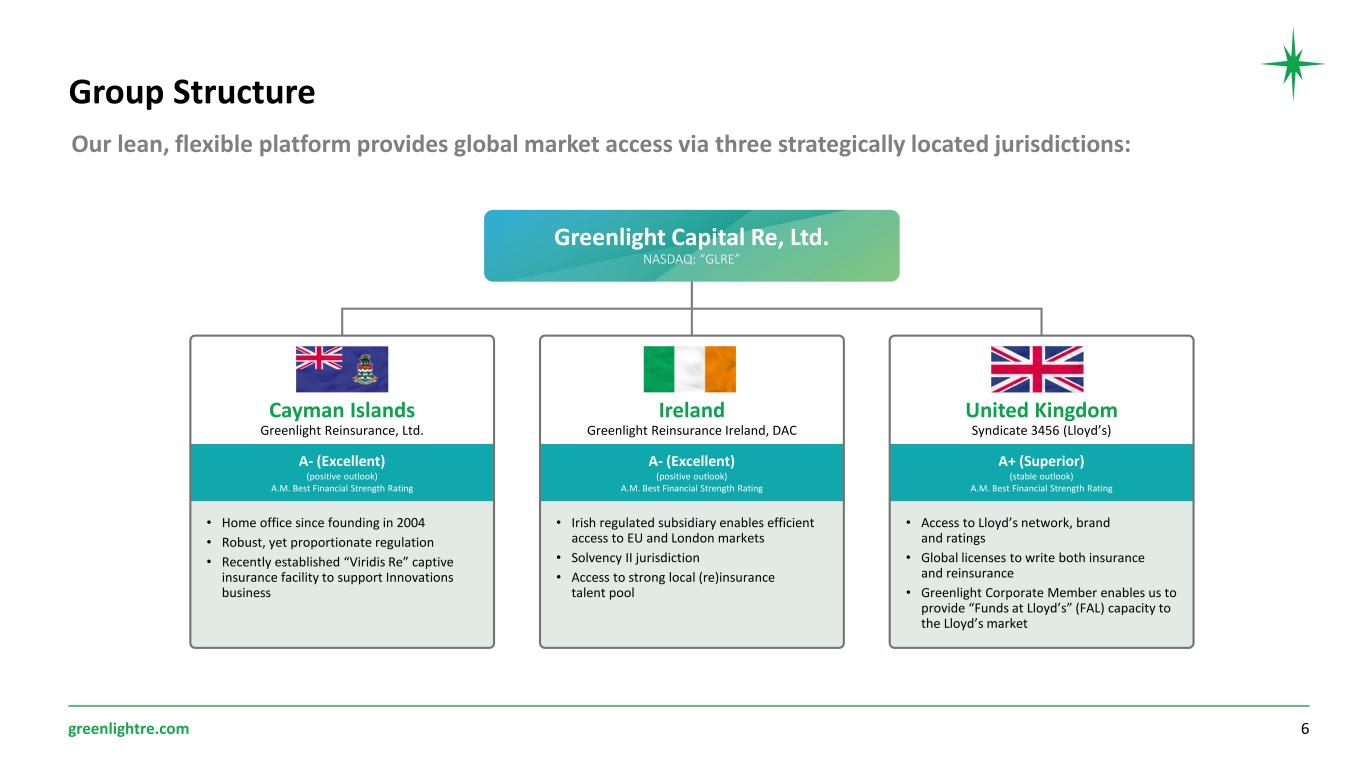

| Cayman Islands | 001-33493 | N/A | ||||||

|

(State or other jurisdiction of incorporation)

|

(Commission file number)

|

(IRS employer identification no.)

|

||||||

| 65 Market Street | ||||||||

| Suite 1207, Jasmine Court | ||||||||

| P.O. Box 31110 | ||||||||

| Camana Bay | ||||||||

| Grand Cayman | ||||||||

| Cayman Islands | KY1-1205 | |||||||

| (Address of principal executive offices) | (Zip code) | |||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |||||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Ordinary Shares | GLRE | Nasdaq Global Select Market | ||||||

| Director | For |

Against |

Abstain |

Broker non-votes | ||||||||||||||||||||||

| Greg Richardson | 21,985,408 | 807,645 | 2,914 | 4,793,289 | ||||||||||||||||||||||

| David Einhorn | 21,892,612 | 900,341 | 3,014 | 4,793,289 | ||||||||||||||||||||||

| Johnny Ferrari | 21,783,652 | 1,004,115 | 8,200 | 4,793,289 | ||||||||||||||||||||||

| Ursuline Foley | 22,039,122 | 724,892 | 31,953 | 4,793,289 | ||||||||||||||||||||||

| Leonard Goldberg | 21,435,761 | 1,329,192 | 31,014 | 4,793,289 | ||||||||||||||||||||||

| Victoria Guest | 20,963,797 | 1,143,682 | 688,488 | 4,793,289 | ||||||||||||||||||||||

| Ian Isaacs | 21,661,025 | 1,130,928 | 4,014 | 4,793,289 | ||||||||||||||||||||||

| Bryan Murphy | 21,661,948 | 1,131,005 | 3,014 | 4,793,289 | ||||||||||||||||||||||

| Joseph Platt | 21,430,136 | 1,361,817 | 4,014 | 4,793,289 | ||||||||||||||||||||||

| Daniel Roitman | 21,802,102 | 876,121 | 117,744 | 4,793,289 | ||||||||||||||||||||||

| For | 27,435,465 | |||||||

| Against | 123,620 | |||||||

| Abstain | 30,171 | |||||||

| Broker non-votes | — | |||||||

| For | 20,710,729 | ||||

| Against | 1,840,506 | ||||

| Abstain | 244,732 | ||||

| Broker non-votes | 4,793.289 | ||||

| Exhibit No. | Description of Exhibit | |||||||

| 99.1 | Earnings press release, "GREENLIGHT RE ANNOUNCES FINANCIAL RESULTS FOR SECOND QUARTER AND SIX MONTHS ENDED JUNE 30, 2025", dated August 4, 2025, issued by the Registrant. |

|||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |||||||

| GREENLIGHT CAPITAL RE, LTD. | ||||||||

| (Registrant) | ||||||||

| By: | /s/ Steven Archambault | |||||||

| Name: | Steven Archambault | |||||||

| Title: | Chief Accounting Officer | |||||||

| Date: | August 4, 2025 | |||||||

| June 30, 2025 | December 31, 2024 | ||||||||||

| (Unaudited) | |||||||||||

| Assets | |||||||||||

| Investments | |||||||||||

| Investment in related party investment fund, at fair value | $ | 461,265 | $ | 387,144 | |||||||

| Other investments | 76,036 | 73,160 | |||||||||

| Total investments | 537,301 | 460,304 | |||||||||

| Cash and cash equivalents | 82,362 | 64,685 | |||||||||

| Restricted cash and cash equivalents | 576,698 | 584,402 | |||||||||

| Reinsurance balances receivable (net of allowance for expected credit losses) | 755,296 | 704,483 | |||||||||

| Loss and loss adjustment expenses recoverable (net of allowance for expected credit losses) | 93,971 | 85,790 | |||||||||

| Deferred acquisition costs | 98,816 | 82,249 | |||||||||

| Unearned premiums ceded | 36,623 | 29,545 | |||||||||

| Other assets | 6,957 | 4,765 | |||||||||

| Total assets | $ | 2,188,024 | $ | 2,016,223 | |||||||

| Liabilities and equity | |||||||||||

| Liabilities | |||||||||||

| Loss and loss adjustment expense reserves | $ | 944,985 | $ | 860,969 | |||||||

| Unearned premium reserves | 383,424 | 324,551 | |||||||||

| Reinsurance balances payable | 106,103 | 105,892 | |||||||||

| Funds withheld | 22,577 | 21,878 | |||||||||

| Other liabilities | 8,728 | 6,305 | |||||||||

| Debt | 58,889 | 60,749 | |||||||||

| Total liabilities | 1,524,706 | 1,380,344 | |||||||||

| Shareholders' equity | |||||||||||

Ordinary share capital (par value $0.10; issued and outstanding, 34,198,153) (2024: par value $0.10; issued and outstanding, 34,831,324) |

$ | 3,420 | $ | 3,483 | |||||||

| Additional paid-in capital | 479,097 | 481,551 | |||||||||

| Retained earnings | 180,801 | 150,845 | |||||||||

| Total shareholders' equity | 663,318 | 635,879 | |||||||||

| Total liabilities and equity | $ | 2,188,024 | $ | 2,016,223 | |||||||

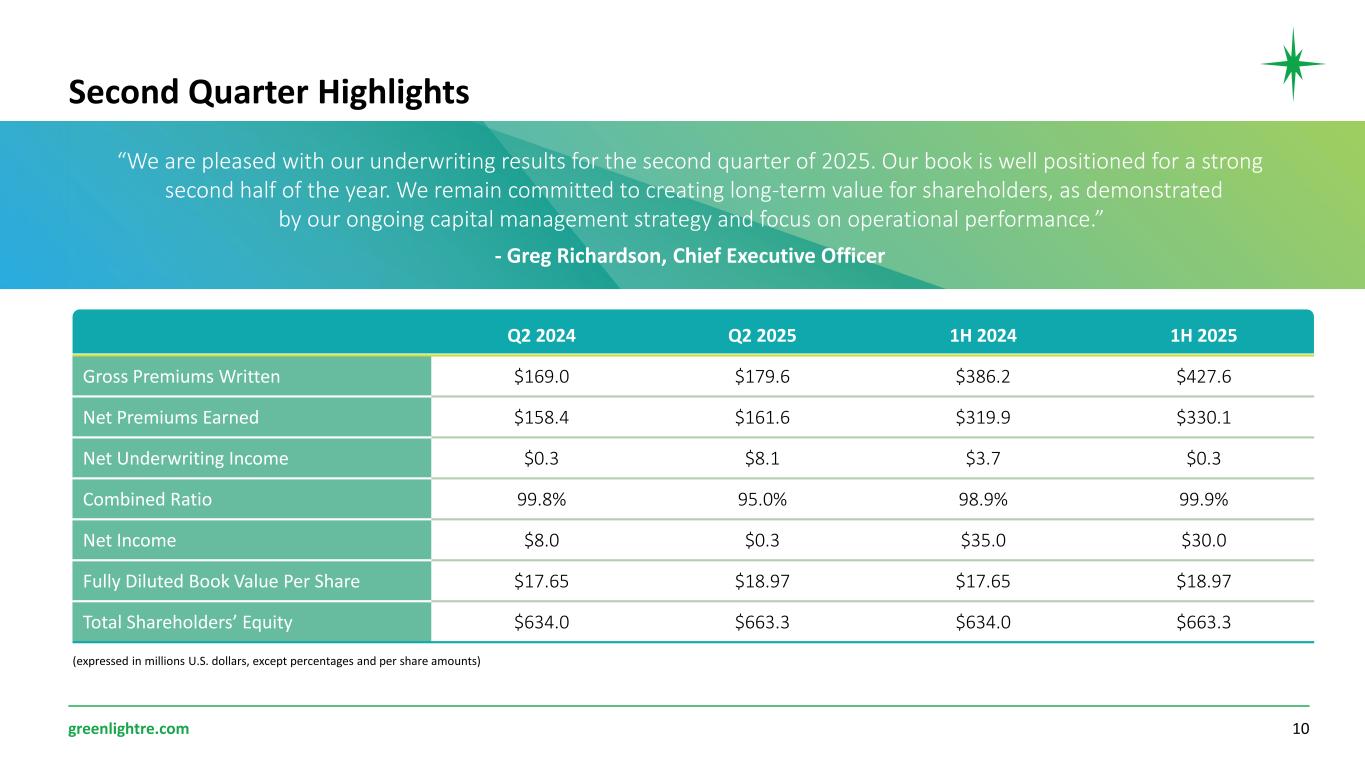

| Three months ended June 30 | Six months ended June 30 | |||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||||

| Underwriting results: | ||||||||||||||||||||||||||

| Gross premiums written | $ | 179,628 | $ | 168,975 | $ | 427,573 | $ | 386,233 | ||||||||||||||||||

| Gross premiums ceded | (15,101) | (14,832) | (43,649) | (38,013) | ||||||||||||||||||||||

| Net premiums written | 164,527 | 154,143 | 383,924 | 348,220 | ||||||||||||||||||||||

| Change in net unearned premium reserves | (2,886) | 4,255 | (53,820) | (28,286) | ||||||||||||||||||||||

| Net premiums earned | $ | 161,641 | $ | 158,398 | $ | 330,104 | $ | 319,934 | ||||||||||||||||||

Net loss and LAE incurred: |

||||||||||||||||||||||||||

| Current year | $ | (97,032) | $ | (102,722) | $ | (215,698) | $ | (206,647) | ||||||||||||||||||

| Prior year | (3,047) | 689 | (7,265) | (4,712) | ||||||||||||||||||||||

Net loss and LAE incurred |

(100,079) | (102,033) | (222,963) | (211,359) | ||||||||||||||||||||||

| Acquisition costs | (46,848) | (50,454) | (93,714) | (92,064) | ||||||||||||||||||||||

| Underwriting expenses | (6,481) | (5,811) | (12,839) | (12,150) | ||||||||||||||||||||||

Deposit interest income (expense), net |

(124) | 233 | (273) | (643) | ||||||||||||||||||||||

Net underwriting income |

$ | 8,109 | $ | 333 | $ | 315 | $ | 3,718 | ||||||||||||||||||

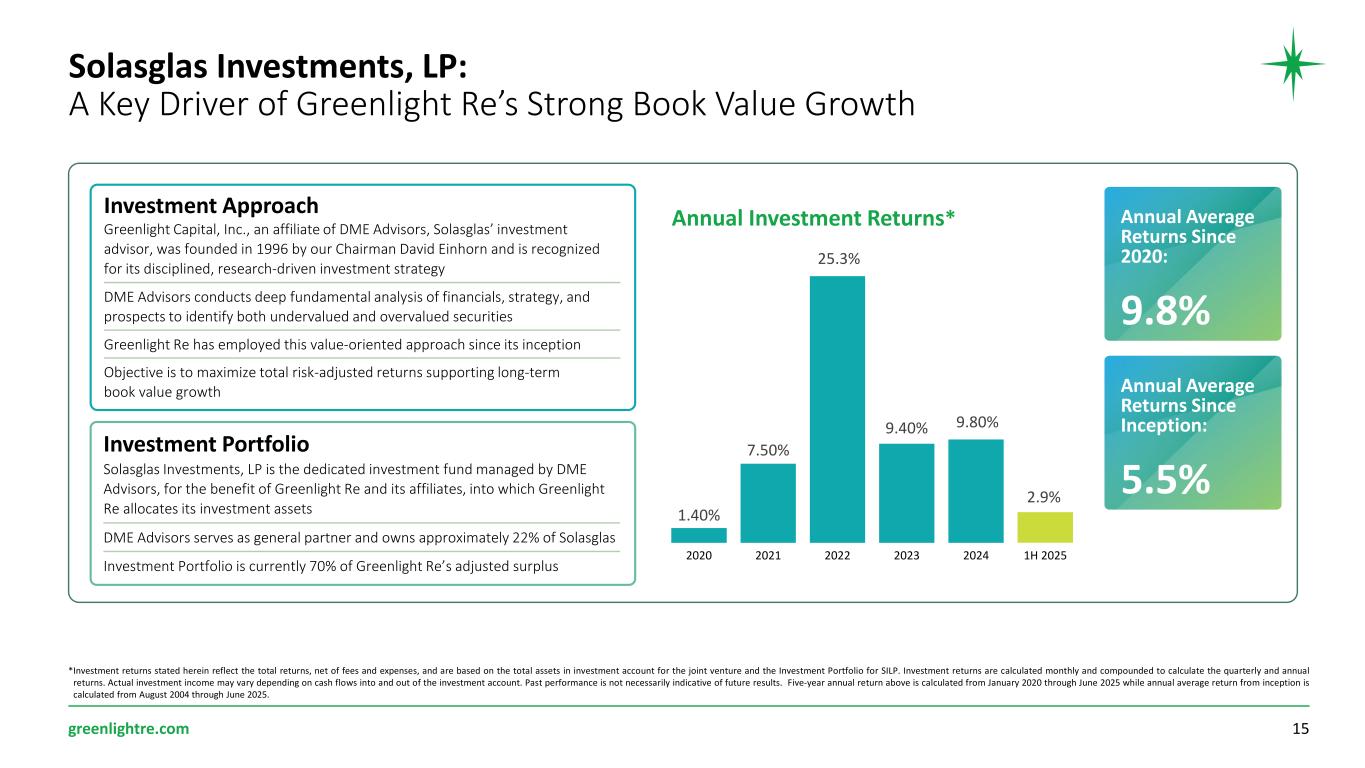

Income from investment in Solasglas |

$ | (18,276) | $ | 4,330 | $ | 13,921 | $ | 22,578 | ||||||||||||||||||

| Net investment income | 10,470 | 10,948 | 18,757 | 24,126 | ||||||||||||||||||||||

| Total investment income (loss) | $ | (7,806) | $ | 15,278 | $ | 32,678 | $ | 46,704 | ||||||||||||||||||

| Corporate and other expenses | $ | (4,755) | $ | (4,706) | $ | (9,427) | $ | (9,081) | ||||||||||||||||||

| Foreign exchange gains (losses) | 6,271 | (932) | 10,626 | (2,581) | ||||||||||||||||||||||

| Interest expense | (1,144) | (1,560) | (2,608) | (2,809) | ||||||||||||||||||||||

| Income before income tax | 675 | 8,413 | 31,584 | 35,951 | ||||||||||||||||||||||

| Income tax expense | (346) | (435) | (1,628) | (954) | ||||||||||||||||||||||

| Net income | $ | 329 | $ | 7,978 | $ | 29,956 | $ | 34,997 | ||||||||||||||||||

Earnings per share |

||||||||||||||||||||||||||

| Basic | $ | 0.01 | $ | 0.23 | $ | 0.88 | $ | 1.02 | ||||||||||||||||||

| Diluted | $ | 0.01 | $ | 0.23 | $ | 0.87 | $ | 1.01 | ||||||||||||||||||

Underwriting ratios: |

||||||||||||||||||||||||||

Current year loss ratio |

60.0 | % | 64.9 | % | 65.3 | % | 64.6 | % | ||||||||||||||||||

Prior year reserve development ratio |

1.9 | % | (0.4) | % | 2.2 | % | 1.5 | % | ||||||||||||||||||

| Loss ratio | 61.9 | % | 64.5 | % | 67.5 | % | 66.1 | % | ||||||||||||||||||

| Acquisition cost ratio | 29.0 | % | 31.9 | % | 28.4 | % | 28.8 | % | ||||||||||||||||||

| Composite ratio | 90.9 | % | 96.4 | % | 95.9 | % | 94.9 | % | ||||||||||||||||||

| Underwriting expense ratio | 4.1 | % | 3.5 | % | 4.0 | % | 4.0 | % | ||||||||||||||||||

| Combined ratio | 95.0 | % | 99.9 | % | 99.9 | % | 98.9 | % | ||||||||||||||||||

| Open Market | Innovations | Corporate | Total Consolidated | ||||||||||||||||||||

| Gross premiums written | $ | 152,333 | $ | 27,596 | $ | (301) | $ | 179,628 | |||||||||||||||

| Net premiums written | $ | 142,111 | $ | 22,716 | $ | (300) | $ | 164,527 | |||||||||||||||

| Net premiums earned | $ | 140,554 | $ | 21,386 | $ | (299) | $ | 161,641 | |||||||||||||||

Net loss and LAE incurred |

(83,475) | (15,244) | (1,360) | (100,079) | |||||||||||||||||||

| Acquisition costs | (40,900) | (6,012) | 64 | (46,848) | |||||||||||||||||||

| Other underwriting expenses | (4,861) | (1,620) | — | (6,481) | |||||||||||||||||||

Deposit interest expense, net |

(124) | — | — | (124) | |||||||||||||||||||

| Underwriting income (loss) | 11,194 | (1,490) | (1,595) | 8,109 | |||||||||||||||||||

| Net investment income | 5,629 | 431 | 4,410 | 10,470 | |||||||||||||||||||

| Corporate and other expenses | — | (602) | (4,153) | (4,755) | |||||||||||||||||||

Income (loss) from investment in Solasglas |

(18,276) | (18,276) | |||||||||||||||||||||

| Foreign exchange gains (losses) | 6,271 | 6,271 | |||||||||||||||||||||

| Interest expense | (1,144) | (1,144) | |||||||||||||||||||||

| Income (loss) before income taxes | $ | 16,823 | $ | (1,661) | $ | (14,487) | $ | 675 | |||||||||||||||

| Underwriting ratios: | |||||||||||||||||||||||

| Loss ratio | 59.4 | % | 71.3 | % | -454.8 | % | 61.9 | % | |||||||||||||||

| Acquisition cost ratio | 29.1 | % | 28.1 | % | 21.4 | % | 29.0 | % | |||||||||||||||

| Composite ratio | 88.5 | % | 99.4 | % | -433.4 | % | 90.9 | % | |||||||||||||||

| Underwriting expenses ratio | 3.5 | % | 7.6 | % | — | % | 4.1 | % | |||||||||||||||

| Combined ratio | 92.0 | % | 107.0 | % | -433.4 | % | 95.0 | % | |||||||||||||||

| Open Market | Innovations | Corporate | Total Consolidated | ||||||||||||||||||||

| Gross premiums written | $ | 143,311 | $ | 25,319 | $ | 345 | $ | 168,975 | |||||||||||||||

| Net premiums written | $ | 131,585 | $ | 22,212 | $ | 346 | $ | 154,143 | |||||||||||||||

| Net premiums earned | $ | 125,865 | $ | 25,348 | $ | 7,185 | $ | 158,398 | |||||||||||||||

Net loss and LAE incurred |

(73,403) | (13,634) | (14,996) | (102,033) | |||||||||||||||||||

| Acquisition costs | (40,511) | (8,406) | (1,537) | (50,454) | |||||||||||||||||||

| Other underwriting expenses | (4,816) | (995) | — | (5,811) | |||||||||||||||||||

Deposit interest income, net |

233 | — | — | 233 | |||||||||||||||||||

| Underwriting income (loss) | 7,368 | 2,313 | (9,348) | 333 | |||||||||||||||||||

| Net investment income | 9,782 | 366 | 800 | 10,948 | |||||||||||||||||||

| Corporate and other expenses | — | (810) | (3,896) | (4,706) | |||||||||||||||||||

| Income from investment in Solasglas | 4,330 | 4,330 | |||||||||||||||||||||

| Foreign exchange gains (losses) | (932) | (932) | |||||||||||||||||||||

| Interest expense | (1,560) | (1,560) | |||||||||||||||||||||

| Income (loss) before income taxes | $ | 17,150 | $ | 1,869 | $ | (10,606) | $ | 8,413 | |||||||||||||||

| Underwriting ratios: | |||||||||||||||||||||||

| Loss ratio | 58.3 | % | 53.8 | % | 208.7 | % | 64.5 | % | |||||||||||||||

| Acquisition cost ratio | 32.2 | % | 33.2 | % | 21.4 | % | 31.9 | % | |||||||||||||||

| Composite ratio | 90.5 | % | 87.0 | % | 230.1 | % | 96.4 | % | |||||||||||||||

| Underwriting expenses ratio | 3.6 | % | 3.9 | % | — | % | 3.5 | % | |||||||||||||||

| Combined ratio | 94.1 | % | 90.9 | % | 230.1 | % | 99.9 | % | |||||||||||||||

| Six months ended June 30, 2025: | Open Market | Innovations | Corporate | Total Consolidated | |||||||||||||||||||

| Gross premiums written | $ | 373,042 | $ | 55,062 | $ | (531) | $ | 427,573 | |||||||||||||||

| Net premiums written | $ | 337,720 | $ | 46,687 | $ | (483) | $ | 383,924 | |||||||||||||||

| Net premiums earned | $ | 290,195 | $ | 40,391 | $ | (482) | $ | 330,104 | |||||||||||||||

Net loss and LAE incurred |

(196,238) | (25,590) | (1,135) | (222,963) | |||||||||||||||||||

| Acquisition costs | (81,781) | (12,045) | 112 | (93,714) | |||||||||||||||||||

| Other underwriting expenses | (9,658) | (3,181) | — | (12,839) | |||||||||||||||||||

Deposit interest expense, net |

(273) | — | — | (273) | |||||||||||||||||||

| Underwriting income (loss) | 2,245 | (425) | (1,505) | 315 | |||||||||||||||||||

| Net investment income | 11,400 | 879 | 6,478 | 18,757 | |||||||||||||||||||

| Corporate and other expenses | — | (1,174) | (8,253) | (9,427) | |||||||||||||||||||

| Income from investment in Solasglas | 13,921 | 13,921 | |||||||||||||||||||||

| Foreign exchange gains (losses) | 10,626 | 10,626 | |||||||||||||||||||||

| Interest expense | (2,608) | (2,608) | |||||||||||||||||||||

Income (loss) before income taxes |

$ | 13,645 | $ | (720) | $ | 18,659 | $ | 31,584 | |||||||||||||||

| Underwriting ratios: | |||||||||||||||||||||||

| Loss ratio | 67.6 | % | 63.4 | % | -235.5 | % | 67.5 | % | |||||||||||||||

| Acquisition cost ratio | 28.2 | % | 29.8 | % | 23.2 | % | 28.4 | % | |||||||||||||||

| Composite ratio | 95.8 | % | 93.2 | % | -212.3 | % | 95.9 | % | |||||||||||||||

| Underwriting expenses ratio | 3.4 | % | 7.9 | % | — | % | 4.0 | % | |||||||||||||||

| Combined ratio | 99.2 | % | 101.1 | % | -212.3 | % | 99.9 | % | |||||||||||||||

Six months ended June 30, 2024: |

Open Market | Innovations | Corporate | Total Consolidated | |||||||||||||||||||

| Gross premiums written | $ | 330,372 | $ | 55,387 | $ | 474 | $ | 386,233 | |||||||||||||||

| Net premiums written | $ | 299,301 | $ | 48,456 | $ | 463 | $ | 348,220 | |||||||||||||||

| Net premiums earned | $ | 257,475 | $ | 45,545 | $ | 16,914 | $ | 319,934 | |||||||||||||||

Net loss and LAE incurred |

(160,103) | (26,761) | (24,495) | (211,359) | |||||||||||||||||||

| Acquisition costs | (74,090) | (14,459) | (3,515) | (92,064) | |||||||||||||||||||

| Other underwriting expenses | (10,294) | (1,856) | — | (12,150) | |||||||||||||||||||

Deposit interest expense, net |

(643) | — | — | (643) | |||||||||||||||||||

| Underwriting income (loss) | 12,345 | 2,469 | (11,096) | 3,718 | |||||||||||||||||||

| Net investment income | 22,398 | 183 | 1,545 | 24,126 | |||||||||||||||||||

| Corporate and other expenses | — | (1,400) | (7,681) | (9,081) | |||||||||||||||||||

| Income from investment in Solasglas | 22,578 | 22,578 | |||||||||||||||||||||

| Foreign exchange gains (losses) | (2,581) | (2,581) | |||||||||||||||||||||

| Interest expense | (2,809) | (2,809) | |||||||||||||||||||||

| Income (loss) before income taxes | $ | 34,743 | $ | 1,252 | $ | (44) | $ | 35,951 | |||||||||||||||

| Underwriting ratios: | |||||||||||||||||||||||

| Loss ratio | 62.2 | % | 58.8 | % | 144.8 | % | 66.1 | % | |||||||||||||||

| Acquisition cost ratio | 28.8 | % | 31.7 | % | 20.8 | % | 28.8 | % | |||||||||||||||

| Composite ratio | 91.0 | % | 90.5 | % | 165.6 | % | 94.9 | % | |||||||||||||||

| Underwriting expenses ratio | 4.2 | % | 4.1 | % | — | % | 4.0 | % | |||||||||||||||

| Combined ratio | 95.2 | % | 94.6 | % | 165.6 | % | 98.9 | % | |||||||||||||||

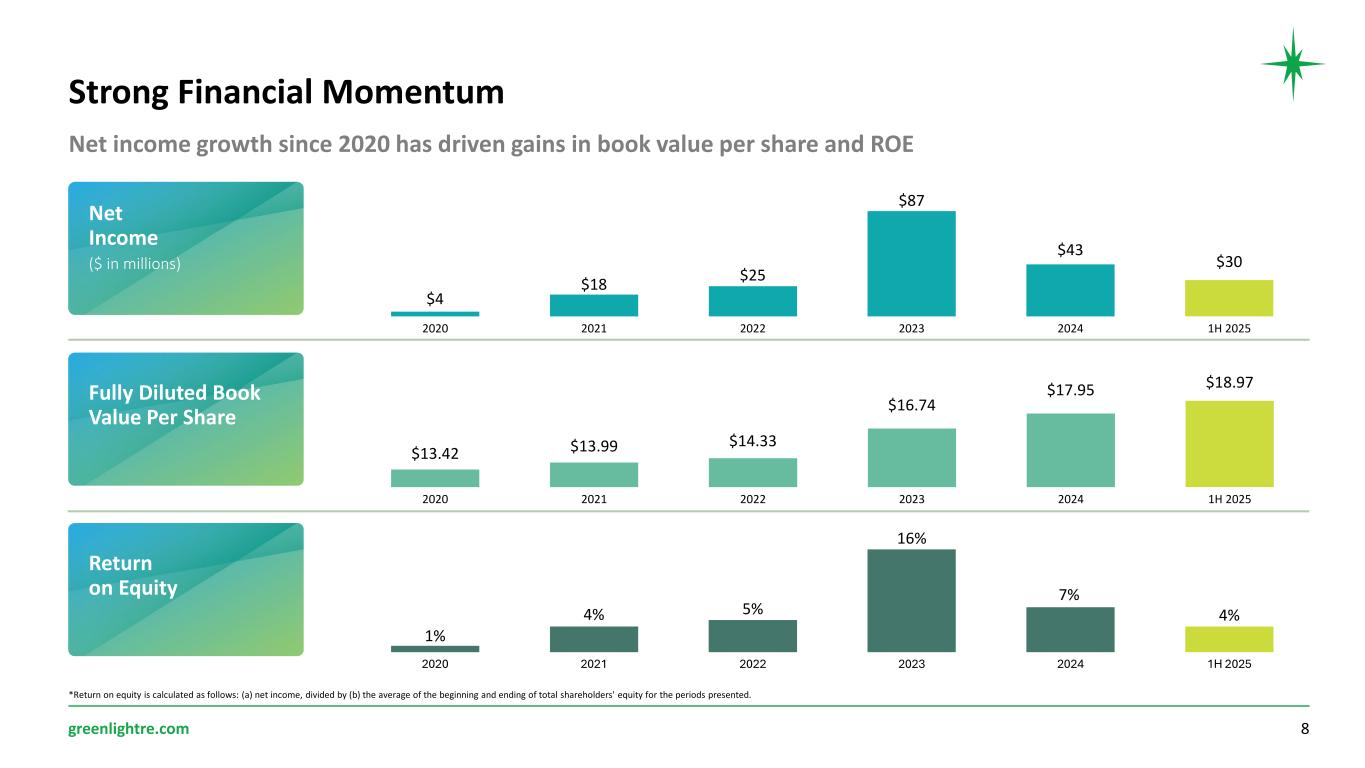

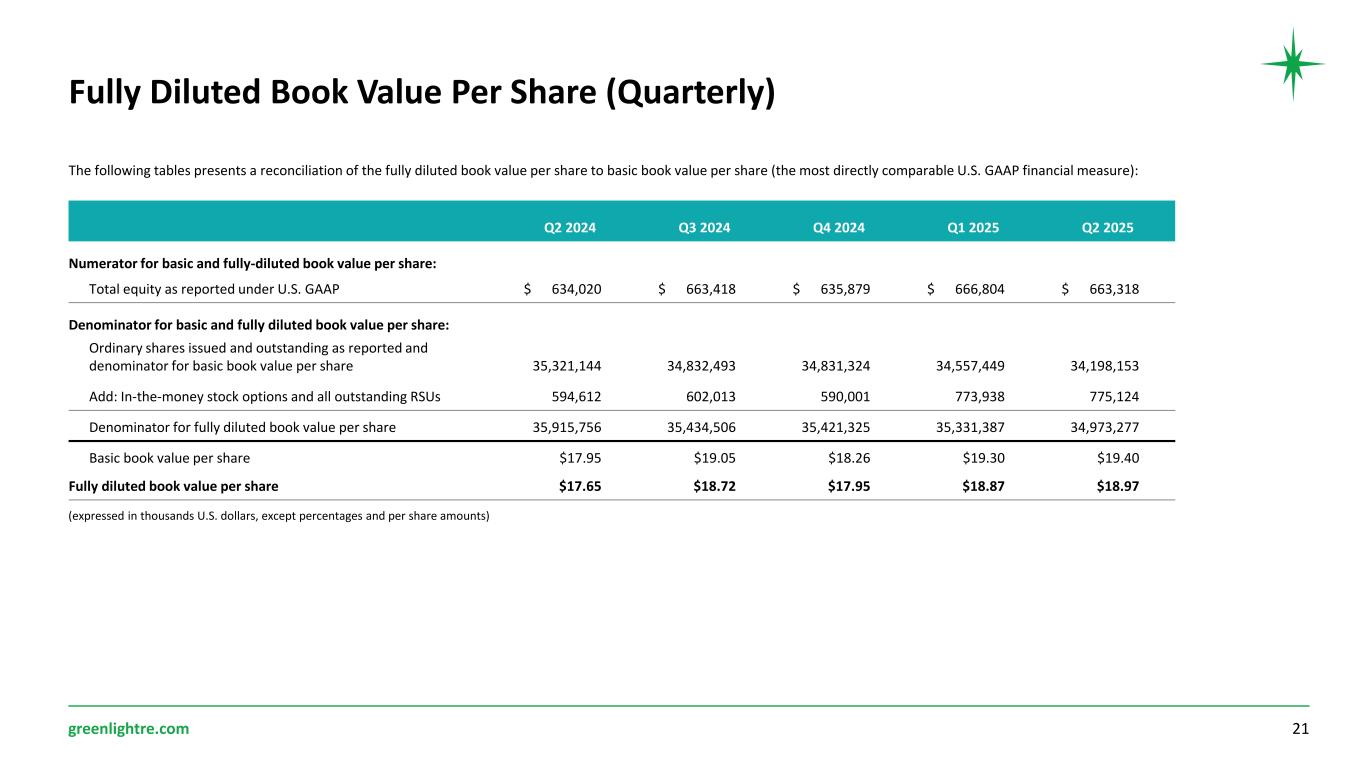

| June 30, 2025 | March 31, 2025 | December 31, 2024 | September 30, 2024 | June 30, 2024 | |||||||||||||||||||||||||

| Numerator for basic and fully diluted book value per share: | |||||||||||||||||||||||||||||

| Total equity as reported under U.S. GAAP | $ | 663,318 | $ | 666,804 | $ | 635,879 | $ | 663,418 | $ | 634,020 | |||||||||||||||||||

Denominator for basic and fully diluted book value per share: |

|||||||||||||||||||||||||||||

| Ordinary shares issued and outstanding as reported and denominator for basic book value per share | 34,198,153 | 34,557,449 | 34,831,324 | 34,832,493 | 35,321,144 | ||||||||||||||||||||||||

Add: In-the-money stock options (1) and all outstanding RSUs |

775,124 | 773,938 | 590,001 | 602,013 | 594,612 | ||||||||||||||||||||||||

| Denominator for fully diluted book value per share | 34,973,277 | 35,331,387 | 35,421,325 | 35,434,506 | 35,915,756 | ||||||||||||||||||||||||

| Basic book value per share | $ | 19.40 | $ | 19.30 | $ | 18.26 | $ | 19.05 | $ | 17.95 | |||||||||||||||||||

| Fully diluted book value per share | $ | 18.97 | $ | 18.87 | $ | 17.95 | $ | 18.72 | $ | 17.65 | |||||||||||||||||||