Document

EXHIBIT 99.1

Citizens Community Bancorp, Inc. Reports Third Quarter 2025 Earnings of $0.37 Per Share; Redeems $15 Million of Subordinated Debt

EAU CLAIRE, WI, October 27, 2025 - Citizens Community Bancorp, Inc. (the “Company”) (Nasdaq: CZWI), the parent company of Citizens Community Federal N.A. (the “Bank” or “CCFBank”), today reported earnings of $3.7 million and earnings per diluted share of $0.37 for the third quarter ended September 30, 2025, compared to $3.3 million and earnings per diluted share of $0.33 for the second quarter ended June 30, 2025, and $3.3 million and $0.32 earnings per diluted share for the quarter ended September 30, 2024, respectively. For the nine months ended September 30, 2025, the Company reported earnings of $10.1 million and earnings per diluted share of $1.02 compared to the prior year period of $11.0 million and earnings per diluted share of $1.07.

The Company’s improved third quarter 2025 operating results reflected the following changes from the second quarter of 2025: (1) a decrease in net interest income of $0.1 million, due to a decrease of $0.7 million in the recognition of interest income from loan payoffs, partially offset by a $0.4 million increase from higher asset yields and lower deposit costs and one more day of interest income; (2) lower provision for credit losses of $0.65 million compared to a $1.35 million provision in the second quarter; (3) higher non-interest income of $0.2 million; and (4) higher non-interest expense of $0.3 million.

Book value per share improved to $18.95 at September 30, 2025, compared to $18.36 at June 30, 2025, and $17.88 at September 30, 2024. Tangible book value per share (non-GAAP)1 was $15.71 at September 30, 2025, compared to $15.15 at June 30, 2025, and a 7.3% increase from $14.64 at September 30, 2024, with dividends paid of 2.44% of the September 30, 2024 tangible book value. Since September 30, 2024, the Company has paid dividends to shareholders totaling $0.36 per share. For the third quarter of 2025, the increase in tangible book value was primarily due to the increase in net income in the quarter, along with the impact of lower unrealized losses on the available for sale investment portfolio. Stockholders’ equity as a percentage of total assets was 10.82% at September 30, 2025, compared to 10.57% at June 30, 2025. Tangible common equity (“TCE”) as a percent of tangible assets (non-GAAP)1 increased to 9.13% at September 30, 2025, compared to 8.89% at June 30, 2025.

“Earnings met expectations, and capital grew in the quarter strengthening our balance sheet for share buybacks and strategic opportunities. Our tangible capital ratio now exceeds 9.1% and tangible book value increased 3.7% from the linked quarter to $15.71 per share. There was continued expansion in the net interest margin and strong non-interest income was driven by mortgage and SBA gains on sale. Strong credit practices resulted in net loan recoveries of $51 thousand and a $7 million decrease in criticized assets, offset partially by a $3.4 million increase in substandard loans. The ACL, which increased from 1.59% to 1.68% from last quarter, provides 141% coverage of non-performing loans. Unemployment remains below national averages, but middle-income consumers and smaller businesses, who are facing the pressure of higher costs (real estate taxes, insurance) and slowing income growth, are exhibiting increasing stress,” stated Stephen Bianchi, Chairman, President, and Chief Executive Officer.

September 30, 2025, Highlights:

•Quarterly earnings were $3.7 million, or $0.37 per diluted share for the quarter ended September 30, 2025, an increase compared to earnings of $3.3 million, or $0.33 per diluted share for the quarter ended June 30, 2025, and an increase from $3.3 million, or $0.32 per diluted share for the quarter ended September 30, 2024.

•For the nine months ended September 30, 2025, earnings were $10.1 million or $1.02 per diluted share compared to $11.0 million or $1.07 per diluted share for the nine-month period ending September 30, 2024. The decline in earnings for the nine-month period primarily relates to provisions for credit losses for the most recent nine-month period versus negative provisions for credit losses during the nine-month period ending September 30, 2024, as economic variables used by our third-party provider in the calculation of the allowance for credit losses (“ACL”) have begun to normalize in the most recent periods.

•Net interest income decreased $0.1 million to $13.2 million for the current quarter ended September 30, 2025, from $13.3 million for the quarter ended June 30, 2025, and increased from $11.3 million for the quarter ended September 30, 2024. The decrease in net interest income from the second quarter of 2025 was primarily due to: (1) a net decrease of $0.5 million (11 bps) of interest income recognized on the payoffs of nonperforming loans to $0.2 million; (2) a decrease in purchase accretion of $0.3 million (7 bps) to $0.1 million as a result of loan payoffs; (3) the impact of one more day in the quarter on interest income, net of interest expense or $0.1 million, with these impacts removed from items 4 and 5 which follow: (4) higher interest income of $0.2 million (5 bps) on loans and investments due to loans repricing, the impact of new loan originations and mix of investments; (5) a decrease in deposit and borrowing costs of $0.2 million (4 bps); and (6) the impact of an increase in non-interest-bearing deposits (3bp).

•The net interest margin decreased 7 basis points (“bps”) to 3.20% for the quarter ended September 30, 2025, compared to the quarter ended June 30, 2025, and increased 57 bps from the quarter ended September 30, 2024. The basis for the changes in the net interest margin is noted above.

•The provision for credit losses was $0.65 million for the quarter ended September 30, 2025, compared to a provision for credit losses of $1.35 million, and a negative provision for credit losses of $0.4 million during the quarters ended June 30, 2025, and September 30, 2024, respectively. Factors affecting the September 30, 2025, provision for credit losses include: (1) the impact of changes in credit quality, i.e., changes in reserves on impaired loans, and the impact of delinquent loans at June 30, 2025, becoming current at September 30, 2025, of $0.9 million; partially offset by: (2) the net shrinkage in the loan portfolio of approximately $0.1 million; (3) $51 thousand of net recoveries; and (4) a decrease in off-balance sheet commitments from new construction originations of $0.1 million. The allowance for credit losses on loans was $22.2 million or 141% of total nonperforming loans of $15.8 million at September 30, 2025.

•Non-interest income increased by $0.2 million in the third quarter of 2025 to $3.0 million from $2.8 million the prior quarter and $0.1 million from the third quarter of 2024 of $2.9 million. The increase in the third quarter of 2025 from the second quarter was primarily due to higher gains on sale of loans, partially offset by a net loss on the sale of equity securities.

•Non-interest expense increased $0.3 million to $11.1 million from $10.8 million for the previous quarter and increased $0.7 million from $10.4 million for the third quarter of 2024. The increase in non-interest expense compared to the linked quarter was largely due to compensation items, including higher medical costs and modestly higher incentive costs. The $0.7 million increase from the third quarter of 2024 was largely due to higher compensation expense, which includes the annual merit increase impact, higher medical costs and incentive costs along with inflation factors impacting non-interest expense.

•The effective tax rate was 18.8% for the quarter ended September 30, 2025, compared to 19.2% for the quarter ended June 30, 2025, and 21.5% for the quarter ended September 30, 2024.

•Loans receivable decreased $22.6 million during the third quarter ended September 30, 2025, to $1.323 billion compared to the prior quarter end. The decrease was largely due to a reduction in loan originations from the second quarter.

•Nonperforming assets increased $3.7 million during the quarter to $16.7 million at September 30, 2025, compared to $13.0 million at June 30, 2025, largely due to a $9 million multifamily loan moving from special mention to substandard which was partially offset by a $5 million payoff of an agricultural loan relationship.

•Special mention loans decreased $10.3 million to $12.9 million at September 30, 2025, from $23.2 million at June 30, 2025. The decrease was largely due to a $9 million multi-family loan moving to substandard.

•Substandard loans increased $3.4 million largely due to the $9 million multi-family loan moving to substandard and nonaccrual, partially offset by the payoff of a $5 million agricultural loan that was substandard and nonaccrual.

•Total deposits increased $2.1 million during the quarter ended September 30, 2025, to $1.48 billion. This was largely due to growth in commercial deposits of $17.1 million, partially offset by the seasonal shrinkage in public deposits of $15.2 million, with historical growth expected in the fourth quarter.

•On September 1, 2025, the Company redeemed a 6% subordinated debt totaling $15 million.

•The efficiency ratio was 67% for the quarter ended September 30, 2025, compared to 66% for the quarter ended June 30, 2025.

•On July 24, 2025, the Board of Directors authorized a new 5% common stock buyback authorization, or 499 thousand shares. The Company repurchased approximately 136 thousand shares at an average all in price of $14.93 per share during the quarter ended September 30, 2025. There remain approximately 363 thousand shares under this authorization.

Balance Sheet and Asset Quality

Total assets decreased by $8.2 million during the quarter to $1.727 billion at September 30, 2025.

Cash and cash equivalents increased $15.0 million as interest-bearing cash increased due to loan principal repayments and deposit increases.

The on-balance sheet liquidity ratio, which is defined as the fair market value of AFS and HTM securities that are not pledged and cash on deposit with other financial institutions, was 13.4% of total assets at September 30, 2025, compared to 12.2% at June 30, 2025. On-balance sheet liquidity, collateralized new borrowing capacity, and uncommitted federal funds borrowing availability was $741 million, or 267%, of uninsured and uncollateralized deposits at September 30, 2025, and $730 million, or 277% at June 30, 2025.

Securities available for sale (“AFS”) increased $2.9 million during the quarter ended September 30, 2025, to $137.6 million from $134.8 million at June 30, 2025. The increase was due to the purchase of new corporate debt securities of $5 million, a decrease in the unrealized loss on AFS securities of $2.1 million partially offset by principal repayments of $32.8 million, and corporate debt security redemptions of $1.8 million.

Securities held to maturity (“HTM”) decreased $1.5 million to $81.5 million during the quarter ended September 30, 2025, from $83.0 million at June 30, 2025, due to principal repayments.

Loans receivable decreased $22.6 million during the third quarter ended September 30, 2025, to $1.323 billion compared to the prior quarter end, as loan payoffs and scheduled principal payments outpaced new loan originations.

The office loan portfolio consisting of seventy-one loans totaled $26 million at September 30, 2025, compared to seventy loans totaling $26 million at June 30, 2025. Criticized loans in the office loan portfolio for the quarter ended September 30, 2025, totaled $0.2 million, compared to $0.5 million at June 30, 2025, and there have been no charge-offs in the trailing twelve months.

The allowance for credit losses on loans increased by $0.8 million to $22.2 million at September 30, 2025, representing 1.68% of total loans receivable compared to 1.59% of total loans receivable at June 30, 2025.The provision for credit losses was $0.65 million for the quarter ended September 30, 2025, compared to a provision for credit losses of $1.35 million, and a negative provision for credit losses of $0.4 million during the quarters ended June 30, 2025, and September 30, 2024, respectively. Factors affecting the September 30, 2025 provision for credit losses include: (1) the impact of changes in credit quality, i.e., changes in reserves on impaired loans, and the impact of delinquent loans at June 30, 2025, being current at September 30, 2025, of $0.9 million; partially offset by: (2) the net of shrinkage in the loan portfolio of approximately $0.1 million; (3) $51 thousand of net recoveries; and (4) a decrease in off-balance sheet commitments from new construction originations of $0.1 million.

Allowance for Credit Losses (“ACL”) - Loans Percentage

(in thousands, except ratios)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

June 30, 2025 |

|

March 31, 2025 |

|

December 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans, end of period |

|

$ |

1,323,010 |

|

|

$ |

1,345,620 |

|

|

$ |

1,352,728 |

|

|

$ |

1,368,981 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses - Loans |

|

$ |

22,182 |

|

|

$ |

21,347 |

|

|

$ |

20,205 |

|

|

$ |

20,549 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ACL - Loans as a percentage of loans, end of period |

|

1.68 |

% |

|

1.59 |

% |

|

1.49 |

% |

|

1.50 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In addition to the ACL - Loans, the Company has established an ACL - Unfunded Commitments of $0.493 million at September 30, 2025, $0.627 million at June 30, 2025, and $0.460 million at September 30, 2024, classified in other liabilities on the consolidated balance sheets.

Allowance for Credit Losses - Unfunded Commitments:

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 and Three Months Ended |

|

|

|

September 30, 2024 and Three Months Ended |

|

September 30, 2025 and Nine Months Ended |

|

September 30, 2024 and Nine Months Ended |

| ACL - Unfunded commitments - beginning of period |

|

$ |

627 |

|

|

|

|

$ |

712 |

|

|

$ |

334 |

|

|

$ |

1,250 |

|

|

|

|

|

|

|

|

|

|

|

|

| Additions (reductions) to ACL - Unfunded commitments via provision for credit losses charged to operations |

|

(134) |

|

|

|

|

(252) |

|

|

159 |

|

|

(790) |

|

| ACL - Unfunded commitments - end of period |

|

$ |

493 |

|

|

|

|

$ |

460 |

|

|

$ |

493 |

|

|

$ |

460 |

|

Special mention loans decreased $10.3 million to $12.9 million at September 30, 2025, from $23.2 million in the previous quarter. The decrease was largely due to the transfer of one multi-family loan to substandard and nonperforming, which is experiencing slower leasing activity than expected.

Substandard loans increased $3.4 million to $21.3 million at September 30, 2025, compared to $17.9 million at June 30, 2025, largely due to the transfer from special mention of a multi-family loan totaling $9.0 million, partially offset by the payoff of one nonperforming loan relationship of $5 million.

Nonperforming assets increased by $3.7 million to $16.7 million at September 30, 2025, compared to $13.0 million at June 30, 2025. As described above, a $9 million multi-family loan that is experiencing slower leasing activity than expected was placed on nonaccrual in the third quarter, which was partially offset by the payoff of an agricultural nonperforming loan relationship of $5 million.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands) |

|

|

September 30, 2025 |

|

June 30, 2025 |

|

March 31, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

| Special mention loan balances |

|

$ |

12,920 |

|

|

$ |

23,201 |

|

|

$ |

14,990 |

|

|

$ |

8,480 |

|

|

$ |

11,047 |

|

| Substandard loan balances |

|

21,310 |

|

|

17,922 |

|

|

19,591 |

|

|

18,891 |

|

|

21,202 |

|

| Criticized loans, end of period |

|

$ |

34,230 |

|

|

$ |

41,123 |

|

|

$ |

34,581 |

|

|

$ |

27,371 |

|

|

$ |

32,249 |

|

Deposit Portfolio Composition

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2025 |

|

|

|

|

|

June 30,

2025 |

|

|

|

|

|

March 31,

2025 |

|

December 31,

2024 |

|

September 30,

2024 |

| Consumer deposits |

|

$ |

855,226 |

|

|

|

|

|

|

$ |

856,467 |

|

|

|

|

|

|

$ |

861,746 |

|

|

$ |

852,083 |

|

|

$ |

844,808 |

|

| Commercial deposits |

|

423,662 |

|

|

|

|

|

|

406,608 |

|

|

|

|

|

|

423,654 |

|

|

412,355 |

|

|

406,095 |

|

| Public deposits |

|

175,689 |

|

|

|

|

|

|

190,933 |

|

|

|

|

|

|

211,261 |

|

|

190,460 |

|

|

176,844 |

|

| Wholesale deposits |

|

25,977 |

|

|

|

|

|

|

24,408 |

|

|

|

|

|

|

26,993 |

|

|

33,250 |

|

|

92,920 |

|

| Total deposits |

|

$ |

1,480,554 |

|

|

|

|

|

|

$ |

1,478,416 |

|

|

|

|

|

|

$ |

1,523,654 |

|

|

$ |

1,488,148 |

|

|

$ |

1,520,667 |

|

At September 30, 2025, the deposit portfolio composition was 58% consumer, 28% commercial, 12% public, and 2% wholesale deposits compared to 58% consumer, 27% commercial, 13% public, and 2% wholesale deposits at June 30, 2025.

Deposit Composition By Type

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2025 |

|

June 30,

2025 |

|

March 31,

2025 |

|

December 31,

2024 |

|

September 30,

2024 |

| Non-interest-bearing demand deposits |

|

$ |

262,535 |

|

|

$ |

260,248 |

|

|

$ |

253,343 |

|

|

$ |

252,656 |

|

|

$ |

256,840 |

|

| Interest-bearing demand deposits |

|

360,475 |

|

|

366,481 |

|

|

386,302 |

|

|

355,750 |

|

|

346,971 |

|

| Savings accounts |

|

157,317 |

|

|

159,340 |

|

|

167,614 |

|

|

159,821 |

|

|

169,096 |

|

| Money market accounts |

|

354,290 |

|

|

357,518 |

|

|

370,741 |

|

|

369,534 |

|

|

366,067 |

|

| Certificate accounts |

|

345,937 |

|

|

334,829 |

|

|

345,654 |

|

|

350,387 |

|

|

381,693 |

|

| Total deposits |

|

$ |

1,480,554 |

|

|

$ |

1,478,416 |

|

|

$ |

1,523,654 |

|

|

$ |

1,488,148 |

|

|

$ |

1,520,667 |

|

Uninsured and uncollateralized deposits were $277.7 million, or 19% of total deposits at September 30, 2025, and $263.2 million, or 18% of total deposits at June 30, 2025. Uninsured deposits alone at September 30, 2025, were $421.5 million, or 28% of total deposits and $419.6 million, or 28% of total deposits at June 30, 2025.

Federal Home Loan Bank advances remained at $0 at September 30, 2025, and at June 30, 2025, and decreased $5.0 million from December 31, 2024.

On August 29, 2025, the Company redeemed a 6% subordinated debt totaling $15 million.

The Company repurchased approximately 136 thousand shares at an average all in price of $14.93 per share. There remain approximately 363 thousand shares under the current buyback authorization plan. This share repurchase authorization does not oblige the Company to repurchase any shares of its common stock.

Review of Operations

Pre-Provision Net Revenue (PPNR)

(in thousands, except yields and rates)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

June 30, 2025 |

|

March 31, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

|

|

|

|

| Pre-tax income |

|

$ |

4,535 |

|

|

$ |

4,047 |

|

|

$ |

3,974 |

|

|

$ |

3,358 |

|

|

$ |

4,185 |

|

|

|

|

|

| Add back provision for credit losses |

|

650 |

|

|

1,350 |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

| Subtract negative provision for credit losses |

|

— |

|

|

— |

|

|

(250) |

|

|

(450) |

|

|

(400) |

|

|

|

|

|

| Pre-Provision Net Revenue |

|

$ |

5,185 |

|

|

$ |

5,397 |

|

|

$ |

3,724 |

|

|

$ |

2,908 |

|

|

$ |

3,785 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-Provision Net Revenue (“PPNR”) is defined as net interest income plus total non-interest income minus total non-interest expense. This measure is a non-GAAP financial measure since it excludes the provision for (recovery of) credit losses included in net income.

Pre-provision net revenue includes net interest income recognized on the payoff of nonaccrual loans and loans with purchase credit discounts of $0.3 million and $1.1 million for the three-month periods ended September 30, 2025, and June 30, 2025, respectively.

Net interest income decreased $0.1 million to $13.2 million for the current quarter ended September 30, 2025, from $13.3 million for the quarter ended June 30, 2025, and increased from $11.3 million for the quarter ended September 30, 2024. The decrease in net interest income from the second quarter of 2025 was primarily due to: (1) a net decrease of $0.5 million (11 bps) of interest income recognized on the payoffs of nonperforming loans to $0.2 million; (2) a decrease in purchase accretion of $0.3 million (7 bps) to $0.1 million as a result of loan payoffs; (3) the impact of one more day in the quarter on interest income, net of interest expense or $0.1 million, with these impacts removed from items 4 and 5 which follow: (4) higher interest income of $0.2 million (5 bps) on loans and investments due to loans repricing, the impact of new loan originations and mix of investments; (5) a decrease in deposit and borrowing costs of $0.2 million (4 bps); and (6) the impact of an increase in non-interest-bearing deposits (3bp).

Net interest income and net interest margin analysis:

(in thousands, except yields and rates)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

|

|

|

|

September 30, 2025 |

|

June 30, 2025 |

|

March 31, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

|

|

|

|

|

Net Interest Income |

|

Net Interest Margin |

|

Net Interest Income |

|

Net Interest Margin |

|

Net Interest Income |

|

Net Interest Margin |

|

Net Interest Income |

|

Net Interest Margin |

|

Net Interest Income |

|

Net Interest Margin |

|

|

|

|

|

|

|

| As reported |

|

$ |

13,214 |

|

|

3.20 |

% |

|

$ |

13,311 |

|

|

3.27 |

% |

|

$ |

11,594 |

|

|

2.85 |

% |

|

$ |

11,708 |

|

|

2.79 |

% |

|

$ |

11,285 |

|

|

2.63 |

% |

|

|

|

|

|

|

|

| Less scheduled accretion for PCD loans |

|

(17) |

|

|

— |

% |

|

(23) |

|

|

(0.01) |

% |

|

(36) |

|

|

(0.01) |

% |

|

(42) |

|

|

(0.01) |

% |

|

(45) |

|

|

(0.01) |

% |

|

|

|

|

|

|

|

| Less paid loan accretion for PCD loans |

|

(133) |

|

|

(0.03) |

% |

|

(416) |

|

|

(0.10) |

% |

|

— |

|

|

— |

% |

|

— |

|

|

— |

% |

|

— |

|

|

— |

% |

|

|

|

|

|

|

|

| Less scheduled accretion interest |

|

(30) |

|

|

(0.01) |

% |

|

(33) |

|

|

(0.01) |

% |

|

(33) |

|

|

(0.01) |

% |

|

(33) |

|

|

(0.01) |

% |

|

(33) |

|

|

(0.01) |

% |

|

|

|

|

|

|

|

| Without loan purchase accretion |

|

$ |

13,034 |

|

|

3.16 |

% |

|

$ |

12,839 |

|

|

3.15 |

% |

|

$ |

11,525 |

|

|

2.83 |

% |

|

$ |

11,633 |

|

|

2.77 |

% |

|

$ |

11,207 |

|

|

2.61 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The table below shows the impact of certificate, loan and securities contractual fixed rate maturing and repricing.

Portfolio Contractual Repricing:

(in millions, except yields)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q4 2025 |

|

Q1 2026 |

|

Q2 2026 |

|

Q3 2026 |

|

Q4 2026 |

|

FY 2027 |

| Maturing Certificate Accounts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contractual Balance |

|

|

|

|

|

$ |

95 |

|

|

$ |

138 |

|

|

$ |

63 |

|

|

$ |

36 |

|

|

$ |

10 |

|

|

$ |

3 |

|

| Contractual Interest Rate |

|

|

|

|

|

3.90 |

% |

|

3.98 |

% |

|

3.97 |

% |

|

3.93 |

% |

|

3.85 |

% |

|

0.84 |

% |

| Maturing or Repricing Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contractual Balance |

|

|

|

|

|

$ |

42 |

|

|

$ |

40 |

|

|

$ |

55 |

|

|

$ |

117 |

|

|

$ |

98 |

|

|

$ |

233 |

|

| Contractual Interest Rate |

|

|

|

|

|

4.95 |

% |

|

4.59 |

% |

|

4.71 |

% |

|

3.70 |

% |

|

3.84 |

% |

|

4.64 |

% |

| Maturing or Repricing Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contractual Balance |

|

|

|

|

|

$ |

7 |

|

|

$ |

2 |

|

|

$ |

7 |

|

|

$ |

7 |

|

|

$ |

3 |

|

|

$ |

7 |

|

| Contractual Interest Rate |

|

|

|

|

|

4.45 |

% |

|

3.72 |

% |

|

3.57 |

% |

|

3.44 |

% |

|

3.27 |

% |

|

4.76 |

% |

Non-interest income increased by $0.2 million in the third quarter of 2025, to $3.0 million from $2.8 million the prior quarter and $0.1 million from the third quarter of 2024 of $2.9 million. The increase in the third quarter of 2025 was due to higher gains on sale of loans, partially offset by lower gains on sale of equity securities and lower loan fees due to lower nonaccrual loan payoffs.

Non-interest expense increased $0.3 million to $11.1 million from $10.8 million for the previous quarter and increased $0.7 million from $10.4 million the third quarter of 2024. The increase in non-interest expense compared to the linked quarter was largely due to compensation items, including higher medical costs and modestly higher incentive costs. The $0.7 million increase from the third quarter of 2024 was largely due to higher compensation expense, which includes the annual merit increase impact, higher medical costs, incentive costs, and inflation factors impacting non-interest expense.

Provision for income taxes was $0.9 million in the third quarter of 2025 compared to $0.8 million in the second quarter of 2025. The effective tax rate was 18.8% for the quarter ended September 30, 2025, 19.2% for the quarter ended June 30, 2025, and 21.5% for the quarter ended September 30, 2024.

Certain items previously reported may be reclassified for consistency with the current presentation. These financial results are preliminary until the Form 10-Q is filed in November 2025.

About the Company

Citizens Community Bancorp, Inc. (NASDAQ: “CZWI”) is the holding company of the Bank, a national bank based in Altoona, Wisconsin, currently serving customers primarily in Wisconsin and Minnesota through 21 branch locations. Its primary markets include the Chippewa Valley Region in Wisconsin, the Twin Cities and Mankato markets in Minnesota, and various rural communities around these areas. The Bank offers traditional community banking services to businesses, ag operators and consumers, including residential mortgage loans.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements contained in this release are considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified using forward-looking words or phrases such as “anticipate,” “believe,” “could,” “expect,” “estimates,” “intend,” “may,” “on pace,” “preliminary,” “planned,” “potential,” “should,” “will,” “would” or the negative of those terms or other words of similar meaning.

Such forward-looking statements in this release are inherently subject to many uncertainties arising in the operations and business environment of the Company and the Bank. These uncertainties include: conditions in the financial markets and economic conditions generally; the impact of inflation on our business and our customers; geopolitical tensions, including current or anticipated impact of military conflicts; higher lending risks associated with our commercial and agricultural banking activities; future pandemics (including new variants of COVID-19); cybersecurity risks; adverse impacts on the regional banking industry and the business environment in which it operates; interest rate risk; lending risk; changes in the fair value or ratings downgrades of our securities; the sufficiency of allowance for credit losses; competitive pressures among depository and other financial institutions; disintermediation risk; our ability to maintain our reputation; our ability to maintain or increase our market share; our ability to realize the benefits of net deferred tax assets; our ability to obtain needed liquidity; our ability to raise capital needed to fund growth or meet regulatory requirements; our ability to attract and retain key personnel; our ability to keep pace with technological change; prevalence of fraud and other financial crimes; the possibility that our internal controls and procedures could fail or be circumvented; our ability to successfully execute our acquisition growth strategy; risks posed by acquisitions and other expansion opportunities, including difficulties and delays in integrating the acquired business operations or fully realizing the cost savings and other benefits; restrictions on our ability to pay dividends; the potential volatility of our stock price; accounting standards for credit losses; legislative or regulatory changes or actions, or significant litigation, adversely affecting the Company or Bank; public company reporting obligations; changes in federal or state tax laws; and changes in accounting principles, policies or guidelines and their impact on financial performance. Stockholders, potential investors, and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. Such uncertainties and other risks that may affect the Company’s performance are discussed further in Part I, Item 1A, “Risk Factors,” in the Company’s Form 10-K, for the year ended December 31, 2024, filed with the Securities and Exchange Commission (“SEC”) on March 13, 2025, and the Company’s subsequent filings with the SEC. The Company undertakes no obligation to make any revisions to the forward-looking statements contained in this news release or to update them to reflect events or circumstances occurring after the date of this release.

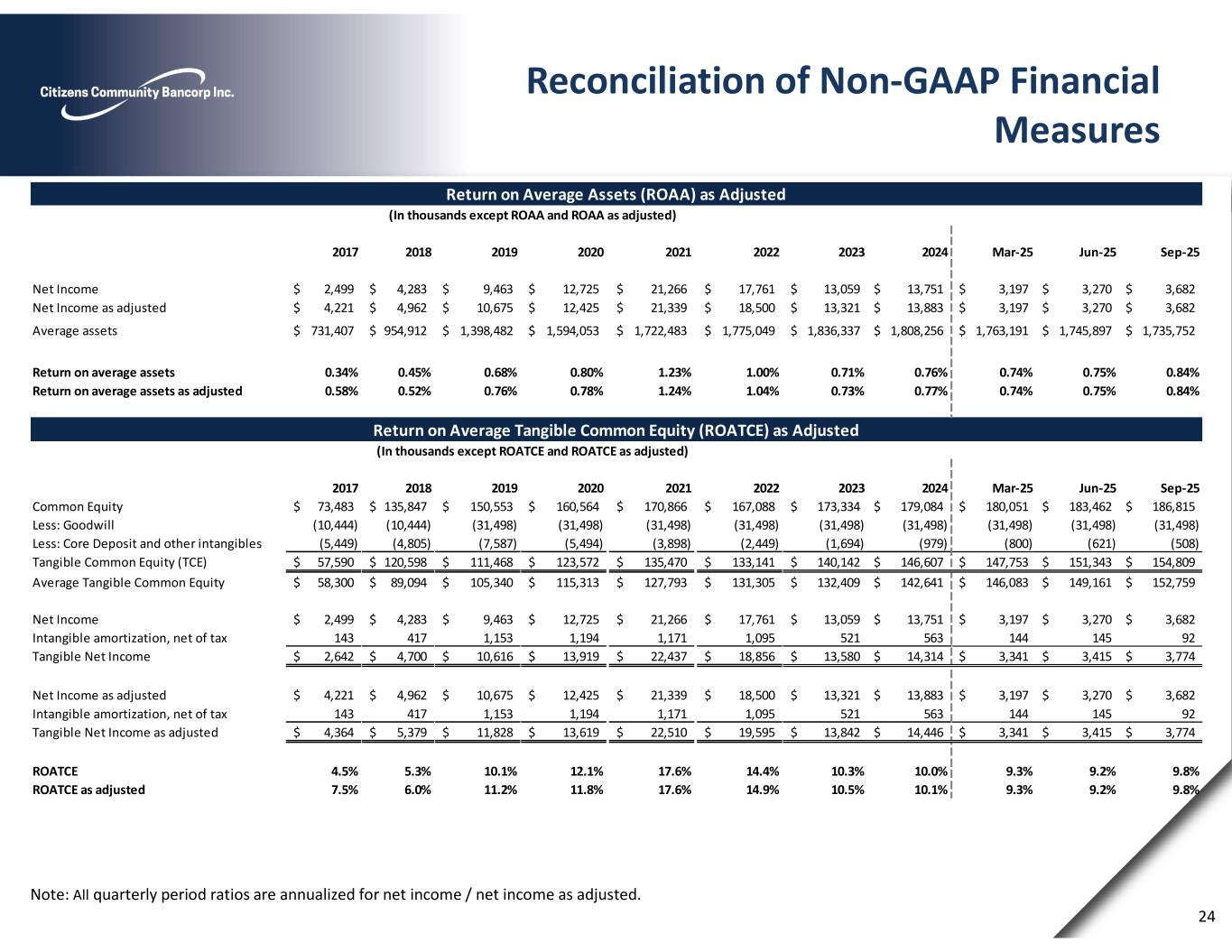

1 Non-GAAP Financial Measures

This press release contains non-GAAP financial measures, such as net income as adjusted, net income as adjusted per share, tangible book value, tangible book value per share, tangible common equity as a percent of tangible assets and return on average tangible common equity, which management believes may be helpful in understanding the Company’s results of operations or financial position and comparing results over different periods.

Net income as adjusted and net income as adjusted per share are non-GAAP measures that eliminate the impact of certain expenses such as branch closure costs and related severance pay, accelerated depreciation expense and lease termination fees, and the gain on sale of branch deposits and fixed assets. Tangible book value, tangible book value per share, tangible common equity as a percentage of tangible assets and return on average tangible common equity are non-GAAP measures that eliminate the impact of goodwill and intangible assets on our financial position. Management believes these measures are useful in assessing the strength of our financial position.

Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in this press release. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other banks and financial institutions.

Contact: Steve Bianchi, CEO

(715)-836-9994

(CZWI-ER)

CITIZENS COMMUNITY BANCORP, INC.

Consolidated Balance Sheets

(in thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 (unaudited) |

|

June 30, 2025 (unaudited) |

|

December 31, 2024 (audited) |

|

September 30, 2024 (unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

82,431 |

|

|

$ |

67,454 |

|

|

$ |

50,172 |

|

|

$ |

36,632 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities available for sale “AFS” |

|

137,639 |

|

|

134,773 |

|

|

142,851 |

|

|

149,432 |

|

|

|

|

|

| Securities held to maturity “HTM” |

|

81,526 |

|

|

83,029 |

|

|

85,504 |

|

|

87,033 |

|

|

|

|

|

| Equity investments |

|

5,675 |

|

|

5,741 |

|

|

4,702 |

|

|

5,096 |

|

|

|

|

|

| Other investments |

|

12,370 |

|

|

12,379 |

|

|

12,500 |

|

|

12,311 |

|

|

|

|

|

| Loans receivable |

|

1,323,010 |

|

|

1,345,620 |

|

|

1,368,981 |

|

|

1,424,828 |

|

|

|

|

|

| Allowance for credit losses |

|

(22,182) |

|

|

(21,347) |

|

|

(20,549) |

|

|

(21,000) |

|

|

|

|

|

| Loans receivable, net |

|

1,300,828 |

|

|

1,324,273 |

|

|

1,348,432 |

|

|

1,403,828 |

|

|

|

|

|

| Loans held for sale |

|

5,346 |

|

|

6,063 |

|

|

1,329 |

|

|

697 |

|

|

|

|

|

| Mortgage servicing rights, net |

|

3,532 |

|

|

3,548 |

|

|

3,663 |

|

|

3,696 |

|

|

|

|

|

| Office properties and equipment, net |

|

16,244 |

|

|

16,357 |

|

|

17,075 |

|

|

17,365 |

|

|

|

|

|

| Accrued interest receivable |

|

6,159 |

|

|

6,123 |

|

|

5,653 |

|

|

6,235 |

|

|

|

|

|

| Intangible assets |

|

508 |

|

|

621 |

|

|

979 |

|

|

1,158 |

|

|

|

|

|

| Goodwill |

|

31,498 |

|

|

31,498 |

|

|

31,498 |

|

|

31,498 |

|

|

|

|

|

| Foreclosed and repossessed assets, net |

|

911 |

|

|

895 |

|

|

915 |

|

|

1,572 |

|

|

|

|

|

| Bank owned life insurance (“BOLI”) |

|

26,700 |

|

|

26,494 |

|

|

26,102 |

|

|

25,901 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other assets |

|

15,620 |

|

|

15,916 |

|

|

17,144 |

|

|

16,683 |

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

1,726,987 |

|

|

$ |

1,735,164 |

|

|

$ |

1,748,519 |

|

|

$ |

1,799,137 |

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

$ |

1,480,554 |

|

|

$ |

1,478,416 |

|

|

$ |

1,488,148 |

|

|

$ |

1,520,667 |

|

|

|

|

|

| Federal Home Loan Bank (“FHLB”) advances |

|

— |

|

|

— |

|

|

5,000 |

|

|

21,000 |

|

|

|

|

|

| Other borrowings |

|

46,762 |

|

|

61,722 |

|

|

61,606 |

|

|

61,548 |

|

|

|

|

|

| Other liabilities |

|

12,856 |

|

|

11,564 |

|

|

14,681 |

|

|

15,773 |

|

|

|

|

|

| Total liabilities |

|

1,540,172 |

|

|

1,551,702 |

|

|

1,569,435 |

|

|

1,618,988 |

|

|

|

|

|

| Stockholders’ Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock— $0.01 par value, authorized 30,000,000; 9,856,745, 9,991,997, 9,981,996, and 10,074,136 shares issued and outstanding, respectively |

|

99 |

|

|

100 |

|

|

100 |

|

|

101 |

|

|

|

|

|

| Additional paid-in capital |

|

113,030 |

|

|

114,537 |

|

|

114,564 |

|

|

115,455 |

|

|

|

|

|

| Retained earnings |

|

86,913 |

|

|

83,709 |

|

|

80,840 |

|

|

78,438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accumulated other comprehensive loss |

|

(13,227) |

|

|

(14,884) |

|

|

(16,420) |

|

|

(13,845) |

|

|

|

|

|

| Total stockholders’ equity |

|

186,815 |

|

|

183,462 |

|

|

179,084 |

|

|

180,149 |

|

|

|

|

|

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

1,726,987 |

|

|

$ |

1,735,164 |

|

|

$ |

1,748,519 |

|

|

$ |

1,799,137 |

|

|

|

|

|

CITIZENS COMMUNITY BANCORP, INC.

Consolidated Statements of Operations

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, 2025 (unaudited) |

|

June 30, 2025 (unaudited) |

|

|

|

September 30, 2024 (unaudited) |

|

September 30, 2025 (unaudited) |

|

September 30, 2024 (unaudited) |

| Interest and dividend income: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and fees on loans |

|

$ |

19,759 |

|

|

$ |

20,105 |

|

|

|

|

$ |

20,115 |

|

|

$ |

58,466 |

|

|

$ |

60,204 |

|

| Interest on investments |

|

2,495 |

|

|

2,397 |

|

|

|

|

2,397 |

|

|

7,393 |

|

|

7,450 |

|

| Total interest and dividend income |

|

22,254 |

|

|

22,502 |

|

|

|

|

22,512 |

|

|

65,859 |

|

|

67,654 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest on deposits |

|

8,220 |

|

|

8,287 |

|

|

|

|

10,165 |

|

|

25,104 |

|

|

28,712 |

|

| Interest on FHLB borrowed funds |

|

1 |

|

|

1 |

|

|

|

|

128 |

|

|

13 |

|

|

1,216 |

|

| Interest on other borrowed funds |

|

819 |

|

|

903 |

|

|

|

|

934 |

|

|

2,623 |

|

|

2,960 |

|

| Total interest expense |

|

9,040 |

|

|

9,191 |

|

|

|

|

11,227 |

|

|

27,740 |

|

|

32,888 |

|

| Net interest income before provision for credit losses |

|

13,214 |

|

|

13,311 |

|

|

|

|

11,285 |

|

|

38,119 |

|

|

34,766 |

|

| Provision for credit losses |

|

650 |

|

|

1,350 |

|

|

|

|

(400) |

|

|

1,750 |

|

|

(2,725) |

|

| Net interest income after provision for credit losses |

|

12,564 |

|

|

11,961 |

|

|

|

|

11,685 |

|

|

36,369 |

|

|

37,491 |

|

| Non-interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

| Service charges on deposit accounts |

|

449 |

|

|

432 |

|

|

|

|

513 |

|

|

1,304 |

|

|

1,474 |

|

| Interchange income |

|

565 |

|

|

564 |

|

|

|

|

577 |

|

|

1,647 |

|

|

1,697 |

|

| Loan servicing income |

|

649 |

|

|

565 |

|

|

|

|

643 |

|

|

1,773 |

|

|

1,751 |

|

| Gain on sale of loans |

|

992 |

|

|

699 |

|

|

|

|

752 |

|

|

2,411 |

|

|

1,998 |

|

| Loan fees and service charges |

|

173 |

|

|

237 |

|

|

|

|

165 |

|

|

530 |

|

|

704 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net gains (losses) on equity securities |

|

(66) |

|

|

99 |

|

|

|

|

(78) |

|

|

43 |

|

|

(569) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bank Owned Life Insurance (BOLI) death benefit |

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

184 |

|

| Other |

|

260 |

|

|

240 |

|

|

|

|

349 |

|

|

743 |

|

|

859 |

|

| Total non-interest income |

|

3,022 |

|

|

2,836 |

|

|

|

|

2,921 |

|

|

8,451 |

|

|

8,098 |

|

| Non-interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

| Compensation and related benefits |

|

6,341 |

|

|

6,008 |

|

|

|

|

5,743 |

|

|

17,946 |

|

|

16,901 |

|

| Occupancy |

|

1,266 |

|

|

1,196 |

|

|

|

|

1,242 |

|

|

3,749 |

|

|

3,942 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Data processing |

|

1,811 |

|

|

1,753 |

|

|

|

|

1,665 |

|

|

5,283 |

|

|

4,787 |

|

| Amortization of intangible assets |

|

113 |

|

|

179 |

|

|

|

|

178 |

|

|

471 |

|

|

536 |

|

| Mortgage servicing rights expense, net |

|

161 |

|

|

148 |

|

|

|

|

163 |

|

|

449 |

|

|

427 |

|

| Advertising, marketing and public relations |

|

201 |

|

|

194 |

|

|

|

|

225 |

|

|

562 |

|

|

575 |

|

| FDIC premium assessment |

|

195 |

|

|

191 |

|

|

|

|

201 |

|

|

584 |

|

|

606 |

|

| Professional services |

|

359 |

|

|

432 |

|

|

|

|

336 |

|

|

1,299 |

|

|

1,249 |

|

| Losses (gains) on repossessed assets, net |

|

(4) |

|

|

— |

|

|

|

|

65 |

|

|

— |

|

|

47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

608 |

|

|

649 |

|

|

|

|

603 |

|

|

1,921 |

|

|

2,427 |

|

| Total non-interest expense |

|

11,051 |

|

|

10,750 |

|

|

|

|

10,421 |

|

|

32,264 |

|

|

31,497 |

|

| Income before provision for income taxes |

|

4,535 |

|

|

4,047 |

|

|

|

|

4,185 |

|

|

12,556 |

|

|

14,092 |

|

| Provision for income taxes |

|

853 |

|

|

777 |

|

|

|

|

899 |

|

|

2,407 |

|

|

3,043 |

|

| Net income attributable to common stockholders |

|

$ |

3,682 |

|

|

$ |

3,270 |

|

|

|

|

$ |

3,286 |

|

|

$ |

10,149 |

|

|

$ |

11,049 |

|

| Per share information: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings |

|

$ |

0.37 |

|

|

$ |

0.33 |

|

|

|

|

$ |

0.32 |

|

|

$ |

1.02 |

|

|

$ |

1.07 |

|

| Diluted earnings |

|

$ |

0.37 |

|

|

$ |

0.33 |

|

|

|

|

$ |

0.32 |

|

|

$ |

1.02 |

|

|

$ |

1.07 |

|

| Cash dividends paid |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

$ |

0.36 |

|

|

$ |

0.32 |

|

| Book value per share at end of period |

|

$ |

18.95 |

|

|

$ |

18.36 |

|

|

|

|

$ |

17.88 |

|

|

$ |

18.95 |

|

|

$ |

17.88 |

|

| Tangible book value per share at end of period (non-GAAP) |

|

$ |

15.71 |

|

|

$ |

15.15 |

|

|

|

|

$ |

14.64 |

|

|

$ |

15.71 |

|

|

$ |

14.64 |

|

Loan Composition

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

June 30, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Loans: |

|

|

|

|

|

|

|

|

| Commercial/Agricultural real estate: |

|

|

|

|

|

|

|

|

| Commercial real estate |

|

$ |

683,931 |

|

|

$ |

693,382 |

|

|

$ |

709,018 |

|

|

$ |

730,459 |

|

| Agricultural real estate |

|

64,096 |

|

|

69,237 |

|

|

73,130 |

|

|

76,043 |

|

| Multi-family real estate |

|

237,191 |

|

|

238,953 |

|

|

220,805 |

|

|

239,191 |

|

| Construction and land development |

|

74,789 |

|

|

70,477 |

|

|

78,489 |

|

|

87,875 |

|

| C&I/Agricultural operating: |

|

|

|

|

|

|

|

|

| Commercial and industrial |

|

101,700 |

|

|

109,202 |

|

|

115,657 |

|

|

119,619 |

|

| Agricultural operating |

|

30,085 |

|

|

31,876 |

|

|

31,000 |

|

|

27,550 |

|

| Residential mortgage: |

|

|

|

|

|

|

|

|

| Residential mortgage |

|

125,198 |

|

|

125,818 |

|

|

132,341 |

|

|

134,944 |

|

| Purchased HELOC loans |

|

1,979 |

|

|

2,368 |

|

|

2,956 |

|

|

2,932 |

|

| Consumer installment: |

|

|

|

|

|

|

|

|

| Originated indirect paper |

|

2,567 |

|

|

2,959 |

|

|

3,970 |

|

|

4,405 |

|

|

|

|

|

|

|

|

|

|

| Other consumer |

|

4,155 |

|

|

4,275 |

|

|

5,012 |

|

|

5,438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross loans |

|

$ |

1,325,691 |

|

|

$ |

1,348,547 |

|

|

$ |

1,372,378 |

|

|

$ |

1,428,456 |

|

| Unearned net deferred fees and costs and loans in process |

|

(2,563) |

|

|

(2,629) |

|

|

(2,547) |

|

|

(2,703) |

|

| Unamortized discount on acquired loans |

|

(118) |

|

|

(298) |

|

|

(850) |

|

|

(925) |

|

| Total loans receivable |

|

$ |

1,323,010 |

|

|

$ |

1,345,620 |

|

|

$ |

1,368,981 |

|

|

$ |

1,424,828 |

|

Nonperforming Assets

Loan Balances at Amortized Cost

(in thousands, except ratios)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

June 30, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

|

|

|

|

| Nonperforming assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Nonaccrual loans |

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial real estate |

|

$ |

4,592 |

|

|

$ |

5,013 |

|

|

$ |

4,594 |

|

|

$ |

4,778 |

|

|

|

|

|

| Agricultural real estate |

|

220 |

|

|

5,447 |

|

|

6,222 |

|

|

6,193 |

|

|

|

|

|

| Multi-family real estate |

|

8,970 |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

| Construction and land development |

|

— |

|

|

— |

|

|

103 |

|

|

106 |

|

|

|

|

|

| Commercial and industrial (“C&I”) |

|

1,312 |

|

|

600 |

|

|

597 |

|

|

1,956 |

|

|

|

|

|

| Agricultural operating |

|

— |

|

|

— |

|

|

793 |

|

|

901 |

|

|

|

|

|

| Residential mortgage |

|

520 |

|

|

549 |

|

|

858 |

|

|

1,088 |

|

|

|

|

|

| Consumer installment |

|

— |

|

|

— |

|

|

1 |

|

|

20 |

|

|

|

|

|

| Total nonaccrual loans |

|

$ |

15,614 |

|

|

$ |

11,609 |

|

|

$ |

13,168 |

|

|

$ |

15,042 |

|

|

|

|

|

| Accruing loans past due 90 days or more |

|

137 |

|

|

521 |

|

|

186 |

|

|

530 |

|

|

|

|

|

| Total nonperforming loans (“NPLs”) at amortized cost |

|

15,751 |

|

|

12,130 |

|

|

13,354 |

|

|

15,572 |

|

|

|

|

|

| Foreclosed and repossessed assets, net |

|

911 |

|

|

895 |

|

|

915 |

|

|

1,572 |

|

|

|

|

|

| Total nonperforming assets (“NPAs”) |

|

$ |

16,662 |

|

|

$ |

13,025 |

|

|

$ |

14,269 |

|

|

$ |

17,144 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans, end of period |

|

$ |

1,323,010 |

|

|

$ |

1,345,620 |

|

|

$ |

1,368,981 |

|

|

$ |

1,424,828 |

|

|

|

|

|

| Total assets, end of period |

|

$ |

1,726,987 |

|

|

$ |

1,735,164 |

|

|

$ |

1,748,519 |

|

|

$ |

1,799,137 |

|

|

|

|

|

| Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

| NPLs to total loans |

|

1.19 |

% |

|

0.90 |

% |

|

0.98 |

% |

|

1.09 |

% |

|

|

|

|

| NPAs to total assets |

|

0.96 |

% |

|

0.75 |

% |

|

0.82 |

% |

|

0.95 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Balances, Interest Yields and Rates

(in thousands, except yields and rates)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30, 2025 |

|

Three Months Ended

June 30, 2025 |

|

Three Months Ended

September 30, 2024 |

|

|

Average

Balance |

|

Interest

Income/

Expense |

|

Average

Yield/

Rate |

|

Average

Balance |

|

Interest

Income/

Expense |

|

Average

Yield/

Rate |

|

Average

Balance |

|

Interest

Income/

Expense |

|

Average

Yield/

Rate |

| Average interest earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

62,395 |

|

|

$ |

693 |

|

|

4.41 |

% |

|

$ |

44,377 |

|

|

$ |

493 |

|

|

4.46 |

% |

|

$ |

25,187 |

|

|

$ |

360 |

|

|

5.69 |

% |

| Loans receivable |

|

1,342,635 |

|

|

19,759 |

|

|

5.84 |

% |

|

1,353,332 |

|

|

20,105 |

|

|

5.96 |

% |

|

1,429,928 |

|

|

20,115 |

|

|

5.60 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment securities |

|

220,213 |

|

|

1,738 |

|

|

3.13 |

% |

|

223,318 |

|

|

1,735 |

|

|

3.12 |

% |

|

236,960 |

|

|

1,966 |

|

|

3.30 |

% |

| Other investments |

|

12,373 |

|

|

64 |

|

|

2.05 |

% |

|

12,400 |

|

|

169 |

|

|

5.47 |

% |

|

12,553 |

|

|

71 |

|

|

2.25 |

% |

| Total interest earning assets |

|

$ |

1,637,616 |

|

|

$ |

22,254 |

|

|

5.39 |

% |

|

$ |

1,633,427 |

|

|

$ |

22,502 |

|

|

5.53 |

% |

|

$ |

1,704,628 |

|

|

$ |

22,512 |

|

|

5.25 |

% |

| Average interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Savings accounts |

|

$ |

158,905 |

|

|

$ |

306 |

|

|

0.76 |

% |

|

$ |

160,849 |

|

|

$ |

335 |

|

|

0.84 |

% |

|

$ |

170,777 |

|

|

$ |

450 |

|

|

1.05 |

% |

| Demand deposits |

|

376,145 |

|

|

2,061 |

|

|

2.17 |

% |

|

372,723 |

|

|

1,986 |

|

|

2.14 |

% |

|

357,201 |

|

|

2,152 |

|

|

2.40 |

% |

| Money market accounts |

|

358,956 |

|

|

2,512 |

|

|

2.78 |

% |

|

361,420 |

|

|

2,510 |

|

|

2.79 |

% |

|

381,369 |

|

|

3,126 |

|

|

3.26 |

% |

| CD’s |

|

339,566 |

|

|

3,341 |

|

|

3.90 |

% |

|

342,959 |

|

|

3,456 |

|

|

4.04 |

% |

|

379,722 |

|

|

4,437 |

|

|

4.65 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total deposits |

|

$ |

1,233,572 |

|

|

$ |

8,220 |

|

|

2.64 |

% |

|

$ |

1,237,951 |

|

|

$ |

8,287 |

|

|

2.69 |

% |

|

$ |

1,289,069 |

|

|

$ |

10,165 |

|

|

3.14 |

% |

| FHLB advances and other borrowings |

|

54,389 |

|

|

820 |

|

|

5.98 |

% |

|

61,781 |

|

|

904 |

|

|

5.87 |

% |

|

80,338 |

|

|

1,062 |

|

|

5.26 |

% |

| Total interest-bearing liabilities |

|

$ |

1,287,961 |

|

|

$ |

9,040 |

|

|

2.78 |

% |

|

$ |

1,299,732 |

|

|

$ |

9,191 |

|

|

2.84 |

% |

|

$ |

1,369,407 |

|

|

$ |

11,227 |

|

|

3.26 |

% |

| Net interest income |

|

|

|

$ |

13,214 |

|

|

|

|

|

|

$ |

13,311 |

|

|

|

|

|

|

$ |

11,285 |

|

|

|

| Interest rate spread |

|

|

|

|

|

2.61 |

% |

|

|

|

|

|

2.69 |

% |

|

|

|

|

|

1.99 |

% |

| Net interest margin |

|

|

|

|

|

3.20 |

% |

|

|

|

|

|

3.27 |

% |

|

|

|

|

|

2.63 |

% |

| Average interest earning assets to average interest-bearing liabilities |

|

|

|

|

|

1.27 |

|

|

|

|

|

|

1.26 |

|

|

|

|

|

|

1.24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|