| Cayman Islands | 001-33493 | N/A | ||||||

|

(State or other jurisdiction of incorporation)

|

(Commission file number)

|

(IRS employer identification no.)

|

||||||

| 65 Market Street | ||||||||

| Suite 1207, Jasmine Court | ||||||||

| P.O. Box 31110 | ||||||||

| Camana Bay | ||||||||

| Grand Cayman | ||||||||

| Cayman Islands | KY1-1205 | |||||||

| (Address of principal executive offices) | (Zip code) | |||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |||||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Ordinary Shares | GLRE | Nasdaq Global Select Market | ||||||

| Exhibit No. | Description of Exhibit | |||||||

| 99.1 | Earnings press release, "GREENLIGHT RE ANNOUNCES FINANCIAL RESULTS FOR THIRD QUARTER AND NINE MONTHS ENDED SEPTEMBER 30, 2025", dated November 3, 2025, issued by the Registrant. |

|||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |||||||

| GREENLIGHT CAPITAL RE, LTD. | ||||||||

| (Registrant) | ||||||||

| By: | /s/ Steven Archambault | |||||||

| Name: | Steven Archambault | |||||||

| Title: | Chief Accounting Officer | |||||||

| Date: | November 3, 2025 | |||||||

| September 30, 2025 | December 31, 2024 | ||||||||||

| (Unaudited) | |||||||||||

| Assets | |||||||||||

| Investments | |||||||||||

| Investment in related party investment fund, at fair value | $ | 456,861 | $ | 387,144 | |||||||

| Other investments | 63,182 | 73,160 | |||||||||

| Total investments | 520,043 | 460,304 | |||||||||

| Cash and cash equivalents | 68,789 | 64,685 | |||||||||

| Restricted cash and cash equivalents | 586,444 | 584,402 | |||||||||

| Reinsurance balances receivable (net of allowance for expected credit losses) | 731,707 | 704,483 | |||||||||

| Loss and loss adjustment expenses recoverable (net of allowance for expected credit losses) | 82,783 | 85,790 | |||||||||

| Deferred acquisition costs | 98,476 | 82,249 | |||||||||

| Unearned premiums ceded | 36,123 | 29,545 | |||||||||

| Other assets | 9,690 | 4,765 | |||||||||

| Total assets | $ | 2,134,055 | $ | 2,016,223 | |||||||

| Liabilities and equity | |||||||||||

| Liabilities | |||||||||||

| Loss and loss adjustment expense reserves | $ | 938,308 | $ | 860,969 | |||||||

| Unearned premium reserves | 379,274 | 324,551 | |||||||||

| Reinsurance balances payable | 97,980 | 105,892 | |||||||||

| Funds withheld | 15,139 | 21,878 | |||||||||

| Other liabilities | 9,720 | 6,305 | |||||||||

| Debt | 34,745 | 60,749 | |||||||||

| Total liabilities | 1,475,166 | 1,380,344 | |||||||||

| Shareholders' equity | |||||||||||

Ordinary share capital (par value $0.10; issued and outstanding, 34,099,226) (2024: par value $0.10; issued and outstanding, 34,831,324) |

$ | 3,394 | $ | 3,483 | |||||||

| Additional paid-in capital | 479,099 | 481,551 | |||||||||

| Retained earnings | 176,396 | 150,845 | |||||||||

| Total shareholders' equity | 658,889 | 635,879 | |||||||||

| Total liabilities and equity | $ | 2,134,055 | $ | 2,016,223 | |||||||

| Three months ended September 30 | Nine months ended September 30 | |||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||||

| Underwriting results: | ||||||||||||||||||||||||||

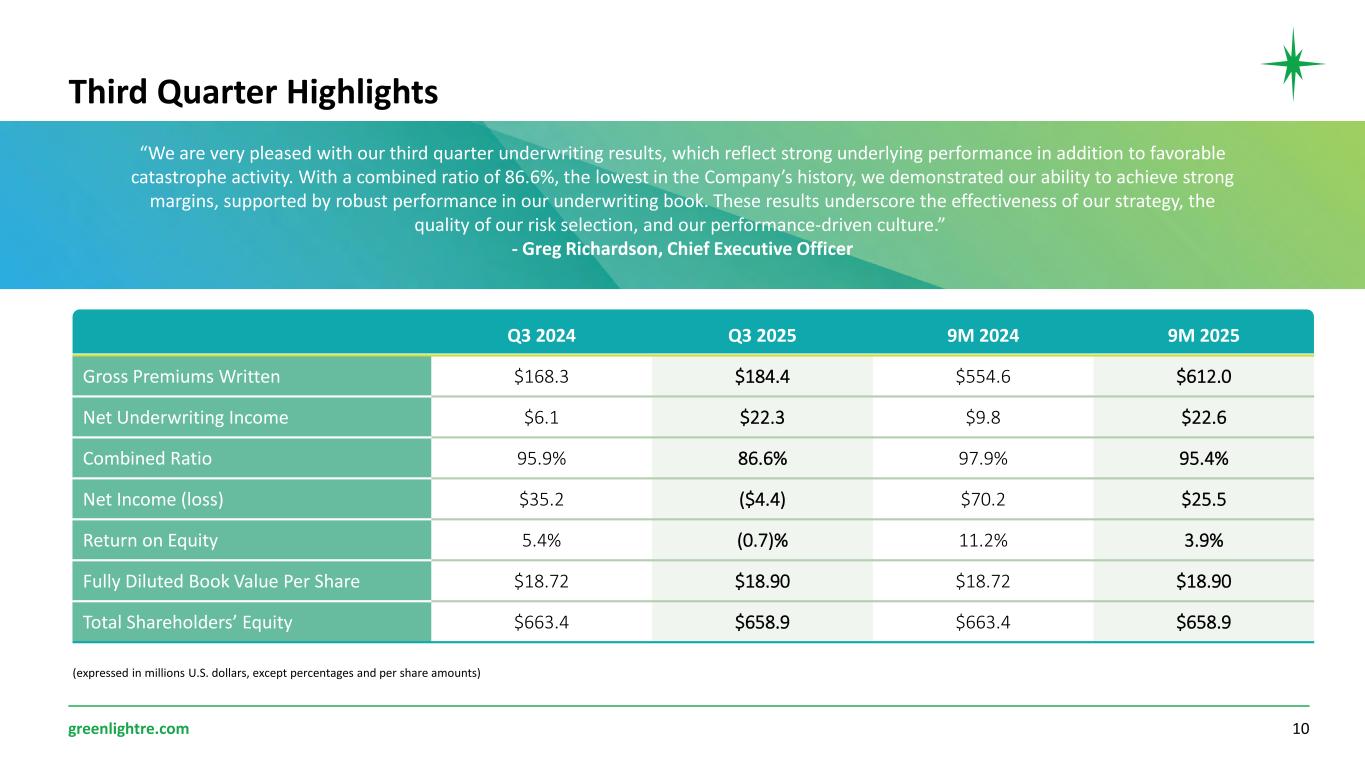

| Gross premiums written | $ | 184,377 | $ | 168,346 | $ | 611,950 | $ | 554,579 | ||||||||||||||||||

| Gross premiums ceded | (21,695) | (26,598) | (65,344) | (64,611) | ||||||||||||||||||||||

| Net premiums written | 162,682 | 141,748 | 546,606 | 489,968 | ||||||||||||||||||||||

| Change in net unearned premium reserves | 2,737 | 10,136 | (51,083) | (18,150) | ||||||||||||||||||||||

| Net premiums earned | $ | 165,419 | $ | 151,884 | $ | 495,523 | $ | 471,818 | ||||||||||||||||||

Net loss and LAE incurred: |

||||||||||||||||||||||||||

| Current year | $ | (87,776) | $ | (98,820) | $ | (303,474) | $ | (305,467) | ||||||||||||||||||

| Prior year | (817) | 5,655 | (8,082) | 943 | ||||||||||||||||||||||

Net loss and LAE incurred |

(88,593) | (93,165) | (311,556) | (304,524) | ||||||||||||||||||||||

| Acquisition costs | (46,962) | (46,162) | (140,676) | (138,226) | ||||||||||||||||||||||

| Underwriting expenses | (7,472) | (6,073) | (20,311) | (18,223) | ||||||||||||||||||||||

| Deposit interest expense | (94) | (377) | (367) | (1,020) | ||||||||||||||||||||||

Net underwriting income |

$ | 22,298 | $ | 6,107 | $ | 22,613 | $ | 9,825 | ||||||||||||||||||

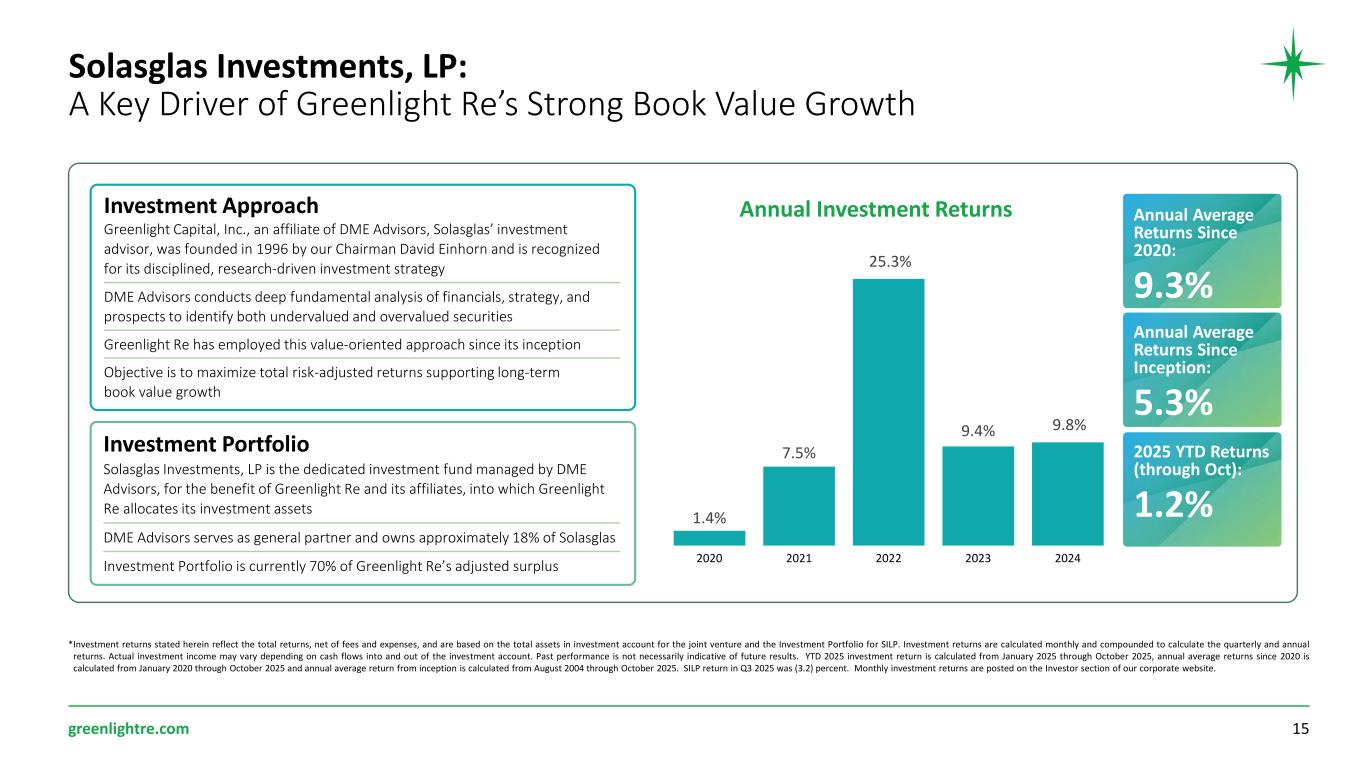

| Income (loss) from investment in Solasglas | $ | (14,404) | $ | 19,844 | $ | (483) | $ | 42,422 | ||||||||||||||||||

| Net investment income (loss) | (2,950) | 10,454 | 15,807 | 34,580 | ||||||||||||||||||||||

| Total investment income (loss) | $ | (17,354) | $ | 30,298 | $ | 15,324 | $ | 77,002 | ||||||||||||||||||

| Corporate and other expenses | $ | (5,399) | $ | (4,253) | $ | (14,826) | $ | (13,334) | ||||||||||||||||||

| Foreign exchange gains (losses) | (1,994) | 5,826 | 8,632 | 3,245 | ||||||||||||||||||||||

| Interest expense | (1,430) | (2,018) | (4,038) | (4,827) | ||||||||||||||||||||||

| Income (loss) before income tax | (3,879) | 35,960 | 27,705 | 71,911 | ||||||||||||||||||||||

| Income tax expense | (526) | (723) | (2,154) | (1,677) | ||||||||||||||||||||||

| Net income (loss) | $ | (4,405) | $ | 35,237 | $ | 25,551 | $ | 70,234 | ||||||||||||||||||

Earnings per share |

||||||||||||||||||||||||||

Basic |

$ | (0.13) | $ | 1.03 | $ | 0.75 | $ | 2.05 | ||||||||||||||||||

Diluted |

$ | (0.13) | $ | 1.01 | $ | 0.74 | $ | 2.02 | ||||||||||||||||||

Underwriting ratios: |

||||||||||||||||||||||||||

Current year loss ratio |

53.1 | % | 65.0 | % | 61.2 | % | 64.7 | % | ||||||||||||||||||

Prior year reserve development ratio |

0.5 | % | (3.7) | % | 1.6 | % | (0.2) | % | ||||||||||||||||||

| Loss ratio | 53.6 | % | 61.3 | % | 62.8 | % | 64.5 | % | ||||||||||||||||||

| Acquisition cost ratio | 28.4 | % | 30.4 | % | 28.4 | % | 29.3 | % | ||||||||||||||||||

| Composite ratio | 82.0 | % | 91.7 | % | 91.2 | % | 93.8 | % | ||||||||||||||||||

| Underwriting expense ratio | 4.6 | % | 4.2 | % | 4.2 | % | 4.1 | % | ||||||||||||||||||

| Combined ratio | 86.6 | % | 95.9 | % | 95.4 | % | 97.9 | % | ||||||||||||||||||

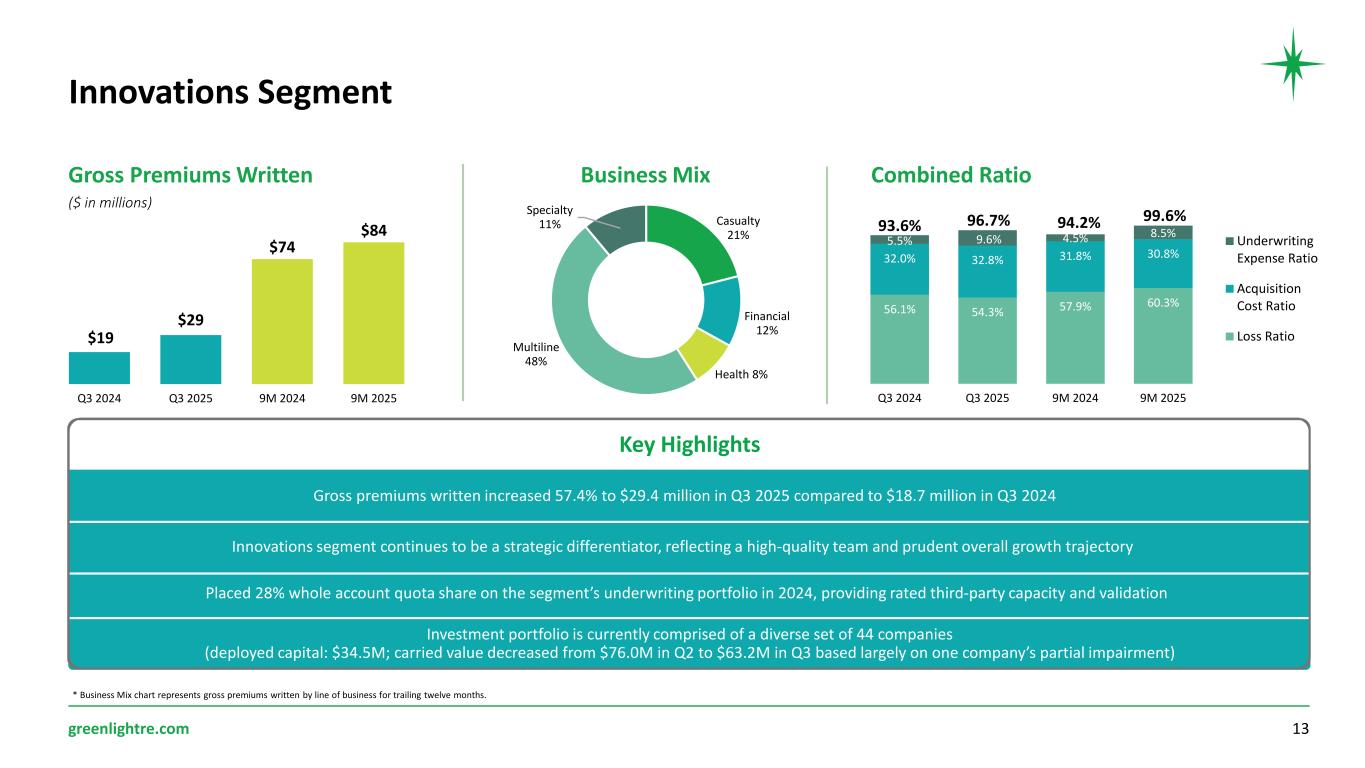

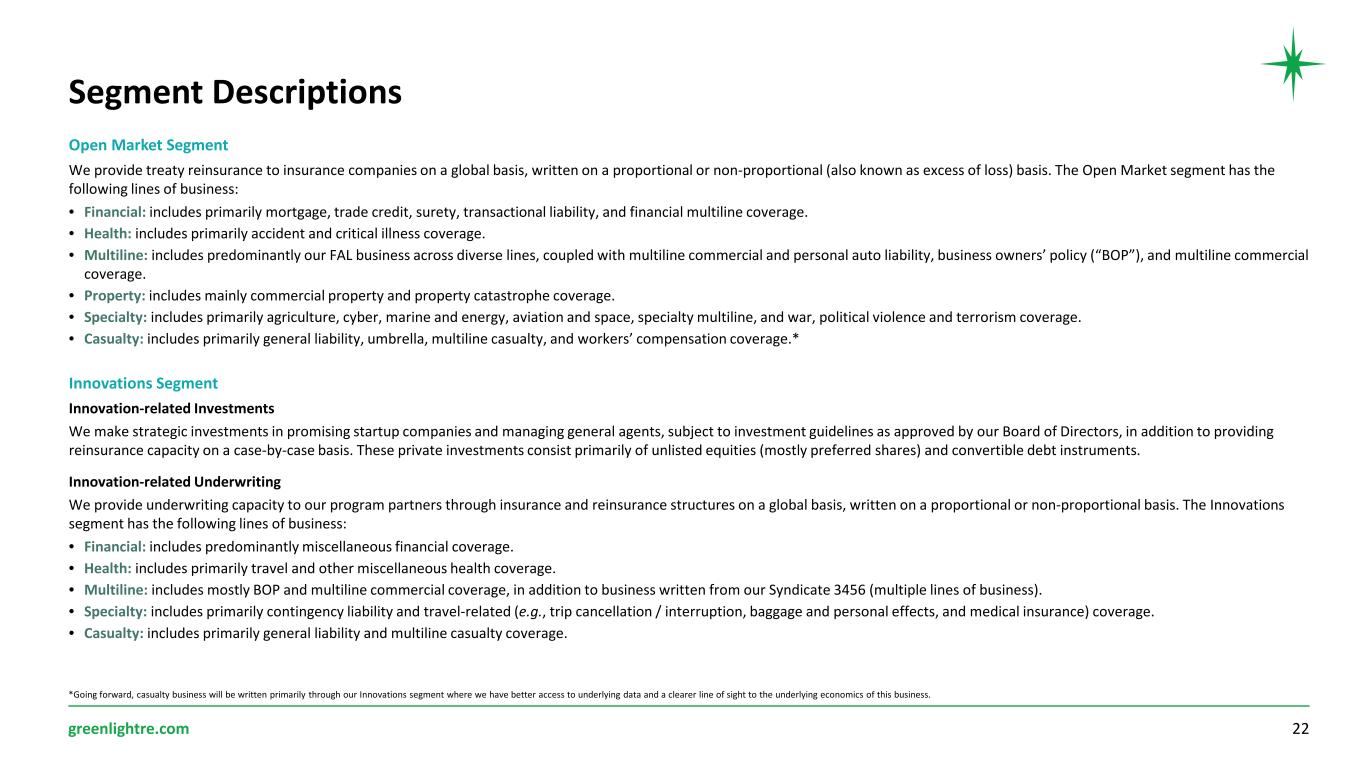

| Open Market | Innovations | Corporate | Total Consolidated | ||||||||||||||||||||

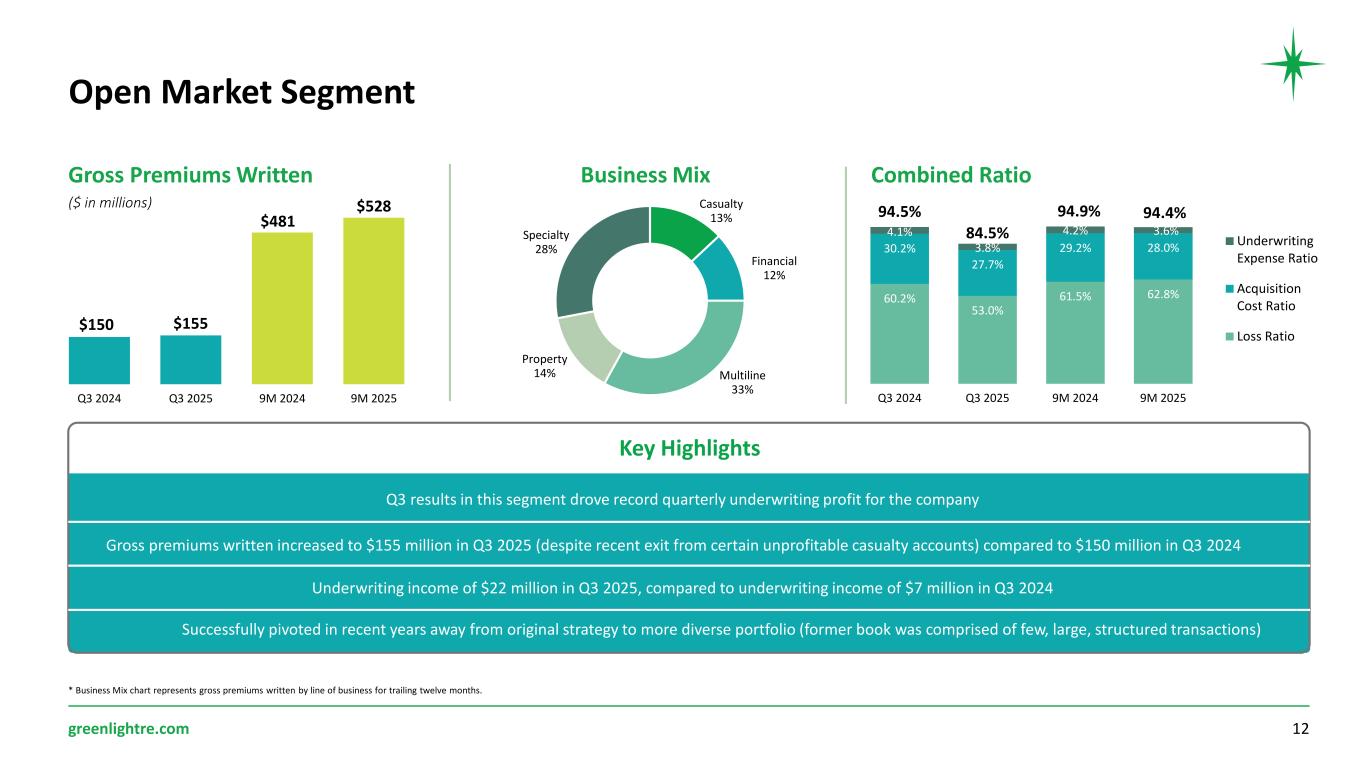

| Gross premiums written | $ | 154,994 | $ | 29,393 | $ | (10) | $ | 184,377 | |||||||||||||||

| Net premiums written | $ | 140,372 | $ | 22,318 | $ | (8) | $ | 162,682 | |||||||||||||||

| Net premiums earned | $ | 144,427 | $ | 21,000 | $ | (8) | $ | 165,419 | |||||||||||||||

Net loss and LAE incurred |

(76,590) | (11,412) | (591) | (88,593) | |||||||||||||||||||

| Acquisition costs | (40,069) | (6,894) | 1 | (46,962) | |||||||||||||||||||

| Other underwriting expenses | (5,446) | (2,026) | — | (7,472) | |||||||||||||||||||

Deposit interest expense, net |

(94) | — | — | (94) | |||||||||||||||||||

| Underwriting income (loss) | 22,228 | 668 | (598) | 22,298 | |||||||||||||||||||

| Net investment income (loss) | 5,623 | (11,270) | 2,697 | (2,950) | |||||||||||||||||||

| Corporate and other expenses | — | (724) | (4,675) | (5,399) | |||||||||||||||||||

Income (loss) from investment in Solasglas |

(14,404) | (14,404) | |||||||||||||||||||||

| Foreign exchange gains (losses) | (1,994) | (1,994) | |||||||||||||||||||||

| Interest expense | (1,430) | (1,430) | |||||||||||||||||||||

| Income (loss) before income taxes | $ | 27,851 | $ | (11,326) | $ | (20,404) | $ | (3,879) | |||||||||||||||

| Underwriting ratios: | |||||||||||||||||||||||

| Loss ratio | 53.0 | % | 54.3 | % | NM* | 53.6 | % | ||||||||||||||||

| Acquisition cost ratio | 27.7 | % | 32.8 | % | NM* | 28.4 | % | ||||||||||||||||

| Composite ratio | 80.7 | % | 87.1 | % | NM* | 82.0 | % | ||||||||||||||||

| Underwriting expenses ratio | 3.8 | % | 9.6 | % | NM* | 4.6 | % | ||||||||||||||||

| Combined ratio | 84.5 | % | 96.7 | % | NM* | 86.6 | % | ||||||||||||||||

| Open Market | Innovations | Corporate | Total Consolidated | ||||||||||||||||||||

| Gross premiums written | $ | 150,331 | $ | 18,675 | $ | (660) | $ | 168,346 | |||||||||||||||

| Net premiums written | $ | 128,238 | $ | 14,170 | $ | (660) | $ | 141,748 | |||||||||||||||

| Net premiums earned | $ | 126,577 | $ | 21,793 | $ | 3,514 | $ | 151,884 | |||||||||||||||

Net loss and LAE incurred |

(76,177) | (12,223) | (4,765) | (93,165) | |||||||||||||||||||

| Acquisition costs | (38,223) | (6,963) | (976) | (46,162) | |||||||||||||||||||

| Other underwriting expenses | (4,871) | (1,202) | — | (6,073) | |||||||||||||||||||

Deposit interest income, net |

(377) | — | — | (377) | |||||||||||||||||||

| Underwriting income (loss) | 6,929 | 1,405 | (2,227) | 6,107 | |||||||||||||||||||

| Net investment income | 9,360 | 253 | 841 | 10,454 | |||||||||||||||||||

| Corporate and other expenses | — | (608) | (3,645) | (4,253) | |||||||||||||||||||

| Income from investment in Solasglas | 19,844 | 19,844 | |||||||||||||||||||||

| Foreign exchange gains (losses) | 5,826 | 5,826 | |||||||||||||||||||||

| Interest expense | (2,018) | (2,018) | |||||||||||||||||||||

| Income (loss) before income taxes | $ | 16,289 | $ | 1,050 | $ | 18,621 | $ | 35,960 | |||||||||||||||

| Underwriting ratios: | |||||||||||||||||||||||

| Loss ratio | 60.2 | % | 56.1 | % | 135.6 | % | 61.3 | % | |||||||||||||||

| Acquisition cost ratio | 30.2 | % | 32.0 | % | 27.8 | % | 30.4 | % | |||||||||||||||

| Composite ratio | 90.4 | % | 88.1 | % | 163.4 | % | 91.7 | % | |||||||||||||||

| Underwriting expenses ratio | 4.1 | % | 5.5 | % | — | % | 4.2 | % | |||||||||||||||

| Combined ratio | 94.5 | % | 93.6 | % | 163.4 | % | 95.9 | % | |||||||||||||||

| Open Market | Innovations | Corporate | Total Consolidated | ||||||||||||||||||||

| Gross premiums written | $ | 528,036 | $ | 84,455 | $ | (541) | $ | 611,950 | |||||||||||||||

| Net premiums written | $ | 478,092 | $ | 69,005 | $ | (491) | $ | 546,606 | |||||||||||||||

| Net premiums earned | $ | 434,622 | $ | 61,391 | $ | (490) | $ | 495,523 | |||||||||||||||

Net loss and LAE incurred |

(272,828) | (37,002) | (1,726) | (311,556) | |||||||||||||||||||

| Acquisition costs | (121,850) | (18,939) | 113 | (140,676) | |||||||||||||||||||

| Other underwriting expenses | (15,104) | (5,207) | — | (20,311) | |||||||||||||||||||

Deposit interest expense, net |

(367) | — | — | (367) | |||||||||||||||||||

| Underwriting income (loss) | 24,473 | 243 | (2,103) | 22,613 | |||||||||||||||||||

| Net investment income (loss) | 17,023 | (10,391) | 9,175 | 15,807 | |||||||||||||||||||

| Corporate and other expenses | — | (1,898) | (12,928) | (14,826) | |||||||||||||||||||

Income (loss) from investment in Solasglas |

(483) | (483) | |||||||||||||||||||||

| Foreign exchange gains (losses) | 8,632 | 8,632 | |||||||||||||||||||||

| Interest expense | (4,038) | (4,038) | |||||||||||||||||||||

Income (loss) before income taxes |

$ | 41,496 | $ | (12,046) | $ | (1,745) | $ | 27,705 | |||||||||||||||

| Underwriting ratios: | |||||||||||||||||||||||

| Loss ratio | 62.8 | % | 60.3 | % | -352.2 | % | 62.8 | % | |||||||||||||||

| Acquisition cost ratio | 28.0 | % | 30.8 | % | 23.1 | % | 28.4 | % | |||||||||||||||

| Composite ratio | 90.8 | % | 91.1 | % | -329.1 | % | 91.2 | % | |||||||||||||||

| Underwriting expenses ratio | 3.6 | % | 8.5 | % | — | % | 4.2 | % | |||||||||||||||

| Combined ratio | 94.4 | % | 99.6 | % | -329.1 | % | 95.4 | % | |||||||||||||||

| Open Market | Innovations | Corporate | Total Consolidated | ||||||||||||||||||||

| Gross premiums written | $ | 480,703 | $ | 74,062 | $ | (186) | $ | 554,579 | |||||||||||||||

| Net premiums written | $ | 427,539 | $ | 62,626 | $ | (197) | $ | 489,968 | |||||||||||||||

| Net premiums earned | $ | 384,052 | $ | 67,338 | $ | 20,428 | $ | 471,818 | |||||||||||||||

Net loss and LAE incurred |

(236,280) | (38,984) | (29,260) | (304,524) | |||||||||||||||||||

| Acquisition costs | (112,313) | (21,422) | (4,491) | (138,226) | |||||||||||||||||||

| Other underwriting expenses | (15,165) | (3,058) | — | (18,223) | |||||||||||||||||||

Deposit interest expense, net |

(1,020) | — | — | (1,020) | |||||||||||||||||||

| Underwriting income (loss) | 19,274 | 3,874 | (13,323) | 9,825 | |||||||||||||||||||

| Net investment income | 31,758 | 436 | 2,386 | 34,580 | |||||||||||||||||||

| Corporate and other expenses | — | (2,008) | (11,326) | (13,334) | |||||||||||||||||||

| Income from investment in Solasglas | 42,422 | 42,422 | |||||||||||||||||||||

| Foreign exchange gains (losses) | 3,245 | 3,245 | |||||||||||||||||||||

| Interest expense | (4,827) | (4,827) | |||||||||||||||||||||

| Income (loss) before income taxes | $ | 51,032 | $ | 2,302 | $ | 18,577 | $ | 71,911 | |||||||||||||||

| Underwriting ratios: | |||||||||||||||||||||||

| Loss ratio | 61.5 | % | 57.9 | % | 143.2 | % | 64.5 | % | |||||||||||||||

| Acquisition cost ratio | 29.2 | % | 31.8 | % | 22.0 | % | 29.3 | % | |||||||||||||||

| Composite ratio | 90.7 | % | 89.7 | % | 165.2 | % | 93.8 | % | |||||||||||||||

| Underwriting expenses ratio | 4.2 | % | 4.5 | % | — | % | 4.1 | % | |||||||||||||||

| Combined ratio | 94.9 | % | 94.2 | % | 165.2 | % | 97.9 | % | |||||||||||||||

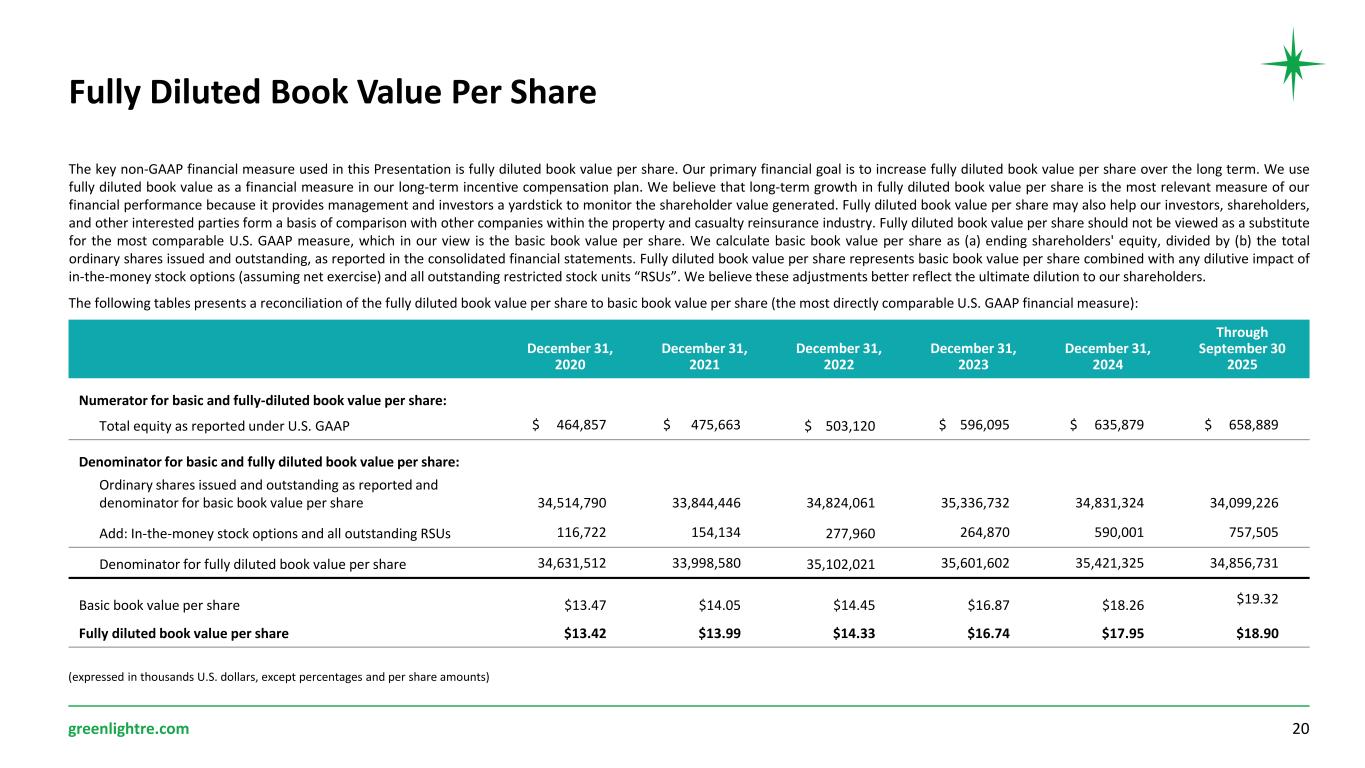

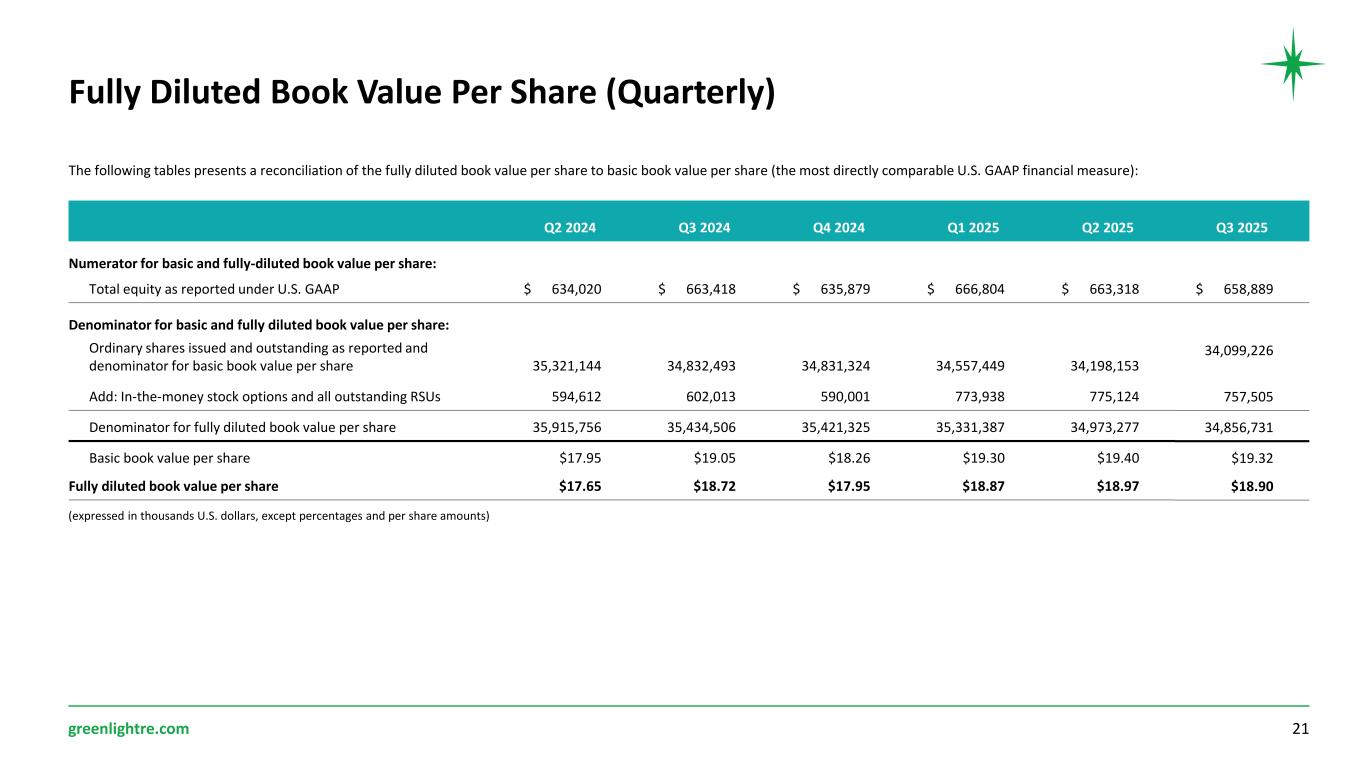

| September 30, 2025 | June 30, 2025 | March 31, 2025 | December 31, 2024 | September 30, 2024 | |||||||||||||||||||||||||

| Numerator for basic and fully diluted book value per share: | |||||||||||||||||||||||||||||

| Total equity as reported under U.S. GAAP | $ | 658,889 | $ | 663,318 | $ | 666,804 | $ | 635,879 | $ | 663,418 | |||||||||||||||||||

Denominator for basic and fully diluted book value per share: |

|||||||||||||||||||||||||||||

Ordinary shares issued and outstanding as reported and denominator for basic book value per share |

34,099,226 | 34,198,153 | 34,557,449 | 34,831,324 | 34,832,493 | ||||||||||||||||||||||||

Add: In-the-money stock options (1) and all outstanding RSUs |

757,505 | 775,124 | 773,938 | 590,001 | 602,013 | ||||||||||||||||||||||||

| Denominator for fully diluted book value per share | 34,856,731 | 34,973,277 | 35,331,387 | 35,421,325 | 35,434,506 | ||||||||||||||||||||||||

| Basic book value per share | $ | 19.32 | $ | 19.40 | $ | 19.30 | $ | 18.26 | $ | 19.05 | |||||||||||||||||||

| Fully diluted book value per share | $ | 18.90 | $ | 18.97 | $ | 18.87 | $ | 17.95 | $ | 18.72 | |||||||||||||||||||