Document

EXHIBIT 99.1

PROS HOLDINGS, INC. REPORTS SECOND QUARTER 2025 FINANCIAL RESULTS

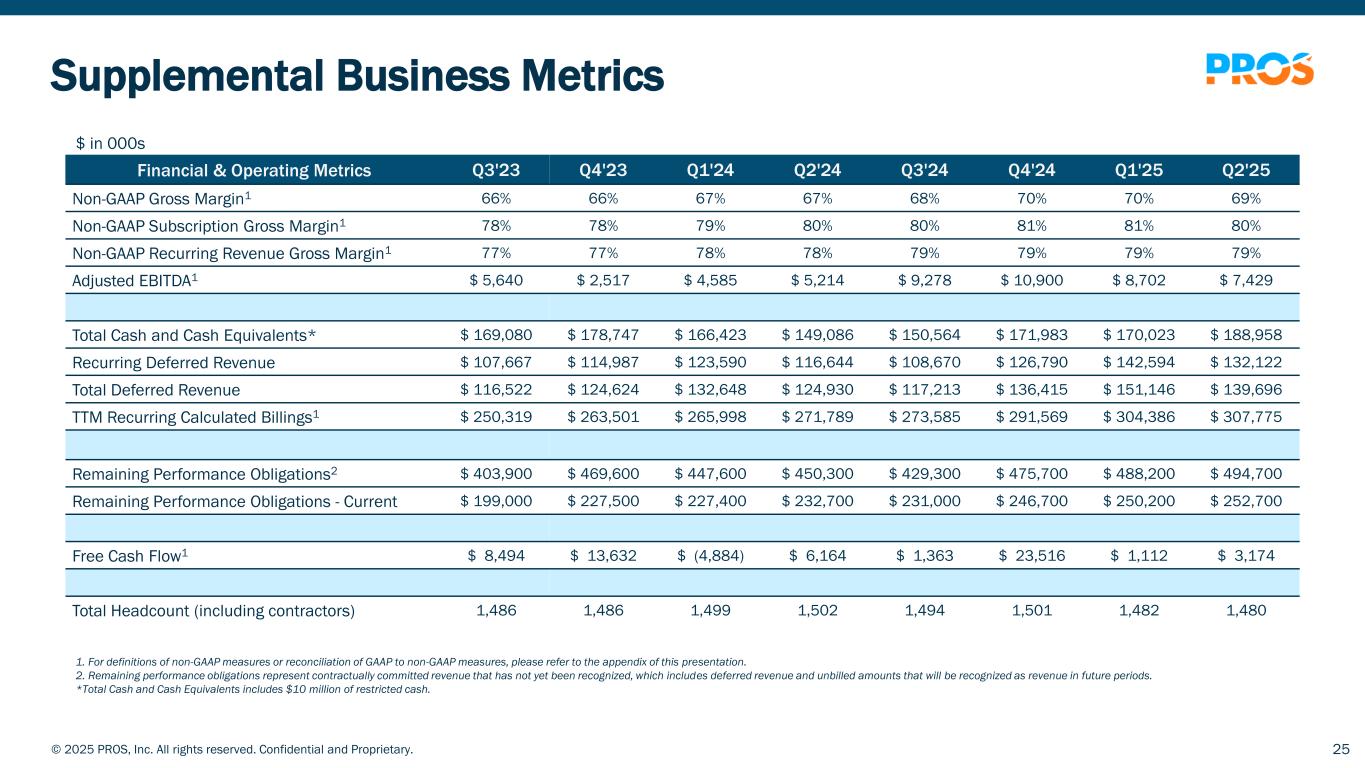

•PROS is raising its full year outlook for subscription revenue and subscription ARR.

•Grew subscription revenue by 12% year-over-year to $73.3 million in the second quarter.

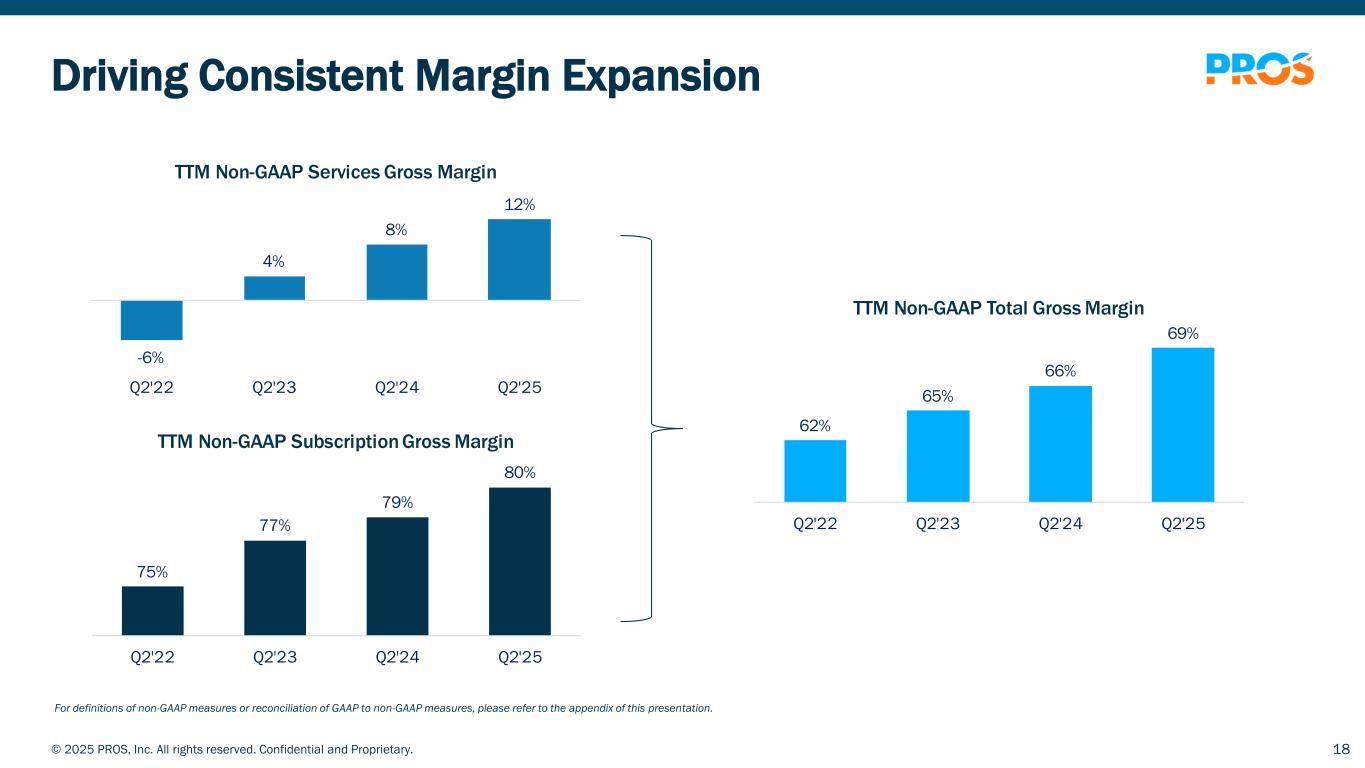

•Expanded subscription gross margin by more than 50 basis points year-over-year to a subscription gross margin of 79% and a non-GAAP subscription gross margin of 80% in the second quarter.

HOUSTON – July 31, 2025 — PROS Holdings, Inc. (NYSE: PRO), a leading provider of AI-powered SaaS pricing and selling solutions, today announced financial results for the second quarter ended June 30, 2025.

“At the heart of commercial success today is bringing the right mix of products and solutions together with the right price to win, and businesses are turning to PROS to optimize their winning formula,” stated CEO Jeff Cotten. “This is evidenced by our strong second quarter, where we exceeded the high end of our guidance ranges across all metrics. I’m proud of our team, and excited for the future of PROS, as we are well positioned to capture long-term value and lead in this next era of AI-powered enterprise transformation.”

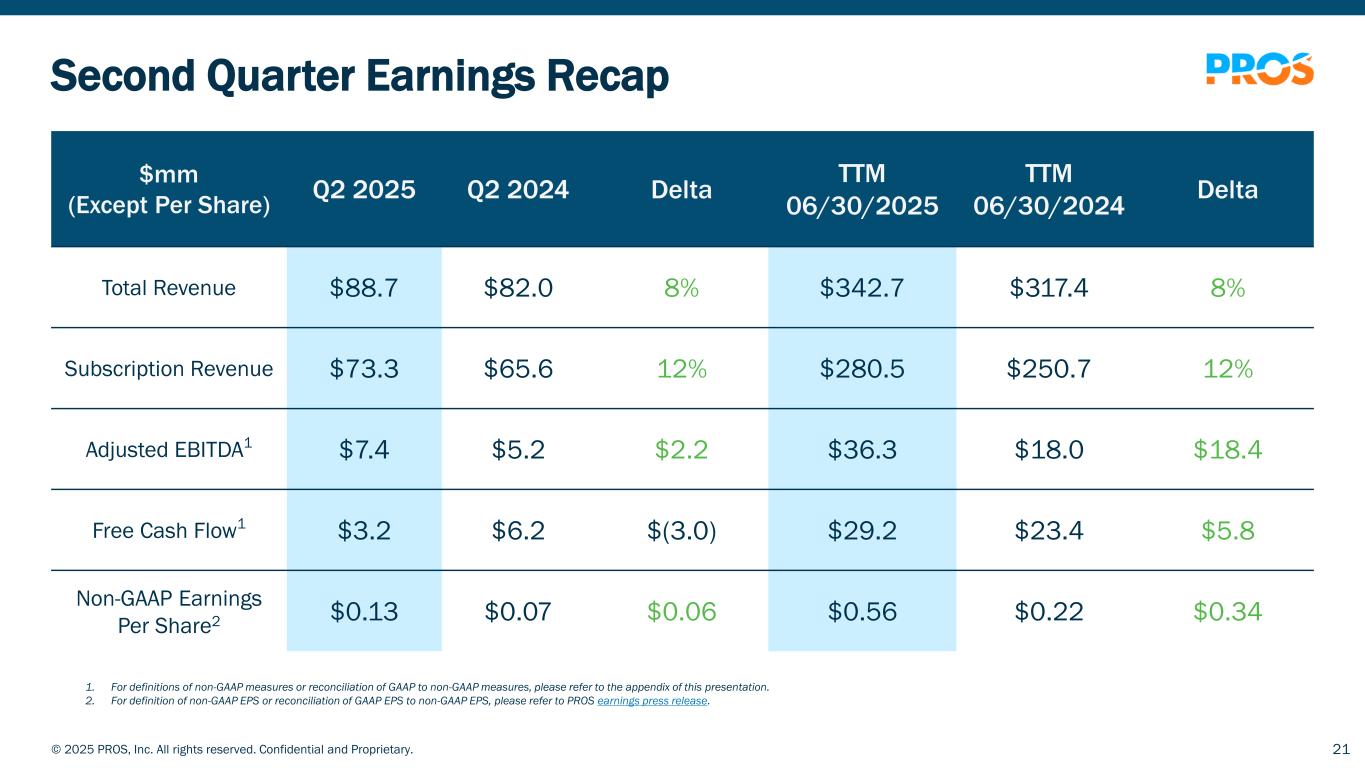

Second Quarter 2025 Financial Highlights

Key financial results for the second quarter 2025 are shown below. Throughout this press release all dollar figures are in millions, except net earnings (loss) per share. Unless otherwise noted, all results are on a reported basis and are compared with the prior-year period.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP |

|

Non-GAAP |

|

Q2 2025 |

|

Q2 2024 |

|

Change |

|

Q2 2025 |

|

Q2 2024 |

|

Change |

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

| Total Revenue |

$88.7 |

|

$82.0 |

|

8% |

|

n/a |

|

n/a |

|

n/a |

| Subscription Revenue |

$73.3 |

|

$65.6 |

|

12% |

|

n/a |

|

n/a |

|

n/a |

| Subscription and Maintenance Revenue |

$75.9 |

|

$69.0 |

|

10% |

|

n/a |

|

n/a |

|

n/a |

| Profitability: |

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit |

$59.5 |

|

$53.2 |

|

12% |

|

$61.3 |

|

$55.3 |

|

11% |

| Operating (Loss) Income |

$(7.6) |

|

$(7.2) |

|

$(0.4) |

|

$6.5 |

|

$4.4 |

|

$2.2 |

| Net (Loss) Income |

$(1.8) |

|

$(7.4) |

|

$5.6 |

|

$6.3 |

|

$3.3 |

|

$3.1 |

| Net (Loss) Earnings Per Share |

$(0.10) |

|

$(0.16) |

|

$0.06 |

|

$0.13 |

|

$0.07 |

|

$0.06 |

| Adjusted EBITDA |

n/a |

|

n/a |

|

n/a |

|

$7.4 |

|

$5.2 |

|

$2.2 |

| Cash: |

|

|

|

|

|

|

|

|

|

|

|

| Net Cash Provided by Operating Activities |

$3.2 |

|

$6.4 |

|

$(3.2) |

|

n/a |

|

n/a |

|

n/a |

| Free Cash Flow |

n/a |

|

n/a |

|

n/a |

|

$3.2 |

|

$6.2 |

|

$(3.0) |

The attached table provides a summary of PROS results for the period, including a reconciliation of GAAP to non-GAAP metrics.

Recent Business Highlights

•Welcomed many new customers who are adopting the PROS Platform such as Air Greenland, Aurigny Air, HellermannTyton, Lennox, Louis Dreyfus, and RHI Magnesita, among others.

•Expanded adoption of the PROS Platform within existing customers including American Airlines, BASF, Carrier, Holcim, Saint-Gobain, Scoot, and Unidas, among others.

•Earned recognition as a Leader in ISG’s 2025 CPQ Buyers Guide, PROS fourth consecutive leadership designation from an industry analyst in just three quarters; this recognition from ISG, along with previous acknowledgments from Gartner, Forrester, and IDC, underscores our relentless focus on AI innovation that drives profitable growth for our customers.

•Announced a strategic partnership with Commerce, formerly known as BigCommerce, to bring together PROS enterprise-grade pricing and CPQ with Commerce’s portfolio of eCommerce solutions, enabling B2B merchants to dynamically price, automate complex quotes, and deliver real-time offers to customers, addressing the evolving needs of enterprise sellers in an increasingly dynamic market.

•Won the 2025 CSO Award for the second consecutive year, one of the industry’s highest distinctions in cybersecurity excellence, recognizing PROS deep commitment to protecting the integrity, availability and confidentiality of data through continuous innovation, rigorous governance and industry-leading practices.

•Hosted a successful Outperform 2025, PROS flagship industry event, bringing together global leaders to explore how AI is defining a new era of intelligent commerce. The conference featured a record number of customer speakers and unveiled PROS revolutionary AI Agents that combine natural language and numerical reasoning to deliver intelligent, goal-oriented automation that unlocks boundless productivity.

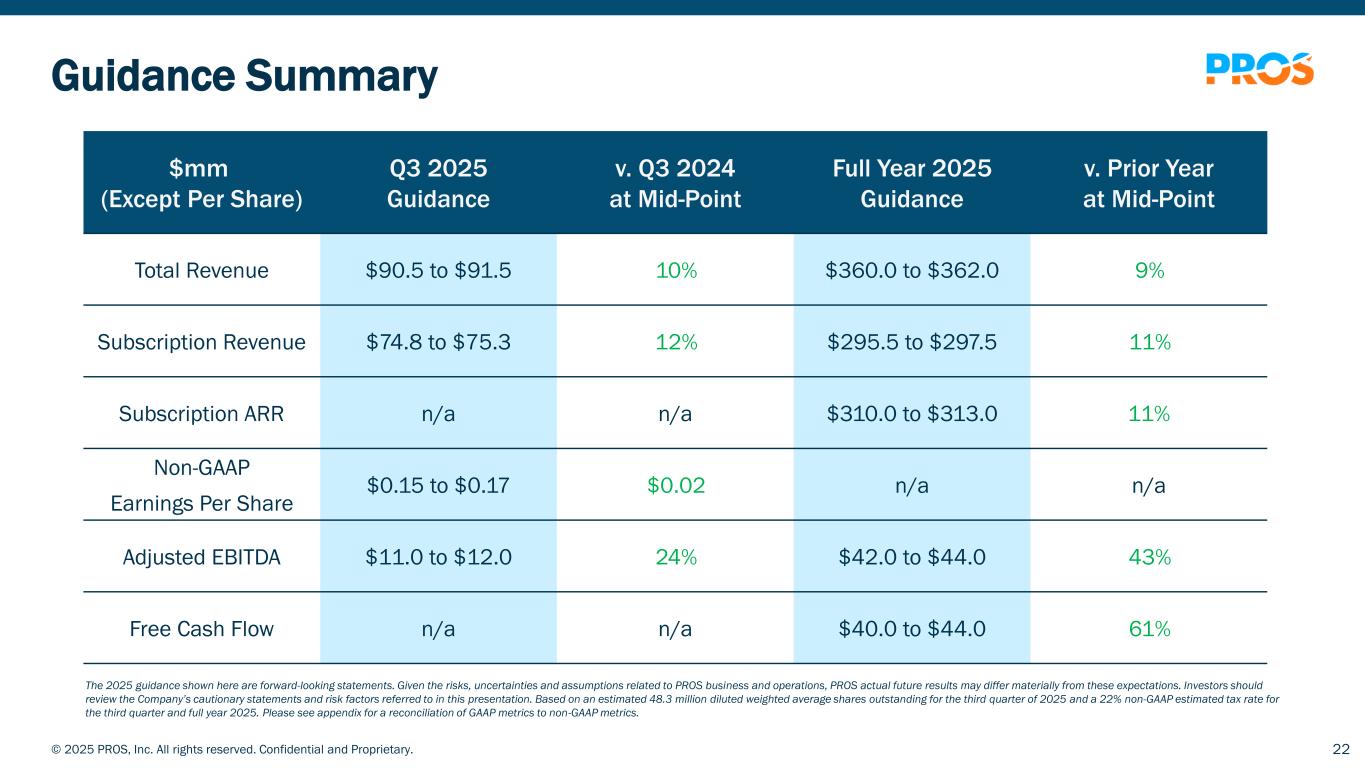

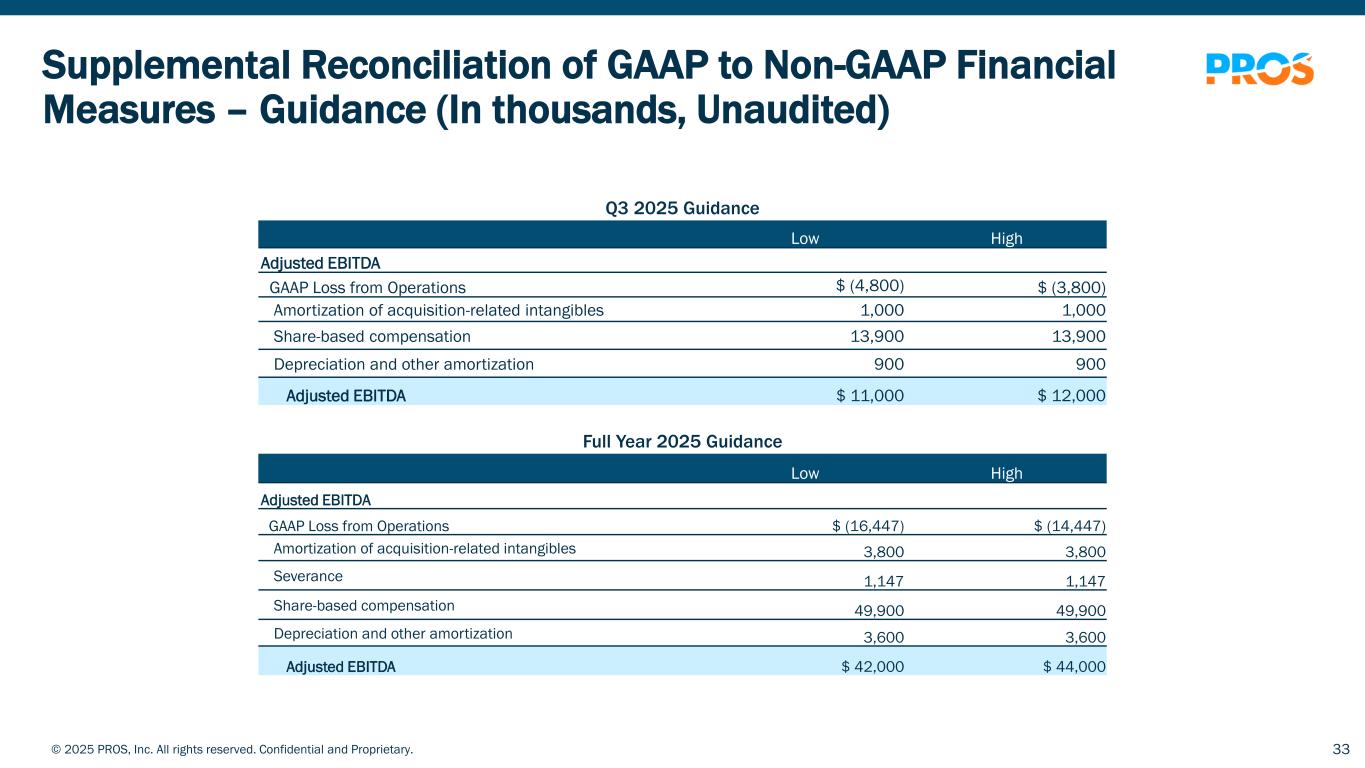

Financial Outlook

PROS currently anticipates the following based on an estimated 48.3 million diluted weighted average shares outstanding for the third quarter of 2025 and a 22% non-GAAP estimated tax rate for the third quarter and full year 2025.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q3 2025 Guidance |

|

v. Q3 2024 at Mid-Point |

|

Full Year 2025 Guidance |

|

v. Prior Year at Mid-Point |

| Total Revenue |

$90.5 to $91.5 |

|

10% |

|

$360.0 to $362.0 |

|

9% |

| Subscription Revenue |

$74.8 to $75.3 |

|

12% |

|

$295.5 to $297.5 |

|

11% |

|

|

|

|

|

|

|

|

| Subscription ARR |

n/a |

|

n/a |

|

$310.0 to $313.0 |

|

11% |

| Non-GAAP Earnings Per Share |

$0.15 to $0.17 |

|

$0.02 |

|

n/a |

|

n/a |

| Adjusted EBITDA |

$11.0 to $12.0 |

|

24% |

|

$42.0 to $44.0 |

|

43% |

| Free Cash Flow |

n/a |

|

n/a |

|

$40.0 to $44.0 |

|

61% |

Conference Call

In conjunction with this announcement, PROS Holdings, Inc. will host a conference call on Thursday, July 31, 2025, at 4:45 p.m. ET to discuss the Company’s financial results and business outlook. To access this call, dial 1-877-407-9039 (toll-free) or 1-201-689-8470. The live and archived webcasts of this call can be accessed under the “Investor Relations” section of the Company’s website at www.pros.com.

A telephone replay will be available until Thursday, August 7, 2025, 11:59 PM ET at 1-844-512-2921 (toll-free) or 1-412-317-6671 using the pass code 13754225.

About PROS

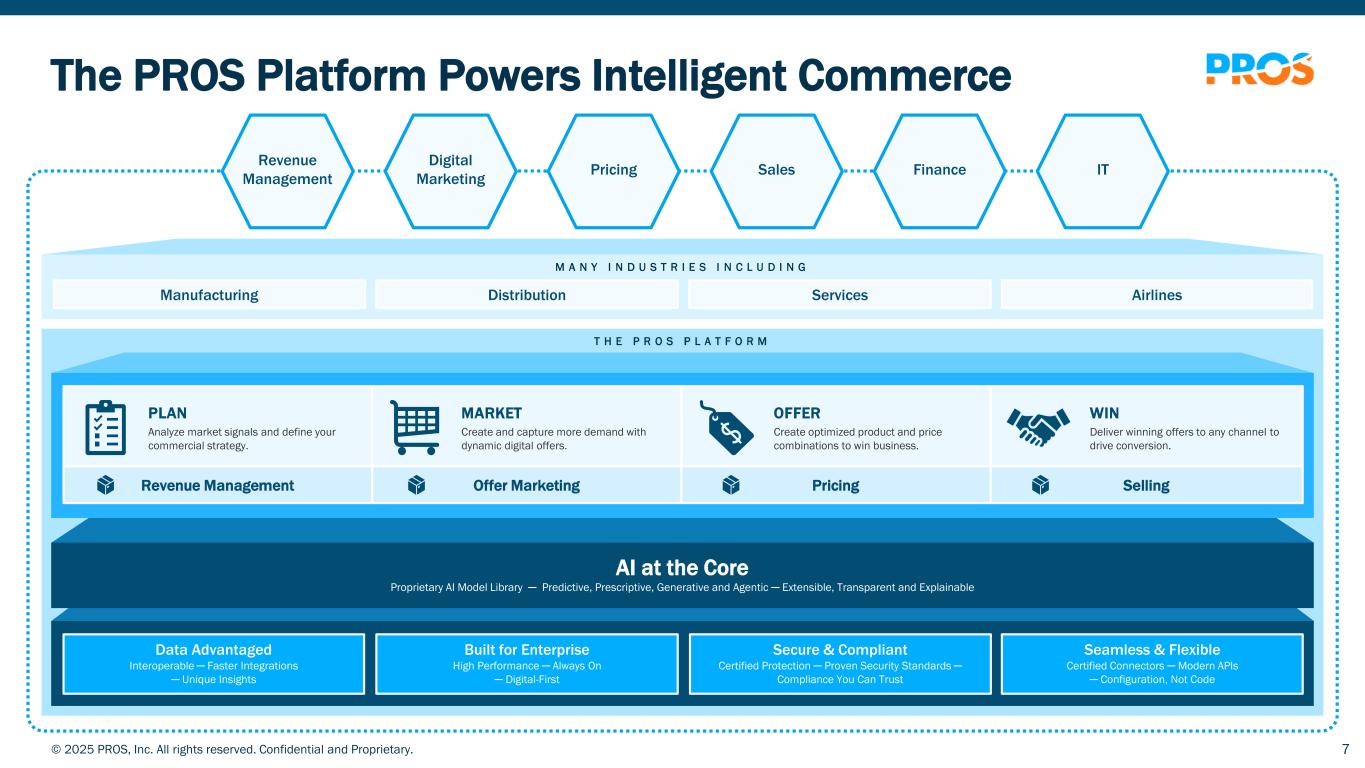

PROS Holdings, Inc. (NYSE: PRO) is a leading provider of SaaS solutions that optimize omnichannel shopping and selling experiences, powering intelligent commerce. Leveraging leadership in revenue and pricing science, the PROS Platform combines predictive AI, real-time analytics, and powerful automation to dynamically match offers to buyers and prices to products. Businesses win more with PROS. Learn more at pros.com.

Forward-looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about our financial outlook; expectations; ability to achieve future growth and profitability goals; management's confidence and optimism; positioning; customer successes; demand for our software solutions; pipeline; business expansion; revenue; subscription revenue; subscription ARR; non-GAAP earnings (loss) per share; adjusted EBITDA; free cash flow; shares outstanding and effective tax rate. The forward-looking statements contained in this press release are based upon our historical performance and our current plans, estimates and expectations and are not a representation that such plans, estimates or expectations will be achieved.

Factors that could cause actual results to differ materially from those described herein include, among others, risks related to: (a) cyberattacks, data breaches and breaches of security measures within our products, systems and infrastructure or products, systems and infrastructure of third parties upon whom we rely, (b) the macroeconomic environment and geopolitical uncertainty and events, (c) increasing business from customers, maintaining subscription renewal rates and capturing customer IT spend, (d) managing our growth and profit objectives effectively, (e) disruptions from our third party data center, software, data, and other unrelated service providers, (f) implementing our solutions, (g) cloud operations, (h) intellectual property and third-party software, (i) acquiring and integrating businesses and/or technologies, (j) catastrophic events, (k) operating globally, including economic and commercial disruptions, (l) potential downturns in sales and lengthy sales cycles, (m) software innovation, (n) competition, (o) market acceptance of our software innovations, (p) maintaining our corporate culture, (q) personnel risks including loss of any key employees and competition for talent, (r) expanding and training our direct and indirect sales force, (s) evolving data privacy, cyber security, data localization and AI laws, (t) the rapid adoption, evolution, and understanding of AI, (u) our debt repayment obligations, (v) the timing of revenue recognition and cash flow from operations, and (w) returning to profitability. Additional information relating to the risks and uncertainties affecting our business is contained in our filings with the SEC. These forward-looking statements represent our expectations as of the date hereof. Subsequent events may cause these expectations to change, and PROS disclaims any obligations to update or alter these forward-looking statements in the future, whether as a result of new information, future events or otherwise.

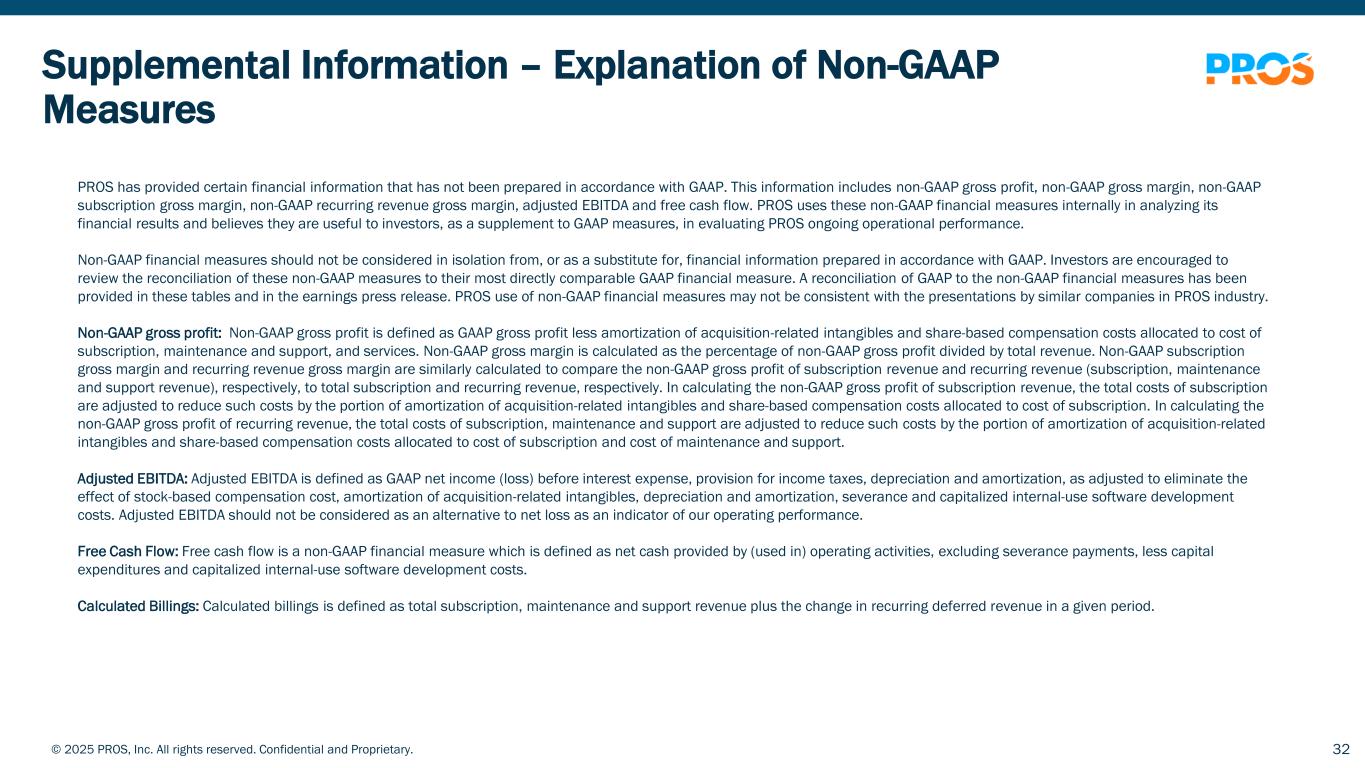

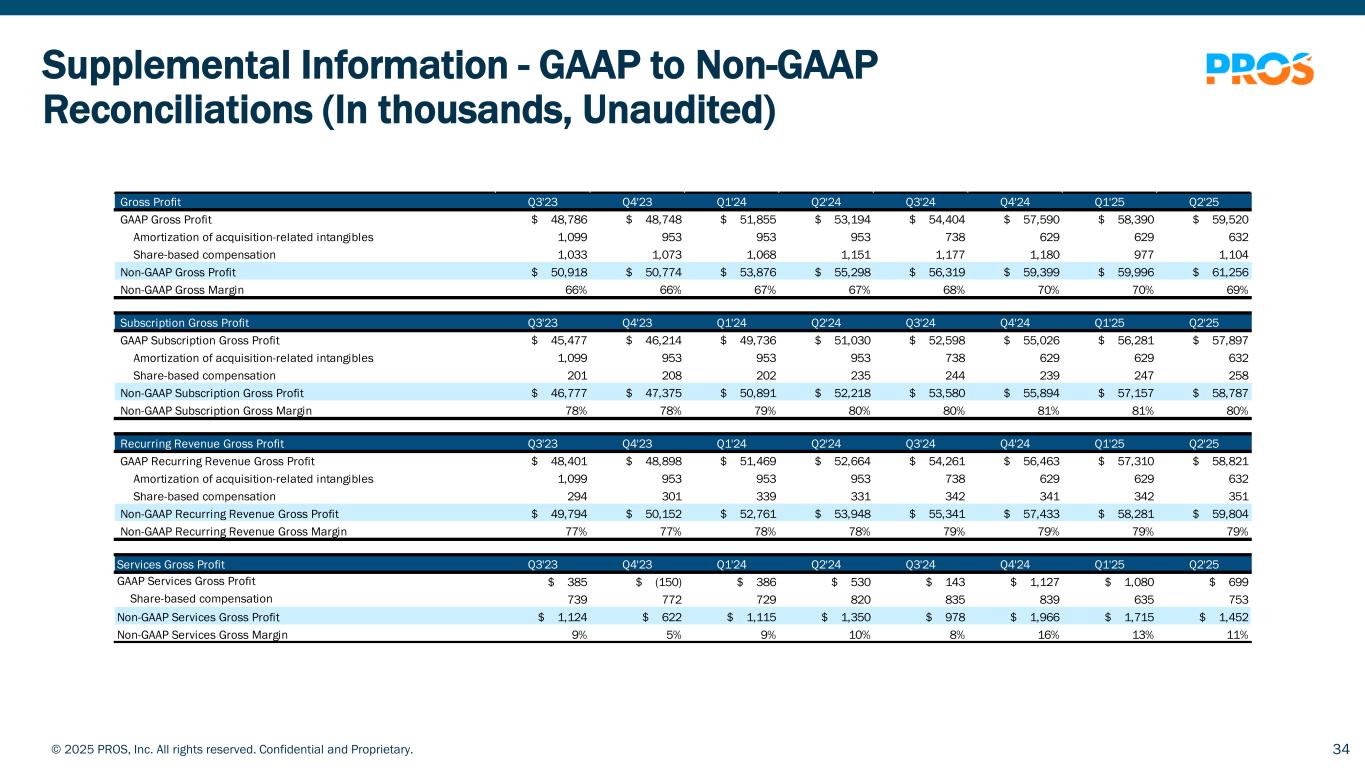

Non-GAAP Financial Measures

PROS has provided in this release certain non-GAAP financial measures, including non-GAAP gross profit and margin, non-GAAP subscription margin, non-GAAP income (loss) from operations or non-GAAP operating income (loss), subscription annual recurring revenue, adjusted EBITDA, free cash flow, non-GAAP tax rate, non-GAAP net income (loss), and non-GAAP earnings (loss) per share. PROS uses these non-GAAP financial measures internally in analyzing its financial results and believes they are useful to investors, as a supplement to GAAP measures, in evaluating PROS ongoing operational performance and cloud transition. Non-GAAP gross margin can be compared to gross margin which can be calculated from the condensed consolidated statements of income (loss) by dividing gross profit by total revenue. Non-GAAP gross margin is similarly calculated but first adds back to gross profit the portion of certain of the non-GAAP adjustments described below attributable to cost of revenue. Non-GAAP subscription margin can be compared to subscription margin which can be calculated from the condensed consolidated statements of income (loss) by dividing subscription gross profit (subscription revenue minus subscription cost) by subscription revenue. Non-GAAP subscription margin is similarly calculated but first subtracts out from subscription cost the portion of certain of the non-GAAP adjustments described below attributable to cost of subscription. These items and amounts are presented in the Supplemental Schedule of Non-GAAP Financial Measures.

Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measure as detailed above. A reconciliation of GAAP financial measures to the non-GAAP financial measures has been provided in the tables included as part of this press release, and can be found, along with other financial information, in the investor relations portion of our website. PROS use of non-GAAP financial measures may not be consistent with the presentations by similar companies in PROS industry. PROS has also provided in this release certain forward-looking non-GAAP financial measures, including non-GAAP income (loss) from operations, subscription annual recurring revenue, non-GAAP earnings (loss) per share, adjusted EBITDA, free cash flow, non-GAAP tax rates, and calculated billings (collectively the "non-GAAP financial measures") as follows:

Non-GAAP income (loss) from operations: Non-GAAP income (loss) from operations excludes the impact of share-based compensation, amortization of acquisition-related intangibles and severance. Non-GAAP income (loss) from operations excludes the following items from non-GAAP estimates:

•Share-Based Compensation: Although share-based compensation is an important aspect of compensation for our employees and executives, our share-based compensation expense can vary because of changes in our stock price and market conditions at the time of grant, varying valuation methodologies, and the variety of award types. Since share-based compensation expense can vary for reasons that are generally unrelated to our performance during any particular period, we believe this could make it difficult for investors to compare our current financial results to previous and future periods. Therefore, we believe it is useful to exclude share-based compensation in order to better understand our business performance and allow investors to compare our operating results with peer companies.

•Amortization of Acquisition-Related Intangibles: We view amortization of acquisition-related intangible assets, such as the amortization of the cost associated with an acquired company's research and development efforts, trade names, customer lists and customer relationships, as items arising from pre-acquisition activities determined at the time of an acquisition. While these intangible assets are continually evaluated for impairment, amortization of the cost of purchased intangibles is a static expense, one that is not typically affected by operations during any particular period.

•Severance: Severance costs relate to the departure of our Chief Revenue Officer. These amounts are unrelated to our core performance during any particular period, and therefore, we believe it is useful to exclude these amounts in order to better understand our business performance and allow investors to compare our results with peer companies.

Non-GAAP earnings (loss) per share: Non-GAAP net income (loss) excludes the items listed above as excluded from non-GAAP income (loss) from operations and also excludes amortization of debt premium and issuance costs, gain on debt extinguishment and the taxes related to these items and the items excluded from non-GAAP income (loss) from operations. Estimates of non-GAAP earnings (loss) per share are calculated by dividing estimates for non-GAAP net income (loss) by our estimate of weighted average shares outstanding for the future period. The weighted average shares outstanding used in the calculation of non-GAAP earnings (loss) per share exclude the impact of the 2027 convertible notes exchanged. In addition to the items listed above as excluded from non-GAAP income (loss) from operations, non-GAAP net income (loss) excludes the following items from non-GAAP estimates:

•Amortization of Debt Premium and Issuance Costs: Amortization of debt premium and issuance costs are related to our convertible notes. These amounts are unrelated to our core performance during any particular period, and therefore, we believe it is useful to exclude these amounts in order to better understand our business performance and allow investors to compare our results with peer companies.

•Gain on Debt Extinguishment: Gain on debt extinguishment relates to the 2027 convertible notes exchange, a non-recurring transaction, during Q2 2025. These amounts are unrelated to our core performance during any particular period, and therefore, we believe it is useful to exclude these amounts in order to better understand our business performance and allow investors to compare our results with peer companies.

•Taxes: We exclude the tax consequences associated with non-GAAP items to provide investors with a useful comparison of our operating results to prior periods and to our peer companies because such amounts can vary significantly. In the fourth quarter of 2014, we concluded that it is more likely than not that we will be unable to fully realize our deferred tax assets and accordingly, established a valuation allowance against those assets. The ongoing impact of the valuation allowance on our non-GAAP effective tax rate has been eliminated to allow investors to better understand our business performance and compare our operating results with peer companies.

Subscription Annual Recurring Revenue: Subscription Annual Recurring Revenue ("subscription ARR") is used to assess the trajectory of our cloud business. Subscription ARR means, as of a specified date, the contracted subscription revenue, including contracts with a future start date, together with annualized overage fees incurred above contracted minimum transactions. Subscription ARR should be viewed independently of revenue and any other GAAP measure.

Non-GAAP Tax Rate: The estimated non-GAAP effective tax rate adjusts the tax effect to quantify the impact of the excluded non-GAAP items.

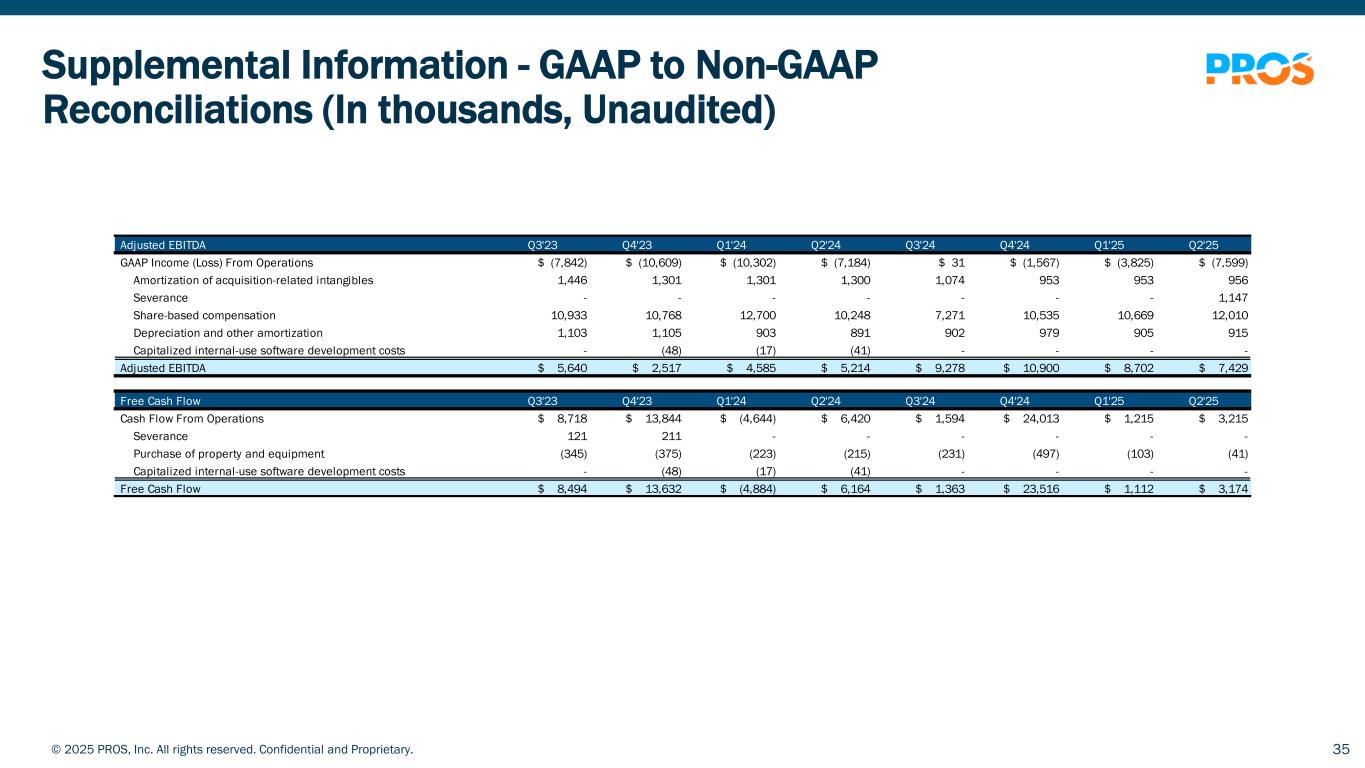

Adjusted EBITDA: Adjusted EBITDA is defined as GAAP net income (loss) before interest expense, provision for income taxes, depreciation and amortization, as adjusted to eliminate the effect of stock-based compensation cost, amortization of acquisition-related intangibles, depreciation and amortization, severance and capitalized internal-use software development costs. Adjusted EBITDA should not be considered as an alternative to net income (loss) as an indicator of our operating performance.

Free Cash Flow: Free cash flow is a non-GAAP financial measure which is defined as net cash provided by (used in) operating activities, less capital expenditures and capitalized internal-use software development costs.

Calculated Billings: Calculated billings is defined as total subscription, maintenance and support revenue plus the change in recurring deferred revenue in a given period.

These non-GAAP estimates are not measurements of financial performance prepared in accordance with GAAP, and we are unable to reconcile these forward-looking non-GAAP financial measures to their directly comparable GAAP financial measures because the information described above which is needed to complete a reconciliation is unavailable at this time without unreasonable effort.

Investor Contact:

PROS Investor Relations Belinda Overdeput (In thousands, except share and per share amounts)

713-335-5879

ir@pros.com

PROS Holdings, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2025 |

|

December 31, 2024 |

Assets: |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

|

$ |

178,958 |

|

|

$ |

161,983 |

|

|

|

|

|

|

| Trade and other receivables, net of allowance of $1,142 and $922, respectively |

|

65,172 |

|

|

64,982 |

|

Deferred costs, current |

|

4,902 |

|

|

4,634 |

|

Prepaid and other current assets |

|

12,174 |

|

|

7,517 |

|

|

|

|

|

|

Total current assets |

|

261,206 |

|

|

239,116 |

|

Restricted cash |

|

10,000 |

|

|

10,000 |

|

Property and equipment, net |

|

18,384 |

|

|

19,745 |

|

Operating lease right-of-use assets |

|

18,237 |

|

|

16,066 |

|

Deferred costs, noncurrent |

|

12,339 |

|

|

11,515 |

|

Intangibles, net |

|

5,131 |

|

|

7,044 |

|

Goodwill |

|

108,955 |

|

|

107,278 |

|

|

|

|

|

|

|

|

|

|

|

Other assets, noncurrent |

|

8,789 |

|

|

9,138 |

|

Total assets |

|

$ |

443,041 |

|

|

$ |

419,902 |

|

Liabilities and Stockholders’ (Deficit) Equity: |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable and other liabilities |

|

$ |

6,765 |

|

|

$ |

8,589 |

|

Accrued liabilities |

|

16,407 |

|

|

14,085 |

|

Accrued payroll and other employee benefits |

|

19,341 |

|

|

27,117 |

|

Operating lease liabilities, current |

|

5,179 |

|

|

6,227 |

|

Deferred revenue, current |

|

135,497 |

|

|

130,977 |

|

|

|

|

|

|

Total current liabilities |

|

183,189 |

|

|

186,995 |

|

Deferred revenue, noncurrent |

|

4,199 |

|

|

5,438 |

|

Convertible debt, net, noncurrent |

|

312,027 |

|

|

270,797 |

|

Operating lease liabilities, noncurrent |

|

26,764 |

|

|

23,870 |

|

Other liabilities, noncurrent |

|

1,741 |

|

|

1,505 |

|

Total liabilities |

|

527,920 |

|

|

488,605 |

|

Stockholders' (deficit) equity: |

|

|

|

|

Preferred stock, $0.001 par value, 5,000,000 shares authorized; none issued |

|

— |

|

|

— |

|

Common stock, $0.001 par value, 75,000,000 shares authorized; 52,667,166

and 52,083,732 shares issued, respectively; 47,986,443 and 47,403,009 shares outstanding, respectively |

|

53 |

|

|

52 |

|

Additional paid-in capital |

|

624,530 |

|

|

634,212 |

|

| Treasury stock, 4,680,723 common shares, at cost |

|

(29,847) |

|

|

(29,847) |

|

Accumulated deficit |

|

(673,172) |

|

|

(667,727) |

|

Accumulated other comprehensive loss |

|

(6,443) |

|

|

(5,393) |

|

|

|

|

|

|

Total stockholders’ (deficit) equity |

|

(84,879) |

|

|

(68,703) |

|

Total liabilities and stockholders’ (deficit) equity |

|

$ |

443,041 |

|

|

$ |

419,902 |

|

PROS Holdings, Inc.

Condensed Consolidated Statements of Loss

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

Revenue: |

|

|

|

|

|

|

|

|

| Subscription |

|

$ |

73,333 |

|

|

$ |

65,600 |

|

|

$ |

144,163 |

|

|

$ |

129,949 |

|

| Maintenance and support |

|

2,567 |

|

|

3,385 |

|

|

5,297 |

|

|

6,980 |

|

| Total subscription, maintenance and support |

|

75,900 |

|

|

68,985 |

|

|

149,460 |

|

|

136,929 |

|

| Services |

|

12,815 |

|

|

13,028 |

|

|

25,577 |

|

|

25,772 |

|

| Total revenue |

|

88,715 |

|

|

82,013 |

|

|

175,037 |

|

|

162,701 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

| Subscription |

|

15,436 |

|

|

14,570 |

|

|

29,985 |

|

|

29,183 |

|

| Maintenance and support |

|

1,643 |

|

|

1,751 |

|

|

3,344 |

|

|

3,613 |

|

| Total cost of subscription, maintenance and support |

|

17,079 |

|

|

16,321 |

|

|

33,329 |

|

|

32,796 |

|

| Services |

|

12,116 |

|

|

12,498 |

|

|

23,798 |

|

|

24,856 |

|

| Total cost of revenue |

|

29,195 |

|

|

28,819 |

|

|

57,127 |

|

|

57,652 |

|

| Gross profit |

|

59,520 |

|

|

53,194 |

|

|

117,910 |

|

|

105,049 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

| Selling and marketing |

|

26,791 |

|

|

23,537 |

|

|

50,799 |

|

|

46,219 |

|

| Research and development |

|

23,019 |

|

|

21,786 |

|

|

45,626 |

|

|

46,199 |

|

| General and administrative |

|

17,309 |

|

|

15,055 |

|

|

32,909 |

|

|

30,117 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

(7,599) |

|

|

(7,184) |

|

|

(11,424) |

|

|

(17,486) |

|

| Convertible debt interest and amortization |

|

(1,228) |

|

|

(1,148) |

|

|

(2,356) |

|

|

(2,350) |

|

| Other income, net |

|

7,326 |

|

|

1,323 |

|

|

9,238 |

|

|

1,781 |

|

| Loss before income tax provision |

|

(1,501) |

|

|

(7,009) |

|

|

(4,542) |

|

|

(18,055) |

|

| Income tax provision |

|

255 |

|

|

377 |

|

|

903 |

|

|

688 |

|

| Net loss |

|

$ |

(1,756) |

|

|

$ |

(7,386) |

|

|

$ |

(5,445) |

|

|

$ |

(18,743) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.04) |

|

|

$ |

(0.16) |

|

|

$ |

(0.11) |

|

|

$ |

(0.40) |

|

| Diluted |

|

$ |

(0.10) |

|

|

$ |

(0.16) |

|

|

$ |

(0.16) |

|

|

$ |

(0.40) |

|

| Weighted average number of shares: |

|

|

|

|

|

|

|

|

| Basic |

|

47,916 |

|

|

47,068 |

|

|

47,783 |

|

|

46,942 |

|

| Diluted |

|

51,501 |

|

|

47,068 |

|

|

51,807 |

|

|

46,942 |

|

PROS Holdings, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

Operating activities: |

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(1,756) |

|

|

$ |

(7,386) |

|

|

$ |

(5,445) |

|

|

$ |

(18,743) |

|

Adjustments to reconcile net loss to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

1,871 |

|

|

2,191 |

|

|

3,729 |

|

|

4,395 |

|

| Amortization of debt premium and issuance costs |

|

(232) |

|

|

(302) |

|

|

(535) |

|

|

(586) |

|

Share-based compensation |

|

12,010 |

|

|

10,248 |

|

|

22,679 |

|

|

22,948 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for credit losses |

|

157 |

|

|

11 |

|

|

311 |

|

|

160 |

|

| Gain on lease modification |

|

— |

|

|

— |

|

|

— |

|

|

(697) |

|

Loss on disposal of assets |

|

— |

|

|

— |

|

|

— |

|

|

774 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on debt extinguishment |

|

(4,189) |

|

|

— |

|

|

(4,189) |

|

|

— |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Trade and other receivables |

|

3,989 |

|

|

3,271 |

|

|

(313) |

|

|

1,173 |

|

Deferred costs |

|

(76) |

|

|

(34) |

|

|

(1,092) |

|

|

572 |

|

Prepaid expenses and other assets |

|

(1,631) |

|

|

(896) |

|

|

(4,397) |

|

|

174 |

|

| Operating lease right-of-use assets and liabilities |

|

(68) |

|

|

(668) |

|

|

(277) |

|

|

(1,516) |

|

Accounts payable and other liabilities |

|

613 |

|

|

4,522 |

|

|

(3,088) |

|

|

3,885 |

|

Accrued liabilities |

|

(108) |

|

|

91 |

|

|

1,600 |

|

|

2,418 |

|

Accrued payroll and other employee benefits |

|

4,046 |

|

|

3,100 |

|

|

(7,729) |

|

|

(13,511) |

|

Deferred revenue |

|

(11,411) |

|

|

(7,728) |

|

|

3,176 |

|

|

330 |

|

| Net cash provided by operating activities |

|

3,215 |

|

|

6,420 |

|

|

4,430 |

|

|

1,776 |

|

Investing activities: |

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

(41) |

|

|

(215) |

|

|

(144) |

|

|

(438) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capitalized internal-use software development costs |

|

— |

|

|

(41) |

|

|

— |

|

|

(58) |

|

|

|

|

|

|

|

|

|

|

Investment in equity securities |

|

— |

|

|

— |

|

|

— |

|

|

(113) |

|

| Proceeds from equity securities |

|

— |

|

|

— |

|

|

118 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

(41) |

|

|

(256) |

|

|

(26) |

|

|

(609) |

|

Financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from employee stock plans |

|

— |

|

|

— |

|

|

1,030 |

|

|

1,024 |

|

Tax withholding related to net share settlement of stock awards |

|

(1,334) |

|

|

(1,823) |

|

|

(5,495) |

|

|

(10,161) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of convertible debt, net |

|

50,000 |

|

|

— |

|

|

50,000 |

|

|

— |

|

Debt issuance costs related to convertible debt |

|

(3,525) |

|

|

— |

|

|

(3,525) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Purchase of Capped Call |

|

(27,895) |

|

|

— |

|

|

(27,895) |

|

|

— |

|

| Repayment of convertible debt |

|

— |

|

|

(21,713) |

|

|

— |

|

|

(21,713) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) financing activities |

|

17,246 |

|

|

(23,536) |

|

|

14,115 |

|

|

(30,850) |

|

| Effect of foreign currency rates on cash |

|

(1,485) |

|

|

35 |

|

|

(1,544) |

|

|

22 |

|

| Net change in cash, cash equivalents and restricted cash |

|

18,935 |

|

|

(17,337) |

|

|

16,975 |

|

|

(29,661) |

|

Cash, cash equivalents and restricted cash: |

|

|

|

|

|

|

|

|

Beginning of period |

|

170,023 |

|

|

166,423 |

|

|

171,983 |

|

|

178,747 |

|

End of period |

|

$ |

188,958 |

|

|

$ |

149,086 |

|

|

$ |

188,958 |

|

|

$ |

149,086 |

|

|

|

|

|

|

|

|

|

|

| Reconciliation of cash, cash equivalents and restricted cash to the condensed consolidated balance sheets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

178,958 |

|

|

$ |

139,086 |

|

|

$ |

178,958 |

|

|

$ |

139,086 |

|

| Restricted cash |

|

10,000 |

|

|

10,000 |

|

|

10,000 |

|

|

10,000 |

|

| Total cash, cash equivalents and restricted cash |

|

$ |

188,958 |

|

|

$ |

149,086 |

|

|

$ |

188,958 |

|

|

$ |

149,086 |

|

PROS Holdings, Inc.

Reconciliation of GAAP to Non-GAAP Financial Measures

(In thousands, except per share data)

(Unaudited)

We use these non-GAAP financial measures to assist in the management of the Company because we believe that this information provides a more consistent and complete understanding of the underlying results and trends of the ongoing business due to the uniqueness of these charges.

See breakdown of the reconciling line items on page 10.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Quarter over Quarter |

|

Six Months Ended June 30, |

|

Year over Year |

|

|

|

2025 |

|

2024 |

|

% change |

|

2025 |

|

2024 |

|

% change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP gross profit |

|

$ |

59,520 |

|

|

$ |

53,194 |

|

|

12 |

% |

|

$ |

117,910 |

|

|

$ |

105,049 |

|

|

12 |

% |

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangibles |

|

632 |

|

|

953 |

|

|

|

|

1,261 |

|

|

1,906 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

1,104 |

|

|

1,151 |

|

|

|

|

2,081 |

|

|

2,219 |

|

|

|

Non-GAAP gross profit |

|

$ |

61,256 |

|

|

$ |

55,298 |

|

|

11 |

% |

|

$ |

121,252 |

|

|

$ |

109,174 |

|

|

11 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP gross margin |

|

69.0 |

% |

|

67.4 |

% |

|

|

|

69.3 |

% |

|

67.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP loss from operations |

|

$ |

(7,599) |

|

|

$ |

(7,184) |

|

|

6 |

% |

|

$ |

(11,424) |

|

|

$ |

(17,486) |

|

|

(35) |

% |

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangibles |

|

956 |

|

|

1,300 |

|

|

|

|

1,909 |

|

|

2,601 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Severance |

|

1,147 |

|

|

— |

|

|

|

|

1,147 |

|

|

— |

|

|

|

|

Share-based compensation |

|

12,010 |

|

|

10,248 |

|

|

|

|

22,679 |

|

|

22,948 |

|

|

|

|

Total non-GAAP adjustments |

|

14,113 |

|

|

11,548 |

|

|

|

|

25,735 |

|

|

25,549 |

|

|

|

Non-GAAP income from operations |

|

$ |

6,514 |

|

|

$ |

4,364 |

|

|

49 |

% |

|

$ |

14,311 |

|

|

$ |

8,063 |

|

|

77 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP income from operations % of total revenue |

|

7.3 |

% |

|

5.3 |

% |

|

|

|

8.2 |

% |

|

5.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net loss |

|

$ |

(1,756) |

|

|

$ |

(7,386) |

|

|

(76) |

% |

|

$ |

(5,445) |

|

|

$ |

(18,743) |

|

|

(71) |

% |

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-GAAP adjustments affecting loss from operations |

|

14,113 |

|

|

11,548 |

|

|

|

|

25,735 |

|

|

25,549 |

|

|

|

|

Amortization of debt premium and issuance costs |

|

(301) |

|

|

(372) |

|

|

|

|

(674) |

|

|

(725) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on debt extinguishment |

|

(4,189) |

|

|

— |

|

|

|

|

(4,189) |

|

|

— |

|

|

|

|

Tax impact related to non-GAAP adjustments |

|

(1,531) |

|

|

(539) |

|

|

|

|

(2,689) |

|

|

(801) |

|

|

|

Non-GAAP net income |

|

$ |

6,336 |

|

|

$ |

3,251 |

|

|

95 |

% |

|

$ |

12,738 |

|

|

$ |

5,280 |

|

|

141 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP earnings per share |

|

$ |

0.13 |

|

|

$ |

0.07 |

|

|

|

|

$ |

0.27 |

|

|

$ |

0.11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in computing GAAP diluted earnings per share |

|

51,501 |

|

|

47,068 |

|

|

|

|

51,807 |

|

|

46,942 |

|

|

|

|

Remove the dilutive effect of the 2027 convertible notes exchanged |

|

(3,585) |

|

|

— |

|

|

|

|

(4,024) |

|

|

— |

|

|

|

|

Add the dilutive effect of stock awards |

|

108 |

|

|

589 |

|

|

|

|

268 |

|

|

790 |

|

|

|

Shares used in computing non-GAAP diluted earnings per share |

|

48,024 |

|

|

47,657 |

|

|

|

|

48,051 |

|

|

47,732 |

|

|

|

PROS Holdings, Inc.

Supplemental Schedule of Non-GAAP Financial Measures

Increase (Decrease) in GAAP Amounts Reported

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Subscription Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangibles |

|

632 |

|

|

953 |

|

|

1,261 |

|

|

1,906 |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

258 |

|

|

235 |

|

|

505 |

|

|

437 |

|

Total cost of subscription items |

|

$ |

890 |

|

|

$ |

1,188 |

|

|

$ |

1,766 |

|

|

$ |

2,343 |

|

|

|

|

|

|

|

|

|

|

Cost of Maintenance Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

93 |

|

|

96 |

|

|

188 |

|

|

233 |

|

Total cost of maintenance items |

|

$ |

93 |

|

|

$ |

96 |

|

|

$ |

188 |

|

|

$ |

233 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Services Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

753 |

|

|

820 |

|

|

1,388 |

|

|

1,549 |

|

Total cost of services items |

|

$ |

753 |

|

|

$ |

820 |

|

|

$ |

1,388 |

|

|

$ |

1,549 |

|

|

|

|

|

|

|

|

|

|

Sales and Marketing Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangibles |

|

324 |

|

|

347 |

|

|

648 |

|

|

695 |

|

Severance |

|

1,147 |

|

|

— |

|

|

1,147 |

|

|

— |

|

Share-based compensation |

|

2,602 |

|

|

2,437 |

|

|

5,288 |

|

|

6,065 |

|

Total sales and marketing items |

|

$ |

4,073 |

|

|

$ |

2,784 |

|

|

$ |

7,083 |

|

|

$ |

6,760 |

|

|

|

|

|

|

|

|

|

|

Research and Development Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

2,441 |

|

|

2,114 |

|

|

4,793 |

|

|

5,645 |

|

Total research and development items |

|

$ |

2,441 |

|

|

$ |

2,114 |

|

|

$ |

4,793 |

|

|

$ |

5,645 |

|

|

|

|

|

|

|

|

|

|

General and Administrative Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

5,863 |

|

|

4,546 |

|

|

10,517 |

|

|

9,019 |

|

Total general and administrative items |

|

$ |

5,863 |

|

|

$ |

4,546 |

|

|

$ |

10,517 |

|

|

$ |

9,019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROS Holdings, Inc.

Supplemental Reconciliation of GAAP to Non-GAAP Financial Measures

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Adjusted EBITDA |

|

|

|

|

|

|

|

|

GAAP Loss from Operations |

|

$ |

(7,599) |

|

|

$ |

(7,184) |

|

|

$ |

(11,424) |

|

|

$ |

(17,486) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangibles |

|

956 |

|

|

1,300 |

|

|

1,909 |

|

|

2,601 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Severance |

|

1,147 |

|

|

— |

|

|

1,147 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

12,010 |

|

|

10,248 |

|

|

22,679 |

|

|

22,948 |

|

Depreciation and other amortization |

|

915 |

|

|

891 |

|

|

1,820 |

|

|

1,794 |

|

Capitalized internal-use software development costs |

|

— |

|

|

(41) |

|

|

— |

|

|

(58) |

|

Adjusted EBITDA |

|

$ |

7,429 |

|

|

$ |

5,214 |

|

|

$ |

16,131 |

|

|

$ |

9,799 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Cash Provided by Operating Activities |

|

$ |

3,215 |

|

|

$ |

6,420 |

|

|

$ |

4,430 |

|

|

$ |

1,776 |

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

(41) |

|

|

(215) |

|

|

(144) |

|

|

(438) |

|

|

|

|

|

|

|

|

|

|

Capitalized internal-use software development costs |

|

— |

|

|

(41) |

|

|

— |

|

|

(58) |

|

Free Cash Flow |

|

$ |

3,174 |

|

|

$ |

6,164 |

|

|

$ |

4,286 |

|

|

$ |

1,280 |

|

|

|

|

|

|

|

|

|

|

| Guidance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q3 2025 Guidance |

|

Full Year 2025 Guidance |

|

|

Low |

|

High |

|

Low |

|

High |

| Adjusted EBITDA |

|

|

|

|

|

|

|

|

GAAP Loss from Operations |

|

$ |

(4,800) |

|

|

$ |

(3,800) |

|

|

$ |

(16,447) |

|

|

$ |

(14,447) |

|

Amortization of acquisition-related intangibles |

|

1,000 |

|

|

1,000 |

|

|

3,800 |

|

|

3,800 |

|

Severance |

|

— |

|

|

— |

|

|

1,147 |

|

|

1,147 |

|

Share-based compensation |

|

13,900 |

|

|

13,900 |

|

|

49,900 |

|

|

49,900 |

|

Depreciation and other amortization |

|

900 |

|

|

900 |

|

|

3,600 |

|

|

3,600 |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

11,000 |

|

|

$ |

12,000 |

|

|

$ |

42,000 |

|

|

$ |

44,000 |

|

PROS Holdings, Inc.

Supplemental Reconciliation of GAAP to Non-GAAP Financial Measures (Continued)

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Quarter over Quarter |

|

Six Months Ended June 30, |

|

Year over Year |

|

|

|

2025 |

|

2024 |

|

% change |

|

2025 |

|

2024 |

|

% change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP subscription gross profit |

|

$ |

57,897 |

|

|

$ |

51,030 |

|

|

13 |

% |

|

$ |

114,178 |

|

|

$ |

100,766 |

|

|

13 |

% |

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangibles |

|

632 |

|

|

953 |

|

|

|

|

1,261 |

|

|

1,906 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

258 |

|

|

235 |

|

|

|

|

505 |

|

|

437 |

|

|

|

Non-GAAP subscription gross profit |

|

$ |

58,787 |

|

|

$ |

52,218 |

|

|

13 |

% |

|

$ |

115,944 |

|

|

$ |

103,109 |

|

|

12 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP subscription gross margin |

|

80.2 |

% |

|

79.6 |

% |

|

|

|

80.4 |

% |

|

79.3 |

% |

|

|