |

Under Evaluation(2) |

|

— |

|

— |

|

— |

Total |

|

— |

|

— |

|

1.00 |

Net Exploratory Wells(3) |

|

|

|

|

|

|

Productive |

|

— |

|

— |

|

— |

Dry(1) |

|

— |

|

— |

|

0.25 |

Under Evaluation(2) |

|

— |

|

— |

|

— |

Total |

|

— |

|

— |

|

0.25 |

BRAZIL |

|

|

|

|

|

|

Ecopetrol Óleo e Gás do Brasil Ltda. |

|

|

|

|

|

|

Gross Exploratory Wells |

|

|

|

|

|

|

Productive(5) |

|

— |

|

— |

|

— |

Dry(1) |

|

1.00 |

|

— |

|

— |

Under Evaluation(2) |

|

— |

|

— |

|

— |

Total |

|

1.00 |

|

— |

|

— |

Net Exploratory Wells(3)(4) |

|

|

|

|

|

|

Productive |

|

— |

|

— |

|

— |

Dry(1) |

|

0.20 |

|

— |

|

— |

Under Evaluation(2) |

|

— |

|

— |

|

— |

Total |

|

0.20 |

|

— |

|

— |

(1) |

A dry well or hole is an exploratory well found to be incapable of producing either crude oil or natural gas in sufficient quantities to justify completion as a crude oil or natural gas well. |

(2) |

An “under evaluation well” is an exploratory well where there is not yet enough information to determine its result as successful or dry. This classification is maintained until additional well testing operations are carried out to determine the hydrocarbon production capacity or some petrophysical parameter of the rocks or fluids in the reservoir. |

(3) |

Net exploratory wells were calculated according to our percentage of ownership in these wells. |

(4) |

None of our international wells were drilled pursuant to a sole risk contract. |

Seismic

During 2024, Ecopetrol Óleo e Gás do Brasil Ltda, aligned with its commitment to the National Petroleum Agency (ANP, for its acronym in Portuguese), completed the high-quality multi-client 3D seismic campaign, acquiring 2,173 km2 of 3D seismic data this year, for a total of 10,816 km2 of 3D seismic data located in the southern Santos basin. This dataset will be used to evaluate the exploratory potential of the area and mature existing opportunities within the portfolio.

3.5.2 |

Production Activities |

In 2024, our consolidated average production was 745.8 thousand barrels of oil equivalent per day (“mboed”), showing an increase of 9.2 mboed as compared to 2023, primarily due to the following factors: (i) incremental production from Permian, (ii) an increase in production of 7.6 thousand barrels of oil per day (“mboed”) as compared to 2023 due to a better performance in production and increased capacity in water facilities in Caño Sur Field; and (iii) better performance in basic production in fields located in Llanos and Central regions. The above was partially offset by: (i) environmental impacts mainly of the fields located in Llanos, Putumayo and Arauca (6.4 mboed decrease in 2024 compared to 6.7 mboed decrease in 2023); (ii) Hurricane season in Gulf of Mexico (aka Gulf of America) that affected Ecopetrol America LLC, and (iii) a decrease in gas sales.

17

The following table summarizes the results of our oil and gas production activities for the periods indicated:

Table 5 – Ecopetrol Group’s Oil and Gas Production

|

|

For the year ended December 31, |

||||||||||||||||

|

|

2024 |

|

2023 |

|

2022 |

||||||||||||

|

|

Oil |

|

Gas(1) |

|

Total |

|

Oil |

|

Gas(1) |

|

Total |

|

Oil |

|

Gas(1) |

|

Total |

|

|

(mboed) |

||||||||||||||||

Total gross production in Colombia(2)(5) |

|

509.4 |

|

135.1 |

|

644.5 |

|

515.7 |

|

147.6 |

|

663.3 |

|

509.9 |

|

152.5 |

|

662.4 |

Total international gross production(3) |

|

60.4 |

|

40.9 |

|

101.3 |

|

44.5 |

|

28.8 |

|

73.3 |

|

31.9 |

|

15.2 |

|

47.1 |

Total gross production of Ecopetrol Group |

|

569.8 |

|

176.0 |

|

745.8 |

|

560.2 |

|

176.4 |

|

736.6 |

|

541.8 |

|

167.7 |

|

709.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total production of Ecopetrol Group for presentation of reserves(4) |

|

531.6 |

|

152.6 |

|

684.2 |

|

521.1 |

|

156.9 |

|

678.0 |

|

502.1 |

|

155.2 |

|

657.3 |

(1) |

Conversion between million cubic feet per day (mcfpd) and boepd is performed at 5,700 mcfpd to 1 boepd. Includes natural gas and natural gas liquids. |

(2) |

Total production in Colombia corresponds to Ecopetrol S.A. and Hocol. Includes royalties. |

(3) |

Total International production corresponds to Ecopetrol Permian LLC and Ecopetrol America LLC. Includes royalties. |

(4) |

For the Company’s presentation of reserves, the Company deducts from its total gross production the 100% of crude royalties from Ecopetrol Group companies and gas royalties from non-Colombian Ecopetrol Group companies, Ecopetrol Permian LLC (United States) and Ecopetrol America LLC (United States). Gas royalties derived from Colombian production are not deducted because according to local regulation the Company is entitled to such gas royalties. Also includes self-consumption, which is only comprised of natural gas self-consumption and is immaterial. Oil production include natural gas liquids (“NGL”) and oil self-consumption, which is immaterial. |

(5) |

The total gross production in Colombia, includes the production of 50% of Arauca field (0.5 mboed). In December 2024, Ecopetrol S.A. and Parex filed a request to transfer Ecopetrol’s 50% stake in the agreement for the Arauca field to Parex, as a result of the business collaboration agreement (BCA) executed between Ecopetrol S.A. and Parex. |

3.5.2.1 |

Production Activities in Colombia |

3.5.2.1.1 |

Ecopetrol S.A.’s Production Activities in Colombia |