UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2025

Commission File Number 001-34175

| ECOPETROL S.A. |

|

(Exact name of registrant as specified in its charter)

|

| N.A. |

|

(Translation of registrant’s name into English)

|

| COLOMBIA |

|

(Jurisdiction of incorporation or organization)

|

| Carrera 13 No. 36 – 24 |

| BOGOTA D.C. – COLOMBIA |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes ¨ No x

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SIGNATURES

| Ecopetrol S.A. | ||||

|

By: |

/s/ Alfonso Camilo Barco | |||

| Name: |

Alfonso Camilo Barco |

|||

| Title: | Chief Financial Officer | |||

Date: May 6, 2025

|

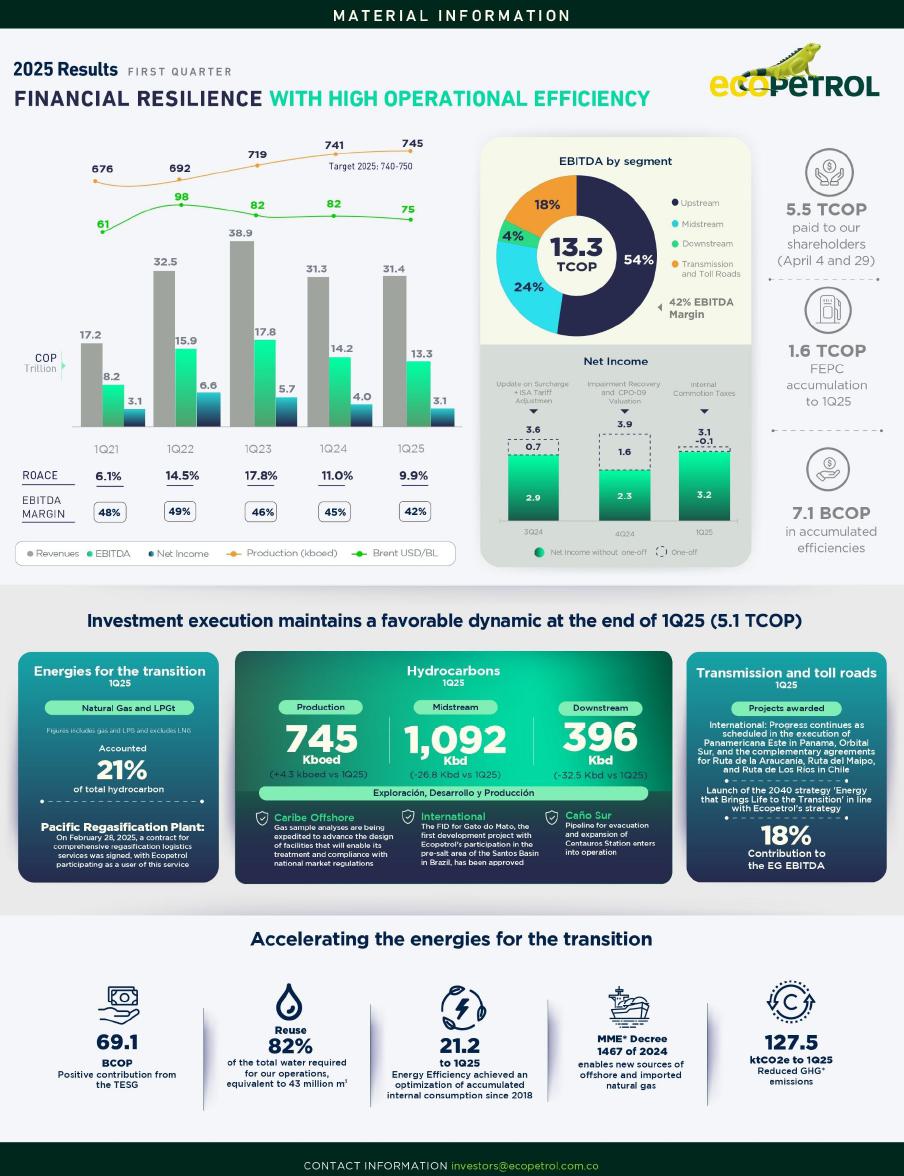

We started 2025 with results supported by our operational and financial strength. We are facing an environment affected by exogenous variables, geopolitical tensions and mainly with a strong impact from the fall in the prices of Brent benchmark crude oil. The Ecopetrol Group continues to demonstrate its operational resilience, supported by its diversification of markets and portfolio, the integration of the hydrocarbons business, the maximization of efficiencies, optimization and savings in operations, thus achieving favorable results and generating a competitive level of profitability in the industry.

In the first quarter of the year, we recorded revenues of COP 31.4 Trillion, an EBITDA of COP 13.3 Trillion, a net profit of COP 3.1 Trillion, an EBITDA margin of 42% and a ROACE of 9.9%. In April 2025, we made the dividends payment to our minority shareholders for an approximate value of COP 1 trillion and to our majority shareholder for an approximate value of COP 4.5 trillion, with the last payment to the Nation pending to be made at the end of June.

In the Hydrocarbons line, we highlight the strength of our traditional business, maintaining production at 745 kboed, within the goal set for the year despite the events in the local environment; on the other hand, the volumes transported stood at 1,092 kbd and refining throughputs at 396 kbd, despite the scheduled maintenance at the Barrancabermeja Refinery, operational and environmental events. We highlight the investment decision (FID) of the gas condensate project in the Santos Basin of Brazil, Gato Do Mato, in deep waters between 1,750 and 2,050 meters of water table from which it is expected to incorporate oil reserves by 2025

In terms of sales, we highlight the good start of the year for our commercial subsidiaries in Houston and Singapore facing global tensions that have arisen, as the differential of the crude oil basket was USD 6.26/bl compared to USD 8.26/bl in 1Q24, showing a strengthening of USD 2.0 bl, which corresponds to an improvement of 25%. The offices in Colombia, the United States and Singapore have managed to capture market opportunities and maximize the benefit for the Group. |

In the line of Energies for Transition, we highlight the signing of the comprehensive logistics services contract for the Pacific Regasification Plant, which will have a regasification capacity of up to 60 million cubic feet per day (MCFD), with an estimated operation entry in the second half of 2026. Likewise, we highlight that during 1Q25 an energy optimization of 1.27 petajoules was achieved, equivalent to a saving of COP 22.9 billion in the operations of the Ecopetrol Group.

In the line of Transmission and Roads, we highlight the launch of ISA's 2040 strategy "Energy that gives life to the transition" that focuses on consolidating electric power transmission in Latin America, accelerating new businesses, doubling 2024 EBITDA, venturing into new geographies and active portfolio management

On the corporate governance front, the General Shareholders' Meeting was held, where the new members of the Board of Directors were elected, who will contribute in terms of diversity, age and gender, as well as their experience, will seek to preserve the Company's traditional business, ratifying their commitment to move towards a fair and responsible energy transition. In April, we filed the 20F form with the Securities and Exchange Commission (SEC) for the 2024 period. With this report, Ecopetrol, through its Board of Directors and senior management, demonstrates its solid practices in terms of compliance and transparency towards its investors in the international market.

Finally, given the market situation, the Group initiated actions aimed at reducing costs and expenses above the goal of the financial plan by one trillion pesos and has a flexibility of 500 million dollars in the execution of investments. Likewise, going forward we will continue monitoring market conditions and take the measures required to preserve the financial stability of the Ecopetrol Group. Historically we have been resilient and we are confident that we are prepared for the challenges that this year poses.

Ricardo Roa Barragán President of Ecopetrol S.A. |

The Ecopetrol Business Group generated net profit of COP 3.1 trillion in 1Q25, EBITDA of COP 13.3 trillion, and EBITDA margin of 42%. The quarterly results show an outstandng recovery in production growth, planned maintenance in the Refining segment to guarantee the production of quality fuels and the advantages of being a diversified business Group in an environment of lower hydrocarbon prices and high volatility.

Table 1: Financial Summary Income Statement - Ecopetrol Group

| Billions (COP) | 1Q 2025 | 1Q 2024 | ∆ ($) | ∆ (%) | |

| Total Sales | 31,365 | 31,302 | 63 | 0.2% | |

| Depreciation and amortization | 3,738 | 3,452 | 286 | 8.3% | |

| Variable costs | 11,920 | 10,821 | 1,099 | 10.2% | |

| Fixed Costs | 5,047 | 4,790 | 257 | 5.4% | |

| Sale costs | 20,705 | 19,063 | 1,642 | 8.6% | |

| Gross profit | 10,660 | 12,239 | (1,579) | (12.9%) | |

| Operating and exploration expenses | 2,280 | 2,437 | (157) | (6.4%) | |

| Operating profit | 8,380 | 9,802 | (1,422) | (14.5%) | |

| Financial revenues (expenses), net | (2,418) | (2,002) | (416) | 20.8% | |

| Share in profit of companies | 209 | 197 | 12 | 6.1% | |

| Profit before tax on gains | 6,171 | 7,997 | (1,826) | (22.8%) | |

| Income tax provision | (1,939) | (2,921) | 982 | (33.6%) | |

| Net consolidated profit | 4,232 | 5,076 | (844) | (16.6%) | |

| Non-controlling interest | (1,105) | (1,064) | (41) | 3.9% | |

| Net profit attributable to Ecopetrol shareholders | 3,127 | 4,012 | (885) | (22.1%) | |

| EBITDA | 13,258 | 14,238 | (980) | (6.9%) | |

| EBITDA Margin | 42.3% | 45.5% | - | (3.2%) |

The figures included in this report are not audited and are expressed in billions of Colombian pesos (COP), or United States dollars (USD), or thousands of barrels of oil equivalent per day (kboed) or tons and are indicated as such when applicable. For the purposes of presentation, certain figures in this report were rounded to the nearest decimal place.

Forward-looking Statements: This release may contain forward-looking statements related to business prospects, estimates for operating and financial results, and growth of Ecopetrol. These are projections and, as such, are based solely on management's expectations regarding the future of the Company and its permanent access to capital to fund its business plan. Such forward-looking statements depend, basically, on changes in market conditions, government regulations, competitive pressures, the performance of the Colombian economy and the industry, without limitation thereto; therefore, they are subject to change without prior notice.