UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 3, 2025

TransAct Technologies Incorporated

(Exact name of registrant as specified in its charter)

| Delaware | 0-21121 | 06-1456680 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| One Hamden Center | |

| 2319 Whitney Ave, Suite 3B, Hamden, CT | 06518 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (203) 859-6800

(Former name or former address, if changed since last report): Not applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $.01 per share | TACT | NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

On November 3, 2025, TransAct Technologies Incorporated (the “Company”) entered into a Third Amendment to Lease (“Lease Amendment”) with One Hamden Center, LLC (the “Landlord”). The Lease Amendment amends the Company’s lease with the Landlord (as successor to 2319 Hamden Center I, L.L.C.), dated November 27, 2006 (as amended by the First Amendment to Lease, dated as of January 3, 2017, and the Second Amendment to Lease, dated as of April 30, 2021, the “Lease”), with respect to the Company’s corporate headquarters located at One Hamden Center, 2319 Whitney Avenue, Suite 3-B, Hamden, CT (the “Premises”). The Lease was scheduled to expire on October 31, 2025.

The Lease Amendment provides for an extension of the Lease for an additional four (4) years and two (2) months, from November 1, 2025 to December 31, 2029. The Lease Amendment reduced the leased square foot area of the Premises from approximately 11,000 to 3,630 square feet. Under the Lease, as amended by the Lease Amendment, the monthly base rent for the Premises is $6,806.25. The previous amount of monthly base rent due under the Lease, prior to the Lease Amendment, was $19,473.55 for the period from November 1, 2024 to October 31, 2025. In addition to the base rent, the Lease, as amended by the Lease Amendment, requires the Company to pay 3.20% of any increase in the Landlord’s operating costs with respect to the Premises over 2025 operating costs, and to pay to the Landlord a monthly electric charge.

The Lease Amendment also provides that the Landlord, at the Landlord’s expense, will perform the work to separate and demise the new Premises from the existing Premises.

The foregoing summary of the terms of the Lease Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Lease Amendment, a copy of which is filed herewith as Exhibit 10.1.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits:

| Exhibit | Description | |

| 10.1 | Third Amendment to Lease, dated as of November 3, 2025, by and between One Hamden Center, LLC and TransAct Technologies Incorporated | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| TRANSACT TECHNOLOGIES INCORPORATED | ||

| By: | /s/ Steven A. DeMartino | |

| Steven A. DeMartino | ||

| President, Chief Financial Officer, Treasurer and Secretary | ||

Date: November 7, 2025

Exhibit 10.1

THIRD AMENDMENT TO LEASE

This Third Amendment to Lease (this “Third Amendment”), entered into as of the 3rd day of November, 2025, by and between ONE HAMDEN CENTER, LLC, as Landlord, and TRANSACT TECHNOLOGIES INCORPORATED, as Tenant.

WITNESSETH:

WHEREAS, Landlord, as successor to 2319 Hamden Center I, L.L.C., and Tenant are parties to that certain Lease dated November 27, 2006, as amended by First Amendment to Lease entered into as of January 3, 2017, and as further amended by Second Amendment to Lease entered into as of April 30, 2021 (as so previously amended, the “Lease”) with respect to certain 11,075 rentable square foot premises known as Suite 3-B, 2319 Whitney Avenue, Hamden, Connecticut (the “Existing Premises”) in Landlord’s Building known as One Hamden Center, 2319 Whitney Avenue, Hamden, Connecticut 06518; and

WHEREAS, Landlord and Tenant further mutually desire to amend the Lease;

NOW, THEREFORE, in consideration of the sum of $1.00 and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

1. Unless otherwise defined in this Third Amendment, all defined terms shall have the meanings set forth in the Lease.

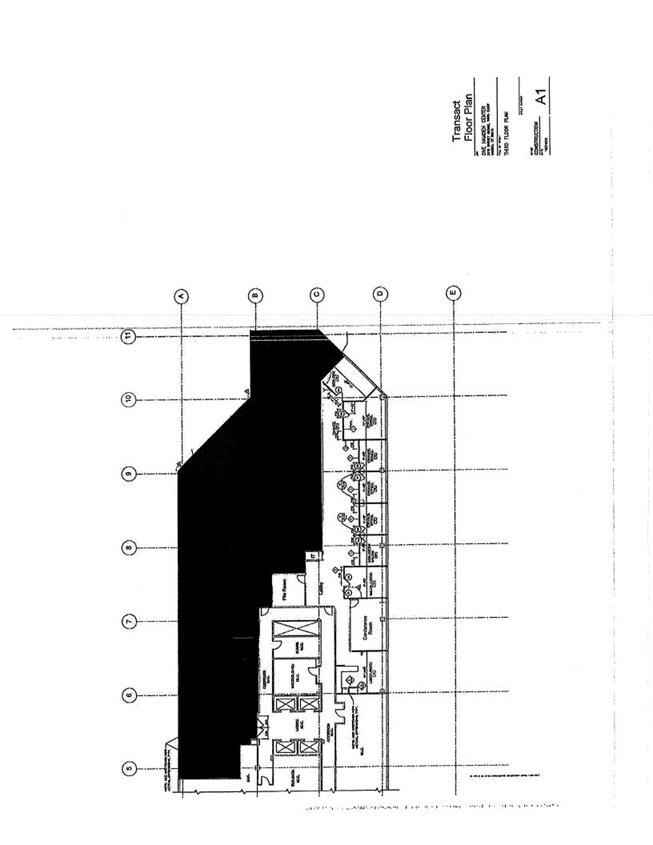

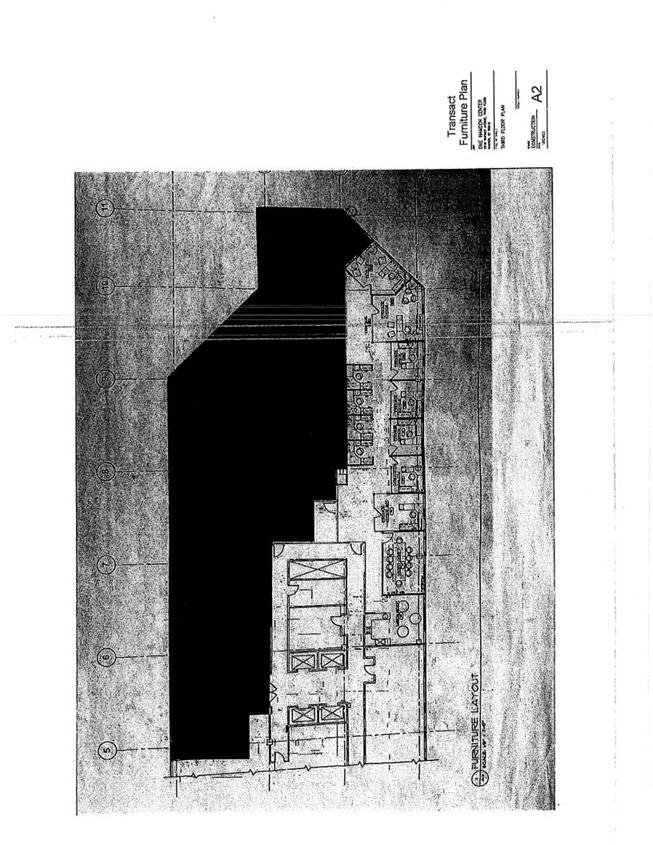

2. Attached hereto as Exhibit A, subject to minor modifications to be mutually agreed between Landlord and Tenant, is a sketch of the Existing Premises. Effective November 1, 2025, Tenant shall lease from Landlord and shall have the right to use and occupy only that portion of the Existing Premises shown on said Exhibit A (the “New Premises”), which New Premises shall continue to be known as Suite 3-B, but contain only 3,630 rentable square feet. Prior to November 1, 2025, Landlord, at Landlord’s expense, shall commence the work necessary to separate and demise the New Premises from the balance of the Existing Premises in accordance with all applicable laws. Landlord and Tenant shall cooperate with each other to complete such work prior to November 1, 2025.

3. In completing the work to separate and demise the New Premises from the balance of the Existing Premises, Landlord shall (i) construct and paint all required demising walls, (ii) repair or replace, with building standard materials, any carpet damaged during such construction, (iii) repair or replace, with building standard material, any ceiling tiles damaged during such construction and modify any lighting configuration, (iv) provide tenant with a new entrance door designed with a full glass insert and sidelight, (v) at its cost breakdown the existing office cubicles and relocate cubicles to the New Premises and (vi) at its costs install cabinets under countertop and outlets to code in existing lunchroom area. The foregoing work shall be completed by Landlord at Landlord’s sole cost and expense and shall be completed in accordance with all applicable laws. Tenant shall be responsible to remove all personal items, equipment, furniture and furnishings from the work area. The work to be done by Landlord is anticipated to be performed during normal business hours, and Landlord and Tenant shall cooperate with each other in the performance of same to seek to minimize interference with Tenant’s business operations. Except as provided in this Paragraph 3, Tenant accepts the New Premises in their “AS IS” condition.

4. The term of the Lease with respect to the New Premises shall commence on November 1, 2025 and shall continue for a term of four (4) years and two (2) months ending December 31, 2029 (the “New Premises Extended Term”).

5. Commencing November 1, 2025 and continuing during the New Premises Extended Term: (a) the monthly Base Rent shall be $6,806.25, (b) Tenant’s Percentage Share shall be 3.20%, (c) the Base Year shall be 2025, and (d) anything in the Lease to the contrary notwithstanding in lieu of submetering, Tenant shall pay a monthly electric charge of $1.00 per rentable square foot per annum, or $302.50 per month, increasing by 3% on November 1, 2026, and 3% on each November 1st thereafter during the New Extended Lease Term.

6. As hereby modifi\ed, the Lease remains in full force and effect.

7. Landlord represents and warrants that no consent or approval of this Third Amendment by any third party (expressly including the holder of any mortgage encumbering the Building) is required or that each such consent or approval has been obtained by Landlord and is in full force and effect.

8. Landlord and Tenant each warrant and represent to the other that it has had no dealing with any real estate broker or agent in connection with the negotiation of this Third Amendment. Except for any commission claims made by a broker claiming to represent Tenant in connection with this Third Amendment, Landlord shall pay any commissions payable to any brokers pursuant to any agreement to which Landlord may be a party.

9. This Third Amendment shall be governed by and construed in accordance with the laws of the State of Connecticut.

7. This Third Amendment may be executed in two (2) or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

[Signature page follows]

IN WITNESS WHEREOF, Landlord and Tenant have executed this Third Amendment as of the day and date first above written.

| One Hamden Center, LLC, | |||

| a Delaware limited liability company | |||

| By: | 2319 HAMDEN CENTER I, L.L.C., a Connecticut | ||

| limited liability company, its Member | |||

| By: | Hamden Center Investors, Inc., a | ||

| Connecticut corporation, its Manager | |||

| By: | /s/ Michael Belfonti | ||

| Michael Belfonti, President | |||

| TRANSACT TECHNOLOGIES INCORPORATED | |||

| By: | /s/ Steven A. DeMartino | ||

| Name: Steven A. DeMartino | |||

| Its Duly Authorized: President and CFO | |||

EXHIBIT A