SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2025

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

(Exact name of registrant as specified in its charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

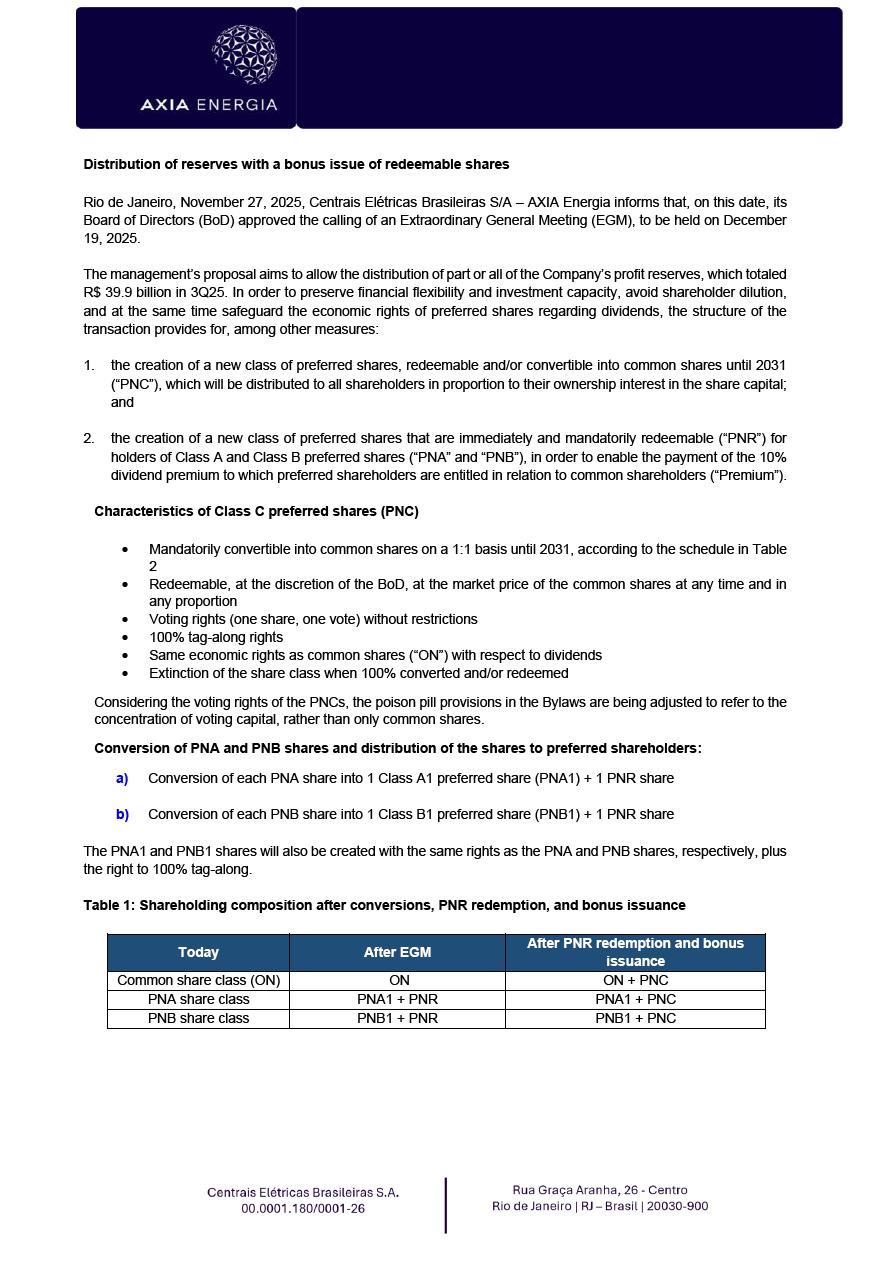

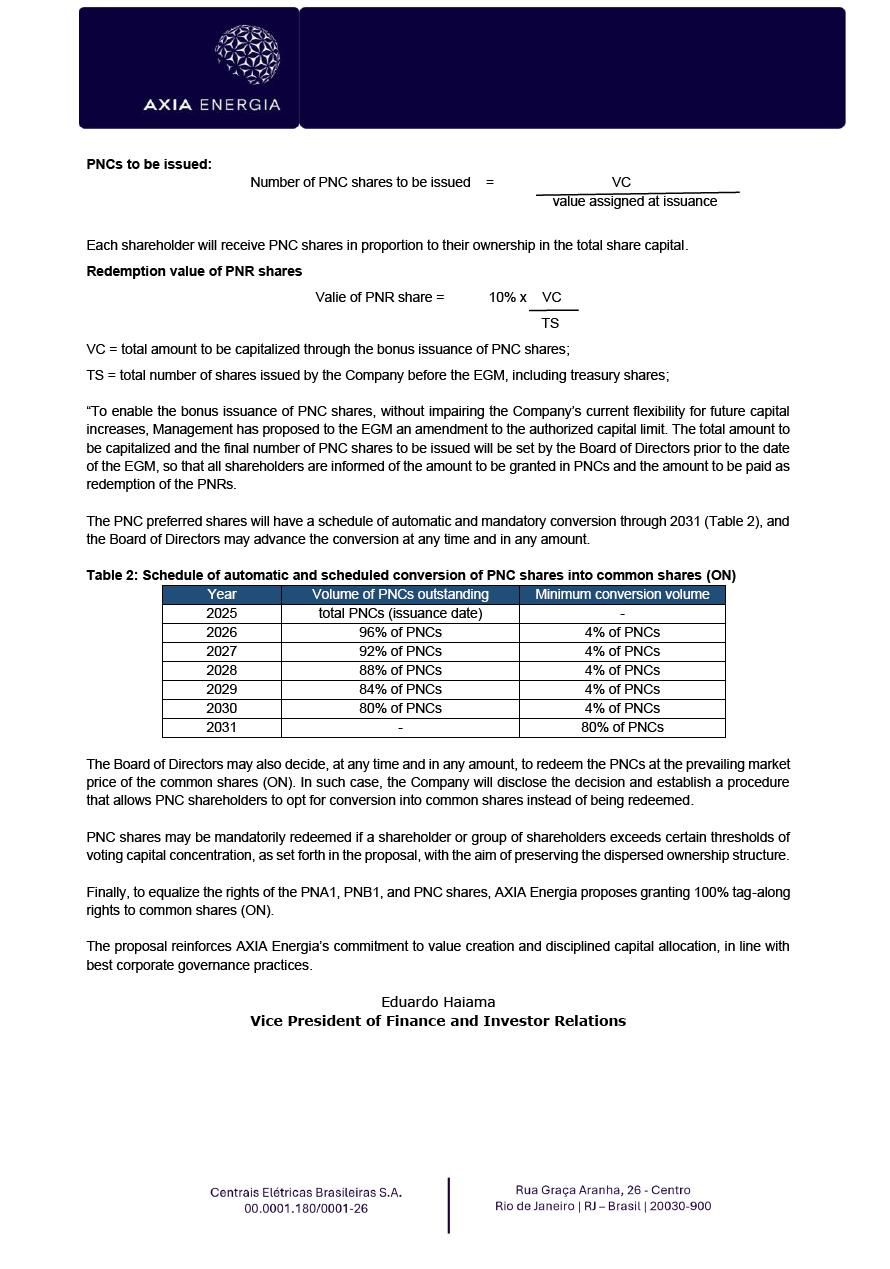

Distribution of reserves with a bonus issue of redeemable shares Rio de Janeiro, November 27, 2025, Centrais Elétricas Brasileiras S/A – AXIA Energia informs that, on this date, its Board of Directors (BoD) approved the calling of an Extraordinary General Meeting (EGM), to be held on December 19, 2025. The management’s proposal aims to allow the distribution of part or all of the Company’s profit reserves, which totaled R$ 39.9 billion in 3Q25. In order to preserve financial flexibility and investment capacity, avoid shareholder dilution, and at the same time safeguard the economic rights of preferred shares regarding dividends, the structure of the transaction provides for, among other measures: 1. the creation of a new class of preferred shares, redeemable and/or convertible into common shares until 2031 (“PNC”), which will be distributed to all shareholders in proportion to their ownership interest in the share capital; and 2. the creation of a new class of preferred shares that are immediately and mandatorily redeemable (“PNR”) for holders of Class A and Class B preferred shares (“PNA” and “PNB”), in order to enable the payment of the 10% dividend premium to which preferred shareholders are entitled in relation to common shareholders (“Premium”). Characteristics of Class C preferred shares (PNC) • Mandatorily convertible into common shares on a 1:1 basis until 2031, according to the schedule in Table 2 • Redeemable, at the discretion of the BoD, at the market price of the common shares at any time and in any proportion • Voting rights (one share, one vote) without restrictions • 100% tag-along rights • Same economic rights as common shares (“ON”) with respect to dividends • Extinction of the share class when 100% converted and/or redeemed Considering the voting rights of the PNCs, the poison pill provisions in the Bylaws are being adjusted to refer to the concentration of voting capital, rather than only common shares. Conversion of PNA and PNB shares and distribution of the shares to preferred shareholders: a) Conversion of each PNA share into 1 Class A1 preferred share (PNA1) + 1 PNR share b) Conversion of each PNB share into 1 Class B1 preferred share (PNB1) + 1 PNR share The PNA1 and PNB1 shares will also be created with the same rights as the PNA and PNB shares, respectively, plus the right to 100% tag-along. Table 1: Shareholding composition after conversions, PNR redemption, and bonus issuance Today After EGM After PNR redemption and bonus issuance Common share class (ON) ON ON + PNC PNA share class PNA1 + PNR PNA1 + PNC PNB share class PNB1 + PNR PNB1 + PNC PNCs to be issued: Number of PNC shares to be issued = VC value assigned at issuance Each shareholder will receive PNC shares in proportion to their ownership in the total share capital. Redemption value of PNR shares Valie of PNR share = 10% x VC TS VC = total amount to be capitalized through the bonus issuance of PNC shares; TS = total number of shares issued by the Company before the EGM, including treasury shares; “To enable the bonus issuance of PNC shares, without impairing the Company’s current flexibility for future capital increases, Management has proposed to the EGM an amendment to the authorized capital limit. The total amount to be capitalized and the final number of PNC shares to be issued will be set by the Board of Directors prior to the date of the EGM, so that all shareholders are informed of the amount to be granted in PNCs and the amount to be paid as redemption of the PNRs. The PNC preferred shares will have a schedule of automatic and mandatory conversion through 2031 (Table 2), and the Board of Directors may advance the conversion at any time and in any amount. Table 2: Schedule of automatic and scheduled conversion of PNC shares into common shares (ON) Year Volume of PNCs outstanding Minimum conversion volume 2025 total PNCs (issuance date) - 2026 96% of PNCs 4% of PNCs 2027 92% of PNCs 4% of PNCs 2028 88% of PNCs 4% of PNCs 2029 84% of PNCs 4% of PNCs 2030 80% of PNCs 4% of PNCs 2031 - 80% of PNCs The Board of Directors may also decide, at any time and in any amount, to redeem the PNCs at the prevailing market price of the common shares (ON). In such case, the Company will disclose the decision and establish a procedure that allows PNC shareholders to opt for conversion into common shares instead of being redeemed. PNC shares may be mandatorily redeemed if a shareholder or group of shareholders exceeds certain thresholds of voting capital concentration, as set forth in the proposal, with the aim of preserving the dispersed ownership structure. Finally, to equalize the rights of the PNA1, PNB1, and PNC shares, AXIA Energia proposes granting 100% tag-along rights to common shares (ON). The proposal reinforces AXIA Energia’s commitment to value creation and disciplined capital allocation, in line with best corporate governance practices. Eduardo Haiama Vice President of Finance and Investor Relations Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SIGNATURE

Date: November 27, 2025

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS | ||

| By: |

/S/ Eduardo Haiama |

|

|

Eduardo Haiama Vice-President of Finance and Investor Relations |

||

FORWARD-LOOKING STATEMENTS

This document may contain estimates and projections that are not statements of past events but reflect our management’s beliefs and expectations and may constitute forward-looking statements under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. The words “believes”, “may”, “can”, “estimates”, “continues”, “anticipates”, “intends”, “expects”, and similar expressions are intended to identify estimates that necessarily involve known and unknown risks and uncertainties. Known risks and uncertainties include, but are not limited to: general economic, regulatory, political, and business conditions in Brazil and abroad; fluctuations in interest rates, inflation, and the value of the Brazilian Real; changes in consumer electricity usage patterns and volumes; competitive conditions; our level of indebtedness; the possibility of receiving payments related to our receivables; changes in rainfall and water levels in reservoirs used to operate our hydroelectric plants; our financing and capital investment plans; existing and future government regulations; and other risks described in our annual report and other documents filed with the CVM and SEC. Estimates and projections refer only to the date they were expressed, and we do not assume any obligation to update any of these estimates or projections due to new information or future events. Future results of the Company’s operations and initiatives may differ from current expectations, and investors should not rely solely on the information contained herein. This material contains calculations that may not reflect precise results due to rounding.